Mastercard 作為全球最大支付網絡之一,正處於一個可能徹底改變資金在全球金融體系中流動方式的十字路口。2025 年 10 月下旬,有報導指這間支付巨頭正與 Zero Hash 進行收購談判,金額介乎 15 至 20 億美元。如果交易落實,這將是 Mastercard 對加密貨幣基礎設施最大的一次押注。

這不只是另一宗企業併購,而象徵傳統金融支柱正準備擁抱一種截然不同的支付結算模式。數十年來,卡組織、銀行及商戶一直受「銀行營業時間」規則限制 —— 批次處理時段只限平日,跨境清算還需透過中介銀行層層核對,資金確認可延誤數天。但 Zero Hash 的基建帶來全新選擇:全年無休、隨時以穩定幣清算交易。

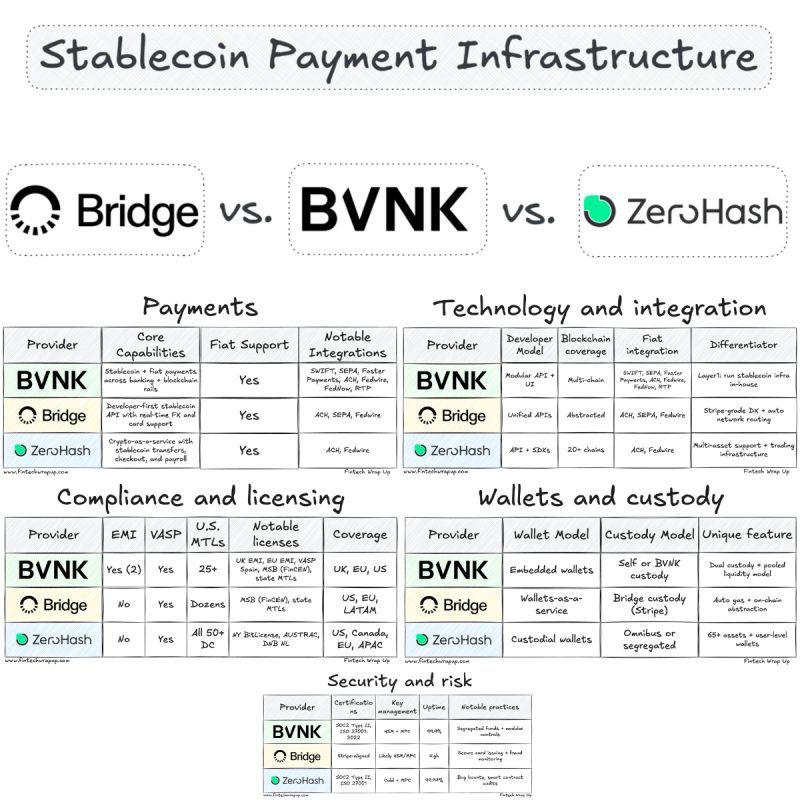

早前有報導指 Mastercard 曾考慮收購另一家穩定幣平台 BVNK,公司估值約 20 億美元。這些行動顯示出 Mastercard 的戰略急迫 —— 它需即時獲得一站式加密基建,且要越快越好。

為何要急?因為穩定幣產業爆炸式增長。2025 年,穩定幣全年總交易量約為 $46 兆美元,可與 Visa 的支付量媲美。穩定幣總供應量亦於 2025 年 9 月突破 2,800 億美元(年初僅約 2,000 億),各方預測該市場至 2030 年有望達 $1.9 兆美元,甚至看高至 4 兆美元。

對 Mastercard 而言,這既有機遇亦有威脅。穩定幣理論上可繞過中介直接轉帳,衝擊其核心業務模式。不過,同時也有助其進軍傳統基建薄弱或未覆蓋的市場。收購 Zero Hash — 提供銀行與金融科技公司加密託管、合規及穩定幣串流服務 — 讓 Mastercard 無須自行搭建,即可瞬間切入現成加密支付網絡。

影響遠不止 Mastercard 財務報表。如果一個每年處理數十億筆交易的網絡,開始以 USDC 或 EURC 實時結算,不再等批次處理完成,企業財庫管理、商戶回款及跨境支付等運作都將本質上改變。週末及假日延誤可望成歷史,白天透支及預先資金壓力也或大為減輕,「銀行營業時間」的無形限制或逐步消失。

以下會分析變革可能如何展開,先探討傳統支付模式的約束,再梳理 Mastercard 透過 Multi-Token Network 及 Crypto Credential 項目打造怎樣的新路徑。本篇並非預測未來,而是理清推動力及觀察關鍵信號。

傳統支付結算模式及其限制

要理解 Mastercard 推動穩定幣的重要性,首先要明白現時支付結算模式運作方式及其問題。

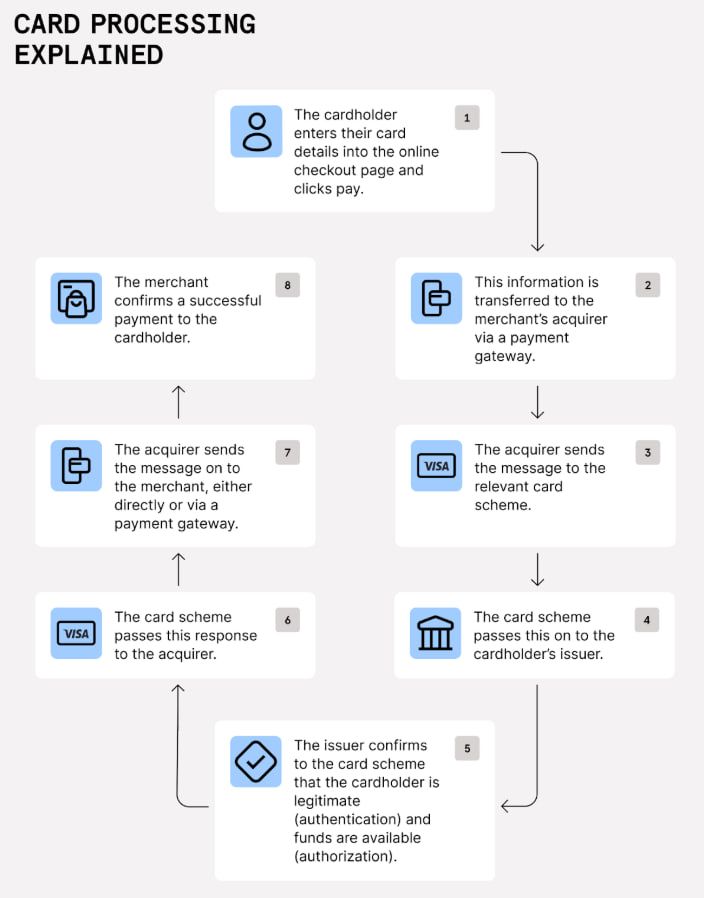

信用卡支付現行結算流程

當消費者用 Mastercard 在商戶消費時,資金由持卡人銀行(發卡行)流向商戶銀行(收單行),整個過程分為授權(檢查資金)、清算(資訊批次交換)及結算(資金真正過帳)。

結算階段的時間和架構限制一覽無遺。卡交易需透過批次窗口、平日截止等機制處理。銀行並非即時逐單清算,而是將交易集合成批次,於特定時段(通常每日一至兩次營業時間內)處理。

以美國為例,卡結算多以 T+1 或 T+2 進行,即交易後 1 至 2 個工作天完成。跨國交易更可歷時更久,因為往往經過多家中介銀行,每一步都帶來額外時間成本與複雜度。

銀行營業時間的硬限制

傳統支付只在俗稱「銀行營業時間」內運作:星期一至五、不包括假期。美國 ACH 網絡只有在聯儲時段內分批結算。周五傍晚發出指令,最快要到星期一早上才會處理。

歐洲 SEPA 系統同樣受限。SEPA 銀行轉帳及自動扣賬週末不運作,只有 SEPA 即時轉帳全年無休,但普及率尚未理想。

此等約束在支付每個層級都引發摩擦:

對商戶: 週末銷售資金要到星期一或二才到帳,影響營運現金流。利潤微薄行業(如飲食、零售)需預先注資以應付開支。

對銀行及收單方: 批次處理令運作出現樽頸。銀行需綿密控管流動資金,確保結算時能付清。日間透支(即結算額暫時超出可用資金)須嚴密監控,有時還要支付額外費用。

對跨境付款: 問題加劇。例如美國公司向歐洲供應商付款,資金需多次經中介銀行,每家機構均有自身截止時間及步驟,總結算時程可拖數天,手續費層層累積,滙率波動風險亦隨時間增加。

對消費者與自由職業者: 薪資直入多數也受批次付款限制。如發薪日適逢週末,主流公司多於週五預先處理,避免員工要等到星期一。

為什麼這些模式仍然存在?

如果約束這麼多,為何模式依然不變?答案在歷史、風險管理及基礎設施鎖定。

批次機制誕生於電腦算力有限、通訊成本高昂年代。集合大量交易可減少信息交換,便於大規模核對。後來這模式融入監管、銀行流程與商戶契約。

銀行利用結算延時作風險管理。授權與過帳間的等候容許查找詐騙、處理異議及回滾錯誤。全面即時結算需要全新理賠與爭議解決方案。

最後,雖然中介銀行鏈條緩慢,卻保障不同地區多種貨幣、法規、法系下的十字連接。要更換不僅涉及技術,也需法律、流動性及監管全面配合。

全面通證化的願景

Mastercard 近年一直釋放通證化(Tokenization)訊號。在一篇官方博客,公司提出「無形握手」理念 —— 即通證化金錢與資產可跨區塊鏈安全兌換,享有 Mastercard 歷年建立的信任及消費保障。

但單靠通證化並不足夠。要以穩定幣取代現有批次結算,必須全面融入現有支付架構。商戶得可接收,銀行要能持有,監管當局需批准,技術更要可靠支撐每年數十億筆交易。

這正是 Mastercard 有系統推進,包括自建與收購多線並進的戰略意義。

Mastercard 正在建設什麼:基礎設施、通證化與支付網絡

Mastercard 的加密戰略並非只局限於 creating a consumer-facing wallet or launching its own stablecoin. Instead, the company is building infrastructure - the pipes and protocols that will allow banks, fintechs, and merchants to transact in tokenized money without having to manage the complexity of blockchain technology themselves.

建立面向消費者的錢包或發行自家穩定幣都唔係重點。相反,該公司專注於建設「基建」——為銀行、金融科技公司同商戶鋪設好讓他們可以用代幣化貨幣進行交易的「管道」同協議,咁佢哋就唔使自己管理區塊鏈技術嘅複雜性。

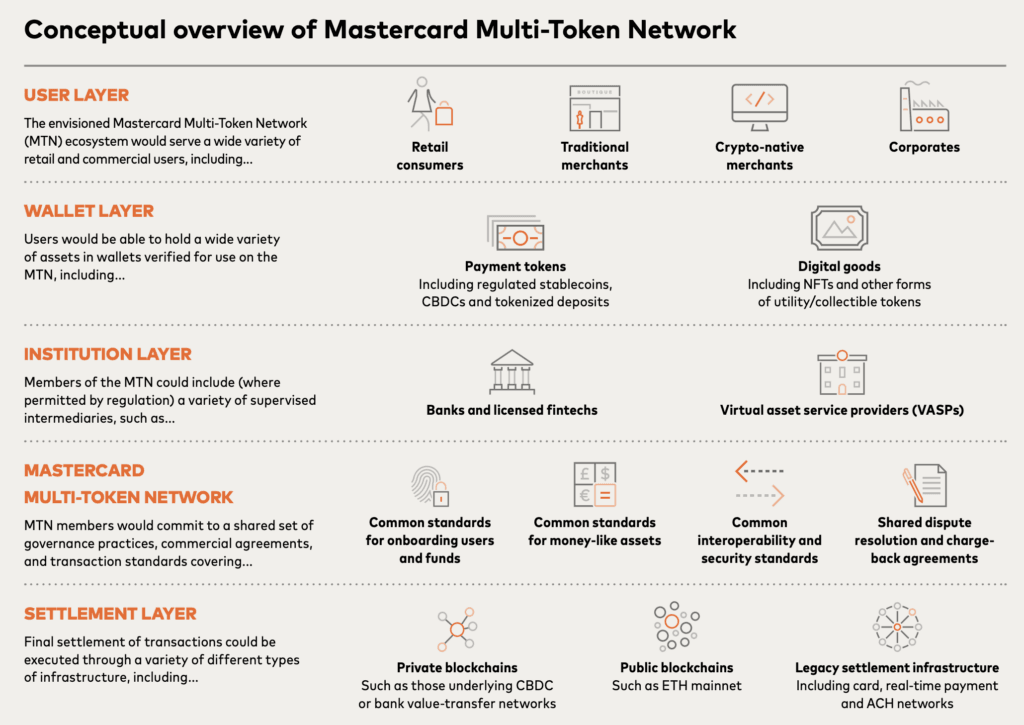

The Multi-Token Network (MTN)

At the center of this strategy is the Multi-Token Network (MTN), announced in June 2023. MTN is a set of API-enabled blockchain tools designed to make transactions with tokenized money and assets secure, scalable, and interoperable.

呢個策略核心就係 Multi-Token Network (MTN),於2023年6月公布。MTN 係一套基於API的區塊鏈工具,專為令代幣化貨幣及資產交易變得安全、可擴展、同時可互通而設。

The network is built on four pillars of trust:

整個網絡建立於四大信任支柱之上:

Trust in counterparty: Effective identity management and permissions are essential for building trusted networks. This is where Mastercard's Crypto Credential (discussed below) comes in - verifying that wallets and exchanges meet certain standards before they can transact on the network.

信任交易對手: 有效嘅身份管理同權限設計,係建立信任網絡嘅基礎。呢度就用到Mastercard嘅 Crypto Credential(下文會講)——確保任何錢包或交易所必須通過一定認證標準先可以喺網絡上進行交易。

Trust in digital payment assets: For MTN to work, it needs stable, regulated payment tokens. Last year, Mastercard tested the use of tokenized commercial bank deposits between financial institutions, settling through its existing network. The company also participated in the Regulated Liability Network (RLN), a consortium exploring how central bank digital currencies (CBDCs) and tokenized deposits might work together.

信任數碼支付資產: MTN 要運作順利,必須有穩定且受監管的支付代幣。去年Mastercard就試過喺金融機構間用代幣化銀行存款進行結算,落實喺佢哋原有網絡上。公司亦參加咗 Regulated Liability Network (RLN) 聯盟,探討央行數碼貨幣(CBDC)同代幣化存款之間點樣協作。

Trust in technology: Blockchain networks need to be scalable and interoperable. MTN aims to support multiple blockchains and payment tokens, allowing institutions to choose the networks that best fit their needs without being locked into a single ecosystem.

信任技術本身: 區塊鏈網絡都需要具備可擴展性同可互通。MTN目標係支援多個區塊鏈同支付代幣,令機構可以自由揀選最適合自己需求的網絡,而唔會被鎖死喺一個生態系統入面。

Trust in consumer protections: Mastercard's decades of experience with chargeback rules, fraud detection, and dispute resolution will be layered onto MTN. The goal is to ensure that tokenized payments offer the same protections consumers expect from traditional card transactions.

信任消費者保障: Mastercard多年來喺信用卡退款規則、防詐騙及糾紛處理方面的經驗,都會加到 MTN 上面。目標係要確保代幣化支付提供等同傳統卡交易的保障,令消費者用得安心。

MTN went into beta testing in the UK in 2023 and has since expanded. In 2024, Mastercard executed its first live test of tokenized deposits with Standard Chartered Bank Hong Kong, involving a client purchasing a carbon credit using tokenized deposits.

MTN 於2023年喺英國進入測試階段,之後再逐步擴展。2024年,Mastercard 與渣打銀行香港進行咗首次實時測試,有客戶透過代幣化存款購買碳信用額。

In February 2025, Ondo Finance became the first real-world asset provider to join MTN, bringing its tokenized U.S. Treasury fund (OUSG) to the network. This integration allows businesses on MTN to earn daily yield on idle cash and deploy funds into tokenized Treasury bills 24/7 using traditional fiat rails - no need for stablecoin onramps or waiting for settlement windows.

2025年2月,Ondo Finance 成為MTN首家實體資產供應商,將其代幣化美國國庫債基金(OUSG)引入平台。此舉令MTN上的企業可以用傳統法定貨幣軌道隨時(24/7)將閒置資金滾存、或者投放去代幣化國債,唔使靠穩定幣入金或等結算視窗。

Raj Dhamodharan, Mastercard's executive vice president for blockchain and digital assets, described the vision: "This connectivity will enable the banking ecosystem to move to 24/7 functionality on a global basis."

Mastercard區塊鏈及數碼資產執行副總裁Raj Dhamodharan 如是形容願景:「呢種互聯可令全球銀行生態系統實現全年無休(24/7)功能。」

In November 2024, Mastercard integrated MTN with JPMorgan's Kinexys Digital Payments platform (formerly JPM Coin) to enable on-chain foreign exchange and "automation of 24/7, near real-time multicurrency clearing and settlement."

2024年11月,Mastercard將MTN與摩根大通Kinexys Digital Payments平台(前稱JPM Coin)整合,實現鏈上外滙同多種貨幣就快實時自動清算同結算,支援全年24/7運行。

MTN is not a finished product. It's a framework - an evolving set of standards and tools that Mastercard is testing with partners. But the pieces are coming together: tokenized deposits, real-world assets, integration with major banks, and 24/7 settlement capabilities.

MTN尚未係個最終產品,而係一個框架——一套持續發展既標準同工具,Mastercard 依家就同唔同夥伴一齊試緊。不過,各項元素逐步到位,例如代幣化存款、實物資產、同大型銀行整合、以及全年無休結算等等。

Crypto Credential: Building Trust in Blockchain Transactions

Parallel to MTN is Mastercard Crypto Credential, a verification layer announced in April 2023 and launched for live peer-to-peer transactions in May 2024.

與MTN並行的係 Mastercard Crypto Credential,這是2023年4月公布、2024年5月正式支援P2P交易的區塊鏈認證層。

Crypto Credential addresses one of the biggest pain points in blockchain transactions: the complexity and risk of wallet addresses. A typical blockchain address is a long string of alphanumeric characters - easy to mistype and impossible to verify at a glance. Crypto Credential allows users to create human-readable aliases (similar to email addresses or Venmo handles) that map to their wallet addresses.

Crypto Credential針對咗區塊鏈交易其中一個最大痛點:錢包地址又長又複雜,好易打錯,肉眼難以核實。呢個方案容許用戶設置易記既人性化用戶名(類似email 或Venmo帳號),從而映射到背後的錢包地址。

But Crypto Credential does more than simplify addresses. It also verifies that:

但Crypto Credential除咗簡化地址外,仲會做到:

-

The user has met a set of verification standards (KYC/AML compliance).

-

The recipient's wallet supports the digital asset and blockchain being used.

-

Travel Rule information is exchanged for cross-border transactions (a regulatory requirement to prevent money laundering).

-

用戶符合一套驗證標準(如KYC/AML合規)

-

收款方錢包的確支援該數字資產與區塊鏈

-

跨境交易時會交換Travel Rule資料(符合法規以防洗錢)

When a user initiates a transfer, Crypto Credential checks the validity of the recipient's alias and confirms wallet compatibility. If the receiving wallet doesn't support the asset or blockchain, the sender is notified and the transaction doesn't proceed - protecting both parties from lost funds.

當用戶啟動轉帳時,Crypto Credential 會核對對方用戶名是否有效兼有冇支援相關資產及鏈。如果收款錢包唔支援,發送方會收到提示,交易唔會執行——保障雙方資金安全。

The first live transactions went live in May 2024 on Bit2Me, Lirium, and Mercado Bitcoin exchanges, enabling cross-border and domestic transfers across multiple currencies and blockchains in Argentina, Brazil, Chile, France, Guatemala, Mexico, Panama, Paraguay, Peru, Portugal, Spain, Switzerland, and Uruguay.

2024年5月,Bit2Me、Lirium及Mercado Bitcoin等交易所首先上線,覆蓋多個國家、法幣和鏈,支持阿根廷、巴西、智利、法國、瓜地馬拉、墨西哥、巴拿馬、巴拉圭、秘魯、葡萄牙、西班牙、瑞士和烏拉圭等地的跨境及本地匯款。

In January 2025, Crypto Credential expanded to the UAE and Kazakhstan, with exchanges including ATAIX Eurasia, Intebix, and CoinMENA joining the network.

2025年1月,Crypto Credential擴展至阿聯酋同哈薩克斯坦,ATAIX Eurasia、Intebix、CoinMENA等交易所亦有加入。

Crypto Credential is critical to Mastercard's stablecoin strategy because it addresses a key barrier to institutional adoption: trust. Banks and payment processors need to know that their counterparties are verified, compliant, and using compatible technology. Crypto Credential provides that assurance.

Crypto Credential對於Mastercard推進穩定幣策略至關重要,因為它攻破咗機構採用的最大壁壘——信任。銀行及支付機構要確保對手方經過認證、合規及使用兼容技術,Crypto Credential就提供呢層保障。

Stablecoin Settlement Pilots

While MTN and Crypto Credential provide the infrastructure, Mastercard has also been piloting actual stablecoin settlement with merchants and acquirers.

MTN同Crypto Credential負責基建部分,Mastercard亦已開始同商戶及收單機構試行穩定幣結算。

In August 2025, Mastercard and Circle announced an expansion of their partnership to enable USDC and EURC settlement for acquirers in the Eastern Europe, Middle East, and Africa (EEMEA) region. This marked the first time that the acquiring ecosystem in EEMEA could settle transactions in stablecoins.

2025年8月,Mastercard同Circle宣布擴大合作,使東歐、中東、非洲(EEMEA)地區收單機構可以用USDC及EURC兩種穩定幣結算。呢係該地區首度支援以穩定幣完成收單生態結算。

Arab Financial Services and Eazy Financial Services were the first institutions to adopt the capability. Acquirers receive settlement in USDC or EURC - fully-reserved stablecoins issued by regulated affiliates of Circle - which they can then use to settle with merchants.

阿拉伯金融服務公司及Eazy金融服務公司係第一批採用穩定幣結算的機構。收單公司可以直接以 USDC 或 EURC(由Circle合規子公司發行、有100%儲備的穩定幣)進行結算,再用嚟同商戶清算。

Dimitrios Dosis, president of Mastercard's EEMEA region, described the move as strategic: "Our strategic goal is to integrate stablecoins into the financial mainstream by investing in the infrastructure, governance, and partnerships to support this exciting payment evolution from fiat to tokenized and programmable money."

Mastercard EEMEA區總裁Dimitrios Dosis 說:「我們的策略目標係透過投資基建、管治及合作,協助穩定幣走進主流金融體系,推動支付由法定貨幣邁向代幣化及可編程貨幣嘅演進。」

The pilot builds on earlier work. Mastercard and Circle had already collaborated on crypto card solutions like Bybit and S1LKPAY, which use USDC to settle transactions.

呢個試點係建立喺現有合作之上,Mastercard同Circle之前已經有合作支援Bybit、S1LKPAY等加密卡方案,並以USDC結算相關交易。

Mastercard's stablecoin strategy isn't limited to USDC. The company supports a growing portfolio of regulated stablecoins, including Paxos' USDG, Fiserv's FIUSD, and PayPal's PYUSD, and is driving use cases across remittances, B2B transactions, and payouts to gig workers via platforms like Mastercard Move and MTN.

Mastercard 支持的穩定幣不止 USDC,佢哋越來越多受監管的穩定幣組合,例如 Paxos 的 USDG、Fiserv 的 FIUSD、PayPal 的 PYUSD,並推動喺匯款、B2B交易、以及像Mastercard Move、MTN這類平台上向零工派發薪酬等場景落地。

These pilots are incremental steps. They're limited in geography and transaction volume. But they demonstrate that the technology works and that there's demand from acquirers and merchants who want faster settlement and lower liquidity costs.

呢啲試點項目都係按部就班推進,雖然現時地域及交易量有限,但已證明技術可行,亦有收單及商戶積極需求:更快結算、流動性成本更低。

The Strategic Acquisition: Zero Hash and BVNK

With MTN and Crypto Credential providing the scaffolding, Mastercard now needs

MTN和Crypto Credential作為基建骨幹,Mastercard 下一步就需要…production-scale infrastructure to handle custody, compliance, and stablecoin orchestration across hundreds of financial institutions. This is where Zero Hash comes in.

大規模生產級基礎設施,用於處理資產保管、合規,以及在數以百計的金融機構之間協調穩定幣。這正正是 Zero Hash 發揮作用的地方。

What Zero Hash Does

Zero Hash is a U.S.-based fintech infrastructure company founded in 2017 that provides backend technology for crypto, stablecoin, and tokenized asset services. The company enables banks, brokerages, fintechs, and payment processors to offer crypto and stablecoin products to their customers without having to build their own infrastructure or navigate the regulatory maze themselves.

Zero Hash 是一間總部設於美國,於 2017 年成立的金融科技基礎設施公司,主要提供加密貨幣、穩定幣及代幣化資產相關的後台技術。佢令到銀行、券商、金融科技公司及支付處理商,可以唔使自己搭建基礎設施或者親身摸索繁複監管架構,就為客戶提供加密貨幣及穩定幣產品。

Zero Hash's services include:

Zero Hash 提供的服務包括:

-

Custody and wallet infrastructure: Secure storage of digital assets with institutional-grade security.

-

Stablecoin orchestration: Tools to convert between fiat and stablecoins, manage liquidity, and route payments across blockchains.

-

Regulatory compliance: Licensing and regulatory frameworks that allow clients to operate in multiple jurisdictions.

-

Payouts and settlements: Infrastructure for paying merchants, gig workers, and contractors in stablecoins.

-

資產保管及錢包基礎設施: 以機構級安全標準保障數碼資產存放。

-

穩定幣協調: 提供法幣與穩定幣兌換、流動性管理、跨鏈支付路由等工具。

-

監管合規: 採用多地通行的牌照與監管框架,方便客戶在不同司法區經營。

-

支付及結算: 建立以穩定幣支付商戶、自由工作者和承辦商的基礎設施。

The company has grown rapidly. In September 2025, Zero Hash raised $104 million in a Series D funding round led by Interactive Brokers, with backing from Morgan Stanley and SoFi. The round valued the company at $1 billion. Zero Hash processed more than $2 billion in tokenized fund flows in the first four months of 2025, reflecting surging institutional demand for on-chain assets.

公司發展迅速。2025 年 9 月,Zero Hash 完成 D 輪融資,籌集 1.04 億美元,領投為盈透證券,摩根士丹利和 SoFi 亦有參與,估值達 10 億美元。此外,於 2025 年首四個月,Zero Hash 的代幣化資金流動處理額超過 20 億美元,反映機構對鏈上資產的需求急增。

In November 2025, Zero Hash obtained a MiCA (Markets in Crypto-Assets) license from Dutch regulators, enabling it to offer stablecoin services across 30 countries in the European Economic Area. This makes Zero Hash one of the first infrastructure providers authorized under the EU's comprehensive crypto regulatory framework.

2025 年 11 月,Zero Hash 獲得荷蘭監管機構頒發的 MiCA(加密資產市場)牌照,可於三十個歐洲經濟區國家提供穩定幣服務,成為歐盟全面加密規管架構下首批獲授權基礎設施供應商之一。

The BVNK Alternative

Before targeting Zero Hash, Mastercard was reportedly in late-stage talks to acquire BVNK for around $2 billion. BVNK is a stablecoin platform that focuses on enabling businesses to use stablecoins for global payroll, treasury management, and payments. Coinbase was also reportedly pursuing BVNK, creating a bidding war.

據報導,在主攻 Zero Hash 之前,Mastercard 曾進入收購 BVNK 的最後協商階段,涉資約 20 億美元。BVNK 是專攻穩定幣業務的平台,主力協助企業用穩定幣作全球發薪、財資管理及支付。Coinbase 同時有意競購 BVNK,令形勢一度出現搶購戰。

The fact that Mastercard was willing to pay $2 billion for either company underscores the strategic value of turnkey stablecoin infrastructure. Building such capabilities in-house would take years and require expertise in blockchain development, custody technology, regulatory compliance, and client integrations. Acquiring Zero Hash or BVNK provides an instant on-ramp.

Mastercard 願意為任一間公司支付高達 20 億美元,其實反映出一站式穩定幣基礎設施的戰略價值。自家由頭搭建類似能力需要數年,加上區塊鏈開發、資產保管、合規及客戶整合等專才。收購 Zero Hash 或 BVNK,則可即時投入市場。

Why Acquire Instead of Build?

Mastercard is no stranger to blockchain technology. It acquired CipherTrace, a blockchain analytics firm, in 2021. It has participated in CBDC pilots, launched MTN, and deployed Crypto Credential. So why buy Zero Hash instead of continuing to build organically?

Mastercard 一直有涉足區塊鏈技術。早於 2021 年收購過區塊鏈分析公司 CipherTrace,亦曾參與央行數碼貨幣(CBDC)試點、推出 MTN、部署 Crypto Credential。咁點解佢今次唔係繼續自己起,而要買 Zero Hash?

The answer comes down to speed, scale, and regulatory moats.

答案就係:速度、規模,以及監管門檻。

Speed: The stablecoin market is growing fast, and competitors are moving aggressively. Stripe acquired Bridge for $1.1 billion in October 2024 and has been rapidly integrating stablecoin payments across its platform. Visa is expanding its own stablecoin settlement capabilities. Mastercard can't afford to fall behind.

速度: 穩定幣市場增長火速,競爭對手亦行動迅速。Stripe 於 2024 年 10 月以 11 億美元收購 Bridge,馬上將穩定幣支付整合入自家平台。Visa 亦積極擴展自己嘅穩定幣結算方案。Mastercard 冇得再遲疑。

Scale: Zero Hash already serves a roster of clients and processes billions in tokenized flows. Acquiring the company gives Mastercard instant scale and a proven platform that works in production.

規模: Zero Hash 已有一大批客戶,代幣化資金流每年以十億美元計。收購零哈許,Mastercard 可以即時大規模運作,並且用上一個已經驗證可行的平台。

Regulatory moats: Navigating crypto regulations is complex and time-consuming. Zero Hash holds multiple licenses and has built compliance frameworks that allow it to operate across jurisdictions. With its new MiCA license, Zero Hash can serve the entire European Economic Area - a capability that would take Mastercard years to replicate on its own.

監管壁壘: 處理加密監管既複雜又費時。Zero Hash 擁有多個類型牌照,自建跨域合規架構。靠新獲 MiCA 牌照,佢能夠服務成個歐洲經濟區,若 Mastercard 自己起,要用幾年時間。

Jake, a research analyst at Messari, noted: "If Mastercard pays $1.5-$2 billion, that's a 50-100% markup for late-stage investors in one quarter. For Mastercard, that's the cost of speed. Buying a fully licensed, production-grade crypto infrastructure provider is faster than building one."

Messari 研究分析員 Jake 曾指出: 「如果 Mastercard 出價 15-20 億美元,等於讓後期投資人一季已獲利 50-100%。對 Mastercard 來講,這就是為速度付款。買一間已獲全套牌照、足以生產的加密基建供應商,始終比自己慢慢整快得多。」

Risks and Uncertainties

The deal is not yet closed. Fortune reported that negotiations are at an advanced stage, but the transaction "may still fall through." Integration challenges, regulatory approvals, and due diligence could derail the acquisition or delay its completion.

交易仲未落實。據 Fortune 報道,談判進入尾聲,但「可能隨時夭折」。技術整合、監管批核、盡職調查等問題,都可以令收購延遲或告吹。

Even if the deal closes, Mastercard will face the challenge of integrating Zero Hash's technology into its own network. The companies operate in different regulatory environments and serve different customer bases. Ensuring seamless interoperability between Zero Hash's stablecoin rails and Mastercard's existing payment infrastructure will require careful engineering and coordination.

即使成功收購,Mastercard 都要解決將 Zero Hash 技術整合到自家網絡的難題。兩公司於不同監管環境營運,客戶群亦各異。要確保 Zero Hash 的穩定幣通道同 Mastercard 現有支付基建無縫配合,必須謹慎規劃及協調。

Still, the strategic intent is clear. Mastercard is betting that stablecoin settlement is the future of payments - and it's willing to pay a premium to secure the infrastructure it needs to compete in that future.

不過,策略方向都非常明確 —— Mastercard 押注穩定幣結算係支付未來,並願意以溢價購買所需基礎設施,確保持續競爭力。

How the Move Could End 'Banking Hours'

If Mastercard acquires Zero Hash and integrates stablecoin settlement into its core payment network, the implications for "banking hours" could be profound. To understand how, it's useful to walk through a concrete example of how settlement might work in a stablecoin-enabled system.

如果 Mastercard 收購 Zero Hash 並將穩定幣結算直接整合到其核心支付網絡,「銀行營業時間」這概念將受到重大衝擊。要明白點解,不如舉個穩定幣系統下的實例。

The 24/7 Settlement Model

In the traditional model, a cardholder makes a purchase on Saturday. The merchant receives authorization immediately, but settlement doesn't happen until Monday or Tuesday. The merchant must wait for the batch window to close, the acquiring bank to process the transaction, and Mastercard to net the obligations between the issuing and acquiring banks.

傳統模式下,持卡人星期六消費,商戶會即時收到授權訊息,但結算一般要等到星期一或二。商戶要等批量處理時間結束,收單行過數,再等 Mastercard 在發卡行同收單行之間進行資金清算。

In a stablecoin-enabled model, the process looks different:

喺穩定幣結算新模式下,流程會有好大唔同:

-

Authorization: The cardholder makes a purchase. Mastercard verifies that funds are available and approves the transaction. This step is unchanged.

-

授權: 持卡人落單消費。Mastercard 驗證可用資金並批核交易。這步同以前一樣。

-

Settlement option: Instead of waiting for batch processing, the acquiring bank can choose to receive settlement in USDC or EURC. This option is available 24/7, including weekends and holidays.

-

結算選項: 無需再等批量結算,收單行可選即時收到 USDC 或 EURC,全年無休,無論平日定假期都得。

-

On-chain netting: Obligations between the issuing bank and the acquiring bank are netted on-chain. Mastercard uses its MTN infrastructure to execute an atomic swap: the issuer's stablecoins move to the acquirer, and the acquirer's stablecoins (if any) move to the issuer.

-

鏈上交收: 發卡行與收單行之間的資金義務在鏈上做淨額結算。Mastercard 透過 MTN 基建進行原子兌換 —— 發卡行的穩定幣流向收單行,必要時對方的穩定幣也可相反轉帳。

-

Instant liquidity: The acquiring bank receives USDC or EURC immediately. It can choose to hold the stablecoins, convert them to fiat through approved liquidity partners, or use them to settle with merchants directly.

-

即時流動性: 收單行即時收到 USDC 或 EURC。佢可以選擇繼續持有、經批准的流動性夥伴兌回法幣,或直接用穩定幣過數畀商戶。

-

Treasury automation: Treasury teams can sweep funds in near real-time. They can apply programmable rules for foreign exchange, fees, and reserve management. Funds can be converted back to fiat whenever needed, without waiting for banking hours.

-

財資自動化: 財資團隊幾乎實時歸總資金,設置自動兌換、收費、儲備管理等規則。隨時可將穩定幣兌回法幣,無需受銀行營業時間限制。

Use Case: A Merchant in Argentina

Consider a merchant in Buenos Aires that accepts Mastercard payments from international tourists. Under the traditional model, settlement happens in U.S. dollars via correspondent banks. The funds take several days to arrive, and exchange rate fluctuations during that time can erode profit margins.

要了解效果,可以睇下阿根廷布宜諾斯艾利斯的商戶,接收國際旅客用 Mastercard 支付。傳統模式下,錢係經對應銀行以美元結算,要等幾日先到賬,期間匯率波動隨時侵蝕利潤。

With stablecoin settlement, the merchant's acquiring bank could receive USDC on Saturday night - immediately after the tourist makes the purchase. The bank can convert USDC to Argentine pesos at the current exchange rate and deposit the funds in the merchant's account the same day. No batch delays. No correspondent chains. No weekend wait.

用穩定幣方案,商戶的收單行可以星期六夜晚即時收到 USDC —— 旅客一用卡,款項已經到手。銀行可以即刻按最新匯價兌換阿根廷披索,當日過數入商戶戶口。無需批量等待,無需對應銀行,中途無週末阻滯。

This is not a hypothetical. Mastercard's EEMEA pilot with Circle is already testing this model with Arab Financial Services and Eazy Financial Services. The acquiring institutions receive settlement in USDC or EURC and use those stablecoins to settle with merchants.

這不只是理論。Mastercard 聯同 Circle 已於中東歐東南非多國同阿拉伯金融服務(AFS)及 Eazy Financial Services 試行此類方案。收單金融機構直接收到 USDC 或 EURC,再用穩定幣快速結算予商戶。

Quantifying the Benefits

What are the concrete benefits of 24/7 settlement?

一日 24 小時、全年無休結算有咩實質好處?

Reduced pre-funding: Banks and acquirers currently need to prefund merchant accounts to ensure timely payments. With instant stablecoin settlement, pre-funding requirements can be reduced or eliminated, freeing up capital for other uses.

減少預存資金: 銀行與收單機構要預先壓錢進商戶賬戶,確保能準時過數。有咗即時穩定幣結算,可以大幅減少 或完全取消 預存要求,釋放出更多資金調動。

Lower daylight overdraft risk: Banks that run negative balances during settlement windows often incur fees or regulatory scrutiny. Real-time settlement reduces the window of exposure and the associated risk.

減低白天透支風險: 傳統結算窗口期間,如銀行要透支,會有費用或監管壓力。實時結算縮短曝露時間,自然風險較低。

Faster cross-border flows: Cross-border transactions that currently take 3-5 days can settle in minutes. This is especially valuable for remittances, B2B payments, and supply chain finance.

加快跨境資金流動: 跨境交易由三至五日減至幾分鐘內完成,對匯款、B2B 支付或供應鏈融資尤其有幫助。

Improved working capital: Merchants that receive funds faster can reinvest them sooner, improving cash flow

提升營運資金效率: 商戶收錢變快,可以及早再投資或用作其他營運開支,現金流自然改善。and reducing the need for short-term credit.

以及減少對短期信貸的需求。

Weekend and holiday availability: Businesses that operate 24/7 - such as e-commerce platforms, gig economy companies, and hospitality providers - no longer face delays when settlement falls on a weekend or holiday.

週末及假期可用性: 24/7 營運的企業——例如電子商務平台、零工經濟公司同款待服務提供者——再唔會因為結算撞正週末或公眾假期而拖慢資金到賬。

The Contrast with T+1 Settlement

與T+1結算的對比

It's worth emphasizing how different this is from the current T+1 model. In the traditional ACH system, transactions initiated on Friday evening don't begin processing until Monday morning. If Monday is a federal holiday, processing is delayed until Tuesday. The same constraints apply to card settlement.

值得強調,呢種新模式同現時T+1(即「第二個營業日結算」)有幾咁大分別。以傳統ACH系統為例,如果禮拜五晚入咗單,要到星期一朝早先開始處理。如果星期一啱啱又係聯邦假期,就要再等到星期二。信用卡結算都面對同樣限制。

With stablecoin settlement, time zones and holidays become irrelevant. A transaction initiated at 11 PM on Christmas Eve settles just as quickly as one initiated at 10 AM on a Tuesday. This "always-on" capability is not just an incremental improvement - it's a fundamental shift in how money moves.

用穩定幣結算,時區同假期根本唔使理。有單喺平安夜夜晚11點發起,結算速度同星期二朝早10點幾乎一樣咁快。呢種「永遠開放」嘅能力唔只係小小提升,簡直係貨幣流通方式嘅一次根本性轉變。

Ecosystem-Wide Impacts: Banks, Merchants, Cross-Border, and Crypto

生態圈影響:銀行、商戶、跨境支付同加密行業

The implications of Mastercard's stablecoin push extend far beyond the company itself. If 24/7 settlement becomes the norm, it will reshape how banks, merchants, cross-border payment providers, and the crypto industry itself operate.

萬事達卡推進穩定幣對整個行業都有重大影響。如果24/7結算成為標準,會重新塑造銀行、商戶、跨境支付同加密行業嘅運作方式。

For Banks and Payment Processors

對銀行及支付處理商

Banks and payment processors face both opportunities and challenges.

銀行同支付處理商既有新機遇,亦有新挑戰。

Opportunities:

機遇:

-

Fewer vendors: By using Mastercard's MTN and Zero Hash infrastructure, banks can reduce the number of vendors they need to manage. Instead of contracting separately with blockchain networks, custody providers, and compliance platforms, they can plug into Mastercard's turnkey solution.

**更少合作夥伴:**用萬事達卡MTN同Zero Hash基建,銀行可以減少要打交道的供應商,唔使再同區塊鏈、託管或合規平台分別簽約,直接接駁一條龍解決方案。 -

Faster time to market: Rolling out stablecoin services in-house can take years. Mastercard's infrastructure allows banks to launch new products in months.

**更快推出市場:**自己搞穩定幣服務要搞幾年,接入萬事達卡基建可以幾個月內出新產品。 -

New revenue streams: Banks can offer stablecoin-based treasury management, cross-border payments, and programmable payment features to corporate clients.

**新收入來源:**銀行可以為企業客戶提供穩定幣財資管理、跨境支付同可編程支付等新服務。

Challenges:

挑戰:

-

On-chain risk: Stablecoins introduce new risks - smart contract vulnerabilities, de-peg events, custody breaches, and blockchain network outages. Banks will need to develop expertise in managing these risks.

**鏈上風險:**穩定幣帶來新風險,包括智能合約漏洞、脫鈎、託管失守同區塊鏈網絡崩潰,銀行要建立相關風險管理能力。 -

Key management: Holding and transferring stablecoins requires managing private keys. Banks accustomed to centralized ledgers will need to implement robust key management systems and controls.

**密鑰管理:**持有同轉帳穩定幣要管理私鑰。習慣中心化帳簿嘅銀行需要搞好密鑰管理同內部管控。 -

Operational complexity: Running both fiat and stablecoin rails in parallel increases operational complexity. Banks will need new accounting systems, reconciliation processes, and reporting tools.

**運作複雜度提升:**法定貨幣同穩定幣並行運作,令營運複雜化,銀行要有新會計系統、對賬流程同報告工具。

For Merchants and Treasurers

對商戶同財資主管

Merchants stand to benefit significantly from faster settlement, but they will also face new choices and complexities.

商戶受惠於加快結算,但亦要面對更多選擇同複雜情況。

Benefits:

好處:

-

Settlement transparency: Blockchain-based settlement provides a transparent audit trail. Merchants can verify that funds have been sent and track their movement across the network.

**結算透明度提升:**區塊鏈結算有透明審計紀錄,商戶可以核實資金已匯出,以及跟蹤流向。 -

Faster reconciliation: Real-time settlement simplifies reconciliation. Merchants no longer need to match batches of transactions that arrive days after the sale.

**更快對賬:**即時結算令對賬簡單啲,唔使再等幾日先收齊交易數據再逐單對。 -

Option to hold stablecoins: Merchants that operate internationally may choose to hold USDC balances to avoid currency conversion fees and exchange rate risk.

**可選擇持有穩定幣:**國際商戶可以選擇持有USDC等穩定幣,減少兌換費同匯率風險。

Challenges:

挑戰:

-

Treasury management: Deciding when to convert stablecoins to fiat becomes a treasury decision. Holding stablecoins exposes merchants to de-peg risk and regulatory uncertainty.

**資金管理:**幾時將穩定幣兌換成法幣要更審慎考慮。持有穩定幣有脫鈎同監管不明朗風險。 -

New accounting standards: Stablecoins are not yet recognized as cash equivalents under IFRS or GAAP. Treasurers will need to navigate complex accounting treatments.

**新會計標準:**依家IFRS/GAAP未承認穩定幣屬等同現金,財資部要應付會計難題。 -

Vendor relationships: Merchants will need to ensure their acquiring banks support stablecoin settlement and understand the fees, terms, and risks involved.

**供應商關係:**商戶要確保收單銀行支援穩定幣結算,並了解有關費用、條款及風險。

For Cross-Border Payments

對跨境支付

Cross-border payments have long been a pain point for businesses. Correspondent banking chains, SWIFT fees, and multi-day settlement times make international transfers slow and expensive.

跨境支付一直係商界大難題。傳統做法涉及層層代理銀行、SWIFT手續費同長時間結算,搞到國際匯款又慢又貴。

Stablecoins offer a compelling alternative. A payment from the U.S. to Nigeria can be executed in USDC in seconds, with minimal fees. The recipient converts USDC to local currency at the current exchange rate, avoiding the markups imposed by traditional remittance providers.

穩定幣提供咗一個好吸引嘅新選擇。由美國匯錢到尼日利亞,用USDC可以數秒內完成,而且手續費低。收款人可以即時按市價兌換當地貨幣,唔使捱傳統匯款服務嘅高收費。

This is already happening at scale. Stablecoins moved $46 trillion in transaction volume in 2024, rivaling Visa's throughput. Much of this volume is driven by cross-border flows - remittances from the U.S. to Latin America, payments for digital goods in emerging markets, and B2B settlements.

呢啲已經係大規模發生緊。2024年穩定幣交易量達46萬億美元,差唔多追得上Visa。大部分係跨境業務推動——美國匯款到拉美、新興市場購買數碼產品、B2B結算等等。

For businesses, the implications are profound:

對企業嚟講,影響深遠:

-

Shorter settlement times: Cross-border payments that once took 3-5 days can settle in minutes.

**結算時間大減:**以前要等三五日嘅跨境支付,幾分鐘搞掂。 -

Lower costs: By eliminating correspondent banks and reducing FX fees, stablecoins can cut cross-border payment costs by 50% or more.

**成本更低:**無需代理銀行同減少外匯費用,穩定幣可以令跨境支付成本減半以上。 -

Access to underserved markets: Stablecoins enable businesses to transact in countries where traditional banking infrastructure is weak or nonexistent.

**打入缺乏金融基建市場:**穩定幣令企業可以入到傳統銀行難以覆蓋嘅地區做生意。

For the Crypto Industry

對加密行業

Mastercard's stablecoin push represents mainstream validation for the crypto industry. When one of the world's largest payment networks commits $2 billion to acquiring stablecoin infrastructure, it sends a powerful signal: crypto is no longer a niche experiment - it's core financial infrastructure.

萬事達卡推穩定幣證明咗加密行業愈嚟愈主流。當全球最大支付網絡之一以20億美元買入穩定幣基建,等同對外宣佈:加密貨幣唔再係小圈子實驗,而係核心金融基建。

This validation has several effects:

呢份認同帶嚟多方面影響:

Increased institutional flows: Banks and payment processors that were hesitant to touch crypto may now feel comfortable offering stablecoin services under Mastercard's umbrella.

**機構資金流入增加:**曾經唔敢碰加密貨幣嘅銀行及支付商,依家可以安心經萬事達卡提供穩定幣服務。

Regulatory momentum: Mainstream adoption by Mastercard and other incumbents may accelerate regulatory clarity. Policymakers are more likely to create clear frameworks when major financial institutions are involved.

**監管推進:**萬事達卡等主流採納,可能加快監管界定。有大機構參與,政策制定者更有誘因設明確框架。

New rails for tokenized assets: Stablecoins are just the beginning. The same infrastructure that enables USDC settlement can be extended to tokenized securities, commodities, and real-world assets. This opens the door to a much larger tokenization market.

**資產代幣新基建:**穩定幣只係開端,呢套基建將來可以支援證券、商品同實體資產代幣化,打開龐大新市場。

Industry Projections

行業預測

The growth projections for stablecoins are staggering. Citigroup's September 2025 report forecasts that stablecoin issuance could reach $1.9 trillion by 2030 in a base case scenario, with a bull case of $4 trillion. On an adjusted basis, stablecoin transaction volumes could support nearly $100 trillion in annual activity by 2030.

穩定幣未來增長令人咋舌。花旗2025年9月報告指,基本情景下2030年穩定幣發行量可達1.9萬億美元,牛市預估更有4萬億。 經調整後,2030年穩定幣交易量年計可近100萬億美元。

These projections assume continued regulatory clarity, institutional adoption, and integration into traditional payment systems - exactly the path Mastercard is pursuing.

呢啲預測都假設監管進一步明朗、機構大量採納同融入傳統支付系統,即係萬事達卡現時走緊嘅路。

Competitor Responses

對手市場反應

Mastercard is not alone in this race. Stripe acquired Bridge for $1.1 billion and has since launched stablecoin financial accounts, card issuing, and payment acceptance across 101 countries. Visa has partnered with Bridge to issue stablecoin-linked Visa cards, enabling cardholders to spend stablecoins at any of the 150 million merchants that accept Visa.

萬事達卡絕非單打獨鬥。Stripe以11億美元收購Bridge,並已經喺101個國家推行穩定幣金融賬戶、發卡、收款等服務。Visa就同Bridge拍住上,發穩定幣掛鈎Visa卡,等用戶可以去全球1.5億間Visa商戶用穩定幣消費。

This competitive dynamic is accelerating the pace of innovation. No major player wants to cede market share to rivals. The result is a strategic arms race, with each company trying to build or buy the best stablecoin infrastructure.

呢場競爭令創新速度大大加快。無人想俾市場份額比對手搶走,各家都鬥快打造或收購最強穩定幣基建,進入戰略競賽狀態。

Operational, Compliance, Liquidity, and Risk Challenges

運作、合規、流動性及風險挑戰

For all the promise of 24/7 stablecoin settlement, significant challenges remain. These obstacles - operational, regulatory, and market-related - will determine how quickly the vision becomes reality.

雖然24/7穩定幣結算前景吸引,但現實仍有不少關卡——無論營運、監管還是市場層面——影響願景實現速度。

Fiat Rail Limits

法幣通道限制

Stablecoins may operate 24/7, but fiat rails do not. ACH and SEPA transfers still observe banking hours. This creates a mismatch: a merchant might receive USDC on Saturday night, but converting it to fiat for deposit in a traditional bank account requires waiting until Monday.

穩定幣通道簡直24/7無休,但法定貨幣通道唔係咁。ACH同SEPA匯款仍然按銀行辦公時間運作。變相出現落差:商戶星期六晚收咗USDC,但要兌換入銀行戶口,要等到星期一。

This isn't an insurmountable problem - merchants can hold stablecoins over the weekend and convert them on Monday morning - but it limits the benefit of instant settlement. Until fiat on-ramps and off-ramps operate 24/7, there will always be a bottleneck.

呢個難題唔算解決唔到——商戶可以等星期一先兌換穩定幣——但即時結算效益就打咗折扣。未來只有法定貨幣進出通道都做到24/7,樽頸先會消失。

Some banks are addressing this by offering instant payment services like FedNow and RTP, which operate around the clock. But adoption is still limited, and international instant payment networks are fragmented.

有啲銀行開始搞如FedNow、RTP等即時支付服務,日日夜夜照做,但現時未算普及,而且國際之間即時支付網絡好分散。

Custody and Key Management

託管與密鑰管理

Holding stablecoins requires managing private keys - the cryptographic credentials that control access to funds. Unlike traditional bank accounts, where access is mediated by usernames and passwords, blockchain assets are controlled by whoever holds the private key.

持有穩定幣,要管理私鑰——即控制資金存取的密碼憑證。傳統銀行戶口是靠用戶名密碼管理,區塊鏈資產則誰掌握私鑰誰就有權。

This creates new risks:

咁會帶來新風險:

-

Key loss: If a private key is lost, the funds are irrecoverable.

私鑰遺失: 一旦私鑰唔見,啲錢無得救返。 -

Key theft: If a key is stolen, the funds can be drained instantly.

私鑰被竊: 私鑰一被人偷取,資金即時可以俾人洗走。 -

Operational errors: Sending funds to the wrong address or blockchain can result in permanent loss.

操作錯誤: 寄去錯地址或者錯鏈,都可能導致永久損失。

Banks and payment processors will need to implement institutional-grade custody solutions with multi-signature controls, hardware security modules, and rigorous access policies. Zero Hash and other providers offer custody infrastructure, but integrating these

銀行同支付商要用機構級託管方案,包括多重簽名控制、硬件安全模組同嚴格存取政策。市面如Zero Hash等都提供託管基建,但整合...systems into existing bank operations is non-trivial.

將穩定幣系統整合到現有銀行運作之中並不簡單。

Smart Contract Vulnerabilities

智能合約漏洞

Many stablecoin transactions involve smart contracts - self-executing programs that run on blockchains. While smart contracts enable programmability, they also introduce vulnerabilities. Bugs in smart contract code can be exploited by attackers, resulting in loss of funds.

許多穩定幣交易涉及智能合約——這些是於區塊鏈上自動執行的程式。雖然智能合約令交易具備可編程性,但同時亦會帶來漏洞。黑客有機會利用智能合約程式碼的缺陷進行攻擊,導致資金損失。

High-profile exploits - such as the $600 million Poly Network hack in 2021 - have underscored the risks. For mainstream adoption, stablecoin infrastructure must be audited, tested, and continuously monitored for vulnerabilities.

過往多宗備受關注的攻擊事件——例如 2021 年 Poly Network 遭黑客盜取 6 億美元——已突顯相關風險。若要令穩定幣普及使用,其基建必須經過審計、測試,並持續監察漏洞。

Stablecoin De-Peg Risk

穩定幣脫鈎風險

Stablecoins are designed to maintain a 1:1 peg with fiat currencies, but this peg can break. In 2022, TerraUSD (UST) lost its peg and collapsed, wiping out tens of billions of dollars in value. While USDC and EURC are backed by reserves and have maintained their pegs, the risk is not zero.

穩定幣理論上與法定貨幣 1:1 挂鈎,但這種掛鉤未必長期保持。2022 年 TerraUSD (UST) 脫鈎並全面崩潰,一度蒸發數以百億美元計的市值。雖然 USDC 及 EURC 由儲備資產支持,並一直保持掛鉤,但風險仍然存在。

A de-peg event during settlement could create losses for banks, merchants, or payment processors. Risk management frameworks will need to account for this possibility - perhaps by using stablecoins only for short-duration settlements or by maintaining reserve buffers.

於結算期間出現穩定幣脫鈎,可能為銀行、商戶或支付處理機構帶來損失。風險管理框架須考慮這情況——例如只將穩定幣用於短週期結算,或設立儲備緩衝。

Compliance Challenges: AML, Travel Rule, Chargebacks

合規挑戰:反洗錢、旅遊法則、退款機制

Traditional payment systems have well-established compliance frameworks. Banks conduct KYC (Know Your Customer) checks. Transactions are monitored for suspicious activity. Chargebacks allow consumers to dispute fraudulent charges.

傳統支付系統具備完善合規框架:銀行會進行 KYC(認識你的客戶)核查,監控可疑交易;消費者亦可透過退款機制對可疑或欺詐收費提出爭議。

Stablecoin systems must replicate these protections, but the mechanisms are different:

穩定幣系統亦需複製這些保障,但執行方式有所不同:

AML/CTF: Anti-money laundering and counter-terrorism financing rules require that transactions over certain thresholds be reported. Mastercard's Crypto Credential supports Travel Rule compliance, but implementing this at scale requires coordination with exchanges, wallets, and regulators.

反洗錢/反恐資金: 反洗錢及反恐融資規定要求對超過特定金額的交易進行申報。Mastercard 的 Crypto Credential 支援旅遊法則合規,但要大規模落實,仍須與交易所、錢包及監管部門協調。

Chargebacks: Blockchain transactions are generally irreversible. Once funds are transferred, they cannot be clawed back without the recipient's consent. This makes implementing chargeback mechanisms more complex. Some solutions involve multi-signature escrow accounts or programmable smart contracts that can reverse transactions under certain conditions, but these add complexity and cost.

退款機制: 區塊鏈交易通常不可逆,資金一旦轉帳,除非收款人同意,否則無法追回。這令退款設計更為複雜。有些方案採用多重簽署的託管帳戶或可編程智能合約,在特定情況下允許逆轉交易,但會增加系統複雜度及成本。

Accounting systems: Existing accounting systems are designed for fiat transactions that settle on T+1 or T+2 schedules. Continuous stablecoin settlement requires new accounting standards and software that can handle real-time reconciliation and reporting.

會計系統: 現有會計系統主要針對 T+1 或 T+2 結算的法定貨幣交易設計。若要支援持續的穩定幣結算,需要全新會計標準及軟件,以處理實時對賬報告。

Liquidity and Market Risks

流動性及市場風險

Stablecoin markets are still maturing. While USDC and Tether are highly liquid, spreads can widen during off-hours or periods of market stress. Converting large amounts of stablecoins to fiat may incur slippage, especially on weekends when liquidity is lower.

穩定幣市場仍在成熟階段。雖然 USDC 及 Tether 流通量高,但在非交易時段或市場壓力下點差會拉闊。大額兌換穩定幣至法幣時,特別在週末流動性較低時,容易出現滑點。

Additionally, stablecoin liquidity is concentrated on certain blockchains. Ethereum and Tron account for 64% of stablecoin transaction volume. If a bank needs to settle on a different blockchain, it may face liquidity constraints or higher conversion costs.

另外,穩定幣的流動性集中於少數區塊鏈平台。以太坊和波場(Tron)合共佔穩定幣交易量 64%。銀行如需於其他鏈上結算,可能面對流動性不足或較高兌換成本。

Integration Risk

系統整合風險

Integrating stablecoin infrastructure with legacy payment systems is a major engineering challenge. Banks operate on decades-old core banking systems that were never designed to handle blockchain transactions. Ensuring seamless interoperability - without creating new points of failure or security vulnerabilities - will require careful planning, testing, and phased rollouts.

把穩定幣基礎設施與傳統支付系統整合涉及重大的工程挑戰。銀行核心系統動輒數十年歷史,並未為處理區塊鏈交易而設。要確保系統無縫互通而不會帶來新的故障點或安全漏洞,需謹慎規劃、測試及分階段推行。

Vendor consolidation poses another risk. If Mastercard acquires Zero Hash and becomes a dominant provider of stablecoin infrastructure, banks and merchants may become dependent on a single vendor. This concentration risk could lead to higher fees, reduced innovation, or systemic vulnerabilities if Mastercard's systems experience outages.

供應商過於集中亦帶來風險。如 Mastercard 收購 Zero Hash 後成為穩定幣基建壟斷者,銀行及商戶或會對單一供應商形成依賴。這會造成集中風險,若 Mastercard 系統故障,或會令全行收費上升、創新減慢,甚至出現系統性弱點。

Regulatory Uncertainty

監管不明朗

While the regulatory environment for stablecoins has improved - particularly with the passage of the GENIUS Act in the U.S. and the implementation of MiCA in Europe - many questions remain unresolved:

雖然穩定幣監管環境已見改善——特別係美國通過GENIUS 法案,歐洲落實 MiCA 條例——但仍有不少問題未有定論:

-

Cross-border regulation: Different jurisdictions have different rules for stablecoins. A stablecoin that is compliant in the U.S. may not be authorized in the EU or Asia.

跨境監管: 各地對穩定幣規則不一,美國獲批之穩定幣,未必可於歐盟或亞洲合規落地。 -

Tax treatment: How are stablecoin transactions taxed? Are they considered currency exchanges, property transactions, or something else?

稅務處理: 穩定幣交易應如何徵稅?是作為貨幣兌換、資產買賣,還是其他性質? -

Systemic risk: If stablecoins become a significant part of the financial system, regulators may impose stricter capital requirements, reporting obligations, or operational standards.

系統性風險: 若穩定幣成為金融體系重要一環,監管機構或會要求更高資本準備、更多申報及更嚴謹運作標準。

Where This Could Lead: Scenarios and What to Look For

未來發展路向:可能情景及觀察重點

Given the opportunities and challenges, how might Mastercard's stablecoin push unfold over the next several years? It's useful to consider three scenarios: a base case, an accelerated adoption case, and a stalled transition case.

面對機遇與挑戰,Mastercard 穩定幣發展於未來數年可能會如何演變?可以考慮三種情景:基本情境、加快普及情境、及停滯過渡情境。

Base Case: Hybrid Model Persists

基本情境:傳統與新模式共存

In this scenario, Mastercard completes the acquisition of Zero Hash and integrates stablecoin settlement into MTN. Stablecoin usage grows steadily, but legacy fiat rails remain dominant.

此情境下,Mastercard 完成收購 Zero Hash,並將穩定幣結算納入 MTN。穩定幣用量穩步上升,但傳統法幣結算路線仍主導市場。

Key characteristics:

主要特徵:

-

Stablecoin settlement is available as an option for acquirers and merchants, but most transactions still settle in fiat via traditional batch processing.

穩定幣結算成為收單行和商戶可選方案,但大部份交易仍以法幣傳統批次處理完成。 -

Geographic rollout is gradual, starting with emerging markets where stablecoins provide the most value (e.g., high-inflation countries, cross-border corridors with limited banking infrastructure).

新興市場(如高通脹國家、銀行基礎設施匱乏的跨境渠道)率先採用穩定幣,地區擴展步伐較慢。 -

Regulatory frameworks continue to evolve, with ongoing debates about capital requirements, reserve standards, and systemic risk.

監管框架持續演變,有關資本要求、儲備標準、系統性風險等議題仍不停討論。 -

Banks and payment processors maintain dual infrastructure - supporting both fiat and stablecoin rails in parallel.

銀行及支付商繼續雙軌運作——傳統法幣及穩定幣結算同時兼容。

Timeline: By 2028, stablecoin settlement accounts for 10-15% of Mastercard's transaction volume, concentrated in specific use cases (cross-border payments, gig economy payouts, remittances).

時間線: 2028 年前穩定幣結算佔 Mastercard 總交易量約 10-15%,多數集中於特定用途(跨境支付、零工經濟派發、匯款)。

What to watch:

觀察重點:

-

Completion of the Zero Hash acquisition and integration roadmap.

Zero Hash 收購案及整合進展 -

Expansion of USDC/EURC settlement beyond EEMEA to additional regions.

USDC/EURC 結算推廣至 EEMEA 以外地區 -

Adoption metrics: How many banks and acquirers are using MTN? What percentage of merchants are receiving stablecoin settlements?

採用率指標:有幾多銀行及收單行用 MTN?多少商戶選擇收穩定幣結算?

Accelerated Adoption: Banking Hours Fade

快速普及情境:銀行營業時間被打破

In this scenario, stablecoin adoption exceeds expectations. Regulatory clarity accelerates, liquidity deepens, and both institutional and retail users embrace 24/7 settlement.

這情境下,穩定幣應用快過預期。監管明朗、流動性提升、機構及散戶用戶均普遍採用 24/7 實時結算。

Key characteristics:

主要特徵:

-

Mastercard completes the Zero Hash acquisition and rapidly rolls out stablecoin settlement globally. By 2027, stablecoin settlement accounts for 30-40% of Mastercard's transaction volume.

Mastercard 完成 Zero Hash 收購,並迅速將穩定幣結算推廣至全球。到 2027 年,穩定幣結算佔總交易量 30-40%。 -

Banks begin offering stablecoin-denominated accounts to corporate clients. Treasurers hold USDC balances to earn yield and manage liquidity more efficiently.

銀行開始推出以穩定幣計值的企業戶口。財資部門持有 USDC 結餘以賺取收益及更高效管理流動性。 -

Citigroup's bull case forecast materializes: stablecoin market cap reaches $4 trillion by 2030, with transaction volumes exceeding $100 trillion annually.

花旗集團的樂觀預測實現:到 2030 年,穩定幣市值達 4 兆美元,年交易額超過 100 兆美元。 -

Traditional batch settlement becomes the exception rather than the rule. Weekend and holiday delays are eliminated for most transactions.

傳統批次結算成為少數例外;大部份交易即使週末及假日亦可即時結算。

Timeline: By 2030, "banking hours" as a concept no longer constrains most payment flows. Merchants and businesses operate in a continuous settlement environment.

時間線: 到 2030 年,「銀行營業時間」已不再限制支付流程。商戶及企業採用實時結算新常態。

What to watch:

觀察重點:

-

Regulatory milestones: Does the U.S. pass additional legislation supporting stablecoin issuance and use? Do other jurisdictions follow MiCA's lead?

監管重要進展:美國會否通過更多支援穩定幣的法律?其他地區會否跟隨 MiCA 步伐? -

Liquidity indicators: Are stablecoins trading with tight spreads 24/7? Are market makers providing liquidity on weekends?

流動性指標:穩定幣能否 24/7 低點差交易?週末市造商有無繼續提供流動性? -

Institutional adoption: Are Fortune 500 companies holding stablecoin balances? Are central banks issuing CBDCs that interoperate with stablecoins?

機構用戶採用情況:500 強企業有無持有穩定幣資產?央行有無發行與穩定幣互通的 CBDC?

Stalled Transition: Legacy Rails Dominate

過渡停滯情境:傳統法幣結算維持主導

In this scenario, operational and regulatory challenges slow adoption. Stablecoin settlement remains a niche offering, and traditional fiat rails continue to dominate.

這情境下,運營及監管挑戰拖慢穩定幣普及步伐,穩定幣結算只屬小眾選項,傳統法幣結算持續主導市場。

Key characteristics:

主要特徵:

-

The Zero Hash acquisition faces regulatory hurdles or integration challenges. Rollout is delayed or limited in scope.

Zero Hash 收購案遇上監管或技術整合困難,未能如期推行或只限少部分地區。 -

Stablecoin de-peg events or smart contract exploits create reputational damage and regulatory backlash.

穩定幣脫鈎或智能合約被攻擊,對行業聲譽造成損害,甚至引發監管反彈。 -

Banks and merchants are reluctant to adopt stablecoin settlement due to concerns about custody risk, accounting complexity, or regulatory uncertainty.

銀行與商戶因為資產託管風險、賬目複雜或監管前景不明而卻步。 -

Competitor offerings (e.g., instant payment networks like FedNow) provide a fiat-based alternative that meets the need for faster settlement without the complexity of crypto.

競爭對手(如 FedNow 之類即時支付網絡)以法幣即時結算回應市場需求,毋須引入加密貨幣相關複雜因素。

Timeline: By 2030, stablecoin settlement accounts for less than 5% of Mastercard's transaction volume, concentrated in niche use cases.

時間線: 到 2030 年,穩定幣結算佔 Mastercard 總交易量不足 5%,只在小眾場景出現。

What to watch:

觀察重點:

-

Deal closure: Does the Zero Hash acquisition actually close? If not, does Mastercard pursue an alternative target or pivot to a different strategy?

收購能否成事?如未能落實,Mastercard 會否另覓對象或轉變策略? -

Regulatory setbacks: Are new restrictions imposed on stablecoins? Do accounting standards fail to recognize stablecoins as cash equivalents?

監管受阻:會否有新限制?會計準則會否阻礙穩定幣視作現金等價物? -

Competitive dynamics: Do instant payment networks capture the market share that stablecoins were expected to win?

競爭形勢:即時支付網絡會否搶佔本來屬於穩定幣的市場?

Indicators to Monitor

關鍵觀察指標

Regardless of which scenario unfolds, several indicators will signal the direction of travel:

無論上述哪個情境實現,下列指標均反映未來趨勢:

-

Zero Hash acquisition status: Does the deal close? What is the integration timeline?

Zero Hash 收購進度: 交易能否完成?何時整合? -

BVNK outcome: If Mastercard doesn't acquire BVNK, does Coinbase or another competitor do so? How does this affect the competitive landscape?

BVNK 發展: 如 Mastercard 無收購 BVNK,Coinbase 或其他對手會否出手?競爭格局有何改變? -

MTNadoption: MTN現時有多少間銀行同金融科技機構已經接駁?佢哋正處理緊幾大交易量?

-

Crypto Credential推廣情況: 有幾多間交易所同錢包已經支援Crypto Credential?除咗匯款之外,佢有冇拓展到其他應用場景?

-

USDC/EURC結算量: 穩定幣結算量係咪持續每季度增長?邊啲地區或行業最推動應用?

-

監管新發展: 主要市場有冇新嘅穩定幣法律框架出台?呢啲政策係咪利好定阻礙行業普及?

-

競爭對手動態: Visa、Stripe、PayPal同其他支付巨頭喺穩定幣領域有咩新舉動?

對加密貨幣及金融界嘅更廣泛影響

Mastercard推動穩定幣,影響唔止係結算效率。佢關乎加密貨幣喺金融體系嘅角色、穩定幣作為全球結算層嘅未來,同傳統金融同去中心化金融(DeFi)嘅融合。

由投機資產到核心基礎設施

過去加密貨幣一直俾人覺得係投機資產——波動大、風險高,同實體經濟脫節。相比之下,穩定幣設計目的就係穩陣,保值為主、唔炒賣。佢哋更似一種金融基礎設施,而唔係投資產品。

Mastercard著重發展穩定幣結算,就係鞏固緊呢個轉變。當一個支付網絡以USDC處理十億級交易時,穩定幣唔再係邊緣實驗,已經變成全球支付系統核心部分。

咁樣轉型會有幾個後果:

- 合法性提升: 穩定幣成為被認可嘅支付方式。原本觀望或懷疑嘅商戶、銀行同監管機構,都可能會轉趨接受。

- 監管: 當資產嵌入主流金融,政策制定者更大機會制訂清晰又有利嘅規則。

- 投資: 機構資金會流向穩定幣基建——託管平台、流動性供應商、合規工具——加速生態圈擴展。

穩定幣作為全球結算層

如果穩定幣成為主流跨境支付工具,佢哋就有機會成為全球結算層——即係一種「Eurodollar 2.0」,喺區塊鏈上運作。

原始的Eurodollar市場——即美金存放喺美國以外銀行——由60年代開始,變成全球流動性重要來源。穩定幣有機會扮演同類角色,令世界各地無需美國銀行帳戶都用到美元流動性。

超過99%穩定幣都以美元計價,預計2030年達到3萬億美元以上,增長10倍。呢個增長會加強美金優勢,令全球商戶用USDC付款、儲值、做財資管理。

對美國嚟講,咁有地緣政治影響。美國財政部長Scott Bessent都提過,發展穩定幣有機會「加強美元霸權」,將美金融入數碼支付同貿易結算。穩定幣已持有超過1,320億美元美國國債,多過南韓國債持有量。若穩定幣市值達5萬億美元,可能為美國國債帶來1.4至3.7萬億美元新買家,壯大本地買家基礎。

資產代幣化同現實世界資產市場

穩定幣只係一種資產代幣化。支持USDC結算嘅基建,亦可以推展到代幣化證券、大宗商品、房地產、同其他現實資產(RWA)。

Mastercard同Ondo Finance整合,就係早期例子,將美國國債基金代幣帶入MTN。企業可以用閒置資金投資代幣國債,24/7賺取利息,成個過程唔洗離開Mastercard網絡。

咁樣為更大嘅資產代幣市場鋪路。花旗估計,銀行代幣(即代幣化存款)到2030年交易量可高達100萬億美元,有望超越穩定幣。而且呢啲代幣產品比較容易接入現有財資系統,監管亦更熟悉。

穩定幣、代幣化存款同代幣化現實世界資產融合,有機會建立統一基建,實現可編程資金同資產,模糊咗支付、財資同資本市場之間界線。

加速機構採用

Mastercard、Visa同其他主流玩家入場,從多方面加快咗機構採用:

風險降低: 有大型金融機構肯定穩定幣基建,其他銀行企業就冇咁擔心「先行者風險」。

標準化: Mastercard嘅MTN同Crypto Credential為身份、合規、互通提供統一標準,方便機構整合。

網絡效應: 愈多銀行、商戶加入Mastercard穩定幣網絡,參與價值就愈高,形成「飛輪」效應——愈多人用,愈普及。

監管收斂

Mastercard參與,亦可推動監管趨同。金融巨頭喺穩定幣基建上落場,決策者更大機會制訂明確規則。美國GENIUS法案通過、歐洲MiCA落地就係好例子。

等監管逐步成熟,可能逐漸圍繞以下原則:

- 儲備要求: 穩定幣必須用高質素、流動性資產作擔保

- 透明度: 發行方要定期披露儲備證明

- 兌換權利: 持有人必須可以一比一兌換法定貨幣

- 合規: 平台要合規AML/CTF同Travel Rule

呢啲原則有助減少「監管套利」,為全球穩定幣普及打好穩定基礎。

消費者影響

對消費者嚟講,Mastercard推穩定幣雖然影響冇咁即時,但都相當重要。

加快收款: 用家未必留意到結算用咗穩定幣,不過佢哋會受惠於更快退錢、平台即時收款、國際轉帳唔洗等。

新型錢包體驗: 穩定幣基建成熟後,消費者有機會用到新產品——例如USDC高息儲蓄戶口,或者到收銀點自動兌換加密貨幣嘅支付卡。

託管風險: 另一方面,持有穩定幣都有託管風險,例如錢包俾人hack或遺失私鑰,未必有申訴渠道。消費者保障框架需要與時並進。

總結

Mastercard傳聞20億美元收購Zero Hash,意義唔止於一宗收購,而係全球最具影響力支付網絡之一睇好穩定幣結算前景。如果執行得好,有機會顛覆傳統「銀行營業時間」,令商戶、銀行同企業24/7可以交易,唔洗等批次處理,唔怕週末或假期。

呢個藍圖好吸引:跨境支付唔洗幾日,可以幾分鐘搞掂;省卻繁複代理銀行環節,財資團隊可以直接on-chain對沖結存;唔再受T+1結算時差,收款即時到賬——隨時隨地。

但願景唔等如必然。由試點至全球普及,前路長而不確定。操作上要解決法定資金入場限制、託管風險、智能合約漏洞,法規要日漸成熟,區塊鏈同時區流動性亦要加深。銀行、商戶、消費者都要相信好處大過風險。

目前三個大方向都可能:基本情境係穩定幣結算穩步增長,但仍然同舊有法定資金並存;加速情境下,普及激增,十年內銀行營業時間成過去式;但如果遇上技術或監管障礙,穩定幣只會局限於小眾應用。

最後實際發展要睇執行、競爭同外部因素。Zero Hash收購能否順利完成將成早期指標,而USDC/EURC新區域推展、大型銀行採用MTN、Crypto Credential走入更多交易所,都會提供進一步蛛絲馬跡。監管發展(包括利好或利淡消息)亦會影響變革步伐。

唯一可以肯定,就係技術基礎建設緊。Mastercard已經打好架構:MTN用作安全、可編程交易;Crypto Credential負責驗證同合規互動;試點證明穩定幣...settlement works in practice. Acquiring Zero Hash would provide the production-scale infrastructure to accelerate these efforts.

這並非單純關於「加密貨幣熱潮」,而是下一代基礎設施層的發展。支付、支付通道和代幣正在與日常金融變得難以分辨。Mastercard 所構想的「隱形握手」——令代幣化貨幣可以在區塊鏈網絡間無縫流動,同時享有與傳統支付同樣的信任和保障——現正從概念走向現實。

這一轉變可能需要數年時間,期間可能會遇到挫折。但發展的方向已經非常明確。過去數十年我們所熟悉的銀行營業時間,正逐步被二十四小時運作、全球互聯的支付系統所取代。Mastercard 這項二十億美元的賭注,是押注這個未來不僅可能實現,更是必然發生。

對各位讀者——無論你是銀行家、商戶、政策制定者,還是一般觀察者——現在的任務是密切關注各種指標、追蹤採用曲線,以及觀察這套基礎設施如何演變。支付革命並不是未來才會來到,它其實已經發生。問題不再是穩定幣結算會否重塑金融業,而是它會以多快、多廣泛的方式,以及帶來甚麼影響。