Polymarket 創辦人 Shayne Coplan 僅用五個詞引爆幣圈揣測熱潮——完全沒有說明、背景,也沒有證實,只有五個幣種代號與一個思考表情符號。

「$BTC $ETH $BNB $SOL $POLY,」Coplan 在 X 上寫道,把假想的 POLY 代幣和比特幣、以太幣、幣安幣以及 Solana 排在一起——這四種貨幣市值最大(不含穩定幣)。

這則貼文發表時機極佳,就在洲際交易所(ICE)、紐約證券交易所母公司宣布斥資至多 20 億美元投資 Polymarket、給予其八十億美元投資前估值的隔天。這宗投資案讓 27 歲的 Coplan 躋身彭博億萬富翁榜,成為史上最年輕白手起家億萬富翁,也讓他的預測市場平台一舉成為史上最有價值的加密原生新創公司之一。

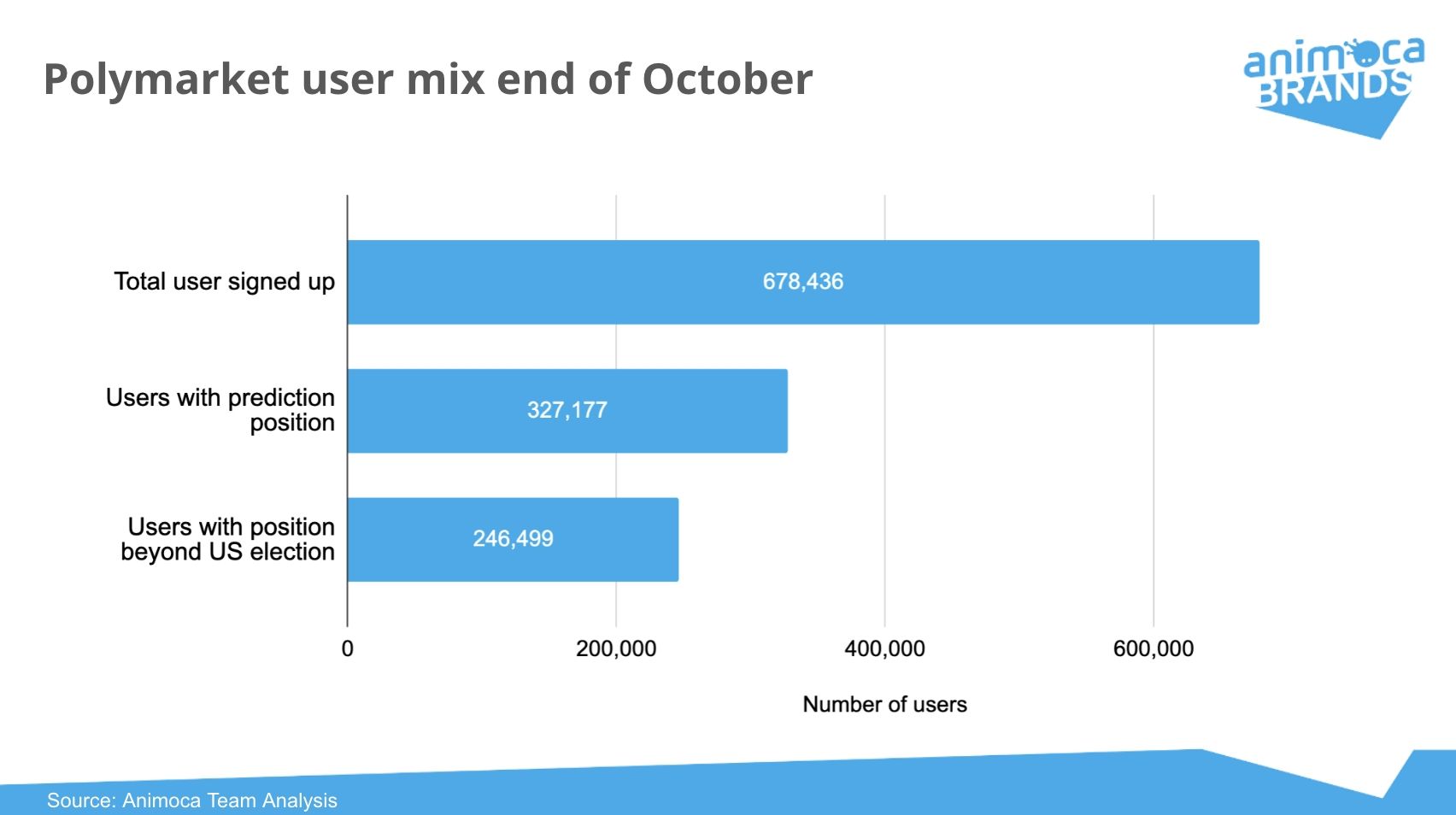

對於交易者而言,這背後的含義明確:假如 Polymarket 決定推出原生代幣,並把它透過空投分發給早期用戶——這是去中心化金融生態常見做法——那麼 POLY 代幣空投規模有可能躋身史上最大規模之列。以 ICE 估值及一般空投分配比例推算,POLY 一旦空投,總分發金額甚至有機會超越 2023 年 Arbitrum 的 19.7 億美元,當時的紀錄至今未被打破。

然而,對這波揣測背後,則是 hype、法規、機構資本與技術不確定性交錯。Polymarket 長期處於監管灰色地帶,2022 年曾與美國商品期貨交易委員會(CFTC)達成和解,直到近期才獲准重返美國市場。該平台核心業務——讓用戶以真金白銀押注選舉、運動賽事或總體經濟指標結果——剛好介於金融衍生品與博弈兩者之間,這將決定 POLY 代幣的法規可行性。

本文將深入探討相關證據、過往案例、風險以及這件事對產業和未來最大的可能影響——如果它真的發生的話。

Polymarket 崛起:從浴室創業到九十億美元估值

Polymarket 運作方式為區塊鏈預測市場,讓用戶對各種未來事件,以二元合約進行交易。每個市場提出一個「是或否」問題:川普是否贏得 2024 年總統大選?聯準會十一月會降息嗎?年底前以太幣會不會破三千美元?

用戶購買每股 0~1 美元之間的合約,價格代表隱含機率。例如每股 0.65 美元,表示市場認為該事件發生機率 65%。事件結束後,選對結果的合約用戶可獲得每股 1 美元(USDC 結算),而未中選者則歸零。這種設計藉由財務誘因集結大眾智慧,理論上預測準確度優於傳統民調。

Polymarket 由 Coplan 於 2020 年 6 月創立。當時他 21 歲,從紐約大學休學,在曼哈頓浴室臨時辦公,最初發展艱辛。在退學之前,他修過電腦科學,並嘗試過多個加密專案。創業靈感來自經濟學家 Robin Hanson 關於預測市場的論文,啟發他打造比專家還有效率聚合分散資訊的新系統。

平台以 Polygon(以太坊第 2 層擴展網)為基礎鏈,交易手續費不到一美分且結算時間快於 5 秒,讓 Polymarket 用戶能即時成交,不必受以太坊主網高額 gas 費困擾。流動性池透過自動化造市商根據買賣壓動態調整價格。

Polymarket 的大突破發生於 2024 年美國總統大選期間。單就「川普對哈里斯」市場,成交量就超過 33 億美元,與選舉相關的市場佔 2024 年 10 月總成交的 76%~91%。月成交量從 2024 年 1 月的 5400 萬美元暴增至 11 月的 26.3 億美元,一年成長 48 倍。

平台預測展現驚人準確度。2024 年 6 月底,總統辯論結束後數日,Polymarket 給出「拜登退選」機率 70%,早於官方宣布數週。同樣該平台約莫在大選投票一個月前就預示川普獲勝,即便如 FiveThirtyEight 等傳統民調當時仍顯示哈里斯略占上風。

截至 2024 年底,根據 The Block 數據,Polymarket 自 2020 啟動以來累積交易額已突破 90 億美元。2024 年 12 月活躍交易用戶達到 314,500 人,當月進行中的市場(open interest)總規模於選舉期間攀上 5.1 億美元高峰。

其用戶組成涵蓋喜歡娛樂及投機的散戶、觀察選情的政治分析師,還有用 Polymarket 數據作為即時預測工具的機構投資人。值得一提的是,2024 年 6 月它與馬斯克旗下 X(原推特)達成協議,將 Polymarket 預測整合進社群數據服務。

Coplan 從沒錢的大學輟學生搖身一變成億萬富翁,正好體現加密產業提倡的創業冒險精神。彭博於 2025 年 10 月 7 日認證他身價破十億,當時 ICE 這一輪估值已衝上 90 億美元。他本人的股份傳聞逾 10%,帳面價值超過 10 億美元。

ICE 兩億美金下注:為何華爾街突然青睞加密預測市場?

洲際交易所(ICE)投資被視為傳統金融機構對於加密基礎設施的重大背書。ICE 除了營運自 1792 年成立的紐約證券交易所外,還掌管全球 13 個交易所,每年交易金額以兆計,監管合規經驗豐富。

2025 年 10 月 7 日公告顯示,這是一次規模高達 20 億美元、投前估值 80 億、投後 90 億美元的戰略性投資。ICE 將獲得 Polymarket 全球唯一事件數據經銷權,向機構客戶提供即時市場主題氣氛指標。雙方亦將合作推動未來的資產代幣化,但細節尚未公開。

ICE 董事長暨執行長 Jeffrey Sprecher 表示:「本投資將 ICE——1792 年成立的紐約證券交易所東主,与前瞻且兼具革命性的 DeFi 業界新貴攜手。」

ICE 對 Polymarket 的投資,是將預測市場視為正規金融工具,而非邊緣賭博。該公司認為 Polymarket 的眾包預測數據有助於彌補傳統資訊盲點,讓貨幣政策、地緣風險等議題擁有新型即時民意。

ICE 投資主因之一,是預測市場在二元明確事件上的預測能力經常媲美甚至超越專家。2024 年選舉時,Polymarket 預測川普勝出遠早於主流民調,驗證了該機制資訊聚合成效。

再者,監管環境正逐步明朗。歷經多年境外經營,Polymarket 於 2025 年 7 月以 1.12 億美元收購獲美國 CFTC 核准的衍生品交易所 QCEX,結合 CFTC 無異議函,為其在美國合法展業鋪路。

第三,預測市場產業正高速成長。Piper Sandler 預估產業收入至 2030 年可達 80 億美元,驅動力包括體育博彩、金融市場預測及企業決策工具。同業 Kalshi 於 2024 年募得 1.85 億美元、估值達 20 億美元,反映資本熱度。

ICE 的加入為 Polymarket 帶來制度公信力、監管經驗並可望加速主流應用。ICE 擅於證券、商品、衍生品監管,有助其導航預測合約的複雜法律環境。

然而,也有聲音擔憂 ICE 的嚴格監管身分將限制 Polymarket 的創新。交易所營運者須受證券、商品及國際機構多重審查。若未來發行 POLY 代幣,將需比一般加密計畫更多合規措施,可能包含證券註冊、反洗錢制度和用戶身份驗證。

市場觀察家指出,ICE 的進場等於讓預測市場正式被納入正規金融資產一環。「這是推動預測市場走入金融主流的重大一步,」Coplan 於公告中表示。該交易也呼應近期傳統金融業者紛紛謹慎踏入加密領域的趨勢。 infrastructure — from JPMorgan's blockchain initiatives to BlackRock's tokenized money market funds.

skip translation for markdown links

這個夥伴關係的「代幣化」元素暗示了未來的潛在方向。ICE 可能利用 Polymarket 的區塊鏈基礎設施,為機構客戶建立受監管的事件合約,或將現有的衍生性金融商品代幣化,以實現鏈上結算。這些可能性目前仍屬於揣測階段,但它們顯示出 ICE 對 Polymarket 的看法不僅僅是資料提供者而已。

POLY 代幣的猜測:線索、模式與市場炒作

no translation for image markdown

目前沒有任何 POLY 代幣的官方文件。Polymarket 尚未提交成立文件、公開發表白皮書或宣布發放計畫。所有的猜測都基於 Coplan 神秘的五個代幣縮寫貼文及一些間接證據,顯示可能正在為代幣發行做準備。

最直接的線索出現在 2024 年 11 月,也就是川普勝選幾天後,Polymarket 的 X 帳號短暫發布過一條訊息「we predict future drops.」(我們預測未來會有空投)。該推文隨即被刪除,但加密貨幣交易者普遍解讀為即將準備發空投的暗示。

更具實質內容的是,在 2025 年 9 月,Polymarket 母公司 Blockratize 提交了 SEC Form D 文件,披露其最近一輪融資中包含「其他認股權證」。這種架構與去中心化交易所 dYdX 在 2021 年 9 月發行代幣前的做法如出一轍,當時早期投資人除了獲得股份,也取得了代幣認股權證。這份文件顯示 Polymarket 可能為未來代幣發放保留彈性空間。

此外,Coplan 在 2025 年 10 月 7 日公開 Polymarket 完成了兩輪此前未曝光的融資:2024 年由 Blockchain Capital 領投的 5500 萬美元,2025 年初則由 Founders Fund 領投、估值達 12 億美元的 1 億 5,000 萬美元融資。後一輪投資者還包括 Ribbit Capital、Valor Equity Partners、Point72 Ventures、SV Angel、1789 Capital、1confirmation 以及 Coinbase Ventures。這些投資方 —— 特別是 Founders Fund 與 Coinbase —— 擁有豐富的代幣項目經驗,往往會在投資協議中談妥代幣分配權益。

Coplan 貼文的五個幣種縮寫格式也充滿象徵意義。把 POLY 與 BTC、ETH、BNB、SOL —— 這四大流通市值最高的加密資產並列,代表 Coplan 的目標是晉身前五大。以目前加密貨幣估值來看,要進入前五市值,POLY 的完全稀釋市值得超過 800 億美元,這意味著必須擁有極具野心的代幣經濟設計與高度分散的流通結構。

市場參與者已根據過往成功的 DeFi 空投案例,開始對可能的空投模式進行揣測。最常見的模式是根據平台使用指標分配代幣,獎勵早期為平臺提供流動性、交易量或創建市場者。Polymarket 可能會截取用戶錢包快照,根據歷史交易量、獲利金額或平台使用時長發放 POLY 代幣。

也有其他分配模式。Blur 在 2023 年舉辦雙重空投,根據遊戲化積分分配給 NFT 市場使用者,有人甚至領超過百萬美元等值的代幣。Arbitrum 在 2023 年 3 月的空投則根據複雜資格矩陣分發,評估了交易次數、過橋金額、網路活躍時長等參數。Celestia 2023 年 10 月空投則鎖定特定對象——開發者、rollup 用戶及 Cosmos 生態參與者——不須「農空投」行為。

對 Polymarket 來說,若干分配標準似乎具有可行性:

- 交易量:以累積 USDC 投注總額獎勵用戶,能激勵流動性提供,但可能導致「刷量交易」——即用戶自導自演增加交易量。Polymarket 過去始終力阻此類行為維持預測準確性。

- 獲利交易:獎勵歷史上有正向盈虧紀錄的用戶,回饋真正具判斷力者。但此方式可能排除那些雖然虧損、卻對流動性貢獻巨大的散戶。

- 創建市場:提出且資助新預測市場的用戶實際推動了平台成長。獎勵市場創建者可促使生態擴展到更多事件類型。

- 時間基準:長期參與(主流採用前即已用戶)的人提供早期流動性與回饋。以帳號年齡分級獎勵可彰顯這些貢獻。

- 混合制:數個指標加權並用,兼顧彈性也減少刷榜動機。參與者可按多個類別累積資格分,最終分配依總分數決定。

目前尚未知快照日期,這對是否計算近期活動納入空投資格帶來不確定性。如果快照早已完成,近期新用戶「農空投」行為就不會被納入;若快照在未來才會發生,則交易行為可能日益不自然,因投機者將為爭取分配調整操作。

空投炒作的市場心理產生自我強化循環。預期發放促進新用戶湧入,自然推高交易量與平台曝光,引來更多希望獲得資格的投機人潮。這樣的飛輪效應,曾幫 Arbitrum 在 2023 年 1 至 5 月間(其 3 月發幣前)TVL 增長了 147%。

然而,炒作也是風險所在。若 POLY 最終未發行,或空投排除多數用戶,市場情緒可能急轉直下。過度承諾卻無法兌現的平台,面臨聲譽損失與用戶流失。Polymarket 至今保持緘默,很可能是在管理預期,並避免觸及未註冊證券發行的監管紅線。

監管複雜性:Polymarket CFTC 和解與合規之路

Polymarket 的監管歷程,使任何潛在的代幣發行變得更複雜。在 2022 年 1 月,CFTC(美國商品期貨交易委員會)對以 Polymarket 名義運營的 Blockratize Inc. 發出處分命令,理由是該公司提供未註冊的二元選擇權合約,且未在 CFTC 登記成為指定合約市場或掉期執行設施。

該命令發現,自 2020 年 6 月起,Polymarket 就非法運營了基於事件的二元選擇權交易市場。平台上合約包括「$ETH(以太幣)在 7 月 22 日是否會高於 2,500 美元?」、「美國 7 日平均 COVID-19 病例數是否會在 7 月 22 日當天低於 15,000?」等。CFTC 才認定這些屬於其管轄的 swap,只能在註冊交易所提供。

Polymarket 同意支付 140 萬美元民事罰款、關閉不合規市場、協助用戶提領資金,並停止違反《商品交易法》。CFTC 指出 Polymarket 積極配合,因此酌情減輕罰款。之後,該平台阻擋美國用戶並將業務重新定位僅服務非美國市場。

「所有衍生品市場——無論採用哪種技術——都得遵守法律界線,這點尤其適用於所謂『去中心化金融』(DeFi)領域。」時任執法局代理主任 Vincent McGonagle 在 CFTC 公告中如此表示。

這次和解,立即造成美國市場對 Polymarket 的封鎖。接下來三年,Polymarket 完全在海外營運,在歐洲、亞洲和拉丁美洲建立用戶群,美國交易者只能遠觀。儘管平台採取地區封鎖措施,監管機關仍懷疑美國用戶以 VPN 等方式繞過限制。

到了 2024 年 11 月,也就是川普贏得大選一週後,FBI 掃蕩了 Coplan 位於曼哈頓的公寓,查扣手機及其電子設備。司法部以 Polymarket 涉嫌允許美國用戶參與違反 2022 年和解協議的賭注為由展開偵查。Polymarket 則稱這次搜索是「政治動機」,暗示該調查源於平台對川普勝選的「精準預測」與主流民調背道而馳。

此次調查於 2025 年 7 月結案,司法部及 CFTC 均宣布不再提出新指控。加上川普政府對加密友善的監管氛圍,Polymarket 終於獲得重回美國的可能性。

2025 年 7 月,Polymarket 宣布以 1 億 1,200 萬美元收購佛州衍生品交易所及結算所 QCEX,該公司擁 CFTC 註冊牌照。這樁交易提供了合規營運美國所需的法規基礎設施。2025 年 9 月,CFTC 市場監管處與清算及風險處聯合發函,豁免 Polymarket 某些報告與紀錄保存要求,實際上等於為其美國業務開綠燈。

「CFTC 已授權 Polymarket 在美國上線。」Coplan 於 2025 年 9 月 4 日宣布。

這段監管歷程突顯預測市場在美國的經營挑戰。事件型合約易模糊商品衍生品(屬 CFTC)、證券(SEC)、博彩(州法)之間的界線。預測市場主張自身是資訊集成,而非賭博,但實際操作機制難脫下注本質。

POLY 代幣未來也會面臨類似的法律分類挑戰。其法律地位視其功能而定:

-

功能型代幣(Utility token):如果 POLY 僅用於進入平台功能——比如減免手續費、治理投票權或市場創建權益——則或有機會被認定為功能型代幣,不受 SEC 管轄。但在多起執法案件中,「功能型代幣」辯護經常失敗,實務上——primarily held for speculative investment.

主要是為投機投資目的而持有。 -

Security token: If POLY represents ownership claims, profit-sharing rights, or investment in Polymarket's business, it would likely constitute a security requiring SEC registration. The Howey Test, established by a 1946 Supreme Court case, defines securities as investment contracts involving money, common enterprise and profit expectations derived from others' efforts.

-

Security token:如果 POLY 代表所有權主張、分紅權益或投資於 Polymarket 業務,那麼它很可能被視為證券,需向美國證券交易委員會(SEC)註冊。Howey 測試(Howey Test)是 1946 年美國最高法院確立的一項標準,定義證券為包含金錢投入、共同事業、利潤期待且利潤來自他人努力的投資合約。

-

Commodity token: If POLY functions as a pure medium of exchange without governance or profit rights, it might be classified as a commodity under CFTC oversight. Bitcoin and Ethereum have received this treatment, though their decentralization distinguishes them from single-company tokens.

-

Commodity token:如果 POLY 僅作為交易媒介,沒有治理權或分紅權,那麼它可能會被視為商品,由美國商品期貨交易委員會(CFTC)監管。比特幣和以太坊皆曾被如此歸類,雖然它們的去中心化特性與單一公司發行的代幣有所區別。

-

Gaming asset: State gambling regulators might argue POLY enables illegal betting, particularly if tokens can be exchanged for fiat currency. This classification would trigger state licensing requirements and potentially criminalize distribution in jurisdictions where online gambling is prohibited.

-

Gaming asset:州級賭博監管機構可能主張,若 POLY 可用於法幣兌換,則屬於非法賭博工具。這種分類將觸發各州的執照要求,並可能在禁止網路賭博的地區導致發行行為觸法。

ICE's involvement adds both credibility and constraint. As a heavily regulated entity, ICE cannot easily partner with platforms offering unregistered securities or facilitating illegal gambling. Any POLY token would likely require extensive legal vetting, potentially including SEC registration, CFTC approval, and state-by-state gambling license review. ICE 的參與同時帶來公信力與限制。作為高度受監管的機構,ICE 無法輕易與提供未註冊證券或非法賭博的平台合作。任何 POLY 代幣都可能需經過嚴格的法律審查,包括但不限於 SEC 註冊、CFTC 核准,以及逐州的賭博執照審查。

The compliance requirements could delay launch indefinitely or result in a heavily restricted token available only to accredited investors through private placement. Such an outcome would undermine the community-building ethos of crypto airdrops, which typically distribute tokens widely to reward grassroots adoption. 合規要求可能使發行時間無限延後,或導致代幣僅能以私募方式發給合格投資人。這將破壞加密空投一貫廣泛分發、獎勵基層用戶的社群精神。

Alternatively, Polymarket might structure POLY as a pure governance token with no economic rights, similar to how Uniswap's UNI token grants voting power without profit-sharing. This approach reduces securities risk but limits token value capture, potentially disappointing users expecting financial upside. 另一種方式是,Polymarket 將 POLY 設計為純治理代幣,不包含經濟權益,如同 Uniswap 的 UNI 僅賦予投票權不分紅。這種做法可降低證券法律風險,但限制了代幣的價值承載,可能令期待財務回報的用戶失望。

International regulatory approaches vary significantly. European Union frameworks under the Markets in Crypto-Assets (MiCA) regulation provide clearer pathways for tokenization, though prediction markets remain contested. Several European countries, including Switzerland, France and Poland, have blocked or restricted Polymarket access under national gambling laws. A POLY token might face similar jurisdiction-by-jurisdiction battles. 國際監管取向差異顯著。歐盟《加密資產市場》(MiCA)規範提供更明確的代幣化路徑,但預測市場仍具爭議。包括瑞士、法國與波蘭在內的數個歐洲國家,已依各自賭博法封鎖或限制 Polymarket。POLY 代幣未來也可能面臨各地法規戰。

Airdrop Mechanics: What "One of the Biggest Ever" Might Mean

To contextualize potential POLY distribution scale, examining historical airdrops provides reference points. Crypto airdrops serve multiple functions: distributing governance rights, rewarding early adopters, generating marketing buzz, and achieving decentralization to bolster regulatory defense. 欲檢視 POLY 可能的發放規模,可參考過往重大加密空投案例。加密空投通常有多重目的:發放治理權、獎勵早期用戶、製造行銷熱度,以及促進去中心化以強化法規防禦力。

The largest crypto airdrop by day-one value remains Uniswap's UNI distribution in September 2020, which allocated $6.43 billion worth of tokens at all-time-high prices. Every address that had used the decentralized exchange received 400 UNI tokens. The airdrop shocked recipients who had used Uniswap casually, suddenly finding themselves holding five-figure sums. 截至目前,單日最高價值的加密空投為 2020 年 9 月 Uniswap 發放 UNI 時,按歷史高點價格計算共分配 64.3 億美元代幣。所有曾在該去中心化交易所互動過的錢包地址皆獲 400 枚 UNI。許多僅隨意用過 Uniswap 的使用者,突然間意外持有數萬美元。

Uniswap's success established the airdrop as a standard DeFi launch mechanism. Subsequent protocols adopted similar strategies with varying scales: Uniswap 的成功讓空投成為 DeFi 問世標配。之後多個協議紛紛仿效,規模不一:

-

Arbitrum (ARB) — March 2023: Distributed 1.162 billion tokens worth approximately $1.97 billion at launch, making it the largest airdrop by day-one market value. Eligible users had to meet multiple criteria including bridging funds to Arbitrum, executing transactions over multiple months, and conducting certain transaction types. The complex eligibility matrix reduced farming effectiveness while rewarding genuine usage.

-

Arbitrum(ARB)— 2023 年 3 月:發放 11.62 億枚代幣,上市首日市值約 19.7 億美元,成為歷來單日最大空投。用戶需達多重資格條件,如跨鏈至 Arbitrum、數月內多次交易、執行特定類型操作等。此複雜條件設計降低了「農夫」的套利效果,獎勵了真正活躍用戶。

-

Optimism (OP) — May 2022: Allocated $672 million worth of tokens to early adopters of the Ethereum layer-2 network. Distribution followed multiple rounds, with subsequent airdrops targeting different user segments.

-

Optimism(OP)— 2022 年 5 月:向乙太坊二層網路早期用戶發放價值 6.72 億美元代幣。分階段空投,不同輪次針對不同用戶群。

-

Ethereum Name Service (ENS) — November 2021: Distributed $1.87 billion to .ETH domain holders, with allocation based on domain registration duration and account age.

-

Ethereum Name Service(ENS)— 2021 年 11 月:向擁有 .ETH 網域的錢包分配共 18.7 億美元,空投量依註冊年期及帳戶年齡調整。

-

Celestia (TIA) — October 2023: Allocated $730 million to developers, rollup users and Cosmos ecosystem participants, explicitly avoiding farming incentives.

-

Celestia(TIA)— 2023 年 10 月:針對開發者、rollup 用戶及 Cosmos 生態成員分發 7.3 億美元,並明確排除「農民」參與資格以避免套利濫用。

-

Blur (BLUR) — February 2023: Two airdrops totaling $818 million rewarded NFT marketplace users based on trading activity. Some power users received over $1 million, though allegations of wash trading controversy followed.

-

Blur(BLUR)— 2023 年 2 月:兩次空投共達 8.18 億美元,依 NFT 市場交易量獎勵用戶。部分重度玩家拿到逾百萬美元,惟亦因洗售交易爭議遭到質疑。

For a POLY airdrop to qualify as "one of the biggest ever," it would need to match or exceed Arbitrum's $1.97 billion day-one value. Given ICE's $9 billion post-money valuation and typical token allocation structures, several scenarios emerge: 若 POLY 空投欲被稱為「史上最大之一」,則需追平或超越 Arbitrum 首日 19.7 億美元的市值。依 ICE 90 億美元估值及常見代幣分配模型,有幾種可能:

-

Conservative scenario: 10% of total token supply allocated to users. If POLY launches at a fully diluted valuation matching Polymarket's equity value ($9 billion), a 10% airdrop would distribute $900 million worth of tokens — substantial but below Arbitrum's record.

-

保守情境:將總量 10% 配給用戶。如 POLY 以 Polymarket 股權價(90 億美元)全面稀釋計價,空投總額為 9 億美元,大型但未破 Arbitrum 記錄。

-

Moderate scenario: 15-20% allocation to users, combined with a token valuation premium over equity valuation (common in crypto markets where tokens trade at multiples of underlying business value). A 15% allocation at a $15 billion fully diluted valuation would yield a $2.25 billion airdrop, exceeding Arbitrum's record.

-

積極情境:以 15-20% 配給,並將代幣市場價設在高於股權價的水位(加密圈常見現象)。15% 配給、全面稀釋估 150 億美元,空投總額 22.5 億美元,超越 Arbitrum。

-

Aggressive scenario: 25-30% allocation with significant valuation premium, driven by hype and ICE's institutional backing. A 25% allocation at a $20 billion fully diluted valuation would create a $5 billion airdrop — nearly 2.5x larger than any previous distribution.

-

超激進情境:25-30% 配給,且由市場熱度及 ICE 資本助推代幣價值至 200 億美元全面稀釋市值,則 25% 空投將達 50 億美元,為歷來空投規模 2.5 倍的新高。

The latter scenario might seem implausible, but crypto markets have repeatedly demonstrated willingness to assign valuations disconnected from traditional metrics. Tokens often trade at premiums to equity valuations, reflecting greater liquidity, speculative interest and governance value. 最後一種情境乍看誇張,但加密市場常以高度溢價評價新代幣,其價格常遠高於傳統企業股權,反映了流動性、投機期待、治理價值等額外溢價。

However, achieving a successful large-scale airdrop requires careful design to balance competing objectives: 然而,要讓大規模空投順利成功,需在多元目標間審慎權衡:

-

Sufficient distribution breadth to achieve decentralization and regulatory defensibility. Securities law analysis often considers whether token ownership is sufficiently dispersed that no single entity controls the network.

-

必須有足夠廣泛的分發,促進去中心化,強化法律抗辯力。證券法律分析時常考量網路是否已無單一主控者。

-

Adequate allocation depth to create meaningful economic stakes for recipients, incentivizing ongoing participation and governance engagement.

-

分配金額需具意義性,以建立使用者的實質獎勵,激勵參與長期治理。

-

Anti-gaming measures to prevent wash trading, sybil attacks (creating multiple accounts to claim multiple allocations), and other manipulation tactics that dilute rewards for genuine users.

-

設計防堵作弊的機制(如洗售、女巫攻擊等惡意多帳申領),避免濫用稀釋真用戶利益。

-

Vesting schedules to prevent immediate mass dumping that could crash token price, destroying value for long-term holders.

-

設立解鎖期,避免一上線就遭到砸盤,損害長期參與者利益。

Reserve allocations for future community initiatives, ecosystem development, and team retention, ensuring the project remains sustainable beyond the initial launch. 亦需保留資源,用於未來社群活動、生態發展、團隊留任等,以保專案可持續經營。

Past airdrops offer lessons in pitfalls to avoid. Arbitrum's launch experienced severe technical issues, with the blockchain explorer crashing and users paying exorbitant gas fees to claim tokens. Blur's gamified farming incentives led to wash trading that distorted NFT market metrics. Worldcoin's biometric verification approach raised privacy concerns and regulatory scrutiny. 過去空投經驗也展現不少陷阱。例如 Arbitrum 上線時區塊瀏覽器多次癱瘓,用戶為了領幣支付高額手續費;Blur 以遊戲化農耕激勵,反促洗售惡化 NFT 數據;Worldcoin 的生物辨識驗證則引發嚴重隱私及監管爭議。

If Polymarket pursues an airdrop, its decentralized structure on Polygon provides advantages. Polygon's low transaction costs would make claiming tokens inexpensive, avoiding the gas fee catastrophe that plagued Arbitrum. The blockchain's high throughput could handle concurrent claim transactions without network congestion. 若 Polymarket 推行空投,其架設於 Polygon 去中心化架構帶來明顯優勢。Polygon 交易費用低廉,能避開 Arbitrum 當初高額手續費災難;其高吞吐量亦足以應付大規模同時申領,不會擁塞全網。

However, Polymarket's regulatory constraints create unique challenges. The platform's U.S. ban from 2022-2025 means many early users were international. An airdrop including international recipients might face securities law complications if tokens are deemed investments. Conversely, restricting distribution to U.S.-cleared users would exclude the community that sustained Polymarket during its offshore years, potentially triggering backlash. 然而 Polymarket 的監管現實下另具挑戰。平台 2022-2025 年期遭美國封禁,早期用戶多為海外人士。若空投納入國際用戶,且代幣被定義為投資工具,便可能惹上證券法問題;若僅限美國合規用戶,又將忽略離岸時期撐起社群的用戶群,易激起不滿。

The ICE partnership adds another layer of complexity. Would ICE want its name associated with a massive, unregulated token distribution that might enrich speculators? Or would the exchange operator insist on a controlled rollout with extensive KYC, potentially undermining crypto's permissionless ethos? ICE 的加入讓情勢再度複雜。ICE 會否容許自己名下項目參與大型、無監管的空投,讓炒作獲利者大撈一筆?又或是堅持全程實名認證,徹底毀棄加密世界著重開放性的傳統?

Technical Unknowns: Chain, Governance and Token Utility

No technical specifications exist for POLY, leaving fundamental architecture questions unanswered: 目前尚無任何 POLY 技術細節公布,基本架構設計仍未定案:

-

Blockchain selection: Polymarket currently operates on Polygon, making it the natural choice for a native token. Polygon's infrastructure advantages include sub-cent transaction fees, five-second settlement, and established institutional adoption — BlackRock's BUIDL tokenized money market fund runs on Polygon, as do enterprise partnerships with Nike and Stripe. The network recently completed the Rio upgrade, increasing throughput to 5,000 transactions per second with near-instant finality and zero reorganization risk.

-

區塊鏈選擇:Polymarket 目前運作於 Polygon,故其代幣最直覺也將發在 Polygon。Polygon 具備手續費低於一美分、五秒結算、大型機構採用(如貝萊德 BUIDL、Nike、Stripe 等)等基礎設施優勢。且鏈上剛完成 Rio 升級,將吞吐提升至每秒 5000 筆,實現即時最終確定、無重組風險。

-

However, alternatives exist. Ethereum mainnet offers maximum security and decentralization but suffers from high fees that would make frequent POLY transactions impractical. Other layer-2 solutions like Base (Coinbase's network), Arbitrum, or Optimism could provide competitive infrastructure with different tradeoffs in decentralization versus performance.

-

然而不只一種選擇。以太坊主網安全性最高、極度去中心化,但手續費昂貴,難以承受高頻 POLY 交易。其他二層解決方案如 Base(Coinbase)、Arbitrum、Optimism,則可能在去中心化和效能之間取不同平衡,給出新競爭力。

-

Solana represents another option, offering high throughput and low costs comparable to Polygon but with different validator economics and ecosystem positioning. However, migrating from Polygon to Solana would require substantial technical work and abandon existing infrastructure investments.

-

Solana 亦為選項,擁有與 Polygon 相當的高效能與低費用,但計算節點經濟模型與生態定位大異。從 Polygon 遷移至 Solana,需巨幅技術重構,既費時又耗損原有架構投資。

-

Multi-chain deployment could maximize accessibility, allowing POLY to exist simultaneously on Ethereum, Polygon, and other networks via bridges. This approach increases complexity but expands potential user base and liquidity venues.

-

多鏈部署則可最大化使用者覆蓋率,使 POLY 同時存在於以太坊、Polygon 等多條網路並可透過橋接轉移。此舉會增加複雜度,但有助拓寬用戶基礎和流動性渠道。

-Token supply and distribution: 總代幣供應量從根本上決定了其價值與通膨(膨脹)動態。固定供應模式(如比特幣的 2100 萬上限)帶來稀缺性,但限制了未來獎勵與生態系激勵的彈性。具備程式化發行的通膨模式則能支撐網絡持續安全,卻會稀釋現有持有者的權益。

Distribution mechanisms include:

- Airdrop to existing users (10-30% of supply)

- Team and investor allocations with multi-year vesting (20-30%)

- Ecosystem reserves for market creation incentives, liquidity mining, grants (20-30%)

- Treasury for governance-directed initiatives (10-20%)

- Public sale or liquidity provision (0-10%)

分配機制包含:

- 空投給現有用戶(庫存 10-30%)

- 團隊與投資人多年度歸屬分配(20-30%)

- 生態儲備,用於市場啟動激勵、流動性挖礦、補助(20-30%)

- 國庫金庫,用於治理導向倡議(10-20%)

- 公開發售或流動性提供(0-10%)

即時分配與長期儲備的平衡,會影響代幣流通速度(token velocity,即代幣週轉率)和稀缺性。早期空投比例過重,雖然容易產生拋壓並帶起話題,但保守分配則有助於保存未來彈性,卻可能讓部分使用者短期預期落空。

Governance mechanisms: Most DeFi tokens grant voting rights over protocol parameters. For Polymarket, POLY could enable governance over:

- Market resolution rules and oracle selection

- Fee structures for trading and market creation

- Treasury allocation for ecosystem development

- Protocol upgrades and technical improvements

- Listing standards for new event categories

治理機制:大多數 DeFi 代幣賦予協議參數的投票權。就 Polymarket 而言,POLY 可以讓用戶參與下列治理:

- 市場結算規則及預言機選擇

- 交易與建立市場的費率結構

- 生態系發展的國庫金分配

- 協議升級與技術改進

- 新賽事類型的上架與標準

治理模型從最簡單的代幣加權投票(一幣一票),到更複雜的如投票委託、二次方投票(quadratic voting)、或鎖倉投票(time-locked voting),即承諾持有越久權力越大等模式。

有效治理需平衡財閥化(由富人主導投票結果)與民粹化(低資訊選民做出錯誤技術決策)的矛盾。許多協議皆面臨低參與率困境,治理提案的投票率往往不到 10%。

Utility mechanisms: Beyond governance, POLY could serve multiple platform functions:

- Fee rebates: Users staking POLY receive reduced trading fees, similar to Binance's BNB model. This creates holding incentives and reduces token velocity.

- Market creation deposits: Requiring POLY deposits to create new prediction markets would deter spam while rewarding successful market creators who attract trading volume.

- Liquidity mining: Users providing liquidity to prediction markets earn POLY rewards, incentivizing market depth and tighter spreads.

- Resolution staking: POLY holders stake tokens to vote on disputed market outcomes, earning rewards for correct judgments and suffering slashing for wrong votes. This mechanism aligns incentives for accurate resolution.

- Data access: Premium data feeds or advanced analytics could require POLY payment, creating revenue streams for token holders.

- Advertising: Market creators could pay POLY to promote their prediction markets to platform users, creating organic demand.

效用機制:除了治理之外,POLY 還能具備多種平台功能:

- 交易費減免:用戶質押 POLY 享有較低交易手續費,類似幣安的 BNB 模式,創造持有動機並減緩代幣流通速度。

- 市場創建保證金:建立新預測市場時需存入 POLY,可以阻絕垃圾市場,同時獎勵成功吸引交易量的市場創建者。

- 流動性挖礦:為預測市場提供流動性的用戶,獲得 POLY 獎勵,激勵更好的市場深度和更小價差。

- 結算質押:POLY 持有人可質押代幣參與有爭議市場的裁決,正確判斷獲得獎勵,錯誤則會被懲罰。此機制使正確結算有經濟誘因。

- 數據服務:高級資料供應或進階分析可要求以 POLY 支付,為代幣持有人帶來收入來源。

- 廣告推廣:市場創建者可支付 POLY 在平台中推廣預測市場,形成有機需求。

效用設計組合直接影響價值累積:也就是經濟活動能有多少反映在代幣價格。強大的效用帶來穩定需求,薄弱的效用則使代幣成為單純的投機工具。

Technical risks: Smart contract vulnerabilities represent significant risk for any token launch. Bugs in token logic, governance contracts, or staking mechanisms could enable theft, unintended inflation, or governance attacks. Extensive auditing by reputable security firms (Trail of Bits, OpenZeppelin, ConsenSys Diligence) is standard practice, but audits cannot guarantee zero risk.

技術風險:智能合約漏洞對任何代幣發行來說都代表重大風險。代幣邏輯、治理合約及質押機制的 bug 可能導致盜竊、非預期的通膨,甚至治理攻擊。委託知名安全公司(如 Trail of Bits、OpenZeppelin、ConsenSys Diligence)做全面審計已經是業界標準,但審計也無法保證零風險。

Oracle dependencies also matter. If POLY governance relies on off-chain voting aggregation or market resolution data, oracle manipulation could compromise system integrity. Chainlink, Pyth, and other oracle networks provide data feeds, but each carries specific trust assumptions.

預言機依賴也很重要。如果 POLY 治理需要鏈下投票彙總或市場結算數據,預言機遭操控可能危及系統安全。Chainlink、Pyth 等預言機方案雖提供數據來源,但各自也有不同信任前提。

Regulatory classification affects technical design. If POLY must comply with securities law, the token might require transfer restrictions, investor accreditation verification, or lock-up periods — all of which complicate technical implementation and reduce composability with DeFi protocols.

監管分類會影響技術設計。如果 POLY 需符合證券法,則代幣可能會有轉讓限制、投資人資格認證或鎖定期——這些都會讓技術實作更為複雜,且降低與 DeFi 協議的可組合性。

Risk and Compliance Perspectives: ICE Changes the Game

ICE's involvement fundamentally alters the risk profile of a potential POLY token. When a heavily regulated NYSE parent invests $2 billion, it brings institutional risk management standards that crypto-native projects rarely face.

風險與合規觀點:ICE 介入改變一切

ICE 的參與從根本上改變了 POLY 代幣的風險輪廓。當嚴格監管的紐約證交所母公司投入 20 億美元時,所帶來的機構級風控標準,是傳統加密項目鮮少面臨的。

Anti-money laundering (AML) and know-your-customer (KYC) requirements: ICE operates under Bank Secrecy Act requirements, European Market Infrastructure Regulation, and dozens of other compliance frameworks. Any POLY token distribution or trading venue associated with ICE would likely require identity verification to prevent money laundering, terrorist financing, and sanctions evasion.

反洗錢(AML)與認識你的客戶(KYC)要求:ICE 遵循銀行保密法、美國與歐洲金融基礎設施法規及數十種合規框架。與 ICE 相關的任何 POLY 代幣發行或交易平台,很可能都需經過身份驗證,以防止洗錢、恐怖分子融資及規避制裁。

Traditional airdrops often distribute tokens to anonymous blockchain addresses with no KYC requirements, embracing crypto's pseudonymous ethos. However, ICE cannot partner with anonymous token distributions without regulatory exposure. This tension might force a hybrid model: unverified users receive limited allocations with transfer restrictions, while KYC-compliant users access full functionality.

傳統空投經常用於分發給匿名區塊鏈地址,無需 KYC,代表加密貨幣的假名精神。然而 ICE 不能與匿名空投合作,否則會有監管風險。這種矛盾可能迫使採用混合模式:未驗證者僅能有限領取且有轉讓限制,KYC 合格用戶則能享受全部功能。

Smart contract auditing and insurance: Institutional involvement demands rigorous technical diligence. ICE would likely require multiple independent security audits, formal verification of critical smart contract logic, bug bounty programs, and potentially smart contract insurance coverage. These measures add significant development time and cost but reduce catastrophic risk.

智能合約審計與保險:機構參與需嚴謹技術盡職調查。ICE 可能會要求多重獨立安全審計、對關鍵智能合約進行形式化驗證、懸賞漏洞計畫,甚至購買智能合約保險。這些措施會增加大量成本與開發時程,但能降低重大災難風險。

Custody and key management: Institutional token holders require qualified custodians with proper insurance, segregated wallets, and disaster recovery procedures. If POLY grants governance rights, ICE might need custody solutions that enable vote delegation without exposing private keys to online systems.

託管與私鑰管理:機構級代幣持有人需經過資質驗證的託管方,擁有適當保險、分離錢包與災難復原流程。如果 POLY 給予治理權限,ICE 還須有能不暴露私鑰於網路但能執行投票委託的託管方案。

Tax reporting: U.S. tax law treats cryptocurrency as property, requiring cost basis tracking and capital gains reporting for every transaction. Institutional investors need detailed transaction histories for tax compliance. Polymarket would need to provide Form 1099 reporting infrastructure for POLY distributions and trading activity, adding operational complexity.

稅務申報:美國稅法將加密貨幣視為財產,要求每筆交易皆追蹤成本基礎並申報資本利得。機構投資人需要完整的交易紀錄以符合法令。Polymarket 需建立 1099 表格報告基礎設施,對 POLY 發放與交易進行申報,這會增加大量營運複雜度。

Market manipulation surveillance: Securities regulators prohibit wash trading, spoofing, and other manipulation tactics. Even if POLY is not classified as a security, ICE's reputational risk demands robust market surveillance. Polymarket would need systems to detect and prevent coordinated manipulation, insider trading ahead of market resolution, and other abusive practices.

市場操縱監控:證監會禁止洗售(wash trading)、虛假下單(spoofing)等操縱手法。即使 POLY 未被列為證券,ICE 基於聲譽也須嚴格市場監控。Polymarket 需建立系統以偵測並防範共謀操縱、結算前內線交易與其他不當行為。

Legal classification: The token's legal status remains the central question. Several frameworks apply:

- The Howey Test (SEC securities analysis) examines whether POLY involves: (1) an investment of money, (2) in a common enterprise, (3) with expectation of profits, (4) derived from others' efforts. If all four prongs are satisfied, POLY is a security requiring registration.

- The Reves Test (debt security analysis) considers whether tokens represent loans with fixed returns, as opposed to equity or utility assets.

- The Lanham Act (consumer protection) evaluates whether token marketing makes false or misleading claims about functionality, value, or regulatory status.

- State-level securities laws (Blue Sky Laws) add another layer. Even if POLY passes federal scrutiny, individual states might require separate registration or impose restrictions.

法律分類:代幣的法律定位是核心難題,目前有幾套框架適用:

- Howey 測試(SEC 證券分析):檢查 POLY 是否涉及(1)資金投入,(2)共同事業,(3)有獲利預期,(4)利潤來自他人努力。若全部命中,POLY 屬於必須註冊的證券。

- Reves 測試(債券證券分析):判斷代幣是否屬於具固定報酬的借貸票據,而非股權或效用型資產。

- Lanham 法案(消費者保護):判定代幣推廣是否對功能、價值或監管狀態有虛假或誤導主張。

- 州級證券法(Blue Sky Laws):即使 POLY 通過聯邦審查,個別州也可能要求註冊或其他合規限制。

Recent case law provides limited guidance. The SEC has pursued numerous token issuers, achieving settlements that establish certain tokens as securities (XRP partially, various DeFi tokens). However, courts have also found that tokens can evolve from securities to non-securities as networks mature and decentralize.

近期案例法指引有限。SEC 曾對多家發幣方提訴,和解後部分代幣被認定為證券(如 XRP 部分,以及多款 DeFi 代幣)。但法院也認可隨著網絡成熟與去中心化,代幣可從「證券」轉為「非證券」。

Compliance strategies: Several approaches could mitigate regulatory risk:

- Registration approach: File Form S-1 registration with the SEC, treating POLY as a security from inception. This ensures legal clarity but imposes extensive disclosure requirements, financial auditing, and ongoing reporting obligations. Only accredited investors could purchase tokens in private placements, limiting distribution breadth.

- Regulation A+ exemption: Use Reg A+ mini-IPO provisions to offer up to $75 million in tokens annually to non-accredited investors with simplified disclosure. This allows broader distribution than traditional securities offerings but still requires SEC review.

- Utility token defense: Design POLY strictly as a governance and utility token with no economic rights, arguing it falls outside securities law. Emphasize decentralized governance, community ownership, and use-case functionality rather than investment potential. This approach carries enforcement risk if SEC disagrees.

- International structuring: Launch POLY through foreign entities in jurisdictions with clearer crypto frameworks (Switzerland, Singapore, UAE), restricting U.S. access until regulatory clarity improves. This limits U.S. market exposure but abandons Polymarket's largest potential user base.

- Progressive decentralization: Begin with centralized control, KYC requirements, and conservative distribution. Gradually transition toward decentralization as the network matures, arguing that initial security status evolves into commodity status. This follows the approach suggested in SEC Commissioner Hester Peirce's "safe harbor" proposal.

合規策略:可考慮下列方案減輕監管風險:

- 註冊路線:向 SEC 提交 S-1 表格,直接將 POLY 視為證券。能確保法律明確性,但需廣泛資訊揭露、財報審計及持續申報義務。僅限合資格投資人私募申購,限制流通範圍。

- Regulation A+ 豁免:用 Reg A+ 小型 IPO 機制向非認可投資人公開發行,每年上限 7500 萬美元且資訊揭露簡化,相對更能大範圍分發,但仍需 SEC 審查。

- 效用性抗辯:將 POLY 嚴格設計為治理與效用型代幣,無經濟權益,主張不受證券法規管。強調去中心化治理、社群所有與使用場景,而非投資收益。但若 SEC 持不同見解則有執法風險。

- 國際結構:透過瑞士、新加坡、阿聯酋等監管明確國家發行,初期限制美國用戶參與,待監管明朗再開放。此法能減少美國風險,但也放棄最大潛在用戶市場。

- 漸進去中心化:先採中心化管理、KYC 與保守配發,網絡成熟後逐步去中心化,主張證券初期地位已轉型為商品化。這種方式接近 SEC 專員 Hester Peirce 的「安全港」提案。

ICE's involvement likely favors conservative compliance. The company has negligible risk tolerance for securities violations, money laundering exposure, or sanctions breaches. A POLY token backed by ICE would probably include extensive identity verification, transaction monitoring, and restricted distribution — disappointing crypto purists but reassuring regulators.

ICE 的參與極可能走保守合規路線。該公司對證券違規、洗錢、違反制裁等零容忍。ICE 支持的 POLY 代幣勢必會包含嚴格身分認證、交易監控及受限分配──雖讓加密純粹主義者失望,但能讓監管機關放心。

U.S. vs. International Prediction Market Regulation: A Fragmented Landscape

美國 vs. 國際預測市場監管:分歧的監管圖景

Regulatory treatment of prediction markets varies dramatically acrossjurisdictions, complicating any global token launch.

司法管轄區,讓任何全球代幣發行變得更加複雜。

United States: Federal oversight splits between CFTC (commodity derivatives) and state gambling regulators. The CFTC permits event contracts but requires designated contract market registration. States maintain independent authority over gambling, with most prohibiting or heavily restricting online betting outside sports.

美國:聯邦監管分為美國商品期貨交易委員會(CFTC,商品衍生品)與州級博彩監管機構。CFTC允許事件合約,但要求註冊指定合約市場。各州對博彩擁有獨立管理權力,大多數州在體育以外對線上賭博採取禁止或嚴格限制的態度。

Kalshi operates as a CFTC-registered designated contract market, offering fully compliant event contracts on elections, economic indicators, and weather. However, Massachusetts regulators sued Kalshi in 2025, claiming its NFL contracts constitute illegal sports betting under state law. The case could determine whether federal CFTC jurisdiction preempts state gambling prohibitions.

Kalshi 作為 CFTC 註冊的指定合約市場,提供符合規範的選舉、經濟指標和天氣等事件合約。但在2025年,麻薩諸塞州監管機構起訴Kalshi,聲稱其NFL合約依據州法律構成非法體育賭博。此案可能決定聯邦CFTC的管轄權是否優先於州級博彩禁令。

The Unlawful Internet Gambling Enforcement Act of 2006 prohibits processing payments for illegal online gambling but contains exemptions for "skill games" and certain financial instruments. Prediction markets argue they qualify as skill-based information aggregation rather than gambling, but this distinction remains contested.

2006年非法網路賭博執法法案禁止為非法線上賭博處理付款,但對「技能遊戲」與部分金融商品有豁免。預測市場主張他們屬於以技能為基礎的資訊聚合,而非賭博,但這一區分仍存有爭議。

European Union: MiCA regulation establishes comprehensive crypto asset frameworks but largely omits prediction markets, leaving member states to determine classification. Individual countries diverge significantly:

歐盟:MiCA 法規建立了全面的加密資產體系,但多數未涵蓋預測市場,因此分類由會員國自行決定。各國規範差異很大:

- France: The National Gaming Authority (ANJ) blocked Polymarket in November 2024, requiring geo-restriction for French users due to violations of gambling and sports betting laws.

法國:國家博彩管理局(ANJ)於2024年11月屏蔽Polymarket,因違反賭博與體育博彩法,要求對法國用戶實施地理封鎖。 - Poland: The Ministry of Finance blocked Polymarket in January 2025 under anti-gambling provisions.

波蘭:財政部於2025年1月根據反賭博條例封鎖Polymarket。 - Switzerland: The Federal Gaming Board blocklisted Polymarket in November 2024 for controversial prediction market aspects violating gambling regulations.

瑞士:聯邦博彩管理局於2024年11月將Polymarket列入黑名單,理由是有爭議的預測市場違反賭博規定。 - United Kingdom: Gambling Commission oversees betting markets, requiring operator licenses. Prediction markets on financial outcomes may fall under Financial Conduct Authority oversight.

英國:賭博委員會負責監管賭盤市場,營運商需持有牌照。若預測市場結果涉及金融,可能會受到金融行為監管局(FCA)監管。

Asia-Pacific: Approaches range from restrictive to permissive:

亞太地區:各國態度從嚴格限制到較為開放不等:

- Singapore: Blocked Polymarket under gambling laws, restricting access for residents.

新加坡:依賭博法禁止Polymarket,限制本地居民使用。 - Japan: Gambling restrictions are strict, though regulated sports betting exists. Crypto prediction markets lack clear legal framework.

日本:賭博限制非常嚴格,雖有受監管的體育博彩。加密預測市場則尚無明確法律架構。 - Australia: Interactive Gambling Act prohibits offshore gambling services without Australian licensing. Prediction markets might qualify as derivatives outside gambling law, but classification remains ambiguous.

澳洲:《互動賭博法》禁止未獲澳洲牌照的離岸賭博服務。預測市場在博彩法之外或可被歸類為衍生品,但定義依舊模糊。

The fragmented landscape creates operational challenges. A global POLY token would need to navigate dozens of legal regimes, potentially requiring geo-restrictions, market-specific features, or separate token variants for different jurisdictions.

這種支離破碎的監管格局帶來營運挑戰。全球發行的POLY代幣必須應對數十種法律體系,可能要實施地區封鎖、設計市場專屬功能,或為不同司法區設立分別的代幣形式。

ICE's international exchange operations provide expertise in multi-jurisdiction compliance. The company manages regulatory requirements across North America, Europe and Asia, offering a template for POLY token structuring. However, ICE's conservative approach might result in overly restrictive access, limiting token utility in major markets.

ICE的國際交易所業務擅長多司法區合規。公司橫跨北美、歐洲與亞洲處理監管要求,為POLY代幣架構提供參考範本。然而,ICE採用保守策略,可能導致訪問過度受限,限制代幣於主要市場的實用性。

Market Reaction: Trading, Memes and Tokenized Information Futures

市場反應:交易、迷因與資訊未來的代幣化

Coplan's five-ticker post ignited immediate social media speculation. Within hours, crypto Twitter flooded with analysis threads, meme posts, and eligibility guides for potential POLY recipients.

Coplan發佈的五標籤推文立刻引發社群媒體瘋傳。幾小時內,加密貨幣推特湧現分析文、迷因貼圖以及各種可能獲得POLY的資格攻略。

"Is this confirmation of the coin release?" asked Unstoppable Domains, a blockchain domain service provider, in response to Coplan's post.

區塊鏈域名服務商Unstoppable Domains對Coplan的貼文回應:「這是不是代幣發行的正式確認?」

Community members dissected Coplan's tweet history for additional clues. The thinking emoji (🤔) suggested intentional ambiguity, neither confirming nor denying token plans. The choice of BTC, ETH, BNB and SOL — rather than smaller-cap assets — signaled ambitious market positioning.

社群成員開始解讀Coplan以往的推文尋找更多線索。思考表情符號(🤔)顯示故意保持模糊,既不證實也不否認代幣計畫。選擇BTC、ETH、BNB和SOL這些主流資產而非小幣種,也暗示了品牌定位的野心。

Prediction markets on competing platforms reflected uncertainty. Myriad, a prediction market operated by Decrypt's parent company, showed 65% odds that Polymarket would not announce a token in 2025 — though those odds improved from 83% after Coplan's post, indicating the tweet shifted sentiment despite lack of confirmation.

競爭平台上的預測市場反映出不確定性。Decrypt母公司的預測市場Myriad顯示,Polymarket在2025年不會發行代幣的機率為65%,但在Coplan貼文後,這個機率從83%下降,顯示雖無正式確認,推文仍改變了市場情緒。

Polymarket's own markets showed no official prediction on POLY token launch, likely to avoid creating conflicts of interest or regulatory complications. However, Discord and Telegram communities dedicated channels to airdrop speculation, with users sharing on-chain heuristics and eligibility models.

Polymarket本身沒有開設任何有關POLY代幣發行的官方預測市場,應是為了避免產生利益衝突或監管責任。不過,Discord和Telegram等社群平台已設有空投討論頻道,大家紛紛分享鏈上行為分析與合格判斷標準。

Several behaviors emerged as traders attempted to position for potential airdrops:

為求提前布局潛在空投,用戶出現下列行為:

- Volume farming: Users artificially inflated trading activity by repeatedly buying and selling the same position, hoping volume-based allocation would reward them. Polymarket's order book structure makes this easier than automated market makers, where large trades face price impact.

交易量農耕:用戶重複買賣相同倉位,人為提升交易量,希望空投採交易量分配時能受益。Polymarket的訂單簿現貨撮合方式,讓此行為比自動做市商(AMM)平台容易,而後者大額交易會有明顯價格影響。 - Wash trading: Coordinated trading between multiple accounts controlled by the same person creates apparent activity without genuine risk. Blockchain analytics firms like Chainalysis can detect some wash trading patterns, but sophisticated actors employ mixing techniques to obscure connections.

洗售交易:同一人控制多帳戶彼此對倒,營造活躍表象卻無實際風險。Chainalysis等區塊鏈分析公司可偵測部分洗售交易,但有些高手會用混幣等手段降低被追蹤風險。 - Market creation: Users proposed new prediction markets across diverse categories, hoping that market creator rewards would factor into airdrop calculations. The platform saw a surge in niche markets on obscure topics, some with minimal trading volume.

建立新市場:用戶大量開設新主題的預測市場,企圖藉市場創建獎勵納入空投評選。平台因此湧現不少小眾或冷門題材,部分市場幾無成交量。 - Profitability optimization: Rather than chasing volume, some traders focused on maintaining positive PnL records, anticipating that profitable users might receive preferential allocation. This approach requires genuine prediction skill rather than mechanical farming.

獲利優化:有些用戶不追求成交量,而專注維持高勝率和正報酬,希望有獲利紀錄者能獲得較佳分配。這就需要真本事而非純「農耕」。 - Social engagement: Users increased activity on Polymarket's social channels, participated in Discord discussions, and promoted markets to followers. If the airdrop includes social engagement metrics, early community builders could benefit.

社群活躍度:用戶在Polymarket社群頻繁發言、積極參加Discord討論並對外推廣市場。若空投計算包括社群參與,早期推廣者有望獲利。 - The speculation itself became a subject of prediction markets on other platforms. Kalshi and PredictIt created contracts on whether Polymarket would announce a token by specific dates, effectively allowing users to hedge their POLY speculation.

空投猜測本身也成為其他平台的預測標的。Kalshi與PredictIt開設了「Polymarket是否會在指定日期前宣布發幣」的預測市場,等於用戶可以對自己的POLY投機行為進行對沖。

Crypto media coverage amplified the hype cycle. CoinDesk, The Block, Decrypt, and other major publications ran analysis pieces examining the evidence, potential scale, and regulatory implications. Bloomberg's billionaire list addition for Coplan provided mainstream credibility, with CNBC and Wall Street Journal coverage introducing prediction markets to traditional finance audiences.

加密媒體報導讓熱潮進一步升溫。CoinDesk、The Block、Decrypt等主流媒體紛紛發布解析報導,探討各種證據、規模潛力和監管影響。彭博將Coplan列入億萬富豪榜提升了社會認可度;CNBC和華爾街日報的報導也讓預測市場首次大規模進入傳統金融圈視野。

Meme culture embraced the speculation. Social media filled with images of Coplan's bathroom office setup, contrasting humble origins with current billionaire status. "Against all odds" became a recurring phrase, lifted from Coplan's own tweet contextualizing his journey.

迷因文化也全程參與這場熱議。社群上流傳著Coplan浴室辦公桌的圖片,象徵他從平凡到億萬富翁的對比。「Against all odds」(逆勢而上)也成為社群口頭禪,源自Coplan自己貼文對其旅程的描述。

The attention created reflexive dynamics. Increased coverage drove new user acquisition, which boosted trading volume, which generated more coverage. Polymarket's daily active users fluctuated but maintained elevated levels compared to pre-speculation baseline, suggesting sustainable interest beyond pure airdrop farming.

高關注產生自我循環效應。媒體討論吸引更多新用戶,帶動交易量再帶來進一步報導。雖然每日活躍用戶有所波動,但明顯高於炒作前的基準線,暗示需求有望延續並不限於「農耕」空投。

Market sentiment data from Kaito, which tracks crypto mindshare across social platforms, showed prediction market discussion rising from under 1% of crypto conversation in early 2025 to nearly 3% by October — a threefold increase correlated with election activity and ICE investment news.

數據平台Kaito監測社群加密貨幣輿情顯示,預測市場討論度在2025年初僅占不到1%,至10月已升至近3%,成長三倍。這波成長與大選活動和ICE投資新聞高度相關。

Expert Opinions and Industry Outlook: Between Validation and Skepticism

專家觀點與產業展望:肯定與質疑並行

Industry analysts offered mixed perspectives on both Polymarket's future and potential POLY token implications.

產業分析師對Polymarket未來及POLY代幣發行前景看法分歧。

Thomas Peterffy, founder of Interactive Brokers, framed prediction markets as educational tools: "Prediction markets teach the public to think in probabilities. They turn opinion into measurable confidence." This perspective emphasizes social value beyond pure profit-seeking, aligning with arguments that prediction markets improve collective decision-making.

盈透證券創辦人Thomas Peterffy認為預測市場有教育意義:「預測市場教大眾用機率思考,把意見轉為可量化信心。」此觀點強調其超越獲利動機的社會價值,與支持預測市場能促進全社會決策品質的看法一致。

However, skepticism persists. CFTC Commissioner Kristin Johnson warned in 2025 that "speculative incentives can blur intent" in prediction markets, expressing concern that platforms marketed as information aggregation tools function primarily as gambling venues.

但質疑聲音仍備受關注。CFTC委員Kristin Johnson於2025年警告:「投機誘因會模糊預測市場的本意」,擔憂這些號稱資訊聚合工具的平台實際上主要是在推賭博。

"The greatest thing crypto has done is rebranding 'betting' as 'prediction markets,' right up there with calling salt and rocks 'electrolytes,'" wrote mert, CEO of blockchain infrastructure firm Helius and former Coinbase engineer. The critique highlights how linguistic framing shapes regulatory and public perception.

Helius執行長、前Coinbase工程師mert諷刺:「加密貨幣業最大成就是把賭博改名叫『預測市場』,就跟把鹽和石頭叫做『電解質』一樣。」這番話凸顯語言包裝對監管及公眾觀感的影響力。

Venture capital perspectives reflect cautious optimism. Claude Donzé, a principal at Greenfield Capital, told DL News: "This is a major challenge for them. I would be surprised if they can get another bet of similar size sometime soon," referring to Polymarket's post-election volume decline. The comment questions whether platform engagement can sustain without marquee events like presidential elections.

創投圈普遍冷靜樂觀。Greenfield Capital合夥人Claude Donzé接受DL News訪問時表示:「這對他們是重大挑戰。如果他們近期還能再有一次同樣規模的賭局,我會很意外。」意指大選後平台成交量下跌,質疑未來沒有大型話題時的黏著度。

Rennick Palley, founding partner at early-stage venture firm Stratos, offered a more positive outlook: "The product market fit for a prediction market and an election is as good as it can get. It happens every four years, people are anticipating what's going to happen, and there's a huge amount of media coverage."

早期創投Stratos創辦合夥人Rennick Palley則較為樂觀:「預測市場跟大選的產品市場適配度一流,四年一次,每次大家高度關注又能上大媒體。」

Douglas Campbell, economics professor at the New Economic School and founder of prediction platform Insight Prediction, noted that volume declines post-election were inevitable but emphasized upcoming catalysts: "The next big US election is only two years away," referring to 2027 midterms.

新經濟學院經濟學教授暨Insight Prediction創辦人Douglas Campbell指出,選後使用量下滑屬必然,但強調催化事件不遠:「下一次重大美國大選只剩兩年」,意指2027年期中選舉。

Institutional adoption signals continue to emerge. A 2025 OECD report indicated that 58% of hedge funds now use DeFi derivatives, up from 23% in 2023, as they diversify risk exposure and enhance liquidity. Additionally, 42% of institutional investors plan to increase digital asset allocations in coming years.

機構用戶採用相關產品訊號持續浮現。OECD 2025年報告顯示,58%的對沖基金已經使用DeFi衍生品,遠高於2023年的23%,以分散風險並提升流動性。同時,42%機構投資人未來計畫提升數位資產配比。

Crypto market analysis firm Delphi Digital issued research suggesting prediction markets could achieve $8 billion annual revenue by 2030, echoing Piper Sandler's estimate. The analysis highlighted sports betting as a major

加密分析機構Delphi Digital發布研究,預估預測市場2030年有望創造80億美元年營收,與Piper Sandler預測一致。該分析特別強調運動博彩也是主要...growth vector, with prediction markets potentially capturing market share from traditional bookmakers through lower fees and greater transparency.

成長向量,預測市場有潛力透過較低的手續費與更高的透明度,從傳統博彩商手中搶佔市場份額。

Technical analysts at blockchain research firm Messari examined potential POLY tokenomics, modeling scenarios where governance tokens for major DeFi protocols typically trade at 0.5x to 3x underlying platform valuation. Applied to Polymarket's $9 billion equity valuation, this suggests POLY could achieve $4.5 billion to $27 billion fully diluted valuation depending on utility design and market conditions.

區塊鏈研究公司 Messari 的技術分析師探討了 POLY 可能的代幣經濟學,建模顯示,主要 DeFi 協議的治理代幣通常以平台價值的 0.5 倍至 3 倍進行交易。若應用於 Polymarket 90 億美元的股權估值,這意味著依照實用設計及市場狀況不同,POLY 的完全稀釋估值可能落在 45 億至 270 億美元之間。

Kaiko, a crypto market data firm, analyzed liquidity dynamics for potential POLY markets. The report suggested major exchanges including Binance, Coinbase, and Kraken would likely list POLY given Polymarket's profile and ICE backing, ensuring adequate liquidity for price discovery. However, initial volatility could be extreme, with potential 50-70% price swings in the first weeks as early airdrop recipients sell to realize gains.

加密市場數據公司 Kaiko 分析了 POLY 代幣潛在市場的流動性動態。報告指出,鑑於 Polymarket 的市場地位及 ICE 的支持,幣安、Coinbase、Kraken 等主要交易所很有可能上架 POLY,確保價格發現具備足夠流動性。然而,前幾週內波動幅度可能極大,初期空投獲得者為實現獲利,價格或有 50-70% 的大幅波動。

Legal experts weighed in on regulatory viability. Lewis Cohen, partner at law firm DLx Law, suggested that a carefully structured governance token could avoid securities classification if designed purely for protocol parameter voting without profit rights. However, he cautioned that SEC enforcement staff has shown skepticism toward pure governance defenses, particularly when tokens trade on exchanges where buyers clearly expect price appreciation.

法律專家針對其合規可能性發表意見。DLx Law 律師事務所合夥人 Lewis Cohen 指出,如果治理代幣僅設計用於協議參數投票、無獲利權益,且架構謹慎,有可能避免被歸類為證券。然而,他也警告,美國證管會 (SEC) 執法人員對於「純治理」防禦立場表現出懷疑,特別是當這些代幣於交易所上市、買家明顯存在升值期待時。

Preston Byrne, partner at law firm Byrne & Storm, offered a more pessimistic view: "Any token distributed in connection with a platform that takes custody of user funds and intermediates financial bets is going to face an uphill battle arguing it's not a security." He noted that ICE's involvement actually increases regulatory scrutiny rather than providing safe harbor.

Byrne & Storm 律師事務所的 Preston Byrne 持較悲觀立場:「凡是與平台相關、掌管用戶資金與中介金融賭注的代幣,在聲稱『不是證券』時,幾乎注定困難重重。」他指出,ICE 的參與實際上加強了監管審查,而非帶來安全庇護。

Blockchain analytics firm Chainalysis published research on airdrop farming patterns, finding that approximately 30-40% of addresses claiming major airdrops showed characteristics consistent with sybil attacks or wash trading. The analysis suggested that effective anti-gaming measures typically require complex multi-factor eligibility scoring combined with human review of suspicious patterns.

區塊鏈分析公司 Chainalysis 發佈有關空投農耕行為的研究,發現約有 30-40% 的主要空投申請地址出現與女巫攻擊(Sybil Attack)或假交易(wash trading)相符的特徵。該分析指出,有效的防作弊措施通常需複雜的多因子資格評分,且必須搭配人工審查可疑模式。

Future Scenarios: If POLY Launches (and If It Doesn't)

未來情境:若 POLY 上線(或未上線)時

Multiple pathways exist for potential POLY token development, each carrying distinct implications: POLY 代幣未來開發有多種可能路徑,每條路徑都帶來不同後果:

Scenario 1: Traditional Airdrop with Governance Token

情境一:傳統治理代幣空投

Polymarket announces a POLY governance token distributed to historical users based on trading volume, profitability, and platform tenure. The token grants voting rights over market resolution rules, fee parameters, and treasury allocation. Distribution occurs over multiple phases to reduce immediate selling pressure.

Polymarket 宣布發行治理代幣 POLY,根據歷史用戶的交易量、獲利能力與平台資歷進行分配。此代幣賦予持有人對市場裁決規則、手續費參數及財庫分配進行投票的權利。發放將分階段進行,以減少立即拋售壓力。

Implications: Strong initial hype drives exchange listings and media coverage. Token price likely shows extreme volatility, with early airdrop farmers selling immediately while long-term users and new speculators accumulate. Governance participation may be low initially, typical of DeFi tokens where less than 10% of supply votes on proposals. Polymarket gains decentralization defense against securities law but faces ongoing governance coordination challenges.

影響:初期熱潮強勁,推動交易所上架與媒體關注。幣價極度波動,早期空投農夫立刻拋售,長期用戶與新投機者則趁機累積。治理參與率起初可能偏低,這在 DeFi 代幣常見,通常不到 10% 的供應參與投票。Polymarket 以去中心化作為對抗證券法的防線,但仍須面對持續的治理協調挑戰。

Scenario 2: Hybrid Model with ICE-Compliant Distribution

情境二:ICE合規混合模式

POLY launches with strict KYC requirements, vesting schedules, and restricted distribution to prevent immediate dumping. Only verified U.S. users and qualified international users receive allocations. Institutional investors access tokens through separate channels with additional restrictions.

POLY 發行時將採嚴格 KYC、歸屬期與限制分發,以防止秒拋。僅經驗證的美國用戶與合格國際用戶可分配,機構投資人則透過獨立渠道獲得配額,且附加更多限制條件。

Implications: Reduced hype compared to traditional airdrops due to identity verification friction and vesting lock-ups. However, institutional credibility increases, potentially attracting serious long-term investors. Price stability may be better with restricted supply, but liquidity could suffer. Crypto community may view the launch as compromising decentralization principles, though regulatory risk declines substantially.

影響:因身份認證阻力與鎖倉期,炒作熱度相較傳統空投下降,惟機構認可信度提升,有望吸引嚴肅長線資金。供給受控或有助價格穩定,但流動性可能受影響。加密社群可能批評其犧牲去中心化原則,儘管監管風險大幅降低。

Scenario 3: Exchange Listing Without Airdrop

情境三:僅交易所上市,無空投

Polymarket launches POLY through exchange initial offerings or traditional fundraising, with no airdrop to existing users. Tokens are purchased rather than distributed freely.

Polymarket 透過交易所首次發售(IEO)或傳統募資發行 POLY,既有用戶無法獲得空投。代幣需購買,並非免費分發。

Implications: Community backlash would likely be severe. Users who spent years providing liquidity and platform validation would feel cheated. Competitors offering airdrops could capitalize on resentment to poach users. However, Polymarket avoids securities law risks associated with free distributions and maintains revenue from token sales. This approach mirrors traditional equity markets but contradicts crypto's ethos of rewarding early adopters.

影響:社群反彈恐極為激烈,長年提供流動性、驗證平台的用戶將覺得被背叛。競爭者若有空投誘因,能趁勢挖角。但此舉可避免與免費分發相關之證券法風險,並保有代幣銷售收入。這做法近似傳統股票市場,但違背「獎勵早期貢獻者」的加密精神。

Scenario 4: Institutional-Only Token

情境四:僅限機構參與的代幣

POLY exists exclusively for institutional participants, serving as settlement currency or governance mechanism for large-scale event contracts. Retail users continue using USDC.

POLY 僅限機構參與,做為大型事件合約的結算貨幣或治理機制。一般散戶持續使用 USDC。

Implications: Minimal community impact since retail users wouldn't expect allocation. Institutional adoption could be stronger without retail speculation complicating governance. However, this defeats the decentralization narrative and limits token liquidity. Polymarket might struggle to justify why the token exists if it doesn't broaden stakeholder participation.

影響:一般用戶無分配期待,社群反應影響輕微。排除散戶投機後,機構採用度可望更高。但這也徹底背離去中心化敘事,並限縮代幣流動性。若不能拓展利益關係人,Polymarket 可能無法合理解釋 POLY 的存在意義。

Scenario 5: No Token Launch

情境五:不發行代幣

Coplan's post was mere speculation, meme-posting, or testing market reaction. No POLY token ever materializes.

Coplan 的貼文純屬臆測、梗圖或測試市場反應,POLY 代幣終究未出現。

Implications: Short-term disappointment among users farming potential airdrops. However, Polymarket continues operating profitably without token distribution complexities. The company maintains complete control over platform direction without governance token constraints. Users might appreciate avoiding the volatility and distraction of token speculation. The decision could be seen as responsible restraint or missed opportunity depending on perspective.

影響:空投農夫們短期失望,但 Polymarket 無需面對代幣分配複雜性,能持續穩健經營。公司保有平台方向的全部主控權,不受治理代幣掣肘。部分用戶或會樂見免於「幣價炒作」的波動與干擾。這決定可被看作是務實自律或錯失良機,端看角度而定。

Strategic considerations: Several factors will likely influence Polymarket's decision:

策略考量:多項因素將影響 Polymarket 的抉擇:

- Regulatory environment: If crypto regulation becomes more favorable under continued Trump administration policies and CFTC modernization, token launches face lower legal risk. Conversely, aggressive SEC enforcement under a different future administration could make tokens legally untenable.

- 監管環境:若川普政府續任、美國商品期貨交易委員會(CFTC)現代化,整體監管環境趨於友善,代幣發行之法律風險降低。反之,若未來政府對加密執法趨於強硬(如 SEC 嚴格查處),則代幣發行或陷於困境。

- Competitive dynamics: Kalshi's success as a regulated U.S. prediction market without a token demonstrates viability of token-free models. However, if competitors launch successful governance tokens that attract users through financial incentives, Polymarket may feel pressured to respond.

- 競爭態勢:Kalshi 作為合規美國預測市場,未發代幣亦能成功,證明「無代幣模式」的可行性。然而,若競爭對手以治理代幣吸引用戶,Polymarket 勢必面臨跟進壓力。

- ICE partnership terms: The investment agreement likely contains provisions affecting token launch decisions. ICE might have veto rights over significant corporate actions, or the deal structure might include token warrant provisions obligating future distribution.

- ICE 合作條件:投資協議中可能含有影響發幣決策的條款。例如 ICE 也許保有對重大決策的一票否決權,或協議包含需未來分發代幣的權證條件。

- Market timing: Crypto market conditions affect optimal launch windows. Bull markets support higher valuations and positive sentiment, while bear markets create skepticism and selling pressure. Polymarket would likely time any launch to coincide with strong broader market conditions.

- 市場時機:加密市場行情決定最佳發行時點。牛市利於高估值與氣氛推波助瀾,熊市則懷疑氛圍及賣壓加劇。Polymarket 發行代幣時點,勢必考量總體行情。

- Technical readiness: Building secure token infrastructure requires significant development time. Smart contract auditing, governance frameworks, and distribution mechanisms need thorough testing before launch. Rushing to meet speculative timelines risks catastrophic technical failures.

- 技術成熟度:建構安全的代幣基礎設施需長時間開發。智能合約審計、治理架構與分配機制皆須充分測試,貿然趕進度易釀嚴重技術災難。

Final thoughts

最後想法

Shayne Coplan's five-symbol post captured the crypto industry's perpetual tension between genuine innovation and speculative frenzy. The possibility of a POLY token represents a legitimate question about how decentralized prediction markets should be governed, financed, and sustained. The market hype reflects both rational interest in potentially valuable assets and irrational exuberance driven by get-rich-quick psychology.

Shayne Coplan 的五字推文,恰好點出了加密產業永恆的張力:創新與投機狂潮之間的拔河。POLY 代幣的可能性,正觸及了去中心化預測市場應如何治理、融資與永續的根本提問。市場熱潮既反映了理性的價值投資關注,也蘊藏著一夜致富的非理性亢奮。

What we know with certainty: Intercontinental Exchange has invested $2 billion in Polymarket at a $9 billion valuation. This unprecedented endorsement from a traditional financial powerhouse validates prediction markets as serious financial infrastructure, not just gambling curiosities. The deal gives Polymarket resources, credibility, and distribution channels that could accelerate mainstream adoption. 已知事實是:洲際交易所 (ICE) 以 20 億美元投資 Polymarket,估值達 90 億美金。這是傳統金融巨頭對預測市場史無前例的背書,使其不再僅是賭博玩物,而是嚴肅的金融基礎設施。協議帶來了資金、信譽與發行渠道,有望加速主流普及。

We also know that Coplan has hinted at token possibilities through cryptic social media, strategic silence, and corporate structuring that mirrors pre-launch patterns from other DeFi protocols. Whether these signals indicate genuine intent or merely strategic positioning remains ambiguous.

我們也能確認 Coplan 曾透過曖昧社交發言、策略沈默、以及類比過往 DeFi 協議發幣時的組織結構,間接釋放發幣信號。但這些徵象究竟是真準備還是純策略操作,尚不明確。

What remains uncertain: whether a POLY token will actually launch, what form it might take, how it would be distributed, and when any announcement might occur. The regulatory complexity alone could delay launch indefinitely or render it impossible under current law. ICE's involvement simultaneously increases token legitimacy and constrains design flexibility.

尚不確定的是:POLY 代幣是否真的會推出、會採何種型態、如何分發,以及可能何時發布訊息。僅就監管複雜度,就足以讓發行無限延宕或直接難產。ICE 參與一方面帶來合法性認證,另方面卻也壓縮設計彈性。

The broader context matters more than any single token launch. Polymarket represents a test case for whether crypto-native financial infrastructure can mature into regulated, institutionally-backed systems without losing the permissionless innovation that made the technology valuable. If successful, POLY could demonstrate a pathway for other DeFi protocols to achieve legitimacy while maintaining decentralization.

大環境遠比單一代幣本身更重要。Polymarket 是個測試案例,驗證加密原生金融基礎設施,能否在不喪失無需許可的創新精神下,成熟為合規、機構支持的體系。若能成功,POLY 亦可為其他 DeFi 協議指引合法性與去中心化並行之路。

If unsuccessful — whether through regulatory shutdown, technical failure, or design flaws — it would reinforce skeptics' view that crypto remains fundamentally at odds with compliance requirements necessary for mainstream finance.

若失敗──無論是監管關停、技術事故或設計缺陷──都將強化懷疑論者觀點:加密產業本質上與主流金融合規所需規範格格不入。

For users contemplating whether to farm potential airdrops, the calculus is straightforward: genuine platform usage costs nothing beyond trading capital and time. Artificial volume farming through wash trading risks account restrictions without guaranteed rewards. The most rational approach is to use Polymarket for its intended purpose — aggregating information about future events — and treat any potential airdrop as a bonus rather than

對於考慮「農空投」的用戶,算式其實簡單:正常使用平台,除了交易成本與時間,不會有額外花費。若一味假量農耕(如洗盤造假),反而可能被限制帳戶,且不保證有回報。最理性的做法,就是將 Polymarket 當作它既有的目的來使用──彙聚未來事件資訊──把一切潛在空投當作意外紅利,而不是必然收穫。primary motivation.

對於預測市場產業而言,POLY 的潛在推出是一個分水嶺。一次成功的代幣發放,可能催化競爭對手的推出,加速機構採用,並將預測市場建立為一個永久性的金融基礎設施層。如果發行失敗或受到破壞,則可能引發監管打擊,並證實那些認為該領域只是偽裝成金融的賭博的批評者。

POLY 是否成為加密圈史上最大空投之一,答案取決於市場投機之外的諸多變數:監管裁決、技術實施方式、戰略優先事項,以及數月甚至數年後的市場環境。Coplan 貼出的神祕推文,也許是真正的預告、策略布局,抑或只是純粹戲謔。

在 Polymarket 發出官方聲明之前,POLY 完全就是那個思考表情符號所代表的意義:一個值得關注的可能性,但還稱不上可以假設為必然的確定性。在這個情緒可撬動數十億美元的加密市場、訊息與炒作邊界模糊不清的世界,那種曖昧不明或許是最可預期的結果。

不論 POLY 最終會否如 Coplan 所暗示,成為改變局面的發放,還是僅僅停留於加密推特內部的笑話,這場討論本身已經取得了一項重要成就:讓預測市場從小眾 DeFi 好奇事物提升為主流金融討論話題。在這個注意力往往先於採用的產業裡,也許這正是 Coplan 用五個符號所能帶來的最有價值信號。