Circle Internet Group 最近宣布 透過新推出的 Arc 區塊鏈探索可逆 USDC 交易,這一舉動引發自區塊大小之爭以來加密貨幣領域最激烈的爭議。

Circle 總裁 Heath Tarbert 坦言公司正在「思考交易是否可能可逆」同時維持「結算終局性」,這不僅代表了大眾化採納所需的務實進化,也可能被視為對加密貨幣核心原則的根本背離。

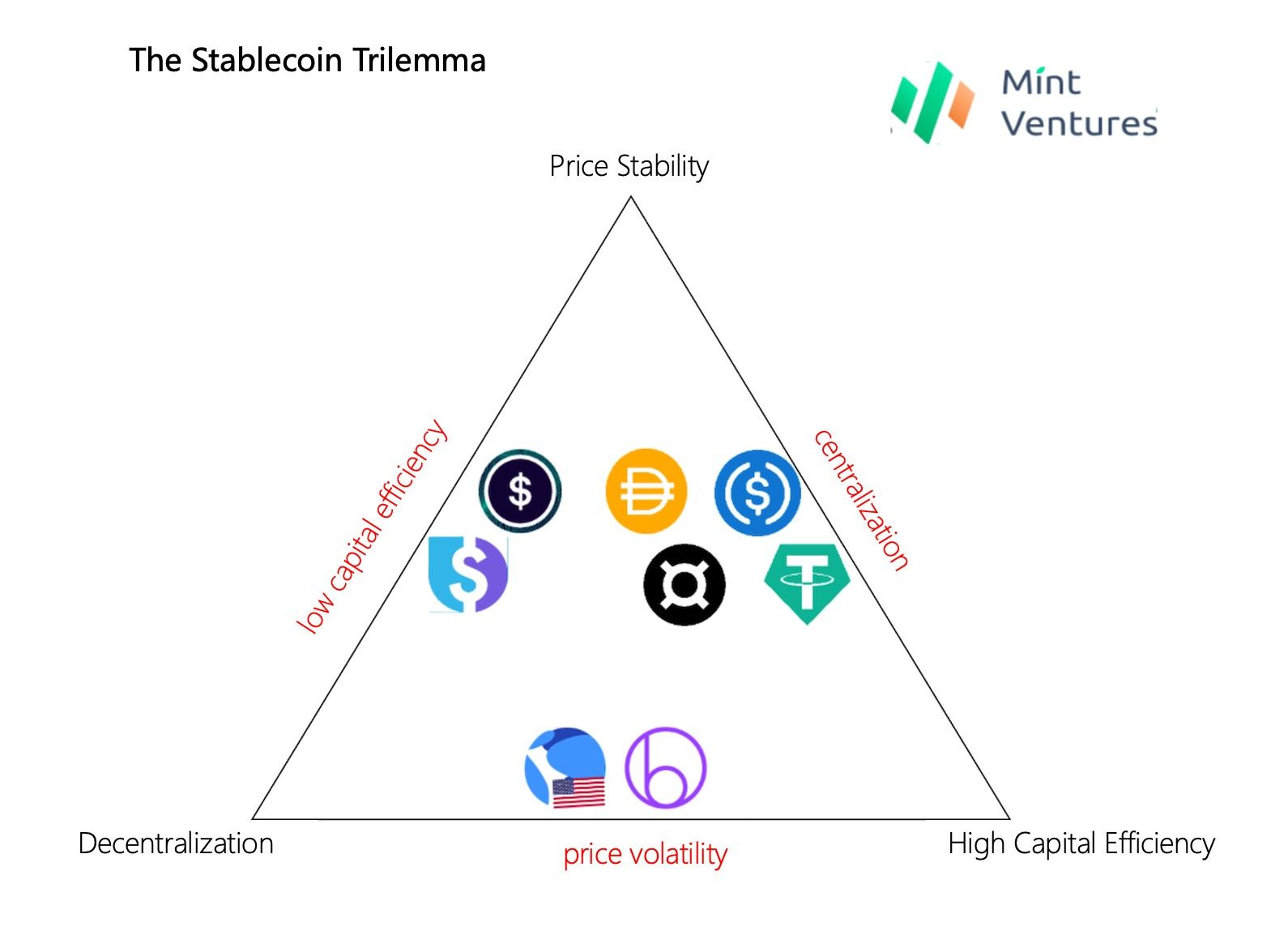

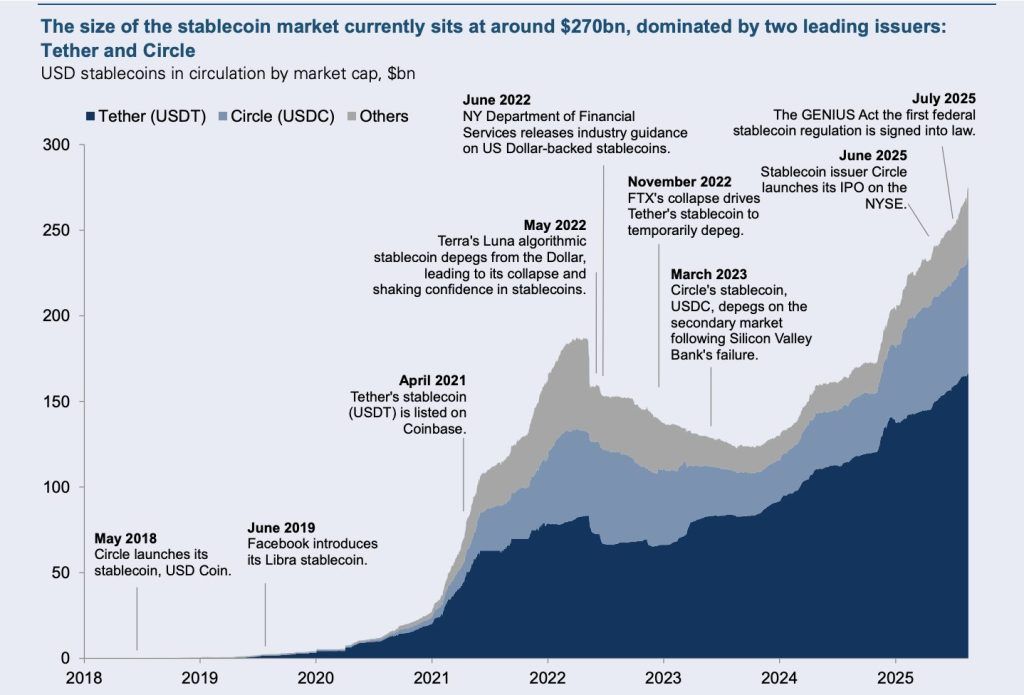

這關係著產業未來。USDC 市值高達 650 億美元,高盛預測 2027 年將達到 770 億。Circle 對穩定幣可逆性的實驗,可能決定區塊鏈技術是成為傳統金融的橋樑,還是為機構舒適而犧牲其革命性潛力。這種不可變性與用戶保護間的張力,正是加密產業的根本問題:去中心化貨幣能否在滿足機構合規要求的同時,維持抗審查性?

爭議發生於穩定幣發展關鍵時刻。2024 年全球穩定幣交易量達 27.6 兆美元,超越 Visa 與 Mastercard 總和 7.68%。川普總統推動 GENIUS 法案,首次建立聯邦級穩定幣監管框架。Arc 區塊鏈將於今年秋季上測試網,年底部署主網,提出類似信用卡退款機制的「對付支付」層,實現可逆交易同時保留底層最終性,挑戰過去十年不可逆即加密貨幣最大特徵的正統思維。

比特幣與以太坊奠定不可變性為加密基石

交易不可變性透過比特幣的原始設計與以太坊的智能合約架構,成為加密貨幣的基礎原則。研究指出,比特幣達到「比其他數位貨幣更難逆轉的不可變性」,3-6 個區塊(約 30-60 分鐘)後交易幾乎不可逆。以太坊亦類似,經過約 12 個區塊(2-3 分鐘)達到實際終局性。

不可變性已被貨幣理論學者定義為「貨幣第七大特性」,革新了耐用性、可攜性、可分割、均一性、有限供應、可接受性等傳統六項。不同於傳統數位支付可長期逆轉,區塊鏈交易以密碼學方式實現無任何單一實體能單方面推翻的終結性。

此理念源於 1990 年代的賽博龐克運動,Eric Hughes 等人宣稱「隱私是開放社會的必要條件」,「賽博龐克寫程式」。此思想強調用密碼學抗衡集中權力,直接影響中本聰於 cypherpunk 郵件論壇首次發表比特幣白皮書。該運動堅持「普及強加密及隱私增進技術」,提倡去中心化、個人自主與避開集中權威。

比特幣的不可變性功能不僅只是技術上永續,也消除了對手風險,確保銀行、政府或中介不能逆轉已完成交易。預測性結算終局性讓複雜金融應用無需信任第三方,最重要的是它保障用戶免於強權機構任意凍結或沒收資產。

以太坊藉智能合約擴展上述概念。智能合約是自動執行且無法被干預的程式,發佈後即按規則自動運作。「程式即法律」理念把不可變規則交由分散網路自我執行,比人類機構更可靠,避開貪腐與脅迫。

不可變性的經濟意涵涉及不只技術架構。研究顯示,區塊鏈價值主張在於「攻擊成本高、移除困難」帶來的可信承諾-可能帶來政策無法回頭,哪怕短期有利。失去不可變性,區塊鏈就無法超越現有中心化模式。

Circle Arc 區塊鏈以對付支付層引入可控可逆機制

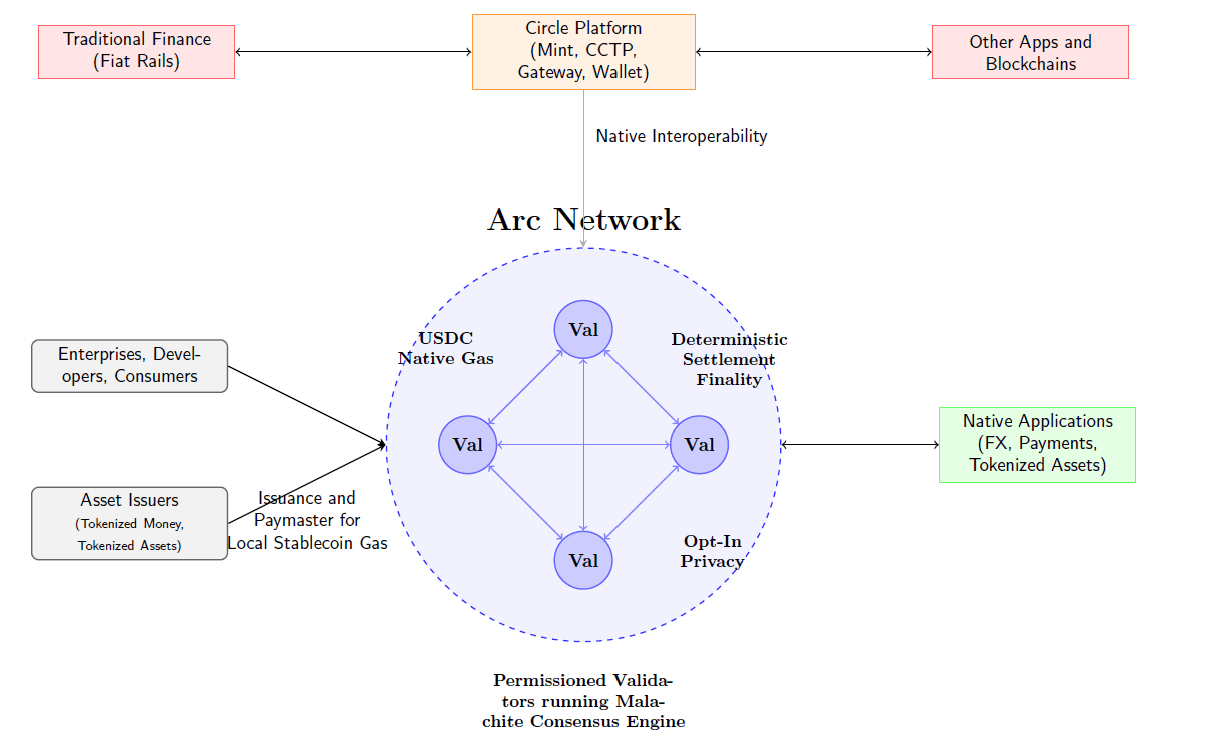

Arc 區塊鏈是加密史上最接近金融業傳統要求,試圖調和不可變性與法規需求的實驗。這條 Layer-1 主網計劃於 2025 秋上測試網,年底主網上線,採取新穎架構:基層維持確定性終局,高層實作可選的交易可逆。

技術創新核心是 Malachite 共識引擎,這套拜占庭容錯系統於 2025 年 8 月自 Informal Systems 併購而來。僅需 20 個驗證者即可帶來 350 毫秒內的次秒級終局性,4 驗證者下每秒可達 1 萬筆交易。不同於需等多次確認的機率性終局系統,Arc 提供即時且非機率化結算,標榜同時滿足鏈圈理想與機構需求。

Arc 最具爭議之處在於「對付支付」層-這是一種在不可變主鏈之外運行的鏈外爭議解決機制。Heath Tarbert 表示,此設計在「結算終局」同時「賦予交易可逆的可能性」,明言這裡有「立即轉移但不可撤銷」的內在張力。

運作方式採條件可逆,需雙方同意;不同於傳統一方可單方面撤銷的退款,Arc 的逆轉必須各方共識。此設計旨在平衡欺詐防範及傳統支付濫用的困境,所有逆轉操作經由鏈外、可稽核的透明流程進行,不影響主鏈不可變性。

Arc 上 USDC 為原生 gas 代幣,用戶無需持有高波動幣支付手續費。機構可享固定美元計價的預測性費用結構,並有「費率平滑」與「基本費率上限」防範網路壅塞時費用失控。

Arc 具備企業級可選隱私,允許交易金額加密、位址公開,達到機密企業財務運作與合規能力兼備。此選擇性揭露採 EVM 預編譯及可插拔密碼後端,可依不同需求切換隱私層級。

平台原生支持 Circle 全產品線:包括 Circle Payments Network、多種穩定幣(USDC、EURC、USYC)、Circle Mint、錢包、合約、跨鏈轉帳協議與 Circle Gateway。此整合打造專為穩定幣業務優化的懂行金融基建,差異於通用型鏈。

目標應用包括自動匯兌的跨境支付、穩定幣外匯合約(FX perpetuals)、整合身分及現金流歷史的鏈上信貸、交割支付一體的資本市場結算、以及支持 AI 市場的自主商務。Circle 已宣布攜手 Fireblocks 佈局機構託管,合作逾百家金融機構,並與 FIS、Fiserv 等傳統金融基礎建設商集成。

驗證人機制採初期授權制:由知名機構驗證者合乎營運和合規要求,未來規劃轉至受限權限的權益證明機制。此方式重合規輕去中心化,與比特幣無門檻共識大異其趣,彰顯哲學分歧。

批評者認為這套架構把傳統金融中心化以「區塊鏈」包裝,並非真正去中心化創新。Circle 則認為,此為促進機構採納所必須的務實路徑,且 USDC 650 億市值及監管明朗度提升,正驗證策略有效。

加密社群強烈反擊「反加密」的可逆性

可逆 USDC 上線消息一出,立即引爆加密社群強烈反彈,痛批此舉根本「反加密」並背叛區塊鏈核心原則。

抨擊聲浪迅即蔓延。加密圈名人 Aaron Day 更直接表示:「USDC 宣布可逆交易。我們完全迷失方向了。USDC 成為監控帳本上的法幣,這已不再是加密貨幣。」 tyranny。”另一位社群成員則形容 USDC 的目標是「成為首個徹底中心化、可被 1000% 控制的穩定幣」,另有人警告 Circle「會抹殺所有優勢,斷送 USDC 在 DeFi 生態中的用武之地」。

ZachXBT 這位具影響力的區塊鏈調查者指出 Circle 的行為前後不一,批評「Circle 甚至不會主動凍結與北韓或駭客集團相關的地址」——質疑可逆性究竟是出於真正的安全需求,還只是配合監管的表面功夫。這則批評尤具共鳴,因為 Circle 以往在凍結被盜資金上反應遲緩,與現在強調交易可逆的立場形成鮮明對比。

這些哲學層面的反對意見,比純粹的技術憂慮來得更深。B2 Ventures 的 Arthur Azizov 指出「傳統金融機構正越來越多地主導加密貨幣領域的敘事」,而「密碼龐克精神則逐漸退出聚光燈下」。這句話道出了社群對可逆穩定幣的深層恐懼——它象徵的不是單純的技術妥協,而是對機構壓力的文化投降。

“CypherMonk” 宣言警告說:「這些科技一旦進入主流,我們就會冒著變得只迷信『程式即法律』,而忘記了真正驅動我們的理想。」這種觀點反映出更深一層的憂慮——加密貨幣從革命性技術正蛻變為由企業掌控、僅僅數位化現有金融權力結構的基礎設施。

技術上的反對意見則聚焦在實際執行挑戰,特別是批評者所謂的「燙手山芋問題」:駭客若能將 USDC 迅速兌換成其他資產,逆轉原始的 USDC 交易反而可能傷及無辜的流動性提供者與 DEX 用戶,卻未必能抓到罪犯。正如一位分析師指出:「如果駭客已經兌換,怎麼逆轉 USDC?要砍 LP 嗎?還是交易所?」

不少社群成員認為,可逆交易會「讓去中心化金融重回中心化」,也會消滅「我們今日所擁有的自由」。這一批評直指 DeFi 強調無需許可、自我託管的本質,與可逆穩幣必然仰賴中心化決策機構的根本矛盾。

強調「消費者監控與官方帳號登記」的做法,與去中心化金融的價值主張背道而馳——後者承諾無須許可、抗審查的金融系統接入。批評者擔憂,可逆穩定幣很可能成為政治審查與社會管控的工具,特別是在各國政府加強監管加密貨幣交易的背景下。

然而,也有聲音為 Circle 的做法辯護,認為這是必要的進化。Falcon Finance 的 Andrei Grachev 指出,完全不可逆「絕非金融體系在機構等級的真實運作方式」,「可逆性不是缺陷,合適的規則、用戶同意以及鏈上強制,可以讓它成為有用的功能」。支持者則舉例如 Sui 鏈挽回 Cetus 漏洞損失 1.62 億美元,認為經過控管的可逆性在實務上可行,同時也沒有破壞系統整體的完整性。

這場辯論呈現了對加密未來的兩種截然相反的願景。傳統加密支持者視不可篡改性為不可妥協的原則,認為放棄這一點等於摧毀區塊鏈最核心的價值主張。擁抱機構化的人士則認為,意識形態的純粹性必須讓位給主流應用和合規的現實需求。

這種文化張力體現在所謂的「不可篡改性悖論」:區塊鏈最大的強項,可能同時也是最大風險。正如一位開發者所說:「如果讓系統徹底不可篡改,就有可能把缺陷也一同封死;如果允許升級修正,信任又回到原本被科技想要取代的人類手裡。」這一爭議還揭示了監管壓力,特別是與 GDPR「被遺忘權」的衝突——後者明確要求資料可修改或刪除,而這與區塊鏈的不可更改性正面矛盾。研究發現,「區塊鏈的不可篡改性與 GDPR 認為資料可為符合法律義務而更改或刪除的預設不符」,而可逆設計或許能為合規帶來解方。

社群的回饋顯示,對許多加密用戶而言,損及不可篡改性即是踩到紅線。正如一位評論者所說,這將決定「去中心化究竟能不能存活,還是會在機構主導下滅亡?」這個結果或將決定,加密貨幣究竟能否維持密碼龐克的初衷,還是最終演變為掛著區塊鏈名號的數位版傳統金融。

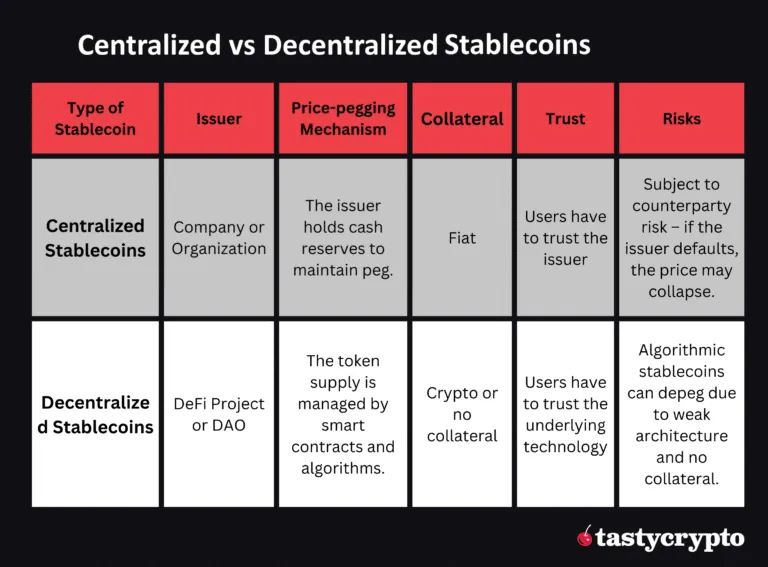

傳統金融為消費者保護與合規要求可逆性

傳統金融機構之所以熱衷於可逆穩定幣交易,根本原因在於深厚的制度要求以及數十年來為保障消費者和維護系統穩定而發展出的監管框架。這些要求與區塊鏈的不可篡改性存在基本衝突,而 Circle 的 Arc 區塊鏈即試圖解決這一問題。

銀行必須在龐大的合規架構下運作,並依法具備交易可逆(reverse transaction)的能力。美國《銀行保密法》(BSA)要求對可疑活動進行通報,並持續審查客戶及其異常活動;OFAC(海外資產控制辦公室)制裁規定要求即時凍結受制裁主體資金,並建立詳盡審核紀錄以備日後釋放資產;消費者保護法如 Regulation E(電子支付轉帳法案)與 Regulation Z,則提供消費者權利保障,包括退款與爭議處理機制,這些早已被視為基本金融權利。

對金融機構而言,其實務好處十分明顯。現有支付系統讓銀行能為顧客提供爭議處理,具備暫停可疑交易的風險控管能力,因交易可逆提供簡化的合規報告流程,以及透過退單等機制建立顧客信任和忠誠度。

美國財政部長 Scott Bessent 強調,穩定幣務必「鞏固美元全球主導地位」,並需處於傳統監管框架之下。在此觀點下,可逆穩定幣不被視為妥協,而是升級——在維護既有金融體系保護消費者的基礎上,補上數位效率。

2025 年 7 月川普總統簽署的 《GENIUS 法案》,明訂所有穩定幣發行方都應具備「法律要求時有能力查封、凍結、銷毀支付型穩定幣」的技術能力。這項聯邦強制令展現了政策制定者對消費者保護與執法能力的高度重視,並視為主流金融基礎建設不可妥協的基本要求。

各國監管也趨向一致支持這一方向。歐盟 MiCA 規範、日本支付服務法的納管、新加坡完整虛擬資產框架、瑞士早期的加密監管,都以消費者保護與已監管穩定幣的交易可逆性作為重點。這股全球共識,意味著可逆功能很可能成為機構型穩定幣採用的標準要求。

傳統金融界認為,不可篡改系統會造成消費者極大的風險。與熟悉不可逆交易風險的原生加密用戶不同,一般消費者普遍期望金融系統能提供修正錯誤和處理詐騙的機制。銀行以既有支付體系每年為顧客追回數十億美元詐騙損失為例,論證可逆性確實發揮關鍵的消費者保障效果。

可逆系統的合規優勢,還遠超消費者保護。包括即時阻斷交易以強化 AML/CFT、協助監管單位調查所需的簡化稽核、提升利用既有機制進行爭議處理、以及與既有制度接軌來減少合規壓力等,都讓機構採用可逆穩定幣更具誘因。

聯邦監管機構更直接表態支持。聯準會分析強調,穩定幣「由於易受挤兑,對金融穩定構成潛在風險」,並建議建立完整聯邦框架以確保發行方監督;商品期貨交易委員會(CFTC)把結構完善的穩定幣視為需要設有消費者保護機制的商品;美國證券交易委員會(SEC)於 2025 年 4 月發布的指引則明確支持合規的穩定幣發行人,遵循消費者保護標準。

國會聽證會也揭示兩黨一致支持設立消費者保障的穩定幣監管。《GENIUS 法案》在眾議院以 308 對 122 通過,甚至有 18 位民主黨參議員跨黨支持,顯示建立數位美元基礎設施必須繼承傳統金融保障的罕見共識。

國際協調更加強化這些要求。國際清算銀行有關結算最終性的指引承認,「設計良好並受適當監督」的穩定幣不僅有助於支付創新,也必須配備消費者保障機制;美國財政部也與國際組織合作,推動全球穩定幣監管標準,要求可逆功能成為已監管穩定幣系統的必備條件。

傳統機構堅稱,不可篡改型區塊鏈無法履行最基本的受託責任。銀行對客戶的義務包括防詐欺、錯誤更正,以及maintaining funds availability during disputes. Immutable systems make these responsibilities impossible to fulfill, creating legal and ethical conflicts that reversible stablecoins resolve.

在爭議期間維持資金可用性。不可更改(immutable)的系統讓這項責任無法履行,導致法律和倫理上的衝突,而可逆穩定幣則解決了這些問題。

This institutional perspective views Circle's Arc blockchain as pragmatic evolution rather than philosophical compromise, enabling digital efficiency while preserving essential consumer protections that decades of financial system development have proven necessary.

這種機構觀點將 Circle 的 Arc 區塊鏈視為務實的演進,而非哲學上的妥協,使得數位效率得以實現,同時保留數十年金融體系發展已證明必須存在的重要消費者保護措施。

Trump administration champions dollar-backed stablecoins while establishing federal oversight framework

川普政府支持以美元為基礎的穩定幣,並建立聯邦監管框架

The Trump administration has positioned itself as the most crypto-friendly government in U.S. history while simultaneously establishing comprehensive regulatory frameworks that benefit both institutional adoption and American dollar dominance globally. This dual approach creates favorable conditions for Circle's reversible stablecoin experiment while maintaining strict oversight requirements.

川普政府宣稱自己是美國史上對加密貨幣最友善的政府,同時建立了全方位的監管框架,不僅有利於機構採用,也鞏固美元在全球的主導地位。這種雙重策略為 Circle 的可逆穩定幣實驗創造了有利條件,同時維持嚴格的監管要求。

President Trump's Executive Order 14178, "Strengthening American Leadership in Digital Financial Technology," issued January 23, 2025, establishes core policy priorities including promoting "development and growth of lawful and legitimate dollar-backed stablecoins worldwide," providing regulatory clarity through technology-neutral regulations with well-defined jurisdictional boundaries, explicitly prohibiting Central Bank Digital Currencies, and protecting blockchain development and self-custody rights.

川普總統於 2025 年 1 月 23 日發布的行政命令 14178「強化美國在數位金融科技的領導地位」,訂定了核心政策優先事項,包括推動「全球合法且正當的美元穩定幣的發展與成長」、透過技術中立又劃分明確管轄範圍的法規提供監管明確性,明確禁止中央銀行數位貨幣(CBDC),並保護區塊鏈發展與自主保管權。

The administration's Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile, established March 6, 2025, signals unprecedented government-level cryptocurrency adoption. This policy shift reflects Trump's acknowledgment that crypto support serves both economic and political purposes, stating "I also did it for the votes" while emphasizing stablecoins' role in reinforcing U.S. dollar global dominance and driving Treasury securities demand.

該政府於 2025 年 3 月 6 日設立了戰略比特幣儲備和美國數位資產儲備,展現了前所未有的政府層級加密貨幣採用。這項政策轉變也反映出川普認知到支持加密貨幣既有經濟也有政治意義,他公開表示「我也是為了選票才這麼做」,同時強調穩定幣在鞏固美元全球主導地位和提升美國國債需求上的作用。

Key administration appointments demonstrate pro-innovation leadership. David Sacks serves as Special Advisor for AI and Crypto, Bo Hines directs the Presidential Council of Advisers for Digital Assets, and Paul Atkins chairs the SEC with explicitly crypto-friendly policies. These appointments ensure regulatory coordination favoring innovation while maintaining oversight requirements.

多位關鍵人事任命也顯示出此政府鼓勵創新的領導風格。例如 David Sacks 擔任 AI 和加密貨幣特別顧問,Bo Hines 擔任總統數位資產諮詢委員會主任,Paul Atkins 則以明確友善加密貨幣政策主管管證交會(SEC)。這些任命保障了監管整合與創新友善並行,同時維持監管要求。

The GENIUS Act represents the administration's signature cryptocurrency achievement. Passed during "Crypto Week" (July 14-18, 2025) with the Anti-CBDC Surveillance Act and Digital Asset Market Clarity Act, the legislation creates dual federal-state oversight with the Treasury Department as primary regulator, mandates 100% backing with liquid assets, establishes licensing requirements for permitted payment stablecoin issuers, provides consumer protection through priority claims in insolvency proceedings, and requires technical capability to seize, freeze, or burn stablecoins when legally required.

「GENIUS 法案」是該屆政府加密貨幣政策的代表性成就,於 2025 年 7 月 14-18 日的「加密週」與反 CBDC 監控法案、數位資產市場明確性法案一起通過。該法案建立了聯邦與州兩級監管制度,以財政部為主要監管者,規定穩定幣需 100% 以流動資產為後盾、要求穩定幣發行商必須獲得執照、在破產時給予消費者優先索賠權,以及在符合法律規定時具備查封、凍結或銷毀穩定幣的技術能力。

The administration views stablecoins as strategic tools for American financial hegemony. Treasury Secretary Scott Bessent emphasizes using stablecoins to "cement dollar dominance globally" by increasing international demand for dollar-denominated assets and Treasury securities. This perspective treats reversible stablecoins not as compromise with crypto principles but as enhancement of American financial power projection through digital channels.

該政府將穩定幣視為維持美國金融霸權的戰略工具。財政部長 Scott Bessent 強調,要利用穩定幣「鞏固全球美元主導地位」,提升國際對美元計價資產與美國國債的需求。這種觀點認為可逆穩定幣並非對加密貨幣原則的妥協,而是藉由數位管道增強美國金融實力的投射。

Political motivations align with policy outcomes. Trump's crypto industry support during the 2024 election generated substantial political capital and financial backing. The administration leverages this support to advance policies that benefit American financial institutions while maintaining regulatory control. The resulting framework favors compliant, regulated issuers like Circle over international competitors operating outside U.S. oversight.

政治動機與政策成果保持一致。川普於 2024 年大選期間對加密產業的支持,為其帶來巨大的政治資本與財務支援。該政府借此推動有利美國金融機構、同時維持監管主導地位的政策。最終的框架使合規、受監管的發行商如 Circle 較受益,而非處於美國監管之外的國際競爭者。

Congressional passage required significant political maneuvering. The GENIUS Act needed 18 Senate Democrats to cross party lines despite attempts to bar presidential crypto profits and concerns about conflict of interest. The bipartisan support reflects recognition that stablecoin regulation serves national economic interests beyond partisan politics.

法案在國會通過過程中需大量政治協調。GENIUS 法案需要 18 位民主黨參議員跨黨支持,儘管曾有制止總統從加密貨幣中獲益及關注利益衝突的提案。兩黨支持反映出,規管穩定幣已是凌駕黨派的國家經濟利益需求。

Federal agency coordination ensures comprehensive implementation. The Working Group on Digital Asset Markets includes Treasury Secretary (Chair), Attorney General, Commerce Secretary, SEC and CFTC Chairmen, Federal Reserve officials, and banking regulators. This structure enables coordinated policy development and enforcement across traditional jurisdictional boundaries. The administration explicitly supports reversible transaction capabilities as necessary infrastructure features. Treasury's August 2025 Request for Comment on "innovative or novel methods, techniques, or strategies that regulated financial institutions use, or could potentially use, to detect illicit activity involving digital assets" signals government interest in controllable digital payment systems.

聯邦機構協調確保全面執行。數位資產市場工作小組包含財政部長(擔任主席)、司法部長、商務部長、證交會(SEC)及商品期貨交易委員會(CFTC)主席、聯準會(Fed)官員、銀行監理官等。此架構促進跨傳統監管界線的協同政策規劃與執行。政府明確支持可逆交易作為必要基礎設施。財政部於 2025 年 8 月發出徵詢意見,主題為「金融機構檢測數位資產非法活動時現有或潛在可用的創新方法、技術或策略」,顯示政府對可控數位支付系統的興趣。

International coordination amplifies American influence. The Treasury Department works with international bodies to establish global standards favoring American-regulated stablecoin issuers. This approach uses regulatory clarity as competitive advantage, enabling Circle and other compliant issuers to expand internationally while foreign competitors face regulatory uncertainty.

國際協調進一步放大美國影響力。美國財政部與國際組織合作,建立有利美國監管穩定幣發行商的全球標準。此策略將監管明確性作為競爭優勢,使 Circle 等合規發行商得以全球擴展,同時令外國競爭對手面臨監管不確定性。

The administration frames crypto regulation as America First policy. By establishing comprehensive frameworks for dollar-backed stablecoins while prohibiting government digital currencies, Trump positions private stablecoin innovation as patriotic alternative to foreign government digital currencies. This narrative justifies regulatory requirements as necessary tools for maintaining American financial leadership. Enforcement priorities reflect political realities. The administration selectively enforces existing regulations while providing clarity for compliant actors, creating incentives for institutional adoption of approved stablecoin models. This approach benefits Circle's regulated approach while maintaining pressure on non-compliant competitors.

本屆政府將加密貨幣監管定位為「美國優先」政策。透過為美元穩定幣建立完善框架,同時禁止政府數位貨幣,川普將私人穩定幣創新描繪為愛國、可對抗外國政府數位貨幣的解方。這套說法賦予監管要求正當性,是維持美國金融領導力的必要手段。執法重點則考量政治現實,該政府對既有法規進行有選擇性執行,並向合規業者提供監管明確性,激勵機構採用經核准的穩定幣模式。這種做法既有利於 Circle 的合規模式,也對不符規業者持續施壓。

The administration's strategy successfully balances crypto industry support with traditional financial system stability, creating political conditions favoring Circle's reversible stablecoin experiment while ensuring government oversight capabilities remain intact.

該政府的策略成功平衡了對加密產業的支持和傳統金融系統的穩定性,營造出有利於 Circle 可逆穩定幣實驗的政治環境,並確保政府監督能力不受損。

Goldman Sachs projects trillion-dollar stablecoin markets driven by institutional adoption

高盛預測機構帶動下穩定幣市場將達兆美元規模

Goldman Sachs' research division has issued the most bullish institutional projection for stablecoin growth, forecasting USDC expansion of $77 billion through 2027 representing 40% compound annual growth while identifying trillion-dollar market potential driven by the massive $240 trillion global payments market. This institutional endorsement provides crucial credibility for Circle's reversible transaction experiment.

高盛研究部門發布了最樂觀的機構級穩定幣增長預測,預計到 2027 年 USDC 將增長 770 億美元,代表 40% 的年複合成長率,並指出 240 兆美元的全球支付大市場將帶來兆美元級規模潛力。這項機構級背書為 Circle 的可逆交易實驗帶來關鍵信心。

Goldman's "Stablecoin Summer" research identifies massive untapped opportunity in the global payments market, breaking down the $240 trillion annual volume into consumer payments ($40 trillion), business-to-business payments ($60 trillion), and person-to-person disbursements. Currently, most stablecoin activity remains crypto-trading focused rather than mainstream payments, suggesting enormous potential for expansion into traditional use cases that institutions prefer.

高盛「穩定幣之夏」的研究指出,全球支付市場仍有龐大未開發契機,將 240 兆美元年交易量分為消費者支付(40 兆)、企業對企業支付(60 兆)、個人對個人匯款。目前多數穩定幣用途集中於加密交易,而非主流支付場景,意味著轉型進入機構偏好的傳統應用有極大增長空間。

The economic mechanics favor stablecoin growth through treasury demand. Bank for International Settlements research demonstrates that 2-standard deviation stablecoin inflows lower 3-month Treasury yields by 2-2.5 basis points, creating beneficial feedback loops where stablecoin growth supports government debt markets. Each stablecoin issued increases demand for backing assets, primarily U.S. Treasuries, aligning private innovation with government fiscal needs.

經濟機制上,穩定幣增長有利於美債需求。國際清算銀行研究顯示,穩定幣流入若達兩個標準差,會使三個月期美國國債殖利率下降 2 到 2.5 個基點,產生良性循環:穩定幣增長帶動政府債券市場。每發行一單位穩定幣都會提升對支撐資產(主要為美國國債)的需求,使民間創新與政府財政需求緊密結合。

2024 market performance validates Goldman's optimism. Stablecoins processed $27.6 trillion in annual transactions, surpassing Visa and Mastercard combined by 7.68%. Supply grew 59% reaching 1% of total U.S. dollar supply, with 70% of transaction volume automated and reaching 98% on emerging networks like Solana and Base. These metrics suggest stablecoins are transitioning from experimental technology to essential financial infrastructure.

2024 年的市場表現驗證了高盛的樂觀預期。穩定幣年交易總額達 27.6 兆美元,超越 Visa 與 Mastercard 合計 7.68%;流通量成長 59%,佔美國總貨幣供應量 1%;其中 70% 交易量為自動化,且在 Solana、Base 等新興區塊鏈網路上這數字達 98%。這些數據顯示穩定幣正從實驗技術邁向關鍵金融基礎設施。

USDC specifically demonstrates institutional preference patterns. Despite Tether's larger market capitalization ($165 billion vs. Circle's $74 billion), USDC captures 70% of total stablecoin transfer volume, suggesting institutional users prefer Circle's compliance-focused approach over Tether's trader-optimized model. This volume preference supports Goldman's projection that regulated stablecoins will capture institutional growth.

USDC 最能展現機構使用偏好。雖然 Tether 流通市值較大(1,650 億美元對比 Circle 的 740 億),但 USDC 佔據 70% 穩定幣轉帳量,顯示機構用戶偏好 Circle 著重合規的經營方式,而非 Tether 著重交易者導向的模式。這種量能優勢亦支撐高盛「受監管穩定幣將主導機構增長」的預期。

Regulatory clarity accelerates institutional adoption. The GENIUS Act's federal framework and SEC guidance creating "Covered Stablecoin" categories eliminate regulatory uncertainty that previously constrained institutional participation. Circle's full regulatory compliance contrasts with competitors facing enforcement uncertainty, creating competitive advantages that Goldman's analysis incorporates into growth projections.

監管明確性加速機構採用。GENIUS 法案賦予全國框架,SEC 則創設「受規範穩定幣」分類,消除了以往限制機構參與的監管不確定性。Circle 的完全合規姿態,也與競爭對手面臨的不確定執法風險形成對比,成就了高盛納入增長預測的競爭優勢。

Circle's financial performance supports aggressive growth targets. Q2 2025 results showed $658 million revenue with 53% year-over-year growth, USDC circulation growth of 90% year-over-year to $61.3 billion, reserve income of $634 million representing 50% year-over-year increase, and adjusted EBITDA of $126 million with 52% year-over-year growth. These metrics demonstrate operational scalability supporting Goldman's expansion forecasts.

Circle 的財務表現亦支撐其高增長目標。2025 年第二季收入 6.58 億美元,年增 53%;USDC 流通量年增 90% 達 613 億美元;備用資產利息收入 6.34 億美元,年增 50%;調整後 EBITDA 為 1.26 億美元,年增 52%。這些數字反映運營可擴展性,支撐高盛的成長預期。

International expansion creates additional growth vectors. Circle achieved MiCA compliance in Europe with EURC, becoming the only major compliant stablecoin in EU markets after Tether chose non-compliance. This regulatory arbitrage creates market opportunities that Goldman's analysis factors into global growth projections.

國際拓展則出現額外增長動能。Circle 已取得歐洲 MiCA 規範下的合規資格,EURC 也成為歐盟市場唯一主要合規穩定幣,Tether 則選擇不合規。這種監管套利帶來的市場契機也被高盛納入全球增長預測。Here’s your translation into zh-Hant-TW, following your formatting request (markdown links skipped):

Institutional partnership pipelines validate market demand. Circle announced relationships with over 100 financial institutions, partnerships with traditional payment infrastructure providers FIS and Fiserv, integration with Corpay for cross-border solutions, and cooperation with Standard Chartered/Zodia Markets for institutional trading. These partnerships provide distribution channels supporting Goldman's growth assumptions. Arc blockchain infrastructure addresses institutional requirements that Goldman identifies as adoption barriers. Dollar-denominated gas fees, deterministic finality, built-in FX engines, and regulatory compliance features create institutional-grade infrastructure that current blockchain platforms lack. Goldman's analysis suggests these capabilities could accelerate adoption beyond current market expectations.

機構合作夥伴的拓展驗證市場需求。Circle 宣布已與超過 100 家金融機構建立合作關係,並與傳統支付基礎設施供應商 FIS 和 Fiserv 建立夥伴關係,整合 Corpay 的跨境解決方案,以及與渣打銀行/Zodia Markets 合作,拓展機構交易領域。這些合作關係成為推動高盛成長假設的分銷通路。Arc 區塊鏈基礎設施回應高盛所識別的機構級採用障礙。以美元計價的 gas 費、確定性的終局性、內建的外匯引擎及合規功能,創造了現有區塊鏈平台所缺乏的機構級基礎設施。高盛的分析認為,這些功能有可能使採用速度超越當前市場預期。

Competitive positioning favors Circle's institutional strategy. While Tether earned $13 billion in 2024 compared to Circle's $156 million, Tether's trader-focused approach limits institutional penetration. Circle's compliance-first model accepts lower profitability for broader institutional access, aligning with Goldman's thesis that regulated stablecoins will capture mainstream growth. Economic incentives support Goldman's projections. Federal Reserve research on stablecoin "runs" suggests properly regulated systems with reversibility mechanisms could achieve systemic importance without threatening financial stability. This creates policy conditions supporting massive scale expansion that Goldman incorporates into trillion-dollar market projections.

競爭定位有利於 Circle 的機構化策略。雖然 Tether 於 2024 年獲利 130 億美元,而 Circle 為 1.56 億美元,Tether 以交易者為主的策略卻限制了其機構層面的滲透力。Circle 的「合規優先」模式,願意以較低獲利換取更廣泛的機構接觸,與高盛認為「受監管穩定幣將抓住主流成長」的論點一致。經濟激勵支持高盛的預測。聯準會針對穩定幣「擠兌」的研究認為,若設有可逆機制且適當監管,穩定幣系統可達到系統重要性而不危及金融穩定,此一政策條件也促成高盛將巨規模擴張納入其兆美元市場預測。

Technology adoption patterns favor institutional stablecoins. Historical analysis of financial technology adoption shows institutions prioritize compliance and reversibility over decentralization and immutability. Goldman's research suggests stablecoins following this institutional preference pattern will capture disproportionate growth from mainstream financial system integration. Cross-border payment disruption drives adoption. Stablecoin technology reduces remittance costs by 60% compared to traditional methods in markets like Nigeria while providing near-instant settlement versus days for wire transfers. Goldman's analysis identifies these efficiency gains as drivers for institutional adoption across international payment corridors.

科技採用模式偏向機構型穩定幣。對金融科技歷史的分析發現,機構更重視合規性和可逆性,而非去中心化及不可竄改性。高盛的研究顯示,順應這類機構偏好的穩定幣將從主流金融系統整合中取得超額成長。跨境支付的顛覆推動採用。穩定幣技術在奈及利亞等市場,匯款成本遠比傳統方式低 60%,且比電匯快數天。高盛分析認為這些效率提升推動機構在國際支付走廊採納穩定幣。

Goldman's trillion-dollar market projection reflects institutional recognition that compliant, reversible stablecoins represent inevitable evolution toward digitized traditional finance rather than revolutionary decentralized alternatives, providing economic validation for Circle's approach.

高盛對兆美元市場的預測,反映出機構層面已認知到,合規且具可逆性的穩定幣,代表著傳統金融數位化的必然演進(而非革命性的去中心化替代品),為 Circle 的作法提供了經濟驗證。

Privacy features balance institutional confidentiality with regulatory transparency requirements

Circle's Arc blockchain introduces sophisticated privacy mechanisms designed specifically for institutional use cases while maintaining the regulatory compliance capabilities that traditional financial institutions require. This approach represents a middle ground between cryptocurrency's privacy-maximizing technologies and the transparency demands of institutional oversight.

Circle 的 Arc 區塊鏈引入了專為機構用例設計的高度隱私機制,同時保有傳統金融機構所需的合規能力。這種作法呈現了加密貨幣極大化隱私與機構監管透明需求間的中庸之道。

Arc's selective disclosure architecture enables "confidential but compliant" transactions through encrypted transaction amounts while keeping addresses visible. This design allows corporations to conduct private treasury operations and business payments without revealing sensitive financial information to competitors or unauthorized observers, while ensuring regulatory authorities retain oversight capabilities when legally required.

Arc 採用選擇性揭露架構,將交易金額加密但保留地址公開,實現「保密且合規」的交易。此設計讓企業可進行私密的財務運作及商業付款,不暴露敏感資訊給競爭對手或未授權人士,同時若有法律需求,監管機構依然可執行監督權限。

The technical implementation uses EVM precompiles with pluggable cryptographic backends, providing flexibility for different privacy requirements across various use cases. Unlike privacy-maximizing cryptocurrencies that obscure all transaction details, Arc's approach enables surgical privacy protection for specific data elements while preserving auditability and compliance functionality.

技術實作方面,Arc 使用 EVM precompile 與可插拔的加密後端,彈性支援不同用例下的多元隱私需求。與極大化隱私的加密幣(會隱蔽全部交易細節)不同,Arc 針對個別資料欄位提供精細的隱私保護,同時保留稽核和合規功能。

Enterprise use cases drive privacy feature development. Corporate treasury operations require confidentiality for inter-company transfers to prevent competitors from analyzing business relationships and financial flows. Banking operations need privacy for settlements between financial institutions to maintain client confidentiality and competitive positioning. Capital markets demand discretion for large-scale transactions that could move prices if publicly observable. Supply chain finance requires protected vendor payment information to prevent supply chain intelligence gathering.

企業用例推動隱私功能的發展。企業財庫作業需要對內轉帳保密,以防競爭對手分析商業關係及資金流。銀行之間的清算也要保護隱私,以維持客戶機密和競爭優勢。資本市場的大額交易若公開,可能影響價格波動,因此需謹慎處理。供應鏈金融則要求賣方付款資訊受保護,以避免供應鏈情資被蒐集。

Arc's privacy model contrasts sharply with existing cryptocurrency privacy technologies. Zero-knowledge proof systems like those used in Zcash or privacy coins like Monero aim for maximum privacy protection, often creating regulatory compliance challenges. Circle's approach deliberately balances privacy with oversight requirements, enabling institutional adoption while satisfying regulatory frameworks that demand transaction visibility when legally required.

Arc 的隱私模式與現有加密貨幣的隱私技術截然不同。像 Zcash 使用的零知識證明技術或 Monero 等隱私幣追求極致保密,但往往產生法規合規困難。Circle 則刻意平衡隱私與監管需求,使能機構採納並滿足法律要求之下的交易可見性。

Regulatory compatibility drives design decisions. GDPR's "right to be forgotten" conflicts with blockchain immutability, but Arc's privacy features could potentially address these concerns through selective data encryption rather than immutable public records. AML/CFT compliance requires transaction monitoring capabilities that Arc maintains through controlled privacy mechanisms rather than complete anonymization. The privacy implementation supports graduated disclosure levels based on user requirements and regulatory jurisdiction. Basic transactions can operate with full transparency, while institutional users can opt into amount encryption for sensitive commercial operations. This granular approach enables compliance with varying international regulatory requirements without compromising functionality.

合規性需求驅動設計決策。GDPR 所謂「被遺忘權」和區塊鏈不可竄改性產生衝突,不過 Arc 透過選擇性資料加密而非不可變的公開紀錄,可能可解決此問題。反洗錢/反資恐合規要求交易監控,Arc 保留可控的隱私機制而非完全匿名,以符合法規。此隱私設計支援依用戶需求或法區設計分級揭露層級:一般交易可完全公開,機構用戶則可選擇敏感商業操作進行金額加密。這種細緻方式,讓功能落實各國不同監理要求且不妥協核心能力。

Circle's privacy philosophy differs from cypherpunk approaches that view surveillance resistance as fundamental human rights. Arc's privacy features serve commercial confidentiality rather than political protection, focusing on business use cases rather than censorship resistance. This institutional orientation reflects Circle's broader strategy of bridging traditional finance and blockchain technology. Compliance-first privacy design maintains regulatory oversight capabilities. Unlike privacy coins that prevent external monitoring, Arc's privacy features include mechanisms for authorized access by regulatory authorities. This "privacy with accountability" model enables institutional adoption while satisfying government oversight requirements that pure privacy systems cannot meet.

Circle 的隱私觀念與強調監控抗性為基本人權的 cypherpunk 理念不同。Arc 的隱私功能立足於商業機密,而非政治性保護,著眼於商業應用而非審查抗性。這種機構取向反應 Circle 致力於連結傳統金融與區塊鏈的大方針。合規優先的隱私設計保有監管機構監督能力。與徹底阻擋外部監控的隱私幣不同,Arc 提供授權監管機構可以合法查閱資訊的機制。這種「負責任隱私」模式促進機構採納,同時滿足政府監督要求,而純粹的極隱私系統則無法辦到。

The technical architecture enables selective revelation for dispute resolution. Arc's reversible transaction mechanisms require access to transaction details for legitimate dispute resolution, creating natural integration points between privacy features and reversal capabilities. This design supports institutional requirements for both confidentiality and dispute resolution without requiring complete privacy sacrifice. Competitive advantages emerge from regulatory-compliant privacy. While privacy-maximizing cryptocurrencies face increasing regulatory scrutiny and potential bans, Arc's measured approach positions Circle to capture institutional users requiring confidentiality within regulatory frameworks. This creates market differentiation from both transparent public blockchains and completely private systems.

Arc 的技術架構可針對爭議處理做選擇性揭露。可逆交易機制如需調查爭議,能得知相關交易細節,巧妙結合了隱私與可逆功能。此設計符應機構對機密與交易爭議解決的雙重需求,無需完全犧牲隱私。合規的隱私也帶來競爭優勢。當極隱私的加密貨幣面臨監管審查及禁令壓力,Arc 的穩健方針則讓 Circle 能攫取需營運於合規體制下的機構市場,實現與透明公鏈與全隱私系統的差異定位。

International regulatory frameworks influence privacy feature design. MiCA in Europe, GENIUS Act in the United States, and similar regulations globally require balance between user privacy and regulatory oversight. Arc's architecture enables compliance across multiple jurisdictions through configurable privacy levels rather than one-size-fits-all approaches. Privacy features address institutional security concerns beyond regulatory compliance. Corporate financial flows provide competitive intelligence that privacy protection helps secure. Treasury operations revealing working capital positions could disadvantage companies in negotiations or market positioning. Banking settlement information could enable front-running or market manipulation if publicly observable.

國際監理體系左右隱私設計。歐洲 MiCA、北美 GENIUS 法案及全球類似規管,皆需在用戶隱私與監管監督之間取平衡。Arc 經由可自訂隱私層級,而非單一解決方案,使其可符應多司法區域合規要求。隱私功能更針對機構資安痛點,而非只應付法規。企業資金流若外洩即淪為競爭情資,需隱私庇護。流動資金狀態被揭露,將損及企業談判或市場地位;銀行清算資訊若透明,恐遭搶跑或市場操控。

The integration with traditional financial infrastructure requires privacy considerations that pure public blockchains cannot provide. Banks cannot operate with completely transparent transactions due to client confidentiality requirements and competitive concerns. Arc's privacy model enables blockchain integration while preserving necessary business confidentiality. Circle's approach represents pragmatic evolution of blockchain privacy toward institutional requirements rather than maximal privacy protection, creating tools for commercial confidentiality within regulatory frameworks rather than surveillance resistance technologies favored by cryptocurrency purists.

要與傳統金融基礎建設整合,必需採納純公鏈無法提供的隱私考量。銀行不可能在完全透明的交易環境中運作,因為需保障客戶機密及競爭利益。Arc 的隱私模式讓區塊鏈與銀行業順利整合,又保有必要的商業機密。Circle 提供的,是符合機構需求的區塊鏈隱私漸進演化,力求在合規體系下實現商業保密工具,而非加密貨幣純粹主義者追求的反監控技術。

Decentralized stablecoins maintain immutability principles despite institutional pressure

去中心化穩定幣在機構壓力下仍堅守不可竄改原則

Decentralized stablecoin protocols represent the philosophical counterpoint to Circle's reversible transaction experiment, maintaining blockchain's original immutability principles even as institutional pressure mounts for controllable alternatives. These systems demonstrate alternative approaches to stability and governance that preserve cryptocurrency's censorship resistance while serving major portions of the DeFi ecosystem.

去中心化穩定幣協議作為 Circle 推動可逆交易實驗的理念對立面,堅持區塊鏈最初的不可竄改(immutability)原則,即使面臨機構要求可控替代方案的壓力仍不動搖。這些協議展示了替代性的穩定與治理方案,一方面守護加密貨幣的審查抗性,另一方面服務著 DeFi 生態系的主要領域。

MakerDAO's DAI exemplifies the immutable approach with approximately $3.4-3.5 billion market capitalization maintained through over-collateralization with Ethereum-based assets. The protocol's governance through MKR token holders provides decentralized control over stability parameters without enabling transaction reversals. DAI successfully maintained its 1:1 USD peg despite an 80% ETH price decline during its first year, demonstrating that immutable systems can achieve stability

MakerDAO 的 DAI 是不可竄改運作模式的代表案例,出於以太坊資產超額抵押,目前市值約 34-35 億美元。協議透過 MKR 治理權人去中心化決定穩定參數,無法進行交易回溯。DAI 初創期曾遇 ETH 價格暴跌 80%,照樣成功維持 1:1 美元匯率,證明不可竄改系統亦能實現穩定。 through economic mechanisms rather than centralized control.

透過經濟機制,而非集中式控制來達成。

The DAO's governance model contrasts sharply with Circle's institutional approach. MKR holders vote on collateral types, stability fees, and protocol parameters through on-chain governance rather than corporate decision-making. This distributed control prevents any single entity from reversing transactions or freezing funds, maintaining the censorship resistance that cryptocurrency advocates view as fundamental to the technology's value proposition.

DAO 的治理模型與 Circle 的機構化作法形成鮮明對比。MKR 持有者透過鏈上治理的方式,對擔保資產類型、穩定費率及協議參數進行投票,而非由公司決策。這種分散式控制防止任何單一實體撤銷交易或凍結資金,維護了加密貨幣倡導者視為技術核心價值的抗審查性。

Recent controversy within MakerDAO illustrates the community's commitment to immutability. The proposed transition to Sky Protocol's USDS token faced significant community resistance specifically because it included freeze functions that many users viewed as compromising DAI's immutable principles. This rejection demonstrates that even economically rational upgrades may be rejected when they compromise core philosophical commitments.

近期 MakerDAO 的爭議展現了社群對不可更改性的堅持。提議將 DAI 轉換到 Sky Protocol 發行的 USDS 代幣時,因其包含可凍結功能,許多用戶視為違背 DAI 不可更改的原則,因此遭到社群強烈反對。這項否決顯示,即使是具有經濟合理性的升級,只要侵害核心理念也會遭到拒絕。

FRAX Protocol represents innovation within immutable frameworks through its hybrid fractional-algorithmic design combining collateral backing with market-driven seigniorage mechanisms. The protocol maintains dynamic collateralization ratios based on market conditions (currently 96% USDC backing, 4% burned FXS tokens) while preserving transaction immutability. FRAX's broader ecosystem includes decentralized exchanges, lending protocols, and liquid staking offerings that create multiple use cases without requiring centralized control.

FRAX 協議透過其混合的部分準備金/演算法設計,在不可更改框架下結合擔保品支持與市場主導的增發機制。該協議依據市場狀況動態調整擔保品比率(目前為 96% 以 USDC 支持,4% 為銷毀 FXS 代幣),同時保持交易的不可更改。FRAX 更廣泛的生態系包括去中心化交易所、借貸協議及流動質押服務,創造多樣應用場景而無需集中控制。

The technical architecture of decentralized stablecoins enables immutability through algorithmic governance. Automated market operations, liquidation mechanisms, and stability fee adjustments occur through smart contracts rather than human intervention. This automation eliminates discretionary decision-making that could enable transaction reversals while maintaining system stability through economic incentives. Decentralized stablecoin users actively choose immutability over convenience. Despite Circle's USDC offering better regulatory clarity and institutional integration, DAI and other decentralized alternatives maintain substantial market share among users who prioritize censorship resistance over compliance features. This user preference suggests significant market segments will resist reversible alternatives.

去中心化穩定幣的技術架構,通過演算法治理來實現不可更改。自動的市場操作、清算機制及穩定費調整都由智能合約執行,而非人工干預。這種自動化消除了可裁量決策,避免交易被撤銷,同時透過經濟激勵維護系統穩定。去中心化穩定幣的用戶主動選擇不可更改性,而非方便性。儘管 Circle 的 USDC 在合規性及機構整合度上較佳,DAI 及其他去中心化選擇仍在重視抗審查用戶中維持可觀市占率。這種用戶偏好顯示,市場中的一大部分將會抵抗可撤銷的替代品。

DeFi protocol integration favors immutable stablecoins because transaction finality enables complex automated operations without counterparty risk. Lending protocols, yield farming, automated market makers, and other DeFi applications require predictable transaction outcomes that reversible systems could potentially disrupt. The $200+ billion DeFi ecosystem largely depends on immutable stablecoins for operational reliability.

DeFi 協議整合偏好不可更改的穩定幣,因為交易最終性讓複雜的自動化操作無需承擔對手方風險。借貸協議、收益農場、自動做市商及其他 DeFi 應用均需可預期的交易結果,而可撤銷系統可能造成干擾。超過 2000 億美元的 DeFi 生態,很大程度依賴不可更改的穩定幣來維持運作可靠性。

Governance token mechanisms provide decentralized oversight without enabling transaction reversals. Token holders can modify protocol parameters, add collateral types, and adjust fee structures through transparent on-chain voting rather than centralized corporate control. This distributed governance maintains community oversight while preserving transaction immutability. Economic incentives align community interests with protocol stability. Governance token holders benefit from protocol success through token appreciation and fee collection, creating market-driven incentives for responsible parameter management. These economic mechanisms replace institutional oversight with decentralized market forces that maintain stability without requiring centralized control.

治理代幣機制提供分散監督,但不會導致交易可逆。代幣持有者可以透過公開的鏈上投票,修改協議參數、增加抵押資產以及調整費率,而無需中央控制。這種分散式治理維持社群監督並保有交易不可更改性。經濟激勵讓社群利益與協議穩定性一致。治理代幣持有者可因協議成功受益,例如代幣升值及手續費分潤,使參與者有市場驅動的誘因負責管理參數。這些經濟機制以去中心化市場力量取代機構監管,維持穩定性且不需集中式控制。

Cross-chain expansion of decentralized stablecoins demonstrates continued demand for immutable alternatives. DAI operates across multiple blockchain networks, FRAX has expanded to various chains, and new decentralized stablecoin protocols continue launching despite regulatory pressures favoring centralized alternatives. This expansion suggests robust market demand for immutable options. Technical innovation continues within immutable frameworks. Liquity's LUSD uses algorithmic liquidations without governance tokens, providing stability through purely economic mechanisms. Olympus DAO's OHM experiments with reserve-backed models that maintain decentralization. These innovations demonstrate that immutable stablecoins can evolve technically without compromising philosophical principles.

去中心化穩定幣的跨鏈擴展,展現市場對不可更改替代品的持續需求。DAI 已串聯多條區塊鏈運作,FRAX 也擴展到其他鏈,雖然監管趨勢更偏向集中式選項,但新的去中心化穩定幣協議仍持續誕生,顯示對不可更改選擇的強勁市場需求。不變性框架內的技術創新亦未止歇,例如 Liquity 的 LUSD 採用無治理代幣的自動清算機制,純粹以經濟機制維持穩定;Olympus DAO 的 OHM 則嘗試去中心化的儲備支持模式。這些創新證明不可更改穩定幣能在不損核心理念前提下,持續技術演化。

Community resistance to centralized alternatives strengthens over time. As traditional financial institutions increase involvement in cryptocurrency through regulated stablecoins, crypto-native users increasingly value alternatives that maintain original blockchain principles. This cultural preservation creates persistent demand for immutable stablecoins regardless of institutional preferences. Interoperability between immutable and reversible systems remains possible through bridge technologies and atomic swap mechanisms that enable users to choose transaction finality models based on specific use cases. This technical compatibility suggests market segmentation rather than winner-take-all competition between approaches.

社群對集中式選項的抗拒隨時間增強。隨著傳統金融機構透過合規穩定幣加深參與加密貨幣市場,加密原生用戶愈加重視能維持區塊鏈原則的替代品。這種文化堅持讓不可更改穩定幣持續有需求,不受機構偏好所影響。不可更改與可逆系統間的互通,仍可透過橋接技術和原子交換實現,用戶可根據特定場景選擇交易最終性模式。這種技術兼容性,預示市場分層,而非單一模式勝出。

The philosophical commitment to immutability extends beyond technical implementation to community values, governance structures, and development roadmaps that prioritize censorship resistance over institutional adoption. These deep cultural commitments suggest decentralized stablecoins will persist as alternatives regardless of regulatory or institutional pressures favoring reversible systems. Decentralized stablecoins thus represent the preservation of cryptocurrency's original vision within evolving market conditions, maintaining immutable principles through economic mechanisms and distributed governance rather than institutional compliance and centralized control.

對於不可更改的理念追求,不僅體現在技術層面,更擴及社群價值觀、治理結構與發展路線圖,將抗審查性置於機構採用之上。這種深層文化承諾表明,無論監管或機構力挺可逆系統,去中心化穩定幣始終會作為替代方案存在。因此,去中心化穩定幣在變動的市場條件下,透過經濟機制與分散治理持續維護不可更改原則,不需依賴機構合規或集中式控制,守護加密貨幣的原初願景。

Tether maintains market dominance through trading-focused strategy and regulatory arbitrage

Tether 靠交易導向策略與監管套利維持市場主導地位

Tether's strategic approach to stablecoin markets contrasts sharply with Circle's institutional compliance model, maintaining overwhelming market dominance through trader-focused services, aggressive international expansion, and selective regulatory engagement that prioritizes market access over comprehensive compliance.

Tether 在穩定幣市場的策略性布局與 Circle 的機構合規模式形成強烈對比。Tether 透過以交易用戶為核心的服務、積極的國際擴張及選擇性監管參與(重視市場開放高於全面合規),持續維持壓倒性的市場主導。

Tether's market position remains formidable with $165 billion market capitalization compared to Circle's $74 billion USDC circulation, despite Circle's active efforts to gain market share through regulatory compliance. Tether's business model generates substantially higher profits - $13 billion in 2024 versus Circle's $156 million - through more aggressive investment strategies including Bitcoin holdings, commercial loans, and gold reserves that regulatory frameworks increasingly restrict.

Tether 的市場地位依然強大,市值達 1,650 億美元,而 Circle 的 USDC 流通僅為 740 億美元,儘管 Circle 積極以合規方式搶占市占。Tether 靠更激進的投資策略(包含比特幣部位、商業貸款及黃金儲備,而這些日益受到監管限制)產生遠高於 Circle 的利潤——2024 年為 130 億美元,Circle 僅為 1.56 億美元。

The competitive battle reflects different philosophical approaches to stablecoin utility and governance. While Circle actively lobbies for stricter regulations favoring U.S.-based, audited issuers, Tether utilizes political connections and market positioning to resist restrictive legislation. Treasury Secretary nominee Howard Lutnick's role as CEO of Cantor Fitzgerald - Tether's primary banking partner - provides Tether with high-level political access that could influence regulatory outcomes.

這場競爭反映出雙方對穩定幣應用與治理根本理念的差異。Circle 積極在美推動嚴格監管、偏好美國註冊且可審計的發行方;Tether 則運用政治關係與市場地位抗拒限制性法規。美國財政部長被提名人的 Howard Lutnick 同時是 Cantor Fitzgerald(Tether 的主要銀行合作夥伴)執行長,讓 Tether 能接觸到高層政治資源,有潛力影響監管走向。

Geographic market segmentation benefits Tether's strategy. EU MiCA regulation created regulatory advantages for Circle's compliance model, leading to EURC becoming the dominant compliant stablecoin in European markets after Tether chose non-compliance. However, Tether's continued operation in non-regulated jurisdictions maintains global market access that Circle's compliance-focused approach cannot match. This regulatory arbitrage enables Tether to serve crypto-native users while Circle pursues institutional markets.

地理市場分層有利於 Tether 策略。歐盟 MiCA 規範為 Circle 的合規模式帶來優勢,Tether 選擇不合規後,EURC 成為歐洲市場的主流合規穩定幣。然而,Tether 持續在未受監管地區營運,維持了全球市場觸及率,是 Circle 的合規策略無法比擬的。這種監管套利讓 Tether 可以服務加密原生用戶,而 Circle 則主攻機構市場。

Trading volume patterns favor Tether's approach. USDT captures 79.7% of stablecoin trading volume on average, demonstrating strong preference among crypto traders for Tether's model over Circle's institutional focus. Ethereum-based USDT reserves surged 165% year-over-year, indicating continued growth in Tether's core market segment despite regulatory pressures and compliance concerns.

交易量數據偏好 Tether 選擇。USDT 平均佔據 79.7% 的穩定幣交易量,顯示加密交易者明顯更偏好 Tether 的模式,而非 Circle 的機構導向。以太坊上的 USDT 儲量年增 165%,意味著儘管有監管壓力與合規疑慮,Tether 的核心市場仍持續擴大。

Enforcement activity demonstrates different risk tolerance levels. Tether has blacklisted 1.5 billion tokens across 2,400+ addresses compared to Circle's 100 million across 347 addresses, suggesting more aggressive enforcement of regulatory requirements. However, critics argue that both issuers respond slowly to freezing stolen funds, questioning whether reversibility mechanisms would improve security outcomes or merely create compliance theater.

執法活動展現不同的風險承受度。Tether 曾在 2,400 多地址上黑名單 15 億顆代幣,而 Circle 僅有 3.47 百萬顆於 347 地址,顯示 Tether 在監管規定執行上較為強硬。但批評者指出,兩家對凍結遭竊資金反應皆慢,質疑可逆機制是否真能提升安全,還是只流於合規表象。

Tether's reserve structure provides higher yields but creates regulatory vulnerabilities. The company's investment approach includes riskier assets that generate superior returns compared to Circle's conservative cash and Treasury bill strategy. However, these investments face increasing regulatory scrutiny as governments demand full collateralization with liquid assets, potentially forcing reserve restructuring that could reduce profitability.

Tether 的儲備架構提供較高收益,但也帶來監管風險。Tether 的投資策略包含較高風險資產,收益高於 Circle 謹慎的現金與國債策略。然而,這些投資正受日益嚴格的政府監管要求(如要求全額流動性擔保),可能將迫使 Tether 重組儲備、降低獲利能力。

Network distribution strategies reflect different market priorities. Tether operates across multiple blockchain networks with particular strength on Tron and emerging networks where transaction costs remain low for retail users. Circle's multi-chain expansion through Cross-Chain Transfer Protocol focuses on institutional networks and regulated environments, creating complementary rather than directly competitive market positioning.

網路分佈策略反映不同市場優先權。Tether 活躍於多鏈生態,尤其在 Tron 及新興網路上表現突出,這些網絡交易費用低,適合零售用戶。Circle 則以跨鏈傳輸協議拓展多鏈布局,著重機構網絡與合規市場,與 Tether 形成互補而非完全直接競爭的定位。

International expansion approaches diverge significantly. Tether's strategy emphasizes emerging markets, particularly in Latin America, Asia, and Africa where regulatory frameworks remain developing and dollar access is limited. Circle's expansion focuses on regulated jurisdictions with established financial infrastructure, targeting institutional customers rather than retail users seeking dollar access.

國際拓展路線顯著不同。Tether 偏重新興市場,特別是拉丁美洲、亞洲及非洲等監管尚不完整且美元匯兌受限地區。Circle 則專注於有完善金融基礎設施與合規的管轄區域,主攻機構客戶,而非需要美元入口的散戶。

The competitive dynamics suggest market bifurcation rather than winner-take-all outcomes. Tether's trader-focused, yield-maximizing approach serves crypto-native users prioritizing efficiency

競爭態勢顯示市場分層而非一方獨大。Tether 以交易為核心、追求收益最大化,服務著重效率的加密原生用戶。 over compliance. Circle 的機構級、可逆交易模式以傳統金融整合為目標。這些不同的價值主張創造了明顯劃分的市場區隔,直接競爭有限。

政治發展可能改變競爭格局。川普政府對加密友善的政策對兩家發行商都有利,但可能偏向各自策略的不同面向。Tether 透過 Lutnick 的政治關係可能獲得監管上的保護,而 Circle 的合規模式則與政府強調美元穩定幣推廣及帶動美債需求的方向一致。市場演化趨勢顯示兩者將持續共存。具收益型穩定幣的採用大幅上升(成長 414%,占穩定幣市場 3%),為兩家發行商開拓了新機遇。Tether 的高收益策略有機會吸引追求收益的用戶,而 Circle 的監管合規則可透過傳統金融整合接觸到機構級收益機會。

技術差異化變得日益重要。Tether 著重於在多元公鏈上提供低成本交易,服務注重可及性的零售用戶。Circle 的 Arc 區塊鏈則提供可逆交易、隱私功能,以及機構級整合,主要服務重視合規與風險管理的企業用戶。這些技術差異促進了市場區隔,而非直接競爭。長遠的可持續發展則取決於監管變化。Tether 的模式假設監管套利機會和國際市場准入能持續存在,儘管會承擔合規成本。Circle 則假設合規要求將全球化,為搶先合規帶來競爭優勢。各自策略的成敗取決於監管走向和機構採用速率。

因此,Tether 與 Circle 之爭,體現了加密貨幣演化過程中,堅守加密原生精神與追求主流機構採納之間的廣泛張力,最終市場結果可能更取決於監管發展與用戶偏好變化,而非任何一方技術上的優越性。

Systemic risks emerge from centralization, censorship, and trust vulnerabilities

Circle 的可逆穩定幣實驗,透過中心化機制、審查脆弱性與信任依賴,為加密基礎建設帶來前所未有的系統性風險,有可能根本動搖區塊鏈的核心價值主張,並讓惡意人士找到新的攻擊向量。

中心化風險讓權力集中,與區塊鏈設計原則背道而馳。Arc 的有權驗證者由 Circle 指定,產生單一失效點,企業決策或外部壓力都有可能損害網絡完整性。與比特幣的全球分散挖礦或以太坊 PoS 驗證者不同,Arc 的機構驗證人可能受到政府、監管機構或其他掌控力強的實體協同脅迫,以達到操控交易回溯的目的。

決定交易是否可回溯的權力集中於 Circle 的公司架構內,這是前所未有的權力集中。傳統區塊鏈共識由數千名參與者分散維持,可逆系統則須仰賴中心化仲裁者處理爭議交易。仲裁權力可能成為政府或企業操控的工具,造成審查、差別執法,動搖加密貨幣「中立、免許可金融」的承諾。

可逆交易機制讓技術攻擊向量成倍增加。安全研究已識別出近兩百個區塊鏈專屬漏洞,約一半尚未公開登錄於公共資料庫。加入可逆層級後,智能合約複雜性大增,出現更多失效點,例如:回溯機制的重入攻擊、控制回溯觸發的預言機操縱、針對回溯決策的治理代幣攻擊、以及回溯等待期間的新型時間型攻擊。

「回溯博弈」可能開創全新攻擊類型,惡意人士可藉回溯機制進行雙重支付或交易操弄。不同於傳統區塊鏈需大量算力或資本的攻擊,這種手法可能利用社會工程、法律操作或行政漏洞來變更已認證的交易。

透過可逆穩定幣基礎建設,政府與企業濫用審查的可能性大幅提升。紐約聯邦儲備銀行對 Tornado Cash 制裁案例分析揭示,區塊鏈系統極易受到合規壓力影響。可逆穩定幣更容易受到政府強制回溯、企業因政治壓力要求交易異動、制裁執行過程中的交易操縱,以及威權政府利用資金回溯執行政治審查及追溯懲罰。

分析威權政體下的政府監控機制可見,中心化金融管控是壓制的重要手段。可逆穩定幣可能加速社會信用體系整合、政敵資金斷流、與追溯懲罰,使金融基礎建設淪為社會控制工具。

信任依賴,則損害區塊鏈最根本的價值主張。區塊鏈技術的最大創新,在於消除了對中心化中介的信賴需求,靠密碼驗證與分散式共識來確保正確。可逆系統則讓用戶必須重新仰賴企業、政府、仲裁方做出「公平、一致、無政治性」的回溯決斷。

道德風險升高是重大經濟風險。金融分析指出:「讓用戶以為轉帳可撤銷,創造的道德風險將減少交易確定性,提高冒險行為。」這種心理轉變也會減少用戶核對交易的謹慎性,讓抱持「可逆」心態的不良分子更敢嘗試詐騙,最終損害區塊鏈生態對安全細節的堅持。

DeFi 互聯協定之間的系統性風險也可能連鎖引爆。研究指出,「若主要穩定幣失效,將引發連鎖清算,波及整體協定。」可逆穩定幣帶來交易最終性不確定,恐進一步擾亂自動協定,回溯決策可造成突發市場波動,甚至動搖機構對加密基礎設施穩定性的信心。

技術複雜度提升,失效模式多元,頗似過去演算法穩定幣崩潰的根本原因。複雜的回溯決策可能癱瘓治理機制,甚至被攻擊者把持。回溯機制的智能合約錯誤,或成為大規模竊盜漏洞。提供回溯資料的預言機亦可能遭高級玩家操控。

一旦可逆基礎設施普及,法律與監管武器化的風險將升高。只要存在回溯能力,政府、企業都可能要求擴大適用範圍,從原本的詐騙,演變到政治異議、競爭糾紛、價值觀不同等領域。交易可逆的先例,也可能擴大當前政府金融監控與控制的範圍。

回溯機制系統性地侵犯隱私。爭議交易調查需深入檢視個人財務資訊,錯及複雜交易鏈上的無辜方,進而損害用戶隱私。該監控能力亦可能用於非金融監控與操控目的。

市場分裂與用戶混淆,恐影響整體加密普及率。若部分穩定幣可逆,部分不可逆,用戶可能錯估交易最終性,導致資金損失與對加密系統信心下降,反而拖慢主流普及進度。

國際監管衝突將帶來營運混亂。不同司法轄區若要求矛盾的回溯,Circle 可能因配合一國要求而違反他國法規,進退維谷,甚至危及營運存續。

最嚴重的系統性風險,是用戶信心長期侵蝕。加密貨幣的成功,有賴於「系統遵循透明、可預期規則,而非人為隨意干預」的信任。即便有完善安全措施,可逆性也代表「系統可被追溯改變」,最終動搖對所有區塊鏈金融基建的信心。

這些系統性風險顯示,可逆穩定幣雖能解決部分機構採納難題,卻可能對加密貨幣「無信任、抗審查」金融基礎的根本價值與長期生命力造成更大風險。

Future scenarios range from market bifurcation to regulatory capture

The long-term implications of Circle's reversible stablecoin experiment extend far beyond single company strategy, potentially reshaping the entire cryptocurrency ecosystem through market segmentation, regulatory evolution, and technological precedent-setting that could determine whether blockchain technology maintains its decentralized foundations or evolves toward institutionally controlled infrastructure.

Market bifurcation represents the most likely near-term outcome with institutional capital flowing toward reversible stablecoins for regulatory compliance while crypto-native users gravitate toward immutable alternatives for censorship resistance. This division would create parallel financial ecosystems serving different user bases with distinct values and requirements. McKinsey research suggests "early coexistence" between TradFi-compatible reversible systems, crypto-native immutable protocols, and hybrid models offering conditional reversibility with strict governance mechanisms.

最有可能的短期結果,是機構資本將流向可逆的穩定幣以取得合規,而加密原生用戶則因抗審查性而偏好不可逆的替代方案。這種分化將創造出平行運作的金融生態系,服務擁有不同價值觀和需求的用戶族群。麥肯錫的研究指出,傳統金融(TradFi)相容的可逆系統、加密原生的不可逆協議及嚴格治理機制下的條件式可逆混合模型,將在「早期共存」的狀態下並行發展。

The institutional adoption pathway could accelerate mainstream integration if Goldman Sachs' $77 billion USDC growth projection materializes alongside regulatory requirements mandating consumer protection features. EU MiCA regulations and U.S. GENIUS Act requirements already create framework precedents that could spread globally, effectively mandating reversibility for regulated stablecoin operations. This regulatory forcing function could make reversible features standard requirements rather than optional innovations.

若高盛對USDC規模成長到770億美元的預測得以實現,並配合強制消費者保護功能的監管要求,機構採用路徑將可能加速進入主流。歐盟MiCA法規與美國GENIUS法案的要求,已建立起全球可仿效的法規典範,實際上意味著受監管穩定幣營運必須具備可逆性。這種法規驅動的效果,可能使可逆性從創新選項,變成標準配備。

Technical interoperability solutions could enable ecosystem coexistence through bridge protocols supporting both immutable and reversible stablecoins, atomic swap mechanisms allowing users to choose finality models based on specific transactions, and universal stablecoin standards accommodating different settlement characteristics. These solutions could prevent winner-take-all competition by enabling users to access both system types as needed.

技術互通性方案可以透過橋接協議,支持不可逆和可逆的穩定幣共存;透過原子交換機制,讓用戶可根據特定交易選擇結算最終性模型;還有通用的穩定幣標準,包容不同的結算特性。這些方案有助避免贏者全拿的局面,讓用戶可按需存取兩種體系。

Regulatory capture scenarios pose significant risks to cryptocurrency's foundational principles. Success of reversible stablecoins could establish precedent for broader blockchain control mechanisms including programmable compliance features in all cryptocurrency applications, government backdoors in smart contract systems, and centralized governance override capabilities across decentralized protocols. This precedent could transform blockchain technology from trustless infrastructure into government-controllable financial surveillance systems.

監管俘獲的情境對加密貨幣的基礎原則構成重大風險。可逆穩定幣若取得成功,恐為更廣泛的區塊鏈監控機制樹立先例,例如:在所有加密應用程式內內建可編程合規功能、於智慧合約系統設置政府後門、及於去中心化協議上引入集中監管覆寫能力。這種先例,有可能將區塊鏈技術自無需信任的基礎設施,轉變為政府可控的金融監控體系。

International regulatory conflicts could create operational complexity as different jurisdictions establish competing requirements for transaction reversibility, privacy protection, and surveillance access. Circle and similar issuers might face impossible compliance situations where satisfying one government's reversal demands creates violations in another jurisdiction, potentially fragmenting global stablecoin markets along regulatory boundaries.

國際監管衝突將使營運變得更加複雜,因不同司法管轄區對於交易可逆性、隱私保護和監控權限制定彼此競爭的規範。Circle及其他發行商可能陷入無法兼顧合規的兩難:一國要求交易可撤消,卻衝突於另一國法規,導致全球穩定幣市場按監管疆界碎片化。

Technological evolution precedents suggest broader industry transformation. Circle's approach could inspire similar "practical" compromises with blockchain principles across the ecosystem. Other cryptocurrency applications might adopt centralized override mechanisms, compliance-focused governance structures, and institutional-friendly features that prioritize regulatory approval over decentralization. This trend could fundamentally alter blockchain technology's value proposition.

技術演進的先例推示產業將經歷更大幅度的變革。Circle的做法可能啟發整個生態圈對區塊鏈原則進行類似的「務實」妥協。其他加密應用可能引入中央覆寫機制、以合規為導向的治理結構、及優先取得監管認可的機構友善功能,而非堅持去中心化。這種趨勢將從根本上改變區塊鏈的價值主張。

Economic incentive realignment could reshape developer and user behavior. If institutional capital flows predominantly to compliant, reversible systems, developers may focus innovation on regulated protocols rather than censorship-resistant alternatives. Users seeking financial services might accept reversibility trade-offs for institutional integration benefits, gradually shifting ecosystem incentives away from decentralization priorities.

經濟誘因的重組也會改變開發者與用戶行為。若大部分機構資本流向合規可逆系統,開發者將更傾向於在監管協議上創新,而非抗審查替代品。追求金融服務的用戶,也可能為了機構整合利益,接受可逆性的權衡,漸漸讓生態系誘因由去中心化移轉。

Cultural transformation risks accompany institutional adoption success. Cryptocurrency's cypherpunk origins emphasized individual sovereignty, privacy protection, and resistance to centralized authority. Mainstream success through institutional compliance could erode these cultural values, transforming cryptocurrency from revolutionary technology into digitized traditional finance with blockchain characteristics rather than fundamental alternatives to existing systems.

機構導入成功伴隨著文化變遷的風險。加密貨幣的密碼龐克起源,強調個人主權、隱私保護、以及抗拒中央集權。隨著合規成為主流,這些核心價值恐遭侵蝕,讓加密貨幣從革命性技術,變質為僅具區塊鏈外觀、但本質依舊傳統金融數位化的產品,而非現有體系的根本替代方案。

Network effects could determine long-term outcomes. If major institutions adopt reversible stablecoins for business operations, smaller users might be pressured to use compatible systems for interoperability. Conversely, if privacy-focused and DeFi applications maintain immutable requirements, institutional systems could face adoption limitations that reduce their competitive advantage.

網路效應可能成為長期發展的關鍵。若大型機構在商業上大量導入可逆穩定幣,小型用戶為了互通可能被迫跟進。相反地,若注重隱私和DeFi應用堅持不可逆要求,機構系統則可能遇到採用侷限,削弱其競爭力。

Failure scenarios remain significant possibilities. Technical implementation challenges, governance failures, security vulnerabilities, or loss of community trust could cause reversible stablecoin experiments to collapse. These failures might discredit institutional crypto adoption attempts while validating immutable alternatives, potentially strengthening rather than weakening decentralized systems.

失敗的情境依然是重要可能。技術實作難題、治理失靈、安全漏洞、或社群信任崩解,皆可能導致可逆穩定幣實驗失敗。這些失敗會使機構型加密採用蒙受聲譽損失,反而證明不可逆方案的合理性,有可能加強去中心化系統的地位,而非削弱。

Hybrid evolution could produce compromise solutions combining elements of both approaches. Time-limited reversibility windows providing fraud protection without permanent controllability, opt-in reversal mechanisms requiring explicit user consent, or layered architectures maintaining base-layer immutability while enabling higher-level dispute resolution could satisfy both institutional requirements and crypto principles.

混合型發展路徑可能催生結合兩者元素的妥協方案。例如,設定時效性的可逆期以防詐但不保留永久控制權、須用戶明確同意的選擇性撤銷機制、或採用分層架構保持基層不可逆性、同時允許上層處理糾紛。這些方式有機會同時滿足機構需求與加密原則。

Global geopolitical factors could influence adoption patterns. Countries seeking financial sovereignty might prefer immutable stablecoins resistant to foreign government control, while nations prioritizing international integration might mandate reversible systems compatible with traditional banking. These geopolitical preferences could create regional adoption patterns that fragment global cryptocurrency markets.

全球地緣政治因素亦將影響採用趨勢。注重金融主權的國家可能偏好抗外國政府控制的不可逆穩定幣;追求國際接軌的國家則可能強制要求與傳統銀行體系兼容的可逆系統。這些地緣偏好將在全球市場造成區域化碎片分布。

Technological advancement could render current trade-offs obsolete. Zero-knowledge proofs, advanced cryptographic protocols, or novel consensus mechanisms could potentially provide consumer protection without sacrificing decentralization. These innovations could make current reversibility debates temporary challenges rather than permanent feature requirements.

技術進步或許能使目前的權衡成為過去式。零知識證明、先進密碼學協議、或新型共識機制等創新,有望兼顧消費者保障與去中心化,不必為可逆性爭論永久買單。這些突破有可能使當前的可逆性問題僅是暫時挑戰,而非永久設計。

The ultimate outcome likely depends on user preference evolution rather than technical or regulatory factors alone. If mainstream users prioritize convenience and institutional protection over sovereignty and censorship resistance, reversible systems could dominate through market demand. However, if users value blockchain's original promises of financial independence and trustless operation, immutable systems could maintain competitive advantage despite institutional pressure.

最終結果很可能取決於用戶偏好的演化,而非單靠技術或監管因素。倘若主流用戶更重視便利性和機構保障,而非主權與抗審查,可逆系統就會因市場需求而佔優勢。反之,若用戶堅守區塊鏈所承諾的財務自主與無需信任,則不可逆系統即使面臨機構壓力依然具備競爭力。

The next 24-36 months will prove critical as Circle's Arc blockchain launches, regulatory frameworks solidify, and market participants vote with capital allocation between reversible and immutable alternatives. The cryptocurrency ecosystem's future structure - centralized or decentralized, compliant or resistant, institutional or sovereign - hangs in the balance of this fundamental choice between blockchain principles and mainstream adoption requirements.

未來的24至36個月將是關鍵期,包括Circle的Arc區塊鏈上線、監管框架落地,市場參與者通過資本配置,在可逆及不可逆方案中投票。加密貨幣生態系的未來結構——中心化或去中心化、合規或抗壓、機構或主權——將取決於這場區塊鏈原則與主流採用要求之間的根本抉擇。

The defining choice between crypto principles and institutional adoption

加密原則 vs. 機構採用的決定性選擇

Circle's reversible USDC experiment represents cryptocurrency's most consequential crossroads since Bitcoin's creation, forcing the ecosystem to choose between preserving its foundational principles of immutability and censorship resistance or compromising those values for institutional adoption and regulatory approval. This choice will determine whether blockchain technology fulfills its revolutionary potential as trustless, sovereign financial infrastructure or evolves into digitized traditional finance with programmable control mechanisms.

Circle推出可逆USDC的實驗,是自比特幣誕生以來,加密貨幣生態面臨的最關鍵十字路口——究竟要堅守不可逆與抗審查的根本原則,或為了機構採用與監管認可做出妥協。這一選擇將決定,區塊鏈技術能否實現其作為無需信任、主權型金融基礎設施的革命潛力,抑或僅僅變成具可編程控制的數位傳統金融。

The technical innovation behind Arc blockchain demonstrates sophisticated engineering that addresses legitimate institutional concerns through deterministic finality, enterprise privacy features, and dollar-denominated transaction costs. Circle's approach acknowledges that pure immutability creates genuine challenges for error correction, fraud recovery, and consumer protection that traditional financial institutions cannot ignore. The company's success in achieving regulatory compliance and maintaining $65 billion in USDC circulation validates institutional demand for controlled, auditable digital dollar infrastructure.

Arc區塊鏈背後的技術創新展現了高度工程水準,能以確定性最終性、企業級隱私功能及美元計價的交易成本,回應機構的真正疑慮。Circle的做法承認,徹底的不可逆性確實在錯誤修正、詐欺追討和消費者保護上,對傳統金融機構造成不可忽視的困難。該公司能取得監管合規並維持650億美元的USDC流通量,也證明機構對於可控、可稽核數位美元基礎設施的需求。

However, the crypto community's visceral negative reaction reflects deeper concerns about sacrificing cryptocurrency's core value propositions for mainstream acceptance. The cypherpunk movement that birthed Bitcoin sought to create alternatives to centralized financial control, not more efficient versions of existing systems. Reversible transactions, regardless of sophisticated implementation, reintroduce the trust dependencies and centralized authority that blockchain technology was designed to eliminate.

然而,社群本能性的負面反應,反映出對於為主流認可而犧牲加密核心價值的深層擔憂。誕生比特幣的密碼龐克思潮,志在創造能取代中心化金融控制的選擇,而不是讓現有體系更有效率。可逆交易即使設計再精巧,也終究讓區塊鏈本意要消除的信任依賴與集中權力再次回歸。

The regulatory landscape clearly favors systems enabling transaction control through the GENIUS Act's reversibility requirements, MiCA's compliance frameworks, and international regulatory convergence around consumer protection mandates. Traditional financial institutions operate within these frameworks successfully and view reversible capabilities as essential risk management tools rather than philosophical compromises. The Trump administration's support for dollar-backed stablecoins creates political conditions favoring Circle's institutional approach.

監管環境明顯偏好實現交易可控的系統,如GENIUS法案的可逆性要求、MiCA的合規架構,以及國際監管對消費者保護的趨同性。傳統金融機構在這些框架下運作多年,視可逆功能為基本風控工具,而非理念上的妥協。川普政府支持美元掛鉤穩定幣,也為Circle的機構路線創造有利的政治條件。

Market forces suggest bifurcation rather than winner-take-all outcomes. Goldman Sachs' trillion-dollar market projections validate institutional stablecoin demand while decentralized alternatives like DAI maintain strong user bases among sovereignty-focused users. The $27.6 trillion in annual stablecoin transactions demonstrates massive scale that could support multiple approaches serving different market segments with distinct value propositions.

市場力量暗示,未來將分流而非單一勝者。高盛的兆元市場預測證明機構型穩定幣有旺盛需求,同時如DAI等去中心化方案,在追求主權的用戶間也有極強黏著度。每年27.6兆美元的穩定幣交易,顯示市場規模足以容納多種方案,服務不同利基市場及價值主張。

The systemic risks of centralized reversibility mechanisms cannot be dismissed through technical safeguards alone. History demonstrates that financial control tools, once created, inevitably expand beyond their original purposes through political pressure, regulatory mission creep, and authoritarian abuse. Reversible

中心化可逆機制的系統性風險,並不能僅靠技術防線消除。歷史早已證明,凡是被創造的金融監控工具,終究會因政治壓力、監管侵蝕或威權濫用,而逐步失控,遠超其最初設計與用途。可逆......stablecoins could become infrastructure for financial surveillance and political control that transforms cryptocurrency from liberation technology into oppression tools.

然而,機構採用所面臨的挑戰同樣是真實存在的。不可逆轉的交易,對於那些習慣於錯誤更正和防詐保護機制的銀行、企業和消費者來說,構成了無法接受的風險。如果不透過技術創新或監管調適來解決這些疑慮,加密貨幣可能會始終只是一種利基技術,而無法成為能服務數十億用戶的全球金融基礎設施。

這個哲學層面的重大問題,不僅影響穩定幣市場,也關係到加密貨幣的文化身份和長期發展路徑。可逆系統的成功,可能為與去中心化原則的更廣泛妥協立下先例,進而逐步將區塊鏈技術轉變為政府可控的基礎設施。若失敗,則會證明持純粹主義觀點者的正確性,但同時也會限制加密貨幣傳道者長久以來承諾的大眾市場潛力。

未來仍有多種共存情境,會根據技術發展、監管演變、以及用戶偏好變化而有所不同。橋接協議(Bridge protocols)可實現不可逆系統與可逆系統的互通。具時限的可逆性,能在不永久可控的前提下保護消費者。國際監管碎片化,則可能造就符應不同主權偏好的地理市場分割。

接下來的18個月將至關重要,隨著Circle推出Arc區塊鏈、各類競爭方案逐漸成熟,以及機構陸續做出攸關生態系未來數十年走向的關鍵技術選擇。這一結果極可能決定加密貨幣究竟能否實現其“無需信任、抗審查”的原初願景,還是會逐步演化為服務傳統金融系統目標的受監管數位基礎設施。

這項選擇最終反映了現代金融體系演進過程中,圍繞個體主權與集體安全、創新與穩定、全球可及性與監管合規等基本張力。Circle的這場實驗,正考驗著這些張力究竟能否透過技術創新得以化解,抑或屬於必須做出明確價值取捨的根本矛盾。加密貨幣社群正面臨其決定性時刻。選擇擁抱對機構友好的妥協方案,或堅持純粹主義立場,勢必決定區塊鏈技術最終會躍升為新金融典範之基礎,亦或僅僅提升現存權力結構下的效率。這攸關的不僅是金錢的未來,更是人類文明的走向。

Circle提出的可逆USDC方案,有可能成為連結傳統與去中心化金融世界的橋樑,在保有區塊鏈關鍵能力的同時實現主流採用。反之,這也有可能成為加密貨幣為追求機構認可而遺失革命精神的分水嶺。歷史將會評判,是這種務實的演進正確,還是這是一種哲學領域的背叛。但這個關鍵時期所做下的選擇,必將在未來數十年的金融體系發展中不斷迴響。

這一決定的影響遠不僅止於穩定幣市場,而是攸關人類社會究竟能否建立真正去中心化、抗審查的金融基礎設施,亦或所有貨幣系統終將不可避免地落入機構與政府管控之下。Circle的這項實驗,將為這一關乎人類文明金融未來的終極命題,提供關鍵的參考依據。