加密貨幣交易所 Gemini 推出了一項幾年前根本想像不到的產品:一張可自動將日常消費轉換為質押加密貨幣的信用卡,讓你在睡覺時都能賺取被動回報。

這張 Gemini Solana 信用卡 讓持卡人消費時最高可獲 4% 的 SOL 回贈,而且有一項創新機制:這些獎賞 SOL 可自動質押,年回報率最高達 6.77%,即是說,日常消費可以變成你的加密資產複合投資工具。

這產品不僅僅是同類型回贈卡中的新選擇,更標誌著三大領域的融合:消費支付、加密貨幣獎賞計劃,以及去中心化網絡質押機制。用 Gemini Solana 卡入油,不止是獲得現金回贈。

你會正參與一個複雜的經濟系統:商戶手續費資助代幣獎賞,這些獎賞自動委託到區塊鏈驗證者身上,保障 Solana 網絡,同時與你分享收益。

影響遠不止於這張卡本身。正如 Mizuho 分析師指出,Gemini 信用卡申請人由 2024 年的 8,000 人爆升至 2025 年 8 月接近 31,000,人們對連接傳統金融及加密原生收益產品的需求極大。

根據 Gemini 資料,用戶如果持有 Solana 獎勵超過一年,至 2025 年 7 月,該等持倉已經增長了 299.1%,這既包括質押回報,也反映了牛市期間 SOL 升值。

下文分析集質押功能於一身的加密幣信用卡機制、好處、風險及未來走向。

尤其是:這些產品實際運作如何?交易所推廣的動機何在?用戶接受這類產品會作出哪些經濟取捨?監管政策和科技進步下,日常消費會否成為鏈上收益的標準入門?萬一加密寒冬來臨,當帳面利潤變成真實損失,而用戶繼續購買波動資產又會如何?

現時加密幣信用卡生態:市場正在成熟

在深入了解質押創新之前,值得認識加密幣信用卡的整體發展:它們已由小眾商品成為由大型支付網絡支持的主流產品。

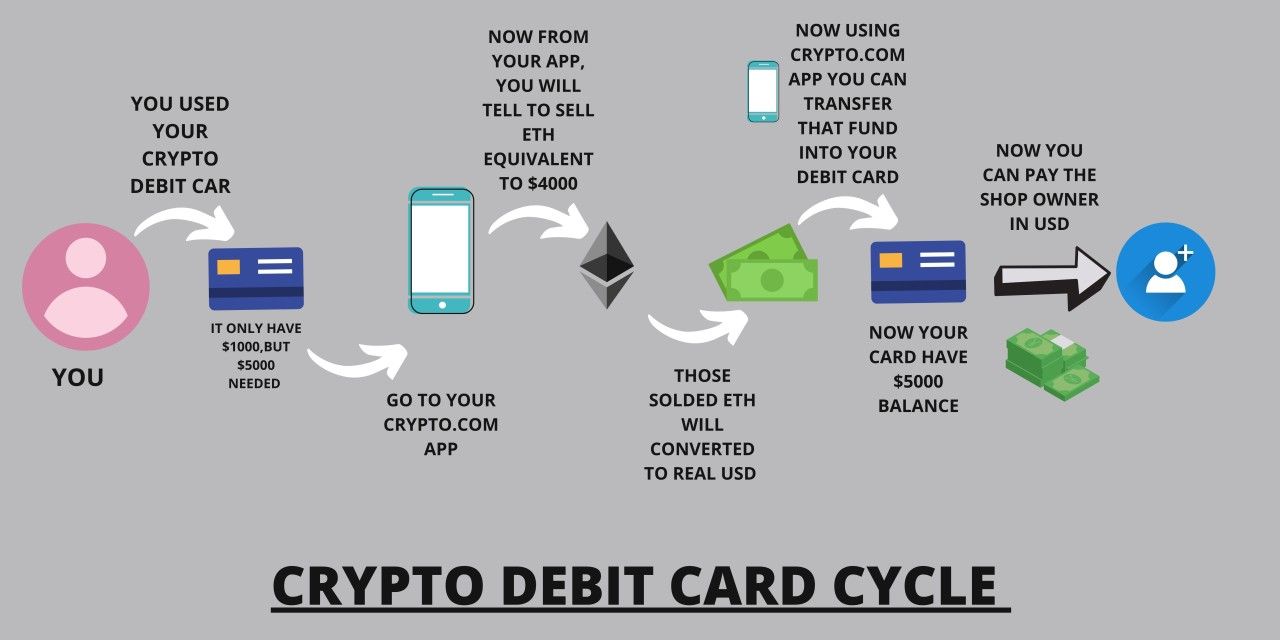

現時主流的加密幣信用卡,是由受監管銀行發行的傳統信用產品,將加密貨幣作為獎賞機制,取代現金回贈或積分。與直接扣除加密貨幣餘額的扣帳卡不同,這些是真正的信用卡,設有月結單、利息及信貸審批程序。加密獎賞通常按消費金額比例計算,然後存入持卡人於發卡交易所或託管方的賬戶,通常在交易後數小時或數日內到帳。

過去數年市場急速擴大,當中有多個推動因素。首先,交易所在交易量競爭激烈以及監管壓力增長下,需要尋找新的人流來源及保持用戶黏性的策略。信用卡能提升客戶關係,將「每日消費」和「偶爾炒幣」結合,提高用戶終身價值。

其次,隨著加密基建到位,令實時發放獎勵、用波動資產計算回報、以及資產託管運作變得可行。第三,Visa、Mastercard 及各大合作銀行,經多年預付加密卡實驗後,亦開始接受以加密獎賞為基礎的產品。

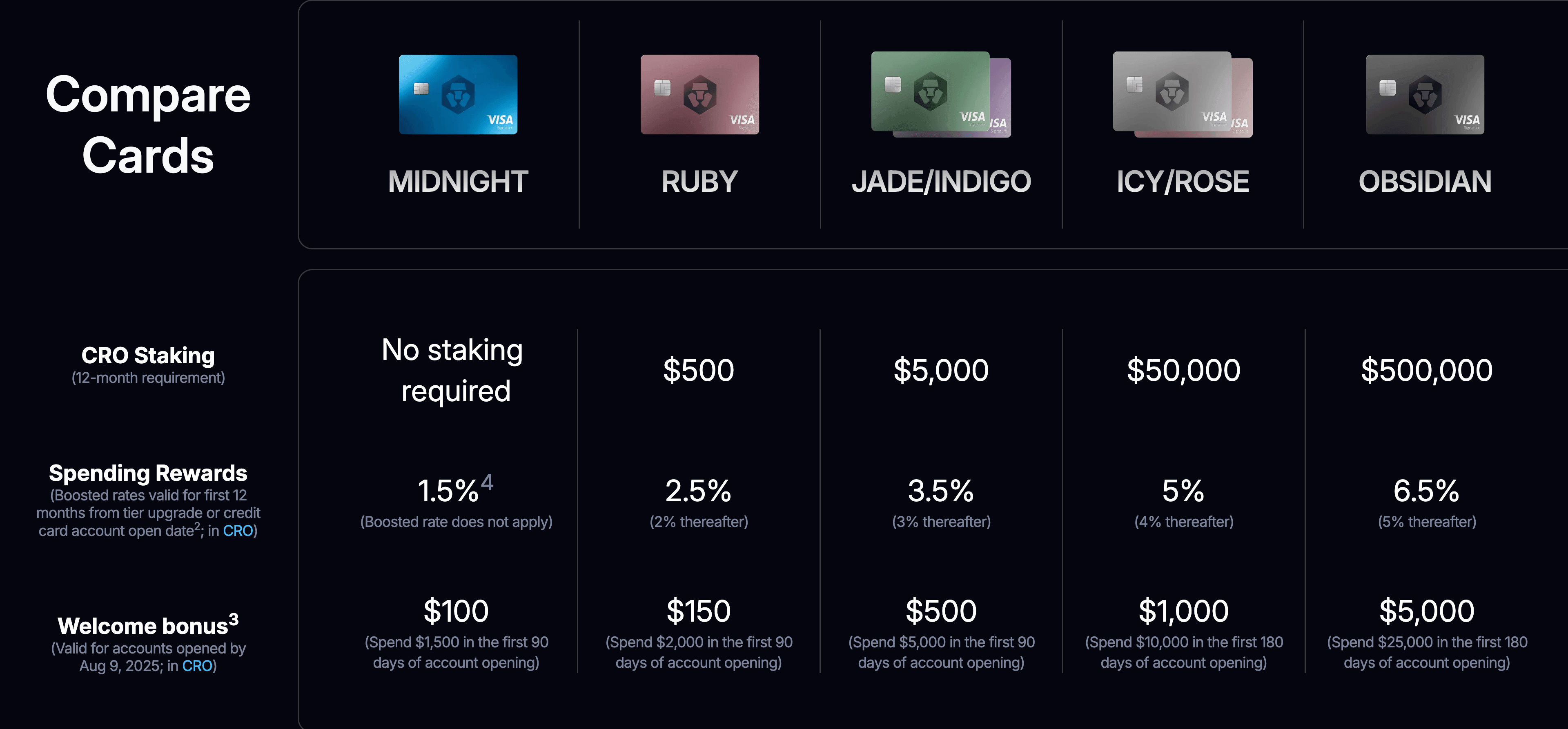

有關市場現時主流產品,Crypto.com 的卡 可謂其中最具代表性。平台分多個等級,回報結構與用戶於平台質押的 CRO 代幣量掛鈎。頂級卡曾有高達 8% 回贈,但 2022 年因市況轉差已大幅下調,現時不同層級回報由 1.5% 至 6% 不等。

Crypto.com 需要用戶鎖定一定數量的 CRO 代幣達六個月,才能享受高階福利,門檻由 Ruby Steel 級別的 $400 美元,至 Obsidian 級的 $400,000。質押要求既增加用戶財務承諾,亦減少流通量,更促使用戶利益與平台經濟掛勾。

Coinbase 宣佈 將於 2025 年秋天推出與 American Express 合作的 Coinbase One Card,主打最高 4% 比特幣回贈,只限 Coinbase One 會員,回贈率隨在平台資產總值而調整。

這種做法與 Gemini 主打區塊鏈單一代幣(如 Solana)不同,更注重比特幣作為儲值工具,再以訂閱會籍作門檻。持卡人可用 Coinbase 持有的加密貨幣還款,而比特幣獎賞無需申報於 1099 納稅表,但日後賣出仍需課稅。

Gemini 亦有出過比特幣及 XRP 信用卡,獎賞結構大致穩定:油費、電車充電、共乘回贈最高 4%;餐飲 3%;超市 2%;其他消費 1%。此卡毋需年費及外幣手續費。不過 Solana 版首次加入自動質押功能,讓用戶額外賺取最高 6.77% 年回報。

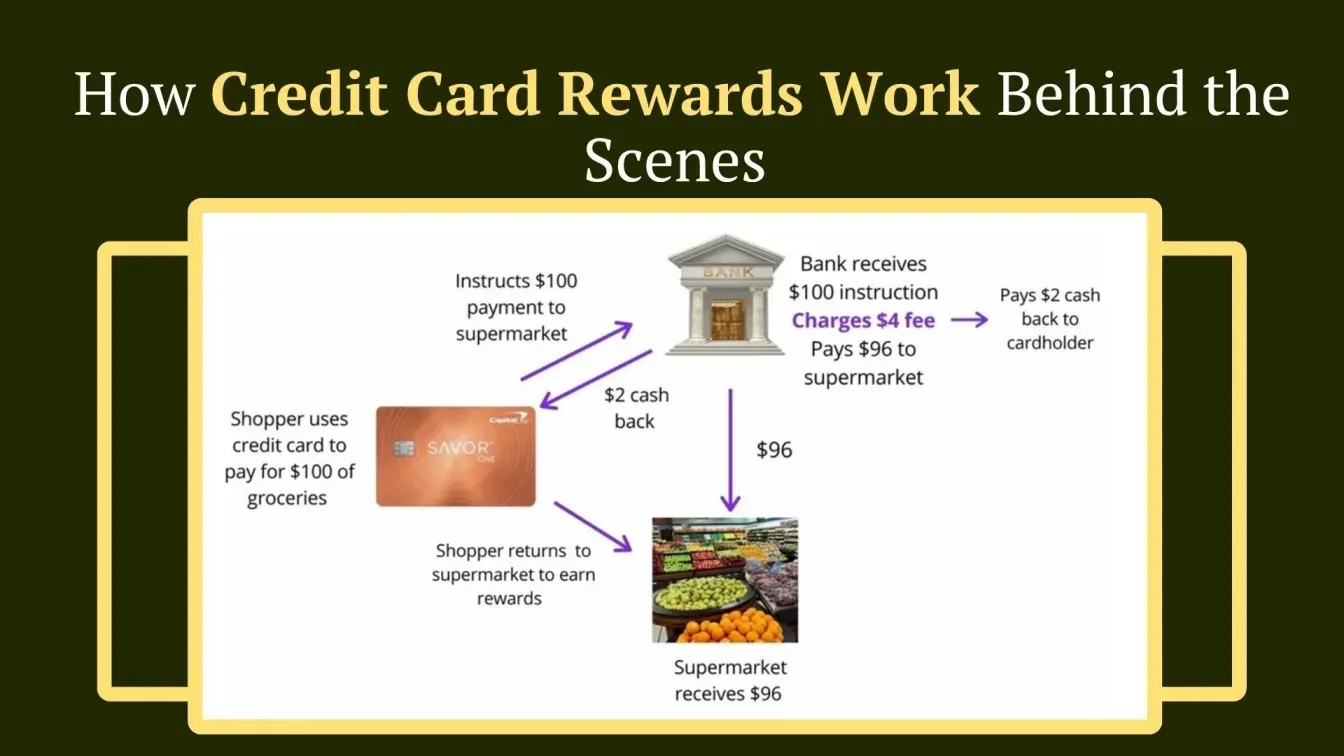

市場格局受多方影響。發卡機構主要靠商戶手續費、用戶累欠利息及部分為推廣而設的策略性補貼來支付獎賞。不同於傳統信用卡的法幣回贈,加密卡發卡行持有的獎勵代幣,遇上升市可因幣價上升而得益,增加計劃可持續性,即使回贈百分比不變。

用戶採納數據亦具啟示性。根據行業數據,近半 Gemini 持卡人同時成為交易所每月用戶,帶動「飛輪效應」,即信用卡成為推廣整個平台的入口,這反映交易所即使在利潤壓縮時仍願提供高回報,因信用卡用戶的終身價值遠高於單純手續費收入。

2025 年競爭更趨白熱化,大量平台透過區塊鏈網絡專屬合作、高回贈、獨特質押整合及高端福利做出差異化。這雖讓消費者受惠於更多選擇、待遇提升,但亦令生態更複雜:各有不同代幣結構、獎賞規則、質押門檻及稅務考慮。

以 Gemini Solana 信用卡為例:運作細節與推廣動機

想深入了解消費與質押如何融合,必須看看 Gemini Solana 信用卡的設計和背後理念。

此卡是由 WebBank(猶他州的工業銀行)發行的 Mastercard World Elite 卡,銀行負責發卡、信貸審批及合規,交易所則管理客戶關係和獎賞發放。用戶透過 Gemini App 申請,經標準信貸審查,批核後獲派印有 Solana 主題設計的實體卡,盡顯區塊鏈視覺特色。

獎賞結構和 Gemini 一貫分級制度一致,最高回贈多集中於... categories that represent frequent, predictable spending. The 4% rate on gas, electric vehicle charging, and rideshare applies to up to $300 in monthly spend in these categories, after which the rate drops to 1%. This cap prevents gaming of the system while still delivering substantial rewards for typical users. The dining category earns 3% with no cap, recognizing that restaurant spending represents a sizable portion of discretionary budgets for many cardholders. Groceries earn 2%, and all other purchases earn 1%. Additionally, Gemini's Vault Rewards program offers up to 10% back at select merchants, subject to monthly limits and merchant-specific terms.

經常性及可預測的消費類別會被歸納為特定分類。汽油費用、電動車充電及共乘服務這些類別,每月合資格消費首$300可享4%回贈,超出部分則降至1%。設立上限可防止濫用,同時仍能為一般用戶帶來可觀的獎賞。餐飲類別無消費上限且享有3%回贈,體現餐廳消費在不少持卡人預算中佔重要份額。超市消費有2%回贈,其他消費則為1%。另外,Gemini的Vault Rewards計劃亦可於指定商戶獲得高達10%回贈,惟設有每月上限及指定條款。

Rewards are distributed in real time, a significant advantage over traditional rewards programs that require waiting for statement cycles. When a transaction posts, the corresponding SOL reward appears in the user's Gemini account almost immediately. This immediacy serves several purposes: it creates instant gratification, encourages users to check their account balance frequently, and exposes users to real-time token price movements that can amplify the psychological impact of rewards as prices fluctuate.

獎賞會實時發放,這點較傳統信用卡獎賞需等結單週期而言,是一大優勢。每當交易入賬,相應的SOL獎勵幾乎即時顯示於用戶Gemini賬戶。即時獎賞不但帶來即時滿足感,還可令用戶更頻密查閱賬戶餘額,同時讓他們即時體驗代幣價格波動對獎賞價值帶來的心理衝擊。

The automatic staking feature represents the core innovation. Users can opt into auto-staking either during card signup or by selecting Solana as their preferred reward currency in their account settings. Once enabled, SOL rewards are automatically delegated to Gemini's staking infrastructure, where they begin earning additional yield through participation in Solana network validation. Gemini advertises a staking rate of up to 6.77%, though this rate varies based on network conditions, validator performance, and Gemini's commission structure.

自動質押功能是這張卡的核心創新。用戶可於辦卡時選擇開啟自動質押,或於賬戶設定選擇Solana作為優先回贈貨幣後啟用。啟用後,獲發SOL獎勵會自動委託至Gemini的質押架構,並開始參與Solana網絡驗證,賺取額外收益。Gemini 宣稱年化質押回報可達6.77%,但實際回報會因應網絡情況、節點表現及平台手續費而浮動。

The staking mechanism operates through Gemini's institutional-grade custody and staking infrastructure. Rather than requiring users to manage their own wallet addresses, validator selections, and epoch timing, Gemini handles these technical complexities behind the scenes. SOL rewards are pooled with other user stakes and delegated to validators that Gemini has vetted for performance, reliability, and security. This abstraction makes staking accessible to users who lack the technical knowledge or desire to manage these details themselves, though it also creates a centralized point of control and counterparty risk.

質押機制透過Gemini的機構級託管及質押系統運作。用戶無需自行管理錢包地址、驗證人選擇或epoch時序,所有技術細節均由Gemini處理。所有SOL獎勵會與其他用戶的質押合併,並委派至Gemini已審核過、信譽及穩定性俱佳的驗證人。這種抽象化設計令不熟技術或不欲處理技術細節的用戶亦可簡易參與,但同時亦帶來中央化管理和對手風險。

Users can unstake their rewards at any time through the Gemini app, though withdrawal times may vary from several hours to a few days due to Solana's epoch-based activation and deactivation mechanisms. This liquidity feature distinguishes the product from traditional staking arrangements that often impose longer lock-up periods, though users must still plan ahead if they need immediate access to their staked SOL.

用戶可隨時透過Gemini手機應用解除質押並提取獎勵,但因應Solana網絡以epoch為本的激活及釋放機制,提現時間或需數小時至數日不等。這種流動性優勢有別於傳統質押產品動輒需長期鎖倉,但如須即刻動用已質押SOL時,仍需預先籌劃。

From Gemini's strategic perspective, the Solana card serves multiple objectives. First, it deepens the exchange's relationship with the Solana ecosystem following earlier initiatives including support for USDC and USDT transfers on Solana, institutional staking services for Solana, and partnerships with Solana ecosystem projects. By aligning with one of crypto's fastest-growing networks, Gemini positions itself to benefit from Solana's momentum in decentralized finance, payments, and developer activity.

從Gemini的策略角度來看,Solana信用卡承擔多重目的。首先,這令平台與Solana生態圈的關係更緊密。繼早前陸續支援Solana上的USDC、USDT轉賬、Solana機構級質押服務,以及與Solana生態項目合作,Gemini正藉與加密圈其中一個增長最快的網絡攜手,從去中心化金融、支付及開發者生態的動力中受惠。

Second, the card creates a natural on-ramp for users to accumulate SOL through regular spending rather than explicit purchases. This approach can be psychologically powerful, as users may view rewards as "free money" even though they are effectively converting spending into SOL accumulation. According to Gemini's data, cardholders who held Solana rewards for at least one year saw gains of nearly 300%, though this figure reflects SOL's price performance during a bull market period and should not be interpreted as guaranteed future returns.

其次,卡片為用戶提供自然的SOL累積渠道,用日常消費取代直接購幣。這種方式具有不容忽視的心理影響力,因不少用戶會視持續消費所得的加密貨幣如「免費錢」,即使本質上只是將消費轉換成SOL資產累積。根據Gemini數據,持有SOL獎勵至少一年之持卡人,資產升值近300%,但需留意這反映的是牛市期間的SOL價格表現,並不保證未來必然有類似回報。

Third, the automatic staking feature increases the stickiness of the product by creating a yield-generating position that users may be reluctant to abandon. The compounding nature of staking rewards means that users who maintain their card and allow rewards to accumulate over time can build substantial positions without the friction of regular purchases or deposits. This reduces churn and increases the likelihood that users remain engaged with the Gemini platform over the long term.

第三,自動質押令產品更具黏性,用戶會因不想放棄產生收益的資產而更長期留在平台。質押收益具複利效應,持卡人若持續保留卡片及累積獎勵,不需頻繁買入或存款之下,亦可建立可觀的SOL持倉。如此有助降低流失率,提升用戶長期黏著度及平台活躍度。

Fourth, the card generates valuable data about user spending patterns, category preferences, and price sensitivity that can inform Gemini's product development, marketing strategies, and partnership opportunities. This data advantage is particularly valuable as the crypto industry matures and platforms seek to build more personalized, targeted user experiences.

第四,這張卡可為Gemini帶來極具價值的用戶消費數據,包括消費習慣、類別偏好及價格敏感度,有助推動產品開發、市場推廣及合作策略。當加密產業趨向成熟,平台能夠利用這些數據優勢為用戶提供更個人化、更精準的服務體驗。

The Solana network also benefits from the card's existence. Each card user who opts into staking contributes additional stake to the network, increasing its security and decentralization. While individual card rewards represent relatively small stakes, at scale across thousands of users the aggregate impact can be meaningful. Additionally, the card serves as marketing for Solana, exposing mainstream consumers to the network's capabilities and ecosystem. The alignment between Gemini's commercial interests and Solana's network growth creates a symbiotic relationship that both parties are motivated to nurture.

Solana網絡同時受惠於新卡。選擇啟用質押的每位持卡人,均為網絡增加去中心化及安全性。儘管單一用戶的獎勵份額細小,但當規模擴展到數以千計用戶時,累積效應相當可觀。此外,這張卡也為Solana生態圈發揮推廣作用,令主流消費者認識其網絡效能與生態。Gemini的商業利益與Solana網絡發展連成共生體,雙方均有動機發展這種合作關係。

The Mechanics of Rewards and Staking: How Value Flows Through the System

獎勵與質押的運作機制︰價值如何在系統中流動

Understanding how crypto credit cards with staking actually work requires tracing value flows from the point of purchase through reward distribution to staking yield and eventual liquidity. The mechanics involve multiple parties, several technical systems, and economic relationships that differ fundamentally from traditional rewards programs.

要深入理解具有質押功能的加密卡實際如何運作,需層層追蹤由消費、獎賞發放、質押收益以至資金流動各步驟。過程涉及多方參與、複雜技術系統及與傳統信用卡不同的經濟模式。

When a cardholder makes a purchase, the transaction follows the standard credit card payment flow. The merchant's payment processor communicates with the card network, which routes the transaction to the issuing bank for authorization. The bank checks the available credit, applies fraud detection algorithms, and either approves or declines the transaction. If approved, the merchant receives payment minus the interchange fee, a percentage that varies by merchant category and transaction type but typically ranges from 1.5% to 3.5% for credit card transactions. This interchange fee is what ultimately funds most credit card rewards programs.

當用戶進行消費時,交易會按照標準信用卡支付流程處理。商戶的支付處理商會與信用卡網絡通訊,然後再將請求發送至發卡銀行進行授權。銀行會確認信貸額度、執行欺詐檢測,然後決定批核或拒絕交易。若獲批核,商戶會收到扣除手續費後的款項,不同行業及交易類型的手續費(Interchange Fee)通常為1.5%-3.5%。大部分信用卡獎賞計劃的獎勵來源正是這項手續費收入。

For crypto rewards cards, the reward calculation happens in parallel with or immediately after transaction posting. The card issuer's system determines the reward rate based on the transaction category and multiplies it by the transaction amount. For example, a $100 restaurant charge on the Gemini Solana card would trigger a 3% reward calculation, resulting in $3 worth of SOL being allocated to the cardholder's account. The actual number of SOL tokens distributed depends on the prevailing market price at the moment of calculation, introducing the first point of cryptocurrency price volatility into the equation.

對加密貨幣回贈卡而言,回贈計算會在交易入賬時同步或即時進行。發卡平台根據消費分類設定回贈率,再乘以交易金額。例如,Gemini Solana卡於餐廳消費$100會觸發3%計算,即$3等值SOL分配到賬戶。實際派發SOL數量視乎即時計價而定,這也是首次將加密貨幣價波動引入獎賞計算之中。

The reward tokens must come from somewhere. In most cases, the card issuer maintains an inventory of the reward cryptocurrency, purchasing it either on the open market or through partnerships with the token's foundation or ecosystem development funds. The issuer may buy tokens in advance to lock in predictable costs, purchase them in real time as rewards are distributed, or use a combination of both strategies. In some cases, particularly with native tokens like CRO for Crypto.com or when working directly with blockchain foundations, issuers may receive tokens at subsidized rates or through ecosystem development agreements that provide marketing value in exchange for discounted token prices.

平台必須備有發放獎賞的加密代幣。大多數情況下,發卡商會在公開市場購買所需加密貨幣,或與項目基金會、生態基金直接合作取得。發卡商可提早買入以鎖定成本,或即時購買配合即時計算,甚至混合採取多種做法。有時候,若涉及如Crypto.com的原生代幣CRO或直接與區塊鏈基金會協作,發卡商更可能獲取折扣、補貼價購入代幣,以換取推廣宣傳或長遠合作。

Once the reward tokens are allocated to a user's account, the staking mechanism can engage if the user has opted in. For the Gemini Solana card, this happens automatically. The SOL tokens are transferred from the user's main account balance to a staking account, where they are delegated to validators on the Solana network.

當獎賞代幣派發到用戶賬戶後,若已啟用質押功能,機制會自動執行。Gemini Solana卡便會自動將SOL由主賬戶轉到質押賬戶,並委派到Solana網絡上的驗證人。

Solana staking operates through a delegated proof-of-stake mechanism. Token holders delegate their SOL to validators, who use this stake to participate in network consensus. Validators propose blocks, vote on which blocks should be added to the blockchain, and collectively secure the network against attacks. The more stake a validator controls through delegation, the more voting weight they have in consensus and the more frequently they are selected to propose blocks.

Solana的質押採用委託權益證明(DPoS)機制。持幣人可將SOL委託給驗證人,讓他們以該部分權益參與網絡共識。驗證人會提出新區塊、投票決定哪些區塊加入區塊鏈,並共同維護網絡安全。驗證人獲分配委託的權益愈多,在共識機制中的投票權及出塊機會就愈大。

Validators earn rewards for their participation through two primary mechanisms. First, they receive a portion of newly minted SOL tokens that are created through the network's inflation schedule. Solana's inflation rate started at 8% and decreases by 15% annually, targeting a long-term rate of 1.5%. As of 2024, inflation had reached approximately 4.8%.

驗證人可透過兩項主要機制分享收益:首先,他們會根據網絡通脹機制分得一部分新發行的SOL。Solana通脹率最初為8%,每年下調15%,長遠目標為1.5%。截至2024年,年通脹率約為4.8%。

These newly minted tokens are distributed to validators and their delegators in proportion to their stake. Second, validators earn a portion of transaction fees paid by users who interact with the network. While currently small compared to inflation rewards, transaction fees will become increasingly important as inflation declines over time.

新鑄造代幣會按權益比例分派給驗證人及其委託人。驗證人第二項收入來自網絡中的交易手續費——即用戶進行操作時所支付的費用。現階段這部分佔比尚小,但隨通脹獎勵下降,其重要性將逐步上升。

Validators charge commission fees for their services, typically ranging from 0% to 10% but commonly around 5-8%. This commission is deducted from rewards before they are distributed to delegators. [Gemini's advertised ...]staking rate of up to 6.77%](https://www.theblock.co/post/375361/gemini-launches-solana-credit-card-with-sol-token-rewards-and-staking) 代表扣除驗證人佣金後的實際回報率。實際利率會因應網絡通脹、總質押SOL量、驗證人表現,以及Gemini的佣金架構而浮動。

獎勵的分派時間是根據Solana的epoch結構。一個epoch大約持續兩至三日,期間驗證人負責處理交易和維持網絡運作。每個epoch結束時,獎勵會根據各驗證人表現計算,包括運作時間、投票準確度和提出區塊的數量等因素。這些獎勵會按用戶質押的SOL比例分配給委託人。

當用戶決定解除質押SOL時,會啟動一個跟epoch同步的離場程序。剛剛解除質押的代幣會進入「離場中」狀態,並於下一個epoch開頭變回完全流通。這通常意味著等候幾個小時至幾日不等。另外,Solana設有流出限額,單一epoch裏只允許最多25%的全網質押SOL可被解除,以防止網絡安全出現突然而極端的動盪情況。

質押獎勵具備「複利效應」,即收益會加到本金和之前所得獎勵之上,隨著時間推移產生指數式增長(一旦持有量不變且獎勵持續自動再質押)。簡單利息和複利回報之間的差距在長期下會大大擴大,因此像Gemini Solana卡這類產品,特別強調自動再質押功能。

將這種安排與其他獎賞結構比較,可以更清楚見到當中的權衡。傳統加密現金回贈卡如Coinbase Card提供即時流通性獎勵,用戶可以隨時賣出、兌換或轉移代幣,無需質押,著重彈性而且避開出入門檻,但也因此放棄了質押能帶來的額外收入。若像Crypto.com這種模式,要求質押原生代幣來解鎖較高的獎賞利率,則為平台營造更強的用戶黏著度,令用戶的財務利益與平台代幣表現緊密掛鈎。

Gemini Solana則取中庸之道:用戶獲取的是一種流通資產(SOL),並不是Gemini的原生代幣,但這些獎勵可自動參與產生收益的質押,毋需額外操作或承諾。這設計減少摩擦,同時加入收益元素,有助用戶更長期持有,以及更深入參與Gemini和Solana生態。

用戶、發卡商、網絡的三贏價值主張

將消費、獎勵同質押結合,為生態圈中的每一位參與者帶來不同好處,當然同時要考慮相關風險與取捨,稍後將會詳細分析。

對於用戶,最直接的好處是毋需作出明確投資決定便可賺取加密貨幣獎勵。與需要主動入金、設預算、甚至在市況波動下堅持持有的加密買賣不同,這種獎勵型入貨方式只需照常消費就可以被動賺取。有這種心理優勢,令用戶能較輕鬆地維持長期持幣倉位,因所獲獎勵不像本金般要冒資本風險。

自動質押功能再提供第二層被動收入,毋須懂得如何揀驗證人、管理錢包或掌握epoch時序。很多用戶會被直接質押的複雜流程嚇怕,Gemini Solana卡完美消除這阻力,令用戶即使完全不懂epoch同validator分別,甚至連proof-of-stake原理都未必了解,都可以賺取質押回報。這種易用性有潛力大幅擴大參與質押活動人數,實現由資深加密玩家專享的收益民主化。

複利回報潛力為長期持有者創造吸引經濟誘因。例如一個每月用卡消費三千美元、平均回贈率2%的用戶,每月賺取60美元SOL獎勵。若這些獎勵以年化6.77%自動質押,一年後可單靠消費賺到約741美元SOL,以及約25美元質押收益。

如消費行為和收益率不變,5年下來可累積超過3,800美元SOL,其中近200美元來自質押回報。這還未包括SOL價格升跌,牛市時回報可急升,熊市則隨之收縮。

對於主力持有法定貨幣或傳統資產的用戶,培養分散投資意識也是一大優點。消費自動轉換成加密獎勵,讓用戶逐步建立於傳統市場低相關性的資產部位。以小額慢慢建立,減輕一下子做大分配決定的心理壓力,但長遠來講組合也會變得有意義。支持加密長遠發展但難以掌握入市時機的用戶,這種「consumption-averaging」方式其實就是等同用消費來做定期定額入貨。

對Gemini這類發行商,最大好處在於用戶增長、活躍度同終身價值。信用卡每宗交易都帶來手續費收入,伴隨消費自然上升。而更重要的是信用卡本身就是絕佳拉新工具,Mizuho分析指出,信用卡申請可產生「飛輪效應,"約有一半卡主會成為每月活躍的交易所用戶。這轉化率令信用卡成為一條自帶過濾與潛在高質的市場推廣渠道,吸引本身已經有理財及交易需求的用戶。

用卡數據帶來用戶行為、消費類別等深層見解,有助產品開發、市場營銷同夥伴合作。交易數據只反映市況波動時的短期行為,但用卡記錄則揭示用戶日常理財及長期習慣。這資訊可以用來制定更精準的用戶體驗、個人化推廣,甚至預測客戶終身價值。

質押功能可有效提升用戶黏著度,因為賺到的獎勵一旦留在質押狀態越來越多,用戶就會更難換卡或流失。獎勵持續滾存,與其他平台轉換的機會成本亦越來越高。用戶忠誠度提升,使平台即使在利潤壓縮時仍可提供有競爭力的獎賞比率。

區塊鏈生態策略亦是發卡商重要好處。像Gemini同時推出比特幣、XRP同Solana生態專屬信用卡,有助定位成為這些網絡的合作夥伴(而非競爭對手或一般服務商),有望爭取生態基金支援、聯合推廣、整合原生應用,同時搶佔首發優勢。當區塊鏈網絡陸續意識到吸引零售用戶的重要性時,能同時搭建傳統支付同加密原生基建橋樑的發行商將變得極之有價值。

對於Solana這類網絡,最大得益在於擴大質押參與、用戶增長及提高生態能見度。每一位選擇自動質押的持卡人都為網絡帶來實質質押量,令安全性、去中心化及抗攻擊力都提升。雖然單一用戶由獎勵產生的質押未必大,但大量用戶累積起來就不可忽視。更關鍵是,這類來自零售用戶而非機構或大戶的分散質押,提升了網絡的健康度與去中心化程度。

信用卡同時是Solana的推廣渠道,將大眾用戶首次導入這個品牌和生態。很多持卡人其實未必對Solana或區塊鏈技術有深認識,但因為用卡可以輕鬆賺取SOL獎勵、參與質押,這體驗有助他們視Solana為日常一部份,並成為進一步參與生態的入門(如NFT交易平台、DeFi等)。持有SOL後,有一部分用戶自然會好奇如何將資產用得更多元、更深入參與生態。

用戶消費、發卡商營收和網絡增長三方目標一致,形成正向循環(positive feedback loop),全體參與者均能受惠於信用卡使用量增長。usage。這個三方價值主張解釋了為甚麼生態系統專屬卡在2025年普及起來,多間交易所爭相與主要區塊鏈網絡合作推出聯名卡。

關鍵風險與取捨:將消費變成收益的隱藏代價

雖然有抵押整合的加密貨幣信用卡帶來可觀好處,相關風險與取捨同樣不容忽視。用戶在參與這些安排時,應該清楚自己為了獲取獎勵和收益而要承擔甚麼。

加密貨幣價格波動,是持卡人面臨的最大風險。不同於提供穩定美元價值的傳統現金回贈,加密獎勵的價值持續波動。用戶某月賺到價值100美元的SOL作獎勵,下星期可能只值80或升至120美元,全視乎市場變化。長遠而言,這種波幅可以非常極端。用戶若在牛市期間累積獎勵,到市況回調或熊市時,可能見到帳面價值大幅蒸發。

Gemini有關持有SOL獎勵一年錄得299%升幅的數據,體現了這種波動的上行潛力,也掩蓋了下行風險。在加密貨幣定期出現的熊市,SOL曾由高位至低位下挫超過九成。用戶若於高峰期累積獎勵,市況逆轉時,相關資產價值可能同樣暴跌。縱使期間有質押收益累積,通常都不足以抵消重大跌幅。例如6.77%的質押年收益,當標的資產跌一半時,幾乎無補於事。

獎勵累積與價格波動之間的相互影響,可能對消費行為造成錯誤誘因。用戶若在牛市過份追求獎勵,可能會超出自己負擔範圍消費,實際上博價升繼續。相反,若因市跌而蒙受重大損失,使用者可能對信用卡產生負面聯想,減少使用,違背推出相關產品時希望提升用戶參與度的原意。

流動性風險則源自質押本身的設計。雖然Gemini容許隨時解除質押,但要等待Epoch週期完成,從數小時至數天不等,才能將質押代幣全面套現。若用戶急需提取獎勵,這個延遲可能成為問題,特別是在價格劇烈波動期間,解除質押與實際賣出之間的時間差,可能導致價值損失。

全網解除質押的速率限制,在壓力情境下進一步加劇流動性風險。如網絡上大比例用戶在危機時同時要求解除質押,每個Epoch最多只可解除總質押SOL的25%,造成輪候排隊,大幅延長提現時間。一般情況下,這未必影響個別持卡人,但在極端市況或網絡事件時,屬於「長尾風險」。

系統裡存在多層對手風險。選擇Gemini自動質押的用戶,必須信任交易所負責代幣託管、選擇合適驗證者、正確派發獎勵,以及兌現提款申請。雖然Gemini屬於受監管美國交易所,安全措施健全,但加密世界歷來都有多宗交易所倒閉、被駭或濫用客戶資金的個案。換句話說,為享用自動質押和託管管理便利,用戶變相要承擔Gemini作為對手方的風險。

驗證者風險屬於另一層對手方風險。雖然Solana絕大多數情況無傳統「斬倉」懲罰,但驗證者表現不佳仍會導致獎勵減少。運作率低、漏投票、技術問題等都會影響分派予委託人的回報。根據表現指標挑選驗證者對回報至關重要,但Gemini選擇驗證者的流程不透明,用戶無法清晰知道自己的資產如何部署及有否用上最優質人選。

網絡層面的風險包括潛在協議漏洞、共識失效或安全弱點,這些都可能衝擊Solana區塊鏈。儘管Solana自推出以來展現過強勁性能與安全,但亦曾數次出現網絡停運和效能下降的事件,暫時令交易處理中斷。這些情況下,質押或能維持運作,但整個生態受挫會削弱信心並拖低幣價。持有大量卡獎勵質押SOL的用戶,會承受這些網絡層面的潛在危機。

監管和稅務考慮令情況進一步複雜。在美國,加密獎勵通常當作普通收入,需要以獲得時的市價申報。即用戶即使未將獎勵兌現,每年都要為當時市值繳交所得稅。對長期累積大量獎勵的用戶,這會生成需沽出部分資產來交稅的壓力,減少質押效應帶來的複式增值。

質押收益稅務更見繁複。美國國稅局尚未就質押獎勵提供明確指南,令大家無從判定獎勵該在取得時當作普通收入,還是於出售時計作資本利得抑或其他類別。不同會計師可能有不同建議,質押大額資產者隨時因見解轉變或新指引面臨突如其來的稅單。稅務不明確增加守規風險,也可能衍生重大隱藏代價。

信用卡負債與加密累積之間的互動也是一項容易被忽視但潛在嚴重的風險。用戶若在加密獎勵卡上「留底」而需付利息,其實等同借錢來投資加密貨幣。比如用戶有五千美元未還,每年收20%息,在賺取SOL獎勵的同時,卻每年付一千美金利息來換取或許只值得一兩百的回報。這種明顯不利的取捨,在牛市時被幣價上漲暫時掩蓋,但行情轉差就無法逃避現實。用戶必須嚴守財務紀律,絕不能只為攞獎勵便留下餘額,否則形同用信用卡炒幣,極貴且高風險。

行為風險則來自加密獎勵令消費遊戲化。獎勵被視為「免費錢」的心理效應,誘發過度消費或非理性消費決定。用戶或會為賺取獎勵,合理化不必要開支,其實選擇不花這筆錢更划算。質押的複式效應,令用戶傾向把獎勵當作投資,放大消費理由,甚至超出自己負擔能力。

把這些風險與傳統獎勵計劃比較,更能突顯堆加密+質押類型的獨特性。傳統現金回贈卡的風險主要只是積累卡數太多,回贈價值穩定,無流動性延遲,也沒太多稅務煩惱。用戶以簡單和穩定性,換來加密卡那種有潛在升值、質押收益的波動和複雜性及額外風險,目標是博得更高回報。

競爭格局與未來創新:這趨勢將如何發展

加密信用卡在2024及2025年迅速普及,反映了傳統金融與加密原生基建融合的大趨勢。掌握競爭動態和未來可能走向,有助理解Gemini Solana卡在這個快速轉變市場的定位。

Crypto.com 仍然是該領域最具代表性的玩家之一,早在信用產品推出前已經有預付卡計劃。該平台最近與Bread Financial合作,在美國推出信用卡,並可根據不同Level Up訂閱級別,提供以CRO代幣派發的分級獎勵,最高可達5-6%。這一模式與Gemini最大分別在於,必須質押平台原生代幣以解鎖高回報,變相加強客戶黏性,同時令用戶風險集中於CRO表現,而非多元化加密資產。該獎勵計劃也曾面臨挑戰,包括2022年大幅削減獎勵引發用戶強烈反彈,但憑環球佈局及品牌知名度,依然是主要競爭對手。

Coinbase已宣布與美國運通合作推出Coinbase One Card,代表…another significant competitive development. Expected to launch in fall 2025, the card offers up to 4% back in Bitcoin with tiered rates based on total assets held on the platform. By focusing on Bitcoin rather than alternative tokens, Coinbase is targeting a different segment of users who view Bitcoin as the primary or only cryptocurrency worth holding.

另一個具競爭力的重要發展。有望於2025年秋季推出,該張信用卡根據用戶於平台持有的總資產,以分級制度回贈最高4%的比特幣。Coinbase著重於比特幣,而非其他代幣,是針對那些將比特幣視為唯一或最值得持有的加密貨幣的另一類用戶族群。

The subscription requirement ties the card to broader platform engagement, and the American Express partnership brings premium perks and strong merchant acceptance. The ability to repay balances with crypto held on Coinbase adds another dimension of integration between credit products and platform assets.

訂閱要求把信用卡與平台的更廣泛參與連結起來,而American Express的合作則帶來高級禮遇及穩健的商戶接受程度。可以利用Coinbase持有的加密貨幣償還信用卡結餘,更加深了信貸產品與平台資產之間的整合。

Beyond these major players, several smaller platforms and specialized products are testing alternative approaches. Some cards offer multi-token rewards where users can select from rotating options, allowing for diversification or speculation on specific assets. Others provide higher rates in exchange for annual fees or required platform activity thresholds. Still others focus on specific niches like international travelers, gamers, or DeFi power users, creating differentiated value propositions for targeted segments.

除這些大型參與者外,亦有不少較細規模的平台及針對性產品正嘗試不同的新模式。有些信用卡提供多代幣獎勵,讓用戶可從輪換選項中自選,實現資產分散或針對某些資產作投機。亦有一些以較高年費或平台活動門檻換取更高回贈。還有針對特定市場,例如國際旅客、遊戲玩家、或DeFi高階用戶,以切合目標群組需要創造差異化價值主張。

The next frontier of innovation likely involves several directions. Programmable debit and credit cards could allow users to set custom rules for reward allocation, automatically splitting rewards across multiple tokens, adjusting exposure based on portfolio targets, or routing rewards to different yield strategies based on market conditions. Smart contract integration could enable rewards to flow directly to DeFi protocols, where they could participate in lending, liquidity provision, or more complex yield strategies without ever touching a centralized exchange. This would create truly decentralized spending-to-yield pipelines where every purchase triggers on-chain financial activity.

創新下一波很可能朝多個方向發展。可編程的扣帳卡及信用卡讓用戶自行設定回贈分配規則,自動把回贈分配至不同代幣,根據投資組合目標調整曝險,或根據市況把獎勵路由至不同收益策略。結合智能合約,更可把回贈直接流動至DeFi協議,參與借貸、流動性供應,或更複雜的收益策略,無需經過中心化交易所。如此,便能締造一條完全去中心化的消費到收益流程,每一項消費即時引發鏈上金融活動。

Tokenized credit lines represent another potential evolution. Rather than traditional bank-issued credit backed by fiat reserves and user creditworthiness, future products might offer credit lines collateralized by on-chain assets or governed by decentralized protocols. Users could borrow against their crypto holdings to fund spending, with rewards flowing back to reduce debt or increase collateral positions. This would blur the lines between credit cards, DeFi lending, and asset management in ways that could unlock new forms of financial utility.

代幣化信貸額是另一個演化方向。將來的產品不一定依賴傳統銀行發行、以法定貨幣儲備及用戶信貸評分作支撐,或會以鏈上資產作擔保,或由去中心化協議管理。用戶可押注其持有的加密資產來套現進行消費,獎勵則可用來減債或增加擔保,從而令信用卡、DeFi借貸及資產管理互相融合,開拓新的金融工具。

Spending-collateralized staking could enable users to earn even higher yields by allowing their staked positions to serve as collateral for credit lines. A user might stake SOL earned through card rewards, use those staked tokens as collateral to obtain additional credit, spend using that credit to earn more rewards, and repeat the process in a leveraged cycle. While potentially powerful for sophisticated users, this approach would significantly amplify risks and likely require robust safeguards to prevent excessive leverage and liquidation cascades.

消費抵押質押(staking)可讓用戶以其質押倉位作擔保獲得信貸,從而賺取更高收益。例如,用戶可把以信用卡獎勵得到的SOL進行質押,再以該質押代幣作擔保獲得額外信貸,繼續消費賺取更多獎勵,如此循環加槓桿。此模式雖對資深用戶潛力極大,惟同時大大增加風險,需要強而有力的風控,以防止過度槓桿及連鎖清算風險。

Co-branded ecosystem cards could deepen partnerships between issuers and blockchain networks. Rather than generic cards that offer rewards in a network's token, future products might be developed in direct partnership with network foundations, featuring exclusive benefits like priority access to new token launches, governance voting rights, or special yields on ecosystem-specific staking mechanisms. These partnerships could include revenue sharing arrangements where network foundations subsidize rewards in exchange for user acquisition and ecosystem growth.

生態聯名卡可令發卡機構與區塊鏈網絡合作更深入。未來產品或會由網絡基金會直接參與設計,提供專屬福利,如優先參與新代幣發售、治理投票權、或生態特定質押機制的特別收益等。這類合作夥伴關係還可包括收益分成,例如由網絡基金會資助獎勵,換取吸引用戶和促進生態發展。

The Gemini Solana card can be viewed as a lead indicator of these trends. Its automatic staking feature represents the first step toward deeper integration between spending and on-chain yield generation. The ecosystem-specific branding demonstrates the strategic value of network partnerships. The custodial simplicity makes advanced crypto mechanics accessible to mainstream users. Future iterations will likely build on this foundation, adding programmability, expanding integration points, and creating more sophisticated ways to turn everyday spending into portfolio construction.

Gemini Solana信用卡正是這些趨勢的先聲。其自動質押功能開創了消費與鏈上收益深度結合的第一步;生態品牌突顯網絡合作的戰略價值;託管簡便讓普羅用戶也能用上高階加密功能。未來版本大概會在這基礎上發展,加入可編程元素、擴闊整合界面,構建更複雜實用的消費轉組合方案。

Competition will likely intensify around several dimensions. Reward rates will continue to be a primary battlefield, with platforms racing to offer higher percentages even as underlying economics become challenging. Staking yields and integration depth will differentiate products as users become more sophisticated and demand access to more advanced yield strategies. Network ecosystem partnerships will create exclusive moats as blockchain foundations recognize the user acquisition value of co-branded cards. User experience and simplicity will remain crucial as mainstream adoption depends on making complex crypto mechanics feel effortless and secure.

競爭將於多個範疇加劇。回贈比率仍是主戰場,各平台即使基本盈利情況轉差,仍會競相推出更高百分比。質押收益及整合深度成為產品分野,因為用戶愈來愈精明,需求提升。區塊鏈生態系合作將成為壁壘,因基礎鏈基金會意識到聯名卡吸引用戶的重要性。用戶體驗及簡便程度依然關鍵,始終主流採納建基於令煩複的加密操作變得輕鬆及安全。

The long-term trajectory points toward a future where the boundary between spending, saving, and investing becomes increasingly blurred. Crypto credit cards with staking represent an early example of products that make this blurring tangible, allowing users to simultaneously consume, accumulate, and earn yields through a single instrument. As the technology matures, regulatory frameworks stabilize, and user sophistication increases, these integrated financial products may become the norm rather than the exception.

長遠來看,消費、儲蓄和投資的界線將會更模糊。附設質押功能的加密信用卡,就是這種模糊界線的初步體現——讓用戶一張卡同時消費、累積及賺取回報。隨著技術成熟、監管穩定、用戶愈趨專業,這類整合型金融產品或會成為新常態。

Regulatory, Compliance, and Consumer Protection Considerations: Navigating a Complex Landscape

監管、合規及消費者保障考量:穿梭複雜格局

The intersection of credit cards, cryptocurrency rewards, and staking mechanisms creates a regulatory environment of unusual complexity, involving multiple agencies, overlapping jurisdictions, and evolving interpretations of existing law.

信用卡、加密貨幣回贈及質押機制的結合引發出前所未有的監管難題,涉多個機構、多重司法管轄權,而且法例解讀不斷轉變。

Credit cards themselves are heavily regulated financial products subject to consumer protection laws, disclosure requirements, and oversight by banking regulators. In the United States, the issuing bank – WebBank in the case of Gemini's cards – must comply with banking regulations administered by the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, and state banking authorities. The Truth in Lending Act requires clear disclosure of interest rates, fees, and terms. The Credit Card Accountability Responsibility and Disclosure Act imposes additional restrictions on rate increases, overlimit fees, and billing practices.

信用卡本身受嚴格金融監管,須遵守消費者保障、披露義務,以及銀行監管機構的監督。在美國,以Gemini信用卡為例,其發卡銀行WebBank必須遵守由聯邦存款保險公司、貨幣監理署及各州銀行當局的金融規例。《貸款真實法案》要求清楚披露利率、收費、條款;《信用卡責任與披露法》則在加息、超額消費費用、帳單處理上施加更多限制。

Cryptocurrency exchanges face their own regulatory requirements, including anti-money laundering programs, know-your-customer verification, suspicious activity reporting, and in some jurisdictions, money transmitter licensing or securities registration. The SEC and CFTC have increasingly asserted jurisdiction over crypto markets, with ongoing debates about whether specific tokens should be classified as securities subject to SEC oversight or commodities under CFTC authority. The regulatory landscape shifted substantially in 2025 with the Trump administration's more crypto-friendly approach, including the creation of a crypto task force and efforts to provide clearer regulatory frameworks.

加密貨幣交易所則有自身的監管要求,包括反洗錢、用戶審查、可疑活動通報,以及部分司法管轄區要求持有匯款業牌照或證券註冊。證券交易委員會SEC及商品期貨委員會CFTC不斷加強對加密市場的監管聲索,爭論部分代幣該納入證券SEC管轄,還是商品CFTC監管。2025年,特朗普政府推行較為友善加密的政策,設立專責小組及努力釐清監管框架,令監管格局出現重大變化。

Staking introduces additional regulatory questions. Are staking rewards investment income, ordinary income, or something else? Do staking arrangements constitute investment contracts subject to securities laws? Can staking services be offered without registration under various financial services regulations? The Consumer Financial Protection Bureau has proposed extending consumer protections to digital payment mechanisms, potentially capturing certain cryptocurrency transactions.

質押(staking)帶來更多監管疑問:質押收益究竟屬投資收入、普通收入還是別的?質押安排屬不屬於投資合約,需否受證券法監管?這類質押服務能否毋須註冊就可提供?消費者金融保障局已建議把消費者保障擴展至數碼支付工具,這可能涵蓋某些加密貨幣交易。

For crypto credit card issuers, navigating this regulatory maze requires coordination between the issuing bank, the exchange platform, and legal counsel specialized in both traditional banking and digital assets. Products must be structured to comply with payment card regulations while also satisfying crypto-specific requirements. Rewards programs must be disclosed clearly, including explanations of how token values fluctuate, what risks users face, and what happens to rewards during market volatility or platform issues.

加密信用卡發卡方要穿梭這個複雜監管網絡,必須銀行、交易平台、金融與加密領域律師多方協作。產品設計須同時滿足支付卡及加密貨幣監管,獎勵計劃必須清楚披露,包括代幣價值波動、用戶面臨風險,以及遇上市場波動或平台異常時獎賞安排。

Consumer protection implications are substantial. Traditional credit card rewards programs are straightforward: users earn a fixed percentage back, receive that value in stable currency or points with known redemption rates, and face minimal complexity. Crypto rewards introduce volatility, counterparty risk, tax complexity, and technical barriers that many users may not fully understand when signing up. Regulators are increasingly focused on ensuring that platforms provide adequate disclosures and do not mislead users about the risks they are accepting.

消費者保障亦面臨全新挑戰。傳統信用卡回贈明確簡單:固定百分比,換成穩定貨幣或可預期的積分,沒大複雜性。加密回贈則帶來波幅、對手風險、稅務複雜性及技術門檻,許多用戶未必完全了解。監管機構日益重視平台是否充分披露,不可誤導用戶忽視相關風險。

The automatic staking feature raises specific regulatory questions. Does automatically staking user rewards constitute investment advice requiring registration with the SEC? Are users providing informed consent to have their rewards staked, or are they accepting this feature without understanding its implications? What happens if staking yields decline or turn negative after accounting for validator fees and opportunity costs? Platforms must carefully structure these features to avoid crossing lines that would trigger additional regulatory requirements or create liability.

自動質押功能尤為值得關注:自動質押回贈是否構成需註冊的投資建議?用戶真的充分知情和同意嗎?還是接受時未意識到潛在後果?假如計及驗證人費用及機會成本後,質押收益轉負又應如何處理?平台設計這些功能時須謹慎,以免涉及新監管或法律風險。

Tax reporting obligations add another layer of complexity. Exchanges must issue Form 1099 to users who receive cryptocurrency rewards exceeding certain thresholds, reporting the fair market value of rewards as income. Coinbase has stated that Bitcoin rewards from its upcoming credit card will not appear on 1099 forms, though the legal basis for this treatment remains unclear and may be subject to

稅務申報責任又添一層複雜。交易所須向收到加密回贈達一定門檻的用戶發出1099表格,把回贈市價申報為收入。Coinbase曾表示即將推出的信用卡所發比特幣獎勵無需載列於1099表格,但這種處理的法律依據未明朗,或有待進一步厘清。change. Users remain responsible for accurately reporting income and capital gains regardless of whether they receive tax forms from platforms.

(毋須翻譯 markdown links)

變動。用戶始終有責任準確申報收入同資本收益,無論係唔係有由平台發出嘅稅務表格都一樣。

國際監管規定存在差異,為全球營運嘅平台帶嚟額外複雜性。歐盟《加密資產市場監管》(Markets in Crypto-Assets Regulation, MiCA)為加密服務供應商設立全面要求,包括發牌、披露、營運標準等。英國監管機構就採取較審慎做法,要求加密平台註冊及遵守反洗黑錢規則,同時考慮需唔需要設定進一步監管。亞洲地區做法就好參差,部分地方積極推動加密創新,亦有地方實施嚴格限制甚至全面禁止。

用戶如果考慮用到有 staking 功能嘅加密信用卡,就要就住多個監管及合規議題三思而後行。首先,要確定發卡銀行已經取得適當牌照,同埋該卡本身符合相關信用卡監管條例。要留意持卡人協議書入面,費用、利率及條款有無清晰披露。第二,要了解發卡交易平台嘅監管地位,知唔知道佢有冇喺你嘅司法管轄區註冊或領牌。無牌經營嘅平台隨時會畀執法機構採取行動,影響服務甚至令你無法提取資金。

第三,要細閱有關加密貨幣獎勵同 staking 條款。要知道係邊個平台幫你保管咗 staking 嘅代幣、你有咩權利解鎖或提取、如果平台遇到技術問題或安全事故會點處理,以及糾紛點樣解決。第四,要考慮稅務影響,確保你能夠滿足申報要求。如果獎勵金額較大,建議搵熟悉加密貨幣稅務嘅專業人士協助,以免日後出現意外。第五,要地清楚信用卡同扣賬卡(debit card)之間分別。信用卡涉及舉債,未清還結餘會有利息,而扣賬卡就只會用返帳戶餘額。要根據自己鍾意咩產品、消費習慣去揀。

加密貨幣監管環境不斷演變,隨住加密進一步主流化,監管機構制訂更先進架構。用戶要留意政策改變,避免影響自己張卡、報稅義務或使用功能。優先重視合規、提供透明披露、同監管機構合作嘅平台,相信更有機會穩健發展,經得起監管審查。

對用戶嘅策略啟示:如何將 Crypto 信用卡融入你嘅財務規劃

如果你考慮申請支有 staking 功能嘅加密信用卡,有幾個策略性問題值得提前思考,確保產品同你整體理財目標及風險承受能力相符。

第一要考慮,係計算淨回報率同風險。根據你實際消費模式同每個消費類別去估算預期回報。例如你每月用 $2,000,平均回報率2%,每月賺到 $40,一年即係 $480。加埋 staking 收益—如果年息 6.77%,假設回報逐步累積兼即時 staking,第一年大約再多 $32。計落總回報大約 $512,即你全年消費總額 2.13%(未計代幣價格波動)。

再同其他選擇比較。例如優質現金回贈卡可以穩定 2% 回贈(無波動,無複雜性);高級旅遊卡可能用得其所,有2-3%旅遊積分。加密卡只適合當 token 價格上升同 staking 收益多過價格下跌風險同管理波動嘅成本時。如果你本身想持有加密貨幣、計劃分批買入,呢張卡算係 bonus 叠加平均買入。相反,如果你唔太 interested in crypto 或比較怕風險,其實用傳統產品風險回報更好。

選邊隻代幣攞獎賞好關鍵。Bitcoin 獎賞卡可享最成熟、流通性最好嘅幣;平台專屬 token(如 CRO)會同平台興衰綁死,但若平台有問題會有集中風險;生態系統 token(如 SOL)可享更高增長潛力,但同時有較高技術及價格風險。用戶應根據投資理念及風險偏好去選,或考慮多張卡分散。

Unstaking 靈活度都值得考慮。如產品規定長期鎖倉或提前贖回懲罰較重,會減少流動性,亦令你難及時回應市場變動或個人需要。Gemini Solana 卡可隨時 unstake,只係需等 epoch 起結,有較高靈活度,但用戶要清楚明白 unstake 時機。如果條款非常緊,理應提供更高利率補貼流動性損失。

收費結構會直接影響淨回報。無年費、無外幣手續費、領取獎勵無手續費啲卡最乾淨。要收年費只有附加福利夠多先值得。有啲隱藏收費特別要小心,例如換匯點差、獎賞兌換費或者高 validator 傭金,會食走 staking 收益。

Credit vs Debit 之分會影響你用卡同承擔嘅風險。信用卡可累積結餘及收利息,賺取加密獎勵之餘容易積聚債務。信用卡多數 fraud 保護及爭議處理較強。扣賬卡就用現有資金,唔會積債,但無信用卡免息期。要結合自己消費習慣及財政紀律去選。

要誠實評估你會唔會因為有 crypto 獎勵而亂用消費。其實無論點 reward,唔必要消費都會拉低你最終財政狀況。例如你為咗賺 $3 獎賞而洗 $100,實際蝕咗 $97。Crypto 獎勵卡要配合本身需要支持既消費,記住收支規律如用普通信用卡一樣。

稅務規劃都要預早衡量。如果賺到嘅獎賞唔少,你會即時為該市值畀稅,可能有季度預繳稅義務或年尾補稅。要納入整體評估,如有需要要提走部分獎賞套現交稅,或者確保有其他收入來源抵消。

Crypto 喺你財務規劃嘅角色亦係重要背景。如果你有明確資產配置策略,有特定 target 持有 crypto,比用幣買小額日常消費可以幫你平衡倉位。如果冇 coherent 投資策略,純粹因為好玩而儲幣,反而會令整體規劃欠焦點。Crypto 卡應納入現有理財架構,而唔係當獨立活動。

未來產品成熟之後,錢包同生態整合會越嚟越重要。將來可能自動將獎賞送去自管錢包、直接參與 DeFi 協議、按預設規則轉多種 token。想要靈活度高用戶應揀有強效 API、大量整合支援、著重互通平台。想圖方便就要注重平台介面簡易、全面客服支援。

獎賞累積過程嘅心理作用值得注意—對好多用戶嚟講,睇住 crypto 獎勵因 staking 自動複利,會促使多用卡同持幣,若能提升紀律投資及財富增值則屬好事。相反,如因此過度消費、對回報過分樂觀、或過份執著持有(明明應該調整或出貨)就有危險。要警覺產品對你心理及決策模式有咩影響,覺得唔妥就要調整應對。

最後思考

Gemini Solana 信用卡屬於消費支付、加密貨幣累積、鏈上收益三者融合嘅創新產品。每日消費自動轉為加密 staking,普通消費同投資原先嘅矛盾一步解決,打造成一種新型「複利收益引擎」式一體化金融體驗,連買餸食飯都可以產生主動投資。

這種原先分隔嘅金融活動走向融合,亦顯示銀行、支付同投資管理之間界線......(未完)dissolving。傳統界線——信用與扣賬、消費與儲蓄、消費與投資——在單一信用卡交易同時提供便利、獎賞同回報嘅情況下,變得冇咁明顯。心理同實際層面嘅影響都好深遠:用戶可以透過簡單嘅付停車費或買咖啡動作,參與複雜嘅金融策略。

但係,當中嘅權衡都係好大,唔可以小覷。用戶要接受加密貨幣價格波動、對手方風險、稅務複雜性同流動性限制,去換取可能會有回報同收益,但呢啲都未必一定足以補償相關成本。宣傳中提到嘅質押收益潛力同代幣升值,可以掩蓋住喺加密熊市時,當代幣價格下跌而覆蓋晒溫和質押回報,導致本金損失嘅真實可能性。

過往表現,包括 Gemini 關於長期持有 SOL 可得 299% 回報的數據,反映嘅只係特定市場狀況,未必會重現。

監管環境依然處於變動階段,相關部門正努力釐清現有法例點樣適用於呢啲混合產品,同埋要唔要定立新規例。用戶應該預期,未來獎賞點樣計稅、平台需要披露乜資料、同消費者保障適用情況等,都會繼續有變化。能夠配合監管、披露透明嘅平台,預計會比起鋌而走險或淡化風險嘅營銷平台,更加有競爭力。

如果你考慮是否採用呢類產品,有幾個指標值得持續留意。首先,要比較廣告話的獎賞率同實際賬戶收到嘅收益,並計算所有費用、佣金、有價波動。平台有時強調理論上最高獎賞率,但實際可能因類別限制、消費上限、驗證者費用、代幣價波動等,派得遠低過宣傳。第二,留意質押解鎖期及流動性條款。

面對財政壓力嘅平台,可能會額外限制提款或拉長處理時間,令原本有流動性嘅資金變成鎖死。第三,留意商戶採納情況同支付網絡關係。即使獎賞率再高,如果失去大型商戶支持或出現處理限制,相關卡片都會無乜用。

第四,觀察獎賞代幣表現,對比其他選擇。如果你攞緊嘅代幣持續跑輸其他加密貨幣或傳統投資,揸住呢啲獎賞嘅機會成本可能遠高過你實際收到嘅名義收益。第五,觀察監管執法同指引。新規則、對同類平台的執法行動、或不利稅務安排,都會大幅改變產品風險同經濟結構。獲得監管批准或主動配合有關部門的平台,與身處灰色地帶甚至被執法嘅平台比,邊際風險顯著較低。

展望未來,問題唔係日常消費會唔會融入投資組合——呢個融合已經喺市場多個產品中實現緊——而係整合的精密程度可以去到幾高。用戶會唔會將獎賞分配自訂規則,唔同消費類型自動分流去唔同收益策略?獎賞會唔會直入 DeFi 協議,唔洗經中央交易所?信貸額度會否得用鏈上質押倉位做抵押,借貸同投資界線會唔會進一步模糊?

促成呢啲可能性嘅基建而家已經開始搭建。智能合約功能、互操作標準、監管框架同用戶界面,都一路變化,支持消費同收益融合得更複雜。Gemini Solana 卡的自動質押功能,可以視為全面整合金融體驗之旅的早期一步——未來每一筆交易都同時服務多個用途。

對於企喺超市收銀處、想了解加密貨幣嘅消費者嚟講,以 Gemini Solana 卡一刷,賺取 2% SOL 並自動年化質押 6.77% 收益,問題已經有答案:日常消費已經成為質押組合一部分。至於呢個係審慎的金融創新定只係投機過火,只有當產品經歷完整市場周期——經歷高峰同低谷——之後先會知。

消費即質押時代已經開始。最終會去到邊,仍然有待揭曉。