區塊鏈一直承諾讓金融與協作更加普及。但只要嘗試進行跨鏈代幣交換的人都會發現現實不是如此:多個錢包互動、鏈專屬 Gas 代幣、滑價計算,以及失敗交易導致資金損失的威脅無處不在。區塊鏈潛力與實際可用性之間的鴻溝依然頑固難解。

這時,「以意圖為中心」的設計嶄露頭角,有望根本改變用戶與 Web3 的互動模式。過去,使用者被迫指定每一個交易細節——用哪條鏈、哪個協議、合約調用順序——而意圖為中心的架構只要用戶聲明想要達成的目標,其餘交由底層基礎設施自動處理。

這種變革正如電腦發展史中出現過的範式轉移。從早期必須寫彙編程式指定每個指令,到現在只需點擊、輸入或語音指令達成目的。意圖為中心的設計,也讓區塊鏈從命令式程序(「做這個,再做那個」)進化到聲明式表達(「幫我達成這個結果」)。

自以太坊誕生以來,主流 Web3 一直採用基於交易的模式,用戶必須了解許多本應被抽象掉的技術細節。想跨鏈換幣時,你得先橋接資產、備齊正確 Gas 代幣、找到適合的去中心化交易所、設置滑價參數,還得提防 MEV 機器人搶單。每一步都有摩擦與風險。

像 Anoma、Flashbots 的 SUAVE、CoW Protocol 等項目正在引領另一種方向。這些以意圖為中心的架構引入「解算器」網絡,競爭著最佳實現用戶目標。用戶只需表達想要的結果,由解算器負責複雜執行。如此,Web3 感覺起來將像是完成一件事而非寫程式。

這場變革,對於受複雜流程困擾的一般用戶、忙於跨鏈整合的開發者,以及想突破極限的幣圈生態,影響深遠。不過,以意圖為中心的設計也帶來集中化、隱私、解算器責任等新風險。當這種架構逐漸從理論走向落地,理解其利弊益發重要。

什麼是以意圖為中心的設計?

核心理念是,意圖代表用戶期望達到的「結果狀態」,而不是被規定的操作步驟。從技術上講,意圖是一個簽名訊息,說明用戶想要的結果與限制條件,界定能接受的實現方式。

基於交易和基於意圖的互動方式差異,正體現這一範式轉變。在像以太坊這種基於交易的系統裡,用戶要撰寫明確指令:「對合約 Y 執行函數 X,參數為 Z。」區塊鏈按此指令確定執行,用戶得理解合約界面、管理 nonce、持有 Gas 代幣、預判狀態變化。

意圖為本的系統正好相反。用戶只需宣告:「我希望用資產 A 兌換資產 B,條件為 C。」也許會標明最大滑價容忍度、時間窗口或隱私需求,但不必指定執行細節。第三方解算器收到這些意圖後,競爭尋找最優方案,可動用鏈上流動性、跨鏈橋、鏈下做市商或點對點匹配等各種資源。

具體例子來看,傳統交易模式下,用戶若想用 100 USDC 換 ETH,須:

- 準備 ETH 作為 Gas

- 找到特定 DEX

- 批准 USDC 合約授權

- 計算可接受滑價

- 提交 swapping 交易

- 防範 MEV 攻擊

- 等待確認

在意圖模式下,用戶只要簽署:「我希望 10 分鐘內用 100 USDC 至少換得 X ETH。」接下來解算器競爭提供最佳方案,可能:

- 和有相反需求的用戶點對點清算

- 同時多源路由流動性

- 跨多個 DEX 執行以降低價格衝擊

- 動用鏈下做市商流動性

- 處理全部 Gas 支付及授權細節

Anoma 將這稱為「廣義型意圖」——適用於所有應用類型的意圖,不限於交易。遊戲裡可能是「以最佳價格獲得某道具」;DeFi 則或是「在不同鏈上以最高資本效率維持槓桿頭寸」。系統從關注流程,變成聚焦結果。

這種抽象帶來多重直接好處。用戶不需深厚技術背景即可操作區塊鏈,不必持有多種 Gas 代幣,也更能避免搶跑等陷阱,因為是由多個解算器爭取最佳履約,而不是單純將意圖公開到 mempool 被執行。Web3 操作認知門檻大減。

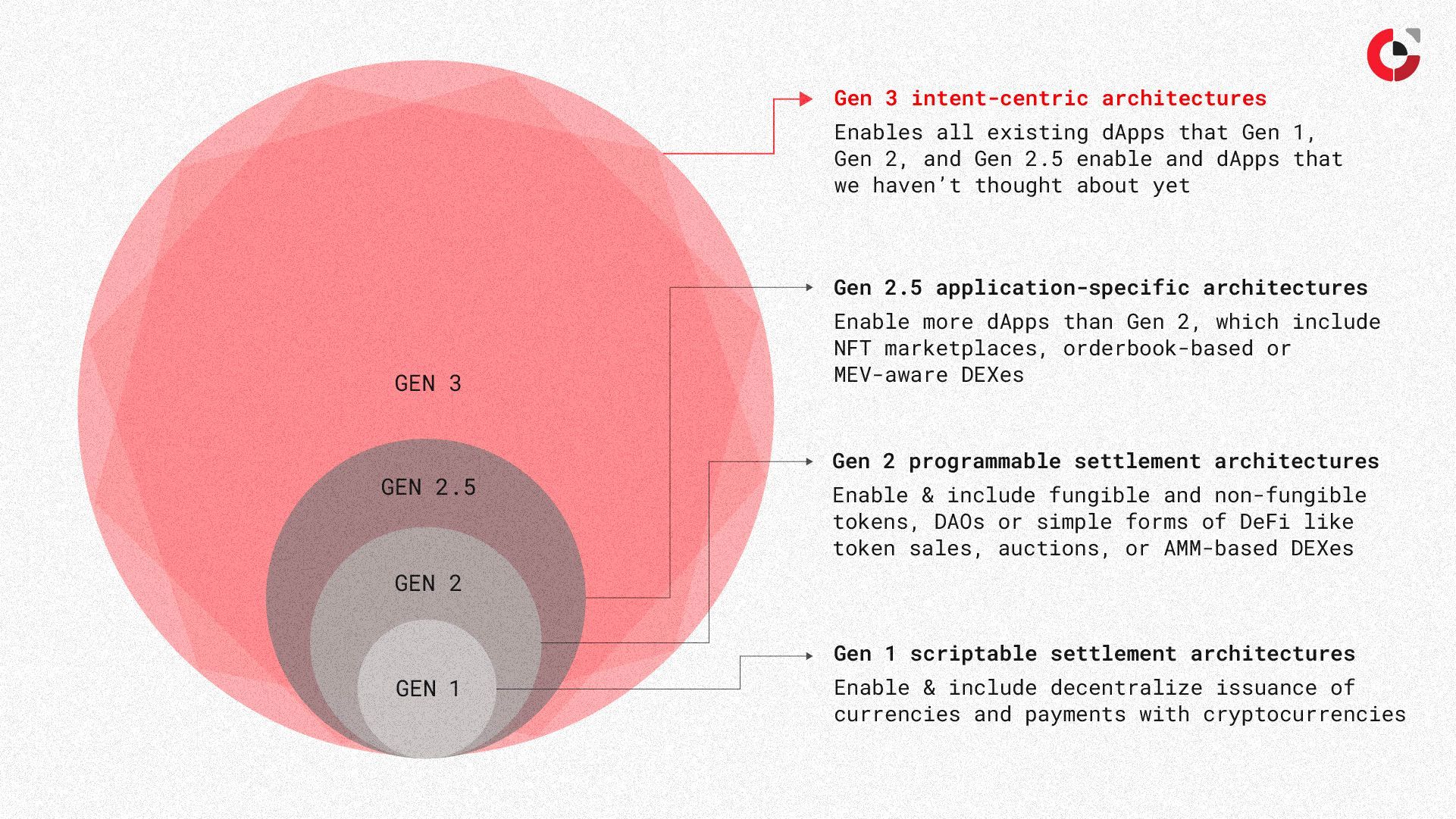

以意圖為中心的架構將應用視為協調系統,基本原子不是「交易」而是「狀態轉換需求」。這新觀點影響協議設計、流動性組織方式與價值流動路徑。某些研究人員稱之為區塊鏈「第三代架構」——繼比特幣的指令性結算、以太坊的可編程結算之後。

各項目如何搭建意圖層

多個主要項目正積極建構以意圖為中心的基礎設施,各有不同的技術方案。

Anoma:意圖運行系統

Anoma 自定位為意圖型應用的分散式作業系統。不是作為應用層加在既有鏈上,而是意圖出發重新設計整體架構。其技術重點包括:

意圖機器(Intent Machine) 負責處理用戶意圖並協調執行。就像以太坊虛擬機把交易轉成狀態變化,Anoma 的意圖機器將意圖轉成狀態變化。用戶透過各種應用表達期望,這些意圖經去中心化 gossip 網絡廣播。這根本不同於傳統 mempool 僅傳遞可執行交易。

解算器 是 Anoma 網絡的專業節點,負責聆聽意圖廣播並尋找相符的對手。假如 Alice 想買 NFT、Bob 想賣,解算器促成撮合,提出能在任何互通鏈原子結算的平衡交易。Anoma 重要在支援廣義意圖——不只限金融交易,還能協調複雜多方需求。

Anoma 資源機器(ARM) 則負責約束有效狀態更新,角色相當於 EVM,但專門為意圖型運算設計。ARM 採用資源導向的狀態模型,資源可代表任何資產及其生成、消耗邏輯。此抽象比傳統帳戶或 UTXO 更具可組合彈性。

Anoma 的設計跳脫「一切圍繞區塊鏈」的限制,思考除了結算以外區塊鏈是否真的必要。設計將底層鏈統一成單一開發環境,消除用戶與狀態碎片,方便開發一次即部署至多鏈。

項目已籌集逾六千萬美金,有 Polychain Capital、Coinbase Ventures、Electric Capital 等知名投資機構背書。Anoma 正準備主網上線,初步規劃先落地以太坊,再拓展到更多生態。

SUAVE:Flashbots 為 MEV 打造的意圖層

專注 MEV 緩解的研究組織 Flashbots,正開發 SUAVE(Single Unifying Auction for Value Expression),作為多鏈共用 mempool 及排序層。SUAVE 結構路線與 Anoma 有別,重點針對 MEV 供應鏈與訂單流。

SUAVE 以專用區塊鏈形式運作,主要解耦 mempool 並... block builder role from existing chains. Rather than users submitting specific transactions to individual chain mempools, they submit preferences – intents – to SUAVE's universal auction. These preferences can range from simple ("swap A for B") to complex ("rebalance my portfolio across chains while maximizing yield").

現有鏈上的區塊構建者角色。用戶不再需要將特定交易提交到單個鏈的內存池(mempool),而是將偏好——即「意圖」——提交到 SUAVE 的全域拍賣系統。這些偏好可以很簡單(「將 A 兌換成 B」),也可以很複雜(「在多條鏈之間重新平衡我的投資組合並最大化收益」)。

The architecture introduces several novel components. SUAVE uses confidential computing through Intel SGX to allow computation on sensitive user order flow without revealing information to potential exploiters. This addresses a fundamental tension: solvers need information to provide optimal execution, but too much information enables MEV extraction.

這個架構引進了多項新穎組件。SUAVE 採用機密運算(Confidential computing),透過 Intel SGX 執行敏感用戶訂單流的計算,但不會將資訊暴露給潛在的惡意利用者。這針對了一個根本性張力:求解者(solvers)需要資訊來提供最佳執行,但過多的資訊容易促成 MEV(最大可提取價值)的發生。

Block builders who only operate on a single chain find themselves at a disadvantage due to cross-domain MEV. SUAVE allows builders to capture value across multiple chains simultaneously. Validators maximize revenue on their blockspace. Users transact privately with better execution and minimal fees. The design aims to prevent centralization induced by cross-chain MEV extraction.

僅在單一區塊鏈運作的 block builder,因跨域 MEV 而處於劣勢。SUAVE 讓 block builder 能夠同時在多條鏈上捕獲價值。驗證者可以最大化自身區塊空間的收益。用戶則可以以更佳的執行和最低的手續費私密進行交易。這種設計旨在避免因跨鏈 MEV 提取導致的中心化。

SUAVE's roadmap includes progressive decentralization milestones. Early versions use trusted execution environments with assumptions about Flashbots, while later versions move toward fully decentralized operation. The project explicitly invites competitors to participate, recognizing that distributing MEV infrastructure serves the ecosystem's long-term health better than any single entity controlling it.

SUAVE 的發展藍圖包含了逐步去中心化的里程碑。早期版本使用可信執行環境(TEE)並假設 Flashbots 的信任,未來將朝全面去中心化營運邁進。該專案也明確邀請競爭者參加,因為他們認識到,分散 MEV 基礎設施比由單一實體獨占,更有利於生態長期健康發展。

While SUAVE focuses more on searcher intents than general user intents currently, the infrastructure provides a foundation for broader intent-based applications. As the system matures, it may expand to handle more diverse intent types beyond order flow optimization.

雖然 SUAVE 目前主要聚焦於搜尋者意圖而非一般用戶意圖,但其基礎設施為更廣泛的意圖型應用奠定了基礎。隨著系統逐步成熟,未來也可能擴展支援各種更豐富的意圖類型,而不只限於訂單流優化。

CoW Protocol: Practical Intent-Based Trading

CoW Protocol:實用的意圖型交易

CoW Protocol pioneered intent-based trading in 2021, making it one of the earliest production implementations of these concepts. The protocol's name references "Coincidence of Wants" – the economic concept where two parties desire each other's goods and can trade directly without intermediaries.

CoW Protocol 在 2021 年率先推出意圖型交易,成為最早落地這一概念的協議之一。該協議名稱意指「Coincidence of Wants」(需求巧合),即雙方都想要對方手上的資產,從而直接撮合交易而無需中介。

CoW Protocol works by collecting trades over time into batches. Users sign off-chain orders expressing their trading intent: desired assets, acceptable price ranges, time limits. These intents flow to a network of solvers who compete in auctions to provide the best execution for the entire batch.

CoW Protocol 的運作方式是將一段期間內的交易收集為批次處理。用戶以鏈下簽名的方式發出訂單,清楚表達自身的交易意圖:期望的資產、可接受的價格範圍、時間限制等。這些意圖會流向一個解決者網路,在拍賣中競爭,爭取為整批訂單提供最佳執行。

Solvers can fulfill intents through multiple methods:

- Direct matching: When two users want opposite trades, solvers match them peer-to-peer without using on-chain liquidity

- Ring trades: Multi-party circular trades that optimize across several simultaneous intents

- DEX aggregation: Routing through existing AMMs, combining liquidity sources

- Private market makers: Tapping off-chain liquidity when profitable

解決者可以通過多種方式滿足用戶意圖:

- 直接撮合:當兩名用戶想要相反方向的交易時,解決者能點對點匹配訂單,完全不佔用鏈上流動性

- 環狀交易:多方圓環型交換,針對多筆同時意圖進行整體最佳化

- DEX 聚合:路由至現有自動化做市商(AMM)等,整合多重流動性來源

- 私有做市商:有利可圖時可動用鏈下流動性

The batch auction mechanism provides natural MEV protection. All trades within a batch execute at uniform clearing prices, eliminating first-come-first-served dynamics that enable front-running. Solvers bear gas costs, meaning users pay nothing if trades fail to meet their specified minimums.

批次拍賣機制自帶 MEV 防護。同一批次內所有交易均以一致的成交價格成交,消除先搶先贏帶來的搶跑行為。解決者承擔 gas 成本,意味者交易如果未達到用戶最低標準,用戶無需支付任何費用。

CoW Swap has processed over $30 billion in volume, saved users more than $82 million in surplus through optimal execution, and grown to capture 63% market share among intent-based DEX aggregators. The protocol demonstrates that intent-based architectures can work at scale today, not just in future systems.

CoW Swap 已促成超過 300 億美元的交易量,並通過最優執行為用戶節省超過 8,200 萬美元的價值,在意圖型 DEX 聚合器中市佔率達 63%。由此證明,意圖架構已可在當前規模下運作,而並非僅屬於未來藍圖。

Other Notable Projects

其他重要專案

Several other projects contribute to the intent-centric ecosystem:

還有數個專案也在推動意圖為中心的生態:

-

Essential: Building intent-only protocols from the ground up, where no user-submitted transactions exist – only batched intent solutions

-

UniswapX: Uniswap's intent-based routing using Dutch auctions and filler networks, with cross-chain capabilities launching in 2024-2025

-

Across Protocol: Proposing standards for cross-chain intent interoperability alongside UniswapX

-

1inch Fusion: Intent-based swap routing from the established DEX aggregator

-

DappOS: Infrastructure for intent-centric application interaction, including intent assets and intent execution

-

Essential:從零開發純意圖型協議,完全無用戶提交的傳統交易,僅有批次意圖解決方案

-

UniswapX:Uniswap 推出的意圖型路由,結合荷蘭競標與填單網路,跨鏈功能預計 2024~2025 年推出

-

Across Protocol:與 UniswapX 一同推動跨鏈意圖標準化及互通性

-

1inch Fusion:既有 DEX 聚合器的意圖型兌換路由

-

DappOS:專注意圖導向應用互動的基礎設施,支援意圖資產及意圖執行

These projects share common technical patterns: off-chain intent broadcasting, competitive solver networks, on-chain settlement verification, and cross-chain coordination. The diversity of approaches suggests the space is still exploring which architectural choices prove most effective.

這些專案有許多共通技術模式:鏈下意圖廣播、競爭性解決者網路、鏈上結算驗證與跨鏈調度。方法百花齊放,顯示整個領域仍處於摸索最有效架構路線的初期階段。

Why Intent-Centric Architectures Matter

意圖為中心的架構有何重要性?

Intent-centric design addresses several fundamental problems plaguing Web3 adoption and efficiency. The benefits span user experience, economic optimization, and systemic resilience.

意圖導向設計能解決困擾 Web3 普及和效率的根本性問題。其優勢橫跨用戶體驗、經濟最適化與系統韌性。

Dramatic Improvement in User Experience

用戶體驗劇烈提升

The most immediately visible benefit is radical simplification of the user journey. Current Web3 systems are complex and present barriers to entry, requiring users to navigate fragmented infrastructure. A user wanting to participate in DeFi across multiple chains faces daunting complexity: managing multiple wallets, holding various gas tokens, understanding protocol-specific interfaces, monitoring for optimal timing, and constantly worrying about MEV exploitation.

最直接可見的好處就是極大化簡用戶流程。現今 Web3 系統極為複雜並形成進入障礙,用戶需在破碎的基礎設施中來回切換。若想在多鏈參與 DeFi,要同時管理多個錢包、持有不同鏈的 gas 代幣、熟悉協議特有介面、觀察執行時機,還要時刻擔心遭遇 MEV 掠奪。

Intent-centric systems collapse this complexity. Users specify desired outcomes in natural terms. The system can even use AI interfaces to translate plain English into formal intents: "I want to rebalance my portfolio to 60% ETH, 30% stablecoins, 10% LINK" becomes a structured intent that solvers automatically fulfill.

意圖導向系統徹底簡化了上述複雜性。用戶只需以自然語言表達想達成的結果,系統甚至能結合 AI 介面將英文語句自動化為明確意圖:「我想將資產重新配置成 60% ETH、30% 穩定幣、10% LINK」——解決者便能自動完成撮合執行。

This abstraction particularly benefits less sophisticated users. Today's average DeFi user struggles to access the types of execution and pricing only available to well-capitalized firms with in-house technical teams. Intent-based architectures democratize access to institutional-grade execution.

這種抽象最受一般大眾用戶受惠。目前多數 DeFi 用戶難以觸及只有機構或技術團隊才能實現的高級執行與定價。意圖型架構則徹底打破門檻,讓所有人都享有機構等級的待遇。

Failed transactions cost users nothing in gas with intent systems – solvers bear those costs. Users need not hold chain-specific gas tokens; solvers collect fees in the tokens being traded. The friction of managing technical minutiae decreases, while confidence in optimal execution increases.

意圖系統下,無論成交與否,用戶一律無須負擔 Gas 費——解決者自行承擔相關開支。用戶不必預存各鏈 gas 代幣,解決者直接以兌換資產收取合理費用。繁瑣技術事務的摩擦越來越小,對最佳執行的信心則顯著提高。

MEV Reduction and Value Recapture

降低 MEV,價值回饋用戶

Miner/Maximal Extractable Value represents billions in value extracted annually from blockchain users. Traditional transaction models expose users to front-running, sandwich attacks, and other forms of predatory extraction. Public mempools broadcast users' intentions before execution, giving sophisticated actors time to exploit them.

所謂 MEV(最大可提取價值)每年自區塊鏈用戶身上吸走數十億美元。傳統交易模式把用戶曝露於搶跑、三明治攻擊等各種掠奪傷害之中。公開內存池早早將意圖外洩,讓惡意攻擊者伺機而動。

Intent-centric architectures change these dynamics fundamentally. Since users sign intents rather than executable transactions, there's essentially no way to front-run an intent. Solvers compete to provide the best outcome for the signed state change, but the execution path remains flexible. This removes the predictability MEV bots exploit.

意圖導向架構徹底顛覆這一現狀。用戶簽名的是「意圖」而非可直接執行的交易,因此本質上不存在被前置搶跑的可能。解決者要競相爭取最佳執行結果,具體路徑則保持彈性,消除了 MEV 機器人所需的可預測性。

Batch auction mechanisms like those used by CoW Protocol aggregate orders over time windows, further reducing MEV opportunities. When multiple trades execute simultaneously at uniform prices, the traditional MEV extraction vectors disappear. What value does exist gets competed away by solver networks rather than captured by malicious actors.

如 CoW Protocol 採用的拍賣機制,將訂單在時間窗中聚合,進一步降低 MEV 空間。多筆交易同時、同價成交,傳統 MEV 收割向量將不復存在。現存價值將由解決者網路透過競爭回饋用戶,而非被惡意人士瓜分。

Importantly, intent systems don't eliminate MEV entirely – they transform it from extractive to productive. Solvers in competitive networks bid value back to users rather than extracting it. The criterion for winning becomes maximizing user satisfaction rather than exploiting information asymmetries.

特別重要的是,意圖系統並非徹底消滅 MEV,而是將其從「掠奪型」轉化為「增值型」——解決者於競爭網絡中將價值返還用戶,贏家標準不再是資訊不對稱下的巧取豪奪,而是誰能最大化用戶利益。

Cross-Chain Interoperability and Composability

跨鏈互通性與可組合性

Perhaps the most profound impact comes from how intent-centric design handles the multi-chain reality of Web3. Today's ecosystem is fragmented across Layer 1s, Layer 2s, and sidechains, each with isolated liquidity and user bases. Moving value between chains requires bridges, wrapped assets, and complex trust assumptions.

意圖導向設計對多鏈現實的處理,或許是其最深遠的影響。目前的生態系切割於不同 Layer 1、Layer 2 與側鏈,各自資金孤島、用戶群分散。跨鏈轉移資產需倚賴橋接、包裝資產與各種信任假設,極其繁雜。

Intent-centric architectures enable composability at the intent level rather than the transaction level, unifying state across connected chains. Users express intents without specifying which chain executes them. Solvers determine optimal execution venues, potentially splitting large orders across multiple chains or routing through whichever venue offers best liquidity at that moment.

意圖型架構將可組合性提升到「意圖層級」而非傳統交易層級,統一互聯鏈上的狀態。用戶僅需描述「我想做什麼」,而非指定「在哪條鏈」執行。解決者根據流動性情況,自動決定最佳執行場域,大型訂單甚至能智慧拆分於多個鏈上同時兌換。

This abstraction benefits developers as much as users. Rather than deploying separate smart contracts per chain and managing cross-chain messaging complexity, developers can write intent-centric

這種抽象對開發者同樣大有裨益。開發者不再需要為每鏈單獨部署智能合約與維護複雜的跨鏈訊息機制,而是能專注於設計意圖為本的新型應用......applications once. The underlying infrastructure handles chain-specific details. Applications become truly portable, following liquidity and users rather than being locked to specific chains.

基礎設施會處理不同鏈的細節,讓應用程式只需部署一次就能運作在多條鏈上。應用因此真正實現可攜性,隨流動性及用戶移動,而不再被鎖死在某一條鏈上。

The intent layer can aggregate liquidity across all connected domains, solving the chicken-and-egg problem where new chains struggle to bootstrap usage without liquidity. If users and solvers participate in a unified intent network, liquidity fragmentation becomes less critical. Orders flow to wherever they can be optimally filled.

意圖層能聚合所有連接網域的流動性,有望解決新鏈因缺乏流動性而難以啟動使用量的「雞生蛋蛋生雞」問題。如果用戶和解決者都參與在統一的意圖網路,流動性的碎片化問題就不再那麼嚴重。訂單會自動流向最佳執行的位置。

Capital Efficiency and Innovation

資本效率與創新

Intent-based models enable new forms of capital efficiency. When solvers can use their own inventory to facilitate trades, capital no longer needs to sit idle in liquidity pools. Professional market makers can provide liquidity dynamically, only deploying capital when profitable opportunities arise.

基於意圖的模型帶來全新型態的資本效率。當解決者能自行用庫存來協助交易時,資金不必再閒置於流動性池中。專業做市商可根據市場狀況動態提供流動性,只在有利可圖時才部署資本。

The system unlocks use cases that couldn't exist in traditional transaction models. Complex multi-party coordination becomes feasible when expressing outcomes rather than choreographing exact execution sequences. Applications that were impractical due to high gas costs or coordination complexity become viable when intent networks handle the execution details efficiently.

這類系統解鎖了傳統交易模式難以實現的全新應用。當重點轉為表達最終目標(outcome),而不是編排精確的執行順序時,複雜的多方協調流程也變得可行。過去因高gas費用或協同複雜度而難以發展的應用,現在只要意圖網路高效處理執行細節,都有可行性。

What the Transition Looks Like: From Smart Contracts to Intent Layers

轉型會是什麼模樣:從智慧合約到意圖層

Understanding where intent-centric design fits in blockchain's evolution provides perspective on its significance and likely trajectory.

了解以意圖為核心的設計在區塊鏈發展中扮演的角色,有助於掌握它的重要性與未來趨勢。

The Evolution of Web Architectures

Web架構的演進

Web1 was read-only: static pages served from centralized servers. Users consumed content but rarely participated in creating it. The architecture reflected this passivity – simple HTML pages with minimal interactivity.

Web1 是唯讀的:靜態頁面直接由中心化伺服器提供,用戶只能消費內容,很少參與內容創作。這種架構體現了被動性—HTML頁面極為簡易,幾乎無互動。

Web2 introduced user-generated content and dynamic applications but maintained centralized control. Platforms like Facebook and Google enabled participation while capturing data and value centrally. Users traded control for convenience, creating the surveillance capitalism model that Web3 aims to disrupt.

Web2 引入了用戶產生內容(UGC)與動態應用,但仍保持中心化控制。像Facebook、Google這類平台讓用戶參與,卻將資料和價值收歸於己。用戶以放棄控制權換取便利,催生了Web3想要顛覆的「監控資本主義」模式。

Web3's first generation, exemplified by Bitcoin, introduced scriptable settlements. Users could program money with basic conditional logic, but the scripting language remained deliberately limited. Bitcoin proved blockchains could work but offered restricted expressiveness.

Web3 第一代,以比特幣為代表,引入可撰寫腳本的結算方式。用戶可以用簡單條件邏輯來程式化貨幣,但腳本語言設計上有諸多限制。比特幣證明了區塊鏈可行,但在表達力上有很大侷限。

Ethereum pioneered second-generation architecture with fully programmable settlements. The EVM enabled arbitrary computation, spawning an explosion of applications: tokens, DAOs, DeFi protocols, NFT marketplaces. But this programmability came with complexity. Users became de facto programmers, composing transactions from smart contract calls.

以太坊開創了第二代架構,提出全可編程結算方式。EVM實現任意運算,催生出各式應用:代幣、DAO、DeFi協議、NFT市集等。然而高度的可程式化也帶來複雜性,用戶基本上都變成「半程式設計師」—需要以多筆智慧合約呼叫來組合交易。

The limitation of Gen 2 architectures became apparent as applications grew sophisticated. Complex applications like NFT marketplaces and orderbook DEXes require centralized components for counterparty discovery and optimization – functions the blockchain itself doesn't provide efficiently. These Gen 2.5 architectures work but compromise on decentralization.

隨著應用複雜度提升,第二代架構的瓶頸日益明顯。像NFT市集及訂單簿型DEX等複雜應用常需部分中心化組件以配對對手方及最佳化撮合—這些並非區塊鏈上能高效原生提供的功能。這類「2.5代」架構雖可運作,但對去中心化程度妥協。

Third-generation intent-centric architectures aim to provide end-to-end decentralization for arbitrary application types. By making intents the fundamental primitive, these systems offer generalized intent completion, counterparty discovery, solving, and settlement – everything applications need without forcing them into blockchain-centric designs.

第三代以意圖為核心的架構,目標是在不同應用型態下都能落實徹底去中心化。以「意圖」作為基礎原語,這些系統能普遍支援意圖撮合、對手方發現、解決、結算等一切應用需求,無須勉強貼合區塊鏈本位設計。

What Changes for Developers

對開發者的改變

The shift to intent-centric architectures transforms the developer experience fundamentally. Today's blockchain developers must:

- Master multiple programming languages (Solidity, Rust, Move)

- Understand each chain's specific quirks and gas models

- Build custom bridges and cross-chain messaging

- Implement their own MEV protection

- Handle edge cases around chain reorganizations

- Optimize for expensive on-chain computation

切換到以意圖為核心的架構會徹底改變開發者的體驗。現今區塊鏈開發者必須:

- 精通多種程式語言(如Solidity、Rust、Move)

- 瞭解每條鏈的特殊規則和Gas模型

- 開發客製化橋接與跨鏈訊息方案

- 自行實作MEV防護

- 處理鏈的重組等邊緣狀況

- 最佳化高昂的鏈上運算

Intent-centric development abstracts many of these concerns. Developers define intent languages – the vocabulary of desires their applications understand. The underlying infrastructure handles execution details. Rather than writing separate implementations per chain, applications become portable by default.

以意圖為核心的開發抽象掉這些繁瑣問題。開發者只需定義意圖語言—即應用能理解的「需求字彙」,底層基礎設施會處理所有執行細節。不必再針對各鏈寫不同實作,應用天生就有可移植性。

This mirrors earlier transitions in software development. Developers once managed memory allocation manually; now garbage collectors handle it. Developers once wrote platform-specific code; now frameworks provide cross-platform abstractions. Intent-centric design brings similar abstraction to blockchain development.

這就像早期軟體開發的轉變:以前程式設計師要自己管理記憶體分配,現在有垃圾回收機制;以前需撰寫特定平台代碼,現在則由框架提供跨平台抽象。以意圖為核心的設計,為區塊鏈開發帶來類似層次的抽象。

The transition won't happen overnight. Existing smart contracts represent significant investment and network effects. Migration paths must exist for current applications to incorporate intent-based interactions gradually. Hybrid architectures will likely dominate the transition period, with intent layers wrapping traditional transaction systems.

這場轉變不會一蹴可幾。現有智慧合約已投入大量資源並具備網路效應,必須留有現有應用逐步過渡到「基於意圖」互動的路徑。在過渡期內,混合架構很可能成為主流,由意圖層包裹傳統的交易系統。

What Changes for Infrastructure

對基礎設施的改變

The infrastructure layer shifts from chains competing for applications to solver networks competing for order flow. Chains become settlement layers rather than execution environments. The valuable real estate moves up the stack to intent orchestration and solver networks.

基礎設施層將從「各鏈爭奪應用」轉變為「解決者網路搶單」。區塊鏈本身轉為純結算層,而非運算執行環境。價值重心將往上移到意圖編排與解決者網路。

This redistribution of value and power has significant implications. MEV searchers can transition to becoming solvers, using similar skills but in a value-positive rather than value-extractive context. Liquidity providers might operate differently, providing just-in-time liquidity rather than parking capital in pools. Validators' role becomes verifying intent fulfillment rather than ordering transactions.

這種價值與權力重分配帶來重大影響。MEV獵人可轉型為解決者,運用相似技巧,但在「增值」而非「抽值」的體制下競爭。流動性提供者不再只是將資本鎖池,而是提供即時流動性。驗證者角色則轉為驗證意圖是否成功實現,而不光是排序交易。

New infrastructure needs emerge: intent gossip networks, solver reputation systems, constraint satisfaction engines, cross-chain settlement protocols. The ecosystem requires standards for expressing intents, allowing different systems to interoperate. Without standards, the space risks fragmenting into incompatible intent silos.

新型基礎設施需求也隨之出現:意圖流言網、解決者聲譽系統、約束滿足引擎、跨鏈結算協議等。生態系需建立意圖表達標準,才能實現不同系統互通。若無標準,意圖空間恐碎片化成數個不兼容的小孤島。

What Goes Wrong? Risks and Trade-Offs

可能出現的問題、風險與取捨

Like any architectural shift, intent-centric design introduces new attack vectors, centralization risks, and unintended consequences alongside its benefits.

像所有架構轉型一樣,以意圖為中心的設計同樣帶來新的攻擊面、中心化風險及預期外的影響。

Solver Centralization

解決者中心化

Perhaps the most significant risk involves solver network centralization. Running competitive solver infrastructure requires sophisticated technical capabilities and significant capital. Solvers must maintain inventory across multiple chains, run complex optimization algorithms, manage gas costs, and respond with minimal latency.

最顯著的風險或許是解決者網路的中心化。要營運有競爭力的解決者基礎設施,需高度技術力與大量資本。解決者需要在多條鏈上維持庫存,運作複雜的最佳化演算法,管理gas成本,並做到低延遲反應。

These requirements create barriers to entry. If only a handful of entities can effectively solve intents, the system reintroduces centralization under a new name. A few dominant solvers could collude to offer suboptimal execution, extracting value similarly to how MEV bots exploit traditional systems. Users gain simplified interfaces but lose the decentralization that made blockchain compelling.

這些門檻阻礙了多元參與。若只有少數實體能高效執行意圖,整個系統實際上換個名字又回到中心化。若僅有少數大型解決者出現,甚至有共謀空間提供次佳執行,與傳統MEV機器人抽走價值無異。用戶得到易用介面,但失去區塊鏈最初追求的去中心化。

Some protocols use permissioned solver networks initially, requiring whitelisting to participate. This ensures execution quality but contradicts Web3's permissionless ethos. The challenge lies in designing mechanisms that maintain quality while allowing open participation.

某些協議在早期導入白名單制解決者網路,確保執行品質,卻與Web3強調的無許可性精神背道而馳。難題在於如何兼顧開放參與與品質管控。

Reputation systems, stake requirements, and slashing mechanisms might mitigate these risks. Solvers could post significant bonds that get slashed if misconduct is detected. Users could monitor solver performance publicly and route intents to trustworthy operators. But these mechanisms add complexity and may not fully solve the centralization problem.

聲譽系統、押注要求、懲罰機制都可能減少風險。解決者可強制抵押資金,一旦行為不當直接沒收。用戶也可以公開監控解決者表現,把意圖下給可信營運者。但這些措施都會拉高複雜度,也未必完全根除中心化問題。

Privacy Concerns

隱私疑慮

Expressing intents publicly creates information leakage risks. Broadcasting that you want to trade large amounts reveals your strategy, potentially allowing solvers or observers to front-run at the intent level rather than transaction level. While intents provide some protection through competitive solving, they don't eliminate all information asymmetry.

將意圖公開表達會產生資訊洩漏風險。公開你有大量交易需求會讓策略曝光,有可能被解決者或旁觀者以意圖級別而不是交易級別進行搶先交易。雖然意圖透過競爭性解決者有一定保護,但仍難消除所有資訊非對稱。

SUAVE addresses this using trusted execution environments, but these introduce security assumptions around Intel SGX and similar hardware. Cryptographic approaches like zero-knowledge proofs offer stronger privacy guarantees but come with significant computational overhead.

SUAVE透過可信執行環境(TEE)嘗試解決,但這引入對Intel SGX等硬體的信任假設。類如零知識證明等密碼學方法則雖可強化隱私,但計算負擔極重。

The design space involves difficult tradeoffs. Solvers need information to provide optimal execution, but too much information enables exploitation. Finding the right balance remains an open research problem, with no clear winning solution yet.

這其中涉及艱難的取捨。解決者需足夠資訊來優化執行,但過多資訊又會被濫用。如何取捨仍是待攻克的開放性研究難題,目前尚無明確最佳方案。

Implementation Complexity and Latency

實作複雜度與延遲

Building intent-centric systems involves substantial technical complexity. Efficient intent matching across potentially millions of users requires sophisticated algorithms. Cross-chain settlement introduces coordination challenges and latency. Ensuring atomic execution when multiple chains are involved demands careful protocol design.

打造以意圖為核心的系統需克服高度技術複雜度。要在數百萬用戶間高效配對意圖,需要先進演算法。跨鏈結算帶來協調與延遲問題。多鏈參與時要確保原子性執行,則需謹慎協定設計。

These complexities can introduce failure modes. What happens when optimal solving takes longer than users tolerate? How do systems handle partial fulfillment?

這些複雜度會帶來新的失敗風險。例如,最優解決若超過用戶可忍受的等待時間怎麼辦?如果只能部分撮合,又該如何處理?What recourse do users have when intents expire unfulfilled? Traditional transaction systems provide predictable outcomes; intent systems add uncertainty about if and how execution occurs.

用戶在意圖過期未被實現時可以有什麼申訴方式?傳統的交易系統提供可預測的結果,但意圖系統則增加了執行是否及如何發生的不確定性。

Standardization challenges compound these technical hurdles. Without common intent expression formats, different systems can't interoperate. But premature standardization might lock in suboptimal designs. The ecosystem must balance moving fast with building robust foundations.

標準化的挑戰讓這些技術障礙更加複雜。沒有統一的意圖表達格式,不同系統無法互通協作。但過早標準化又可能導致欠佳的設計被固化。整個生態系統必須在快速推進與建立堅實基礎之間取得平衡。

Smart Contract Legacy and Migration

The existing Web3 ecosystem contains billions in locked value across smart contracts built on transaction-based models. These contracts cannot simply be rewritten overnight. Migration paths must exist for gradual adoption of intent-centric designs.

當前的 Web3 生態圈中,數十億美元價值鎖定於以交易為基礎的智能合約中。這些合約無法在一夜之間全部改寫。意圖為本設計的逐步遷移路徑至關重要。

Hybrid architectures where intent layers wrap existing contracts provide one solution, but add complexity. Developers must learn new paradigms while maintaining legacy systems. Users face confusion about which applications support which interaction models. The transition period creates fragmentation rather than unity.

「混合架構」讓意圖層包覆現有合約,這是一種可行方案,但會增加系統複雜度。開發者必須學習新模型,同時維護舊系統。用戶會對哪些應用支持哪些互動模式感到困惑。這段過渡時期會造成碎片化,而非統一。

Developer education poses another challenge. The mental model shift from imperative transaction programming to declarative intent expression is significant. Current blockchain developers have deep expertise in specific languages and patterns; retraining takes time. Universities and bootcamps have just begun teaching Solidity; intent-based development adds another learning curve.

開發者教育也是一大挑戰。從命令式的交易編程思維轉向宣告式的意圖表達,這是很大的改變。[現有區塊鏈開發者多精通特定語言與模式];重新培訓需時。大學與訓練營也才剛開始教 Solidity,意圖導向開發又要增加新學習曲線。

Accountability and Recourse

Transaction-based systems provide clear accountability. If your transaction fails or behaves unexpectedly, you can examine the exact sequence of operations. Intent-based systems abstract execution away, making it harder to understand what went wrong when outcomes don't match expectations.

基於交易的系統具有明確問責制。如果交易失敗或有異常,你可以檢查執行過程的每一步。[意圖導向系統則將執行過程抽象化],導致結果不符預期時更難追查問題原因。

Who is responsible when a solver provides suboptimal execution? What recourse do users have? How can they prove a solver acted maliciously rather than making an honest error? These questions lack clear answers in many current designs. Building accountability frameworks for intent-centric systems remains crucial for user protection.

當解決者執行不理想時,誰該負責?用戶有何申訴途徑?他們如何證明解決者是惡意行為而非誠實錯誤?這些問題在很多現有設計中都沒有明確答案。為意圖導向系統建立問責架構,對於用戶保護至關重要。

Pre-Token Launch Checklist for Intent-Based Projects

Teams preparing to launch tokens in intent-centric systems face unique considerations beyond typical token launch preparations. These projects must align tokenomics with the underlying solver network dynamics and intent matching mechanisms.

準備在意圖導向系統上發行代幣的團隊,需面對常規代幣發行外的特殊考量。這些項目必須讓代幣經濟模型與解決者網路動態及意圖匹配機制一致。

Define Clear Intent Language and Protocols

Successful intent-based projects require unambiguous intent expression standards. Teams should:

成功的意圖導向項目,需要明確無誤的意圖表達標準。團隊應該:

Document intent schemas comprehensively: Specify exactly what types of intents the system supports, how users express constraints, what parameters are required versus optional. Intent languages must be expressive enough to capture user desires while remaining parseable by solver networks.

完整記錄意圖結構:明確說明系統支援哪些意圖類型、用戶如何表達限制條件、哪些參數是必填、哪些是選填。[意圖語言需足夠強大],既能表達用戶需求,又能被解決者網路解析。

Provide developer SDKs and tooling: Building applications on intent-centric systems requires different tools than transaction-based development. Clear documentation, code examples, and testing frameworks lower adoption barriers.

提供開發者 SDK 與工具:開發意圖導向應用需要和交易導向不同的工具。清晰的說明文件、程式範例和測試框架可以降低採用門檻。

Consider future extensibility: Intent languages should support evolution. New intent types will emerge; the standard should accommodate them without breaking existing implementations. Versioning schemes and deprecation policies matter.

考量未來可擴展性:意圖語言要能支持未來演變。新型意圖會不斷出現,標準需能兼容而不破壞現有實作。版本管理與淘汰政策也很重要。

Build or Partner for Solver Infrastructure

Solver networks represent the execution backbone of intent systems. Token projects must ensure robust solving capacity:

解決者網絡是意圖系統的執行主樞。發行代幣的項目須確保有強健的解決能力:

Bootstrap initial solver participation: Launch requires sufficient solvers to provide competitive execution. Teams might need to run initial solvers themselves, provide subsidies for early participants, or partner with existing solver operators from other protocols.

啟動初期解決者參與:上線時需要足夠多的解決者以提供競爭性執行。團隊可能需自行運營首批解決者、補助早期參與者,或與其他協議的解決者合作。

Design solver incentive mechanisms carefully: Solvers need compensation that covers costs while incentivizing optimal user outcomes. Token economics should reward good solver behavior – providing surplus to users – while punishing or excluding bad actors.

仔細設計解決者激勵機制:[解決者應獲得足夠補貼,既彌補成本又能驅動用戶最優利益]。代幣經濟要獎勵優質解決者,將好處回饋用戶,並懲罰或排除惡意行為者。

Avoid solver monopolies through design: Multiple strategies can promote solver decentralization. Lower barriers to entry by minimizing capital requirements. Implement reputation systems that allow new solvers to build credibility gradually. Consider delegated solving models where solvers specialize rather than requiring each to handle everything.

透過設計避免解決者壟斷:可用多種策略促進解決者去中心化。降低資本門檻以便新手進入。建置聲譽系統讓新解決者逐步建立信譽。考慮代理解決模型,讓解決者各自專精而非全能。

Plan for cross-chain solver coordination: If the protocol involves cross-chain intents, solvers need mechanisms to cooperate across domains. Define how settlement occurs, who bears bridging costs, and how disputes are resolved.

規劃跨鏈解決者協調:若協議涉及跨鏈意圖,解決者需要有橫跨不同區塊鏈協作的機制。明定結算流程、橋接成本歸屬、糾紛如何處理。

Audit Intent-Solver Matching Logic

The core of any intent-based system is how intents match with solver capacity. Before token launch:

任何意圖系統的核心都在於意圖如何匹配解決者能力。在發幣前應:

Conduct thorough security audits: Intent matching logic must be bulletproof. Bugs could enable solvers to extract value unfairly or leave intents unfulfilled. Engage multiple audit firms with experience in mechanism design, not just smart contract security.

進行嚴謹安全審計:意圖匹配邏輯必須無懈可擊。漏洞可能讓解決者不當套利或導致意圖無法實現。應找具備機制設計經驗的多家審計公司,而非僅限智能合約安全。

Stress test matching algorithms: Simulate high-load scenarios. What happens when thousands of intents arrive simultaneously? How does the system degrade gracefully under load? Where are bottlenecks?

壓力測試匹配演算法:模擬高負載情境。當同時湧入數千筆意圖時會怎麼樣?系統會如何有彈性地降級?瓶頸在哪裡?

Verify incentive compatibility: Game theory matters enormously. Ensure solvers cannot profit from deviating from honest behavior. Check that Nash equilibria align with desired outcomes. Consider attack vectors where colluding solvers might exploit users.

驗證激勵相容性:博弈理論極為重要。確保解決者偏離誠實策略時無利可圖。確認納許均衡確實帶來期望結果。考慮解決者勾結時是否會有新攻擊手法。

Prioritize User Experience Testing

The purpose of intent-centric design is improving user experience. Validate this before launch:

意圖導向設計的核心目的在於提升用戶體驗。發行前務必檢驗:

Test with non-technical users: Put the interface in front of people unfamiliar with blockchain complexity. Can they understand what intents mean? Do they trust the system to execute as desired? Where do they get confused?

與非技術用戶測試:讓不懂區塊鏈技術的人實際操作介面。他們看得懂「意圖」是什麼嗎?相信系統會如預期執行嗎?哪裡會不清楚?

Measure against traditional alternatives: Compare the intent-based experience to transaction-based equivalents. Is it actually simpler? Are outcomes consistently better? Document specific improvements quantitatively.

與傳統方式對照:將意圖導向體驗與傳統交易模式比較。是否真的更簡單?結果有更一致且好的體驗嗎?要量化記錄具體改善點。

Design clear feedback mechanisms: Users need to understand what's happening with their intents. Provide status updates: intent received, solvers competing, execution proposed, settlement confirmed. Unclear feedback breeds mistrust.

設計明確回饋機制:用戶需了解其意圖的狀態。提供及時狀態通知:意圖已接收、解決者競標中、執行建議中、結算確認等。資訊不明將導致不信任。

Prepare for edge cases: What do users see when intents can't be fulfilled? How do they modify or cancel intents? What happens during network congestion? Polish these experiences thoroughly.

準備邊界情境:當意圖無法實現時,用戶會看到什麼?他們怎麼修改或取消意圖?網路壅塞時的用戶體驗?這些都要細緻打磨。

Establish Governance and Decentralization Paths

Token-based governance should align with intent-centric principles:

基於代幣的治理應符合意圖導向原則:

Define upgrade mechanisms: Intent protocols will evolve. Establish clear processes for proposing, testing, and deploying changes. Balance move-fast iteration with stability that solver networks require.

定義升級機制:意圖協議會隨時間進化。要建立明確的提案、測試與發佈流程。快速迭代與解決者網路所需穩定性必須兼顧。

Plan solver governance participation: Should solvers have special governance rights? How does the protocol prevent capture by a solver cartel? Consider whether solver participation requires token holdings and what that means for centralization risks.

規劃解決者治理參與:是否要給解決者特殊治理權限?如何預防解決者聯手把持權力?思考參與是否必須持有代幣,以及這對去中心化有何影響。

Progressive decentralization roadmap: Most projects launch with some centralized components for pragmatic reasons. Document the path toward full decentralization explicitly. What milestones mark the transition? What triggers shifts in control?

逐步去中心化藍圖:大多項目初期會先有部分中心化,為現實考量。要明確說明完全去中心化的路線圖、階段里程碑、何時轉移控制權。

Transparency in tokenomics: Users and solvers need confidence in token economics. Publish clear documentation about emissions, vesting, treasury usage, and value accrual mechanisms. Avoid surprises that erode trust.

代幣經濟透明化:用戶與解決者都要對代幣經濟有信心。[發布關於釋放、歸屬、金庫用途及價值累積機制的明確說明文件]。避免因黑箱操作導致信任流失。

Ensure Cross-Protocol Compatibility

Intent-centric ecosystems benefit from network effects. Isolating your protocol limits value:

意圖導向生態系倚賴網路效應。孤立自己的協議會限制價值:

Support emerging intent standards: Participate in cross-chain intent standard development. Implement proposed ERCs related to intent expression. Make integration with other protocols straightforward.

支持新興意圖標準:[積極參與跨鏈意圖標準的制定],實作相關的 ERC 提案,使協議易於與他協議整合。

Build modular architecture: Avoid vendor lock-in by keeping components separable. Other projects should be able to integrate your solver network or intent matching without adopting your entire stack.

打造模組化架構:讓各元件可分離,避免供應商綁定。其他專案應能只接你的解決者網路或意圖匹配模組,而無需全盤整合。

Partner with complementary protocols: Intent ecosystems involve specialized providers – some focus on cross-chain settlement, others on specific asset types, still others on privacy. Strategic partnerships create more value than isolated development.

與互補協議合作:[意圖生態需專業分工],有的專注跨鏈結算,有的專攻特定資產型態,或聚焦隱私。策略聯盟比單打獨鬥能創造更高價值。

Maintain chain neutrality: Avoid favoring specific Layer 1s or Layer 2s unless your use case demands it. Intent-centric design's power comes from abstracting chain differences; artificial limitations reduce appeal.

維持鏈中立性:除非用途特殊,避免偏好某些 L1 或 L2。意圖導向設計的強大,在於忽略鏈之差異;人為限制會減損吸引力。

What the Future Could Look Like

Intent-centric architectures could reshape Web3 dramatically if they achieve widespread adoption. Extrapolating current trends suggests several possible futures.

若意圖為本的架構被廣泛採納,將徹底改變 Web3 版圖。推論目前趨勢,可以預見幾種未來情境。

Beyond Trading: Intent-Centric Everything

While early implementations focus on DeFi trading, the paradigm extends far beyond. Gaming applications could use intents for in-game asset management, allowing players to specify desired gear or progression paths without understanding blockchain mechanics. Supply chain coordination could express logistics intents: "deliver thesematerials to this location by this date with proof of authenticity.

社會協調機制可能會以意圖(intent)為基礎運作。DAO 可以表達集體的願望——例如資助這些公共產品、實現這些結果——而解題者(solver)網絡則可以找出最佳資源分配方式。二次方資助、事後公共產品資助和其他機制設計在意圖層處理執行複雜性時,變得更加實用。

跨鏈收益優化可能會變得完全自動化。用戶表達風險承受度和收益預期;解題者動態地在協議和鏈之間再平衡以最大化成果。主動管理 DeFi 持倉的心理負擔將不復存在。

交易設計的變革

當前 DEX 的設計或許只是過渡,而不是最終型態。如果意圖匹配足夠高效,就可能不再需要獨立的交易所介面。錢包本身就可以成為意圖介面,解題者則及時提供流動性,而不是長期鎖定於流動性池。

這項變革能極大提升資本效率。與其數十億美元鎖在 AMM 池中僅獲低利潤,不如讓專業做市商動態地運用資本。用戶獲得更優價格;流動性供應者獲得更高收益。提供價值的中介——也就是高級解題者——能得到合理報酬,而不像從前是被動資本獲得大部分獎勵。

聚合器可能會演化為元解題者(meta-solvers),協調各專業解題者網絡。不再是直接聚合 DEX 流動性來源,而是聚合解題能力,將意圖導向最能執行該類型意圖的網絡。

權力轉移:從鏈到解題者

價值與控制的核心可能會從 Layer 1 區塊鏈轉移到意圖協調層。如果用戶主要是透過意圖介面互動,底層的結算鏈就變得沒那麼重要。由解題者選擇執行場域;用戶只關心結果。

這種轉變可能會減少鏈之間的部落意識和競爭。如果以太坊、Solana 和其他鏈主要作為意圖網絡的結算層,他們的差異性將變成技術面(速度、成本、安全性)而非文化面。應用則真正實現鏈不可知性。

然而,這同時也讓權力更加集中於解題者網絡。如果少數解題者營運商佔據主導,他們就能控制哪些鏈被使用、哪些應用成功、價值如何流動。區塊鏈原本承諾的去中心化,有可能被集中式解題基礎設施所削弱。要防止這種結果,必須嚴格關注解題者網絡的設計。

智能合約開發的演變

智能合約開發人員可能會將重心從撰寫執行邏輯,轉為定義意圖語言和有效性條件。不再是「如果 X 發生,則執行 Y」,而是「這些結果有效,其他皆為無效」。

這場變革呼應了其他程式設計範式的轉移。宣告式程式設計已主導許多領域——資料庫用 SQL,網頁樣式用 CSS,用戶界面用 React。以意圖為核心的區塊鏈開發則將宣告式手法延伸到鏈上協調。

開發者被重視的技能可能會有所改變。對特定 VM 指令集的深厚認識將變得沒那麼重要;理解機制設計、賽局理論、約束滿足(constraint satisfaction)會更為關鍵。這場轉型將偏向那些關心結果與激勵,而非只著重於實作細節的開發者。

監管影響

以意圖為基礎的系統,可能會讓監管監督變得更為複雜。當用戶只表達結果而由解題者執行時,合規責任到底歸屬誰?如果解題者在履行技術上有效的意圖時一不小心牽涉到意外的法規違規,責任要算在誰頭上?

反過來,意圖架構反而也有可能促進合規。意圖本身可以包含解題者必須遵守的監管約束。地理限制、KYC 要求、交易上限——這些都可以作為意圖約束明確表述。違規的解題者會失去聲譽和履約保證金,產生市場驅動的合規自律。

最終結果取決於項目如何設計問責機制。既能讓合規驗證變得簡單、又能保障用戶隱私的系統,有機會同時滿足監管與 Web3 價值觀。反之,若允許透過隱晦解題網絡規避監管的設計,顯然將面臨嚴格整頓。

最後想法

以意圖為核心的設計,代表人類與區塊鏈互動方式的徹底再想像。在智能合約實現了可編程結算的基礎上,意圖導向架構則承諾了可編程「意圖」——用戶宣告他們要什麼,而不是如何達成。

這帶來極具吸引力的優點:大幅簡化的使用者體驗、防止 MEV 剝削、無縫的跨鏈協調與資本效率提升。像 CoW Protocol 這樣的早期實作已證明這些優勢不僅僅是未來想像,現在就能實現。Anoma、SUAVE 等項目正致力於打造能讓以意圖為核心之互動成為 Web3 主流的基礎建設。

然而,這種變革風險也值得大家警惕。解題者集中化可能會複製區塊鏈原本要消除的權力結構。隱私挑戰尚未被完全解決。實作複雜度也可能限制普及。從「交易為本」的系統轉型將是漸進且混亂的過程。

身為用戶,理解這個轉變很重要,因為未來數年你與區塊鏈應用的互動會因此改變。以意圖為基礎的介面可能會成為常態,一方面隱蔽複雜性,一方面也看不到執行細節。當你簽署意圖(而非交易)時,要清楚自己信任的對象是誰。

身為開發者,意圖導向設計帶來打造過去不可能實現的應用的機會。但也要求你學習新的範式,也必須接受你的程式碼不會直接被執行——而是交由解題者網絡來處理。考慮這種模式是否適合你應用的需求。

若你屬於這個領域的代幣團隊,前述檢查清單凸顯了超越傳統代幣發行的考慮點。意圖為基礎的協議能否成功,取決於解題網絡健康、機制設計正確性與用戶體驗品質。在關注幣價之前,把這些基本面做好。

轉向以意圖為核心的架構不會在一夜之間發生,也不太可能是徹底的切換。混合型系統可能會主導未來數年。但方向已相當明確:若 Web3 希望走向主流,就必須抽象掉複雜性。意圖導向設計提供了一條可行路線,雖然犧牲了一些透明度,卻能換取巨大可用性提升。

這場轉型能否真正兌現承諾,取決於這個生態系如何平衡各種取捨。解題者網絡能否保持去中心化?隱私能否兼顧最優執行?相關標準能否誕生,實現互通而不扼殺創新?

這些問題的答案,將決定以意圖為中心的設計是否會成為 Web3 的主流架構,還是僅止於特定用例的小眾實踐。可以確定的是,討論已經跨過「是否」的階段,來到「如何」:這個範式正在被構建,背後有數十億資本和大量開發者投入。

對 Web3 參與者——無論您是用戶、開發者、投資者還是研究人員——理解以意圖為核心的架構,已不再是選項,而是必須。這不再是遙不可及的願景,而是區塊鏈核心架構正在發生中的變革。定義 Web3 第一章的智能合約,正讓位給可能定義下個時代的意圖層。

請保持關注,謹慎實驗,並認識到看似只是些許體驗改良,實則可能是區塊鏈自以太坊實現可編程結算以來最重大結構革新的開端。Web3 的未來,正被意圖語言、解題者網絡,以及那些將決定區塊鏈是全民普及還是專家領域的設計選擇一同譜寫。

機會巨大,風險也同樣龐大。