以太坊價格於 2025 年強勢爆升,近日衝上約 $4,600,達到自 2021 年 12 月以來新高。呢個急升再次令全球第二大加密貨幣成為焦點,同時引發一個熱門問題:以太坊係唔係已經帶領緊新一輪山寨幣季節?隨住機構資金湧入以太坊基金 ,零售交易亦急增,市場情緒樂觀,但到底係真係山寨幣熱潮開始,定純粹只係「以太坊季節」—一場主要聚焦於 ETH 本身嘅單點爆升?今次文章會深入分析以太坊近期跑贏大市嘅各種證據同背景,檢視佢喺加密市場周期入面嘅角色,並探討其對其他山寨幣及以太坊 Layer-2 生態嘅潛在影響。

「山寨幣季節」通常指比特幣以外其他加密貨幣(基本上係所有非比特幣幣種)出現大幅升幅,並持續跑贏比特幣嘅時期。呢啲階段多數係資金由比特幣輪動去風險較高嘅幣種、價格全面上升、投資者一窩蜂追逐下個「10X 大牛」。傳統上,山寨季節多數喺比特幣帶動回調、價格開始穩定時萌芽,因為交易者會努力搵更高回報機會。

目前,隨著比特幣創新高突破 $100,000 後稍作冷卻,已為山寨幣爆發提供條件。最大山寨幣以太坊已經呈現出強烈牛市訊號—從鏈上交易創新高到機構參與度史無前例—顯示佢有力成為帶動今波升勢主角。但究竟成個山寨市場係咪真係入緊「快車道」,定只係以太坊一枝獨秀?更重要嘅係,如果真係由以太坊領跑,會如何牽動其他部分生態,特別係高速增長嘅 Layer-2 網絡?

文內會以 2025 年現況為中心,亦會總結過往市況輪動經驗。我哋將會細分討論推動以太坊爆升嘅關鍵因素(如 ETF 資金流、企業應用)、以太坊網絡現狀,以及 ETH 如何成為去中心化金融「支柱」嘅新敘事。亦會檢視山寨季節初現嘅信號:比特幣市值佔比 有所下滑,一些老山寨幣突然挑起復甦熱潮—呢啲都係輪換徵兆。不過亦要小心潛在風險,包括以太坊創辦人 Vitalik Buterin 本人對機構槓桿過重的預警,及現時樂觀情緒可能面臨的回調。最後,隨著以太坊同 Layer-2 解決方案日益緊扣,文章會討論「以太坊季節」對 Arbitrum、Optimism 及 Base 等 Layer-2 網絡有咩啟示,呢啲網絡而家已處理愈來愈大比例嘅交易量。

2025 年以太坊強勢回歸:重登歷史高位邊緣

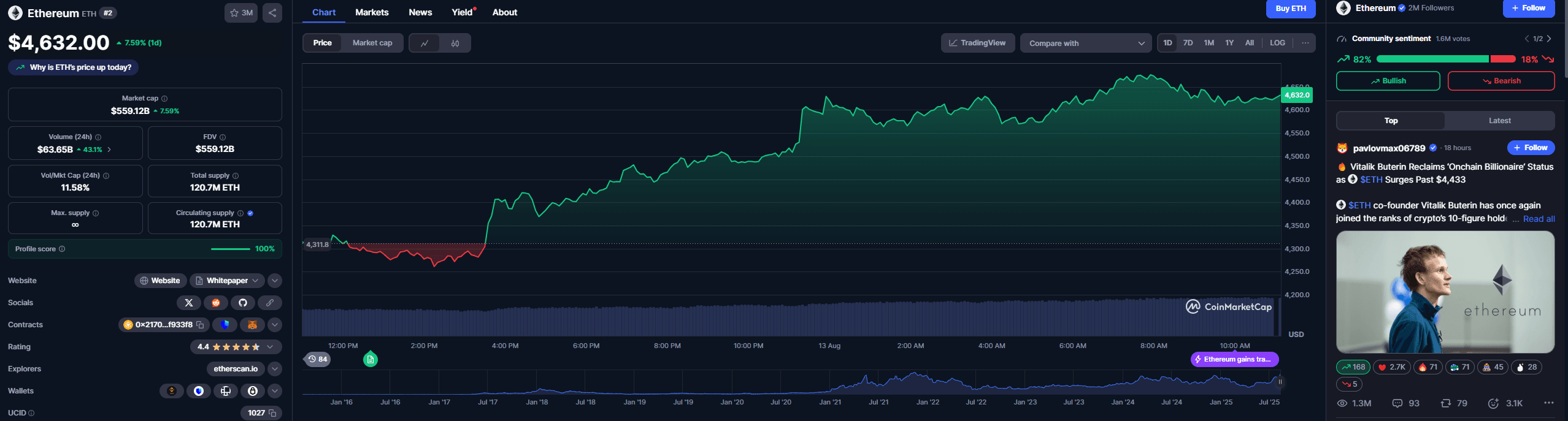

歷經 2022-2023 年熊市洗禮後,以太坊過去一年強勢反彈。2025 年 8 月初,ETH 首次突破 $4,000,在短短幾日內又迅速越過 $4,200 及 $4,500。去到 8 月中,ETH 一度觸及約 $4,600,距離 2021 年 11 月全歷史高位約 $4,800 只差幾個百分點。作對比,熊市最低時以太坊曾下跌至近 $1,000,即今次反彈漲幅達四倍以上。強勢升勢夾雜著大量空頭回補浪潮:當價格急升,睇淡 ETH 嘅交易員需被迫平倉,加劇升浪。在不足 48 小時內,交易所超過 $2 億美元嘅 ETH 空單被清算,進一步推高價格。「ETH 熊仔俾人屠殺緊!」有分析師咁講,突如其來的急升令淡友措手不及。呢啲連鎖式清算,唔單只印證升勢威力,更反映市場情緒逐漸傾向以太坊。

好多數據指標都反映以太坊重返牛市格局。交易量隨價格水漲船高:8 月 8 日,ETH 首破 $4,000 當日,主流交易所成交量接近平時日均三倍,顯示零售及機構興趣都再度集中於以太坊。此外,鏈上數據顯示以太坊網絡使用量創新高,說明今次升市並非單靠炒作推動,而係有實際需求主導。2025 年 7 月,以太坊區塊鏈全月錄得 4,667 萬宗交易—創下歷史新高。換句話講,即使同 2021 年末最火熱時期比,現時以太坊交易活躍程度都更勝以往。以美元計,2025 年 7 月以太坊鏈上總結算量高達 $2,380 億,比上個月大升七成。無論係用戶於去中心化交易所交易、轉穩定幣、定係同智能合約互動,以太坊每月要處理的經濟價值都驚人,反映生態極為活躍。

重要的是,呢種爆發式增長未有再次拖垮網絡導致手續費飆升—以往牛市時曾出現過。2025 年 7 月及 8 月初,以太坊平均手續費大致介乎 $0 至 $4,只有喺高峰時曾暫時升到 $6–$8。相比 2021 年牛市最火熱時,單宗交易動輒收費幾十甚至百幾美元,今次費用明顯溫和。現時較低交易費,反映出以太坊擴容升級與 Layer-2 技術發揮作用(詳見後文)。事實上,以太坊區塊平均只用到一半(即約 50% gas 用量),多得協議升級和鏈外擴容,令網絡尚有明顯剩餘承載力。呢個現象令網絡可以承接更多增長,用戶唔會立即受高昂用費壓力影響。

另一個凸顯市場信心嘅指標係被鎖定而非被拋售嘅 ETH 數量。自以太坊 2022 年完成「合併」遷移至權益證明(proof-of-stake)後,持幣人持續將 ETH 質押保障網絡並賺取回報。至 2025 年 8 月,全網已有超過 30% 總供應量的 ETH 被質押於存款合約,僅係數年間激增,對應超過 1.2 億枚 ETH、合計市值大於 $1,500 億美元。質押意味呢啲幣短期唔易流通,造成市場供應收緊,有助推高價格。與此同時,交易所現存可售 ETH 持續下跌,跌至 1,530 萬枚,為 2016 年以來最低,即係現時每八枚以太坊,就有一枚被質押;而交易所冷熱錢包持幣比例,亦已降至九年新低。呢種組合說明投資者傾向長期持有,不論係賺取質押回報或單純等升浪都好,不急於套現沽貨。咁樣會大幅減少沽壓,形成更緊供需平衡,有助支撐升幅。Cointelegraph 分析師亦指出,上述鏈上活躍度提升、交易所供應低企及質押參與高,都是 ETH 牛市信號。

以太坊現在出現咗所謂「鏈上財富效應」— ETH 漲價拉高投資者持倉市值,大家再將利潤部分投向其他幣種,令升勢漫延至更廣山寨市場。例如 Litecoin、Solana、Chainlink 等中型幣近期同步錄得雙位數升幅。但探討山寨板塊前,先要理解今次以太坊爆升嘅真正原因—今次漲市唔係憑空出現,背後射入咗多項基本因素,同大環境轉變有關。下一節會拆解 ETF 資金流入、大戶敘事轉型等,如何令以太坊成為 2025 年最有睇頭主流幣種。

是咩推動以太坊爆升?機構資金、新敘事等多方合力

多種因素交匯推動以太坊於 2025 年步步高升,反映主流認可同應用價值與日俱增。最明顯嘅係近期機構資金大舉流向以太坊。2025 年 8 月,美國掛牌以太坊 ETF 出現破紀錄資金流入,巨額資本爭相部署 ETH。單單於 2025 年 8 月 11 日,以太 ETF 淨流入高達 $10.1 億美元,係史上單日最高。作一個比較,當日比特幣基金只錄得 $1.78 億淨流入,遠不及 ETH。黑石(BlackRock)iShares Ethereum Trust 一日吸資約 $6.4 億,Fidelity Ethereum 基金再吸 $2.77 億。總括來說,美國以太 ETF 推出不足一年,資產總額已超 $250 億美元,約等於以太坊總市值的 4.8%。 explosive interest from institutions in an Ethereum investment vehicle would have been unthinkable a few years ago, when Bitcoin was the only crypto considered palatable for Wall Street.

幾年前,華爾街只覺得比特幣是唯一可以接受的加密貨幣,當時機構會對以太坊投資產品產生「爆炸性興趣」根本難以想像。

This sudden institutional pivot toward Ethereum has been driven by a changing narrative. For years, Bitcoin was king in the eyes of traditional finance, lauded as “digital gold” – a simple, compelling analogy that helped institutions get comfortable with BTC as a store of value. Altcoins, by contrast, were often viewed with skepticism. But Ethereum has increasingly differentiated itself with a coherent value proposition that big investors are starting to appreciate. If Bitcoin is digital gold, Ethereum is being touted as “the backbone of future financial markets,” thanks to its role in decentralized finance (DeFi), smart contracts, and tokenized assets. This phrasing comes straight from Bloomberg ETF analyst Nate Geraci, who observed that many in traditional finance previously underestimated Ether simply because they didn’t understand it, but that is now changing. Ethereum’s blockchain is where a huge chunk of crypto economic activity happens – from lending and borrowing to trading and issuing new tokens – so owning ETH is increasingly seen as owning a crucial piece of the infrastructure for the “digital economy”. In essence, ETH produces yield (via staking), powers transactions in a vibrant network of dApps, and even burns fees (reducing supply) with each transaction. These features make it more akin to a productive asset or a form of “digital oil” that fuels Web3 platforms, rather than just a speculative token. Such narratives have given traditional investors a new bullish thesis for Ethereum on top of Bitcoin’s store-of-value appeal.

機構突然轉向以太坊,主要源於市場說法的改變。多年來,比特幣一直是傳統金融界的王者,被譽為「數碼黃金」——這個簡單又有說服力的比喻令機構投資者更易接受 BTC 作為價值儲存工具。相反,山寨幣一直備受懷疑。但以太坊近年以清晰的價值定位脫穎而出,越來越多大型機構投資者開始欣賞其潛力。如果說比特幣是數碼黃金,以太坊則被形容為「未來金融市場的支柱」,因為它在去中心化金融(DeFi)、智能合約及資產代幣化方面的獨特角色。彭博 ETF 分析師 Nate Geraci 指出,過往傳統金融界之所以低估以太幣,純粹因為未搞清楚它的用處,如今情況正在改變。絕大部分加密經濟活動——無論是借貸、交易還是發行新代幣——都在以太坊區塊鏈發生,因此持有 ETH 開始被視為掌握着「數碼經濟」重要基建的一部分。本質上,ETH 能夠產生收益(質押獲利)、為活躍的 dApp 網絡提供動力,每次交易還會銷毀手續費(減少供應)。這些特質令它更像是一種具生產力的資產,或是推動 Web3 平台運作的「數碼石油」,而不只是一枚投機代幣。這種新敍事,為傳統投資者在比特幣以外,提供另一個看好以太坊的理由。

The data backs up this narrative shift. Consider the trend of corporate treasury adoption of Ether. A few years ago, a handful of companies (like MicroStrategy or Tesla) made headlines for holding Bitcoin in their treasuries. Now, we are seeing companies begin to hold Ethereum as a strategic asset. By August 2025, public companies and fund treasuries collectively hold over $11 billion worth of ETH on their balance sheets. This figure swelled from around $9 billion to $13 billion just in the recent rally, as the price increase boosted the value of their holdings. More firms are embracing ETH “not just as a speculative play, but as a strategic financial tool,” explains Jamie Elkaleh, an executive at Bitget Wallet. Companies see that by holding and staking Ethereum, they can earn passive yield (currently staking yields are on the order of ~5% annually) while also participating in the burgeoning DeFi economy. This is a stark contrast to holding, say, cash (which yields little) or even Bitcoin (which has no native yield unless lent out). In Elkaleh’s words, Ethereum’s appeal to corporates lies in its “foundational utility” – treasuries can put ETH to work and simultaneously help secure the network by staking. It’s a mutually reinforcing dynamic, and one that further cements Ethereum’s image as the “digital oil” lubricating the gears of new financial infrastructure.

數據亦支持這股敍事轉變。例如越來越多企業金庫開始持有以太幣。幾年前,只有像 MicroStrategy 或 Tesla 這類公司因為持有比特幣登上新聞頭條,現在則開始有公司把以太坊納入戰略資產。到 2025 年 8 月,上市公司及基金金庫合共持有超過 110 億美元的 ETH,這個數字近期由約 90 億膨脹至 130 億美元——因為 ETH 價格上升大幅推高賬面價值。越來越多公司採用 ETH「不單是投機炒賣,而是作為一個戰略金融工具」,Bitget Wallet 高層 Jamie Elkaleh 解釋。企業發現,只需持有和質押以太坊,不單獲得大約 5% 年收益的被動收入,還可以參與方興未艾的 DeFi 經濟。這跟持有現金(回報極低),甚至比特幣(除非借出,否則無本地收益)形成強烈對比。Elkaleh 形容,以太坊吸引公司入手,正正在於其「基礎效用」——公司金庫既能讓 ETH 發揮作用,又可以通過質押同時協助網絡安全。這種正向互動進一步鞏固以太坊作為「數碼石油」的地位,成為新金融基建的潤滑劑。

Another tailwind for Ethereum has been the evolving regulatory and macroeconomic environment in 2025, which has generally been more favorable to crypto than the storms of previous years. In the U.S., a major overhang was resolved when the Securities and Exchange Commission (SEC) effectively ended its lawsuit against Ripple (XRP) in mid-2025 and conceded ground on what constitutes a security in crypto. The conclusion of that high-profile case was interpreted as a broader green light for altcoins, Ethereum included, since Ether had also faced past questions about its regulatory status. In addition, U.S. regulators provided clarity that certain staking services and liquid staking tokens are not securities, easing fears that Ethereum’s move to proof-of-stake could invite regulatory crackdowns. This “regulatory clarity” around Ethereum’s core activities has boosted confidence among institutions and retail participants alike. Globally, countries like Canada and several in Europe already have Ethereum ETF products and friendly stances, adding to the legitimacy of ETH as an investable asset.

推動以太坊的另一股追風,是 2025 年監管和宏觀經濟環境逐步轉好,遠比過去幾年風雨飄搖時對加密貨幣更有利。在美國,困擾多時的難題終於解決:證券交易委員會(SEC)於 2025 年中正式結束對 Ripple(XRP) 的訴訟,並在界定加密資產屬不屬於證券方面讓步。這宗轟動案件的了結,被視為山寨幣(包括以太坊)獲廣泛「開綠燈」——因為以太坊過去同樣備受監管地位質疑。此外,美國監管機構亦明確指出部份質押服務和流動性質押代幣並非證券,消除了市場對以太坊升級至權益證明(proof-of-stake)後會被嚴厲監管的擔憂。對以太坊核心活動的這種「監管明確性」,大大提升了機構和散戶的信心。放眼全球,加拿大及多個歐洲國家早已推出以太坊 ETF 產品,政策亦相對友善,令 ETH 這種資產更具合法投資地位。

The macro backdrop cannot be ignored either. After a period of rising interest rates in 2022–23 that hurt risk assets, the pendulum is swinging back. By mid-2025, there is a strong expectation that the U.S. Federal Reserve will begin cutting interest rates, potentially as soon as the fall. Futures markets put the probability of a September 2025 rate cut at over 80%. This prospect of easier monetary policy has been a boon for equities and crypto alike, as lower rates typically drive investors toward higher-yielding or growth-oriented assets (since bonds and cash become less attractive). Ethereum, with its combination of growth narrative and yield from staking, stands to benefit in a “lower for longer” rate environment. Indeed, news of softening inflation and imminent rate cuts coincided with Ether’s push past $4,300 in August. Simultaneously, geopolitical and policy developments such as the U.S. Congress advancing pro-crypto legislation (e.g., a bill to regulate stablecoins, known as the GENIUS Act) have improved sentiment. Sean Dawson, head of research at Derive, noted that “favorable U.S. government policy and well-timed institutional engagement has resulted in blood rushing back into the crypto market.” All these forces – macro tailwinds, regulatory clarity, and institutional narrative shifts – have aligned to create a kind of perfect storm for Ethereum specifically.

同時,宏觀經濟大環境亦不容忽視。2022–23 年加息週期打擊風險資產後,如今情勢開始逆轉。到 2025 年年中,市場強烈預期美聯儲最快秋季開始減息,期貨市場對 9 月減息機會率估計已超過 80%。貨幣政策「轉鬆」對股票及加密市場皆有利,因為低息通常推高高回報或增長型資產需求(令債券和現金吸引力下降)。以太坊兼具成長敘事及質押收益,預計可於「長期低息」環境受益。事實上,通脹回落及減息將至的消息,與 8 月 ETH 升穿 $4,300 不謀而合。與此同時,美國國會推動支持加密的政策(例如立法監管穩定幣,即 GENIUS Act),亦有助市場氛圍回暖。Derive 研究主管 Sean Dawson 指出,「美國政策友好,加上機構介入時機理想,令資金開始湧回加密市場」。這一切——宏觀助力、監管明朗、機構敍事轉變——全部匯聚,為以太坊創造出前所未有的完美升勢。

On the retail side, Ethereum is also seeing renewed interest, albeit in a more measured way than the meme-fueled crazes of the past. There has been a steady uptick in the number of active Ethereum addresses (over 680,000 daily actives recently, a multi-year high), suggesting new and returning users are engaging with the network. Retail crypto investors are also increasingly aware of Ethereum’s central role in DeFi and NFTs, and many view owning ETH as a gateway to participate in those ecosystems. The psychological element is key: as Ethereum approaches their previous all-time high, retail traders have grown more bullish in online chatter – terms like “buying” and “bullish” started vastly outnumbering “selling” and “bearish” in social media posts once ETH crossed $4k. This uptick in retail optimism can itself become a self-fulfilling driver in the short term (through FOMO buying), though it’s something to watch cautiously as excessive euphoria can herald corrections. Market intelligence firm Santiment pointed out that the surge in bullish sentiment in early August was notable and cautioned that overconfidence sometimes leads to short-lived pauses even during uptrends.

散戶方面,以太坊亦見重燃興趣,雖然比起過往 meme 熱潮時更加理性穩定。以太坊活躍地址持續增加(最近每天超過 68 萬,刷新多年高位),反映新用戶和回流用戶都在積極參與網絡。散戶投資者對以太坊在 DeFi 及 NFT 的核心地位越來越有認識,很多人視持有 ETH 為參與這些生態圈的入場券。心理因素亦至關重要:當 ETH 接近歷史高位時,散戶在網絡討論變得更樂觀——一旦升穿 $4,000,「買入」、「睇好」這類字眼在社交媒體中遠超「賣出」、「睇淡」。這種樂觀情緒可在短期內自我推動(即 FOMO 追入),不過對於過度亢奮要保持警惕,因為往往意味調整臨近。市場數據公司 Santiment 亦指出,8 月初的樂觀情緒激增值得留意,並警告「過度自信即使在升市,亦往往導致短暫休整」。

In summary, Ethereum’s surge is underpinned by strong fundamentals and shifting perceptions. Big investors are buying in via record-breaking ETF flows, embracing Ethereum as a core holding alongside Bitcoin. Companies are putting ETH on their balance sheets and staking it, adding a long-term demand base. The network itself is smashing usage records in transactions and volume, reflecting real adoption. And external conditions – from Fed policy to regulatory wins – have created a more hospitable climate for a rally. All of these set the stage for Ethereum to potentially lead the crypto market’s next phase. But does this translate into a full-blown altcoin season? To answer that, we need to step back and examine how an “altcoin season” is defined, and whether the current market structure supports the idea that we’re entering one.

總結來說,以太坊近期的升勢,背後有堅實基本面和市場觀感轉變支撐。大型投資者通過創紀錄的 ETF 資金流入購入 ETH,視之為與比特幣同等重要的核心持倉。企業開始把 ETH 納入資產負債表又進行質押,形成長線需求。以太坊網絡本身在交易及用量上屢創新高,反映用戶真實採納。外部環境,包括聯儲局政策及監管突破,亦帶來更利好氣氛。這一切鋪排下,以太坊極有可能帶領下個加密牛市周期。但這是否意味著「山寨幣季節」的全面爆發?要解答這個問題,我們要先看看「山寨幣季節」怎樣定義,以及現時市場結構是否已經具備進入這一階段的條件。

Altcoin Season 101: Understanding the Cycle and Historical Parallels

“Altcoin season” (or “altseason”) is a slang term, but it describes a very real market phenomenon. By definition, an altcoin season is a period when alternative cryptocurrencies broadly outperform Bitcoin for an extended period (usually measured in weeks or a few months). During these phases, a majority of altcoins see significant price increases, often achieving multiples of their previous value, while Bitcoin either trades sideways or grows at a slower pace. In practical terms, if you see your crypto portfolio’s smaller coins shooting up much faster than BTC, you’re likely in an altcoin season. These periods tend to be marked by high volatility and frenetic trading activity across the crypto spectrum. New projects can skyrocket overnight, and even older, long-forgotten coins can suddenly come back to life as traders hunt for the next big gainer. Crucially, altcoin seasons are usually short-lived climactic moments of a bull market – they often occur near the later stages of an overall crypto uptrend and can cool off quickly once the speculative excesses burn out.

「山寨幣季節」(或稱 altseason)雖然是業界俚語,但描述的卻是真實的市場現象。所謂「山寨幣季節」,即是指一段時期內,大部份替代幣的表現全面跑贏比特幣(通常以數星期到數個月計)。在這種情況下,多數山寨幣價格都會大幅上升,往往幾倍於過去價值,而比特幣只是橫行或上升速度較慢。簡單而言,當你發現自己加密倉內小幣急升超過 BTC 時,很可能正在經歷山寨季節。這些時段市場波幅巨大,買賣極之活躍。不少新項目一夜暴升,甚至歷史久遠的老幣都會突然復活,只因交易者四處尋找「下一個大贏家」。最重要的是,山寨季節大多是牛市的「短暫高潮」——多數發生於升市較後階段,並且在投機過熱消退後很快冷卻。

Historically, altcoin seasons have coincided with declining Bitcoin dominance. Bitcoin dominance is the share of Bitcoin’s market capitalization relative to the total crypto market cap. When Bitcoin dominance falls sharply, it means altcoins (collectively) are growing in value faster than Bitcoin. We have two prime historical examples to consider: the altcoin booms of late 2017/early 2018 and of spring 2021.

歷史上,每逢山寨季節,通常都伴隨比特幣市佔率大幅下跌。比特幣市佔率,即比特幣市值佔整體加密市值的比例。當比特幣市佔率急降,代表山寨幣整體升幅遠超 BTC。這方面有兩個經典例子:2017 年尾/2018 年初的山寨牛市,以及 2021 年春季。

-

2017–2018 Altcoin Season: Bitcoin had a massive rally in late 2017, peaking just below $20,000 in December of that year. At its height, Bitcoin commanded about 85% of the entire crypto market’s value. But as 2018 began, Bitcoin’s dominance plunged – from 86% in late 2017 to roughly 38% by January 2018. This collapse in dominance was because hundreds of altcoins were exploding in price, even as Bitcoin itself actually started to pull back from its highs. The trigger was a mania for Initial Coin Offerings (ICOs) – essentially crowdfunding sales for new tokens – that led to a flood of money into Ethereum (which was used to buy ICO tokens) and into the new tokens themselves. Ethereum’s price in that period shot up to about $1,400 (from under $10 a

-

2017-2018 山寨季節:比特幣於 2017 年末大爆發,12 月衝高至接近二萬美元。當時比特幣市佔率高達 85%。但到了 2018 年初,比特幣主導地位急瀉——由 2017 年尾的 86% 暴跌至 2018 年 1 月的約 38%。市佔率突然崩潰,因為數以百計的山寨幣爆升,即使比特幣開始由高位回落。觸發點正是首次代幣發行(ICO)熱潮——這種全新眾籌方式吸引大量資金湧入以太坊(用來買 ICO 代幣),以及這批新幣本身。當時以太幣價格由不足 10 美元一度衝上約 1,400 美元。year prior),好多細規模嘅替代幣(Altcoin),例如瑞波幣(XRP)、Cardano等等,都出現咗爆炸性升幅。有段短時間,似乎每隻幣都會上月球,甚至連比特幣都變得「悶」起上嚟。嗰次Altseason係喺2018年初受監管機構對ICO嘅憂慮同市場普遍疲態影響下,突然急劇結束——之後熊市期間,大部份替代幣都失去咗其大部分價值。

-

2021年Altcoin季節:時間快轉到2020–2021年,加密貨幣市場又迎來一輪大牛市。比特幣再次率先急衝,喺2021年4月創下大約$64,000嘅歷史新高。但當比特幣衝頂過後,焦點開始轉向替代幣,特別係春季期間。去到2021年5月,比特幣嘅市場份額由年初嘅約70%跌到年中得返約40%。依段時間,「meme幣」如狗狗幣(Dogecoin)同柴犬幣(Shiba Inu)爆升(狗狗幣只係幾個月就升超過10,000%,網上社交媒體同明星熱炒推波助瀾)。同時,NFT(非同質化代幣)板塊亦喺以太坊及其他公鏈大爆發,帶動咗相關NFT平台同GameFi幣種強勁上升。呢一輪Altseason比之前更加多元化——唔單止得一個概念(如ICO),而係包括咗meme幣、去中心化金融(DeFi)代幣、NFT相關代幣、智能合約平台幣等多條主線齊齊加速。去到2021年4月16日,一個受歡迎嘅「替代幣季節指數」錄得100分之98——極端地顯示過去90日內Altcoin完勝比特幣。簡單嚟講,你如果2021年初揸住頭五十位嘅大部份Altcoin,回報都好可能優於單單揸比特幣。好似2018年咁,呢場Altcoin熱潮最後亦漸漸冷卻;比特幣喺2021年尾再創新高,唔少替代幣輪流見頂回落,周期去到2022年進入調整。

由呢幾次經歷可以見到一個模式——Altcoin季節往往喺比特幣大升之後,當比特幣升勢開始橫行或回氣時出現。手頭賺咗大錢嘅比特幣投資者,會將部分資本換落替代幣,希望博更高短線升幅。呢個資金輪動路徑經常被形容為:“BTC賺錢 -> ETH開車 -> 中小型替代幣起飛。” 開頭通常係以太坊(作為最大及最易買賣嘅Altcoin),後續資金就會流入更細、更高風險嘅幣。前提係比特幣至少要「企穩」;如果比特幣插水,大部分替代幣仲插得更加勁,Altseason根本唔會發生。但只要比特幣夠硬淨或者橫行,投資者就會有信心同誘因落注Alt幣。

明白咗呢個規律之後,咁而家2025年又點?2025年上半年,比特幣大爆發,突破之前$69,000嘅高位,年中升到大約$100k~$120k。根據報道,2025年7月比特幣創新高(有交易所見過$119,000)。經過呢場破頂升勢,比特幣動力開始冷卻返,近排大多數時間都喺$110k–$120k附近徘徊,無再不斷衝高。正如過往經驗,我哋開始見到資金由比特幣流向以太坊同部分Altcoin。比特幣主導率喺之前升浪一度重返六成以上,呢幾年罕見,現時已開始下跌。7月初BTC dominance約64%,去到2025年8月初已經跌到大約59%。聽落跌幅唔算超誇張,但以加密市值以萬億計嚟講,主導率跌5個百分點,即係一大筆資金由比特幣流向替代幣。只要BTC主導率破勢頭,市場一定會密切關注。其實有技術分析師指出,2025年中比特幣主導率跌穿一條多年上升趨勢線,可能係大型Altcoin周期開波嘅強烈訊號。

再者,以太坊近幾星期表現明顯跑贏比特幣。喺一個月時間內(6月底至8月初),ETH升咗約54%,但比特幣同期只升大約10%。以太坊呢種超額升幅,通常都係Altcoin季節甫開始嘅標誌之一。BlockchainCenter嘅Altcoin Season Index呢段時間持續向上——由「比特幣季節」嘅低位逐步升到三四十(滿分一百),顯示市場開始傾向Altcoin,但截至8月初仲未完全轉為高位Altseason。8月中,該指數去到五十頭左右(觀望區),反映近90日有大約一半主流幣升幅跑贏比特幣。另一個短線指標Altcoin Month Index(30日波幅比較)就出現明確「It’s Altcoin Month!」信號(分數超過75)。簡單講,比起之前,過去一個月資金明顯傾向替代幣,雖然長線局勢仍未完全逆轉。

同時,我哋亦見到一啲典型Altseason啟動嘅質性現象。例如一啲本來「瞓咗覺」甚至老牌Altcoin同步爆升,好多時都代表資金由比特幣泛濫開去其他幣。2025年7月中就見到:比特幣啱啱創新高後未再升,成批「老朋友」Altcoin開始抽水。XRP(瑞波幣)困擾咗多年嘅SEC官司總算解決大部分法律不明朗,幣價即時爆升到歷史新高約$3.65——7年來首次創頂。受XRP帶動,其他「OG」幣如Ethereum Classic(ETC),萊特幣(LTC),比特幣現金(BCH)都喺7月出現雙位數百分比日升幅。呢啲老牌大眾幣平時唔太郁,通常都要等市場氣氛大轉先會郁。一名專家話,呢種現象可能「係更廣泛Altseason開展初期信號。」創投公司Maelstrom投資總監Akshat Vaidya 7月同Decrypt講:「老牌代幣抽水係早期信號」,但佢同時提醒未必咁快見到「真正Altseason」,至少要等埋啲新型細規模幣都一齊起飛先算。Vaidya觀察到比特幣主導率「開始由高位下跌」,而「資金明顯流向以太坊等Altcoin,動力開始聚集。」佢認為正正反映過往經驗:每次比特幣創新高,之後幾個月往往出現Altcoin大升——簡單嚟講,加密貨幣歷史又重複一次。

呢啲現象同而家見到嘅情況一致:以太坊領頭,再到XRP、LTC等大型Altcoin,之後可能輪到其餘市場。要留意並非所有替代幣都已起飛,7月期間好多細幣、新項目幣仍然相對低調,焦點主要喺以太坊同幾隻大牌。有分析員認為,呢一輪Altcoin周期仲只係初期,未去到完全瘋狂階段。「暫時仲未全面爆發」,正如Vaidya講。一般嚟講,愈高風險(如細規模DeFi幣、新興L1、meme幣等),會喺Altseason後段先接力起飛,即大藍籌先升,然後資金再流向更高風險幣種。如果大環境繼續配合,幣圈資金輪動可以有機會行到呢一階段。

總結而言,現時市場指標同專家觀察都顯示以太坊領軍嘅Altcoin季節有可能逐步浮現。比特幣主導率由高位回落——依家徘徊喺五十幾個百分點,呢個區間傳統上對替代幣比較有利。以太坊近期香港炒到力壓比特幣,又真係見到有人資金換馬。一位幣圈作家8月13日形容:「依家未算真正‘Altseason’,不如話係‘以太坊季節’。」所以有一個有趣變化出現:有可能現時係一個特別所謂「以太坊季節」。下文就會深入探討呢個概念,同廣義Altcoin季節有乜分別。

以太坊季節 vs. 替代幣季節:Ether係咪已經自成一派?

(圖片略)

「以太坊季節」呢個詞近來俾市場分析員提出,意思係以太坊唔單止跑贏比特幣,仲遠遠領先大部分其他替代幣——成為資金輪動最大贏家。所謂以太坊季節,即係市場注意力同升幅集中喺ETH身上,細啲嘅替代幣反而落後甚或只係輕微上升。2025年中留意到好多Altcoin對ETH反而係下跌,於是「以太坊季節」開始有市場迴響。加密分析師Benjamin Cowen就指出:自2025年4月以來,除咗BTC、ETH以外嗰籃替代幣(Altcoins ex-BTC, ETH)兌ETH計價大跌約50%。即係你如果拎住一籃子ETH以外幣,過幾個月平均已經輸咗一半俾ETH——慘烈跑輸。Cowen結論:「而家未係大規模Altseason,舞台暫時屬於以太坊。」CaptainAltcoin一份報告咁總結:「Altcoin有朝一日會出頭——但現時市場目光只盯住ETH能否衝上$5K。」只要以太坊市佔率(即佔Altcoin總市值份額)持續升,事實上等同進入以太坊主導階段。

而且,以太坊近來喺市值同話語權都提升咗。ETH而家已經佔據市場總市值約20%(比特幣約55–60%)。以太坊市值大過其後幾大Altcoin加埋總和。所以,有啲人甚至覺得以太坊而家唔再單純係一隻「Altcoin」,而係同比特幣並列市場主角。一啲交易員甚至會將ETH歸為獨立類別。網上流傳:「not altseason, it’s #EthereumSeason」——circulated as ETH/BTC ratio ticks up. That ratio – which measures how many BTC one ETH is worth – is a key barometer. It has been rising off its lows, indicating Ethereum gaining on Bitcoin. As of August, ETH is around 0.038 BTC (3.8% of a Bitcoin). While that’s still below the peaks (Ethereum was ~8% of Bitcoin’s value at times in 2017 and 2021), the ratio has improved in Ethereum’s favor in recent weeks, reversing a prior trend of BTC outperformance earlier in the year.

隨住ETH/BTC比率上升,相關消息不停流傳。呢個比率反映每一個ETH可以兌換幾多BTC,係加密市場一個好重要指標。比率最近由低位回彈,顯示以太坊相對比特幣強勢。去到八月,ETH大約值0.038 BTC(即一個比特幣嘅3.8%)。雖然仍然低過歷史高位(2017同2021年有時以太坊值到比特幣嘅8%左右),但最近幾個星期,以太坊明顯追上比特幣,扭轉咗年頭比特幣領先嘅走勢。

One consequence of an Ethereum-centric rally is that investor capital tends to flow into Ethereum-related projects more than into external alt themes. We’re seeing that play out: tokens and projects directly tied to Ethereum’s ecosystem (like Layer-2 network tokens, decentralized exchange tokens, liquid staking derivatives, etc.) have garnered interest. For example, the native tokens of Layer-2 networks Arbitrum (ARB) and Optimism (OP) have bounced from their bear-market lows as Ethereum usage grows, though so far their price gains have been modest compared to ETH’s run. Another example is Coinbase’s new Layer-2, Base, which doesn’t have a token but has attracted a flood of capital into applications built on it (like the recent social app Friend.tech that went viral). Base’s total value locked (TVL) reportedly rocketed by 9,000% in a matter of weeks, reaching about $4.5 billion, as users rushed to deploy assets on this Ethereum-aligned network. Such staggering growth underscores that much of the excitement is concentrated within the Ethereum universe – the “Ethereum-led ecosystem,” as one report calls it.

以太坊帶領大市上升有一個重要影響,就係資金大多數會流入同以太坊生態相關嘅項目,而唔係分散去其他外圍山寨主題。呢個現象最近好明顯:直接屬於以太坊生態嘅項目同代幣(例如Layer-2網絡代幣、去中心化交易所代幣、流動質押衍生品等)開始吸引市場注意力。例如,Layer-2網絡Arbitrum(ARB)同Optimism(OP)原生代幣,隨着以太坊使用量急升,價錢已經由熊市低位反彈,雖然升幅仲未及ETH本身。另一例子係Coinbase新推出嘅Layer-2網絡Base,雖然無發行代幣,但因為近期大熱應用(例如爆紅社交app Friend.tech),吸引大量資金湧入新dApp,據報TVL(總鎖倉價值)幾星期內激增9,000%,去到大約45億美元。咁誇張嘅增長,其實反映咗大部分炒作都集中係以太坊生態入面——所以有報告稱為「以太坊主導生態圈」。

During this Ethereum season, smaller altcoins measured against ETH have struggled. Cowen notes that many alt/ETH pairs have been bleeding, meaning if you held alt X instead of ETH, you’d have less ETH now than a few months ago. This dynamic could persist until Ethereum decisively breaks its all-time high and perhaps exhausts some of its momentum. Historically, what often happens is: Ethereum leads the initial phase of the alt rally, sometimes even nearly keeping pace with Bitcoin’s gains, and then once Ethereum itself hits a plateau (for instance, if ETH reaches a big psychological price like $5,000 and then consolidates), the next phase begins where capital rotates to smaller alts en masse. A similar pattern was observed in previous cycles: Ethereum would pump hard, then when it cooled, the truly manic altseason kicked off (with things like the DeFi summer in 2020 or the meme coin craze in 2021). We could be heading for a repeat. As Cowen mentioned, traders should watch the ETH/BTC trend – “as long as ETH/BTC keeps climbing, altcoins measured against BTC will likely rise too. However, ALT/ETH pairs will continue to bleed for another week or two before we get any meaningful relief bounce.” In other words, first ETH outperforms everything (Ethereum season), then eventually the smaller alts start outperforming ETH in the later stage of a full altcoin season.

今次以太坊周期入面,好多細山寨幣(以ETH作單位計)都表現較差。Cowen指出,好多山寨幣兌ETH都一直下跌,意思即係如果投資者揸住山寨X而唔係ETH,宜家計返要少咗ETH。呢個狀況有可能會持續到以太坊創出新高,或者升勢明顯放緩先會改變。歷史經驗係,通常以太坊會帶領山寨上升首階段,有時連比特幣升幅都追得好埋身,但一到以太坊自己停一停(例如去到$5,000心理大關先整固),下一階段即係一大批資金會流向細山寨。之前循環都係咁:以太坊先爆拉一輪,冷卻後就入山寨瘋狂期(好似2020年DeFi Summer或者2021年meme coin狂熱)。今次有機會重複。Cowen提到,交易者應該密切留意ETH/BTC趨勢——*「只要ETH/BTC繼續上升,山寨幣對BTC一般都會同步升。但Alt/ETH對仍會再流血一兩個星期,然後先會有像樣反彈。」*總結即係:初期ETH最強(以太坊周期),最尾山寨先輪流贏ETH,進入全面山寨季。

Some market analysts have even sketched out a potential roadmap for this rotation. Crypto commentator Miles Deutscher described a three-stage cycle that could play out over months: Stage 1: An ETH-led mini altcoin season (we’re arguably in this now) where Ether rallies strongly and large-cap alts perk up. Stage 2: A rotation back into Bitcoin – he speculates that at some point Bitcoin may regain dominance and make another push (possibly toward $120k–$140k) while many altcoins lag behind. Stage 3: Finally, a “blow-off” altcoin rally where capital floods back into Ethereum and then into smaller tokens, marking the cycle’s speculative peak. Under this scenario, the true broad altseason might still be ahead, after a potential interim Bitcoin run. Whether or not things unfold exactly in that sequence, the key takeaway is that Ethereum’s strength is a necessary ingredient for a broader altcoin season, but it might not immediately translate into across-the-board altcoin gains until a bit later. For now, Ethereum is in the driver’s seat.

有分析師已經畫咗一個輪換路線圖。加密評論員Miles Deutscher形容呢輪市可能分三階段:第一步,ETH帶頭小規模山寨季(現階段正正就係咁),以太坊領升,大市值山寨跟住上。第二步,資金回流比特幣——佢推測某個時候比特幣會再發力(有機會衝去12萬至14萬美金),而好多山寨會落後。第三步,最後出現瘋狂山寨潮,資金先湧返去以太坊,再蔓延到細幣,形成全周期最瘋狂階段。如果呢個劇本成真,即係而家嘅大山寨季依然未來臨,可能要等比特幣再跑一轉先有。順序點行未必一樣,但重點都係:以太坊夠強係開啟主山寨周期關鍵,未必一開始就即時帶動全場山寨暴升,仲要等多一段時間。短期內,由以太坊話晒事。

It’s also worth considering how sentiment and risk appetite differ in an Ethereum-led phase versus a typical alt free-for-all. When Ethereum is the focus, it suggests the market mood is bullish but still somewhat measured – investors are putting money into what is arguably a “safer” big-cap crypto with fundamental support. Ethereum has institutional buyers, real usage, and comparatively lower risk than tiny altcoins. An “Ethereum season” implies confidence in crypto’s medium-term outlook, but not blind speculation on every token. Once we transition to a full altseason, usually the psychology shifts to a more euphoric, risk-blind chase of any coin that’s moving (we saw that with dog-themed coins in 2021, etc.). There are early signs of increasing speculative appetite – for example, mentions of obscure altcoin tickers popping up more on forums, and some relatively new projects (like Sui or Sei, which are new layer-1 chains) popping 20-30% in a day. But overall, the market in August 2025 still seems to be placing its biggest bets on Ethereum and a handful of top players. As one trader on X (Twitter) put it, “We’re seeing early signals of an altcoin season... It could very well be that history repeats, with a post-BTC all-time high altseason. But you’ll have to wait for a true altseason to see newer coins pump”.

值得一提,不同於傳統山寨幣大亂鬥,以太坊主導時市況同參與者風險胃納都唔一樣。當市場焦點落喺以太坊,意味大家睇法都係偏樂觀,但相對保守——資金主力投入呢隻算穩陣、有基本面支持嘅大幣。以太坊有機構資金、有實際應用,同微型山寨比較,風險低好多。所謂「以太坊季」即係市場中線有信心,但唔係盲炒無厘頭幣。一旦進入全面山寨浪潮,心理上會突然偏向極度興奮,唔理風險咩都追(就好似2021年狗狗幣、柴犬幣熱潮)。近期開始出現投機加溫跡象——例如有啲冷門山寨代碼喺討論區多咗,或者啲新項目(例如Sui、Sei呢啲新Layer-1)單日都可以彈20-30%。但整體嚟講,去到2025年8月,市場最大注碼依然係ETH同少數藍籌。正如有位X(Twitter)交易員講:「見到山寨潮啲初步信號......有可能重演歷史,即係等比特幣創歷史新高後再爆山寨季。不過你要等真全面山寨先會睇到D新幣開槓桿。」

For the average crypto participant, the implications are clear: Ethereum is currently providing leadership and relative stability, and many are eyeing ETH’s milestones (like the all-time high near $4.8k, and the big $5,000 level) as the next pivotal moments. If Ethereum decisively breaks into price discovery above its old peak, it could trigger a wave of FOMO (fear of missing out) and a shift into “full risk-on mode” across crypto. Until then, it remains “Ethereum season.” As Petar Jovanović wrote on August 13, the market’s eyes are on ETH hitting $5K, and “for now, this is still very much Ethereum season. Altcoins will have their time – but [first] the market’s eyes are on ETH...”.

對一般參與者嚟講,信息好清楚:現階段由以太坊帶領市場,穩定性亦較高,多數人都watch住ETH新高(例如$4.8k舊頂同$5,000大關)會唔會被突破。如果真係升穿歷來高位,可能會觸發FOMO效應(怕走寶潮),整個加密市都會轉入全面冒險模式。暫時之前,繼續屬於「以太坊季」。正如Petar Jovanović 8月13日寫:「市場焦點係睇ETH幾時上$5,000,目前仍然係以太坊季。Altcoin遲啲有機會——但而家全世界目光都落喺ETH .......」

Speaking of Ethereum-centric growth, one area tightly interwoven with Ethereum’s success is the Layer-2 scaling sector. Ethereum’s rally and heavy usage directly impact Layer-2 networks that help carry its load. Let’s examine how an Ethereum-led altcoin season (or “Ethereum season”) might play out for those Layer-2 solutions and what changes we’re seeing in network usage patterns.

講到以太坊驅動生態增長,Layer-2擴容方案同以太坊成功可謂環環相扣。以太坊上升同用量激增,直接推高咗為以太坊「搬磚」嘅Layer-2網絡需求。我哋可以睇吓,以太坊主導下嘅山寨季(或者叫「以太坊季」)對Layer-2網絡影響,以及現時見到嘅網絡流量新趨勢。

Layer-2 Networks in an Ethereum Boom: Scaling Up for the “Season”

以太坊牛市下嘅Layer-2網絡:迎接「以太坊季」的擴容之戰

One of the most significant developments since the last crypto cycle is the rise of Ethereum Layer-2 networks – secondary blockchains or rollups that extend Ethereum’s capacity by processing transactions off the main chain (Layer 1) and then settling results back to it. In 2021, high traffic on Ethereum meant sky-high fees and a poor experience for many users. By contrast, here in 2025, Ethereum’s bull run is occurring in tandem with unprecedented Layer-2 adoption, fundamentally changing how a new altcoin season could unfold. In short, if “Ethereum season” comes true and usage explodes, Layer-2 networks are poised to absorb much of that activity, keeping the system more scalable and efficient than in past booms.

自上個牛市周期以來,加密領域最大技術突破之一就係以太坊Layer-2網絡嘅興起——呢類二層鏈或者rollup方案,透過喺主鏈(Layer-1)以外處理交易,再將結果回寫返L1,大幅提升以太坊容量。2021年市旺時以太坊塞車,手續費貴到離譜,好多人用得唔開心。相比之下,2025年今次升浪,Layer-2應用普及度前所未有,基本改寫晒新一輪山寨季個玩法。簡而言之,如果今次真係「以太坊季」爆發,用戶量激增,Layer-2肯定可以吸收大量新增交易,令網絡規模擴大得多、效率高過以往任何周期。

The numbers are revealing: as of mid-2025, it’s estimated that over 85% of all Ethereum ecosystem transactions now occur on Layer-2s rather than the Layer-1 chain. In other words, the vast majority of individual user transactions (like token swaps, NFT trades, game interactions, etc.) are happening on networks like Arbitrum, Optimism, Base, zkSync, and others that piggyback on Ethereum’s security. Meanwhile, Ethereum L1 continues to do what it does best – act as the settlement and security layer for big value transfers. It still processes about 85% of all the value moved (since large transfers, whales moving funds, and final settlements often occur on L1). Ethereum L1 also holds the lion’s share of assets: around 90% of all stablecoin value and over 80% of tokenized real-world assets in crypto are on Ethereum mainnet. So Ethereum is evolving into a two-tier system: Layer-1 as the high-value backbone, and Layer-2 as the high-volume workhorse for everyday transactions.

數字講得最清楚:2025年年中,超過85%以太坊生態系統交易,已經唔係發生喺L1主網,而係Layer-2上。即係話,大部分散戶日常交易(Token兌換、NFT買賣、鏈遊互動等)都轉咗去Arbitrum、Optimism、Base、zkSync等L2,享受以太坊安全嘅底層保障。而L1主網繼續發揮佢擅長角色——作為大型價值結算、保安層,仍然處理咗大約85%實際金額流動(因大額交易、巨鯨調度、最終結算多數都係L1做)。L1資產份額一樣霸道:全網穩定幣價值近九成同過八成token化現實資產都係主網。成個以太坊系統變成兩級結構:L1主力托大額、L2做日常海量細單。

This shift has been supercharged by recent technical upgrades. In late 2024, Ethereum implemented the “Dencun” hard fork (which includes the EIP-4844 upgrade, also nicknamed Proto-Danksharding). Dencun introduced so-called “blobs” of data that Layer-2 rollups can use to post transactions to Ethereum at very low cost. The result was a drastic reduction in the cost for L2s to write data to L1 – essentially cutting their operating costs by an order of magnitude. One report noted that after Dencun, data settlement costs became “near-zero” for L2s, allowing some like Coinbase’s Base network to operate with over 98% profit margins on its transaction fees. With such low costs, L2s can keep user fees extremely cheap (often just pennies per transaction) and still be sustainable businesses. This has made Layer-2s far more attractive to users, driving a virtuous cycle of adoption. For example, on decentralized exchanges (DEXs), the number of trades on L2 more than doubled year-over-year by May 2025, and that month Base even surpassed Ethereum L1 in total DEX trading volume – a remarkable milestone. It shows that users, when given the option, will happily trade on a faster, cheaper L2 venue while relying on Ethereum’s security assurances in the background.

呢個大轉變背後,關鍵係一系列重大技術升級。2024年底,以太坊完成「Dencun」硬分叉(當中EIP-4844俗稱Proto-Danksharding),引入咗所謂「blob」數據塊,Layer-2 rollup可以用超低價寫交易入主網。成效係L2寫數據入L1成本急降十倍級數,有報告指Dencun之後,L2嘅資料結算開支「接近零」,令Base等新興L2網絡抽交易費都可以賺到98%毛利。成本咁低,L2用戶費用可以壓到幾毫子仲長做得住,業務可持續,吸納力急劇增加,帶動正向循環。例如,去中心化交易所(DEX)上,2025年5月L2交易量按年多咗一倍,同月Base仲一度超越主網成為DEX成交冠軍,創歷史新高。用家有得揀之下,大多數都會去快又平嘅L2落盤,同時享受以太坊主網背書安全。

So, if Ethereum usage surges further in an altcoin season, Layer-2 networks are ready to carry the extra load. We’re already seeing them step up. Base, the newcomer L2 incubated by Coinbase, has made headlines with its explosive growth. Within just a few months of launch, Base reportedly saw a 9,000% increase in total value locked, reaching about $4.5B TVL, thanks in part to popular new dApps launching there. Base has also become the dominant L2 by some measures: by May 2025 it was accounting

所以如果以太坊真係喺新一輪山寨季用戶爆升,Layer-2網絡已經準備好頂住大部分新增活動。現時好多L2已經開始搶show。由Coinbase孵化嘅新星Base,憑爆炸性增長成為市場焦點。上線幾個月內,總鎖倉(TVL)跳升9,000%,達到約45億美元,因為有一堆受歡迎新dApp喺度登場。Base按部分指標已成為主導L2玩家:去到2025年5月已經佔據...for over 80% of all L2 transaction fees and generating nearly $6 million in monthly revenue (suggesting very high usage). Some of that activity is driven by hype cycles (like Base’s ecosystem had a frenzy of meme coin trading and a new social app), but importantly, it demonstrates the scalability of Ethereum’s broader network. At one point, Base alone handled more transactions than the entire Ethereum mainnet, and combined, L2s routinely process many times the throughput of L1. Despite that, Ethereum L1 itself has not buckled – its block utilization is around 50%, fees are moderate, and it’s serving its role as final settlement.

超過八成所有 L2 交易費用都來自這裡,每月收入將近 600 萬美元(這代表使用量極高)。部分活動當然受炒作周期影響(例如 Base 生態系在 meme 幣交易和新社交 app 掀起熱潮),但更重要的是,這證明以太坊整體網絡的可擴展性。曾經有一段時間,單是 Base 的交易量已經超越整個以太坊主網,加上其他 L2,各 L2 合共的處理量遠高過 L1。不過,以太坊 L1 本身依然穩定 —— 現時區塊利用率約 50%,手續費屬中等水平,依然能穩妥地發揮最終結算層的作用。

What does this mean for a potential altcoin season led by Ethereum? It means the next altcoin frenzy might look and feel different for participants. In 2017, if you tried to buy a hot ICO token, you probably did it on Ethereum L1 and paid high gas fees (or the network lagged). In 2021, trading DeFi tokens or minting NFTs on Ethereum became prohibitively expensive at peak times, pricing out smaller users. In 2025, Layer-2s offer an outlet to handle a surge of transactions without congesting Ethereum mainnet. If millions of new users rush into crypto chasing altcoin gains, they can be onboarded via L2s where they’ll experience low fees and fast confirmations, all while ultimately being secured by Ethereum. This is likely to encourage even more activity, as the usual brake on altcoin manias – e.g. $50 or $100 transaction fees on Ethereum making small trades uneconomical – is far less of an issue now. So an altcoin season in the Layer-2 era could potentially be more intense and involve even higher transaction counts than previous ones, since the capacity is so much greater. It also means that the benefits will accrue back to Ethereum: every trade on Arbitrum or Base still ultimately uses ETH (for paying L2 fees, which eventually consume ETH on L1) and showcases Ethereum’s platform effect.

咁其實呢啲現象對一個由以太坊帶領嘅新一輪山寨幣季節有咩啟示呢?即係下次山寨幣炒作潮,實際參與感覺會同以前唔同。記得 2017 年,如果你想買啲當時啱啱 launch 嘅 ICO 幣,通常都係走上 Ethereum 主網然後俾貴 gas(唔係就係網絡塞爆)。到 2021 年,想買 DeFi 幣或者 mint NFT,繁忙時段手續費貴到嚇死人,細戶根本頂唔順。嚟到 2025,Layer-2 就提供咗個新出口,令大量交易都可以唔使塞爆主網。萬一有幾百萬新用戶湧入加密貨幣追求升幅,佢哋可以直接經 L2 上車,享受平費用同極快確認,同時背後依然由 Ethereum 保駕護航。呢一點應該會帶動 更多 參與,因為以前阻嚇山寨熱潮嘅因素(例如用 Ethereum 一次交易要成五十、一百蚊,美股細 trade 根本唔值)而家已經唔係大問題。所以 Layer-2 時代嘅山寨潮可以更激烈,成交數量比過去多好多,因為處理能力大咗太多。更重要係所有收益依然會回饋返 Ethereum:你無論係 Arbitrum 定 Base 做咩 trade,最終都要用 ETH 交 L2 費用,而 L2 收到嘅費最後都會消耗返 L1 上嘅 ETH,直接反映平台效應。

Layer-2 tokens and ecosystems might themselves become part of the altcoin season story. Many L2 networks launched tokens (Arbitrum’s ARB, Optimism’s OP, etc.) and those could rally if speculation turns their way. So far, the performance of L2 tokens has been somewhat underwhelming – for instance, ARB trades below its initial airdrop price as of August, even though Arbitrum is one of the top rollups by usage. Some traders attribute this to the fact that these tokens are mainly governance tokens (not required for using the network, aside from maybe paying fees in some cases), so their value isn’t directly tied to usage. However, in a euphoric market, fundamentals often take a backseat to narrative. If Ethereum is soaring and people are looking for the “next Ethereum,” they might bid up L2-related projects or DeFi protocols running on L2s, expecting them to catch up. Already, we saw hints of this: when Ethereum’s price blasted past $4,200, optimism spread to smaller-caps and one report noted “smaller-cap altcoins follow ETH’s bullish trajectory”. It cited that Ethereum’s rally was “triggering broader market participation”, implying traders were starting to branch out beyond just ETH.

其實 Layer-2 本身嘅幣同生態都可能成為下個山寨季嘅焦點。唔少 L2 網絡都有推自己啲代幣(好似 Arbitrum 嘅 ARB、Optimism 嘅 OP 等),如果炒風集中埋去佢地自家生態,呢啲幣都可能會有一波升勢。到目前為止,L2 幣表現其實有啲令人失望——比如 ARB 截至 8 月都仲低過空投價,雖然 Arbitrum 係用戶量最大嘅 rollup 之一。有交易員認為,因為呢啲 L2 幣主要都係治理 token,唔一定直接影響系統運作(最多有啲用嚟交 L2 費),所以表現同生態使用未必掛鈎。不過如果遇到瘋狂市況,基本因素就常常俾故事推動力取代。要係以太坊抽得高,大家尋找「下一隻以太坊」,L2 關聯項目或者 L2 上面啲 DeFi 協議都可能跟上補漲。我哋已經見到跡象:當以太坊價一度突破 $4,200,信心即刻蔓延到細市值幣,報導都話 「細市值 altcoin 追隨 ETH 牛市走勢」,指明以太坊升浪 「推動市場更廣泛參與」,暗示交易者開始將注意力由 ETH 擴大到其他板塊。

Moreover, specific success stories on L2s can create mini-seasons of their own. For example, if a certain DeFi application on a Layer-2 becomes the hot thing (much like how Compound or Uniswap kick-started DeFi Summer on Ethereum in 2020), it could drive a lot of new users and capital to that L2. We’ve already seen early examples: the friend.tech social token platform launched on Base in August 2023 brought a surge of transactions and fees to Base. In the current climate, any viral dApp on an L2 can direct attention (and token value) to that layer. This adds another dimension to altcoin season: not only do we consider which coin, but also on which chain the activity is happening. Right now, Ethereum and its Layer-2s form a kind of interconnected megasystem, and collectively they dominate many sectors (DeFi TVL, NFT trading, on-chain stablecoins, etc.). As noted earlier, Ethereum hosts 58% of all tokenized assets across all chains – by far the largest share. So if we indeed get a roaring alt season, much of that could play out on Ethereum mainnet and L2s, reinforcing Ethereum’s position. It’s telling that even after all the growth of rival blockchains in recent years, Ethereum still anchors the majority of on-chain economic activity in categories like stablecoins and real-world asset tokens.

另外,某啲 Layer-2 上面嘅成功個案甚至可以掀起「迷你山寨季」。例如,若果有某個 Layer-2 上嘅 DeFi 應用爆紅(就好似當年 Compound、Uniswap 引爆 2020 年 DeFi Summer 咁),就有機會吸引成堆新用戶、新資金湧入該 L2。其實好似 Friend.tech 呢類平台——2023 年 8 月喺 Base 推出就立即帶動 Base 交易量、費用急升。依家任何一個 L2 上爆紅嘅 dApp 都可能帶連鎖效應,連同 token 價值都引返去該 Layer。呢點令山寨季更有層次:唔止要諗邊隻幣,仲要睇邊條鏈活動發生。現時 Ethereum 連同各 Layer-2 共組一個大型互聯網絡,聯手壟斷多個領域 (例如 DeFi TVL/NFT 交易/鏈上穩定幣等),正如早前提及,Ethereum 承載咗全鏈 58% tokenized 資產——絕對領先。換句話講,即使真係再爆 alt season,大部分熱潮都極大機會發生喺 Ethereum 主網同 L2,更進一步鞏固以太坊地位。就算過去幾年有咁多對手鏈冒起,以太坊依然係穩定幣、RWA 等類別鏈上經濟活動主力。

One potential challenge with L2s during a frenzy is bridging and liquidity fragmentation. Users have to move assets between Ethereum L1 and various L2s (and possibly other L1s). In a fast-moving market, bridges can become bottlenecks or points of risk (hacks, delays). However, infrastructure has improved here too, with many fast bridges and decentralized bridge protocols now in place to shuttle funds around quickly. If Ethereum fees do spike at the absolute peak of usage, some chaos could ensue with moving funds, but likely far less severe than in past cycles thanks to advance planning and multiple options (e.g., you can always trade on a different L2 instead of rushing back to L1).

但 L2 喺炒作潮時都有啲挑戰,例如橋接(bridging)同流動性分散。用戶要係 Ethereum 主網、唔同 L2(甚至其他 L1)之間調動資產。如果市况急速,橋樑可以變成瓶頸甚至風險(如黑客、延遲)。不過現時相關基建又進步咗好多,好多高速、去中心化橋樑協議都出晒嚟,可以迅速轉移資金。如果遇到使用量極峰,Ethereum 手續費急升,資金搬動時有啲亂都好,但總體可能無以前咁嚴重,因為有更周全嘅預備以及多條路徑選擇(例如直接喺另一條 L2 買賣,唔使急返主網)。

In essence, Layer-2s ensure that an Ethereum-led altcoin season can be bigger and more accessible than ever. They allow the excitement to scale. For average users, this means you might experience the next altcoin boom through networks like Arbitrum or Base without even touching Ethereum mainnet directly – yet Ethereum will still be the underlying security blanket making it all possible. It also means the narrative of Ethereum being the “backbone of future finance” is validated in real time: while Bitcoin sits largely in wallets as digital gold, Ethereum’s network (with its L2 extensions) is bustling with activity, trade, and innovation even at peak times.

簡單講,Layer-2 令以太坊主導下嘅山寨熱潮可以大過以往兼任誰都易入場,炒風可以無限放大。對普通用戶嚟講,你未必再直接接觸 Ethereum 主網都可以參與新一輪山寨牛市(例如直接用 Arbitrum、Base 等網絡),但背後安全保障依然靠 Ethereum。呢個現象同時印證咗以太坊作為「未來金融骨幹」嘅論述:比特幣主要放喺錢包當數碼黃金,但以太坊(以及新版 L2)即使喺巔峰時刻依然百花齊放,交易、創新活動都無停過。

From an investment standpoint, one might conclude that if you believe an altcoin season is coming, betting on Ethereum and its ecosystem could be a relatively safer way to capture that upside. This is something even prominent analysts have suggested. Veteran trader Michaël van de Poppe commented that while Ethereum’s rapid rise to $4,200 was a “wild move” and chasing it at those highs carries risk, allocating capital to projects within the ETH ecosystem might deliver better percentage returns if momentum continues. His rationale is that smaller projects related to Ethereum (like certain L2 tokens or DeFi protocols) could see outsized gains once the rally broadens, potentially outpacing even ETH, but they are still tethered to Ethereum’s success. In other words, if you’re bullish on ETH, there are leveraged ways within its orbit to express that – though of course with higher risk.

以投資角度睇,如果你相信山寨季即將到來,買入 Ethereum 同其生態反而可能係相對穩陣又可以捕捉升幅嘅方法。有啲資深分析師都建議咁做。老牌交易員 Michaël van de Poppe 都講明,以太坊狂升到 $4,200 算係「瘋狂升浪」,但分配資金去 ETH 生態項目如果牛市延續,實際回報可能更大。因為同以太坊相關嘅細項目(如部分 L2 幣或 DeFi 協議)一旦升浪擴展,有機會升幅跑贏 ETH 本身,但最終都繫於 Ethereum 成敗。換句話講,你睇好 ETH,生態內仲有槓桿倍化表現機會——風險當然都會較大。

To summarize, Layer-2 networks stand as critical infrastructure and likely beneficiaries of an Ethereum-led market rally. If Ethereum truly leads a new altcoin season, expect L2 usage to set fresh records as users flock to cheaper platforms to trade and invest. Already, by mid-2025, L2s handle the majority of transactions (85%+) in the Ethereum ecosystem. That trend will only intensify if the pace of speculation picks up. The endgame envisioned by many Ethereum proponents – where the main chain is a secure settlement layer and most activity happens on L2s – is basically happening now. An altcoin season will test just how far this “modular” approach can go in accommodating a tidal wave of demand. All signs so far are encouraging: the network has headroom, fees are low, and upgrades like Dencun have done their job in supercharging capacity. For traders and developers, it’s an exciting prospect: a bull run without the same bottlenecks and pain points as last time.

總括而言,Layer-2 網絡作為關鍵基建,很大機會成為新一輪以太坊主導牛市最大受益者。如果 Ethereum 真係領軍新一季 altcoin season,預計 L2 用量肯定破新高,因為用戶一窩蜂轉晒去平遊平台交易、投資。事實上,去到 2025 年中,L2 已經處理晒 Ethereum 生態 85% 以上嘅交易。呢個趨勢,只會炒得越犀利越快。好多以太坊支持者夢寐以求嘅終極狀態——主網負責安全結算,絕大多數活動都上落 L2——其實已經變成現實。新一波山寨潮將會測試呢種「模組化」思維可以 accommodate 幾大波動需求。暫時所有訊號都正面:網絡仲有容量,費用低,升級如 Dencun BLOB 功能已經大大提升產能。對於交易員或開發者嚟講,今次牛市有望避開以往啲塞車痛點,非常令人期待。

Of course, no rally is without risks. It’s important to temper excitement with an understanding of what could go wrong or throw the market off course. In the final section, we’ll look at the key risks and uncertainties that could affect Ethereum’s trajectory and the broader altcoin season thesis.

當然,任何升浪都唔會零風險。大家需要冷靜分析,一早諗定有咩可以行差踏錯,預埋有咩可能轉市。以下最後一節,我哋會探討有咩關鍵風險因素,可能會影響 Ethereum 嘅升勢同整個山寨幣季節主題。

Risks and Challenges: Caution in the Midst of Euphoria

風險與挑戰:全民狂歡下保持警覺

While the current outlook for Ethereum and altcoins is undeniably optimistic, it’s crucial to acknowledge that the crypto market remains highly volatile and laden with risks. History has shown that roaring rallies can reverse suddenly, and new challenges can emerge just when things seem most bullish. Here are some of the key risks and factors to watch as we evaluate whether Ethereum will successfully lead a sustained altcoin season:

雖然現時以太坊同山寨幣前景樂觀得無可否認,但加密市場所面對嘅波動性同風險一樣唔容忽視。歷史一早證明過,每逢大升浪都可能即刻掉頭回調,而新挑戰往往喺最看漲嘅時候殺出黎。以下就列舉幾個關鍵風險因素,值得留意以判斷以太坊能否成功引領一個持久嘅山寨幣季節:

-

Overheating and Pullbacks: Rapid price appreciation often sows the seeds of its own correction. As Ethereum hovers near all-time highs, some traders are growing wary of a short-term pullback. Profit-taking by short-term holders is already on the rise according to on-chain data. We saw a glimpse of this when ETH briefly hit $4,600 – shortly after, there was a bout of selling as speculators locked in gains, causing minor dips. Market sentiment indicators also flash warnings; Santiment noted that bullish chatter spiked dramatically as ETH crossed $4k, which can signal overconfidence. In strong uptrends, pauses or corrections are healthy and expected. Even staunch bulls urge caution about “buying at such elevated levels” without a plan. We should remember that after Ethereum’s previous peak in 2021, it suffered multiple 20-30% corrections on the way up and much larger ones in the subsequent bear market. A sudden macro scare or a wave of deleveraging could easily cause ETH to retrace a chunk of its gains in the short run. Such a pullback, if it happened, might temporarily stall any budding altcoin season because a sharp ETH drop would likely shake the entire market.

-

過熱與回調:價格快速上升往往孕育咗自身修正。以太坊現時徘徊歷史高位,部分交易員已經警覺可能短線回吐。鏈上數據顯示,短線持有人獲利盤明顯增加。近期 ETH 一度升至 $4,600,隨後就有投機者鎖利出貨,引發小幅回調。市場氣氛指標亦發出警號,Santiment 指 ETH 衝破 $4k 時,牛市討論急劇上升,意味市場信心過高。強勢升浪本應有暫停或調整,健康且屬預期之內。就算最大牛都建議唔好*「高位瞓身買入」*,冇 plan 風險高。記得以太坊 2021 年上一波高峰後,上升途中經歷過多次 20-30% 回調,熊市更唔使講。萬一外圍宏觀有驚嚇或全市場減槓桿潮,ETH 隨時短期獲利回吐一大截。呢種回調一旦出現,短暫令 altcoin season 停頓,因為 ETH 急跌大概率會拖累全市場。

-

Institutional Overleverage: One of the new risk factors in this cycle, as highlighted by none other than Vitalik Buterin, is the possibility of institutions overextending themselves with Ethereum. The fervor around Ethereum ETFs and corporate treasury accumulation, while positive, can have a dark side if not

-

機構過度槓桿:呢一輪週期新出現嘅風險之一,連 Vitalik Buterin 都特別提及,就係機構有機會對 Ethereum 過度進取。與以太坊 ETF 熱潮及企業準備金大量吸納相關,表面好消息,實際背後如果唔......managed prudently. Vitalik cautioned in August that the trend of corporations buying up ETH for their treasuries and staking yields could turn into an “overleveraged game.” What did he mean by this? Essentially, if companies or funds are borrowing money to buy ETH (leveraging their positions) or if ETF providers are utilizing derivatives extensively to meet demand, it introduces the risk of a cascade. Imagine if ETH’s price fell sharply – those same institutional players might face margin calls or risk controls that force them to sell into a falling market. Jamie Elkaleh echoed this concern, warning that overleveraging by corporate treasuries could destabilize the ecosystem, especially if forced liquidations trigger cascading sell-offs. This scenario is somewhat analogous to past incidents in crypto (for instance, the leveraged unwinding of positions that contributed to 2021’s mid-cycle crash or even the 2022 collapse of players like Terra/Luna, albeit that was more DeFi-centric). While there is no immediate sign of crisis – corporate holdings are still a fraction of ETH supply – it is a risk factor that grows as more big players pile in. The saving grace is that many of these institutional holders claim to be long-term oriented. But sentiment can change quickly if, say, a major ETF sees outflows or a big fund decides to trim exposure.

審慎管理。Vitalik 喺八月時已經提出警告,佢話企業買入 ETH 作為資產庫存,再加上質押收益,呢個趨勢可能會變成一場*「過度槓桿遊戲」。佢咁講係咩意思呢?大致意思係,如果公司或者基金用借貸去買 ETH(即係加大槓桿),又或者 ETF 供應商大量用衍生工具應付需求,就會帶來連鎖危機。諗下如果 ETH 價格急跌,啲機構投資者就有機會觸發追加保證金通知或者其他風險控制,令佢哋逼住要喺下跌市沽貨。Jamie Elkaleh 都有類似擔心,佢警告如果企業庫存槓桿太高,可能會動搖成個生態,特別係被迫平倉引發連鎖拋售。呢種情況有啲似過去加密圈既事件(例如2021年中段因為槓桿強平導致既股災,或者2022年 Terra/Luna 崩潰,雖然後者係 more DeFi-centric)。雖然而家未見有即時危機——企業揸住既 ETH 只係供應既一小部分——但隨住大戶愈來愈多,呢個風險都會逐步上升。唯一可以安慰係,好多機構持有人都話自己係長線*策略。不過,情緒隨時可以轉變,例如有大型 ETF 出現資金流走、或者有大基金削減倉位。

-

Regulatory and Legal Risks: The regulatory climate has improved, but it’s not without remaining hazards. In the U.S., the SEC has thus far only approved futures-based Ethereum ETFs, not a spot ETF. There is optimism that a spot Ether ETF could eventually get greenlit (especially given Grayscale’s recent legal win for a Bitcoin ETF), but no guarantees. If regulators were to push back or if some negative ruling emerged – for example, classifying certain Ethereum-based yield products as securities – it could chill institutional enthusiasm. Globally, regulations on crypto taxation, exchange licensing, or stablecoins could indirectly impact Ethereum usage. One specific area to watch is stablecoin regulation: Ethereum heavily relies on stablecoins like USDT and USDC as its liquidity engine in DeFi. The GENIUS Act progressing in Congress aims to regulate stablecoin issuance. If mishandled, new rules could affect stablecoin availability, which in turn would affect trading volumes on Ethereum. Additionally, Ethereum’s status as not a security is generally accepted in the U.S. now (the SEC’s focus has moved elsewhere), but were that ever to be challenged, it’d be a huge blow. European and Asian regulators are mostly positive on ETH, but one should keep an eye on any nation that might curtail crypto activity (for instance, if a major economy limited crypto trading, it reduces global liquidity).

-

監管及法律風險:監管環境係改善咗,但並非完全無風險。喺美國,SEC 目前只批咗以期貨為基礎既以太坊 ETF,現貨 ETF 就未批。雖然市場對現貨以太幣 ETF 最終獲批有信心(特別係 Grayscale 剛剛打贏咗比特幣 ETF 訴訟),但都唔保證一定批到。如果監管機構收緊、或者有不利裁決(例如將某啲以太坊收益產品歸類做證券),都有機會浸熄機構熱情。全球唔同地方對加密貨幣課稅、交易所牌照、或者穩定幣既新規定,都可以間接影響 Ethereum,特別係穩定幣監管。以太坊喺 DeFi 裏面好依賴 USDT、USDC 呢啲穩定幣做流動性引擎。美國國會正推進嘅 GENIUS 法案,目標係規管穩定幣發行。如果執行得唔好,新規例可能影響穩定幣供應,進一步影響以太坊交易量。補充一點,以太坊唔係證券 喺美國基本上而家都算係既定事實(SEC 注意力轉去其他地方),但將來如果有人挑戰呢個地位,影響會好大。歐洲同亞洲監管普遍對 ETH 睇法都算正面,不過都要留意有冇大國會打壓加密貨幣(例如有大經濟體限制加密交易,會拖低全球流動性)。

-

Macro Economic Shifts: The macroeconomic tailwinds that currently favor crypto could shift direction. Markets are pricing in interest rate cuts and a soft landing for the economy. However, if inflation were to unexpectedly roar back or if the Federal Reserve changes its stance to a more hawkish tone, risk assets like crypto could see renewed pressure. One cannot rule out macro surprises – e.g., an economic slowdown that’s sharper than anticipated or a credit event in traditional markets – that cause investors to reduce exposure to volatile assets. In such scenarios, Bitcoin tends to outperform altcoins (investors retreat to the relative safety of BTC or to cash), which would put a quick end to an altcoin season. So far in 2025, the macro signs are benign, but this is a variable largely outside crypto’s control.

-

宏觀經濟變化:依家整體大環境都算係向住有利加密貨幣既方向,但呢啲追風都可以突然轉向。市場預期減息同經濟「軟著陸」,但如果通脹突然反彈,或者聯儲局變得更鷹派,加密呢啲高風險資產可能會再受壓。宏觀層面都有唔少不可預測——例如經濟增長突然比預期差好多、或者傳統市場爆信用危機——導致投資者縮減暴露喺波動資產上面。喺呢啲情況下,比特幣一般會跑贏其他山寨幣(因為投資者傾向揀 BTC 或者現金避險),咁山寨季可能即刻完結。以 2025 年而言,宏觀環境暫時都算溫和,但呢啲因素其實加密圈完全控制唔到。

-

Security and Technical Hurdles: Ethereum’s core infrastructure has proven resilient through the Merge and subsequent upgrades, but rapid growth can sometimes reveal technical bottlenecks or vulnerabilities. One example is the risk associated with bridges connecting Layer-2s and other chains. In past years, bridge hacks have led to significant losses. If an altcoin season intensifies and more value flows through multi-chain bridges, they become juicy targets for attackers. A major hack or exploit (whether on a DeFi protocol or a cross-chain bridge) could momentarily spook the market and dent confidence in the ecosystem’s safety. Ethereum itself hasn’t had a catastrophic technical failure in a long time (the last major incident was the DAO hack and chain split in 2016, which gave birth to Ethereum Classic), and it’s battle-tested at this point. But one should always consider tail risks – for instance, what if a critical bug were found in a popular Layer-2’s code, forcing a pause or rollback? Such an event could freeze activity and impact prices. The Ethereum core developers are also planning future upgrades (like the Verge, Purge, etc. in the roadmap); while none seem likely to destabilize things, any complex software rollout carries risk.

-

安全及技術障礙:以太坊核心基建喺 The Merge 同之後既升級都證明咗穩定,但系統增長太快,有時都會爆出技術樽頸或者漏洞。例如唔同 Layer-2 或其他鏈之間既橋接經常有風險,過去幾年已經有唔少橋接被黑客攻擊,造成大量損失。如果山寨季膨脹,跨鏈橋會成為攻擊者既肥肉,越多價值流經橋,就越危險。一旦有大型黑客事件(唔論係 DeFi 協議或跨鏈橋),都會短暫嚇親市場,損害大家對生態安全既信心。以太坊本身耐唔耐都冇出咩大技術災難(上次較嚴重都係2016年DAO被駭造成分叉,即係而家既 Ethereum Classic),證明夠 battle-tested。但都要考慮尾部風險,例如萬一有熱門 Layer-2 出現致命漏洞,要停鏈回滾,活動會停晒,價格都會受影響。以太坊核心開發團隊未來仲有一系列升級(例如 Verge、Purge 等),雖然似乎唔會搞亂大局,但所有大型升級都有軟件風險。

-

Market Psychology and Timing: There’s a saying: “By the time everyone calls it altcoin season, it’s almost over.” Markets are forward-looking and often contrarian. If sentiment becomes unanimously convinced that altcoin season is here and will persist, that’s when one must be most cautious. We’ve started to see mainstream financial media pick up on Ethereum’s rally and altcoin chatter. A sudden flood of retail FOMO, while initially boosting prices, could create a blow-off top scenario. Already, some analysts are issuing lofty price targets – for example, Fundstrat’s Tom Lee recently predicted Ethereum could reach $16,000 by year-end 2025 if macro tailwinds hold and derivatives demand persists. Prediction markets give about a 74% probability that Ethereum will hit a new all-time high in 2025. These are optimistic odds. If everyone is positioned for more upside, the market can become fragile to any disappointment. It’s possible the altcoin season, if it fully materializes, might be short and intense, as these periods often are. Timing exits is notoriously hard – many retail investors got caught when the music stopped in previous cycles, holding bags of altcoins that plunged in value.

-

市場心理與時機:有句說話係:「當所有人都話到係山寨季,差唔多就要完咗。」市場永遠係前瞻同矛盾。如果大家一面倒覺得山寨季已經到,同埋會持續落去,呢個時候其實最要小心。近排主流財經媒體開始大做以太坊升勢同山寨幣話題。如果零售投資者出現集體 FOMO,開始一窩蜂入市,最開始會推高價格,但可能造成「吹爆頂」嘅場景。事實上,依家都有分析師放出好高嘅目標價——例如 Fundstrat 嘅 Tom Lee 最近就話如果宏觀順風同衍生品需求持續,以太坊2025年底可以上到 $16,000。預測市場大約有74% 機會見到以太坊2025年創新高。呢啲機率都幾樂觀。如果人人都預備向上,市場對任何失望都變得好脆弱。即使真係全面山寨季,都可以好短促同猛烈,過去週期好多散戶就係高位走唔切,結果揸住暴跌山寨。

-

Competition from Other Altcoins and Blockchains: Another angle to consider is that while Ethereum is in focus now, crypto markets have many moving parts. It’s conceivable that another narrative could steal the spotlight from Ethereum if something big happens. For example, if a rival smart contract platform like Solana or Cardano suddenly delivers a breakthrough or an explosive rally (perhaps due to its own upgrade or a specific app going viral there), it could divert capital from Ethereum and muddle the idea of an Ethereum-led altseason. In 2021, we saw mini-seasons like the “Solana Summer” where SOL and its ecosystem boomed independently. Right now, Ethereum has the clear momentum and its L2s cover its scalability, but one shouldn’t dismiss the rest of the field. There are still Bitcoin-centric cycles (like if Bitcoin ETFs get approved, BTC could briefly suck the oxygen again), and specific sectors like AI tokens or metaverse coins could have their own runs not tightly correlated with Ethereum. An altcoin season implies broad participation, but it’s possible not all boats will rise evenly. If Ethereum becomes too dominant, ironically, that might limit the upside of smaller alts (as we discussed in Ethereum season).

-

其他山寨幣同區塊鏈既競爭:仲有一個角度要諗,雖然而家焦點係以太坊,但加密市場其實有好多 moving parts。唔排除有另一個故事會搶走以太坊既風頭,例如競爭智能合約平台(如 Solana 或 Cardano)突然爆突破、或者爆升(可能因為升級或者有新應用爆紅),都會吸引資金流走以太坊,令「以太坊山寨季」變得混亂。2021年曾經有「Solana 夏季」,SOL 同生態完全自己起飛。現時以太坊 momentum 明顯,L2 覆蓋擴展性,不過都唔可以忽略其他鏈。比特幣主導既週期都仲會出現(例如比特幣 ETF 一批,BTC又會吸乾市場),A.I. 幣或者元宇宙板塊都可以同以太坊唔太相關地自己起浪。山寨季意味著廣泛參與,但唔排除唔係每隻幣都一齊升。如果以太坊太強勢,反而可能限制咗小型山寨幣空間(就好似前面講過既「以太坊季」)。

In light of these risks, prudent risk management is key even as optimism runs high. The fundamentals for Ethereum look stronger than ever and the ingredients for an altcoin season are largely in place, but external shocks or internal excesses could derail things. Traders and investors are advised to keep an eye on leverage in the system (funding rates, borrow levels), watch for any signs of trend reversals in BTC dominance or ETH momentum, and not overextend on illiquid alt positions that could become hard to exit in a downturn.

面對咁多風險,即使樂觀氣氛濃厚,風險管理始終都係最重要。以太坊基本面比以往更強,山寨季既條件大致齊全,但外部衝擊或者內部過度都可以令形勢逆轉。建議持續觀察槓桿指標(資金費率、借貸規模)、同時留意比特幣主導率或以太坊走勢有冇逆轉,唔好將本過度押注喺流動性低嘅山寨幣,到時跌市想走都走唔甩。

Jamie Elkaleh perhaps summed it up well: “All the ingredients for an Ethereum altcoin season are here, but there are no guarantees… risk management remains critical to preserve both value and decentralization.”. It’s a reminder that even as Ethereum becomes a “lightning rod for corporate capital” and retail enthusiasm, one must stay vigilant for potential downsides.

Jamie Elkaleh 總結得好好:「以太坊山寨季嘅一切條件都有,但冇乜包冇保證……做好風險管理先可以保住價值同去中心化。」 呢個都係提醒大家,就算以太坊成為「企業資本/散戶熱潮之貫雷」都唔可以鬆懈,要時刻警覺負面風險。

Final thoughts

Ethereum’s powerful resurgence in 2025 – marked by new price highs, booming network activity, and surging institutional interest – has positioned it as the prime contender to lead a new altcoin season. The evidence of a shifting regime in crypto markets is mounting: Bitcoin’s dominance has started to slip from its peak, capital is rotating into Ether, and even long-dormant altcoins are showing flickers of life as investors broaden their horizons. In many ways, what we are witnessing could be dubbed an “Ethereum season.” Ethereum has taken center stage with outsized gains and is currently outperforming most of the crypto field. Its breakout above key levels – climbing past $4,000, then $4,500 – has been the catalyst injecting confidence into the entire altcoin complex.

以太坊喺2025年全面強勢反彈——不論係新高價位、網絡爆炸性增長或者機構資金倍升——已經成為領軍新一輪山寨季嘅大熱門。市場格局正在轉變:比特幣主導率高位回落、資金明顯輪換入 ETH,就連塵封多時嘅山寨幣都開始有返生跡象。以多個角度睇,呢一輪根本可以叫做「以太坊季」。以太喺市場表現完全搶鏡、甚至比幾乎所有主流加密資產都優勝;多次突破關鍵阻力,大步跨過 $4,000 再攻至 $4,500,帶動成個山寨市場士氣爆燈。

Yet, the full bloom of an altcoin season, classically defined, requires more than just a strong Ethereum. It requires sustained and broad-based altcoin outperformance versus Bitcoin, a trend that persists over multiple weeks or months. Are we there yet? Not quite, but we appear to be on the cusp. By all accounts, Ethereum’s recent rally is a vital clue and precursor. Jamie Elkaleh emphasized that Ethereum’s surge alongside a dip in BTC dominance toward the high-50% range “points to early capital rotation”, and on-chain signals like record transaction volume and growing Layer-2 usage “add weight to the shift.” Still, Elkaleh rightly notes a true altcoin season will hinge on sustained altcoin outperformance, a rising total altcoin market cap, and persistent new liquidity inflows (such as those driven by ETFs or other investment vehicles). In plainer terms, altcoins need to keep beating Bitcoin over an extended period, and fresh money – not just recycled

不過,要完全符合「山寨季」定義,唔止要有一支強勢以太坊。仲需要係一段較長時間入面,多數山寨幣持續跑贏比特幣,呢啲超卓表現要維持幾個星期甚至幾個月。依家去到未?未完全到,不過已經好接近。以太坊近期升浪係重要線索同先兆。Jamie Elkaleh 強調,以太大升同時比特幣主導率跌至 50% 高位,「證明資金開始輪動」,鏈上數據如創新高既交易量、Layer-2 應用爆增,都加重左資金流向變化。不過 Elkaleh 都講得啱,一個真正「山寨季」需要山寨幣持續跑贏、整體山寨巿值上升、同時有新資金(例如 ETF 或其他投資工具)不斷流入。簡單啲講,就係山寨幣要長期贏比特幣,加上有大量新錢——而唔係純粹資金轉圈——才能穩定維持。

(如需延續內容翻譯請補充原文。)profits – should be coming into the altcoin space.

而家呢個時刻,許多要素都已經齊備。Ethereum(以太坊)已經交出非常強勁的基本面表現:用量創歷史新高,技術升級提升了承載力,而且呢隻資產而家已經係機構投資者雷達上面,有創紀錄嘅ETF資金流。圍繞Ethereum嘅敘事亦都演變成突顯佢喺未來金融體系中嘅關鍵角色,令到Ethereum成為一個吸引投資故事,擺喺Bitcoin(比特幣)「數碼黃金」以外。資金流已開始滲入其他山寨幣,但步伐算係溫和。我哋可以見到,XRP訴訟勝利點燃咗傳統舊派山寨幣一把火,又見到DeFi(去中心化金融)平台同Layer 2(第二層擴展方案)網絡,正在Ethereum勢頭之下欣欣向榮。如果以太坊能穩住呢條上升軌道,唔再單純跟隨比特幣動向——即係話搵到屬於自己獨立嘅領導地位——咁佢就可以「進一步鞏固佢喺其他山寨幣之上嘅地位」,帶動成個市場一齊上。

跟住會點?有幾個可能性場景。最樂觀嘅情況就係Ethereum繼續上升,終於突破歷來高位,甚至企穩五千美金以上。呢個重大里程碑,有可能成為心理觸發點,令加密貨幣市場「全面冒險」氛圍爆發。散戶FOMO(怕錯過)急增,後知後覺資金唔止追ETH,仲會入手多種類山寨幣,而傳統嘅Altseason(山寨幣季節)模式——先大市值、之後中市值、再細市值瘋漲——可能好快就出現。咁情況下,比特幣主導率(Bitcoin dominance)大概率再跌去50%甚至以下,同時全部山寨幣(不計BTC)市值顯著上升。Ethereum ETF同有可能即將面世嘅Bitcoin現貨ETF,會不斷提供資金,繼續助燃呢個行情,最少短期內係咁。Layer 2(第二層網絡)喺呢個環境下會大放異彩,應付大量用戶同交易流量,其增長又會進一步加強Ethereum嘅價值,形成正向反饋循環。

至於較為中性嘅場景,可能就係Ethereum帶動一波溫和山寨幣升勢,但未必導致全面瘋狂。可能ETH表現優於其他,創新高,但山寨幣整體升幅偏向有選擇性——只利好一些優質項目或者有清晰故事(例如Ethereum生態系代幣、AI相關幣等),唔會所有幣種一齊瘋漲。呢種情況會有啲似「Ethereum season」兼輕微Altseason,但未去到2017或2021年嗰啲極端瘋狂。咁情形下,比特幣表現可能依然穩健,主導率維持中等區間。加密貨幣市場會出現領漲輪動(BTC、ETH、再到部分其他),但未必會出現以往周期末段嗰種瘋狂高潮。有啲人甚至會覺得咁更健康,只係對炒100倍嘅投機者嚟講冇咁刺激。

最後,悲觀情況下,突發事件——無論係宏觀經濟衝擊定加密圈內部問題——都可以令山寨幣反彈提早終結。Ethereum升勢可能喺某個阻力位(例如之前歷史高位)止步,而如果比特幣亦都回調,成個市場可能會降溫,Altseason有機會要遲啲先嚟。值得記住,2019年就試過比特幣自己升咗一大段,但完全冇Altseason,反而BTC主導率長期持續上升。會唔會再出現?相比2019年,Ethereum今日用量同地位都提升好多,重現嗰一幕似乎機會細啲,但加密世界,一切皆有可能。

至於Layer 2角度——「如果真係成為Ethereum season,Layer 2會點?」有研究指出,如果Ethereum進入高需求期(價錢同使用量都爆升),Layer 2方案會承擔大部分交易壓力,令增長可以更持續而唔容易塞車。其實依家已經睇到,Ethereum用量創新高時,L2目前已經處理緊85%以上嘅交易,仲可以保住低Gas費。如果Ethereum season進一步升溫,可以預期會有更多用戶、流動性同投資注意力湧入Layer 2(如風投資金或者代幣炒作)。實際上,入場搵山寨幣升浪嘅新人,可能直接喺Base、Arbitrum呢啲L2網絡起步,甚至唔知原來自己用緊Ethereum基建——證明咗擴展已經變得極為無縫。Layer 2大熱亦意味住,今次Altseason會同Ethereum生態嘅關聯比以往更大。最多人氣嘅山寨幣好可能係直屬Ethereum生態(不論係L2代幣、DeFi幣、定係Staked ETH衍生資產)。Ethereum水漲,自家船先得勢。

總結嚟講,Ethereum有機會成為新一輪Altseason領頭羊,標誌加密市場第二大資產開始成熟。由2015年只係靠承諾嘅「山寨幣」,Ethereum發展成一個多元平台,支撐住加密經濟大半江山。佢能力吸引認真資金同用量,證明今次山寨幣升浪可以由基本面推動,而唔係淨係靠炒作。但話說回來,加密市場從來唔單靠基本面,心理、宏觀趨勢、創新節奏都好重要。炒家同愛好者都要保持資訊更新同靈活變通。要留意幾個指標:比特幣主導率(繼續跌?)、ETH/BTC比率(Ether繼續跑贏BTC?)、DeFi同L2鎖倉總值(健康增長定過熱?)、同埋ETF批核、利率決定等外部事件。

最後總結——問「Ethereum係咪帶領緊新一輪Altseason?」而家可以話:Ethereum明顯係近年最有力爭做下一個山寨幣熱潮火車頭嘅資產。近來表現,加上基本盤(機構資金、鏈上基礎、擴展方案),已經營造到往年大升浪前夕嘅氛圍。如果現時趨勢持續,真係有可能見證到所謂「Ethereum季節」——即Ethereum唔單做火車頭,甚至暫時定義住成個市場周期。只要Ethereum做到,其他山寨幣都極可能被帶起,踏入一個更闊嘅升浪之中。

始終,投資者面對呢個令人興奮嘅前景時,都始終要樂觀中帶警覺。加密市場瞬息萬變,不過就目前情況睇,勢頭明顯在Ethereum一方。Ethereum季節好大機會會黎到,而依住過往經驗,山寨幣升浪往往跟得好貼——不過要記住,季節會變,理性策略長存過任何最癲升市。