Binance —— 全球最大的加密貨幣交易所 —— 週一宣布,已全面向所有用戶開放比特幣「賣方期權」功能。實際上,這代表Binance上的一般用戶現可賣出比特幣的認購期權及認沽期權,不再僅限於購買。以往這類複雜策略只適用於機構或高級別用戶。Binance的這項決定,源於散戶對高階衍生產品(非單純買入持有)的需求大增。

Binance產品副總裁Jeff Li就業務擴展表示:「加密貨幣普及化將推動市場對複雜流動性工具的需求,我們致力打造更完善的衍生產品陣容來支持用戶。」

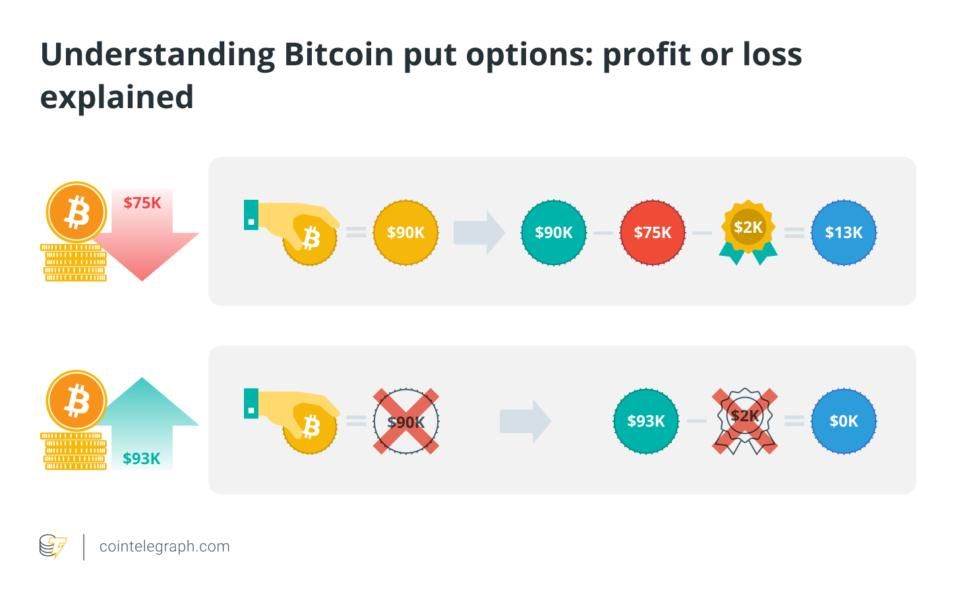

賣出期權(又稱為寫出期權)意指交易員與期權買方相對做單——本質上即為他人提供財務保險,賺取對方支付的權利金,但需承擔行情大幅波動時的潛在風險。Binance解釋,無論賣出認購還是認沽期權,概念類似於出售比特幣漲跌行情的「保險」。如果市價未突破執行價,賣方可直接袋走權利金作利潤;一旦觸發,賣方需按合約內容結算損益(或交付資產)。

風險管理:鑑於寫出期權涉及不少風險,Binance設有嚴格風控。用戶必須通過適格性評估以證明理解期權交易,並須繳交保證金來對應潛在損失。這些措施旨在防止用戶不當槓桿或承擔超出實力的風險。據稱,所有Binance期權均屬全額抵押(以穩定幣結算),設有固定到期日(分別有日、週、月、季,結算時間為08:00 UTC)。

Binance此時開放期權賣方功能,正值整體加密衍生產品市場急速膨脹。根據官方新聞稿,比特幣期權交易量2020年僅41.1億美元,至2025年6月已飆升至約1,387.6億美元,五年暴增逾3200%。這反映機構和散戶已廣泛採用期權作投機和對沖目的。Binance期望藉拓展賣方群組,讓用戶「表述市場觀點、管理風險、賺取權利金,以及落實多元化投資策略」。

為鼓勵參與,新開立期權合約(包括BTC、ETH、BNB、SOL)將享有八折手續費優惠。Binance亦將升級機構及大戶的期權增強計劃——降低入門門檻並優化費率。各項措施顯示Binance積極搶佔更大加密期權市場份額,致力提升市場可及性及降低成本。

總結而言,Binance向所有用戶開放比特幣期權寫作權,是加密貨幣交易的一大突破。普及了以往只屬專業人士的進階期權策略,同時亦展現加密衍生品日趨成熟與壯大。但究竟比特幣期權是甚麼?交易員又該如何善用?本文餘下部分會詳細剖析比特幣期權基本概念、運作方式、交易流程,以及落實風險管理與增值的實用策略。

甚麼是比特幣期權?

比特幣期權是一種衍生合約,讓持有人擁有但不必強制執行於指定日期前,以預定價格買入或賣出指定數量比特幣的權利。簡單來說,期權是一種連動比特幣價格(標的資產)的金融工具,為投資者帶來彈性:

-

認購期權(買入權):賦予持有人在到期日前或當天,按協定價格買入比特幣的權利。交易員如看好比特幣價格將上升,可買入認購期權——這是一種看漲部署。當比特幣市價超過執行價時,認購期權價值上升。例如,持有一個1個月、執行價3萬元的認購期權,無論市價多高都能3萬美元購入1 BTC。若BTC市價升至3.5萬美元,該期權即「價內」——可3萬買幣,當場賺取5,000美元內在價值(減去已付手續費/權利金)。如期滿市價低於3萬,期權屆時將作廢,最多只損失所付權利金。

-

認沽期權(賣出權):賦予持有人可於指定到期日前或當天,按協定價格賣出比特幣。這是一種看淡或避險的方式——若比特幣市價跌穿執行價,認沽期權價值將隨之上升。投資者常用認沽期權作跌市保險。例如持有一個2.5萬美元行使價、下月到期的認沽期權,即使市價插水至2萬,仍可用2.5萬賣出BTC。此種期權在急跌市況下具保底作用。相反,如市價高於2.5萬,該期權作廢,損失僅限已付權利金。

兩者共同點,是期權持有人擁有選擇權——可根據市況行使或放棄,不必強制執行。如市況有利,可行使或直接賣出合約圖利;未達預期則可讓其作廢,最大損失只限於付出之權利金。這種「有限風險(權利金),高回報潛力」特性正正吸引不少交易員參與期權投資。

關鍵詞彙:討論期權時,常見數個基本名詞:

- 行使價(Strike Price):即期權持有人可買入(認購)/賣出(認沽)比特幣的固定價格。以3萬美元認購期權為例,代表到到期日前無論市價如何,均可3萬買BTC。

- 到期日(Expiration Date):合約作廢前的最後期限,屆時需決定是否執行權利。比特幣期權設有多種到期時段——如每日、每週、每月、每季等。到期後合約自動結算及終止。

- 權利金(Premium):購買期權需支付的費用(賣方即時實收收入),由市場根據現貨價、行使價、剩餘時限及波幅等因素決定。此為擁有期權的代價。例如,投資者買入1個月BTC認購期權權利金為500美元,如期權報銷則損失上限為該500美元(對賣方則為利潤)。

市場普及情況:期權早已在股票及商品市場流行數十年,但比特幣期權約2020年初才廣泛上市。自那時起逐漸成為熱門衍生工具。主要交易所如芝商所(CME)於2020年推動受監管BTC期權,加密平台如Deribit、OKX、Binance亦各有活躍市場。現時投資者除可在傳統交易商(如CME現金結算產品/比特幣ETF的期權)買賣外,也可於加密貨幣交易所買賣期權。

比特幣期權為交易員及投資者提供更多靈活策略。主要優點在於,允許在高波動市況下對沖或博取收益,同時將風險鎖定為已付權利金。與直接買賣比特幣(如做空損失無限,或需大資本買入)相比,期權能以較低成本部署看漲/看跌策略並設定風險上限。合理運用能保護資產組合,亦有望提升回報,詳情下文逐步說明。

比特幣期權如何運作?

要理解比特幣期權實際操作,須拆解其機制及買/賣方的後續流程:

- 期權價值與價內/價外狀態:期權在不同時刻的價值,視乎比特幣市價相對行使價的變化,以及距離到期的時間長短。常用以下三種「價內/外」術語:

-

價內(ITM):認購期權於比特幣現價高過行使價時為「價內」(即比現市價更便宜買入);認沽期權則市價低於行使價即為「價內」(以高於市價賣出更化算)。價內期權有現金價值。例如,你持有3萬行使價的認購期權,BTC現價3.2萬,賬面即每比特幣賺2,000美元(未扣權利金)。如持有3萬元認沽期權,BTC現價2.5萬,就是5,000美元價內。

-

價外(OTM):認購期權若現價低過行使價,屬「價外」(以更高價買,自然不化算);認沽期權則市價高於行使價為價外。價外期權無現金價值,屬對未來市價變動的「期望」。這類期權通常便宜,但市況不利則到期報銷。 call when BTC is at $25K is $5K out-of-the-money; unless BTC rallies above $30K, that call won’t pay off.

當比特幣(BTC)價格喺$25,000,而call期權嘅行使價係$30,000時,呢張call係“價外”$5,000;除非BTC升穿$30,000,否則果張call都唔會有回報。 -

At-the-Money (ATM): When Bitcoin’s price is approximately equal to the strike price. An ATM option is right on the cusp – it has little intrinsic value, mostly time value. Traders often favor ATM options for their balance of cost and likelihood of expiring profitable.

-

平價(ATM):即係比特幣現價大約等於行使價。平價期權處於臨界點—本身內在價值好少,主要都係時間值。好多交易員都鍾意平價期權,因為佢哋成本同賺錢機會都取得平衡。

The distinction matters because it affects exercise decisions and pricing. An ITM option is likely to be exercised if held to expiration (since it gives a profitable trade at the strike). OTM options will expire unused (worthless) unless the market moves beyond the strike.

分得ITM、ATM同OTM幾重要,因為會影響行使決定同價格。ITM(價內)期權如果持有到到期日,通常都會行使,因為可以賺錢。OTM(價外)期權就通常到期會冇人用,變成廢紙,除非市場突破行使價。

-

European vs. American Style: Bitcoin options offered on most crypto exchanges are typically European-style, meaning they can only be exercised at the moment of expiration (on the expiry date). In contrast, American-style options (common in equity markets) allow the holder to exercise at any time before expiry. European options simplify things for exchanges and traders – you don’t have to worry about early exercises. However, it means as a holder you must wait until expiration to capture the option’s value by exercise (though you can still sell the option contract to someone else earlier). Notably, CME’s Bitcoin options and many crypto platforms use European-style contracts, so exercise happens only on expiry. This is important for planning: if you have a profitable European option, you’ll usually sell it on the market before expiry if you want to lock in gains, rather than exercising early.

-

歐式期權 vs. 美式期權:而家大部分加密貨幣交易所提供嘅比特幣期權都係歐式,即只可以喺到期嗰一刻行使;美式期權(股票市場常見)就可以隨時行使(即到期前嘅任何時間)。歐式期權簡化咗交易所同交易員嘅處理,唔使煩早行使。不過,如果你持有歐式期權,想實現價值就一定要等到期(不過你中途都可以賣畀人離場)。CME同好多主流加密平台都係用歐式合約,所以只限到期行使。呢點對部署期權好重要:如果你持有一張有利潤嘅歐式期權,想套現利潤,通常都會到期前把張單賣出去,而唔係早行使。

-

Settlement: Bitcoin options may be physically settled or cash settled. Physically settled means if the option is exercised, actual bitcoin changes hands (the call buyer buys BTC, the put buyer sells BTC). Cash-settled means the payout is done in cash (or stablecoin) equivalent to the profit of the option, without transferring actual BTC. For example, Binance’s options are USDT-settled: profits or losses are paid in the tether (USDT) stablecoin, and you don’t have to deliver or receive actual BTC. CME’s options on futures are cash-settled in dollars. It’s important to know which type you’re trading, especially if you write options – physical settlement means you should be prepared to deliver BTC (for a call seller) or purchase BTC (for a put seller) if the option ends ITM.

-

結算方式:比特幣期權可分為實物結算或者現金結算。實物結算,即係如果你行使期權,真‧BTC要轉手(call買家買BTC,put買家賣BTC)。現金結算則係唔需要真‧BTC搬運,只係以現金(或穩定幣)支付利潤。例如Binance期權係USDT結算:賺錢或者蝕本都用Tether(USDT)穩定幣結算,你唔使交收真‧BTC。CME人仔期貨期權都係用美金現金結算。一定要清楚自己玩緊邊款制,尤其係賣期權嗰陣—如果係實物結算,call賣家要準備好交BTC,put賣家要準備買BTC(如果期權到最後係ITM)。

-

Pricing Factors: The premium of an option is determined by several factors, often explained by the Black-Scholes model or simply supply and demand in the market. Key factors include: the current spot price of BTC, the strike price relative to spot, time to expiration, volatility of BTC’s price, and interest rates. One can think of an option’s price as having two components: intrinsic value (if any, based on moneyness) and time value (the extra value from the possibility that the option could become profitable before expiry). Generally, the more volatile Bitcoin is expected to be, or the more time until expiry, the higher the premium for a given strike – because there’s a greater chance the option ends up valuable. As time passes, the time value portion decays (this is known as theta decay), which is bad for option buyers but beneficial for option sellers (writers) who earn that decay as profit if the option expires worthless.

-

價格因素:期權保費係根據多個因素釐定,市場多數用Black-Scholes模型或者純粹睇供求。主要考慮有:比特幣現價、對應行使價、到期日尚餘時間、比特幣價格波動率同埋利率等等。你可以簡單咁睇,期權價格有兩部份:內在價值(根據價內價狀況)同時間值(即係將來變有利潤嘅可能性)。一般嚟講,比特幣越波動、離到期越耐,保費就越高,因為有更大機會變成有價值。時間過,時間值會逐步流失—呢個就係所謂「θ值衰減」(Theta decay),對買家唔利,對寫(賣)期權嘅人則有利,因為如果期權最終冇價值,賣家就「袋咗」呢筆衰減做收益。

-

At Expiration: On the expiration date, the option will either be exercised (if it’s in the money and the owner chooses to exercise) or expire worthless (if out of the money). Many crypto exchanges automatically handle exercise: if you are holding a bitcoin call that’s ITM at expiry, the platform may automatically exercise it for you and either credit you the profit or deliver the BTC per the contract terms. If it’s OTM, it simply expires and stops trading. Before expiry, an option’s market price will fluctuate – you don’t have to wait until the expiration; you can close your position by selling the option (if you bought it) or buying it back (if you wrote it) at the market price any time. This allows traders to realize profits or cut losses before the deadline.

-

到期時:期權到期日,要麼就行使(如果係ITM同時擁有者選擇行使),要麼就變成廢紙(如果OTM)。好多加密僑易所會自動幫你處理行使:如果你手上有張比特幣call,到期時係ITM,平台會自動幫你行使然後根據合約條款派利潤或者交收BTC。如果係OTM,咁就算數,期權自動消失同停曬交易。其實你唔一定要等到到期,如果想即刻平倉賺錢或止蝕,隨時可以喺市面賣咗期權(買家)或買返自己寫出去嗰隻(賣家)—咁你就可以提早套現或止蝕。

Example Scenario: To illustrate how a bitcoin option works, consider this example adapted from a recent market scenario:

例子說明:為咗解釋比特幣期權操作,參考市況,可以睇下面呢幾個例子:

-

Ellen buys a BTC call option with a strike of $55,000, expiring 3 months from now, and pays a $1,200 premium for it. This contract gives Ellen the right to purchase 1 BTC at $55K even if the market price is higher. Suppose within those 3 months, Bitcoin’s price surges to $70,000. Ellen’s call option is now deep in-the-money – she can exercise and buy at $55K, then immediately sell that BTC at market $70K. Her profit would be roughly $70,000 – $55,000 = $15,000 minus the $1,200 premium paid, netting $13,800 gain. If she didn’t have the funds to buy the full BTC, she could alternatively sell the call option itself for about $14K (its intrinsic value) to another trader and take profits that way. Conversely, if BTC’s price had stayed at $50,000 (below the strike) by expiry, Ellen’s call would end out-of-the-money and expire worthless. She’d lose the $1,200 premium – that’s her maximum loss, which was known upfront.

-

Ellen買咗一張BTC call,行使價$55,000,到期3個月後,付咗$1,200保費。合同賦予Ellen以$55,000買1 BTC權利,不論市價點高。假設3個月內BTC升到$70,000,Ellen張call就深度ITM—佢可以用$55,000行使買入,再即時喺市價$70,000賣出。毛利為$70,000 – $55,000 = $15,000,以扣返$1,200保費,Ellen淨賺$13,800。如果Ellen冇足夠錢實際買一粒BTC,佢可以選擇將張call(而家價值大約$14,000內在值)賣俾其他人套現。反過來,如果BTC到期前都保持喺$50,000(行使價之下),Ellen張call就OTM,到期變廢紙,損失就止於最初嘅$1,200保費—呢個最大損失,一開始就係清楚既。

-

Paul buys a BTC put option with a strike of $50,000, expiring in 90 days, as a hedge in case of a market drop. He pays, say, a $1,000 premium. If Bitcoin indeed plunges to $40,000 before expiry, Paul’s put becomes valuable. It gives him the right to sell BTC at $50K while the market is at $40K. By exercising, he could essentially get $10,000 more for his bitcoin than the market would otherwise offer. If Paul didn’t actually own BTC, he could still profit by selling the put option contract (which would be worth up to $10K intrinsic value) to someone else. On the other hand, if BTC stays above $50K, the put isn’t needed and expires worthless, limiting Paul’s loss to the $1,000 premium (the cost of insurance).

-

Paul買一張BTC put,行使價$50,000,90日後到期,當做跌市嘅對沖,付$1,000保費。如果BTC真係喺到期前跌咗去$40,000,Paul張put就變得有價值,畀佢以$50,000沽BTC,明顯比市場價$40,000高。如果Paul手上其實冇BTC,佢都可以將呢張put(內在值可高達$10,000)賣畀第二個人賺錢。反之,如果BTC一直喺$50,000之上,個put根本唔需要,最終作廢,Paul最多蝕$1,000保費(好似買保險咁,止蝕有限)。

Bottom Line: Bitcoin options work as powerful tools that can be used to either speculate on price movements with defined risk or to hedge against adverse moves. They introduce concepts like time decay and volatility into crypto trading, which are new considerations beyond just the price of the coin. Traders should familiarize themselves with how option pricing behaves – for instance, an out-of-the-money option can suddenly become profitable if BTC makes a big move in the right direction, and vice versa, an in-the-money option will lose value rapidly as it approaches expiration if it looks unlikely to stay ITM.

重點總結:比特幣期權其實係一個極有力嘅工具,可以用嚟限風險炒波幅,或者做資產對沖。期權為加密市場帶嚟新元素—時間衰減、波動等,唔再淨係單睇幣價。交易者要熟悉期權價格嘅行為—例如OTM期權,如果BTC突然郁大步就會變得有錢賺,反之ITM期權如果臨到期仲係邊緣,價值可以好快縮水。

Next, we will discuss why traders use bitcoin options and what benefits they offer over simply trading bitcoin itself, before diving into how you can start trading options and some popular strategies.

下一步,我哋會講吓點解咁多人用比特幣期權,同埋佢有咩優勢多過單純炒現貨。之後亦會教你點開戶、點開始玩期權,同埋分享幾個熱門策略。

Why Trade Bitcoin Options?

Bitcoin options have rapidly grown in popularity because they offer several strategic advantages and use cases that regular spot trading of bitcoin cannot. Here are some key reasons traders and investors turn to options:

點解要玩比特幣期權?

比特幣期權而家咁受歡迎,主因就係有好多普通炒現貨冇嘅策略優勢同玩法。以下係交易員同投資者揀期權嘅幾個原因:

-

Risk Management and Hedging: One of the most common motivations is hedging against unfavorable price movements. If you hold a significant amount of BTC, you might worry about a short-term drop. Instead of selling your bitcoin (and potentially missing an upside rebound), you can buy put options as insurance. A put option will increase in value if BTC’s price falls, offsetting some of your losses on the holdings. Professional miners and long-term holders also use options to lock in prices or protect against downturns. In essence, options allow you to insure your crypto portfolio – much like buying insurance on a house – limiting downside without necessarily liquidating your assets.

-

風險管理同對沖:最多人用期權,其實係想避免BTC跌價風險。如果你持好多BTC但又驚短期回調,與其賣走隻幣(仲有可能錯過之後升返),不如買啲put期權當保險。如果BTC跌,put價就升,可以彌補持倉損失。專業礦工或者長揸戶都會用期權鎖價,或者做市況下跌嘅保障。本質上,期權可以幫你「買保險」護住加密資產組合—好似買樓險咁,限制損失又未必真係要清倉。

-

Leverage and Capital Efficiency: Options provide a form of built-in leverage. By paying a relatively small premium, an options trader can control a larger notional amount of bitcoin than if they bought the coin outright. For example, instead of spending $30,000 to buy 1 BTC, a trader might spend $1,500 on a call option that gives exposure to 1 BTC’s upside. If BTC’s price rallies, the percentage returns on that $1,500 could far exceed the percentage gains of holding BTC – yielding a high return on investment. This ability to amplify gains with limited capital is attractive to speculators. (Of course, if BTC doesn’t rise, the call can expire worthless and the premium is lost, so leverage cuts both ways.) The key point is that options let you take meaningful positions with less capital outlay.

-

槓桿效應同資金效率:期權本身已經有槓桿作用。你只需花細額保費,就可以控大量比特幣市場頭寸。例如,唔駛用$30,000買1粒BTC,只需$1,500就可以買入一張call,賭漲幅。如果BTC升,嗰$1,500升幅比實際持幣回報多得多。有限資本內放大回報,呢個吸引好多投機者。(不過,BTC唔升call就會歸零,保費冇咗,所以槓桿都有風險。)重點係,用細啲錢都可以開大少少倉。

-

Limited Risk (for Buyers): When you buy options (calls or puts), your maximum risk is capped at the premium paid. This is a crucial difference from margin trading or futures, where losses can exceed your initial investment. For instance, going long BTC futures could lead to large losses if price drops significantly, potentially even liquidation. But buying a BTC call option will never lose more than the upfront cost, no matter how badly the market moves against you. This limited downside, unlimited upside profile appeals to many traders – you can seek upside exposure to bitcoin, but know exactly how much you’d lose in a worst-case scenario. In a notoriously volatile market like crypto, such clarity on risk is valuable.

-

買家有限損失:買期權(無論call定put),你最大損失只係已付保費。呢個同孖展炒現貨或期貨分別好大—現貨或期貨跌深會輸過本,甚至要爆倉。但買call,最多只蝕得落最初嗰份錢,唔理市況幾黑都一樣。有限蝕、無限賺,呢個吸引咗好多交易員,因為想賭就賭得心安,最差情況都好清楚自己輸幾多。加密幣市場成日大起大落,呢個特質更加值錢。

-

Flexibility and Strategic Diversity: Options enable complex strategies that can profit from any market condition – up, down, or even sideways. You are not limited to simply betting on price going up (long) or down (short). With options, you can profit from volatility itself (regardless of direction), set target price ranges, or earn yield if the market stays relatively stable. For example, if you expect Bitcoin to trade in a tight range for a month, you could use an options strategy (like selling both calls and puts – an iron condor or strangle) to collect premiums that profit if indeed the price remains range-bound. Conversely, if you expect a major move but aren’t sure of the direction (say, around an important regulatory decision or economic event), you could buy a combination of calls and puts (a straddle strategy) to gain if a

-

靈活多變,策略選擇多:期權可以組合出好多複雜策略,唔理市升市跌,甚至冇方向都可以賺錢。你唔使只係賭升(long)或者賭跌(short)。期權可以賺波動本身(唔理方向),或者設定目標價範圍,抑或當市場好穩陣時用賣call/put策略收租。例如你估比特幣一個月內都係窄幅上落,可以用類似鐵兀鷹或者strangle咁既組合(即賣call又賣put),如果市真係冇乜郁動,就可以收盡保費。反過來,如果你覺得有大市動但唔知升定跌(例如有重大政策/經濟事件),買一組call同put(straddle)都可以賺錢。big swing occurs either way. This flexibility to design custom payoff profiles is a huge benefit of options. Traders can fine-tune how they want to express a market view, far beyond just “buy or sell”.

大市大幅波動時都可受益。這種可以自訂回報模式的靈活性是期權的巨大優勢之一。交易者可以根據自己想法,細緻調校對市場的立場,不再只局限於「買」或「賣」那麼單一。

-

Income Generation (Yield): As hinted in the Binance news, writing options can generate extra income on your holdings. If you own bitcoin (or another crypto), you can sell call options against your position (a covered call strategy, which we explain later) to earn premiums. Many crypto holders use this as a way to earn yield – essentially “renting out” their coins for income. As long as BTC stays below the strike price, the options expire worthless and you keep the premium, boosting your overall returns. This is similar to how stock investors sell covered calls on shares to earn yield in flat markets. With interest rates on fiat relatively low and many DeFi yields declining, option premiums can be an attractive source of return on crypto assets. (Note: While income strategies like covered calls are popular, they do cap your upside if the asset rallies strongly, so there’s a trade-off of limiting potential future gains in exchange for immediate income.)

-

產生收益(回報率):正如Binance新聞所提,寫期權(沽出期權合約)可以為你手上持有的資產帶來額外收入。如果你持有比特幣(或其他加密貨幣),你可以賣出認購期權(即covered call策略,我們稍後會解釋),透過收取期權金來賺取額外利潤。好多加密貨幣持有人都用這個方法去掙取收益——本質上類似「出租」你的幣嚟搵收入。如果BTC價格一直低於協定價,到期時期權就會成為廢紙,而你就可以袋取期權金,提升整體回報。這個手法同股票投資者在橫行市況時賣出covered call一樣,透過賣option搵yield。現時法定貨幣利率相對低,DeFi項目回報又下滑,期權金成為加密資產一個有吸引力的回報來源。(注意:雖然covered call等策略很受歡迎,但如果資產升幅勁,這種方法會鎖死你啲潛在升幅,換來即時收入,要取捨未來升幅同眼前現金。)

-

Access for Institutional Players: The advent of regulated bitcoin options (e.g. CME options) has provided institutions a way to get exposure or hedge exposure to crypto in a familiar format, often without holding the underlying asset directly. Some large funds or traditional financial institutions that have mandates against holding actual crypto can use options and futures to participate indirectly. The growth in options open interest to record highs (nearly $50+ billion by mid-2025 across exchanges) suggests rising institutional involvement. Options allow these players to structure positions that align with risk management rules – for instance, an institution can buy protective puts on their bitcoin investments to limit downside risk to a known amount, which might be required by their risk committees.

-

機構參與門檻降低:有規管的比特幣期權(如CME的比特幣期權)面世,讓機構資金可以用熟悉的格式去接觸、或對沖加密貨幣風險,通常毋須直接持有相關資產。部分大型基金或傳統金融機構按規定唔可以直接持有加密貨幣,他們就用期權、期貨這類衍生工具間接參與。期權未平倉合約總額創新高(到2025年中全行業總規模接近500億美元),反映愈來愈多機構進場。期權可令他們根據風險管理原則組合倉位——例如機構可買入protective put(認沽期權)對沖比特幣投資,將最大下行風險控制於可知範圍,這通常都是他們風險管理委員會要求的。

-

Price Discovery and Market Sentiment: Options markets can also be insightful for gauging sentiment. The relative demand for calls vs. puts (often measured by metrics like the put/call ratio or the “skew” in implied volatility) gives clues about whether investors as a whole are leaning bullish or bearish. For example, if far more traders are buying puts (downside protection) than calls, it might signal caution or bearish sentiment. Conversely, heavy call buying might indicate bullish speculation is rampant. Additionally, large open interest at certain strike prices can act as magnets or resistance levels for the spot price as expiry approaches (a phenomenon traders watch known as “max pain” theory). In summary, options trading is not only a way to trade, but also provides data that reflect what the market expects about future volatility and price movements.

-

價格發現及市場情緒:期權市場對觀察市場情緒有啟示作用。認購/認沽期權需求比例(如Put/Call ratio、引伸波幅skew曲線)可以反映整體投資者的樂觀或悲觀傾向。舉例,若市場多數人揀買put(即保護跌市),而少買call,可能表示市場審慎或看淡;反過來,如果大家瘋狂買call,代表大家預期有機會大升。另外,在某些協定價有大量未平倉期權,臨到結算會產生「磁石」效應,變為現貨價格的阻力位或吸引位(交易員叫這現象做「max pain理論」)。總結,期權唔止是交易工具,更會產生數據,反映市場對未來波幅、價格走勢的預期。

In essence, bitcoin options add a toolbox for crypto market participants: hedgers use them to protect against adverse moves; speculators use them to bet on moves with defined risk; and yield seekers use them to generate income. All of this contributes to a more mature market ecosystem. As crypto adoption accelerates, demand for such sophisticated tools is likely to continue growing – a trend Binance’s latest offering clearly aims to capitalize on.

總括而言,比特幣期權為加密貨幣市場玩家增添了一個工具箱:做對沖的可以用來保護自己免受市場劇變;做投機的可以用有限風險博大波幅;又或者本身只想穩定搵收入的,也可以用來創造收益。這些都令市場生態更成熟。隨着加密貨幣受眾愈來愈多,對這類複雜工具的需求只會不斷增長——這亦是Binance新推期權產品背後的商機。

How to Trade Bitcoin Options (Step-by-Step)

Trading bitcoin options might sound complex, but getting started can be straightforward if you follow a step-by-step process. Here’s a guide for beginners on how to begin trading BTC options, from choosing a platform to executing your first trade:

交易比特幣期權聽起上來好複雜,但如果你跟住步驟做,其實都可以好容易入門。下面這份新手教學,會由揀選平台到落第一張單,每步詳盡解釋如何開始BTC期權交易:

-

Pick a Reputable Options Trading Platform: The first step is to find an exchange or brokerage that offers bitcoin options. Not all crypto platforms have options trading, so you’ll need to seek out those that do. Major crypto exchanges known for BTC options include Deribit (a popular platform specializing in crypto options), Binance (for non-U.S. users), OKX, Bybit, and others. In the U.S., regulated options on bitcoin are available via the CME (through futures brokers) or on Bitcoin ETFs (like options on the BITO ETF), since direct crypto platforms are limited for U.S. residents. When choosing a platform, consider factors like security record, liquidity (trading volume and open interest in options), user interface, fees, and whether you can meet any eligibility requirements. For example, some exchanges might require you to pass a quiz or demonstrate understanding of derivatives before enabling options trading (Binance now does this for writing options) to ensure you know the risks.

-

挑選可靠的期權交易平台:第一步先要搵到有提供比特幣期權的交易所或券商。唔係每個加密平台都有期權交易,所以要特別揀專門有做這方面的。主流例子有Deribit(專做加密期權)、Binance(非美國用戶)、OKX、Bybit等。如果你係美國,可以經CME(期貨經紀)做有規管的比特幣期權,或者交易比特幣ETF的期權(如BITO ETF),因為美國用戶直接用加密交易所會有限制。揀平台時要考慮安全紀錄、流動性(交易量同open interest)、用戶界面、收費、同你是否符合開戶要求等。有啲平台會要求你通過小測試或者要證明識得衍生產品風險先畀你開通期權(Binance最近賣option就要),以減低風險。

-

Sign Up and Verify Your Account: Once you’ve chosen a platform, create an account. This usually involves providing an email and password, and then completing any required KYC (Know Your Customer) verification if applicable. Many regulated exchanges will require identity verification (ID upload, proof of address) before you can trade derivatives, in compliance with anti-money laundering rules. Make sure to secure your account with strong 2FA (two-factor authentication) since you’ll be trading valuable assets.

-

開戶及認證:揀好平台後開戶口。通常要電郵、密碼,跟住做KYC認證(如平台有要求的話)。好多有規管交易所做衍生產品時,一定要核實身份(上載身份證、住址證明),符合反洗錢規定。記住設定好強密碼及雙重認證(2FA),因為涉及大額資產。

-

Fund Your Trading Account: After your account is set up, you need to deposit funds. Depending on the platform, you may deposit cryptocurrency (like USDT, USDC, BTC, etc.) or fiat currency (USD, EUR) to act as collateral for trading. Many crypto exchanges operate in crypto terms – for example, Deribit uses USD-denominated contracts but requires Bitcoin or Ethereum as collateral; Binance might allow USDT as collateral for options. Ensure you understand what currency your account needs. If you’re using a platform like CME via a broker, you’d deposit cash to your brokerage which then allows you to trade BTC options. On retail crypto platforms, often stablecoins like USDT are convenient to fund your account for options trading (as they’re used for settlement).

-

充值資金到戶口:開好戶之後,要注入資金。視乎平台,可能用加密貨幣(例如USDT、USDC、BTC等等)或者法幣(USD,歐元),作為交易抵押。好多加密平台都係以加密資產計算——例如Deribit是USD計價合約但要用BTC或ETH抵押;Binance可能支援USDT做collateral。你務必搞清楚那個平台要咩做抵押。如果你經CME broker,要先注入法定貨幣現金到券商賬戶,再開展BTC期權交易。多數零售平台都係用USDT這種穩定幣最方便(也是用來做交收貨幣)。

-

Navigate to the Options Trading Section: Inside the exchange’s interface, find the derivatives or options section. This might be under a separate tab or menu (sometimes labeled “Options” or under “Derivatives”). On Binance, for example, you’d navigate to the Options trading screen. On Deribit, you’d go to the Options order book for BTC. Familiarize yourself with the layout: you should see a list of available option contracts organized by expiry date and strike price. There’s usually an order book or pricing interface showing premiums for various strikes, often separated into Calls and Puts. Take a moment to understand how to read the option quotes – typically you’ll see the premium (price) and possibly implied volatility for each option.

-

進入期權交易版面:登入交易所介面之後,要搵到衍生品或期權專區。一般會有獨立功能表(有時寫「Options」或「Derivatives」)。以Binance為例,選擇Options專屬界面就得;Deribit則直接有BTC期權的order book。睇清楚版面:會有依到期日同協定價organize的option清單,通常有order book/報價畫面,分開Call(認購)及Put(認沽)。花點時間了解怎樣睇option報價——一般有期權金(Premium),有時會見到引伸波幅(implied volatility)。

-

Choose Your Option Contract: Decide on the specific option you want to trade, based on your strategy or market outlook. You’ll need to pick the expiration date, the strike price, and whether it’s a call or put. For example, you might choose a call option expiring in one month with a strike price of $35,000. Or a put option expiring this Friday with a strike of $28,000. Most trading interfaces have filters to narrow down by date and strike. A key consideration is your market view: if you’re bullish, you might buy calls (or sell puts); if bearish or seeking protection, you might buy puts; if aiming for income, you might sell calls against holdings, etc. Ensure you also consider the strike relative to current price – in the money, at the money, or out of the money – depending on how aggressive or conservative you want to be.

-

選擇目標期權合約:根據你的策略/市況預測,決定想做的option,要揀定到期日、協定價同係call定put。例如揀一張下月到期、協定價$35,000的call,或者選本周五到期、協定價$28,000的put。大部分平台都可用到期日、協定價篩選合約。要认真考慮你的立場:看好想博升可以買call(或者賣put);想保險或預期跌,可以買put;想搵yield則可以賣call對沖持倉等。亦要衡量協定價同現價距離——係價內、價外、定價平,按個人取態調整進取程度及風險暴露。

-

Examine the Premium and Greeks: Before executing, check how much premium you’ll pay or receive for that option. The platform will show a premium quote (often in BTC or in USD terms). This is the price per unit of the underlying (many exchanges use 1 BTC as the contract unit for simplicity). For instance, a quote might show a premium of 0.010 BTC for a certain option, meaning it costs 0.01 BTC (about 1% of BTC price) to buy one contract. Also be aware of contract size – some platforms use 1 BTC as one option contract, others might use e.g. 0.1 BTC per contract. Additionally, advanced traders will examine the “Greeks” (Delta, Theta, etc.) provided, which measure the option’s sensitivity to various factors. Delta tells you roughly how much the option’s price moves for a $1 move in BTC; Theta tells you how much value the option loses per day from time decay, etc. Beginners need not master these immediately, but it’s useful to note that a near ATM call might have a delta around 0.5 (behaving like half a BTC position) whereas a far OTM call might have a small delta (low probability of paying off).

-

篩查期權金及希臘值(Greeks):落單前要睇清楚這張option要畀幾多premium或可以收幾多premium。平台會顯示每張合約期權金(以BTC或USD計)。這是以每單位標的資產計的價錢——好多交易所以1 BTC為每份合約,有些平台或用0.1 BTC計。自己要清楚contract size。有經驗者會順便檢查格雷克值(Delta、Theta等),這些是分析option對標的價格/時間/波幅改變的敏感度指標。例如Delta roughly反映BTC每移動1蚊option價升跌幅度;Theta反映因時間值減少每天option價損失幾多。新手唔使立即完全明白這些,但要知道譬如接近現價(ATM)的call,Delta大約0.5,即等同持有半個BTC,而價外好遠的call Delta會很細(即中獎機會低)。

-

Place Your Trade (Buy or Sell the Option): Now you’re ready to execute. If you’re buying an option (long call or long put), you will pay the premium (make sure you have enough balance). If you’re selling (writing) an option, you will receive the premium, but you must have sufficient collateral/margin to cover the position. Enter the order details: number of contracts, and the price. You can often choose a limit order (setting the premium you’re willing to pay/receive) or execute at the market price for immediate fill. Double-check everything – for a buy, confirm you’re buying the correct call or put, strike, expiry, and that the premium is acceptable. For a sell, ensure you understand the margin impact and have the asset to cover if it’s a covered call (or enough margin if it’s uncovered/naked). Submit the order and wait for it to fill. Once executed, you’ll see the open position in your account.

-

落單買入/賣出期權:確認好細節就可以落單。買option(long call/long put)要支付期權金,要有足夠資金;賣option(寫option)收期權金,必須有足夠抵押或保證金cover倉位。要填妥合約數量同出價。一般可自行設定限價(limit)或即市價(market price)入單。落單前要再核查一次——for買單,要確認買緊正確option、call/put、協定價、到期日、期權金;for賣單,要知道對保證金的影響,以及如果係covered call要有相關資產(或者naked要margin夠)。確定冇問題就submit order,等成交。做完會見到open position出左係賬戶度。

-

Monitor Your Position: After the trade, keep an eye on how your option is performing. Option prices will change as Bitcoin’s price moves, and as time to expiry counts down. Your exchange interface should show real-time unrealized P&L (profit or loss) for your option positions. Be aware of key moments like

-

監察你的持倉:完成交易後要持續留意option表現。隨着比特幣價格變動及臨近到期日,option價錢會有波動。交易平台一般會實時更新未平倉option的浮動盈虧(unrealized P&L)。亦要特別留意某些關鍵時刻,如臨近到期(期權於最後一星期或數天會快速失去時間值)及任何可能帶來大波動的重大事件(股票世界是業績,對比特幣可能是宏觀經濟事件或ETF審批)都需要特別留意。監察亦包括睇住你賣出期權時嘅保證金——如果市場走勢對你嘅淡倉不利,你可能要加按金去維持倉位。

-

平倉或執行期權:到期前或到期時,你要決定如何結束交易。如果你買入期權並且賺緊,你有以下幾個選擇:

-

將期權賣返市場鎖定利潤(最常見做法)。

-

揸到到期(如果係價內期權)然後選擇執行,以買入/交收BTC,或選擇現金結算。好多散戶會選擇到期前賣出,現實化利潤,咁就唔使理執行程序。

-

如果期權係價外且大機會到期變無值,你都可以選擇坐等到期(咁你最大損失就係已付嘅期權金)。 如果你一開始賣出(寫)呢個期權,你可以:

-

買返期權平倉(例如你0.01 BTC賣出,依家市價0.005 BTC,你可以更低價買返入嚟,賺取差額)。

-

揸到到期:

- 如果到期係價外,期權變無值,你保留全部期權金——賣方最佳結果。

- 如果到期係價內,你會被行使。即係如果你賣咗call,要以行使價交BTC(或等值現金)俾買方;如果賣咗put,就要以行使價向買方買入BTC。好多平台會自動用你嘅按金/餘額結算,記得預先準備好呢個情況。

好多啱啱學玩期權嘅人,會由「紙上交易」(如testnet或模擬賬戶)或者極細注碼開始熟習操作。強烈建議咁做,因為期權考慮因素多過現貨,而介面初時睇落都會複雜啲。

流行比特幣期權交易策略

<!-- Markdown link/image skipped per instruction -->掌握咗基本知識之後,我哋可以探索下一啲受歡迎嘅比特幣期權策略。唔同策略有唔同目標——有啲想喺特定市況下追求最高利潤,有啲係用嚟保障資產或者產生收入。下面介紹幾種比特幣市場廣泛使用而且實用嘅策略,同埋佢哋運作原理:

1. 持幣沽Call(Bitcoin Covered Call寫權策略)

目標:喺市況中性或略為看漲情況下,為你持有嘅BTC產生額外收入(期權金)。

策略簡介:所謂持幣沽Call,即你原本已經持有比特幣,同時賣出(寫)相等數量嘅call期權。因為你持有BTC,所以呢個call係「有貨cover」——即係人哋行使時你可以交貨。呢個策略可以賺call期權金,不過換嚟嘅係,如果BTC升穿某個價(執行價),你同意用嗰個價賣出去。

運作方式:假設你有1 BTC,依家市價$30,000。你估一個月內BTC唔會升得太多─可能$35,000樓下。你賣一張一個月到期、行使價$35,000嘅call期權,收$500期權金。最後結果有:

- 到期時BTC如果仍喺$30,000或者升唔穿$35,000,call期權到期變無值(因市場≤行使價)。買方唔會行使,你繼續持有1 BTC,同時保留$500期權金(扣除手續費),即係每月賺咗$500收益,提升資產回報。

- 如果BTC升穿$35,000(例如去到$38,000),call變咗價內期權,買方大機會行使。你要以$35,000賣出1 BTC(比市價平)。你同樣保留$500期權金,但你miss咗行使價以上嘅升幅。即你實際回報係$35,500(行使價加期權金),比市價$38,000低──即係少咗$2,500潛在升幅。風險就在呢度,你嘅利潤被鎖死喺行使價加期權金。

持幣沽Call一般視為守穩型策略。你唯一風險係BTC升穿行使價時賺少咗,但你本身持有BTC,除非跌價先有損失(但期權金可以微微抵消跌幅)。橫行或慢升市最適合,咁你又有收入,又唔怕要高價賣貨。如果預期會爆升,就唔宜用。唔少長線投資者,會定期喺部分持倉做呢個策略穩收期權金,特別適用於區間市。依家有啲平台(好似DeFi保險庫或ETF)都自動化咗呢個策略,2024年初甚至出現Bitcoin Covered Call ETF申請,可見人流行。

風險:最大風險係「機會成本」——如果BTC升多過行使價,你只能賣於低價,走失潛在利潤。相反BTC大跌,收咗期權金都只係微量抵消損失,冇全面下方保障。

2. 保護性買Put(Buy Protective Put:購買下跌保險)

目標:為你嘅BTC持倉提供大跌風險保障(即買保險),又保留向上潛力。

策略簡介:保護性put即你持有BTC,同時買入put期權(行使價貼近或略低現價),咁你無論如何都可以用個strike價賣出BTC,即大跌都頂到底。等於買咗份避險保單。

運作方式:假設BTC $30,000,你擔心短期內會跌(可能有監管變動或技術走勢唔靚),但唔想賣貨。你買一張一個月、行使價$28,000嘅put,付$500期權金。到期時情況有:

- 如果BTC暴跌到$20,000,你手上put變得極值錢。你可以選擇行使,$28,000賣BTC(遠高於市價),或者直接賣出put合約(約$8,000內在值)。咁你原本應該蝕$10,000($30K跌到$20K),但put保護咗你,大約只蝕$2,000($30K到$28K)加$500期權費。即跌浪由put對沖咗。

- 如果BTC升價或維持原價(如收$32,000或$30,000),put到期變無值,你唔會用佢,也無需要自低價賣貨。損失就係$500期權金,但BTC仲升咗值。咁你上升都賺到,代價只係買咗吓保險。

本質上,買put就係為BTC鎖定最差賣出價,買個安心。好多投資者會喺預期市況波動時(好似有大消息前)買put保護,股市好常見(買指數put避險股票組合),而加密貨幣機構資金都越嚟越鍾意咁做。

成本考慮:「保險」唔平——大波動時,put期權金特別貴。用家要判斷代價值唔值,有時會買略價外put(低過現價少少)壓低期權金成本,但一樣有「極端跌市」保障。低成本方案仲有下一種collar策略。

3. 頸圈(Collar)策略:低成本下行保護+上行換取代價

目標:用低成本甚至零成本避開下行(大跌)風險,條件係放棄部分大升潛力(過某水平以外)。

策略簡介:Collar即係同時買put及賣call——你買put避跌,同時賣call收期權金去補貼put成本。結果等於目前價格上下都搵到個「波幅帶/頸圈」:跌穿某價(put strike)有保護,升穿某價(call strike)利潤受限。

運作方式:照用上面例子BTC $30,000——你想保險唔跌穿$28,000,但又唔想畀咁多put premium。你可以賣一張高價call抵銷。即係買$28,000 put(付$500),同時賣$35,000 call(收$500),同一到期日。保費大致抵銷,做成零成本collar(或微成本)。結果如下:

- BTC跌到$20,000,put啓動,保障你$28,000兜底(call毫無價值,期權金都入袋)。咁你用超低成本就幾乎完全避開跌浪,非常吸引。

- 如果BTC到到期都介乎$28K-$35K,兩張期權都無值。你繼續持有BTC(而且價值

might be roughly same value) and likely paid very little for the collar. No harm, no foul – aside from opportunity cost if BTC did go up a bit and you had no upside cap because it didn’t breach $35K anyway. - 如果BTC升穿$35K,例如去到$40K,你賣出的call變成實際有價(ITM)。你會被迫用$35,000賣出BTC(或結算差價),雖然市場價已經去到$40K,所以你會錯過$35K以上的額外升幅。其實你係鎖死咗個最高賣價喺$35K。不過記住你有個下方put,所以collar的作用係:你為咗保障$28K以下跌幅,而放棄咗$35K以上升幅。你為自己回報設定咗一個合理範圍:最少唔低過$28K(地板),最多唔高過$35K(天花),至少喺嗰段期限內。因為call同put嘅權利金互相抵銷,所以基本上,呢個組合成本近乎“免費”。

collar係一個保守偏牛既策略——你夠樂觀所以揸住資產(預計有啲升幅),但同時又想防範大跌,同埋願意為咗保障而犧牲極端升幅。有啲投資者想「夜晚瞓得着」就會用collar,因為已經計好最壞情況同最好結果。Jack Ablin,一間資產管理$650億嘅CIO,最近就推介collar策略,可以「小心翼翼咁入場BTC,又唔怕損手爛腳」——即係你可以有BTC升幅,但大幅度限制潛在虧損。

當波幅高時(保護put好貴),但市況又有啲樂觀(有人願意讓出部份升幅),collar特別受歡迎。你可以自定strike價——收窄範圍(貼近strike)甚至可能有淨收入,放寬則要俾小小錢。玩味在於點樣平衡保險成本同利潤讓渡。

4. 長跨(Long Straddle:博大波幅)

目標:預期有大波幅(即價格會大上大落,不肯定方向),希望兩邊郁大都可以賺錢。

策略大意:長跨係同價同到期日,買入一個call同一個put。因為兩邊齊買,一旦市場大升或大跌,其中一邊會大賺,理想狀態能覆蓋曬兩個權利金開支之餘仲有多。此策略唔理市升跌,只打波幅,所以係方向中立,但希望有大郁動。

運作方法:假設BTC現價$30,000,即將有重大事件(例如美國證券監管ETF批核、或宏觀經濟消息),你預計一有消息市會大動,但唔知向上定向下。你買一個一個月期$30K的call同一個$30K的put。假設每隻權利金$1,000,即一共俾$2,000。咁:

- 如果BTC勁升至$40,000(+33%),call好深度價內(ITM),有大約$10,000的內在值(可以$30K買入,市價$40K)。put就作廢,都唔緊要——因為你call賺到遠多過權利金。可以平出去賺大錢,所以市升得勁就賺錢。

- 如果BTC反而跌到$20,000(–33%),put好值錢(有約$10,000內在值,因為你$30K賣出,市價$20K)。call會變廢,但put賺嘅都遠多於已付出權利金,淨賺。

- 如果BTC幾乎無郁,例如收市$31K或$29K(小幅上落),call同put會齊齊貶值——call稍為價內或外,put都係類似。兩張option可能到時都接近冇價值。咁你基本上輸淨$2,000權利金。即係風險所在——如果波幅冇預期咁大,straddle會兩邊都輸錢。

straddle特別啱臨近已知二元事件前使用、或者當隱含波幅被低估時。加密貨幣市場好多時係消息市(例如ETF批核、減半、監管突襲),所以交易員會開straddle捕捉預期嘅波動。不過記住成本問題:一定要郁得「夠大」先回本。例如上述例子,價錢期滿時只要超出$28K ~ $32K(大約),開始有機會賺錢,夾喺中間則輸晒權利金。

有變奏叫strangle,即買入價外嘅call同put(唔同strike,例如$32K call同$28K put)。因為OTM option平啲但你要市價郁得更大先有得賺(始終一開始已經OTM)。交易員會根據自己估計move大小同心理預算揀邊種結構。

5. 牛市認購價差(Bull Call Spread:中度做多價差)

目標:用有限風險且上升潛力有限嘅方式,賺BTC有機會溫和上升,成本會比直接買call平。

策略大意:bull call spread即係買一張低行使價call,同時賣一張高行使價call(同到期日)。兩張都係call,淨係做多,但賣高價call封頂返個最大利潤,但咁做可以回籠少少權利金,減低入場成本。係垂直價差玩法,常見係想表達牛市觀點,但預算有限。

運作方法:假設BTC$30,000,你估佢有機會一個月內升到$35K附近,但難話去到$40K。直接開$30K call成本高,所以開bull call spread。你買一個月$30,000 call要$1,200,同時賣$35,000 call收$400(例子價)。實際淨成本$800。到期情境:

- 如果BTC正如預期咁升到你目標範圍,例如$36K,你個$30K call有$6,000實際價值($30K買入$36K賣出),$35K call變$1,000(對家$35K買你手BTC,市價$36K)。總payoff = $5,000(6K–1K);減返$800成本,你實賺$4,200。

- 最大利潤係BTC收市高過或等於$35K時。你$30K call完全價內,$35K call都價內兼被對家執行。你等於$30K買、$35K賣,賺$5,000/coin。所以$5,000係兩條strike之間最大spread,賺咗$5K再減$800成本,即最高$4,200利潤。價錢再高都只係賺到咁多,因為長call賺嘅會被短call蝕返。

- 如果BTC未能上升,留喺$30K樓下,兩張call都變廢紙,虧咗$800權利金——即係你最大虧損,比起純買call要輸$1,200低。

- 如果BTC溫和升至$33K,$30K call值$3K,$35K call冇價值(價外)。你賺$3K–$0,減$800成本,即$2,200。

- 平衡點係($30,000+$800)=$30,800,即期滿收市價要高過$30,800先唔輸錢。

牛市認購價差係有限風險的做多方法。你用小成本換取合理機會,犧牲無限升幅賺大錢可能。適合有明確目標位或區間人士,特別係隱含波幅高、call價好貴時(賣高價call可減成本)。同樣思路,睇淡就用bear put spread:買高strike put、賣低strike put,賭跌勢同時限定最大蝕額。

6. 鐵兀鷹(Iron Condor:進階區間交易策略)

目標:當你預料BTC會維持在某個區間橫行,希望賺取權利金收益,並將風險限制於區間兩邊。

策略大意:鐵兀鷹即係組合兩組價差:賣一張價外call、一張價外put(齊齊收權利金,即short strangle),同時為兩邊買遠啲嘅call/put做保險(限制潛在損失)。即係四個Option:賣一張OTM call、買一張更高價call(封頂上方風險)、賣一張OTM put、買一張更低價put(封頂下方風險)。你會即收權利金作為淨收入,而最大損失都有限。只要BTC留喺兩條short strike區間,賺盡權利金。

運作方法:假設BTC現價$30K,你預期下個月區間係$25K至$35K,無咩大突破。你setup iron condor:

- 賣$35K call,買$40K call(即short call spread)。

- 賣$25K put,買$20K put(即short put spread)。 假設賣call收$300,賣put收$200,買call同put用$100 x 2做保險。淨收入:$300+$200–$100–$100 = $300。

幾個主要範圍:

- 賺錢區:$25K到$35K(短option係strike位)。如果BTC喺呢範圍收市,short put同short call都無價值,你袋實$300權利金,長option(保險)失效都無問題,因為本身只係用嚟限制額外風險。

- 如果BTC跌穿$25K:short put入價,但你有$20K長put保底,即過咗$20K後損失唔會再擴大。最大損失係兩條strike之間差價($25K–$20K = $5,000),減開頭收咗嘅權利金。例如簡單啲講,若你結構設計成本最大損失$500,減$300收入,最大淨蝕$200。同理上方……

- 如果BTC爆升穿$35K:short call價內,但有$40K長call幫你抽頂,即超過$40K後損失唔會再增加。所以call spread損失上限係($40K–$35K差價)

(翻譯到此。如需餘下片段,請告知!)minus the premium. Again limited.

- 最壞情況:如果到期時比特幣價格超出你買入期權的任何一邊(在這個假設下低於$20K或高於$40K),你其中一組價差倉位會完全處於價內(ITM),即全部損失。你的最大損失就是該組價差的寬度減去你一開始收到的權利金。換來你要承擔這些風險,你一開始獲得$300。

總結而言,鐵兀鷹策略如果市場保持在一個合理區間內,可以賺取穩定(但有限)的回報,而且本身內置止蝕功能,萬一市場極端波動時,可以控制災難性損失。交易員多數在低波幅、區間震盪市況時應用鐵兀鷹,有系統地收取權利金。這個策略之所以屬於進階級,係因為涉及四張期權合約,以及必須做好風險管理。而加密貨幣市場一向大波幅,如果判斷失誤,鐵兀鷹可能好危險 —— 突然爆邊兩邊都會虧蝕。不過,由於風險係定義好(本質上兩組合蓋價差),已比毫無對沖的裸賣strangle(同時賣call與put,冇防守)安全好多,後者係無限風險。

比特幣期權交易的風險與考慮因素

雖然比特幣期權為你帶來好多新機會,同時都伴隨住重大風險。玩期權必須保持謹慎同有知識。以下係幾點主要風險同要點:

-

風險比現貨高:買賣期權普遍風險同複雜度都高過單純買賣比特幣現貨。買現貨BTC就算跌價最多都係賬面縮水,你唔可能蝕過本(甚至可以揸住等反彈)。但期權,特別係寫(賣)期權或者用槓桿,萬一市場逆轉,好容易短時間內產生巨額損失。例如你賣出未備兌call(裸call),理論上BTC不停升你要無限補倉。雖然買期權最多蝕晒權利金,但如果未達到目標價,損失全部權利金都唔奇。永遠唔好用輸唔起嘅錢玩期權,特別係可以歸零。

-

期權可以歸零:同現貨BTC可以永久持有唔同,期權有到期日。如果你判斷方向正確但時間抄唔啱,過咗限期冇郁動,期權一夜之間可以變成廢紙。時間因素好重要 —— 有時你覺得「比特幣會升」,但升係你期權到期後先發生,你一樣會輸。咁代表期權較現貨加多咗「時間風險」。好多新手低估咗要cover返權利金成本,其實點變化先至可以打和。記住計算打和點(行使價 ± 權利金),同埋設想剩返多少時間俾你兌現預期。

-

價格複雜 & Greeks因素:期權定價唔止受資產本身價位影響。仲有其它因素(即「Greeks」)會影響期權價值:時間流逝(Theta)、波幅(Vega)、Delta(對資產價格變動敏感度)、Gamma(Delta的彎度)等等。例如,即使比特幣走向你預期,如果太慢、時間值流失,期權值會蝕,或者波幅下跌同樣拉低價值。呢啲複雜性令到期權盈虧唔係「現貨咁直觀」。以下幾點要有個大約概念:

- Theta(時間損耗):每日臨近到期期權會自動折讓。如果其它因素唔變,持有者自然損耗資產。買家等於同時間競賽。

- Vega(波幅):市況波幅縮細,期權價值都會跌,就算BTC冇郁都可能。大波幅時期權權利金都會貴好多。

- Delta:深價外(OTM)期權Delta細,價內(ITM)期權Delta大,等於揸住資產。貼價期權(ATM)大約0.5。

- Gamma:期權賣家最怕Gamma —— 資產移動Delta都會改變。突發大波動會將本來安全嘅短倉一下打爆。

你唔需要做數學家,但要記住,期權同資產唔係一齊郁,有時會有估唔到嘅情況,單睇現貨價格唔夠。

-

流動性同市場結構:比特幣期權市場比起過去已經大好多,但依然唔及傳統資產流通。大部分成交集中於少數平台(歷來最大係Deribit,近年CME、OKX、Binance等都開始有做)。咁即係話買賣價差會闊啲,流動性都有限,特別係遠期合約或者遠價外行使價。市場深度唔夠,開倉或平倉都可能貴。滑點(期望同成交價分別)亦係風險。另外,除咗大行使價或臨近到期日,搵對家可能要推高/推低市價。初學者建議首先用流動性較高嘅到期日(月到期、季到期)及常用價距做交易。

-

交易所及對手風險:用加密貨幣交易所即係要信平台託管你資金(除咗用分散式協議)。交易所有風險被黑、破產,或者技術故障。例如有衍生品交易所喺極端市況時「擠爆」或癱瘓,咁無得即時平倉或止蝕,可能非常危險。一定要用有信譽、安全措施齊整同有保險基金嘅平台。即使如此都唔好將所有本錢放在一個地方。

-

保證金同強平風險:如果你寫期權(賣put/call),交易所會收你按金。萬一市場反轉,按金要求會隨時上調。如果比特幣市值大上大落,你賣咗期權隨時會被追加按金,冇得補交隨時會被自動強平,以極不利價位全部平晒,大蝕。一定要熟悉該平台按金制度。部分平台用Portfolio Margin,會考慮對沖,但有啲比較簡陋。切忌壓晒,全靠按金頂,應盡量留多啲備用資金,盡快止蝕或調整倉位。裸賣期權(冇hedge賣call/put)尤其高危 —— 好似執硬幣蠱過馬路咁,唔小心就大劑。

-

法規及稅務考量:按你所屬地區,玩衍生品如期權可能有限制或需經驗/資格審查。加密衍生品監管環境持續變化。例如Binance等有地區性受限,尤其是美國居民多數唔可以玩海外期權平台,必須用CME或受規管的平台。請確保遵守當地法例。另外期權有機會涉及複雜稅務(例如深某啲地方期權稅種或到期算係徵稅點)。記錄所有交易資料方便報稅。

-

教育與策略風險:最後,無知本身就係最大風險。期權通常被形容為非線性工具,對新手嚟講行為好難預計。正式下大注前,一定要多啲學習。網上有好多期權教材(書、文、甚至測試網)。多做模擬、想定各種情境。開始可考慮簡單策略(買call、買put、做covered call),千祈唔好一開波玩複雜組合盤或者裸賣。正所謂學行先學走。好消息係資源越來越多,例如Binance要求寫期權要先過理解測驗,確保用家明白風險。

總結,比特幣期權功能好強大,風險都要小心尊重。按你投資組合合理分配額度(期權波幅大,輸贏同樣大)。善用止蝕/止盈、監控Greeks,慎用複合策略(多倉位,大多數以spreads限損),避免裸持大風險。隨著你經驗增多,先逐步複雜化盤路或加大注碼。期權對有知識嘅交易員絕對有高回報潛力,但疏忽大意可以好慘。

總結

比特幣期權由小眾變成加密貨幣市場一個重要一環——為交易員同投資者帶來新工具,無論係投機、避險定係賺收益。Binance等大型平台開放寫期權功能俾所有用戶,正好證明市場成熟:以往只屬於華爾街/老手的工具,如今普通用戶都用得。而期權成交量過去幾年暴升幾十倍,可見佢將會長期留在加密市場生態圈。

本指南覆蓋咗比特幣期權的基本知識及運作原理,由最入門嘅買權(call)及賣權(put)概念,到更深入期權定價及到期細節。我們討論咗使用期權的理由——避險、槓桿、收息,以及點樣落盤。我們亦深入拆解咗常見策略——包括最簡單的covered call、protective put,到複雜少少的spreads、波幅策略,每一種都係交易員戰書上嘅一環。

對一般加密行家,最重要的啟示係:期權可以大幅提升你管理和賺取加密資產的能力,亦更有彈性:Here is the translation into zh-Hant-HK, following your formatting directions:

你而家唔再局限於只係喺價格上升時先有得賺——你可以透過買入put(沽出期權)喺價格下跌嘅時候獲利,或者用straddle策略單純賭波幅,又或者用賣出期權收取權利金賺錢,當市況橫行都可以有着數。除此之外,期權其實仲可以提供一定程度嘅保障(雖然聽落好似有啲反直覺),如果你用嚟對沖,例如:買咗個先見之明嘅protective put,喺市場崩盤時可以幫你減少嚴重損失。

不過,有大嘅力量就有大嘅責任。由於期權本身複雜同含有槓桿,所以學識同小心係首要條件。如果你係期權新手,最好由細細地、簡單啲嘅操作開始。可以試下只係買一兩張期權,感受下佢哋嘅價格點樣同比特幣價錢同步波動。至於寫(賣)期權,而家Binance咁嘅平台都俾大家廣泛參與,雖然個收益好吸引,但要記住賣期權係一種義務,而且風險可以無限大。要確保你完全明白,如果市場劇烈波動嘅時候,會有咩情況發生。

好彩而家有啲大交易所例如Binance開始有風險控制措施(例如小測、保證金規則)——要善用呢啲資源,測試下自己嘅知識。其實期權世界有自己一套用語(call、put、strike、希臘字母、condor策略!),初初入門真係幾壓力。不過,好多交易者都發現一旦開竅,期權就成為航行加密貨幣市場必不可少嘅工具——無論市況平靜定動盪都有機賺錢,需要時又有保障。

隨住加密市場不斷進步,未來可能仲有更高階衍生產品,甚至監管更清晰,吸引更多人入場。依家見到嘅趨勢好明顯:零售同機構投資者都開始投入加密期權,帶動持倉創新高,甚至有新ETF專用期權策略。對於願意肯花時間學習嘅人,比特幣期權就係數碼資產交易嘅新機遇。

總結嚟講,只要用得聰明,比特幣期權可以大大提升回報同管理風險。佢帶來一層層策略,唔再只係「HODL」或者「低買高賣」咁簡單。無論你係想鎖定將來價格、幫自己資產保險、有限風險下注直覺,定係穩穩收息——總會有一種期權策略啱你。記住行得穩陣啲,尊重風險,持續提升自己知識。只要多啲實踐同謹慎,比特幣期權可以成為你加密資產交易路上強大嘅盟友,幫你更靈活同有信心咁駕馭市場。