2025年11月11日,SoFi Technologies 創下歷史,成為美國首間獲全國執照的銀行,向零售客戶直接提供加密貨幣交易服務。SoFi Crypto 的推出標誌着傳統銀行與數字資產融合掀起重要一頁,讓 1,260萬名會員 可以在同一個銀行應用程式內,連同支票帳戶、貸款、投資及其他金融產品一併買賣和持有比特幣、以太幣、Solana 及數十種加密貨幣。

這並不只是又一家金融科技公司加新功能或加密貨幣交易所易名做銀行。SoFi 持有 全方位國家銀行牌照,受 FDIC 存款保險及美國貨幣監理署(OCC)監管。雖然加密貨幣不受 FDIC 保障且風險較高,其底層銀行設施、合規框架和監管護欄,代表數字資產與傳統金融體系的整合出現根本轉變。

這發展的意義遠超 SoFi 客戶本身。過去規管嚴格、機構人士持懷疑態度,銀行與加密貨幣之間的高牆已開始倒下。銀行不再把加密貨幣當成“高危資產”避之則吉,反而視作主流消費者越來越渴望於其信任的銀行內可接觸的正規金融產品。

我們下文將深入分析 SoFi 這個創新舉動的多面影響,包括如何將加密貨幣升格為銀行生態中的一個資產類別,並剖析銀行推出該類服務時所需面對的託管、合規及監管框架。此外還會探討此舉如何改寫傳統銀行、金融科技公司、新型銀行與原生加密平台的競爭格局。

這場變革影響深遠。截至目前,大約28%的美國成年人持有加密貨幣,而自2021年底以來,持有率差不多倍增。問題已不再是銀行會否擁抱加密貨幣,而是它們會有多快、以及多全面地推行。從SoFi的決定看來,答案很可能較大多數觀察者預期還要快。

SoFi的舉動:發生了甚麼?有何重大意義

公告及背景

SoFi於11月11日宣布分階段推出 SoFi Crypto,當日已率先開通,數星期內將擴展至所有合資格會員。用戶可買賣及持有多種主流加密貨幣如比特幣、以太幣、Solana等。CEO Anthony Noto 指,這是「銀行與加密貨幣於一個應用程式上的歷史關鍵時刻」,強調平台具備銀行級別安全、機構級合規標準,並接受聯邦層級監管。

推出安排與時機反映戰略部署。SoFi將加密貨幣定位為其「一站式」金融服務生態的一部分,會員可於同一界面管理支票、儲蓄、借貸、投資,現在更包括加密貨幣資產。公司指出,擁有加密貨幣的會員中,六成人更傾向在持牌銀行(而非主流加密平台)交易,顯示消費者渴望合規機構及對銀行監管的信心。

發佈同時也透露 SoFi 長遠的區塊鏈策略。除了加密貨幣交易,公司還計劃推出與美元掛鈎的穩定幣,將加密貨幣納入借貸及基建服務以實現成本更低的借貸、更快支付及新型金融功能。SoFi已善用區塊鏈推動全球加密貨幣匯款,大幅提升國際匯款效率和降低費用。

由暫停到重投加密

要了解今次重啟的意義,必須回顧 SoFi 走過的數字資產之路。2019年,公司 與Coinbase合作,透過 SoFi Invest 首度提供加密貨幣交易。但至 2022年1月 SoFi 獲OCC批准國家銀行牌照時,批文附加嚴格條件:進行任何加密資產業務,須先獲「OCC 出具無監管異議書」。

此限制反映當時監管取態。拜登政府下的聯邦銀行監管機構對加密貨幣日趨審慎,視其為可能危及銀行穩健的風險。至 2023年底,SoFi 被迫全面暫停加密服務,給用戶僅數星期將資產搬至其他平台如 Blockchain.com 或變現。對於一直以創新及全面金融服務作招徠的SoFi,這可說是一次痛苦的撤退。

至2025年形勢徹底逆轉。 OCC於3月發出解釋信第1183號,明確指出國家銀行可從事加密資產託管、特定穩定幣業務及分布式帳本網絡活動,並撤銷事前取得「無異議」的要求。署理監理專員Rodney Hood強調,銀行展開新型業務與傳統金融應實施同等風險控管,但明確表示機構將「減輕銀行開展加密相關活動的監管負擔」。

到 2025年5月,OCC再追加1184號解釋信,進一步釐清銀行可根據客戶指示買賣受託加密資產,亦可將包括託管、執行等活動外判,前提是做好風險管理。這兩道指引實際上扭轉了2023年將SoFi逐出加密市場的監管立場,為其2025年11月重返市場奠定法律基礎。

SoFi CEO Anthony Noto 於 CNBC節目解釋監管大轉變:「過去兩年我們始終無法作加密貨幣買賣及存放——那時作為銀行不被容許。但今年3月,OCC發出了解釋信,讓如SoFi等銀行現時得以正式提供加密貨幣服務。」

「攞頭啖湯」的重要性

SoFi作為首家全國性消費者銀行整合加密貨幣交易,帶來明顯競爭優勢。銀行創新者往往具先發優勢,原因是用戶黏性高及轉換成本大,客戶一旦慣用主要金融機構便很難換。SoFi憑「搶頭啖湯」,可優先吸納追求傳統金融與加密資產合一管理的新一批用戶,趁競爭對手未反應前鞏固客戶基礎。

「銀行級信心」在現今行業格外重要——銀行業仍在從一連串平台崩潰中復原。2022至2023年 FTX、Celsius、Voyager 及 Terra Luna倒閉,蒸發數千億用戶資產,嚴重動搖對加密平台的信任。很多散戶因遭重創對獨立交易所望而卻步,但或會考慮經有FDIC存款保險及聯邦監管的銀行嘗試重投加密資產。

此舉同時警示其他銀行,加密整合不但可行,更潛藏利機。Noto 指 摩根大通、富國或美銀等大型銀行短期內未必跟隨,因為它們欠缺SoFi的純數碼架構及以會員為本的設計。不過,分析認為地區銀行及其他數字銀行隨政策鬆綁、SoFi證明市場需求後,有望加快跟進。

更重要是,SoFi 今次舉動讓加密貨幣這類資產首次獲主流銀行正名及認可。多年來,加密貨幣大多只與傳統金融偶有交集。傳統銀行頂多只向財富管理客戶推介比特幣 ETF,或授權獨立子公司提供機構級交易。SoFi今次則首次將加密貨幣即時交易直接整合至自家生態...... core consumer banking app represents a fundamentally different approach: treating digital assets as just another financial product that everyday retail customers should be able to access through their bank.

核心消費者銀行應用程式採用一種根本不同的思維方式:把數碼資產睇作其中一種金融產品,令日常零售客戶都可以透過佢哋嘅銀行去接觸到。

Retail Banking Model Re-Engineered

零售銀行模式重新打造

The One-Stop-Shop Value Proposition

一站式金融服務嘅價值主張

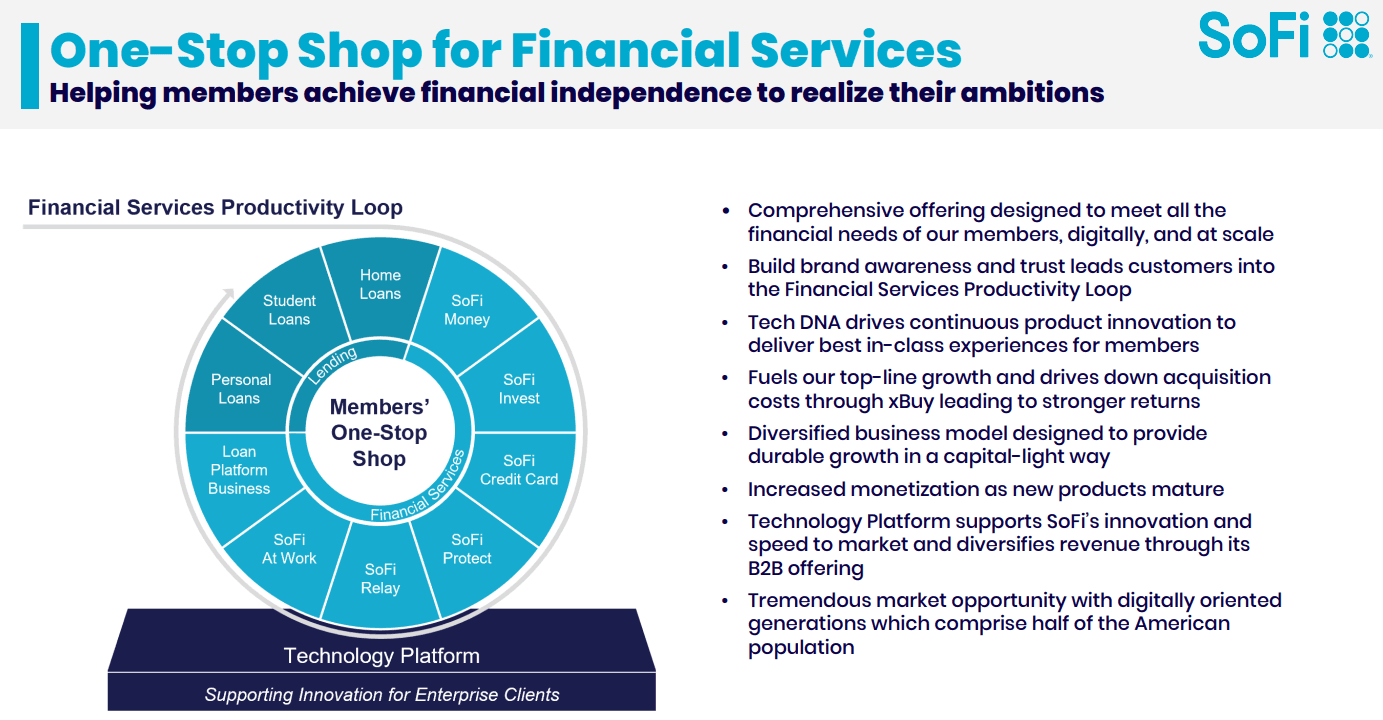

SoFi建立佢個業務模式,圍繞住一個金融「一站式平台」嘅理念,會員可以喺同一個統一平台上處理銀行、借貸、投資、保險同埋其他金融服務。加埋加密貨幣買賣,可以進一步推動用戶獲取、互動同維繫。

客戶獲取方面,就係吸引啲對加密貨幣有興趣但本身冇諗過用SoFi嘅用戶。 調查數據顯示60%持有加密貨幣嘅SoFi會員都想經有牌銀行管理佢哋嘅加密資產。呢樣反映咗對加密市場有興趣,但對獨立交易平台又唔太放心嘅用戶有唔少潛在需求。SoFi提供受監管嘅入口,可以吸收一批只係有興趣但未有膽落場嘅客戶。

至於參與度,因為加密貨幣市場本身好動態。唔同普通儲蓄戶口平時冇乜活動、或係按揭貸款咁每月交一次,做加密交易會令用戶頻繁登入同交易。 加密市場24小時不停運作,用戶有可能每日查好幾次持倉,提升佢哋喺SoFi app上面停留嘅時間。互動多咗,自然有更多機會賣其他金融產品,亦令客戶關係更深厚。

而客戶黏性方面,統一平台多產品令切換銀行成本變高。如果淨係開咗個支票戶口,出面加多啲利息就可能攞晒啲錢走。但係當你用SoFi管理你嘅支票、投資、加密持倉同貸款,要轉銀行要搞好多嘢,例如搬多個戶口或者賣加密貨幣仲有機會要交稅。所以用得多SoFi就越唔想轉。

Impacts on Deposit Flows and Revenue Streams

對存款流同收入來源嘅影響

加密貨幣交易功能加入後,對存款流同收入結構會產生新嘅動力。SoFi設計咗用戶可以即時用FDIC認可嘅SoFi Money支票或儲蓄戶口買入加密幣,唔使轉錢去外面交易所。唔做加密交易果時,現金照停喺收息戶口,最高覆蓋到兩百萬美金嘅FDIC保障。

咁樣會產生一個存款飛輪效應。炒加密多數要預備一大筆現金以便捕捉市況,如果現金唔好擺喺交易所,SoFi就建議用戶擺喺銀行戶口,又賺利息又令銀行存款量上升。尤其遇上市況加息時,存款同貸款利差帶嚟更加高利潤。

收入方面又唔止靠息差。銀行做加密交易通常會收交易費,同股票brokerage差唔多。雖然SoFi冇公開收費細節,但業界大約係每單0.5%到2%不等,視乎幣種同金額。幾百萬潛在用戶加上加密波動性大,交易額自然更多,收費就有得賺。

計劃推出嘅美元穩定幣都可以成為新收入來源。如果SoFi發行一隻由美元儲備支持嘅穩定幣,一方面可以賺穩定幣儲備帶嚟嘅利息,一方面又可以方便支付、匯款等金融應用。最近GENIUS法案通過,為支付型穩定幣帶來清晰監管規矩,令呢條路數更有可行性。

Risk Management and Compliance Shifts

風險管理及合規要求之變化

銀行想提供加密貨幣服務,要由頭檢視風險管理及合規政策。傳統銀行存款好穩定,好易預測,加密貨幣價值波動勁大,會影響客戶行為,也帶來營運挑戰。

反洗錢同認識客戶規定做到好複雜。SoFi本身喺AML/KYC方面已經有好勁嘅安排,但區塊鏈嘅半匿名特性,令加密交易要做更多監察。例如要提防有人將加密貨幣轉去/收嚟自有問題嘅地址,包括受制裁對象或非法用途。

銀行要設置好流程,杜絕客戶加密資產同銀行自己資產混合,一定要分清楚。 美國OCC強調銀行做加密託管時要確保活動安全穩妥、符合法律。即係要有清楚程序,點樣存放、邊個有私鑰、交易點授權、以及萬一遇到資安事故或系統出錯,銀行要點應對。

營運風險方面,仲要適應加密市場24/7運作同交易不可逆特性。傳統銀行出錯好多時都可以補鑊或逆轉,但加密送去錯地址唔可以追回,所以界面設計、交易核對同客服都要特別小心。

Consumer Experience Implications

對用戶體驗嘅影響

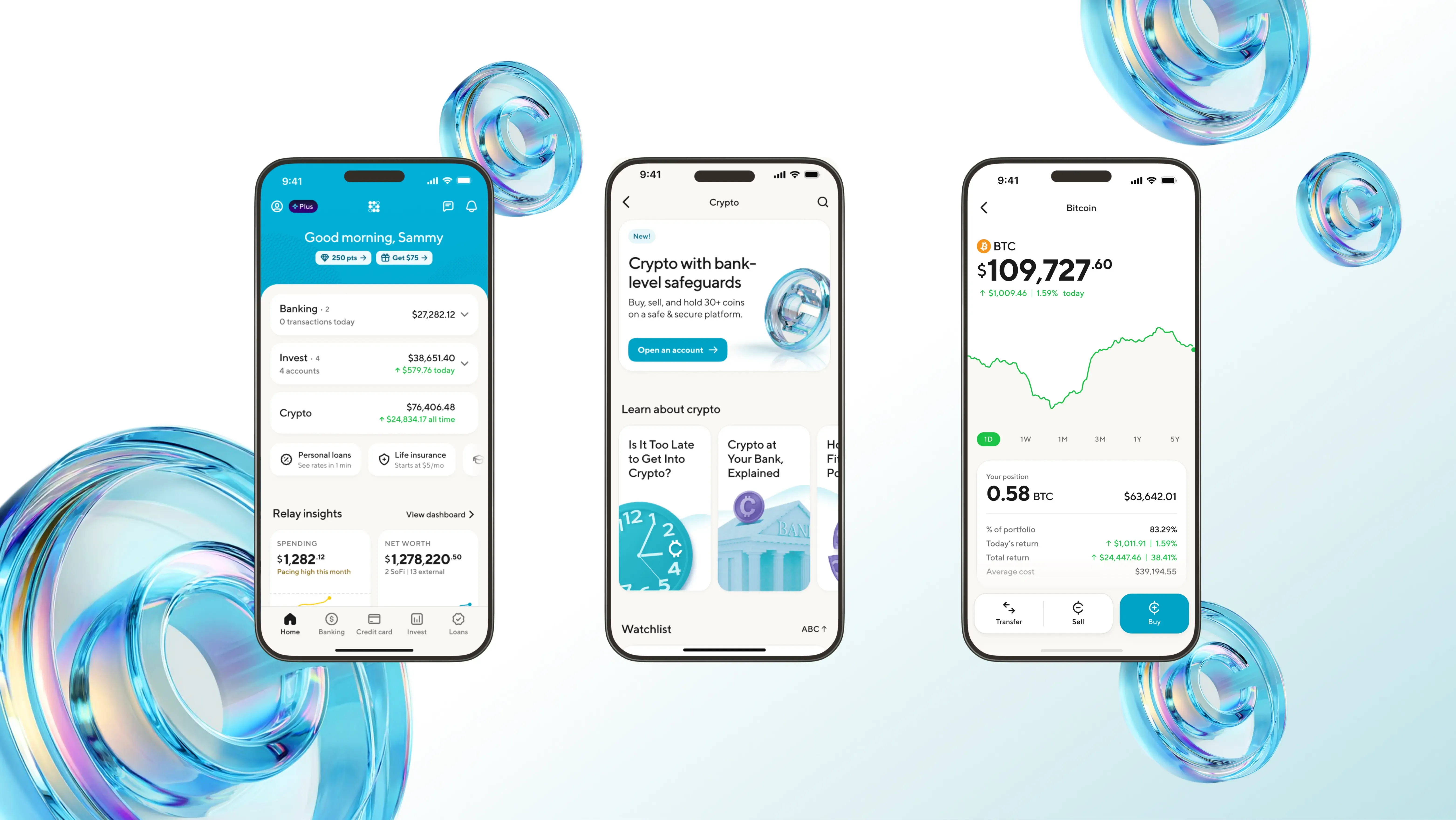

對客戶嚟講,SoFi集成加密貨幣服務大大簡化咗用戶體驗,唔使另外開戶、重複做身份認證、唔使加外面銀行帳戶供款、亦唔使同多個金融機構周旋,全部一App搞掂。

簡化咗個流程,對大眾接受有決定性影響。調查一再顯示,加密貨幣「太複雜、唔熟識」一向係非技術用戶踏入市場嘅最大障礙。調查數據話,有63%美國人唔覺得現有加密投資或使用方式可靠安全,年紀大嘅更加顧慮。可信賴銀行提供一個熟口熟面嘅界面,可以舒緩好多疑慮。

SoFi亦著重教育內容同新手操作指引,適合第一次接觸。好多加密交易所預設用戶識得wallet、私鑰、gas費、chain確認咁,但SoFi由用戶角度出發,用銀行式教育資源,令一啲本來唔會接觸加密貨幣嘅人都可以放心試下。

但挑戰都有。加密波幅勁大,銀行要小心管理用戶期望,確保佢哋明白風險。唔同FDIC受保存款有最高25萬美元保障,加密幣投資風險係會全輸。SoFi申報聲明都好清晰——「加密貨幣及其他數碼資產唔係銀行存款,唔受FDIC或SIPC保障,冇任何銀行保證,價值可以升可以跌,有可能會全冇。」

銀行涉足加密市場,仲要預計好市況波動時嘅客服需求。例如Bitcoin每日跌20%或有大型黑客入侵熱炒代幣時,用戶查詢會爆升。銀行要有足夠人手、訓練同後勤撐場,唔可以拖慢傳統銀行服務質素。

Custody, Banking Regulation and Crypto Integration

託管、銀行監管同加密整合

The Custody Challenge

加密資產託管難題

Custody of digital assets presents fundamentally different challenges from custody of traditional securities or bank deposits. With stocks or bonds, custody typically involves entries in electronic book-entry systems maintained by central securities depositories like the Depository Trust Company. If something goes wrong, there are established processes for identifying ownership and reversing erroneous transactions.

數碼資產嘅託管同傳統證券或銀行存款託管係完全唔同一回事。股票、債券託管,通常依靠中央證券託管機構(如Depository Trust Company)嘅電子簿記系統管理,出現問題都有既定流程可以追回或糾正錯誤交易。

Cryptocurrency custody requires managing cryptographic

加密貨幣託管就要處理密碼學安全......private keys that provide access to assets on blockchain networks. Whoever controls the private keys effectively owns the crypto. If keys are lost, stolen or compromised, the assets can be permanently unrecoverable or transferred to thieves with no ability to reverse the transactions.

掌握著區塊鏈網絡資產的私鑰就等於擁有這些資產。任何人只要控制咗私鑰就形同實際擁有相關加密貨幣。如果私鑰遺失、被盜或者洩露,這啲資產有機會永久無法取回,或者會畀賊人搶走,無法追回相關交易。

For banks offering crypto services, this creates enormous operational and liability concerns. SoFi must implement what it describes as "institutional-level security" and "rigorous compliance standards" to protect customer assets. This likely involves a combination of hot wallets for operational liquidity and cold storage for the bulk of customer holdings, multi-signature authorization requirements, hardware security modules, regular security audits and comprehensive insurance coverage.

對銀行而言,提供加密貨幣服務帶嚟極大嘅操作風險同法律責任憂慮。SoFi必須落實佢所講嘅「機構級安全」同「嚴謹合規標準」去保障客戶資產。實際上,呢啲措施往往包埋熱錢包用作日常流動資金管理、冷錢包儲存大部分客戶資產、多簽認證要求、硬件安全模組、定期安全審計,同全面保險保障等多種安全架構。

Many banks are expected to partner with specialized enterprise custody providers like Anchorage Digital, BitGo or Fireblocks rather than building custody infrastructure in-house. These providers offer institutional-grade security specifically designed for digital assets, including features like multi-party computation for distributed key management, policy engines for transaction authorization and integration with banking compliance systems.

好多銀行預計會揀同專門企業託管供應商(例如Anchorage Digital、BitGo、Fireblocks等)合作,而唔係自己砌託管基建。呢啲第三方專門公司提供針對數碼資產嘅機構級安全功能,包括多方運算技術分散管理私鑰、交易授權策略引擎,及同銀行原有合規系統高度整合等。

The OCC's Interpretive Letter 1184 explicitly permits banks to outsource crypto-asset activities including custody to third parties, provided they maintain "appropriate third-party risk management practices." This means banks must conduct due diligence on custody providers, establish clear service level agreements, monitor ongoing performance and maintain business continuity plans in case a provider fails or is compromised.

OCC第1184號解釋信明確允許銀行將加密資產嘅服務(包括託管)外判比第三方,只要銀行做到「適當第三方風險管理」。即係銀行一定要認真做盡職調查、簽訂清晰服務水平協議、定期監察服務表現,同時備有業務持續計劃,以應對仲有機會發生供應商服務中斷或者被攻擊等情況。

Regulatory Oversight Framework

Banks offering crypto services must navigate a complex web of overlapping regulatory authorities. The OCC supervises national banks and federal savings associations, including their crypto activities. The Federal Reserve oversees bank holding companies. The FDIC provides deposit insurance and supervises state-chartered banks. The Financial Crimes Enforcement Network enforces Bank Secrecy Act compliance.

提供加密貨幣服務嘅銀行面對嘅監管架構好複雜,涉及多個重疊嘅監管機構。OCC負責監督全美銀行同聯邦儲蓄協會,包括佢哋嘅加密業務;聯邦儲備局監管銀行控股公司;FDIC提供存款保險同監督州特許銀行;美國金融犯罪執法局則負責銀行保密法嘅執行。

Beyond banking regulators, crypto activities may also trigger oversight from the Securities and Exchange Commission if assets are deemed securities, the Commodity Futures Trading Commission for derivatives, and state regulators depending on the specific activities and jurisdictions involved.

銀行業監管以外,如果加密資產屬於證券,證券交易委員會都會介入;涉及衍生工具則由商品期貨交易委員會負責,加埋根據實際涉及嘅商品及業務範疇,唔同州份監管機構都有可能管。

The GENIUS Act, signed into law on July 18, 2025, provides the first comprehensive federal framework for payment stablecoins. The legislation establishes a dual federal-state regulatory system where stablecoin issuers can be supervised by the OCC as federal-qualified nonbank issuers, regulated under state frameworks, or issued by insured depository institutions. The Act requires payment stablecoins to maintain one-to-one backing with liquid reserves and subjects issuers to strict capital, liquidity and transparency requirements.

2025年7月18日簽署成法嘅GENIUS法案,係美國第一套全面規管支付穩定幣嘅聯邦框架。法例確立咗聯邦—州雙重監管體制:穩定幣發行人可以選擇申請OCC聯邦認證(成為合資格非銀行發行商)、受州監管框架規範,或者由受保存款機構發行。新法要求穩定幣必須有一對一現金或高度流動資產作為儲備,發行人仲要符合嚴格嘅資本、流動性同透明度要求。

This regulatory clarity matters enormously for banks considering crypto integration. For years, the primary regulatory risk was uncertainty about whether activities would be deemed permissible and what standards would apply. The combination of OCC interpretive letters and the GENIUS Act provides much clearer parameters, even though many implementation details remain to be worked out through subsequent rulemaking.

呢個監管清晰度對諗住開展加密業務嘅銀行黎講好重要。之前一直最大風險就係唔知啲活動認唔認受,應用咩標準。OCC指引加埋GENIUS法例,為銀行定咗比較清晰嘅界線,雖然仲有好多細節未真正落實,要再透過規則制定慢慢完善。

However, the regulatory framework for cryptocurrencies other than payment stablecoins remains less settled. Bitcoin and Ethereum are generally not considered securities, but the classification of many other tokens continues to be debated. Banks must carefully evaluate the regulatory status of any crypto asset they plan to offer and implement risk management frameworks appropriate to the level of uncertainty.

不過,除咗支付穩定幣之外,其餘加密貨幣嘅監管框架仍然唔穩定。比特幣同以太坊一般唔當係證券,但好多其他代幣嘅分類仍然有爭議。銀行提供加密資產前,一定要審慎評估相關資產嘅監管地位,同建立適合相關不確定性的風險管理措施。

Bank-Grade Claims and What They Mean

SoFi repeatedly emphasizes its "bank-grade security" and "institutional-level" compliance as key differentiators. These claims reflect meaningful differences in how regulated banks approach crypto compared to standalone exchanges.

SoFi好強調佢哋提供「銀行級安全」同「機構級合規」,作為主要賣點。其實,銀行受監管方式處理加密貨幣,確實同一般獨立交易所好唔同。

Banks are subject to regular examinations by federal regulators who assess capital adequacy, asset quality, management capabilities, earnings performance and liquidity. These examinations are comprehensive and intrusive, with examiners reviewing lending files, testing compliance programs, evaluating internal controls and assessing management decisions. Banks that fail to meet standards face enforcement actions ranging from written agreements to civil money penalties to removal of management.

銀行每年要接受聯邦監管部門嘅全面審查,包括資本充足率、資產質素、管理水平、盈利能力、流動性等。這啲審查好仔細、好嚴格,監管人員會查貸款紀錄、測試合規系統、評估內部控制、檢視管理決策。如果唔達標,銀行會受到處分,可以係書面協議、民事罰款,甚至撤換管理層。

This supervisory infrastructure does not exist for most crypto exchanges, which may be registered as money service businesses but face far less intensive ongoing oversight. The contrast became starkly apparent during the 2022-2023 crypto crisis, when exchanges like FTX collapsed due to misuse of customer funds, inadequate internal controls and fraudulent activities that would likely have been detected quickly through bank examination processes.

但好多加密貨幣交易所只需註冊做「貨幣服務商」,實際監管遠遠冇銀行咁嚴格持續。喺2022到2023年加密貨幣危機時期,FTX等交易所以挪用客戶資金、內部控制差、甚至欺詐而倒閉,呢啲醜聞如果有銀行級審查,應該早就被發現。

Bank-grade security also means maintaining capital ratios that provide cushion against losses, liquidity buffers to meet withdrawal demands, and risk management frameworks tested across multiple market cycles. While crypto exchanges might fail overnight when withdrawals surge or a hack depletes reserves, banks are specifically designed to weather financial stress through prudential regulation requirements.

「銀行級安全」仲包括保持資本充足率以應對損失、設有流動性儲備應付提現潮,建立經歷多個市場周期考驗嘅風險管理架構。加密貨幣交易所在客戶大量提款或者遇到黑客攻擊時隨時會即晚倒閉,但銀行透過審慎監管要求,專門應對金融壓力。

For customers, this translates to tangible differences in how their assets are protected. While the cryptocurrencies themselves remain uninsured, the banking infrastructure supporting custody and trading operates under regulatory standards specifically designed to prevent loss of customer assets. SoFi's deposit accounts that fund crypto purchases carry FDIC insurance, meaning customers never risk their bank deposits even if something goes wrong with crypto operations.

對客戶嚟講,佢資產受保障方式真係好唔同。雖然加密貨幣本身冇保險,但存放嘅銀行基礎設施同託管、交易流程經過特別監管設計,保障客戶資產安全。SoFi用嚟結算買賣加密貨幣嘅存款戶口有FDIC存款保險,即使加密部門出事,客戶銀行存款都唔會有損失。

Self-Custody Versus Bank Custody Implications

SoFi's model, where the bank provides custody of customer crypto assets, represents a fundamentally different approach from the "self-custody" ethos that underlies much of crypto culture. Bitcoin and many other cryptocurrencies were designed to enable individuals to hold and transfer value without intermediaries. The rallying cry "not your keys, not your coins" reflects the belief that true ownership requires controlling your own private keys rather than trusting a third party.

SoFi模式下,由銀行託管客戶加密資產,呢種做法同加密貨幣界持有嘅「自我託管」原則截然不同。比特幣等加密貨幣,其設計本意就係想用戶可以唔靠中間人自己保管同轉移資產。有句名言「唔係你嘅私鑰,唔係你嘅幣」,即係強調真正擁有權在於你控唔控制自己嘅私鑰,而唔係交比第三方便。

Bank custody of crypto assets inverts this philosophy. SoFi customers do not control the private keys to their holdings. Instead, they trust SoFi to maintain custody, similar to how securities investors trust brokers to custody stock holdings. This brings both benefits and tradeoffs.

銀行託管模式完全推翻咗加密貨幣圈個理念。SoFi客戶係無直接控制自己加密貨幣嘅私鑰,實際係信任SoFi幫手保管,情況有啲似證券投資者依靠券商保管股票一樣。呢種方式有好處亦有妥協。

The primary benefit is convenience and risk mitigation. Most retail investors lack the technical sophistication to securely manage private keys, operate hardware wallets or protect against phishing attacks. The prevalence of user error leading to lost crypto suggests that for many people, bank custody may actually be safer than self-custody.

主要好處係方便同減低出錯風險。大部分散戶都未必有足夠技術去安全保管私鑰、使用硬件錢包、或者抵禦釣魚詐騙。過去用戶自己保管私鑰經常發生遺失資產,對好多用家嚟講,交比銀行託管反而仲安全。

Bank custody also enables account recovery mechanisms. If customers forget passwords or lose devices, banks can verify their identity through existing authentication processes and restore access to accounts. With self-custody, forgetting a seed phrase or losing a hardware wallet means permanent loss of assets with no recourse.

銀行託管仲可以做到賬戶回復。如果客戶唔記得密碼或者遺失咗裝置,銀行可以透過身分認證流程協助恢復戶口。自我託管就冇咁方便,唔記得助記詞或者部硬件錢包唔見咗,就等於資產永遠損失,無得追討。

However, bank custody means customers must trust the institution and accept that their holdings could be frozen by court order, targeted by government seizure or affected by the bank's own financial difficulties. This runs counter to the original vision of cryptocurrency as censorship-resistant money that governments and institutions cannot control.

但係揀銀行託管,客戶就要信任銀行,亦要接受佢嘅資產有機會根據法庭命令被冻结、被政府查封或者銀行自身出現財政問題。呢個情況同加密貨幣初衷“不受審查、政府控制唔到”背道而馳。

The emergence of bank custody as a major model for crypto holdings has important implications for consumer behavior and the overall crypto ecosystem. If most retail investors access crypto through banks rather than self-custody wallets, it may slow adoption of features that require direct blockchain interaction, like decentralized finance protocols or NFT marketplaces. Conversely, it may accelerate mainstream adoption by reducing barriers to entry and providing familiar banking interfaces.

銀行託管成為主流,對消費者行為以及整個加密生態都有深遠影響。如果大部分散戶都經銀行而非自我託管錢包入手,可能會減慢某啲需要直接連區塊鏈互動嘅應用(例如DeFi、NFT市場)嘅普及。反過來,銀行介面熟悉、門檻低,可能會加快主流用戶入場。

Regulatory Implications and Competitive Landscape

Regulatory Dimension: Increased Scrutiny and Frameworks

SoFi's move into crypto will inevitably attract intensified regulatory attention to the intersection of banking and digital assets. The OCC has stated that it expects banks to maintain strong risk management controls for crypto activities, but specific supervisory guidance continues to evolve. As more banks offer crypto services, regulators will gather data on how these activities affect bank safety and soundness, consumer protection and financial stability.

SoFi開展加密貨幣服務,必然會令銀行同數碼資產之間嘅接合點成為監管焦點。OCC已經表明,銀行展開加密服務時必須實現強大風險管控,不過具體監管指南仍然持續演變。隨住越來越多銀行提供加密服務,監管機構會收集更多數據,分析這類業務究竟會點影響銀行穩健、消費者保障同金融體系穩定。

Several regulatory concerns will likely drive ongoing policy development. Consumer protection remains paramount, given crypto's complexity and

有幾個監管關注點預計會推動後續政策發展。基於加密貨幣本身複雜性,消費者保障仍然至關重要,而...volatility。監管機構必須在支持創新與確保銀行充分披露風險、防止不適當投資,以及妥善處理客戶投訴之間尋求平衡。貨幣監理署(OCC)及其他銀行監管機構有可能頒布具體指引,規定銀行在推廣加密貨幣服務時應採取的營銷方式、所需披露的資訊,以及合適的客戶篩查程序。

系統性風險考慮同樣重要。如果加密資產成為銀行資產的重要部分,或銀行與加密貨幣市場產生重大依賴關係,這可能會形成金融傳染的渠道。如果管理不善,加密貨幣市場嚴重崩盤恐會影響銀行盈利、資本比率或流動性。監管機構可能會對集中風險設限,或要求對加密資產曝險計提額外資本。

存款保險問題與加密貨幣之間存在複雜交集。雖然加密貨幣本身明確不屬於FDIC保險範圍,但用於購買加密貨幣的存款帳戶則享有保險保障,這容易令客戶混淆,因此需要小心溝通。此外,隨著銀行可能發行由存款儲備支持的穩定幣,也引發了穩定幣的經濟實質是否等同存款,以及是否應享有類似保障的問題。

銀行監管與其他監管體系的互動增加了複雜性。美國證券交易委員會(SEC)持續聲稱,許多加密資產屬於證券,具備監管權限;而商品期貨交易委員會(CFTC)則主張對加密衍生品作為商品享有監管權。銀行監管機構必須與這些部門協調,以確保監管一致性,避免機構刻意將業務活動規劃於監管最寬鬆的機構範圍內,造成監管套利空間。

金融機構間的競爭動態

SoFi的公告即時改變了金融服務業的競爭格局。雖然行政總裁Anthony Noto對大型銀行會否迅速跟進持懷疑態度,認為它們欠缺整合加密貨幣所需的數碼基建及以會員為本的服務模式,但其他機構已明顯有所關注。

多間大型銀行正同步研究加密貨幣策略。摩根大通、美國銀行、花旗及富國銀行據報已初步商討,合資成立新公司並由這些銀行共同持有,包括經營Zelle的Early Warning Services,以及The Clearing House,希望推動聯合運作的穩定幣。雖然尚處初步階段,這計劃已反映華爾街最大銀行認為加密整合勢在必行,並積極維護數碼資產普及化後的市場地位。

摩根大通已營運JPM Coin作內部結算用途,富國銀行也試行Wells Fargo Digital Cash用於其網絡中的跨境支付。美國銀行行政總裁Brian Moynihan亦曾表示,只要監管配合,該行可發行全額美元支持的穩定幣。現有計劃顯示,大銀行早已為加密業務整合作出部署,即使暫未推出面向消費者的交易服務。

地區性銀行及數碼優先型金融機構則可能行動更快。相對有着數十年實體分行網絡與系統整合負擔的傳統銀行,純數碼銀行可更易於平台新增加密資產功能。預期隨着銀行體認到加密服務對吸引年輕客戶、滿足其對數碼資產服務的基本期望愈趨重要,會有一波銀行效法SoFi,進軍加密市場。

傳統券商同樣壓力大。像Charles Schwab、Fidelity及TD Ameritrade等公司,曾透過現貨比特幣ETF提供比特幣曝險,但未有提供直接加密交易。隨着銀行進軍加密,券商或需跟進,才可在投資帳戶領域維持競爭力。據報,Charles Schwab及PNC亦正準備推出相關服務。

至於原生加密貨幣交易所,則面臨最具破壞性的競爭威脅。Coinbase、Kraken及Gemini等公司過去因銀行拒絕提供加密服務而迅速崛起,專注於數碼資產市場。現時銀行進場,擁有龐大品牌信譽、穩定客戶群、全方位金融服務及監管信任等優勢。交易所必須透過更佳產品、更廣資產選擇,或獨特達到銀行難以複製的服務來突圍。

機構金融轉型

不僅零售銀行,SoFi的舉措亦體現並加快了機構金融的轉型。渣打銀行於2025年7月成為全球第一間系統重要性銀行,向機構客戶提供現貨比特幣及以太坊交易,並整合於其現有外匯平台。這讓企業財務主管、資產管理人及機構投資者可使用熟悉的銀行介面並經受監管的結算方式交易數碼資產。

機構採納加密的模式與零售市場明顯不同。大型企業及投資者需要加密資產以應對資金管理、避險策略或客戶服務等特定用途,而非純炒賣。他們需要先進的託管方案、稅務最佳化服務、合規支援及與企業風險管理系統融合的能力。能夠提供這些服務的銀行有機會從機構級加密業務中收取可觀費用。

資產代幣化亦是銀行積極部署的新領域。美國國債、房地產及私募股權等資產的代幣化正逐步改變機構創造、交易及投資的方式。兼具傳統證券及區塊鏈專長的銀行,在協助這場轉型上具備優勢。

中央銀行數碼貨幣(CBDC)亦可能成為遊戲改變者。雖然美國尚未決定發行CBDC,但不少國家正積極推進相關發展。銀行有望在CBDC發行及整合過程中扮演核心角色,因此早早強化數碼資產能力極有戰略意義。

對監管者的啟示

從監管角度看,銀行提供加密服務既是機會亦是挑戰。機會在於可把數碼資產納入可管理、可監控的監管框架之內,較大多數加密原生平台無監管、無紀錄理想得多。現有銀行接受定期檢查、保留詳盡紀錄、舉報可疑活動及受消費者保障法約束,而絕大多數加密交易所根本沒有這些要求。

但加密與銀行業融合亦帶來嶄新監督難題。銀行監管人員需就區塊鏈技術、加密市場、數碼資產風險管理接受培訓;檢查手冊需更新,納入加密特有考慮;資本監管框架或要調整,以正確計算加密資產風險權重。

當銀行掌握客戶加密資產,如何處理銀行倒閉事件亦更複雜。傳統銀行倒閉後,FDIC會保障存戶及有序安排收購或清盤,但如果銀行倒閉持有客戶加密資產怎辦?GENIUS法例已處理穩定幣,在破產時給予穩定幣持有人優先索償權,但對託管下其他加密資產的處理則仍未明確。

監管機構同時要考慮銀行從事加密業務會否影響金融穩定。於2022—2023年加密危機期間,Terra Luna、Celsius、Voyager及FTX的崩潰主要發生於銀行體系以外,對銀行傳染有限。隨着銀行與加密資產日益交織,溢出效應風險增大。壓力測試與情景分析需涵蓋加密事件對銀行資本及流動性的可能影響。

Vast Bank的教訓

Vast Bank的經歷正好警惕銀行倉促進入加密領域的風險。這家位於奧克拉荷馬塔爾薩的銀行於2021年8月正式推出加密銀行服務,容許客戶保存及兌換數碼資產。行政總裁Brad Scrivner曾誇口該項目只用了八星期,就讓其零售客戶群增加達四十年才累積到的50%。

但這種急速增長實際掩蓋了結構性問題。到2023年10月,OCC向Vast Bank發出同意令,指控該行存在「不安全或不... practices”有關資本、策略規劃、項目管理、賬簿及記錄、託管賬戶監控以及新產品的風險管理。指令要求Vast維持較高資本比率、制定全面策略計劃,以及建立適當的託管監控。

到2024年1月,Vast 宣佈將停用及移除其加密貨幣流動應用程式,清算客戶數碼資產並關閉加密帳戶。行政總裁Tom Biolchini向當地媒體表示,聯邦監管機構對銀行為客戶持有加密資產表示關注,而該加密業務佔銀行持有資產不足1%,卻帶來不成比例的監管風險。

Vast Bank事件顯示,提供加密貨幣服務遠不只是實現買賣的技術能力。銀行需要有穩健的風險管理框架、充足的資本緩衝、適當的託管基建,以及能應對加密獨有挑戰的全面策略規劃。監管審查十分嚴格,任何不足均可能導致高昂的執法行動甚至被迫退出市場。

SoFi的做法則較為審慎。該銀行並沒有盲目搶佔加密貨幣機會,而是等待監管明確指引出現,並於推出前建立了機構級基建。這種耐心或會成為SoFi長遠成功的關鍵,而Vast Bank則失敗於此。

加密金融融合的更廣泛影響

市場結構轉型

SoFi將加密貨幣納入主流銀行是加密市場結構的根本變革。多年來,散戶投資者主要通過Coinbase、Kraken、Binance等獨立交易平台接觸數碼資產。這些平台處於一個平行金融宇宙,需要單獨帳戶、不同資金存取機制及與傳統銀行、券商截然不同的用戶體驗。

銀行整合加密貨幣買賣打破了這種分隔。隨著越來越多銀行跟隨SoFi的步伐,零售資金可能會愈來愈多地透過銀行平台流向加密市場,而非獨立交易所。這有助推動主流採納,因為減少摩擦,但同時亦令加密貨幣的接入權集中於受規管金融機構,與加密貨幣原有去中心化精神背道而馳。

隨着銀行整合交易擴大,市場流動性格局亦可能轉變。銀行提供加密貨幣服務時,通常會與流動性服務商合作並串連交易所網絡,而不是自行運作訂單簿。因此,透過SoFi執行的交易依然與更廣泛加密市場互動,但用戶體驗則無需直接接觸交易所。

隨著機構及散戶資金愈來愈多地經銀行平台進出,價格發現機制亦可能演化。傳統金融主要通過受規管交易所及系統性莊家進行相對集中的價格形成。加密市場過去則在多個交易所、去中心化交易所及點對點平台中碎片化定價。銀行整合加密後,或會推動更標準化、近似傳統證券市場的定價機制。

對代幣市場及流動性的影響

透過銀行渠道注入的零售資金,對加密市場各細分範疇影響不一。比特幣和以太坊作為最成熟和流通性最強的數碼資產,極有可能最受銀行整合所惠及。這類代幣已具有明確監管、機構接納和完善市場基建,適合銀行提供。

較不成熟的代幣則前景不明朗。銀行必須嚴格審核每款加密資產的監管狀況、安全特性和市場流動性。很多只在加密原生交易所流通的山寨幣,或因監管顧慮、流動性不足或安全問題,而無法被銀行引入平台。

這或會形成兩極市場:獲「銀行認可」的代幣得到機構背書及透過主流金融服務獲得散戶入口,而其他代幣則長期限於加密原生平台。這種分化有機會令流動性集中在少數資產,邊緣小幣種的資本流入則進一步減少。

穩定幣市場將特別受惠於銀行整合。GENIUS法案的監管框架為銀行發行穩定幣及跨業整合提供清晰指引。SoFi計劃推出自家美元穩定幣只是其中一例。若主要銀行均發行穩定幣,這些有望成為主導的支付工具,同時實現可編程資金流並兼顧美元資產支持和監管監督。

植入式加密貨幣產品及服務

銀行整合不單止簡單買賣,還可推動結合區塊鏈技術與傳統金融的嵌入式加密貨幣產品。SoFi目前已利用區塊鏈進行全球加密貨幣匯款,令跨國匯款更快捷及廉宜,這只是潛在應用的開始。

穩定幣開啟的可編程貨幣將改變銀行處理支付的方法。不再像傳統銀行般需批量處理及結算延誤,穩定幣支付可即時結算和完成。這帶來全新產品,例如即時發薪、實時發票結算、甚至按條件自動執行的程式化第三方託管。

以加密資產作抵押貸款是另一新領域。銀行無需用戶變賣加密資產,即可批出以數碼資產抵押的貸款,用戶既可繼續持有加密倉位,又能套現資金作其他用途。不過,加密資產波動大,抵押品價值急速下跌的風險,需要銀行加強風險管理。

資產和證券代幣化也可能帶來顛覆。例如股票以區塊鏈代幣形式24小時流通,用作各平台抵押或拆細讓零售投資者參與。具備傳統證券及區塊鏈技術專業的銀行,有條件帶動這種轉型,開拓新收入來源,同時為金融基建現代化。

獎賞計劃與回贈同樣能結合加密代幣。有銀行或會推出加密貨幣現金回贈、質押獎勵,甚至代幣積分,讓用戶自由買賣或跨生態圈使用。這些功能尤其吸引年輕一代,追求數碼原生的金融體驗。

數碼資產經濟加速

銀行基建納入加密,或會加快形成以區塊鏈資產為核心的數碼資產經濟。這場轉型已不止是加密貨幣本身,更包括NFT、實物資產代幣化、去中心化金融協議以及Web3應用。

然而,銀行介入亦可能將這股浪潮引向較受監管、較集中的模式,而非加密純粹主義者理想的完全去中心化。最終,未必是純粹點對點系統,而是結合區塊鏈基建與銀行作受規管服務提供者的「混合架構」。

這引發一個問題——加密貨幣的原始願景,經主流銀行渠道採納後,仍能保存多少?比特幣設計的初衷是讓價值轉移無需任何中介和審批。銀行引入後又再形成中介和許可結構。去中心化金融則希望消除金融守門人,銀行導入則加強這一層,但亦同時可能將區塊鏈效率帶入傳統體系。

大致而言,未來很可能同時出現兩個平行生態系:一個是受規管、銀行仲介的加密經濟,為主流用戶提供所習慣的金融服務;另一個則維持原有去中心化精神,給願意接受複雜性及風險的用戶。這些生態會互相影響和滲透,但所服務的目的和用戶群將有明顯分別。

過度炒作的風險

即使業界對銀行整合加密貨幣感到樂觀,亦需現實看待種種挑戰與限制。加密貨幣波動極大,不少用戶將蒙受損失,損害對數碼資產及相關銀行的信心。比特幣單日下挫20%或山寨幣一週蒸發50%的情況,不但不是例外,反而幾乎是常態。

銀行若提供加密貨幣服務,必須審慎管理客戶預期並作足風險披露。用戶要明白,加密投資隨時全軍覆沒,市場極度波動難以預測,即使「穩定」幣都曾經脫鉤。that caused significant losses. The more seamlessly banks integrate crypto into their platforms, the greater the risk that users might treat digital assets like traditional banking products without fully appreciating the differences.

造成重大損失。銀行將加密貨幣無縫整合到其平台越多,用戶便越容易將數碼資產視為傳統銀行產品,卻未必能真正了解兩者之間的分別。

Security vulnerabilities persist despite bank-grade custody. While banks implement robust security measures, determined attackers continue targeting crypto systems. High-profile hacks have stolen billions from exchanges, wallets and DeFi protocols. Banks offering crypto become attractive targets and must maintain vigilance against evolving threat vectors.

即使有銀行級託管,加密貨幣依然存在安全漏洞。雖然銀行採用嚴密的保安措施,但有心的攻擊者仍然會將加密系統作為目標。多宗大型駭客事故已令交易所、錢包及DeFi協議損失數十億美元。提供加密貨幣服務的銀行變得更具吸引力,因此必須時刻保持警覺,應對不斷演變的安全威脅。

Regulatory uncertainty remains despite recent clarity. The OCC interpretive letters and GENIUS Act provide important frameworks, but many questions remain unresolved. Future administrations might take different regulatory approaches. International regulatory divergence creates complexity for global banks. Banks must maintain flexibility to adapt as the regulatory landscape evolves.

即使近期香港監管有了明確方向,但仍存在很多不確定性。OCC解釋信函及GENIUS法案雖然建立了重要框架,但仍有不少待解決問題。未來政府可能採用不同的監管取向。國際監管標準之間的差異,令全球銀行運作更複雜。銀行必須保持靈活,以適應日新月異的監管環境。

Consumer education challenges should not be underestimated. Despite growing awareness, many Americans lack basic understanding of how cryptocurrency works, what blockchain technology does, or why digital assets might be valuable. Banks offering crypto must invest heavily in education, customer support and user experience design that makes complex technology accessible without oversimplifying risks.

消費者教育的難度亦不可小覷。雖然認知逐步提高,但很多美國人對加密貨幣的運作、區塊鏈技術的作用,以及數碼資產的價值基礎,都仍然認識有限。提供加密貨幣服務的銀行,必須大力投資於教育、客戶支援,以及用戶體驗設計,令複雜技術更易明,但又不會過度簡化風險。

Case Studies and Comparative Banking Moves

個案分析及銀行業比較

Standard Chartered's Institutional Approach

渣打銀行的機構客戶方案

While SoFi focuses on retail consumers, Standard Chartered took a different path by becoming the first global systemically important bank to offer spot Bitcoin and Ethereum trading to institutional clients. The London-based bank launched its service in July 2025 through its UK branch, integrating crypto trading with existing foreign exchange platforms.

SoFi主攻零售市場,相反,渣打銀行選擇走另一條路,成為首家為機構客戶提供現貨比特幣和以太幣交易的全球系統重要性銀行。這間倫敦銀行,2025年7月於英國分行推出相關服務,並將加密交易整合到現有外匯平台之中。

Standard Chartered's approach targets corporates, asset managers and institutional investors who need crypto access for treasury management, hedging strategies or client services. By operating through familiar FX interfaces, the bank reduces friction for sophisticated users who are comfortable with institutional trading platforms but may be hesitant to engage with crypto-native exchanges.

渣打銀行針對企業、資產管理人及機構投資者,為其財資管理、對沖策略或客戶服務需要而提供加密資產通道。借助現有熟悉的外匯介面,銀行為習慣機構交易平台但對原生加密交易所較為保守的專業用戶,大大減低介入門檻。

The institutional focus allows Standard Chartered to emphasize different value propositions than SoFi. Rather than simplicity and education for retail users, the bank highlights sophisticated risk controls, balance sheet strength and integration with global treasury operations. Institutional clients can settle trades to their chosen custodian, including Standard Chartered's own digital asset custody service, providing flexibility while maintaining security.

這種機構導向讓渣打銀行展現出與SoFi截然不同的價值主張。相比著重簡易和教育零售用戶,渣打強調高階風險控制、財務實力及與全球財資運作的整合。機構客戶可選擇自行託管的數碼資產,包括使用渣打自家託管服務,兼顧靈活性與安全性。

CEO Bill Winters declared that "digital assets are a foundational element of the evolution in financial services" and emphasized the bank's readiness to help clients manage digital asset risk safely within regulatory requirements. The bank plans to introduce non-deliverable forwards trading for Bitcoin and Ethereum, expanding beyond spot trading to provide hedging instruments institutional clients need.

行政總裁 Bill Winters 表示,「數碼資產是金融服務演化的基石」,強調銀行已準備好協助客戶在符合法規要求下妥善管理數碼資產風險。該行亦計劃引入比特幣和以太幣的不可交收遠期交易,拓展至現貨以外的對沖產品,滿足機構客戶需求。

Standard Chartered's institutional-first strategy complements rather than competes with SoFi's retail approach. Together, these moves signal that bank crypto integration is occurring simultaneously across retail and institutional segments, with different value propositions and product features appropriate to each market.

渣打銀行先機構後零售的策略,其實與SoFi的零售主導方針相輔相成,並非直接競爭。這些舉措顯示,銀行加密業務整合正同時在零售與機構市場推進,並根據不同市場需求提供適合的產品特色與定位。

Global Banking Crypto Initiatives

全球銀行加密方案動向

Beyond the United States, banks worldwide are exploring crypto integration in ways that reflect different regulatory environments and market conditions. European banks benefit from the Markets in Crypto-Assets (MiCA) framework, which provides comprehensive regulation for crypto-asset service providers across the European Union. This regulatory clarity has enabled more proactive bank strategies.

美國以外,全球各地銀行根據當地監管環境及市場需求,探索不同的加密整合方案。歐洲銀行受惠於加密資產市場法規(MiCA)框架,有明確全歐盟監管規範,令銀行能更積極部署相關業務。

Société Générale launched EURCV, a euro-denominated stablecoin, in 2023 through its crypto arm SG Forge and is reportedly exploring a U.S. dollar stablecoin as well. This demonstrates how banks can become not just distributors of crypto but issuers of blockchain-based financial instruments that serve institutional treasury management and payment needs.

法國興業銀行於2023年透過SG Forge推出歐元穩定幣EURCV,並據報正探索發行美元穩定幣的可行性。這反映銀行不單可作為加密資產分銷者,更能成為發行區塊鏈金融產品的重要參與,支援機構財資及支付需要。

Asian banks have pursued different strategies reflecting their regional markets. Singapore's Monetary Authority has been proactively encouraging digital asset innovation, issuing multiple licenses to crypto service providers. Standard Chartered chose Singapore for a stablecoin pilot through partnership with DCS Card Centre, launching DeCard, a credit card allowing users to spend stablecoins for everyday purchases.

亞洲銀行則因應各自地區實情採取不同策略。新加坡金融管理局積極推動數碼資產創新,發出台多張加密服務牌照。渣打銀行選擇新加坡作為穩定幣試點區,夥拍DCS Card Centre推出DeCard信用卡,用戶可以穩定幣作日常消費。

Latin American banks face unique pressures driving crypto adoption. In countries experiencing high inflation or currency instability, stablecoins provide attractive alternatives to volatile local currencies. Banks in these regions increasingly offer crypto services to remain competitive and prevent deposit flight to crypto-native platforms. Brazil's Nubank, for example, has explored Bitcoin Lightning Network integration for payments.

拉丁美洲銀行則面對獨特壓力,推動加密應用。當地部分國家受高通脹或貨幣動盪困擾,穩定幣成為傳統貨幣外吸引的選擇。當區銀行積極推行加密服務,保持競爭力並阻止存款流向原生加密平台。例如巴西Nubank就研究過結合比特幣閃電網絡作支付。

Hong Kong's stablecoin legislation, passed in May 2025, requires issuers of stablecoins backed by the Hong Kong dollar to obtain licenses from the Hong Kong Monetary Authority, with backing by high-quality liquid reserve assets. This creates a framework for banks to issue regulated stablecoins while maintaining oversight similar to e-money regulations.

香港於2025年5月通過穩定幣法例,要求發行以港元作資產支持的穩定幣者,必須獲得金管局牌照及持有高流動性優質儲備資產。這為銀行發行受監管穩定幣提供明確框架,監管模式與電子貨幣相近。

What SoFi's Model Could Expand Into

SoFi模式的潛在擴展方向

SoFi's current crypto trading service represents just the beginning of a potentially much broader blockchain integration strategy. The company has outlined plans that extend significantly beyond basic buy/sell functionality, suggesting a comprehensive reimagining of banking through blockchain technology.

SoFi現時的加密交易服務,只是更廣泛區塊鏈整合策略的起點。該公司已規劃一系列超越簡單買賣的藍圖,意圖全面顛覆傳統銀行模式,善用區塊鏈技術之便。

The planned USD stablecoin could become central to SoFi's payment infrastructure. Rather than just offering another investment vehicle, a SoFi-issued stablecoin could facilitate instant peer-to-peer payments, international remittances, merchant payments and programmable money applications. The GENIUS Act framework provides regulatory clarity for banks to issue stablecoins with proper reserves and oversight, making this strategy viable.

計劃中的美元穩定幣,有望成為SoFi支付基礎設施之核心。不單純是新增投資產品,SoFi發行的穩定幣,可支援即時P2P支付、國際匯款、商戶收款及可編程應用。GENIUS法案框架為銀行發行受儲備保障及監管的穩定幣提供依據,令上述策略更可行。

Lending against crypto collateral would extend SoFi's borrowing products into the digital asset space. Customers with substantial crypto holdings could access liquidity without selling, using their Bitcoin or Ethereum as collateral for loans. This maintains crypto exposure while providing capital for other needs, though it requires sophisticated risk management to handle collateral volatility.

以加密資產作抵押借貸,將把SoFi的貸款產品擴展至數字資產範疇。擁有大量加密貨幣的客戶,無須變現即可質押比特幣或以太幣獲取流動資金,既可保留加密資產升值機會,又滿足其他資金需要,但當中風險管理要求極高,需要處理抵押品波動性。

Yield-generating products could offer staking services where customers earn rewards for participating in proof-of-stake blockchain networks. Rather than customers needing to understand the technical complexity of staking, SoFi could manage this process and pass through rewards, creating a crypto equivalent of interest-bearing accounts.

創收型產品方面,SoFi可提供Staking(質押)服務,用戶參與權益證明區塊鏈,即可賺取獎勵。SoFi可統一處理背後技術,不需要客戶自行學習複雜流程,把「利息帳戶」的體驗帶進加密世界。

Tokenized asset offerings might enable fractional ownership of real estate, private equity or other alternative investments. By tokenizing these assets on blockchain networks and offering them through the SoFi platform, the bank could democratize access to investment opportunities typically available only to accredited investors while using blockchain technology to enable efficient trading and settlement.

資產代幣化產品則可讓用戶以碎片化形式參與物業、私募基金或其他另類投資。透過區塊鏈技術將這類資產代幣化,經SoFi平台銷售,銀行一方面讓投資機會普及化,另一方面用區塊鏈提升交易及結算效率。

International expansion of crypto services could tap into remittance markets where SoFi is already using blockchain for crypto-enabled remittances. Crypto rails offer advantages over traditional remittance services in speed, cost and accessibility, particularly for corridors where traditional banking infrastructure is limited.

在國際層面,SoFi亦可擴大加密匯款服務——現時已率先應用區塊鏈提升跨境匯款。加密支付網絡相較傳統匯款,在速度、成本和普及度均佔優,對基建落後市場尤其重要。

Early Adoption Metrics and Rollout

初步採用指標及推出進度

While comprehensive user data has not yet been publicly disclosed, some early indicators suggest strong initial interest in SoFi Crypto. The company is conducting a phased rollout that began November 11, 2025, with access expanding to more members over the following weeks. The rollout includes a promotional opportunity for customers to enter for a chance to win one Bitcoin by joining the waitlist by November 30, opening a crypto account and making three qualifying transactions of at least $10 by January 31, 2026.

雖然暫時未有完整用戶數據公布,但初步跡象顯示SoFi Crypto推出初期反應理想。公司正分階段推出,於2025年11月11日啟動,之後數週逐步開放予更多會員。期間伴隨推廣活動:2025年11月30日前加入等候名單並開設加密帳戶,以及於2026年1月31日前完成三筆不少於10美元的合資格交易,即有機會贏取一枚比特幣。

This promotional strategy signals SoFi's commitment to driving rapid adoption. By offering a high-value prize and creating urgency through deadlines, the bank

這種推廣策略彰顯SoFi推動用戶快速採納的決心。以高價值獎品結合限時參加,引導更多人及早體驗加密業務。incentivizes early trial while gathering data on customer interest and usage patterns.

為客戶提供早期試用誘因,並同時收集有關客戶興趣同埋使用習慣嘅數據。

CEO Anthony Noto's statement that 3% of his personal portfolio is allocated to crypto provides a signal about how the bank thinks about appropriate exposure levels. This measured approach contrasts with the all-in enthusiasm sometimes seen in crypto circles, instead positioning digital assets as one component of a diversified portfolio.

行政總裁Anthony Noto表示佢個人投資組合有3%分配咗去加密貨幣,反映咗銀行對於加密貨幣所需風險曝險水平嘅睇法。呢種審慎嘅做法同坊間經常見到全情投入加密貨幣圈子既熱情好唔同,反而係將數碼資產當作多元化投資組合入面其中一個部份。

The company's emphasis on 60% of members preferring crypto trading through a licensed bank suggests that demand for bank-intermediated crypto access could be substantial. If even a significant minority of SoFi's 12.6 million members adopt crypto trading, this would represent a material shift in how retail investors access digital assets.

公司指出有60%會員傾向透過持牌銀行進行加密貨幣交易,顯示市場對銀行作為中介提供加密交易服務有龐大需求。即使SoFi 1,260萬會員只係有顯著一部分開始用加密貨幣交易,都會令散戶投資者接觸數碼資產嘅方式產生重大改變。

Risks, Challenges and What to Watch

風險、挑戰同埋關注重點

Operational and Security Risks

營運同保安風險

Despite bank-grade infrastructure, crypto operations face operational risks that differ meaningfully from traditional banking. The 24/7 nature of crypto markets means systems must maintain availability around the clock, including weekends and holidays when traditional banking systems often undergo maintenance. Any downtime during volatile market conditions could prevent customers from managing positions, potentially resulting in losses and reputational damage.

就算銀行有一流基建,加密貨幣業務仍然面對同傳統銀行好唔同嘅營運風險。由於加密貨幣市場全年無休,系統必須保持24/7運作,包括傳統銀行會維修嘅假日同周末。萬一系統喺市況波動時停機,就可能令客戶損手,帶嚟損失同聲譽受損。

Custody security remains paramount. While SoFi emphasizes institutional-level security, crypto custody has proven challenging even for sophisticated institutions. Major hacks and security breaches continue affecting the crypto industry, with 2025 thefts reaching $2.6 billion, up 18% year-over-year. While banks implement multiple security layers, they also become high-value targets that attract determined adversaries.

資產託管安全依然極為重要。雖然SoFi強調機構級別嘅保安標準,但連高度專業嘅機構都證明託管加密資產係一大挑戰。大型黑客攻擊同安全漏洞事件持續影響市場,2025年因為盜竊損失達26億美元,按年升18%。銀行用多重安全層保護,但同時都成為高價值目標,吸引到有心人攻擊。

The irreversibility of blockchain transactions creates unique operational challenges. Traditional bank transfers can often be reversed if errors are detected quickly. Crypto transactions sent to wrong addresses or with incorrect amounts typically cannot be recovered. This requires exceptional attention to user interface design, transaction verification processes and customer support protocols to prevent costly mistakes.

區塊鏈交易無法逆轉帶嚟獨特嘅營運挑戰。傳統銀行轉帳如果快搵到錯,都有機會轉返。而加密貨幣一旦送錯地址或金額,就基本無得救返。呢方面要特別著重用戶界面設計、交易核實流程,同客戶支援機制,避免發生昂貴錯誤。

Smart contract risks affect banks that integrate with decentralized finance protocols or use blockchain technology for automated processes. Bugs in smart contract code have resulted in hundreds of millions in losses across the crypto ecosystem. Banks must thoroughly audit any smart contracts they deploy or interact with and maintain contingency plans for potential failures.

智能合約風險對使用去中心化金融協議或自動化流程區塊鏈技術嘅銀行構成風險。過去智能合約漏洞已導致加密圈損失數億美元。銀行部署或連接任何智能合約前,都要仔細審計同埋為失敗情況預留應變方案。

Crypto Market Volatility and Bank Risk Profile

加密市場波動同銀行風險

Cryptocurrency volatility poses challenges for banks offering crypto services. While the cryptocurrencies themselves sit off the bank's balance sheet as customer holdings rather than bank assets, crypto market volatility still affects the bank's business in several ways.

加密貨幣波動性高,對提供相關服務嘅銀行帶來不少挑戰。雖然加密資產通常唔會記錄喺銀行資產負債表上,而係屬於客戶持有,但市場波動依然會有多方面影響。

Revenue volatility from crypto-related fees will fluctuate with trading activity. During bull markets when crypto prices are rising and trading volumes surge, fee income could be substantial. But during bear markets or crypto winters when trading activity declines, this revenue stream could dry up quickly. Banks need to avoid becoming dependent on crypto-related revenue that may prove unsustainable.

加密相關手續費收入會隨住交易活躍度而波動。牛市時價格升、成交旺,手續費賺得多。但熊市或幣市低潮時,交易量急降,相關收入亦隨時消失。銀行要避免過分依賴加密業務收入,以免生意難以維持。

Reputation risk intensifies during market crashes. When crypto prices plummet, customers who lost money may blame the bank for offering the service, even if the bank provided appropriate disclosures. During the 2022-2023 crypto crisis, exchanges and crypto platforms faced severe backlash from users who lost funds. Banks offering crypto must prepare for similar customer frustration and potential litigation during inevitable downturns.

市道急跌時聲譽風險會大大上升。幣價大跌時,有蝕錢嘅客戶或者會即使銀行已經披露風險,都可能會埋怨銀行提供該服務。喺2022–2023年加密危機期間,好多平台都被用戶追究。銀行要有心理準備遇到市場低潮時,要應對客戶投訴甚至訴訟。

Concentration risk emerges if particular customer segments or geographic regions embrace crypto disproportionately. A bank with concentrated crypto adoption among certain demographics might face clustered losses or reputation damage if those segments are particularly affected by market downturns or security incidents.

如果某幾類客群或地區特別熱衷加密貨幣,銀行會面對集中特定群體爆發損失或聲譽危機嘅風險。一旦嗰啲客戶segment遇到市場或安全問題,損失或者好多都來自同一批人。

Credit risk considerations arise if banks eventually offer crypto-collateralized lending. Loans secured by volatile crypto assets create potential for rapid collateral devaluation, requiring frequent marking to market and potentially forced liquidations during crashes. Banks must maintain conservative loan-to-value ratios and robust risk monitoring to avoid losses.

如果銀行未來提供加密資產抵押借貸,就會出現信貸風險。加密資產好波動,作抵押品時一跌就要即時重新估值,極端情況甚至要強制平倉,否則銀行有可能蒙受損失。所以一定要確保低槓桿同嚴密風險監控。

Regulatory and Compliance Challenges

監管同合規挑戰

Even with recent regulatory clarity, banks offering crypto services face ongoing compliance challenges. The OCC's interpretive letters and GENIUS Act provide frameworks, but implementation details continue evolving through rulemaking and supervisory guidance.

雖然近期監管政策越嚟越清晰,但銀行做加密貨幣服務仍然要應對一連串合規難題。 美國監管機構OCC指引同埋GENIUS法案都建立咗框架,但細節仲要視乎後續法規同監管指引慢慢定下來。

Anti-money laundering compliance becomes more complex with crypto. While traditional banking transactions flow through established payment networks with clear counterparty identification, crypto transactions can involve pseudonymous addresses, cross-border transfers and interactions with mixing services or privacy-focused protocols. Banks must implement sophisticated blockchain analytics to monitor for suspicious activities and maintain compliance with Bank Secrecy Act requirements.

加密貨幣令到反洗錢合規變得複雜。傳統銀行過數有明確身份,但加密交易可能涉及匿名地址、跨境轉帳、混幣服務或注重私隱的協議。銀行要用高級區塊鏈分析工具揾出可疑交易,維持符合法例(如美國的Bank Secrecy Act)要求。

Sanctions compliance poses particular challenges. The Treasury Department's Office of Foreign Assets Control designates certain crypto addresses associated with sanctioned entities or individuals. Banks must screen transactions to prevent customers from interacting with these addresses, but the pseudonymous and permissionless nature of blockchains makes this technically challenging.

制裁合規尤其困難。美國財政部OFAC會點名某啲加密地址係受制裁個人或機構擁有。銀行就要保障用戶唔好同嗰啲地址有交易來往,但區塊鏈匿名、去中心特性令得技術實施困難重重。

Tax reporting requirements create administrative burdens. Crypto trading generates taxable events that must be reported to the IRS. Banks offering crypto services need systems to track cost basis, calculate gains and losses, generate appropriate tax documentation and report to regulators. The complexity intensifies when customers transfer crypto between platforms or engage in sophisticated trading strategies.

稅務報告要求亦會帶嚟大負擔。做加密貨幣交易都會產生納稅義務,需要向美國國稅局(IRS)申報。銀行提供加密服務,要有系統追蹤買入成本、計算盈虧,生成相關稅務文件及上報監管機構。客戶喺唔同平台之間轉幣、或者做複雜操作時,複雜性就更加高。

Evolving regulatory interpretations mean banks must maintain flexibility. Future administrations may take different approaches to crypto regulation. New types of digital assets may emerge that require classification decisions. International regulatory divergence creates complexity for global banks. Successful banks will maintain adaptable compliance frameworks that can evolve as the regulatory landscape shifts.

監管口徑隨時會變,所以銀行合規系統要夠彈性。將來個新政府對加密貨幣管理可能又唔同,會有新型數字資產需要歸類,國際監管標準又會唔同步。叻嘅銀行係會保持靈活合規結構,以適應不斷變化嘅監管環境。

What to Watch: Key Indicators

關注指標

Several metrics and developments will indicate whether SoFi's crypto integration succeeds and whether other banks follow:

有幾個指標可以睇到SoFi整合加密貨幣服務有冇成功,以及其他銀行會唔會跟住做:

User adoption rates will be critical. How many of SoFi's 12.6 million members actually adopt crypto trading? What percentage maintain active usage versus trying it once and abandoning it? How does adoption correlate with demographics, account types and existing product usage?

最關鍵就係用戶採納率。SoFi 1,260萬個會員裏面,到底有幾多人真係用加密貨幣交易?長期活躍用戶有幾多?即試即停比例又有幾多?而採納率同咩客戶群、帳戶類型、用戶本身用開咩產品有冇關係?

Competitive responses matter enormously. Do major banks like JPMorgan, Bank of America and Wells Fargo accelerate their own crypto initiatives? Do regional banks and credit unions begin offering similar services? How quickly does crypto become a standard banking feature versus remaining a niche offering?

競爭對手反應都係大重點。啲大銀行好似JPMorgan、Bank of America、Wells Fargo會唔會加快自己做加密貨幣業務?啲地區銀行或信用合作社又會唔會跟住做?加密貨幣究竟有幾快會成為普通銀行標準服務,而唔係只係小眾產品?

Regulatory actions or guidance will shape the industry's trajectory. Does the OCC or other banking agencies issue additional guidance on crypto activities? Do enforcement actions target banks for crypto-related deficiencies? How do regulators respond to any incidents or failures?

監管行動或者指引會左右發展。監管機構會唔會再推新指引?有冇執法針對銀行加密業務做得唔好?遇到事故,監管機會點回應?

Deposit flow patterns could reveal whether crypto integration affects bank funding. Do customers maintain larger balances to facilitate crypto trading? Does crypto adoption correlate with increased engagement across other banking products? Or do customers primarily use crypto services while maintaining relationships primarily with other institutions?

存款流向會睇到整合加密貨幣服務有冇影響到銀行資金。啲客會唔會為交易加密貨幣而保持大額存款?用開加密服務個班人會唔會主動用多咗其他銀行產品?抑或佢哋主要用加密功能,日常資金都放喺其他金融機構?

Crypto event shocks will test how well banks manage crisis scenarios. The next major crypto crash, exchange failure, stablecoin depeg or security breach will reveal whether banks have successfully insulated themselves from contagion or whether their crypto exposure creates meaningful risks.

加密市場如果出現震盪,例如下一次大跌市、交易平台出事、穩定幣脫鈎或者安全漏洞,都會係銀行風險管理嘅大考。睇下銀行能否有效隔絕風險,定係加密曝險反而拖累咗本身生意。

Market capitalization and trading volumes in "bank-approved" tokens versus those available only on crypto-native platforms could indicate whether bifurcation is occurring. If liquidity increasingly concentrates in assets available through banking platforms, this would validate the bank integration thesis while potentially disadvantaging smaller tokens.

「銀行認可」嘅加密資產市值同成交量會同只喺本地平台流通嘅資產形成比較,如果資金越嚟越集中喺銀行選咗提供嘅資產,銀行嘅整合戰略就更有說服力,但同時細眾幣可能會被邊緣化。

Innovation in embedded crypto products will signal how ambitiously banks approach blockchain integration. Are they simply offering basic trading, or are they developing novel applications like programmable money, tokenized assets and blockchain-based financial services that meaningfully improve on traditional offerings?

加密貨幣產品創新速度會睇到銀行有幾積極整合區塊鏈。淨係做基本交易定係會研究埋編程式錢、資產代幣化、區塊鏈上新型金融服務,甚至希望全面提升傳統金融產品?

Outlook: What This Means for Mainstream Financial Adoption

前景展望:對傳統金融廣泛應用意味住咩?

Three to Five Year Projection

三至五年預測

Looking ahead three to five years, bank integration of crypto services will likely accelerate significantly, transforming how mainstream consumers access and use digital assets. The current moment may mark an inflection point similar to the mid-2010s when mobile banking apps transitioned from novelty to standard expectation.

展望未來三至五年,銀行加速整合加密貨幣服務將有高機會發生,會徹底改變普羅消費者接觸和使用數碼資產嘅方式。依家呢個時刻,好可能就好似2010年代中期嘅手機銀行App咁,從新奇玩意變成行業標準。

By 2028-2030, crypto trading could (未完,可繼續提供餘下內容)become a standard feature offered by most major banks, rather than a differentiator for early movers like SoFi. The technology infrastructure, regulatory frameworks and operational practices will have matured to the point where offering basic crypto services requires limited incremental investment beyond initial setup. Banks that resist integration may face competitive disadvantages, particularly in attracting younger customers who expect digital asset access.

成為大多數大型銀行都提供的標準功能,不再只是像 SoFi 這類早期進入者的競爭優勢。技術基礎設施、監管框架和營運做法將會成熟至,只要完成初始設置後,提供基本加密貨幣服務所需的額外投資十分有限。拒絕整合的銀行,尤其在吸引期望可接觸數碼資產的年輕客戶方面,可能會面對競爭劣勢。

Stablecoin usage will likely expand dramatically as banks issue and integrate dollar-backed tokens into payment infrastructure. Rather than exotic crypto products, stablecoins may become the dominant rails for instant payments, international remittances and programmable money applications. The GENIUS Act framework provides the regulatory foundation, while bank involvement brings trust and liquidity.

穩定幣的使用很可能會隨著銀行發行及整合美元支持的代幣至支付基建中而急劇增加。穩定幣或會由以往被視為「奇特」的加密產品,變成即時支付、國際匯款和可程式貨幣應用的主流支付渠道。GENIUS 法案框架提供監管基礎,而銀行參與則帶來信任和流動性。

Asset tokenization could reach meaningful scale, with billions or potentially trillions in traditional assets represented on blockchain networks. Banks facilitating this transition will generate new revenue opportunities from issuance, custody, trading and servicing of tokenized assets while modernizing financial infrastructure in ways that reduce costs and increase efficiency.

資產代幣化可能會達到具規模的層面,令數十億甚至數萬億傳統資產可於區塊鏈網絡上表示。協助推動這項轉變的銀行,除了可從代幣資產的發行、託管、交易及相關服務中獲取新收入來源,亦可藉此現代化金融基建,降低成本和提升效率。

However, challenges and setbacks are inevitable. Some banks will experience crypto-related losses, security incidents or operational failures that create temporary setbacks. Regulatory frameworks will evolve in ways that sometimes constrain innovation. Market crashes will test consumer trust and institutional commitment. The path forward will be neither straight nor smooth.

然而,挑戰和挫折是無可避免的。部分銀行可能會承受與加密貨幣相關的損失、遭受安全事故或營運失誤,導致短暫倒退。監管框架的發展,有時亦會限制創新。市場崩潰將考驗消費者信任和機構承擔。未來的路必定並非直線或順利。

Potential Scale of Mainstream Adoption

Current crypto adoption sits at approximately 21-28% of U.S. adults owning cryptocurrency. Bank integration could substantially expand this percentage by addressing the main barriers that have prevented broader adoption: complexity, lack of trust in crypto-native platforms and integration friction.

現時,美國約有21-28% 的成年人持有加密貨幣。若銀行進行整合,有望打破加密貨幣廣泛普及的主要障礙(包括複雜性、對原生平台的信任不足,以及整合困難),大幅提升這個比率。

If bank-integrated crypto becomes as commonplace as stock trading through banking apps, adoption could potentially reach 40-50% of adults over the next decade. This would represent roughly 100-125 million Americans with crypto exposure through their banking relationships, compared to roughly 65 million today. However, this assumes continued positive regulatory development, absence of catastrophic market failures and successful customer education efforts.

如果銀行整合的加密服務可以普及至像銀行 app 股票交易一樣常見,未來十年加密貨幣採納率有望達致 40-50% 成人,即大約 1 億至 1.25 億美國人會經由其銀行戶口接觸加密貨幣,遠高於現時約 6,500 萬人的水平。不過,這一切有賴於監管持續積極發展、市場沒有災難性崩潰,以及成功的客戶教育工作。

The depth of adoption matters as much as breadth. Will customers simply allocate small speculative amounts to crypto while maintaining primary focus on traditional assets? Or will digital assets become meaningful components of diversified portfolios? Current data suggests the former is more likely, with CEO Noto's 3% personal allocation potentially representing a reasonable benchmark for informed investors.

採納的深度與廣度同樣重要。用戶會否只將少量資金作投機用途,主力仍放在傳統資產?抑或數碼資產會成為多元化投資組合的重要組成?根據現有數據,前者較可能發生,行政總裁 Noto 的個人 3% 配置或反映了知情投資者的合理參考值。

Global adoption patterns may differ significantly from U.S. trends. Countries with unstable currencies, capital controls or limited banking infrastructure may see faster crypto adoption as digital assets address real economic needs rather than serving primarily as speculative investments. Banks in these markets may approach crypto integration with greater urgency than their U.S. counterparts.

國際間的採納情況可能與美國大相徑庭。貨幣不穩、資本管制或銀行服務不足的國家,數碼資產能切實回應經濟需求,其普及或會更快,並非僅視為投機工具。這些地區的銀行,推動加密貨幣整合的緊迫性,更甚於美國本土銀行。

Transformation of Banking Business Models

The integration of crypto and blockchain technology could fundamentally transform how banks operate and generate revenue, though the timeline and extent of disruption remain uncertain.

加密貨幣與區塊鏈技術的整合,有潛力徹底改變銀行的營運及賺錢模式,雖然其破壞力的時間表和範圍依然不明。

Fee income diversification becomes possible as banks generate revenue from crypto trading, stablecoin issuance, tokenized asset services and blockchain-based financial products. This matters particularly in low interest rate environments where net interest margin compression squeezes traditional profitability. Crypto-related fees could provide growth when traditional banking revenue stagnates.

銀行能透過加密貨幣交易、穩定幣發行、資產代幣化服務及區塊鏈金融產品開拓多元化手續費收入來源。在低息環境下,傳統利差收窄令銀行盈利受壓,因此加密相關收費可望帶來新的增長點。

Deposit acquisition and retention dynamics may shift as crypto-interested customers prioritize banks offering digital asset services. Younger demographics increasingly expect seamless digital experiences and integrated financial services. Banks offering crypto alongside traditional products present more compelling value propositions for these segments than institutions that remain crypto-free.

客戶對存款動態的取態或會改變。熱衷加密貨幣的客戶,會優先考慮提供數碼資產服務的銀行。年輕一代對無縫數碼體驗和綜合金融服務的需求日益提高,能同時提供加密貨幣與傳統產品的銀行,對這類客戶更具吸引力。

Risk models and asset allocation frameworks will need updating to incorporate crypto. Whether regulators ultimately require banks to hold capital against crypto-related activities and at what rates will significantly affect economics. Banks may need to develop entirely new risk management frameworks that account for crypto's unique characteristics.

現有風險模型及資產配置框架需要更新,以納入加密資產。監管機構最終會否就加密活動要求銀行持有資本,以及相應標準如何,將大大影響經營經濟效益。銀行或須開發全新風險管理體系,應對加密貨幣的獨有特質。

Payment infrastructure transformation could be the most significant long-term impact. If stablecoins and blockchain-based payments become dominant rails for instant value transfer, this could reshape how banks handle deposits, payments and settlement. Rather than batch processing through legacy systems, real-time programmable money flows could dramatically improve efficiency while reducing costs.

支付基建的轉型或會帶來最深遠長遠的影響。如穩定幣及區塊鏈支付成為即時數值轉移的主渠道,將會徹底改寫銀行如何處理存款、支付和結算。即時、可編程的貨幣流動可以大幅提升效率和降低成本,取代以往依靠舊式系統進行批次處理的做法。

Implications for Retail Investors

From the retail investor perspective, bank integration of crypto services offers important benefits alongside continuing risks. The primary advantage is simplified access to digital assets through trusted institutions with familiar interfaces, regulatory oversight and customer support infrastructure.

對零售投資者而言,銀行整合加密貨幣服務帶來重大好處之餘,風險依然存在。最大優點是可透過受信任機構取得更簡化的數碼資產存取渠道,並借助熟悉的用戶介面、監管制度和完善的客戶支援。

Investment diversification becomes easier as crypto sits alongside stocks, bonds and other assets in integrated platforms. Rather than managing relationships with multiple providers and juggling between platforms, investors can view their complete financial picture in one place and make holistic allocation decisions.

投資多元化亦變得更容易,因為加密貨幣可與股票、債券及其他資產同時在一個平台管理。投資者毋需再同時處理多個服務供應商,在單一界面便能觀看自身全盤財務狀況,作出更全面的配置決策。

Security concerns diminish compared to self-custody or crypto-native exchanges. While crypto holdings remain uninsured, bank custody infrastructure implements institutional-grade security specifically designed to protect customer assets. The risk of losing funds to user error, phishing attacks or exchange failures likely decreases substantially.

與自行保管或原生加密貨幣交易平台相比,安全疑慮大為減少。雖然銀行託管的加密資產仍未獲存款保險保障,但其基建已採用機構級安全措施,專為保障客戶資產而設。因用戶操作錯誤、釣魚攻擊或交易平台倒閉導致損失的風險大大降低。

Educational resources and customer support improve as banks invest in helping customers understand crypto. Rather than crypto exchanges that assume technical knowledge, banks can provide banking-style educational content, customer service representatives trained on crypto topics and user interfaces designed for mainstream audiences rather than crypto natives.

隨著銀行加大資源幫助客戶了解加密貨幣,教育及客戶支援質素均有所提升。與假設用戶已有專業知識的加密平台不同,銀行可提供銀行式教學內容、熟悉加密主題的客戶支援人員,以及為主流用戶而設的介面設計。

However, investors should maintain realistic expectations. Cryptocurrencies remain highly volatile assets that can lose significant value quickly. Bank offering does not reduce market risk or guarantee investment success. Appropriate position sizing remains essential, with most financial advisors suggesting crypto allocations of 5% or less for investors comfortable with high volatility.

然而,投資者仍須保持合理期望。加密貨幣波動性仍然很高,可以在短時間內大幅貶值。銀行提供加密服務並不等於降低市場風險或保證投資成功。適當持倉分配依舊相當重要,多數財務顧問建議即使願意承受高波動,配置加密貨幣的比例亦不宜超過 5%。

The loss of certain crypto-native features represents a tradeoff. Bank-custodied crypto cannot easily interact with decentralized finance protocols, cannot be used in many Web3 applications and gives up the censorship resistance and self-sovereignty that motivated Bitcoin's creation. For some users, these limitations outweigh the convenience and security benefits of bank integration.

部份原生加密特性的損失亦是取捨所在。經銀行託管的加密貨幣難以直接與去中心化金融協議互動,亦難用於許多 Web3 應用,更放棄了比特幣創立時強調的抗審查及自主權。對部分用戶來說,這些限制可能比銀行化所帶來的便利和安全更為重要。

Key Open Questions

As banking and crypto converge, several fundamental questions remain unresolved:

隨著銀行與加密貨幣融合,仍有多項關鍵問題尚待解決:

Will banks become crypto hubs or maintain cautious limited offerings? The enthusiasm or restraint with which banks embrace crypto integration will largely determine how quickly and comprehensively digital assets enter mainstream finance. If major banks aggressively expand crypto services, adoption accelerates dramatically. If they proceed cautiously with minimal offerings, the transformation occurs more gradually.

銀行會成為加密貨幣樞紐,抑或只維持謹慎及有限的服務?銀行在整合加密貨幣時的積極或保守態度,將決定數碼資產進入主流金融的速度及普及程度。如果大型銀行積極擴展加密貨幣服務,採納率將大幅提速;如果持續審慎,僅提供有限功能,整體轉型則會較為緩慢。

How will regulatory frameworks evolve as bank crypto activities scale? The current regulatory clarity represents progress but leaves many questions unanswered. How will regulators respond if crypto becomes a significant portion of bank assets? What happens when the next crypto crisis occurs and banks are directly affected? Will consumer protection frameworks require strengthening?

隨銀行加密活動擴大,監管框架會如何演變?現時的監管清晰度雖然已有進展,但仍留有大量疑問未解。例如:當加密貨幣成為銀行資產的重要部分時,監管者有何回應?一旦發生新一輪加密危機,銀行直接受牽連會怎樣處理?消費者保護層面又會否需要加強?

Can banks successfully manage the cultural tensions between traditional banking conservatism and crypto innovation? Banks are designed to be risk-averse institutions focused on safety, soundness and regulatory compliance. Crypto emerged from a cypherpunk ethos emphasizing decentralization, permissionless innovation and disruption of traditional finance. Reconciling these fundamentally different cultures within banking organizations may prove challenging.

銀行能否有效調和傳統保守作風與加密創新文化的矛盾?傳統銀行天生傾向避險,強調安全、穩健和符合法規,而加密社群則秉持去中心化、開放創新甚至顛覆金融體制的 cypherpunk 精神。要在銀行內部融合兩種截然不同的文化,落實並不容易。

What tipping point will drive mainstream banks to move aggressively into crypto? Currently, institutions like JPMorgan and Bank of America are exploring crypto cautiously while not yet offering consumer services. What would trigger them to accelerate? Competitive pressure from SoFi and other digital banks? Customer demand reaching critical mass? Regulatory requirements? Or will they remain perpetually cautious?

什麼因素會令主流銀行大舉進軍加密領域?現階段摩根大通、美國銀行等雖有探索,但還未面向消費者推出服務。甚麼情況會令它們加速推進?來自 SoFi 等數碼銀行的競爭壓力?用戶需求突破臨界點?還是監管要求?抑或它們將繼續保持謹慎?

How will international regulatory divergence affect global banks? The U.S. has the GENIUS Act, Europe has MiCA, and Asia has fragmented frameworks. Banks operating globally must navigate these different regimes while providing consistent customer experiences. How this complexity gets managed will significantly affect global crypto adoption.

國際間的監管分歧會怎樣影響全球銀行?美國立有 GENIUS 法案,歐洲有 MiCA,亞洲則較零碎。跨國營運的銀行,既要穿梭不同法規,又需為客戶帶來一致體驗,這種複雜局面如何管理,將深遠影響全球加密貨幣的普及進程。

Final thoughts

SoFi Technologies's November 11, 2025 launch of crypto trading services marks a pivotal moment in the convergence of traditional banking and digital assets. As the first nationally chartered U.S. bank to integrate cryptocurrency buying, selling and holding directly into its consumer banking platform, SoFi has broken down the wall that long separated mainstream finance from crypto markets.

2025年11月11日加密貨幣交易服務的推出,標誌住傳統銀行業同數碼資產融合一個關鍵時刻。作為全美首間將加密貨幣買賣及持有直接整合入消費者銀行平台的全國持牌銀行,SoFi打破咗一直以嚟主流金融同加密市場之間嘅隔閡。

The significance extends far beyond a single bank's product announcement. SoFi's move signals that the regulatory, technological and market conditions have aligned to enable banks to embrace digital assets as legitimate financial products worthy of integration into their core offerings. The OCC's interpretive letters providing regulatory clarity, the GENIUS Act establishing stablecoin frameworks and the demonstrated consumer demand for bank-intermediated crypto access have created a window for mainstream financial institutions to finally engage with blockchain technology in meaningful ways.

呢個意義,遠遠唔止係一間銀行產品嘅宣佈。SoFi嘅行動代表住監管、科技同市場條件已經到位,等銀行可以將數碼資產當成正規金融產品,納入到自身核心服務入面。[美國貨幣監理署(OCC)嘅釋義信件]提供咗監管清晰度、[GENIUS 法案]建立咗穩定幣框架,再加埋消費者對銀行中介加密服務嘅實際需求,為主流金融機構真正參與區塊鏈技術創造咗窗口。

However, the ultimate success of this convergence depends on execution, continued regulatory support, consumer education and the ability to navigate inevitable challenges. The Vast Bank experience demonstrates that entering crypto without adequate preparation and infrastructure can result in costly regulatory enforcement and forced market exits. SoFi's more methodical approach, waiting for regulatory clarity and building institutional-grade systems before launch, may prove more sustainable.

然而,融合能否最終成功,要視乎執行、持續嘅監管支持、消費者教育,以及面對必然出現挑戰時應對能力。[Vast Bank嘅經驗]證明,如果冇充足準備同完善基礎設施就貿然進入加密市場,分分鐘會招致成本高昂嘅監管執法同被迫退出市場。相比之下,SoFi用更審慎嘅方法,等到監管明朗、先搭建好機構級系統再推出服務,可能可以行得更長遠。

The broader transformation this heralds could fundamentally reshape both banking and crypto. Traditional banks gain new revenue streams, enhanced customer engagement and opportunities to modernize aging infrastructure through blockchain technology. Cryptocurrency gains mainstream legitimacy, simpler access for everyday users and integration with the trusted financial services that hundreds of millions of people already use.

呢場更大嘅變革,有機會徹底改變銀行業同加密世界。傳統銀行可以開拓新收入來源、提升客戶互動,用區塊鏈技術現代化陳舊嘅基礎設施。而加密貨幣得到主流認可,一般用家都更易接觸到,並直接同全球數以億計人用開、信得過嘅金融服務整合埋一齊。

Yet questions remain about how much of crypto's original vision survives this institutionalization. Bank custody, regulatory oversight and integration with traditional finance represent departures from the decentralization and censorship resistance that motivated Bitcoin's creation. The outcome may be a bifurcated ecosystem where bank-intermediated crypto serves mainstream users while crypto-native platforms maintain the original ethos for users prioritizing sovereignty over convenience.

不過,加密貨幣原有嘅理念,在呢種機構化過程中可以保留下幾多,仲係未知之數。銀行託管、監管機構監察、同傳統金融整合,其實同比特幣開初為去中心化、抗審查而生嘅初心有啲距離。最終,可能會出現一個雙軌生態圈——有銀行中介的加密服務滿足主流用家,而堅持自主權、重視便利以外價值嘅人就會繼續揀用原生加密平台。

For retail investors and everyday banking customers, the integration of crypto into mainstream financial services represents both opportunity and responsibility. Easier access to digital assets through trusted banking relationships could accelerate portfolio diversification and participation in blockchain-based financial innovation. But crypto remains highly volatile, and bank offering does not eliminate market risk or guarantee investment success.

對零售投資者同普通銀行客戶嚟講,加密貨幣融入主流金融服務即係帶嚟機會之餘都有責任。經由信任嘅銀行,更容易接觸到數碼資產,的確可以幫手加快投資組合多元化同參與區塊鏈金融創新。但[加密貨幣波動性極大],就算銀行有提供,都無法消除市場風險或者保證投資肯定成功。

As we look ahead, the phase that SoFi's announcement inaugurates will define how banking and crypto evolve together over the coming years. Other banks will watch closely to gauge consumer response, regulatory reactions and operational success or failure. If SoFi demonstrates that bank-integrated crypto services can be offered safely, profitably and in ways that genuinely benefit customers, expect a cascade of competitive offerings from institutions eager to avoid being left behind. If challenges or failures emerge, the transformation may proceed more cautiously.

展望將來,SoFi今次宣佈打響咗頭炮,未來幾年銀行業同加密界點樣發展,會由呢個階段決定。其他銀行會密切觀察客戶反應、監管態度同執行成敗。如果SoFi證明銀行整合加密貨幣服務可以安全而且有錢賺,又真係帶到好處畀客戶,咁市場上會有一浪接一浪嘅競爭方案冒起,機構都唔想被人甩低。如果期間出現咗咩挑戰或者失敗,呢場轉型就可能行得更加謹慎。

The integration of banking and crypto services may finally make digital assets accessible to mass-market consumers in ways that a decade of standalone exchanges never achieved. But this phase will determine whether that accessibility comes with adequate safeguards, appropriate education and sustainable business models, or whether it creates new categories of risk that regulators and institutions are unprepared to manage. The stakes are substantial for financial services, digital assets and the millions of consumers who will navigate this evolving landscape.

銀行服務同加密服務整合,或者終於可以令大眾消費者便利接觸數碼資產——係過去十年獨立交易所永遠做唔到嘅事。但係,今次轉型會唔會一齊帶來足夠保障、配套教育同可持續營運模式,定係搞出新風險令監管機構同市場措手不及,就要睇呢段時間表現。對金融服務、數碼資產、甚至未來數以百萬計用家,都係舉足輕重。

SoFi has opened the door. How quickly and how wisely the rest of the banking industry walks through it will shape finance for decades to come.

SoFi已經幫大家開咗道門。究竟行業其他參與者行得幾快、幾謹慎,就會決定未來幾十年金融行業發展嘅格局。