加密貨幣資產日益打開了全球公民及居留選項的大門。到2025年中,全球已有超過172,000名加密百萬富翁,帶動投資型護照申請激增64%。

相應地,現時有多個國家接受擁有加密財富的投資者申請“黃金簽證”,甚至第二國籍。雖然大部分計劃最終仍要求以傳統貨幣繳費,但越來越多獲認可的中介和政府部門,在申請過程中都接受比特幣、以太幣及穩定幣。

在部分情況下,持牌中介會代申請人將加密貨幣兌換成本地貨幣,而少數先驅國家正嘗試更直接地納入加密支付。這代表政策正從昔日只接受法定貨幣的模式,過渡到允許數碼資產作合法資金來源並應用於移民。

下文將概述現時10個結合加密貨幣的投資移民或國籍計劃,從熱帶避稅天堂的即取護照,到經濟強國的創新居留簽證。每個章節會列出計劃要求、加密幣融入方式及針對持幣投資者的重點利與弊。資訊截至2025年8月,內容客觀中立,根據事實編寫。

1. 瓦努阿圖—加密資助捐款開啟極速國籍

計劃概述:南太平洋國家瓦努阿圖開設名為“發展支援計劃(DSP)”的投資公民計劃,是全球獲取第二護照最快捷的路徑之一:一般約30至60日即可完成。所需資金為捐款給瓦國政府基金,單人申請人約13萬美元起,四口之家約18萬美元。成功者會獲得瓦國完整公民身份及護照。

加密融合:瓦努阿圖政府本身不會直接收取加密貨幣,但允許獲授權的代理以申請人名義收加密幣。部分經認證代理宣稱可接受比特幣或主流穩定幣作為DSP捐款,並負責換匯及文書。換言之,持幣人士經正常反洗黑錢審查,只要資金來源清晰,就可用加密資產辦理瓦國公民資格。有代理會以BTC直接報價,大致相當於11.5–13萬美元,流程更方便加密投資者。

加密投資者優勢:瓦努阿圖最大的賣點是簡捷與高速,全程線上辦理,無需任何居住、旅遊或面試要求,亦無語言及學歷門檻,可雙重國籍。對加密創業家尤為吸引的是,瓦國對個人收入、資本增值、財富及遺產一律零稅,適合持大額數碼資產者作為免稅天堂。持護照者可免簽進出約90國,包括英國、香港及新加坡,但歐盟申根區通行權正值審查。家庭申請上,配偶、25歲以下子女、50歲以上父母均可一併入籍。

注意事項:此計劃特別受加密百萬富翁與數碼遊牧族青睞,常作為備用身份提升安全或流動性。雖節省時間、私隱高,持幣申請人必須經代理換匯,並提交詳盡資產來源證明。總括而言,瓦努阿圖是對加密資產最友善的第二國籍途徑之一,速度極快且容納新型財富。

2. 安提瓜和巴布達—加勒比地區最友善加密投資入籍國

計劃概述:加勒比島國安提瓜和巴布達擁有成熟的投資入籍(CBI)制度,投資者可選擇對國家發展基金捐款(單人申請最低10萬美元)、或購買批准房地產(最低20萬美元),辦理期約3至6個月,經授權中介代理處理。安提瓜護照免簽超過150國,涵蓋歐盟申根國及英國,通行力高。

加密融合:安提瓜成為區內首個在CBI申請過程明確接納加密資產的國家。至2025年初,成為唯一可接受加密貨幣資產作財富證明的加勒比計劃。儘管捐款本身仍必須以傳統貨幣支付,安提瓜投資單位允許申請人提交比特幣或以太幣等加密資產,作為資產證明。只要有妥善紀錄及經認可渠道兌換成法幣繳費即可。一些本地律師及中介甚至可接受以比特幣支付專業費,令辦理過程對傳統銀行依賴更低。

官方多次表態歡迎加密投資者。政府代表曾明言,儘管不直接收加密捐款,但“允許投資者將加密資產兌換法幣以履行要求”,因此對追求第二護照的人而言屬“相當友善”。上述寬容態度和配套法規,令安提瓜成為加密富人主選。

加密投資者優勢:除加密認證外,安提瓜生活及稅務待遇均屬上乘。該國於2016年取消個人所得稅,本地不課任何加密交易及投資收益稅,亦無全球入息稅和資本增值稅,有助有效提升加密持幣盈利。護照本身可在歐盟申根區逗留90日及英國停留6個月。

家庭辦理同樣慷慨,單筆10萬美元捐款可覆蓋一家四口或更多(超額人員須補費)。安提瓜正積極推動成為加密產業樞紐,邀請區塊鏈顧問、探索引進數碼資產交易所並討論相關立法,屬持續支持創新。

注意事項:所有申請均須嚴格盡職審查,包括背景調查及部分案件須接受線上面談。申報加密資產意味須準備較詳盡資金出處文件,政府常利用第三方鑑證大額加密交易。審批期比極速計劃如瓦努阿圖略長(3–6個月),但能以資產證明的方式靈活運用加密幣,只需最後兌換為法幣交費。整體而言,安提瓜是在官方規章下公開接納加密財富的典範,把監管與創新平衡得恰到好處。

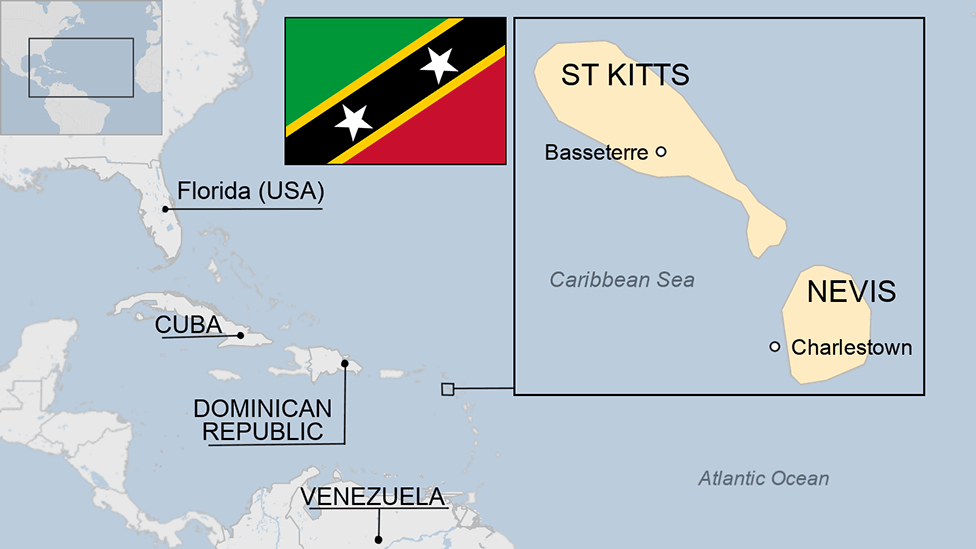

3. 聖基茨和尼維斯—以加密資產作財富證明的入籍先驅

計劃概述:聖基茨和尼維斯是全球歷史最悠久的投資入籍計劃(自1984年)。這個雙島聯邦通常要求單人捐款15萬美元至可持續增長基金,或在獲批項目上投資房地產不少於20萬美元。護照在加勒比地區屬最強之一,涵蓋約150國免簽或落地簽,包括歐盟申根區與英國,通行力與安提瓜類同。一般申請期約4至6個月,受盡職審查影響。

加密融合:2025年3月,聖基茨和尼維斯調整CBI政策,正式接納申請人在資產聲明時納入加密貨幣。官方公民投資單位(CIU)宣佈,申請人可將比特幣、以太坊等主要加密資產寫入財產證明,證明符合財務要求。不過並非代表可直接用BTC支付15萬美元捐款—— not yet taken. Rather, crypto can count toward demonstrating overall net worth and liquidity. By acknowledging digital assets as legitimate wealth, St. Kitts is integrating crypto into its due diligence framework.

尚未收取。相反,加密貨幣可以用來證明總體淨資產及流動性。聖基茨承認數碼資產屬於正當財富,將加密貨幣納入其盡職審查框架。

With this allowance come additional compliance steps. Applications involving crypto are subject to enhanced due diligence and fees. The CIU requires extensive documentation for crypto funds, including proof of ownership of the assets, full transaction histories to verify how the crypto was acquired, and third-party valuation reports at the time of application. Essentially, an applicant might need to produce exchange account statements or wallet records showing they legitimately obtained their crypto (for example, through trading or as income) and that any gains were legal. These documents help ensure the funds are not proceeds of illicit activities. If satisfied, the CIU allows the crypto to be converted to fiat and used for the investment, or simply counted in net worth calculations before the applicant liquidates a portion to make the required donation.

但有此安排亦意味著要遵守更多合規程序。涉及加密貨幣的申請要接受加強版盡職審查並需繳交額外費用。公民身份單位(CIU)要求申請人提交有關加密資金的詳盡文件,包括資產持有證明、完整交易紀錄以核實加密貨幣的來源,及申請時期的第三方估值報告。即是申請人或需提交交易所賬戶結單或錢包紀錄,以證明他們合法獲得其加密貨幣(例如透過買賣或作為收入)及相關收益來源正當。這些文件有助確保資金並非非法所得。如審查通過,CIU可允許將加密貨幣兌換為法定貨幣作為投資用途,或者直接在計算總資產淨值時計入,待申請人提取部分用來作所需捐款。

Benefits for Crypto Investors: St. Kitts and Nevis extending recognition to crypto wealth is a landmark because this program has long been considered a “platinum” standard in the investment migration industry. The country’s willingness to innovate signals greater flexibility for applicants who might have significant assets in crypto rather than cash. Investors who have a large portion of their net worth in Bitcoin, for instance, no longer need to move all of it into a bank account before even applying – they can present their BTC holdings to satisfy wealth requirements (though eventually the donation will still be made in fiat after converting a portion of those holdings).

加密投資者的好處:聖基茨和尼維斯認可加密財富是一個重要里程碑,因為其計劃長期被視為投資移民行業中的「白金」標準。該國願意創新,為擁有大量加密資產而非現金的申請人提供更大彈性。例如,大部分淨資產持於比特幣的投資者,現時毋須在申請前把所有資產轉入銀行戶口,他們可以直接展示持有的BTC來達到財富要求(雖然最終捐款仍須在轉換部分加密貨幣後用法定貨幣支付)。

Once approved, new citizens of St. Kitts & Nevis enjoy one of the best travel documents in the Caribbean. The St. Kitts passport offers visa-free travel across Europe, and under current agreements, citizens can spend up to 90 days in a 180-day period in Schengen countries and up to 6 months per year in the UK without a visa. Like Antigua, St. Kitts imposes no capital gains or income tax on individuals locally, which means crypto profits are not taxed in-country – an attractive feature for those planning to reside or structure assets there. The country also has a stable Eastern Caribbean dollar (pegged to USD) and uses the Eastern Caribbean Central Bank, providing a reasonably safe financial environment.

成功獲批後,聖基茨與尼維斯新公民可享用加勒比地區其中一個最佳護照。聖基茨護照允許歐洲多國免簽證出行,目前協議下,在申根地區每180天內可停留最多90天,在英國每年最多可停留6個月,無需簽證。與安提瓜一樣,聖基茨本地對個人不徵收資本增值稅或入息稅,即加密貨幣收益在當地無須交稅——這對打算居住或轉移資產至當地的人士極具吸引力。該國貨幣穩定(東加勒比元與美元掛鈎),並採用東加勒比中央銀行,金融環境相對安全。

Notable Considerations: St. Kitts & Nevis is known for stringent vetting of applicants – in recent years they’ve tightened their due diligence to protect the reputation of the program. The inclusion of crypto may lengthen the review process for some files, as extra verification is performed on blockchain transactions. Applicants should budget for higher due diligence fees if using crypto as part of their application, and expect potentially a few extra weeks of background checks. Additionally, St. Kitts does not currently allow dual citizenship for certain nationalities it deems high-risk, and generally, all applicants must have clean source of funds and no criminal record. The acceptance of crypto does not bypass these fundamentals; it simply adds a new avenue for legitimate wealth declaration. Overall, St. Kitts & Nevis has embraced crypto in a cautious but meaningful way, making it a top option for those who want a renowned passport and have crypto wealth to back their application.

須注意事項:聖基茨和尼維斯對申請人查核一向嚴格,近年更收緊盡職審查以維護計劃聲譽。加入加密貨幣資產可能令部分申請檔案審批時間增加,因要對區塊鏈交易作額外核實。如申請時用加密貨幣,請預留更高的盡職審查費及數星期背景調查時間。此外,聖基茨目前不容許部份高風險國籍的人士享有雙重國籍,而所有申請人普遍都要資金來源清白,且沒有刑事紀錄。加密貨幣的接納不會繞過這些基本條件,只是為合法財富聲明提供新途徑。總括而言,聖基茨和尼維斯以審慎而積極的方式擁抱加密貨幣,成為追求著名護照和擁有加密財富人士的首選之一。

4. Dominica – Longest-Running Program Embracing Crypto via Trusted Agents

Program Overview: The Commonwealth of Dominica (not to be confused with the Dominican Republic) operates one of the world’s longest continuously active citizenship-by-investment programs, launched back in 1993. Dominica’s program typically requires a monetary contribution to its Economic Diversification Fund (EDF). The minimum donation is usually $100,000 for a single applicant, with higher amounts for including a spouse or family (for example, around $175,000 for a family of four, plus fees). Dominica also offers a real estate investment route (minimum $200,000 in approved developments) as an alternative. The processing time is approximately 3 to 5 months on average, and no visit to Dominica is required to obtain the passport.

項目簡介:多米尼克(不要與多明尼加共和國混淆)營運全球歷史最悠久的持續運作投資入籍計劃之一,自1993年已啟動。該計劃一般要求申請人向其經濟多元化基金(EDF)作出資助,最低捐款額為單人$100,000,如包括配偶或家庭成員則需更高(例如一家四口約$175,000,加上相關費用)。多米尼克亦提供房地產投資渠道(經批准項目最低$200,000)作為替代。平均審批時間約為3至5個月,申請人無需親身到訪多米尼克即可獲發護照。

Crypto Integration: Dominica’s government doesn’t directly accept cryptocurrency for payments, but it has signaled openness to crypto-derived funds by allowing the use of authorized agencies that can facilitate crypto-to-fiat conversion. In practice, an investor can work with one of the licensed CBI consulting firms (such as those mentioned in industry sources like Apex Capital Partners or Citizenship Bay) to pay the required donation using Bitcoin, Ethereum, or Tether (USDT). The agency will accept the crypto on behalf of the client, convert it through legal banking channels into USD, and then deposit the fiat donation with Dominica’s government fund. This model ensures the source of funds is transparent – applicants must still provide documentation proving the lawful origin of their crypto (e.g., exchange statements, trading records) so that the funds can be treated like any other asset during due diligence. Essentially, crypto serves as the funding mechanism, even though the final payment to the government is in dollars.

加密貨幣整合:多米尼克政府本身不接受直接以加密貨幣付款,但承認經授權中介協助進行加密貨幣兌換的資金有一定彈性。實際操作上,投資者可以與經認可的CBI顧問公司合作(如業界常見Apex Capital Partners或Citizenship Bay等),用比特幣、以太幣或泰達幣(USDT)支付所需捐款。代理公司會代表客戶收取加密貨幣,然後經合法銀行渠道轉換為美元,最後將法定貨幣存入多米尼克政府基金。此模式確保資金來源透明——申請人仍需提交相關證明文件(如交易所結單、買賣紀錄),以證明加密資產來源合法,使該筆資金在審查過程中能按其他資產對待。本質上,加密貨幣只是集資方式,最終交到政府仍以法幣計價。

Dominica’s CIU has experience dealing with crypto wealth. It works closely with due diligence firms that understand blockchain transactions, making sure that any digital asset wealth is properly vetted. The use of crypto via trusted intermediaries means that from the government’s perspective, they receive fiat currency – but the investor is conveniently able to liquidate crypto without leaving the migration process. This approach has made Dominica and some of its peer Caribbean programs popular among those “moving abroad with crypto” or seeking a “Bitcoin passport,” since it reduces friction in using digital wealth for a second citizenship.

多米尼克的CIU有處理加密資產經驗,與擅長區塊鏈交易之盡職調查公司合作,確保任何數碼資產財富都能被審慎核查。允許透過可信賴中介使用加密貨幣,換句話說,政府收到的是法定貨幣,投資者則可以輕鬆在入籍過程中現金化其加密資產。這做法令多米尼克及部分加勒比項目成為希望「帶住加密出國」或尋求「比特幣護照」投資者的熱門選擇,減低以數碼財富獲得第二國籍的阻礙。

Benefits for Crypto Investors: Dominica’s passport is often cited as one of the best values in the CBI market. It grants visa-free or visa-on-arrival access to about 140 countries, including the Schengen Area of the EU, the UK, Singapore, Hong Kong and others. For crypto entrepreneurs who travel frequently, this opens up major financial centers and crypto hubs without needing separate visas. The program also allows dependent family members to be included – spouse, children (up to age 30 if financially dependent), and even parents or grandparents over a certain age can all be added, which is convenient for those looking to secure mobility for their whole family. Dominica imposes no residency requirement (you never have to live there before or after citizenship), and there are no language exams or cultural tests involved. It’s truly an investment-for-passport exchange, handled efficiently.

加密投資者的好處:多米尼克護照素來被譽為CBI市場上最具性價比之一。可免簽證或落地簽方式進出約140個國家,包括歐盟申根區、英國、新加坡、香港等。對經常出行的加密創業家而言,毋須逐個另外辦簽證即可前往主要金融樞紐。計劃同時容許包括受養家屬如配偶、子女(若經濟依賴最長可至30歲)、甚至一定年齡的父母或祖父母,可靈活將全家一起獲得流動性。多米尼克完全無居住要求(入籍前後都不用住,多留少留由你決定),亦無語言或文化考試。真正做到投資換護照,且流程有效率。

From a crypto standpoint, Dominica has been friendly. The country even announced plans to issue a national digital currency in partnership with the blockchain network TRON in 2022 (granting statutory status to certain Tron crypto tokens), highlighting its innovative stance on blockchain adoption. While that initiative is separate from the CBI program, it underscores that Dominica’s government is not averse to crypto-related ideas. Moreover, Dominica’s banking sector has frameworks for dealing with converted crypto funds, and its regulators are familiar with KYC/AML around crypto, which can make the process smoother for applicants.

以加密社群角度,多米尼克友好態度明顯。該國甚至在2022年宣布與區塊鏈TRON合作發行法定數碼貨幣(並授予部分Tron幣法定地位),展示其對區塊鏈創新應用的開放。雖然這和CBI計劃無直接關聯,但反映多米尼克政府不排斥與加密資產相關的想法。此外,多米尼克銀行界有應對加密資產兌換法幣的框架,監管者熟悉加密貨幣KYC/AML程序,令申請人辦理流程較順利。

Notable Considerations: As with other Caribbean CBIs, thorough due diligence is a cornerstone. Dominica in particular partners with independent investigative agencies to vet applicants – any hint of illicit gain (crypto or otherwise) will result in rejection. Investors must ensure their crypto can be traced back to legal sources and that they have paid any required taxes on those gains in their home jurisdiction, if applicable. Another point is that Dominica’s pricing (especially the $100k donation) is for a single applicant; adding family members raises the contribution significantly (for example, a family of four typically must donate $175k plus around $25k per additional dependent) – so the “$100k Bitcoin citizenship” often touted is really the entry-level cost. Lastly, one must convert the necessary amount of crypto into fiat for the donation. This exposes the investor to market risk (crypto volatility) – agencies usually lock in a rate or require the equivalent fiat value, so plan for that. In summary, Dominica provides a time-tested, efficient pathway to a second passport and welcomes crypto as funding through trusted intermediaries, which has kept it in the spotlight for crypto investors.

注意事項:如同其他加勒比CBI計劃,嚴謹的盡職審查是核心,多米尼克尤與獨立調查機構合作進行審核——有任何非法所得線索(不論加密貨幣或其他)均會被拒絕。投資者必需保證加密貨幣資金可追溯到合法來源,並在自己本國區域已繳清相關稅項(如適用)。另外,多米尼克的收費(特別是$10萬美元門檻)只適用於單一申請人,如加家人則貢獻大幅提升(一家四口通常需$17.5萬美元,再加每名額外家屬約$2.5萬),故「$10萬比特幣護照」往往只是入場門檻。最後,必須將指定加密資產兌換為法定貨幣用於捐款,即會承受加密市場波動風險——代理一般會設定一個固定價格或要求等值美元,請預留安排。總體而言,多米尼克提供經歷考驗且效率高的第二護照渠道,並歡迎通過可信中介以加密貨幣集資,故一直深受加密投資者關注。

5. Saint Lucia – Flexible Investment Options Paid via Crypto Conversion

Program Overview: St. Lucia is another Caribbean nation offering citizenship in exchange for investment, and it’s notable as one of the newer programs (established in 2015). The Saint Lucia Citizenship by Investment Program provides multiple routes: a donation to the National Economic Fund starting at $100,000 for single applicants ($140,000 for a couple, $150,000 for a family of up to four), or an investment in government-approved real estate projects (minimum $200,000–$300,000 depending on the project), or purchase of government bonds (a $300,000 minimum, recently adjusted) among others. Processing is relatively quick, often about 4 months, and like its neighbors, St. Lucia imposes no residency or visit requirement to obtain or keep the citizenship.

項目簡介:聖露西亞是另一個加勒比國家,亦提供投資換公民身份,並屬近年成立的新計劃(2015年推出)。聖露西亞投資入籍計劃有多種選擇:向國家經濟基金捐款(單人$10萬美元,夫婦$14萬,四人家庭$15萬)、或投資政府認可地產項目(按項目不同,最低$20—30萬美元)、或購買政府債券(近期調整,最低$30萬美元),等等。審批程序較快,通常約4個月。與鄰國類同,聖露西亞亦無設居住或訪問要求,獲批或持續保有國籍都毋須親自到訪。

Crypto Integration: Saint Lucia’s approach to crypto is similar to Dominica’s – while the official CIU doesn’t take Bitcoin or other coins directly, it allows

聖露西亞對加密貨幣的態度與多米尼克相似——雖然官方CIU不直接接受比特幣或其他幣種,但容許authorized agents and financial service providers to accept crypto payments from applicants.

授權代理人同金融服務供應商可以接受申請人用加密貨幣付款。

Several migration agencies working with St. Lucia advertise that they can take USD Tether (USDT), Bitcoin, Ethereum, or other major coins as a form of payment, converting them to fiat to pay the government fees and donation. 有幾間同聖盧西亞合作嘅移民中介公開聲稱佢哋可以接受美元泰達幣(USDT)、比特幣、以太幣,或者其他主流加密幣作支付方式,會幫你換做法定貨幣去交政府費用同捐款。

Essentially, an investor could fund their St. Lucian donation or real estate purchase by transferring crypto to an escrow or to the agent’s account; that crypto is liquidated through exchanges or OTC brokers into U.S. dollars which are then forwarded to St. Lucia’s National Economic Fund or the property developer’s account. 簡單講,投資者可以畀加密幣去第三方託管帳戶或者代理公司帳戶,嚟支付聖盧西亞捐款或者買樓。代理或者中介會將加密幣通過交易所或者OTC經紀賣出,換成美金,再轉賬去聖盧西亞國家經濟基金或者發展商戶口。

This setup means the applicant can complete the whole process without needing to leave the crypto ecosystem until the last step, which the agent handles. 咁樣申請人可以全程都唔使離開加密幣生態圈,最後轉做法定貨幣由代理負責。

As long as the applicant provides documentation (like transaction records and proof of original source of funds that bought the crypto), St. Lucia’s government is satisfied that the investment comes from legitimate money, just as if it had come from a bank account. 只要申請人提供有關文件(例如交易紀錄,同埋證明買加密幣嘅原始資金來源),聖盧西亞政府會認可呢啲資金係合法錢嚟,好似你由銀行匯款一樣。

In 2022, Saint Lucia’s officials explicitly mentioned they were open to exploring crypto contributions and even considered whether to hold some CBI funds in cryptocurrencies, though ultimately they maintained a fiat-only stance for custody. 2022年,聖盧西亞官員曾經表示樂意探討接受加密幣捐款,甚至考慮過將部分入籍計劃資金以加密幣持有,不過最後決定資產託管只限用法定貨幣。

However, by allowing the back-end conversion via agents, they effectively enable crypto-funded applications. 但係,通過授權代理進行後台兌換,實際上已經令加密貨幣資金成功應用到申請裏面。

This indirect acceptance has been utilized by many crypto entrepreneurs. 好多加密貨幣投資者都已經用緊呢個模式。

For example, someone holding a large amount of stablecoins can apply for St. Lucia citizenship by having an intermediary convert (say) 150,000 USDT into USD for the donation and fees. 例如,有人持有大量穩定幣,可以搵中間人幫佢將大約150,000 USDT換成美元來支付捐款同費用,申請聖盧西亞護照。

The key benefit is convenience and potentially speed – transferring stablecoins can be faster and easier than arranging an international wire transfer from a bank, especially for those already operating heavily in crypto. 最大優點係方便快捷——穩定幣轉帳通常比國際銀行電匯快同方便好多,特別適合同時用加密貨幣頻繁操作既人。

Benefits for Crypto Investors: St. Lucia’s passport is on par with Dominica’s, granting visa-free access to around 145 countries including all of the EU’s Schengen zone, the UK, much of Latin America, and key Asian destinations like Singapore. 對加密幣投資者嘅好處:聖盧西亞護照效力同多米尼克差唔多,可以免簽進入大約145個國家,包括歐盟申根區、英國、拉丁美洲大部分國家,同亞洲重點地點如新加坡。

This provides excellent global mobility for someone coming from, for instance, a country with a weaker passport. 對來自護照唔靈既國家的人來講,呢張護照大大提升國際流動性。

The program allows inclusion of spouse, children up to age 21 (or 30 if supported by the applicant), and even parents over 55, under one application, making it family-friendly. 呢個計劃可以一次過包括配偶、21歲以下子女(如有申請人經濟贍養可至30歲)、甚至55歲以上父母,一家人一齊申請好方便。

St. Lucia also stands out for offering multiple investment pathways (donation, real estate, bonds), so investors can choose based on their financial strategy – e.g., a crypto investor might prefer the non-refundable donation if they want a lower upfront cost, or they might choose buying property (perhaps hoping the property appreciates). 聖盧西亞仲有唔同投資路線可揀(捐款、房地產、國債),投資者可以按財務策略選擇,例如想低首期就揀捐款,想業主身份等升值就可以揀買樓。

In any case, crypto can be used to facilitate whichever route. 無論揀邊條路,用加密幣做資金都用得著。

For those concerned about taxation, St. Lucia, like most Caribbean jurisdictions, has a very favorable tax regime for individuals. 如果你關注稅務,聖盧西亞同大部分加勒比國家一樣,對個人稅制非常有利。

There are no capital gains taxes, no worldwide income tax, and no inheritance tax for St. Lucian residents or citizens. 本地居民同公民無資本增值稅,全球收入免稅,遺產稅都冇。

If a crypto investor decided to relocate to St. Lucia (not required, but possible), they would not be taxed on crypto profits earned abroad. 加密幣投資者如果選擇移居聖盧西亞(雖然唔要求),海外賺到嘅加密幣利潤係唔駛交稅。

The country is also a member of the Eastern Caribbean Currency Union, and its stable currency and regulatory environment add confidence for business or banking activities. 聖盧西亞亦係東加勒比貨幣聯盟成員,貨幣穩定,監管環境良好,做生意或者理財都加強信心。

Saint Lucia’s CBI unit is also known for being efficient and customer-service oriented. 聖盧西亞嘅入籍部門效率高,客戶服務又好。

As long as applications are complete, they sometimes approve files in as little as 3 months. 申請文件齊全,有時最快3個月就批核。

For a crypto investor, that means one could theoretically convert some Bitcoin into a second passport in hand within one quarter of a year – a compelling proposition in volatile times. 對於加密幣投資者,即係理論上可以用部分比特幣換到第二本護照,最快一季搞掂,特別係市場波動時期非常吸引。

Notable Considerations: Saint Lucia has had to implement robust due diligence after learning from older programs – expect a thorough background check. 注意事項:聖盧西亞近年加強盡職調查程序,上咗一課,查背景查得好緊。

If your wealth is in crypto, be prepared to explain the origin of the funds used to acquire that crypto. 如果你財富大部分係加密幣,記住要準備解釋買幣嘅資金來源。

This might include providing bank statements from the time you initially bought crypto, or sale agreements if you sold a business and put proceeds into crypto. 可能要俾最初買幣時期嘅銀行月結單,或者如果係賣樓/賣生意換唔到加密幣,要交交易合約。

Transparency is key; simply showing a wallet with a large balance is not sufficient for their review. 公開透明係重點;只係顯示你錢包有大額餘額係唔夠㗎。

Also, St. Lucia’s real estate option requires a hold period (usually 5 years) and those properties can be limited in resale market, so the donation is often the cleanest route for most. 另外,買樓路線有持有期(通常5年),呢啲樓盤轉售市場唔大,所以多數人最後都揀直接捐款最簡單。

Lastly, as with all these programs, the conversion rate and fees should be considered. 最後,好似所有計劃一樣,要注意匯率同手續費。

If you pay via crypto, agents might charge a fee or set a conservative exchange rate to protect against volatility. 如果用加密幣付款,代理有機會收額外費用,或者特登設定保守匯率來對沖價格波動。

Make sure to clarify the terms: e.g., is the USDT pegged 1:1, is there any premium for BTC due to price swings during conversion, etc. 記住一定要問清楚條款,例如USDT係咪1:1兌換,有冇因為比特幣浮動而加價等等。

Given those caveats, St. Lucia remains an attractive, flexible option for crypto investors seeking a quick second citizenship, and its willingness to integrate crypto via trusted intermediaries keeps it among the top choices. 考慮咗以上因素,聖盧西亞對加密幣投資者嚟講依然係個非常有彈性又吸引、想快啲另攞本護照嘅一線選擇,肯用代理整合加密幣資金特別受歡迎。

6. Grenada – Crypto-Friendly Stance and Pathway to a Valuable Passport

Program Overview: Grenada, a Caribbean island state, offers a Citizenship by Investment program that has gained attention for its geopolitical perks. 計劃簡介:格林納達係加勒比海島國,有自己嘅投資入籍計劃,因為地緣政治優勢而吸引咗唔少目光。

To obtain Grenadian citizenship, investors have two main options: a donation of at least $150,000 to the National Transformation Fund (for single applicants) or an investment in government-approved real estate starting from $220,000 (which must be held for at least 5 years). 要攞格林納達護照有兩大條路:一係向國家轉型基金捐最少$150,000美金(單人申請),一係買政府認可房地產(起碼$220,000美金,持有最少5年)。

Processing takes roughly 4–6 months. 過程大約需要4至6個月。

Grenada’s passport is strong (visa-free access to about 144 countries) and uniquely includes visa-free travel to China – a rare benefit among CBI passports. 格林納達護照實力唔錯(免簽國家大約144個),而且特別可以免簽去中國——呢點係其他入籍護照都罕有。

Moreover, Grenada is the only CBI-country that has an active treaty with the United States allowing E-2 Investor Visas, meaning Grenadian citizens can apply to reside in the U.S. as entrepreneurs. 再者,格林納達係唯一同美國有E-2投資者簽證條約嘅入籍護照國——即係話,攞到格林納達護照後可以申請E-2簽證去美國做生意同住屋。

This makes Grenada’s program particularly attractive beyond just the usual travel freedoms. 所以格林納達唔止旅行自由,對想打入美國市場嘅人更加吸引。

Crypto Integration: The Grenadian authorities have explicitly embraced applicants with cryptocurrency wealth. 加密幣整合:格林納達官方公開表示歡迎有加密幣資產嘅申請人。

The government now accepts crypto-derived funds as evidence of an investor’s net worth and source of funds, so long as those assets are fully documented and converted through approved, regulated channels. 政府現時接受由加密幣套現所得嘅資金作為財富證明同資金來源,只要你嘅加密資產有詳細證據,同經過合規渠道轉換。

While, as with others, the final investment must be in fiat (USD), the key point is Grenada’s CIU will recognize and work with crypto holdings. 雖然最尾投資都要落地成法定貨幣(美金),但重點係格林納達CIU會承認同處理加密幣持有資產。

According to one analysis, Grenada is willing to accept that an applicant’s money comes from selling Bitcoin or other crypto, as long as the crypto’s origin is legal and well-documented. 根據分析,只要來源合法、文件齊全,格林納達都接受申請人嘅錢原本係賣比特幣或其他加密幣得返嚟。

Applicants can provide portfolio screenshots, exchange statements, and letters from exchanges or custodians to substantiate their crypto wealth. 申請人可以提供資產錢包截圖、交易所對賬單、交易所/託管機構出信等等,嚟證明持有加密資產。

The funds can then be converted to dollars in a compliant way (through banks or OTC desks) for the actual donation or real estate purchase. 之後可以用合規方式(銀行或者OTC櫃枱)換做美金,正式畀錢捐款或者買樓。

This is significant because some countries’ immigration units still balk at crypto money, fearing difficulty in verification. 呢點好重要,因為有啲國家移民單位仲係抗拒加密幣錢,驚唔易查到來源。

Grenada, however, has kept pace with crypto adoption. 但格林納達其實好跟得上市場潮流。

By 2023-2024, it had put in place a regulatory framework – the Virtual Asset Business Act – to license and oversee crypto businesses. 到2023-2024年,已經有「虛擬資產商業法」,對加密貨幣企業發牌同監管。

That familiarity has translated into the CBI sphere. 咁嘅經驗亦反映到佢哋入籍領域。

In practical terms, many agencies and law firms dealing with Grenada’s program can accept Bitcoin or USDT from applicants, handle the exchange, and present the resulting fiat funds to the government. 實際上,幫手申請格林納達嘅代理公司、律師樓都可以直接收你比特幣、USDT,幫你兌換然後再將美金交俾政府。

Grenada’s CIU, comfortable with this arrangement, will review the documentation of the crypto transactions during due diligence and, if everything checks out, approve the application. 格林納達CIU對呢種安排好熟手,查踢交易紀錄冇問題就批。

Benefits for Crypto Investors: Grenada is often cited as one of the most crypto-friendly jurisdictions, not only for its CBI policy but also its domestic economic policies. 加密幣投資者嘅好處:格林納達一直被公認係其中一個對加密幣最友好嘅司法管轄區,不止入籍政策,連經濟政策都咁。

For one, Grenada imposes no capital gains tax on individuals. 首先,格林納達對個人冇資本增值稅。

This means if you’re a Grenadian tax resident (which you could be after getting citizenship, if you choose to reside there), any profit from selling or trading cryptocurrency is entirely tax-free at the personal level. 即係話,攞埋格林納達護照,選擇係當地居住成為稅務居民之後,個人炒賣加密幣所賺全部唔駛交稅。

There’s also no tax on crypto holdings (no wealth tax) and no specific cryptocurrency transaction taxes in Grenada. 持有加密幣冇稅(冇資產稅),加密幣交易都無特別稅。

The country runs on a largely territorial tax system – foreign-sourced income is often exempt for residents – which can potentially shield active crypto traders or investors who base themselves in Grenada from taxation on their global crypto earnings. 格林納達採用來源地徵稅制,居民嘅海外收入通常都免稅,對活躍嘅加密幣交易員或者投資者嚟講,可以將全球加密幣利潤避開稅務。

From a regulatory perspective, Grenada provides clarity without hostility. 監管角度而言,格林納達有透明規則,唔會無啦啦限制人。

Cryptocurrency trading and usage are legal in Grenada, and the government’s approach has been to regulate rather than restrict. 格林納達買賣加密幣合法,政府係用規管方式而唔係一味封殺。

As mentioned, the Virtual Asset Business Act (2021) and its 2024 regulations set up a reasonable licensing regime for exchanges and crypto service providers. 正如之前講過,2021年嘅虛擬資產商業法同2024年新規清晰訂明,對交易所、加密貨幣服務供應商要發牌管理。

This means crypto businesses can operate in Grenada under clear rules, and individual crypto users benefit from an environment that is not arbitrary. 咁樣加密貨幣生意可以根據好明確條例經營,用家唔怕政策朝令夕改。

For example, a Grenadian citizen running a crypto startup or fund can register it locally with regulatory approval, rather than operate in a grey zone. 例如格林納達公民創辦加密幣公司或基金,可以正正常常喺本地註冊得到監管批文,唔使行灰色地帶。

The local financial watchdog (GARFIN) oversees compliance but has moderate fees and a pro-business attitude. 本地金融監管機構(GARFIN)負責監察合規,收費寬鬆,態度親商。

Another big advantage of Grenadian citizenship for crypto folks is the previously mentioned E-2 investor visa treaty with the United States. 對加密圈人最著數之一,係用格林納達護照可以申請美國E-2投資者簽證。

Grenada is the only country with a CBI program that has this treaty. 格林納達係唯一有呢個條約嘅入籍護照國。

It means if you become a Grenadian and you have a bona fide business to invest in the U.S., you can apply for a renewable E-2 visa, allowing you (and your family) to live in the U.S. and run that business. 即係話,你揸住格林納達護照,只要有真實生意可以投資入美國,就有得申請續期E-2簽證,全家一齊過去住同執生意。

Many crypto entrepreneurs eyeing the U.S. market find this valuable. 好多想打美國市場嘅加密幣創業者都覺得呢個渠道好珍貴。

Additionally, Grenada’s visa-free list includes the UK, EU, Russia, and as noted, China – the China access can be aboon for crypto businesspeople who travel to Asia frequently.

對經常往返亞洲的虛擬貨幣業界人士來說,是一大好處。

Notable Considerations: Grenada’s CBI program does cost a bit more than some others for families (e.g., the donation for a family of four is $200,000, which is higher than Dominica/St. Lucia’s family donation). However, the value can justify it given the unique benefits. The due diligence process will examine crypto funds closely. Grenada may sometimes request that large crypto-to-fiat conversions be done via specific channels (like a well-known exchange or bank) to ensure a clean paper trail. Applicants might also need to provide a third-party audit or attestation of their crypto wallet holdings – for example, an accountant or forensic firm’s letter confirming the balances and that the coins were acquired legally. This adds to application prep time and cost, but it’s part of ensuring credibility.

值得留意的是,格林納達的公民投資計劃(CBI)對於家庭來說,費用會比某些其他國家高一點(例如,四人家庭的捐款額為$200,000,比多米尼克/聖露西亞的家庭捐款門檻高)。不過,這些獨特好處或值回票價。申請過程中的盡職調查會特別審查虛擬貨幣資金。格林納達有時會要求大額加密貨幣兌換法幣,必須通過指定渠道(如知名交易所或銀行)進行,以確保清晰的資金記錄。申請人亦有機會需提供第三方審計或資產證明,例如會計師或法證公司出具的信,證明錢包餘額及幣種來源合法。這會令申請準備時間與成本增加,但有助確保申請的可信性。

It’s also worth noting that while Grenada doesn’t tax crypto gains, the U.S. E-2 treaty option has its own implications. If one uses Grenadian citizenship to live in the U.S. on an E-2 visa, their worldwide income (including crypto gains) would then be subject to U.S. taxes because of U.S. tax residency—so careful planning is needed. For those who plan to physically remain outside high-tax jurisdictions, Grenada’s zero-tax advantage on crypto stands. Lastly, the geographic location: Grenada is a beautiful island with good infrastructure by Caribbean standards, but for those not intending to relocate there, this may be moot. However, it could be a future-friendly place if one ever needed to spend time in a crypto-welcoming, low-tax environment. All said, Grenada’s combination of an open attitude to crypto wealth, a strong passport, and extra U.S. treaty benefits cements its place in the top ranks for crypto citizenship options.

另外,雖然格林納達並不對加密貨幣資本利得徵稅,但如果利用格林納達國籍去美國申請E-2條約投資簽證並在美國居住,則會因成為美國稅務居民,而需要就全球收入(包括加密貨幣獲利)申報美國稅,因此要求有周詳規劃。至於本身不打算搬去高稅國家的人士,格林納達對虛擬貨幣零稅率的優勢依然保留。最後從地點來看:格林納達是個加勒比海地區基建不錯的美麗小島,但如果你原本沒打算遷居,也未必有影響。不過,萬一日後需要長時間逗留一個對虛擬貨幣友善、低稅的環境,格林納達亦是理想選擇。綜合來說,格林納達對加密資產的開明態度、強大的護照以及美國條約額外益處,令其穩佔虛擬貨幣公民身份方案的頂尖之選。

7. Portugal – Golden Visa Residency with Crypto-Funded Investments

Program Overview: Portugal has been a magnet for crypto investors in recent years, thanks to its combination of lifestyle, tax benefits, and residency-by-investment program (known as the “Golden Visa”). The Portugal Golden Visa grants a renewable residence permit in Portugal (an EU country) in exchange for qualifying investments. Traditionally, buying real estate worth €500,000 was the most popular route. However, since 2022–2023, the program shifted focus away from metropolitan real estate and towards alternatives like €500,000 investments in regulated investment funds, €500,000 in scientific research, or €250,000 in cultural heritage support. The investment-fund route has become prominent – investors put at least €500k into a Portuguese venture capital or private equity fund that is approved for Golden Visa purposes. After maintaining the investment and meeting minimal stay requirements (just 7 days in the first year and 14 days in each subsequent two-year period), one can renew the residency and become eligible for permanent residency or citizenship after five years (note: a pending law may extend this to 10 years for citizenship).

計劃簡介:葡萄牙近年成為虛擬貨幣投資者新熱點,結合了生活質素、稅務優惠及投資移民(即“黃金簽證”)的吸引力。葡萄牙黃金簽證只要合資格投資,即可獲得可續期的葡國(歐盟國家)居留許可。過往主流是購買價值至少€500,000的不動產;不過2022-2023年後,計劃已由大城市房產轉移至其他選擇,如於受監管投資基金投資€500,000、科研€500,000或文化遺產支援€250,000等。當中以投資基金方式最受矚目 —— 投資者只需向獲批黃金簽證的葡萄牙創投/私募基金注資最少€50萬。維持投資並符合極低居住要求(首年只需7天,往後每兩年14天),可續期並於5年後有資格申請永久居民甚至入籍(註:最新法案或將國籍申請期延長至10年)。

Crypto Integration: While Portugal does not allow paying the Golden Visa investment in Bitcoin directly, it has effectively created pathways for crypto holders to participate. Several investment funds geared towards Golden Visa applicants accept subscriptions funded by crypto wealth. For instance, there are Portuguese funds that invest in blockchain startups or even hold a percentage of assets in crypto – often marketed as “crypto-friendly funds.” Examples include a so-called “Golden Crypto Fund” that mixes bonds with up to 35% Bitcoin exposure, or venture funds targeting Portuguese crypto and fintech startups. An investor can use their crypto gains to invest in such a fund by first converting crypto to euros through a bank or exchange; the converted euros are then placed into the fund to meet the Golden Visa threshold. Essentially, the role of crypto is indirect: it’s the source of the money, but it becomes fiat when actually invested.

加密貨幣參與方式:葡萄牙不允許直接用比特幣支付黃金簽證投資金額,但實際上已為加密貨幣持有人開闢參與通道。現時多個專為黃金簽證設立的投資基金,接受以虛擬貨幣變現的資金。例如有基金專注於區塊鏈初創,甚至部分持有加密貨幣資產 —— 常標榜為「加密友善基金」。如某「黃金加密基金」同時持有高達35%比特幣,亦有針對葡國加密和金融科技初創的創投基金。投資人可將加密貨幣結算成人民幣或歐元,注資到基金以符合理門檻。換言之,加密貨幣只是資金來源,本質於實際投資時已轉成法定貨幣。

However, what makes Portugal special is the broader crypto-friendly environment that complements the Golden Visa. For many years, Portugal famously did not tax individual crypto trading profits at all if the activity wasn’t a professional business. As of 2023, Portugal introduced a tax (20% rate) on short-term crypto gains (held under 1 year), but long-term holdings (over one year) by individuals are still exempt from capital gains tax. This favorable tax rule means a Golden Visa holder who moves to Portugal could potentially liquidate large crypto positions after a year and realize gains tax-free under domestic law. Moreover, Portugal has a “Non-Habitual Resident (NHR)” regime that can provide additional tax breaks for 10 years on foreign income, which many expatriates use.

葡萄牙的獨特之處,在於整體加密貨幣友善氛圍與黃金簽證相互配合。多年來,個人只要非專業買賣,葡萄牙對虛擬貨幣交易獲利一律免稅。2023年起,只針對短線(持有不足一年)加密獲利徵收20%,持幣超過一年則個人依然豁免資本增值稅。這個有利稅制,意味黃金簽證持有人若遷居葡萄牙,只要手持加密貨幣一年後沽出,便有望合法免稅。此外還有「非習慣居民(NHR)」稅制,10年內外來收入再享豁免,最適合僑民。

To cater to Golden Visa applicants with crypto, Portuguese banks and lawyers have developed expertise in source-of-funds verification for crypto. Applicants typically must show how they obtained the €500k – if it’s from crypto, that means providing documentation like trading logs, proof of initial purchase, etc. Local institutions, having seen many crypto investors apply, are becoming more adept at handling this without outright rejecting crypto-based wealth. There are even services that will issue a formal report tracing your wallet’s history to satisfy any compliance questions.

為服務持有加密資產的黃金簽證申請人,葡國銀行與律師已非常熟悉核實虛擬貨幣資金來源。申請人通常需解釋€50萬的來歷——如果來自虛擬貨幣,則需附上交易紀錄、購買憑證等。隨着加密投資者申請急增,當地機構愈來愈擅長處理這類客戶,少有一刀切拒收虛擬資金。坊間更有專人出具錢包來源追蹤報告,應付合規審核要求。

Benefits for Crypto Investors: The Portugal Golden Visa is a residency (not immediate citizenship), but it’s one of the few routes into the European Union for crypto entrepreneurs that doesn’t require abandoning crypto activities. Benefits include the right to live, work, and study in Portugal and travel freely across the 26 Schengen countries. Crucially, after five years of holding the Golden Visa (and maintaining the investment), one can apply for Portuguese citizenship – gaining an EU passport – without having to live in Portugal full-time. The physical presence requirement is minimal (an average of 7 days/year), which is perfect for digital nomads or those frequently on the move. If the proposed law extending the wait to 10 years takes effect, that timeline could double, but even so, Portugal remains one of the faster paths to EU citizenship available.

對加密投資者的好處:葡萄牙黃金簽證屬居留權(非即時入籍),但乃極少數毋須放棄加密活動即可通往歐盟的路徑。優勢包括可居住、工作、讀書於葡萄牙,自由出入26個申根國家。最重要是持黃金簽證5年及維持投資後,可申請葡萄牙國籍 —— 獲得歐盟護照,而且不需要長期定居葡國,逗留要求極低(每年平均只需7日),非常合適經常流動的數碼遊牧族。如果「10年入籍」法案真落實,入籍年期會加倍,但比起大多數歐盟路線,依然是捷徑之一。

Portugal’s pro-crypto stance extends beyond taxes. The country has a growing blockchain startup scene (particularly in Lisbon) and has hosted major conferences like the Web Summit where crypto features prominently. The government has not taken harsh regulatory actions against crypto businesses; on the contrary, it has issued clear rules (for example, defining how exchanges should be licensed) while fostering innovation. This means as a resident, you can be relatively confident that the regulatory environment won’t suddenly turn hostile to crypto.

友善虛擬貨幣的政策不止稅務上。當地区塊鏈初創生態漸成規模(特別在里斯本),並舉辦過如Web Summit等大型國際會議,虛擬貨幣元素濃厚。政府對加密產業管制並不苛刻,反而積極制定清晰規則(如虛擬貨幣平台牌照要求),同時鼓勵創新。作為居民,不太擔心環境會突然轉向敵視加密資產。

Another big plus: quality of life. Many crypto investors have relocated to Lisbon, attracted by the mild climate, safety, and vibrant community. Even if you don’t fully move, spending your 7 days a year in Portugal can be quite enjoyable. English is widely spoken, and services are modern. For those who do choose to reside, Portugal’s cost of living is moderate by Western European standards.

另一優勢是生活質素。很多虛擬資產投資者選擇移居里斯本,貪其氣候溫和、治安好、社群活躍。即使不常住,一年逗留7日都很寫意。當地英語普及,配套又現代。真要定居,葡萄牙生活成本以西歐標準仍屬適中。

Notable Considerations: The Golden Visa program in Portugal has been undergoing changes. As mentioned, the government moved to end the program’s real estate option in major cities to cool the housing market. By mid-2025, it was still possible to invest in real estate in interior regions, but most crypto folks prefer the fund route to avoid property management hassles. The legislative debate about extending the citizenship timeline to 10 years created some uncertainty, but even if extended, Golden Visa holders would still enjoy residency and EU mobility in the interim. Another consideration is bureaucratic delays – Portugal has faced backlogs in processing Golden Visa applications, sometimes taking over 12 months to schedule biometric appointments or approvals. This has been frustrating for applicants. In other words, even if the law says 5 years to citizenship, practical delays might stretch that.

注意事項:黃金簽證計劃現正持續調整。正如上文所述,政府為壓抑樓市,取消大城市房地產選項。截至2025年中,偏遠地區仍可買樓申請,但多數加密族群為省卻管理物業麻煩,傾向揀基金路徑。至於將入籍年期延至10年的立法爭議帶來不確定性,但即使延長,黃金簽證持有人期間仍享有居留與歐盟自由流動。另需留意官僚延誤 —— 近年葡萄牙處理申請嚴重積壓,有時單是預約指紋、審批等已等逾一年,令申請人沮喪。換言之,法律列明5年可入籍,實際時間或會更長。

From the crypto perspective, one must also be mindful of compliance: moving large sums from crypto into Portugal’s financial system will trigger scrutiny. Ensure that any crypto profits you convert have been declared if needed in your home country, and that you use reputable exchanges or OTC brokers. Portuguese banks sometimes temporarily freeze or question incoming large transfers (especially from crypto-related sources) until additional documentation is provided. Working with a lawyer who has handled crypto-funded Golden Visas can smooth this over.

從加密資產角度,必須留意合規風險:將大額加密資金轉進葡國金融體系會觸發審查。應確保你結算出來的虛擬資產利得(如有需要)已於原居國申報,並選用有信譽的平台或OTC過數。葡萄牙銀行偶爾會臨時凍結或查問大額入帳(特別源自加密平台),直至你補交文件。合作過加密資金辦黃金簽證的律師能幫你減少阻滯。

In summary, Portugal doesn’t let you plonk down Bitcoin at a government counter for a visa. But it does let crypto wealth pave the way to EU residency and eventually citizenship, through investment vehicles tailor-made for crypto-savvy applicants and a national policy mix that is arguably the friendliest in Europe toward cryptocurrency holders. That makes it an indispensable entry on this list.

總結就是,葡萄牙暫時未能讓你直接拎住Bitcoin走去政府櫃檯辦簽證。但它的確讓虛擬資產成為通往歐盟居留、甚至國籍的捷徑,而且為加密市場度身訂造多元投資渠道,配合全歐洲最友善的加密政策,絕對是本榜單不可缺少的選擇。

8. El Salvador – The World’s First “Bitcoin Citizenship” Program

Program Overview: El Salvador made global headlines by becoming the first country to adopt Bitcoin as legal tender in 2021. In line with its crypto-forward reputation, the Salvadoran government launched the “Freedom Visa” program in December 2023, designed specifically to attract Bitcoin investors. The program offers immediate permanent residency and a rapid path to citizenship for those who commit a substantial investment in cryptocurrency. The headline requirement is a $1 million investment in Bitcoin or Tether (USDT), which qualifies an individual (and their family)

計劃簡介:薩爾瓦多於2021年成為全球第一個將比特幣定為法定貨幣的國家,震撼全球。配合其推動虛擬貨幣政策的聲譽,薩爾瓦多政府於2023年12月推出 “自由簽證” 計劃,專為吸引比特幣投資者而設。此計劃讓承諾投資大量加密資產人士可即時獲得永久居留權,以及快速取得國籍的渠道。申請門檻為用比特幣或Tether(USDT)投資最少100萬美元,合資格者(連其家庭)以下是翻譯內容(已根據您的說明跳過 markdown 連結):

申請Freedom Visa(自由簽證)。此計劃每年名額上限為1,000名投資者,以保持獨特性並管理資金流入。值得注意的是,與傳統投資者簽證可能接受股票或現金不同,薩爾瓦多的計劃明確僅限加密貨幣——該計劃是與Tether合作推出,被標榜為全球首個全加密貨幣資金支持的入籍途徑。

加密貨幣整合:薩爾瓦多的做法獨特,允許申請人直接用加密貨幣向政府付款。整個流程分為兩步:首先,申請人需要繳交一筆不可退還的申請審查按金,數額為$999美元,以BTC或USDT支付。這筆費用用於申請處理及背景審查。使用加密貨幣相當直接——申請人實際上只需將約0.03枚BTC(以2025年中價計)傳送到政府指定錢包。當申請經審批並獲批(近期初審大約需時6星期),申請人接著必須投資餘下的$999,001美元(湊夠$1,000,000總投資額)到薩爾瓦多。投資可以是各種獲批選項——例如購買政府債券、基建或科技項目融資,甚至可能是指定公私合營計劃的股權。最關鍵是,整筆投資也可用Bitcoin或USDT完成。政府與Tether合作,確保加密貨幣的轉換和保管流暢進行。Tether介入理論上確保若有人傳送$1M USDT,代幣會迅速兌換成等值法幣或以其他方式托管,令政府能使用資金,而投資者的義務亦以加密方式履行。

總結來說,薩爾瓦多的計劃完全繞過法幣中介:只要你有足夠加密貨幣,全程無需電匯美元。政府本身願意收取及持有加密貨幣(或由Tether協助兌換成穩定資產)。這與其他計劃必須進入傳統銀行體系的步驟大相徑庭。由於薩爾瓦多已將比特幣法定化,政府直接視加密貨幣為有效付款工具。甚至連居留卡及申請流程也配合加密貨幣付款而特別調整,方便快捷。

值得一提的是,2025年初薩爾瓦多立法機關有修改《比特幣法》,使商戶接受BTC屬自願(回應IMF要求),但這不影響Freedom Visa框架——該計劃本身在全國正式普及比特幣後才制定,政府至今仍極為親加密。只是取消了所有店舖“必須接受BTC”的強制要求;然而比特幣仍屬法定貨幣,而政府在其項目內當然依然接受加密付款。

對加密投資者的好處:Freedom Visa即時為申請人提供薩爾瓦多永久居留,且有快證入籍通道。雖非即時入籍,但遠比一般歸化手續快捷。有成功申請者反映,獲批居留後最短僅需6至12個月即成為公民,因為加速歸化過程已寫入計劃。基本上,只要投資$1M美元指定項目,總統有權豁免傳統需多年的居留門檻,令投資者可於短期內申請薩爾瓦多護照(具體時間視乎個案審批,但明顯比一般5年以上快得多)。這意味大約一年內,已可擁有薩爾瓦多護照,現時可免簽前往134國,包括整個歐盟申根區、英國、日本、新加坡及絕大部分美洲。此外,有一項較少人知道的額外福利:薩爾瓦多公民在西班牙居住兩年後可合資格申請西班牙國籍(西班牙對前殖民地公民有特別規則),對打算遷居歐洲者是進一步入歐門票。

另一優點是,薩爾瓦多對比特幣的收益徵收零資本增值稅,因其為法定貨幣(這點即使經過IMF談判後仍保留)。總體而言,薩爾瓦多對加密貨幣極度友好:比特幣買賣、持有均免稅,科技企業亦享受額外稅務優惠。Freedom Visa參加者同時以資金支持國家發展項目,政府亦強調這是推動國家(教育、科技、基建等)繁榮的方式。對於有理想、信仰比特幣願景的投資者,支持薩爾瓦多這大膽試驗具有哲學層面的吸引力。

值得留意,Freedom Visa涵蓋整個家庭——投資者可包括配偶、子女(包括已成年受養子女)及受養父母於同一投資下。雖然$1M門檻很高,但不論是一人還是五人家庭,費用一樣。所有家庭成員均同享居留及加速入籍時間表。所批居留無需實際居住——毋須身在薩爾瓦多亦可保留身份、甚至取得國籍。實際上,這正是一個投資換護照的計劃,只不過選用了加密貨幣這非一般途徑。

需要注意事項:門檻高——$1,000,000要用加密貨幣支付,自然只針對極富有的幣圈人士。有別於加勒比海多個起步僅$100k的項目,這項針對超高淨值群體。此外亦要考慮政治風險:薩爾瓦多推動比特幣政策主要靠現任總統Bukele——他國內極受歡迎,特別是大力打擊罪案帶來治安明顯改善。但未來一旦政局有變,相關比特幣措施或有機會被調整(雖然已批入籍者受法律保障,難以推翻)。目前為止,Bukele政黨掌權穩固,國家仍明確加碼加密,例如推動“比特幣城市”,發行比特幣債券等。

另外,薩爾瓦多護照不俗(134國免簽),但無美國或加拿大免簽(大多數護照都不行),且目前無中國免簽(對這市場有興趣者注意,部分加勒比護照如格林納達則可)。不過基本涵蓋全歐,被譽為拉美最強護照之一。

還有投資機會成本需要考慮:專門將$1M比特幣鎖定於這個計劃(資金需投向政府指定投資,可能鎖定一段時間或存在一定風險)而非其他投資產品。而實際架構未必完全清晰,未來能否收回本金、獲得回報,還是純費用,需要更多官方說明。最初$999是手續費,$999,001則進入投資部份,或有機會產生收益(如屬純投資而非捐款,或有機會取回——有待進一步官方資料)。

最後,即使比特幣不再強制用於消費,薩爾瓦多仍然圍繞加密貨幣運作。當地生活多方面可用比特幣支付,政府設有Chivo錢包系統——真要移居,會發現很便利。而美元亦是法定貨幣,全國普遍流通。另值得幣圈移居者注意,薩爾瓦多治安顯著改善。由於嚴厲打擊幫派,2025年兇殺率創歷史新低,現時可能比美國許多城市更安全。但當地生活文化始終是個人取向——不過最大便利是,毋須居住一樣有護照。

總結來說,薩爾瓦多比特幣支持簽證/入籍計劃,開創先河,直接將加密財富轉化為第二國籍手段。成本確高,但方案全面,無需傳統法幣手續,可短期內獲准新國籍。對真正重視加密資產者,薩爾瓦多自我定位為避風港,極有競爭力,只不過名額針對少數人。

9. 哈薩克斯坦 – 新興加密中心提供10年期「黃金簽證」

Program Overview: In May 2025, Kazakhstan – a resource-rich nation straddling Central Asia and Eastern Europe – launched its first formal residence-by-investment program. This “Golden Visa” is actually a 10-year renewable residency permit (not citizenship) aimed at attracting foreign capital. The required investment is $300,000 (USD), which must be invested either as equity in a local Kazakhstani company or in government-approved securities/bonds. Once the investment is made and verified, the applicant receives a residency card valid for 10 years and can be renewed thereafter, as long as the investment is maintained. Family members (spouse and dependent children) are included under the same permit, enjoying the right to live, work, and study in Kazakhstan. This program makes Kazakhstan the first country in Central Asia to offer a long-term investor visa akin to Golden Visas in Europe.

It’s important to note that this residency does not directly lead to citizenship in the way an outright CBI program would. Kazakh citizenship has separate stringent requirements (at least 5 years of residency, language proficiency in Kazakh or Russian, and renouncing previous citizenship, since Kazakhstan typically doesn’t allow dual citizenship). So this is more of a long-term residency solution – essentially a base to live and do business, with potential for naturalization down the road if one fully integrates and gives up other nationalities.

基本上,這是一個可以居住和做生意的基地,如果你完全融入當地並放棄其他國籍,日後有機會申請入籍。

Crypto Integration: Kazakhstan has been actively trying to brand itself as crypto-friendly, especially after China’s crackdown on Bitcoin mining in 2021 led many miners to move to Kazakhstan’s cheap energy environment. The new Golden Visa, however, currently requires the $300k investment in fiat currency; the legislation did not explicitly provide for crypto contributions. Investors must convert any crypto to dollars or tenge (the local currency) and invest through normal channels. That said, the overall environment in Kazakhstan is very welcoming to crypto businesses and innovation. The Ministry of Digital Development has publicly pushed for initiatives like creating a national crypto asset reserve, licensing banks to handle crypto transactions, and even considering a state-supported crypto exchange. There is also the Astana International Financial Centre (AIFC) in the capital (Nur-Sultan, formerly Astana) which is a special economic zone with its own legal system (based on English common law) and a regulatory sandbox for fintech and crypto ventures. AIFC has already issued licenses to crypto exchanges and even hosted pilot projects for crypto trading under oversight.

加密貨幣融入:哈薩克一直積極推廣自己為親加密貨幣的國家,特別是自從中國於2021年打擊比特幣挖礦後,很多礦工轉移到哈薩克享用便宜的能源。不過,現時的新黃金簽證要求以法幣投資30萬美元,法例上未有明文接納以加密貨幣作投資。投資者必須將任何加密貨幣兌換成美元或本地貨幣(堅戈),並透過一般途徑作出投資。不過哈薩克整體對加密貨幣業務以及創新非常友好。數碼發展部公開推動多項措施,包括成立國家加密資產儲備、發牌予銀行處理加密貨幣交易,甚至考慮建立國家級加密貨幣交易所。首都努爾蘇丹(前稱阿斯塔納)設有「阿斯塔納國際金融中心」(AIFC),這是個有自己法律體系(以英國普通法為基礎),並為金融科技和加密業務提供監管沙盒的經濟特區。AIFC已經批出牌照予多家加密貨幣交易所,更有進行加密交易的試點項目。

All these moves signal that Kazakhstan may integrate crypto more directly into its investment programs in the future. For now, licensed intermediaries in Kazakhstan can assist in converting crypto to fiat for meeting the Golden Visa criteria. It’s plausible that if demand is seen, the government might allow a portion of the $300k to be in crypto or simplify conversion via state channels. But as of 2025, the prudent path is to liquidate your crypto through a legal exchange (perhaps even at the AIFC exchange) and then invest the proceeds into, say, shares of a Kazakh company or bonds, to qualify.

這些措施都顯示哈薩克未來可能會更直接地把加密貨幣納入投資移民計劃。目前,哈薩克的持牌中介可以協助投資者把加密貨幣轉成法幣,以符合黃金簽證的條件。可以預見,如果需求高,政府或容許部分30萬美元可以用加密貨幣滿足,或透過官方渠道簡化兌換程序。但截至2025年,較穩妥的做法仍然是先通過合法交易所(甚至AIFC交易所)將你的加密貨幣變現,然後再將資金投資到哈薩克公司的股份或債券之類資產上,以符合資格。

Benefits for Crypto Investors: Kazakhstan’s appeal to crypto investors is partly strategic and partly financial. Strategically, Kazakhstan is positioning itself as a regional crypto hub – it’s at the crossroads of Europe and Asia, bordering China and Russia, and not far from key markets in the Middle East. Having a base here could be useful for entrepreneurs interacting with CIS countries or looking at emerging markets. The country has abundant inexpensive energy, which has already attracted crypto mining operations; the government, rather than banning mining, has tried to regulate and even tax it modestly, indicating a willingness to incorporate crypto industries rather than exclude them.

對加密貨幣投資者的吸引力:哈薩克吸引加密貨幣投資者既有策略性,也有財務上的原因。策略上,哈薩克正積極打造自己為地區性的加密金融樞紐,地理位置正好位於歐亞交匯,與中國和俄羅斯接壤,亦鄰近中東主要市場。對於經常與獨聯體國家有生意往來、或有意深耕新興市場的創業者而言,在哈薩克建立基地有其價值。哈薩克能源資源豐富且廉價,吸引了大量加密礦場落戶;政府選擇對挖礦活動規管,並徵取適度稅項,而非施行禁令,顯示出願意包容和納入加密產業,而非排斥。

Financially, the Golden Visa is relatively affordable at $300k compared to many European Golden Visas which ran €500k or more. And unlike those, Kazakhstan’s permit lasts 10 years straight (most others require renewals every 2 years or so). Kazakhstan also provides significant tax incentives: there is a flat 10% income tax rate, one of the lowest globally. Additionally, certain foreign-sourced income might be exempt for residents (Kazakhstan has flirted with territorial tax principles for foreigners, especially in the AIFC zone). So a crypto trader residing in Kazakhstan might benefit from relatively low taxation, depending on the structuring. The AIFC offers even zero tax for 5-10 years for companies registered in that zone, which could include crypto exchanges or startups.

財務上,黃金簽證所需的30萬美元相對不少歐洲黃金簽證(往往要€50萬或以上)較平。與其他國家不同,這裏的身份有效期一批便有10年(很多歐洲類似身份每兩年要續期)。哈薩克亦有吸引的稅務優惠:利得稅一律10%,全球數一數二的低。此外,某些外來收入對居民或可豁免徵稅(哈薩克對外國人在AIFC區實行類似地域稅制的原則)。因此,一個在哈薩克定居並合理安排架構的加密貨幣交易者,有機會享受到全球較低的稅負。AIFC更對在該區註冊的公司(包括加密貨幣交易所及初創)免稅5至10年。

Another plus is the inclusion of family – one $300k investment covers spouse and kids, making it a potentially good Plan B for a family. Unlike citizenship programs, there’s no additional fee per dependent for the visa (though there might be nominal processing fees).

另外,該計劃包括家庭成員——只需一筆30萬美元投資便可涵蓋配偶和子女,對於一家人來說是不錯的B計劃。與某些入籍項目不同,這種簽證對每個家屬不會再收額外費用(但可能有行政費)。

Quality of life in cities like Almaty and Nur-Sultan is also decent, with modern infrastructure. Kazakhstan is culturally welcoming to foreigners; many people speak English in business circles, and Russian is widely used (which many international folks pick up). The cost of living can be much lower than in Western countries.

阿拉木圖、努爾蘇丹等大城市的生活水平也不錯,基建現代。哈薩克社會對外來人口普遍友善,商業圈內不少人會講英文;俄文亦被廣泛使用(不少外國人會學幾句)。生活成本比起西方國家可能低好多。

Notable Considerations: The residency is conditional on maintaining the investment. If the investor pulls out the $300k from the company or sells the securities before 10 years (or without renewing properly), the residency can lapse. It’s not a one-time donation like in the Caribbean; it’s a real investment that ideally should generate returns or at least preserve principal. Therefore, one should do due diligence on where to invest – e.g., putting $300k into a stable Kazakh company or in government bonds (if allowed) might be wise for capital preservation.

注意事項:這個居留身份要根據投資才可維持。如果投資者在10年內將30萬美元撤出相關公司,或提早賣掉證券(或未有適當續期),身份會失效。這不同於加勒比海那些「一次性捐款」計劃;這裏是真正的投資,最好能夠有回報或最少保本。因此,投資地點要謹慎選擇,例如放在穩健的哈薩克公司或國債(如政策容許)或許較為穩妥。

Kazakhstan’s political system is stable but essentially an authoritarian republic; it went through a leadership transition in 2019 and some unrest in 2022. The government remains keen on foreign investment and is unlikely to jeopardize a flagship program by policy whim, but it’s a different environment than EU or Commonwealth nations. Laws can change – for instance, while dual citizenship is not allowed for locals, they haven’t clarified how it would work if a foreign investor later qualifies for citizenship (likely you’d have to renounce originals). But since most investors view this as a residency, not immediate passport, it’s not a concern unless planning for the very long term.

哈薩克的政治體制算是穩定,但基本上屬於威權型共和國;2019年曾有領導層過渡,2022年也發生過一些動亂。政府極度重視外資,不太可能突然以政策影響這個旗艦計劃,但這裏始終與歐盟或英聯邦成員國的投資環境有異。法例亦有可能改變——例如本地人不能雙重國籍,而對外國投資者將來如果符合入籍資格會如何處理則未有清楚指引(很大可能需要放棄原有國籍)。但大部分投資者其實都當這是「居留權」而非「即時護照」,除非你計劃極長遠,否則暫時不用太擔心。

Also, as a predominantly Muslim-majority country (secular state), and a former Soviet republic, there are cultural differences. However, most crypto investors would probably treat Kazakhstan as a business base rather than a personal liberty paradise – though it is quite free in many respects (religious freedom, relatively open internet except some political censorship, etc.).

此外,哈薩克是以穆斯林為主的世俗國家,也曾經是蘇聯加盟共和國,文化上有些不同。不過多數加密貨幣投資者都是把這裏當做生意基地,而非追求個人自由的天堂——雖然哈薩克在多方面都挺自由(宗教信仰寬鬆、網絡較開放,雖然有些政治審查等情況)。

Finally, climate and location: Kazakhstan is landlocked and can be very cold in winter, especially in the north (Nur-Sultan is one of the coldest capitals). Almaty is milder and more cosmopolitan. If you were thinking of actually living there, these factors matter – if not, holding a residence permit to occasionally visit might be fine.

最後是地理和氣候:哈薩克是內陸國家,冬天特別北部(努爾蘇丹)會非常寒冷——是全世界最凍的首都之一。阿拉木圖則較溫和、更有國際大都會氣息。如果你真打算長期居住,這些因素要認真考慮。否則純粹偶爾到訪,持有身份證也沒問題。

In conclusion, Kazakhstan’s new Golden Visa is a promising option especially for those looking at frontier markets and a jurisdiction actively courting crypto business. While you still need to translate your crypto into a traditional investment, the nation’s embrace of crypto culture and its business incentives make it an intriguing addition to the list of crypto-friendly destinations.

總結:哈薩克新黃金簽證對於想發展前沿市場、或尋求積極親近加密市場的法域來說,是個具吸引力的選擇。雖然你仍需將加密貨幣兌換成傳統投資,但哈薩克對加密產業的擁抱和各種商業優惠,確實令它成為加密友好地點清單中不可忽視新星。

10. Cayman Islands – Crypto-Friendly Residency in a Tax Haven via Investment

Program Overview: The Cayman Islands, a British Overseas Territory in the Caribbean, doesn’t offer citizenship-by-investment per se (very few can actually become Caymanian citizens except through a lengthy residency and British naturalization process). However, it offers prestigious permanent residency visas for wealthy investors, which can eventually lead to British Overseas Territory citizenship and even UK citizenship in the long run. The main route is the Residency Certificate for Persons of Independent Means. To qualify, an individual typically must invest around KYD 2 million (approximately USD $2.4 million) in real estate in the Cayman Islands and demonstrate a stable annual income and substantial net worth. Alternatively, there is a 25-year renewable residency for those who invest at least KYD 1 million in Cayman (with some in property) and maintain financial solvency. The exact amounts and criteria can vary, but essentially, if you invest a few million dollars and have a proven high income, Cayman will grant you the right to reside indefinitely (with no work permit needed, though you can’t take up local employment unless you invest in a business).

計劃簡介:開曼群島是英國在加勒比海的海外屬地,並沒有所謂的「投資入籍」計劃(極少人能真正成為開曼公民,除非經過長期居留及最後英國入籍程序)。但它向高淨值人士提供極具地位的永久居留權,長遠來說最終可以申請英國海外屬地公民身份,甚至再進一步成為英國公民。最主要門路是「獨立資產人士居留證」:一般需在開曼房地產投資約200萬開曼元(約240萬美元),同時證明有穩定年收入及高淨值。另有一種方案,為投資至少100萬開曼元(部分要投資房產)並保持資產穩健的,則可獲續簽25年的居留權。不同類別條件略有出入,但基本上只要你投入數百萬美元並能證明收入,開曼便會批你無限期居住(無須工簽,但不可受僱本地工作,除非自己開公司)。

While citizenship in Cayman (which is essentially British citizenship via the territory) is a very distant prospect (one could apply after, say, 5 years for naturalization as a BOTC and then for full British citizenship after 12 months as a BOTC – but those are not guaranteed), the residency by investment gives you a safe haven in one of the world’s most affluent, low-tax jurisdictions.

至於真正的「公民」身份(即最終成為英國公民),是非常遙遠的目標(例如居住5年後可申請成為英國海外屬地公民,再居12個月後才可申請英國公民——但兩步並無保證)。但投資取得的永久居留權,令你在全球最富裕、低稅的地區有一個安全基地。

Crypto Integration: Cayman Islands is a major global financial center and has also become a hub for crypto funds and exchanges. There is no specific “crypto passport” scheme, and officials have clarified that Cayman does not offer a special citizenship-by-investment linked to crypto. However, in practice, crypto investors can leverage their assets to meet the investment criteria for residency. Notably, some real estate developers and brokers in Cayman will facilitate property purchases using cryptocurrency. For instance, an investor might buy a luxury condominium in Grand Cayman for $3 million and pay in Bitcoin via an intermediary service; the seller or broker converts the Bitcoin to USD (or keeps it if they choose) and the sale proceeds normally. By doing so, the investor fulfills the requirement for the residency certificate (having invested the required amount in property) using crypto wealth as the source of funds.

加密貨幣應用:開曼是全球金融中心,也是加密基金和交易所熱點之一。這裏沒有特設「加密護照」計劃,官方亦明言無設專為加密資產的投資入籍方案。不過,實際操作上,加密貨幣投資者的資產可用來滿足居留資格。有部分地產發展商或中介願意協助以加密貨幣購房,例如投資者想在Grand Cayman買一個價值300萬美元的豪宅,可透過中介用比特幣付款,由賣家/中介將BTC兌換成美元(或選擇保留),交易就正常進行。如此,投資者即成功以加密資產「轉化」成房產,達到居留門檻。

Cayman’s government itself has been friendly to blockchain businesses. They have a regulatory framework for virtual asset service providers (VASPs) that is considered sensible, and many crypto hedge funds and decentralized finance projects are domiciled in Cayman for its regulatory advantages. There’s even a community of crypto professionals living on the islands, drawn by the zero income tax and high quality of life. So, while you cannot pay government fees in Bitcoin, every other element – from demonstrating net worth to making qualifying investments – can involve crypto conversion. The process would involve converting crypto to fiat through a reputable channel to deposit into a Cayman bank or directly into the investment (since any large transaction will be scrutinized, one must ensure the crypto origin is clear and it’s converted via a compliant exchange).

開曼政府對區塊鏈企業十分友善,為虛擬資產服務供應商(VASP)訂立了完善監管規則,並憑藉監管優勢吸引大量加密資產對沖基金與DeFi項目註冊。當地形成了加密專業人士社群,為零所得稅和高生活質素而來。雖然政府費用仍未可用比特幣支付,但其他步驟——由證明資產、到進行合資格投資——都可以加密資產轉換作基礎。通常流程需經可信渠道將加密貨幣換成法幣,存入開曼銀行或直接用作投資(因大筆交易會被審查,所以必須有陳述資金來源,且須以合規交易所兌換)。

Benefits for

好處包括Crypto Investors: The Cayman Islands is often synonymous with “tax haven”. There are no personal income taxes, no capital gains taxes, no corporate taxes, and no estate or inheritance taxes in Cayman for residents or companies. This means a crypto trader or entrepreneur living in Cayman keeps 100% of their gains – a huge incentive. This tax neutrality is balanced by the islands being well-regulated and not on blacklist (Cayman complies with international standards sufficiently to be a major financial center).

加密貨幣投資者:開曼群島經常被視為「避稅天堂」。本地居民或公司在開曼無需繳交個人入息稅、資本增值稅、公司稅,以及遺產或繼承稅。換句話說,住喺開曼嘅加密貨幣交易員或創業者可以百分百保留自己所有利潤——呢個誘因非常之大。開曼能做到稅務中立,之餘亦維持完善監管體制,唔喺任何黑名單上(開曼合乎國際監管標準,足以成為主要金融中心)。

With a Cayman residency certificate, you can live year-round in a tropical paradise that boasts one of the highest standards of living in the Caribbean. Grand Cayman in particular is very developed, safe, and has excellent healthcare, international schools, and connectivity. For travel, Cayman residents (holding just their original passport plus the permit) don’t automatically get new travel benefits – they still use their citizenship’s passport – but as a BOTC territory, once one eventually naturalizes (if they choose to and qualify years down the line), one could obtain a British passport.

有咗開曼居留證,你全年都可以住喺呢個熱帶天堂,生活水平係加勒比海地區數一數二。當中大開曼島尤其發展成熟,治安良好,有優質醫療、國際學校同高連接性。至於出入境,開曼居民(只持有原有護照同居留許可證)唔會自動擁有新旅遊便利——仍然要用返自己國籍個護照——但由於開曼屬英國海外領土,如日後你選擇入籍並符合資格,就可以申請英國護照。

For the more immediate future, being a legal resident in Cayman with substantial means also often eases travel visas for other countries (you can show ties and residence in Cayman as opposed to, say, a volatile country). And practically, many crypto folks simply want a physical base where they can go if needed – Cayman offers that safe harbor, literally and figuratively.

短期內,成為有實力的開曼合法居民,亦幫助你辦理其他國家旅遊簽證(比起話自己住喺一啲局勢不穩地方,可以展示你同開曼的聯繫同住址)。對不少Crypto圈人士,實際上佢哋都想有個地方隨時可以落腳——開曼無論實質抑或象徵意義上都係一個安全港。

Another benefit is Cayman’s robust financial infrastructure. Dozens of banks operate there, and it’s relatively straightforward to open accounts (with proper KYC) and even integrate crypto holdings via institutional custody if needed. The jurisdiction also has no foreign exchange controls, so moving money in and out (fiat or crypto conversions) is not restricted, aside from international AML norms. The Cayman government actively encourages HNW individuals to reside there and often grants the maximum 25 or 30-year initial term for those who qualify, which then can become permanent. Also, after 5 years of residency, one can apply for naturalization as a British Overseas Territory Citizen (BOTC), which gives a Cayman Islands passport (slightly different from a full UK passport). A year after that, one could register as a full British citizen, gaining a UK passport – this path is long but available, meaning ultimately the investment can lead to top-tier citizenship.

另一個優勢係開曼有強大金融基礎設施。度有幾十間銀行,開戶口(只要通過KYC)相對簡單,如有需要亦可透過機構託管整合加密資產。開曼亦冇任何外匯管制,即意味住出入金(法幣或加密貨幣兌換)都冇限制,除咗要跟國際反洗錢準則。開曼政府積極吸引高淨值人士落戶,合資格者通常都會批出最長25或30年初步居留權,之後可以轉永居。再者,住夠五年之後可申請英國海外領土公民(BOTC),攞到開曼護照(同英國護照略有唔同);一年後就可以註冊做英國公民,拎到英國護照——條路比較長,但確實可行,即最終投資可換來頂級公民身分。

Notable Considerations: The buy-in is extremely high (millions of dollars in property). This is in a different league than, say, a $150k donation for a Caribbean passport. So Cayman residency is for those who not only have significant crypto wealth but are willing to tie a portion of it into luxury real estate. The real estate market in Cayman is generally strong (many wealthy individuals buying vacation homes, etc.), but it’s also not very liquid if you needed to pull out money quickly. So it’s a lifestyle/tax play more than a pure investment.

要注意嘅係,門檻好高(要幾百萬美金物業投資),唔同於例如只需捐十五萬美金就買到加勒比護照嘅計劃。所以開曼居留只適合本身已經有大量Crypto財富,且樂意投放部分於高端地產嘅人。開曼地產市場整體強勁(唔少富豪買度假屋),但若快要現金流未必容易脫手,所以計劃本質係生活/稅務考慮多於純粹投資。

Also, Cayman’s program requires the applicant to demonstrate a continued annual income of a certain amount (often around USD $150k per year) and maintain a substantial bank balance or net worth (over $1 million). Basically, they want only genuinely well-off people who won’t seek employment. This is usually no problem for crypto investors who can show large asset holdings and perhaps yield from investments.

另外,申請開曼計劃要求申請人證明自己有持續每年收入(通常約每年美金十五萬)並保持相當金額銀行存款或淨資產(過百萬美金)。基本上,只吸納真正富有,唔會搵工嘅人。一般對Crypto投資者嚟講,證明有龐大資產或投資回報都唔難。

It’s important to stress what the government spokesperson said: Cayman isn’t handing out passports for crypto. They are offering residencies to qualified high-net-worth individuals, including those in the crypto space, via traditional means. The attitude is crypto-inclusive but not crypto-centric. They note they “actively attract blockchain and cryptocurrency businesses” with their policies, which is absolutely true given the number of crypto investment funds there.

要強調政府發言人講嘅重點:開曼唔係專為Crypto發護照。而係經傳統方式向合資格高淨值人士——包括加密圈嘅人——發居留權。官方立場係兼容Crypto,但唔係以Crypto為中心。佢哋政策真係有「積極吸引區塊鏈及加密貨幣業務」,以開曼咁多Crypto基金都證明到。

For the day-to-day, Cayman can be expensive (cost of living and services are high). And while culturally diverse, it’s a small place – some may find island life limiting after a while. But many residents split time between Cayman and elsewhere (it’s easy to travel out).

日常生活方面,開曼生活成本高(消費、服務都貴),文化氛圍算多元,但地方細——有啲人住耐會覺得侷促。不過好多居民實際上都是分開曼同其他地點兩邊走(出遊都好方便)。

One must also obey the residency rules: usually you need to spend a certain minimum time in Cayman to not jeopardize the permit (like 30 days a year, depending on the type of certificate). This is to ensure people are actually using the residence. It’s far less stringent than typical visas though, and certainly you can spend as much time as you want.

亦要遵守居留規定:一般每年需喺開曼住夠最少定額日數(例如30日,視乎證書類型),保住資格。主要係確保大家真係有用個居留。規定比傳統簽證寬鬆得多,而且你想喺度住幾耐都可以。

In conclusion, the Cayman Islands offer a premium residency option that is compatible with crypto wealth. By investing your crypto profits into a stable asset like Cayman property, you can secure a personal haven with unparalleled tax advantages and an environment that fully embraces financial innovation. It’s not a quick passport in your hand, but for those thinking about a long-term base for wealth preservation and a comfortable lifestyle, Cayman stands out as a top-tier choice.

總結嚟講,開曼群島提供一個尊貴居留方案,與Crypto財富非常匹配。只要你願意將Crypto利潤投資於開曼地產等穩定資產,就可以享受個人避風港之餘,仲有無與倫比稅務優勢,同埋一個全然擁抱金融創新的環境。雖然唔係一拎手就有護照,但如果你諗緊長遠財富保值同高質生活落腳地,開曼確實係頂級選擇。

Important Considerations for Crypto-Funded Immigration

由加密貨幣資本支持移民需注意事項

The above countries and programs illustrate that the door is opening for crypto investors seeking global mobility. However, anyone considering these pathways should keep a few critical points in mind:

以上嘅國家與計劃都顯示到,全球移動性之門已向加密貨幣投資者慢慢打開。不過,準備走呢條路嘅人,有幾點重要事項要記住:

Regulatory Compliance is Essential: Regardless of which program you choose, strict KYC/AML (Know Your Customer / Anti-Money-Laundering) rules apply. You will need to thoroughly document the origin of your crypto funds. This typically means providing records of how you acquired your cryptocurrency (exchange receipts, mining income records, etc.), and if you traded frequently, possibly transaction histories. Many programs treat crypto like any other asset – if you liquidated stock to raise money, they’d want to see the stock sale contract; similarly for crypto, they might want to see blockchain transaction printouts and exchange withdrawal confirmations. Make sure your crypto wealth is held or moved on regulated platforms when converting to fiat; selling coins peer-to-peer for cash, for example, will raise red flags if you cannot produce solid evidence of the transfer. Using reputable exchanges or OTC desks that provide invoices and receipts will smooth the process. Be prepared for enhanced due diligence if a large portion of your wealth is in crypto – some countries may hire specialized firms to audit your wallet activity as part of background checks.

合規非常關鍵:無論揀邊個計劃,都會有嚴格KYC/AML(認識你的客戶/反洗錢)規定。你需要詳細證明你的加密資金來源。一般要提供買幣途徑紀錄(交易所收據、挖礦收入記錄等),如你經常交易,更可能要提供歷史交易明細。好多計劃都當Crypto同其他資產一樣——例如你賣股票套現,要交股票買賣合約;Crypto一樣要提供鏈上交易記錄、交易所提現證明。確保你資產放喺受監管平台,換法幣時用合規渠道;例如以現金P2P賣幣,如果無法證明來源會惹起懷疑。用有發收據之正規交易所或OTC平台做記錄會令程序順利。如果大量財富係Crypto,請預備好會被「加強盡職審查」——某啲國家甚至可能請第三方審查你的錢包紀錄作背景調查。

Convert Through Approved Channels: In almost all cases, the government itself will ultimately want fiat currency for the investment or donation. This means you’ll either convert crypto to fiat yourself or work with an agent who does it for you. It’s crucial to use approved banking channels for this conversion. Many jurisdictions require that the investment funds come from an account in the applicant’s name. So you might need to first cash out crypto to your bank, then send the wire to the program’s account. Some agents can intermediate (you send them crypto, they send the wire from their account), but then you’ll have to show the trail from your crypto to the agent’s fiat. Always comply with any currency reporting rules in your home country when moving large sums, to avoid regulatory troubles that could later complicate your application. Essentially, think of crypto as the origin but ensure it turns into a clean wire transfer on record.

用合規渠道兌現:幾乎所有例子,政府最終都係要你用法幣去投資或捐贈。即你要自己將Crypto換成法幣,或者搵中介幫你做。一定要經合資格銀行渠道兌現。好多司法管轄區要求資金必須由申請人本人戶口──所以你可能要先賣幣到自己銀行,再匯款去計劃指定戶口。有代理可以代辦(你給佢Crypto佢幫你法幣匯款),但你都要展示Crypto至法幣嘅完整流水。轉大錢記住依從自己本國匯報規則,咁先唔會因為違規令之後申請出咗意外。總之Crypto係你資產「來源」,但記得最終要成為一筆乾淨有紀錄的銀行電匯。

Expect Extra Scrutiny (and Fees) for Crypto: Programs like St. Kitts have explicitly stated that applications involving crypto wealth may face additional due diligence fees and longer processing. This is because they might conduct deeper background investigations to ensure the crypto wasn’t tied to illicit activities. Don’t be surprised if a Caribbean CBI unit asks for an independent audit of your wallet, or if you have to pay a few thousand dollars extra for specialized vetting. It’s wise to budget both time and money for this. It’s also helpful to proactively provide explanations for large or unusual transactions in your past if you know they’ll see them. For example, if a wallet associated with you received funds from a mixer years ago (even innocently), address it upfront with a written explanation and any proof to dispel concerns. Transparency will generally work in your favor.

要預咗Crypto會被特別審視(同加收費):例如聖基茨已明講,涉及Crypto財富的申請會多收盡職調查費同拉長審批時間。佢哋有機會查更深入背景,確保你資產來源無涉非法行為。加勒比CBI辦都有可能要求你錢包做獨立審計,甚至另收幾千美元資產審查費。你要預好時間同現金;如明知自己過去有巨額或不尋常交易,好主動寫解釋同備文件證明,反而加分。例如你一個錢包幾年前收過mixer的fund(即使冇心),好坦白同時提供解釋同證明,消除疑慮,有助於過關。

Policy Changes Can Happen: Investment migration programs are subject to political and policy shifts. Always stay updated on the latest rules. For instance, Portugal’s move to potentially extend the citizenship timeline from 5 to 10 years can affect the value proposition of its Golden Visa – an investor in 2025 should consider that they might not get an EU passport until 2035 under new rules. Similarly, the accessibility of certain passports can change (e.g., if the EU imposes visa requirements on a Caribbean country in response to too many passports being sold). Due diligence controversies or geopolitical events can influence how attractive and easy these programs remain. It’s wise to consult with investment migration professionals or lawyers who specialize in this field and keep track of developments. As of mid-2025, the programs listed here are active and accepting crypto-funded applicants, but always double-check the current status before committing funds.

政策隨時或有變:投資移民計劃都會受政治、政策影響。一定要追最新規則。好似葡萄牙考慮將歸化年限由5年拉長到10年,直接影響黃金簽證價值——2025年投資者要諗清楚,可能要去到2035先有機會有歐盟護照。另外,有啲護照政策可能收緊(例如歐盟如果發現加勒比國家賣太多護照,就會要求持有人入歐辦簽證)。盡職審查爭議或地緣局勢都可能令計劃吸引力或便利度有變。最好搵專業移民顧問或律師,持續監察局勢。2025年中,上述列舉的計劃都仍然開放並接受Crypto資本,但臨落實資金前都要再次確認現況。

Tax and Legal Advice: Acquiring a new residency or citizenship can have tax implications. For example, if you become a tax resident of a no-tax country (like Vanuatu or Cayman) that might free you from taxes back home – but only if you properly sever tax residency in your original country. Some countries have “exit taxes” or continue to tax citizens even if they move (the U.S. famously taxes its citizens worldwide regardless of where they live). Before you reposition yourself, get advice on how to optimize your situation legally. You may need to spend a certain number of days out of your home country to stop being tax resident there, or potentially renounce citizenships in extreme cases, to fully enjoy a tax

稅務及法律建議:申請新居留或國籍對稅務有重大影響。例如,如果你成為免稅地區(如瓦努阿圖或開曼)稅務居民,可能可免返鄉稅——但前提係你正確終止原有國家稅務居民身份。有啲國家有「撤離稅」,甚至離境都仍然全球徵稅(美國就係無論你住喺邊都收稅最出名)。所以你搬之前記得搵專家合法規劃,如何最優化自己嘅稅務狀況。有時要喺原居地外住夠日數先算脫離稅籍,甚至極端情況下要放棄原本國籍,先真正可以享受新地稅務優惠。Sure, here is the translated content in zh-Hant-HK, following your formatting guidelines (skipping markdown links):

避風港的好處。同時,亦要考慮遺產及財務規劃——第二國籍可能會令這些問題變得更複雜或更有利,取決於相關法律。懂得處理加密貨幣及跨境資產規劃的專業人士非常重要;他們可以協助你設立合適的架構(例如信託或離岸公司),在申請過程中持有你的加密貨幣,以減少稅務負擔或確保合法合規。

生活質素與責任:最後,記住公民或居留身份不只是一張紙——它會將你與該國連繫起來。請研究清楚成為某國公民或居民的責任。有些國家,公民身份可能會附帶義務(例如陪審團服務,雖然美國以外較罕見,或某些情況下需服兵役——我們討論過的國家都無強制兵役,但最好還是確認一下)。如果你打算長時間居住,更要確保你對當地法律和文化感到舒適。薩爾瓦多的加速入籍政策十分創新,但如果真的要在當地生活,必須適應新文化及政治環境。同樣,第二本護照可以成為避險方案(當其他地方出現問題時可前往),但要負責任地使用——遵守新國家的法律,不要只將其當作「便利旗」,而不尊重其意義。

總結,用加密貨幣購買公民身份或黃金簽證,已在多國成為現實,每個國家的細節不一。只要選擇合適自己目標的選項——無論是為了旅行的快捷離岸護照、長期歐盟居留身份,抑或押注以比特幣為本的新國家——你都可以大大提升個人和財務自由。不過,記得要清楚了解規則,準確保存所有文件,有需要時諮詢專家意見。加密貨幣與全球公民身份的結合,是2025年其中一項最令人興奮的新發展,把以往狹窄的投資移民渠道,轉化為加密資產持有者的一條新路。只要規劃得好,你的數碼資產很可能會成為解鎖新機遇與安全避風港的關鍵。