本週加密市場堪稱混亂與逆轉並存,投資者目睹閃崩、突發上架及大膽治理舉措。OM價格一年來最驚人暴跌,暴瀉逾九成;同時,SPA、COMBO等代幣亦因質押熱潮及品牌重塑出現顯著反彈。

同時,AERGO因突如其來的Binance合約上線,再度成為市場焦點,無懼早前下架威脅。隨著迷因幣炒作熱度稍退,企業級公鏈與治理驅動型代幣重新受到關注。以下是本週備受關注的10枚代幣。

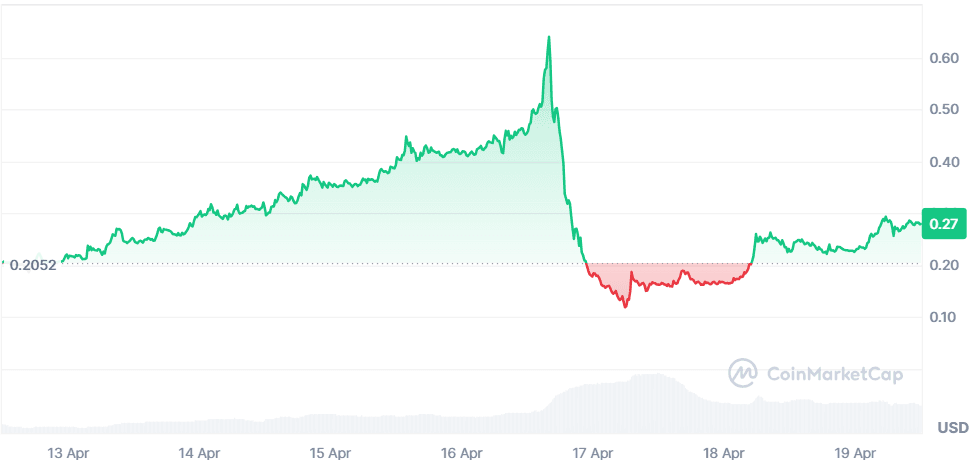

AERGO (AERGO)

7日價變: +36.09%

現價: $0.2793

消息

AERGO繼上週後再度成為焦點。Binance宣布下架後突然開放AERGOUSDT永續合約,槓桿高達15倍。三星、韓新銀行及現代汽車為其背書,企業應用定位引來市場持續關注。近期亦與BitGo合作,提供機構級托管,展現其對安全和合規區塊鏈架構的承諾。這些發展重燃投資者信心,令AERGO成為混合型企業區塊鏈強勁競爭者。

預測

Binance合約上線後AERGO急升,現正於高位整固。RSI徘徊約64,呈輕微超買。只要守穩$0.24支持線,有望繼續上攻$0.33。如RSI重上70且成交配合,短線突破機會濃。若失守$0.24,可能回試$0.21。需留意槓桿爆倉情況捕捉轉勢信號。

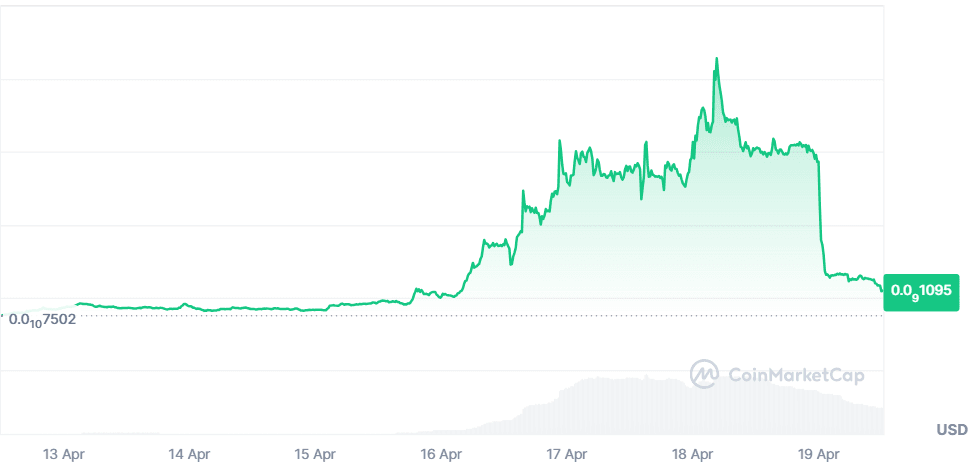

ArbDoge AI (AIDOGE)

7日價變: +46.06%

現價: $0.0000000001093

消息

ArbDoge AI於Bitget推出USDT永續合約(槓桿高達20倍且支援機械交易)後短暫抽升。然而,鯨魚集中度極高(84.39%)、用戶對獎勵分發及質押提款問題的質疑,加上網站基建多次故障,導致信心下滑。雖然自稱完全去中心化,但其創辦人已透露因個人原因暫時離場,項目缺乏明確領導層,透明度與可行性備受市場質疑,信任大幅下降。

預測

技術面來看,AIDOGE飆升後急跌,RSI跌穿30,屬極度超賣。惟買方成交淡薄,下一個需求區約$0.000000000097。如價格穩定並RSI上回40,短線或回彈至$0.00000000013。但鯨魚沽壓及不明朗因素,限定升幅。風險極高,後市或見劇烈波動或死貓彈。

COMBO (COMBO)

7日價變: +266.03%

現價: $0.03174

消息

COMBO原名Cocos-BCX,曾被市場忽略甚至面臨下架。本週因品牌重塑單週暴升近300%,成交量報升581%,鯨魚投機活躍,其中單筆高達$581K交易引起關注。市況樂觀,社群有61%看好。惟現時缺乏具體產品進展及應用消息,長線可持續性仍受質疑。

預測

COMBO曾見RSI高達78,屬嚴重超買。$0.06跌至$0.03顯示炒作降溫。倘若RSI失守60且成交配合不足,或會回落$0.026支持。但如守住$0.03並出現牛市背馳,可望再測$0.045。波動大,適合短線炒家進場,長線則耐心候$0.025區域確認。

Stratis [New] (STRAX)

7日價變: +52.11%

現價: $0.0638

消息

STRAX本週幾近暴升七成,主要由於市場炒作Web3遊戲/AI潛在合作及網絡升級、硬分叉等未確定傳聞,資金湧入帶動成交量升至上週5倍。STRAX突破多個技術阻力,暫未獲官方確認。短線資金與技術炒家主導今波升勢。

預測

RSI約71,接近超買邊緣。若市場消息落實有望上試$0.075–$0.08區間,否則獲利回吐壓力大,短期或回落$0.058–$0.062。需留意成交,若買盤轉弱恐加劇回調。若日線收高於$0.065且量能配合,有望短暫延續升勢。

Ardor (ARDR)

7日價變: +76.70%

現價: $0.1144

消息

ARDR曾被Binance列入“投票下架”,但最終本週反升,成為平台最大升幅幣種之一,單週漲幅逾110%。市場重視其“父子鏈”模塊化架構建基於Nxt區塊鏈,並強調能源效率。連串鏈上討論及潛在升級憧憬,令ARDR不單因抗議炒作,更有基本面支持。

預測

ARDR受投機熱潮帶動,RSI近68。若成交保持高水平,有力挑戰$0.125–$0.13。但Binance正式下架風險仍在,一旦發生或會急跌,失守$0.105支持則或見$0.09。技術面需觀察RSI頂背馳或MACD死叉,建議嚴設止蝕。

Raydium (RAY)

7日價變: +24.20%

現價: $2.22

消息

Raydium憑推出自家LaunchLab代幣創建平台重燃市場熱潮,意圖與Pump.fun競爭。此前,Pump.fun已撤離Raydium流動性池,令成交下跌。LaunchLab引入LP質押鎖定、推薦賺SOL分紅、自動流動性遷移及25% RAY回購等新功能。推出後RAY價升至$2.33,日成交暴增180%,生態鏈有望重回主導。

預測

日線結構偏強,RSI約60,尚有上升空間。如重上$2.30且成交配合,下站料挑戰$2.45。若於$2.15–$2.22整固,有利牛市累積。反之,失守$2.10或令市況逆轉,跌向$1.95。應緊盯成交及RSI變化,以確定牛市延續。

Threshold (T)

7日價變: +37.86%

現價: $0.01969

消息

Threshold Network 因宣布DAO架構重組及通過TIP-103進行T幣回購和再投資策略而急升。tLabs接手開發、營銷和DeFi整合,邁向可持續發展,營運成本每年節省逾$1.1M。DAO已完成3,000萬T幣回購,需求強勁。現佔有$8-9M儲備及約4.2億T幣多簽保管,搶攻擴展,尤其tBTC於DeFi平台應用增長。

預測

T突破$0.017阻力引發市場關注,RSI約67,顯示有望持續... bullish bias. A close above $0.02 could target $0.023 next. If RSI crosses 70, short-term overheating might cause a pullback toward $0.017–$0.018. On-balance volume (OBV) remains strong, signaling accumulation. As long as support holds, Threshold could continue its bullish structure into the next week.

強勢走向。若收市價升穿 $0.02,下個目標或指向 $0.023。若RSI突破70,短線過熱可能會引發價格回調至 $0.017–$0.018。OBV(能量潮指標)持續強勁,顯示資金正在累積中。只要支撐位保持,Threshold 有望將強勢結構延續至下星期。

Gomble (GM)

Price Change (7D): +25.38%

Current Price: $0.02481

News

GM received a boost from its multi-exchange listings, including Binance Alpha and Coinone, alongside airdrop events and token claiming challenges. Bitget also launched a special $4,600 GM earning event. The unique claiming system allows community members to either vest or engage in a multiplier-based “challenge” for early access. The transparency around investor and team token unlocks has been well-received, reinforcing trust. These mechanics seem designed to retain user attention while preventing rapid token dumps.

GM 最近因多間交易所上架帶動,包括 [Binance Alpha] 及 [Coinone],同期亦舉辦了空投活動和領取挑戰賽。[Bitget] 亦推出了總值 $4,600 GM 嘅特別賺取活動。佢哋的獨特領取系統,允許社群成員選擇鎖倉或參加倍率“挑戰”提早領取。團隊及投資者解鎖資訊透明,增強咗用戶信心。此一系列設計旨在吸引和保留用戶注意力,同時防範代幣被短時間內大量拋售。

Forecast

GM’s RSI sits at a healthy 59, suggesting it still has room to run. After rejecting resistance near $0.035, it’s now finding support at $0.023–$0.025. If this range holds, and volume picks up again post-Binance airdrop, GM could retest $0.03. If momentum fails and RSI dips below 50, expect a correction to $0.021. While short-term sentiment is bullish, cautious optimism is advised given the project’s novelty and speculative tokenomics.

GM 嘅 RSI 保持健康,約為59,意味仍有上行空間。試穿 $0.035 阻力失敗後,目前尋找 $0.023–$0.025 支撐。假如呢個區間建立得到,加上Binance空投後交易量再度增加,有機會重測 $0.03 水平。如動能未能持續、RSI 跌穿50,或會回落至 $0.021。總體短線氣氛偏好,但考慮項目本身新穎,以及獎勵及代幣經濟屬投機性質,仍要保持審慎樂觀。

Sperax (SPA)

Price Change (7D): +42.64%

Current Price: $0.02068

News

SPA rallied after a new governance proposal (SIP-70) was introduced, seeking to pause token minting and renounce contract ownership - a strong decentralization move. This followed the failure of SIP-69 due to quorum issues, prompting adjustments in voting configurations. The listing on Pionex and updates showing healthy protocol activity - like $8.48M TVL, 4.083% APY, and 343M SPA locked in veSPA - strengthened confidence. The token burn of nearly 15K SPA this week and consistent staking engagement also signaled commitment to deflationary supply and community alignment.

[SPA] 於推出新治理提案 ([SIP-70]) 後抽升,該提案主張暫停鑄幣以及棄權合約持有,屬於重大去中心化舉措。此前SIP-69因法定人數不足未能通過,導致投票設定進行調整。獲得 [Pionex] 上架及近期公佈的[協議數據](包括 $8.48M TVL、4.083% APY、343M SPA 被鎖於 veSPA)亦加強外界信心。本週接近1.5萬SPA 被銷毀,加上穩定的質押活動,顯示團隊致力於銳減供應及社群目標一致。

Forecast

SPA’s RSI is around 62, supporting its bullish momentum. The coin has retraced from a high near $0.027 and is consolidating near $0.020 support. A sustained push above $0.022 could open room for a climb toward $0.025. However, waning volume and a rising wedge pattern may suggest near-term pullback risk. Watch for RSI divergence or MACD crossovers—these could hint at upcoming exhaustion. Support sits at $0.0185 in case of correction.

SPA RSI 約為62,反映強勢動力。幣價自 $0.027 高位回吐,現階段於 $0.020 支撐整固。若能穩定升穿 $0.022,可望挑戰 $0.025。但交投量趨弱,加上形成上升楔形,有可能短期調整。留意 RSI 背馳或 MACD 死叉,皆可能預示動力快將耗盡。若出現回調,$0.0185 構成支撐。

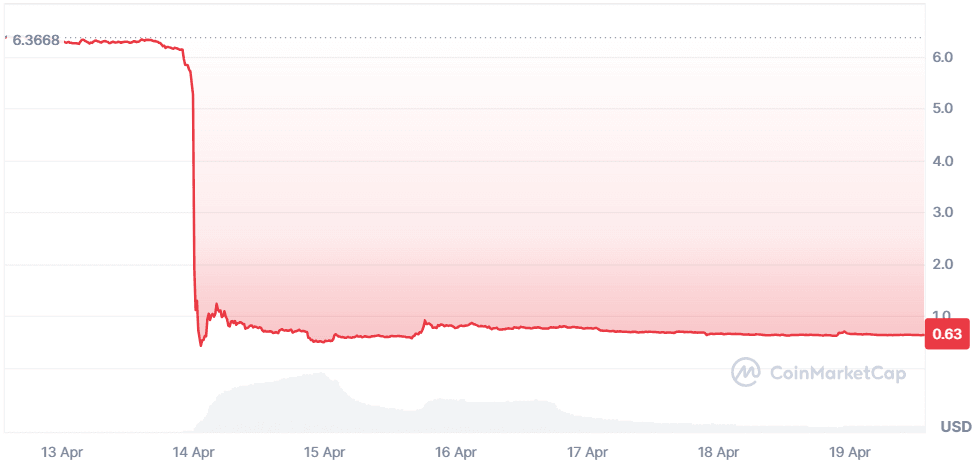

MANTRA (OM)

Price Change (7D): -89.95%

Current Price: $0.6396

News

OM experienced a catastrophic crash of over 90%, plunging from above $6.30 to under $0.50 due to forced liquidations during low-liquidity hours. The sell-off was traced to legacy ERC-20 tokens, not team allocations, which remain locked on the MANTRA Chain mainnet. In response, the MANTRA team launched a multi-step recovery plan including token buybacks, burns (300M OM burned), and a transparency dashboard. While regulatory approval in Dubai and RWA partnerships remain bullish long-term indicators, investor sentiment is shaken.

[OM] 遭遇史無前例崩盤,於流通量低迷時段因強制平倉暴跌逾九成,從 $6.30 上方插水至 $0.50 以下。調查發現沽壓主要來自 [舊ERC-20代幣],而非團隊配發,後者仍鎖於MANTRA Chain主網。團隊現已啟動多步復甦計劃,包括 [代幣回購]、[銷毀300M OM] 與透明度儀表板。雖然 [杜拜監管批准] 及RWA合作屬長線利好,但投資者信心仍極度受挫。

Forecast

OM is in a fragile recovery zone, trading around $0.63 with RSI near 35, signaling oversold territory. If it holds above $0.60, a technical rebound toward $0.75 is possible, but broader structure remains bearish. A bear pennant pattern is forming, and failure to break above $0.70 with conviction could result in a drop to $0.55 or lower. Until confidence returns through execution of its roadmap, traders should expect continued volatility and sharp intraday moves.

OM 現時於極為脆弱的復甦區間徘徊,交投於 $0.63 左右,RSI 低見35,踏入超賣區。假如守穩 $0.60,有望技術反彈至 $0.75,但大方向仍屬弱勢。正形成熊旗型態,假如不能有力突破 $0.70,或會跌返 $0.55 甚至更低。未來除非路線圖明確實踐重建信心,否則預期市況將高度波動,日內波幅極大。

Closing Thoughts

This week’s crypto market painted a stark contrast between meme-fueled hype and protocol-driven utility. Governance and infrastructure tokens like AERGO, SPA, and T saw renewed investor trust, largely due to active ecosystem upgrades, staking metrics, and structured reforms. These coins drew in more community and institutional participation, especially as traders moved away from volatile meme sectors after AIDOGE's selloff and OM’s crash exposed liquidity gaps.

While sectors tied to real-world assets and DeFi infrastructure (like Raydium and MANTRA) saw heavy activity, it was the hybrid blockchain and tokenomic reform stories that stole attention. Coins backed by strong narratives—be it decentralization, token burns, or ecosystem expansion—continued to outperform. As we move forward, market sentiment appears to be shifting toward sustainable growth plays over speculative pumps, setting the stage for a more utility-driven bull cycle.

結語

今個星期加密市場呈現鮮明對比:一方面係meme幣炒作熱潮,另一方面係協議應用及實用性項目。AERGO、SPA、T 等治理與基建類代幣,因生態升級、質押指標及結構性改革,重獲投資者信心。尤其係AIDOGE拋售潮及OM閃崩揭示流動性缺口後,越來越多資金及社群轉向這類穩健項目。

雖然連結現實資產及DeFi基建(如Raydium、MANTRA)領域依然活躍,但真正吸睛的反而是混合區塊鏈、代幣經濟革新等議題。凡是有明確主題(如去中心化、銷毀、擴大生態圈)的項目,表現依然搶眼。展望未來,市場情緒似乎已漸漸偏向可持續增長而非純炒作,為下一輪以實用性為主導的牛市鋪路。