證監會暫停QMMM Holdings交易,因該股在宣佈一單可疑的1億美元加密幣配置計劃後急升近2,000%,成為證監針對二百多間採取類似策略的上市公司展開嚴厲監管行動中最轟動的一宗例子。

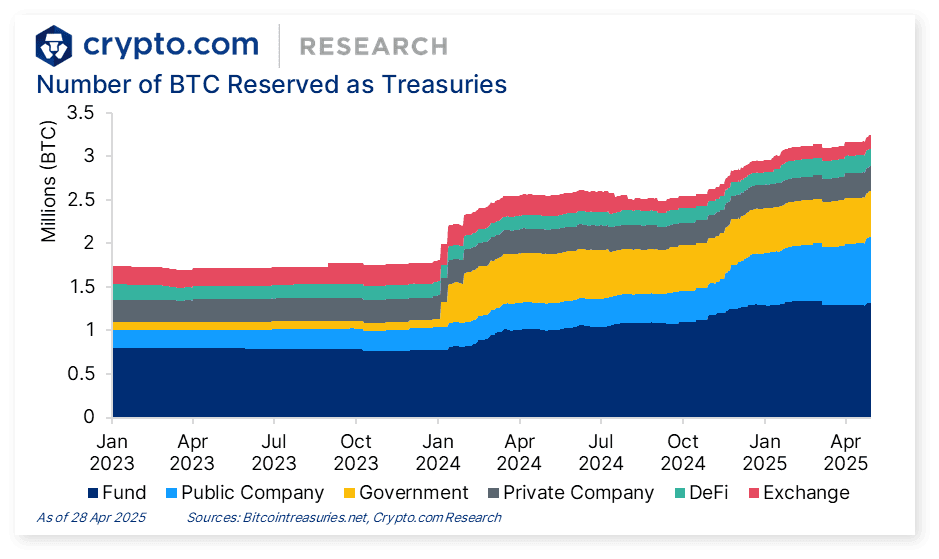

此案凸顯隨企業加密貨幣儲備突破1,120億美元,監管機構日益關注由社交媒體推動的股價操控行為,這些行為可能危及投資者保障。今次暫停交易,傳達出企業採納加密貨幣雖不斷加速——持幣量已超過一百萬枚比特幣——但前景須建立在更嚴謹治理、透明度和合規基礎上,徹底改變了企業如何合法將數碼資產納入資產負債表。

QMMM自九月初不足十二美元,於公告當日創下303美元高位,正好反映加密熱潮結合微型股份弱點帶來的潛在危機。這間總部位於香港的數碼廣告公司,年營業額僅270萬美元且持續蚀本,卻宣佈計劃配置1億美元到比特幣、以太幣和Solana,實際現金僅擁有約49.8萬美元。

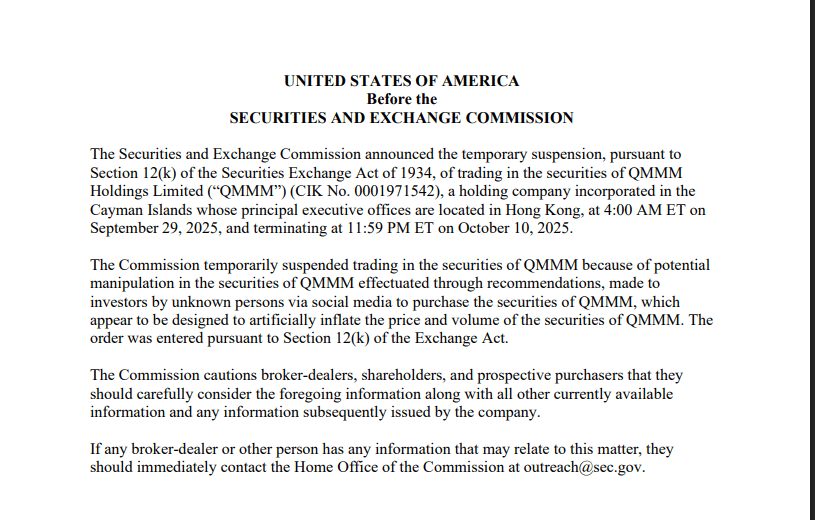

證監會明確指出,暫停交易原因是懷疑「未知人士利用社交媒體向投資者推薦」,意圖「人為拉高股份價格及交易量」。此案之所以特別重要,正值《華爾街日報》披露監管機構正在調查數百間2025年轉型加密資金策略的公司可疑交易活動,許多股份在消息公佈前出現非常規交易量及價格異動。

本文將剖析自MicroStrategy於2020年開創比特幣資金模式後,證監會最全面的一次對企業加密現象的監管行動,探討相關介入會否打擊企業部署數碼資產,還是促使訂下更健康合理標準,最終讓這策略獲得正規認可。

證監會如何動用暫停權力保障金融市場

美國證監會的暫停交易權力,來源於1934年《證券交易法》第12(k)節,可於有需要時暫停股份交易最多十個工作天,以保障投資者及公眾利益。此權力毋須事先警告,無需聆訊,也無需舉證,僅要指出有潛在操控或公開資訊不足便可。暫停行動本身並不等同指控違規,而是為監管機構調查可疑活動及讓投資者在市場冷靜期內重新評估持倉,減少市場異常波動帶來壓力。

暫停交易的法律門檻十分低,證監會只需擔心「公開資料準確性」或潛在操控,便能即時叫停交易。期間,涉事公司不能於任何交易所或場外市場買賣股份,致令股東被困,直至完成監管調查。暫停結束後,有關股份通常只能在流動性極低的OTC市場恢復交易,估值大幅受壓,機構投資者大多選擇離場,無論最終有否正式被控違規,停牌污點亦會長期影響聲譽。

過往案例顯示,證監會愈發積極應對涉及加密幣的股票炒作。2017年長島冰茶案成為典型例子:一間飲品公司宣佈轉型區塊鏈及更名為Long Blockchain Corp,股份單日暴升380%,儘管實際並無區塊鏈業務。股價由2.45美元衝至9.49美元,主要是零售投資者因為「區塊鏈」而蜂擁入市。證監會於2018年2月暫停交易,事後調查揭發管理層通風報信內線交易,最終公司除牌,註冊吊銷,三名涉事人士因證券詐騙等罪被起訴。至2021年7月,證監會指公司管理層「發表多次具誤導性聲明,意圖誑騙及利用投資者對比特幣及區塊鏈技術的關注」。

Riot Blockchain(前身Bioptix,生物科技公司),2017年宣佈轉型區塊鏈後股份同樣單日跳升400%;英國On-line Plc僅在名稱加上“blockchain”,亦急升394%。上述公司基本業務均無變,單憑與加密幣的聯想就煽動炒作。這些案例成為證監審視QMMM的前車之鑑:本業下滑的微型股,公司突然高調配置加密資產,規模遠超其現金儲備,同時社交媒體熱烈炒作,股價升幅極端。

2021年4月至2025年1月證監會主席Gary Gensler任內,針對加密相關操控的執法模式出現大幅變化。期間,證監會展開125宗加密貨幣相關執法行動,98宗已結案,罰款總額達60.5億美元,是過往主席時期的近四倍。Gensler取態著重將絕大部分加密資產歸類為受現行證券法規範,並非設新法規,推行「先執法後規則」方針,引起業界不滿,但確立了企業涉足加密市場一樣須守傳統證券法。

至2025年1月Paul Atkins繼任主席,監管調子改以創新出發,委員Hester Peirce領軍新設Crypto Task Force,加快制定明確規則。不過QMMM停牌及大規模調查,證明就算政策取向轉變,打擊詐騙及炒作沒有軟化。證券律師評論認為,雖然監管或有利設合法渠道讓企業引入加密,但同時必然會加強針對利用加密幣題材哄抬股價的行動。

QMMM暴升及可疑大跌的成因

QMMM Holdings Limited於2024年7月通過IPO以每股4美元上市納斯達克,共融資860萬美元。公司在開曼群島註冊、主營香港,前身為ManyMany Creations,逾十八年專注數碼廣告、虛擬化身技術及投影映射服務,服務對象包括頂級品牌、地產商及主題公園。惟其財務表現每況愈下:2024財年營收僅得270萬美元,淨虧損擴至158萬。2025年初,公司因股價長期低於標準收到納斯達克最小價格警告,隨時面臨除牌風險。

2025年9月9日,QMMM於GlobeNewswire宣佈「進軍加密貨幣領域」,詳述將組建1億美元多元化加密資產庫房,重點配置比特幣、以太坊及Solana。新聞稿又提及計劃發展AI驅動的加密分析平台、去中心化數據交易市場、DAO資金管理代理、智能合約漏洞檢測工具。CEO Bun Kwai稱「數碼資產和區塊鏈全球普及史無前例加快」,此舉能「連接數碼經濟與實體應用」。

市場反應極度激烈。QMMM股份9月9日開市報11美元,盤中曾高見303美元,收報207美元——單日升幅按不同算法介乎1,737至2,144%。成交量暴增逾1,000%,市值按收市價由約1.41億美元暴脹至118.4億美元。翌週因波動過大,熔斷暫停多達4次。至9月27日,股價回落至119.40美元,但仍較月初高出約1,736%。

嚴謹分析揭示公告內容與財務現況嚴重不符。QMMM 2024年財報顯示手頭現金及等值僅497,993美元,公司亦無交代如何籌措1億美元——該筆資金等於擁有現金的200倍、全年營收37倍。2025年6月,QMMM以每股0.20美元倉卒配售新股集資800萬,導致股份數目幾乎四倍攤薄,反映企業極力自救,距離有條件動用九位數美元配置加密幣相去甚遠。

QMMM升浪背後的社交媒體環境呈現典型抽水特徵。Reddit討論區大讚QMMM是「隱世潛力,準備搭上下一輪加密大潮」。Twitter推文清一色著墨加密轉型,忽略本業疲弱。StockTwits情緒在股價回落期間仍維持「極度樂觀」,相關訊息量增「以千倍計」。部分用戶則發出警告——有StockTwits用戶直斥「抽水騙局,很大機會跌返三十」 dollars - but these cautions were drowned out by promotional fervor.

但這些警告聲音都被宣傳熱潮所掩蓋。

The SEC's September 29 suspension order specifically cited "potential manipulation in the securities of QMMM effectuated through recommendations, made to investors by unknown persons via social media to purchase the securities of QMMM, which appear to be designed to artificially inflate the price and volume." The language emphasizes three critical elements: the recommendations came from "unknown persons" rather than identifiable market participants, they utilized social media platforms for broad reach, and they appeared designed for artificial inflation rather than reflecting genuine investment analysis. Securities lawyer Carl Capolingua noted that "if the SEC can link those unknown persons responsible for promoting buying the company's stock back to employees, or worse, to management, then the penalties can be severe, including large fines or jail time."

證監會於九月二十九日的暫停交易指令中特別提到「QMMM證券存在潛在操縱情況,通過不知名人士在社交媒體向投資者發出購買QMMM證券的推介,該等推介似乎旨在人為地推高股價及成交量。」該措辭突出了三個關鍵元素:這些推介來自「不知名人士」而非可識別的市場參與者、利用社交媒體作大規模傳播,而且看似目的為人為炒高價格,而非基於真正的投資分析。證券律師Carl Capolingua指出:「如果證監會能追查到這些推廣買入公司股票的不明身份人士與公司職員,甚至管理層有關,則處罰會相當嚴厲,包括巨額罰款甚至監禁。」

The trading suspension runs through October 10, 2025, providing regulators ten business days to investigate the identity of promoters, examine trading records for coordination, and determine whether company insiders participated in or benefited from the manipulation. When trading resumes, QMMM faces an uncertain future: the company must address how it actually plans to fund crypto purchases, explain the timing and sources of promotional activity, and convince investors that legitimate business strategy rather than stock promotion motivated the announcement. Historical precedent suggests few companies recover from such suspensions.

該暫停交易將維持至2025年10月10日,讓監管機構有十個工作天時間調查推廣者身份、檢查買賣記錄有否協同操作,以及了解公司內部人士是否參與或得益於操縱行為。待復牌時,QMMM將面臨不明朗前景:公司必須交代實際如何為加密貨幣購買作出資金安排,解釋宣傳活動的時間與來源,並說服投資者公司公佈事項源於正當業務策略而非單純股價炒作。歷史經驗顯示,極少公司能從類似停牌事件中復元。

The explosive growth of corporate cryptocurrency treasuries

企業加密貨幣金庫爆炸性增長

Nearly 200 publicly traded companies now hold over $112 billion in cryptocurrency assets as of September 2025, representing one of the most dramatic shifts in corporate treasury management in modern financial history. This movement began modestly in August 2020 when MicroStrategy, a business intelligence software company, purchased $250 million worth of Bitcoin as a treasury reserve asset. CEO Michael Saylor articulated a thesis that Bitcoin represented "superior money" and a better store of value than cash, which faced debasement through monetary expansion and negative real interest rates.

截至2025年9月,接近200間上市公司合共持有超過1,120億美元加密貨幣資產,這是現代金融史上企業金庫管理方式其中一次最戲劇性的轉變。這場變革最初於2020年8月由商業智能軟件公司MicroStrategy帶動,該公司以2.5億美元購入比特幣作為庫存資產。行政總裁Michael Saylor強調比特幣屬於「優越貨幣」,在貨幣寬鬆及負實際利率下,比現金作為價值儲存工具更優勝。

MicroStrategy's bet proved spectacularly successful. The company continued accumulating Bitcoin through equity offerings, convertible notes, and cash flow, amassing between 632,000 and 640,000 BTC by September 2025 - holdings worth approximately $73 billion at current prices. The company formally rebranded as "Strategy" in February 2025, signaling its identity shift from software firm to Bitcoin treasury company. Strategy's stock price surged 2,919 percent from August 2020 through September 2025, dramatically outperforming major technology stocks including Nvidia, Tesla, and Microsoft over the same period. The company now holds approximately three percent of Bitcoin's 21 million total supply and trades at a 112 percent premium to its Bitcoin net asset value, reflecting investor willingness to pay substantial premiums for leveraged Bitcoin exposure through public equities.

MicroStrategy的策略非常成功,公司透過配股、可換股債券及現金流持續增持比特幣,至2025年9月持有量已達632,000至640,000枚比特幣,按現價計算總值約730億美元。公司於2025年2月正式更名為「Strategy」,象徵其由軟件企業轉型為比特幣金庫公司。Strategy股價由2020年8月至2025年9月急升2,919%,遠超同期其他大型科技股表現(包括Nvidia、Tesla及Microsoft)。公司現時持有比特幣總發行量約三百份之一,並以比特幣資產淨值高出112%溢價交易,反映投資者願意為槓桿式比特幣曝險支付高溢價。

Corporate Bitcoin holdings across all publicly traded companies now exceed 1 million BTC, representing approximately 4.7 percent of total supply and valued between $115 and $120 billion. The concentration remains extreme: Strategy alone accounts for over 60 percent of the top ten corporate holders. Marathon Digital Holdings, a Bitcoin mining company that accumulates production rather than selling immediately, holds approximately 52,000 BTC worth $6 billion. Tesla maintains 11,509 BTC valued at $1.24 billion after selling 75 percent of its holdings during the 2022 bear market - a decision that cost the company approximately $3.5 billion in foregone gains had it maintained its full position.

截至目前,上市公司持有比特幣總量已超過100萬枚,佔總供應量約4.7%,市值在1150至1200億美元之間。持倉極度集中:Strategy一家公司佔十大企業持倉總量的六成以上。比特幣挖礦公司Marathon Digital Holdings採取累積產出而非即時出售方式,持有約52,000枚比特幣(約值60億美元)。Tesla於2022年熊市低位沽出75%比特幣後,目前還持有11,509枚,約值12.4億美元。若未曾沽出,該批貨幣現時可為公司帶來約35億美元額外利潤。

The corporate Bitcoin adoption trajectory accelerated dramatically in 2024 and 2025. Only 64 public companies held Bitcoin at the start of 2024, a figure that grew to 79 by Q1 2025 and exploded past 200 by September 2025. This 166 percent year-over-year growth rate reflects both genuine strategic adoption by established companies and opportunistic pivots by struggling firms seeking stock price appreciation. Bernstein Private Wealth Management projects that public companies globally could allocate as much as $330 billion to Bitcoin over the next five years, suggesting the trend remains in early stages despite recent growth.

企業採用比特幣金庫策略於2024及2025年間急劇加速。2024年初僅有64家上市公司持有比特幣,到2025年第一季增至79家,再暴升至2025年9月的超過200家。這 166% 的年增長率反映既有大企業真誠納入新策略,也有弱勢公司借勢轉型炒作股價。Bernstein私人財富管理預計,全球上市公司未來五年可能合共配置高達3,300億美元於比特幣,顯示這股趨勢雖然增長迅速,但尚屬早期階段。

Beyond Bitcoin, corporate Ethereum holdings have surged past $10 billion across approximately 13 publicly traded companies. BitMine Immersion Technologies leads with 2.4 million ETH worth approximately $10 billion, aiming to acquire five percent of total Ethereum supply. SharpLink Gaming, led by Ethereum co-founder Joseph Lubin as chairman, holds between 361,000 and 839,000 ETH valued at $1.3 to $3.4 billion. The company stakes 95 percent of holdings to generate yield and is building Ethereum-powered stablecoin payment systems for its iGaming platforms. Bit Digital pivoted entirely from Bitcoin to Ethereum, selling its entire BTC treasury and raising $172 million to purchase 120,000 ETH, positioning itself as a pure-play Ethereum treasury company.

除了比特幣,上市公司以太幣持倉亦已突破100億美元,分布於約13家上市公司。BitMine Immersion Technologies以2,400,000枚以太幣(約100億美元)居首,目標取得以太坊總供應量5%。SharpLink Gaming由以太坊創辦人Joseph Lubin出任主席,持倉由361,000至839,000枚(約值13億至34億美元)。該公司將95%資產參與質押產生收益,並開發以太坊為基礎的穩定幣支付系統予其網上博彩平台。Bit Digital則完全轉型至以太坊,沽清全部比特幣金庫,再集資1.72億美元購入120,000枚以太幣,定位為純以太坊金庫股。

Solana represents the newest frontier for corporate treasuries, with total holdings exceeding $2.5 billion across eight major public companies. Forward Industries raised $1.65 billion to acquire 6.8 million SOL, backed by Galaxy Digital, Jump Crypto, and Multicoin Capital. Upexi accumulated 1.9 million SOL over four months in 2025 with strategic advice from BitMEX founder Arthur Hayes, staking holdings for seven to eight percent annual yield. SOL Strategies operates Solana validators with assets under delegation of 3.6 million SOL, generating dual revenue from treasury appreciation and validator operations.

Solana成為企業金庫新戰線,八家主要上市公司總持倉已超過25億美元。Forward Industries集資16.5億美元購買6,800,000枚SOL,背後有Galaxy Digital、Jump Crypto和Multicoin Capital財團撐腰。Upexi於2025年四個月內累積了1,900,000枚SOL,並在BitMEX創辦人Arthur Hayes策略指導下,將持倉質押爭取每年7-8%收益。SOL Strategies營運Solana驗證人,委託資產達3,600,000枚SOL,兼取金庫增值與驗證營運雙重收入。

The diversity of companies adopting crypto treasuries has expanded well beyond technology firms. Semler Scientific, a medical device company, holds 4,449 BTC worth $510 million. GameStop, the video game retailer that became a 2021 meme stock phenomenon, announced in May 2025 it had acquired 4,710 BTC. Allied Gaming & Entertainment saw shares surge 105 percent intraday after announcing a Bitcoin and Ethereum treasury strategy. Even healthcare company MEI Pharma announced crypto purchases, though regulators flagged unusual call option activity before the public disclosure.

採用加密貨幣金庫的公司種類已不再局限於科技界。醫療儀器公司Semler Scientific持有4,449枚比特幣(價值5.1億美元);2021年成為迷因股的遊戲零售商GameStop,亦於2025年5月公佈購入4,710枚比特幣。Allied Gaming & Entertainment在宣佈採取比特幣及以太幣庫存策略後單日股價暴升105%。甚至連醫療公司MEI Pharma亦宣佈加密貨幣購入計劃,但監管方隨即指出公佈前有異常認購期權活動。

However, not all corporate crypto strategies succeed. Tesla's sale of 75 percent of its Bitcoin holdings in Q2 2022, near the bear market bottom, exemplifies the risk of panic selling during volatility. The company sold approximately $936 million worth of Bitcoin at prices between $20,000 and $30,000 per coin - holdings that would be worth roughly $5 billion at current prices. Some 2025 crypto treasury adopters now trade below their Bitcoin net asset value, with 25 percent of public Bitcoin holders experiencing market capitalizations less than the value of their crypto holdings alone. This negative premium suggests investor skepticism about management's ability to create value beyond simply holding cryptocurrency.

但不是所有企業加密貨幣策略都會成功。Tesla於2022年第二季熊市低位沽出75%比特幣正好示範了波動市況下恐慌拋售的風險。當時公司以每枚兩萬至三萬美元沽出合共9.36億美元的比特幣——這批貨幣如今價值約為50億美元。部分2025年新加入企業現時股價已低於其比特幣資產淨值,當中有25%上市持幣公司市值僅相當於其加密資產本身,出現負溢價。這情況反映投資者質疑管理層能否除囤幣之外創造額外價值。

The stock market reaction to crypto treasury announcements has become remarkably predictable yet increasingly scrutinized. Animoca Brands research found that companies announcing crypto treasury strategies surged an average of 150 percent within 24 hours of disclosure in 2025. Brera Holdings skyrocketed 464 percent after announcing plans to rebrand as Solmate and transition to a Solana-based digital asset treasury. Allied Gaming surged 105 percent intraday on its Bitcoin-Ethereum announcement. However, Smart Digital Group crashed 87 percent in a single day after its crypto announcement met with investor skepticism about vague details and questionable execution, demonstrating that markets can distinguish between credible strategies and opportunistic pivots.

股市對企業公佈加密貨幣金庫策略的反應變得預測性強且引起更嚴格審視。Animoca Brands研究發現,2025年公佈相關策略的公司,平均於24小時內股價上升150%。Brera Holdings宣佈易名為Solmate、轉型Solana資產金庫後,股價暴漲464%。Allied Gaming宣佈比特幣及以太幣策略當日即升105%。但Smart Digital Group因公佈含糊、執行能力受質疑,一日內暴跌87%,顯示市場能分辨策略可行與否及是否純粹投機。

Social media amplification and the mechanics of market hype

社交媒體擴散與市場炒作運作機制

Social media platforms have fundamentally transformed how stock manipulation operates, replacing traditional "boiler room" operations with viral promotion campaigns that reach millions of potential investors within minutes at minimal cost. Academic research published in Technological Forecasting and Social Change documented that publicly traded companies announcing blockchain initiatives experience substantial stock price premiums and sustained volatility increases, with the largest gains coming from highly speculative motives like coin creation and corporate name changes rather than substantive business integration.

社交媒體平台徹底改變了股票操控手法,傳統所謂「鍋爐房」式(boiler room)電話騙局已被病毒式推廣所取代,幾分鐘內便可極低成本地接觸數以百萬計潛在投資者。刊於Technological Forecasting and Social Change的學術研究指出,上市公司一旦宣佈區塊鏈大計,股價普遍錄得明顯溢價兼持續波動,當中以創建新幣種或公司改名等高投機動機有最大升幅,而非實質業務整合。

The Long Island Iced Tea to Long Blockchain case from 2017 established the template. When the beverage company announced its blockchain pivot and name change on December 21, 2017, shares jumped 289 percent to 380 percent despite the company having no blockchain operations, expertise, or revenue. The announcement itself - containing only vague references to "evaluating potential opportunities" - sufficed to trigger explosive retail investor interest. Subsequent SEC investigation revealed that leading shareholder Eric Watson tipped off broker Oliver Barret-Lindsay about the impending announcement, who then tipped friend Gannon Giguiere. Giguiere purchased 35,000 shares and sold within two hours of the public announcement, realizing $160,000 in illicit profits from a textbook insider trading scheme.

「長島冰茶改名Long Blockchain」2017年事件堪稱典型案例。2017年12月21日,這間飲品公司宣佈轉型區塊鏈及改名,雖無任何區塊鏈業務、專業或收入,股價竟飆升289%至380%。單單以「正評估潛在機遇」等含糊說法已引爆零售投資者熱情。其後證監會調查發現,最大股東Eric Watson預先向經紀Oliver Barret-Lindsay透露即將有重大公佈,後者再轉告朋友Gannon Giguiere。Giguiere公佈前即購入35,000股並於兩小時內於市場賣出,靠標準內幕交易手法非法賺取16萬美元。

Reddit's WallStreetBets community, which exploded from obscurity to 13.3 million members by end of 2022, demonstrated the power of coordinated social media trading. While the community's GameStop short squeeze in January 2021 involved legitimate market dynamics exploiting over-leveraged institutional positions, the tactics popularized there - "diamond hands" culture encouraging holding stocks regardless of fundamentals, detailed "due diligence" posts mixing analysis with hype, and meme-driven promotion creating

Reddit的WallStreetBets社群由無名小組暴增至2022年底的1,330萬成員,充分展現協同社交媒體炒股威力。該社群於2021年1月GameStop的逼空行動雖是合理市場博弈,利用機構過度槓桿,但其推廣的炒作手法——如堅持死揸(diamond hands)無視基本因素、細緻鑽研(due diligence)帖文結合誇張言論、以迷因推波助瀾——已逐步成為炒作主流手段。Sure! Here is your requested translation, following your formatting instructions:

in-group identity - became templates for manipulation. Similar communities emerged focused specifically on crypto-related stocks, promoting QMMM and similar companies as vehicles for capturing crypto upside through equity markets.

內部群組認同——成為操控嘅範本。類似嘅社群亦陸續出現,專注於加密貨幣相關股票,推廣 QMMM 以及類似公司,作為透過股票市場捕捉加密幣升值機會嘅工具。

Twitter and X serve as primary amplification channels for stock promotion. Research from USC's Information Sciences Institute tracked crypto pump-and-dump operations by detecting coordinated tweeting activity with direct correlation to cryptocurrency price movements. Machine learning algorithms identified clusters of accounts communicating with each other and posting identical promotional content within narrow timeframes. Academic research published in International Review of Financial Analysis found that Twitter effectively garners attention for pump-and-dump schemes, with notable effects on abnormal returns before pump events. Critically, investors relying on Twitter exhibited delayed selling behavior during post-dump phases, resulting in significant losses compared to other participants who recognized manipulation patterns.

Twitter 同 X 係推廣股票嘅主要放大渠道。南加州大學資訊科學研究所嘅研究追蹤過加密幣「抽水拋售」(pump-and-dump)活動,發現可以通過偵測協同發帖,搵到同加密貨幣價格變動直接相關嘅炒作行為。機器學習演算法辨認到一啲帳戶群組會互相聯絡,並喺短時間內發佈一模一樣嘅推廣內容。有學者喺《國際金融分析評論》發表研究,發現 Twitter 有效吸引大家注意「抽水拋售」計劃,亦會令抽水前有顯著異常回報。最關鍵嘅係,依賴 Twitter 嘅投資者,在拋售階段出現咗延遲沽貨嘅行為,比起發現操控跡象嘅其他參與者,損失更加嚴重。

Telegram and Discord enable even more sophisticated coordination through private groups with thousands of members. The CFTC's 2018 customer advisory documented typical pump-and-dump countdown messaging: "15 mins left before the pump! Get ready to buy," followed by "5 minutes till pump, next message will be the coin!" Instructions to "Tweet about us" amplified reach beyond the private groups to broader audiences. These operations complete entire pump-and-dump cycles in as little as eight minutes, exploiting thin liquidity in low-cap cryptocurrencies and stocks.

Telegram 同 Discord 透過有幾千名會員嘅私人群組,令協調行動仲更精密。CFTC 2018 年客戶提示書記錄過典型「抽水拋售」倒數訊息:「仲有 15 分鐘就開始抽水啦!準備買貨!」跟住又話「仲有 5 分鐘,下一個訊息就係公布邊隻幣!」再叫大家「幫手 Twitter 宣傳」, 令覆蓋範圍由私人群擴展到更大群眾。呢啲行動最快可以 8 分鐘內完成成個抽水拋售流程,專門利用流通量薄弱嘅細市值加密幣同股票搵快錢。

The SEC's December 2022 charges against eight social media influencers illustrated the scale and sophistication of these schemes. The defendants cultivated a combined 1.5 million followers on Twitter and Discord, promoting themselves as successful traders with market expertise. They purchased stocks before publicly recommending them to followers, posted price targets and statements like "buying, holding, adding," then sold shares when follower demand drove prices up - all without disclosing their dump plans. When accused of dumping, one defendant explicitly stated "I don't dump on anyone... I have diamond hands" while simultaneously selling. The scheme generated approximately $100 million in fraudulent profits over two years.

SEC 2022 年 12 月向 8 位社交媒體 KOLs 提出檢控,反映該等計劃嘅規模同複雜程度。被告總共喺 Twitter 同 Discord 吸引咗 150 萬粉絲,自稱係成功、有經驗嘅交易員。佢哋會喺公開推薦某隻股票之前先入貨,再發出目標價同「買入、持有、加注」等訊息,等粉絲買入推高股價後,即刻食糊落車——期間完全冇披露預計拋售安排。有人質疑佢哋抽水時,被告企圖粉飾話「我冇抽水……我係鑽石手」,但同一時間其實係沽緊貨。成個計劃兩年呃咗大約一億美元。

The mechanics of exploiting thin liquidity in micro-cap and penny stocks are well-documented. Stocks with market capitalizations below $50 million and those trading under five dollars per share feature low trading volumes, making price manipulation relatively inexpensive. A coordinated buying campaign by a few hundred or thousand retail investors can drive prices up 100 to 300 percent in hours. Manipulators employ sophisticated tactics including bid support to create artificial price floors, coordinated trading across multiple accounts to simulate broader market interest, and strategic selling that gradually dumps positions without triggering panic.

利用細市值同仙股流通量不足去操控價格嘅機制已經有充足記錄。市值低過五千萬美元、股價低於五蚊嘅股票,一般成交量都好少,所以操控股價嘅成本相對低。只要幾百至幾千個散戶協同買入,股價就可以短時間內升一倍甚至三倍。操盤手會用不同招數,包括掛盤托價,製造虛假支撐位;跨多個帳戶協同交易,假扮係市場熱炒;仲會分段慢慢沽貨,避免引發恐慌。

Chinese experimental research published in International Review of Economics and Finance provided causal evidence by posting 20,000 messages with strong sentiment but no fundamental information on the EastMoney Guba forum for 100 CSI 300 stocks. The posted messages led to a 0.26 percent rise in same-day stock returns, demonstrating that "stock prices can be manipulated by simply posting messages without any fundamental information." The effect was driven primarily by positive sentiment messages, and the study concluded that markets with high retail investor participation are particularly vulnerable.

一項發表於《國際經濟及金融評論》嘅中國實驗研究,用 2 萬個有強烈情緒、但冇基本面資訊嘅帖子,發佈喺東方財富股吧 100 隻滬深 300 股份度。結果當日股價平均升 0.26%,證明「單靠發放冇實質內容但有煽動性嘅訊息,都可以操控股票價格」,效果主要來自正面情緒訊息。研究總結,散戶參與度高嘅市場尤其脆弱。

Academic research comparing social media coverage to traditional news media coverage found opposite effects on stock volatility: news media coverage predicted decreases in subsequent volatility and turnover, while social media coverage predicted increases in both metrics. This pattern aligns with an "echo chamber" model where social media repeats existing news but a subset of traders interpret these repetitions as new information, generating excessive trading activity and volatility disconnected from fundamental developments.

學術研究比較過社交媒體同傳統新聞報道對股市波動性嘅影響,結果相反:新聞報道預示之後波動同成交減少,但社交媒體討論反而預示兩者上升。呢個現象印證咗「回音室」效應——媒體反覆傳遞原有新聞,有部分炒家會將重複內容當新消息炒作,導致超額交易活動,股價波動同基本面脫節。

For QMMM specifically, the social media environment exhibited all the classic manipulation red flags. Promotional posts emphasized the crypto narrative while ignoring the massive disconnect between announced allocation size and available capital. Message volume spiked thousands of percent on StockTwits concurrent with the price surge. Reddit discussions celebrated QMMM as a hidden opportunity despite the company's tiny revenue base and persistent losses. Twitter activity focused on price targets and momentum rather than business analysis. The SEC's identification of "unknown persons" making recommendations via social media suggests a coordinated campaign rather than organic investor interest - precisely the pattern that triggers regulatory intervention.

以 QMMM 為例,社交媒體生態顯示晒所有典型操控警號。宣傳文主打加密幣話題,完全忽視公佈撥備規模同實際可用資本嘅巨大落差。StockTwits 噏量喺股價抽升時飆幾千倍。Reddit 討論區大肆吹捧 QMMM 係「隱藏機會」,但完全無提公司收入細微同長期蝕錢。Twitter 集中講價位同動力,唔做業務分析。SEC 指有「無名人士」透過社交媒體發聲,代表唔係正常投資者興趣,而係有組織炒作——正正係會引發監管介入嘅模式。

Regulatory crackdown and the debate over chilling effects

監管打壓與「寒蟬效應」爭議

The QMMM suspension represents just one data point in a much broader regulatory investigation that threatens to reshape corporate crypto adoption. On September 26, 2025, the Wall Street Journal revealed that the SEC and FINRA were examining over 200 companies that announced crypto treasury strategies in 2025, investigating unusual trading patterns before announcements, abnormally high trading volumes, sharp price increases preceding public disclosures, and potential violations of Regulation Fair Disclosure. This probe represents the most comprehensive regulatory examination of the corporate crypto phenomenon since its emergence in 2020.

QMMM 停牌只係更大規模監管調查入面其中一單。2025 年 9 月 26 日,華爾街日報披露 SEC 及 FINRA 正調查超過 200 間喺 2025 年公佈加密幣庫存策略嘅公司,追查喺消息公佈前是否出現異常交易模式、成交量暴增、價錢大幅預先抽升,以及有冇違反公平披露規例。呢次大規模行動,係自 2020 年以來最全面嘅公司加密幣現象監管審查。

Regulation Fair Disclosure, or Reg FD, prohibits companies from selectively disclosing material nonpublic information to certain investors who could trade on it before public announcement. The pattern regulators identified across numerous 2025 crypto treasury companies showed suspicious activity: stocks doubling or tripling in the days before public crypto announcements, unusual option activity with heavy call buying, and "clustered trading" suggesting coordinated purchases based on leaked information. This pattern implies either insider trading by company executives and their associates or strategic leaking of announcement details to preferred investors.

「公平披露規例」(Reg FD) 禁止公司選擇性披露重大、未公開嘅資料畀某啲可以偷步交易嘅投資者。2025 年好幾間加密庫存公司都出現咗類似跡象:公佈前數日股價一倍甚至三倍,期權市場呼買異常,仲有「集團式買盤」暗示有人聯手根據內幕消息入市。呢啲現象要麼係管理層及關聯人員偷步炒股,要麼就係策略性洩漏消息畀指定投資者。

Several specific cases demonstrate the pattern. SharpLink Gaming's stock jumped 433 percent on heavy volume before its May 28, 2025 Ethereum treasury announcement. MEI Pharma shares nearly doubled in the four days before its Litecoin purchase disclosure, accompanied by unusual call option activity. Mill City Ventures, Kindly MD, and Empery Digital all experienced significant pre-announcement spikes flagged by surveillance systems. Trump Media & Technology Group saw volatility before its May 27 disclosure of a $2 billion Bitcoin commitment, drawing regulatory attention despite the company's political prominence.

有幾單個案突顯咗呢個模式——SharpLink Gaming 喺 2025 年 5 月 28 日公佈持有以太幣前,股價爆升 433%,成交暴增。MEI Pharma 喺公佈購入萊特幣前四日,股價幾乎翻倍,亦有離奇期權活動。Mill City Ventures、Kindly MD 同 Empery Digital 喺公布前都有異常抽升,被監控系統標記。特朗普旗下 Trump Media & Technology Group 亦喺 5 月 27 日宣佈投放 20 億美元入比特幣前出現大幅波動,儘管公司本身具政治光環,照樣收到監管關注。

FINRA's role in the investigation involves sending detailed questionnaires to flagged companies, asking about the timing of board decisions, which executives and board members knew about crypto plans in advance, trading activity in company stock by insiders and their associates, and communications between management and investors before announcements. David Chase, a former SEC enforcement lawyer, noted that "when those FINRA letters go out, it really stirs the pot. It's typically the first step in an investigation." Companies receiving such letters face the choice of cooperating fully, which may expose wrongdoing, or resisting, which signals potential problems and intensifies scrutiny.

FINRA 參與調查,包括向被標記公司發出詳細問卷,查問董事會決策時間、哪啲管理層或董事預先知道加密計劃、內部人員及關聯人在公司股票作過啲咩交易、管理層同投資者喺公告前有冇聯絡等問題。前 SEC 執法律師 David Chase 指:「FINRA 一寄出啲問卷,已經好大件事啦,通常係調查嘅第一步」。收到問卷嘅公司要決定完全配合(有機會暴露問題),抑或抵抗(反而容易畀人覺得有古怪,加深調查)。

Nasdaq itself has responded to the crypto treasury trend by tightening requirements. The exchange now requires shareholder approvals before companies can issue new equity to fund crypto reserve purchases and has warned it will delist companies that fail to comply with these enhanced requirements. This policy targets a common financing pattern where companies announce crypto strategies, experience stock surges, then immediately issue shares at elevated prices to fund the purchases - a sequence that benefits selling shareholders and company executives with stock compensation but dilutes existing investors.

納斯達克因應加密庫存潮流收緊規定,現時要求公司發行新股份買加密資產前,必須獲得股東批准,同時警告會將唔合規公司除牌。呢個政策係針對常見融資模式:公司宣佈加密戰略→股價抽升→即時高價發新股融資買幣, 舊股東受稀釋,真正受益係賣股嘅大股東同領取股票報酬嘅管理層。

The enforcement climate under SEC Chair Paul Atkins, who assumed leadership in January 2025, represents a complex evolution from his predecessor Gary Gensler's aggressive enforcement approach. Atkins and Commissioner Hester Peirce, who leads the new Crypto Task Force, have signaled openness to creating clearer regulatory frameworks that enable innovation. Peirce apologized in a September 25, 2025 speech for the SEC's past stance that hindered innovation and urged the crypto industry to seize opportunities created by the new environment. However, both officials have made clear that fraud and manipulation enforcement will continue unabated regardless of broader policy evolution toward crypto-friendly regulation.

SEC 新任主席 Paul Atkins(2025 年 1 月上任),佢帶嚟嘅執法氛圍同前任 Gary Gensler 強硬風格形成複雜對比。Atkins 同負責 Crypto Task Force 嘅 Hester Peirce 均表明願意推動更清晰、促進創新的監管框架。Peirce 更喺 2025 年 9 月 25 日公開道歉,話 SEC 過往立場阻礙創新,呼籲加密產業把握新機遇。但兩人同時強調,對詐騙同操控嘅執法力度不會削弱,無論政策大方向點親加密都唔會手軟。

This creates a bifurcated environment where legitimate corporate crypto strategies may face clearer regulatory pathways and reduced compliance uncertainty, while manipulative schemes exploiting crypto narratives for stock promotion face intensified enforcement. Securities lawyers emphasize this distinction: companies with genuine treasury strategies, proper board governance, strong internal controls, transparent disclosure, and arms-length financing arrangements have less to fear from regulatory scrutiny than those with suspicious pre-announcement trading, vague business plans, and inconsistencies between announced strategies and financial capacity.

此舉造就咗一個分化局面:正規公司採取合法加密策略,未來合規路徑會清晰啲、減低合規不確定性;而利用加密敘事推高股票、進行操縱嘅行為會面臨更大執法壓力。證券律師特別強調:有真正財庫策略、正當董事會治理、強大內部監控、信息透明、融資安排公平的公司,冇咁驚接受監管,更大風險好多時只係啲有可疑炒作交易、業務曖昧、策略同實力唔一致嘅公司。

The debate over potential chilling effects centers on whether aggressive enforcement discourages beneficial innovation. Industry advocates argue that regulatory uncertainty and enforcement risk deter legitimate companies from adopting crypto treasuries even when strategically sound.

對所謂「寒蟬效應」嘅討論焦點,係激進監管會唔會阻礙有益創新。業界擁躉話,監管不明朗同執法風險,會令好多本來有戰略意義、其實有理據去持有加密資產嘅正規公司,都唔敢郁,錯失發展機會。They point to the fragmented U.S. regulatory landscape - with the SEC, CFTC, FinCEN, state regulators, and banking authorities all claiming jurisdiction over different aspects of crypto activity - as creating compliance complexity that favors only the largest, most resourced companies. Smaller firms that might benefit from crypto treasury strategies lack the legal budgets to navigate this complexity, potentially missing opportunities to strengthen balance sheets and attract investor interest.

他們指出美國監管環境四分五裂,包括SEC、CFTC、FinCEN、各州監管機構同銀行當局等,都聲稱對加密貨幣活動唔同範疇有監管權,導致合規複雜,結果只係對最大、資源最充足嘅公司有利。較細嘅公司即使可以受惠於加密財資策略,都無足夠法律預算去處理這啲複雜要求,可能錯過咗強化資產負債表同吸引投資者興趣嘅機會。

Conversely, investor protection advocates argue that the 2025 explosion of crypto treasury announcements - with over 200 companies pivoting to crypto strategies in a single year - exhibits clear signs of faddish behavior driven by stock promotion rather than sound financial management. They note that 25 percent of public companies holding Bitcoin now trade below their Bitcoin net asset value, indicating market skepticism about management's value creation beyond passive cryptocurrency holdings. The pattern of struggling companies with declining core businesses suddenly announcing crypto pivots mirrors the 2017 blockchain bubble, when adding "blockchain" to a company name sufficed to trigger triple-digit stock gains.

相反,投資者保障倡議者認為2025年大量公司宣佈採用加密財資策略——一年內有超過200間公司轉向加密策略——明顯係炒作而唔係穩健財務管理。他們指出,現時有25%持有比特幣嘅上市公司其股價已經低過佢哋持有比特幣資產淨值,顯示市場對管理層除被動持幣以外的價值創造能力持懷疑態度。好多經營困難、核心業務下滑嘅公司,突然轉型做加密財資,重複咗2017年區塊鏈泡沫時期嘅模式——當時只要加個「區塊鏈」落公司名,都可以令股價飆升幾倍。

Grant Thornton's crypto policy outlook suggested that "a lighter regulatory touch and specific crypto legislation could drive cryptocurrency adoption and sector growth," arguing that clear rules legitimize the industry and attract institutional capital. However, Brookings Institution countered that "today's crypto policy choices are occurring against the backdrop of rising bitcoin prices and a regulatory environment where oversight is weakening and political entanglements are deepening - raising legitimate concerns about regulatory capture, ethical conflicts, and public accountability."

Grant Thornton嘅加密政策展望指出,「較寬鬆嘅監管同專屬加密貨幣法例可以推動加密貨幣普及及行業增長」,佢哋認為明確規則可以令行業正規化同吸引機構資本。不過Brookings Institution反駁,話「現時制定加密政策時,背景係比特幣價格上升,而監管環境趨向放鬆、政治糾葛加深——引發對監管被操控、道德衝突及公眾問責的合理擔憂。」

The International Monetary Fund emphasized that effective regulation should pursue consistent objectives across jurisdictions: protecting consumers and investors, preserving market integrity against fraud and manipulation, preventing money laundering and terrorism financing, and safeguarding financial stability. The IMF warned that the actual or intended use of crypto assets attracts attention from multiple domestic regulators with fundamentally different frameworks and objectives, creating coordination challenges that manipulators exploit.

國際貨幣基金組織強調,有效監管應該跨地區追求一致目標,包括保障消費者同投資者、防止欺詐和操縱以維護市場完整性、防止洗黑錢及資助恐怖主義,同埋維護金融穩定。IMF警告,無論加密資產實際用途定預期用途,都會吸引多個國內監管機構關注,而佢哋嘅框架同目標都大不同,造成協調困難,畀不法份子有機可乘。

Perhaps the most compelling argument for stricter oversight comes from market surveillance firms tracking the negative premium phenomenon. When 25 percent of Bitcoin treasury companies trade below net asset value, it signals that markets do not trust management to deploy capital effectively or create shareholder value beyond passive crypto holdings. This discount persists despite crypto price appreciation, suggesting reputational damage from the association with speculative schemes. If stricter enforcement and clearer compliance standards separate legitimate strategies from promotional schemes, the resulting credibility could actually increase institutional investor participation in well-governed crypto treasury companies.

其中一個最有說服力要求加強監管嘅理據,來自市場監察公司觀察到嘅「負溢價」現象。當有25%比特幣財資公司股價低過其資產淨值,表示市場唔信任管理層能有效運用資本或者被動持有加密貨幣之外有創造價值能力。即使加密價格升緊,這種「折讓」依然存在,說明涉及炒作嘅聲譽風險。如果更嚴格執法同明確合規標準,可以將正規策略同炒作計劃分隔清楚,行業公信力提升,反而有助吸引更多機構投資者參與管理良好嘅加密財資公司。

Understanding manipulation risks at the crypto-corporate intersection

Skip translation for heading

The intersection of securities regulation and cryptocurrency markets creates unique manipulation vulnerabilities that traditional enforcement frameworks struggle to address. Stock markets operate under comprehensive surveillance systems with trade reporting, audit trails, broker-dealer supervision, and civil and criminal penalties for manipulation. Cryptocurrency markets, particularly for smaller altcoins, operate with minimal oversight, limited transparency, and frequent cross-border transactions that complicate enforcement. When these two ecosystems meet through corporate crypto holdings, manipulators exploit regulatory gaps and information asymmetries.

證券監管同加密貨幣市場之間嘅交集,形成傳統執法機制難以處理嘅操控漏洞。股票市場有完善監察系統,包括交易報告、審計追蹤、券商監督、以及針對操控行為嘅民事同刑事處罰。但加密貨幣市場,尤其細規模山寨幣,通常監管極低,資訊透明度有限,而且好多跨境交易,令執法更困難。當企業持有加密資產,呢兩個生態系統就真係會產生監管漏洞同資訊不對稱,畀投機者有機可乘。

The classic pump-and-dump scheme adapted to crypto treasury stocks follows a predictable pattern. Promoters identify a small-cap company with weak financial performance, limited institutional ownership, and low trading volumes - characteristics that enable price manipulation with relatively modest capital. They approach company management with a proposal to announce a crypto treasury strategy, often providing convertible debt financing or agreeing to purchase shares at premiums to market. The announcement gets drafted with crypto buzzwords, ambitious language about AI integration and Web3 adoption, and allocation figures designed to impress rather than reflect available capital.

典型嘅「炒高落貨」(Pump and Dump)騙局,應用喺加密財資股上有一套固定套路。推手會搵啲細市值、業績差、機構持股少、成交稀疏嘅公司,因為呢啲特質令用細資本都可以操控股價。佢哋會向公司管理層提議宣佈推出加密財資策略,往往會提供可換股債融資,或以高於市價認購股份。公告通常加入大量加密術語、AI同Web3集成等誇大說法,配以「令人印象深刻」但全無實際資本後盾嘅分配數字。

Before public announcement, promoters position themselves in the stock through purchases spread across multiple accounts to avoid triggering unusual activity alerts. They coordinate with social media promoters who control large followings on Twitter, Reddit, Telegram, and Discord. Some promoters create sophisticated infrastructure including dedicated websites, promotional videos, and fake analyst reports to lend credibility. The announcement timing gets coordinated with social media campaigns beginning immediately upon release, with countdown posts building anticipation, coordinated buying pressure in the opening minutes, and promotional posts emphasizing price targets and momentum.

未公開前,推手會分散喺多個戶口入貨,避免觸發異常活動警告。佢哋會同社交媒體上有大量粉絲嘅推廣員合作(例如Twitter、Reddit、Telegram、Discord)。有啲推手會整埋專屬網站、宣傳片、甚至偽裝分析報告,增強信譽。公告發佈時間會配合社交媒體宣傳,即時有倒數貼文、開市數分鐘同步托價、再加宣傳貼高亮目標價同衝勢。

The stock surges on the announcement day, often triggering exchange-mandated volatility halts that paradoxically increase attention rather than dampening enthusiasm. Retail investors seeing 100 to 200 percent gains fear missing out and chase the price higher throughout the day and following sessions. Meanwhile, promoters gradually sell their holdings into the buying frenzy, carefully managing sell volume to avoid triggering panic. Within days or weeks, promotional activity ceases, buying pressure evaporates, and the stock collapses - often declining 70 to 90 percent from peak levels. Late-arriving retail investors suffer catastrophic losses while promoters realize substantial profits.

宣布當日,股票暴升,經常觸發交易所強制波幅暫停,不過呢種暫停反而吸引更多注意力,未有令熱情冷卻。散戶見到100至200%升幅,怕錯過機會追價。推手乘機慢慢將貨沽出,賣貨量控制得好細,唔會嚇親人。過咗幾日甚至幾星期,推廣活動停晒,買盤消失,股價即刻崩盤——通常會由高位跌返七至九成。遲入場嘅散戶慘輸,推手就賺到盤滿缽滿。

Several factors make crypto treasury stocks particularly vulnerable to this manipulation pattern. First, the crypto narrative alone generates speculative interest from retail investors attracted to potential cryptocurrency upside. Many retail investors maintain crypto holdings and follow crypto markets closely, creating a large potential audience predisposed to view crypto exposure positively. Second, the complexity of evaluating crypto treasury strategies creates information asymmetries that favor sophisticated promoters over retail investors. Most investors lack the expertise to assess whether announced crypto allocations are financially realistic, strategically sound, or properly structured from tax and accounting perspectives.

有幾個原因令加密財資股特別易被操控:首先,單靠「加密」兩個字就已經吸引好多散戶投機,受潛在升幅誘惑。好多散戶本身有持幣,密切留意加密市場,一見相關消息就容易受吸引。第二,評估加密財資策略複雜,產生資訊不對稱,叻嘅推手好易玩死一般散戶。大部分人根本無能力判斷啲宣佈係唔係真的經濟可行、有冇戰略意義,或者稅務會計上有冇漏洞。

Third, the accounting treatment of cryptocurrency holdings under generally accepted accounting principles creates opportunities for misleading disclosure. Until December 2024, companies had to treat crypto assets as intangible assets subject to impairment testing but could not recognize gains without selling. The FASB's ASU 2023-08 now requires fair value measurement with changes reflected in net income each period, improving transparency but also increasing earnings volatility. Companies can emphasize unrealized gains during bull markets to present favorable narratives while downplaying the volatility risks that materialize during bear markets.

第三,一般會計準則下嘅加密資產賬目處理方法,製造咗誤導性披露嘅機會。直至2024年12月,公司要將加密資產當無形資產,做減值測試,但未賣出前唔可以計盈利。FASB嘅ASU 2023-08新規定,要用公平價值計量,加密資產每期升跌要反映喺盈利,令信息透明咗,但同時盈利波動性更高。公司通常會喺牛市標榜未變現利潤,講靚故事,熊市就淡化波幅風險。

Fourth, the leverage dynamics of corporate crypto treasuries create attraction for certain investor profiles while obscuring risks for others. Strategy's success at raising capital through convertible debt and equity offerings to purchase more Bitcoin demonstrates that leverage applied to Bitcoin appreciation can generate extraordinary returns. The company's introduction of "Bitcoin yield" as a key performance indicator - measuring BTC per share growth rather than traditional financial metrics - reflects this refocusing on cryptocurrency accumulation rather than underlying business operations. However, leverage amplifies losses equally during downturns, and the permanent nature of balance sheet Bitcoin holdings means companies cannot easily exit positions without taking losses and disappointing investors.

第四,企業加密財資運用槓桿,有啲投資者鍾意,但有啲人被風險蒙蔽。成功透過換股債及增發股份融資去買比特幣,說明加槓桿喺幣價升市下回報極高。有啲公司開始用「比特幣孳息」做表現指標——計算每股比特幣增長,不睇傳統財務數據,反映已將重心放喺累積加密貨幣多於實業經營。不過,槓桿喺下行市同樣擴大損失,而資產負債表持有比特幣屬永久性,想離場就要認輸同令投資者失望。

Fifth, the international nature of many crypto treasury companies complicates regulatory oversight. QMMM's Cayman Islands incorporation with Hong Kong operations exemplifies structures designed to limit regulatory exposure. Cayman Islands exempted companies face minimal disclosure requirements and no corporate taxation, creating incentives for financial engineering that prioritizes founder and promoter benefits over shareholder protection. When suspicious activity emerges, U.S. regulators must coordinate with foreign authorities who may lack comparable enforcement resources or priorities.

第五,唔少加密財資公司本身國際架構複雜,增加監管困難。例如QMMM喺開曼群島註冊、香港運營,專登用複雜架構減低監管風險。開曼免稅公司披露要求極低、無企業稅,導致結構性誘因偏重創辦人、推手好處,多於保護股東。一旦有可疑行為,美國監管要聯絡外國,對方可能資源有限、重心又唔同,執法難度大增。

The options market interaction with crypto treasury stocks creates additional manipulation potential. Unusual call option activity before announcements, as regulators flagged with MEI Pharma, suggests parties with advance knowledge of announcements positioning for leveraged gains. Options markets in micro-cap stocks typically have minimal liquidity and wide bid-ask spreads, making unusual activity easier to detect but also easier to profit from given leverage. Buying call options before positive announcements and puts before negative announcements allows manipulators to multiply returns beyond stock gains alone.

期權市場同加密財資股互動又增添操控空間。監管部門監察到MEI Pharma等案例,公佈前有異常認購期權活動,顯示有人預先掌握消息賺槓桿回報。市值細股票期權一向流通量低、買賣差距大,異常活動更明顯,同時都好容易畀有心人用槓桿賺大錢。正面消息前買認購,負面消息前買認沽,坐享股份以外嘅翻倍收益。

Market surveillance systems operated by exchanges and regulators detect many manipulation patterns through statistical analysis of trading volumes, price movements, and correlations with external events. However, detection occurs with lag - often days or weeks after suspicious activity - and proving manipulation requires connecting trading patterns to communications and coordination evidence. The use of encrypted messaging apps, international participants, and nominee accounts frustrates investigation efforts. Even when manipulation gets detected, penalties often represent small fractions of ill-gotten gains, creating insufficient

交易所同監管機構運作嘅市場監控系統,係靠統計分析成交量、價格波動同外部事件相關性,去發現唔同操控模式。不過,多數都要過咗幾日甚至幾星期漏洞先至會被捉到,而要證明係內幕或聯合操縱,仲要將交易行為同溝通、協調證據連結起上嚟。加上用加密通訊軟件、國際人士、或人頭戶操作,查證難上加難。即使發現有操控,罰款常常只係賺到錢嘅一小部分,未能有效威嚇。

**(已到段落尾句,原文未完,翻譯至此)**deterrence.

QMMM案件全面展示了這些動態。一家營收下滑、現金極少的微型市值公司,突然宣布配置加密貨幣,規模高達其財政能力200倍。來歷不明的「未知人士」在社交媒體上的推廣,推動股價呈拋物線式上升,完全脫離基本面。成交量暴增,波幅觸發多次熔斷。該公司未能就資金來源作出可信解釋。當監管當局暫停股份買賣時,股價已飆升2,000%,意味推廣者很可能在過程中獲取巨額利潤。即使美國證監會日後成功識別及控告操控者,投資者損失亦難以追回,因為利潤已分散到多個司法管轄區及戶口。

全球監管分歧與競爭動態

監管機構對企業持有加密貨幣的取態,在主要司法管轄區之間差異極大,形成影響公司註冊地點、交易市場及可行策略的競爭動態。歐盟的加密資產市場規例(MiCA)是全球最全面、統一的監管框架,於2024年12月30日全面生效。MiCA為加密資產服務提供者訂立清晰要求,對穩定幣儲備及資訊披露有具體規定,並於全體27個歐盟成員國統一適用。

MiCA要求穩定幣發行人以高質素流動資產(包括現金及國債)一比一足額儲備,法律及運作上分隔儲備與公司資金,並將三成資產掛鈎代幣儲備及六成電子貨幣代幣儲備存於歐盟銀行帳戶。發行人須公開詳盡白皮書,涵蓋代幣特性、風險、儲備組成、技術規格及環境影響。季度審計及每月公開儲備管理細節,確保透明度。代幣持有人可於任何時候五個營業日內以面值贖回,而「重要」穩定幣(超過一千萬持有人、市值五十億歐元或每日2.5百萬交易次數)需遵守更嚴格資本要求。

MiCA的實際影響已可見端倪。市值最大穩定幣Tether USDT因未符合MiCA要求,於歐盟主要交易所受限。Circle旗下USDC及EURC則主打合規優勢,有望擴大歐洲市佔。歐洲九大銀行宣布將聯合推出合規歐元穩定幣。行業估計規例將騙案減少60%,同時令84%發行人能達到合規要求。約七成五歐洲金融機構指已於更明確框架下探索加密資產。

新加坡金融管理局按支付服務法構建審批制度,所有數碼支付代幣服務商須領牌,至2025年9月已有33間領牌公司。資本要求包括公司最低25萬新元。金管局規定九成客戶資產需冷錢包託管、每日對賬及其託管功能必須獨立於交易。新加坡「從首元起」的KYC要求,比FATF標準更嚴;沒有最低金額門檻。而當地禁止加密貨幣在大眾媒體和社交媒體網紅推廣,只准於公司自家渠道宣傳。

新加坡「守護者計劃」體現其機構導向重點,聯同超過40間全球金融機構推動債券、外匯及資產管理代幣化,全部經監管框架運作。「守護者債券框架」和「守護者基金框架」於2024年11月公佈,為機構採用提供明確路徑。該模式強調發展批發市場,多於散戶投機,反映於2024年主要機構牌照如Gemini、OKX、Upbit、BitGo和GSR等獲批。新加坡長期位列亞太區創新及投資者保障領先地位。

香港證監會自2023年6月起強制要求虛擬資產交易平台領牌,採原則為本方法。2025年2月公佈的ASPIRe框架,擴展為涵蓋接入、保障、產品、基建及關係五大支柱,包括OTC服務、加密資產託管及網絡紅人推廣加密資產須領牌等新監管。香港率先批准亞洲首隻現貨比特幣及以太坊ETF,並劃清專業及零售投資者規則。框架要求98%客戶資產冷儲存、獨立審計及與公司資金隔離。

香港的比較定位,走平衡機構參與與零售保護路線。相較新加坡對散戶保護更強,但比歐盟MiCA細節較鬆。這中間路線吸引了Crypto.com和Bullish等大型平台申請牌照,維持香港作為亞洲金融樞紐角色。公司持有加密貨幣無資本增值稅、監管路徑清晰,相比稅制不利司法管轄區,更具競爭力吸納企業財資部位。

阿聯酋(特別是杜拜)成為或許最寬鬆的主要司法管轄區。2023年2月建立的虛擬資產監管局框架要求牌照,但採取親創業者的規則,旨在吸引全球加密業務。2024年9月杜拜VARA與聯邦證券及商品管理局簽訂協議,通過VARA註冊達致全國牌照。關鍵是阿聯酋維持個人加密貨幣收益零入息稅及零資本增值稅,企業只對逾10萬美元利潤徵9%公司稅。個人加密貨幣交易的增值稅已於2024年10月取消。

阿聯酋政府自持大約6,300枚比特幣,市值7億至7.4億美元,全球第六大官方持幣國。幣安估算阿聯酋實體總比特幣持倉約400億美元,人口加密貨幣滲透率高達25.3%,為全球之冠。監管清晰、稅務優惠及官方支持,令大批加密企業湧至杜拜。惟長遠零稅模式可持續性,以及監管深度仍備受質疑,相對傳統金融中心存在不確定。

日本自2017年起已建立加密交易規管,規定平台必須登記於金融廳。現行稅制帶來極大阻力:個人按普通收入最高55%課稅,企業則需按持幣未實現收益課30%。但2025年擬議稅改將對賣出交易徵一律20%資本利得稅,並取消企業加密貨幣未實現收益課稅。如落實,將大為改善企業持幣環境。日本家庭儲蓄14萬億美元,如能降低監管稅務障礙,潛在入場資金巨大。穩定幣前瞻性監管及Progmat等機構平台普及,展現日本正走向主流整合。

美國現時由多個機關交叉監管,加重合規難度。證監會監管屬證券的加密資產,商品期貨委員會管衍生品,FinCEN執行反洗錢規定,州政府管匯款人業務,銀行監管機關則影響加密公司的銀行關係。2025年7月通過的GENIUS法案,首次建立聯邦穩定幣監管,必須足額一對一儲備、禁止支付息金,並視發行規模設聯邦或雙重監管。惟綜合加密市場架構法例仍未落實。

證監會2025年4月指引,要求企業加密資產資訊披露,包括業務階段(開發/營運)、風險因素(波動、監管不確定性)、證券特性(持有權利、技術要求)、管理層背景及重大利益衝突。財務報告按FASB ASU 2023-08,每季公允價值變動須反映損益表。證監會及金融業監管局正調查逾200間企業加密公司,雖政策走向更明確,執法不確定性仍高。

這種全球監管分歧創造套利機會與競爭壓力。公司傾向於如阿聯酋或開曼群島等低稅區註冊,而於其他地方營運。新加坡和歐盟的監管清晰吸引不願面對美國分裂局面的機構資金。然而美國資本池規模最大,欲接觸美國投資者仍需遵循證監會規例,不論註冊地點。中國 comprehensive ban on crypto trading and mining drove activity offshore to Kazakhstan, the United States, and Southeast Asia, demonstrating that overly restrictive regimes cannot eliminate activity but merely displace it.

全面禁止加密貨幣交易和挖礦的政策,將相關活動逼到哈薩克、美國和東南亞等海外地區,顯示過度嚴格的監管制度並不能根除這些活動,只是將活動轉移到其他地方。

Academic analysis by the Atlantic Council tracking 75 countries found cryptocurrency adoption rates weakly correlated with regulatory restrictiveness. Even countries with bans maintain high adoption rates, suggesting prohibition proves generally ineffective. The most successful frameworks combine clear rules enabling innovation with investor protection measures preventing fraud - the balance Singapore and the evolving EU MiCA framework appear to achieve. Overly permissive regimes like the UAE attract activity but face questions about supervision quality and long-term stability. Overly restrictive approaches like China's ban or fragmented approaches like the U.S. current state create regulatory arbitrage without meaningfully protecting investors or preventing adoption.

大西洋理事會追蹤75個國家的學術分析發現,加密貨幣普及率與監管嚴格程度只有微弱相關。即使實施禁令的國家,普及率仍然很高,證明禁令普遍無效。最理想的制度是既有清晰規則支持創新,同時又有保護投資者、防止騙案的措施——新加坡和正發展中的歐盟MiCA框架似乎正好取得這個平衡。過於寬鬆的體制(如阿聯酋)雖有吸引力,但監管質素和長遠穩定性備受質疑。過於嚴厲(如中國禁令)或破碎(如美國現狀)的做法,只會造成監管套利,實際上既未有效保護投資者,也未能遏止加密貨幣的採用。

Scenarios for the future of corporate digital asset strategies

未來企業數碼資產策略的情景

The regulatory inflection point marked by the QMMM suspension and broader investigation of 200 companies creates three primary scenarios for corporate crypto treasury evolution, each with distinct implications for market structure, investor protection, and institutional adoption.

QMMM暫停及對200間公司的大規模調查,標誌著監管拐點,為企業加密資產資金運用帶來三大主要情景。每個情景都對市場結構、投資者保障和機構採納產生不同影響。

The base case scenario envisions regulatory legitimization through stricter oversight that paradoxically accelerates institutional adoption by creating clear compliance pathways and separating legitimate strategies from manipulative schemes. In this scenario, the SEC and FINRA investigations result in enforcement actions against the most egregious manipulators while simultaneously the Crypto Task Force issues clearer guidance on acceptable corporate crypto treasury practices. Companies with robust governance, realistic financing plans, transparent disclosure, and alignment between announced strategies and business fundamentals face minimal disruption. Those with suspicious pre-announcement trading, impossible financial commitments, or connections to promotional schemes face delisting, penalties, and potential criminal charges.

基本情景預計,透過更嚴格監管實現合法化,反而為機構參與提供清晰的合規路徑,令機構採納步伐加快,並將合法策略和操控計劃分隔開來。在這個情景下,SEC和FINRA的調查會懲治最不當的操盤手,同時加密貨幣專責小組會發布更清晰的企業資金運用指引。公司若有健全的管治、合理融資規劃、透明披露及策略和業務基本面一致,影響便有限。若涉及可疑消息前交易、不切實際財務承諾或與推廣計劃有關連,則面臨除牌、罰款甚至刑事調查。

This bifurcation benefits well-capitalized companies with experienced management and institutional investor bases. Strategy's continued success at raising tens of billions through convertible debt for Bitcoin purchases demonstrates that sophisticated capital markets participants will fund crypto strategies they view as credible. Metaplanet's rise from $15 million to $7 billion market capitalization in one year while Bitcoin only doubled shows that proper execution of the treasury model generates extraordinary shareholder returns. Companies following these templates - establishing clear Bitcoin yield metrics, maintaining transparent reporting, securing institutional-grade custody, implementing strong internal controls - attract capital even amid broader regulatory scrutiny.

這種分流對資本充足、有經驗管理團隊及有機構投資者支持的公司最有利。Strategy靠發行可換股債券購買比特幣,成功集資數十億美元,說明資本市場願意為他們認可的加密策略提供資金。Metaplanet一年之內市值由一千五百萬升至七十億美元,而比特幣同期只翻了一倍,顯示正確執行資金運用模式可為股東帶來極高回報。跟隨這些範本(如訂明比特幣回報指標、保持透明報告、採用機構級託管、落實嚴謹內部監控)的公司,即使在嚴密監管下,仍能吸引資本流入。

Bernstein's projection of $330 billion in corporate Bitcoin allocations over the next five years assumes this legitimization pathway materializes. The projection envisions corporate treasuries becoming standard asset class considerations alongside bonds, equities, and real estate for diversified balance sheet management. EY's finding that 83 percent of institutional investors plan to increase digital asset allocations in 2025 supports this trajectory. Sygnum Bank's research suggesting 2025 may mark the year crypto achieves standard asset class status in institutional portfolios reflects growing conviction that regulatory clarity enables mainstream adoption.

Bernstein預計未來五年企業分配於比特幣的資產會達3300億美元,前提是這條合法化道路得以實現。這個預測預期企業資金運用將把加密貨幣與債券、股票及房地產一樣,納入常規資產配置,實行資產多元化。安永調查指,八成三機構投資者計劃於2025年增加數碼資產配置,支持了這個趨勢。Sygnum銀行的研究更稱,2025年或會是加密貨幣獲機構投資組合視為標準資產類別的一年,反映監管明確性令主流採納度不斷增強。

However, this scenario requires resolution of several structural challenges. The U.S. must clarify the fragmented regulatory landscape, ideally through comprehensive legislation establishing which agency has primary jurisdiction over different crypto activities. Accounting standards need further evolution to address the volatility that fair value measurement introduces into earnings. Tax policy must resolve uncertainties around the Corporate Alternative Minimum Tax potentially applying to unrealized crypto gains starting in 2026, which analysts warn could create "hefty tax implications" for major holders like Strategy. Banking regulators need to provide clear guidance enabling crypto companies to maintain accounts without fear of sudden relationship termination.

不過,這個情景下仍需解決多項結構性問題。美國必須釐清支離破碎的監管框架,最好是立法界定各監管部門對不同加密活動的主要權責。會計準則亦要進一步改革,以處理公允價值計量所帶來的盈利波動。稅務政策方面,需明確企業最低替代稅(AMT)自2026年起或適用於未實現加密幣收益的安排——分析員警告主力持有人如Strategy將面臨沉重稅負。銀行監管方面,則要發出清晰指引,讓加密公司可安心維持帳戶,而不用擔心銀行突然終止業務關係。

The bull case scenario envisions these challenges getting resolved favorably, unleashing a wave of mainstream institutional adoption that dwarfs current activity. In this scenario, corporate Bitcoin holdings reach the $330 billion Bernstein projection by 2028 rather than 2030, with acceleration coming from Fortune 500 companies that currently avoid crypto due to regulatory uncertainty. Ethereum and Solana treasury adoption expands from $12 billion currently to $50 billion or more as institutional comfort with alternative layer-one protocols grows. Stablecoin integration into corporate treasury operations becomes routine, with companies using crypto-native payment rails for cross-border transactions, vendor payments, and working capital management.

樂觀情景認為上述難題順利解決,大規模主流機構採納潮爆發,令現時的活動規模遠遠不及。企業比特幣持倉於2028年便達到Bernstein預計的3300億美元(而非2030年),促使現時因監管不明而未踏足加密領域的《財富》500強企業加快進場。以太坊及Solana的企業資金運用由現時的120億美元擴展至至少500億美元,反映機構採用替代Layer 1協議的信心提升。穩定幣納入企業資金管理成為日常,企業用原生加密支付網絡支付跨境款項、供應商費用和靈活資金管理。

DeFi market growth from $21 billion in 2025 to over $231 billion by 2030, averaging 53 percent compound annual growth as projected by Crypto.com, would support this scenario by creating yield opportunities for corporate treasuries beyond passive holdings. AI-driven risk management tools projected to launch by 2026 would address institutional concerns about volatility and security. Project Guardian's tokenization initiatives expanding from 40 institutions to hundreds would normalize on-chain capital markets. Bitcoin reaching $200,000 by early 2026 as Bernstein forecasts would vindicate early corporate adopters and accelerate bandwagon effects.

Crypto.com預測,DeFi市值會由2025年的210億美元增長至2030年的2310億美元,年複合增長達53%,這將為企業資金運用帶來除被動持有以外的收益機會。預計2026年面世的AI風險管理工具,將解決機構對波動性及安全的顧慮。Project Guardian的代幣化倡議由40間機構擴展至數百間,令鏈上資本市場常態化。Bernstein 預測比特幣2026年初升至20萬美元,為早期企業採用者正名,並推動跟風效應。

This scenario faces skepticism from analysts noting that 25 percent of current Bitcoin treasury companies already trade below net asset value despite Bitcoin appreciation. The negative premium suggests markets question whether corporate structures add value beyond individual Bitcoin ownership. If this skepticism persists or intensifies, the premium required to raise capital for crypto purchases increases, limiting the leverage that makes treasury strategies attractive. Additionally, the bull case assumes no major negative events like exchange failures, custody breaches, or protocol vulnerabilities that could trigger institutional flight despite regulatory clarity.

不過,這個情景受到分析員質疑,因為現時有25%持有比特幣的企業,其股價低於資產淨值,即使比特幣本身升值。負溢價反映市場質疑企業架構是否能為比特幣持有人創造附加值。如果這股質疑持續或加劇,企業要為買加密幣集資時要給出更高溢價,限制了資金運用策略中的槓桿吸引力。而且,樂觀情景假設期間沒有出現如交易所倒閉、託管失守或基礎協議漏洞等重大負面事件,否則可能會觸發機構撤資,即使監管環境再清晰也無補於事。

The bear case scenario envisions regulatory crackdown producing market consolidation and shakeout that discourages corporate adoption for years. In this scenario, SEC and FINRA investigations reveal widespread insider trading and Reg FD violations across dozens of companies. High-profile enforcement actions with eight-figure penalties and potential criminal charges for executives create chilling effects. Nasdaq and other exchanges delist numerous companies failing to meet enhanced governance requirements. Investor losses from collapsed promotional schemes generate political pressure for stricter rules preventing companies from holding speculative assets.

悲觀情景則是假如監管嚴厲打擊導致市場整合與淘汰,企業採納加密策略多年間受挫。在這情況下,SEC和FINRA的調查揭發數十間公司涉及內幕交易和違反公平披露(Reg FD)規定。高調執法涉及八位數巨額罰款,甚至高層面臨刑事責任,對業界產生寒蟬效應。納斯達克及其他交易所會將不達增強管治要求的公司除牌。宣傳騙局倒閉損害投資者利益,加劇政治壓力,要強化法律防止公司持有投機資產。

The accounting treatment creates additional pressure in this scenario. Strategy's declining Bitcoin yield - from 2.6 BTC per basis point in 2021 to 58 BTC in 2025 - reflects diminishing returns as holdings grow and capital requirements increase exponentially. Fair value accounting means that crypto market corrections immediately flow through corporate earnings, creating quarterly volatility that conflicts with traditional corporate communication strategies. The 2026 implementation of Corporate Alternative Minimum Tax potentially applying to unrealized gains forces some companies to sell crypto holdings to fund tax payments, creating selling pressure during downturns.

會計處理亦增添壓力。Strategy的比特幣回報已由2021年的每基點2.6 BTC,降至2025年的58 BTC,隨持倉規模增長和資金要求幾何式膨脹,回報邊際遞減。公允價值會計令加密市況一有調整便即時反映於盈利,造成季度業績波動,衝擊傳統企業對外溝通策略。2026年企業最低替代稅(AMT)或適用於未實現收益,或令部分公司需沽出加密貨幣套現繳稅,加劇跌市時的拋售壓力。

Banking relationships deteriorate in this scenario as regulators indicate displeasure with financial institutions supporting crypto activities. Companies struggle to maintain accounts, custody relationships, and payment processing. The concerns expressed by Brookings Institution about "regulatory capture, ethical conflicts, and public accountability" leading to insufficient oversight materialize through major market failures. Public pension funds and endowments that began allocating to crypto treasury stocks suffer losses triggering political backlash. Congress passes restrictive legislation limiting corporate crypto holdings to small percentages of assets or prohibiting them entirely for certain company types.

在此情景下,隨著監管當局對銀行支持加密活動表示不滿,銀行關係惡化。公司維持帳戶、託管及支付處理變得困難。布魯金斯學會提出過的「監管俘虜、道德衝突和公共問責」導致監管不力,在重大市場崩潰中成為現實。開始化加密資產於財政資產的公營退休基金及捐贈基金出現損失,引發政治反彈。國會通過嚴格立法,限制企業可持有的加密幣比例,甚至某類企業全面禁止。

This scenario would not eliminate corporate crypto holdings entirely - Strategy and core believers would persist regardless - but would freeze growth and potentially force some exits. The pattern would mirror the 2022 bear market when numerous companies that announced crypto holdings during the 2021 bull market quietly divested during the crash. However, the higher baseline of adoption in 2025 compared to 2022 and the structural changes in custody, accounting, and institutional infrastructure make a complete reversal less likely than during previous cycles.

這種情景並不會令企業加密持有量完全消失——Strategy和核心信徒仍會堅持——但會凍結增長,甚至迫使部分公司離場。這與2022年熊市的情境相似,當時很多在2021年牛市宣布持有加密資產的公司,在熊市時無聲無息地沽清。但2025年比2022年基礎普及率更高,加上託管、會計及機構基建結構性改變,出現全面逆轉的機會較以往周期低。

The most probable outcome combines elements of all three scenarios: regulatory legitimization for well-governed strategies, continued institutional adoption at measured pace, and market consolidation that eliminates speculative excess while preserving the innovation core. The QMMM suspension and broader investigation represent necessary corrections to a 2025 market that clearly featured excessive faddish behavior and manipulation. Companies announcing crypto strategies without financial capacity or business rationale deserve scrutiny and face appropriate consequences. However, companies like Strategy, Metaplanet, and others with multi-year track records, transparent operations, and sustained Bitcoin accumulation demonstrate that the treasury model can create genuine shareholder value when executed properly.

最有可能的結果是三大情景並存:良好管治策略獲合法地位、機構繼續以審慎步伐參與、而市場經歷整合淘汰過剩投機熱潮,但保留創新核心。QMMM暫停和大型調查是對2025年明顯過度追捧和操縱行為的必要糾正。沒有足夠財力或業務理據卻宣布加密策略的公司,值得審查並需承擔後果。不過,Strategy、Metaplanet等公司,具多年歷史、透明營運、持續儲備比特幣,證明只要正確執行,企業資金運用模式確可為股東創造真正價值。

The key question becomes whether regulatory

關鍵問題變成監管是否……interventions can distinguish between these categories effectively. Overly broad enforcement that treats all crypto treasury companies suspiciously would damage legitimate innovators and drive activity offshore. Insufficient enforcement that allows manipulation to continue would undermine investor confidence and delay institutional adoption. The optimal outcome threads this needle through clear guidance, vigorous enforcement against fraud, and permissive posture toward compliant strategies - the approach Commissioner Peirce and Chair Atkins appear to pursue.

干預措施能有效地區分這些類別。過於廣泛的執法,對所有加密資金公司一概視為可疑,會損害合法創新者並促使行業外移。執法不力,放任操縱行為持續,則會削弱投資者信心,拖延機構採納。最佳情況下,應通過清晰指引、對欺詐嚴格執法,以及對合規策略持寬鬆態度這些手段,成功取得平衡——這正是Peirce專員及Atkins主席所追求的方式。

Balancing innovation imperatives with investor protection mandates

在創新需求與投資者保障責任之間取得平衡

The QMMM case crystallizes fundamental tensions inherent in regulating financial innovation. Cryptocurrency and blockchain technology offer genuine potential to improve financial systems through faster settlement, reduced intermediary costs, programmable money, and democratized access to investment opportunities. Corporate adoption of crypto treasuries represents one pathway for traditional businesses to participate in and benefit from this technological evolution. Legitimate strategic rationales exist for companies to hold Bitcoin as an inflation hedge, Ethereum as infrastructure for blockchain applications, or stablecoins as payment rails.

QMMM案件凸顯監管金融創新的根本矛盾。加密貨幣與區塊鏈技術確實有潛力,透過更快結算、降低中介成本、實現可編程貨幣,以及讓更多人有機會投資,來改善金融體系。企業採用加密資金,是傳統企業參與及受惠於這場科技變革的其中一條路。公司持有比特幣作為抗通脹資產、以以太幣作為區塊鏈應用基礎設施、或用穩定幣作為支付渠道,都有其正當戰略理據。

However, the same innovation narrative that attracts genuine entrepreneurs and value creation also provides cover for fraud, manipulation, and exploitation of unsophisticated investors. The 2017 blockchain name-change bubble, the 2021 meme stock phenomenon, and the 2025 crypto treasury explosion share common patterns: struggling companies pivoting to trendy narratives, stock promoters coordinating through social media, retail investors suffering losses while insiders profit, and eventual regulatory intervention after damage occurs. Each cycle generates calls for stricter oversight to prevent recurrence and industry resistance arguing that regulation stifles innovation.

但同樣的創新故事,既吸引到真正的創業家與價值創造者,也被欺詐、操縱、剝削缺乏經驗投資者的行為利用。2017年區塊鏈「改名」炒作潮、2021年迷因股現象,以及2025年加密資金爆發,都展現共同模式:掙扎中的公司追風倒向新潮敘事,股票推手透過社交媒體協調,散戶投資者承受損失,內部人士卻獲利,最後都是監管介入,等到損失已經發生。每一輪循環都引發要求加強監管以防重蹈覆轍的呼聲,但同時業界也抗議監管扼殺創新。

The data from the QMMM investigation supports aggressive regulatory intervention. A company with $2.7 million in revenue, $1.58 million in annual losses, and under $500,000 in cash announcing a $100 million crypto allocation represents an obvious disconnect that should trigger immediate scrutiny. The 2,000 percent stock surge driven by social media promotion from "unknown persons" fits every element of classic pump-and-dump schemes. The pattern of suspicious pre-announcement trading across 200 companies investigated by SEC and FINRA suggests systematic abuse rather than isolated incidents. The fact that 25 percent of Bitcoin treasury companies trade below net asset value indicates market recognition that many strategies create no value beyond passive crypto holdings.

QMMM調查所得數據支持採取激進監管的行動。一間收入僅270萬美元、年虧損158萬美元、現金少於50萬美元的公司,竟發布一億美元加密貨幣配置計劃,明顯出現斷層,理應立即受審查。受「不明人士」社交媒體推廣推動下暴升2,000%的股價,符合經典「抽水後拋售」手法所有特點。SEC與FINRA調查的200家公司在消息公布前出現可疑交易,也反映這屬系統性濫用,而非個別事件。至於有25%比特幣資金公司股價低於帳面資產,亦顯示市場認同,部分策略除被動持有加密貨幣外,並無創造其他價值。

Yet the existence of manipulation does not invalidate the underlying strategy. Strategy's $8 billion gain on Bitcoin holdings year-to-date in 2025 and 2,919 percent stock appreciation since adopting the strategy in August 2020 demonstrate that leveraged Bitcoin exposure through corporate structures can generate extraordinary returns. The company's success at raising over $21 billion through convertible debt and equity offerings shows that sophisticated capital markets participants will fund strategies they view as credible. Metaplanet's market capitalization increase from $15 million to $7 billion while Bitcoin only doubled proves that proper execution generates premiums to underlying holdings.

然而,有操縱行為的存在,並不代表策略本身無效。以Strategy為例,2025年至今持有比特幣已獲利80億美元,於2020年8月採用該策略以來,股價累升2,919%,說明以公司架構槓桿操作比特幣曝險,確實可帶來卓越回報。該公司能夠透過可換股債券與股票發行融資逾210億美元,表示成熟資本市場的參與者會投資於自認可行的策略。Metaplanet市值由1,500萬美元增至70億美元,而比特幣同期僅升一倍,亦證明執行得法能令資產升值遠高於持幣本身。

The International Monetary Fund's framework for crypto regulation provides useful guidance: protect consumers and investors, preserve market integrity against fraud and manipulation, prevent money laundering and terrorism financing, and safeguard financial stability. These objectives apply uniformly whether regulatory approaches lean permissive or restrictive. The challenge lies in implementation through fragmented national regulatory systems with different legal frameworks, agency mandates, and enforcement capacities.

國際貨幣基金組織(IMF)提出的加密監管框架,為行業提供了有用指引:保障消費者與投資者、維護抵抗欺詐和操縱的市場誠信、防止洗錢和恐怖分子融資,以及守護金融穩定。無論監管取態偏寬鬆或嚴謹,這些目標都是一體適用。挑戰在於,各地法制、部門職權及執法能力不同,導致制度分裂,執行困難。

MiCA represents the most ambitious attempt at comprehensive harmonization, establishing clear rules across 27 EU member states for custody, disclosure, reserve requirements, and redemption rights. The regulation's focus on stablecoins reflects recognition that systemically important digital assets require bank-like supervision. Early results show Tether facing restrictions while Circle and European bank consortiums build compliant alternatives - exactly the market sorting that effective regulation should produce. The projected 60 percent fraud reduction and 84 percent issuer compliance rate suggest MiCA strikes a workable balance between investor protection and enabling innovation.

MiCA則是歐洲最具雄心的統一措施,為27個歐盟成員國就託管、披露、儲備要求及贖回權利等訂立清晰規則。規例著重穩定幣條款,反映當局認同,系統性重要的數字資產要有銀行級監管。初步效果見Tether受限制,而Circle及歐洲銀行聯盟則積極開發符合法規的替代品——正正是一場有效監管導致的市場重整。預期詐騙案數字可減少60%,發行人合規率達84%,顯示MiCA在投資者保障及創新推動之間,實現出可行平衡。

Singapore's approach emphasizes institutional market development over retail participation through stringent licensing, high capital requirements, robust custody standards, and marketing restrictions. The 33 licensed VASPs include institutional-grade platforms like Gemini, OKX, BitGo, and GSR rather than retail-focused exchanges. Project Guardian's 40-plus institutional participants exploring tokenization demonstrates that clear rules attract sophisticated capital even when retail access is limited. This institutional-first approach may prove more sustainable than retail-driven markets prone to manipulation and speculation.

新加坡方式則著重發展機構市場,多於零售參與,並透過嚴格牌照、高資本要求、穩健的託管標準及行銷限制來實現。獲發牌照的33間虛擬資產服務供應商,大多是Gemini、OKX、BitGo、GSR等機構級平台,而非以零售為主的交易所。Project Guardian計劃下逾40間機構參與探索代幣化,證明即使零售渠道受限,規則清晰一樣能吸引成熟資本。這種「機構先行」模式,或比容易受操縱炒作的零售市場更具可持續性。

Hong Kong's middle path between Singapore's institutional focus and broader retail access reflects its traditional role balancing mainland China relationships with international financial center status. The approval of spot Bitcoin and Ethereum ETFs alongside strict VATP licensing and 98 percent cold storage requirements shows how jurisdictions can enable access while maintaining controls. The ASPIRe Framework's expansion to OTC services, custody licensing, and influencer regulation demonstrates regulatory adaptation as markets evolve.

香港則在新加坡「機構為本」與更寬零售取向之間,走出一條中間道路,反映其在維持國際金融中心地位和與內地保持關係之間的傳統平衡。現貨比特幣及以太幣ETF獲批,同時VATP(虛擬資產交易平台)的嚴格牌照及98%冷錢包託管要求,共同證明本地監管可在允許市場參與與風險控制之間兼容。ASPIRe框架擴展至場外交易、託管牌照及KOL(網紅)監管,亦反映監管當局隨市場發展作出調整。

The U.S. fragmentation across SEC, CFTC, FinCEN, state regulators, and banking agencies creates compliance complexity that favors large, well-resourced firms over smaller innovators. However, this fragmentation also enables experimentation and prevents single-point regulatory failure. The evolution from Gensler's enforcement-heavy approach to Atkins and Peirce's innovation-focused strategy shows how leadership changes can shift policy without legislative action. The GENIUS Act's stablecoin framework and expected comprehensive market structure legislation may resolve the worst fragmentation while preserving beneficial regulatory competition.

美國方面,由於SEC、CFTC、FinCEN、各州監管機構及銀行監管部門分工不明,令合規複雜度大增,對大機構有利,但對小型創新者卻構成障礙。不過,機制分拆亦讓業界有空間試驗和避免出現「單點故障」的監管失誤。由Gensler偏重執法,轉到Atkins與Peirce重視創新的策略,說明監管風格能隨領導更迭而不需立法而大轉彎。而GENIUS法案針對穩定幣的監管框架,加上預計出台的全面市場結構立法,有望解決最嚴重的分拆問題,同時保留有益的監管競爭。

The Atlantic Council's finding that cryptocurrency adoption rates correlate weakly with regulatory restrictiveness suggests that prohibition proves ineffective while clear enabling frameworks accelerate institutional adoption. China's comprehensive ban drove mining operations to the United States, Kazakhstan, and other jurisdictions rather than eliminating activity. Nigeria's restrictions pushed trading to peer-to-peer platforms. Conversely, Singapore's clear licensing attracted major institutions despite high compliance costs. The EU's MiCA framework is accelerating rather than slowing institutional exploration.

大西洋理事會分析亦發現,加密貨幣普及率與監管嚴厲性關聯不大——禁令成效低下,相反清晰規範可加速機構入場。中國的全面禁令,促使挖礦轉移到美國、哈薩克等地,並未真正杜絕活動;奈及利亞的限制則令交易轉入點對點平台。反之,新加坡雖需高昂合規成本,卻憑明確規則吸引到大型機構。至於歐盟MiCA,明顯為機構探索加速而非放慢了步伐。

For corporate crypto treasuries specifically, the path forward requires several elements. First, clear disclosure standards distinguishing between companies with track records of accumulation, proper custody, and transparent reporting versus those making opportunistic announcements without financial capacity or business rationale. Second, enforcement targeting manipulation schemes while avoiding overly broad actions that create uncertainty for compliant companies. Third, accounting standards evolution that addresses earnings volatility from fair value measurement without forcing economically irrational behavior. Fourth, tax policy clarity on whether unrealized gains face taxation and at what thresholds.

至於企業加密資金,未來發展應包含多項元素。第一,披露標準要清晰,能區分有累積紀錄、託管適當和透明報告的公司,與那些只趁機發布消息、沒財務實力和缺乏商業理據的公司。第二,執法要針對操縱行為,但避免過份模糊化,令合規公司也陷不確定中。第三,會計準則要與時並進,既處理由公允價值帶來的盈虧波動,又不強迫企業作出不合經濟理性的行為。第四,稅務政策要明確界定未實現收益是否需繳稅,以及適用門檻。

Fifth, custody standards requiring institutional-grade solutions with multi-signature controls, cold storage for majority of assets, insurance coverage, independent audits, and segregation from operational funds. Sixth, governance requirements including board oversight of crypto strategies, independent directors reviewing risk management, disclosure of conflicts between management compensation tied to stock price and decisions to announce crypto pivots, and shareholder approval for material allocations. Seventh, financing structure transparency distinguishing between companies funding purchases with existing cash flow versus those issuing dilutive equity or debt.

第五,託管標準須要求機構級的多重簽名控制、大部分資產以冷錢包存放、保險保障、獨立審計、並與日常營運資金分開。第六,管治標準,包括董事會須監管加密策略、獨立董事審核風險管理、披露高級管理層因與加密消息相關的薪酬潛在利益衝突、以及重大配置須取得股東批准。第七,資金結構必須透明,要區分是利用現金流購買,還是透過發行稀釋性股票或債券融資。

Companies following these practices - Strategy, Metaplanet, Coinbase, Galaxy Digital, and others with multi-year track records - face minimal risk from enhanced regulatory oversight. Those making announcements designed primarily to generate stock price surges rather than execute sustainable strategies face appropriate consequences. Market consolidation eliminating the bottom quartile trading below net asset value would strengthen rather than weaken the ecosystem by improving average quality and reducing association with speculative excess.

有多年紀錄並執行上述做法的公司——如Strategy、Metaplanet、Coinbase、Galaxy Digital等——在監管加強下風險極低;反而只靠消息推動股價、無意實施可持續策略的公司,則理應承擔相應後果。市場縮減低於資產淨值的底層企業,反而能提高整體質素,減少與過度投機的聯想,鞏固生態系統。

The most compelling argument for viewing stricter oversight as long-term legitimization rather than existential threat comes from institutional investor behavior. EY's finding that 83 percent of institutional investors plan to increase crypto allocations assumes clear regulatory frameworks enabling fiduciary compliance. Sygnum's argument that 2025 may mark crypto achieving standard asset class status depends on resolution of the regulatory uncertainty that prevented earlier adoption. Bernstein's $330 billion corporate allocation projection requires confidence that strategies won't face sudden prohibition or punitive treatment.

最有說服力的論點,就是機構投資者的實際行為,證明嚴監管是正規化的長遠過程,而非加密的生存威脅。安永指83%機構投資者計劃增加加密配置,前提便是監管明確、符合法律責任。Sygnum認為,2025年或許正是加密資產被正式接納為標準資產類別的關鍵——前提同樣需解決監管不確定性。Bernstein預計企業配置可達3,300億美元,亦必需業界相信監管不會突然禁令或過度懲罰。

If the current regulatory inflection point produces clear rules, vigorous fraud enforcement, and permissive posture toward compliant strategies, the likely outcome is acceleration rather than deceleration of institutional adoption. Companies will understand what practices are acceptable, investors will have

如果目前的監管拐點能帶來明確規則、嚴打詐騙,同時對合規策略持開明態度,最終結果很可能是機構採納會加速而不是放緩。公司會明白哪些做法可接受,投資者亦會……confidence in disclosure quality, custodians will provide institutional-grade infrastructure, and traditional financial institutions will integrate crypto services rather than avoiding them. The alternative - continued regulatory uncertainty combined with inadequate manipulation enforcement - produces the worst outcome: sophisticated participants capture opportunities while retail investors suffer losses and the technology's legitimate potential remains unrealized.

對披露質素有信心,託管人會提供機構級基礎設施,而傳統金融機構將會整合加密貨幣服務,而唔係全面避開。另一個選擇——即持續既監管不明朗,同埋執法打擊操控不足——只會帶嚟最壞結果:有經驗既大戶繼續搵機會,散戶就慘蝕錢,而科技本身既正當潛力都實現唔到。

The QMMM suspension and broader investigation of 200 companies represent necessary corrections to a market exhibiting obvious excesses. A struggling Hong Kong advertising firm with minimal cash announcing an impossible crypto allocation and experiencing a 2,000 percent stock surge driven by anonymous social media promotion deserves regulatory intervention regardless of one's views on crypto generally. The question is whether interventions stop there, targeting clear manipulation, or expand to create chilling effects that discourage legitimate innovation.

QMMM暫停運作,同時對200間公司展開更大規模調查,其實係對一個過度炒作市場作出必要既調整。有間財政捉襟見肘既香港廣告公司,宣布一個根本唔可能實現既加密貨幣資產分配,跟住因網上匿名炒作股價狂升20倍,呢啲情況就算你點睇加密貨幣都好,其實都應該要有監管部門介入。問題係,監管行動係唔係就停喺明顯操控度,定係會過度擴大,變成凍結正常創新既「寒蟬效應」。

Early indications suggest regulators understand this distinction. Commissioner Peirce's apology for past SEC approaches that hindered innovation and Chair Atkins' emphasis on creating clear frameworks rather than enforcement-only strategies signal awareness that effective regulation enables rather than prevents valuable activity. The continuation of fraud enforcement alongside policy evolution shows that these objectives are complementary rather than contradictory. Companies can innovate within clear rules while manipulators face consequences for exploiting ambiguity.

初步見到,監管機構似乎明白咗呢個分別。Peirce專員就早前美國證監會過份扼殺創新既做法公開道歉,Atkins主席又強調要有清晰規範,而唔係淨係靠執法,反映大家都意識到,有效既監管其實係協助推動有價值活動,而唔係一味阻止。打擊詐騙同時持續完善政策,說明兩個目標可以並行唔悖。公司可以喺有清晰規則之下搞創新,利用漏洞操控既就要付出代價。

The corporate crypto treasury phenomenon ultimately tests whether regulatory systems can adapt to technological innovation at a pace that protects investors without preventing value creation. The traditional model of waiting for crises, then imposing reactive restrictions, then gradually loosening as industry matures creates unnecessary volatility and delays beneficial adoption. A more effective model establishes clear principles - transparency, custody standards, conflicts management, adequate capital - then allows innovation within those boundaries while enforcing vigorously against violations.

企業用加密貨幣做財資,其實考驗緊監管制度能唔能夠以保護投資者既速度適應科技創新,而唔係扼殺價值創造。傳統做法通常係等出事先收緊要求,然後行業成熟先慢慢放寬,結果只會搞到波動大同拖慢有益既應用。更有效既模式,係一開始訂明清晰原則——資訊透明、資產託管標準、利益衝突管理、資本足夠,跟住俾創新喺呢啲範圍內發展,同時嚴格打擊違規。

MiCA's comprehensive framework implemented before major failures rather than after represents this proactive approach. Singapore's institutional-first development prioritizing quality over quantity reflects similar thinking. The United States' current inflection point offers opportunity to establish clearer frameworks before rather than after the next major crisis. The QMMM suspension and broader investigation, while creating short-term uncertainty, may ultimately prove to be constructive corrections that accelerate long-term adoption by improving market quality and investor confidence. The companies that survive this scrutiny with reputations intact will find themselves in stronger competitive positions with clearer paths to institutional capital and mainstream legitimacy.

歐盟MiCA監管框架係主動先行,未有大鑊出事前已經推行,正正係咁既例子。新加坡以機構先行、重質唔重量都係同樣思路。美國而家就喺一個轉捩點,有機會喺下一次大危機前,訂立更加清晰既規範。QMMM暫停及更大規模調查,雖然短暫內帶嚟唔明朗,長遠講可能反而係有建設性既調整,令市場質素同投資人信心都改善,加快長遠普及。能夠通過呢輪審視而聲譽無損既公司,將會有更強競爭力,條路都會更清晰咁引入機構資本同獲得主流認同。