每間大型銀行都話自己有應用人工智能。無論係服務聊天機械人、防詐騙系統、定係量化交易,佢哋都不斷宣布各種AI方案。但大部份都只係響舊有基建加少少自動化,未去到根本性改革。

2025年金融業要諗的真正問題,唔係銀行會唔會用AI,而係AI會唔會徹底重塑銀行業 —— 將所有業務流程、決策同客戶互動全部交俾人工智能,做到真正「智能銀行」。

摩根大通,依家全球市值最大嘅銀行,正推行所謂「全面AI連結企業」,等每個員工都有AI代理人,幕後流程全面自動化,用AI去優化每個客戶體驗。呢種願景遠遠超越咗一般銀行科技方案表面自動化,而係試圖由根本重新定義銀行係乜野同點樣運作。想明白呢場變革,要分清市場炒作同真正系統性改變,睇清今日新技術能力,以及佢帶嚟既組織、經濟同監管深遠影響。

呢場博弈,形勢重大。顧問公司麥肯錫估計,如果銀行可以將生成式AI全面應用響合規、客戶服務、程式開發同風險管理,每年可以多賺2,000至3,400億美元。但要落實呢個潛力,不止係買新工具咁簡單。仲要由頭起過銀行基建,拆解舊有系統、適應不明朗監管環境,兼且管理行業大洗牌,影響成個勞動市場。

文章會深入探討點樣建立真正嘅AI銀行。會用摩根大通作案例,分析AI點轉變核心業務,解釋獨立決策嘅AI「代理人」系統點生成,研究對勞動力的影響,評估競爭格局,檢視執行挑戰、監管同道德問題,分析傳統銀行AI同DeFi(去中心化金融)有咩唔同。最終會描繪當AI銀行成熟時,金融機構同智能系統之間界線會幾咁模糊。

定義AI銀行:唔再只係表面自動化

「AI銀行」呢個詞已經俾人用到無意思。其實而家每間銀行都用緊機器學習做信用評分、防詐騙、客戶分層等,雖然都係好大嘅技術進步,但唔代表根本性改革。想清楚一間AI為本銀行同傳統銀行加AI工具有咩分別,要睇下面幾個特點:

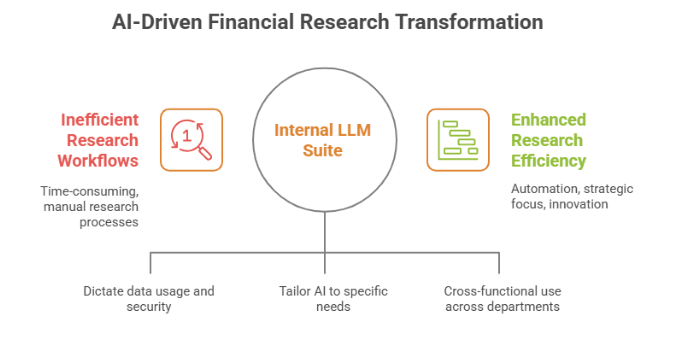

第一,AI銀行會將人工智能滲透入整個業務堆疊,而唔係得零碎部署。傳統銀行AI通通常係散落響某啲地方:嗰度做反詐騙,呢度有聊天機械人,可能某啲市場會有量化交易,但好少會互聯互通。一間真AI銀行,會搭建一個統一智能層,連結所有系統、數據庫同流程。例如摩根大通嘅LLM Suite,就係一個用OpenAI及Anthropic大型語言模型的人機入口,銀行不斷將自己各個大型業務的數據同軟件餵畀模型,每八星期更新一次。

第二,AI銀行會用到能夠自動執行複雜多步流程、需要極少人類監督嘅「代理人」AI系統。呢個係自動化質的飛躍。以前銀行科技只係自動化某一小段程序 —— 例如入數、出報表、搜旗可疑交易等,全部都只靠一套規則。啱啱興起的「代理人」AI,可以應對模糊情境、識得按環境下決策、協調流程,以前要人判斷嘅嘢都慢慢交由AI。例如摩根大通已開始試行用AI代理人幫員工做多步流程決策,而且幅度愈來愈大,可能愈嚟愈多崗位會被AI取代或重整。

第三,真AI銀行會以AI能力重新設計整個工作流程 —— 唔淨係用AI去強化現有職位,而係重組崗位、通報架構同業務流程,完全發揮AI優勢。呢點極關鍵。一間銀行俾交易員用AI分析,咁係強化傳統角色;但如果用AI代理執行交易,由人監督,咁個交易崗位本質上已經唔同哂。

第四,AI銀行會建立「持續學習系統」,透過不斷接觸真實運作數據嚟自我提升。唔同死板舊軟件,AI系統會日積月累咁學習,觀摩每個客戶互動、交易模式、市場變動同運作結果,形成一種「複利優勢」,對複雜模式理解會不斷精進。

最後,AI銀行會將原本多重決策流程自動化到尾,抹走人要插手的環節。人類角色會由「實做」變成「指揮監督」,好似指揮家咁調度機器智慧,而唔係逐件手動做。

呢幾個特點,先叫根本性變革,唔係淨係逐步改善。其實今日大部分銀行都係介乎傳統與真AI銀行之間。摩根大通依家係最前線推動全面AI化嘅例子之一。

摩根大通:AI優先銀行藍圖

摩根大通AI轉型,係行內最完整示範大銀行點樣用AI重建自己。核心係LLM Suite專有平台,俾員工用上最頂尖語言模型,同時確保銀行運作需要的安全與合規。

佢由2024年夏季起推LLM Suite,140,000名員工用緊,八個月內衝上20萬人登記,係全行最大型生成式AI部署之一。咁爆場源於員工真係有需要,唔係上頭叫你裝嘅指令,證明AI有解決實際工作痛點。

技術架構反映摩根大通點樣平衡創新同機構要求。銀行冇自己由零起大型基礎模型 —— 即使佢每年科技預算有180億美元,成本都極高 —— 反而做咗一個入口平台,可以接駁多間外部AI模型。平台起步時用OpenAI,之後可按用途接入唔同模型,無需死綁一間供應商,方便追得上AI新突破。

安全及知識產權係設計重點。摩根大通唔俾員工用ChatGPT,就係驚銀行數據外洩,因此LLM Suite就算用OpenAI,都確保本身數據安全、唔會俾外面攞去訓練。哩點解決晒金融機構最大難題:AI要好用,必須食到大量數據,但銀行啲客戶、交易、策略資訊極敏感。用入口平台方法,AI能力照用,數據主權又能完全掌控。

LLM Suite功能涵蓋全行多個部門。投資銀行方面,AI大大加快準備材料嘅效率 —— 以前要分析員OT夜做嘅簡報,依家30秒內幫科技公司CEO起好五版PowerPoint。分析總監Derek Waldron示範LLM Suite短時間就組出完整投資簡報。銀行仲教AI起草幾百頁的併購保密書,裏面綜合咗複雜的財務、法律同戰略分析。

個人銀行方面,應用重心係提升業務效率同客戶服務。EVEE Intelligent Q&A生成式AI工具俾客戶主任,方便一問即搵到Chase政策或文件答案,加快處理效率同提升工作體驗。 and customer satisfaction. This addresses a persistent challenge in consumer banking: customer service representatives must navigate vast repositories of product information, regulatory requirements, and procedural guidelines. AI that can instantly surface relevant information transforms their effectiveness.

以及客戶滿意度。這正正解決咗消費者銀行業常見嘅一個難題:客戶服務專員要應對大量產品資訊、法規要求同埋流程指引。能夠即時彈出相關資訊嘅人工智能(AI)可以大大提升佢哋嘅工作效率。

For technology teams, JPMorgan deployed a coding assistant that has been playing a significant role in improving software development efficiency, with the bank seeing 10 to 20 percent productivity increases. Given that Goldman Sachs equipped 12,000 of its developers with generative AI and cites significant productivity gains, this application represents a broad industry trend. Software development represents a particularly strong use case for AI because coding involves translating requirements into logical sequences of instructions - precisely the kind of pattern-matching and generation task where language models excel.

對於科技團隊嚟講,摩根大通推出咗一個編程助手,有助提升軟件開發效率,銀行整體工作效率提升咗10至20%。再加上高盛早前為12,000名開發人員配備生成式AI,並表示生產力有顯著提升,呢個應用已經成為行業趨勢。軟件開發本身好適合用AI,因為編寫代碼就係將需求轉化成邏輯指令,而呢種模式識別同內容生成正正係語言模型嘅強項。

The most ambitious aspect of JPMorgan's initiative involves the transition from generative AI that creates content to agentic AI that executes processes. According to an internal roadmap, JPMorgan is now early in the next phase of its AI blueprint, having begun deploying agentic AI to handle complex multistep tasks for employees, with these agents becoming increasingly powerful in their capabilities and connectivity throughout the institution. This transition represents a fundamental escalation in AI's role, moving from assisting humans to autonomously executing tasks.

摩根大通最進取嘅一步,係由生成內容嘅AI(生成式AI),轉型成可以自主執行流程嘅AI代理(Agentic AI)。根據內部路線圖,摩根大通而家已經踏入AI藍圖嘅下一階段,開始部署Agentic AI去幫員工處理複雜多步驟嘅工作,呢啲AI代理會越嚟越強大,同公司內部各種系統連接。呢個轉變非常關鍵,標誌住AI喺企業入面由輔助人類,進一步演化成可自動完成任務。

The vision extends to complete organizational integration. JPMorgan's broad vision is for a future where the bank is a fully AI-connected enterprise, with every employee provided with AI agents, every behind-the-scenes process automated, and every client experience curated with AI concierges. Realizing this vision, however, faces substantial obstacles. Even with an $18 billion annual technology budget, it will take years for JPMorgan to realize AI's potential by stitching the cognitive power of AI models together with the bank's proprietary data and software programs, with thousands of different applications requiring significant work to connect into an AI ecosystem.

呢個願景更延伸至全公司層面嘅全面整合。摩根大通嘅宏觀目標,係打造成一間100% AI連結嘅企業,所有員工有AI助手支持,所有幕後流程自動化,每個客戶體驗都有AI禮賓員為其量身打造。不過,要實現呢個藍圖仍然有好多難關。即使年年有180億美元科技預算,摩根大通都需要幾年時間,先可以將AI模型嘅智能同銀行自家數據、各類軟件系統整合埋一齊,因為有成千上萬種不同應用要逐一納入AI生態,要落好多工夫。

The financial impact of JPMorgan's AI investments has begun materializing. The bank's first-quarter earnings in 2025 reflected the strategic importance of these innovations, reporting net income of $14.6 billion, up 9 percent year-over-year, with investments in AI and technology cited as major contributors to this performance. This validates the business case for AI transformation, demonstrating that the technology delivers measurable value rather than merely consuming resources in pursuit of speculative benefits.

摩根大通喺AI投資方面嘅成效已經開始浮現。2025年第一季財報反映咗這些創新措施嘅戰略價值-季度純利146億美元,比去年同期升咗9%,而AI同科技方面嘅投資被點名為主要推動力。呢個結果證明AI轉型嘅商業價值唔只停留喺願景,而真係帶嚟實質回報,唔係單單消耗資源、追逐未知利益咁簡單。

JPMorgan's approach offers important lessons about AI transformation at scale. First, the bank prioritized internal, employee-facing applications before launching client-facing AI products. This strategy allows institutions to capture immediate efficiency gains while battle-testing technology in controlled, lower-risk environments. Second, the portal architecture that leverages multiple external models while protecting proprietary data provides a template for other regulated institutions navigating similar security and compliance requirements. Third, the emphasis on comprehensive integration rather than isolated pilot projects reflects recognition that AI's greatest value emerges from system-wide deployment rather than point solutions.

摩根大通嘅做法,為大規模AI轉型帶嚟幾個重要啟示。第一,銀行優先發展內部、面向員工嘅應用,先於對客戶公開AI產品。呢個策略讓企業可以先行提升效率,同時喺可控、低風險環境試煉技術。第二,佢哋用嘅門戶式架構搵到個平衡點,即利用多個外部模型同時守護公司數據私隱,為其它有安全及合規要求嘅監管行業作出榜樣。第三,強調全面整合而唔係單獨試點項目,體現咗一個認知:AI最大價值係系統性落地,而唔係頭痛醫頭腳痛醫腳。

Transformation Across Banking Domains

Understanding how AI reshapes banking requires examining specific domains where the technology's impact manifests most dramatically. Each area of banking operations presents distinct challenges and opportunities for AI transformation.

要理解AI如何重塑銀行業,必須研究一下呢個技術喺唔同專業範疇中最突出嘅影響。每個營運領域都有其獨特難題同AI轉型帶嚟嘅機遇。

Investment Banking: From Analyst Armies to AI Augmentation

Investment banking traditionally operated through a hierarchical model where junior analysts performed grunt work - building financial models, creating presentations, conducting research - while senior bankers focused on client relationships and deal structuring. AI fundamentally disrupts this model by automating much of the analytical drudgery while augmenting strategic decision-making.

投資銀行長期運作喺高度層級分化嘅模式下,初級分析員會做晒啲「苦力」-起財務模型、整展示材料、做研究,高層就專注處理客戶關係同交易結構。AI從根本上打破咗呢個模式,大量分析性苦差可以自動化,戰略決策反而得到AI協助。

JPMorgan's demonstration of creating investment banking presentations in 30 seconds illustrates this transformation. The implications extend beyond simple time savings. Investment banks have long faced criticism for brutal junior analyst working conditions, with 80 to 100 hour weeks common for entry-level employees. If AI can handle tasks that previously consumed thousands of analyst hours, banks face decisions about workforce sizing and the traditional apprenticeship model where junior analysts learn by doing extensive analytical work.

摩根大通公開示範過用AI三十秒整好投資銀行PPT,呢個革新唔只幫大家慳時間咁簡單。投資銀行一向俾人詬病嘅,係初級分析員超長工時(新仔每週做足八、九十甚至一百個鐘),如果AI可以承包以往需要幾千人小時先搞掂嘅工作,銀行就要考慮人手規模同「傳統師徒制」嘅未來:以前新仔要做大量分析先學得嘢,AI令呢個模式大變。

AI's capabilities in this domain continue expanding. The systems can now analyze earnings reports, synthesize market research, build comparable company analyses, and generate initial drafts of pitch materials. They can scan news feeds for relevant information about clients and prospects, monitor regulatory filings for material changes, and flag potential deal opportunities based on pattern recognition across vast datasets.

AI喺呢個領域嘅能力仲不斷擴展。系統依家可以分析業績報告、整合市場研究、做同業比較分析,甚至自動寫初稿簡報。AI仲可以掃描新聞資訊、留意客戶及潛在目標嘅動態、追蹤監管申報,喺大量數據入面認識模式、捕捉潛在交易機會。

The strategic implications reach beyond efficiency. Investment banks compete largely on the depth of their industry knowledge, the sophistication of their analysis, and the speed with which they can respond to client needs. AI that rapidly synthesizes information across multiple sources and generates sophisticated analysis could compress the timeline for deal processes, raise analytical quality, and enable smaller teams to compete with larger institutions that traditionally wielded advantages through analyst armies.

影響唔止提升效率咁簡單。投資銀行最大競爭力其實係行業知識嘅深度、分析手法幾精密,以及對客戶需求嘅反應有幾快。如果AI可以極速整合同時分析多個資訊來源、產出高端分析報告,會令交易流程大為縮短、分析質素提升,細隊伍都可以同一向靠「人海戰術」起優勢嘅大行競爭。

However, investment banking also illustrates AI's current limitations. Deal-making fundamentally involves judgment calls about valuation, timing, competitive dynamics, and client relationships. While AI can inform these decisions by analyzing relevant data and generating options, the ultimate choices require human judgment shaped by experience, intuition, and interpersonal understanding that current AI systems lack. The most successful firms will likely be those that most effectively blend AI's analytical capabilities with human strategic insight.

不過,投資銀行亦說明咗AI現時嘅局限。成交過程其實要大量判斷-價值、時機、大市競爭同客戶關係。AI可以提供數據分析同選項,但最終決定要靠人類經驗、直覺同人情世故,呢啲現有AI未能做到。最成功嘅公司,應該係能夠將AI分析力同人類戰略判斷完美結合。

Retail and Consumer Banking: Personalization at Scale

Retail banking faces different challenges than investment banking. Rather than supporting small numbers of high-value transactions, consumer banking handles millions of relatively standardized interactions. AI's ability to deliver personalized experiences at mass scale makes it particularly powerful in this domain.

零售銀行要面對嘅挑戰同投資銀行好唔同。零售銀行唔係處理少量高價值交易,而係每日處理過百萬次、相當標準化嘅日常互動。AI能夠大規模提供個人化體驗,喺呢個領域表現尤其突出。

Fraud detection represents one of the most mature AI applications in consumer banking. Traditional rules-based systems flagged transactions that matched predetermined suspicious patterns - large cash withdrawals, international purchases, rapid sequences of transactions. These systems generated many false positives while missing sophisticated fraud schemes. Modern AI systems analyze vast numbers of variables simultaneously, recognize subtle patterns that indicate fraud, and continuously learn from new fraud techniques. JPMorgan uses AI to curtail fraud, and such systems now operate across the industry.

詐騙偵測係消費者銀行最成熟嘅AI應用之一。傳統規則式系統只會標記預設嘅可疑交易-例如大額提款、海外消費、連環交易等。呢啲方法好多時誤判,又會忽略精密詐騙手法。現代AI系統可以同時分析大量變數,察覺微細詐騙跡象,不斷學習新型詐騙花樣。摩根大通已經用AI控制詐騙,依類系統現時幾乎行業標配。

Customer service represents another major application domain. Banks like HSBC use generative AI to create customized product recommendations based on individual spending habits. Rather than offering the same credit card or savings account to all customers, AI analyzes individual transaction histories, identifies patterns, and suggests products aligned with specific financial behaviors and needs. This personalization extends to timing - AI can determine optimal moments to present offers when customers are most likely to engage.

客戶服務亦係另一個主要AI應用場景。例如滙豐銀行就用生成式AI根據用戶消費習慣提供個人化產品推薦。佢唔係一式一樣咁Offer信用卡或儲蓄戶口,而係AI分析每人消費歷史,搵出模式,推薦最切合其需求同財務行為嘅產品。呢種個人化連時間都可優化-AI判斷咩時候出Offer最容易吸引客戶反應。

Account management processes that traditionally required extensive human involvement increasingly flow through AI systems. Opening accounts, verifying identities, assessing creditworthiness, and resolving routine issues can all be handled through AI-powered systems with human intervention reserved for edge cases and complex situations. This dramatically reduces operational costs while potentially improving customer experience through faster processing and 24/7 availability.

以前要人手跟進嘅賬戶管理工序,依家越嚟越多交咗俾AI系統處理。開戶、身份認證、信貸評分、處理日常問題,全部可以自動化,只有特殊或複雜情況先由人介入。咁做大大降低營運成本,同時處理更快、更方便,仲可以24小時不間斷,潛在令用戶體驗更好。

The vision extends to AI-powered financial advisors that provide personalized guidance across the customer base. Banks leverage AI-powered insights to understand customer behavior more deeply, with algorithms analyzing spending patterns and financial behaviors to provide personalized recommendations, and advanced machine learning models assessing risk tolerance through both traditional questionnaires and behavioral data. This democratizes financial planning capabilities that previously required human advisors accessible only to wealthy clients.

遠景更進一步,包括AI理財顧問,為所有客戶提供個人化財務建議。銀行利用AI見解深入了解客戶行為-用演算法分析消費模式和財務行為,從而作出個人化建議;高階機器學習模型用傳統問卷加埋實際行為數據,評估客戶風險承受能力。咁做可以普及理財策劃嘅服務,令一般客戶都享有過去只屬有錢人先請到嘅專業建議。

The consumer banking transformation, however, raises important questions about financial inclusion and algorithmic bias. AI systems trained on historical data can perpetuate or amplify existing disparities in credit access, insurance pricing, and financial services availability. Banks deploying AI in consumer-facing applications must grapple with ensuring their systems treat all customers fairly while remaining profitable businesses.

不過,消費者銀行轉型亦引發出金融共融同演算法偏見等重要問題。AI只會根據過往數據訓練,有機會強化現有信貸門檻、保險定價或金融服務覆蓋不足嘅不公平狀況。銀行用AI做對客戶服務時,要點樣兩者兼顧:一方面照顧所有客戶公平對待,另一方面確保業務可持續發展。

Risk Management and Compliance: Intelligent Monitoring

Banking fundamentally involves managing risk - credit risk, market risk, operational risk, liquidity risk, and compliance risk. AI transforms risk management by enabling continuous, comprehensive monitoring at scales impossible for human analysts.

銀行本質上就係管風險-信貸、巿場、營運、流動性風險同合規風險等等。AI可以全方位、持續大規模監察,超越人類分析員所能,為風險管理帶來顛覆性變化。

Know Your Customer and Anti-Money Laundering processes exemplify AI's impact on compliance operations. HSBC's AI-powered approach enables the bank to navigate contemporary financial crime complexities by identifying unusual patterns and potentially illegal activities, proving far more effective at distinguishing between normal and suspicious behavior than traditional methods. Traditional compliance systems relied on rules-based screening that

「了解你的客戶」(KYC)以及反洗錢流程,正正體現出AI對合規操作嘅影響。例如滙豐銀行引入AI後,可以辨識不尋常嘅交易模式或潛在非法活動,大大提升釐定正常同可疑行為嘅能力,成效明顯優於舊有乏力嘅規則式篩查系統。generated enormous numbers of alerts requiring manual review. Most proved to be false positives, consuming compliance staff time while creating risk that true suspicious activity might be buried in the noise. AI systems apply more sophisticated pattern recognition, learn from feedback about which alerts prove meaningful, and dramatically improve the signal-to-noise ratio.

產生了大量需要手動審查的警示,大部分都證明是誤報,不僅消耗合規人員的時間,還有可能令真正可疑的活動被噪音淹沒。AI系統運用更高級的模式識別技術,並從哪些警示屬於真正有意義這些反饋中學習,大大提升訊號與噪音之間的比例。

Credit risk assessment illustrates how AI enables more nuanced evaluation. Credit risk assessment has evolved from analyzing 8 to 10 variables into a sophisticated system capable of processing over 100 different factors simultaneously. This allows banks to extend credit to customers who might be declined by traditional scoring models while more accurately identifying high-risk borrowers. The implications for financial inclusion are significant - many individuals and small businesses historically denied credit because they don't fit standard profiles may gain access through AI systems capable of recognizing creditworthiness through alternative data and more sophisticated analysis.

信貸風險評估正好顯示AI如何實現更細緻多元的分析。信貸風險評估已由只分析8至10個變數,發展到能夠同時處理超過100個不同因素的先進系統。這讓銀行能夠批出貸款予傳統評分模式下可能會被拒的客戶,同時亦能更準確地識別高風險借款人。對於金融共融的影響極為重大——不少過往因不符合標準客戶檔案而被拒貸的個人或小型企業,現時可憑AI系統利用替代數據及更深入的分析方法,獲得信貸機會。

Market risk management benefits from AI's ability to process vast amounts of market data, news, and social media sentiment in real-time, identifying correlations and predicting volatility patterns that inform trading positions and hedging strategies. AI analytics tools process market data faster and more accurately than humans, spotting trends and predicting behavior with superior precision.

市場風險管理方面,AI可以即時處理大量市場數據、新聞及社交媒體情緒,找出相關性並預測波動模式,幫助決定交易倉位及對沖策略。AI分析工具處理市場數據的速度及準確度均大大超越人類,更能精準捕捉趨勢和預測市場行為。

Regulatory compliance increasingly relies on AI to navigate the complexity of financial regulation. Investments like BBVA's stake in Parcha, which builds enterprise-grade AI agents that automate manual compliance and operations tasks including reviewing documents, extracting data, and making decisions on onboarding, compliance, and risk management, illustrate banks' recognition that AI is essential for managing regulatory burdens. The volume of regulatory requirements, the frequency of updates, and the need to apply rules consistently across thousands of transactions make compliance a natural fit for AI.

合規監管方面,金融機構愈來愈多地依靠AI來應對複雜的監管要求。例如BBVA投資Parcha,該公司開發企業級AI agent自動化手動合規及營運工作,包括審查文件、提取數據及處理客戶開戶、合規和風險管理等決策,反映銀行認同AI在管理繁重監管壓力上不可或缺。規管要求的數量、更新頻率及須在成千上萬單交易中一致執行,使合規天然地適合引入AI。

Treasury Operations and Trading: Speed and Precision

Trading represents one of the earliest and most extensive applications of AI in banking. Algorithmic trading has dominated equity markets for years, with AI-powered systems executing trades at microsecond speeds, managing complex portfolios, and identifying arbitrage opportunities faster than any human trader could comprehend.

交易是銀行業最早、最廣泛應用AI的領域之一。程式交易多年來主導股票市場,AI系統能以微秒級速度執行交易、管理複雜投資組合,並比任何人類交易員都更快識別套利機會。

The current wave of AI extends beyond traditional algorithmic trading into more sophisticated applications. AI systems now incorporate natural language processing to analyze earnings call transcripts, news articles, and social media for sentiment signals that might move markets. They apply machine learning to recognize patterns in order flow that indicate institutional positioning. They optimize trade execution strategies based on market microstructure analysis that considers liquidity, volatility, and transaction costs across multiple venues.

目前AI的應用已超越傳統程式交易,進入更高層次。AI現時應用自然語言處理,分析業績電話紀錄、新聞報道及社交媒體,以捕捉可能影響市場的情緒訊號;同時運用機器學習分析訂單流中的模式,推斷機構持倉;並根據市場微觀結構分析,包括流動性、波動性和跨市場交易成本,優化執行策略。

Treasury operations benefit from AI's ability to optimize liquidity management, predicting cash flows across the institution, determining optimal deployment of capital, and managing collateral requirements efficiently. These back-office functions lack the glamor of front-office trading but represent enormous operational complexity and significant optimization opportunities.

財資部門受益於AI提升流動性管理,包括預測全行現金流、決定最優資金配置,以及有效管理抵押品要求。雖然這些後勤職能未及前台交易矚目,卻涉及巨大運作複雜度及優化潛力。

The competitive dynamics in AI-powered trading create a technological arms race. Institutions that deploy more sophisticated AI, access better data, or achieve faster execution speeds gain advantages that translate directly into profitability. This drives continuous investment in AI capabilities and infrastructure, with banks spending on AI initiatives projected to increase from $6 billion in 2024 to $9 billion in 2025, and potentially as much as $85 billion by 2030.

AI主導的交易領域形成「科技軍備競賽」格局。部署更高階AI、獲取更優質數據或達到更高執行速度的機構可直接轉化為盈利優勢。這推動銀行不斷加大AI能力和基建投資,預計相關開支將由2024年的60億美元,增至2025年的90億美元,並有望在2030年升至850億美元。

Operations: The Invisible Transformation

Banking operations - the behind-the-scenes functions that settle trades, reconcile accounts, process payments, and maintain systems - represent the largest single opportunity for AI-driven efficiency gains. These functions employ enormous numbers of people performing repetitive, rules-based work that AI can increasingly handle.

銀行營運——即背後完成交易結算、帳目核對、付款處理及系統維護等流程——是AI驅動效率提升最大的單一機會。這些職能涉及大量人員從事重複及規則式工作,而AI現時已可逐漸取代。

AI-powered automation has reduced the cost of routine banking operations by 25 to 30 percent for institutions like Wells Fargo, which uses AI to automate mortgage processing, saving millions in operational costs each year, while Citibank reports AI reduced document processing time by 60 percent, contributing to significant cost savings. These efficiency gains manifest not only in reduced costs but also in faster processing times, fewer errors, and improved customer experience.

AI自動化令富國銀行等機構的日常營運成本減少25%至30%,如透過AI處理按揭程序,每年節省數百萬營運開支;花旗銀行則表示AI令文件處理時間縮短60%,帶來可觀成本效益。這些效益除了削減成本,亦令處理時間更快、錯誤更少、客戶體驗更佳。

The implications for employment in banking operations are profound. These roles represent exactly the kind of work AI systems excel at automating - high-volume, rules-based, repetitive tasks that require accuracy but not creative problem-solving or complex judgment. Banks face difficult questions about how to manage workforce transitions as automation eliminates jobs that currently employ hundreds of thousands of people.

而銀行營運崗位的就業影響重大,因為這些正正是AI最擅長自動化的工種——大量、高度規則性、需精確但毋須創意或複雜判斷的重複性任務。當自動化取代全行數以十萬計現有職位時,銀行如何推動員工轉型,成為迫切難題。

Agentic AI: The Decisive Technological Shift

Understanding what makes current AI transformation fundamentally different from previous waves of banking automation requires examining agentic AI - systems capable of autonomous multistep reasoning and action with minimal human oversight. This represents a qualitative leap beyond earlier AI applications.

要理解今次AI轉型為何本質上與過往銀行自動化不同,必須認識 agentic AI —— 能夠自主地進行多步推理和執行任務,而只需要最少人類監督的系統。這種改變比以往的AI應用有「質的飛躍」。

Traditional banking automation worked through predetermined rules. A system might automatically flag a transaction that exceeded certain thresholds, but a human decided how to respond. It might route customer inquiries to appropriate departments, but humans handled the actual interactions. It might generate standard reports, but humans interpreted them and made decisions. These systems followed scripts, and breaking from those scripts required human intervention.

傳統銀行自動化主要依賴預設規則:例如系統可自動標記超出限額的交易,但如何跟進則需人類決定;亦會按查詢將客戶分流至相關部門,實際溝通仍需人手;系統可產生標準報告,但由人類去解讀及下決定。所有這些系統都遵照「預設劇本」運作,稍有偏離便要人手介入。

Agentic AI operates differently. These systems can pursue goals through sequences of actions they determine autonomously. They reason about what steps are necessary to accomplish objectives, make decisions at each stage, and adapt their approach based on outcomes. They operate more like human employees who receive high-level direction and figure out how to execute than like traditional software that follows explicit instructions.

Agentic AI 則完全不同。這些系統能根據目標,自主決定一連串行動步驟,並會分階段推理每一步所需、制定決策並按結果調整策略。它們的運作模式,比傳統只是依照指令的軟件,更接近於一個只能獲得大方向指示、然後自己想辦法執行的「人類員工」。

The technical capabilities enabling agentic AI emerged from advances in large language models. These models demonstrate something approaching general reasoning abilities - they can understand complex instructions, break problems into components, generate plans, and evaluate options. When combined with the ability to use tools and access data, they become capable of sophisticated autonomous behavior.

支持 agentic AI 的技術,來自大型語言模型的突破。這些模型具備初步的一般推理能力:能理解複雜指令、將問題拆解、制定計劃及評估多個選項。配合使用工具及數據的能力後,便能展現高度自主行為。

Consider a concrete example from investment banking. A traditional automation system might generate a standard financial analysis based on a template and predefined data sources. An agentic AI system, by contrast, could receive a high-level instruction like "prepare materials for a meeting with a potential acquisition target" and then autonomously determine what information to gather, which analyses are most relevant, what comparisons would be useful, and how to structure the presentation. At each step, the system reasons about options and makes choices without explicit human direction.

以投資銀行為例,傳統自動化只會根據範本及預設數據自動生成標準分析報告;但 agentic AI 可以收到「為潛在收購對象準備會議材料」這些較籠統指示後,自主決定要搜集甚麼資料、哪些分析最相關、要做甚麼比較,以及如何組織報告。每一步都能獨立推理和作出選擇,毋須明確的人手指令。

Capital One owns one of the only public agentic use cases in Chat Concierge and plans to use its same agentic framework to build other tools around the bank. The system demonstrates how agentic AI can handle complex customer interactions autonomously, understanding intent across multiple conversation turns, gathering necessary information, and taking action to resolve issues without human intervention.

Capital One 是其中一間擁有公開 agentic AI 應用(聊天客戶服務)的銀行,並計劃運用同一架構開發其他銀行工具。這個系統展示了 agentic AI 如何自動處理複雜客戶互動:能理解多輪對話的意圖、搜集所需資料並自動採取行動解決問題,無需人手介入。

The implications of widespread agentic AI deployment extend far beyond efficiency. These systems fundamentally change the nature of work by shifting humans from task execution to supervision and goal-setting. An investment banking analyst spends less time building models and more time formulating questions and evaluating AI-generated analyses. A compliance officer spends less time reviewing individual transactions and more time establishing parameters for AI monitoring systems and investigating flagged cases. A trader spends less time executing orders and more time developing strategies that AI trading agents implement.

agentic AI被廣泛應用會帶來遠超效率的影響:它改變了工作本質,將人類由執行工作轉變為監督及設定目標。例如投行分析員會減少模型搭建時間,改為聚焦設計問題及審視AI生成的分析結果;合規人員不再逐宗審查交易,而是建立AI監察系統的參數及深入調查警示個案;交易員亦會少做下單,轉向設計策略供AI交易agent執行。

This transformation creates both opportunities and challenges. On one hand, it potentially frees humans from tedious tasks and allows them to focus on higher-value activities requiring creativity, judgment, and interpersonal skills. On the other hand, it threatens to displace workers whose roles consisted primarily of tasks that agentic AI can now handle. The transition period - where some institutions have deployed agentic AI while others have not - creates significant competitive advantages for early adopters.

這場轉型既帶來機遇,亦充滿挑戰。一方面,它有望為人類擺脫乏味重複工作,令大家可以將心力投放到更高增值、需創意判斷及人際技巧的活動。另一方面,如今 agentic AI 已能自動化的崗位將面臨消失風險。過渡期間,率先部署 agentic AI 的機構將取得明顯競爭優勢。

The technology also raises important questions about control and accountability. When an agentic AI system makes a sequence of decisions that leads to a poor outcome, who bears responsibility? The employee who set the system's goals? The institution that deployed the technology? The AI developers who created the underlying models? Traditional concepts of accountability assume human decision-makers whose judgment can be evaluated and who bear responsibility for outcomes. Agentic AI complicates these assumptions by distributing decision-making across human-AI systems in ways that obscure individual responsibility.

這技術同時引發對控制及問責的重大爭議——若 agentic AI 一連串決策導致不良後果,究竟應由誰負責?是設定目標的員工?部署系統的機構?還是開發基礎模型的AI工程師?傳統問責觀念基於人類決策者可被評估及承擔結果責任,但 agentic AI 把決策分拆到人機聯合系統之中,令責任歸屬變得模糊。

As agents become increasingly powerful in their AI capabilities and increasingly connected into JPMorgan, they can take on more and more responsibilities, but this shift also brings challenges with ensuring reliability, security, and transparency paramount

隨著這些agent在AI能力不斷提升並進一步融入摩根大通的系統,能夠承擔越來越多重要任務,但這種轉變同時對可靠性、安全和透明度等方面帶來極大挑戰。as these agents make more consequential decisions, requiring robust governance frameworks, continuous monitoring, and ethical guardrails to manage risk and compliance. Banks deploying agentic AI must develop new governance frameworks that account for autonomous AI decision-making while maintaining accountability and regulatory compliance.

隨着這些智能代理能作出更具影響力的決策,銀行必須建立強而有力的管治框架、持續監察及設置道德防線,以管控風險及合規要求。推行主動型AI的銀行,必須制定新型管治框架,同時兼顧AI自主決策、責任歸屬以及符合法規的要求。

Workforce Disruption: Beyond Automation Anxiety

人力資源動盪:不只是自動化焦慮

The employment implications of AI banking transformation extend far beyond simple automation displacing workers. The impact manifests through complex dynamics involving workforce composition changes, skill requirement shifts, geographic labor distribution, and fundamental questions about the future nature of banking employment.

AI帶來的銀行業轉型,對就業的影響遠不止於自動化取代人手。這種影響涉及人力結構改變、技能需求轉變、地理勞動分佈重新劃分,以及對銀行業未來工作性質的根本性疑問,變化複雜且層面廣泛。

The Displacement Reality

崗位流失的現實

Citigroup published a research report predicting artificial intelligence will displace 54 percent of jobs in the banking industry, more than in any other sector, and a Bloomberg Intelligence report found that global banks are expected to cut as many as 200,000 jobs in the next three to five years as AI takes on more tasks. These projections reflect the reality that banking employs enormous numbers of people in roles involving information processing, analysis, and decision-making - precisely the kinds of tasks where AI systems demonstrate increasing competence.

花旗集團有份發表研究報告,預計人工智能會取代銀行業54%的職位,比例高於任何其他行業。彭博行業研究則指出,隨着AI承擔更多工作,未來三至五年全球銀行將裁員多達20萬人。這些預測反映銀行業有大量員工負責訊息處理、分析及決策,這些正是AI愈來愈擅長的範疇。

JPMorgan's consumer banking chief told investors that operations staff would fall by at least 10 percent, providing specific indication of the scale of workforce reduction that even leading institutions expect. The impact falls unevenly across roles. Those at risk of having to find new roles include operations and support staff who mainly deal in rote processes like setting up accounts, fraud detection, or settling trades, while the shift favors those who work directly with clients like private bankers with rosters of rich investors, traders who cater to hedge fund and pension managers, or investment bankers with relationships with Fortune 500 CEOs.

摩根大通消費銀行部主管曾向投資者表示,營運人員將最少減少一成,這對裁員規模作了具體說明,即使是龍頭機構亦預期如此。不同職位受影響程度不一。高危需轉職的,包括從事重複性工序的營運或支援人員,如開戶、偵測詐騙、結算交易等;而直接與客戶交流的崗位則較受惠,例如服務富有投資者的私人銀行家、為對沖基金及退休金經理提供服務的交易員,或擁有「財富500強」CEO人脈的投資銀行人員。

This creates a bifurcation in banking employment. High-skill, client-facing roles that require relationship management, strategic judgment, and interpersonal skills remain valuable and may even become more valuable as AI handles supporting analytical work. Middle-skill roles involving standardized information processing and analysis face the greatest displacement risk. Entry-level positions that traditionally served as training grounds for careers in banking may largely disappear, raising questions about how institutions develop future senior talent.

這將令銀行業人力出現「兩極化」。高技能、面向客戶、需要人際關係管理及策略判斷力的崗位,隨着AI處理更多分析事宜,價值反而更高。至於負責標準化訊息處理及分析的中級職位,則最易被取代。傳統上不少初級崗位屬銀行業新手「學師」跳板,但這些角色可能逐漸消失,令人關注銀行如何培養未來高層人才。

Dario Amodei, chief executive of AI firm Anthropic, said nearly half of all entry-level white-collar jobs in tech, finance, law, and consulting could be replaced or eliminated by AI. This projection directly challenges the traditional career development model in professional services where junior employees learn by performing routine tasks under senior supervision. If AI eliminates these entry-level roles, institutions must develop alternative pathways for developing expertise and advancing careers.

AI公司Anthropic行政總裁Dario Amodei指出,科技、金融、法律與諮詢等領域的初級白領職位近半都可能被AI取代或消失。這直接衝擊傳統專業職涯模式——新人透過日常工作,由高層帶領,累積經驗。如AI消滅了這些入口崗位,機構需另覓途徑培養專業及晉升人才。

Retraining: Promise and Limits

再培訓:承諾與侷限

A Federal Reserve Bank of New York survey found that rather than laying off workers, many AI-adopting firms are retraining their workforces to use the new technology, with AI more likely to result in retraining than job loss for those already employed, though AI is influencing recruiting, with some firms scaling back hiring due to AI and some firms adding workers proficient in its use. This suggests institutions recognize the value of retaining experienced employees and helping them adapt to new roles rather than simply replacing them with AI.

紐約聯邦儲備銀行調查發現,很多採用AI的企業傾向為現有員工再培訓,教懂新科技,而非單純裁員。AI更可能帶來再培訓,多於令在職員工丟飯碗,但的確影響招聘模式,有機構縮減吸納新血,亦有因需要懂AI的人才而加大聘用。這反映機構重視資深員工的經驗,願意幫助他們轉型,而非全面以AI取而代之。

However, research on retraining effectiveness paints a more sobering picture. Job-training programs under the Workforce Innovation and Opportunity Act generally lead to increased earnings for displaced workers, but those entering high AI-exposed occupations see smaller gains - about 25 to 29 percent less - than those targeting low AI-exposed roles, with only certain fields such as legal, computation, and arts showing high potential for retraining into well-paid, AI-exposed jobs. This indicates that while retraining helps, it may not fully compensate workers displaced from roles eliminated by AI.

然而,有關再培訓效用的研究卻較為冷靜。根據《勞動力創新與機會法案》項下的職業培訓計劃,雖有助被裁員工提升收入,但若轉職到易受AI取代的職業,收入增幅僅為低風險行業的25至29%。只有法律、計算和藝術等領域,轉型為高薪、易受AI影響的崗位潛力較高。顯示再培訓雖有幫助,但未必足以彌補被AI淘汰職位的損失。

The challenge extends beyond individual capability to systemic capacity. The World Economic Forum projects that 92 million jobs will be displaced by 2030 but 170 million new ones will be created requiring new skills. Even if this net-positive scenario materializes, the transition creates enormous friction as displaced workers acquire new skills, geographic labor markets adjust, and institutions adapt to new workforce models. The timeline matters critically - if displacement occurs faster than job creation and retraining, the period of disruption could be painful and prolonged.

挑戰並不局限於個人能力,更涉及體制層面的承載力。世界經濟論壇預計,到2030年將有9200萬職位被淘汰,另新創造1.7億個要求新技能的職位。即使最終有正面增長,過渡期時,受影響員工重學新技能、不同地區勞動市場作出調整,機構轉型,過程會產生巨大摩擦。如果職位消失速度快於新工種創造和培訓速度,動盪期將既長且艱難。

McKinsey Global Institute estimates approximately 375 million workers globally - about 14 percent of the workforce - will need significant retraining by 2030 to remain economically viable, with the speed of current displacement surpassing even those predictions. The scale of this reskilling challenge dwarfs anything attempted in modern economic history, raising serious questions about whether existing training infrastructure can meet the need.

麥肯錫全球研究院估計,全球到2030年約有3.75億名員工(約佔全球勞動力14%)需再接受大規模培訓才能在經濟上維持競爭力,而現時職位淘汰的速度甚至比預期更甚。此等規模的技能轉型,為現代經濟史上所未見,令人質疑現有培訓體系能否應付。

Geographic Redistribution

地理分布重整

AI's impact on banking employment extends to geographic distribution of jobs. Banks have increasingly concentrated back-office operations in lower-cost locations - Bangalore, Hyderabad, Guangzhou, Manila, and other offshore centers. HSBC faces a shortfall of nearly 10,000 desks in locations like Bangalore, Hyderabad, and Guangzhou where technologists and back-office people work, and the bank is in talks with companies to automate back-office functions and reduce its cost base. If AI can perform work previously offshored, the geographic distribution of banking employment could shift significantly, with implications for both developed and developing economies.

AI對銀行從業分布的影響,還波及跨地域層面。銀行近年趨向在成本較低的地區設後勤中心——如班加羅爾、海得拉巴、廣州、馬尼拉等地。滙豐在班加羅爾、海得拉巴和廣州等地的桌面數量短缺近萬,這些地點有大量科技和後勤員工,該行現正與多家公司商討將後勤工序自動化,壓低營運成本。若AI能取代過往外判至海外的工序,銀行僱用分布會大幅變動,深遠影響發達及發展中地區。

This creates complex dynamics. Developing economies have built substantial sectors providing services to multinational banks. If AI displaces this work, it eliminates employment that has lifted millions into middle-class prosperity. Simultaneously, banks may consolidate operations closer to their headquarters if physical headcount becomes less relevant, potentially reversing offshoring trends but creating a smaller absolute workforce.

由此產生複雜局面。發展中國家靠為跨國銀行提供外判服務而發展出龐大經濟體系。倘若AI取代相關工種,將令原本帶領數以百萬計人家躋身中產的職位消失。同時,若實體人手重要性下降,銀行或將後勤職能集中於總部地區,令外判潮流逆轉、但整體職位數量更少。

New Roles and Skills

新興崗位與技能

Job displacement represents only part of the employment story. AI also creates new roles that didn't previously exist. As AI systems become more embedded in banking operations, a parallel workforce is emerging to manage, monitor, and refine these technologies, with AI auditors ensuring algorithms operate within regulatory and ethical boundaries, ethics officers evaluating AI models for biases and unintended consequences, and human-AI trainers continuously feeding data to machine learning models and fine-tuning outcomes based on customer behavior.

被淘汰的崗位只是冰山一角,AI同時創造前所未有的新職位。隨着AI深度滲入銀行營運流程,出現一批專責管理、監察及優化AI技術的新工作,當中AI審核員確保演算法守住法規及道德底線,道德主任評估AI模型偏見及意外後果,而人類與AI協同培訓師則負責不斷輸入數據、根據客戶行為優化機器學習結果。

These roles require combinations of domain expertise and technical understanding. An AI auditor working in lending must understand both credit risk evaluation and machine learning model behavior. An ethics officer must comprehend both regulatory compliance and algorithmic bias. These hybrid roles command premium compensation but require skills that few current workers possess, creating talent shortages even as AI displaces workers from other banking roles.

這些工作結合專業知識與技術理解。比如做貸款AI審核,需同時精通信貸風險評估及機器學習模型;道德主任既要識得法規合規,也懂演算法偏見等。這些混合型工作待遇高,但現有人才極少,AI一邊淘汰部分舊工種,同時又帶來新的人才缺口。

The advent of generative AI is like the impact Microsoft Excel had when it came out in 1980, with everyone saying it would eliminate finance people, but instead it changed how they work. This historical analogy suggests AI might ultimately expand banking capabilities rather than simply replacing workers. Excel didn't eliminate financial analysts; it enabled them to perform more sophisticated analyses more quickly, raising expectations for analytical depth and creating demand for analysts who could leverage the tool effectively. AI might follow a similar pattern, with banks that deploy it effectively able to offer more sophisticated services, serve more clients, and ultimately employ substantial workforces in reconfigured roles.

生成式AI的出現,猶如1980年代Excel面世時外界懷疑會取代財務人員,但實際上改變了工作方式。這歷史經驗預示AI或會擴闊銀行能力,而非單純被取代。Excel不但沒有淘汰分析師,反而令他們能更快進行複雜分析,要求更深入的專業,帶動懂用新工具的分析師需求。AI亦可能如是,銀行能夠善用AI,便可提供更精細服務、服務更多客戶,最終維持大量人手,不過職位內容已徹底重塑。

The employment transition ultimately depends on how institutions manage change. Banks that invest in comprehensive retraining programs, create pathways for displaced workers to move into new roles, and approach AI deployment as augmenting rather than replacing humans can potentially minimize disruption. Those that pursue AI primarily as a cost-cutting measure through workforce reduction will create more painful transitions for employees while potentially sacrificing institutional knowledge and expertise that proved difficult to replicate with AI alone.

最終人手轉型結果取決於機構如何管理變革。銀行若有膽色投資於大型再培訓,協助被調配的員工轉型新職位,視AI為助力人力而不是取而代之,有機會穩妥過渡。反之,單以AI為削減人手工具者,不僅令員工轉型陣痛大增,更可能犧牲很多難以用AI複製的企業知識和專業。

Competitive Dynamics and Strategic Advantages

競爭動態與戰略優勢

If JPMorgan can beat other banks to the punch on incorporating AI, it will enjoy a period of higher margins before the rest of the industry catches up. This observation captures the competitive dynamics driving massive AI investments across banking. Early movers gain temporary advantages, but those advantages erode as competitors adopt similar capabilities, eventually pushing the entire industry to higher performance levels that become the new baseline.

若摩根大通能領先其他銀行率先採納AI,該行將短期內享受更高利潤,直至同業追趕上來。這句話說明了整個銀行業瘋狂投資AI的競爭本質。先行者可獲得短暫優勢,但隨着其他對手購買同等能力,這些優勢會逐漸消失,最終全行業被推向更高的效能,形成新的行業標準。

The pattern mirrors previous technology transformations in banking. When ATMs emerged, early adopters gained cost advantages and customer convenience benefits. But ATMs quickly became ubiquitous, and the advantage shifted to banks that deployed them most extensively and integrated them most effectively with broader service offerings. Online banking followed similar dynamics - first-movers gained customer acquisition advantages, but within years, every bank needed online capabilities to compete. AI appears to be following this trajectory, but with potentially more dramatic effects.

這種規律和銀行以往科技改革無異。自動櫃員機(ATM)面世初期,先採用者因成本及便利獲益,但很快便成為標配,最大得益者變成能最廣泛布署及有效整合服務的銀行。網上銀行也一樣,初步推出對客戶有吸引力,但很快所有銀行都必須有線上業務以競爭。AI似乎重複這個軌跡,只是潛在衝擊更大。

Several factors determine which institutions gain the most from AI investments. First, scale matters enormously. JPMorgan's $18 billion annual

(內容到此為止,如需繼續,請補充下一段內容。)technology budget enables investments that smaller institutions cannot match. Building sophisticated AI systems, assembling specialized talent, and integrating AI across vast operational infrastructure requires resources that favor the largest banks. This could accelerate industry consolidation as smaller banks struggle to keep pace with AI-powered competitors.

科技預算令大型銀行可以作出中小型機構難以匹敵的投資。建立先進人工智能系統、招聘專業人才,以及將AI整合到龐大營運架構內,都需要大量資源,這些優勢明顯傾向規模最大的銀行。如果細行無法追上有AI優勢的競爭對手,行業整合速度將會加快。

Second, data advantages create compounding returns. AI systems improve through exposure to more data, and larger banks process more transactions, serve more customers, and operate in more markets than smaller institutions. This data richness enables more sophisticated AI that delivers better customer experiences, attracts more customers, and generates more data - a reinforcing cycle that advantages incumbents with established customer bases over new entrants.

第二,數據優勢會帶來複利效應。人工智能系統需要吸收大量數據來提升表現,而大型銀行能夠處理更多交易、服務更多客戶,以及在更多市場營運,數據份量遠超小型機構。豐富數據令AI更加高階,可以提供更佳客戶體驗,吸引更多客戶,產生更多數據——這種良性循環進一步鞏固現有大型銀行對新入行者的優勢。

Third, legacy infrastructure both constrains and shapes AI deployments. Banks operate on technology stacks accumulated over decades, with critical systems running on mainframes alongside modern cloud applications. There is a value gap between what the technology is capable of and the ability to fully capture that within an enterprise, with companies working in thousands of different applications requiring significant work to connect those applications into an AI ecosystem and make them consumable. Institutions with more modern infrastructure can deploy AI more rapidly and comprehensively than those wrestling with complex legacy systems.

第三,舊有基建同時限制以及影響AI應用方式。銀行的科技環境複雜,由幾十年來積累下來的各種系統組成,既有在大型主機(mainframe)運行的重要系統,又有現代雲端應用。科技本身可以做到的事,與企業實際能全面落實的能力之間存在「價值落差」。不少銀行用緊成千上萬個不同的應用程式,要將它們整合成一個AI生態圈,變到可用,需要大量工程。相對之下,基建較現代化的機構,比掙扎於複雜舊系統的銀行,能更快和更全面地部署AI。

Fourth, regulatory compliance capabilities matter increasingly. Banks operate in heavily regulated environments where deploying new technology requires demonstrating that it meets regulatory requirements for transparency, fairness, security, and reliability. Institutions with sophisticated compliance frameworks and strong regulatory relationships can navigate AI deployment challenges more effectively than those with weaker compliance capabilities.

第四,合規能力愈來愈重要。銀行一直處於高度監管的環境,任何新科技應用都要證明符合法規對於透明度、公平性、安全和可靠的要求。有完善合規框架及良好監管關係的機構,可以更有效應對AI應用時的合規挑戰,相比起合規能力較弱的銀行更具優勢。

Industry structure influences how AI advantages manifest. In highly commoditized banking services - payments processing, basic deposit accounts, simple loans - AI-driven efficiency advantages translate primarily into cost reductions that either improve margins or enable price competition. In differentiated services - wealth management, investment banking, sophisticated corporate banking - AI can enable service enhancements that support premium pricing and market share gains.

銀行業結構會影響AI優勢的展現方式。於高度商品化的銀行服務——例如支付處理、普通儲蓄戶口、簡單貸款——AI帶來的效率主要體現在降低成本,繼而提升利潤率或者開展價格競爭。而在差異化服務方面——例如財富管理、投資銀行、複雜企業銀行服務——AI則有助提升服務質素,支持收取溢價價格同擴大市佔率。

Citigroup armed 30,000 developers with generative AI coding tools and rolled out a pair of generative AI-powered productivity enhancement platforms to its broader workforce, while Goldman Sachs has furnished roughly 10,000 employees with an AI assistant and expects to complete companywide rollout by year's end. These deployments by JPMorgan's major competitors indicate the AI transformation has become imperative across the industry. No major bank can afford to ignore AI, and competitive dynamics ensure that AI investments will continue accelerating.

花旗銀行為三萬名開發人員配備生成式AI編碼工具,並向更廣泛員工推出兩個生成式AI生產力平台。高盛亦已為約一萬名員工提供AI助手,並預計全公司覆蓋將於年底完成。摩根大通主要對手的這些大規模應用清楚顯示,AI轉型已成為整個行業的必然趨勢。任何大型銀行都不能忽視AI,而市場競爭動態會令AI投資持續加速。

The geographic dimension of competition adds complexity. Bank of America is spending $4 billion on AI and new technology initiatives in 2025, accounting for nearly one-third of its $13 billion technology cost line. American banks face competition not only from each other but also from European institutions, Asian banks, and potentially Big Tech firms that might expand into financial services. Chinese banks deploy AI extensively in mobile payments and lending, European banks face regulatory pressures that both constrain and shape AI deployment, and Asian institutions like DBS and HSBC pursue aggressive digitalization strategies.

地域競爭令形勢更複雜。美國銀行預計2025年會於AI及新科技項目上投放40億美元,佔其技術開支的三分之一。美國銀行面對的不只是本地競爭,他們亦要應付來自歐洲、亞洲銀行,以及有機會進軍金融服務的大型科企的壓力。中國銀行廣泛應用AI於手機支付及貸款,歐洲銀行受到監管壓力所限制,亞洲如星展、滙豐等則積極推行數碼化戰略。

Big Tech represents a particularly interesting competitive dynamic. Companies like Google, Amazon, and Microsoft possess world-leading AI capabilities, vast computational resources, and enormous user bases. While regulatory restrictions have historically limited their expansion into core banking, they increasingly offer financial services at the margins - payments, lending, financial planning. If regulators allow deeper Big Tech participation in banking, AI-powered platforms operated by technology giants could disrupt traditional banking business models fundamentally.

大型科企形成特別有趣的競爭動態。Google、Amazon、Microsoft等公司擁有全球領先的AI技術、強大運算能力及大量用戶群。雖然監管一直限制他們參與傳統銀行核心業務,但他們已逐步在支付、借貸、理財等邊緣業務提供金融服務。如果監管機構放寬限制,容許科企更深入參與銀行業,這些由科技巨頭營運的AI平台可能會從根本上顛覆傳統銀行模式。

The ultimate competitive outcome remains uncertain. AI might amplify advantages held by the largest, most sophisticated institutions, leading to industry consolidation. Alternatively, AI could lower barriers to entry by enabling smaller institutions to deliver sophisticated services without massive human workforces, promoting competition. Most likely, the industry will bifurcate, with a small number of massive, AI-powered universal banks competing against specialized institutions that use AI to excel in specific niches.

最終競爭格局仍未確定。AI可能會放大大型、先進銀行的既有優勢,導致行業進一步整合;又或者AI可以降低進入門檻,令細行毋須龐大人手都可以提供高端服務,促進更多競爭。最有可能的情況是行業出現兩極化:一邊是少數超大型、由AI驅動的綜合銀行,另一邊是靠AI在專門領域中脫穎而出的專業銀行。

Implementation Realities: The Value Gap Challenge

(跳過圖片連結)

There is a value gap between what the technology is capable of and the ability to fully capture that within an enterprise, with companies working in thousands of different applications requiring significant work to connect those applications into an AI ecosystem and make them consumable. This observation by JPMorgan's chief analytics officer captures the central challenge in AI banking transformation: the technology's potential vastly exceeds what institutions can currently implement.

科技的能力與企業實際能夠落實和發揮的程度之間,存在著一個「價值落差」。不少公司同時運行著數千個不同應用,如何將這些應用整合入AI生態圈並變為可用,需付出大量工作。摩根大通首席分析官的這番話道出了AI在銀行業轉型的核心難題:現時機構能落實的遠遠落後於科技的真正潛力。

Several factors create this value gap. First, legacy infrastructure presents massive integration challenges. Banks operate critical systems dating to the 1960s and 1970s, written in COBOL and running on mainframes. These systems handle functions like account management, transaction processing, and payment clearing where any failure could be catastrophic. Connecting them to AI systems requires extensive interface development, rigorous testing, and careful risk management.

這個「價值落差」來自多重因素。首先,舊有基建帶來整合上的巨大困難。不少銀行有些核心系統源自上世紀六、七十年代,用COBOL語言編寫,在主機上運行,處理賬戶管理、交易等關鍵職能,出錯後果嚴重。要將這些舊系統與AI銜接,需大量開發接口、嚴格測試和審慎風險管理。

The complexity multiplies because banks don't operate on unified platforms but rather on collections of hundreds or thousands of distinct applications accumulated through decades of organic development, mergers and acquisitions, and technological evolution. Each application has its own data formats, business logic, and interfaces. Creating an AI layer that can interact with all these systems coherently represents an enormous engineering challenge.

難度更高的是,銀行並非在一個統一平台運作,而是累積了數百至上千個因歷年自然發展、合併收購和技術演進而來的應用系統。每個應用都有不同的數據格式、業務邏輯和接口。要開發一個可以和全部系統協調運作的AI層面,實屬龐大的工程挑戰。

Second, data quality and accessibility issues limit AI effectiveness. AI systems require clean, structured, consistent data to function well. Banks' data resides across innumerable systems in incompatible formats with inconsistent definitions, incomplete records, and quality problems accumulated over decades. Before AI can deliver its potential, institutions must undertake massive data remediation efforts - standardizing formats, resolving inconsistencies, establishing data governance, and building pipelines that make data accessible to AI systems.

第二,數據質素及可存取性問題限制AI效用。AI需依靠乾淨、有結構、格式一致的數據,但銀行的資料分布於無數系統、格式各異、定義不一、不完整,長年累積矛盾和欠缺。要令AI發揮最大潛力,機構需大舉整理數據——標準化格式、解決衝突、建立數據管理和建設令AI可用的數據管道。

Third, organizational resistance slows implementation. AI transformation requires changing how people work, which business processes flow, and who holds decision-making authority. These changes threaten existing power structures, require learning new skills, and create uncertainty about job security. Even when leadership commits to AI transformation, middle management resistance, employee anxiety, and simple inertia can dramatically slow implementation.

第三,組織阻力拖慢落實速度。要推行AI轉型,必須改變人手工作方式、業務流程,甚至是誰有權決策。這些變動會威脅舊有權力架構、要求學習新技能,亦令職位安全變得不穩。即使高層支持AI轉型,中層阻力、員工不安及組織慣性同樣可以大大拖慢執行進度。

Fourth, talent scarcity constrains deployment speed. JPMorgan employs more AI researchers than the next seven largest banks combined, but even JPMorgan faces talent constraints. The number of people who understand both advanced AI and banking operations remains limited relative to industry needs. This talent shortage drives up compensation costs and limits the pace at which institutions can expand AI capabilities.

第四,人才短缺制約AI推展。摩根大通的AI研究人員數量比其餘七間最大型銀行加起來還要多,但連他們都面對人才不足問題。能夠同時明白先進AI及銀行運作的人遠遠不足以配合整個行業的發展。人才供應少推高薪酬水平,也限制AI能力擴展的速度。

Fifth, regulatory uncertainty complicates planning. Banks must satisfy regulators that their AI systems operate safely, fairly, and transparently. However, regulatory frameworks for AI in banking remain under development, creating uncertainty about what requirements institutions must meet. This uncertainty makes banks cautious about deploying AI in ways that might later prove non-compliant, slowing adoption.

第五,法規不明確令規劃更難。銀行須向監管機構保證他們的AI系統安全、公平和透明。然而銀行界AI的監管仍在制定中,業界不清楚究竟需要達到什麼要求。不確定性令銀行更謹慎,避免未來被追究不合規,因而推慢AI應用步伐。

JPMorgan Chase builds its AI foundation on AWS, pushing the AWS SageMaker machine learning platform and AWS Bedrock generative AI platform beyond experimentation into production applications, with 5,000 company employees using SageMaker and more than 200,000 employees now using LLM Suite. This partnership approach - leveraging cloud infrastructure and AI platforms from technology providers rather than building everything internally - helps address some implementation challenges by providing scalable infrastructure and reducing the burden of maintaining AI development platforms.

摩根大通以AWS作為AI基礎,將AWS的SageMaker機械學習平台及Bedrock生成式AI平台由試驗推進到生產應用現場,現時已有5,000名員工使用SageMaker,超過200,000人用緊LLM Suite。這種合作模式—即利用科技供應商的雲端基建及AI平台,而非全部自建—可以提供可擴展基礎設施,減少維護AI平台的負擔,有助應對部分落實AI時遇到的難題。

The organizational dimension of implementation presents perhaps the greatest challenge. Chase is going with a "learn by doing" approach for generative AI, wanting tools in employees' hands with a belief that there is no better way to learn than by actually utilizing the tools, and the bank has been reported to have 450 proofs of concept in the works, a number expected to climb to 1,000. This grassroots approach recognizes that successful AI transformation requires cultural change, not just technology deployment. Employees must understand AI capabilities, identify opportunities for application, and integrate AI into daily workflows. This learning-by-doing approach takes time but builds sustainable capabilities.

落實過程中,組織因素也許是最大挑戰。摩根大通就生成式AI採用「做中學」方式,希望員工親身用工具,相信實際操作才是最好學習方法,據報現在已經有450個AI應用原型正在開發,目標增至1,000個。這種由下而上的方式反映成功的AI轉型不單止是技術問題,更在於文化改變。員工必須理解AI的能力、識別應用機會、將AI融入日常工作流程。「做中學」雖然需時,卻能建立持續發展的能力。

The financial dimension complicates implementation. Banks' spending on AI initiatives is predicted to increase from $6 billion in 2024 to $9 billion in 2025, and potentially as much as $85 billion in 2030. These investments must be justified through clear return-on-investment cases, but AI's benefits often materialize over years through cumulative efficiency gains, improved decision-making, and enhanced customer experiences that prove difficult to quantify precisely. Institutions face pressure

財務因素亦令AI落實更繁複。預計銀行業於AI項目上的開支,將由2024年的60億美元,增至2025年的90億美元,2030年或高達850億美元。這些投資都需有明確回報理據,但AI帶來的效益往往需多年才逐步累積展現,包括效率提升、更佳決策和客戶體驗等,而這些效益很難全面量化。銀行機構正面對壓力...to demonstrate results while pursuing transformations that require sustained investment before full benefits emerge. 為了在追求需要長遠投資方能見到全部成效的轉型同時,展示初步成果。

The testing and validation challenge for AI systems exceeds that of traditional software. Traditional software follows deterministic logic - given the same inputs, it produces the same outputs, making testing straightforward. AI systems, particularly those using advanced machine learning, behave probabilistically and can produce different outputs for the same inputs. Testing must evaluate not just whether the system works correctly for known cases but whether it generalizes appropriately to novel situations, handles edge cases safely, and degrades gracefully when encountering inputs outside its training distribution. 對於AI系統來說,測試同驗證的難度比傳統軟件更高。傳統軟件採用確定性邏輯——相同輸入必定產生相同輸出,測試起來相對簡單。AI系統,特別係採用先進機器學習技術的,則有機會係同一輸入下產生唔同結果,即屬概率性行為。測試唔止要睇系統有冇正確處理已知情況,仲要衡量系統應唔應該能夠適當地應對新情況、安全地處理極端個案,以及遇到非訓練範圍嘅輸入時,能否逐步降級而唔會突然出錯。

These implementation challenges explain why AI banking transformation proceeds gradually despite enormous potential. Institutions must balance moving quickly enough to capture competitive advantages against moving carefully enough to manage risks and ensure reliable operations. The tension between speed and caution shapes deployment strategies, with most banks pursuing parallel approaches that layer AI capabilities atop existing systems rather than attempting to rebuild core banking infrastructure from scratch. 正因為有呢啲實施上的挑戰,AI銀行轉型雖然潛力龐大,但推進得比較漸進。各機構要平衡快啲搶佔競爭優勢,與小心翼翼管理風險兼確保系統可靠運作。速度與審慎之間嘅拉鋸,影響咗落地策略,大部分銀行選擇係現有系統上並行疊加AI能力,而唔係一開始就重建核心基建。

Risks, Ethics, and Regulatory Gaps

風險、倫理與監管缺口

AI banking transformation raises profound questions about safety, fairness, accountability, and social impact that regulators, banks, and society must address. These concerns span technical, ethical, legal, and political dimensions. AI推動銀行業轉型,引發一系列有關安全、公平、問責和社會影響的重大問題,需要監管機構、銀行同社會共同正視。這啲憂慮涉及技術、倫理、法律和政治多方面。

Algorithmic Bias and Fairness

演算法偏見與公平

AI systems in banking, particularly those used to help make credit decisions, may inadvertently discriminate against protected groups, with AI models that use alternative data like education or location potentially relying on proxies for protected characteristics, leading to disparate impact or treatment. This challenge emerges because AI systems learn patterns from historical data that may reflect past discrimination. If historical lending data shows that applicants from certain neighborhoods or with certain characteristics were denied credit, AI systems may learn to replicate these patterns even when the underlying factors don't represent legitimate credit risk indicators.

銀行業使用嘅AI系統,特別用嚟做信貸決策嗰啲,有機會無意識咁歧視受保護群體。呢啲AI模型如果採用咗教育、地區等替代數據,可能間接引用咗屬於受保護特徵嘅代理,導致差別對待。因為AI系統會由歷史數據中學習模式,而呢啲數據本身可能反映過往存在歧視。如果以往貸款數據顯示某些地區或特徵申請人比較多被拒批,AI就可能重複咗呢啲偏見,即使嗰啲特徵本身其實唔應該代表實際信貸風險。

The problem extends beyond simple replication of historical bias. AI can amplify bias through feedback loops where algorithmic decisions influence future data in ways that reinforce initial patterns. For example, if an AI system denies credit to members of a particular group, those individuals cannot build credit histories that might later demonstrate creditworthiness, perpetuating the cycle. 問題唔止係重複歷史偏見咁簡單。AI甚至會喺演算法決策影響未來數據嘅反饋迴圈下,進一步放大偏見。例如如果AI拒絕咗某個群體成員貸款,佢哋無法建立信用紀錄來證明自己有還款能力,令偏見不斷被強化。

Addressing algorithmic bias requires technical solutions, policy frameworks, and institutional commitments. Financial institutions must continuously monitor and audit AI models to ensure they do not produce biased outcomes, with transparency in decision-making processes crucial to avoiding disparate impacts. This monitoring must extend beyond simple outcome analysis to examine the factors AI systems use for decisions and ensure they don't rely on proxies for protected characteristics. 解決演算法偏見需要技術方案、政策框架同機構承諾。金融機構要持續監察同審計AI模型,確保結果唔會帶嚟偏見,決策過程嘅透明度亦好重要,可以避免導致差別對待。監察工作唔止要分析結果,仲要檢視AI系統究竟基於咩因素去做決定,避免依賴受保護特徵嘅代理。

The challenge intensifies as AI systems become more sophisticated. Simple models using limited variables can be audited straightforwardly - analysts can examine each factor and assess whether it represents legitimate business considerations or problematic proxies for protected characteristics. Complex neural networks processing hundreds of variables through multiple hidden layers resist such straightforward analysis. They may achieve better predictive accuracy but at the cost of reduced transparency. AI系統愈精密,挑戰愈大。簡單模型只用少量變數,可以輕易進行審核——分析師可以逐個檢查判斷邊啲因素係正當商業考慮,邊啲屬問題代理。但複雜神經網絡用幾百個變數多重隱藏層,已經好難用同樣方式審查,雖然準確度高咗,但透明度就低咗。

Data Privacy and Security

數據私隱與安全

Banks hold vast amounts of sensitive personal information - financial transactions, account balances, investment positions, personal identifiers, behavioral patterns. AI systems require access to this data to function effectively, creating tension between AI's data appetite and privacy imperatives. The increasing volume of data and the use of non-traditional sources like social media profiles for credit decision-making raise significant concerns about how sensitive information is stored, accessed, and protected from breaches, with consumers not always aware of or consenting to the use of their data. 銀行掌握大量敏感個人資料,包括金融交易、戶口結餘、投資持倉、個人識別同行為模式。AI系統要發揮效用必須取得這啲數據,呢個「數據饑渴」同私隱需求之間就產生咗矛盾。連同數據日益增加同用啲非常規數據來源(例如社交媒體個人資料)嚟做信貸決策,大家會好擔心敏感資訊點樣儲存、查閱同防止洩露,因為消費者唔一定知道甚至未必同意佢哋嘅資料被咁用。

The privacy challenge extends beyond traditional data security to questions about data usage. Customers may consent to banks using their transaction data for fraud detection but not expect that same data to inform marketing algorithms or be shared with third parties. As AI systems become more sophisticated at extracting insights from data, the line between uses customers expect and approve versus those they find intrusive becomes increasingly important. 私隱問題不單止關於傳統數據安全,仲涉及數據用途。客戶可能同意銀行用資料去偵測詐騙,但唔期望啲資料會俾銀行用來做市場推廣算法或者分享畀第三方。隨住AI系統對數據嘅洞察力愈來愈強,客户預期及接受的用途同覺得侵犯私隱之間條界線就變得更加重要。

The technical challenge of privacy-preserving AI remains largely unsolved. Techniques like federated learning - where AI trains across distributed data without centralizing it - and differential privacy - where noise is added to data to protect individual privacy while preserving aggregate patterns - show promise but aren't yet mature enough for widespread banking deployment. Most AI systems still require access to detailed individual-level data to achieve optimal performance. 要實現保障私隱的AI,技術層面上好多難題仍未解決。分布式學習(即AI唔需要集中全部數據就可以訓練)同差分私隱(即對數據加雜訊以保護個人私隱但保持總體趨勢)雖然有潛力,不過仲未成熟到可以大規模應用於銀行業。現時大部分AI系統仍然需要存取詳細的個人級數據先至做到最佳表現。

Model Opacity and Explainability

模型黑盒與可解釋性

The German regulator BaFin stated that the extent to which a black box could be acceptable in supervisory terms is dependent on how the model concerned is treated in the bank's risk management, with expectation that financial service providers can explain model outputs as well as identify and manage changes in AI models' performance and behavior. This regulatory perspective captures a fundamental tension in AI banking: the most powerful AI systems are often the least explainable. 德國監管機構BaFin曾經表示,監管上能否接受黑盒模型,要視乎銀行如何將該模型納入風險管理體系。監管方期望金融服務提供者能夠解釋模型輸出,亦能識別同管理AI模型表現同行為上的改變。呢個觀點正好點出AI銀行化最大嘅矛盾之一:最強大的AI往往最難解釋。

Traditional credit scoring models used linear regression with a handful of variables, making it straightforward to explain why any particular applicant received a specific score. Modern AI systems may use ensemble methods combining multiple models, neural networks with hidden layers, or other approaches that resist simple explanation. A bank might be able to demonstrate statistically that such a system performs better than simpler alternatives but struggle to explain why it made any specific decision. 傳統信貸評分模型係用線性回歸分析、只用少量變數,解釋點解某申請人攞到某分數都幾直接。而家啲AI系統可能用綜合多模型、神經網絡隱藏層,又或者其他難以用簡單方式解釋的手法。銀行可能證明到新AI系統表現確實比舊方法好,但要解釋清楚點解出到某個決定就好吃力。

This opacity creates problems for consumers who want to understand why they were denied credit or charged higher interest rates. It creates problems for regulators trying to assess whether models are fair and appropriate. It creates problems for banks trying to manage model risk and ensure their systems behave appropriately. The lack of explainability becomes particularly problematic when AI systems make consequential decisions that affect people's financial lives. 黑盒帶來好多問題:消費者想知點解被拒批貸款或要俾貴利息無從問起;監管機構難以判斷模型係咪公平合適;銀行自身想管理模型風險同確保系統表現得當亦很困難。當AI系統要作出重大且影響到人財產嘅決策時,解釋唔到成為一個大問題。

Regulatory approaches to explainability vary. The SEC implements the Market Access Rule mandating strict pre-trade risk controls to prevent market manipulation and erroneous trading, and joint guidance from OCC, Federal Reserve, CFPB, and FTC highlights explainability, bias mitigation, and consumer transparency requirements. These frameworks establish principles for AI transparency but often lack specific technical requirements, leaving banks to determine how to satisfy regulators that their systems are appropriate. 各地監管對解釋性有唔同要求。美國證監會(SEC)有市場准入規例,要嚴格事前風險控制,防止市場操縱同錯誤交易,而貨幣監理署、聯儲局、消費金融局和聯邦貿易委員會聯合指引都有強調解釋性、減少偏見和透明度。呢啲框架定咗一啲原則,但具體技術要求唔多,銀行要自行研究如何向監管解釋其AI系統係合適。

Systemic Risk and Stability

系統性風險與穩定性

AI's impact on financial stability raises concerns that extend beyond individual institutions. If many banks deploy similar AI systems trained on similar data, their behavior may become correlated in ways that amplify market volatility or create systemic vulnerabilities. During market stress, AI trading systems might simultaneously try to sell the same assets or hedge the same risks, exacerbating price movements and potentially triggering cascading effects across financial markets. AI對金融穩定性的影響,唔止單靠某間機構可以處理。如果好多銀行採用相似數據訓練相似AI系統,行為就會高度相關,有機會放大市場波動或製造系統性漏洞。例如,市場受壓時AI交易系統可能齊齊沽售同一類資產,或者同時對沖一批風險,加劇價格波動,甚至引發連鎖反應。

The complexity of AI systems also creates operational risks. Banks become dependent on AI for critical functions, and failures or malfunctions could disrupt operations in ways that affect customers, counterparties, and markets. The interconnection of financial institutions means that AI failures at one bank could propagate through the financial system. AI系統複雜度亦帶來營運風險。銀行如果過於依賴AI處理重要職能,一旦系統出錯或者失效,會影響客戶、對手方甚至整個市場。金融機構互相聯繫,某間銀行AI出事亦有機會傳染開去。

Citi projects 10 percent of global market turnover to be conducted through tokenized assets by 2030, with bank-issued stablecoins as the main enabler, and 86 percent of surveyed firms piloting generative AI for client onboarding and post-trade specifically. The convergence of AI and tokenization creates new systemic risk considerations as financial assets migrate to blockchain-based infrastructure where AI agents could execute transactions autonomously. 花旗銀行預計2030年全球市場交投有10%會經由代幣資產進行,而銀行發行的穩定幣係主要推手,另外有86%受訪公司已經試行用生成式AI做客戶開戶同交易後服務。AI同資產代幣化結合,令金融資產進一步遷移到區塊鏈基礎設施,AI代理可以自主執行交易,產生新一輪系統性風險。

Accountability and Liability

問責與法律責任

When AI systems make decisions that result in harm - discriminatory lending, erroneous trading, privacy violations - questions of accountability become complex. Traditional liability frameworks assume human decision-makers who can be held responsible for choices. AI distributes decision-making across human-machine systems in ways that obscure responsibility. 當AI系統的決策造成損害——例如歧視放貸、錯誤交易、侵犯私隱——問責問題就好複雜。傳統責任框架預設有個人負責,但AI將決策分散在人機之間,令責任歸屬變得含糊。

If an AI-powered lending system systematically discriminates against a protected class, who bears liability? The data scientists who built the model? The business managers who deployed it? The executives who approved the AI strategy? The bank as an institution? These questions lack clear answers under current legal frameworks, creating uncertainty for both banks and consumers. 例如AI放貸系統若長期歧視某類人,究竟係模型設計嘅數據科學家、啟用AI的業務主管、批核AI策略的高層,定整間銀行要負責?而家法律體系並未有清晰答案,銀行同消費者都會受困擾。

Regulatory Landscape

監管環境

The EU AI Act, effective by mid-2025, classifies AI systems by risk, with high-risk applications in finance like credit assessments and insurance pricing requiring transparency, human oversight, and bias mitigation, with financial firms required to document and justify AI decisions, setting a global standard for responsible AI. The European approach establishes comprehensive regulatory frameworks specifically addressing AI risks. 歐盟《AI法案》將係2025年中生效,根據風險對AI系統分級,金融高風險應用(例如信貸評估和保險定價)需確保透明度、人類監督及減低偏見,金融機構亦要紀錄同解釋AI決策,成為全球負責任AI監管新標準。歐洲嘅做法有較完善的針對AI風險監管框架。

American regulation, by contrast, remains fragmented. President Trump signed Executive Order 14179 on January 23, 2025, revoking President Biden's comprehensive AI 美國監管相對分散。特朗普總統於2025年1月23日簽署第14179號行政命令,撤銷拜登總統之前的一套全面AI...Below is the requested translation, per your formatting instruction (skipping markdown links):

行政命令——特朗普政府推動放寬人工智能(AI)使用的監管。這導致監管上的不確定性,因為聯邦層面的框架被撤回,州政府監管機構才開始介入,並通過了關注偏見、透明度及合規性的法例,管理AI在貸款和就業決策中的應用。有幾個州明確指出,歧視性的AI行為會根據他們自己的「不公平或欺騙性行為」法例作出評估,這結果造成了監管拼圖式的局面。

國家信用合作社管理局(NCUA)缺乏具體詳細的模型風險管理指引,未有針對信用合作社應如何管理包括AI模型在內的風險,亦無權審查科技服務供應商,儘管信用合作社越來越多地依賴後者提供AI驅動服務。這個監管縫隙正好反映AI發展快於監管能力,僅僅機構部署先進系統的速度已經超越監管框架的適應能力。

監管機構應要求銀行表明是否利用AI以遵守社區再投資法(CRA)規定,要求有關系統具備可解釋性,要求所有機構接受第三方AI審計,並要求銀行定期檢討其《銀行保密法》(BSA)系統,以確保準確性及可解釋性。這些建議反映出社會愈發認同銀行界中的AI需要嶄新的監管方式,但要將原則轉化為可落實的規定仍然是一項進行中的工作。

全球層面令監管發展變得複雜。銀行業務橫跨多個司法管轄區,對AI又有不同的監管方式。各機構需同時應對歐盟AI法案、亞洲不同國家的法規、美國的州級要求,以及如國際結算銀行等國際組織的新興標準。這種監管碎片化使合規更加複雜,亦可能拖慢AI於跨境銀行營運中的普及。

AI銀行 vs 自主金融:去中心化金融(DeFi)比較

AI驅動的傳統銀行迅速興起,與去中心化金融(DeFi)逐漸成熟同時發生,形成兩種截然不同的科技金融願景。AI銀行強化傳統金融機構的智能化和自動化,而DeFi則運用區塊鏈協議,追求無需傳統中介的金融服務。兩者的融合與競爭正共同塑造金融未來的發展軌跡。

穩定幣與代幣化

過去18個月,穩定幣的流通數量翻了一番,但每日交易量僅約三百億美元,佔全球資金流不足1%。支持者認為相關技術可超越銀行辦公時間與地域界限,提升當前支付基建的速度、成本、透明度、可得性,並促進金融包容,惠及那些傳統銀行服務不足的人口。這些數位資產相等於區塊鏈上的現金等價物,讓資金24/7結算,無需傳統銀行中介。

預計到2030年,代幣化會把多達16萬億美元的現實資產帶到鏈上,徹底改革全球金融運作模式。華爾街領袖如貝萊德(BlackRock)、摩根大通(JPMorgan)和高盛(Goldman Sachs)已率先試點推出代幣化債券、國庫券及存款。這顯示傳統金融機構愈來愈將區塊鏈基建視為補充而非競爭者。

當機構利用AI管理代幣化資產時,AI銀行與代幣化間的關係就特別值得關注。花旗預計到2030年,全球10%市場交易會變成代幣化資產,主要來自銀行發行穩定幣協助抵押品效率及資金代幣化。調查顯示86%受訪企業已經測試AI於客戶開戶流程,這是資產管理人、託管人及經紀商的關鍵應用場景。這種融合預示AI將同時在傳統銀行和區塊鏈資產上運作。

自主協議 vs AI代理人

DeFi協議透過智能合約運作——這些合約是部署在區塊鏈的代碼,會根據預設規則自動執行交易,涵蓋借貸、交易、衍生工具等金融操作,完全不需要人手中介。願景是讓金融服務變成運行於去中心化網絡的軟件,而非由機構操作。

銀行裡的AI代理人發揮類似作用,但運作於機構框架之內。它們並非取代銀行,而是令銀行更高效更具能力。兩者的根本分別在於管治及控制權——DeFi協議一經部署,會自律運作,管治有時則由代幣持有人共享;AI代理人則一直受機構權威管理,銀行維持主導及承擔責任。

這造就了不同的風險回報特徵:DeFi有抗審查、全天候可用、代碼透明及低中介依賴等優點,但亦存在智能合約風險、風險發生時追討困難、監管不明朗,以及難以規模化等挑戰;AI銀行則有合規、消費者保障、完善爭議仲裁及與現有金融基建相整合等優勢,但仍有把關角色、監管束縛,以及可能比去中心化方案成本更高。

監管待遇

全球多項法例致力確保代幣化現金運作穩定及安全,涵蓋儲備、資訊披露、反洗黑錢(AML)及「認識你的客戶」(KYC)合規、適當牌照等。例如美國《國家創新穩定幣法案2025》,今年6月已於參議院通過,訂明儲備、穩定性及監督等條件。這些監管發展說明,穩定幣及代幣化正逐步離開灰色地帶,走向明確規範。

聯邦儲備局最近亦舉辦研討會聚焦支付創新,探討穩定幣、去中心化金融、人工智能及代幣化等議題,理事Waller形容這些技術能簡化支付並加強私營部門合作。這反映央行已意識到這些新興科技的潛在影響,並積極研究其與貨幣政策及金融穩定的交集。

這樣的監管形勢為銀行帶來戰略抉擇:應否只在傳統銀行基建上發展AI,還是同時把AI應用於區塊鏈的DeFi協議?應否自行發行穩定幣以競爭,還是將現有穩定幣整合到業務?在區塊鏈結算效率與監管複雜、技術風險之間,該如何取捨?

混合架構

最有可能的結果,是傳統銀行、AI能力及區塊鏈基建融合的混合模式。銀行可發行以傳統儲備作支持的代幣化存款或穩定幣,用區塊鏈結算同時維持機構擔保。AI系統甚至可跨傳統支付渠道及區塊鏈網絡運作,根據成本、速度等優化路徑。

Consensys 2025 討論強調去中心化金融迅速增長,涵蓋去中心化交易所普及、穩定幣使用急升、實體資產代幣化興趣激增及高息協議進展等問題,並以新監管法例帶來的清晰背景討論。這種行業參與,表明傳統金融與DeFi的界線亦日漸模糊。

AI與區塊鏈融合帶來嶄新技術可能:智能合約可融合AI決策,創造可根據市場狀況自動調整行為的自主協議;AI系統可監察鏈上交易防詐騙、分析DeFi協議狀況、甚至跨多協議優化「挖礦」策略。銀行可部署跨傳統及DeFi協議的AI代理,為客戶提供統一介面同時接觸兩種體系。

這種融合帶來金融中介角色的哲學性問題:如果AI可自動執行大部分銀行功能,而區塊鏈又可實現無需傳統中介的交易基礎設施——我們是否仍然需要銀行?或者,金融是否最終演變為AI代理跨去中心化協議為用戶服務,而傳統銀行到頭來要麼適應新規則提供相關服務,要麼逐漸式微?

答案有賴於監管發展、消費者偏好及技術成熟度。如果監管完成保障消費者同時允許區塊鏈金融發展,金融服務或會大幅走向混合體系;如區塊鏈難以擴展,或監管傾向傳統機構,AI銀行則可能繼續佔主導。最有可能的,是一個多元並存的局面——傳統銀行、AI強化機構及去中心化協議共存,各自服務不同需求及偏好。

真正AI銀行:2030年願景

(下文略)

---toward their logical conclusion allows us to envision what a genuine AI bank might look like when the transformation reaches maturity, likely sometime in the early 2030s. This vision helps clarify what fundamental transformation means and raises profound questions about whether such an institution still represents a "bank" in any traditional sense.

隨住人工智能(AI)轉型走到邏輯終點,我哋可以想像到真正AI銀行成形時嘅模樣——可能最快要到2030年代初。呢種願景,有助我哋清楚理解「根本性轉型」嘅意思,亦帶嚟一個好深層次嘅問題:呢類機構仲算唔算傳統意義上嘅「銀行」?

Universal AI Assistance

全方位AI助理

In a true AI bank, every employee operates with a personal AI assistant deeply integrated into all workflows. Investment bankers instruct their AI to prepare client meeting materials, analyze potential acquisition targets, or draft term sheets. Traders direct AI agents to monitor markets, execute strategies, and optimize portfolios. Compliance officers task AI with monitoring transactions for suspicious patterns, generating regulatory reports, and researching regulatory changes. Technology teams use AI for software development, infrastructure management, and system optimization.

喺一間真正嘅AI銀行,每個員工都會擁有一個深度整合入工作流程嘅個人AI助理。投資銀行家會指示AI預備客戶會議資料、分析潛在收購對象、或者草擬條款清單。交易員會叫AI代理監察市場、執行策略、同時優化投資組合。合規部會揾AI去監控交易過程有冇可疑模式、自動生成監管報告、同埋研究監管規則變動。IT團隊則會用AI進行軟件開發、基建管理同系統優化。

These AI assistants don't simply respond to individual queries like current chatbots. They maintain context across conversations, proactively identify tasks that need completion, schedule their own meetings with other AI assistants to coordinate work, and continuously learn from interactions to better anticipate needs. The human role shifts toward setting strategic direction, making high-level decisions, and handling situations requiring judgment, creativity, or interpersonal skills that AI lacks.

呢啲AI助理唔再只係好似而家啲聊天機械人咁,單純應答問題。佢哋會跨對話記住上下文,主動搵出要做嘅工作,會自行約其他AI助理開會協調任務,不斷自我學習,更加預知人手需要。人類嘅角色會轉向制定策略方向、做高層決策,同處理AI做唔到——即需要判斷力、創意或者人際技巧——先做到嘅工作。

Autonomous Operational Processes

自主營運流程

Core banking operations - account opening, payment processing, trade settlement, reconciliation, regulatory reporting - flow through AI systems with minimal human intervention. These systems don't follow rigid scripts but adapt behavior based on context. They detect anomalies and determine whether to flag them for human review or resolve them autonomously. They optimize resource allocation dynamically rather than following static rules. They identify process improvements and implement changes after appropriate approval.

銀行核心業務——開戶、付款處理、交易結算、對賬,甚至監管報告——全部都由AI系統執行,基本唔需要人手介入。呢啲系統唔係死死地咁跟程序,而係可以根據情境自行調整操作。佢哋會主動搵出異常狀況,判斷需唔需要提交比人審查,定由自己解決。資源分配都變到動態優化,而唔係死板照章行事。流程有改進空間,AI都可以自動發現同提出改良方案,獲批之後自動實行。

The traditional operations workforce largely disappears, replaced by smaller teams of engineers, analysts, and oversight specialists who monitor AI systems, handle edge cases, and continuously refine automated processes. The efficiency gains prove dramatic - processes that required thousands of employees complete with dozens, and processing times measured in days compress to seconds.

傳統營運人手幾乎消失,只需要小型團隊——工程師、分析員、監察專家——24小時監控AI系統,處理特殊個案,持續優化自動化流程。效率提升絕對驚人——以前要成千人處理嘅流程,依家幾十人已足夠;原本要計日數先做完嘅工夫,今時今日只需幾秒。

AI-Curated Customer Experiences

由AI主導嘅客戶體驗

Every customer interaction - whether through mobile apps, websites, phone calls, or in-person branches - flows through AI that personalizes the experience based on comprehensive understanding of the customer's financial situation, preferences, goals, and behavioral patterns. The AI doesn't offer generic products but instead designs solutions tailored to individual circumstances.

所有客戶接觸——無論係手機應用、網頁、打電話定親身去分行——全部由AI主導,根據對客戶財務狀況、喜好、目標同行為模式嘅全方位了解,度身訂造專屬體驗。AI推介嘅唔係千篇一律產品,而係根據每位客戶實際需要,設計合適方案。

For retail customers, AI provides financial planning guidance that rivals human advisors, monitors spending patterns to identify savings opportunities, and proactively suggests actions to improve financial health. It detects life events - a new job, a home purchase, a child's birth - and adjusts recommendations accordingly. For corporate clients, AI analyzes business operations, identifies financial optimization opportunities, and structures tailored banking solutions.

對零售客戶嚟講,AI可以提供媲美真人財策嘅諮詢,主動留意消費習慣搵出慳錢機會,建議點樣改善財政狀況。甚至會識得感應到重要人生事件——轉工、置業、生小朋友等——再因應情況調整提議。對企業客戶,AI會分析公司營運,搵出財務優化潛力,再度身訂造銀行方案。

The human advisor role doesn't disappear but evolves. For high-net-worth individuals and complex corporate clients, humans provide strategic counsel, relationship management, and judgment on sophisticated financial decisions. For routine needs and standard products, AI handles interactions entirely.

人類財務顧問呢個角色唔會消失,但會有新定位。針對高淨值人士同複雜企業客戶,真人專注做策略諮詢、關係管理、提供高難度判斷同專業意見。至於一般需求同標準產品,全部由AI全權處理。

Intelligent Risk Management

智能風險管理

Risk management becomes continuous, comprehensive, and adaptive rather than periodic and rules-based. AI systems monitor every transaction, every position, every counterparty exposure in real-time. They detect subtle patterns indicating emerging risks before they manifest as losses. They conduct scenario analysis across hundreds of potential futures, identifying vulnerabilities and suggesting mitigations. They optimize capital allocation to maximize risk-adjusted returns while maintaining regulatory compliance.

風險管理唔再係周期性、按規則操作,而係全時段、全面且靈活適應。AI實時監察每一宗交易、每一個持倉同對手盤風險,發現細微異常早過實際虧損發生。AI會跨多種情景做分析,預先搵出潛在弱點,主動提議預防措施。資本分配亦經常優化,確保滿足監管要求同時盡量提升風險調整回報。

Credit decisions happen instantaneously through AI analysis that considers far more factors than traditional underwriting - transaction patterns, behavioral signals, external data sources, and subtle correlations that human analysts would never detect. The result is both more accurate risk assessment and greater financial inclusion as AI can extend credit to customers who lack traditional credit histories but demonstrate creditworthiness through alternative indicators.

批核信貸由AI即時分析完成,納入嘅因素多過傳統批核好幾倍——包括消費習慣、行為線索、外部數據,仲有好多分析員都睇唔到微妙關連。咁樣令風險評估更準確,同時大大提升金融包容程度,因為冇慣常信貸紀錄但符合新指標嘅客戶,AI都識得批出貸款。

Agentic Trading and Treasury Management

授權型AI交易同資金管理

Trading evolves from humans making decisions with AI assistance to AI agents executing strategies under human supervision. These agents don't simply follow instructions but adapt tactics dynamically based on market conditions. They identify opportunities, assess risks, and execute trades across multiple markets and asset classes simultaneously.

交易由傳統「人主導、AI協助」變成「AI代理執行、人類監督」。呢啲AI代理唔止係執行命令,仲會根據市場動態主動調整策略,自己搵機會、評估風險,跨市場跨資產同時操作買賣。

Treasury operations become largely autonomous, with AI managing liquidity, optimizing funding costs, deploying capital efficiently, and managing regulatory capital requirements. The systems continuously learn from outcomes and refine their strategies, achieving performance that surpasses human traders while operating at scale impossible for human teams.

財資部門幾乎全面自動化,由AI掌管流動性、壓低融資成本、部署資本、管理監管資本要求。系統會自動從結果學習,不斷優化策略,表現甚至超越人類交易員,而且處理規模更大,速度更快。

Seamless Cross-Border Operations

無縫跨境營運

The AI bank operates globally as a unified institution rather than as a collection of regional operations. AI systems handle cross-border transactions, navigate different regulatory regimes, manage multiple currencies, and optimize global operations. Language barriers disappear as AI provides real-time translation. Time zone differences become irrelevant as AI operates 24/7. Regulatory complexity gets managed through AI that tracks requirements across jurisdictions and ensures compliance.

AI銀行會以統一機構形式運作全球,而唔係一堆互不相干嘅地區業務。AI全自動處理跨境交易、應付唔同地方監管、管理多種貨幣、優化全球操作。語言障礙消失——AI即時翻譯;時區唔再係事——AI 24x7運作。監管複雜度由AI統一追蹤各地合規要求,確保每個市場都守好規矩。

Predictive and Proactive Banking

先知先覺嘅銀行服務

Rather than reacting to customer requests, the AI bank anticipates needs. It identifies when a customer will likely need credit and offers it proactively. It detects when a business client might face cash flow challenges and suggests solutions before crises emerge. It recognizes market conditions where clients might benefit from portfolio adjustments and recommends actions.

AI銀行唔再等客戶開口先服務,而係主動預料需要。佢會推斷客戶幾時有信貸需求,提早主動提供;又會察覺商用客戶幾時可能現金流唔夠,未爆煲已經建議解決方案。當市場環境轉變,AI都會預先提示客戶調整投資組合,提出合適行動。

This proactive approach extends to risk management, where AI predicts potential fraud before it occurs, identifies emerging cyber threats, and detects operational vulnerabilities. The institution shifts from managing problems to preventing them.

呢套主動預測手法,應用落風險管理都一樣——AI可以預判未發生嘅欺詐、發現新型網絡威脅、搵到營運漏洞。銀行角色,從事後管理,轉為防患未然。

Organizational Structure

組織架構

The organizational structure of a true AI bank differs dramatically from traditional banks. The massive hierarchical structures of traditional banking - layers of management overseeing armies of workers performing specialized functions - give way to flatter organizations where smaller teams of specialized experts oversee AI systems executing work.

真正AI銀行嘅組織架構,會同傳統銀行好唔同。以前層層疊疊嘅管理階層、大批人手做專門工序,慢慢會變成較扁平成、細隊形專家監管AI系統執行所有工序。

Job categories shift from operators to orchestrators, from executors to strategists, from processors to problem-solvers. The institution becomes a hybrid human-AI organization where defining the boundary between human and machine contributions becomes difficult.

工種分類都由執行者、操作員,轉型成協調者、策略師同問題解決專家。機構變成「人+AI」混合體,咩工由人做、咩工由AI做,界線開始模糊。

The Category Question

類別之問

This raises a profound question: Is such an institution still a "bank," or does it represent something fundamentally new - an intelligent financial system that happens to be organized as a corporation? Traditional banks are human organizations that provide financial services. AI banks are artificial intelligence systems governed by humans that provide financial services. The distinction may seem semantic, but it carries implications for regulation, liability, corporate governance, and how we think about financial institutions' role in society.

呢個就牽涉到一個根本嘅哲學問題:咁嘅「銀行」仲算唔算「銀行」?定係已經係全新事物——一套智能金融系統,只係巧合地用公司形態表達出嚟?傳統銀行係人類組織,負責提供金融服務。AI銀行其實係人類管理下嘅人工智能系統,亦一樣提供金融服務。呢個分別,好似只係字眼之爭,但實際上有重大的監管、法律責任、公司管治同社會定位影響。

If banking work largely flows through AI systems, with humans providing oversight and strategic direction but not executing most tasks, how should we regulate such institutions? Do traditional frameworks built around human decision-making and accountability still apply? What happens when AI systems make decisions that harm customers or create systemic risks?

如果大部分銀行工作都落在AI系統上面,而人類主要做監督同策略指引,咁應該點監管呢啲機構?傳統以人為主腦、強調責任歸屬嘅監管方式,仲啱唔啱用?萬一AI系統作出決定,導致客戶受損或引發系統性風險,責任又點算?