加密貨幣和區塊鏈技術正在逐步滲透到世界知名企業的商業策略中。到了2025年,這項原本被視為小眾科技實驗的趨勢已經成為零售巨頭、奢侈品牌、汽車製造商、社交媒體平台等不同領域的合格商業工具。從咖啡店忠誠獎賞,到高端汽車購買,大品牌正以不同方式於全球各地探索加密貨幣的應用。

一項最新調查顯示,接近六成的全球500強企業已積極發展區塊鏈計劃。許多企業將數碼資產視為吸引顧客、簡化支付流程,或取得創新優勢的方法。本文會全面分析各大品牌如何於2025年運用加密貨幣——涵蓋真實例子、動機和挑戰,以資訊性和分析角度闡述。

當然,並非所有探索都獲得巨大成功。例如,星巴克曾高調推出NFT獎賞計劃,但在兩年內便悄悄叫停。相反,Elon Musk的Tesla不單曾以比特幣作電動車支付(雖然其後取消),亦採用狗狗幣(Dogecoin)作周邊產品交易,令加密貨幣成為企業關注焦點。不同產業均不乏相似案例:全球品牌試行加密貨幣支付、代幣化獎賞、NFT推廣,甚至把比特幣納入企業財庫。雖然各家方針不一,但共通點是加密貨幣已不只是金融科技初創或偏鋒愛好者的專屬玩意,現已進入不少知名企業董事會議題。

文章將探討品牌採納加密貨幣的多個主要場景:獎賞和忠誠計劃、直接接受加密貨幣、發行專屬代幣或穩定幣、NFT與元宇宙的興衰,以及金融和科技巨頭如何帶領大眾應用加密貨幣。內容亦會分析這些企業為何選擇投入、消費者如何反應,以及現時障礙何在。希望以事實和不中立深入講解2025年大品牌加密貨幣應用現狀,範圍涵蓋星巴克獎賞、Tesla代幣支付等。

用區塊鏈沖調忠誠度:星巴克與代幣獎賞新趨勢

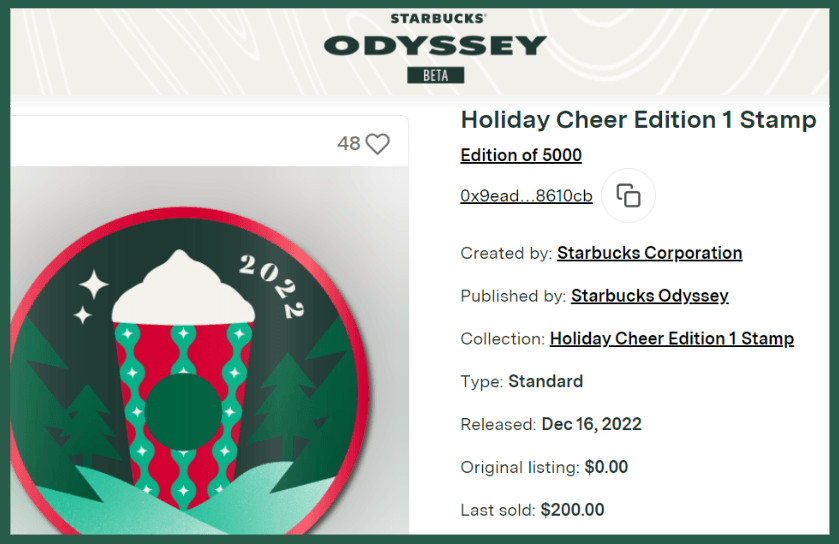

結合加密科技與消費者忠誠計劃的其中一項代表性嘗試,來自星巴克。2022年尾,這間連鎖咖啡店推出了“Starbucks Odyssey”,是現有獎賞計劃的延伸,利用區塊鏈代幣(NFT)令顧客參與變得更具遊戲感。顧客可以透過完成小遊戲、購物或網上互動賺取Polygon區塊鏈上的NFT“印章”,再兌換獨家優惠。作為主流品牌,星巴克一向在忠誠計劃上具創意,這次無疑是一次大膽的Web3實驗。

一杯星巴克Frappuccino——這位咖啡巨頭於2022年推出名為Odyssey的區塊鏈獎賞計劃,以NFT“印章”獎勵顧客參與。 雖然計劃一開始吸引不少科技圈關注,但短短一年多已宣告終止。2024年3月15日,星巴克宣布將於同月結束Odyssey測試,並未交代具體原因,只表示正準備演進獎賞概念。市場分析認為有幾個可能原因。首先,星巴克推出Odyssey時,NFT熱潮其實已經逐步“降溫”,一般消費者對NFT的興趣比高峰期低得多。一份行銷分析甚至指出:“現實是星巴克跟NFT風潮擦身而過——NFT價值早於計劃面世時大幅回落。”更根本的,是Odyssey或許違背了忠誠計劃的黃金法則:簡單易明。傳統獎賞:「買咖啡、儲星、換免費飲品」一直極受歡迎。反觀Odyssey同時有NFT印章及Odyssey Points兩種系統及多重玩法,令一般顧客覺得複雜難明。一位忠誠計劃專家就直言:“顧客其實只想要簡單、流暢的體驗……[Odyssey]真的太多手續了。”

雖然品牌NFT新猷未如預期,但星巴克仍然從中吸收新嘗試的經驗,公司表示感激學習,暗示日後或會以改良模式回歸。事實上,星巴克並非唯一研究區塊鏈獎賞的企業。2023年,德國漢莎航空(Lufthansa)亦於Polygon推出NFT獎賞計劃Uptrip,乘客只要完成航班便可收集數碼卡NFT換取優先入閘、額外里數等福利。該計劃軟推出時逾二萬名用戶收集超過二十萬張數碼卡,反應理想。其他旅遊及酒店品牌亦有意利用代幣化獎賞,期望提升互動,更打通不同計劃之間的積分轉換。業界遠景是:有朝一日你的飛行里數、酒店點數或咖啡獎賞,都可化身為數碼錢包內可流通的代幣,更靈活易用。例如薩爾瓦多(承認比特幣為法定貨幣)國內星巴克門市,已可直接用比特幣買咖啡,獎賞積分與貨幣界線進一步模糊。

關鍵在於新技術必須為顧客“加值”,而非只造成混亂或疏遠。星巴克Odyssey的啟示就是,創新本身不足夠——加密動力的顧客獎賞計劃一定要和傳統系統一樣簡單易懂。簡潔易用和明確利益依然最重要。由於NFT熱潮退減,部分企業亦縮減相關項目,例如 GameStop 於2023年關閉NFT平台,Meta(Facebook/Instagram)亦短暫加入即終止NFT功能。然而,忠誠及行銷領域依然充滿區塊鏈潛力。Reddit就以免費的Collectible Avatars(Polygon上NFT頭像)悄悄推動數百萬人接觸Web3,將NFT簡化為“數碼藏品”。Nike等品牌(曾收購RTFKT數碼時尚公司)亦成功營造出NFT球鞋和服飾社群,結合忠誠度與收益。Nike的NFT各類發行(如CryptoKicks球鞋、虛擬球衣)至今令公司賺取超過1億8千5百萬美元,遠超其他品牌。如 Dolce & Gabbana、Tiffany & Co.、Gucci和Adidas等時尚品牌,2022年NFT相關收益也有千萬美元級別。這一切證明,只要策略正確,NFT的確可以成為品牌互動及創收的新渠道。

總結來說,加密貨幣應用於獎賞計劃的確誘人,亦具一定難度。星巴克高調試水反映了代幣化忠誠的潛力(獨家優惠帶動粉絲忠心),同時突顯其隱憂(複雜和熱潮消退)。展望將來,品牌或會將區塊鏈應用於後台,保持用戶界面簡單親切。關鍵始終是讓顧客清晰得益。如果顧客幾乎“察覺不到”加密科技,卻明顯感受到新福利或更彈性,品牌忠誠計劃或許將會成為加密貨幣悄然主流化的橋頭堡。

加密支付普及化:由Tesla到巨無霸

品牌應用加密貨幣最直接的方法之一,就是接受數碼貨幣作支付。這趨勢由部分科技公司如Microsoft、Overstock於2010年代中期開始接受比特幣,至2021年Tesla高調入場才急速升溫。2021年2月,Tesla宣布斥資15億美元購入比特幣,並將接受BTC購買電動車,令加密市場一度瘋狂。Tesla隨即於春季短暫開放比特幣支付新車,但行政總裁Elon Musk於同年5月叫停,因擔心比特幣挖礦對環境造成影響。這種反覆顯示加密支付面臨的核心挑戰——波幅高企及環保爭議——令不少大型企業對以比特幣日常支付猶豫不決。

不過,Tesla並未完全放棄加密貨幣。它反以輕鬆娛樂的方式把焦點轉移到模因幣狗狗幣(Dogecoin),讓用戶可用DOGE於網店訂購周邊商品。自2022年1月起,Tesla接受Dogecoin購買各款產品,例如“Giga Texas”皮帶扣、Cyberwhistle等新奇玩意。消息一出,Dogecoin應聲升幅達14%,突顯Musk對加密市場的影響力。Tesla網店部份商品直接用DOGE標價,用戶連結狗狗幣錢包即可支付。公司明確聲明“只收狗狗幣”,錯誤匯入其他幣種則無法追回。這種玩味結合科技迷粉絲,很快受到追捧——分析人士形容 Dogecoin-priced goods were selling out even faster than those priced in dollars, calling it “an illustration of crypto's continued penetration of corporate culture”. As of 2025, Tesla’s Dogecoin experiment is still ongoing – you can buy a t-shirt or mug with DOGE – but the company has not resumed Bitcoin payments for vehicles, nor expanded to other cryptocurrencies. In fact, Tesla disclosed in 2022 that it sold about 75% of its Bitcoin holdings (while retaining some), indicating a cautious stance toward crypto on its balance sheet. Musk, however, remains a vocal crypto proponent personally, and has hinted that in the future Twitter (now renamed X under his ownership) could integrate crypto payments – possibly another avenue where Tesla’s influence may show up in fintech.

狗狗幣定價的貨品比用美元定價的賣得更快,這被形容為「加密貨幣持續滲透企業文化的一個好例子」。去到2025年,Tesla的狗狗幣實驗仲繼續進行中——你仲可以用DOGE買T恤或者水杯——但公司並未恢復以比特幣購車,亦未擴展到其他加密貨幣。事實上,Tesla在2022年披露已經沽出大約75%持有的比特幣(但保留了一啲),反映他們在財務報表上對加密貨幣採取審慎態度。不過Musk本人仍然強力支持加密貨幣,仲暗示未來Twitter(現已改名為X,屬於Musk旗下)有機會加入加密支付功能——可能係Tesla在金融科技界顯現影響力的另一個方向。

Tesla’s mixed journey aside, many other household-name brands have dipped their toes into crypto payments. Perhaps surprisingly, a luxury automaker has been among the most aggressive: Ferrari. In late 2023, Ferrari announced it had started accepting cryptocurrency for its high-end sports cars in the U.S., and planned to roll out crypto payments to European dealers in 2024. The decision came “in response to requests from the market” – in other words, Ferrari’s wealthy clients asked to pay in crypto. “Many of [our] clients have invested in crypto,” explained Ferrari’s marketing chief, noting that some are young entrepreneurs who built fortunes in crypto, while others are traditional investors seeking portfolio diversification. Through payment processor BitPay, Ferrari buyers can now purchase a car with Bitcoin, Ethereum, or USDC stablecoins. Importantly, the prices are still denominated in fiat (no crypto price fluctuation), and BitPay instantly converts the crypto to euros or dollars for the dealer, shielding Ferrari from volatility. “No fees, no surcharges if you pay through cryptocurrencies,” Ferrari emphasized, as they wanted the experience to be as seamless as a normal sale. The company also addressed environmental concerns head-on: Ferrari noted that major coins are becoming more energy-efficient (Ethereum’s move to proof-of-stake, etc.) and said accepting crypto does not compromise its carbon neutrality goals for 2030. In essence, Ferrari identified a genuine customer demand – crypto-rich buyers – and found a way to serve it within regulatory and sustainability guardrails. By mid-2024, the iconic prancing horse logo was posted at some dealerships alongside notices that Bitcoin and Ethereum are accepted here. It’s a striking image of crypto’s normalization that a person can walk into a showroom and drive out in a six-figure Ferrari paid for with cryptocurrency.

撇開Tesla嘅複雜經歷,唔少家傳戶曉嘅品牌都開始接觸加密支付。可能令人意外,進取程度最高之一反而係豪華車廠——法拉利。2023年尾,Ferrari宣佈已經開始喺美國接受加密貨幣用來買高級跑車,並計劃2024年擴展到歐洲經銷商。呢個決定係「回應市場需求」——即係話Ferrari嘅有錢客人主動要求用加密支付。Ferrari市場部主管解釋話,「我哋好多客都投資咗加密貨幣」,有啲係靠加密致富嘅年輕創業家,有啲則係想分散投資組合嘅傳統投資者。通過BitPay支付平台,Ferrari買家而家可以用比特幣、以太幣或USDC穩定幣買車。重點係價格依然用法定貨幣報價(唔受加密幣波動影響),BitPay即時將加密貨幣兌換成歐元或美元畀車行,幫助Ferrari避開波動風險。「用加密貨幣支付冇手續費、冇加價」,Ferrari強調,希望令交易體驗無縫連貫得如同一般銷售。環保問題方面,Ferrari都正面回應:指出主流加密幣愈來愈節能(如以太坊轉用權益證明機制等),而接受加密支付唔會影響其2030碳中和目標。換句話講,Ferrari捕捉到一個真實既客戶需求——有加密資產嘅買家——並在監管同可持續原則下找到服務方法。2024年中,部分車行已經張貼咗躍馬Logo和告示,表示接受比特幣同以太幣。呢個畫面好震撼——一個人可以行入陳列室用加密貨幣買一部六位數字嘅Ferrari。

A barber shop in El Salvador advertises that Bitcoin is accepted for haircuts. After El Salvador made Bitcoin legal tender in 2021, global brands like McDonald’s and Starbucks had to begin accepting Bitcoin at their outlets in the country. Beyond headline-grabbing cases like Tesla and Ferrari, everyday retail and food brands have also warmed to crypto payments, often through third-party facilitators. Fast-food giants including McDonald’s, Subway, and Starbucks started accepting Bitcoin in El Salvador in 2021 due to that nation’s Bitcoin Law, which required all businesses to take BTC alongside the U.S. dollar. Videos of Salvadorans buying Big Macs or lattes with lightning-fast Bitcoin transactions went viral, highlighting that even conservative multinationals can adapt when local regulations demand. In other countries, adoption has been voluntary: Starbucks in the U.S. partnered with Bakkt in 2021 to let customers convert crypto to load their Starbucks Card (indirectly spending crypto on coffee), and some Subway sandwich franchises in Europe now accept Bitcoin via Lightning Network. In 2022, several luxury fashion houses like Gucci and Balenciaga announced select boutiques would take crypto payments, largely targeting high-net-worth clientele and partnering with payment providers (e.g. BitPay) to handle conversion. AMC Theatres, a well-known movie chain, rolled out online crypto payments for tickets and concessions, allowing Bitcoin, Ether, Dogecoin, and other coins via a mobile wallet app integration. Even e-commerce players have inched forward: Shopify enables thousands of independent merchants to accept crypto by integrating with gateways, and Overstock.com (a pioneer since 2014) still accepts and holds various cryptos.

薩爾瓦多有間理髮店招牌寫住剪髮收比特幣。自從薩爾瓦多2021年將比特幣列入法定貨幣,包括麥當勞、星巴克等全球品牌都要喺當地分店接受比特幣。除Tesla、Ferrari等上新聞的例子之外,日常零售同飲食品牌都逐漸接受加密支付,多數透過第三方協助。麥當勞、Subway同星巴克等快餐巨頭,2021年因為薩爾瓦多比特幣法,開始接受比特幣,所有商戶都要同時收比特幣同美元。有關當地人用極快比特幣支付買漢堡、大杯咖啡嘅片段爆紅,證明連最保守嘅跨國集團都識得因應本地法例調整。在其他國家,品牌多屬自願試行:Starbucks美國站2021年與Bakkt合作,讓客戶可將加密貨幣兌換上Starbucks卡(間接用加密買咖啡);歐洲部分Subway加盟店而家透過閃電網絡接受比特幣。2022年,Gucci、Balenciaga等多個奢侈品牌宣佈部份專門店會收加密貨幣,主要針對高資產客人,並與類似BitPay合作處理結算。戲院龍頭AMC則開始線上接受加密票款與小食消費,支持比特幣、以太幣、狗狗幣及其他幣種,並透過手機錢包整合進行。連電子商貿品牌都逐步試行:Shopify幫助成千上萬獨立商戶加入加密支付閘道,Overstock.com(自2014年已領先)都依然接受及持有多個幣種。

Still, it’s important to stress that crypto payments in 2025 remain a niche slice of overall transactions. The majority of big brands do not yet accept Bitcoin or other tokens directly for mainstream sales. Volatility is one barrier – no CFO wants to see yesterday’s $50,000 car payment in Bitcoin turn into $40,000 or $60,000 by quarter’s end. Regulatory uncertainty is another, especially in the U.S., where rules on treating crypto in commerce and handling taxes are complex. And consumer demand, while growing, is not overwhelming; most shoppers still find credit cards or mobile payments more convenient than fumbling with a crypto wallet QR code at checkout. The patchy adoption so far tends to follow either (a) marketing PR opportunities – e.g., accepting Dogecoin garnered Tesla free headlines and endeared it to crypto fans – or (b) genuine use-case fits, such as serving crypto-heavy customer segments (Ferrari’s case) or enabling cross-border customers to pay easily. In the latter category, stablecoins are emerging as a compelling tool. A stablecoin like USDC or USDT (tied 1:1 to the dollar) removes the volatility issue while still offering the advantages of crypto – fast, irreversible, low-fee transactions globally. We’re now seeing payment processors and credit card networks integrate stablecoin support, heralding a future where crypto works behind the scenes. For example, Visa has been piloting USDC stablecoin settlements with merchant acquirers, even leveraging faster blockchains like Solana to improve speed. Mastercard likewise has partnered with crypto firms (such as a collaboration with MoonPay) to allow crypto-to-fiat conversion within its network. These efforts are largely invisible to end customers but indicate that payment giants are preparing for a world where stablecoins and CBDCs could be routine in commerce. In markets with high inflation or unstable banking, stablecoins are already used by millions for everyday purchases via local fintech apps – a trend global brands cannot ignore if they want to tap those consumer bases.

不過,要強調係,即使到2025年,加密貨幣支付都只係整體交易佔比嘅一小撮。大部分國際大品牌暫時都未有直接接受比特幣或其他代幣做主流銷售。波動問題係一大障礙——冇CFO想見到四月底收咗$50,000比特幣買咗架車,到季尾變咗$40,000或$60,000。規管不明朗亦係主因,特別係美國,商業應用同稅務處理嘅規則都非常複雜。消費者需求雖然上升,但談不上勁大;大多數人依然覺得信用卡或者手機支付比起結帳時要對住加密錢包QR Code方便得多。至今各地推行情況斷斷續續,多以(a)市場推廣宣傳——例如接受狗狗幣替Tesla帶來免費宣傳,又圈粉加密社群;或(b)真正在特定場合有用,例如針對重加密資產客戶(如Ferrari),或便利跨境客付款。後者當中,穩定幣開始成為熱門方案。USDC、USDT等穩定幣對美元1:1掛鈎,既冇波動問題,又有加密本身快、不可逆、全球低費用等優點。現時已經有支付處理商、信用卡網絡加入穩定幣功能,預示支付系統未來「加密在幕後運行」。例如Visa就同商戶收單方試行USDC穩定幣結算,仲利用像Solana咁快的區塊鏈提升速度;Mastercard亦與MoonPay等合作,讓網絡上可即時兌換加密至法幣。呢類舉措客戶未必察覺,但說明支付巨頭正為穩定幣和央行數碼貨幣的大規模商業應用鋪路。至於高通脹或金融不穩國家,穩定幣已經被數百萬人日常消費用本地金融科技App購物——這是全球品牌想打入這些市場就不能忽視的趨勢。

In summary, paying with crypto has gone from a quirky publicity stunt to a realistic option in certain contexts by 2025. You likely still can’t pay your Netflix or Amazon bill in Bitcoin directly, but you can buy a airline ticket on AirBaltic with crypto, purchase electronics on Newegg or Rakuten using Bitcoin, or book a hotel via agencies like Expedia (through partners) accepting crypto. As regulatory clarity improves and stablecoin usage grows, more companies are expected to integrate crypto payments, especially online where the technical integration is simplest. The endgame may not be everyone paying for coffee in Bitcoin, but rather crypto operating under the hood – for instance, a customer pays in dollars as usual, but the merchant might receive an instant stablecoin settlement that avoids card fees. In effect, crypto could streamline payments infrastructure while the front-end experience remains familiar. Brands that have begun accepting crypto today are gaining early insight into this new payments landscape, positioning themselves for a time when digital currencies could be as unremarkable a payment method as Apple Pay or PayPal.

總結來講,去到2025年,用加密貨幣消費已經由以往「博宣傳」嘅噱頭,變成某啲場景下的現實選擇。你可能依然不能直接用比特幣交Netflix或Amazon月費,但可以用加密貨幣在AirBaltic買機票、在Newegg或者Rakuten買電子產品、或透過Expedia等合作夥伴預訂支持加密支付的酒店。隨住監管逐步明朗化及穩定幣普及,預期愈來愈多公司會加入加密支付,特別是網上市場,技術整合同門檻低。終極目標未必係人人「用比特幣買咖啡」,而係加密技術「幕後運作」——例如客戶一如以往付美元,商戶則即時收到穩定幣,避過信用卡手續費。換句話說,加密有潛力令支付基建更高效,前線體驗依然親切熟悉。率先接受加密支付的品牌,現時已搶先洞察這個全新支付生態,為未來數碼貨幣同Apple Pay、PayPal一樣平常做準備。

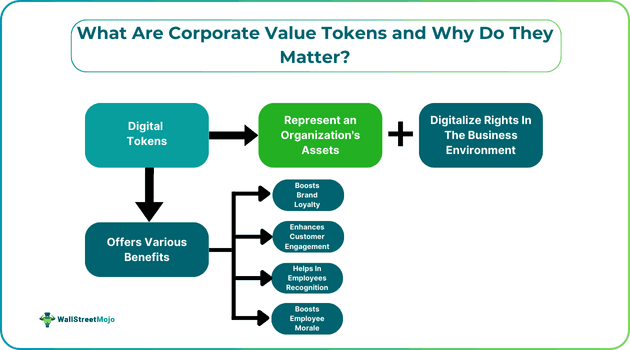

Big Brands Issuing Coins: Corporate Tokens and Stablecoins

While some companies are content to accept existing cryptocurrencies, others have taken a step further – creating or considering their own crypto tokens. This can be a delicate endeavor, raising regulatory eyebrows (as Facebook’s ill-fated Libra project demonstrated), but 2025 has seen a few notable moves on this front. The most high-profile example is PayPal, the American fintech giant, which in August 2023 launched its very own U.S. dollar-pegged stablecoin called PayPal USD (PYUSD). This marked the first time a major U.S. financial brand issued a stablecoin. PayPal’s coin is issued in partnership with Paxos (a regulated blockchain company), fully backed by cash reserves, and designed for seamless use in PayPal’s network. The idea is that PayPal’s 400+ million users could eventually send, spend, or transfer money instantly using PYUSD – for example, a customer might use PYUSD to pay a merchant, who instantly converts it to local currency, with lower fees and faster settlement than traditional card processing. As of 2025, PayPal’s stablecoin is still gaining traction, but it signals a broader trend: trusted consumer brands leveraging stablecoins to enhance payments.

有啲公司滿足於接受現有的加密貨幣,但亦有企業更進一步——自己創建或計劃推出自家代幣。呢種行為牽涉不少監管風險(例如Facebook失敗的Libra計劃),但2025年都出現咗幾個令人關注的新發展。最矚目的例子係美國金融科技巨頭PayPal,2023年8月推出咗自家美元穩定幣PayPal USD(PYUSD),成為美國主要金融品牌首次發行穩定幣。PYUSD由受監管的區塊鏈公司Paxos負責發行,全數以現金儲備支持,並專為PayPal網絡無縫應用而設。PayPal有超過4億用戶,未來可以隨時用PYUSD即時付款、轉帳或消費——例如客戶用PYUSD付款,商戶即時換回當地貨幣,手續費、更快結算都優於傳統信用卡處理。到2025年,PayPal穩定幣不斷擴大影響力,反映值得信賴的消費品牌正利用穩定幣強化支付體驗。

Other tech behemoths have stablecoin ambitions too. According to a June 2025 report, at least four Silicon Valley titans – Apple, Google, X (Twitter), and Airbnb – have been exploring stablecoin integration as a way to lower transaction fees and improve cross-border payments. Each is at a different stage: Google appears furthest along, reportedly already facilitating some stablecoin payments internally. Airbnb has been in talks with payment processors about using stablecoins to cut the hefty fees it and its hosts pay to credit card networks. And Elon Musk’s X (formerly Twitter) has been quietly obtaining money transmitter licenses across U.S. states, laying groundwork for a payments feature that could include crypto – Musk has openly mused about using Dogecoin or other crypto within X’s envisioned “everything app”. Apple, famously secretive, hasn’t announced anything

其他科技巨頭亦有穩定幣大計。根據2025年6月報告,最少有四間矽谷巨企——Apple、Google、X(前身Twitter)及Airbnb——都正積極研究如何結合穩定幣以降低交易成本、改善跨境支付流程。目前進度各有不同:Google據報已率先在內部試行部分穩定幣支付;Airbnb則與支付公司磋商用穩定幣減輕自己及房東支付信用卡網絡的高昂費用;Elon Musk的X(即Twitter),則悄悄於美國多州辦理金錢服務牌照,為加入包括加密支付的新功能鋪路——Musk本人更加公然討論想在未來「超級App」之內使用狗狗幣或其他加密貨幣。至於一向神秘的Apple,暫時未有正式消息......public, but insiders suggest Apple is evaluating how stablecoins might reduce the ~3% interchange fees on its App Store and Apple Pay transactions. The attraction is clear: stablecoins could allow near-instant settlement of payments at virtually no cost, saving companies and consumers billions in fees. Stablecoins have arguably become crypto’s first mainstream use case, with global stablecoin market capitalization soaring 90% from January 2024 to mid-2025 (from $131 billion to about $249 billion in circulation). When Stripe – one of the largest online payment processors – acquired a stablecoin startup in late 2024 for $1+ billion, Fortune called it the “starting gun” for Silicon Valley to take stablecoins seriously.

雖然表面未有公開,但有內部消息指 Apple 正評估如何透過穩定幣減低其 App Store 以及 Apple Pay 交易時需繳交的大約 3% 交換費。原因明顯:穩定幣幾乎可以零成本地即時清算款項,為公司和消費者節省數以十億美元計的手續費。穩定幣可以說已成為加密貨幣首個真正主流的應用例子,2024 年 1 月至 2025 年年中,全球穩定幣市值激增 90%(由 1,310 億美元增至大約 2,490 億美元流通中)。當全球最大網上支付處理公司之一 Stripe 在 2024 年底以逾 10 億美元收購穩定幣初創時,《Fortune》形容這是矽谷正式認真看待穩定幣的「起跑槍聲」。

That said, regulators are watching closely when Big Tech and big finance dabble in issuing currency-like tokens. In the U.S., Congress has been debating the “Stablecoin GENIUS Act” (Guiding and Establishing National Innovation for U.S. Stablecoins Act) to lay down rules for stablecoin issuers. Lawmakers have expressed unease at the notion of tech giants effectively creating private money that could compete with the dollar’s role. There’s talk of adding provisions to ban Big Tech firms from issuing their own stablecoins, forcing them instead to use regulated third-party coins like USDC or USDT. Memories of Facebook’s Libra (later Diem) project loom large – in 2019, Facebook unveiled plans for a global stablecoin governed by a consortium, but backlash from central banks and politicians was swift and severe. By early 2022, the Diem project was wound down without launch, serving as a cautionary tale. Apple and Google have no desire to repeat that political firestorm. Thus, their approach seems to be to partner or use existing coins rather than launch an “AppleCoin” outright. Airbnb’s CEO Brian Chesky once hinted at crypto integration after thousands of customers requested it, but any proprietary token from Airbnb would raise securities questions, so supporting established crypto assets is the likely route.

但監管機構正密切留意科技巨頭及大型金融機構涉足發行類似貨幣的代幣。在美國,國會正討論「Stablecoin GENIUS Act」(美國穩定幣創新及標準法案),為穩定幣發行人訂立規則。有議員對科技公司實質創造可與美元競爭的私人貨幣概念表示不安,亦有聲音建議加入條文,禁止大科技公司發行自家穩定幣,迫使它們只能採用如 USDC 或 USDT 這類受監管的第三方穩定幣。Facebook 的 Libra(後來為 Diem)項目仍令人記憶猶新——2019 年,Facebook 公佈全球穩定幣計劃,由財團治理,結果央行和政界即時猛烈反對。到 2022 年初,Diem 計劃未等面世已被終止,成為前車之鑑。Apple 及 Google 都不想重蹈政治爭議覆轍。因此,兩者現時傾向與現有穩定幣合作或直接採用,無意推出「AppleCoin」。Airbnb 行政總裁 Brian Chesky 亦曾因數千名客人要求而暗示整合加密貨幣,但一旦發行自家代幣即涉證券監管問題,支援主流加密資產較大機會成為發展方向。

Outside of stablecoins, some brands have toyed with bespoke tokens for customer use. For instance, fashion brand LVMH (Louis Vuitton Moët Hennessy) helped develop a private blockchain (Aura) to track luxury goods and considered tokenizing those products, though not a public crypto per se. Fan tokens issued by sports teams (like FC Barcelona’s $BAR or Paris Saint-Germain’s $PSG tokens on the Socios platform) show how brands can create their own digital assets to monetize fan engagement globally. These fan tokens often grant holders voting rights on minor club decisions or access to VIP perks, effectively functioning as a cross between loyalty points and mini cryptocurrencies. By 2025, dozens of major sports brands – from European football clubs to Formula 1 teams – have launched such tokens. The reception has been mixed: while they do generate revenue and engagement, critics argue that fan tokens are highly volatile and many fans don’t fully understand the financial risk (especially when teams underperform and token prices drop). Nonetheless, they represent a new way brands are minting value from their communities via crypto.

除了穩定幣外,一些品牌亦有試驗度身訂造的專屬代幣供顧客使用。例如時裝品牌 LVMH(路易威登酩悅軒尼詩)協助開發私有區塊鏈(Aura)以追蹤奢侈品,亦考慮過將產品代幣化,但並非公開加密貨幣。又例如球會發行的粉絲代幣(如巴塞隆拿的 $BAR 或巴黎聖日耳門在 Socios 平台上的 $PSG 代幣),展示品牌如何以自家數碼資產變現全球粉絲的參與。這些粉絲代幣通常賦予持有人對小型球會決策的投票權或獲取 VIP 禮遇,實際上結合了積分制與迷你加密貨幣的特性。到 2025 年,歐洲足球會至 F1 車隊等數十間頂尖體育品牌已推出這類代幣。市場反應褒貶不一:雖然這帶來收益與更高互動,但亦有人批評粉絲代幣波幅極大,而且很多粉絲並不真正明白當中財務風險(特別是成績欠佳時,代幣跌價的情況)。縱然如此,這類產品代表品牌以加密方式鑄造價值,回饋自己的社群。

It’s worth noting another form of corporate crypto asset: the NFT membership or “digital twin” token. We touched on loyalty NFTs earlier with Starbucks, but beyond loyalty, some brands have issued NFTs tied to physical products or VIP memberships. For example, Porsche released NFT digital art linked to its iconic 911 model (though a poorly received launch in early 2023 highlighted the importance of understanding the NFT community’s expectations). Budweiser and Coca-Cola have both dropped limited-edition NFTs for marketing campaigns – Budweiser sold NFT beer can designs, and Coca-Cola auctioned NFTs with special experiences attached, often for charity. These aren’t fungible “coins” per se, but they indicate brands creating digital assets unique to their identity. In the realm of metaverse and gaming, tokens and virtual currencies have also been used by brands: e.g., Nike’s RTFKT might issue tokens within a virtual sneaker game, or Starbucks may yet return with a more refined blockchain-based reward token after Odyssey, perhaps one not even marketed as an NFT to users.

另一種企業加密資產值得留意:NFT 會員或「數碼孿生」代幣。我們之前提及 Starbucks 的忠誠度 NFT,但除會員積分外,一些品牌已發行與實物產品或 VIP 會籍掛鉤的 NFT。例如 Porsche 推出過與 911 車款有關聯的 NFT 數碼藝術(但於 2023 年初的發行評價不佳,突顯理解 NFT 社群期望需更到位)。Budweiser 及可口可樂分別推出限量 NFT 作品牌推廣——Budweiser 賣 NFT 啤酒罐設計,可口可樂則拍賣附帶特別體驗的 NFT,經常與慈善相關。這些並不算是真正可替代「幣」種,更是品牌創造獨一無二數碼資產以突出身份。至於元宇宙或遊戲世界,品牌亦有發行代幣和虛擬貨幣:例如 Nike 的 RTFKT 可能在虛擬波鞋遊戲內發幣,Starbucks 亦或會繼 Odyssey 後推出更精緻的區塊鏈獎勵代幣,甚至不以 NFT 名義向用戶推廣。

Lastly, we should mention how corporations are increasingly stockpiling existing cryptocurrencies on their balance sheets, effectively issuing themselves a crypto exposure. This isn’t creating a new coin, but it’s a significant trend of brands treating crypto as a strategic asset. We saw the beginning with Tesla’s big Bitcoin buy in 2021. Now in 2025, public companies hold a record amount of crypto: by Q1 2025, publicly traded firms held over 688,000 BTC combined (over 3% of all Bitcoin), a 16% increase from the previous quarter. These include not just crypto-centric firms but retailers like GameStop, which in May 2025 disclosed a purchase of 4,710 BTC (over $500 million worth at the time) as part of its new corporate investment policy. GameStop’s embrace of Bitcoin – raising funds to build a BTC treasury – shows how even companies outside finance see crypto as a reserve asset to potentially hedge inflation or ride an anticipated price upswing. The fear of missing out is palpable: when one company publicly profits from a crypto bet (as MicroStrategy famously did, or GameStop hopes to), competitors wonder if they should follow. It’s gotten easier for firms to hold crypto now that accounting rules have changed to allow marking assets at fair value (so companies can report gains when crypto prices recover, not just impairments when they fall, as was the case under old rules). This removal of an accounting headache in late 2024 has made CFOs more open to dipping into Bitcoin. Still, not everyone is convinced – Meta’s shareholders voted down a proposal to add Bitcoin to the balance sheet, and similar shareholder ideas at Amazon and Microsoft were also rejected. Many executives remain wary of crypto’s volatility and regulatory uncertainties.

最後,值得一提的是,越來越多企業把現有加密貨幣儲存在資產負債表中,等於為自己開創加密資產曝險。這並不是發行新幣,但反映品牌正將加密貨幣視為策略資產。2021 年 Tesla 首次大手買入比特幣就是開始。到 2025 年,上市公司持有加密貨幣規模創新高:2025 年第一季,上市公司持有超過 688,000 枚 BTC(約佔全體比特幣 3%),較上一季上升 16%。當中不止純加密行業公司,還包括 GameStop 等零售巨企,該公司於 2025 年 5 月披露購入 4,710 枚 BTC(當時約值 5 億美元)作為新企業投資政策一部分。GameStop 擁抱比特幣——集資建 BTC 國庫——證明即使非金融界公司亦視加密貨幣為儲備資產,以對沖通脹或賭未來升浪。害怕錯過的心理非常明顯:當有公司公開因投資加密貨幣獲利(如 MicroStrategy 曾做過,或 GameStop 希望達到),對手自然懷疑是否要跟隨。因為會計準則已改,允許以公允價值反映價格(即公司不只是因幣價跌要記錄減值,幣價升時亦可入帳利潤),現在企業持幣容易得多。這個 2024 年底帳目煩惱的解除,使 CFO 更傾向少量配置比特幣。但仍然有人不贊同——Meta 股東否決了增持比特幣的議案,Amazon 和 Microsoft 股東的類似方案亦被否決。很多高管對加密貨幣的波動性及監管前景仍然抱觀望態度。

In conclusion, some of the world’s biggest brands are indeed venturing to issue or adopt crypto assets in-house, whether stablecoins for payments, community tokens for fans, or NFTs for product experiences. The overarching strategy is to harness what crypto offers (speed, global reach, engagement, or store-of-value) without running afoul of laws or alienating users. It’s a delicate balancing act. Those companies that succeed – such as PayPal with a well-regulated stablecoin, or Nike with culturally resonant NFTs – are often those that partner with crypto-native firms and focus on real user value. Those that misstep (Facebook’s Libra, or a poorly executed token drop) serve as cautionary examples that in the crypto space, even big brands must earn trust and navigate a complex regulatory maze.

總結來說,不少全球最大品牌確實正嘗試內部發行或採用加密資產,不論是用於支付的穩定幣、粉絲社群代幣還是產品體驗 NFT。整體策略是善用加密貨幣帶來的速度、全球性、互動性及儲值屬性,同時不觸犯法規或疏遠用戶。這是一場微妙的平衡。成功的公司——例如 PayPal 擁有監管完善的穩定幣,Nike 推出切合文化的 NFT——往往都是與加密原生公司合作、聚焦於真實用家價值。反之,失誤者(如 Facebook Libra,或發行失敗的代幣)則成為警號,證明即使大品牌亦要建立信任、謹慎應對複雜的監管環境。

NFTs and the Metaverse: Branding in the Digital Age

No discussion of brands using crypto is complete without examining the NFT (non-fungible token) boom and “metaverse” strategies that swept through corporate marketing departments in the early 2020s. At the height of NFT mania in 2021–2022, it seemed every brand – from fast food to high fashion – was scrambling to release some kind of digital collectible. The rationale was clear: NFTs offered a new medium to engage younger, digitally native audiences and unlock revenue from purely digital goods. By 2025, the initial hype has tempered, but many brands have established enduring NFT-based initiatives or at least gained valuable experience from pilot projects.

談及品牌利用加密貨幣,不得不提過去幾年席捲企業市場部的 NFT(非同質化代幣)熱潮及「元宇宙」策略。NFT 狂熱高峰期是 2021 至 2022 年,幾乎每個品牌——由快餐連鎖到高端時裝——都搶著推出不同數碼收藏品。背後原因顯而易見:NFT 提供全新媒介吸引年輕、數碼原生一代消費者,並開拓純數碼商品的收益來源。到 2025 年,初期熱潮已降溫,但不少品牌已建立起長遠的 NFT 企劃,抑或至少在試點中累積了寶貴經驗。

The fashion and luxury sector has been particularly active. We noted earlier Nike’s massive success through RTFKT, which has effectively positioned Nike as a leader in digital wearable collectibles. Rival Adidas jumped in with its own NFT collaboration in late 2021, partnering with popular collections like Bored Ape Yacht Club and others to launch the “Into the Metaverse” NFT series. Adidas sold thousands of NFTs that granted holders exclusive streetwear merchandise and access to online metaverse experiences, signalling that even a 70-year-old apparel brand can reinvent some marketing via blockchain. Gucci likewise made waves: it not only began accepting crypto at some stores, but also issued branded NFTs and bought virtual land in The Sandbox metaverse to create a Gucci-themed digital environment. By 2023, Gucci had partnered with Yuga Labs (the Bored Ape creators) on a project, invested in an NFT marketplace, and released luxury NFTs like the Gucci “Superplastic” collectibles, underscoring that high-end brands see NFTs as an extension of their storytelling and exclusivity in the digital realm.

時裝及奢侈品行業尤其活躍。正如之前提及,Nike 透過 RTFKT 取得巨大成功,已成為數碼穿戴收藏品領域的領導者。對手 Adidas 於 2021 年底亦推出自己的 NFT 合作計劃,聯同 Bored Ape Yacht Club 等人氣系列,發行「Into the Metaverse」NFT 系列,售出數千枚 NFT,持有人可換領獨家潮流服飾並參與網上元宇宙體驗,證明即使是逾七十年歷史的服裝品牌,亦可以區塊鏈方式革新營銷。Gucci 同樣製造話題:不單部分分店接受加密貨幣,還發行自家 NFT 及於 Sandbox 元宇宙購置虛擬土地,打造 Gucci 主題數碼世界。2023 年,Gucci 與 Yuga Labs(Bored Ape 創辦人)合作新項目、投資 NFT 市場,並推出如 Gucci「Superplastic」等奢華 NFT 收藏品,突顯頂級品牌視 NFT 為數碼領域延續故事與專屬感的新途徑。

Luxury conglomerate LVMH launched several experiments: Louis Vuitton created “Louis: The Game” in 2021, a mobile game with embedded NFTs celebrating its founder’s bicentennial, and LVMH’s blockchain platform Aura (developed with Prada and Cartier) aims to issue NFT certificates of authenticity for luxury goods. Even jewelry got involved – Tiffany & Co. in 2022 sold an ultra-exclusive set of NFTs called “NFTiffs” that came with real diamond pendants for CryptoPunk owners, merging digital and physical luxury. Though only 250 NFTiffs existed (priced at 30 ETH each, around $50,000 at the time), they sold out quickly, demonstrating crypto’s reach into the upper echelons of consumerism.

奢侈品集團 LVMH 亦做過多項測試:Louis Vuitton 於 2021 年推出「Louis: The Game」手遊,內置 NFT 慶祝創辦人兩百周年;LVMH 更聯同 Prada 和 Cartier 開發區塊鏈平台 Aura,旨在發行奢侈品 NFT 認證證書。連珠寶界也參與其中——Tiffany & Co. 於 2022 年發行極罕有 NFT 套裝「NFTiffs」,CryptoPunk 擁有人可換取真鑽吊墜,融合數碼與實體奢華。雖然只限 250 枚(每枚 30 ETH,當時約 50,000 美元),卻很快售罄,證明加密貨幣已伸延至消費金字塔頂層。

In entertainment, major franchises and media companies hopped on the NFT train. Disney licensed its characters for NFT collectibles on platforms like VeVe, dropping limited edition Marvel and Star Wars digital figurines that fans could buy, trade, and display in augmented reality. Warner Bros. released NFTs for The Matrix and even a special NFT version of “The Lord of the Rings” (bundling the film in 4K with collectible extras). These were exploratory moves to test consumer appetite for owning digital versions of beloved content. Sports leagues too found success: the NBA’s Top Shot platform, launched in

在娛樂產業,各大電影 IP 和本地傳媒公司亦紛紛投身 NFT 熱潮。Disney 授權旗下角色於 VeVe 等平台推出 NFT 收藏品,發售限量 Marvel 及 Star Wars 數碼公仔,讓粉絲可以購買、交易,並於擴增實境中展示。Warner Bros. 則為《Matrix》甚至《魔戒》發行特別版 NFT(結合 4K 電影及收藏品)。這些都是試水溫、觀察用戶是否願意擁有心愛內容數碼資產的策略。體育聯盟方面,NBA 的 Top Shot 平台推出後亦取得成功——2020年,將精彩片段轉化為NFT,成為首批在主流粉絲之間爆紅的例子之一,當時有超過一百萬用戶在交易籃球「時刻」。去到2025年,雖然Top Shot的交易量已經遠低於高峰期,但NBA同夥伴Dapper Labs證明,只要產品好玩又易用,球迷會願意接受數碼收藏品(Top Shot 支援信用卡付款、保管模式,令用戶唔使識區塊鏈都用到)。NFL、MLB、同其他聯盟都好快跟住推出自己嘅「時刻」NFT和紀念品市場。

同時,好多品牌如可口可樂、百事、漢堡王、麥當勞都將NFT用作短期推廣。可口可樂2021年拍賣過獨特NFT(例如「Friendship Loot Box」數碼禮物箱)做慈善,籌錢之餘又攞到好形象。百事推出過「Mic Drop」NFT——卡通咀咀咪——免費送俾用戶,將品牌同NFT文化連結。漢堡王2021年搞過「Burger King Real Meals」活動,送NFT收藏品,仲有得換一年Whopper漢堡等獎賞,把加密元素納入營銷策略。麥當勞中國2021年發行188款NFT藝術品做周年紀念,美國麥當勞都出過限量版McRib NFT當作俾粉絲獎品。呢啲做法有啲玩味成分多,但都反映大型快餐品牌都係度試緊用加密方式吸客。

「元宇宙」buzzword都刺激品牌投入加密相關新嘗試。沃爾瑪、三星、Nike等企業都喺Decentraland、Roblox等元宇宙平台建虛擬店舖或搞體驗。雖然唔係所有元宇宙都用區塊鏈(例如Roblox本身係封閉系統),但賣虛擬商品/服飾好多時都會用到NFT。Ralph Lauren同Zara都搞過虛擬服裝系列;Balenciaga幫Fortnite設計皮膚;Nike既Nikeland(Roblox)同Gucci Sandbox世界都係提早插旗做準備。呢啲玩法長遠價值仍有待觀察——有啲人質疑去中心化元宇宙活躍用戶其實好少——但品牌都當係一種學習投資。萬一元宇宙經濟真係盛起,佢地就會有知識產權同數碼產品準備妥當——就好似早年啲品牌保守咁開Facebook Page,結果證明係明智之舉。加密元素如NFT畀到用戶真正擁有虛擬商品,未來品牌數碼商品可能比傳統遊戲內購更有意義、甚至可自由交易。

當然,過程唔係一路亨通。消費者有時對品牌NFT嘗試唔買帳,特別係驚騙案或環保影響。好似2021年Ubisoft喺某款遊戲出NFT物品都被玩家鬧爆,覺得純係搵快錢,最後Ubisoft都要收回相關計劃。NFT當年(主要係Ethereum未轉向PoS之前)環保問題都令部份品牌卻步,但自從以太坊2022年9月合併後能耗大減99%,呢個問題已冇咁嚴重。仲有啲簡單嘅趨勢風險:有批評話啲公司入場純粹「怕輸」(FOMO),根本冇諗清楚點解要搞NFT。Starbucks的Odyssey,Fast Company出文就問:「Starbucks究竟諗清楚點解搞呢個NFT計劃未,定純粹跟風?」有啲公司策略真係未諗熟。

2025年今日,NFT市場已比高峰期「冷靜」咗好多,NFT交易量只有投機狂熱高峰時小部分。好多NFT系列都跌價,一般消費者食飯唔會再討論NFT。但大型品牌其實私底下更務實地整合緊NFT技術,唔再炒噱頭。我哋之前講過忠誠度計劃同數碼收藏品,強調功能性/粉絲參與,而唔係賺快錢。更有品牌用NFT做門票(有啲活動直接發NFT門票,同時當數碼紀念品又防偽)同顧客管理(例如車廠送俾車主一個NFT「數碼孖生」,log曬車輛維修記錄)。呢啲低調用法未必有百萬NFT拍賣咁搶眼,但可能更長久。

總括而言,大品牌探索NFT、元宇宙,象徵品牌策略新章節——消費者參與及擁有程度提升。擁有某品牌NFT時,你唔止係佢客,變咗品味俱樂部一員(好似Adidas NFT持有人咁),有時甚至可以從品牌發達時NFT升值中得益。呢種創新顛覆傳統品牌同顧客關係,所以唔少人覺得Web3會徹底改變市場推廣格局。現時大家參與程度成光譜:有啲公司反而收縮(停掉啲唔受落NFT項目),有啲則加碼(Nike直接整平台 .SWOOSH,吸引波鞋迷入Web3)。隨著技術同消費者心態演變,品牌預計會繼續微調佢地Crypto策略,分清哪些真係創新,哪些純屬新鮮感。

金融巨頭搭橋推Crypto:華爾街及其影響

除咗各個零售品牌同娛樂公司,2025年更值得留意金融行業巨頭及基建服務商點樣擁抱加密貨幣——往往仲助力咗其他品牌大規模參與。支付網絡、銀行、金融科技App都係Crypto世界同日常商業之間嘅連接組織,佢哋採納Crypto有乘數效應。我哋之前提到Visa同Mastercard加緊整合穩定幣,亦與初創Crypto公司合作推新服務。這些公司花咗幾十年建立信用及支付普及,現在確保自己唔會比加密貨幣浪潮淘汰。2023年初,雖然整個市場「加密寒冬」,Visa同Mastercard仍然表明會繼續推進Crypto整合,打臉咗有報導指佢地要暫停相關計劃。到2024年底,Visa進一步擴展穩定幣結算試行計劃,仲擴充到支持歐元穩定幣EURC。佢哋嘅願景好明確:日後如果商家希望用USDC收款,而唔使處理銀行過賬,Visa網絡有日就可以幫你搞掂。

Mastercard推出咗「Crypto Secure」計劃,幫銀行評估Crypto交易風險,推合規友善的Crypto卡。佢哋仲推咗Mastercard Crypto Credentials,訂定驗證區塊鏈地址標準,對抗不法交易——可見主流金融界積極處理過往阻礙進入障礙嘅痛點(安全、合規)。2023年,Mastercard更與Web3公司合作,推出NFT debit card,等NFT持有人正正用自己NFT資產消費。這類創新令舊有同新金融界線愈來愈模糊。

環球銀行及投資公司亦由研究走到落地。Fidelity同BlackRock等機構,例如,已經向客戶開放加密資產投資。Fidelity 2022年底允許零售用戶買賣比特幣、以太幣,以及允許(公司同意下)將比特幣納入401(k)退休帳戶。BlackRock作為全球資產管理最大公司,不僅為機構開比特幣私募信託,還在2023年遞交現貨比特幣ETF申請(若批出將是加密投資合法化里程碑)。2025年,市場所望美國比特幣ETF乃至以太幣ETF終於可供交易,屆時或迎來更多傳統企業、年金基金細碼撥資Crypto。

另外,BNY Mellon(美國最老牌銀行)已為機構提供Crypto託管服務,Nasdaq都計劃做Crypto託管生意——意即安全保管加密資產(為其他品牌、投資者)將會變成新賺錢方式。摩根大通(JPMorgan)過去CEO曾狠批Bitcoin,現在反而自己發JPM Coin做內部結算,更有全組Blockchain division Onyx負責資產代幣化等。2022年,摩根大通更首次用公有鏈Polygon買賣代幣債券,顯示佢地對「乜有用就用乜」相當務實。高盛開設Crypto Trading Desk、推出Crypto衍生工具。歐亞多間大型銀行證券行——由倫敦證券交易所到新加坡DBS——都設置數碼資產平台或試點,交易債券、碳權等token化項目。

點解對全部大品牌都重要?因為有金融巨頭入局,非Crypto原生企業入場會易啲、穩陣啲。一間中型零售連鎖未必識得如何儲存Bitcoin,但有銀行提供托管,佢地可以透過信得過夥伴處理。公司財務日後買賣Bitcoin ETF會像買黃金/指數基金一樣簡單。如果品牌想用穩定幣出糧或結算,唔耐煩等銀行過賬,之後有機會靠Visa或自己銀行安排行政。「華爾街+支付業」係為Crypto鋪好上下車通道,補足咗以往最大既障礙。

此外,fintech apps that millions use daily have normalized crypto over the past few years. Cash App (Block, formerly Square) let users buy Bitcoin since 2018 and integrated Lightning Network withdrawals by 2022, so you can send Bitcoin instantly to anyone. Venmo and PayPal brought easy crypto buying to their massive user bases in 2021. Revolut in Europe, Robinhood, SoFi, Webull, and others – all have made crypto a tab in their apps alongside stocks and savings accounts. This means the average consumer who may trust a familiar brand (their bank or brokerage) can access crypto without venturing onto a specialized exchange like Coinbase. Indeed, a recent Coinbase-sponsored survey found one-third of U.S. small and mid-sized businesses now use crypto, double the number from a year prior, attributing part of this rise to easier access via fintech tools. And among large firms, 20% of Fortune 500 executives said on-chain crypto initiatives are a core part of their strategy going forward.

過去幾年,數以百萬計人每日使用的fintech應用程式已經令加密貨幣變得司空見慣。Cash App(Block,前稱Square)自2018年已經讓用戶可以買比特幣,2022年更支援Lightning Network提款,用戶可以秒速將比特幣發送給任何人。Venmo和PayPal亦於2021年將簡單的加密貨幣買賣引入其龐大用戶群。歐洲的Revolut、美國的Robinhood、SoFi、Webull等,都已經把加密貨幣作為與股票和儲蓄賬戶並列的app功能之一。這代表一般消費者可以透過自己信任的知名品牌(銀行或者券商)接觸加密貨幣,而毋需特意上Coinbase等專門交易所。事實上,最近一項Coinbase贊助的調查發現,三分之一美國中小企業現時會用加密貨幣,數字是前年同期的兩倍,一部分是因為fintech工具令入門更容易。而在大型企業之中,20%《財富》500大企業的高層表示,on-chain加密貨幣相關業務已經成為往後策略的核心部分。

What’s holding some back? Primarily regulatory uncertainties and reputational risk. The U.S. regulatory climate, for example, has been ambiguous, with the SEC cracking down on some crypto products and Congress yet to pass comprehensive crypto laws (though efforts are underway). 90% of Fortune 500 executives surveyed said clear crypto regulation is needed to support innovation, underscoring that many companies are in “wait-and-see” mode until rules of the road are established. In Europe, the new MiCA regulation (Markets in Crypto-Assets) was approved in 2023 and will start applying in 2024–25, giving a single set of rules across EU nations. This clarity could make European brands more comfortable rolling out crypto-related services, knowing what’s allowed. We might thus see more European companies accepting crypto or issuing tokens (perhaps a luxury brand in Paris or a carmaker in Germany launching a pilot) once MiCA is in effect.

有啲企業仲未跟上,最主要原因是監管不明朗同聲譽風險。例如美國監管環境一向曖昧不明,證券交易委員會(SEC)針對某啲加密產品嚴厲執法,但國會又一直未通過全面加密法律(現時仍努力推進中)。根據調查,90%《財富》500大企業高層表示,需要明確加密監管去支持創新,反映好多公司都按兵不動,等規定清楚咗先會行動。至於歐洲,最新MiCA(加密資產市場)條例於2023年通過,會喺2024至25年陸續實施,為歐盟國家訂立統一規則。有了這種清晰度,歐洲品牌拓展加密相關服務會更有信心,知到咩可以做、咩唔可以做。一旦MiCA正式落地,可能會見到更多歐洲公司接受加密貨幣或者發行代幣(例如巴黎的奢侈品牌或德國車廠搞試點計劃)。

Another consideration is the environmental and social governance (ESG) aspect, which is significant for publicly listed brands. Bitcoin’s energy usage has often been criticized, and companies with ESG mandates have steered clear of associating with it. However, improvements are happening: Bitcoin mining is gradually shifting to renewable sources in some regions, and initiatives exist to certify “green” mined coins. Ethereum’s switch to proof-of-stake in 2022 eliminated the bulk of NFT energy complaints, meaning brands using Ethereum or Polygon can honestly say their blockchain transactions are now very low-carbon. Ferrari’s comments about crypto reducing its footprint and not derailing Ferrari’s carbon-neutral goals highlight how brands are reconciling crypto with sustainability messaging. Expect more of this narrative as companies align their crypto usage with ESG commitments, e.g. only accepting coins mined with clean energy, or buying carbon offsets for blockchain activity.

另一項考慮係環境、社會及公司治理(ESG)因素,對於上市品牌尤其重要。比特幣能源消耗一直受人詬病,有ESG目標的企業多數不敢與之扯上關係。不過,情況正逐步改善:部分地區的比特幣挖礦已經慢慢轉用可再生能源,市場上亦有認證「綠挖」幣的機制。至於以太坊2022年改用權益證明(Proof-of-Stake)機制,大幅度減低NFT等應用的耗能,品牌若利用Ethereum或Polygon,可以實話實說區塊鏈交易碳排量非常低。法拉利(Ferrari)強調加密貨幣並無妨礙其碳中和目標,反而能減少足跡,亦反映品牌如何同時考慮可持續發展形象。未來,相信會有更多這類故事:企業會將加密資產應用同ESG承諾掛鈎,例如只接受綠色挖礦的幣,或者為區塊鏈交易購買碳排放抵消額等。

Challenges and Conclusion: The Road Ahead for Brands and Crypto

挑戰與結語:品牌與加密貨幣的未來之路

As we’ve seen, by 2025 a broad array of major brands have ventured into the crypto universe in one form or another – from Starbucks trying NFT rewards, to Tesla dabbling in token payments, to Nike and Gucci selling digital collectibles, to PayPal minting its own stablecoin. This mainstreaming of crypto in corporate strategy would have been hard to imagine just five years ago. Yet it’s not been a uniformly smooth ride, and many experiments are exactly that: experiments. Brands are still feeling out how best to leverage blockchain tech to meet their business goals without falling into the traps of hype or backlash.

如上所見,去到2025年,已經有唔同主流大品牌以各自方式進入加密世界——Starbucks嘗試NFT獎勵,Tesla實驗用代幣支付,Nike、Gucci賣數碼收藏品,PayPal自家推出穩定幣。放眼五年前,真係好難想像加密貨幣已成公司發展策略一部分。不過,整體進程並不平坦,絕大多數嘗試都屬於「試水溫」性質。品牌仲係摸索階段,想搵出點樣善用區塊鏈技術去達到業務目標,同時避免炒作或公關災難。

One challenge is consumer education and reception. While crypto awareness is high in 2025, understanding remains shallow for many. A loyalty program like Starbucks Odyssey might have been too far ahead of its average customer’s comfort level. For crypto initiatives to succeed, brands often have to “abstract away” the crypto part – making the user experience so simple that a user might not even realize blockchain is under the hood. Reddit did this effectively with its Collectible Avatars; Starbucks may have learned it needs to do the same if it revisits blockchain rewards (for example, calling them digital stamps and handling all the wallet stuff behind scenes). In contrast, some brands explicitly targeted the crypto-savvy niche – luxury car makers or high-fashion NFT drops aimed at the overlap of their clientele and crypto holders. Those efforts can thrive on a small scale (e.g., a few hundred NFTs to loyal collectors) but won’t move the revenue needle for a global corporation.

第一個挑戰係消費者教育同接受程度。雖然去到2025年,大家對加密幣無咩陌生,但好多消費者其實唔係好明。好似Starbucks Odyssey獎勵計劃咁,可能太超前,對一班平均顧客嚟講簡直離地。為咗推動加密項目成功,品牌通常要「抽象化」加密層,務求用戶體驗非常簡單,令用戶用緊區塊鏈都唔察覺。Reddit推出數碼頭像就係好例子;Starbucks如果再搞區塊鏈獎賞,應該都會識得用「數碼印花」等概念包裝,錢包嘢幫你背後處理。相反,有啲品牌專登針對加密圈層——高級車廠或者時裝牌子的NFT發售,冧住既係原有客戶又持有加密的精英用戶。呢啲做到小型成功(例如幾百件NFT賣晒俾收藏家),但對跨國大企業營收影響有限。

Another challenge is regulatory compliance and legal risk. Brands have to ensure any token or crypto product doesn’t inadvertently become an unregistered security or violate money transmission laws. The regulatory landscape is moving, but unevenly. Companies have to engage lawyers and sometimes even lobby for clearer rules. When El Salvador mandated Bitcoin acceptance, corporations had to quickly figure out how to handle the accounting and tax treatment. In the US, stablecoin legislation and potential new SEC rules could impact how brands use crypto. This is a big reason many companies partner with established crypto firms (e.g., Starbucks partnered with Polygon and a startup called Forum3 for Odyssey, rather than build in-house) – to rely on their expertise.

第二個挑戰係監管合規同法律風險。品牌要確保任何token或者crypto產品唔會無意中變咗未註冊證券,亦避免違反資金轉移法例。監管環境雖然向前行,但都尚未統一。公司要聘請律師,甚至游說政府達到明確規範。好似El Salvador強制接受比特幣,企業就要即刻搞掂會計同稅務處理。至於美國,穩定幣立法同SEC新規都可能直接影響品牌用加密。呢個都係好多公司選擇同成熟加密企業(例如Starbucks揀Polygon同Forum3合作做Odyssey,而非自己起)合作的主因——借助專家知識避險。

Then there’s volatility and financial risk. Accepting crypto or holding it means dealing with price swings. Techniques like instant conversion to fiat (used by Ferrari and others) mitigate that, as does focusing on stablecoins. But holding Bitcoin in treasury is essentially a speculative position – which can pay off spectacularly or cause write-downs. We saw Tesla’s Bitcoin bet yield paper profits during the 2021 bull, then Tesla sold most of it during the 2022 downturn to limit downside. Corporate boards will differ in risk appetite, and some may view crypto as too risky unless it’s a minuscule allocation or hedged.

第三,波動性同財務風險。接受或持有加密幣,必須面對價格大上落。有啲公司採用即時兌換法幣(Ferrari等做法)以減低風險,或者專注穩定幣,但持有比特幣儲備其實類似投機——賺得多亦可以蝕好多。Tesla於2021年牛市賬面大賺,2022年跌市則大手沽貨限制損失。每間公司董事會風險取態都唔同,有啲覺得加密太危險,只會涉獵極小部分或對沖處理。

Security is another concern: handling crypto brings new cybersecurity challenges (protecting private keys, avoiding scams). A hack of customer crypto wallets or a breach in a brand’s NFT platform could be a PR nightmare. As such, brands often leave custody and security to specialists (for instance, many NFT marketplaces custody the NFTs for users, and merchants rely on payment processors to handle crypto transactions). Still, the onus is on the brand to ensure their partners are reputable (one recalls how the collapse of FTX in late 2022 shook confidence; any brand tied to such an exchange would have suffered reputational damage).

安全亦係一大考慮:處理加密貨幣涉及全新網絡保安風險(例如保護私鑰、防詐騙)。客戶錢包被黑或者NFT平台被攻破,可以造成極嚴重公關災難。所以品牌多數將託管同安全交俾專業公司(例如NFT市場普遍幫用戶託管NFT,商戶就靠支付服務供應商處理加密交易)。但品牌本身都有責任,確保合作伙伴夠信譽(記得2022年末FTX爆煲動搖信心,任何和該交易所有關聯的品牌形象即時受損)。

Despite these challenges, the overall trajectory is continued integration of crypto into consumer and enterprise activities, albeit at a measured pace. The burst of initial enthusiasm might have waned – no more “we’re launching an NFT because everyone is” announcements – but what remains are use cases with real merit and commitment. In 2025 we see crypto being used in ways that align with core business objectives: reducing costs (stablecoins for cheaper payments), increasing engagement (loyalty tokens, fan tokens), driving new revenue streams (NFT sales of digital goods), reaching new markets (accepting crypto from customers in countries with weak banking), and positioning as innovative (brand image benefits, attracting younger demographics). Each company must weigh these benefits against the risks and invest accordingly.

雖然有這麼多挑戰,大趨勢仍是加密貨幣逐步融入消費者同企業活動,只係步伐更穩妥罷了。初期那種「人人搞NFT」的熱潮褪色了,但落地應用同真誠投入留下來。2025年,大家見到,加密貨幣正用來服務企業核心目標:減低成本(用穩定幣支付更平)、提升參與(積分代幣、粉絲代幣)、開拓新收入來源(賣數碼產品NFT)、切入新市場(收海外無銀行客戶crypto付款)、塑造創新形象(吸年輕人、增品牌活力)。每間公司都要仔細權衡風險得失,再因應自己情況投資。

Looking ahead, a few trends seem likely. If crypto markets continue to mature and possibly enter another bull phase, more brands may re-engage with dormant projects – for example, we might see Starbucks Odyssey 2.0 if consumer interest in NFTs resurges under better market conditions. Central Bank Digital Currencies (CBDCs) might come into play: countries like China already have a digital yuan in circulation, and others are exploring CBDCs. Brands operating in those jurisdictions may have to adapt their payment systems to accept CBDCs (which function like government-backed stablecoins). If, say, the EU issues a digital euro, retailers across Europe will incorporate that – further normalizing digital currency use for average folks, which by extension normalizes other digital currencies.

展望未來,有幾個新趨勢會進一步浮現。如果加密市場發展成熟,甚至再進入牛市,更多品牌可能會重啟沉寂項目——例如一旦NFT市場好返,Starbucks Odyssey 2.0都有機會出場。中央銀行數碼貨幣(CBDC)都可能成主角:中國的數字人民幣已經正式流通,其他國家亦不斷試驗。品牌如果要喺呢啲地區經營,日後或需接受CBDC(功能類似政府支持的穩定幣)。如果歐盟發行數碼歐元,歐洲零售商會即時接入——一般人用開這類數碼錢,自然會接受其他加密貨幣。

Interoperability and partnerships will likely increase. We could envision loyalty tokens from different brands being tradable on some platforms (imagine swapping airline miles for hotel points via a decentralized exchange, if regulatory approved). Payment apps might auto-convert various cryptos to local currency in the background, so a customer could pay a merchant in Bitcoin and the merchant receives euros seamlessly. Those technical pieces are being built now.

互通性同跨品牌合作亦會越來越多。有朝一日,不同品牌的積分token未來可以喺某啲平台自由交易(譬如你上去去中心化交易所換飛行里數換酒店分,只要規管許可)。支付app未來可以自動幫你將多種加密幣即時轉換本地貨幣,消費者用比特幣畀錢,商戶收歐元都無縫。這些技術基礎正逐步建設中。

Perhaps the greatest endorsement of crypto’s place in corporate America came indirectly: in mid-2025, the U.S. Vice President spoke at a Bitcoin conference, calling the U.S. a “firm ally” of the crypto industry and saying Bitcoin has become a mainstream part of the economy. Such political support, along with improved accounting rules and success stories, has made executives far more comfortable exploring crypto than they were years ago.

有趣地,加密貨幣在美國企業界的最大背書竟然來自政界:2025年中,美國副總統親自在比特幣會議發言,稱美國會做crypto行業「堅定盟友」,而且比特幣已經成為經濟主流內容。這種政治支持,加上會計新規、商業成功案例,令企業高層探索加密貨幣相比幾年前放心得多。

In conclusion, the relationship between big brands and crypto in 2025 is one of cautious embrace. We see unquestionable momentum – a majority of top companies have some blockchain project underway, and iconic names from Starbucks to Tesla have paved the way. Each use case comes with lessons learned. Some, like Starbucks, learned that not every customer base is ready for Web3 (at least not explicitly). Others, like Tesla and Ferrari, discovered pockets of real demand for crypto payments but must manage practical concerns. The experiments of the early 2020s have yielded valuable know-how, separating fads from functional innovations. As the crypto industry itself evolves (with more regulation, more stability, and more user-friendly tech), big brands will be able to integrate crypto in more seamless

總結來說,2025年大品牌同加密貨幣之間,屬於審慎接受。我哋見到明顯動力——多數頂級公司都有區塊鏈項目進行中,Starbucks、Tesla等巨頭亦為業界探出路。每單案例都有寶貴教訓,有啲如Starbucks發現唔係個個客都ready玩Web3(至少唔適合明刀明槍推),有啲如Tesla、Ferrari就發現加密支付有真實需求,但實務問題唔少。2020年代頭那批實驗,換來很多Know-how,幫大家分清咩係曇花一現、咩係可持續創新。隨住加密產業自己不斷成熟(更多監管、更穩定及更易用技術),大品牌日後將會更順滑地將crypto融入業務……and invisible ways. In time, using crypto within your favorite brands’ ecosystem might feel as normal as using reward points or gift cards – the complexity hidden beneath a familiar surface.

而且有時是無形的方式。隨住時間過去,喺你最鍾意嘅品牌生態圈入面用加密貨幣,可能會變得同用積分或者禮品卡一樣平常 —— 複雜嘅技術隱藏咗喺熟悉嘅介面之下。

For now, crypto remains a tool that savvy brands deploy judiciously: enhancing loyalty here, adding a payment option there, engaging fans with digital collectibles or leveraging blockchain for supply chain efficiencies. The key is fact-based strategy over hype – exactly what we’ve aimed to present in this explainer. By staying grounded in real use cases and outcomes, brands can continue to explore the crypto frontier without losing sight of what their customers want. And as consumers, we can expect to see more chances to interact with crypto through the brands we love, whether that’s earning a digital collectible for buying a latte or choosing to pay for our next car in Bitcoin. The intersection of big brands and crypto is no longer theoretical – it’s happening now, and it’s only getting bigger as we move forward in this digital decade.

目前,加密貨幣仲係一啲醒目品牌審慎使用嘅工具:呢度用嚟提升客戶忠誠度,嗰度加多一個付款選項,或者用數碼收藏品嚟同粉絲互動,甚至利用區塊鏈去改善供應鏈效率。最重要係根據事實制定策略,而唔係盲目追捧 —— 呢啲正正就係我哋今次想講畀你知嘅重點。只要著重實際例子和結果,品牌就可以繼續探索加密貨幣呢個新領域,同時唔會偏離客戶真正嘅需要。作為消費者,我哋亦都可以期待,有更多機會透過自己鍾意嘅品牌接觸到加密貨幣 —— 無論係買杯咖啡就攞到數碼收藏品,定係揀用比特幣去買下一架車。大品牌同加密貨幣交集,已經唔再係理論,係實際發生緊,仲會愈嚟愈重要,踏入呢個數碼年代。