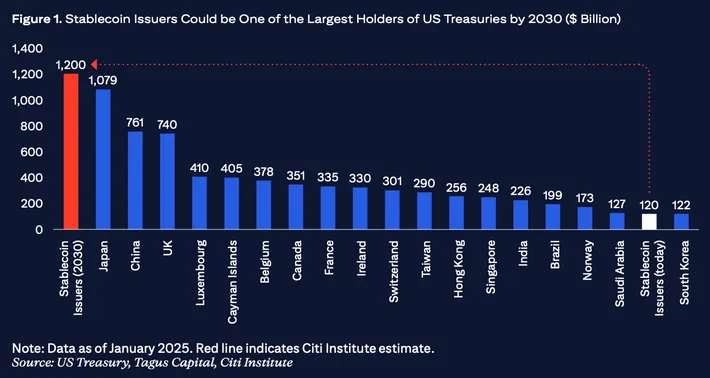

穩定幣發行商已經悄然成為美國短期國債的最大持有人之一,截至2025年年中,Circle、Tether及其他主要供應商持有超過1200億美元的國庫券及相關工具。本篇深入調查分析加密貨幣行業追求穩定數字美元,如何創造了一條連接去中心化金融與聯邦儲備貨幣操作的直接資金融通管道。

當Circle發佈其2024年7月的儲備覆核報告時,加密觀察者注意到一項在三年前還難以想像的現象。USDC背後的公司(市值第二大的穩定幣)報告其儲備基金有286億美元,其中281億美元直接投資於短期美國國債及與聯儲局的隔夜逆回購協議。剩下的5億美元則是存放於受監管金融機構的現金存款。

這種結構不僅僅是審慎的儲備管理,更反映穩定幣行業已根本轉型為美國國債的專業橋樑,基本游離於傳統銀行監管體系之外。發行商透過穩定幣持有人收入接近零息的資金,將資產投入國債市場,並從兩者息差中獲取數十億美元收益。

數據說明一切。Tether作為全球規模最大的穩定幣發行商,截至2024年10月,USDT發行量約1200億美元。在其2024年第二季透明度報告中披露,其84.5%儲備為現金、等同現金及短期國庫券。按這比例和規模計算,Tether本身就已躋身美國國債前20大持有人,超越多個主權國家的國債儲備。

這種模式在穩定幣圈屢見不鮮。Paxos,作為發行USDP和過去協助Binance BUSD儲備管理的受監管信託公司,早於2021年已幾乎全持美國國債作為儲備。即使是較新的穩定幣方案,例如Ethena Labs於2023年底發行合成美元USDe,採用中性衍生品做法,於資金利差負值時期同樣引入國庫券作為儲備組合一部分。

穩定幣廣泛轉向國債,其實不是巧合,而是反映經濟根本現實。穩定幣在實質上已變成了運作於區塊鏈上的無保險貨幣市場基金,具即時贖回功能。其收入主要來自資金成本(實際為零,因為大多數穩定幣不付息)與短期國債「無風險利率」之間的息差。

這種現象影響深遠。當2024年上半年穩定幣新發行量增加約400億美元時(參考CoinGecko數據),相關資本多流入國債市場,壓縮國庫券收益、影響回購市場動態。反之,遇上加密市況下行時,穩定幣大量贖回需變現手上國債,有機會加劇貨幣市場波動。整個穩定幣行業已成為美國貨幣政策傳導系統的「水管」之一,造成中央銀行正開始關注的回饋效應。

以下將深入探討這場「靜悄悄貨幣化」如何發生、誰是受益人、引發哪些風險,以及為何加密「軌道」與國債市場融合是數碼金融最重要但又最被忽視的趨勢之一。本故事涵蓋儲備管理運作、收益捕捉經濟學、代幣化國債產品興起,以及監管機構如何跟不上模糊傳統證券、貨幣與支付系統界線的創新。

穩定幣與「儲備」

要明白穩定幣如何成為國債風險曝險工具,先要理解什麼是穩定幣、如何維持掛鈎,以及此處所謂「儲備」的真正含義。

最基本層面,穩定幣是一種設計成與特定資產(最常見為美元)保持穩定兌換比率的加密貨幣。與比特幣、以太幣因市場供需波動價值不同,穩定幣力求始終於1美元附近交易。這一穩定性讓它們在加密市場發揮多元用途:成為交易所對盤貨幣、避險於市況波動時的臨時價值儲存、去中心化金融協議的結算機制,以至跨境支付工具日趨普及。

穩定機制決定了穩定幣的風險輪廓及儲備組合。加密行業目前已有三大類穩定幣設計,每種均有不同的價值維持方式。

法幣儲備型是主流,也正是本文重點。這類穩定幣保證1:1兌換美元(或其他法幣),同時聲稱有等值現金或高流動性證券作支持。USDC、USDT、USDP等多屬此類。

用戶將美元直接或透過授權夥伴存款給發行商,發行商即按等值發幣。當用戶贖回時,交回代幣即可換回美元。理論上,儲備總額始終等於或高於流通代幣總數,確保所有持有人均能以面值贖回。

關鍵問題在於:這些儲備實際由哪些資產組成?早期穩定幣多存銀行現金,但此法對發行商而言經濟效率低落。現金存款,尤其零息環境下,幾乎無收益;同時維繫銀行關係操作成本高;更重要是發行商需自負所有營運及合規成本,但用戶資金靜止不動並無收入。

現實考慮促使穩定幣逐漸遷移至短債資產。截至2021年底,大型法幣穩定幣普遍將儲備重點配置於隔夜及短期國庫券、逆回購協議、國債貨幣市場基金。這些工具在加息環境下帶來可觀利息回報(2023年3個月期國債一度逾5%年息),同時具高流動性、幾乎零信貸風險(因政府背書)、而且監管壓力比公司債或商業票據輕。

各發行商每月或每季發佈的儲備覆核報告,正是了解儲備組合情況的窗口,只是披露細節因公司而異。Circle的報告由Deloitte審核,會細分國債到期期限、逆回購、指定銀行現金等分類。Tether的報告則由BDO Italia審核,過去披露較籠統,但近年已增加國債、貨幣市場基金等比例分佈。

Paxos作為紐約信託公司,受更嚴格披露規定所限,須每月公開與國債儲備有關的CUSIP識別。

演算法穩定幣則靠市場機制與誘因設計維持掛鈎,而非直接以法幣作擔保。TerraUSD(UST)2022年5月失去掛鈎後,價格暴跌導致約400億美元灰飛煙滅,充分暴露此路線的風險。

UST與其姊妹幣LUNA設有演算法動態調節,一旦信心崩潰,將引發系統性清算崩潰。不少業界從此轉向超額抵押或法幣儲備型設計,同時全球監管機構也更加戒心算法路線。

合成或加密資產抵押穩定幣則以加密資產作為擔保,通常要求超額抵押。DAI由MakerDAO所創,用戶需鎖定市值至少150%的以太幣等加密資產,才能鑄造DAI。如抵押品值跌穿要求,系統將自動清算。近年更演變至引入實體資產,MakerDAO亦逐步整合代幣化國債作為DAI一部分支持,反映連原生加密穩定幣也無法抗拒國債誘惑。

現時主導市場的法幣儲備型穩定幣,儲備組合直接決定價格錨點安全及業務模式經濟效益,發行商面臨結構性抉擇:他們既需要 sufficient liquidity to process redemptions quickly (which argues for overnight instruments and cash), but they also want to maximize yield on reserves (which argues for slightly longer-duration securities). This tension has largely been resolved in favor of short-dated Treasury exposure, typically overnight to 3-month maturities, which offers attractive yields while maintaining next-day liquidity.

足夠流動性去快速處理贖回(即係要用隔夜票據同現金),但同時又想最大化儲備嘅回報率(就要揀稍長期啲嘅證券)。呢個矛盾一般都用短期美國國庫債券做平衡,通常會揀隔夜至三個月到期嘅票據,可以維持翌日流動性之餘,亦有吸引回報。

The attestation process itself deserves scrutiny. These are not full audits in most cases. Attestations involve accountants examining whether the stated reserves exist at a specific point in time, but they typically do not verify the continuous adequacy of reserves, test internal controls, or assess the quality and liquidity of all assets.

其實,審核(attestation)過程本身都值得關注。大部分都唔係全面審計,只係由會計師喺某一特定時點核實聲稱嘅儲備係咪真係存在,但通常唔會查證儲備係咪持續充足、唔會測試內部控制、又或者評估所有資產嘅質素同流動性。

Some critics argue this creates gaps in transparency. A company could theoretically optimize its balance sheet just before an attestation date, present favorable numbers, and then adjust positions afterward. However, the trend has been toward more frequent attestations and greater detail, particularly as regulatory pressure increases.

有啲批評就話會造成透明度嘅漏洞。例如公司可以喺審核日前短暫調整資產負債表,令數字睇落去好靚,過咗審核之後就還原。不過,呢排趨勢都係做得愈來愈頻密、內容愈詳細,特別係監管壓力加大之下。

Understanding this foundation is essential because the shift from cash to Treasuries in stablecoin reserves represents more than a technical portfolio adjustment. It represents the crypto industry's integration into the apparatus of government debt monetization, with all the systemic implications that entails.

了解呢個基礎好重要,因為穩定幣儲備由現金轉去美債唔淨止係資產組合技術性調整,仲代表住虛擬資產行業正式融入政府債務貨幣化嘅體系,涉及到一連串深遠嘅系統性影響。

The Mechanics of Yield: How Treasury Exposure Generates Return

收益運作機制:點樣透過持有美債獲得回報

The transformation of stablecoin reserves from cash to Treasury instruments created a straightforward yet highly lucrative business model: capture the spread between the near-zero interest rate paid to stablecoin holders and the risk-free rate on government securities. Understanding exactly how this yield generation works requires examining the specific instruments and market operations that stablecoin issuers employ.

由現金轉去美債,令穩定幣儲備變成一個簡單但極度吸引嘅生意模式:食穩定幣持有人基本唔收息同政府債券無風險回報中間嘅息差。要清楚明白點解有呢個收益,就要睇清發行商實際用邊啲金融工具同市場操作。

Treasury Bill Purchases represent the most direct approach. A Treasury bill is a short-term debt obligation issued by the U.S. government with maturities ranging from a few days to 52 weeks. Unlike bonds, bills are sold at a discount to their face value and do not pay periodic interest. Instead, investors earn returns through the difference between the purchase price and the par value received at maturity. For example, if a 3-month Treasury bill with a $1,000 face value sells for $987.50, the buyer earns $12.50 in yield over three months, equivalent to approximately 5% annualized.

**買入短期國庫券(Treasury Bills)**係最直接做法。國庫券係美國政府發行嘅短期債券,期限由幾日到52星期,係以折讓價賣出,到期時支付面值,中間唔會派息。投資者就係賺買入價同到期收返面值之間嘅差價。例如一張面值1,000蚊、3個月到期嘅國庫券,以$987.50買入,3個月之後拎返$1,000,即係3個月賺$12.50,年化大約5%。

Stablecoin issuers can purchase Treasury bills directly through primary dealers or on secondary markets. When Circle holds $28 billion in Treasury securities, those positions represent outright purchases of bills across various maturities, typically weighted toward shorter dates to maintain liquidity. The yield on these positions flows directly to Circle's bottom line, since USDC holders receive no interest on their holdings.

穩定幣發行商可以直接透過一級交易商或者二手市場買國庫券。例如Circle持有$280億美債,即係實際持有唔同到期日嘅國庫券,通常會側重短期,保持流動性。呢啲美債帶嚟嘅息口完全歸Circle,因為USDC持有人一分息都冇。

In a 5% rate environment, $28 billion in Treasury bills generates approximately $1.4 billion in annual gross interest income. After deducting operational costs, regulatory compliance expenses, and redemption-related transactions, the net margin remains substantial. This explains why stablecoin issuance became such an attractive business once interest rates rose from near-zero levels in 2022-2023.

如果息率係5%,$280億國庫券一年就有大約$14億利息收入。就算扣除營運、合規、贖回交易等成本,淨利潤都好可觀。呢個亦解釋到點解自從2022-2023年息口由近零水平升返上去之後,穩定幣業務咁吸引。

Reverse Repurchase Agreements offer an alternative mechanism, particularly for overnight positions. In a reverse repo transaction, the stablecoin issuer effectively lends cash to a counterparty (typically a primary dealer or the Federal Reserve itself) in exchange for Treasury securities as collateral. The transaction includes an agreement to reverse the trade the next day at a slightly higher price, with the price differential representing the interest earned.

**逆回購協議(Reverse Repo)**就係另一種方法,特別適合隔夜資金部署。穩定幣發行商喺呢啲交易裏面,其實就係出錢短暫借畀對手方(多數係一級交易商或聯儲局),對方擔保用國庫券做抵押物,第二日以略高價格將交易倒返轉,當中價差就係利息。

The Federal Reserve's overnight reverse repo facility (ON RRP) became particularly important for stablecoin issuers. This facility allows eligible counterparties to deposit cash with the Fed overnight and receive interest at the overnight reverse repo rate, with Treasury securities provided as collateral. While stablecoin issuers cannot access the ON RRP directly (eligibility is limited to banks, government-sponsored enterprises, and money market funds), they can access it indirectly by investing in government money market funds that participate in the facility.

聯儲局嘅隔夜逆回購機制(ON RRP)對於穩定幣發行商尤其重要。參與者可以隔夜存現金畀聯儲局,拎到國庫券做抵押品,同時收隔夜利息。雖然穩定幣發行商唔可以直接進入(資格限制咗只限銀行、政府資助機構咁啱),但佢哋可以透過投資參與咗呢個機制嘅貨幣基金間接接觸。

The advantage of reverse repo is perfect liquidity: these are genuinely overnight positions that can be unwound daily to meet redemption demands. The disadvantage is that overnight rates are typically lower than rates on term bills. Issuers therefore maintain a mix, using reverse repo for their liquidity buffer while investing the remainder in term Treasury bills to capture higher yields.

逆回購最大優點係絕對流動性—真係可以日日拆倉應付贖回,但缺點係隔夜利率通常低過短期國庫券。所以發行商會混合運用,一部分放逆回購做流動性緩衝,另一部分投資短期國庫券食高啲息。

Money Market Funds serve as another vehicle for Treasury exposure, particularly Treasury-only government money market funds. These funds invest exclusively in Treasury securities and related repurchase agreements. They offer professional management, diversification across maturities, and typically maintain a stable $1.00 net asset value, making them functionally equivalent to cash for liquidity purposes while generating yield.

貨幣市場基金都係另類手段,特別係淨係買國庫券嘅政府貨幣市場基金。佢哋只投資國庫券同相關回購協議,有專業管理、分散到唔同到期日,而且通常保持$1.00淨值,對流動性管理嚟講等同現金之餘仲有息收。

Circle has explicitly structured part of its reserve holdings through the Circle Reserve Fund, managed by BlackRock. This fund invests exclusively in cash, U.S. Treasury obligations, and repurchase agreements secured by U.S. Treasuries (Circle Reserve Fund documentation). By utilizing an institutional money market fund, Circle gains several advantages: professional portfolio management, economies of scale in transaction costs, automatic diversification across maturities and instruments, and enhanced liquidity management through same-day redemption features.

Circle明言將部分儲備用Circle Reserve Fund(由貝萊德管理)管理。呢隻基金專投現金、美國國庫債同以美債作抵押嘅回購協議(根據Circle Reserve Fund文件)。用機構貨幣基金,Circle有好多好處:有專業組合管理、交易成本有規模效益、自動分散唔同到期日及工具、仲可以即日贖回加強流動性。

The mechanics work as follows: Circle deposits a portion of USDC reserves into the Reserve Fund, receives shares valued at $1.00 each, and earns a yield that fluctuates with overnight and short-term Treasury rates. The fund manager handles all securities purchases, maturities, and rollovers. When Circle needs cash for USDC redemptions, it redeems fund shares on a same-day basis, converting them back to cash. This arrangement allows Circle to maintain the liquidity characteristics of a cash deposit while earning Treasury-like yields.

運作流程就係:Circle將部分USDC儲備放入Reserve Fund,換到每份$1.00嘅基金單位,收到利息(利息會隨住隔夜及短債利率變動)。基金經理負責買賣、到期、續做。Circle要贖回現金時,可以即日贖回基金單位變返現金。呢個安排令Circle可以兼顧現金流動性同時食到美債息。

Tri-Party Repurchase Agreements add another layer of sophistication. In a tri-party repo, a third-party custodian (typically a clearing bank like Bank of New York Mellon or JPMorgan Chase) sits between the cash lender and the securities borrower, handling collateral management, margin calculations, and settlement. This reduces operational burden and counterparty risk for both parties.

**三方回購(Tri-Party Repo)**仲進階一啲。呢類交易會有第三方託管行(多數係紐約梅隆銀行、摩根大通等結算銀行)做中間人,負責管理抵押品、計算保證金、同埋結算,減輕雙方運作負擔以及對手風險。

For stablecoin issuers, tri-party repo arrangements allow them to lend cash against high-quality Treasury collateral with daily mark-to-market margining and automated collateral substitution. If a counterparty faces financial stress, the custodian can liquidate the Treasury collateral and return cash to the lender. These arrangements typically offer higher yields than ON RRP while maintaining strong liquidity and safety characteristics.

穩定幣發行商可以透過三方回購,用現金抵押高質素美債,每日按市值結算保證金,抵押品自動換倉。如果對手出事,託管行可以快速套現美債還返現金。呢種安排通常比ON RRP爭取到更高收益,但一樣有良好流動性同安全性。

Securities Lending represents a more advanced strategy that some larger issuers may employ. In a securities lending arrangement, an entity that owns Treasury securities lends them to other market participants (typically broker-dealers or hedge funds seeking to short Treasuries or meet delivery obligations) in exchange for a lending fee. The borrower posts collateral, usually cash or other securities, worth slightly more than the lent securities.

**證券借貸(Securities Lending)**係再進階啲嘅部署,大型發行商先會搞。持有美債嘅發行商可以借出美債畀要沽空或者交貨嘅券商、對沖基金等,收取借貸費用。借方要交保證金做抵押(通常係現金或其他證券),價值通常高過借入物。

For a stablecoin issuer, this creates a double yield opportunity: earn interest on the Treasury securities themselves, plus earn lending fees by making those securities available to the lending market. However, securities lending introduces additional operational complexity and counterparty risk. If a borrower defaults and the collateral is insufficient to replace the lent securities, the lender faces losses. Most stablecoin issuers have avoided securities lending given the reputational risks and regulatory scrutiny, though it remains theoretically possible.

呢個策略令發行商可以一雞兩味:又有美債息,又收借貸費。不過亦會帶來更多營運複雜性同對手風險。如果借方違約,抵押品唔夠換返美債,發行商就要蝕。大部分穩定幣發行商都因為聲譽同監管風險暫時唔做,但理論上可行。

Treasury ETFs and Overnight Vehicles provide additional options for reserve deployment. Short-term Treasury ETFs like SGOV (iShares 0-3 Month Treasury Bond ETF) or BIL (SPDR Bloomberg 1-3 Month T-Bill ETF) offer instant liquidity through exchange trading while maintaining Treasury exposure. An issuer could theoretically hold these ETFs in a brokerage account and sell shares during market hours to meet redemption demands, though most prefer direct Treasury holdings or money market funds due to the potential for ETF prices to trade at small premiums or discounts to net asset value.

短期美債ETF同其他隔夜產品都係部署儲備嘅選擇。例如SGOV(iShares 0-3個月美債ETF)、BIL(SPDR Bloomberg 1-3個月T-Bill ETF)都係交易所即時流通之餘,有美債曝險。發行商理論上可以喺券商戶口持有,隨時市價賣貨應付贖回。不過多數都揀持有國庫券或者貨幣基金,因為ETF有機會同資產淨值有細微溢價或折讓。

The Flow of Funds in practice follows a clear path:

實際操作流程係咁:

-

A user deposits $1 million with an authorized Circle partner or directly with Circle through banking channels

-

Circle mints 1 million USDC tokens and delivers them to the user's wallet

-

Circle receives $1 million in cash in its operating accounts

-

Circle's treasury operations team immediately deploys this cash into the reserve fund: perhaps $100,000 stays in overnight reverse repo for immediate liquidity, while $900,000 purchases Treasury bills maturing in 1-3 months

-

Those Treasury positions generate yield - perhaps $45,000 annually at 5% rates

-

When the user later wants to redeem, they return 1 million USDC tokens to Circle

-

Circle destroys (burns) the tokens and returns $1 million to the user

-

To fund this redemption, Circle either uses its cash buffer or sells Treasury bills on secondary markets, receiving same-day or next-day settlement

-

用戶經授權Circle夥伴或者直接經銀行渠道存入$100萬

-

Circle新造100萬個USDC,派去用戶錢包

-

Circle喺營運戶口收咗$100萬現金

-

Circle財資部即刻部署:可能$10萬放隔夜逆回購做短期流動性,$90萬買1-3個月到期國庫券

-

呢啲美債倉產生回報—例如5%息即年收$45,000

-

用戶之後要贖回,就將100萬個USDC還畀Circle

-

Circle銷毀(burn)呢啲代幣,還返$100萬現金畀用戶

-

Circle會用現金buffer或者賣二手國庫券籌錢,一般可以即日或翌日到數

The user receives exactly $1 million back - no interest, no fees (beyond any fees charged by intermediaries). Circle keeps the entire $45,000 in interest income generated during the period

用戶收返足$100萬—無利息、無費用(除非中介有收手續費)。Circle就將整個期間賺咗嘅$45,000利息全部自用。the capital was deployed. This is the fundamental economics of the fiat-backed stablecoin model in a positive interest rate environment.

資本已經投放。這正是法定貨幣支持嘅穩定幣模式喺正利率環境下最基本嘅經濟原理。

Yield Striping and Maturity Laddering optimize this process. Stablecoin issuers don't simply dump all reserves into a single Treasury bill maturity. Instead, they construct laddered portfolios with staggered maturities: perhaps 20% in overnight positions, 30% in 1-week to 1-month bills, 30% in 1-3 month bills, and 20% in 3-6 month bills. This laddering ensures that some positions mature weekly, providing regular liquidity without requiring asset sales. It also allows issuers to capture higher yields on the term portion of the curve while maintaining sufficient overnight liquidity.

收益分拆同到期梯級策略可以優化呢個流程。穩定幣發行商唔會將所有儲備一次過買晒同一到期期限嘅國庫券,而係會組合出一個分期到期嘅投資組合,例如:20%放喺隔夜、30%放喺一星期至一個月、30%係一至三個月,20%係三至六個月。呢種分布可以確保每個星期都有部分倉位到期,持續供應流動性,而無需賣出資產。發行商亦可以喺保持足夠隔夜流動性之下,把握到較長期限部分嘅高息回報。

The practical result is that major stablecoin issuers have become sophisticated fixed-income portfolio managers, operating treasury desks that would be familiar to any corporate treasurer or money market fund manager. They monitor yield curves, execute rollovers as bills mature, manage settlement timing, maintain relationships with primary dealers, and optimize the tradeoff between yield and liquidity on a continuous basis.

實際上,大型穩定幣發行商已經變成高級固定收益投資組合管理員,佢哋營運嘅財資部門同一般企業財資主管或者貨幣市場基金經理用嘅架構一樣。佢哋需要監察孳息曲線、處理到期換倉、管理結算時機、同一級交易商建立關係,並不斷優化回報同流動性之間嘅平衡。

This infrastructure represents a profound shift from crypto's early ethos of decentralization and disintermediation. The largest "decentralized" finance protocols now depend on centralized entities operating traditional fixed-income portfolios denominated in U.S. government debt. The returns from this model have proven too compelling to resist.

呢種基建同加密貨幣早期那種去中心化、去中介嘅精神已有重大分別。最大型嘅「去中心化」金融協議而家實際上靠哂運作傳統美國國債投資組合嘅中心化機構。呢種模式嘅回報實在太吸引,令人無法抗拒。

Who Earns What: The Economics

(略過圖片 markdown)

The revenue model behind Treasury-backed stablecoins is deceptively simple: issuers capture nearly all the yield generated by reserves, while users receive a stable claim on dollars with zero or minimal interest. However, the full economics involve multiple parties extracting value at different points in the chain, and understanding these splits is crucial to grasping the incentive structure driving the sector's growth.

由國債支持嘅穩定幣嘅收益模式表面上好簡單:發行商幾乎攞晒儲備產生嘅所有利息,而用戶只係攞到一個穩定無息或者極低息嘅美元權益。不過,實際嘅經濟結構涉及多個持份者喺唔同環節抽取價值,要理解呢啲分賬非常重要,先可以睇得明推動行業增長嘅誘因結構。

Issuer Margins constitute the largest share of economic rent. Consider Circle as a worked example. With approximately $28 billion in USDC reserves deployed predominantly in Treasury securities and reverse repo agreements as of mid-2024, and with short-term rates averaging around 5% in that environment, Circle's gross interest income would approximate $1.4 billion annually. Against this, Circle faces several categories of costs.

發行商利潤係整條經濟鏈入面最大份。以Circle做例子,去到2024年中,USDC儲備大約有280億美元,主要投放喺國債同逆回購協議,而短息約5%,咁即係Circle每年總利息收入大約有14億美元。不過,Circle都會面對幾大類成本。

Operational expenses include technology infrastructure to maintain the blockchain integrations across multiple networks (Ethereum, Solana, Arbitrum, and others), staff costs for engineering and treasury operations, and customer support for authorized partners and large clients. Regulatory and compliance costs have grown substantially, encompassing legal expenses, attestation fees paid to accounting firms, licenses and regulatory registrations in multiple jurisdictions, and ongoing compliance monitoring. Banking relationship costs include fees paid to custodian banks, transaction costs for deposits and redemptions, and account maintenance fees at multiple banking partners to maintain operational resilience.

營運成本包括維護多條區塊鏈(如 Ethereum、Solana、Arbitrum 等)嘅技術設施、工程及財資團隊人手、以及支援大型客戶同授權合作夥伴嘅客戶服務。法規同合規成本大幅上升,包括律師費、會計師事務所審核費、唔同司法管轄區嘅牌照同註冊、以及持續合規監控。銀行合作成本包括畀託管銀行嘅費用、入提款交易費、同為咗確保營運彈性而喺多間銀行維持戶口嘅費用。

Redemption-related costs occur when users convert USDC back to dollars. While many redemptions can be met from incoming issuance flows, significant net outflows require selling Treasury securities before maturity. This triggers bid-ask spreads in secondary markets and potential mark-to-market losses if interest rates have risen since purchase. During the March 2023 banking crisis when USDC experienced approximately $10 billion in redemptions over several days, Circle had to liquidate substantial Treasury positions, likely incurring millions in trading costs and market impact.

贖回成本發生喺用戶將USDC換返成美元嗰陣。雖然有好多贖回都可以靠新發行流入資金解決,但如果出現大量淨流出,就需要賣走未到期嘅國債,咁就會遇到二手市場買賣差價,同埋如果息口升咗,仲可能出現市值虧損。2023年3月銀行危機期間(聯儲局報告),USDC幾日之內就有大約100億美元贖回,Circle要大量拋售國債,估計已經損失過千萬美元交易費同市場影響。

Industry analyst estimates suggest that well-run stablecoin issuers operating at scale achieve net profit margins in the range of 70-80% on interest income during elevated rate environments (Messari Research, "The Stablecoin Economics Report," 2024). Applying this to Circle's $1.4 billion in gross interest would imply net profits approaching $1 billion annually - a remarkable return for what is essentially a money market fund with a fixed $1.00 share price that never pays distributions to shareholders.

行業分析估計,運作得好而且夠大規模嘅穩定幣發行商喺高息環境下,純利率可以去到利息收入嘅70至80%(見 Messari Research, "The Stablecoin Economics Report," 2024)。即係話,如果以Circle每年14億美元利息計,純利會接近10億美元——對於本質只係一隻每股$1又唔派息嘅貨幣市場基金嚟講,呢個回報真係極之誇張。

Tether's economics are even more striking due to its larger scale. With approximately $120 billion in circulation and similar reserve composition, Tether would generate roughly $6 billion in annual gross interest income in a 5% rate environment. Tether has historically disclosed less detailed expense information, but its profit attestations have confirmed extraordinary profitability. In its Q1 2024 attestation, Tether reported $4.5 billion in excess reserves (assets beyond the 1:1 backing requirement) accumulated from years of retained earnings (Tether Transparency Report, Q1 2024). This excess represents years of yield capture flowing to the company's bottom line rather than to token holders.

Tether嘅營運規模更大,數字更加誇張。流通量去到約1200億美元,同樣類型儲備,5厘息環境下一年大約有60億美元總利息。Tether一向披露少啲開支細節,但財政報告都已確認其利潤非常驚人。喺2024年第一季報告,Tether宣稱有45億美元「超額儲備」(即資產多過1:1支持嘅部分),係幾年累積落嚟嘅利潤(見Tether Transparency Report, Q1 2024)。呢啲超額其實係發行商賺到嘅孳息,唔係派畀代幣持有人。

Returns to Holders are explicitly zero for traditional stablecoins like USDC and USDT. This is a feature, not a bug, of the business model. Issuers have strongly resisted adding native yield to their tokens for several reasons. Paying interest would make stablecoins more obviously securities under U.S. law, triggering full SEC regulation and registration requirements. It would reduce the enormous profit margins that make the business attractive to operators and investors. And it would complicate the use cases; stablecoins function as transaction media and numeraires precisely because their value is stable and simple - adding variable interest rates would introduce complexity.

持有人回報:對於傳統穩定幣如USDC、USDT,回報明確係零,呢個係商業模式嘅設計唔係漏洞。發行商堅決反對喺穩定幣上加利息有幾個原因:一來派息會令穩定幣符合美國證券法定義,要接受SEC全面監管同注冊;二來會減少發行商巨大利潤;三來會搞亂用途——而家穩定幣之所以啱做交易媒介同計價單位,係因為價值簡單又穩定,變動利息會令成件事複雜。

However, a category of yield-bearing stablecoins has emerged to capture the opportunity issuers were leaving on the table. These tokens either distribute yield generated by reserves to holders or appreciate in value over time relative to dollars. Examples include:

不過,都開始有一類「有息」穩定幣出現,捕捉發行商原本放棄咗嘅機會。呢啲幣會將儲備產生嘅利息派畀持有人,或者會隨時間對美元升值。例子包括:

sUSDe (Ethena's staked USDe) distributes yield from Ethena's Delta-neutral perpetual futures strategy and Treasury holdings to stakers, with annual percentage yields that have ranged from 8-27% depending on funding rates and Treasury exposures.

sUSDe(Ethena發行嘅staked USDe):將Ethena嘅delta中性永續合約策略同國債投資產生嘅利息派畀staking用戶,年息曾經介乎8%至27%,視乎槓桿同國債倉位而定。

sFRAX (Frax's staked version) accumulates yield from Frax Protocol's automated market operations and RWA holdings.

sFRAX(Frax的staked版本):收集Frax協議自動做市操作同現實世界資產(RWA)帶嚟嘅孳息。

Mountain Protocol's USDM passes through Treasury yields to holders after fees, effectively operating as a tokenized Treasury money market fund with explicit yield distribution.

Mountain Protocol嘅USDM:在扣除費用後,直接將國債孳息派畀持有人,本質上等於一隻token化、明碼標價派息嘅國債貨幣市場基金。

The economics of these yield-bearing variants differ fundamentally. By distributing yield, they sacrifice the issuer's ability to capture the full spread, but they gain competitive advantages in attracting capital and DeFi integrations. Whether yield-bearing stablecoins can achieve the scale of zero-yield alternatives remains an open question, but their existence demonstrates market demand for returns on dollar-denominated crypto holdings.

呢啲有息穩定幣喺經濟結構上根本不同。將孳息派畀持有人,係犧牲兼吸引資金同整合DeFi方案嘅競爭優勢。呢類有息穩定幣可唔可以做得大過傳統零息穩定幣,暫時未有定論,不過佢哋出現,足證市場對美元加密資產回報有需求。

Custodian and Banking Fees extract another layer of value. Stablecoin issuers must maintain relationships with qualified custodians - typically large banks with trust charters or specialized digital asset custodians regulated as trust companies. These custodians charge fees for holding assets, processing transactions, providing attestation support, and maintaining segregated accounts.

託管同銀行費用:又係另一層價值被抽走。穩定幣發行商必須同合資格託管商建立關係——一般係有信託牌照嘅大銀行,或者受規管信託公司嘅數字資產託管商。託管商會為資產保管、交易處理、提供審核支援、隔離賬戶等收費。

Custodian fee structures vary but typically include basis point fees on assets under custody (perhaps 2-5 basis points annually on Treasury holdings), per-transaction fees for deposits and withdrawals, and monthly account maintenance fees. For a $28 billion reserve portfolio, even modest 3 basis point fees amount to $8.4 million annually. These costs are material in absolute terms though small relative to the issuer's yield capture.

託管費用有唔同做法,一般會收資產規模費(如國債部分每年2至5個基點)、每單入出金交易費、每月維護費。以280億美元儲備組合做例子,即使淨係收3個基點,都要8百40萬美元一年,金額唔少,不過相對於發行商吸收嘅總息口嚟講只屬一小部分。

Banking partners also charge fees for operating the fiat on-ramps and off-ramps. When a user deposits dollars to mint stablecoins, that transaction typically flows through a bank account, triggering wire fees or ACH costs. Redemptions trigger similar charges. For retail users, intermediaries may charge additional spreads or fees beyond what the issuer charges.

銀行夥伴亦會對法定貨幣入出金口岸收費。用戶存美元鑄造穩定幣時,資金會經銀行戶口流轉,要畀電匯費或者ACH手續費。贖回時亦一樣要收。另外,散戶用戶可能要畀中介另收嘅差價或雜費,唔止發行商收費咁簡單。

Market Maker Profits emerge in the secondary market for stablecoins. While stablecoins theoretically trade at $1.00, actual trading prices fluctuate based on supply and demand across decentralized exchanges. Market makers profit from these spreads by providing liquidity on DEXs and CEXs, buying below $1.00 and selling above, or arbitraging price differences across venues.

做市商利潤:穩定幣喺二級市場都有另一層利潤空間。理論上應該係$1,實際喺去中心化交易所(DEX)同中心化平台(CEX)成交價會隨供求波動。做市商會捕捉價差:低過$1買入、高過$1賣出,或者不同平台之間套利。

During periods of stress, these spreads widen significantly. In March 2023 when USDC briefly depegged to $0.87 due to Silicon Valley Bank exposure concerns, sophisticated traders who understood the situation bought USDC at a discount and redeemed directly with Circle at par, earning instant 15% returns (though bearing the risk that Circle might not honor redemptions at par if banking problems worsened). These arbitrage opportunities are self-limiting; they attract capital that pushes prices back toward peg.

喺市場有壓力嗰陣,呢啲差價會擴大好多。2023年3月,因矽谷銀行有事,USDC短暫跌到$0.87,有啲識門路嘅交易員低位買入,再直接向Circle贖回$1,夠膽即賺15%(雖然要承受一旦銀行問題惡化,Circle唔能夠$1等值贖回的風險)。呢啲套利機會本身有自我糾正效果,因為會吸引資本將價格推返去錨點。

Protocol and DAO Treasury Revenue accrues to DeFi protocols that integrate stablecoins into their operations. When stablecoins are deposited into lending protocols like Aave or Compound, these protocols earn spreads between borrowing and lending rates. When stablecoins are used to mint other synthetic assets or provide liquidity in automated market makers, fees flow to liquidity providers and protocol treasuries.

協議及DAO國庫收入:用穩定幣運作嘅DeFi協議都會有收入。當穩定幣存入Aave/Compound等借貸協議,協議可以賺取借貸息差。如果用作鑄造其他合成資產、或喺自動做市池供應流動性,亦會有手續費分配畀流動性提供者及協議金庫。

Some protocols have begun to recognize that holding large stablecoin reserves in their treasuries means forgoing substantial yield. This has driven interest in tokenized Treasury products that allow DAOs to earn yield on dollar-denominated holdings while maintaining on-chain composability. MakerDAO's move to integrate over $1 billion in tokenized Treasury

一啲協議已經發現,如果將大量穩定幣放喺國庫,等如放棄大量利息。呢個現象推動咗市場對token化國債產品嘅興趣,因為咁DAOs可以賺取美元資產孳息之餘又保持鏈上可組合性。MakerDAO近年已採取行動,將超過10億美元國庫資金投入token化國債...Skip translation for markdown links.

Content:

對DAI資產抵押曝險的深入討論,正反映出這股趨勢的一個表現(Spark Protocol documentation, 2024)。

投資者回報會流向支持穩定幣發行商的風險投資和股權投資者。Circle先後由Fidelity、BlackRock以及其他投資者籌得超過10億美元,然後遞交上市申請。這些投資者將透過最終的流動性事件實現回報,而估值則基於儲備管理產生的經常性收入。如果按年收入14億美元、淨利潤率70%計算,Circle的穩定幣業務每年可產生10億美元淨利,理論上支持數以十億美元計的估值。

整體經濟模式顯示價值捕獲極度集中。發行商保留了絕大部分的經濟剩餘(或許高達總回報的70-80%),託管機構和做市商僅分得小部分,而最終存入本金的用戶除了獲得在區塊鏈上持有穩定美元的便利外,基本沒有任何其他收益。這種分配隨着競爭加劇和用戶要求回報或會難以持續,但根據當前市場結構,這一現象依然極為穩定。

這種模式特別吸引人的地方,在於其可擴展性和資本效率。一旦基礎設施建成,新增USDC或USDT的發行只需極少額外成本,但帶來的利息收入則線性增長。以發行規模達五百億美元的穩定幣發行商來說,與規模一千五百億美元的發行商相比,在財資管理方面優勢不大,意味競爭將集中於少數可以利用規模優勢應對監管合規、銀行關係和網絡效應的主導者手中。

其結果,就是形成一個結構上類似貨幣市場基金,但經濟效益完全不同的行業。傳統貨幣市場基金憑藉將收益最大化回饋投資者來爭奪資產,利潤極微薄。但穩定幣發行商則因為不需在回報上競爭,能從每一美元資產中獲得遠遠高於傳統的利潤。這種錯位不可能長期持續,隨着市場成熟會被改變,但目前來說,它是金融界最賺錢的商業模式之一。

鏈上與鏈下的融合:國債代幣化、RWA與去中心化金融(DeFi)

穩定幣從純現金儲備過渡到國債支持的金融工具,標誌着加密貨幣與政府債券市場融合的第一階段。而國債代幣化產品和現實資產(RWA)協議的出現,則是第二階段——這承諾會令兩者聯系更緊密,並創造新的組合性與系統連通性。

國債代幣化產品將美國國債直接帶到區塊鏈上,產生原生加密資產,代表對特定國債的所有權。與穩定幣(將儲備集中並承諾按面值兌付)不同,國債代幣化產品代表對底層債券的直接分割持有,類似證券行戶口的託管模式。

市面上出現了幾種主要的國債代幣化模式。第一種是託管包裝:由受監管的機構購買國債並託管,然後在區塊鏈上發行代表受益所有權的代幣。例如:

Franklin Templeton 的 BENJI(已在Stellar和Polygon鏈上推出),容許投資者購買代幣化的 Franklin OnChain 美國政府貨幣基金單位。每個代幣代表國債和政府回購協議組合中的比例份額,基金受傳統貨幣市場基金法規監管,同時以區塊鏈紀錄和轉讓份額。

Ondo Finance 的 OUSG則通過代幣化基金結構,帶來短期美國國債的曝險。Ondo與傳統的基金行政和託管機構合作,由他們持有國債資產,同時在以太坊上發行ERC-20基金單位代幣。基金主要採取短存續期國債策略,允許持有人用鏈上方式獲取國債收益。

Backed Finance 的 bIB01把BlackRock國債ETF代幣化,創建一個追蹤短期國債回報的合成資產。這種方式包裝現有ETF股份而非直接持有國債,因此減低了監管複雜度,同時令加密資產用戶可以獲得國債收益。

**MatrixDock 的 STBT (短期國債代幣)**代表由合規託管機構持有的國債的直接持有權。投資者可使用穩定幣或法幣購買STBT代幣,而代幣價值隨底層國債利息增長。這種模式目標是提供更接近直接持券而非基金單位的體驗。

技術層面涉及多個層次。最底層是由受監管的託管機構或基金經理購買持有的實際國債。智能合約層則鑄造代表該等資產所有權的代幣。傳送限制和KYC/AML核查一般會通過受權區塊鏈、白名單制或鏈上身份驗證機制落實。價值累積方式亦各異;有些代幣會隨時間升值(像國債本身),亦有些會定期派發收益。

法律結構同樣差異巨大。有些代幣化產品根據傳統證券法規注冊為投資基金,有些只限合資格投資者的私募產品,還有一些則以受監管信託產品方式運作,代幣代表受益權。這種法律多樣性為DeFi整合與跨境流通帶來挑戰,因為不同架構會面對不同的轉讓及合資格持有人限制。

DeFi整合才是真正令國債代幣化產生深遠影響之處。傳統穩定幣與DeFi協議作為獨立資產運作,如USDC於 Aave 上可以借貸,但實際國債儲備卻鎖在Circle的託管帳戶,不可與其他協議組合。相反,國債代幣化可以成為借貸協議的抵押品、去中心化交易所的流動性來源、協助支持合成資產,甚至可整合進更複雜的金融原語。

MakerDAO 整合 RWA 倉庫(vaults)正好體現這種融合。2023至2024年間,MakerDAO(現時以Sky品牌運作)不斷提高對代幣化現實資產的曝險,尤其是透過BlockTower和Monetalis等夥伴增持短期國債。這些RWA倉庫讓MakerDAO可以把DAI金庫資產部署到能產生收益的鏈下資產,回報則用於維持DAI穩定和資助DAO運作。其運作機制是由專門實體以MakerDAO借來的資本購入國債,作為抵押並支付利息。

Ethena Labs 的 USDe引入另一種整合模式。USDe通過「Delta-neutral」永續合約組合維持與美元掛鉤(即同時持有現貨加密資產並做等值永續空單)以從資金費率中賺取收益。不過一旦資金費率由空倉支付多倉(即負值),此策略就會變成負收益。為應付這種情況,Ethena會將部分資產分配到美國國債,在負收益期間切換至國債息差,根據市場情況動態調配(Ethena documentation)。如無代幣化或易於獲取的國債產品,這種靈活配置很難實現。

Frax Finance 透過 Frax Bond(FXB)系統,採取更進取的RWA戰略,旨在將不同存續期的國債搬上鏈上,以建構完整的國債收益曲線,讓DeFi協議除了短期貨幣市場利率外,還可獲取更長年期的政府債息。有關概念令鏈上固定收益策略更豐富,但推行過程遇到監管及技術挑戰。

Aave Arc 與受權DeFi池則是另一種融合方式。留意到受監管機構投資者無法用全開放的協議,Aave推出Arc及後續機構專屬服務,設立只容許KYC認證參與者借貸的白名單池。國債代幣化可以作為這些池的抵押品,讓機構在守規限下持有政府證券並同時提取槓桿。這種模式將傳統金融與DeFi串連,背後推動力正是國債代幣化產品。

穩定幣資產託管與國債代幣化在法律與技術上分別很大。當Circle持有280億美元國債作為USDC儲備,這些證券實際上僅以Circle名義或代USDC持有人在託管銀行登記,不能細分、不能鏈上直接轉讓、也不能於Circle體系外作抵押。USDC持有人理論上有合約權利……

redemption at par, but no direct property interest in the underlying Treasuries.

以面值贖回,但並不直接擁有相關國債的產權。

Tokenized Treasuries, by contrast, represent direct or fund-level ownership interests. A holder of Franklin's BENJI tokens owns a fractional share of the underlying fund's portfolio, similar to owning shares of a conventional money market fund. This ownership interest may be transferable (subject to securities law restrictions), usable as collateral in other protocols, and potentially redeemable directly for underlying securities rather than just cash.

相反,代幣化國債代表直接或基金層面的擁有權益。持有Franklin的BENJI代幣即代表擁有該基金投資組合中的部分權益,類似於持有傳統貨幣市場基金的單位。這種擁有權可能可以轉讓(但受證券法規定限制),可用於其他協議作為抵押品,甚至有可能直接以相關證券贖回,而不只限於現金。

These differences create distinct risk profiles and use cases. Stablecoins remain superior for payment and transaction use cases because they maintain stable $1.00 pricing and avoid mark-to-market fluctuations. Tokenized Treasuries may fluctuate slightly in value based on interest rate movements and accrued interest, making them less ideal as payment media but more suitable as collateral or investment vehicles. The two categories are complementary rather than competitive.

這些分別帶來不同的風險情況和應用場景。穩定幣之所以在支付和交易場景中仍然有優勢,是因為其價格穩定在一美元,亦能避免市值波動。代幣化國債的價值則會因利率變動和應計利息出現輕微波動,不太適合用作支付媒介,但更適合當作抵押品或投資工具。這兩類產品是互補多於競爭關係。

Regulatory Implications of tokenization remain unclear in many jurisdictions. In the United States, tokenized Treasuries that represent fund shares are likely securities requiring registration or exemption under the Investment Company Act and Securities Act. The SEC has provided limited guidance on how to structure these products compliantly, creating legal uncertainty that has slowed institutional adoption. In Europe, the Markets in Crypto-Assets (MiCA) regulation will classify most tokenized Treasuries as asset-referenced tokens requiring authorization and reserve management similar to stablecoins, though with different requirements if they qualify as securities.

在很多司法管轄區,代幣化的監管影響仍然未明朗。在美國,代表基金股份的代幣化國債很可能會被當作證券,需按《投資公司法》和《證券法》註冊或獲豁免。美國證監會(SEC)對這些產品的合規結構僅提供了有限指引,因此法律不確定性令機構投資者採納的步伐減慢。在歐洲,加密資產市場條例(MiCA)會將大多數代幣化國債歸類為資產參考型代幣,規定獲取授權和儲備管理類似穩定幣,但如屬證券則有不同要求。

The broader trend is unmistakable: crypto is building an increasingly sophisticated infrastructure for representing and transacting in U.S. government debt. What began as stablecoin issuers parking reserves in Treasuries has evolved into multiple parallel efforts to bring Treasuries directly on-chain, integrate them into DeFi protocols, and create yield curves and term structures that mirror traditional fixed-income markets.

大方向已非常明確:加密世界正建立越來越精細的基建,以代表和處理美國國債。最初只是穩定幣發行商將儲備存放於國債,現已演變為多項同步的努力,將國債直接鏈上化,將其整合到DeFi協議之中,並創建與傳統固定收益市場類似的收益曲線和期限結構。

The end state may be a parallel financial system where most dollar-denominated assets on-chain ultimately trace back to Treasury exposure, creating deep dependencies between crypto market functioning and U.S. government debt market stability.

最終結果可能出現一個平行式的金融體系,鏈上大部分以美元計價的資產最終都可追溯至國債,令加密市場運作與美國國債市場穩定性產生深層依賴。

How Stablecoin Flows Influence Fed Operations and the Treasury Market

穩定幣流動如何影響聯儲操作與國債市場

The scale of stablecoin reserve deployment into Treasury markets has grown large enough to create measurable effects on interest rates, repo market dynamics, and Federal Reserve policy transmission. Understanding these feedback loops is critical to assessing both the financial stability implications and the potential for regulatory intervention.

穩定幣儲備規模流入國債市場已大到足以對利率、回購市場動態及聯儲政策傳導產生可觀影響。了解這些反饋機制,對評估金融穩定性及未來監管介入的可能性都極為重要。

Size and Scale in Context: As of mid-2024, the combined market capitalization of major fiat-backed stablecoins exceeded $150 billion, with approximately $120-130 billion held in U.S. Treasury bills and related money market instruments based on disclosed reserve compositions (aggregated from Circle, Tether, and other issuer reports). To put this in perspective, $130 billion represents roughly 2-3% of the total outstanding U.S. Treasury bill market, which stood at approximately $5.5 trillion as of Q2 2024. While not dominant, this is large enough to matter, particularly during periods of rapid inflows or outflows.

**規模和比例背景:**截至2024年中,主流法幣支持型穩定幣的總市值已超過1,500億美元,當中大約1,200至1,300億美元投放在美國國庫券及相關貨幣市場工具(據Circle、Tether及其他發行人披露的儲備資料匯總)。換個角度思考,1,300億美元約佔美國國庫券總發行量的2-3%,當時整體市場規模約$5.5萬億美元(2024年第二季)。雖未達主導地位,但規模已不可忽視,特別是在出現資金快速流入或流出時。

For comparison, $130 billion is larger than the Treasury holdings of many sovereign wealth funds, exceeds the foreign exchange reserves of numerous countries, and approaches the size of major money market fund complexes. When stablecoin net issuance grows by $40-50 billion over a few months, as occurred in early 2024, that capital flow represents demand for short-term Treasuries comparable to what a mid-sized central bank might generate over the same period.

作為對比,1,300億美元國債持倉高於許多主權基金,更超過不少國家的外匯儲備,並接近大型貨幣市場基金的規模。如果穩定幣淨發行在幾個月內增長400至500億美元(如2024年初所見),這股資金流帶來的短期國債需求,相當於一個中型央行同時期的購買量。

Demand Effects on Treasury Yields: When stablecoin issuance accelerates, issuers must deploy billions in newly minted dollars into Treasury bills and repo agreements within days or weeks to earn yields and maintain reserve adequacy. This surge in demand for short-dated securities compresses yields, all else equal. The mechanism is straightforward: increased buying pressure for a fixed supply of bills pushes prices up and yields down.

**對國債孳息率的需求效應:**當穩定幣發行加速,發行商必須在數日或數周內將數十億新鑄造美元投放於國庫券和回購協議,以獲取利息收益及保持儲備充足。對短期證券的強烈需求會壓縮孳息率。原理很簡單:當固定供應的國庫券遇上買盤壓力時,價格被推高,收益率隨之下跌。

The effect is most pronounced at the very short end of the curve, particularly for overnight and one-week maturities where stablecoin issuers maintain their highest liquidity buffers. During periods of strong stablecoin growth in 2023-2024, observers noted persistent downward pressure on overnight repo rates and Treasury bill yields at the shortest maturities, even as the Federal Reserve maintained policy rates around 5.25-5.5%. While multiple factors influence these rates, stablecoin demand contributed to the compression.

這種效應在收益率曲線的極短端最為明顯,尤其是一晚及一周的短期到期,因為穩定幣發行商會在這些期限保持最高流動性緩衝。2023至2024年間穩定幣急速增長,市場觀察到即使聯儲局政策利率維持在5.25-5.5%,隔夜回購利率及短期國庫券孳息率仍出現持續下行壓力。雖然導致利率走勢的因素眾多,但穩定幣需求亦有一定壓縮作用。

This creates a paradox: stablecoins are most profitable for issuers when interest rates are high, but their success in attracting deposits and growing issuance tends to push the rates they can earn on those deposits downward through demand effects. This feedback loop is self-limiting but creates interesting dynamics in rate-setting markets.

這形成了矛盾:高息環境下,發行穩定幣最賺錢,但規模增長所帶來的資金需求,又會壓低國債收益,令發行商可賺到的息差回落。這種反饋循環有自我限制,但亦創造出利率市場有趣的動態。

Repo Market Interactions: The overnight and term repo markets serve as the plumbing of the U.S. financial system, allowing banks, hedge funds, and other institutions to borrow cash against Treasury collateral or vice versa. The Federal Reserve's reverse repo facility (where counterparties lend cash to the Fed overnight) and repo facility (where the Fed lends cash against collateral) establish floor and ceiling rates that influence the entire money market structure.

**回購市場互動:**隔夜和定期回購市場是美國金融體系的基建,銀行、對沖基金和其他機構可透過國債質押借入資金,或相反操作。聯儲局的反向回購機制(對手方隔夜把現金借給聯儲局)及正回購機制(聯儲局用抵押品借給對手方現金)共同形成短期利率的地板和天花,影響整個貨幣市場結構。

Stablecoin issuers' reliance on repo agreements as reserve instruments integrates them directly into this system. When Circle or Tether invest billions in overnight reverse repo, they are effectively supplying cash to repo markets that would otherwise be supplied by money market funds or other cash-rich institutions. This tends to put upward pressure on repo rates (since more cash is being lent) all else equal, though the effect is muted by the Fed's ON RRP facility which provides an elastic supply of counterparty capacity at a fixed rate.

穩定幣發行商把回購協議作為儲備工具,直接連接進這個系統。現時Circle或Tether斥資數十億美元參與隔夜反向回購,實質等於向回購市場注入流動性,否則這些資金會由貨幣市場基金或其他現金充沛機構提供。在其他條件一樣的情況下,這種行為傾向推高回購利率(因資金被借出增多),但聯儲的隔夜逆回購工具設有彈性上限和固定利率,使這種影響被部分抵銷。

The more significant impact occurs during stress events. If stablecoins experience rapid redemptions, issuers must extract billions from repo markets over short periods, creating sudden demand for cash and reducing the cash available to other repo market participants.

更大影響來自壓力事件。如果穩定幣被迅速贖回,發行商需於短期內自回購市場提取數十億美元,令市場突然現金需求大增,其他回購參與者可用現金大減。

During the March 2023 USDC depeg event, when approximately $10 billion in redemptions occurred over three days, Circle liquidated substantial repo and Treasury positions to meet redemptions. This type of forced selling can amplify volatility in repo markets during precisely the moments when liquidity is most valuable.

在2023年3月USDC脫鉤事件期間,三天內出現約100億美元贖回,Circle被迫大幅賣出回購及國債部位,以應付贖回需求。這類強制性沽盤,會在市場最需要流動性的時刻加劇回購市場波動。

Federal Reserve Policy Transmission: The Fed's policy rate decisions affect stablecoin economics and hence stablecoin issuance, creating feedback into Treasury markets. When the Fed raises rates, the profit margin for stablecoin issuers increases (they earn more on reserves while still paying zero to holders), making stablecoin issuance more attractive to operators and potentially spurring growth. This growth increases demand for short-term Treasuries, partially offsetting the Fed's tightening intent by keeping yields compressed at the short end.

**聯儲政策傳導:**聯儲局的政策利率決定會影響穩定幣經濟,對發行量產生反饋作用,並進而影響國債市場。當聯儲局加息,穩定幣發行商的利潤率上升(收益增多,但無需向持有人付息),令發行更具吸引力,可能推動規模膨脹。這進一步加大對短期國債的需求,令短端孳息被壓低,從而部分抵銷聯儲收緊貨幣政策的效果。

Conversely, if the Fed cuts rates toward zero, stablecoin economics deteriorate dramatically. In a near-zero rate environment, issuers earn minimal yields on Treasury reserves, making the business model far less attractive (though still valuable for payment services). This could slow stablecoin growth or even trigger redemptions as issuers reduce capacity or users seek better yields elsewhere. Reduced stablecoin demand for Treasuries would remove a source of demand from bill markets.

反過來說,若聯儲將利率調低至接近零,穩定幣的盈利模式將嚴重惡化。近零利率環境下,發行商持有國債的利息收入大幅減少,營運模式吸引力大減(但用於支付服務仍有價值)。這將令穩定幣增長放緩,甚至在用戶尋求更高回報、發行商減少發行時引發大量贖回。穩定幣對國庫券的需求下降,國庫券市場亦會因此失去一大買家。

This creates a pro-cyclical dynamic: stablecoin demand for Treasuries is highest when rates are high (when the Fed is tightening) and lowest when rates are low (when the Fed is easing). This pattern tends to work against the Fed's monetary policy intentions, providing unintended support for Treasury prices during tightening cycles and withdrawing support during easing cycles.

這帶來順周期特徵:加息時穩定幣對國債需求最強,減息時需求最弱。這種局面往往與聯儲的政策意圖背道而馳——收水時反而支持了國債價格,放水時撤走了買盤。

Market Structure and Concentration Risks: The concentration of stablecoin reserves among a handful of issuers, invested through a small number of custodian relationships, creates potential points of fragility. If Tether, with $120 billion under management, needed to liquidate substantial Treasury positions rapidly, that volume would affect market depth and pricing. During the 2008 financial crisis, forced selling by money market funds facing redemptions amplified Treasury market volatility; stablecoins could play a similar role in future stress scenarios.

**市場結構與集中風險:**穩定幣儲備高度集中於少數幾個發行人,並依賴少數託管銀行,形成潛在脆弱點。以Tether為例,管理超過1,200億美元,一旦要大規模快速沽售國債,將直接衝擊市場深度和價格。於2008年金融危機期間,貨幣市場基金被迫賣出引發國債動盪,未來壓力下穩定幣可能產生類似效應。

The concentration is also evident in custodial relationships. Most stablecoin reserves are held through just a few large custodian banks and institutional trust companies. If one of these custodians faces operational problems or regulatory restrictions, it could impair multiple stablecoin issuers' ability to access reserves, triggering redemption bottlenecks. The March 2023 Silicon Valley Bank failure, which held substantial Circle deposits, illustrated this interconnection risk. While only a small portion of USDC reserves were affected, the uncertainty triggered a depeg and $10 billion in redemptions.

這種集中在託管層面亦非常明顯。大部分穩定幣儲備由數家大型託管銀行及機構信託公司持有。如果其中一家遇到營運問題或受監管限制,將影響多個穩定幣發行人的資產調配能力,引發贖回堵塞。2023年3月矽谷銀行倒閉事件,當時Circle有大量存款受影響,正好體現了這種連鎖風險。儘管當時僅一小部分USDC儲備被凍結,不確定感卻即時觸發了脫鉤和百億美元級別的贖回。

Volatility Amplification During Crypto Market Stress: Stablecoin redemption dynamics are closely tied to crypto market cycles. When crypto prices fall sharply, traders flee to stablecoins,

**加密市場壓力下的波動放大效應:**穩定幣的贖回動態與加密市況息息相關。當加密貨幣價格急跌,交易員紛紛轉向穩定幣……increasing issuance. When they recover, traders redeem stablecoins to buy crypto, reducing issuance. When confidence breaks entirely, users may exit crypto completely, redeeming stablecoins for fiat and removing billions from the system.

發行量隨著市場起伏而增加。當市場恢復時,交易者會將穩定幣贖回並購買加密貨幣,導致發行量減少。當市場信心完全崩潰時,用戶可能會徹底退出加密貨幣市場,把穩定幣兌換成法定貨幣,令系統內的資金流失數十億。

These cyclical flows create corresponding volatility in Treasury demand. A $50 billion reduction in stablecoin supply over several months translates to $50 billion in Treasury selling, occurring during periods when crypto markets are likely already experiencing stress. If crypto stress coincides with broader financial stress, this forced Treasury selling would occur when market liquidity is most challenged, potentially amplifying problems.

這些週期性的資金流動,亦引起國債需求的相關波動。假如數月內穩定幣供應減少五百億美元,這會相當於五百億美元的國債遭到拋售,而此情況往往發生於加密貨幣市場已經出現壓力的時候。如果加密市場壓力同時夾雜更廣泛的金融壓力,這種被迫拋售國債的情況將會發生於流動性最偏緊張的時候,令問題進一步惡化。

The converse is also true: during crypto bull markets when stablecoin issuance surges, tens of billions in new Treasury demand emerges from a non-traditional source, potentially distorting price signals and rate structures in ways that confuse policymakers trying to read market sentiment.

反之亦然:當加密貨幣市場牛市時,穩定幣發行量大幅增加,非傳統渠道帶來數百億的新國債需求,可能扭曲價格訊號和利率結構,令政策制定者難以準確解讀市場情緒。

Cross-Border Capital Flows: Unlike traditional money market funds which primarily serve domestic investors, stablecoins are global by nature. A user in Argentina, Turkey, or Nigeria can hold USDT or USDC as a dollar substitute, effectively accessing U.S. Treasury exposure without directly interacting with U.S. financial institutions. This creates channels for capital flow that bypass traditional banking surveillance and balance of payments statistics.

跨境資本流動: 穩定幣本質上具備全球性,與主要服務本土投資者的傳統貨幣市場基金不同。阿根廷、土耳其或尼日利亞等地的用戶可以持有USDT或USDC作為美元替代品,等同於間接持有美國國債風險敞口,毋須直接與美國金融服務機構交手。這為資金流動開闢了繞過傳統銀行監控和國際收支統計的新渠道。

When global users accumulate billions in stablecoins, they are indirectly accumulating claims on U.S. Treasury securities, funded by capital outflows from their home countries. This demand for dollar-denominated stores of value supports both the dollar and Treasury markets, but it occurs outside formal channels that central banks and regulators traditionally monitor. During currency crises or capital control periods, stablecoin adoption can accelerate, creating sudden spikes in demand for Treasuries that market participants may struggle to explain using conventional models.

當全球用戶累積了數十億美元穩定幣,實際是間接持有美國國債的索償權,這些資金來自本國的資本外流。這種對美元計價保值工具的需求同時支持了美元及國債市場,但這一過程發生在央行和監管機構傳統監察框架之外。當出現貨幣危機或資本管控時,穩定幣的採用可以快速加速,導致對國債需求出現突然而難以用傳統模型解釋的迅增。

The integration of stablecoins into monetary plumbing is still in early stages, but the direction is clear: crypto has created a new channel for transmitting monetary policy, distributing government debt, and mobilizing global dollar demand, with feedback effects that central banks and treasury departments are only beginning to study systematically.

穩定幣融入全球貨幣體系的進程仍然處於初步階段,但發展方向非常清晰:加密貨幣創造了一條傳遞貨幣政策、分銷國債和凝聚全球美元需求的新渠道,其反饋效應才剛剛引起央行和財政部門系統性的關注研究。

Risks: Concentration, Runs, and Maturity Transformation

風險:集中、擠兌與到期結構錯配

The fusion of stablecoin infrastructure and Treasury exposure creates multiple categories of risk, some familiar from traditional money markets and others unique to crypto-native systems. Understanding these risks is essential because a major stablecoin failure could have ripple effects extending far beyond crypto markets.

穩定幣基建及國債敞口的融合,帶來多種類型的風險—有部分與傳統貨幣市場類似,也有只屬加密原生系統的獨特風險。了解這些風險至關重要,因為一旦有大型穩定幣爆煲,影響可能遠遠超出加密貨幣市場本身。

Run Dynamics and Redemption Spirals represent the most immediate danger. Stablecoins promise instant or near-instant redemption at par, but their reserves are invested in securities that may take days to liquidate at full value. This maturity mismatch creates classic run vulnerability: if a large percentage of holders simultaneously attempt to redeem, the issuer may be forced to sell Treasury securities into falling markets, realize losses, and potentially break the peg.

擠兌動態與贖回螺旋是最即時、直接的危險。穩定幣承諾可即時或極快速按面值贖回,但其儲備多投資於需要數天時間才能完全變現的證券。這種到期日錯配造成了典型的擠兌脆弱性:如果大量持有人同時申請贖回,發行商可能被迫在市場下跌時沽售國債,造成損失以致嚴重情況下會失去穩定幣錨定。

The mechanism differs from bank runs in important ways. Banks face legal restrictions on how quickly they can be drained; wire transfers and withdrawal limits impose friction. Stablecoins can be transferred instantly and globally, 24/7, with no practical limits beyond blockchain congestion. A loss of confidence can trigger redemptions at digital speed. During the March 2023 USDC event, approximately $10 billion redeemed in roughly 48 hours - a burn rate that would challenge any reserve manager.

這種機制與傳統銀行擠兌有幾個重要分別。銀行受法律規範限制提款速度,而電匯和提現限制亦增加摩擦。穩定幣則可全球24小時即時轉賬,除了區塊鏈擠塞外,幾乎無硬性上限。信心一旦崩潰,贖回會以數碼速度發生。2023年3月USDC事件中,約100億美元在大約48小時內被贖回—這種燒錢速度任何儲備管理人都難以承受。

The TerraUSD collapse in May 2022 demonstrated how quickly confidence can evaporate in crypto markets. UST lost its peg over a few days, triggering a death spiral where redemptions begat price declines which begat more redemptions. While fiat-backed stablecoins have stronger backing than algorithmic stablecoins, they are not immune to similar dynamics if doubt emerges about reserve adequacy or liquidity.

2022年5月TerraUSD崩盤清楚說明加密市場信心消失之快。UST短短數天脫鈎,引發死亡螺旋—贖回導致價格下跌,繼而刺激更多贖回。即使有法定貨幣支持的穩定幣比純算法穩定幣有更強後盾,一旦市場對儲備充足或流動性產生疑慮,仍難保不會出現類似螺旋。

The structure of stablecoin redemptions creates additional pressure. Typically, only large holders and authorized participants can redeem directly with issuers, while smaller holders must sell on exchanges. During stress events, exchange liquidity can dry up, causing stablecoins to trade at discounts to par even while direct redemptions remain available. This two-tiered structure means retail holders may experience losses even if institutional holders can redeem at par, creating distributional inequities and accelerating panic.

穩定幣贖回機制本身增加額外壓力。通常只有大戶及授權參與者可直接向發行商贖回,散戶則要在交易所買賣。壓力時候,交易所流動性可能枯竭,雖然直接贖回依然開放,但穩定幣市場交易價會低於面值。這種兩級結構導致散戶可能出現實際損失,而大戶可在面值贖回,加劇不公平分配並令恐慌加劇。

Liquidity Mismatch arises from the fundamental tension between instant redemption promises and day-to-day settlement cycles in Treasury markets. While Treasury bills are highly liquid, executing large sales and receiving cash still requires interaction with dealer markets and settlement systems that operate on business-day schedules. If redemptions spike on a weekend or during market closures, issuers may face hours or days during which they cannot fully access reserves to meet outflows.

流動性錯配來自即時贖回承諾與國債市場結算周期不吻合的根本矛盾。雖然國庫券流動性高,但大量沽售及取回現金仍要與做市商及結算系統對接,後者遵循工作日運作。如遇到週末或市場休市期大量贖回,發行商在數小時甚至數日內未必能動用全部儲備回應資金流出。

Stablecoin issuers manage this through liquidity buffers - portions of reserves held in overnight instruments or cash. However, determining the right buffer size involves guesswork about tail-risk redemption scenarios. Too small a buffer leaves the issuer vulnerable; too large a buffer sacrifices yield. The March 2023 USDC event suggested that even sizable buffers may prove insufficient during confidence crises.

穩定幣發行商會設流動性緩衝—將部分儲備保留於過夜債券或現金。不過,設計合適緩衝規模仍需對極端贖回情景作推測。緩衝太細,風險高;緩衝太大,利潤低。2023年3月USDC事件亦顯示,即使緩衝不細,信心危機時仍可能不夠應付。

Mark-to-Market vs. Amortized Cost Accounting creates transparency and valuation challenges. Treasury bills held to maturity return par value regardless of interim price fluctuations, but bills sold before maturity realize market prices. If interest rates rise after an issuer purchases bills, those bills decline in market value, creating unrealized losses.

按市價評值vs.按攤銷成本法帶來資料透明度和估值上的挑戰。待到期的國庫券可取回面值,不論期間價值如何波動,但如中途沽售,只能以市價成交。若發行人購買國債後遇上加息,債券市值便會下跌,產生未實現虧損。

Stablecoin attestation reports typically value reserves using amortized cost or fair value approaches. Amortized cost assumes bills will be held to maturity and values them based on purchase price adjusted for accruing interest. Fair value marks positions to current market prices. In stable conditions, these methods produce similar results, but during interest rate volatility, gaps can emerge.

穩定幣的定期審核報告一般以攤銷成本法或公允價值法來計算儲備。攤銷成本法假設債券會持有至到期,按購入成本加計利息;公平價值法則按現時市價計算。在穩定情況下兩者接近,但利率波動時差異會拉闊。

If an issuer holds $30 billion in Treasury bills at amortized cost but interest rates have risen such that the fair value is only $29.5 billion, which number represents the "true" reserve value? If forced selling occurs, only $29.5 billion may be realizable, creating a $500 million gap. Some critics argue that stablecoins should mark all reserves to market value and maintain over-collateralization buffers to absorb such gaps, but most issuers use cost-basis accounting and claim 1:1 backing without additional buffers.

如果發行商以攤銷成本法持有300億美元國債,利率上升後公允價值只剩下295億,那究竟哪個金額才是真正的儲備數字?如被迫出售,只能取回295億,中間便有5億美元落差。有批評指穩定幣應該按市價評值,並保持超額抵押來吸收這些損失,但大部分發行商仍以成本為基礎,按1:1宣稱完全抵押卻缺乏額外緩衝。

Counterparty and Custodial Concentration poses operational risks. Stablecoin reserves are held at a small number of banking and custody institutions. If one of these institutions faces regulatory intervention, technological failure, or bankruptcy, access to reserves could be impaired. The Silicon Valley Bank failure in March 2023 demonstrated this risk; USDC's exposure was only about 8% of reserves, but even that limited exposure triggered sufficient uncertainty to cause a temporary depeg.

對手方及託管集中度構成營運風險。穩定幣的儲備多由少數銀行和託管機構持有。如果當中某間機構因監管、技術出錯或破產,儲備資產就可能無法動用。2023年3月矽谷銀行倒閉就顯示出此風險,USDC有約8%儲備暴露於該行,已足以引發市場恐慌短暫脫鈎。

More broadly, the crypto custody industry remains young and evolving. Operational risks include cyber attacks on custodian systems, internal fraud, technical failures that impair access to funds, and legal complications in bankruptcy or resolution scenarios. While traditional custody banks have decades of institutional experience, the crypto custody space includes newer entrants with shorter track records.

更廣泛而言,加密貨幣託管行業仍新興未成熟,營運風險包括託管系統遭受黑客、內部詐騙、技術問題導致無法存取資金,以及破產清盤時的法律複雜性。傳統託管銀行歷史悠久,業界經驗豐富;加密貨幣託管行業則有不少新晉者、歷史較短。

Regulatory and Jurisdictional Arbitrage creates risks from inconsistent oversight. Stablecoin issuers are chartered in various jurisdictions with different regulatory approaches. Circle operates as a money transmitter in the U.S. with varying state-level licenses. Tether is registered in the British Virgin Islands with less stringent disclosure requirements. Paxos operates as a New York trust company with strong regulatory oversight. This patchwork means that similar products face different rules, disclosure standards, and supervisory intensity.

監管和法域套利造成監管不一的系統風險。穩定幣發行商分別註冊於不同地區,各自受不同監管。有如Circle於美國以多個州級牌照作為轉帳機構經營,Tether則註冊於英屬處女群島、披露要求較寬鬆,Paxos則以紐約信託公司身份受到較嚴格監管。這種拼貼式監管格局,令同類產品面對不同規則、披露標準和監管強度。

The potential for regulatory arbitrage is obvious: issuers may locate in jurisdictions with lighter oversight while serving global users, externalizing risks to the broader system. If a crisis emerges, the lack of clear regulatory authority and resolution frameworks could create coordination problems and delay effective responses.

監管套利問題顯而易見:發行商可能選擇監管較寬鬆地區設立,卻服務全球用戶,將風險外溢給整個金融系統。一旦危機發生,缺乏明確監管權力和解決框架,很容易引發協調混亂,拖慢應對速度。

Contagion Channels to Traditional Finance run in both directions. If a major stablecoin fails, forced liquidation of billions in Treasuries could disrupt repo markets and money market funds, particularly if the liquidation occurs during a period of broader market stress. The selling would affect prices and liquidity, creating mark-to-market losses for other Treasury holders and potentially triggering margin calls and additional forced selling.

向傳統金融蔓延的渠道可雙向運作。如果有大型穩定幣爆煲,受迫賣出數十億國債,可能會攪亂回購市場與貨幣市場基金,尤以事件發生於整體市況低迷時。這類拋售會影響價格和流動性,令其他國債持有人出現市值虧損,甚至被追加保證金,進一步觸發連鎖強制賣出。

Conversely, stress in traditional finance can contaminate stablecoins. Banking system problems can impair stablecoin issuers' access to custodied reserves, as occurred with Silicon Valley Bank. A broader banking crisis could create cascading failures across multiple stablecoin custodians simultaneously. Money market fund problems could impair the funds that some stablecoin issuers use for reserve management.

反過來,傳統金融系統困境也可以波及穩定幣。銀行體系問題會影響發行商對託管儲備的存取,如矽谷銀行事件所見。若銀行危機大規模爆發,或會導致多間穩定幣託管方同時接連出事。貨幣市場基金流動性問題,亦可影響部分穩定幣發行商的儲備管理。

Historical Analogies provide sobering context. The Reserve Primary Fund "broke the buck" in September 2008 when its holdings of Lehman Brothers commercial paper became worthless, triggering redemptions across the entire money market fund industry. The Fed ultimately intervened with lending programs to stabilize the sector, but not before significant damage occurred.

歷史案例為討論提供重要參照。2008年9月,Reserve Primary Fund「跌破面值」事件,源自其持有的雷曼兄弟商業票據變得一文不值,引發整個貨幣市場基金行業的贖回潮。聯儲局最後要透過緊急貸款出手穩定市場,但重大損失早已出現。

Earlier, in the 1970s, (未完,如需後續請提出)money market funds experienced periodic runs as investors questioned the value of underlying commercial paper holdings during corporate debt crises. These events led to regulatory reforms including stricter portfolio rules, disclosure requirements, and eventual SEC oversight under the Investment Company Act.

貨幣市場基金喺企業債務危機期間,因為投資者質疑其持有嘅商業票據價值,曾經出現週期性擠提。呢啲事件導致監管改革,包括更嚴格嘅投資組合規則、披露要求,以及最終喺《投資公司法案》下由美國證監會(SEC)監管。

Stablecoins today resemble money market funds circa 1978: rapidly growing, lightly regulated, increasingly systemic, and operating under voluntary industry standards rather than comprehensive regulatory frameworks. The question is whether stablecoins will experience their own "breaking the buck" moment before regulation catches up, or whether proactive regulatory intervention can avert such an event.

現時嘅穩定幣,好似1978年時期嘅貨幣市場基金咁:增長迅速、監管寬鬆、愈來愈具系統性,同埋主要依賴行業自律標準而唔係全面監管架構。問題係,穩定幣會唔會喺監管追上之前,出現屬於自己嘅“跌破一蚊”時刻,定係監管部門可以主動介入,防止咁嘅情況發生。

Maturity Transformation and Credit Intermediation creates additional concerns if stablecoins evolve toward lending practices. Currently, most major stablecoins invest only in government securities and repo, avoiding credit risk. However, economic incentives push toward credit extension: lending to creditworthy borrowers generates higher yields than Treasuries, increasing issuer profitability.

如果穩定幣進一步發展到借貸業務,期限轉換同信貸中介會帶嚟額外風險。現時主流穩定幣大多只投資於政府證券及回購協議,避免信貸風險。不過,經濟誘因會推動信貸擴張——借貸畀優質借款人,回報比國債高,發行人利潤自然增加。

Some stablecoin issuers have experimented with or discussed broader reserve compositions including corporate bonds, asset-backed securities, or even loans to crypto companies. If this trend accelerates, stablecoins would begin performing bank-like credit intermediation - taking deposits (issuing stablecoins) and making loans (investing in credit products) - but without bank-like regulation, capital requirements, or deposit insurance.

部分穩定幣發行商曾經試驗或討論將儲備擴展至企業債、資產支持證券,甚至借畀加密貨幣公司。若果呢個趨勢繼續加快,穩定幣就會開始執行類似銀行嘅信貸中介功能——吸收存款(發行穩定幣),並向外貸款(投入信貸產品)——但係冇銀行監管、資本要求或者存款保障。

This would amplify all the risks discussed above while adding credit risk: if borrowers default, reserve values decline, potentially below the value of outstanding stablecoins. Historical experience suggests that entities performing bank-like functions without bank-like regulation tend to fail catastrophically during stress events, from savings and loans in the 1980s to shadow banks in 2008.

呢種做法會加強上述所有風險,並新增信貸風險:一旦借款人違約,儲備價值下跌,甚至低於在外流通的穩定幣金額。歷史經驗顯示,執行銀行職能但冇銀行監管嘅機構,通常會喺壓力事件中出現災難性倒閉(由1980年代嘅儲貸協會危機,到2008年嘅影子銀行危機)。

Transparency Deficits persist despite improvements in attestation frequency and detail. Most stablecoin attestations remain point-in-time snapshots rather than continuous audits. They typically do not disclose specific counterparties, detailed maturity profiles, concentration metrics, or stress-testing results. This opacity makes it difficult for holders, market participants, and regulators to assess true risk levels.

雖然穩定幣發行商喺合規證明嘅頻率同詳情上有所改善,但透明度不足問題仍然存在。大部分穩定幣嘅證明仍然只係即時快照,而非持續審計。佢哋通常唔會披露具體交易對手、詳細到期結構、集中度指標同壓力測試結果。呢種不透明,令持有人、市場參與者同監管部門難以評估真正嘅風險水平。

Moreover, the attestation standards themselves vary. Some reports are true attestations by major accounting firms following established standards. Others are unaudited management disclosures. The lack of standardized, comprehensive, independently audited reporting makes comparison difficult and creates opportunities for issuers to present reserve compositions in misleading ways.

另外,證明標準本身亦唔一致。有啲報告係由大會計師樓按標準出具,有啲就只係管理層自行披露,無經審計。缺乏統一、全面同獨立審核嘅報告,難以比較,亦令發行人有機會用誤導方式展示其儲備狀況。

The overall risk profile suggests that while stablecoins backed primarily by short-term Treasuries are dramatically safer than algorithmic or poorly-collateralized alternatives, they are not risk-free. They remain vulnerable to runs, liquidity mismatches, operational failures, and contagion effects. The migration toward Treasury exposure reduced but did not eliminate these risks, and the growing scale of the sector increases the systemic stakes if something goes wrong.

整體風險概況顯示,以短期國債為主做後盾嘅穩定幣,比算法型或抵押品不足的代幣安全好多,但仍然唔等同於零風險。佢哋依然容易被擠提、流動性錯配、操作失誤或連鎖反應影響。雖然資產逐步轉向國債,有助減低風險,但冇辦法徹底消除,而且規模越大,出事時對金融系統構成的風險就越高。

Who Regulates What: Legal and Supervisory Gaps

誰負責監管:法律同監管落差

The regulatory landscape for stablecoins remains fragmented across jurisdictions and unsettled within them, creating uncertainty for issuers, users, and the broader financial system. Understanding this landscape is crucial because regulatory decisions will determine whether stablecoins evolve into well-supervised components of the monetary system or remain in a gray zone vulnerable to sudden restrictions.

穩定幣監管格局喺唔同司法區之間分散零亂,區內亦冇統一,導致發行者、用家同整體金融系統都陷入不確定。了解呢個監管環境好關鍵,因為相關政策決定穩定幣係咪會變成受嚴格監管嘅貨幣體系一部分,抑或繼續處於灰色地帶,隨時面對突然打壓。

United States Regulatory Patchwork: No comprehensive federal framework for stablecoins existed as of late 2024, leaving issuers to navigate a complex mosaic of state, federal, and functional regulators. The Securities and Exchange Commission (SEC) has asserted that many crypto assets are securities subject to federal securities laws, but has taken inconsistent positions on whether stablecoins constitute securities. The SEC's primary concern with stablecoins relates to whether they represent investment contracts or notes under the Howey test and other securities definitions.

**美國監管碎片化現狀:**截至2024年底,美國仍然未有全面聯邦穩定幣監管架構,發行方要應對州及聯邦各級、唔同職能監管部門嘅複雜安排。美國證券交易委員會(SEC)話好多加密資產屬於證券,西應用聯邦證券法規,但對穩定幣係咪證券立場唔一致。SEC主要關注點喺於穩定幣係咪符合《豪威測試》及其他定義下嘅投資合約或票據。

For yield-bearing stablecoins that promise returns to holders, the securities characterization becomes stronger. The SEC has suggested that such products likely require registration as investment companies under the Investment Company Act of 1940, subjecting them to comprehensive regulation including portfolio restrictions, disclosure requirements, and governance rules. Non-yield-bearing stablecoins like USDC and USDT occupy murkier territory; the SEC has not definitively classified them but has not exempted them either.

對於承諾有回報收益嘅穩定幣,作為證券的屬性更明顯。SEC建議呢類產品可能需要根據1940年《投資公司法案》註冊為投資公司,要符合投資組合限制、披露要求同管治規則等全面監管。至於USDC、USDT等冇收益的穩定幣,情況比較模糊,SEC未有定性,但亦冇明確豁免。

The Commodity Futures Trading Commission (CFTC) asserts jurisdiction over stablecoins to the extent they are used in derivatives markets or meet the definition of commodities. CFTC Chairman Rostin Behnam has advocated for expanded CFTC authority over spot crypto markets, which could include stablecoins used as settlement instruments on derivatives platforms.

商品期貨交易委員會(CFTC)認為,若穩定幣用於衍生品市場或符合商品定義,CFTC有權監管。CFTC主席Rostin Behnam曾推動擴大CFTC對現貨加密市場監管權限,包括納入用作衍生品平台結算工具的穩定幣。

The Office of the Comptroller of the Currency (OCC) oversees banks and has issued guidance suggesting that national banks may issue stablecoins and provide custody services for them, but with significant restrictions and supervisory expectations. The OCC's 2021 interpretive letters indicated that banks could use stablecoins for payment activities and hold reserves for stablecoin issuers, but these positions faced subsequent uncertainty under changing OCC leadership.

貨幣監理署(OCC)負責監管銀行,曾發指引指國家銀行可以發行穩定幣及提供託管服務,但有嚴格規限同監督要求。OCC 2021年嘅指引話銀行可以用穩定幣作支付,同為發行方持有儲備,但之後OCC高層變動,政策方向亦生變。

State regulators maintain their own frameworks. New York's BitLicense regime regulates virtual currency businesses operating in the state, including stablecoin issuers serving New York residents. The New York Department of Financial Services requires licensees to maintain reserves equal to or exceeding outstanding stablecoin obligations, hold reserves in qualified custodians, and submit to regular examinations. Paxos operates under New York trust company charter, subjecting it to full banking-style supervision by New York regulators.

各州監管機構有其自身框架。紐約 BitLicense制度 規管州內虛擬貨幣業務,包括服務紐約居民的穩定幣發行商。紐約金融服務署要求持牌人要有充足或超過穩定幣發行量的儲備,並由合資格保管人托管,又要定期接受審查。Paxos採用紐約信託公司牌照,所以亦接受銀行級別監管。

Other states have developed money transmitter licensing frameworks that may apply to stablecoin issuers. The challenge is that requirements vary dramatically: some states require reserve segregation and regular attestations, while others impose minimal standards. This creates regulatory arbitrage opportunities and uneven protection for users depending on where an issuer is located.

其他州都有資金轉移牌照架構,可能涵蓋穩定幣發行人。問題喺各州要求差很遠:有啲要求儲備隔離同定期證明,有啲就只設低門檻。令監管套利同保障參差,用家保障取決於發行人在哪個州。

Federal Legislative Efforts: Multiple stablecoin bills were introduced in the U.S. Congress during 2022-2024, though none achieved passage as of late 2024. These proposals generally aimed to establish federal licensing for stablecoin issuers, impose reserve requirements, mandate regular attestations or audits, and create clear supervisory authority (either at the Fed, OCC, or a new agency).

**聯邦立法努力:**2022—2024年,美國國會有多項穩定幣法案提出,但截至2024年底都未通過。立法主要目標係為發行人設立聯邦牌照、強制儲備要求、定期審計/證明、以及由聯儲局、OCC或新監管機構明確監督。

Key provisions in various bills included requirements that reserves consist only of highly liquid, low-risk assets (typically defined as cash, Treasuries, and repo); prohibition on lending or rehypothecation of reserves; monthly public disclosure of reserve compositions; and capital or surplus requirements. Some versions would have limited stablecoin issuance to banks and federally supervised institutions, effectively prohibiting non-bank issuers like Tether from operating in the U.S. market.

多數法案重點要求儲備只能用極高流動性、低風險資產(通常指現金、國債、回購協議);禁止出借或重複抵押儲備;每月公開儲備結構;並有資本或盈餘要求。有些草案只准銀行或聯邦監管機構發行穩定幣,實際上令非銀行發行人(例如Tether)難以進入美國市場。

The regulatory disagreements centered on whether stablecoin issuers should be treated as banks (requiring federal charters and comprehensive supervision), as money transmitters (requiring state licenses and lighter supervision), or as an entirely new category with sui generis regulation. Banking regulators generally favored stringent oversight comparable to banks, while crypto industry advocates pushed for lighter-touch frameworks that would not impose bank-level capital requirements or examination intensity.

監管爭議焦點在於:要將穩定幣發行人當銀行(需聯邦牌照同全面監管)、當資金轉移公司(需州牌照同較輕監管),定作全新類別度身訂做新監管。銀行監管部門贊成用銀行級審查,區塊鏈行業則主張輕鬆框架,唔想被要求銀行水平資本或監察。

European Union - Markets in Crypto-Assets (MiCA): The EU's MiCA regulation, which began taking effect in phases during 2023-2024, created the world's first comprehensive framework for crypto asset regulation, including detailed rules for stablecoins (termed "asset-referenced tokens" and "e-money tokens" under MiCA).

**歐盟——加密資產市場(MiCA):**歐盟《加密資產市場規例》(MiCA)自2023-2024年分階段實施,係全球首個全面監管加密資產嘅框架,當中對穩定幣(分別叫「資產參照型代幣」同「電子貨幣代幣」)有詳細規定。

Under MiCA, issuers of asset-referenced tokens must be authorized by competent national authorities, maintain reserves backing tokens at least 1:1, invest reserves only in highly liquid and low-risk assets, segregate reserves from the issuer's own assets, and undergo regular audits. For e-money tokens (which reference only a single fiat currency), the requirements align more closely with existing e-money regulations in the EU, potentially allowing established e-money institutions to issue them under existing licenses with some modifications.

根據MiCA,資產參照型代幣發行人必須由合資格國家監管部門授權,確保儲備至少1:1支持發行金額,只可投資極高流動性及低風險資產,儲備要獨立於發行人資產,並須定期審計。至於單一法幣對標嘅電子貨幣代幣,要求更貼近歐盟現有電子貨幣規例,有機會由現有電子貨幣機構按牌照作出部分調整繼續發行。

MiCA also imposes significant holder rights including redemption at par, disclosure obligations regarding reserve composition and valuation methodologies, and governance requirements. Perhaps most significantly, MiCA limits the ability of non-EU stablecoins to circulate in the EU unless their issuers comply with comparable regulatory standards and are authorized by EU authorities. This could theoretically restrict Tether and other non-compliant stablecoins from being offered to EU users, though enforcement mechanisms and transition timelines remain somewhat unclear.

MiCA還保障持有人權益,如按面值贖回、儲備組成同估值方法的披露義務、管治要求等。最關鍵係,MiCA限制非歐盟發行嘅穩定幣喺歐盟流通,除非遵守類似監管標準並獲歐盟許可。理論上,呢條款或會令Tether等未符標準穩定幣唔可以畀歐盟用家用,不過具體執行同過渡時間表仍然唔算清晰。

United Kingdom

英國Approach:** 英國採取混合型方式,將穩定幣視為一類獨立受規管的代幣,同時沿用現行電子貨幣及支付服務規例進行監管。金融行為監管局(FCA)及英倫銀行已發表聯合諮詢文件,建議對穩定幣發行人實施類似系統性支付系統的監管,包括審慎要求、營運韌性標準以及儲備管理規則。

英國監管框架區分未有資產支持的加密資產(不受監管)、主要用於支付的穩定幣(須接受加強監管)、以及用作投資產品的穩定幣(或受證券法監管)。英倫銀行亦探討部分穩定幣是否應被指定為系統性支付系統,從而受中央銀行直接監管。

英國建議一般要求儲備資產設於破產隔離結構,按公平價值每日評估,只可包括高質素的流動資產。英倫銀行亦指明,對於具系統重要性的穩定幣,其儲備資產須直接存放於中央銀行,或以能夠快速轉化為中央銀行儲備而無市場風險的形式持有。

國際協調: 金融穩定委員會(FSB)、國際結算銀行(BIS)及其他國際組織已提出有關穩定幣監管的政策建議。這些建議主要強調多項原則,包括同樣風險、同樣監管(如穩定幣具備類似銀行職能應受銀行級規管)、對生態系統內所有實體(發行人、託管人及驗證人)全面監管、強健的儲備及披露要求,以及跨境監管合作。

但挑戰在於,國際標準並無約束力,須由各國落實才能生效。不同司法管轄區如何將原則本地立法,產生持續分歧及監管套利空間。

披露與透明度規則: 一個較為收斂的範疇是資訊披露。大部分嚴謹的監管建議,要求公開每月或每季度的儲備資產組成,詳盡程度足以進行有意義的分析。一般會包括資產類型、到期結構、對手方集中度及估值方法等分項。

但「充分披露」的標準仍有分歧。有些地區規定必須根據認可會計準則進行全盤審計。部分地方則接受簡單證明只確定特定時點的資產存在,卻不覆核控制程序或持續合規。還有地區接受未經審核的管理層聲明。這些差異導致外界難以分辨哪些穩定幣真正達到高標準。

清盤及失敗應對框架: 多數監管體制最明顯的缺口,是缺乏明確規定若穩定幣發行人出事時如何處理。例如 Tether 若破產,儲備資產的法定權益屬誰?優先次序?執行程序?持有人是否如破產債權人般按比例分配,還是像部分地區安排有如存款人般享有優先權?

同樣地,若一款系統性穩定幣出現擠提但仍然有償付能力,中央銀行會否如銀行般提供流動性支援?當局有否緊急凍結贖回的權力?這類不明朗因素可能在壓力時期惡化恐慌。

國債通證化問題: 監管當局面對通證化國債產品時特別棘手。這些屬不屬證券,需要全面註冊及招股章程?與傳統國債持有有否本質相似,可否豁免?可否供去中心化金融(DeFi)協議使用,還是必須留在封閉、需審批的環境內?

美國證監會未有提出詳細指引,令通證化國債發行人普遍採取保守結構設計(只限認可投資者,倚賴豁免條例 D,並設限轉讓等措施)以減低監管風險。此舉窒礙創新,亦令通證化國債難以發揮開放互通潛力。

監管及監察能力挑戰: 即使紙上已有監管框架,實際監察加密原生行業時,機構往往缺乏人手、專業知識及科技配套。審核傳統銀行須懂信貸審查、利率風險管理、貸款組合;審查穩定幣發行人則需掌握區塊鏈技術、加密安全、分佈式帳本會計、智能合約風險,以及 24/7 環球數碼資產的營運特性。

主管機構正積極招聘加密專才及強化內部能力,但需時建立。監管企圖與實際監察能力之間的落差,令違規風險可能被忽視直到問題惡化。

整體監管發展呈現漸趨收斂但仍存明顯缺口、不一致與未知數。大趨勢明確:主要地區正朝向把系統性穩定幣視為受規管金融機構。不過時間表、細節要求及執法方式仍未明確,對發行人構成持續合規挑戰,亦為用戶帶來風險。

案例分析與證據

剖析特定穩定幣發行人及其儲備策略,有助具體說明本報告中的行業動態。這些案例反映出不同策略同時存在,但都受到「國債曝險」這個共同重力牽引。

Circle 與 USDC:透明度領先

Circle Internet Financial 於 2018 年聯同 Coinbase 以 Centre Consortium 管治框架推出 USD Coin。一開始,Circle 已將 USDC 定位為 Tether 以外更透明、合規的選擇,強調與監管合作和全面的資產認證。

USDC 的儲備發展展現了行業大勢。最初儲備主要為現金存放於多間 FDIC 保險銀行。至 2021 年初,Circle 開始將部分資產儲備配置於短期美國國債及 Yankee 存款證,並稱進可兼顧收益、流動性及安全。

然而,Circle 一度因未有公佈具體組合百分比及其商業票據信用品質而受抨擊。在監管機構和加密社群壓力下,Circle 於 2021 年 8 月宣布 會將 USDC 儲備全面轉為現金及短期美國國債,不再持有商業票據及其他企債。

至 2023 年 9 月,Circle 已完成上述轉型。每月資產證明顯示,近乎 100% 的儲備為 Circle 儲備基金(由 BlackRock 管理,只投資國債及國債回購)及在受規管銀行的現金。2023 年 10 月證明報告記錄總儲備約 246 億美元,支持 246 億流通 USDC,其中約 238 億在儲備基金,8 億為現金(Circle Reserve Report, October 2023)。

至 2024 年組合持續穩健。2024 年 7 月證明顯示總儲備約 286 億美元,當中 281 億於由 BlackRock 管理、投資於國債及回購的儲備基金,5 億現金存放於包括紐約梅隆銀行和 Citizens Trust Bank 等銀行夥伴(Circle Reserve Report, July 2024)。

其意義明顯:Circle 的營運模式現時完全依賴國債利息收益,支付給 USDC 持有人則零利息。假設 5% 利率環境,280 億美元一年就產生約 14 億美元毛息。扣回營運開支(估計 2-4 億,包括技術、合規、銀行費等),Circle USDC 部門年淨利約有 10 億美元,全靠資金成本為零與國債息差。

Circle 的透明度固然行業領先,但仍有疑問。每月資產證明屬靜態快照,非連續審計,並未公開儲備基金國債的到期分布、回購交易對手風險,或流動性專業模型。即使如此,Circle 的做法已屬主流發行人中最強披露標準,並成為監管參考的行業基準。

Tether 與 USDT:爭議巨擘

Tether Limited 於 2014 年發行 USDT,為首個大型穩定幣,最初宣稱全數由美元資金存銀行作支持。多年來,Tether 持續受質疑儲備充足性、透明度及公司管治。有批評指 Tether 未有全數資產支持,與關連方例如 Bitfinex 交易所混用儲備,並誤導資產構成。

這些問題最終導致 2021 年 2 月與紐約州總檢察署和解。Tether 同意支付 1,850 萬美元罰款及...cease trading activity with New York residents, and most significantly, committed to enhanced transparency through quarterly public reporting on reserve composition.

停止與紐約居民進行交易活動,更重要的是,承諾通過每季向公眾公布儲備組合報告以提升透明度。

Tether's subsequent reserve disclosures revealed substantial evolution. The Q2 2021 attestation showed that only approximately 10% of reserves consisted of cash and bank deposits, while roughly 65% were in commercial paper and certificates of deposit, 12% in corporate bonds and precious metals, and other assets making up the remainder (Tether Transparency Report, Q2 2021). This composition triggered significant concern; Tether held tens of billions in commercial paper from unknown counterparties, potentially including Chinese property developers and other risky credits.

Tether其後的儲備披露顯示出重大變化。2021年第二季的核證文件顯示,只有約10%的儲備為現金及銀行存款,約65%為商業票據及存款證,12%為公司債券及貴金屬,餘下則屬於其他資產(Tether Transparency Report, Q2 2021)。這種儲備結構引發重大憂慮;Tether持有數百億來自身份不明交易對手的商業票據,當中或包括中國地產開發商及其他高風險信貸。

Following pressure from regulators and market participants, Tether began transitioning toward safer assets. By Q4 2022, Tether reported that over 58% of reserves consisted of U.S. Treasury bills, with another 24% in money market funds (which themselves invest primarily in Treasuries and repo), approximately 10% in cash and bank deposits, and smaller allocations to other assets (Tether Transparency Report, Q4 2022).

在監管機構及市場參與者施壓下,Tether開始逐步將儲備轉向較安全資產。至2022年第四季,Tether報告指超過58%儲備為美國國庫券,另外24%為貨幣市場基金(其本身主要投資於國庫券及回購協議),約10%為現金及銀行存款,餘下屬較小比例的其他資產(Tether Transparency Report, Q4 2022)。

This trend continued through 2023-2024. The Q2 2024 attestation showed Tether's reserve composition had shifted even further toward government securities: approximately 84.5% of roughly $118 billion in reserves consisted of cash, cash equivalents, overnight reverse repo, and short-term U.S. Treasury bills (Tether Transparency Report, Q2 2024). Tether disclosed holding over $97 billion in U.S. Treasury bills, making it one of the largest Treasury bill holders globally.

這趨勢在2023至2024年間持續。2024年第二季核證顯示,Tether的儲備組合更進一步偏向政府證券:大約1180億美元的儲備中,約84.5%為現金、等同現金資產、隔夜逆回購及短期美國國庫券(Tether Transparency Report, Q2 2024)。Tether公開持有超過970億美元美國國庫券,成為全球最大的國庫券持有者之一。

Tether's profitability from this model is extraordinary. At $97 billion in Treasury bills earning approximately 5% yield, Tether generates nearly $5 billion in annual gross interest income. Tether's Q1 2024 attestation disclosed over $4.5 billion in excess reserves (assets beyond the 1:1 backing requirement), representing accumulated retained earnings (Tether Q1 2024 attestation). This excess demonstrates years of capturing spread income that flowed entirely to Tether's shareholders rather than USDT holders.

Tether在這種模式下獲利極為可觀。970億美元的國庫券帶來約5厘收益,Tether每年便錄得接近50億美元的總利息收入。Tether 2024年第一季核證顯示,超過45億美元屬於過剩儲備(即超出1:1對應的資產),代表多年積累的留存收益(Tether Q1 2024 attestation)。這些盈餘全數流向Tether股東,而非USDT持有人。

However, Tether's transparency remains inferior to Circle's. Tether's reports are quarterly rather than monthly, use attestations rather than full audits, provide less granular detail about Treasury holdings and banking relationships, and disclose little about corporate structure or governance. Tether's domicile in the British Virgin Islands and limited public information about its ownership structure perpetuate concerns despite improved reserve disclosures.

然而,Tether的透明度仍不及Circle。Tether只每季公布報告,並非每月,而且只進行核證,未有全面審計,對國庫券持倉及銀行關係的資訊也較少細節,幾乎沒有企業架構或管治細節披露。Tether註冊於英屬處女群島,控股結構公開資料有限,即使儲備披露有所改善,外界疑慮依然存在。

The contrast between Circle and Tether illustrates a key industry tension: Tether's lighter regulatory approach allowed it to maintain dominance and maximize profitability, while Circle's compliance-first strategy positions it better for eventual regulation but sacrifices some short-term advantage.

Circle與Tether的對比,正好反映行業矛盾關鍵:Tether因監管要求較低而可維持主導並追求最大獲利;相反Circle採取合規優先策略,雖然有利長遠正式監管,但短期某些優勢會被犧牲。

Ethena Labs and USDe: The Synthetic Dollar Experiment

Ethena Labs及USDe:合成美元實驗

Ethena Labs represents a newer approach to stablecoin design, launching USDe in late 2023. USDe aims to be a "synthetic dollar" that maintains its peg not through fiat reserves but through Delta-neutral derivatives strategies and diversified backing.

Ethena Labs提出穩定幣設計的新路徑,2023年底推出USDe。USDe屬「合成美元」,並非靠法幣儲備保持掛鈎,而是運用Delta中性衍生工具策略配合多元資產支持來維持價值。

The mechanism involves holding both long spot cryptocurrency positions (primarily Bitcoin and Ethereum) and equivalent short positions in perpetual futures contracts. When these positions are balanced, changes in crypto prices cancel out: if Bitcoin rises 10%, the long position gains 10% but the short position loses 10%, maintaining stable dollar value. The strategy generates yield from funding rates paid in perpetual futures markets; typically longs pay shorts a funding rate, creating income for Ethena's strategy.

其機制是同時持有現貨加密貨幣(主要是比特幣和乙太幣)的多頭倉位,以及相等規模的永續合約空頭倉位。當這些頭寸平衡時,加密貨幣價格波動可互相抵消:如比特幣升10%,多頭賺10%,空頭虧10%,總值維持穩定。這策略亦能從永續合約市場產生收益,因多數情況為多頭需向空頭支付資金費率,為Ethena帶來收入來源。

However, funding rates can turn negative during bearish periods, making the derivatives strategy costly rather than yield-generating. To address this, Ethena incorporated U.S. Treasury bill exposure into USDe's backing strategy. During periods of negative funding or as a risk management measure, Ethena allocates capital to Treasury bills either directly or through tokenized Treasury products (Ethena documentation, 2024).

但在熊市或負資金費率時,這套策略不僅無法帶來收益,反而需付出成本。Ethena因此把美國國庫券納入USDe的儲備策略。在負資金費率或作為風險管理措施時,Ethena會直接或透過代幣化國庫產品將資金分配到國庫券(Ethena documentation, 2024)。

As of mid-2024, USDe had scaled to over $3 billion in circulation, making it one of the larger stablecoins despite its recent launch. The backing composition varied dynamically based on market conditions, but Ethena disclosed maintaining billions in Treasury exposure as part of its reserve strategy, supplementing the core Delta-neutral derivatives positions.

至2024年中,USDe流通量已超過30億美元,即使剛推出不久,仍屬於較大型穩定幣。其儲備組合會按市況靈活調整,但Ethena曾披露其國庫券持倉達數十億美元,用以補足主要的Delta中性策略。

Ethena's approach differs fundamentally from pure fiat-backed stablecoins. USDe holders receive no redemption guarantee from Ethena; instead, they rely on arbitrage mechanisms and market forces to maintain the peg. Ethena offers a yield-bearing version called sUSDe that passes through returns generated from funding rates and Treasury yields, with annual yields ranging from 8-27% depending on market conditions in 2024.

Ethena這個路線與傳統法幣支持的穩定幣本質不同。USDe持有人並無Ethena官方兌換保障,只依靠套利機制及市場力量維持匯率掛鈎。Ethena另有收益型代幣sUSDe,會將資金費率及國庫收益回饋予持有人,2024年全年回報介乎8-27%,視市況而定。

The Ethena case demonstrates how even innovative, crypto-native stablecoin models gravitate toward Treasury exposure for risk management and yield generation. The presence of Treasuries in USDe's backing provides both stability during unfavorable derivatives market conditions and additional yield streams that make the product economically viable.

Ethena個案說明,連創新及原生加密資產穩定幣模式,最終都傾向納入國庫券以管理風險及產生收益。國庫券在USDe儲備中的存在,不僅可於衍生品市場不利時穩定幣值,也能帶來新收益來源,令產品經濟模式成立。

Paxos Trust and Regulated Stablecoins

Paxos信託及受規管穩定幣

Paxos Trust Company, chartered as a limited-purpose trust company by the New York Department of Financial Services, represents the most heavily regulated major stablecoin issuer. Paxos issues its own USDP stablecoin and formerly managed reserves for Binance USD (BUSD) before that product's wind-down in 2023.

Paxos信託公司由紐約金融服務署(NYDFS)發牌為有限用途信託公司,是目前監管最嚴格的主要穩定幣發行方。Paxos發行自家USDP穩定幣,亦曾為Binance USD(BUSD)管理儲備,直至2023年該產品退場。

Operating under a trust company charter subjects Paxos to comprehensive banking-style supervision including regular examinations, capital requirements, strict reserve segregation rules, and detailed reporting obligations. Paxos publishes monthly attestations prepared by independent accounting firms that disclose exact CUSIP identifiers for every security in its reserve portfolios, providing unprecedented transparency.

作為信託機構,Paxos受到全面銀行式監管,包括定期審查、資本要求、嚴格儲備分隔及詳細報告義務。Paxos每月由獨立會計師事務所核證儲備,並公開每項儲備資產的CUSIP識別碼,前所未有地透明。