隨著傳統投資工具面對通膨與經濟不確定性的挑戰,加密貨幣投資人越來越重視兩大區塊鏈網絡收益模式:雲端挖礦與加密質押。這兩者分別體現了對區塊鏈運作及參與者回饋的不同理念,但同樣吸引人之處在於:不需主動交易也能賺取加密貨幣。

想判斷2025年哪一種方式較為獲利,必須深入研究不僅僅是收益數字,更要看其底層運作邏輯、風險樣貌,以及影響回報的市場動態。目前以太坊每日通膨率為0.00096%,年化0.35%(鑄造略多於銷毀),並有3440萬顆ETH被質押(約佔流通量28%);Solana目前活躍質押供給為2.97億SOL(質押率約51%)。同時,比特幣礦工每日創造約兩千萬美元的比特幣收入,每月高達六億美元,雲端挖礦平台正嘗試讓這巨額經濟活動更為普及化。

2025年市場條件空前緊張。最新礦機價格約為每太哈$16(2022年為$80/太哈),這使得挖礦的經濟結構徹底改變。與此同時,權益證明(PoS)網路已達前所未有的普及程度:以太坊質押標準年化殖利率為3.08%(通膨調整後2.73%),成為DeFi利率基準、而Solana提供年化11.5%(實質12.5%)給願意承擔複雜質押機制的投資者。

本分析將結合真實2025年市場數據、法規變革及技術進展,結構化檢視雲端挖礦與加密質押的獲利機制。文中不單純提供直接投資建議,而是建構一套判斷邏輯,協助投資人根據不同風險偏好、技術能力與個人屬性,找出當前加密市場最適合的收益策略。

2025年雲端挖礦的經濟邏輯

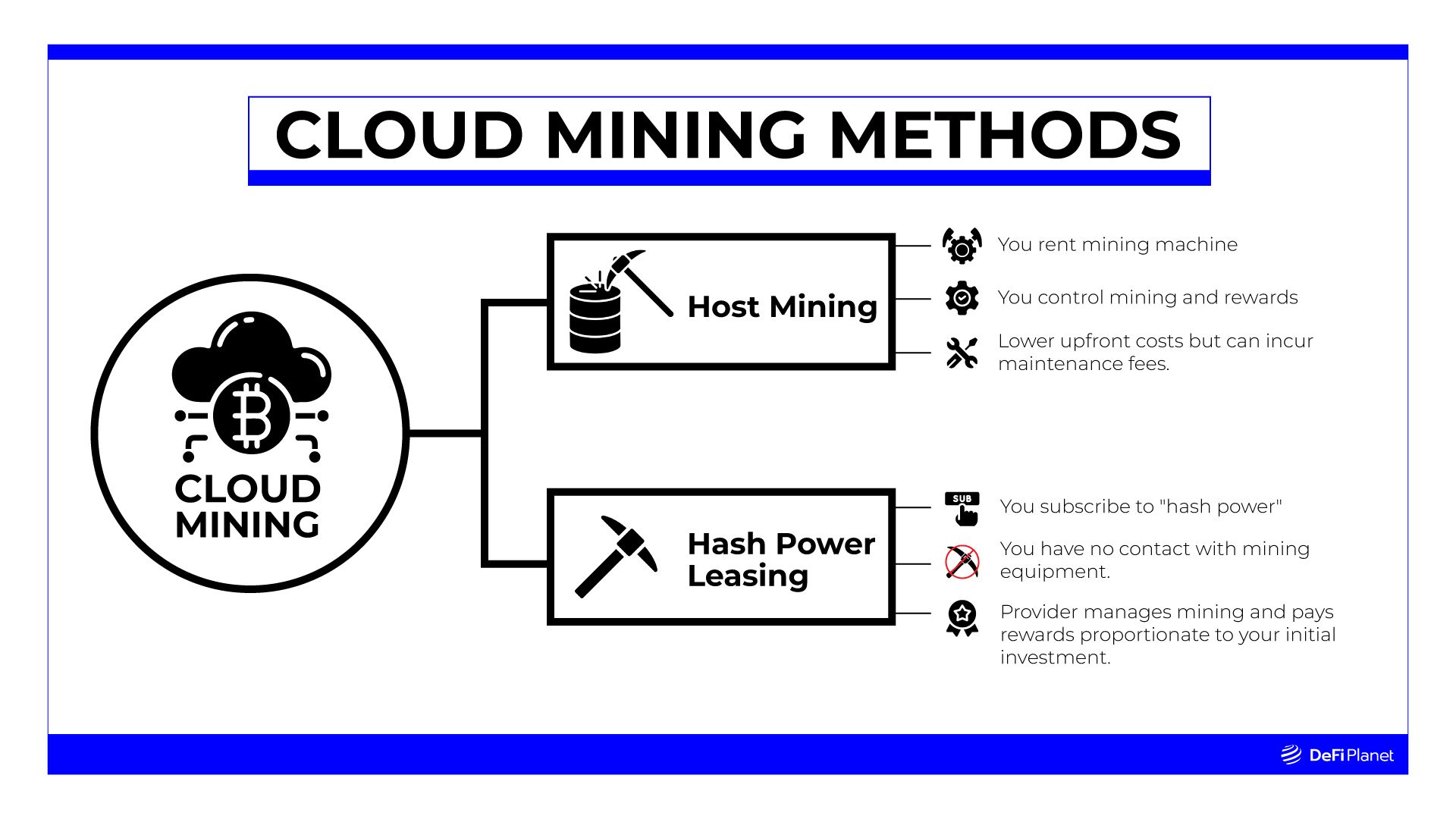

雲端挖礦象徵原始加密貨幣願景的重大演進,將原應個人參與網路安全的挖礦行為,抽象為一種服務商模式。這正面對了比特幣和其他工作量證明網絡日趨成熟後出現的核心問題:挖礦成本高漲且技術門檻提升,零售投資人實際上已無法直接參與基礎層的網絡安全維護。

概括而言,雲端挖礦平台以大型資料中心部署專用礦機,然後將算力「賣出」或「租賃」給欲獲得挖礦收益但不想自備設備的個人。這種模式讓平台依靠資本與運營規模、專業積累效率,同時讓客戶能以個人資本無力取得的挖礦產能,獲得收益分成。

雲端挖礦的盈利邏輯建立在多個動態變數:比特幣難度每2016個區塊自動調整,用以維持十分鐘區塊時間,直接影響每單位算力可產生的比特幣數量。礦工越多,難度提升,單位算力產出變少;若礦工因虧損退場則難度下滑,存留者產量短暫提升。

當前挖礦區塊獎勵為3.125BTC(約合$187,500,假設比特幣年均價$60,000)。這筆獎勵加上交易手續費,構成全球挖礦總誘因。雲端挖礦平台按照貢獻的算力比例取得相應部分,扣除運營支出與利潤後分配給合約用戶。

能源成本是雲端挖礦最大運營開銷,通常佔總收入的40-70%。頂尖平台會將數據中心建於低電價區,例如冰島的地熱與水電、哈薩克的火力,以及美國部分可再生能源富餘地點。這些地理優勢直接提高平台與用戶的淨收益。

硬體效能升級部分抵銷了難度上升對獲利性的蠶食。現代ASIC礦機每瓦效能大幅超越舊世代,在同樣能耗下產生更多比特幣。儘管比特幣一度漲至$100,000,但不少熱門礦機仍因成本效益不佳而被迫停機,反映出技術迭代也會在礦圈創造勝敗。

比特幣價格與挖礦獲利之間存在複雜的回饋循環。比特幣大漲時,現有合約以法幣計價更為可觀,但高價格又會吸引更多競爭,提升難度、壓低同額算力下的產出。這使得雲端挖礦的高獲利時期又蘊含日後趨於平緩的種子。

現代雲端挖礦平台已發展出複雜服務模式,包含各類彈性合約(短至日租長至多年),方便用戶依據市場時機調整參與度。有的平台還會根據收益表現自動切換不同工作量證明貨幣,管理最有利可圖之礦幣,並以用戶指定貨幣發放收益。

隨再生能源雲端挖礦興起,環保投資人的新選擇也逐漸成形。這些平台強調取電自太陽能、風力、水力及地熱,並多得益於政府發展可再生能源的補貼,故能以競爭電價運營。本質上獲利邏輯大致一致,但賦予投資人參與礦業且顧及環保聲譽的新選項。

2025年主流雲端挖礦平台現況與績效分析

如今雲端挖礦市場橫跨老牌企業到創新新貴,各有不同民主化挖礦參與的切入點。理解市場現況,需關注的不僅僅是宣傳報酬,更包括實際收益、費用結構及透明度。

諸如 MiningToken、ECOS 等平台全部托管,無需購買硬體或維護節點,2025年度雲端挖礦回報約在5%-10%年化,這是扣除所有成本後的合理期望,遠低於可疑項目聲稱的三位數高利,但真實反映比特幣挖礦經濟本質。

ECOS 提供受監管的雲端挖礦服務,營運據點於亞美尼亞自由經濟區,結合礦業錢包及教育資源。初階合約門檻僅約$50,美滿友好零售投資人小額試水溫。平台亦內建ROI試算,根據實時網絡條件,協助用戶評估報酬(但無法涵蓋未來比特幣價格及難度波動)。

ECOS 強調透明度,實時公開礦場用電、算力部署及維護排程等數據,有效降低客戶對算力兌現的信任疑慮。平台亦處理並優化礦池選擇及獎勵分配,對不熟技術環節的用戶非常友善。

MiningToken 則主打瑞士法規合規及以AI智能分配算力。平台會根據即時收益演算法,把客戶算力分配至不同礦池與幣種,動態優化回報。 addresses a key limitation of traditional cloud mining, where customers are locked into mining specific cryptocurrencies regardless of changing market conditions.

- 解決了傳統雲端挖礦的一項主要限制——客戶無論市場狀況如何變化,都被限制只能挖掘特定的加密貨幣。

The platform's emphasis on renewable energy sourcing appeals to the growing segment of cryptocurrency investors who want to support environmentally sustainable mining practices. MiningToken partners with mining farms powered by hydroelectric, solar, and wind energy, often located in regions where renewable power is abundant and competitively priced. This environmental focus doesn't necessarily translate to higher yields, but it does provide a marketing advantage and aligns with corporate sustainability initiatives that are becoming increasingly important for institutional cryptocurrency adoption.

- 該平台強調採用再生能源,吸引了越來越多希望支持環保挖礦的加密貨幣投資者。MiningToken 與使用水力、太陽能及風力發電的礦場合作,這些礦場通常位於再生能源豐富且價格具有競爭力的地區。這種環保導向未必能帶來更高收益,但確實成為行銷優勢,並與現在日益重要的企業可持續發展倡議相符,有助於機構用戶採納加密貨幣。

NiceHash operates as a marketplace model rather than a traditional cloud mining platform, connecting hash power sellers directly with buyers in a peer-to-peer arrangement. This approach creates more price transparency, as hash power rates fluctuate based on supply and demand rather than fixed platform pricing. However, the marketplace model also introduces additional complexity and fees, typically around 3% of transactions, which can erode net returns.

- NiceHash 採用的是市集模式,而非傳統雲端挖礦平台,讓算力供應者與買家能以點對點方式直接對接。此種做法提高了價格透明度,算力價格會依供需浮動,而不是平台固定價格。不過,這種市集模式也帶來更多複雜性與手續費,通常交易需收取約3%的費用,這有可能侵蝕最終淨收益。

The marketplace approach allows more sophisticated users to potentially achieve better returns by timing their hash power purchases around network difficulty adjustments or cryptocurrency price movements. When mining profitability spikes due to price increases or difficulty decreases, demand for hash power on NiceHash increases, driving up rental rates. Conversely, during periods of reduced profitability, hash power becomes cheaper, potentially allowing strategic buyers to secure favorable rates.

- 市集模式讓更有經驗的用戶可以根據網絡難度調整或幣價變化,精準選擇購買算力時機,進而獲得更好的報酬。當幣價上漲或難度下降、挖礦利潤提高時,NiceHash 上對算力的需求增加,租金也會上升。反之,在收益率較低時,算力則變得便宜,這讓有策略的買家能以較優惠價格獲取算力。

Recent entrants like CryptoSolo allows simultaneous mining of Bitcoin and Dogecoin, which is a game-changer. By diversifying, users can reduce risk and take advantage of market opportunities in multiple coins. This multi-cryptocurrency approach represents an evolution in cloud mining strategy, where platforms optimize across different proof-of-work networks rather than focusing solely on Bitcoin mining.

- 新興平台如 CryptoSolo 支援同時挖掘比特幣與狗狗幣,這堪稱市場重大突破。透過多元化,使用者能降低風險並掌握多幣種的市場機會。這種多加密貨幣挖礦策略,標誌著雲端挖礦戰略的進化,平台會針對不同工作量證明(PoW)網絡進行最佳化,而非僅專注於比特幣挖礦。

ETNCrypto leads the way, offering unmatched transparency, strong ROI, and daily Bitcoin payouts according to recent analysis, though as with all cloud mining platforms, independent verification of claimed returns remains challenging. With these plans, investors can earn $2,000+ daily on premium contracts, making ETNCrypto the most profitable BTC mining platform in 2025, though such high-dollar claims require careful scrutiny of the required capital investment and risk levels involved.

- 根據近期分析,ETNCrypto 以卓越透明度、高報酬率及每日比特幣支付領先同業,但和所有雲端挖礦平台一樣,其收益聲明仍難以獨立驗證。根據其方案,使用高階合約的投資人每天可以賺取超過2,000美元,使 ETNCrypto 成為2025年最賺錢的BTC挖礦平台之一。不過,如此高的報酬主張,必須仔細檢視所需投入的資本與相關風險。

The platform comparison reveals a common pattern where newer services advertise higher returns to attract customers, while established platforms like HashNest focus on reliability and consistent performance over time. HashNest, originally launched by Bitmain, remains one of the most reliable cloud mining platforms, leveraging its connection to one of the world's largest ASIC manufacturer to provide stable, if modest, returns.

- 各平台比較顯示,較新服務常以高收益吸引客戶,而像 HashNest 這類老牌平台則專注於長期穩定與可靠的績效。HashNest 由比特大陸打造,是目前最可靠的雲端挖礦平台之一,依託全球最大 ASIC 礦機製造商之一的背景,即使報酬不高,亦能提供穩定收益。

For entry-level participants, platforms like Mining City have reduced barriers to participation, though this accessibility often comes with trade-offs in terms of return rates and contract flexibility. The proliferation of user-friendly cloud mining services has democratized access to mining participation, but it has also created a challenging landscape for investors to navigate the legitimate opportunities versus marketing-heavy schemes with unsustainable economics.

- 對初學者而言,像 Mining City 這類平台降低了參與門檻,但這種易用性通常也意味著回報率及合約彈性上的折衷。多數雲端挖礦平台強調用戶友善,確實讓更多人能參與挖礦,卻也帶來良莠不齊的市場環境,投資人須小心辨識合法商機及過度行銷、不切實際的模式。

The Mechanics and Economics of Crypto Staking

Crypto staking represents a fundamental shift from the energy-intensive proof-of-work model toward proof-of-stake consensus mechanisms that achieve network security through economic incentives rather than computational competition. This transition has created new opportunities for cryptocurrency holders to earn yield by participating directly in network validation and governance processes.

- 加密貨幣質押(staking)是從高耗能的工作量證明(Proof-of-Work, PoW)模型,根本性地轉向以經濟誘因維持網路安全,而非計算競賽的權益證明(Proof-of-Stake, PoS)共識機制。這項變革創造了持幣者參與網絡驗證與治理、直接賺取收益的新機會。

The core concept of staking involves locking up cryptocurrency tokens to support network operations and earn rewards in return. Unlike mining, which requires specialized hardware and consumes electricity to solve cryptographic puzzles, staking rewards participants based on their committed stake and their contribution to network security. This approach aligns the interests of token holders with network health, as misbehavior or downtime can result in penalties that reduce staked balances.

- 質押的核心就是將加密貨幣鎖定於網路中,以支持運作並獲得報酬。與必須動用專業硬體與電力解決密碼運算的挖礦不同,質押以用戶投入的代幣數量及對網路安全的貢獻計算報酬。這種模式讓持幣人利益與網路健康綁定,因為違規或離線將面臨質押資產被懲罰扣減的風險。

Ethereum has a larger validator set of 1.07M validators, while Solana, with higher hardware demands, has 5,048 validators but over 1.21M delegators. This structural difference illustrates how different proof-of-stake networks balance decentralization, scalability, and accessibility. Ethereum's approach allows more individual validators to participate directly, while Solana's higher performance requirements create a more concentrated validator set with broader delegation participation.

- 以太坊有超過107萬個驗證者(validator),而硬體門檻較高的 Solana 只有5,048個驗證者,卻吸引了121萬個質押委託人(delegator)。這些結構差異說明不同 PoS 網絡在去中心化、延展性與參與門檻間的取捨。以太坊容許更多人直接當驗證者;Solana 則因性能需求高,驗證者集中,使用委託模式吸引大量用戶間接參與。

The economic incentives in proof-of-stake systems come from several sources, primarily inflation-based rewards and transaction fees. Networks mint new tokens to reward validators and delegators, creating inflation that incentivizes participation while distributing ownership of the network more broadly over time. Transaction fees provide additional rewards that fluctuate with network usage, creating variable yield components that can significantly impact overall returns during periods of high activity.

- 權益證明系統的經濟激勵主要來自通膨型獎勵與交易手續費。網絡透過發新幣給驗證者和委託人,提高參與誘因並達到持幣分散。手續費則會隨網絡活躍度增加額外獎勵,產生浮動收益,尤其在高流量期間對總報酬有顯著影響。

Ethereum's post-merge staking economics demonstrate the complexity of modern proof-of-stake systems. When burning exceeds issuance, the inflation-adjusted yield becomes more attractive. The EIP-1559 fee burn mechanism can actually make Ethereum deflationary during periods of high network usage, effectively increasing the real yield for stakers as the total token supply decreases while they earn newly minted rewards.

- 以太坊合併升級後的質押經濟展現現代 PoS 系統的複雜度。當銷毀量大於發行量時,通膨調整後的實質收益會更高。EIP-1559 手續費銷毀機制,使以太坊在高網絡活動時進入通縮,代幣總量減少,質押者能同時獲得新鑄幣獎勵與更高的實質年化報酬。

Ethereum's continuous issuance results in an annualized inflation rate of 0.35%, with burns from EIP-1559 often leading to deflationary periods. This dynamic creates a complex relationship between network activity, token supply, and staking yields that doesn't exist in traditional fixed-income investments. During periods of high DeFi activity or NFT trading, increased transaction fees can drive significant token burning, effectively boosting real returns for stakers even if nominal yields remain constant.

- 以太坊持續鑄幣,導致年化通膨約0.35%,但EIP-1559 的銷毀亦會使某些時期進入通縮狀態。這種動態讓網路活動、幣量與質押收益間的關係遠比傳統定存投資複雜。當 DeFi 或 NFT 爆發時,手續費大幅提升,更多代幣被銷毀,即使名目收益不變,質押者實質報酬也會提升。

Solana's approach to staking economics follows a different model with higher baseline inflation. Solana follows an epoch-based inflation schedule with a current annualized inflation rate of 4.7%, set to stabilize at 1.5%. This higher inflation rate supports higher nominal staking yields but requires more active participation to avoid dilution. The epoch-based reward distribution creates predictable payout schedules that some investors prefer over Ethereum's more variable reward timing.

- Solana 採取不同經濟模型,設定較高的基礎通膨:目前年化通膨4.7%,將逐步降至1.5%。因此質押名目收益較高,但用戶須更積極參與以避免幣值被稀釋。基於時期(epoch)分配獎勵使收益發放更有預測性,有些投資人會偏好這類固定週期、可規劃的回饋。

The delegation model used by most retail stakers introduces additional economic considerations around validator selection and commission rates. Validators charge commissions ranging from 0% to 20% of earned rewards to cover their operational costs and generate profit from their validation services. However, the lowest commission validators are not necessarily optimal choices, as factors like uptime, performance, and geographic distribution affect overall returns and network stability.

- 多數散戶習慣以委託方式參與質押,這又牽涉到驗證者選擇與佣金費率。驗證者通常收取0%~20%不等的獎勵金作為營運與服務利潤。不過,最低佣金未必最佳,還要考慮上線率、效能、地理分布等因素,才能確保整體報酬率與網路安全。

Liquid staking has emerged as one of the most significant innovations in the staking ecosystem, addressing the traditional trade-off between earning yield and maintaining liquidity. Over 11 million JitoSOL is held in user wallets, spread across more than 653,000 accounts. This makes up the vast majority of JitoSOL's total TVL, highlighting strong retail-level participation. This widespread adoption of liquid staking tokens demonstrates how the innovation has resolved a fundamental limitation of traditional staking.

- 流動質押是質押生態系中最重要的創新之一,有效解決獲取質押收益與維持流動性間的矛盾。目前有超過1,100萬 JitoSOL 分散在超過65萬3千個錢包中,占其總鎖倉價值(TVL)絕大多數,顯示散戶參與極為活躍。這樣的普及,證明流動質押解決了傳統質押的根本限制。

Platforms like Lido for Ethereum and Marinade for Solana have created liquid staking derivatives that maintain most of the yield benefits of direct staking while providing tradeable tokens that can be used throughout the DeFi ecosystem. These liquid staking tokens can be traded, used as collateral for lending, or deployed in yield farming strategies, creating multiple layers of return potential beyond basic staking rewards.

- 以太坊的 Lido 和 Solana 的 Marinade 等平台提供流動質押衍生品,不僅保有直屬質押的收益優勢,還能轉為可交易的代幣自由運用於 DeFi 生態。這些流動質押憑證可交易、作為借貸抵押物,或進行收益農耕(yield farming),讓用戶質押之外還可以疊加多重回報。

The emergence of restaking represents the next evolution in staking economics, allowing already-staked tokens to secure additional protocols and earn additional rewards. Restaking has arrived on Solana, with platforms like Jito and Solayer offering stakers new yield layers. As of April 2025, at least 2.25 million SOL is restaked across major providers. This innovation creates the possibility of earning yields from multiple sources simultaneously, though it also introduces additional slashing risks if the restaked protocols misbehave.

- 再質押(restaking)是質押經濟進化的下一步,可將已質押代幣用於支持更多協定,疊加新層收益。Solana 生態也已出現如 Jito、Solayer 等再質押平台,截至2025年4月,主要平台累計超過225萬 SOL 進行再質押。這帶來同時多來源收益的新可能,惟若再質押協定出現問題則會加劇懲罰(slashing)風險。

The geographic distribution of staking participation differs significantly from mining, as validators can operate from anywhere with reliable internet connectivity rather than requiring access to cheap electricity. This broader geographic distribution contributes to network decentralization and resilience, while also making staking accessible to participants in regions where energy costs would prohibit profitable mining.

- 質押的地理分布與挖礦不同,驗證者只需穩定網路即可全球運營,無須仰賴低價電源。這讓網路分散化與抗壓性提升,同時也使能源成本高昂、原先無法獲利挖礦地區的用戶能參與質押。

Comparative Yield Analysis: Real-World Returns in 2025

Understanding the true profitability of cloud mining versus staking requires examining actual yields achieved by participants rather than theoretical maximum returns or marketing claims. The cryptocurrency market's volatility, combined with the different risk profiles and operational requirements of each approach, creates a complex landscape for comparing investment returns.

- 想瞭解雲端挖礦與質押的真實獲利情況,必須檢視用戶實際得到的收益,而非理論極限或行銷數據。加密貨幣市場的波動,以及各種方案的風險輪廓與操作難度差異,使投資報酬比較變得複雜。Here is the traditional Chinese (Taiwan) translation for your requested content, following your formatting instructions:

名目質押收益率為 3.08%(經通膨調整後為 2.73%),這代表相對保守的回報,與該網路作為主流智慧合約平台的定位相符。此收益計算包括新發行的 ETH 獎勵與部分交易手續費,但後者成分隨網路活動量有顯著變動。

經通膨調整後的收益更能準確反映長期持有人的實際報酬,考量新發行代幣的稀釋效應。在 EIP-1559 推動大規模代幣銷毀、以手續費為主的時期,隨著總 ETH 供給量減少且質押獎勵持續,實際報酬有時可能超越名目收益。然而,這種通縮動態並無保證,需仰賴持續活躍的網路使用量。

Solana 的較高收益反映出其網路較新,以及經濟模型不同。年收益率通常落在 5–7%,若以 6% 年收益率質押 100 SOL,一年稅前可獲約 6 SOL,但實際收益會依驗證人表現與網路情況而有所不同。有些來源報導 Solana 在最佳驗證人選擇和流動質押策略下,年化收益可達 11.5%(實質 12.5%)。

Solana 各種收益報告的差異說明了一個重要考量:不同參與方式與平台,即使針對同一基礎網絡,也可能產生顯著不同的報酬。經由高效驗證人直接質押可能取得比透過交易所質押更高的收益,因交易所通常會收取額外的便利及託管服務費。

雲端挖礦的回報更為多變,合法平台一般提供 5%-10% 的年化收益率(APR)。然而這些收益以所挖加密貨幣計算,而非法幣,讓回報計算變得更為複雜。以比特幣計算產生 5% 收益的雲礦合約,於合約期間,比特幣價格漲跌將導致法幣回報大幅變動。

根據目前網絡條件,390.00 TH/s 的比特幣算力每天可挖得 0.00018903 BTC,說明要取得有意義的挖礦回報需相當規模的投資。扣除挖礦算力成本與礦池費用後,最終每天比特幣挖礦淨利潤為 $12.72,顯示營運成本對淨利影響甚鉅。

這例子揭示了雲端挖礦經濟學的關鍵洞見:所賺取的加密貨幣總額僅是計算獲利的起點。平台手續費、維護成本以及電費都會大幅減少最後淨收益。一份看似每天產生 $20 比特幣的合約,實際扣除後可能只淨得 $12-$15,強調理解總成本結構的重要性,而非只關注總收益。

挖礦的回報時間軸也與質押收益有根本上的不同。截至 2025 年 8 月 28 日(週四),按照目前的比特幣難度、算力與區塊獎勵,要挖出 1 顆比特幣需 5,290.2 天,顯示挖礦累積策略的長期性。這個期限假設網路狀況維持不變,然而實際上難度調整與市場動態讓礦業經濟處於持續變動中。

對願意涉足更複雜網路或承擔額外風險的投資人而言,還有更高階的質押機會。Cosmos 驗證人最高名義年化獲利可達 18%,不過通膨與驗證人佣金後的實際回報一般接近 12-15%。同樣地,像 Near Protocol 與 Aptos 等較新網路為吸引驗證人、推動網絡安全,年化收益約落在 7-10% 區間,反映其以優厚獎勵計畫啟動網絡的策略。

評估這些高收益機會的難點,在於理解所牽涉的交換條件。能提供 15% 以上質押收益的網路,通常是因需要藉高額獎勵吸引參與,要不是因網路採用度較低,就是高通貨膨脹率長期稀釋收益。此外,這些網絡的驗證人生態較不成熟,操作風險較高或回報結構較不穩定。

流動質押平台則進一步複雜化了收益比較情境,讓質押獎勵可與 DeFi 收益疊加。例如,透過 Lido 進行以太坊質押的用戶會獲得 stETH 代幣,這同時可賺取以太坊質押收益及參與其它 DeFi 協議帶來的額外回報。然而,流動質押通常會因平台手續費導致基本收益下降 1-2 個百分點,因此需審慎評估額外 DeFi 機會是否足以彌補核心回報的減少。

地理與監管環境對不同投資人可獲實際收益有重大影響。美國投資人面對質押與挖礦所得的不同稅務處理,質押獎勵一般在取得時即視為應稅收入,而非出售時才課稅。這一稅務處理可能顯著影響稅後回報,尤其對高稅率或有額外州所得稅的投資人而言。

國際投資人則可能因監管規範與合規要求而可存取不同的平台或收益機會。歐洲投資人,例如,或可存取符合 EU 金融法規的特定質押平台,但美國投資人則無法使用;同時部分雲端挖礦平台則根據當地加密採礦法規限制用戶存取。

風險評估與因應策略

雲端挖礦與質押的基本風險屬性大相逕庭,必須採用不同的風險評估與投資組合管理方式。對這些風險的理解遠不只計算表面回報數字,還要涵蓋營運、技術、監管和市場風險,這些都會影響預期收益的實現機率與潛在全損風險。

雲端挖礦涉及重大的對手方風險,參與者必須信任平台業者確實佈署宣稱的算力並誠實分配獎勵。加密貨幣領域見證過眾多雲端挖礦詐騙,從 BitClub Network 7 億美元的騙案,到無數攜款潛逃的小型平台。即便是合法平台也面臨操作風險,像設備故障、自然災害影響礦場,或經濟困難使平台業者無法履約,都有可能干擾獎勵發放。

判斷雲端挖礦平台真偽的挑戰,在於需要檢視多重驗證點,而大多數散戶缺乏充分評估相關資訊的專業能力。合法業者應能提供可驗證的礦場資訊,包括地點數據、設備規格以及電力消耗統計。然而,成熟的詐騙集團也善於偽造相關文件,使個人投資者的盡職調查越趨困難。

地理集中風險對雲端挖礦參與者的影響,與質押者大異其趣。礦業聚集於電費低廉的區域,使其易受當地監管政策變動、自然災害或政治不穩等影響。中國 2021 年的挖礦禁令,就是監管巨變一夕之間讓全球挖礦生態失去整個地區,投資人與綁定受影響礦場的合約因此受困。

質押風險則主要聚焦於協議層的漏洞與驗證人表現,而非對手方詐騙。最直接的風險是「懲罰機制」(slashing),即驗證人有違規或無法維持必需的在線率,將被永遠銷毀部分質押代幣。大多數散戶會將質押委託予專業驗證人,但仍藉由選擇驗證人而間接受到懲罰風險。

不同權益證明(PoS)網路的懲罰計算方式差異甚大。以太坊針對雙重簽署訊息或持續離線的驗證者,採取較嚴格的懲罰,有機會損失大量質押 ETH。但以太坊設計的懲罰條件很難意外觸發,通常需有惡意行為或重大操作失誤。

Solana 則主在對績效不佳驗證者減少獎勵,而非全部沒收質押資產。這讓驗證人出錯環境較寬容,但用戶選到表現差的驗證人,將承擔收益持續下滑的風險,而非瞬間全損。對不同懲罰設計的理解,有助質押參與者根據自身風險承受度選擇適合的網路。

對流動質押參與者而言,智能合約風險是另一項考量,他們必須信任代幣衍生品與獎勵分配的合約代碼。像 Lido、Marinade 等平台由智能合約管理數十億美元質押代幣,對駭客而言極具吸引力,且若發現漏洞將產生重大損失。近期 DeFi 發展史上,多起智能合約漏洞造成用戶全損,凸顯平台資安稽核和保險覆蓋之重要性。

市場波動

both cloud mining and staking participants, but through different mechanisms that require distinct management approaches. Cloud mining contracts typically generate returns denominated in the mined cryptocurrency, meaning that declining crypto prices directly impact the fiat value of returns even if the underlying mining yields remain constant. This creates a leveraged exposure to cryptocurrency price movements that some investors may not fully appreciate when evaluating expected returns.

跳過翻譯 markdown 連結。

雲端挖礦和質押參與者皆可參與,但機制不同,因而需有不同的管理方式。雲端挖礦合約產生的收益通常以所挖到的加密貨幣計價,這代表即使基礎的挖礦產量不變,若加密貨幣價格下跌,收益換算成法幣的價值也會直接受到影響。這導致投資者對於加密貨幣價格波動擁有槓桿敞口,有些投資人於評估預期報酬時,未必完全理解其中風險。

Staking participants face similar cryptocurrency price risk, but with additional considerations around the illiquidity of staked tokens. Traditional staking requires lock-up periods during which tokens cannot be sold, potentially preventing participants from exiting positions during market downturns. The typical unbonding period for Solana is approximately 2-3 days, while some other networks require weeks or months for unstaking, creating material liquidity constraints during volatile market periods.

參與質押的投資人同樣面臨加密貨幣價格風險,但還須考量質押代幣的流動性不足問題。傳統質押需鎖倉一段時間,期間無法出售代幣,因此在市場下跌時,參與者可能無法及時退出部位。以 Solana 為例,解綁期約為 2-3 天,其他部分鏈則可能需要數週甚至數月才能解質押,在市場波動劇烈時形成重大流動性限制。

Liquid staking platforms attempt to address liquidity concerns by providing tradeable derivatives, but these solutions introduce their own risks. The price of liquid staking tokens can deviate from the underlying staked assets during periods of market stress, particularly if large numbers of participants attempt to exit positions simultaneously. Additionally, the smart contracts governing liquid staking may not be able to honor redemption requests immediately if the underlying staked tokens remain locked in network protocols.

流動性質押平台試圖透過可交易的衍生品減緩流動性問題,但這類解決方式也帶來自身的風險。在市場壓力大時,流動性質押代幣的價格可能偏離底層質押資產,尤其當大量參與者同時嘗試贖回時更明顯。此外,若底層質押資產尚未從網路協議中解鎖,流動性質押相關智能合約也未必能即時處理贖回請求。

Regulatory risk manifests differently across cloud mining and staking, reflecting the different treatment these activities receive under evolving cryptocurrency regulations. Mining operations face direct regulatory pressure in jurisdictions concerned about energy consumption or financial stability, while staking may be classified as investment contract activity subject to securities regulations in some regions.

監管風險在雲端挖礦與質押方面呈現不同態樣,反映這兩種行為在加密貨幣監管進化中的不同對待。礦業營運在對能源消耗或金融穩定有疑慮的國家,會直接面臨監管壓力;而質押在部分地區可能被歸類為證券相關的投資合約活動,需遵守證券相關監管規定。

The regulatory uncertainty surrounding staking rewards taxation creates compliance risks for participants who fail to properly report earnings. Different jurisdictions treat staking rewards as either income at the time of receipt or capital gains only when sold, creating complex reporting requirements that can result in penalties for non-compliance. Additionally, the treatment of liquid staking derivatives remains unclear in many jurisdictions, potentially subjecting participants to unexpected tax obligations as regulatory clarity emerges.

質押獎勵稅務上的監管不確定性,使參與者若未妥善申報收入,便有合規風險。不同司法管轄區對質押獎勵的課稅時點認定不一,有些視為領取時的所得,有些僅在出售時認列資本利得,導致申報規則繁複,若未遵守可能遭罰。此外,流動性質押衍生品的稅務處理,在多數地區仍不明確,隨監管規範進一步明朗化,參與者可能需負擔意料之外的稅賦責任。

Platform Ecosystem Analysis: Leading Services and Their Performance

The cryptocurrency earning ecosystem in 2025 encompasses a diverse range of platforms, each offering different approaches to cloud mining and staking participation. Understanding the competitive landscape requires evaluating not just advertised yields, but platform reliability, fee structures, regulatory compliance, and long-term viability in an increasingly competitive and regulated environment.

平台生態系統分析:領先服務及其表現

截至 2025 年,加密貨幣收益生態系涵蓋各式平台,每者對雲端挖礦與質押參與提供不同方案。想認識競爭格局,需評估的不僅是標榜的年化報酬率,還有平台的可靠度、費用結構、監管合規性及在日益競爭且受監管的環境下維持營運的長期能力。

Traditional cryptocurrency exchanges have expanded significantly into staking services, leveraging their existing customer relationships and regulatory compliance frameworks to offer simplified staking access. Coinbase has emerged as a dominant player in institutional staking, providing enterprise-grade custody and reporting services that appeal to larger investors and corporate participants. The platform's regulated status and insurance coverage provide additional security assurances that pure-play staking platforms may struggle to match.

傳統加密貨幣交易所大舉拓展質押服務,善用其原有的客戶基礎及合規架構,簡化客戶的質押流程。Coinbase 已成為機構質押領域的主導者,提供企業級資產託管與報表服務,吸引大型投資人與企業機構參與。該平台受監管的地位及保險保障,為用戶提供額外安全性,是純質押平台難以比擬的優勢。

Robinhood's entry into staking services represents a significant expansion of traditional financial service providers into cryptocurrency yield products. Starting October 1, 2025, Robinhood will charge a 25% commission on all staking rewards, with the fee structure aligning with industry standards while providing access to Ethereum and Solana staking for mainstream retail investors. The platform's integration with traditional brokerage services appeals to investors who prefer consolidated account management, though the 25% commission rate is notably higher than many specialized staking platforms.

Robinhood 進入質押服務,象徵傳統金融服務業者大舉進軍加密貨幣收益產品領域。自 2025 年 10 月 1 日起,Robinhood 將對所有質押獎勵收取 25% 的手續費,與業界標準相符,並向主流散戶投資人開放以太坊和 Solana 質押功能。平台與傳統券商服務的整合,適合偏好帳戶一站式管理的投資人,惟 25% 的手續費明顯高於許多專門質押平台。

The commission structure comparison across platforms reveals significant variations that can meaningfully impact net yields. While Robinhood charges 25% commissions, many dedicated staking platforms operate with fees ranging from 5% to 15%, highlighting the premium investors pay for convenience and integration with traditional financial services. However, these fee differences must be evaluated alongside factors like platform security, regulatory compliance, and customer service quality.

橫向比較不同平台的手續費結構,會發現其實差異極大,對最終淨收益有直接影響。Robinhood 收取 25% 佣金,但許多專業質押平台手續費僅在 5% 至 15% 間,凸顯投資人為了一站式便利和整合所付出的額外成本。不過,評估手續費差異時,也應並行考量平台安全性、監管合規性和客服品質等綜合因素。

Uphold has positioned itself as a comprehensive cryptocurrency platform offering competitive yields reaching up to 24% APY on certain assets, though these high-yield opportunities typically involve smaller or newer cryptocurrencies with correspondingly higher risk profiles. The platform's emphasis on regulatory compliance and transparent fee structures appeals to investors seeking diversified staking opportunities beyond the major networks like Ethereum and Solana.

Uphold 則定位為全方位加密貨幣平台,某些資產年化報酬率高達 24%,但這類高收益通常來自規模較小或較新的加密貨幣,相對風險也更高。該平台強調合規經營及費率透明,吸引想分散投資至以太坊、Solana 等主流鏈以外質押項目的投資人。

The emergence of specialized liquid staking platforms has created a new category of service providers focused specifically on solving the liquidity constraints of traditional staking. Jito is the leading liquid staking protocol on Solana, combining high yields, MEV reward sharing, advanced validator performance, and deep DeFi integrations with over 11 million SOL staked. The platform's success demonstrates the substantial demand for staking solutions that maintain liquidity while generating yield.

專門做流動性質押的創新平台湧現,開創出專為解決傳統質押流動性不足問題的服務類型。Jito 是 Solana 上的領先流動性質押協議,整合高收益、MEV 獎勵共享、頂級驗證者績效,以及深度 DeFi 生態鏈結,目前已有超過 1,100 萬 SOL 被質押。該平台的成功顯示市場對「同時兼顧流動性與收益」的質押解決方案有強烈需求。

Marinade Finance represents another significant liquid staking innovation, particularly in its approach to democratizing access to high-performance validators. The platform's liquid staking yields around 10–12% APY in mid-2025, achieved through algorithmic delegation to validators based on performance metrics rather than simple stake weighting. This approach helps smaller validators compete for delegation while potentially improving overall network decentralization.

Marinade Finance 則是另一個重要的流動性質押創新者,尤其在於將高績效驗證者的參與門檻民主化。平台中流動性質押年化報酬約 10–12%(2025 年中),其演算法會依據表現指標分配質押額,而非只看質押數量,協助規模較小的驗證者參與競爭,也有助提升整體網路去中心化程度。

The MEV (Maximum Extractable Value) reward sharing offered by platforms like Jito adds an additional yield component that traditional staking methods cannot capture. MEV rewards come from validators' ability to reorder transactions within blocks to capture arbitrage opportunities or other value extraction strategies. While these rewards can meaningfully boost overall yields, they also introduce additional complexity and potential regulatory scrutiny as authorities examine whether MEV constitutes fair market practices.

像 Jito 這類平台的 MEV(最大可提取價值)獎勵共享機制,提供傳統質押獲得不了的額外收益。MEV 收益來自驗證者能在區塊內重排序交易,捕捉套利或其他價值提取機會。雖然這有助提升總報酬,但也帶來額外複雜度及潛在監管審查,因為主管機關正檢視 MEV 是否屬於公平市場行為。

Cloud mining platform evaluation requires different criteria than staking services, focusing more on operational transparency and hardware deployment verification. Established platforms like HashNest leverage their connection to Bitmain's manufacturing capabilities to provide verified access to current-generation mining equipment, though this relationship also creates concentration risk if Bitmain faces operational or financial difficulties.

雲端挖礦平台評比標準與質押不同,更需著重營運透明度及礦機部署驗證。像 HashNest 這樣的老牌平台,憑藉與比特大陸(Bitmain)製造端的關係,為客戶提供可查證的現代礦機存取,不過這種合作也意味著一旦比特大陸出現營運或財務困難,平台本身的風險會提高。

The emergence of renewable energy-focused cloud mining platforms addresses growing environmental concerns while potentially offering cost advantages in regions with abundant clean energy resources. These platforms often operate in locations like Iceland, Norway, or parts of the United States where hydroelectric, geothermal, or wind power provides both cost and environmental benefits. However, the premium pricing for "green" mining contracts may not always justify the environmental benefits from a pure return perspective.

專注於可再生能源的雲端挖礦平台問世,回應不斷升高的環保關注,同時在擁有豐富綠能資源的地區提供潛在成本優勢。這些平台通常在冰島、挪威或美國某些地區運營,當地水力、地熱或風力發電不僅降低成本,也有助環保。不過所謂「綠色」挖礦合約的溢價定價,從純粹投資回報角度來看,未必完全合理。

NiceHash's marketplace model provides price discovery and transparency that traditional cloud mining contracts lack, but it also introduces complexity that may not appeal to less sophisticated investors. The platform's real-time pricing reflects supply and demand dynamics for hash power, creating opportunities for strategic buyers to secure favorable rates during periods of low demand while exposing participants to rate volatility that fixed contracts avoid.

NiceHash 採取市場交易模式,帶來傳統雲端挖礦所缺乏的價格發現與透明度,但同時也因機制較複雜,對經驗不足的投資人吸引力較低。平台按即時價格供需撮合算力,讓策略型買家能在低需求時鎖定優惠價格,但參與者也需承擔固定合約無需面對的價格波動風險。

Emerging platforms like Best Wallet represent the evolution toward integrated cryptocurrency management solutions that combine staking, storage, and DeFi access in single applications. On-chain staking is one of the best passive ways to earn APY on some of the most popular Proof-of-Stake cryptocurrencies, and Best Wallet users can stake multiple assets without having to undergo KYC. This non-custodial approach appeals to privacy-conscious users while providing access to multiple networks and staking opportunities.

新興平台如 Best Wallet,代表加密管理服務朝整合型發展的趨勢,在單一應用內結合質押、儲存與 DeFi 功能。鏈上質押是持有熱門權益證明型加密貨幣獲取年化收益的首選被動方式之一,而 Best Wallet 用戶可於無需 KYC 認證下質押多種資產。這種非託管方式吸引了重視隱私的族群,同時開放更多鏈、更多質押機會的參與門檻。

The integration of staking into comprehensive cryptocurrency management platforms reflects broader industry trends toward ecosystem consolidation and user experience simplification. Rather than requiring users to manage separate accounts across multiple specialized platforms, integrated solutions provide streamlined access to various yield-generating opportunities while maintaining control over private keys and transaction history.

質押納入綜合型加密貨幣管理平台,反映了產業朝生態整合與用戶體驗簡化發展的大趨勢。投資人不必再在多個專業平台間分散管理帳戶,而是能在單一平台上便捷存取各類收益機會,同時維持對私鑰和交易紀錄的主控權。

Platform security and insurance coverage have become increasingly important differentiators as the cryptocurrency industry matures and institutional adoption grows. Many platforms now offer insurance coverage through traditional providers, though the scope and terms of this coverage vary significantly. Understanding insurance limitations and exclusions becomes crucial for larger investors whose positions may exceed coverage limits or fall outside covered scenarios.

隨著產業成熟及機構化參與者增加,平台安全性與保險保障也成為重要的分野。許多平台現已通過傳統保險公司投保,但覆蓋範圍和條款相差甚遠。大額投資人需特別注意保險的責任界線及不理賠項目,避免持倉規模超出保險額度或不在承保範圍內。

Environmental Impact and Sustainability Considerations

The environmental implications of cloud mining versus staking represent one of the most significant philosophical and practical differences between these yield-generating approaches. As cryptocurrency adoption grows and environmental consciousness increases, the sustainability profile of different earning strategies has become a material consideration for many investors and institutions.

環境影響與永續性考量

雲端挖礦與質押在環境上的影響,構成這兩種收益方式最大、最具哲學與實務意義的差異之一。隨著加密貨幣採用率提升、全球環保意識日益高漲,各種收益策略的永續性特徵,已成為投資人和機構做決策的重要考量。energy consumption to maintain network security through computational competition.

維持網絡安全所需的能耗,來自於運算競爭。

Analyses find that Bitcoin mining alone consumes 100+ terawatt-hours (TWh) per year, comparable to entire countries like Poland.

有分析指出,僅比特幣挖礦每年就消耗超過100太瓦時(TWh)的電力,與波蘭等整個國家相當。

This massive energy consumption stems from the fundamental design of proof-of-work systems, where security increases with the total computational power dedicated to mining, creating an arms race for more efficient hardware and cheaper electricity.

如此龐大的能耗源於工作量證明(PoW)系統的基本設計──網絡安全性由投入挖礦的總運算能力決定,導致礦工間競相追求更高效的硬體與更便宜的電力,形成一場軍備競賽。

The carbon footprint of mining operations depends heavily on the energy source powering mining facilities. Operations located in regions with coal-heavy electrical grids contribute significantly more carbon emissions per Bitcoin mined than those powered by renewable sources.

挖礦作業的碳足跡取決於其所使用的能源類型。若礦場位於以燃煤為主的電網區域,每生產一枚比特幣所產生的碳排放量就遠高於採用再生能源的地區。

However, the economic incentives in mining naturally drive operators toward the cheapest available electricity, which has historically favored fossil fuel-based power generation in many regions.

然而,挖礦的經濟誘因使營運商自然而然會傾向選擇最便宜的電力來源,歷史上在許多地區這通常會優先選擇化石燃料發電。

Recent trends indicate a gradual shift toward renewable energy use in mining operations, driven by both cost considerations and regulatory pressure.

近年來,在成本考量及監管壓力的推動下,挖礦作業逐漸朝向更多採用再生能源。

Several Icelandic miners use the cold Arctic air for free cooling, slashing cooling bills while tapping into abundant geothermal and hydroelectric resources.

幾家冰島礦場利用寒冷的北極空氣進行免費冷卻,大幅降低冷卻成本,同時利用豐富的地熱與水力資源。

Similarly, mining operations in regions with surplus renewable energy capacity can access power at rates below traditional grid pricing, creating economic incentives that align with environmental benefits.

同樣地,位於可再生能源過剩區域的挖礦作業,能以低於傳統電網價格取得電力,實現經濟效益與環保優勢的雙贏。

The geographic distribution of mining activity reflects these energy cost dynamics, with operations clustering in regions with power surpluses or advantageous regulatory environments for renewable energy development.

挖礦活動的地理分布也反映了能源成本的變化,礦場多聚集於電力過剩或有利於可再生能源發展的區域。

Parts of Texas with excess wind power capacity, Quebec with abundant hydroelectric resources, and Nordic countries with geothermal energy have become important mining centers where environmental and economic incentives align more favorably.

德州部分風電過剩地區、魁北克的豐沛水力資源,以及具有地熱優勢的北歐國家,已成為環保與經濟誘因相對一致的重要挖礦中心。

However, the overall environmental impact of Bitcoin mining remains substantial despite improvements in renewable energy adoption.

然而,儘管再生能源使用有所提升,比特幣挖礦對環境的整體影響依然相當巨大。

The network's energy consumption continues to grow as more efficient hardware and additional mining capacity comes online, and the majority of mining operations still rely at least partially on fossil fuel-powered grids.

隨著更高效的硬體及新增的挖礦產能投入,整個網絡的能耗持續攀升,且大多數礦場至少部分仍依賴以化石燃料為主的電網。

This reality creates an inherent tension for environmentally conscious investors considering cloud mining participation.

這種現實也讓有環保意識的投資人,在考慮參與雲端挖礦時面臨不可忽視的矛盾。

Staking-based networks demonstrate dramatically different environmental profiles due to their fundamentally different approach to achieving network security.

以質押(staking)為基礎的網絡,因其實現網絡安全的方式根本不同,展現出截然不同的環境影響。

Independent analyses find that Ethereum's switch to PoS cut its energy use by ~99.8%, providing a rough guide that PoS networks use orders of magnitude less power than comparable PoW networks.

獨立分析顯示,以太坊轉向權益證明(PoS)後,其能耗下降約99.8%,可大致推論權益證明網絡所需能量遠低於類似規模的工作量證明網絡。

This efficiency improvement stems from eliminating the computational competition that drives energy consumption in proof-of-work systems.

這項效率上的巨大提升,源自於PoS取消了推動PoW巨量能耗的挖礦競爭。

The energy requirements for proof-of-stake validation primarily involve running server hardware to maintain network connectivity and process transactions.

權益證明的驗證能耗,主要來自運行伺服器以維持網絡連線與處理交易。

While validators must maintain reliable internet connections and sufficient computational power to handle network consensus activities, these requirements are comparable to running web servers rather than the specialized, energy-intensive hardware required for mining.

驗證者雖須維持穩定網路連線與適量運算能力來參與共識,這項負擔與運營網頁伺服器類似,無需動用高耗能的專用礦機。

Ethereum's post-merge energy consumption demonstrates the potential for large-scale networks to operate with minimal environmental impact while maintaining security and decentralization.

以太坊合併(The Merge)之後的能耗,顯示大型網絡有可能兼顧安全、去中心化,且對環境的影響降至最低。

The network continues to process similar transaction volumes and maintain comparable security guarantees while using a fraction of its previous energy consumption, providing a concrete example of how alternative consensus mechanisms can address environmental concerns.

該網絡在消耗原來極小一部分電能的情況下,依然維持類似的交易量及安全性,提供了替代共識機制能因應環保議題的實例。

The environmental advantages of staking extend beyond direct energy consumption to include reduced electronic waste generation.

Staking 的環境優勢不限於能耗,更體現在降低電子廢棄物產生上。

Proof-of-work mining drives continuous hardware upgrades as more efficient ASIC miners obsolete previous generations, creating substantial electronic waste streams.

工作量證明挖礦驅動礦工不斷升級專用ASIC礦機,致使舊機型快速淘汰,產生大量電子廢棄物。

Mining hardware typically becomes uneconomical within 18-36 months as network difficulty increases and more efficient models become available.

隨著網絡難度增加及更高效機型問世,挖礦硬體通常在18至36個月內便失去經濟效益。

Staking infrastructure, by contrast, relies on standard server hardware that maintains utility for much longer periods.

相比之下,staking基礎架構仰賴標準伺服器硬體,可延長使用年限。

Validators can often operate successfully on hardware for several years without requiring upgrades, and when hardware does reach end-of-life, it can be repurposed for other computing applications rather than becoming specialized electronic waste.

驗證者往往能在同一台硬體上運作數年無需升級,終止使用後也能轉作其他用途,減少專用電子廢棄物的產生。

Corporate sustainability initiatives increasingly influence cryptocurrency adoption and platform selection, with many institutions requiring environmental impact assessments before engaging with cryptocurrency services.

企業永續發展政策日益影響加密貨幣的採用和平台選擇,許多機構在參與加密貨幣服務前都要求環境影響評估。

The clear environmental advantages of staking over mining have led many ESG-focused investors and institutions to prefer proof-of-stake networks and staking services over cloud mining participation.

Staking 相較挖礦的明顯環保優勢,使愈來愈多重視ESG的投資人與機構,偏好權益證明網絡及staking服務,而非參與雲端挖礦。

However, the environmental analysis becomes more complex when considering the broader cryptocurrency ecosystem.

然而,若考慮到整體加密生態系,環境分析會變得更加複雜。

Many staking-based networks depend on bridges to Bitcoin or other proof-of-work networks, creating indirect connections to energy-intensive mining operations.

許多staking網絡需要與比特幣或其他PoW網絡進行跨鏈橋接,間接連結到高能耗挖礦作業。

Additionally, the environmental benefits of staking may be partially offset if staking rewards are used to purchase Bitcoin or other proof-of-work cryptocurrencies.

此外,若staking獎勵被用來購買比特幣或其他PoW代幣,也可能部分抵銷其原有的環境效益。

The emergence of carbon offset programs and renewable energy certificates in the cryptocurrency space reflects growing attention to environmental impact measurement and mitigation.

加密貨幣領域出現碳抵換計畫和再生能源憑證,顯示業界越來越重視環境影響的評估與減緩。

Some cloud mining platforms now offer carbon-neutral contracts through verified offset purchases, though the effectiveness and additionality of these offset programs vary significantly and require careful evaluation.

部分雲端挖礦平台推出碳中和合約,透過購買核可的碳抵換額來實現,但這些抵換計畫的實效性與額外性差異甚大,需審慎評估。

Regulatory Landscape and Compliance Considerations

The regulatory environment for cryptocurrency earning strategies continues evolving rapidly, with different jurisdictions taking varying approaches to cloud mining and staking activities. Understanding the current regulatory landscape requires examining both existing rules and anticipated developments that could significantly impact the profitability and legality of different earning strategies.

加密貨幣收益策略的監管環境正快速演變,各地對雲端挖礦與staking活動的規範態度不一。理解現有監管現狀,必須同時考察已存在的規定與未來發展趨勢,這些變化可能會大幅影響各項收益策略的合法性與獲利情形。

United States regulatory treatment of cryptocurrency earning activities reflects the complex interplay between multiple federal agencies with overlapping jurisdictions.

美國對於加密貨幣收益活動的監管,反映多個聯邦機構間職權重疊的複雜互動。

The Internal Revenue Service treats both mining rewards and staking rewards as taxable income at fair market value when received, creating immediate tax obligations regardless of whether the cryptocurrency is subsequently sold.

美國國稅局(IRS)將挖礦獎勵與staking獎勵視為應稅收入,並以收到當下的市價課稅,無論該加密貨幣日後是否出售,納稅義務當下即產生。

This treatment can create cash flow challenges for participants who receive rewards in volatile cryptocurrencies that decline in value before they can be liquidated to pay tax obligations.

此規定可能導致參與者面臨現金流困難,若獲得的獎勵為價格波動劇烈的代幣於變現前已下跌,納稅義務仍須履行。

The Securities and Exchange Commission has signaled increasing scrutiny of staking services, particularly liquid staking platforms that issue derivative tokens.

美國證券交易委員會(SEC)近期加強檢視staking服務,特別是發行衍生憑證的流動式staking平台。

The SEC itself has signaled that liquid staking tokens might be treated more like commodities than securities, though this guidance remains preliminary and could change as regulatory frameworks develop.

SEC曾暗示流動式staking衍生品可能會比照商品而非證券處理,但目前仍屬初步指引,未來隨監管架構演進可能有所更動。

The distinction between securities and commodities treatment has significant implications for platform operators and users, affecting everything from registration requirements to taxation.

證券與商品的定義差異,對平台業者與用戶影響重大,涉及註冊管理、稅務等多方面。

State-level regulations add additional complexity, with some jurisdictions implementing specific requirements for cryptocurrency business operations.

各州的監管令情勢更為複雜,有些州針對加密貨幣業務另行規範。

In several states, including California, Maryland, New Jersey, New York, and Wisconsin, Robinhood does not allow users to stake, likely due to varying regulatory environments across different regions.

在加州、馬里蘭州、新澤西州、紐約州、威斯康辛州等地,Robinhood不允許用戶staking,很可能與各地監管環境的差異有關。

These geographic restrictions reflect the patchwork of state-level cryptocurrency regulations that can limit access to certain platforms or services.

這種地域性限制反映出各州間加密法規的拼貼狀態,從而限制民眾使用某些平台或服務。

European Union cryptocurrency regulations under the Markets in Crypto-Assets (MiCA) framework provide more comprehensive guidance for staking and mining activities, though implementation varies across member states.

歐盟在加密資產市場(MiCA)監管框架下對staking及挖礦提出更全面的指引,但各會員國的具體執行情形仍不盡相同。

The regulatory clarity in many European jurisdictions has attracted cryptocurrency businesses seeking predictable compliance frameworks, potentially creating advantages for European investors in terms of platform availability and consumer protections.

歐洲多數地區監管較清晰,吸引用戶及企業追求預期可控的合規環境,對投資者而言平台選擇與消費者保護也更具優勢。

The treatment of cloud mining presents particular regulatory challenges because it involves service contracts rather than direct cryptocurrency transactions.

雲端挖礦因屬於服務合約而非直接代幣交易,監管認定特別棘手。

Many jurisdictions struggle to classify cloud mining activities within existing financial service frameworks, creating regulatory uncertainty that can impact platform operations and user rights.

許多地區很難將雲端挖礦納入現有金融服務規範,造成監管不確定性,影響平台營運及用戶權益。

Some regions treat cloud mining as investment contracts subject to securities regulations, while others classify them as service agreements outside traditional financial oversight.

部分地區將雲端挖礦視為投資合約,受證券法規管;另一些地區則當作純粹服務合約,不屬於傳統金融監理範疇。

Anti-money laundering (AML) and know-your-customer (KYC) requirements increasingly apply to both staking and cloud mining platforms, particularly those handling significant transaction volumes or serving institutional clients.

反洗錢(AML)及認識你的客戶(KYC)要求,也日益適用於staking及雲端挖礦平台,尤其是交易量龐大或對機構客戶提供服務的平台。

These compliance requirements can create barriers to entry for smaller platforms while providing additional user protections and regulatory legitimacy for established operators.

這些合規要求可能造成小型業者進入門檻提高,同時為大型平台用戶提供更多保護與法規正當性。

However, compliance costs often translate to higher fees or reduced yields for users.

但合規所衍生的成本,往往也反映在較高的手續費或降低用戶收益上。

International tax treaty implications affect cross-border cryptocurrency earning activities, particularly for platforms operating in multiple jurisdictions or users accessing services from different countries.

國際稅收協定會影響跨國加密收益活動,尤其涉及多國營運平台或用戶跨境使用服務時。

Tax withholding requirements, reporting obligations, and treaty benefits can significantly impact net returns for international participants, requiring careful analysis of the complete tax implications before engaging with foreign platforms.

稅款扣繳、申報義務及協定優惠,都可能大幅左右國際參與者的實際淨收益,參與海外平台前必須仔細分析所有稅賦影響。

The evolving regulatory landscape creates ongoing compliance risks for both platforms and users.

不斷演變的監管環境,使平台與用戶都面臨持續的合規風險。

Regulatory changes can retroactively

(原文未結束,省略...)impact the tax treatment or legality of previously compliant activities, potentially creating unexpected obligations or penalties. Staying informed about regulatory developments and maintaining detailed transaction records becomes essential for managing these compliance risks effectively.

影響原先合規活動的稅務處理或合法性,可能產生意料之外的義務或罰則。隨時掌握監管動態並維持詳盡的交易紀錄,對於有效管理這些合規風險變得至關重要。

Regulatory uncertainty also impacts platform development and service availability. Many cryptocurrency businesses limit service availability in certain jurisdictions to avoid potential regulatory conflicts, reducing options for users in those regions. Additionally, regulatory compliance costs can impact platform economics, potentially resulting in higher fees or reduced yields as platforms invest in legal and compliance infrastructure.

監管不確定性也會影響平台的發展與服務可用性。許多加密貨幣業者為避免潛在監管衝突,會在特定司法管轄區限制服務提供,導致該區用戶選擇變少。此外,合規成本也會衝擊平台經濟效益,當平台必須投入法律與合規基礎建設時,可能造成手續費提高或收益降低。

The trend toward increased regulation generally favors larger, better-capitalized platforms that can invest in comprehensive compliance frameworks. This regulatory moat effect may reduce competition and innovation in the cryptocurrency earning space while providing greater consumer protections and market stability. Understanding how regulatory trends impact different platforms and earning strategies becomes crucial for long-term investment planning.

監管趨嚴的趨勢通常有利於資本規模大、能投入完善合規架構的平台。這種監管護城河效應,可能讓加密貨幣收益領域的競爭與創新減少,但同時增強消費者保護和市場穩定。了解監管趨勢如何影響不同平台與獲利策略,對長期投資規劃至關重要。

Future Outlook and Technological Developments

未來展望與技術發展

The trajectory of cloud mining versus staking profitability through 2025 and beyond will be shaped by technological developments, market maturation, and evolving user preferences that are already beginning to manifest in current platform offerings and network upgrades. Understanding these trends requires examining both the technical innovations underway and the economic forces driving cryptocurrency network evolution.

雲端挖礦與質押(staking)獲利前景,至2025年甚至更遠的未來,將受到技術進步、市場成熟度以及用戶偏好演變等多重影響,這些趨勢已在現有平台服務與網路升級中初現端倪。要理解這些趨勢,需同時觀察現在進行中的技術創新與推動加密貨幣網路演化的經濟力量。

Mining technology continues advancing through improvements in ASIC efficiency and renewable energy integration, though these improvements face the fundamental constraint of Bitcoin's difficulty adjustment mechanism that maintains consistent block times regardless of total computational power. Next-generation ASICs are roughly 20–50% more efficient than their predecessors, meaning they mine more BTC per watt consumed. However, these efficiency gains primarily benefit miners during the period before network difficulty adjusts to account for increased hash power, suggesting that technological improvements provide temporary rather than permanent profitability advantages.

挖礦技術持續進步,包括ASIC效能提升與再生能源整合,但這些進步受到比特幣難度調整機制的根本限制,無論全網算力多寡,區塊產出時間都會被維持一致。新一代ASIC約比前一代提升20%到50%的效率,也就是每消耗一瓦可以挖出更多BTC。不過,這些效率提升主要在難度尚未對應算力增長而調整前,對礦工最有利,顯示技術進步帶來的是暫時性的獲利優勢,而非永久性收益保障。

The shift toward renewable energy sources in mining operations represents a more sustainable trend that could reshape the competitive landscape of cloud mining platforms. Beyond cost considerations, renewable energy adoption addresses regulatory pressure and corporate sustainability requirements that increasingly influence institutional cryptocurrency adoption. Mining operations that establish reliable access to low-cost renewable energy may develop sustainable competitive advantages over those relying on traditional grid power.

礦業轉向使用再生能源,是邁向永續經營的重要趨勢,未來有機會重塑雲端挖礦平台的競爭格局。除了電費成本考量,採用綠能亦能回應監管壓力與企業永續責任的要求,這越來越影響到機構級加密貨幣採納。若礦場能確保穩定且低價的再生能源供應,對於仍依賴傳統電網的業者將產生長期競爭優勢。

Staking technology evolution focuses more on user experience improvements and yield optimization strategies rather than fundamental changes to energy consumption or hardware requirements. The development of restaking protocols allows already-staked tokens to secure additional networks and earn multiple yield streams simultaneously, potentially increasing overall returns without requiring additional capital deployment. However, restaking also introduces additional complexity and risk that may limit adoption among less sophisticated participants.

質押技術演化主要著重於提升用戶體驗以及收益優化,而非像挖礦那樣仰賴能源或硬體本質上的改變。再質押協議(restaking)的出現,讓已經質押的代幣可同時協助多條網路運作、並創造多重收益來源,潛在可提升整體報酬且無須再投入新資本。但再質押也帶來額外複雜性與風險,對於經驗較淺或技術不熟的參與者,可能限制其採納率。

Liquid staking innovation continues addressing the fundamental liquidity constraints of traditional staking while expanding integration with broader DeFi ecosystems. The evolution toward more sophisticated liquid staking derivatives could enable increasingly complex yield strategies that combine staking rewards with lending, liquidity provision, and other DeFi activities. However, this complexity also increases smart contract risk and regulatory uncertainty around the classification of these financial instruments.

流動性質押創新,持續解決傳統質押流動性受限的問題,同時加強與更廣泛DeFi生態的接軌。更進階的流動性質押衍生品,能讓用戶結合質押獎勵、借貸、流動性挖礦及其他DeFi操作,組成複合收益策略。然而,這種複雜性也帶來智能合約風險,以及相關金融商品監管認定的不確定性。

Cross-chain staking development may enable token holders to secure multiple networks simultaneously or to stake tokens on networks different from their native blockchain. These innovations could increase the addressable market for staking services while providing users with more diversification opportunities. However, cross-chain solutions often introduce additional technical risks and complexity that could offset their benefits.

跨鏈質押的發展,將使持幣者可同時為多個網路提供安全性,甚至可在與原生區塊鏈不同的網路上進行質押。這類創新不僅擴大質押服務的可觸及市場,亦提升用戶分散投資的彈性。不過,跨鏈方案往往也引入額外的技術風險與複雜度,可能抵銷部分其帶來的效益。

The institutional adoption of cryptocurrency earning strategies continues expanding, with traditional financial institutions increasingly offering staking and mining exposure products to their clients. This institutional involvement brings additional capital and regulatory clarity to the space while potentially reducing yields as increased participation drives down returns toward traditional financial market levels.

機構採納加密貨幣收益策略的情形持續擴大,傳統金融機構愈來愈多地為客戶提供質押與挖礦收益產品。這帶來額外資本與監管明朗性,但隨著參與者增多、報酬也可能被壓低至較接近傳統金融市場水準。

Central bank digital currency (CBDC) development may impact both staking and mining dynamics by providing government-backed alternatives to decentralized cryptocurrencies. While CBDCs are unlikely to directly compete with earning strategies on decentralized networks, they could influence regulatory approaches and user adoption patterns in ways that affect the overall cryptocurrency ecosystem.

中央銀行數位貨幣(CBDC)發展,可能透過提供政府信用支持的替代品,對質押及挖礦市場帶來影響。雖然CBDC不太可能直接與去中心化網路的收益機制競爭,但其有可能改變監管策略和用戶採納模式,間接影響整體加密貨幣生態。

The evolution of Layer 2 scaling solutions on Ethereum creates new staking opportunities while potentially reducing yields on the main Ethereum network. Layer 2 networks often implement their own staking mechanisms and reward systems, providing additional earning opportunities while distributing economic activity across multiple networks. However, the proliferation of earning opportunities across different layers and networks increases the complexity of optimizing yield strategies.

乙太坊Layer 2擴容方案的發展,創造了新質押機會,但也可能壓縮主鏈的收益率。Layer 2網路通常設有不同於主鏈的質押或獎勵機制,使經濟活動分散至多條網路,產生額外的賺取機會。但這樣多層次、多網路的收益管道,會讓最佳化策略變得更加複雜。

Environmental regulations and carbon pricing mechanisms may increasingly influence the economics of both mining and staking operations. Jurisdictions implementing carbon taxes or requiring renewable energy usage could create significant cost differences between platforms based on their energy sources and operational locations. These regulatory developments could accelerate the shift toward proof-of-stake networks while creating additional costs for cloud mining operations.

環境法規與碳定價機制日益影響挖礦與質押經濟。推行碳稅或要求使用再生能源的司法轄區,可能讓依不同能源來源與運營據點的平台,出現顯著成本差異。這類規範將加速加密貨幣轉向權益證明(Proof-of-Stake, PoS)模式,同時讓雲端挖礦面臨更多額外成本。

Market maturation trends suggest that yield opportunities in both staking and cloud mining may gradually decline toward levels more consistent with traditional financial markets as increased participation and institutional involvement drive down risk premiums. This normalization process could make earning strategies more predictable and accessible while reducing the outsized returns that characterized earlier phases of cryptocurrency development.

市場逐漸成熟的趨勢顯示,隨著參與者增多以及機構涉入,質押與雲端挖礦的收益將逐步下降,趨近於傳統金融市場的水準,並壓縮原先較高的風險溢價。這種常態化過程雖可提升收益策略的可預測性及普及性,卻會減少早期加密貨幣所見的超額報酬。

Strategic Recommendations for Different Investor Profiles

不同投資者輪廓的策略建議

The optimal choice between cloud mining and staking depends heavily on individual circumstances, including risk tolerance, technical sophistication, capital availability, and investment timeline. Rather than declaring one approach universally superior, effective strategy development requires matching earning methods to investor characteristics and objectives.

雲端挖礦與質押何者為優,極端取決於個人狀況,包括風險承受度、技術熟練度、資本規模與投資期間。與其尋求「最佳單一方案」,不如針對不同投資人特性與目標,因地制宜設計合適收益組合。

Conservative investors seeking predictable returns with minimal technical complexity may find exchange-based staking services most appropriate for their needs. Platforms like Coinbase, Kraken, and Binance offer staking services that handle all technical requirements while providing familiar customer service and regulatory compliance frameworks. These services typically sacrifice some yield potential in exchange for convenience and security, making them suitable for investors who prioritize simplicity over maximum returns.

對於追求穩定收益且不想碰太多技術細節的保守投資者,交易所型質押服務最為合適。Coinbase、Kraken、幣安等平台都提供把所有技術和合規細節一手包辦的質押服務,給客戶熟悉的客服體驗。這類服務通常以較低報酬換取便利與安全,適合重視簡便、願意放棄部分收益以省事的投資人。

The trade-off analysis for exchange staking involves accepting lower yields in exchange for reduced operational risk and complexity. While direct validation or delegation to high-performance validators may achieve higher returns, exchange staking eliminates slashing risk, removes technical setup requirements, and provides customer support for issues that may arise. For investors treating cryptocurrency earning as a minor portfolio component, these conveniences often justify the reduced yields.

交易所質押的權衡是以降低操作與技術風險為代價,接受較低收益。雖然自己運行節點或委託於高效驗證人,理論上能獲得更好回報,但透過交易所則完全無需擔心被懲罰砍倉(slashing)等風險,也免除任何技術設置,只需和一般交易服務一樣享有客服支援。假如加密收益只佔組合一小角,這點便利性其實遠比收益重要。

Aggressive investors seeking higher yields may prefer direct staking through native wallets or specialized platforms that offer access to high-performance validators and restaking opportunities. This approach requires greater technical understanding and active management but can achieve meaningfully higher returns through optimal validator selection, MEV reward capture, and participation in newer networks with higher reward rates. However, these strategies also expose participants to additional risks including slashing penalties, smart contract vulnerabilities, and reduced liquidity.

進取型投資人若追求更高報酬,可選擇用原生錢包或專業質押平台,直接參與高效驗證人或再質押機會。這需要較強的技術能力與主動管理,但可以透過優化驗證人選擇、爭取MEV(最大可提取價值)獎勵,以及參與新創報酬較高的網路,拉高整體收益。不過,這路線伴隨的額外風險也顯著,包括被砍倉懲罰、智能合約漏洞及流動性不足等。

The risk-return optimization for aggressive staking strategies requires careful balance between yield maximization and downside protection. Diversifying across multiple networks, validators, and staking methods can reduce concentration risk while maintaining access to higher-yield opportunities. However, diversification also increases management complexity and may require maintaining assets across multiple platforms and networks.

進取型質押的風險報酬最佳化,需要在追高收益和控管下行之間取得平衡。跨多條網路、驗證人與質押方案分散,有助於降低集中風險,並持續捕捉高收益機會。但這也意味著資產須分布在多平台、多網路,帶來管理複雜度的提升。

Technical sophistication requirements vary significantly between different earning approaches, influencing their suitability for different investor types. Cloud mining requires minimal technical knowledge but demands careful platform due diligence and understanding of mining economics. Staking can range from simple exchange-based services to complex multi-network validation strategies that require substantial blockchain knowledge and operational capabilities.

不同的收益方式需要的專業程度差異很大,因此也影響其對不同投資人類型的適用性。雲端挖礦技術門檻低,但必須非常注重平台審查和了解挖礦經濟。質押服務則可從極為簡單的交易所質押,到極度複雜的多鏈驗證,而這需要豐富區塊鏈知識和操作實力。

For technically inclined investors, running independent validators or participating in governance activities can provide additional rewards beyond basic staking yields. Many networks offer increased rewards for validators that participate in governance voting, community activities, or network upgrade testing. However, these additional earning opportunities require significant time investment and technical expertise that may not

對有技術能力且願意主動參與的投資人來說,自己運行獨立驗證人、參與社群治理活動,除了基本質押收益外還能拿到額外獎勵。許多網路會給參加治理投票、社區參與或協助測試升級的驗證人更高報酬。不過,這些額外獲利機會同樣需要高度的時間投入與技術專業, be justified for smaller stake amounts.

資本分配策略應該考慮不同賺取方式的流動性特性以及最低投資門檻。雲端挖礦合約通常需要在一開始支付固定金額,持續一定合約期間,這產生了類似傳統固定收益投資的流動性限制。質押則透過解押機制提供較大彈性,但在市場波動時,解綁期可能會帶來暫時的流動性限制。

Liquid staking 提供最高的靈活性,因為其維持可隨時交易並立即兌現的代幣,儘管通常相比於傳統質押收益率略低。對於需要快速調整加密貨幣持倉、以回應市場發展或投資組合再平衡需求的投資人來說,這個流動性溢價可能是值得的。

稅務優化策略在質押與挖礦活動之間有顯著差異,需要不同的記錄保存與時機管理方式。質押獎勵一般於收到時視為收入產生即時納稅義務,因此可以利用稅務年度邊界進行時機安排。挖礦獎勵則有相似的收益性質,但雲端挖礦參與者對於獎勵發放時點的控制較小。

對能夠接觸不同平台或監管環境的投資人來說,地理套利機會依然存在,某些地區可能有更優稅務待遇。然而,這類策略需要格外注意稅收協議細節、報稅要求,以及監管變動對長期策略可行性的影響。

將賺取策略納入更廣泛的投資組合時,必須考慮相關性與風險管理。加密貨幣賺取活動通常與整體加密貨幣市場表現高度相關,比表面看來提供的分散性較低。不過,其收益成分能在市場下行時提供一定下檔保護,同時又能參與牛市時的上漲空間。

Final thoughts

2025年針對雲端挖礦與質押的比較顯示,這是個遠比單純比較獲利能力還要複雜的投資決策領域。兩者皆為合理的加密貨幣賺取方式,但服務對象、風險管理需求和適合策略各不相同,欲達最佳化結果必須分別因應。

目前市場環境下,多數散戶投資人較適合透過成熟平台進行質押,尤其是提供 liquid staking 服務的平台。具有競爭力的收益率、運營風險較低、以及門檻下降的便利性,使質押成為希望參與加密貨幣收益、但不願承擔雲端挖礦技術複雜度與對手風險的投資人理想選擇。以以太坊3%、Solana 6~7%報酬為合理基準,若能接受更高複雜性或新興網路風險,還有更高收益的選擇。

對於希望取得比特幣曝險,或偏好雲端挖礦明確合約結構投資人來說,雲端挖礦依然可行。然而,業界過去涉及詐欺與運營失敗的歷史,要求投資人在平台挑選與盡職調查上格外謹慎,而這在多數散戶上並不容易做到。合法雲端挖礦年化5-10%的回報大致能與質押競爭,但額外風險對大多數投資人來說未必值得。

驅動這兩個領域的技術趨勢透露,未來將朝向用戶體驗提升和機構化採用發展。liquid staking 創新突破傳統質押參與障礙,restaking 協議則帶來更高收益機會。與此同時,雲端挖礦平台也愈發重視使用再生能源與運營透明度,以回應環境與信任相關的顧慮。

監管發展將對不同賺取策略的相對吸引力產生重大影響,隨著各國推進加密貨幣法規,趨勢往更明確的監管架構發展。從目前來看,監管環境一般較有利於質押而非雲端挖礦,因質押行為辨識較單純,同時避開 PoW 網路帶來的環境爭議。

環境因素也日漸影響投資人和機構決策,賦予質押遠高於挖礦策略的結構性優勢。PoS網路能源效率的大幅提昇,與推動ESG投資理念高度契合,未來隨環保法規擴大,也有望成為競爭優勢。

對大多數投資人而言,最佳策略通常是將成熟質押平台的安全和便利為主,並依自身風險承受與技術能力,選擇性參與更高報酬機會,藉此實現分散化,兼顧不同網路生態圈曝險,同時管理集中於單一平台或方法所帶來的風險。

在加密貨幣收益策略取得成功,需要持續關注市場動態、監管演變及平台發展。這個領域創新腳步非常快速,最佳策略未必一成不變,主動管理與定期檢視所選方案至關重要。

加密貨幣收益生態愈趨成熟,朝向機構級服務和法規合規邁進,對不同類型投資人同時帶來機會與挑戰。雖然更高的正規性和消費保護有利於所有參與者,收益率可能逐步趨近於傳統市場,過去能吸引投資者的超額報酬空間可能隨之縮減。

最後,2025年雲端挖礦與質押的抉擇,應該根據廣泛的投資目標、風險承受度、與投資組合建構原則來權衡,而非僅以表面收益率作比較。最成功的加密貨幣賺取策略能與總體投資方案無縫整合,適當分散風險,為長期財富累積提供堅實基礎。