加密貨幣市場變化極快,主要受新聞與網路炒作推動。一則推文或突發頭條,往往在幾分鐘內就能讓幣價暴漲或暴跌。實際上,研究顯示,一則有影響力的推文——例如來自 Elon Musk——可以瞬間讓比特幣價格上漲至 16.9%,或狂瀉 11.8%,充分證明社群媒體訊息對加密市場的巨大影響力。

對交易者與投資人來說,緊盯無止盡的新聞周期既重要,又令人精疲力盡。加密貨幣 24 小時全球不停交易,當你睡覺時,另一端的新聞標題可能正影響比特幣價格。每小時都有數百篇新文章、數千則社交貼文湧入生態系। 重要資訊可能被這場「新聞海嘯」淹沒,錯過任何一則關鍵消息可能就等於錯過行情,甚至在負面消息出現時還抱著下跌的幣。

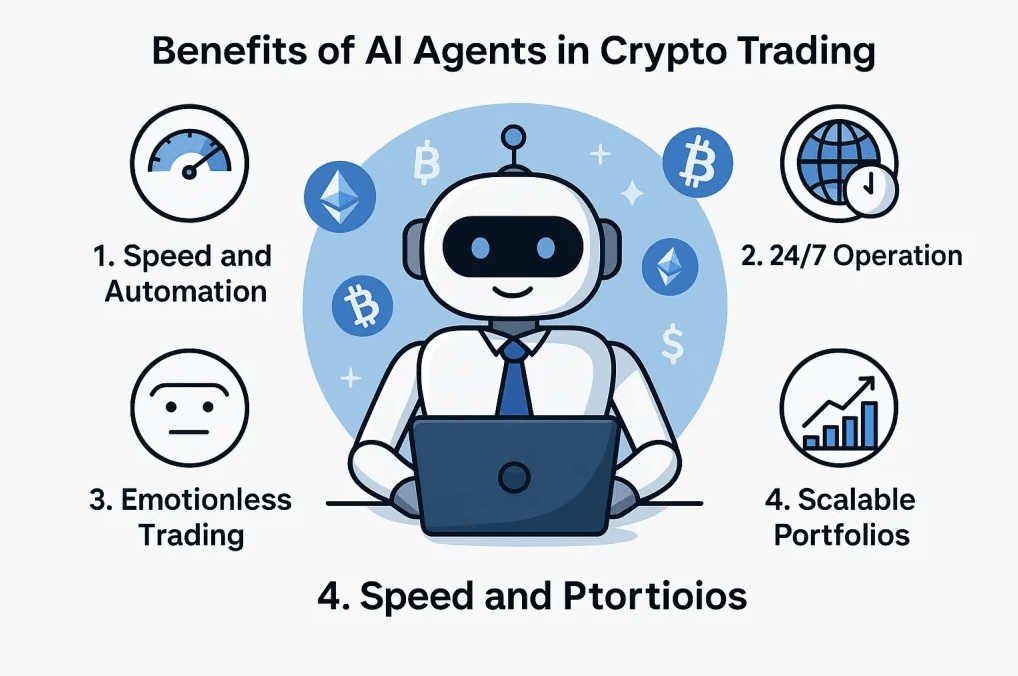

面對這些噪音,誰能夠快到及時反應呢?這正是現代人工智慧(AI)大顯身手的地方。現在的 AI 平台能將龐大的新聞流轉化為可操作洞察,讓一般加密愛好者也能使用過往只屬華爾街量化基金的工具。AI 驅動系統能即時閱讀並理解數以千計新聞來源與推特,掌握市場情緒,甚至預測新聞對幣價可能的影響。

本文將探討如何利用 AI 解碼加密新聞、預測市場反應,把加密「炒作周期」中的瘋狂動盪,轉化為可衡量的交易優勢——無需程式設計。我們將秉持事實與中立觀點,引用可靠研究資料,幫你分辨真正的優勢與單純噱頭。閱讀到最後,你將明白 AI 如何成為你的全天候分析師,助你在快速變化的加密市場中保持領先。

新聞與炒作:加密市場的命脈

加密世界仰賴新聞和情緒。比起其他金融市場,加密貨幣更受圍繞它的敘事與情緒驅動。傳統基本面常常退居次要地位,投資人情緒、熱情與恐懼才是王道。研究發現,加密價格變動「主要受投資人熱情帶動,無論新聞方向為何」。換句話說,不只是消息本身,而是它在群眾間引發的激動或恐懼。一則合作傳聞就可能讓幣價飆漲,隨後卻因實際但較平淡的正面消息而下跌。這種現象造就了「買傳聞,賣消息」的俗語,說明了加密市場中,投機與炒作時常領先於事實。

標題能引發劇烈波動。眾所皆知,一則推文或突發新聞就能把市場攪得天翻地覆。馬斯克的推特正是最佳案例:當他對加密發表正面言論(即使是一個迷因或一個字),價格通常大漲;而批評或隨口評論則讓行情重挫。學界分析證實這一影響—馬斯克個人推文曾讓比特幣產生顯著異常報酬,最高推升近 17%,或重挫 12%。推文內容(正負面)很重要,但關注度的高低同樣關鍵。更有趣的是,研究發現推特討論量本身比推文情緒預測比特幣走向更準。換言之,當群眾開始瘋狂討論某幣時(即使不都是好話),往往預示價格波動。這就是「任何曝光都是好曝光」的現象——注意力提升會帶動資金流入,因更多交易者留意到該資產。

加密新聞來自四面八方。與股票市場受限於少數官方報告(財報、經濟數據)相比,加密市場受無數消息源影響。監管公告、交易所上架、資安事件、宏觀經濟變化、技術進展、KOL 站台——這些都每天衝擊加密新聞網。政府官員在亞洲談規管、歐洲 DeFi 項目被駭,或計劃博客公布新合作,都能在同一天左右市場。

社群平台(Twitter/X、Reddit、Telegram)更模糊「新聞」與社群討論界線,經常充當趨勢預警系統(或謠言放大器)。

牛市時,即使幽默的新聞或迷因都能引發投機狂潮(如 Dogecoin 就因迷因與名人推文暴漲)。熊市時,充滿恐懼的標題能讓市場恐慌性拋售。最終結果是,市場對資訊——甚至錯誤資訊——極度即時敏感。

炒作周期主導漲跌。加密圈以高速炒作周期著稱:一波敘事點燃,資產價格快速暴漲,熱度退去後又急轉直下。2017 ICO 熱潮、2020 DeFi 夏天、2021 NFT 狂潮、迷因幣(DOGE/PEPE)、乃至 2023-2024「AI 概念幣」熱,都是明證。每次,市場主題奪人眼球,短期報酬驚人——但現實與獲利賣壓一來,瘋狂升勢迅速消退。例如 2021 年初,毫無實用性的 Dogecoin 就因社交熱潮和站台暴漲 20 倍,隨後又迅速崩回原點。這個模式太常見了,所謂加密市場周期其實就是炒作周期。

對交易者來說,關鍵是敘事與炒作不是「背景雜音」,而是可交易的訊號。能早一步發現主題浮現,或許就能搶搭早班車。同樣重要的是,能感受到樂觀情緒的高峰,適時獲利了結或避免追高。正如某分析所述:「在加密世界裡,敘事常常讓好點子變成短線交易狂潮」。2025 年有一個叫 LaunchCoin 的代幣案例,強調社群媒體即可輕鬆發幣。此幣在炒作高峰暴漲 3,500%,吸引無數網紅與交易者追捧,但幾週後快速回落至發行價 20 倍左右,熱度明顯消退。這完全吻合典型炒作循環,就像*「迷因幣 $DOGE、$PEPE(暴漲暴跌)、NFT 藏品 2021 年大紅、2022 年卻迅速冷卻」*。這些例子都證明,抓準市場情緒高低轉折是必備技能。

只是,時機掌握談何容易?炒作無法用基本面或財報衡量,而是活在推特、Reddit 討論串與四處蔓延的新聞裡。等大多數人發現敘事熱到極點時,往往已經太晚——早期漲幅已消失,你可能正接盤。反之,要察覺敘事剛起火的小徵兆(在全世界討論它前)根本如大海撈針。這正是 AI 能賦予交易者優勢的領域。

資訊爆炸:交易者為何需要 AI

加密資訊量已遠超任何人力可應付。新聞與謠言從不休息,也不侷限於任何語言或地區。紐約的比特幣投資人可能一覺醒來,才發現夜間行情已被北京的監管聲明或首爾交易所被駭攪局。「你在讀這句話時,數百篇財經新聞同時問世……當你讀完標題、決定如何反應時,機會(或災難)可能早已發生」,某 AI 交易公司如此形容傳統方式難以應對。錯失關鍵新聞的焦慮讓許多交易者不眠守盤,但長期下來既不健康也難以持續。

再看 24 小時不停歇的加密市場。與有固定時段的股票不同,加密貨幣永不打烊。重大發展隨時可能發生:周日宣佈合作、假日時被政府突襲禁止、凌晨三點瘋傳的社群貼文。人類交易者需要吃飯、睡覺與過生活,市場卻無時無刻都在運作。

這場不對稱,註定人類的反應總會有盲點——有些時刻你根本無法盯盤。在這空檔裡,反應更快的演算法(和其他時區的交易者)可能早已賣買完畢。等你醒來,價格早已劇變。波動激烈的市場中,幾小時、甚至幾分鐘,就是獲利與錯失良機、甚至虧損的分野。

資訊總量也是問題。不是只有一個新聞源要盯,而是數十個。加密新聞來自專業媒體(Cointelegraph、Coindesk 等)、一般財經(路透、彭博)、官方部落格、開發者更新、監管新聞稿、交易所公告,還有瘋狂多元的社群媒體(Twitter/X、Reddit、Discord 等社群)。

重大事件時,這些資訊渠道會灌爆你的畫面。例如,當熱門加密項目遭遇危機(如資安漏洞、爭議硬分叉),各大平台立即出現無數貼文、新聞,內容有些極具關鍵,有些則混淆視聽。 adding noise. Separating fact from rumor, signal from fluff, in real time is an enormous challenge. Important clues – maybe a developer’s tweet hinting at an exploit, or a pattern of large transfers picked up by on-chain sleuths and discussed on forums – can be lost amid the cacophony.

在即時資訊流中,增加雜訊、分辨事實與謠言、辨認重點訊號與無用內容,是一項巨大的挑戰。一些重要線索——比如開發者在推特上暗示出現漏洞,或者鏈上偵探偵測到大額轉帳模式並在論壇討論——都有可能在這一片嘈雜聲中被忽略。

Cognitive bias plays a role as well. Human traders can get tunnel vision or become biased by the narratives they’ve already heard. One might downplay a piece of bearish news because they’re emotionally committed to a coin, or overreact to fear on social media and sell at the worst time. Emotions and biases make it hard to objectively assess every new development, especially under pressure. AI, in contrast, has no emotions – it treats a glowing press release and a damning hack report with equal, dispassionate attention, scoring them based on data. This isn’t to say AI is infallible (we’ll discuss its limitations), but removing emotional bias is a big potential advantage when reacting to news.

認知偏誤同樣會影響判斷。人類交易者容易陷入思維的死胡同,或者因為已經聽過的故事而產生主觀偏見。有人可能因為情感上的執著而輕忽了看跌消息,或受到社群媒體上的恐慌煽動,在最糟糕的時機賣出。情緒與偏見讓人在壓力下很難客觀評估新動態。相比之下,AI 沒有情緒——無論是正面的新聞稿還是嚴重的駭客通報,它都能以相同、冷靜的態度根據數據給予評分。這不是說 AI 沒有限制(我們稍後會討論),但是剔除情緒偏誤,對於及時反應新聞,無疑是一大優勢。

In summary, the modern crypto trader faces an impossible information challenge: too much data, moving too fast, in too many places at once. Missing a single critical headline could mean being on the wrong side of a sudden 30% price swing. No wonder many traders feel they’re always one step behind the market’s twists and turns.

總而言之,現代加密貨幣交易者面臨幾乎不可能的信息挑戰:數據量龐大、更新極快,同步分布在各個平台。錯過一條關鍵頭條,可能就站錯立場,遭遇三成的突發行情波動。難怪許多交易者都覺得自己總是慢市場一步。

Enter AI – the idea is to let machines do the heavy lifting of reading and reacting to news at scale and speed. As Forbes noted in mid-2025, it’s now often cheaper and faster to let AI monitor the market around the clock and flag only the news that matters. With the right AI tools, you don’t need an army of analysts or an absence of need for sleep – you can have a tireless digital assistant digesting the world’s crypto information for you. Let’s explore exactly how these AI platforms work and how they turn the chaos of news into clear trading signals.

AI 正式登場——核心理念是讓機器代勞,負責大規模、快速地閱讀與回應新聞。正如 Forbes 在 2025 年中所言,現在讓 AI 全天候監控市場、只提醒重要新聞,往往比傳統人工又快又省錢。有了妥善的 AI 工具,你不需要一大票分析師,也不用熬夜不睡——你可以擁有一位永不休息的數位助理,為你消化全球加密信息。接下來我們說明這些 AI 平台到底如何運作,以及它們如何把雜亂的新聞轉換為明確交易信號。

AI Platforms: Decoding the News Flow in Real Time

AI 平台:即時解析新聞洪流

Imagine having a personal market analyst who never sleeps, reads every news article and tweet about your investments, and instantly tells you the market’s mood. That, in essence, is what modern AI-driven news sentiment platforms promise to do. They transform an infinite stream of raw news into organized, actionable intelligence. At the core is natural language processing (NLP) – the branch of AI that enables machines to read and interpret human language. Thanks to major advances in NLP (from models like GPT-4 and others), AI can now read thousands of articles and social media posts per minute, understand context, and even gauge sentiment with a high degree of nuance.

想像你有一位永不眠的專屬市場分析師,能夠閱讀你所投資標的的每一條新聞和推文,還能即時告訴你市場氛圍。這正是現代 AI 驅動的新聞情緒平台所承諾的服務。它們把無限量的原始新聞流,轉化為結構化且可行的資訊。這一切的核心就是自然語言處理(NLP)——AI 使機器能讀懂並理解人類語言的學科。憑藉 NLP 的重大進展(例如 GPT-4 這類模型),AI 現可每分鐘閱讀成千上萬篇文章或社媒貼文,不僅理解語境,還能細緻品味其情緒。

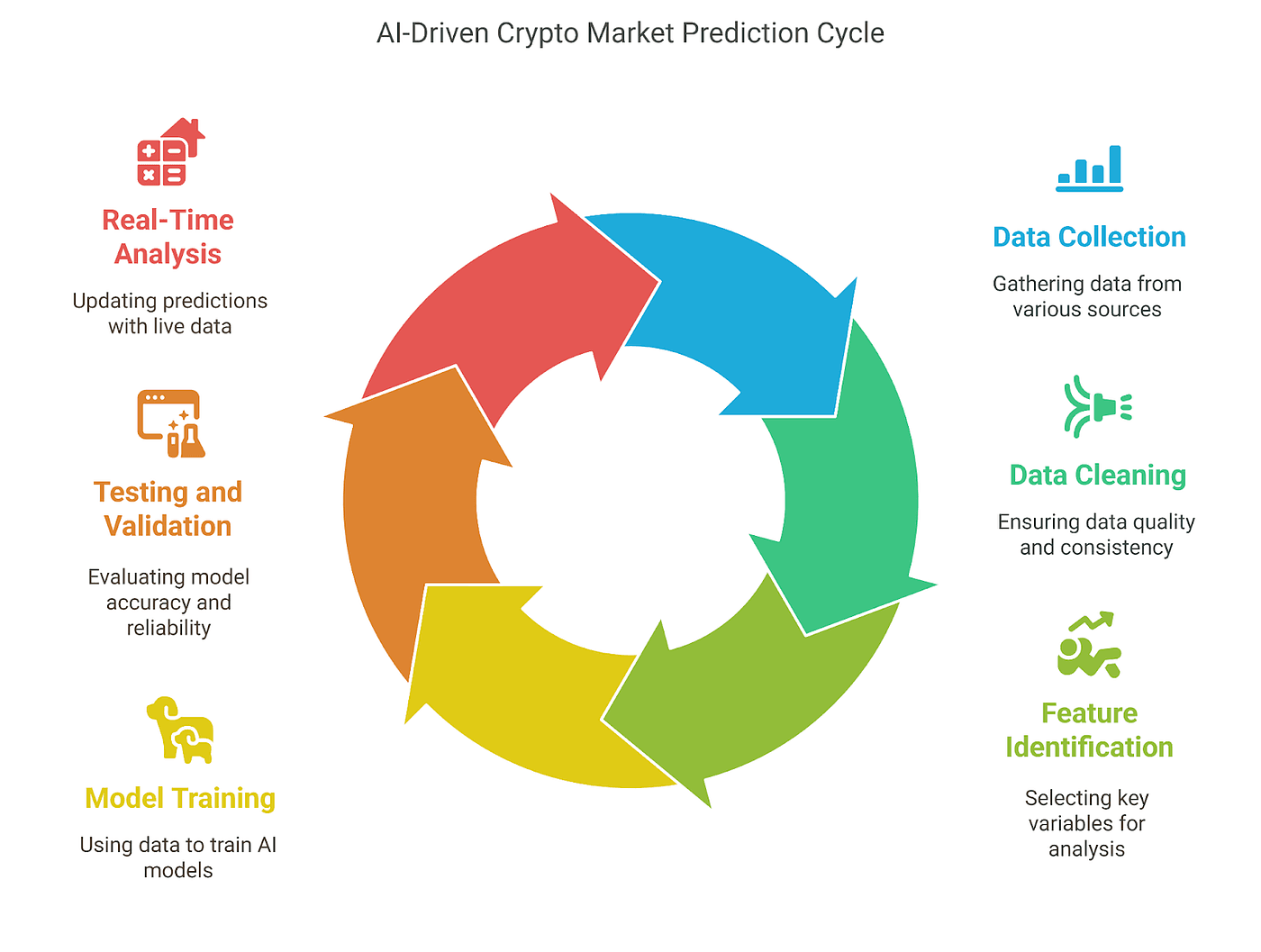

So how does an AI “read” the news? The process typically involves several stages:

那麼,AI 到底如何「閱讀」新聞?這一過程大致可以分為幾個步驟:

-

Data Collection: The AI system first gathers data from an array of sources. This includes scanning crypto news websites, general financial news outlets, social media platforms (Twitter/X, Reddit, Telegram channels), forums, and even analyst reports. Top platforms might monitor thousands of sources globally – from major publications to niche blogs – ensuring nothing relevant slips through. For instance, the AI might ingest everything from a Reuters breaking news alert on Bitcoin, to a tweet by a blockchain developer, to a Reddit post on r/CryptoCurrency, all in parallel. This comprehensive sweep builds a real-time picture of what’s being said about the market.

-

資料收集:AI 系統首先會從多元管道蒐集資料,包括加密新聞網站、一般財經媒體、社群平台(如 Twitter/X、Reddit、Telegram 頻道)、討論區、甚至分析師報告。先進的平台通常會全球同步監控上千個來源——從主流媒體到利基部落格,確保不遺漏任何重要資訊。例如,AI 可能同時讀取路透有關比特幣的突發新聞、區塊鏈開發者的推特、還有 r/CryptoCurrency 版上的 Reddit 貼文。這種全面掃描,可以即時掌握市場上的所有動態。

-

Language Understanding: Next, NLP algorithms parse each text, much like a human would read and comprehend it. But beyond simply reading, the AI looks for key entities and context: Which coin or project is this news about? Is the tone positive, negative, or mixed? What are the key themes (e.g. regulation, technology upgrade, hack, adoption news)? Modern AI doesn’t just scan for keywords – it actually attempts to understand context and intent. For example, it can tell the difference between “Ethereum hit by negative news” versus “Ethereum hit a new all-time high,” despite both containing the word “hit.” It recognizes sarcasm or negation in text to some extent, and it can weigh the credibility of the source (a tweet from an unknown account is not the same as a report from the Wall Street Journal). Crucially, AI tries to determine if a given piece of news is market-moving or not. A sophisticated system will identify truly critical developments – say, “SEC approves first Bitcoin ETF” – versus routine or minor updates that might not affect prices much. This context awareness is what separates AI analysis from simplistic keyword alerts.

-

語意理解:接著,NLP 演算法像人一樣逐條解析文本。但不只單純閱讀,AI 會尋找關鍵實體與語境:這則新聞關於哪種幣或哪個專案?調性偏正面、負面還是中性?重點主題是什麼(例如監管、技術升級、駭客事件、採用新聞等)? 現代 AI 不只是掃描關鍵字,還會嘗試理解上下文與意圖。例如,它能分辨 “以太坊遭遇壞消息” 和 “以太坊創新高”,雖然都有 hit 一字。AI 甚至能辨認部分諷刺或否定語氣,並且評估資訊來源可信度(無名帳號的推特可遠不及《華爾街日報》的影響力)。最重要的是,AI 會盡力判斷某則新聞是否真正能影響市場。高階系統能辨識出真正關鍵事件——比如 “美國證監會通過首檔比特幣 ETF”——和那些影響有限的日常消息。正是這種上下文意識,區分了 AI 深度分析和單純關鍵字快訊。

-

Sentiment Analysis: For each item of news or social post, the AI assigns a sentiment score or label. This usually ranges on a spectrum from very negative (bearish) to very positive (bullish), with neutral in between. But it’s not just binary; advanced systems provide a degree of confidence and intensity. For example, an AI might output: “Overall news sentiment on Ethereum today: Bullish (confidence: 80%, strength: strong). Key drivers: upcoming network upgrade and institutional investment news”. This condenses hundreds of articles into a simple pulse-check on market mood. Importantly, the AI looks at aggregate sentiment: one negative article might not outweigh ten positive ones, and vice versa. It can thus present a net sentiment after reading everything. Some platforms even produce a real-time sentiment index number (similar to a Fear & Greed Index, but more granular) that updates as news flows in.

-

情緒分析:針對每條新聞或社群貼文,AI 會給予情緒分數或標籤,從極度負面(看跌)到極度正面(看漲),中間還有中性。而且不只是二分法,先進系統會給出信心度與情緒強度。例如,AI 可能顯示:「今日以太坊總體新聞情緒:看漲(信心 80%,強度:強)。關鍵驅動:即將啟動的網路升級與機構投資新聞。」 這種結果將數百篇文章濃縮成一個市場脈動指標。更重要的是,AI 評估整體情緒趨勢:單一負面新聞未必能蓋過十條正面消息,反之亦然。AI 閱讀所有資訊後,能給出一個淨情緒結果。有些平台甚至會即時產出情緒指數(類似 Fear & Greed Index,但更加細緻),隨著新聞即時更新。

-

Signal Aggregation: Beyond just saying “news is positive or negative,” AI platforms distill insights further. They often highlight the most impactful news items of the day – effectively curating the top market-moving stories you need to know. For instance, if 50 articles came out about Bitcoin, the AI might flag that two of those are “critical developments” (say, a major bank announcing crypto services, and a major hack on a Bitcoin exchange) which are likely driving market sentiment. The rest might be classified as secondary or noise. This helps a trader focus on what actually matters, ignoring the chatter. Additionally, AIs can provide summaries of the positives and negatives. One AI sentiment tool offers a balanced summary: a list of bullish developments and bearish developments affecting an asset. This means you see both sides of the story at a glance – for example, “Positive factors: high-profile partnership announced, rising user adoption. Negative factors: regulatory investigation in progress, large token unlock coming”. Such balanced intelligence prevents one from being blindsided by only hearing one side (over-exuberant hype or doom-and-gloom), which is “critical for risk management,” as experts note.

-

信號彙總:AI 平台不只判斷「新聞是看漲還是看跌」,還會把見解進一步提煉出來。它們經常會標示出當日最具影響力的新聞——有效篩選出真正改變市場的重大事件。例如,假設同一天出現 50 則關於比特幣的新聞,AI 可能指出其中有兩則為「關鍵發展」(例如某大銀行宣布加密業務、某加密交易所遭駭客攻擊),可能主導了市場情緒,其餘則歸入次要或雜訊。這能幫助交易者抓住重點,不被雜音干擾。此外,AI 還能總結多空消息。一款 AI 情緒分析工具甚至給出平衡摘要:列出影響資產的看漲與看跌因素。也就是說,你能一目了然掌握全貌——比如 「利多:重磅合作消息、用戶成長攀升。利空:監管調查進行中、大量代幣即將解鎖」。如此平衡的資訊可避免你因只聽到單方聲音而突然被打得措手不及(無論盲目樂觀或災難預期),正如專家指出,這對「風險管理」極為關鍵。

Within seconds, a well-designed AI platform can go from raw news articles to a concise dashboard of insights. Imagine opening an app, typing in a cryptocurrency ticker, and instantly seeing: “Sentiment: Bearish 🔻 (Confidence: High). Key News: (1) Exchange XYZ hacked for $100M – negative. (2) Central Bank official hints at crypto ban – negative. (3) New partnership with major retailer – positive, but overshadowed. Net effect: strongly negative sentiment today.” This kind of output is incredibly powerful. It condenses hours of reading and analysis into a snapshot. And it’s not just for one asset – you could do this for any coin or even the whole market.

只需數秒,一個設計完善的 AI 平台就能把原始新聞濃縮成簡明的洞察儀表板。想像你打開一個 App,輸入某加密貨幣代碼,馬上可見:「情緒:看跌 🔻(信心:高)。關鍵新聞: (1) XYZ 交易所遭駭,損失 1 億美元——負面;(2) 中央銀行官員暗示考慮加密禁令——負面;(3) 與大型零售商新合作——正面,但被前兩則消息壓過。整體影響:今日情緒極度負面。」 這樣的輸出非常強大,將數小時的閱讀分析濃縮為一個快照。且不只針對單一資產,你也能針對任何幣種、甚至整個市場進行查詢。

Example: An AI-driven market sentiment tool analyzing news for a cryptocurrency. The platform aggregates thousands of sources to deliver an overall sentiment rating (bullish, bearish, or mixed) along with confidence levels and key drivers. Such AI systems parse news content in real time, separating truly impactful developments from noise to give traders a clear picture of market mood.

範例:AI 驅動的市場情緒工具分析單一加密貨幣新聞,系統匯整上千來源,給出總體情緒評等(看漲、看跌或中性),同時標註信心程度與關鍵推動因素。這類 AI 系統能即時解析新聞內容,分辨重要發展與雜訊,助交易者一眼看清市場心理。

Notably, AI doesn’t just tally up news sentiment blindly; it also accounts for source impact and credibility. For instance, a report from a highly respected source or an official announcement will be weighted more heavily than an unverified social media rumor. AI can learn which sources have historically moved markets (e.g., a tweet from a famous trader might reliably cause a stir, whereas dozens of random tweets might not). It can also detect repetition – if 100 outlets are all echoing one original news story, a human might feel overwhelmed by volume, but the AI knows it’s essentially one piece of news replicated, not 100 independent events.

值得注意的是,AI 並非只是一味計算總體新聞情緒分數,同時還會考慮來源的權重與可信度。例如,來自公信力極高的主流媒體或官方公告,影響力遠大於未證實的社群謠言。AI 甚至會學習有哪些來源過往對市場有顯著推動力(例如名人交易者的推文往往能帶來波動,但隨機網友的推文大多影響有限)。此外,AI 也能偵測到重複——假如有一百家媒體都在重複同一條原始新聞,人類閱聽者可能被數量嚇到,但 AI 明白這其實就只是一則新聞被廣泛轉載,並非一百件獨立事件。

In the crypto realm, some AI platforms even blend on-chain data or market data with news sentiment to enrich their analysis. They might note, for example, that despite very bullish news sentiment on a coin, on-chain activity or trading volume isn’t picking up, suggesting caution. Or conversely, bearish news sentiment combined with a surge of coins moving to exchanges could be a red flag of an impending sell-off. The combination of off-chain news and on-chain analytics is a cutting-edge approach some advanced tools are taking to leave no stone unturned.

在加密世界中,有些 AI 平台甚至會把鏈上數據或市場數據結合新聞情緒,以豐富分析深度。例如,當某幣種的新聞情緒極為看漲,但鏈上活動或交易量卻未明顯提升,可能就暗示要保持警惕。相反地,當負面新聞情緒搭配大量代幣轉進交易所時,就有潛在拋售風險。這種整合鏈下新聞與鏈上分析的方法,正是部分頂尖工具正在採用的前沿做法,務求滴水不漏。

Real-world example: During a volatile period in 2024, suppose there’s a swirl of news around a major altcoin. An AI sentiment agent scans everything and concludes: “Overall sentiment on Altcoin XYZ is strongly bearish today. Critical development: a respected crypto outlet reported a security vulnerability in XYZ’s code, triggering negative coverage. Other factors: high social media fear with many mentions of ‘scam’ and ‘hack’ (emotional signal: fear). Confidence in bearish sentiment: very high.”*

實際例子:2024 年某波劇烈行情期間,假設某大型山寨幣周圍流傳諸多消息。AI 情緒助手快速掃描後得出結論:「XYZ 山寨幣今日總體情緒極度看跌。關鍵事件:受信賴的加密媒體報導出 XYZ 代碼出現安全漏洞,引發連鎖負評。其他因素:社群媒體高度恐慌,大量出現 ‘詐騙’、‘駭客’等字眼(情緒信號:恐懼)。看跌信心度:極高。」

A trader equipped with this information early could decide to reduce exposure or hedge that position, potentially avoiding a significant loss as the broader market digests the news. Meanwhile, a trader relying only on their own reading might learn of the vulnerability later or underappreciate its significance until the price already fell. This illustrates how AI’s rapid, wide-ranging comprehension can directly translate to a trading advantage in reacting to news.

有了這些第一時間的資訊,交易者可以選擇降低部位或提前對沖,或許能在大盤解讀消息期間成功避險,減少潛在重大損失。反之,單靠個人閱讀消息的交易者,很可能得知漏洞為時已晚,或未能察覺其嚴重性,等價格跌了才反應。這正說明 AI 廣泛且快速理解資訊,能如何直接轉化為交易訊號優勢。

To sum up, AI platforms act as news sentiment radars,

總結來說,AI 平台就像新聞情緒雷達,Below is the translation following your formatting instructions (skipping translation for markdown links):

不知疲倦地掃描地平線,提醒你前方的風暴或晴空。他們能即時解讀市場氛圍——這在人工操作、規模放大的情境下幾乎不可能實現。

通過這麼做,AI為下一步鋪路:將那些解碼出的訊號用來預測實際價格變動,並指導交易策略。

從情緒到訊號:用 AI 預測代幣影響

識別情緒與關鍵新聞只是戰局的一半——下一個挑戰是預測這些信息對價格和波動率究竟意味著什麼。AI 在這裡真正展現其作為策略工具的價值。現代 AI 系統不僅能告訴你新聞情緒,還能從歷史模式中學習,預測類似新聞可能對某幣價產生的影響。本質上,它們試圖回答:鑒於此新聞及情緒背景,這項資產接下來可能上漲或下跌(以及幅度)嗎? 這等於把原始資訊轉化為交易訊號——如買入、賣出,或觀望(如果訊號混亂或不明)。

其中一種方法是用機器學習模型訓練歷史數據。研究員與量化交易者會將多年加密市場數據餵給模型,包括價格波動及來自新聞和社群媒體的情緒指標。這些模型,無論是神經網絡、樹狀算法,還是混合系統,都能學會情緒變化與後續價格變動間的複雜關聯。例如,模型可能學會,當整體 ETH 情緒急劇轉正且伴隨高推文量時,短期內的價格通常會上揚——除非技術指標已極度超買,否則這可能只是虛假炒作。這些關聯往往具有非線性和微妙特質,AI 更能捕捉到這點,而非僅靠簡單人類的 if-then 邏輯。

2024 年一項學術研究就指出,投資人情緒以非線性方式影響加密貨幣波動——線性模型加上情緒後預測並無進步,但先進的機器學習則能捕捉這些細微影響,大多數情況下提升準確度。事實上,像 LightGBM、XGBoost、LSTM 神經網路等模型,納入情緒數據後,預測能力明顯增強,超過傳統波動模型一半以上的時間。

案例研究——用情緒預測比特幣:佛羅里達國際大學的研究團隊建立一個系統,結合來自新聞與社群媒體 55 種不同的情緒訊號,預測比特幣價格走勢。這些訊號——由金融情緒數據公司 MarketPsych 提供——涵蓋 情感基調(如新聞的恐懼、喜悅、憤怒)、對價格預測的情緒、事實性提及、*流行術語/熱詞(如 “to the moon”)*和綜合情緒。AI 模型隨後分析這些訊號以及交易數據(價格動能、成交量等),如何預測隔日比特幣的價格。

結果令人印象深刻:聚焦預測能力最強的訊號並加以組合後,AI 能提升預測準確度,甚至打敗市場。在實測中,受這些情緒訊號指引的投資組合在風險調整後戰勝基準市場回報高達 39.6%。最強訊號是情感類——“恐懼比 FOMO 更具預測力,而 FOMO 又勝過[單純]相關性,” 研究人員指出。白話來說,就是當新聞充滿恐懼時,這更能預示價格下跌或高度波動,甚至強過「害怕錯過」的炒作。AI 有效學會辨認出何時新聞中的恐懼達到臨界點、常常導致拋售,以及正面熱議多到能引發一波行情時。

另一例子:AI 能辨識事件模式。它可能學到 某個小型山寨幣上交易所 的新聞,通常會在 24 小時內產生 20–30% 價格飛漲(因為流動性變高,交易者蜂擁而至)。相反地,代幣解鎖(流通量增加) 的消息常常導致幾天後價格下跌,如 Pi Network 解鎖代幣後出現價格下滑。一旦掌握這些知識,AI 驅動系統就能發出交易訊號:「ABC 項目宣布上架幣安——歷史上,這類新聞對類似資產偏多;短線買入訊號,信心強。」 或遇到負面情境:「XYZ 幣明天將解鎖 10% 流通量——歷來這是利空事件;建議賣出或做空,中等信心。」 當然,這些訊號是機率而非保證,但都是來自多次事件的模式辨識。

AI 還能自動納入更寬廣的市場背景,這點就連再謹慎的交易者也可能忽略。比如,AI 會在整體大盤(如 BTC、ETH)正在下跌或避險時調降單一山寨幣的多頭訊號。它「知道」對小幣來說,再強的利多也未必能扭轉強烈空頭氛圍。反之,在全面牛市時,就連一般利多消息也可能產生放大效應(因為大家本來就想買)。這種情境觀念正如人類分析師的建議:新聞訊號效果最好要跟更廣的大盤走勢一併考慮(例如 BTC 走勢或山寨幣動能)。AI 能定量的把這種情境納入考量。

現在有越來越多交易者能用類似 ChatGPT 這樣的大型語言模型 (LLMs) 來解讀新聞並產生交易靈感。以 ChatGPT 為例,它解析新聞標題並判斷對幣種是利多或利空的能力相當突出。只要設計得好的提示語,把新聞送給 ChatGPT 要求分析與建議行動即可。例如,交易者會問:「下面這則新聞標題:‘Cardano 與全球 500 強企業建立重大合作關係。’ ChatGPT,這是 ADA 買進訊號嗎?為什麼?」 AI 會根據過往知識和邏輯推理回答,例如:「這項合作對 ADA 偏多,有助於現實應用和信譽提高。加密領域中,過去有類似合作往往會刺激短線價格漲升,激發投資人熱情。但我會看整體大盤,如果市場強多,效果會被放大;但如果整體空頭,ADA 也不一定大漲。這是個潛在買進訊號,但也應檢查 ADA 技術面(是否過熱)並確認這新聞屬實且夠有份量。」

這種質化分析既快又彈性,即使是不懂技術的交易新手也能據此做初步判斷。在 Cointelegraph 的案例,一位用戶問 ChatGPT 關於 Pi Network 的利空新聞,ChatGPT 也正確點出這是個賣出訊號,並說明原因(供給增加、需求疲弱等)。同時它還補充長線持有者可能視為超賣機會,顯見思考既細膩又具平衡。

例子:大型語言模型(ChatGPT)分析加密新聞標題並提出交易建議。這案例中 AI 被問到一條新聞(“Pi Network 價格逼近歷史新低,供給壓力加劇”),給出簡短分析,因為多項利空(如發行量增加、需求疲弱、技術面超賣),偏向賣出。像 ChatGPT 這種工具能用白話英文解讀新聞,讓交易者快速獲得免寫程式的洞見——不過任何 AI 產生的建議在執行前最好還是驗證其他數據。

多元訊號融合:AI 真正威力在於能把新聞情緒和其他數據——技術指標、鏈上數據、成交量等——一起綜合判讀。AI 沒有只能同時關注一件事的認知極限,能同時處理多維度輸入。例如,一個 AI 模型收到:「新聞情緒=極度偏多,社群熱度=爆發(推文量高),技術型趨勢=價格在 50 日均線上且成交量上升,鏈上=大戶正持續加碼。」 獨立來看,每個都是偏多信號;合起來,AI 就能識別出一個所有訊號共振的強烈買入情境。

2025 年有研究指出,結合 GPT 類轉換器的 AI 模型、能融合社交情緒與技術分析,比傳統模型績效更高、風險更低——甚至能用即時情緒訊號提前預警波動率轉折點來降低回撤。這代表 AI 不只追求獲利,還能協助管理風險——例如當情緒轉空、波動可能飆升時,提示你調緊停損、減碼獲利。

值得強調的是,AI 預測都是機率性的,沒有系統能 100% 準確。目標是提高勝率——獲取優勢。如果 AI 模型能有 60% 的交易訊號是對的,並能對錯誤訊號(剩餘 40%)快速止損或避開,長期下來策略就能賺錢。例如 FIU 研究提及風險調整後回報提升;另一篇同儕審查論文發現,神經網路策略在多年回測下報酬率高達 1640%,對比單純買進持有比特幣的 223%(雖然那理想化條件下較極端)。即使考慮交易成本,AI 策略也大幅超越,展現其潛在優勢。但此類成果通常需複雜設計且基於回溯資料,實際運作仍有變數並需持續監控。

人類加 AI——強強聯手:實際上,最好的結果往往在於人類...經驗與直覺結合了 AI 的資料運算能力。AI 可能會在今天標記出十多個極度看漲情緒的幣種;而老練的交易員則會進一步篩選:這些幣裡,哪些的技術圖表型態良好?哪些有即將發生的事件與市場情緒相符?人類可以確認這些情緒背後是否有合理“故事”(是可持續的消息還是單純炒作?)。同時,AI 也可能提醒人類忽略的風險——或許一個原本認為基本面很穩健的幣,突然在媒體上出現大量負面新聞,促使你重新評估其狀況。

AI 還可以用於模擬和策略測試:現在的交易員會利用像 ChatGPT 這樣的語言模型來模擬各種情境(例如:「如果聯準會宣布升息,短期內加密貨幣價格可能如何受到影響?」),或用白話生成交易規則,AI 則將其轉換成可用於回測的程式碼。這些工作流程過去屬於程式設計師的專業領域,但隨著 AI 能將自然語言「翻譯」為可執行的輸出,現在連不懂程式的人也能輕鬆上手。這已經有點超出新聞分析的範疇,但也顯示了 AI 給策略開發帶來的加速效果,讓從想法到執行的過程越發流暢。

總結來說,AI 能夠從過去的經驗與當下的資訊中學習,把新聞轉化為預測。它可以直接輸出具體交易訊號——像是“看漲信號,可考慮做多”或“看跌展望,可考慮降低持倉”——這些都根據情緒與數據的綜合分析得出。這種方式並不代表交易絕對萬無一失(風險依然存在,黑天鵝事件還是可能出現),但它給予交易員一個強大、以事實為基礎的決策起點。與其憑感覺盲猜,倒不如借助 AI 這個分析幫手,處理出遠比人類單靠手動分析還要多的資訊。下一個章節將深入探討這一切如何應用到我們前面提過的加密貨幣瘋狂炒作循環,以及 AI 如何幫助你更精準地駕馭多空情緒浪潮。

將炒作循環轉化為交易優勢

炒作循環——那些爆炸性熱潮與隨後的冷卻退潮——常被看作是雙面刃。一方面,如果能早早抓住炒作浪潮,獲利機會可能改變人生;另一方面,如果“進場”剛好在炒作高點,隨之而來的崩盤則可能令人損失慘重。關鍵就在於時機,而時機的核心就是判斷故事正在加熱還是已經燒盡。AI 結合新聞與社群情緒的即時“脈動”,能量化炒作熱度,讓交易員在熱潮中獲得可衡量的客觀訊號。

提早發現炒作:通常一枚幣價格還沒暴衝之前,它的社群和媒體曝光次數早就先暴衝。群眾開始熱烈討論,意見領袖放大故事,媒體也開始用力報導“下一個大熱門”。AI 演算法可以即時追蹤這些指標:某幣在 Twitter 或 Reddit 的提及次數、相關討論的情緒,以及這些數字隨時間的變化。出現突發且持續增加的曝光量,極可能代表該幣或某個板塊主題正進入炒作熱潮。回想我們前面提到的研究:即使情緒只出現小幅度改善,也可以引爆加密市場超額報酬。

Nodiens 報告(2025 年 7 月)顯示,在 2024 年底的行情中,像 Hedera 和 Cardano 這類幣種,情緒指標只出現+3% 到 +9% 的溫和上升,卻創造出 +9% 到 +21% 的大幅度價格增長。

這相當於3 倍槓桿效應,將情緒轉化為價格動能。對交易員來說,這種“情緒槓桿”彌足珍貴——只要能及早察覺情緒回升,就可能搭上超比例的價格飆升。AI 可藉由同步監控多個資產的情緒指標或氣氛數據,快速捕捉這種現象,這是人力難以做到的。舉例來說,AI 也許會警示 「過去 48 小時內,Token XYZ 的情緒從中性大幅升至極度正向,社群熱度(討論次數)跳升至平時的 5 倍」。如果歷史顯示這樣的變化往往預示價格即將飆升,就很有必要趁主流市場還沒發現前先行佈局 XYZ 做多。

追蹤聰明資金 vs. 散戶熱潮:有時炒作純粹來自基層(散戶 FOMO),但更常有大戶介入。AI 工具亦能針對“鯨魚”行為或機構動向做出即時追蹤。例如:某個一向低調的專案忽然有一連串好消息與社群熱議,AI 便能同步掃描區塊鏈數據,發現不尋常的大額資金流動(鯨魚囤積)或訂單簿變化。一些高級平台清楚標明「可辨識鯨魚動向及其市場效應」以應對情緒轉折。若鯨魚提前進場且市場情緒跟著升溫,組合起來是極為利多的訊號——代表內部資金正在提前卡位。相反地,如果炒作火熱但鯨錢包卻不斷分批賣出(在高點倒貨),AI 也會警示這種背離:該輪炒作恐怕難以持續。

抓住極度亢奮的頂點:交易時最難的事情之一,就是知道泡沫什麼時候會破。人人都在歡呼,利潤看似無限——但那通常是最後一波。AI 可以從量化數據中辨識炒作頂峰。這包括:情緒從極度正向轉向趨緩,連續利多新聞間出現首度負面消息,或網路互動指標開始停滯。前述 Token Metrics 的案例便是一例:其 AI 驅動模型在 LaunchCoin 熱潮尚未見頂、社交媒體仍一片樂觀時,提早數週捕捉到動能減弱與社群參與度下滑。

事實上,數據(成交量、動能指標、情緒強度)已經表現出這波漲勢出現破綻,即使表面炒作氛圍還沒消退,也給了精明交易者早一步的預警。AI 或可輸出類似 「警示:Coin ABC——情緒依然看漲,但較上週轉弱;成交量未與社群熱度同步成長;或有炒作頂點成形」 的資訊。懂得這樣訊號的人就會開始獲利了結或提高停損,而非一味貪心抱上山頂後反轉。

此外,AI 也能偵測題材輪動的開始。加密幣市場強烈偏好輪流炒作主題——這個月大家瘋 DeFi,下個月又換元宇宙或 AI 幣,再過一陣轉向現實資產或其他新板塊。當某項目題材交易過於擁擠、動能衰退後,另一題材會浮現。AI 可以透過追蹤不同領域的情緒與資本流向,掌握炒作轉向。例如,在 2025 年中期「社交幣」熱潮(如 LaunchCoin)冷卻之後,數據顯示資金移轉到其他板塊:「資金從社交幣撤離,我們看到注意力開始轉向 AI 幣、DeFi 借貸協議與現實世界資產平台」——正如業界報告所述。

有用 AI 系統的交易員能及時發現這類資金輪動:系統可能強調 AI 相關幣種的情緒與成交正在升溫,而社交幣則進入盤整。這就是要調整自己的持倉,適時減碼已熄火題材、加碼新興主題。一些頂級平台會針對不同板塊主題(AI、DeFi、迷因幣等)篩選出當日/當週強勁多頭訊號,這本質就是發掘當下題材的動能來源。即使沒有專業平台,也能直接問 ChatGPT 這類 AI:「本週哪些加密貨幣題材最受矚目?」它會根據所讀新聞總結出「AI 類幣種、部分 Layer-2 網路最受到市場關注」等資訊。

衡量下跌恐慌情緒:炒作循環不只牽涉上漲,反面則是回檔時的恐慌和出清。AI 情緒分析同時能偵測壓力極大時的低點,這往往反而是逢低布局的逆向訊號。例如,如果一枚幣價格重挫、消息全是壞消息(全世界都在寫墓誌銘),社群就是一片恐慌,AI 適時偵測到弱手玩家幾乎都已出清。有些投資人會看經典的“恐懼與貪婪指數”來抓整體市場的情緒溫度——極度恐懼時往往見底。

AI 可針對個別資產或板塊,生成更精密且即時的恐慌指數。當情緒極端看跌,卻又從極低點開始回升(譬如從“極度悲觀”提升為“非常悲觀”),這一變化可能代表最壞時刻已過。加密市場確實發生過情緒跌落谷底(全世界都說你瘋了還敢買)時,結果反而精準抄底的案例。AI 能量化這類信號,協助你有根據地判斷“大眾恐懼已過頭”的時機。

實務上,將炒作熱潮轉化為交易優勢,就是根據數據設立明確規則與訊號。例如:「如果某幣社群討論 24 小時內暴增三倍且情緒指數超過 80% 正向,而價格尚未漲超過 10%,這可能是買進訊號——炒作正在醞釀還沒完全反映在價格上。」 相對地,「如果某幣情緒維持極度正向但日趨下滑,價格仍持續上漲,便可能是見頂警訊。」 這些條件可以請 AI 自動警示你。交易員則把這些提示與技術面分析結合(如:價格是否碰到阻力?最後一波上攻成交量是否反而萎縮?)來做最後決策。

許多交易員常用的一個具體工具是「社群熱度(討論量)與價格漲幅背離」檢查——當價格尚未大漲,但網路討論量暴衝,可能暗示“話題先行、價格後至”,一旦資金跟進就可能出現一波急漲。但如果價...skyrocketing and social volume is also skyrocketing to an extreme, it could mean everyone who’s going to buy is talking about it (peak hype), and any falter could cause a rapid drop. AI charts can visualize this in real time: some sentiment analytics platforms show graphs of sentiment and volume against price. Traders watch for inflection points – like sentiment rolling over while price is still up, or sentiment surging when price has yet to react.

當價格飆升、社群討論量也極度攀升時,這可能意味著所有想買的人都在談論它(達到熱潮高峰),任何一點動搖都可能導致價格迅速回落。AI 圖表可以即時將這些現象視覺化:有些情緒分析平台能顯示情緒分數和交易量與價格的變化圖。交易者會觀察轉折點——例如情緒開始反轉但價格還在高檔,或情緒急增而價格尚未反應等情況。

Let’s revisit an example: LaunchCoin’s life cycle. Early on, AI might have flagged its rise: social media mentions spiked, narrative sentiment very bullish, price starting to climb – a strong momentum buy signal. At the height, perhaps the AI noted an anomaly: sentiment was still high but no longer rising, and trading volume started to wane despite Twitter remaining euphoric. That loss of momentum is exactly what was observed; as one analysis described, “the sharp retrace from its peak indicated a critical shift: interest was waning, even if believers remained vocal… Today’s pullback reflects narrative fatigue — a critical turning point for traders”. An AI detecting “narrative fatigue” would have been invaluable to get out near the top.

讓我們再看一個例子:LaunchCoin 的生命週期。早期時,AI 可能已提醒它的上漲:社群媒體提及量激增,敘事情緒非常偏多,價格開始上漲——這是強勁的動能買進訊號。在高點時,AI 可能發現了一個異常情況:情緒雖然仍高,但已不再上升,即使 Twitter 上仍然十分亢奮,交易量卻開始減少。這種動能衰退正是當時觀察到的現象;正如一份分析所描述,「自高點急劇回撤表示出一個關鍵轉折:興趣正在消退,即使信仰者仍舊發聲……今日的拉回反映出敘事疲勞——對交易者而言是一個重要的轉折點」。如果 AI 能夠偵測到「敘事疲勞」,那對於接近高點出場來說將是無價之寶。

Another interesting note from the Nodiens report was that they categorized assets by how sentiment-driven they were. Some assets (“Sentiment-Leverage Leaders”) had strong correlation between mood and price – those are prime candidates for a news/sentiment strategy, since riding hype there can pay off big. Others (“Divergents”) could rise despite negative sentiment – meaning they had other factors (maybe strong fundamentals or whale support) that overpowered public sentiment. Knowing which type of asset you’re dealing with helps: AI might tell you “Coin XYZ is heavily sentiment-driven historically, so current hype likely equals price momentum” versus “Coin ABC often moves opposite to crowd sentiment, perhaps due to insider accumulation – be cautious interpreting sentiment at face value.” This nuance is part of deep AI models or at least the interpretation a skilled user can derive from AI outputs.

Nodiens 報告還有一點很有趣,他們根據資產受情緒影響的程度進行分類。有些資產(“情緒槓桿領袖”)情緒與價格高度相關——這類資產非常適合新聞/情緒交易策略,因為搭上熱潮容易獲利。另一些資產(“反向型”)則能在情緒看跌時上漲——代表有其他因素(例如基本面強勁或大戶撐盤)壓倒了大眾情緒。知道自己面對的資產屬於哪種類型很重要:AI 可能會告訴你「XYZ 幣歷史上高度受情緒驅動,所以目前熱度極高很有可能等同於價格動能」;反之,「ABC 幣常常走出與群眾情緒相反的行情,可能和內部累積有關——因此解讀情緒時要多加小心」。這種細膩之處,正是深度 AI 模型或有經驗使用者能從 AI 輸出中提煉的價值。

In short, AI can turn the art of reading hype into a more systematic science. It provides early indicators of hype emergence, metrics for hype intensity, and warnings for hype demise. By quantifying the unquantifiable (enthusiasm, greed, fear), AI gives traders a way to navigate the boom-bust cycles with more foresight. Instead of getting swept up emotionally, you can set rules – take profit when X sentiment peak signal hits, or buy when extreme fear abates – and let the data guide you. Many traders find that having these data-driven rules helps counteract the psychological biases that otherwise lead them to buy high and sell low during wild swings.

簡而言之,AI 能把看熱度這門「藝術」變成更系統化的「科學」。它可以提供熱潮初現的早期預警、熱度強度的量化指標、還有熱度消退的警訊。AI 透過量化原本難以量度的情緒(如熱情、貪婪、恐懼),讓交易者在市場大起大落時更具前瞻性。不必再隨情緒起舞,你可以設定規則——例如情緒指標達到 X 高點時獲利了結,或極度恐慌消退時逢低買進——讓數據來引導決策。許多交易者發現,遵循這些資料驅動的規則,有助於抵銷在劇烈波動中本來容易買高賣低的心理偏誤。

Of course, execution matters – acting on these signals requires discipline and risk management. Which brings us to how traders can practically integrate AI tools into their workflow, and what considerations to keep in mind.

當然,執行很重要——根據這些訊號操作需要紀律與風控。這就引出另一個重點:交易者要怎麼實際把 AI 工具整合到日常流程中,並需要注意什麼事項。

No Coding Required: AI Tools at Every Trader’s Fingertips

無須寫程式:AI 工具人人可用,交易者隨手可得

One of the most exciting developments in the past couple of years is that AI-powered trading insights are no longer limited to hedge funds or PhD quants. Regular crypto enthusiasts – even those with no background in programming or data science – can now access AI tools to analyze news and market sentiment. The barrier to entry has dropped dramatically, thanks to user-friendly platforms and conversational AI interfaces.

過去幾年最令人興奮的發展之一,就是 AI 驅動的交易洞見已經不再只是對沖基金或擁有博士學歷的量化高手的專利。一般加密貨幣愛好者——即使完全不懂程式或數據科學——現在也能使用 AI 工具來分析新聞與市場情緒。透過更友善的操作介面和對話式 AI,門檻大幅降低。

Chatbots and assistants: As demonstrated earlier, you can literally use ChatGPT or similar AI chatbots as your personal market analyst. All it takes is typing in a question or prompt in plain English. For instance, “ChatGPT, summarize today’s major crypto news and tell me if the market sentiment is leaning bullish or bearish,” or “Given the latest news on Ethereum’s upgrade and current market trends, what’s your outlook on ETH’s price action this week?” The AI will output a coherent analysis based on the information it was trained on or provided with. OpenAI’s ChatGPT, Google’s Bard, and Anthropic’s Claude are examples of LLMs that people have started using in this fashion. Even domain-specific chatbots are emerging: for example, Grok (an AI assistant launched in 2024) has been mentioned alongside ChatGPT in crypto circles. Vitalik Buterin, the co-founder of Ethereum, recently highlighted the potential of AI tools like ChatGPT and Grok for assisting crypto participants, noting that these AIs can provide “valuable insights and responses” that help traders stay informed on market conditions. Such endorsements underscore that even industry veterans see value in leveraging AI assistants for market analysis.

聊天機器人與助理:如前所述,你其實可以把 ChatGPT 或類似的 AI 聊天機器人當作你的個人市場分析師。你只需用自然英文輸入問題或指示即可。例如:「ChatGPT,請總結今天主要的幣圈新聞並告訴我市場情緒偏多還是偏空」;或「考量以太坊升級的最新消息與目前行情,你怎麼看這週 ETH 的走勢?」AI 會根據訓練資料或你給的消息,產出有條理的分析。OpenAI 的 ChatGPT、Google 的 Bard、Anthropic 的 Claude 都是這種用法的 LLM 例子。甚至有專屬幣圈的聊天機器人陸續出現:像 2024 年推出的 Grok 也常被和 ChatGPT 並列討論。以太坊共同創辦人 Vitalik Buterin 最近就特別點名像 ChatGPT 和 Grok 這類 AI 工具對幣圈用戶的幫助,強調這些 AI 能給出有價值的見解和回應,協助交易者掌握市場動態。這類業界巨頭的背書,也突顯 AI 助理於市場分析上的實用價值。

Importantly, these chatbot tools typically require no coding or complex setup. If you can use a web browser and chat interface, you can use them. Some are integrated into messaging apps or trading platforms directly.

值得一提的是,這些聊天機器人幾乎都不需要寫程式或複雜設定。只要你會用瀏覽器或聊天室,就會用了。有些甚至直接整合於即時通訊軟體或交易平台中。

For example, by 2025, there are trading bots on platforms like TradingView or Telegram where you can ask in natural language about a coin’s sentiment or even ask the bot to execute a trade when certain conditions (which you describe in words) are met. One platform, Capitalise.ai, famously lets users create automated trading scenarios using everyday English (“Buy BTC if sentiment is very positive and price crosses above $30,000” etc., then test and deploy that) – truly code-free automation.

例如,到 2025 年時,像 TradingView 或 Telegram 上就有交易機器人,讓你自然語言詢問某幣情緒指標,甚至用白話描述條件,請機器人自動下單。像 Capitalise.ai 這類平台,知名之處就在於讓使用者能用白話建立自動化交易策略(例如「若 BTC 情緒非常正向且價格突破 3 萬美元就買進」),直接測試並部署,真正做到無程式碼自動化。

Sentiment dashboards: There are also specialized crypto sentiment websites and dashboards that anyone can use. These typically present real-time charts of sentiment scores, buzz metrics, and maybe a feed of relevant news. For example, tools like LunarCrush, Santiment, The TIE, StockGeist.ai (to name a few) provide various sentiment and social indicators for hundreds of cryptocurrencies. A user can visit such a site, type in a coin, and see things like sentiment trend (bullish/bearish over the last day/week), social volume trend, top keywords in recent posts about the coin, etc.

情緒儀表板:市面上也有專門做幣圈情緒分析的網站與儀表板,人人皆可使用,通常提供即時情緒分數、熱度指標、還可能整合相關新聞。例如 LunarCrush, Santiment, The TIE, StockGeist.ai 這些工具,都針對數百種加密貨幣提供不同的情緒和社群指標。用戶只要進站、輸入該幣名,就能看到:情緒趨勢(過去一天/一週偏多還是偏空)、社群討論熱度走勢、近期熱門關鍵字等資訊。

Many of these services freemium models – basic data is free, advanced features for paid users. The key point: you don’t have to build a neural network yourself; you can harness one via an interface. For instance, StockGeist provides real-time sentiment monitoring for many coins, labeling them bullish, neutral, or bearish based on the tone of recent social and news posts. Messari, a popular crypto research firm, introduced an “AI news” feature that uses AI to summarize and analyze news for users.

這些服務多半採「基本免費、高級收費」的 freemium 模式 —— 重點是,你不需要自己訓練神經網路,透過現成介面就能使用。舉例,StockGeist 可以即時監控眾多幣種,根據最新社群/新聞內容判讀其偏多、持平或偏空。知名研究機構 Messari 則推出「AI 新聞」功能,讓 AI 自動為用戶總結、解析新聞大事。

AI-enhanced trading platforms: Major trading and data platforms are integrating AI features too. Reuters and Bloomberg, the giants of financial data, have started incorporating crypto sentiment and AI indices into their terminals. Even retail-focused platforms like TradingView have begun adding AI-driven analytics (for example, TradingView in 2024 added a feed of news with sentiment tags powered by an AI algorithm). Crypto exchanges and brokerages are not far behind – some have chatbots for customer service that double as market info bots, and others are exploring AI-driven advisory features (though regulatory constraints mean they must be careful not to cross into “financial advice” territory).

AI 強化型交易平台:大型交易與數據平台也積極導入 AI 功能。例如路透社及彭博這類財金巨頭,已將加密市場情緒指數與 AI 指標納入終端機介面。連以個人用戶為主的 TradingView 也在 2024 年起加入了 AI 寫作的帶情緒標籤新聞流。交易所和券商也不遑多讓——有的提供兼具客服、行情查詢的聊天機器人,有的則著手開發 AI 智能顧問(不過受限於監管,不能直接提供「投資建議」)。

An example of integration: some users pair ChatGPT with real-time data plugins or APIs. While ChatGPT on its own doesn’t browse current news by default, OpenAI has provided plugins and the newer versions can have browsing enabled (as of 2025) so it can fetch up-to-date info. If you enable, say, a news plugin or connect it to a crypto news API, you can ask: “Hey ChatGPT, check the latest crypto headlines and give me any that might impact XRP price, then analyze them.” The AI will fetch current data and do what you asked. Similarly, people connect ChatGPT to trading APIs to create semi-automated agents. One enthusiast described a setup where ChatGPT would pull sentiment data from an API, technical indicators from another, and then output a trading suggestion – all without the user writing code, just orchestrating via natural language and available tools. This underscores how accessible building a personalized “AI trading assistant” has become.

集成應用案例:部分進階用戶會把 ChatGPT 跟即時數據外掛或 API 搭配使用。雖然 ChatGPT 本身預設不會主動抓新聞,但 OpenAI 已陸續釋出外掛功能,新版甚至(到 2025 年)能直接啟用網路瀏覽,取得即時訊息。開啟像新聞外掛或串接加密幣新聞 API 後,你能問:「ChatGPT,查查看最新加密市場頭條,告訴我哪些可能影響 XRP 價格,並幫我分析。」AI 會自動抓取新聞並產出分析。同理,也有人串接交易 API,讓 ChatGPT 變半自動交易助理。有玩家分享,他讓 ChatGPT 拉 API 取情緒數據、再取技術指標、最後自動給出交易建議——全程不用寫程式,只用自然語言和現成工具就搞定。這顯示打造個人化 AI 交易助理變得前所未有的容易。

For those not inclined to tinker, even just following some AI-curated indices can help. For example, in late 2024 a “Crypto Fear & Greed Index 2.0” was launched on some sites which is AI-powered, combining more inputs than the older basic index. There are also AI-based token indexes that algorithmically pick a basket of trending coins. While one must be cautious with such products, they reflect the trend of AI doing the heavy analytical lifting in packaged forms.

對於不想 DIY 或自建流程的用戶,直接關注由 AI 編制的指數也能有幫助。例如 2024 年底,部份網站推出依賴 AI 算法運算、納入更多資料來源的「加密恐懼與貪婪指數 2.0」。還有些 AI 自動生成話題幣籃子的智能指數商城。這類產品固然需要小心風險,但反映了 AI 已把大量分析工作濃縮包裝成現成服務給用戶用。

Educational and strategy support: Another underrated aspect is how AI tools educate and guide users. ChatGPT and peers can explain trading concepts, summarize on-chain metrics, or even warn you of risks if prompted. They can help novices understand why certain news is significant. For instance, a beginner could ask, “Why is everyone concerned about the Mt. Gox Bitcoin unlock news?” and the AI would give a historical explanation and potential market impact. This informative tone helps traders not just copy signals but learn the rationale. Many AI tools also produce plain-language reports – e.g., “Today’s Market Sentiment Report: Market is moderately bullish. Positive drivers: XYZ adoption news. Negative drivers: regulatory uncertainty in US…” – which make it easier to digest than raw data tables.

教育與策略輔助:AI 工具還有一個常被低估的強項,就是能幫用戶學習和指導。例如 ChatGPT 可協助解釋交易觀念、整理鏈上指標、甚至主動提醒潛在風險。對初學者來說,還能問出「為什麼大家都在關注 Mt. Gox 比特幣解鎖新聞?」這類疑問,AI 會給出歷史脈絡及可能影響。這種知識型說明,不僅讓交易者跟信號,更真正明白背後原因。許多 AI 工具還會產出白話、易於吸收的報告,例如「今日市場情緒報告:大致偏多。正面驅動:XYZ 普及新聞。負面驅動:美國監管不確定性……」等等,比單看數據表輕鬆理解多了。

No free lunch: It must be said that while these tools are powerful, they’re not a magic money machine. The accessibility of AI means many traders can use similar tools, which could theoretically arbitrage away some of the edge. For example, if an AI signals a bullish trade, lots of algorithmic traders might jump on it, moving the price quickly (making it harder for slower movers to profit). However, crypto

沒有白吃的午餐:話雖如此,這些工具再強,也不是賺錢靈丹妙藥。AI 門檻變低意味著許多交易者都能用到類似工具,理論上部分優勢會被市場無風險套利掉。舉個例子,如果某 AI 發出看多信號,大量算法交易者同時採取動作,價格可能瞬間被推動,後進者就很難跟上獲利。然而,加密幣...markets are still very heterogeneous, and not everyone uses the same tools or reacts at the same speed, so opportunities persist, especially in smaller caps or during volatile news events where human hesitation still abounds.

市場仍然非常多元,不是每個人都使用相同的工具或以同樣的速度做出反應,因此機會依然存在,特別是在小型市值標的或有劇烈新聞事件時,當中人為猶豫的現象依舊普遍。

Another important note: be mindful of the sources and quality of AI output.

另一個重要提醒:請注意 AI 輸出的來源及品質。

Some free AI-driven content (like certain auto-generated news articles) might not be accurate – always verify critical info from original sources. Use reputable AI platforms or cross-check what the AI tells you. For instance, if ChatGPT summarizes a news event, one should double-check the key facts in that summary via a trusted news site if planning a big trade on it.

有些免費 AI 生成內容(如某些自動產生的新聞報導)可能不夠準確——對於關鍵資訊一定要從原始來源驗證。請選擇知名度高的 AI 平台,或是交叉比對 AI 給你的內容。例如,如果 ChatGPT 幫你摘要某則新聞事件,當你計劃以此做重大交易時,記得從可信賴的新聞網站再次查證摘要裡的關鍵事實。

Finally, consider the security aspect when integrating AI with trading. If you use any AI trading bot that executes trades via API keys to your exchange account, secure those keys and use read-only keys if just analyzing. There have been scams and hacks in the crypto space masquerading as AI tools – stick to well-known providers and never give an unvetted AI tool direct access to manage funds. AI can enhance your strategy, but you remain in control of your capital.

最後,將 AI 與交易結合時請務必考量安全層面。如果你使用任何透過 API 金鑰執行交易的 AI 交易機器人,請務必妥善保管這些金鑰;若只是做分析,建議僅使用唯讀權限的金鑰。幣圈過去就出現過冒充 AI 工具的詐騙與駭客事件——務必選用知名度高的供應商,絕不要讓來路不明的 AI 工具直接操作你的資金。AI 可以強化你的策略,但資金的主控權還是在你手上。

Risks and Limitations of AI-Driven Strategies

AI 驅動策略的風險與限制

While AI offers exciting capabilities, it’s not a crystal ball or a substitute for due diligence. Traders must be aware of the limitations and risks when relying on AI for investment decisions. Here are some key considerations (in an informative, cautionary tone):

雖然 AI 具備許多令人興奮的功能,但它並不是預知未來的水晶球,也無法取代你自己應做的審慎調查。當你在投資決策上仰賴 AI 時,必須清楚了解其限制和風險。以下是幾點重要考量(請以資訊性並帶有警示的語氣來看待):

-

Accuracy and “garbage in, garbage out”: AI predictions are only as good as the data and patterns they’re based on. If the market enters a regime that has little precedent, AI can falter. For example, an AI trained on the mostly bull market data might not foresee a black swan event or a paradigm shift (like an unprecedented regulation that changes everything). Moreover, AI can misinterpret misinformation as real news – especially if scraping social media where rumors abound. If false news starts trending, AI might initially flag extremely bearish sentiment, prompting trades, only for the news to be debunked later. Human judgment is needed to validate critical news (at least from multiple reputable sources) before acting. Always verify the inputs your AI is using; if you feed it biased or incomplete information, you’ll get a biased or flawed outcome.

-

準確性與「垃圾進、垃圾出」:AI 的預測準確性高度依賴其所用資料和模型。如果市場進入先前少有經驗的特殊狀態,AI 可能會失靈。例如,只訓練於多頭行情數據的 AI,可能無法預見黑天鵝事件或典範轉移(像是前所未見的新規定造成巨大變化)。此外,AI 也可能把假消息誤認為真新聞——特別是在大量謠言流竄的社群媒體資料中。如果假消息突然爆紅,AI 可能一開始就標示極度看空,導致交易,結果消息後來被推翻。關鍵新聞需依賴人為判斷(至少多方查證於不同可靠來源)後再行動。永遠確認 AI 使用的輸入資料;若給的是偏頗或不完整的資訊,結果自然也會失準或有誤差。

-

Overreliance and complacency: It’s tempting to hand over decisions to the “smart” AI, but blindly following AI-generated signals is dangerous. As Cointelegraph wisely noted, “AI is a tool, not a guarantee”. One should always verify AI insights with other research, charts, and risk management before executing trades. There have been instances where GPT-based models sound very confident in a prediction or analysis that turns out to be incorrect. This is known as the AI’s propensity to hallucinate – basically, to generate a convincing-sounding answer that isn’t grounded in fact. A study mentioned that in high-stakes strategy tasks, people using GPT-4 without caution sometimes performed worse (23% worse in one finding) than those who didn’t use it, likely because they trusted the AI too much. The lesson is clear: treat AI recommendations as one input, not gospel.

-

過度依賴和自滿:將決策交給「聰明」的 AI 固然很吸引人,但盲目照單全收 AI 訊號極其危險。正如 Cointelegraph 所說:「AI 只是工具,不是保證」。下單前務必用其他研究、圖表和風控來驗證 AI 的見解。有許多案例顯示,基於 GPT 的模型即使口氣很自信,結果卻是錯誤的,這就是所謂 AI 的「幻覺」傾向——也就是它會產生聽起來像真的、其實沒根據的答案。有研究指出,在涉及重大決策時,不謹慎用 GPT-4 的人,有時表現甚至比不用 AI 的差(其中一項發現是差了 23%),原因很可能就是太過信任 AI。教訓很明確:把 AI 建議當作其中一條參考,不是聖經。

-

Lack of real-time reactivity (for some AI): Unless properly connected, models like ChatGPT do not have live data streaming in. If you ask ChatGPT (the base model without browsing) about “current” market conditions, it might only rely on its training data which isn’t up-to-the-minute. This means if something big happened seconds or minutes ago, it won’t know. There are versions with plugins and other AI tools that are real-time, but latency and data feed quality are considerations. In ultra-fast markets, even a few minutes delay can matter. Dedicated sentiment platforms often update by the second – those are more reliable for split-second traders. But for most swing traders, minute-level is fine.

-

即時反應上的不足(針對部分 AI):除非進行適當串接,像 ChatGPT 這類模型原本就沒有即時數據。如果你問 ChatGPT(未連網的基礎模型)「現在」的市場狀況,它所依據的僅是訓練期間的資料,而非實時資訊。所以若幾秒前或幾分鐘前有重大事件發生,它是不會知道的。有些帶外掛或高階 AI 工具有即時功能,但延遲與資料品質都值得關注。在極高速的市場裡,即便延遲幾分鐘也影響很大。專門情緒分析的平台多半能做到秒級更新——這對做高頻短線交易的玩家較為可靠。不過對於大部分波段交易者來說,分鐘級的資訊已足夠。

-

Technical issues and downtime: AI platforms and bots can encounter glitches. There might be times the API is down, the model outputs an error, or data isn’t updating. If you were leaning heavily on an AI alert to trigger a trade and it fails to fire due to a tech issue, you could miss out or be left exposed. Always have a basic plan that doesn’t solely rely on an AI tool functioning perfectly. Redundancy (multiple data sources) is wise if you’re serious. Additionally, some AI trading bots require maintenance – prompt changes, retraining for new data, etc. A noted incident involved an AI trading tool pushing an untested update that caused erroneous outputs. This reminds us that these systems are complex and can have bugs.

-

技術問題與停機風險:AI 平台與機器人也會遇到技術故障。有時 API 會停擺、模型會出錯、資料更新不即時。如果你將交易過度託付給 AI 訊息,當它因故障沒通知,你可能錯失機會或暴露於風險之下。一定要有基本策略,不能完全仰賴 AI 工具絕對正常運作。認真點的做法是設資料來源冗餘。此外,有些 AI 交易機器人還需要定期維護——像是更換提示、根據新數據再訓練等。曾有 AI 交易工具推送未測試的更新導致錯誤結果,這提醒我們這些系統背後仍然複雜且容易出 bug。

-

Security and privacy: If you use AI platforms, be aware of what data you share. If you’re plugging in your proprietary trading strategy or sharing sensitive info with a third-party AI service, there’s a potential data leak risk. From a funds perspective, if you integrate trading APIs, protect your keys. Use 2FA on exchange accounts as an extra layer in case anything gets compromised. And avoid AI bots that promise absurd returns or ask you to deposit crypto into unknown wallets – scammers might use the AI hype to lure victims.

-

資安與隱私:如果你使用 AI 平台,請注意你上傳分享了哪些數據。如果你輸入自己的專有交易策略或敏感資訊給第三方 AI,資料外洩的風險就會增加。從資金管理的角度,若你整合交易 API,務必保護好金鑰。交易所賬號請開啓兩步驟驗證(2FA),防範帳密外洩。另外,避開那些承諾誇張獲利或要求你匯入幣到陌生錢包的 AI 機器人——詐騙集團很可能會利用 AI 熱潮吸金。

-

Market impact and crowding: As AI becomes more popular, many participants could start reacting to the same signals. If everyone’s AI says “buy now,” who are they buying from, and how long before the edge erodes? In traditional markets, we saw something akin to this with high-frequency trading and news algos – when a news headline hits, lots of algos trade on it, making the price jump almost instantly, which leaves little room for slower actors. In crypto, there’s still plenty of inefficiency, especially in smaller cap coins and emerging news. But over time, if sentiment-AI trading is ubiquitous, its signals may get “priced in” faster. This doesn’t negate AI’s usefulness, but strategies may need to evolve continuously. AI might also potentially create feedback loops – e.g., AI sees others are bearish and becomes bearish, exacerbating a sell-off. Diversity of strategies and human oversight can mitigate such herding effects.

-

市場影響與擁擠現象:隨著 AI 越來越受歡迎,越多參與者可能同步反應於同一組訊號。如果大家的 AI 都說「快買」,那買單要跟誰買?利基又能維持多久?在傳統市場裡,我們看到過類似現象,比如高頻交易與新聞演算法——一條新聞標題出現,大量演算法即時買賣,價格幾乎瞬間跳動,讓反應慢的人沒機會進場。在加密貨幣領域,目前還有許多低效率現象,尤其在小型市值幣與突發新聞時。但長期來看,若情緒型 AI 交易普及,這些訊號也可能更快反應於價格,市場利基會逐漸縮短。AI 的價值並不因此消失,但策略需持續演化。AI 也可能產生反饋迴圈——比方 AI 看其他人偏空自己也更偏空,造成拋售惡化。多元策略與人為監督有助於防堵羊群效應。

-

Ethical and regulatory aspects: While not a direct trading risk, note that regulators are increasingly watching AI usage in trading. Using AI is legal, but if an AI-driven strategy were to inadvertently facilitate market manipulation (say it decides to post fake news to drive sentiment – a far-fetched but not impossible scenario if an agent is autonomous), that would be problematic. Always use AI within the bounds of market rules – e.g., using it to quickly parse public info is fine; using it to try to front-run non-public info is not.

-

倫理與法規層面:雖然不是直接的交易風險,但請留意監管單位正越來越關注 AI 在交易的各種應用。用 AI 是合法的,但如果某些 AI 策略意外促進了市場操縱(例如主動上傳假新聞來炒作情緒——雖然罕見但並非不可能,尤其是自動化 agent),則屬問題行為。永遠要讓 AI 遵守市場規範——例如用來快速解析公開資訊沒問題,但用來搶先內線消息就不可以。

-

Complex scenarios and qualitative factors: Some market moves are driven by very qualitative factors that AI might not fully grasp, especially if they involve human decisions outside of historical patterns. For instance, geopolitical events or sudden policy changes can defy the “mood” logic. Also, crypto markets sometimes rally or dump for reasons that are arguably irrational (like meme stocks, except in crypto form, where a movement has no clear news or sentiment reason). AI might scratch its head (figuratively) in such cases or give a misleading signal because it expects a rational catalyst that isn’t there or it misattributes cause and effect. > Human intuition and experience still count – for example, understanding that a coin pumping 100% on a meme has no fundamental support and will likely crash, even if AI says sentiment is euphoric (AI would be right about sentiment, but you as a human might know it’s a bubble to be cautious of).

-

複雜情境與質性因素:有些市場波動純粹受到質性因素推動,AI 可能無法完全掌握,尤其中間有人為裁定、而且過往無先例時。例如地緣政治事件或突發政策可能完全違反「情緒邏輯」。另外,加密貨幣有時會因非理性原因暴漲暴跌(就像迷因股,只是變成幣圈版本,現象背後沒有明確新聞或情緒解釋)。這時 AI 可能就「丈二金剛摸不著頭腦」,甚至產生誤導訊號,因為它預期有個合理導火線,結果要嘛根本沒有、要嘛是誤判因果關係。>人的直覺與經驗依然很重要——比如你看到某個幣因 meme 概念暴漲 100%,明知根本沒基本面支撐,之後大機率回跌,即使 AI 呈現狂熱情緒(AI 對於情緒的判斷沒錯,但你作為人類判斷得出那就是泡沫,需要提防)。

Risk management is paramount. No matter how good an AI strategy is, crypto remains volatile and risky. Traders should use basic risk controls: position sizing (don’t bet too big on one AI signal), stop-loss orders to protect against sudden crashes, and diversification of strategies. AI can assist in some of this – e.g., it can recommend a stop-loss level by analyzing volatility, or it can watch multiple positions at once – but the trader must decide their risk appetite. As one guide recommended, never trade more than you can afford to lose – AI can guide you, but it’s not foolproof. Implementing stop-losses and take-profits is still essential. AI might tell you the trend is strong, but unexpected news can hit at any time.

風險控管最為關鍵。再厲害的 AI 策略下,虛擬貨幣依然波動激烈、風險高。交易者應採取基本風控措施:部位分散(不要將太大倉位壓在某一 AI 訊號)、設立停損來防止突如其來的崩盤、策略多元化。AI 可以協助部分流程,像是根據波動度推薦停損位,或同時監控多筆持倉——但風險承受度仍需你自己決定。有份指引就說過:永遠不要下注超過自己可以承受虧損的金額——AI 可協助你,但它不是萬無一失。設立停損與獲利點仍舊很重要,即便 AI 言之鑿鑿趨勢很強,突發新聞隨時可能出現。

Finally, maintain a critical mindset. Continuously evaluate how well the AI’s suggestions align with reality and your own analysis. Treat it as a junior analyst: helpful, quick, but needing supervision. Over time, you’ll learn in what situations your AI tool is reliable and when it tends to err. For instance, you may notice it does great in trending markets but lags in choppy, range-bound markets. You can then adjust your reliance accordingly.

最後,持續保持批判思維。經常檢驗 AI 給你的建議與市場現實和你自身判斷的契合度。把它當作小助理:反應快、效率高,但需要監督。久而久之,你會發現在哪些情境裡 AI 工具表現可靠、哪些狀況容易出錯。比如你注意到它在趨勢行情表現很好,但遇到盤整震盪時就比較不穩。這樣你就可以有針對性地調整對它的信任程度。

Final thoughts

結語

The marriage of AI and crypto trading has ushered in a new era of possibility for individual investors and traders. By leveraging AI to decode the never-ending flow of crypto news and social chatter, market participants can gain a clearer, faster understanding of what’s driving prices. Instead of drowning in information overload, you can have at your fingertips a distilled snapshot of market sentiment – bullish or bearish, euphoria or fear – drawn from thousands of sources. Modern AI platforms essentially transform news into data, and data into actionable signals. They forecast how a headline or a hype trend might translate into price movement, giving traders a precious head start in forming strategy.

AI 與加密貨幣交易的結合,已經為個人投資人與交易者帶來嶄新的可能性。藉由運用 AI 來拆解不停湧現的幣圈新聞與社群討論,市場參與者能更快、更清晰地理解價格背後的驅動力。你不再需要在資訊洪流中掙扎,而是能隨時掌握來自成千上萬來源凝練出的市場情緒快照——從極度看多、看空到亢奮或恐慌。現代 AI 平台本質上就是把新聞轉換成資料,再轉成可行動的訊號。它們預測一則頭條或一波熱潮會如何影響價格,讓交易者在策略規劃上搶得先機。

Crucially, this can be done without writing a single line of code, in accessible interfaces, leveling the playing field between hobbyist traders and big institutions. The scenarios we’ve explored show that with the right prompts or tools, anyone can ask an AI questions like an expert analyst. Whether it’s ChatGPT outlining why a piece of news might be a buy signal, or a dashboard flashing a sentiment heatmap across the market, AI brings sophisticated analysis to your screen in seconds. It can warn you of a surging narrative before it peaks, or alert you to gathering storm clouds of negative sentiment so you can manage risk proactively.

數秒內,將精密的分析呈現在你的螢幕上。它能在一個敘事熱潮尚未達到高峰前就發出警告,或是在負面情緒逐漸集結時提醒你,讓你能夠主動管理風險。

However, as we’ve emphasized, AI is not a magic wand or a replacement for sound judgment. It offers augmented intelligence – it amplifies your ability to process information and make informed decisions, but it doesn’t remove the need for human oversight. The best outcomes often arise when human intuition and domain knowledge combine with AI’s computational power. Think of AI as an assistant that can tirelessly monitor the market’s pulse and whisper insights in your ear, while you remain the decision-maker with a finger on the trigger.

然而,正如我們不斷強調的,AI 不是魔法棒,也無法取代穩健的判斷力。它提供的是增強式智慧——提升你處理資訊和做出明智決策的能力,但並不取代人類監督的必要性。最佳成果往往來自於人類的直覺與領域知識,結合 AI 的運算能力。你可以把 AI 想像成一位能夠不懈監控市場脈動、在你耳邊低聲提供洞見的助理,而你則是那位手握決策權、隨時準備行動的決策者。

Going forward, the influence of AI in crypto is likely to grow even more. We may see increasingly sophisticated sentiment models, AI-driven funds, and tools that integrate every facet of crypto data (news, technicals, on-chain, derivatives) into one coherent analysis. Traders who adapt to and embrace these technologies – using them ethically and intelligently – could gain a significant edge in a market where information is both an asset and a weapon.

展望未來,AI 在加密貨幣領域的影響力只會有增無減。我們有可能看到越來越先進的情緒模型、由 AI 主導的基金,以及能夠將加密貨幣領域的各項數據(新聞、技術面、鏈上數據、衍生品等)整合為一的工具。能夠適應並善用這些科技,並以道德且智慧的方式使用它們的交易者,將可在這個資訊既是資產也是武器的市場中,獲得顯著優勢。

In the spirit of an informative-analytical yet unbiased tone, it’s clear that AI can be a powerful ally in navigating crypto’s turbulence. It helps cut through hype and fear by quantifying them, turning what used to be gut feeling into something a bit more scientific. Yet, caution and continuous learning remain your allies. By staying curious and cautious – verifying AI-derived ideas, testing strategies on small scales, and keeping an eye on the ever-evolving market conditions – you can harness AI’s strengths while mitigating its weaknesses.

以一種具資訊性、分析性,且中立的語氣來說,AI 無疑是因應加密市場波動的一大利器。它能量化炒作與恐懼,讓原本僅靠直覺判斷的東西變得更科學一些。然而,謹慎與持續學習依然是你的好夥伴。保持好奇與謹慎——驗證 AI 提供的想法、小規模實測策略、並持續關注不斷變化的市場情勢——你便能發揮 AI 的長處,同時降低其短處的風險。

In sum, turning crypto news into an investment strategy with AI is about working smarter, not just harder. It means letting modern algorithms do what they excel at (scanning, crunching, finding patterns), so that you can do what humans excel at (big-picture thinking, strategic decision-making, creative problem-solving). As the crypto landscape heads into the future, one characterized by rapid innovation and equally rapid information flow, the traders who thrive will likely be those who combine the best of both worlds – human insight and artificial intelligence. By doing so, they’ll be able to convert the frenzy of the news cycle and the ebb and flow of hype into real, measurable trading edges in their favor.

總結來說,運用 AI 將加密貨幣新聞轉化為投資策略,重點在於「更聰明地工作,而不只是更努力」。這代表讓現代演算法去發揮其善長(掃描、計算、挖掘模式),讓你能專注於人類最擅長的部分(大局思考、策略決策、創意思維解難)。隨著加密貨幣產業步入創新與訊息快速流動的未來,最能適應並脫穎而出的交易者,很可能就是善於結合人類洞察與人工智慧的那群人。藉此,他們得以把新聞熱潮與情緒起伏,轉化為自己可實際量化的交易優勢。