比特幣 網絡將於 2028 年 3 月迎來新一輪減半,屆時將處於加密貨幣史上最機構化的環境——現時有超過 10% 比特幣供應由企業及 ETF 持有,而 2020 年減半時這比例不足 1%。

這個重大的擁有權轉變——由散戶主導變為機構主導,加上此前周期未曾見過的完善監管框架及基建,意味著 2028 年的減半將更像是一個供應震盪放大器,而不單是炒作催化劑。以往減半帶來 93 倍至 7 倍的漲幅,但 2028 年事件面臨的環境已徹底改變——現時有 140 萬枚比特幣安放於 ETF 金庫,同時企業金庫還持有 85.5 萬枚,形成了結構性需求,足以令價格持續上升,即使升幅較前幾次周期為和緩。

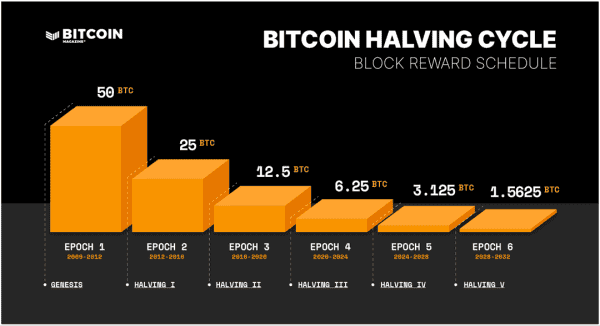

數學原理不變:礦工獎勵會由每區塊 3.125 枚減至 1.5625 枚,每日新供應會由 450 枚減至 225 枚,屆時大約還剩 127.5 萬枚比特幣等待開採。但經濟環境已完全翻新:僅黑石(BlackRock)一隻比特幣 ETF 就管理著 710 億美元資產,微策略(MicroStrategy)則持有多達 58.2 萬枚比特幣,總值超過 620 億美元。

機構參與為價格帶來緩衝及持續的需求壓力,這是過往幾次減半所缺乏的。現時的供應減少會遇上結構上已經改變的需求模式,有可能令周期拉長,同時支撐更高的價格底部。

推動比特幣「數碼黃金」論的稀缺數學

比特幣的貨幣政策精確得前無古人。截至 2025 年 8 月,約有 1972.5 萬枚比特幣已被開採,佔總上限 2100 萬枚的 94%。即只餘 127.5 萬枚待由現時至約 2140 年逐步挖出。供應增長曲線極速放緩——2020 年前已被挖出 87%,而最後 13% 需用逾百年完成,皆因每次減半都以幾何級數遞減。

每 210,000 個區塊,約每四年,比特幣協議會自動將挖礦獎勵減半;無需任何人干預。這帶來了極其優美的序列:2009 至 2012 年每區塊 50 枚,2016 年前降至 25 枚,2020 年前為 12.5 枚,2024 年 4 月前為 6.25 枚。現時每區塊 3.125 枚,直至 2028 年 3 月減半至 1.5625 枚。

減半機制造就了遠超白銀、接近黃金的存量與新增流通比。該比值衡量現有供應與年生產的比例,目前比特幣約為 58,預計 2028 年後將倍增至 116。黃金常年存流比約為 70,工業商品一般只是 1 至 5,比特幣的稀缺愈來愈逼近傳統保值工具。

這種稀缺背後涉及的能源經濟已出現巨大變化。現代 ASIC 礦機在減半後,每生產一枚比特幣約需 854,404 千瓦時,是減半前的兩倍。結合全球算力增長至 898.86 exahash/秒,即使獎勵減少,市場力量仍驅動網絡安全。礦工難度每 2016 個區塊自動校正,確保區塊時間維持約 10 分鐘,無論算力升跌,供應皆可預測。

參與者普遍明白,約有 300-400 萬枚比特幣因私鑰遺失或硬件毀壞而永遠損失,實際流通量大概只有 1600-1700 萬枚。這令稀缺程度進一步提升,產生永久性的通縮壓力,無任何中央權力能透過印鈔或充公資產扭轉。

機構採納如何重寫減半規律

比特幣由散戶主導轉型為機構主導,可說是自創網以來最重大的結構變革。2020 年減半時,機構參與只是九牛一毛;今時今日,光是黑石 IBIT ETF 已掌控超過 710 億美元比特幣,ETF 總共藏有約 140 萬枚,比整體供應的 6.8%,企業金庫則多存 85.5 萬枚,令機構總持有量突破流通量的 10%。

微策略是企業應用領頭羊,持有 58.2 萬枚比特幣,價值超過 620 億美元,其財資策略更鼓勵眾多上市公司仿傚。該企業訂下 2027 年前共購 840 億美元比特幣的目標,目前已完成約 32%。Marathon Digital、Bitcoin Standard Treasury 及其他上市公司亦同樣持有巨額比特幣,而 GameStop 更透過「Project Rocket」計劃專為購買比特幣集資 15 億美元。

機構持續吸納徹底改變了 2028 減半前後的供應局勢。交易所儲備已跌至 250 萬枚,創 2019 年以來新低;自 2024 年 11 月以來,機構從交易所提走了 42.5 萬枚,同期上市公司就吸納了 35 萬枚,明顯縮緊流通供應。

高盛(Goldman Sachs)正好體現傳統金融如何擁抱比特幣:該行將 ETF 持倉增至 88%,一躍成為黑石 IBIT 最大持有人,持有資產達 14 億美元。摩根大通(JPMorgan)持有近 10 億美元的比特幣 ETF,同步為 Chase 信用卡客戶推加密服務;摩根士丹利、嘉信理財、PNC 銀行等也宣布支援比特幣,而道富銀行(State Street)正為機構推出全面託管解決方案。

ETF 生態逐漸成熟,滿足了以往減半周期機構參與無法實現的要求。2025 年 7 月推出即供即換機制,有效提升 ETF 效率並減少追蹤誤差。比特幣與以太坊 ETF 2025 年 8 月實現每週 400 億美元成交量,機構級流動性已與主流資產看齊。這套基建讓機構無需直接管理、卻能合規參與比特幣上漲潛力。

企業財庫採納與 ETF 投資策略不盡相同。像微策略這類公司視比特幣為勝現金、債券的財務資產,作出長期價值儲存的戰略分配,並非短炒。這產生出「強者之手」持有,即使市場波動亦堅持不賣,從而於調整期托底,升浪時又減輕拋壓。

挖礦產業經歷四次減半如何轉型

經歷四次減半,比特幣挖礦從業餘晉身為工業級規模,每輪都需技術與經濟適應,以維持收益。網絡總算力變化證明這一點:2009 年僅微量運算力,今日已達 898.86 exahash/秒,超越了絕大多數國家。即使獎勵由每區塊 50 枚跌至當下 3.125 枚,比特幣升值和技術進步已充份抵銷減半影響。

當今礦業生態以公開上市公司為主角,規模空前。Marathon Digital 運行 29.9 exahash/秒產能,並計劃年內扩至 50 exahash。Core Scientific 自行挖礦產能達 19.1-20.1 exahash,並發展 AI 及高效能計算託管服務。Riot Platforms、CleanSpark、TeraWulf 等主要業者合計控有全球龐大算力,每次減半後產業整合更趨明顯,低效礦工逐步出場。

礦池格局反映了地域與技術的重大遷移。Foundry USA 目前佔有全球 33.49% 算力,標誌礦業向北美遷移。AntPool 仍保持 18.24%,雖受中國監管所累已不得不轉地。美國現時佔全球逾四成算力,過往周期僅佔極小比重;而中國的霸主地位則由高峰期七成五大幅下跌。

持續提升效率對礦業減半後盈虧非常關鍵。現代 ASIC 离礦效率達到 24-26 焦耳/TH,比早期動輒數百焦耳/TH 有巨大改善。新一代礦機預期 2025 年再進步,達到 5 焦耳/TH,能效再提升三倍。 efficiency improvement that could offset halving impact on marginal mining operations. This efficiency race drives constant capital investment in newer equipment, with older miners becoming unprofitable as rewards decline.

提升效率有機會抵銷減半對邊際礦工嘅影響。呢場效率競賽令礦業公司不斷投入資本買新設備,當獎勵下降時,舊機器礦工變得無利可圖。

Energy consumption patterns have shifted toward renewable sources as mining operations seek cost advantages and regulatory compliance. Cambridge University data indicates Bitcoin mining now uses - 43% renewable energy - , including hydro, wind, solar, and nuclear power. Mining companies increasingly co-locate with renewable energy projects, providing demand for stranded energy resources that would otherwise go unutilized. Texas leads this trend, with mining operations balancing wind and solar intermittency while participating in grid stabilization services.

隨住礦業尋求成本優勢同合規,能源消耗模式已經慢慢轉向可再生能源。根據劍橋大學數據,現時比特幣挖礦用 - 43% 可再生能源 - ,包括水力、風力、太陽能同核能。越嚟越多礦業公司同可再生能源項目合作,消耗本來用唔到嘅閒置能源。德州係領頭羊,礦場仲要應付風能同太陽能唔穩定,兼提供電網穩定服務。

The economic reality facing miners heading into 2028 involves doubled production costs due to halving effects. Current mining operations become profitable at electricity costs below - $0.06 per kilowatt-hour - for older equipment, while next-generation miners extend profitability thresholds to higher energy costs. Post-halving, these thresholds effectively double, forcing industry consolidation among the most efficient operators with access to cheapest electricity sources.

到2028年,礦工面對嘅經濟現實係,生產成本因為減半效應而倍增。現時啲舊機器礦工,如果電費低過 - 每千瓦時 $0.06 - 就有錢賺;新一代礦機可以應付更高電價。減半後,臨界點幾乎要雙倍,最後逼使產業去整合,只係得最有效率、搵到平電嘅礦工可以撐落去。

Mining revenue increasingly depends on transaction fees as block rewards diminish over successive halvings. Currently, transaction fees represent a small fraction of total mining revenue, but fee markets become increasingly important for long-term network security. During network congestion periods, daily fees can exceed $3 million, compared to historical averages below $1 million. The development of fee markets becomes critical for maintaining mining incentives beyond 2140 when block rewards reach zero.

隨住每次減半,礦工收入要越來越依賴交易手續費。依家手續費只佔挖礦收入嘅一小部份,但長遠嚟講,手續費市場會越嚟越重要,保障個網絡安全。塞車時期,單日手續費可以超過三百萬美金,相比昔日平均值低過一百萬。推動手續費市場發展好關鍵,尤其到2140年以後,當區塊獎勵去到零時,點先可以維持礦工動力靠嘅就係手續費。

Geographic distribution continues evolving due to regulatory changes and energy economics. While China's mining ban forced massive relocations, countries like Kazakhstan, Russia, and Canada have attracted significant mining investment. The United States benefits from diverse energy markets, favorable regulations in states like Texas and Wyoming, and established financial infrastructure supporting publicly traded mining companies. This geographic diversification reduces regulatory risks while improving network decentralization.

因為監管及能源經濟變化,礦場地理分布都持續轉變。中國封礦令一大批礦工搬家,成個生態圈移去哈薩克、俄羅斯、加拿大等地。美國則靠能源多元、德州及懷俄明等州有利法規,以及完善嘅金融基建,使上市礦業公司得益。咁分散地理上既降低監管風險,亦令整個網絡更去中心化。

Historical halving impacts reveal evolving market patterns

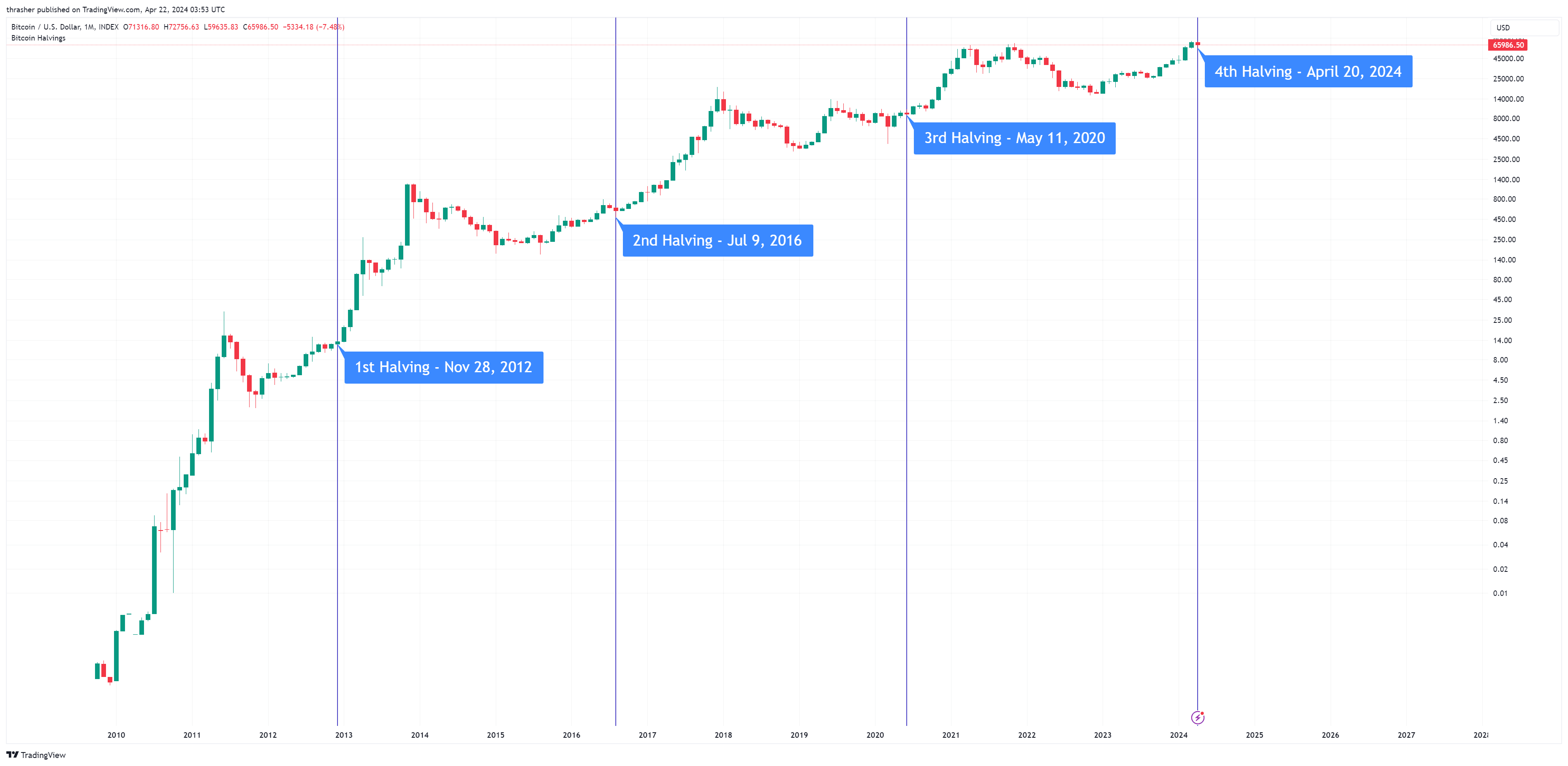

Bitcoin's four completed halvings provide quantitative evidence for how supply reductions affect price discovery, though each cycle occurred within different market contexts that influenced magnitude and timing of price responses. The mathematical progression shows diminishing returns as Bitcoin matures, but also longer cycle durations and higher absolute price levels that maintain mining profitability despite reduced percentage gains.

比特幣已完成四次減半,為供應減少點影響價格發現提供咗量化證據。不過,每次週期出現於唔同既市況,影響咗升幅同響應時間。數學上見到,隨住比特幣成熟,回報率下降,但周期變長、絕對價格抬高,又保住咗礦工利潤,即使升幅百分比減少。

The November 28, 2012 halving established the foundational pattern when mining rewards dropped from 50 to 25 bitcoins per block. Bitcoin traded at - $12.35 on halving day - and reached - $1,147 within twelve months - , representing a staggering 9,188% gain. This inaugural halving cycle occurred during Bitcoin's experimental phase with minimal institutional awareness, limited exchange infrastructure, and CPU-based mining operations. The network's hash rate barely exceeded 25 terahashes per second, while daily trading volumes remained below $10 million.

2012年11月28日第一次減半,產量由每格50個減至25個,建立起比特幣減半嘅典型走勢。當日價錢 - $12.35 - ,十二個月後去到 - $1,147 - ,升幅高達9,188%。當時仲係比特幣實驗階段,機構未有關注,交易所基建未完善,大家都用CPU玩挖礦。全網Hashrate只係25 TH/s左右,日成交量都低過一千萬美金。

The July 9, 2016 halving reduced rewards from 25 to 12.5 bitcoins per block amid growing institutional interest and professional mining operations. Bitcoin's halving day price of - $650.63 - preceded an initial 40% decline before the sustained bull market drove prices to - $19,987 by December 2017 - , a 2,972% gain over seventeen months. This cycle featured the emergence of cryptocurrency derivatives, regulated exchanges, and ASIC mining equipment that dramatically increased network security to 1.5 exahashes per second.

2016年7月9日減半,區塊獎勵由25減至12.5個,比特幣逐漸受到機構關注,礦業開始專業化。當日價錢 - $650.63 - ,初期回落咗40%,但長牛市推到 2017年12月 - $19,987 - ,升幅有2,972%。呢個周期開始有幣衍生品、受規管交易所以及ASIC礦機,網絡算力暴升至1.5 EH/s。

The May 11, 2020 halving coincided with COVID-19 pandemic uncertainty and early institutional adoption signals. MicroStrategy and Tesla's corporate treasury allocations during this cycle marked the beginning of institutional acceptance. Bitcoin's halving day price of - $8,821 - eventually reached - $69,040 by November 2021 - , representing a 683% gain over eighteen months. The concurrent DeFi boom and NFT speculation created additional demand for Bitcoin as a foundational cryptocurrency, while network hash rate expanded to 120 exahashes per second.

2020年5月11日減半撞正COVID-19疫情,機構投資訊號初現。MicroStrategy同Tesla等企業進場標誌住機構開始接納。減半當日價錢 - $8,821 - ,到2021年11月升到 - $69,040 - ,即683%升幅。同期DeFi及NFT爆紅,令比特幣作為基礎幣需求增加,全網算力升到120 EH/s。

The April 20, 2024 halving broke historical patterns by occurring after Bitcoin had already achieved new all-time highs in March 2024. The - $73,135 pre-halving peak - represented the first time Bitcoin reached record prices before a halving event, driven by ETF launches that generated over $9 billion in institutional inflows. Bitcoin traded at - $64,968 on halving day - before declining 16% in subsequent weeks, suggesting traditional "sell-the-news" dynamics as the event became widely anticipated.

2024年4月20日減半打破過往走勢,因為比特幣響同年三月已創新高。 - $73,135 - 係首個減半前立新高,主因ETF上市,吸引超過九十億美金機構資金流入。減半當日交投 - $64,968 - ,之後幾星期回落16%,徹底反映「賣消息」效應,因為大家早有預期。

Academic analysis reveals consistent statistical patterns across halvings despite different market contexts. Regression analysis demonstrates 95% confidence intervals for outperformance beginning 100+ days post-halving, with optimal timing windows occurring 400-720 days after each event. The average performance 500 days post-halving across the first three cycles exceeded 1,800% gains, though with decreasing magnitude as Bitcoin's market capitalization expanded.

學術分析發現,即使各次減半市況有異,但統計走勢一致。回歸分析指,減半後100日開始高於大市有95%信心,最佳升浪喺400-720日之間。頭三次減半後500日平均升幅超過1800%,但隨市值擴大,幅度每次縮減。

Mathematical models based on historical data predict the next cycle peak around November 2025, approximately 19 months after the 2024 halving. These models anticipate the following trough in November 2026, 31 months post-halving, based on extending historical cycle patterns. However, the unprecedented pre-halving all-time high and institutional demand structure suggest traditional timing models may require recalibration for current market conditions.

基於歷史數據嘅數學模型預測下次牛頂係2025年11月,即2024減半後19個月左右。下一次大調整周期預計2026年11月,即減半後31個月。不過今次首次減半前已創新高,加上機構參與方式有變,傳統周期估算或要調整。

The evolution from 93x gains in 2012 to 7x gains in 2020 demonstrates Bitcoin's maturation trajectory while absolute price increases remain substantial. Even diminished percentage returns translate to significant dollar appreciation as Bitcoin's price base expands. A theoretical 3x gain from $70,000 pre-2028 halving levels would reach $210,000, representing hundreds of billions in market capitalization increase despite modest percentage terms relative to early cycles.

2012年升咗93倍,到2020年只得7倍,其實反映比特幣逐漸成熟。不過,雖然升幅收窄,價格基數升咗好多,以美金計都係勁噴。舉例下次減半前$70,000起步,如果升3倍都可上到$210,000,市值加幾千億美金,雖然幅度相對以前低,但數量依然好誇張。

Market microstructure has transformed across halving cycles as institutional participation increased. The 2012 cycle featured retail-dominated trading with high individual volatility. The 2016 cycle included early institutional players alongside sophisticated retail traders. The 2020 cycle mixed retail enthusiasm with emerging corporate adoption. The 2024 cycle demonstrated institutional flows dominating through ETF demand structure, creating different volatility patterns and recovery timelines compared to retail-driven historical cycles.

隨住機構參與,減半周期見到市場結構大變。2012年散戶主導,波動勁。2016年已有早期機構,加上進階散戶。2020年就有企業參與,零售興奮。到2024年,ETF等機構資金主導市場,波動模式、復甦節奏同舊式散戶時代已截然不同。

Corporate treasuries and ETFs reshape demand dynamics

The structural transformation of Bitcoin demand from speculative trading to strategic allocation fundamentally alters traditional halving economics. Unlike retail investors who often trade based on sentiment and technical analysis, institutional holders typically maintain positions through extended periods, creating sustained demand pressure that previous cycles lacked. This "strong hands" ownership pattern becomes increasingly significant as institutional allocation percentages continue expanding.

比特幣需求由投機買賣轉成策略配置,令傳統減半經濟學徹底改變。唔同零售炒家,機構通常長期持有,帶來長線買盤,過往周期無出現過。「強手」持幣模式愈來愈重要,因為機構配置比例一直升。

BlackRock's IBIT ETF exemplifies institutional demand mechanics with - $71 billion in assets under management - and record-breaking inflows reaching - $6.35 billion in May 2025 alone - . The fund's success demonstrates institutional appetite for Bitcoin exposure through regulated financial products rather than direct cryptocurrency ownership. IBIT's - $4.2 billion single-day trading volume - in April 2025 exceeded many individual stock trading volumes, indicating Bitcoin's integration into traditional portfolio management strategies.

BlackRock旗下IBIT ETF就好好示範咗機構需求,管理資產規模 - $710億 - ,2025年5月單月資金流入破頂,高達 - $6.35億 -。呢隻基金顯示機構想要受監管產品去接觸比特幣,而唔係直接持有加密貨幣。IBIT 2025年4月 - 單日成交$42億 -,超越不少股票,反映比特幣已納入傳統投資組合策略。

The competitive dynamic between ETFs and corporate treasury adoption reveals different institutional approaches to Bitcoin investment. While ETFs provide diversified exposure for institutional investors managing multiple asset classes, corporate treasury allocation represents strategic decisions by individual companies to hold Bitcoin as a primary reserve asset. The second quarter of 2025 data shows - corporate treasuries acquired 131,000 bitcoins - compared to - 111,000 bitcoins added by ETFs - , marking the third consecutive quarter where direct corporate buying exceeded ETF accumulation.

ETF同企業資金參與構成咗不同機構投資方式。ETF幫機構多元配置資產,企業財資則係公司主動選擇持幣做儲備。2025年第二季數據顯示, - 企業賬戶買入13.1萬個比特幣 -,而 - ETF增持為11.1萬個 -,連續三季企業直接買入多過ETF。

MicroStrategy's treasury strategy serves as a template for corporate Bitcoin adoption, with the company holding - 582,000 bitcoins - valued at over $62 billion. The company's aggressive acquisition program targets $84 billion in total Bitcoin purchases by 2027, representing one of the largest corporate asset allocation strategies in history. MicroStrategy's approach involves using debt and equity offerings specifically to fund Bitcoin purchases, creating a direct pipeline from capital markets to Bitcoin demand.

MicroStrategy嘅財資策略成為企業買幣樣板,持有 - 58.2萬個比特幣 -,市值超過620億美金。佢哋目標2027年前累計買到840億美金比特幣,成為史上最大公司持資產計劃之一。MicroStrategy更以發債、供股等專門為買幣集資,將資本市場資金直接引到加密貨幣。

The withdrawal of - 425,000 bitcoins from exchanges - since November 2024 demonstrates how institutional accumulation directly impacts liquid supply. This phenomenon creates artificial scarcity beyond the protocol's halving mechanism, as long-term holders remove coins from trading circulation. Exchange reserves at - 2.5 million bitcoins - represent five-year lows, indicating that available supply for trading has declined even as total bitcoins in circulation continue growing through mining.

自2024年11月起,交易所 - 減少咗42.5萬個比特幣 -,證明機構吸納對供應有直接影響。長線持有人將幣移出交易所,造成減半以外嘅供應人為短缺。交易所剩餘 - 250萬個比特幣 - 屬於五年新低,顯示流通供應縮減,就算同時繼續有新幣挖掘流入市面。

Goldman Sachs's evolution exemplifies traditional finance's Bitcoin integration path. The investment bank increased its Bitcoin ETF holdings by - 88% to $1.4 billion - , becoming BlackRock's largest IBIT shareholder while expanding cryptocurrency services forinstitutional clients. 這種從懷疑到大量配置的轉變,反映了更廣泛的華爾街接受度,這種趨勢自2020年減半周期開始,在2024年ETF獲批後進一步加速。

支援機構投資者入場的監管框架,較過往幾次減半後有重大成熟。2024年1月,美國證監會(SEC)批准現貨比特幣ETF,移除以往限制機構參與的監管障礙。緊接著,2025年7月,批准ETF以實物創建及贖回機制,提升ETF運作效率及減少專業投資者關注的追蹤誤差。這些監管優化為2028年減半周期機構持續入場,建立穩固運作基礎。

銀行界整合令機構採納進一步加速,利用傳統金融服務渠道。JPMorgan夥拍Coinbase,讓Chase信用卡可用於加密貨幣充值;而PNC Bank直接提供銀行賬戶加密貨幣交易。Morgan Stanley考慮向數千名經紀推薦比特幣ETF,有機會令數以百萬計散戶投資者,經傳統財富管理渠道接觸比特幣。

由以交易為主轉向持有為主的需求轉變,預示2028年減半時價格行為將有別以往。歷史減半周期通常先急升後劇烈調整,因散戶交易者會獲利了結。機構持有人則較多會穿越高波動期繼續持倉,著重長線價值增長多於短線交易利潤。這種行為差異有機會延長牛市週期,並減緩以往高峰至低谷大幅波幅。

採礦經濟經產業化蛻變

比特幣採礦經多輪減半周期,已由去中心化個人行為,演化為高度集中的產業化運作,對網絡安全性、地域分布及經濟可持續性帶來重大影響,迎向2028年。數學現實是每四年採礦獎勵減半,但運作成本持續上升,迫使技術不斷革新與追求效能以維持利潤空間。

目前全網算力高達 - 898.86 exahashes per second - ,其計算力超越大多數國家總和,透過工作量證明共識機制守護比特幣網絡。儘管經歷三次減半,算力仍持續上升,反映幣價升值及技術進步得以抵消獎勵減半的影響。不過,下一輪2028年減半獎勵將由3.125降至1.5625枚比特幣每區塊,邊際礦工生產成本實際倍升,考驗此一動態能否延續。

現代ASIC礦機效能已提升至 - 24-26 joules per terahash - ,較早期設備提升一千倍。比特大陸、微比特與嘉楠等公司持續創新半導體設計,以面對減半後利潤收窄。新一代礦機目標2025年達到 - 5 joules per terahash - ,效能3倍提升,雖然創新速度已放緩,不及比特幣早年指數型增長。

現時上市礦企主導算力分布,取代早年個人礦工的地位。Marathon Digital擁有 - 29.9 exahashes per second - 運作能力,需多個數據中心及工業級基建,總耗電量等同小型城市。Core Scientific操作 - 19.1-20.1 exahashes per second - 並多元發展AI及高性能運算托管,提升設施利用及開拓新收入來源。

中國禁礦後,全球算力分布重組,反映監管變動可迅速重塑網絡安全格局。原來佔全球逾75%算力的中國礦場,2021年政策出台數月內,大規模轉移至哈薩克、俄羅斯、加拿大及美國。現時美國承載超過 - 40%全球算力 - ,受惠於多元化能源市場、德州及懷俄明州等州的寬鬆政策,以及支援上市礦企的金融基建。

能源補給已變成爭勝關鍵,礦場力爭最低成本電力以維持利潤。劍橋大學數據顯示 - 43%用可再生能源 - 包括水力、風電、太陽能及核能。德州為可再生能源礦業領頭羊,運作時平衡風、太陽能不穩定,同時在用電高峰期提供電網穩定服務。越來越多礦企與可再生能源項目共址,轉化無法送往用戶的過剩能源資源。

礦業利潤底線取決於電力成本,現時較舊設備需低於$0.06每千瓦時電價方可存活。2028年減半後,損益線將加倍,促進行業整合,唯有擁有最低電價與最有效設備的營運商可生存。這一整合趨勢每次減半後更明顯,低效礦工陸續退場,留下具可持續競爭力的經營者。

隨著區塊獎勵每次減半接近零,交易費用收入日益重要。現時高峰時每日交易費用約 - 300萬美元 - ,歷史常態低於100萬美元,反映費用市場逐步形成。不過,手續費收入仍佔比不高,長遠對於2140年區塊獎勵歸零後,如何保障網絡安全仍然存疑。

礦池分布反映算力高度集中於大型運營商。Foundry USA掌控 - 33.49%全球算力 - ,主要服務北美礦企並當地專業礦池。AntPool則維持 - 18.24% - ,即使面臨中國禁礦監管。算力集中於首數大礦池引起去中心化憂慮,但礦池用戶可隨時轉池,若礦池行為惡意,形成公平運作的經濟動力。

雙用途礦業設施是一新興方向,場地同時支援加密貨幣挖掘、AI訓練及高性能運算。這種多元化策略能於比特幣挖礦短暫虧損時維持設施利用,令礦場可跨越商品價格週期,保持穩定收入。

越來越多環保規例影響礦場經營,政府推行碳排放限制及可再生能源要求。歐盟建議取消加密礦業稅務優惠,不同司法區亦直接限制以化石燃料供電。這一趨勢有利已實現可再生能源或碳中和運作的礦企,除純電價外形成額外競爭優勢。

價格預測模型與分析師觀點一致看好大幅升值

多個量化模型、機構分析及學術研究一致認為,2028年減半周期內比特幣價格將有可觀升幅,儘管預測目標及時點分歧甚大。傳統金融機構、加密研究公司及學術模型大致看好升勢,但針對目標及估值方法手法各異。

ARK Invest提供最進取的機構預測, - 熊市情境目標約30萬美元 - , - 基本情境約71萬美元 - , - 牛市情境到2030年高達150萬美元 - 。其多元模型納入ETF機構採納速度、新興市場需求、主權儲備潛力及Metcalfe定律網絡效應,推斷指數型增長路徑。模型假設比特幣ETF到2033年佔總供應15%,需要機構持續吸納,延續現有趨勢。

傳統投行提供較保守但仍然看好的評估,主要採用生產成本及價值儲存競爭模型。高盛估算,若比特幣佔全球價值儲存市場20%,可達 - 10萬美元 - ,直接挑戰黃金避險地位。JPMorgan則根據生產成本,認為減半後價格可穩於 - 5.3萬美元 - 以上,但起初仍預計需經一輪修正才可持續上升。

Stock-to-flow(S2F)模型雖於2022年預測失效,但基於稀缺性的原理仍預計大幅升值。現時S2F約為58,減半後可升至約116,支持 - 13萬美元 - 以上目標。儘管模型於2022年加密寒冬時失效,支持者認為機構入場與監管明朗化,令市場動態不同,或可回復過往稀缺與價格間的歷史關係。

Metcalfe定律應用於Bitcoin估值顯示,按網絡擴展計算,具有指數式增長潛力。Fidelity的模型預測——到2038-2040年,每個比特幣價值可達10億美元——並且依照用戶採納曲線和網絡價值關係,預計中期目標價——2030年前後的每個比特幣約100萬美元。這些模型假設比特幣用戶基數及其應用性持續擴展,不僅僅作為投機工具,還能作為功能性貨幣和價值儲存手段。

學術研究對比特幣長期估值潛力持有不同觀點。聯邦儲備局的分析指出,比特幣與傳統宏觀經濟因素脫鉤,質疑標準資產定價模型是否適用於加密貨幣市場。然而,網絡外部性研究則顯示,價值會隨著採用率和交易量的增長成正比上升,若比特幣能夠作為數碼貨幣被更廣泛接受,則支持長線看漲走勢。

風險場景分析揭示,即使市場整體預期看漲,對於主流預測仍然存在大量不確定性。監管打壓、技術故障、市場飽和、利率上升令具收益資產更具吸引力,以及挖礦中心化問題,都有機會令升值走勢受阻。相反,若國家層面持有比特幣儲備、機構採納加速、貨幣貶值帶動對替代資產需求,以及Layer 2技術成功發展,都有可能令價格超越現有進取目標。

Monte Carlo模擬試圖通過概率模型量化預測不確定性。ARK Invest的分析顯示——一年期預測有77%機會錄得正回報——在95%信心區間下,價格分佈於3萬至44.8萬美元,說明即使市場主流預期向好但仍存重大不確定性。這些寬廣的預測範圍,反映對於採納速度、監管回應和宏觀經濟條件的不確定性,這些因素將影響比特幣的長遠走勢。

生產成本模型則聚焦於挖礦經濟學以確立底價,認為比特幣價格長遠會貼近邊際生產成本。2028年減半之後,獎勵減少亦即生產成本有效地翻倍,或可支撐更高的價格水平。但這些模型是假設挖礦活動持續有利可圖,並忽視技術效率提升有可能降低成本的情況。

與傳統商品的比較分析則提供了其他估值框架。比特幣的庫存對流量(Stock-to-Flow)比接近黃金,意味理論上或可按其優越的攜帶性、可分割性及易確認性,達到跟黃金同價甚至溢價。假如比特幣能夠從黃金——市值13萬億美元——搶佔大量市佔,單個比特幣價格純以市場替代效應計算,或可高達數十萬美元。

市場認同的主流觀點是,2028減半周期前,價格將大幅升值,較為保守的預測為10萬至20萬美元一枚,進取模型則提出40萬至60萬美元的目標。這個寬幅預測反映市場對機構級採納速度、監管回應、技術發展及宏觀經濟條件存有真正的不確定性,而最終會決定比特幣在下次減半周期的價格走勢。

監管環境變革帶來前所未有的機構支持

圍繞比特幣的監管環境自過去數個減半週期以來已徹底改變,從敵意及懷疑轉為結構化接納,為機構投資者提供大規模採納所需的法律清晰度和營運框架。這一監管演變令2028年減半時的環境,將與過往所有監管不明朗和執法高壓的週期大相逕庭。

特朗普政府於2025年1月23日簽署的行政命令「Strengthening American Leadership in Digital Financial Technology」是美國歷來最全面的支持加密貨幣政策框架。該命令訂立使美國成為「全球加密之都」的目標,同時推動美元支撐穩定幣、建立戰略比特幣儲備及數字資產儲備庫。這一由上屆政府強硬執法措施轉向的政策逆轉,為機構投資者帶來策略性配置所需的監管確定性。

SEC主席Paul Atkins領導下,推動由以往Gary Gensler的敵對監管轉變為以創新為導向的政策框架,務求為加密企業提供清晰的發展路徑。Hester Peirce專員帶領的加密貨幣專責小組制定了涵蓋證券分類、定制披露制度及實用登記途徑的規定。這種協作方式與以往減半週期充斥的執法打壓及監管不穩大相徑庭。

撤銷SAB 121之前,大型銀行因需承擔繁重資產負債管理要求,無法提供加密貨幣託管服務。監管變革令傳統金融機構可以直接提供比特幣託管及交易服務,使機構客戶群超越了原本專門的加密服務公司。摩根大通、高盛、摩根士丹利等多家大型銀行,均於獲得監管明朗後宣佈拓展加密貨幣服務。

2024年1月比特幣ETF獲批,成為機構級接受的重要轉捩點,讓監管產品符合退休基金、捐贈基金及機構資產管理人的受託要求。隨後於2025年7月批准ETF實物創建及贖回機制,提高了ETF運作效率並減低了高端投資者關注的追蹤誤差。這些監管突破,奠定了支撐管理超過——5,000億美元比特幣ETF資產——的營運基建(截至2025年)。

州級採納比特幣的步伐亦因法例支持加密儲備及支付而加速。新罕布什爾州撥出州儲備5%配置於比特幣,亞利桑那州亦推出比特幣儲備計畫。這類州級舉措為更廣泛政府接受帶來監管先例和政治動力,並可能左右聯邦政策和國際規範協調的進程。

國際協調方面,G20及金融行動特別工作組(FATF)的標準落實建立了全球加密合規和跨境交易框架。加密資產共同申報標準(CARF)令48個國家間自2025年起自動交換加密資產交易信息,讓稅務機關獲得完整數據,同時為跨多司法管轄區經營的機構投資者提升監管確定性。

歐盟的「加密資產市場法」(MiCA)於2024年12月30日實現全部成員國覆蓋,為加密服務提供商和穩定幣設定了全面規管,歐盟跨國營運權讓合法加密服務迅速覆蓋所有成員國,推動了歐洲機構普及採納。

央行數碼貨幣(CBDC)發展形成的競爭關係,反而推動比特幣需求。現時全球137個佔98% GDP國家研究CBDC,但研究顯示政府數碼貨幣和比特幣回報之間呈正相關。特朗普政府禁止發行美國CBDC,同時推動美元支撑穩定幣,為比特幣作為非政府數字資產帶來政策清晰度。

稅務政策的演變亦為機構投資者提供配置所需的營運確定性。2025年起Form 1099-DA申報要求將涵蓋所有加密交易,而2026年起的成本基準追蹤,則讓機構資產組合管理更為透明和規範。這些監管變革消除過往因稅務不明朗而影響機構採納比特幣的障礙。

環保監管越來越多地影響挖礦運作,包括碳排放限制及可再生能源要求,不過不同司法轄區政策分歧極大。歐盟建議取消挖礦稅務優惠,而美國如德州則鼓勵以可再生能源進行加密挖礦。這種監管分化使對加密友好的地方具競爭優勢,但或限制那些環保標準高的地區挖礦業發展。

銀行業整合步伐加快,來自監管明朗化,令傳統金融機構可放心提供加密業務。摩根大通與Coinbase合作為Chase信用卡加密資金充值,PNC Bank亦允許賬戶直接交易加密貨幣,摩根士丹利則考慮向客戶推薦比特幣ETF,顯示加密與傳統金融的融合是得益於政策明確。

回顧過往減半周期,可見監管演進對機構採納的重要性。2012年減半時監管一片混亂,Mt. Gox基本上是唯一交易所且缺乏真正監管。2016年減半雖有初步框架,但執法風險仍然高企。2020年減半監管清晰度增加但機構基建仍不足。2028年減半,則........全面監管框架以史無前例的規模支持機構參與。

技術網絡發展擴展比特幣用途,超越「數碼黃金」

比特幣的技術基礎設施經過Layer 2解決方案、協議改進及擴容發展大幅提升,將網絡的用途由單一價值存儲延伸,創造新增的需求動力,有機會放大2028年減半的經濟效應。這些技術發展針對過去在交易吞吐量、可編程性及用戶體驗上的限制,同時維持比特幣底層的安全性及去中心化特質。

閃電網絡(Lightning Network)作為最重要的Layer 2擴容方案,截至2025年,總鎖倉價值約1.45億美元,擁有超過16,400個節點及75,700條支付通道。閃電網絡令比特幣交易可以即時結算,平均交易費僅0.0016聰($0.000000443),比起基礎層動輒超過$10的擁塞時段大幅降低交易開支。這個支付基建令比特幣不僅僅作為價值存儲工具,也可以成為交換媒介,有潛力拓展超越投機及財庫配置的需求。

閃電網絡的普及主要來自商戶整合、匯款服務及利用比特幣可編程特性的微支付應用。主要支付處理商如Strike、Cash App,以及多間國際匯款服務,都採用閃電網絡進行跨境轉賬,無需傳統代理銀行系統。這些應用場景為比特幣帶來持續流動性需求,並展現多於單純投資外的實際用途。

Rootstock(RSK)則為比特幣引入智能合約功能,兼容以太坊,同時透過合併挖礦方式維持比特幣的安全性。這條側鏈允許去中心化金融(DeFi)應用、資產代幣化及編程化比特幣功能,打破其他鏈在此領域的壟斷。RSK的發展令比特幣有潛力在DeFi市場捕捉更多價值,同時底層保持穩健發展。

Stacks則是另一重大Layer 2發展,透過其獨特共識機制,將智能合約及去中心化應用帶進比特幣並錨定到其底層。其Clarity程式語言提供正式驗證能力,相對其他智能合約平台更加安全,而比特幣錨定則確保交易不可逆與工作量證明共識。

Liquid Network 則以聯邦側鏈方式運作,為機構級比特幣交易提供更快結算及更強隱私功能。這個網絡讓主要交易所及金融機構可以進行大額交易和託管運作,減輕基礎層因高額轉賬而造成的塞車,為機構參與提供所需基建。

除了閃電網絡之外,其他狀態通道實作亦針對特定用例(如遊戲、微支付、串流應用等)提供額外擴容選項。這些技術發展讓比特幣具備可編程功能,同時不損其基礎層安全性,推動新應用,持續提升比特幣流動性需求。

比特幣改進提案(BIP)程序持續通過社群共識推動協議發展,至今比特幣歷史上已有389項BIP,涵蓋關鍵協議變動、協議優化及過程改進。近年BIP重點包括隱私提升、擴容優化及開發工具等,既提升比特幣技術潛能,又保障兼容性及去中心化特質。

2021年Taproot升級為增強隱私及可編程性奠定基礎,Layer 2解決方案續於此之上開發。Taproot腳本效率提升可降低交易成本,令更複雜智能合約成為可能,並以輸出不可區分性提升私隱。這些底層升級為Layer 2發展提供堅實基石,擴闊比特幣技術能力。

挖礦基建近年的突破包括利用滯留能源變現、可再生能源融合及雙用途設施,可優化加密貨幣挖礦與人工智能運算的資源配置。這些基建提升挖礦經濟效益,同時解決環保疑慮,有助機構採用及監管層面決策。

以比特幣為基礎的金融服務發展,進一步令比特幣需求突破單純投機及財庫配置。借貸協議、衍生品平台及託管服務皆於比特幣基礎建設上運作,容許複雜金融應用,並同時維持比特幣安全屬性。這些服務使比特幣產生收息機會,足以與傳統固定收益產品競爭。

閃電網絡、混幣服務及協議層的隱私增強,針對機構對交易可見度及合規性的關注。進一步的私隱功能,讓比特幣可用於需保密交易的應用,同時以選擇披露機制維持監管透明度。

跨鏈互操作性方案透過封裝比特幣(Wrapped Bitcoin)、原子交換及橋協議,令比特幣可與其他區塊鏈網絡整合。這些技術發展讓比特幣跨越不同去中心化金融生態,同時保留原生擁有權及安全性。

技術基礎成熟後,比特幣需求動力超越投機,足以放大2028年減半帶來的經濟效應。比特幣由數碼黃金演進為可編程貨幣,Layer 2解決方案讓網絡擷取來自支付、去中心化金融等多元應用的價值,持續帶動流動性需求。這種用途擴展會與減半機制造成的供應壓縮效應產生協同,對比特幣價格帶來更大上升動力。

與傳統商品比較揭示比特幣獨特經濟特質

比特幣的貨幣與經濟特徵與傳統商品大相逕庭,衍生前所未見的供求動力,有機會放大減半效應,超越傳統商品市場的既有行為。雖然黃金及其他貴金屬可作比較框架,比特幣的數碼性質、編程式稀缺以及網絡效應,在傳統商品市場中極為罕見。

黃金的「存量/年流量比率」(stock-to-flow)大約為70,每年產量約三千公噸,現存地上黃金總量約二十萬公噸。比特幣現時的存量/流量比為58,已接近黃金,到2028年減半後預期提升至約116,超越黃金的稀缺度。不過,比特幣供應由演算法確定,不受地質發現或挖礦經濟影響,與黃金誕生模式根本不同,產生本質上截然不同的供應動力。

與黃金不同,黃金開採會因價格刺激而增加探礦及擴產,但比特幣挖礦無論價格或投資多少,總供應都不會超過預定安排。正因為這種供應非彈性,比特幣價格一旦上漲,不會像傳統商品牛市一樣,激發更多供應從而緩和升幅。比特幣這種數學確定的供應安排,在商品市場史無前例地創造出獨特的稀缺經濟學。

工業商品如銅、石油、農產品,一般存量/流量比介乎1至5之間,原因是持續被製造及能源產業消耗。這些商品會因產能調整或替代品出現而平衡供需,亦自然平抑價格波動。比特幣既無工業用途,亦無替代品,故需求動力只由貨幣及投機因素推動,而非生產經濟應用。

白銀是另一比較對象,兼具工業金屬與貨幣資產角色,存量/流量比大約是25,比特幣已超前。白銀的雙重需求令其價格動力與純粹儲值資產如比特幣大為不同。不過,白銀供應會受挖礦及回收影響,價格上升時可有增產,而比特幣的固定供應模型則排除供應方對需求增長的回應。

傳統商品交易涉及實體儲存、物流、質量驗證及交割程序,增加營運成本及市場摩擦。但比特幣作為數位資產,完全消除了這些實體限制,做到全球即時傳送、可細分至小數點後八位、利用加密簽章進行百分百真偽驗證。這些優越貨幣屬性,令比特幣在儲值用途上較物理商品更具競爭優勢。

網絡效應令比特幣有別於傳統商品,根據梅特卡夫定律,網絡價值隨用戶數平方上升。黃金及其他商品並無此網絡效應,其價值只源於傳統供需平衡而非用戶網絡擴展。比特幣的網絡效應創造出價值指數級上漲的潛力。as adoption increases, contrasting with linear supply-demand relationships governing traditional commodities.

隨著比特幣被越來越多人採用,其經濟特性同傳統商品受線性供求關係支配有鮮明對比。

Storage and custody differences create operational advantages for Bitcoin compared to physical commodities. Gold storage requires secure vaults, insurance, transportation, and verification systems that generate ongoing costs and operational risks. Bitcoin storage requires secure key management but eliminates physical infrastructure costs while enabling global accessibility through internet connectivity. These operational advantages reduce barriers to Bitcoin ownership and accumulation.

儲存同託管方式上的分別,令比特幣喺操作上比實體商品,例如黃金,更有優勢。黃金必須存放喺安全金庫、購買保險、運輸同驗證,呢啲都會帶嚟長期成本同操作風險。但比特幣只需要進行安全密鑰管理,完全唔需要物理基建開支,而且透過互聯網全球都可以隨時存取。呢啲操作優勢減低左持有或者儲存比特幣嘅入場門檻。

Divisibility and transferability provide Bitcoin with monetary properties that exceed traditional commodities. Gold's physical properties limit divisibility and complicate small-value transactions, while Bitcoin enables micro-transactions and precise value transfer without physical constraints. These properties support Bitcoin's utility as medium of exchange in addition to store-of-value applications, creating broader demand patterns than pure commodity investments.

可分割性同易轉讓性,令比特幣具備超越傳統商品嘅貨幣特性。黃金受限於其物理屬性,難以細分,亦唔方便進行小額交易;但比特幣則能精細分割、輕鬆進行微交易或者準確轉帳,而且完全唔受物理限制。呢啲特質,支援比特幣除左作為價值儲存之外,亦可做交易媒介,因而帶來比純商品投資更廣闊嘅需求。

Market structure differences affect price discovery mechanisms between Bitcoin and traditional commodities. Commodity markets feature established futures markets, spot trading, and industrial hedging that create sophisticated price discovery mechanisms. Bitcoin markets remain relatively nascent but increasingly sophisticated through ETF development, derivatives markets, and institutional participation that improve price efficiency and reduce volatility.

市場結構分別影響比特幣同傳統商品嘅價格發現機制。商品市場已經有完善嘅期貨市場、現貨交易同工業對沖,令價格發現機制成熟。而比特幣市場雖然仲相對新,但隨住ETF發展、衍生工具市場同機構參與程度提升,價格效率改善,波動減低,市場漸趨成熟。

Regulatory frameworks governing Bitcoin differ substantially from traditional commodity regulations developed over decades of market evolution. Commodity markets operate under comprehensive regulatory oversight addressing market manipulation, position limits, and delivery requirements. Bitcoin regulation continues evolving but increasingly resembles securities regulation rather than commodity frameworks, creating different market dynamics and investor protection mechanisms.

比特幣嘅監管基礎同經歷數十年演變嘅傳統商品監管大為不同。商品市場由全面監管負責,包括操縱監控、持倉限制、交收規定等。比特幣監管框架不斷變化,亦越來越似證券監管體系多過傳統商品,形成唔同市場動態同投資者保障機制。

The absence of productive yield distinguishes Bitcoin from income-generating assets but aligns with gold and other non-yielding stores of value. However, Bitcoin's potential for yield generation through lending, staking derivatives, and Layer 2 applications creates opportunities for return enhancement without compromising base asset ownership, contrasting with physical commodities that lack similar yield opportunities.

比特幣冇產生收益,令佢同會派息或者派利息嘅資產區分開,但就同黃金等冇息資產一樣。不過,比特幣透過借貸、質押衍生品、Layer 2應用等方式,有機會創造額外收益,而且唔需要放棄資產擁有權,呢一點參與比傳統的實體商品有優勢。

Correlation patterns between Bitcoin and traditional commodities reveal changing relationships as Bitcoin matures. Early Bitcoin development showed minimal correlation with commodity markets, but institutional adoption has increased correlation with risk assets while maintaining negative correlation with the U.S. dollar. These correlation patterns suggest Bitcoin increasingly functions as risk asset rather than commodity hedge, though this relationship may evolve as institutional adoption progresses.

比特幣同傳統商品之間嘅相關性,隨住比特幣市場成熟不斷變化。早期比特幣同商品市場關聯極低,但機構參與增加之後,比特幣同風險資產相關性提升,仍然保持同美元負相關走勢。呢啲走勢顯示,比特幣愈來愈傾向係風險資產,而唔係商品避險工具,但隨住機構進一步介入,呢種關係未來仲可能再變。

The unique combination of programmatic scarcity, network effects, superior monetary properties, and institutional adoption creates economic dynamics for Bitcoin that differ fundamentally from traditional commodities. While commodity frameworks provide useful analytical tools, Bitcoin's digital nature and network characteristics generate unprecedented economic behavior that may amplify halving effects beyond historical commodity market patterns.

比特幣結合左編程式稀缺、網絡效應、卓越貨幣屬性同機構採納,構成同傳統商品完全唔同嘅經濟動力。雖然可用商品分析框架參考,但比特幣嘅數字特性同網絡效應會產生超乎以往商品市場嘅前所未見經濟行為,有可能進一步加劇減半效應。

Current 2025 market conditions set stage for unprecedented halving dynamics

現時2025年市場環境為比特幣帶來史無前例嘅減半動力

The Bitcoin market environment heading into the 2028 halving presents unprecedented institutional adoption, regulatory clarity, and technical infrastructure that fundamentally differs from conditions surrounding previous halving events. These structural changes suggest the 2028 halving will operate within mature financial markets rather than speculative cryptocurrency ecosystems that characterized earlier cycles, potentially creating different risk-reward profiles and volatility patterns.

比特幣市場喺踏入2028年減半前,已經出現咗極高機構參與度、更明確監管規範同成熟技術基建,基本格局同過去幾次減半完全唔同。呢啲結構性變化預示,2028年減半將喺成熟金融市場運作,而唔再係過往以投機主導嘅加密貨幣生態,有機會創造更唔同嘅風險回報特徵同波動性形態。

Institutional ownership concentration has reached levels that create structural demand and supply dynamics unlike previous halving cycles. With - over 10% of Bitcoin supply controlled by institutions - through ETFs and corporate treasuries, the market features significant "strong hands" ownership that historically maintains positions through volatility periods. This ownership concentration reduces liquid trading supply while providing price support during market corrections, creating conditions where supply reduction from halving meets already constrained available supply.

機構持倉集中度已達到令結構性供需局面發生重大變化嘅水平。現時有超過10%比特幣供應量由ETF及企業金庫等機構長期持有,市場擁有大量「強手」持倉,過往經常穩陣捱過市場波動。呢種持倉集中化導致流通供應減少,對價錢提供支持,所以當減半令供應更加少時,市場可供買賣份額已經好有限。

Bitcoin's correlation with traditional financial markets has evolved from near-zero relationships during early halvings to current correlations of - 0.58 with the Russell 1000 - and - 0.53 with financial stocks - . This integration with traditional markets means Bitcoin price movements increasingly reflect broader economic conditions, institutional portfolio allocation decisions, and macroeconomic factors rather than purely cryptocurrency-specific developments. These correlation patterns suggest the 2028 halving will occur within broader financial market context rather than isolated cryptocurrency speculation.

比特幣同傳統金融市場嘅相關性,由早期幾乎零關係,到而家同Russell 1000指數相關度達0.58,同金融股亦有0.53。呢種融合意味住比特幣價格變動愈來愈多受到經濟大環境、機構投資組合調整、同宏觀因素影響,唔再只受加密貨幣本身因素主導。相關走勢顯示,2028減半將會發生喺更廣泛金融市場視野底下,而唔係孤立炒作事件。

The emergence of Bitcoin as a treasury asset for public companies creates sustained demand that operates independently of speculative trading cycles. MicroStrategy's - 582,000 bitcoin holdings - and aggressive acquisition program targeting - $84 billion in total purchases by 2027 - represents strategic allocation decisions based on long-term value storage rather than short-term trading. This corporate treasury trend creates predictable demand that could provide price floors during market volatility.

比特幣成為上市公司金庫資產,帶嚟由投機週期以外產生嘅長遠需求。以MicroStrategy持有582,000枚比特幣同計劃於2027年前斥資840億美元持續購入為例,呢啲都係基於長線儲值而唔係短炒。企業金庫趨勢帶來穩定需求,有望喺市場波動時為價格提供底部支持。

Current trading volumes averaging - $38.9 billion daily - demonstrate institutional-grade liquidity that supports large-value transactions without significant price impact. However, exchange reserves at - 2.5 million bitcoins - representing five-year lows indicate that available trading supply has declined even as institutional participation has increased. This combination of high liquidity and reduced available supply creates market conditions where incremental demand could generate substantial price impacts.

現時每日平均成交額達389億美元,體現左機構級流動性,能夠支持大額交易而唔致引發重大價變。不過,交易所只剩下250萬枚比特幣儲備,為五年新低,說明儘管參與增加,可供交易供應反而減少。高流動性配合有限供應,意味每多一分需求,都有可能引起大幅價格反應。

The regulatory environment provides institutional investors with legal clarity and operational frameworks that enable strategic Bitcoin allocation decisions. SEC approval of Bitcoin ETFs, banking integration through traditional financial institutions, and comprehensive regulatory frameworks remove barriers that previously limited institutional participation. This regulatory clarity enables pension funds, endowments, and other fiduciary investors to consider Bitcoin allocation without previous legal uncertainties.

監管環境為機構投資者帶來法律清晰同操作標準,令佢地可以制定比特幣配置策略。SEC批准比特幣ETF、傳統金融機構銀行業務融入,加上更完善監管架構,一舉清除左以前機構參與嘅障礙。呢啲明確監管令退休基金、捐贈基金等受託人投資者可以考慮配置比特幣,而唔需要再擔心法律風險。

Interest rate environment and monetary policy create macroeconomic conditions that could influence Bitcoin demand through the 2028 halving cycle. Federal Reserve policy decisions, inflation expectations, and currency debasement concerns affect institutional asset allocation decisions between Bitcoin, bonds, equities, and alternative investments. Bitcoin's negative correlation with the U.S. dollar creates potential hedging demand during currency weakness periods.

利率環境同貨幣政策構成宏觀經濟因素,會影響2028減半期間比特幣需求。美聯儲政策、通脹預期、貨幣貶值疑慮,都會影響機構喺比特幣、債券、股票同另類資產之間嘅配置。比特幣同美元負相關,更有潛力成為貨幣貶值時嘅避險資產。

Geopolitical developments including nation-state Bitcoin adoption, central bank digital currency competition, and international monetary system evolution create additional demand drivers beyond traditional investment allocation. Countries like El Salvador's Bitcoin legal tender adoption and proposed U.S. Strategic Bitcoin Reserve create government demand that operates independently of market speculation, potentially providing sustained price support through halving cycles.

地緣政治發展,例如國家層面接受比特幣、央行發展數字貨幣競爭同國際貨幣體系演變,帶來比傳統配置更多元化嘅需求動力。例如薩爾瓦多正式將比特幣列為法定貨幣,以及美國提出戰略比特幣儲備,都創造咗與市場投機無關、長期可持續嘅政府需求,有可能於減半周期提供價格支持。

Technical infrastructure maturation through Layer 2 solutions, payment systems, and financial services creates utility demand for Bitcoin beyond speculative investment and treasury allocation. Lightning Network growth, decentralized finance integration, and merchant acceptance create sustained demand for Bitcoin liquidity that compounds with investment demand to create upward price pressure.

技術基建成熟,例如Layer 2方案、支付系統同金融服務,擴闊比特幣用途,唔單止係投資或者金庫儲備咁簡單。閃電網絡壯大、去中心化金融(DeFi)結合、商戶開始接受比特幣付款等都推動持續流動性需求,令價格同時受投資同實際應用雙重需求所推高。

Market microstructure evolution toward institutional-grade trading infrastructure supports large-value transactions and sophisticated trading strategies that improve price discovery and reduce manipulation risks. Professional market makers, algorithmic trading systems, and derivatives markets create trading environments that resemble traditional asset markets rather than early cryptocurrency exchanges with limited liquidity and operational risks.

市場微觀結構進化,建立起機構級別嘅交易基建,能夠支撐大額交易同先進交易策略,提升價格發現效率,減低被操控風險。專業做市商、算法交易系統和發達的衍生產品市場,令交易環境愈來愈似傳統資產市場,而非早期流動性低、操作風險高的加密貨幣交易所。

The unprecedented combination of institutional ownership, regulatory clarity, technical infrastructure, and macroeconomic conditions creates market conditions for the 2028 halving that differ fundamentally from previous cycles. These structural changes suggest potential for sustained price appreciation with reduced volatility compared to retail-driven historical cycles, though absolute price movements may remain substantial due to Bitcoin's expanding market capitalization and institutional demand patterns.

史無前例嘅機構持有、明確監管、成熟技術基建同宏觀經濟因素,令2028年減半面臨嘅市場狀況同以往周期根本唔同。這些結構性改變意味住,未來價格可能持續上升而波幅較細,不過由於比特幣市值愈來愈大、機構需求強,絕對價格變動依然有機會好大。

Environmental, social, and governance (ESG) considerations increasingly influence institutional Bitcoin allocation decisions through renewable energy mining requirements, carbon accounting frameworks, and sustainability reporting standards. Mining industry evolution toward renewable energy sources and carbon-neutral operations addresses institutional concerns while creating operational advantages for mining companies with environmental compliance.

環境、社會及管治(ESG)因素越來越多影響機構投資比特幣決策,包括對可再生能源開採要求、碳排放管控同可持續發展報告標準。挖礦行業不斷向可再生能源同碳中和方向發展,一方面回應機構關注,另一方面亦令守規礦企有操作優勢。

Derivatives market development provides institutional investors with sophisticated risk management tools including futures, options, and structured products that enable hedged Bitcoin exposure and yield generation strategies. These financial instruments create additional demand for underlying Bitcoin while providing institutions with familiar risk management frameworks from traditional asset classes.

衍生市場發展,為機構投資者提供先進風險管理工具,包括期貨、期權、結構性產品等,可以對沖比特幣風險或者設計產生回報的策略。這些金融工具一方面增加對實物比特幣的需求,另一方面令機構能夠用傳統資產管控模式操作比特幣。

Long-term implications beyond the 2028 halving

2028年減半以後嘅長遠意義point in cryptocurrency evolution from experimental technology to established institutional asset class, with long-term implications extending far beyond immediate price impacts. The convergence of institutional adoption, regulatory frameworks, technical infrastructure, and global monetary uncertainty creates conditions that could establish Bitcoin's role in the international financial system for decades following the halving event.

加密貨幣由試驗性科技發展至已確立的機構級資產類別,這個過程標誌著一個重要轉捩點,其長遠影響遠遠超越短期價格變動。隨着機構採納、監管框架、技術基建以及全球貨幣體系不確定性的交匯,已經逐步形成有利條件,有望令比特幣在減半事件之後的數十年間,鞏固其於國際金融體系中的角色。

Monetary policy implications become increasingly significant as Bitcoin's stock-to-flow ratio exceeds gold and central banks grapple with debt sustainability and currency debasement concerns. Bitcoin's fixed supply schedule provides institutional investors and nation-states with hedging mechanisms against monetary expansion that traditional assets cannot match. The mathematical certainty of Bitcoin's scarcity creates competitive advantages over gold and other stores of value that depend on mining economics and geological constraints.

當比特幣的庫存流通比超越黃金之際,其貨幣政策影響亦變得愈來愈重要;而各國央行正同時面對債務可持續性及貨幣貶值的挑戰。比特幣固定的供應安排為機構投資者及國家提供一種傳統資產無法媲美的對沖貨幣擴張機制。比特幣稀缺性的數學確定性,較依賴開採經濟及地理限制的黃金和其他價值儲藏品更具競爭優勢。

The transition from mining reward dependence to transaction fee sustainability approaches critical thresholds as successive halvings reduce block rewards toward zero. Post-2028, mining rewards of 1.5625 bitcoins per block will require substantial fee market development to maintain network security through economic incentives. Layer 2 solutions and increased Bitcoin utility could generate sufficient transaction volume and fees to sustain mining operations, though this transition remains untested at required scales.

隨着每次減半將區塊獎勵逐步減至接近零,由依賴挖礦獎勵過渡至依賴交易費用以維持生態系統正進入關鍵臨界點。2028年後,每區塊獎勵僅得1.5625比特幣,屆時必須發展具規模的費用市場以經濟誘因維持網絡安全。第二層解決方案以及比特幣應用度提升,有機會為礦工產生足夠交易量與手續費,得以繼續運作,惟此一過渡至今尚未於必需規模下驗證過。

International monetary system integration could accelerate through nation-state Bitcoin adoption and central bank reserve diversification. Countries facing currency instability, sanctions risks, or inflation pressures may increase Bitcoin allocation as shown by El Salvador's legal tender adoption and proposed U.S. Strategic Bitcoin Reserve legislation. This government demand creates sustained upward price pressure while establishing Bitcoin as geopolitical asset alongside gold and foreign exchange reserves.

透過國家級採納比特幣及央行外匯儲備多元化,國際貨幣體系的整合有可能加快。面對貨幣不穩、受制裁風險或通脹壓力的國家,可能參考薩爾瓦多將比特幣定為法定貨幣,或美國提出的戰略比特幣儲備立法等作法,增加比特幣配置。這種政府層面的需求不單能帶來持續的升值壓力,亦鞏固比特幣成為繼黃金與外匯儲備外的重要地緣政治資產。

Financial infrastructure maturation through traditional banking integration, custody solutions, and regulatory frameworks enables Bitcoin participation by pension funds, insurance companies, and sovereign wealth funds with trillion-dollar asset bases. These institutional investors operate with longer time horizons and larger capital bases than current Bitcoin holders, potentially creating sustained demand that extends through multiple halving cycles.

傳統銀行業整合、託管解決方案以及監管體系成熟,令持有數萬億美元資產的退休基金、保險公司及主權基金等能夠參與比特幣市場。這批機構投資者的投資週期更長、資本規模遠大於現時比特幣持有者,有潛力帶來橫跨多輪減半周期的持續需求。

Technology evolution through quantum computing, cryptographic advances, and blockchain scaling solutions could affect Bitcoin's long-term value proposition and network security. While quantum computing threatens current cryptographic security, Bitcoin's development community has already begun preparing quantum-resistant solutions. Successful adaptation to technological challenges could reinforce Bitcoin's antifragile characteristics and institutional confidence.

隨着量子運算、密碼學進步及區塊鏈擴容方案演進,這些技術變革有可能影響比特幣的長遠價值主張及網絡安全性。儘管量子運算對現有加密技術構成威脅,比特幣開發社群已著手研發能抗量子計算的方案。成功應對這些科技挑戰,將進一步強化比特幣反脆弱(antifragile)特質及機構層面信心。

Competitive landscape development through central bank digital currencies, alternative cryptocurrencies, and traditional financial innovation creates potential challenges to Bitcoin's monetary role. However, Bitcoin's decentralized architecture, proven track record, and network effects provide competitive advantages that government-controlled digital currencies cannot replicate. Competition could accelerate Bitcoin innovation while validating its core value propositions.

央行數碼貨幣(CBDC)、其他加密貨幣及傳統金融創新發展,均可能對比特幣的貨幣角色造成挑戰。然而,比特幣去中心化架構、經驗證的紀錄及網絡效應,令其具備政府控制數碼貨幣難以複製的競爭優勢。競爭一方面或可加速比特幣創新,亦同時證明其核心價值主張。

Environmental sustainability requirements increasingly influence institutional Bitcoin allocation decisions through ESG investment frameworks and regulatory compliance standards. Mining industry evolution toward renewable energy sources and carbon-neutral operations addresses these concerns while creating operational advantages for environmentally compliant miners. Successful environmental integration could eliminate barriers to institutional adoption while supporting long-term price appreciation.

環境可持續發展要求,日益影響機構於ESG投資框架及監管合規標準下對比特幣資產的配置決策。礦業業界逐步轉用可再生能源及碳中和運作,有助回應相關關注,同時為環境合規的礦工創造營運優勢。若能成功與環境政策融合,將有助消除機構採納障礙,支持比特幣長遠升值。

Generational wealth transfer represents significant long-term demand driver as younger demographics with cryptocurrency familiarity inherit substantial wealth from traditional asset holders. This demographic transition could accelerate Bitcoin adoption as portfolio allocation preferences shift toward digital assets, creating sustained demand that extends beyond current institutional adoption trends.

跨代財富轉移將成為重要的長期需求動力。對加密貨幣有認識的年青世代,將陸續繼承大量傳統資產,這種人口結構變化或會加快比特幣滲透,隨著投資組合分配轉向數碼資產,形成持續且超越現時機構採納趨勢的需求。

The mathematical progression toward Bitcoin's 21 million maximum supply creates increasingly rare events as remaining bitcoins decline toward zero over the next century. Each subsequent halving reduces available new supply by smaller absolute amounts but maintains percentage reductions, creating potential for sustained scarcity premiums that could extend price appreciation across multiple decades.

隨着比特幣朝着2100萬枚總供應上限的數學推進,未來百年所剩比特幣愈趨稀少。每次減半,新供應的絕對數量雖然遞減,但百分比減幅不變,為持續的稀缺溢價創造條件,有機會令價格升值延續數十年。

Economic theory development around digital scarcity, network effects, and programmable money continues evolving as Bitcoin demonstrates unprecedented monetary properties. Academic research, central bank analysis, and institutional frameworks increasingly recognize Bitcoin's unique characteristics while developing analytical tools and valuation models specific to digital assets rather than traditional commodity frameworks.

環繞數碼稀缺性、網絡效應及可編程貨幣的經濟理論,隨着比特幣展現前所未有的貨幣特質而不斷進化。學術研究、央行分析及機構框架,愈來愈重視比特幣的獨特屬性,並逐步發展專屬於數碼資產的新型分析工具和估值模型,不再單靠傳統商品框架。

The intersection of artificial intelligence, blockchain technology, and digital payments could create novel applications for Bitcoin that extend utility beyond current store-of-value and payment functions. These technological convergences may generate demand drivers that amplify network effects while creating new economic models around programmable money and autonomous financial systems.

人工智能、區塊鏈科技及數碼支付三者的結合,有機會開發出比特幣新型應用,令其用途超越現時的價值儲存及支付工具。這種技術匯聚,或會帶來新一輪需求動力,進一步提升比特幣的網絡效應,並圍繞可編程貨幣及自主金融體系創造新經濟模式。

Global financial system resilience benefits from Bitcoin's decentralized architecture that operates independently of traditional banking infrastructure, government monetary policy, and geopolitical conflicts. These systemic advantages become increasingly valuable during financial crises, banking failures, or international conflicts that compromise traditional financial systems, potentially creating sustained demand for decentralized alternatives.

比特幣去中心化架構,能夠獨立於傳統銀行基建、政府貨幣政策及地緣衝突運作,為全球金融體系的抗逆力帶來好處。當遇上金融危機、銀行倒閉或國際衝突導致傳統體系受損,這些系統性優勢的價值愈加凸顯,有機會為去中心化替代方案帶來持續需求。

Conclusion: the institutional halving era

結語:機構化減半時代

The 2028 Bitcoin halving will mark the definitive transition from Bitcoin's experimental phase to its institutional epoch, fundamentally altering the economic dynamics that have characterized previous supply reduction events. The convergence of unprecedented institutional ownership exceeding 10% of total supply, comprehensive regulatory frameworks, and mature financial infrastructure creates conditions where traditional halving effects may be both amplified through constrained liquidity and moderated through sophisticated market participation.

2028年的比特幣減半將會正式標誌比特幣由試驗階段步入機構時代,從根本上改變以往減半周期的經濟動力。隨着機構持倉突破總供應量10%、完善的監管機制以及成熟的金融基建三者匯聚,傳統減半效應可能因流動性收緊而加劇,同時因高階市場參與而調節過度波動。

Unlike previous cycles driven by retail speculation and technical adoption, the 2028 halving occurs within an environment where - 1.4 million bitcoins sit in ETF vaults - , - 582,000 bitcoins anchor MicroStrategy's treasury strategy - , and traditional financial institutions integrate Bitcoin services across their client bases. This institutional presence provides both sustained demand drivers and price stability mechanisms that previous cycles lacked, suggesting potential for extended appreciation periods with reduced volatility amplitude characteristic of mature asset classes.

這一輪減半,不再如過往由散戶投機及初始採納主導,而是在1,400,000枚比特幣存放於ETF金庫、582,000枚屬於MicroStrategy庫存策略、及傳統金融機構廣泛提供比特幣服務的大環境下發生。機構參與為市場帶來持續需求與價格穩定機制,彌補過去週期的缺失,有望出現價值穩步上升、波動幅度下降的成熟資產現象。

The mathematical certainty of mining reward reduction from 3.125 to 1.5625 bitcoins per block creates predictable supply constraints that will interact with structurally altered demand patterns in unprecedented ways. With exchange reserves at five-year lows of 2.5 million bitcoins and institutional accumulation continuing to remove coins from liquid trading supply, the 2028 halving's supply shock will operate within already constrained market conditions that could amplify traditional scarcity effects.

礦工獎勵由3.125枚減至1.5625枚的數學必然性,為供應帶來可預計收縮,並將與深度變化的需求模式作前所未見的互動。當交易所儲備降至5年低位2,500,000枚,機構持續吸納並鎖定流通供應,2028年的減半衝擊將於緊張市況下觸發,或會進一步擴大傳統稀缺效應。

Technical infrastructure evolution through Layer 2 solutions, payment systems, and financial applications expands Bitcoin's utility beyond pure speculation or treasury allocation, creating sustained demand for Bitcoin liquidity that compounds with investment demand. Lightning Network growth, smart contract capabilities, and traditional finance integration demonstrate Bitcoin's evolution toward programmable money that captures value from diverse economic applications rather than purely speculative trading.

第二層解決方案、支付科技及金融應用基建升級,令比特幣用途跨越純投機或庫存配置,形成增長中的流動性需求並與投資需求協同。閃電網絡發展、智能合約功能、以及傳統金融系統接軌,都證明比特幣正進化為可編程貨幣,其價值來自多元經濟應用,而不止於炒賣。

The regulatory transformation from enforcement uncertainty to structured acceptance provides institutional investors with legal clarity and operational frameworks necessary for strategic allocations. SEC Bitcoin ETF approvals, banking integration authorization, and comprehensive compliance standards remove barriers that previously limited institutional participation while creating infrastructure supporting trillion-dollar asset class development.

監管層面從執法不確定轉變為有結構性接受,為機構投資者提供策略性資產配置所需的法律明確性及營運框架。美國證監會審批比特幣ETF、銀行獲准開展相關服務、以及嚴謹的合規標準,均打開了過往銀行級投資無法參與的市場通道,為萬億級資產類別的發展建立穩固基礎。

Price forecasting convergence among credible institutional analysts suggests substantial appreciation potential through the 2028 halving cycle, with conservative estimates projecting $100,000-$200,000 levels and aggressive models reaching $400,000-$600,000 targets. These predictions reflect genuine institutional adoption trends and supply-demand economics rather than speculative enthusiasm, indicating sustainable appreciation potential supported by fundamental economic drivers.

多間具公信力的機構投資分析師預測,2028年減半周期帶來可觀升值潛力,保守估算介乎10萬至20萬美元一枚,進取模型預測高達40萬至60萬美元。這些預測反映真實的機構採納趨勢及供需經濟,而非單純炒作,印證以基本面為本的可持續升值潛力。

The broader implications extend beyond immediate price impacts toward Bitcoin's role in international monetary systems, portfolio allocation strategies, and technological innovation across financial services. The 2028 halving represents not merely another supply reduction event but a confirmation of Bitcoin's transition from experimental technology to established monetary asset that competes directly with gold, government bonds, and traditional stores of value.

宏觀層面的意義不止於即時價格波動,更在於比特幣將於國際貨幣體系、投資組合分配及金融科技創新中扮演更重要角色。2028年減半,不只是供應再度減少,而是象徵比特幣已由試驗性科技躍身為成熟貨幣資產,與黃金、國債及傳統價值儲藏品正面競爭。

Most significantly, the 2028 halving will test whether Bitcoin's institutional maturation maintains the network effects and appreciation potential that characterized earlier cycles or whether market efficiency and institutional sophistication moderate historical patterns toward more traditional asset behavior. The unprecedented combination of mathematical scarcity, institutional adoption, and

最關鍵的是,2028年減半將驗證,比特幣在機構化後,能否維持以往週期的網絡效應與升值潛力,還是市場效率提升與機構化令價格表現趨向傳統資產。今次的數學稀缺性、機構參與等多重疊加,勢必創造前所未有的新局面。regulatory integration creates conditions for Bitcoin's most significant economic experiment since its creation - demonstrating whether digital scarcity can maintain exponential growth characteristics within mature financial systems.

監管整合為比特幣自創立以來最重要的經濟實驗創造了條件——即展示數字稀缺性能否在成熟的金融體系中保持指數式增長的特性。

This institutional halving era marks Bitcoin's graduation from cryptocurrency markets to traditional asset class inclusion, with implications for monetary policy, portfolio theory, and international finance that will extend far beyond the immediate supply reduction effects.

這個機構化減半時代標誌著比特幣從加密貨幣市場畢業,正式邁向傳統資產類別,對貨幣政策、投資組合理論以及國際金融等方面,都會帶來遠超單純供應減少效應的深遠影響。

The 2028 halving stands as the definitive test of Bitcoin's ability to maintain revolutionary growth characteristics while achieving evolutionary integration within established financial systems.

2028年減半將成為決定性測試,驗證比特幣能否在逐步融入現有金融體系的同時,仍然保持其革命性的增長特徵。