當2025年伊始,極少分析師預計一個交易所代幣能脫穎而出成為年度最矚目的表現者。然而來到最後一季,Binance Coin(BNB)已錄得驚人、年初至今約129.89%的升幅,遠遠拋離比特幣的25%和以太幣的30%。這一年受到監管轉向、機構資本流動及華盛頓對加密政策的巨大變化主導,BNB的表現成為加密圈最出人意表的成功故事之一。

這個最初只用作世界最大交易所手續費折扣的代幣,今天已經發展成一個蓬勃區塊鏈生態圈的核心。BNB現時驅動著BNB Chain網絡,每天處理數以百萬計的交易、承載成千上萬個去中心化應用,更在爭奪區塊鏈主導權時成為以太坊和Solana的強勁競爭者。到9月,每月活躍錢包高達五千八百萬,生態鏈上鎖定資產總值逼近170億美元,標誌著BNB已從交易所工具全面昇華成一個多元化區塊鏈平台。

這一切源於深刻的市場轉型。2025年3月,美國總統特朗普宣布成立比特幣戰略儲備,令美國成為「全球加密貨幣之都」,而10月對幣安創辦人趙長鵬的特赦進一步消除了長期籠罩交易所及代幣的監管陰霾。與此同時,美國證券交易委員會在新領導下對數字資產採取明顯不同的立場,5月VanEck申請推出美國首隻BNB ETF也反映機構資金對交易所代幣的興趣日增。

不過,BNB的瘋狂升勢同時引來根本性的提問:這表現是長遠向以實用性導向代幣轉型的證據,還是純粹反映幣安依然主導市場?一個與中心化實體緊密綁定的交易所代幣,能否於去中心化仍是加密圈信條的環境下持續發展?BNB的成功又折射出,在逐步成熟的加密資產市場中,機構資本正流向何方?

下文將深度分析BNB於2025年異常表現背後的結構性、市場及監管因素。我們會解構BNB從交易所代幣蛻變成區塊鏈底層基建的生態發展,探討監管由逆風吹向順風的關鍵,並評估這波升勢究竟會否成為未來週期的範本,抑或只是難以複製的特例。

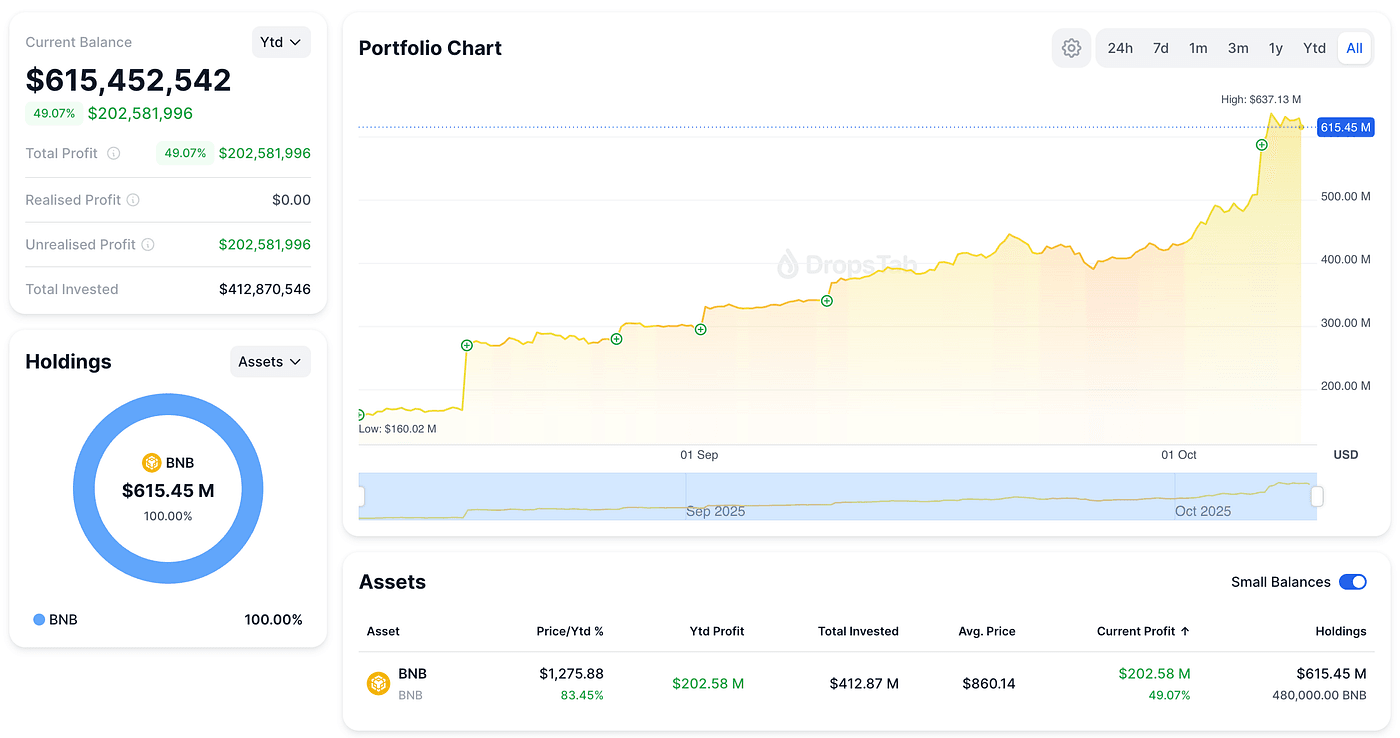

BNB之年:數字說話

要理解BNB於2025年的軌跡,必須將其表現數據置於歷史背景和同行比較下。數字道出一段由關鍵催化事件點綴的持續動力故事。

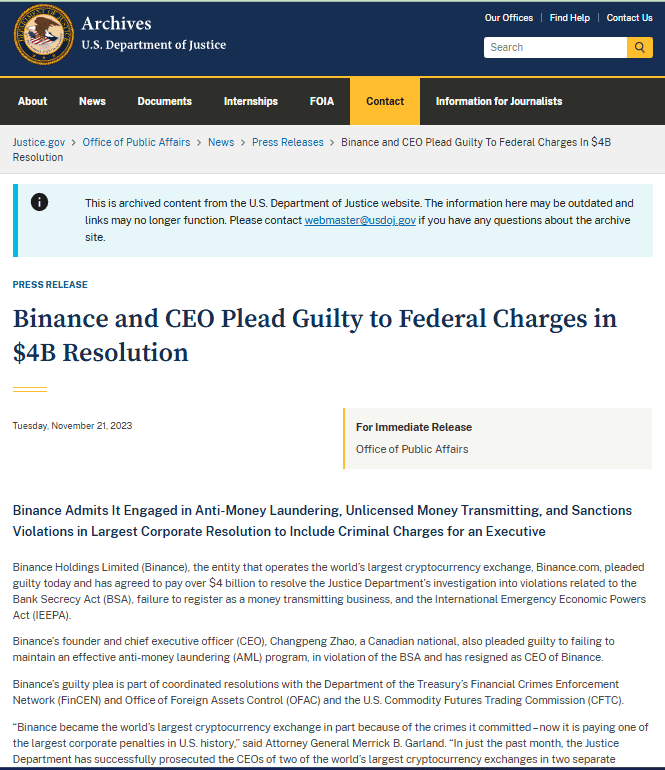

BNB踏入2025年時於600至700美元區間交投,當時它已渡過2023年的監管風暴 —— Binance當年與美國當局和解,支付43億美元罰款,創辦人認罪違反銀行保密法。至10月底,代幣價格已衝破1,200美元,更一度觸及歷史新高1,370美元。這不只代表從過去困難中復元,更是BNB在整個加密生態中的徹底重估價值。

對比表現數據突顯出BNB今年「離譜」的跑勢。比特幣雖然作為市場指標年度上升約25%,但受聯儲局貨幣政策不明朗及地緣局勢牽制。以太坊即使現貨ETF上市及愈來愈多企業金庫採用,全年升幅亦僅為30%,同時不斷受Layer 2協調難題及主網費用下跌所困擾。

至於主要競爭對手Solana,10月底徘徊於185至195美元,雖有韌性,卻未見BNB的爆發力;Toncoin及其他Layer 1新貴則更顯平淡。即使其他交易所代幣表現也遠遜BNB,說明推動這次升勢主要是Binance自身因素,而非整個板塊趨勢。

鏈上數據同樣令人印象深刻。10月中旬,BNB Chain每日處理約2,670萬宗交易、活躍地址達348萬,位居用途最廣泛區塊鏈之列。交易量數據顯示,BNB Chain於9月24小時去中心化交易量達1,780億美元,超越Solana的1,430億,反映經濟活動實質增長,而非僅限於炒作。

市值方面更增添另一層意義。BNB於10月底一度超越XRP,奪回僅次非穩定幣加密資產第三位,市值高達1,610億美元。儘管排名隨市況波動,這已是曾被視為交易所代幣的重大里程碑。

波幅數據亦可觀。即使大升,BNB整體波幅卻明顯較中小型山寨幣低,反映投資者基礎趨於成熟、流動性更深厚。代幣與比特幣的價格相關性亦逐漸減弱,BNB交易愈來愈依賴生態圈特有催化劑,而非僅看大市氣氛。

成交量分析顯示全年度機構參與明顯增長,未平倉合約由6億美元增至10月的12億,據CoinGlass數據顯示,說明推高價格主要來自專業投資者佈局,而非散戶炒作。

最矚目的還是supply動態。得益於Binance積極的銷毀機制,到10月底BNB流通量已減至1.3774億枚,遠低於最初發行的2億枚,即換句話說,超過6,400萬枚已經被永久銷毀。在需求激增下,這種真正的稀缺性尤為罕見。

BNB生態重建的內幕

BNB價格表現背後,反映了更深層次的故事:BNB Chain由Binance中心化網絡重塑為能與老牌Layer 1競爭的多鏈生態,這個重建工程歷經多年,但於2025年明顯提速,為代幣估值重塑提供了實用基礎。

BNB Chain生態系統聚焦於三大基礎層,各司不同但互補功能。BNB Smart Chain作為2020年推出的EVM兼容主網,負責絕大部分交易流及承載龐大的DeFi生態。opBNB是為高頻應用設計的Optimistic Rollup擴容層,為遊戲、社交及高頻交易平台帶來規模效益。BNB Greenfield則作為去中心化儲存層,提供愈來愈關鍵的Web3資料可用性與存儲基礎。

全生態鎖倉總值展現DeFi韌性的鮮明個案。年初僅約55億美元,到9月曾高見170億,10月底回穩於86至95億,據DeFiLlama數據。雖然波動看似巨幅,但實際上,9月的峰值正值...... growth of memecoin launchpads如Four.meme,曾一度推動短暫的流動性湧入,隨後才回復正常。TVL穩定在約86億至95億美元,比2024年1月的55.2億美元基線上升了約56%至73%,這顯示增長更可持續,是由核心協議的實際採用所帶動,而非單純投機炒作。

PancakeSwap作為BNB Chain的旗艦去中心化交易所,就正好體現了這種生態圈成熟的表現。到2025年第四季,PancakeSwap的TVL約為37億美元,依然是加密貨幣界最頂尖的DeFi協議之一。更勁的是,其2025年第三季的交易量達到7720億美元,比上一季增加了42%。9月份,PancakeSwap更一度超越Uniswap成為交易量第一,這個標誌性時刻說明BNB Chain在DeFi最基本指標上具有競爭力。

Aster這個跨鏈永續合約交易協議的興起,是生態系統發展中特別重要的事件之一。Aster於2025年9月推出,根據Messari數據,短短幾周內就突破兩百萬用戶以及20億美元TVL。9月28日,Aster於永續DEX交易量一度超越Solana,證明BNB Chain不單能在現貨交易領域競爭,連複雜衍生品市場都企得穩。雖然DeFiLlama其後移除部分Aster數據,原因是與Binance交易量有可疑關聯,但協議快速積累用戶證明了BNB原生永續合約有真正市場需求。

Lista DAO則成為另一個生態支柱協議,提供流動質押衍生品,提高整體資本效率。其TVL突破28.5億美元,USD1穩定幣流通量超過八千萬,展示BNB Chain發展出自己DeFi原生元素,而不是一味照搬以太坊生態。協議獲得Binance Launchpool資產認可,創造出新型飛輪效應,讓用家在BNB Chain質押享有其他平台無法提供的機會。

技術基建提升正正成為整個生態發展的根基。Scalable DB升級於10月落實,徹底重構BNB Smart Chain的數據架構,帶來同步更快、驗證者延遲更低以及大型應用有更佳效能。Gas費跌至0.05 Gwei,較2024年4月下跌98%;區塊時間平均為0.75秒,最終確認僅需1.875秒。這類革新不只是小修小補,而是徹底擴大容量,令BNB Chain有能力在全力運作時處理每日1億宗交易。

更具戰略意義的是BNB Chain積極轉向現實資產代幣化及機構級DeFi。與Ondo Finance、Kraken、Franklin Templeton的Benji平台及Circle的USYC建立夥伴合作,將美股、國債及機構級穩定幣引進BNB Chain。BNB Chain業務發展主管Sarah S.在10月訪問中表示,網絡正為未來作定位:「下一波TVL增長將由現實資產及機構DeFi帶動,特別是鏈上孳息產品吸引力上升」。

開發者活動數據亦印證這一發展方向。BNB Chain上已部署超過4,000個活躍dApp,涉足DeFi、NFT、遊戲和社交應用,開發者生態多元化格局已初步形成。生態獎勵計劃、黑客松賽事,以及與YZi Labs等基建夥伴的合作,吸引更多開發者參與;而趙長鵬(CZ)在多個項目的戰略顧問角色,亦為生態注入資本及信心。

迷因幣熱潮統治了2025年不少注意力,值得細緻分析。Four.meme作為BNB Chain對應Solana Pump.fun的回應,單在10月8日便錄得47,800個獨立代幣合約創建。雖然不少批評聲音指出這部份只是投機泡沫,但其帶來的文化動力和新用戶,其實相當有價值。到2025年底,BNB Chain已佔全球迷因幣交易量的11.4%,僅次於以太坊的12%。更重要的是,許多原為迷因幣而來的人,後來轉投DeFi,令「一時吸引」變成「黏性流動性」。

機構與監管變局

雖然生態發展打好根基,但監管和機構層面的變化才真正催化BNB於2025年重估。從監管棄兒轉變為政治連結的合規平台,成為近年加密圈最戲劇性的敘事逆轉之一。

2023年11月,Binance因違反銀行保密法認罪,支付43億美元罰款,創辦人更需服刑,一度帶來陰影。但諷刺地,這次(雖然痛苦的)法律解決反而帶來明確性,最終對BNB有利。有了最壞情況「既已發生而非仍未明朗」,投資者終於可對已知風險定價。

特朗普總統於10月23日特赦趙長鵬(CZ)進一步加速這個重估敘事。白宮辯稱趙是「拜登政府反加密貨幣戰爭的受害者」,並指「沒有詐騙或明確受害人」的指控。當然包括參議員Elizabeth Warren在內的批評者則指,鑑於Binance以MGX資助特朗普的World Liberty Financial穩定幣20億美元投資,這舉動有利益衝突。然而,市場反應正面,BNB在消息公布後即時上升約3%。

特赦的意義超越CZ個人,更釋出明確訊號,特朗普政府將Binance和BNB視為合法企業,有可能為本已看似封死的美國市場重開大門。CZ在特赦後表示會「幫助美國成為加密資本」,更顯示Binance與新政府策略目標一致。

特朗普政府更廣泛的加密政策成為重要順風。3月6日的戰略比特幣儲備行政命令指明政府持有的20萬枚比特幣將作為儲備,不會拋售。其後,特朗普再宣布將數字資產儲備涵蓋以太坊、XRP、Solana及Cardano。雖未明言包括BNB,但這種對數字資產視作合法儲備工具的態度,為整個行業帶來新認受性。

SEC(美國證監會)的換班亦同樣重要。Gary Gensler離職、由親加密委員Paul Atkins接任,象徵監管態度轉變。國家加密貨幣執法小組的解散及取消銀行涉足加密業務的事前批准規定...demonstrated substantive policy shifts rather than just rhetorical support.

展現出實質性的政策轉向,而唔只係停留喺口頭支持。

Against this backdrop, VanEck's May filing for a spot BNB ETF represented a watershed moment. As the first proposed U.S. ETF tracking BNB, the application signaled institutional asset managers believed regulatory approval was sufficiently likely to justify the filing costs and reputational risks. The proposed fund would include staking capabilities, suggesting the SEC under Atkins might approve features Gensler's SEC had rejected for Ethereum ETFs.

喺呢個大環境下,VanEck 喺五月提交現貨BNB ETF嘅申請成為咗一個分水嶺。作為全美首隻追蹤BNB嘅ETF申請,呢個舉動反映出機構資產管理人認爲監管批准嘅機會高到足以值得承擔申請成本同形象風險。建議中嘅基金仲包括質押功能,暗示Atkins領導下嘅SEC或者會批准Gensler時代對Ethereum ETF所拒絕嘅功能。

Coinbase and Robinhood listings in late October provided another crucial institutional validation point. These platforms adding BNB on October 23 created dramatically improved access for U.S. retail and institutional investors who had been unable to easily acquire the token. The immediate price jump above $1,100 following the announcements demonstrated genuine demand rather than just speculative interest.

Coinbase同Robinhood喺十月底上幣為BNB帶嚟另一個關鍵嘅機構認證時刻。呢兩大平台喺 10 月 23 日加入BNB,大幅改善咗美國散戶及機構投資者入手BNB嘅渠道。公布消息之後BNB即時升穿$1,100,反映市場有真正嘅需求,而唔係純粹投機。

International regulatory positioning also evolved favorably. Binance's Dubai VARA licensing and preparation for MiCA compliance in Europe demonstrated the exchange was building out compliant infrastructure globally rather than operating in regulatory gray zones. The exchange's restructuring under CEO Richard Teng, who replaced Zhao as part of the DOJ settlement, emphasized regulatory compliance and institutional partnerships over the aggressive expansion that had created past problems.

國際監管局勢同樣向好。幣安獲得咗杜拜VARA發牌同準備配合歐洲MiCA規管,顯示交易所正喺全球建立合規基建,而唔係繼續活喺監管灰色地帶。交易所亦進行換帥及重組,新CEO Richard Teng係因DOJ和解取代趙長鵬,並以合規及機構合作為先,改變咗以往盲目擴張導致嘅問題。

The MGX investment using World Liberty Financial's USD1 stablecoin to complete a $2 billion investment in Binance represented perhaps the clearest signal of institutional capital flowing toward the BNB ecosystem. While the Trump family connections raised obvious conflict-of-interest questions, from a pure market perspective it demonstrated that billion-dollar capital allocators viewed Binance and BNB as core infrastructure plays worth massive commitments.

利用World Liberty Financial所發行嘅USD1穩定幣,進行MGX入股同20億美元投資案入幣安,可能係最明顯表現機構資本湧入BNB生態圈嘅信號。雖然特朗普家族嘅關聯引起利益衝突質疑,但單從市場角度睇,呢啲百億級別資本配置者,已經視幣安同BNB為基礎設施投資,值得巨大投放。

Why BNB Beat BTC and ETH This Cycle

Understanding BNB's outperformance requires examining both what went right for BNB and what constrained its larger rivals. The story is one of utility meeting narrative at precisely the right regulatory moment, while Bitcoin and Ethereum faced structural headwinds.

要明白BNB點解喺呢輪週期跑贏BTC同ETH,就要睇下BNB做啱咩,而佢嘅競爭對手又畀咩掣肘。講到底,係BNB嘅實用性同故事把握住咗正確嘅監管時機,而Bitcoin同Ethereum就受到結構性障礙。

Supply dynamics provided BNB's most fundamental advantage. The 33rd quarterly burn completed on October 27 destroyed 1.44 million BNB tokens worth approximately $1.2 to $1.69 billion, reducing total supply to 137.74 million tokens. Since Binance implemented its auto-burn mechanism, over 64 million BNB have been permanently removed from circulation, with the target of 100 million representing an additional 37 million to be burned.

供應動態係BNB最核心優勢。第33次季度銷毀喺10月27日完成,1,440,000枚BNB銷毀,價值大約12至16.9億美元,總供應縮減到1.3774億枚。自從開始自動銷毀機制以嚟,超過6,400萬枚BNB已經永久銷毀,目標供應1億枚,即仲有3,700萬要繼續銷毀。

Unlike Bitcoin's programmatic halvings that take place every four years, BNB's quarterly burns created more frequent supply shocks. More importantly, the burn amount isn't arbitrary but algorithmically determined based on BNB price and blocks produced, creating a transparent mechanism that adjusts to network activity. When BNB price rises, burns become more valuable in dollar terms even if fewer tokens are burned, generating headlines and attention. When usage increases, more blocks generate more fees feeding into burn calculations. This creates self-reinforcing dynamics where success drives scarcity drives further success.

唔同於Bitcoin每四年一次嘅機制減半,BNB季度銷毀帶嚟更頻密嘅供應衝擊。更重要係,銷毀數量並非隨意決定,而係依據算法,按BNB價格同產生區塊數而調整,形成一個透明機制,動態反映網絡活躍程度。BNB升價時,即使燒少啲Token,銷毀總值都係照樣吸睛。網絡用量上升,區塊多咗,費用又多,加快計入銷毀額度。成個機制自我加強——成功推高稀缺,稀缺帶嚟更多成功。

Utility provided the demand-side complement to supply restriction. While Bitcoin's primary use case remains store of value and payment, and Ethereum's centers on DeFi and smart contract platform, BNB straddles multiple categories. It serves as the native gas token for one of the world's busiest blockchains, commands trading fee discounts on the largest exchange by volume, acts as collateral in DeFi protocols, powers governance in numerous projects, and increasingly facilitates real-world asset transactions.

BNB喺需求層面又有補足。Bitcoin主要被用作價值儲存或者支付,Ethereum主攻DeFi同智能合約平台,BNB就跨足唔同領域:做全世界最繁忙鏈之一嘅Gas代幣、喺最大交易所享交易手續費優惠、做DeFi協議抵押品、參與多個項目治理,仲越嚟越用喺現實世界資產交易。

This utility breadth meant that as various crypto sectors heated up throughout 2025, BNB captured value from multiple trends simultaneously. The DeFi renaissance drove demand for gas and collateral. Memecoin mania increased trading volumes boosting exchange revenues. RWA tokenization required stable infrastructure benefiting established chains. Each trend fed BNB demand from different angles rather than relying on a single narrative.

呢種多元實用性令BNB可一同受惠唔同加密板塊2025年爆發。DeFi復興時增加咗對Gas同抵押品需求;迷因幣炒作推高交易量,帶動交易所搵錢;RWA資產代幣化要靠有穩定基建嘅大鏈。唔同熱潮都可成為BNB需求動力,而唔止靠一個主線故事。

Bitcoin faced different dynamics. The spot ETF approvals in January 2024 drove massive 2024 gains but by 2025 had become mature enough that consistent inflows no longer generated the same price response. The Strategic Bitcoin Reserve executive order was already priced in by March. And macro factors including Federal Reserve policy uncertainty and U.S.-China trade tensions weighed on risk assets. Bitcoin's now-established correlation with tech stocks and macro liquidity meant it couldn't escape broader market constraints even as regulatory support improved.

Bitcoin面對唔同動態。現貨ETF獲批令2024年大升,不過到2025已太成熟,資金持續流入再唔會有同一效果。美國「戰略比特幣儲備」總統令三月前就反映曬喺價格度。再加上聯儲政策不明朗、中美貿易戰升溫,風險資產都受拖累。比特幣已經同科技股同流動性大市同步,就算監管氣氛改善都難以獨善其身。

Ethereum encountered even more specific challenges. The post-Merge shift to Proof of Stake dramatically reduced issuance, creating deflationary dynamics that should theoretically support price. Yet the proliferation of Layer 2 networks - handling 63 percent of transactions by 2025 - meant fee revenues accruing to Ethereum mainnet collapsed. While this represented technical success in scaling, it created economic challenges for ETH holders who watched value migrate to L2 tokens.

Ethereum遇到更實質問題。合併轉型PoS大大減少新幣發行,理論上應該有助價格向上。但大量Layer 2方案冒起,到2025已佔63%交易運載,主網的手續費收入大跌。雖然技術上解決咗擴容問題,但對ETH持有者嚟講,眼白白睇住經濟價值搬去L2 Token,形成困局。

Treasury company adoption of Ethereum, with 71 companies holding an estimated $22 billion worth, provided some support. But it couldn't offset the fee revenue decline or the complexity challenges developers faced coordinating across multiple L2s. The BTC/ETH ratio reaching levels near 54, last seen in pre-pandemic days, illustrated how dramatically Ethereum lagged Bitcoin, let alone BNB.

雖然以太坊有企業開始進行財庫配置,有71間公司估算持有220億美元ETH,帶嚟啲少支持。但收費收入下跌同開發者要跨多條L2協調嘅複雜性,根本無得彌補。BTC/ETH比率一度飆近54,係疫情前水平,完全反映Ethereum大落後Bitcoin,更遑論BNB。

Network metrics further illuminated the divergence. While Ethereum maintained approximately 123 million wallet addresses and 4.5 million daily active users, BNB Chain's 58 million monthly active addresses and consistent 2.37 million daily users showed competitive engagement despite being a younger ecosystem.

鏈上數據進一步解釋這種分歧。雖然Ethereum仍有約1.23億個錢包地址和450萬日活用戶,但BNB Chain嘅5,800萬月活地址及穩定237萬日活用戶,顯示雖然係年輕生態圈,但已經非常有競爭力。

Lower regulatory overhang paradoxically helped BNB. After the massive DOJ settlement, the worst was behind Binance with clarity on what compliance required. In contrast, Ethereum faced ongoing uncertainty about whether staking constituted securities offerings, why some L2 tokens might be securities, and how DeFi protocols should be regulated. This regulatory clarity deficit became a hidden tax on Ethereum's valuation.

監管陰霾減退反而幫咗BNB。DOJ巨額和解之後,幣安最大風險已過,合規要求講到明。反觀Ethereum仲煩緊質押係咪證券發行,一啲L2 Token算唔算證券,DeFi如何監管等長期不明朗,呢種監管透明度赤字就形成以太坊估值嘅隱形拖累。

CEA Industries CEO David Namdar articulated BNB's structural strength following the October burn: "The burn process underscores the asset's structural strength and long-term scarcity and therefore value creation." This simple formula - consistent scarcity creation plus expanding utility plus regulatory clarity - provided a more compelling value proposition than Bitcoin's largely static supply schedule or Ethereum's complex Layer 2 economics.

CEA Industries行政總裁David Namdar 喺十月銷毀後指出:「銷毀過程突顯資產嘅結構強度同長期稀缺性,從而創造價值。」總結就係——持續建立稀缺+實用性擴張+監管明朗,呢個組合比比特幣死定供應表,或者以太幣複雜Layer 2經濟,更加具吸引力。

Market Mechanics: Exchange Tokens and Liquidity Power

The resurgence of exchange tokens as a distinct asset category represents one of 2025's most interesting structural shifts. BNB's performance led this trend, but understanding the broader mechanics illuminates why platform tokens gained favor.

交易所代幣重新成為獨立資產類別,係2025年最有趣嘅結構性轉變之一。BNB跑首位帶動熱潮,但要理解背後運作,先會明平台幣點解咁受市場青睞。

Exchange tokens possess unique characteristics that distinguish them from pure utility tokens or governance tokens. They combine elements of equity-like cash flow (though legally distinct ... (以上未完,請指示如需繼續。)from securities), platform utility (fee discounts, staking rewards, governance rights), and speculative instruments (liquid, exchange-listed, and tradeable against major pairs). This hybrid nature creates peculiar advantages during certain market phases.

由於結合了證券屬性、平台功能(例如手續費折扣、質押獎勵、治理權利)以及投機產品(流通性高、可在交易所掛牌、並可與主要幣種交易),令這類代幣具備了混合特質,在某些市場階段產生獨有優勢。

Liquidity depth represents the most fundamental advantage. BNB trades on its native platform with massive volume, creating tight spreads and deep order books that institutional players require. This isn't theoretical - DEX volume hitting $5.064 billion on BNB Chain in a single day demonstrates institutional-grade liquidity. When Coinbase and Robinhood added BNB in October, they simply expanded existing liquidity rather than bootstrapping new markets.

流動性深度係最核心優勢。BNB 喺自己條鏈上交易量極大,帶嚟窄買賣差價同深厚掛單簿,正好切合機構級玩家需要。呢啲唔係紙上談兵——去中心化交易所(DEX)單日成交額高達 50.64 億美元,足以證明機構級流動性。十月 Coinbase 同 Robinhood 上架 BNB,其實只係擴展現有流動性,而唔係重新建立一個新市場。

Revenue linkages create natural value accrual mechanisms. While legally structured to avoid securities classification, exchange tokens benefit economically when their platforms succeed. Binance's position as the world's largest exchange by volume means every uptick in crypto trading activity directly benefits BNB through increased burn amounts, higher staking yields, and greater platform usage. This creates correlation with overall crypto market health while adding platform-specific alpha.

收入環環相扣,造就自然的價值累積機制。雖然法理上迴避證券身份,但交易所代幣只要平台向好就自然得益。Binance 作為全球成交量最高交易所,意味每次加密貨幣交易量增加,BNB 都受惠於燒毀量提升、質押回報變高、平台使用度增加。咁既帶動同大市同向關聯,又有平台專屬阿爾法收益。

Comparing BNB to other exchange tokens reveals divergent fortunes. OKB, the native token of OKX, showed solid performance but lacked BNB's ecosystem depth. CRO, Crypto.com's token, struggled with the platform's reduced marketing spend and user growth challenges. GT (Gate.io) remained largely regional despite the exchange's success in Asia. These comparisons suggest that exchange token performance requires both platform success and genuine ecosystem development - BNB uniquely achieved both.

BNB 同其他交易所代幣一比,就見到路向好唔同。OKB(OKX 幣)雖然表現唔錯,但生態深度不及 BNB;CRO(Crypto.com 代幣)遇著平台宣傳開支及用戶增長停滯,表現受壓;GT(Gate.io 代幣)雖然亞洲勢頭好,但始終未能走出區域性。呢啲比較反映咗,交易所代幣要有好表現,唔單止靠平台本身仲要靠背後完整生態——而 BNB 恰恰係做到兩樣。

The meme season phenomenon illustrated exchange tokens' asymmetric advantage. When retail attention surges toward speculative trading, exchange tokens benefit from every trade regardless of which specific memecoin pumps or dumps. This created a paradoxical dynamic where BNB captured value from both serious DeFi activity and speculative memecoin gambling without needing to pick winners.

meme 币熱潮進一步反映交易所代幣邊際優勢。散戶專注投機交易時,每一單買賣不論係邊隻 meme 幣升定跌,交易所代幣都分到利。結果就係出現一種矛盾現象:BNB 無需挑贏家都可以同時食 DeFi 正經用途同 meme 幣投機既雙重紅利。

Stablecoin infrastructure provided another structural advantage. With $14.16 billion in stablecoins on BNB Chain, the network possessed the payment rails necessary for seamless trading, settlements, and DeFi operations. This stablecoin depth - crucial for market makers and institutional participants - meant BNB Chain could facilitate large trades without price impact that would plague smaller chains.

穩定幣基建亦係系統優勢之一。BNB 鏈上有141.6 億美元穩定幣,為交易、結算和 DeFi 操作提供咗暢順支付通道。呢種穩定幣深度對做市商同機構級玩家極重要,令 BNB 鏈可以承接大型成交而唔會出現細鏈經常遇到既價格沖擊。

The spot-to-perpetuals ratio of roughly 14:1 in October suggested BNB Chain's activity was more organic than leverage-driven. While perpetual markets attract sophisticated traders, overwhelming spot dominance indicates real economic activity - payments, DeFi swaps, NFT purchases - rather than purely speculative positioning.

即時現貨對永續合約比例約 14:1,反映 BNB 鏈活動以自然需求為主,多過單靠槓桿炒作。雖然永續市場多高階交易員,但現貨佔比極大,代表支付、DeFi 兌換、NFT 購買等真正經濟活動為主,而唔係單靠投機盤。

Validator economics created another dimension of exchange token advantage. BNB Chain validators earn not just from transaction fees but from the broader BNB ecosystem including potential Binance relationships. This incentivizes validator performance and network security in ways that purely transaction-fee-based models struggle to match.

驗證者經濟模型又係另一個優勢。BNB 鏈驗證者唔單止賺取交易手續費,仲享受更大生態利益,包括同 Binance 相關既合作空間。咁既鼓勵措施,比單靠手續費分紅更能推動驗證者表現同強化網絡安全。

The rotation into exchange tokens represented implicit market recognition that centralized exchanges aren't disappearing despite DeFi's growth. Rather than picking individual DeFi protocols with uncertain token economics, investors could gain exposure to entire ecosystems through exchange tokens. BNB's $161 billion market cap effectively represented a bet on Binance maintaining market leadership and BNB Chain capturing sustainable ecosystem share.

市場資金流向交易所代幣,反映大家認同:即使 DeFi 發展得再快,中心化交易所都唔會消失。與其揀單一 DeFi 協議,不如透過交易所代幣暴露全生態增長潛力。BNB 市值高達 1610 億美元,其實即係押注 Binance 繼續領導地位,同埋 BNB 鏈能搶到可持續生態份額。

The Risks Beneath the Rally

Balanced analysis requires acknowledging significant risks that could derail BNB's momentum or expose underlying fragilities. Several deserve particular attention.

暴升背後的風險

理性分析要正視足以破壞 BNB 上升動力/暴露其潛在脆弱性的重大風險,以下幾點格外值得關注。

Centralization concerns remain paramount. Despite technical decentralization across validator nodes, Binance's influence over BNB Chain governance, development priorities, and ecosystem direction remains substantial. If regulatory pressures forced Binance to distance itself from BNB Chain, the resulting uncertainty could severely impact valuations. The exchange's $4.3 billion settlement demonstrates how platform-level legal challenges can create ecosystem-wide fallout.

中心化疑慮仍未解決。雖然驗證者節點實現技術去中心化,Binance 喺 BNB 鏈治理、開發方向同生態規劃方面嘅影響力都仲好大。若果監管壓力迫使 Binance 同 BNB 鏈割席,相關不明朗足以嚴重影響幣價。交易所 43 億美元天價和解事件,證明平台級法律風險會波及整個生態。

Regulatory risk cuts multiple ways. While U.S. regulatory clarity improved dramatically, international jurisdictions present ongoing challenges. European MiCA implementation, Asian regulatory frameworks, and potential future U.S. administration changes could all shift the regulatory landscape unfavorably. The SEC's past consideration of BNB as a potential security hasn't been definitively resolved, creating residual legal overhang.

監管風險層層遞進。美國監管環境雖然明朗化,但全球其他地方仍充滿挑戰。歐洲 MiCA 推行、亞洲監管新規矩、同未來美國政權更替都可令監管環境突變。美國 SEC 曾考慮將 BNB 歸類為證券,至今亦未徹底釐清,令潛在法律風險持續。

Data integrity concerns emerged around ecosystem metrics. DeFiLlama's removal of Aster perpetual trading data citing "suspicious correlations with Binance volume" raises questions about whether all reported activity represents genuine economic behavior versus artificial inflation. While such concerns haven't been proven broadly, they create uncertainty around which metrics can be trusted.

數據真確性疑慮開始浮現。DeFiLlama 曾因發現「與 Binance 交易量高度異常相關」而刪除 Aster 永續數據,令外界質疑生態數據有冇造假或流量注水。雖然呢啲疑點未廣泛證實,但確實令部份指標可信度蒙上陰影。

Whale concentration presents another vulnerability. On-chain analysis suggests significant holdings among early investors and insiders. While CZ has publicly stated he has "never sold BNB, except for spending," significant holders exiting could create cascading price declines given the token's relatively limited circulating supply of 137.74 million tokens.

大戶集中亦係一大隱憂。鏈上數據分析顯示,早期投資者、內部人持有大量籌碼。雖然 CZ 公開強調過「從未沽過 BNB,只有用嚟消費」,但一旦大戶拋售,在供應量相對有限(1.3774 億枚)的情況下,或會引發骨牌式價格暴瀉。

Derivatives markets showed concerning positioning at times. Reports of $412 million in whale shorts ahead of Trump administration announcements suggested sophisticated market participants betting against sustained rallies. While these positions haven't materialized into major crashes, they indicate substantial skepticism among some traders about valuations.

衍生品市場有時出現值得關注的持倉。坊間報導指特朗普政府宣布消息前,大戶曾累積4.12 億美元空單,即有資深投資人唱淡升浪。雖然最終無引發大跌,但反映不少玩家對現價存在實質質疑。

Competitive pressures from Ethereum Layer 2s, Solana's resurgence, and emerging platforms like Sui threaten BNB Chain's market share. If a competitor offers meaningfully better technology or developer experience, BNB Chain's current momentum could reverse quickly in crypto's fast-moving landscape.

來自以太坊 Layer2、Solana 重新崛起、同新興平台 Sui等競爭壓力正威脅 BNB 鏈市佔率。一旦有對手技術或開發者體驗大幅超前,喺 crypto 咁急速變化氛圍下,BNB 鏈既先機可以迅速逆轉。

The memecoin-driven growth that provided 2025 user acquisition may prove ephemeral. If retail interest wanes or regulators crack down on memecoin launchpads, a significant driver of recent ecosystem activity could disappear. Converting memecoin speculators into long-term DeFi users remains unproven at scale.

memecoin 帶動既用戶增長可能好快就消退。假如散戶熱情冷卻,或者監管打擊 meme launchpad,近期推高生態活躍度的動力大可一夜消失。要將 meme 投機客成功轉化為長期 DeFi 用戶,規模化落未有實質案例。

Oracle reliability issues during the October market crash, which contributed to a $450 billion market-wide wipeout, demonstrated infrastructure fragilities. While quickly resolved, such incidents remind investors that technical risk persists even in mature protocols.

十月市場暴跌期間,預言機穩定性問題導致 4,500 億美元市值瞬間蒸發,暴露基建脆弱。雖然事後迅速修復,但提醒大家,即使技術再成熟,系統性風險始終難以根治。

Macroeconomic headwinds including Federal Reserve policy, U.S.-China tensions, and potential recession could overwhelm crypto-specific tailwinds. BNB's reduced but still-present correlation to Bitcoin means macro shocks would likely impact BNB alongside the broader market.

大環境逆風,包括美聯儲政策、中美矛盾、甚至經濟衰退,都可能蓋過 crypto 行業自身順風。BNB 雖然相關性已降低,但同 Bitcoin 仍有一定聯動,若大環境震盪,亦不能獨善其身。

The relationship between World Liberty Financial and Binance, while providing short-term support, creates long-term political risk. If the Trump administration faces legal challenges or political backlash over crypto conflicts of interest, Binance and BNB could be caught in the fallout.

世界自由金融與 Binance 關係短期帶來支持,但亦埋下長遠政治風險。萬一特朗普政府因 crypto 利益衝突受到法律挑戰或政壇反彈,Binance 同 BNB 都可能受到波及。

Macro Implications: What BNB's Rally Signals About the Market

BNB's outperformance tells us something important about where crypto markets are heading and what investors increasingly value. Several broader implications deserve consideration.

宏觀啟示:BNB 暴升透露市場咩信號

BNB 跑贏大市,其實說明咗加密市場未來方向,同投資者最新重視啲咩。以下幾點值得深思。

The utility narrative is clearly back. After years where pure speculation and meme-driven narratives dominated, BNB's success suggests investors are rewarding tokens with genuine use cases. The 15.8 million daily transactions and billions in DeFi volume on BNB Chain aren't theoretical - they represent real economic activity generating demonstrable value.

實用性故事重臨。經歷多年純炒作同 meme 帶動,今次 BNB 勝出,顯示市場開始青睞有實際用途既代幣。每日1580萬宗交易,加上生態內千億級 DeFi 交易量,都係實實在在既經濟活動,產生有目共睹既價值。

Platform tokens may be entering a golden age. If exchange and ecosystem tokens continue capturing value from multiple concurrent trends while avoiding the complexity

(註:原文此處未完結,如需繼續請補充完整內容。)of picking individual protocol winners, capital allocation could increasingly favor this middle layer. This would represent a shift from the 2017-2021 period where Layer 1 competition defined narratives, toward an era where integrated platforms combining centralized and decentralized elements dominate.

選擇個別協議贏家的時代有可能過去,資本分配將越來越傾向於這個中間層。這代表市場將由2017至2021年由Layer 1競爭主導的格局,轉向以結合中心化與去中心化元素的綜合平台為主導的新時代。

Regulatory clarity now commands premium valuations. BNB's rally accelerated after major regulatory resolutions rather than remaining suppressed by past issues. This suggests markets are willing to look past problems if there's clear resolution and path forward. The implication for other projects: addressing regulatory uncertainty proactively rather than ignoring it may unlock significant value.

監管明確性現時會為資產帶來溢價。BNB在大型監管問題獲得解決後反而更快上升,沒再因往績受壓。這顯示只要有明確解決方案和發展路徑,市場願意忽略過去問題。對其他項目的啟示是:主動處理監管不確定性,而非逃避它,或可釋放重大價值。

The centralization versus decentralization debate may be resolving toward pragmatism. BNB Chain's success despite centralization concerns suggests users and investors prioritize performance, cost, and ecosystem vibrancy over ideological purity. This doesn't mean decentralization doesn't matter, but rather that sufficient decentralization for security may be more important than maximum decentralization.

有關中心化與去中心化的爭論,現時或正走向務實主義。即使外界憂慮中心化,BNB Chain依然成功,反映用戶及投資者更重視效能、成本及生態圈活力,而非絕對的意識形態。這並不等於去中心化不重要,只是「足夠用以確保安全」的去中心化,比極致去中心化更重要。

Institutional capital appears to be diversifying beyond Bitcoin and Ethereum. The VanEck ETF filing, major exchange listings, and treasury company interest in BNB demonstrate that sophisticated allocators view crypto as a multi-asset class rather than BTC-only or BTC-plus-ETH.

機構資金現時似乎不再只集中於比特幣和以太坊。VanEck申請ETF、主要交易所上市,及多家財務公司關注BNB,都反映專業分配者已經視加密貨幣為「多元資產類別」,而不僅限於比特幣或比特幣+以太坊。

The CeFi and DeFi convergence exemplified by BNB suggests the future may be hybrid rather than purely decentralized. Projects successfully bridging centralized efficiency with decentralized transparency and composability may capture disproportionate value. BNB Chain's integration of centralized exchange liquidity with decentralized protocols demonstrates this model's potential.

以BNB為代表的CeFi和DeFi融合,顯示未來加密世界或將以混合模式為主,而非絕對去中心化。能夠成功結合中心化效率、去中心化透明度與可組合性的項目,更有機會取得超額回報。BNB Chain將中心化交易所流動性與去中心化協議整合,正好展現這類模式的潛力。

Real-world asset tokenization is transitioning from concept to implementation. BNB Chain's partnerships with Ondo, Franklin Templeton, and other RWA platforms moving tokenized stocks, treasuries, and other traditional assets on-chain suggests institutional-DeFi integration is accelerating. BNB's success positions it as infrastructure for this transition.

現實資產(RWA)代幣化已經從概念走向落地實行。BNB Chain夥拍Ondo、Franklin Templeton等RWA平台,將股票、國債及其他傳統資產搬上鏈,反映機構與DeFi融合正在提速。BNB的成功,也令其定位成為這場轉型的重要基建。

The importance of founder credibility remains high even after regulatory issues. CZ's continued influence despite legal troubles suggests crypto markets still value visionary founders who maintain community trust. His pardon and active ecosystem engagement demonstrated that reputation can survive setbacks if handled strategically.

即使有監管風波,創辦人個人聲譽依然舉足輕重。CZ雖然捲入訴訟,但持續影響力說明市場依然重視具遠見、能維繫社群信任的創辦人。他獲特赦及積極參與生態建設,亦證明聲譽只要正確應對,即使遇挫折都可修復。

U.S. political engagement by crypto platforms yields measurable results. Binance's lobbying spending, including $450,000 to firms with White House connections, correlated with dramatic policy shifts including CZ's pardon. While controversial, this demonstrates that political strategy is becoming as important as technical development.

美國政圈遊說對加密機構確實有效。Binance為參與遊說活動,向具白宮背景的公司支付45萬美元,最終促成包括CZ特赦在內的政策大轉變。雖然引發爭議,卻反映政治策略正變得與技術發展同等重要。

Network effects and first-mover advantages in ecosystems may be undervalued. Despite technical superiority claims from competing chains, BNB Chain's established ecosystem, developer relationships, and liquidity proved difficult to disrupt. This suggests that once platforms achieve critical mass, competitive moats become formidable.

生態圈的網絡效應與先行者優勢或被低估。雖然其他鏈自稱技術優越,BNB Chain已建立的生態、開發者關係和流動性,令其難以被動搖。這證明當平台達到臨界規模後,其護城河非常堅固。

Sustainability and Outlook

The critical question facing investors as 2025 winds down: can BNB sustain its outperformance, or does reversion to mean valuations appear inevitable?

來到2025年尾,投資者最關心的是:BNB能否維持超額表現,抑或最終復歸正常估值不可避免?

Several factors support continued strength through Q4 2025 and into 2026. The 34th quarterly burn scheduled for Q4 will remove approximately 1.24 million more tokens worth an estimated $1.4 billion, providing another supply shock. Technical infrastructure improvements including sub-150ms finality and 20,000+ transactions per second targeting completion in late 2025 will enhance competitive positioning.

有不少因素支持BNB於2025年第四季至2026年持續強勢。第34次季度銷毀將移除約124萬枚BNB,價值約14億美元,為供應帶來衝擊。技術基建上,項目將於2025年底完成低於150毫秒最終性與秒處理二萬宗交易等多項升級,有助提升競爭地位。

The VanEck BNB ETF, while not guaranteed approval, represents significant upside potential if authorized. Spot Bitcoin ETFs attracted $112 billion in assets within their first year; even a fraction of that flowing to BNB would substantially impact a token with just 137.74 million supply.

VanEck BNB ETF(雖未保證獲批),如能通過將有重大上升空間。首年現貨比特幣ETF吸資約1120億美元,即使只有小部分流向BNB,對其只得1億3774萬枚總供應的幣價也可造成巨大影響。

Continued real-world asset integration with institutional partners like Franklin Templeton and Circle provides catalysts independent of broader crypto volatility. As Sarah S., BNB Chain's BD Head, noted, "institutional DeFi and tokenized assets" represent the next growth wave - positioning that should strengthen through 2026.

繼續與Franklin Templeton及Circle等機構合作,把現實資產整合上鏈,為BNB帶來與市場波動無關的利好催化劑。正如BNB Chain業務發展主管Sarah S.所言,「機構DeFi與資產代幣化」是未來成長波,預料2026年前會持續鞏固這定位。

Ecosystem expansion into new geographies, particularly Asia where regulatory frameworks are clarifying and Binance maintains strong presence, offers growth vectors that don't depend solely on U.S. market dynamics.

生態圈正擴展至更多地區,尤其在監管趨明朗、Binance本身影響力極大的亞洲,有望帶來不只依賴美國市場的增長動力。

However, significant risks to sustained outperformance exist. Technical indicators show BNB trading just above the 50-day EMA at $1,207 with the 20-day EMA at $1,254 acting as near-term resistance. RSI at 45.43 indicates neutral-to-weak momentum, suggesting consolidation rather than continued explosive growth may be most likely near-term scenario.

但持續領先亦存在風險。技術指標顯示BNB現於50日EMA($1,207)之上,20日EMA($1,254)成為短期阻力。RSI為45.43,代表動能偏中性至弱,短期内以側向整固為主爆發式升幅機會較小。

If BNB loses the critical $1,000 to $1,020 support level, technical traders warn substantial selling pressure could emerge. Conversely, breaking above $1,250 with volume could target the previous all-time high around $1,370 or potentially $1,500 if momentum extends.

若BNB失守$1,000至$1,020重要支持位,技術交易員警告可能出現大量拋售。反之,若能放量突破$1,250,有機會挑戰前高$1,370甚至延續動能到$1,500。

Analyst forecasts for 2026 range widely from conservative projections around $1,088 to $1,295 to bullish cases targeting $2,000 or higher if ETF approval and continued ecosystem growth materialize. The wide range reflects genuine uncertainty about whether 2025's outperformance represents sustainable revaluation or temporary momentum.

分析師對2026年估值預測差異很大,保守估計為$1,088至$1,295,大膽則衝至$2,000或以上(如ETF獲批及生態持續壯大)。這種極大分歧反映市場對2025升勢究竟會否延續成重估還是純屬短暫動力仍存在高度不確定。

Three scenarios appear most plausible for 2026:

2026年最有可能出現三種情景:

Consolidation Scenario (40% probability): BNB trades in a $900 to $1,400 range throughout 2026, consolidating 2025 gains while ecosystem continues growing. This occurs if macro conditions remain choppy, ETF approval is delayed but not denied, and no major negative catalysts emerge.

整固情景(40%機會):BNB全年於$900至$1,400區間橫行,鞏固2025升幅,生態慢慢擴大。前提是大環境反覆,ETF獲批時間延後但未遭否決,且無重大利淡消息。

Continuation Scenario (35% probability): BNB reaches $1,600 to $2,200 by end-2026 driven by ETF approval, sustained ecosystem growth, and BTC/ETH potentially experiencing their own challenges. This requires multiple positive catalysts aligning including strong regulatory clarity and institutional adoption acceleration.

延續情景(35%機會):BNB在2026年底登上$1,600-$2,200,由ETF通過、生態持續壯大及BTC/ETH出現挑戰帶動。此情境需多重利好,包括監管明朗與機構採納提速。

Correction Scenario (25% probability): BNB retraces to $600 to $850 as profit-taking intensifies, macro conditions deteriorate, or ecosystem vulnerabilities emerge. This could occur if regulatory clarity reverses, major security incidents impact BNB Chain, or competing platforms capture significant market share.

回調情景(25%機會):BNB回落至$600-$850,原因包括獲利盤湧現、宏觀環境轉差、或生態出現漏洞。如監管出現倒退、遭遇重大安全事故或同類平台搶佔大量市場份額均有可能導致此情況。

The most likely path appears to be consolidation with volatility, punctuated by sharp moves in either direction based on catalysts like ETF decisions, quarterly burns, and macro shifts. For investors, this suggests that while BNB's fundamental story remains compelling, the explosive 2025 returns are unlikely to repeat in 2026 with similar magnitude.

最有可能的走向是波動中整固,當ETF決定、季度銷毀或宏觀消息出現時,價格會急升急跌。對投資者而言,這代表BNB基本面依然吸引,但2025年的爆炸性升幅難於2026年重現。

Conclusion: Lessons for the Market

BNB's remarkable 2025 run offers several enduring lessons about digital asset markets, regardless of whether the specific performance proves sustainable.

BNB在2025年的驚人表現為加密資產市場帶來了多個長遠啟示,不論這番升勢能否持續。

First, utility matters more than many observers credited. In an era of memecoins and speculation, the boring work of building actual use cases - processing transactions, facilitating DeFi, enabling payments - created sustainable value drivers. BNB didn't just pump on narrative; it delivered ecosystem growth that justified revaluation.

第一,實用性比許多人預期更重要。即使迷因幣滿天飛,投機氣氛濃烈,但踏踏實實地推動交易、發展DeFi、推進支付,才是可持續價值的來源。BNB並非只靠炒作,而是真正令生態增長,承托估值重評。

Second, regulatory resolution, however painful, ultimately benefits tokens more than ambiguity. Binance's willingness to face consequences, pay massive fines, and restructure positioned BNB to benefit from subsequent regulatory improvements. Projects avoiding rather than addressing regulatory challenges may face permanently suppressed valuations.

第二,認真解決監管問題(即使過程痛苦)比不明朗對幣價更有利。Binance肯承擔責任、賠巨額罰款、改組架構,令BNB得以受益於後來的監管好消息。相反選擇逃避的項目,估值或會長期被壓抑。

Third, supply dynamics deserve greater analytical attention. BNB's aggressive burn mechanism created genuine scarcity that complemented demand growth. Tokenomics aren't just theoretical - they materially impact price discovery when implemented consistently.

第三,供應動態值得重視。BNB的積極銷毀機制帶出真正稀缺配合需求增長。代幣經濟學並非紙上談兵,若長期執行,對價格形成有實質影響。

Fourth, integrated ecosystems combining centralized and decentralized elements may represent crypto's practical future. Pure decentralization remains ideologically important, but BNB's success suggests users and investors value performance and ecosystem richness over maximum decentralization. The winning formula may be sufficientHere is your requested translation, following the specified rules (skipping markdown links):

去中心化提升安全,加上中心化元素提升效率。

第五,只要公開透明地處理,創辦人的公信力可以在遭遇挫折後仍然保住。CZ 即使遭監禁及面臨巨額罰款,依然能保持影響力,顯示加密社群重視領導層的一貫性及真誠。他被赦免後沒有淡出,反而主動參與,說明聲譽資本是可以重建的。

第六,虛擬資產平台參與政治逐漸成為基本門檻。無論有無爭議,Binance 積極遊說及與具政治關係的機構合作都帶來具體政策轉變。未來忽視政治策略的項目,縱使技術再好,也可能處於劣勢。

最後,交易所幣作為一類資產,值得重新評估。它們獨有的生態接觸面、實用性及流動性,為純 Layer 1 或 DeFi 投資以外帶來分散效果。BNB 的成功亦反映這種混合型資產類別應獲得比以往更多機構性配置。

展望未來,如果一枚交易所幣能引領牛市周期,下一輪的市場領袖會是甚麼模樣?也許會像 BNB 結合生態整合及多元功能、Ethereum 的去中心化及開發者生態,以及 Bitcoin 的文化意義。又或者它會來自意想不到的類別 —— 遊戲幣、社交平台幣、或者 AI 協議。

可以肯定的是,2025 年有關實用性、監管明確性、一致性的代幣經濟,以及生態建設的經驗,將決定哪些項目能於未來周期中脫穎而出。BNB 的出色表現並非偶然;而是多年基礎建設、生態耕耘和策略部署,剛好配合有利監管環境與市場情緒所致。

對投資者而言,BNB 的故事說明專注基本價值推動力的耐心資本,即使在以投機著稱的加密市場,仍然有機會跑贏大市。對建設者來說,更是一個明證:持續推動生態發展,最終會得到回報,即使短期焦點可能在別處。而對行業整體而言,這反映加密世界的成長不只限於抄襲傳統金融——而是要以務實方式融合中心化效率及去中心化創新,走出一條混合的新路。

BNB 能否維持領先地位直至 2026 年甚至更遠現在還未可知。但其 2025 年的表現,已經足以成為教科書案例,說明看似成熟的資產,只要基礎變革與市場情緒、監管動力互相配合,依然可以找到新的增長方向。在這個變化極快、容易遺忘的行業,這是一堂值得記住的課。