傳統銀行的儲蓄利率普遍只有約1-3%,但去中心化金融(DeFi)生態系統卻截然不同,標榜雙位數甚至三位數的年化百分比收益率(APY)。如此巨大差異吸引了數十億美元資金湧入,無論是個人加密愛好者還是尋求傳統投資替代方案的機構巨頭都紛紛參與。

來到2025年中,DeFi生態系統最核心的疑問是:這些驚人的回報究竟是金融革命的可持續表現,還只是一場即將破滅的投機泡沫?這個問題並非學術討論,實際上對數以百萬計投資者、更廣泛的加密貨幣市場,甚至整個金融體系都會有深遠影響。

DeFi收益能否持續,受制於科技創新、經濟理論、監管不明朗與金融行為轉變交織的影響。支持者認為,區塊鏈本身帶來高效,以及去除傳統中介,可令回報維持高水平,即使市場成熟亦如是。反對者則指出,現時的高收益實則建立於不可持續的代幣經濟、隱藏風險及短暫的監管套利,而非真正的價值創造。

最近的發展更令這個爭論激烈。例如BlackRock的專屬加密貨幣部門於2025年3月宣布擴展其DeFi業務,反映了機構層面的興趣日增。與此同時,高收益協議的倒閉事件也屢見不鮮,如VaultTech於2025年1月崩潰,原本承諾可持續35% APY,結果令投資者損失超過2.5億美元,進一步加深懷疑論者的憂慮。

本文將全面分析雙方觀點,深入探討DeFi高收益的機制、風險、歷史模式及創新動向,以判斷這到底是一場金融新紀元,抑或不可持續的異常現象。

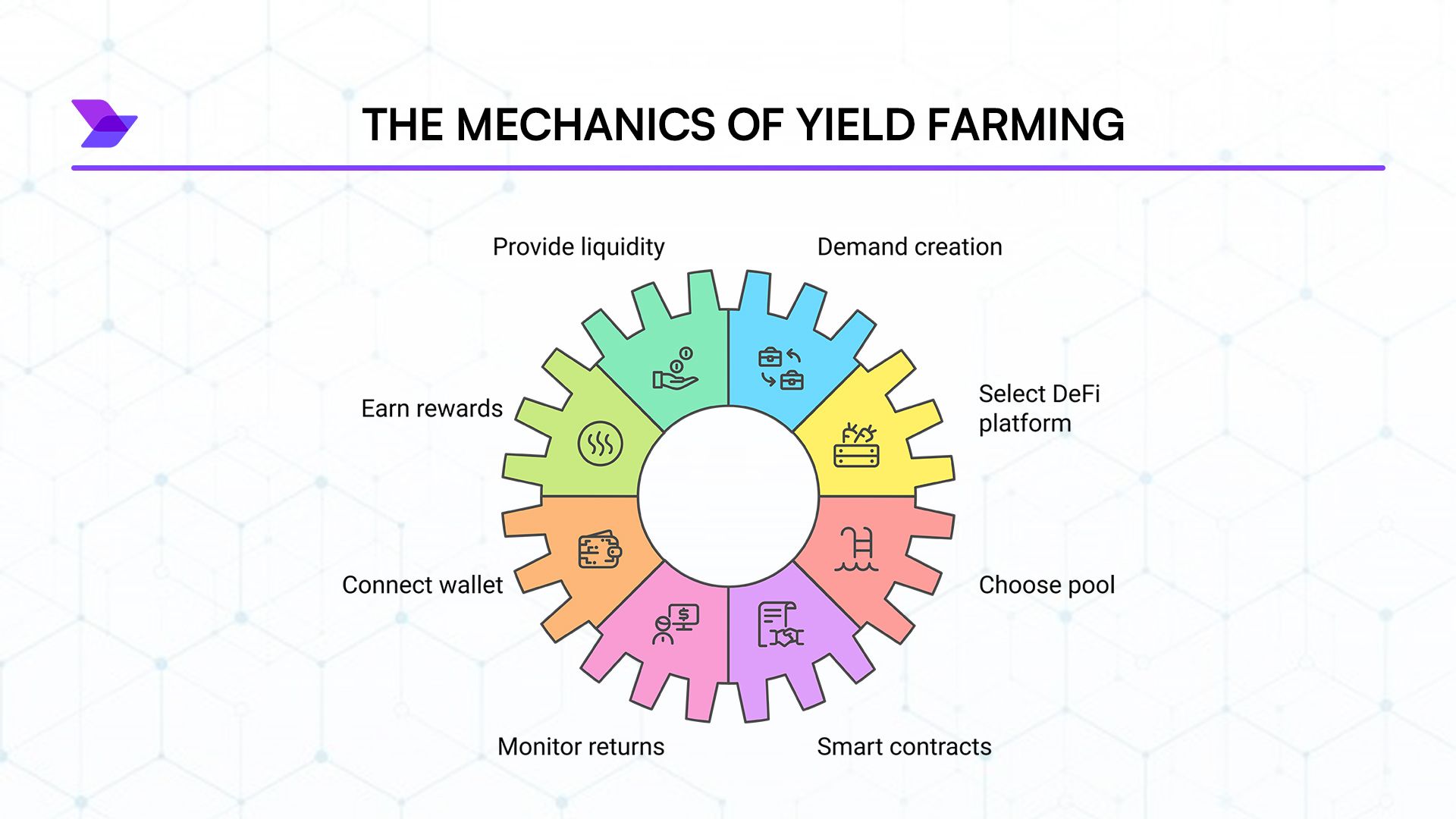

收益耕作的運作機制:DeFi如何創造回報

DeFi收益的基本架構

收益耕作是DeFi價值主張的核心,用戶透過將數碼資產投入去中心化協議賺取被動收入。本質上,收益耕作指的是將加密貨幣存入流動資金池-這些由智能合約管理的儲備池,為多種金融服務提供基礎。這些資金池使DeFi的核心操作如去中心化交易所(DEX)換幣、借貸平台放貸或提供合成資產抵押成為可能。

操作過程由用戶接駁數碼錢包至DeFi協議,並將代幣存入智能合約開始。有別於傳統金融,這些操作毋須繁複文件或身份認證,也無須理會辦公時間,交易全天候運作,門檻極低。舉例說,一名收益耕作者可以將價值10,000美元的以太幣(ETH)和USD Coin(USDC)存入Uniswap流動資金池,為其他用戶提供兌換這些代幣的流動性。

作為交換,用戶會從多個渠道獲得回報。首先,他們一般會獲得協議產生的費用分帳--以Uniswap為例,每宗交易收取0.3%手續費,按池中比例分配給流動性提供者。其二,多數協議還額外派發其原生治理代幣作為獎勵。

這種雙重獎勵機制(手續費分成加代幣激勵)令DeFi收益數字引人注目,吸引了數以百萬計參與者。但要理解這些回報能否持續,必須細看各組成部分,因其經濟原理根本上有所不同。

常見收益耕作策略類型

自面世以來DeFi生態系統日益演進,催生出適合不同風險胃口、技術水平及資本要求的多元化收益耕作策略。根據CoinDesk最新分析,現時主流策略包括:

流動性挖礦

流動性挖礦可說是最簡單直接的收益耕作方式。用戶透過向Uniswap、SushiSwap或PancakeSwap等DEX存入成對等值代幣,為平台提供流動性。例如,用戶可將價值5,000美元的ETH與5,000美元的USDC存入ETH/USDC資金池。作為獎勵,他們會獲得LP(流動性提供者)代幣,代表其資池份額,同時賺取交易手續費及平台原生代幣。

流動性挖礦APY差異極大,老牌主流幣對可僅有5%,新計劃初期則高達1000%以上。但高回報伴隨高風險,例如無常損失及持幣質素參差等。

借貸平台

借貸是另一種基本策略,用戶可將資產存入如Aave、Compound及其他新興協議,賺取借款人利息。這些平台全以智能合約運作,無需中央管理。

利息由供求自動調節-借貸需求大時,自動提升利率。很多平台還會頒發代幣獎勵,進一步提升實際回報。相對於流動性挖礦,借貸回報較低但較穩定,因此較適合保守型用戶。

質押機制

DeFi中的質押早已超越簡單的權益證明(PoS)區塊鏈。現時包括:

- 協議質押:鎖定代幣參與治理及賺取獎勵

- 流動性質押:將ETH等存入Lido等協議,換取可於DeFi其他地方使用的液態質押衍生品(如stETH)

- LP代幣質押:將流動性LP代幣再次質押以賺取額外獎賞

液態質押衍生品創造了資產可同時於多個地方賺取收益的組合能力,這成為2025年DeFi的關鍵特色,加速了收益策略的進化。例如,Pendle Finance創新地把基礎資產與未來收益分離,讓兩者可獨立交易和優化。

進階收益策略:把握組合性

DeFi真正革命性的地方在於其組合性——協議之間能無縫整合,創造越趨複雜的金融工具。這種「錢的積木」特性,讓傳統金融難以實現的高階收益策略成為可能。

收益聚合器

Yearn Finance等平台建立了複雜的Vault,能自動將資本分配到多個收益來源,實現回報優化,並減少風險和Gas成本。聚合器的策略包括:

- 按表現自動調整不同收益來源配置

- 以存款資產作抵押策略性借貸,提升回報

- 獎賞自動複投,提高APY

- 利用即時借貸跨協議套利收益差

到2025年2月,Yearn的Vault資產管理規模超過110億美元,主力穩定幣策略即使在熊市亦穩定提供15-20%回報。這證明自動化與優化,可藉效率產生可持續收益,而非單靠代幣通脹。

衍生品及期權策略

DeFi的成熟推動了複雜衍生品及期權協議的發展,創出全新收益來源。Opyn和Ribbon Finance等平台,通過結構性產品以期權策略產生收益,如:

- 賣出covered call:持有資產同時賣出認購期權賺取權利金

- 賣出put option:鎖定抵押品,賺取賣出認沽期權的權利金

- 波幅套利:利用不同到期日價格差異賺取盈利

這些策略更接近傳統金融工程,不再只是初期的單純代幣獎勵,更可能憑真正的市場活動帶來持續回報。

高回報可持續的理由

區塊鏈效率優勢

要判斷DeFi高收益是否可持續,首先須探討區塊鏈和智能合約較傳統金融基礎設施的根本技術優勢。這些優勢或能解釋即使市場成熟後依然可維持較高回報。

區塊鏈技術的核心,在於前所未見的規模和效率下實現無須信任的協作。傳統金融需在不同機構間進行繁複的對數和冗餘程序。例如證券交易,必須有多個機構同時維護獨立賬本並不斷核對,整個過程需時數天,還涉及 Here’s your translation in zh-Hant-HK, with original markdown links preserved per your instructions:

在經歷數十年數碼化努力後,仍然需要大量人手工作。

區塊鏈的共享分類帳通過建立一個所有參與者都可以獨立驗證的單一真相來源,消除了這種重複性。這種架構性的改變大幅減少了間接成本。根據麥肯錫2024年銀行科技報告,大型銀行一般會將5-10%營運預算用於對賬程序,但區塊鏈已令絕大部分這些程序變得可有可無。

智能合約進一步放大這些效率優勢,通過自動化複雜的金融邏輯。傳統貸款發放流程通常涉及申請處理、信貸審查、人手承保、法律文件和服務管理 — 這些工序分別由不同專業人士負責,而他們的報酬最終來自存貸差價。相反,Aave或Compound等借貸協議,就以智能合約自動化整條工作流程,實時執行且成本極低。

這種基本效能優勢創造了一個技術上的「收益溢價」(yield premium),或可無限持續,就如互聯網企業對傳統線下企業的結構性優勢一樣。這個溢價幅度仍有爭議,但Messari Research的分析認為,各類金融活動的回報可以持續提升2-5%。

去中介化:剔除中間人

除了純粹的技術效率之外,DeFi還能通過激進的去中介化產生重大價值 — 即剔除掉傳統金融價值鏈中每一層抽取費用的中間人。這種去中介化或許就是去中心化金融獲得可持續高收益的最強論據。

傳統金融系統仰賴龐大的中介網絡,每一層都在榨取價值:

- 零售銀行收取賬戶費用,並從存貸利差中賺錢

- 投資銀行收取包銷費、交易佣金和顧問費

- 資產管理公司每年徵收約0.5%-2%管理費

- 經紀-交易商賺取買賣差價及執行費用

- 結算所收settlement同託管費

DeFi則通過智能合約支配的點對點直接交易,系統性地剔除了大部分中介角色。當用戶為DEX提供流動性或通過DeFi協議進行借貸時,他們是直接與對家互動,而無需被中間人抽取價值。

這條精簡價值鏈令更多經濟利益可直接流向資本提供者,而非落入中介人手中。例如,交易員在DEX換幣時,有大約70-90%的交易費直接分配給流動性提供者,對比傳統做市商只有約20-30%的分成。

WinterTrust於2024年12月的分析比較了傳統金融與去中心化金融的費用結構,發現DeFi協議運行成本大約低70-80%。這令協議能同時為資本提供者帶來更高回報,亦為用戶帶來更低費用 — 一舉兩得,反映這種去中介化優勢可長期令回報保持於較高水平。

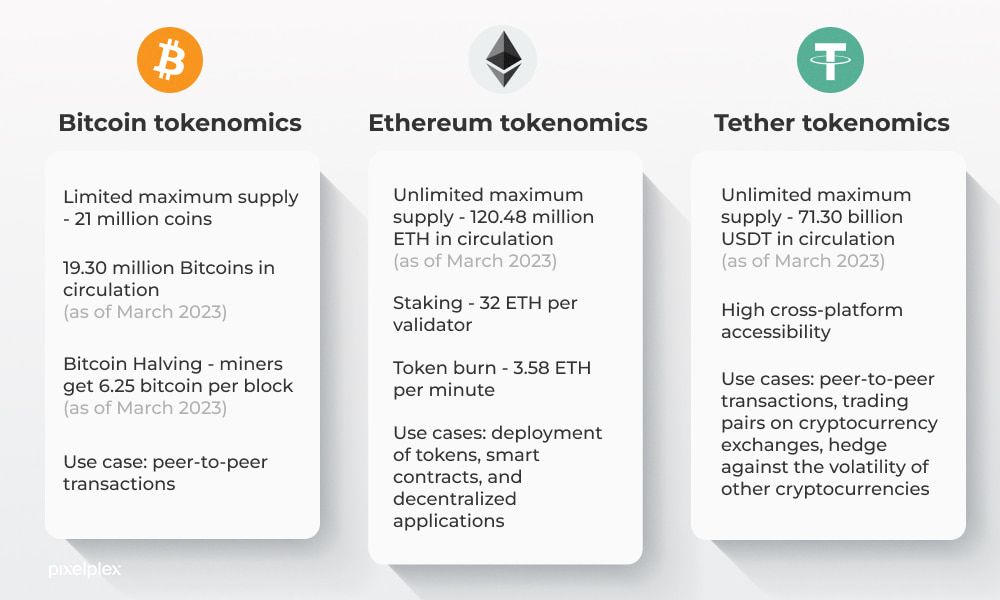

創新型代幣經濟學(Tokenomics)

DeFi中的創新型代幣經濟模型代表可持續高收益的另一來源。儘管批評者經常將代幣激勵等同於單純通脹,細心研究相關設計會發現,部分機制確實能通過創造和分配真正價值,來持續提供吸引回報。

治理代幣 — 讓持有人可就協議參數及未來路向擁有投票權 — 在金融系統設計中是一項根本性創新。不同於傳統金融機構治理權集中於股東(而用戶通常被排除),DeFi協議不少都將治理權廣泛分配予用戶,從而令整個生態的利益更一致。

最先進的協議已經由單純通脹向可持續價值捕獲機制演化,包括:

- 分費模式:如Curve Finance及Sushi,將部分手續費分派予代幣質押者

- 協議自有流動性:由Olympus DAO首創並被多個項目改良,容許協議運用自家庫房資產產生可持續收益

- 實體資產整合:Centrifuge等協議將DeFi與不動產及貿易融資等現實資產連結,產生由真實經濟活動支持的回報

這些創新模式代表超越早期單純「印代幣賺收益」的根本進化。當代幣經濟設計與真實價值創造及捕獲掛鉤時,協議能建立不依賴新資金流入的可持續收益來源。

資本效率革命

DeFi資本效率的持續演進,或許是推動可持續高收益的最具前景技術發展。傳統金融普遍存在嚴重資本效率問題——銀行需持有大量準備金、資產分散於不同業務、資本在各機會之間流動緩慢。

DeFi透過高可組合性和可編程性帶來了資本效率革命,包括:

- 集中流動性:如Uniswap v3和Ambient,允許提供者在特定價格範圍內集中投放資本,成倍提升實際回報

- 遞歸式借貸:平台讓用戶存入資產再借出,再把借得資產重複存入,從而放大風險和回報

- 再基型(rebasing)代幣:如OHM、AMPL等會自動調整供應量,實現嶄新收益機制

- 快閃貸款(Flash Loan):無需抵押、於單一區塊內完成的零風險即時借貸,利於更高效套利和收益最大化

這些資本效率創新,令同一筆資產可同時創造多重收益層,是相比傳統金融的根本突破。史丹福區塊鏈研究中心於2025年3月的論文估算,DeFi的資本效率革新理論上可令可持續收益比傳統金融高出3-7%,而風險水平不變。

全球接入與市場低效

DeFi所具的無需審批(permissionless)特徵,帶來可持續收益的另一潛在優勢:全球接入。傳統金融受制於國界,令各地市場低效嚴重,收益差異顯著。DeFi則打破這些限制,有望透過捕捉全球市場潛力,持續創造較高收益。

例如,美國國債息率僅2-3%,而新興市場政府債券經調整匯率後,風險類近但年回報可達8-12%。傳統金融受制於監管令一般投資者難以參與,但DeFi平台可以無縫整合這些全球機會。

這種全球套利機會不限於政府債券。DeFi協議正愈來愈多地連接不同司法區的現實資產,發掘以往只屬機構投資者專享的回報機會。如Goldfinch與TrueFi等平台,率先於新興市場向企業提供無抵押貸款,產生高達15-20%、由真實經濟活動支持的可持續收益,而非單靠代幣發放。

隨着DeFi不斷打通全球金融壁壘,這種地域套利或可維持多年甚至數十年,直到全球金融市場達致完全高效——然而考慮到監管和基建障礙長期存在,這步遙不可及。

反對高回報的論據:系統性風險

膨脹型代幣經濟

雖然支持者強調DeFi的創新型tokenomics,反對者則認為,不少協議依賴的本質上屬於不可持續的發幣排程,數學上根本難以長期維持高收益。嚴謹分析這些代幣模式時,會發現其長線可持續性存在不少隱憂。

不少DeFi協議會根據預設的發幣計劃,把治理代幣派發作為收益激勵。這些發放通常是恆定發行(每日定量派發)或者逐步減少(定期細幅減發)。若無同步令用戶需求或代幣用途增長的話,單憑供應擴張,數學上會推導出價格貶值。

發幣(token emission)本質會稀釋現有持有人的利益,除非協議能持續創造新價值,抵銷這種膨脹。這種稀釋機制,令早期「挖礦」參與者受惠,而遲來者蒙受損失——這場零和遊戲在牛市中往往被幣價上升掩蓋。最令人擔憂的代幣經濟模型,甚至帶有數學及經濟學界認定為龐氏騙局的特性——即舊參與者回報主要依賴新資本流入,而非可持續價值產生。

CryptoResearch一份全面分析對50個領先DeFi協議的發幣計劃進行研究,發現Here is the translation of your content to zh-Hant-HK, following your formatting guidelines (skipping translation for markdown links):

有36%在數學上肯定會出現重大收益壓縮,無論協議是否被廣泛採納或市場狀況如何。研究發現了幾個令人憂慮的趨勢:

- 排放量超出收入:協議派發的代幣獎勵價值為實際手續費收入的3-10倍

- 死亡螺旋危機:當幣價下跌時觸發更高的代幣發放,進一步拖低價格的代幣經濟設計

- 治理集中:項目由「內部人」掌握足夠投票權,可以為私利維持不可持續的高排放

這些從根本上不可持續的代幣經濟設計,已經導致多個知名協議倒閉,包括2024年6月的UmaMi Finance及2024年11月的MetaVault危機。兩個平台都承諾「可持續」高收益,但從數學上講,其高回報根本不可能在初期增長階段後繼續下去。

無常損失:隱藏的收益殺手

雖然DeFi推廣材料強調吸引人的年回報率(APY),但往往鮮有提及無常損失(IL)──這是一種獨特風險,可以大幅蠶食甚至完全抹去流動性提供者的回報。理解這個現象,對於評估DeFi回報的真正可持續性至關重要。

無常損失是在你為流動池提供流動性後,如果池中兩項資產價格比率改變,就會產生的損失。數學上,它代表了「被動持有資產」與「提供資產給自動化做市商(AMM)」之間的差異。對於高波動性的資產對,這種損失可以十分可觀:

- 一項資產價格變動25%:約0.6%損失

- 一項資產價格變動50%:約2.0%損失

- 一項資產價格變動100%:約5.7%損失

- 一項資產價格變動200%:約13.4%損失

這些損失會直接減低流動性提供者的實際回報。例如,一個標榜20%年回報率的池,在波動市場下計算無常損失後,實際回報可能只有7-8%。在極端情況下,無常損失甚至會超越基本回報,直接導致單純持有資產反而賺得更多。

來自倫敦帝國學院的研究檢視了主要AMM的歷史表現,發現典型流動性提供者每年平均遭遇2-15%的無常損失,部份高波動性資產對甚至損失超過50%。這種隱藏成本,根本削弱了許多高年回報流動性挖礦機會的可持續性敘事。

應對無常損失的挑戰,反映出現行DeFi模式本身存在結構性低效率,使流動性挖礦無法長期維持高回報。雖然集約化流動性(concentrated liquidity)和主動管理策略等創新試圖緩解此問題,但同時亦引入額外複雜性與成本,最終可能限制回報可持續的上限。

智能合約漏洞

除了代幣經濟和市場風險外,DeFi回報還面臨着更本質性的威脅:構成生態系統基石的智能合約本身存有的安全漏洞。這些風險加入了傳統金融工具中普遍不會遇到的災難性尾部風險,使「可持續回報」的想法受到挑戰。

DeFi領域長期受到安全漏洞困擾,已導致數十億美元損失。即使到了2025年,在多年的安全升級後,大型漏洞仍然時有發生。分析多宗主要攻擊事件發現,某些攻擊方式依然屢見不鮮,難以根除:

- 閃電貸攻擊:利用無抵押借貸進行短時市場操控

- 預言機操控:篡改價格數據餵送,誘發有利於攻擊者的清算

- 重入漏洞:通過特殊調用順序重覆提取資金

- 權限管理失效:目標是漏洞百出的權限機制

- 邏輯錯誤:複雜財務機制中的業務邏輯缺陷

這些漏洞持續存在,對回報的可持續性提出根本疑問。任何收益計算都必須考慮到本金全失(即歸零)的非零概率──這種風險會隨着時間及多協議同時暴露而不斷累積。

DeFi SAFU報告2025梳理生態系統過去五年的安全事件,發現儘管行業安全措施有所進步,但因黑客及攻擊造成的年化損失率仍然平均佔總鎖倉價值(TVL)的4.2%。這等同在生態層面上加了一層額外「保險費」,理論上應相應減低可持續回報。

這種「安全稅」是DeFi對比傳統金融長期高回報優勢的持續成本限制。即使某些協議安全記錄出色,但用戶傾向把資金分散於多個平台,自然會增加總體尾部風險的暴露。

監管不確定性

技術及經濟因素固然深刻影響回報可持續性,但監管考慮最終或許更具決定性。監管環境逐步演變,對很多DeFi回報機制構成生死挑戰,因其多以「合規灰區」方式營運。

截至2025年,全球DeFi監管環境雖仍然分散,但相比早年已大為明朗。主要發展包括:

- 證券分類框架:美國SEC加大力度,將多種DeFi代幣歸為證券,並對重點協議提起標誌性訴訟

- KYC/AML要求:多個司法管轄區已強制要求DeFi參與者驗證身份,衝擊很多機制本質上的匿名性

- 穩定幣監管:全球穩定幣框架落實儲備及透明度標準

- 稅收執法:先進區塊鏈分析令稅務機構可更積極監察DeFi活動

這些監管發展,對基於無許可、假名制的協議提出重大合規挑戰。不少高收益策略實質建基於「監管套利」──即因為不需承擔傳統金融對手的合規及資本成本而獲取優勢。隨着監管壓力增加,部分DeFi回報優勢或僅為暫時的監管套利,而非可持續的創新成果。

區塊鏈數據分析公司Elliptic發表的Compliance Cost Index估計,若完全合規,大多數DeFi協議的營運成本會增加,相當於TVL的2-5%。這意味部分現有回報優勢會隨監管落實而被侵蝕,因為協議必須執行更多合規措施。

資本集中與競爭態勢

DeFi生態系統出現明顯「贏家通吃」特徵,資本集中及競爭態勢最終或會壓縮回報。隨市場成熟,資本往往流向最安全、高效、流動性最深的協議,這趨勢自然會令回報因充分競爭而壓縮。

這種現象已在DeFi幾個主要板塊浮現:

- 穩定幣收益:最高回報由2021年的20-30%,壓縮至2025年的8-12%,效率因資本集中提升

- 藍籌借貸:ETH及BTC等成熟資產的回報,隨競爭加劇由3-10%變為1-4%

- 主流去中心化交易所:熱門資產對的流動性提供者年化回報已趨於5-10%,以往常見20-50%的高位大幅下降

這個不可逆轉的資本集中過程,威脅整個生態系對「異常高回報」的可持續性。隨協議在爭奪流動性及用戶時,經濟理論預示最終回報會收斂至有效邊界,風險與回報取得合理平衡。

瑞士巴塞爾大學的研究檢視2020-2024年DeFi協議收益壓縮,發現收益往往會收斂至成熟後比傳統金融對應產品高出約3-5%的均衡點。這表示,DeFi或可保留結構性回報優勢,但吸引早期參與者的三位數回報,長遠看來根本不可持續。

歷史數據及回報趨勢

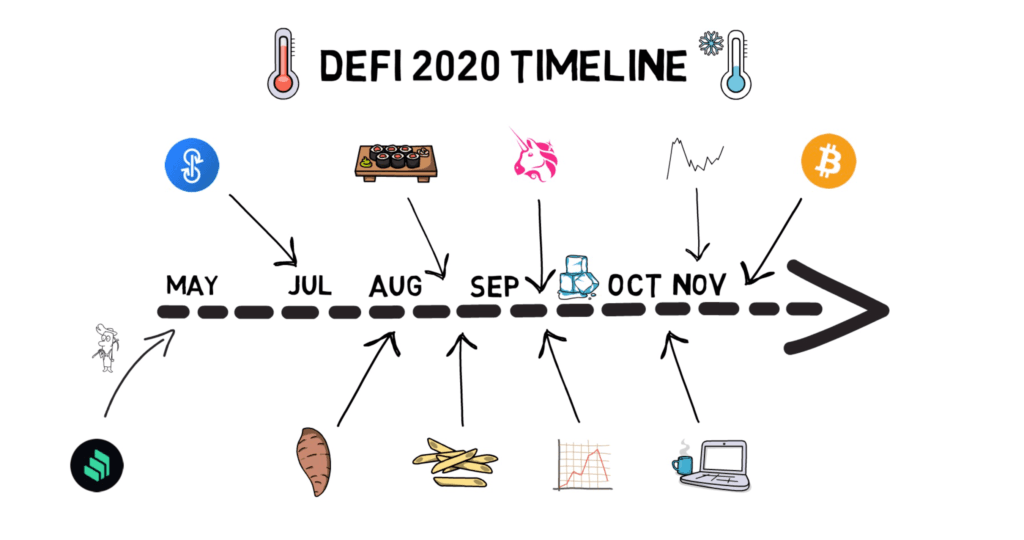

2020年DeFi之夏及其後

業界稱為「DeFi之夏」的2020年,是分析回報可持續性的關鍵參考時期。這一階段,DeFi協議爆炸式增長,「收益農場」首次進入主流加密社群視野。

DeFi之夏的引爆點出現在2020年6月,Compound發佈COMP治理代幣,並按用戶參與協議程度派發。這一創新引發骨牌效應,令用戶發現,透過愈來愈複雜的借貸及做市策略,能創造三位數年回報率(APY)。

這段時期的關鍵數據顯示其非凡一面:

- 總鎖倉價值(TVL)增長:DeFi的TVL由2020年5月約10億美元,短短數月飆升至2020年9月超過150億美元

- 代幣估值:如YFI等治理代幣,短時間由零升至超過4萬美元

- 收益水平:常見策略動輒100-1,000% 年化回報

這個時期為以代幣激勵推動增長建立了模板,並深刻影響日後的DeFi發展方向。然而,它同時也證明了

---how unsustainable many early yield models were - by late 2020, many of the initially eye-catching yields had already compressed significantly as capital flooded into farming opportunities.

有好多早期嘅收益模式都唔可持續——去到2020年尾,好多一開始好吸引眼球嘅高收益,因為大量資金湧入賺息機會,已經大幅收窄。

Yield Compression and Market Cycles

One of the most significant patterns in DeFi's evolution has been the progressive compression of yields across most strategies. This compression provides important evidence regarding the equilibrium level of sustainable returns in a maturing market.

DeFi演變入面其中一個最顯著嘅趨勢,就係大多數策略嘅收益逐步收窄。呢個過程為成熟市場裏面可持續回報嘅平衡水平,提供咗重要證據。

During the 2020-2021 bull market, DeFi yields displayed several characteristic patterns:

- Correlation with token prices: Yields denominated in dollars increased as governance token values appreciated

- Protocol proliferation: New platforms launched with aggressive incentives, creating yield spikes

- Capital efficiency innovations: Protocols developed increasingly sophisticated strategies

- Leverage expansion: Users employed greater leverage to amplify yields

2020至2021牛市期間,DeFi收益展現咗幾個特徵:

- 同代幣價格掛勾:以美元計價嘅收益喺治理代幣升值時同步上升

- 協議大爆發:新平台用進取嘅獎勵手法,帶嚟收益高峰

- 資本效率創新:協議開發出越嚟越高級嘅策略

- 槓桿擴張:用戶透過更大槓桿放大回報

The subsequent 2022-2023 bear market provided a crucial stress test for DeFi yield sustainability. As token prices declined sharply, many yield sources collapsed or significantly compressed. In particular, the market downturn exposed the unsustainable nature of yields based primarily on token emissions.

隨後嘅2022-2023熊市為DeFi收益可持續性帶嚟重大壓力測試。當代幣價格大跌,唔少收益來源倒塌或者大幅壓縮。特別係主要靠代幣發放(token emissions)支撐嘅收益模式,被突顯為唔可持續。

By 2024-2025, a clearer pattern has emerged: protocols generating yields from actual usage fees, liquidations, and financial activities showed relatively stable returns regardless of market conditions. In contrast, yields derived primarily from token emissions or speculative demand fluctuated dramatically with market sentiment. This pattern suggests a core yield advantage derived from genuine efficiency gains and disintermediation benefits, upon which cyclical components layer additional returns during expansionary periods.

去到2024-2025年,一個更明顯嘅趨勢出現咗:協議如果係靠實際用戶手續費、清算同金融活動去產生收益,回報無論市場點都相對穩定;相反,靠代幣發放同炒賣需求支撐嘅收益,會隨著市場情緒劇烈波動。呢個模式意味著,核心收益來自真正效率提升同去中介化紅利,而周期性牛市下先會額外帶嚟更高回報。

DeFi Llama's Yield Index has tracked this evolution since 2021, showing that sustainable "core yields" across the ecosystem have stabilized in the 5-15% range for most major assets and strategies. This represents a significant compression from earlier periods but still maintains a substantial premium over traditional finance alternatives.

[DeFi Llama's Yield Index] 自2021年開始追蹤呢個趨勢,顯示整個生態圈大部分主要資產同策略嘅可持續「核心回報」已經穩定喺5-15%左右。雖然比過去壓縮好多,但仍然大幅優於傳統金融選項。

Case Studies of Sustainable Yield Protocols

Examining specific protocols with demonstrated yield sustainability provides concrete evidence for the case that DeFi's high returns aren't merely a speculative bubble. These case studies illustrate how well-designed protocols can maintain attractive yields through genuine value creation rather than unsustainable mechanics.

分析啲有明顯可持續收益嘅協議,可以實質證明DeFi高回報唔單係投機泡沫。以下案例展示設計良好嘅協議如何通過真正創造價值,而唔係靠唔可持續嘅手法,嚟保持有吸引力嘅收益。

Curve Finance: The Stability King

Curve Finance has emerged as perhaps the most compelling example of sustainable yield generation in DeFi. Launched in 2020, Curve specializes in stable asset swaps, focusing on minimizing slippage for stablecoins and similar pegged assets.

Curve Finance可以話係DeFi入面最經典嘅可持續收益示範。佢2020年推出,主打穩定資產交換,專注幫穩定幣同掛勾資產用最低滑點兌換。

Curve's yield sustainability stems from multiple reinforcing mechanisms:

- Trading fees: Liquidity providers earn from the platform's 0.04% fee on swaps

- CRV emissions: The protocol distributes CRV tokens to liquidity providers

- Vote-escrowed economics: Users can lock CRV for up to 4 years to receive veCRV

- Bribes market: Third-party protocols pay veCRV holders to direct emissions

Curve嘅可持續回報來自多重互補機制:

- 交易手續費:流動性供應者可分配平台0.04%兌換費

- CRV發放:協議會派發CRV代幣俾流動性供應者

- 鎖倉投票機制:用戶最多可鎖倉4年CRV換取veCRV

- 「賄賂」市場:第三方協議會向veCRV持有者付費,要求佢哋引導CRV發放

What makes Curve particularly notable is how these mechanisms create aligned incentives across stakeholders. Long-term believers lock their CRV for maximum voting power, reducing circulating supply while gaining control over the protocol's liquidity direction. This model has maintained competitive yields ranging from 5-20% annually on stablecoin pools even during extended bear markets.

Curve最值得留意嘅係,佢啲機制令各方利益一致。長線信徒鎖倉CRV換取最大投票權,減少流通量,同時主導協議流動性分配方向。呢種模式令穩定幣池,即使長時間熊市下,依然能維持每年5-20%具競爭力收益。

Aave: Institutional-Grade Lending

Aave represents another compelling example of sustainable yield generation in the lending sector. As one of DeFi's premier money markets, Aave allows users to deposit assets to earn interest while enabling others to borrow against collateral.

Aave係借貸領域另一個出色嘅可持續收益例子。身為DeFi頂級資金市場之一,Aave比用戶存款收息,亦同時容許其他人用抵押借貸。

Aave's yield sustainability derives from several key factors:

- Market-driven interest rates: Aave's utilization curve automatically adjusts rates based on supply and demand

- Risk-adjusted pricing: Different assets command different rates based on their risk profiles

- Protocol fees: A small portion of interest payments goes to the protocol treasury and stakers

- Safety Module: AAVE token stakers provide insurance against shortfall events

Aave嘅收益可持續性源自幾大關鍵:

- 市場導向利率:用戶和需求自動影響利率

- 風險定價:唔同資產按各自風險收唔同回報

- 協議費用:部分利息會入協議金庫同分俾Staker

- 安全模組:AAVE代幣Staker為協議短缺提供保險

Aave的借貸收益證明咗高度穩定,穩定幣一般有3-8%,高波動資產有1-5%,唔同市況都能維持。呢啲回報主要來自實際借貸需求,而唔係代幣補貼,有理論上永久運作嘅潛力。

Lido: Liquid Staking Dominance

Lido Finance has revolutionized Ethereum staking through its liquid staking derivatives model. By allowing users to stake ETH while receiving liquid stETH tokens that can be used throughout DeFi, Lido created a fundamentally sustainable yield source.

Lido Finance用流動質押衍生品模型徹底革新咗Ethereum質押。用戶可以質押ETH,但同時收stETH代幣,周圍DeFi生態都用得,咁Lido就創造咗穩健嘅收益來源。

Lido's yields derive directly from Ethereum's protocol-level staking rewards - currently around 3-4% annually - with additional yield opportunities created through stETH's DeFi compatibility. This model creates sustainable yield without relying on token emissions or unsustainable incentives.

Lido收益直接來自以太坊協議層質押獎勵——目前每年大約3-4%,加上stETH於DeFi生態搵到更多額外回報。呢個模型全程唔靠代幣發放或者唔可持續獎勵,確保收益可持續。

The protocol has maintained consistent growth, capturing over 35% of all staked ETH by 2025, while offering yields that closely track Ethereum's base staking rate plus a premium for the liquid staking innovation. This demonstrates how infrastructural DeFi protocols can create sustainable yield advantages through genuine innovation rather than unsustainable tokenomics.

Lido協議一直穩步增長,去到2025年佔咗超過35%總質押ETH,所提供回報緊貼基礎質押利率,再加流動質押創新溢價。證明基礎設施類DeFi協議可以靠真創新,而非唔可持續嘅Tokenomics,創造穩定回報優勢。

Risk-Adjusted Returns: A More Realistic Perspective

Comprehensive Risk Assessment

When evaluating DeFi yields, considering risk-adjusted returns provides a more accurate picture of sustainability than focusing solely on nominal APYs. Risk-adjusted metrics attempt to normalize yields based on their corresponding risk profiles, enabling fairer comparison between different opportunities.

評估DeFi收益時,如果只睇表面APY並唔全面,更應該考慮「風險調整回報」,先反映到可持續性。呢啲數據會根據風險特徵將回報標準化,令唔同產品可以公平比較。

Advanced risk-adjusted yield models calculate:

- Sharpe-like ratios: Yield excess over risk-free rate divided by yield volatility

- Sortino variations: Focusing specifically on downside risk rather than general volatility

- Maximum drawdown-adjusted returns: Yields normalized by worst historical performance

- Conditional value at risk: Accounting for tail risk beyond simple volatility measures

- Probability-weighted expected returns: Incorporating likelihood of different scenarios

進階嘅風險調整模型會計算:

- Sharpe比率:回報減去無風險利率,用回報波動率去除

- Sortino變體:專注下行風險(跌市)而非一般波幅

- 最大回撤調整:依據歷史最大損失標準化回報

- 條件風險值(CVaR):考慮尾部風險

- 概率加權預期回報:納入唔同情景嘅發生機率

These metrics reveal which yields genuinely compensate for their associated risks versus those that appear attractive only by ignoring or underpricing their risk profiles. Analysis using these measures suggests that many apparently high-yielding opportunities actually offer poor risk-adjusted returns compared to more modest but sustainable alternatives.

呢啲指標會揭示邊啲收益真係有「合理風險溢價」,邊啲純粹因為風險無被合理定價先大包圍。用呢啲方式計算後,好多表面高回報產品都唔及啲穩健、可持續產品嘅風險調整回報。

Risk-adjusted yield aggregator DeFiSafety has compiled extensive data showing that after accounting for all risk factors, "true" sustainable DeFi yields likely fall in the 6-12% range for most strategies - significantly lower than advertised rates but still substantially higher than traditional alternatives.

風險調整收益聚合平台DeFiSafety有大量數據證明,如果計晒啲風險,「真正」可持續DeFi回報其實大多數策略介乎6-12%,雖然低過廣告,但仍遠高於傳統金融。

Risk Categories in DeFi

Advanced risk assessment models categorize DeFi risks into multiple dimensions, each with distinct implications for yield sustainability:

進階風險評估模型會將DeFi風險分幾大類,每樣都會影響回報可持續性:

Smart Contract Risk:

- Code vulnerability probability

- Historical audit quality

- Complexity metrics

- Dependencies on external protocols

智能合約風險:

- 代碼漏洞可能性

- 歷史審計質素

- 複雜度指標

- 依賴外部協議

Economic Design Risk:

- Tokenomic stability measurements

- Incentive alignment scores

- Game theory vulnerability assessment

- Stress test simulation results

經濟設計風險:

- 代幣經濟穩定度

- 激勵對齊度評分

- 博弈學弱點評估

- 壓力測試模擬結果

Market Risk:

- Liquidity depth metrics

- Correlation with broader markets

- Volatility profiles

- Liquidation cascade vulnerability

市場風險:

- 流動性深度

- 同大市相關性

- 波動性特徵

- 清算連鎖反應風險

Operational Risk:

- Team experience evaluation

- Development activity metrics

- Community engagement measures

- Transparency indicators

營運風險:

- 團隊經驗評估

- 開發活躍度

- 社群參與度

- 透明度指標

Regulatory Risk:

- Jurisdictional exposure analysis

- Compliance feature integration

- Privacy mechanism assessment

- Legal structure evaluation

監管風險:

- 地域監管風險分析

- 法規遵從功能

- 私隱機制評分

- 法律架構評估

By quantifying these diverse risk categories, comprehensive frameworks create risk profiles for each protocol and yield source. These profiles enable calculation of appropriate risk premiums - the additional yield necessary to compensate for specific risks. This approach suggests that sustainable DeFi yields likely settle at levels providing reasonable compensation for their genuine risks - typically 3-10% above truly risk-equivalent traditional finance alternatives once all factors are properly accounted for.

用數據量化呢啲風險後,全面框架可以為每個協議及回報來源描繪詳細風險輪廓,進而計算適當風險溢價——即額外回報去補償某啲特定風險。計算後,DeFi可持續收益大致會落喺比等風險傳統金融高3-10%嘅區間。

The Risk-Adjusted Yield Frontier

The concept of a "risk-adjusted yield frontier" helps visualize sustainable DeFi returns. This frontier represents the maximum theoretically achievable yield for any given risk level, with positions below the frontier indicating inefficiency and positions above suggesting unsustainable returns that will eventually revert.

「風險調整收益前沿」呢個概念有助理解可持續DeFi回報。前沿代表某個風險水平下,理論可達到嘅最大收益,低於則代表效率低,高於則唔可持續,遲早跌返落嚟。

Research by Gauntlet Networks, a leading DeFi risk modeling firm, has mapped this frontier across various DeFi strategies. Their analysis suggests that sustainable risk-adjusted yields in DeFi might exceed traditional finance by approximately:

- 2-4% for conservative, secured lending strategies

- 4-8% for liquidity provision in established markets

- 8-15% for more complex, actively managed strategies

[Gauntlet Networks]作為頂級DeFi風險建模團隊,研究過唔同策略嘅收益前沿。佢哋話,DeFi可持續風險調整收益比傳統金融可能高:

- 2-4%(穩健抵押放貸)

- 4-8%(成熟市場流動性供應)

- 8-15%(複雜主動管理策略)

These premiums derive from the fundamental efficiency and disintermediation advantages discussed earlier, suggesting that DeFi can maintain a sustainable yield advantage even after accounting for its unique risks. However, these premiums fall significantly short of the triple-digit APYs that initially attracted many participants to the ecosystem.

呢啲溢價源自效率提升同去中介優勢,證明DeFi即使考慮晒本身獨特風險,都有可持續回報優勢。不過,呢啲溢價都遠低於最初吸引好多參加者嗰啲三位數APY。

The Integration of AI into DeFi's Future

AI-Driven Protocol Design

Looking toward the future, artificial intelligence is increasingly

(未完)shaping how DeFi protocols are designed from the ground up. This integration promises to create more sustainable yield mechanisms by embedding intelligent systems directly into protocol architecture.

由設計層面開始,這種整合正在改變 DeFi 協議的根本設計方式。透過將智能系統直接嵌入協議架構,有望創造出更可持續的收益機制。

Several key developments are already emerging in 2025:

去到 2025 年,已經出現多個重要的發展:

-

Adaptive Yield Parameters: Protocols using AI to dynamically adjust emission rates, fee distributions, and other yield-determining factors based on market conditions and sustainability metrics. These systems can respond to changing conditions much more effectively than traditional governance processes. Synthetix's Perceptron system, launched in late 2024, dynamically adjusts staking rewards to maximize protocol growth while ensuring economic sustainability.

-

自適應收益參數︰協議利用人工智能根據市場狀況及可持續性指標,動態調整發放比率、費用分配及其他決定收益的因素。這些系統可以比傳統治理流程更有效率地回應市場變化。Synthetix 於 2024 年底推出的 Perceptron 系統,會動態調整質押獎勵,以最大化協議增長同時確保經濟可持續性。

-

Predictive Risk Management: AI systems embedded within lending and derivatives protocols to predict potential market dislocations and adjust collateralization requirements or liquidation thresholds preemptively, reducing systemic risks. For example, Gauntlet's Risk AI now powers risk parameters for over $15 billion in DeFi assets, using simulation-based machine learning to optimize for safety and capital efficiency.

-

預測型風險管理︰借貸及衍生品協議中嵌入的人工智能系統,可以預測潛在市場大幅異動,並預先調整改保要求或清算門檻,減少系統性風險。以 Gauntlet 的風險 AI 為例,現時為超過 150 億美元的 DeFi 資產設置風險參數,運用模擬基礎的機器學習去優化安全性同資本效率。

-

Personalized Yield Strategies: Platforms offering AI-generated yield strategies tailored to individual user risk profiles, time horizons, and financial goals rather than one-size-fits-all approaches. DefiLlama's AI Advisor, launched in February 2025, analyzes users' portfolios and risk preferences to recommend personalized yield strategies across hundreds of protocols.

-

個人化收益策略︰平台用 AI 根據個人風險輪廓、投資期及財務目標生成獨有的收益策略,不再一刀切。DefiLlama 於 2025 年 2 月推出的 AI 顧問,能夠分析用戶的投資組合及風險偏好,然後在數以百計的協議中建議個人化收益策略。

The integration of AI into protocol design represents a significant evolution beyond merely using AI for analysis. By embedding intelligence directly into the protocols themselves, DeFi systems can potentially create more sustainable and adaptable yield mechanisms that respond to changing conditions while maintaining appropriate risk parameters.

AI 融入協議設計,代表着超越單純用 AI 做分析的一大進化。當智能直接成為協議一部份,DeFi 系統就可以主動應對市場變化,同時維持合適的風險參數,創造出更可持續同更多變化應對能力的收益機制。

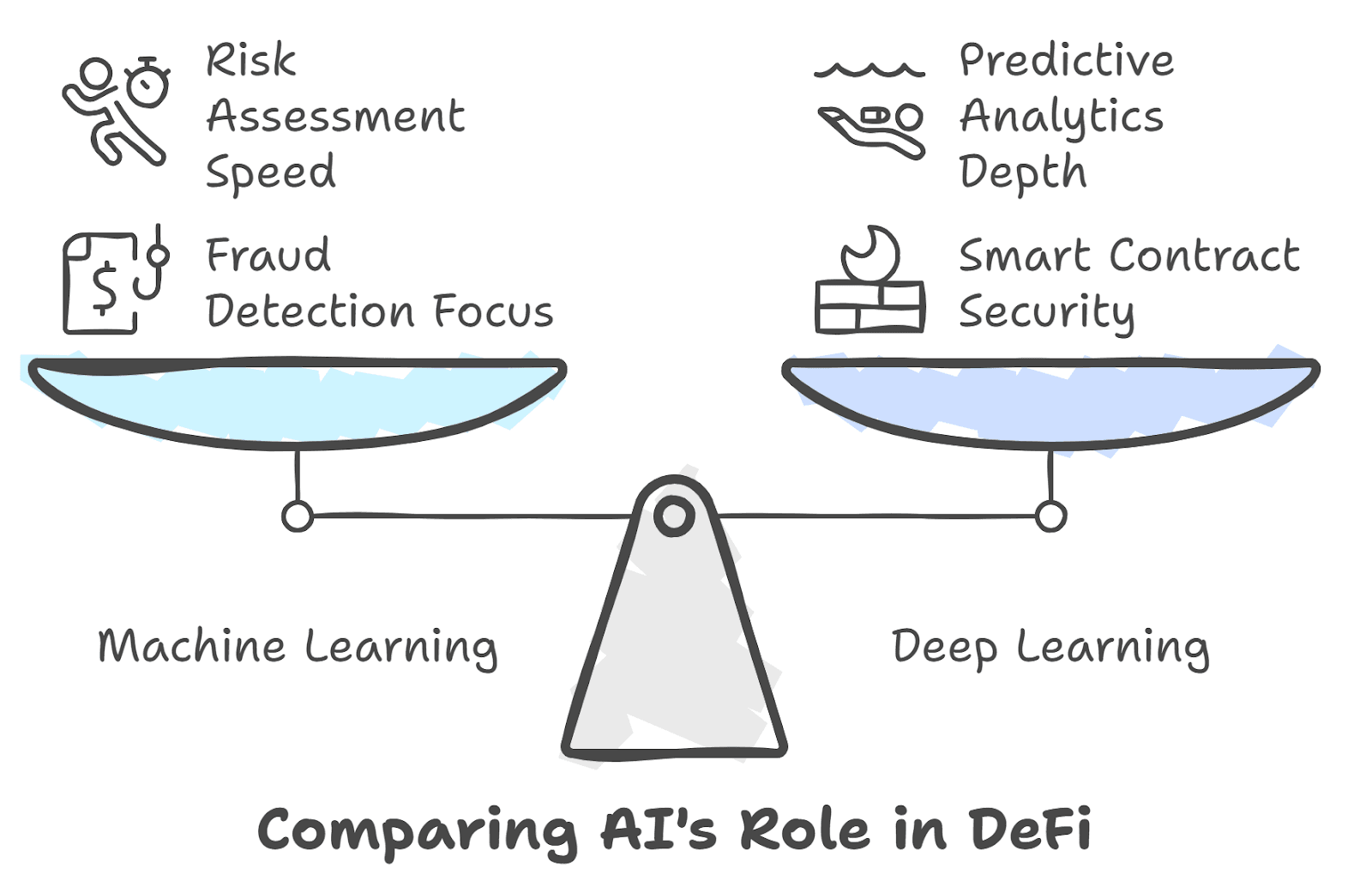

AI Applications in DeFi Risk Assessment

人工智能在 DeFi 風險評估中的應用

Artificial intelligence has become an increasingly crucial tool for analyzing DeFi yield sustainability. As the ecosystem grows in complexity, AI's ability to process vast datasets and identify subtle patterns offers unprecedented insight into what yields might be sustainable long-term.

人工智能已成為分析 DeFi 收益可持續性的重要工具。隨着生態愈來愈複雜,AI 能處理龐大數據集及識別細微模式,為哪些回報可長遠維持帶來前所未有的洞見。

By 2025, AI has permeated virtually every aspect of DeFi operations and analysis. AI models now routinely evaluate protocol security risks by analyzing smart contract code, governance structures, and historical performance. Advanced systems can identify potential vulnerabilities that might escape human auditors by comparing new protocols against databases of previous exploits.

去到 2025 年,AI 幾乎已滲透至 DeFi 各個操作及分析層面。AI 模型現時會常規地檢視協議的安全風險,包括分析智能合約程式碼、治理架構及過去表現。進階系統甚至會將新協議與過往出現過的攻擊資料庫比對,搵出人手審計未識破的潛在漏洞。

These risk assessment capabilities have direct implications for yield sustainability. Machine learning algorithms can quantify previously subjective risk factors into concrete probability metrics, allowing for more accurate risk-adjusted yield calculations. For instance, AI systems regularly generate comprehensive risk scorecards for DeFi protocols that correlate strongly with subsequent exploit likelihood.

這些風險評估能力對收益可持續性有直接影響。機器學習演算法可以將以往主觀的風險轉化為具體的概率指標,計算出更準確的風險調整後收益。例如,AI 系統會定期為 DeFi 協議生成風險評分卡,這些評分同之後出現漏洞的機會高度相關。

A notable example is Consensys Diligence AI, which has analyzed over 50,000 smart contracts, identifying vulnerability patterns that have helped prevent an estimated $3.2 billion in potential losses. This security layer potentially enables higher sustainable yields by reducing the "security tax" discussed earlier.

一個值得留意的例子是 Consensys Diligence AI,已分析超過五萬份智能合約,識別出漏洞模式,協助避免高達 32 億美元的潛在損失。這個安全層有機會降低之前提到的「安全稅」,令高收益變得更可持續。

Yield Optimization Through Machine Learning

透過機器學習優化收益

Perhaps the most visible application of AI in DeFi comes in the form of increasingly sophisticated yield optimization strategies. Modern yield aggregators employ machine learning to:

AI 在 DeFi 最明顯的應用,可能就是不斷進化的收益優化策略。現代的收益聚合器會利用機器學習執行下列操作:

- Predict short-term yield fluctuations across protocols

- 預測各協議短期內的收益波動

- Identify optimal entry and exit points for various strategies

- 搵出各種策略最佳入場、離場時機

- Balance risk factors against potential returns

- 平衡風險因素與潛在回報

- Optimize gas costs and transaction timing

- 優化 gas 成本及交易時機

Platforms like Yearn Finance now employ advanced AI to manage billions in assets, automatically shifting capital between opportunities based on complex models that consider dozens of variables simultaneously. These systems have demonstrated an ability to generate returns 2-3% higher annually than static strategies by capitalizing on yield inefficiencies before they're arbitraged away.

例如 Yearn Finance 現時已用上先進 AI 管理數十億資產,自動根據複雜模型(同時考慮數十個變數)在不同機會間調動資本。這些系統已證明,能夠捉緊尚未被套利的收益差異,使投資組合年回報比靜態策略高出 2-3%。

The consensus from advanced yield prediction models suggests several important conclusions regarding sustainability:

進階的收益預測模型綜合所得,於可持續性方面提出了幾個重要結論:

- Base yield layers: Models identify persistent "base layers" of sustainable yield across various DeFi categories, typically 3-7% above traditional finance alternatives.

- 基礎收益層︰模型指出,在不同 DeFi 類型中都會出現持續性的「底層收益」,通常較傳統金融高 3-7%。

- Protocol maturation curves: Models characterize the typical yield compression curve as protocols mature.

- 協議成熟曲線︰模型描繪出協議成熟時常見的收益收窄曲線。

- Sustainability thresholds: AI systems identify critical thresholds in metrics like emissions-to-revenue ratio that strongly predict long-term yield viability.

- 可持續性門檻︰AI 系統可識別如發放對收入比率這類重要指標,以預測長遠收益的可行性。

- Risk premiums: Models quantify the appropriate risk premium for different protocol categories, distinguishing between justified high yields and unsustainable returns.

- 風險溢價︰模型清楚量化不同協議類別應獲得的風險溢價,區分合理高收益與不可持續回報。

DefiAI Research has developed comprehensive models suggesting that AI-optimized strategies could maintain a 4-8% yield advantage over traditional finance indefinitely through efficiency gains and continuous optimization across the DeFi ecosystem.

DefiAI Research 建立的模型認為,經 AI 優化的策略可透過效率提升及連續優化,在 DeFi 生態內長期維持比傳統金融高 4-8% 的收益優勢。

Pattern Recognition and Anomaly Detection

模式識別與異常偵測

Beyond basic prediction, advanced AI systems excel at identifying subtle patterns and anomalies within DeFi yield data that provide insight into sustainability questions. These capabilities enable researchers to detect unsustainable yield mechanisms before they collapse and identify truly innovative models that might sustain higher returns.

除咗基本預測外,先進的 AI 系統能夠識別 DeFi 收益數據中微妙嘅模式及異常,有助研究人員搵出不可持續機制未崩潰前的徵兆,亦可發現可能持續維持高收益的真正創新模式。

AI research has identified several distinct yield patterns that correlate strongly with sustainability outcomes:

AI 研究識別到數個與可持續性高度相關的收益模式︰

- Sustainable Yield Pattern: Characterized by moderate baseline returns (5-15%), low volatility, minimal correlation with token price, and strong connection to protocol revenue.

- 可持續收益模式:以穩定的基礎回報(5-15%)、低波幅、同代幣價格相關性低、與協議收入強烈掛勾為特徵。

- Emissions-Dependent Pattern: Marked by high initial yields that progressively decrease following a predictable decay curve as token emissions reduce or token price falls.

- 發放依賴型模式︰初期回報極高,但隨代幣發放減少或價格下跌,而按一條預期減幅曲線逐漸下降。

- Ponzi Pattern: Identified by yields that increase with new capital inflows but lack corresponding revenue growth.

- 庞氏模式︰收益隨新資金流入而上升,但缺乏相應收入增長支撐。

- Innovation-Driven Pattern: Distinguished by initially high but eventually stabilizing yields as a truly innovative mechanism finds its market equilibrium.

- 創新推動型模式︰初段高收益,但隨著創新機制找到市場平衡,回報逐步穩定下來。

By combining pattern recognition and anomaly detection, AI researchers have developed effective early warning systems for unsustainable yield mechanisms. These systems monitor the DeFi ecosystem for signs of yield patterns that historically preceded collapses or significant contractions.

綜合應用模式識別與異常偵測,AI 研究人員已經建立有效的不可持續收益機制預警系統。這些系統會持續監控 DeFi 生態,搵出過往崩潰或大幅收縮前經常出現的模式。

ChainArgos, a leading blockchain analytics platform, has developed AI models that successfully predicted major yield collapses in protocols like MetaVault and YieldMatrix weeks before their public implosions. This predictive capability offers a potential path to more sustainable DeFi participation by allowing investors to avoid unsustainable yield traps.

區塊鏈數據分析領先者 ChainArgos 已開發出 AI 模型,能夠提前數周成功預測如 MetaVault 及 YieldMatrix 等協議的重大收益崩潰。呢種預測能力,有機會協助投資者避開不可持續收益陷阱,令參與 DeFi 更可持續。

The Emergence of Real Yield

真正收益的興起

From Emissions to Revenue

由發放變為收入

The concept of "real yield" has emerged as a crucial distinction in assessing DeFi sustainability. Real yield refers to returns derived from actual protocol revenue and usage fees rather than token emissions or other potentially unsustainable sources.

「真正收益」(Real Yield)呢個概念,已成為衡量 DeFi 可持續性的關鍵分野。真正收益,即是來自協議實際經營收入和使用費用的回報,而不是依賴代幣發放或其他可能不可持續的來源。

In the early days of DeFi, most yields were heavily dependent on token emissions - protocols distributing their governance tokens to attract liquidity and users. While this approach successfully bootstrapped the ecosystem, it inevitably led to token dilution and yield compression as emissions continued. The mathematical reality of token emissions means they cannot sustain high yields indefinitely unless matched by corresponding growth in protocol value and utility.

DeFi 剛起步時,大部分收益高度依賴代幣發放– 即協議派發治理代幣攬資及拉新。雖然這成功啟動了生態,但持續發放必然會出現代幣稀釋、收益收窄等問題。數學上,單靠發放不可能無限維持高回報,除非協議價值及應用能夠同步增長。

By 2025, many leading protocols have successfully transitioned toward real yield models where returns come predominantly from:

到了 2025 年,很多領先協議已成功轉型至「真正收益」模式,回報主要來源包括:

- Trading fees on decentralized exchanges

- 去中心化交易所的交易手續費

- Interest paid by borrowers on lending platforms

- 借貸平台的借款利息

- Liquidation fees from collateralized positions

- 抵押品止損清算費

- Premium payments for risk protection

- 風險保障的保費

- Protocol revenue sharing mechanisms

- 協議的收入分成機制

This transition marks a critical maturation of the DeFi ecosystem. While real yields are typically lower than the eye-catching numbers seen during emission-heavy periods, they represent fundamentally more sustainable return sources. Protocols generating significant revenue relative to their token emissions demonstrate much greater yield stability across market cycles.

這種轉變代表著 DeFi 生態圈關鍵的成熟階段。雖然「真正收益」未必像過去靠發放時那麼誇張,但它屬於更可持續的回報來源。協議如果能產生與發放比例相當的收入,收益在不同市場週期都會更穩定。

DeFi Pulse's Real Yield Index, launched in October 2024, tracks yields derived solely from protocol revenues across the ecosystem. Their analysis shows that real yields across major DeFi protocols averaged 7.3% in Q1 2025—significantly lower than advertised rates but still substantially higher than comparable traditional finance alternatives.

2024 年 10 月推出的 DeFi Pulse「真正收益指數」 專門追蹤只來自協議收入的收益。根據其分析,2025 年第一季主流 DeFi 協議的「真正收益」平均為 7.3%,雖然比宣傳時所見為低,但仍遠高於傳統金融可比產品。

The Buy-Back and Revenue-Sharing Model

回購及收入分成模式

A particularly promising development in sustainable yield generation is the rise of protocols that share revenue directly with token holders through systematic token buy-backs and revenue distribution. This model creates a transparent, auditable yield source tied directly to protocol performance.

在可持續收益生成上,其中一個最有潛力的新趨勢,是協議直接以定期回購或分派收入的方式,同代幣持有人共享經營利潤。這個模式創造出透明、可審核、與協議表現直接掛鈎的回報來源。

Leading examples of this approach include:

一些領先例子包括:

- GMX: This decentralized perpetual exchange distributes 30% of trading fees to esGMX stakers and another 30% to GLP liquidity providers, creating sustainable yields backed directly by platform revenue

- GMX:去中心化永續合約交易所,會將 30% 交易手續費分配給 esGMX 質押者,另一 30% 分給 GLP 流動性提供者,收益直接以平台收入作背書。

- Gains Network: Their synthetic trading platform shares 90% of trading fees with liquidity providers and governance token stakers

- Gains Network:合成資產交易平台,將 90% 交易手續費分配給流動性提供者及治理代幣質押者。

- dYdX: Their v4 chain implements an automatic buy-back and distribution mechanism that returns trading revenue to governance token stakers

- dYdX:v4 主鏈實現自動回購同收益分派機制,將交易收入返還給治理代幣質押者。

These revenue-sharing mechanisms represent perhaps the most sustainable yield models in DeFi, as they directly link returns to genuine economic activity rather than unsustainable token emissions. While yields from these mechanisms typically range from 5-20% rather than the triple-digit returns seen in emission-heavy models, they demonstrate

這些收入分成模式,大概是 DeFi 當中最可持續的收益模式,因為回報直接來自實際經濟活動 而 非不可持續的代幣發放。雖然這種收益一般只有 5-20%,不像過往大量發放型協議的三位數字回報,但其穩健性和可持續性明顯更高。much greater stability across market cycles.

TokenTerminal data shows that revenue-sharing protocols maintained relatively stable yield distributions throughout both bull and bear market conditions in 2023-2025, suggesting this model might represent a truly sustainable approach to DeFi yield generation.

TokenTerminal 數據 顯示,收益分成協議於 2023 至 2025 年的牛市及熊市期間,依然能維持相當穩定的收益分佈,反映呢個模式有機會成為 DeFi 產生收益既真正可持續方法。

Real-World Asset Integration

實體資產(RWA)整合

Perhaps the most significant development in sustainable DeFi yield generation is the integration of real-world assets (RWAs) into the ecosystem. By connecting DeFi liquidity with tangible economic activity beyond the crypto sphere, RWA protocols create yield sources backed by genuine economic productivity rather than speculative mechanisms.

其中一個對可持續 DeFi 收益產生影響最大既新趨勢,就係將實體資產(RWA)納入生態圈。RWA 協議將 DeFi 流動性同加密圈以外既實際經濟活動連接起來,創造出有真實經濟生產力支持既收益來源,而唔再只係依賴投機機制。

The RWA sector has grown exponentially, from under $100 million in 2021 to over $50 billion by early 2025, according to RWA Market Cap. This growth reflects increasing recognition that sustainable yields ultimately require connection to real economic value creation.

據 RWA Market Cap 指出,RWA 行業自 2021 年不足 1 億美元,激增至 2025 年初超過 500 億美元。呢個增長反映市場越來越多人意識到,可持續收益本質上要連結返真正既經濟價值創造。

Major RWA yield sources now include:

目前主流既 RWA 收益來源包括:

-

Tokenized Treasury Bills: Protocols like Ondo Finance and Maple offer yields backed by U.S. Treasury securities, providing DeFi users access to sovereign debt yields plus a small premium for the tokenization service

代幣化國債:例如 Ondo Finance 同 Maple 等協議,提供以美國國債做擔保既收益,令 DeFi 用戶可以享受國債回報外,仲有代幣化服務既小量溢價。 -

Private Credit Markets: Platforms like Centrifuge connect DeFi liquidity with SME financing, invoice factoring, and other private credit opportunities

私人信貸市場:例如 Centrifuge 等平台,令 DeFi 流動性可以參與中小企融資、發票質押等私人信貸業務。 -

Real Estate Yields: Projects like Tangible and RealT tokenize property income streams, enabling DeFi users to access real estate yields

房地產收益:如 Tangible 同 RealT 等項目,會將物業收入流代幣化,令 DeFi 用戶可以參與物業收益。 -

Carbon Credits and Environmental Assets: Protocols like KlimaDAO generate yields through environmental asset appreciation and impact investing

碳信用額及環保資產:例如 KlimaDAO,透過環保資產升值及影響力投資生成收益。

These RWA yield sources typically offer returns ranging from 3-12% annually—less spectacular than some native DeFi opportunities but generally more sustainable and less volatile. Their growing integration with traditional DeFi creates a promising path toward long-term yield sustainability by anchoring returns to fundamental economic value.

呢啲 RWA 收益來源年回報率一般約為 3-12%,雖然未必及原生 DeFi 投機機會咁誇張,但勝在更穩健可持續,波動性亦細得多。隨住 RWA 同傳統 DeFi 進一步融合,可以為長遠收益可持續發展,提供更健康既經濟基礎。

The recent BlackRock tokenized securities partnership with several DeFi platforms marks mainstream financial validation of this approach, potentially accelerating the integration of traditional financial yields into the DeFi ecosystem.

最近 貝萊德(BlackRock)聯同多個 DeFi 平台推動代幣化證券合作,正正式式為呢個方向提供主流金融既認可,有機會加速傳統收益資產同 DeFi 生態融合。

Institutional Perspectives on DeFi Yields

機構對 DeFi 收益的看法

Traditional Finance Adoption Patterns

傳統金融採納 DeFi 的模式

The relationship between traditional financial institutions and DeFi has evolved dramatically since 2020. Early institutional engagement was primarily exploratory, with most established players maintaining skeptical distance from the volatile, unregulated ecosystem. By 2025, institutional adoption has accelerated significantly, providing important signals about which yield sources sophisticated investors consider sustainable.

自 2020 年以來,傳統金融機構同 DeFi 之間既關係發生咗好大變化。早期,多數大型機構都以探索性質為主,對呢個波動大而未受監管既生態保持距離。而去到 2025 年,機構參與步伐顯著加快,對邊類收益渠道被專業投資者當做可持續選項,形成重要市場指標。

Several distinct institutional adoption patterns have emerged:

有幾種明顯既機構參與模式:

-

Conservative Bridging: Institutions like BNY Mellon and State Street have established conservative DeFi exposure through regulated staking, tokenized securities, and permissioned DeFi instances, targeting modest yield premiums (2-5%) with institutional-grade security

保守銜接:如紐約梅隆銀行(BNY Mellon)同 State Street 等,以受監管質押、代幣化證券及獲授權 DeFi 平台進行保守參與,目標係收取 2-5% 較傳統略高既收益,並且保障機構級安全性。 -

Dedicated Crypto Desks: Investment banks including Goldman Sachs and JPMorgan operate specialized trading desks that actively participate in sustainable DeFi yield strategies, particularly in liquid staking derivatives and RWA markets

加密貨幣專業團隊:某啲投資銀行如高盛(Goldman Sachs)及摩根大通(JPMorgan)均設有專業加密團隊,積極參與可持續 DeFi 收益策略,特別係流動質押(LSD)衍生品同 RWA 市場。 -

Asset Manager Integration: Traditional asset managers like BlackRock and Fidelity have integrated select DeFi yield sources into broader alternative investment offerings, focusing on opportunities with transparent revenue models

資產管理公司融合:貝萊德(BlackRock)、富達(Fidelity)等傳統資產管理大行,將部份 DeFi 收益機會納入其另類投資產品線,重點關注收益模式清晰透明既協議。

Particularly notable is the launch of JPMorgan's Tokenized Collateral Network, which incorporates DeFi mechanisms while meeting regulatory requirements. This initiative signals institutional recognition that certain DeFi yield innovations offer sustainable efficiency improvements over traditional alternatives.

其中 JPMorgan 推出既 代幣化抵押品網絡(TCN),正正係結合 DeFi 機制同時滿足監管要求既案例,標誌著機構層面已認同某啲 DeFi 收益創新,係比舊有方案更可持續而且提高效率。

Institutional Risk Assessment Frameworks

機構級 DeFi 風險評估架構

Institutional investors have developed sophisticated frameworks for evaluating which DeFi yields might prove sustainable long-term. These frameworks provide valuable insight into how professional risk managers distinguish between sustainable and unsustainable return sources.

機構投資者建立咗成熟既框架,用以評估啲 DeFi 收益長遠上邊啲先算得上可持續。呢啲框架俾咗我哋好多啟示,睇吓專業風控人員如何分辨可持續同唔可持續既收益來源。

Galaxy Digital's DeFi Risk Framework, published in March 2025, offers a comprehensive methodology incorporating:

Galaxy Digital 於 2025 年 3 月發表既 DeFi 風險評估框架,包括以下重點:

-

Protocol Risk Tiering: Categorizing protocols from Tier 1 (highest security, longest track record) to Tier 4 (experimental, unaudited), with explicit limits on exposure to lower tiers

協議分級:將協議由最高安全、歷史最悠久既 Tier 1 分至風險較高、實驗性強、未審計既 Tier 4,對低級別協議投資有明確比例限制 -

Yield Source Analysis: Classifying yield sources as either "fundamental" (derived from genuine economic activity) or "incentive" (derived from token emissions), with strong preference for the former

收益來源分析:分辨係「基本收益」(真實經濟活動產生)定「激勵收益」(代幣發放),機構對前者有強烈偏好 -

Composability Risk Mapping: Tracing dependencies between protocols to quantify systemic exposure

組合風險映射:追蹤協議間既相依性,量化系統性風險敞口 -

Regulatory Compliance Scoring: Evaluating protocols based on their compatibility with evolving regulatory requirements

監管合規評分:按協議對不斷變化既監管要求既配合程度打分

The framework concludes that institutionally acceptable sustainable yields likely range from 2-4% above traditional alternatives for Tier 1 protocols, with progressively higher yields required to compensate for additional risk in lower tiers.

此框架結論為:機構可接受既可持續 DeFi 收益,一般於 Tier 1 協議高於傳統替代品約 2-4%;級數愈低,需更高回報來彌補額外風險。

Institutional Capital Flows and Market Impact

機構資金流向及市場影響

The patterns of institutional capital allocation provide perhaps the most concrete evidence regarding which DeFi yields professional investors consider sustainable. By tracking where sophisticated capital flows, we can identify which yield mechanisms demonstrate staying power beyond retail speculation.

觀察機構資金如何分配,可以最清晰睇到邊類 DeFi 收益真係俾專業投資人視為可持續。追蹤資本流向,有助識別超越散戶短炒而能長期維持既收益機制。

According to Chainalysis's 2025 Institutional DeFi Report, institutional capital has concentrated heavily in several key segments:

根據 Chainalysis 2025 年機構 DeFi 報告,機構資金主要集中於幾個領域:

-

Liquid Staking Derivatives: Capturing approximately 40% of institutional DeFi exposure, with Lido Finance and Rocket Pool dominating

流動質押衍生品:約 40% 資金投向呢類協議,以 Lido Finance 同 Rocket Pool 等為主 -

Real World Assets: Representing 25% of institutional allocation, primarily through platforms offering regulatory-compliant tokenized securities

實體資產:佔約 25%,主要係經合規確認既代幣化證券平台 -

Blue-Chip DEXs: Comprising 20% of institutional activity, focused on major venues with demonstrated revenue models

藍籌 DEX:大約 20%,集中於收入模式清晰既主流去中心化交易所 -

Institutional DeFi Platforms: Capturing 15% of flows through permissioned platforms like Aave Arc and Compound Treasury

機構級 DeFi 平台:例如 Aave Arc、Compound Treasury,佔資金 15%

Notably absent from significant institutional allocation are the high-APY farming opportunities and complex yield aggregators that dominated retail interest in earlier cycles. This allocation pattern suggests professional investors have identified a subset of DeFi yield sources they consider fundamentally sustainable, while avoiding those dependent on speculative dynamics or unsustainable tokenomics.

過往零售用戶熱捧既高年化挖礦機會同複雜收益聚合工具,明顯喺機構配置中消失。呢種配置說明專業投資者只選擇真正可持續既 DeFi 收益來源,避開過度依賴投機與唔健康代幣經濟既選項。

The March 2025 announcement that Fidelity's Digital Assets division had allocated $2.5 billion to DeFi strategies - focusing exclusively on what it termed "economically sustainable yield sources" - represents perhaps the strongest institutional validation of DeFi yield sustainability to date.

富達(Fidelity)數碼資產部於 2025 年 3 月宣布投放 25 億美元於 DeFi 策略,專注於其稱「經濟上可持續」既收益來源,無疑係截至目前對 DeFi 收益可持續性最有分量既機構認證。

The Yield Farming 2.0 Evolution

產量耕作 2.0 的進化

Sustainable Yield Farming Strategies

可持續「耕作」策略

The DeFi ecosystem has witnessed a significant maturation in yield farming approaches since the initial "DeFi Summer" of 2020. This evolution, sometimes termed "Yield Farming 2.0," emphasizes sustainability, risk management, and genuine value creation over unsustainable token incentives.

自 2020「DeFi 夏天」以來,DeFi 生態於產量耕作策略上出現重大成熟演變。所謂「Yield Farming 2.0」,著重可持續性、風險管理、實質價值創造,而唔再只靠唔可持續既代幣激勵。

Key characteristics of these sustainable yield strategies include:

這些可持續耕作策略重點特徵包括:

-

Diversification Across Yield Sources: Modern yield farmers typically spread capital across multiple uncorrelated yield sources rather than concentrating in single high-APY opportunities, reducing specific protocol risk

多元化收益來源:現代農夫會將資本分散多個互不相關來源,而唔係 all-in 單一高年化協議,減低單一協議風險 -

Revenue-Focused Selection: Prioritizing protocols with strong revenue models where yields derive primarily from fees rather than token emissions

以收入為主導選擇:首選以協議收費作主要收益,而唔係純粹靠代幣派息既項目 -

Strategic Position Management: Actively managing positions to minimize impermanent loss and maximize capital efficiency rather than passive "set and forget" approaches

策略性持倉管理:主動管理持倉,減少無常損失,提升資本效率,唔再係「擺咗就唔理」既消極做法 -

Risk-Adjusted Targeting: Setting realistic yield targets based on comprehensive risk assessment rather than chasing outlier APYs

風險調整目標:根據全面風險評估設定現實可達收益,而唔係盲目追逐極端年化

These evolutionary changes have created yield farming approaches with substantially different risk-return profiles compared to earlier generations. While Yield Farming 1.0 often produced spectacular but ultimately unsustainable returns through aggressive token emissions, Yield Farming 2.0 typically generates more modest but sustainable yields through genuine value capture.

呢種進化帶來既產量耕作策略,風險回報特質同舊式已完全唔同。以往 1.0 時代靠高強度代幣排放做收益,雖然亮眼但難以持久;而家 2.0 則追求更穩健踏實、可持續既真實協議收入。

The rising popularity of platforms like DefiLlama Yield, which explicitly separates "Farm APR" (token emissions) from "Base APR" (genuine protocol revenue), demonstrates growing retail awareness of these sustainability distinctions.

DefiLlama Yield 等新平台將「耕作用 APR」(代幣發放)同「基礎 APR」(協議實收)分開,越來越多散戶都留意到兩者可持續性有重大分別。

Quantitative Yield Optimization

定量收益優化

A significant development in sustainable yield farming has been the rise of quantitative approaches to yield optimization. These strategies apply mathematical models and algorithmic execution to maximize risk-adjusted returns while minimizing downside risks.

可持續產量耕作另一大進展,係引入定量策略提升收益:利用數學模型同自動化算法,搵到風險調整回報最大化、同時最細化下行風險既最優處理方式。

Leading quantitative yield strategies now include:

主流既定量收益策略包括:

-

Dynamic LTV Management: Algorithms that continuously optimize loan-to-value ratios in lending protocols based on volatility predictions, maximizing capital efficiency while minimizing liquidation risk

動態 LTV 管理:算法實時根據波動率預測,優化借貸協議中的貸款價值比,提升資本效率並減少爆倉風險 -

Impermanent Loss Hedging: Sophisticated strategies that use options, futures, or other derivatives to hedge against impermanent loss in liquidity provision

對沖無常損失:運用期權、期貨等衍生品精細對沖做市流動性遇到的無常損失 -

Yield Curve Arbitrage: Exploiting inefficiencies across lending protocols' interest rate curves through strategic borrowing and lending

利率曲線套利:利用不同借貸協議的利率曲線差異,策略性進行高低息套利 -

MEV Protection: Implementing transaction execution strategies that protect against miner/validator extractable value,

MEV 保護:實施交易執行策略,避免被礦工/驗證者抽取收益(MEV)preserving yields that would otherwise be captured by front-runners

保存本應被搶先交易者奪去的收益

These quantitative approaches have demonstrated ability to generate 3-5% additional annual yield compared to passive strategies, potentially enhancing the sustainable yield frontier. Platforms like Exponential and Ribbon Finance have pioneered these strategies, bringing sophisticated quantitative finance techniques to DeFi yield optimization.

這些量化方法已經證明,與被動策略相比,可以產生額外3-5%的年化收益,有潛力推動可持續收益的邊界。像 Exponential 和 Ribbon Finance 這樣的平台率先應用這些策略,把先進的量化金融技術引入 DeFi 收益優化。

Governance-Based Yield Mechanisms

The evolution of protocol governance has created entirely new yield mechanisms based on controlling protocol resources and directing incentives. These governance-based yields represent a distinct category that potentially offers sustainable returns through strategic influence rather than passive capital provision.

協議管治的演變創造了全新的收益方式,這些方式以控制協議資源和引導獎勵為基礎。這類管治型收益屬於獨立的分類,能透過策略性影響力(而非單純資本投入)提供持續回報。

The most sophisticated governance-based yield strategies involve:

最先進的管治型收益策略包括:

- Vote-Escrow Models: Locking tokens for extended periods to gain boosted yields and governance power, pioneered by Curve and adopted by numerous protocols

投票鎖倉模式:將代幣鎖定一段較長時間以獲得提升的收益和管治權,最初由 Curve 創立,後來被很多協議採納 - Bribe Markets: Platforms where protocols compete for governance influence by offering rewards to governance token holders, creating additional yield layers

賄選市場:在這些平台上,協議透過向管治代幣持有人提供獎勵來競爭管治影響力,添加額外收益層 - Treasury Management: Participating in governance to influence protocol treasury investments, potentially generating sustainable returns from productive asset allocation

金庫管理:參與管治以影響協議金庫的投資決策,透過有效資產配置帶來可持續回報 - Strategic Parameter Setting: Using governance rights to optimize protocol parameters for yield generation while maintaining system stability

策略性參數設置:運用管治權利優化協議參數,以兼顧收益與系統穩定

The Convex and Aura ecosystems exemplify how governance-based yields can create sustainable return sources by efficiently coordinating governance power across multiple protocols. These mechanisms create value through coordination efficiencies rather than unsustainable token emissions, potentially representing more durable yield sources.

Convex 和 Aura 生態系就是協調多個協議的管治權,創造可持續收益來源的最佳例子。這些機制是由協調效益(而非不可持續的代幣發放)產生價值,有潛力成為更持久的收益來源。

The Long-Term Outlook: Convergence or Disruption?

The Sustainable Yield Equilibrium Hypothesis

As DeFi matures, an important question emerges: will yields eventually converge with traditional finance or maintain a persistent premium? The Sustainable Yield Equilibrium Hypothesis proposes that after accounting for all relevant factors, DeFi yields will settle at levels moderately higher than traditional finance counterparts due to genuine efficiency advantages, but significantly lower than early-phase returns.

隨著 DeFi 成熟,一個重要問題浮現:收益最終會與傳統金融趨同,還是保持持續溢價?「可持續收益均衡假說」認為,考慮所有相關因素後,DeFi 的收益會比傳統金融高出一個溫和的水平,這是因為真正的效率優勢,但將會遠低於初期的高回報。

The hypothesis suggests three distinct yield components:

此假說提出三種不同的收益組成:

- Efficiency Premium: A sustainable 2-5% yield advantage derived from blockchain's technical efficiencies and disintermediation benefits

效率溢價:來自區塊鏈技術與去中介化帶來的可持續 2-5% 收益優勢 - Risk Premium: An additional 1-8% required to compensate for DeFi's unique risks, varying by protocol maturity and security profile

風險溢價:為補償 DeFi 獨有風險而需要的額外 1-8%,視協議成熟度及安全性而變 - Speculative Component: A highly variable and ultimately unsustainable component driven by token emissions and market sentiment

投機組成:受代幣發放與市場情緒驅動、高度波動且最終不可持續的成分

Under this framework, only the first component represents a truly sustainable advantage, while the second appropriately compensates for additional risk rather than representing "free yield." The third component - which dominated early DeFi returns - gradually diminishes as markets mature and participants develop more sophisticated risk assessment capabilities.

在這個框架下,只有第一個組成部份是真正可持續的優勢,而第二部份是合理補償額外風險,並非「免費收益」。第三部份——早期 DeFi 回報的主因——隨著市場成熟和參與者風險評估能力提升會逐步減弱。

Research by the DeFi Education Fund examining yield trends from 2020-2025 supports this hypothesis, showing progressive compression toward an apparent equilibrium approximately 3-7% above traditional finance alternatives for risk-comparable activities.

Defi 教育基金對2020至2025年間收益趨勢的研究 支持這個假說,發現收益正逐步收窄至比同等風險的傳統金融高出約3-7%的明顯均衡。

The Institutional Absorption Scenario

An alternative view suggests that as traditional financial institutions increasingly absorb DeFi innovations, the yield gap may narrow more significantly through a process of institutional adoption and regulatory normalization.

另一種看法認為,隨著傳統金融機構越來越多地吸收 DeFi 創新,收益差距有可能因機構採納及監管常態化而明顯收窄。

Under this scenario, major financial institutions gradually integrate the most efficient DeFi mechanisms into their existing operations, capturing much of the efficiency premium for themselves and their shareholders rather than passing it to depositors or investors. Simultaneously, regulatory requirements standardize across traditional and decentralized finance, eliminating regulatory arbitrage advantages.

在這情況下,大型金融機構會逐步將最有效的 DeFi 機制整合進自己的運作,將大部分效率溢價留給自己及股東,而非讓存戶或投資者受惠。與此同時,傳統金融和去中心化金融的監管要求將標準化,消除監管套利空間。

This process has already begun with initiatives like Project Guardian, a partnership between the Monetary Authority of Singapore and major financial institutions to integrate DeFi mechanisms into regulated financial infrastructure. Similar projects by central banks and financial consortia worldwide suggest accelerating institutional absorption.

這種過程已經由「Guardian 計劃」等項目率先展開——這是新加坡金融管理局與大型金融機構合作,把 DeFi 機制引入受監管金融市場基建。全球各地央行及金融聯盟推行類似計劃,顯示機構吸收正加速進行。

If this scenario predominates, sustainable DeFi yields might ultimately settle just 1-3% above traditional alternatives - still representing an improvement, but less revolutionary than early adopters envisioned.

如果這種情景主導,DeFi 的可持續收益最終可能只比傳統方案高出 1-3%——雖然有所提升,但未必如早期用戶所想般具革命性。

The Innovation Supercycle Theory

A more optimistic perspective is offered by the Innovation Supercycle Theory, which suggests that DeFi represents not merely an incremental improvement over traditional finance but a fundamental paradigm shift that will continue generating new yield sources through successive waves of innovation.

更樂觀的「創新超級周期論」認為,DeFi 不只是對傳統金融的逐步改良,更是根本的範式轉移,會透過持續湧現的創新浪潮,不斷產生新的收益來源。

Proponents of this view point to historical precedents in technological revolutions, where early innovations created platforms for successive waves of new development, each generating distinct value propositions. They argue that DeFi's composable, permissionless nature will continue spawning novel financial primitives that create genuinely sustainable yield sources unforeseen by current models.

這種觀點支持者舉出歷次科技革命的先例——早期創新為往後新一輪發展創造平台,每一浪都有嶄新價值主張。他們認為 DeFi 具可組合、無准入門檻等特質,會持續孕育新型金融基元,從而帶來現有模式無法預見的可持續收益來源。

Evidence for this theory includes the rapid emergence of entirely new financial categories within DeFi:

這理論的證據包括 DeFi 內部全新金融類型的迅速崛起:

- Liquid staking derivatives emerged in 2021-2022

流動質押衍生品於 2021-2022 年出現 - Real-world asset tokenization gained significant traction in 2023-2024

現實資產代幣化於 2023-2024 年大受關注 - AI-enhanced DeFi protocols began delivering measurable value in 2024-2025

AI 加持的 DeFi 協議於 2024-2025 年開始產生可量化的價值

Each innovation cycle has created new yield sources not directly comparable to traditional finance alternatives. If this pattern continues, DeFi could maintain a substantial yield advantage through continuous innovation rather than settling into equilibrium with traditional systems.

每一輪創新周期都創造了傳統金融無法直接比較的新收益來源。如果這種模式持續,DeFi 有望經持續創新保持顯著收益優勢,而非與傳統體系達成均衡。

MakerDAO's recent paper argues that we're currently witnessing just the third major innovation wave in DeFi, with at least four additional waves likely over the coming decade, each potentially creating new sustainable yield sources through fundamental innovation rather than unsustainable tokenomics

MakerDAO 最近的文件 指出,我們目前只經歷了 DeFi 的第三輪重大創新浪潮,未來十年內至少還有四輪,每一輪都可能通過根本性創新(而不是不可持續的代幣經濟學)創造新型可持續收益來源。

Final thoughts

The question of DeFi yield sustainability defies simple answers. The evidence suggests that while many early yield mechanisms were fundamentally unsustainable, built on temporary token incentives and speculative dynamics, the ecosystem has evolved toward more durable models based on genuine efficiency advantages, disintermediation benefits, and innovative financial primitives.

DeFi 收益可持續性的問題沒有簡單答案。種種證據顯示,雖然許多早期收益機制本質上並不持久,只靠臨時性代幣獎勵和投機動力驅動,但生態系已演進到依靠真正效率優勢、去中介化好處,以及創新金融基元等較持久模式。

The most likely outcome involves stratification across the ecosystem:

最可能的結果是整個生態呈分層發展:

-

Core DeFi Infrastructure: Established protocols like Curve, Aave, and Lido will likely continue offering sustainable yields 3-7% above traditional finance alternatives, derived from genuine efficiency advantages and reasonable risk premiums.

核心 DeFi 基建:像 Curve、Aave 及 Lido 這類成熟協議可能繼續提供比傳統金融高 3-7% 的持續收益,來源為真正的效率溢價及合理風險補償。 -

Innovation Frontier: Emerging protocol categories will continue generating temporarily higher yields during their growth phases, some of which will evolve into sustainable models while others collapse when unsustainable mechanisms inevitably fail.

創新前線:新興協議類別會在成長初期持續帶來較高短期收益,當中部分會發展成可持續模式,另有一些則會在不可持續機制無法支撐時崩潰。 -

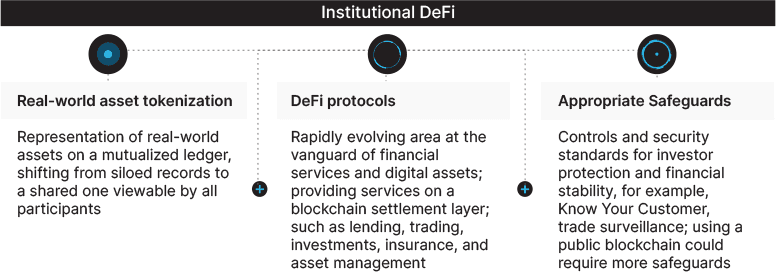

Institutional DeFi: A growing regulated segment will offer yields 1-3% above traditional alternatives, with enhanced security and compliance features targeting institutional participants unwilling to accept full DeFi risk exposure.

機構級 DeFi:不斷增長的合規化部分會提供比傳統金融高 1-3% 的收益,同時增強安全與合規功能,針對不願承擔完整 DeFi 風險的機構參與者。

For investors navigating this landscape, sustainable DeFi participation requires distinguishing between genuinely innovative yield sources and unsustainable mechanisms designed primarily to attract capital. The growing array of analytical tools, risk frameworks, and historical data makes this distinction increasingly possible for sophisticated participants.

對於在此領域投資的人來說,參與可持續的 DeFi 需要識別哪些是真正創新的收益來源,哪些只是吸引資本的不可持續機制。隨著分析工具、風險框架及歷史數據日益豐富,有經驗的參與者愈來愈能作出這種分辨。

The broader significance extends beyond individual investors. DeFi's ability to generate sustainably higher yields than traditional finance - even if more modest than early returns - represents a potentially transformative development in global capital markets. By creating more efficient financial infrastructure and disintermediating rent-seeking entities, DeFi could ultimately raise the baseline return on capital throughout the economy, benefiting savers and productive enterprises alike.

其意義並不只限於個人投資者。即使不及早期回報誇張,DeFi 仍有機會穩定提供高於傳統金融的回報,這有可能為全球資本市場帶來變革。DeFi 憑更高效率金融基建及消除尋租中介,最終或可提升整體經濟的資本回報基準,讓儲蓄者和生產型企業皆得益。

Up to date, one conclusion seems increasingly clear: while DeFi's triple-digit APYs were largely a temporary phenomenon of its bootstrapping phase, a significant portion of its yield advantage appears fundamentally sustainable - not because of speculative tokenomics, but because blockchain technology enables genuinely more efficient financial systems. The future likely holds neither the extraordinary returns of DeFi's early days nor complete convergence with traditional finance, but rather a new equilibrium that permanently raises the bar for what investors can expect from their capital.

總結至今,有一點似乎愈來愈明確:DeFi 三位數 APY 基本上只是啟動初期的暫時現象,而大部分收益優勢其實是可以持續——並不是靠投機性代幣經濟,而是區塊鏈令金融體系變得真正更有效率。未來既不大可能重現 DeFi 早期的超高回報,也不會完全與傳統金融拉平,而係建立一個新均衡,長期抬高投資者對資本回報的期望水平。