2025 年 10 月,Grayscale Investments 標誌着機構加密貨幣投資的分水嶺。全球最大數碼資產投資平台宣布其 Ethereum Trust ETF (ETHE)、Ethereum Mini Trust ETF (ETH) 及 Solana Trust (GSOL) 成為美國首批上市、可質押的現貨加密貨幣 ETF。

對於一向要應對監管阻力的行業來說,這不止是產品功能的升級,更代表美國監管機構對區塊鏈網絡安全及被動收益這一核心機制觀感的根本轉變。

這個消息是在多年來監管爭拗、執法行動及多次「胎死腹中」後才出現。僅僅在兩年半前的 2023 年 2 月,美國證券交易委員會(SEC)曾經迫使加密貨幣交易所 Kraken 繳付 3,000 萬美元罰款,並關閉其美國質押服務,指其違反證券法。

SEC 主席 Gary Gensler 曾公開警告整個行業,指「質押即服務」屬於未經註冊的證券發行,從而劃下紅線,窒礙創新,將質押活動推向海外。然而,這條紅線如今卻突然被抹消。Grayscale 這次的推出,不僅是現有產品的功能新增,更是監管制度演變、技術成熟與愈來愈大的機構壓力累積的結果,令質押從合規風險變成主流可接受的投資策略。

本文將探討促成 Grayscale 歷史性突破的各種力量,包括相關監管框架、機構運作上的複雜考慮,以及這一發展對加密資產管理未來的意義。要了解這次轉變,必須審視政策、科技同市場動態三方的交集 —— 更要明白 2025 年 10 月 6 日這一天,是多年孕育下來的結果。

質押為何成為監管痛點

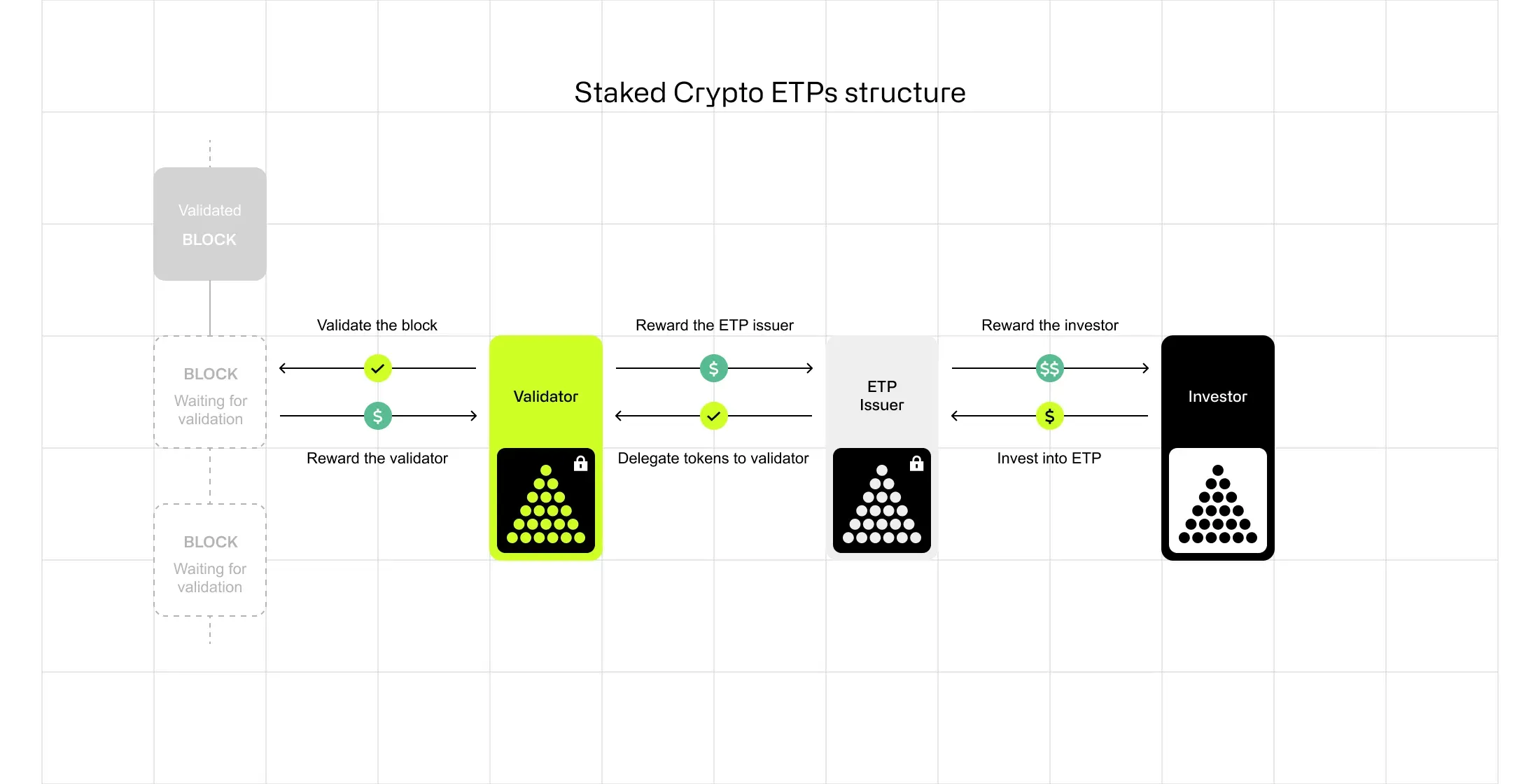

要明白 Grayscale 於 2025 年 10 月推出的重要性,首先要理解什麼是質押,以及為什麼監管機構對此疑慮重重。質押,是參與權益證明(Proof-of-Stake, PoS)區塊鏈的用戶,以加密貨幣作抵押,協助驗證交易並保護網絡。不同比特幣等需密集運算解題的工作量證明(Proof-of-Work),權益證明(如以太坊、Solana)則根據質押加密貨幣數量選出驗證人。跟足規則者可賺得新發行的代幣及手續費獎勵,若試圖操縱系統則會被「削減」質押資產作懲罰。

對個人代幣持有人來說,質押能賺取被動收益——年回報一般介乎 2% 至 8%,同時有助提升區塊鏈安全。這一機制已成現今年代區塊鏈網絡的核心。以太坊於 2022 年 9 月完成「The Merge」升級後,由工作量證明轉為權益證明,現時約有 28% 的流通 ETH 正在質押。

Solana 於 2020 年以權益證明網絡推出,目前質押率超過一半流通量。如此高的參與率,反映質押既是經濟誘因,也是區塊鏈底層運作的必要條件。

不過,在 2025 年以前,SEC 眼中質押卻是監管難題。委員會聚焦三大關連問題:證券定性、託管風險、以及收益披露。當中介(如交易所、託管人或投資平台)以代客質押並按回報分成時,SEC 按「Howey Test」(最高法院界定投資合約的原則)審視這種安排。如果涉及資金(加密資產)投資共同事業,並期望由他人努力得到回報,就符合證券定義。

SEC 指當客戶將代幣交予 Kraken 等平台質押,期待透過該平台的驗證服務獲得收益,就是一項投資契約。

客戶投資資金(加密貨幣),與其他人共同參與(平台的質押基建),期望收取收益(質押回報),而這一切倚靠平台的專業及運行。SEC 主席 Gensler 於 2022 年 9 月公開指出,透過中介質押「與借貸極為相似,只是換了個包裝。」

2023 年 2 月 SEC 對 Kraken 的執法行動,將上述疑慮正式寫入監管規則。據 SEC 指控,Kraken 自 2019 年起向零售投資者提供質押服務,廣告標榜最高 21% 年回報。此平台集合用戶加密資產,於多條 PoS 區塊鏈上質押,再按分成分派給客戶。同時,SEC 指 Kraken 未有按 1933 年證券法要求做足風險、費用及營運資訊披露,令投資者缺乏應有透明度,構成未經註冊證券發行。

合和內容要求 Kraken 立即終止美國所有質押服務,並支付 3,000 萬美元罰款。而 Gensler 隨即在電視訪問中,嚴正警告所有相關平台:「其他平台都應留意,儘快遵守規定」,又補充指提供質押服務的公司必須「做好充分披露及註冊」。被問及質押服務是否一律違法,他指出理論上可向 SEC 註冊,但未有清晰交代註冊詳情或標準。

Kraken 事件在業界引起巨大震盪。Coinbase CEO Brian Armstrong 公開質疑 SEC 的做法,是否等同全面禁止美國散戶質押。SEC 內部對加密友好的委員 Hester Peirce,則激烈批評該和解「專橫又懶散」。

她批評 SEC 將一個「對用戶有利」的服務一刀切腰斬,卻不認真研究如何制定合適的註冊框架,讓質押能合規繼續。「最令人擔憂的是,我們處理違規註冊的方法是直接關閉這個真正服務到用戶的計劃。」

這次執法,隨即令加密平台和資產管理公司面臨營運挑戰。多間交易所都縮減或限制了質押功能。當 2024 年初 ETH 現貨 ETF 申請湧入 SEC 時,發行人最初文件都考慮質押信託持倉來增加收益。例如 BlackRock iShares Ethereum Trust 曾打算就其 ETH 進行質押,讓持有人享有額外回報。

不過,隨着 SEC 審查進度明朗,大家漸認質押仍屬「大忌」。到 2024 年 7 月 ETH ETF 終獲批,全數發行人都特別修訂文件,明確表示不會參與質押。以 BlackRock 獲批版本為例,載明信託「不會直接或間接以任何方式,令持有的 ETH 參與權益證明驗證或用作收取額外 ETH/賺取收益。」

於是出現尷尬局面:以太坊 ETF 讓投資者經合規的傳統券商戶口接觸 ETH 價格,這是突破沒錯,但卻特意排除本來就是以太坊核心收益的質押功能。等同推行收息股票 ETF 但卻禁止收息。業界都明言,這是監管現實下的妥協而非投資邏輯。BlackRock 數碼資產主管 Robbie Mitchnick 於 2025 年 3 月公開表示,沒了質押能力,ETH ETF「的確有所不足」。大家的疑問不是「會否」開放質押,而是「何時」及「要如何改變」才有可能。

關鍵轉捩點:2025 年有何改變

由 2023 年 2 月 Kraken 事件,到 2025 年 10 月 Grayscale 推出質押 ETF,過程既不直線亦充滿變數。當中涉及 SEC 換屆、法律解讀演變、行業施壓,最終還有明確的新指引重塑「證券活動」的界線。這些變化,橫跨政治、法律、營運三大層面。

政治層面由 2024 年美國總統大選拉開序幕。雖然 SEC 名義上屬獨立機構,但總統易任,監管方向無可避免會受影響。Gary Gensler 在 2021 年 4 月由拜登提名任 SEC 主席,迅即成為加密行業的頭號敵人。 Under his leadership, the SEC brought enforcement actions against major exchanges, challenged the securities status of numerous tokens, and maintained a generally skeptical posture toward crypto innovation. However, following the transition to a new administration in January 2025, pressure mounted for a recalibration of the SEC's approach.

在他的領導下,證券交易委員會(SEC)對主要交易所採取執法行動,質疑多種代幣是否屬於證券,同時對加密創新保持普遍懷疑的態度。然而,隨著2025年1月新一屆政府上任,有關調整SEC方針的壓力與日俱增。

By spring 2025, several factors converged to create momentum for regulatory change. The successful launch of spot Bitcoin ETFs in January 2024 had demonstrated institutional appetite for crypto exposure through traditional investment vehicles. Those Bitcoin ETFs collectively attracted more than $35 billion in assets under management within their first year, representing one of the most successful ETF launches in history.

到2025年春季,幾個因素匯聚起來,推動監管政策改革。2024年1月現貨比特幣ETF成功推出,證明市場對透過傳統投資工具接觸加密資產存在巨大機構需求。這些比特幣ETF在推出首年已共吸納超過350億美元資產管理規模,成為史上最成功的ETF產品之一。

Ethereum ETFs followed in July 2024, though their inability to offer staking yields dampened investor enthusiasm - they attracted only about $2.4 billion in net inflows through early 2025, according to data from Farside Investors. Industry participants argued publicly and in regulatory filings that the prohibition on staking placed U.S. products at a competitive disadvantage relative to European and Asian offerings that already incorporated yield generation.

以太幣ETF於2024年7月緊接推出,但由於不能提供Staking收益,投資者興趣受挫。根據Farside Investors數據,截至2025年初,相應淨資金流入僅約24億美元。業內人士在公開場合及監管呈報中表示,禁止Staking令美國同類產品在與已提供收益的歐洲及亞洲產品競爭時處於劣勢。

Congressional sentiment also shifted. Multiple bills aimed at providing regulatory clarity for digital assets made progress through committee processes. While comprehensive crypto legislation remained politically challenging, the general thrust was toward establishing clearer frameworks rather than maintaining enforcement-by-examination. The Commodity Futures Trading Commission began coordinating more openly with the SEC on jurisdictional questions, reducing some of the inter-agency friction that had complicated previous policy initiatives.

國會態度亦有所轉變。多項針對數碼資產監管清晰化的法案在委員會審議中取得進展。雖然全面性的加密法例依然在政治層面具爭議性,但大方向是建立更明確的監管框架,而非單靠執法個別處理。商品期貨交易委員會(CFTC)開始與SEC就管轄問題更公開協調,緩和了以往部門間的矛盾,讓政策推動更為順暢。

The legal dimension involved a fundamental reassessment of how staking activities fit within securities law. This reassessment culminated in a groundbreaking statement issued on May 29, 2025, by the SEC's Division of Corporation Finance. Titled "Statement on Certain Protocol Staking Activities," the document represented the clearest regulatory guidance the crypto industry had received on staking since the Kraken settlement two years earlier.

法律層面亦重新審視Staking活動與證券法的關係。這種審視最終於2025年5月29日,由SEC轄下Corporation Finance部門發出突破性聲明,名為《Statement on Certain Protocol Staking Activities》(關於若干協議Staking活動之聲明)。這文件是自兩年前Kraken事件以來,加密行業在Staking領域上獲得最明確的監管指引。

The statement analyzed staking through the lens of the Howey Test and concluded that certain categories of staking - specifically those the document termed "Protocol Staking Activities" - did not constitute securities transactions requiring registration.

該聲明以Howey Test(豪威準則)分析Staking,判斷哪些類別——特別是文件中稱為「協議Staking活動(Protocol Staking Activities)」——並不屬於所需註冊的證券交易。

The Division's analysis focused on the fourth prong of the Howey Test: whether participants have a reasonable expectation of profits derived from the entrepreneurial or managerial efforts of others. The statement concluded that in properly structured staking arrangements, rewards are derived from the administrative or ministerial act of validating network transactions according to algorithmic rules, not from entrepreneurial decision-making by third parties.

部門重點分析Howey準則的第四點:參與者有否合理預期收益來自他人之創業或管理努力。結論認為在適當設計的Staking模式下,回報來自根據協議規則驗證網絡交易的行政工作,而不是由第三方的企業決策帶動。

The Division identified three acceptable staking models. Self-staking (also called solo staking) occurs when a token holder runs their own validator node, maintaining complete control over their assets and technical operations. Self-custodial staking involves delegating validation rights to a third-party node operator while retaining ownership and control of the underlying tokens. Custodial staking allows a custodian to take custody of tokens and stake them on behalf of the owner, provided the custodian acts purely as an agent following the owner's instructions rather than exercising discretionary control.

部門列出三種可接受Staking方式:自我Staking(又稱單獨Staking)——持幣人自行運行驗證器節點,完全掌控其資產和運作;自我託管Staking——將驗證權限委託第三方節點運營商,但資產擁有權和控制權仍屬持幣人;由託管機構Staking——由託管人代持幣人保管資產及作Staking,前提是託管人只作代理人身份,依據擁有人指示行事,無酌情自主權。

Critically, the statement addressed "ancillary services" that platforms might offer alongside staking. These included slashing insurance (protecting against penalties for validator misbehavior), early unbonding (allowing withdrawals before the protocol's natural unstaking period), modified reward payment timing, and aggregation services (pooling assets to meet minimum staking thresholds).

聲明特別提及平台可能與Staking一同提供的「附加服務」,包括惡意行為懲罰保險(slashing insurance)、提前解綁(early unbonding,容許在協議正常解鎖期前提取資產)、靈活收益派發時間與資產組合托管服務(協助達到最低Staking要求)。

The Division concluded that these services, when offered in connection with Protocol Staking Activities, remained administrative or ministerial in nature and did not convert staking into an investment contract. This was significant because it meant that institutional custodians could offer sophisticated risk management and operational conveniences without triggering securities registration requirements.

部門認為,這些隨協議Staking活動一起提供的服務,本質仍屬行政性質,未構成投資合約。因此,機構級託管可提供更進階的風險管理和運營便利,而毋須觸發證券登記要求。

Commissioner Hester Peirce, in her statement accompanying the Division's guidance, praised the clarity it provided. "Today, the Division of Corporation Finance clarified its view that certain proof-of-stake blockchain protocol 'staking' activities are not securities transactions within the scope of the federal securities laws," Peirce wrote.

專員Hester Peirce於聲明附文中稱讚此新指引,認為清晰度大增。她寫道:「今日,Corporation Finance部門已闡明,一些於權益證明(proof-of-stake)區塊鏈協議下的Staking活動,不屬聯邦證券法下之證券交易。」

She noted that previous regulatory uncertainty had "artificially constrained participation in network consensus and undermined the decentralization, censorship resistance, and credible neutrality of proof-of-stake blockchains." Her endorsement signaled that the guidance had support from at least some commissioners, though dissenting views from other commissioners suggested the policy remained contested internally.

她指出,過去監管不明確「人為限制了參與網絡共識,也損害了權益證明區塊鏈的去中心化、抗審查與可信中立性」。她的支持說明至少有部分專員同意該指引,雖然有其他專員表示異議,意味政策在內部尚存爭議。

The May 2025 statement was not the end of the SEC's guidance. On August 5, 2025, the Division of Corporation Finance issued a follow-up statement addressing liquid staking - a variation in which users receive tradable tokens (liquid staking tokens or LSTs) representing their staked assets. Liquid staking had become increasingly popular because it solved a fundamental problem: when users stake tokens directly through protocols, those assets are typically locked for a period during which they cannot be transferred or sold.

2025年5月的聲明並非SEC指引的終章。2025年8月5日,Corporation Finance部門就液態Staking(liquid staking)發表新聲明——這種變體允許用戶獲得可交易的代幣(LST,liquid staking tokens=液態Staking代幣),代表他們已被Staking的資產。液態Staking越來越受歡迎,因為它解決了本質性問題:用戶直接在協議Staking時,其資產通常須被鎖定一段期間,期間無法轉讓或買賣。

Liquid staking protocols issue receipt tokens that can be traded immediately, allowing users to maintain liquidity while still earning staking rewards. The August statement clarified that these arrangements, too, fell outside securities regulation when properly structured, as the receipt tokens represented ownership of the deposited assets rather than deriving value from managerial efforts.

液態Staking協議會發出可即時交易的憑證代幣,令用戶同時享有流動性和Staking收益。8月聲明澄清,若正確結構化,這些安排同樣不受證券規管,因為憑證代幣只是代表存入資產的擁有權,而非源自第三方管理努力的價值。

These statements did not mean the SEC had abandoned all scrutiny of staking. The Division was careful to limit its guidance to activities involving "Covered Crypto Assets" - tokens that are intrinsically linked to the operation of public, permissionless networks and do not have inherent economic rights or claims to future income of a business enterprise.

這些聲明並不代表SEC完全放棄對Staking的監管。部門特意將指引範圍限制於「受保障加密資產」(Covered Crypto Assets)——即那些與公開、無許可網絡運作密不可分,且本身不賦予持有人公司未來收益權或經濟權益的代幣。

The guidance did not extend to arrangements where platforms exercised discretion over when or how much to stake, guaranteed returns, or combined staking with other financial services like lending. Platforms that bundled staking with yield farming, proprietary trading strategies, or re-hypothecation of customer assets remained potentially subject to securities laws. Nevertheless, the boundaries were now clearer than they had been at any point since proof-of-stake networks emerged as viable alternatives to proof-of-work.

該指引不涵蓋平台對Staking時機和數量有酌情決定、保證回報或與其他金融服務(如借貸)結合的安排。若平台將Staking與收益耕作、專屬交易方案、重複質押等混合,則仍可能受證券法約束。雖如此,相關界線已較權益證明網絡出現以來任何時期都要清晰。

Beyond the formal guidance, operational realities also shifted. In early 2025, the SEC quietly dropped staking-related allegations from its ongoing litigation against Coinbase, effectively retreating from the broad position Gensler had staked out in the Kraken settlement. While the agency did not issue a public explanation, market participants interpreted this as a signal that internal thinking had evolved. Bloomberg Intelligence analyst James Seyffart noted in April 2025 that staking approval for Ethereum ETFs could come "as early as May," though he cautioned that the process might extend through the end of the year as the SEC worked through procedural questions and potential tax implications with the IRS.

除了正式指引外,實際操作亦有轉變。2025年初,SEC悄悄撤回在Coinbase訴訟中針對Staking的控訴,形同撤回Gensler於Kraken和解時提出的廣泛立場。儘管SEC未有公開解釋,市場普遍解讀為內部觀點已有所轉變。彭博分析師James Seyffart於2025年4月指出,以太ETF通過Staking功能「最快可於5月發生」,但他亦提醒程序可能拖延至年底,因SEC仍需與國稅局協調程序及稅務問題。

By summer 2025, the dam had broken. Major ETF issuers including BlackRock, Fidelity, Franklin Templeton, 21Shares, VanEck, and Grayscale all filed amendments seeking approval to add staking capabilities to their Ethereum products. The filings were remarkably similar in structure, reflecting careful coordination with the SEC's guidance.

到2025年夏季,形勢徹底逆轉。主要ETF發行人如BlackRock、Fidelity、Franklin Templeton、21Shares、VanEck及Grayscale等,全部遞交申請修訂,爭取為旗下以太產品加入Staking功能。相關申請的結構極為相似,反映與SEC指引緊密協調。

Each specified that staking would occur through institutional custodians and diversified validator networks, that rewards would flow to the fund's net asset value, and that the arrangements would comply with the Protocol Staking framework outlined in the Division's May statement. The SEC extended review deadlines multiple times through September and early October, suggesting intensive behind-the-scenes discussions about operational details, disclosure requirements, and accounting treatment.

每份申請均明確指出Staking會透過機構託管及多元化驗證網絡進行,收益計入基金淨資產價值,並遵守部門5月聲明所列的協議Staking框架。SEC先後將審核截止期延長至九月及十月初,顯示內部對操作細節、信息披露與會計處理有深入討論。

Grayscale emerged from this review process first - not because it had any special regulatory advantage, but because its products were not structured as registered investment companies under the Investment Company Act of 1940. ETHE and ETH, though traded on exchanges, are technically commodity trusts exempt from '40 Act registration.

Grayscale率先通過審核流程,並非因其具特別監管優勢,而是因其產品並非根據《1940年投資公司法》設計為註冊投資公司。ETHE及ETH雖於交易所買賣,實際技術上屬商品信託,毋須《1940法案》註冊。

This meant they operated under a slightly different regulatory framework than traditional ETFs, potentially allowing for faster implementation of staking once the underlying securities-law questions were resolved. On October 6, 2025, Grayscale announced that staking was live across its Ethereum and Solana products, managing a combined $8.25 billion in assets. The company noted it had already staked more than 40,000 ETH, representing a significant commitment of capital to validator infrastructure.

這令其監管架構有別於傳統ETF產品,在核心證券法問題釐清後,Staking得以更快推行。2025年10月6日,Grayscale宣布旗下以太坊及Solana產品正式提供Staking功能,管理合共82.5億美元資產,公司表示已Staking逾4萬枚ETH,顯示對驗證基建的大型資本投入。

Grayscale's Implementation: How the Staking ETPs Actually Work

Grayscale's launch was not merely about flipping a regulatory switch. It required sophisticated operational infrastructure, careful selection of custodial partners, and transparent communication with investors about how staking would affect fund performance and risk profiles. The company's approach offers a template for how institutional staking products can be structured within the regulatory framework established by the SEC's 2025 guidance.

Grayscale的Staking功能並非簡單「打開監管開關」那麼直接,而是需建構先進的營運基礎設施、謹慎挑選託管夥伴,以及向投資者清楚說明Staking如何影響基金表現及風險概況。Grayscale方案為機構級Staking產品在SEC 2025年監管框架下的結構樹立了範例。

At the core of Grayscale's staking operations are threedistinct layers: custody, validation, and reward distribution. The custody layer involves institutional-grade digital asset custodians that hold the ETH and SOL backing the trusts.

不同層面:託管、驗證同獎勵分配。託管層涉及機構級數字資產託管人,負責持有為信託提供保障的ETH同SOL。

While Grayscale has not publicly disclosed all its custodial partners for the staking program, industry standards suggest these are likely qualified custodians such as Coinbase Custody, Anchorage Digital, or BitGo - the three institutions that dominate institutional crypto custody in the United States. These custodians maintain private key management systems, cold storage protocols, insurance coverage, and regulatory compliance infrastructure designed to protect billions of dollars in digital assets.

雖然Grayscale冇公開所有參與質押計劃的託管夥伴,但按行內標準推測,佢哋多數係合資格託管機構,例如Coinbase Custody、Anchorage Digital或BitGo——呢三間公司係美國機構級加密貨幣託管市場嘅主導者。呢啲託管人會維持私鑰管理系統、冷錢包協議、保險保障,以及為保障數十億美元數碼資產而設嘅合規制度。

The validation layer determines how staked assets actually participate in blockchain consensus. Rather than operating its own validator nodes, Grayscale works with what it describes as "a diversified network of validator providers." This approach serves multiple purposes. From a risk management perspective, distributing stake across numerous validators reduces exposure to any single point of failure.

驗證層就決定咗質押資產點樣實際參與區塊鏈共識。Grayscale 無自己營運驗證節點,而係同佢稱為「多元化驗證人供應商網絡」合作。呢個做法有多重好處。喺風險管理角度,分散質押於大量驗證人有助減低單點故障所帶來嘅風險。

If one validator experiences downtime or technical issues, the impact on overall staking rewards is minimized. From a decentralization perspective, spreading stake among many validators supports network health by avoiding excessive concentration of validation power. From a compliance perspective, using established, institutional-grade validators with proven track records addresses potential concerns about operational risk and security.

如果其中一個驗證人有停機或者技術問題,對整體質押回報嘅影響都會減到最低。喺去中心化角度,分散質押有助維持網絡健康,防止驗證權力過度集中。喺合規角度,用有良好往績同機構級驗證人,可以減少運營風險及安全疑慮。

Validator selection is not random. Institutional staking requires validators that meet stringent criteria for uptime (validators must be online and responsive to validate blocks), security (validator infrastructure must be protected against attacks), and regulatory compliance (validators must operate transparently and often under regulated entities). On Ethereum, validators must maintain at least 32 ETH staked and face slashing penalties if they validate conflicting transactions or remain offline for extended periods.

驗證人並非隨機揀選。機構級質押要求驗證人符合嚴格嘅標準——包括上線時間(要長時間上線及即時處理)、安全性(基礎設施要防範各類攻擊)、合規性(要透明運作,通常要受監管機構監督)。而以太坊上,驗證人至少要質押32 ETH,如驗證矛盾交易或者長時間離線會被處罰扣幣。

On Solana, validators compete for stake delegation based on performance metrics including vote credits (successful votes on finalized blocks) and commission rates. Grayscale's selection process likely involves ongoing monitoring of validator performance, periodic rebalancing of stake distribution, and contractual arrangements that define responsibilities and liabilities.

至於Solana,驗證人會根據表現指標(包括投票積分及佣金率)去吸引質押委託。Grayscale嘅選擇過程好大機會包括持續監控驗證人表現、定期調整委託分布、同埋訂立合約明確責任同風險分擔。

The reward distribution layer addresses how staking yields flow to investors. In Grayscale's model, staking rewards are not distributed as cash dividends or additional shares. Instead, they accrue to the trust's net asset value. This means that as the trust's ETH or SOL holdings earn staking rewards, the total assets under management increase, which in turn increases the value of each outstanding share proportionally.

獎勵分配層就規定質押回報點分給投資者。以Grayscale來講,質押回報唔會以現金股息或者新發股份派發,而係直接累積喺信託嘅資產淨值入面。即係話,當信託持有嘅ETH或SOL賺取質押獎勵時,總管理資產會隨之增加,每股價值亦會按比例提升。

For example, if ETHE holds 1 million ETH and generates a 3% annual staking yield, the trust would accumulate approximately 30,000 additional ETH over the course of a year. This additional ETH increases the NAV per share, benefiting all shareholders without requiring distributions or creating immediate tax events.

例如,假如ETHE持有100萬ETH而產生3%年質押收益,信託一年度就會累積大約30,000顆額外ETH。呢啲ETH會提升每股資產淨值,令所有股東得益,而唔需要派息或者即時產生稅務事項。

This accrual approach has several advantages for institutional investors. It simplifies accounting by avoiding the complexity of tracking numerous small distributions. It potentially defers tax liabilities, as shareholders only realize gains when they sell shares rather than on an ongoing basis as rewards are earned.

呢種累積方式對機構投資者有多個好處:簡化會計處理,唔使跟蹤繁複的小額分派;亦有可能推遲稅款產生,因為股東只喺賣出股份時先要申報利得,而唔係每次有回報時就計稅。

It also eliminates the need for reinvestment decisions - rewards automatically compound within the trust structure. However, it also means that the trust's management fee (Grayscale charges 0.25% annually for ETH and 2.5% for ETHE) is calculated on a larger and growing asset base, which effectively captures a portion of staking rewards as management fees.

同時亦唔使再考慮點再投資,回報會自動在信託結構下複利滾存。不過,這亦代表信託管理費(Grayscale收ETH每年0.25%、ETHE每年2.5%)會計算喺越來越大嘅資產基礎之上,實際上部分質押獎勵都會用作支付管理費。

Grayscale has been transparent about the risks and limitations of staking. The company published an educational report titled "Staking 101: Secure the Blockchain, Earn Rewards" concurrent with its staking launch. The report explains how staking works, why networks require it, and what participants should understand about yields and risks.

Grayscale對於質押風險與局限一直都講明白。公司喺推出質押時同時發布左份教育報告《Staking 101:保障區塊鏈,賺取獎勵》,解釋咗質押運作方式、原因同參與者應該知嘅收益同風險。

Key disclosures include the acknowledgment that staking yields are variable and depend on network conditions, validator performance, and the total amount of assets staked across the network. If network-wide staking participation increases significantly, yields for all stakers decrease proportionally as rewards are distributed across a larger pool.

重點披露包括:質押收益會因網絡狀況、驗證人表現、全網總質押資產多寡而變動。假如全網質押比率大升,全部參與者分到嘅獎勵就會按比例減少,因為要分嘅池子大咗。

The report also addresses slashing risk - the possibility that validators could lose a portion of staked assets due to protocol violations. While properly managed institutional validators have extremely low slashing rates, the risk is not zero. Technical failures, configuration errors, or coordinated attacks could result in penalties.

報告亦有講述“懲罰風險”——即驗證人因違規而失去部分質押資產。雖然管理嚴格嘅機構級驗證人被懲罰機率極低,但風險唔會係零。技術故障、設定失誤、協同攻擊都可能造成損失。

Grayscale's use of multiple validators helps mitigate this risk, as does the selection of established providers with strong operational track records. Some institutional custodians offer slashing insurance as an ancillary service, though the availability and cost of such insurance varies by provider and network.

Grayscale用多個驗證人同揀有豐富經驗的營運方,都是減少懲罰風險嘅措施。有啲機構型託管人仲會額外提供懲罰險,不過各家供應及每個網絡的保障同收費都唔同。

Liquidity considerations are another important aspect of Grayscale's staking implementation. Unlike direct staking through protocols, where users must wait for an "unbonding period" (approximately 27 hours for Ethereum, one epoch or 2-3 days for Solana) before staked assets become liquid, Grayscale's ETF structure maintains continuous liquidity for investors. Shareholders can sell their ETHE or ETH shares on the exchange at any time during market hours, receiving the current market price.

流動性亦係Grayscale質押操作一個相當重要考慮。唔同於直接用協議質押——例如ETH要等約27小時、Solana要一個周期或2-3日既「解綁期」——資產先變得可流通,Grayscale嘅ETF結構可以持續俾投資者流通股份。股東可隨時於交易時間在市場沽出ETHE或ETH股份,即時收取市場價。

The trust handles the operational complexity of managing staked and liquid asset pools to meet redemption demands. This is possible because not all trust assets need to be staked simultaneously - Grayscale can maintain a buffer of unstaked tokens to handle routine redemptions while keeping the bulk of assets staked to maximize yield.

信託會負責管理好質押同流通資產池,以應對贖回需求。之所以可行,係因為唔需要所有資產同時質押——Grayscale可以留一部分token作為流動緩衝,方便日常贖回,同時將大部分資產用嚟爭取最大質押收益。

Peter Mintzberg, Grayscale's Chief Executive Officer, framed the launch in terms of the company's longstanding positioning as a crypto innovation leader. "Staking in our spot Ethereum and Solana funds is exactly the kind of first mover innovation Grayscale was built to deliver," Mintzberg said in the October announcement. "As the #1 digital asset-focused ETF issuer in the world by AUM, we believe our trusted and scaled platform uniquely positions us to turn new opportunities like staking into tangible value potential for investors."

Grayscale行政總裁Peter Mintzberg就用公司長期作為加密創新領袖嘅定位去形容今次業務開展。「喺我哋現貨以太坊同Solana基金引入質押,就正正係Grayscale本身想做嘅先行者創新。」Mintzberg於10月發佈時稱,「作為全球資產規模最大嘅數字資產ETF發行人,我哋相信自身可靠而有規模的平台,可以令新機遇(如質押)真正轉化為投資者具體價值。」

The statement reflected confidence that Grayscale's early move would attract assets from investors who had been waiting for yield-enhanced crypto products, potentially helping the company recapture market share it had lost to competitors like BlackRock and Fidelity in the spot Bitcoin ETF race.

呢番講話反映Grayscale有信心,今次早著先機可以吸引一班等高收益加密產品好耐嘅投資者,有機會幫公司從競爭對手(如BlackRock同Fidelity於比特幣現貨ETF戰場)手中奪回失去的市場份額。

Institutional Custody and Risk Management in the Staking Era

質押時代的機構託管同風險管理

The operational complexities of staking at institutional scale extend far beyond simply locking tokens in a protocol. For custodians, asset managers, and the validators they work with, enabling staking within the regulatory framework requires sophisticated risk management, technological infrastructure, and compliance processes that go significantly beyond what retail staking platforms provide. Understanding these operational realities helps explain why institutional staking took years to emerge despite being technically possible from the moment proof-of-stake networks launched.

機構級質押遠唔止淨係將token鎖喺協議咁簡單。對於託管人、資產管理人及合作驗證人,要喺合規框架內做質押,需要遠超散戶平台的高階風險管理、科技基建及合規流程。理解呢種運作現實,有助解釋明明技術上早就可行,但機構質押點解幾年之後先開始流行。

Custodial responsibility begins with the fundamental tension between security and accessibility. Traditional custody of digital assets follows the principle "not your keys, not your coins" - whoever controls the private keys effectively owns the assets.

託管責任由安全與可取用性之間的矛盾開始。傳統數字資產託管講究「冇你私鑰,唔係你錢」——邊個控制到私鑰就等於擁有資產。

Cold storage, where private keys are kept entirely offline on hardware devices or in secure facilities disconnected from any network, provides maximum security against hacking but makes assets inaccessible for real-time transactions. Hot wallets, which maintain private keys online for rapid transaction signing, enable operational flexibility but create attack surfaces that sophisticated hackers continually probe.

冷儲存,即私鑰完全離線存放係硬件或者無網絡連接的安全設施,可以提供最高度防駭安全,但會令資產變得唔適合即時交易。熱錢包則將私鑰放喺網上,方便快速簽署交易,提高靈活性,但就會成為駭客重點攻擊對象。

Staking complicates this security model because actively validating requires ongoing interaction with blockchain networks. Validators must sign attestations and propose blocks on regular schedules - every 12 seconds for Ethereum, continuously with rotating leadership for Solana. This necessitates hot wallet infrastructure that can sign validation messages without manual intervention. Yet institutional custodians must maintain the security standards their clients expect, including multi-party computation (where no single entity holds complete private keys), hardware security modules, and air-gapped signing ceremonies for certain operations.

而質押就更為複雜,因為主動參與驗證都要同區塊鏈持續互動。驗證人要定期簽署及提議區塊——以太坊每12秒簽名一次、Solana持續輪替領導。呢啲操作需要熱錢包,自動簽名,不需人工介入。但機構級託管人仍需維持客戶期望嘅高安全標準,包括多方計算(即冇單一實體掌握完整私鑰)、硬件安全模組,以及某些操作需完全隔離網絡的簽名儀式。

The solution that has emerged involves segregation of responsibilities and tiered security architectures. Custodians like Anchorage Digital, which holds the distinction of being the only federally chartered crypto bank in the United States, maintain client assets in cold storage while delegating validation rights to carefully vetted node operators. The node operator receives the authority to sign validation messages on behalf of the staked tokens without gaining custody of the underlying assets.

現時主流解決辦法係職責分離同分層安全體系。好似Anchorage Digital—全美唯一聯邦核准加密銀行—會將客戶資產冷藏,同時將驗證權限授予經過審核嘅節點營運者。節點營運者獲授權可代表質押token簽署驗證訊息,但無擁有底層託管資產。

This is accomplished through blockchain-level mechanisms that separate validation capabilities from ownership. On Ethereum, for example, validators have withdrawal credentials (which control asset ownership) and signing keys (which control validation operations). The custodian retains control of withdrawal credentials while the node operator manages only the signing keys needed for validation.

呢做法靠區塊鏈層面分隔驗證權利同擁有權。例如以太坊上,驗證人分有提取憑證(控制資產所有權)同簽名私鑰(控制驗證操作)。託管人掌握提取憑證,而節點營運者只持有簽名私鑰。

BitGo, which secures approximately 20% of all on-chain Bitcoin transactions by value and serves as custodian for numerous crypto ETFs, approaches institutional staking through what it calls a "100% cold storage" model combined with qualified

BitGo作為全網比特幣交易總價值約20%託管方,亦係多隻加密ETF託管人,其機構質押方案就主打所謂「100%冷儲存」模式,結合合資格...custody structures. The company emphasizes that client assets remain protected by insurance policies (up to $250 million) even during active staking. BitGo's staking-as-a-service offering integrates with its existing custody infrastructure, allowing institutions to stake from the same wallets and accounts they use for holdings, with unified reporting and risk management. The platform supports both self-custody staking (where clients retain control of private keys) and qualified custody staking (where BitGo Trust Company serves as custodian under its New York state trust charter).

保管架構。該公司強調,即使在進行積極質押期間,客戶資產仍會受到保險政策(最高2.5億美元)的保障。BitGo 的質押即服務(staking-as-a-service)方案與其現有的託管基建整合,讓機構可以用一直持有資產的相同錢包及賬戶參與質押,又能進行統一匯報及風險管理。此平台同時支援自我託管質押(由客戶自己掌控私鑰)及合資格託管質押(由 BitGo Trust Company 按紐約州信託牌照擔任託管人)。

Coinbase Custody, which serves as custodian for many of the spot Bitcoin and Ethereum ETFs launched in 2024, has built extensive staking capabilities across multiple proof-of-stake networks. The platform supports native staking for Ethereum, Solana, Cardano, Polkadot, Cosmos, Avalanche, and numerous other networks. Coinbase Custody Trust Company is a fiduciary under New York state banking law and a qualified custodian for purposes of SEC rules, a status that provides regulatory certainty for institutional clients.

Coinbase Custody 為2024年多隻現貨比特幣及以太幣 ETF 擔任託管人,並已建立跨多個權益證明(proof-of-stake)網絡的強大質押功能。該平台原生支援以太幣、Solana、Cardano、Polkadot、Cosmos、Avalanche 及其他多個網絡的質押。Coinbase Custody Trust Company 按紐約州銀行法屬於受託人身份,並根據美國證監會(SEC)規定屬於合資格託管人,為機構客戶帶來監管上的明確性。

The custody platform maintains SOC 1 Type II and SOC 2 Type II audits conducted by Deloitte & Touche, providing third-party verification of control effectiveness. For staking specifically, Coinbase offers multiple models including traditional staking (with standard network unbonding periods), liquid staking (issuing receipt tokens), and dedicated validator options for large institutions that want control over their validation infrastructure.

託管平台維持由德勤會計師事務所進行的 SOC 1 Type II 及 SOC 2 Type II 審計,為其管控效能提供獨立第三方驗證。針對質押,Coinbase 提供多種模式,包括傳統質押(有標準網絡解綁期)、流動質押(發行收據型代幣),以及為大型機構設計、能掌控驗證基建的專屬驗證人選項。

Insurance represents a critical component of institutional risk management that distinguishes institutional staking from retail offerings. While blockchain protocols do not inherently insure participants against losses, institutional custodians have worked with insurance providers to develop coverage specifically for digital asset custody and staking operations. Coverage typically includes protection against theft of private keys, employee malfeasance, infrastructure failures, and certain types of hacking attacks. Insurance does not, however, generally cover market risk (price declines) or protocol-level slashing that results from validator misbehavior.

保險是機構風險管理中極為重要的部分,亦是機構質押與零售質押的明顯分別之一。雖然區塊鏈協議本身不會為參與者提供損失保障,但機構託管人會與保險公司合作,專門針對加密資產託管及質押業務設置保障。保險一般涵蓋私鑰被盜、內部人不當行為、基建故障及特定的黑客攻擊等風險。不過,保險通常不會保障市價風險(價格下跌)或因驗證人不當行為導致被協議懲罰(slashing)的損失。

Slashing risk management involves both validator selection and technical safeguards. Slashing occurs on proof-of-stake networks when validators violate protocol rules - either through malicious behavior (such as signing conflicting attestations, sometimes called "double signing") or through operational failures (such as extended periods of downtime).

有關 slashing 風險(協議懲罰)管理,涵蓋驗證人選擇及技術安全措施。Slashing 會在權益證明(PoS)網絡上出現,當驗證人違反協議規則時,無論是出於惡意行為(例如簽署有衝突的認證,俗稱「double signing」),還是操作失誤(如長時間離線)等,均會被罰。

The penalties vary by network and severity. On Ethereum, minor slashing for downtime results in small penalties, while malicious slashing (provably signing conflicting attestations) can result in losing a substantial portion of staked ETH and forced ejection from the validator set. Solana's slashing implementation is currently less severe, though the protocol design allows for stricter penalties to be activated through governance decisions.

懲罰程度按網絡及嚴重性而不同。在以太坊,因為離線而被罰只需繳付小額懲罰金,但若惡意被 slashing(證明有簽署矛盾認證),就會損失大部分已質押的 ETH,甚至被強制踢出驗證人名單。Solana 目前的 slashing 罰則較輕,但協議設計上容許透過治理提高懲罰嚴重性。

Institutional validators mitigate slashing risk through redundant infrastructure, extensive testing, and careful key management. Best practices include running backup validator nodes that can take over if the primary node fails, implementing "slashing protection" software that prevents validators from signing conflicting messages even under failure scenarios, and maintaining comprehensive monitoring to detect and respond to issues before they escalate.

機構級驗證人透過重複基建、廣泛測試及嚴格私鑰管理來減低 slashing 風險。最佳實踐包括設立備用驗證人節點(主節點故障即時頂上)、安裝「slashing protection」軟件(即使遇上意外也不會簽署矛盾訊息),並進行全面監控,及早偵測及應對問題防止惡化。

Some validators offer slashing insurance as an ancillary service, effectively guaranteeing to reimburse clients for losses that occur due to the validator's operational failures. This insurance is distinct from custodial insurance and is typically provided by the validator or a specialized insurer working with validators.

有部份驗證人會提供 slashing 保險當作額外服務,即保障客戶因驗證人操作失誤而蒙受的損失。這種保險跟一般託管保險不同,通常由驗證人或與驗證人合作的專門保險公司承保。

Accounting and tax treatment of staking rewards remains an evolving area with significant implications for institutional investors. The fundamental question is whether staking rewards should be treated as income when received or whether they represent capital gains only when eventually sold. For many institutional investors, particularly regulated funds and corporate treasuries, this distinction affects reported earnings, tax liabilities, and financial statement presentation.

質押獎勵的會計和稅務處理仍在不斷演化中,對機構投資者影響甚大。最核心的問題是:質押時收到的獎勵,究竟應當作當期收入入賬,還是只計算為資本收益,等到出售時才確定?對很多機構投資者而言,特別是受規管的基金和企業財資部門,這分別會影響收入報表、稅務負擔及財務報表呈現。

The IRS provided initial guidance in 2023 indicating that cryptocurrency received as staking rewards generally constitutes income at the time of receipt, valued at fair market value. This applies to direct staking rewards. However, the tax treatment becomes more complex for staking within trust structures like Grayscale's ETFs.

美國國稅局(IRS)於2023年發出初步指引,表示明加密貨幣質押獎勵通常在收到時按市值計作收入。這針對的是直接參與質押的獎勵。不過,若以信託架構質押(如 Grayscale ETF),相關稅務處理就變得更複雜。

Because the trusts are grantor trusts for tax purposes, and because rewards accrue to NAV rather than being distributed, the precise tax timing and character of income has been subject to ongoing discussion between the industry and regulators. The SEC's Division of Corporation Finance acknowledged these complications in its May 2025 statement, noting that the IRS would need to provide clarity on certain aspects.

由於這些信託屬於稅務上的 grantor trust,而且獎勵會計入資產淨值(NAV)而不是即時分派,所以有關何時入賬及收入性質仍在業界和監管機構之間討論中。美國證監會(SEC)公司融資部門於2025年5月的聲明中確認這些複雜問題,並指 IRS 需要為相關細節提供明確指引。

For institutional investors, the tax question influences product design and investment decisions. If staking rewards are immediately taxable as income, funds must ensure they have sufficient liquid assets to meet tax obligations even though rewards remain invested in the trust. If rewards are treated as increases in cost basis (taxable only upon sale), the accounting is simpler but may not reflect the economic reality that rewards represent compensation for validating transactions. Different investors may prefer different treatments depending on their tax status - tax-exempt entities like endowments and pension funds may be relatively indifferent, while taxable corporate investors may strongly prefer deferral.

稅務處理方式直接影響機構投資者的產品設計及投資決策。如果質押獎勵即時入稅,基金就需要確保即使資產仍在信託內投資,仍有足夠流動資產應付稅項。如果只計算為成本基礎提升(出售時才課稅),會計上簡單得多,但可能反映不了獎勵其實屬驗證交易的酬勞。不同投資者會按其稅務狀況而有所偏好 – 免稅機構如捐贈基金、退休基金較無所謂,但應稅企業投資者則大多傾向選擇延遲課稅。

Comparative Analysis: How the U.S. Approach Differs from Europe and Asia

Grayscale's October 2025 staking launch was groundbreaking in the U.S. context, but it was not unprecedented globally. European and Asian crypto ETPs had incorporated staking capabilities for years, reflecting different regulatory frameworks and policy priorities. Understanding these international differences illuminates both why U.S. institutions faced such prolonged obstacles and what competitive pressures ultimately helped drive regulatory change.

Grayscale 於2025年10月於美國推出 staking,雖然屬於當地創舉,但其實在全球早有先例。歐洲和亞洲的加密貨幣 ETP 早已納入質押功能,反映出各自不同的監管框架及政策側重點。了解這些國際差異,能解釋為何美國機構長期受阻,以及最終市場競爭壓力如何推動監管改革。

Europe's crypto regulatory landscape is shaped primarily by the Markets in Crypto-Assets Regulation (MiCA), which took effect in stages throughout 2024. MiCA established the first comprehensive regulatory framework for crypto assets across the European Union, creating uniform rules for issuers, trading platforms, and service providers. Unlike the U.S. approach, which relies heavily on applying existing securities laws developed for stocks and bonds, MiCA created crypto-specific categories and requirements.

歐洲加密市場監管主要由《加密資產市場監管條例》(MiCA)塑造,該條例於2024年分階段生效。MiCA 是歐盟首個加密資產的全面監管框架,為發行人、交易平台和服務商建立統一規則。與美國嚴重依賴傳統股票及債券證券法律不同,MiCA 則訂立了針對加密行業的專屬資產分類及合規要求。

The regulation distinguishes between asset-referenced tokens (stablecoins backed by reserves), e-money tokens (stablecoins equivalent to fiat currency), and utility tokens (all other crypto assets). Service providers including exchanges, custodians, and investment platforms must obtain authorization and comply with conduct-of-business rules, but the framework explicitly recognizes that many crypto activities fall outside traditional securities regulation.

規例分清資產掛鈎代幣(有儲備支持的穩定幣)、電子貨幣代幣(法幣等值的穩定幣)和功能型代幣(其他加密資產)。相關服務供應商,例如交易所、託管人及投資平台,須先取得授權並遵守業務規管守則,不過該框架亦明文確認,許多加密業務其實不屬於傳統證券監管範疇。

For staking specifically, European regulators never took the broad position that staking-as-a-service constitutes securities offerings. Instead, staking has been treated primarily as an operational service that platforms provide, subject to general duties of care and disclosure but not requiring securities registration. This permissive approach allowed European crypto ETPs to incorporate staking from their inception. As early as 2021, 21Shares - a major European ETP issuer - launched products that included staking yields. The company's Solana Staking ETP (ticker ASOL), for example, has provided investors with both price exposure and staking rewards since its launch.

對於質押,歐洲監管機構從未採取「質押即服務」等同證券發售的立場。相反,他們只把質押視為平台層面的營運服務,平台必須履行謹慎義務和資訊披露,但毋須進行證券登記。這種寬鬆做法令歐洲加密 ETP 從一開始就可以納入質押。早在2021年,主要歐洲 ETP 發行商 21Shares 已推出包括質押收益的產品。例如其 Solana Staking ETP(股票代碼 ASOL),自推出以來就同時提供資本敞口及質押回報。

The 21Shares approach involves partnering with institutional custodians and validator networks, similar to what Grayscale now does in the U.S., but it benefited from operating in a regulatory environment where staking's legitimacy was never in serious question. The company has emphasized that staking aligns ETP returns more closely with the actual economic performance of the underlying blockchain networks.

21Shares 的做法是與機構託管人和驗證人網絡合作,與現時 Grayscale 在美國的模式相似,不過他們最大的優勢是監管環境自始對質押的合法性從沒存疑。該公司強調,質押能讓 ETP 回報更緊貼底層區塊鏈網絡的實際經濟表現。

"As institutional adoption of cryptoasset ETPs accelerates and regulatory clarity strengthens across Europe, we remain committed to expanding our product offerings to meet growing investor demand," said Mandy Chiu, Head of Financial Product Development at 21Shares, in March 2025 when the company expanded its Nordic offerings to Nasdaq Stockholm.

21Shares 金融產品開發主管 Mandy Chiu 於2025年3月公司將北歐產品擴展到納斯達克斯德哥爾摩交易所時表示:「隨著機構採納加密資產 ETP 加快,以及全歐監管更清晰明朗,我們會繼續擴展產品線以迎合投資者日益增長的需求。」

ETC Group, VanEck Europe, and CoinShares have similarly offered staking ETPs in European markets. These products trade on regulated European exchanges including Deutsche Börse's Xetra, SIX Swiss Exchange, and Euronext, making them accessible to retail and institutional investors across the EU. The products generally charge management fees in the range of 0.2% to 1% annually and distribute staking rewards through NAV appreciation similar to Grayscale's model. Because MiCA establishes clear custody requirements, transparency standards, and investor protection rules, these products operate within a regulatory framework that provides legitimacy without imposing prohibitive restrictions.

ETC Group、VanEck Europe 和 CoinShares 亦有在歐洲市場推出質押 ETP。這些產品分別在德國證交所 Xetra、瑞士 SIX 交易所、Euronext 等受監管歐洲市場交易,投資者涵蓋歐盟零售及機構投資者。產品年費介乎0.2%至1%,透過 NAV 升值分派質押回報,與 Grayscale 模式相似。由於 MiCA 明確訂有託管條件、透明度標準及投資者保障規則,這類產品能於一個合法但不設過度限制的監管環境下運作。

The regulatory clarity in Europe has had measurable competitive effects. European crypto ETPs collectively managed more than $15 billion in assets as of mid-2025, and staking-enabled products represent a substantial portion of that total. Institutional investors based in Europe, particularly pension funds and asset managers subject to UCITS (Undertakings for Collective Investment in Transferable Securities) regulations, can access staking yields through regulated investment vehicles.

歐洲的明確監管制度帶來了明顯競爭優勢。截至2025年中,歐洲加密 ETP 總資產超過150億美元,當中質押產品佔很大比重。歐洲本地機構投資者,尤其受 UCITS(可轉讓證券集合投資架構)監管的養老金基金及資產管理人,可以直接透過合規投資產品享有質押回報。

This meant that when

所以當……U.S. ETFs launched without staking capabilities in 2024, they were offering an inferior product compared to what was already available to European investors. Industry participants argued that this put U.S. capital markets at a disadvantage and deprived American investors of yield opportunities available to their European counterparts.

美國ETF於2024年推出時未有提供質押(staking)功能,因此產品質素比歐洲投資者可獲得的同類產品為低。有業內人士指出,這使美國資本市場處於劣勢,亦令美國投資者失去一同歐洲投資者可享的收益機會。

Asia's approach varies significantly by jurisdiction. Singapore, which has positioned itself as a crypto-friendly financial hub, allows regulated crypto funds to offer staking under the supervision of the Monetary Authority of Singapore (MAS). The MAS has taken a balanced approach, requiring licensing and compliance for crypto service providers while generally avoiding blanket prohibitions. Hong Kong, seeking to compete with Singapore for crypto business, launched a regulatory regime in 2023 that permits licensed platforms to offer staking services to retail investors. The Hong Kong Securities and Futures Commission requires platforms to disclose staking risks clearly and maintain adequate systems and controls, but treats staking as a permissible activity rather than a securities offering requiring prospectus registration.

亞洲地區在這方面的做法則因司法管轄區不同而有很大分別。新加坡定位自己為加密友善的金融中心,允許受監管的加密基金在新加坡金融管理局(MAS)監管下提供質押服務。MAS採取平衡方法,要求加密服務商持牌及遵守規例,但一般避免全面禁止。為爭取加密業務,香港於2023年推出新監管制度,容許持牌平台向零售投資者提供質押服務。香港證監會要求平台須清晰披露質押風險,並維持適當系統與監控,但將質押視為一項允許活動,而非需要招股書註冊的證券發售。

Switzerland, often categorized separately due to its unique position outside the EU, has been particularly progressive. The Swiss Financial Market Supervisory Authority (FINMA) established early guidance recognizing that payment and utility tokens do not generally constitute securities.

瑞士因不屬於歐盟而常被另作一類,其做法也特別進取。瑞士金融市場監管局(FINMA)早早便指引市場,確認支付型及功能型代幣一般不屬證券範疇。

Swiss crypto banks like Sygnum and SEBA Bank have offered institutional staking services since 2020, working within Switzerland's banking regulations while leveraging the country's established expertise in wealth management and custody. These institutions serve international institutional clients, creating yet another competitive pressure on U.S. providers who were prohibited from offering equivalent services domestically.

瑞士的加密銀行如Sygnum及SEBA Bank自2020年起已依照當地銀行法規,並借助瑞士在財富管理及託管的優勢,向機構客戶提供質押服務。這些機構亦服務國際客戶,令無法在國內提供同類服務的美國業者承受更大競爭壓力。

The competitive dynamics became particularly visible when VanEck, a U.S.-based asset manager, announced plans in September 2025 to file for a Hyperliquid staking ETF in the U.S. while simultaneously preparing a Hyperliquid ETP for European markets. The dual-track strategy reflected the reality that European approval processes were faster and more certain, even though the U.S. market is larger.

這種競爭格局在美國資產管理公司VanEck於2025年9月表示,計劃在美國申請Hyperliquid質押ETF、同時為歐洲市場準備Hyperliquid ETP時更加明顯。此「雙軌」策略反映出,雖然美國市場更大,歐洲的審批流程卻更快捷且確定性更高。

As Kyle Dacruz from VanEck noted, launching in Europe first would establish proof of concept and market demand while U.S. regulatory processes continued. This type of regulatory arbitrage - where U.S. firms develop products offshore to serve international clients - has been a recurring theme in crypto markets and represented one of the strongest arguments for U.S. regulatory modernization.

正如VanEck的Kyle Dacruz所言,先在歐洲推出可驗證概念及市場需求,待美國監管流程繼續進行。這種監管套利(即美國企業於海外開發產品服務國際客戶)已在加密市場屢見不鮮,也是推動美國監管現代化最強的理由之一。

The contrast between U.S. and international approaches stems from fundamental differences in regulatory philosophy. U.S. securities regulation developed primarily through the Securities Act of 1933 and Securities Exchange Act of 1934, laws written during the Great Depression to address stock market manipulation and corporate fraud.

美國與國際間做法的差異,源自基本監管理念不同。美國證券監管主要依據1933年證券法及1934年證券交易法,這兩套大蕭條時期針對股票市場操控和公司詐騙而設的法例。

These laws rely heavily on disclosure-based regulation: the government does not approve investments as "good" or "safe," but rather requires issuers to provide sufficient information for investors to make informed decisions. The challenge with applying this framework to crypto is determining which crypto activities constitute securities offerings requiring disclosure and which are something else entirely - commodities, services, or sui generis digital phenomena that don't fit existing categories.

這些法律重視「披露」制度:政府並不會批核某項投資為「好」或「安全」,而是要求發行人提供足夠資訊讓投資者作明智決定。將這套框架套用於加密資產的最大難題,是分辨哪些活動屬於須披露的證券發售,哪些卻屬商品、服務或獨有數碼現象並不適用現有分類。

European regulators, starting with a relatively clean slate through MiCA, could design categories that better fit crypto's realities. By treating most crypto assets as distinct from securities and establishing clear rules for service providers, MiCA reduced regulatory uncertainty even while imposing substantial compliance burdens. The trade-off is that MiCA requires authorization and ongoing supervision for activities that might be permissionless or minimally regulated in the U.S., but it provides clarity about what is allowed.

歐洲監管機構則透過MiCA由零開始,能更靈活設計適合加密實況的分類。MiCA多數將加密資產與證券劃分,為服務供應者定下明確規則,減少監管不確定性,即使這意味合規負擔較重。相對地,MiCA要求某些在美國可「無需許可」或「低度監管」的活動,需取得授權並持續受監察,但它為可行之事提供清晰界線。

The SEC's 2025 shift toward permitting staking represents a middle path: staking is not a free-for-all, but neither is it categorically prohibited. The Division of Corporation Finance's guidance establishes principles for determining when staking falls outside securities regulation, effectively allowing activities that are passive, algorithmic, and non-discretionary while potentially restricting arrangements involving active management, guaranteed returns, or combinations with other financial services.

美國證監會(SEC)於2025年的政策轉變,批准某程度上的質押,屬折衷路線:質押並非完全自由,但亦不是一律禁絕。公司融資部門發表指引,列明如何釐定質押何時不屬證券監管範疇。總結來說,被動、算法式及非主動管控的質押活動可獲許可,而涉及主動管理、保證回報或與其他金融服務捆綁的模式則或會受限制。

This principles-based approach provides flexibility but also leaves gray areas that will likely require ongoing clarification through additional guidance, no-action letters, or enforcement actions.

這種原則導向路線雖然較有彈性,但留下不少灰色地帶,料日後需透過更多細則指引、不執法信函(no-action letter)、或執法行動持續澄清。

Looking forward, international coordination on crypto regulation appears likely to increase. The Financial Stability Board, an international body that monitors the global financial system, has called for coordinated crypto standards to address cross-border regulatory arbitrage.

展望未來,各國在加密監管的協調預料會逐步加強。負責監督全球金融體系的國際金融穩定委員會亦曾呼籲各地統一加密監管標準,以防止跨境監管套利。

As major jurisdictions including the U.S., EU, U.K., Singapore, Hong Kong, and Japan all develop crypto frameworks, pressures toward harmonization will grow - both from industry participants seeking consistency and from regulators concerned about risks migrating to less-regulated markets. The global nature of blockchain networks makes them inherently difficult to regulate on a purely national basis, suggesting that international standards may eventually emerge, particularly for custody, staking, and other operational aspects of crypto investment products.

隨著美國、歐盟、英國、新加坡、香港及日本等主要司法區都發展自身加密監管框架,無論是業界追求一致性,還是監管者憂慮風險流向監管較寬鬆市場,對「協調」的壓力都將增加。而區塊鏈的全球性特質亦令其難以單靠本國法規監管,預示未來國際標準很可能出現,特別是針對託管、質押及其他加密投資產品的操作層面。

Market Impact and Institutional Adoption Trajectories

Grayscale's staking launch did not occur in a vacuum. It arrived at a moment when institutional allocation to crypto assets had already accelerated dramatically, when the success of Bitcoin ETFs had validated the ETF structure for digital assets, and when institutional investors were increasingly viewing crypto not as a speculative asset class but as a legitimate portfolio component with distinct risk-return characteristics. Understanding the market impact of staking-enabled ETPs requires examining both the direct effects on fund flows and asset prices and the broader implications for how institutions think about crypto allocation.

Grayscale推行質押並非偶然。這正值機構資金大舉配置加密資產、比特幣ETF大獲成功進一步鞏固數碼資產ETF地位、以及機構投資者愈來愈多把加密資產視為具獨特風險回報特徵的正規投資組合成分,而非只作投機。要理解具質押功能ETP的市場影響,必須審視其如何直接影響資金流及資產價格,以及對機構配置加密資產思維的長遠轉變。

The yield component of staking creates a fundamental shift in the investment proposition. Bitcoin ETFs offer pure price exposure: investors profit if BTC appreciates and lose if it declines, with no cash flow or yield component.

質押帶來的收益,會根本改變投資定位。比特幣ETF單純讓投資者參與價格波幅:BTC升就賺,跌就蝕,並無現金流或收益元素。

This makes Bitcoin comparable to gold or other commodities - a store of value whose returns depend entirely on capital appreciation. Ethereum and Solana ETPs without staking offer the same pure price exposure. However, once staking is enabled, the investment proposition transforms into something more akin to dividend-paying stocks or interest-bearing bonds. Investors receive both potential price appreciation and ongoing yield, creating multiple sources of return.

這令比特幣類似於黃金或其他商品——儲值單靠價格上漲來盈利。以太坊和Solana若無質押,同樣只是「價格曝險」工具。然而,一旦加入質押,投資定位便像派息股或收息債券:投資者同時享有資本升值及持續收益,多種回報來源兼備。

Current staking yields provide context for this transformation. Ethereum's network staking yield as of October 2025 was approximately 3% annually. This yield is determined by several factors: network issuance (new ETH created to reward validators), the total percentage of ETH that is staked network-wide (higher staking participation dilutes rewards across more participants), transaction fees (validators receive a share of priority fees and MEV), and validator uptime.

現時各項質押年化收益也突顯這個轉變。例如,以太坊網絡於2025年10月的全年質押收益約為3%。此收益由數個因素決定:網絡發行(按新ETH獎勵驗證者)、全網質押百分比(愈多人質押即攤薄收益)、交易手續費(驗證者可分成優先費及MEV),以及驗證者運作正常率。

Approximately 28% of Ethereum's circulating supply was actively staked, meaning that the 3% annual yield was available to roughly 34.4 million ETH actively participating in validation. For institutional investors, a 3% yield on an asset with the potential for price appreciation represented a meaningful enhancement, particularly when compared to money market rates that had declined below 3% as central banks moderated interest rate policies.

當時約有28%以太坊流通量被主動質押,即大概3440萬ETH參與驗證,並可享有3%的年回報。對機構來說,一項有升值潛力資產的3%收益十分可觀,尤其是當貨幣市場利率因央行政策放寬而跌穿3%的大環境下。

Solana's staking yields are considerably higher, ranging from 6% to 8% depending on validator selection and network conditions. Solana's inflation schedule begins at 8% annually and decreases by 15% each year until reaching a long-term rate of 1.5%, with the current inflation rate at approximately 4.7% as of 2025.

Solana的質押回報更高,視乎驗證者與網絡狀況介乎6%至8%。Solana通脹率起初為8%,每年下調15%,長遠目標是1.5%,2025年時約為4.7%。

More than 50% of Solana's circulating supply is actively staked, reflecting both the ease of staking SOL (no minimum balance requirements) and the attractive yields. For institutional investors considering Solana allocation, the 6-8% staking yield significantly improves the risk-adjusted return profile compared to non-staking products. At Grayscale's current management fee of 2.5% for GSOL, net staking yields would range from 3.5% to 5.5% - still competitive with many traditional fixed-income alternatives.

超過一半Solana流通供應已被質押,反映兩大因素:SOL質押門檻極低(無最低餘額要求)、回報吸引。對考慮配置Solana的機構投資者而言,6-8%質押收益令其風險調整後回報遠勝無質押產品。以Grayscale旗下GSOL 2.5%管理費計算,扣除後的質押淨回報仍有3.5-5.5%,在傳統固定收益產品中具競爭力。

These yields matter because they change how institutions model portfolio allocation. Modern portfolio theory suggests that investors should allocate capital across assets to optimize the risk-return tradeoff. In a traditional portfolio, stocks provide growth potential but with high volatility, while bonds provide stability and income with lower expected returns. Gold and other commodities serve as inflation hedges but generate no cash flow.

這些收益結構重要,因為它會影響機構設計資產分布的方法。現代投資組合理論主張,投資者應將資金分配予不同資產,以取得最佳風險回報平衡。傳統組合中,股票提供增長但波幅大;債券穩定、有收益但預期回報較低;黃金及其他商品當作抗通脹工具,但並不產生現金流。

Where does crypto fit? Without yield, crypto's role is primarily as a speculative growth asset or portfolio diversifier whose returns are largely uncorrelated with traditional assets. With staking yield, crypto begins to resemble an emerging market growth equity with a dividend - higher volatility than developed market stocks but with income generation that provides some downside cushion and return even in periods when prices are flat.

那麼,加密資產怎樣融入?若沒有收益,加密資產主要只是具高度投機性的增長工具,或可用作與傳統資產低相關性的分散投資元素。有了質押收益後,則類似新興市場的增長股(帶股息),波動性比已發展市場股票為高,但多一份收益令組合在市況平穩時亦能有回報,某程度緩衝下行風險。

Several institutional investment research firms have published analyses suggesting that staking-enabled crypto products could attract material allocations from traditional portfolio managers. Bloomberg Intelligence analysis in mid-2025 suggested that even a 1-2% allocation to staking Ethereum from U.S. pension funds, endowments, and family offices

多間機構投資研究公司發表分析,指具質押功能的加密產品或將吸引傳統投資組合經理作較大規模投資。彭博資訊於2025年年中分析認為,即使僅有1-2%的美國退休基金、捐贈基金及家族辦公室資產分配至帶質押的以太坊...could drive tens of billions in additional demand. The analysis noted that pension funds facing persistent deficits and low-yield environments have been searching for sources of yield enhancement, and that crypto staking - despite its volatility and emerging status - offers yields competitive with private credit, emerging market debt, and other alternative income sources.

有關分析指出,這可能為市場帶來數百億美元的額外需求。分析亦提到,面對長期赤字同低息環境,退休基金一直搵辦法提升回報。而加密貨幣質押(staking),雖然波動大同屬新興產品,但提供嘅年息具有競爭力,足以同私人信貸、新興市場債券及其他另類收益產品媲美。

The AUM impact on Grayscale specifically could be substantial. The company entered October 2025 with approximately $35 billion in total assets under management across its product suite, making it the largest digital asset investment platform globally.

對Grayscale嚟講,資產管理規模(AUM)影響可能十分顯著。截至2025年10月,Grayscale旗下產品管理總資產大約有350億美元,係全球最大嘅數碼資產投資平台。

However, Grayscale had faced significant competitive pressure from BlackRock, Fidelity, and other ETF issuers whose spot Bitcoin products gained dominant market share through lower fees and stronger distribution relationships with wealth management platforms. By being first to market with staking-enabled ETPs, Grayscale created a differentiation point that could attract yield-seeking investors and potentially reverse some of the market share losses.

不過,一直以嚟,Grayscale都受到BlackRock、Fidelity以及其他ETF發行商嘅強大競爭壓力。呢啲對手透過更低嘅費用,同擁有強大分銷網絡嘅理財平台合作,令其現貨比特幣產品迅速奪得主導市場份額。而Grayscale率先推出支援質押(staking)嘅ETP,有助建立差異化優勢,或者能夠吸引追求收益嘅投資者,甚至有機會扭轉部份市場份額流失。

Early indications suggested positive reception. While Grayscale did not disclose specific inflow data in the immediate days following its October 6 launch, market observers noted that share prices of ETHE and ETH traded near or slightly above their net asset values - a positive signal that demand exceeded supply. This contrasted with periods earlier in 2025 when Grayscale's products occasionally traded at discounts to NAV due to redemption pressure. The Solana Trust (GSOL), pending its conversion to a fully listed ETP, similarly showed positive trading dynamics.

早期指標反映市場反應正面。雖然Grayscale無有公開10月6日推出後嘅即時資金流入數據,但市場觀察者指出,ETHE同ETH嘅基金價格一度貼近甚至高過資產淨值(NAV),反映需求多過供應。呢個情況同2025年較早時,因贖回壓力令產品出現NAV折讓大為不同。而同樣等待轉為完整上市ETP嘅Solana信託(GSOL),都見到正面嘅交易動態。

The competitive landscape would soon expand beyond Grayscale. BlackRock, Fidelity, Franklin Templeton, 21Shares, Bitwise, VanEck, and other major issuers all had pending amendments seeking approval to add staking to their Ethereum ETFs.

但競爭格局好快就擴展到Grayscale以外。BlackRock、Fidelity、Franklin Templeton、21Shares、Bitwise、VanEck等主要發行商都有申請修訂,爭取批准將質押功能加入佢哋嘅以太幣ETF。

Bloomberg analyst James Seyffart predicted in September that these approvals would come in waves through Q4 2025, with regulatory delays suggesting the SEC was working through operational and disclosure details rather than reconsidering the fundamental permissibility of staking. Once these amendments are approved, the market would likely see rapid standardization, with staking becoming an expected feature of Ethereum ETFs rather than a unique differentiator.

彭博分析員James Seyffart 喺9月時預測,相關批文會喺2025年第四季分階段批准。由於監管部門延遲主要集中喺運作同披露細節,而唔係重新考慮質押本身應唔應該俾做。一旦全部批准,市場好快會見到標準化,各家以太坊ETF都會將質押納為基本功能,而唔再係單一產品嘅獨特賣點。

This standardization raises questions about competitive dynamics. In the Bitcoin ETF market, issuers competed primarily on fees (with expense ratios ranging from 0.19% to 0.25%) and distribution partnerships (with BlackRock and Fidelity's relationships with major wealth management platforms proving decisive).

不過,標準化亦引發競爭新考慮。以比特幣ETF為例,發行商主要靠比拼收費(費用率由0.19%至0.25%),同埋分銷夥伴網絡(BlackRock同Fidelity 同主流理財平台嘅關係成為關鍵)。

In a staking-enabled Ethereum ETF market, issuers would compete on net yields after fees, validator quality and diversification, liquidity management, and operational transparency. Funds with lower management fees would deliver higher net staking yields to investors. Funds with better validator selection and risk management would experience less downtime and fewer slashing events, marginally increasing yields. Funds with deeper liquidity buffers could maintain continuous secondary market trading without having to unstake assets to meet redemptions, avoiding the forgone yield during unbonding periods.

而質押版以太幣ETF,發行商就要比拼扣除費用後嘅實際回報、驗證人(validator)質素及多樣化、流動性管理,以及操作透明度。低費用基金自然可以俾到投資者更高淨質押收益;驗證人組合選得好同風險控制做得好,可以減少服務中斷同被罰(slashing)次數,提升回報;流動性buffer充足嘅基金,可以喺二級市場繼續交易,而無需因應贖回而解質,避免unbonding期間暫時失去收益。

Beyond ETFs, staking's approval has implications for other institutional crypto products. Separately managed accounts (SMAs) for high-net-worth individuals and family offices could now incorporate staking strategies, allowing for more customized risk management and tax optimization. Hedge funds that had avoided staking due to regulatory uncertainty could now offer staking-enhanced strategies. Crypto lending products could differentiate between staking yield (protocol-based and relatively low-risk) and lending yield (counterparty-dependent and higher-risk), allowing for more sophisticated portfolio construction.

質押獲批,除咗ETF,仲影響其他機構級加密產品。例如針對高淨值人士同家族辦公室嘅獨立管理帳戶(SMA),可加入質押策略,落實更按本身需要嘅風險管理同稅務規劃。之前因監管不明朗而避開質押嘅對沖基金,依家可以考慮加入質押增強策略。加密貨幣借貸產品都可以分清質押收益(基於協議、風險較低)同借貸收益(受對手風險影響、風險較高),俾投資組合配置更精細。

The participation rate effects on blockchain networks themselves represent another important impact. When institutional capital flows into staking, it increases the economic security of the underlying networks. Security in proof-of-stake systems is roughly proportional to the value of staked assets - the higher the economic cost of attacking the network (requiring substantial stake to control validation), the more secure the network becomes.

質押參與率對區塊鏈網絡安全都有重要意義。一旦大量機構資金湧入質押,基礎網絡嘅經濟安全會提升。因為PoS(權益證明)系統安全程度,大致與被質押資產總值成正比──攻擊網絡成本越高,要控制驗證需要質押大量資本,網絡自然更安全。

Ethereum's transition to proof-of-stake in September 2022 succeeded in part because the network quickly attracted substantial stake, reaching over $40 billion in staked ETH within months. Institutional participation through ETFs further increases this security by directing capital to validation rather than allowing it to sit idle on exchanges.

以太坊喺2022年9月轉型做PoS之所以成功,有一部分原因係相關網絡好快吸納到大量質押,其ETH總值幾個月內超過400億美元。而機構透過ETF參與質押,進一步將資金引流去驗證人而唔係閒置喺交易所,令網絡經濟安全再提升。

However, there are valid concerns about centralization effects. If a few large ETF providers control substantial portions of staked ETH or SOL, they effectively gain influence over network governance and consensus. While the validators are technically distributed (Grayscale works with multiple validators, and each validator operates independently), the economic control rests with the ETF issuer who selects validators and could theoretically direct how stake is allocated. Blockchain communities have debated whether limits should be placed on any single entity's stake to preserve decentralization, though no consensus has emerged on where such limits should be set or how they would be enforced.

但唔少人都擔心中心化風險。如果少數幾間大型ETF發行商控制咗可觀嘅 ETH 或 SOL 質押額,其實已經有網絡治理同共識嘅影響力。雖然驗證人表面上分散(例如Grayscale用好多唔同驗證人,各自獨立運作),但實際經濟控制權屬於ETF發行商,佢哋決定搵邊個驗證人、點分配質押。區塊鏈社群對於應唔應該限制單一實體質押比例,都有爭議,現時對於限制幾多、點執行都未有共識。

The Next Wave of Institutional Crypto Innovation

Grayscale's October 2025 staking launch represents a milestone, but it is better understood as an inflection point than a conclusion. The regulatory framework that enabled staking is still evolving, the operational infrastructure is maturing, and the next generation of crypto investment products is already taking shape. Understanding where institutional crypto is heading requires examining the innovations on the horizon and the barriers that remain.

Grayscale 喺2025年10月推出質押產品固然係里程碑,但更應該視為轉捩點,而唔係終點。推動質押嘅監管框架仍在演變,營運基建不斷成熟,新一代加密投資產品都已見雛形。要了解機構級加密貨幣未來向邊走,要睇緊新興創新同未解難題。

Liquid staking derivatives represent the most immediate frontier. Traditional staking locks assets for network-defined periods, creating liquidity trade-offs for investors. Liquid staking protocols address this by issuing receipt tokens that can be traded while the underlying assets remain staked. Lido Finance's stETH (staked ETH), Rocket Pool's rETH, and Jito's jitoSOL are examples of liquid staking tokens that have gained adoption in decentralized finance. The SEC's August 2025 statement clarifying that liquid staking receipt tokens are not securities opened the door for institutional products based on these assets.

流動性質押衍生品(liquid staking derivatives)係當前最前沿創新。傳統質押要鎖倉指定時間,影響資金流動性。流動性質押協議就採用可另行交易的收據代幣(receipt token),基本資產照樣繼續質押。Lido Finance 發行的 stETH、Rocket Pool 的 rETH、Jito 的 jitoSOL,都已經喺DeFi普遍被使用。SEC喺2025年8月明確表示流動質押代幣唔屬於證券後,為機構推出此類產品打開大門。

VanEck has already filed for a spot ETF based on jitoSOL, Jito's liquid staking token for Solana. If approved, this would create a multi-layered yield product: investors would gain exposure to SOL's price movements, SOL's staking yield, and potentially additional yields from Jito's MEV optimization.

VanEck已經申請基於jitoSOL(Jito針對Solana的流通質押代幣)嘅現貨ETF。呢種產品如獲批核,會係多層回報模式:投資者同時受惠於SOL價格、市場質押息,仲有機會額外攞到Jito優化MEV所得收益。

MEV (maximal extractable value) refers to profit that validators can earn by strategically ordering, including, or excluding transactions in the blocks they produce. Jito's technology allows validators to capture MEV more efficiently and distributes a portion to stakers, creating yields that can exceed standard staking by several percentage points. An ETF structure around jitoSOL would package these multiple yield sources into a single investment vehicle, though with additional complexity and risk compared to native staking.

MEV(最大可提取價值)即係驗證人透過調整區塊內交易排序、選擇性處理部分交易所獲利。Jito技術令驗證人更高效賺取MEV並派發俾質押者,收益比傳統質押可以高幾個百分點。ETF以jitoSOL為基礎,將多重收益來源打包成單一投資產品,但同原生質押比起會更複雜,潛在風險亦更高。

Restaking - the practice of using already-staked assets to secure additional protocols - represents another innovation gaining institutional attention. EigenLayer, a protocol built on Ethereum, allows stakers to "restake" their ETH to provide economic security for other applications and networks beyond Ethereum itself. In exchange, restakers earn additional rewards from the protocols they secure.

再質押(restaking)即係用已經質押住嘅資產,再去支援其他協議,係另一個吸引機構留意嘅創新。建基於以太坊的協議EigenLayer,允許質押者用ETH再質押,提供安全服務俾其他應用或網絡。作為交換,參與再質押者可以收多一重協議回報。

BitGo and other institutional custodians have begun offering restaking services, and several fund managers have expressed interest in creating restaking-focused products once the regulatory treatment is fully clarified. Restaking introduces additional risks (securing multiple protocols creates multiple potential slashing events) but offers enhanced yields, creating another risk-return trade-off for institutional investors to evaluate.

BitGo等機構級託管商已開始推再質押服務。有基金經理表明,只要監管有清晰指引,即會考慮推出主打再質押產品。當然,再質押除咗提升息口,亦多咗風險(同時保障多個協議增加被扣減罰金機會),機構投資者都要好好權衡回報同風險。

Cross-chain staking products could emerge as markets mature. Rather than requiring separate allocations to Ethereum, Solana, Cardano, Polkadot, and other proof-of-stake networks, multi-asset funds could provide diversified exposure to staking yields across multiple blockchains. Such products would need to address technical complexity (each network has different staking mechanisms, reward structures, and unbonding periods) and concentration risk (diversification requires research to ensure the underlying networks are truly independent rather than vulnerable to common failure modes).

隨著市場成熟,跨鏈質押產品有機會面世。屆時投資者無需單獨分配資金俾以太坊、Solana、Cardano、Polkadot等各個PoS網絡,而係透過多資產基金一次過分散參與多條鏈嘅質押回報。當然,相關產品要處理好多技術難題(每條鏈質押機制、獎勵及解質時間唔同)同集中風險(多元化投資都要研究各鏈有冇真正獨立,唔會一同失敗)。

The crypto ETF landscape is moving in this direction: Grayscale's Digital Large Cap Fund (GDLC), approved in September 2025, provides exposure to five cryptocurrencies including Bitcoin, Ethereum, XRP, Solana, and Cardano. Once staking approval extends to XRP and Cardano products, multi-asset staking funds become feasible.

加密貨幣ETF亦朝住呢方向發展。例如Grayscale數碼大盤基金(GDLC)已於2025年9月獲批,提供比特幣、以太坊、XRP、Solana、Cardano共五種加密貨幣投資。一旦質押獲批拓展至XRP及Cardano等產品,多資產質押基金就可以推向市場。

Options and structured products on staking ETFs represent another layer of innovation that could accelerate institutional adoption. Traditional equity markets feature extensive options markets that allow investors to hedge positions, generate additional income through covered call strategies, or implement sophisticated arbitrage and volatility strategies. BlackRock's Ethereum ETF has had exchange-listed options since the SEC approved them in April 2025.

針對質押ETF嘅期權同結構性產品,亦屬推動機構採用創新一環。傳統股票市場有齊各類期權,方便投資者對沖、靠備兌認購增收,甚至執行複雜套利或波幅策略。BlackRock以太坊ETF自2025年4月獲SEC准許後,已經有交易所掛牌期權。

As staking becomes standard, options strategies could be tailored to staking-enhanced products. For example, an institutional investor might hold a staking Ethereum ETF, earn 3% annual staking yield, and write call options to generate additional premium, creating a covered call strategy that

隨著質押成為標配,期權策略都可以根據質押型產品為投資者度身訂做。例如機構投資者可以買入質押型以太坊ETF,每年攞3%質押息,再沽認購期權攞權利金,就係一個標準嘅備兌認購策略——潛在地在區間震盪市況下可令實際收益翻倍。

2025年9月通過針對加密貨幣ETF的通用上市標準,有機會加速產品創新。以往,每一隻加密ETF都需分別提交19b-4文件——即交易所規則更改建議,由SEC逐宗審核,過程常需數月,並涉及大量來回溝通。

通用上市標準與股票ETF的安排類似,只要加密ETF產品符合預設的流動性、託管及市場監察標準,交易所便可直接上市某些類型的加密ETF,而無需SEC逐一審查。若全面落實,將顯著減省新加密ETF產品的上市時間及成本,推動涵蓋各類加密幣、質押策略及不同風險取向的產品激增。

稅務創新有機會緊貼產品創新而來。現時對質押獎勵的稅務處理——於收取時視作收入——令投資者操作複雜。未來的產品有機會加入稅務優化結構,例如針對海外投資者的離岸方案、或針對美國投資者的退休帳戶包裝。在傳統金融界已有前例:房地產信託(REITs)、主限合夥(MLPs)及封閉式間歇基金等,皆設有針對特定投資策略而設的稅務架構。隨住加密資產管理成熟,類似的專門結構極可能出現。

儘管近來有所進展,監管挑戰依然存在。SEC於2025年5月及8月有關質押的指引,是由公司財務部門發布,僅代表部門意見,並非全體委員會政策。雖然職員聲明有一定分量,但不具法律效力,隨時可被修訂或推翻。未來政府亦有機會採取不同解讀;國會有可能通過法例確認現行做法,或引入新限制。國際監管動向—尤其若主要司法區採取與美國政策不一致的方式—更有可能加大進一步變革的壓力。

隨機構參與質押規模擴大,託管及營運風險將始終屬核心關切。質押資產規模愈大,便愈成為高層次攻擊的目標。國家級黑客、有組織的網絡犯罪團伙、離職內部人員等,都是加密金融基建的潛在威脅。

雖然託管技術不斷進步—例如多方計算、門檻簽署、硬件安全模塊等創新帶來更強保障—但在維持營運可用性的同時安全存放私鑰,這個根本難題一直存在。若發生嚴重保安事故,極可能引致監管強硬反應,甚至動搖機構信心。

網絡持續演進,同時帶來機遇及風險。以太坊按規劃持續進行擴容升級,有機會改變質押機制、回報結構或驗證要求。Solana曾出現網絡中斷事件,即使網絡近期大有改善,外界對其穩定性仍存疑慮。

其他權益證明網絡正競逐機構參與,各自具備獨特技術特徵、治理架構及風險狀況。機構投資質押產品,本質上是在對未來哪些鏈能維持相關性、安全性及開發者活躍度作長線押注——但在快變科技環境下,這些預測天生充滿不確定。

專家觀點:業界領袖有何看法

隨住支持質押的新型加密貨幣ETP面世,業界參與者、分析師及市場策略師均提出廣泛評論。這些觀點有助解讀如Grayscale推出質押產品等發展的重要性,以及體現業界對機構加密市場未來的不同預期。

彭博資訊ETF分析師James Seyffart一直是觀察加密ETF動向的重要人物。2025年期間,Seyffart定期更新質押修訂申請的審批進度,經常率先預警SEC決定的臨近。

2025年4月,他預計以太坊ETF的質押功能取批「最快可於5月,但更大機會拖至年底」,指出SEC正多次用盡90日的審查期處理多宗申請。Seyffart強調,申請數量之多——最終累計達到96宗覆蓋多種資產的加密ETF提交——反映「資產類別正走向成熟」,亦顯示機構需求是推動監管適應的主因,而非倒過來。

Seyffart的同事,Eric Balchunas,同樣強調加密ETF市場的競爭態勢。Balchunas指出,SEC將質押批核押後至2025年第三季,是一種策略,目的是在開放質押產品申請大門前,先定立通用上市標準。他在九月説明:「他們一直拖住所有申請……我們估計SEC會等到通用標準出爐才會處理」,最終他預測準確:通用標準於九月底通過,Grayscale質押產品隨即推出。

BlackRock(貝萊德)數碼資產主管Robbie Mitchnick一向大力主張以太坊ETF需具備質押功能。2025年3月,他公開稱「缺乏質押的以太坊ETF不夠完善」,理由是未能捕捉原生網絡收益,與直接持有ETH相比屬人為劣勢。

BlackRock於2025年7月申請為其iShares Ethereum Trust (ETHA) 增設質押功能,正正反映該立場。雖然BlackRock非首家推出質押ETF(該里程由Grayscale奪得),但其積極參與已釋放傳統資產管理巨頭認為質押屬機構級以太坊產品的必備,而非附加功能。

機構託管服務供應商則強調風險管理與營運專業。BitGo行政總裁Mike Belshe宣布成為數隻加密ETF的託管人時指出,「百分百冷錢包存放作為獨立主託」令BitGo的方案與眾不同。Belshe既強調冷儲安全,同時支援質押,突顯提供機構級服務所需的技術複雜性。

Anchorage Digital聯合創辦人及行政總裁Nathan McCauley則以該公司的聯邦銀行牌照作賣點:「我們的聯邦牌照——取代州級監管,確立我們為合資格託管人——令ETF託管多元化自然選擇我們。」

SEC專員Hester Peirce一向是委員會內最支持加密的聲音,她盛讚2025年5月的質押指引,同時亦坦言其局限性。Peirce寫道:「今天,公司財務部釐清部分權益證明區塊鏈協議的質押活動,不屬於聯邦證券法所涵蓋的證券交易。」

她形容該指引為「美國質押人及‘質押即服務’供應商提供了歡迎的明確釐清」,但亦指出邊緣個案及混合方案仍存不少疑問。Peirce於2023年Kraken和解案中的異議——當時她批評SEC「家長式兼懶惰」——已確立其主張以支持創新、非以執法封堵新發展的監管路線為己任。

業界組織則聚焦與國際市場的競爭問題。區塊鏈協會(Blockchain Association,為美國領先的加密業界組織)於2024-2025年期間多次指,圍繞質押的監管不明,正推動機構資金流向歐亞市場。

該會引用歐洲質押ETP的成功案例,指出美國市場正流失競爭力。此說法似乎影響到政策討論:SEC 2025年指引推出時,正值更廣泛的市場創新與資本競爭討論高潮。

聚焦加密市場的學術研究則探索機構質押的經濟效應。區塊鏈數據分析公司Coin Metrics於2024年12月發表研究,顯示以太坊的質押參與率已穩定於流通供應的約28%,當中機構持份者佔比持續上升。

研究指出,透過ETF的機構參與可進一步推高以太坊質押率,或達總供應的35-40%,這有利網絡安全,但亦提升持有未質押ETH的機會成本。Solana的質押經濟則顯著不同:逾50%的質押率反映Solana設計取向(無最低存額要求、短解綁期)及較高表面回報。

投資顧問及財富管理人對質押產品表現出審慎興趣。CoinDesk於2025年夏季的調查發現,約六成註冊投資顧問(RIA)表示「有興趣」或「非常有興趣」向客戶推薦支持質押功能的加密ETF,但有四成坦言擔心波幅、監管不確定及資產類別新穎性。

調查顯示,質押收益令加密產品對著重收益的保守客戶更具吸引力,但顧問們對大比例配置於加密貨幣仍持審慎態度,盡管有額外收益優勢。

批評機構加密產品者則關注集中化效應及系統性風險。Nic Carter,一位創投...and crypto researcher, has written extensively about the risks of excessive concentration in ETF-driven staking. Carter argues that if a handful of large ETF providers control significant portions of network stake, they gain influence over blockchain governance and create potential points of failure.

Carter指出,如果少數大型ETF供應商控制咗網絡中大量嘅Staking份額,佢哋就可以對區塊鏈治理有重大影響力,亦都會造成潛在嘅風險點。Carter喺2025年9月嘅一篇文章入面寫道:「我哋可能會面對一個情況,就係加密貨幣世界嘅BlackRock同Vanguard控制住整個美國企業界。」呢句亦都係回應傳統股票市場入面,大型指數基金供應商市場力量嘅討論。Carter嘅擔憂,其實亦都係部分區塊鏈開發者嘅共同想法,佢哋擔心機構化會違背Proof-of-Stake最初推動去中心化嘅理念。

A New Chapter in Institutional Crypto, Not the Final One

Grayscale喺2025年10月6號推出美國首隻帶有Staking功能嘅現貨加密貨幣ETP,呢一步確實係數碼資產市場成熟過程中一個重要里程碑。經歷過多年監管不明、執法關閉先驅Staking服務,以及ETF審批不順,依家機構投資者終於可以透過熟悉、受監管嘅投資工具,接觸可以產生收益嘅區塊鏈資產。個意義唔只局限於某一個產品或公司。Staking由監管禁區變成可接受投資功能,亦都為創新打開咗新門路——而呢啲門路喺2023年都仲係封死咗。

不過,認同呢個里程碑之餘,都要知道佢有限制所在。Grayscale今次推出,其實都只係基於SEC職員聲明定立嘅框架,而唔係正式嘅法規或立法。雖然職員意見具有影響力,但未來執政者或委員會都可能會修訂或推翻。

成個指引都定得好窄,只係適用於某啲特定類型嘅Staking安排,而其他架構嘅問題仲未解決。稅務處理方面都仲有唔確定性,特別係針對流動Staking衍生品咁嘅創新產品。營運風險方面,例如網絡安全、Slashing(懲罰機制)、網絡穩定等,都仲係挑戰緊就算係最精密嘅機構操作者。

BlackRock、Fidelity同其他主要ETF供應商都遞交咗加埋Staking功能嘅以太坊ETF申請,一旦獲批,Staking將會由差異化功能變成標配。屆時,真正嘅競爭焦點將會變成營運表現:邊個供應商可以靠更好嘅驗證人選擇、更低費用、同更卓越嘅風險管理,提供最高淨回報。隨住通用上市標準生效,市面上加密ETF產品數量好大機會急劇增加,覆蓋唔同加密貨幣、Staking策略,以及不同風險回報組合。

國際格局都會繼續影響美國政策。歐洲同亞洲市場已經證明,有Staking功能嘅產品可以喺適當監管框架下成功運作,咁會加大美國市場要保持競爭力嘅壓力。同時,美國監管決定亦都會影響全球市場——SEC喺2025年5月同8月對Staking發表嘅指引,好大機會會成為其他司法管轄區處理類似問題時嘅參考。監管機構開始體會到區塊鏈本身冇國界、全球可達成嘅特性下,國際間協調加密貨幣標準愈來愈可能成為趨勢。

機構採納加密貨幣嘅路徑,好明顯係加快而唔係減慢。比特幣ETF推出首年已經吸引咗超過$350億美元資金流入。以太坊ETF,由於一開始冇Staking功能而受到局限,但當Staking變做標配後,預計又會有新一波資金湧入。

到Solana ETF推出並配備Staking功能時,預計年回報率有機會超過6%——喺任何市場環境都好有吸引力,尤其係債券等傳統固定收益表現普通嘅時候。其他Proof-of-Stake網絡,如Cardano、Polkadot、Avalanche同Cosmos,已經有ETF申請,每一個都有唔同Staking機制、收益曲線同風險特徵。

除咗ETF之外,機構採納會有多種形態。例如獨立管理帳戶、專業託管直接持有、對沖基金策略包括Staking alpha、以及運用加密衍生品設計嘅結構性產品,都會令機構接觸Staking收益嘅方式不斷拓展。

退休基金、捐贈基金、保險公司、企業財資部門、主權基金等,都處於評估加密資產配置比例嘅不同階段。Staking收益加到投資組合入面——即係創造一種好似派股息或者收息票咁嘅「數碼股息」——令加密資產對一向質疑純粹靠價格升跌賺錢嘅保守機構投資者嚟講,變得更熟悉同更易接受。

風險依然真實而且重大。價格波動冇消失——每年3-8%嘅Staking收益只係對沖短期價格波動微不足道,如果遇到30%、50%、甚至70%嘅市況調整,分分鐘都唔夠頂。監管風險都依然存在:一個政府容許嘅嘢,後一個政府隨時收緊。

營運風險都要時刻警惕:愈嚟愈複雜嘅網絡安全攻擊,促使託管同驗證設施要不斷升級。網絡層面嘅風險包括:部分區塊鏈或者會隨住技術發展而式微,或者因為治理爭議,有可能出現分拆,投資者資本被困。

不過,大方向好清晰。Staking已經由監管禁區,轉做可接受嘅機構慣例。整個基建——託管、驗證、風險管理、會計、稅務——都迅速成熟化。產品——ETF、ETP、基金、帳戶——亦都愈嚟愈多。投資者陣容——由淨係得Crypto原住民、冒險型對沖基金,到依家大型傳統資產管理人、主流機構客戶——都參與其中。

Grayscale歷史性推出唔係一個句號,而只係一個起點:標誌住機構加密投資進入新時代,納入區塊鏈網絡最基本、最具價值增長潛力嘅收益產生機制。由Kraken 2023年2月和解,到Grayscale 2025年10月推出,兩年半時間,已經代表監管思維、市場基建、機構接受度嘅重大轉變。

呢個故事嘅下一章——會有咩創新誕生、邊個網絡成為機構重點配置、監管機構點樣應對新挑戰——仲未寫完。不過,有一點係肯定嘅:機構投資者而家已經唔再被拒諸於區塊鏈驗證經濟門外,而且佢哋嘅參與將會喺加密貨幣市場同傳統金融世界帶嚟潛移默化嘅大改變。