Solana 區塊鏈已成為加密貨幣最具戲劇性的競爭戰場,協助幣種創建的平台創造了數億美元收入,並徹底改變數位資產誕生的模式。

這已不僅是另一個 DeFi 熱潮──它徹底重新想像了幣種發行流程,從過往專業審核的 IDO 平台,演變成無需許可、每日處理超過 25,000 個新幣種的迷因幣工廠。

當下的啟動板大戰不單是市場競爭,更代表從傳統創投型代幣銷售,到全民參與、娛樂至上的資產創造趨勢。Pump.fun 自 2024 年 1 月以來營收超過 8 億美元,而新進平台 HeavenDEX 上線一週即拿下 15% 市佔,靠的是革命性的代幣經濟模型。同時,有 98.6% 創建的幣種實為詐騙或拉高出貨計劃,突顯這個生態系急速擴張下的根本挑戰。

這波轉型反映了更廣泛的加密市場趨勢──強調開放性、投機與社群傳播力,而非傳統的投資論述。勝出的平台憑藉複雜的債券曲線、利潤分配及社群協作持續創新,失敗者則受困於過時模式。要理解這些新動態格外重要,因為這已深刻影響所有區塊鏈的代幣生成模式,並可能形塑去中心化金融的未來。

去中心化幣種創建的崛起

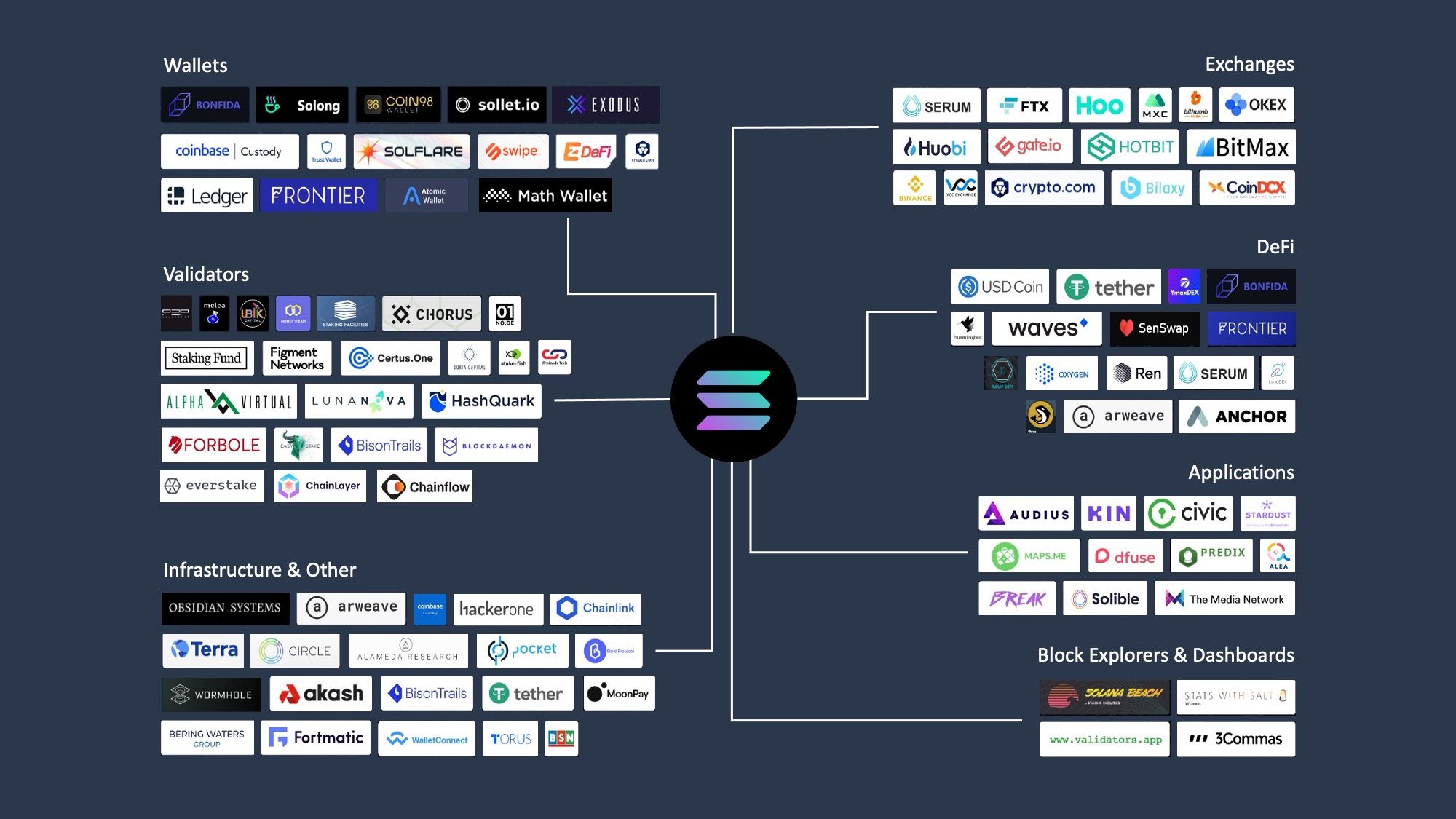

Solana 啟動板生態於 2021 年始於傳統的 IDO 平台,如 Solstarter、Solanium 與 Boca Chica,採用需 KYC 認證、複雜階級與嚴格專案審核等傳統模式。這類平台每次發行收費 1 萬至 2 萬美元,並嚴格設限,只開放給有強大後盾的專案參與。

這種受控模式曾在 2021 年 DeFi 牛市奏效,當時 Solana 鎖倉總值高達 120 億美元,投資者青睞具備完整白皮書與開發藍圖的「高品質」項目。然而,2022 年熊市與 FTX 崩潰使 Solana 生態重創,這類模式的侷限性暴露無遺,引發對幣種發行流程的根本反思。

2024 年 1 月 19 日,Pump.fun 以全新做法登場,引發革命。不設門檻、毋需審核,任何人只需數分鐘即可創幣,零預付、零身份驗證,可即時交易。Pump.fun 以數學公式的債券曲線取代傳統流動性池,根據供應動態自動定價,達到市值 $69,000 自動轉到 Raydium DEX 並燒毀 LP 提防詐騙,為優質幣種鋪設晉升之路。

這一民主化進程帶來劇變。短短數月間,Pump.fun 取得超過 90% Solana 幣種創建份額,每日流量高峰時平台營收超過 1,500 萬美元。成功證明市場有巨大需求,期待能輕鬆創建幣種,進而徹底改變市場對發行流程的期待。

傳統平台與之差異愈發明顯。舊有 IDO 平台因流程複雜、用戶流失而式微,Pump.fun 以極簡體驗累積 600 萬以上幣種、1,300 萬用戶。這股轉變,不僅技術領先,更反射用戶偏好由理性投資轉為娛樂、投機與社群傳播。

現代啟動板背後的技術革命

現代 Solana 啟動板屬於高度複雜的金融基礎設施,建築於創新的智能合約結構與經濟機制之上。平台強大技術基礎,令其能日處理數千幣種,同時兼顧安全與用戶體驗。

債券曲線機制是多數新型啟動板的數學核心,作為自動化做市商,根據供需自動定價,無需傳統流動提供。Pump.fun 採取常數乘積模式──每 10 億枚代幣配置 8 億在虛擬 SOL 池作交易,使定價全憑數學運算,不依賴人工。

表面簡單下隱藏著複雜設計。代幣初始定價約 0.000000028 SOL,依據購買活動與所剩供給呈指數曲線上升。市值達 $69,000(85 SOL 注入)即自動上 Raydium DEX,並立刻燒毀 LP,防止資金盤出逃。

HeavenDEX 帶來更進階的創新:整合自動做市與程式化回購機制,每五秒自動運作。平台合約會把 100% 交易手續費自動回購並銷毀原生 LIGHT 幣,持續產生通縮壓力,使平台成敗與幣價緊密掛鉤。這一「God Flywheel」需高階狀態管理與跨程序調用,方能實現全自動流程。

技術架構大量運用工廠式模式以優化代幣發佈,主合約提供範本,子合約以最小克隆策略部署,大幅降低發佈成本,同時確保不同代幣隔離安全。Anchor 框架整合,實現型別安全、帳戶驗證與重入防護。

進階平台還整合反 MEV 工具,防止搶跑與夾擊攻擊。HeavenDEX 結合 Ellipsis Labs 技術,另設六秒線型衰減機槍稅,其他平台則嘗試身分驗證與動態費率,對抗自動化策略交易。

Solana 原生架構帶來極大優勢。Proof-of-History 高效排序,減低共識負擔;平行運算能同時處理多組債券曲線;SVM 的 Berkeley Packet Filter 加速字節碼驗證,帳戶模型則實現代碼與數據分離,優化儲存空間。

盈利分配機制同樣演進為複雜的智能合約系統,管理平台手續費、創作者獎勵、回購與流動池,每個平台按市況自訂分配比。

主要平台拆解:市場領頭者及策略

競爭格局中,各大平台持續創新,爭奪市場。每個主要平台都有其獨特賣點、技術創新和社群對齊策略,決定其市佔與成長方向。

Pump.fun 雖遭新興競爭者挑戰,依然穩居龍頭。平台執掌約 90% Solana 幣種新發,累計營收突破 7 億美元。2025 年 8 月每日營收達 135 萬美元,雖較 2025 年初高峰的每日 1,500 萬美元大幅下降。

平台優勢在於先發優勢、品牌認知與極佳用戶體驗,累積 1,300 萬用戶、600 萬新幣。操作介面化繁為簡,創幣只需 60 秒,立即可交易,打造難以複製的網路效應。近期創新包含 2025 年 3 月推出 PumpSwap,擺脫對 Raydium 的依賴,以及創作者分潤,將 50% 手續費分派給創幣人。

然而,Pump.fun 也面臨壓力。因所謂「迷因幣賭場」與證券法疑慮,遭遇總額 55 億美元集體訴訟。平台詐騙率高達 98.6%,700 多萬幣中僅 97,000 枚流動性超過 1,000 美元,損害生態信任。此外監管挑戰升溫,包括英國 FCA 警告與區域封鎖,不斷承受合規壓力。

HeavenDEX 憑藉徹底的技術革命與社群對齊的代幣經濟模型,成為 Pump.fun 最大勁敵。於 2025 年 8 月 15 日上線,一周內搶占 15% 市場,每日成交量達 4,000 萬美元,手續費排名 Solana 第五。

此平台革命在於「God Flywheel」設計,平台全部收入持續回購並銷毀 LIGHT 幣。 creates direct correlation between platform success and token holder value, aligning incentives in ways traditional platforms cannot match. During the first week, HeavenDEX spent $1.4 million on buybacks, burning 2% of LIGHT supply while driving the token's market capitalization to $120 million - a 225% increase in six days.

建立了平台成功與代幣持有者價值之間的直接關聯,使激勵機制獲得傳統平台無法比擬的一致性。在啟動的第一週,HeavenDEX 投入了 140 萬美元進行回購,燒毀了 2% 的 LIGHT 供應量,並將代幣市值推升至 1.2 億美元——六天內暴增 225%。

Technical differentiators include an integrated automated market maker eliminating external dependencies, anti-MEV features protecting users from front-running, and a tiered token classification system distinguishing between creator, community, and blocked tokens. The platform's vertical integration keeps all value within its ecosystem rather than sharing with external DEX partners.

技術上的差異化特色包括內建自動化做市商(AMM),消除對外部基礎設施的依賴、防前跑的反MEV機制,有效保護用戶,以及分層的代幣分類系統,區分創作者、社群及封鎖代幣。其垂直整合設計確保所有價值留存在生態內部,而不需與外部DEX合作夥伴共享。

LetsBonk experienced meteoric rise and subsequent decline that illustrates the volatility inherent in launchpad competition. The platform briefly achieved 78% market share in July 2025, capturing 65.9% of all Solana token launches and facilitating successful graduations like USELESS, which reached $400 million market capitalization. However, market share collapsed back to minimal levels as the platform failed to maintain momentum against more innovative competitors.

LetsBonk 經歷了大起大落,充分說明 launchpad 競爭本質上的高波動性。該平台在2025年7月一度取得 78% 市佔率,掌控了 65.9% 的 Solana 代幣發行,並促成了 USELESS 等成功畢業項目,其市值一度高達 4 億美元。然而,隨著在創新競爭對手面前無法維持動能,其市佔隨後暴跌至極低水平。

The platform's decline reflected several strategic limitations. Over-reliance on BONK ecosystem integration limited broader market appeal, while insufficient revenue-sharing mechanisms - only 1% of fees directed toward buybacks - couldn't compete with more aggressive value-capture models. The platform's brief success demonstrated that community backing alone isn't sufficient without sustained technical innovation and competitive differentiation.

這個平台的衰退反映了多項策略上的局限性。過度依賴 BONK 生態系整合限制了更廣泛市場的吸引力,而收益分享機制不足(僅有1%的費用用於回購)無法與更積極的價值捕獲模式競爭。這段短暫的成功證明,僅靠社群支持,在缺乏持續技術創新和競爭區隔的情況下是遠遠不夠的。

Token Mill launched August 20, 2025, with unique gamification mechanics targeting trader psychology rather than community building. The "King of the Mill" system creates competitive dynamics where tokens compete every 30 minutes across three tiers, with winners determined by trading volume and platform fees directed toward buying and burning successful tokens. Built by the team behind Trader Joe and Merchant Moe, the platform focuses purely on volatility and price action.

Token Mill 於 2025 年 8 月 20 日上線,主打獨特遊戲化機制,鎖定交易者心理,而非社群營造。「King of the Mill」系統讓代幣每 30 分鐘在三個層級中進行競爭,由交易量決定勝者,平台費用則用於回購並燒毀勝出代幣。該平台由 Trader Joe 和 Merchant Moe 團隊打造,專注於波動性與價格行為。

Other notable platforms include Bags, which pioneered Twitter-native token creation through @launchonbags mentions and was first to integrate Meteora DAMM V2 technology, providing creators with 2% perpetual royalties from trading volume. Moonshot emphasizes mobile-first design with fiat on-ramps and security features, while Magic Eden leverages its dominant NFT marketplace position to expand into token launches.

其他值得注意的平台還包括 Bags,其首創了 Twitter 原生代幣創建(透過 @launchonbags 標註),並率先整合 Meteora DAMM V2 技術,讓創作者能從交易量中永久獲得 2% 版稅。Moonshot 主打行動裝置優先設計、法幣入金及安全性功能,而 Magic Eden 則利用其 NFT 市場領導地位跨足代幣發行。

The competitive dynamics reveal clear patterns determining success and failure. Platforms succeeding demonstrate technical innovation in tokenomics, superior user experience design, community alignment through revenue sharing, and ability to adapt quickly to market changes. Those failing typically rely on outdated models, lack differentiation from established players, or fail to provide compelling value propositions for either creators or traders.

競爭態勢顯示出決定成敗的明顯規律。成功的平台展現了代幣經濟學上的技術創新、優異的用戶體驗設計、透過收益共享與社群保持一致,以及快速調整以應對市場變化的能力。失敗的平台則多半依賴過時模式、缺乏與現有競爭者的區隔性,或未能為創作者或交易者提供具吸引力的價值主張。

The economics of attention and speculation

(標題略譯:注意力與投機經濟學)

The Solana launchpad ecosystem has evolved into a sophisticated attention economy where viral content, cultural moments, and speculative psychology drive multi-billion dollar trading volumes. Understanding these dynamics is crucial for comprehending how platforms capture value and users make decisions in an environment processing over 25,000 new tokens daily.

Solana launchpad 生態系已演變為高度精緻的注意力經濟體:爆紅內容、文化話題與投機心理,共同推動了數十億美元的交易量。在每天有超過萬枚新代幣上線的情境下,理解這些動態,對於判斷平台如何捕捉價值、以及用戶如何做決策,至關重要。

The sheer scale of token creation reveals the speculative appetite underlying this ecosystem. During peak periods, platforms facilitate token launches every few seconds, with individual wallets creating hundreds of tokens daily. Data shows one bot-operated wallet launched 491 tokens in 24 hours on LetsBonk, illustrating the automated nature of much activity. Yet despite this massive volume, graduation rates remain extremely low - Pump.fun maintains just 0.0085% graduation rate, while LetsBonk achieves 1.02% and Believe reaches 2.58%.

代幣發行量之巨大,彰顯了該生態背後的強烈投機欲望。在高峰期,平台每隔幾秒就有新代幣發行,單一錢包一天內可創建數百枚代幣。數據顯示,有個機器人錢包在 LetsBonk 24 小時內發行了491枚代幣,突顯出活動的自動化本質。然而,儘管發行數量龐大,實際畢業率卻極低——Pump.fun 僅有 0.0085% 畢業率,LetsBonk 則為 1.02%,Believe 則達 2.58%。

This creates a highly efficient attention allocation mechanism where only tokens generating sustained community interest and trading volume achieve meaningful liquidity and market presence. The bonding curve structure functions as a continuous filtering system, with mathematical price increases naturally eliminating projects lacking genuine community support or viral potential.

這形成了一套極為高效的注意力分配機制,只有持續引發社群興趣與交易量的代幣,才能獲得實質流動性與市場地位。Bonding curve 結構就像一套持續篩選系統,數學式的價格成長自然淘汰掉缺乏真實社群支持或爆紅潛力的項目。

Successful tokens demonstrate clear patterns connecting cultural relevance with economic outcomes. Politically themed tokens like TRUMP and memecoin derivatives achieve massive market capitalizations during relevant news cycles, while celebrity-backed projects like Iggy Azalea's MOTHER reached $200 million valuation through strategic social media integration. MOODENG achieved $170 million market cap in three days by leveraging viral animal content, while FARTCOIN sustained multiple 40% daily gains through absurdist humor resonating with crypto communities.

成功的代幣展現出明確的規律——文化相關性與經濟成果高度連結。政治主題代幣(如 TRUMP)與迷因衍生幣,常在相關新聞週期創下驚人市值;名人加持項目(如 Iggy Azalea 的 MOTHER)透過策略性社群整合達到 2 億美元估值。MOODENG 利用爆紅動物內容,三天內市值衝上 1.7 億美元;FARTCOIN 則以荒謬幽默屢屢獲得加密社群共鳴,維持每日 40% 漲幅。

The revenue models underlying these platforms reveal sophisticated value extraction mechanisms. Pump.fun's 1% trading fees generated over $800 million lifetime revenue, while additional revenue streams include $2 SOL first purchase requirements and post-graduation fee sharing. HeavenDEX's more aggressive approach captures 0.5% trading fees plus additional creator verification charges, with 100% revenue recycling creating sustainable competitive advantages.

這些平台背後的收益模式展現出先進的價值提取機制。Pump.fun 以 1% 交易手續費創下逾 8 億美元終身收入,另有每筆首次購買需 $2 SOL 以及畢業後的收益分潤。HeavenDEX 則採更積極手法:0.5% 交易手續費加上創作者認證費並 100% 回饋,形成永續競爭優勢。

Platform fee structures have evolved toward greater complexity and creator alignment. Modern platforms typically distribute revenue across multiple stakeholder groups: platform operations, creator incentives, token buybacks, liquidity provision, and community rewards. This multi-sided approach attempts to balance platform sustainability with creator motivation and community retention.

平台的手續費結構日益複雜且更加注重與創作者利益一致。現代平台多會將收益分配給多方:包括平台營運、創作者激勵、代幣回購、流動性提供、以及社群獎勵。這種多方利益協調,旨在兼顧平台長期可持續發展、創作者動力與社群留存。

The psychological elements driving user behavior center on concepts of democratized access, viral potential, and early-stage opportunity identification. Unlike traditional investment frameworks requiring substantial capital and sophisticated analysis, launchpad tokens enable participation with minimal financial commitment while offering theoretically unlimited upside potential. This creates compelling user psychology combining gambling mechanics with investment opportunity perception.

影響用戶行為的心理因素,主要圍繞在民主化參與、話題爆紅潛力及早期機會識別等概念。與傳統投資需要大量資本和專業分析不同,launchpad 代幣允許用戶用極低資金門檻參與,且理論上上漲空間無限,使其同時兼具賭博心理與投資機會的吸引力。

The timing dynamics prove crucial for both platforms and individual tokens. Successful launches often correlate with broader cultural moments, market conditions, and social media trends. Platforms achieving viral adoption typically benefit from first-mover advantages in specific market segments, while those entering established categories face significantly higher user acquisition costs and competitive pressures.

時機動態對平台與個別代幣同樣至關重要。成功發行常常和文化趨勢、整體市況、社群媒體潮流息息相關。實現病毒式傳播的平台,往往在特定市場版塊取得先發優勢,反之,進入已成熟品類的新平台,則需承受高昂的用戶獲取成本與競爭壓力。

Network effects within individual tokens create winner-take-all dynamics where early momentum compounds through increased visibility, trading volume, and community growth. This creates powerful incentives for early participation while simultaneously increasing risks for late-arriving participants who may purchase tokens at unsustainable valuations driven by speculation rather than fundamental value.

個別代幣的網絡效應形成贏者通吃態勢,早期動能將隨著可見度、交易量和社群成長產生正向循環。這給早期參與者帶來強烈誘因,同時也提升後進者、在高估值階段入場的風險,因其價格已被投機而非基本面推高。

The broader economic impact extends beyond individual token performance to influence Solana network utilization, validator revenue, and ecosystem development patterns. Launchpad activity drives significant transaction volume, generating meaningful fee revenue for network validators while testing network capacity and spurring infrastructure improvements. The correlation between launchpad activity and SOL price performance demonstrates these platforms' systemic importance within the broader Solana ecosystem.

更廣泛的經濟影響不僅限於個別代幣表現,也直接影響到 Solana 網路的使用率、驗證人收益及生態發展模式。Launchpad 活動帶來大量鏈上交易,有效提升驗證人手續費收入,並檢驗網路容量、推動基礎設施升級。Launchpad 活躍度與 SOL 價格表現的聯動性,證明這些平台在Solana生態系內的系統性地位。

Innovation cycles and market evolution

(標題略譯:創新循環與市場演化)

The rapid evolution of Solana launchpads demonstrates accelerating innovation cycles driven by intense competition and massive revenue opportunities. Each platform generation introduces new technical capabilities, economic mechanisms, and user experience improvements that collectively push the ecosystem toward greater sophistication and sustainability.

Solana launchpad 的快速發展,體現了在激烈競爭及巨大收益機會驅動下的加速創新週期。每一代新平台均引入新技術能力、經濟機制及用戶體驗改善,推動整個生態系向更高層次的精緻與永續發展前進。

The first generation of platforms, exemplified by Solanium and Solstarter, focused on replicating traditional IDO models with basic smart contract functionality and manual curation processes. These platforms served initial market demand but proved inflexible when market preferences shifted toward more accessible, entertainment-focused token creation.

第一代平台(如 Solanium、Solstarter),主要複製傳統 IDO 模式,採用基礎智能合約和人工篩選流程。雖然填補了最初市場需求,但當市場偏好轉向更易用、娛樂導向的代幣創建時,便顯得僵化。

Pump.fun represented the second generation breakthrough, introducing bonding curves, permissionless token creation, and immediate trading functionality. This innovation wave eliminated traditional barriers while demonstrating massive latent demand for simplified token launch processes. The platform's technical architecture became the template for numerous competitors, establishing bonding curves as the dominant mechanism for price discovery and liquidity provision.

Pump.fun 則展現了第二代的突破,帶來 bonding curve、無需許可的自助代幣發行,以及即時交易功能。這波創新浪潮消除了傳統障礙,展現出對簡化發幣流程的潛在巨大需求,並讓其技術架構成為同業範本,鞏固 bonding curve 做為主流價格發現和流動性機制。

The current third generation, led by platforms like HeavenDEX and Token Mill, emphasizes advanced tokenomics, community alignment, and sustainable revenue models. These platforms experiment with 100% revenue buybacks, gamification mechanics, and sophisticated anti-MEV protections that address limitations identified in earlier models. The integration of automated market makers, cross-program invocations, and complex fee distribution mechanisms represents significant technical advancement over previous generations.

現今的第三代(由 HeavenDEX、Token Mill 等領軍)著重於進階代幣經濟學、社群一致性及永續收益模式。這些平台嘗試 100% 收益回購、遊戲化機制、複雜的反MEV防護,針對早期模式的缺陷對症下藥。自動化做市商(AMM)、跨程式調用及複雜手續費分配機制的整合,都代表著相較前代的重大技術進化。

Innovation patterns reveal clear technological progression. Early platforms required substantial manual intervention for token launches and relied on external infrastructure for trading functionality. Current platforms achieve full automation with integrated trading, programmable fee distribution, and sophisticated user protection mechanisms. Future development appears focused on artificial intelligence integration, cross-chain compatibility, and institutional-grade compliance features.

創新趨勢顯示技術明顯進步。早期平台發行代幣需大量人工介入、交易功能依賴外部架構。現今平台則全面自動化,集成交易、可程式化費用分配、進階用戶保護機制。未來發展將聚焦 AI 整合、跨鏈兼容、及機構級合規性功能。

The competitive dynamics driving these innovation cycles operate through several mechanisms.

驅動這些創新循環的競爭動力,主要運作機制有數種:First-mover advantages prove significant but not insurmountable, as HeavenDEX's rapid market share capture demonstrates. Technical differentiation becomes crucial as users develop more sophisticated preferences, while community alignment through revenue sharing proves increasingly important for long-term platform sustainability.

先行者優勢雖然顯著,但並非不可超越,正如 HeavenDEX 能迅速搶佔市場份額所展現的那樣。隨著用戶需求日益成熟,技術差異化變得至關重要,而透過利潤分享等機制強化社群共識,則成為平台長期永續經營的核心之一。

Platform lifecycle patterns show clear stages: initial launch with novel features, rapid growth through user acquisition, market share competition with established players, and eventual consolidation or displacement. Successful platforms demonstrate ability to iterate rapidly while maintaining core value propositions, while failed platforms typically struggle to differentiate or adapt to changing market conditions.

平台生命週期呈現明確階段:新功能初始上線、快速用戶增長、與既有玩家的市場份額競爭、最終整併或被取代。成功的平台能在維持核心價值主張的同時快速迭代,失敗的平台則通常無法有效區隔或適應市場環境的變化。

The broader market evolution suggests maturation toward more sustainable models balancing speculation with community value creation. Early purely extractive approaches are being replaced by platforms sharing revenue with creators and communities, indicating growing sophistication in platform economics and user expectations.

更廣泛的市場演變顯示,整體正朝向兼顧投機性與社群價值創造的永續模式發展。早期單一收割型的做法,逐漸被與創作者及社群共享收益的平台所取代,這反映出平台經濟學與用戶期望正日益成熟。

Regulatory pressures are accelerating innovation in compliance and user protection features. Platforms increasingly implement KYC requirements, geographic restrictions, and automated fraud detection systems in response to growing regulatory scrutiny. This trend toward compliance infrastructure represents significant development resources but potentially enables institutional adoption and mainstream integration.

監管壓力正在推動平台不斷創新以增強合規與用戶保護。越來越多平台加強實施 KYC(認識你的客戶)要求、地理限制,以及自動化詐騙偵測系統,因應日益嚴格的監管審查。這有助於機構採用與主流整合,但同時也意味著需投入大量開發資源於合規基礎設施。

Cross-chain integration appears to be the next major innovation frontier, with platforms exploring deployment across multiple blockchains while maintaining unified user experiences and liquidity pools. This development would significantly expand addressable markets while requiring substantial technical infrastructure and capital requirements.

跨鏈整合將成為下一波重要創新前沿,平台正探索在多條公鏈間部署,並維持統一的用戶體驗與流動池。此舉將大幅擴大可觸及市場,但也需相應增加技術基礎建設與資本投入。

The integration of artificial intelligence for token analysis, market prediction, and automated quality assessment represents another emerging trend. Platforms implementing ML-driven reputation systems and predictive analytics could provide competitive advantages in user protection and success rate optimization.

人工智慧於代幣分析、市場預測及自動化品質評估的應用亦是另一新興趨勢。導入機器學習(ML)驅動的信譽系統與預測分析,將提升用戶保護、優化專案成功率,成為平台競爭優勢所在。

Regulatory challenges and compliance evolution

監管挑戰與合規進化

The explosive growth of Solana launchpads has attracted significant regulatory attention, creating complex compliance challenges that platforms must navigate while maintaining their core value propositions of accessibility and innovation. The regulatory landscape continues evolving rapidly as authorities worldwide grapple with how to oversee platforms facilitating massive token creation volumes.

Solana 發行平台的爆炸性成長,吸引了大量監管關注,也帶來了複雜的合規挑戰。平台必須在維持開放性與創新本質的同時,應對各國監管壓力。由於各地政府積極思考如何監管大批代幣發行的網路平台,整體法規環境正快速演化中。

The most significant legal challenges center on securities law compliance. Multiple class action lawsuits totaling $5.5 billion target Pump.fun specifically, alleging operation of an illegal "Meme Coin Casino" and violations of the Securities Act for selling unregistered securities. These lawsuits name specific tokens including PNUT, FWOG, FRED, and GRIFFAIN, claiming the platform facilitates coordinated racketeering schemes that have cost retail traders billions while generating over $722 million in platform revenue.

最關鍵的法律挑戰集中在證券法合規。數個總額達 55 億美金的集體訴訟指名 Pump.fun,指控其運作非法「迷因幣賭場」並違反證券法,銷售未註冊證券。訴訟更點名 PNUT、FWOG、FRED、GRIFFAIN 等特定代幣,聲稱平台協助組織性詐騙,造成散戶損失數十億美元,同時平台本身營收超過 7.22 億美金。

The legal complexity arises from fundamental questions about token classification and platform responsibility. Traditional securities regulations weren't designed for permissionless token creation environments where millions of digital assets launch with minimal oversight. Courts must determine whether bonding curve mechanisms constitute securities offerings, how platform facilitation affects liability, and what compliance obligations apply to decentralized protocols.

其法律複雜性源於:代幣歸類以及平台責任的根本問題。傳統證券監管並未預見到這種可無需許可大量發行加密資產的環境。法院必須釐清,包括:

- 綁定曲線機制是否構成證券發行

- 平台在協助代幣發行時應負何等責任

- 去中心化協議應適用哪些合規規範

International regulatory responses vary significantly. The UK Financial Conduct Authority issued warnings in December 2024, leading to geographic blocking of UK users from major platforms. This established precedent for national-level platform restrictions based on securities law concerns. Other jurisdictions are developing different approaches, creating complex compliance matrices for platforms operating globally.

各國監管對策差異顯著。英國金融行為監理機構(FCA)於2024年12月發出警告,主流發行平台因此開始封鎖英國用戶,立下因證券法疑慮而國家級封鎖平台的先例。其他地區則發展出不同手段,全球營運平台的合規矩陣更為複雜。

The SEC's evolving position on Solana itself affects the entire ecosystem. Initially labeling Solana as a security in lawsuits against major exchanges, the SEC amended its Binance complaint in July 2024 to remove assertions about Solana's security status. This shift signals potential regulatory clarity, supported by Bloomberg analysts assigning 90% probability to Solana ETF approval in 2025.

美國 SEC 對 Solana 的態度轉變,對生態系影響極大。SEC 最初在起訴大型交易所時將 Solana 歸為證券,但於2024年7月修訂對 Binance 的起訴狀中,刪除關於 Solana 是證券的描述。這個轉變意味監管有望逐步明朗。根據彭博分析師預期,Solana ETF 在 2025 年獲批的機率高達 90%。

ETF developments represent significant regulatory progress with potential ecosystem implications. SEC requests for amended S-1 filings for Solana ETFs indicate serious consideration of approval, while inclusion of staking features suggests acceptance of Solana's unique consensus mechanisms. ETF approval would likely increase institutional interest in Solana-based platforms while potentially requiring enhanced compliance standards.

Solana ETF 的相關發展,代表監管進程獲得重大突破且對生態圈產生長遠影響。SEC 要求修正版 S-1 文件凸顯其慎重考慮批准,並同意納入 Staking 機制,顯示對 Solana 共識設計的認可。若 ETF 正式通過,勢必加速機構資金進入,也將帶動平台提升合規水準。

Platform responses to regulatory pressure demonstrate various strategic approaches. Some maintain permissionless access while implementing geographic restrictions, others introduce comprehensive KYC/AML protocols, and several have pursued preemptive compliance measures including smart contract audits and legal structure optimization.

面對監管壓力,各平台展現多元策略。有些維持無需許可但加入地區限制,有些加強 KYC/AML(反洗錢)流程,也有平台主動強化合規,如智能合約審計、法律架構優化等。

The compliance costs associated with regulatory adherence are substantial. Platforms implementing full KYC requirements face increased operational complexity and user friction, while legal defense costs for major platforms like Pump.fun reach millions of dollars. These expenses create barriers to entry for new platforms while potentially favoring larger, better-capitalized competitors.

合規遵循帶來的成本極為可觀。全面推行 KYC 增加平台營運複雜度、降低用戶體驗,而如 Pump.fun 此類平台的法律應訴費用可高達數百萬美元。這些成本會提高新進平台門檻,反而強化大型、資本充沛者的競爭優勢。

Regulatory arbitrage opportunities emerge as different jurisdictions develop varying approaches to launchpad oversight. Platforms may optimize legal structures and operational locations to take advantage of more favorable regulatory environments while maintaining global user access through decentralized infrastructure.

隨各地對發行平台監理政策不一,法律套利空間浮現。平台或將優化其法人架構與營運據點,以利用較寬鬆法規,並透過去中心化架構維持全球用戶可及性。

The international coordination challenges become apparent as platforms operate across multiple jurisdictions with conflicting regulatory requirements. Harmonized international standards remain years away, creating ongoing compliance complexity for platforms serving global user bases.

多重司法轄區之間的規範衝突,讓發行平台國際營運協調面臨更高挑戰。各國合規標準統一化仍需時日,導致全球性平台長期處於高度合規複雜度。

Future regulatory development appears focused on balance between innovation preservation and investor protection. Regulatory sandboxes, safe harbor provisions, and industry-specific guidance represent potential approaches enabling continued innovation while addressing legitimate fraud and manipulation concerns.

未來監管發展方向,將在維護創新與保護投資人間尋求平衡。「監管沙盒」、安全港條款、產業指引等,皆是促進持續創新、同時解決詐騙與操縱風險的可能方案。

The tension between decentralization principles and regulatory compliance requirements creates fundamental architectural challenges. Platforms must balance regulatory adherence with core value propositions of permissionless access and decentralized operation, potentially requiring significant technical and operational modifications.

去中心化原則與監管要求之間的張力,帶來根本性架構挑戰。平台需在合規與無需許可、去中心化等核心價值間取得平衡,這或需重大技術與營運調整。

Industry self-regulation initiatives are emerging as platforms collectively address reputational concerns and preempt restrictive government intervention. These efforts include voluntary compliance standards, shared fraud prevention systems, and collaborative engagement with regulatory authorities.

產業自主規範亦逐漸興起。平台藉由自發合規標準、聯合防詐系統、主動與監管單位溝通等行動,協力守住聲譽並減少政府嚴管風險。

The technical infrastructure powering mass adoption

促成大規模採用的技術基礎設施

The ability of Solana launchpads to process thousands of daily token launches while maintaining user experience standards demonstrates sophisticated technical infrastructure that enables mass adoption at unprecedented scale. Understanding this infrastructure reveals both current capabilities and future scalability constraints.

Solana 發行平台每日能處理數千次代幣發行,且維持高用戶體驗,展現出強大的技術基礎,為史無前例的大規模採用鋪路。深入瞭解這套基礎設施,有助掌握其現有能力與未來可擴展性限制。

Solana's native technical advantages provide the foundation for launchpad success. The blockchain's 400 millisecond block times and theoretical throughput of 65,000+ transactions per second enable real-time user interactions that would be impossible on slower networks. Proof-of-History consensus reduces traditional validation overhead, while parallel processing capabilities allow simultaneous bonding curve interactions across thousands of token launches.

Solana 原生的技術優勢,是發行平台成功的根基。其區塊時間僅 400 毫秒,理論上每秒可處理超過 65,000 筆交易,這讓即時用戶互動成為可能、也非他鏈所能及。Proof-of-History 共識機制降低傳統驗證負擔;平行處理能力則允許平台同時執行成千上萬個綁定曲線互動。

The cost economics prove crucial for mass adoption. Solana transaction fees averaging $0.00025 enable economically viable microtransactions and token creation, while Ethereum's higher fees would make similar platforms prohibitively expensive for most users. This cost advantage enables experimentation and iteration that drives platform innovation and user engagement.

成本結構對大規模採用至關重要。Solana 平均手續費僅約 0.00025 美元,使微交易、代幣發行等應用具有經濟可行性;以太坊則因手續費高昂,多數用戶難以負擔。低成本優勢促進大量實驗與快速迭代,也推動了平台創新與活躍度。

Smart contract architectures have evolved toward modular, upgradeable designs that balance security with innovation velocity. Most platforms employ proxy patterns enabling protocol upgrades without disrupting existing token contracts, while minimal clone deployment strategies reduce gas costs for individual token launches. Anchor framework adoption provides type safety and security guarantees while maintaining development velocity through standardized patterns.

智能合約架構趨向模組化與可升級設計,以平衡安全性與創新速度。多數平台採代理合約模式,能在不影響既有代幣合約下升級協議;極簡複製部署策略也大幅降低單一代幣發行的費用。Anchor 框架則以標準化手法,兼顧型別安全、合約安全與開發效率。

State management challenges become significant at scale. Platforms must efficiently store and retrieve data for millions of tokens while maintaining query performance and user experience standards. Advanced platforms implement sophisticated database architectures with off-chain indexing and caching layers to handle the massive data volumes generated by continuous trading activity.

規模擴大後,狀態資料管理成為極大挑戰。平台需高效儲存、取用數百萬代幣資料,同時維持查詢效能及體驗。進階平台採用複雜資料庫架構,運用鏈下索引與快取技術,應對持續交易所產生的海量數據。

The integration with existing Solana DEX infrastructure proves essential for graduated token liquidity and broader ecosystem adoption. Automated integration with Raydium, Jupiter, and other major DEXs enables seamless user experiences while leveraging established liquidity sources. This integration requires sophisticated cross-program invocation patterns and careful state synchronization between launchpad and DEX protocols.

與現有 Solana 去中心化交易所(DEX)基礎設施的整合,對於新代幣流動性與擴大生態應用至為關鍵。平台自動串接 Raydium、Jupiter 等主要 DEX,讓用戶無縫體驗,同時享有成熟流動性。但這也需處理複雜的跨程式調用設計與細緻的協議狀態同步。

User interface innovation focuses on mobile-first design and social media integration reflecting user behavior patterns in crypto adoption. Platforms

使用者介面創新聚焦於行動優先設計與社群媒體整合,以呼應加密貨幣用戶的真實行為習慣。平台...increasingly emphasize touch-optimized interfaces, one-click token creation workflows, and native sharing mechanisms for social platforms. The integration of Twitter/X through Solana Blinks enables direct blockchain interactions from social media posts.

越來越強調適合觸控操作的介面設計、一鍵發幣的工作流程,以及面向社群平台的原生分享機制。透過 Solana Blinks 串接 Twitter/X,實現用戶直接從社交媒體貼文進行區塊鏈互動。

Infrastructure monitoring and reliability systems have become critical as platforms handle millions of dollars in daily volume. Advanced platforms implement comprehensive monitoring, automated failover systems, and redundant infrastructure to maintain availability during high-traffic periods. The correlation between platform uptime and user retention makes infrastructure reliability a competitive advantage.

隨著平台每天處理數百萬美元的交易量,基礎設施的監控與可靠性系統變得至關重要。先進的平台會導入全方位監控、自動故障切換系統以及備援基礎設施,以確保在高流量期間保持可用性。平台上線時間與用戶留存之間的關聯,使基礎設施的可靠性成為競爭優勢。

Security infrastructure extends beyond smart contract auditing to include front-end security, API protection, and user fund safeguarding. Multi-layered security approaches implement rate limiting, bot detection, and abuse prevention while maintaining accessibility for legitimate users. The balance between security and user experience requires sophisticated risk management systems.

安全基礎建設已不僅止於智能合約審計,還包括前端安全、API 保護及用戶資金保障。多層次安全架構會導入流量限制、機器人偵測及濫用防禦,同時兼顧合法用戶的使用體驗。安全性與用戶體驗的平衡,需要先進的風險管理機制。

Analytics and data infrastructure enable platforms to understand user behavior, optimize fee structures, and predict token success patterns. Real-time analytics dashboards, custom metrics tracking, and predictive modeling systems provide competitive advantages in user acquisition and retention.

分析與數據基礎設施,使平台能夠理解用戶行為、優化手續費結構並預測代幣成功模式。即時數據儀表板、自訂指標追蹤和預測建模系統,為用戶獲取與留存帶來競爭優勢。

Cross-chain integration infrastructure represents emerging technical challenges as platforms explore expansion beyond Solana. Bridge protocols, state synchronization systems, and unified user experience design require significant technical investment while potentially expanding addressable markets substantially.

跨鏈整合基礎設施成為新興技術挑戰,因為平台開始探索跨越 Solana 以外的擴展路徑。橋接協議、狀態同步系統與一致性的用戶體驗設計都需大量技術投入,並有機會大幅拓展目標市場。

The development velocity required for competitive differentiation places significant demands on technical teams. Platforms must balance rapid feature development with security considerations, requiring sophisticated development practices including automated testing, staged deployment systems, and comprehensive code review processes.

為了在競爭中脫穎而出,所需的開發速度對技術團隊帶來極大壓力。平台必須在快速功能開發與安全性之間取得平衡,這需要先進的開發實踐,包括自動化測試、分階段部署系統,以及全面的程式碼審查流程。

Future infrastructure development appears focused on artificial intelligence integration, enhanced user protection mechanisms, and institutional-grade compliance features. These developments will likely require substantial technical infrastructure investment while potentially enabling new user segments and use cases.

未來的基礎設施發展傾向於結合人工智慧、提升用戶保護措施與導入機構級合規特色。這些趨勢將需要大量的技術性基礎建設投入,同時可能啟動全新的用戶族群和應用場景。

Cultural impact and social dynamics

The Solana launchpad ecosystem has transcended pure financial infrastructure to become a significant cultural phenomenon influencing how communities form, express identity, and participate in collective value creation. The social dynamics underlying token creation and trading reveal complex interactions between technology, psychology, and cultural evolution.

Solana Launchpad 生態系已經跨越了單純的金融基礎設施層面,成為一種深具影響力的文化現象,左右著社群的形成、身份認同的展現,以及集體價值創造的參與。圍繞發幣與交易的社會動態,揭示了科技、心理和文化演化之間的複雜互動關係。

The democratization of token creation has enabled new forms of digital expression where communities can manifest shared beliefs, humor, or cultural affiliations through economic instruments. Tokens become vessels for cultural transmission, enabling groups to coordinate around shared narratives while potentially capturing financial value from collective attention and engagement.

代幣創造的民主化,讓社群可以透過經濟工具,展現集體信念、幽默感或文化歸屬感,開啟全新的數位表達形式。代幣成為文化傳遞的載體,使群體得以圍繞共同敘事協作,同時將集體注意力與參與轉化為潛在的經濟價值。

Meme culture drives substantial platform activity as communities leverage absurdist humor, political commentary, and cultural references to create viral tokens. The success of tokens like FARTCOIN, MOODENG, and politically themed derivatives demonstrates how cultural resonance translates directly into economic outcomes within these systems. This creates feedback loops where cultural relevance generates financial returns, incentivizing continued cultural participation.

迷因文化推動了大量平台活動,社群透過荒謬幽默、政治評論與文化符號創造爆紅代幣。像 FARTCOIN、MOODENG 及政治主題衍生代幣的成功,展現文化共鳴如何在這些系統中直接轉化為經濟成果。這形成正向循環:文化相關性帶來財務回報,進而激勵持續的文化參與。

The phenomenon of celebrity and influencer token launches represents new models of fan engagement and monetization. Iggy Azalea's MOTHER token reached $200 million market capitalization through direct artist involvement and community building, while various political figures and internet personalities leverage token launches for audience engagement and potential revenue generation. This creates new dynamics in celebrity-fan relationships mediated by financial instruments.

名人與網紅發幣的現象,展現了粉絲互動和變現的新模式。Iggy Azalea 的 MOTHER 代幣因藝人直接參與與社群經營,市值一度突破 2 億美元。各種政治人物及網路名人,也利用發幣與粉絲互動並創造潛在收入。這種現象,使名人與粉絲之間的關係出現以金融工具為媒介的新動態。

Community formation patterns around successful tokens reveal sophisticated social coordination mechanisms. Token holders develop shared identities, communication channels, and collective action capabilities that extend beyond financial interests. These communities often engage in marketing activities, content creation, and platform evangelism that supports token value while building social capital.

成功代幣背後的社群組成模式,顯示出高度社會協作機制。持幣者建立共同認同、專屬通訊渠道及集體行動能力,而這些遠超純粹的財務利益。這些社群經常參與行銷、內容生產及平台布道,不僅鞏固代幣價值,更累積社會資本。

The psychological elements underlying participation combine gambling mechanics with social belonging, creative expression, and potential financial opportunity. Users report motivations including entertainment value, community participation, speculative profit potential, and alignment with cultural or political movements they support.

參與動機背後的心理因素,混合了賭博機制、社群歸屬感、創意表達及經濟機會。用戶表示,參與的動機包括娛樂性、社群互動、投機獲利潛力,以及認同支持的文化或政治運動。

Social media integration has become central to token success with platforms optimizing for viral content creation and sharing mechanisms. Twitter/X integration, Discord community building, and TikTok marketing strategies determine token visibility and adoption more than traditional financial metrics or technical fundamentals.

社群媒體整合成為代幣成功的核心,平台優化病毒式內容生產與分享功能。與 Twitter/X 串接、在 Discord 組建社群、以及 TikTok 行銷策略,比起傳統財務指標或技術基礎,更能決定代幣的能見度與採用率。

The emergence of "token tribalism" creates competing community factions supporting different tokens or platforms, leading to coordinated promotional activities, competitive dynamics, and occasionally hostile interactions between communities. This tribalism drives engagement and network effects while potentially creating barriers to broader mainstream adoption.

「代幣部落主義」的興起,造就支持不同代幣或平台的社群派系,產生協同性宣傳、競爭態勢,甚至偶有敵對互動。這種部落主義刺激平台活躍度和網絡效應,但同時也可能為進一步主流採納帶來阻礙。

The cultural legitimacy questions surrounding meme tokens and speculative trading create tensions between traditional financial norms and emerging digital native behaviors. Generational differences in risk tolerance, technological comfort, and cultural values influence participation patterns and regulatory acceptance.

圍繞迷因幣與投機交易的文化正當性,引發傳統金融規範與新生數位原生行為間的張力。世代在風險承受度、科技習慣及文化價值觀的差異,也會影響參與模式與政策監理接納度。

Creator economy integration enables new monetization models for content creators, artists, and community builders through token launches, revenue sharing mechanisms, and community ownership structures. This creates alternative economic pathways for creative professionals while potentially disrupting traditional platform-mediated creator monetization.

創作者經濟的整合,使內容創作者、藝術家、社群經營者透過發幣、收入分潤與社群共治體制開創全新變現模式。這為創意產業者開啟另類收益管道,也可能衝擊原有由平台主導的變現模式。

The global nature of these platforms facilitates cross-cultural exchange and collaboration while also creating challenges around cultural context, language barriers, and regulatory differences. Successful tokens often transcend geographic boundaries while culturally specific tokens may struggle to achieve broader adoption.

這些平台具備全球性,促進跨文化交流與合作,但同時也帶來文化情境、語言障礙和法規異同的挑戰。成功的代幣往往能超越地理邊界,而特定文化色彩鮮明的代幣則可能較難推向更廣泛市場。

Educational and literacy challenges emerge as platforms require users to understand complex financial concepts including liquidity, market making, and token economics without traditional financial education or consumer protections. This creates both opportunity and risk as users navigate sophisticated financial instruments through gamified interfaces.

隨著平台要求用戶理解如流動性、市場做市、代幣經濟等複雜金融概念,在缺乏傳統理財教育和消費者保護下,也帶來教育與素養上的挑戰。用戶在經過遊戲化介面的同時操弄高階金融工具,這既蘊含機會,也隱藏風險。

The long-term cultural impact may include normalization of token-mediated community formation, integration of financial instruments into social interaction, and evolution of new collective decision-making mechanisms enabled by blockchain technology and token economics.

長期來看,文化影響可能包含:以代幣作為中介的社群組成常態化、金融工具與社交互動的深度結合,以及由區塊鏈技術和代幣經濟促成的新型集體決策機制的誕生。

Market manipulation and user protection

The largely unregulated nature of Solana launchpads creates significant opportunities for market manipulation while challenging platforms to balance accessibility with user protection. Understanding these dynamics is essential for evaluating platform sustainability and user risk management in an environment where 98.6% of launched tokens ultimately fail or represent scams.

Solana Launchpad 幾乎沒有監管,使得市場操控機會大增,也逼使平台在用戶易用性及保護措施間權衡。了解這些運作動態,對於評估平台可持續性及用戶風險管理尤為關鍵,畢竟在這個環境下高達 98.6% 的代幣最終失敗或屬於詐騙。

Sophisticated manipulation techniques exploit the permissionless nature of token creation and trading. Common patterns include coordinated launch and dump schemes where creators generate artificial hype through social media and influencer partnerships before immediately selling allocated tokens to early buyers. Bot networks enable rapid token creation, artificial volume generation, and coordinated purchasing patterns that mislead retail investors about genuine community interest.

複雜的操控手法利用了代幣發行及交易的無許可特性。常見模式包括協同行銷與拋售:創建者透過社群媒體和網紅合作炒作,隨後立即將預分配的代幣賣給早期投資者。機器人網絡則支援高速發幣、虛假交易量製造,以及協同採購行為,從而誤導散戶投資人對社群熱度的判斷。

The technical architecture of bonding curves creates specific manipulation vulnerabilities. Early buyers can acquire large token allocations at minimal cost, then coordinate marketing efforts to drive additional purchasing that benefits their positions disproportionately. The mathematical certainty of bonding curve pricing enables sophisticated actors to calculate optimal exploitation strategies and timing.

邦定曲線的技術架構存在特定操控漏洞:早期買家能以極低成本購得大量代幣,然後協助推動市場行銷,誘使更多人進場,進而不成比例地收割收益。這類數學定價機制為技術嫻熟的參與者,提供精確計算最佳操作策略與時機的空間。

Pump.fun's internal data reveals the massive scale of fraudulent activity, with only 97,000 out of over 7 million tokens maintaining liquidity above $1,000. This represents an extraordinary failure rate that indicates either systematic fraud or fundamental misalignment between platform incentives and user outcomes. The platform's revenue model creates direct financial incentives to facilitate high-volume token creation regardless of user outcomes.

Pump.fun 的內部數據揭露了龐大的詐騙規模:在逾 700 萬顆發幣中,僅 97,000 顆維持 1,000 美元以上流動性,顯示出異常的失敗率,也暗示可能存在系統性詐欺,或平台激勵機制與用戶結果的根本錯位。平台的營收模式使其直接受益於大量代幣發行,無論用戶是否獲益。

Platform responses to manipulation vary significantly in sophistication and effectiveness. HeavenDEX implements tiered token classification systems with manual review processes at $100,000 volume thresholds, attempting to distinguish legitimate projects from obvious scams. Anti-MEV features protect users from front-running and sandwich attacks, while longer-term measures include reputation systems and automated quality assessment.

不同平台針對市場操控的應對措施,在成熟度與效果上差異甚大。HeavenDEX 推行分級代幣分類制度,於成交量達 10 萬美元時進行人工審查,藉以辨識合規項目與明顯詐騙。平台的防 MEV 功能可防範搶先交易與三明治攻擊,長遠則計劃導入聲譽系統及自動品質評級機制。

Some platforms experiment with proof-of-personhood requirements, staking mechanisms for token creation, and time-delay systems that reduce automated exploitation opportunities. However, these protective measures often conflict with core value propositions of accessibility and permissionless participation, creating difficult trade-offs between user protection and platform usability.

部分平台也嘗試實名驗證、發幣質押機制及時延設計,降低自動化濫用空間。然而,這些防護措施往往與「可及性」及「無需許可」等核心價值衝突,不免在用戶保護與平台體驗間產生困難抉擇。

The lack of traditional consumer protections means users bear full responsibility for investment decisions without recourse for losses from fraudulent tokens. Unlike regulated securities markets with investor protections and fraud remedies, launchpad participants operate in caveat emptor

缺乏傳統消費者保護,意味著用戶需對自己的投資決策負全部責任,遭遇詐騙代幣損失時亦無申訴途徑。與受監管的證券市場(具備投資人保障與詐騙救濟)不同,Launchpad 參與者只能奉行「買者自負」原則。environments where sophisticated scammers target inexperienced users.

高明騙徒鎖定缺乏經驗的用戶的環境。

Social engineering techniques target psychological vulnerabilities specific to crypto communities. Manipulators leverage fear of missing out, community belonging desires, and get-rich-quick fantasies to drive participation in obviously unsustainable schemes. The gamification elements and social media integration amplify these psychological pressures.

社交工程技巧針對加密社群中特有的心理弱點。操縱者利用錯失恐懼症、渴望融入社群、和一夜致富的幻想,誘導用戶投入明顯不可持續的計劃。遊戲化設計與社群媒體的整合更強化了這些心理壓力。

Educational initiatives attempt to address user protection through improved financial literacy and risk awareness. Some platforms implement warning systems, educational content, and clear disclosure of statistical failure rates. However, the effectiveness of educational approaches remains limited when competing against sophisticated marketing and psychological manipulation techniques.

教育倡議希望藉由提升金融知識和風險意識來加強用戶的保護。有些平台設置警告系統、教育內容,並清楚揭露統計失敗率。然而,當這些教育做法需要與精密行銷與心理操控手段競爭時,其成效依然有限。

The broader ecosystem impact of widespread manipulation includes reputational damage to legitimate projects and platforms, regulatory attention that may result in restrictive oversight, and user exodus as losses accumulate. Platforms face long-term sustainability challenges if manipulation continues undermining user trust and generating negative regulatory attention.

詐欺手法廣泛流行對生態系統造成影響,包括正牌專案與平台的聲譽受損、監管單位的關注可能帶來更加嚴格的監督,以及越來越多用戶因損失而退出市場。如果這些操弄行為持續破壞用戶信任並引發負面監管關注,平台將面臨長期永續經營的挑戰。

Industry self-regulation efforts include shared blacklist systems, collaborative fraud detection, and voluntary compliance standards. However, the competitive pressures and revenue incentives make comprehensive self-regulation difficult to achieve without external enforcement mechanisms.

業界自律的努力包括建立共享黑名單機制、共同反詐欺偵測,以及自願遵循法規標準。然而,激烈的競爭壓力和利潤誘因,使得沒有外部強制力的情況下,要落實全面自律非常困難。

Future protection mechanisms may include AI-driven fraud detection, automated quality assessment systems, enhanced user verification processes, and integration with traditional financial consumer protection frameworks. The challenge remains balancing innovation and accessibility with meaningful user protection in decentralized environments.

未來的保護機制可能包括AI驅動的詐騙偵測、自動化品質評估系統、強化的用戶驗證流程,以及與傳統金融消費者保護結構的整合。在去中心化環境下,如何在創新、易用性與確實的用戶保障之間取得平衡,仍具極大挑戰。

The evolution toward greater user protection likely requires combination of improved platform design, enhanced regulatory clarity, industry collaboration on fraud prevention, and continued user education about risks associated with speculative token trading.

朝向更完善用戶保護演進,勢必需要平台設計提升、監管清晰化、業界在防詐領域的協作,以及持續教育用戶理解投機型代幣交易的相關風險。

Future outlook: evolution and consolidation

The Solana launchpad ecosystem stands at a critical inflection point where massive growth potential intersects with regulatory challenges, technical limitations, and market maturation pressures. Understanding likely evolutionary paths requires analyzing current trends, competitive dynamics, and broader crypto market development patterns.

Solana孵化平台生態系正處於關鍵轉捩點,龐大成長潛力與法規挑戰、技術瓶頸及市場成熟壓力交會。預測其未來走勢,需剖析當前趨勢、競爭態勢和更廣泛加密市場的發展格局。

Platform consolidation appears inevitable as the current proliferation of competitors faces economic reality of limited market share and substantial operational costs. The winner-take-all dynamics evident in other platform markets suggest eventual emergence of 3-5 dominant players with distinct specializations rather than the current fragmented landscape with dozens of platforms competing for users.

現今競爭者雨後春筍,但受限於市場規模和龐大營運成本,平台整併似乎勢不可免。如同其他平台市場的贏者全拿現象,未來將可能僅存三到五個具備鮮明特色的主要玩家,而不再是目前數十個平台各自搶占用戶的破碎格局。

The technical evolution trajectory points toward greater sophistication in user protection, automated quality assessment, and institutional integration. Artificial intelligence integration for fraud detection, predictive analytics for token success probability, and automated compliance monitoring represent likely near-term developments that could provide competitive advantages while addressing current ecosystem challenges.

技術演進路徑將朝向更精密的用戶保障、自動化品質評估和機構級整合。結合AI做詐欺偵測、用於代幣成敗預測的數據分析,以及自動化法遵監控,皆是近期可能實現的發展,不僅能解決當前生態系問題,也是未來競爭優勢關鍵。

Regulatory clarity development will significantly influence platform architecture and operations. Potential SEC approval of Solana ETFs signals mainstream financial acceptance that could enable institutional participation while requiring enhanced compliance infrastructure. Platforms may need to implement comprehensive KYC/AML systems, audit requirements, and investor protection mechanisms that fundamentally alter their current permissionless approaches.

監管明確化將深刻影響平台架構與運作。若SEC通過Solana ETF,表示主流金融領域接受此類資產,將吸引機構入場,但亦要求平台強化法遵基礎。平台很可能必須導入完整的KYC/AML機制、審計要求與投資人保護措施,這將根本改變現有無需許可的營運方式。

Cross-chain expansion represents both opportunity and risk as platforms explore deployment across multiple blockchains. Successfully executing multi-chain strategies could dramatically expand addressable markets and reduce platform-specific risks, but requires substantial technical investment and operational complexity management.

跨鏈擴展同時帶來機遇及風險,平台積極於不同公鏈上部署。若能成功推動多鏈策略,將顯著增加可觸及市場規模,並分散平台單一風險,但也需投入大量技術資源及管理更複雜的營運作業。

The maturation of token economics and community alignment mechanisms suggests evolution toward more sustainable models balancing speculation with genuine value creation. Platforms implementing sophisticated revenue sharing, creator incentives, and community governance structures may achieve longer-term sustainability compared to purely extractive models.

代幣經濟與社群共識機制漸趨成熟,代表未來將走向兼顧投機與實質價值創造的可持續模式。導入高階收益共享、創作者激勵、社群治理架構的平台,較純粹抽水型模式更可能取得長遠發展。

Integration with traditional financial infrastructure appears increasingly likely as mainstream institutions explore crypto exposure. Platforms that successfully bridge decentralized token creation with traditional finance compliance and user experience standards could capture significant institutional demand while expanding mainstream adoption.

隨主流機構尋求加密資產布局,與傳統金融基礎設施的整合趨勢也日益明顯。若平台能維持去中心化代幣發行的靈活性,同時符合傳統金融的合規與用戶體驗標準,將有望滿足龐大的機構需求,推動加密大眾化採用。

The competitive landscape may evolve toward specialization rather than comprehensive platform competition. Platforms might differentiate through focus on specific token types, user segments, or geographic markets rather than attempting to capture entire market share across all categories.

競爭態勢將從全方位競爭轉向垂直專精。平台可能專注於某些特定代幣類型、特定用戶群或特定區域市場,而非試圖橫跨所有領域攫取市場。

Technology infrastructure development will likely focus on scalability, security, and user experience optimization. Advanced features like gasless transactions, simplified onboarding processes, and mobile-native experiences become competitive requirements rather than differentiators as user expectations evolve.

技術基礎建設重點將放在擴展性、安全性和用戶體驗優化。像是免Gas手續費、簡化註冊流程、原生行動裝置體驗等進階功能,隨著用戶預期提高,將成為基本競爭條件而非差異化因素。

Regulatory compliance costs will increasingly favor well-capitalized platforms capable of sustaining comprehensive legal and compliance infrastructure. This dynamic could accelerate consolidation while potentially excluding smaller competitors lacking resources for regulatory adherence.

法遵成本日益提升,有充足資本者才能負擔全方位法務及合規架構。這種情勢將加速市場整併,同時也會將無力負擔的中小型競爭者拒於門外。

The broader DeFi ecosystem evolution influences launchpad development as platforms integrate with emerging protocols for lending, derivatives, and structured products. Token launches may become components of more sophisticated financial products rather than standalone speculative instruments.

更大範圍的DeFi生態系發展,也會影響孵化平台發展。隨這些平台與借貸、衍生品、結構型商品等新興協議整合,代幣發行將逐漸轉為複合金融產品的一環,而非單純的投機工具。

User behavior evolution suggests growing sophistication in risk assessment, platform evaluation, and investment decision-making as early adopters gain experience and losses. This could drive demand for platforms emphasizing user protection and sustainable tokenomics over pure speculation.

用戶行為將出現明顯演化,早期參與者隨經驗增長和損失累積,對風險評估、平台選擇與投資決策將更趨精明。這有望帶動更重視用戶保障與永續代幣經濟的平臺,凌駕於純投機性質之上。

Market cycle dependencies remain significant as platform activity correlates strongly with broader crypto market conditions. Platforms developing counter-cyclical revenue streams and sustainable business models during bear markets will likely achieve competitive advantages during subsequent bull markets.

平台活動仍高度受整體加密市場週期影響。能夠在熊市建立逆週期收入與可持續商業模式的平台,往往能在下一波牛市中取得競爭優勢。

The long-term outcome probably involves mature platforms serving distinct market segments: institutional-focused platforms with comprehensive compliance infrastructure, community-oriented platforms emphasizing creator economics and user protection, and specialized platforms serving specific token types or user demographics.

長遠來看,生態系將由成熟平台分別服務不同市場區隔:強調合規、主攻機構客戶的平台;重視創作者經濟與用戶保障的社群型平台;以及服務特定代幣類型或目標用戶的垂直專案平台。

Success factors for surviving platforms include technical innovation, regulatory adaptability, community alignment, sustainable economics, and ability to evolve with changing market conditions. Platforms rigidly adhering to current models without adaptation capability face displacement by more flexible competitors.

平台要在競爭中存活,關鍵可歸納為技術創新、法規彈性、社群共識、經濟永續,以及與市場共變進化的能力。反之,若墨守現有模式、缺乏調整彈性者,終將被靈活創新的平台取代。

Conclusion: the transformation of token creation

The Solana launchpad ecosystem represents one of crypto's most dramatic transformations, evolving from exclusive IDO platforms serving vetted projects to permissionless factories generating billions in trading volume through millions of token launches. This evolution reflects broader changes in crypto markets, user behavior, and technological capabilities that extend far beyond individual platform success.

Solana孵化平台生態系象徵著加密產業最劇烈的變革之一,從僅限審核專案參與的IDO平台,轉變為無需許可、每月推出數百萬個代幣、累積數十億交易量的自動化工廠。這波演進,反映出加密市場、用戶行為及技術能力的總體變遷,所產生的影響遠超任何個別平台的成敗。

The competitive dynamics reveal clear patterns where technical innovation, community alignment, and sustainable economics determine long-term platform viability. HeavenDEX's rapid market share capture through revolutionary revenue-sharing mechanisms demonstrates that even dominant platforms like Pump.fun face disruption from superior value propositions and innovative tokenomics.

競爭格局也顯示出明確趨勢:技術創新、社群共識與經濟永續,是平台長期存續的主因。舉例來說,HeavenDEX藉由革命性的收益分潤機制快速擄獲市場,說明即便是Pump.fun等主流巨頭,也可能被具備更強價值主張和創新代幣經濟的新玩家顛覆。

The cultural and social impact extends beyond financial metrics to influence how communities form around shared narratives, express collective identity, and participate in democratized value creation. The intersection of meme culture, social media integration, and financial instruments creates new forms of digital expression and community coordination that may persist regardless of specific platform success.

此變革的文化與社會影響力,已經超越純粹財務數據,左右社群如何依共通敘事聚集、展現集體認同與參與民主化價值創造。迷因文化、社交媒體整合與金融工具的交會,創造了嶄新的數位表達模式及社群協作模式,不論哪個平台最終勝出都會持續存在。

The regulatory challenges facing the ecosystem highlight tensions between innovation and investor protection that will shape the industry's future development. Multiple billion-dollar lawsuits and increasing regulatory scrutiny indicate a maturing regulatory environment that will likely require significant platform adaptation while potentially enabling institutional participation.

生態系面臨的監管難題,凸顯創新與投資人保護之間的拉鋸,也決定了產業未來發展走向。數宗數十億美元規模的集體訴訟及日益嚴格的監管關注,意味法規環境正在成熟,未來平台勢必要大幅調整,以回應新型合規要求,並可能促使機構市場參與。

The technical infrastructure achievements demonstrate Solana's advantages for mass adoption applications requiring high throughput, low costs, and real-time user experiences. The ability to process thousands of daily token launches while maintaining usability standards validates Solana's technical architecture for complex financial applications.

技術基礎建設上的突破,展現了Solana在大規模應用場景中的核心優勢——高吞吐量、低成本、即時體驗。平台每日可支撐數千個代幣上線,同時維持流暢體驗,驗證了Solana架構極適合承載複雜金融應用。

The market manipulation and user protection challenges underscore the need for evolved platform design balancing accessibility with meaningful consumer protections. The 98.6% failure rate of launched tokens indicates systematic issues requiring platform innovation, regulatory intervention, or user education to address sustainably.

市場操縱與用戶保護兩大課題,凸顯平台設計必須升級以兼顧易用性與實質消費者保護。98.6%的代幣最終失敗,說明產業存在系統性問題,急需平台創新、法規介入,或以教育機制來建立長遠解方。

Looking forward, the ecosystem appears headed toward consolidation around platforms demonstrating sustainable economics, regulatory adaptability, and genuine community value creation. The pure speculation models driving current activity may evolve toward more sophisticated community ownership and creator monetization mechanisms.

展望未來,整體生態系將聚焦於能展現經濟永續、法規彈性以及真實社群價值創造的平台。當前以投機為主的模式,預料會漸漸演化為更成熟的社群共管和創作者變現機制。

The broader implications for cryptocurrency adoption include demonstration of massive latent demand for

(原文未完,無法翻譯其下段落)Here is your requested translation (markdown links preserved):

accessible financial tools, validation of blockchain technology for complex economic coordination, and evolution of new models for community formation and value creation. The lessons learned from Solana launchpad competition will likely influence token creation across all blockchain ecosystems.

可近用的金融工具、區塊鏈技術在複雜經濟協調中的驗證,以及社群組成與價值創造新模式的演進。從 Solana 發射台競賽中獲得的經驗教訓,很可能會影響所有區塊鏈生態系上的代幣創建。

The ultimate success measure extends beyond individual platform revenues to encompass the ecosystem's contribution to financial democratization, community empowerment, and technological innovation. While current metrics focus on trading volumes and token creation statistics, the lasting impact will be determined by the platform's role in enabling new forms of economic participation and community coordination.

最終的成功指標已超越個別平台收益,涵蓋生態系對金融民主化、社群賦權以及技術創新的貢獻。雖然目前的評量著重於交易量和代幣創建統計數據,長遠影響將取決於平台在促成新型經濟參與及社群協作中的作用。

The Solana launchpad wars continue evolving rapidly, with new platforms launching regularly and existing competitors adapting to changing market conditions. The platforms that survive and thrive will be those that successfully balance innovation with sustainability, accessibility with protection, and speculation with genuine value creation for their communities.

Solana 發射台之爭持續迅速演變,新的平台不斷推出,現有競爭者也在因應市場條件變化加速調整。能夠存活並茁壯的平台,將是那些在創新與永續、可近用性與保護,以及投機與真正價值創造之間成功取得平衡的平台。

This transformation of token creation from exclusive, gatekept processes to permissionless, community-driven mechanisms represents a fundamental shift in how digital assets emerge and develop. The implications extend throughout the cryptocurrency ecosystem and may influence broader financial system evolution as traditional finance increasingly integrates with decentralized technologies.

代幣創建從專屬、封閉的流程,轉變為無需許可、由社群驅動的機制,這代表了數位資產誕生與發展方式的根本性轉變。這項改變的影響遍及整個加密貨幣生態系統,並可能在傳統金融與去中心化技術日益結合下,推動更廣泛的金融體系演變。