當 Celestia 於2023年10月推出其 TIA 代幣時,市場一片樂觀。這個模組化區塊鏈項目獲得大型交易所支持,籌得大量風投資金,更自居成為 Web3 未來的基礎設施。經過2024年9月,TIA 一度成交接近 20 美元。十六個月後,價格跌至 1.5 美元以下,蒸發超過九成市值。

問題並非技術失誤或市場操控,而是更根本的原因:糟糕設計的代幣經濟學,在需求未能配合下,大量供應被解鎖。2024年10月,一次 cliff 解鎖釋出了 1.76 億顆代幣,一夜間流通供應接近倍增。早期投資者紛紛拋售,價格急瀉,社群信心被徹底動搖。

Celestia 的發展路徑反映了一個在2024-2025市場週期中已經成為共識的現實:代幣推出的成敗早於首單成交前已分高下。被視為行政例行公事的推出前階段,如今成為分辨可持續項目與曇花一現之間的關鍵。

這種轉變體現了機構化成熟。2021年牛市重視炒作與短期套利,到了2024-2025年反彈,紀律成為核心。歐盟的《加密資產市場法》(MiCA)於2024年12月全面生效,對發行人和服務商施加嚴格合規要求。機構投資者以私募股權標準審視代幣經濟學。經歷前幾輪教訓的零售投資者,投入資金前要求極高透明度。

在這個背景下,嚴謹發行與災難發行之間的分野是什麼?本文分析項目團隊在發行代幣前必須完成的關鍵步驟,由設計、流動性策略到合規、社群建設和技術準備。如今,錯誤空間極窄,風險極高。

打好基礎,應對市場驗證

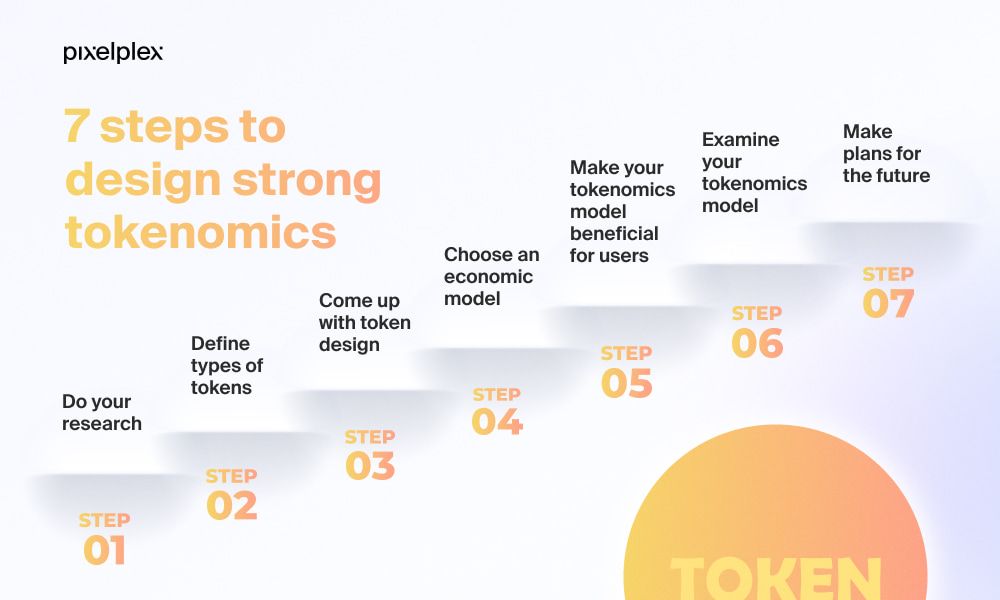

代幣經濟學不單是供應分配的算術遊戲,而是經濟架構,決定了代幣價值能否在上市投機熱潮後仍然持續。設計得妥善,代幣經濟學可將持有人利益與協議增長結合,有效管理通脹,並產生真正用途,鼓勵長線持有而非短期套利離場。

可惜不少團隊將代幣經濟學視為事後想法,反向設計供應只為取悅風投,卻無法打造可持續的需求機制。後果顯而易見。另一備受關注的 Layer 2 項目 Blast,2024年6月一次性解鎖了105億枚代幣(佔總供應一半以上),大量代幣湧入流通,令流動性不堪負荷,儘管成交量可觀,價格仍然跌至新低。

此模式在多個項目不斷重現。Berachain 過於激進的 cliff 解鎖機制,導致上市價隨即腰斬。Omni Network 上市首日持有人急於出場,代幣價格暴跌一半以上。這些都不是個別事故,而是系統性設計失誤:團隊追逐集資,犧牲經濟可持續性,造成沽壓,宣傳再多亦無補於事。

有效的代幣經濟學始於誠實的需求分析。除了投機,為何要持有這個代幣?答案必須具體且可驗證。如果協議沒有實際決策,治理權毫無意義。質押回報高於協議收入,便只是稀釋效應。聲稱有用途,但代幣可被輕易替代或實際使用量遠低於流通供應,說服力自然大減。

Messari 研究指出,成功項目將代幣發行與網絡活動、現實需求掛鉤,而不是靠武斷的發行時間表。NodeOps Network 於2025年6月推出其 NODE 代幣、累積超過370萬美元收入,正是範例。該協議將代幣燒毀與實際用戶服務掛鉤,實現根據實際經濟活動管理供應,而非預設通脹曲線。

Messari 創辦人兼行政總裁 Ryan Selkis 在公司2024年度報告 提到:「過去十二個月又是艱辛週期,但建設者已經為加密產業下一步發展奠定基礎。」這觀點進一步反映出,健康的代幣經濟學依靠持續建設,而非炒作。

分配設計與供應機制同樣重要。Arbitrum 於2023年3月空投,將總供應的11.5%分配予用戶、1.1%分配給生態 DAO,餘下44%給投資者和團隊設明歸屬期,分配兼顧社群治理,同時保留足夠資金支持長遠發展。相對之下,部分項目將超過六成配額無鎖定發予內部,幾乎必定首日遭到拋售壓力。

歸屬期設計需特別小心。cliff 解鎖導致預計沽盤,高手提前跑路,散戶承受損失。線性分期雖可分散拋售,但需配合市場造市策略吸納供應。最佳方案必須根據項目特性而定,任何設計令流通供應一夜倍增,都反映對價格誠信的失職或漠視。

代幣效用則是長期需求的動力。Optimism 的 OP 代幣具備治理作用,雙議會 DAO 架構讓持有人可參與協議升級、激勵分配及公共物品資助,為持有代幣提供持續動力。相反,缺乏鏈上活動或權力集中的協議,治理代幣實際價值甚微,最終淪為純投機工具。

最後,項目團隊必須在發行前預演各類供需情境。若成交量低於預期一半如何?若質押率超標會否導致通脹失控?大戶拋售時,流動性能否吸收而不致價格災難?這些均要以實質數據分析,而不只是樂觀假設。若將代幣經濟視為一成不變的「創世密碼」,市場只會讓團隊明白市場的本質不會理會華麗白皮書。

健全的代幣經濟學不是靠操控維護價格,而是憑經濟工程作保障。從設計上鼓勵持有、妥善分配、發行與實際活動掛鉤,並預視沽售行為。隨著市場愈趨專業化,稍有不慎便可能招致災難。

合規及法規準備

2024至2025年間,代幣發行時的監管環境發生巨大變化,由各國割裂局面轉向協調一致,令發行人需要承擔更重合規負擔。若團隊當監管可有可無,或推遲法律準備至發行後,愈來愈多面臨延遲上市、執法行動,甚至遭主流市場禁止。

歐盟的 MiCA 規例自2024年12月30日全面生效,建立了27個成員國首個完善的加密資產監管框架,區分三大類加密資產:一是資產參照型代幣(以多資產儲備維持穩定),二是電子貨幣代幣(對應單一法幣),三是其他所有加密資產(包括功能型代幣)。每個類別均有不同發行許可、披露及持續監管要求。

根據 MiCA,發行人必須在歐盟市場所交易前發佈詳細白皮書,內容涵蓋代幣特性、發行人資料、相關權益、底層技術及風險。未有充分披露或作出虛假陳述,發行人將面臨行政處罰及刑事責任。

加密資產服務供應商,包括交易所、錢包及託管服務,必須向國家主管部門申請牌照,須證明具備足夠資本、治理架構、風險管理與合規能力。只有於歐盟註冊成立企業,方可發行資產參照型或電子貨幣代幣,而未有資產支持的算法「穩定幣」則不獲許可。

MiCA 亦於同日實施資金轉移規則,進一步要求反洗黑錢措施。服務商須建立系統,對轉移加密資產的發送人及接收人的個人資料進行交換,確保透明及防止非法資金。這些義務效仿傳統銀行標準,並將其套用於過去設計為去中心化且逃避審查的區塊鏈網絡。

除歐盟外,各地監管亦日益趨嚴。美國證券交易委員會... continued its enforcement approach, treating many tokens as unregistered securities subject to federal securities laws. Ripple's ongoing legal battle with the SEC, which began in 2020 and saw mixed rulings through 2024, illustrates the risk of launching without clear regulatory positioning. The case has cost Ripple hundreds of millions in legal fees and created persistent uncertainty about XRP's status.

繼續執行其執法方針,把許多代幣視為未經註冊的證券,受聯邦證券法規管。Ripple 自2020年起與美國證券交易委員會 (SEC) 展開的法律糾紛,至2024年間亦有不同的判決結果,突顯在未有明確監管定位下啟動項目的風險。這宗案件令 Ripple 支付了過億美元的法律費用,亦令XRP的法規地位一直存有不確定性。

Asian jurisdictions pursued varied approaches. Singapore maintained relatively permissive rules for utility tokens while imposing strict requirements on tokens that function as securities or payment instruments. Hong Kong opened to retail crypto trading with licensing requirements. China maintained its blanket prohibition on token offerings. This fragmentation means projects cannot adopt a one-size-fits-all compliance strategy but must tailor their approach to target markets.

亞洲法域採取了不同做法。新加坡對功能型代幣(utility token)採取相對寬鬆的規則,但對作為證券或支付工具的代幣則有嚴格要求。香港向散戶開放加密貨幣交易,同時設有發牌規定。中國則維持全面禁止任何代幣發售。這種分散局面令項目無法以單一模式滿足所有合規要求,必須根據目標市場度身定制策略。

Jurisdiction selection has become a critical strategic decision. Many projects incorporate in jurisdictions perceived as crypto-friendly: the British Virgin Islands, Cayman Islands, Singapore, or Switzerland. These locations offer established legal frameworks, favorable tax treatment, and reduced regulatory friction. However, incorporation location does not determine regulatory obligations in markets where tokens are sold or traded. A BVI-incorporated issuer selling tokens to EU residents must comply with MiCA regardless of where the entity is domiciled.

選擇註冊地已成為關鍵策略決定。不少項目選擇在被視為「加密友善」的司法管轄區註冊公司,例如英屬維京群島、開曼群島、新加坡或瑞士。這些地方有成熟的法律架構、稅務優惠及較少監管阻力。不過,註冊地點並不決定在現實市場中銷售或交易代幣的監管責任。例如,一間在BVI(英屬維京群島)註冊的發行人在向歐洲居民售賣代幣時,仍然必須遵守MiCA規定,無論公司實際註冊地屬哪裏。

Know-your-customer and anti-money laundering procedures now represent baseline requirements for any serious token launch. Major exchanges and launchpads require compliance audits before listing consideration. CoinList, a leading token sale platform, operates under U.S. money transmitter licenses and conducts extensive investor verification before allowing participation. This creates friction and excludes some retail participants, but it also provides legal defensibility and access to institutional capital that increasingly demands regulatory compliance.

「認識你的客戶」(KYC)及反洗黑錢(AML)程序已成為任何認真的代幣發行的基本要求。主流交易所和發行平台,在考慮上幣或發售前都會要求合規審計。領先的代幣售賣平台 CoinList,持有美國金錢轉移執照,並會對投資者進行全面身份驗證。這會造成一定阻力,並令部分散戶投資者被拒之門外,但同時亦為平台提供法律抗辯基礎,以及滿足愈來愈重視監管合規的機構資本進場要求。

The classification question - utility versus security - remains central despite years of debate. The Howey Test, articulated by the U.S. Supreme Court in 1946, asks whether an investment contract exists based on whether someone invests money in a common enterprise with expectation of profit from others' efforts. Many token sales meet this definition during initial fundraising even if the token later evolves into pure utility. Projects that fail to address this distinction risk retrospective enforcement based on launch-phase activity.

「功能型」定義(utility)與「證券型」(security)的歸類問題,歷經多年辯論至今仍屬核心議題。美國最高法院於1946年提出的 Howey 測試,用以判斷某宗投資合約是否存在,即參與者有否向一間共同企業投入資金,並期望藉他人努力獲利。即使某些代幣日後只作功能用途,不少發行都在融資階段符合上述定義。項目如未能正視這種分野,將有機會因最初發行階段的行為而面臨追溯執法風險。

Expert guidance from specialized law firms has become essential rather than optional. Firms like Coin Center, ConsenSys's legal team, and specialized blockchain practices at major law firms provide analysis of regulatory requirements, structure compliant offerings, and negotiate with regulators on novel issues. Legal costs for a well-structured token launch now routinely exceed $500,000, but this investment provides protection against enforcement actions that could cost multiples more.

來自專業律師事務所的意見已成為必需品而非可選項目。Coin Center、ConsenSys 法律團隊及主流律師行的區塊鏈專業部門,會就監管要求提供分析、協助項目合規設計架構,並在新問題上與監管部門談判。現時結構完善的代幣發行,相關法律費用動輒超過50萬美元,然而這些投資可以為項目避免數倍甚至更多成本的執法風險。

The compliance burden creates natural barriers to entry that favor well-capitalized projects with professional teams. This professionalization benefits the ecosystem by reducing scams and low-effort launches, but it also raises concerns about centralization and regulatory capture. Teams must balance legal defensibility against decentralization principles, recognizing that perfect decentralization may be legally infeasible in practice.

合規負擔建構了入場門檻,自然有利資本充足及團隊專業化的項目。這種專業化讓生態圈減少騙局和低質量項目出現,但亦引起關於權力集中與監管俘獲的擔憂。團隊必須在法律抗辯基礎與去中心化原則之間取得平衡,亦須明白「完美去中心化」在法律層面上往往難以實踐。

Looking forward, regulatory frameworks will continue converging globally, creating clearer rules but also more extensive obligations. Projects that treat compliance as core infrastructure rather than unwelcome overhead will navigate this environment successfully. Those that attempt regulatory arbitrage or ignore legal requirements entirely will face escalating consequences as enforcement capabilities mature.

展望未來,全球監管框架將會持續收斂,規則會更明確,但同時亦會帶來更多義務。將合規視為項目核心基建而非「不必要負擔」的團隊,將會較能成功應對這個環境。反之,試圖利用監管套利或完全忽視法律要求的項目,日後隨著執法力量更成熟,將面臨愈來愈嚴重的後果。

As Alexander Ray, CEO and co-founder of Albus Protocol, emphasized in his compliance analysis: "Launching a token involves numerous regulatory considerations, from understanding how tokens are classified to ensuring proper KYC/AML compliance. By following this checklist and seeking legal advice where necessary, projects can navigate the complex regulatory landscape and launch their tokens with confidence."

正如 Albus Protocol 創辦人兼行政總裁 Alexander Ray 在其合規分析中強調:「發行代幣涉及大量監管考慮,包括代幣分類及確保KYC/AML等程序合規。只要按照相關清單、並於必要時諮詢法律意見,項目便能在這個複雜監管環境中順利發行代幣,信心提升。」

Launchpads: Visibility vs. Vulnerability

發行平台:曝光度與風險並存

Launchpads emerged as critical infrastructure for token distribution, offering projects access to engaged crypto communities, built-in liquidity, and credibility through association with established platforms. Yet launchpad selection involves complex trade-offs between visibility, cost, control, and risk that teams often underestimate until contracts are signed and launch mechanics are immutable.

發行平台已成為代幣發佈的重要基礎設施,協助項目接觸積極參與的加密社群、自帶流動性,亦因與知名平台掛鈎而提升信譽。然而,選擇哪個發行平台,其實涉及曝光度、成本、控制權與風險等複雜取捨,很多團隊往往等到合約簽妥、發行方式板上釘釘時,才意識到其中利害。

Binance Launchpad, the category leader, provides unmatched exposure to the world's largest exchange user base. Since 2019, it has facilitated more than 100 token launches raising over $200 million in combined funding, with six million all-time unique participants. Projects like Axie Infinity, Polygon, and The Sandbox achieved breakout success following Binance listings, benefiting from immediate liquidity across multiple trading pairs and sustained marketing support.

Binance Launchpad 作為該類型的領導者,帶來無可比擬的全球交易所用戶曝光。自2019年起,它促成超過100個代幣項目發售,合共募集超過2億美元,並累計吸引600萬名全球獨立參與者。Axie Infinity、Polygon 及 The Sandbox 等項目,在 Binance 上市後迅速取得爆炸性成績,受惠即時多交易對流動性和持續市場推廣。

But Binance's dominance comes with stringent requirements. The vetting process is notoriously selective, with acceptance rates below five percent. Binance charges competitive fees - typically one percent of total raise - but maintains significant control over launch timing, token allocation, and post-launch liquidity management. Geographic restrictions prevent participants from certain jurisdictions, including parts of the EU, from accessing offerings. For projects that make the cut, Binance Launchpad represents the gold standard. For the vast majority, it remains aspirational.

但 Binance 的霸主地位同時帶來嚴格要求。其審核過程之嚴苛業界知名,錄取率少於5%。Binance 收取具競爭性的費用(一般佔募資額1%),並對發佈時間、代幣分配、上市流動性管理等保留高度控制權。地區限制亦令某些法域(例如歐盟部分地區)的參與者無法加入。對獲選項目來說,Binance Launchpad 屬市場黃金標準;對大多數團隊而言則僅止於憧憬。

CoinList positions itself as the compliance-focused alternative for established projects with institutional ambitions. Founded in 2017, CoinList operates under U.S. money transmitter licenses and has hosted launches for Algorand, Solana, Filecoin, and other major protocols. The platform provides investor verification, cap table management, vesting administration, and advanced token economics controls - services that appeal to projects navigating complex regulatory requirements.

CoinList 則定位為專注合規的方案,適合已初具規模、計劃吸引機構資金的項目。該平台於2017年成立,持有美國金錢轉帳牌照,並已協助 Algorand、Solana、Filecoin 等大型協議發行代幣。CoinList 提供投資者認證、股權流水帳管理、解鎖期分配以及進階代幣經濟工具等服務,對於需應對複雜監管要求的項目頗具吸引力。

CoinList's strength is also its constraint. The extensive KYC process creates friction and excludes participants from restricted jurisdictions. Token allocations follow a karma-based point system that rewards platform activity, meaning even approved participants face no guarantee of receiving desired allocation. For projects willing to accept these trade-offs in exchange for regulatory defensibility and access to institutional capital, CoinList offers unmatched infrastructure. For projects prioritizing broad retail distribution or rapid launch velocity, the process may feel bureaucratic.

CoinList 的優勢同時是其限制。繁複的KYC流程會增加參與阻力,亦令部分地區用戶無法加入。其代幣分配採用「karma」積分制,鼓勵用戶在平台參與活動,令即使通過資格審查亦不一定能取得預期配額。願意接受這些限制,以換取合規保障及機構資本進場的項目,CoinList 是無可比擬的基建。若優先考慮大眾化分發或追求快速發行,CoinList 的流程則或會顯得官僚。

DAO Maker pioneered the Strong Holder Offering mechanism, designed to give retail investors access to early-stage opportunities previously reserved for venture capital. The platform has facilitated more than 130 initial DEX offerings raising over $72 million, with projects including Orion Protocol, My Neighbor Alice, and Sweat Economy. DAO Maker's social mining approach rewards community participation in project development, theoretically aligning incentives between investors and founders.

DAO Maker 創立了 Strong Holder Offering 機制,讓早前只限風險投資者的早期機會,開放給散戶。平台已舉辦超過130個初始DEX發行(IDO),合共募集超過7,200萬美元,涉及的項目包括 Orion Protocol、My Neighbor Alice、Sweat Economy 等。DAO Maker 的「社群挖礦」模式以社區參與項目發展給予獎勵,理論上可協調投資者與項目方的利益。

The tiered system requires participants to stake DAO tokens to access allocations, with higher tiers receiving guaranteed slots while lower tiers enter lottery systems. This creates economic moat around the platform but also concentrates benefits among large token holders. Critics argue the model replicates venture capital dynamics it claims to disrupt, simply substituting DAO staking for institutional connections. Supporters counter that transparent, blockchain-based allocation beats opaque venture processes.

其分層制度要求參與者質押DAO平台幣以獲分配名額,高級別可獲保證配額,低級別則要抽籤。這種設計為平台築起經濟護城河,同時令利益集中於大戶之間。有批評認為,這只將DAO質押取代傳統機構關係,本質仍是沿用風投路線;支持者則認為,既然分配機制透明、由區塊鏈記錄,已比傳統風投黑箱作業更勝一籌。

For blockchain gaming and NFT projects, Seedify has established dominance through specialized infrastructure including Initial Game Offerings, playtesting support, and customizable sale structures. More than 75 launches have used the platform, with tiered staking systems similar to DAO Maker's approach. The gaming focus provides valuable network effects as projects gain exposure to communities specifically interested in blockchain games rather than generic crypto investors.

針對鏈遊與NFT項目,Seedify 透過專門基建(例如 Inital Game Offerings、測試支援、定制性強的發售機制)樹立領導地位。現時已有超過75個項目經此平台發行,並採用與DAO Maker類近的質押分層制度。其專注遊戲領域帶來寶貴網絡效應,直接接觸對鏈遊有特別興趣的社群,而非一般加密幣投資者。

Fjord Foundry and Polkastarter represent the decentralized launchpad category, using liquidity bootstrapping pools and algorithmic pricing rather than fixed-price sales. These mechanisms allow market forces to determine token valuation rather than relying on team-set prices that often overshoot or undershoot fair value. The model reduces price volatility post-launch by distributing tokens more efficiently based on genuine demand curves. However, it also introduces complexity and requires sophisticated understanding of bonding curve mechanics.

Fjord Foundry 及 Polkastarter 屬去中心化發行平台類別,採用流動性自啟動池(liquidity bootstrapping pools)及演算法定價,取代傳統定價發售。這讓市場力量而非團隊設價決定代幣價值,減少出現高估或低估情況。該模式依據實際需求曲線更有效分配代幣,有助穩定發售後的價格波幅。不過,其複雜性颇高,需要參與者對債券曲線等機制有較深認識。

The performance metrics tell sobering stories. DAO Maker remains the only major launchpad showcasing positive average return on investment across all historical token sales, according to comprehensive platform analysis. Most others, including well-regarded options like TrustSwap and BSCPad, show negative current average ROI when measured from launch prices to subsequent trading. This reflects both general market conditions and the challenge of launching tokens at valuations that leave room for appreciation.

業績數據反映出現實。市面上只有DAO Maker在歷史發售所有代幣時,平均投資回報為正(根據平台分析)。大部分其他主流平台,包括 TrustSwap 及 BSCPad 等,若按發售價計現時回報率,平均數皆屬負數。這反映一來與市場整體環境有關,二來說明代幣開盤定價太高,欠缺升值空間大大增加挑戰。

Launchpad contracts contain crucial clauses that teams often overlook during negotiation. Performance-based refund mechanisms allow investors to recover funds if projects fail to meet specified milestones - engagement targets, development deadlines, or liquidity thresholds. While investor-friendly, these provisions create

發行平台合約中常有關鍵條款,團隊在談判時往往忽視。以表現為基礎的退款條款,讓項目如未達至某些里程碑(如用戶參與目標、開發進度期限或流動性門檻),投資者可要求退回資金。這些設計雖然對投資者有利,但同時亦...ticking time bombs for teams that underestimate implementation complexity or encounter unexpected delays. A single missed milestone can trigger mass refunds that crater the project before it properly launches.

對於低估實施複雜性或者遇到突發延誤的團隊來說,這些就如同計時炸彈。一個目標未達成,便足以觸發大量退款,令項目在正式推出前就已經崩潰。

Fee structures extend beyond upfront costs to include ongoing obligations. Some platforms take ongoing percentages of token supply, require listing on specific exchanges, or impose minimum liquidity commitments that drain treasuries. Teams should model total launch costs including these contingent obligations, not just headline numbers.

收費結構不只限於前期成本,還涉及持續性的責任。有些平台會長期抽取代幣供應的一定比例、要求在指定交易所上市,或者強制定下最低流動性承諾,令項目金庫被持續抽乾。團隊在計算推出總成本時,應包括這些或有責任,而不是只看表面的數字。

Due diligence on launchpad reputation has become essential. Past project success rates, token retention periods, community quality, and founder testimonials provide insight into whether a platform delivers genuine value beyond token distribution mechanics. Platforms with histories of failed projects or communities dominated by short-term speculators offer questionable value regardless of headline participation numbers.

對發射台聲譽的盡職調查已成為不可或缺。過往項目的成功率、代幣鎖倉期、社群質素、創辦人推薦等,都能反映平台是否有實際價值,而不只是分發機制。平台如果歷來項目多次失敗、社群被短線炒家主導,即使參與人數看似可觀,實際價值都值得懷疑。

The optimal launchpad strategy depends on project specifics. High-quality infrastructure projects with strong fundamentals benefit from tier-one platforms like Binance or CoinList despite higher barriers. Gaming and NFT projects find specialized value in Seedify. Experimental DeFi protocols may prefer decentralized options that attract more sophisticated, risk-tolerant participants. Regional projects should prioritize platforms strong in target markets rather than chasing global reach.

最適合的發射台策略要視乎項目屬性。質素高、基本面穩健的基礎設施項目,即使門檻較高,選擇Binance、CoinList等一線平台會帶來更大好處。遊戲和NFT項目則可考慮專注細分市場的Seedify。實驗性質重的DeFi協議可能較適合去中心化的發射台,吸引有經驗和較能承擔風險的參與者。至於本地或地區性項目,應視乎目標市場而選擇強勢平台,而不是一味追求全球知名度。

Some projects eschew launchpads entirely, conducting direct community sales or liquidity bootstrapping on decentralized exchanges. This approach maximizes control and minimizes fees but sacrifices the built-in distribution and credibility that established platforms provide. The calculus depends on whether the project has sufficient organic community to ensure successful distribution without platform support.

有些項目完全不依賴發射台,選擇直接社群售賣或在去中心化交易所啟動流動性。這種方式可以最大程度自主和減低平台費用,但同時失去現有大平台提供的發行渠道和公信力。這取決於項目本身是否有足夠自然、活躍的社群,能否不靠平台仍順利分發。

Launchpads should be evaluated as partners, not just distribution channels. The best platforms provide strategic guidance, connect projects with market makers and exchanges, offer post-launch support, and maintain engaged communities beyond the initial sale. The worst extract maximum fees while providing minimal value beyond basic token distribution infrastructure.

發射台應被視作合作夥伴,而不只是分銷渠道。最好的平台會給予策略指導、協助對接莊家與交易所,並在發售後繼續支援項目及維繫活躍社群;最差的只會抽高昂費用,提供的只限於最基本的分發工具,增值極有限。

Teams should negotiate aggressively and compare multiple platforms before committing. The excitement of launchpad acceptance should not prevent careful contract review and scenario modeling. What happens if crypto markets crash during the launch window? If engagement metrics fall short? If development timelines slip? Clear answers to these questions should exist before signing, not after problems emerge.

團隊下決定前應積極議價,多比較不同平台。一時通過發射台審核不應成為鬆懈條款審查和情景分析的原因。假如市場在發售期暴跌怎辦?參與人數不足怎辦?開發進度延誤呢?所有這些問題都應在簽約前有清晰答案,而不是事後才臨急抱佛腳。

Exchange Listings: Smart Sequencing and Cost Management

Exchange listings represent crucial milestones that provide liquidity, visibility, and trading infrastructure. Yet the listing process involves substantial costs, complex negotiations, and strategic decisions that significantly impact token performance. Teams that chase tier-one exchanges without clear strategy often drain treasuries while securing listings that deliver minimal incremental value.

交易所上市是極為關鍵的里程碑,為代幣帶來流動性、曝光率和交易基建。不過,上市過程涉及大量成本、複雜談判及策略取捨,對代幣表現影響深遠。若團隊盲目追求一線交易所,但策略不清,往往既消耗大量資金,最後又未必帶來明顯增值。

Binance, Coinbase, and OKX dominate trading volume among centralized exchanges, collectively accounting for the majority of spot and derivatives activity. A Binance listing provides instant exposure to millions of users, deep liquidity across multiple trading pairs, and powerful signaling that institutional investors and other exchanges monitor closely. But Binance selectivity means most projects have no realistic path to listing, and even those that succeed pay substantial fees - often multi-million dollar ranges including listing costs, liquidity commitments, and marketing packages.

Binance、Coinbase、OKX等大型中心化交易所主導交易量,佔據現貨及衍生品市場大部份。登陸Binance即時可接觸數百萬用戶、多交易對深厚流動性,亦有強烈信號作用,吸引機構投資者和其他平台關注。不過,Binance嚴格篩選,大部份項目難有機會,成功上線者也需承擔巨額費用——包括上市費、流動性承諾、推廣配套等,動輒數百萬美元。

Coinbase emphasizes regulatory compliance and focuses on assets likely to satisfy U.S. securities law requirements. The exchange maintains stricter listing criteria than most competitors, resulting in a more curated but smaller asset universe. For projects with strong legal positioning and U.S. market focus, Coinbase provides premium access to institutional capital and retail traders in the world's largest economy. For projects with regulatory ambiguity or international orientation, other options may better serve needs.

Coinbase極重合規,專注於美國證券法下較易過關的資產。其上市條件比其他交易所更嚴,導致資產池較細但篩選更精。如項目法律定位明確,目標美國市場,能打入Coinbase就等同打開接觸美國機構及散戶的大門。反之如監管不明確,或主攻海外市場,其它交易所未必更適合。

Regional and second-tier exchanges - MEXC, Bitget, Gate.io, Bybit - offer more accessible listing pathways with lower fees and fewer requirements. These platforms provide genuine liquidity in specific geographic markets or for certain asset classes. However, they also carry risks including fake volume through wash trading, limited user bases outside core markets, and less rigorous due diligence that may associate projects with lower-quality listings.

地區性及二線交易所如MEXC、Bitget、Gate.io、Bybit等,上市門檻較低,收費亦較便宜。這些平台在部分地區或資產類別確有實際流動性,但風險亦不少:包括刷量造假、核心市場以外用戶稀少、審查寬鬆甚至經常出現質素參差的項目等。

The sequencing question looms large. Should projects pursue tier-one listings immediately or build liquidity on smaller exchanges first? The answer depends on project maturity and resource availability. Launching directly on Binance creates maximum impact but requires substantial preparation and capital. Sequencing through progressively larger exchanges allows teams to refine tokenomics, build community, and demonstrate traction before approaching top-tier platforms. Neither approach is universally superior.

上市先後問題十分關鍵。應該一開始就攻頂級交易所,還是先在細平台累積流動性?這取決於項目成熟度和資源。直接Binance上市震撼力最大,但門檻極高;循序漸進由小至大型交易所試水溫,可調節經濟模組、積累社群和實績後再博大平台。兩種方法並無絕對優劣。

Liquidity distribution across exchanges matters as much as which exchanges list the token. Concentrating liquidity on a single platform creates fragility - if that exchange experiences technical issues, regulatory problems, or reputational damage, the token's entire trading infrastructure collapses. Distributing liquidity across multiple exchanges and both centralized and decentralized venues provides resilience but requires more sophisticated market making and inventory management.

除了去哪間交易所上市,流動性分布同樣關鍵。只集中一個平台,該交易所若遇上技術、監管或聲譽問題,整個代幣交易環境會即時崩潰。將流動性分布於多個中心化及去中心化平台,有助提升抗逆力,但對莊家操作、市場造市和存貨管理要求更高。

Exchange negotiations involve more than listing fees. Teams must commit to providing liquidity, often through dedicated market-making arrangements or direct capital deposits. Some exchanges demand ongoing marketing activities, exclusive first listing windows, or equity stakes in the project. Understanding total obligations and evaluating whether they align with project goals requires careful analysis beyond headline listing costs.

與交易所談判不只在於上市費。團隊往往還需承諾提供流動性(派莊家或直送資金)、持續推廣、甚至承諾獨家首發或讓渡項目股權。了解全部責任、評估是否符合項目利益,遠比只看標價重要。

The wash trading problem deserves mention. Some exchanges inflate reported volumes through fake activity - either internally or through arrangements with affiliated market makers. Reported $10 million daily volume may represent $1 million genuine trading and $9 million circular wash trades. This misleads projects about actual liquidity and creates false impressions of market interest. Teams should evaluate real order book depth, executed trade sizes, and bid-ask spreads rather than headline volume when assessing exchanges.

不可不提刷量造假問題。有交易所會自家刷量,或者協助關聯莊家製造假成交,表面$1,000萬日成交,很可能只有$100萬真實交易,餘下都是假盤。這會誤導項目方估算實際流動性,對市場關注度產生錯覺。評估交易所時,應留意真正委託簿深度、實際成交單和買賣差價,不可只看標題成交量。

Celestia's listing strategy illustrates sophisticated multi-exchange coordination. The project secured day-one listings on Binance and Coinbase, providing immediate liquidity in major markets. Simultaneous listings on multiple tier-two exchanges ensured geographic coverage and prevented arbitrage opportunities that often emerge when listings are staggered. While tokenomics problems ultimately undermined price performance, the exchange strategy itself executed well.

Celestia的上市操作是如何協調多家交易所的好例子。項目一開盤就同時在Binance及Coinbase上線,大市即時有流動性;數間二線交易所亦同步上市,覆蓋多個地區,又防止分期上市常見的跨市套利問題。雖然代幣經濟設計其後出現問題導致價格表現不理想,但其上市步驟本身執行得非常好。

Sui and Wormhole adopted similar approaches, launching across multiple exchanges simultaneously to maximize liquidity and prevent fragmented markets. This strategy requires extensive preparation and coordination but delivers cleaner launches with less price volatility during the critical initial trading period.

Sui 和 Wormhole 採用相近做法,多間交易所同步首發,確保流動性最大化,而且防止市場分裂。這種做法籌備量大、協調繁複,但換來開市時波幅較小、氣氛較靜,不易被炒作。

Some projects take the opposite approach, initially listing exclusively on decentralized exchanges to maintain decentralization principles and minimize corporate entanglements. Uniswap, SushiSwap, and other DEXs provide permissionless listing pathways that bypass centralized gatekeepers. However, DEX liquidity typically starts thin and requires significant incentivization to attract liquidity providers. The trade-off between decentralization ideals and practical liquidity concerns has no easy resolution.

亦有部分項目反其道而行,選擇只於去中心化交易所(如Uniswap、SushiSwap等)首發,以維護去中心化理念及減少與企業利益糾纏。不過,DEX流動性初期通常很薄弱,需以大量獎勵吸引流動性提供者。去中心化理想與實際流動性的拉鋸,難有一個絕對答案。

Teams should model exchange costs across the full listing lifecycle, not just initial fees. Ongoing market-making expenses, liquidity maintenance, potential delisting risks, and opportunity costs of capital locked in exchange wallets all factor into total cost. A tier-one exchange charging $2 million for listing but providing $50 million daily volume may deliver better value than a tier-two exchange charging $200,000 with $2 million daily volume, depending on project needs.

團隊應把整個上市週期成本納入預算,而不單是一筆過上市費。包括莊家成本、長期流動性維護、被下架風險、資金鎖定成本等等。以實際例子說,一線交易所收$200萬上市,但每日流量有$5,000萬;二線平台只收$20萬,但每日流量只有$200萬,孰優孰劣,必須視乎項目訴求而定。

The maxim bears repeating: listing is a tool, not validation. The exchange announcement creates a one-time price impact that quickly dissipates if underlying fundamentals are weak. Sustainable value accrues from protocol usage, revenue generation, and community growth - factors that listings facilitate but cannot substitute. Teams that understand this distinction allocate resources appropriately rather than treating exchange listings as the ultimate success metric.

值得一再強調:上市只是一個工具,並非成功的認證。消息公布雖能帶來短期價格效應,但如基本因素薄弱,熱潮很快便會冷卻。可持續的價值來自協議用量、實際收益和社群成長——上市可以支持這些元素,但不能代替。明白此理的團隊,才會合理分配資源,不會把上市本身當成終極目標。

Market Makers: Stability, Not Spectacle

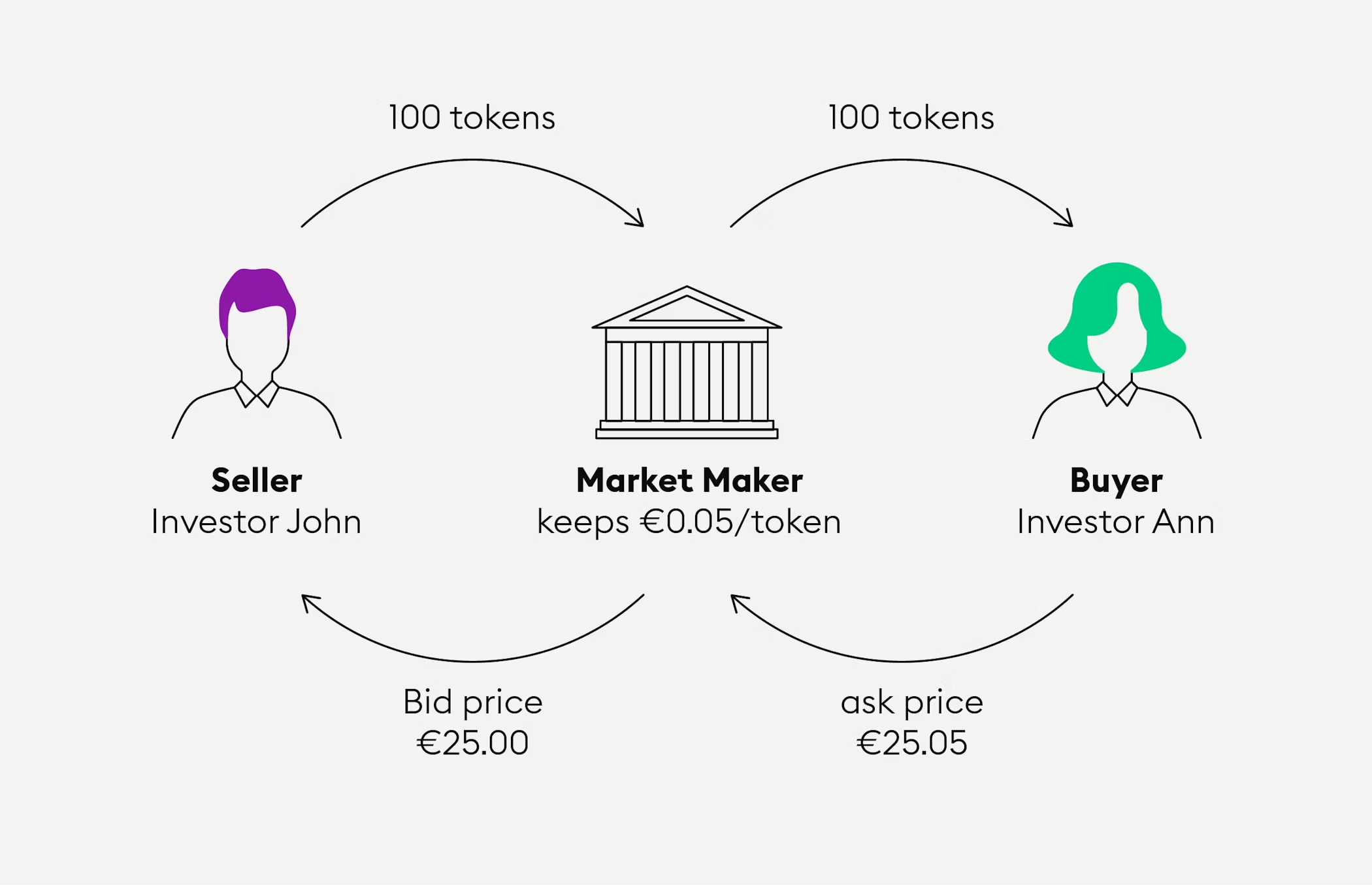

Market makers provide the liquidity infrastructure that enables trading by continuously offering to buy and sell tokens at publicly quoted prices. High-quality market making tightens bid-ask spreads, reduces price volatility, absorbs large orders without catastrophic slippage, and creates the appearance of genuine trading interest that attracts additional participants. Poor market making amplifies volatility, creates the appearance of manipulation through artificial volume, and ultimately destroys trust.

做莊家為市場提供流動性基建,透過持續掛單買賣代幣,維持公開報價。高質莊家能窄化買賣差價、降低價格波動、吸收大額交易不致嚴重滑點,又能營造健康的買賣氣氛吸引更多參與者。劣質莊家則會放大波幅、用假成交營造假象,最終損害市場信任。

The distinction between legitimate and predatory market making has become increasingly important as the industry professionalized through 2024 and 2025. Reputable firms like Wintermute, GSR, and Flowdesk operate with transparency, provide genuine two-sided liquidity, and align incentives with project success over multi-year timeframes. Predatory

合法與掠奪式造市的分別,在 2024 及 2025 年行業逐步專業化後越發重要。像 Wintermute、GSR、Flowdesk 等享負盛名的莊家公司,講求透明度,真正提供雙邊流動性,亦會將利益和項目長期表現掛鈎。掠奪式莊家則……operators generate fake volume, engage in front-running or other manipulative strategies, and prioritize short-term extraction over long-term value creation.

操盤手會製造虛假交易量、參與搶先交易(front-running)或其他操縱市場的行為,並把短期利益提取置於長遠價值創造之上。

Market conditions matter significantly for launch timing. Guilhem Chaumont, CEO of Paris-based market maker Flowdesk, observed following the FTX collapse: "Post-FTX we have seen liquidity dry as up to 50% on major coins. On smaller market caps, the liquidity reduction has been even worse." Chaumont advised projects during that period to postpone launches by three to six months until liquidity conditions improved.

市場狀況對於發行時機非常重要。巴黎市場莊家 Flowdesk 的 CEO Guilhem Chaumont 於 FTX 倒閉後指出:「FTX事發後,我哋見到主要加密貨幣嘅流動性減少咗達50%。市值較細嘅幣,流動性情況仲要嚴重。」Chaumont 當時建議項目推遲發行三至六個月,等流動性狀況改善先好推出。

Wintermute represents the market-making veteran, with more than $600 billion lifetime trading volume and integration across more than 50 centralized and decentralized exchanges. The firm maintains positions on major platforms including Coinbase, Kraken, Uniswap, and dYdX, providing both centralized and on-chain liquidity. Proprietary algorithms enable Wintermute to maintain efficient markets during volatile conditions when less sophisticated market makers withdraw. The firm's reliability and scale make it a default choice for major projects, though premium pricing reflects this positioning.

Wintermute 屬於資深的莊家,累計交易量超過六千億美元,整合了五十多個中心化及去中心化交易所。該公司喺 CoinBase、Kraken、Uniswap 同 dYdX 等主流平台維持倉位,為中心化同鏈上市場提供流動性。自家演算法讓 Wintermute 可以喺市場波動大、其他莊家撤出時,依然保持高效市場運作。因為可靠同規模夠大,Wintermute 成為大型項目嘅首選莊家,收費亦相對較高,反映其市場地位。

GSR, based in London with operations globally, brings a decade of experience and plugs into more than 60 exchanges. The firm emphasizes transparency through daily reporting that provides clients detailed KPI metrics including order book depth, slippage rates, and trading volumes. This openness ensures projects understand market conditions and can evaluate whether market-making arrangements deliver promised results. GSR focuses on fair price discovery and narrow spreads rather than volume maximization, prioritizing genuine liquidity over superficial metrics.

GSR 總部設於倫敦,業務遍及全球,擁有超過十年經驗,並已接入六十多個交易所。GSR 著重透明度,每日向客戶匯報包括訂單簿深度、滑點率、成交量等詳盡關鍵指標(KPI)。呢種開放度,令項目能掌握市場狀況,同時評估莊家合作有冇交到承諾效果。GSR 強調公平價格發現同窄幅差價,重視真實流動性,而唔係單單追求虛高成交量。

Flowdesk specializes in emerging digital assets and leverages technology to streamline operations for newer projects gaining traction. The firm's smaller size relative to industry giants enables agility in adapting strategies to specific client needs and evolving market conditions. For projects without massive budgets but requiring professional market making, Flowdesk offers an attractive middle ground between premium-tier firms and questionable lower-cost alternatives.

Flowdesk 主力為新興數碼資產提供服務,善用科技提升新項目營運效率。流動性團隊規模相對行業巨頭細,變陣靈活,能因應客戶要求或市場環境快速調整策略。對於冇大預算,但又需要專業莊家的項目,Flowdesk 可以係高端公司同風險低價選項之間,提供吸引嘅平衡方案。

Cumberland, a division of traditional finance powerhouse DRW Trading, entered crypto in 2014 and provides institutional-grade market making with emphasis on large-block trades and over-the-counter transactions. The firm caters to hedge funds, exchanges, and projects needing to execute high-volume trades without triggering market disruption. Cumberland's traditional finance background brings mature risk management practices and operational discipline that purely crypto-native firms sometimes lack.

Cumberland 隸屬傳統金融巨頭 DRW Trading,2014 年已經進軍加密市場,主打機構級莊家服務,聚焦大額交易及場外成交。業務對象包括對沖基金、市場、以及需要安靜處理大量成交的項目方。Cumberland 有傳統金融底蘊,帶來成熟嘅風險管理手法及運營紀律,而這些往往係純加密公司所欠缺。

Market-making contracts typically involve several components. Firms receive token inventory to deploy across exchanges, creating the capital base for two-sided quoting. Performance targets specify minimum spreads, maximum response times to orders, and uptime commitments. Fees range from fixed monthly retainers to variable structures based on trading volume or price stability metrics. Some contracts include option-based compensation where market makers receive discounted token purchases, aligning incentives with price appreciation but also creating potential conflicts if firms prioritize option value over client objectives.

一般莊家合約包括多個環節。莊家會獲得代幣存貨,分派到各大交易所,形成雙向報價資本基礎。績效目標涵蓋最小差價、最大接單應對時間、以及在線率承諾。收費可以係固定月費、按成交量浮動、或基於價格穩定性等機制。有啲合約會加入選擇權作為報酬,莊家可用折讓價購買代幣,既可以與價格升值掛鈎,也可能引發利益衝突——如果莊家為追求自身利益而犧牲客戶目標。

Red flags include guaranteed returns, profit-sharing arrangements, or extremely low fees. Legitimate market making involves capital risk and operational expense that requires appropriate compensation. Firms promising results for unrealistic fees either plan to generate fake volume, engage in token price manipulation, or simply lack competence. Teams should be skeptical of spectacular promises and instead seek firms with track records, verifiable client references, and clear explanations of how they create value.

值得注意的警號包括:保證回報、分紅分成、或者極低服務費。正規市場莊家都要承擔資本風險和運營成本,收費理應合理。若有公司聲稱可以用低得不合理嘅價錢交出成績,往往係打算做假量、操控幣價,或者本身實力不足。團隊應對「天花亂墜」嘅承諾保持警惕,優先考慮有往績、可驗證客戶推薦、同埋清楚解釋點樣創造價值的莊家。

The treasury management question deserves careful consideration. How much token inventory should teams provide market makers? Too little constrains liquidity provision; too much creates risk if the firm mismanages assets or suffers security breaches. Most arrangements involve segregated accounts with clearly specified risk limits and daily reconciliation. Teams should never provide market makers unrestricted access to treasury funds or accept opaque reporting on inventory usage.

資金管理問題要審慎處理:應該俾幾多代幣存貨畀莊家?俾得太少流動性有限,俾太多又會增加資產管理失誤或安全問題的風險。一般安排會設獨立賬戶、明確規定風險上限、每日對賬。團隊切忌讓莊家無限制提用金庫資金,或接受含糊不清的存貨報告。

Market making on decentralized exchanges involves distinct considerations. DEX liquidity pools require depositing tokens directly into smart contracts where they remain until withdrawn. Impermanent loss - the opportunity cost when asset prices diverge from initial ratios - affects returns and must be managed through rebalancing strategies. Some projects actively manage their own DEX liquidity rather than outsourcing to market makers, maintaining direct control but requiring technical sophistication and continuous attention.

去中心化交易所做莊有其特別考慮。DEX 流動性池要將代幣直接存入智能合約,直到提款先可移出。不可變損失(impermanent loss)即係資產價格偏離初始比例嘅機會成本,會影響回報,要通過平衡操作控制。有項目選擇自行管理 DEX 流動性,而唔係外判俾莊家,保持自主性,但同時要求技術實力同長期管理。

The relationship between market makers and exchange listings merits mention. Some exchanges require projects to retain specific market makers or meet minimum liquidity commitments before approving listings. Understanding these requirements early prevents surprises during listing negotiations. Additionally, coordinating market maker deployment across multiple exchanges ensures consistent liquidity and prevents arbitrage opportunities that create unnecessary token price volatility.

莊家同交易所上市要求之間的關係值得注意。有啲交易所會要求項目必須聘用指定莊家,或達到最基本流動性要求先肯上架。盡早了解有關要求,可以避免上市談判時出現突發情況。同時,如果多個交易所同步部署莊家,可以確保整體流動性一致,減少出現套利空間,從而降低幣價不必要波動。

Integration timelines matter. Professional market makers require several weeks to onboard new clients, analyze tokenomics, deploy infrastructure, and begin trading. Teams should initiate market maker discussions months before launch, not weeks. Last-minute arrangements rarely work well and often force teams to accept unfavorable terms or suboptimal partners.

整合作業時間亦很關鍵。專業莊家一般需要幾星期為新客戶開戶、分析代幣經濟學、搭建基礎設施及啟動交易。團隊一定要早於發行前幾個月就展開莊家洽談,而非臨急抱佛腳。臨時拉夫既難搵到好莊家,條件又未必理想。

Post-launch performance monitoring is critical but often neglected. Teams should review regular reports, verify that promised metrics are being delivered, and engage proactively when performance deviates from expectations. The best market-making relationships involve ongoing communication where both parties share market intelligence and adjust strategies based on changing conditions. The worst relationships involve set-and-forget arrangements where neither party actively manages outcomes.

發行後的績效監察經常被忽略,但其實非常重要。團隊應定期翻查報告,對比承諾同實際指標,並且定期追蹤、主動溝通。最佳合作關係是雙方保持持續對話,互通市場資訊,並按市況調整策略。最差情況就係放任自流,雙方都唔理會實際結果。

Market making should be evaluated as long-term partnership, not transaction. Firms aligned with project success provide strategic advice beyond pure liquidity provision, introduce projects to exchanges and investors, and remain engaged through market cycles. Firms seeking quick profits extract value during favorable conditions and disappear when markets turn. The difference becomes apparent only through sustained relationships, making initial partner selection exceptionally important.

市場莊家合作應該視為長期夥伴關係,而唔係一單交易。真心支持項目成功的莊家,除咗提供流動性,仲會俾策略建議、引介交易所或投資者、並能跨越牛熊市週期持續參與。純粹為快錢而來的莊家,行情好就抽水,市況差就人間蒸發。兩者分別要靠長期合作關係先至睇得出,所以揀莊家初期尤其關鍵。

Community and Communications: Building Belief Before Price

社群與溝通:建立信念先於價格

Community strength predicts post-launch resilience better than most other factors. Projects with engaged, educated communities that genuinely believe in the protocol's mission can weather tokenomics mistakes, bear market conditions, and competitive challenges. Projects with mercenary communities attracted solely by airdrop speculation collapse when incentives end and attention shifts elsewhere.

社群實力比其他大部分因素都更能預測發行後項目的韌性。能吸引投入且認同協議理念嘅成員的社群,即使出現代幣經濟失誤、熊市、競爭挑戰都可以捱過。反之如果社群只是為空投衝著獎勵而來,一旦激勵結束、注意力分散,項目很快就會瓦解。

Building authentic community requires starting early - ideally before token design finalizes. This seems counterintuitive when teams are heads-down on technical development, but community input during the tokenomics phase creates psychological ownership that persists long after launch. Participants who feel their feedback shaped the protocol behave differently than those who receive tokens through anonymous airdrops.

建立真誠社群要從早做起——最好喺代幣設計敲定前開始。雖然團隊可能正專注技術開發,好似唔應該分心搞社群,但如果喺 tokenomics 階段吸納用戶意見,會令參與者有「歸屬感」,這種心理投入可以持續到發行之後。有參與過設計的用戶,行為會同只係匿名收空投的人截然不同。

The 2024-2025 meta of "points farming" illustrates both the power and perils of gamified engagement. Blast, LayerZero, Kamino, and others deployed points systems that rewarded on-chain activity before token generation events. The approach successfully attracted users and drove protocol metrics upward. However, it also attracted purely mercenary capital that exited immediately once points converted to tokens. The challenge lies in distinguishing genuine users from farmers.

2024-2025 年風行的「分數耕作」玩法(points farming),正正體現 gamification 對社群的助力與風險。Blast、LayerZero、Kamino 等項目,早期透過分數機制獎勵鏈上活動即使還未發幣。有關做法成功拉動用戶,同時提升協議數據。但同時吸引一大堆純粹逐利的資金,分數轉換代幣即離場。最大難題係分辨真正用戶與耕分水軍。

Effective points programs require carefully structured to reward behaviors that indicate long-term commitment rather than short-term extraction. Points that accumulate based on consecutive activity over months rather than total volume in a week filter for patience. Requirements to maintain activity post-airdrop to unlock full allocations create incentive to stay engaged. Penalties for transferring points or tokens immediately after distribution reduce mercenary appeal. None of these mechanisms perfectly separates wheat from chaff, but they tilt odds toward attracting serious participants.

有效的分數計劃需要謹慎設計,應該獎勵真正代表長期承諾的行為,而非短線炒作。例如,按月累計連續參與活動,而非單看單周交易量,可以篩選出有耐性嘅參與者。空投過後要求持續互動才能領足配額,能提升黏性。派分後即時轉移就設罰則,可以減低投機吸引力。呢啲機制未必可以完全分辨好壞,但至少能傾向吸納認真的人。

Educational content serves community building better than hype. Detailed documentation explaining protocol mechanics, tokenomics rationale, governance procedures, and roadmap milestones creates informed holders who understand what they own and why. Shallow marketing that emphasizes price predictions and "moon" rhetoric attracts speculators who disappear during downturns. The labor investment required to produce quality educational content is substantial, but the community quality difference is stark.

教育內容對社群建設遠勝於炒作。詳細說明協議運作、代幣設計原理、治理流程、發展路線圖嘅文章,會造就明白自己持有甚麼、為何持有的社群。相反,只會吹捧目標價、喊「to the moon」的宣傳,只吸引投機者,市況差就全部消失。雖然生產高質素教育內容非常花人力,但建立出來的社群質素有天淵之別。

Ambassador programs scale community efforts beyond what core teams can manage. Effective programs recruit engaged community members, provide them resources and training, reward meaningful contributions, and create structured pathways for increasing responsibility. Poor programs pay people to shill on social media without providing real value. The distinction lies in whether ambassadors genuinely believe in the project or simply monetize their audience.

大使制度可將社群拓展規模至團隊以外。成效好的制度,會招募積極參與的社群成員、提供資源及培訓、獎勵有意義貢獻,並設有晉升階梯。失敗的大使計劃則只是出錢請人喺社交媒體亂吹亂噏,無實質價值。重點分別係大使本身有無認同項目,抑或牌面上只係賺 audience 錢。

AMAs (ask-me-anything sessions) provide direct dialogue between teams and communities. When done well, they demonstrate transparency, address concerns proactively, and build personal connections

AMA(問我任何問題)環節可建立團隊與社群之間直接對話。運作得好,可以展現高透明度、主動回應疑慮,建立個人連結。between founders and supporters. When done poorly, they become echo chambers where softball questions receive marketing responses while difficult questions go unasked or unanswered. Teams should welcome challenging questions and provide honest, thoughtful responses even when answers are "we don't know yet" or "we made mistakes and here's how we're fixing them."

創辦人同支持者之間嘅交流。如果做得唔好,就會變咗做自我讚美嘅回音倉,入面淨係有啲軟性、冇深度嘅問題同市務回應,而啲難問或尷尬嘅問題淨係無人問,或係永遠無人回應。團隊應該歡迎挑戰性問題,並且提供誠實又有思考嘅答案,就算答案係「我哋仲未知道」或者「我哋出咗錯,依家咁去改善」。

Discord and Telegram channels require active moderation to prevent scams, manage FUD (fear, uncertainty, doubt), and maintain productive conversations. Understaffed channels become spam-filled wastelands. Over-moderated channels suppress legitimate criticism and create cultish environments where only cheerleading is tolerated. The balance requires clear community guidelines, consistent enforcement, and moderators empowered to use judgment rather than following rigid rules.

Discord同Telegram群組要有積極管理,先可以防止騙案、處理FUD(恐懼、不確定、懷疑),同時保持有建設性嘅交流。如果人手唔夠,就會變成充滿垃圾訊息嘅死城;但太過嚴格管理又會壓抑合理批評,搞到成個群組好似邪教,只容許人無腦打氣。要搵到平衡,必須有清晰社群守則、一致執行,同時授權管理員用判斷力,而唔係死跟規則。

Twitter/X remains dominant for crypto communication despite platform chaos and changing ownership. Projects need consistent voice, regular updates, and engagement with both supporters and critics. The temptation to respond defensively to criticism or ignore negative feedback should be resisted. Public acknowledgment of problems and clear communication about remediation builds more trust than pretending everything is perfect.

雖然而家Twitter/X平台本身亂晒大籠又轉手,但仍然係加密貨幣圈主要嘅溝通渠道。項目團隊要保持一致立場、定期更新,亦要同支持者同批評者都交流。要抗拒見到批評就防守性回應,或者直接無視負評嘅衝動。正面承認問題同清楚講點樣解決,會比假扮冇事更能建立信任。

Nansen, CoinGecko, and LunarCrush provide analytics on community health indicators. On-chain metrics like holder distribution, transaction patterns, and wallet behaviors reveal whether community is concentrated among few large holders or widely distributed. Social metrics including sentiment analysis, engagement rates, and follower growth distinguish authentic communities from bot-inflated numbers. Projects should monitor these indicators and use them to guide community strategy rather than treating community building as unmeasurable art.

Nansen、CoinGecko同LunarCrush等平台提供社群健康指標分析。鏈上數據例如持幣分布、交易模式同錢包行為,可以睇到社群係咪集中喺少量大戶定分散。社交媒體數據包括情緒分析、互動率同追蹤人數成長,分得出真社群定係bot堆數。項目團隊應該主動監測呢啲指標,據此調整社群策略,而唔係覺得建設社群淨係靠感覺冇得量度。

Arbitrum exemplifies sustainable community building. The project spent years developing technology and engaging developers before token launch. The March 2023 airdrop rewarded actual protocol usage over nine months across multiple criteria, filtering for genuine users. Post-launch governance actively involves community in protocol decisions. The result is a community that remained engaged through bear market conditions because members identified with the protocol rather than just the token.

Arbitrum係可持續社群建設嘅好例子。個項目用咗幾年時間發展技術同凝聚開發者先至推出代幣。2023年3月嘅空投獎勵真正有用Protocol、滿足多項標準嘅用戶,有效過濾咗水分。推出代幣後,治理都持續積極邀請社群參與協議決策。結果就係,即使熊市都仲有活躍成員,因為大家對個protocol有歸屬感,唔係淨係貪代幣。

Contrast this with countless projects that launched with massive social media followings, conducted hyped airdrops, then watched communities evaporate as token prices declined. The pattern repeats: initial spike, rapid exodus, ghost town. The underlying cause is the same: community was never real, just a collection of mercenaries attracted by extraction opportunity rather than genuine belief.

反觀一大堆項目,出場時有好多social media粉絲,做大規模空投造勢,結果代幣價一跌,全社群即散晒水。模式都一樣:頭先爆、好快走、剩低死城。根本原因一樣——呢啲所謂社群,其實只係一堆見有著數就嚟搵快錢嘅傭兵,冇真正信念。

Community building cannot be outsourced. Marketing agencies can execute tactics, but authentic communities coalesce around founders and core contributors who demonstrate commitment, competence, and genuine care for participant experience. There is no shortcut or substitute for the human connection that transforms users into believers.

建立社群唔可以外判。市務公司可以搞策劃,但真正有生命力嘅社群,一定係圍繞啲有承諾、有能力、真心關心參加者體驗嘅創辦人同核心團隊。冇捷徑、更冇東西可以取代嗰種人情味——正正係佢,將用戶變成信徒、粉絲。

From a practical marketing standpoint, as outlined in a comprehensive token launch playbook: "Most crypto startups have a core product and a token - do not confuse the two. Your product likely fixes a problem, adds value to the user, and would probably be used without a token." The key is building genuine product-market fit first, then using the token to amplify growth rather than substitute for weak fundamentals.

由實務市務角度,正如一份詳細講token launch嘅營銷指南[提到]: 「大部分加密初創都有個核心產品同一隻token——唔好混淆兩者。你產品本身多數解決某個問題,對用家有價值,冇token都有人用。」重點係要先做到真產品市場契合(product-market fit),之後至用token推動增長,而唔係用token去掩飾基礎唔扎實。

Technical Readiness: Audits, Infrastructure, and Stress Tests

技術準備:審計、基礎設施同壓力測試

Token launches are fundamentally technical events that require robust infrastructure, thoroughly audited code, and proven ability to handle real-world usage. Yet many projects treat technical preparation as secondary to marketing and fundraising, resulting in preventable failures that destroy community trust and token value simultaneously.

發行代幣本質上係一個技術性質好強嘅事件,必須要有穩陣嘅基礎設施、已審計嘅代碼,仲要證明到足夠應付現實世界流量。但好多項目就將技術準備排後於市場推廣同集資,結果就有一啲本來唔應該出現嘅大型事故,令社群信心、代幣價值一次過瓦解。

Smart contract audits represent the baseline requirement, not optional luxury. Industry experts consistently emphasize that security must be baked in from the start. As noted in comprehensive token development guidance: "In 2025, rug pulls, exploits, and contract bugs still plague the industry. A single flaw can destroy user trust and investor confidence. This is why conducting a third-party smart contract audit is no longer optional - it's mandatory for any serious token launch." Reputable firms - CertiK, Trail of Bits, OpenZeppelin, ConsenSys Diligence - employ experienced security researchers who systematically analyze code for vulnerabilities including reentrancy attacks, integer overflows, access control failures, and logic errors. A single undiscovered vulnerability can enable exploits that drain protocol treasuries or manipulate token supplies.

智能合約審計係基本要求,唔係奢侈品。行內專家一直強調,安全要由Day 1開始落實。正如[有指],去到2025年 rug pull、被人攻擊或者合約臭蟲,仲係困擾緊業界。一粒漏洞就可以摧毀用戶同投資者信心,所以嚴肅對待token launch,一定要有第三方智能合約審計,唔再係可有可無。信譽良好嘅公司——CertiK、Trail of Bits、OpenZeppelin、ConsenSys Diligence 等——會由資深安全專家徹底分析漏洞,例如重入攻擊(reentrancy)、整數溢出、權限控制失效、邏輯錯誤等等。一個未發現嘅漏洞都可以導致協議金庫俾人掏空,或者token供應畀人操控。

The Nomad Bridge hack in August 2022 illustrates audit limitations. Despite passing audit, a critical vulnerability allowed attackers to withdraw $190 million. The Wormhole bridge lost $320 million in February 2022 after exploiters discovered flaws in signature verification. Mango Markets suffered a $110 million exploit in October 2022 through oracle manipulation that audit did not anticipate. These incidents demonstrate that audit does not guarantee security, but lack of audit virtually guarantees eventual compromise.

2022年8月Nomad Bridge俾人黑走1.9億美金就係審計有限度嘅例子:明明過咗審計,但嚴重漏洞都冇捉到。同年2月Wormhole bridge因為簽名驗證有錯失,俾人偷走3.2億美金。Mango Markets則係2022年10月俾人玩oracle manipulation走咗1.1億,連審計都估唔到。呢啲事件反映:審計唔等於百分百安全,但無審計就等於遲早出事。

Multiple audits from independent firms provide more confidence than single assessments. Different auditors bring different perspectives and methodologies. Code that satisfies one firm's review may contain vulnerabilities that another identifies. The cost - typically $50,000 to $200,000 per audit depending on code complexity - represents essential infrastructure investment rather than optional expense.

多間獨立公司做重複審計,自然比一間幫你睇一次放心。唔同審計師眼光、方法各異,一間過咗嘅code,第時另一間可能會搵到隱藏漏洞。審計收費一般5萬到20萬美金一鑊,視乎代碼複雜度,但呢筆係基礎設施投資,不應視為可有可無開支。

Bug bounty programs complement formal audits by crowdsourcing security review to broader researcher communities. Programs on platforms like Immunefi or HackerOne offer rewards for vulnerability discovery, creating economic incentive for ethical disclosure rather than exploitation. Successful programs offer meaningful bounties - major vulnerabilities should command six-figure rewards - to compete with black market exploitation rewards that can reach millions.

漏洞懸賞計劃可以補足正式審計,將安全檢查外包比更大社群嘅安全研究員。Immunefi、HackerOne這類平台,發現漏洞有賞金,等研究員有動力正當報告而唔係私下濫用。成功計劃會針對嚴重大漏洞,提供六位數獎金,先吸引得到啲專家,因為黑市價分分鐘過百萬美金。

Infrastructure testing often receives insufficient attention despite being critical to launch success. RPC node capacity must handle expected transaction loads with margin for spikes. A successful token launch generates far more activity than typical usage - claim transactions, trading activity, and curious users all converge simultaneously. Insufficient infrastructure causes timeouts, failed transactions, and frustrated users.

基礎設施測試經常唔被重視,但其實係launch成功關鍵。RPC節點供應要頂得住預計交易量,仲要預留突發冇爆升。代幣launch一刻啲活動會係平時幾倍,有人claim、有人trade、亦有大批新手同圍觀者一齊湧入。基礎設施未夠就會timeout、交易失敗,搞到用戶嬲嬲豬。

Load testing simulates heavy usage before real users arrive. Synthetic tests generate thousands of simultaneous transactions to identify bottlenecks, measure response times under stress, and verify that systems degrade gracefully rather than catastrophically when capacity limits are exceeded. Teams should test at multiples of expected launch day activity because real-world usage invariably exceeds projections.

負載測試要預早做,模擬重型流量。要用虛擬測試產生幾千個並發交易,搵出瓶頸、壓力下反應幾多慢,驗證容量爆咗之後係咪都唔會死機。團隊要測多幾倍於預計max用量,因為現實永遠比預算誇張。

Token bridge security deserves particular attention for projects deploying across multiple chains. Bridges represent persistent attack surfaces that require continuous monitoring and security updates. Each bridge integration introduces dependencies on external systems whose security the project cannot fully control. Teams should carefully evaluate which chains genuinely benefit their use case versus which represent speculative expansion that increases attack surface without corresponding value.

多鏈上token bridge安全尤其要小心,因為橋永遠都係被人打主意位,要不斷監測同升級。每加一條橋,就多一份對外依賴,啲安全未必由項目自己單方面把關。團隊應分析清楚,邊條鏈真係有用,邊條純粹為炒作,增加風險無帶到價值。

Integration testing with exchanges and market makers prevents launch day chaos. Does token contract format match exchange expectations? Do transfer mechanics work correctly? Are decimal places handled consistently? These mundane details cause real problems when discovered during live trading rather than test environments. Coordination calls between technical teams several weeks before launch identify and resolve compatibility issues.

與交易所、市場莊家嘅整合測試,可以避開launch嗰日亂晒龍。Token contract格式同交易所要求一唔一樣?轉帳細節有無bug?小數點位處理有無統一?啲瑣碎細節如果當日先發現會搞到大件事,事前幾個星期就要後台技術團隊一齊協調、解決所有兼容性問題。

Frontend user experience receives less attention than backend infrastructure but determines user success rates. If claiming tokens requires multiple transaction confirmations, each step represents dropout opportunity. If error messages provide no actionable guidance, users give up rather than troubleshoot. If gas estimation fails, users either overpay or have transactions fail. Polished user experience - clear instructions, helpful error messages, transaction status tracking - dramatically improves launch success.

前端用戶體驗好多時被忽略,但其實決定到幾多人用得成。如果claim token要click好多次,每一步都有人走佬;如果出錯message唔清楚,又唔教人點做,咁啲人直接放棄唔會慢慢試;Gas計錯價,要么用戶比貴gas,要么交易爆掉。完善嘅用戶體驗,例如有清晰指示、友善錯誤提醒、交易狀態追蹤,可以大幅提升launch成功率。

Monitoring and incident response capabilities must be in place before launch. When problems occur - and they will - how does the team detect issues, coordinate response, communicate with users, and deploy fixes? A documented incident response plan, pre-established communication channels, and assigned roles prevent chaos when seconds matter. The difference between quickly resolving a problem and letting it spiral often determines whether the project maintains credibility.

launch前,一定要set好監控同事故應變計劃。總會出事——點先搵到?團隊點協調、點通知用戶、點推fix?應該預先有書面事故應對章程,有預設溝通channel、分配好職責先可以面對秒殺時間下嘅混亂。問題能否即時解決定任由惡化,分分鐘決定個project聲譽存亡。

Rollback mechanisms require consideration despite philosophical resistance from decentralization advocates. If critical vulnerability is discovered hours after launch, can contracts be paused? Can migrations to corrected contracts occur without starting over? The tension between immutability principles and practical ability to respond to discoveries has no perfect resolution, but having options beats discovering during crisis that no remediation path exists.

就算去中心化信徒唔多認同,都要考慮rollback機制。萬一launch後幾粒鐘就發現重大漏洞,可唔可以暫停合約?可唔可以遷移去修正過嘅合約唔洗打掉重做?永續原則同實際反應能力,唔會有完美答案,但總比臨危先發現原來乜後路都冇好。

Third-party dependencies should be catalogued and monitored. Does the token contract depend on oracles? What happens if those oracles malfunction? Does frontend rely on specific RPC providers? What if they experience downtime? Identifying single points of failure and establishing backup providers creates resilience.

第三方依賴要有清單,並持續監測。例如token合約有冇依賴oracle?oracle壞咗會點影響?前端有冇pegged死某啲RPC provider?啲provider落咗機又如何?搵到啲單點失效source,早做backup先夠穩定。

Technical preparation cannot be rushed. Teams should allocate months for 技術準備切忌急就章。團隊應預留數個月時間……security review, infrastructure building, testing, and bug fixing. Compressed timelines lead to shortcuts that create vulnerabilities. The market will not reward teams for launching on arbitrary deadlines if launches are plagued by technical failures. Better to delay launch than to execute poorly and damage reputation permanently.

安全審查、基礎設施建設、測試同修正漏洞。時間壓縮會令人行捷徑,造成安全漏洞。市場唔會因為團隊喺任意死線上線而獎勵你,如果發佈時出現技術故障,咁只會帶嚟損失。同其草草了事,永久損害聲譽,倒不如推遲發佈。

Timeline and Coordination: How to Sequence the Launch

Token launches require coordinating across technical, legal, marketing, and partnership workstreams with precise timing. The typical pre-launch timeline spans three to six months, though complex projects may require longer preparation. Understanding critical path dependencies and sequencing decisions prevents costly delays or rushed execution.

Token發佈需要協調技術、法律、市場推廣、合作夥伴等多條工作流程,而且要精確配合時間。通常Token發佈前嘅籌備期約三至六個月,複雜項目可能要更長時間。瞭解關鍵路徑依賴同步順序,有助避免貴重嘅拖延或倉促執行。

As emphasized in a16z crypto's operational guidelines: "The first thing to know when launching a token is that it takes time and teamwork. The process involves several types of stakeholders - protocol developers, third party custodians, staking providers, investors, employees, and others - all of whom must be on the same page when preparing for the creation and custody of a new digital asset."

正如a16z crypto嘅操作指引所強調: 「發行Token最重要嘅認知就係需要時間同團隊合作。個流程包含多種持份者——協議開發者、第三方託管人、質押服務供應商、投資者、員工等等——全部人都要同步,齊心協力準備新數位資產嘅創建同託管。」

The timeline begins at T-minus six months with tokenomics finalization and legal structure establishment. Teams must complete token design, model supply and demand dynamics under various scenarios, and incorporate entities in appropriate jurisdictions. Legal structure determines tax treatment, regulatory obligations, and ability to engage with service providers. These foundational decisions constrain all subsequent choices, so rushing them creates problems that cannot be fixed later.

計劃線由T減6個月開始,包括最終確認Token經濟模型同建立法律架構。團隊要完成Token設計,模擬唔同情境下嘅供需動態,同埋喺合適地區註冊實體。法律結構會決定稅務處理、監管責任、能否同服務供應商合作。呢啲基礎決定會影響之後每個選擇,所以如果草率處理,後果就覆水難收。

Smart contract development and initial security review occur in months four through six. Teams write token contracts, vesting contracts, governance mechanisms, and any protocol-specific functionality. First pass code audits identify major issues that require redesign rather than minor fixes. This phase requires close collaboration between developers and auditors to ensure that fixes do not introduce new vulnerabilities.

智能合約開發同初步安全審查喺第4至第6個月內進行。團隊會編寫Token合約、解鎖合約、治理機制,以及協議所需功能。第一次代码審計主要識別需要重寫設計嘅重大問題,而唔係細微修正。呢階段需要開發者同審計員緊密合作,確保修改唔會帶嚟新安全隱患。

Market maker and exchange discussions begin at T-minus three months. Professional market makers require months to evaluate opportunities, negotiate terms, and deploy infrastructure. Exchanges have listing pipelines with limited capacity and their own schedules. Starting these conversations early ensures availability and prevents finding that preferred partners have no capacity for the planned launch window.

T減3個月要開始同做市商同交易所傾。專業做市商需時幾個月去評估機會、傾條款同部署基礎建設。交易所有上幣窗口同排期,所以早啲展開溝通,確保有檔期,唔會遇到理想夥伴無得配合。

Final audits, legal opinion letters, and compliance documentation consume T-minus two months. After code changes are complete, formal audits issue final reports. Legal teams prepare opinion letters on regulatory classification, draft white papers or prospectuses meeting local requirements, and confirm that all compliance obligations are satisfied. This bureaucratic phase feels slow but attempting shortcuts invites regulatory attention.

T減2個月就進入最後審計、法律意見信同合規文件流程。程式改動完成後,要正式審計同出最終報告。法律團隊要準備監管類別嘅意見書,草擬講解文件或說明書以符合本地要求,確認所有法規責任都達標。呢階段雖然官僚,但想行捷徑只會引嚟監管關注。

T-minus one month focuses on marketing acceleration and community mobilization. Announcement schedules are finalized, content calendars are populated, press relationships are activated, and community calls increase frequency. The goal is generating maximum attention at launch while providing sufficient information that participants make informed decisions rather than speculating blindly.

T減1個月係推廣加速同社群動員。公告排程落實、內容日曆排滿、PR媒體啟動、社群活動次數增加。目的係發佈時引最大注意力,提供足夠資訊等持份者理性參與,唔係胡亂投機。

The final week before launch requires military precision. All systems undergo final testing. Exchange integrations are verified. Market makers confirm readiness. Legal teams provide clearance. Communication plans are rehearsed. Backup procedures are validated. War rooms are established with representatives from every function standing by to address issues.

最後一周要軍事化準確。所有系統最後測試,交易所整合驗證,做市商確認準備就緒,法律團隊清場,溝通方案預演,備用流程驗證。戰情室設立,各部門代表隨時應對突發狀況。

Launch day itself is both climax and anticlimax. If preparation was thorough, the actual launch is mechanical execution of tested procedures. Teams monitor systems, track performance metrics, communicate updates, and respond to inevitable surprises. If preparation was inadequate, launch day is chaos - systems fail, partners are not ready, community is confused, and price action reflects the disorder.

發佈日本身高潮又平靜。如果準備充足,只需機械性執行早已測試好嘅程序。團隊會監察系統、追蹤指標、發送更新、應對突發。如果準備唔足,發佈當天就一團糟——系統出錯、夥伴未Ready、社群迷茫、價格更反映混亂。

Post-launch, the first 24 to 72 hours are critical. Initial trading establishes price discovery, community reactions determine sentiment trajectory, and technical performance either validates preparation or exposes gaps. Teams should be fully available for this period rather than treating launch as endpoint.

發佈後第一至第三日非常關鍵。初始交易會決定價格形成,社群反應主導情緒走向,技術表現亦會印證備戰有無漏洞。團隊要全程緊貼,千祈唔可以當完成發佈就落閘收工。

Cross-functional coordination cannot be overemphasized. Developers, lawyers, marketers, and business development teams often operate in silos with inadequate communication. Token launches require these functions to operate in lockstep with shared timelines, mutual dependencies, and constant information flow. Weekly cross-functional meetings in the final quarter before launch ensure alignment and surface issues before they become crises.

跨部門協調極之重要。開發、律師、推廣、商業拓展往往各自為政,溝通不足。Token發佈要各功能部門完全同步,時間表共用、依賴明確、信息流通。發佈前三個月應每週開跨部門會,確保溝通一致,盡早發現及解決潛在危機。

Buffer time should be built into timelines. Audits take longer than vendors promise. Legal opinions require multiple revision rounds. Exchange integrations reveal compatibility issues requiring code changes. Marketing assets require unexpected revisions. Building slack into schedules prevents cascading delays when individual workstreams slip.

時間表一定要預備Buffer。審計成日遲過供應商報稱,法律意見要多次修訂,交易所對接發現兼容問題又要改code,宣傳物料亦常常要臨時大改。有Buffer可以防止單一環節Delay,引發連鎖遲滯。

The temptation to rush should be resisted. Market conditions may seem perfect, competitors may be launching, or impatient investors may pressure for speed. But premature launch with incomplete preparation damages projects far more than short delays. Markets forget delays quickly. Markets never forget disastrous launches.

想急起直追嘅誘惑要忍住。即使市況好,對手出貨,投資者心急,都唔可以冒然發佈。準備不足推出,損害遠遠大過短暫拖延。市場對Delay好快會忘記,但對災難性發佈永遠唔會忘。

Common Mistakes to Avoid

Analyzing token launch failures across the 2024-2025 cycle reveals recurring patterns that teams should actively avoid. These mistakes are neither subtle nor novel, yet they persist with depressing regularity.

2024-2025輪Token發佈失敗例子顯示,有幾種錯誤團隊反覆犯,明明唔新亦唔隱晦,卻屢屢出現。

Unrealistic valuations top the list. Teams that raise at $1 billion fully diluted valuations despite minimal users, negligible revenue, and speculative roadmaps burden their tokens with mountains of overhead. Early investors who purchased at $10 million valuations naturally sell when public markets offer exits at $500 million. The resulting selling pressure overwhelms genuine demand, causing price spirals that destroy confidence. Conservative valuations that leave room for growth serve projects far better than headlines about massive raises.

高估值係榜首。啱啱啟動用戶少、收入微、規劃全靠推測,就賣十億美金全攤薄估值,令Token背上沉重包袱。早期投資者入場價只係一千萬,輪到公開市場五億美金時自然拋售,帶來龐大沽壓,需求跟唔上,價格瀑布式下跌,一鋪打沉信心。保守估值、留空間俾增長,對項目遠勝高調「天價融資」。

Insufficient liquidity provision creates fragile markets where single transactions cause violent price swings. Teams that launch with thin order books discover that excited community members cannot buy tokens without pushing prices to unsustainable levels, while small profit-takers crash prices precipitously. Adequate liquidity - through market-making arrangements, protocol-owned liquidity, or treasury-seeded pools - enables price discovery without chaos.

流動性提供不足,導致脆弱市場,一宗交易就大幅波動。初上市訂單簿薄得可憐,社群成員想買都要迫高價,小沽貨就秒殺價。足夠流動性(用做市協議、協議自有流動池或財庫資金池)可避免混亂,支持合理價格發現。

Community overhype without substance generates expectations that reality cannot match. Marketing that promises revolutionary technology, transformative economics, or exponential growth creates disappointment when delivery is merely incremental progress. Better to underpromise and overdeliver than to set expectations that guarantee disillusionment.

社群炒作無實質,「只許州官放火」。市場大灑革命科技、顛覆性經濟、指數級增長,而最終只係逐步細改,自然大失所望。寧願「少講多做」都唔好畫大餅,否則保證幻滅。

Token unlock cliffs create predictable dump events that sophisticated traders exploit while retail holders suffer losses. Projects that release 50 percent of supply in single unlocks watch prices crater as recipients race to exit. Linear vesting over extended periods distributes pressure evenly. Coordinating unlocks with protocol milestones ties supply increases to demand catalysts.

Token解鎖懸崖,變咗專業炒家專利,散戶卻蝕底。一次過解鎖50%供應,所有收錢者都急急拋售,價格崩潰。長期線性釋放量會平均分散壓力,連結Unlock同協議重要發展,可令供應增加成為需求催化劑。

Insider dumps destroy trust permanently. When team members or early investors sell significant positions immediately after lock-up expiry, community interprets this as lack of confidence. Even if sales are planned treasury management, the optics are devastating. Teams should communicate sale intentions proactively, structure disposals gradually, and demonstrate continued commitment through remaining holdings.

內部人拋售一鋪失信。解鎖完團隊成員或早期投資者即刻拋貨,社群只會覺得你無信心。即使係財務安排,都係觀感極差。團隊應該主動披露出售意圖,漸進式減持,同時持續持有大部份倉位以表誠意。

Overreliance on single exchanges or market makers creates fragility. Projects entirely dependent on Binance for liquidity discover that exchange technical issues, regulatory complications, or shifting priorities can eliminate trading infrastructure suddenly. Diversification across exchanges, venues, and service providers provides resilience.

過份依賴單一交易所或做市商會帶嚟脆弱。全靠Binance流動性,萬一出現技術、監管、或平台策略變動,交易即時癱瘓。多交易所、場外、分多供應商可增強抗壓力。

Poor communication during crisis situations compounds problems. When exploits occur, when markets crash, when roadmaps slip, transparency and rapid acknowledgment maintain trust better than silence or spin. Communities forgive mistakes but rarely forgive deception or negligence.

遇事失溝通只會雪上加霜。被攻擊、價格暴跌、路線延期時,透明同快回應比沉默或兜圈好多。社群會容許失誤,唔會原諒掩飾或失職。

The failures carry common DNA: teams prioritized short-term metrics over long-term sustainability, valued marketing over fundamentals, rushed preparation to meet arbitrary deadlines, and failed to model downside scenarios honestly. Success requires inverting these tendencies - building genuine value, managing expectations conservatively, preparing thoroughly, and planning for adversity.

失敗有共通「基因」:只顧短線,唔顧可持續性,重宣傳過重內涵,為應死線而亂準備,對下行風險唔認真。要成功就要反過來——建立真正價值、期望管理保守、周全準備、預先規劃逆境。

The Future of Token Launches: Professionalization and Transparency

The token launch landscape in 2025 looks dramatically different from 2021's speculative frenzy or even 2023's cautious recovery. Professionalization has accelerated, driven by regulatory frameworks, institutional participation, and hard lessons from previous cycles.

2025年Token 發佈生態完全唔同2021年炒作狂潮,或者2023年謹慎復甦。專業化步伐加快,一方面係法規逐步完善,亦多咗機構參與,加上過往週期痛苦教訓,大家都成熟咗。

On-chain launch frameworks are emerging as alternatives to traditional launchpad models. CoinList OnChain, Base Launch, and similar platforms conduct token distributions entirely through smart contracts, eliminating central intermediaries while maintaining compliance and fairness mechanisms. These systems use verifiable on-chain credentials to establish participant eligibility, conduct price discovery through algorithmic auctions, and distribute tokens programmatically. The transparency is absolute - anyone can verify that distributions occurred as specified and that no preferential treatment occurred.

鏈上發佈框架應運而生,成為傳統Launchpad模式之外新選擇。CoinList OnChain、Base Launch等平台完全用智能合約分發Token,冇中間人,但保持合規同公平。系統用鏈上資格證書確保參與者身份,透過機制競拍定價,程式化分發。全程開放透明,任何人都可以查核過程,確保無特權。

Regulatory compliance is shifting from grudging necessity to

(內容未完,如需繼續請告知。)competitive advantage. Projects that operate transparently within legal frameworks increasingly access institutional capital unavailable to regulatory arbitrageurs. MiCA's implementation across the EU creates standardized rules that reduce uncertainty for compliant projects while increasing costs for those attempting to operate in gray areas. The U.S. regulatory environment, while less clear than Europe's, is also maturing with ongoing SEC enforcement and potential legislative clarity.

競爭優勢。能夠於合法框架下透明運作的項目,愈來愈容易獲得監管套利者難以觸及的機構資本。MiCA 在歐盟的落實,為合規項目帶來標準化的規則,減少不明朗因素,同時提高灰色地帶運作項目的成本。美國的監管環境雖然未至於像歐洲般明確,但隨着證監會持續執法及立法逐漸明朗化,亦正逐步成熟。

Data transparency and analytics are becoming prerequisites for serious consideration. Projects that publish real-time on-chain metrics, conduct independent tokenomics audits, and provide verifiable evidence of protocol usage earn trust that marketing cannot manufacture. Platforms like Dune Analytics, Nansen, and Token Terminal enable anyone to verify claims about users, revenue, and activity. In this environment, projects cannot fake success - numbers speak for themselves.

數據透明度和分析已成為認真考慮的先決條件。能夠公開實時鏈上數據、進行獨立代幣經濟審計,以及提供可驗證協議使用證據的項目,可以建立宣傳無法偽造的信任。像 Dune Analytics、Nansen 和 Token Terminal 這些平台,令任何人都可以驗證有關用戶、收入和活動等聲稱。在這種環境下,項目無法造假成功——數字是真相。

The rise of on-chain reputation systems creates accountability that previous cycles lacked. Team members whose projects fail or who engage in questionable practices carry that history across future ventures. Protocols that deliver on promises build reputations that transfer value to subsequent projects. These dynamics incentivize long-term thinking and responsible behavior while punishing short-term extraction.

鏈上信譽系統的興起,帶來了以往周期所缺乏的責任制。團隊成員如其項目失敗或涉及可疑操作,這些紀錄都會隨他們於未來項目帶走。有兌現承諾的協議,能累積信譽並將價值延展至之後的項目。這些動態促使項目傾向長遠思考和負責任行事,同時懲罰短期掠奪行為。

Token launches are converging toward a recognizable playbook: conservative tokenomics that prioritize sustainability over hype, comprehensive legal preparation that enables operation in major markets, multi-month community building that creates genuine believers rather than mercenary farmers, professional service providers that deliver infrastructure rather than smoke and mirrors, and transparent communication that earns trust through honesty rather than promising moons.

現時代幣發行漸漸走向一套清晰流程︰保守的代幣經濟學設計以可持續發展為先而非單靠炒作、全面的法律準備令項目能於主要市場運作、展開多月的社群建設,培養真實信仰者而非投機農夫、聘用專業服務方提供基礎設施而非虛有其表,以及以誠信而非虛假承諾建立信任的透明溝通策略。

The playbook does not guarantee success - market conditions, competitive dynamics, and execution quality still matter enormously. But following the playbook dramatically increases odds while ignoring it virtually guarantees problems.

這套流程並不能保證成功——市場狀況、競爭格局和執行質素仍然至關重要。但遵從這些做法能大大提升成功機會,忽視則幾乎必定出現問題。

Looking forward, the professionalization trend seems irreversible. The marginal token launch in 2026 will involve more legal review, more sophisticated tokenomics modeling, more rigorous technical preparation, and more professional service providers than its 2021 equivalent. This creates higher barriers to entry that filter low-effort projects while enabling better-prepared teams to stand out.

展望將來,專業化趨勢似乎已無法逆轉。到2026年,即使是一個邊緣的代幣發行,都會涉及比2021年更多法律審查、更精細的代幣經濟建模、更嚴謹的技術準備,以及更多專業服務配合。這不但提高入場門檻篩走敷衍項目,亦讓準備充足的團隊更易突圍。

The question facing founding teams is whether they treat token launches as speculative events or strategic operations. Those who understand the difference and prepare accordingly will benefit from institutional tailwinds, regulatory clarity, and market evolution that rewards substance over hype. Those who cling to previous cycle playbooks will struggle in an environment that no longer tolerates shortcuts.

創辦團隊現時需要思考的,是將代幣發行當作投機活動還是戰略行動。明白分別並作好相應準備的團隊,能受惠於機構推動、監管清晰和市場趨勢,獲得以實力而非炒作為本的回報。仍舊死守舊有套路的,則難以於這個不再容忍走捷徑的環境立足。

The next wave of successful tokens will come from disciplined teams that understand what must happen before the token drops, prepare meticulously across every dimension, coordinate seamlessly across functions, and execute launches that reflect genuine value rather than manufactured excitement. The market has matured. Have you?

下一波成功的代幣,將來自有紀律的團隊︰他們明白代幣發行前的必備條件、每個細節均精心準備、部門間緊密協作,並實踐真正由價值驅動(而非炒作造勢)的發行模式。市場已經成熟——你準備好了嗎?