Bitcoin's 的身份危機已經結束。多年來,機構投資者把 BTC 當作數碼黃金 —— 一種被動價值儲存工具,被鎖在冷錢包裏,慢慢升值但完全沒有收益。

但到了 2025 年,這個敘事已徹底改變。比特幣愈來愈被視為可產生實質收益的「生產性基建」,機構可透過鏈上部署策略、結構化借貸框架及機構級財資管理來創造收益,而不是把它當成呆滯資本。

推動這場轉變的並不是投機狂熱,而是基建成熟度。監管明朗化、機構級託管方案以及合規收益協議 正在匯聚,解鎖一系列機制,讓企業財資部門、資產管理公司及主權基金得以在不犧牲安全與合規的前提下,把持有的比特幣部署到產生收入的策略中。這場變化代表比特幣的「第二幕」:從「取得與累積」走向「主動資本部署」。

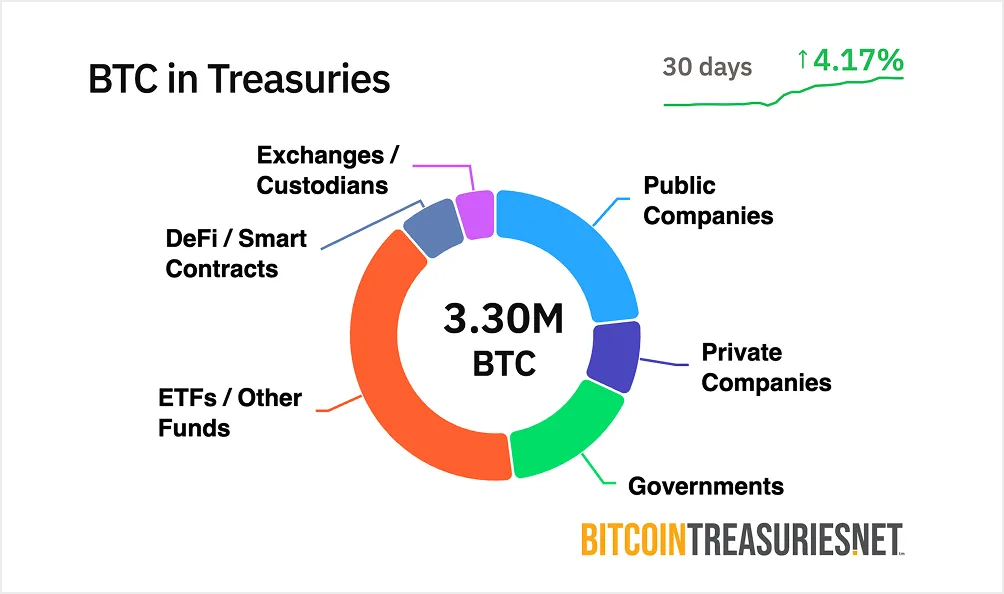

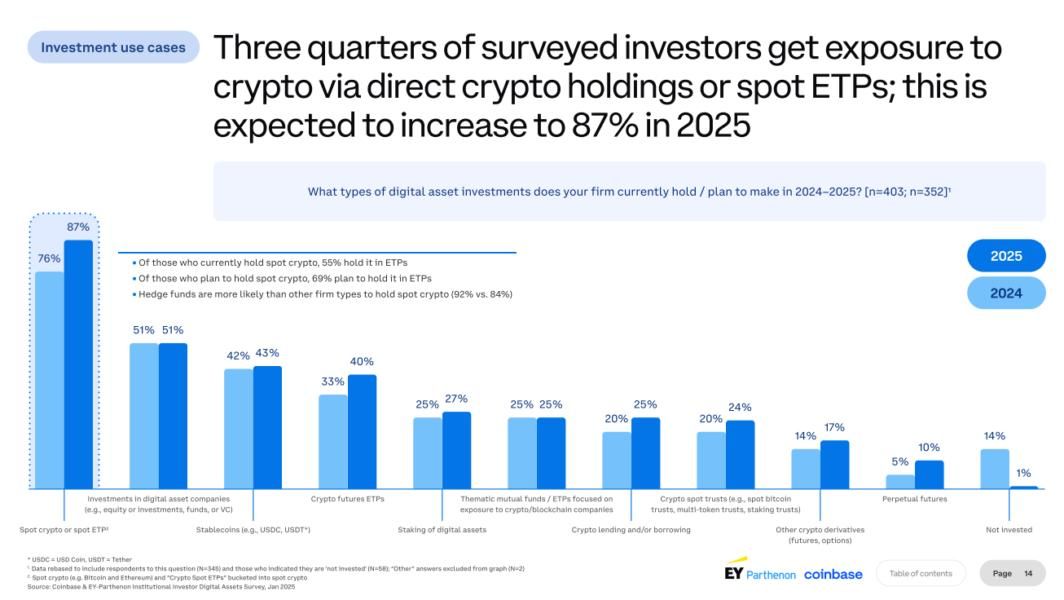

為何是現在?比特幣 ETF 已解決「如何買到」的問題。到 2025 年第三季,現貨比特幣 ETF 已錄得逾 307 億美元淨流入,令 BTC 成為傳統投資組合中的常規資產類別。但單純被動持有,無法回應「機會成本」這個問題。掌管數以億計美元比特幣的機構 —— 目前機構持有的 BTC 已逾 2,000 億美元 —— 正面對壓力,需要創造與其他財資資產相若的回報。收益部署是下一個前沿,而支援這一切的基建如今已準備就緒。

為何機構要追求比特幣收益

企業財務運作有個簡單原則:資本必須「運作」。投組經理會輪動資產、對沖頭寸、優化存續期,並在任何可能地方榨取收益。然而,大部分機構持有的比特幣仍完全閒置 —— 在產生零收益之餘,還要支付每年約 10 至 50 個基點不等的託管成本。

這造成一個悖論。調查數據顯示,83% 機構投資者計劃在 2025 年增加加密資產配置,但絕大多數卻缺乏將這些持倉「生產化」的機制。對習慣於持有年息 4–5% 貨幣市場基金或可產生可預期回報的短債的財資主管而言,把比特幣鎖在冷錢包裏,感覺就像把資本停泊在一個「無息戶口」裏 —— 不論其價格潛在升值空間有多大。

機會成本正變得難以忽視。正如一位財資主管所言:「如果你在做比特幣託管,你每年就會在那成本上損失 10–50 個基點,你會想把這部分抹平。」壓力並不只是「最大化回報」,而是提升投組效率、維持競爭力,以及證明比特幣可以作為「營運資本」,而不只是投機性儲備。

被動持有正從多個方向受到挑戰。首先,監管明朗化移除了關鍵障礙。2025 年 SEC 職員會計公告 SAB 121 被撤銷,消除了銀行替客戶持有加密資產時的資產負債表阻力,而 CLARITY Act 等框架則為託管操作提供法律確定性。其次,機構級基建已成熟。託管商目前提供 7,500 萬至 3.2 億美元不等的保險覆蓋,配合多方計算(MPC)安全機制及符合受託人標準的合規框架。

第三,競爭加劇。曾經以「買入與累積比特幣」領跑的企業財資,如今開始評估如何在持倉上擠出更多價值。Bernstein 分析師預計,未來五年內全球上市公司可能合共配置高達 3,300 億美元於比特幣,較目前約 800 億美元大幅增加。隨著採用規模擴大,懂得掌握收益部署的機構,將比只維持被動持倉的對手擁有戰略優勢。

供給面與收益機會

比特幣的底層設計創造了一種獨特的收益動態。不同於驗證者可賺取質押獎勵的 PoS 區塊鏈,比特幣作為 PoW 模型並沒有原生收益機制。網絡安全由挖礦提供,而並非質押,減半事件則持續壓縮新供應的發行量。2024 年 4 月的減半把區塊獎勵削減至 3.125 BTC,意味著未來六年約只有 70 萬枚新比特幣進入流通。

這種稀缺模型是比特幣作為價值儲存工具的優勢,但亦造就行內人所稱的「閒置 BTC 問題」。逾 2,000 億美元的比特幣正靜靜躺在機構金庫裏,一分收益也沒產生。其約 1.3 兆美元市值代表著龐大的鎖定資本。行業估計,目前透過收益策略被視為「生產性資本」的部分不足 2%。

機會在於結構性因素。比特幣波動率已大幅下降 —— 自 2023 年以來下跌約 75%,夏普比率 0.96 已可與黃金比肩。這種成熟度令比特幣適用於過去只屬債券或國庫券的「類固收」策略。機構配置人愈來愈傾向把 BTC 視為一種正規財資資產,而不只是高 Beta 投機標的,理應賺取與其風險輪廓相稱的回報。

比特幣 DeFi 的鎖倉總價值在過去 12 個月飆升 228%,顯示鏈上收益基建不斷擴張。不過,其中大部分活動仍圍繞在以太坊或側鏈上的包裝比特幣,而非原生 BTC 的直接部署。比特幣市值與其收益基建之間的落差,正是一大機會。隨著可組合協議成熟及監管框架穩固,機構層級的比特幣收益市場,在下一個周期有機會達到數千億美元規模。

機構部署框架與鏈上基建

要用比特幣創造收益,遠不止有借貸協議這麼簡單。機構需要的是託管方案、審計軌跡、監管合規,以及符合受託責任標準的透明風險框架。支撐這些需求的基建在 2025 年已出現巨大演進。

鏈上借貸是最直接的部署機制。過度抵押借貸協議如 Aave,目前鎖倉總價值接近 440 億美元,允許機構存入比特幣 —— 通常是以 wBTC 形式 —— 從借款人那裏賺取浮動收益。利率會隨資金利用率在約 3–7% 之間波動,在借貸需求上升時會拉高。

機制相對簡單:企業財資把 wBTC 存入借貸池;需要流動性的借款人則按貸款價值的 150–200% 抵押資產;智能合約會自動清算抵押不足的頭寸,保障出借人;機構以比特幣計價收取利息。像 Morpho 等協議進一步優化了這個模式,透過零費用借貸及「金庫策略」最大化出借收益,目前鎖倉價值已逾 63 億美元。

以收益為導向的「財資金庫」則是一種更結構化的做法。與其直接與協議互動,機構可以透過專為企業財資設計的管理型收益產品來部署比特幣。Coinbase Asset Management 在 2025 年 5 月推出 Coinbase Bitcoin Yield Fund,目標為非美國機構投資者提供以比特幣支付、年化 4–8% 的淨回報。基金負責所有營運複雜度 —— 策略執行、風險管理、合規 —— 投資者只需以 BTC 認購與贖回。

這類產品標誌著重大轉變。過去,企業財資若要接觸收益策略,必須自建內部加密專業團隊;如今,機構管理人已將比特幣部署「包裝」成一站式方案,配合熟悉的基金架構、季度報告與受託監督。該基金追求扣除所有費用與開支後的淨回報,令表現透明,亦便於與傳統固收產品比較。

固定收益與浮動收益模型之間的區別,對風險而言相當關鍵。 management。浮動收益策略會按市場情況調整回報——當需求高企時借貸利率上升,淡靜時則回落。相反,固定收益產品透過結構性票據或衍生工具提供預先約定的回報,並不依賴資金使用率。Fixed structures often use covered call writing or basis trading 來產生可預期的收入流,但通常會在比特幣大幅升值時封頂潛在升幅。

支撐這些策略的基礎設施愈趨成熟。託管服務商如 BitGo, Anchorage Digital, and BNY Mellon now offer institutional-grade solutions ,提供多方計算保安、合規機制和保險保障。這些託管機構自 2022 年起,通過硬件保安模組和分散式私鑰管理等創新,已將成功被攻破的事件減少了 80%。

合規與審計要求已不再是事後才考慮的問題。Leading protocols integrate with global reporting standards like MiCA in the EU,確保機構能符合不斷演變的監管要求。季度審計會公布儲備證明,管治框架採用多重簽名 DAO 來管理協議參數,而交易透明度則令抵押品健康狀況可以被即時監察。

實際落地部署正急速擴張。雖然 MicroStrategy(現改名為 Strategy)率先以比特幣作庫房儲備,但其他企業正轉向主動部署。Jiuzi Holdings announced a $1 billion Bitcoin treasury initiative,明確將收益策略納入其財資管理框架的一部分。GameStop 在 2025 年 3 月宣布,會透過可換股債券發行把比特幣納入庫房儲備,這顯示連零售企業亦開始探索結構化的比特幣敞口。

由「累積」走向「部署」的轉變,在 Strategy 的演變上最為明顯。The company holds over 628,000 BTC as of July 2025,令其成為全球持有比特幣最多的上市公司。雖然 Strategy 的核心戰略仍然是透過集資作收購,但公司已開始探索收益機制。Its "$42/42" plan targeting $84 billion in capital raises through 2027 越來越多地考慮各種部署策略,以期在其龐大持倉上產生回報。

收益方法與策略類型

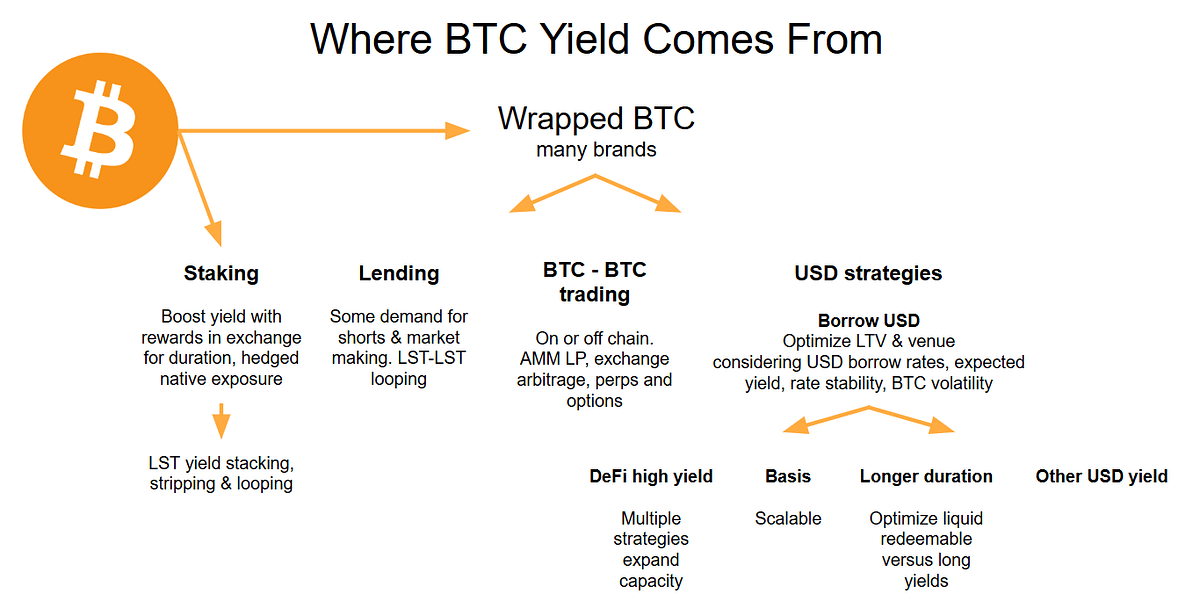

產生比特幣收益的機制大致可分為幾個類別,各自有不同的風險輪廓、操作需求和回報特性。

市場中性策略在沒有比特幣價格方向性暴露的情況下提供收益。Basis trading involves buying spot Bitcoin and simultaneously shorting futures contracts,從現貨與期貨兩個倉位之間的價差中獲利。在穩定的市況下,這個價差通常可帶來年化 5–10% 的回報。該策略是 delta 中性——無論比特幣升跌,只要現貨與期貨價格收斂便可獲利。

執行上需要同時接入現貨市場和期貨交易所。機構可能透過託管商買入 1,000 萬美元的現貨比特幣,再於 CME 或 Binance 等平台做等值名義金額的期貨空倉。隨着期貨合約臨近到期,其價格會向現貨收斂,機構便可將這段基差收入囊中。Automated bots optimize rate capture,但在波動時期,執行速度對避免滑點極為關鍵。

資金費率套利的運作方式相似,但使用的是永續合約而非定期期貨。In bull markets, perpetual swap longs pay shorts a funding rate,通常年化約 2–5%。機構會做多現貨比特幣並做空永續合約,定期收取資金費率。該策略需要持續監察,因為在熊市時資金費率可能轉為負值,把原本盈利的交易變成虧損倉位。

備兌買權策略是機構比特幣持有人採用最廣泛的收益機制之一。The approach involves holding Bitcoin while selling call options against those holdings,藉此收取權利金收入,但代價是當 BTC 價格高於行使價時會封頂升幅。Bitcoin's historically high implied volatility - often exceeding 46% 意味著相對傳統資產而言,比特幣選擇權的權利金通常更豐厚。

操作機制相對簡單。一個持有 100 BTC 的庫房可以賣出行使價較現價高 10%、到期日為 30 日的買權期權。若比特幣維持在行使價以下,機構可保留權利金——通常相當於倉位價值每月 2–3%。若比特幣升破行使價,倉位會被「叫走」,但機構仍可從行使價加上權利金中獲利。BlackRock filed for the iShares Bitcoin Premium ETF in September 2025,顯示主流機構已對以備兌買權產生比特幣收益產生濃厚興趣。

缺點是機會成本。During strong bull markets, covered call strategies historically lag their underlying asset,因為上升空間被行使價封頂。於 2024 年初賣出 100,000 美元行使價買權的比特幣持有人,在 BTC 升越該水平時便錯失了可觀升幅。較保守的實作方式會使用價外行使價(高於現價 5–15%),在保留一定上升空間的同時,仍可收取可觀權利金。

目前已有多隻 ETF 把備兌買權策略打包,供零售及機構使用。The NEOS Bitcoin High Income ETF launched in October 2024, delivering a 22% dividend yield,透過多層買權沽出策略套用於比特幣敞口以產生收益。The Roundhill Bitcoin Covered Call Strategy ETF seeks 4-8% net returns,其方法為結合合成長倉與每週寫出買權。這些產品展示了進階期權策略可以規模化運作,並供機構部署。

結構性借貸與保險庫策略則屬較複雜的實作方式。像 Ribbon Finance 這類 DeFi 選擇權保險庫會自動執行備兌買權,dynamically selecting strike prices based on volatility and optimizing returns,並以演算法管理以優化回報。Yields range from 5-10% annually,協議會處理所有操作複雜性,包括行使價選擇、展期管理和權利金收取。

賣出賣權的保險庫則反向運作——機構賣出比特幣賣權,收取權利金,同時承擔若期權被行使便需在較低行使價買入 BTC 的義務。This strategy generates 4-8% yields,並有機會在調整期間以折扣價吸納比特幣。其風險在於機構必須維持相當於行使價的穩定幣抵押品,令本可用於其他地方的資本被鎖定。

透過 CeFi 平台進行比特幣抵押借貸,則提供較保守、風險性質不同的收益。Regulated platforms like BitGo and Fidelity Digital Assets now offer 2-5% annual yields ,向經審核的機構借款人放出比特幣貸款。這些平台在 2022 年多家 CeFi 爆雷後重整旗鼓,實施更嚴格的抵押要求、借款人審核,以及符合機構受託責任標準的透明度。

風險與回報之間的取捨是根本問題。市場中性策略提供較低收益(2–10%),但方向性暴露極小。備兌買權可產生較高收入(5–15%),但會封頂升值空間。DeFi 借貸有機會帶來雙位數回報,但涉及智能合約風險及對手方風險。機構資產配置人員必須根據自身授權來配對策略選擇——保守的退休基金或會偏向受監管的 CeFi 借貸,而較進取的財資部則可能投放資金於 DeFi 保險庫或衍生工具策略。

基礎設施、風險與合規挑戰

收益生成會帶來機構投資者不能忽視的操作複雜性。支撐比特幣部署的基礎設施,必須在託管、安全、合規與風險管理方面符合嚴格要求——這些標準往往是許多偏向零售的協議無法達到的。

託管仍然是根基。機構不可能——也不會——把比特幣部署到protocols that require them to relinquish custody or expose private keys. Leading providers use multi-party computation (MPC) technology that distributes key fragments across multiple parties, ensuring no single entity can access funds unilaterally. MPC prevents insider theft even if one key fragment is compromised, since reconstructing a complete key requires multiple independent parties to coordinate.

Cold storage, multi-signature wallets, and hardware security modules form the backbone of institutional custody. Cold wallets keep private keys offline and air-gapped from internet connectivity, preventing remote attacks. Multi-signature approvals require multiple authorized parties to sign transactions, eliminating single points of failure. HSMs provide tamper-proof cryptographic protection, securing keys against physical theft or insider compromise.

Auditability and transparency are non-negotiable. Institutional investors require real-time visibility into collateral health, liquidation risks, and fund flows. Leading protocols publish quarterly proof-of-reserve audits verified by third parties, ensuring that reserves match outstanding obligations. All minting, burning, and transactional data should be publicly verifiable on-chain, allowing institutions to independently validate protocol solvency without relying solely on operator disclosures.

治理控制可以防止未經授權的交易,並管理協議風險。Multi-signature DAO 以集體方式管理參數變更,確保沒有單一一方可以單獨修改關鍵變數,例如抵押率或清算門檻。機構要求具備正式的治理框架,包括對參數變更設置 time-lock、緊急暫停機制,以及處理安全事故的清晰升級程序。

隨着監管框架不斷演進,合規要求亦愈趨複雜。歐盟的《加密資產市場規例》(MiCA) 以及美國證券交易委員會的指引訂立了託管標準、反洗錢要求及申報義務。紐約州金融服務署亦已提出具體的加密託管標準,要求機構在向機構客戶提供服務前,必須證明其符合相關監管框架。

在部署比特幣收益策略時,風險相當實在,且必須主動管理。再質押(rehypothecation)——即多次借出客戶資產——在中心化借貸中仍然是一大隱憂。機構必須核實託管方是否維持 1:1 儲備,並且沒有進行未披露的再質押操作,否則在壓力時期可能造成系統性風險。

交易對手違約是最明顯的風險。如果借貸平台變得無力償債,無論抵押安排如何,存款人都有可能損失部分甚至全部比特幣。2024 年加密駭客事件激增,約有 22 億美元被盜,說明即使是技術先進的平台仍然存在漏洞。機構應該把資產分散於多個託管方及協議,避免集中風險導致災難性損失。

資產與負債之間的流動性錯配,會在波動期間造成壓力。如果某機構把比特幣存入提供即時贖回的借貸協議,但該協議卻把這些資產以定期形式借出,就會出現期限錯配。在市場出現嚴重扭曲時,協議可能缺乏足夠流動性以處理贖回要求,被迫延遲甚至暫停贖回。機構應事先釐清贖回條款,並維持充足的流動儲備,以應付營運需要。

包裝比特幣與原生比特幣之間的分別,對風險評估相當重要。Wrapped Bitcoin(wBTC)佔 DeFi 中絕大部分的比特幣,它作為以太坊上的 ERC-20 代幣,由 BitGo 等託管方以 1:1 的實際比特幣作背書。超過 100 億美元的 wBTC 在以太坊生態的各協議中流通,讓 BTC 持有人可以在以太坊上參與借貸、交易及挖礦收益等活動。

wBTC 模式依賴一個聯邦式託管架構,由多間機構擔任 merchant 及託管人。雖然每季審計會核實其 1:1 儲備,但機構仍需信任託管方不會管理不善儲備或變得無力償債。這種中心化引入了風險,而原生比特幣在 Rootstock 或 Lightning Network 等第二層方案上可能可以避免這些風險,只是那些生態在收益基建方面仍遠不成熟。

智能合約風險適用於任何 DeFi 部署。即使是經過充分審計的協議,亦可能包含被惡意人士利用的漏洞。機構應優先選用曾獲多間獨立公司(如 OpenZeppelin、Spearbit 和 Cantina)審計的協議,並設有高額(六位或七位數)漏洞賞金計劃,以及有在壓力市況下運行紀錄的協議。

合規與審計框架必須令機構風險委員會信服。實現收益與隱含收益之間的差異必須透明——部分協議標榜的高年化收益率(APY)包含代幣獎勵,而非實際現金收益。在高頻策略中,滑點、交易成本及 gas 費用可大幅蠶蝕回報。最大回撤分析則可顯示在不利市況下的最大損失,協助機構理解最壞情況。

機構加密託管市場預計至 2030 年將以 22% 的年複合增長率增長至 60.3 億美元,主要受對符合合規要求方案的需求所帶動。然而,要實現這種增長,仍有賴基礎設施供應商在規模化層面上解決上述風險及合規挑戰。

對企業庫房及機構資產配置的意義

由被動持有轉向主動部署,從根本上改變了企業司庫對比特幣敞口的思考方式。企業庫房不再只把 BTC 視為對沖通脹或純粹投機升值的工具,而是可以把它當作能產生回報的營運資金,與其他流動資產相若。

以一名管理 5 億美元現金等價物的企業司庫為例。傳統上,這筆資金會存放於年息 4-5% 的貨幣市場基金,或是帶來可預期回報的短期商業票據。如今,假設該投資組合有 10%——即 5,000 萬美元——配置於比特幣。在零收益情況下,這筆 BTC 一方面不產生收入,另一方面還要承受託管成本。但若把其投入每年產生 4-6% 收益的保守收益策略,該頭寸便可在維持比特幣敞口之餘,為庫房帶來可觀收入。

把數位資產庫房轉化為營運資金可以帶來數項策略性轉變。首先,比特幣可以用於供應商合約及 B2B 結算。全球營運的公司可以以 BTC 訂立供應商協議,利用鏈上結算軌道來降低外匯兌換成本及結算時間。比特幣儲備所產生的收益,可抵銷因持有部分營運資金於數位資產而帶來的波動風險。

其次,庫房可以把比特幣用作流動性管理的抵押品。企業無需為了套現而賣出 BTC——以免觸發納稅事件並錯過未來升值——而是可以把比特幣作為抵押品,換取穩定幣貸款或信貸額度。過度抵押的借貸模式,讓庫房可以動用相當於其比特幣價值 50-75% 的流動資金,同時維持對 BTC 的長期持有。

第三,收益部署為資本配置創造了更多選擇空間。庫房在比特幣持倉上每年賺取 5% 收益後,可以把這些回報再投資於業務營運、股份回購,或進一步增持比特幣。多年下來的複利效果,會令整體回報顯著優於單純被動持有。

心態上的轉變同樣關鍵。曾把比特幣視為純投機工具的 CFO 和董事會,如今開始把它視為可產生收益的資產。有調查顯示,83% 機構投資者計劃增加加密資產配置,反映他們愈來愈相信比特幣可以履行受託責任,而不僅是一場高風險豪賭。收益部署成為加密原生熱情與機構風險管理要求之間的橋樑。

當比特幣能產生收入時,投資組合行為亦會改變。如果庫房可從 BTC 身上賺取與債券或國庫券相若的收益率,便可能把更大比例的儲備配置到比特幣上。原本保守的 2-3% 配置,有機會在風險調整後回報合理的情況下擴大至 5-10%。Bernstein's projection of $330 billion in corporate Bitcoin allocations by2030 假設了這種動態——隨住收益基建成熟,機構對比特幣嘅胃納會按比例增加。

呢種影響唔只限於企業財務部,仲會延伸到退休基金、捐贈基金同主權財富基金。呢啲機構喺嚴格授權要求之下管理住以萬億計嘅資產,必須實現多元化配置、產生收益、同埋控制下行風險。比特幣同傳統資產嘅相關性,加上愈趨成熟嘅收益基建,令佢越嚟越吸引,成為投資組合多元化嘅工具。家族辦公室已經將投資組合嘅 25% 配置到加密資產,而隨住合規框架日益穩固,更大規模嘅機構資金池好大機會會跟隨。

對加密市場格局嘅展望同影響

比特幣收益部署嘅軌跡顯示,喺未來 3-5 年內,好可能出現幾個會重塑加密市場嘅發展。

基建擴容係最即時嘅演變方向。比特幣 DeFi 嘅鎖倉總價值(TVL)喺過去一年增長咗 228%,但仍然只佔比特幣整體市值嘅一小部分。隨住協議成熟同機構採用加速,鏈上比特幣 TVL 有機會由幾十億增長到幾千億。要達到呢個擴張,需要喺用戶體驗、Layer 2 解決方案嘅 gas 費優化、同埋透過審計同漏洞懸賞不斷加強安全性方面作出改進。

隨住市場成熟,以比特幣為基礎產品嘅收益曲線可能會出現。現時收益率會因策略、協議同市場情況而有好大差異。長遠嚟睇,機構資金流有機會令期限結構變得更可預測——例如 3 個月嘅比特幣借貸利率、6 個月期基差交易收益、1 年期結構性票據回報。呢啲收益曲線可以提供更清晰嘅定價透明度,亦可以用比特幣作為核心固定收益替代品,去構建更成熟嘅投資組合。

監管框架會繼續演化,以專門處理比特幣收益相關嘅問題。現行指引主要集中喺託管同現貨交易,但隨住機構收益產品擴大規模,監管機構好可能會為借貸、衍生工具同結構性產品引入專門框架。清晰嘅監管有機會透過消除不確定性加速採用,但如果規管過於嚴苛,反而可能將活動趕到離岸地區,或者轉移到透明度較低嘅結構。

關於比特幣本身嘅敘事,正由「價值儲存」轉向「可產生收益嘅抵押品」。Bitcoin is infrastructure, not digital gold 呢個講法好好咁概括咗呢個轉變。機構唔再只係將 BTC 同黃金呢啲靜態資產比較,而係愈嚟愈多將佢視為多功能基建,可以支援借貸、結算、抵押同收益產生。呢種框架更符合資本市場實際運作方式——資產應該可以產生回報,而唔只係靠升值。

喺 DeFi 同傳統金融嘅關係方面,比特幣收益創造咗最有說服力嘅橋樑。機構配置者明白咩叫抵押品、利率同風險溢價。佢哋喺心理上更加傾向以 5% 利率借出比特幣,而唔會去 obscure 嘅協議度耕作治理代幣。隨住比特幣 DeFi 基建採用傳統金融標準——包括審計追蹤、合規框架、受監管嘅託管——鏈上金融同傳統金融之間嘅分野會變得冇咁重要。資本會流向風險調整後回報最高嘅地方,無論喺鏈上定鏈下。

資本市場有機會出現以比特幣計價或者喺鏈上結算嘅新工具。公司可能會發行以 BTC 償還嘅可轉換債券。各國財政部可以發行以比特幣計價嘅國庫券。國際貿易嘅結算系統可能會遷移到比特幣支付軌道。呢啲發展都取決於收益基建能否令比特幣變得足夠具流動性同生產力,使其可以作為貨幣使用,而唔只係一種資產。

值得關注嘅關鍵信號包括大型機構收益計劃嘅推出。如果有大型退休基金宣布採用比特幣收益策略,就等於為數以百計其他機構投資者提供咗正面示範。如果有主權財富基金將比特幣儲備部署到結構性收益產品入面,就代表連最保守嘅資金池都接受 BTC 收益呢個概念。每一個里程碑,都會為下一波機構採用降低門檻。

比特幣相關協議嘅鏈上 TVL,係直接反映部署活動嘅指標。目前估計少於 2% 嘅比特幣以生產性資本形式運作。如果增長到 5-10%,就代表有以千億計嘅新資本部署,很可能會觸發基建改善、收益率因競爭而被壓縮,以及比特幣作為合法財庫資產被主流接受。

釐清收益分類嘅監管框架會消除大量不確定性。比特幣借貸係唔係證券交易?寫覆蓋式買權(covered call)會唔會觸發特定註冊要求?跨境比特幣收益產品應該點樣處理預扣稅?呢啲問題嘅答案,會決定機構收益部署係繼續停留喺小眾領域,定係會變成標準做法。

比特幣價格波動同收益產生嘅關係,會創造出有趣嘅動態。較高波動會推高期權溢價,令覆蓋式買權策略更賺錢。較低波動則會令比特幣作為借貸抵押品更具吸引力,有機會增加借貸需求同貸出利率。對機構收益嚟講,最佳波動環境可能同價格升值嘅最佳環境唔一樣,從而喺追求最大升值嘅長期持有人(hodlers)同優化收入嘅收益策略參與者之間,產生潛在張力。

最後嘅想法

比特幣由閒置儲備資產轉型為生產性資本基建,係加密資產機構採用故事入面其中一個最重要嘅發展。第一階段係「取得接觸」,已經由 ETF 同受監管託管解決。第二階段係「產生收益」,而支援呢一階段嘅基建而家已經運作中。

對機構配置者嚟講,啟示好直接:比特幣持倉唔需要再淨係擺喺度。保守嘅借貸策略、市場中性衍生品倉位、同結構性收益產品,都提供咗可以媲美傳統固定收益資產嘅回報機制。雖然風險特徵唔同,基建亦較新,但基本嘅架構積木已經到位。

企業財務主管而家可以將比特幣視為營運資金,而唔只係投機性敞口。產生嘅收益可以抵銷託管成本、為投資組合帶嚟多元化,亦為資本配置創造更多選項。隨住愈來愈多公司展示成功部署案例,呢個模式好可能會喺唔同行業同地區擴散。

市場參與者應該關注乜?大型機構收益計劃嘅公告,會標誌住主流接受程度。比特幣相關協議嘅鏈上 TVL 增長,會展示實際部署活動。針對借貸、衍生品及結構性產品提供清晰指引嘅監管框架,會消除更廣泛採用嘅障礙。呢啲指標加埋一齊,就可以睇到比特幣收益會否維持為小眾策略,定係會成為標準機構實務。

呢個演變之所以重要,係因為比特幣嘅敘事會決定其採用路徑。如果 BTC 一直主要被視為「數碼黃金」——靜態、會升值,但本質上冇生產力——機構配置自然會受限。保守投資組合唔會持有大量冇收益嘅資產。但如果比特幣被認可為可以產生可預測、風險調整後回報嘅生產性基建,其可觸及嘅機構市場就會大幅擴張。

比特幣機構採用嘅下一階段,取決於收益部署能否被證明係可持續、可擴展同合規。早期證據顯示,基建正快速成熟、機構胃納強勁,而且監管框架亦正演化,以支援合規嘅收益產生。對於及早掌握呢個轉型嘅機構,戰略優勢可能會相當可觀。