過去24小時,加密貨幣市場受利好因素帶動,氣氛樂觀。比特幣(BTC)一度突破歷史新高,觸及約$124,000,市值升至約2.45萬億美元,驟超Alphabet(Google母公司)。

這波升勢主要來自四大宏觀利好:市場預期聯儲局減息、監管環境較為友善、地緣政治風險暫時緩和,以及機構資本持續流入加密資產。在這些利好推動下,CoinDesk 20主要加密貨幣指數升逾1%,比特幣主導地位進一步鞏固,刷新紀錄新高。

不過,加密市場一向波動大。比特幣創新高數小時後,突然閃崩約5%,由$124K急挫至約$118,500,一小時內引發約5.77億美元長倉爆倉。以太坊(ETH)及多種主流山寨幣同樣在快速回調中下跌3–5%。分析指出,這次急挫源於山寨幣市場高槓桿,主要山寨的未平倉合約曾達創紀錄的470億美元,獲利盤出現時放大了跌幅。值得注意的是,這種大上大落屬加密市場「常態」——急升後常有急回,震走投機資金後又會回穩再上。換句話說,過去一日的快速回調,其實反而可能是有經驗的交易者「逢低吸納」的機會,只要大市升勢基調未改變。

在這大環境下,山寨幣持續出色。除比特幣外,許多代幣在過去一天錄得雙位數升幅,回調前表現搶眼。資金明顯由主流流入近期動能強勁且有利好催化劑的項目,涵蓋智能合約、交易所平台幣及迷因幣。以下精選過去24小時表現最突出的10隻加密貨幣,這些幣種不僅在升市時大幅領先,同時有技術走勢、基本消息或用戶增長支持,或預示升勢有望延續。

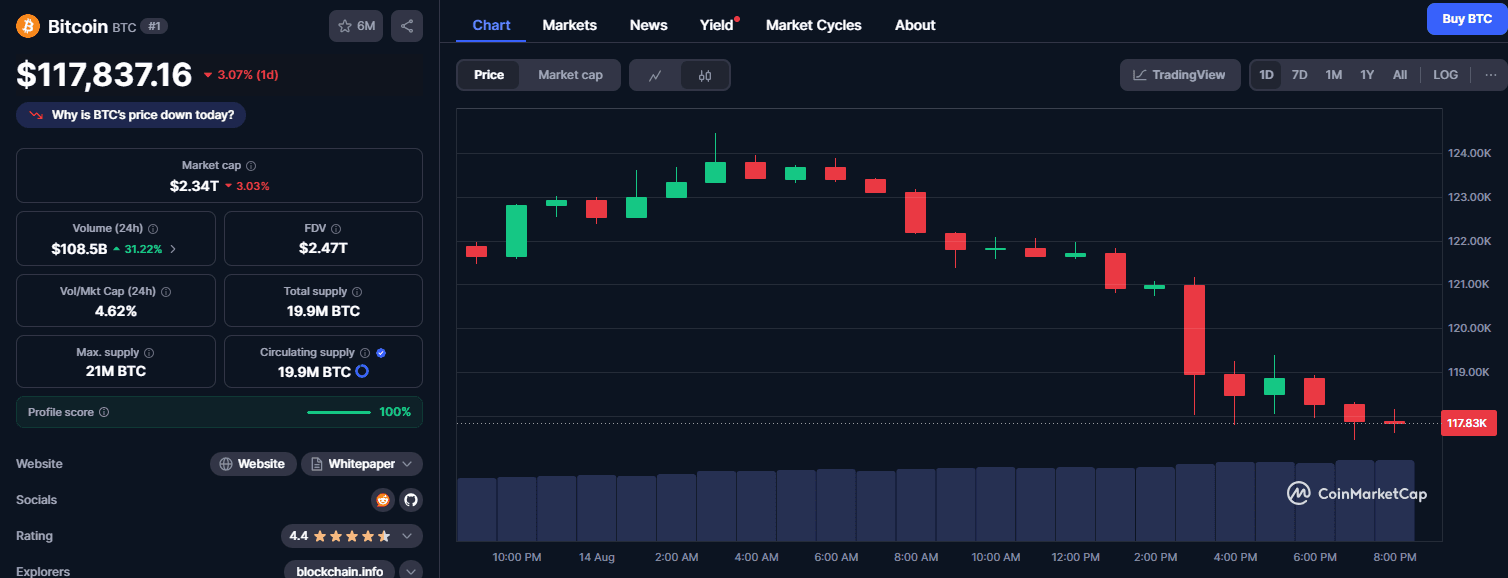

1. 比特幣(BTC):創新高後健康回調

比特幣今日繼續作為市場風向標的角色。作為龍頭加密貨幣,BTC於24小時內衝上逾$124,000歷史新高,升幅約3.5%,地位進一步鞏固。市值一度邁進全球第5大資產,超越Alphabet等巨擘。推動這輪升浪的因素包括:市場憧憬通脹放緩促使聯儲局減息、監管壓力略為紓緩、地緣風險(如烏克蘭戰事)有所緩和,以及ETF及企業資金持續流入各大加密幣。多重正面因素匯聚,推高BTC,鞏固其「數碼黃金」地位。

不過,比特幣亦證明即使牛市時也不可能直線上升。觸及約$124K後,BTC於大成交拋壓下急跌至約$118K,一度觸發大量自動爆倉(數以億計長倉瞬間蒸發),部分高槓桿投資者受到重創。這種回調可被視為「健康修正」——幫助過熱市場降溫、洗走過度槓桿。截稿時BTC已逐步回穩至$119K–$120K附近,大多數升幅得以保住。分析表示,$118K一帶已形成強力支持,整體市場結構仍然偏多,快閃式回升反映「逢跌吸納」資金正在進場,許多投資者視突如其來的回落為介入升勢的折讓機會。

展望未來,比特幣動力未見減弱。鏈上及宏觀數據仍支持多頭:ETF和機構資金庫內累計持有超過360萬枚BTC(佔供應17%),僅上月增長3.3%,反映長線持有者決心。聯儲局最快下月減息的預期亦令美元走弱,歷史上有利比特幣及其他硬資產。當然,衍生品未平倉仍高,未來波動或會加劇,但總體氣氛屬積極。隨着整體加密市場仍追捧BTC,相信往後如再有顯著回調都會有大量投資者伺機「撈底」,視BTC為加密生態的根基及牛市必備標的。

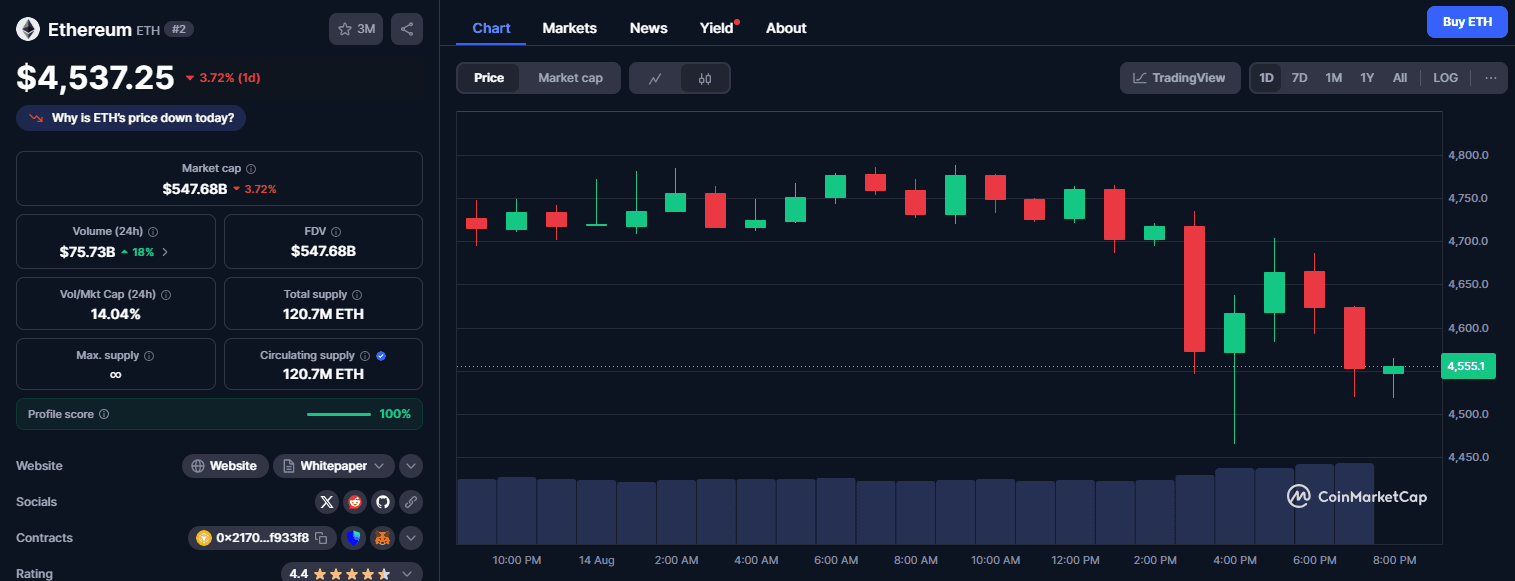

2. 以太坊(ETH):穩步上揚,機構資本湧入

以太坊作為市值第二大加密貨幣,近期亦默默跟隨比特幣上升。過去一日,ETH升至約$4,750,升幅約2–3%,距離歷史高位($4,800以上)只差一步。雖然升幅未及BTC搶鏡,但以太坊這輪勢頭頗具意義——距再創新高只差臨門一腳,反映市場對其前景信心回升。樂觀因素之一來自機構買盤:本周聚焦於ETH的投資產品錄得歷史新資金流入,僅現貨ETH ETF及基金就吸引逾22億美元資金。同時,主流加密企業也積極儲備ETH,專家認為由於ETH市值規模較小且流動性較低,這些機構資金流能對價格產生較大影響。QCP Capital分析師表示「預計只要資金繼續流入,ETH現有上升動能可維持。」

基本面方面,以太坊網絡自轉為權益證明(Proof-of-Stake)及多項升級(如EIP-1559銷毀手續費、上海升級允許提款)後,令ETH通脹壓力減少及可用性大增。另外,監管風險似乎緩和,暫未見ETH遭遇如部分山寨幣般的強硬執法。市場十分關注以太坊ETF進展:美國多隻現貨以太坊ETF有望獲批,市場猜測美國證監會或在未來數月效法比特幣ETF批核。如果以太坊ETF成事,加上穩定幣生態持續壯大,部分分析師看好ETH中線有望衝上$7,500,比現價高超50%,再次印證其在DeFi及鏈應用的主導地位。

當然,以太坊也並非沒有人趁高套現——以太坊基金會就有分段減持(屬於金庫管理策略),但這些小規模拋售對升勢影響有限。ETH現於$4,700區間交易,態勢仍然樂觀,技術指標顯示上升動能強(連續多月守穩50日及200日線)。短線而言,$4,800到$5,000屬重要阻力區,若能突破將創新紀錄,或引發動能盤追入。下方$4,400–$4,500有過去整固區作支持,如市場再現回調有望托價。由於以太坊在NFT、智能合約等範疇舉足輕重,很多投資者都將ETH「逢低吸納」列作優先選擇,尤其他的鏈上數據(如用戶及銷毀規模)持續支撐長遠增長。總結而言,以太坊近來穩定升勢、機構力撐及多項潛在催化劑,令其成為市場調整時值得考慮撈底的主力幣種之一。

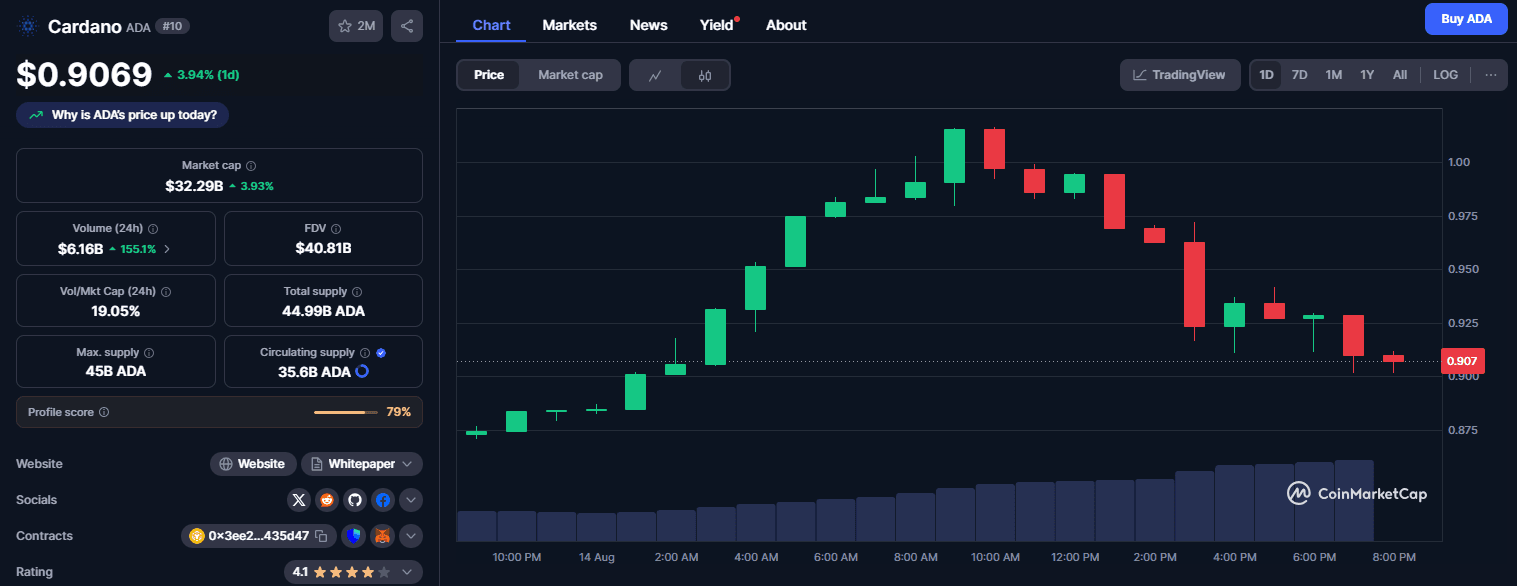

3. 卡爾達諾(ADA):18%升幅後突破動能顯現

卡爾達諾(ADA)是近一日山寨板塊表現最亮眼的幣種之一,目前見到技術突破信號,結束長時間橫行。ADA單日升近9%,過去一周累積升幅約18%,現交投於$0.90水平。此波升勢直逼2021年高位延伸下來的重要阻力——約$0.90–$0.92結構性壓力區,現正測試這個「天花板」,引起市場對一旦突破或會迎來更大升勢的猜測。

多個技術指標正為ADA發出強烈利好信號。其中,日線圖的移動平均線收斂背馳(MACD)指標成為焦點。交易老手Christopher Visser近日指出,卡爾達諾的日線MACD本周首度出現牛市交叉,為數月來首見。值得留意,上一輪ADA日線MACD轉正(6月底)後,幣價數周內曾勁升約62%。更加 intriguing, Visser points out that we are seeing multiple timeframe MACD alignments: the 2-hour, 4-hour, and 6-hour MACDs for ADA are all either bullish or on the verge of crossing, a pattern that previously preceded explosive upside in Cardano. In addition, Bollinger Bands on the 6-hour chart have tightened significantly, indicating a period of low volatility that often comes before a major price move. This kind of volatility squeeze is relatively rare on higher timeframes and suggests ADA is coiling up for a potential jump – the bands narrowing implies the price has been range-bound, and when it breaks out of that range, the move can be sharp.

有趣的是,Visser 指出,現時我哋見到多個時段 MACD 指標開始出現同步:ADA 嘅兩小時、四小時同埋六小時線全部都偏向牛市,或者臨近黃金交叉,呢個模式以往喺 Cardano 價格大爆發之前都曾經出現過。除此之外,六小時圖嘅布林通道大幅收窄,顯示市況近期波幅好細,呢個現象通常係大升浪嘅前奏。咁高時段出現波幅壓縮其實唔常見,亦都意味住 ADA 隨時一觸即發——通道收窄即係價格盤整得好耐,一旦突破區間上落,升跌都可以好急好快。

From a broader perspective, Cardano appears to be nearing the end of a multi-year downtrend. Since its September 2021 all-time high around $3.10, ADA spent four years in a wide consolidation range, with two failed breakout attempts (peaking at $1.63 in 2022 and $1.32 in 2024). Now, ADA is on its third attempt to escape this range, and the setup is “almost identical” to prior successful breakouts, according to Visser. The token has strong support in the mid-$0.70s (where trading volume has been highest historically), and above the current price, the volume profile thins out – meaning if bulls push past $1.00, there may be relatively little resistance until much higher levels. Visser even posits a long-term price target around $3.90 for Cardano if it can complete this breakout of the multi-year wedge pattern. That would imply ADA regaining and exceeding its former record high. While he doesn’t attach a specific timeline to that target, it underscores the growing optimism around Cardano’s trajectory.

放眼睇,Cardano 而家似乎就嚟擺脫咗幾年嘅下跌格局。由 2021 年九月創到歷史高位(約 $3.10)之後,ADA 有成四年都一直係超大幅度橫行整固,期間試過兩次想升穿(2022 年見頂於 $1.63,同 2024 年嘅 $1.32),但都失敗咗。今次係第三次挑戰區間上限,Visser 話今次嘅走勢同之前真係極為相似,陣式幾乎「一模一樣」。呢隻 token 喺 $0.70 幾呢個位有好強支持(歷史最大嘅成交量都集中喺度),而現價以上嘅成交量分布就明顯稀疏——即係話,如果牛市真係衝穿 $1.00,後面阻力都唔多,可以一路衝到更高。Visser 甚至話,如果突破成功,Cardano 長線有機會望向 $3.90,直指三角收斂多年間的量度升幅。雖然佢冇講明咩時候會到,但呢個目標都可以凸顯市場對 Cardano 越嚟越樂觀。

It’s worth mentioning the fundamental context too: Cardano’s ecosystem development continues (e.g. recent upgrades like Hydra for scaling), and its community remains very active. ADA has sometimes lagged other majors during fast market moves, but its slow-and-steady approach – emphasizing peer-reviewed research and measured upgrades – means that when momentum does come, it can build unexpectedly fast as investor confidence returns. As always, nothing is guaranteed – false breakouts can happen, and Cardano’s low volatility phases have frustrated traders before. But with ADA’s chart flashing bullish signals and the coin outperforming many peers this week, it has earned a spot on the list of coins not to ignore when “buying the dip.” A successful push above the $1.00–$1.10 zone could mark a major trend change for Cardano, potentially kicking off a new chapter of upside for this long-consolidating cryptocurrency.

基本因素方面都值得一提:Cardano 生態系統持續發展(例如新嘅擴容項目 Hydra),社群亦一直好活躍。ADA 雖然偶有落後其他主流幣,但佢一向主打穩健路線、重視學術審核同逐步升級,變相市況一旦轉好,往往更快吸引信心回流,升勢會嚟得突如其來。當然,世事無絕對——假突破隨時會發生,過往低波幅市況都令唔少炒家失望。不過,結合而家嘅牛市訊號、以及近排相對跑贏同業,ADA 明顯唔可以「睇漏眼」做低吸首選。如果後市真係突破 $1.00–$1.10 區間,有機會引發 Cardano 重大趨勢逆轉,寫下橫行多年後新一章。

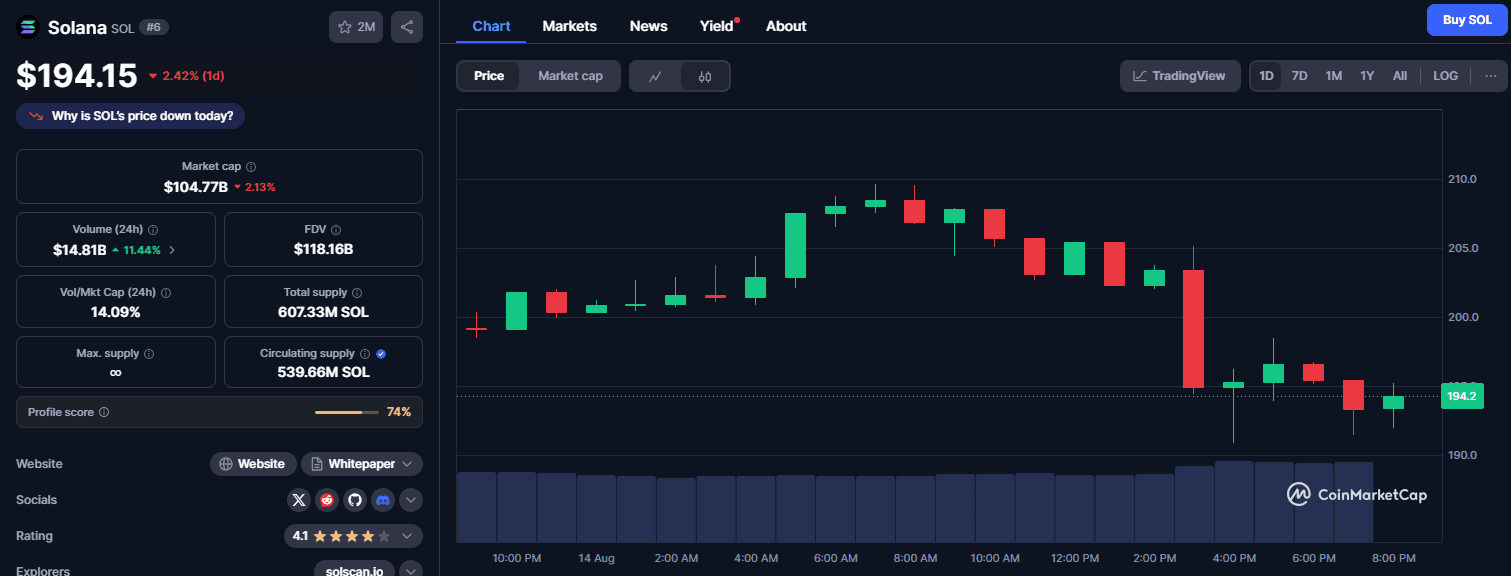

4. Solana (SOL): High-Performance Chain Regains the $200 Milestone

Solana (SOL) has made a dramatic comeback in recent days, reasserting itself as a top-performing layer-1 blockchain token. In the last 24 hours, Solana’s price surged back above the psychologically important $200 level, a price it had not seen in over a year. At one point SOL hit roughly $199.5 on major exchanges, up 13.5% on the day, before the broader market pullback trimmed its price to just under $200. Still, the very fact that Solana reclaimed the $200 mark is significant – it signals a full recovery from the deep slump of 2022 and showcases renewed investor enthusiasm for Solana’s ecosystem. This current rally to multi-month highs has reinvigorated interest in SOL and reinforced its position as a key player among smart contract platforms.

Solana (SOL) 近排可以話係華麗反彈,重奪一線 Layer-1 公鏈地位。過去 24 小時,SOL 價格強勢升上咗心理關口 $200,創返一年以嚟新高。當日高見 $199.5,升幅一度達 13.5%,雖然臨收市時全市場有少少回吐壓力,但都守住咗 $200 樓上。呢個表現非常有意義——意味著 Solana 完全走出 2022 年低谷,亦反映投資者重拾對其生態圈興趣。今次由多月新高帶起嘅升浪,成功鞏固咗 SOL 喺智能合約平台層面嘅龍頭地位。

Solana’s rebound is underpinned by its strong technological fundamentals and expanding use-cases. Often dubbed a “high-performance blockchain,” Solana is known for processing thousands of transactions per second with negligible fees, thanks to its unique proof-of-history consensus design. These capabilities have fueled a vibrant developer community and led to a flourishing array of decentralized finance (DeFi) protocols, non-fungible token (NFT) projects, and blockchain games running on Solana. Over the last quarter, Solana’s on-chain activity has boomed: one report noted the network hit a record of 7.3 million monthly active addresses in Q3, indicating a surge in user engagement (though that particular stat was for Avalanche, Solana has likewise seen rising activity). Solana’s total value locked (TVL) in DeFi has also been climbing, reflecting renewed capital inflows into Solana-based lending, trading, and yield platforms. This uptick in on-chain metrics provides fundamental support to SOL’s price appreciation – investors see that the network is being used more heavily, which reinforces Solana’s value proposition as a fast, scalable blockchain for real-world applications.

Solana 能夠反彈,背後靠住強大技術根基同不斷擴展嘅應用場景。佢一向有「高速區塊鏈」之稱,每秒可處理數千筆交易、手續費極低,全賴其獨有 Proof-of-History 共識機制。呢啲本事吸引到大批開發者入駐,帶旺咗 DeFi、NFT、區塊鏈遊戲等等豐富生態。過去一季,Solana 鏈上數據明顯向好:有報告指第三季活躍地址達到 730 萬個(雖然原數據其實屬於 Avalanche,但 Solana 亦實質有上升趨勢)。Solana DeFi 鎖倉量(TVL)亦持續創新高,證明資金重投 Solana 上面嘅借貸、交易、收益平台。鏈上各項指標起飛,進一步支撐住 SOL 價格——投資者見到網絡越用越多,自然認同 Solana 作為高速可擴展公鏈嘅價值。

Crucially, institutional and developer adoption of Solana is growing as well. Solana has attracted attention from enterprises and big players looking for scalable blockchain solutions. For example, there’s increasing talk of traditional finance experimenting with Solana for payment networks or tokenized assets, given its throughput advantages. The Solana Foundation has also been fostering development with hackathons and grants, leading to a proliferation of tools and platforms on Solana. The network’s resiliency has improved too – after some notorious outages in its early days, Solana has steadily enhanced its software to handle traffic bursts, which boosts confidence among users and validators. All these factors – high speed, low cost, a growing ecosystem – have solidified Solana’s status as a top “Ethereum-alternative” platform.

更重要嘅係,Solana 的機構及開發者採用率持續上升。越來越多企業、大型機構留意呢款可擴展公鏈,有傳統金融甚至考慮將支付網絡、實體資產 token 化等落實喺 Solana 上面,因為其高吞吐量優勢。Solana Foundation 方面亦大量支持開發,例如舉辦黑客松、提供撥款資助,加快生態工具平台擴展。網絡穩定性亦有顯著提升——早幾年出現閃斷問題,而家已改善咗處理高峰流量能力,令用戶同驗證者對其更有信心。種種優勢——速度快、成本低、日益茁壯生態——都令 Solana 成為以太坊最佳替代者之一。

From a market perspective, flipping the $200 price level from resistance into support is a bullish development. $200 is a round-number milestone that carries psychological weight, and SOL’s ability to reclaim it indicates strong buying pressure. Technical analysts note that this move came on high volume and strong momentum, suggesting it wasn’t a fluke. Indeed, SOL was up nearly 50% over the past few weeks leading into this, making it one of the best-performing large-cap altcoins lately. Of course, after such a rapid ascent, some volatility is to be expected – and as the market pullback showed, SOL can retrace quickly if sentiment wavers. Traders will be watching how Solana behaves around the $180–$200 zone in the coming days; holding above previous resistance ($180) would be a sign of strength, while a deeper dip might find support around $150–$160 (areas of prior consolidation). For now, the broader trend is positive. The recent dip across crypto offers SOL believers a chance to “buy the dip” on Solana, betting that its combination of technical prowess and ecosystem growth will continue to drive adoption. With some analysts even floating long-term targets of $250–$300 for Solana in a sustained bull scenario, it’s clear that SOL has re-entered the conversation as one of the top coins to watch – and potentially accumulate on any interim weakness – as altseason momentum builds.

市場角度嚟睇,將 $200 關口由阻力變成支持,絕對係牛市信號。$200 係心理大位,SOL 能夠收復,反映買盤好強。技術分析師指,今次突破有成交配合,升幅又急又狠,唔似偶然。其實過去幾個禮拜 SOL 已升近五成,係近期表現最佳嘅主流幣之一。當然,升得快好大機會有回吐,正如今次回調,市況一淡隨時會下跌。之後大家會密切觀察 SOL 喺 $180–$200 美元區間點走,上守 $180 證明夠強,落返去 $150–$160 係以前整固位,都有機會頂住。總體而言大勢向好,近期回調正好畀信徒趁低吸納,博 SOL 將繼續以技術實力+生態增長推動採用。有分析甚至睇長線都可能衝上 $250–$300,所以 SOL 得以再次成為「必留意」主流幣,投資者可以考慮中長線分段收集,等牛市 momentum 真正來臨。

5. Dogecoin (DOGE): Meme King Flashes a Golden Cross Signal

A physical Dogecoin coin with the iconic Shiba Inu, set against an ascending candlestick chart. Dogecoin’s recent price uptick and “golden cross” pattern have traders speculating about another potential breakout.

一枚實體 Dogecoin,前面係招牌柴犬,背景係向上嘅 K 線圖。最近 Dogecoin 嘅升勢連同黃金交叉型態,令不少炒家開始憧憬又一波爆升。

No daily crypto roundup would be complete without the mention of Dogecoin (DOGE) – the original meme cryptocurrency that still commands a fervent fanbase. In the past 48 hours, Dogecoin quietly staged a robust rally, jumping about 15% over two days and briefly trading above $0.25 for the first time in several weeks. On Wednesday (Aug. 13), DOGE was up roughly 5.3% for the day to around $0.249, capping a steady climb from ~$0.22 earlier in the week. This push not only marked a one-month price high for Dogecoin, but it also coincided with a closely watched bullish technical pattern: a “golden cross” on its daily chart. A golden cross occurs when a coin’s 50-day moving average crosses above its 200-day moving average, signaling that recent upward momentum is overtaking the longer-term trend. For Dogecoin, this is the first golden cross since November 2024, a event that, in that instance, preceded a 130% price surge in the following month.

每日加密貨幣快訊點都唔可以唔提狗狗幣(DOGE)——始祖 meme 幣依然教唔少炒家為之瘋狂。過去 48 小時內,DOGE 悄悄暴力反彈,兩日飆升約 15%,幾個星期以來首次升穿 $0.25。星期三(8 月 13 日)DOGE 單日升幅約有 5.3%,收報約 $0.249,短短數日由約 $0.22 爬升到而家。呢波升幅唔單止創咗 1 個月新高,仲啱啱同日出現一個備受關注嘅牛市圖表訊號:日線「黃金交叉」。所謂黃金交叉,即係 50 日線升穿 200 日線,代表短期升勢超越中長線趨勢。對 DOGE 而言,上一次出現黃金交叉已經係 2024 年 11 月,當時翌月就爆升成 130%。

The emergence of this golden cross has stoked optimism among Doge enthusiasts that history might repeat – or at least rhyme. Dogecoin has a track record of explosive moves following technical signals: beyond the late-2024 rally, a similar golden cross in late 2023 foreshadowed a 25% climb in four weeks, and an earlier one in 2020 kick-started Dogecoin’s infamous 1,000%+ moonshot over a few months. While it’s important to note that technical patterns are not guarantees (and the golden cross can sometimes be a lagging indicator), the fact that DOGE’s averages have aligned bullishly reflects the genuine improvement in its market momentum recently. The rally has been accompanied by elevated trading volumes, indicating not just retail meme traders but also larger players are active in Dogecoin right now.

今次黃金交叉出現,自然又燃起 DOGE 支持者「歷史重演」或最少押注「押韻」的憧憬。事實上,Dogecoin 以技術圖破位暴走都唔係第一次——2024 年底爆升在前,2023 年底黃金交叉後四星期飆咗 25%,而 2020 年果次更加成為瘋漲超過 1,000% 嘅傳奇。當然,呢啲技術形態並唔代表必然(黃金交叉有時都會滯後),不過最低限度反映 DOGE 近排走勢明顯改善、升勢比以往更強。值得留意係,今次升浪同步有成交配合,證明唔只係散戶 meme party,連大戶投資者都開始積極參與。

Indeed, behind the scenes, whale investors have been accumulating DOGE aggressively during this period of price strength. Blockchain data indicates that over 1 billion DOGE (worth roughly $200 million) were scooped up by large wallets in recent sessions. These whales now control nearly half of Dogecoin’s circulating supply – a remarkable concentration that signals sustained institutional or high-net-worth interest in Dogecoin, despite its lighthearted origins. Such accumulation often provides a floor of support under the price, as big holders are presumably confident in Dogecoin’s longer-term prospects (or at least are content to hold a large stake). This whale activity may help explain Doge’s resilience and its ability to break through resistance. In fact, as Dogecoin surged this week, it cleanly broke above the $0.25 level, which traders identify as a key

事實上,呢輪升勢背後,「巨鯨」級大戶亦不斷加倉 DOGE。鏈上數據顯示,近期有超過 10 億枚 DOGE(約值 $2 億美金)畀大戶錢包掃入。呢啲 whale 而家控制住 DOGE 市面流通貨幣幾乎一半,呢種集中度反映咗機構或高淨值人士對呢隻本身「玩住嚟」嘅幣依然超有興趣。大戶密集收集,往往托住價格底、防止暴跌——貨在手自然唔驚長期前景,或者搶住坐大莊。呢啲巨鯨動作可能都解釋到點解 DOGE 咁堅靭、次次頂唔住阻力仲可以突破。事實上,狗狗幣今個星期一爆升,即刻乾淨俐落升穿咗 $0.25 這個緊要位……psychological and technical resistance that had capped previous attempts. Conquering $0.25 is no small feat – it sets the stage for potential moves toward the next target around $0.28–$0.30, near the token’s local highs from July.

心理同技術上嘅阻力之前一直限制住嘅嘗試。要突破$0.25其實唔容易——但成功之後就打開咗向下一個目標$0.28–$0.30(接近7月時本地高位)邁進嘅空間。

The broader backdrop is also in Dogecoin’s favor. In times of bullish market sentiment, meme coins like DOGE often see amplified gains as speculative appetite grows. Elon Musk’s rebranding of Twitter to “X” earlier in 2023 had sparked hopes of Dogecoin integration (given Musk’s fondness for Doge), and while nothing concrete has emerged on that front, the power of the Dogecoin community and brand shouldn’t be underestimated. It’s a coin that captures mainstream attention in a way few cryptocurrencies do – making it something of a sentiment gauge for crypto at large. Right now, that sentiment is turning positive. Analysts will be watching if Dogecoin can hold above the $0.22–$0.25 zone during any broader market dips; doing so would indicate a new support base. On the upside, clearing the $0.28 hurdle could open a run toward $0.35 or higher. As always, volatility is part of Dogecoin’s DNA – swift pullbacks can happen if euphoria fades. But given the fresh bullish signals (like the golden cross) and whale backing, many traders consider Dogecoin a top coin to accumulate on dips, hoping to ride the next wave of meme-fueled momentum if it comes. In sum, DOGE’s recent technical breakout and strong community support make it a coin you “shouldn’t dodge” when formulating a buy-the-dip strategy.

大環境同樣對Dogecoin有利。當市場情緒樂觀時,DOGE呢類meme幣往往會因投機需求上升而獲得更大升幅。Elon Musk 2023年初將Twitter改名為「X」,曾引發Dogecoin整合嘅憧憬(始終Musk本人都幾鍾意狗狗幣),雖然到目前為止都未有實質進展,但唔可以低估Dogecoin社群同品牌嘅力量。呢隻幣吸引主流關注嘅能力,係好多加密貨幣都做唔到——係一個全球市場情緒指標。依家,呢個情緒明顯正轉向樂觀。分析員會觀察Dogecoin係咪可以喺較大市回調時守穩$0.22–$0.25區間;如果做得到,即係有新支持位現身。向上反而,如果可以突破$0.28阻力,可能會有機會衝向$0.35甚至更高。要留意,波動係Dogecoin嘅基因之一——情緒一淡返,隨時急速回落。但考慮近期多個牛市信號(例如黃金交叉)同大戶支持,好多交易員都認為Dogecoin係值得逢低吸納嘅強幣,希望一旦meme熱潮再起,可以搭車再賺一轉。總括而言,DOGE最近嘅技術突破加上強大社群支持,令佢成為「唔應該忽略」嘅逢低吸納對象。

6. Shiba Inu (SHIB): Layer-2 Hype Gives the Meme Coin New Life

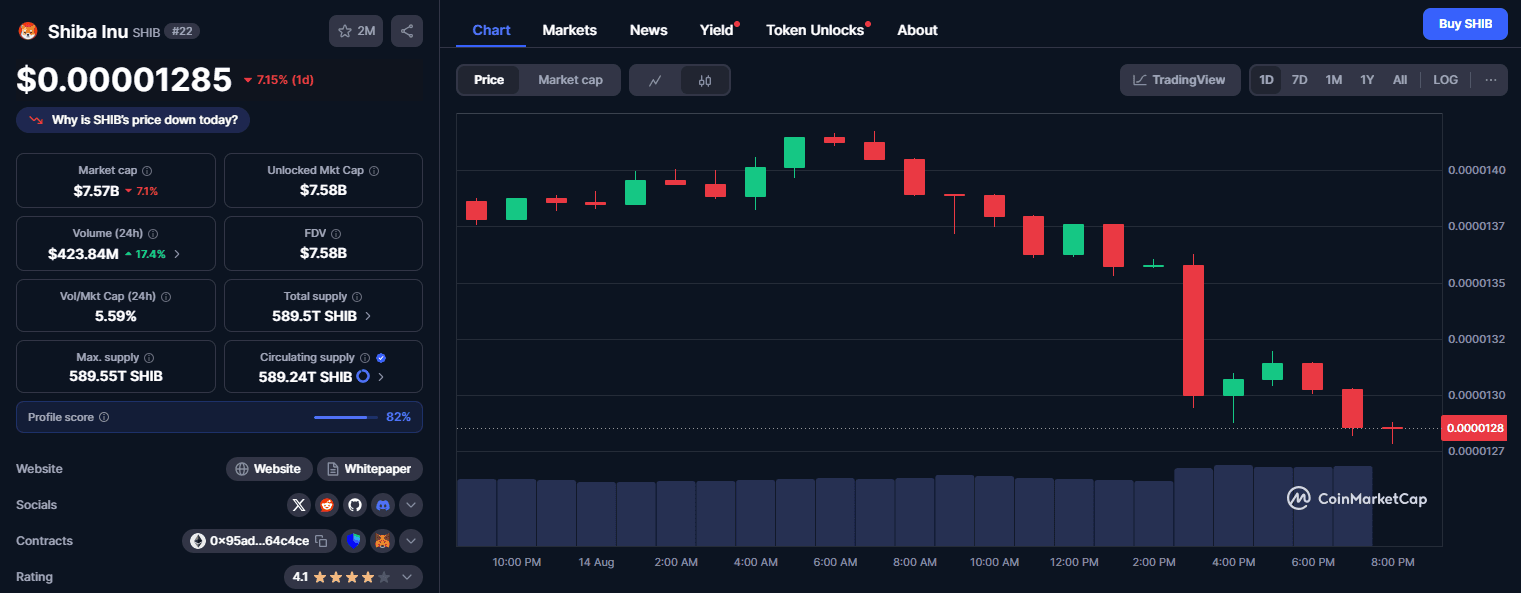

Another prominent meme-inspired cryptocurrency showing promising signs is Shiba Inu (SHIB) – often seen as Dogecoin’s younger cousin and one of the most popular Dogecoin alternatives. While Shiba Inu’s price is just a tiny fraction of a cent, its percentage movements and passionate community are anything but small. In the last day, SHIB jumped roughly 4–5% to around $0.0000138 per token. That pop outperformed many other large-cap coins and came on the back of a specific catalyst: fresh developments in Shiba Inu’s layer-2 network, Shibarium. The project’s developers teased upcoming upgrades to Shibarium, sparking a wave of optimism that propelled SHIB’s price higher and boosted its trading volumes.

另一隻有明顯炒作潛力嘅meme幣係Shiba Inu (SHIB)——經常被當成Dogecoin「細佬」而且係其中一隻最受歡迎嘅狗狗幣替代品。雖然SHIB嘅價格低到只係一小分之一美仙,但總升跌幅度同狂熱社群絕對唔細。最近一日,SHIB漲咗大約4–5%,去到約$0.0000138一枚。呢個升浪比好多主流大市值幣都強,背後原因係一個明確催化劑:Shiba Inu Layer-2網絡Shibarium有新發展。項目開發團隊預告Shibarium將有升級,激發咗一波樂觀情緒,帶動價錢上升同成交增加。

The Shiba Inu team’s hint – delivered via a brief statement on social media – suggested that significant improvements or new features for Shibarium are on the horizon. This was enough to ignite speculation across major crypto forums and among retail traders who follow SHIB closely. Shibarium, which launched earlier in 2023, is a Layer-2 scaling solution for Ethereum aimed at making transactions faster and cheaper for the Shiba Inu ecosystem. If the hinted upgrades meaningfully enhance Shibarium’s performance or usability, it could drive greater adoption of SHIB in DeFi, gaming, or other applications, increasing the token’s utility. The mere anticipation of this has turned sentiment on SHIB bullish in the short term – a notable shift, because Shiba Inu had been relatively quiet price-wise in prior weeks. The renewed buzz translated into a 4.5% price pump on Aug. 13 and a flurry of chatter that pushed SHIB to the top of trending token lists on platforms like CoinMarketCap.

Shiba Inu團隊透過社交媒體發表簡短聲明,暗示Shibarium快將有重大功能升級或新特性。呢個消息足以令主要加密論壇同密切留意SHIB嘅散戶散戶炒家瘋狂猜測。Shibarium係2023年初推出,係Ethereum嘅Layer-2擴容方案,目標係令Shiba Inu生態環境內交易更快更平。如果未知升級真係大幅提升咗Shibarium效能或者易用度,會吸引更多人喺DeFi、遊戲或者其他應用採用SHIB,提升代幣用途。單係憧憬之下,SHIB短期情緒已由淡轉好——值得留意,因為過去幾星期Shiba Inu一直好靜冇乜動作。今次熱度回升帶動8月13日SHIB抽升4.5%,同時好多討論令佢飛到CoinMarketCap等平台熱門代幣之首。

From a technical perspective, Shiba Inu’s move, while modest in percentage, did have it testing the upper bounds of recent trading ranges. SHIB has been fluctuating in a somewhat sideways pattern, and the push to $0.0000138 brought it near its local resistance levels (around the mid-$0.000013s). A clean break above $0.000014, if achieved, could signal a bullish breakout from its summer range. Some analysts highlight that Shiba Inu’s Bollinger Bands have tightened in the past week, similar to Dogecoin, indicating reduced volatility that often precedes a bigger move. The question is whether that move will be up or down, and the Shibarium upgrade news tilts the odds upward in the near term by injecting a dose of positive fundamentals.

由技術角度睇,今次SHIB升幅雖然唔算誇張,但已經推高到近期區間頂部。SHIB上幾個星期大致橫行為主,而最近升到$0.0000138,已經近本地阻力位(大約中段$0.000013x)。如果順利突破$0.000014就有機會擺脫夏季嗰個區間展開新升浪。有分析提到,Shiba Inu近期Bollinger Bands明顯收窄,好似Dogecoin咁,預示波幅減少、有機會預示大升/大跌前奏。唯一問題係今次會向上定向下,而Shibarium升級消息短線內令睇升因素佔優。

It’s worth noting that Shiba Inu’s ecosystem has grown beyond just the SHIB token. It now includes other tokens (LEASH, BONE) and the Shibarium network itself, which collectively form a budding DeFi ecosystem. Hints of upgrades could involve anything from new decentralized apps (dApps) launching on Shibarium, to improved throughput or interoperability, or even new tokenomics like additional SHIB burning mechanisms. The SHIB community is known to rally around news of token burns (which reduce supply), and any upgrade that potentially increases the burn rate or utility of SHIB could be a bullish catalyst. In fact, Shibarium’s initial launch came with the promise of burning SHIB with each transaction, and further enhancements there would be welcomed by holders aiming for long-term scarcity.

值得留意,Shiba Inu生態圈已經唔只得一隻SHIB代幣。現時仲包括咗LEASH、BONE等代幣,連同Shibarium自身,合共構成新興DeFi生態。今次所暗示嘅升級,可能涉及新dApps(去中心化應用)喺Shibarium上線、性能提升、跨鏈互通,甚至全新通證經濟制度,例如加快SHIB銷毀機制。SHIB社群向來對銷毀(即減少供應)消息好瘋狂,任何提升SHIB銷毀速率或者實用性的升級都有機會觸發另一波升勢。事實上,Shibarium最初開通時已講明每單交易都會燒幣,之後如果有更多優化,對希望長線促成稀缺性的持幣者嚟講當然係好消息。

However, caution is warranted. As TradersUnion analysts noted, SHIB still faces significant resistance at recent peaks and lacks clearly defined long-term support due to its large swings. The meme coin’s fortunes can be highly speculative and tied to hype cycles. If the actual Shibarium updates (when revealed) fall short of expectations or are delayed, the recent gains could fade quickly as “buy the rumor, sell the news” takes effect. For now though, market momentum appears skewed bullish for Shiba Inu, with momentum indicators and social sentiment on the upswing. For traders who believe in the Shiba Inu roadmap, any interim dip – for example, if SHIB pulls back to support around $0.000012 – might be seen as a chance to accumulate before the full Shibarium potential is realized. In summary, Shiba Inu’s recent pop and the prospect of its layer-2 upgrades have put it back on the radar as a coin to consider buying on dips, especially for those who missed its earlier 2023 rally. The combination of a fervent community, upcoming tech improvements, and the general uptick in meme-coin interest make SHIB a notable inclusion in today’s top 10 highlights.

不過,要留意風險。正如TradersUnion分析員指出,SHIB近期高位阻力依然壓力大,加上波幅極大、長線明確支持位仍未清楚。呢類meme幣本身就高度依賴炒作循環,變數多。如果Shibarium升級到時冇大家期望咁高,或者有延誤,短線升幅隨時即刻被「傳聞買入、消息賣出」效應沖淡。不過目前技術與市場動力係傾向樂觀,連動指標同社群情緒都有上升。對於認同Shiba Inu規劃嘅炒家嚟講,中間如果有回調(例如跌返近$0.000012支持位)都有人視為低吸機會,搏等到Shibarium 進一步實現潛力。總括來講,SHIB近期突圍加上Layer-2升級憧憬令佢再度成為逢低吸納名單之選,尤其對早前錯過2023年升浪嘅人。社群火熱、技術新進步同埋整個meme幣熱度一齊推動,令SHIB成為今日十大加密幣焦點之一。

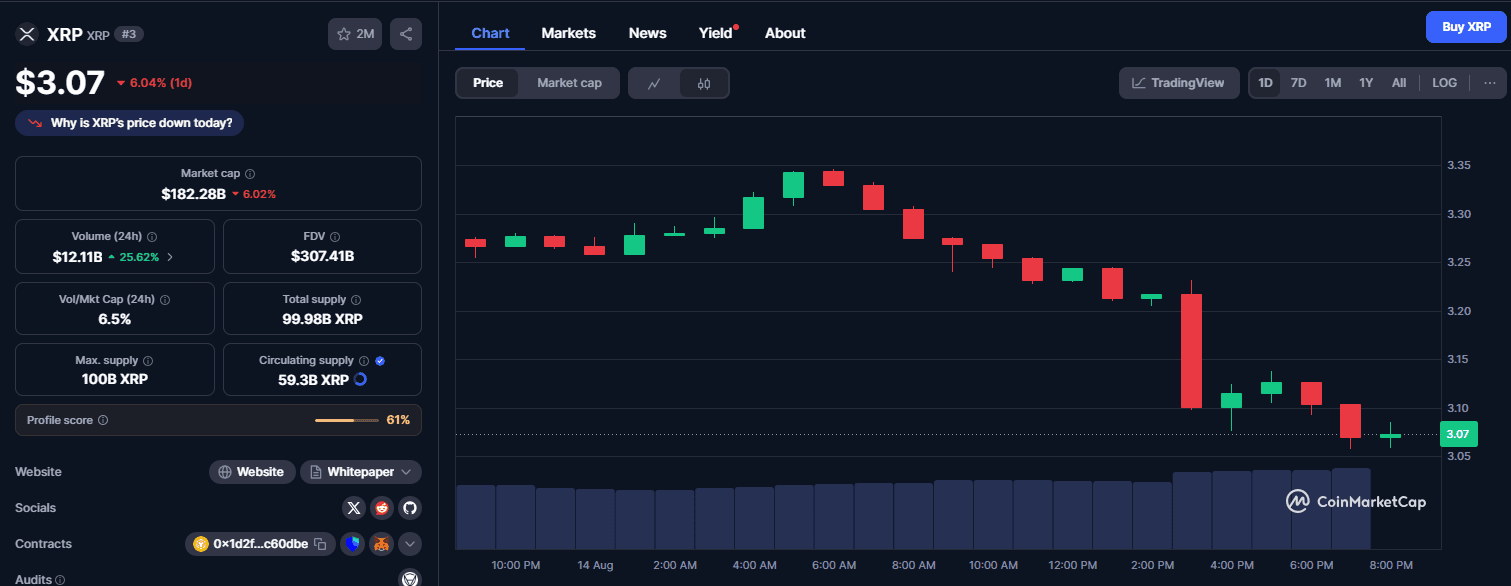

7. XRP (XRP): Holding Strong After a Legal Victory and Rally

XRP, the cryptocurrency associated with Ripple’s payments network, has had an eventful summer. Just a few weeks ago in mid-July, XRP soared to a multi-year high of around $3.65, fueled by a landmark legal victory in the long-running SEC vs. Ripple case (a U.S. judge ruled that XRP is not a security when sold to the public). That news catalyzed a surge of mainstream attention and a wave of FOMO buying, briefly making XRP one of the best-performing major assets of 2025. Since that spike, XRP did undergo a healthy correction, but impressively it has held onto much of its gains. Over the past 24–48 hours, as the market fluctuated, XRP found support and reclaimed the key $3.15 level, suggesting that bulls are stepping in to defend prices on dips. After the flash crash on Aug. 14, XRP quickly bounced from about $3.11 back above $3.15, indicating real buying interest at those levels.

XRP,Ripple支付網絡相關加密貨幣,今年夏天可謂風波不斷。七月中,XRP因應SEC對Ripple訴訟案出現突破性法律勝利(一位美國法官裁定XRP向公眾出售時並非證券),價格飆升至近年新高約$3.65。消息引爆主流關注、FOMO大量追入,一度令XRP成為2025年表現最佳大幣之一。之後,雖然有健康回調,但大部份升幅依然穩守。過去24–48小時,市場波動下,XRP穩企並重上$3.15關鍵支持位,反映有買家積極低吸。8月14日急插後,XRP由約$3.11很快反彈返上$3.15,顯示該價位有真金白銀承接。

Analysts note that $3.00–$3.20 is a pivotal zone for XRP – both psychologically and technically. Encouragingly, XRP’s ability to stay above $3 (even during market volatility) and claw back to $3.15 has reinforced bullish market structure. Crypto commentator Crypto Eagles highlighted that XRP “cleanly reclaimed” $3.15 support after filling a fair value gap during the pullback, calling it a “pivotal shift” that could signal the start of a new uptrend leg if the level holds. In practice, maintaining support above ~$3.15 keeps XRP in a pattern of higher lows, preserving its positive momentum from the July breakout. Should buying pressure persist, analysts are eyeing near-term targets around $3.30 and $3.40 – areas where XRP saw selling pressure on its way down from the recent highs. A break above ~$3.40 would be particularly bullish, potentially confirming a “third wave” uptrend for XRP, as some Elliott Wave theorists in the community have proposed.

分析員指出,$3.00–$3.20係XRP心理同技術雙重關鍵位。最鼓舞人心係XRP可以穩企$3樓上(即使全市大波動),而家仲重上$3.15,加強整個牛市結構。加密評論員Crypto Eagles提到,XRP喺回調期間填補咗公平價格「缺口」之後,「乾脆利落」地重奪$3.15支持,話呢個係「關鍵轉勢」,只要守穩此位或預示新一輪升浪開始。實際上,守穩$3.15以上就保住左底愈來愈高嘅升勢,延續七月突破以來既正面動力。如果買盤持續,分析員預期短期之內有望挑戰$3.30、$3.40——呢啲都係近期高位下來時出現拋壓嘅地方。如果成功突破$3.40,更加屬特強信號,可能確認社群裏部分艾略特波浪理論分析師所講「第三浪」升幅正式啟動。

Fundamentally, XRP’s backdrop remains strong post-SEC verdict. Ripple’s partial legal win (clarifying that programmatic sales of XRP aren’t securities) has led to XRP’s relisting on major U.S. exchanges like Coinbase, vastly improving access and liquidity for U.S. investors. Additionally, Ripple has been making strides in its business – expanding cross-border payment corridors and even testing a central bank digital currency platform – which bolsters the narrative of XRP as having real utility in global finance. On-chain metrics show that whale accumulation has been significant during this period: one market analysis noted that whales scooped up 900 million XRP within 48 hours during the post-ruling excitement. Such accumulation suggests large entities are positioning for potential long-term upside, viewing the recent legal clarity as a green light to get back into XRP. Moreover, institutional interest in XRP is rising; for instance, some crypto funds are dedicating a portion of their portfolio to XRP anticipating wider adoption in settlement networks.

基本面上,XRP(在SEC判決之後)仍然有力。Ripple今次半勝訴(法庭釐清認定XRP程式化銷售唔屬證券),令XRP重新喺Coinbase等美國主要交易所上架,大大提升美國投資者參與度及流動性。此外,Ripple業務發展一向進取,不斷拓展跨境支付渠道,亦測試中央銀行數碼貨幣平台,強化XRP全球金融「實用」形象。鏈上數據顯示,大戶累積力強——有分析指出,判決剛出嗰48小時,鯨魚級別投資者收集咗九億枚XRP。呢種累積,反映大機構積極布局長線升值,認為法律明朗化係「綠燈」可以返場吸納XRP。加上機構投資興趣上升,例如部分加密基金已預留倉位給XRP,預期其結算網絡未來更廣泛採用。

That said, short-term sentiment on XRP is split between euphoria and caution. The run from $0.50 in early 2023 to over $3.50 now has been breathtaking – XRP is up several hundred percent year-to-date – so naturally some traders are wary of a “bull trap,” where the rebound could lure in late buyers before a deeper correction. The argument for caution cites that Bitcoin’s dominance is still high (~59%), and if Bitcoin were to retrace further, alts like XRP might also see outsized pullbacks. Additionally, XRP’s volatility is elevated, meaning 5-10% daily swings (in either direction) are still quite possible. However, the counter-argument – supported by people like Sasha (aka “why NOT”) from the XRP community – is that structural factors favor XRP’s bull case now. These include

不過短線方面,現時XRP市場氣氛既有興奮亦有警惕。因為2023年初由$0.50升到今日超過$3.50,累積數倍升幅,好多交易員會擔心「牛市陷阱」,即係反彈可能吸引遲來者接火棒後段時間會有更大回調。持保守立場一方認為,現時比特幣市值主導地位仍高(約59%),若比特幣進一步回撤,XRP等山寨幣隨時會出現較大回吐。另外XRP波幅依然勁,一日升跌5-10%都好常見。不過,另一邊廂,包括Sasha(亦稱「why NOT」)等XRP社群支持者就認為,現時多項結構性因素對XRP牛市有利,包括rising institutional adoption, the legal clarity (reducing existential risk), and whales actively buying. So far, those bullish factors have kept XRP on solid footing, even as it consolidates below its recent highs.

隨著機構投資者逐漸加入、法規明朗化(降低存亡風險),以及大戶積極入場買入,這些利好因素至今一直令XRP企穩,即使現時於近期高位之下盤整。

For traders considering XRP on a dip: the $2.70–$3.00 range has emerged as a support “buy zone” (it’s where XRP consolidated after the July spike), and many will be watching if any further dips toward that area get quickly bought up. Conversely, a push above ~$3.30 on strong volume could confirm that XRP’s next leg higher is underway, possibly targeting the mid-$3s or beyond. Some optimistic forecasts from analysts (for example, on Brave New Coin and Cryptobasic) even envision XRP reaching $5–$8 by year-end 2025 in a bull scenario, though those are speculative long-range calls. In the near term, XRP’s inclusion in the day’s top highlights is well-earned: it performed best among majors during the recent rally, has clear indicators of future growth (institutional interest, whale buys, technical support), and presents a compelling dip-buying case if one believes its uptrend will continue.

如有交易者考慮趁低吸納XRP,$2.70至$3.00區間已成為一個重要的「支持買入區」,(這正是XRP於七月飆升後盤整的地方),亦會有不少人關注若價格回落該區,會否再被迅速吸納。相反,若能在大量成交下突破約$3.30,便可能確立XRP踏入新一輪升浪,甚至有機會上望至中$3或以上。部分分析師較樂觀(例如Brave New Coin及Cryptobasic),甚至預期2025年底牛市情景下XRP有望升至$5-$8,雖然這些屬長線且帶投機色彩的預測。短期而言,XRP能上榜成為當日焦點絕對實至名歸:它於最近一輪反彈中表現冠絕主流幣,具備明顯未來增長信號(機構關注、大戶買盤、技術支持),倘若相信其升勢延續,趁低吸納依然是不俗選擇。

8. OKB (OKB): Exchange Token Soars on Massive Token Burn

如果要選出過去24小時內最能體現「爆發式突破」的幣,非OKX交易所的平台幣OKB莫屬。OKB單日急升超過130%,創下歷史新高約$135,隨後回落至$110-$120區間——即使如此,24小時內價值依然超過翻倍。對於一隻大型平台幣而言(OKB當時市值排名全市場前30),這樣的升幅極為罕見。其原因,是OKX發布了一宗震撼性消息:巨額銷毀行動,永久減少OKB流通量6,500萬枚,令其供應瞬間削減一半,絕無僅有,銷毀價值約76億美元,令剩下的OKB劇烈稀缺。

市場反應即時而強烈。OKX確認銷毀及公布生態升級後,OKB價格由$45直線飆升至峰值$142,短暫日內升幅高達約160%。雖然其後出現獲利回吐(大升後屬正常),OKB當日稍後仍穩守$100以上(24小時升幅約132%)。交易量同期爆炸式增長逾130倍,可見消息對OKB持有人及整個市場影響之大。到底發生了什麼?OKX今次宣佈有數個重點:

-

代幣銷毀:OKX銷毀了共65,256,712枚先前回購或預留的OKB,將總供應量固定於2,100萬枚——與比特幣供應上限一致。供應被斬半後,強勢引入通縮效應。一般而言,若需求不變供應減少,價格傾向上升;今次供應衝擊尤為誇張。交易者自然而然紛紛重估OKB價值。這機制亦展現OKX獎勵持幣者的決心;以美元計,論規模本次絕對屬加密項目最大型銷毀之一。

-

“X Layer” 升級:OKX同步推出自家區塊鏈生態重大升級「OKB鏈」,又稱“X Layer”。該鏈基於zkEVM Layer-1 技術(利用Polygon技術),重點發展DeFi、支付及實體資產應用。這個代號「鳳凰計劃(Project Phoenix, PP)」的升級,提升吞吐量至5,000 TPS,減低手續費,並增強與以太坊兼容性。OKX計劃全面將X Layer整合至旗下產品(交易所、錢包、支付等),令OKB在生態中扮演更關鍵角色。值得注意的是,OKX將逐步離開舊鏈(如基於Cosmos的OKTChain),並僅在新鏈使用OKB,同時淘汰基於以太坊版本的OKB。所有動作均以OKB成為下一代區塊鏈平台中心為目標,如X Layer吸引更多用戶及開發者,對OKB需求或會增加。

-

代幣經濟學大更新:完成銷毀後,OKX亦升級OKB智能合約,永久移除增發能力,徹底鎖定2,100萬的發行上限。即是說,未來再無可能新鑄造OKB,OKB正式晉身為永久稀缺資產。過往OKB作為平台幣並非固定供應,是次改革完全轉向比特幣式硬頂模式。同時OKX預告會成立生態基金及流動性激勵計劃,推動X Layer發展,加強OKB地位。

總結來說,OKX今次三管齊下:供應大減、用途提升、未來規劃鞏固,OKB即時被市場重新估值,難怪成為當日最大贏家。對交易者而言,現在關鍵是OKB後市如何。因應這種單日爆升,短期波幅勢必極高。OKB的相對強弱指數(RSI)一度衝破94(指標解讀超過70已屬超買),反映買盤異常熾熱。這樣高的RSI通常意味短線過熱——事實上OKB在頂位一小時內已回吐約15%。但鑒於基本面大變天,多頭或會視任何大型回調為吸納現時更稀缺OKB的機會。重要支持位可留意$90(銳升後首個回穩區嗎)及$70(突破前橫盤區頂)——若有更深回落,這些區域或有承托。

再作同業比較:2,100萬上限下,如每枚OKB約$100,完全稀釋市值僅約21億美元。對標其他大型交易所幣(如BNB現約400億美元)這並不算高。當然,OKX規模較Binance小,但其成交額同樣可觀,若新鏈發展順利,長遠OKB或仍有上升空間。總體來講,OKB的通縮衝擊及生態拓展,正好印證平台幣敘事有多易於瞬間轉變。OKB當日無疑穩佔主流位置,若看好交易所幣或OKX發展,任何回調都會吸引買家。惟切記:急升過後定有風險——熱潮退卻時不免出現大幅調整。總的來說,OKB現在根本面大幅強化、於OKX生態舉足輕重,一夜之間成為眾多加密投資者密切關注標的(亦有不少人表示早一日買到便好了)。

9. Arbitrum (ARB): Layer-2 Token Jumps on Adoption News, Despite Token Unlock Looming

Arbitrum(ARB),作為以太坊熱門Layer-2擴容網絡的原生代幣,近期表現同樣亮眼,受惠於市場對各類擴容方案的濃厚興趣。過去一天ARB價格上升約15-16%,最新報$0.56左右,位列當日山寨幣升幅前列。這波上升,延續了ARB近一週的強勢勢頭,即使面臨即將到來的巨額代幣解鎖,仍無損價格表現。實際上,本輪ARB升勢主因在於PayPal採納Arbitrum網絡——近期有消息指,PayPal推出的以太坊穩定幣(PYUSD)雖以以太坊發行,但部份交易以Arbitrum處理,更見支付巨頭主動關注Layer-2方案。如此級別的機構肯定成為了ARB強勁催化劑,幫助其由上週$0.42反彈至現時$0.50以上。

值得留意的是,ARB價格急升正值即將於2025年8月16日釋放大量代幣。當日會有92,650,000枚ARB(約佔總供應1.8%)解鎖發放予早期投資者或團隊,有機會引發拋售壓力。大部分情況下,大家預期大量解鎖會拖低價格(因有潛在供應增壓)。但今次ARB逆市上升,反映投資者或許已提早部署(認為解鎖已被市場消化,或吸納盤可以承接新增供應),或看好Arbitrum近來重要進展可抵銷解鎖負面因素。能夠於如此背景下造好,顯示市場對項目前景有信心。

技術走勢方面,Arbitrum圖表呈現明顯強勁上升信號。其RSI指標約69——雖然高,但略低於一般超買70水平——代表動力旺盛但並未過度延伸。MACD於多個時框均已翻正上行,且ARB現時價格穩站各主要移動平均線(7日、20日、50日、200日)之上,並呈現多頭排列,形成技術性支持,每次回調都容易於上升移動均線獲得承托。此外,ARB今次升浪更突破了布林上軸(常見作為升勢強勁訊號),雖然短期易被視為超買,但如強勢大市資產亦有可能「貼住布林帶」上升。交易者普遍關注$0.58短線阻力——該位既是當天高位,亦是圖表關鍵參考區。一旦成功突破並企穩$0.58,下一個目標將是上輪主要高位約$1.17(52週新高),雖升幅顯著,但若Layer-2熱潮推升人氣亦屬合理。支持方面,$0.36被視為重要…support (the recent swing low), with additional backing around $0.29 if things were to drop further.

支撐位(即近期低位),如果股價進一步下跌,大約 $0.29 亦有額外承托。

Looking beyond the immediate price action, Arbitrum is arguably the largest Layer-2 ecosystem by total value locked and user base at the moment. It has become a hub for DeFi activity outside the Ethereum main chain, thanks to its fast and cheap transactions. The PayPal news underscores Arbitrum’s growing real-world integration – it’s not every day a household name in finance uses crypto infrastructure, and Arbitrum’s role there is a big credibility boost. Moreover, the Arbitrum community and developers are active; there’s continuous progress on upgrades (like Arbitrum’s upcoming Stylus initiative to support more programming languages) and plenty of new dApps launching. These factors give investors confidence that ARB has fundamental staying power, not just speculative appeal.

暫時撇開即時價格走勢唔講,以總鎖倉價值同用戶基數計,Arbitrum 可以話係目前最大嘅 Layer-2 生態系統。由於交易快速且手續費低廉,佢已經成為主鏈以外 DeFi 活動嘅集中地。PayPal 最近既消息進一步彰顯咗 Arbitrum 與現實世界業務嘅融合——金融界大品牌採用加密基建唔係日日有,Arbitrum 角色正正大大加強咗其信譽。此外,Arbitrum 嘅社群及開發團隊都非常活躍,持續有升級,例如即將推出嘅 Stylus 計劃支持更多編程語言,大量新 dApps 都不斷上線。呢啲因素令投資者更加相信 ARB 係有基本面支持,而唔只得投機吸引力。

In the context of “buying the dip,” ARB presents an interesting scenario. If one is bullish on the future of Ethereum Layer-2 networks, then any post-unlock dip in ARB (should it occur around mid-August) might be seen as a prime buying opportunity. The unlock is a known event; sometimes markets overshoot to the downside in fear of unlocks, only to rebound after the supply is absorbed. Conversely, if ARB doesn’t dip much at all during the unlock, that relative strength would be a very bullish sign in itself. In any case, ARB’s 24-hour performance and positive indicators (adoption by PayPal, strong tech outlook) firmly place it among the top coins of the day to monitor. The coin’s ability to defy unlock gravity so far shows the market’s focus on Arbitrum’s long-term value. Traders and investors who believe in the Layer-2 scaling narrative will likely be poised to accumulate ARB on any weakness, aiming to ride the next leg of growth as Ethereum’s scaling solutions gain further traction.

講到「趁低吸納」,ARB 呢個情景確實幾值得留意。如果你睇好以太坊 Layer-2 網絡未來,咁 ARB 如於八月中左右解鎖後出現回調,可能會係極佳入貨時機。解鎖係已知事件,市場有時會因驚解鎖而過度下跌,但等供應被消化後又會反彈。相反,如果 ARB 喺解鎖期間基本上唔跌,咁相對強勢本身都係一個強烈利好訊號。無論點,ARB 近 24 小時表現加埋啲正面因素(如 PayPal 採用、科技前景強勁)都穩坐全日重點觀察幣種之列。佢一路打破解鎖壓力,反映市場真係睇重 Arbitrum 嘅長遠價值。相信 Layer-2 擴容概念嘅交易員及投資人,隨時準備趁任何回吐吸納 ARB,搏多一站增長,因為隨著以太坊擴容方案更受市場追捧。

10. Avalanche (AVAX) & Polkadot (DOT): Surging on Strong Fundamentals and Institutional Interest

Rounding out our top 10 list, we spotlight two major layer-1 networks – Avalanche (AVAX) and Polkadot (DOT) – which have both seen noteworthy surges to multi-month highs, backed by improving fundamentals and growing interest from big players. While Avalanche and Polkadot are distinct projects, they share a common theme: each is a platform with a strong technological proposition that is now reaping rewards as the market shifts focus to coins with tangible use-cases and network activity. Their recent performance underscores a broader rotation into what one might call “quality alts” – cryptocurrencies that are more than just memes or hype, but have robust ecosystems or innovative tech. Let’s look at each:

嚟到我哋十強榜尾,會聚焦兩個主要 layer-1 網絡——Avalanche (AVAX) 同 Polkadot (DOT)。兩者近日都大幅攀升至數月新高,背後原因係基本面明顯改善,仲有愈來愈多大戶關注。雖然 Avalanche 同 Polkadot 係兩個完全唔同項目,但都有共通點:兩者平台都建立咗堅實技術基礎,現市場焦點轉向有實際用途同活躍網絡效應嘅幣,呢種定位開始收割成果。佢哋近期表現正正反映大市持續輪動去「優質細幣」——即不只是純粹 meme 或炒作,而是真有生態系統或新技術。個別先睇:

-

Avalanche (AVAX): Over the last day and week, Avalanche’s AVAX token has been on a tear, breaking through key resistance levels and climbing into the mid-$20s (it was around $24–$25, up ~4–5% on the day and significantly on the week). This puts AVAX at a multi-month peak, reflecting a clear change in its market trend from sideways to upward. What’s driving Avalanche’s rally? Fundamentally, Avalanche has posted impressive on-chain growth metrics: the network recently recorded over 7.3 million monthly active addresses in Q3, a new high that signals growing user engagement and adoption. Additionally, Avalanche’s tokenomics have turned increasingly deflationary due to its unique fee-burning mechanism. More than 4.7 million AVAX tokens have been permanently burned so far (through transaction fees and subnet creation fees), directly reducing supply. This deflationary pressure, combined with Avalanche’s high throughput and sub-second finality features, reinforces AVAX’s appeal as a top Layer-1 asset with a potentially diminishing supply over time. Traders have taken note that Avalanche’s price surge is underpinned by these strong fundamentals – record user activity and token burns – rather than just speculation. It suggests the rally has substance. Moreover, Avalanche has seen increasing institutional and developer interest. The network’s ability to host institutional-scale deployments (like financial asset tokenization projects) and its Avalanche Subnets (custom blockchains) have been attractive for certain enterprise and gaming use-cases. All this has led analysts to view AVAX as well-positioned for the next bull phase, which is now seemingly kicking off. Technically, Avalanche has broken above its 200-day moving average and previous resistance around $22, which now turns to support. The next significant resistance might be around the $30 mark (a round number and prior high range), and if momentum continues, some foresee AVAX heading toward that zone in the coming weeks. For dip-buyers, any retracement into the high teens or low $20s might be seen as an opportunity, given Avalanche’s strengthening fundamentals.

-

Avalanche (AVAX):過去一日及一星期,AVAX 展現強勢,突破多個主要阻力位,升上 $24–$25 左右,單日升幅約 4–5%,全星期更顯著。依家 AVAX 已創下近幾個月新高,反映市況明顯由橫行轉升。咁,今次升浪有咩基本因素呢?主要係鏈上增長數據亮眼:Q3 月活躍錢包超過 730 萬,創下新高,說明用戶參與度不斷提升。再者,AVAX 代幣經濟越來越趨向通縮,皆因其獨特燒毀機制——手續費及子網建立費用至今已永久銷毀逾 470 萬隻 AVAX,直接減少流通量。呢股通縮壓力,加上高速處理同交易秒清等技術特點,令 AVAX 身為頂級 Layer-1 資產既吸引力更多。交易者留意到,今次升幅係有強大基本面作底——活躍用戶紀錄、新一輪銷毀等,並非純炒作,升浪「有料到」。另外,Avalanche 愈來愈受機構同開發者關注。佢支援機構級應用(例如金融資產代幣化)、Avalanche Subnets(自訂區塊鏈)成為部分企業同遊戲商心頭好。於是,分析師一致認為 AVAX 已預備好迎接下一波牛市,而事實似乎已經啟動咗。技術面睇,Avalanche 已企穩 200 天線及舊有阻力 $22,轉為支持。下個明顯阻力係 $30 陣(重要心理及歷史阻力),如果動力持續,未來幾星期有機會進一步挑戰。對於趁低吸納者而言,如股價回落至 $19–$22 之間都可作考慮,畢竟基本面進一步加強。

-

Polkadot (DOT): Not to be outdone, Polkadot’s DOT token also surged roughly 11% recently, pushing above the $4.20 level that it had struggled to crack in some time. This move came amid a “robust recovery rally” for DOT, where it bounced off support around ~$3.85 and rallied firmly, demonstrating resilience. Polkadot’s bullish case centers on its vision of cross-chain interoperability and a multi-chain future. Over the past weeks, there have been signs of renewed institutional accumulation of DOT – possibly as investors seek undervalued layer-1s that didn’t yet pump this cycle. Polkadot’s development activity remains among the highest in the industry (a metric where it often ranks at or near the top, reflecting the work on its ecosystem of parachains). The project’s unique architecture – connecting multiple specialized blockchains (parachains) into one unified network – continues to be a compelling alternative for developers who need scalability and interoperability. Recently, some Polkadot-based parachains have shown progress in areas like DeFi, and with Polkadot’s latest upgrades (such as asynchronous backing improving block time), the network is becoming more efficient. Analysts have pointed to Polkadot’s active developer community and ongoing innovation as reasons it’s a “dark horse” altcoin that could surprise the market. Now, with DOT’s price perking up, that thesis might be playing out. DOT pushing past $4.20 is significant because that level had been a stubborn ceiling; its clearance suggests the downtrend has been broken. The next challenge for DOT may be the $5 mark (and above that, $6, which some forecasts like a recent BeInCrypto analysis earmarked as a target if momentum continues). On the downside, DOT appears to have solid support in the high $3 range, courtesy of the strong base it built when it “defended pivotal support” during the crypto market dip earlier this year. For those bullish on Polkadot’s long-term prospects – like the rise of its parachains and use in Web3 – accumulating DOT on pullbacks (say, towards $4 or below) could be a favored strategy, given that DOT still trades far below its 2021 highs (around $55) and could have plenty of room to run if an altcoin season truly unfolds.

-

Polkadot (DOT):唔甘示弱,DOT 近日都大升約 11%,成功突破長期死守嘅 $4.20,之前一直好難衝破。今次係一波「強而有力嘅反彈」,由 $3.85 附近支持彈起,充分展現韌力。Polkadot 嘅長線利好主題係”跨鏈互通、未來多鏈世界“。過去幾星期,有跡象顯示機構重新開始收集 DOT,可能因為有啲 layer-1 今輪尚未爆升,有估值吸引力。Polkadot 嘅開發動態長期穩居行內首幾位(反映平行鏈生態活力)。其獨特架構——將多條專門功能嘅平行鏈連成一張網——依然係需要擴容同互通功能開發者嘅替代選擇。近期有部分 Polkadot 下平行鏈 DeFi 進展理想,加上本身最新升級(如 async backing 提升出塊速度),整體網絡更高效。分析師指出,Polkadot 活躍嘅開發者群同創新能力,令佢成為能出奇制勝嘅黑馬。隨住 DOT 開始轉強,呢個說法可能逐步成真。今次升破 $4.20 意義重大,因為呢個價一直係阻力位;一破即代表跌勢已改變。之後挑戰位係 $5,之後再上則係 $6(有分析如 BeInCrypto 新報告都標明呢個目標)。支持方面,$3.8–$4 區係早前大市深度回調時建立落嚟,所以打底極紮實。對於長線睇好 Polkadot(如平行鏈發展同 Web3 應用)的投資者嚟講,趁回落至 $4 或以下逐步吸納 DOT 係一種策略,特別係佢現價遠低於 2021 年高位(約 $55),真有牛裂拉升時有好多上升空間。

Stepping back, the success of Avalanche and Polkadot lately highlights a larger trend in the crypto market: a shift towards fundamentals-driven value. As noted in a CoinWorld market update, investors are increasingly rotating into altcoins with strong use cases, solid development, and clear value propositions, rather than chasing purely speculative plays. Both AVAX and DOT fit this bill – they’re backed by well-funded foundations, led by credible teams, and have vibrant ecosystems. The market’s optimism on them suggests that as the crypto rally broadens, the market is rewarding projects that have delivered technologically. It reflects a maturation: crypto participants are looking beyond just Bitcoin and Ethereum, and into the “infrastructure” altcoins that could form the backbone of Web3. Avalanche’s focus on speed and subnets and Polkadot’s focus on interoperability and shared security each address key scalability challenges, which is why institutional interest in these networks is picking up as well.

宏觀睇,Avalanche 同 Polkadot 近排冒起,正反映加密市場一個大趨勢:投資者開始回歸基本價值驅動。不少市場觀察(如 CoinWorld 報告)認為,大家更加主動換馬至有實際用例、開發力度足夠、價值主張明確的幣,而非一味追短炒。AVAX 與 DOT 都符合同一模式——有資源雄厚嘅基金會撐腰,由可靠團隊領導,生態活躍。市場對兩者樂觀,顯示今次牛市推廣到技術交功課嘅項目。標誌市場成熟化:資金開始唔止係睇重比特幣和以太坊,更願意投入未來 Web3「基礎設施」型 altcoin。Avalanche 主打交易速度和子網,Polkadot 專注互通同共享安全,各自針對擴容難題,機構因此開始增持。

Of course, risks remain – broader market volatility could impact these tokens, and they face competition from other layer-1s and layer-2s. But their recent strength, both in price and fundamentals, makes AVAX and DOT hard to ignore. For someone looking to buy dips in high-quality projects, Avalanche and Polkadot present compelling cases. Both have significantly lagged their all-time highs (so some view them as value buys), and yet they are now showing tangible signs of a trend reversal upward. In summary, Avalanche and Polkadot’s multi-month highs and institutional tailwinds earn them a joint spot in today’s top highlights. They exemplify how altseason 2025 is not just about memes and micro-caps, but also about major platforms coming into their own. Any pullback in these two – which are bound to have bumps along the way – could be seen as a strategic entry point by those confident in their long-term trajectories.

當然,風險未走晒——大市波動仍可影響上述幣種,同時佢哋都需面對來自其他 layer-1、layer-2 競爭。但基於價位同基本因素強勢,AVAX 同 DOT 真係唔可以輕視。對於想趁技術派回檔吸納優質幣嘅人嚟講,Avalanche 同 Polkadot 都有好吸引嘅投資故事。兩者都比歷史高位落後好多(所以有啲人睇佢哋屬超值盤),而近期亦出現咗明顯見底反彈現象。總結嚟講,Avalanche 同 Polkadot 能創下近數月新高,加上獲得機構追捧,獲選今日重點推介雙冠。佢哋就係 2025 altseason 並非純粹 meme 同細市值炒作,而係主流平台逐步發力良好例證。兩者日後如有回調——都難免會有震盪——長線投資者會視之為戰略性加倉機會。

Final thoughts

The past 24 hours have showcased a broad resurgence of confidence – from Bitcoin’s record-setting rally to altcoins across the spectrum posting impressive gains. We’ve highlighted ten coins that stood out with exceptional performance and clear indicators of potential future growth. Each of these – whether it’s a blue-chip like Ethereum or a resurgent platform like Solana, a meme heavyweight like Dogecoin or an exchange token like OKB – has a story of strength in the current market and reasons to anticipate further upside. Crucially, many are backed by tangible fundamentals: technical breakouts, network upgrades, institutional inflows, or improving on-chain metrics. This suggests that the rally has depth beyond mere speculation.

過去 24 小時市場信心大爆發——由比特幣創歷史新高,到各類細幣全面上升。我哋總結咗十大表現突出的加密貨幣,每一隻都有出色表現同未來增長證據。無論係以太坊呢類藍籌,抑或再起平台如 Solana,大熱 meme 幣如狗狗幣,又或者有實力的交易所幣 OKB,都各有強勁故事同持續上升理由。更重要係,佢哋唔少都有真實基本面支撐:技術突破、網絡升級、機構資金流入或者鏈上數據見好。呢啲都說明,今次升浪,比單純投機更有深度。

However, as the saying goes, “markets take the stairs up and the elevator down.”

不過,正如俗語所講:「市場升市如爬樓梯,跌市如搭升降機。」Crypto’s notorious volatility means that “buying the dip” requires both courage and caution.

加密貨幣一向以波動劇烈聞名,所謂「撈底」唔單止要有膽識,仲要保持謹慎。

The sharp midday correction we witnessed is a reminder that even in bullish times, rapid pullbacks can and do occur.

今日中午出現嘅急速回調其實再次提醒大家,即使係牛市時段,市場都可能會出現突然急跌。

For investors and traders, the key is discernment – separating temporary dips from fundamental trend reversals.

對投資者同交易員嚟講,能夠分辨「一時回調」定係「基本趨勢逆轉」先係關鍵。

The coins profiled above all experienced dips of their own amidst the market shake-out, yet each showed resilience or quickly regained support, indicating strong hands and interest on the buy-side.

上述介紹過嘅幣種都喺今次市場震盪入面有自己嘅回調,但無論係企得穩定定係好快搵返支持位,都反映住背後有強勁買家同市場興趣。

These are encouraging signs if you’re considering a dip-buying strategy.

如果你考慮趁低吸納,呢啲都係幾正面嘅訊號。

Risk management, of course, remains paramount.

風險管理,當然,一直都係最重要嘅。

Diversification across some of these leading assets can mitigate the risk of any single coin faltering.

揀幾隻有領導地位嘅幣分散投資,可以減低單一資產表現失準嘅風險。

It’s also wise to scale into positions rather than going all-in at once – given the likelihood of continued swings.

由於波動性依然存在,所以逐步加碼會好過一次過 All-in。

Keep an eye on major support levels we’ve discussed (for example, Bitcoin near $118K, Ethereum around $4.4K, ADA around $0.73, etc.) and how prices behave if they’re tested again.

記住要留意我哋之前提過嘅主要支持位(例如 Bitcoin 喺 $118K、Ethereum 係 $4.4K、ADA 喺 $0.73 左右等等),睇下價位再被測試時有冇守得住。

Technical levels and fundamental news will be catalysts: a successful retest of support or a positive development (like an ETF approval, a mainnet upgrade, or a partnership announcement) could quickly reignite an uptrend for these coins.

技術面同基本面消息都會係催化劑:例如支持位成功守住,或者有好消息(例如 ETF 通過、主網升級、重大合作)都可以令呢啲幣好快重拾升勢。

On the flip side, external factors – macroeconomic news or regulatory changes – could introduce headwinds, so staying informed is critical.

相反,外圍因素如宏觀經濟消息或者監管變動,都有機會令市場遇到阻力,所以要時刻留意最新消息。

The overarching tone of the market now is informative-analytical optimism: data and developments are tilting positive, but seasoned observers know to stay analytical, not get carried away by hype.

依家大市基調屬於理性偏樂觀:資料同新消息有利好傾向,但有經驗嘅人都知道要保持分析精神,唔好俾氣氛沖昏頭腦。

Crypto readers following this space can take away that there are real reasons behind the pumps we’ve seen: Bitcoin’s surge was supported by macro tailwinds and institutional buys; altcoins like Cardano, Solana, and XRP have concrete technical and adoption signals backing their moves; tokens like OKB and ARB had specific fundamental catalysts (burns and network use) driving demand.

有留意加密貨幣市場嘅讀者可以留意,其實近期升浪背後都有實質原因:Bitcoin 上升有宏觀因素同機構買盤支持;Cardano、Solana、XRP 呢啲主流山寨幣都有實質技術同應用數據支撐;OKB、ARB 呢類 token 就有明確嘅基本面催化(如銷毀或者網絡活躍度)推高需求。

This fact-based narrative provides confidence that these aren’t purely random jumps, but part of a broader crypto market upswing.

有數據、有理由嘅升幅令大家更有信心,知道呢啲唔係純粹隨機炒作,而係整體加密貨幣市場嘅升勢一部分。

In conclusion, the last day’s highlights reaffirm a classic strategy: focus on the coins with strong momentum and strong stories, and consider accumulating them when the market hands you a dip.

總結嚟講,近日市場走勢再次印證咗經典策略:鎖定勢頭強、故事好嘅幣,有回調時可以考慮分段吸納。

The ten coins we’ve covered fit that description, each in their own way.

我哋討論過嘅十隻幣都屬於呢個範疇,各有獨特之處。

As always, do your own due diligence – but if the current trends persist, those who can strategically buy into temporary weakness on these leading performers may find themselves well-positioned to capitalize on the next leg up.

一如以往,每次入市都要自己做足研究-但如果而家呢個形勢可以持續,懂得把握領先板塊短暫低位吸納嘅人,下輪升浪應該會企到正好位。

The crypto market can be unforgiving, but it also tends to reward conviction paired with sound analysis.

加密市場可以好唔留情面,但堅守信念再配合理性分析,市場往往都會俾合理回報。

And right now, the analysis suggests that these top coins are among those you shouldn’t ignore when looking to buy the dip in today’s market.

以現時分析計,今日想「撈底」嘅話,呢啲代表性幣種都唔應該忽視。

Stay safe, stay informed, and happy trading!

祝大家安全、緊貼市場、交易愉快!