2025 年 8 月,加密貨幣業界歷時最久、影響最深遠的法律爭端終於落幕。美國證券交易委員會 (SEC) 與 Ripple Labs 正式結束長達數年的訴訟,雙方共同撤回對 XRP 案件的上訴。在近五年的不確定、訴訟和市場波動後,雙方退出上訴程序,為數位資產監管不明朗劃下句點。

和解的核心結果維持了一項具代表性的司法裁決:在公開交易所銷售的 XRP 不構成證券,但機構銷售則屬證券。這項由 Analisa Torres 法官於 2023 年 7 月首次作出的判決,創造出一個雙軌監管框架,重塑加密貨幣產業、監管機構及機構投資者如何面對數位資產分類。

此影響遠超 Ripple 財報或 XRP 代幣價格。這場案件成為衡量數十年證券法是否適用於新型區塊鏈資產的試金石,為代幣分類、Howey 測試於數位市場中的界限、以及產業朝監管成熟發展樹立先例。

本文將探討 XRP 案件判決的多重影響:導致此結果的法律架構,即時市場效應,機構採用浪潮,以及目前全球加密貨幣市場正在展開的監管重組。本文綜合法院文件、SEC 公報、市場數據與產業報導,全方位說明這項和解對加密產業由投機邊陲邁向合規金融基礎設施的關鍵意義。

SEC 與 Ripple 爭訟始末

2020 年 12 月,SEC 對 Ripple Labs 提起訴訟,是該機構於加密貨幣領域最強勢的執法行動之一。法院認定 Ripple 機構銷售 XRP 屬於未註冊證券發售,違反 1933 年證券法第 5 條,但其他二級市場銷售則不在此限。

原告指控 Ripple 未註冊即向機構投資者與散戶發行價值 13 億美元的 XRP 代幣。SEC 依循 1946 年最高法院 Howey 測試,將 Ripple 的 XRP 發行模式納入投資契約定義。依該測試,若交易涉及出資參與共同企業,且獲利期望來自他人努力,即構成證券。

此訴訟時機與範圍對加密市場造成劇烈衝擊。美國多家主流交易所即時下架或暫停 XRP 交易、機構合作喊停,幣價在數週內暴跌逾六成。這一訊號鮮明:監管不確定性已不再是抽象風險,而是威脅任何可能被認定為證券數位資產的生存危機。

在近三年的過程中,案情經歷調查、動議及法律攻防,針對加密設計與發行模式的關鍵問題作出延宕審查。重點爭議即是 XRP 的屬性是否因銷售方式而改變。Ripple 辯稱 XRP 屬於商品,無論分銷渠道都作為去中心化 XRP 帳本的跨境支付橋樑。

關鍵性突破於 2023 年 7 月出現,Torres 法官作出兩面俱陳的簡易判決。法院下令永久禁止 Ripple 未來違反第 5 條,並處逾 1.25 億美元民事罰金。裁決認定向專業機構銷售構成未註冊證券發行,但在數位資產交易所上的程序化銷售及員工分配則不屬之。這種劃分建立了嶄新的法律框架——同一代幣能依銷售場合產生不同監管屬性,而非取決於其本質。

雙方均提起上訴。SEC 對於二級市場交易不屬證券部分提出異議,Ripple 則質疑機構銷售的認定及罰金金額。2024 年至 2025 年間繼續纏訟,第二巡迴法院原預計審理雙方爭議,導致 XRP 監管地位懸而未決。

案件挑戰了加密法律疆界:法院該如何以 1946 年證券法解讀去中心化區塊鏈協議?數位資產的監管身份是否能因發行方式而異?購買者的專業程度是否影響證券認定?這些問題讓 Ripple 案成為整個加密產業監管未來的指標性案例。

2025 年 8 月的和解——真正意義何在

最終解決速度超出許多人預期。SEC 提交了與 Ripple Labs、Bradley Garlinghouse、Christian A. Larsen 達成和解協議,制定了解決民事執法糾紛的程序。

根據 2025 年 5 月公開、8 月最終生效的協議,雙方將共同請求地方法院表示是否解散 2024 年 8 月 7 日定案裁決中對 Ripple 的禁令,另要求釋放託管帳戶內被判處民事罰金的 1.25 億 3515 萬美元資金,其中 5,000 萬美元判給 SEC 作為最終罰金,其餘返還 Ripple。

Ripple 已以現金支付 1.25 億美元罰金,完成 XRP 訴訟和解。前 SEC 律師 Marc Fagel 證實此款項為現金而非 XRP,這一細節顯得重要,清楚區分了公司責任與代幣經濟。

Torres 法官維持的法律先例,建立分類學標準,預示未來其他代幣分析方式。在數位資產交易所的二級市場交易,因購買者與發行公司無直接關係,不納入證券監理;機構銷售則屬於註冊或豁免之證券發行,因其購買者多期待公司推動而得利。

此框架隱含:分發機制與代幣特性同樣重要,監管判斷需看情境,非一體適用。此原則改變過去 SEC 動輒將代幣視為證券、不論銷售對象的做法。

SEC 內部對此表現出政策分歧。SEC 專員 Caroline Crenshaw 反對這項和解,表示「這項和解及 SEC 加密監管計畫分解,不僅嚴重損及投資公眾,更損害法院解釋證券法的角色」。

她指出,和解破壞法院認定,撤銷民事罰金與禁令,未來若 Ripple 再次向機構銷售未註冊 XRP,SEC 恐再不做為。

業界反應是審慎樂觀。Ripple 執行長 Brad Garlinghouse 曾稱最終裁決對 Ripple 與加密領域都是勝利。其法律團隊強調判決證明 XRP 在絕大多數情境下更像貨幣,而非法規定義的證券。

此次和解更深層意義在於監管思想的重大轉向。2025 年 1 月新任領導上任後,SEC 從激進監管轉向明確立法及協商解決。SEC 更注重撤回過去註冊訴訟,並啟動加密專案小組,建立新的「監理路徑」。

對 Ripple 而言,和解終結了自 2020 年 12 月以來籠罩公司的生存危機。儘管需繳高額罰款並保留對機構銷售違規的認定,但 Ripple 在公開交易所主要應用場景已獲監管明確,能展開美國業務擴張、申請銀行執照及推動機構合作,這些皆因訴訟延宕而受阻。

市場效應——XRP 價格、交易量與機構熱潮

監管明朗化立即對市場產生重大影響。和解消息一出,XRP 價格於 24 小時內從 2.99 美元飆升至 3.30 美元。等待多年結果的投資人湧入,成交量暴增。 the market. Daily volumes increasing by 208% following the settlement announcement, with sustained elevated activity through August and September.

市場成交量。自和解公告後,日成交量增加了208%,且8月至9月持續維持高檔活躍。

The price movement reflected more than speculative enthusiasm. XRP experienced a 5% drop in value before stabilizing, with significant trading volume highlighting institutional activity, demonstrating that sophisticated market participants were actively repositioning rather than simply retail traders chasing momentum.

價格走勢反映的不僅僅是投機熱情。XRP價格在穩定前曾下跌5%,且伴隨龐大成交量,顯示機構資金正在積極重新布局,說明市場中精明的參與者正在調整部位,而不是僅僅由散戶追漲帶動。

Technical analysis revealed solid support establishing around specific price levels. $3.15-$3.16 emerges as strong accumulation zone following early-session selloff, while late-session breakout cleared $3.22 resistance on sustained large-order flow above 4 million units. These patterns indicated that institutional players were methodically accumulating positions at strategic price points rather than engaging in undisciplined buying.

技術分析顯示,特定價位附近建立了穩固支撐。$3.15-$3.16在早盤拋壓過後成為強勢吸納區域,而尾盤則在超過四百萬單的大單推動下突破$3.22的壓力位。這些走勢顯示機構投資人正有計劃地在戰略價點進行布局,而非無序追價買進。

The derivatives market provided perhaps the clearest evidence of institutional adoption's velocity. CME Group's XRP futures, launched in May 2025, became a phenomenon. XRP futures contracts on the Chicago Mercantile Exchange recorded over $19 million in notional trading volume on their first day. The growth trajectory proved even more impressive. XRP futures on CME Group has now crossed the $1 billion open interest milestone, becoming the fastest crypto contract to do so, just three months after launch.

衍生品市場或許是機構採用速度最明確的證據。CME集團於2025年5月推出的XRP期貨一推出便成為焦點。芝加哥商品交易所的XRP期貨合約首日名義成交量超過1,900萬美元。其增長曲線更為亮眼——CME集團的XRP期貨僅用三個月便突破10億美元未平倉合約,成為史上增長最快的加密合約。

The speed of this achievement was unprecedented. Solana futures reached a $1 billion open interest mark faster than ether and bitcoin. Futures tied to the payments-focused XRP crossed that threshold in August, just three months after they began trading. For context, Bitcoin took three years to reach the same milestone, Ethereum took eight months, and even the fast-growing Solana needed five months. XRP's three-month sprint to $1 billion open interest signaled extraordinary institutional appetite.

這一成就的速度前所未見。Solana期貨雖比以太幣與比特幣更快達到10億美元未平倉額,但和專注跨境支付的XRP期貨相比仍遜色一籌。XRP期貨自開始交易僅三個月便於8月跨越此槓桿門檻。作為參照,比特幣花了三年以達到同一規模,以太坊用時八個月,甚至成長迅速的Solana也要五個月。XRP僅三個月便達標,顯示出極其強勁的機構需求。

Record monthly XRP futures average daily volume of 6,600 contracts ($385 million in notional) and average daily open interest of 9,300 contracts ($942 million in notional) in August 2025. These figures represented genuine institutional positioning rather than retail speculation, as CME's regulatory framework and capital efficiency features primarily serve professional traders and fund managers.

2025年8月,XRP期貨創下單月每日期均成交量6,600口(合計名義金額3.85億美元)及平均每日未平倉9,300口(名義金額9.42億美元)的紀錄。由於CME的監管架構與資本效率設計主要針對專業交易商與資產管理人,這些數據更顯示是真正的機構布局而非零售炒作。

The custodian market provided additional evidence of institutional adoption's depth. BitGo reported that XRP made up 3.9% of its holdings as of June 30, 2025, highlighting its growing share in regulated portfolios. For context, BitGo serves as one of the cryptocurrency industry's largest qualified custodians, managing assets for institutional clients including hedge funds, family offices, and traditional financial institutions. XRP's presence in nearly 4 percent of custodied assets represented substantial institutional allocation.

託管市場也補充了機構採用深度的證據。BitGo報告指出,截至2025年6月30日,XRP占其託管資產的3.9%,顯示XRP在合規資產組合中的比重持續上升。作為全球最大合格加密貨幣託管機構之一的BitGo,主要服務對象為對沖基金、家族辦公室及傳統金融機構。XRP近4%的託管資產占比,代表著顯著的機構配置。

Market capitalization metrics told a compelling story about XRP's resurgence. XRP's market cap at $181.944 billion and $10 billion+ daily trading volume positioned it firmly as a major digital asset by any measure. Throughout 2025, XRP traded as the third or fourth largest cryptocurrency by market capitalization, occasionally surpassing Ethereum in specific trading metrics during peak institutional activity periods.

市值指標也見證了XRP的強勢復甦。XRP的市值達1,819.44億美元、單日成交量超過100億美元,無論何種標準都屬一線主流數位資產。2025年全年,XRP始終維持加密市值第三或第四大,且於機構高峰活動時在部份交易指標上一度超越以太坊。

The liquidity profile transformation was equally significant. In the years following the SEC lawsuit, XRP suffered from fragmented liquidity across global exchanges, with U.S. markets effectively shut off. The settlement's resolution triggered relisting on major U.S. platforms and consolidated global liquidity. XRP rose 4% in the 24-hour period ending August 13, climbing from $3.15 to $3.25 within a $0.20 range with volume exceeding 140 million units. These volume figures represented healthy, sustained liquidity rather than episodic spikes.

流動性結構的變化同樣顯著。在美SEC訴訟期間,XRP在全球交易所出現流動性碎片化現象,美國市場幾乎停擺。和解後,XRP於美國主要平台重新上架,全球流動性獲得整合。8月13日止24小時內,XRP上漲4%,在$3.15至$3.25的$0.20區間內成交量超過1.4億枚。這些數字意味著健康且持續的流動性,而非偶發爆量。

Price stability patterns also emerged as institutional participation deepened. While XRP experienced the volatility typical of cryptocurrency markets, support confirmed at $2.84 with high-volume absorption of sell pressure, with resistance at $2.94-$2.95. These defined trading ranges with clear support and resistance levels indicated mature order flow and institutional market-making activity.

隨著機構參與加深,價格穩定結構也開始浮現。儘管XRP仍具備加密市場的波動性,$2.84形成堅實支撐(海量賣壓被吸收),而阻力位則位於$2.94-$2.95。這些明確的交易區間與支撐壓力線,透露出成熟的流動性及機構造市行為。

Institutional Reentry - From Risk Asset to Regulated Product

The settlement catalyzed a fundamental recategorization of XRP within institutional frameworks. Before August 2025, compliance departments at banks, asset managers, and broker-dealers treated XRP as radioactive due to the SEC lawsuit's unresolved status. After the settlement, institutional perspectives shifted dramatically.

機構回流──從高風險資產到合規產品

這次和解促使XRP在機構體系內被根本性重新分類。2025年8月前,因訴訟懸而未決,銀行、資管、券商的合規部門普遍視XRP為“高危資產”。和解之後,機構觀點徹底扭轉。

The exchange-traded fund filing wave illustrated this transformation. Asset managers Grayscale, Bitwise, Canary, CoinShares, Franklin, 21Shares, and WisdomTree on Friday all filed updated statements for their proposed spot XRP exchange-traded funds. The synchronized filing activity demonstrated coordinated industry momentum toward creating regulated investment products.

ETF申請熱潮,就是這股轉變的最佳註腳。資產管理公司Grayscale、Bitwise、Canary、CoinShares、Franklin、21Shares和WisdomTree,於週五同步提交更新聲明,申請推廣現貨XRP ETF。這種一致動作,展現出產業推動合規投資產品的協同氣勢。

XRP ETFs highly anticipated with approval odds 95%, while ProShares' UXRP (futures) already holds $1.2 billion. The ProShares Ultra XRP ETF, a two-times leveraged futures-based product, launched in July 2025 and quickly demonstrated robust institutional demand. Its $1.2 billion in assets under management within the first month provided a preview of potential capital inflows that spot ETF products might attract.

XRP ETF備受期待,獲批率高達95%;而ProShares的UXRP(期貨型)產品資產規模已達12億美元。ProShares Ultra XRP ETF為二倍槓桿型期貨ETF,2025年7月推出後,迅速吸引機構熱潮,首月管理資產衝上12億美元,預示著現貨ETF吸金潛力驚人。

The first spot XRP ETF breakthrough came in September. The REX-Osprey XRPR, the first US-listed spot XRP ETF, launched on September 18, 2025, which garnered substantial first-day trading volume. The REX-Osprey XRP ETF launched with a record-breaking $37.7 million in trading volume - far exceeding the $1 million benchmark. This debut volume significantly surpassed typical ETF launch metrics and signaled strong pent-up demand for regulated XRP exposure.

首檔現貨XRP ETF於9月問世。REX-Osprey XRPR,為美國首檔掛牌現貨XRP ETF,於2025年9月18日上市,首日成交量即達3,770萬美元,遠超過ETF一般上市1百萬美元基準。上市量能大爆發,明顯顯示合規XRP敞口的強大滯留需求。

Multiple additional spot ETF applications remained in SEC review with decision deadlines clustered in October 2025. Eight spot XRP ETF filings await SEC decision Oct 18-25, 2025. The compressed timeline suggested potential coordinated approval decisions similar to the Bitcoin spot ETF approvals in January 2024.

還有多檔現貨ETF正排隊等待SEC審查,決查時點集中於2025年10月。共有八檔XRP現貨ETF在10月18日至25日期間等候SEC裁定,密集時程暗示,可能如同2024年1月比特幣ETF,出現協調式集體核准。

The structural amendments in ETF filings revealed regulatory engagement progress. Analysts take the cluster of filings as a sign that asset managers are responding to feedback from the regulatory agency. The updated filings appear to change the structure of some of the funds to allow for XRP or cash creations and cash or in-kind redemptions, rather than simply cash creations and redemptions. This evolution toward flexible creation and redemption mechanisms indicated that the SEC was working constructively with issuers to establish viable ETF structures rather than simply rejecting applications.

ETF申請文件的結構變革也凸顯監管互動進展。分析師普遍視申請案集中為產業回應監管建議之證據。新版本申請把部份基金結構從單一現金申購/贖回調整為XRP或現金申購,以及現金或實物贖回,顯示SEC正與發行商積極協作,創建可行架構,而非僅僅否決申請。

Beyond ETF products, direct institutional allocation strategies emerged. Galaxy Digital, a Wall Street crypto firm, disclosed a $34 million XRP holding in its Q2 2025 SEC filing. For a publicly traded financial services company to hold XRP on its balance sheet and disclose it in regulatory filings represented a significant validation of XRP's institutional acceptability.

除了ETF產品外,直接機構配置策略亦浮現。華爾街加密公司Galaxy Digital於2025年Q2監管申報文件披露持有3,400萬美元XRP資產。能見於上市金融服務公司資產負債表,並在監管文件公開的部位,體現XRP日益被機構認可。

Corporate treasury adoption marked another frontier. Corporate treasuries from non-crypto firms - Quantum Biopharma, Worksport Ltd., and Hyperscale Data Inc. - added XRP to their balance sheets. These companies, operating in pharmaceuticals, automotive manufacturing, and data infrastructure respectively, had no inherent connection to cryptocurrency or blockchain technology. Their XRP allocations signaled that treasury professionals viewed the token as a legitimate reserve asset with functional utility for corporate operations.

企業金庫採用成為另一戰線。非加密產業公司Quantum Biopharma、Worksport Ltd.及Hyperscale Data Inc.已將XRP納入資產負債表。這些分別來自製藥、汽車及數據基礎設施產業的企業與加密幣無本質聯繫。它們配置XRP,代表企業財務專業人員將該代幣視為具功能價值、可支援營運活動的合法儲備資產。

Nature's Miracle CEO James Li announced a $20 million XRP treasury allocation, signaling corporate validation of its cross-border payment utility. Li's public statements emphasized operational rather than speculative rationale: the company intended to use XRP for international payments and settlements, leveraging the token's fast settlement times and low transaction costs for business operations.

Nature’s Miracle執行長James Li宣布2,000萬美元的XRP公司金庫配置,確認其跨境支付效用獲企業背書。李強調,該公司運用XRP作國際支付與清算,強調的是營運價值而非投機動機,藉助其結算速度快、手續費低等優勢提升營運效率。

Institutional holdings reached substantial scale. Institutional holdings of XRP reached $7.1 billion in Q2 2025, with 92% client retention and 47 Fortune 500 companies now using RippleNet. The retention rate suggested that institutional adopters found sustained value in XRP-based payment solutions rather than engaging in experimental pilots that they later abandoned.

機構持有量達到顯著規模。2025年第二季,XRP機構持有額達71億美元,客戶留存率92%,現在已有47家世界500大企業採用RippleNet。這樣的留存率說明機構客戶將XRP支付解決方案視為有持續價值的方案,而非僅做實驗性嘗試即草草離場。

The custody and infrastructure buildout accelerated. South Korean custody provider BDACS launched institutional-grade XRP solutions for exchanges like Upbit and Coinone. South Korea represents one of the world's most active cryptocurrency markets, and BDACS's entry into XRP custody services indicated growing institutional demand in Asian markets.

託管與基礎設施建設步伐加快。南韓託管服務商BDACS針對Upbit、Coinone等主流交易所推動機構級XRP託管解決方案。南韓為全球最活躍的加密幣市場之一,BDACS切入XRP託管,意味著亞洲機構需求不斷增加。

Banking relationships also began normalizing. Ripple announced partnerships with multiple financial institutions that had paused collaborations during the SEC lawsuit. The company's expanded efforts to secure a national bank charter through Office of the Comptroller of the Currency review demonstrated ambitions to operate within traditional banking regulatory frameworks rather than circumventing them.

銀行關係也逐步正常化。Ripple宣佈已恢復與數家在訴訟期間中斷合作的機構夥伴關係,並積極通過美國貨幣監理署的審查,力求取得全國性銀行執照,表明企業欲深耕傳統金融監管架構,而非繞道行事。

The institutional adoption wave distinguished itself from previous cryptocurrency hype cycles through its focus on utility over speculation. Ripple's On-Demand Liquidity service processed $1.3 trillion in Q2 2025 alone, with 300+ institutions, including J.P. Morgan and Santander, adopting the platform. These transaction volumes represented actual cross-border payments and liquidity management rather than speculative trading.

本輪機構採用潮最大特色是聚焦實用性,而非炒作。Ripple的按需流動性服務,2025年第二季單季處理交易額已達1.3兆美元,已有超過300家機構(包括摩根大通與西班牙桑坦德銀行)接入此平台。這些交易量反映的是實際跨境支付和流動性管理,而非純粹客戶投機交易。

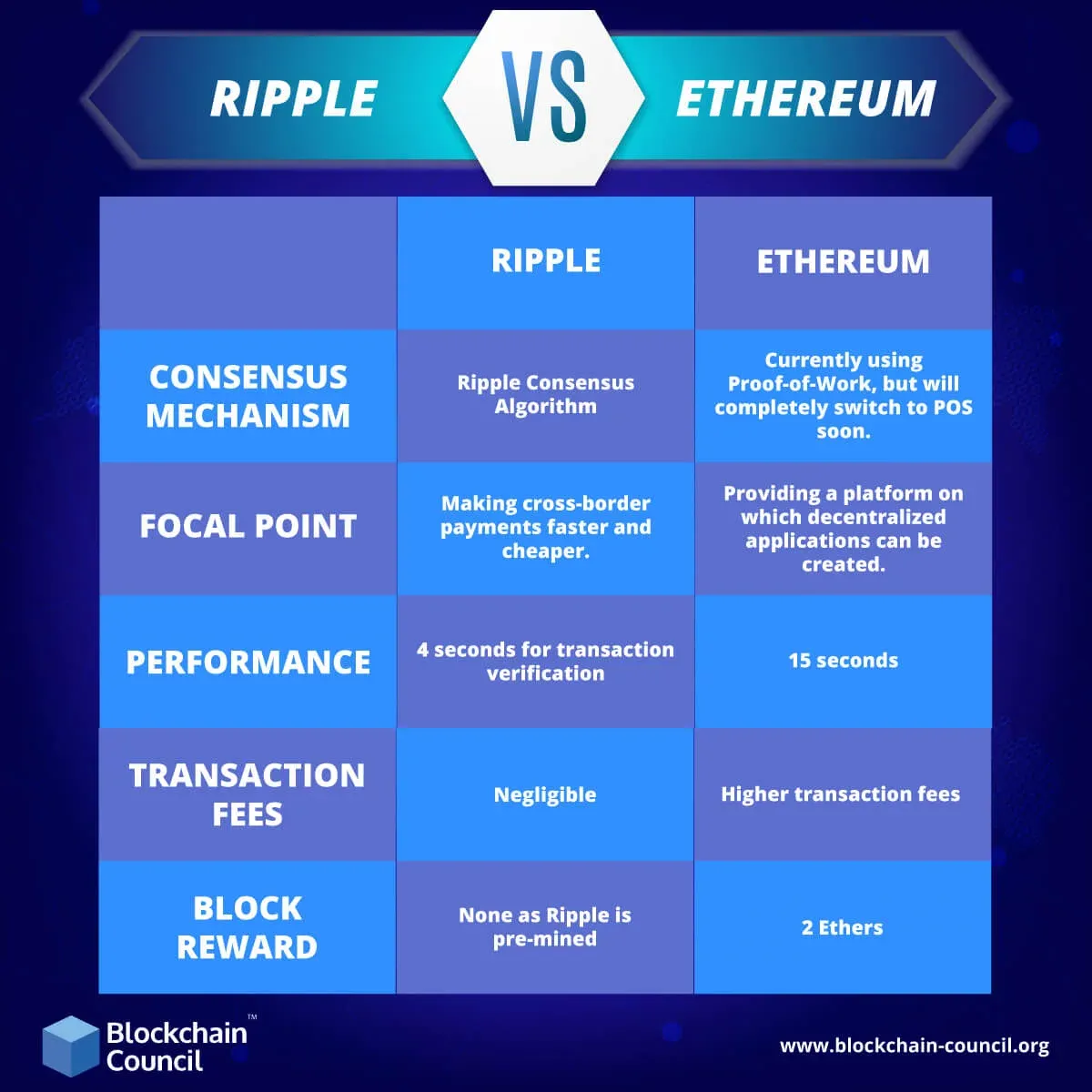

The cost efficiency advantage proved compelling for institutional adopters. XRP's cost efficiency - $0.0004 per transaction versus $1.88 for Bitcoin and $0.46 for Ethereum - has made it a preferred solution for correspondent banking. For institutions moving hundreds of millions or billions of dollars annually in cross-border payments, these cost

XRP的低成本優勢極具吸引力。XRP每筆交易成本僅$0.0004,相較比特幣的$1.88與以太坊的$0.46,極具競爭力,使其成為同業銀行清算的首選。對於每年須進行數億元、甚至數十億美元跨境支付的機構來說,這些成本...differentials translated to meaningful operational savings.

差異轉化為有意義的營運節省。

Settlement speed provided another practical advantage. XRP Ledger transactions settle in three to five seconds with finality, compared to ten minutes or longer for Bitcoin and potentially longer for Ethereum depending on network congestion. For treasury operations and time-sensitive payments, settlement speed directly impacts working capital efficiency and operational flexibility.

結算速度帶來了另一個實際優勢。XRP分類帳的交易最終結算僅需3到5秒,相比之下,比特幣則需十分鐘以上,以太坊根據網絡壅塞情況可能還要更久。對於資金調度和時間敏感的支付來說,結算速度直接影響營運資金效率與操作彈性。

XRP vs. ETH - The 2025 Rivalry in Context

Throughout 2025, XRP and Ethereum engaged in an unexpected rivalry for institutional attention and capital allocation. The comparison revealed fundamentally different value propositions competing for position in institutional portfolios.

2025年期間,XRP與以太坊展開了一場意料之外的機構關注度和資本配置競賽。這種對比揭示了兩者在機構投資組合中爭奪地位時,根本不同的價值主張。

Price performance metrics showed XRP's dramatic outperformance on an annual basis. XRP has significantly outperformed ETH over the past year. Since July 2024, XRP has surged by 552%, while ETH has recorded a modest gain of 6.34%, rising to $3,630 from $3,432. Year-to-date performance also highlights XRP's strength, with the token climbing to $3.10 from $2.08 (a 49% increase), compared to ETH's 9.5% rise over the same period.

價格表現指標顯示XRP在年度表現上有驚人的超越。過去一年XRP大幅跑贏ETH。自2024年7月以來,XRP暴漲552%,而ETH僅溫和上漲6.34%,價格從$3,432升至$3,630。年初至今的表現同樣突顯XRP的強勁成長,幣價從$2.08升至$3.10(增幅49%),對比同期間ETH只上升了9.5%。

These performance differentials reflected distinct catalyst timelines. XRP's surge came primarily from resolving regulatory uncertainty and the subsequent institutional reentry. Ethereum's more modest gains occurred despite its established position as the second-largest cryptocurrency, suggesting that market participants had already priced in much of Ethereum's institutional adoption story while XRP represented a reopening trade.

這些表現差異反映出不同催化劑的時間線。XRP的大漲主要來自於監管不確定性獲解決及隨後機構資金重返。而以太坊即便身為第二大加密貨幣,漲幅依舊溫和,顯示市場參與者早已將其機構採用的利多反映於價格之中,反觀XRP則屬於重啟型題材。

Market capitalization and liquidity metrics, however, showed Ethereum's continued dominance in absolute terms. Ethereum's market cap at $538.25 billion and a price of $4,465.74 as of 2025, with 24-hour trading volume of $14.42 billion. XRP holds a $169.82 billion market cap and a price of $2.99, with a trading volume of $2.13 billion. Ethereum commanded more than three times XRP's market capitalization and nearly seven times its daily trading volume.

然而,市值與流動性指標展示出以太坊在絕對數據上的持續主導地位。2025年時以太坊市值達5382.5億美元,價格為$4,465.74,24小時成交量達144.2億美元。XRP則擁有1698.2億美元市值,價格$2.99,成交量21.3億美元。以太坊的市值超過XRP三倍以上,日交易量近乎七倍。

The ecosystem comparison revealed divergent strategic focuses. Ethereum had established itself as the foundation for decentralized finance, with hundreds of billions of dollars locked in DeFi protocols, thriving NFT markets, and thousands of developers building smart contract applications. Its ecosystem breadth encompassed lending platforms, decentralized exchanges, synthetic assets, gaming applications, identity solutions, and layer-two scaling networks.

生態系比較揭示了截然不同的策略重心。以太坊奠定了自己作為去中心化金融基礎的位置,有數千億美元鎖定於DeFi協議、NFT市場蓬勃發展,以及數千開發者在建構智能合約應用。其生態範圍涵蓋借貸平台、去中心化交易所、合成資產、遊戲應用、身份解決方案及第二層擴容網絡等。

XRP Ledger, by contrast, optimized for a narrow but critical function: facilitating fast, low-cost value transfer. XRP's network utility is defined by its speed and low cost. The XRP Ledger handles 1,500 TPS with settlement times of 3–5 seconds. While Ethereum supported complex programmable money and decentralized applications, XRP focused on being exceptionally good at moving value efficiently.

相較之下,XRP分類帳則專注於一項狹窄但關鍵的功能:促進快速且低成本的價值轉移。XRP網路的實用性來自於其速度和低交易成本。XRP分類帳處理1,500筆TPS,結算僅需3至5秒。以太坊支持複雜可編程貨幣和去中心化應用,XRP則專注於高效移轉價值的極致表現。

This specialization versus generalization tradeoff shaped institutional allocation decisions. Asset managers seeking exposure to DeFi innovation, smart contract platforms, and Web3 application infrastructure naturally gravitated toward Ethereum. Those focused on payment optimization, treasury operations, and cross-border settlement efficiency found XRP's purpose-built design more appealing.

這種專精與通用性的取捨塑造了機構配置決策。尋求DeFi創新、智能合約平台及Web3基礎建設的資產管理人,自然傾向以太坊;而著重支付優化、資金調度及跨境結算效率者,則更青睞XRP量身打造的設計。

Regulatory clarity dynamics also differed significantly. Ethereum secured informal regulatory blessing as a non-security through SEC statements in 2018 and subsequent actions. XRP achieved similar clarity only after five years of litigation and a nuanced court ruling. However, XRP's hard-fought legal victory may have created more robust precedent than Ethereum's regulatory accommodation, as Judge Torres' decision provided detailed judicial analysis rather than agency discretion.

監管明確性的動態亦大有不同。以太坊於2018年SEC聲明及隨後舉措,以「非證券」身份獲得非正式監管背書。而XRP則歷經五年訴訟及細緻法庭判決後才取得相似明確性。儘管如此,XRP辛苦取得的法律勝利,或許建立起更堅實的先例,因為Torres法官的裁決提供了細緻司法分析,而非單純行政裁量。

Institutional adoption pathways diverged based on use case. Ethereum's institutional momentum and regulatory clarity position it as a superior buy in 2025, particularly for investors seeking exposure to a maturing crypto ecosystem. XRP, while undervalued in its niche, remains a high-risk, high-reward asset dependent on regulatory outcomes.

依據應用場景,機構採用路徑也不相同。以太坊因其機構動能與監管明確性,2025年被認為更具吸引力,特別適合尋求進入成熟加密生態的投資者。XRP則雖在其利基領域被低估,卻仍屬高風險高報酬資產,極度依賴監管結果。

The stablecoin relationship illustrated different strategic positions. Ethereum hosted the vast majority of stablecoin supply, with USDT, USDC, and other dollar-pegged tokens operating as ERC-20 tokens on Ethereum and its layer-two networks. Ethena Labs' inclusion of XRP in its $11.8 billion USDe stablecoin framework exemplifies this shift. By leveraging XRP's market cap and daily trading volume, USDe enhanced its peg stability and resilience during redemptions. XRP's role as stablecoin collateral represented a newer but growing use case.

穩定幣生態關係說明了不同戰略定位。以太坊主導了穩定幣總供給,USDT、USDC及其他美元掛鉤代幣以ERC-20形式運行於以太坊及其二層網絡。Ethena Labs將XRP納入其118億美元USDe穩定幣框架,成為這一轉變的典型。藉由運用XRP的市值及日交易量,USDe增強了其掛鉤穩定性及贖回彈性。作為穩定幣抵押品,XRP的角色雖新但正逐漸擴展。

Payment integration strategies also differed. PayPal's July 2025 integration of XRP into its "Pay with Crypto" service further expanded its retail and business reach, reducing fees to 0.99% and shielding users from volatility. Ethereum had earlier secured PayPal integration for stablecoin transfers, but XRP's addition to payment rails represented competitive positioning in the merchant services space.

支付整合策略亦不盡相同。PayPal於2025年7月將XRP納入「加密支付」服務,進一步拓展其零售和商業版圖,手續費降至0.99%,且替用戶屏蔽波動風險。以太坊先前已獲PayPal支持穩定幣轉帳,但XRP成為支付渠道則代表其在商戶服務領域的競爭定位。

Technical infrastructure evolution showed Ethereum prioritizing layer-two scaling solutions to address high gas fees, while XRP maintained its layer-one efficiency advantage but faced questions about programmability limitations. Ethereum's transition to proof-of-stake reduced energy consumption and established staking yield as an institutional value driver, while XRP's consensus protocol provided different security and decentralization tradeoffs.

技術基礎建設發展方面,以太坊優先解決高Gas費問題,推動二層擴容方案。XRP則維持其一層效率優勢,但在可編程性上受到質疑。以太坊轉型為權益證明(PoS)降低能源消耗,並把質押收益建立為機構價值驅動力;XRP的共識機制則提供不同安全性與去中心化權衡。

The institutional portfolio positioning question crystallized around risk-adjusted return profiles and strategic alignment. A balanced portfolio could include both assets, leveraging Ethereum's ecosystem growth and XRP's utility in remittances. Additionally, exposure to Ethereum-based DeFi platforms enhances yield potential.

機構投資組合的定位問題最終聚焦在風險調整後的報酬與戰略配適上。平衡型組合可同時納入兩項資產,既利用以太坊的生態成長,也可借助XRP於匯款領域的實用性。而投資以太坊為基礎的DeFi平台,還能提升收益潛力。

Legal and Regulatory Ripple Effects

(略過 Markdown 鏈結)

The XRP settlement's influence extended far beyond Ripple's corporate interests, establishing precedent and principles that would shape cryptocurrency regulation globally.

XRP和解案的影響遠超Ripple公司本身,不僅創造了判例,也建立了將塑造全球加密貨幣監管的原則。

The secondary market doctrine emerged as perhaps the most significant legal innovation. By distinguishing between institutional sales and programmatic secondary market transactions, Judge Torres' ruling created a pathway for tokens to achieve regulatory clarity even if their initial distribution involved securities law violations. This framework suggested that a token's current regulatory status depends on present distribution characteristics rather than being permanently determined by launch mechanics.

二級市場原則成為最重要的法律創新之一。Torres法官藉由區分「機構銷售」與「程式化二級市場交易」,為代幣即使初次發行涉嫌違反證券法,仍可在現流通條件下取得監管明確性開闢了道路。這一架構表示,代幣現時的監管狀態取決於最新流通特徵,而非一發行即永久定論。

This principle carried profound implications for other tokens facing potential securities classification. Projects that conducted ICOs or token sales in 2017-2018 without proper registration might still argue their tokens currently function as commodities if secondary market trading has become sufficiently decentralized and disconnected from issuer promotional efforts.

這一原則對面臨潛在證券認定的其他代幣具有重要意義。那些於2017-2018年未經適當註冊的ICO或代幣發售專案,若現時二級市場交易已充分去中心化且與發行單位推廣無關,仍可主張其代幣目為「商品」身分。

The Howey Test application to digital assets gained nuance through the XRP ruling. Rather than analyzing whether a token itself is a security, the court focused on whether specific transaction types constitute investment contracts. This distinction matters because it shifts analysis from token characteristics to distribution context, potentially allowing the same token to have different regulatory treatments in different contexts.

XRP案的判決,讓Howey測試應用於數位資產時更具細膩度。法庭不再單看代幣本身是否為證券,而是聚焦特定交易類型是否構成投資契約。此不同點影響重大,因為它將分析重心由代幣本質轉移到發行與流通情境,任何一種代幣在不同情境下可能有不同監管結果。

Congressional action gained momentum from the regulatory uncertainty that the Ripple case highlighted. The passage of the GENIUS Act and Digital Asset Market CLARITY Act in July 2025 provided a legal framework for corporate adoption, reducing compliance burdens and encouraging firms to allocate XRP to their treasuries. These legislative initiatives reflected bipartisan recognition that regulatory clarity required statutory foundations rather than relying solely on enforcement actions and court interpretations of 1940s-era securities law.

國會行動因Ripple案凸顯的監管不確定性而加速。GENIUS法案與數位資產市場清晰法案於2025年7月通過,為企業採納數位資產提供法規基礎、降低合規負擔並鼓勵企業將XRP納入庫存。這些立法反映了朝野共識:法規明確性應建立在法令基礎上,而非僅依賴執法行動與對1940年代證券法的法院解讀。

The legislation established frameworks for treating certain digital assets as commodities rather than securities, created safe harbors for specific token distribution methods, and clarified the division of regulatory authority between the SEC and CFTC. While implementation details remained subject to rulemaking processes, the statutes provided legal architecture that the Ripple litigation had revealed was desperately needed.

這些法令建立了某些數位資產可被視為商品(非證券)的處理架構、為特定發行方式提供安全港,並釐清了SEC與CFTC監管權限的劃分。雖然細則仍有待經過訂定流程,這些法律已補足Ripple案所揭示的制度性缺口。

International regulatory approaches showed divergent reactions to U.S. precedent. The European Union's Markets in Crypto-Assets Regulation (MiCA), which entered into force in stages throughout 2024-2025, took a different approach by creating bespoke regulatory categories for crypto-assets rather than forcing them into existing securities frameworks. XRP's classification under MiCA as a utility token eligible for certain regulatory accommodations demonstrated how different jurisdictions could reach similar practical outcomes through distinct legal pathways.

國際監管取態對美國先例反應不一。歐盟的加密資產市場規則(MiCA)於2024-2025年間分階段生效,採用自行劃分類別替加密資產量身訂造法規,而非硬塞進既有證券體系。XRP被MiCA歸類為可獲得部分監管豁免的實用型代幣,說明不同法域可透過不同法律路徑達成類似的實質結果。

United Kingdom regulators observed the U.S. developments with interest. The Financial Conduct Authority's approach emphasized proportional regulation based on token functionality and use cases. XRP's payment-focused utility aligned well with the UK's regulatory philosophy of matching oversight intensity to consumer risk and market integrity concerns.

英國監理機構高度關注美國發展。英國金融行為監理局(FCA)強調根據代幣功能和應用比例監管。XRP以支付為主的實用性,與英國以風險和市場完整性為核心的監管政策相符合。

Asian financial centers, particularly Singapore, Hong Kong, and Japan, had already established clearer frameworks for payment tokens versus investment tokens before the Ripple settlement. In May 2025, CME Group introduced XRP futures, which saw $542 million in trading volume during their first month - about 45% of it from outside North America. The substantial non-U.S. participation in XRP derivatives trading reflected that international institutions had maintained engagement with XRP even during U.S. regulatory uncertainty.

亞洲金融重鎮,尤以新加坡、香港與日本,早在Ripple和解前已對支付型與投資型代幣劃分监管。2025年5月,芝商所(CME)推出XRP期貨,首月成交額達5.42億美元,其中約45%來自北美以外。眾多非美機構參與XRP衍生品交易,反映即使美國出現監管不確定,國際機構仍積極參與XRP市場。

Japan's relationship with XRP proved particularly noteworthy. Japanese regulators hadclassified XRP as a cryptocurrency rather than a security years before the U.S. settlement, and major Japanese financial institutions including SBI Holdings maintained active involvement in Ripple partnerships throughout the SEC litigation. The regulatory clarity in the U.S. removed friction for Japanese institutions' U.S. operations and cross-border integration of XRP-based payment systems.

已於美國解決方案前數年將XRP歸類為加密貨幣而非證券,包括SBI控股在內的日本大型金融機構,在SEC訴訟期間仍積極參與與Ripple的合作。美國的監管明確性,消除了日本機構於美國營運及XRP為基礎的跨境支付系統整合上的障礙。

The precedent's influence on other token cases began manifesting quickly. SEC enforcement actions against other projects now faced questions about whether the agency could distinguish between institutional sales and secondary market transactions as Judge Torres had done. Defendants in ongoing cases cited the XRP ruling to argue for similar analysis of their token distribution models.

此先例對其他代幣案件的影響很快開始顯現。SEC對其他項目的執法行動,現在面臨質疑其是否能像Torres法官那樣區分機構銷售與二級市場交易。正在進行中的案件被告引用XRP裁決,主張應以相同方式分析其代幣分發模式。

The regulatory philosophy shift proved equally significant. The SEC was pursuing a programmatic shift to dismiss registration cases in the crypto context, pointing to a new regulatory path based on the SEC's Crypto Task Force. This pivot from aggressive enforcement toward rulemaking and negotiated frameworks suggested that the Ripple settlement represented an inflection point in the agency's approach to digital assets.

監管哲學的轉變同樣意義重大。SEC正著手推行系統性轉向,在加密貨幣領域中駁回註冊案件,並以SEC加密貨幣特別小組為基礎,開啟新的監管路徑。這種從積極執法轉向制定規則及協商架構的做法,顯示Ripple和解案已成為該機構對數位資產監管策略的分水嶺。

Commissioner Hester Peirce's leadership of the SEC's Crypto Task Force, established in 2025, reflected this evolution. The task force's mandate included developing clearer guidelines for token classification, creating safe harbor provisions for certain distribution methods, and establishing pathways for compliant token offerings. These initiatives acknowledged that pure enforcement had failed to provide the clarity that markets, issuers, and investors required.

2025年設立的SEC加密貨幣特別小組由Peirce委員領導,反映出這項演進。該小組任務包括制訂更明確的代幣分類指引、為特定分發方式創設安全港條款,以及建立合規發行代幣的路徑。這些舉措承認僅靠執法不足以為市場、發行人和投資人帶來所需的清晰度。

The settlement also influenced state-level regulation. States with active virtual currency licensing regimes, including New York's BitLicense framework, began updating guidance to reflect federal precedent from the Ripple case. This coordination reduced regulatory fragmentation that had complicated interstate cryptocurrency operations.

該和解案也影響到州層級的監管機制。擁有虛擬貨幣牌照制度的州份,包括紐約州BitLicense框架,已開始根據Ripple案的聯邦先例更新指引。此種協調有效減少了監管碎片化現象,簡化了跨州加密貨幣業務營運。

Investor Behavior and Market Structure Evolution

The XRP settlement catalyzed measurable shifts in how both institutional and retail investors approached cryptocurrency portfolio construction and risk assessment.

XRP和解案促使機構及散戶投資人在加密貨幣投資組合建構與風險評估方式上產生明顯變化。

The concept of "regulatory risk premium" became explicitly quantifiable. Before the settlement, XRP traded at valuations that embedded substantial discount for potential adverse legal outcomes. The litigation's resolution removed this uncertainty overhang, allowing investors to assess XRP based on fundamental utility and market dynamics rather than binary legal risk. The resulting price appreciation partially reflected compression of this regulatory risk premium.

「監管風險溢價」的概念變得可被明確量化。在和解前,XRP的估值包含了因潛在不利法律結果而產生的重大折價。訴訟解決後,此一不確定性壓力消失,投資人可根據基本效用及市場動態,而非二元法律風險來評價XRP,隨之帶來的價格上漲部分反映了監管風險溢價的收斂。

Institutional allocation frameworks evolved to incorporate legal clarity as a portfolio construction factor. XRP's 3-5 second settlement speed and regulatory clarity position it as a bridge between traditional finance and blockchain ecosystems. Compliance departments at traditional financial institutions began distinguishing between legally-clear assets like Bitcoin (commodity classification confirmed), Ethereum (SEC statements indicating non-security status), and now XRP (court ruling establishing secondary market non-security status) versus tokens with ongoing regulatory uncertainty.

機構投資組合分配框架已將法律明確性納為建構因素。XRP具備3至5秒的結算速度及監管明確性,使其成為傳統金融與區塊鏈生態系統的橋樑。傳統金融機構的合規部門開始區分比特幣(已確定為商品)、以太幣(SEC聲明為非證券)、及現在XRP(法院裁決二級市場非證券地位)等法律明確資產,與尚具監管不確定性的代幣分開處理。

This taxonomy created a tiered market structure where legally-clear assets commanded premium valuations and institutional allocation preference. The market increasingly differentiated between speculative DeFi tokens with undefined regulatory status and utility-focused tokens with established legal frameworks.

此一分類產生了階層化的市場結構,法律明確的資產獲得溢價估值與機構資金偏好。市場更為明確區分具不定監管狀態的DeFi投機型代幣,與已建立法律框架的功能型代幣。

Whale accumulation patterns demonstrated sophisticated investor positioning. According to data from Santiment, 2,743 wallets now hold over one million XRP each, amounting to 47.32 billion tokens - roughly 4.4% of the total circulating supply. This concentration level, while raising some concerns about market power, also indicated that large holders maintained conviction through the legal uncertainty and positioned for long-term appreciation.

巨鯨累積行為體現了成熟投資者的部位調整。據Santiment數據,目前有2,743個錢包各持有逾一百萬枚XRP,合計47.32億枚,約佔總流通量4.4%。這種集中特性雖引發一定市場權力的疑慮,但同時也顯示大型持有者在法律不確定性期間依舊堅定持倉,並部署長期價值增長。

The correlation dynamics between XRP and other major cryptocurrencies shifted through 2025. Historically, XRP traded with high correlation to Bitcoin and Ethereum, as most altcoins do during broad market moves. However, during specific periods surrounding settlement announcements and regulatory developments, XRP demonstrated reduced correlation, moving on idiosyncratic catalysts rather than following broader crypto market sentiment.

2025年期間,XRP與其他主要加密貨幣的相關性出現變化。歷來XRP和比特幣、以太幣高度連動,正如多數山寨幣在大盤波動時的表現。然而,在與和解公告或監管相關的特定時期,XRP的相關性降低,更多受自身催化劑驅動而非隨大市起伏。

Retail investor behavior showed increased sophistication and longer holding periods. Exchange metrics revealed that XRP holders increasingly moved tokens off exchanges into self-custody or staking arrangements, suggesting investment rather than trading orientation. The average holding period for XRP positions extended significantly compared to 2023-2024, when litigation uncertainty encouraged shorter-term trading approaches.

散戶投資行為變得更為成熟,持有期間拉長。交易所數據顯示,XRP持有者將代幣轉出交易所,自主管理或質押的比例攀升,反映出較強的投資導向而非短線交易。在2023-2024年訴訟不確定性的情況下,XRP的平均持倉期顯著提升。

The derivatives market structure matured alongside spot markets. Total crypto futures open interest has doubled year-over-year, now reaching $30 to $35 billion daily. XRP's contribution to this growth reflected both speculative interest and genuine hedging demand from institutional holders seeking to manage price risk while maintaining XRP exposure for operational purposes.

衍生性商品市場隨現貨市場共同成長。加密貨幣期貨未平倉總量年增一倍,每日達3,000億至3,500億美元。XRP在其中的成長反映出一方面的投機需求,另一方面也有機構參與者為控管價格風險、維持XRP持倉而出現的避險操作。

Options market development provided additional tools for sophisticated risk management. CME Group announced plans to launch options on Solana and XRP futures on October 13, 2025. Options strategies allow investors to establish asymmetric payoff profiles, hedge downside risk, or generate yield through covered call writing. The availability of these instruments attracted institutional capital that required risk management capabilities.

選擇權市場的發展為複雜風險管理增添工具。CME集團宣布將於2025年10月13日推出Solana及XRP期貨選擇權。選擇權策略可讓投資者打造非對稱收益結構、對沖下檔風險,或以覆蓋性賣權方式創造收益。此類工具的出現,吸引了對風險控管有需求的機構資金進駐。

The yield-bearing asset development represented another evolution. The Flare Network's Total Value Locked grew to $236 million in August 2025, driven by institutional-grade yield strategies and partnerships with custodians like BitGo and Fireblocks. APY rates for XRP via Flare's FXRP model ranged between 4% and 7% in Q3 2025. These yield opportunities transformed XRP from a pure price-appreciation asset into a productive investment generating returns through DeFi protocols.

收益型資產的出現代表著另一波演進。Flare Network於2025年8月的鎖倉總價值達到2.36億美元,主要來自機構級收益策略與BitGo、Fireblocks等託管方合作。透過Flare的FXRP模式,2025年第三季XRP的APY年收益率介於4%到7%。這些收益機會使XRP從單純價值上漲標的蛻變為能透過DeFi協議產生實質收益的投資工具。

Portfolio allocation models began incorporating XRP into specific strategy buckets. Conservative institutional allocators treated XRP as a payment infrastructure investment, comparable to positions in payment processing companies or foreign exchange platforms. More aggressive allocators positioned XRP as a compliance-forward alternative to higher-risk DeFi tokens, accepting lower speculative upside in exchange for reduced regulatory uncertainty.

投資組合配置模型開始將XRP納入特定策略分類。保守的機構配置者將XRP視為支付基礎建設投資,類似於對支付處理公司或外匯平台的布局。較積極者則把XRP定位為比高風險DeFi代幣更具合規性的選擇,願意用較低投機上漲空間換取較小的監管不確定性。

The retail investment thesis evolved from speculative moonshot to utility-based value proposition. Educational content and investor communications increasingly emphasized XRP's functional role in cross-border payments, institutional partnerships, and practical use cases rather than purely price speculation. This maturation reflected broader cryptocurrency market evolution toward fundamental analysis over meme-driven narratives.

散戶投資論點也從投機暴漲升級為功能性價值主張。教育內容和投資人溝通日益強調XRP於跨境支付、機構合作與實用場景中的功能角色,而非僅僅關注價格投機。這項成熟,反映整體加密市場從迷因炒作到更注重基本面分析的趨勢。

Trading venue development also evolved. After major U.S. exchanges relisted XRP following settlement clarity, liquidity consolidated on regulated platforms. This centralization into compliant venues made markets more efficient but also highlighted the importance of regulatory status for liquidity access.

交易場域的發展也有所演進。美國主要交易所於和解後重新上架XRP,市場流動性也向合規平台集中。這類合規場域的中央化提升市場效率,同時突顯監管地位對流動性取得的重要性。

Challenges, Counterarguments, and Open Risks

Despite significant progress, XRP faces substantial challenges and legitimate skepticism about its long-term competitive position and growth sustainability.

儘管取得重大進展,XRP仍面對諸多挑戰與對其長期競爭地位及成長持續性的合理質疑。

Global regulatory inconsistency remains a persistent concern. While the U.S. settlement provided clarity within American jurisdiction, other countries maintain different classification frameworks. This fragmentation creates complexity for institutions operating across multiple jurisdictions, as an asset classified as a commodity in the U.S. might face different treatment in Europe, Asia, or Latin America. Multinational institutions must navigate these varying requirements, potentially limiting XRP's utility as a truly global bridge currency.

全球監管標準不一仍是長期隱憂。儘管美國和解案帶來國內明確性,但其他國家仍採行不同分類模式。這種碎片化使跨國營運機構更為複雜,一項在美國被當作商品的資產,可能在歐洲、亞洲或拉丁美洲被賦予不同法律地位。跨國機構必須應對各種不同要求,或將限制XRP作為全球橋樑貨幣的實際效用。

Competitive threats from central bank digital currencies represent perhaps the most formidable long-term challenge. Stablecoins may present a more practical bridge than XRP's native token, as banks and corporations generally prefer settling transactions in real-world denominations such as the U.S. dollar or other fiat currencies. As CBDCs emerge in major economies, they offer instant settlement, government backing, and native currency denomination without cryptocurrency volatility or conversion requirements.

來自央行數位貨幣(CBDC)的競爭威脅可能是最艱鉅的長期挑戰。穩定幣可望比XRP原生代幣成為更實際的橋樑,理由在於銀行及企業更傾向以美元或其他法幣進行結算。隨著主要經濟體推動CBDC,其能提供即時結算、官方背書及原生貨幣計價,無加密幣波動或兌換風險。

The SWIFT network's modernization efforts also pose competitive risks. SWIFT has begun rolling out blockchain and tokenization pilots, partnering with several major financial institutions to test use of distributed ledger technology for cross-border payments. If SWIFT successfully integrates blockchain technology while maintaining its existing institutional relationships and network effects, it could capture efficiency gains without requiring adoption of a neutral cryptocurrency like XRP.

SWIFT支付網絡的現代化改革亦具競爭威脅。SWIFT已開始進行區塊鏈和代幣化試點,並與多家大型金融機構合作測試分散式帳本用於跨境支付。若SWIFT在維持原有機構客戶與網絡效應的情況下順利整合區塊鏈,則有機會在不需採用XRP等中立加密貨幣下實現效率提升。

Stablecoin competition intensified through 2025. Circle's USDC, Tether's USDT, and PayPal's PYUSD all expanded into cross-border payment applications. These dollar-denominated stablecoins offer price stability that XRP cannot match, making them potentially more attractive for risk-averse institutions and treasury operations where currency volatility is unacceptable.

穩定幣競爭於2025年進一步白熱化。Circle的USDC、Tether的USDT及PayPal的PYUSD皆已擴展至跨境支付應用。這些以美元計價的穩定幣具備XRP無法比擬的價格穩定性,對於偏好低風險及無法容忍幣值波動的機構和財務操作來說更具吸引力。

Developer ecosystem weaknesses relative to smart contract platforms remain evident. While XRP Ledger supports some programmability features, its developer community and application ecosystem pale in comparison to Ethereum, Solana, or other platforms optimized for decentralized applications. This limits XRP's flexibility to expand beyond payment use cases into broader DeFi functionality.

相較於智能合約平台,XRP的開發者生態系仍顯不足。雖然XRP Ledger支援部分可編程功能,其開發者社群及應用生態遠不及以太坊、Solana或其他去中心化應用優化平台。這限制了XRP超越支付用途、擴展至更廣泛DeFi應用的彈性。

Market concentration concerns center on Ripple's substantial (譯至此處,請提供剩餘內容以便繼續翻譯)XRP持有量。該公司將數十億枚XRP托管於託管賬戶中,定期釋放代幣以支付營運費用並資助生態系統發展。批評者認為,執法減弱可能會助長不法分子的囂張,從而帶來監管套利的風險。這種集中度使Ripple對供應動態擁有顯著影響力,引發了去中心化的質疑,也讓人懷疑XRP是否真的作為一個中立、無准入門檻的加密貨幣,還是依舊實質上受創辦公司的控制。

相較於穩定幣,XRP的價格波動為企業採用帶來阻力。雖然XRP能以極低手續費、數秒內結算交易,但企業在進行跨境支付時,在短暫持有期間面臨外匯風險。如果在購買與兌換XRP之間價格大幅波動,原本預期的成本節省將蕩然無存。這種波動性使得企業商業模式的量化分析比穩定幣困難得多,因後者始終維持美元等值。

XRP在消費型應用的採用有限,有別於比特幣等透過意識形態號召發展出自然用戶群的加密貨幣,或以太坊等能支援創新應用的平台。XRP至今仍以機構工具為主,大多數代幣由金融機構、市場做市商及投資人持有,而非普通用戶用於支付。如此狹窄的用戶基礎也意味著其過於依賴機構持續採納。

持懷疑態度的分析師質疑,XRP的機構興起究竟能否形成長遠的戰略地位,還是僅是曇花一現的反彈。隨著XRP表現的變化,投資人開始思考一個重要問題:XRP現在會是最聰明的加密貨幣投資選擇嗎?毫無疑問,全球金融基礎建設亟需數位化升級,而XRP因帶來有說服力的解決方案而贏得信譽。不過,現在是否真的最值得買進,仍充滿爭議。

網絡效應上的挑戰仍在,因SWIFT於對應銀行關係中依然具主導地位。儘管RippleNet不斷成長,SWIFT現仍連接全球超過11,000家金融機構、遍佈200多個國家和地區。即使到2025年,SWIFT在機構支付領域市占率從85%下降至78%,但依然代表著壓倒性優勢,儘管技術優勢明顯,徹底撼動需要數年時間。

其他區塊鏈支付解決方案也在同一機構應用場景中競爭。例如Stellar Lumens(XLM)同樣提供快速、低成本結算,並明確以推動金融普惠與跨境支付為核心。IBM及其他大企業也大力支持基於Stellar的計劃。儘管Stellar規模尚未追上XRP,但它證明了多條區塊鏈可針對同一支付用例而競爭,而非被整合成單一標準,從而可能分散而非鞏固市場採用。

有關XRP Ledger可否負荷真正全球規模支付流量的可擴展性問題也不時浮現。現時交易吞吐量雖大幅高於以太坊或比特幣,但若要處理全球跨國支付相當比例,仍需提升數個數量級的容量。隨著需求成長,協議能否順利擴展,存在技術路線圖執行風險。

機構採用的依賴性形成集中風險。假如機構興趣冷卻或策略合作未能轉換為持續交易量,XRP的基本價值主張就會削弱。不同於擁有強大散戶用戶基礎、或可獨立於企業運作的去中心化協議,加密貨幣XRP的成功高度依賴金融行業的持續擁抱。

監管環境演變仍充滿不確定。雖然現有和解帶來清晰,但未來新政府可能採取不同的執法優先策略。此外,正在國會審議的全面加密貨幣立法,日後也有機會以利或不利方式改變XRP的監管定位及競爭優勢。

Ripple勝訴後的發展藍圖

<!-- markdown link and image skipped as per instructions -->隨著SEC訴訟塵埃落定,Ripple Labs提出了雄心勃勃的戰略藍圖,計畫擴大XRP在全球金融的角色,同時加深在美國市場的機構滲透。

公司當前首要任務,是重建並擴展在訴訟期間凍結的美國合作夥伴。Ripple宣布已與多家地區銀行及信用合作社建立關係,這些機構正探索以RippleNet作為對應銀行與匯款通道方案。公司強調,這些合作將以遵守監管為前提,並堅持在現有銀行體系框架下運作,而非刻意從外部顛覆傳統金融。

中央銀行數位貨幣(CBDC)推動則成為重要戰略重心。Ripple自我定位為CBDC建設的基礎設施提供者,將XRP Ledger作為主權數位貨幣的科技基礎。公司宣布已在拉美、亞洲及中東多個國家展開CBDC試點,惟為尊重央行溝通慣例,多數具體合作國家未公開。

CBDC戰略展現Ripple對於區塊鏈在金融領域的務實定位。與其將XRP視為法幣替代,Ripple強調XRP Ledger可作為支持XRP和主權數位貨幣轉移的中性基礎設施。這種多元用途規劃,旨在讓Ripple無論XRP未來是否被全球作為橋接資產採納,都能在支付現代化過程中扮演關鍵角色。

為銀行打造的私有賬本(Private Ledger)則是另一項企業導向的新舉措。Ripple開發了權限版本技術,允許銀行部署區塊鏈支付通道而無須使用XRP或依賴公有XRP Ledger。儘管這看似會削弱XRP的角色,Ripple反而主張,不論目前是否採納代幣,只要能抓住銀行的支付現代化預算,即可建立合作關係,未來再進一步推廣到公有XRP Ledger。

申請美國貨幣監理署(OCC)國家銀行牌照則是Ripple在監管整合上的最大膽動作。OCC預計於2025年10月對Ripple國家銀行執照作出決議,若獲通過,XRP的監管地位和美國市場准入將更進一層。國家銀行執照將允許Ripple直接提供銀行服務,而無須再透過銀行夥伴,包括開立存款帳戶、貸款產品與支付服務等,並可望與XRP深度整合。

通證化(Tokenization)戰略則致力讓XRP Ledger在實體資產表示領域發揮功能。中國供應鏈金融巨頭聯易融(Linklogis)已將其1.3兆美元的數位供應鏈金融平台整合到XRP Ledger上,實現跨境結算與實體資產通證化。這些合作證明XRP Ledger可支援加密貨幣以外資產,包括發票、貿易融資工具及其他商業票據。

即便表面上可能與XRP的價值主張形成競爭,公司的穩定幣戰略仍持續演進。Ripple於2024年12月發行RLUSD美元穩定幣,認為穩定幣是對XRP的補充而非取而代之,金融機構可用RLUSD處理美元相關交易,並以XRP在非美貨幣間兌換。此穩定幣同時讓Ripple能直接參與快速成長的美元通證市場。

去中心化金融(DeFi)的整合,透過如Flare Network等合作夥伴,讓XRP持有人可於系統內部產生收益。Flare的XRP Earn Account允許用戶透過DeFi策略(如出借與質押)把XRP換成FXRP參與賺取4-7%回報。這些合作針對過往XRP缺乏DeFi功能的批評,讓持有人也能透過包裹或跨鏈形式參與出借、提供流動性及其他收益型活動。

託管及機構基礎設施的大規模建設也獲得大量投資。Ripple與多家主要託管商和主經紀商合作,確保XRP持倉具備機構級安全和合規。以12.5億美元收購主經紀Hidden Road,更增強XRP作為金融工具的地位,該收購為300家機構客戶提供符合法規的入金通道且可用XRP結算。

監管溝通戰略由防禦性訴訟轉向積極參與政策倡議。Ripple擴大政府關係與政策團隊,積極參與加密立法和規則制定,並自我定位為支持明確規則與合規的負責產業領袖,而非尋求監管套利。

國際化擴展迅速,重點放在高成長匯款走廊。Ripple於2025年第二季在阿聯酋-印度走廊處理9億美元交易。公司鎖定傳統銀行基礎設施昂貴或效率低落的特定匯款與貿易融資通道,集中火力推廣RippleNet。

發展開發者生態依舊面臨挑戰,需進一步投注精力。Ripple啟動多項獎助金及開發者激勵計畫,用以擴展XRP Ledger上的應用生態,使其超越僅由公司自身產品主導。儘管成效較以太坊或Solana相對有限…developer activity, incremental progress in attracting independent builders could enhance XRP Ledger's versatility.

開發者活動,逐步吸引獨立開發者的進展,有助於提升XRP帳本的多樣性和應用潛力。

The strategic question facing Ripple involved balancing growth ambition against regulatory caution. Having narrowly survived an existential legal threat, the company operated with heightened awareness that regulatory missteps could trigger renewed enforcement. This created tension between aggressive expansion and conservative compliance, with Ripple generally erring toward the latter to protect its hard-won legal clarity.

Ripple所面臨的策略性問題,是如何在成長野心與法規謹慎之間取得平衡。在剛剛歷經一場攸關生存的法律危機後,公司運作時更加警覺,深知法規上的一絲不慎都可能再度引來監管機構的執法行動。這讓公司在積極擴展與保守合規之間產生拉鋸,Ripple通常選擇傾向後者,以守護得來不易的法律明朗性。

The Broader Impact - Crypto's Legal Maturity Moment

更廣泛的影響──加密產業法律成熟的時刻

The XRP settlement represented more than resolution of a single case; it symbolized cryptocurrency's transition from regulatory wilderness toward legal normalization and institutional integration.

XRP的和解案不僅是單一案件的落幕,更象徵著加密貨幣從監管荒野走向法律常態化與機構化整合的轉捩點。

The evolution from binary hostility to negotiated frameworks marked a philosophical shift. For years, cryptocurrency industry relationships with regulators oscillated between periods of benign neglect and aggressive enforcement with little middle ground. The XRP settlement demonstrated that complex regulatory questions could be resolved through litigation followed by pragmatic settlement rather than requiring complete capitulation by either party.

從二元對立走向協商框架,反映出觀念的重大轉變。長年以來,區塊鏈產業與監管機關的關係總在寬鬆忽視與激烈執法之間擺盪,鮮少中庸之道。XRP案證明,複雜的監管爭議能透過訴訟與實務和解來化解,而不必成為一方必然全面讓步的戰場。

Comparison with other landmark cases illustrated this maturation process. The SEC's approval of Bitcoin ETFs in January 2024 represented regulatory acceptance of cryptocurrency as an investment asset class after years of rejections. The Grayscale litigation that compelled the SEC to approve Bitcoin ETF conversions established judicial oversight as a check on agency discretion. The XRP settlement added another dimension: tokens could secure non-security status through judicial determination even after allegations of initial distribution violations.

與其他指標性案件相比,亦可見產業成熟軌跡。美國證券交易委員會(SEC)於2024年1月核准比特幣ETF,結束多年否決局面,顯示監管單位終於接受加密貨幣作為投資資產類別。Grayscale訴訟促使SEC批准比特幣ETF轉換,讓法院對監管機關裁量權進行監督。XRP案則補上另一拼圖:即便最初分發被指控違規,代幣仍可藉司法判定取得非證券地位。

Binance's regulatory settlements in 2023-2024 with the Department of Justice, Treasury Department, and CFTC established precedent for resolving cryptocurrency exchange compliance failures through negotiated penalties and ongoing monitoring rather than criminal prosecution shutting down operations. This pattern of settlements rather than closures suggested regulators recognized that cryptocurrency businesses provided legitimate services worth preserving under reformed compliance frameworks.

幣安(Binance)於2023至2024年間與司法部、財政部及商品期貨交易委員會(CFTC)達成監管和解,確立了透過協議罰款與持續監管來處理加密交易所合規疏失,而非以刑事訴訟強制關閉的先例。此種「以和解取代關閉」的趨勢,顯示監管單位已認同加密產業的合法服務有其保存價值,只要配合加強合規。

Coinbase's legal challenge to the SEC's enforcement approach reflected industry confidence in seeking judicial review of regulatory interpretation. Rather than accepting the SEC's classification authority as final, major companies now regularly litigated regulatory questions, betting that courts would apply securities laws more narrowly than the agency's expansive interpretation.

Coinbase對SEC執法路線提出法律挑戰,也反映產業對爭取監管詮釋司法審查的信心。業界大公司不再接受SEC的最終定義權,而是積極訴諸訴訟,希望法院能以較狹窄、合理的方式適用證券法,而不是接受監管當局的泛化解釋。

The psychological impact on market participants transcended specific legal precedents. The resolution removes a long-standing regulatory overhang and opens the door for broader corporate and institutional adoption. After years of regulatory FUD (fear, uncertainty, and doubt) hanging over cryptocurrency markets, the XRP settlement contributed to a narrative shift where legal clarity seemed achievable rather than perpetually out of reach.

對市場參與者而言,這不僅是單一判例的影響,而是一種心理層面的突破。此一解決消除了長年的監管陰影,為企業和機構更大規模採用鋪路。在經歷多年監管FUD(恐懼、不確定、懷疑)壟罩之後,XRP和解案改變了敘事走向,讓業界開始相信法律明確性是可以達成的目標,而非永遠遙不可及。

Institutional trust metrics showed measurable improvement. Survey data from institutional investors indicated that regulatory clarity ranked as the number one factor preventing larger cryptocurrency allocation. As major cases resolved and clearer frameworks emerged, these surveys showed declining regulatory concern and rising allocation intentions.

機構信任指標也有明顯改善。針對機構投資人的調查顯示,「監管明確性」成為阻礙大規模配置加密資產的首要因素。隨著重大案件陸續落幕、規範架構漸形明朗,相關調查中監管疑慮明顯下降,資產配置意願不斷攀升。

The ETF proliferation illustrated this trust evolution. After years of rejections, 2024-2025 saw waves of cryptocurrency ETF approvals: Bitcoin spot ETFs in January 2024, Ethereum spot ETFs in July 2024, and applications for Solana, XRP, Cardano, Litecoin, and other tokens through 2025. This progression from zero approved cryptocurrency ETFs to dozens within eighteen months represented regulatory normalization's rapid pace once the initial barrier broke.

ETF核准浪潮正好說明了信任演進的過程。歷經多年拒絕後,2024-2025年間加密貨幣ETF如雨後春筍般通過:2024年1月的比特幣現貨ETF、2024年7月的以太幣現貨ETF,以及Solana、XRP、Cardano、萊特幣等其他代幣的ETF申請持續至2025年。從「零ETF」到十八個月內批准數十種,展現監管常態化一旦破冰,速度極為驚人。

Long-term credibility for cryptocurrency as an asset class strengthened through this regulatory evolution. Institutional investors who previously dismissed cryptocurrency as unregulated speculation increasingly treated it as an emerging asset class requiring specialized expertise but no longer off-limits for fiduciary duty reasons.

加密貨幣作為資產類別的長期信譽,透過這波法規演進大幅提升。過去將加密貨幣視為「無法可管的投機產品」的機構投資人,如今逐漸認定它是值得投入專業研究、但已不再因受託人責任而完全拒絕的「新興資產類別」。

The professionalization of cryptocurrency companies paralleled regulatory normalization. Major cryptocurrency firms built substantial legal, compliance, and government relations departments rivaling those of traditional financial institutions. This infrastructure investment signaled industry recognition that operating within regulatory frameworks rather than fighting them represented the path to sustainable growth.

加密產業的專業化也跟著監管正常化同步發展。主要加密公司陸續打造規模龐大的法務、合規與政府關係部門,其規格堪比傳統金融機構。這種基礎建設投資,象徵產業理解唯有融入法規、而非對抗法規,才是永續成長之道。

Academic and policy discourse evolved beyond whether cryptocurrency should exist to how it should be regulated. Law schools offered cryptocurrency law courses, regulatory agencies hosted cryptocurrency-focused working groups, and think tanks published detailed policy proposals for optimal regulatory frameworks. This intellectual infrastructure development suggested that cryptocurrency had achieved sufficient legitimacy to warrant serious policy attention rather than dismissal.

學術與政策討論已從「加密貨幣該不該存在」進化到「該如何監管」的層次。法學院開辦加密貨幣法律課程,監管機關設置相關工作小組,智庫則推出詳盡政策建議。這種知識和政策基礎的累積,顯示加密產業的正當性已達足以獲得嚴肅政策對待的地步,不再被一筆帶過。

International regulatory coordination advanced, with multilateral organizations including the Financial Action Task Force, Bank for International Settlements, and International Organization of Securities Commissions developing harmonized approaches to cryptocurrency regulation. While perfect global uniformity remained elusive, the general direction toward clearer, more consistent rules reduced jurisdictional arbitrage opportunities and supported legitimate business development.

國際間的監管協調也同步推展。包括金融行動工作組織(FATF)、國際清算銀行(BIS)、國際證券監管者組織(IOSCO)等多邊單位,都積極研擬統一的加密貨幣監管架構。雖難以達到全球完全一致,但規範朝向更清晰一致的趨勢,已顯著減少監管套利空間,也有利於合法業務發展。

The symbolic importance of the XRP settlement extended beyond its legal specifics. The case demonstrated that even after years of regulatory adversity, cryptocurrency companies could achieve legal clarity, rebuild institutional relationships, and ultimately thrive. This resilience narrative encouraged other companies facing regulatory challenges to pursue judicial resolution rather than surrendering or relocating to more permissive jurisdictions.

XRP和解案的象徵意義超越其法律細節。此案證明,即使歷經多年監管逆境,加密產業仍有機會走出法律困境、修復機構關係,甚至再度壯大。這樣的韌性故事,鼓勵其他面臨監管挑戰的公司,也可選擇司法解決,而非放棄或遷往監理寬鬆的地區。

What XRP's Victory Means for the Next Era of Crypto

XRP勝訴對下一個加密時代的意義

The August 2025 resolution of the SEC versus Ripple litigation marked the conclusion of cryptocurrency's longest-running regulatory battle and the beginning of a new chapter in digital asset institutional adoption. The settlement's preservation of Judge Torres' bifurcated regulatory framework established that digital assets can achieve non-security status for secondary market transactions even amid institutional sales restrictions, creating a roadmap for regulatory clarity that other tokens and protocols may follow.

2025年8月,SEC與Ripple案獲解決,終結了加密產業史上最長的監管拉鋸,也開啟數位資產機構化採用的新篇章。本案維持了Torres法官所提出的二分監理框架,即使機構銷售有部分限制,數位資產仍可在二級市場取得「非證券」地位,為其他代幣及協議的監管明確性指出參考方向。

XRP's transformation from regulatory pariah to institutional favorite illustrated how rapidly market positioning can shift when legal uncertainty resolves. Within months, the token progressed from delisted on major U.S. exchanges to featuring in CME futures with record-breaking institutional adoption, proposed spot ETFs from every major asset manager, and $7 billion in institutional holdings. This velocity of institutional reentry demonstrated that regulatory clarity, not technological innovation or market sentiment, had been the binding constraint on institutional cryptocurrency adoption.

XRP從監管棄兒變成機構寵兒,徹底反映出市場地位因法律明朗而能迅速逆轉。短短數月內,該幣從美國主流交易所下架,搖身一變進入CME期貨市場,達成機構採用新高、列入各大資產管理者的現貨ETF申請,機構持有額突破70億美元。這種機構資金回流的速度,證明真正的阻礙從來不是技術或情緒,而是監管明確性。

The settlement's core lesson centered on compliance and transparency as competitive advantages rather than mere legal obligations. Ripple's willingness to engage in years of expensive litigation rather than settling early or relocating operations to friendlier jurisdictions ultimately paid dividends through establishing precedent beneficial to the entire industry. Companies observing this outcome may conclude that proactive regulatory engagement and legal persistence deliver better long-term results than evasion strategies.

這起和解案的核心啟示,是「合規與透明」不僅是法律義務,更是競爭優勢。Ripple寧捨鉅額訴訟成本,不願早早和解或外遷至監管寬鬆地區,最終成功為全產業建立良好先例。見證此局面的其他公司或將體認,積極面對監管、堅持法律爭取,長期成果遠勝以規避為上的策略。

The regulatory landscape transformation extends beyond XRP to signal broader acceptance of cryptocurrency as a legitimate, if still emerging, component of the financial system. The progression from Bitcoin's commodity status to Ethereum's de facto non-security treatment to XRP's judicially-confirmed secondary market framework suggests an incremental but steady march toward comprehensive digital asset regulation. While the U.S. regulatory approach remains fragmented across multiple agencies with overlapping jurisdiction, the direction points toward eventual legislative clarity that supersedes case-by-case enforcement.

這波監管環境的變革,不只侷限於XRP個案,更意味著加密貨幣作為金融體系「新興但正當」要素的普遍認可。從比特幣的商品地位、以太幣實質上的非證券認定、到XRP經司法確認的二級市場框架,顯示出數位資產監管正朝著全面且穩健的方向邁進。雖然美國監管仍由多個機構分工、有重疊,但未來發展趨勢將朝立法取代個案執法而去。

Looking forward, several questions will determine whether XRP maintains its momentum or faces new challenges. Can the token sustain institutional adoption as central bank digital currencies and stablecoin networks scale? Will spot ETF approvals trigger projected multi-billion-dollar inflows or disappoint relative to elevated expectations? Can Ripple convert payment corridor successes into sustained transaction volume growth that validates XRP's utility value proposition?

往後將有多項問題決定XRP能否保持動能、或迎來新挑戰。當央行數位貨幣和穩定幣網路規模化後,XRP是否能維持機構採用?現貨ETF的通過,是會如預期吸引數十億美元資金流入,還是將令市場失望?Ripple能否將主要匯款通道的成功轉化為持續、可驗證XRP實用性價值的交易量成長?

The competitive landscape for cross-border payment solutions remains dynamic, with established players like SWIFT innovating, new entrants like stablecoin networks gaining traction, and government-issued digital currencies potentially reshaping the playing field. XRP's edge lies in its established institutional relationships, proven technology operating at scale, and now-clarified regulatory status. Whether these advantages prove sufficient to capture meaningful market share in the massive global payments industry will determine XRP's long-term valuation trajectory.

跨境支付解決方案的競爭格局仍然多變:SWIFT等老牌巨頭持續創新,新興的穩定幣網絡逐步崛起,政府發行的數位貨幣也可能擾動產業走向。XRP的競爭優勢在於建立深厚的機構網絡、成熟可規模化的技術,以及如今明確的法規地位。這些優勢能否讓XRP在龐大的全球支付市場取得足夠市占率,將左右其長線估值走勢。

The broader cryptocurrency implications extend beyond payment tokens to encompass governance around decentralized finance protocols, NFT platforms, layer-two scaling solutions, and novel tokenization applications. The XRP precedent of achieving legal clarity through litigation and settlement may inspire other projects to pursue similar paths rather than accepting regulatory ambiguity as permanent condition.

更廣泛的產業啟示,也不限於支付型代幣,還涵蓋了去中心化金融、NFT平台、Layer 2擴容方案和創新資產證券化等新應用。XRP「透過訴訟與和解取得法律明確性」的範例,將激勵其他專案尋求司法路徑,而非把監理模糊視為常態。

Regulatory certainty is emerging as cryptocurrency's most valuable commodity, potentially

監管確定性正成為加密產業最有價值的稀缺資源,並可能——more important than technological superiority or network effects in driving institutional adoption. Projects that achieve clear legal status gain disproportionate institutional capital flows as compliance departments greenlight allocations, exchanges list tokens without reservation, and derivative products launch without regulatory intervention risk. This dynamic creates competitive incentive for proactive regulatory engagement rather than the earlier cryptocurrency ethos of regulatory avoidance.

比技術優勢或網絡效應在促進機構採用上更為重要。取得明確法律地位的項目會獲得不成比例的機構資本流入,因為合規部門會批准配置,交易所也會毫不猶豫地上架代幣,衍生性產品則能在沒有監管干預風險的情況下推出。這種動態產生了積極主動參與監管的競爭動機,有別於早期加密貨幣避開監管的精神。

The institutional integration of cryptocurrency continues accelerating, with XRP's post-settlement trajectory providing a case study in how assets transition from speculative trading instruments to operational financial infrastructure. This evolution from speculation to utility represents cryptocurrency's maturation from technological experiment to financial industry component, a transformation that will define the sector's next decade as significantly as price volatility and technological innovation defined its first.

加密貨幣的機構整合持續加速,XRP在和解後的發展軌跡成為資產如何從投機交易工具轉變為實際金融基礎設施的案例。這種由投機轉向實用的演變,代表著加密貨幣從技術實驗走向金融產業組成要素的成熟,這種轉變將像價格波動和技術創新定義產業的第一個十年一樣,深刻影響接下來的十年。

Ripple's victory may not just reshape XRP's future - it may redefine the entire cryptocurrency industry's relationship with regulatory authority, shifting from adversarial resistance to cooperative coexistence within clear frameworks. This transition from regulatory frontier to normalized asset class will determine whether cryptocurrency achieves its advocates' vision of transforming global finance or remains a niche alternative to traditional systems. The XRP settlement suggests the former outcome grows more probable with each legal precedent established and each institutional allocation greenlit.

瑞波的勝利不僅可能重塑XRP的未來--還可能重新定義整個加密貨幣產業與監管機關之間的關係,從對抗式抵抗轉向在明確架構下的合作共存。這種從監管邊疆到正常化資產類別的轉換,將決定加密貨幣能否實現其支持者所期望的全球金融變革,還是僅侷限於傳統體系的利基替代品。XRP的和解表明,隨著每一個法律先例的建立和每一次機構配置的放行,前者的可能性正持續增加。

The path forward requires balancing innovation with compliance, decentralization ideals with institutional integration demands, and technological possibility with regulatory reality. XRP's journey from regulatory target to compliance exemplar offers a template other projects may follow as the cryptocurrency industry continues its evolution from outsider disruption to insider transformation of global financial infrastructure.

未來的道路需要在創新與合規、去中心化理念與機構整合需求,以及技術可能性與監管現實之間取得平衡。XRP從過去的監管目標到現在的合規典範,其經歷為其他項目提供了可仿效的範本,隨著加密貨幣產業從局外的顛覆者走向全球金融基礎設施的內部轉型,這樣的發展將持續演進。