加密貨幣衍生品市場正在經歷權力根本性的轉換。多年來,中心化交易所主宰了永續合約這類產品—這種衍生品讓交易者能以槓桿並無到期日地參與加密價格的投機交易。但到了 2025 年,去中心化替代方案已占超過市場五分之一,這場轉變三年前還少有人能預料。

在這場革新的核心,是重新定義去中心化交易所可能性的 Hyperliquid。然而它的主導地位正遭遇 來自新星 Aster 的史無前例挑戰。Aster 由幣安共同創辦人趙長鵬 (CZ) 支持,平台自上線數週即爆炸式成長,每週交易量激增至數千億美元。這些平台間的交鋒,不僅是市占份額的競爭,更是未來加密交易基礎建設架構的主導權對決。

永續合約(俗稱「perp」)是一種衍生品,允許交易者以槓桿操作加密資產,無需擁有標的代幣。與傳統期貨在指定日期交割不同,永續合約可無限持有,且藉由資金費率機制與現貨市場保持價格連動—通常是多方人數多時,多單方需定時支付空單。這套機制讓永續合約成為加密交易主流,2025 年約佔總加密交易量的 68%~75%。

去中心化永續交易所的核心吸引力在於用戶完全掌控資產,避開如 FTX 崩潰時受害者慘劇的對手方風險。這類平台將交易結算置於鏈上,強調透明,杜絕中心化場外的黑箱操作。過去的代價則是表現-去中心化平台在速度、流動性深度和專業體驗上長期落後專業交易者的需求。

但 Hyperliquid 的崛起徹底改變了這個現狀。該平台證明了去中心化基礎設施能媲美甚至超越中心化交易所的效能,不僅交易能在秒內完成且完全透明。這成就引發資本大舉流向去中心化交易領域,尤其當全球監管壓力擴大,越來越多交易者尋求自我保管資產的管道。

市場演變:從利基走向主流

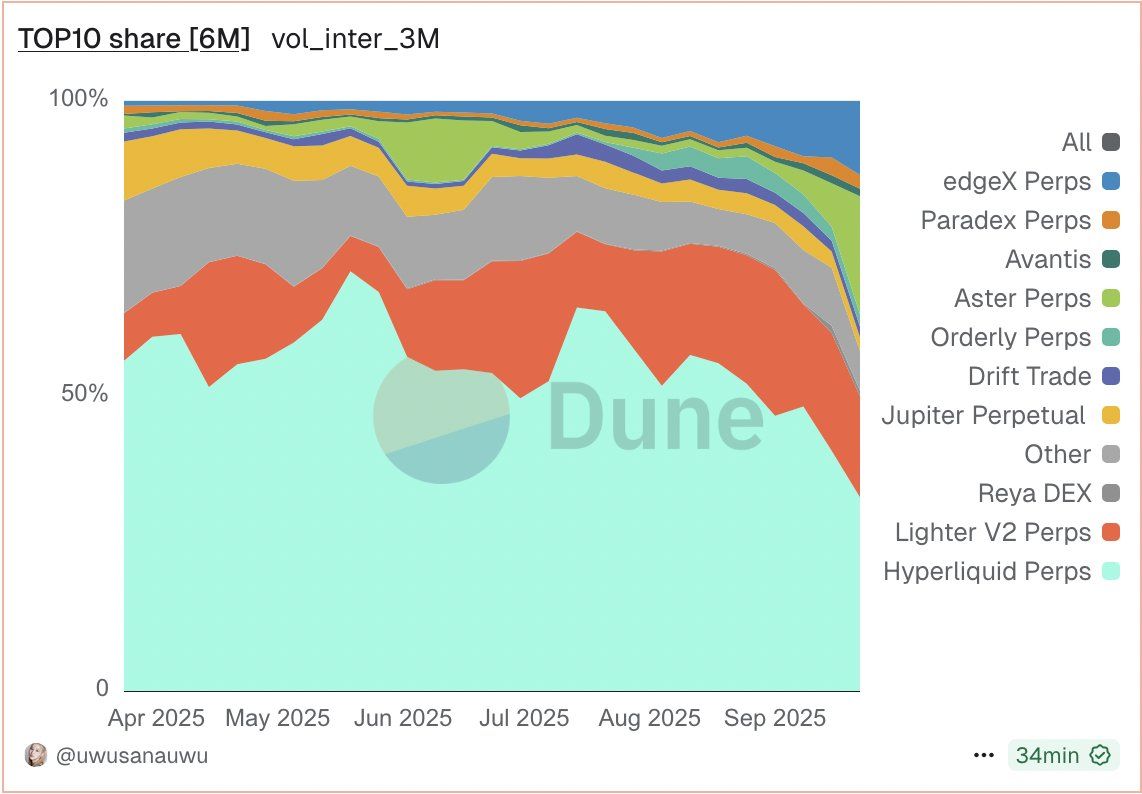

去中心化永續平台的成長軌跡,是加密市場結構劇變的最佳寫照。2022 年前,去中心化永續平台只佔中心化交易所交易量的不到 2%。到 2024 年中,這比例攀升至 4.5% 以上。2025 年 9 月,去中心化平台市占已突破 20%,部分指標顯示甚至達 26%。

以絕對數字說明:2025 年第一季,前十大中心化交易所共處理約 5.4 兆美元永續合約量,僅幣安一間就有 2 兆美元。同期,去中心化平台也已做到數千億美元的交易量。2025 年第二季去中心化永續交易量達 8980 億美元。光是 2025 年 9 月,這類平台即首度單月突破 1 兆美元交易量。

這波爆發式成長有多重推力。多地監管打擊中心化所,促使交易者尋求更隱私、更能抗審查的選項。2022 年 11 月 FTX 崩潰及其他中心化機構倒閉事件,使非託管交易需求激增。區塊鏈技術突破—尤其在延遲、吞吐量和 gas 費優化—終於令高頻去中心化交易實現。

DeFi 流動性基建成熟亦至關重要。早期平台流動性分散、滑價嚴重,較大單交易成本極高。新一代平台已經達到可比中型中心化所的流動性深度,更採用與傳統市場相近的訂單簿架構。這推動不僅散戶,也吸引量化機構及尋求合規與透明的機構玩家進場。

中心化與去中心化交易平台之間競爭,體現了明確的取捨。中心化所絕對流動性仍有優勢—例如幣安在數百萬美元大單滑價可低於 0.3%。同時整合進階圖表、手機端和客服功能,也能提供最高 125 倍槓桿及複雜的訂單類型與組合保證金。

相對地,去中心化平台主打非託管、自主管理私鑰,杜絕對手方風險。多數平台無需 KYC,保留隱私並向受限制地區用戶開放。所有交易、清算及資金費率都完全鏈上透明。多家平台甚至設計創新代幣經濟,將協議收益直接回饋給代幣持有者,而非公司股東。

於是交易者的選擇越來越看重自身需求:追求極致流動性與最低延遲的大額專業戶多半仍以中心化所為主。但愈來愈多重視資產自保、透明和抗審查性的群體,則願意接受些微較高滑價及仍在發展中的產品生態。兩者體驗上的差距也正月月縮小,去中心化平台持續快速優化服務。

Hyperliquid:老牌主宰

Hyperliquid 之所以能主導去中心化永續合約市場,是規模化產品與市場需求精准結合的經典。自 2023 年私測、2024 年全面上線以來,平台結合技術創新與社群激勵大獲交易者青睞。至 2025 年 3 月,Hyperliquid 累積處理永續合約總交易額已逾 1 兆美元,市佔率約 6 成。2025 年 5 月,單月交易量 2480 億美元,總鎖倉價值翻倍至 14.6 億美元,營收突破 7000 萬美元。

其主導地位於 2025 年中達到高峰,市占 75~80% 的去中心化永續市場。最亮眼的 2025 年 7 月,單月成交量 3200 億美元,單月增長 47%,當月區塊鏈協議總營收市占率達 35%。每日交易規模經常超過 150 億美元,是 dYdX、ApeX 與 Drift 等對手總和的二十倍以上。

Hyperliquid 有別於過去去中心化衍生品試驗的根本,在於其底層架構。並非在以太坊等現成鏈上或一般 layer-2 延伸部署,Hyperliquid 團隊打造了專為高頻交易最佳化的客製 Layer-1 區塊鏈,採 HyperBFT 共識機制,能提供秒級最終性並支援每秒逾 20 萬筆訂單處理—表現堪比甚至超越眾多中心化交易所。

架構上分為兩大核心:HyperCore 是鏈上撮合引擎,負責訂單提交、成交、保證金管理及清算,都在中心限價訂單簿系統內執行。不同於早期 DeFi 流行的做市商機制,Hyperliquid 改採專業交易者熟悉的訂單簿架構,實時展示買賣盤並能精準按價成交,整個過程全數鏈上流轉,避免競品的鏈外撮合黑箱。

HyperEVM 則作為兼容以太坊虛擬機的通用型智能合約層,讓現有以太坊應用能無縫移植並激發生態擴張。到 2025 年 9 月,HyperEVM 已支援 100 多個協議,總鎖倉額約 20 億美元,每日應用營收約 300 萬美元。主流 DeFi 專案如 Pendle、Morpho、Phantom 都已上鏈部署,本地應用如 Kinetiq、Hyperlend 也同步成長。

Hyperliquid 的使用者體驗專為破除過去去中心化痛點設計。平台永續合約交易免 gas 費,消除了高頻交易在傳統 DEX 上的難題。撮合費率與中心化所看齊,掛單者最高回饋 0.02%,吃單費 0.05%。主流資產如比特幣與以太幣可用最高 50 倍槓桿,超過 150 個交易對包括主流及長尾幣種。

平台不要求 KYC procedures - users simply connect a Web3 wallet to begin trading. This permissionless access has attracted users from jurisdictions with restrictive financial regulations, though it has also drawn scrutiny from regulators concerned about compliance with anti-money laundering requirements. Hyperliquid's terms of service restrict access from the United States, Canada's Ontario province, and sanctioned regions, though enforcement relies on users' attestations rather than active geographic blocking.

程序 —— 用戶只需連接 Web3 錢包即可開始交易。這種無需許可的存取方式吸引了來自金融管制嚴格地區的用戶,不過也因此受到監管機構的關注,他們擔心反洗錢規範的遵循情況。Hyperliquid 的服務條款禁止美國、加拿大安大略省,以及受制裁地區的用戶存取,但執行主要依賴用戶自我聲明,而非積極的地理封鎖。

The HYPE token lies at the heart of Hyperliquid's economic model. Launched through a community airdrop in November 2024, the token distributed 310 million units - 31 percent of the total 1 billion supply - to early users based on trading activity and platform participation. This airdrop, valued at several billion dollars at peak prices, created substantial wealth for active community members and established goodwill that competitors have struggled to replicate.

HYPE 代幣是 Hyperliquid 經濟模型的核心。該代幣於 2024 年 11 月通過社群空投發行,根據用戶的交易活動及平台參與度,向早期用戶分配了 3.1 億枚代幣,佔總供應量 10 億枚的 31%。這次空投在價格高點時價值數十億美元,讓活躍社群成員獲得了巨大財富,也建立起同業難以比擬的信任基礎。

HYPE serves multiple functions within the ecosystem. Token holders can stake to participate in network security while earning rewards. The token grants governance rights, allowing holders to propose and vote on protocol upgrades and parameter adjustments. Most significantly, Hyperliquid implements an aggressive fee-burning mechanism that allocates approximately 97 percent of protocol fees to buy back and burn HYPE tokens, creating deflationary pressure that theoretically benefits long-term holders.

HYPE 在生態系中扮演多重角色。代幣持有者可以質押(Staking)參與網絡安全,並獲取獎勵;同時,HYPE 擁有治理權,賦予持有人提案及投票決定協議升級和參數調整的權力。值得一提的是,Hyperliquid 採取激進的手續費銷毀機制,約 97% 的協議手續費會用於回購並銷毀 HYPE 代幣,形成通縮壓力,理論上有利於長線持有者。

As of late September 2025, HYPE trades around $44 to $49, down from an all-time high of approximately $51 reached in August. The token commands a market capitalization exceeding $12.6 billion, making it the 19th-largest cryptocurrency by market cap. Trading volume regularly exceeds $600 million daily, providing liquidity for both long-term investors and active traders.

截至 2025 年 9 月底,HYPE 價格約為 44 至 49 美元,較 8 月創下的歷史高點約 51 美元有所回落。該代幣市值超過 126 億美元,位居加密貨幣市值排行第 19 名。日均交易量穩定超過 6 億美元,為長線投資人與主動交易者提供了充足流動性。

Yet Hyperliquid faces structural challenges that complicate its outlook. Beginning in November 2025, the platform will initiate a major token unlock, gradually releasing approximately 237.8 million HYPE tokens - representing 23.8 percent of total supply - to core contributors over 24 months. This translates to roughly 9.9 million tokens entering circulation monthly, worth approximately $446 million at current prices. Token unlocks of this magnitude create persistent selling pressure as recipients convert their holdings to liquid capital, potentially constraining price appreciation even as the protocol thrives operationally.

然而,Hyperliquid 也面臨結構性挑戰,令前景複雜化。自 2025 年 11 月起,平台將啟動大規模代幣解鎖,在 24 個月內,逐步向核心貢獻者釋放約 2.378 億枚 HYPE,約占總供應量 23.8%。這意味著每月約有 990 萬枚新幣流入市場,按現價計算約值 4.46 億美元。如此規模的解鎖,將產生長期拋壓,得幣者會兌現資產換取現金,即便協議運營表現亮眼,也可能壓抑代幣上漲。

Analysts debate how this selling pressure will interact with Hyperliquid's fee-burning mechanism. Optimists note that the protocol's strong revenue generation - it regularly ranks among the top three crypto assets by fee revenue - should provide substantial buying power to offset unlock-related sales. The platform's upcoming HIP-3 proposal, which would require builders to stake significant HYPE holdings to launch new perpetual markets, could create additional demand that functions as a "supply sink" for the token. Critics counter that monthly unlock volumes exceeding $400 million will overwhelm even robust buyback programs, particularly if trading volumes decline or competition erodes market share.

分析師對這波拋壓與 Hyperliquid 的手續費銷毀機制間的動態關係持不同看法。樂觀者指出,該協議的收入表現強勁,手續費收入長期位居前三大加密資產,應能產生顯著回購力度,抵銷解鎖帶來的賣壓。而即將推出的 HIP-3 提案,要求建商質押大量 HYPE 才能上線新永續合約市場,亦可能產生額外需求成為「供給黑洞」。但批評者認為,即便回購機制完善,每月 4 億美元以上的解鎖規模仍可能壓過買盤,尤其遇上交易量下滑或市場份額被競爭者侵蝕時。

Aster's Meteoric Rise: The Binance-Backed Challenger

If Hyperliquid's story is one of methodical market capture through technological excellence, Aster's trajectory represents disruption through explosive growth and high-profile backing. The platform emerged from the merger of Astherus, a multi-asset liquidity protocol, and APX Finance, a decentralized perpetuals platform, completed in late 2024. The combined entity officially launched under the Aster brand on March 31, 2025, with modest expectations for gradual adoption.

如果說 Hyperliquid 的發展歷程是一場有規劃、穩紮穩打的技術型市場攻堅,那麼 Aster 則代表著爆炸式成長與明星背書帶來的顛覆。該平台由多資產流動性協議 Astherus 與去中心化永續合約協議 APX Finance 於 2024 年底合併誕生。合併後的新實體於 2025 年 3 月 31 日正式以 Aster 品牌上線,初期僅預期緩慢推廣。

What followed defied industry norms. Aster's token generation event on September 17, 2025, catalyzed a price surge exceeding 1,500 percent in the first 24 hours, briefly pushing the token to a $3.2 billion market cap and the 50th position among all cryptocurrencies by valuation. More significantly, the platform's trading volumes exploded from negligible levels to over $270 billion weekly within weeks of launch. By late September 2025, Aster had captured majority market share among decentralized perp exchanges, processing $290 billion in perpetual trading volume over a 30-day period and surpassing Hyperliquid in some short-term metrics.

後續發展超乎業界想像。Aster 於 2025 年 9 月 17 日舉辦代幣生成活動,24 小時內價格暴漲超過 1,500%,一度推高市值至 32 億美元,排名衝上所有加密貨幣第 50 位。更關鍵的是,平台交易量在上線數週內從幾乎為零暴增至每週超過 2,700 億美元。至 2025 年 9 月底,Aster 已奪下去中心化永續合約市場的多數市佔,30 天總交易量高達 2,900 億美元,有些指標甚至暫時領先 Hyperliquid。

The catalyst for this remarkable adoption was unambiguous: Changpeng Zhao's public endorsement. CZ, as the Binance co-founder is universally known, posted his support for Aster on social media in September 2025, explicitly comparing it favorably to competitors. The endorsement carried extraordinary weight given CZ's status as crypto's most influential figure and Binance's position as the industry's largest exchange. Within days, Aster's total value locked briefly hit $2 billion before stabilizing around $655 million. Trading volume surged as both retail traders and whales - including BitMEX co-founder Arthur Hayes - rotated capital from Hyperliquid to explore the new platform.

推動這一波驚人採用的關鍵原因毫不含糊:趙長鵬(CZ)的公開加持。這位幣安共同創辦人在 2025 年 9 月於社群媒體表態力挺 Aster,並直接將其與同儕競品相較。這番背書由於 CZ 本身在圈內地位,以及幣安作為最大交易所的影響力,顯得分外重要。幾日內,Aster 的總鎖倉價值(TVL)瞬間衝上 20 億美元高點,隨後回穩在 6.55 億美元左右。交易量激增,包括散戶與巨鯨 —— 例如 BitMEX 共同創辦人 Arthur Hayes —— 都將資本從 Hyperliquid 轉入以探索新平台。

Aster's competitive positioning emphasizes several differentiators. Unlike Hyperliquid's custom blockchain, Aster operates natively across multiple networks including BNB Chain, Solana, Ethereum, and Arbitrum. This multi-chain approach lowers friction for traders already active on these ecosystems, eliminating the need to bridge assets to a new network. The platform offers eye-watering leverage up to 1,001x on select pairs - far exceeding Hyperliquid's 50x maximum and even surpassing Binance's 125x limit for eligible traders. While such extreme leverage attracts attention and generates trading volume, it also magnifies risks and has drawn criticism from those concerned about retail trader protection.

Aster 的競爭定位強調多項差異化特色。不同於 Hyperliquid 的專屬區塊鏈,Aster 原生支援 BNB Chain、Solana、Ethereum 與 Arbitrum 等多條鏈。這種多鏈策略大幅降低了已在這些生態活躍用戶的進入門檻,無需將資產橋接至新網絡。平台最高提供 1,001 倍槓桿(限指定交易對),遠超 Hyperliquid 的 50 倍上限,甚至超過幣安對合資格交易員開放的 125 倍。如此極端槓桿固然吸引關注與交易量,但也帶來高度風險,並引發對散戶保護不足的批評。

The platform's "Trade & Earn" model allows users to employ yield-bearing assets as margin for perpetuals trading, theoretically enabling capital to serve dual purposes. This innovation addresses a common inefficiency where traders must choose between earning yield on stablecoins in lending protocols versus deploying those assets as trading margin. Aster also emphasizes privacy features, notably "Hidden Orders" that allow large traders to place orders without revealing size and price to the market - addressing a pain point CZ himself highlighted in June 2025 when advocating for dark pool functionality in decentralized exchanges.

平台的“Trade & Earn” 模型允許用戶將可產生收益的資產作為永續合約交易保證金,理論上讓資本可同時發揮雙重效益。這創新解決了過去交易者在穩定幣存借協議賺取利息與用作交易保證金間必須二選一的效率損失。Aster 也強調隱私特性,特別是“隱藏單”功能,讓大戶下單不必向市場暴露其數量和價格 —— 這正好回應 2025 年 6 月時 CZ 對去中心化交易所黑池需求的倡議。

Aster's institutional backing extends beyond CZ's endorsement. The project received support from YZi Labs, formerly known as Binance Labs, the investment and incubation arm of Binance. While the exact financial terms remain undisclosed, this backing provides not just capital but also access to Binance's extensive network of market makers, trading firms, and institutional partners. The platform's close ties to Binance raise questions about how "decentralized" it truly is - a tension evident in its reliance on Binance's oracles for price feeds and its integration with the broader BNB Chain ecosystem.

Aster 的機構支持不僅止於 CZ 的背書。該項目獲得 YZi Labs(前身為 Binance Labs,即幣安的投資與孵化部門)支援。儘管實際投資條件尚未公開,但這份資助不只是帶來資金,更為 Aster 打開了幣安龐大造市商、交易機構和機構夥伴網絡。平台與幣安系統高度關聯,也引發外界對其“去中心化”實質程度的疑慮 —— 例如對於報價預言機高度依賴幣安、深度接入 BNB Chain 生態系等現象。

The platform's tokenomics and incentive structure have proven controversial. Aster implemented an aggressive points program that rewards trading activity with season-based accumulations expected to convert to token allocations. Critics argue that such programs inevitably attract mercenary capital - traders who farm points through wash trading or other artificial volume generation, only to dump tokens and depart once rewards vest. Data showing Aster's volume-to-open-interest ratio at unusually high levels compared to established platforms lends credence to these concerns.

Aster 的代幣經濟與激勵機制也存在爭議。平台推出激進的積分活動,根據每季累積量獎勵交易行為,且預期可轉成代幣分配。批評指出,此類活動免不了吸引「傭兵」資本 —— 即透過對敲等手法洗出虛假交易量,只為刷積分和未來拋售套現。據數據顯示,Aster 的交易量與未平倉量比值遠高於老牌競品,反映這種隱憂。

Open interest, which measures the total value of outstanding futures contracts, provides a more stable indicator of genuine platform adoption than raw trading volume. While Aster's trading volume briefly exceeded Hyperliquid's in late September 2025, its open interest remained substantially lower. This discrepancy suggests that much of Aster's volume stems from short-term speculative positioning and incentive farming rather than sustained capital commitment from users building lasting positions.

未平倉量(open interest)指的是尚未結算的合約總價值,比起單一交易量,更能穩定反映用戶對平台的真實採用情況。2025 年 9 月底,Aster 的交易量雖短暫超越 Hyperliquid,但其未平倉量卻明顯較低。這種差距顯示,Aster 很大部分成交量來自短線投機與激勵刷單,而非用戶長期持倉的實質資本承諾。

Some analysts detect warning signs in Aster's explosive growth pattern. The platform's 30-day total value locked fluctuates dramatically, and concerns about wash trading persist despite the platform's anti-manipulation mechanisms. The upcoming token unlock scheduled for mid-October 2025 - releasing approximately 11 percent of supply - will test whether early users remain committed or capitalize on price appreciation to exit positions. Market observers note that projects experiencing parabolic initial growth often face steep corrections once incentive programs mature and early adopters seek liquidity.

有分析師認為,Aster 的爆發式成長模式亦隱含警訊。其 30 日鎖倉總價劇烈波動,加上即便平台設有防操控機制,市場仍憂慮洗單現象。預定於 2025 年 10 月中旬的代幣解鎖將釋放約 11% 流通量,屆時能否留住早期用戶,不被套現離場,是一大考驗。市場觀察指出,初期成長呈現拋物線的項目,等激勵結束、早鳥求現之時,經常面臨劇烈修正。

Yet dismissing Aster as merely a flash-in-the-pan phenomenon would be premature. The platform has demonstrated genuine innovation in areas like hidden orders and multi-chain accessibility. Its revenue metrics, while disputed, show substantial fee generation that could translate to sustainable business fundamentals if retained. The backing from CZ and the Binance ecosystem provides resources and credibility that few competitors can match. Most significantly, Aster has exposed Hyperliquid's vulnerability to competition - proving that decentralized perp markets remain contestable rather than winner-take-all.

然而,若單純認為 Aster 僅曇花一現也為時過早。平台在隱單、多鏈存取等方面展現了真正創新。其收入數據(雖存在爭議)顯示手續費產能可觀,若能持續,或有機會變現強勁的營運體質。來自 CZ 與幣安生態的資源與信用,更是極少競品能及。最重要的是,Aster 揭示了 Hyperliquid 面臨競爭的脆弱性 —— 驗證了去中心化永續市場始終存在優勝劣敗機會,而非贏者全拿的格局。

The platform's roadmap includes launching its own Layer-1 blockchain, currently in internal testing, designed specifically for private perpetuals trading using zero-knowledge proofs. This "Aster Chain" aims to provide institutional-grade privacy that masks trade sizes and profit-and-loss while maintaining auditability - a feature set that could attract large traders and funds requiring confidentiality. If successfully implemented, this infrastructure could differentiate Aster from transparent alternatives while addressing compliance concerns that prevent many traditional institutions from embracing fully public blockchains.

平台發展藍圖還包括打造專屬 Layer-1 區塊鏈,目前已進入內部測試。該區塊鏈專為零知識證明下的私密永續合約交易打造,稱為 “Aster Chain”,旨在提供機構級別的隱私保障 —— 可隱藏交易規模、盈虧資訊,卻又保有可稽核性。這一特性,有機會吸引要求高度隱密的大戶與機構資金。若能落實,Aster Chain 將與現有高度透明模式拉出明顯區隔,也有望解決不少傳統機構因合規顧慮而不敢採用公開鏈的難題。

The Competitive Landscape: Beyond the Duopoly

While Hyperliquid and Aster dominate headlines, the decentralized perpetual futures ecosystem includes numerous platforms pursuing distinct strategies. Some position themselves as direct competitors to the market leaders, while others target underserved niches or experiment with novel mechanisms.

雖然Hyperliquid和Aster成為新聞焦點,去中心化永續合約生態系其實還包含許多採取不同策略的平台。有些平台直接與市場領導者競爭,其他則專注於服務尚未被滿足的利基市場或嘗試創新機制。

Lighter has emerged as perhaps the most credible third player in the space. Backed by prominent venture capital firms including Andreessen Horowitz (a16z), Dragonfly Capital, Haun Ventures, and Lightspeed Venture Partners, Lighter launched its private beta in January 2025 and transitioned to public mainnet in late summer. The platform processed approximately $9 billion in weekly trading volume as of late September 2025, capturing roughly 16.8 percent of decentralized perp market share.

Lighter已然成為這個領域中最具可信度的第三大平台。該平台獲得包括Andreessen Horowitz (a16z)、Dragonfly Capital、Haun Ventures以及Lightspeed Venture Partners等知名創投公司的支持,並於2025年1月推出私測版本,於夏季末正式上線主網。截至2025年9月底,該平台每週交易量約為90億美元,占去中心化永續合約市場約16.8%的份額。

Lighter's core innovation lies in its proprietary zero-knowledge rollup architecture, which enables the platform to prove every computation its central limit order book engine executes with sub-5-millisecond latency while settling finality to Ethereum. This approach theoretically provides the performance of a centralized exchange with the security guarantees of Ethereum settlement - a hybrid model that differs from both Hyperliquid's independent Layer-1 and Aster's multi-chain deployment. The platform targets institutional traders and high-frequency trading firms through a differentiated fee structure: retail traders accessing the front-end pay zero fees, while API and algorithmic trading flows incur charges that monetize professional usage.

Lighter的核心創新在於其專有的零知識滾動架構,使平台能夠在5毫秒以內延遲的情況下驗證中心限價訂單簿引擎執行的每一次計算,同時將結算最終性提交到以太坊。這種方法理論上能兼得中心化交易所的效能以及以太坊結算的安全保證,是一種有別於Hyperliquid獨立Layer-1和Aster多鏈部署的混合模式。該平台針對機構交易者和高頻交易公司設計了差異化費率架構:前端散戶免手續費,API及程式化交易則收取費用,以實現專業用戶變現。

Since launching public mainnet, Lighter has demonstrated impressive growth metrics. The platform achieved over $2 billion in daily trading volume with total value locked rising from $2.5 million in early March to over $340 million by July 2025. It attracted more than 56,000 users during its private beta phase, with approximately 188,000 unique accounts and 50,000 daily active users recorded. The platform's points program, which runs through late 2025 and is widely interpreted as preceding a token launch, has effectively incentivized participation.

自主網公開上線以來,Lighter展現了驚人的成長數據。該平台日交易量突破20億美元,鎖定總價值(TVL)從三月初的250萬美元激增至2025年七月超過3.4億美元。其私測階段吸引超過56,000名用戶,總計約有188,000個獨立帳戶與50,000個日活躍用戶。平台的積分計劃預計運行至2025年底,廣泛被認為可能是發幣前奏,並有效激勵了用戶參與。

Yet questions surround the sustainability of Lighter's growth. Its volume-to-open-interest ratio sits around 27 - substantially higher than Hyperliquid's 0.76, Jupiter's 2.44, or dYdX's 0.40. Analysts typically consider ratios below 5 as healthy, with figures above 10 suggesting significant wash trading or incentive-driven activity. Lighter's points system, while effective at attracting users, may be "contributing heavily to the platform's upbeat figures," as one analyst noted. The platform must demonstrate that users remain engaged once points programs conclude and token incentives vest.

不過,外界對於Lighter的成長是否能夠持續仍有疑慮。其交易量與未平倉合約比例接近27,遠高於Hyperliquid的0.76、Jupiter的2.44或dYdX的0.40。分析師普遍認為,該比率低於5才算健康,超過10則可能存在大規模刷量或激勵驅動的行為。一位分析師指出,Lighter的積分機制雖然成功引流,但「可能大幅推升了平台數據」。Lighter必須證明在積分活動結束、代幣激勵釋放後,仍然能夠維持用戶活躍度。

EdgeX, a Layer-2 blockchain built atop Ethereum specifically for perpetual futures trading, represents another significant competitor. The platform processed approximately $6.1 billion in weekly trading volume in late September 2025, making it the fourth-largest on-chain derivatives trading project. EdgeX differentiates through its focus on fairness and transparency, employing mechanisms designed to prevent front-running and ensure that all market participants receive equitable treatment regardless of connection speed or geographic location.

EdgeX是另一個重要競爭者,該平台作為以太坊上的Layer-2專為永續合約設計。2025年9月底每週交易量約為61億美元,是第四大鏈上衍生品交易項目。EdgeX透過強調公平與透明來差異化競爭,採用機制防止搶跑,確保所有用戶不受連線速度或地理位置影響,都能獲得平等對待。

Jupiter Perpetuals, the derivatives offering from Solana's largest decentralized exchange aggregator, has carved out meaningful market share by leveraging its existing user base and Solana's high-speed, low-cost infrastructure. The platform processed approximately $21.5 billion in perpetual trading volume during September 2025, ranking fifth among decentralized perp platforms. Jupiter offers leverage up to 100x on major cryptocurrencies and benefits from deep integration with Solana's DeFi ecosystem, allowing users to seamlessly transition between spot trading, yield farming, and perpetuals without bridging to other networks.

Jupiter Perpetuals作為Solana最大去中心化交易匯聚器推出的衍生品平台,憑藉既有用戶基礎與Solana的高速、低成本基礎設施,在市場佔有一席之地。2025年9月,該平台永續合約交易量約為215億美元,排名第五。Jupiter為主要加密貨幣提供最高100倍槓桿,並與Solana DeFi生態深度結合,讓用戶在現貨、收益農耕和永續合約間無縫切換,無需跨鏈橋接其他網路。

Additional platforms including DIME, ORDER, REYA, APEX, AVNT, RHO, Ostium, Hibachi, and MKL have attracted meaningful volume, collectively processing billions in weekly trades. Many experiment with novel approaches: some employ hybrid automated market maker and order book models, others focus on specific asset classes like tokenized real-world assets, and several target particular geographic markets or language communities.

其他平台如DIME、ORDER、REYA、APEX、AVNT、RHO、Ostium、Hibachi和MKL同樣吸引了可觀交易量,合計每週處理數十億美元的交易。許多平台嘗試創新方式:部分採混合AMM與訂單簿模式,部分專注於特定資產類別(如代幣化實體資產),還有一些專為特定地區或語言社群設計。

The diversity of approaches suggests that the decentralized perpetual futures market remains in its experimental phase, with multiple competing visions for optimal architecture, user experience, and economic models. This proliferation of platforms benefits traders through competition that drives innovation and fee compression. However, it also fragments liquidity - a trader seeking to execute a large order may need to route across multiple platforms to achieve acceptable slippage, adding complexity that centralized exchanges avoid through concentrated liquidity pools.

多元化的發展方向顯示去中心化永續合約市場仍處於實驗階段,關於最佳架構、用戶體驗及經濟模型皆有多元競爭藍圖。平台百花齊放帶動創新及手續費下滑,有利於交易者,然而也造成流動性分散——大單交易者可能需跨多平台掛單才能避免過大滑價,這種複雜性是中心化交易所以集中流動池可以避免的。

Volume Versus Open Interest: Understanding the Metrics That Matter

The competition between Hyperliquid and Aster has elevated a longstanding debate about which metrics best measure a derivatives platform's true strength. Trading volume and open interest each tell part of the story, but they measure fundamentally different phenomena with distinct implications for platform health and sustainability.

Hyperliquid與Aster間的競爭再次突顯出一個長期爭論:究竟哪些指標最能衡量衍生品平台的真正實力?成交量和未平倉量各自反映部分真相,但兩者本質量度的現象不同,對平台健康與永續性有截然不同的意義。

Trading volume represents the total notional value of contracts traded over a specific period - typically measured daily, weekly, or monthly. High volume indicates active price discovery, tight spreads, and sufficient liquidity for traders to enter and exit positions. Platforms pursuing volume growth often implement maker rebates that reward liquidity providers, creating incentives for market makers to quote competitive prices. Volume also generates fee revenue directly - platforms typically charge a percentage of notional traded, meaning higher volume translates to greater protocol income.

交易量代表在特定期間內成交合約的名義總價值(通常以日、週或月計)。高交易量表示有積極的價格發現、窄價差,以及足夠流動性讓交易者順利進出場。為了推動成交量增長,平台常設置造市者返現獎勵,激勵流動性供應者報價競爭。交易量同時直接帶來手續費收入——平台收取名義成交額的一定比例,高成交量即代表協議收入增加。

Open interest measures the total value of outstanding futures contracts that remain open and unsettled at a given moment. It represents capital commitment - traders holding positions with unrealized profits or losses, rather than simply churning through short-term trades. Open interest grows when new contracts are created through a trade where both parties are opening positions, and it decreases when both parties are closing existing positions. Unlike volume, which can be generated repeatedly by the same capital trading back and forth, open interest reflects actual market participation depth.

未平倉量則測量在某一時刻仍未結算的所有永續合約總價值。這代表資金的實際承諾——交易者持倉尚有未實現損益,而非只是反覆短線操作。雙方於開新倉時未平倉量會上升,雙方同時平倉時則下降。與交易量不同,未平倉量不能無限反覆產生,它更切實反映了市場參與深度。

DeFi analyst Patrick Scott has articulated the key distinction in explaining why he considers Hyperliquid more investable than Aster despite the latter's volume surge: "Unlike volume and revenue, which measure activity, open interest measures liquidity. It's much stickier." As of early October 2025, Hyperliquid commands approximately 62 percent of the decentralized perpetual exchange open interest market - substantially higher than its 8 to 38 percent share of trading volume depending on timeframe measured.

DeFi分析師Patrick Scott就此點明:他認為即便Aster成交量激增,Hyperliquid仍更具投資價值。「成交量和收入只是活動指標,未平倉量才是流動性,它更黏著。」截至2025年10月初,Hyperliquid在去中心化永續合約市場的未平倉量佔比約62%,遠高於其在成交量上的8至38%市佔(依據不同時間段計算)。

This divergence reveals important dynamics. Aster's explosive volume growth, which saw it process over $270 billion weekly by late September, has not translated to proportional open interest capture. The platform's volume-to-open-interest ratio remains elevated, suggesting that much trading activity represents short-term speculation, algorithmic trading churning through positions, or points farming rather than sustained capital allocation. Traders may be using Aster for specific trades or to farm incentives while maintaining their core positions and margin on Hyperliquid or other established platforms.

這種差異揭示了關鍵動態。Aster成交量爆發式成長,到9月底每週交易額超過2700億美元,但未平倉量卻未同步提升。其交易量與未平倉量之比始終偏高,顯示大量操作來自短線投機、程式化交易不斷開平倉,或單純為積分農耕,而非實質資金長期配置。許多交易者可能只在Aster上操作特定交易或挖激勵,但將主倉、保證金仍放在Hyperliquid等老牌平台。

High volume combined with low open interest can indicate several scenarios, not all problematic. Active traders who rapidly enter and exit positions contribute genuine volume without maintaining significant open interest. Arbitrageurs exploiting price discrepancies between platforms generate substantial volume while keeping positions minimal. Market makers providing liquidity through algorithmic quoting add volume without directional exposure. These activities support price efficiency and tight spreads.

高成交量搭配低未平倉量可能出現於多種情形,並非全為負面。積極的短線交易者頻繁進出場,會拉高成交量,但未必持續保有大量持倉。套利者在多平台間搬磚,也能創造大量成交但維持低持倉。流動性提供者程式報價,提升成交量卻不暴露趨勢風險。這些行為都有助於價格效率與縮小價差。

However, artificially inflated volume through wash trading - where the same party trades with itself or colluding entities to fake activity - remains a persistent concern in cryptocurrency markets. While decentralized platforms' transparency theoretically exposes wash trading more readily than centralized exchanges' black-box operations, sophisticated actors can obscure their activities through multiple wallets and complex trading patterns. Platforms running aggressive incentive programs that reward volume regardless of sustainability risk attracting mercenary capital that departs once rewards diminish.

然而,通過自成交或共謀洗單來虛增交易量的行為,在加密貨幣市場依然是長期隱憂。理論上,去中心化平台的透明性較中心化「黑箱」更易揭露洗單,但精明玩家可透過多錢包和複雜策略掩蓋行跡。若平台大量發放和成交量掛鉤的激勵措施,極易吸引唯利是圖的資本,在獎勵衰退後立刻撤離。

Open interest stability provides a more reliable signal of platform stickiness and user commitment. Traders who maintain leveraged positions over days or weeks demonstrate confidence in the platform's reliability, security, and fair execution. High open interest relative to total value locked indicates capital efficiency - users putting their deposits to work in active positions rather than leaving funds idle. Platforms with deep open interest can better withstand market volatility, as the margin backing these positions provides stability during price swings.

未平倉量的穩定性則更能反映平台的黏著度與用戶承諾。交易者能在平台長時間持有槓桿持倉,代表他們信任其穩定性、安全性與公平執行。若未平倉量與鎖倉總價值停留在高檔,意味資金運用效率高——用戶將資產實際投入市場,而非閒置。未平倉量深厚的平臺也較能抵禦波動,因為有更多保證金支撐。

Hyperliquid's ability to maintain dominant open interest market share even as competitors capture volume suggests several strengths. Its proven track record and months of reliable operation without major exploits or failures have earned user trust. Professional traders and market makers - who typically maintain larger positions and contribute disproportionately to open interest - may prefer Hyperliquid's mature infrastructure and deeper liquidity for their core operations while experimenting with new platforms for tactical trades. The platform's comprehensive trading pairs and efficient liquidation mechanisms reduce the risk of cascading failures during volatility.

交易對和高效的清算機制降低了市場波動期間連環崩盤的風險。

Revenue generation, which combines aspects of both volume and open interest, provides another crucial metric. Platforms earn fees based on trading volume, meaning high-volume platforms can generate substantial income even with modest open interest. However, sustainable revenue typically requires a balance - pure volume without position commitment suggests reliance on incentive programs that drain treasury reserves, while high open interest with minimal trading indicates users are holding positions but not actively trading, limiting fee revenue.

收益產生融合了交易量與未平倉部位兩個重要面向,成為另一項關鍵指標。平台根據交易量收取手續費,因此高交易量的平台,即使只有適中的未平倉部位,也能獲得可觀收益。然而,永續性的收益通常需要取得平衡——僅有龐大交易量但無頭寸承諾,代表過度依賴激勵方案來拉抬流量,這將消耗金庫儲備;反之,高未平倉部位但成交稀少,則代表用戶主要是持倉而非積極交易,導致手續費收入有限。

Analysts evaluating platform investments or assessing competitive positioning increasingly emphasize metrics beyond headline volume. Revenue per user, cost of capital acquisition through incentives, platform fee revenue relative to token market cap, and sustainability of fee-burning or distribution mechanisms all factor into sophisticated analysis. The tension between short-term growth metrics and long-term sustainability will likely determine which platforms emerge as lasting leaders versus which fade after initial momentum wanes.

分析師在評估平台投資或競爭定位時,正日益重視交易量以外的指標。例如:每用戶收益、透過激勵取得資金的成本、平台手續費收入與代幣市值的比值,以及手續費銷毀或分配機制的可持續性,這些都已成為進階分析的要件。短期成長數據與長期永續性的拉鋸,很可能決定哪些平台能成為長青領頭羊,又有哪些在初步熱潮過後逐漸沈寂。

Hyperliquid's Expansion: Building an Ecosystem

Hyperliquid 的擴張:建立生態體系

Hyperliquid's leadership team has demonstrated awareness that relying solely on perpetual futures trading exposes the platform to competitive and market risks. The launch of HyperEVM in early 2025 represented the first major expansion beyond the platform's core perpetuals offering, transforming Hyperliquid from a single-product exchange into a Layer-1 blockchain supporting a broader DeFi ecosystem.

Hyperliquid 團隊深知僅靠永續合約交易會讓平台暴露在競爭與市場風險下。2025 年初 HyperEVM 上線,標誌著公司首度跨足主力永續合約以外的領域,也讓 Hyperliquid 從單一產品交易所轉型為支援更大型 DeFi 生態系的 Layer-1 區塊鏈。

HyperEVM's growth has exceeded expectations. By September 2025, the network hosted over 100 protocols with approximately $2 billion in total value locked - a substantial figure for a blockchain less than a year old. Native applications like Kinetiq, a derivatives optimization protocol, and Hyperlend, a lending platform, have gained traction alongside deployments from established projects including Pendle, Morpho, and Phantom. The ecosystem generates around $3 million in daily application revenue, contributing meaningfully to overall blockchain activity beyond perpetuals trading.

HyperEVM 的發展超乎預期,截至 2025 年 9 月,網路上已有超過 100 個協議,鎖倉金額約 20 億美元──對於一條未滿一年的新鏈而言極具意義。原生應用如衍生品優化協議 Kinetiq、借貸平台 Hyperlend 逐步獲得用戶青睞,同時還吸引了 Pendle、Morpho、Phantom 等知名專案部署。整體生態單日應用創收約 300 萬美元,已成為推動區塊鏈活躍度的重要引擎,影響力超越永續合約本業。

This ecosystem expansion serves multiple strategic purposes. It creates network effects that make Hyperliquid stickier - users who deploy capital across multiple applications on the network face higher switching costs than those simply trading perpetuals. Revenue diversification reduces dependence on trading fees, which can fluctuate substantially with market conditions and competitive dynamics. Application developers building on HyperEVM become stakeholders invested in the network's success, forming a coalition that defends Hyperliquid's market position through continuous innovation.

這一輪生態拓展達成多重戰略目標。不僅產生網路效應、黏住用戶——在多個應用中投入資本的用戶,切換成本遠高於僅用永續合約的交易者,也讓平台收益來源分散、減少對手續費的依賴(手續費易受市場與競爭變化劇烈影響)。此外,在 HyperEVM 上開發應用的團隊,將成為利害攸關者,願意共同守護創新與 Hyperliquid 的市場地位。

The architectural decision to maintain Ethereum Virtual Machine compatibility was strategically critical. Developers familiar with Ethereum's dominant programming environment can deploy to Hyperliquid with minimal code modifications, dramatically lowering adoption barriers. Existing Ethereum tools, libraries, and infrastructure largely function on HyperEVM, allowing projects to leverage battle-tested components rather than building everything from scratch. This compatibility also enables cross-chain composability as DeFi matures, potentially positioning Hyperliquid as a liquidity hub that bridges multiple ecosystems.

在架構上選擇相容 Ethereum 虛擬機(EVM),是極具戰略意義的決策。習慣以乙太坊生態主流開發環境的工程師,幾乎無需修改程式碼即可部署,大大降低專案移植門檻。現有的乙太坊工具、資源庫與生態基礎建設也都能直接用在 HyperEVM,上線專案可以直接利用成熟安全的元件,而非從零開始。這種相容性還促進了跨鏈組合,隨著 DeFi 發展成熟,Hyperliquid 有望成為多元生態系之間的流動性樞紐。

The September 2025 launch of USDH represents Hyperliquid's most ambitious ecosystem expansion yet. This native stablecoin, pegged to the US dollar and backed by a combination of cash and short-term US Treasury securities, directly challenges the dominance of Circle's USDC and Tether's USDT - stablecoins that collectively command over 90 percent of the market. For Hyperliquid, which holds approximately $5.6 to $6 billion in USDC deposits representing roughly 7.5 percent of all USDC in circulation, launching a native stablecoin addresses both economic and strategic imperatives.

2025 年 9 月推出的 USDH,堪稱 Hyperliquid 有史以來最具野心的生態擴張。這是一種以美元掛鉤、由現金與短期美國國債共同支持的原生穩定幣,直接挑戰 Circle(USDC)與 Tether(USDT)這兩個合計壟斷九成市場的主流穩定幣。對於持有 56 億至 60 億美元 USDC(約佔全網流通量 7.5%)的 Hyperliquid 來說,自推穩定幣同時具有經濟層面與策略上的重要意義。

The economic rationale is straightforward: USDC's reserves generate substantial interest income from Treasury yields, all of which flows to Circle rather than Hyperliquid or its users. Analyst estimates suggest that fully migrating Hyperliquid's USDC holdings to USDH could capture approximately $220 million in annual Treasury yield revenue, assuming a 4 percent return on reserves. Under the proposed model, half of this revenue would fund HYPE token buybacks, creating ongoing demand for the governance token, while the other half would support ecosystem growth initiatives, developer grants, and user incentives.

經濟上的考量非常簡單:USDC 所存的準備金能帶來大量國債利息,這些收益目前全數流向 Circle,而非 Hyperliquid 或用戶。分析師預估,若 Hyperliquid 將 USDC 儲備全面轉換為 USDH,每年可多創造約 2.2 億美元的國債利息收益(以 4% 報酬率估算)。根據設計,一半收益將拿來回購 HYPE 治理代幣,推升對代幣的長期需求,另一半則投入生態成長、開發者獎勵與用戶激勵。

The strategic benefits extend beyond revenue capture. A native stablecoin reduces systemic risk from dependence on external issuers. Circle has demonstrated willingness to freeze USDC in specific addresses when requested by law enforcement, raising concerns about censorship risk for decentralized platforms. Regulatory actions targeting Circle or changes to USDC's compliance policies could ripple through Hyperliquid if the platform remains overly dependent on the stablecoin. USDH provides optionality and resilience by diversifying stablecoin exposure.

除資金流向外,戰略利益還包括降低對外部穩定幣發行方的系統性風險。Circle 曾經在執法人員要求下,凍結特定地址的 USDC,使去中心化平台面臨審查風險。如果 Hyperliquid 過度依賴 USDC,一旦 Circle 政策有變或者受到監管行動打擊,影響恐會迅速外溢。USDH 則讓平台穩定幣來源更為多元,提高了風險抵禦能力。

Native Markets, the startup selected to issue USDH after a competitive bidding process that saw proposals from Paxos, Ethena, Frax Finance, Agora, and others, secured victory with 97 percent validator support. The team brings relevant experience - co-founder Max previously worked at Liquity and Barnbridge focusing on stablecoins and fixed-rate instruments, while advisor Mary-Catherine Lader served as President and COO of Uniswap Labs and led BlackRock's digital asset initiatives. This expertise should prove valuable as USDH navigates complex regulatory requirements and operational challenges.

Native Markets 這家新創,競爭擊敗 Paxos、Ethena、Frax Finance、Agora 等多家專案,以高達 97% 節點支持率,獲選成為 USDH 的發行平台。團隊具備相關經歷——聯合創辦人 Max 曾在 Liquity 與 Barnbridge 專注於穩定幣設計與固定利率方案,而顧問 Mary-Catherine Lader 則曾任 Uniswap Labs 總裁暨營運長,並領導過 BlackRock 的數位資產計畫。如此專業背景,對 USDH 應對監管與營運挑戰將是一大助力。

USDH's reserve structure employs a dual approach: off-chain holdings managed by BlackRock combined with on-chain reserves handled by Superstate through Stripe's Bridge platform. This hybrid model balances security and transparency - institutional-grade custody for the majority of reserves with on-chain visibility that allows users to verify backing in real-time. The stablecoin complies with the GENIUS Act, comprehensive US stablecoin legislation signed into law in July 2025 that established regulatory standards for reserve composition, transparency, and redemption mechanisms.

USDH 的準備金採雙軌模式:鏈下資產由 BlackRock 託管,鏈上儲備則透過 Stripe 的 Bridge 平台,由 Superstate 管理。這樣的混合體制兼顧安全與透明——大部分資金由機構等級託管保障,而鏈上部分則讓用戶可即時驗證準備金狀況。USDH 亦遵循 2025 年 7 月美國通過的 GENIUS 法案,這是針對穩定幣的全方位專法,嚴格規範了儲備架構、資訊透明與兌換機制。

Early adoption metrics show promise but also reveal challenges ahead. Within 24 hours of launch on September 24, 2025, Native Markets pre-minted over $15 million USDH with early trading generating more than $2 million in volume. The USDH/USDC pair maintained its dollar peg at 1.001 in initial sessions, demonstrating stability. By late September, total supply reached approximately 2.38 million tokens with a $2.37 million market cap - modest figures that underscore the difficulty of displacing entrenched stablecoins even with superior economics.

首波採用指標呈現希望,但也揭示後續挑戰。2025 年 9 月 24 日上線首 24 小時,Native Markets 即預鑄 1,500 萬美元 USDH,早期交易量超過 200 萬美元。USDH/USDC 初期穩定維持 1.001 匯率,表現穩健。然而,9 月底時流通總量約 238 萬枚,市值僅 237 萬美元——這顯示即使經濟誘因更強,要動搖現有主流穩定幣地位亦非易事。

The platform's integration roadmap for USDH includes several critical milestones. Short-term plans involve making USDH available as a quote asset on spot markets, enabling direct minting on HyperCore, and potentially introducing USDH-margined perpetuals that would allow traders to post the stablecoin as collateral. Longer-term ambitions include expanding USDH adoption beyond Hyperliquid to other chains and DeFi protocols, transforming it from a platform-specific token into a widely-used stablecoin. Success would significantly enhance Hyperliquid's strategic position and revenue potential.

平台針對 USDH 的整合路線圖規劃數個重要里程碑。近期目標包括將 USDH 納入現貨市場計價資產、支援在 HyperCore 直接鑄造,並探討推出以 USDH 保證金的永續合約,讓交易者能以穩定幣作為抵押品。長期則期望推動 USDH 跨足多鏈及其他 DeFi 協議,從平台內專屬代幣,蛻變為主流穩定幣。倘若成功,將大幅提升 Hyperliquid 的戰略地位與營收潛力。

The upcoming HIP-3 proposal represents another major expansion initiative. This governance proposal would implement a permissionless market creation mechanism allowing builders to launch new perpetual markets by staking substantial amounts of HYPE tokens - initially proposed at 1 million HYPE, worth approximately $45 to $49 million at current prices. Market creators could earn up to 50 percent of fees generated by their markets, creating powerful incentives for identifying and launching trading pairs with genuine demand.

即將推出的 HIP-3 提案則是另一波重大擴展。該治理提案預計上線一套去中心化市場增設機制,允許開發者只要抵押足量 HYPE 代幣(初步設定 100 萬顆,約合 4,500 至 4,900 萬美元),即可上架全新永續合約市場。市場創建者最多可獲得所屬交易市場手續費的 50%,強力激勵團隊發掘與上架具實際需求的新交易對。

HIP-3 addresses several strategic objectives simultaneously. It creates substantial demand for HYPE tokens as prospective market creators must acquire and lock significant holdings, functioning as a "supply sink" that could offset selling pressure from token unlocks. It accelerates the addition of new trading pairs without requiring core team approval for each listing, enabling Hyperliquid to rapidly expand its asset coverage and capture emerging trends. It transforms Hyperliquid into infrastructure for other builders to create businesses, fostering ecosystem growth and innovation.

HIP-3 同時達成多重戰略目標。首先,它創造了對 HYPE 代幣的巨大需求——有志於創建新市場的團隊,必須收購並鎖定大量持倉,形同「供給黑洞」,有助於緩解解鎖後的拋壓。其次,讓新交易對上架流程擺脫核心團隊審批,大幅加快資產覆蓋速度、緊抓市場新趨勢。最後,Hyperliquid 正從單一平台轉型為底層基礎建設,鼓勵更多專案孵化、壯大整體生態。

The proposal also carries risks. Permissionless market creation could flood the platform with low-quality trading pairs that fragment liquidity without attracting meaningful volume. Scam projects might launch deceptive markets hoping to profit from unsophisticated traders, creating reputational risks for Hyperliquid. The high HYPE staking requirement could limit market creation to well-funded entities, preventing grassroots community-driven listings. Execution details - including mechanisms to remove failed markets, adjust staking requirements, and govern fee sharing - will determine whether HIP-3 achieves its ambitious goals or introduces new challenges.

該提案當然也存在潛在風險。完全開放的新市場機制,易讓平台被低品質交易對淹沒,導致流動性被稀釋卻無實質交易量。詐騙專案可能利用機會上線誤導性市場,讓不熟悉的新手受害,損及 Hyperliquid 品牌聲譽。此外,HYPE 高額抵押門檻亦可能使新市場創建僅限於資金雄厚勢力,基層社群難以推動上架。最終能否實現願景,將端賴於如失敗市場下架、抵押需求調整、手續費分配治理等細節設計與落實。

These expansion efforts collectively represent Hyperliquid's bet that sustainable competitive advantage requires more than excellence in a single product category. By building a comprehensive ecosystem encompassing perpetuals, spot trading, lending, stablecoins, and permissionless market creation, Hyperliquid aims to create a moat that pure-play competitors struggle to replicate. Whether this strategy succeeds depends on execution across multiple complex workstreams while maintaining the performance, security, and user experience that established the platform's reputation.

這一連串擴展措施,正體現 Hyperliquid 認為可持續競爭優勢須遠超單品領域強項。唯有建立橫跨永續、現貨、借貸、穩定幣、開放市場等完整生態體系,平台方能築起厚實護城河,讓純粹單一競爭對手難以複製。成敗關鍵,仍需依賴團隊能否在多線運作下,維持既有的效能、安全與用戶體驗。

Compliance, Innovation, and Uncertainty

合規、創新 與 不確定性

The explosive growth of

...decentralized perpetual exchanges operates against a backdrop of evolving regulatory frameworks that could fundamentally reshape the market. Regulators globally are grappling with how to apply traditional derivatives oversight to novel decentralized structures, while the industry debates optimal approaches to compliance that preserve decentralization's core benefits.

去中心化永續合約交易所正處於不斷演變的監管體系背景下運作,這些框架可能從根本上重塑市場。全球的監管機構正努力思考如何將傳統衍生品監管方式應用到新興的去中心化架構,同時業界也針對如何在保持去中心化核心優勢下做出最佳合規方案展開辯論。

In the United States, perpetual futures have historically existed in a regulatory gray area. Traditional futures contracts trade on Commodity Futures Trading Commission-regulated Designated Contract Markets with strict rules governing margin, clearing, and reporting. Perpetuals, with their lack of expiration dates and continuous funding rate settlements, didn't fit neatly into existing frameworks. This ambiguity drove most perpetual trading to offshore exchanges like Binance, OKX, and Bybit, which captured enormous volume from US traders willing to use VPNs to circumvent geographic restrictions.

在美國,永續期貨過去一直處於監管灰色地帶。傳統期貨合約須在商品期貨交易委員會(CFTC)監管的指定合約市場進行交易,規範嚴格,涵蓋保證金、結算和報告等多方面。永續合約由於沒有到期日且持續進行資金費率結算,難以被現有監管框架清楚歸類。這種模糊性導致多數永續合約交易轉移到如Binance、OKX和Bybit等離岸交易所,這些平台吸納了大量願意用VPN繞過地理限制的美國交易員的交易量。

The regulatory landscape shifted dramatically in 2025. In April, the CFTC issued requests for comment on both 24/7 derivatives trading and perpetual-style contracts, signaling openness to onshoring these products. By July, Coinbase Derivatives self-certified two perpetual futures contracts - BTC-PERP and ETH-PERP - that became effective for trading on July 21, 2025, after the CFTC's ten-day review window passed without objection. This represented the first time a CFTC-regulated US exchange offered perpetual futures, marking a watershed moment for domestic market structure.

2025年,監管環境發生了劇烈變化。今年四月,CFTC針對24小時全年無休衍生品交易以及永續類合約發出意見徵詢,表示對讓這類產品回流本土持開放態度。到了七月,Coinbase Derivatives自我認證了兩項永續期貨合約——BTC-PERP與ETH-PERP,並於CFTC十天審查期無異議後,於2025年7月21日開始交易。這是美國首度有CFTC監管的交易所提供永續期貨,為本土市場結構帶來劃時代意義。

The products differ from offshore perpetuals in important ways. They carry five-year expirations rather than truly perpetual durations, though this distinction becomes semantic given the extended timeframe. They offer up to 10x leverage rather than the 100x or higher common internationally, reflecting conservative regulatory positioning. Most significantly, they trade on a regulated venue with CFTC oversight, providing legal clarity and consumer protections that unregulated offshore platforms lack.

這些產品在多方面與離岸永續合約不同。它們為五年期合約而非真正意義上的永續合約,儘管時間拉長後這點差異僅屬語義層面。槓桿倍數最高10倍,遠低於部分國際平台常見的100倍以上,反映監管取向的保守。最重要的是,它們在受CFTC監管的平台交易,帶來法律明確性與消費者保護,這是非監管離岸平台所缺乏的。

In September 2025, the Securities and Exchange Commission and CFTC held a joint roundtable on regulatory harmonization, addressing jurisdictional overlaps and conflicts between the two agencies. Both regulators expressed interest in facilitating decentralized finance innovation, with statements indicating willingness to consider "innovation exemptions" that would allow peer-to-peer trading of perpetual contracts over DeFi protocols. This collaborative approach marks a stark departure from the adversarial regulatory environment that characterized much of 2023 and 2024.

2025年九月,美國證券交易委員會(SEC)與CFTC舉行聯合圓桌論壇,討論監管協調,聚焦於兩機構間管轄權重疊與衝突問題。雙方均表達推動去中心化金融創新的興趣,並表示願意考慮「創新豁免」,讓DeFi協議上的永續合約能以點對點方式合法交易。這一合作姿態,與2023、2024年過去以對立為主的監管氛圍大相徑庭。

The passage of the GENIUS Act in July 2025 provided crucial clarity for stablecoin operations. This comprehensive legislation established regulatory standards for dollar-backed stablecoins including reserve composition, transparency requirements, and redemption guarantees. For platforms like Hyperliquid launching native stablecoins, compliance with GENIUS Act standards provides legal certainty and builds trust with institutional users. The law's existence also signals broader regulatory acceptance of crypto infrastructure as permanent financial market components rather than temporary phenomena.

2025年7月《GENIUS法案》的通過,為穩定幣運作提供了關鍵明確性。這份綜合法律建立了美元穩定幣的監管標準,涵蓋儲備組成、透明度要求及兌換保障等。對於如Hyperliquid等發行本地穩定幣的平台而言,遵循GENIUS法案標準,可以帶來法律確定性並提升機構用戶信任。這項法律的存在,亦象徵監管單位開始廣泛接納加密基礎設施成為永久金融市場組成,而非暫時性現象。

Europe has taken a more prescriptive approach through the Markets in Crypto-Assets Regulation, which established comprehensive rules for crypto service providers including derivatives offerings. Exchanges serving European users must obtain MiFID licenses to offer perpetual swaps and other leveraged products, subjecting them to traditional financial services oversight. This creates higher barriers to entry but provides clarity that enables institutional participation. Several platforms have pursued European licenses to access this market legally.

歐洲則以《加密資產市場監管法案》(MiCA)採取更具指導性的監管方法,為加密服務商(包含衍生品提供者)建立完整規則。為歐洲用戶提供永續合約與其他槓桿產品的交易所必須取得MiFID執照,納入傳統金融監管體系。雖然這提高了進入門檻,但帶來足夠明確性,使機構投資人願意參與。已有數個平台積極申請歐洲牌照,以合法取得該市場通路。

Asia presents a patchwork of regulatory environments. Hong Kong has embraced crypto innovation through clear licensing frameworks that enable regulated perpetual trading. Singapore maintains strict requirements but provides pathways for compliant operators. Mainland China continues its comprehensive ban on cryptocurrency trading. Japan requires registration and limits leverage offered to retail traders. The United Arab Emirates has positioned itself as crypto-friendly through low-friction licensing in free zones like Dubai's Virtual Assets Regulatory Authority jurisdiction.

亞洲則呈現多元的監管光譜。香港以明確牌照制度擁抱加密創新,允許受監管的永續合約交易。新加坡規範嚴格,但亦為合規經營提供明確路徑。中國大陸仍全面禁止加密貨幣交易。日本則須登記並限制散戶交易者的槓桿倍數。阿聯酋則透過如杜拜虛擬資產監管局所在的自貿區,以低門檻牌照吸引加密產業進駐。

Decentralized platforms face unique regulatory challenges. The absence of a central operator complicates questions of jurisdiction, compliance, and enforcement. Who bears responsibility for regulatory violations - token holders who govern the protocol, liquidity providers who facilitate trading, or individual users executing transactions? How can platforms implement know-your-customer procedures without centralized identity verification? Can protocols offering leveraged products to retail users in multiple jurisdictions simultaneously comply with divergent national requirements?

去中心化平台面臨獨特監管挑戰。其無中央營運者,導致管轄權、合規與執法責任分配變得複雜。當監管違規發生時,究竟是治理協議的代幣持有人、協助撮合的流動性供應者,還是執行交易的個別用戶須負責?平台在無中心化身分驗證下如何推行KYC?向多國散戶同時提供槓桿產品的協議,能否合規滿足各國不同法規?

Some platforms have addressed these challenges through aggressive geographic restrictions. Hyperliquid blocks US and Canadian Ontario users, eliminating the largest potential enforcement jurisdiction but also excluding substantial market opportunity. Others like dYdX have implemented optional KYC that unlocks additional features or higher leverage tiers, attempting to balance permissionless access with regulatory compliance. Some new platforms are exploring zero-knowledge proof systems that verify user compliance with requirements like sanctions screening without revealing underlying personal information.

部分平台以激進地理限制來應對這些難題。例如Hyperliquid明確封鎖美國及加拿大安大略省用戶,雖減少潛在最大監管風險,但也排除了可觀的市場機會。另如dYdX則推行可選KYC,通過驗證後可開啟額外功能或更高槓桿,嘗試在去許可訪問與合規間取得平衡。部分新平台亦正探討零知識證明系統,驗證用戶符合法規如制裁篩查要求,卻不需揭露個資。

The tension between regulatory compliance and decentralization's core value propositions remains unresolved. Many traders embrace decentralized platforms specifically because they require no KYC, preserve privacy, and enable access regardless of jurisdiction. Introducing identity verification, geographic restrictions, or regulatory reporting fundamentally compromises these benefits. Yet operating without any compliance framework exposes platforms to enforcement actions, debanking of critical service providers, and exclusion from institutional adoption.

監管合規與去中心化核心價值之間的張力,依然尚未獲得解決。許多交易者青睞去中心化平台,正因其無需KYC、保有隱私、無地域限制。若強行導入身分驗證、地理封鎖或監管報告,將從根本上破壞這些特點。然而,完全沒有合規框架也可能讓平台面臨監管追訴、關鍵服務商撤離、甚至被機構投資排除在外等風險。

Institutional participation represents a particular regulatory pressure point. Traditional financial institutions - hedge funds, family offices, and eventually perhaps banks and pension funds - require regulatory clarity before allocating significant capital to any derivatives venue. They need assurance that trading on a platform won't violate internal compliance policies, trigger regulatory sanctions, or create legal liabilities. This requirement inherently pushes toward more regulated, compliant platforms and away from truly permissionless alternatives.

機構參與成為監管壓力的特殊關鍵點。傳統金融機構——對沖基金、家族辦公室,甚至未來的銀行和退休基金——在分配大筆資本到任何衍生品平台前,均需明確的監管保障。它們必須确信於平台上的交易不致違反本身合規政策、不會引發監管制裁或產生法律責任。這項需求使市場自然而然趨向更受監管、更合規的平台,而遠離徹底無需許可的方案。

The question of whether perpetual contracts constitute securities versus commodities carries major implications. Bitcoin and Ethereum have achieved informal regulatory acceptance as commodities, allowing perpetual futures based on these assets to trade on CFTC-regulated venues. But hundreds of other crypto assets remain in regulatory limbo, with the SEC maintaining that many constitute unregistered securities. If a token underlying a perpetual contract is a security, the derivative itself may need to be a "security future" tradable only on SEC-regulated exchanges or jointly SEC-CFTC-regulated venues - a requirement that would dramatically complicate multi-asset decentralized platforms.

關於永續合約屬於證券或大宗商品的歸類,具有重大影響。比特幣與乙太幣已在監管上被非正式承認為大宗商品,使基於這類資產的永續期貨可於CFTC監管下交易。然而,數百種其他加密資產仍處於監管模糊地帶,SEC主張其中多數為未註冊證券。若某永續合約標的代幣被認定為證券,則該衍生品本身可能需成為只能在SEC或SEC+CFTC聯合監管平台交易的「證券期貨」,這對多資產去中心化協議將造成極大複雜化。

Looking forward, regulatory evolution will likely occur through iterative steps rather than comprehensive legislation. Pilot programs, no-action letters, and exemptive relief for specific use cases may provide pathways for compliant innovation. Regulatory sandboxes that allow experimentation under supervision could help authorities understand decentralized protocols' actual risks versus theoretical concerns. International coordination through bodies like the Financial Stability Board might harmonize approaches across jurisdictions, reducing the compliance burden for global platforms.

展望未來,監管演進更可能以逐步試點和個案豁免、不作為函取代一次性立法。監管沙盒制度允許在受控環境中創新實驗,有助於官方了解去中心化協議的實際風險與理論擔憂的差距。透過如金融穩定委員會等國際組織協調,也有機會在跨國間統一標準,減輕全球平台的合規負擔。

The regulatory uncertainty cuts both ways for decentralized versus centralized platforms. Centralized exchanges face clearer requirements but also direct enforcement mechanisms - regulators can sanction corporate entities, freeze assets, and compel operational changes. Decentralized platforms operate in greater legal ambiguity but lack clear enforcement targets, creating both opportunity and risk. As frameworks mature, platforms that successfully navigate compliance while preserving decentralization's benefits will likely capture the largest market share from traditional finance's eventual migration to crypto infrastructure.

監管不確定性對於中心化與去中心化平台各有利弊。中心化交易所需遵守更明確的規範,卻也容易受到直接制裁——監管單位能懲罰公司主體、凍結資產或強制營運改變。去中心化平台則處於更高的法律不明確狀態,缺乏明確的懲罰對象,既有機會也有風險。隨著監管日益成熟,最終能兼顧合規與去中心化利益的平台,將有望在傳統金融遷移至加密基礎設施時取得最大市占。

Token Economics and Competitive Dynamics

The intensifying competition between Hyperliquid, Aster, and emerging platforms reverberates through token markets and protocol economics, creating winners and losers beyond just the trading volumes each platform captures. Understanding these secondary effects illuminates the broader transformation underway in crypto market structure.

Hyperliquid、Aster 以及新興平台之間日益激烈的競爭,不僅反映在交易量上,更蔓延到代幣市場與協議經濟層面,產生勝負分野。洞悉這些次級效應,有助於理解加密市場結構正在進行的更深刻轉型。

Hyperliquid's HYPE token has experienced significant volatility as competitive dynamics shift. After reaching all-time highs near $51 in August 2025, the token declined over 20 percent through September as Aster's surge raised questions about Hyperliquid's sustainable dominance. The token stabilized in the $44 to $49 range by early October, down from peaks but substantially above its November 2024 airdrop levels around $3.81. This performance reflects investor uncertainty about whether Hyperliquid's fundamental strengths can overcome aggressive competition from well-funded challengers.

隨著競爭格局變化,Hyperliquid的HYPE代幣出現顯著波動。2025年8月創下歷史新高接近51美元後,隨著Aster迅速崛起引發外界質疑Hyperliquid領先地位的可持續性,該代幣於9月下跌超過20%。至10月初,價格穩定在44至49美元區間,雖低於高點,卻遠高於2024年11月空投時的約3.81美元。這一表現反映了投資人對於Hyperliquid基本面優勢是否足以抵擋財力雄厚競爭者的強勢挑戰,所存的不確定性。

The token's valuation relative to protocol revenue provides context for investment analysis. Hyperliquid generates strong fee revenue, regularly ranking among the top three crypto assets by this metric. At current market capitalization of approximately $12.6 billion and monthly fee revenue reaching tens of millions during peak periods, the protocol trades at a premium to some DeFi comparables but at a discount to major centralized exchanges when normalized for volume. Bulls argue this valuation reflects Hyperliquid's growth potential and network effects, while bears point to competitive threats and upcoming token unlocks as headwinds.

以成交量校正後,目前較大型中心化交易所存在折價。多頭認為這樣的估值反映了Hyperliquid的成長潛力與網絡效應;空頭則認為競爭壓力與即將解鎖的代幣供應將會造成阻力。

The November 2025 token unlock represents the critical overhang on HYPE's near-term outlook. Releasing approximately $446 million worth of tokens monthly for 24 months creates persistent selling pressure as core contributors monetize their holdings. Historical precedent from other projects suggests that token unlocks of this magnitude typically depress prices unless offset by exceptional growth or aggressive buyback programs. Hyperliquid's substantial fee-burning mechanism may provide some counterbalance, but whether buybacks can absorb unlock-related sales remains uncertain.

2025年11月的代幣解鎖是HYPE短期前景的關鍵壓力來源。未來24個月,每月將釋出約4.46億美元市值的代幣,讓核心貢獻者變現其持有,形成本質持續的賣壓。其他專案的歷史經驗顯示,如此大規模的解鎖若未有優異成長或積極回購計畫加以抵銷,通常會壓低代幣價格。Hyperliquid的大規模手續費燃燒機制或能提供一定抵銷作用,但代幣回購是否足以應付解鎖相關拋售仍未可知。

Aster's ASTER token experienced even more dramatic volatility. The token surged over 1,500 percent in the 24 hours following its September 17, 2025 token generation event, briefly pushing market capitalization toward $3.2 billion. This meteoric rise reflected a combination of genuine enthusiasm from CZ's endorsement, speculative mania, and potential airdrop farming by users anticipating future token distributions. By late September, ASTER had retreated substantially from its peak but remained well above TGE levels, trading around $1.57 with a market cap near $655 million to $1 billion depending on methodology.

Aster的ASTER代幣波動幅度更為驚人。2025年9月17日TGE後24小時內,該幣暴漲超過1,500%,市值一度接近32億美元。如此迅猛的漲勢反映了CZ加持下的熱情、投機狂熱,以及部分用戶預期未來空投進行「空投農耕」。到了9月底,ASTER已大幅回檔,但仍遠高於TGE初始水平,交易價格約在1.57美元,按不同市值計算方式市值介於6.55億至10億美元之間。

The token's sustainability faces significant questions. Its revenue generation, while impressive in absolute terms, remains disputed - critics argue that much derives from incentive-driven wash trading rather than organic activity. The October 2025 token unlock releasing 11 percent of supply will test whether early supporters remain committed or exit at the first opportunity. Without Aster's own equivalent to Hyperliquid's fee-burning mechanism, the token lacks clear value accrual beyond governance rights and speculative appreciation, potentially limiting long-term upside.

代幣的可持續性存有重大疑慮。雖然絕對營收可觀,但其來源備受質疑——批評者認為大部分營收來自激勵誘導的虛假交易,而非自然需求。2025年10月釋放11%供給的代幣解鎖,將檢驗早期支持者是否持續持有,或趁機獲利了結。Aster缺乏類似Hyperliquid燃燒手續費的價值累積機制,除了治理權與投機升值外,難以正本建立長期成長潛力。

The competition between HYPE and ASTER tokens embodies broader debates about optimal token economics. Hyperliquid's aggressive fee-burning creates clear value accrual for holders - as the protocol generates revenue, it removes tokens from circulation, theoretically increasing the value of remaining supply. This mechanism aligns protocol success directly with token performance, though it requires sustained revenue generation to offset selling pressure from unlocks and general trader selling.

HYPE與ASTER兩者的競爭體現了社群對最佳代幣經濟學的更廣泛辯論。Hyperliquid激進的手續費燃燒設計為持幣人帶來明確價值累積——協議產生的收入會用於燃燒代幣,理論上讓留存供給價值上升。這一機制讓協議成功與代幣表現直接掛鉤,惟需持續創造收入以抵消解鎖賣壓與一般拋售壓力。

Aster has not yet implemented comparable token economics, though future governance proposals could introduce fee sharing, buybacks, or other mechanisms that direct protocol value to token holders. The platform's governance model remains under development, with community debates about optimal structures ongoing. Some argue that Aster should prioritize growth over immediate value accrual, using protocol revenue to fund liquidity mining, developer grants, and marketing that expand the user base. Others contend that without clear token utility, ASTER will struggle to maintain value as speculative fervor fades.

Aster目前尚未實行類似的代幣經濟設計,未來治理提案可能會加入手續費分潤、回購等將價值反饋給持幣人的機制。其治理模式仍在發展中,社群亦持續討論最佳結構。一派認為應優先推動用戶增長,把協議收入用於流動性挖礦、開發者補助與行銷擴展用戶基礎;另一派則指若缺乏明確代幣效用,投機熱潮退燒後ASTER難以維持價值。

The broader implications extend beyond individual token performance to questions of sustainable business models for decentralized platforms. Traditional exchanges generate profits for shareholders through retained earnings, dividends, or buybacks funded by trading fees. Decentralized protocols must either distribute fees to token holders - creating investment returns that justify holding the token - or retain fees in treasuries for operational expenses and growth initiatives.

這些討論的影響早已超越單一幣種表現,關涉去中心化平台能否建立可持續營運模式。傳統交易所透過交易手續費為股東創造盈餘、分紅或回購股份。去中心化協議則必須做出選擇 —— 要將費用分配給持幣人創造收益動機,還是留在金庫用於營運成本與業務推廣。

Heavy reliance on token incentives to attract users creates challenges. Mercenary capital - traders who chase subsidized fee rates and farm points only to exit once rewards diminish - generates impressive volume metrics but limited sustainable adoption. Platforms can burn through substantial treasury reserves funding these programs without building lasting competitive advantages. Yet some level of incentives appears necessary to bootstrap liquidity and overcome network effects that favor established platforms.

高度依賴代幣激勵吸引用戶會帶來不少挑戰。所謂傭兵資本——只追逐補貼與積分的短線戶,一旦獎勵減少便離場——確實能帶來亮眼成交量,卻難以形成持續用戶基礎。平台可能因資助這些計畫而消耗大量金庫資金,卻難以建立長遠競爭優勢。但某種程度的激勵似乎還是啟動流動性、打破傳統平台網路效應的必要手段。

The competition has also influenced the broader DeFi derivatives ecosystem. Alternative platforms have seen renewed interest and capital inflows as traders diversify beyond Hyperliquid and Aster. Jupiter, Lighter, and edgeX have all experienced volume surges in recent months as users explore options. This fragmentation benefits traders through competition-driven innovation but challenges platforms trying to achieve the liquidity depth required for institutional-scale trading.

這場競爭也影響到更廣泛的DeFi衍生品生態。越來越多用戶由Hyperliquid與Aster轉向其他備選平台,帶動資金與關注重新湧入Jupiter、Lighter、edgeX等,近期成交量大幅提升。這種市場碎片化雖然鼓勵創新、讓用戶得利,卻讓平台難以累積足夠深度來服務機構級交易。

Liquidity mining programs - where platforms reward users with tokens for providing liquidity - remain controversial. Proponents note that these programs successfully attracted billions in liquidity to early DeFi protocols, catalyzing growth that eventually became self-sustaining. Critics argue that liquidity mining attracts unsustainable capital that departs when subsidies end, leaving platforms with depleted treasuries and reduced liquidity. The evidence suggests that liquidity mining works best when combined with strong product-market fit - users initially attracted by rewards stay because the underlying product delivers superior value.

流動性挖礦計畫——平台透過發放代幣鼓勵供給流動性——依然極具爭議。支持者指出,這些計畫曾成功替早期DeFi協議吸引數十億美元流動性,進而帶動自我維生的生態圈成長。批評者則認為,流動性挖礦吸引的是不可持續的短期資本,補貼結束平台即陷資金枯竭及流動性下滑。事實顯示,流動性挖礦唯有與產品市場契合結合時效果最佳——用戶雖為獎勵前來,卻會因產品本身優勢而長期留下。

Fee structures also reveal competitive positioning. Hyperliquid's zero gas fees and competitive maker rebates reduce trading costs to levels comparable with centralized exchanges. Aster's multi-chain approach leverages the low fees of networks like Solana and BNB Chain. Lighter offers zero fees for retail traders while charging institutional users, attempting to attract broad participation while monetizing professional activity. These different approaches reflect varying theories about optimal pricing: should platforms maximize fee revenue, subsidize usage to achieve scale, or implement tiered pricing that charges based on user sophistication?

手續費結構同樣反映各平台的競爭定位。Hyperliquid以零Gas Fee與競爭性的掛單返傭壓低交易成本,媲美中心化交易所。Aster則走多鏈路線,善用Solana、BNB Chain等網路的低廉費用。Lighter對散戶採用免手續費、向機構收取費用,期望同時吸引普羅用戶並變現專業交易行為。不同的定價策略,也顯現各自對最佳利潤模式的假設:應專注於手續費收入極大化、用費用補貼換取規模,還是採分級收費根據用戶成熟度收費?

The competition ultimately benefits traders and users through lower costs, improved execution, and accelerated innovation. Platforms racing to differentiate themselves introduce features that become industry standards, raising the baseline experience across all competitors. Fee compression transfers value from protocol operators to users, though it must be balanced against the need for sustainable protocol revenue that funds development, security, and infrastructure.

這場競爭最終讓用戶與交易者受益——成本降低、下單效率提升、創新步伐加快。平台為了差異化推出的功能,逐漸成為產業標配,全面提升用戶體驗標準。手續費競爭將價值從協議方轉移給用戶,但也需權衡分配與平台永續經營所需開發、維運的資金。

For investors, the competitive dynamics complicate valuation analysis. Market leaders command premium valuations due to network effects, proven execution, and sustainable competitive advantages - but face disruption risk from well-funded challengers. New entrants offer explosive growth potential with corresponding volatility and execution risk. Diversification across multiple platforms may provide optimal risk-adjusted exposure to the sector's growth, though concentrated bets on eventual winners would deliver superior returns if correctly timed.

對投資者來說,這種競爭動態讓估值分析變得更為複雜。領頭平台因網絡效應、成熟執行力與持續優勢享有溢價,但也面臨資本充沛新人的挑戰風險。新平台雖然成長潛力驚人,卻伴隨高波動與落實風險。多元布局可分散風險參與行業成長,若對最終贏家押中時機則潛在報酬更勝一籌。

Practical Implications and Opportunities

實務意涵與機會

For active traders navigating this competitive landscape, the proliferation of decentralized perpetual platforms creates both opportunities and complexities. Understanding how to evaluate platforms, exploit inefficiencies, and manage risks has become increasingly sophisticated.

對活躍交易者而言,當前去中心化永續平台的繁榮帶來機會與挑戰並存。如何評估平台、把握市場低效點並妥善控管風險,均需要更高層次的專業能力。

Liquidity distribution directly impacts execution quality. A trader placing a $100,000 order on a highly liquid market might experience 0.02 to 0.05 percent slippage - the difference between expected and actual execution price - whereas the same order on a fragmented or thin market could suffer 0.5 percent or greater slippage. This difference compounds across multiple trades, substantially affecting profitability for active traders. Platforms with deep order books and tight bid-ask spreads deliver better execution, making them preferable for larger trades despite potentially higher fees.

流動性分佈直接影響成交品質。100,000美元的大單在高流動性市場僅有0.02至0.05%的滑價(即預期與實際成交價的差距),但同樣訂單在流動性分散或極薄市場或可能遇到0.5%甚至更高滑價。這種差異多次累積下,嚴重左右活躍交易員獲利。擁有深度掛單簿和緊密買賣價差的平臺,即使手續費略高,亦更受大單用戶青睞。

Sophisticated traders increasingly employ cross-platform strategies to optimize execution. Rather than conducting all activity on a single exchange, they monitor prices across multiple venues and route orders to wherever offers the best combination of liquidity, fees, and speed. This "smart order routing" mirrors practices common in traditional equity markets but requires technical sophistication and often algorithmic execution to capture fleeting arbitrage opportunities.

熟練交易者越來越多採用跨平台策略優化下單結果。他們不再只在單一交易所操作,而是同時監控多個平台價格,將訂單發送到流動性、手續費與速度最佳的地點。這種「智慧訂單路由」與傳統股票市場常見策略相似,不過需要更高技術能力及有時需演算法自動執行,才能把握瞬間套利機會。

Arbitrage between decentralized platforms represents a significant trading strategy. Price discrepancies emerge regularly due to fragmented liquidity, varying funding rates, and temporary imbalances. A trader might simultaneously buy a perpetual contract on one platform while selling the equivalent position on another, capturing the price spread. As prices converge, they close both positions, profiting from the initial divergence. This activity provides valuable market function by enforcing price consistency across venues, though it requires capital, sophisticated execution infrastructure, and careful risk management.

去中心化平台間的套利是一項重要交易策略。由於流動性分散、資金費率差異及臨時供需失衡,價格時常出現分歧。交易者可同時在一個平台買進永續合約、在另一平台賣出同樣部位,鎖定價格差異。待價格趨於一致時再同步平倉,便可賺取起始價差。這種活動除帶來收益外,也促進了平台間價格一致性,但需配備資本、專業執行基礎設施及審慎風控措施。

Funding rate arbitrage offers another opportunity. Funding rates - periodic payments between longs and shorts that keep perpetual prices aligned with spot markets - vary across platforms. A trader might hold long positions on platforms with negative funding rates (where shorts pay longs) while simultaneously holding short positions on platforms with positive funding rates (where longs pay shorts), collecting payments from both sides while maintaining a market-neutral hedged position. This strategy requires precise risk management and monitoring, as price movements between platforms can generate losses that exceed funding rate income.

資金費率套利亦是一種機會。資金費率為多空持倉間定期支付機制,用於保持永續合約價格與現貨市場一致。但各平台費率常不同。交易者可在負資金費率的平台持有多單(空方付費給多方),同時在正資金費率的平台持空單(多方付費給空方),取得兩邊收入並以市場中性方式對沖部位。這種策略需非常精細的風控與即時監控,因為平台間價格變化可能導致損失超過資金費率獲利。

The proliferation of points programs and airdrops creates meta-trading opportunities where users optimize activity not just for trading profit but for expected token rewards. Sophisticated farmers analyze platform incentive structures to determine which activities generate maximum points per dollar of capital deployed. This might involve specific trading pairs, order sizes, or

積分計畫和空投的氾濫造就了新型「元交易」機會,參與者不只追求交易利潤,也會最大化預期代幣獎勵。老練的空投農夫會仔細分析平台激勵結構,計算哪些活動能以每投入一美元獲得最多積分。這可能包括特定交易對、下單規模,或timing of transactions. While this activity inflates volume metrics, it also provides liquidity and early adoption that benefits platforms if converted to sustained usage.

Skip translation for markdown links.

交易時機的掌握。雖然這類行為會膨脹交易量統計數據,但如果能轉化為持續使用,也為平台提供了流動性和早期採納。

風險管理在多平台環境下變得更加複雜。智能合約漏洞是最嚴重的風險——如果某平台遭受攻擊,使用者存入的資金可能會瞬間全部損失,且求助無門。去中心化平台通常無法逆轉交易或彌補損失,與部分中心化交易所設有保險基金保障用戶不同。交易者在決定資本部署前,必須評估每個平台的安全審計歷史、營運時間長短及過往運作記錄。

各平台的清算機制差異顯著,影響重大。有些平台採社會化損失制度,即若保險基金不足,獲利交易者需分擔破產頭寸產生的未實現損失。其他平台則採自動去槓桿,直接關閉部分獲利頭寸來補足虧損戶口。中心化交易所有時會動用自有資本介入,防止此類情形發生。了解各平台的清算程序,有助於交易者評估極端行情下的尾部風險。

合規風險會因法域而異,對交易者影響不同。位於加密貨幣政策嚴格國家的用戶,如在特定平台交易,可能面臨法律後果。去中心化平台因無需許可、地域不限,表面上人人皆可進入,但交易者仍需明白本地法規。部分平台會實施軟性限制,要求用戶聲明其非受限制地區居民,這為法律責任帶來模糊空間。利用 VPN 繞過地理封鎖,違反多數平台的使用條款,一旦發現可能導致帳戶被凍結。

提領時間與跨鏈轉資成本亦屬實際操作考量。像 Hyperliquid 這種自建 Layer-1 區塊鏈的平臺,資產進出時須橋接(Bridge),過程中將產生延遲與手續費。像 Aster 這類運作於 Solana 或 BNB Chain 的多鏈平台,則可提供更快、更低成本的存取體驗。對需頻繁調度資本、跨場館轉倉的交易者而言,這些差異將大幅影響操作效率。

用戶介面與工具差異,攸關工作流程效率。職業交易者仰賴進階圖表、技術指標、API 算法交易接口,以及完備委託類型(包含停損、止盈、移動停損、時間加權均價等)。平台功能豐富度差別很大——有些媲美中心化交易所,有些則僅提供基礎操作。交易者在選擇平台時,需於功能、費用、流動性等多面考量取得平衡。

行動端可用性日益重要,因為交易趨於全球化且連續進行。設計良好的行動應用程式,可讓用戶無論身在何處皆能監看倉位、迅速下單;僅提供網頁操作的平台則限制彈性。行動端的實作品質——速度、穩定性與桌面端的功能一致性——對需要隨時進場的交易者影響甚鉅。

對散戶來說,考量點與機構不同。交易資本較低時,手續費的絕對額度不如百分比影響來得重大——省下十個基點的手續費,往往比提升一點點流動性來得更有感。使用門檻簡單、教育資源豐富,有助新手駕馭操作複雜度。安全與平台穩定性至關重要,因散戶通常無力承擔攻擊或故障事件的損失。

機構交易者則有截然不同的優先考量。他們需要充足的流動性,方能無滑價執行大單。託管設置、對手風險管理、合規要求,遠比費率節省來得舉足輕重。API 介面、同地共置(co-location)機會、與演算法下單能力,支援了許多機構的高頻策略。明確的合規與執照狀況也往往是關鍵——機構寧可在合規場館付出較高費用,也不會選擇無監管、條件雖優但風險高的平台。

多數認真經營的專業交易者,現實上會同時在多個平台開設帳戶。這種分散策略可分散單一平台失靈的風險、允許跨平台套利和最佳化下單,同時能確保隨時捕捉各處交易機會。然而,資本分散會降低槓桿效率、提升操作複雜性,並令交易者同時暴露於多套智能合約風險。如何於分散與簡化之間取得平衡,是一項持續挑戰。

市場演進情境分析

Projecting the future of decentralized perpetual futures trading requires considering multiple plausible scenarios shaped by competitive dynamics, regulatory developments, and technological evolution. The market's ultimate structure remains highly uncertain, with credible arguments supporting divergent outcomes.

預測去中心化永續合約市場的未來,需全面考量競爭態勢、監管新進展及技術革新所形塑的各種可能路徑。市場最終格局高度不確定,不同情境各有其邏輯依據與合理論點。

「Hyperliquid 持續主導」情境,假設現有領導者透過執行力與生態拓展繼續保持霸主地位。此路徑下,Hyperliquid 的核心優勢——穩定性經考驗、流動性最深、工具成熟、社群活躍——能壓制競爭威脅。Aster 初期流量隨激勵結束與洗盤交易消退逐漸回歸正常,最終有效交易量遠低於表面統計。新興競爭者如 Lighter、edgeX 等搶下利基市場,但無法動搖 Hyperliquid 的主導地位。

支撐此情境的關鍵,在於 Hyperliquid 巨大的先行優勢與網路效應。用戶熟悉平台,做市商優化系統,協議已整合進 HyperEVM,均形成轉移門檻。平台積極的手續費回購機制與生態系擴展產生正向循環——用戶越多,收入越高,就有更多資源進行回購與推動生態繼續成長,進一步吸引更多用戶。HIP-3 提出的無許可創建市場,可能加速資產覆蓋面擴展,壓制競爭對手以新增交易對差異化的空間。

USDH 若成功普及,將大幅強化這一情境。若 Hyperliquid 能將大量 USDC 基礎資產轉換為本位穩定幣,帶來的收入與經濟效益,可為平台持續發展與積極成長策略提供更充足資金。穩定幣自給自足帶來的戰略自主性,也降低對外部壓力的敏感度。由 USDH 收益資助的 HYPE 回購,能抵銷解鎖潮帶來的賣壓,穩定甚至推升 HYPE 價格,吸引更多投資。

「Aster 崛起」情境則假設挑戰者借助幣安的資源,最終超越 Hyperliquid。此情境下,CZ 持續背書與 YZi Labs 強大資源,成為長期競爭優勢。Aster 成功從短期補貼活動轉型為用戶自發採納——交易者看重其多鏈通路、強隱私性、高槓桿等,逐步建立忠誠度。預計推出的 Aster Chain 若能兌現隱私承諾,吸引需保密執行的機構資本。此外,Aster 的代幣經濟也可望進化,達到甚至超越 Hyperliquid 的價值積累模式。

這情境因幣安龐大資源與生態圈而具可行性。幣安擁有全球最大現貨與衍生品成交量,與無數做市商、交易公司及機構用戶維持密切關係。若幣安戰略性優先推進 Aster——如提供上幣優惠、對幣安用戶展開聯合行銷、技術整合等——這些優勢可能產生壓倒性效果。CZ 作為加密圈指標型人物,其信任感影響力能吸引大批用戶投向該平台。

Aster 多鏈架構在加密生態分化至多重 Layer-1/Layer-2 網絡時將更顯彈性。交易者無須強行橋接到單一鏈,Aster囊括了 Solana、Ethereum、BNB Chain 甚至未來自家鏈,直接在用戶持有資金的地方提供服務。此彈性有可能削弱 Hyperliquid 的流動性優勢,尤其隨著整體市場活動分散至各生態鏈。

「多極市場」情境描繪的是:無單一主導者,而是多家競爭平台根據用途、用戶或地域各自占有一席之地。Hyperliquid 持續深耕專業玩家及重視透明度的 DeFi 原生客群。Aster 成功爭取訴求隱私、極致槓桿、與幣安生態聯動的用戶。Lighter 憑藉 Ethereum 結算與零知識架構獲得機構青睞。Jupiter 則鎖定偏好與現貨、DeFi 深度整合的 Solana 用戶。

在這種發展下,市場分割將常態化,各平台針對不同價值主張深度優化。有些交易者追求極限槓桿,有些重透明與合規,有些要求託管與大額執行。合規分割又加劇這一分歧——各地允許的平臺不盡相同,地理市場進一步分區。跨平台基礎建設也應運而生,包括訂單路由集成器、跨協議流動性共享等,加速不同平台之間的無縫對接。

這種市場格局將使交易者受益,因其...competition-driven innovation and fee compression but challenges platforms achieving sufficient scale for sustainability. Liquidity fragmentation raises trading costs across all venues. Smaller platforms struggle funding development and security from limited revenue. Regulatory compliance becomes more challenging as platforms must navigate multiple jurisdictions' requirements. Market consolidation might eventually occur as weaker competitors fail or get acquired.

競爭驅動的創新與手續費壓縮促進了產業發展,但也為平台帶來了難以達到可持續規模的挑戰。流動性分散導致各交易場所的交易成本上升。規模較小的平台因收入有限,在資金投入開發與資安保障時面臨壓力。隨著平台必須應對多地監管要求,合規難度持續提升。隨著較弱競爭者失敗或被併購,市場整合可能最終發生。

The "Regulatory Reset" scenario sees governmental intervention fundamentally reshape decentralized derivatives markets. Major jurisdictions could implement strict requirements making current decentralized platform operations untenable. These might include mandatory KYC, leverage limits, geographic restrictions, capital requirements for protocol operators, or securities registration for governance tokens. Platforms failing to comply face enforcement actions, while compliant venues operate under costly regulatory oversight that erodes decentralization's benefits.

「監管重設」情境下,政府干預將從根本上重塑去中心化衍生品市場。主要司法管轄區可能實施嚴格規定,令當前去中心化平台的運作難以為繼,包括強制 KYC、槓桿上限、地域限制、協議團隊資本要求,或治理代幣需完成證券登記。未能合規的平台將遭到執法行動,而合規平台則需承擔高昂監管成本,進一步削弱去中心化的優勢。

This scenario would dramatically favor centralized exchanges or regulatory-compliant hybrid models over truly decentralized alternatives. Coinbase's CFTC-regulated perpetuals and other compliant offerings would capture share from platforms operating in regulatory gray areas. Some current platforms might seek licensing and accept centralized elements to continue operating legally. Others might shut down or relocate to permissive jurisdictions while blocking users from strict regulatory regimes.

這種情境將明顯有利於中心化交易所或合規的混合架構,並對真正去中心化的競爭對手極為不利。像 Coinbase 這類受 CFTC 監管的永續合約產品,以及其他合規方案,將會搶占在監管灰色地帶營運的平台市占。一些現有平台可能會尋求牌照,接受更中心化的元素以持續合法運營;其他則可能因合規壓力選擇關閉或遷徙至監管較寬鬆的司法管轄區,並封鎖來自嚴格地區的用戶。

Alternatively, positive regulatory developments could accelerate adoption. If the CFTC and SEC provide clear guidance enabling compliant decentralized perpetual trading, institutional capital might flood into the sector. Traditional finance firms could launch competing platforms or integrate decentralized protocols into their operations. This mainstreaming would dramatically expand the addressable market while potentially commoditizing current platforms as larger financial institutions leverage their advantages.

相反地,若監管朝正面發展,可能大幅推動採用速度。若 CFTC 與 SEC 提供清楚指引,允許合規的去中心化永續合約交易,機構資本將湧入此領域。傳統金融機構也可能推出競爭平台,或將去中心化協議整合到自身服務。這類主流化將大幅擴大目標市場,但也可能使現有平台商品化,因為大型金融機構將能充分發揮其規模優勢。

The "Technological Disruption" scenario imagines breakthrough innovations that obsolete current architectural approaches. New consensus mechanisms might achieve centralized-exchange performance with perfect decentralization. Zero-knowledge technology could enable private trading without trusted parties. Cross-chain protocols might unify liquidity across all platforms transparently. Artificial intelligence could optimize trade execution and risk management far beyond human capabilities.

「技術顛覆」情境預想出現突破性創新,使現有架構方式過時。例如新型共識機制可能在維持完全去中心化的同時,達到中心化交易所的效能;零知識技術能讓用戶無需信任第三方即可實現隱私交易;跨鏈協議有望將各平台流動性透明統合;人工智慧則可能在交易執行與風險管理方面大幅超越人類表現。

Under this scenario, current market leaders face disruption risk from technologies not yet widely deployed. The specific form disruption takes remains speculative but precedent suggests crypto markets frequently experience rapid power shifts as innovations emerge. Platforms must continuously invest in research and development to avoid technological obsolescence, though first-mover advantages and network effects may prove difficult to overcome even with superior technology.

在該情境下,現有市場領導者將面臨來自尚未廣泛部署的新技術的顛覆風險。雖然顛覆會以何種型態出現仍屬推測,但先例顯示,隨著新創技術出現,加密市場往往會快速重組勢力。但即使新技術優越,由於搶先進入帶來的優勢與網路效應,領先者或許仍具備難以打破的地位,因此平台必須持續投入研發避免被淘汰。

The most likely outcome probably incorporates elements of multiple scenarios. Hyperliquid likely maintains strong market position absent execution failures, given its substantial advantages and lead. Aster will probably capture meaningful sustained share though perhaps not majority dominance, particularly if it delivers on its privacy-focused blockchain. Several smaller competitors will carve out niches serving particular segments. Regulatory evolution will shape operations but likely through gradual clarification rather than sudden crackdowns, though jurisdiction-specific divergence will persist.

最有可能出現的結果是多種情境交織下的局面。若無重大的執行失誤,Hyperliquid 有望維持其強勁的市佔與領先優勢。Aster 應會取得顯著但未必主導的長期市占,尤其如果其專注隱私的區塊鏈順利落地。數個小型競爭者則將聚焦特定細分族群,挖掘利基市場。監管發展將持續影響營運,但大多以逐步清晰、而非政策突襲的方式出現,不過不同司法管轄區的分歧仍會存在。

The competition ultimately benefits the ecosystem by driving innovation, compressing fees, and expanding options for traders. Whether centralization or decentralization better serves derivatives trading remains an open question that market forces will answer through revealed preference. The timeframe for market structure stabilization extends years rather than months - expect continued experimentation, new entrants, business model evolution, and unpredictable developments that rewrite conventional wisdom.

這場競爭最終將惠及整體生態,推動技術與機制創新、手續費壓縮,並為交易者提供更多選擇。衍生品交易更適合「中心化」還是「去中心化」目前仍無定論,最終將由市場偏好給出答案。未來市場結構要達到穩定狀態,預計需數年而非數月。在此期間,實驗、新進者、商業模式演化、意外新發展都將層出不窮,持續改寫既有認知。

Final thoughts

總結

The battle between Hyperliquid and Aster for decentralized perpetual futures dominance encapsulates broader tensions in crypto market evolution. These platforms represent competing visions for how derivatives trading should function: Hyperliquid's transparent, community-owned infrastructure built from first principles versus Aster's pragmatic multi-chain approach backed by crypto's most powerful incumbent.

Hyperliquid 與 Aster 爭奪去中心化永續合約霸主地位,體現了加密市場進化過程中的各種深層張力。這兩個平台代表了衍生品交易應如何運作的不同願景:前者主打從原理出發、透明公開、社群共治的基礎建設,後者則為由加密產業強勢集團支持、強調多鏈實用主義的方案。

Current metrics paint an ambiguous picture. Hyperliquid has seen its volume share decline from 45 to 80 percent down to 8 to 38 percent depending on timeframe, while Aster surged to process over $270 billion weekly. Yet Hyperliquid retains approximately 62 percent of open interest - the stickier, more meaningful indicator of true adoption. Revenue generation, ecosystem development, and token economics favor Hyperliquid's sustainability. Aster's explosive growth could represent either the early stages of a true challenger or unsustainable incentive-driven activity that fades as subsidies end.

各項數據目前呈現出混沌態勢。Hyperliquid 的交易量市占曾在 45% 至 80% 間波動,目前降至 8% 到 38%(取決於時間段),而 Aster 週交易額則一度暴漲突破 2,700 億美元。然而 Hyperliquid 仍保有約 62% 的持倉份額,這是更具黏著度且能反映真實採用的指標。在營收、完整生態系開發以及代幣經濟設計方面,Hyperliquid 更具可持續性。Aster 的爆炸性成長,有可能是真的挑戰者步入早期階段,也可能僅是補貼誘因帶來的短暫繁榮,待補貼結束即消退。

The broader market transformation from less than 2 percent of centralized exchange volume in 2022 to over 20 percent in 2025 demonstrates that decentralized alternatives have achieved product-market fit. Traders increasingly accept - and in many cases prefer - on-chain derivatives that offer transparency, self-custody, and censorship resistance even if execution occasionally lags centralized counterparts. This shift will likely accelerate as technology matures, regulatory frameworks clarify, and institutional participation expands.

更廣義的市場正持續轉型:去中心化合約平台於 2022 年僅佔中心化交易所交易量的不到 2%,但預期到 2025 年將超過 20%。這代表去中心化產品已獲得市場驗證。越來越多交易者開始接受,甚至在許多情境下更偏好鏈上衍生品,因其具備透明度、自主管理、抗審查等特性,儘管執行效率偶有落後於中心化平台。隨著技術成熟、監管清晰和機構參與增加,這種趨勢有望進一步加快。

For market observers, several questions warrant monitoring. Can Hyperliquid's ecosystem expansion and stablecoin initiative reduce its dependence on perpetuals trading sufficiently to sustain growth if competitive pressure intensifies? Will Aster's connection to Binance prove sustainable competitive advantage or liability if regulatory scrutiny increases? Can Lighter, edgeX, and other competitors develop sufficient differentiation to capture lasting market share beyond initial farming enthusiasm? How will upcoming token unlocks affect market sentiment and platform stickiness?

對市場觀察者而言,未來有多個關鍵問題值得持續追蹤。Hyperliquid 能否透過生態系擴張與穩定幣計畫減緩對永續合約交易的高度依賴,並在競爭壓力升高時維持增長?Aster 與幣安的關聯,在監管加劇時能是持續優勢還是反成包袱?Lighter、edgeX 等新競爭者能否成功塑造足夠差異性,在流動性挖礦熱潮後仍保持市占?即將到來的大規模代幣解鎖又會如何影響市場情緒與平台用戶黏著?