特朗普總統宣布100%關稅引發了加密貨幣史上最大規模清算事件——而且遠超之前。

只用了八個小時。

這就是在2025年10月10日星期五晚上,特朗普總統宣布對中國進口產品徵收100%關稅後,190億美元的加密貨幣槓桿倉位消失的時間。到亞洲市場星期六早上開市時,超過160萬個交易帳戶已經被清算,數據機構Coinglass正式宣布這是「加密貨幣歷史上最大規模清算事件」。

比特幣從12.2萬美元暴跌至10.7萬美元以下——這是12%的自由落體崩盤。以太坊大跌16%。山寨幣?不用說了,有些代幣數小時內損失了40%的價值。

這次屠殺遠遠超越了之前的所有加密幣崩盤。大家公認很嚴重的2021年5月拋售?才100億美元。2020年新冠期間的下跌?僅12億美元。FTX崩潰?16億美元。2025年10月10-11日,規模比過往任何清算事件大10至20倍,這是加密幣16年來最驚人的一夜。

但這場崩盤最令人著迷的是:加密市場基礎設施大致上還保持住了。穩定幣維持1美元錨定,主要交易所處理了數十億被強制平倉的資產卻沒倒下,DeFi協議也平穩地處理了數億壞帳而未累積毒資。而且令人驚訝的是,截至星期六下午,美國沒有任何監管部門——SEC、CFTC或財政部——針對幾小時內蒸發掉比不少國家全年GDP還多資本的事件發出任何聲明。

究竟發生咩事?以下逐步拆解今年加密市場最瘋狂的48小時。

引爆點:中國打出稀土王牌

導火線來自10月9日星期三北京。中國商務部宣布廣泛稀土出口管制——這些稀土元素雖然被視為冷門,但卻是生產半導體、電動車、國防系統和你手上每件現代科技產品的關鍵原料。

關於稀土要明白:中國掌控全球70%供應、90%加工能力。當北京規定含量超過0.1%的稀土產品出口需申請牌照時,這經濟影響力爆炸。

這個宣布猶如重磅炸彈落在全球市場。這些不是普通礦物,而是現代科技供應鏈的根基。電動車馬達需要釹,風力發電機用鏑,LED螢幕靠銪,半導體離不開鋱。失去稀土,全球科技行業全面停擺。

中國早前已逐步收緊稀土出口管控,但今次完全不同,這是正式宣戰。特朗普當然唔會坐視不理。

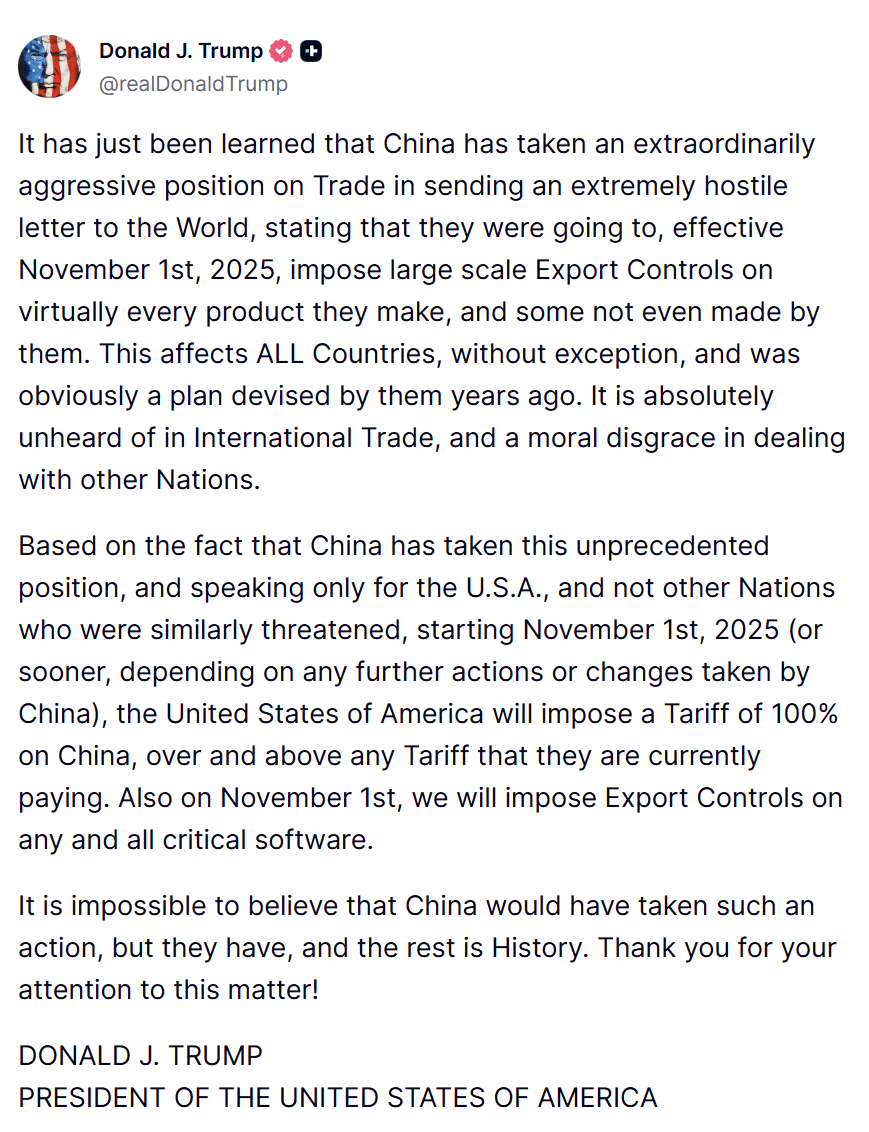

星期五早上:特朗普首先出擊

東岸時間上午11:26,特朗普於Truth Social發文,威脅將對中國商品徵收「大幅度提升」關稅,並暗示取消原定兩周後於南韓APEC峰會與習近平的會議。

「我原本兩周後在APEC見習主席,而家已經無理由再會面,」特朗普寫道,「中國絕不可以挾持世界!」

貼文即時引發全球金融市場震盪。這不再是特朗普一貫威脅,正值全球經濟疲弱之時火上加油。

市場初時反應尚算冷靜:

- 比特幣由12.2萬跌至約11.7-11.8萬美元

- 以太坊跌4.7%至4,104美元

- 首輪清算約7.7億美元

但真實傷害在傳統市場發生。S&P 500指數在特朗普發文後幾分鐘從最高位回落1.2%。納斯達克下跌1.7%。多間與中國供應鏈緊密的科技股遭重挫。

到收市(下午4時),傳統股市損失慘重:

- S&P 500:-2.71%(2025年4月以來最差一天)

- 納指:-3.56%

- 道指:-876點(-1.9%)

S&P 500於特朗普早段發文後40分鐘內蒸發了1.2萬億美元市值。半導體股跌5-7%,蘋果(中國依賴重)跌4.2%,特斯拉跌6.8%。

但這只是前菜。等到傳統市場安心收市過週末,特朗普將放出殺手鐧,把早上損失比下去。

下午5:08:殺招落地

大約美東下午5:08——收市後一小時多——特朗普於Truth Social發佈具體措施。內容極其嚴苛。

對所有中國進口貨加徵100%關稅——即在本來30%基礎(包括20%芬太尼措施+10%反制關稅)上加碼。即總關稅升至130%,由2025年11月1日或更早生效(視中國舉措再調整)。

不止於此。特朗普同時宣布美國限制「所有關鍵軟件」出口至中國。這次不單純是貿易,而是史上最大規模科技脫鉤。

特朗普將中國稀土措施形容為「極度敵對的全球性來信」及「對其他國家的道德恥辱」。語氣之激烈,連特朗普都少見。

幾秒之內,加密市場劇烈震盪。比特幣即時跌3,000美元。隨即賣壓加劇,開始瘋狂拋售。

加密交易者盯住螢幕不敢相信眼前所見。訂單簿好似紙咁被瞬間掃清。價格每秒幾次更新——愈跌愈低。

就係呢刻,一切全面失控。

清算連環爆:190億美元瞬間蒸發

接下來三小時只能稱作屠殺。

特朗普宣布具體關稅後90分鐘內,加密市場成了屠場。所有主流加密貨幣同步崩潰,大量槓桿倉位被斬,交易所系統湧入追繳保證金,強迫拋售進一步引發連鎖反應,價格一浪低於一浪。

比特幣慘烈下瀉

比特幣首小時內跌穿11萬美元,部分交易所閃崩至105,262美元。全球最大加密交易所幣安短暫見106,100美元才反彈,Coinbase曾低見107,300美元。以往交易所之間差價只有數百美元,當刻擴大至2,000美元以上,市場流動性瞬間消失。

從當日高位122,456美元,到日內低位105,262美元,比特幣跌幅達13.6%。比特幣市值單日損失超過2,500億美元。

做個比較:這比Netflix、可口可樂或輝瑞市值都高。一晚全蒸發。

以太坊崩潰

以太坊早段徘徊4,300-4,400美元,至低位按不同交易所跌至3,461-3,761美元,跌幅16-18%,甚至比比特幣還要嚴重。

作為DeFi(去中心化金融)核心,以太坊除了現貨市場恐慌,還遭遇自動清算、DeFi金庫賣盤急需維穩,加上網絡大擁塞,Gas費衝上150+ gwei,創數月新高。

暴跌期間Gas費大升形成死亡循環:費用高導致平倉搬資產更貴,恐慌加劇→交易量暴增→手續費再升。想保本,只能講噩夢。

山寨幣大滅絕

比特幣、以太坊已經夠慘,山寨幣簡直滅絕。

XRP本來高見3.10美元,一度跌至2.40-2.42美元,視乎時間下跌20-30%。Solana從240美元跌至150-182美元區間,下挫25-30%。狗狗幣從0.25美元跌至0.19美元,跌幅22-30%。

藍籌都如此,細碼山寨幣更「被斬得血都乾」:

- Cardano (ADA)由0.85美元跌40%至0.51美元

- Chainlink (LINK)由22-23美元跌至17-18美元,跌40%

- AAVE由290-300美元跌40%至232美元

全市場加密市值從4.27兆跌到4.05兆美元——短短四小時蒸發了2,200億美元。對比一下,這等同新西蘭或葡萄牙GDP,一夜消失。

清算高峰:晚上9點到11點

晚上9點至11點,清算浪潮達到最高峰。這是風暴的眼,強逼拋售響徹整個加密歷史。

Coinglass數據顯示單這兩小時內有超過60億美元清算灌入交易所撮合系統。即每分鐘5,000萬美元,每秒83.3萬美元。絕無僅有。

運作過程冷酷有效:

持槓桿做多的投資人,當比特幣下跌時收到追加保證金通知。如追加資金唔夠快—— enough, exchanges' automated liquidation engines kicked in, forcibly selling their positions at market prices.

但問題變得更嚴重:這些被迫的市價拋售進一步加大了價格下跌的壓力,從而觸發了下一輪的追加保證金通知,導致更多斬倉,又令價格跌得更多,再引發新一輪的追加保證金。

這是一個斬倉瀑布——每一波被迫拋售都產生了下一波被迫拋售的條件,自我強化的反饋循環。加上大量交易員採用類似槓桿水平和類似止損點,結果就是整個市場連環爆倉。

做市商——即平時透過報價買賣為市場提供流動性的公司——為管理自家風險紛紛退場。冇人會主動「撈底」刀落緊市,因為冇人知底會跌到邊。訂單簿深度瞬間蒸發。有啲細市值山寨幣,order book 薄到只要市價拋售十萬美元就會令價格大幅波動 5-10%。

買賣差價(spread)劇烈擴大。好似 BTC/USDT 這類主要交易對,本來只係 USD10-20 的 spread,即時擴大到 USD500-1,000。山寨幣差價再誇張五倍以上。想沽貨,就要付出巨大滑點「入場費」。

24 小時內全市場斬倉總額最終達到 USD19.13 億——但 Coinglass 指出「實際數字可能高得多」,因為全球最大交易所幣安(Binance)喺危機期間數據報得非常慢。

多空大屠殺:87% 都係牛

有個數字可以話畀你知市場頭寸有幾一面倒:USD191.3 億被斬倉當中,有 USD166 億係長倉。即係 87%。

空倉只係被斬咗 USD24 億——只佔 13%。

諗下呢個意思:每七個賭升嘅人,只有一個係賭跌。市場過份而且極度偏向牛市。當特朗普出動關稅大招嗰下,全部牛通殺。

呢個唔係正常波幅下嘅均衡市場。係一場擁擠交易自爆,場面極度壯觀。

根據數據,差唔多有 160 萬個交易帳戶被斬倉——小至幾百蚊,大至 HTX 交易所曾經持有過史上最大單一中央化平台斬倉紀錄,即 USD8,750 萬 BTC/USDT 大長倉。

喺 Hyperliquid 呢個去中心化永續平台,交易員親眼見證 USD2.03 億 ETH/USDT 長倉即場被斬——創下 DEX 史上最大規模斬倉紀錄。平台上仲有多個 USD1,500-2,000 萬嘅大頭寸同時爆倉。

有估算指,當日最恐怖嘅一段時間內,高達 96% 期貨交易員都被斬倉。呢啲唔係市場回調,簡直係一場斬倉世界末日。

點解加徵關稅會搞爆 Crypto:宏觀傳導鏈條

如果你會諗:「中國電子產品加稅關美國有咩事,點解比特幣會跟住一齊崩?」咁你問啱咗!背後答案正正反映咗呢幾年加密貨幣生態的巨大轉變。

Crypto 唔再係野蠻西部。佢已經變成咗機構級資產類別。主權基金、保險公司持有比特幣。對沖基金炒以太坊。家族辦公室將 Crypto 當其中一環放進多元資產組合。 BlackRock 的 BTC ETF 管理資產都接近一千億 USD。

而機構係用傳統金融思維睇 Crypto,唔係革命視角——佢哋當呢啲係高 Beta 科網 proxy,即押注創新、風險胃納、同經濟增長。

特朗普一宣布加 130% 關稅,大家即時怕衰拖經濟入衰退,機構電腦程式邊分你咩資產,一齊斷纜一齊沽。納指、比特幣、以太坊、高息債、新興市場貨幣——全部一齊跌。

Kraken 全球首席經濟師 Thomas Perfumo 講得好貼切:「加密市場下跌反映更大層面的風險厭惡情緒。呢個唔係失望離場,而係宏觀主導、重新定價。」

逐條拆解下——加徵關稅消息,點樣傳導到 Crypto 一路殺落去:

1. 供應鏈受創

130% 關稅再加出口管制,全球科技供應鏈即時中槍。唔係淨係 Apple、Tesla 受害——Crypto 基建一樣中。

比特幣礦機?大部分都係中國製或者用咗中國零件。挖礦專用 ASIC 晶片,都靠先進晶片產業鏈。出口軟件受限,設計、製造工具都會俾人卡到。

以太坊節點?好大機會運行喺集成咗中國元件的伺服器上。

Crypto 實體基建——礦機、節點、數據中心——一切都要靠全球科技供應鏈。供應鏈曝住大威脅,Crypto 自然受影響。

2. 通脹憂慮同聯儲局政策

經濟 ABC:主要貿易夥伴入口加到 130% 關稅,進口貨更貴,所有成本轉嫁到消費者度。物價升,通脹加速。

聯儲局天職就係控通脹。通脹一高,要嘛加息,要嘛 keep 高息期比市場預期長。息口高咗,風險資產比返 T-bills 冇著數。

永恆問題:「啲現金有 5% 無風險收益,點解仲要揸極波動嘅比特幣?」息越高,資金越流向安全資產——Crypto 呢類高風險資產就第一個中招。

市場一早預計聯儲局會喺 2025 年尾或 2026 年初減息,特朗普關稅消息一出,預期即刻清零。關稅推高通脹,聯儲局更鷹,風險資產冇運行。

3. 經濟衰退風險

貿易戰拉低全球 GDP 增長。出口、進口都貴咗,貿易活動萎縮,經濟增長收緊。

特朗普消息一出,經濟學家全線預警衰退可能。摩根大通將衰退機率由 30% 提高到 45%。高盛亦發表報告,指 130% 關稅或令美國 2026 年 GDP 增長率減 1.5%。

經濟衰退危機一到,風險資產全軍覆沒。2008 金融危機時未有比特幣;2020 年 3 月 COVID 衰退,比特幣兩日爆跌 50%。每逢衰退,錢都湧向安全資產:現金、黃金、國債,純投機野自然冇人問。

4. 美元強勢

全球風險上升,資金自然避險湧入美元。美元升值。但比特幣大部分 Crypto 都以美元計價。

美元升,國際買家買比特幣就相對貴咗。中國買家買同樣比特幣要換更多人民幣,歐洲買家要換更多歐元,海外 demand 跌。

10 月 10-11 日大跌市當天,美元指數(DXY)升咗 0.8%,確認咗避險資金流入美元,離開風險資產。

5. 跟科網股連動

最重要嘅係,比特幣同科技股(特別係納指)連動性急劇上升。納指跌,比特幣跌。科網股升,比特幣升。

10 月 10 日,納指跌咗 3.56%。比特幣跟跌 12%。即係約 3.4 倍槓桿,完全切合「高 Beta 科網 proxy」特質。

重點係:Crypto 暴跌時,黃金同期升咗 1.7%。證明今次真係標準避險走勢,唔係亂市。安全資產升,風險資產沉底。教科書般機制。

槓桿計時炸彈引爆

令今次崩盤極之嚴重,源於 Crypto 市場入場嗰刻已經離譜地過度槓桿化。

預警訊號已經連閃數天,但大家置諸不理,因為價升緊。比特幣 10 月 6-7 日先剛創新高 USD126,223,以太坊都逼近 USD5,000。Altcoins 個個勁升,個個都賺緊,邊有人收槓桿?

呢個就係「近期偏誤」(recency bias),害死最多交易員——以為升得昨日就必然升多一日。

數據一直在警告:Funding rate 升穿 8%

永續合約 funding rate 反映持倉成本。正 funding rate 就長倉付錢比空倉;負 funding rate 就反過來。

BTC 永續正常 funding rate 係 0.01-0.03%(年化 10-30%)。崩盤前幾日,有啲交易所 funding rate 爆到過 8%——即係年化超過 700% 才可守住長倉。

癲晒!8% 以上意味市場長倉逼爆,空軍可以收天價才肯頂對手走貨。極端倉位擠壓、回調在即,典型警號。

幣圈 BTC open interest 達 1,000 億美元

open interest(未平倉合約總值)10 月初不斷創新高,淨係 BTC across 全交易所已接近 1,000 億 USD。全市場衍生品 open interest 去到 1,870 億。

對比:2021 年 5 月斬 100 億閃崩,open interest 只係 600 億——今次系統持有槓桿係歷史崩盤時的 3 倍。

100-200 倍槓桿依然任炒

Here is the translated content in zh-Hant-HK, with markdown links left unaltered:

儘管之前經歷過多次「清算連環爆」後應該學到教訓,主流交易所依然提供令人匪夷所思嘅高槓桿比率。MEXC 喺比特幣期貨上提供 200倍槓桿。Bybit 提供 100倍。Binance 更高達 125倍。

當你用100倍槓桿炒賣時,只要價格逆你1%,你個倉就會完全清倉。比特幣下跌12% —— 就好似10月10日咁 —— 唔只係清倉咁簡單,根本直接「蒸發」,咩都唔剩,得番一張清算通知。

諗下條數:如果你喺比特幣價$120,000時開100倍槓桿多倉,只要跌到$118,800(跌咗1%),你個倉會自動俾人爆,輸清光。200倍槓桿?只係0.5%波動已經爆倉。

呢啲根本唔係交易,純粹賭博。如果話10月10日係賭場,今次真係賭場清場。

連環清算機制

今次連環清算嘅過程完全可以話係教科書級 —— 無情又高效,黑暗得嚟帶住種毀滅嘅美感。

階段一:初步衝擊(美東時間5:08PM – 6:00PM)

特朗普發表聲明令比特幣由$117,000插水4%去到$112,000。用25倍槓桿或以上嘅交易者開始收到追加保證金通知。好多人未必夠快加錢入倉,甚至根本唔想加。

階段二:第一輪清算(6:00PM – 7:00PM)

交易所啟動自動清算引擎。最高槓桿頭位會即時以市價強制平倉。呢啲被迫市價賣出嘅倉位大約加咗20億美元賣壓,令比特幣再跌3%去到$109,000。

階段三:連環開始加劇(7:00PM – 9:00PM)

更低價位觸發新一輪追加保證金——啱啱一個鐘前仲好地地,用15至20倍槓桿嘅人,宜家已經大幅穿倉。更多清算、更多強制賣盤。比特幣跌穿$110,000支持位,直插落$105,000。

做市商開始撤退。佢哋見到連環清算形成,唔想再做接盤俠。訂單簿深度由平時喺中間價旁邊50至1億跌到只剩1,000萬至2,000萬。

階段四:清算高峰(9:00PM – 11:00PM)

呢個階段真係出晒事。交叉保證金倉位開始被清算——即係用一個戶口質押多個持倉,如果比特幣蝕錢,連帶ETH、SOL同其他山寨幣都要被迫平倉。

冇得揀,唔止比特幣跌,所有幣種同時插水,因為系統自動平所有倉為咗填補BTC損失。影響擴散到成個加密圈。

週末更加雪上加霜。本來ETF機構買家可能會撐下市——但ETF市場週末收市,冇人救火,只係清算砌清算。

階段五:散戶投降(11:00PM – 2:00AM)

堅持到而家嘅散戶開始恐慌性拋售。可能佢哋原本冇炒槓桿,但坐艇坐到資產短短幾個鐘跌15%,心理壓力爆棚。恐懼與貪婪指數由70(貪婪)兩日之內插到35(恐懼)——係加密史上最快之一情緒逆轉。

本來以為安全嘅止蝕位(如$110,000或$108,000)被大量觸發。每一個止蝕,變做市價賣盤,進一步推低價格。

社交媒體放大咗恐慌。Twitter(X)爆滿清算截圖。Reddit熱爆損失貼。KOL不停發文話「可能見頂」。驚慌指數瘋狂傳播。

階段六:亞洲開市成屠場(2:00AM – 8:00AM/亞洲週六早上)

亞洲交投員星期六朝早一睜大眼,發現時勢大亂。比特幣落咗12%,山寨幣大跌20-40%。大家齊齊問:「發生咩事?」

週末亞洲流動性稀少,即使小額賣壓都足以移動價格。比特幣盤間一度喺$107,000至$112,000,5分鐘內波幅$2,000-$3,000。

去到香港中午,據Coinglass,清算總額過咗160億美元。到週六下午,最後數字:191.3億美元。

重傷代幣:逐隻幣驗屍

唔係所有幣種都同樣受創。市場結構、深度、衍生品持倉、同基本用途,都左右咗邊啲幣最重傷。睇吓邊幾隻最中招。

Cardano (ADA):-40%

數據:ADA由$0.85跌到某啲交易所低至$0.51 —— 慘跌40%。市值由280-290億跌到大約200億。交易量飆升200%以上——恐慌性拋售加劇。

點解咁傷:Cardano原本就試突破300日下降通道,正正喺大閘爆發之時。技術派最鍾意呢啲位——長期下跌通道一爆頂,好多時會勁升。

不過今次槓桿破頂炒家全軍覆沒。唔少人止蝕設喺$0.70附近。一旦比特幣拖市,ADA唔止突破失敗,仲倒跌返落通道直穿多個支持位。

技術突破失敗+高槓桿集中+巨型流通供應(358億枚ADA),就算適中拋壓都可以變大額損失。

Chainlink (LINK):-40%

數據:LINK由$22-23插水落低位$17-18。市值由150億跌到大約110億。成交量爆升200%。

點解爆煲:Chainlink係DeFi協議Oracle龍頭——冇錯,佢負責向智能合約提供報價。呢次DeFi平台(如Aave、Compound、GMX)大舉清算時,LINK直接被拖落水。

不止咁——LINK期貨槓桿倉勁大。數據顯示LINK永續合約未平倉量創多月新高,而且資金費率反映大部分倉位都係long。

DeFi平臺清算爆倉、LINK現貨價一跌,long位悲劇連環被抬出場。惡性回饋循環出現:DeFi有壓力→LINK跌→LINK期貨清算→加劇賣壓→LINK再跌。

作為DeFi Oracle基礎設施通證,LINK同DeFi命運綁埋一齊。DeFi爆煲——LINK大出血。

Aave (AAVE):-40%

數據:AAVE由$290-300插水落$232。市值由44億跌到大約32億。成交量增長250%。

點解又爆:Aave係最大DeFi借貸協議,鎖倉(TVL)超過680億美金。呢場崩盤期間,協議實時清算借貸倉超過2.1億美金。

用戶見到Aave清算咁多貸款,即刻質疑:協議本身有冇風險?會唔會爆壞賬?不如跌價之前沽咗先。

鏈上數據證明一切:AAVE流入交易所(等於準備賣)激增180%。大戶拋貨謀求現金。

心理好易明白。AAVE通證價值建基於協議本身。如果大家對協議安全有疑慮,通證就危危乎。雖然Aave實際上冇出現壞賬,清算系統運作完美,但「有危機」嘅印象已引發沽壓。

Dogecoin (DOGE):-22%至-30%

數據:DOGE由$0.25插落低位$0.19。市值由350-400億跌到約270-300億。成交量升150%。

點解流血:迷因幣全靠信心,冇實際用途、冇協議收入、冇現金流——價值完全建立係大家信明天會有人更貴接貨。

只要出宏觀大事,信心類資產即死。比特幣自己都跌12%,邊個仲會揸DOGE?主角滴血,小丑仆街。

散戶炒家DOGE用重槓桿追過去升浪。保證金爆煲時,全線自動清倉。

大量交易量同市值睇落強勁,但實際訂單簿超薄——市價幾百萬美金已經推動DOGE價5-10%,因為做市商唔願喺波動時攞真金白銀頂住。

Litecoin (LTC):-23%

數據:LTC由$130插水到$100。市值約跌20-30億美元。成交量增長180%。

點解大跌:LTC老幣冇乜新意。冇強DeFi生態,冇清晰定位。好似比特幣嘅「數碼白銀」——呢個故事2013年仲講得過,到2025年已經走樣。

LTC過去一向同比特幣走勢同步,但波幅更大。好似BTC衍生品加大版,冇機構支持、ETF產品或者企業資金入場。比特幣跌12%,LTC跟跌20-25%,「只共跌唔共升」。

期貨未平倉倉位大爆發,引發清算潮。加埋礦工喺低價下唔賺錢——LTC再插深啲,挖礦變蝕,算力跌,網絡安全受損,死亡漩渦開始。

Solana (SOL):-25%至-30%

數據:SOL由$240插落低位$150-$182(視乎來源及交易所)。市值由超過

[截稿前原文到此為止]$100 billion to approximately $70-75 billion - a devastating $25-30 billion loss. Volume exploded over 200%.

由一千億美元跌至約七十至七十五億美元,損失達二十五至三十億美元。成交量爆升超過200%。

Why it crashed hard: Solana hosts the largest meme coin ecosystem via Pump.fun, the platform that lets anyone launch a token in minutes. When macro stress hit and Bitcoin crashed, meme coins got absolutely demolished - many falling 50-80% in hours.

點解跌得咁勁?Solana 經 Pump.fun 平台,成為最大嘅 Meme Coin 生態圈所在。任何人都可以幾分鐘內發幣。當宏觀壓力襲來,加上 Bitcoin 跌市,Meme Coin 幾乎全軍盡墨——好多幣幾個鐘內暴跌五至八成。

When the meme coin ecosystem that represents a huge part of Solana's transaction volume and value proposition collapses, SOL's network value proposition weakens proportionally. If transactions fall, fees fall, network activity falls, and the fundamental case for SOL's valuation takes a hit.

Meme Coin 生態圈係 Solana 交易量同價值主張嘅最大部份之一。一旦崩潰,SOL 嘅網絡價值主張就會被削弱。交易量跌,手續費跌,網絡活動減,SOL 嘅基本估值都會受壓。

Solana also has historical network stability concerns that resurface during stress. The network has experienced multiple outages in previous years. During the crash, anxiety about potential network stress added to selling pressure - traders worried that high transaction volumes might cause network degradation.

Solana 仲有一個長期問題,就係網絡穩定性成疑,之前連續幾年都停過機。今次市況大跌,大家擔心會出現網絡壓力,進一步加重沽壓——好多炒家怕高交易量會再令網絡出事。

Most critically, SOL had the highest concentration of leveraged positions among major Layer-1 smart contract platforms. The funding rate data showed SOL perpetual futures were even more crowded than Bitcoin's. When liquidations hit, SOL got wrecked harder than almost anything except smaller altcoins.

最嚴重嘅係,SOL 係主流 Layer-1 智能合約平台入面,槓桿倉位最集中。資金費率數據顯示,SOL 永續合約倉位甚至多過比特幣。清算潮一到,SOL 比大部分幣都更傷,只有啲更細嘅山寨幣輸得更慘。

Solana DEX volume dropped 40% as the crash progressed, indicating declining network activity and user confidence. When the ecosystem is bleeding, the base layer token bleeds too.

Solana DEX 交易量喺跌市進一步插水,跌咗40%,反映網絡活動同用家信心都大幅下降。生態圈崩潰時,平台幣都係受害者。

XRP: -20% to -30%

The numbers: XRP crashed from $3.10 to lows of $2.40-$2.42. Market cap fell from approximately $110 billion to around $85 billion - a $25 billion loss. Volume increased 120%.

數字:XRP 由 $3.10 跌到最低見 $2.40-$2.42。市值由約一千一百億美元跌至八百五十億美元,蒸發咗二百五十億美元。成交量升咗120%。

Why it fell: The U.S.-China trade tensions directly threaten XRP's core narrative: cross-border payments. If global trade is contracting due to tariff wars, the demand for cross-border payment infrastructure falls.

點解咁跌?中美貿易緊張直接威脅 XRP 嘅主打概念——跨境支付。全球貿易因為關稅戰縮水,跨境支付需求自然跌。

Institutional hopes for an XRP ETF - which had been building through 2025 - were suddenly dampened by risk-off sentiment. When markets are crashing, regulators and institutions aren't thinking about launching new crypto products. They're thinking about survival.

2025 年以來機構對 XRP ETF 充滿憧憬,但呢股「避險」情緒一來,即刻打沉咗呢類期望。大市插緊水,監管機構同投資者都唔會諗住推新加密產品,只會諗住點自保先。

Concerns about Ripple's large XRP treasury added pressure. Ripple holds billions of XRP tokens. During market stress, traders worry about the company selling tokens to fund operations - adding supply during a time of falling demand.

市場仲擔心 Ripple 手上持有大量 XRP。跌市期間,炒家驚 Ripple 會為咗搵錢營運而拋售加幣,使供應增加,需求又下跌,正面惡性循環。

On-chain data showed XRP exchange inflows increased 95% during the crash. Millions of tokens moved from private wallets to exchanges - the clearest possible signal of selling pressure. Large holders were dumping.

鏈上數據顯示,XRP 流入交易所數量暴升95%。大量 XRP 由私人錢包轉去交易所——明顯係準備拋售,大戶都沽緊貨。

Ethereum (ETH): -15% to -16%

The numbers: ETH plunged from $4,300-$4,400 to lows between $3,461-$3,761. Market cap fell from over $500 billion to approximately $420-450 billion - a $75-100 billion loss. Liquidations totaled $1.68-2.24 billion, making it the second-most liquidated asset after Bitcoin.

數字:ETH 由 $4,300-$4,400 跌到最低 $3,461-$3,761。市值由超過五千億美元跌至約四千二百億至四千五百億,損失七十五至一百億美元。全網清倉總額達十六億八千萬至二十二億四千萬美元,只比 Bitcoin 少。

Why it crashed: As the primary DeFi chain, Ethereum bore the brunt of every DeFi protocol liquidation happening simultaneously. Aave liquidations, Compound liquidations, MakerDAO liquidations, GMX liquidations - they all happened on Ethereum and they all added selling pressure to ETH.

點解咁跌?以太坊作為主力 DeFi 鏈,所有 DeFi 協議同時清倉——Aave、Compound、MakerDAO、GMX 接連清算,全拖累 ETH 被不斷拋售。

Automated smart contract liquidations across dozens of protocols amplified the selling. These aren't emotional retail traders deciding to sell - these are cold, emotionless code executing predetermined liquidation logic. When collateral ratios breach thresholds, smart contracts automatically sell to protect protocol solvency.

各個協議自動化智能合約同時清倉,賣壓倍增。唔係散戶受驚沽貨,而係冷冰冰嘅程式照例執行清算邏輯。一爆倉,智能合約自動拋售保協議安全。

Network congestion during the panic drove gas fees to 150+ gwei - multi-month highs that added negative sentiment. High gas fees during a crash create a terrible user experience: you're losing money on your positions AND paying exorbitant fees to do anything about it.

大恐慌下,以太坊 gas fee 衝到 150+ gwei,創多月新高,進一步推高負面情緒。跌市加埋天價 gas fee,輸錢之餘,咩操作都要俾天價手續費,體驗超差。

ETH spot ETF flows told a dark story. On October 10, all nine Ethereum ETFs reported zero net inflows. The previous day's positive momentum had completely reversed. Total outflows reached $175 million - institutional money was quietly heading for the exits.

ETH 現貨 ETF 流向非常唔樂觀。10月10日,9隻以太坊 ETF 全部零資金淨流入。前一日嘅正面動力一夜殲滅。總資金淨流出達一億七千五百萬美元——機構錢潛水出貨。

Binance Coin (BNB): -10% to -15%

The numbers: BNB fell from $1,280 to lows around $1,138. Market cap dropped approximately $15-25 billion. Volume increased about 90%.

數字:BNB 由 $1,280 跌到最低約 $1,138。市值大約蒸發十五至二十五億美元。成交量升九成。

Why it fell: As Binance's native token, BNB faces selling pressure when traders reduce their exchange exposure during volatility. If you're worried about exchange risk during a crash, you sell your exchange tokens first.

點解會咁?作為 Binance 原生代幣,每逢波動時炒家想減揸持交易所幣,第一時間就會沽 BNB。

DeFi protocols on BNB Chain (formerly Binance Smart Chain) experienced their own liquidation cascades, adding to the selling pressure. BNB's dual use case - exchange utility token and DeFi ecosystem gas token - meant it faced selling pressure from both sides.

BNB 鏈(前 Binance Smart Chain)嘅 DeFi 協議都出現連鎖清倉,賣壓加劇。BNB 一方面係交易所效用幣,另一方面又係鏈上 gas 代幣,兩邊都要沽。

The relatively smaller decline compared to other altcoins reflects BNB's utility value (you need it for trading fee discounts on Binance) and Binance's quarterly token burns, which provide price support by reducing supply.

比起其他山寨幣,BNB 跌幅相對細,反映佢嘅效用價值(用嚟折扣 Binance 交易費)同 Binance 定期銷毀機制有效減供撐價。

Bitcoin (BTC): -10% to -12%

The numbers: BTC crashed from the October 10 high of $122,456 to an intraday low of $105,262. From the October 6-7 all-time high of $126,223, the decline was over 16%. Market cap fell from over $2.4 trillion to approximately $2.15 trillion - a loss of more than $250 billion. Liquidations totaled $1.83-2.46 billion, the largest of any asset.

數字:比特幣由 10月10日高位 $122,456 跌到日內低位 $105,262。由 10月6-7日歷史高位 $126,223 計,跌超過 16%。市值由超過 24,000 億美元跌到大約 21,500 億,蒸發超過 2,500 億美元。清算總額 18.3 至 24.6 億美元,係所有資產中最大。

Why even Bitcoin fell: Bitcoin isn't immune to macro shocks, especially when they're this severe. A 130% tariff announcement from the President of the United States representing an existential threat to global trade - that's a macro shock.

點解連 Bitcoin 都跌?比特幣都唔可能絕對抗拒宏觀衝擊,尤其今次咁嚴重——美國總統宣佈 130% 關稅,全球貿易生存堪憂,呢啲絕對係宏觀級 shock。

Bitcoin had just hit all-time highs days before with record leverage in the system. The classic "buy the rumor, sell the news" dynamic was playing out, except the "news" was far worse than anyone expected.

幾日前 BTC 先破歷史高位,全市場槓桿爆標。「買傳聞、沽消息」嘅劇本再次出現,但今次「消息」遠比大家估想差。

When BTC broke below $120,000, it triggered cascading stop-losses. Traders who set stops at "safe" levels like $118,000 or $115,000 got stopped out as the market blew straight through those levels.

跌穿 $120,000 時,連環觸發止蝕。好多以為安全嘅 $118,000、$115,000 止蝕位都一齊被殺穿。

The largest single liquidation in the entire crash was an $87.53 million BTC/USDT long position on HTX exchange. Someone - or some institution - had bet huge that Bitcoin would keep rising. They were catastrophically wrong.

今次全市最大一單清算,係 HTX 有人(或者某機構)開咗張 8,753 萬美元嘅 BTC/USDT long 倉,結果慘遭爆倉。

DeFi's Moment of Truth: When Smart Contracts Met Market Panic

While centralized exchanges were processing the largest liquidation event in history, decentralized finance was facing its own stress test. Would smart contract-based lending protocols accumulate bad debt? Would oracle systems fail to update prices accurately during extreme volatility? Would DeFi prove to be a fair-weather innovation that only works during bull markets?

當中心化交易所處理史上最大清算大潮時,去中心化金融都接受緊自己嘅壓力測試。智能合約放貸平台會唔會爆壞帳?預言機會唔會喺極端波動下 update 唔到價格?DeFi 會唔會只係牛市先有用,唔撐得起熊市考驗?

The answer, surprisingly, was largely positive.

出乎意料,結果整體係正面嘅。

Aave: $210 Million Liquidated, Zero Bad Debt

Aave is the largest DeFi lending protocol with over $68 billion in total value locked across multiple blockchains. During the crash, Aave's automated liquidation system processed over $210 million in liquidations during a comparable stress period.

Aave 係最大型 DeFi 放貸協議之一,多鏈總鎖倉金額逾六百八十億美元。今次急跌,Aave 嘅自動清算系統處理超過二億一千萬美元清算。

Here's what's remarkable: despite processing a quarter-billion dollars in emergency liquidations, Aave accumulated zero new bad debt. Not one dollar. The liquidation system worked exactly as designed.

最厲害嘅係:雖然應急清算金額達二億幾美元,Aave 完全冇爆生壞帳,一蚊都冇。清算系統運作完全正常。

How did it work? When a borrower's collateral ratio drops below the liquidation threshold (typically around 82-83% for most assets), Aave's liquidation smart contracts automatically trigger. Liquidators - specialized actors who monitor the system looking for liquidation opportunities - can purchase the borrower's collateral at a discount (usually 5-10%) and use it to pay off the loan.

點做到嘅?只要借款人抵押比例低過清算門檻(多數資產約 82-83%),Aave 清算智能合約會自動觸發。清算人可以以低價(一般5-10% discount)買入抵押品還貸。

The liquidator makes a profit from the discount. The protocol remains solvent because loans get repaid. The borrower loses their collateral but at least their debt is cleared. It's a remarkably elegant system - and during crypto's worst liquidation event ever, it worked perfectly.

清算人賺折讓,協議收回貸款保本,借款人雖蝕咗抵押品但還咗債。呢個系統好優雅——而且就算面對史上最大清算潮都照做得掂。

This is a massive maturity signal for DeFi. In previous crashes, DeFi protocols accumulated significant bad debt because liquidations couldn't process fast enough or liquidators weren't incentivized properly. In October 2025, the system held.

呢個係 DeFi 成熟嘅重要信號。過去幾次大跌,DeFi 經常爆壞帳,要麼清算唔夠快,要麼啲清算人無誘因。2025年10月今次,成功頂過。

MakerDAO: DAI Stability Through the Storm

MakerDAO's DAI stablecoin - the largest decentralized stablecoin with over $5.36 billion in circulation - faced a critical test. Would DAI maintain its dollar peg during the liquidation cascade? The answer: absolutely.

MakerDAO 發行嘅 DAI 稳定幣係最大去中心化穩定幣,市面流通超過五十三億六千萬美元。今次經歷大規模清算,DAI 會唔會守得住美元掛鈎?答案係百分百做到。

Throughout the entire crash, DAI traded in a range of $0.9992 to $1.0005. That's essentially perfect peg maintenance. For comparison, during the March 2020 COVID crash, DAI briefly depegged to $1.09 as the system struggled to process liquidations and the ETH price fell so fast that the oracle system lagged.

整個跌市期間,DAI 價格一直維持 $0.9992 至 $1.0005 之間,基本係完美掛鈎。相比 2020 年 3 月疫情大跌時,DAI 曾一度偏離到 $1.09,今次運作順暢非常。

In October 2025, no such issues emerged. MakerDAO's Liquidation 2.0 system, which replaced the older auction-based mechanism with a more efficient Dutch auction model, processed liquidations smoothly. The protocol's over-collateralization model proved robust even during extreme stress.

今次完全冇出現同類問題。MakerDAO 2.0 新清算系統(用荷蘭拍賣代替舊競標制)運作順暢,協議超額抵押設計喺極端壓力都頂得住。

No bad debt was accumulated. The system maintained solvency. And most importantly for ecosystem stability, DAI holders never panicked - there was no run on redemptions, no depegging spiral, no contagion to other stablecoins.

0 壞帳,系統保持充裕流動性。對穩定幣生態圈,更重要嘅係 DAI 持有人完全冇恐慌——冇發生大規模救贖、冇脫錨漩渦、冇傳染到其他穩定幣。

Compound: The Absorb Mechanism Performs

Compound, one of DeFi's original lending protocols, has evolved its liquidation mechanism over recent versions. Compound III introduced an "absorb" mechanism where underwater borrower positions are transferred to the protocol itself, which then auctions off the collateral.

Compound 作為 DeFi 元祖貸款協議之一,近年大幅升級本身清算機制。Compound III 加入咗「吸收」機制,被清算嘅借貸位會轉到協議本身,再由協議逐步拍賣抵押品。

Historical data shows Compound processed approximately $80 million in liquidations during comparable periods of market stress. While exact October 10-11 figures weren't immediately available, on-chain data showed no unusual bad debt accumulation or protocol distress.

依照過往類似市況,Compound 曾處理大約八千萬美元清算。今次 10 月 10–11 日具體數字未即時有,但鏈上數據見唔到有不尋常壞帳或協議危機。

The absorb mechanism's advantage is that it doesn't rely on external liquidators acting quickly. The protocol itself takes ownership of troubled positions and can manage the unwind more systematically. During a crash, this provides more stability thanmechanisms that depend on liquidators acting in real-time during chaotic conditions.

依賴清算人在混亂情況下即時行動嘅機制。

Oracle Systems: The Critical Infrastructure That Didn't Fail

Oracle 系統: 無出事嘅關鍵基建

Perhaps the most critical infrastructure test was for oracle systems - specifically Chainlink, which provides price feeds for the vast majority of DeFi protocols.

或者話,最關鍵嘅基建考驗就喺 oracle 系統——特別係 Chainlink,佢為大部分 DeFi 協議提供價格數據。

If oracles fail to update prices accurately during extreme volatility, the consequences are catastrophic. Protocols make decisions about liquidations based on oracle prices. If those prices are stale or inaccurate, protocols either liquidate too early (unfair to users) or too late (accumulating bad debt).

如果 oracle 喺極端波動時未能準確更新價格,後果會好嚴重——協議係根據 oracle 價格嚟做清算決定。如果啲價舊或唔準,協議就會過早清算(對用戶不公平),或者太遲(累積壞帳)。

During the October 10-11 crash, Chainlink's oracle network functioned without failures or significant delays. Price feeds updated continuously, providing accurate data to protocols even during peak volatility when prices were updating multiple times per second.

喺 10 月 10-11 日崩市期間,Chainlink 嘅 oracle 網絡運作無任何失誤或明顯延誤。即使市場極度波動,幾乎每秒更新幾次價,Chainlink 都可持續更新價格數據,為協議提供準確嘅資訊。

This is a huge deal. Chainlink supports over $93 billion in on-chain value across 60+ blockchains and thousands of smart contracts. A failure during the largest liquidation event ever would have been disastrous - potentially causing cascading protocol failures across the entire DeFi ecosystem.

呢件事好重要。Chainlink 為超過 93 億美元嘅鏈上價值提供支援,橫跨 60 條以上公鏈同成千上萬條智能合約。如果佢喺史上最大規模清算事件中出現故障,成個 DeFi 生態都可能骨牌式爆煲。

The fact that it worked flawlessly is a major validation of decentralized oracle architecture. Centralized price feeds have single points of failure. Decentralized oracle networks proved they can handle extreme stress.

佢能夠無失誤運行,確證咗去中心化 oracle 架構嘅效能。中心化價格數據好容易出事,但去中心化 oracle 網絡證明咗佢哋可以頂得住極端壓力。

DEX Performance: Uniswap and Curve Hold Steady

DEX 表現:Uniswap 同 Curve 穩住大局

Decentralized exchanges faced their own challenges: would liquidity providers pull liquidity during the panic? Would automated market makers face catastrophic losses? Would slippage become so severe that DEXs became unusable?

去中心化交易所都面臨自己嘅挑戰:大跌市時流動性供應者會唔會撤資?自動做市商會唔會大虧?滑點會唔會大到 DEX 根本唔掂用?

Uniswap, the largest DEX, maintained its 50-65% market share of weekly volume throughout the crash. Its concentrated liquidity model (introduced in v3 and refined in v4) meant that liquidity providers had positioned capital efficiently around current price ranges.

最大嘅 DEX,Uniswap,喺崩市期間依然保持住 50-65% 嘅每週成交佔比。佢既集中式流動性模型(v3 引入,v4 優化)令流動資金有效率咁集中喺現價附近。

When prices moved violently, LPs did face impermanent loss - the inevitable consequence of providing liquidity during volatility. But the system remained functional. Traders could still execute swaps. Liquidity didn't vanish entirely.

價錢大上大落時,LPs(提供流動性嘅人)的確會蝕咗無常損失——但這啲係波動期間提供流動性嘅必然代價。不過成個系統都無停過,交易員都可以成功做交易,流動性都無完全消失。

Curve Finance, designed specifically for stablecoin and correlated asset swaps, maintained its role as DeFi's liquidity backbone. With $2.48-2.61 billion in TVL, Curve's StableSwap algorithm kept slippage minimal on stable pairs throughout the chaos.

Curve Finance 主要支援穩定幣同高相關資產交換,依然發揮住 DeFi 流動性支柱作用。總鎖倉量有 24.8-26.1 億美元,Curve 嘅 StableSwap 算法確保穩定幣組合低滑點,即使喺大混亂時都好穩。

No major DEX pool imbalances were reported. No smart contract exploits emerged during the confusion. The decentralized exchange infrastructure - built on immutable smart contracts and automated market making - proved robust.

無重大 DEX 資金池失衡,更無智能合約喺亂局混水摸魚。用不可更改智能合約同自動化做市組成嘅 DEX 基建再次證明自己夠硬淨。

Hyperliquid: The DEX That Made History (And Someone Rich)

Hyperliquid:創歷史(亦有人一夜暴富)嘅 DEX

Hyperliquid, a decentralized perpetual futures exchange, recorded the largest single DEX liquidation in history: a $203 million ETH/USDT long position. Multiple other liquidations in the $15-20 million range also processed through the platform.

Hyperliquid 呢個去中心化永續期貨交易所創咗歷史:做咗史上最大單一 DEX 清算——2.03 億美元嘅 ETH/USDT 多單。仲有好多 1,500 萬到 2,000 萬美元嘅單都一齊被清算咗。

But here's where things get interesting - and potentially sketchy. One whale trader on Hyperliquid opened over $1 billion in short positions hours before Trump's tariff announcement. When the market crashed, this trader reportedly profited approximately $190-200 million.

但最得意(甚至有啲可疑)嘅係,有個大戶喺特朗普公布關稅前幾個鐘,喺 Hyperliquid 開咗過十億美元沽空單。崩市之後,傳聞佢贏咗大約 1.9 到 2 億美金。

The timing was suspiciously perfect. Did this trader have advance knowledge of Trump's announcement? Was it just incredible luck? Or sophisticated analysis of market positioning and trade war dynamics?

個 timing 完美得有啲可疑。係咪有人事前收到特朗普消息?定純粹好運?還是有人做咗深度市場倉位分析同貿易戰預判?

We don't know. But when someone makes $200 million on a trade with timing that precise, people ask questions.

無人知。但如果賺 2 億美金,仲要時機咁啱,大家都會諗多咗幾步。

The Stablecoin Surprise: Perfect Pegs During Chaos

穩定幣新鮮事:大混亂下都一蚊唔散

If you've been around crypto for a while, you remember the stablecoin panics. You remember when Tether depegged to $0.90 in 2018. You remember USDC falling to $0.87 during the March 2023 Silicon Valley Bank crisis. You remember the Terra/UST collapse where a $1 "stablecoin" went to $0.10 in days.

玩開加密貨幣你都記得啲穩定幣危機:2018 年 Tether 脫鈎跌到 $0.90、2023 年 3 月矽谷銀行出事 USDC 跌到 $0.87、仲有 Terra/UST 爆煲個陣,「一蚊」穩定幣幾日跌到剩 $0.10。

So when the largest liquidation event in crypto history hit on October 10-11, everyone watching stablecoins was nervous. Would USDT hold? Would USDC crack? Would panicked traders rush to redeem billions of stablecoins, creating a bank run that could destroy the entire ecosystem?

所以 10 月 10-11 日史上最大清算事件爆發時,大家盯住穩定幣個個都緊張:USDT 頂唔頂得住?USDC 會唔會斷?會唔會炒家一齊贖回、穩定幣擠提爆煲搞到成個生態玩完?

None of that happened.

甚麼事都無發生。

USDT: Perfect Peg, Massive Volume

USDT:穩到足,成交夠爆

Tether's USDT, with a market cap of $177-179 billion, held its dollar peg perfectly throughout the entire crash. The token traded in a tight range around $1.00 with minimal deviation - exactly what a stablecoin should do.

Tether 個 USDT,市值 1,770 至 1,790 億美金,崩市成程都緊貼 $1.00,基本上無咩脫鈎——正正就係穩定幣應該做到嘅野。

But here's what's remarkable: trading volume exploded by 152% to over $328 billion in 24-hour volume. Think about what that means. During the crash, traders weren't redeeming USDT - they were buying it.

最巴閉嘅係:成交量一夜暴升 152%,24 小時內超過 $3,280 億美金。即係咩?即係市場崩嘅時候,大家唔係贖回 USDT,而係爭住買。

This was flight-to-safety behavior. As Bitcoin and Ethereum crashed, traders sold their volatile assets and held the proceeds in USDT. That's exactly what stablecoins are designed for: providing a stable dollar-denominated safe haven during crypto volatility.

呢啲就係典型「避險」走勢。比特幣、以太坊一跌,大家賣晒啲波幅野,拎住 USDT 等穩陣——穩定幣就係用嚟咁用,幫你避開加密市場波動。

The surge in USDT volume actually increased demand for the token rather than triggering redemptions. More demand means more buying pressure, which if anything helps support the peg rather than threatening it.

USDT 成交量飆升反而推高需求,冇引發贖回潮,仲令 USDT 更穩。需求勁即係買力勁,對維持掛鈎好過傷害。

Tether's reserves - which now include $113 billion in U.S. Treasury securities - provided confidence that redemptions could be honored if needed. The company has consistently published attestations showing over-collateralization. During the crash, no one questioned whether Tether could honor redemptions.

Tether 儲備依家有 1,130 億美元都係美國國債,好多人覺得佢贖回無問題。加埋公司一向有公開證明自己超額抵押,崩市時外界都無懷疑佢兌唔到錢。

USDC: Circle's Moment of Validation

USDC:Circle 終於揚眉吐氣

Circle's USDC, with a market cap of $74-75 billion, held its peg even more tightly than USDT. Throughout the crash, USDC traded in a range of $0.9998 to $1.0005. That's essentially perfect.

Circle 嘅 USDC,市值 740-750 億美金,比 USDT 仲要貼價,成個崩市間基本維持喺 $0.9998 到 $1.0005,簡直完美。

Volume increased 167% to $51+ billion - again, demonstrating flight-to-safety behavior rather than redemption panic.

成交量都升咗 167%,終止喺 $510 億,反映一樣係避險走資唔係驚青贖回。

For Circle, this was a moment of validation. The company had faced existential questions during the SVB crisis in March 2023, when $3.3 billion of USDC's reserves were trapped in Silicon Valley Bank over a weekend. USDC depegged to $0.87 as panic spread about whether Circle could honor redemptions.

對 Circle 嚟講呢次真係雪恥。2023 年 3 月矽谷銀行爆煲時,有 33 億美元嘅 USDC 儲備困喺銀行,Weekend 都搵唔到錢,引發 USDC 脫鈎跌到 $0.87,大家都驚佢兌唔出。

That crisis led Circle to restructure its reserves entirely into U.S. Treasury bills held at segregated custodians. No bank deposits. No corporate bonds. Just the safest, most liquid assets in the world.

事件後,Circle 將所有儲備換哂去美國國債,而且分開保管,唔再放銀行戶口,唔玩公司債,只持全球最穩最流通資產。

The October 2025 crash proved the strategy worked. When crypto faced its worst liquidation event ever, USDC holders didn't panic. They trusted the reserves. The peg held.

2025 年 10 月大崩市證明策略 work 得。全行最勁清算潮,美 USDC 持有人都無驚,信得過儲備,USDC 一蚊無甩過。

Why 2025 Was Different

2025 有乜唔同?

The stark contrast between 2025's stablecoin stability and previous crises reveals how much the market has matured:

2025 年穩定幣企穩同過往幾次崩市完全唔同,反映市場成熟左好多:

Better Reserve Quality: Both Tether and Circle now hold primarily U.S. Treasuries - the most liquid, safe assets in the world. In 2018, Tether's reserves were murky and included commercial paper and other questionable assets. In 2025, transparency and quality are dramatically improved.

儲備質素高咗:Tether 同 Circle 而家主要全部持有美國國債,全球最安全最流通資產。2018 年 Tether 啲儲備好含糊又有啲可疑資產(例如商業票據),但 2025 年透明度同質素提升好明顯。

Regulatory Clarity: The GENIUS Act, passed in July 2025, established the first comprehensive federal stablecoin framework. Issuers know the rules. Regulators have clear oversight. The legal ambiguity that created panic in previous years has been largely resolved.

監管明確咗:GENIUS 法案於 2025 年 7 月生效,訂立咗聯邦級完整穩定幣框架,發行商有規可依,監管都落實晒,之前法律灰色地帶製造緊張嘅情況已經大致解決。

Market Maturity: The stablecoin market has grown to nearly $300 billion across multiple issuers. Deeper liquidity, more arbitrage traders, better market-making infrastructure - all contribute to peg stability during stress.

市場成熟咗:穩定幣市場總規模已經接近 3,000 億美元,好多發行商,流動性更深,套利者多咗,做市設施優化,全部都有助壓力時期啲穩定幣維持穩定。

Flight-to-Safety Dynamics: In 2018-2023, stablecoin panics often stemmed from fears about crypto itself collapsing. In 2025, the crash was triggered by external macro factors (tariffs). Traders wanted to exit volatile crypto positions but stay in crypto-dollar equivalents. That meant buying stablecoins, not redeeming them.

「避險」心態主導:2018-2023 年啲穩定幣驚係因為驚虛擬貨幣本身爆;2025 年今次崩市係受外部宏觀因素(關稅)推動。炒家只想避走波動市,但繼續留喺 crypto 美金等值入面,所以買穩定幣多過贖回。

The October 2025 crash was the stress test stablecoins needed to prove they work during real crises. They passed.

10 月 2025 大崩市正正係穩定幣最緊要嘅壓力測試,結果真係交到卷。

Institutional Money: The Pre-Crash Euphoria and Post-Crash Questions

機構資金:大跌前高潮,大跌後疑問

The institutional adoption story of 2024-2025 had been Bitcoin's defining narrative. BlackRock's IBIT ETF became one of the most successful ETF launches in history. Pension funds began allocating to crypto. Corporate treasuries bought Bitcoin. Crypto had "made it."

2024-2025 年,機構資金進場風頭一時無兩。BlackRock 隻 IBIT ETF 變咗史上最勁 ETF 新品之一。退休基金都買 crypto,公司金庫買比特幣,虛擬貨幣行業似乎「入屋」咗。

Then came October 10.

然後就出事,係 10 月 10 日。

The ETF Inflow Tsunami

ETF 資金潮

Leading into the crash, institutional money had been flooding into crypto - particularly through Bitcoin and Ethereum ETFs.

大崩市前,其實機構資金係不斷湧入,加碼得最勁係 BTC ETF 同 ETH ETF。

Bitcoin ETFs:

- October started with a bang: $3.5 billion in net inflows in just the first four trading days

- October 7: BlackRock's IBIT alone recorded $899.47 million in single-day inflows

- October 8: Bitcoin ETFs collectively saw $1.21 billion in net inflows

- Year-to-date through October 9: $25.9 billion in cumulative inflows

- BlackRock's IBIT crossed 800,000 BTC in assets (approximately $97 billion) on October 8

比特幣 ETF:

- 10 月頭四個交易日淨流入 $35 億美金

- 10 月 7 日,BlackRock IBIT 一日單日流入 $8.99 億美金

- 10 月 8 日,全體 BTC ETF 一日總流入 $12.1 億美金

- 到 10 月 9 日止,全年度總流入 $259 億美金

- 10 月 8 日,BlackRock IBIT 帶住 80 萬隻 BTC(約 $970 億美金資產)

Ethereum ETFs:

- October inflows through October 6: $621.4 million total

- More than doubled September's $287.5 million

- Cumulative net assets across all Ethereum ETFs: $29.72 billion

以太坊 ETF:

- 10 月頭六日流入 $6.21 億美金

- 比 9 月成個月 $2.88 億多一倍

- 全體 ETH ETF 管理資產總數 $297.2 億美金

These weren't retail numbers. This was institutional capital - pension funds, hedge funds, family offices, RIAs allocating client capital. Real money from real institutions building real positions.

呢啲數字唔係散戶嘅,係機構基金、退休基金、家族基金、理財顧問客戶資金,貨真價實機構倉位。

And the timing was catastrophically bad.

而 timing 極之唔啱。

October 9: The Warning Sign Everyone Ignored

10 月 9 號:大家無理嘅警示

On October 9 - the day before the crash - something interesting happened. Bitcoin ETFs recorded $197.68 million in inflows. Solid, but well below recent days' numbers. But Ethereum ETFs told a different story: $8.54 million in outflows, breaking an eight-day inflow streak.

10 月 9 號,即崩市前一日,有啲細節:比特幣 ETF 流入 $1.98 億美金,雖然都係淨流入但明顯比前幾日細。反而以太坊 ETF 有 $854 萬美金流出,打破咗連續八日流入。

Was this a warning signal? Were sophisticated institutional investors quietly heading for the exits while retail was still buying?

呢個係咪警號?資深機構投資者係咪見勢唔對靜靜地散緊貨,而散戶仲追緊貨?

We'll never know for certain. But in hindsight, that flow reversal on Ethereum ETFs looks prescient.

而家回望,ETH ETF 個日轉向真係幾先知。

The Weekend Timing Problem

周末時差的問題

When Trump dropped his tariff bomb at 5:08 PM on Friday, traditional markets were closed. More importantly, ETF markets were closed. No institutional buying could come in to support

特朗普星期五下午五點零八分爆出加徵關稅消息時,傳統市場已收市,更重要係 ETF 都唔開市,冇機構資金可以入場支持...prices, even if institutions wanted to.

即使機構投資者想做,也無法影響價格。

BlackRock's IBIT, which had just crossed $97 billion in assets, watched helplessly as Bitcoin crashed 12%. By Saturday's lows, that AUM had shrunk to approximately $87-90 billion. Fidelity's FBTC, VanEck's HODL, all the spot Bitcoin ETFs - they all suffered similar paper losses.

BlackRock的IBIT,資產規模剛突破970億美元,只能眼白白睇住比特幣暴跌12%。到星期六最低位,管理資產已縮水至大約870至900億美元。Fidelity的FBTC、VanEck的HODL、所有現貨比特幣ETF——全部都遭遇類似的帳面損失。

But they couldn't do anything about it. No trading. No rebalancing. No buying the dip. Just watching.

但佢哋完全無得做。無法交易;無法重新平衡;無得趁低吸納。只可以望住發生。

Ethereum ETFs faced the same problem. From cumulative assets of $29.72 billion, estimated losses of 16% would have reduced AUM to around $25 billion at the crash lows.

以太幣ETF都遇到同樣問題。從總資產297.2億美元計,估計損失16%後,最低位管理資產大概減到250億美元。

The Monday Question

星期一大問題

The most important question for Bitcoin's price trajectory in the week following the crash is simple: What do institutional investors do Monday morning when markets reopen?

今次暴跌後,比特幣走勢最關鍵嘅問題好簡單:星期一開市,機構投資者會點做?

Three scenarios:

三個可能嘅情景:

Scenario 1: Panic Selling

第一:恐慌拋售

If institutions view the tariff situation as fundamentally changing crypto's risk profile and decide to reduce exposure, we could see massive ETF outflows on Monday. Billions leaving Bitcoin and Ethereum ETFs would add enormous selling pressure and potentially drive another leg down.

如果機構覺得加關稅係徹底改變咗加密貨幣嘅風險屬性,決定減持,星期一就可能見到大規模ETF贖回。幾十億美元流出比特幣同以太幣ETF,會構成巨大沽壓,價格可能再插多腳。

This seems unlikely given the macro cause of the crash, but it's possible if institutional risk officers mandate reduced exposure to volatile assets.

考慮到今次暴跌主因係宏觀因素,其實未必咁大機會發生,但如果機構風險官員硬性要求減倉,都唔排除。

Scenario 2: Hold Steady

第二:按兵不動

Institutions could simply do nothing - acknowledging the loss but maintaining allocation targets and viewing the crash as temporary macro volatility. This would likely result in modest outflows as some weak hands exit, balanced by some opportunistic buying.

機構都可以乜都唔做——認賠但保持既定配置,比火龍唔當一回事,當係短暫宏觀波動。咁大概只有少量資金流出,部分弱手走人,其他機構則乘機趁低吸納。

This is probably the base case. Most institutions have defined allocation targets and don't make major changes based on short-term volatility.

呢個最有可能成為主流做法——大多數機構都有明確配置目標,唔會因一次短期波動大手調整。

Scenario 3: Buy the Dip

第三:逢低吸納

If institutions view $105,000-$110,000 Bitcoin as an attractive entry point - especially if they believe the tariff situation will eventually be resolved - we could see renewed inflows. "Buy fear" is a classic institutional strategy.

如果機構覺得十萬五至十一萬蚊嘅比特幣係入場好時機——特別係對關稅爭拗最終有望解決有信心——資金可能會回流ETF。「買恐慌」一向係機構經典策略。

This is the bullish case. If BlackRock's IBIT records $500+ million in net inflows on Monday, that would signal institutional confidence and likely support a recovery.

呢個係牛市情景。如果BlackRock嘅IBIT星期一錄得五億美元或以上淨資金流入,代表機構信心,有機會頂住市況反彈。

Monday October 13's ETF flow data will be the most important market data point of the week.

十月十三日(星期一)的ETF資金流動就會成為本週最重要嘅市場數據。

Regulatory Silence: The Dog That Didn't Bark

監管無聲——靜到有啲可疑

As Saturday afternoon turned into evening on October 11, something remarkable was happening - or more accurately, not happening.

到十月十一日星期六下晝轉入黃昏,有件好特別嘅事發生緊——又或者講,根本就咩都無發生。

Despite the largest liquidation event in cryptocurrency history, wiping out $19 billion in positions and affecting 1.6 million trader accounts, not a single major U.S. regulatory agency had issued any public statement.

雖然今次係加密貨幣史上最大規模一次強制平倉,1,900億美元持倉被抹走,影響到一百六十萬個賬戶,但美國冇一個主流監管機構出過公開聲明。

The Securities and Exchange Commission? Silent.

證監會?無聲。

The Commodity Futures Trading Commission? Nothing.

商品期貨交易委員會?靜晒。

The Treasury Department? No comment.

財政部?無回應。

The White House? Radio silence.

白宮?一片靜悄悄。

Congress? Not a peep.

國會?一粒聲都無。

Major international regulators in Europe and Asia? Also quiet.

歐洲、亞洲主要監管機構?一樣無聲氣。

Why the Silence Matters

點解無聲咁重要

Contrast this with previous major crypto crises:

對比下過往大型加密危機:

FTX Collapse (November 2022):

- SEC announced investigation within 48 hours

- CFTC issued statement about customer fund protections

- Congressional hearings announced within a week

- International regulators issued warnings

FTX爆煲(2022年11月):

- 證監會兩日內就宣布調查

- 商品期貨委員會就客戶資金保障發聲

- 國會一星期內開聽證會

- 各地監管即刻發警告

Terra/Luna Collapse (May 2022):

- Treasury Secretary Janet Yellen testified to Congress about stablecoin risks

- SEC expanded investigative authority

- Multiple state regulators launched probes

Terra/Luna 爆煲(2022年5月):

- 財長耶倫親自講穩定幣風險

- 證監擴大調查權

- 多州監管部門聯同查

March 2020 COVID Crash:

- Fed issued statements about financial stability

- Multiple agency coordination on market support

- Congressional action on economic relief

2020年3月疫情股災:

- 聯儲局即發表金融穩定聲明

- 多個部門協調救市

- 國會推出紓困方案

Yet in October 2025, after a $19 billion liquidation event - nothing.

但今次——2025年10月,接近200億美元強平後——零聲音。

Five Reasons for the Regulatory Silence

五個監管「靜得咁奇怪」原因

- Weekend Timing

時機——逢周末

The crash occurred Friday evening through Saturday morning. Government offices are closed. Staff are home with their families. Emergency responses take time to coordinate.

今次係周五晚到周六早上爆發。政府部門放假,人員喺屋企。緊急應變都要時間協調。

That said, the FTX collapse also happened on a Friday and regulators issued statements by Monday. The weekend excuse only goes so far.

不過,FTX都係周五爆煲,星期一照樣有聲明,所以「周末原因」都唔算咁大藉口。

- Government Shutdown

政府停擺

The U.S. federal government entered shutdown on October 1, 2025 due to budget impasse. Many agencies were operating with skeleton crews, handling only essential functions.

因預算僵局,美國聯邦政府10月1日起停擺。好多野只留骨幹人手做最基本工作。

Regulatory analysis of crypto market events arguably isn't "essential" in the legal sense, even if a $19 billion wipeout feels pretty essential to the 1.6 million people who got liquidated.

嚴格嚟講,加密市場崩盤分析未必算「必要」服務,雖然對160萬個爆倉嘅人來講就肯定必要。

- Attribution to Trade Policy

政策原因

The crash was triggered by President Trump's tariff announcement - a deliberate government policy action. It wasn't fraud. It wasn't an exchange failure. It wasn't market manipulation.

今次係特朗普宣布關稅政策引爆——即係政府自己人搞出嚟,唔係詐騙、唔係交易所爆煲、唔係人為操控。

When the government's own policy causes a market crash, what exactly are regulators supposed to say? "We're investigating the market impact of our boss's decision"? That's awkward.

如果政府政策令市場大跌,咁監管機構點講先?「我哋調查下老細自己嘅決定害到市」?夾硬都尷尬。

- Pro-Crypto Administration

新政府撐Crypto

The Trump administration has positioned itself as explicitly pro-crypto:

特朗普政府明顯傾向撐加密貨幣:

- CFTC代理主席Caroline Pham 8月1日宣佈Crypto Sprint,致力令美國做全球加密中心

- SEC主席Paul Atkins推Crypto Task Force,由Hester Peirce領軍,「支持創新」為目標

- 財長Scott Bessent 7月30日講「打造加密黃金時代」

- 特朗普3月6日簽署行政命令,成立比特幣戰略儲備

When your political priorities include promoting crypto adoption, publicly criticizing the industry during a crisis - even one this large - creates awkward optics.

政治將加密貨幣納入核心議題,出咩事時出嚟鬧區塊鏈圈,畫面真係幾尷尬。

- Infrastructure Held

第五:架構受得住

Perhaps most importantly: despite $19 billion in liquidations, the crypto market's infrastructure mostly worked.

更關鍵係:今次強平近200億美金,但主流加密市場基建大致冇斷過。

Major exchanges remained operational. No Mt. Gox-style collapses. No missing customer funds. No exchange insolvencies. Stablecoins held their pegs. DeFi protocols processed liquidations without accumulating bad debt. Oracle systems functioned without failures.

主要交易所照常運作,冇Mt.Gox咁爆煲、冇客戶資金失蹤、冇交易所破產、穩定幣守住錨定,DeFi協議處理強平冇遺留壞賬,預言機系統都無問題。

Yes, 1.6 million people lost money. Yes, it was brutal. But from a systemic stability perspective - which is what regulators ultimately care about - the system absorbed the shock and kept functioning.

係啦,的確有160萬人賠大錢,真係好殘忍,但由系統穩定角度睇——就係監管機構最關心果樣——成個行業都撐得住。

When everything breaks, regulators need to step in. When everything works (even if it's ugly), maybe they don't.

乜都壞晒就要監管出場,乜都運作緊(就算幾難睇)可能真係唔需要理。

What Regulators Are Probably Thinking (But Not Saying)

監管機構心聲(不過唔敢講)

Behind closed doors, you can imagine the regulatory conversations:

關上門,監管其實係咁想:

The Bull Case (Pro-Crypto Regulators):

牛派(撐Crypto):

"The market worked. People using excessive leverage got liquidated - that's exactly what's supposed to happen. Stablecoins held pegs. Exchanges processed orders. DeFi protocols remained solvent. This proves crypto infrastructure is mature enough to handle stress."

「市場有運作,過度槓桿嘅人被強平,金融學角度都話係正常——系統照運行,穩定幣守得住,交易所履行訂單,DeFi無爆煲。證明基建成熟到頂住壓力。」

The Bear Case (Skeptical Regulators):

熊派(懷疑論):

"1.6 million people lost their money in eight hours because exchanges offer 200x leverage and nobody stops them. This is casino capitalism. We need position limits, leverage restrictions, and circuit breakers."

「160萬人係八粒鐘內輸清光,就因為交易所開200倍槓桿,無人制止。呢個係賭場資本主義,應該立刻設持倉上限、槓桿限制、熔斷機制。」

The Pragmatic Middle:

中間派(最實際):

"It's a $19 billion mess triggered by macro factors, but no systemic risks emerged. We'll monitor for any delayed fallout - exchange insolvencies, DeFi protocol failures, stablecoin stress. If those emerge, we'll act. If not, this was just an expensive lesson about leverage."

「今次200億美金洗倉係宏觀引爆,但見唔到有系統性風險。我哋會繼續睇住有冇後遺症——交易所會唔會破產,DeFi爆煲,穩定幣失聯,真要發生即刻出手。否則,當係用錢買個關於槓桿嘅教訓。」

Based on the silence, it seems the pragmatic middle is winning.

由大家都收聲來睇,實際派暫時勝出。

Market Structure: What Broke and What Held

市場結構:咩斷咗、咩頂得住

The October 10-11 crash provided the most intense stress test crypto markets have ever faced. $19 billion in liquidations is unprecedented. So what does it reveal about market structure - the strengths, weaknesses, and vulnerabilities of crypto markets in 2025?

今次十月十至十一日大瀉,無疑係加密市場史上最大壓力測試。19億美元強平,未試過。到底今次對2025年市場結構有咩啟示——包括優勢、弱點同漏洞?

What Broke: Critical Weaknesses Exposed

咩斷咗——核心弱點曝晒出嚟

- Excessive Leverage Remains Systemic

一:極端高槓桿根深蒂固

Despite every previous crash, despite every "lesson learned," exchanges are still offering 100-200x leverage on Bitcoin and Ethereum futures. This is insane.

過去咁多次爆倉、咁多所謂「吸取教訓」,交易所依然敢開100至200倍槓桿俾人炒BTC、ETH期貨。簡直癲。

Funding rates above 8% before the crash - versus normal rates of 0.01-0.03% - showed extreme positioning. When 87% of liquidations are long positions, that's not a diversified market. That's a crowded trade waiting to explode.

暴跌前資金費率一度高達8%以上,平時只得0.01-0.03%。即係市場倉位極端單邊。今次清算87%係多頭,完全唔係多元化,係爆倉前充滿埋頭一鍋粥。

The $19 billion figure represents approximately 20% of total derivatives open interest being forcibly closed in less than 24 hours. Think about that. One-fifth of all leveraged positions in the entire crypto market wiped out in a day.

今次19億美金強平,相當於全市場期貨未平倉合約嘅兩成,一日冇晒。諗諗吓,五分之一槓桿倉位一日消失。

No other financial market operates with such extreme leverage available to retail traders. You can't get 100x leverage on Apple stock. You can't get 200x leverage on gold. The fact that crypto exchanges offer this is enabling gambling, not trading.

其他金融市場冇可能俾散戶開到咁大槓桿。你買蘋果股票唔會畀100倍槓桿,炒黃金都冇200倍。Crypto交易所咁做,簡直係提供賭博平台唔係做投資。

- Liquidity Fragmentation and Weekend Vulnerability

二:流動性分散加周末死位

The crash occurred Friday evening into Saturday - the worst possible timing. Traditional markets closed. ETF markets closed. Institutional buying support completely absent.

今次崩盤完全踩正星期五晚到星期六——最差時間。傳統市場收市、ETF收市、機構冇機會趁低吸納。

What liquidity remained was badly fragmented across dozens of exchanges with order books that evaporated during peak selling. Average order book depth for top altcoins is typically only $1-5 million within 2% of mid-market. During the crash, that depth collapsed to a fraction - maybe $200,000-$500,000 on smaller tokens.

剩低嘅少少流動性分散晒幾十間交易所,賣盤高峰期掛單厚度一掃而空。正常主流山寨幣訂單簿,2%之內都可能只有一百萬至五百萬美金流動性;暴跌期間即刻狠縮到得二十萬至五十萬美金。

When order books are that thin, selling pressure causes dramatic price moves. A $1 million sell order in normal conditions might move price 0.5%. During the crash, the same order moved prices 5-10%.

買賣盤咁薄,沽壓隨時令價格極端跳水。平時一百萬賣單郁0.5%,今次可以一次過跌5-10%。

Market makers pulled back to manage their risk, creating a liquidity vacuum exactly when liquidity was most needed. This is rational from their perspective - you don't want to catch a falling knife when you can't hedge your exposure - but it turns normal corrections into crashes.

做市商為自保,齊齊收水,最需要流動性時偏偏真空。換句話講,佢哋唔肯「捉飛刀」都合情合理——但市場就變成普通調整變為大屠殺。

- Cross-Margin Contagion

三:跨品種槓桿連鎖反應

Binance experienced dramatic, brief depegging events in several assets during the crash:

- USDE (Ethena's synthetic dollar) dropped to $0.6567

- BNSOL (Binance's wrapped Solana token) fell to $34.9 from $211+

- WBETH (Wrapped Beacon ETH) hit $430.65 from $3,700+

今次Binance有幾隻資產出現極短暫脫鈎:

- USDE(Ethena合成美元)最低跌到$0.6567

- BNSOL(Binance版Solana)由$211+瀉到$34.9

- WBETH(合成Beacon ETH)由$3,700跌到$430.65

These weren't actual asset collapses. They were artifacts of cross-margin liquidations where traders using one account to margin multiple

呢啲唔係資產真係爆煲,而係由於跨品種槓桿連環平倉引發嘅短暫奇異價。 traders用一個帳號同時孭多隻資產……positions saw everything liquidated simultaneously when Bitcoin fell.

當比特幣下跌時,所有倉位都會同時被清倉。

When Bitcoin drops and triggers a margin call, the exchange liquidates not just your BTC position but also your ETH, SOL, BNB, and every other holding in that account. If you're holding a relatively illiquid wrapped asset like WBETH, forced selling into thin order books creates price dislocations.

當比特幣下跌並觸發追加保證金時,交易所不單止會清算你的BTC倉位,還會將你帳戶入面的ETH、SOL、BNB,以及任何其他資產一齊清算。如果你持有像WBETH咁相對唔流通嘅包裝資產,被迫喺單薄嘅掛單簿沽貨會造成價格異常。

This cross-margin contagion is dangerous because it spreads stress from one asset across entire portfolios, amplifying market-wide volatility.

呢種全倉制嘅連鎖爆倉風險好危險,因為佢會由一種資產傳到成個組合,令全市場波動放大。

- Potential Whale Manipulation

有可能出現大戶操控市場

The Hyperliquid whale who opened over $1 billion in short positions just hours before Trump's tariff announcement and profited ~$190-200 million raises serious questions.

有一位Hyperliquid大戶喺特朗普宣佈加關稅前幾個鐘,開咗超過十億美元嘅淡倉,最後賺咗大約一億九千到兩億美金,引起一堆疑問。

Was this:

- Incredible timing and sophisticated analysis of trade war dynamics?

- Advance knowledge of Trump's announcement (insider trading)?

- Manipulation where the whale somehow influenced the timing?

究竟係:

- 純粹時機勁好,對貿易戰形勢有深入分析?

- 早已知情特朗普宣佈(內幕交易)?

- 定係大戶自己有能力影響事件發生嘅時間?

We don't know. But when someone makes $200 million with timing that precise, it erodes confidence in market fairness. Retail traders who got liquidated might reasonably wonder: is this market rigged against us?

我哋冇人知道。但當有人可以準確到咁每次都可以賺近兩億美金,對市場嘅公正性絕對係一種打擊。被爆倉嘅散戶好自然會諗:係咪成個市場都係整定死我哋嘅?

What Held: Signs of Maturity

穩住咗啲咩:市場成熟嘅跡象

Despite these weaknesses, several critical components of crypto infrastructure passed the stress test.

雖然有啲弱點,但有幾個加密貨幣基建重點部份經得起考驗。

-

Exchange Infrastructure Remained Operational

-

交易所基建無出大事

This cannot be overstated: despite processing $19 billion in forced liquidations in less than 24 hours, major centralized exchanges remained operational.

呢點真係要大大聲講:喺短短廿四小時內清算一百九十億美金倉位,幾間大型中心化交易所都冇崩潰。

Binance, Coinbase, Kraken, Bybit, OKX - all processed billions in orders without catastrophic failures. Systems strained but didn't break. Customer funds remained segregated and secure. No Mt. Gox-style collapse. No FTX-style fraud revealed.

Binance、Coinbase、Kraken、Bybit、OKX等全部可以處理數十億美金訂單,系統雖然頂唔住壓力但冇斷,全程都做到資產分離客戶錢安全。冇"Mt. Gox"式爆煲、冇類似FTX咁嘅詐騙爆出。

Yes, there were brief delays and high latency during peak volumes. Yes, some users couldn't access accounts for minutes. But the core infrastructure held. That's a massive achievement given the unprecedented stress.

係啦,係有啲高峰期會延遲,要等幾分鐘先入到帳,但整體基建經得起壓力,呢個已經好勁。

-

DeFi Protocols Proved Resilient

-

去中心化金融(DeFi)協議表現堅挺

Aave processed $210+ million in liquidations with zero bad debt. MakerDAO maintained DAI's peg throughout. Compound's systems functioned as designed. Chainlink's oracles provided accurate, timely price data without failures.

Aave清算咗超過2.1億美金,無壞賬。MakerDAO全程Dai都緊貼美元。Compound運作如常。Chainlink預言機都無出錯,價格更新夠快又精準。

These aren't trivial accomplishments. Smart contract-based lending protocols faced a test that would have destroyed them in 2020-2021. In 2025, they passed.

呢啲都唔係細事。2020-21年啲智能合約借貸協議遇到咁大壓力早已爆煲。到2025年終於捱到。

DeFi's transparency is also worth noting. Every liquidation is visible on-chain. Every transaction is auditable. When centralized exchanges report liquidation data, you trust their numbers. When DeFi protocols liquidate positions, you can verify it yourself on Etherscan.

DeFi透明度都好誇張。每次清算都公開上鏈,全部交易都查得到。中心化交易所話爆幾多倉你要信佢,但DeFi一清算你可以即刻自己去Etherscan查,全部公開。

-

Stablecoin Stability Was Perfect

-

穩定幣表現超水準

USDT and USDC held their dollar pegs throughout the largest liquidation event in crypto history. This is a game-changer.

USDT同USDC全程都無脫鉤,真係改寫咗歷史。

If stablecoins had depegged - if USDT had fallen to $0.90 or USDC had dropped to $0.85 - the contagion would have been catastrophic. Panic would have fed on itself. The entire crypto ecosystem could have faced an existential crisis.

如果穩定幣有脫鉤——例如USDT落到$0.90、USDC跌到$0.85——後果可以好嚴重,恐慌會惡性循環,全個市場都會陷入危機。

Instead, stablecoins served their designed purpose: providing a stable safe haven during volatility. Traders sold Bitcoin and held USDT. Sold Ethereum and held USDC. The flight-to-safety behavior actually increased stablecoin demand rather than triggering redemptions.

結果穩定幣做咗佢嘅本份:成為動盪市場下嘅避風港。啲人沽BTC轉USDT,沽ETH轉USDC。大家求安全反而推高穩定幣需求,冇掀起換回潮。

This validates years of infrastructure development, reserve management improvements, and regulatory clarity from the GENIUS Act.

證明多年來嘅基建投入、儲備管理優化同政策透明(GENIUS法案出咗力)都有效。

-

No Contagion to Traditional Finance

-

無蔓延到傳統金融

The crypto crash remained contained within crypto. No major banks faced losses from crypto exposure. No hedge funds announced blow-ups. No pension funds required bailouts.

今次加密貨幣崩盤冇傳遞到傳統金融體系。大銀行冇因為加密貨幣損失。冇對沖基金爆倉,冇退休基金要救。

Traditional financial markets experienced volatility from the tariff news itself, but crypto's problems stayed in crypto. This decoupling - or more accurately, the lack of contagion - shows that crypto's integration with traditional finance hasn't created systemic risks yet.

傳統市場都係因為關稅新聞出現波動,加密問題只留喺加密市場。呢個"脫鈎"(或者應該話"無連鎖反應")證明咗加密貨幣同傳統金融暫時未產生系統性風險。

Critics often warn that crypto could trigger a financial crisis. October 10-11 showed that at least for now, crypto can experience its own crisis without dragging everything else down with it.

以往好多專家話加密貨幣可以引發金融危機。今次10月10-11日證明,最少而家加密自己爆都唔會拉埋傳統金融水埗。

Investor Psychology: From Greed to Fear in 48 Hours

投資者心理:四十八小時由貪婪變恐懼

Markets are driven by two primal emotions: greed and fear. The October 10-11 crash provided a textbook case study in how quickly sentiment can shift - and how brutal the transition can be.

市場受兩種原始情緒驅動——貪婪同埋恐懼。10月10-11日呢次崩盤就係一堂活生生嘅教材,示範情緒可以幾快翻轉同翻轉得幾狠。

The Fear & Greed Index: 70 to 35

恐懼與貪婪指數:由70跌到35

One of the most watched crypto sentiment indicators is the Crypto Fear & Greed Index, which aggregates various data points (volatility, volume, social media sentiment, dominance, trends) into a single number from 0 (Extreme Fear) to 100 (Extreme Greed).

加密貨幣最受關注嘅情緒指標之一係「恐懼與貪婪指數」,結合波幅、成交量、社交媒體情緒、市場份額、趨勢等,得出一個 0(極度恐懼)到100(極度貪婪)之間嘅分數。

On October 9, the day before the crash, the index read 70 (Greed). Optimism was high. Bitcoin had just hit new all-time highs. ETF inflows were setting records. "Uptober" was trending on social media - the narrative that October is traditionally Bitcoin's best month.

10月9日,崩盤前一日,該指數去到70(貪婪)。市場極度樂觀。比特幣啱啱創新高,ETF資金流入破頂。「Uptober」仲喺社交媒體洗版——即係話十月一向係比特幣最佳月份。

By October 11, the index had plunged to 35 (Fear). A 35-point swing in under 48 hours.

去到10月11日,指數急插至35(恐懼),即係唔夠兩日插咗三十五分。

This represents one of the fastest sentiment reversals in crypto history. For context, the index fell from around 60 to 10 during the March 2020 COVID crash, but that took over a week. This was a two-day collapse in sentiment.

呢個係加密貨幣歷史上其中一次最快情緒逆轉。2020年三月新冠疫情嗰次,指數由60跌到10都用咗一個星期,今次兩日搞掂。

Social Media: From Moon Boys to Loss Porn

社交媒體:由興奮衝月變成「損失戲」

The shift in social media discourse was whiplash-inducing.

社交媒體風向之轉變,快到令人趕唔切氣。

Pre-Crash Discourse (October 1-9):

- "Uptober baby! New ATH incoming 🚀"

- "I just leveraged my entire portfolio, let's ride this to $150K"

- "The bull market is just getting started"

- "If you're not 50% crypto right now you're missing out"

- "Everyone I know is finally asking about Bitcoin again"

崩盤前(10月1-9日)大家討論:

- 「Uptober!新高嚟緊🚀」

- 「全倉開槓桿,衝到十五萬睇住嚟!」

- 「大牛市啱啱開始咋!」

- 「你依家仲冇一半資金喺crypto就落後啦」

- 「身邊個個終於又問我比特幣啦」

During/Post-Crash (October 10-11):

崩盤期間/之後(10月10-11日):

Trader Pentoshi, a widely-followed crypto analyst, captured the mood: "I know there are a lot of emotions right now and this flush is in the top 3 all time. There are a lot of people in incredible pain right now, myself included."

著名分析員Pentoshi講:「依家情緒肯定爆棚,今次清倉絕對歷史排頭三!好多人極痛苦,包括我自己。」

Zaheer Ebtikar, CIO of Split Capital: "The altcoin complex got absolutely eviscerated. Full leverage reset and market dislocation."

Split Capital投資總監Zaheer Ebtikar:「山寨幣全面被屠殺,槓桿全清、市場亂晒。」

Reddit's cryptocurrency forums filled with "loss porn" - screenshots of liquidated positions, often with dark humor masking genuine financial devastation. One post showed a $450,000 portfolio liquidated down to $3,200. Another showed a $1.2 million position completely wiped out.

Reddit上加密版都係「損失戲」——一堆爆倉截圖,黑色幽默背後其實真係輸到傾家蕩產。有帖主show住自己$45萬倉位清得返$3,200,另一個$120萬全炸冇咗。

Twitter became a real-time chronicle of panic:

- "Just got liquidated. Wife doesn't know yet. What do I do?"

- "Lost my entire stack. 5 years of accumulation gone in one night."

- "I can't believe I thought 100x leverage was a good idea"

- "This is why I have trust issues with crypto"

Twitter一片恐慌live現場:

- 「我啱啱爆倉,老婆仲未知,我應該點?」

- 「成副身家冇咗,五年儲嘅一夜蒸發。」

- 「唔信我用過100倍槓桿俾自己嚇親啦」

- 「唔怪得我咁唔信crypto」

The Recency Bias Trap

近期偏誤陷阱

What happened to investor psychology in early October is a classic case of recency bias - the tendency to overweight recent experiences when making decisions about the future.

十月果陣啲投資者心理就係典型嘅近期偏誤——即係過份將最近嘅經驗外推到未來。

Bitcoin hits $126K on October 6-7? Obviously it's going to $150K next.

比特幣10月6-7日去到$126,000?梗係個個覺得下一站$150,000。

ETF inflows hit record levels? Obviously institutional adoption is accelerating.

ETF有史以嚟最大資金流入?梗係當機構進場爆緊發展。

Every time you check your portfolio it's worth more than before? Obviously leverage makes sense.

查portfolio次次都升?用槓桿仲唔係時候。

This is how bubbles form. Not through fraud or manipulation, but through the subtle psychological trick where recent positive outcomes convince you that positive outcomes are more likely than they actually are.

泡沫就係咁生出嚟嘅——唔一定係人作假或操控,而係人心理俾最近好消息帶著走,以為好消息會再來。

Professional traders talk about "fighting the last war" - preparing for the previous crisis while missing the next one. Retail traders in early October were fighting the 2022 bear market, convinced that this time was different. It was different - just not in the way they expected.

專業交易員成日講「打上一場仗」——準備返上次危機,結果錯過今次。十月啲散戶就係打2022年熊市,其實今次唔同,但唔係佢諗果種唔同。

On-Chain Sentiment Indicators

鏈上數據反映情緒

Blockchain data revealed the psychological shift in cold, hard numbers.

區塊鏈數據用事實話你知心理點變。

Bitcoin Exchange Flows: Exchange inflows increased 140% during the crash. In just four hours, over 15,000 BTC moved from private wallets to exchanges - the clearest possible signal of panic selling. When people move Bitcoin to exchanges, they're preparing to sell.

比特幣交易量流向: 崩盤期間,流入交易所數量暴增140%。四個鐘內有超過15,000枚比特幣由私人錢包送去交易所——即係最明顯嘅恐慌沽貨信號。搬入交易所即係準備沽貨。

Exchange outflows - moving BTC off exchanges to cold storage, suggesting long-term holding - collapsed to near-zero. Nobody was buying for the long term. Everyone was trying to preserve capital or cut losses.

另一方面,提款去冷錢包——即係打算長期持有——跌到近乎零。等於冇人諗住長揸,齊齊保本止蝕。

Ethereum Holder Behavior: Over $2 billion in ETH was deposited to exchanges during the crash - the highest level since May 2025. Large holders (addresses with >10,000 ETH) reduced positions by approximately 8%.

以太坊持有人行為: 崩盤時,超過20億美金ETH送咗去交易所,係2025年5月以嚟最高。大戶地址(>10,000 ETH)減持約8%。

These aren't retail investors. These are whales - early adopters, miners, institutions, or foundations. When whales sell during panic, it signals capitulation.

呢班唔係散戶,係大戶——早期玩家、礦工、機構或基金會。大戶都係恐慌沽貨,即係投降。

XRP Panic Selling: XRP exchange inflows increased 95%, with millions of tokens moving from wallets to exchanges. The on-chain data matched the price action: holders were dumping.

XRP恐慌沽貨: XRP流入交易所數量升95%,數百萬枚由錢包搬去交易所。鏈上同價格走勢一齊反映晒:大家都係沽緊。

The FOMO-to-Panic Pipeline

FOMO(怕錯過)到恐慌嘅心理軌跡

There's a predictable psychological pipeline in crypto:

加密市場有一條預期之內嘅心理曲線:

Stage 1: Skepticism "Bitcoin is a scam. No thanks." (Bitcoin $20,000)

第一階段:懷疑 「比特幣係騙局,唔好搞啦」 (BTC $20,000)

Stage 2: Interest "Okay maybe there's something here, but I'll wait for a better entry." (Bitcoin $50,000)

第二階段:有啲興趣 「嘩好似有啲料,但再等低啲先入啦」 (BTC $50,000)

Stage 3: FOMO "Everyone's making money except me. I need to get in NOW." (Bitcoin $120,000)

第三階段:FOMO 「全部人賺錢得我冇份,我即刻要入場」 (BTC $120,000)

Stage 4: Euphoria "I'm a genius. I should quit my job and trade full-time." (Bitcoin $126,000 ATH)

第四階段:亢奮 「我天才呀,不如辭咗工專職炒幣!」 (BTC $126,000新高)

Stage 5: Denial "This is just a healthy correction. We'll be back at ATH tomorrow." (Bitcoin $115,000)

第五階段:否認 「呢啲叫健康調整啦,聽日又返新高」 (BTC $115,000)

Stage 6: Panic "Oh God I'm down 15%. SELL EVERYTHING." (Bitcoin $105,000)

第六階段:恐慌 「仆街蝕咗15%,快D走貨呀!!」 (BTC $105,000)

Stage 7: Capitulation "Crypto is dead. I'll never touch this shit again." (Bitcoin $95,000-100,000? TBD)

第七階段:投降 「Crypto玩完,下世唔掂呢啲嘢㗎啦」 (BTC $95,000-100,000?)

The October crash caught thousands of traders somewhere between Stages 4 and 6. Many had bought at or near all-time highs in the $120,000-126,000 range, potentially using leverage to maximize gains.

十月呢次崩盤,幾千幾萬個交易員淨係卡喺第四至六階段。好多都係$120,000-126,000(歷史頂)附近高追,又用晒槓桿搏殺。

When prices fell 12-15%, they faced a choice: take the loss and exit, or hold and hope for recovery. Those using high leverage didn't get the choice - the market liquidated them automatically.

跌一成二到一成半時,多數人只可以揀:止蝕走人,定捱住等反彈。用槓桿嘅基本唔駛揀,直接自動清算。

What Happens Next: Four Potential Paths Forward

之後點走?四個可能發展方向

The trillion-dollar question: where does crypto go from here?

呢個係值一萬億美金嘅問題:加密市場之後點走?

Let's examine four potential scenarios,

不如睇下有邊四個可能嘅劇本。their probability, requirements, and timelines.

它們的機率、所需條件同時間表。

Scenario 1: V-Shaped Recovery (20-30% probability)

情景一:V型反彈(20-30%機率)

What it looks like: Bitcoin bounces back to $120,000+ within 1-2 weeks. Quick recovery. By end of October, prices are near or above pre-crash levels. By December, new all-time highs.

表現:比特幣喺一至兩星期內反彈返去$120,000以上,回升非常快。到十月尾,價格已經接近甚至高過閃崩前水平。到十二月,創下新高。

Requirements:

所需條件:

- Trade war de-escalates quickly (Trump and Xi reach compromise)

貿易戰好快降溫(特朗普同習近平達成妥協) - Monday ETF flows show strong institutional buying ("buy the dip")

星期一ETF資金淨流入,顯示有強勁機構買盤(「低吸」) - No additional macro shocks

無額外宏觀衝擊 - Technical support at $105,000 holds firm

$105,000技術支持守穩 - Funding rates normalize without additional liquidations

融資費率回復正常,無再有大規模爆倉

Key signals to watch:

重點觀察訊號:

- Monday October 13 ETF flows (critical)

- Trump's social media for any trade war softening

睇特朗普社交媒體有冇貿易戰降溫跡象 - Bitcoin holding above $110,000 through weekend

幣價週末能否守住$110,000 - Funding rates recovering to positive but sustainable levels (0.01-0.03%)

融資費率回正但唔過火(0.01-0.03%) - Exchange reserves declining (Bitcoin moving off exchanges)

交易所比特幣存量減少(即比特幣流走離開交易所)

Timeline: 1-2 weeks to pre-crash levels, new ATH potentially by end of Q4 2025

時間線:1至2星期回到閃崩前水位,2025年第四季前有機會再創新高

Why it might happen: Previous Bitcoin crashes have often seen V-shaped recoveries when the fundamental bull thesis remains intact. If the market views $105,000-110,000 as an attractive entry point and institutional money agrees, buying pressure could quickly overwhelm the liquidated supply.

點解有機會出現:以前比特幣閃崩,基本面冇變時,好多時都V型反彈。如果市場覺得$105,000-$110,000好吸引,機構錢入市搶貨,有機會短時間消化晒爆倉貨源。

Why it might not: Trade war escalation is hard to predict. Trump's strategy is unpredictable. China's response could be worse than expected. And massive leveraged positions just got wiped out - it takes time for new leverage to build.

點解未必出現:貿易戰走勢難估,特朗普善變,中方反制可能比預期狠。再加啲高槓桿頭寸啱啱清倉晒,重建新一輪槓桿都要時間。

Scenario 2: Gradual Recovery with Consolidation (50-60% probability) [BASE CASE]

情景二:逐步回穩+橫行整固(50-60%機率)【基本情景】

What it looks like: Bitcoin consolidates in the $95,000-$115,000 range for 4-8 weeks. Multiple tests of support and resistance. Slow, choppy recovery. Eventually breaks higher in late November/December, potentially reaching $130,000-$150,000 by year-end.

表現:比特幣大致徘徊喺$95,000至$115,000,橫行整固4至8星期。多次試探支持同阻力。升得慢、波動大,但最終喺十一月尾或十二月突破上行,年底可能升到$130,000-$150,000。

Requirements:

所需條件:

- Trade tensions remain elevated but don't dramatically worsen

貿易緊張氣氛持續但冇惡化 - ETF flows stabilize (modest outflows or neutral, then gradually positive)

ETF資金流開始穩定(小幅流走或持平,之後慢慢轉正) - No additional major macro shocks

無新一輪宏觀風波 - Time for leverage to reset and confidence to rebuild

槓桿要時間重設,市場情緒需要修復 - Technical indicators to stabilize and show accumulation

技術指標企穩,有吸納跡象

Key signals to watch:

重點觀察訊號:

- ETF flows over multiple weeks (trend matters more than single days)

多星期ETF資金流趨勢(唔係睇單日數字) - Bitcoin's ability to hold $95,000-$100,000 support zone

比特幣守唔守得住$95,000-$100,000支持位 - Funding rates staying near zero or slightly positive

融資費率維持接近零或微正 - Short-Term Holder SOPR (realized profit/loss indicator)

- Accumulation Trend Score from on-chain analytics

Timeline:

時間線:

- Week 1-2: Consolidation $105,000-$115,000

第一至二週:$105,000-$115,000區間橫行 - Week 3-4: Testing support, possibly down to $95,000-$100,000

第三至四週:試探支持位,可能插落$95,000-$100,000 - Week 5-6: Base building, accumulation phase

第五至六週:築底,吸納期 - Week 7-10: Gradual recovery toward $120,000

第七至十週:慢慢反彈向$120,000進發 - Week 11-14: Break above previous ATH, potential $130,000-$150,000

第十一至十四週:突破前高,有機會見$130,000-$150,000

Why this is base case: This matches historical patterns after major liquidation events. The leverage needs time to reset. Sentiment needs time to heal. Traders who got burned need time to lick their wounds before re-entering.

點解係基本情景:以往大規模爆倉後都係咁走勢,槓桿重建要時間,市場情緒要慢慢回復,捱爆倉嘅人唔會即刻入場,要等佢哋舔舔傷口先。

Zaheer Ebtikar laid out a similar timeline: "Market bleeds and market makers pause (24-48 hours) → Data feeds stabilize (2-3 days) → Market stabilization (3-7 days) → Market finds floor (1-2 weeks)."

Zaheer Ebtikar都有類似時間表:「市場先失血做調整(24-48小時)→ 數據開始穩定(2-3日)→ 市場有企穩跡象(3-7日)→ 徹底尋底(1-2星期)。」

His framework suggests a 2-4 week bottoming process, which aligns with this gradual recovery scenario.

佢估計2至4星期尋底,同呢個逐漸回穩策略吻合。

Why it might be wrong: Could underestimate either upside (V-shaped recovery) or downside (prolonged bear) if macro situation evolves faster than expected.

點解會唔夠準:如果宏觀轉勢好快,可能升得超預期(V型反彈)或跌得更深(長熊),都有可能走樣。

Scenario 3: Prolonged Bear Market (15-20% probability)

情景三:長時間熊市(15-20%機率)

What it looks like: Bitcoin breaks below $95,000 support decisively. Cascading technical breakdowns lead to further selling. Price reaches $75,000-$85,000 range. Multi-month recovery process (6-12 months). Possible retest of 2024 highs around $73,000 before eventual recovery.

表現:比特幣徹底冧穿$95,000支持,連鎖性技術失守,引發持續拋售。價格落到$75,000-$85,000。需要6至12個月才逐步回穩復原。甚至可能再試2024年高位$73,000先有轉機。

Requirements:

所需條件:

- Significant trade war escalation (China retaliates with own tariffs/controls)

貿易戰重大升級(中國以高關稅/出口管制反制) - U.S. recession develops in Q4 2025 or Q1 2026

美國喺2025年Q4或2026年Q1陷入衰退 - Major exchange failure or DeFi protocol collapse (delayed consequences from crash)

主要交易所出事或者有大型DeFi協議爆破(閃崩後遲來的後果) - Additional regulatory crackdown from unexpected source

有額外預計唔到嘅監管介入 - ETF outflows accelerate and continue for weeks

ETF大規模資金流出持續數星期

Catalysts that could trigger:

可能引爆因素:

- Trump escalates beyond 130% tariffs

特朗普加關稅去到超過130% - China bans rare earth exports entirely

中國全面禁罕見金屬出口 - Major economic data shows recession (GDP, unemployment)

重要經濟數據顯示衰退(GDP、失業率惡化) - Crypto-specific black swan (exchange hack, major protocol exploit)

幣圈黑天鵝(交易所被黑、大型協議漏洞) - Regulatory emergency action (unlikely but possible)

突然出現監管緊急行動(機會低但唔排除)

Key signals to watch:

重點觀察訊號:

- Break below $95,000 with high volume

體量配合下跌穿$95,000 - ETF outflows exceeding $1 billion per week consistently

ETF單週淨流出持續超過10億美元 - Short-Term Holder Cost Basis breaking down (currently around $117,000)

- Funding rates staying deeply negative (indicating crowd shorts)

融資費率長期好負面,(顯示全世界開淡倉) - Traditional markets entering bear market (S&P 500 down 20%+)

傳統市場都踩入熊市(S&P 500跌20%以上)

Timeline: 3-6 months to reach bottom ($75,000-$85,000), 6-12 months total for recovery back to pre-crash levels

時間線: 3-6個月見底($75,000-$85,000),6-12個月才重返閃崩前水平

Why it could happen: The macro environment is genuinely concerning. 130% tariffs could trigger recession. If recession hits while crypto is already wounded, a prolonged bear becomes much more likely.

點解會發生:宏觀環境頗令人擔心。關稅去到130%隨時觸發衰退。如果衰退爆發,幣市本身又未復原,長熊好大機會出現。

The crypto market is still young and prone to boom-bust cycles. Just because we had a bull market in 2024-2025 doesn't mean another bear market is impossible.

加密貨幣市場本身就仲細,週期大上大落。2024-25升市過唔代表唔會有新一輪大跌。

Why it probably won't: Institutional infrastructure is much stronger in 2025 than previous cycles. Bitcoin ETFs hold ~$97 billion in assets. Corporate treasuries hold Bitcoin. The support structure is more robust. Previous bears were driven by crypto-specific disasters (Mt. Gox, ICO crash, exchange failures). This crash was macro-driven - if macro improves, crypto should too.

點解未必咁差:2025年市場基建強好多,ETF持有大約970億美金比特幣,企業金庫都有比特幣,支持力強咗。上次熊市多數係幣圈自爆,但今次係宏觀拖低。如果宏觀轉好,幣市都可以跟住回復。

Scenario 4: Regulatory Clampdown (5-10% probability)

情景四:監管收緊(5-10%機率)

What it looks like: U.S. regulators (CFTC, SEC, Treasury) announce emergency measures in response to crash: mandatory leverage limits (25x maximum), position limits for retail traders, circuit breakers for extreme volatility, margin requirement increases, mandatory insurance funds. Implementation over 6-12 months. Market impact uncertain - could be initially negative then stabilizing.

表現:美國監管機構(CFTC、SEC、財政部)因閃崩突擊出手,包括槓桿上限(最多25倍)、散戶持倉限制、極端市況下啟動「跌停板」、提高保證金要求、強制成立保險金池。6-12個月內陸續實施。對市場短線有壓力,之後可能穩定下來。

Requirements:

所需條件:

- Political will to act (currently absent given pro-crypto administration)

必須有政治動力出手(現屆政府明顯親加密,暫時無跡象) - Public pressure about consumer harm (1.6 million liquidations)

社會或民間對1,600,000宗爆倉損失產生壓力 - Additional failures or issues emerging from crash aftermath

閃崩後再有新事故爆出 - Congressional hearings revealing systemic concerns

國會公聽會中揭露出系統風險 - Coordination between multiple regulatory agencies

監管機構多方協調

Catalysts:

可能觸發因素:

- Delayed exchange insolvencies from crash losses

閃崩損失導致交易所遲爆倒閉 - Consumer complaints reaching critical mass

市民集體投訴到臨界點 - Media coverage highlighting human costs (retirement savings lost, suicides)

媒體大肆渲染人間悲劇(退休金跌冇、自殺事件等) - Political winds shifting against crypto

政治氣氛轉為敵視加密幣 - International regulatory pressure (G20, IMF)

國際監管壓力(G20、IMF出聲)

Timeline: Proposals 1-3 months, comment periods and hearings 3-6 months, implementation 6-12 months

時間線:政策建議1-3個月、收集意見及公聽會3-6個月、真正落實6-12個月

Why it probably won't happen: Current administration is explicitly pro-crypto. Trump wants America to be "crypto capital of world." Agencies are focused on enabling innovation, not restricting it. The crash was bad but infrastructure held - regulators may view this as "markets working" rather than market failure.

點解未必會發生:依家政府明顯親加密,特朗普想美國做全球加密大本營。部門重點係推動創新多過管制。閃崩雖然嚴重,但市場基建頂得住,監管機關可能當「市場自我調節」而唔會大規模介入。

Why it might: 1.6 million people lost money in eight hours. Some lost life savings. If media coverage shifts from "biggest liquidation ever" to human interest stories about financial devastation, political pressure could build. Regulators often act in response to public outcry more than market data.

點解有機會發生:8個鐘1,600,000人輸錢,好多人輸清光。媒體如果轉向報道人間慘案(破產、自殺),可能加大政治壓力。好多時監管機構都係受輿論、社會壓力推動多過分析數據。

What Should Traders Do Now? Practical Takeaways

依家應該點做?實用重點

You've read a lot about the October 10-11 crash. Now what?

你睇完10月10-11號閃崩分析,咁實戰上應該點?

Here are practical, actionable takeaways for different types of market participants:

以下係唔同類型市場參與者應該記住、做到嘅重點建議:

For Retail Traders

對散戶交易者:

- Leverage Kills - Seriously, Stop

槓桿害死人,真係收手啦

This cannot be said enough. The 1.6 million liquidated accounts are not statistics - they're real people who lost real money, often money they couldn't afford to lose.

呢句講多幾次都唔嫌多。1,600,000個爆倉唔係數字遊戲,每一個都係真錢真銀,仲有唔少係賭身家。

If you're using more than 3-5x leverage, you're gambling, not trading. If you're using 50x or 100x leverage, you're not even gambling - you're just giving your money away with extra steps.

用超過3-5倍槓桿就已經唔係投資係賭博。50x、100x更誇張,根本等於白送錢畀人。

Yes, leverage amplifies gains on the way up. But it amplifies losses on the way down, and during crashes, losses come much faster than gains ever did.

槓桿升市時好爽,但跌市時你永遠守唔住。閃崩一嚟蝕得比升市快十倍百倍。

Action item: If you currently have leveraged positions, reduce them. Take profits. Reduce leverage. Trade with capital you can afford to lose.

實際步驟:有槓桿倉位就減、落袋先。槓桿要減,淨係用你輸得起的錢去玩。

- Weekend Vulnerability is Real

週末高危,唔係講笑

The crash happened Friday evening into Saturday - the worst possible timing. Traditional markets closed, ETF markets closed, liquidity thin, volatility extreme.

今次閃崩係星期五晚至星期六,最差時間。傳統市關門,ETF唔郁,流通性差、波幅極大。

If you're holding leveraged positions Friday night, you're exposed to maximum risk with minimum support. Consider closing or dramatically reducing positions before weekends, especially during uncertain macro environments.

星期五晚捱槓桿即係全無保護、最易爆倉。唔穩陣時最好收縮、唔好週末留倉。

Action item: Review your portfolio every Friday. Ask: "Am I comfortable holding these positions through the weekend if another Trump tweet drops?"

實際步驟:每個星期五檢查倉位,問吓自己:萬一有料到,週末我頂唔頂得順?

- "Greed" Readings Are Warnings

「貪婪指數」高=要減倉唔係加倉

The Crypto Fear & Greed Index at 70+ preceded the crash. Extreme greed should trigger risk reduction, not FOMO.

恐懼與貪婪指數過70,通常之後都易爆煲。呢啲時候係減風險唔係FOMO。

When everyone is euphoric, when social media is full of moon boys, when your barber is asking about altcoins - that's when you should be taking profits, not adding leverage.

成街都討論幣、連你髮型師都問你幣,社交媒體全部喊著升,呢個時候更要走貨唔好加注。

Action item: Check the Fear & Greed Index weekly. When it's above 70, start reducing risk. When it's below 30, consider adding.

實際步驟:每星期睇一睇「恐懼與貪婪指數」。過70就要減倉,低過30先至諗吓撈。

- Stablecoins Are Your Friend

穩定幣係朋友

During the crash, the smart move was selling volatile assets and holding stablecoins. USDT and USDC held their pegs perfectly - they did exactly what they're supposed to do.

閃崩時,最聰明係沽咗啲高風險資產,改揸穩定幣。USDT/USDC一直無事,做到保值本份。

Don't be afraid to sit in stablecoins during uncertainty. You're not missing out by holding cash. You're preserving capital and maintaining optionality.

有動盪時坐定定揸穩定幣無問題,唔係浪費機會,係保命、留返底氣。

Action item: Keep 20-30% of your crypto portfolio in stablecoins. It provides dry powder for opportunities and psychological comfort during volatility.

實際步驟:保持穩定幣佔倉20-30%。一來可以隨時進攻,二來有心理安慰。

- Stop-Losses Are Not Optional

止蝕點唔可以唔設

Many traders skip stop-losses because "Bitcoin always recovers." That might be true over months or years, but during a crash, the mark-to-market losses can force you to sell at the worst possible time anyway.

好多散戶唔設止蝕,以為「比特幣一定會反彈」。但閃崩時,帳面損失會被迫斬倉,可能最差時要被人掃走。Here’s your translation in zh-Hant-HK, with markdown links left unaltered as requested:

stop-losses at levels where you'd legitimately want to exit (not where liquidation forces you). You can always buy back if you're wrong.

止蝕要設喺你真係想離場嘅水平(唔係俾清算強制走人)。萬一判斷錯,可以隨時買返。

Action item: Every position needs a stop-loss. No exceptions. If you can't stomach the stop-loss level required for your position size, your position is too large.

行動要點:每個倉位都必須設止蝕,無得例外。如果止蝕位你頂唔順,即係倉位太大。

For Institutional Investors

給機構投資者

-

ETF Timing Risk is Real

-

ETF 入市時機風險真實存在

The record $2.2 billion weekly inflows immediately preceding the crash is a lesson in flow analysis. Extreme flows in one direction often precede reversals.

暴跌前的一周,ETF錄得創紀錄22億美元流入,對資金流向分析來講係一課。極端單邊資金流,成日係轉向嘅前兆。

Consider dollar-cost averaging into positions rather than making large lump-sum purchases during euphoric periods.

考慮用成本平均法入市,多過係亢奮時一次過買晒。