每天,超過五萬億美元在全球銀行體系中流動,這些網絡建構於數十年前,那時交易需要電傳機與紙本確認。

SWIFT訊息系統於1973年面世,至今仍是大部分國際資金流動的基石。付款必須經由眾多代理銀行層層傳遞,每個環節都需數小時甚至數天才能處理只存在於專屬資料庫之間來回跳動的訊息。對賬以批次形式進行,結算還要等待辦公時間。全球金融機器,即使多精密,其基建仍舊建立於網絡時代誕生前的設計。

然而,在這舊有結構之下,一場根本性的變革正在悄悄展開。並非來自於公鏈的炫目宣傳或病毒式加密貨幣熱潮,而是來自於全球最大金融機構內部精密穩健的工作。花旗集團行政總裁Jane Fraser與摩根大通行政總裁Jamie Dimon雙雙將代幣化存款及區塊鏈基礎設施,擺於機構跨境支付及財資現代化戰略藍圖核心。這些並非“小圈子實驗”項目,而是資金跨機構流動方式的全面重建。

花旗於2023年9月推出Token Services平台,將機構客戶的存款轉換為數碼代幣,達致全天候即時跨境支付;摩根大通於2025年6月推出JPMD存款代幣,部署於Coinbase的Base區塊鏈上,讓機構用戶享有連息結算能力且可全年無休。德意志銀行2025年5月加入以區塊鏈為本的Partior結算平台,成為歐元及美元結算銀行,進一步拓展原已連結亞洲最大金融機構的網絡。

這些術語聽起來技術性高、甚至有點沉悶:如“代幣化存款”、“分布式賬本技術”、“原子結算”等等。但背後意義深遠,觸及全球金融體系的核心運作。這並非單純在講代幣化存款與穩定幣之爭,也不是銀行要跟加密貨幣對抗,而是國際金融最根本的基建正被一筆一筆新交易,用可編程貨幣及共享賬本親手重塑。

這場變革正在發生,真金白銀已在實際系統中流動。摩根大通區塊鏈平台自2020年以來,已處理逾1.5萬億美元交易,日均成交額超過20億美元。花旗支付業務每日處理五萬億美元、連接90多個國家,並正有系統地將區塊鏈技術整合到這龐大基建中。

有別於加密貨幣市場的公眾爭議,這次革新是透過企業協議、監管批准,按步就班地跟現有系統整合。對比鮮明——去中心化金融(DeFi)曾宣稱要從外圍顛覆銀行,現在的代幣化存款則是銀行內部自我重建,採用同樣區塊鏈技術,但應用於受規管、有限許可的環境,針對機構級應用而設。

Jane Fraser曾形容花旗的區塊鏈堆疊是流動資金管理的潛在“殺手級應用”,正好說明這股變革背後的戰略推動力。在企業財資主管期望得到即時資訊、實時操控;全球供應鏈全天候運作;資本市場要求即時結算的年代,傳統銀行基建明顯老化。代幣化存款不只是小幅改善,而是一種根本性的結構升級:全天候運作、可程式自動化、原子結算、透明對賬。

問題已不是這場變革會否發生——各大銀行已投入數以億計美元和無數開發工時。真正問題在於:全新基建對更廣泛金融體系意味甚麼?怎樣監管,仍有哪些瓶頸?最終,SWIFT時代的代理銀行體系會否如電傳機一樣走進歷史?

本文將深入探討這場變革,不停留於表面比較,而會從技術、營運、監管及戰略層面細看代幣化存款的方方面面。理解建構過程及其意義,我們便可一窺21世紀金融架構如何在現有市場的表層之下逐漸成形。

什麼是真正的代幣化存款?

要探討代幣化存款如何改變銀行基建,首先需明確其定義及與類似工具的區別。這些名詞即使對熟悉市場的專業人士亦常有混淆,因此明確說明尤為重要。

代幣化存款,即由商業銀行發行、記錄在分布式賬本或區塊鏈上的銀行負債數碼化表徵。企業客戶持有代幣化存款時,其對受監管存款機構擁有直接請求權,和傳統銀行戶口同樣。關鍵分別不在於法律關係或負債性質,而是該負債的表述、轉移及可編程方式。

簡單來說,傳統銀行存款存在於各自銀行所維護的專屬資料庫中。當資金跨不同銀行戶口轉移時,資料訊息需經SWIFT等網絡傳達,驅動相應資料庫更新。每家銀行獨自記錄賬簿,造成對賬難題與結算延誤。相反,代幣化存款以數碼代幣存在於多間授權機構均可同時存取的共享賬本。代幣本身即為負債最終記錄,轉帳過程只需更新共同賬本,無須於各自系統之間來回傳送訊息。

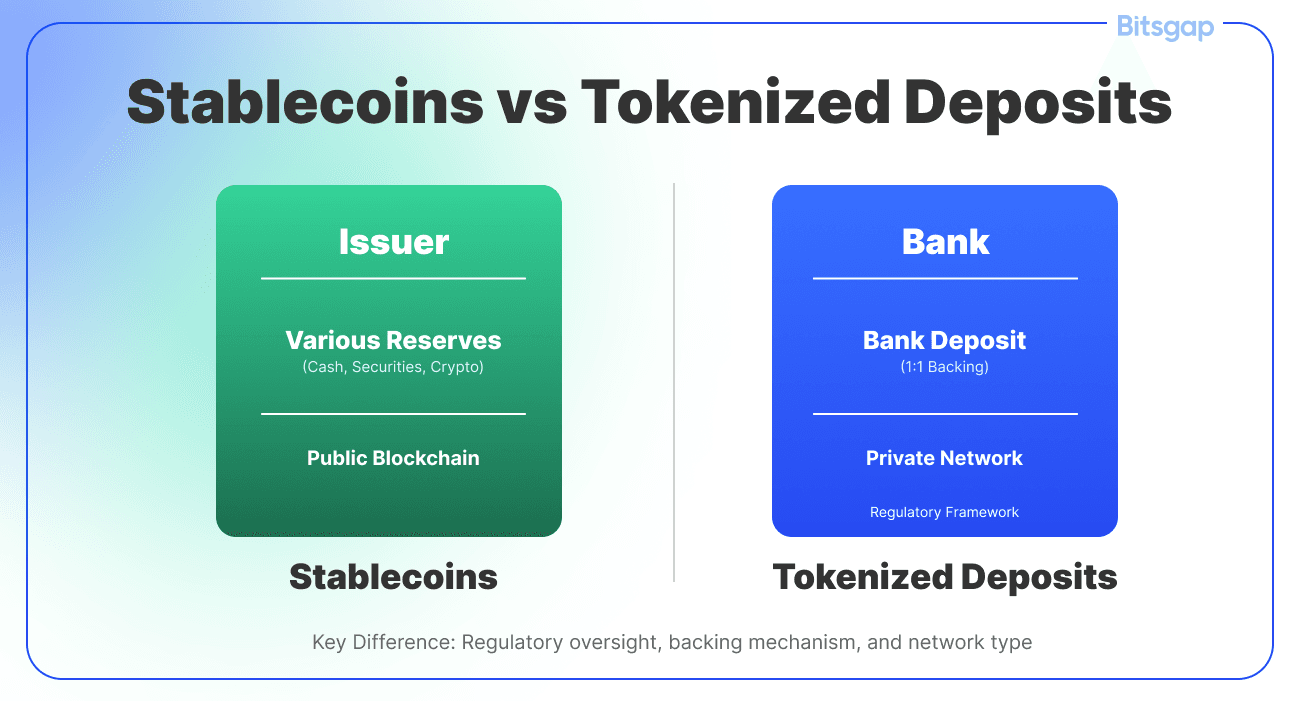

與穩定幣的區別至關重要,但經常被誤解。穩定幣多由非銀行實體如Circle或Paxos發行,與美元掛鉤,資產由短期國債及現金儲備作支持,該等儲備與發行者的營運資產分離,通常存於特殊載體或信託結構,目的是在發行方失效時保障持有人。穩定幣可於公鏈或許可區塊鏈間無銀行參與下點對點流轉。

代幣化存款運作方式截然不同。它們直接由受監管商業銀行發行,屬於該銀行資產負債表上的實際存款責任,因而本質上屬於“銀行資金”而非其他資產類別。當你持有摩根大通的代幣化存款時,對摩根大通銀行擁有直接請求權,與傳統存戶保障(如下FDIC存保)一致。每個JPMD單位均100%由等值法幣存款支持,確保鏈上與鏈下責任完全對等。

這一差異對監管、風險及應用有重大影響。代幣化存款完全屬於現行銀行法律監管範疇。毋須新增監管分類,因其僅是傳統銀行存款一種新技術形式。發行代幣化存款的銀行已持有正規銀行牌照,受全面審慎監察,需維持資本流動性緩衝,並接受監管部門定期檢查。監管清晰已內嵌其中。

中央銀行數碼貨幣(CBDC)則是另一類型。CBDC為中央銀行負債,處於貨幣體系頂層。如採零售模式,理論上公民可直接於聯邦儲備局或歐洲央行開戶,潛在徹底改組銀行體系,令商業銀行退居支付服務外圍;而批發型CBDC則只用於金融機構間結算,類似今日中央銀行儲備,但技術結構各異。

由紐約聯儲及各大銀行研究的“受規管負債網絡”概念,預想一個共同分布式賬本上同時支持批發型中央銀行數碼貨幣及商業銀行存款代幣的體系。這反映貨幣系統既需中央銀行資金作最終結算媒介,也需商業銀行資金以支援信貸及客戶服務。

電子貨幣代幣(如歐盟電子貨幣指令及現在的MiCA框架)則屬鄰近範疇。電子貨幣代表預付存值,多由專門的電子貨幣機構發行,與全方位銀行差別在監管要求及經營模式,偏重支付而非整體銀行服務。

代幣化存款的賬本架構,各家銀行方案各異,但大多有共通特點。主流銀行多採用“有權節點方可參與”——即只限授權單位可驗證交易及維護賬本的受許可區塊鏈或分布式賬本技術。花旗的Token Services用的是私有、以Ethereum為基礎的區塊鏈;摩根大通則將JPMD部署於Base(Coinbase公有Ethereum支鏈),但通過權限控制限制存取。

有限許可的做法兼顧多重目標,既確保只有已驗證、獲授權的機構可參加... participate in the network, supporting know-your-customer and anti-money-laundering compliance. It allows banks to maintain control over governance, operational procedures, and technical standards. It enables higher transaction throughput than public blockchains typically achieve. And it provides the operational finality and reversibility mechanisms that regulated financial systems require when dealing with errors, fraud, or legal orders.

參與網絡,支援認識你客戶(KYC)及反洗黑錢(AML)合規要求。佢可以令銀行繼續控制管治、營運程序同技術標準。相對於公鏈,佢支持更高嘅交易吞吐量。而且,當遇到錯誤、詐騙或者法律指令時,佢都提供受規管金融體系所需嘅運作最終確定性同可逆轉機制。

From the client's perspective, tokenized deposits can operate almost invisibly. Citi designed its Token Services so clients don't need to set up separate wallets or hold tokens in accounts they must manage independently. The tokenization happens at the infrastructure layer, enabling new capabilities without forcing clients to adopt entirely new operational models. A corporate treasurer can instruct a payment through familiar interfaces, and the underlying technology handles the blockchain transactions transparently.

從客戶角度嚟睇,代幣化存款幾乎可以隱形運作。花旗為其Token Services設計時,令到客戶唔需要另外設立錢包,亦都唔使自行管理賬戶內嘅代幣。代幣化喺基建層面進行,可以賦予新嘅功能,而唔會迫客戶徹底改變現有操作模式。公司司庫可以用習慣嘅介面落付款指示,底層技術會自動透明地處理區塊鏈交易。

This design philosophy reflects a pragmatic recognition: large corporations and institutional clients care about functionality, not technology for its own sake. They want faster settlement, better liquidity management, programmable automation, and transparent reconciliation. Whether those benefits arrive through distributed ledgers, traditional databases, or some hybrid matters less than whether the system is reliable, cost-effective, and compatible with their existing operations.

呢個設計理念反映咗一種務實嘅體認:大型企業同行業客幾乎只關心功能,唔係技術本身有幾先進。他哋追求更快結算、更好嘅流動性管理、可編程自動化,以及透明對賬。至於呢啲好處係靠分布式賬本、傳統數據庫或者混合方案,重要性都不及系統本身夠唔夠可靠、成本效益如何、同現有營運模式睇唔睇夾。

The ownership structure reinforces the banking paradigm. Traditional banks maintain custody of the underlying fiat deposits represented by tokens. The tokens themselves are bearer instruments in a technical sense, meaning possession of the cryptographic keys controls the tokens. However, the tokens only exist on permissioned ledgers where all participants are known and authorized. You cannot simply send a tokenized deposit to an anonymous wallet on a public blockchain. The tokens move only within controlled environments between identified counterparties.

持有結構加強咗銀行業嘅模式。傳統銀行負責託管由代幣代表嘅基礎法定存款。技術上,代幣本身就係持有人票據,即係話你持有解鎖私鑰就可以控制代幣。不過,呢啲代幣淨係存在於私有賬本上,所有參與者身份都已知、獲授權。你唔可以輕易將代幣化存款發送去公有鏈上嘅匿名錢包。代幣只會喺受控環境內嘅已確認對手方之間流轉。

This closed-loop architecture addresses one of the fundamental tensions in digital money design: the conflict between programmability and regulatory compliance. Stablecoins on public blockchains can move anywhere, to anyone, at any time. This creates obvious compliance challenges. Tokenized deposits trade some of that permissionless flexibility for regulatory clarity and institutional compatibility. They are programmable money for the regulated financial system rather than for the open internet.

呢種封閉循環架構解決咗數碼貨幣設計入面一個基本矛盾:可編程性同合規要求之間嘅衝突。公鏈穩定幣可以隨時隨地自由流轉畀任何人,所以出現明顯合規問題。代幣化存款以部分放棄「無需許可」嘅彈性,換取更清晰嘅合規性同機構間兼容。佢地係為受規管金融體系而設嘅可編程貨幣,而唔係開放互聯網上嘅匿名貨幣。

The regulatory classification flows naturally from this structure. Under the GENIUS Act passed by the U.S. Senate in 2025, deposit tokens issued by regulated banks are explicitly recognized as distinct from stablecoins issued by nonbank entities. Banks issuing deposit tokens operate under their existing banking charters and supervision. They need no separate "stablecoin license" because they are not issuing stablecoins; they are simply using new technology to represent traditional deposit liabilities.

依個架構,監管分類都好自然咁流出嚟。根據美國參議院2025年通過嘅GENIUS法案,受監管銀行發行嘅存款代幣被明確區分開唔係銀行機構發行嘅穩定幣。發行存款代幣嘅銀行照用現有銀行牌照同接受原有監管,唔需要特別申請牌照成為「穩定幣發行人」,因為佢哋唔係發穩定幣,只係用新技術去代表傳統存款負債。

Understanding what tokenized deposits are and are not provides the foundation for assessing their impact. They are not a new form of money but a new technology for representing existing money. They are not crypto assets seeking regulatory approval but regulated banking products using blockchain technology. They are not alternatives to the banking system but tools for upgrading it. This distinction shapes everything that follows: how tokenized deposits function, how they are regulated, what advantages they provide, and what challenges they face.

明白代幣化存款係乜、唔係乜,係評估其影響嘅基礎。佢哋唔係一種新貨幣,而係代表現有貨幣嘅新技術;唔係等住合規批文嘅加密資產,而係用區塊鏈技術嘅受規管銀行產品;唔係傳統銀行體系嘅替代品,而係升級銀行嘅工具。正正係呢種分野,決定咗代幣化存款點運作、點樣監管、有咩優勢、會遇到咩挑戰。

From SWIFT to Smart Contracts: How Money Movement Is Changing

由SWIFT到智能合約:資金流動模式點變緊

The transformation from legacy payment rails to blockchain-based settlement represents more than a technology upgrade. It fundamentally reimagines how financial institutions coordinate, how transactions achieve finality, and how global liquidity flows.

從傳統支付基礎設施過渡到區塊鏈結算,唔只係技術升級咁簡單。佢係根本上重新定義金融機構之間如何協調、交易點樣實現最終結算,以及全球流動資金點樣流轉。

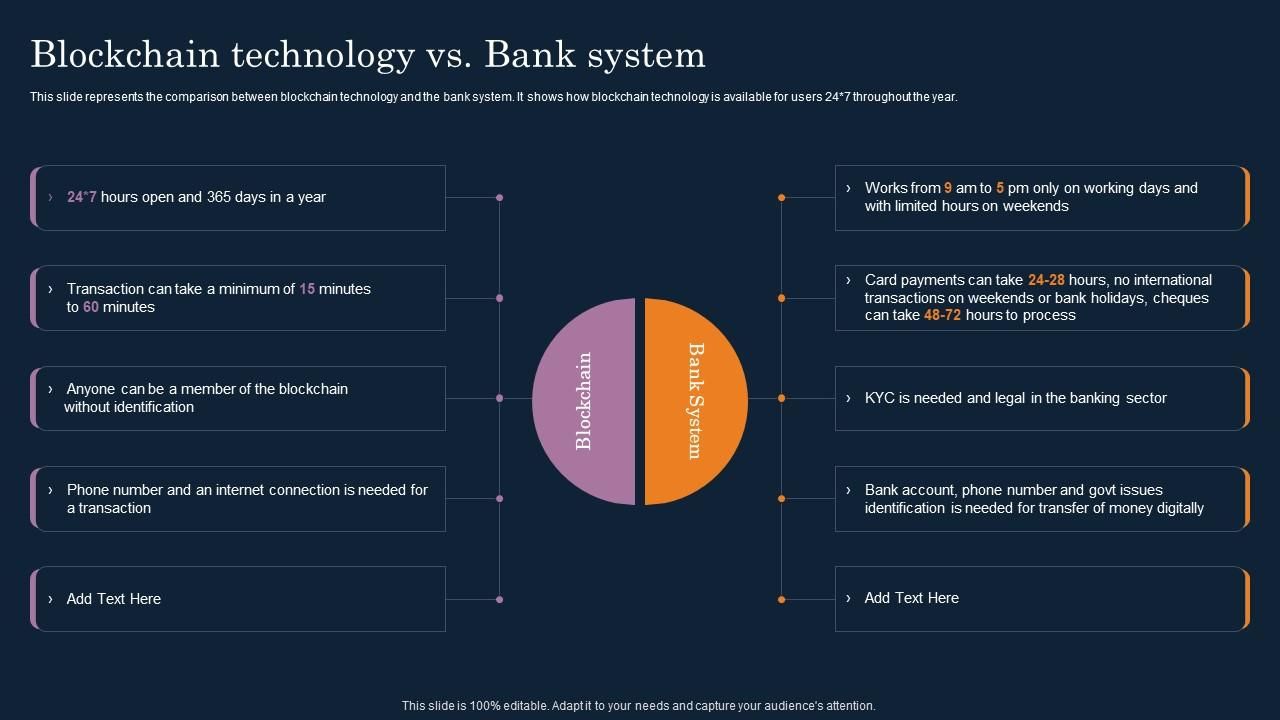

To understand the magnitude of this change, we must first examine what is being replaced. The SWIFT network, formally the Society for Worldwide Interbank Financial Telecommunication, does not actually move money. It moves messages about money. When a corporation in New York instructs its bank to pay a supplier in Frankfurt, that instruction becomes a SWIFT message transmitted from the sending bank to the receiving bank, possibly passing through intermediary correspondent banks along the way.

要明白今次轉變有幾大,我們要先睇下現有系統點運作。SWIFT其實叫環球銀行金融電訊協會,佢本身唔會直接轉錢,只係傳送有關資金嘅訊息。例如一間紐約公司指示銀行支付畀法蘭克福供應商,呢個指令會由付款銀行經由SWIFT網絡,傳送訊息去收款銀行,當中可能經過一啲中間的對應銀行。

Each institution in this chain maintains its own ledger. The SWIFT message instructs them to update those ledgers, debiting one account and crediting another. But the actual movement of funds between banks happens through separate settlement mechanisms: correspondent banking relationships where banks maintain accounts with each other, or through central bank settlement systems like Fedwire in the United States or TARGET2 in Europe.

呢條鏈裡面每間機構都有自己盤賬。SWIFT訊息通知各方更新自己賬本,要扣減一個賬戶,入數去另一個。但銀行與銀行之間資金實際移動,其實要靠獨立嘅結算機制:例如對應銀行互相持有賬戶,或經中央銀行結算系統,好似美國Fedwire同歐洲TARGET2。

This architecture introduces multiple friction points. Messages travel separately from settlement. Different institutions update different databases, creating reconciliation requirements. Transactions queue in batches processed during business hours. Cross-border payments may traverse multiple correspondent banks, each adding time, cost, and operational risk. Foreign exchange conversion happens through separate trades that must be coordinated with the underlying payment. Throughout the process, money sits in nostro and vostro accounts, trapped as pre-funded liquidity that cannot be used for other purposes.

依個架構製造咗好多摩擦點:訊息同結算分開,各機構自己更新自己個種數據庫,因此要對賬。交易排隊等批處理,只限辦公時間做。跨境支付要經多間對應銀行,每跳一次就多啲時間、成本同風險。換匯又分開進行,要同底層付款配合。在整個流程裡,錢都困咗喺nostro同vostro賬戶裡,作為預先撥備流動性,冇辦法用埋去做其他嘢。

The result is a system characterized by latency, opacity, and inefficiency. A traditional cross-border payment might take days to settle, passing through multiple intermediaries in a hub-and-spoke model that adds time and costs at each step. Senders and recipients see limited information about transaction status. Banks tie up enormous amounts of capital in correspondent account balances. Errors require manual intervention to unwind transactions already recorded across multiple separate systems.

咁最終系統變成:高延遲、不透明、效能低。傳統跨境付款要幾日先結算,經過層層中介,每一站又慢又貴,成個系統似一個輪輻式網絡。發送方與收款方對交易狀態只知少量資訊。銀行好多資金都綁喺對應賬戶結餘,動彈不得。萬一出錯,要人手介入,重做一大堆已分散記錄嘅賬目。

None of this would matter if global commerce operated on a nine-to-five schedule in a single time zone with occasional cross-border transactions. But modern business runs continuously across all time zones with supply chains spanning multiple countries and currencies. The disconnect between how commerce operates and how payment systems function creates enormous friction.

如果全球貿易係朝九晚五、一個時區、間唔中先跨境,咁就冇所謂啦。但現代生意係全日運作、跨時區、供應鏈連接唔同國家與貨幣。商業運作同支付系統脫節,摩擦就好大。

Tokenized deposit systems address these limitations through several key innovations, all enabled by the shared ledger architecture. First and most fundamentally, they combine messaging and settlement into a single atomic operation. When a tokenized deposit transfers from one party to another on a shared ledger, both the instruction and the settlement happen simultaneously. There is no separate message instructing a separate settlement. The transfer of the token is the settlement.

代幣化存款系統透過幾個重要創新,全部建立喺共享賬本架構上,去解決呢啲限制。最根本嘅係指令同結算合二為一,變成單一原子操作。當代幣化存款係共享賬本上由甲方轉去乙方,落指令同完成結算係同一刻完成,唔再係一份指令、一份結算分開處理。代幣嘅轉移就等於結算。

This atomic settlement property eliminates many failure modes inherent in message-based systems. You cannot have a situation where the message is received but settlement fails, or where settlement occurs differently than the message instructed. Either the entire transaction succeeds or the entire transaction fails. The shared ledger provides a single source of truth that all parties can see simultaneously.

呢種原子結算,消除了訊息型系統本身好易出錯嘅地方。例如唔會出現收咗訊息但結算唔到,或者指令同實際結算唔一致。只有成筆交易成功,或者成筆取消。共享賬本係所有參與方同步見到嘅唯一事實來源。

Citi's Token Services enables institutional clients to complete cross-border payments instantly, around the clock, transforming processes that traditionally took days into transactions completed in minutes. The speed improvement is dramatic but understates the deeper change. More important than speed alone is the combination of speed with finality and transparency. Parties know immediately that settlement has occurred and can see proof on the shared ledger.

花旗Token Services令機構客戶可以隨時隨地即時完成跨境支付,將原本要用日計嘅流程,縮短到幾分鐘搞掂。速度快咗好多,但更重要嘅係速度、最終性同透明度合為一體。各方即刻知道已經結算,而且可於共享賬本上睇到證據。

JPMorgan's Kinexys Digital Payments system, formerly JPM Coin, provides similar capabilities, processing roughly two billion dollars in daily transactions with near-instant settlement available 24/7. The system supports multiple currencies and integrates with JPMorgan's foreign exchange services to enable on-chain FX settlement. This means a corporate client can instruct a payment in one currency to a counterparty receiving a different currency, and the entire transaction including FX conversion settles atomically on the blockchain.

摩根大通嘅Kinexys Digital Payments系統(前稱JPM Coin),都有類似功能,每日處理大約二十億美金,全年無休近乎即時結算。系統支援多種貨幣,又同摩根大通嘅外匯服務整合,做到鏈上即時換匯。即係公司客戶可以用一種貨幣落指令,對家收另一種貨幣,整個過程(連同外匯兌換)都可以係區塊鏈上一筆過原子結算。

The operational implications are profound. Consider a multinational corporation managing cash across dozens of subsidiaries in different countries. Under traditional correspondent banking, moving funds between subsidiaries requires navigating multiple payment rails with different operating hours, settlement times, and fees. Liquidity gets trapped in transit and in buffers maintained to ensure subsidiaries can meet local obligations.

實際運作上,有深遠影響。舉例講,一間跨國企業要管理唔同國家幾十間子公司嘅資金。傳統對應銀行體系下,資金喺子公司間流轉,要走唔同支付渠道、唔同營運時間、唔同結算周期同手續費。流動資金好多時都困喺轉賬途中,或者要困係個啲buffer度,保證子公司可應付本地需求。

With tokenized deposits on a shared ledger, the same corporation can move funds between subsidiaries continuously and instantly. Clients can now pay disbursements to counterparties without the need for prefunding, optimizing liquidity management and reducing transaction costs. A treasury department can maintain a more centralized liquidity pool and deploy funds precisely where and when needed rather than maintaining expensive buffers in each location.

有咗代幣化存款與共享賬本,呢間公司可以隨時隨地實時喺子公司之間轉賬。客戶出款時無需預先撥備資金,流動性管理更優化,交易成本亦減低。財資部可以保持資金集中管理,有需要時精準調配,唔使每個地點擺大量buffer凍結住。

The network effects matter enormously here. JPMorgan processes transactions reaching multiple billions of dollars on some days after introducing programmability to the network. Citi's payments business handles five trillion dollars daily across more than 90 countries, including 11 million instant transactions. As more counterparties join these tokenized networks, the utility increases dramatically. A closed-loop system connecting only a single bank's clients provides limited benefit. A network connecting hundreds of institutions and thousands of corporate clients fundamentally changes liquidity dynamics.

網絡效應係關鍵。摩根大通加咗可編程性之後,有啲日子每日處理數十億美元交易。花旗支付業務涵蓋90幾個國家,每日處理五萬億美元,包括1,100萬宗即時交易。愈多對手方加入代幣化網絡,功能價值指數級增長。一個淨係串連單一銀行客户嘅閉環系統,影響有限;但百幾間銀行、幾千企業客户一齊落網絡,資金流動模式會徹底改變。

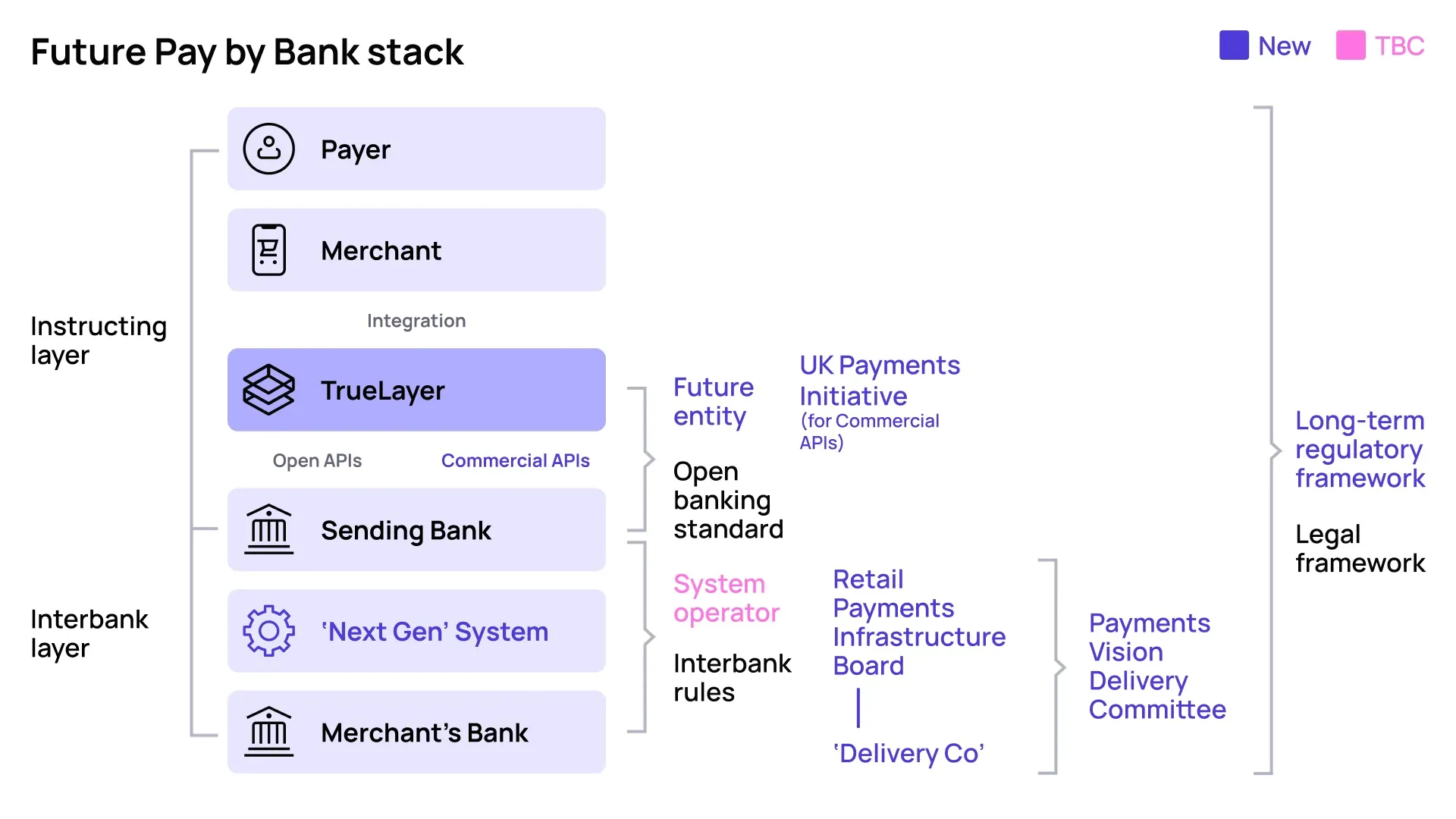

Partior's blockchain-based settlement platform exemplifies this network approach, providing real-time atomic clearing and settlement for participating banks using tokenized commercial bank and central bank liabilities. The platform supports Singapore dollars, U.S.

Partior嘅區塊鏈結算平台就正正係網絡式架構嘅例子,為參與銀行提供即時原子級清算與結算,使用嘅包括商業銀行同中央銀行代幣化負債。平台現時支持新加坡元、美元等貨幣。 dollars, and euros through founding correspondent banks including DBS, JPMorgan, and Standard Chartered. Deutsche Bank completed its first euro-denominated cross-border payment on Partior in collaboration with DBS, executing the transaction across different financial market infrastructures and demonstrating how blockchain can complement existing systems.

美元、歐元等貨幣,通過包括星展銀行(DBS)、摩根大通(JPMorgan)同渣打(Standard Chartered)等創始代理銀行進行。德意志銀行(Deutsche Bank)已經聯同星展銀行,喺 Partior 平台上完成首宗以歐元結算嘅跨境支付,橫跨唔同金融市場基建,展示咗區塊鏈可以點樣同現有系統互補。

The Partior model is instructive because it shows how tokenized deposits can create shared infrastructure while preserving banks' individual client relationships and regulatory compliance obligations. Financial institutions connect to Partior to make instant interbank cross-border payments 24/7, resolving longstanding inefficiencies including settlement delays, high costs, and limited transaction transparency. Nium became the first fintech to join the Partior network, giving its clients access to 24/7 instant payments without requiring another API integration, demonstrating how the network can extend beyond traditional banks to encompass the broader financial ecosystem.

Partior 呢個模式好有參考價值,因為佢展示咗代幣化存款可以喺唔影響銀行現有客戶關係同合規責任嘅情況下,建立共享基建。金融機構可以連接 Partior,全天候 24/7 實時處理跨行跨境支付,解決咗長期存在嘅結算延遲、高成本同交易透明度不足等問題。Nium 成為首間加入 Partior 網絡嘅金融科技公司,畀佢嘅客戶可以無需新增 API 整合之下,用到 24/7 實時支付,示範咗呢個網絡唔單止侷限傳統銀行,亦可以擴展到更大銀行以外嘅金融生態圈。

Smart contracts add another dimension by enabling programmable settlement logic. In traditional systems, conditional payments require manual processes or complex escrow arrangements. Smart contracts allow parties to encode business logic directly into the payment instruction. A payment can be programmed to execute automatically when specified conditions are met: delivery confirmation, regulatory approval, or completion of a related transaction.

智能合約為結算帶嚟新層次,因為佢可以實現可編程嘅結算邏輯。傳統系統下,條件式付款往往要依靠人手處理或複雜嘅託管安排。智能合約容許雙方將業務規則直接寫入支付指令入面。一筆付款可以預先設定條件,當滿足指定情況——例如收貨確認、監管批核或者完成相關交易——就會自動執行付款。

Citi's Token Services can optimize trade finance by replacing letters of credit and bank guarantees with smart contracts that automatically release payments once set conditions are met. In pilot testing, international shipping company Maersk transferred tokenized deposits to instantly pay service providers, compacting process times from days to minutes.

花旗銀行(Citi)嘅 Token Services 可以用智能合約取代信用證同銀行擔保,只要達到設定條件後自動釋放付款,從而優化貿易融資流程。喺試點測試時,國際航運公司馬士基(Maersk)用代幣化存款即時支付服務供應商,令原本要幾日先完成嘅程序,現喺幾分鐘就搞掂。

The trade finance use case illustrates the power of combining atomicity with programmability. Traditional trade finance involves complex coordination between multiple parties: importer, exporter, banks in different countries, shipping companies, customs authorities, and insurance providers. Documents must be verified, goods must be inspected, title must transfer, and payment must release, all according to carefully sequenced conditions. The coordination happens through a combination of legal agreements, physical documents, and manual verification.

貿易融資嘅案例展現咗「原子性」加「可編程性」結合之後嘅力量。傳統貿易融資要多方協調,包括進口商、出口商、唔同地區嘅銀行、船務公司、海關部門同保險公司。成個流程要核實文件、檢查貨品、轉移貨權同按程序放款,步驟全部需要跟足嚴謹次序。協調過程係經由法律文件、實體文件同人手核查一齊做到。

Smart contracts can encode much of this logic and execute it automatically when conditions are verified. The verification itself can happen through oracle services that feed external data onto the blockchain, or through tokenization of the underlying assets and documents. When the bill of lading is tokenized and transferred, confirming receipt of goods, the smart contract can automatically release payment. Settlement happens atomically: the buyer receives the tokenized bill of lading representing ownership of the goods, and the seller receives payment, simultaneously and irreversibly.

智能合約可以將呢啲業務邏輯寫入程式,當條件驗證到就自動執行。驗證過程可以通過「預言機服務」將外部資料導入區塊鏈,或者將相關資產/文件代幣化。當提單被代幣化並轉讓出去,證明貨品已經收妥,智能合約會自動釋放付款。結算係原子性進行:買方獲得代表貨權嘅提單代幣,賣方同時收到付款,一次完成、不可逆轉。

This atomic delivery-versus-payment capability extends beyond trade finance. JPMorgan's Kinexys Digital Assets platform launched a Tokenized Collateral Network application enabling the transfer of tokenized ownership interests in money market fund shares as collateral for the first time on blockchain. The system supports frictionless transfer of collateral ownership without the complexity of moving assets through traditional means. The platform has already enabled more than 300 billion dollars in intraday repo transactions by providing short-term borrowing in fixed income through the exchange of cash for tokenized collateral.

呢種原子交收功能唔只局限於貿易融資。摩根大通(JPMorgan)旗下嘅 Kinexys Digital Assets 平台推出 Tokenized Collateral Network,首次喺區塊鏈上實現貨幣市場基金份額代幣化作抵押物權益轉移。系統支援無摩擦抵押品權益轉讓,唔使通過傳統複雜操作搬移資產。平台已經協助日內回購市場完成超過三千億美元交易,以代幣化抵押品換現金處理短期固定收益借貸。

The repo market provides a compelling example of how atomic settlement reduces risk. In traditional repo transactions, there is a brief window where one party has transferred securities but not yet received cash, or vice versa. This creates settlement risk that participants must manage through margins, collateral agreements, and credit limits. Atomic settlement on a shared ledger eliminates this risk entirely. Securities and cash transfer simultaneously in an indivisible transaction. Either both sides complete or neither does.

回購市場好好說明咗原子結算如何降低風險。傳統回購交易,會有一段短時間其中一方已經移交證券但未收到資金,或相反。呢個結算風險要靠追加保證金、抵押協議、信用額度等手段處理。喺共享帳本做原子結算可以完全消除呢種風險,證券同現金同步、不可分割地交換——要嘛雙方同時完成,要嘛都唔完成。

Foreign exchange settlement benefits similarly. Standard Chartered completed euro-denominated cross-border transactions between Hong Kong and Singapore using Partior's global unified ledger infrastructure, becoming the first euro settlement bank to use the platform. FX settlement risk, where a bank might pay out one currency before receiving the other, represents one of the largest intraday risk exposures in financial markets. Payment-versus-payment settlement on blockchain networks can eliminate this risk.

外匯結算都受惠於呢個模式。渣打用 Partior 全球統一帳本基建,完成香港同新加坡之間以歐元結算嘅跨境交易,成為首間用上呢個平台做歐元結算嘅銀行。傳統 FX 結算有一種風險,銀行可能會先支付一種貨幣但未收到對方貨幣,呢種結算風險係金融市場風險最大嘅其中一種。用區塊鏈網絡實現 payment-versus-payment 結算,可以徹底解決呢個問題。

Partior is developing payment-versus-payment capabilities for FX settlement, which offers significant promise in reducing settlement risk especially for non-mainstream currencies. Other planned features include intraday FX swaps, cross-currency repos, and programmable enterprise liquidity management, all building on the atomic settlement foundation.

Partior 正開發 payment-versus-payment 功能處理 FX 結算,對減低結算風險(特別係非主流貨幣)有好大潛力。未來仲會加入日內外匯掉期、跨幣種回購,同可編程企業流動性管理等新功能,全部基於原子結算基礎。

The technical implementation varies across platforms but shares common patterns. Transactions are submitted to the network, validated according to predefined rules, executed atomically, and recorded on the shared ledger. The validation can check balances, verify signatures, ensure compliance with payment limits or regulatory requirements, and confirm that smart contract conditions are met. The ledger update happens only if all validations pass, ensuring transaction integrity.

唔同平台嘅技術實施有差異,但基本模式都相似:交易送到網絡,按預設規則驗證,原子執行,寫入共享帳本。驗證內容包括:查核餘額、簽名認證、支付限額或監管要求合規、確保智能合約條件無誤。只有全部驗證通過先會更新帳本,保障交易完整性。

Throughput, latency, and finality present important technical considerations. Public blockchains like Ethereum mainnet currently process 15-30 transactions per second with block times of 12-13 seconds, insufficient for global payment systems handling millions of transactions daily. JPMorgan chose Base for JPMD deployment partly because it offers sub-second, sub-cent transactions, dramatically better performance than Ethereum mainnet. Layer 2 scaling solutions and permissioned blockchains can achieve much higher throughput, with some systems processing thousands of transactions per second.

吞吐量、延遲同最終性係重要技術考慮。現時以太坊主網每秒只可處理 15-30 筆交易,區塊生成時間約 12-13 秒,對全球每日幾百萬筆交易嘅支付系統明顯唔夠。摩根大通選擇 Base 網絡推 JPMD 部分原因就係因為佢可以做 sub-second、極低交易成本,效能遠勝以太坊主網。Layer 2 擴容方案同許可鏈可達到更高吞吐量,有系統甚至每秒處理過千交易。

Finality, the point at which a transaction becomes irreversible, varies across blockchain designs. Some systems provide probabilistic finality where the chance of reversal decreases exponentially as more blocks build on top of a transaction. Others provide deterministic finality where transactions are final as soon as they are confirmed. For institutional payments, deterministic finality is strongly preferred because participants need certainty that settlement is complete and cannot be unwound except through deliberate counterparty action.

交易「最終性」——即交易無法逆轉嘅時間點——隨區塊鏈設計而異。有啲系統係機率型最終性,隨住越多區塊堆疊,交易被逆轉機會就越低。有啲區塊鏈用確定性最終性,一經確認即視為最終。機構級支付大多數都希望有確定性最終性,因為參與者需要確保結算不可撤銷,除非對家主動操作。

Security represents another critical dimension. Blockchain systems must protect against both external attacks and internal malfeasance. External attacks might target the network infrastructure, cryptographic keys, or smart contract code. Internal malfeasance could involve node operators, bank employees, or compromised client credentials. Permissioned networks can implement stronger access controls and identity verification than public blockchains, reducing certain attack vectors while introducing different governance challenges around who controls the network and under what rules.

安全性都係一個關鍵維度。區塊鏈系統要提防外部攻擊同內部不當行為。外部攻擊可以針對網絡基建、密鑰管理或者智能合約漏洞。內部問題可能涉及節點營運者、銀行職員或者用戶認證資料洩漏。許可鏈可以天生做得更好身分認證同權限控制,減少部份攻擊路徑,但又帶嚟治理新挑戰——即由邊個掌控網絡,用咩規則操作。

The comparison with public blockchain infrastructure highlights different design philosophies optimized for different use cases. Blockchain eliminates the need for multiple intermediaries by creating direct payment corridors, with transactions often completed in minutes rather than days. Public blockchains prioritize permissionless access, censorship resistance, and decentralized control. Permissioned networks prioritize transaction throughput, regulatory compliance, and operational governance. Neither is inherently superior; they serve different purposes for different users.

公有區塊鏈同許可區塊鏈本質上有唔同設計方向,針對唔同場景。區塊鏈可以打通直接支付通道,不必好多中介,將交易由幾日壓縮到幾分鐘。公有鏈重視開放、抗審查同去中心化;許可鏈著重交易效率、合規同運營治理。兩者冇邊個一定優勝,主要睇邊種用於咩場景。

For institutional financial services, the permissioned approach currently dominates because it better aligns with regulatory requirements, risk management practices, and business models based on trusted relationships rather than trustless protocols. Public blockchains succeed where openness and censorship resistance provide fundamental value, as in cryptocurrency markets or certain decentralized finance applications. The question is not which is better in absolute terms but which better fits specific use cases and constraints.

對機構金融服務嚟講,許可網絡目前係主流選擇,因為佢更貼合法規要求、風險管理、同「以信任為本」嘅商業模式。公有鏈適合需要開放同抗審查價值場景,好似加密貨幣市場同部分 DeFi 應用。重點唔係邊個絕對好,而係邊個更適合特定場景。

As tokenized deposit infrastructure matures, hybrid models may emerge that bridge permissioned and public networks. A corporation might maintain tokenized deposits on a bank's permissioned blockchain for most treasury operations but interact with public DeFi protocols through controlled gateways for specific purposes. Interoperability between networks, discussed in later sections, will determine how fluid such interactions can become.

隨住代幣化存款基建成熟,未來可能出現結合許可鏈同公有鏈嘅混合模式。例如公司用銀行許可鏈管理大部分財資,但偶爾通過受控閘道對接公有 DeFi 協議。網絡之間互通(下文會詳細討論)會決定將來互動彈性。

The trajectory is clear even if the endpoint remains uncertain: money movement is shifting from message-based correspondent banking toward direct settlement on shared ledgers. SWIFT will not disappear overnight, and traditional correspondent banking relationships will persist for many purposes. But the gravitational center of global payments infrastructure is migrating toward tokenized deposits on blockchains that combine instant settlement with programmable logic and 24/7 availability. This represents not just faster legacy systems but a fundamentally different architecture for how financial institutions coordinate and how money moves through the global economy.

發展方向清晰,盡管最終形態未明朗——資金流動模式正由傳統通訊訊息式代理行轉移至共享帳本直接結算。SWIFT 唔會一朝一夕消失,傳統代理行關係依然喺唔同用途上存在。但未來支付基建重心移向結合即時結算、可編程邏輯同全天候 24/7 網絡可用性嘅區塊鏈代幣化存款。呢個唔只係加快傳統系統,而係從根本改變金融機構協作方式同資金全球流通方式。

The 24/7 Bank: Why Always-On Finance Changes Everything

24/7 銀行:全時運作點樣徹底顛覆金融

The transition from batch processing to continuous real-time operation represents one of the most significant operational transformations in modern banking. Yet this shift remains underappreciated, perhaps because the implications extend far beyond technology into

由批次處理轉向連續實時運作,其實係現代銀行營運最重大嘅轉型之一。不過,呢個轉變暫時未獲得應有重視,可能因為佢影響深遠,唔單止係技術層面......組織文化、風險管理及業務模式。

傳統銀行按營業日時間表運作,並設有明確的截止時間。截止時間之後收到的付款,要等到下一個處理周期才會清算。跨境交易需應對多個時區和本地營業時間。證券結算通常以T+2或T+1完成,交易執行與最終結算之間存在時間差。管理全球業務的財資部門,必須保留資金緩衝,以確保各地分公司在本地營業時間內有足夠資金,即使這意味着,有些地方的資本要在夜間或周末閒置,而另一處或會出現資金短缺。

這種批處理模式,在交易需人手介入、電腦資源昂貴難以全天候運行及全球商貿步伐較慢的時代,是合理的。如今這些限制已不復存在。企業供應鏈全年無休地運作。金融市場雖有收市時段,但總有某些交易所仍在營業。跨國企業需隨時隨地調動資金,應業務所需,而非遷就銀行的處理時間表。

代幣化存款實現真正的24/7全天候銀行服務,因為共享帳本基建可以持續運作,交易即時清算,無分日期時間。Partior的24/7區塊鏈網絡可與本地即時貨幣支付及RTGS系統互補和互通,這些系統未必能持續運行。紐約的財資主管可於星期日下午,瞬間將資金調撥至新加坡子公司,交易即時生效,毋須等待星期一早上處理,亦無須等對應時區代理銀行開市。

其營運影響從多方面滲透至企業財資管理。首先也是最顯著的,流動資金管理會大幅提升效率。過往無24/7彈性,企業需在各地維持流動資金緩衝,以應對於不能即時調撥資金期間的潛在需要。有了持續運作能力,財資可採用更集中的資金池,按需要精準調配資金。

以一間橫跨亞洲、歐洲及美洲的全球製造商為例。如果無即時的全球支付,財資主管或需在區域資金池內合共準備一億美元流動性,以確保本地能出糧、支付供應商及處理突發需要。有了24/7即時轉帳,同一企業或只需七千萬美元流動資金,在中央資金池及地區緩衝之間分配,根據實際需要即時調配,而非預先高價維持假設性需求的緩衝。

釋放出來的三千萬美元可更靈活應用:還債、投資業務或購入高息資產。長遠而言,全球成千上萬間企業僅因減少閒置資金,已創造可觀效益。

隨之而來的是利息優化。在批處理模式下,週五下午轉帳的資金或要到週一才到帳,失去兩天潛在利息收入。即時清算下,資金可持續產生回報,不會因途上延誤而損失利息。對管理億萬流動資金的大型企業而言,即使改善幅度細微,長遠積累的額外利息亦頗可觀。

Jane Fraser指出,即使銀行可提供24/7 代幣化貨幣,許多企業財資部門仍未準備好全年無休運作。這點凸顯一個重點:科技能力往往超前於組織的適應速度。一間公司週六深夜收到即時付款,必須有系統可即時偵測、記錄及回應這些交易。財資管理系統、企業資源規劃(ERP)及會計系統皆須由批處理轉型為持續運作。

同時,人力層面同樣重要。傳統財資部門按辦公時間工作,因為交易也是在這段時間內處理。持續運作則衍生超時監控、異常處理及決策要求。企業是否需要設立24/7財資營運中心?自動化系統能否應付大部分情況,僅需適時人手監察?機構如何平衡全天候運作帶來的效率,與長期輪班的人力成本?

不同機構會根據規模、行業及運作模式各自取態。跨時區生產的全球製造企業,可能順理成章接受24/7財資運作,作為現有營運模式的自然延伸。而業務較穩定的專業服務公司,即使基建已支援即時清算,或選擇於辦公時間內段落式批量處理。

風險管理層面除營運外更見複雜。持續清算微妙地改變信貸風險、市場風險及操作風險的本質。日內信貸風險降低,因資金即時結算,不會晝累積到批量處理時一次清算。但24/7運作亦產生新錯誤及欺詐途徑,有機會即時觸發,難以靠批量對賬環節發現。

智能合約自動化提供新契機亦帶來新風險。一方面,自動執行減少人為錯誤,確保商業邏輯貫徹執行。另一方面,合約程式碼錯誤可導致大量交易出現系統性故障。美國股市2010年5月「閃電崩盤」,就是自動化交易演算法引發,反映自動化既可化解部分風險,亦可誇大其他失誤模式。

對賬與會計亦是成熟營運重要一環。批處理制度下,對賬於每個處理周期結束後按批次進行。會計系統按日或定期登錄交易。Citi的Token Services提供自動對賬,大幅減少當不同機構分別更新各自帳簿時需人手對賬的工夫。共享帳本讓所有方共享唯一真相來源,消除傳統需要兩邊核對差異並解決爭議的困難。

然而持續清算亦意味會計必須持續處理。會計系統須即時處理及入帳整日內發生的每宗交易,而非每天匯總一次。企業資源規劃系統須跟區塊鏈支付系統整合,實時擷取交易數據,並即時反映於財務記錄。技術層面可解決,但必然涉及大量系統升級與流程重設。

24/7營運模式亦會改變銀行自身資產負債表管理方式。傳統銀行按辦公時間預計日內流動資金調動。持續運作則因應沒有「自然休息」時段,每時每刻都要預備資金。與傳統穩定幣不同,存款代幣將來或受存款保險保障,兼具計息特質,即銀行或會為代幣存款支付利息。息口型存款代幣運作上類似傳統活期戶口,但息口即時結算、資金隨時可用,更模糊銀行產品界線。

抵押品管理走向類似。JPMorgan的Tokenized Collateral Network能即時轉讓貨幣市場基金代幣化持股作抵押,實現抵押品管理動態調整,毋須等批次清算。此能力於回購市場、衍生工具市場尤為重要,因抵押要求隨市價及倉位波動。

以衍生工具市場為例,持續清算及抵押品管理可大幅降低對手風險。現時做法為於指定時點各自增減初始及變動保證金,期間市況或超出緩衝範圍。持續結算及保證金管理雖提升操作複雜度,卻可封堵相關風險。

文化及組織影響亦不容忽視。銀行長久以來依循與辦公日及結算日相連的作息。交易員、財資主管、營運及風控人員依賴市場開合、結算周期去安排工作。推行持續運作會打亂這些節奏,需要機構重新思考崗位編排、職責分配及監管方式。

部分機構可能積極主動採納新模式,視流動資金管理及客戶服務新優勢為競爭力。有些則被客戶或市場壓力驅使,在舊有系統及組織慣性間進展緩慢。最早的開拓者很可能是早已橫跨多時區、運作節奏本已「全天候」的大型機構,地區性細行或會較長時間維持傳統運作。

客戶教育又是一大挑戰。企業財資主管熟悉批處理和營業日習慣,因為他們已……operated within those constraints for decades. Explaining the benefits of 24/7 settlement, demonstrating how to use new capabilities, and helping clients redesign their own treasury processes to take full advantage all require sustained effort. Fraser's comment about corporate readiness for always-on operations likely reflects this educational and change management challenge as much as technological concerns.

在這些限制下運作已經有數十年了。解釋 24/7 結算的好處、展示如何運用新功能,以及協助客戶重新設計他們的財資流程以充分發揮優勢,都需要持續的努力。Fraser 對企業準備好全天候運作的評論,很大程度上反映了教育及變革管理上的挑戰,而不單只是技術層面的關注。

The regulatory implications deserve attention as well. Banking regulations developed when institutions operated during business hours with defined settlement cycles. How do reserve requirements, capital buffers, liquidity coverage ratios, and stress test scenarios adapt to continuous operations? Should regulators expect different operational risk profiles from 24/7 banks? These questions lack definitive answers but will shape how continuous settlement integrates with prudential regulation.

監管層面同樣值得關注。現行銀行監管是在機構於辦公時間內按既定結算周期運作時制定的。法定準備金要求、資本緩沖、流動性覆蓋率及壓力測試方案應如何適應連續性運作?監管機構是否應該預期 24/7 銀行會有不同的操作風險型態?這些問題暫時沒有確切答案,但將會左右持續結算如何與審慎監管結合。

Looking forward, the always-on bank represents not merely a faster version of existing banking but a qualitatively different operational model. The implications extend from technology infrastructure through accounting systems, risk management frameworks, organizational structures, client relationships, and regulatory expectations. Early adopters will discover which changes create competitive advantage and which introduce new challenges. Followers will learn from pioneers' experience but risk falling behind as client expectations shift toward continuous service and instant settlement.

展望未來,「隨時運作」的銀行不單純是現有銀行的加快版,而是質性上截然不同的運作模式。所帶來的衝擊由科技基礎設施至會計系統、風險管理框架、機構架構、客戶關係甚至監管期望,都會受到影響。先行者會找到哪些轉變可帶來競爭優勢,哪些又會帶來新挑戰。後進者雖可從先驅者的經驗中學習,但當客戶期望轉向持續服務與即時結算時,他們則或會面臨落後風險。

The transformation is irreversible not because the technology compels it but because client needs demand it. Once corporate treasurers experience instant cross-border settlement and continuous liquidity management, they will not willingly return to batch processing and business-hour constraints. The 24/7 bank becomes the new baseline expectation, forcing the entire industry to adapt or risk losing clients to more agile competitors.

這場轉型之所以不可逆,並不是因為技術推動,而是因應客戶需求。一旦企業財資部體驗過即時跨境結算以及持續流動性管理,他們絕不會主動回到批次處理和辦公時間限制。24/7 銀行將成為新的基本期望,逼使整個行業適應轉變,否則就會被更靈活的競爭對手搶走客戶。

Technical Infrastructure and Interoperability

技術基礎設施與互操作性

The promise of tokenized deposits depends fundamentally on the technical infrastructure supporting them: the blockchain architectures, smart contract platforms, interoperability layers, and APIs that enable institutions to deploy programmable money at scale. Understanding this infrastructure reveals both the capabilities currently available and the challenges that remain.

代幣化存款的前景,最根本上取決於支撐它們的技術基建:包括區塊鏈架構、智能合約平台、互操作層以及 API,讓機構能夠大規模部署可編程資金。了解這些基建,有助揭示現有的能力與仍待解決的挑戰。

Most major tokenized deposit implementations use permissioned distributed ledger technology, though specific choices vary. Citi's Token Services operates on a private, Ethereum-based blockchain, giving the bank full control over network participation and governance while benefiting from Ethereum's mature tooling and development ecosystem. JPMorgan deployed JPMD on Base, Coinbase's public Ethereum layer-2 blockchain, but implemented permissioned access controls so only authorized institutional clients can use the tokens.

大部分主要的代幣化存款方案都採用私有分布式帳本技術,但具體選擇各有不同。花旗的 Token Services 建於一條以以太坊為基礎的私有區塊鏈,讓銀行可以完全掌控網絡參與權及管理,同時受惠於以太坊成熟的工具組及開發生態。摩根大通則將 JPMD 部署在 Base(一條 Coinbase 推出的以太坊 layer-2 公共區塊鏈)上,但加設了受權存取控制,只讓獲授權的機構客戶可使用有關代幣。

The Ethereum Virtual Machine has become something of a standard for smart contract execution even in permissioned environments. Developers familiar with Solidity, the dominant smart contract programming language, can deploy code to Ethereum-based permissioned chains with minimal adaptation. This talent availability and tooling maturity gave Ethereum-derived architectures significant advantages despite the platform's well-known limitations around transaction throughput and fees on public mainnet.

以太坊虛擬機即使在私有場景下,也幾乎已成為智能合約執行的標準。熟悉 Solidity ——主流智能合約語言——的開發者,往往可以輕鬆將代碼部署到以太坊為基礎的私鏈上。因此,人才供應及工具成熟度令以太坊系架構縱然有交易吞吐量及公共主網手續費等知名限制,仍然具備重大優勢。

Other enterprise blockchain platforms like Hyperledger Fabric, Corda, and Quorum offer alternative architectures optimized for permissioned use cases. Hyperledger Fabric uses a modular architecture where components for identity management, consensus, and ledger storage can be customized for specific needs. Corda focuses on financial services use cases with built-in support for complex financial agreements and privacy-preserving data sharing. Quorum, developed by JPMorgan and later spun out, extends Ethereum with enterprise features including transaction privacy and permissioned networks.

其他如 Hyperledger Fabric、Corda 及 Quorum 等企業級區塊鏈平台則提供為私有用途優化的替代架構。Hyperledger Fabric 採用模組化設計,身份管理、共識、帳本儲存等組件都可以按需自訂。Corda 專注於金融服務案例,內建複雜金融合約及保護私隱的數據共用功能。Quorum 則由摩根大通開發(之後獨立),在以太坊基礎上增添交易私隱及私有網絡等企業功能。

The choice between platforms involves tradeoffs across multiple dimensions. Ethereum-based systems benefit from extensive developer communities, mature tooling, and interoperability with Ethereum-native applications. Purpose-built enterprise platforms like Hyperledger and Corda offer better privacy controls, higher transaction throughput, and financial-services-specific features but less extensive ecosystems. Public blockchain deployment with permissioned layers, as JPMorgan chose for JPMD, combines aspects of both: leveraging public infrastructure and tooling while maintaining control over access and usage.

平台之間的選擇涉及多方面的權衡。以太坊系統受惠於龐大的開發者社群、成熟工具及與以太坊原生應用互通性。Hyperledger、Corda 等專為企業打造的平台則在私隱控制、交易吞吐量及金融功能方面有更佳表現,但生態體系較有限。而像摩根大通為 JPMD 選取的模式,則在公共區塊鏈上設私有層,既運用開放基建及工具,同時控制存取及使用。

Consensus mechanisms vary as well. Public blockchains like Ethereum use proof-of-stake or proof-of-work to achieve decentralized consensus among untrusted validators. Permissioned networks can use simpler and faster consensus algorithms like practical Byzantine fault tolerance variants or Raft because all validators are known and authorized. The consensus choice affects transaction finality, throughput, and resilience but matters less to end users who simply want reliable settlement.

共識機制也有分別。像以太坊這類公共區塊鏈會用權益證明(PoS)或工作量證明(PoW)來讓不信任的驗證者間達成去中心化共識;私網則可以用更簡單、更快的如實用拜占庭容錯(PBFT)或 Raft 共識,因為所有驗證者都是已知及受權。共識機制選擇影響交易最終性、吞吐量及抗壓性,但對單純要求穩定結算的用戶而言影響有限。

Smart contract capabilities enable the programmable aspects of tokenized deposits. Contracts can encode conditional logic: execute payment only if certain conditions are met, split payments among multiple recipients according to defined formulas, or trigger secondary transactions automatically when primary transactions complete. The power comes from combining these capabilities: a trade finance smart contract might verify delivery confirmation through an oracle service, automatically execute payment from buyer to seller, trigger a secondary payment from seller to shipping company, and update trade documentation, all atomically and automatically.

智能合約賦予代幣化存款可編程性。合約可內嵌條件邏輯,包括:只在符合某些條件時才執行付款;按指定公式分拆款項給多名收款人;或在主要交易完成時自動觸發次級交易等。真正的威力在於組合運用:例如貿易金融合約可以通過 oracle 服務驗證交付,然後自動完成買家向賣家的付款、觸發賣家轉帳給航運公司,再同步更新貿易單據——全部原子化自動完成。

Security in smart contract development remains challenging. Code vulnerabilities can create exploits that drain funds or disrupt operations. Even well-audited contracts sometimes contain subtle flaws discovered only after deployment. Financial institutions deploying tokenized deposits must invest heavily in code audits, formal verification where practical, and operational safeguards including circuit breakers that can halt activity if anomalies are detected.

智能合約開發的安全風險仍然相當大。代碼漏洞可能被利用來盜取資金或破壞運作,即使通過審計的合約有時亦會部署後才發現微妙缺陷。金融機構引入代幣化存款需要大額投資於代碼審計、可行時進行形式化驗證,並設有營運保障措施(如熔斷機制),在發現異常時即時暫停運作。

Interoperability represents perhaps the greatest technical challenge facing tokenized deposit infrastructure. Each bank's implementation exists on a separate blockchain or private ledger. If you had a separate Citi Coin and a Wells Fargo Coin, there's a good chance they'd use different technologies, creating interoperability challenges for using distributed ledger technology for interbank payments. Transactions within a single institution's blockchain settle efficiently, but moving value between different institutions' systems requires bridges or intermediary layers.

互操作性很可能是代幣化存款基建面對的最大技術難題。每間銀行的系統都各自在不同區塊鏈或私有帳本上運作。如果有 Citi Coin 同 Wells Fargo Coin,就好大機會會用唔同技術,導致銀行之間用分布式帳本付款時出現互通障礙。單一機構內的區塊鏈清算很高效,但機構之間要轉資則需要橋接或中介層。

Several approaches to cross-chain interoperability have emerged. Atomic swaps enable direct exchange of tokens between blockchains using cryptographic techniques that ensure either both sides complete or neither does. Wrapped tokens involve locking tokens on one blockchain and minting equivalent tokens on another, with a custodian managing the locked collateral. Cross-chain messaging protocols like Chainlink's Cross-Chain Interoperability Protocol enable blockchains to exchange data and instructions, allowing smart contracts on one chain to trigger actions on another.

目前已經出現多種跨鏈互通技術。例如原子交換(atomic swap)用密碼學確保兩邊要一齊完成兌換才成立;包裝代幣(wrapped token)則是在一條鏈鎖住代幣,再由託管方負責,在另一條鏈發行等值代幣;而像 Chainlink Cross-Chain Interoperability Protocol 這類跨鏈消息協議,就容許鏈與鏈之間交換數據與指令,使智能合約可以互相觸發操作。

Circle's Cross-Chain Transfer Protocol represents another interoperability approach, enabling native USDC to move between supported blockchains without wrapped tokens. While designed for Circle's stablecoin rather than bank-issued tokenized deposits, the protocol demonstrates technical patterns that could apply more broadly. Users burn USDC on the source chain and mint equivalent USDC on the destination chain, with Circle's infrastructure ensuring atomicity and finality.

Circle 的 Cross-Chain Transfer Protocol 又是另一種互通方案,讓原生 USDC 可以無需包裝代幣地跨鏈轉移。雖然本身設計是支援 Circle 的穩定幣,而非銀行發行的代幣存款,但其技術方式有望更廣泛套用。用戶在來源鏈銷毀 USDC,再於目標鏈鑄造等值 USDC,並透過 Circle 基建確保原子性及最終性。

Partior's approach differs by creating a shared settlement layer that multiple banks use rather than connecting separate bank blockchains. Partior's unified ledger enables real-time atomic clearing and settlement, providing instant liquidity and transparency by using programmable shared infrastructure rather than sequential processing in legacy payment systems. Banks participating in Partior can settle with each other directly on the shared ledger rather than exchanging tokens between separate systems.

Partior 的方式則不同:它不是連接不同銀行的區塊鏈,而是主動建立一個多銀行共用的結算層。Partior 的統一帳本可以即時原子清算與結算,以可編程共享基建取代傳統付款系統的按序處理,提供即時流動性及透明度。參與的銀行可直接在共有帳本間交收,而無需在獨立系統間交換代幣。

The network effects of these different interoperability models vary significantly. Atomic swaps work peer-to-peer but require both parties to be online simultaneously and become complex for multi-party transactions. Wrapped token approaches centralize risk with the custodian managing locked collateral. Cross-chain messaging protocols create dependencies on oracle services and message relay infrastructure. Shared settlement layers like Partior require participants to agree on common governance and technical standards.

不同互操作模型帶來的網絡效應差異極大。原子交換只可點對點,雙方必需同時在線並且多方交易更複雜;包裝代幣則風險集中在託管方;跨鏈消息協議又會依賴外部 oracle 服務與消息中繼基建;至於像 Partior 的共享結算層,則要所有參與方同意共同治理與技術標準。

For institutional use cases, trust-based interoperability solutions may prove more practical than fully trustless bridges. Banks already maintain correspondent banking relationships backed by legal agreements and credit lines. Extending these relationships to include interoperability between tokenized deposit systems adds technical capabilities without fundamentally changing the trust model. A bank might agree to accept another bank's tokenized deposits at par with minimal friction because existing agreements and capital relationships already support that trust.

對機構用途來說,基於信任的互通方案或會比「完全無需信任」的跨鏈橋更務實。銀行本身就有對應銀行關係,由法律協議和信貸額度支撐。將此延展至代幣存款系統間的互通,只是新增技術手段,並未改變核心信任模式。一間銀行可以輕鬆同意以面值接受另一間銀行的代幣化存款,因為現有協議和資本關係已經建立信任基礎。

API layers provide another critical infrastructure component, enabling existing banking systems to interact with blockchain-based tokenized deposit infrastructure. Citi designed its Token Services for seamless integration with clients' existing systems, avoiding the need for clients to adopt entirely new platforms or interfaces. Clients can instruct payments through familiar banking channels, with the bank's systems translating those instructions into blockchain transactions behind the scenes.

API 層也是關鍵的基建組件之一,使現有銀行系統可以與區塊鏈為基礎的代幣化存款基建互動。花旗的 Token Services 就設計成可無縫整合到客戶現有系統,毋須客戶改用全新平台或介面。客戶可以經慣用銀行渠道發出付款指令,銀行系統會自動將其轉為區塊鏈交易於背後執行。

This API approach reflects pragmatic recognition that

這種 API 方案反映......(未完)wholesale replacement of existing corporate treasury systems is unrealistic. Large corporations run complex ERP environments, custom treasury management platforms, and payment processing systems representing decades of investment and configuration. Successful tokenized deposit adoption requires working with this installed base rather than demanding replacement.

以現有企業財資系統作出全面更換並不現實。大型企業運作著龐大的ERP(企業資源規劃)系統、自訂財資管理平台及支付處理系統,這些系統涉及數十年的投資及配置。要成功推動代幣化存款的採用,關鍵在於與現有系統兼容配合,而不是強行要求全部更換。

Latency in tokenized deposit systems generally falls far below traditional correspondent banking but varies by implementation. Partior carried out end-to-end settlements involving both U.S. and Singapore dollars in under two minutes, dramatically faster than traditional cross-border settlement but still longer than the near-instant settlement possible in single-blockchain environments. The difference reflects interoperability overhead and validation requirements when transactions cross institutional boundaries.

代幣化存款系統的延遲通常比傳統代理銀行低得多,但具體情況因實施方案而異。以 Partior 為例,它能在不足兩分鐘內完成涉及美元和新加坡元的端對端結算,速度遠遠快於傳統跨境結算,但仍不及單一區塊鏈環境下幾乎即時的結算快。其差異主要在於當交易跨越不同機構時,需要考慮互通性成本及驗證要求。

For many institutional use cases, settlement in minutes rather than seconds makes little practical difference. The critical threshold is same-day settlement with sufficient speed that transactions can complete within operational timeframes. Instant settlement provides obvious benefits for time-sensitive situations, but the jump from multi-day to sub-hour settlement captures most of the practical value for treasury management applications.

對於許多機構層面的應用來說,數分鐘結算與數秒結算其實分別不大。最重要的是能夠於同日內結算,並且具備充裕速度,讓交易可以在營運時段內完成。即時結算對於時間敏感的情況當然有明顯好處,但將結算速度由幾天縮短至一小時以內,已經能滿足大部分財資管理的實際需求。

Throughput represents another important dimension. Base blockchain offers sub-second, sub-cent transactions, providing the performance required for high-volume payment applications. Permissioned enterprise blockchains can achieve even higher throughput because they optimize for that goal without the decentralization constraints of public blockchains. The relevant question is whether throughput meets or exceeds the transaction volumes the institution expects to handle, not whether the blockchain matches payment card network speeds of thousands of transactions per second.

吞吐量是另一個重要指標。基礎區塊鏈能提供亞秒級、低成本的交易,滿足大規模支付應用的性能要求。私有企業區塊鏈更可進一步提升吞吐量,因為它們專門為此優化,不受公有鏈去中心化的技術限制。最關鍵的是:有關系統的吞吐量能否應付該機構預期處理的交易量,而非是否能達到支付卡網絡每秒數千宗交易的水平。

Privacy-preserving technologies address concerns about transaction visibility on shared ledgers. Institutions may hesitate to use shared blockchains where all participants can potentially see all transactions, even if identities are pseudonymous. Zero-knowledge proofs enable proving transaction validity without revealing transaction details. Ring signatures and mixing protocols obscure transaction graphs. Confidential transactions hide amounts while enabling validation that inputs equal outputs.

保護私隱的技術針對共享分類帳上交易可見性的疑慮作出回應。即使身份是化名,機構對於所有參與者都可能看見所有交易的區塊鏈,亦可能會有所保留。零知識證明允許在不透露交易細節下證明其合法性。環簽名和混合協議可模糊交易圖譜。保密交易則能隱藏金額,同時保證輸入等於輸出。

JPMorgan published a whitepaper demonstrating a proof-of-concept exploring on-chain privacy, identity, and composability, recognizing these as major themes for continued blockchain evolution in institutional contexts. Enhanced privacy measures are crucial for enabling broader adoption without compromising commercial confidentiality or exposing competitive information.

摩根大通曾發表白皮書,展示了有關鏈上私隱、身份及組合性的概念驗證,並指出這些是機構層面區塊鏈持續發展的主要議題。加強私隱保障措施,對於擴大應用範圍並同時保障商業機密和競爭信息極為關鍵。

The governance of blockchain infrastructure matters enormously for institutional adoption. Who controls the network? Who can join as a node operator or validator? How are technical upgrades decided and implemented? What happens when disputes arise or transactions need reversal due to errors or fraud? Public blockchains answer these questions through decentralized governance, albeit often with challenges around coordination and plutocratic voting power. Permissioned networks must establish explicit governance frameworks.

區塊鏈基礎設施的管治對機構採用極為重要。誰人控制網絡?誰可以加入成為節點營運者或驗證人?技術升級由誰決定和執行?遇上糾紛或需因錯誤或詐騙而撤銷交易時該如何處理?公有區塊鏈透過去中心化機制回應這些問題,但協調和握有大量票數者主導決策的情況亦常構成挑戰。私有網絡則必須建立明確的管治框架。

Partior is backed by a consortium of global banks including DBS, JPMorgan, Standard Chartered, and Deutsche Bank, creating a multi-party governance model where major participants collectively control the network's evolution. This approach balances the need for coordination and standards with the desire to avoid single-institution control that could introduce conflicts of interest.

Partior 獲得星展銀行、摩根大通、渣打銀行及德意志銀行等全球性銀行聯盟支持,建立多方共管模式,由主要參與者共同掌控網絡發展方向。這種做法平衡了協調與標準化的需求,同時避免單一機構主導而出現利益衝突。

Network resilience and business continuity require careful consideration. Blockchain networks must continue operating even if individual nodes fail, network partitions occur, or deliberate attacks target infrastructure. Permissioned networks with a limited number of known validators can achieve strong resilience through redundancy and geographic distribution. The tradeoff is that network operation depends on the validators remaining operational and properly motivated to maintain service.

網絡韌性及業務持續性需要仔細考慮。即使有個別節點失效、網絡分裂或受到惡意攻擊,區塊鏈網絡亦必須能維持運作。私有網絡透過已知驗證者有限數目,加強備援及地域分布來提升韌性。其代價是,整個網絡營運依賴於這些驗證者持續正常運作及妥善履行維護的動力。

Operational reversibility presents a particular challenge. Traditional payment systems allow transactions to be reversed or recalled in certain circumstances: errors, fraud, or legal orders. Blockchain systems designed for immutability resist reversal by architecture. Financial institutions need mechanisms to handle exceptional situations while preserving the finality that makes blockchain settlement attractive. Solutions typically involve permissioned capabilities allowing authorized parties to mint new tokens offsetting erroneous transfers rather than literally reversing blockchain transactions.

運作上的可逆性是特殊挑戰。傳統支付系統容許在特定情況下撤銷或追回交易,例如錯誤、詐騙或法律命令。設計上追求不可篡改的區塊鏈,則很難直接逆轉交易。金融機構需要設計機制,在保留區塊鏈結算「最終性」吸引力的同時,有效處理特殊情況。現時常見做法是賦予有權方權限,能夠鑄造新代幣以抵銷錯誤轉賬,而不是真正地逆轉區塊鏈交易。

The technical infrastructure for tokenized deposits continues evolving rapidly. Current implementations provide sufficient capabilities for initial deployment and pilot programs, but scaling to full production across diverse use cases will require ongoing development. Standards for interoperability, identity management, privacy preservation, and cross-chain settlement remain works in progress. The industry must balance the benefits of customization for specific needs against the imperative of compatibility and standardization enabling network effects.

代幣化存款的技術基礎設施正急速發展。目前的實施方案足以支持早期部署與試點項目,但要拓展到全面及多元化實務應用,仍需持續改良。互通性、身份管理、私隱保護及跨鏈結算的標準仍在制定中。業界必須在為個別需求度身訂造和推動兼容性及標準化以促成網絡效應之間取得平衡。

Ultimately, the technical infrastructure matters insofar as it enables the functional capabilities institutions and their clients require: fast settlement, programmable logic, continuous availability, transparent reconciliation, and interoperability across institutions and networks. The specific blockchain platforms, consensus mechanisms, and interoperability protocols are means to these ends rather than ends in themselves. As the technology matures and standards emerge, the infrastructure should become increasingly invisible to end users who simply experience superior payment and liquidity management capabilities without needing to understand the underlying blockchain mechanics.

最終,技術基礎設施之所以重要,是因為它賦予機構及其客戶所需的實際功能:快速結算、可編程邏輯、持續可用性、透明對賬、以及跨機構、跨網絡之互通。區塊鏈平台、共識機制和互操作協議本身只是達致這些目標的手段而非目的。隨技術成熟和標準出台,基礎設施應該愈來愈「隱形」,用戶只會享受到優越的支付和流動性管理體驗,無須理解底層區塊鏈運作細節。

Compliance and Regulation: Built for the Regulated World

One of the most significant advantages tokenized deposits hold over many cryptocurrency alternatives is how naturally they fit within existing regulatory frameworks. While crypto markets often struggle with regulatory uncertainty, tokenized deposits emerged from regulated banks operating under established supervision, making compliance integration a design feature rather than an afterthought.

代幣化存款相對於許多加密貨幣方案的明顯優勢之一,是其本身非常自然地契合現有監管架構。加密貨幣市場經常面對監管不明朗的困境,但代幣化存款是由受監管銀行發行並在成熟監管下運作的產品,其合規性是設計本身固有的一環,而非事後補救。

Traditional banking regulation divides oversight across multiple dimensions: prudential regulation ensuring banks remain safe and sound, conduct regulation governing how banks treat customers, and functional regulation covering specific activities like payments or securities services. Banks issuing tokenized deposits already operate under comprehensive supervision across all these dimensions. The blockchain technology introduces new operational characteristics but does not fundamentally alter the legal nature of the deposit or the regulatory obligations surrounding it.

傳統銀行監管分多個層面:審慎監管確保銀行穩健安全、行為規管監察銀行對客戶之態度、職能監管則涵蓋支付或證券等具體服務。發行代幣化存款的銀行早已受到這些全方位監管。區塊鏈技術僅引入新的操作特性,並未根本改變存款的法律性質或其監管責任。

In the United States, banks issuing tokenized deposits operate under the supervision of their primary federal regulator: the Office of the Comptroller of the Currency for national banks, the Federal Reserve for state member banks and bank holding companies, or the Federal Deposit Insurance Corporation for state non-member banks. These regulators examine banks regularly, assess capital adequacy, review risk management practices, and enforce compliance with banking laws. Tokenized deposits simply represent another product offering subject to this existing supervision.

在美國,發行代幣化存款的銀行會受其主要聯邦監管機構監督:全國性銀行由貨幣監理署(OCC)監管,州成員銀行和銀行控股公司由聯邦儲備局(FED)監管,州非成員銀行則由聯邦存款保險公司(FDIC)監管。這些監管機構定期審查銀行,評估其資本充足水平、審核風險管理措施,以及監管其合規狀況。代幣化存款只是屬於這套現有監管體制下的另一項新產品。

The Office of the Comptroller of the Currency clarified its position on bank crypto activities through interpretive letters beginning in 2020, confirming that national banks may provide custody services for crypto assets, use stablecoins for payment activities, and operate nodes on blockchain networks. The GENIUS Act, passed by the Senate in June 2025 and signed into law in July 2025, established a federal regulatory framework for payment stablecoins while explicitly recognizing deposit tokens issued by regulated banks as distinct from stablecoins issued by nonbank entities.

OCC 自 2020 年起透過詮釋信函闡釋其對銀行從事加密貨幣業務的立場,包括確認全國性銀行可為加密資產提供託管服務、允許銀行用穩定幣進行支付活動及在區塊鏈網絡運營節點。2025 年 6 月美國參議院通過並於 7 月正式簽署成法的 GENIUS 法案,正式為支付穩定幣建立聯邦監管框架,並明確區分受監管銀行發行的存款代幣與非銀行機構發行的穩定幣。

The GENIUS Act requires payment stablecoin issuers to hold at least one dollar of permitted reserves for every stablecoin issued, with permitted reserves limited to coins, currency, insured deposits, short-dated Treasury bills, repos backed by Treasury bills, government money market funds, and central bank reserves. Issuers must submit periodic reports of outstanding stablecoins and reserve composition, certified by executives and examined by registered public accounting firms, with those having more than 50 billion dollars in outstanding stablecoins required to provide audited annual financial statements.

GENIUS 法案規定,支付穩定幣的發行者必須為每一枚發行的穩定幣持有至少一美元的許可儲備。允許的儲備類型包括現金、貨幣、已投保存款、短期國庫券、以國債抵押的回購協議、政府貨幣市場基金及央行準備金。發行者還須定期提交在外流通穩定幣數量及儲備構成報告,報告需經高層簽署並由註冊會計師審核。若流通穩定幣總額超過500億美元,則必須提交經審計的年度財務報表。

The GENIUS Act explicitly states that payment stablecoins issued by permitted issuers are not securities under federal securities laws or commodities under the Commodity Exchange Act, removing them from SEC and CFTC jurisdiction. For banks issuing tokenized deposits, this classification provides clarity: deposit tokens are bank products supervised by banking regulators, not novel crypto assets requiring new regulatory approaches.

GENIUS 法案清楚指出,合乎許可的穩定幣發行者發行的支付穩定幣在聯邦證券法下不是證券,在商品交易法下也不是商品,因此不受SEC及CFTC監管。對發行代幣化存款的銀行來說,這類定義釐清了身份:存款代幣是銀行產品,由相關監管機構監察,而不是需要另設監管框架的新型加密資產。

All stablecoin issuers under the GENIUS Act must comply with the Bank Secrecy Act, implementing anti-money-laundering and counter-terrorist-financing measures. Banks already maintain robust BSA compliance programs as a core regulatory requirement, giving them infrastructure advantage over nonbank stablecoin issuers building compliance capabilities from scratch.

GENIUS 法案下所有穩定幣發行者都必須遵守《銀行保密法》,實施反洗黑錢和反恐怖分子融資措施。銀行本身已擁有成熟全面的 BSA 合規系統,有別於非銀行穩定幣發行者要從零開始建立合規基礎設施。

The know-your-customer requirements embedded in banking regulation align naturally with permissioned blockchain architectures. Distributed ledger systems used for tokenized deposits maintain know-your-customer, anti-money-laundering, and

銀行監管中內置的認識你的客戶(KYC)要求,亦與私有區塊鏈架構高度契合。用於代幣化存款的分布式分類帳系統可維持認識客戶、反洗黑錢等......counter-terrorist-financing checks as integrated components of the infrastructure. When a transaction initiates, the system validates that all parties are properly identified and authorized before allowing execution. This contrasts sharply with public cryptocurrency systems where pseudonymous addresses can receive funds without identity verification, creating ongoing regulatory friction.

反恐資金流動審查被納入為基礎設施的一部份。每當一筆交易開始時,系統會核實所有參與方的身份和授權資格,然後才允許執行。這與公有加密貨幣系統大相逕庭,在那些系統內,偽匿名地址可以在沒有身份驗證下接收資金,持續帶來監管上的摩擦。

Transaction monitoring and suspicious activity reporting become more straightforward on shared ledgers where all participants can see relevant transactions. Rather than piecing together activity across multiple correspondent banks and jurisdictions, a tokenized deposit network provides transparent transaction history visible to relevant authorities. Banks can implement automated monitoring tools examining blockchain data continuously, flagging unusual patterns for investigation.

在共享賬本上,所有參與者都能看到相關交易,使到交易監控和可疑活動舉報變得更加直接。銀行不用再從多個代理銀行和司法管轄區拼湊活動紀錄,因為代幣化存款網絡為主管機關提供了透明的交易歷史。銀行可以實施自動化監控工具,不斷檢查區塊鏈數據,標示出可疑模式以作調查。

The GENIUS Act requires stablecoin issuers to possess technical capability to seize, freeze, or burn payment stablecoins when legally required and to comply with lawful orders. Permissioned blockchain architectures can implement such controls through administrative smart contracts allowing authorized parties to lock or transfer tokens in response to legal process. This capability is essential for law enforcement and sanctions enforcement but challenging to implement in truly decentralized systems.

GENIUS法案規定,穩定幣發行人必須擁有在法律要求時查封、凍結或銷毀支付穩定幣的技術能力,以及遵守合法指令。聯許區塊鏈架構可以透過行政智能合約實現這類控制,讓授權方按照法律程序鎖定或轉移代幣。這項能力對執法和制裁執行非常重要,但在完全去中心化的系統下則難以實現。

Sanctions compliance illustrates both the advantages and challenges of tokenized deposits. Office of Foreign Assets Control regulations prohibit transactions with sanctioned entities, and banks must screen all payments against sanctions lists. The GENIUS Act explicitly subjects stablecoin issuers to Bank Secrecy Act obligations including sanctions compliance, requiring sanctions list verification. Tokenized deposit systems can implement automated sanctions screening before transaction execution, blocking prohibited transfers before they settle rather than identifying violations after the fact.

制裁合規同時呈現出代幣化存款的優點和挑戰。外國資產管制辦公室規定,禁止與受制裁實體交易,銀行必須將所有支付與制裁名單作對照。GENIUS法案明確要求穩定幣發行人需遵守銀行保密法的責任,包括履行制裁合規並驗證制裁名單。代幣化存款系統可在交易執行前自動篩查制裁,於結算前阻止違規轉帳,而非事後才查出違反行為。

However, the programmability of tokenized deposits creates potential compliance challenges. If a smart contract automatically executes payments based on conditions without human review, how do banks ensure each automated payment complies with sanctions requirements? The answer requires embedding compliance checks within smart contract logic or limiting automation to low-risk scenarios with sufficient human oversight. This tension between automation efficiency and compliance assurance will require ongoing attention as smart contract sophistication increases.

然而,代幣化存款的可編程性亦帶來合規風險。若智能合約根據預設條件自動執行付款流程而無需人手審查,銀行如何確保每筆自動付款都符合制裁要求?答案是要在智能合約邏輯中嵌入合規審查,或將自動化限制於可接受風險並有足夠人工監控的場景。隨著智能合約日益成熟,這種自動化效率與合規保障的矛盾,需要持續關注。

The European Union's regulatory approach has evolved rapidly, with MiCA providing comprehensive framework for crypto assets. MiCA's provisions covering asset-referenced tokens and e-money tokens took effect on June 30, 2024, imposing strict reserve requirements, whitepaper disclosures, and authorization processes for stablecoin issuers. Crypto Asset Service Providers must begin applying for licenses starting January 2025, with an 18-month grandfathering period allowing existing providers to continue while transitioning to full compliance.

歐盟的監管策略發展迅速,MiCA已建立加密資產的全面框架。有關資產參考型代幣及電子貨幣代幣的規定已於2024年6月30日生效,對穩定幣發行人實施嚴格的儲備要求、白皮書披露及獲授權程序。加密資產服務供應商須於2025年1月起開始申請牌照,現有營運者有十八個月的過渡期可繼續營運,同時過渡至全面遵規。

MiCA divides stablecoins into e-money tokens backed by single fiat currencies and asset-referenced tokens backed by multiple assets. E-money tokens face requirements similar to electronic money under existing EU e-money directives, requiring issuers to be licensed in the EU, maintain fully backed reserves, and publish detailed disclosures. Issuers must maintain at least 30 percent of reserves in highly liquid assets, with all reserves held in EU financial institutions.

MiCA將穩定幣分為單一法定貨幣支持的電子貨幣代幣,以及多種資產支持的資產參考型代幣。電子貨幣代幣的要求類似現有的歐盟電子貨幣規例,發行人必須在歐盟持有牌照、維持全額資產支持的儲備並公佈詳細披露。發行人至少須將三成儲備存放於高度流動資產,並且全部儲備要存於歐盟的金融機構。

Both GENIUS Act and MiCA require regulated stablecoin issuers to hold reserves in conservative one-for-one ratios against all stablecoins in circulation, with deposits held in bankruptcy-protected structures. Both frameworks entitle holders to redemption at par and impose obligations on exchanges and service providers handling stablecoins. The convergence between U.S. and EU approaches, despite different starting points and political contexts, reflects shared policy goals around consumer protection, financial stability, and regulated money.

GENIUS法案和MiCA都要求受規管的穩定幣發行人,為流通中的所有穩定幣,以一比一的保守比例持有儲備,並將存款置於破產保護結構。這兩套框架都保障持有人能按等值贖回,同時對涉獲穩定幣的交易所和服務商設定法定責任。美歐兩地雖起點和政治環境不同,但其趨同反映了對消費者保障、金融穩定及貨幣監管的共同政策目標。

For banks issuing tokenized deposits in multiple jurisdictions, the proliferation of regulations creates compliance complexity but not fundamental uncertainty. Banks operate across borders routinely, managing compliance with different regulatory regimes as part of normal operations. The key advantage is that tokenized deposits generally fit within existing banking regulation rather than requiring entirely new frameworks.

對於在多個司法管轄區發行代幣化存款的銀行而言,監管規定雖複雜但不致根本不確定。銀行本來就經常跨境營運,管理不同監管體制下的合規事宜屬日常操作。其主要優勢在於,代幣化存款大致適用現有銀行監管,毋須完全另建新制度。

Asia-Pacific jurisdictions have taken varied approaches. Singapore's Monetary Authority of Singapore backed Partior's development and praised it as "a global watershed moment for digital currencies, marking a move from pilots and experimentations towards commercialization and live adoption". Singapore has established itself as a supportive jurisdiction for financial innovation while maintaining strong regulatory oversight, creating an attractive environment for blockchain-based financial services.

亞太地區各司法管轄區做法不一。新加坡金融管理局支持Partior的發展,形容這是「數字貨幣史上的全球分水嶺,標誌著由試點和實驗轉向商用和落地」。新加坡定位為金融創新的友善地域,同時有嚴謹的監管,為區塊鏈金融服務創造了具吸引力的環境。

Hong Kong similarly positioned itself as a digital asset hub, though maintaining careful regulatory controls. Hong Kong's Stablecoin Ordinance, passed in May 2025, requires all stablecoin issuers backed by the Hong Kong dollar to obtain licenses from the Hong Kong Monetary Authority, maintain high-quality liquid reserve assets equal to par value of stablecoins in circulation, and submit to strict requirements including AML/CFT compliance and regular audits.

香港亦積極定位為數字資產中心,但有嚴格的監管規制。香港於2025年5月通過《穩定幣條例》,要求所有以港元支援的穩定幣發行人,必須獲取香港金融管理局牌照、持有等值高質流動儲備資產,並遵守嚴格條件,包括反洗錢及反恐資金規定以及定期審計。

Japan's regulatory approach emphasizes consumer protection and financial stability, with the Financial Services Agency maintaining stringent oversight of crypto activities. Tokenized deposits issued by licensed banks would fall under existing banking regulation, though specific guidance continues developing as the technology matures.

日本的監管以消費者保障及金融穩定為重,由金融廳對加密貨幣活動嚴格監管。由持牌銀行發行的代幣化存款將納入現有銀行監管體系,相關細則會隨技術成熟而陸續出台。

The regulatory landscape remains dynamic, with frameworks continuing to evolve as regulators observe market developments and industry practices. However, the fundamental regulatory advantage of tokenized deposits is already clear: they work within established legal and regulatory structures rather than challenging them. Comptroller of the Currency Jonathan Gould stated that the GENIUS Act "will transform the financial services industry" and that "the OCC is prepared to work swiftly to implement this landmark legislation", indicating regulatory receptiveness to facilitating tokenized deposit adoption.

監管格局依然不斷演變,監管框架會隨市場變化和業界發展而調整。但代幣化存款有一個明顯的根本監管優勢:它們運作於既有法律和監管架構內,而非試圖挑戰體制。美國貨幣監理署Jonathan Gould曾指,GENIUS法案「將推動金融服務業轉型」,OCC亦準備迅速落實這項里程碑法例,顯示監管機構願意推動代幣化存款落地。

The on-chain transparency of blockchain systems provides regulators with new oversight tools. Rather than requesting reports or conducting examinations based on samples, regulators could potentially observe all transactions on permissioned networks in real time. This surveillance capability raises privacy concerns but offers unprecedented regulatory visibility into financial activity. The balance between transparency for oversight and confidentiality for commercial operations will require ongoing negotiation as blockchain adoption expands.

區塊鏈系統的上鏈透明度,為監管機構帶來新型監督工具。不再只是靠申報或抽樣檢查,監管者有可能實時監察可授權網絡上的所有交易。這種監控能力雖引發私隱關注,但大大提升監管可見度。如何平衡監督透明度和商業機密性,將成為區塊鏈應用日益普及下需要持續協調的議題。

One significant area requiring continued regulatory development involves the treatment of smart contracts within banking law. When a smart contract automatically executes a payment based on programmed conditions, who bears liability if the outcome differs from what parties intended? How should courts interpret smart contract code when disputes arise? Should banks be held to the same standards for smart contract execution as for manual transaction processing? These questions lack definitive answers, and different jurisdictions may develop different precedents.

其中一個需要持續完善的重點,是銀行法律下對智能合約的處理。當智能合約按預設條件自動執行付款,但結果有別於各方原意時,責任應如何劃分?有爭議時,法院應如何詮釋合約代碼?銀行執行智能合約時,應否以與手動交易相同標準審視?這些問題目前尚未有定案,各地司法或有不同先例。

Cross-border regulatory harmonization would significantly benefit tokenized deposit development, but achieving such harmonization has proven elusive even in traditional banking. The Basel Committee on Banking Supervision coordinates international banking regulation but allows substantial national discretion. The Financial Stability Board published recommendations on global stablecoin arrangements including cross-border collaboration, transparent disclosures, and compliance with AML/CFT measures, providing high-level principles but leaving implementation details to national authorities.

跨境監管標準化對代幣化存款發展極為有利,但即使於傳統銀行領域,真正落實標準化依然困難。巴塞爾銀行監理委員會雖協調國際銀行監管,但予各國高度自主。金融穩定委員會於全球穩定幣安排發表建議,包括跨境協作、透明披露和反洗錢/反恐資金措施,訂出高層次原則,具體落實則交由各國主管。

For tokenized deposits to realize their full potential for global liquidity management, regulatory frameworks must enable cross-border flows while preserving national policy autonomy and preventing regulatory arbitrage. This tension between integration and sovereignty characterizes international financial regulation generally and will shape tokenized deposit regulation specifically.

要發揮代幣化存款於全球流動性管理的全部潛力,監管框架必須容許跨境資金流通,同時保障國家政策自主、防止監管套利。這種一體化與主權之間的張力,是國際金融監管的一般特徵,亦將具體影響代幣化存款的規管。

Data localization requirements illustrate the challenge. Some jurisdictions require financial data to be stored within their borders, complicating global blockchain networks that inherently distribute data across multiple nodes potentially in multiple countries. Technical solutions like partitioned ledgers or encryption can address some concerns, but regulatory acceptance varies.

數據本地化要求則突顯此一難題。有些地區規定金融數據必須留在本地,這使得本質上分散於多國多節點的全球區塊鏈網絡更為複雜。雖然可用分區賬本或加密等技術舒緩部分問題,但各地監管接受程度不一。

The Digital Operational Resilience Act in the EU represents another regulatory development affecting tokenized deposits. DORA mandates incident reporting, risk management systems, and strong cybersecurity measures for financial entities including crypto asset service providers. Banks deploying tokenized deposits must ensure their blockchain infrastructure meets operational resilience standards, including the ability to continue operations during outages, recover from failures, and respond to cyber attacks.

歐盟的《數字運營韌性法案》(DORA)則是另一影響代幣化存款的重要監管新例。DORA要求金融機構(包括加密資產服務供應商)必須匯報事故、建立風險管理系統及專業網絡安全措施。銀行在部署代幣化存款時,需確保其區塊鏈基建符合營運韌性標準,包括斷線下能維持運作,意外故障後可復原,並能應對網絡攻擊。

Looking forward, the regulatory environment for tokenized deposits will likely remain broadly favorable given that banks operate under established supervision and that tokenized deposits simply represent technological evolution rather than regulatory revolution. Specific rules will continue developing as regulators gain experience with blockchain-based banking and as industry practices mature. The fundamental compatibility between tokenized deposits and existing regulatory frameworks means regulatory development will refine approaches rather than

展望未來,代幣化存款的監管環境大致會持續友善,因為銀行本就受現有監管,而代幣化存款本質上只是科技演化而非顛覆性革命。隨著監管者在區塊鏈銀行業累積經驗及行業實務成熟,具體規則將不斷完善。代幣化存款和現有監管架構的根本兼容性,意味日後監管發展主要在細化和優化方向上進行,而非——determine whether tokenized deposits are permissible at all.

判斷代幣化存款是否根本容許。

This regulatory integration represents a critical advantage over less regulated crypto alternatives. While regulatory clarity sometimes seems to constrain innovation, it also enables institutional adoption at scale. Corporate treasurers, financial institutions, and large-scale users need regulatory certainty to deploy new technologies for mission-critical operations. Tokenized deposits provide that certainty in a way that truly decentralized cryptocurrencies cannot, making them far more viable for transforming mainstream financial infrastructure rather than creating parallel systems outside traditional finance.

這種監管上的融合,相比監管較少的加密貨幣替代方案來說,是一個重大優勢。雖然監管清晰有時似乎會限制創新,但同時亦有效促進大規模機構採用。企業財資主管、金融機構及大型用戶需要監管上的確定性,才能在關鍵運作上應用新技術。代幣化存款正好提供這種確定性,是真正去中心化加密貨幣無法做到的,因此更適合用來轉型主流金融基建,而非只是在傳統金融體系以外創建平行系統。

The Real Competition: Stablecoins, CBDCs, and Tokenized Deposits

真正的競爭:穩定幣、央行數碼貨幣(CBDC)及代幣化存款

The digital currency landscape comprises multiple overlapping categories: tokenized deposits issued by commercial banks, stablecoins issued by nonbank entities, central bank digital currencies issued by monetary authorities, and e-money tokens issued by specialized institutions. Understanding the distinctions between these categories and their relative advantages for different use cases illuminates which forms of digital money will prevail in various contexts.

數碼貨幣的格局涵蓋多個重疊的範疇:有商業銀行發行的代幣化存款、非銀行機構發行的穩定幣、貨幣當局發行的央行數碼貨幣,以及專業機構發行的電子貨幣代幣。明白這些分類的分別及其於不同場景的優勢,有助理解各種數碼貨幣會在甚麼情況下勝出。

The comparison begins with the issuer and the nature of the liability. Tokenized deposits are issued by licensed commercial banks and represent claims on those banks, backed by the bank's full balance sheet subject to capital and liquidity regulations. Stablecoins are typically issued by nonbank entities and backed by reserves held separately from the issuer's operating assets, often in special purpose vehicles or trust structures. Central bank digital currencies would be issued by central banks and represent direct claims on central bank liabilities, placing them at the apex of the monetary hierarchy alongside physical cash and bank reserves.

比較是由發行人和負債屬性開始。代幣化存款由持牌商業銀行發行,代表對該銀行的債權,並以銀行的全部資產負債表作擔保,須受資本及流動性監管。穩定幣一般由非銀行實體發行,主要以與發行人營運資產分隔的儲備作支撐,這些儲備往往存放在特別目的機構或信託架構下。央行數碼貨幣則由央行發行,代表對央行負債的直接權益,與實體現金及銀行準備金同屬貨幣體系頂層資產。

The backing and reserve structure varies accordingly. Tokenized deposits require no separate reserves because they are simply representations of existing bank deposits that are themselves backed by the bank's asset portfolio and capital buffer. When a bank issues a tokenized deposit, it is not creating new money but rather tokenizing existing deposit liabilities. Stablecoin issuers under frameworks like the GENIUS Act must maintain full reserve backing with permitted reserves including cash, insured deposits, Treasury bills, repos, money market funds, and central bank reserves. CBDCs would be backed by central bank balance sheets comprising primarily government securities, foreign exchange reserves, and in some cases gold.

其資產支撐和儲備結構亦有所不同。代幣化存款毋須另設獨立儲備,因為已是現有銀行存款的數碼化呈現,而現有存款本來就有資產組合及資本緩衝支撐。銀行發行代幣化存款,不等同創造新貨幣,而只是將現有存款負債代幣化。在例如《GENIUS法案》等框架下,穩定幣發行商則必須按規定以現金、受保存款、國庫券、回購協議、貨幣市場基金及央行儲備等合資格資產作百分百儲備支撐。CBDC則以央行資產負債表為支撐,主要包括政府債券、外匯儲備,有時亦會包括黃金。

The regulatory treatment reflects these structural differences. Under the GENIUS Act, banks issuing deposit tokens operate under their existing banking charters and supervision, while nonbank stablecoin issuers must obtain approval as qualified payment stablecoin issuers either at the federal or state level. Federal and state regulators must issue tailored capital, liquidity, and risk management rules for stablecoin issuers, though the legislation exempts them from the full regulatory capital standards applied to traditional banks. CBDCs would operate under central bank mandates and oversight, with the specific regulatory framework depending on the CBDC design.

監管對待亦反映這些結構差異。根據《GENIUS法案》,發行存款代幣的銀行繼續受原有銀行牌照及監管規管;而非銀行機構要發行穩定幣,則必須申請成為合資格支付穩定幣發行商,獲取聯邦或州級許可。聯邦及州監管機關需為穩定幣發行人訂立專門適用的資本、流動性及風險管理要求,但法例會把他們由適用於傳統銀行的全部監管資本標準中豁免。CBDC則按央行職權及監督架構運作,具體監管框架則視乎CBDC設計而定。

Access and distribution models differ significantly. Tokenized deposits are available only to customers of the issuing bank and typically restricted to institutional and corporate clients rather than retail users. Stablecoins can be distributed broadly, depending on the issuer's business model and regulatory constraints. Some stablecoins target institutional users exclusively, while others seek mass retail adoption. CBDCs could take various forms: retail CBDCs providing digital central bank money to all citizens, wholesale CBDCs serving only as settlement medium between financial institutions, or hybrid models with different access tiers.

其使用及分發模式也大為不同。代幣化存款只限發行銀行的客戶持有,通常只開放給機構及企業客戶,而非零售用戶。穩定幣則可按發行商的業務模式和監管要求作更廣泛分發,有些穩定幣只針對機構用戶,有些則主攻大眾零售市場。CBDC可有多種形式:零售CBDC向全體市民發放央行數碼貨幣,批發CBDC僅供金融機構間作結算媒介,亦有混合模式可劃分不同使用層級。

Programmability varies by implementation rather than category. Both tokenized deposits and stablecoins can embed smart contract logic, though permissioned tokenized deposit networks may offer more sophisticated programmability given tighter integration with banking infrastructure. Most CBDC designs explored to date emphasize basic payment functionality over advanced programmability, though this reflects policy choices rather than technical limitations.

可編程性方面,差異更多取決於具體實施而非類型。代幣化存款和穩定幣都可以內嵌智能合約邏輯,而許可制的代幣化存款網絡,因與銀行基建高度整合,一般能提供更複雜的可編程功能。現時大多數CBDC設計都以基本支付功能為主,較少強調高度可編程,但這主要是政策取向選擇,技術上其實並無特大限制。

The critical differentiator for many institutional users is counterparty risk. Tokenized deposits carry the risk of the issuing bank, mitigated by deposit insurance up to applicable limits, capital requirements, and regulatory supervision. For large deposits exceeding insurance limits, the risk depends on the bank's creditworthiness and the resolution regime that would apply if the bank failed. Stablecoins carry different risk profiles depending on their structure. The GENIUS Act requires stablecoin holders to have first priority claims on the reserve assets in bankruptcy, providing some protection, but credit risk differs from direct bank deposit risk. CBDCs would carry minimal credit risk given that central banks can create money to meet obligations, though extreme situations like currency crises or sovereign defaults could affect even CBDCs.

對不少機構用戶而言,最關鍵的分野是對手方風險。代幣化存款承受發行銀行的信用風險,這會由存款保險(有上限)、資本要求及監管作一定程度的保障。對於超出保險上限的大額存款,風險則取決於銀行本身的信貸質素,以及銀行若出事後適用的解決機制。穩定幣的風險則視乎其架構,《GENIUS法案》要求穩定幣持有人可於破產時優先追索儲備資產,帶來一定保障,但其信用風險與銀行存款風險並不相同。CBDC由於央行可創造貨幣來履約,信用風險極低,但遇上極端狀況如貨幣危機或國家主權違約,甚至CBDC亦可能受影響。

Yield characteristics differ as well. The GENIUS Act prohibits permitted payment stablecoin issuers from paying interest or yield to stablecoin holders, limiting stablecoins to non-yielding assets. This restriction aims to prevent stablecoins from competing directly with bank deposits for funding. Tokenized deposits can be interest-bearing or non-interest-bearing depending on the bank's product design, functioning like traditional deposit products. Deposit tokens could potentially be interest-bearing, and JPMorgan's JPMD offers the ability to pay interest to holders, giving tokenized deposits flexibility that stablecoins lack. Most retail CBDC designs contemplate non-interest-bearing currency substitutes, though wholesale CBDCs might pay interest similar to bank reserves.

回報特性亦有差異。《GENIUS法案》禁止合資格支付穩定幣發行人向持幣人支付利息或回報,令穩定幣僅限於無息資產。這限制目的是避免穩定幣直接與銀行存款爭奪資金來源。代幣化存款則如傳統存款產品一樣,可按銀行產品設計而有息或無息。存款代幣理論上可發息,摩根大通的JPMD就讓持有人可獲取利息,令代幣化存款比穩定幣靈活。大多數零售CBDC亦設計為無息貨幣,但批發型CBDC可能如銀行準備金般可得利息。

The interoperability and network effects present another key dimension. Stablecoins circulating on public blockchains can move freely between wallets and interact with decentralized finance protocols, providing broad interoperability within crypto ecosystems but limited integration with traditional financial infrastructure. Tokenized deposits operate primarily within banking networks, interoperating well with existing financial systems but requiring specific bridges or partnerships to interact with public blockchain environments. CBDCs could theoretically interoperate with either private banking systems or public crypto networks, depending on design choices, though most proposals emphasize compatibility with existing financial infrastructure over crypto integration.

互通性和網絡效應亦是一大範疇。在公鏈流轉的穩定幣可自由在錢包間轉移,與DeFi協議互操作,實現廣泛的加密生態互通,但與傳統金融基建整合有限。代幣化存款主要在銀行網絡內運作,能與現有金融系統緊密協作,若要與公鏈環境互通,則需特定橋樑或合作平台。CBDC理論上可與私人銀行系統或公有加密網絡互通,視乎設計,但大部分方案都強調與現有金融基建兼容性,而非加密互通。

Scalability varies by implementation. Public blockchain stablecoins face the throughput and latency constraints of the underlying blockchain, though layer-2 solutions and alternative chains have dramatically improved performance. Tokenized deposits on permissioned blockchains can achieve higher throughput because the validator set is limited and optimized for performance rather than decentralization. Wholesale CBDCs would likely use permissioned infrastructure achieving similar performance to tokenized deposits. Retail CBDCs face greater scalability challenges given the need to serve entire populations with potentially billions of transactions daily.

可擴展性則按落實方式而異。公鏈穩定幣受限於底層區塊鏈的處理速度和延遲,不過L2方案和其他鏈已顯著提升效能。許可制區塊鏈上的代幣化存款,因驗證人數有限,著重性能而非完全去中心化,因此可達更高吞吐量。批發型CBDC相信會用類似許可制基建,效能接近代幣化存款。零售CBDC則需應付全人口,每日或涉及數十億筆交易,擴展性挑戰最大。

Privacy considerations differ as well. Stablecoins on public blockchains offer pseudonymous privacy: transactions are visible but addresses are not directly linked to identities. Some privacy-focused stablecoins use zero-knowledge proofs or other techniques to enhance privacy. Tokenized deposits on permissioned networks provide more privacy from public view but less privacy from banks and regulators who can see all transactions. CBDCs raise significant privacy concerns, with retail CBDCs potentially giving central banks unprecedented visibility into all citizens' spending, creating surveillance risks that have generated political opposition in many jurisdictions.