加密貨幣行業本質存在一道矛盾:它建基於財務私隱與抗審查的理念,卻同時處於愈來愈嚴格的反洗黑錢(AML)及認識你的客戶(KYC)監管規範當中。本文將說明加密貨幣公司——如交易所、託管機構、OTC 櫃枱、支付處理商——如何在實際合規營運中調和這種矛盾。

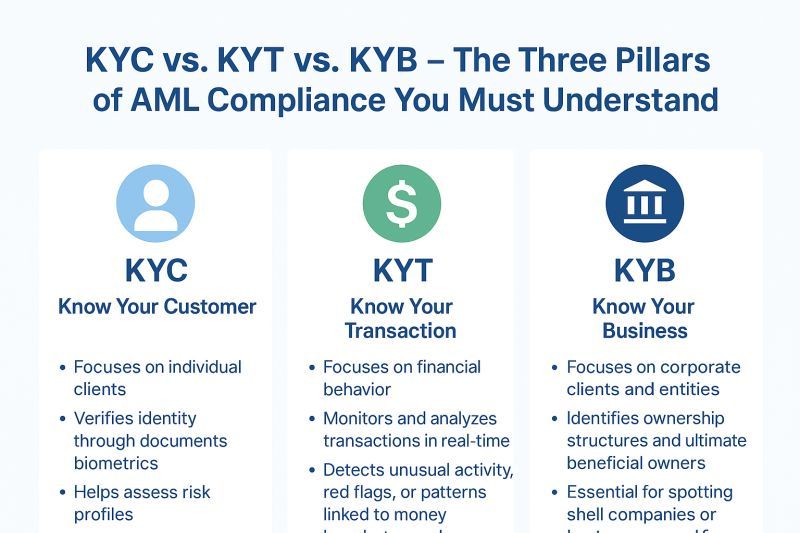

現代加密合規的核心是一張「三腳凳」:KYC(開戶時的身份驗證)、AML(持續監察可疑活動)及 KYT(實時分析區塊鏈資料的 Know-Your-Transaction 工具)。這三方面一起構建合規體系,讓傳統金融機構也感到熟悉,但同時針對加密貨幣的匿名、無地域、全天候特性進行調整。

門檻非常高。自 2020 年以來,全球監管機構已向加密公司徵收超過 50 億美元罰款。2023 年 11 月,幣安因管控不足,被美國當局罰款破紀錄的 43 億美元,證明即使最大的平台若控管不力也可能面臨生存危機。除財務懲罰外,合規失誤實質造成傷害:Chainalysis 2024 年加密犯罪報告估算,2023 年全行業涉及的非法交易額高達 242 億美元,包括勒索軟件、暗網收入和規避制裁行為。

本文將深入探討合規的實際運作,說明技術堆疊——特別是來自 Chainalysis、TRM Labs、Elliptic 的 KYT 工具如何實現交易監控。我們亦會探討哪些風險訊號會觸發凍結賬號,包括與受制裁錢包互動、使用混幣服務、異常交易速率、地理風險等。我們亦會分析公司如何透過最小化資料收集、選擇性披露及新興的零知識證明等密碼學方法,在滿足監管同時保障用戶私隱。

為何合規至關重要:風險、洗黑錢、制裁與聲譽代價

犯罪資金問題

加密貨幣的匿名性和全球流通性,令其吸引非法資金流動。雖然常見說法「大部份加密幣用於犯罪」並不正確——Chainalysis 指 2023 年不法用途只佔交易總額 0.34%,但實際數目依然龐大,而且相關罪行極具破壞性。

勒索軟件操作者自 2020 年以來已收取逾 20 億美元加密資金,攻擊牽連醫院、學校、重要基建。2021 年科洛尼管道(Colonial Pipeline)攻擊事件,單次就有 440 萬美元比特幣贖金(FBI 其後追回部分)。暗網市場助長毒品貿易,已經關閉的 Silk Road、AlphaBay、Hydra 等合共涉及數十億非法銷售。至於恐怖分子融資,佔比雖微,但倘若交易所即使是無意之下幫助資助恐怖活動,亦可能承擔刑事責任。

規避制裁是合規風險中影響最大的一環。美國財政部海外資產控制辦公室(OFAC)在制裁清單(SDN)中列明與受制裁機構相關的加密貨幣錢包地址,包括來自北韓 Lazarus Group(涉 Axie Infinity Ronin Bridge 被盜 6.25 億美元)、俄羅斯暗網營運者、伊朗機構。只要有一單交易涉及受制裁地址,交易所隨時被判處嚴重罰款——過去已發生數百萬美元相關罰款。

監管執法步步進逼

過去五年,監管執法行動顯著增多:

- 幣安(2023):因違反銀行保密法、非法資金傳送、制裁等問題,與美國司法部、FinCEN 及 OFAC 達成 43 億美元和解。承認 KYC 控制不足,允許受制裁國家(伊朗、古巴、敘利亞)用戶交易,並有意規避美國監管。行政總裁趙長鵬認罪。

- KuCoin(2024):因無牌進行資金傳送及違反銀行保密法,被罰 3 億美元。司法部指 KuCoin 在無適當註冊及忽略 KYC/AML 義務下,為美國用戶處理大量可疑交易。

- BitMEX(2021–2022):因無牌經營交易平台及 AML 控制薄弱,遭判處一億美元民事及刑事罰款。檢控方指其管理層私下甚至開玩笑談規避監管。

- Bittrex(2022–2023):因違反制裁及銀行保密法,OFAC 及 FinCEN 罰款合共 5,300 萬美元,包括為受制裁地區用戶處理交易。

這些案例共通之處,是 KYC 上線不足招致受制裁用戶,交易監察不力遺漏紅旗,企業文化重增長輕合規。行業訊息明確:合規失誤,後果嚴重。

聲譽及運營風險

除法律責任外,合規失誤同樣會對聲譽造成嚴重損害。執法後交易所經常會:

- 與銀行關係斷絕,因有風險的金融機構懼怕牽連

- 法幣出入金被下架,支付平台拒絕提供服務

- 用戶流失,轉向合規良好之同業

- 監管限制,無法進入新市場

- 剩餘合作夥伴提升盡職調查要求

糾正問題的運營負擔急升。被執法監控後,公司往往要聘請外部人員設合規監管(一般需 3–5 年)、追溯檢查過往帳戶,並大增合規團隊(幣安據報和解後增聘 500 多人)。

為何「合規」≠「大規模監控」

常見誤會將合規等同大規模監控。事實上,現代加密合規著重風險為本,只針對真正可疑活動分配資源,不會監控所有用戶。有效的合規框架包括:

- 設立交易門檻,專注監察高額、高風險行為

- KYC 分級處理,按帳戶限額及活動性質分級

- 利用機器學習減少誤報,減輕審查壓力

- 僅收集所需資料,符合最小化原則

- 提供投訴及更正渠道,處理誤凍結或誤判

目標是針對真實非法資金風險設下合理管控,同時保障大多合法用戶的私隱。

基礎知識:KYC、AML、KYT——定義及實際運作連繫

認識你的客戶(KYC)

KYC 指公司在用戶開戶時進行的身份驗證。對加密貨幣交易所與託管機構而言,KYC 通常分級如下:

基本 KYC(第一級):

- 全名

- 出生日期

- 住址

- 電郵及電話號碼

- 政府發出之附照片證件(如護照、駕照、身份證)

- 自拍認證(防止身份詐騙及證件被盜用)

加強 KYC(第二級):

- 地址證明(如水電單、銀行月結單)

- 資金來源文件

- 職業及僱主資料

- 預計交易量及模式

- 商業用戶需提供公司註冊和實益擁有人披露

機構級 KYC(第三級):

- 完整公司架構及股東圖

- 審計財務報表

- AML 政策文件

- 相關監管牌照

- 主要負責人背景審查

KYC 會利用如 Jumio、Onfido、Persona 等供應商進行文件認證、人臉識別和比對黑名單數據庫等驗證。簡單案例核查可於數分鐘內完成,但特殊情況(如文件損毀、冷門證件、姓名不符)則需人手審核。

反洗黑錢(AML)

AML 涵蓋防止、偵測和舉報洗黑錢的法律、規則及程序。重點包括:

風險評估:公司需進行覆蓋全企業的風險分析,按不同客群、服務地區、產品類型、交易量等評估洗黑錢弱點。

客戶盡職(CDD):除了開戶 KYC,持續盡職審查包括定期更新用戶資料、監察行為或風險變化、高風險客戶需加強審查。

交易監控:自動化系統會對所有交易進行規則和行為分析,以發現疑似洗黑錢模式。

可疑活動舉報(SAR):如發現可疑行為,需向金融情報單位(如美國 FinCEN、英國 FCA 等)報告,詳述涉及行為、相關人員及交易細節。

記錄保存:法例要求詳細保存用戶數據及交易記錄。

identities, transactions, and compliance decisions, typically for 5-7 years.

身份、交易和合規決策,通常需要保留5至7年。

Independent Testing: Annual audits by internal or external auditors verify AML program effectiveness.

獨立測試:內部或外部審核人員每年進行審核,以驗證反洗黑錢(AML)計劃的有效性。

In the U.S., the Bank Secrecy Act (BSA) and its implementing regulations form the core AML framework. Globally, the Financial Action Task Force (FATF) sets international standards through its 40 Recommendations, which most jurisdictions adopt.

在美國,《銀行保密法》(BSA)及相關執行規例構成反洗黑錢(AML)框架的核心。全球方面,金融行動特別組織(FATF)通過其40項建議來制定國際標準,並獲大多數司法管轄區採納。

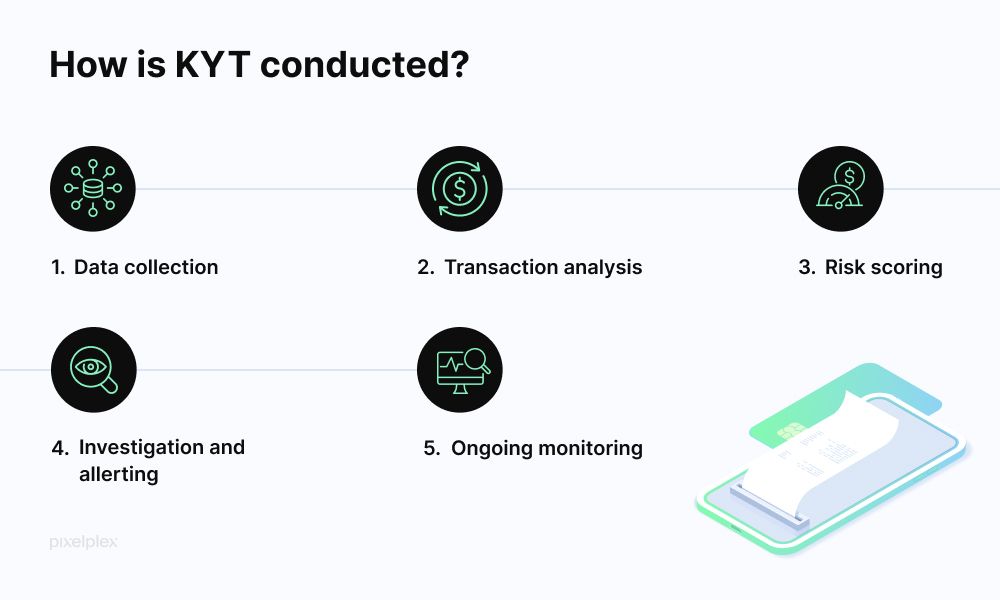

Know Your Transaction (KYT)

KYT represents the crypto-specific evolution of transaction monitoring, leveraging blockchain transparency to analyze transaction patterns and counterparty risk in real-time. Unlike traditional finance where transactions are opaque to most participants, public blockchains allow anyone to trace fund flows, creating both opportunities and challenges for compliance.

KYT(認識你的交易)代表針對加密貨幣的交易監控新進化,利用區塊鏈的透明度,實時分析交易模式及對手方風險。有別於傳統金融,大多數參與者無法了解交易詳情,公有區塊鏈允許任何人追蹤資金流向,既帶來合規上的機遇,同時亦有新挑戰。

KYT tools continuously scan blockchain transactions associated with customer addresses, checking:

KYT工具會持續掃描與客戶錢包地址相關的區塊鏈交易,檢查:

- Direct exposure: Does this transaction directly involve a sanctioned address or known illicit entity?

直接接觸:這筆交易是否直接涉及被制裁的地址或已知的非法實體? - Indirect exposure: Does this transaction's counterparty have recent connections to high-risk sources?

間接接觸:這筆交易的對手方最近有否與高風險來源有聯繫? - Behavioral patterns: Does this transaction fit unusual velocity, structuring, or layering patterns?

行為模式:這筆交易有否出現不尋常的速度、分批或分層模式? - Service risk: Does this transaction involve high-risk services (mixers, darknet markets, unregistered exchanges)?

服務風險:這筆交易有否涉及高風險服務(混幣器、暗網市場、未註冊的交易所)?

Major KYT vendors include Chainalysis (market leader), TRM Labs (emphasizing investigation tools), Elliptic (strong in DeFi and NFT coverage), and CipherTrace (now part of Mastercard). These tools provide APIs that integrate into exchange systems, returning risk scores and alerts in real-time as deposits or withdrawals process.

主要KYT服務供應商包括Chainalysis(市場領導者)、TRM Labs(強調調查工具)、Elliptic(在DeFi和NFT覆蓋範疇突出)及CipherTrace(現為萬事達成員)。這些工具設有API,可直接整合至交易所系統,在存款或提款處理時即時返回風險評分與警報。

How KYC, AML, and KYT Connect Operationally

These three elements form an integrated compliance system:

這三個元素共同組成一套綜合合規系統:

-

Onboarding: KYC verifies identity, establishing the customer's regulatory status (jurisdiction, sanctions screening, PEP status). This determines initial risk scoring and transaction limits.

開戶:KYC用於身份驗證,確認客戶的監管狀況(司法管轄區、制裁篩查、政治敏感人物/PEP狀態),從而確定初始風險評分和交易限額。 -

Ongoing Monitoring: KYT continuously analyzes blockchain transactions, feeding behavioral data into broader AML monitoring systems. High-risk transaction alerts trigger compliance review.

持續監控:KYT持續分析區塊鏈交易,並將行為數據輸入更廣泛的AML監察系統。高風險交易警報會觸發合規審查。 -

Investigations: When alerts fire, analysts use KYC data (identity, stated purpose), KYT forensics (blockchain tracing), and AML context (historical behavior, similar accounts) to make risk decisions.

調查:當警示觸發時,分析師會結合KYC數據(身份、聲稱用途)、KYT取證(區塊鏈追蹤)及AML背景(過往行為、類似賬戶)作出風險判斷。 -

Reporting: Confirmed suspicious activity becomes a SAR, with KYC data identifying parties and KYT forensics documenting the transaction trail.

報告:經確認的可疑活動需呈報(SAR),以KYC資料識別相關人士,並以KYT取證記錄交易路徑。 -

Account Actions: Based on risk findings, companies may restrict services (lower limits), freeze accounts pending investigation, or terminate relationships. KYC data supports required customer notifications and appeals.

賬戶處理:根據風險結果,公司可限制服務(降限額)、凍結賬戶等候調查,或終止業務關係。KYC資料會用於客戶通知及上訴程序。

The feedback loop is continuous: KYT findings may trigger enhanced KYC reviews, while KYC risk factors adjust KYT alert thresholds. 反饋流程是持續的:KYT發現可引致加強KYC審查,而KYC風險因素亦會調整KYT警報門檻。

📊 QUICK EXAMPLE: KYT IN ONE MINUTE

What is it? Know-Your-Transaction monitoring uses blockchain analysis to screen crypto transactions for illicit activity in real-time.

How does it work? Software continuously watches addresses linked to your account, checking every transaction against databases of known bad actors (ransomware wallets, sanctioned addresses, darknet markets). Each transaction receives a risk score based on direct and indirect exposure to risky counterparties.

Key difference from traditional finance: In traditional banking, your bank can't see what happens after you send money to someone else. With crypto, blockchain transparency lets KYT tools trace funds through multiple hops, following the money even after it leaves your account.

What triggers alerts? Direct contact with flagged addresses, use of mixing services, unusual patterns (many small deposits then one large withdrawal), connections to high-risk exchanges, or geographic red flags.

Privacy impact: KYT doesn't read your transaction "purpose" or personal messages. It analyzes on-chain patterns: amounts, timing, counterparty history, and service types. Your identity is only linked to transactions at regulated entry/exit points (exchanges, on-ramps), not on-chain.

📊 一分鐘例子:KYT簡介

什麼是KYT?KYT就是「認識你的交易」,利用區塊鏈分析技術,實時檢查加密貨幣交易有否涉及非法活動。

原理是什麼?軟件會持續監察連結到你賬戶的地址,每宗交易都會與已知惡意實體資料庫(如勒索病毒錢包、受制裁地址、暗網市場)對比。每筆交易會根據直接或間接接觸高風險對手方而獲得一個風險評分。

與傳統金融的最大分別:傳統銀行無法追蹤到你轉賬之後的資金流向,但加密貨幣的區塊鏈透明度令KYT工具可以多次跳躍追蹤資金流向,甚至賬戶錢離開後亦能一路跟蹤。

什麼情況會出警報?直接與受標記地址接觸、使用混幣服務、不尋常交易模式(例如多次小額入金後一次大額提幣)、連接高風險交易所或地域風險訊號等。

私隱影響:KYT不會查看你的交易「用途」或個人訊息,只會分析鏈上的模式(金額、時間、對手方、服務性質)。你的身份只會在受管制進出金點(交易所、入金通道)與交易連結,鏈上則沒有身份關聯。

COMPLIANCE OPS INSIDE EXCHANGES

Onboarding and KYC Flows

Modern centralized exchanges implement tiered verification systems balancing user friction with regulatory requirements and institutional risk tolerance:

現時主流的中心化交易所會實施多級驗證系統,平衡用戶體驗、監管要求及風險容忍度:

Tier 0 - Unverified: Some exchanges allow limited functionality with just email registration - typically browsing markets, accessing educational content, or minimal test transactions. Most have eliminated this tier entirely under regulatory pressure.

級別0-未驗證:部分交易所僅需電郵註冊即可使用有限功能,如瀏覽市場、教學內容或進行少量測試交易。受監管壓力影響,大多數平台已取消這級。

Tier 1 - Basic Verification: Provides access to core trading with limits. Process typically requires:

級別1-基本驗證:允許有限度使用核心交易功能。一般流程包括:

- Government ID capture and verification (automated OCR plus liveness check)

上載並核對政府發出身份證明(自動文字識別及真人驗證) - Sanctions screening against OFAC SDN, UN, EU sanctions lists

按OFAC、聯合國、歐盟等制裁清單進行篩查 - PEP (Politically Exposed Person) screening

政治敏感人士(PEP)篩查 - Basic fraud checks (device fingerprinting, IP geolocation, email/phone validation)

基本反詐騙檢查(設備指紋、IP地理位置、電郵/電話驗證)

Verification timing: 5-15 minutes for automated approval, 1-3 days for manual review cases. Typical limits: $2,000-$10,000 daily trading, smaller withdrawal limits.

驗證所需時間:自動審批約5-15分鐘,手動審查需1-3日。常見限額為每日$2,000-$10,000交易額及較低提現限額。

Tier 2 - Enhanced Verification: For higher limits (often $50,000-$100,000 daily), additional requirements include:

級別2-加強驗證:如需更高限額(通常每日$50,000-$100,000),需額外提供:

- Proof of address (utility bill, bank statement, or tax document within 90 days)

地址證明(近90日內水費單、銀行結單或稅單) - Source of wealth questionnaire

財富來源問卷 - Occupation and employer information

職業及僱主資料 - Additional document verification (tax ID, social security number where applicable)

其他證明文件核實(如稅務號、社會保障號碼等)

Tier 3 - Institutional/VIP: Custom limits with enhanced due diligence including:

級別3-機構/VIP客戶:可設定專屬限額,額外盡職調查包括:

- Video call verification with compliance team

與合規團隊進行視像核實 - Detailed source of funds documentation

詳細資金來源文件 - Background checks on principals

主要負責人背景審查 - Ongoing relationship management with dedicated compliance contact

設立專屬合規聯絡以供持續關係管理

Transaction Monitoring and KYT Integration

Once onboarded, continuous monitoring begins. Exchanges integrate KYT tools at multiple points:

完成開戶後便啟動持續監控。交易所於多個環節整合KYT工具:

Deposit Screening: When cryptocurrency deposits arrive, KYT tools immediately analyze:

入金篩查:當客戶存入加密貨幣時,KYT工具會即時分析:

- Sending address history and known associations

來源地址的歷史與已知聯繫 - Path analysis: Where did these funds originate (potentially many hops back)?

路徑追蹤:這筆資金最初來自哪裡(可追溯多層轉賬) - Direct risk: Any direct exposure to flagged entities?

直接風險:是否直接連結受標記實體? - Indirect risk: Counterparties within 1-2 hops have risky associations?

間接風險:1至2層內對手方是否有高風險關聯? - Service risk: Did funds pass through mixers, unregistered exchanges, darknet markets?

服務風險:是否經過混幣器、未註冊交易所或暗網市場?

Risk scoring happens in seconds. Low-risk deposits credit immediately. Medium-risk deposits may credit with a delayed withdrawal hold pending review. High-risk deposits trigger immediate compliance team escalation, with funds potentially frozen pending investigation.

風險評分可於數秒內完成。低風險入金即時入賬,中度風險則可能暫緩提款以待複檢。高風險入金會即時升級由合規團隊處理,資金或需凍結至調查完成。

Withdrawal Screening: Before processing withdrawals, similar screening checks:

出金篩查:提款前亦會進行類似檢查:

- Destination address risk

目標地址風險 - Known associations of destination

目標地址已知聯繫 - Customer's historical withdrawal patterns (is this unusual?)

客戶過往提款模式(有否異常?) - Velocity checks (has this customer moved through many small deposits and now wants one large withdrawal?)

速度審查(該客戶之前是多次小額存款,現在突然大額提款?)

Some exchanges conduct "pre-flight" checks, showing users a risk assessment before they confirm the withdrawal, allowing them to reconsider high-risk destinations.

部分交易所會提供「飛行前」檢查,在客戶確認提款前顯示風險評估,讓他們可考慮繞開高風險目的地。

Trade Monitoring: While less common than deposit/withdrawal screening, sophisticated exchanges also monitor trading patterns:

交易監控:雖然比入金/出金監控較少見,但部分先進交易所亦會追蹤交易行為:

- Wash trading indicators (self-trading to fake volume)

洗倉指標(自買自賣造假成交量) - Market manipulation signals (pump and dump coordination, spoofing)

市場操控信號(協同拉抬砸盤、虛報假單) - Insider trading patterns (unusual pre-announcement accumulation)

內幕交易模式(公告前有異常買入/累積) - Account takeover signals (sudden strategy changes suggesting compromised account)

賬戶被盜風險(策略突然轉變,懷疑賬戶遭入侵)

Escalation and Investigations Teams

When alerts fire, structured escalation protocols activate: 當警示彈出時,系統會啟動分級升級程序:

Level 1 - Automated Response:

一級-自動回應:

- Low-severity alerts may auto-resolve if contextual data explains the pattern

低嚴重性警報如可由背景數據解釋,系統會自動解除 - System may impose temporary limits (e.g., hold withdrawal for 24 hours) automatically

系統可自動施加臨時限制(例如暫緩提款24小時) - Customer may see generic "additional verification required" messages

客戶會收到一般性的「需要額外驗證」提示

Level 2 - Analyst Review:

二級-分析師審查:

- Compliance analysts (typically requiring 6-12 months training) review flagged cases

經培訓6-12個月的合規分析師審查受標記個案 - Analysis includes: KYC file review, blockchain forensics using KYT tools, checking similar historical patterns, reviewing customer communications

分析包括:檢查KYC文件、用KYT工具追蹤區塊鏈、比較歷史交易模式、查閱客戶通訊記錄 - Analysts can clear (no action), escalate (to senior staff), or impose controls (temporary freeze, permanent limits, account termination)

分析師可決定結案(無需處理)、升級(交由高層處理)、或採取管控措施(凍結、永久降限、終止賬戶) - Timeline: 1-3 business days for most cases

處理時間:大多數個案需1-3個工作天

Level 3 - Senior Investigation:

三級-高級調查:

- Complex cases involving significant amounts, potential sanctions violations, or criminal activity escalate to senior investigators

複雜案件(大金額、潛在制裁違規、刑事嫌疑)會升級到資深調查員處理 - May involve: extensive blockchain tracing, coordination with legal counsel, preparation of formal evidence packages

可能需進行:大規模區塊鏈追蹤、法律意見協調、準備正式證據 - May include: customer outreach requesting additional information, cooperation with law enforcement, filing SARs

亦可能涉及:聯絡客戶補交資料、配合法律機關、提交SAR報告 - Timeline: 1-4 weeks or longer for complex cases

需時:複雜個案通常1-4星期或更長

Level 4 - Executive/Legal Review:

四級-高層/法律審查:

- Highest-risk cases (major sanctions violations, law enforcement inquiries, potential criminal liability) reach executive level

最高風險案件(重大全球制裁違規、執法部門查詢、刑事風險)會呈交管理層 - Decisions involve: Chief Compliance Officer, General Counsel, sometimes CEO

決策涉及:首席合規官、總法律顧問,有時甚至CEO - Outcomes may include: immediate account termination, asset seizure and reporting to authorities, comprehensive lookback reviews for related accounts

行動包括:立刻終止賬戶、凍結資產並通報執法機構、全面回溯審查相關賬戶

Standard Operating Procedures (SOPs)

Leading exchanges maintain detailed SOPs covering common scenarios:

主流交易所會設有詳細標準作業程序(SOP),應對各類常見情境:

SOP Example - Mixer Exposure: If customer deposits funds with direct mixer exposure within 1 hop:

SOP例子-混幣風險:如客戶入金涉及1跳內混幣器:

-

Automatically hold deposit from crediting customer account

1.自動凍結該筆入金,未即時入賬 -

Flag for Level 2 analyst review within 4 hours

2.於4小時內標記,轉交二級分析師審查 -

Analyst reviews: amount (over $1,000 = higher priority), customer history (first offense?), proportion of funds (10% from mixer vs. 90%?), customer risk tier

3.分析師審查:涉事金額(大於一千美元需優先處理)、客戶過往記錄(首次情況?)、資金比例(10%來自混幣器vs.90%?)、客戶風險等級 -

If minor amount, first offense, small proportion: may approve with warning email to customer

4.如款額小、首次、比例低-可批准並向客戶發出警告電郵 -

If significant amount or repeat pattern: escalate to Level 3, potentially

5.如款額大或重複違規-升級三級調查 freeze account and request customer explanation

凍結帳戶並要求客戶作出解釋 -

Document decision rationale in case management system

-

在個案管理系統記錄決策理據

-

If approved, retain enhanced monitoring flag for 90 days

-

如獲批准,保留加強監察標記90日

SOP Example - Sanctions Screening Hit: If customer deposit includes any funds within 2 hops of OFAC SDN address:

標準操作程序範例-制裁篩查命中:如客戶存款中有任何資金於兩級之內曾經涉及OFAC SDN地址:

-

Immediate freeze of deposit, do not credit customer account

-

立即凍結有關存款,不要入賬至客戶帳戶

-

Instant escalation to Level 3 senior investigator

-

即時上報至三級高級調查員

-

Within 2 hours: confirm hit is genuine (not false positive), determine proportion and recency of sanctioned exposure

-

兩小時內:確認命中是否屬實(非誤報),評估涉及制裁的比例及最近曝險時間

-

Within 24 hours: escalate to executive/legal review if genuine sanctions exposure

-

24小時內:若屬真正制裁曝險,升級到高層/法律審查

-

Legal team determines: report to OFAC, file SAR with FinCEN, freeze all customer assets, prepare for potential asset seizure

-

法律團隊決定是否:向OFAC報告,向FinCEN遞交SAR,凍結所有客戶資產,並準備可能的資產充公程序

-

No customer communication until legal clears (avoid tipping off potential sanctions violator)

-

未獲法律部門批准前,不得對客戶作任何溝通(避免走漏消息予潛在制裁違規者)

-

If false positive: document analysis and release funds with apology to customer

-

如屬誤報:記錄調查分析,解凍資金並向客戶致歉

Case Examples

Case 1 - The Innocent Mixer User:

案例一-無辜混幣用戶:

A customer deposited 0.5 BTC that KYT flagged as "high risk - recent mixer exposure." Investigation revealed the customer purchased the Bitcoin on a P2P platform (LocalBitcoins) from an individual seller. Unbeknownst to the customer, that seller had previously used a mixer. The compliance team determined: first offense, customer had no knowledge or control over prior history, relatively small amount. Resolution: Approved the deposit with an educational email to the customer about transaction screening and recommendation to use only regulated exchanges for purchases in the future. Enhanced monitoring applied for 60 days.

一名客戶存入0.5 BTC,被KYT標記為「高風險-最近曾經混幣」。調查發現,客戶是經P2P平台(LocalBitcoins)跟一名個人賣家購買比特幣,客戶並不知情該賣家早前有使用混幣器。合規團隊認定:首次違規,客戶對資金歷史不知情也不可控,涉資額較小。處理方法:批准存款,並向客戶發送教育電郵,解釋交易篩查及建議日後只經受規管交易所購買,加強監察客戶60日。

Case 2 - The Sanctions Evader:

案例二-規避制裁者:

A customer using fabricated KYC documents (purchased identity) deposited funds eventually traced (6 hops back) to a darknet market. The customer made numerous small deposits over weeks, then attempted a large withdrawal to an address with direct ties to a sanctioned entity. Investigation found: VPN use masking true location, use of compromised identity, structured deposit pattern (staying below auto-review thresholds), destination with sanctioned exposure. Resolution: Account immediately frozen, all assets seized, SAR filed, customer information reported to law enforcement, internal review of verification procedures to identify control failure that allowed fake documents.

一名客戶利用偽造KYC文件(購買的身份)入金,資金最終(追查六層)源自暗網市集。該客戶在數周內多次小額入金,然後嘗試大額提款至一個與被制裁實體有直接聯繫的地址。調查揭示:客戶使用VPN隱藏真實地點,冒用身份,刻意分拆入金(低於自動審查門檻),提款目的地涉制裁曝險。處理方法:即時凍結帳戶及資產,遞交SAR及通報執法部門,並對驗證程序進行內部審查,以找出讓偽文件通過的控制漏洞。

Case 3 - The False Positive:

案例三-誤報個案:

A customer received a deposit flagged as "medium risk - connection to unregulated exchange." Investigation revealed the funds came from a well-known decentralized exchange (Uniswap) through an aggregator service. The KYT vendor had incorrectly categorized the aggregator smart contract as "unregulated exchange." Resolution: Cleared the deposit within 4 hours, submitted feedback to KYT vendor to correct mislabeling, implemented whitelist for major DeFi aggregators to prevent future false positives.

一名客戶收到一筆被標記為「中風險-與無牌交易所有關」的存款。調查發現資金源自知名去中心化交易所(Uniswap),並通过聚合器服務轉入。KYT供應商錯誤地將該聚合器智能合約歸類為「無牌交易所」。處理方法:四小時內批准入賬,向KYT供應商反饋,糾正錯誤分類,並設立主要DeFi聚合器白名單以防將來誤報。

Operational Metrics and Challenges

Volume Challenges: Large exchanges process millions of transactions daily. Even a 0.1% false positive rate means thousands of manual reviews. Industry benchmarks suggest:

交易量挑戰:大型交易所每日處理數以百萬計交易。即使只有0.1%誤報率,也意味著每天需要額外數千宗人工審查。行業指標建議:

-

0.5-2% of deposits trigger automated holds

-

0.5-2% 存款會觸發自動暫停

-

0.05-0.2% escalate to human review

-

0.05-0.2% 需要人工審查

-

0.01% result in permanent account actions

-

0.01% 會導致永久帳戶處分

Review Timelines: Most exchanges aim for:

審核時限:大部分交易所目標如下:

-

Low-risk alerts: automated resolution in seconds

-

低風險警報:數秒內自動解決

-

Medium-risk alerts: analyst review within 24 hours

-

中風險警報:分析員24小時內審查

-

High-risk alerts: senior review within 48 hours

-

高風險警報:高級人員48小時內審查

-

Complex investigations: resolution within 5-10 business days

-

複雜調查:5-10個工作天內完成

Staffing Requirements: Industry rule of thumb: 1 compliance analyst per $100-200 million in monthly trading volume, with 3-5 tier structure from junior analysts to senior investigators to legal counsel.

人手要求:行業慣例為每月$1-2億交易量需配備一名合規分析師,團隊設有3-5級,由初級分析員、高級調查人員至法律顧問。

COMPLIANCE OPS INSIDE CUSTODIAL WALLETS & CUSTODIANS

Custodial service providers face additional compliance complexity beyond exchanges. Custody involves safeguarding customer assets (often with segregated cold storage), requiring additional controls around key management, withdrawal authorization, and client asset protection.

託管服務供應商面對比交易所更複雜的合規要求。託管涉及保障客戶資產(通常以分隔冷錢包儲存),需要加強金鑰管理、提款授權及客戶資產保護等多重管控。

Custody-Specific Controls

Segregated Account Management: Custodians maintain separate wallets for each institutional client, preventing commingling that could complicate transaction screening or create liability in case of one client's compliance issues. This differs from exchanges that often use omnibus hot wallets, crediting customers through internal ledger entries.

分隔帳戶管理:託管人為每個機構客戶設立獨立錢包,避免不同客戶資金混合,以防日後出現交易篩查問題或因單一客戶違規而令所有資金受牽連。這與交易所常用的總帳熱錢包,僅靠內部記帳為客戶入賬,做法不同。

Multi-Signature Authorization: Institutional custody typically requires multiple parties to authorize withdrawals:

多重簽署授權:機構級託管一般需要多方共同授權提款:

-

Client provides signed authorization (sometimes requiring multiple client employees)

-

客戶提交已簽署的授權(有時要多名客戶員工共同簽署)

-

Custodian compliance reviews and approves

-

託管人合規部審核並批准

-

Custodian operational team executes using multi-sig wallet

-

託管人運營團隊以多簽錢包執行交易

-

All steps logged for audit trail

-

所有步驟均記錄留底以作審計追蹤

This creates compliance checkpoints: even if a client requests a withdrawal to a high-risk address, custodian compliance can block the transaction.

此設計加強合規把關:即使客戶要求提款到高風險地址,託管人合規部亦可阻止交易。

Enhanced KYT for Custodians: Custodians apply KYT differently than exchanges:

託管機構加強KYT:託管人應用KYT方式與交易所不同:

-

They may not control the initial source of deposited funds (client manages their own incoming transactions)

-

他們可能無法控制入金來源(由客戶自行管理收款)

-

Primary focus is withdrawal screening, ensuring custodian doesn't facilitate transfers to sanctioned or high-risk destinations

-

著重提款篩查,確保託管人不會協助資金轉移至被制裁或高風險地點

-

Emphasis on transaction policy enforcement (client-specific rules about approved destinations, velocity limits, notification requirements)

-

重視交易政策執行(按客戶專屬規則限制提款目的地、頻率、通知要求等)

Disaster Recovery and Key Management: Custody compliance extends beyond AML to operational security:

災備及金鑰管理:託管合規除防洗錢亦牽涉運營安全:

-

Secure key generation and storage (HSMs, multi-party computation, cold storage)

-

安全金鑰生成及存儲(HSM、MPC、多方冷藏)

-

Disaster recovery procedures ensuring client access

-

制定災難復原程序,保證客戶仍能存取資產

-

Insurance and bonding requirements

-

所需保險及擔保安排

-

Regular proof-of-reserves and attestations

-

定期資產保證及獨立驗證

Custody KYC and Onboarding

Institutional custody clients undergo far more extensive due diligence than retail exchange users:

機構託管客戶須進行遠較零售客戶嚴格的盡職審查:

Initial Onboarding (4-8 weeks typical):

初步開戶(一般需時4-8週):

-

Corporate structure verification (articles of incorporation, shareholder agreements, beneficial ownership disclosure)

-

驗證公司架構(成立文件、股東協議、實益擁有人披露)

-

AML/KYC policy review (custodian evaluates client's own compliance program)

-

審查客戶防洗錢/KYC政策(託管人評核其內部合規制度)

-

Sanctions and negative news screening on entity and all key principals

-

對公司及所有關鍵高管進行制裁及負面新聞篩查

-

Financial review (audited statements, proof of legitimate business)

-

財務審查(審計報告、合法業務證明)

-

Reference checks (contacting previous service providers)

-

諮詢推薦人(聯絡過往服務供應商)

-

Legal documentation (custody agreement, fee schedules, liability limitations, insurance requirements)

-

法律文件(託管協議、收費表、責任限制、保險要求)

-

Technical onboarding (key generation ceremonies, access controls, recovery procedures)

-

技術開戶(產生金鑰儀式、權限設定、資產復原程序)

Ongoing Monitoring:

持續監察:

-

Annual re-verification of corporate documents and beneficial ownership

-

每年重新核查公司文件及實益擁有人

-

Quarterly attestations from client regarding compliance status

-

客戶每季提供合規聲明

-

Continuous negative news monitoring

-

持續跟進負面新聞

-

Transaction pattern analysis (are withdrawals consistent with stated business purpose?)

-

分析交易模式(提款是否跟所述業務一致?)

Withdrawal Vetting Procedures

Before executing withdrawals, custodians conduct multi-layer review:

執行提款前,託管人會進行多重審查:

Pre-Authorization Stage:

初步授權階段:

-

Client submits withdrawal request through secure portal

-

客戶經保安網關提交提款申請

-

Custodian verifies request authenticity (multi-factor authentication, callback verification for large amounts)

-

託管人驗證申請真確性(多重認證,大額單需電話覆核)

-

System checks client account status (any holds, flags, or open issues?)

-

系統檢查賬戶狀態(有無凍結、標記或未解決問題?)

-

System performs preliminary KYT screening on destination address

-

系統對目的地址進行初步KYT篩查

Compliance Review Stage:

合規審查階段:

-

Analyst reviews KYT results on destination address

-

分析員審查目的地址的KYT結果

-

Checks destination against client's approved destination list (many custody agreements restrict withdrawals to pre-approved addresses)

-

檢查提款地址是否在客戶預先批核名單內(很多託管協議只准提款至指定地址)

-

Verifies withdrawal is consistent with client's stated activity (nature of business, expected patterns)

-

確認提款用途符合客戶所述業務及預期行為

-

For high-value transactions (often >$100,000), may require senior approval

-

大額交易(通常超過十萬美元)需高層批核

-

For highest-value (often >$1 million), may require executive approval

-

超大額(通常超過一百萬美元)需管理層批准

Execution Stage:

執行階段:

-

Operations team verifies all approvals are in place

-

營運團隊核實所有批核已獲落實

-

Multi-sig authorization process executes transaction

-

以多重簽署程式執行交易

-

Real-time monitoring confirms transaction broadcasts correctly

-

即時監控以確保交易成功上鏈

-

Post-transaction confirmation to client with full audit trail

-

交易完成後通知客戶並提供完整審計紀錄

Special Case - Law Enforcement Holds: If custodian receives legal process (subpoena, seizure warrant) regarding client assets, immediate freeze occurs. Custodian must balance:

特別情況-執法凍結:如託管人收到有關客戶資產的法律程序(如傳票、充公令),需即時凍結資產。託管人須平衡:

-

Legal obligation to comply with valid law enforcement requests

-

遵守有效執法要求的法律責任

-

Contractual obligation to client

-

對客戶的合約責任

-

Potential liability if assets released improperly

-

資產錯誤釋放時或會承擔法律責任

-

Client notification requirements (sometimes delayed by law enforcement)

-

客戶通知責任(有時需配合法律機關延遲通知)

Tradeoffs Specific to Custody

Client Privacy vs. Platform Compliance: Sophisticated custody clients (hedge funds, family offices) often value confidentiality regarding their holdings and trading strategies. Custodians must balance:

客戶私隱與平台合規:高端託管客戶(對沖基金、家族辦公室等)非常重視資產持倉及交易策略保密。託管人需平衡:

-

Collecting sufficient information to satisfy their own compliance obligations

-

收集足夠資料以符合法規要求

-

Respecting client confidentiality

-

維護客戶機密

-

Potentially refusing high-risk clients even if financially attractive

-

可能要拒絕高風險但有利可圖的客戶

Operational Security vs. Velocity: Custody cold storage security (offline keys, geographic distribution, multi-party authorization) inherently creates friction:

營運安全與效率取捨:託管冷錢包(離線私鑰、地理分散、多方授權)本來就增加操作時間:

-

Withdrawal processing may take hours or days vs. seconds for exchange hot wallets

-

提款處理或需數小時或數日,遠遜交易所熱錢包的秒級速度

-

This actually aids compliance (more time to review), but frustrates clients needing rapid access

-

這其實有利合規(有更多時間審查),但令急需資金的客戶感到不便

-

Some custodians offer "hot wallet as a service" for clients needing speed, but with lower balance limits and higher transaction monitoring

-

有些託管人提供「熱錢包托管服務」以滿足部分對速度要求高的客戶,但限制餘額並加強監控

Insurance and Liability: Custodians face unique liability exposure:

保險與責任:託管人需面對獨特法律風險:

-

If custodian facilitates transaction to sanctioned destination, custodian faces enforcement action

-

如協助資金流向被制裁地點,託管人須承擔法律後果

-

If custodian improperly blocks legitimate client transaction, faces breach of contract claims

-

錯誤阻礙合法交易則可能被客戶追討違約責任

-

If custodian's security fails and assets stolen, faces negligence claims

-

如安全措施失效導致資產被竊,涉及疏忽賠償責任

-

Comprehensive insurance is expensive but essential, and underwriters increasingly require robust compliance programs

-

全面保險成本高昂,但屬必需,承保人對合規要求愈趨嚴格

Example: Qualified Custodian Requirements

In some jurisdictions (notably U.S. for RIAs managing >$150 million), investment advisers must use "qualified custodians" for client assets. For crypto assets, this means:

部分司法管轄區(尤以美國,持牌投資顧問資產超過1.5億美元)規定,投資顧問必須將客戶資產存放於「合資格託管人」。加密資產方面,即:

-

Custodian must be a bank, broker-dealer, or registered trust company

-

託管人須為銀行、持牌券商或註冊信託公司

-

Must maintain adequate capital reserves

-

須保持足夠資本儲備

-

Must undergo regular regulatory

-

頻繁接受監管部門的常規審查Here is your translation with markdown links unchanged:

examinations

- 必須直接向客戶提供賬戶結單

- 必須實行獨立的客戶資產保障

這些要求大大限制了託管服務提供者的選擇,並帶來額外的合規負擔,但同時為客戶提供更強的保障。

OTC 場外交易台及流動性供應商的合規操作

場外(OTC)交易台促成大型加密貨幣交易,這些交易不會經公開訂單簿,主要服務機構客戶、高淨值人士及其他交易所。由於客戶層次、交易金額及直接對手方關係不同,OTC 的合規要求與交易所存在明顯差異。

客戶審查及加強盡職調查

OTC 交易台執行超越一般交易所標準的機構級 KYC(認識你的客戶):

首次客戶開戶(2-6 星期):

- 對所有主要負責人進行全面公司及個人背景調查

- 財務報表及資金來源證明(對高淨值人士尤為重要)

- 了解業務模式及對加密資產的正當需求

- 投資理念文件(為何買賣加密貨幣?)

- 預期交易量及頻率

- 銀行關係及傳統金融參考資料

- 加強制裁篩查(OTC 交易常涉六位數或以上,微小比例的制裁風險都有重大隱憂)

客戶風險分類:OTC 交易台將客戶分層:

- 第一層(最高信任):受監管的金融機構、上市公司、合規能力強的大型對沖基金

- 第二層(標準):家族辦公室、經審計財務的高淨值客戶、原生加密基金

- 第三層(需加強監控):新客、來自高風險司法管轄區或文件不齊全客戶

風險級別會影響定價(第一層有最優惠價格)、結算條件(第一層可獲無抵押結算,第三層可能要求使用第三方託管)及監控力度。

交易監察及交易前合規

OTC 交易台與交易所不同,屬於代表客戶執行交易,故每一步均設有合規檢查:

交易前篩查:

- 客戶提交指示(例如:「用美元買入 500 萬 USDC」)

- 交易台驗證客戶授權(指示是否經驗證?)

- 檢查客戶賬戶狀況(有否標註、凍結或問題?)

- 驗證客戶是否持有足夠資產或資金

- 如賣出加密貨幣,會對客戶存款地址做 KYT 風險篩查,確保無污點資金

如 KYT 發現資金高風險來源,交易台可能:

- 全面拒絕該交易

- 要求提供更多資金來源文件

- 只讓乾淨部分成交

- 要求客戶使用其他資金

交易執行:

- 交易台從多家流動性來源(交易所、做市商、其他 OTC 交易台)執行交易

- 結算經既定渠道進行(法幣以電匯,加密貨幣則鏈上轉帳)

- 交易後對目標地址進行 KYT 篩查(如客戶收加密貨幣,會查究收款去向)

交易後監控:

- 持續監察客戶收款後加密貨幣的用途

- 如客戶即時轉至高風險目的地(Mixer、未受規管交易所、受制裁地址),賬戶會被標示加強監控甚至限制交易

- 不尋常的交易後行為或反映客戶為高風險最終用戶的中介

結算控制及對手方風險

OTC 交易台面對獨特的結算風險:

託管及 DvP(交付對價付款):

- 新客戶或高風險客戶可能要求託管結算(第三方持有資產,直至雙方履行責任)

- 使用原子交換或智能合約 DvP 可消除對手方風險,但較複雜

- 第一層客戶可獲無抵押信任式結算,快捷但需高信心

結算時制裁篩查:最終 KYT 檢查包括:

- 驗證目標地址無新被制裁(OFAC 制裁清單經常更新)

- 檢查客戶或其機構有否突發負面新聞

- 核實交易詳情(金額、時間及地址)符合同意內容

OTC 專屬紅旗警號

除交易所通用紅旗外,OTC 交易台還警惕:

層疊洗錢跡象:

- 客戶連續多單交易,疑似掩蓋資金來源(加密 > 穩定幣 > 法幣 > 其他加密)

- 快速反向交易(買入即賣出)

- 使用多重中介或受益人

分拆結構:

- 客戶將大額交易分割成多筆較小交易以避開申報門檻

- 加密貨幣雖無類似美國 1 萬美元申報線,但客戶可能為躲避內部限制或審查而分單

人頭交易跡象:

- 客戶似乎為未公開最終用戶進行交易

- 對交易目的解釋含糊

- 客戶背景(如小型企業)與大額交易(如 1000 萬美元加密貨幣)明顯不符

- 客戶要求結算至未預先公開之第三方

地域風險:

- 擁有正規業務地址的客戶要求結算至高風險地區地址

- 使用與聲稱地點不符的 VPN 或匿名工具

- 無需經多地卻跨多司法區轉帳

OTC 交易台運作結構

成功的 OTC 交易台會嚴格分工:

前台(交易):客戶關係、報價、交易執行。著重客戶服務與價格競爭力。

中台(合規):交易前審批、KYT 風險篩查、加強盡職調查、持續監控。獨立於交易部門,擁有一票否決權。

後台(結算):交易確認、資產轉移、對帳。資金轉帳前的最後核實。

風險管理:整體風險敞口監控、信用額度管理及對手方評估。與合規部緊密協作處理高風險個案。

這種分工確保合規決策不受營收壓力左右——由於單筆 OTC 交易可帶來五位、六位數收入,忽視紅旗的誘因極大,明確職能劃分成為關鍵監控點。

KYT 工具運作原理:技術詳解

「認識你的交易」(KYT)工具是加密合規的技術核心,將區塊鏈透明度轉化為可落地的風險情報。了解其運作原理,可以明白這些工具的威力與局限。

數據來源及收集

KYT 供應商會將多種來源的數據彙總,構建全面的鏈上情報:

鏈上數據(主要來源):

- 支援公鏈的全部歷史交易紀錄(比特幣、以太坊及 100 多條鏈)

- 供應商運行完整節點,索引每一宗交易、地址和智能合約互動

- 數據包括:交易金額、時間戳、發送/接收地址、Gas 費、合約調用

- 比特幣特有:UTXO(未花費交易輸出)追蹤

- 以太坊:賬戶結餘、ERC-20 代幣交易、DeFi 協議互動、NFT 轉移

地址標註(標籤):

- 擁有專有資料庫,將地址與現實世界實體映射

- 來源包括:公開披露(交易所公布存款地址)、暗網情報(已知勒索錢包)、執法機構合作、調查研究、法院傳票回覆

- Chainalysis 據報有逾五億地址標籤

- 類別涵蓋:各類交易所(甚至可分到用戶)、Mixer/Tumbler、暗網市場、博彩平臺、受制裁實體、勒索軟件、騙局、DeFi 協議、礦池

制裁名單:

- OFAC 特別指定國民(SDN)清單(含加密地址)

- 聯合國安理會制裁

- 歐盟制裁

- 各地國家制裁(英國、加拿大、澳洲、日本等)

- 官方一更新即數小時內納入系統

威脅情報:

- 監控暗網論壇、Telegram 頻道、社交媒體追蹤新威脅

- 跟蹤新型騙局、被黑服務、漏洞利用

- 對資金混合技術、鏈上跨跳、隱私工具持續情報收集

用戶舉報:

- 加密交易所及其他客戶可提交標記有風險的地址

- 網絡效應:客戶越多,資料越全面,服務越好

聚類及歸因方法

原始區塊鏈數據只顯示化名地址,非現實身份。KYT 工具用多種啟發法將地址歸類為實體/歸因於真實主體。

共同輸入擁有者法則: 當多個地址同時成為單一比特幣交易的輸入,表示極可能由同一持有人控制(因須持有全部私鑰)。聚類演算法將這些地址分組至同一錢包/實體。

找出找零地址: 比特幣每次交易常會有「找零」輸出(剩餘資金回傳發送者)。分析找零地址有助將其與用戶地址串連。

剝皮鏈分析(Peel Chain): 追蹤資金經多次連續交易移動,常見模式為每次花小額、剩下大額重回自己,辨析資金流向。

聯合花費時間分析: 若地址在短時間內高頻共用,極可能同屬一個控制方。

存款地址重用: 某些交易所為同一用戶反覆使用同一入金地址,直接聯繫用戶身份。

智能合約互動模式:

在以太坊上,細析地址如何與智能合約互動等行為......interact with DeFi protocols, following fund flows through DEX trades, lending protocols, bridges between chains.

與DeFi協議互動,追蹤資金如何通過DEX交易、借貸協議以及跨鏈橋流動。

Cross-Chain Tracking:

跨鏈追蹤:

Following assets as they bridge between blockchains (BTC wrapped to Ethereum, Ethereum bridged to Polygon, etc.). Requires correlating transactions on multiple chains, often using bridge protocol data.

追蹤資產如何在不同區塊鏈之間進行跨鏈操作(例如比特幣包裹到以太坊、以太坊橋到Polygon等)。這需要將不同鏈上的交易聯繫起來,通常會用到跨鏈橋協議的數據。

Risk Scoring and Alert Generation

風險評分及警示產生

KYT tools assign risk scores based on multi-factor analysis:

KYT工具根據多重因素分析分配風險評分:

Direct Exposure Scoring:

直接接觸評分:

- Address has direct relationship with known-bad entity

地址與已知不良實體有直接聯繫 - Severity varies: sanctioned entity = critical, unregulated exchange = medium, mixing service = high

嚴重程度不同:被制裁實體=極高,無監管交易所=中等,混幣服務=高 - Most vendors use 0-100 or 0-1000 scale, with thresholds for auto-actions

大部分供應商用0-100或0-1000分數,並設置自動操作的閾值

Indirect Exposure Scoring:

間接接觸評分:

- Funds came from risky source N hops away

資金來自高風險來源,距離N跳 - Risk decreases with distance: 1 hop = high risk, 2 hops = medium, 3+ hops = low

風險隨距離而遞減:1跳=高風險、2跳=中風險、3跳或以上=低風險 - Proportional weighting: 10% of funds from mixer = lower score than 90% from mixer

按比例計分:10%資金來自混幣=分數低過90%資金來自混幣

Behavioral Scoring:

行為模式評分:

- Transaction fits patterns associated with illicit activity

交易出現洗錢等可疑行為模式 - Examples: structured deposits (many small instead of one large), rapid movement through multiple addresses, mixing service usage, layering through multiple cryptocurrencies

例子:拆單入金(多次小額代替一次大額)、資金快速穿梭多個地址、使用混幣服務、多重幣別分層轉移

Counterparty Reputation:

交易對手聲譽:

- Is destination/source address associated with reputable entity?

收款/發款地址是否屬於可信機構? - Sending to known legitimate exchange = low risk

發送去有良好聲譽嘅大型交易所=低風險 - Sending to address with no history or recent creation = higher risk

發送去無歷史紀錄或新開設嘅地址=較高風險

Geographic and Compliance Risk:

地區及合規風險:

- Does transaction involve addresses associated with high-risk jurisdictions?

交易有否涉及高風險司法管轄區地址? - Does transaction involve service that lacks proper licensing?

有冇涉及冇牌或無監管的服務?

Composite Scoring Example:

綜合評分例子:

Transaction receives final risk score combining:

交易綜合以下權重獲得最終風險分數:

- Direct exposure (40% weight): No direct risky contacts = 0 points

直接接觸(40%):無直接高風險聯繫=0分 - Indirect exposure (30% weight): 2 hops from mixer = 30 points

間接接觸(30%):2跳遠來自混幣=30分 - Behavioral (20% weight): Normal velocity, no structuring = 0 points

行為(20%):速度正常,無拆單=0分 - Counterparty (10% weight): Destination is established exchange = 0 points

交易對手(10%):收款方係主流交易所=0分 - Final Score: 9/100 = Low Risk

最終分數:9/100=低風險

Different transaction:

另一種交易:

- Direct exposure (40% weight): Direct deposit from mixer = 90 points

直接接觸(40%):直接由混幣入金=90分 - Indirect exposure (30% weight): N/A when direct exposure present = 0 points

間接接觸(30%):如已直接接觸則此項無效=0分 - Behavioral (20% weight): First deposit from this source = 20 points

行為(20%):首次由此來源入金=20分 - Counterparty (10% weight): Unknown address = 50 points

交易對手(10%):未知地址=50分 - Final Score: 76/100 = High Risk, triggers manual review

最終分數:76/100=高風險,需要人工審查

Alert Thresholds and Tuning

警示閾值及調整

Customers configure KYT systems with thresholds matching their risk tolerance:

客戶可以根據自身風險偏好設定KYT系統的警示閾值:

Conservative Configuration (Traditional Bank):

保守設置(傳統銀行):

-

80/100 score = auto-block

80分=自動封鎖 - 50-80 = hold for manual review

50-80分=暫停等人工審查 - 30-50 = approve but flag for monitoring

30-50分=批核但標記監控 - <30 = auto-approve

<30分=自動批核

Moderate Configuration (Major Exchange):

中庸設置(大型交易所):

-

90 = auto-block

90分=自動封鎖 - 70-90 = hold for review

70-90分=暫停審查 - 40-70 = approve with monitoring flag

40-70分=批核但設監控標記 - <40 = auto-approve

<40分=自動批核

Aggressive Configuration (Risk-Tolerant Platform):

進取設置(高風險平台):

-

95 = block (only direct sanctioned exposure)

95分=封鎖(只針對直接制裁) - 85-95 = review

85-95分=需要審查 - All else = approve

其他情況全都通過

Threshold Tuning Challenges:

閾值調整難題:

- Too conservative = excessive false positives, customer friction, analyst overwhelm

太保守=大量誤報、影響客戶體驗、分析員工作量暴增 - Too aggressive = miss genuine risks, regulatory exposure

太進取=漏過真正高風險、增加合規風險 - Optimal tuning requires continuous adjustment based on false positive rates, analyst feedback, and risk appetite changes

最佳調整需不斷根據誤報率、分析員反饋、風險胃納變動而優化

Real-Time vs. Batch Processing

實時與批量處理

Real-Time Screening (Deposit/Withdrawal):

即時檢查(存提):

- API call to KYT vendor as transaction processes

交易過程會即時調用KYT供應商API - Response time: 1-5 seconds typically

一般1-5秒回應 - Provides instant risk assessment before crediting deposits or executing withdrawals

在入金記賬或出金前,供即時風險評估 - Handles: direct exposure checks, immediate clustering analysis, real-time sanctions list checks

覆蓋:直接接觸檢查、即時地址聚類分析、即時制裁名單查詢

Batch/Retrospective Analysis:

批量/回溯分析:

- Periodic (hourly, daily) review of all customer addresses

定期(每小時、每日)審查所有客戶地址 - Tracks: changes in risk profile (counterparty became sanctioned after you transacted), new intelligence linking old addresses to illicit activity, behavioral patterns emerging over time

追蹤:風險檔案變動(交易對手事後被制裁)、舊地址新情報(關聯非法活動)、長時間行為模式 - Can trigger: account reviews, enhanced monitoring flags, lookback investigations

可觸發:帳戶回查、提升監控標籤、回顧式調查

Strengths of KYT Technology

KYT技術優勢

Blockchain Transparency Advantage:

區塊鏈透明度優勢:

Unlike traditional finance (where banks can't see counterparties beyond direct customer), blockchain analysis traces fund flows through unlimited hops, creating unparalleled transaction surveillance.

唔同傳統金融(銀行只能見到客戶對手方),區塊鏈分析可以無限追蹤資金流動,實現無可比擬的交易監控。

Speed and Scale:

速度與規模:

Automated analysis of millions of transactions daily, impossible with manual review.

每日可自動分析數以百萬計交易,人工審查無得比。

Network Effects:

網絡效應:

More users submitting intelligence = better data for all = more accurate risk scoring.

愈多用戶貢獻情報=數據愈好=風險評分愈準確。

Proactive Risk Identification:

主動風險識別:

Can identify emerging threats (new scam addresses, newly sanctioned entities) and retroactively scan historical transactions.

能夠識別新興威脅(新詐騙地址、新制裁名單),仲可以回查歷史交易。

Blind Spots and Limitations

盲點及限制

Privacy Coin Challenges:

隱私幣困難:

Monero uses ring signatures and stealth addresses, making transaction amounts and participants cryptographically hidden. KYT tools have minimal visibility into Monero transaction details. Zcash with shielded transactions similarly obscures data. Vendors can track "shielding" and "unshielding" events (moving between transparent and private pools) but not activity within the shielded pool.

Monero使用環簽名與隱形地址,令交易金額同雙方完全加密且不可見,KYT工具基本上無法追蹤Monero細節。Zcash的Shielded交易都有類似問題,供應商只能追蹤「shield」同「unshield」事件(即由公開轉私密,但私密池內部活動追唔到)。

Mixing Service Evolution:

混幣服務進化:

As KYT tools improve at identifying mixer outputs, mixers adapt: using longer chains, more varied patterns, decentralized protocols (CoinJoin, TornadoCash-style smart contract mixers), cross-chain mixing. This creates ongoing cat-and-mouse game.

KYT工具愈來愈識得捉混幣去向,混幣服務就不斷升級:用更長轉帳鏈、更複雜路徑、去中心化協議如CoinJoin、TornadoCash之類智能合約、甚至跨鏈混幣。雙方不斷你追我走。

Decentralized Exchange Complications:

去中心化交易所難題:

DEX trades occur through smart contracts without centralized intermediaries. While on-chain, the transaction complexity makes attribution harder: is this address a trader, a liquidity provider, an arbitrage bot, or the DEX protocol itself?

DEX交易直接透過智能合約,無中央中介。雖然都係鏈上,但交易路徑複雜,難以分辨地址屬於交易用戶、流動性提供者、套利機械人,抑或DEX協議本身。

Layer 2 and Rollup Challenges:

Layer 2及Rollup難題:

Transactions on Layer 2 networks (Lightning Network, Arbitrum, Optimism) may not fully settle on-chain, reducing visibility. Lightning Network in particular creates off-chain payment channels with only open/close transactions visible on Bitcoin mainnet.

Layer 2(如Lightning Network、Arbitrum、Optimism)上嘅交易唔一定全部鏈上結算,追蹤視野會窄咗。Lightning尤其只見到開/關通道喺主鏈上,通道內移動睇唔到。

False Positive Rates:

誤報率:

Industry estimates suggest 5-15% false positive rates even with tuned systems. Innocent users receiving funds from previously-tainted sources, good-faith transactions with legitimate privacy tools, or misattribution in clustering algorithms create compliance burdens and customer frustration.

業內估算即使有優化,誤報率都有5-15%。無辜用戶收到前身有問題資金、合法隱私工具交收、聚類算法歸錯地址,都會令合規壓力加大同客戶不滿。

False Negative Risks:

漏報風險:

Sophisticated actors can evade detection through: prolonged layering (many intermediate steps dilute tainted fund percentage), exploiting attribution gaps (new addresses, unmonitored chains), timing (allowing significant delay between illicit source and exchange deposit), or using privacy-preserving techniques KYT tools can't penetrate.

老手犯罪分子可以用層層轉賬(稀釋污染資金比例)、利用無法屬主新地址或冷門公鏈,或拉長時間差來瞞過檢查,甚至用KYT追唔到的隱私工具。

Labeling Accuracy Issues:

標籤準確性問題:

Address labels depend on investigative research, which can be incomplete or incorrect. Addresses may be mislabeled (marking legitimate service as risky), or labels may become stale (address ownership transfers, service changes business model).

地址標簽靠調查,有時唔全齊或錯誤。有可能誤將正規服務標成高危,又或者標籤過時(用戶轉手、服務改模式等)。

Comparative Vendor Analysis

主要供應商比較

Chainalysis (Market Leader):

Chainalysis(市場龍頭):

- Strengths: Largest address database, strongest law enforcement relationships, most comprehensive blockchain coverage (200+ assets)

優勢:最大地址資料庫、與執法機關合作最深、涵蓋區塊鏈資產種類最齊(超過200種) - Products: KYT (transaction monitoring), Reactor (investigation tool), Kryptos (asset recovery for law enforcement)

產品:KYT(交易監控)、Reactor(調查工具)、Kryptos(官方資產追討) - Pricing: Enterprise licensing typically $100,000-$500,000+ annually depending on transaction volume

收費:企業級授權每年約USD$10萬至50萬以上(按交易量) - Unique features: "Travel Rule" compliance tools, advanced investigation workflows, government partnerships

特色:Travel Rule合規、先進調查流程、多國政府合作

TRM Labs (Investigation Focus):

TRM Labs(調查取向):

- Strengths: Superior investigation UI, real-time attribution updates, strong DeFi protocol coverage

優勢:調查用戶介面優勝、即時標籤更新、支援DeFi協議全面 - Products: TRM Chain (monitoring), TRM Forensics (investigations), TRM Screen (sanctions screening)

產品:TRM Chain(監控)、TRM Forensics(調查)、TRM Screen(制裁篩查) - Pricing: Competitive with Chainalysis, emphasizes value for smaller/mid-size customers

收費:與Chainalysis相若,但重點服務中小型機構 - Unique features: "Cross-chain tracing" through bridges and wrapped assets, TRM Risk API for developers

特色:橋接及包裝資產跨鏈追蹤、開發者專用TRM Risk API

Elliptic (DeFi and NFT Specialty):

Elliptic(DeFi/NFT專家):

- Strengths: Deep DeFi protocol coverage, NFT marketplace monitoring, comprehensive smart contract risk analysis

優勢:深入覆蓋DeFi協議、NFT市場監控、全面智能合約風險分析 - Products: Elliptic Navigator (monitoring), Elliptic Discovery (investigations), Elliptic Lens (wallet screening)

產品:Elliptic Navigator(監控)、Elliptic Discovery(調查)、Elliptic Lens(錢包篩查) - Pricing: Range similar to competitors

收費:與同業相若 - Unique features: DeFi risk scoring, NFT provenance tracking, "Instant Screening" SDK for developers

特色:DeFi風險評分、NFT來源追蹤、開發者即時篩查SDK

CipherTrace (Now Mastercard):

CipherTrace(現屬Mastercard):

- Strengths: Traditional finance integration through Mastercard, strong global regulatory intelligence

優勢:與Mastercard整合傳統金融、全球合規資訊全面 - Products: CipherTrace Armada (platform covering monitoring and investigations)

產品:CipherTrace Armada(集監控與調查一身的平台) - Unique features: Integration with Mastercard's broader financial crime tools, focus on bank/TradFi partnerships

特色:與Mastercard其他金融犯罪系統結合,側重銀行/傳統金融合作

Smaller/Specialized Vendors:

細規模/專項供應商:

- Merkle Science: Asia-Pacific focus, strong compliance automation

以亞太市場為主,合規自動化強 - Coinfirm: European emphasis, MiCA compliance focus

專注歐洲,突出MiCA合規 - AnChain.AI: AI/ML-driven approaches, DeFi focus

主打AI/機器學習手段,鎖定DeFi - Scorechain: Privacy-focused approach, GDPR-compliant EU operations

注重隱私,歐盟GDPR合規

Integration Architecture

整合架構

Exchanges and crypto companies integrate KYT through several patterns:

交易所及加密公司可用多種方式整合KYT:

API Integration (Most Common):

API整合(最常見):

- Exchange systems call KYT vendor API on each transaction

交易所系統每宗交易調用KYT供應商API - Request includes: blockchain, transaction hash or address, amount

請求內容:區塊鏈、公鏈交易hash/地址、金額 - Response includes: risk score, risk factors, recommended action

回應內容:風險分數、成因分析、建議行動 - Typical latency: 1-3 seconds

延遲時間:一般1-3秒

Batch Upload:

批量上傳:

- Exchange provides list of addresses to monitor

交易所提供監控地址列表 - Vendor continuously monitors these addresses, pushing alerts when risky activity detected

供應商持續監控,有高風險即時推送警報 - Suitable for ongoing monitoring vs. real-time screening

多用於持續監測,而非即時風險判斷

On-Premise Deployment:

本地部署:

- For very large exchanges or those with data sovereignty requirements

適合特大交易所或有數據主權要求嘅機構 - Vendor provides software installed on exchange's infrastructure

供應商提供可安裝在交易所內部系統的軟件 - Exchange maintains direct blockchain node connections

交易所直接連接區塊鏈節點 - Reduces latency and data sharing but increases operational burden

可減少延遲、避免數據出外,但營運負擔增加

Hybrid Approach:

混合模式:

- Real-time API for immediate screening (deposits/withdrawals)

入金/出金用API即時檢查 - Batch monitoring for ongoing surveillance

日常持續監控用批量方式 - On-premise investigation tools for compliance team

合規團隊用本地部署調查工具

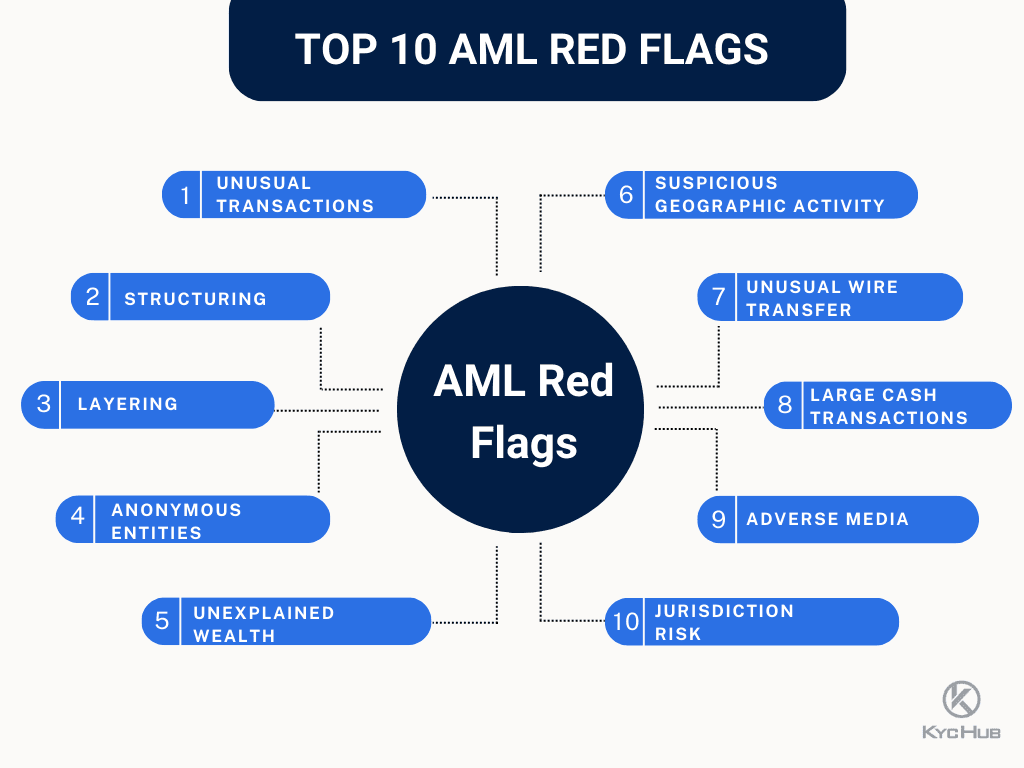

RED FLAGS THAT FREEZE ACCOUNTS: PRACTICAL LIST AND EXAMPLES

Understanding what triggers account freezes helps both companies implement

明白什麼會觸發帳戶凍結,有助公司設立有效措施...effective monitoring and users avoid inadvertent problems. Red flags fall into several categories based on the underlying risk typology.

有效監察及協助用戶避免無意中出現問題。紅旗可根據相關風險類型分為多個範疇。

1. Direct Sanctioned Address Interaction

1. 直接與受制裁地址互動

Description: Transaction directly involves an OFAC-sanctioned address or entity on other sanctions lists.

描述:交易直接涉及OFAC(美國財政部海外資產控制辦公室)受制裁地址,或其他制裁名單上的實體。

Severity: Critical - typically results in immediate freeze and regulatory reporting.

嚴重程度:嚴重 — 通常會即時凍結帳戶並作出監管報告。

Examples:

- Receiving funds from an address on OFAC's SDN list (e.g., addresses associated with Lazarus Group, Russian darknet markets, Iranian entities)

- Sending funds to a sanctioned address

- Acting as intermediary in chain involving sanctioned addresses

例子:

- 從OFAC的SDN名單上的地址收款(例如與Lazarus Group、俄羅斯暗網市場、伊朗實體有關的地址)

- 向受制裁地址發送資金

- 在涉及受制裁地址的轉賬鏈中擔任中介角色

Thresholds: Zero tolerance - any amount triggers action.

門檻:零容忍 — 任何金額都會觸發行動。

Real Case: In 2022, following the Tornado Cash sanctions, several users had accounts frozen at major exchanges after historical Tornado Cash usage, even if the usage predated sanctions designation.

實例:2022年,Tornado Cash被制裁後,有多位用戶因過往用過Tornado Cash(即使早於被制裁前)而在大型交易所被凍結帳戶。

2. Mixing and Tumbling Services

2. 混幣及洗幣服務

Description: Use of cryptocurrency mixers (CoinJoin, Wasabi Wallet, Samourai Whirlpool) or tumblers designed to obscure transaction history.

描述:使用加密貨幣混幣器(如CoinJoin、Wasabi Wallet、Samourai Whirlpool)或專為隱藏交易紀錄而設的洗幣工具。

Severity: High to Critical depending on proportion of funds and customer history.

嚴重程度:高至嚴重,視乎涉事金額比例及客戶過往紀錄。

Examples:

- Depositing funds where >50% recently passed through Tornado Cash

- Withdrawal to known Wasabi CoinJoin address

- Pattern of consistently using privacy-enhancing tools

例子:

- 存入資金時,有超過50%最近經過Tornado Cash

- 提款至已知的Wasabi CoinJoin地址

- 經常性使用提升隱私的工具

Thresholds:

- Conservative platforms: >10% mixer exposure triggers review

- Moderate platforms: >25% mixer exposure requires review

- Many platforms: Direct mixer usage (deposit from or withdrawal to) = automatic hold

門檻:

- 保守平台:超過10%混幣曝光便會審查

- 一般平台:超過25%混幣曝光便需審查

- 很多平台:直接使用混幣器(存入來自或提出到混幣)= 自動凍結

Real Case: User deposited Bitcoin to exchange after running funds through Wasabi Wallet CoinJoin. Exchange froze account pending explanation. User provided documentation showing funds were legitimately earned but wanted privacy from public blockchain exposure. Exchange required additional KYC documentation and source of funds proof before releasing.

實例:有用戶把經Wasabi CoinJoin處理後的Bitcoin存入交易所,被即時凍結帳戶待解釋。用戶出示證明顯示資金來自合法工作,只是想避免交易在區塊鏈上被公開查到。交易所最後要求提供更多KYC及資金來源證明才解凍。

3. Darknet Market and Illicit Service Linkage

3. 暗網市場及非法服務關聯

Description: Funds traced to darknet marketplace, illegal gambling site, unlicensed exchange, or other clearly illicit services.

描述:資金可追蹤至暗網市場、非法賭博網站、未持牌交易所或其他明顯屬非法服務。

Severity: Critical - strong indicators of money laundering or direct criminal activity.

嚴重程度:嚴重 — 強烈顯示有洗黑錢或犯罪活動。

Examples:

- Deposits traced within 2-3 hops to AlphaBay, Hydra, or similar marketplaces

- Funds from addresses associated with ransomware payments

- Connections to known scam addresses (pig butchering schemes, Ponzi schemes)

例子:

- 存款經2至3個轉帳可追溯至AlphaBay、Hydra等暗網市場

- 來自與勒索軟件付款相關的地址

- 與已知詐騙地址(如殺豬盤、龐氏騙局)有關聯

Thresholds:

- Direct connection (1 hop): Immediate freeze regardless of amount

- Indirect connection (2-3 hops) with significant proportion (>25%): Review required

- Distant connection (4+ hops) with small proportion (<10%): May pass with monitoring flag

門檻:

- 直接關聯(1跳):即時凍結,不論金額多少

- 間接關聯(2-3跳)且佔比大於25%:須審查

- 遠距離關聯(4跳以上)且佔比少於10%:可通過但附有監察標記

Real Case: User withdrew their exchange balance to a personal wallet, then several days later sent funds to a darknet market. Exchange's retrospective monitoring detected this, leading to account termination and SAR filing, even though the illicit activity occurred after funds left the exchange.

實例:有用戶將交易所餘額提到個人錢包,數天後再將資金發到暗網市場。交易所事後監察發現,雖然可疑行為發生在資金離開平台後,帳戶仍被終止及報告可疑交易(SAR)。

4. Rapid Movement and Layering Patterns

4. 資金快速轉移與層化模式

Description: Funds moving through multiple addresses, services, or cryptocurrencies in rapid succession, indicating potential layering stage of money laundering.

描述:資金於短時間內經過多個地址、服務或不同加密貨幣,顯示可能正處於洗錢層化階段。

Severity: Medium to High depending on pattern complexity and amounts.

嚴重程度:中至高,按資金流模式複雜程度及金額決定。

Examples:

- Deposit of BTC → immediate conversion to ETH → immediate withdrawal to different service

- Funds that bounced through 10+ addresses in 24 hours before depositing

- Pattern of receiving many small deposits from different sources, then one large withdrawal ("convergence pattern")

例子:

- 入金BTC後即轉為ETH,再馬上提取到其他服務

- 存款前資金在24小時內經過10個以上地址

- 來自不同來源的小額存款大量匯集後一次過大額提取(「收斂模式」)

Thresholds:

- 5+ hops in 48 hours before deposit: Triggers review

- Immediate convert-and-withdraw with no trading: Medium risk flag

- Structured patterns with <$10,000 individual transactions but >$50,000 aggregate: High risk

門檻:

- 在48小時內有超過5個轉帳才存入:須審查

- 即時兌換並提取,無交易行為:中風險提示

- 結構式模式下每次低於$10,000但總額超過$50,000:高風險

Real Case: User received 15 deposits of 0.1-0.3 BTC each over three days from different addresses, then immediately requested withdrawal of entire balance. Exchange froze account suspecting money mule activity. Investigation revealed user was Bitcoin miner consolidating mining pool payouts - legitimate but suspicious pattern. Resolved with documentation of mining activity.

實例:有用戶三日內以0.1-0.3 BTC為單位,由不同地址收取15筆存款,隨即全數提取,被交易所凍結帳戶懷疑作金錢騾活動。查明後,原來用戶是礦工收集礦池派彩,出示證明後解凍。

5. Structured Deposits ("Smurfing")

5. 結構式存款(「拆單」)

Description: Breaking large transactions into multiple smaller ones to avoid reporting thresholds or risk scoring triggers.

描述:將大額交易分拆為多筆小額入賬,避開申報門檻或風險評分。

Severity: Medium to High - indicates awareness of monitoring systems and potential attempt at evasion.

嚴重程度:中至高 — 反映客戶知悉監管制度並可能有逃避行為。

Examples:

- 10 deposits of $900 each (staying below $1,000 threshold) over 24 hours

- Pattern of consistent near-threshold deposits ($9,500 repeatedly when $10,000 triggers CTR)

- Multiple accounts controlled by same person splitting activity

例子:

- 24小時內多達10次每次$900的存款(低於$1,000門檻)

- 持續作接近門檻嘅存款(重複入$9,500而$10,000即需申報)

- 一人控制多個帳戶分拆操作

Thresholds:

- Automated systems typically flag: 3+ transactions within 20% of threshold amount in 24 hours

- Advanced systems use statistical analysis to detect intentional structuring vs. natural patterns

門檻:

- 自動系統通常標記:24小時內有3次以上接近門檻(±20%)的交易

- 進階系統以統計分析區分有意拆單與自然交易模式

Real Case: Family splitting large Bitcoin purchase across three family member accounts to each stay under enhanced KYC threshold. Exchange detected common funding source (same bank account) and linked accounts. Required explanation and consolidated accounts under one primary user with proper KYC.

實例:一個家庭將大額比特幣購買拆分成3個家庭成員帳戶,各自低於強化KYC要求。交易所發現共同資金來源(同一銀行戶口),將帳戶連結並要求解釋,最終要整合為一個合規單一用戶。

6. High-Risk Jurisdiction Indicators

6. 高風險司法管轄區指標

Description: Activity associated with jurisdictions identified as high-risk for money laundering, terrorist financing, or sanctions evasion.

描述:活動涉及被界定為洗黑錢、資助恐怖份子或規避制裁高風險司法管轄區。

Severity: Low to High depending on jurisdiction, customer profile, and transaction details.

嚴重程度:低至高,視乎司法管轄區、客戶背景及交易資料。

Examples:

- Deposits from addresses associated with Iranian or North Korean services

- VPN usage masking true location in sanctioned country

- IP addresses from Financial Action Task Force (FATF) blacklist countries

- Transactions routing through services headquartered in high-risk jurisdictions

例子:

- 來自伊朗或北韓服務相關地址的存款

- 使用VPN掩飾自己身處受制裁國家

- 來自FATF黑名單國家(如北韓、伊朗)的IP地址

- 交易經以高風險司法管轄區為總部的服務

Thresholds:

- FATF blacklist countries (e.g., North Korea, Iran): Typically blocked entirely

- FATF greylist countries: Enhanced monitoring, may require additional documentation

- IP/VPN from high-risk location with inconsistent KYC address: Investigation required

門檻:

- FATF黑名單國家(如北韓、伊朗):通常完全封鎖

- FATF灰名單國家:加強監控,或需補交文件

- IP/VPN來自高風險地點與KYC申報地址不符:須調查

Real Case: User with U.S. KYC documents consistently accessed account through Iranian IP addresses. Exchange investigation revealed user was Iranian-American temporarily residing in Iran. Account frozen pending determination of sanctions implications, eventually terminated due to inability to verify user wasn't violating OFAC restrictions on Iranian nationals.

實例:有人用美國KYC資料開戶,卻長期用伊朗IP登入。交易所調查發現實為伊朗裔美國人暫居伊朗,帳戶先被凍結待查,最後因無法證明無違反OFAC對伊朗國民限制而終止帳戶。

7. Peer-to-Peer Platform Linkage

7. 點對點交易平台關聯

Description: Funds originating from P2P platforms (LocalBitcoins, Paxful, Binance P2P) where KYC/AML controls may be weaker.

描述:資金來自點對點(P2P)平台(如LocalBitcoins、Paxful、Binance P2P),有機會KYC/AML監管較弱。

Severity: Low to Medium - often legitimate but higher risk due to unknown counterparties.

嚴重程度:低至中 — 多數屬合法,但因對家身份不明風險較高。

Examples:

- Deposit from address known to be LocalBitcoins trader

- Pattern suggesting user is P2P marketplace seller (many incoming transfers from different sources)

- Funds from unregulated or jurisdictionally ambiguous P2P platforms

例子:

- 存款來自LocalBitcoins已知賣家地址

- 用戶有疑似P2P賣家模式(接收多筆來自不同地方的資金)

- 來自無監管或司法管轄不明確P2P平台的資金

Thresholds:

- Depends heavily on platform: well-regulated P2P = minimal concern, unregulated = medium risk

- First-time users with P2P source: Often require explanation and enhanced KYC

- Large amounts (>$10,000) from P2P: Review standard

門檻:

- 很視乎平台:有監管平台=低關注,無監管=中等風險

- 首次用P2P資金來源的用戶:多數需解釋及加強KYC

- 大額(>$10,000)P2P存款:標準審查

Real Case: User deposited Bitcoin purchased on LocalBitcoins. KYT tools traced portion of funds to prior mixer use by the LocalBitcoins seller (unknown to user). Exchange requested user provide LocalBitcoins transaction records showing legitimate purchase and encouraged using regulated exchanges in future. Funds released after documentation provided.

實例:用戶將在LocalBitcoins購買的BTC存入交易所,KYT工具追蹤發現其中一部份之前經混幣但買家不知情。交易所要求提供交易紀錄證明為合法購買,並鼓勵下次用受監管平台。查證後釋放資金。

8. Unregulated Exchange or Service Usage

8. 無監管的交易所或服務

Description: Interaction with cryptocurrency exchanges or services lacking proper licensing/regulation in relevant jurisdictions.

描述:與在相關司法管轄區沒有正規牌照/監管的加密貨幣交易所或服務有關聯。

Severity: Low to High depending on platform reputation and regulatory environment.

嚴重程度:低至高,按平台聲譽及監管情況。

Examples:

- Deposits from exchange operating without registration in user's jurisdiction

- Withdrawals to platforms with known compliance deficiencies

- Funds transiting through exchanges serving sanctioned jurisdictions

例子:

- 來自未在用戶所在地註冊經營的交易所的存款

- 提款到已知合規有問題的平台

- 資金經過服務受制裁司法區域的交易所

Thresholds:

- Exchanges with serious compliance failures (binance.com during pre-settlement period): High risk

- Offshore exchanges with minimal regulation: Medium risk

- Legitimate exchanges with presence in user's jurisdiction: Low/no risk

門檻:

- 有嚴重合規問題的交易所(如binance.com達成和解前期間):高風險

- 只受輕度監管的離岸交易所:中風險

- 有在用戶管轄區合規經營的交易所:低或無風險

Real Case: During peak of 2021 bull market, user withdrew funds to newly-launched exchange with minimal KYC requirements. Original exchange flagged destination as "unregulated," but allowed withdrawal with warning to user about counterparty risk. Six months later, destination exchange was hacked and user lost funds - original exchange's warning provided legal protection in subsequent user complaints.

實例:2021年牛市高峰期,有用戶提出資金到新開設、KYC要求極低的交易所。原交易所標記對方為「無監管」,雖然准許提款,但提早警告用戶有對家風險。半年後對方被黑客入侵,客戶損失資金,原交易所的警告在事後客戶投訴時可作法律保障。

9. Velocity and Volume Anomalies

9. 交易速度及金額異常

Description: Transaction patterns inconsistent with user's historical behavior or stated account purpose.

描述:交易方式與用戶過往行為或所聲稱帳戶用途不符。

Severity: Low to Medium - often legitimate (market conditions, life changes) but requires explanation.

嚴重程度:低至中 — 不時屬正常(如市場波動、生活變動),但都需解釋。

Examples:

- Account averaging $1,000 monthly volume suddenly processes $100,000

- User who claimed "long-term holding" suddenly making dozens of daily trades

- Dormant account suddenly activated with large deposits and immediate withdrawals

例子:

- 過往每月平均交易額$1,000的帳戶突然處理$100,000+

- 聲稱「長期持有」的用戶突然日內頻繁交易

- 很久沒活動的帳戶突然有大額存入並即時提出

Thresholds:

- 10x increase in usual volume: Automated review trigger

- Activity inconsistent with stated account purpose: May require re-verification

- Sudden activation after >6 months dormancy with large transactions: Enhanced monitoring

門檻:

- 交易量激增10倍:自動審查

- 行為與聲稱用途不符:或需重新核實資料

- 超過6個月不活躍後突然大額活動:加強監察

Real Case: Long-dormant account received $75,000 Bitcoin deposit and immediately requested withdrawal to external wallet. Exchange froze account suspecting compromise. User verification confirmed legitimate ownership - user had forgotten about account, rediscovered seed phrase, and was consolidating holdings. Account unfrozen after identity reverification.

實例:長期閒置帳戶突然收到$75,000 Bitcoin並即時提出。交易所懷疑帳戶被盜而凍結,經用戶確認身份證明後,原來只是忘記帳戶,找到助記詞後回流資產,結果重新認證後解封。

10. High-Risk Counterparty Indicators

10. 高風險交易對家指標

Description: Transacting with addresses or entities known to have poor compliance controls or high-risk activity.

描述:與風險較高或已知合規差的地址或實體發生交易。

Severity: Low to High depending on counterparty risk profile.

嚴重程度:低至高,依對家風險檔案而定。

Examples:

- Sending funds to gambling sites (especially in jurisdictions where illegal)

- Deposits from ICO

例子:

- 發送資金到賭博網站(特別是在當地屬非法者)

- 來自ICO的存款

(如需繼續或補充後面內容,請通知!)Below is your requested translation, using zh-Hant-HK, and keeping markdown links unaltered:

未有進行適當KYC嘅項目

- 同涉及大規模無預警轉帳(即「塵埃攻擊」)地址有交易

門檻:

- 受規管賭博(有牌照地區):一般可接受

- 無受規管或非法賭博:中至高風險

- 已知騙局或詐騙項目:即時標記

行業實際門檻例子

保守型機構級交易所(Coinbase、Gemini、Kraken):

- 直接制裁曝險:即時凍結

- 超過15%攪拌機/洗幣器曝險:暫停待審查

- 暗網市場多於三跳:需要審查

- 檢測到結構化洗錢:自動升級處理

- 來自P2P平台超過25,000美元:要求提供資金來源

中等風險交易所(Binance.US和解後、Crypto.com):

- 直接制裁曝險:即時凍結

- 超過40%攪拌機曝險:暫停待審查

- 距明顯非法服務多於兩跳:需審查

- 無明確解釋下交易額度提升超過50,000美元:設監控標記

- 提現至高風險目的地:警告但容許(用戶自負風險)

高風險平台(例如2023年前舊Binance.com、小型交易所):

- 僅直接制裁曝險會凍結

- 攪拌機曝險:一般容許,除非超過80%

- 使用無受規管交易所:接受

- 強調用戶自負責任,高於平台預防

以上門檻會根據監管壓力、執法趨勢及機構風險偏好不斷調整。

私隱取捨與緩解技術

合規要求同用戶私隱之間嘅張力,可能係加密貨幣監管中最具爭議問題。呢部分會分析現實中公司常用嘅保護私隱做法,以及佢嘅局限。

最低數據收集實踐

分級KYC方法:

並非要求所有用戶做足身份認證,一啲平台會有分層級需求:

- Level 0:只需電郵,可瀏覽市場、微量入金(100-500美元)

- Level 1:基本證件,適量入金(5,000-10,000美元)

- Level 2:強化認證,高限額(50,000美元以上)

- Level 3:機構級全面盡職審查,不限額

咁樣可令只需要有限服務嘅用戶保留更多私隱,大額活動則預留深入驗證。

數據最少化:

只收必要合規資訊,唔收「順便」用於推廣嘅數據:

- 唔要求就業資料,除非法規規定

- 證件影像只為驗證,唔會長期儲存

- 唔收集瀏覽記錄、交易用途、區塊鏈可見範圍以外嘅對手資訊

- 設立數據保留政策(如無監管扣留,X年後刪除)

分隔式儲存:

將需要合規嘅資料同其他業務系統分開:

- KYC數據存於有權限管理環境,與推廣資料庫分離

- 區塊鏈分析與個人身份資料(PII)分開管理

- 只有合規人員且有合理需要先可接觸PII

假名用戶體驗

地址輪換:

每次交易產生新入金地址,唔重用過往地址。雖然交易所內部可關聯住所有用戶地址,但咁可限制鏈上觀察者拼湊用戶活動。

內部結算:

當發送方同接收方都使用同一交易所時,直接做內部帳面處理,唔記錄鏈上交易,同時內部保持全部合規。

保私隱界面設計:

- 唔公開展示用戶餘額、交易紀錄或交易活動

- UI/UX預設以私隱為優先

- 允許用戶選擇公開個人資料(opt-in),而非預設公開再opt-out

選擇性披露與聲明(Attestation)

聲明式驗證:

用戶唔需要交齊身份證明,而係用加密聲明證明某啲具體事實:

- 「呢位用戶已滿18歲」(毋須公開出生日期)

- 「唔屬於被制裁名單」(毋須公開身份)

- 「居住於合資格地區」(毋須公開詳細地址)

第三方驗證機構發出經數碼簽名之聲明,平台用密碼學驗證,毋須直接見原始個人資料。

可重用KYC證明:

用戶只需同可信驗證方做一次KYC,拎可攜式證書,之後向多個服務展示,唔使重做完整流程:

- 標準:W3C可驗證證書,分散識別符DID

- 用戶有控制權,決定披露乜資料畀乜服務

- 好處:減少重複資料曝露,用戶主動保私隱,減低驗證成本

實施障礙:

- 監管接受程度低(多數地區仍要求直接驗證)

- 憑證撤銷有難度(點樣廢棄被盜證書?)

- 需信任框架(誰可成為受信任聲明發出者?)

- 技術較複雜(錢包軟件、匙管理、憑證標準等)

多方計算(Multi-Party Computation, SMPC)方法

概念:

安全多方計算(SMPC)容許多方共同計算某結果,但唔洩露個別輸入。在合規情景下,可以:

跨平台制裁篩查:

多個交易所集體檢查某地址有冇被制裁,但唔洩露係邊間發起查詢:

- 每間交易所發出加密查詢

- 計算判斷地址有冇出現於任何制裁名單

- 只揭示二元結果(「受制裁」或「唔受制裁」),唔顯示由邊間或原因

協作偵查詐騙:

平台共享詐騙指標,但唔公開客戶資料:

- 偵測同一詐騙者串多間交易所行騙

- 保護個別客戶資料私隱

- 強化集體安全

現有限制:

- 計算耗資較大(比明文操作慢)

- 執行層面複雜,需要專家

- 暫時在加密合規環境應用有限

- 監管不確定(當局會否接受SMPC型合規?)

零知識證明(Zero-Knowledge Proof, ZKP)應用

核心概念:

零知識證明容許一方證明聲明屬實,但除左聲明真偽外唔透露其他資料。

合規應用案例:

無需公開身份完成KYC:

- 用戶證明「我已同可信驗證方X做過KYC」,但唔向服務Y公開身份

- 證明「我證件有效且未過期」,但唔展示文件

- 證明「我唔在制裁名單」,無需公開身份或國藉

交易合規性:

- 證明「本交易無涉被制裁地址」,但唔公開全部交易圖

- 證明「我戶口餘額高於$X」,但唔揭露實際餘額

- 平台呈交監管:「已檢查全部用戶」,唔需交名單

研究實例:

Aztec Protocol開發zk-rollup技術,支援私隱交易及選擇性披露,做到合規。用戶可以證明交易合法,無需公開細節。

Dusk Network實現鏈上「保密證券代幣」,支援合規零知識證明(例如KYC、合格投資者身份等)。

Zcash支援「選擇性披露」,用戶可向指定方(如審計、監管)證明交易詳情,但唔需公開。

實際局限:

- 證明計算量大,耗資高

- 驗證必須可信:誰去驗ZK證明?

- 監管懷疑:監管機構想查證消息,唔只睇數學證明

- 項目多屬研發期,未正式大規模投產

- 鍵管理風險:ZK證明鑰匙若被盜會影響全系統安全

私隱幣風險與應對

私隱幣如Monero、Zcash(shielded)及Dash,喺合規上帶嚟特別挑戰,平台回應如下:

全面下架:

好多受規管交易所唔再支援私隱幣:

- Coinbase從未上架Monero或Zcash隱私地址功能

- Kraken、Bittrex受監管壓力下架私隱幣

- 澳洲交易所被要求下架私隱幣

僅支援透明地址:

有啲交易所只容許私隱幣透明交易:

- Zcash:只接受公開透明t-addr入金/提現,唔支援shielded z-addr

- 禁止平台內部轉換透明/隱私地址

- 將隱私交易暴露當成類近mixer暴露處理

加強監控:

支援私隱幣的平台加強審查:

- 私隱幣提現上限低

- 用戶需更嚴格KYC

- 私隱幣交易即時手動審查

- 條款清楚列明私隱幣運用限制

合規原因:

監管當局認為私隱幣由於難追蹤,有本質高風險。FATF建議私隱幣或不適用於旅規(旅規要求識別對手方,而私隱交易違背呢點)。

風險基礎決策

成功兼顧私隱同合規,要有明智風險分級判斷:

考慮風險因素:

- 客戶風險:散戶定機構、KYC質量、司法管轄區、歷史行為

- 產品風險:簡單現貨定複雜衍生品、有冇法幣通道

- 交易風險:金額、對手、頻率、模式

- 地域風險:經營地點、用戶地點、路徑

分級風控措施:

低風險場景(零售客、細額、熟悉客戶):

- 基本KYC足夠

- 自動交易篩查

- 每月模式分析

- 每年KYC更新

高風險場景(機構客、大額、新客戶):

- 強化盡職審查- 重大交易需手動預先審批

- 持續監控並設置嚴格門檻

- 每季關係檢討

- 專屬合規聯絡人

私隱保障層級:

- 只收集法規要求的最少資料(非能收集到的最多)

- 能用作分析時盡量用彙總/匿名化數據

- 對敏感資料實施技術控制(如加密、存取限制)

- 儘量縮短資料保存期(法例允許即刪除)

- 讓用戶清楚知情資料收集及用途

- 容許用戶控制(如資料匯出、更正、刪除(依法例准許))

此風險為本的方法讓公司可針對高風險範疇施加嚴格控制,同時在低風險活動中保障私隱──在合規責任與用戶期望之間取得平衡。

展望未來:加密貨幣行業的合規與私隱

加密貨幣行業正處於十字路口。文章描述嘅合規基建——KYC啟動流程、KYT交易監控、制裁篩查、風險為本調查——自比特幣剛面世時已大為成熟。過去那個無規管的邊陲,如今已運作於愈來愈完善,甚至個別範疇比傳統金融服務更嚴謹的合規框架。不過,核心矛盾仍未解決。

規管發展方向:融合與擴展

全球監管標準加速融合。FATF 的 Travel Rule 要求對超過 1,000 美元的轉帳披露雙方資料,縱有不少技術障礙,現正於多國實施中。歐盟的 MiCA 規例將於 2024-2025 年生效,建立起全面的發牌、消費者保障及防洗黑錢規定,預計成為其他地區的標準模板。

美國方面,監管部門持續加強執法──SEC 繼續向交易所提出未註冊證券發售指控,CFTC 擴大衍生品管轄權,FinCEN 啟動 BSA 執法,全都朝著更嚴格的監管方向發展。

規管趨同帶來透明度,但同時也提升成本。主要交易所的合規支出每年動輒數千萬美元:KYT 供應商牌照、合規團隊薪酬、技術基建、法律顧問費、監管費等等。這些成本加劇市場整合,大型資本雄厚的平台較易生存,新進創新公司更難突圍。吸引很多人投身加密貨幣的去中心化理念,如今被現實逼到只剩下具備機構級規模的企業才負擔得起全面合規。

技術進化:私隱保護工具日益成熟

儘管規監壓力沉重,私隱保護技術持續進步。零知識證明系統由學術理論進化到生產部署——Aztec、Aleo 等方案已演示私人化與合規可於技術上共存,只是監管接受程度未必同步進展。選擇性披露認證及可驗證憑證標準,提供可重用 KYC 途徑,無需次次提供身份文件。多方計算等技術,甚至可令業界協同偵測詐騙而無需犧牲單一用戶私隱。

問題在於監管機構會否接受這些方法。一貫以來,金管機構偏好主動可見資料,不信純憑密碼學保證。要說服監管當局接受零知識合規證明,除了技術可靠,也要建構機構層面信任、審計架構,以及足以應付政府調查的應急流程。瑞士、新加坡、英國的早期監管沙盒試驗或許為業界鋪路,但全面落地至少還需幾年時間。

行業分岔:受規管 vs. 去中心化生態

合規與私隱的張力正拉扯加密貨幣成為兩個日益分明的生態:

- 受規管平台:中心化交易所、託管商、支付處理商等,營運模式近乎銀行,擁有完善 KYC/AML/KYT 方案、銀行關係、法定貨幣通道、機構託管、並持有監管牌照。這些平台以便利、安全、法律明確為主,較少考慮絕對私隱。

- 去中心化選擇:去中心化交易所、非託管錢包、點對點協議及私隱工具,服務那些重視防審查及金融私隱的用戶。這些方案日益受監管壓力針對——Tornado Cash 被制裁及開發者遭檢控,正反映官方即使面對非託管私隱工具也會出手。

- 這種分化創造一個不太舒適的現實:用戶要二擇其一——要監管保障(保險、追討權、法律明確)還是要財務自主(自我託管、私隱、無須審批自由進出)?「自己做自己銀行」這種加密貨幣願景於技術層面仍可行,但亦愈來愈與以中介設計的監管框架衝突。

用戶與企業的現實選擇

對個人用戶來說,現實上的合規環境需要務實取態:

- 明白只要你用受規管平台,你的身份即永遠與交易紀錄連結,所有交易亦會被監控

- 要知道即使大部分地區私隱工具仍屬合法,但可能惹來額外審查或凍結賬戶

- 接受大部分主流應用場景(交易、託管、法幣兌換)目前都要做 KYC 妥協

- 選擇服務前,應研究平台合規政策,權衡私隱與監管風險

對於行業公司而言,駕馭合規需要策略性選擇:

- 牌照策略將決定你在哪裏、怎樣營運——要在不同司法區要求與營運複雜度中取平衡

- 投資於 KYT、案件管理、調查工具等技術,已成為市場准入不可或缺的成本

- 合規文化需做到內外一致──監管機構現時會懲罰那些只做表面文章的公司

- 你願意承擔幾多風險決定你市場定位:保守雖減低監管風險但可能犧牲競爭優勢

未能解決的矛盾

加密貨幣本來是為實現金融交易無需第三方信任,但合規本質卻要求由中介去識別身份及監控交易。智能合約平台誓言程式自動運行無法阻止,但監管者又需要凍結資產及撤銷交易的能力。公有區塊鏈打造了永久透明記錄,但用戶還是有合理的私隱期望。

以上張力皆無簡單答案。

本文述及的合規策略,其實就是一種務實妥協:合規夠多去安撫監管,但也留足空間維持多少稱得上「加密貨幣」的自主。這種做法是否可長可久,關鍵在於監管怎樣演進、科技如何創新,以及社會最終願唔願接受跟傳統銀行截然不同的金融系統。

加密產業於2020-2025年間合規進化,證明數字資產能在監管架構下共存。問題是2025-2030年間,能否在保留permissionless access、金融私隱、防審查這些初衷下繼續?這答案仍未寫好,將由金融自由、安全與控制哪個願景佔上風這場拉鋸戰決定。