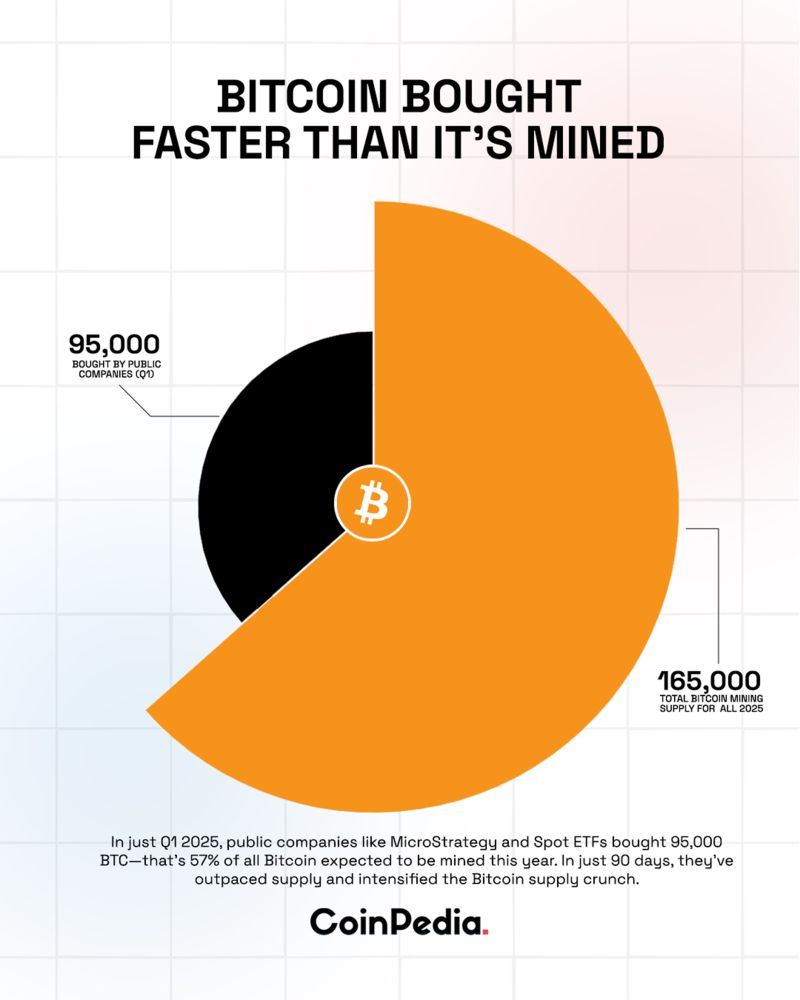

比特幣 2025年飆升,成為年度金融熱話之一。作為全球市值最大加密貨幣,十月初曾衝破$126,000大關,主要受惠於大量機構資金經新獲批的現貨比特幣ETF湧入。這些ETF於2024年一月由美國證券交易委員會批准,根本改變傳統投資者參與比特幣的渠道。過去數月,機構買家需求極之熾熱,現貨ETF消化遠超礦工產新的比特幣數量。

不過,表面牛氣下出現重大轉變。據Capriole Investments分析,七個月以來首次,透過ETF和企業金庫購買的機構需求已經跌穿新挖比特幣速度,於2025年11月3日確認。原本代表機構買盤的藍線,一直大幅領先紅色的每日挖礦供應線,如今首度被反超。

呢個現象不單止係市場機制咁簡單。當機構需求穩定高於新供應時,會強化比特幣稀缺論,為價格帶來基本支撐。相反情況則帶來不確定性。如果能夠承接固定日供的機構離場,點樣補位、用咩價錢都成疑。

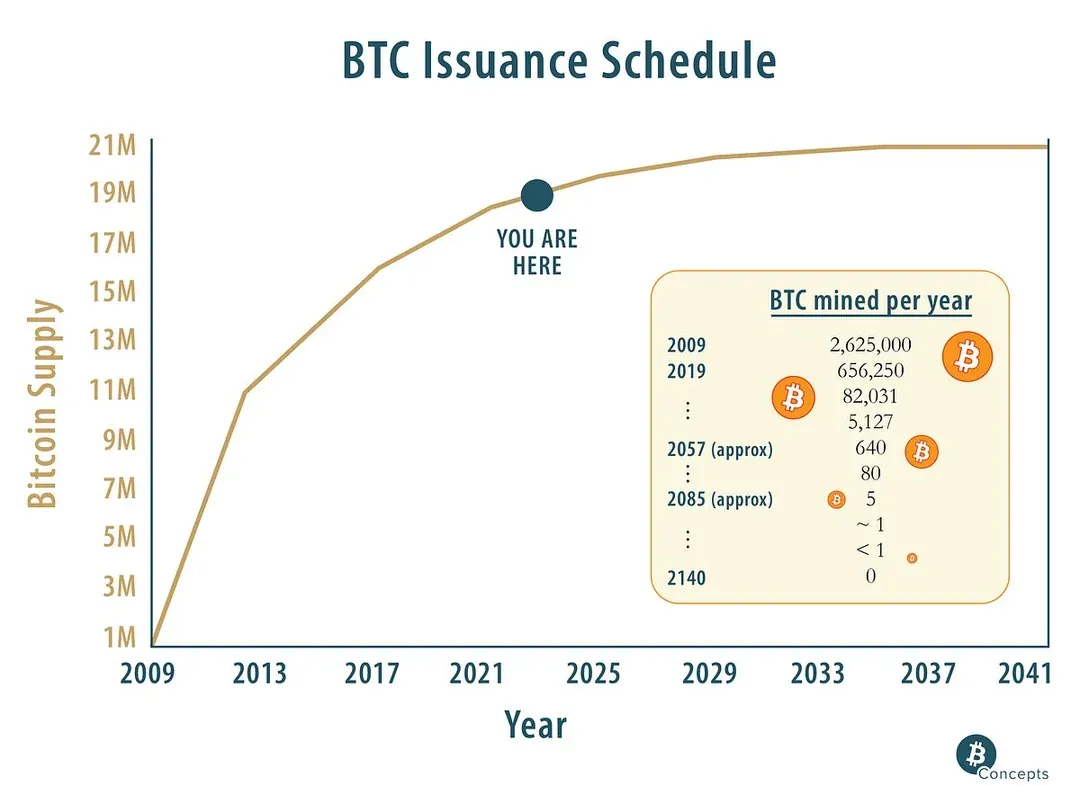

呢點十分重要,因為比特幣的投資價值很大程度建基於編程限制的稀缺。與央行可隨意印鈔的法幣不同,比特幣總量設定為2,100萬,所有新發行都跟隨固定減半週期,每四年一次。2024年四月減半後,每日新產量跌至約450 BTC。現時最精明資金都追唔上供應,就顯示推高比特幣價格既牛市理論出現裂痕。

分析機構需求組成後,情況其實更複雜。現貨ETF只是部分動力。數碼資產金庫公司,即將比特幣納入資產負債表當戰略儲備的企業,近年成為另一大來源。不過呢條渠道亦顯現壓力,資產淨值溢價急速收窄,許多金庫公司交易價低過手頭比特幣市值。

比特幣近期價格變化也反映投資氣氛轉向。十月初曾創歷史高位超過$126,000,之後價格在約109,000美元左右波動。同時大市經歷槓桿多頭清算,幾乎10億美元資金被掃走。現時承托力雖然未絕,但如果機構賣壓持續,以至持續冷淡,未來支持能否維持還是未知之數。

要了解今次供需交叉,須留意多個互相關聯因素。供應層面包括每日新產量、礦工行為、運作成本同比特幣網絡基礎設施。需求方面涉及ETF資金流、企業金庫策略、監管及宏觀經濟對機構投資偏好影響。每個因素都相互作用,細微變化都可能引發重大市場波動。

本文全面拆解比特幣現時供求動態,探究ETF資金由主導買家變成淨賣家過程、企業金庫需求走弱原因,以及這些變化對比特幣市場結構和價格前景的意義。分析以學術供需模型、鏈上數據、監管文件及實時市場觀察為依據,力求提供事實為本的判斷,解析比特幣處於重要分水嶺的狀態。

比特幣經濟模型的供應一環

比特幣供應機制是其最與別不同、亦最具經濟意義的特色之一。傳統金融資產供應可隨公司、央行、市場變動而改變,但比特幣的發行量就根據底層協議規則,絕對固定且不可更改。這個基本設計形塑所有比特幣市場動態,也為理解現時供需失衡提供基礎。

新比特幣是通過「挖礦」生產而來,高效能電腦競爭解密高難度運算題,成功者可寫入新區塊及獲發新比特幣作獎勵。這個礦工獎勵一開始是每區塊50 BTC(2009年首發),協議內置減通脹機制:大約每四年或每21萬個區塊,獎勵減半。

第四次減半發生於2024年4月19日,區塊獎勵由6.25降至3.125 BTC。減半事件深刻改變供應面。此前平均每10分鐘一區塊,比特幣網絡每日產出約900枚新幣。減半後每日發行大約450枚。就2025年10月時每枚約11萬美元計,每日新供應約五千萬美元,較減半前近一億美元大幅萎縮。

學術界提出多個模型解釋比特幣固定供應如何影響價格。Rudd及Porter於2025年在Journal of Risk and Financial Management發表研究,針對比特幣價格提出供需均衡模型,融合完全無彈性的供應曲線及固定替代彈性的需求函數,並套用2024年4月減半的真實市場數據。結果顯示,即使機構需求輕微增加,在流通供應受限下都會引致價格大幅上升。

比特幣供應日程已規劃至未來最遠,即使2140年前全數2,100萬枚才會挖完,截至目前已有19.7萬枚誕生,即現存比特幣約九成四。如此高的發行比重,意味日後的減半雖然會極大影響新發供應,但對總流通量影響反而愈來愈微。

不過,供應遠不止新產量。持有者行為才最影響市面流通。長時期無人動用的比特幣,等同冷藏,技術上雖存在,但市場上基本消失。鏈上統計指約75%比特幣半年未動,說明極多投資者以策略資產持有,而非作短線炒賣。

挖礦行業本身亦面臨重大經濟壓力,影響比特幣新供應流向市場速度。2024年4月減半即時令礦工收入腰斬,唯有提升營運效率或另覓出路才不致倒閉。現時礦業主要有兩大應對策略:升級硬件設備提升效能,以及涉足AI和高效能運算業務增加收入來源。

隨住競爭升級,礦業債務飆升。據VanEck分析,比特幣礦工總負債由2024年Q2的21億美元,暴增至2025年Q2的127億,僅一年飆陞近五倍,大部分用於購置新硬件及基礎建設投資以開拓比特幣礦業以外的收入來源。

多家大型礦企已通過發債及可換股

notes.

TeraWulf 宣佈推出 $32億美元的優先擔保債券,創下公開上市礦企有史以來最大規模。IREN 則完成了10億美元的可換股債券發行,而 Bitfarms 則提出發行3億美元可換股票據。季度數據揭示了這輪借貸的規模:$46億美元在2024年第四季度,2025年初減至2億美元(受減半影響),第二季反彈至15億美元,單單2025年第三季就達到約60億美元。

這些債務帶來極大成本。TeraWulf 最新債券 年利率為7.75%,即每年利息約2.5億美元,幾乎相當於公司2024年1.4億美元收入的兩倍。此財務結構令礦工必須面對強大營收壓力,不論是透過比特幣挖礦,還是轉向其它業務線。一旦比特幣價不能支撐有利可圖的挖礦活動,高槓桿礦工或需被逼賤賣持倉,不合時宜地向市場釋放供應。

VanEck 分析師 Nathan Frankovitz 及 Matthew Sigel 形容這挑戰為"融化中的冰問題":每當礦工延遲升級設備,佢在全球哈希率中佔有的份額都會下降,每日獲得的比特幣減少。這種競爭環境迫使礦企持續投入資本開支,即使獎勵不斷減半,債務週期仍難以終結。

比特幣供應面的複雜度,已遠高於純粹的發行時間表。協議雖然保證新幣的發放可預期,但礦工和長線持有者的行為,卻為多少比特幣可於現貨市場出售帶來極大變數。固定新發行、礦業經濟受壓、以及堅定的長線持倉信念,令可供市場流通的供應很容易收緊,尤其當機構需求繼續強勁時。市場現時最大的疑問是:這份需求能否持續。

機構資金流與比特幣 ETF

2024年1月現貨比特幣 ETF 推出,徹底重塑了機構資本取得比特幣敞口的方法。在這發展之前,想配置比特幣的機構面對諸多障礙:要與專業加密服務提供者建立託管關係,實施嚴格的安全程序,處理監管不明朗的政策環境,以及應對公司合規部門面對數碼資產所產生的種種疑慮。現貨 ETF 消除了大部分這些摩擦點,將比特幣以傳統、受監管產品包裝,讓機構投資者能直接透過常用券商買入。

美國證券交易委員會於2024年1月11日批准了十一隻現貨比特幣 ETF,成為加密貨幣市場發展的重要里程碑。這些產品以現貨持倉,讓投資者直接參與比特幣市價,而不是過往的期貨 ETF,避免了展期損耗及追蹤誤差。包括 BlackRock、Fidelity、Grayscale、Bitwise、ARK Invest 等金融巨頭都參與市場競爭,爭奪機構與散戶配置。

初期需求極為熾熱。2024年2月,現貨比特幣 ETF 平均每日錄得淨流入2.08億美元,遠超當時每日新挖掘的約5,400萬美元比特幣。ETF需貨與新供應之間立即出現嚴重失衡,成為比特幣由2024年年初約45,000美元升至2025年10月歷史高位超過126,000美元的重要推動力。

BlackRock 發行的 IBIT 成為行業巨擘,錄得自2025年起淨流入281億美元,超越所有競爭對手總和。IBIT 成功源於 BlackRock 的分銷網絡、品牌影響力及具競爭力的收費。到2025年底,IBIT 持有超過805,000枚比特幣,按現價計算總值約870億美元,躍升成為全球最大比特幣持有者之一。

2025年5月,供需失衡達到極點。該月,比特幣 ETF 合共買入26,700枚比特幣,但同期礦工僅挖出7,200枚。ETF購買與新供應達3.7倍,創歷史新高。有些星期,ETF買入更達每日產量六倍,比如單周大手買入18,644枚,而當時每天只產出約450枚。

學術界對比特幣 ETF 價格發現的研究,已證實這些產品現時主導比特幣定價。2025年一份刊於 Computational Economics 的研究,分析了自ETF於1月上市至2024年10月的高頻交易數據。經資訊領導力份額指標衡量,三大交易量最大ETF(IBIT、FBTC、GBTC)約有85%時間主導價格發現,說明ETF的機構資金流已經成為比特幣短線波動的最重要動力,取代了過往由加密現貨交易所主導的情況。

ETF的運作機制進一步強化市場影響力。只要有淨流入,授權參與者便需於現貨市場購買比特幣,創造新份額,直接推動需求。反之若有贖回,就必須沽出比特幣,以現金退還投資者。ETF資金流正正成為機構情緒及現貨價格之間的直接傳導途徑。

不過,2024年大部分時間及2025年初所見的強勁淨流入,在夏末出現逆轉。至8月中,機構需求開始減弱,ETF與數字資產庫房的總需求按日均供應下降,趨勢到10月更為明顯。

10月初數據帶來假象。至2025年10月4日止一周,現貨比特幣 ETF 錄得 $35.5億美元流入,令比特幣衝上歷史高位超過$126,000,社群到處慶祝 "Uptober" 行情,相信主流採納和新高價近在咫尺。然而,這份樂觀很快消退。

至2025年10月20日,市場氣氛徹底逆轉。比特幣 ETF 合共出現4047萬美元淨流出,單是 BlackRock IBIT 更有1.0065億美元資金離場,且流出有加劇趨勢。10月30日,比特幣ETF錄得$4.884億美元淨流出,12隻ETF集體無一錄得新資金流入,集體沽壓成形。

以週計,機構意欲冷卻圖畫更為鮮明。至2025年10月31日止一週,現貨比特幣 ETF 錄得 $6億美元淨流出。自10月11日開始,累計資金流出已達$16.7億美元,短短數星期徹底扭轉了早前的紀錄流入。

BlackRock IBIT 雖然仍然領跑,但10月30日出現自8月4日以來最大單日贖回,當日就流出2.9088億美元。ARK & 21Shares 的 ARKB 流出6562萬美元,Bitwise 的 BITB 錄得5515萬美元贖回。連 Grayscale 的產品自由信託轉為ETF後雖然早已不斷失血,多隻ETF資金都未見流入對沖。

幾週內由創紀錄流入轉為大規模流出,足證機構情緒如何瞬息萬變。導致此急劇逆轉的原因有多方面。當中美國聯儲局政策不明朗是重要因素,主席 Jerome Powell 在十月議息後對十二月減息表達疑慮,令市場...repricing of rate expectations reduced risk appetite across asset classes.

利率預期的重新定價令各資產類別的風險胃納下降。

Macroeconomic concerns extended beyond monetary policy. Analysts at CryptoQuant noted that U.S. investor demand for crypto had dropped sharply, with spot BTC ETFs recording their weakest seven-day average outflow since April. The CME futures basis dropped to multi-year lows, suggesting that profit-taking by institutional and retail traders, rather than new demand for exposure, drove recent trading activity.

宏觀經濟的憂慮已不再局限於貨幣政策層面。CryptoQuant 的分析師指出,美國投資者對加密貨幣的需求急劇下降,現貨比特幣 ETF 錄得自四月以來最弱的七天平均淨流出。CME 期貨基差跌至多年新低,顯示最近的交易活動主要由機構及散戶的獲利回吐帶動,而非新資金入市建立持倉。

Yet the most significant development may be the crossing point reached on November 3, 2025, when institutional demand through ETFs and corporate treasuries fell below daily mining supply for the first time in seven months. This metric, tracked by Capriole Investments head Charles Edwards, combines spot ETF flows with digital asset treasury corporate activity to measure total institutional absorption. The blue line representing combined institutional demand, which had consistently exceeded the red line of daily Bitcoin production since March, dipped below it, signaling a fundamental shift in market structure.

然而,或許最具指標性的發展,是在 2025 年 11 月 3 日出現的分水嶺——機構透過 ETF 及企業庫房的比特幣需求,七個月來首次低於每日新開採供應量。這項由 Capriole Investments 負責人 Charles Edwards 跟蹤的重要指標,結合了現貨 ETF 流量及企業庫房的加密資產活動,以衡量總體機構吸納能力。自三月以來,代表機構合計需求的藍線一直高於每日比特幣產量的紅線,近日卻跌穿紅線,顯示市場結構正出現根本性轉變。

Edwards expressed concern about this development, noting it was "the main metric keeping me bullish the last months while every other asset outperformed Bitcoin." The implication is clear: when institutions that previously absorbed supply in excess of mining output become net neutral or sellers, Bitcoin loses a crucial support mechanism that had underpinned its rally.

Edwards 對此表示憂慮,並指出這「是我過去幾個月能夠繼續持樂觀態度的主要指標,儘管其他資產都跑贏比特幣。」這個訊號十分明確:當過去持續吸納超過開採供應量的機構,變得持中性或轉為淨賣家時,比特幣就會失去過去支持升浪的重要基石。

The question facing markets is whether this represents a temporary rebalancing following Bitcoin's vertical ascent to all-time highs or signals a more structural change in institutional appetite for cryptocurrency exposure. The answer will likely determine Bitcoin's trajectory through the remainder of 2025 and into 2026.

市場現時面對的問題在於,這究竟是比特幣直線飆升創新高後的暫時性調整,還是代表機構對加密貨幣配置意欲出現結構性變化。這個答案,很大程度上會決定比特幣於 2025 年下半年至 2026 年的走勢。

When Demand Lags Supply: Conceptualizing the Market Impact

Understanding what happens when institutional demand falls below new supply requires conceptualizing Bitcoin's market as a dynamic equilibrium system where price emerges from the interaction between available supply and competing bids. Unlike traditional commodities where producers can adjust output in response to price signals, Bitcoin's supply schedule is fixed and immutable, making demand the sole variable component in short-term price determination.

要理解當機構需求低於新供應量時會發生甚麼事,需要將比特幣市場想像為一個動態平衡系統,其價格由現有供應與各方出價競爭的互動中浮現。與傳統商品不同,生產者可按價格訊號調整產量,但比特幣的供應時間表是固定且不可更改的,使需求變成短期決定價格的唯一變數。

The current situation presents a scenario where approximately 450 BTC enter the market daily through mining rewards, representing roughly $50 million in new supply at recent price levels. When institutional buyers through ETFs and corporate treasuries consistently absorb more than this amount, they create a supply deficit that must be filled from existing holdings. Holders willing to sell at current prices face competition from institutional buyers, creating upward price pressure that often manifests as higher bids required to attract sufficient supply.

目前情況大致是每日約 450 枚比特幣透過挖礦獎勵流入市場,按最近價格相當於約五千萬美元的新供應。當 ETF 及企業庫房的機構買家長期吸納多於此數量時,會出現供應缺口,需要從現有持有人中尋找額外賣盤。願意按現價出售的持有人,會與機構買家競爭,從而產生上升壓力,反映為必須提高出價才可吸納足夠貨源。

The inverse scenario - demand falling short of new supply - forces a different market dynamic. Miners receiving their 450 daily Bitcoin face a choice: hold the coins in anticipation of higher future prices or sell to cover operational costs and service debt. Given the significant financial pressures facing mining companies, with industry debt exceeding $12.7 billion and many firms carrying interest expenses that exceed their total revenue, the pressure to sell remains considerable. When institutional buyers fail to absorb this daily production, miners must find alternative buyers at potentially lower prices.

相反,當需求不足以消化每日新供應時,市場動態會完全不同。礦工每天獲得 450 枚比特幣,必須在「長期持有,博更高價」與「沽貨變現,應付支出及債務」之間作出取捨。考慮到礦企財務壓力巨大,行業總債務超過 127 億美元,許多公司利息開支甚至大於總收益,沽貨壓力極大。當機構買家無法吸納每日產量時,礦工只能以潛在較低價格,向其他買家沽出。

Academic frameworks for supply-demand modeling provide insight into how these dynamics unfold. The Rudd and Porter model demonstrates that Bitcoin's perfectly inelastic supply curve creates conditions for extreme volatility when demand shifts. Their research, calibrated to data from the April 2024 halving, shows that "institutional and sovereign accumulation can significantly influence price trajectories, with increasing demand intensifying the impact of Bitcoin's constrained liquidity."

供求建模的學術框架有助理解這種動態。Rudd 和 Porter 的模型顯示,比特幣的完全無彈性供應曲線,令需求變化時可引發極端波動。他們針對 2024 年 4 月減半後的數據研究發現,「機構及主權實體的累積能力可大幅影響價格走勢,隨著需求增加,有限流動性的作用將進一步放大。」

The model's implications work in reverse as well. Just as aggressive institutional accumulation can drive hyperbolic price increases by removing coins from liquid supply, institutional indifference or selling can weaken support levels by increasing the available float. When demand consistently falls short of new issuance, the excess supply must clear through one of several mechanisms: price decline until lower levels attract new buyers, absorption by retail traders and smaller entities stepping in as institutions step back, or accumulation on cryptocurrency exchanges where coins wait for eventual buyers.

這個模型的啟示,同樣適用於相反情境。正如積極的機構吸納能從市場抽走流通供應,推高價格至極端升幅,若機構態度冷淡或成為淨賣家,將會增加市場可用貨源,削弱關鍵支持位。長期需求低於新發行量時,多餘供應只能透過以下幾個途徑清理:價格下跌直至吸引新買家、散戶與中小型持份者趁機吸納,或累積在交易所等待有朝一日被消化。

On-chain metrics reveal how Bitcoin's supply distributes across different holder cohorts. Exchange reserves, representing Bitcoin held on trading platforms and theoretically available for immediate sale, have declined to multi-year lows in recent years as more coins moved to long-term storage. This structural reduction in liquid supply had amplified the impact of institutional ETF buying when it dominated market flows. The same dynamic means that renewed selling pressure or even neutral flows from institutions could have outsized effects if exchange reserves remain constrained.

鏈上數據顯示比特幣供應如何在不同類型投資者之間分布。交易所儲備,即存放於交易平台、隨時可沽售的比特幣,近年來跌至多年新低,主因大量資金轉移至長期持倉。這種流動供應結構性減少,過去曾加大 ETF 機構買盤對市場的推動力。同樣地,若交易所庫存一樣受限,即使只是機構資金流淨中性,甚至輕微轉為賣盤,其帶來的下行壓力亦會被放大。

The behavior of different market participant groups becomes critical when institutional demand wanes. Retail investors, who typically demonstrate more price-sensitive buying patterns than institutions executing strategic allocation decisions, may lack the capital to fully offset institutional outflows. Long-term holders, sometimes called "HODLers" in cryptocurrency parlance, generally buy during bear markets and hold through volatility, but they represent a finite pool of demand. Leveraged traders on derivatives platforms can provide short-term buying or selling pressure, but they amplify rather than stabilize price moves.

當機構需求減弱時,不同市場參與者的行為將變得更為關鍵。相對於進行策略性配置的機構,散戶買家對價格變化更敏感,資金規模亦難以完全抵消機構的流出;長期持有者(即俗稱「HODLer」),通常於熊市建倉、持貨應對波動,但這部分需求規模有限;衍生品平台上的槓桿交易用戶則帶來短線買盤或沽壓,但他們更會放大波動,而非穩定市場。

The experience from earlier periods when demand lagged supply offers limited guidance. Prior to the January 2024 ETF launches, no comparable institutional demand channel existed. Bitcoin's price discovery occurred primarily on spot cryptocurrency exchanges through a fragmented global market of retail traders, miners, and early institutional participants like hedge funds and treasury companies. The ETF structure and its authorized participant creation-redemption mechanism represent a structurally different demand source whose behavior under stress remains somewhat untested.

以往出現類似「需求落後於供應」的經驗,其實參考價值有限。2024 年 1 月 ETF 面市前,市場並無可比擬的機構需求渠道。比特幣的價格主要在全球分散的現貨交易所,由散戶、礦工及早期機構參與者(如對沖基金及庫房公司)決定。ETF 與其指定參與者的申贖機制,是截然不同的機構需求來源,在壓力情境下的表現仍屬未知之數。

Historical examples from other asset classes where ETF demand became a dominant factor show mixed outcomes. In equity markets, when ETF flows reverse, underlying stocks can experience amplified volatility as passive flows dominate price-insensitive active management. For commodities like gold, where ETF holdings represent a significant but not dominant share of demand, periods of net selling through ETFs have coincided with price weakness, though physical demand from jewelry, industrial users, and central banks provided alternative support.

其他資產類別的經驗——當 ETF 需求變為主導因素時,結果好壞參半。以股票市場為例,當 ETF 資金流逆轉,相關股份波動會因被動資金主導、主動資金缺乏價格敏感度而被放大。至於黃金等商品,ETF 持倉雖佔需求重要但非壓倒性地位,ETF 淨沽出期間價格亦會走弱,不過首飾、工業及央行帶來的實物需求,則提供了替代支持力量。

Bitcoin's situation differs from these analogues in important ways. The cryptocurrency lacks industrial demand that might provide a floor during periods of investment selling. It generates no cash flows that could anchor valuations through discounted cash flow analysis. Its utility as a medium of exchange remains limited despite original ambitions. Bitcoin's value proposition rests primarily on its scarcity, network security, and status as an uncorrelated asset or "digital gold" - characteristics that require sustained belief and demand from holders.

比特幣的情況與以上例子有重要不同:加密貨幣沒有工業用途,可在投資資金撤出時托底,其本身亦不產生現金流供估值錨定,作為支付媒介的實用性仍極有限。比特幣價值主張,主要靠稀缺性、網絡安全性,以及作為「非相關資產/數碼黃金」的定位,而這些都必須有持續的信念及需求作為支撐。

When institutions that previously validated Bitcoin's investment case through massive capital allocation suddenly reverse course, they challenge that narrative. The supply-demand gap of roughly 450 BTC per day, equivalent to about $50 million at current prices, may seem modest compared to Bitcoin's approximately $2 trillion market capitalization. Yet this daily flow represents the marginal pricing mechanism. Just as oil markets worth trillions can swing dramatically based on marginal supply-demand imbalances measured in millions of barrels per day, Bitcoin's price can move significantly when daily flows shift from institutional buying to selling.

當過去以巨額資本投放為比特幣投資價值背書的機構突然轉勢,基本故事就會被質疑。每日約 450 枚比特幣(現價約五千萬美元)的供求缺口,雖然與約兩萬億美元的比特幣市值相比似乎不大,但這正是決定邊際價格的主要力量。正如數萬億市值的石油市場,每日供求數百萬桶的邊際變化都可引發劇烈波動,比特幣的價格同樣可能因每日機構買盤轉向沽盤而出現明顯變動。

The practical implications manifest across several dimensions. Price momentum weakens when institutional buying that previously propelled rallies turns to selling. Volatility tends to increase as the absence of large, patient institutional buyers removes a stabilizing force and exposes the market to sharper moves on lower volume. The scarcity premium that Bitcoin commands relative to its limited utility may compress if the most sophisticated market participants signal reduced confidence through redemptions.

實際影響將在多方面顯現:帶動升浪的機構買盤轉為沽壓時,升勢會明顯減弱;大型資金耐心買手消失,價格波動勢必擴大,特別是在低成交下更易出現劇烈起伏;而比特幣因供應稀缺而獲得的溢價,相比其有限實用性,若資深投資者通過贖回表態信心不足,也可能被壓縮。

Market depth and liquidity suffer when large buyers step away. Bid-ask spreads can widen, making execution more costly for all participants. Large orders face greater price impact, potentially creating feedback loops where selling begets more selling as stop-losses trigger and leveraged positions face liquidation. These dynamics can persist until prices fall sufficiently to attract value buyers willing to absorb available supply.

當大型買家退場時,市場深度和流動性都會受損。買賣差價擴闊,令所有參與者成交成本上升。大額訂單對價格的衝擊更大,可能出現「跌市觸發止蝕盤及槓桿斬倉,沽壓愈來愈大」的惡性循環。這些情況或會持續,直至價格下跌到能吸引長線投資者接貨為止。

Yet the relationship between institutional demand and price is not mechanically deterministic. Bitcoin has demonstrated remarkable resilience through previous drawdowns, often recovering to surpass prior peaks after extended periods of consolidation. The question facing markets now is whether the current demand weakness represents a brief pause in

不過,機構需求與價格的關係並非機械式一對一。比特幣歷經過多次大調整,亦屢次在長期築底後創新高。市場現時最大問題,是這輪需求低潮究竟只是短暫喘息——institutional adoption or signals a more fundamental reassessment of Bitcoin's role in professional portfolios. The answer will likely determine whether Bitcoin's latest rally represents a sustainable advance or an exhaustion peak.

機構採納,或正標誌着比特幣在專業投資組合中角色的一個更深層次的重新評估。這個答案很可能決定了今次比特幣升浪是持續發展還是見頂回落。

Corporate Treasuries and the Digital Asset Treasury Model Under Stress

企業金庫與數碼資產金庫模式的壓力測試

The corporate treasury trend, pioneered by MicroStrategy (now rebranded as Strategy) in 2020 under CEO Michael Saylor's leadership, introduced a novel capital allocation strategy: converting corporate cash reserves into Bitcoin holdings. The approach rested on a straightforward thesis - Bitcoin's fixed supply and disinflationary monetary policy would preserve purchasing power better than cash, which loses value to inflation and opportunity cost. By 2025, this model had expanded dramatically, with over 250 organizations, including public companies, private firms, ETFs, and pension funds, holding Bitcoin on their balance sheets.

由 MicroStrategy(現已易名為 Strategy)在 2020 年由 CEO Michael Saylor 帶領下開創的企業金庫模式,引入了一個嶄新的資本分配策略:將企業現金儲備轉為比特幣持有。這種做法基於一個簡單的論點——比特幣的供應固定,以及其去通脹的貨幣政策,能較現金更好地保值,因為現金會因通脹及機會成本而貶值。到了 2025 年,這個模式大幅擴張,包括超過 250 間機構,當中有上市公司、私營企業、ETF 及退休基金等,都將比特幣納入財務報表之中。

The digital asset treasury model operates through a self-reinforcing mechanism during bull markets. Companies issue equity or debt at valuations above their net asset value (NAV) - the per-share value of their Bitcoin holdings - then use proceeds to purchase more Bitcoin. This increases their Bitcoin-per-share metric, theoretically justifying the premium valuation and enabling further capital raises. When Bitcoin's price appreciates, these companies' stock prices often rise faster than Bitcoin itself, creating a leveraged exposure that attracts momentum investors.

數碼資產金庫模式在牛市期間能形成自我強化機制。公司會以高於其每股淨資產值(NAV,實質即是其持有的比特幣每股價值)去發行新股或債券,再把集資所得購買更多比特幣。這樣就提升了每股比特幣的數值,理論上合理化高於實際資產值的市價,方便再進一步融資。當比特幣升值,這類公司股價升幅往往快過比特幣本身,有如加了槓桿,吸引了追逐升浪的投資者。

Strategy exemplifies this approach at scale. By mid-2025, the company held over half a million BTC, more than half of all Bitcoin held by public companies. Strategy's stock traded at a significant premium to its Bitcoin NAV, typically 1.7 to 2.0 times the underlying asset value, signaling sustained investor confidence in the company's capital allocation strategy and its ability to grow Bitcoin-per-share through disciplined fundraising.

Strategy 就是這種做法的大型代表。截至 2025 年年中,該公司持有超過 50 萬枚比特幣,超過一半由上市公司持有的比特幣都在其手上。Strategy 股價長期高於其比特幣本身的 NAV,溢價通常介乎 1.7 至 2.0 倍,反映投資者對其資本分配策略及透過籌集資金提升每股持幣能力有持續信心。

The model spawned imitators. Companies like Marathon Digital, Riot Platforms, Bitfarms, Cipher Mining, Hut 8, and others transformed from pure-play mining operations into hybrid enterprises holding substantial Bitcoin treasuries. International players joined the trend, with Japan's Metaplanet emerging as a prominent example. The company transformed from an unprofitable hotel business into the fourth-largest Bitcoin treasury firm, accumulating significant holdings through a combination of debt financing, asset sales, and creative financial engineering.

這種模式吸引了一眾仿效者。像 Marathon Digital、Riot Platforms、Bitfarms、Cipher Mining、Hut 8 等公司,由純挖礦業務轉型成為持有大量比特幣金庫的混合型經營國際公司亦紛紛加入,日本的 Metaplanet 就是突出例子。該公司由一間經營不善的酒店企業轉型成為全球第四大比特幣金庫公司,通過債務融資、資產出售及金融工程累積大量比特幣。

By late 2024 and into 2025, approximately 188 treasury companies had accumulated substantial Bitcoin positions, many with minimal business models beyond Bitcoin accumulation. These entities effectively operated as publicly traded Bitcoin proxies, offering investors leveraged exposure to cryptocurrency price movements through traditional equity markets. During Bitcoin's ascent, this structure worked brilliantly, generating impressive returns for early participants.

去到 2024 年底至 2025 年初,大約188 間金庫公司已累積大量比特幣持倉,其中很多公司除了儲存比特幣外,業務實質極為有限。這些公司實際上成為公開交易的比特幣代理,讓投資者透過傳統股市以槓桿形式參與加密貨幣價格波動。比特幣升浪期間,這個結構帶來可觀回報,對早期進場者尤其有利。

However, the model contains inherent fragilities that surface during periods of price weakness or market skepticism. The central risk involves a scenario researchers describe as the "death spiral" - a cascading failure triggered when a company's stock price falls too close to or below its Bitcoin NAV. When this happens, the multiple of NAV (mNAV) that justified further capital raises compresses or disappears entirely. Without the ability to issue equity at premiums to NAV, companies lose their primary mechanism for acquiring more Bitcoin without diluting existing shareholders.

不過,這個模式本身存在結構性脆弱,只要價格轉弱或市場出現懷疑情緒就會浮現。最核心風險就是所謂的「死亡螺旋」,即當公司股價跌近或低於其比特幣資產 NAV 時觸發的連鎖災難。當這發生,原本能夠支持繼續高於 NAV 發行股份(即 mNAV 溢價)的理據就會消失。缺乏以高於 NAV 溢價集資的能力,這些公司失去不稀釋現有股東的情況下增加比特幣持倉的最主要途徑。

A Breed VC report outlined seven phases of decline for Bitcoin treasury companies. The sequence begins with a drop in Bitcoin's price that reduces the company's NAV premium. As market capitalization contracts relative to Bitcoin holdings, access to capital tightens. Without equity buyers or willing lenders, companies cannot expand holdings or refinance existing Bitcoin-backed debt. If loans mature or margin calls trigger, forced liquidations follow, depressing Bitcoin's price further and dragging other treasury companies closer to their own spirals.

根據 Breed VC 報告,比特幣金庫公司出現「死亡螺旋」分為七個階段。首先,比特幣價格下跌,令公司 NAV 溢價收縮,以持幣計算的市值縮小,集資渠道收緊。找不到股權融資抑或願意借貸的對象,公司既無法增持比特幣,也難以為現有抵押比特幣的債務再融資。如果債務到期或遇上追繳保證金,就會被迫斬倉,進一步壓低比特幣價格,令其他金庫公司進一步陷入螺旋泥潭。

By October 2025, signs of this stress had become apparent. Net asset value premiums collapsed across the digital asset treasury sector. According to a 10x Research analysis, "The age of financial magic is ending for Bitcoin treasury companies. They conjured billions in paper wealth by issuing shares far above their real Bitcoin value - until the illusion vanished." Retail investors who paid two to seven times the actual Bitcoin value when buying treasury company shares during periods of hype saw those premiums evaporate, leaving many shareholders underwater while companies converted inflated capital into real Bitcoin holdings.

過了 2025 年 10 月,這種壓力已變得明顯。淨資產值溢價全線崩潰於整個數碼資產金庫行業蔓延。根據 10x Research 分析:「比特幣金庫公司的金融魔法年代已結束。過去通過高於比特幣實際價值幾倍發新股,創造紙上財富,當幻象消退就一無所有。」那些於熱潮期間以比特幣真實價值兩倍至七倍買入金庫公司股票的散戶,如今看着股價溢價消失,手頭股份倒貼,公司則把虛高的資本成功兌換成真實比特幣。

Metaplanet's experience illustrates the boom-bust dynamic. The company effectively transformed a market capitalization of $8 billion, supported by just $1 billion in Bitcoin holdings, into a $3.1 billion market cap backed by $3.3 billion in Bitcoin. The compression from an 8x premium to trading near or below NAV represented wealth destruction for equity holders even as the company accumulated more Bitcoin. Strategy experienced a similar pattern, with its NAV premium compressing significantly from November 2024 peaks, resulting in a slowdown of Bitcoin purchases.

Metaplanet 的經歷正好展現了這種盛衰循環。該公司由 80 億美元市值(僅有 10 億美元比特幣支持),變成 31 億美元市值(當時持有 33 億美元比特幣)。由八倍溢價壓縮至接近或跌破 NAV,即使公司持有比特幣更多,對股東來說已屬巨大財富破壞。Strategy 亦出現類似情況,NAV 溢價自 2024 年 11 月高位大幅收縮,拖慢了增持比特幣步伐。

The debt burden these companies accumulated amplifies downside risks. By 2025, Bitcoin treasury companies had collectively raised approximately $3.35 billion in preferred equity and $9.48 billion in debt, according to Keyrock Research. This creates a wall of maturities concentrated in 2027 and 2028, along with ongoing interest and dividend payments through 2031. Companies' ability to service these obligations depends heavily on Bitcoin maintaining price levels that support their business models.

這些公司累積的債務壓力令下行風險進一步放大。Keyrock Research 資料顯示,到了 2025 年,所有比特幣金庫公司合共發行約 33.5 億美元優先股及 94.8 億美元債務。這在 2027 及 2028 年產生了到期壓力高峰,2031 年之前還有持續的利息及股息支出。這些公司的償債能力,極倚賴比特幣維持於能支持其商業模式的價位水平。

Cash flow from underlying core businesses varies dramatically across the treasury company cohort. Strategy generates software licensing revenue that provides some cash flow cushion. Mining companies like Marathon and Riot produce Bitcoin directly, though at costs that fluctuate with hashrate difficulty and energy prices. Some treasury companies lack meaningful operating businesses entirely, relying exclusively on capital markets access to sustain operations and acquire more Bitcoin.

這批金庫公司的核心業務現金流大不相同。Strategy 靠軟件授權收入提供一定現金流緩衝。像 Marathon 和 Riot 這類礦業公司則直接產出比特幣,但成本受算力難度及能源價格波動。有些金庫公司則甚至沒有實質經營業務,完全依賴資本市場集資來維持運作和增持比特幣。

The weakening demand from digital asset treasuries compounds the broader institutional demand shortfall. When these companies actively accumulated Bitcoin, they provided consistent buying pressure that helped absorb mining output alongside ETF flows. As NAV premiums collapsed and capital markets access tightened, treasury companies' Bitcoin acquisition pace slowed or stopped entirely, removing another significant demand channel from the market.

數碼資產金庫購買力減弱,令整體機構需求缺口更加嚴重。當這些公司積極買入比特幣,市場有穩定買盤,有助消化礦場新產出及 ETF 流入。但隨着NAV 溢價崩潰、資本市場融資困難,金庫公司增持動作大減甚至暫停,令市場失去了一個重要需求來源。

The structural issues extend beyond individual company health to broader market implications. If overleveraged treasury companies face forced liquidations to meet debt obligations or margin calls, they add to selling pressure precisely when Bitcoin least needs additional supply. The interconnected nature of these companies' fortunes means that weakness in one can cascade through the sector, as declining Bitcoin prices compress all NAVs simultaneously, limiting everyone's capital-raising ability.

這些結構性問題不限於單一公司體質,而影響到整個市場。如果過度槓桿化的金庫公司因債務償還壓力或孖展追繳被迫沽售資產,會在比特幣最不需要額外拋售時增加壓力。再者,這些公司命運互為牽連,一間出現弱勢,全行 NAV 一同被壓縮,資本市場籌資能力便同時受限,可能引發連鎖反應。

Fortunately, most treasury companies in 2025 still rely primarily on equity financing rather than extreme leverage, limiting contagion risk if some entities fail. Strategy's approach of balancing equity issuance with convertible debt, maintaining conservative loan-to-value ratios, and actively managing its capital structure provides a template for sustainable Bitcoin treasury operations. However, the sector's growth attracted less disciplined operators whose capital structures may prove unsustainable if Bitcoin consolidates or corrects from recent highs.

幸運的是,2025 年的大多數金庫公司主要依靠股權融資,而並非極端槓桿,萬一有公司出事亦可減輕傳染效應。Strategy 在發行股權及可轉債之間求取平衡、維持審慎的貸款價值比率、積極管理資本結構,是可持續發展比特幣金庫的參考典範。不過,這個行業的增長也吸引了管理不嚴謹的新進者,若比特幣在高位整固或回調,這些公司的資本結構未必捱得住。

The 10x Research analysis suggests that the NAV reset, while painful for equity holders, creates a cleaner foundation for the next market phase. Companies now trading at or below NAV offer pure Bitcoin exposure with optionality on future operational improvements. The shakeout "separated the real operators from marketing machines," suggesting that survivors will be better capitalized and capable of generating consistent returns. Whether this optimistic view proves correct depends partly on whether Bitcoin's price can stabilize and resume its upward trajectory, restoring the conditions that made the treasury model viable in the first place.

10x Research 的分析認為,NAV 的重設雖然對股東痛苦,卻為下階段打下更健康基礎。現時以 NAV 或低於 NAV 水平交易的公司,為投資者提供更純粹的比特幣曝險,同時保留未來營運改善的可能。這場調整「分開了真正的經營者與只懂包裝的公司」,意味著存活下來的公司資本實力更穩健,有能力帶來穩定回報。但這個樂觀說法能否成真,部分要視乎比特幣價格能否企穩續升,重現支持金庫模式生存的基礎環境。

Contrasting Periods: When ETFs Absorbed Supply Faster Than Mining

The period from late 2024 through mid-2025 represented Bitcoin's golden age of institutional demand dominance. During these months, the combination of spot

2024 年底至 2025 年中,被認為是比特幣機構需求稱霸的黃金時代。在這幾個月當中,現貨...ETF資金流向同企業金庫累積一向都超越每日挖礦產出,而且好多時都遠遠拋離。呢個動態創造咗供應衝擊(supply shock),即係供求框架描述嘅一種結構性失衡——可用供應滿足唔到需求,迫使價格上升,以吸引現有持有人出貨。

2025年5月將呢個趨勢推到極致。如前所述,比特幣ETF喺嗰個月購買咗26,700 BTC,而礦工只生產咗7,200 BTC。呢個3.7比1嘅比率代表機構幾乎吸收咗流通中新供應嘅四倍。有啲星期,失衡更明顯,例如ETF喺單一星期買入18,644 BTC,而日均產量只有450 BTC。咁計落,機構買家可以喺七日內吸收礦工超過40日產出嘅比特幣。

宏觀經濟環境亦支持咗呢種激進嘅累積行為。比特幣喺5月初觸及$97,700,喺急升之後錄得約4%升幅,之後稍微回調到$94,000左右。經過咁急嘅升幅只出現溫和回調,配合機構持續買入,反映強勁嘅基礎需求。每次下跌都有新買家接貨,令價格有持續上升底線,進一步鼓勵機構加倉。

黑石旗下IBIT喺呢段時間特別突出,連續17日冇資金流出,反映機構信心持續。該基金五日內吸納接近25億美元資金,展示資金湧入ETF包裝比特幣產品嘅速度。去到呢個階段,現貨比特幣ETF總資產管理規模超過1,100億美元,鎖住咗比特幣可流通供應嘅相當大部分。

需求高度集中,市場影響就更明顯。例如黑石IBIT一隻基金都可以吸納幾日產出以上嘅比特幣,單日購買需求有時超越咗多日挖礦。而授權參與者為咗創建ETF新單位,要喺現貨市場搵真比特幣,大多以大額交易喺交易所提走貨幣。呢種機械式買壓同傳統即時供求無直接關係,因為ETF資金流主導因素係幾日前或星期前嘅資產配置決定,而唔係實時價格反應。

2025年資料分析顯示,機構累積速度超過新供應5.6倍。同一時期,機構累積咗545,579 BTC,而礦工只生產咗97,082 BTC。咁大嘅失衡,徹底改變咗比特幣市場結構,令比特幣由一隻主要喺分散現貨交易所買賣嘅資產,轉變為愈嚟愈受美國監管ETF主導嘅市場。

供應短缺現象喺市場行為上都睇到。各大交易所賬戶餘額——即交易平台持有、理論上可以賣出嘅比特幣——跌到六年新低。長線持有人唔肯喺現時價格沽貨,預期機構繼續吸貨會推高價格。交易所庫存越來越少,加上ETF激進掃貨,導致即使有小量新需求,都會推動價格大幅波動。

呢種情況印證咗牛市論點——即推動比特幣由2024年初低位約$40,000升上2025年10月高位超過$126,000背後嘅根本原因,其基礎唔係過度投機或槓桿,而係有理有據嘅供需失衡。當機構連續數倍吸收新供應,價格上漲幾乎變成一個機械性結果,每一輪新買盤都促使價格升到可以激發現有持有人願意賣貨嘅新高度。

2024年4月嘅減半令呢種效應再被放大。每日產出由900 BTC減至450 BTC,新供應即時收縮一半,但機構需求無停過。減半前,ETF大約吸收每日產出三倍;減半後產能砍半,但機構買盤不減,結果代表等如每日新供應六倍或以上。呢個數學現實,令價格長期受強大上壓支撐。

學術模型建議,如果流通供應跌至大約200萬BTC以下,而機構需求依然強勁,每日只需略為掃貨,都會觸發指數式價格升幅。Rudd及Porter模型表明,只要機構每日吸納1,000至4,000 BTC(以上述ETF流向觀察,非常可達),只要持續數年,比特幣價格中長期可望見六位數甚至七位數。

呢種機構需求主導同目前需求落後供應嘅情況,正好對比,展現比特幣對邊際資金流變動好敏感。即使比特幣市值約兩萬億美元,每日分分鐘只有幾千萬美金資金流,已經左右短線走勢。當機構由吸收每日產能3-5倍,轉去吸收唔夠每日產能,呢個影響會好快反映喺價格動力同波幅上。

十月初錄得紀錄新高資金流入,轉眼月底持續流出,都反映咗呢個波動。比特幣因十月初高資金流入推升破$126,000,但之後資金持續流出,價格喺$105,000-$110,000區間整固。高位至低位短短幾星期已蒸發超過$20,000,證明只要最大買家(即機構ETF分配者)一停手,市場情緒就會急轉直下。

而家投資者面對最大問題係,機構需求會唔會恢復到高於供應,令比特幣重現有利動力,還是需求疲弱會持續甚至惡化,觸發更大規模重估。歷史經驗提供唔到指引,因現貨比特幣ETF係結構新發明,仲未經歷過完整市場周期,佢嘅行為仍屬未知之數。答案好可能會從日常資金流數據浮現——現已成為最受關注、即時反映比特幣機構化採納軌跡嘅信號。

推動需求變化嘅宏觀、監管與市場情緒因素

2025年底機構比特幣需求急轉直下,反映一系列宏觀經濟阻力、監管不明朗同市場氣氛變化夾雜。了解呢啲因素,有助解釋點解一路以來咁進取嘅機構買家突然縮手,令需求幾個月來首度低於新供應。

貨幣政策係決定機構風險胃納嘅主要宏觀因素。聯儲局對進一步減息抱審慎態度,啱啱喺比特幣創新高時帶來咗不確定性。2025年10月降息之後,聯儲主席鮑威爾質疑12月再減息嘅可能性,指「再減息遠未成定局」。呢句說話引發咗風險資產重估,投資者重新計算貨幣寬鬆速度。

比特幣同整體風險資產相關性,喺2024至2025年進一步加強。數據反映,比特幣同標普500相關系數升至0.77,高於2020年嘅0.3,令比特幣由本來幾乎無關的另類資產,變成高Beta附屬於股票市場風險偏好。當股票市場受壓,例如2025年10月底科網股業績失準後,比特幣同樣要承受同步甚至更大沽壓。而比特幣同美匯指數負相關去到-0.72,即美元強勢(常見於市場避險),通常意味比特幣走弱。

利率預期直接影響機構資產分配決定。國債孳息隨高息預期上升,持有無息資產如比特幣嘅機會成本走高。機構分配者要有充分理據,先可以justify持有高波幅嘅比特幣,而風險回報又唔及國債安穩。10月鮑威爾講話之後,利率預期調整,亦帶動機構賣盤同ETF資金流出。

宏觀層面不明朗進一步放大咗呢啲動態。持續高通脹、高利率同聯儲政策不確定性營造咗高度審慎...Here is your translated content in zh-Hant-HK, with markdown links left untranslated as instructed:

在機構投資者之間。潛在美國政府於十月下旬停擺的陰影,為政治不明朗增添變數,驅使各投資組合減少風險。加密市場的特定憂慮,包括間中發生的交易所安全事故以及監管執法行動,使加密貨幣投資風險溢價保持高企。

監管環境呈現一幅進展與持續不確定性並存的複雜圖景。2024年1月現貨比特幣ETF獲批,是監管一個分水嶺式的背書,確認了比特幣作為機構參與者可投資資產類別的合法地位。然而,針對更廣泛加密貨幣監管仍存疑問,特別是其他數字資產的界定與處理問題,令不明朗依然揮之不去。

特朗普政府對加密貨幣監管的態度最初帶來樂觀預期,但執行仍然未明。雖然競選言論暗示未來會對數字資產更為友善,但具體政策落實到2025年底前仍然模糊。隨著Paul S. Atkins在2025年4月確認出任SEC主席,外界預期批核更多加密產品的進度會加快,監管清晰度亦會提升。但這種支持加密的情緒,實際要落實成具體政策改革,進度較市場原本預計為慢。

機構投資者尤其重視監管明確性,因為合規框架及資本要求,依賴於資產和活動的明確分類。缺乏全面加密貨幣立法或清晰的監管指引,令不少大型資產分配者,特別是遵循嚴格信託責任標準的機構,對大規模加密貨幣投資仍然保持謹慎。在重大監管問題獲得解決前,機構潛在需求的一部份仍無法入市,儘管已有受規管的ETF渠道。

市場結構的考慮因素亦影響2025年下半年的機構行為。ETF資產高度集中於BlackRock的IBIT,引起了系統性風險的關注。有分析指出,若撇除IBIT因素,餘下ETF市場至2025年其實會錄得12億美元的資金淨流出。這種集中意味,BlackRock的資金流向或客戶情緒的任何變化,都可能對ETF整體需求造成超比例影響。當IBIT於2025年10月30日錄得自八月以來單日最大贖回時,亦反映即使是最成功的基金也會遇到沽壓。

市場情緒指標顯示市場心理惡化。恐懼與貪婪指數在十月下旬進一步跌入「恐懼」區間,反映即使價格按歷史標準仍高企,交易員信心亦已動搖。社交媒體討論亦由「Uptober」升浪期間的狂熱,轉為對升市持續性的焦慮與辯論。這種情緒逆轉往往產生自我強化效應:信心下滑促使拋售,從而印證了相關憂慮,引發更多拋售。

技術因素同樣促成需求轉變。比特幣迅速升至126,000美元,大幅突破過往反彈的心理阻力位及移動平均線。當價格短期內升幅太大,獲利回吐對於早前低位吸納的機構投資者便成為合理行為。缺乏持續新買盤於120,000美元之上追價,顯示短期需求已經枯竭,促使按技術分析操作的交易者減持或開淡倉。

衍生產品市場結構亦可窺見機構持倉變化。芝商所比特幣期貨基差(即期貨較現貨溢價)於十月下旬跌至多年低位。這意味市場參與者偏向平倉而非新開多單,對短期升值前景持懷疑態度。永續期貨資金費率亦顯示多頭槓桿需求有限,因為投機者避免支付持倉成本以維持看漲。

機構投資組合再平衡亦可能帶來資金流出。2024年至2025年的強勢表現,令比特幣於部分原本小比例持有的投資組合權重顯著上升。當頭寸超出目標配置,機構投資者無論短線看法,均會受壓調整持倉,尤其年底鎖定業績時。這種機械式減持,與對比特幣長線前景基本看法可無關。

這些因素——貨幣政策不確定、監管模糊、情緒惡化及技術枯竭 —— 交織形成一個情況:原本主導市場資金流的機構需求轉為沽貨或觀望。並在十一月初數學上反映為機構需求低於每日挖礦供應。這情況究竟只是短期整固或屬於機構採納趨勢逆轉,成為比特幣短期前景的關鍵議題。

對比特幣價格及市場結構的風險與後果

當機構需求長期落後於每日比特幣產量,為價格穩定性和市場結構引入數個互相關聯的風險。理解這些風險需考慮,由溫和整固至需求惡化等不同場景,對市場不同參與者的潛在影響。

最直接的風險是,若機構沽售持續或加快,價格進一步受壓。比特幣十月突破126,000美元創下本地高位後,至今未能重返,往上每次嘗試均遇沽壓,形成一浪低於一浪的格局,技術分析解讀為走勢轉弱。若缺乏ETF渠道機構新資金吸納每日產出及現有持有者賣盤,比特幣或將下試更低支持位。

100,000至105,000美元區間,是首個重大支持區,預計將有足夠買盤承托價格。此水平亦是多項技術因素的交匯,比如200日移動平均線、過往整固區(現已變為支持)以及心理關口。然而,如機構沽售加劇或宏觀狀況惡化,該支持或會失守,價格進一步糾正至90,000甚至曾為本地高點的80,000美元亦非不可能。

波動性升溫亦是機構參與減少的重要後果。大型機構買家通常透過耐心、對價格不敏感的增持行為,為市場帶來穩定性。當這類參與者退場,市場便更易受規模較小、對價格高度敏感的交易員及槓桿投機者的影響,出現劇烈波動。10月修正期間$10億美元槓桿倉被清算,正正反映此一現象——價格下跌觸發止蝕及槓桿平倉,進一步放大跌勢波動。

波動性上升,令機構採納步伐困難加劇,影響超越即時市場波動。養老基金、捐贈基金及其他保守型機構,需要相對可預計的風險特性,以作頭寸規劃及風控。當波動性急升,這類參與者便會縮減倉位,或甚至完全迴避,加劇一個負面循環——機構參與下降引致波動率升,波動率升又進一步嚇走機構。

當大型買家撤出,市場深度與流動性亦會受損。交易所掛單簿會變得較薄,大額交易面臨更大價格衝擊;買賣差價擴闊,所有市場參與者的執行成本提升。流動性惡化尤其影響大額交易,易形成惡性循環——成交質素下降,嚇退機構,流動性進一步變差。

價格發現機制的轉變,是具持久影響的市場結構性變化。研究顯示,比特幣ETF自推出後有約85%時間主導價格發現,即機構資金透過受監管產品流入,主導短線價格。當ETF資金流轉負,價格主導權轉回到分散的現貨交易所,這些平台多數交易以投機與基本分配意圖脫鈎。這一轉變會令價格信號雜音增加,降低市場效率。

若機構需求持續疲弱,比特幣「稀缺性溢價」亦會受侵蝕。比特幣之價值命題,很大程度建基於其作為稀缺、總量有限資產逐漸獲機構採納作長線儲備及資產分散工具。當最成熟的市場參與者透過沽售行為發出信號...that they no longer find Bitcoin attractive at current valuations, it challenges the narrative that scarcity alone justifies premium pricing. This psychological shift can prove more damaging than immediate price weakness, as it undermines the fundamental thesis driving long-term investment.

--> 當投資者不再覺得現時估值下的比特幣有吸引力,這就動搖了「單憑稀缺性便可支撐高溢價」這一說法。這種心理變化甚至比即時價格下跌更具破壞性,因為它削弱了長線投資背後最核心的理據。

Corporate treasury companies face acute risks if institutional demand remains subdued and Bitcoin prices fail to advance. As documented earlier, these companies accumulated significant debt loads while building Bitcoin positions, creating fixed obligations that must be serviced regardless of market conditions. If Bitcoin consolidates or declines while institutional demand remains weak, treasury companies lose their ability to issue equity at premiums to NAV, blocking their primary capital-raising mechanism. This scenario could force distressed selling from overleveraged entities, adding to downward price pressure precisely when markets can least absorb it.

--> 如果機構需求持續低迷,而比特幣價格未見上升,企業金庫公司將面臨重大風險。正如早前所述,這些公司在儲備比特幣期間承擔了大量債務,產生了無論市況如何都必需履行的固定債務。一旦比特幣橫行或回落之際,機構需求依然疲弱,這些公司便失去以高於每股資產淨值(NAV)的溢價發新股集資的能力,亦即失去了主要的融資渠道。這種情況下,槓桿過高的公司或會被迫拋售資產,正正在市場最無力承受的時間增加沽壓。

The mining industry confronts similar pressures. With debt loads approaching $13 billion and many firms carrying interest expenses exceeding operating revenues, miners require sustained high Bitcoin prices to remain profitable. If prices decline while operational costs remain elevated, less efficient miners face bankruptcy, potentially reducing network hashrate and security. While Bitcoin's difficulty adjustment mechanism compensates for hashrate changes over time, severe miner distress could create temporary network vulnerability or perception problems that undermine confidence.

--> 挖礦行業同樣面臨壓力。現時挖礦企業的總債務近130億美金,更有不少公司利息開支甚至超過營運收入。礦企需要比特幣價格長時間維持高位才能獲利。如果比特幣跌價而營運成本又高企,效率較低的礦工便有機會破產,可能導致全網哈希率和安全性下降。雖然比特幣設有難度調節機制以平衡哈希率變化,但礦工大規模陷入財困時,網絡可能會短暫出現漏洞或引發市場信心危機。

Distribution channel risks emerge if wealth management platforms and financial advisors become less enthusiastic about Bitcoin ETF allocation following performance disappointments. The institutional adoption story depends partly on Bitcoin ETFs gaining acceptance across major brokerage platforms and wirehouses. While some firms like Morgan Stanley began allowing advisor access, many major platforms including Merrill Lynch, Wells Fargo, and UBS still restrict proactive pitching of cryptocurrency products. Extended underperformance or continued outflows could delay or reverse progress toward broader platform acceptance, limiting the potential addressable market for ETF products.

--> 若理財平台和財務顧問因表現令人失望而對配置比特幣ETF興趣減退,分銷渠道將面臨風險。比特幣ETF能否普及機構採用,一部分取決於能否打入各大主流券商和理財平台。雖然如摩根士丹利等已開始讓顧問經辦這類ETF,但大多數主流平台例如美林、富國銀行、瑞銀等仍限制主動推銷虛擬貨幣產品。如果表現長期遜色或資金繼續流出,將拖慢或逆轉ETF產品打入更廣闊市場的進度,限制了潛在市場空間。

Regulatory risks intensify during periods of market stress. Policymakers and regulators often respond to volatility and consumer losses by implementing restrictions or additional oversight. While spot Bitcoin ETF approval represented regulatory progress, sustained market weakness accompanied by retail investor losses could trigger renewed skepticism about cryptocurrency products' appropriateness for mainstream portfolios. This risk becomes particularly acute if leveraged products or complex derivatives contribute to market dislocations that generate negative headlines.

--> 市場動盪時,監管風險尤為加劇。決策者和監管機構往往會因波動和投資者損失而加強限制或監察。即使現貨比特幣ETF獲批已是監管進步,但若市況持續疲弱、散戶蒙受損失,公眾對加密貨幣產品是否適合主流資產組合將再起疑慮。若槓桿產品或複雜衍生品進一步引發市場異動並造成壞消息,這種風險尤其顯著。

However, not all consequences of reduced institutional demand portend disaster. Market consolidation following rapid appreciation serves healthy functions in price discovery and shakeout of weak holders. Bitcoin has repeatedly demonstrated resilience through drawdowns of 30%, 50%, or even 70% before resuming uptrends and surpassing prior peaks. The current situation may represent normal volatility within an ongoing bull market rather than a fundamental regime change.

--> 不過,機構需求減弱並不一定帶來災難。歷經急速升值後的市場整固,其實有助價格發現和淘汰弱手。比特幣一向能在經歷30%、50%、甚至70%的大跌後再重拾升勢,創下新高。現時情況或只是牛市過程中的正常波動,而非基本面的轉變。

The compression of corporate treasury NAV premiums, while painful for equity holders, creates a cleaner foundation for sustainable growth. Companies now trading near NAV offer direct Bitcoin exposure without paying premiums for questionable added value. This reset separates disciplined operators from promotional entities, potentially strengthening the sector long-term even if near-term pain persists.

--> 企業金庫股價溢價收窄,雖然對普通股股東不利,但卻為可持續增長打下較健康的基礎。現時股價貼近資產淨值的公司,讓投資者可以直接暴露於比特幣,而毋須為那些成效成疑的「額外價值」多付溢價。這次調整有助分清有紀律的經營者和炒作公司,即使短期痛苦,但長遠或令板塊更為穩健。

The ultimate consequence of sustained institutional demand weakness depends on whether alternative buyer groups emerge to fill the gap. Retail investors, sovereign entities exploring Bitcoin reserves, continued accumulation by existing believers, or renewed institutional interest following consolidation could all provide demand support. The coming months will reveal whether the late 2025 institutional retreat represents a worrying exodus or merely a pause before the next wave of adoption.

--> 機構需求若長期疲弱,其最終影響視乎其他買家群體能否補上空缺。散戶、新興儲備比特幣的主權實體、現有信仰者繼續增持,或市場整固後機構資金迴流,都有望帶來需求支持。未來數月將揭曉,2025年底的機構撤退到底是令人擔憂的大逃亡,還是下輪普及前的短暫休整。

Forward Outlook: What Needs to Happen for Demand to Catch Up

--> ## 展望未來:需求要追上供應,需要出現甚麼改變?

Reversing the current dynamic where institutional demand lags Bitcoin's mining supply requires analyzing the catalysts that could restore or accelerate ETF inflows and corporate treasury accumulation. Several potential developments could shift the supply-demand balance back toward demand dominance, though their likelihood and timing remain uncertain.

--> 想改變目前「機構需求落後於比特幣新供應」的局面,需分析到底要有甚麼誘因才能令ETF資金重返、企業金庫積極增持。確實,有數項可能的發展動力可以令需求再次佔優,只是其發生的機率和時機未明朗。

Macroeconomic conditions represent the most powerful potential catalyst. A clear Federal Reserve pivot toward sustained monetary easing would reduce the opportunity cost of holding non-yielding Bitcoin and improve risk appetite across institutional portfolios. If inflation pressures moderate while economic growth remains resilient, creating a "Goldilocks" environment for risk assets, institutional allocators would likely increase cryptocurrency exposure. Rate cuts combined with ending quantitative tightening could inject new liquidity into markets that historically flows partly into Bitcoin and cryptocurrency markets.

--> 宏觀經濟條件是最有力的催化劑。若聯儲局明確轉向持續寬鬆,持有不生息的比特幣之成本便降低,同時提升機構投資組合的風險偏好。假如通脹壓力回落、經濟持續穩健,被稱為「黃金鎮」的危險資產環境便有利資金增配加密貨幣。減息兼結束量化緊縮將為市場注入新流動性,而過往這部份資金經常流入比特幣及加密貨幣市場。

Regulatory clarity could unlock substantial pent-up institutional demand currently sidelined by compliance constraints. Comprehensive cryptocurrency legislation establishing clear classification frameworks, custody standards, and regulatory oversight would remove a major impediment to institutional participation. While spot Bitcoin ETF approval represented significant progress, many potential allocators await more definitive guidance before committing substantial capital. If Congress passes comprehensive crypto legislation or regulators issue clear guidance, it could trigger a wave of previously restricted institutional buying.

--> 監管明朗化可釋放被合規障礙迫使觀望的機構需求。若加密貨幣獲立法規管,訂出明確分類、託管標準及監管框架,便可清除機構參與的一大障礙。即使現貨ETF獲批是重要突破,但很多潛在投資者仍在等待更明確的規則文件才願大額配置。若國會通過加密全面法案,或監管機構發出明確指引,機構買盤或將突然而至。

Geographic diversification of Bitcoin ETF offerings could expand the addressable market significantly. U.S. ETFs currently dominate flows, but similar products in major markets like Europe, Asia, and emerging economies could tap new institutional capital pools. Some jurisdictions already offer cryptocurrency ETPs, but expanded product availability in major financial centers would broaden access. If sovereign wealth funds, pension systems, or insurance companies in additional jurisdictions gain regulatory clearance for Bitcoin exposure, it would diversify and potentially expand demand beyond current U.S.-dominated flows.

--> 比特幣ETF產品地域更多元化,有機會大幅擴大目標市場。目前資金主要集中在美國ETF,但歐洲、亞洲、甚至新興市場推出類似產品,有望吸納當地機構資金。部分地方早有加密貨幣ETP,但如主要金融中心進一步開放產品渠道,市場接觸面必定更廣。假如更多國家的主權基金、退休金制度、保險公司獲准接觸比特幣,需求來源將不再由美國壟斷,有望擴大市場規模。

Product innovation within the ETF structure could attract different investor segments. The launch of options on Bitcoin ETFs, enhanced yield products, or actively managed cryptocurrency strategies might appeal to institutional participants seeking more nuanced exposure than simple spot holdings. If major ETF sponsors introduce products targeting specific use cases - income generation, downside protection, tactical trading - they could capture demand from allocators who find pure spot exposure unattractive.

--> ETF產品結構創新可吸引不同類型的投資者。例如推出比特幣ETF期權、增強收益產品、主動型加密貨幣策略基金,這些新產品特別切合那些對單純現貨持有感到乏味的機構。如主要ETF供應商針對特定應用情境(增收、保護下跌、策略交易)推出產品,更可吸納原本對純現貨無興趣的機構配置。

Corporate adoption beyond treasury companies could provide incremental demand. If major corporations outside the crypto industry begin allocating meaningful portions of cash reserves to Bitcoin, as Strategy pioneered, it would signal broader acceptance and potentially trigger competitive adoption. The model works best when companies can issue equity at premiums to NAV, so renewed market enthusiasm would likely accompany any expansion of this trend. Sovereign adoption would prove even more significant - if nations establish Bitcoin reserves beyond El Salvador and the Central African Republic, the supply impact could prove substantial given the scale of potential allocations.

--> 除金庫公司外,若其他大型企業亦開始將現金儲備配部分到比特幣(正如Strategy率先實踐),便代表市場認受性所及更廣,甚至會引發企業間競相投入。這種模式最理想於公司可溢價發股集資的階段,換句話說,市場再現熱潮時才會出現。主權國採用更具意義——一旦有更多國家(除中非共和國及薩爾瓦多外)建立比特幣儲備,由於國家級資金規模,相對供應的影響可非常驚人。

Improved miner economics could paradoxically help by reducing selling pressure. If Bitcoin miners successfully transition to sustainable business models incorporating AI and HPC revenue alongside mining, their dependence on selling newly mined Bitcoin would decrease. This transition would effectively remove some daily supply from markets even without increased demand, tightening the supply-demand balance. The success of this pivot remains uncertain given the massive debt loads miners accumulated, but positive developments would improve market structure.

--> 礦業經濟若有所改善亦可能反向減輕拋壓。若礦工能順利轉型至結合AI、高性能運算等多元收入模式,便減少對賣出新開採比特幣的依賴。即使整體需求不變,每日市場供應亦會因而減少,令供需結構更緊張。礦工轉型成效仍未確定,累積巨額債務是一大隱憂,但如見成效絕對對市場結構有利。

Technical factors could catalyze renewed buying if Bitcoin establishes clear support at current levels. Traders and algorithms watching for reversal signals might initiate buying if Bitcoin successfully tests and holds $105,000-$110,000 support multiple times, creating a basing pattern that technical analysts interpret as accumulation. Momentum-following strategies that sold on breakdown below key levels would reverse to buying if Bitcoin reclaims important technical thresholds, potentially creating self-reinforcing upward momentum.

--> 若比特幣在現價區間反覆找到明確支持,技術因素便有機會引發新一輪買盤。若幣價多次回測並守住105,000-110,000美元區域,會形成技術分析眼中的「築底」訊號,吸引交易員和程式算法開倉買入。原先見破位下跌而沽出的動能跟隨策略,若幣價重越關鍵阻力,會逆轉入場增持,觸發自我強化的升勢。

Scenario analysis helps frame possible outcomes over coming months. In a base case scenario, institutional demand remains roughly flat at current subdued levels, matching or slightly trailing mining supply. Bitcoin consolidates in a range between $95,000 and $115,000, with neither sustained uptrend nor significant breakdown. This outcome would require macro conditions remaining stable without dramatic improvement or deterioration, regulatory status quo continuing, and no major catalysts emerging to shift sentiment dramatically.

--> 情景分析有助預計未來數月的可能發展。基線情境下,機構需求基本維持當前低位,與新挖礦供應大致相若甚至稍低。比特幣會橫行於95,000至115,000美元,既不上破也無大跌。這要假設宏觀情況維持穩定,監管不進不退,亦未有重大催化劑令市場情緒急劇逆轉。

An optimistic scenario envisions renewed institutional interest driven by improving macro conditions, positive regulatory developments, or successful technical basing. ETF inflows resume at levels exceeding mining supply, perhaps reaching 2-3 times daily

--> 樂觀情景下,釋出動力的包括:宏觀數據回暖、監管利好、或技術面明確轉強,機構買家重燃興趣。ETF資金流回升,超越新挖礦供應,甚至每日達到2-3倍......production as occurred in May 2025. Bitcoin breaks above $125,000 resistance and extends to new all-time highs in the $140,000-$160,000 range by mid-2026. This outcome would restore the favorable supply-demand dynamics that powered 2024-2025's rally and validate the bullish adoption narrative.

如2025年5月一樣進行生產。比特幣突破$125,000阻力位,並於2026年中延伸至$140,000-$160,000的新歷史高位。呢個結果會恢復2024-2025年升浪背後有利供應同需求動力,亦會證實牛市採納論述既有效性。

A pessimistic scenario sees institutional outflows accelerating rather than reversing, potentially driven by macroeconomic deterioration, regulatory setbacks, or systematic failures among corporate treasury companies. Demand falls to 50-75% of daily mining supply, forcing Bitcoin to clear excess supply through price declines. The cryptocurrency tests $80,000-$90,000 support, potentially breaking below these levels if selling pressure intensifies. This outcome would require significant negative catalysts - recession, hawkish Fed pivot, major regulatory crackdown, or cascading treasury company failures.

悲觀情況下,機構資金流出唔止未逆轉,仲有加速跡象,可能受宏觀經濟惡化、監管打擊或企業財務公司系統性失敗所驅動。需求跌至每日挖礦供應既50-75%,逼使比特幣要透過價格下跌先清理多餘供應。加密貨幣會測試$80,000-$90,000既支持位,如果賣壓加劇,仲有機會跌穿呢啲水平。要出現呢種情況,需要重大負面因素——例如經濟衰退、美聯儲突然轉鷹、重大監管打擊或企業財庫公司連環倒閉。

Probabilities for these scenarios remain inherently uncertain and depend on developments across multiple dimensions. Market participants should monitor several key indicators to assess which scenario is materializing:

呢啲情景既發生機會本身極不確定,同多方面發展有關。市場參與者應該留意幾個關鍵指標,以評估邊一個情景漸漸成形:

ETF flow data provides the most direct real-time signal of institutional demand. Daily and weekly flow reports reveal whether the late October selling represented a temporary adjustment or marks the beginning of sustained institutional exodus. If flows stabilize near neutral or return to modest inflows, it suggests consolidation rather than breakdown. If outflows accelerate or persist for multiple consecutive weeks, pessimistic scenarios gain credibility.

ETF資金流數據係機構需求最直接既即時訊號。每日同每週資金流報告可以睇出10月底既拋售係短暫調整,定係持續機構撤資既開始。如果資金流穩定或回復小幅流入,反映呢段只係整固唔係崩潰。如果流出加快或連續數週持續,悲觀情景就更可信。

On-chain metrics reveal whether long-term holders remain committed or begin distributing. The percentage of Bitcoin supply unmoved for 6+ months, currently around 75%, indicates conviction among existing holders. If this metric declines substantially, suggesting long-term holders selling, it would signal weakening fundamental support. Exchange reserves and the pattern of transfers to or from exchanges provide insight into whether holders prepare to sell or continue accumulating for long-term storage.

鏈上數據反映長期持有者到底仲繼續堅定,定係開始沽貨。現時超過6個月未郁動既比特幣供應佔大約75%,顯示持有者信念強。如果呢個比例大幅下跌,即係長期持有人開始賣貨,基礎支持力會減弱。交易所儲備同資金出入交易所既模式,亦反映持有人係咪準備套現,定係繼續長線買入。

Corporate treasury behavior indicates whether the digital asset treasury model retains viability. If treasury companies resume Bitcoin purchases following NAV compression, it suggests the model adapts and survives. If purchases remain frozen or companies begin selling holdings to service debt, it indicates structural problems that could force liquidations.

企業財庫動向可睇到加密資產財庫模式仲有無可行性。如果企業財庫公司係淨資產值收窄後重啟買入比特幣,代表模式有彈性、能適應。如果一直無買入,甚至開始沽售儲備去還債,就代表存在結構性問題,可能導致進一步拋售。

Miner selling pressure reveals whether producers add to or reduce market supply beyond new issuance. Tracking miner wallet balances shows whether newly mined coins immediately reach exchanges or remain in miner treasuries. Increased miner selling would compound institutional demand weakness, while miner holding would partially offset reduced ETF buying.

礦工沽售壓力可以反映生產者有無額外推高市場供應定相反。監察礦工錢包結餘,可以看到新挖出既比特幣係即時入市套現、定係繼續儲存在礦工手上。如果礦工拋售加劇,會令機構需求減弱問題更加嚴重;如果礦工選擇持有,則可部分抵銷ETF買盤減少帶來既壓力。

Macroeconomic conditions and Fed policy remain the dominant external force. Fed communications, inflation data, employment reports, and market pricing of future rate cuts all provide insight into the macro backdrop for risk assets. Improving conditions that boost equity markets typically support Bitcoin, while deteriorating macro environments create headwinds.

宏觀經濟同聯儲政策仍然係最大外部影響因素。美聯儲講話、通脹數據、就業報告,同市場對未來減息既預期,都可以睇出風險資產既宏觀大環境。如果市況改善、股票升,通常都利好比特幣。如果宏觀環境轉差,就會增加阻力。

Regulatory developments in major jurisdictions could prove decisive. Congressional action on comprehensive crypto legislation, SEC rule-makings, international regulatory coordination, or sovereign adoption announcements all could significantly impact institutional appetite for Bitcoin exposure.

主要地區既監管發展可能起決定性作用。國會針對加密行業立法、美國證監會規則、國際協調監管、主權國家正式採納等,都可以大幅改變機構投資比特幣既意欲。

Investors and market participants face decisions about positioning given this uncertainty. Conservative approaches suggest reducing exposure or maintaining tight stop-losses until demand-supply balance improves. Aggressive strategies might view current prices as opportunities to accumulate, betting that temporary demand weakness will reverse once macro conditions improve. Balanced approaches might maintain positions while hedging downside risk through options or position sizing appropriate to elevated uncertainty.

投資者同市場人士要就不確定性下決定部署。保守策略建議降低倉位或設較緊止蝕,直至供需結構改善。進取策略則視現價為吸納機會,賭需求暫時疲弱有機會因宏觀轉好而逆轉。穩健策略則可能維持持倉,同時用期權對沖、或調節倉位來因應高不確定性。

The central question remains whether Bitcoin's long-term adoption trajectory remains intact despite short-term institutional demand weakness. If Bitcoin represents a legitimate emerging reserve asset and uncorrelated portfolio component, temporary periods where ETF flows disappoint should present buying opportunities rather than reasons for concern. However, if institutional retreat signals that Bitcoin failed to deliver on promises of mainstream financial adoption, current weakness might mark a more significant setback requiring years to overcome.

核心問題在於,比特幣長線採納路徑會唔會因短期機構需求減弱而受到動搖。如果比特幣真係作為新型儲備資產、與市埸其他資產低相關,咁ETF流入短暫令人失望其實係一個買入機會多於一個危機。不過,如果機構撤退係因比特幣未能兌現成為主流金融資產既承諾,今次下跌就可能係更嚴重既挫折,未來需時多年才修復。

Historical perspective suggests patience. Bitcoin has weathered numerous periods of declining demand, adverse headlines, and price drawdowns of 50% or more, only to recover and reach new all-time highs. The cryptocurrency's longest-duration bear market lasted roughly 18 months from the 2021 peak to late 2022's bottom, and that period included spectacular failures like Terra/Luna, Three Arrows Capital, Celsius, FTX, and others that current conditions don't approach in severity.

歷史上的教訓提示要保持耐性。比特幣歷史上經歷過多次需求下跌、負面新聞、甚至價格腰斬超過一半,最終都能夠反彈創新高。比特幣歷來最長既熊市由2021年頂部到2022年底,歷時約18個月,期間有Terra/Luna、三箭資本、Celsius、FTX等大型爆煲事件,規模同嚴重程度都比現時嚴重得多。

The supply-demand framework developed by Rudd and Porter suggests that Bitcoin's fixed supply creates conditions where even modest sustained demand can drive substantial long-term price appreciation. Their modeling indicates that daily withdrawals from liquid supply equivalent to 1,000-4,000 BTC - easily achievable by ETFs during strong periods - could push Bitcoin toward six- or seven-figure prices over 5-10 year horizons if maintained. The challenge is whether institutional demand resumes at levels that enable this trajectory or whether the late 2025 slowdown represents the high-water mark of institutional adoption's first wave.

Rudd同Porter建立既供需分析框架認為,比特幣咁樣既固定供應,可以令即使係溫和、持續既需求都會推高長遠價值。他地既模型指,只要每日從流通供應提取1,000-4,000枚比特幣——呢個數ETF牛市時完全做得到——持續5-10年,就可以推動比特幣升到六位數甚至百萬美元。難題係機構需求會唔會回復到可支持呢個路徑既水平,定係2025年底既回調已經係機構採納既第一波頂峰。

Ultimately, the forward path depends on Bitcoin proving it offers sufficient utility - whether as an inflation hedge, portfolio diversifier, decentralized alternative to traditional finance, or digital store of value - to justify sustained institutional allocation despite volatility and regulatory uncertainty. The coming months will provide crucial data points revealing whether institutional conviction in Bitcoin's value proposition withstands its first significant test since spot ETFs introduced this powerful but volatile new demand channel.

最終,前路取決於比特幣能否證明自己有足夠效用——無論係抗通脹工具、資產配置分散化、去中心化金融替代方案或數碼儲值媒介。只有這樣,才能說服機構在波動與監管不確定下長線配置資金。未來數個月會出現好關鍵既數據,睇下機構對比特幣價值理念既信心,能唔能夠經得起現貨ETF作為需求新渠道出現後第一次大考。

Final thoughts

Bitcoin's journey through 2025 has tested the fundamental proposition underlying its multi-trillion-dollar valuation: that programmed scarcity, by itself, justifies premium pricing and ongoing institutional adoption. The cryptocurrency's fixed supply schedule represents an elegant and immutable feature of its design, distinguishing Bitcoin from fiat currencies subject to inflationary monetary policies and even from gold whose annual mine supply responds to price incentives. The April 2024 halving reduced new issuance to approximately 450 BTC daily, creating mathematical scarcity that Bitcoin advocates argue must drive long-term value appreciation as adoption grows.

比特幣喺2025年既經歷,係對其幾萬億美元市值背後既根本假設作出重大考驗:單靠程式化稀缺,就值得獲得高溢價同源源不絕既機構採納。比特幣既固定供應時間表,係其設計上既優雅不變特徵,令人一眼分到佢同會受通脹政策左右既法定貨幣,甚至同會因價高而增產既黃金都唔同。2024年4月減半後,每日新發行量跌至約450枚,製造出數學上既稀缺,比特幣支持者認為只要採納持續增長,就必然推高價格。

Yet the experience of late 2025 demonstrates that scarcity alone provides insufficient support for prices when demand fails to materialize at expected levels. For the first time in seven months, institutional demand through spot Bitcoin ETFs and corporate treasury accumulation fell below the pace of daily mining supply. This crossing point, confirmed on November 3, 2025, represents a potentially significant inflection in Bitcoin's market structure and challenges the complacent assumption that limited supply automatically translates to ever-increasing prices.

但2025年底既經歷證明,如果需求無出現預期水平,單靠稀缺其實頂唔住價格。7個月內頭一遭,現貨ETF同企業財庫既比特幣吸納,首次低過每日挖礦供應速度。呢個於2025年11月3日確認既臨界點,好可能係比特幣市場結構一個重要拐點,亦對「供應有限就一定年年升」既想當然,構成重大挑戰。

The supply side of Bitcoin's equation has performed exactly as designed. The halving occurred on schedule, cutting issuance with mathematical precision. Miners continue securing the network despite compressed economics, though the massive debt accumulation required to maintain operations introduces concerning fragilities. The protocol's supply schedule extends predictably into the distant future, with each successive halving further reducing new issuance until the final Bitcoin is mined around 2140. This supply reliability stands as one of Bitcoin's core features and differentiators.

供應方面完全根據設計運作:按時減半,發行量經數學計算逐步下調。儘管經濟壓力大,礦工依舊維繫住比特幣網絡,不過為營運積聚咗大量(甚至極大)負債,帶來一定風險。不過協議既供應時間表極有可預測性,每次減半都令增發量再一次下降,直到2140年左右最後一枚比特幣被挖出。呢份供應可靠性係比特幣最重要同獨有特徵之一。

The demand side has proven far less predictable. The spot Bitcoin ETF launch in January 2024 initially delivered on promises of mainstream institutional access, with billions flowing into these products and absorption rates exceeding mining output by multiples. This dynamic powered Bitcoin's appreciation from the $40,000s to above $126,000, validating the thesis that accessible institutional products would unlock substantial pent-up demand. However, the reversal to net outflows through late October, totaling $1.67 billion since October 11 and culminating in $600 million weekly outflows, demonstrated how quickly institutional sentiment can shift.

需求面則遠為難測。2024年1月現貨ETF面世初期,成功帶動主流機構入場,數十億資金湧入,有關產品吸納速度遠超挖礦產出。呢個局勢推動比特幣由$40,000區間升穿$126,000,證明簡易機構渠道真係能釋放強大潛在需求。但年尾轉為大規模資金淨流出,由10月11日至今累計$16.7億,更有$6億一週流走,反映機構情緒之轉變可以極之迅速。

The corporate treasury channel that provided complementary demand also weakened substantially. NAV premiums collapsed across the digital asset treasury sector, blocking the capital-raising mechanism these companies used to acquire Bitcoin. With 188 treasury companies holding substantial positions and many facing significant debt obligations, this demand source may provide limited support until market conditions improve enough to restore equity issuance capabilities.

同時,補充需求既企業財庫渠道都大幅轉弱。數碼資產財庫領域NAV溢價急劇收縮,令相關公司無法再經增發股票去集資購幣。現時有188間企業財庫公司持有大量比特幣,當中唔少都背負巨額債務,呢個需求來源可能要等到市況明顯好轉、集資渠道重開先可以恢復支持。

The implications for investors and market participants are sobering. Bitcoin's scarcity creates potential for supply shocks and dramatic price appreciation when demand growth meets or exceeds supply growth. However, the inverse scenario - where

對投資者同市場人士而言,啟示值得警惕。比特幣稀缺令供應震盪可以引致價格急升——前提係需求增長繼續追上供應。但如果......demand growth lags or reverses - introduces downside risk that scarcity itself cannot prevent. The academic frameworks that model Bitcoin price trajectories demonstrate this symmetry: fixed supply amplifies both upside from demand growth and downside from demand contraction.

需求增長放慢甚至逆轉——這帶來了即使是稀缺性本身也無法防止的下行風險。[學術框架] 模擬比特幣價格走勢時,亦展示了這種對稱性:固定供應不單放大了需求增長時的升幅,亦會放大需求收縮時的跌幅。

Market structure considerations suggest increased importance of monitoring institutional flows. Given that Bitcoin ETFs now dominate price discovery approximately 85% of the time, these products function as the primary transmission mechanism between institutional capital allocation decisions and Bitcoin spot prices. When ETF flows reverse, they directly remove demand from markets while simultaneously signaling deteriorating institutional confidence. This creates both mechanical selling pressure and psychological headwinds that can become self-reinforcing.

市場結構角度下,監察機構資金流變得更加重要。由於比特幣ETF現時已大約85%時間內[主導價格發現],這類產品已成為機構資本配置決定與比特幣現貨價格之間的主要傳導機制。當ETF資金流逆轉時,會直接抽走市場需求,同時釋放機構信心轉弱的訊號。這既會造成機械式的拋售壓力,也會帶來心理阻力,並有機會自我強化。

The forward trajectory depends on factors largely outside Bitcoin's protocol control. Macroeconomic conditions, particularly Federal Reserve policy and broader risk appetite, influence institutional willingness to allocate to volatile, non-yielding assets. Regulatory developments in major jurisdictions can either unlock new institutional participation or introduce additional barriers. Technological improvements in custody, execution, and product structures may reduce friction and expand addressable markets. None of these factors relate to Bitcoin's fixed supply, yet all profoundly impact demand and thus price.

未來發展大致取決於比特幣協議以外的因素。宏觀經濟狀況,特別是美聯儲政策和整體市場風險偏好,會影響機構分配資金到高波動、無收益資產的意欲。主要司法管轄區的監管新進展既可能開放新機構參與,也可能帶來額外障礙。託管、交易執行和產品結構上的科技進步,亦可以減低摩擦和擴大可達市場。這些因素都與比特幣供應量無關,但全部會對需求產生重大影響,從而影響價格。

For long-term investors, the current episode reinforces several lessons. First, Bitcoin remains a high-volatility asset whose price can decline substantially even from elevated levels, regardless of supply constraints. Second, institutional adoption through ETFs represents genuine progress for mainstream acceptance but introduces new volatility sources as institutions prove more fickle than ideologically committed retail holders. Third, the interaction between fixed supply and variable demand creates asymmetric outcomes - massive gains during demand surges and significant drawdowns during demand droughts.

對長線投資者而言,這次事件再次帶出幾個重要教訓。第一,比特幣始終屬高波幅資產,就算在高水平下,價格都可能出現大幅回落,供應受限亦無法避免這一點。第二,透過ETF帶動的機構採納,對主流接納來說確實是一大進展,但同時帶來新的波動來源,因為機構往往比堅定信念的零售持有者更善變。第三,固定供應與變動需求的互動造就了非對稱結果——需求激增時錄得極大升幅,需求銳減時則可見顯著回調。

The thesis supporting long-term Bitcoin investment has not fundamentally changed. The cryptocurrency remains the largest, most secure, and most widely recognized digital asset, with growing infrastructure, improving regulatory clarity, and expanding institutional access. Its supply schedule remains immutable and its scarcity property intact. However, realizing the value that scarcity theoretically creates requires sustained demand growth from institutions, corporations, and individuals who find Bitcoin sufficiently compelling to allocate meaningful capital despite its volatility and uncertainty.

支持長期投資比特幣的論點本質上並無改變。這種加密貨幣依然是規模最大、最安全及最為人認可的數碼資產,基礎設施持續發展、監管環境日益明朗、機構參與渠道亦不斷增加。其供應計劃不可更改,稀缺性亦完好無缺。不過,理論上由稀缺性帶來的價值必須仰賴持續的需求增長——來自機構、企業及個人的資本分配,即使面對波動及不明朗性,都覺得比特幣值得投入可觀資金。

The current supply-demand disconnect may mark an important turning point where the market separates sustainable institutional adoption from speculative excess. If Bitcoin weathers this period of reduced institutional demand and eventually attracts renewed interest at higher price levels, it would strengthen the case for Bitcoin as a maturing asset class finding its place in diversified portfolios. If instead institutional retreat persists or accelerates, it would challenge assumptions about Bitcoin's inevitability and mainstream adoption pace.

目前供求失衡或許標誌住一個關鍵轉折點——市場將可持續的機構採納和純粹投機分離。若比特幣能夠捱過這一輪機構需求減弱時期,之後在較高價格水平再次吸引新興機構興趣,則有助鞏固比特幣作為逐漸成熟資產類別、融入多元化投資組合的重要性。相反,若機構撤退持續或加劇,則會顛覆外界對比特幣不可避免性及主流採纳速度的假設。

The cryptocurrency has survived numerous crises and bear markets through its 16-year history, repeatedly recovering to surpass prior peaks. Whether 2025's institutional demand weakness represents another cyclical challenge Bitcoin will overcome or a more structural setback remains to be determined. The answer will emerge through the daily flow data, on-chain metrics, and price action of coming months as the market digests the reality that scarcity, while necessary, requires sustained demand to translate into sustained value appreciation. The Bitcoin story continues, but its next chapter will be written by the institutional allocators whose enthusiasm has proven more variable than the fixed supply schedule they once found so compelling.

在過去16年,比特幣多次經歷危機和熊市,最終都能走出谷底並創新高。2025年機構需求疲弱究竟只屬另一輪週期性挑戰,比特幣最終會度過,還是屬於更結構性的挫折,仍有待確定。答案將會在未來幾個月的每日資金流數據、鏈上指標及價格走勢中逐步浮現——讓市場真正消化事實,即稀缺性固然重要,但要轉化為長遠價值升值,還得有持續的需求。比特幣的故事仍然繼續,但下一章會由這批機構資金分配者主筆——而他們的熱情,事實上,比最初認為如此吸引的固定供應計劃更為反覆無常。