當特朗普總統發佈佢嘅官方 Memecoin(2025 年 1 月 17 日,亦即佢第二次就職前三日)呢一刻,呢個代幣實現咗一個又驚又危險嘅里程碑。

上市短短數小時之內,TRUMP 代幣已經飆升到接近每枚 50 美元,市值一度高達約 150 億美元。當時恐慌式搶購,尤其係美國阿肯色至北卡等地嘅小投資者,既視佢為政治表態,亦視為潛在財務收穫。

但好景唔常。幾星期後,該幣蒸發到約 7 美元,市值蒸發超過 120 億美元。根據 New York Times 委託區塊鏈鑑證公司 Chainalysis 嘅分析,代幣推出後 19 日內,大約 813,294 個加密錢包總共損失約 20 億美元。與此同時,特朗普家族及夥伴通過交易手續費累積近 1 億美元,Trump Organization 及相關實體控制大約 80% 代幣總供應量。

特朗普家族持有大量風險大、波幅高的 meme 代幣,引起金融專家對道德同投資者保障方面嘅重大疑慮。巴魯克學院 Zicklin 商學院金融副教授 Leonard Kostovetsky 係一月對《Fortune》講:「投資者嚟講,紅旗已經舉到天。呢啲 memecoin 本身冇實質價值,只係靠人為炒作。基本上純泡沫。」

特朗普幣事件,反映咗 crypto 市場過去五年反覆出現嘅模式。由 2021 年 Elon Musk 助推之下 Dogecoin 暴升,到 2023 年 PEPE 代幣熱潮、Solana 上嘅 BONK 狂飆,memecoin 都係同一流程:爆炸式上市、病毒式傳播、名人或社群背書、極度亢奮,然後大多數持有人深陷泥潭。即使呢個循環千錘百煉,memecoin 依然係 crypto 最強勢嘅現象之一。

特朗普幣事件,仲首次提出咗政治權力同加密投機交錯時利益衝突等新問題。前美國商品期貨交易委員會主席、現任哈佛資深研究員 Timothy Massad 認為相關結構帶來極大風險:「總統本人同佢身邊人賣代幣,絕對會製造持續利益衝突甚至貪腐危機。有人為咗攏絡權力可能會買幣。」佢 2025 年 3 月對 BeInCrypto 咁講。

呢啲現象,引發外界重新思考 memecoin 角色同 crypto 生態發展。佢哋只係炒作騙局、披上網絡文化外衣嘅割韭菜遊戲,定係能夠承載數碼社會資本、社群凝聚、文化表達嘅新載體?隨住監管架構日漸成熟,同 crypto 邁進第二個十年,對以上問題嘅答案,將決定 memecoin 係成為可持續社群資產定被金融與病毒式傳播結合遺忘嘅警世故事。

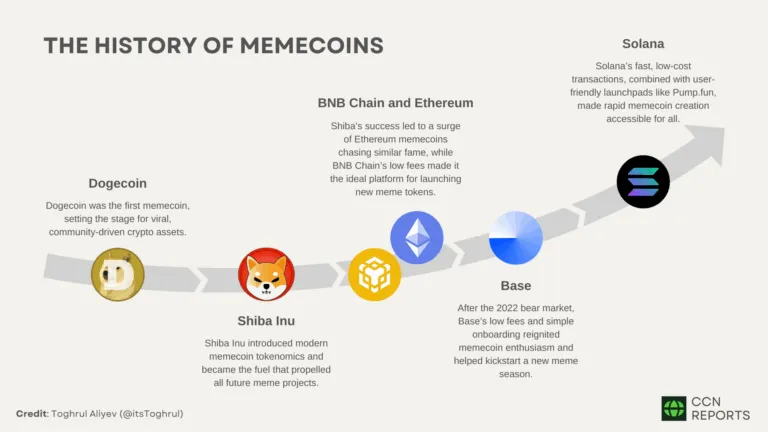

由 Doge 到 Donald:memecoin 進化史

睇清楚 memecoin 前路,先要認識佢哋點嚟。故事始於 2013 年,由 Billy Markus 同 Jackson Palmer 兩位工程師嘅 Dogecoin。佢哋本意求其玩玩,唔認真,攞柴犬 meme 做主角,冇白皮書冇大資本、冇實用規劃,徹頭徹尾嘅 joke。

Dogecoin 多年都只係圈內人玩票,幾毫子一枚,經常用嚟打賞內容創作者。但 2021 年初情況大變。Tesla 行政總裁 Elon Musk 連番推文話 Dogecoin 係「人民銘幣」,兼 post 唔少 meme,令幣價一飛沖天。呢個廣義上屬首輪 memecoin 牛市,喺散戶瘋狂同 Musk 助推下,一度由毫子衝上超過 0.7 美元。笑話變真人生贏家,memecoin 掀起淘金熱。

Dogecoin 成功帶挈一個狗系代幣生態。Shiba Inu(2020 年 8 月推出,自稱「柴犬狗幣殺手」)同樣隨住熱潮水漲船高。去到 2021 年 10 月,市值超過 400 億美元,令早期投資者財富暴增。公式簡單:網絡 meme + 區塊鏈技術 + 社群狂熱 + 名人背書,再加投機炒作推波助瀾。

但 memecoin 唔只限狗仔。市場周期變動,代幣主題與 narrative 都有新變化。2023 年冒起嘅 PEPE,用 Matt Furie 慣常 cartoon 青蛙角色作賣點,抵達網絡文化巔峰。高峰 24 小時內升幅達 2.5%,遠超同類,高度證明 memecoin 吸引力遠超動物吉祥物。

Solana 區塊鏈憑高速低費率,成為 memecoin 熱點。BONK 就係喺 Solana 上空投發行,成為平台社群共同財產及象徵。每一個成功 memecoin 上市,鞏固咗模型,帶動數百模仿者參與,製造自我強化嘅炒作、投機同崩潰循環。

去到 2024、2025 年,memecoin 進化再進一步,納入咗政治主題同 AI 故事。唔止特朗普,拜登、參議員、國際領袖相關幣喺選舉季節都勁爆發。特朗普幣本身正正係此趨勢之最:現任總統親自將名聲影像交咗個毫無作用、冇長遠承諾且純炒作嘅虛擬代幣。

經歷幾輪進化,memecoin 唯一不變就係佢哋根本建基於社會動力,而唔係技術創新或者基本價值 — 正正係網絡文化、財經投機同身份社群焦點。認清呢個 DNA,先可預測佢哋真正嘅發展路。

Memecoin 瘋狂內幕:Tokenomics、交易與部落動態

要了解 memecoin 點解總係爆升爆跌,就要睇清背後經濟結構同交易基建。唔同於比特幣、以太坊等大型加密幣,memecoin 通常故意設計得極簡單,方便炒作。

Tokenomics(代幣經濟學)千篇一律:發行量巨大(幾十億甚至萬億),令人感覺「少少錢買到幾百萬個」,心理落差吸引散戶入場。總供應充裕,加埋低單價,讓資本有限投資者都有需求感。初始發行多偏向內部人,創始者同早參與者攞大部分分配。TRUMP 幣數據就顯示,Trump Organization 相關實體控制八成供應權,一開波勝負已分,當權者話事。

供應高度集中喺少數錢包(俗稱「巨鯨」)手上,既係賣點都係缺點。創辦人可以保持項目話語權,有利帶動長線成果;另一方面,亦方便「拉地毯」式出貨 — 內部人一次性沽清,幣價爆跌散戶接火棒,「割韭菜」依舊,錢落袋走人。

Memecoin 交易場地亦大變。Dogecoin、Shiba Inu 後來上咗 Coinbase、Binance 啲主流交易所,不過大多新 memecoin 都係喺去中心化交易所(DEX)上市。例如以太坊 Uniswap、BNB Chain PancakeSwap、Solana Jupiter 等,都可以隨時創建交易對,注入初始流動性,毋須過 mainstream 平台審查。呢個門檻低,一方面令 token 發行民主化,另一方面充許詐騙同垃圾項目氾濫。

DEX 初期流動性往往極低,好少買賣單都會令價格劇烈波動。活躍炒家上落之間,任何一方都隨時招致巨大盈利或損失。memecoin 交易 ecosystem has also developed its own infrastructure of bots - automated programs that snipe new token launches, execute complex trading strategies, and sometimes manipulate prices through wash trading or coordinated buying.

ecosystem 亦發展咗自己嘅機械人基建——一啲自動化程式,會喺新代幣推出嗰陣即刻搶入、執行複雜嘅交易策略,有時甚至透過洗倉交易(wash trading)或者協調買盤嚟操控價格。

Social media platforms have become the de facto trading floors for memecoins. Telegram groups, Discord servers, Reddit communities, and Twitter/X feeds serve as the primary venues where tokens are promoted, price movements are discussed, and community sentiment is shaped. This psychological shift - from financial transaction to cultural belonging - is what differentiates meme coins from traditional cryptocurrencies, as the metric that matters most is community traction rather than revenue or technological innovation.

社交媒體平台而家已經變咗迷因幣嘅事實交易場。Telegram群組、Discord伺服器、Reddit社群同Twitter/X動態,成為主要嘅宣傳、討論幣價同塑造社群氣氛嘅地方。呢種心理上由純金融交易轉向文化歸屬感的改變,就係迷因幣同傳統加密貨幣最大分別——真正重要指標唔係收入或技術創新,而係社群凝聚力。

The role of community cannot be overstated in memecoin dynamics. Unlike traditional assets where value derives from cash flows or utility, memecoin value is almost entirely social. The strength, enthusiasm, and cohesion of the holder community directly influence price movements. This creates feedback loops: rising prices attract new community members, which creates more buying pressure, which attracts even more members. When the cycle reverses - as it inevitably does - the same dynamics operate in reverse, with declining prices causing community fracture and selling pressure that accelerates the decline.

社群響迷因幣生態入面嘅角色點講都唔算誇張。唔同傳統資產靠現金流或者用途嚟撐價,迷因幣價值幾乎純粹靠社會性。持有人社群嘅強度、熱情同凝聚力會直接影響價格波動。呢個會形成一個循環:升市時,新社群成員加入,推高買盤,吸引更多新入場。跌市返轉頭,跌價導致社群分裂,觸發賣壓,加速下跌。

Understanding these mechanics helps explain why memecoins can experience thousand-percent gains followed by ninety-percent crashes in a matter of days or weeks. They exist in a state of perpetual instability, balanced precariously between community enthusiasm and market reality. Yet this very volatility is part of their appeal, particularly to younger traders who view traditional finance as inaccessible or rigged and see memecoins as a democratized form of speculation where anyone can participate.

明白呢啲運作機制,你就唔難理解點解迷因幣可以幾日甚至幾星期飆升千幾個%、之後又急跌九成。迷因幣長期都處於極唔穩定狀態,喺社群熱情同市場現實之間搖擺不定。不過正正就係呢種波動性,吸引咗一班覺得傳統金融唔易入場或者已經玩壞咗嘅年輕炒家——佢哋覺得迷因幣係一個人人都玩得起嘅民主化投機遊戲。

The Sociology of Speculation: Why People Buy Memecoins

If memecoins lack fundamental value, utility, or technological innovation, why do people continue to buy them? The answer lies not in financial analysis but in psychology and sociology. Memecoins tap into powerful human drives that extend far beyond the desire for profit, though profit-seeking certainly plays a role.

如果迷因幣無根本價值、無實際用途、又無技術創新,點解仲會有人爭住買?答案唔喺金融分析,而喺心理學同社會學。迷因幣扣連到人類深層嘅本能驅動,唔止為錢,雖然搵錢都係一其中一個考慮。

At the most basic level, memecoins appeal to the fear of missing out, or FOMO - a psychological phenomenon that has been amplified to extreme levels by social media. When a token's price is climbing rapidly and social media feeds fill with stories of life-changing gains, the psychological pressure to participate becomes overwhelming. Fear of missing out, herd behavior, and the allure of quick profits have turned meme coins into a high-stakes game of social influence, with retail investors often young and tech-savvy drawn to these tokens. This dynamic creates cascading buying frenzies where rational analysis takes a backseat to emotional impulse.

最基本嚟講,迷因幣好work嘅其中一原因就係FOMO(錯失恐懼症)——呢個心理現象畀社交媒體推至極致。幣價急升,網上成賣「一夜暴富」故事,參與嘅心理壓力就好難頂。FOMO、羊群效應、加埋賺快錢嘅吸引力,將迷因幣炒作變成一場社交影響力大戰,吸引咗一大班年輕、有科技sense嘅散戶參與。成個過程好易炒起瘋狂接盤潮水,理性分析讓位俾情緒衝動。

But FOMO alone cannot explain the staying power of memecoin communities. More fundamentally, these tokens serve as vehicles for identity formation and tribal belonging in an increasingly digital world. Being part of a community like PEPE, LADYS, or SAMO is a source of pride, with being a whale in these tokens considered a badge of honor that is openly discussed, as holders are connected not just by a desire to profit but by strong social bonds and mutual agreements.

不過,單靠FOMO解釋唔到點解迷因幣社群咁黐身。本質上,呢啲代幣成咗身份認同同數碼部落歸屬嘅載體。做PEPE、LADYS、SAMO呢啲迷因幣社群一份子會自豪,重倉(whale)仲可以拎嚟show,因為持有人大家唔止想搵錢,仲有強大嘅社交連繫同默契。

The accessibility and simplicity of memecoins compared to more technical cryptocurrency projects is also central to their appeal. Murad Mahmudov, a former Goldman Sachs analyst and prominent crypto influencer, has argued that memecoins represent the ideal entry point for mainstream crypto adoption. "People will first experience crypto through trading memecoins on exchanges," Mahmudov stated in a December 2024 interview with LBank exchange. "Memecoins are easy to understand, no whitepaper, technology, or restaking. It appeals to all demographics as memes are a universal language."

同一時間,迷因幣比起其他技術型加密貨幣簡單易明,呢點都大大增加咗吸引力。前高盛分析員兼加密KOL Murad Mahmudov認為,迷因幣係大眾入場加密貨幣嘅最好切入點。「大部分人一開始接觸加密貨幣,都會先喺交易所買賣迷因幣」,Mahmudov響2024年12月接受LBank專訪時咁講過,「迷因幣易明,無白皮書、無技術講解、又唔駛restake,因為meme本身就係世界語言,各個圈層都明。」

This social dimension is particularly important for younger generations who have come of age during economic uncertainty, rising inequality, and the fragmentation of traditional community structures. For many Generation Z crypto participants, memecoin communities fill a void left by declining participation in organized religion, civic organizations, and even in-person friendships. The shared language, inside jokes, and collective mission of "taking a token to the moon" create genuine social bonds that transcend mere financial interest.

對現今喺經濟變幻、貧富差距擴大、傳統社會結構破碎下成長嘅年輕人嚟講,呢種社交功能更加重要。Generation Z唔少人喺迷因幣社群搵返一啲逐漸消失喺宗教、社團甚至現實朋友網絡入面嘅社會連結。大家講同一套暗語、笑話,一齊上「To The Moon」嘅集體目標,令到持有人之間出現真誠社交關係,唔再只係投資利害。

Cultural evolution has given birth to what some observers call memecoin cults - semi-religious entities founded on social contracts and shared beliefs, where members don't need to know the price or chart to believe but simply need to share the idea and feel the community's support. This framing, while perhaps dramatic, captures something real about how these communities function. The language of faith, mission, and collective purpose permeates memecoin culture in ways that would seem absurd in traditional financial markets but make perfect sense in the context of online tribal dynamics.

文明進化同樣造就出觀察家口中嘅「迷因幣教派」——一啲靠社交合約同共同信念建立出嚟嘅半宗教組織,成員唔使睇市價或走勢圖都可以堅信,因為重點係理念分享同獲得社群認同。雖然咁講可能有啲誇張,但呢個定位其實真係反映到社群點樣運作。信念、使命、集體目標語言滲透咗迷因幣文化,響傳統金融世界聽落荒謬,但置喺網絡部落世界就非常合理。

The entertainment value of memecoins should not be underestimated either. For many participants, buying memecoins is less about traditional investing and more akin to gambling or fantasy sports - a form of entertainment with the added possibility of profit. The constant price action, community drama, celebrity endorsements, and viral moments create an ongoing spectacle that is inherently engaging. These tokens thrive on the playful and unpredictable side of crypto, where value is driven more by online buzz, viral moments, and community energy than by technology or utility, with volatility being part of their charm.

同時,大家都唔可以睇少迷因幣本身嘅娛樂價值。對不少人而言,買迷因幣其實唔係做傳統投資,大啲似賭錢或者玩fantasy sports——有機會贏錢嘅娛樂。日日價錢大上大落、社群爆戲、明星加持、網絡熱話,組合成不斷上演嘅大騷景都令人難以抗拒。迷因幣享受crypto世界天馬行空、難以預測、娛樂至上的一面,價值由網絡聲勢、熱話同社群能量推動—而唔係技術或實用性,波幅本身都係賣點。

There is also an element of generational wealth transfer at play. Many younger memecoin enthusiasts view these tokens as one of the few available paths to significant wealth in an economy where home ownership feels unattainable and traditional investment vehicles offer modest returns. Memecoins, with their potential for ten-fold or hundred-fold gains, represent lottery-ticket upside in a system that otherwise seems stacked against them. This perspective - accurate or not - drives continued participation despite repeated warnings from regulators and countless examples of failed projects.

當中都涉及一種世代財富轉移。唔少後生迷因幣擁躉覺得呢啲coin係現時經濟中,買樓遙不可及,傳統投資回報有限嘅情況下,為數唔多有機會暴富嘅途徑。迷因幣隨時升十倍、百倍,好似彩票式機會,喺一個本身對佢哋唔太利嘅體制入面搏一搏。無論呢個睇法啱唔啱,都推動住佢哋無懼監管警告、眾多失敗案例,依然繼續參與落去。

The parallels to the meme stock phenomenon of 2021, when retail traders on Reddit's WallStreetBets forum drove up shares of GameStop and AMC, are striking. Both movements share a populist, anti-establishment ethos, a belief in collective action over institutional expertise, and a willingness to embrace risk in pursuit of outsized returns. Both also demonstrate how social media has fundamentally altered market dynamics by enabling rapid coordination among dispersed individuals.

2021年Reddit WallStreetBets散戶炒GameStop、AMC嗰股「迷因股」熱,與迷因幣現象非常相似。兩者都係草根、反建制風格、相信群體行動勝過專業機構、願意為高回報冒險。都顯示咗社交媒體根本上改變咗市場運作—令分散散戶都可以即時協同作戰。

Critics might dismiss memecoin buyers as irrational or naive, but that analysis misses the complexity of what is actually happening. For many participants, memecoins serve multiple simultaneous purposes: they are speculative investments, yes, but also social clubs, political statements, forms of entertainment, and expressions of identity. Understanding this multifaceted appeal is essential to predicting whether memecoins will endure or fade.

有批評者或會話買迷因幣嘅人唔理性或者天真,不過咁分析忽略咗事件真實複雜性。對不少參與者嚟講,迷因幣多重身份同時存在—投機工具、社交圈子、政治宣言、娛樂消遣、身份表現。理解咁多層吸引力,先可以預測迷因幣究竟會長青抑或曇花一現。

How Governments Are Responding to Memecoin Mania

As memecoins have grown from niche curiosity to mainstream phenomenon, they have inevitably attracted regulatory attention. Governments and financial authorities worldwide face a challenging question: how should memecoins be classified and regulated, if at all? The answers emerging from different jurisdictions reveal competing philosophies about market freedom, investor protection, and the proper role of regulation in digital asset markets.

迷因幣由小圈子玩物變成主流現象,始終吸引到監管留意。全球各地政府同金融當局都要面對一個棘手問題:到底迷因幣應該點樣分類同規管,甚至應唔應該規管?各地答案反映咗唔同地方對市場自由、投資者保護同數碼資產市場監管角色嘅差異睇法。

In the United States, the Securities and Exchange Commission has taken a surprisingly hands-off approach to pure memecoins. In February 2025, the SEC's Division of Corporation Finance released staff guidance stating that typical meme coins - cryptocurrencies inspired by internet memes, pop culture, or trending jokes - do not constitute securities under federal law, meaning transactions in these tokens need not be registered under the Securities Act of 1933. This determination marked a significant shift in the regulatory landscape.

美國證券交易委員會(SEC)對純迷因幣出奇地冇咩干預。2025年2月,SEC公司融資部發表咗指引,指出典型迷因幣—受網絡迷因/潮流/搞笑文化啟發嘅加密幣—唔屬於聯邦法下嘅證券,即係話呢啲幣嘅交易唔需要喺1933年證券法下登記。呢個判斷對監管格局嚟講係一個大轉變。

The SEC's analysis applied the famous Howey Test, which defines securities as investments in a common enterprise with profits derived from the efforts of others. The SEC concluded that memecoins do not meet these criteria because those who purchase them are not financing a structured project, and there is no reasonable expectation of profit linked to the efforts of third parties, as their price is driven exclusively by speculation without a team working to ensure future profits.

SEC用咗著名嘅Howey Test去分析,當中證券係指投資於共同事業,而且收益要由第三方努力產生。SEC認為迷因幣唔符合呢啲條件——買家唔係資助一個有結構嘅項目,亦無合理理由預期有第三方努力幫佢哋賺錢,因為迷因幣價格純靠投機推高,無團隊保證將來有得賺。

This regulatory clarity came with important caveats. The staff emphasized that simply labeling a product as a memecoin will not excuse an offering that in economic reality involves a security, as the SEC will look to the substance of the transaction, meaning assets advertised as meme coins but entailing profit-sharing, ongoing development efforts, or other investment features remain subject to the full scope of securities regulation. The guidance applies only to genuine memecoins with no utility, no development roadmap, and no promises of returns.

不過呢個監管清晰度亦有重要但書。SEC強調,如果代幣實際上涉及證券成分,單靠叫自己做迷因幣都唔得,佢哋會睇實際交易內容。如果「迷因幣」設有分紅、長期項目發展或者其它典型投資特性,都會納入證券監管範圍。今次指引只適用於完全冇用途、冇發展路線、冇回報承諾嘅真‧迷因幣。

Importantly, while the SEC will not regulate meme coins or combat fraud related to memecoin transactions, the statement stressed that market participants will not be protected from deceptive activities under federal securities laws, meaning purchasers and holders have no cause of action for misconduct or fraud under federal securities laws. This creates a regulatory void: memecoins are legal to create and trade, but buyers have limited recourse if they fall victim to scams.

值得留意,SEC唔會監管迷因幣或打擊相關詐騙,指引都講明市場參與者唔會獲得聯邦證券法保障,買賣迷因幣時如果出事或呃人,法律冇得追究。換言之,迷因幣合法發行、合法買賣,但買家萬一中伏冇乜保障可言。

The political dimension of memecoin regulation became particularly acute with

迷因幣監管嘅政治敏感度亦因此顯著提升…the launch of Trump's token. US Democrats announced plans to introduce the Modern Emoluments and Malfeasance Enforcement Act, which would prevent senior government officials and their families from launching meme coins, with Representative Sam Liccardo stating that the Trump family's issuance of meme coins financially exploits the public for personal gain and raises concerns about insider trading and foreign influence. However, with Trump's return to the presidency and appointments of crypto-friendly officials, the likelihood of such legislation passing appears remote.

特朗普代幣的發行。美國民主黨宣佈計劃提出《現代薪酬及不當行為執行法案》,該法案將禁止高級政府官員及其家屬發行memecoin(迷因幣)。眾議員Sam Liccardo表示,特朗普家族發行迷因幣,是藉此財務剝削公眾以謀取個人利益,並引發有關內幕交易及外國勢力影響的疑慮。不過,隨著特朗普重返總統寶座及委任親加密貨幣官員,相關立法的通過機會顯得十分渺茫。

Across the Atlantic, the European Union has taken a more comprehensive regulatory approach through its Markets in Crypto-Assets Regulation, or MiCA. MiCA entered into force in June 2023 and began full application by December 2024, creating a unified legal framework that covers all crypto assets operating in the European Union regardless of where providers are registered. Unlike the US approach that exempts memecoins from securities regulation, MiCA applies broad requirements around transparency, disclosure, and consumer protection to virtually all crypto asset service providers.

橫跨大西洋,歐盟則通過「加密資產市場規例」(MiCA)採取更全面的監管方式。MiCA於2023年6月正式生效,並於2024年12月全面實施,建立一個統一的法律框架,涵蓋在歐盟運作的所有加密資產,無論供應商註冊地點何處。不同於美國對memecoin豁免證券監管,MiCA對幾乎所有加密資產服務供應商都實施廣泛的透明度、資訊披露和消費者保障要求。

Under MiCA, crypto asset service providers must publish whitepapers, secure licenses from their National Competent Authority, maintain robust operational resilience including data security and service continuity measures, and follow strict anti-money laundering protocols. While memecoins themselves may not be directly regulated as securities, the platforms that list them and facilitate their trading must comply with these extensive requirements. This creates a practical barrier to memecoin proliferation in Europe, as compliant exchanges may be reluctant to list tokens that carry high fraud risks.

根據MiCA條例,加密資產服務供應商必須發佈白皮書、從本地監管機構獲取牌照、維持穩健的營運抗逆力(包括資料安全和服務持續性措施),以及遵守嚴格的反洗黑錢規定。雖然memecoin本身未必被直接納入證券監管,但掛牌及促進其交易的平台必須符合這些嚴格要求。這對memecoin在歐洲的蔓延構成現實障礙,合規交易所面對高詐騙風險的代幣時,會傾向拒絕掛牌。

The regulatory divergence between the US and EU approaches reveals competing visions for how to balance innovation with investor protection. The American approach emphasizes market freedom and caveat emptor - let the buyer beware - while accepting that some participants will lose money to scams. The European approach prioritizes consumer protection and systematic risk mitigation, even if that means constraining market experimentation.

美國和歐盟的監管分歧展現出對於如何在創新和投資者保護之間取得平衡的不同理念。美國的方式著重市場自由及「買者自負」原則,並接受部分參與者會因騙局而損失金錢。相比之下,歐洲則以消費者保護和系統性風險管理為先,即使這樣會限制市場創新實驗。

Other jurisdictions are still determining their approaches. Asian markets, particularly Singapore and Hong Kong, have generally taken middle paths that attempt to encourage blockchain innovation while implementing safeguards against obvious fraud. The diversity of regulatory responses creates arbitrage opportunities, where memecoin projects can forum-shop for favorable jurisdictions, but it also fragments the global market in ways that may ultimately limit growth.

其他司法管轄區則仍在研究監管立場。亞洲市場,尤其是新加坡和香港,一般採取較中性的方式,一方面鼓勵區塊鏈創新,另一方面設立防止明顯詐騙的保障措施。監管多元化創造了套利機會,memecoin項目可主動尋找有利監管的地方,但同時導致全球市場碎片化,最終或限制增長。

Looking ahead, the regulatory treatment of memecoins will likely evolve in response to high-profile failures and political pressure. The Trump coin collapse, with its massive investor losses and allegations of insider trading, could catalyze new enforcement actions or regulatory initiatives. Recent hints from the SEC about stricter oversight for social media-driven tokens add another layer of uncertainty for the sector. However, the fundamental challenge remains: how do you regulate assets that are explicitly designed to have no fundamental value and exist primarily as social phenomena? Traditional regulatory frameworks built around securities, commodities, and currencies struggle to classify these hybrid social-financial instruments.

展望未來,memecoin的監管方式或會因應高調失敗事件及政治壓力而發展。特朗普幣暴跌引致大規模投資者損失及內幕交易指控,有可能觸發新一輪執法行動或監管倡議。美國證監(SEC)近期更釋出訊號,指將加強對社交媒體驅動代幣的監管,為行業增添更多不明朗因素。但根本挑戰依舊:這些資產本質上就是沒有實際價值、屬於社會現象的產物,傳統圍繞證券、商品或貨幣構建的監管框架,很難分類這些社交—金融混合工具。

How Trading Platforms Navigate the Memecoin Dilemma

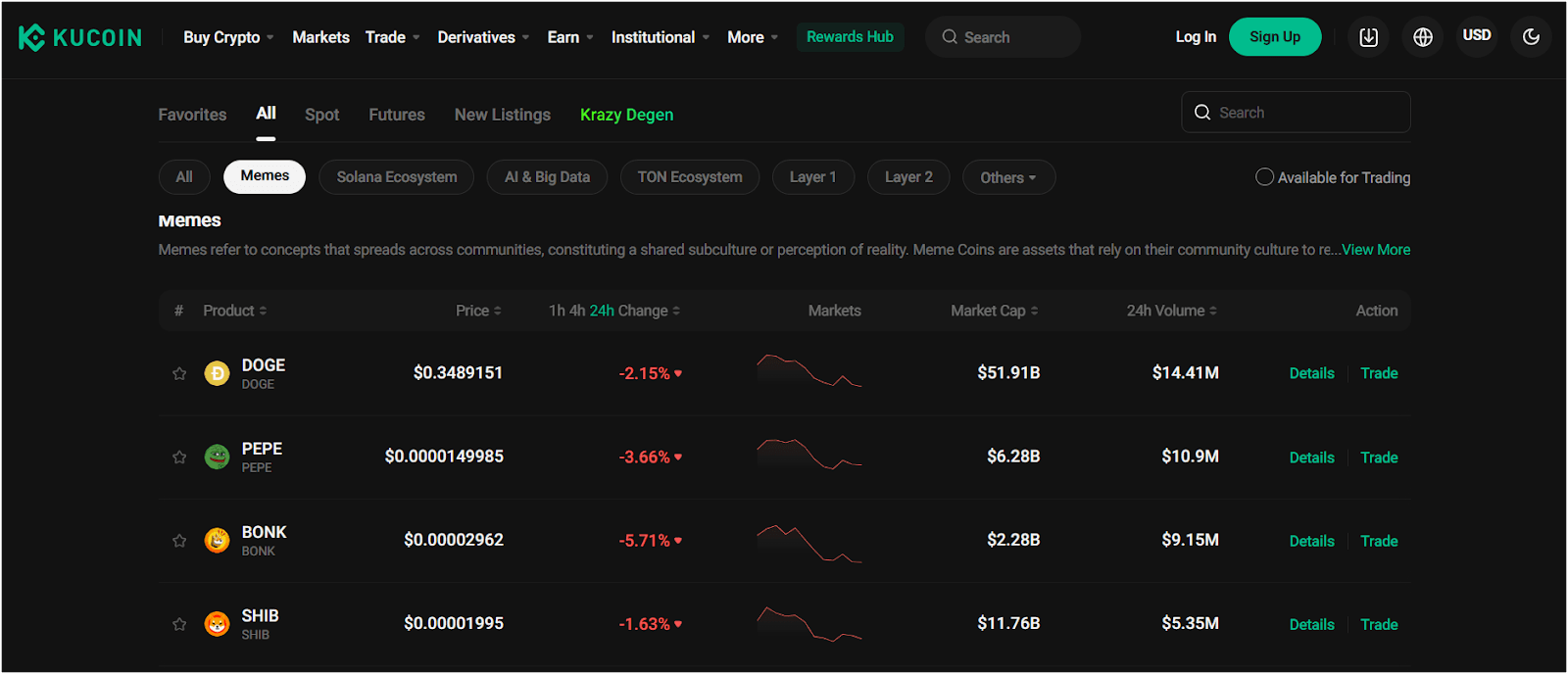

While regulators debate frameworks, cryptocurrency exchanges face immediate practical decisions about which memecoins to list and under what circumstances. These platforms serve as crucial gatekeepers, and their listing policies significantly influence which tokens gain legitimacy and liquidity. The evolution of exchange practices around memecoins reveals the ongoing tension between profit maximization and risk management.

當各地監管機構討論監管模式時,加密貨幣交易所則需立即作出實際抉擇:該掛牌哪些memecoin,條件又是什麼。這些平台實際上是關鍵守門人,其上幣政策直接影響哪類代幣能獲得認受性和流動性。交易所處理memecoin的實踐變化,反映出盈利最大化與風險管理之間的持續矛盾。

Major centralized exchanges like Binance, Coinbase, Kraken, and OKX have developed increasingly sophisticated listing frameworks. When the TRUMP token launched, major crypto exchanges including Coinbase and Binance quickly announced plans to list it, with Binance opening trading on the morning of January 19. This rapid listing of a high-profile but highly risky token illustrated how exchanges weigh various factors: trading volume potential, customer demand, regulatory risk, and reputational considerations.

主流中心化交易所如Binance、Coinbase、Kraken、OKX等,現時都已制定越來越嚴謹的上幣機制。當TRUMP代幣推出時,包括Coinbase和Binance等主流交易所迅速宣佈計劃掛牌,其中Binance更在1月19日上午開放交易。如此高調、風險極高的代幣能被火速上架,反映交易所要綜合考慮多項因素:潛在交易量、用戶需求、監管風險及聲譽影響等。

The contrast with earlier political memecoins was stark, as the MAGA Political Finance fan token had trouble getting listed on major exchanges, with some platforms saying it was too political, but Trump's official memecoin faced no such barriers. This suggests that exchanges are willing to list controversial tokens when backed by sufficiently prominent figures, likely calculating that the trading volume and user acquisition potential outweigh reputational risks.

與較早前的政治memecoin形成鮮明對比。例如「MAGA政治集資粉絲幣」難以登陸主流交易所,有平台更以「過於政治」為由拒絕掛牌,但特朗普官方memecoin則毫無障礙。這顯示,只要有足夠地位突出的背後推手,交易所願意為爭議性代幣掛牌,因為潛在交易量及新客戶價值被認為高於聲譽風險。

The listing process at major exchanges has become more rigorous over time as platforms have learned painful lessons from rug pulls and scams. Binance conducts significant due diligence on projects applying for listing, examining factors including the strength of the development team and clear vision, community support with large engaged user bases, and high trading volume across multiple exchanges. However, these standards are applied inconsistently, particularly for memecoins that can generate enormous trading volumes and thus substantial fee revenue for exchanges.

主流交易所的上幣流程已因過去被捲入拉地毯騙案和詐騙而變得更嚴格。Binance現時對申請掛牌項目進行詳細盡職調查,考慮如開發團隊實力和清晰願景、龐大而活躍的社群支持,以及多個交易所高交易量等。不過,這些標準執行不一,特別是對於本身能帶來巨大交易額、創造高昂手續費收入的memecoin。

Most memecoins are not accepted by major centralized exchanges for not meeting safety and value standards, and are instead only available for trading on decentralized exchanges like PancakeSwap. This creates a two-tier system: a small number of memecoins that achieve mainstream exchange listings gain legitimacy and access to retail capital, while the vast majority remain confined to DEXs where they trade with minimal liquidity and oversight.

大部分memecoin由於未符安全和價值基準,無法登陸主流中心化交易所,只能於PancakeSwap等去中心化交易所(DEX)交易。這形成兩級制度:少數能上主流交易所的memecoin獲認可並接觸散戶資金,而絕大多數仍困在DEX,流動性低且無人監管。

Coinbase, as a US publicly traded company subject to strict regulatory oversight, has generally taken a more conservative approach to memecoin listings than its international competitors. Coinbase prioritizes tokens with strong compliance records, US-friendly regulatory positioning, and public audits or regulatory disclosures. Yet even Coinbase has increasingly embraced memecoins, recognizing that these tokens drive substantial trading activity from retail users.

Coinbase作為美國上市公司,要接受非常嚴格的監管,其對memecoin掛牌向來較國際同行保守。Coinbase偏好合規記錄佳、符合美國監管要求、擁有公開審計或披露資料的代幣。但即使如此,Coinbase近來亦越來越願意擁抱memecoin,因為散戶交易需求旺盛帶動整體活躍度。

The mechanics of how tokens get listed on major exchanges have become an object of intense speculation and analysis among traders looking to identify the next big opportunity. Patterns show that Binance tends to lean into memecoin hype, while Coinbase focuses on assets it believes can clear SEC scrutiny, and following trending tokens listed on one major exchange often signals potential listings on others. This creates predictable price movements around listing announcements, with tokens often experiencing significant pumps when listed on tier-one exchanges.

各代幣如何登錄主流交易所,成為投資者搏一搏「下一桶金」的熱烈討論和分析對象。有跡象顯示,Binance偏向積極炒作memecoin熱潮;Coinbase則緊貼符合美國SEC監管的資產。而一間主流交易所掛牌的熱門幣,常常帶動其他交易所跟進掛牌。這引發上幣消息前後的價格規律波動,特別是頭部交易所掛牌時,代幣價格往往會急升。

However, listings are not permanent. Binance periodically reviews tokens and may apply risk labels or even delist projects that demonstrate instability, though coins like BONK and PEPE have seen such labels removed as they demonstrated growth and stability. This dynamic listing and delisting based on performance creates ongoing uncertainty for memecoin holders and reinforces the speculative nature of these assets.

然而,掛牌並不是永久性。Binance會定期審查代幣,對有問題的項目加上風險標籤,甚至下架。有些如BONK和PEPE等,因其後表現穩定、增長明顯而移除風險標籤。這種「動態掛牌、表現優劣即有可能下架」令memecoin持有人持續處於不安狀態,突顯這類資產的高度投機本質。

The exchange listing game has become so central to memecoin economics that some projects explicitly design their launches around the goal of achieving tier-one exchange listings as quickly as possible. Teams coordinate social media campaigns, recruit influencers, and sometimes engage in wash trading to artificially inflate volume statistics - all to meet the criteria that exchanges use in their evaluation processes. This creates a perverse dynamic where appearances matter more than substance, rewarding projects that excel at marketing and manipulation rather than building genuine utility.

「交易所上幣遊戲」已成memecoin經濟生態的核心,有不少項目直接以最快時間登陸一線交易所為目標。團隊會統籌社交媒體宣傳,招攬KOL推廣,甚至進行假交易刷單,目的是造大成交量,以符合交易所評估標準。這種生態產生反效果:外觀包裝較實際用途更重要,善於市場宣傳和操作的團隊更易受獎勵,反之真正追求實用性的反而較少獲得注意。

Analytics and compliance firms have emerged to serve exchanges navigating these challenges. Companies like Chainalysis, Elliptic, and CipherTrace provide blockchain forensics services that help exchanges identify suspicious activity, track token holder concentration, and assess rug pull risks before listing decisions. Yet even with these tools, exchanges continue to list tokens that subsequently collapse, either because the analytical tools have limitations or because the profit potential outweighs the identified risks.

針對交易所這些挑戰,現時市場上湧現專門提供風險分析及合規服務的公司,例如Chainalysis、Elliptic和CipherTrace等。他們為交易所提供區塊鏈鑑證服務,協助識別可疑活動、查找代幣分布及集中狀況、評估拉地毯風險等。縱使擁有這些工具,交易所仍會掛牌最終出事的代幣,或因工具有局限,或因高利潤遠超已知風險。

The exchange industry's approach to memecoins ultimately reflects a pragmatic calculation. These tokens generate massive trading volumes during their hype cycles, which translates directly to fee revenue for platforms. The risks of listing dubious projects - regulatory scrutiny, user losses, reputational damage - must be weighed against the competitive pressure to capture this lucrative trading activity. In practice, most exchanges have decided that the rewards justify the risks, particularly when legal disclaimers can shield them from liability for user losses.

整體而言,交易所對memecoin的態度最終體現了現實主義盤算:memecoin熱潮期能帶來龐大交易額,直接轉化為平台手續費收入。掛牌有風險的項目會帶來監管關注、用戶損失或聲譽受損,但與搶佔這些利潤豐厚市場的壓力相比,大多數交易所仍決定「有回報就抵搏」,尤其當使用法律聲明可將用戶損失風險轉嫁的情況下更甚。

Can Memecoins Evolve Into Something Sustainable?

As the memecoin phenomenon enters its second decade, a crucial question emerges: can these tokens evolve beyond pure speculation into assets with genuine utility and sustainability? Or are they inherently transient, destined to cycle through periods of mania and collapse until broader market fatigue sets in?

踏入第二個十年,memecoin現象又浮現一個關鍵疑問:這類代幣是否有機會跳出純炒作窠臼,發展成真正有實用價值及可持續的資產?抑或它們早已註定只能階段性瘋炒、崩盤,最終玩完受市場厭倦而消失?

There are emerging signs that some memecoin projects are attempting to build sustainable ecosystems that extend beyond mere speculation. The most successful memecoins have begun adding utility features while maintaining their cultural appeal. Dogecoin, for instance, has been integrated as a payment method by various merchants and has been accepted at Tesla for certain products, giving it at least nominal utility beyond speculation. Shiba Inu has developed an entire ecosystem including a decentralized

有跡象顯示,少數memecoin正嘗試建構跳出純炒作的可持續生態系統。有些最成功的memecoin開始加入實用功能,同時保留其文化吸引力。例如Dogecoin,已被不少商戶用作支付方式,連Tesla部分商品亦接受狗狗幣,賦予其超越炒作的實際用途。Shiba Inu亦建立起一套完整的生態系統,包括一個去中心化的...exchange called ShibaSwap, NFT collections, and even metaverse ambitions, attempting to transform from a simple memecoin into a broader blockchain platform.

一個名為 ShibaSwap 的交易所、NFT 收藏,甚至元宇宙發展野心,企圖由單純的梗幣蛻變成更全面的區塊鏈平台。

More recent projects have launched with utility baked in from the start. Some memecoins now offer staking mechanisms that provide yield to holders, governance features that give token holders voting rights on project decisions, and integration with decentralized finance protocols that enable lending, borrowing, or liquidity provision. These features attempt to address the criticism that memecoins are valueless by creating actual use cases beyond mere holding and trading.

新一代項目一開始已經內置了實際用途。有些梗幣而家提供 Staking(質押)機制,讓持有人獲得收益;又有治理功能,賦予持幣者對項目決策有投票權;仲有與去中心化金融(DeFi)協議整合,容許借貸或者提供流動性。呢啲功能都係想回應外界對梗幣無價值嘅批評,從單純持有買賣,進一步創造實際用例。

Projects like BRETT on Coinbase's Base blockchain have attracted over 860,000 holders with fixed supply and airdrop strategies creating a defensible tokenomics model, while Pudgy Penguins has leveraged its NFT ecosystem to create a hybrid of cultural appeal and utility, with its 300 percent price surge driven not just by speculation but by a growing network of merchandise, games, and social media engagement. These examples suggest that memecoins can evolve into broader cultural brands with revenue streams beyond token appreciation.

好似 BRETT 呢啲運行喺 Coinbase Base 區塊鏈嘅項目,採用咗固定供應量同空投策略,吸引超過86萬持有人,形成有利嘅代幣經濟模式;Pudgy Penguins 就利用 NFT 生態系統結合咗文化吸引力同實用性,佢300%升幅唔單止靠炒作,更加有愈趨龐大嘅周邊商品、遊戲同社交媒體網絡去支持。呢啲例子顯示,梗幣可以演化成更大規模嘅文化品牌,收入來源唔再單靠幣價升值。

The concept of "community tokens" represents perhaps the most promising evolution of the memecoin model. Rather than being pure speculation vehicles, community tokens could serve as membership credentials, governance mechanisms, and value-capture systems for online communities. Imagine a popular content creator whose token grants holders access to exclusive content, voting rights on creative decisions, and a share of advertising revenue. This would blend the viral appeal and community dynamics of memecoins with tangible utility and sustainable economics.

「社群代幣」概念可能係梗幣模型最具前景嘅進化方向。佢哋唔再淨係投機工具,而可以成為網上社區嘅會員證明、治理機制同價值捕捉系統。你可以想像,有啲受歡迎嘅內容創作者推自己代幣,持有人不但可睇獨家內容、參與創作決策投票,甚至分到廣告收益。咁樣就可以將梗幣嘅病毒式傳播力同社群動力,結合埋實際用處同可持續經濟模式。

As one analysis of the memecoin supercycle noted, successful memecoin communities function almost like cults or religions for Generation Z, addressing not just financial challenges but providing belonging and purpose, with members voluntarily creating better marketing content than paid teams at traditional altcoin projects. If this social energy could be channeled toward projects with actual products or services, the result might be sustainable businesses rather than pure speculation bubbles.

有分析指梗幣超級周期之下,成功嘅梗幣社群簡直成為 Z 世代嘅邪教或信仰組織,唔只講錢,仲帶嚟歸屬感同人生意義,會員自發做宣傳,成效甚至贏傳統山寨幣項目嘅專業市場團隊。如果呢種社交能量可以引導去有實體產品或服務嘅項目,可能會出現可持續經營業務,唔再係單純炒作泡沫。

However, significant obstacles stand in the way of memecoin evolution. First, the very characteristic that makes memecoins appealing - their simplicity and lack of pretense - is compromised when utility is added. Part of the memecoin ethos is a rejection of the technobabble and false promises of traditional blockchain projects. Adding genuine utility risks turning memecoins into just another class of utility tokens, losing the cultural distinctiveness that drives community formation.

不過,梗幣進化之路困難重重。首先,梗幣本身吸引人之處就係簡單直接、有反傳統味,一旦加入實用功能就有可能失去本色。同區塊鏈項目嘅高科技術語同空頭支票保持距離,係梗幣精神一部分。如果加咗實用性,梗幣可能變成普通功能型代幣,失去推動社群聚集嘅文化獨特性。

Second, the economics of memecoins work against sustainability. A 2025 analysis warned that 70 percent of memecoins fail to retain value beyond six months, with rug pulls and scams costing investors over $6 billion in 2025 alone. The concentration of supply among insiders, the thin liquidity, and the speculative psychology of memecoin trading create structural instabilities that make long-term survival difficult regardless of utility additions.

第二,梗幣經濟學本身就唔利可持續發展。2025年有分析指,七成梗幣六個月內已經冇晒價值,詐騙同割韭菜單係2025年已令投資者損失超過60億美金。供應集中喺內部人手上、成交量少、交易炒作心理嚴重,就算加咗實用性,都難以解決長遠生存不穩嘅結構性問題。

Third, regulatory pressure may increase rather than decrease over time. While current US policy exempts pure memecoins from securities regulation, tokens that add utility features like governance or revenue sharing may inadvertently transform themselves into securities, triggering registration requirements and compliance burdens. This creates a regulatory catch-22: remaining a simple memecoin means avoiding regulation but also avoiding sustainability; adding utility means potentially becoming more sustainable but also potentially triggering regulatory obligations.

第三,監管壓力可能只會加唔會減。美國而家規定純粹梗幣唔算證券,但加咗治理或分紅功能後,有機會誤中「證券」定義,要註冊同遵守監管。咁就出現「無解困境」:淨係做梗幣唔使受監管,但住唔到可持續發展;加咗實用性有機會可持續,又有機會變成受監管對象。

Despite these challenges, there is reason to believe some form of memecoins will persist. The underlying dynamics that drive their creation - the democratization of token launching, the power of viral marketing, the appeal of community belonging - are not going away. What may change is the market's sophistication and selectivity. Just as the internet boom of the late 1990s eventually evolved from indiscriminate speculation to more discerning investment focused on companies with actual business models, the memecoin market may mature toward projects that combine cultural appeal with genuine value creation.

雖然有咁多困難,但好大機會梗幣形式仍然會長存。支撐梗幣出現嘅深層動力——發幣去中心化、病毒式行銷同社群歸屬感——都唔會消失。真正會變嘅,應該係市場成熟度同選擇性。好似90年代末互聯網熱潮,由亂炒炒到最後識揀有實際商業模式嘅公司,梗幣市場都有機會慢慢趨向結合文化吸引力同真正價值創造嘅項目。

Looking toward 2026 through 2030, several scenarios seem plausible. In the optimistic scenario, a small number of memecoins successfully transition into sustainable community-owned platforms with real products and services. These survivors might pioneer new models of creator economies, community governance, and social-financial integration. The vast majority of memecoins would still fail, but the few successes would validate the category and demonstrate that viral community energy can be channeled into lasting enterprises.

展望2026至2030,有幾個可行劇本。最樂觀嘅情況係少數梗幣成功過渡成可持續、社群擁有及經營、有真產品服務的平台。呢啲倖存者可能開創新型創作者經濟、社群治理同社交金融融合。大部份梗幣最終都會失敗,但呢啲成功例子證明咗梗幣能夠將病毒式社群能量轉化為長久企業。

In the pessimistic scenario, mounting regulatory pressure, investor exhaustion, and continued high-profile failures gradually erode interest in memecoins. New token launches generate less excitement, trading volumes decline, and capital rotates toward other crypto sectors or traditional assets. Memecoins become seen as a historical curiosity of the 2020s, much like the ICO boom of 2017 is now viewed - a speculative mania that briefly captured attention before fading.

最悲觀嘅劇本就係監管愈來愈嚴、投資者無力感上升、連環爆煲,令梗幣關注度慢慢消退。新幣冇咁受歡迎,成交下跌,資金轉去其他加密板塊或者傳統資產,梗幣最後變成2020年代一個歷史小插曲,就好似2017年ICO狂潮——一陣熱潮後回歸平淡。

The most likely scenario probably falls between these extremes. Memecoins will persist as a permanent feature of crypto markets, but in a more mature and stable form. The explosive mania cycles may become less frequent and intense as participants learn from repeated boom-bust cycles. Projects with strong communities, transparent tokenomics, and at least modest utility claims will achieve moderate longevity. The sector may settle into a pattern where a few major memecoins like Dogecoin maintain stable communities, while a constant churn of new tokens provides speculative opportunities for risk-tolerant traders who understand the game they are playing.

最有可能會係介乎兩者之間。梗幣會作為加密市場一個常見元素存在落去,但會變得成熟穩定啲。極端瘋狂泡沫周期會因為大家學咗教訓而冇咁頻密同強烈。有強大社群、透明經濟模式、基本實用性的項目會有長壽力。梗幣界最終會好似有幾個「大哥」例如 Dogecoin 維持穩定大社群,而不斷有新梗幣出現,提供炒家投機機會——呢啲炒家對遊戲規則本身有清楚認知。

What Trump Coin Teaches Us About the Future

Trump Coin 啟示錄

The Trump coin collapse, with its billions in investor losses and uncomfortable questions about conflicts of interest, serves as both cautionary tale and revealing case study. It illustrates in concentrated form all the key dynamics of the memecoin phenomenon: the power of celebrity endorsement, the FOMO-driven buying cascades, the extreme concentration of supply among insiders, the rapid cycle from euphoria to despair, and the ultimate transfer of wealth from retail participants to those who understood the game.

Trump Coin 暴跌,導致投資者損失數十億,兼爆出利益衝突問題,既係警世故事,亦係揭示全梗幣現象嘅經典案例。包括咗明星光環加持、FOMO 幣圈恐懼追高、人為控盤、內部人集中持幣、開心到絕望極速轉變,最終散戶輸錢轉移財富畀深諗清楚遊戲規則嘅人。

What makes the Trump coin story particularly significant is not that it collapsed - that is par for the course in memecoin markets - but rather the scale and speed of the wealth destruction and the political dimensions that made the episode impossible to ignore. When a sitting US president launches a token that wipes out $12 billion in retail investor wealth within weeks while his family collects $100 million in fees, it forces a broader reckoning about what memecoins represent and whether they serve any socially beneficial purpose.

Trump Coin 故事之所以特別,不止因為爆煲—梗幣界見慣,但係規模同爆炸速度,以及事件嘅政治層面,令所有人無法忽視。當一位現任美國總統親自發行梗幣,數星期內蒸發120億零售投資者資產,而其家族袋咗1億美金手續費,呢個情況迫使大家反思:梗幣到底代表乜?佢地究竟有冇為社會帶嚟正面作用?

For critics, the Trump coin debacle validates longstanding concerns that memecoins are simply wealth transfer mechanisms that exploit financially unsophisticated participants through viral marketing and FOMO psychology. The lack of utility, the insider token allocation, the explicit disclaimers that the token should not be viewed as an investment - all of these characteristics scream caveat emptor. From this perspective, the appropriate policy response is aggressive enforcement against fraud and market manipulation, combined with education campaigns warning retail investors about the extreme risks of memecoin speculation.

對批評者嚟講,Trump Coin 爆煲印證咗大家一直以嚟對梗幣界嘅疑慮:梗幣純粹係一種財富轉移工具,靠病毒式宣傳同 FOMO 心理剝削無金融知識嘅參與者。冇實用功能、內部人無厘頭分幣、又特登聲明唔係投資承諾——全部都話緊投資者自負風險。呢個角度下,合理政策反應應該係加強執法打擊詐騙與操控,同時加強公眾教育,警告散戶梗幣投機風險極高。

For defenders and participants, the Trump coin collapse is simply the latest iteration of a familiar cycle that everyone who enters crypto markets should understand. Memecoins are high-risk, high-volatility assets that have made some participants extraordinarily wealthy while wiping out others. This is not a secret; it is the defining characteristic of the asset class. The appropriate policy response, from this view, is not paternalistic regulation but continued education combined with personal responsibility. Adults should be free to speculate on memecoins if they choose, fully aware of the risks.

對捍衛者或者參與者嚟講,Trump Coin 只不過係加密貨幣圈老掉牙週期嘅新一章。梗幣屬高風險高波幅資產,成功者暴富,失敗者歸零,現實就係咁。呢個觀點認為,政策反應唔應該係過度管制,而係持續教育加個人責任。成年人自由選擇投機梗幣,只要清楚晒風險就得。

The truth, as usual, lies somewhere between these poles. Memecoins do serve certain legitimate purposes: they democratize participation in token creation and trading, they provide community formation mechanisms for the internet age, and they serve as accessible entry points into crypto for people intimidated by the technical complexity of other tokens. At the same time, the sector is rife with manipulation, information asymmetries, and wealth extraction that harms vulnerable participants.

事實一如以往,通常係兩者之間。梗幣有其合理存在空間:佢將發幣同交易民主化,為網絡時代社群構建提供平台,又俾對技術門檻有疑慮嘅人輕鬆入門加密世界。但同時呢個領域充斥咗操縱、資訊不對等等問題,財富轉移往往令弱勢最受傷。

The evolution of memecoins will ultimately depend on how these competing dynamics resolve. If projects can successfully add utility and sustainability while maintaining cultural appeal and community energy, memecoins may transform into a genuinely new class of social-financial assets. If regulatory pressure intensifies and investor sophistication improves, the worst scams and most exploitative practices may be curbed even as the legitimate uses persist. If neither of these things happens, memecoins will likely continue in their current form - a Wild West of speculation that periodically produces spectacular gains and devastating losses in equal measure.

梗幣未來進化會點,最終取決於呢幾股力量點協調。如果項目做到兼有實用性、可持續發展、唔失文化吸引力同社群活力,梗幣可以變成新型社交金融資產。如果監管壓力加大,投資者識得揀,最差嘅騙局同剝削可能收斂,即使正當用法可以保留。萬一兩樣都無,梗幣都會以而家呢種「加密世界西部牛仔」嘅形態長存,高風險高回報高輸家。

For investors contemplating participation in memecoin markets, the lessons are clear. Understand that these are among the riskiest assets in an already risky crypto sector. The vast majority of participants lose money, and the gains of the few come directly from the losses of the many. If you choose to participate, limit exposure to amounts you can afford to lose completely, be deeply skeptical of all marketing claims, and recognize that timing and luck matter more

對於有意參與梗幣市場嘅投資者,教訓已經好清楚:呢啲係本身風險已經極高嘅加密界之中最危險嘅資產。絕大多數人都會輸錢,少數人賺錢就係靠大多數人輸嘅本錢。如果你都要參與,資金只可以用絕對輸得起嘅數目,對所有市場宣傳要保持高度懷疑,仲要明白時機同運氣往往比乜都重要。than analysis. Most importantly, never confuse community enthusiasm with fundamental value, and always remember that viral momentum can reverse with shocking speed.

比起分析,更重要的是,千祈唔好將社群熱情同基本價值混為一談,亦要記住病毒式熱潮隨時可以瞬間逆轉。

For the crypto industry more broadly, memecoins represent both opportunity and threat. On one hand, they demonstrate crypto's unique ability to blend technology, culture, and finance in novel ways that resonate with younger generations. They prove that blockchain technology enables new forms of social coordination and value creation that simply were not possible before. On the other hand, the frequent rug pulls, scams, and spectacular failures associated with memecoins reinforce negative perceptions of crypto as lawless and predatory, potentially hindering mainstream adoption of more legitimate blockchain applications.

對加密貨幣行業嚟講,迷因幣係機遇亦係威脅。一方面,佢哋展示咗加密世界點樣可以將科技、文化同金融用前所未有嘅方式結合,亦好能夠引起年輕一代共鳴。佢哋證明咗區塊鏈技術可以創造出新型態嘅社會協作同價值創造,呢啲係傳統上做唔到嘅。不過另一方面,迷因幣頻頻發生「地氈拉走」(Rug Pull)、詐騙同大規模爆煲事件,亦加深咗大眾對加密貨幣「無王管」同「掠水」嘅壞印象,有可能阻礙到更加正規區塊鏈應用推向主流。

The coming years will reveal whether memecoins can evolve beyond their current form into something more constructive and sustainable. The raw ingredients are present: genuine community energy, viral marketing capabilities, and technological platforms that enable instant global coordination. What remains to be seen is whether these ingredients can be combined into recipes that create lasting value rather than just transferring it from the many to the few. The Trump coin collapse suggests the challenge is formidable, but the persistent appeal of memecoins suggests the experiment will continue regardless. In crypto's chaotic ecosystem of innovation and speculation, memecoins remain both symptom and symbol of an industry still figuring out what it wants to become.

未來幾年會揭示到,迷因幣可唔可以突破依家呢種形態,發展成一種更有建設性同可持續嘅東西。基本元素都有齊:有真誠嘅社群力量、病毒式推廣嘅能力,仲有底層技術平台可以即時環球協作。至於這啲元素可唔可以融合出創造持久價值嘅「食譜」,而唔係只係將價值由大眾轉移到小圈子,仲有待觀察。特朗普幣的崩盤顯示,呢個挑戰好大,但迷因幣持續受歡迎又話明呢個實驗會一直繼續落去。在加密貨幣充滿創新同投機嘅混亂生態裏面,迷因幣始終係行業摸索前路時既徵狀亦象徵。