2025 年 10 月 15 日 16:45(UTC),Coinbase Markets 在全球加密社群與交易平台引起轟動。這家位於舊金山、以謹慎且強調合規著稱的交易所,將 BNB 納入官方上幣藍圖。對一般交易所而言或許只是日常業務,但這項決定具有非凡象徵意義──BNB 作為 Binance 廣大區塊鏈生態的原生代幣,正是 Coinbase 最激烈的全球競爭對手的核心。

公告發布僅僅三十三分鐘前,Coinbase 剛揭曉「The Blue Carpet」,這是一項旨在簡化並明確上幣流程、讓代幣發行方與 Coinbase 團隊直接聯繫、提供更高透明度,並強調上市及申請皆不收費的新計畫。這樣的時機選擇絕非巧合。近日,加密產業圍繞交易所上幣行為展開激烈公開爭論,主流平台之間指責不透明費用、厚此薄彼與設限門檻,被認為違背了加密領域所倡導的開放與去中心化原則。

爭議迅速升溫,起因於預測市場平台 Limitless Labs(Coinbase Ventures 投資)執行長 CJ Hetherington 公開指控 Binance 索取巨額代幣分配、多次空投及數百萬美元保證金,作為上幣條件。Binance 立即否認,斥責指控「虛假且誹謗」,並威脅提告,指責 Hetherington 違反保密協議。在此高度緊張氛圍下,Coinbase Base L2 網絡創辦人 Jesse Pollak 於社群媒體宣稱「上幣成本應為 0%」。此番言論立即遭質疑,因 Coinbase 自身遲遲未將市值超過 1,600 億美元、排名第三的 BNB 納入上架。

Coinbase 意外將 BNB 加入藍圖,看似針對批評者直接回應,卻引出更多疑問──這是向交叉生態合作釋出的橄欖枝,還是刻意的公關操作意圖轉移外界批評?如同市值兆美元企業的多數策略決策,答案或許兼而有之。

隔日清晨,通稱 CZ 的趙長鵬公開回應 Coinbase 的公告。作為 Binance 創辦人及多數股東,雖於 2023 年 11 月依美國協議下台,但仍具極高影響力。CZ 在 公開致謝 之餘,立刻於 X(前 Twitter)呼籲 Coinbase 擴大上架更多 BNB Chain 生態項目,強調 Binance 已列出不少來自 Coinbase Base 網絡之項目,反觀 Coinbase 至今未列出任何 BNB Chain 項目,儘管該網路極具活躍度與開發者參與。

這場交鋒,遠不僅是針對個別代幣的爭議,而是兩套中心化交易所運作哲學、服務對象與其對整個加密生態承擔責任的根本衝突多年競爭的縮影。Coinbase、Binance 這組對手關係盤踞多年,時而明朗爆發,此次 2025 年 10 月事件,讓長期矛盾浮上檯面,迫使產業深思權力、透明度,以及在強調去中心化的金融體系下,中心化交易基礎設施未來將走向何方。

背景:Coinbase 與 Binance —— 兩種對立哲學

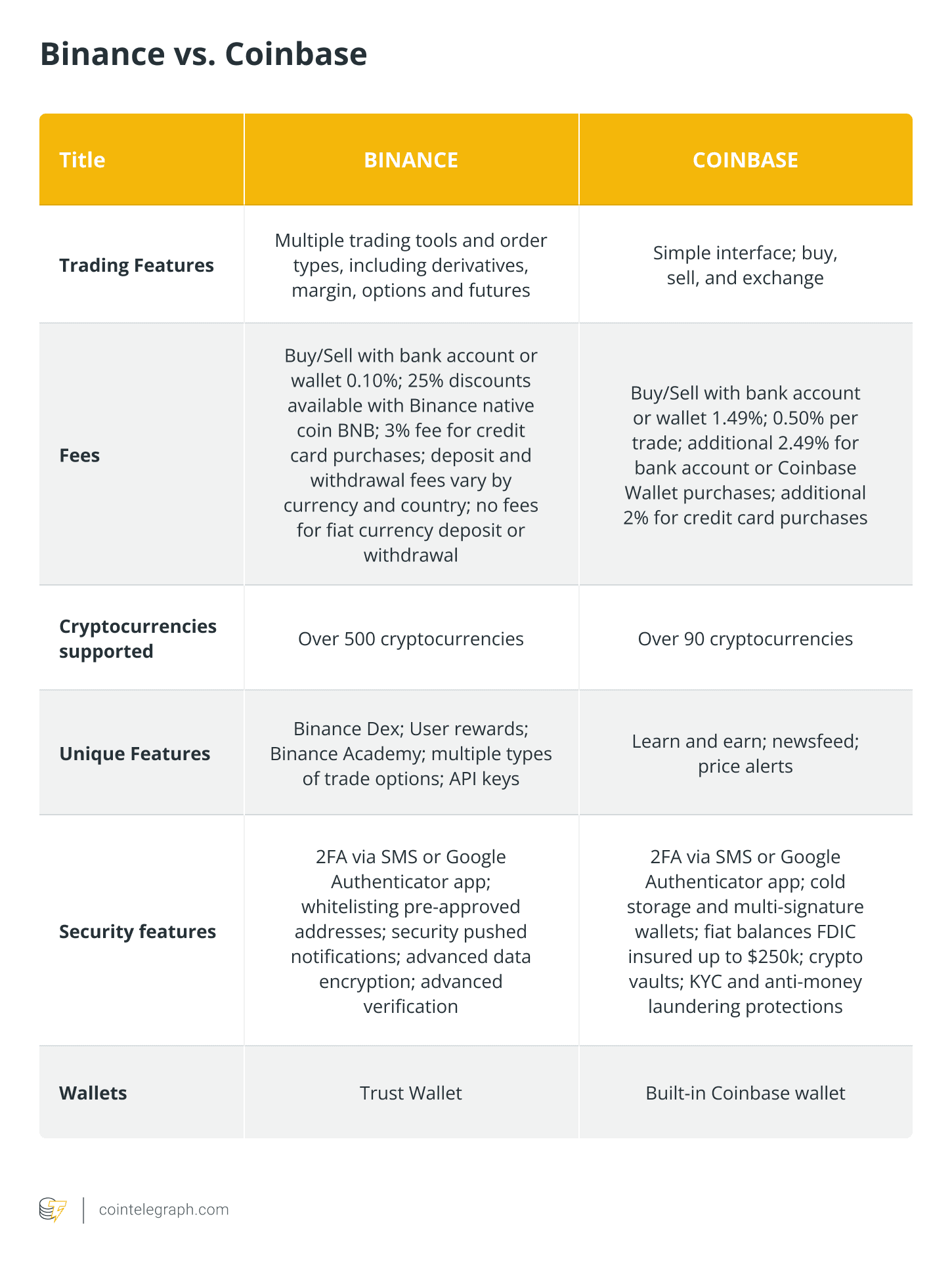

要理解一則簡單上市公告為何能引發如此強烈討論,必須先了解 Coinbase 與 Binance 在創立、發展與戰略路線上的巨大差異。這些差異不僅塑造兩間交易所內部運作,更深刻影響其與監管單位、用戶、開發者及加密生態的互動方式。

Coinbase 2012 年誕生於舊金山灣區新創文化,由 Brian Armstrong 與 Fred Ehrsam 創立,獲得 Y Combinator、Andreessen Horowitz 等知名創投支持。自創立之初,公司就自定位為連結傳統金融與加密貨幣的合規、安全門戶。Armstrong 有 Airbnb 經歷,深知主流用戶與機構投資人要求高度信任、有力監管與保險保障,才能推動數位資產普及。Coinbase 成為首家獲紐約 BitLicense、全美多州匯款牌照,並於 2021 年 4 月以 COIN 代碼直接登入 Nasdaq 的加密交易所。

這種以合規為先的策略,帶來龐大作業成本與限制。Coinbase 法律及監管團隊規模與工程團隊並駕齊驅。每次上幣不僅需從技術面詳查,更涉監管歸屬、證券法風險及全國各級法規框架等冗長審查。此模式使 Coinbase 行事一向謹慎緩慢,不乏項目自認條件完備卻仍須等待數月甚至數年才獲上架。

Coinbase 歷來上幣偏重 Ethereum、Bitcoin,對於其他區塊鏈代表性項目涉獵有限。甚至到 2023 年,仍曾因部分分析師認為封殺非 EVM 優質專案、卻又上架低質代幣而遭外界批評。

為 Coinbase 樹立基調的嚴謹監管立場,自 2023 年 6 月美國證券交易委員會(SEC)控訴其未註冊證券交易、經紀與結算機構後,受到嚴峻考驗。SEC 指控 Coinbase 有 13 種代幣屬證券,本應依法登記。

近兩年,訴訟如烏雲籠罩 Coinbase,使其未來陷入不確定,也抑制了新上幣或創新業務的嘗試。然而,2025 年 2 月 27 日,美 SEC 宣布撤銷執法訴訟,改籌組新「加密特別小組」專注完善監管架構,這一轉折掃除 Coinbase 上方最大監管陰影,亦助其重新活躍,積極推進擴張,包括最終納入 BNB 上幣。

Binance 的創立歷程則截然不同。由華裔加拿大創業家趙長鵬(CZ)於 2017 年創立,曾服務 Blockchain.info、OKCoin。Binance 利用 ICO 募資 1,500 萬美元,正好在中國禁止加密交易平台營運前夕啟動。CZ 並未視此為毀滅打擊,反而擁抱無國界、強調全球彈性,員工分布多國,刻意避免深陷任一監管區域,保留競爭與產品上的極高自主。

這種策略帶來驚人增速。上線半年即登頂全球交易量之最,迄今難以撼動。Binance 上幣極快,有時單月數十新代幣,布局現貨、合約、槓桿交易。平台推自有 Binance Chain(現更名 BNB Chain)、設 Binance Labs、早期項目育成計畫,並延伸去中心化交易所、NFT 市場乃至慈善基金會等多元業務。

然而,這種速度與創新也帶來巨大監管風險。多國監管曾聯合調查 Binance 涉洗錢、制裁逃避與證券違規。英國 FCA、日本 FSA,以及德國、泰國等國紛紛警示或祭出限制。2023 年 11 月 Binance 與美國司法部達成和解,認罰 43 億美元,創下企業罰款紀錄。CZ 個人也承認有罪。 Skipping translation for markdown links as instructed.

違反《銀行保密法》,未能維持足夠的反洗錢計畫,被處以五千萬美元罰款,並同意辭去執行長職務,服四個月監禁。

Richard Teng,曾任幣安區域市場負責人、之前亦於阿布達比全球市場擔任監管機構職務,接任執行長一職,並立即強調合規是一項競爭優勢。在Teng的領導下,幣安於兩年間在合規計劃上投入近兩億美元,大幅擴展法律與法規團隊,同時實施更完善的了解你的客戶(KYC)程序、交易監控系統及風險管理架構。該交易所也積極於多個司法管轄區取得正規牌照,包括在杜拜獲得虛擬資產服務商執照,並尋求重新進入如印度等曾被逐出的市場。

這些截然不同的路徑——Coinbase早期擁抱監管,以及幣安後期的合規轉型——造成了複雜的競爭動態。Coinbase能夠令人信服地說服重視法規確定性和既有法律保障的用戶,自己是最值得信賴、最符合機構需求的交易所。幣安則以更廣泛的全球覆蓋、在更多交易對中的更深流動性,以及更完善的生態系與區塊鏈基礎設施作為優勢。沒有哪種策略絕對優越;兩者服務於不同用戶族群,反映出對監管風險與成長機會的不同評估。

源自這些理念差異的代幣上架策略,已變成圍繞透明度、公平性,以及中心化交易所在名義上去中心化體系中的適當角色等更廣泛爭論的焦點。了解代幣上架在技術和商業層面上的實際運作機制,是評估2025年10月爆發的各種指控和爭議的關鍵。

上架解析:代幣如何進入交易所

對加密產業的局外人來說,數位資產如何在主流交易所上架的過程,似乎不透明甚至帶有武斷色彩。為什麼有些採用度不高、用途不明的代幣能夠獲得顯眼位置,而另一個擁有大量用戶、具備現實世界效用的項目卻乏人問津?答案涉及技術條件、商業考量、法規合規與策略佈局等複雜交織,且不同交易所有巨大差異。

最基本的層面上,將代幣上架於交易所需進行技術整合。交易所的基礎設施必須能與相關區塊鏈溝通、監控充值與提現,處理交易簽名與驗證,為潛在的數百萬用戶做好錢包資安管理,並提供可靠的價格數據來源。對於像Ethereum或Bitcoin這類主流區塊鏈上的代幣來說,整合過程已相對標準化。例如Ethereum上的ERC-20代幣,只要有了基礎設施後,後續新增工料相對有限。然而,來自其他生態(如Solana、Cardano、Cosmos或BNB Chain)的代幣則需投入更多開發資源。交易所須運行這些網路的全節點,實施鏈特有的資安措施,建立合適的錢包架構,並確保針對各類獨特功能或升級機制有足夠的技術支援。

超越技術可行性之外,市值管理基礎設施對於上架的成功則是至為關鍵。如果某代幣交易時出現寬廣買賣差、流動性不足或價格滑點高,用戶將會無比沮喪,進而產生負面觀感,無論該項目的基本面多麼優良。專業造市商——如Jane Street Digital、Jump Crypto或Wintermute等專業企業——會持續報價,讓交易即使在波動或散戶低迷時也能順暢進行。這些造市商會根據預期交易量、波動性、代幣流通與分佈特徵,以及其他市場的價格發現機制來評估上架標的。

交易所通常會和項目方合作,確保有足夠的造市配套才安排上架交易。這經常需要為項目方媒合造市合作對象,設立初始流動性條件(如維持某價格區間內的最小量差),有時還需要針對造市API和系統進行技術整合協商。各家標準差異巨大。Coinbase過去堅持需擁有深度造市才上架資產,雖被批評為上架慢,但也確保用戶下單時價格滑點極小。小型交易所則可能上架流動性很低的標的,使交易體驗崎嶇不穩,卻有助新項目快速進入市場。

法規合規,大概是交易所上架最複雜、最具重大影響面的部分,尤其對像Coinbase這種立足美國的平台而言。自比特幣問世以來,加密市場的終極問題就是:某數位資產是否構成聯邦證券法下的證券。美國最高法院於1946年SEC訴W.J. Howey案確立了判斷投資契約的Howey Test:若某交易包含資金投入一共同企業,且獲利依賴於他人努力,即屬投資契約。每種加密貨幣是否命中這個判準,端賴許多細膩情境,包括如何發行、銷售時項目方如何表述、是否有特定團隊努力推升價值、投資人是否合理預期獲利等。

對Coinbase來說,若將疑似證券的代幣誤列為非證券,後果會動搖生存。交易所因此必須對每一潛在上架標的做法律審查,經常委託證券法專家給出外部意見,檢閱項目方行銷資料與開發路線圖,分析代幣分配與治理機制,參考過往SEC執法案例或司法判決。這個過程需數月,有時因證券法律不確定性而放棄原本有吸引力的項目。反觀過去主要在美國管轄範圍外運作的Binance,在2023年達成和解以前相對寬鬆,如今在合規承諾下也面臨相近限制。

接著是商業層面:爭議不斷的上架費,及項目必須為取得交易所通路付出什麼。這裡的黑箱與反覆無常正是此產業最明顯特徵。一些交易所明確要求上架費,並公開價目表,從小型平台五萬美元到主流交易所百萬美元優先曝光均有。另一些聲稱完全無需上架費,但常以獲取代幣、行銷資源或其他價值交換達到相同目的。

2025年10月的公開爭論將這些現象攤在檯面。Limitless Labs的CJ Hetherington指控Binance索取大量代幣配額與保證金作為上架條件,Binance極力否認,並聲稱仍維持只收慈善捐款、不收直接上架費的政策。與此同時,包含Tron創辦人孫宇晨與Sonic Labs共同創辦人Andre Cronje等知名人物也指出,Coinbase曾要求他們項目繳付數千萬到上億美元的上架費,此一說法與執行長Brian Armstrong公開強調"Coinbase上架資產不收費"形成矛盾。兩家大所都指責對方才是違規者,而如MEXC、OKX、Bitget等中型平台則多保持低調以避開爭議。

從這些互相矛盾的說法中,我們可以看到一個產業仍在尋找標準化、透明流程的過渡期縮影。有些模式已經明顯:市值高、歷史良好、社群需求強的項目可享有好條件,因為各交易所都想瓜分其交易量與手續費收益。剛起步、用戶少的小型項目則處境弱勢,常需以大量支出或代幣分配交換上架,無論這些被標示為上架費、行銷合作、流動性安排還是慈善捐款。條件極度個案化,項目方往往不得不摸著石頭過河,也容易滋生特權或貪污。

沒有標準化,正是加密產業橫跨傳統與新興世界的表現。傳統證券交易所受到嚴格規管,要求上架標準透明且不歧視,亦嚴禁向發行商收費索權。商品交易所也遵守類似原則。但加密貨幣交易所在長期規管模糊地帶下,形成了大量沿用證券市場、商品交易所、傳統造市、網路平台管理模式的臨時性做法。結果就是一套良莠不齊的規範,有時服務使用者,有時極具爭議與混亂。

理解這些技術、商業與監管層面的結構——helps clarify what was actually at stake when Coinbase added BNB to its roadmap in October 2025. This was not simply a matter of technical integration, though that would require work given BNB's role on a non - Ethereum blockchain. It carried symbolic weight about inter - exchange relationships, commercial signaling about zero - fee listing policies, and strategic implications for the competitive positioning of both Coinbase and Binance's respective blockchain ecosystems.

幫助釐清當Coinbase在2025年10月將BNB加入其路線圖時,實際上涉及的真正利害關係。這不僅僅只是技術整合的問題,儘管考量BNB是在非Ethereum區塊鏈上運作,這本身就需要額外的工作。它還具有關於交易所間關係的象徵意義、針對零手續費上架政策的商業訊號,以及對於Coinbase與Binance各自區塊鏈生態競爭定位的戰略層面影響。

The BNB Listing Debate: Strategy, Symbolism, and Suspicion

BNB上架爭議:策略、象徵與質疑

When Coinbase Markets posted its announcement about adding BNB to the listing roadmap, the crypto community immediately recognized both what was said and what was carefully left unsaid. The announcement specified that actual trading would only commence once "market - making support and sufficient technical infrastructure" were in place, with a separate launch notice to follow. This is standard language for Coinbase's roadmap process, but it matters because roadmap inclusion is far from a guarantee of actual listing.

當Coinbase Markets發佈公告,表示將BNB納入其上架路線圖時,加密社群立刻注意到公告中明說與刻意隱晦未提的內容。公告指出,實際交易僅在「有做市支援與足夠技術基礎設施」就緒時方會啟動,隨後還會有單獨的上線通知。這是Coinbase路線圖流程常見的標準用語,但這一點很重要,因為被納入路線圖並不代表真正上架已成定局。

Coinbase's roadmap mechanism serves several purposes simultaneously. It signals to the market that the exchange is evaluating a particular asset, potentially affecting price discovery and generating positive sentiment for the token in question. It provides transparency to projects and users about what might be coming while giving Coinbase flexibility to delay or decline if circumstances change. And it allows the exchange to gauge community interest and gather feedback before making final commitments. Historical precedent shows that tokens can remain on the roadmap for extended periods - sometimes months or even years - while the exchange works through technical integration, liquidity arrangements, or compliance reviews. Some tokens listed on roadmaps have ultimately never launched for trading at all when Coinbase determined they failed to meet evolving standards.

Coinbase的路線圖機制可同時達到多重目的。它向市場釋出訊號,表明該交易所正在評估某個資產,這可能影響價格發現,並為該代幣帶來正面情緒。對於專案與用戶而言,它增進了透明度,告知可能即將上線的資產,同時賦予Coinbase彈性,若情況有所變化可以延後或取消。此機制也讓交易所在最終承諾前,能衡量社群興趣並蒐集回饋。有過往經驗顯示,部分代幣會在路線圖上停留極長時間——有時數月甚至數年——以便交易所處理技術整合、流動性安排或合規審查。有些列於路線圖的代幣,最終因未能符合集合標準而根本未能正式上架交易。

For BNB specifically, the technical challenges are non - trivial. Unlike most major cryptocurrencies available on Coinbase which exist on Ethereum or Bitcoin's networks, BNB functions as the native gas token for BNB Smart Chain, an independent blockchain that uses a Proof of Staked Authority consensus mechanism. Coinbase would need to implement full node infrastructure for BNB Chain, develop appropriate wallet systems, ensure adequate transaction monitoring and security controls, and potentially integrate with Binance's ecosystem more broadly. These technical requirements, while certainly manageable for an exchange of Coinbase's sophistication, require dedicated engineering resources and thorough security audits before launch.

對於BNB來說,技術挑戰並不簡單。與Coinbase上大多數以Ethereum或Bitcoin網絡為基礎的主流加密貨幣不同,BNB是BNB智能鏈(BNB Smart Chain)的原生Gas代幣,該鏈是獨立運作、採用權益委任證明(Proof of Staked Authority)共識機制的區塊鏈。Coinbase需要為BNB Chain建立完整節點基礎設施、開發專屬錢包系統、確保交易監控與安全機制充足,並可能進一步與Binance生態進行更深度整合。這些技術要求對Coinbase這類頂尖交易所而言雖可處理,但仍需投入專門的工程資源及全面的安全稽核,才能順利上線。

The market - making requirement introduces additional complexity. BNB trades with enormous liquidity on Binance itself, obviously, where it serves as the base trading pair for hundreds of markets and benefits from the exchange's vast user base. But its liquidity on other major exchanges has been more limited, partly because competitive dynamics discouraged rivals from providing Binance's token with prominent placement. When Kraken listed BNB in April 2025, that represented a significant shift in inter - exchange dynamics, signaling that major platforms were increasingly willing to cross - list competitor tokens when user demand justified it. For Coinbase to follow suit required arranging for market makers willing to provide competitive quotes without the natural liquidity advantages Binance enjoys.

做市需求又帶來更多挑戰。BNB本身在Binance上擁有龐大流動性,作為數百個市場的基礎交易對,並受惠於Binance龐大用戶基礎。但在其他主流交易所上的流動性則相對有限,部分原因在於競爭考量讓其他交易所不願給予Binance的代幣明顯曝光機會。2025年4月Kraken推出BNB上架,標誌著交易所間動態出現重大轉變——主流平台愈來愈願意在用戶需求足夠時跨平台上架競爭對手的代幣。Coinbase要仿傚此舉,則必須安排能提供具競爭性的報價、而非仰賴Binance自然流動性優勢的做市商參與。

CZ's public response to Coinbase's announcement revealed the strategic thinking underlying his request for more BNB Chain listings. His statement thanked Coinbase for adding BNB but immediately pivoted to urging broader ecosystem support. The logic was straightforward: if Coinbase truly believes in openness and zero - fee listing policies, merely adding the base token BNB represents only a token gesture - pun intended. What would demonstrate genuine commitment to cross - ecosystem collaboration would be listing the applications, protocols, and projects built on BNB Chain, treating that ecosystem with the same seriousness and openness that Coinbase presumably applies to Base, its own layer - 2 network.

CZ對Coinbase公告的公開回應,顯示出其要求更多BNB Chain專案上架的戰略思維。他感謝Coinbase新增BNB,隨即呼籲要給予生態系更廣泛的支持。這邏輯十分簡單:如果Coinbase真心相信開放原則及零手續費上架政策,只上架BNB這個基礎代幣只是象徵動作——此處語帶雙關。真正展現生態跨界合作誠意的做法,是應將建構於BNB Chain上的應用、協議和專案也一併上架,並用和對自家Layer2——Base——同等認真與開放的態度來對待這個生態系。

The comparison CZ drew was pointed. Binance had indeed listed several prominent Base ecosystem projects, providing trading access for tokens from Coinbase's own blockchain platform. Yet Coinbase had not reciprocated by listing projects from BNB Chain, despite that network's substantially larger total value locked, greater developer activity, and longer operational history compared to Base which only launched in August 2023. This asymmetry, CZ suggested, revealed something about Coinbase's stated commitment to openness. Was the exchange truly neutral in its listing standards, or did competitive considerations influence which ecosystems received support?

CZ的比較相當尖銳。Binance確實已經上架過多個Base生態系的重要專案,讓用戶可以買賣來自Coinbase自家區塊鏈平台的代幣;但Coinbase對於BNB Chain生態專案始終未有同等回饋,儘管後者無論鎖倉總值、開發者活動或營運歷史,都遠超2023年8月才問世的Base。這種不對稱,CZ認為透露出Coinbase所稱開放承諾的真實意涵。這個交易所真的在上架標準上保持中立,還是其實受到競爭考量影響、根據利益選擇支持哪些生態?

Public and expert commentary on this exchange reflected the deep divisions within the crypto community about exchange power and responsibility. Some observers praised Coinbase's BNB listing as a mature, industry - minded decision that recognized users should have access to major digital assets regardless of which exchange originally promoted them. This perspective held that exchanges serve users best by maximizing choice rather than engaging in petty rivalries that artificially segment markets and reduce competition. Listing BNB, by this logic, acknowledged that the token's $160 billion market capitalization and genuine utility within DeFi applications made its absence from Coinbase unjustifiable.

這次交易所論戰引發的公眾與業界評論,也反映出加密社群內對交易所權力與責任的分歧。有分析人士讚許Coinbase上架BNB是成熟且以產業大局為重的決定,認同用戶理應能夠接觸主流數位資產,而不該受限於原始推廣交易所。這種觀點認為,交易所提供多元選擇才能最佳服務用戶,不應陷入狹隘的競爭對立進而切割市場、減少競爭。照此邏輯,BNB具備高達1600億美元市值及在DeFi應用上的實際效用,繼續缺席於Coinbase已難以合理化。

Others viewed the move more cynically as calculated public relations designed to deflect criticism during the heated October 2025 debate about listing transparency. Coinbase faced accusations that its stated zero - fee policy masked other barriers to listing including slow processing, stringent requirements that effectively excluded many qualified projects, and potential bias toward its own ecosystem. By suddenly adding BNB to its roadmap hours after launching the Blue Carpet initiative, Coinbase could claim it practiced the openness it preached. But whether this would translate into actual BNB trading availability or meaningful support for BNB Chain ecosystem projects remained unclear.

另一些觀點則更為質疑,認為Coinbase此舉更像精心佈局的公關操作,旨在化解2025年10月關於上架透明度激辯時外界的抨擊。Coinbase雖宣稱實施零手續費政策,卻被批評實際上設下了其它上架障礙——例如審查流程緩慢、要求嚴格,變相排除許多合格專案,以及傾向本身生態的潛在偏誤。Coinbase在啟動Blue Carpet計畫僅數小時後便將BNB納入路線圖,於公關上可宣稱踐行所主張的開放精神。但這究竟會否落實成真正的BNB交易開放,或帶動對BNB Chain生態專案實質支持,仍屬未明。

A third perspective, perhaps the most cynical, suggested both exchanges engaged in strategic theater for competitive positioning without genuine commitment to openness. Under this view, Binance's listing of Base projects served its own interests by capturing trading volumes and demonstrating ecosystem neutrality while the actual projects selected remained relatively small and non - threatening. Similarly, Coinbase's BNB roadmap listing provided PR benefits while the careful hedging about market - making and technical requirements preserved flexibility to delay indefinitely if Coinbase concluded that providing premium support for a competitor's token was strategically unwise.

第三種、更為悲觀的觀點甚至認為,兩家交易所都在進行策略性戲碼,以建立競爭地位,實際上對開放根本毫無誠意。在這個角度下,Binance上架Base專案是為搶佔交易量及營造生態中立形象,實際被挑選的專案規模較小、威脅性低;同理,Coinbase將BNB列入路線圖雖助於公關形象,但對於做市與技術要求卻留有寬大模糊空間,保留了可無限期拖延的彈性,一旦認為高規格支持競業代幣在戰略上不智就能隨時延遲。

The debate also intersected with broader concerns about the concentration of power in centralized exchanges and whether their increasing gatekeeping influence contradicted cryptocurrency's original vision. Coinbase and Binance together control the vast majority of global cryptocurrency trading volume across spot and derivatives markets. Their listing decisions can make or break projects, influence token prices dramatically, and determine which blockchain ecosystems gain mainstream adoption. This power creates natural incentives to favor vertically integrated ecosystems - Base for Coinbase, BNB Chain for Binance - even when they claim to apply neutral, merit - based standards.

這場爭議也延伸到對中心化交易所權力集中的更廣泛憂慮,以及他們日益加劇的把關角色是否違背加密貨幣原創精神。Coinbase與Binance攜手掌控全球絕大部分現貨和衍生品加密資產交易量。他們的上架決策可以決定專案的成敗、顯著影響代幣價格,並主導哪個區塊鏈生態最終獲得主流採納。這種權力自然驅動交易所更傾向偏袒自家垂直整合的生態系——Coinbase是Base,Binance是BNB Chain——縱使他們聲稱以中立、實力為基礎的標準篩選項目。

As October 2025 progressed, the BNB price action following the Coinbase announcement told its own story. The token initially jumped approximately 2% on the news, reflecting immediate positive sentiment. But this gain quickly evaporated as BNB fell back and actually declined over subsequent days, down more than 11% from its all - time high of $1,370 reached just days before the Coinbase announcement. Some analysts attributed this decline to profit - taking after the news. Others suggested that investors recognized the gulf between roadmap listing and actual trading availability, tempering their enthusiasm. Whatever the explanation, the muted market response underscored how the symbolic significance of the announcement outweighed its immediate practical impact.

隨著2025年10月進展,BNB在Coinbase宣布後的價格表現自有說明。消息傳出後,BNB一度上漲約2%,反映出即時正面情緒;但這個漲幅隨即消退,接下來數日不僅回吐漲幅,甚至從Coinbase公告前幾天創下的歷史新高1,370美元回落逾11%。部分分析師認為這是消息發布後套利了結所致;也有人指出,投資人意識到路線圖上架與實際交易開放仍有落差,於是熱情降低。不論哪種解讀,這種反應低調的市場反應都凸顯公告象徵意義勝過即時實際效益。

Transparency vs. Gatekeeping: Competing Listing Philosophies

透明VS把關:上架理念的競逐

The October 2025 controversy brought to the surface competing visions of how cryptocurrency exchanges should make listing decisions and what obligations they bear toward openness and fairness. These visions reflect broader ideological tensions within the crypto space about the proper balance between decentralization ideals and practical realities of building sustainable businesses.

2025年10月的爭議突顯出對加密貨幣交易所作為上架決策者,究竟應如何抉擇、承擔怎樣的開放與公平義務的競逐觀念。這些路線分歧,也反映出加密圈關於去中心化理想和經營永續商業現實之間,更廣泛的意識形態張力。

Binance's critics focus on allegations of high or undisclosed listing fees, preferential treatment for projects willing to provide substantial token allocations, and centralized control that allows the exchange to pick winners and losers based on opaque criteria. The accusations from CJ Hetherington of Limitless Labs, while vigorously denied by Binance, fit a pattern of complaints from projects that have described feeling pressured to provide payments or tokens in exchange for listing consideration. Some projects allege that Binance demanded up to 15% of total token supply, amounts that could run into tens or hundreds of millions of dollars in value for successful projects. Even if Binance labels these arrangements as marketing partnerships, community airdrops, or charitable donations rather than listing fees per se, critics argue the economic substance remains the same: projects must transfer substantial value to gain exchange access.

Binance的批評者,則將矛頭指向高額甚至不公開的上架費、對肯給予大量代幣分配專案的特殊待遇,以及高度中心化的決策權——讓交易所可用不透明標準決定專案勝敗。來自Limitless Labs的CJ Hetherington的指控,雖遭Binance強烈否認,但和多個接獲要求提供支付或代幣以換取上架考量的專案形成共同的抱怨模式。部分專案甚至稱,Binance曾經要求高達總代幣供給15%的分配,對於成功的專案而言金額可達數千或數億美元。就算Binance標榜這些安排為行銷合作、社群空投或慈善捐贈也好,而非直接的上架費,批評者認為經濟實質其實無異:專案仍須轉移大量價值才能獲得交易所上架機會。

Binance's defense rests on several pillars. First, the exchange maintains that it charges no mandatory listing fees and bases decisions on rigorous due diligence evaluating projects'

Binance的辯護有幾個重點。首先,該交易所堅稱不收取強制性上架費,其審核也完全依賴於嚴格的風險評估和實地盡調……technical quality, team credentials, market potential, and compliance with regulatory requirements. Any token allocations or airdrops, according to this framing, are voluntary arrangements that many projects propose themselves for marketing purposes rather than requirements imposed by the exchange. Second, Binance points to its track record of listing numerous projects including many that provided no payments or allocations whatsoever, demonstrating that commercial considerations are not determinative. Third, the exchange emphasizes that its listing pace - historically adding dozens of new tokens monthly - far exceeds competitors like Coinbase, suggesting that if anything Binance errs on the side of inclusiveness rather than restrictive gatekeeping.

- 技術品質、團隊資歷、市場潛力,以及符合法規要求。根據這樣的架構,任何代幣分配或空投都是許多項目團隊為了行銷自行提出的自願安排,而非交易所強制規定的要求。第二,幣安指出它過往上架過許多項目,其中有很多根本沒有支付任何金錢或分配任何代幣,顯示商業考量並非決定性因素。第三,該交易所強調其上架新幣的速度——過去每月新增數十種新代幣——遠高於像Coinbase這樣的競爭對手,這意味著幣安在包容性方面走得更遠,而非設下嚴格門檻。

Co - founder Yi He has been particularly vocal in defending Binance's practices, arguing that the exchange maintains transparent policies and that rumors about exorbitant fees constitute FUD - fear, uncertainty, and doubt - designed to damage Binance's reputation. She notes that Binance has accepted charitable donations since 2018, with project teams determining contribution amounts voluntarily rather than Binance imposing minimums. The exchange also points to its extensive compliance investments following the 2023 settlement with U.S. authorities, suggesting that current policies reflect reformed practices aligned with regulatory expectations.

- 聯合創辦人何一尤為積極為幣安的做法辯護,主張該交易所秉持透明政策,而關於天價上幣費用的傳聞都是FUD(恐懼、不確定與懷疑),旨在損害幣安聲譽。她指出,幣安自2018年起就接受慈善捐款,捐贈金額由項目團隊自願決定,而非幣安設定最低標準。此外,該交易所也強調自2023年與美國當局達成和解後加大合規投資,顯示現有政策已反映出符合監管預期的改革措施。

Yet even sympathetic observers note tensions within Binance's position. The exchange operates different listing tracks including spot markets, futures contracts, and innovation zones with varying requirements and visibility. This complexity creates opportunities for preferential treatment even if Binance denies that fees determine outcomes. Projects report vastly different experiences, with some encountering smooth processes and others describing protracted negotiations over financial arrangements. The lack of published, standardized criteria makes it impossible for outsiders to verify whether listings truly reflect merit - based assessments or whether commercial factors play determinative roles.

- 但即使是同情幣安的觀察者也注意到其立場中的張力。該交易所運作多種上架通道,包括現貨市場、期貨合約及創新區,不同通道有著不同要求與可見度。這種複雜性,即使幣安否認費用決定上幣結果,也難免產生差別待遇的空間。項目團隊回報的經驗差異極大,有些流程順暢,有些則需長時間協商財務安排。缺乏公開且標準化的準則,讓外界無法驗證上架是否真的反映實力評量,還是商業因素才是決定關鍵。

Coinbase faces a distinct set of criticisms despite its claims to transparency and zero - fee listing. The exchange's slow pace of new token additions frustrates projects that believe they meet Coinbase's quality standards but find themselves waiting months or years for evaluation outcomes. Coinbase has listed fewer than 500 cryptocurrencies total across its history, compared to the thousands available on Binance. This selectivity might reflect rigorous quality control and compliance diligence, or it might reflect excessive caution bordering on gatekeeping that privileges established projects over innovative upstarts.

- Coinbase雖自稱透明並零申請費用,但仍面臨另外一套批評。該交易所新增代幣的速度緩慢,讓自認達標的項目需等待數月乃至數年才能得到評估結果。Coinbase歷來上架的加密貨幣不足500種,遠低於幣安動輒數千種。這種嚴選政策或可視為嚴格控管品質和合規,但也可能被批評為過度謹慎、設門檻,讓既有項目遠勝於創新新血。

The limited chain diversity on Coinbase represents another common complaint. For years, the exchange focused overwhelmingly on Ethereum - based tokens and Bitcoin, with modest representation from other blockchain ecosystems. Projects from Solana, Cardano, Cosmos, and other platforms struggled to gain Coinbase listings even when they achieved substantial market capitalizations and user adoption elsewhere. Critics attributed this to Coinbase's technical conservatism and regulatory risk aversion rather than principled quality assessments. Some suggested that Coinbase deliberately maintained higher barriers for ecosystems that might compete with Ethereum, reflecting the exchange's close alignment with the Ethereum ecosystem.

- Coinbase區塊鏈多樣性不足,是另一項常見抱怨。多年來該交易所主要聚焦以太坊生態的代幣與比特幣,其他公鏈代表性有限。Solana、Cardano、Cosmos等其他生態的項目,即使在其他地方已有龐大市值和用戶,也難以進入Coinbase。外界批評這源於Coinbase的技術保守與規避監管風險,而非原則性質量評價。部分觀點甚至認為,Coinbase刻意對可能與以太坊競爭的生態設置更高門檻,反映出交易所與以太坊生態的密切聯繫。

Furthermore, allegations that Coinbase requests substantial listing fees directly contradict CEO Brian Armstrong's public statements but persist from credible sources. Justin Sun's claim that Coinbase requested $330 million in various fees to list TRX, and Andre Cronje's statement that Coinbase sought $60 million for FTM, paint a picture inconsistent with zero - fee rhetoric. Coinbase has not publicly responded to these specific allegations with detailed rebuttals, leaving the contradictions unresolved. Even if the exchange technically charges no listing application fees, if it demands other forms of payment or commercial arrangements, the practical effect remains the same for projects seeking access.

- 另外,關於Coinbase實際收取巨額上幣費的指控,與執行長Brian Armstrong公開聲稱的零費用背道而馳,但卻來自可信消息。孫宇晨稱Coinbase要求各式費用合計高達3.3億美元才能讓TRX上架,Andre Cronje則表示Coinbase為FTM開出6,000萬美元條件,這些都與官方的零費言論不符。Coinbase尚未就這些具體指控公開詳細反駁,使矛盾懸而未解。即便名義上不收上架申請費,若以其他方式收取對價或要求合作,對於希望進入的項目來說,實質效果也沒什麼不同。

Third - party research from firms like Messari, CoinGecko, and The Block has attempted to analyze listing practices more systematically, but perfect transparency remains elusive. These organizations track which tokens appear on which exchanges, price impacts around listing announcements, and liquidity characteristics, but they cannot directly observe internal decision - making processes or commercial negotiations. What emerges is a picture of an industry where stated policies and actual practices sometimes diverge, where individual negotiations produce highly variable outcomes, and where competitive pressures create incentives for opacity rather than transparency.

- Messari、CoinGecko、The Block等第三方機構曾試圖更系統性分析上幣流程,但完全透明依然難以實現。這些機構僅能追蹤哪些代幣在哪些交易所上架、公告對價格的影響,以及流動性特徵,無法直接觀察內部決策或洽談過程。由此呈現的圖景,是一個公開政策和實際做法時有出入、個別協商結果差異極大、且市場競爭壓力反而製造更多不透明誘因的產業生態。

The fundamental question underlying these debates is whether either model - Binance's rapid onboarding approach or Coinbase's selective gatekeeping - truly serves users' and projects' interests optimally. Rapid listing provides projects with market access and gives users more trading options but potentially exposes them to lower - quality assets with inadequate due diligence or poor liquidity. Slow, selective listing protects users from problematic projects but may exclude worthy innovations and reduce competitive pressure that could benefit consumers through lower fees or better services.

- 這些討論背後的根本問題在於,無論是幣安的快速上架模式,還是Coinbase的嚴格篩選路線,是否能真正兼顧用戶及項目團隊的利益?快速上架讓項目迅速取得市場,讓用戶有更多選擇,但也可能放任品質較差、盡職調查不足或流動性薄弱的資產進入市場。緩慢且嚴選的上幣則能保護用戶避免遭遇問題項目,但也可能讓有潛力的創新被排除,減少能帶來更低費用或更好服務的競爭壓力。

Some analysts suggest that the optimal solution lies not in perfecting centralized exchange listing processes but in reducing dependence on centralized exchanges altogether. Decentralized exchanges like Uniswap, PancakeSwap, and others allow any project to create liquidity pools and begin trading without gatekeepers, though at the cost of reduced protections and sometimes shallow liquidity. As DEX technology improves and captures larger market shares, the power of centralized exchanges to determine which projects succeed may diminish. But given that centralized exchanges still handle the vast majority of trading volume and provide the primary onramps from fiat currency into crypto assets, their listing policies will remain consequential for the foreseeable future.

- 一些分析師認為,最佳解方並非讓中心化交易所上幣流程更完善,而是整體減少對中心化交易所的依賴。去中心化交易所(如Uniswap、PancakeSwap等)讓任何項目都能自行開啟流動池並開始交易,完全沒有門檻,但這也意味著保護措施減少,有時流動性亦淺。隨著DEX技術提升、市場份額增長,中心化交易所對項目成敗的主導力或將逐步減弱。但考慮到中心化交易所仍掌握絕大多數交易量,並是法幣進入加密貨幣的主要管道,上幣政策在可見未來仍極具影響力。

Market - Making, Liquidity, and Power Dynamics

To fully grasp why Coinbase conditioned BNB's listing on market - making readiness, one must understand the central role that professional market - making plays in modern cryptocurrency markets and how exchanges use liquidity requirements to manage competitive dynamics. Market - making represents one of the least visible but most influential forces shaping how digital assets trade and what user experiences look like when buying or selling tokens.

- 要真正理解Coinbase為何將BNB上架條件綁定於造市商支持,必須認識專業造市在現代加密貨幣市場中的核心角色,以及交易所如何藉由流動性條件來調控競爭格局。造市是影響數位資產交易方式和買賣體驗最深遠、卻最不為人所見的重要力量之一。

Market makers are specialized trading firms that continuously offer to buy and sell assets at quoted prices, profiting from the bid - ask spread - the small difference between buy and sell prices - while providing liquidity that enables smooth trading even when natural buyers and sellers are temporarily imbalanced. For major assets like Bitcoin or Ethereum, market - making is highly competitive with numerous firms competing to offer tighter spreads and deeper liquidity. For smaller or newer tokens, fewer market makers may be willing to commit capital, leading to wider spreads, higher price slippage, and more volatile trading experiences.

- 造市商是專業交易機構,會持續在報價上下單買賣資產,並從買賣價差(即買賣價間的小差額)獲利,同時也提供流動性,讓交易即使在買賣雙方臨時不平衡時依然順暢。像比特幣、以太坊這類主流資產有眾多造市商競爭,價差更緊、流動性更深。但對小型或新興代幣,肯投入資本的造市商寥寥可數,結果就是價差變寬、滑價加劇、成交體驗更加劇烈波動。

Professional crypto market makers like Jane Street Digital, Jump Crypto, Wintermute, and GSR deploy sophisticated algorithmic trading systems that monitor prices across dozens of exchanges simultaneously, automatically adjusting quotes based on orderbook dynamics, recent trades, and cross - exchange arbitrage opportunities. These systems can quote prices, execute trades, and manage inventory risk at speeds measured in milliseconds. For exchanges, securing commitments from reputable market makers represents an essential precondition for successful listings because poor liquidity generates user complaints and damages exchange reputations.

- Jane Street Digital、Jump Crypto、Wintermute及GSR等專業加密貨幣造市商運用高級演算法交易系統,能同時監控數十家交易所行情,並根據訂單簿動態、近期成交及跨所套利機會自動調整報價。這些系統能千分之一秒內報價、成交並管理庫存風險。對交易所而言,取得知名造市商承諾是成功上幣的必要前提,因為流動性不足會引發用戶抱怨甚至損害交易所聲譽。

When Coinbase noted that BNB trading would be contingent on market - making support, it referenced this fundamental requirement. Despite BNB's enormous market capitalization and substantial liquidity on Binance, establishing adequate market - making on Coinbase requires arranging for firms willing to commit capital, manage inventory risk, and provide competitive quotes. Market makers evaluate this based on expected trading volumes - higher volumes justify more committed capital and tighter spreads - and on the costs of maintaining positions including funding costs, hedging expenses, and technical infrastructure. Because BNB trades heavily on Binance but less actively on other major exchanges, market makers must assess whether Coinbase users would generate sufficient volume to justify their commitments.

- Coinbase強調BNB交易要有造市商支持,就是基於這項基本需求。儘管BNB在幣安有龐大市值和流動性,但若要在Coinbase有足夠造市商,還是得找到願意投入資本、負責風險管理並提供有競爭力報價的專業機構。造市商評估時會考量預期成交量——成交量越高願意投入的資本越多、價差越緊——還有持倉資金、避險成本與技術架構維護等要素。由於BNB在幣安熱絡,但在其他主流交易所交易量有限,造市商需評估Coinbase用戶能否帶來足夠交易量,才值得進場。

Binance's approach to market - making reflects its integrated ecosystem advantages. Because Binance itself maintains the largest BNB orderbook and trading volume, it can provide exemplary liquidity through its own market - making operations and preferred partners. For other tokens, Binance works with a network of market - making firms that benefit from the exchange's enormous user base and trading volumes. The exchange has been known to facilitate introductions between projects and market makers, sometimes as part of the listing process. Critics argue this gives Binance excessive influence over which projects receive adequate liquidity support and which face challenging trading conditions that hamper their growth.

- 幣安的造市策略正反映其生態系優勢。因幣安自身掌握BNB最大訂單簿與成交量,可透過自身的造市團隊和合作夥伴提供最佳流動性。對於其他代幣,幣安則與造市商網絡合作,這些團隊能獲取幣安龐大用戶和交易量紅利。幣安亦會協助項目團隊牽線專業造市商,有時是上幣流程的一環。批評者指此舉讓幣安握有過大的影響力,可決定哪些項目享有充裕流動性支持,哪些則因流動性不足面臨成長阻礙。

The power dynamics embedded in these arrangements extend well beyond technical market - making functions. When exchanges serve as gatekeepers not just for listing decisions but for liquidity provision that determines whether listings actually succeed, they accumulate influence that can be wielded for competitive advantage. An exchange might provide premium market - making support for tokens from favored

- 這些安排中蘊含的權力關係,早已超越單純的造市技術層面。交易所若不僅是上幣決策的把關者,連流動性供給(即上幣成敗關鍵)也能掌握,就自然能累積可用於競爭優勢的影響力。一家交易所有可能為「自己偏好的」代幣提供頂級造市支持……ecosystems while offering minimal support for potential competitors. It might condition liquidity arrangements on commercial terms that benefit the exchange financially. Or it might use market - making relationships as leverage in negotiations over other issues including marketing partnerships, revenue sharing, or integration with exchange - specific features.

生態系統同時對潛在競爭者提供極少支持。它可能將流動性安排設置為有利於交易所金流的商業條件。或者,它也可能利用做市關係作為談判其他事項(包括行銷合作、收益分潤或與交易所專有功能整合)的槓桿。

Coinbase's emphasis on market - making readiness, therefore, serves multiple purposes. At face value, it ensures quality user experiences by preventing listings with inadequate liquidity. But it also provides Coinbase with discretion over timing and terms, allowing the exchange to manage competitive considerations. If Coinbase concluded that providing premium market - making support for BNB was strategically unwise given BNB's association with Binance, it could delay listing indefinitely while technically maintaining that market - making support had simply not materialized to required standards. Conversely, if Coinbase decided that listing BNB promptly would generate positive PR and trading revenue that outweighed competitive concerns, it could prioritize market - making arrangements and accelerate the timeline.

因此,Coinbase 強調做市準備度,實際上具有多重意義。表面上,它確保了有品質的用戶體驗,避免流動性不足的幣種掛牌。但它同時也讓 Coinbase 擁有對上市時機與條件的主動權,使其能因應競爭因素靈活調整。如果 Coinbase 認為,考量到 BNB 與幣安的關聯,提供 BNB 頂級做市支援在策略上不智,它可以無限期延後上市,同時在技術上維持“尚未達標準做市流動性”為由。相反地,如果 Coinbase 判斷 BNB 快速上市所帶來的公關效果與交易收入已高於競爭疑慮,它則能優先安排做市資源,並加速上市進程。

Liquidity depth and spreads themselves function as competitive moats between exchanges. Traders gravitate toward venues offering the best prices and deepest liquidity because even small differences in execution quality compound over time into meaningful cost advantages. For major trading pairs like BTC/USDT or ETH/USDC, the exchanges with the most committed market - making infrastructure capture disproportionate volumes, creating self - reinforcing advantages. Binance's dominant position across numerous trading pairs reflects decades of investment in market - making relationships, fee structures that incentivize liquidity provision, and the sheer scale effects from servicing hundreds of millions of users globally.

流動性深度與買賣價差本身,構成交易所間的競爭護城河。交易者會傾向選擇價格最好、流動性最深的平台,因為就算執行品質的細微差異,長期累積下來都會轉化為顯著的成本優勢。對於像 BTC/USDT 或 ETH/USDC 這類主流幣對,擁有最穩定做市基礎設施的交易所能獲得不成比例的交易量,形成自我強化的優勢。幣安在多種交易對上的主導地位,體現其多年來對做市關係、鼓勵流動性提供的費率結構,以及服務全球數億用戶規模效應的持續投資。

When Coinbase contemplates listing BNB, it necessarily considers not just whether it can provide adequate liquidity but whether doing so might inadvertently strengthen Binance's competitive position. If significant trading volume migrates to Coinbase for BNB, that could reduce Binance's strategic advantage from exclusive control of its token's primary market. But if Coinbase provides only mediocre liquidity, users may continue trading BNB primarily on Binance while viewing Coinbase's listing as an afterthought, failing to generate meaningful volume or revenue for Coinbase while consuming engineering and operational resources.

當 Coinbase 考慮掛牌 BNB 時,不僅要評估能否提供足夠流動性,還必須思考此舉是否無意間強化了幣安的競爭地位。如果大量交易量因交易 BNB 而流向 Coinbase,這可能會削弱幣安對自家代幣一級市場的戰略優勢。但若 Coinbase 僅提供一般的流動性,用戶可能還是選擇在幣安交易 BNB,將 Coinbase 的掛牌視為雞肋,最終無法為 Coinbase 帶來具體的交易量或收益,反而消耗工程和營運資源。

These competitive calculations extend to broader questions about ecosystem integration. Listing BNB might logically lead to requests or expectations that Coinbase should also support BNB Chain deposits and withdrawals, enabling users to move tokens between Coinbase and BNB Chain - based applications. This would require additional technical integration and would effectively position Coinbase as supporting infrastructure for Binance's blockchain ecosystem. While such integration could benefit users who want flexibility to access different blockchain ecosystems from a single exchange account, it also commits Coinbase to maintaining compatibility with a competitor's technology stack and creates dependencies that might complicate future strategic decisions.

這些競爭考量更延伸到生態系統整合的更大範疇。掛牌 BNB 很可能伴隨市場對 Coinbase 支援 BNB Chain 存取的期待,使用戶能將代幣在 Coinbase 與基於 BNB Chain 的應用間轉移。這將需要額外的技術整合,並形同讓 Coinbase 擔任幣安區塊鏈生態的支援基礎設施。雖然這對希望在單一交易所帳號下存取多元鏈生態的用戶來說具有好處,但同時也迫使 Coinbase 必須持續維護與競爭對手技術棧的相容性,產生可能複雜化未來策略決策的依賴。

The broader industry trend appears to be toward greater interoperability and cross - listing despite competitive tensions. As CZ noted in his response to Coinbase, Binance has listed projects from Base and other exchange - affiliated chains, recognizing that users expect access to diverse ecosystems. Kraken's April 2025 listing of BNB preceded Coinbase's move and faced similar questions about why exchanges would support competitors' tokens. The answer seems to be that user demand and competitive pressure from decentralized alternatives are gradually overcoming the instinct to maintain exclusive control. If users can easily trade any asset on decentralized exchanges, centralized exchanges risk losing relevance by refusing to list popular tokens regardless of which platform originally promoted them.

整體產業趨勢顯示,即使存在競爭緊張,互通性和跨平台掛牌正日益盛行。正如 CZ 回應 Coinbase 時指出,幣安也有掛牌 Base 及其他交易所相關鏈的專案,體認到用戶期待能接觸多元生態圈。Kraken 在 2025 年 4 月搶先 Coinbase 掛牌 BNB,也遇到類似質疑:為何交易所會支持競爭對手的代幣?答案似乎是,使用者需求與來自去中心化替代方案的競爭壓力,正逐步凌駕於獨占控制的本能。如果用戶能在去中心化交易所輕鬆交易任何資產,中心化交易所若堅持不掛牌受歡迎的代幣,不論代幣來源,終將失去市場相關性。

This evolution toward openness, however incomplete and strategically motivated, represents meaningful progress from the earlier exchange landscape where deliberate exclusion of competitive tokens was standard practice. Whether it proves sustainable or merely constitutes a temporary phase before new forms of competitive segmentation emerge remains uncertain.

儘管這種趨向開放的轉變尚未完全實現、且具備策略考量,但相較於過往交易所普遍主動排除競爭對手幣種的局面,的確是重大進展。這種開放趨勢能否持續、還是僅是新型競爭分割到來前的過渡階段,尚無定論。

Cross - Chain Ecosystem Rivalries

跨鏈生態系競爭

Behind the Coinbase - Binance listing dispute lies a deeper competition between Base and BNB Chain - two blockchain platforms with profoundly different origins but increasingly overlapping ambitions. Understanding this ecosystem rivalry helps explain why token listing decisions carry implications far beyond simple trading access.

在 Coinbase 與幣安的掛牌糾紛背後,實際埋藏著 Base 與 BNB Chain 兩大區塊鏈平台的深層競爭——儘管它們起源迥異,企圖心卻日益重疊。理解這樣的生態系競逐,有助於說明為何代幣掛牌的決策意義遠超出單純提供交易管道。

BNB Chain, originally launched as Binance Chain in 2019 and subsequently rebranded following the merger with Binance Smart Chain, represents Binance's effort to build a comprehensive blockchain ecosystem that extends well beyond simple exchange operations. The platform uses a Proof of Staked Authority consensus mechanism with a limited set of validators - currently 21 active validators selected from a pool of 45 candidates based on stake amounts - enabling high transaction throughput of roughly 2,000 transactions per second and three - second block times. This makes BNB Chain substantially faster and cheaper than Ethereum mainnet, with average transaction fees around $0.11 compared to Ethereum's $2.14.

BNB Chain 最初於 2019 年以 Binance Chain 啟動,並在與 Binance Smart Chain 合併後更名。這代表幣安不只滿足於交易所,更欲打造涵蓋全方位應用的區塊鏈生態系。該平台採用 Stake 信任權威(Proof of Staked Authority)共識機制,驗證者數量有限,目前由 45 名候選人以質押額選出 21 位現役驗證者,能支援每秒約 2,000 筆交易及 3 秒出塊。這讓 BNB Chain 無論速度還是手續費都遠優於以太坊主網,平均一筆交易手續費僅約 $0.11,美金,而以太坊則為 $2.14。

The BNB Chain ecosystem has achieved remarkable scale across multiple dimensions. Total value locked in DeFi protocols on BNB Chain approached $6.7 billion as of mid - 2025, making it the third - largest blockchain by this metric behind Ethereum and Solana. The network processes over 4.1 million transactions daily, roughly double Ethereum's daily transaction count. PancakeSwap, the dominant decentralized exchange on BNB Chain, accounts for approximately 91% of the chain's DEX volume and recently achieved record - breaking monthly trading volume of $325 billion in June 2025. In March 2025, PancakeSwap briefly surpassed Uniswap in daily trading volume, a symbolic milestone signaling BNB Chain's growing importance in DeFi.

BNB Chain 生態在多個層面達到驚人的規模。2025 年中,在 BNB Chain 上的 DeFi 協議總鎖定價值(TVL)接近 67 億美元,僅次於以太坊與 Solana,排名第三。網路每日處理超過 410 萬筆交易,約為以太坊當日交易數量的兩倍。鏈上主導性去中心化交易所 PancakeSwap 貢獻約 91% DEX 交易量,2025 年 6 月單月創下 3,250 億美元歷史新高。2025 年 3 月,PancakeSwap 日成交量一度超越 Uniswap,象徵 BNB Chain 在 DeFi 領域的重要性正不斷強化。

Developer activity remains robust with 78 protocols actively building on the network and regular hackathons, grant programs, and incubation initiatives supported by Binance Labs and the BNB Chain Foundation. Recent technical upgrades including the Pascal hard fork introduced smart contract wallet support and improved EVM compatibility, making it easier for developers to port applications from Ethereum. The ecosystem has deliberately targeted areas like gaming, NFTs, and meme coins where transaction speed and low costs provide clear advantages over more decentralized but slower alternatives.

開發者活躍度持續高檔,網路上有 78 個協議積極建設,並有 Binance Labs 與 BNB Chain 基金會定期舉辦駭客松、補助計畫與孵化專案。近期包括 Pascal 硬分叉在內的技術升級,引進智慧合約錢包支援並改善 EVM 相容性,讓開發者更容易將以太坊應用移植過來。該生態圈更刻意聚焦於遊戲、NFT、迷因幣等領域,在這些領域,交易速度與低成本明顯優於更去中心化、但速度較慢的競品。

Base launched in August 2023 as Coinbase's layer - 2 scaling solution built on Optimism's OP Stack technology. Unlike BNB Chain which operates as an independent layer - 1 blockchain, Base functions as a layer - 2 rollup that settles transactions on Ethereum, inheriting Ethereum's security properties while achieving much higher throughput and lower fees than Ethereum mainnet. Base has attracted over 25,000 developers as of September 2025 and achieved total value locked approaching $12 billion on its path toward ambitious targets of $20 billion in TVL and one billion transactions by October 2025.

Base 於 2023 年 8 月由 Coinbase 推出,建構於 Optimism 的 OP Stack 技術之上,作為其 Layer 2 擴容方案。與作為獨立 Layer 1 區塊鏈的 BNB Chain 不同,Base 是一種 Layer 2 Rollup,所有交易最終結算在以太坊上,兼具以太坊安全性,又能達成比以太坊主網高得多的處理量和更低手續費。截至 2025 年 9 月,Base 已吸引超過 2.5 萬名開發者,鎖定資產總額接近 120 億美元,目標在 2025 年 10 月挑戰 200 億 TVL 與 10 億交易次數。

The platform benefits from seamless integration with Coinbase's infrastructure, providing direct access to approximately 25 million monthly active users on Coinbase and enabling easy onboarding from fiat currency into Base applications. This represents a substantial competitive advantage over ecosystem chains like BNB Chain which require users to navigate more complex paths from traditional finance into crypto applications. Base has also emphasized EVM compatibility and low fees, positioning itself as developer - friendly infrastructure that reduces barriers to building decentralized applications.

該平台直接整合 Coinbase 基礎設施,可讓將近 2,500 萬月活 Coinbase 用戶一鍵進入,並支援法幣從 Coinbase 直接轉入 Base 應用。這對比 BNB Chain 這類要用戶經過繁複流程才能把資金從傳統金融轉進鏈上生態的競爭者,屬於顯著優勢。Base 也強調其 EVM 相容性與低手續費,自我定位為對開發者友善、能降低 Dapp 開發門檻的鏈上基礎建設。

Where BNB Chain leverages Binance's massive global user base and trading volumes, Base leverages Coinbase's regulatory compliance, institutional relationships, and integration with traditional finance. Where BNB Chain has a seven - year operational history and established ecosystem of protocols, Base represents newer infrastructure with less proven resilience but more modern technical architecture. Where BNB Chain operates independently with its own consensus mechanism and validator set, Base remains tied to Ethereum's base layer and participates in the broader Ethereum ecosystem and the emerging "Superchain" vision of interconnected layer - 2 networks.

BNB Chain 仰賴幣安的全球用戶規模與交易量優勢,Base 則倚賴 Coinbase 合規、機構關係及與傳統金融的深度整合。BNB Chain 有 7 年運營歷史與完備協議生態,Base 則屬於新興基礎建設,雖韌性尚待驗證但技術架構更現代。BNB Chain 為獨立運營、擁自家共識機制與驗證者組成;Base 則綁定於以太坊主鏈,屬於以太坊生態一環,參與新興的 Layer 2“超級鏈”互聯網絡願景。

The competition between these ecosystems manifests most directly in the race to attract developers and their applications. Both platforms offer grant programs, technical support, and visibility for promising projects. Both emphasize low transaction costs and high throughput as advantages over Ethereum mainnet. Both seek to build network effects where more applications attract more users which in turn attract more developers in a virtuous cycle. But they differ significantly in their go - to - market strategies and target audiences.

這兩大生態之間的競爭,最直接表現在吸引開發者及其應用的賽跑。兩者皆推出獎勵計畫、技術支援和知名度提升,以吸引具潛力的專案。雙方都強調低費用、高吞吐量相對以太坊主網的優勢,也同樣追求應用→用戶→開發者的網絡效益飛輪。不過,他們在市場策略和目標受眾上有明顯分歧。

BNB Chain has historically focused on retail users, particularly in regions outside North America and Europe where Binance maintains dominant market share. The chain has supported numerous consumer - facing applications including gaming, NFTs, yield farming, and recently meme coins which drive substantial transaction activity even if critics question their long - term value. The ecosystem tolerates higher risk and more experimental projects, accepting that some will fail or behave problematically in exchange for rapid innovation and growth.

BNB Chain 歷來重點耕耘散戶用戶,尤其是在北美、歐洲以外由幣安主導的地區。該鏈支援眾多面向消費者的應用,包括遊戲、NFT、收益農場,甚至近期流行的迷因幣,這些即使飽受質疑,卻能帶動大量鏈上交易。此生態對高風險與試驗性專案容忍度較高,接受部分專案失敗或出現問題,以換取快速創新與生態成長。

Base has targeted more institutional and regulatory - conscious developers, positioning itself as the compliant, trustworthy infrastructurefor building the future of decentralized finance. The platform has attracted attention from traditional finance institutions exploring blockchain applications and from developers who value the legitimacy and integration that Coinbase's involvement provides. Base's growth strategy emphasizes quality over quantity, selective support for applications that demonstrate clear utility, and alignment with Coinbase's broader vision of bringing digital assets to mainstream adoption.

為建立去中心化金融的未來奠定基礎。這個平台吸引了正探索區塊鏈應用的傳統金融機構,以及重視Coinbase參與所帶來的合法性與整合性的開發者。Base的成長策略強調質重於量,有選擇地支持那些展現出明確實用性的應用,並與Coinbase致力於將數位資產推廣至主流的更廣泛願景相一致。

When Coinbase adds BNB to its listing roadmap but has not yet listed projects from BNB Chain, this asymmetry reflects the competitive tension between these ecosystems. Supporting BNB Chain applications directly would help grow a rival blockchain platform that competes with Base for developers and users. Yet refusing to list any BNB Chain projects appears hypocritical given Coinbase's statements about openness and Binance's willingness to list Base projects. This tension has no easy resolution because genuine user service and competitive strategy point in opposite directions.

當Coinbase將BNB納入其上幣路線圖,卻尚未上架來自BNB Chain的專案時,這種不對稱反映出這些生態系間的競爭張力。若直接支持BNB Chain的應用,等於幫助一個與Base爭奪開發者與用戶的競爭性區塊鏈平台成長。然而,若完全拒絕上架任何BNB Chain專案,考慮到Coinbase宣稱的開放性以及Binance願意上架Base專案,則顯得有些偽善。這種緊張關係難以簡單解決,因為真正的用戶服務與競爭策略指向了相反的方向。

Some industry observers anticipate that cross - chain interoperability will eventually reduce the importance of these competitive dynamics. Technologies enabling seamless transfer of assets and data between blockchain ecosystems could allow users and developers to participate across multiple chains simultaneously without forced choices between exclusive platforms. Initiatives like Wormhole Bridge, LayerZero, and Axelar are building infrastructure for cross - chain communication and asset transfers. If these succeed, the Base versus BNB Chain competition might evolve from zero - sum rivalry toward coexistence where both platforms serve distinct niches within a more interconnected ecosystem.

部分產業觀察者預期,跨鏈互通性最終會降低這些競爭動態的重要性。能夠讓區塊鏈生態間資產與數據無縫轉移的技術,將讓用戶和開發者不需被迫選擇單一專屬平台,而能同時在多條鏈上參與。像Wormhole Bridge、LayerZero與Axelar這些計畫都在打造跨鏈通訊與資產轉移的基礎設施。如果這些計畫成功,那麼Base與BNB Chain之間的競爭可能會從零和競局演變為共存,讓兩者在更為互聯的生態中各自滿足不同利基需求。

However, powerful incentives toward vertical integration and ecosystem lock - in may limit how much interoperability materializes in practice. Both Coinbase and Binance benefit from network effects that concentrate activity within their respective ecosystems. Developers who build on Base gain access to Coinbase's user base but potentially sacrifice reach to users on other chains. Projects on BNB Chain benefit from Binance's marketing support and listing opportunities but might find adoption elsewhere more difficult. These platform dynamics resemble historical patterns in consumer internet where ostensibly open platforms frequently evolved toward proprietary ecosystems with high switching costs.

然而,系統整合與生態鎖定所帶來的強大誘因,可能限制互通性在現實中的實現程度。Coinbase與Binance都受惠於網路效應,使行為集中於各自生態體系。選擇在Base上開發的開發者可接觸Coinbase的用戶群,但可能失去接觸其他鏈用戶的機會。BNB Chain上的專案受惠於Binance的行銷資源與上幣機會,但在其他生態的推廣可能較為困難。這些平台動態類似消費者網路歷史上,各種名為開放的平台最終常發展為專屬、高轉換成本的生態系結構。

For users, the proliferation of ecosystem chains creates both opportunities and complications. More blockchain platforms competing for users and developers could drive innovation and keep fees low. But fragmentation across multiple incompatible chains with different bridging requirements, wallet software, and application landscapes increases complexity and may reduce the seamless user experiences necessary for mainstream adoption. How the industry resolves this tension between competitive ecosystem differentiation and user - friendly interoperability will profoundly shape cryptocurrency's evolution over the coming years.

對於用戶而言,生態系鏈的激增同時帶來機會與困難。更多區塊鏈平台爭奪用戶和開發者有助於推動創新並壓低費用。但多個互不兼容、各自有不同橋接需求、錢包軟體和應用場景的鏈之間的分裂,提升了複雜度,也可能削弱達到主流採用所需的無縫用戶體驗。業界如何解決生態差異化與用戶友善互通性之間的矛盾,將深刻影響加密貨幣未來數年的發展。

Regulatory Pressure and Strategic Signaling

監管壓力與策略性訊號釋放

The October 2025 listing controversy unfolded against a backdrop of dramatic regulatory shifts that have fundamentally altered the environment in which both Coinbase and Binance operate. Understanding these regulatory changes helps explain both exchanges' strategic positioning around transparency, compliance, and listing practices.

2025年10月的上幣爭議,是在劇烈監管變革的背景下發生,這些變革從根本上改變了Coinbase與Binance的運作環境。理解這些監管變動,有助於解釋兩家交易所在透明度、合規性以及上幣政策上的策略定位。

For Coinbase, the February 2025 dismissal of the SEC's enforcement action marked a watershed moment after nearly two years of uncertainty. The lawsuit filed in June 2023 had threatened Coinbase's core business model by alleging that the exchange operated as an unregistered securities exchange by offering trading in tokens that the SEC deemed unregistered securities. The case raised existential questions about whether Coinbase could continue operating lawfully given the SEC's expansive interpretation of what constitutes a security under the Howey test.

對Coinbase而言,2025年2月美國證管會(SEC)撤銷執法行動,為近兩年不確定性的終止點。2023年6月提起的訴訟,曾指控Coinbase作為未註冊證券交易所,讓用戶交易SEC認定為未註冊證券的代幣,對Coinbase的核心商業模式構成威脅。這起案件引發了關鍵的生存疑問,即考量到SEC運用Howey Test極為寬泛的證券定義下,Coinbase是否還能合法經營。

The SEC's decision to dismiss the case did not represent a victory on the merits but rather reflected the agency's policy shift toward developing comprehensive regulatory frameworks rather than pursuing enforcement - first strategies against platforms themselves.

SEC撤銷此案,並非基於實質勝訴,而是反映出機關政策轉向,從「優先執法」轉為著手建立全面監管框架,聚焦於規範制度的建構,而非直接針對平台動用執法手段。

This shift resulted from broader political changes with the incoming Trump administration's more favorable posture toward cryptocurrency and the SEC's formation of a Crypto Task Force led by Commissioner Hester Peirce to develop clear regulatory guidance. The Task Force's ten focus areas include clarifying which digital assets qualify as securities, establishing registration pathways for compliant platforms, addressing custody and broker - dealer requirements, and providing relief for token offerings that previously existed in regulatory gray zones. This represents a fundamental departure from former SEC Chair Gary Gensler's approach of declining to issue new rules while aggressively enforcing existing securities laws through litigation.

這一政策轉變,肇因於更廣泛的政治變動──新上任的川普政府對加密貨幣持較友善態度,加上SEC內部由專員Hester Peirce領軍成立加密貨幣專案小組,專責制定明確監管指引。專案小組聚焦於十大項領域,包括界定哪些數位資產屬於證券、建立合規平台的註冊途徑、明確托管與證券商需求,並針對先前處於監管灰色地帶的代幣發行予以救濟。這標誌著SEC從前主席Gary Gensler時代的「不立新規、專訴舊法」訴訟策略的根本轉折。

The dismissal removed an enormous cloud hanging over Coinbase and emboldened the exchange to expand its token offerings, international operations, and experimental products including staking services that had previously faced regulatory scrutiny. Coinbase also became the first U.S. - based cryptocurrency exchange to obtain a full license under the European Union's Markets in Crypto - Assets regulation, enabling it to offer services throughout the EU single market under comprehensive regulatory framework. This international expansion reflects Coinbase's assessment that clear regulatory frameworks, even if burdensome, provide better operating environments than ambiguous situations where enforcement risk remains unpredictable.

此案撤銷後,Coinbase得以解除長期壓力,並積極擴展代幣發行、國際事業與原本受監管壓力的實驗性產品(如質押服務)。Coinbase更成為首家依歐盟加密資產市場法規(MiCA)完全取得執照的美國交易所,可在歐盟單一市場內提供服務。這波國際擴張,反映Coinbase認為,明確監管即使較為嚴苛,依然優於執法風險高度不可預測的模糊環境。

Public listing policies serve as crucial regulatory signals in this environment. When Coinbase announced the Blue Carpet initiative emphasizing zero listing fees, transparent processes, and enhanced disclosure requirements for token issuers, it positioned the exchange as a leader in responsible self - regulation that anticipates and exceeds forthcoming regulatory requirements. This creates competitive advantages if and when regulators impose standardized listing requirements on all exchanges. By implementing robust practices early, Coinbase can claim it already operates at higher standards than less compliant competitors.

在這樣的環境下,公開的上幣政策具有關鍵監管訊號意義。Coinbase宣布“藍毯計畫”,強調零上幣費、透明流程與加強發行項目資訊揭露時,就是在展現主動自律、超前因應即將到來監管要求的領導姿態。若未來監管機構強制統一所有交易所的上幣標準,Coinbase搶先一步採取嚴格規範,有助於占據競爭優勢,也能主張自身運作標準優於合規性較低的同業。

For Binance, the regulatory journey has followed a much more turbulent path. The November 2023 settlement with the U.S. Department of Justice, Financial Crimes Enforcement Network, and Commodity Futures Trading Commission imposed $4.3 billion in penalties - primarily for anti - money laundering violations - and required CZ's permanent departure from executive management. The settlement resolved criminal and civil charges related to operating an unlicensed money transmitting business, facilitating transactions involving sanctioned jurisdictions including Iran, and failing to implement adequate know - your - customer and anti - money laundering programs.

Binance的監管之路顯得崎嶇得多。2023年11月,Binance與美國司法部、金融犯罪執法網絡(FinCEN)及商品期貨交易委員會達成和解,支付了43億美元罰款(多為反洗錢違規),並要求CZ永久退出執行管理階層。此和解解決了Binance因未獲授權經營資金轉移業務、促進來自伊朗等受制裁地區交易、與未落實充分KYC和反洗錢措施等相關刑事與民事指控。

Since the settlement, Binance has undergone dramatic internal transformation. The exchange invested approximately $200 million in compliance programs over two years, expanding legal and regulatory teams from a few dozen to several hundred employees. New CEO Richard Teng positioned compliance as a competitive advantage, arguing that Binance's financial resources enable it to implement controls that smaller exchanges cannot match. The exchange established proper money services business licenses in numerous U.S. states where it previously operated in regulatory gray zones. It pursued full regulatory licenses in key international markets including obtaining a Virtual Asset Service Provider license in Dubai and seeking approval to re - enter markets like India from which it had been expelled for compliance deficiencies.

和解之後,Binance進行了劇烈的內部改革。兩年內約斥資2億美元於合規計畫,法律與監管團隊由數十人增至數百人。新任執行長Richard Teng將合規當作競爭優勢,強調Binance資本優勢有助於推動小型交易所無法比擬的管控力。該交易所也在原本處於監管灰區的多個美國州份取得合法金流業執照,並在杜拜取得虛擬資產服務供應商執照,以及尋求重返如印度等因合規理由遭驅逐的關鍵國際市場。

This compliance transformation affects listing decisions profoundly. Where Binance previously added dozens of tokens monthly with limited due diligence, the post - settlement exchange faces pressure to demonstrate rigorous evaluation processes. Regulators expect exchanges with proper licenses to conduct adequate due diligence on listed assets, monitor for potential securities law violations, screen for sanctioned persons or entities, and maintain records that enable regulatory oversight. Projects seeking Binance listings now encounter longer timelines and more intrusive due diligence than during the exchange's earlier rapid - growth phase.

這波合規轉型,也讓Binance的上幣決策大為改變。過去Binance每月可大量上幣,盡職調查有限;和解後,交易所必須展現嚴格審查流程。監管機關認為,取得完整執照的交易所必須對上架資產執行適當盡職調查、監控潛在證券法違規、篩查被制裁對象,並維護必要紀錄以供監管機構查核。如今申請Binance上幣的專案,等待期更長、審查也遠比過往成長期更嚴格。

Binance's defense against allegations of problematic listing practices increasingly emphasizes regulatory compliance rather than simply denying that fees exist. The exchange points to its screening procedures, risk assessments, and rejection of projects that fail compliance reviews as evidence of responsible practices. Yi He's statements about rigorous evaluation processes speak directly to regulatory concerns about exchanges serving as gatekeepers against problematic assets. By emphasizing that no amount of payment or token allocation can secure listing for projects that fail compliance reviews, Binance positions itself as responsible infrastructure consistent with regulatory expectations rather than a purely commercial enterprise maximizing revenue regardless of asset quality.

針對各種上幣爭議的指控,Binance的應對重點也從否認收費,轉為強調合規。交易所展示其篩查程序、風險評估機制以及對不合規專案的拒絕,作為自身負責任的證據。何一(Yi He)強調嚴格評審流程,直接回應監管機關關於交易所是否能把關問題資產的關切。Binance強調,無論給付多少費用或代幣,若不符合規審查,皆無法上架,將自身定位為符應監管預期的負責任基礎設施,而非單純追逐商業利益、不問資產品質的公司。

The ongoing SEC case against Binance adds complexity to this regulatory picture. Unlike the comprehensive criminal settlement with the Justice Department, the SEC's civil action filed in June 2023 remains ongoing as of October 2025, though the parties have requested multiple 60 - day pauses to negotiate potential resolution. The SEC alleges that Binance operated as an unregistered securities exchange, offered unregistered securities including BNB and BUSD tokens, and provided unregistered staking services. The case's outcome could significantly impact Binance's ability to serve U.S. customers and the broader regulatory framework for

針對Binance的SEC案件仍持續進行,為這幅監管大局增添更多變數。不同於與司法部的全面刑事和解,SEC於2023年6月提起的民事訴訟截至2025年10月仍未落幕,雙方多次申請各60天暫停,以協商潛在和解。SEC指控Binance未註冊即運營證券交易所,上架未註冊證券(包含BNB與BUSD),同時提供未經註冊的質押服務。此案結果,將可能深刻影響Binance服務美國用戶之能力,以及更廣泛行業監管架構的走向。Global regulatory harmonization efforts add another layer of complexity. The European Union's Markets in Crypto - Assets regulation, which took full effect in 2025, establishes comprehensive licensing requirements for exchanges operating in EU member states. These requirements include minimum capital standards, operational resilience measures, conflict - of - interest management, marketing and disclosure standards, and consumer protection requirements. Similar regulatory frameworks have emerged or are under development in multiple jurisdictions including the United Kingdom, Singapore, Japan, and South Korea.

全球監管法規趨於一致的努力為這個領域增添更多複雜性。歐盟的「加密資產市場規範(Markets in Crypto-Assets)」,於 2025 年全面生效,為在歐盟成員國內經營的交易所建立了全面的牌照申請要求。這些要求包含最低資本標準、營運韌性措施、利益衝突管理、行銷與資訊揭露標準,以及消費者保護規範。英國、新加坡、日本、南韓等多個司法管轄區也陸續出現或正制定類似的監管架構。

The GENIUS Act passed by the U.S. Congress in 2025 establishes federal regulatory framework for stablecoins, requiring full reserve backing and monthly audits. This directly affects both exchanges given their substantial revenues from stablecoin - related activities including trading fees and revenue - sharing arrangements with stablecoin issuers. The Act's passage suggests momentum toward comprehensive federal regulation of digital assets that would supersede the current patchwork of state - level money transmitter licenses and agency - specific enforcement actions.

美國國會於 2025 年通過的 GENIUS 法案,建立了有關穩定幣的聯邦監管架構,規定須有全額準備金支持並進行每月審計。由於交易所大部分收入來自於穩定幣相關業務(如手續費與與穩定幣發行商的收益分潤),這項法案直接影響到這些平台。該法案的通過顯示出聯邦層級對數位資產進行全面監管的趨勢,未來有可能取代現行各州金錢轉移牌照以及機構單獨執法的碎片化現象。

In this evolving regulatory landscape, transparency and documented compliance procedures provide valuable defensive postures. When Coinbase or Binance faces questions about listing practices, being able to point to published standards, documented evaluation processes, and consistent application of transparent criteria helps demonstrate good - faith compliance efforts. Even if perfect transparency proves impossible given commercial sensitivities and competitive considerations, sufficient transparency to satisfy regulatory oversight while maintaining some strategic flexibility represents the pragmatic optimum.

在此日趨變化的監管環境中,透明度與書面合規程序提供了具價值的防禦立場。當 Coinbase 或 Binance 的上幣流程受到質疑時,能夠指向公開的標準、記錄完整的評估流程,以及持續一致應用透明準則,有助於展現其本著誠信進行合規的努力。即使基於商業機密或競爭考量,完全公開並不可能,達到足以讓監管機關滿意的透明力度,同時保留部分策略彈性的做法,也被視為實用的最佳解。

Both exchanges recognize that their long - term viability depends on achieving and maintaining regulatory legitimacy across major markets. This reality increasingly drives their public statements and policy decisions even when those conflict with short - term profit maximization or competitive positioning. The October 2025 listing controversy, therefore, functioned not just as competition between exchanges but as a very public demonstration of their respective commitments to transparency and responsible practices that they hope will influence regulatory treatment going forward.

兩間交易所皆意識到,長遠的生存取決於能否在主要市場獲得並維持監管上的合法性。這樣的現實情況愈發主導其公開聲明與政策決策,即使這些決定有時會與短期獲利極大化或競爭策略產生衝突。因此,2025 年 10 月的上幣爭議,除了是兩大交易所的競爭,也成了一場公開展示對透明與負責任慣例承諾的動作,希望藉此影響未來監管機關的態度。

The Business of Attention: PR, Influence, and Community Reaction

The public nature of the October 2025 dispute between Coinbase and Binance reflects how cryptocurrency exchanges increasingly compete not just for users and trading volume but for narrative control and community sentiment. In an industry where reputation effects can move markets and social media engagement directly translates into business outcomes, the ability to shape public discourse represents a significant competitive asset.

2025 年 10 月 Coinbase 與 Binance 的爭議公開化,反映出近年加密貨幣交易所間的競爭已不僅限於用戶或交易量,更延伸到話語權掌控與社群情感。由於在這個業界名聲效應足以影響市場,社群媒體互動又直接影響業務結果,能夠主導公開討論與敘事已成為一大競爭優勢。

The sequence of events demonstrated sophisticated understanding of attention economics. Jesse Pollak's statement that listing should cost zero percent emerged from a specific context - accusations against Binance about listing fee demands - but rapidly took on broader significance as a rallying cry for exchange transparency. By framing the issue in absolutist terms, Pollak positioned Coinbase as advocating for principles rather than merely defending its own practices. This created immediate pressure for other exchanges to respond with their own positions.

一連串事件展現了對注意力經濟的高度理解。Jesse Pollak 宣稱「上幣費用應該為零」,原本是針對 Binance 被控索要上幣費的事件發言,但很快被擴大成為交易所透明化的號召。Pollak 以絕對化方式界定問題,將 Coinbase 定位成為原則的倡議者而不是僅僅自我辯護,隨之即刻對其他交易所產生回應壓力。

CZ's response exemplified his skill at social media engagement cultivated over years of building Binance's brand through direct communication with cryptocurrency communities. Rather than issue formal statements through corporate communications channels, CZ posted personal responses on X that mixed humor, directness, and strategic messaging. His laugh emoji in response to criticism positioned him as confident and unbothered while his substantive points about Binance listing Base projects created cognitive dissonance for Coinbase's critics. By urging Coinbase to list BNB Chain projects, he moved the conversation from defensive posture about Binance's practices to offensive challenges about Coinbase's consistency.

CZ 的回應則展現其多年經營 Binance 品牌、與加密社群直接溝通所培養的社群媒體操作能力。相比於發布正式聲明,CZ 選擇在 X(原推特)個人帳號以幽默、直率及策略性訊息混合的方式提出回應。他以大笑符號回應批評,塑造自信、毫不在意的形象,同時關於 Binance 上架 Base 項目的具體說明,也為 Coinbase 批評者帶來認知失調。進一步,他呼籲 Coinbase 上架 BNB Chain 項目,將話題從對 Binance 的防衛式辯護,轉化成對 Coinbase 一致性的主動挑戰。

Coinbase's rapid response of actually adding BNB to its listing roadmap demonstrated agility but also suggested sensitivity to narrative dynamics. The exchange could have waited days or weeks to thoroughly evaluate BNB from technical, market - making, and compliance perspectives before making any announcement. Instead, it moved within hours of the Blue Carpet launch, suggesting that reputational considerations outweighed operational caution. This choice generated immediate positive attention and positioned Coinbase as responsive to community feedback, but it also created obligations and expectations that might constrain future flexibility.

Coinbase 迅速將 BNB 納入其上幣計畫(roadmap),展現了敏捷度,同時也顯示出對敘事動態的高度敏感。理論上該交易所可以花數天甚至數週,從技術、市場做市、合規等角度徹底評估 BNB,才發布任何公告,但實際上他們於「Blue Carpet」啟動數小時內就行動,顯示名譽考量已壓倒營運審慎。此決策不僅帶來立竿見影的正面關注,也將 Coinbase 形象塑造成積極回應社群,但同時亦產生未來可能限制彈性的義務與期待。

Community reaction on social media revealed the deep divisions and tribal allegiances that characterize crypto culture. Binance supporters criticized Coinbase as hypocritical, pointing to allegations about massive listing fees from figures like Justin Sun and Andre Cronje. They characterized Coinbase's BNB listing as forced by public pressure rather than voluntary commitment to openness. Coinbase supporters countered that Binance's defensive reactions to listing fee accusations revealed consciousness of guilt and that CZ's demands for reciprocal listing represented strategic deflection from legitimate criticisms.

在社群媒體上的討論中,也突顯了加密圈內部的深層分歧與部落情結。Binance 支持者批評 Coinbase 虛偽,提出 Justin Sun、Andre Cronje 等人爆料關於天價上幣費的指控,並認為 Coinbase 上架 BNB 只是被輿論壓力逼迫,而非真正出於開放承諾。Coinbase 支持者則反駁,指出 Binance 對上幣費指控的防衛反應恰恰反映其「心虛」,而 CZ 要求對等上架其實是為了轉移對 Binance 的正當批評。

Engagement metrics told part of the story. Posts about the listing dispute generated millions of impressions, thousands of comments, and extensive quote - tweet chains as the cryptocurrency community debated which exchange exhibited worse behavior and what this revealed about centralized exchange power. Media coverage from outlets like CoinDesk, The Block, and Decrypt amplified the controversy beyond social media into more mainstream cryptocurrency discourse. Even users who typically ignored exchange operations and listing processes found themselves drawn into debates about the proper standards for such decisions.

互動數據也說明了部分現象。有關此爭議的貼文累積了數百萬曝光、數千則留言,以及一連串轉推討論,整個加密社群對哪一間交易所的做法更可疑,以及這代表中心化交易所權力結構的何種問題展開爭辯。CoinDesk、The Block、Decrypt 等主流媒體推波助瀾,將此話題從社群平台進一步延燒到整個主流加密貨幣討論圈。就連平時對交易所運作與上幣流程不感興趣的用戶,也開始參與關於決策標準的討論。

Token price movements suggested that at least some market participants viewed these developments as financially significant. BNB's initial price jump following the Coinbase listing announcement indicated positive sentiment, though the subsequent decline suggested either profit - taking or recognition that roadmap listing fell short of actual trading availability. Trading volumes for BNB increased across multiple exchanges as attention focused on the token, demonstrating how narrative can directly translate into market activity.

代幣價格走勢也顯示,至少部分市場參與者認為事件具備財務意義。Coinbase 宣布將 BNB 列入上幣計劃後,BNB 價格短線飆升,顯示市場樂觀情緒,但隨後回落則可能是獲利了結或認知到僅僅是計劃尚未實際開盤交易。BNB 在多家交易所的成交量也因關注度提升而增加,顯示敘事變化可直接引導市場動作。

The broader pattern resembles previous cryptocurrency disputes that played out in public view including block size debates in Bitcoin, contentious hard forks in Ethereum, and multiple conflicts over governance and development roadmaps across various projects. Cryptocurrency communities have consistently demonstrated willingness to engage intensely with technical and policy questions that would receive minimal attention in traditional financial markets. This engagement reflects the industry's origins in cypherpunk culture that emphasizes transparency, community governance, and resistance to centralized authority.

這種更大範圍的模式,有如過去幾次加密幣圈公開爭議——比特幣區塊大小之爭、以太坊分叉、以及不同項目之間關於治理與開發路線圖的種種爭執。加密社群一向樂於積極參與這些在傳統金融市場甚少關注的技術與政策議題。這也反映出行業源於賽博龐克(cypherpunk)文化,強調透明、社群治理與抗衡中心化權威的本質。

Yet some observers expressed weariness with what they viewed as performative disputes serving competitive positioning more than genuine principle. A cynical reading suggests both exchanges engaged in strategic theater: Binance defending itself against serious allegations by pivoting to attacks on Coinbase's inconsistency, Coinbase generating positive PR through symbolic gestures while maintaining fundamental practices unchanged. From this perspective, the beneficiaries were neither exchange but rather cryptocurrency media outlets and social media engagement metrics while actual resolution of substantive questions about listing transparency remained elusive.

但也有觀察者對這種表演性質爭議感到疲憊,認為只是各方競爭策略上的表現,與真正的原則無關。較為犬儒的解讀是,兩家交易所都在打策略大戲:Binance 以攻擊 Coinbase 不一致來迴避自身遭嚴厲指責,Coinbase 則靠象徵性動作創造正面公關實質上並未根本改變其行為。從這個觀點來看,最大受益者既不是兩間交易所,而是加密媒體及社群互動平臺,而關於上幣透明性的實質爭議問題仍未被解決。

The attention dynamics also revealed the different audiences each exchange prioritizes. Binance's messaging resonated particularly strongly with retail traders, especially in Asian markets where CZ maintains celebrity status and Binance commands dominant market share. CZ's informal, direct communication style and willingness to engage in social media disputes appeals to communities that value accessibility and view traditional corporate communication as excessively formal and evasive.

這場注意力戰也揭示了各交易所所重視的目標受眾有別。Binance 的訊息更能打動散戶,尤其在亞洲市場,CZ 具明星地位且 Binance 佔據主導市場份額。CZ 非正式、直接的溝通風格及樂於參與社群平台論戰,非常符合強調親近性、認為傳統企業溝通過於正式與閃躲的社群期待。

Coinbase's more measured, institutional approach reflects its focus on regulatory compliance, institutional adoption, and mainstream credibility. The Blue Carpet launch emphasized frameworks, standards, and processes - language designed to appeal to sophisticated projects and regulatory observers more than retail social media audiences. Even Coinbase's decision to list BNB was framed through operational requirements like market - making and technical infrastructure rather than as direct response to competitive pressure.

而 Coinbase 相對謹慎、具體系化的作風,展現其注重法規遵循、機構用戶採納及主流信譽。Blue Carpet 新上幣政策特別強調標準、流程和框架,用語訴求有經驗的專案團隊或監管觀察者,而非主要針對廣大散戶社群。即連 Coinbase 宣布上架 BNB,也著重於市場造市、技術基礎設施等營運需求,而非單純對競爭壓力的直接回應。

As the October 2025 controversy gradually faded from immediate attention, its longer - term impacts on exchange behavior and industry norms remained uncertain. Did the public pressure actually influence how exchanges make listing decisions going forward, or did it merely produce temporary symbolic adjustments while fundamental practices continued unchanged? The answer would emerge only through sustained observation of whether Coinbase accelerates BNB listing to actual trading availability, whether it shows more openness to BNB Chain ecosystem projects, and whether other exchanges feel compelled to enhance their own transparency in response to competitive pressure.

隨著 2025 年 10 月這場爭議的熱度逐漸退去,其對交易所行為及行業規範的長期影響仍未明朗。外界關注的是,公開壓力是否真的會改變未來交易所的上幣決策,還是只帶來短暫象徵性的調整而根本流程絲毫未變?真正的答案,有待觀察 Coinbase 是否會加速 BNB 正式上架、對 BNB Chain 生態系項目更加開放,以及其它交易所在競爭壓力下是否也提升自身透明度。

Broader Implications: The Future of Exchange Competition

The Coinbase - Binance listing dispute offers a lens through which to examine several crucial questions about cryptocurrency's evolution and the future of centralized exchange competition. Whether the specific controversy proves memorable or quickly fades, the underlying tensions it exposed will shape how exchanges

Coinbase 與 Binance 的上幣爭議,成為我們檢視加密貨幣產業演進及未來中心化交易所競爭的多個關鍵議題的切入口。無論這一具體事件最終是長久留存在集體記憶還是很快被遺忘,其所揭露的底層緊張關係,都將影響交易所未來的發展路徑。operate and compete in coming years.

未來幾年內的運作與競爭。

First, the episode highlights how centralized exchanges remain enormously powerful gatekeepers despite cryptocurrency's decentralization ethos. When Coinbase adds BNB to its roadmap, market prices react. When CZ urges listings of BNB Chain projects, media coverage surges. These platforms exercise influence over which tokens achieve mainstream adoption, which blockchain ecosystems attract users and developers, and which projects secure the liquidity necessary for growth. This power inevitably tempts exchanges to favor their own vertically integrated ecosystems, creating tension between their role as neutral infrastructure and their interests as competing businesses.

首先,這一事件凸顯了即便加密貨幣強調去中心化,中心化交易所依然是極具權力的守門人。當 Coinbase 將 BNB 納入其路線圖時,市場價格會產生反應。當 CZ 呼籲上架 BNB Chain 項目時,媒體報導也隨之增加。這些平台掌握著哪些代幣能夠主流化、哪些區塊鏈生態系能吸引用戶和開發者、以及哪些項目能獲得成長所需流動性的影響力。這種權力必然誘惑交易所偏袒自身的垂直整合生態,導致其作為中立基礎設施與作為競爭企業間的角色產生緊張。

The concentration of this power in just two dominant platforms - Coinbase and Binance - creates systemic risks for the broader ecosystem. If exchanges use listing decisions to disadvantage potential competitors or to extract excessive rents from projects seeking access, this could stifle innovation and reduce the dynamism that makes cryptocurrency compelling. Regulatory intervention might address the most egregious abuses, but regulation carries its own risks of excessive restriction or ossification. The optimal outcome would involve exchanges recognizing that long - term success requires maintaining trust and serving users' interests even when this conflicts with short - term profit maximization.

這股權力集中於僅有的兩大平台——Coinbase 與幣安(Binance)——為更廣泛的生態系帶來系統性風險。如果交易所利用上架決策來打壓潛在競爭對手,或對想要上架的項目收取過高費用,恐怕會壓抑創新並削弱加密貨幣原有的活力。監管介入雖可處理最惡劣的濫用情形,但監管本身也可能帶來過度限制或僵化的風險。最佳的情況是,交易所必須意識到只有在信任與用戶利益優先(即使有時與短期利潤最大化相衝突)下,才能長期成功。

Second, the competition between exchange - affiliated blockchain ecosystems - Base versus BNB Chain being merely the most prominent example - may define cryptocurrency's trajectory as much as the underlying technical innovations. These platforms represent attempts to capture network effects and vertical integration advantages similar to those that established tech giants like Apple, Google, and Amazon achieved in Web2. If successful, they could enable better user experiences, lower costs, and more seamless integration between trading, custody, and application access. But they also risk recreating in cryptocurrency the same platform power and lock - in effects that crypto's origins were meant to escape.

第二,與交易所相關聯的區塊鏈生態系(如 Base 與 BNB Chain 的競爭,只是最顯著的例子)也許會和底層技術創新一樣,決定加密貨幣的未來發展走向。這些平台企圖複製蘋果、Google、亞馬遜等 Web2 科技巨頭透過網路效應及垂直整合所建立的優勢。如果順利,它們確實能帶來更好的用戶體驗、更低成本,以及交易、託管、應用存取的無縫整合。但同時,也有可能讓加密貨幣重蹈本應逃避的平台壟斷和被綁定的覆轍。

Whether interoperability can emerge sufficiently to prevent winner - take - all dynamics remains uncertain. Technologies enabling cross - chain communication and asset transfers have improved dramatically, with bridges, wrapped tokens, and universal swap protocols providing users some ability to move between ecosystems. But fundamental friction remains when every blockchain uses different consensus mechanisms, programming languages, wallet software, and development tools. These technical barriers, combined with exchanges' strategic incentives to maintain proprietary advantages, may limit how interoperable the ecosystem becomes.

目前尚不確定跨鏈互通能否發展到足以防止「贏家通吃」局面。現有的跨鏈橋、包裹代幣、通用兌換協議等技術雖然大大提升了生態間資產流動性,讓用戶得以在生態系間轉移。但由於每條區塊鏈的共識機制、程式語言、錢包軟體及開發工具皆不同,基本的摩擦依然存在。這些技術障礙,加上交易所因維持自身優勢而採取的策略,或將限制生態系真正互通的程度。

Third, the listing controversy demonstrates the power and limits of transparency as a competitive strategy. Coinbase's emphasis on published standards, zero - fee listings, and the Blue Carpet framework provides marketing advantages and positions the exchange as responsible infrastructure. But transparency creates its own vulnerabilities. Public roadmap listings generate expectations and obligations. Documented policies constrain flexibility to make exceptions or adjust criteria based on circumstances. Perfect transparency about evaluation processes might enable gaming or reveal competitive intelligence to rivals.

第三,上架爭議展現了透明度作為競爭策略的力量與侷限。Coinbase 強調公開標準、免收上架費、Blue Carpet 機制等,為自身贏得行銷優勢,也讓其形象更像負責任的基礎設施。但高度透明也帶來風險:公開路線圖創造了外界對上架時程和結果的預期與壓力;書面政策讓例外和調整的彈性降低;過度公開評審流程還可能被濫用或洩漏競爭情資。

Binance's more opaque approach avoids these vulnerabilities but creates different risks. Without clear, published standards, projects face uncertainty about listing prospects and terms. This unpredictability might deter some projects from pursuing listings or lead them to competitors offering more defined processes. Opacity also enables accusations about favoritism, corruption, or arbitrary decision - making that damage reputation even when untrue. The optimal balance likely involves sufficient transparency to demonstrate fairness and build trust while preserving enough flexibility to manage competitive dynamics and individual circumstances.

相較之下,幣安選擇較不透明的做法,雖可規避上述問題,卻產生其他風險。沒有明確公開的標準,項目方對被上架的機會和條件感到不確定,這種不可預測性可能讓部分項目不願申請上架,轉投流程更清楚的平台。不透明也讓外界更容易質疑其內部偏袒、貪腐或隨意決策,即便事實未必如此。最佳平衡應是足夠透明來證明公正與建立信任,同時保有彈性以因應競爭與個別狀況。

Fourth, the episode reveals how regulatory compliance increasingly drives exchange behavior and competitive positioning. Both Coinbase and Binance now operate under significant regulatory oversight, though from different jurisdictions with different requirements. This regulatory fragmentation creates challenges for exchanges seeking global reach while maintaining consistent practices across markets. It also creates opportunities for regulatory arbitrage where exchanges emphasize operations in more permissive jurisdictions while limiting services in more restrictive markets.

第四,這次事件也揭露,合規已成主導交易所行為與競爭策略的關鍵因素。Coinbase 和幣安如今皆受重大監管,但所處司法管轄區不同,規範也有差異。這種分散的監管格局,對追求全球化經營且希望維持作業一致性的交易所帶來挑戰。同時也讓交易所有機會進行監管套利,在規範寬鬆的地區積極運營、而在要求較高市場縮減服務。

The trend toward comprehensive regulatory frameworks in major markets - MiCA in Europe, evolving legislation in the United States, updated guidelines in Singapore and Hong Kong - suggests that exchanges will face increasingly standardized requirements including capital adequacy, operational resilience, listing standards, and disclosure obligations. These requirements will favor larger, better - resourced platforms that can afford substantial compliance investments. Smaller exchanges may struggle to compete or may need to specialize in niches where they can differentiate despite fewer resources.

主要市場邁向更完整監管框架的趨勢,如歐洲的 MiCA、美國的新法規、新加坡與香港的更新指引等,代表交易所將面臨資本充足度、營運韌性、上架標準及資訊揭露等標準化要求。這些要求將有利於具備資本與資源投入合規的大型平台。規模較小的交易所可能難以競爭,或被迫專精於資源較少但可差異化的利基市場。

Fifth, the growing sophistication of decentralized alternatives threatens to disrupt centralized exchange dominance over medium to longer timeframes. Decentralized exchanges have achieved substantial scale, with Uniswap alone handling billions in daily trading volume across multiple blockchain networks. While DEXs currently represent a minority of total trading volume, their technological improvements in areas like liquidity concentration, automated market - making algorithms, cross - chain functionality, and gas optimization are gradually closing quality gaps with centralized platforms. As DEXs achieve better user experiences and more institutional - grade functionality, they may erode the moats that currently protect centralized exchanges.

第五,日益成熟的去中心化替代方案,正威脅著中心化交易所在中長期的主導地位。去中心化交易所(DEX)已具相當規模,僅 Uniswap 單一平台的每日交易量便以數十億計,且遍布多條區塊鏈。雖然 DEX 目前僅佔總量少數,但它們在流動性聚合、自動化造市、跨鏈功能、Gas 費優化等方面的技術進步,正逐步縮小與中心化平台之間的品質差距。當 DEX 提供更優質用戶體驗與更適合機構的功能後,或將逐漸侵蝕目前中心化交易所的護城河。

The centralized exchanges' best defense likely involves continued innovation in services that DEXs cannot easily replicate: fiat on - ramps and off - ramps, custody services for institutional clients, sophisticated derivatives products, margin trading, and regulatory compliance that enables traditional finance participation. By positioning themselves as essential infrastructure connecting traditional finance with decentralized protocols rather than competing directly with DEXs, centralized exchanges might sustain relevance even as pure trading functionality becomes increasingly decentralized.

對中心化交易所來說,最佳防守策略或許是持續創新那些去中心化交易所難以輕易複製的服務,如法幣充值與提現、機構客戶託管服務、複雜衍生品、保證金交易,以及合規讓傳統金融參與。將自身定位為連結傳統金融與去中心化協議的重要基礎設施,而非僅與 DEX 直接競爭,中心化交易所才有可能在純交易功能被去中心化的未來維持其重要性。