2024年10月25日,孟買投資人Rhutikumari登入她的WazirX帳戶,本預期可查詢到價值約9,400美元的3,532.30顆XRP,卻發現帳戶遭凍結。交易所因針對以太坊代幣發生2.3億美元駭客事件,計畫以有爭議的「虧損社會化」方案分攤損失給所有用戶——儘管她的XRP從未被盜取。

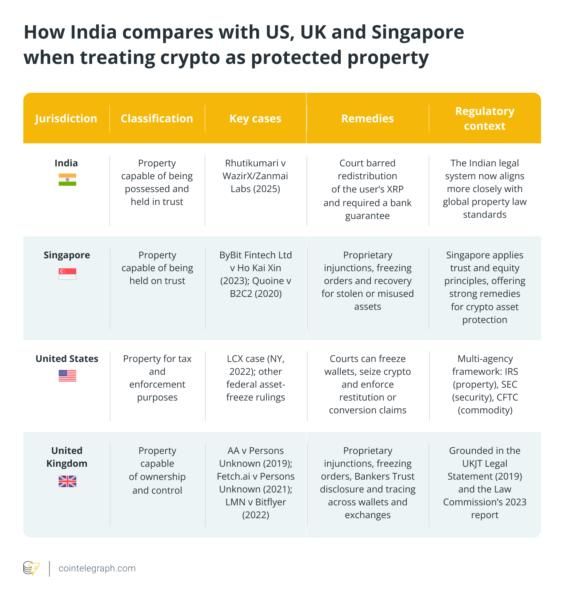

接下來發生的事情在印度加密貨幣圈掀起重大回響。馬德拉斯高等法院法官N. Anand Venkatesh不僅判決Rhutikumari勝訴,更劃時代地宣示:加密貨幣於印度被認定為財產,得以被擁有及信託持有。

「毫無疑問,加密貨幣是財產,」Venkatesh法官寫道,「它並非實體財產或貨幣,但它是一種可享有、得以(以受益形式)持有的財產,也可作為信託。」

這並非僅是司法修辭。這項裁決從根本上改變了這個全球人口最多國家看待數位資產的方式,明確賦予投資人所有權、對交易所的法律救濟權,以及在民事法庭追討補償的能力。對Rhutikumari來說,這表示WazirX不能隨意重新分配她的代幣。對於約有1.15億名印度加密用戶而言,他們持有的資產終於獲得法律保障。

然而,印度承認XRP為財產的案例,也引發了更廣泛的思考:政府何時會正式承認數位資產?這些法律決策如何產生?是什麼促使一個司法管轄區將加密貨幣列為財產、證券、法定貨幣或違禁品?而對於價值數兆美元的加密市場而言,當法律正式給定(或拒絕給定)認可,對代幣、交易所和投資人意味著什麼?

這些問題至關重要,因為法律地位決定了加密貨幣市場的一切。財產認定使投資人能因被竊而提訴;證券註定須遵循揭露規範和交易限制;法定貨幣身分則強制商戶接受支付;而全面禁令則將交易推向地下或境外。不同路徑造就贏家與輸家,塑造市場結構,決定哪些代幣得以發展。

本文調查主要加密貨幣——比特幣、以太幣、XRP等——於特定國家獲得官方認可或優惠待遇的情況。探討這些法律決策的機制、分析其市場影響,評估它們對數位資產普及未來的意義。從薩爾瓦多的比特幣實驗,到日本全方位的財產分類,從香港的發牌制度到中國的全面禁令,全球法律格局日益碎片化。

涵蓋範圍包括市值主流代幣、重要監管司法管轄區,以及四大法律地位類型:法定貨幣、財產、受規管金融資產、禁制商品。我們將解答四個核心問題:哪些代幣被承認?在哪些國家?這些法律框架如何生成?其對投資人、交易所及整個加密生態的影響為何?

隨著加密貨幣自實驗技術走向主流金融工具,法律認可成為區分合法資產與投機騙局的關鍵。印度XRP案僅是全球故事的一環。要理解這場故事,得觀察法律、市場、科技在國界間如何碰撞——以及法院宣判「你的數位資產即是財產」後,世界會發生什麼。

加密貨幣法律地位的光譜

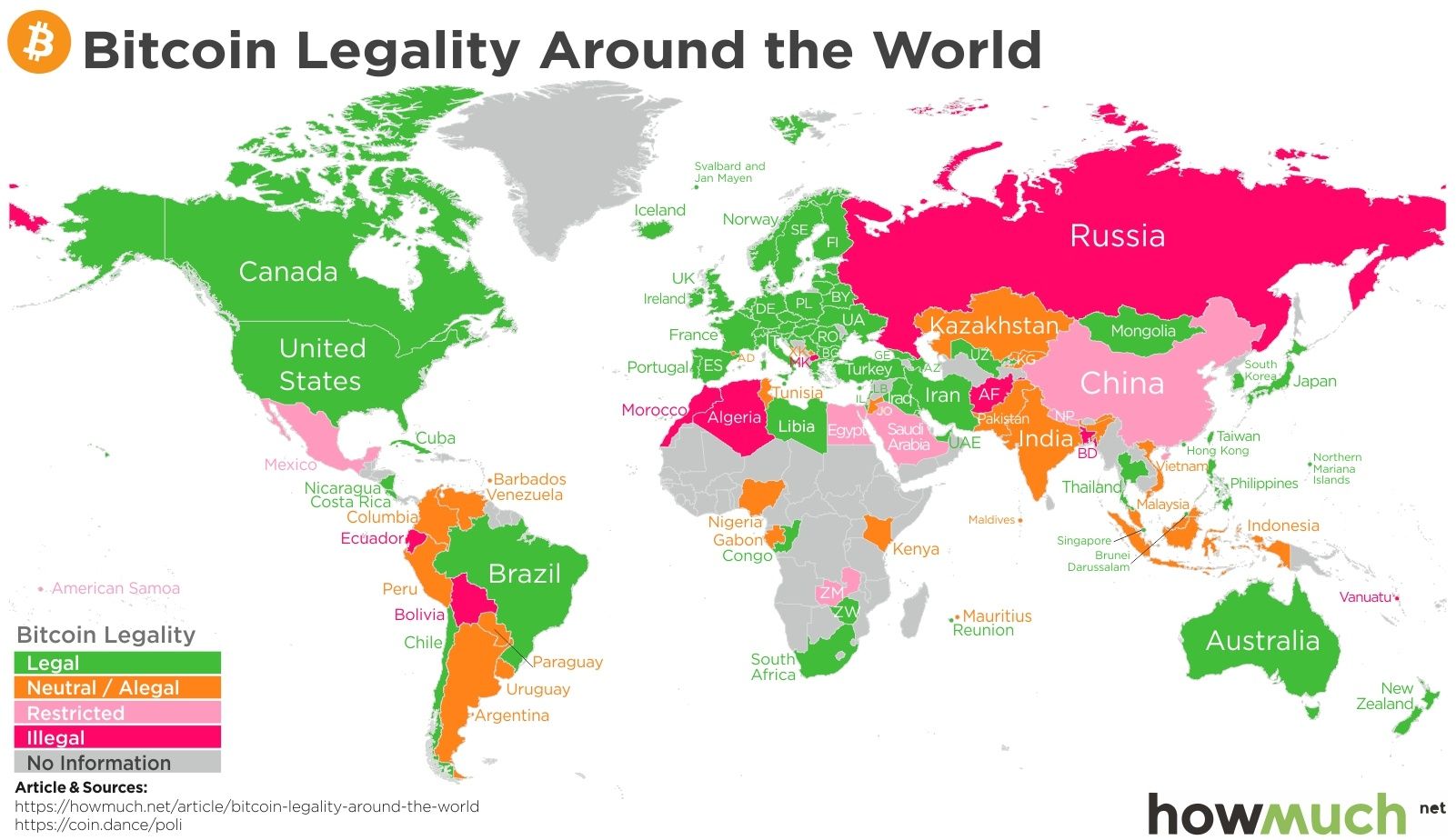

2025年,加密貨幣的法律待遇呈現光譜而非二元對立。一端,比特幣被列為法定貨幣的國家如薩爾瓦多(截至2025年1月),強制商戶接受其支付。另一端如中國,已宣布所有加密交易違法。多數主要經濟體則位於中間地帶——將加密貨幣認定為財產、作為金融資產受監管,或創建獨特而無法簡單分類的法律架構。

這種碎片化對全球市場構成挑戰。在印度被當作財產的代幣,於美國可能被認定為證券,在日本被視為支付工具,而在中國則屬違禁品。印度法庭保護為財產的XRP,在美國仍纏訟於證券交易委員會,爭論其是否屬未註冊證券。司法套利影響代幣經濟、交易所上架與投資行為。

各地法律體系的分歧,反映監管理念及經濟優先順序。有些司法區重視金融創新及吸引加密資本的競爭,另一些則強調投資人保護與金融穩定,亦有視加密貨幣為貨幣主權威脅的國家。這些互異方針形成拼貼式監管環境,使同一代幣因地理而有完全不同的法律地位。

法定貨幣地位:比特幣實驗

最積極的加密貨幣認可即為法定貨幣地位。這種地位原屬法定貨幣,強制商戶接受該資產支付債務,並必須繳稅時接受。2021年9月,薩爾瓦多成為首個賦予比特幣此地位的國家,總統Bukele聲稱此舉可促進無銀行戶金融包容,並降低匯款費用。

此實驗引發全球關注,但成果褒貶不一。2024年調查顯示,僅8.1%薩爾瓦多民眾以比特幣交易,遠低於2021年的25.7%。政府的Chivo錢包技術困難重重。國際貨幣基金多次警示金融穩定和消費者保護風險。至2025年1月,在爭取14億美元IMF貸款壓力下,薩爾瓦多取消比特幣法定貨幣地位,但依然維持比特幣戰略儲備並推廣加密投資。

2022年4月,中非共和國效法薩爾瓦多,成為比特幣法定貨幣的第二國。不過試驗僅維持不到一年,在區域央行BEAC和中非貨幣聯盟CEMAC夥伴壓力下,CAR於2023年4月廢止該法。原因在於:國內網路設施不足(僅11%人口可用)、金融穩定性憂慮,以及與法郎貨幣體系不兼容。

這些失敗揭示為何法定貨幣地位仍非常罕見。此舉需大規模支付基礎建設、商戶普及、價格穩定和技術素養,而這些條件多數吸引比特幣的發展中國家並不具備。法定貨幣地位亦威脅貨幣主權,引發央行與國際金融機構反彈。

財產地位:漸成共識

更具可持續性的認可方式是將加密貨幣視為財產——一種可擁有、轉讓、有法律保障但不具貨幣地位的無形資產。這條中庸之道,允許創新同時維持國家對貨幣政策的掌控。印度近期XRP判決正是例證,但並非唯一。

香港法院於2023年Gatecoin清盤案創下先例,明確認可虛擬資產為財產。法官認定加密貨幣具備所有要求:公鑰可辨識資產、私鑰控制可由第三方識別、可透過廣泛交易被假設存在、而區塊鏈帳本則確立其永久性。財產地位允許投資人對盜竊、信託違約與傳統財產侵權提起民事訴訟。

美國採取混合做法。IRS將加密貨幣視為財產,出售時須課資本利得稅,但美國證券交易委員會則認定多數代幣為證券,觸發聯邦證券法下的登記義務。這種雙重定義產生監管複雜性:同一代幣在不同情境下既是財產(稅務),又可能是證券(交易)。

新加坡架構亦同樣將加密認定為財產,同時針對部分代幣執行證券監管。《2019年支付服務法》規定虛擬資產服務提供者必須取得牌照,新加坡金融管理局則判斷特定代幣是否屬於需更嚴格監管的資本市場產品。這套分級架構努力在創新與投資人保護間取得平衡。

Regulated Asset Frameworks: Japan and the EU Model

受規範資產體系:日本與歐盟模式

Some jurisdictions have developed comprehensive regulatory schemes that recognize crypto as a distinct asset class requiring specialized oversight. Japan pioneered this approach following the 2014 Mt. Gox collapse, which saw 850,000 bitcoins disappear and highlighted the need for exchange regulation.

部分司法管轄區已經制定了全面的監管機制,將加密貨幣視為需要專門監管的獨立資產類別。日本在2014年Mt. Gox倒閉事件後率先採納了這種做法,當時有85萬枚比特幣消失,暴露了交易所監管的迫切需求。

The Japanese Payment Services Act defines cryptocurrencies as "crypto-assets" (暗号資産, angō shisan), formally recognizing them as property with monetary value. The law requires crypto exchange businesses to register with the Financial Services Agency, segregate customer assets, conduct regular audits, and implement anti-money laundering protocols. As of 2025, over 30 exchanges have obtained FSA registration, creating a regulated ecosystem where investors have clear recourse against platform failures.

《日本支付服務法》將加密貨幣定義為「加密資產」(暗號資產, angō shisan),正式承認其為具有貨幣價值的財產。法律規定加密貨幣交易所必須向金融廳(FSA)登記、分隔客戶資產、定期接受審計,並執行反洗錢措施。到2025年已有超過30家交易所取得FSA註冊,打造出一個受規範的生態系,讓投資人面對平台風險時有明確的救濟途徑。

Japan's framework extends beyond exchanges to address stablecoins, custody services, and derivatives. The 2022 amendments created a licensing regime for issuers of fiat-backed stablecoins, treating them as "electronic payment instruments" subject to bank-like reserve requirements. This comprehensive approach positions Japan as a leader in crypto regulation while maintaining the fundamental recognition of digital assets as property.

日本的制度不僅針對交易所,還擴及穩定幣、託管服務和衍生品。2022年修法設立了法幣支持穩定幣發行人的特許制度,將其視為「電子支付手段」,要求有類銀行存款準備金。這種全面方式,讓日本在加密監管領域成為領導者,同時維持數位資產作為財產的基本認定。

The European Union's Markets in Crypto-Assets Regulation (MiCA), which became fully applicable in December 2024, represents the most ambitious attempt to harmonize crypto regulation across multiple jurisdictions. MiCA establishes uniform rules for crypto-asset issuers and service providers across all 27 EU member states, creating a regulatory passport that allows licensed operators to serve the entire single market.

歐盟的《加密資產市場規則》(MiCA)於2024年12月全面生效,代表跨司法管轄區協調加密資產監管的最雄心壯志的嘗試。MiCA對27個成員國的加密資產發行人及服務提供商訂定一致的規範,設立「監管護照機制」,允許持牌業者服務整個單一市場。

MiCA categorizes tokens into three groups: asset-referenced tokens (ARTs) that derive value from multiple assets, e-money tokens (EMTs) pegged to fiat currency, and other crypto-assets. Each category carries specific disclosure, reserve, and governance requirements. The regulation aims to protect consumers, prevent market abuse, and ensure financial stability while fostering innovation through clear rules. Non-compliant stablecoins face delisting from EU exchanges, with major platforms already removing Tether and other non-MiCA tokens from European offerings.

MiCA將代幣劃分為三類:資產參考型代幣(ARTs,價值來自多項資產)、電子貨幣型代幣(EMTs,與法幣掛鉤)及其他加密資產。每一類都有特定的資訊揭露、準備金與治理要求。這些規範旨在保護消費者、防止市場操縱、維護金融穩定,同時透過明確規則促進創新。不合規的穩定幣會被歐盟交易所下架,主要平台已陸續移除Tether及其他非MiCA認可代幣。

The Prohibition Extreme: China's Total Ban

禁令極端例子:中國全面禁止

At the opposite end of the spectrum, China has declared all cryptocurrency transactions illegal. The September 2021 notice from the People's Bank of China banned trading, mining, and exchange operations. Financial institutions cannot provide services related to crypto. Overseas exchanges offering services to Chinese residents are deemed illegal, with employees potentially subject to prosecution.

在譜系的另一端,中國宣布所有加密貨幣交易均屬非法。2021年9月,中國人民銀行發佈公告,禁止加密貨幣交易、挖礦和交易所經營。金融機構不得提供任何加密相關服務。海外交易所向中國居民提供服務也被視為非法,相關員工更有可能面臨刑事指控。

The motivations are multiple: maintaining capital controls, promoting the digital yuan central bank digital currency, preventing capital flight, and eliminating perceived threats to financial stability. China's crackdown forced a massive mining migration, with hash rate plummeting from 65% of the global total to near-zero as operations relocated to Kazakhstan, Russia, and North America.

其背後動機多元:維持資本管制、推廣數位人民幣央行數位貨幣、防止資本外流並消除對金融穩定的威脅。中國的打壓導致礦工大舉外移,全球算力從中國佔比約65%暴跌至近乎零,機器遷往哈薩克、俄羅斯及北美。

Yet even China's ban has limitations. Reports indicate continued underground activity, with approximately $86 billion in over-the-counter trading volume in 2023 despite the prohibition. Peer-to-peer transactions via WeChat and Telegram persist, particularly in inland regions where enforcement is weaker. Some Chinese courts have even ruled that Bitcoin retains property characteristics despite the trading ban, creating legal ambiguity about whether mere possession remains lawful.

但中國禁令也有侷限。報導指即使全面禁止,2023年場外交易總量仍高達860億美元。微信、Telegram等P2P交易依舊活躍,尤其是執法較弱的內陸地區。有些中國法院甚至裁定比特幣雖禁止交易仍具有財產屬性,導致單純持有是否合法充滿法律灰色地帶。

China's approach represents the authoritarian end of the regulatory spectrum: ban first, enforce selectively, and promote state-controlled alternatives. Other countries have watched this experiment closely, with varying conclusions about its effectiveness and desirability.

中國的做法展現出威權式監管極端:先禁後選擇性執法,同時推廣國家主導替代品。其他國家對此密切觀察,各自對其成效與可取性有不同結論。

Implications by Legal Regime

各類法律體系之影響

The choice of legal framework fundamentally shapes how cryptocurrencies function within a jurisdiction. Legal tender status creates maximum integration with the payment system but demands the most from infrastructure and risks monetary instability. Property recognition provides investor protection and enables commercial activity without threatening currency sovereignty. Regulated asset frameworks offer comprehensive oversight but impose compliance costs that favor institutional players over decentralized innovation. Outright bans push activity underground and forfeit any regulatory visibility.

法律體系的選擇決定加密貨幣在一國內的實質運作。法償地位讓加密貨幣完全集成進支付體系,但基礎建設要求最高、貨幣穩定風險也最大。財產認定提供投資人保障並促進商業應用,但不影響貨幣主權。受規範資產架構實現全面監督,但合規成本高,對大型機構有利、壓制去中心化創新。全面禁令則將交易推入地下,完全失去監管能見度。

For token holders, these classifications determine rights and remedies. Property status enables lawsuits for theft or breach of fiduciary duty. Security classification requires issuers to register offerings and provide disclosure. Legal tender status grants payment functionality but exposes holders to price volatility risk. Prohibition forces users offshore or into gray markets with no legal recourse.

對持幣人而言,這些分類決定其權利與救濟渠道。若為財產,可起訴竊盜或信託侵權。若被認定為證券,發行人須註冊並揭露資訊。法償地位賦予支付功能,但持有者需承受價格劇烈波動風險。全面禁止則只好轉向海外或灰色市場,無法獲得法律救濟。

For exchanges, regulatory frameworks dictate operational requirements. Licensed regimes in Japan and Singapore require capital reserves, cybersecurity standards, and governance structures. EU passporting under MiCA allows pan-European operations but demands compliance with harmonized rules. Property recognition without licensing requirements, as in early crypto jurisdictions, allows lighter-touch operations but provides less investor confidence.

對交易所來說,監管體系決定其營運條件。日本、新加坡等地的持牌制度要求資本準備金、資安標準及公司治理。歐盟MiCA「護照」允許跨歐盟經營,但需遵守一體化規範。若僅承認財產地位無須執照(如早期部分國家),營運彈性較大但投資人信心偏低。

For tokens themselves, legal status affects liquidity, listing decisions, and market structure. Coins recognized as property or regulated assets gain listings on compliant exchanges and attract institutional capital. Tokens classified as securities face restricted distribution and higher legal costs. Those deemed illegal in major markets see liquidity fragment across multiple smaller venues.

就代幣本身而言,法律地位影響流動性、能否上市及市場結構。被認可為財產或合規資產的幣種可在合規交易所上架,吸引機構資金。若被歸為證券則發行及流通受限,法律成本升高。遭主流市場禁絕的幣其流動性會分散到小型場外市場。

The global landscape thus creates arbitrage opportunities and strategic choices. Projects incorporate in friendly jurisdictions, target users in property-recognition countries, and avoid prohibited markets. Investors jurisdiction-shop for favorable tax treatment and legal protection. Exchanges relocate to capitalize on regulatory clarity or lax oversight. This dynamic shapes the industry's geography and growth trajectory.

全球不同體系產生了套利和策略選擇:項目方會設立於友善法域,專注於財產認定國家市場、避開禁令地區。投資人會選擇稅負與法律保障較佳國家。交易所則遷移以享受監管明確度或寬鬆環境。這些動態形塑出產業版圖與成長路徑。

XRP Recognition as Property in India

印度承認XRP為財產

The Madras High Court's October 2024 recognition of XRP as property provides a detailed case study of how legal status transforms practical outcomes for investors, exchanges, and tokens. The ruling emerged from specific circumstances, relied on particular legal reasoning, and generated immediate market effects that illustrate the stakes of cryptocurrency classification.

印度馬德拉斯高等法院於2024年10月承認XRP為財產,此案例充分展現法律地位如何實質改變投資人、交易所與代幣的命運。該裁決源自具體事實,引用針對性的法律推理,並立即影響市場,凸顯加密貨幣分類的重要性。

The WazirX Hack and Rhutikumari's Frozen Assets

WazirX駭客事件與Rhutikumari資產凍結

Rhutikumari's troubles began on July 18, 2024, when WazirX announced that one of its cold wallets had suffered a cyberattack. The breach targeted Ethereum and ERC-20 tokens, draining approximately $230 million from the exchange. WazirX, operated by Indian entity Zanmai Labs with Singapore parent Zettai Pte Ltd, responded by freezing user accounts and proposing a "socialization of losses" scheme.

2024年7月18日,WazirX發佈公告稱其一個冷錢包遭受網絡攻擊,主要涉及以太坊及ERC-20代幣,損失約2.3億美元。WazirX由印度Zanmai Labs經營,其母公司為新加坡Zettai Pte Ltd。事發後,交易所凍結用戶帳戶,並提出所謂「社會化損失」方案。

Under this plan, all users would absorb proportional losses regardless of whether their specific holdings were stolen. For Rhutikumari, who held XRP tokens completely unaffected by the hack, this seemed manifestly unjust. Her 3,532.30 XRP had been purchased in January 2024 for approximately ₹1,98,516 ($2,376) and had appreciated to ₹9,55,148 ($11,430) by the time of the freeze. Yet WazirX insisted that all assets, including hers, must be pooled to compensate victims of the Ethereum theft.

依該方案,所有用戶皆須按比例承擔損失,不論其所持資產是否被竊。對於持有未受駭影響的XRP的Rhutikumari來說,這極不公允。她在2024年1月以約19.85萬盧比(2,376美元)購入的3,532.30枚XRP,到凍結時已增值至95.51萬盧比(11,430美元)。但WazirX仍堅稱所有資產都需一併納入彌補受害者損失。

Rhutikumari filed a petition under Section 9 of India's Arbitration and Conciliation Act, seeking interim protection against reallocation of her holdings. She argued that her XRP constituted property held in trust by the exchange, which owed fiduciary duties to preserve those specific assets. The petition challenged WazirX's authority to redistribute client tokens and sought judicial recognition that cryptocurrency ownership entails legal rights enforceable against platform operators.

Rhutikumari依《印度仲裁及調解法》第9條提起訴訟,要求暫時保護她的資產不被重分配。她主張其XRP是由交易所信託持有的財產,交易所應負信託責任維護特定資產。此請求直接挑戰WazirX再分配權力,並要求法院確認加密貨幣持有可對交易平台主張法律權利。

The Court's Reasoning: Property Law and Virtual Assets

法院見解:財產法與虛擬資產

Justice Venkatesh's analysis began with fundamental property law principles. Drawing on Supreme Court precedents including Ahmed GH Ariff v. CWT and Jilubhai Nanbhai Khachar v. State of Gujarat, he established that Indian law defines property broadly to encompass "every valuable right or interest." The question was whether cryptocurrency's intangible, digital nature disqualified it from this definition.

判官Venkatesh首先回歸財產法基本原則,援引最高法院案例(Ahmed GH Ariff v. CWT及Jilubhai Nanbhai Khachar v. State of Gujarat),確認印度法律對財產的定義極為廣泛,包括「一切有價值的權利或利益」。爭點在於,加密貨幣無形且為數位記錄,是否因此不屬於財產概念。

The court examined international precedents extensively. The New Zealand case Ruscoe v. Cryptopia Ltd held that digital tokens constitute "intangible property... more than mere information... capable of being held on trust." Singapore courts reached similar conclusions. U.S. jurisprudence treats cryptocurrency as property for tax purposes and in civil forfeiture proceedings. This comparative analysis suggested a global judicial consensus emerging around property classification.

法院廣泛檢視國際案例。紐西蘭[Ruscoe v. Cryptopia Ltd]案認為數位代幣屬於「無形財產,不僅僅是資訊,可作為信託持有」。新加坡法院也有類似判決。美國法上,加密貨幣在稅務和沒收程序皆被視為財產。比較法分析顯示,全球司法實踐在財產分類上逐漸形成共識。

Justice Venkatesh then applied this framework to cryptocurrency's characteristics. Digital assets are definable through unique blockchain addresses and wallet keys. They're identifiable by third parties who can verify ownership through public ledgers. They're capable of assumption by others through trading and transfer. They possess permanence and stability through immutable blockchain records. These features align

隨後Venkatesh法官將上述框架應用於加密貨幣特點:數位資產可由獨一無二的區塊鏈地址與錢包密鑰界定;第三方可通過公開帳本驗證其所有權;可藉由交易及轉讓由他人取得;透過區塊鏈紀錄具備永久性與穩定性。這些特點完全吻合——with traditional property criteria despite cryptocurrency's intangible nature.

即使加密貨幣本質上是無形資產,法院仍然以傳統財產標準進行評斷。

Critically, the court cited Section 2(47A) of India's Income Tax Act, which defines cryptocurrencies as "virtual digital assets" subject to taxation. This statutory reference, Justice Venkatesh reasoned, represented legislative recognition that crypto possesses value capable of ownership and transfer. If Parliament acknowledges crypto as assets for tax purposes, courts should recognize them as property for civil law purposes.

法院關鍵性地引用了《印度所得稅法》第2(47A)條,該條明確定義加密貨幣為「虛擬數位資產」,並課以稅收。Venkatesh法官認為,這個法規本身就代表著立法機構承認加密貨幣具有可被擁有與轉讓的資產價值。如果議會在稅務上承認加密貨幣為資產,那麼法院在民事法律上也應該把它們當作財產對待。

The ruling explicitly rejected Zanmai Labs' argument that XRP holdings could be "socialized" to cover other tokens' losses. "To use those assets not belonging to Zanmai, and that too by Zettai, and to utilize them for covering losses attributable to other users is not something even on the face of it [acceptable]," the court declared. Crypto held in custody remains users' property, not exchange assets available for redistribution.

判決明確否定了 Zanmai Labs 所提出的「XRP 持有可社會化」以彌補其他代幣損失的說法。法院宣稱:「將這些不屬於 Zanmai 的資產,特別是由 Zettai 操控,拿去補償其他用戶的損失,即使表面上看起來也無法接受。」托管中的加密貨幣仍屬於用戶財產,而不是交易所可自由分配的資產。

Jurisdictional Authority Over Foreign Restructuring

WazirX raised a second defense: that Singapore court-approved restructuring proceedings bound all users, including Rhutikumari, and the Madras High Court lacked jurisdiction. The exchange argued that Zettai's Singapore reorganization plan should govern asset distribution regardless of where users resided.

WazirX 提出第二項抗辯理由:新加坡法院批准的重組程序適用於包括 Rhutikumari 在內的所有用戶,因此馬德拉斯高等法院沒有管轄權。交易所主張,不論用戶居住地位於何處,資產應依照 Zettai 在新加坡的重組計劃分配。

Justice Venkatesh rejected this argument by establishing domestic jurisdiction over assets located in India. Citing the Supreme Court's 2021 decision in PASL Wind Solutions v. GE Power Conversion India, he held that Indian courts can grant interim protection where assets within India require safeguarding. Rhutikumari's transactions originated in Chennai, involved transfers from an Indian bank account, and occurred on a platform operated by Zanmai Labs, which is registered as a reporting entity with India's Financial Intelligence Unit.

Venkatesh 法官駁回了這個主張,強調對位於印度的資產擁有本國管轄權。他援引最高法院 2021 年在 PASL Wind Solutions v. GE Power Conversion India 案的判決,認為印度法院可對境內資產提供臨時保護。Rhutikumari 的交易始於清奈,涉及印度銀行帳戶的匯款,且是在由 Zanmai Labs 運營、並已註冊為印度金融情報單位回報機構的平台上進行。

This jurisdictional finding proved crucial. It established that Indian cryptocurrency holdings fall under Indian court oversight even when exchanges maintain foreign parent companies or overseas restructuring proceedings. Users need not litigate in foreign jurisdictions to protect their domestic assets. This principle matters enormously for investor protection, as it prevents exchanges from evading accountability through offshore incorporation.

這一管轄判斷非常關鍵。它確認了即便交易所的母公司在海外、或進行海外重組,印度境內的加密貨幣持有仍然受印度法院監管。用戶不必到外國訴訟以保護其本地資產。這對投資人保護極為重要,防止交易所以海外登記方式逃避法律責任。

The court distinguished between Zanmai Labs, properly registered to operate in India, and Binance/Zettai entities that lacked Indian registration. Only Zanmai could legally handle customer crypto in India. This regulatory compliance strengthened Rhutikumari's case that Indian law - not Singapore restructuring rules - should govern her Indian-based holdings.

法院區分了已合法註冊於印度營運的 Zanmai Labs 與並未在印度註冊的 Binance/Zettai 實體。只有 Zanmai 才有權在印度合法管理用戶加密貨幣。這樣的合規性強化了 Rhutikumari 的主張:她在印度的資產應由印度法律,而非新加坡重組法則所規範。

Immediate Remedies: Injunction and Bank Guarantee

Having established both property rights and jurisdiction, Justice Venkatesh granted immediate relief. He issued an injunction preventing Zanmai Labs from reallocating or redistributing Rhutikumari's 3,532.30 XRP pending arbitration. He further ordered WazirX to furnish a bank guarantee of ₹9.56 lakh (approximately $11,500), equivalent to the XRP's value, ensuring the tokens could be restored if she prevailed in subsequent proceedings.

在確認財產權與管轄權後,Venkatesh 法官即時給予救濟,頒布禁制令,禁止 Zanmai Labs 在仲裁前重新分配或轉移 Rhutikumari 的 3,532.30 顆 XRP,並要求 WazirX 提供價值 ₹9.56 萬盧比(約 11,500 美元)的銀行保證,相當於這批 XRP 的價值,確保若其最終勝訴時能恢復這些代幣。

These remedies transformed the case from theoretical property discussion into concrete protection. The injunction meant WazirX could not implement its loss socialization scheme over Rhutikumari's objection. The bank guarantee ensured that even if technical failures prevented returning the actual tokens, equivalent value would be available. Traditional property law remedies - injunctions, guarantees, damages - now applied to digital assets.

這些救濟措施把抽象的財產爭議具體化為實質保護。禁制令令 WazirX 不能在 Rhutikumari 反對下適用損失社會化機制。銀行保證則確保即使因技術問題無法歸還原代幣,等值金額仍可取得。傳統財產法中的禁令、保證、損害賠償,現已開始適用於數位資產。

Market Impacts: Legal Clarity and Investor Confidence

The ruling's immediate impact was to strengthen XRP's position in India's crypto market. Exchanges could no longer treat customer tokens as pooled assets subject to arbitrary reallocation. Users gained standing to challenge platform actions through civil litigation. Regulatory ambiguity about whether crypto constituted property was definitively resolved.

此判決立刻增強了 XRP 在印度加密市場中的地位。交易所再也不能任意把客戶代幣視為可被自由調配的共用資產。用戶獲得透過民事訴訟對抗平台行為的權利。加密貨幣是否算作財產的監管模糊地帶也被明確終結。

For WazirX and other Indian exchanges, the decision imposed higher custody standards. Platforms now faced potential liability for failing to segregate and protect individual user holdings. The judgment suggested that exchanges might be held as trustees or fiduciaries, owing heightened duties to clients. This raised operational costs but increased consumer confidence.

該判決要求 WazirX 及其他印度交易所須提升資產託管標準。平台若未妥善隔離並保護個別用戶持有,將面臨潛在法律責任。判決指出,交易所可能會被視為信託受託人或受託義務方,對客戶負有更高標準的責任。雖然這增加了營運成本,但顯著提升了消費信心。

Broader market effects included increased institutional interest in XRP specifically and Indian crypto generally. Legal recognition as property removed a significant investment risk - the possibility that courts would deny ownership rights or refuse to enforce contracts. International firms considering Indian market entry could now rely on judicial protection for digital holdings.

更廣泛的市場效應,包括機構對 XRP 和印度加密市場的興趣上升。將加密貨幣視作財產的法律認可,排除了法院否認所有權或不執行合約的重大投資風險。國際公司若考慮進入印度市場,現在也能倚賴司法對數位資產的保護。

The ruling also influenced ongoing policy debates. India's government has oscillated between crypto skepticism and pragmatic regulation. The Madras High Court's decision provided judicial validation for the regulated-asset approach over outright prohibition. While not binding Parliament, it established momentum toward recognizing crypto within the legal system rather than banning it outright.

判決亦對現行政策辯論帶來影響。印度政府長期於加密懷疑論與務實監管之間搖擺。馬德拉斯高院此次裁決,對「監管資產」路線提供司法支持,優於直接禁止。雖然判決無法約束國會,卻推動法制下承認加密資產的趨勢。

Limitations: Interim Nature and Token-Specific Scope

Despite its significance, the ruling carries limitations. It represents an interim order pending arbitration, not a final judgment on the merits. Higher courts could potentially overturn or modify the property classification. The decision binds only the specific parties and doesn't create universal property rights for all Indian crypto holders, though it establishes persuasive precedent.

雖具指標意義,本案仍有諸多限制。該裁定僅為仲裁前的臨時命令,並非最終判決。上級法院未來可能推翻或調整對財產性的認定。判決僅約束當事雙方,未為所有印度加密幣持有者創造普遍財權,儘管具有說服性先例價值。

The ruling addresses XRP specifically, not cryptocurrency generically. Justice Venkatesh distinguished XRP from the Ethereum-based tokens stolen in the hack, noting they constitute "completely different crypto currencies." This token-specific analysis leaves open questions about whether meme coins, utility tokens, or algorithmic stablecoins would receive similar treatment. Each token's characteristics might require separate judicial analysis.

本案具體針對 XRP,而非籠統涵蓋所有加密貨幣。Venkatesh 法官特別區分 XRP 與駭客所竊的以太坊型代幣,指兩者為「完全不同的加密貨幣」。這種代幣個別分析方式,意味著迷因幣、功能性代幣或演算法穩定幣等是否能獲同等待遇仍有待觀察。每種代幣的特性,可能都需個別司法認定。

Enforcement challenges also loom. While the court ordered WazirX to protect Rhutikumari's holdings, crypto's digital nature creates technical compliance difficulties. Tokens can be transferred instantly across borders. Exchanges may lack adequate reserves to honor all claims. Private keys, once lost, cannot be recovered through court order. These practical limitations constrain even well-intentioned legal protection.

執行面困難亦不容忽視。即便法院命令 WazirX 保護 Rhutikumari 資產,數位資產特性帶來合規技術挑戰。代幣可即時跨境轉移,交易所也未必有足夠準備金滿足所有索賠。私鑰一旦遺失,即便法院判決亦無法取回。這些實務限制會影響再理想的法律保護。

The relationship between property rights and securities regulation remains unresolved. Even if courts recognize crypto as property, regulators might still classify specific tokens as securities subject to offering restrictions. Property status and securities classification are not mutually exclusive - a token can be both someone's property and a regulated security requiring disclosure. The Madras ruling addresses only the property question.

財產權與證券監管的關係仍未釐清。即使法院承認加密貨幣為財產,監管方仍可能認定某些代幣屬於證券,必須遵守發行規範。財產地位與證券分類並不衝突——代幣既可以是某人的財產,也可能同時是受監管需揭露的證券。馬德拉斯高院此次僅處理財產性問題。

Precedent for Other Tokens and Jurisdictions

Despite these limitations, the India XRP case establishes important precedent. It demonstrates how civil litigation can clarify crypto's legal status even absent comprehensive legislation. It shows courts drawing on traditional property principles to address novel digital assets. It illustrates how investor protection concerns can drive judicial recognition despite regulatory uncertainty.

儘管如此,印度 XRP 案仍創下重要先例。它展現了即使尚無完善立法,透過民事訴訟亦能釐清加密貨幣法律地位。法院得以借助傳統財產法原則處理嶄新數碼資產,也反映出投資人保護考量可能促使法院在監管未明時做出肯認。

Other Indian courts will likely follow the Madras precedent when addressing similar disputes. Exchanges may settle future claims rather than risk unfavorable rulings. Regulators might incorporate property principles into developing frameworks. The decision influences the direction of Indian crypto policy at a critical moment when the government weighs comprehensive regulation.

其他印度法院在遇到類似爭議時,預計將參考馬德拉斯此次判例。交易所面對未來爭議時,可能傾向和解以避免不利判決。監管機關未來也可能將財產法原則納入新監管架構。此決定對印度正考慮全面立法之際的加密政策發展,有重大指標意義。

Internationally, the judgment adds to a growing body of common law precedent recognizing cryptocurrency as property. Hong Kong's Gatecoin case, UK rulings on Bitcoin ownership, and now India's XRP decision create consistent judicial reasoning across multiple jurisdictions. This convergence suggests that property recognition may become the global norm, at least in common law countries.

於國際層面,這項判決亦為英美法系法院逐步承認加密貨幣為財產的先例體系再添一筆。包括香港 Gatecoin 案、英國對比特幣所有權的判例,再加上印度 XRP 此次判斷,令多地的司法推理趨於一致。至少於英美法系,財產性認定很可能成為全球通則。

For investors, exchanges, and tokens, the India XRP case illustrates why legal status matters profoundly. Rhutikumari gained specific protections - injunction, bank guarantee, preserved holdings - directly from property recognition. Without that classification, her tokens would likely have disappeared into WazirX's loss socialization scheme. The court's words transformed her legal position from "unfortunate user of failed platform" to "property owner with enforceable rights." That transformation is the power of legal recognition.

對投資人、交易所與代幣來說,印度 XRP 案彰顯法定地位的重要性。Rhutikumari 得以取得禁令、銀行保證、資產保存等具體保障皆肇因於財產性認定。若無此性質,其代幣大概率就落入 WazirX 的損失社會化黑洞。法院的認定把她從「倒閉平台的不幸用戶」變為「具有可強制執行權利的財產所有人」,這正是法律認定的力量所在。

Bitcoin and Other Major Coins Across Jurisdictions

While XRP gained property status in India, Bitcoin has traversed the entire spectrum of legal recognition globally - from legal tender to regulated property to outright prohibition. Examining Bitcoin's treatment reveals how jurisdictional choices shape a token's role, market structure, and investor protection. Ethereum and other major altcoins follow similar patterns, with variations based on token characteristics and timing.

雖然 XRP 在印度獲得財產地位,但比特幣於全球範圍經歷過從法定貨幣、管制財產直至全面禁止的各種法律認定。觀察比特幣如何被不同司法管轄區對待,可看出法律選擇如何決定一種代幣的角色、市場結構與投資人保護。以太坊及其他主流山寨幣則各有類似但細節不同的發展,因代幣特性及出現時機存在差異。

Bitcoin: From Legal Tender to Strategic Reserve

Bitcoin's designation as legal tender in El Salvador represented crypto's most aggressive push for mainstream acceptance. President Bukele's June 2021 announcement at Bitcoin Conference Miami shocked the industry. By September 7, 2021, the Bitcoin Law took effect, requiring all businesses to accept BTC for payments alongside the U.S. dollar. The government distributed $30 in Bitcoin to citizens via the Chivo wallet and offered permanent residency to anyone investing three or more BTC.

比特幣在薩爾瓦多被正式定為法定貨幣,堪稱加密貨幣邁向主流認可的最大膽舉措。Bukele 總統於 2021 年 6 月在邁阿密比特幣大會的宣布震撼了業界。2021 年 9 月 7 日,《比特幣法》正式生效,規定所有商家必須接受比特幣支付,與美元並列。政府透過 Chivo 錢包向公民發放價值 30 美元的比特幣,並向投資三枚比特幣(或以上)的人士提供永久居留權。

The experiment generated intense scrutiny but limited adoption. Only 20% of Salvadorans added funds to Chivo beyond the initial bonus, according to National Bureau

此實驗受到極大關注但採用情形有限。據國家統計局數據,只有20%的薩爾瓦多人在領取初始獎勵後額外為 Chivo 錢包儲值。of Economic Research surveys. Just 1.6% of remittances arrived via digital wallets. By 2024, a mere 8.1% of residents used Bitcoin for transactions. Technical problems plagued the Chivo app. Bitcoin's price volatility deterred merchants. The unbanked population targeted by the program largely continued using cash.

根據經濟研究調查,僅有1.6%的匯款是透過數位錢包到達。到了2024年,只有8.1%的居民使用比特幣進行交易。Chivo應用程式遭遇技術問題。比特幣的價格波動讓商家卻步。該計畫鎖定的無銀行帳戶人口大多仍然以現金為主。

International pressure mounted. The IMF warned repeatedly about risks to financial stability, consumer protection, and capital markets integrity. It conditioned a crucial $1.4 billion loan on El Salvador scaling back Bitcoin's role. Sovereign debt spreads widened dramatically as investors priced in elevated default risk. By January 2025, facing fiscal crisis, El Salvador's Legislative Assembly voted to end Bitcoin's legal tender status, though voluntary use and government accumulation continue.

國際壓力不斷升高。國際貨幣基金組織(IMF)一再警告此政策對金融穩定、消費者保護以及資本市場完整性帶來的風險,並將一項至關重要的14億美元貸款,設定為薩爾瓦多必須縮減比特幣角色的條件。由於投資人預期違約風險上升,國債利差急遽擴大。到了2025年1月,面對財政危機,薩爾瓦多立法議會投票終結比特幣的法定貨幣地位,但自願使用及政府繼續累積比特幣的行為並未停止。

This partial reversal offers lessons about legal tender's viability. The designation requires payment infrastructure, merchant adoption, price stability, and public trust - conditions absent even in small, dollarized economies like El Salvador. Legal tender status also triggers international financial institution opposition, as multilateral lenders view cryptocurrency as incompatible with macroeconomic stability programs. The few remaining countries considering similar moves must weigh potential remittance savings and innovation benefits against these formidable obstacles.

這一局部的政策逆轉為法定貨幣可行性帶來啟示。指定某資產為法定貨幣需要完善的支付基礎建設、商家普及程度、價格穩定及社會大眾信任,而這些條件即便在如薩爾瓦多等小型美元化經濟體中也未能實現。法定貨幣地位同時會引發國際金融機構反彈,多邊貸款者普遍認為加密貨幣與宏觀經濟穩定計劃不相容。僅存幾個考慮跟進的國家,必須在潛在的匯款成本節省與創新效益和這些重大障礙之間做取捨。

El Salvador's current position - maintaining Strategic Bitcoin Reserves while removing legal tender obligations - may represent a more sustainable model. The government continues accumulating BTC, now holding over 6,102 coins worth approximately $500 million. It hosted the PLANB Forum 2025, Central America's largest crypto conference. But merchants can refuse Bitcoin payments, taxes must be paid in dollars, and the Chivo wallet is being wound down. This approach seeks crypto benefits without legal tender's burdens.

薩爾瓦多目前的立場—保留戰略性比特幣儲備,同時取消法定貨幣義務—或許代表一種較可持續的模式。政府仍持續累積BTC,目前持有超過6,102枚,總價值約5億美元。薩國主辦了2025年PLANB論壇,為中美洲規模最大的加密貨幣會議。但商家得以拒絕比特幣付款、稅收須以美元繳交,Chivo錢包也正逐步關閉。此作法嘗試取得加密貨幣的好處,同時免於法定貨幣地位帶來的負擔。

Bitcoin Property Recognition: The United States and Beyond

比特幣的財產認定:美國與其他國家

The United States offers perhaps the clearest example of property classification without legal tender status. The Internal Revenue Service issued guidance in 2014 treating virtual currency as property for federal tax purposes. This means Bitcoin sales trigger capital gains taxes, mining income is taxable as earned, and transactions must be reported on tax returns. Property treatment also enables the IRS to pursue enforcement actions and audit cryptocurrency holdings.

美國或許是將比特幣歸類為財產、同時未賦予法定貨幣地位的最明確案例。國稅局(IRS)於2014年發布規範,將虛擬貨幣在聯邦稅務上視為財產。這代表比特幣買賣需申報資本利得稅,挖礦所得需納稅,相關交易要在報稅時揭露。此外,財產認定也使國稅局能對加密貨幣持有進行稽查與執法。

Beyond taxation, U.S. courts have consistently recognized Bitcoin as property in civil and criminal proceedings. Bankruptcy courts address cryptocurrency in debtor estates, applying traditional property principles to determine ownership and distribution. Civil forfeiture allows government seizure of Bitcoin used in illegal activities, treating it as proceeds of crime subject to asset confiscation. These judicial applications solidify Bitcoin's property status despite ongoing regulatory debates about securities classification.

除了稅務,美國法院在民事及刑事案件中,一貫將比特幣認定為財產。破產法庭會將加密貨幣納入債務人財產,由財產歸屬及分配的傳統原則予以裁定。民事沒收容許政府沒收用於非法活動的比特幣,視其為需查封的犯罪所得。這些司法實務進一步鞏固比特幣的財產地位,儘管關於證券歸類的監管辯論仍在進行。

The property framework provides certain investor protections. Theft of Bitcoin constitutes property crime under state law. Breach of fiduciary duty claims apply when custodians mishandle holdings. Fraud prosecution can address cryptocurrency scams using traditional property fraud statutes. Yet property status doesn't prevent securities regulation - the SEC pursues enforcement actions against offerings of Bitcoin-related products deemed securities, treating the same asset differently depending on context.

「財產」分類可為投資人帶來一定保障。例如,比特幣被竊構成各州法律下的財產犯罪;如保管機構管理失當,投資人可追訴違反信託義務;詐欺相關指控可適用傳統財產詐欺條款應對加密貨幣騙局。不過,財產地位並不阻礙證券監管——美國證券交易委員會(SEC)仍針對被視為證券的比特幣相關商品提起執法行動,根據情境不同,對同一資產有多重性質的規定。

Japan's recognition of cryptocurrency as property through the Payment Services Act creates more comprehensive protection. The law defines crypto-assets as proprietary value used for payment, explicitly excluding fiat currency and currency-denominated assets. Business operators handling crypto must register with the FSA, segregate customer assets, maintain capital reserves, and conduct regular audits. This framework treats Bitcoin as property while imposing prudential regulation on businesses dealing in that property.

日本則經由《資金結算法》將加密貨幣認定為財產價值,提供更完整的保障。該法將「加密資產」界定為用於付款的財產價值,明確排除法定貨幣及計價資產。加密業者須向金融廳(FSA)登記,分離客戶資產、維持資本準備、定期接受審計。這種模式不僅將比特幣視為財產,同時對相關業務施加審慎監管。

Japanese law extends protection beyond simple property recognition. Exchanges must compensate customers for lost or stolen crypto, internalizing security costs. Customer assets cannot be commingled with exchange funds or used for operational purposes. Insolvency proceedings prioritize return of customer crypto over general creditor claims. These provisions create stronger investor protection than pure property classification without business regulation.

日本法規的保護更超出單純的財產認定。交易所必須對客戶遺失或被竊的加密資產負責,將安全成本內部化。客戶資產不能與交易所自有資金混用,也不能用於營運。破產處理優先返還客戶加密貨幣於其他債權人之上。相較於只做財產分類卻無商業監管,這些規定為投資人創造更強的保障。

Ethereum: Property, Security, or Payment Instrument?

以太幣:財產、證券還是支付工具?

Ethereum's legal status presents additional complexity due to its smart contract functionality and transition from proof-of-work to proof-of-stake consensus. The SEC initially suggested Ethereum might be a security due to its 2014 pre-sale, though officials later indicated current ETH is likely not a security. This ambiguity creates regulatory uncertainty for ETH holders, developers, and platforms listing the token.

以太幣的法律地位更為複雜,因其具備智能合約功能,且已從工作量證明機制(PoW)轉型為權益證明(PoS)。美國證券交易委員會(SEC)早期認為以太坊由於2014年前售,有可能構成證券,但後來官員則暗示目前的ETH應不屬於證券。這種模糊性導致ETH持有人、開發者及交易平台在監管上承受不確定性。

The SEC's evolving position reflects Ethereum's technical development. The original ETH crowdsale involved selling future tokens to fund development, potentially creating an investment contract under securities law. But Ethereum's subsequent decentralization and move away from a single promoter may have transformed it into a decentralized commodity. The SEC's reluctance to provide definitive guidance leaves market participants in limbo.

SEC立場變動反映了以太坊的技術演進。最初的ETH群眾募資涉及未來代幣銷售資助開發,可能構成證券法下的投資合約。但隨著以太坊高度去中心化、脫離單一推動者,已逐漸演變為去中心化商品。SEC不願給予明確指引,使市場參與者陷於觀望與不安。

Japan classifies Ethereum as a crypto-asset under the Payment Services Act, requiring exchanges listing ETH to obtain FSA registration. This treats Ethereum functionally equivalent to Bitcoin for regulatory purposes, despite technological differences. The EU's MiCA regulation similarly addresses Ethereum as a crypto-asset subject to service provider licensing requirements. These frameworks avoid security classification by focusing on platform obligations rather than token characteristics.

日本將以太幣依據《資金結算法》列為「加密資產」,要求上架ETH的交易所須取得金融廳登記。此一架構在監管上將以太幣視同比特幣,雖然兩者技術原理大異。歐盟的MiCA法規也將以太幣作為加密資產,由服務業者取得執照管理。這些做法避開證券分類,而是強調平台之義務,而非單純考察代幣的屬性。

Ethereum's property status in common law jurisdictions follows patterns established for Bitcoin. Courts have addressed ETH in bankruptcy proceedings, treating it as intangible property. Tax authorities calculate capital gains on Ethereum sales. Criminal prosecutors use property law to address theft. But the underlying security question creates additional complexity absent with Bitcoin, which the SEC has indicated is not a security.

英美普通法體系對以太坊的財產地位,比照比特幣已建立的模式。法院在破產程序中將ETH視為無形財產,稅務機關則針對買賣以太幣徵收資本利得稅,刑事檢察也以財產罪偵辦竊盜。然而,以太坊沒有像比特幣那樣獲得SEC明確排除證券定位,潛在的證券爭議使性質更為複雜。

Ethereum's staking mechanism post-Merge presents new classification challenges. Stakers receive rewards for validating transactions, potentially creating income rather than capital appreciation. The SEC views some staking services as securities offerings, arguing they involve investment of money in a common enterprise with expectation of profits from others' efforts. This analysis could extend to staking itself, not just intermediated staking services, though no final determination has been made.

以太坊在Merge後的質押(staking)機制帶來新分類挑戰。質押者通過驗證交易獲得報酬,這可能屬於所得而非單純資本增值。SEC將某些質押服務視為證券型產品,指出這涉及將資金投入共同事業並期待他人努力帶來收益。這種說法或將延伸到直接質押,而不僅僅是中介質押服務,目前尚未有最終結論。

XRP: Securities Litigation and Property Recognition

XRP:證券訴訟與財產認定

XRP's legal status is uniquely complicated by ongoing litigation between Ripple Labs and the SEC. The 2020 lawsuit alleged that XRP sales constituted unregistered securities offerings, subjecting Ripple to potential penalties and forcing exchanges to delist the token. A 2023 partial summary judgment held that certain XRP sales to institutional investors were securities, while programmatic sales to retail buyers on exchanges were not.

XRP的法律地位極為複雜,主因是瑞波(Ripple Labs)與美國SEC間的訴訟。2020年,SEC指控XRP發行屬未登記證券,Ripple面臨潛在罰款,多家交易所被迫下架該幣。2023年部分判決指出,針對機構投資人的某些XRP銷售案屬證券,但透過交易所銷售給散戶則不成立證券行為。

This bifurcated outcome creates practical difficulties. The same token is simultaneously a security (for certain past sales) and not a security (for exchange trading). Exchanges face uncertainty about liability for listing XRP. Institutional buyers must determine whether their purchases qualify as securities transactions. Retail investors remain caught in limbo, unsure of their holdings' legal classification.

這種分歧判決造成實務困境,同一代幣在不同情境下同時是證券(針對特定銷售歷史),又不是證券(用於交易所買賣)。交易所不確定上架XRP是否有法律風險,機構投資人需自行判定購買行為是否受證券法約束,散戶持有人更是陷入法律地位模糊的窘境。

Against this backdrop, India's recognition of XRP as property takes on added significance. While U.S. courts wrestle with securities classification, Indian courts address property ownership. The Madras High Court ruling doesn't resolve the securities question - property and securities classifications are not mutually exclusive - but it provides alternative legal grounding for XRP recognition. This illustrates how jurisdictional fragmentation creates different legal statuses for the same token.

在這種背景下,印度認定XRP為財產格外有意義。美國法院聚焦其證券屬性時,印度法院考慮財產所有權。馬德拉斯高等法院的裁決雖未釐清證券問題——財產與證券分類並不互斥——但替XRP合法性提供另一種法律基礎。這也說明不同司法轄區產生相同代幣截然不同的法律地位。

Other countries have taken varying positions on XRP. Japanese exchanges list XRP as a registered crypto-asset following FSA approval. European platforms may continue offering XRP under MiCA's crypto-asset framework, subject to service provider licensing. But some exchanges have remained cautious given regulatory uncertainty, limiting XRP trading or requiring additional disclosures. This patchwork treatment reflects the token's contested legal status.

其他國家對XRP的立場也不一而足。日本交易所於金融廳核准後,將XRP掛牌為「加密資產」。歐洲平台則可能依MiCA規範持續上架XRP,前提是取得服務商執照。不過部分業者因監管不明或要求揭露更多資訊,選擇限制XRP交易。這種拼貼式的處理方式,正反映XRP法律地位所引發的爭議與分歧。

Comparative Framework: How Jurisdictions Classify Major Tokens

比較架構:各國如何分類主流加密貨幣

The differential treatment of major cryptocurrencies across jurisdictions reveals patterns in regulatory approach:

主流加密幣在各司法轄區的不同待遇,反映出監管應對的各種模式:

Bitcoin enjoys the broadest acceptance. Most countries recognizing crypto allow Bitcoin trading, with Japan, the U.S., Hong Kong, Singapore, and the EU all providing clear frameworks. Only jurisdictions with blanket crypto bans like China prohibit Bitcoin entirely. This consensus reflects Bitcoin's decentralization, lack of a single issuer, and established history. Regulators view it as the closest crypto equivalent to digital gold - a commodity rather than security.

比特幣享有最廣泛的認可,大多承認加密資產的國家(如日本、美國、香港、新加坡及歐盟)均允許比特幣交易並建立明確規範。僅極少數如中國,以全面禁令禁止比特幣。這種共識體現比特幣的去中心化、無單一發行人及歷史沉澱。監管機關普遍認為比特幣最接近「數位黃金」,屬於商品而非證券。

Ethereum faces similar treatment to Bitcoin in most jurisdictions, though with greater uncertainty about security classification. The SEC's ambiguous position contrasts with Japan's straightforward crypto-asset designation and the EU's inclusion under MiCA. Ethereum's transition to proof-of-stake has generated new questions, but most regulators continue treating it as property or crypto-asset rather than security.

以太坊在多數國家監管待遇類似比特幣,但在證券歸類的爭議度更高。SEC的立場曖昧,與日本「加密資產」明訂、歐盟MiCA納管形成對比。雖然轉向權益證明後產生新疑慮,但多數監管單位現階段仍將ETH視為財產或加密資產,而非證券。

XRP encounters the most difficulty due to securities litigation and centralized development. While Indian courts now recognize it as property, U.S. classification remains contested. Exchanges have delistedXRP 在那些將其認定為證券身份會帶來合規負擔的司法管轄區內。這說明了訴訟風險與監管不確定性如何影響代幣的流動性與市場准入,無論底層技術如何。

**Stablecoins(穩定幣)**獲得了專門的監管待遇,反映其與貨幣掛鉤的機制。歐盟的 MiCA 區分電子貨幣代幣與其他加密資產,並強制儲備及贖回要求。日本的《資金支付法》單獨設立了法定貨幣支持的穩定幣執照。香港最新的《穩定幣條例》建立了專門的監理制度。這些框架體認到穩定幣作為支付工具,需接受類似銀行的監管。

Utility tokens 與 governance tokens(實用型代幣與治理代幣),現有監管框架多半未有明確規範,造成監管空隙。許多代幣提供進入服務權益或協議內的投票權,卻不具投資屬性。但它們具有可交易性與投機價值,有時仍可能觸發證券法規定,即便創建時並非投資用途。MiCA 對「其他加密資產」設有兜底分類,試圖涵蓋這類代幣,但分類仍須個案判斷。

認定動因:政策考量

各國選擇將特定加密貨幣認定為法定貨幣、財產、受監管資產或禁品,反映其政策目標:

金融普惠是薩爾瓦多採用比特幣為法定貨幣的核心動機,目標是無銀行帳戶人口。此實驗證明,僅有法定貨幣地位不足以推動普及——仍需基礎建設、教育及價值穩定。當前推動金融普惠的國家已轉向中央銀行數位貨幣(CBDC),而非既有加密貨幣。

創新與競爭力驅動日本、新加坡、香港等地將其視為財產認定。這些國家定位自己為加密產業樞紐,以吸引資金、人才與企業。清晰的法律架構,將其與嚴格禁令或完全放任法制明確區隔,於全球金融科技競賽中取得競爭優勢。

投資人保護塑造如 MiCA 或日本《資金支付法》等完整監管框架。這些體系在承認加密資產的同時,強制服務業者履行託管責任、資訊揭露義務及資本標準。目標在於防範消費者受害,同時允許創新——在全面禁止與放任成長之間取得平衡。

貨幣主權解釋中國徹底禁令及其他國家對法定貨幣身份的猶豫。實施資本管制或貨幣不穩的國家,將加密貨幣視為威脅貨幣政策效果。資本外流與美元化風險推動禁令,即便認同創新可能帶來的好處。

稅收收益讓財產分類成為政府偏好的選項。將加密視為財產可課徵資本利得稅、提供評價機制並產生稅務稽核記錄。這項財政動機亦與投資人保護相一致——財產權須伴隨納稅義務——對政府與用戶有雙贏效果。

法律認定對市場與投資人的影響

法律認定從根本改變了加密貨幣作為可投資資產的運作模式。法院宣告代幣具財產性質時,交易所能更有法規信心地上市,政府也會明確稅收規則,市場結構隨之變革。這些影響證明,各地區法律地位的選擇,極大左右代幣經濟、投資人行為以及資本分配。

需求效果:認定如何推動資本流入

主要市場的財產認定會產生即時需求效應。當印度馬德拉斯高等法院將 XRP 分類為財產時,向國內投資人釋出持有權受法律保障的訊號。用戶在考慮購入加密貨幣時,明確知道法院會保障其財產權於交易所倒閉或失職時受到保護。這降低了投資風險,減少投資人因法律不確定性需冒的溢價報酬。

實證證據也支持這點。當薩爾瓦多宣布比特幣作為法定貨幣時,比特幣價格大漲——市場將此舉視為對加密貨幣貨幣潛力的認可。日本加密資產註冊制上路後,零售與機構投資人對受監管平台更有信心,推動國內交易量穩健成長。香港的 VASP 許可制度則吸引國際業者進軍合規的亞洲市場。

這項機制透過多種途徑發揮作用。法律認定令受信託義務約束的機構投資人能配置資本於加密市場。退休基金、捐助基金與資產管理人,即使潛在報酬誘人,在法律地位不明時也無法投資相關資產。財產分類打破了這道障礙,將潛在投資人基礎拓展至除一般散戶外的高端機構資本。

認定也會影響槓桿及衍生品市場。當法院會保障以加密貨幣作為擔保品的權益時,放貸人也更願意提供信貸。這提升槓桿供給,進一步放大需求。受監管的衍生性交易所也能以具認定地位的代幣推出期貨與選擇權,藉此吸引不同投資人。

各類調查數據顯示,投資人高度偏好法律明確性。在明確財產認定或有完善監管的地區,加密貨幣採用率較監管不明朗地區為高。這說明許多潛在投資人會等待法律確定後才入市。認定有助於擴大市場總體潛力,而非僅是需求轉移。

交易所上幣決策與流動性集中

法律地位直接影響各代幣能否及在哪些司法區上市。處於嚴格監管下的交易所——如日本FSA註冊、香港VASP許可、歐盟MiCA合規——面臨將證券或不合規代幣上市的重大責任風險。因此,這些平台傾向僅上架法律地位清楚的資產,導致流動性高度集中於獲認可的主流幣。

比特幣與以太幣之所以佔據最大交易量,部分原因是其財產/商品地位在各主要市場爭議最小。XRP由於證券訴訟風險,上市管道受限。規範不明的小型代幣則多難以達成有效交易流通。這種流動性集中帶來網路效應——被認可代幣吸納更多交易活動、吸引更多交易所、進而進一步提高流動性。

法律認定差異會造成地理上的市場分裂。同一代幣如在日本被歸類為財產,在美國卻被歸為證券,其主要交易將集中於亞洲平台。這加劇流動性分散,使買賣價差拉大、價格效率降低。雖然會有套利空間,但跨境交易仍受資本管制與監管規範所限。

不同監管體系造成的交易所合規成本差異也很明顯。在 MiCA 合規的歐洲上架某代幣,須公告白皮書、進行儲備驗證及定期申報。日本FSA註冊則要求安全稽核、資本儲備及治理標準。這些成本讓大型交易所更具競爭力,亦設下小型業者進入障礙。認定過程同時鞏固交易所市場力量。

重大不利法律發展的下架案例說明這一點。例如美國SEC起訴Ripple時,多家美國主流交易所為避免法律風險,火速下架XRP。交易量隨即轉移至海外較不在意SEC管轄的平台。由於流動性下滑與監管不確定性,XRP價格大跌。這表明法律地位變化對市場的即時影響,遠超訴訟本身。

託管標準與投資人保護

財產認定改變了交易所的託管責任。法院認定加密貨幣為信託財產時,交易所就有法律義務妥善保存這些資產。將客戶代幣與公司自有資金混合,屬於違反信託;挪用客戶資產做營運支出則構成侵占;資安不足即違反善良管理人責任。這些法律義務提升了資產託管標準。

日本《資金支付法》就是明確例證。法律要求交易所將95%的客戶加密資產存放於冷錢包、並與營運資產隔離。需定期接受獨立核查,以驗證資產隔離情形。顧客補償機制則確保即使交易所出現損失,客戶資產亦可全數追回。這些要求將託管風險內部化,刺激業者強化安全措施。

印度XRP案也展現出財產保護效果。Venkatesh大法官裁定,WazirX不得將未涉損失的用戶資產社會化集中承擔,須確認各自用戶代幣唯有其持有人擁有財產權。此一原則禁止交易所將顧客資產視為可用來彌補營運虧損或補貼其他用戶的共同資產池。財產權保障用戶個別請求權,優先於交易所其他債權人。

在破產/清算法院程序中,財產地位會讓加密資產的處理有別於傳統金融資產。一般破產下,全部資產形成一個債權人分配池;但具財產認定的加密資產,可能直接移交給各客戶,而非併入破產財產。此種優先保護在交易所倒閉時極為關鍵,決定用戶是取回全部持有,還是淪為無擔保債權人。

Proof-of-reserve 系統及鏈上透明度則是對託管疑慮的回應。property recognition. If exchanges hold customer assets in trust, transparency about reserve adequacy becomes essential. Some platforms now publish cryptographic proofs demonstrating one-to-one backing of customer deposits. This verifiable custody addresses the principal-agent problem inherent in centralized platforms holding customer property.

資產認定。如果交易所以信託方式持有用戶資產,則其儲備充足度的透明度就變得至關重要。部分平台現已發布密碼學證明,以證明客戶存款有一對一的資產支持。這種可驗證的託管方式針對中心化平台持有用戶資產時所固有的「委託代理人問題」。

Rights of Holders: Legal Recourse and Remedies

持有者權利:法律救濟與補救措施

Property recognition grants cryptocurrency holders specific legal remedies previously unavailable. Theft of crypto becomes property crime subject to criminal prosecution. This contrasts with earlier uncertainty about whether Bitcoin theft constituted larceny of "property" or merely unauthorized access to information. Clear property status enables traditional criminal law to protect digital holdings.

資產認定賦予加密貨幣持有人先前無法取得的法律補救途徑。加密貨幣遭竊將構成財產犯罪,得以追究刑事責任。這與過去比特幣遭竊是否屬於「財產」竊盜還是僅為未經授權存取資訊的爭議不同。明確的財產資格使傳統刑法可適用於保護數位資產。

Civil remedies similarly expand. Property owners can sue for conversion when others wrongfully exercise control over their assets. They can pursue replevin actions to recover specific tokens rather than monetary damages. They can assert adverse claims in interpleader proceedings when multiple parties claim the same holdings. These traditional property law tools become available once courts recognize cryptocurrency as property.

民事救濟同樣得到拓展。資產擁有者若遭他人不法控制其資產,可提起侵權歸還之訴;他們可訴請取回特定代幣而非僅追索金錢賠償;當多方同時主張同一資產時,也可在第三人介入訴訟中提出對立主張。一旦法院認定加密貨幣為財產,這些傳統財產法工具即變得可用。

Breach of fiduciary duty claims gain traction when exchanges hold customer crypto as trustees or fiduciaries. If platforms owe heightened duties of loyalty and care, they face liability for risky trading, inadequate security, or self-dealing. The India WazirX case illustrates this principle: the exchange couldn't use customer property to solve its own problems without breaching fiduciary obligation. This creates accountability beyond contract terms.

當交易所以信託人或受託人身份持有用戶加密貨幣時,違反忠實義務的主張更具說服力。若平台需負高度忠誠及注意義務,則冒險交易,安全措施不足或自身交易都可能產生法律責任。印度 WazirX 案即顯示此一原則:交易所不得為解決自身困難而動用用戶財產,否則即屬違反信託義務。這延伸了責任範圍,不僅止於契約條款。

Inheritance and estate planning become clearer with property recognition. If crypto constitutes property, it passes through intestacy statutes to heirs or can be disposed of through wills. Executors gain authority to access and distribute cryptocurrency holdings. Without property status, legal mechanisms for transferring digital assets at death remain uncertain, potentially leaving holdings stranded in inaccessible wallets.

資產認定亦讓繼承和遺產規劃更具明確性。若加密貨幣屬於財產,則可依照無遺囑繼承相關規定遺留給繼承人,或透過遺囑處分。遺囑執行人也可依法取得存取與分配加密貨幣的權限。否則,若缺乏財產地位,死亡後的數位資產移轉機制不明,可能導致資產永久困於無法存取的錢包中。

Tax treatment gains clarity and potentially becomes more favorable. Property classification typically subjects crypto gains to capital gains rates rather than ordinary income rates. Long-term holdings may qualify for preferential treatment. Investors can use capital losses to offset gains. This tax certainty allows investors to plan transactions with known consequences rather than facing ambiguous or adverse treatment.

稅務處理也更為明確,甚至可能更有利。資產分類下,加密貨幣收益通常適用資本利得稅率,而非一般所得稅率。長期持有可能擁有優惠條件。投資人亦可用資本損失抵銷利得。這種稅務確定性讓投資人能據以規劃交易,毋須面對不明確或不利的待遇。

Risk Factors: Regulatory Reversal and Enforcement Gaps

風險因素:監管逆轉與執法落差

Despite benefits, property recognition carries risks for investors. Legal status can be reversed through legislation, regulation, or judicial decisions. El Salvador's reversal of Bitcoin legal tender illustrates this instability. If jurisdictions treat crypto favorably initially but reverse course after market downturns or stability crises, investors face asset devaluation and liquidity loss.

儘管有諸多好處,資產認定對投資人也帶來風險。法律地位可能隨立法、監管或司法判決而逆轉,例如薩爾瓦多撤回比特幣法定貨幣地位即是一例。若某司法轄區最初對加密貨幣持友善態度,但於市場波動或穩定危機後改變政策,投資人將面臨資產貶值與流動性損失。

Enforcement gaps undermine legal protections even with formal recognition. Cryptocurrency's cross-border nature and pseudonymous transactions create practical challenges for property law enforcement. Stolen tokens can be transferred through mixing services or decentralized exchanges, making recovery difficult even with court judgments. Legal rights matter only as much as enforcement mechanisms exist.

即使形式上獲得認定,執行落差仍削弱法律保護。加密貨幣具跨境性與匿名特質,對財產法執行帶來實質困難。被竊代幣可透過混幣服務或去中心化交易所流轉,即便法院判決也難以實際追回。法律權利的保障依賴於實際的執法機制。

Regulatory arbitrage creates additional risk. If property recognition in one jurisdiction but prohibition in another, investors may structure transactions to obtain favorable treatment. But this arbitrage exposes them to enforcement in restrictive jurisdictions. Capital controls, anti-money laundering laws, and extraterritorial regulation can reach through legal structures designed to exploit jurisdictional differences.

監管套利帶來額外風險。如果一地承認資產地位而另一地禁止,投資人可能調整交易架構以爭取有利待遇。但這也使他們暴露於較嚴格地區的執法風險。資本控管、反洗錢法及域外監管可能針對利用司法差異進行的交易採取行動。

Custody technology limits legal protection effectiveness. If users lose private keys, court orders cannot recover tokens regardless of property status. Unlike traditional property where courts can order turnover, cryptocurrency's cryptographic security means irreversible loss occurs despite recognized ownership. This technological limitation undermines the practical value of legal rights.

託管技術限制法律保障的有效性。如果用戶遺失私鑰,即便法庭判決支持,也無法取回代幣,無論其資產地位如何。與傳統財產可由法院下令強制交付不同,加密貨幣的密碼學設計意味著只要私鑰遺失,無法逆轉損失。此一技術性限制削弱了法律權利的實際效力。

Classification disputes continue even after initial recognition. A court may recognize cryptocurrency as property generally while finding specific tokens to be securities, creating ongoing litigation risk. Regulators may view property status as incomplete, adding securities or commodity regulation atop property law. Investors thus face continuing legal uncertainty about the full scope of rights and obligations even in recognition jurisdictions.

即便初步獲得認定,分類爭議仍可能持續。法院或許普遍認定加密貨幣為財產,卻就特定代幣認定其屬證券,引發持續的訴訟風險。監管機關亦可能認為資產地位不足以涵蓋全部,仍有可能要求適用證券或商品法。即在認可司法轄區內,投資人對權利與義務的完整範圍,仍面臨持續法律不確定性。

Data Evidence: Adoption Metrics and Price Impacts

數據證據:採用指標與價格影響

Empirical research on legal recognition's market impact remains limited but growing. Studies of Bitcoin price reactions to regulatory announcements find significant effects. Positive regulatory news - SEC approval of futures ETFs, Japanese FSA registration, EU MiCA passage - generated price increases. Negative developments - China's mining ban, SEC lawsuit announcements, exchange closures - caused declines. This suggests markets price legal status changes significantly.

關於法律認定對市場影響的實證研究有限但持續增長。對於監管消息,比特幣價格反應的研究顯示效果顯著。正面的監管消息(如美國SEC批准期貨ETF,日本金融廳註冊,歐盟MiCA通過)會推動價格上升;而負面事件(中國禁礦,SEC發布訴訟,交易所關閉)則導致下跌。這證明法律地位的變化被市場顯著反映。

Cryptocurrency adoption metrics show correlation with regulatory clarity. Countries with explicit legal frameworks see higher per capita ownership and transaction volume than those with ambiguous or prohibitive regimes. India's crypto adoption rate increased following the Income Tax Act's recognition of virtual digital assets, suggesting even tax classification provides beneficial certainty.

加密貨幣的採用指標與監管明確性呈現正相關。具明確法律架構的國家,其人均持有量及交易量均明顯高於法規不明或偏嚴的地區。印度自所得稅法承認虛擬資產後,採用率即提高,顯示即使僅有稅務分類,也對市場帶來正向的確定性。

Exchange data reveals liquidity concentration in recognized assets. Bitcoin and Ethereum account for the majority of regulated exchange volume, reflecting their broad legal acceptance. Tokens facing securities classification disputes trade primarily on offshore or decentralized platforms. This liquidity segregation suggests legal status drives venue selection and market structure.

交易所數據顯示,流動性集中於被認定資產。比特幣與以太幣佔據受監管交易所的大部分交易量,反映其廣泛的法律認可。有證券分類爭議的代幣多於離岸或去中心化平台交易。顯示法律地位直接決定交易場域選擇與市場結構。

Institutional investment flows respond to legal clarification. The launch of regulated Bitcoin futures and spot ETFs in the United States and Hong Kong attracted institutional capital previously restricted by fiduciary rules. Publicly disclosed institutional holdings increased following these regulatory approvals. This indicates that legal certainty removes meaningful barriers to professional investor participation.

機構資金流動也因法律明確而顯著改變。美國與香港推動合規比特幣期貨及現貨ETF後,吸引到原受信託規則限制的機構資金。公開揭露的機構持倉亦隨監管通過顯著增加。此顯示法律確定性能消除專業投資人進場的關鍵障礙。

Survey research indicates legal status affects investor composition. Retail investors may accept higher legal ambiguity, trading on unregulated platforms for speculative gains. But institutional investors, family offices, and corporate treasuries require clear legal frameworks before allocating significant capital. Recognition thus shifts investor base toward more stable, long-term holders.

調查研究指出,法律地位影響投資人結構。散戶較可容忍法律不確定性,在未監管平台進行投機;但機構、家族辦公室及企業財庫,則僅在法律明確下才投入大量資金。法律認定因此促使投資者結構朝長期、穩定方向轉變。

Implications for Token Utility and Network Effects

對代幣實用性及網絡效應的影響

Beyond investment demand, legal status affects token utility in commerce and smart contracts. Legal tender designation requires merchant acceptance, creating network effects as payment adoption spreads. Property recognition enables use as collateral in lending protocols, expanding DeFi applications. Security classification restricts distribution and use cases, potentially limiting utility.

除了投資需求外,法律地位也影響代幣在商業和智能合約領域的用途。若被指定為法定貨幣,商家必須接受,可因支付應用擴散產生網路效應。資產認定使其可作為借貸協議之抵押品,推動 DeFi 應用拓展。若被歸類為證券,發行和使用受到限制,實用性可能受到壓縮。

Ethereum's legal ambiguity particularly affects smart contract deployment. If ETH or related tokens face securities classification, developers may limit platform functionality to avoid offering unregistered securities. This regulatory risk constrains innovation compared to jurisdictions with clear property frameworks. Legal certainty thus impacts not just investment returns but technological development.

以太坊的法律地位不明,特別影響智能合約的落地。若 ETH 或相關代幣被歸為證券,開發者恐為避免觸及未註冊證券責任,而限制平台功能。這種監管風險使創新受限,遠不及有明文財產認定的司法轄區。法律確定性不僅影響投資報酬,也攸關技術發展。

Stablecoin regulation illustrates utility-recognition linkages. Comprehensive frameworks like Hong Kong's Stablecoin Ordinance and MiCA's e-money token provisions provide clear rules for fiat-pegged coins. This legal certainty enables payment applications, merchant adoption, and integration with traditional finance. Unregulated stablecoins face uncertain legal status limiting their utility despite technical capabilities.

穩定幣監管即突顯了使用性與法律認定的連動關係。香港穩定幣條例、歐盟MiCA電子貨幣規範等完整法規,為法幣掛鉤穩定幣提供明確規則。此種法律明確性讓其得以發展支付、商戶接受、與傳統金融整合。未受監管的穩定幣,即使技術上可行,因法律定位不明而用途受限。

Non-fungible token (NFT) recognition remains nascent, creating utility uncertainty. Are NFTs property, securities, collectibles, or sui generis? This classification affects intellectual property rights, resale royalties, securities regulation, and tax treatment. Legal clarity about NFT status would unlock utilities from digital art markets to tokenized real estate, but ambiguity currently constrains these applications.

NFT(非同質化代幣)認定尚屬萌芽,導致實用性充滿不確定。NFT究竟是財產、證券、收藏品或特殊型態?此一分類將影響智慧財產權、轉售版稅、證券監管及稅務處理。NFT地位若獲法律明確,將釋放其在數位藝術、代幣化不動產等領域的實用性,目前卻受限於分類模糊。

Governance token utility faces similar recognition gaps. Tokens providing protocol voting rights may constitute securities if structured as investment contracts. But they may also be property enabling decentralized governance. This dual potential creates legal risk for protocols distributing governance tokens, as classification determines whether securities registration is required. Recognition as property without securities characterization would enable broader governance adoption.

治理代幣的用途同樣面臨認定落差。賦予協議投票權的代幣,如依投資契約架構則可能屬於證券,但也可能僅是具分散式治理功能的財產。這種雙重潛力讓協議在發行治理代幣時承擔法律風險,因其分類將決定是否須證券登記。若能純以財產認定而不附加證券屬性,治理應用得以大幅擴展。

Broader Implications for the Crypto Ecosystem

加密生態系統的廣泛影響

Legal recognition of specific cryptocurrencies in certain jurisdictions creates ripple effects extending far beyond individual tokens or countries. These decisions influence global market structure, shape token development, affect regulatory competition, and may fundamentally alter cryptocurrency's role in the financial system. Examining these systemic implications reveals the stakes of recognition debates.

特定加密貨幣於某些司法轄區獲法律認定,其影響不僅止於個別代幣或國家,亦將產生廣泛漣漪效應。這些決策會影響全球市場結構、左右代幣發展、影響監管競爭,甚至可能從根本改變加密貨幣於金融體系內的角色。詳析這些系統性影響,有助於理解認定爭議的利害關係。

Token Rankings and Market Structure

代幣分級與市場結構

When major jurisdictions recognize certain cryptocurrencies as property or regulated assets while treating others as securities or prohibited items, it creates a tiered market structure. Tier-one tokens with clear property status across multiple large economies - Bitcoin, Ethereum - enjoy advantages in exchange listings, institutional investment, and regulatory certainty. These network effects compound, reinforcing their dominance.

當主要司法區承認某些加密代幣為財產或受監管資產,卻將其他視為證券或禁令標的時,市場便呈現階層式結構。第一級代幣-如比特幣、以太坊-因在多個大型經濟體擁有明確財產地位,享有上架、機構入場和監管明確性的優勢。這些網路效應不斷疊加,進一步鞏固其市場主導地位。

This tiering affects token valuations beyond fundamental

*(後文未提供,已依格式完整翻譯至提供內容結尾)*factors. 法律認可成為一種競爭護城河,即使新代幣擁有更優越的技術,也難以挑戰既有的主流幣種。投資者因為法律認可帶來的低監管風險,願意為這些代幣支付溢價估值。這可能導致資本配置效率變差,讓法律地位的重要性壓過實際效用。

最終可能導致加密貨幣市場愈趨集中。比特幣與以太幣已主導市值,法律認可進一步鞏固其地位。新代幣要達到同等地位面臨更高門檻,因為監管機構將資源優先放在主流資產上。這種現象與傳統金融類似,藍籌股獲得比微型股更多監管明確度。

穩定幣市場是這種分級現象的最佳範例。USDT與USDC因廣泛的交易所掛牌與監管參與而主導交易量。新型穩定幣即使有相似技術能力,仍難以獲得關注,因為交易所對監管地位不明的代幣掛牌態度猶豫。因此,法律認可在穩定幣領域造成贏者通吃現象。

DeFi 與未受監管的代幣

去中心化金融(DeFi)協定大多在未正式法律認可的情況下運作,這創造了監管缺口以及創新機會。許多 DeFi 代幣治理包含資產託管、交易撮合或借貸等業務——若由傳統企業操作,這些活動將觸發證券監管。但 DeFi 的去中心化特性讓監管套用變得更複雜。

各法域對 DeFi 治理代幣及協議代幣的處理方式,將影響該領域的發展。如果法院將這些代幣認定為財產而非證券,DeFi 能在現有法律框架內成長。但如果監管機構認為 DeFi 代幣屬於需註冊發行人的證券,許多協議現有形態將缺乏法律基礎。

歐盟 MiCA 規範嘗試透過全面涵蓋加密資產來回應這問題,但對於那些缺乏可識別發行人或服務提供者的純去中心化協議,仍存疑問。日本監管態度同樣涵蓋交易所服務但對點對點 DeFi 協議問題留白。這種監管缺口給 DeFi 帶來發展上的不確定性。

某些法域未來可能制定特定的 DeFi 框架,認可這類代幣的獨特性質。另一些地方則有可能強行以現有證券或銀行監管,套用於 DeFi,即使並不合適。選擇的道路,將決定 DeFi 能否納入法律體系或持續存在於監管灰色地帶,並影響機構採用及與傳統金融的整合。

對代幣發行與設計的影響

法律認可模式會影響新代幣的架構、發放及行銷方式。開發團隊現在在設計代幣時,需預期監管審查,避開可能觸發證券認定的特徵。這包括限制預售、強調實用性勝於投資回報、以及快速實現去中心化以避免被界定為「共同事業」。

美國的 Howey 測試與世界其他類似法規,讓代幣經濟模型不僅是經濟決策,更是法律選擇。如果代幣銷售符合投資契約要件,項目將面臨證券註冊成本及限制。這促使代幣設計更偏重即時效用、去中心化治理、以及避免被看作證券發行的分發機制。

現在有些項目乾脆完全避開美國及其他限制性市場,這些地區既不參與代幣銷售也限制平台訪問。這種地理分割雖然降低市場效率,但對抗監管風險是理性行為。在關鍵市場取得財產認定而又未被視為證券的代幣,具有競爭優勢。

空投與流動性挖礦部分就是為了避開證券認定而出現的分發方式。這些方法根據協議參與度把代幣發給用戶,而非基於資本投資,可避免被認為屬於投資契約。因此,法律考量直接形塑代幣根本的分發經濟模型。

監管競爭及套利

各國對加密貨幣認定不同,造成監管競爭。有意成為加密友善區域的國家,會透過明確法律框架吸引交易所、開發者與資本。新加坡、香港、瑞士及美國某些州,皆以財產認可加上友善監管爭搶加密企業設立。

這種競爭可帶動向上提升(race-to-the-top),各法域發展兼顧創新與投資人保護的先進框架。但也可能導致向下沉淪(race-to-the-bottom),各國為吸引企業擴大鬆綁尺度。最理想狀態需要協調,既防止監管套利,又允許合理的政策試驗。

歐盟 MiCA 是要減少區內監管競爭並推動調和。單一法規覆蓋27個會員國,可防止歐洲內部的「法域選購」,同時維持歐洲和其他地區競爭力。這種模式有可能成為其他區域集團的參考。

監管套利對執法造成實質困難。離岸交易所以 VPN 及加密友善支付管道服務於受限法域用戶。去中心化協議沒有明確的轄區連結。非美國主體發行的穩定幣仍能在美國市場流通。這些執行漏洞,削弱單一國家監管政策的有效性。

與傳統金融整合

財產認可與全面性監管體系,令加密貨幣能納入傳統金融服務。在監管地區,銀行已開始提供加密託管服務,交易所推出衍生性商品,支付業者整合加密支付選項。這種整合提升正當性,但也將加密貨幣受到傳統金融的種種限制。

取得認可資格的地區,機構採用速度加快。資產管理公司推出加密基金,企業財庫將比特幣納入資產表,退休基金配置加密資產。這些機構流量遠超零售投資,有機會穩定價格,但也增加持幣集中度。機構主導可能會改變加密貨幣原本的點對點願景。

央行數位貨幣(CBDC)發展亦受加密貨幣法律認可影響。各國目睹加密貨幣普及,會加快 CBDC 推動以維持貨幣主權。但 CBDC 設計本身可能吸收加密運作經驗。為加密資產設計的法律框架或可套用於 CBDC,產生監管共生。

支付系統整合依賴法律明確度。穩定幣監管使合法的法幣掛鉤代幣能徹底革新跨境支付,降低摩擦與成本。但若法律地位模糊,難以直接串接現有支付管道並納入監管。認可與否,直接決定加密貨幣是顛覆還是協作傳統支付產業。

隱私、監控與金融自由

財產認可的影響擴及隱私與金融自由的辯論。當加密貨幣被定義為須完整申報及納稅的財產時,雖然獲得合法性,卻失去了部分隱私特性。歐盟 MiCA 納入大量數據共享要求;日本支付服務法要求用戶實名認證。這類監控有時與加密貨幣原始的隱私精神牴觸。

財產認定有助於加強稅收執法。政府可要求交易所申報客戶交易明細,執行資本利得稅。這為投資人建立有利的法律確定性,但也抑制以加密貨幣從事逃漏稅或資本外逃的可能性。因此,認可是種「用法律保障換取合規義務」的交易。

注重隱私的加密貨幣如 Monero 與 Zcash 面臨特殊挑戰。它們設計用來隱藏交易細節,卻可能違反認可法域的反洗錢規定。即使這些代幣有財產屬性,部分合規壓力極大的監管交易所仍拒絕上架,因為符合法規成本過高。

中國全面禁令部分反映了資本外逃及國家監控減弱的顧慮。加密貨幣支持跨境資金流,無需央行審批,威脅資本管制。多數國家雖給予認可,但附帶密集追蹤規定以降低上述威脅,但隱私與合規的根本張力依然存在。

邁向資產類別的正規地位

各大法域法律認可的總體效應,是加密貨幣正逐步被納入正規資產範疇。這原本是點對點支付的邊緣實驗,如今越來越像獲得法律保障、監管 oversight,及機構參與的主流投資品項。

這種正規化帶來正反兩面。好處包括投資人保護、市場效率提升、詐騙減少、以及與傳統金融的整合。代價則是監控、合規負擔、隱私縮減,以及隨著法規傾向大型合規業者而小型創新的可能消減。

這種取捨是推動還是削弱加密貨幣原始精神,端看觀點。極端自由主義者視認可是國家挾制,把加密的變革潛力換得主流接受。務實派則認為這是走向大眾採用不可或缺的演化過程。and real-world utility. The debate parallels internet commercialization in the 1990s - inevitable but changing the technology's character.

以及現實世界的實用性。這場辯論類似於 1990 年代網際網路商業化的過程——無可避免,但也改變了技術本身的性質。

Generational change may shape this transition. Early crypto adopters valued privacy, decentralization, and freedom from traditional finance. Newer entrants seek regulatory certainty, institutional custody, and legal protection. As later cohorts dominate, pressure for recognition and integration may override early ethos. Market dynamics thus drive legal recognition regardless of founding principles.

世代更迭也可能影響這一轉變。早期加密貨幣使用者重視隱私、去中心化,以及擺脫傳統金融的自由。新一代參與者則更重視法規明確性、機構託管和法律保障。隨著後進群體成主流,對認可與整合的壓力可能凌駕於早期精神之上。因此,市場動態推動法律承認,不論最初的創立理念為何。

Challenges, Grey Zones and Regulatory Uncertainty

挑戰、灰色地帶與法規不確定性

Despite progress toward legal recognition in many jurisdictions, significant challenges and uncertainties remain. Some countries maintain ambiguous positions. Others are reversing course. Cross-border complications create enforcement gaps. And fundamental questions about cryptocurrency's nature resist easy classification.

儘管許多司法管轄區在法律承認方面已有進展,但仍存在重大挑戰與不確定性。有些國家維持曖昧態度,另有一些國家則政策反覆。跨境問題造成執法黑洞,而加密貨幣本質上的根本問題,也很難被清楚定義或分類。

Jurisdictions With Ambiguous or Negative Stances

立場曖昧或否定的法域

Nigeria exemplifies regulatory ambiguity's challenges. The Central Bank of Nigeria banned financial institutions from facilitating cryptocurrency transactions in 2021, citing concerns about money laundering, terrorism financing, and capital flight. Yet Nigerian courts have not declared crypto illegal for individuals to hold. The Securities and Exchange Commission claims jurisdiction over certain tokens as securities. This creates a grey zone where trading occurs but without legal protection or regulatory clarity.

奈及利亞是監理曖昧所帶來挑戰的代表例子。2021 年,奈及利亞中央銀行以反洗錢、反恐融資及資本外逃為由,禁止金融機構協助加密貨幣交易。然而,奈及利亞法院並未裁定個人持有加密貨幣違法。證券交易委員會則主張部分代幣屬於證券監管範疇。這導致一個灰色地帶:交易雖然存在,但缺乏法律保障與清晰的監理界線。

Nigerian crypto adoption remains high despite the central bank ban. Peer-to-peer trading flourishes as users find workarounds to transfer naira into crypto. But this underground market operates without investor protection, custody standards, or legal recourse. Users face risks of fraud, theft, and platform failure without regulatory safety nets. Ambiguity thus creates worst-case scenarios: limited legal protection without effectively preventing usage.

儘管遭中央銀行禁止,奈及利亞加密貨幣使用仍十分盛行。民眾透過點對點交易,尋找繞道方案將奈拉兌換為加密貨幣。但這類地下市場缺乏投資人保障、託管標準及法律求償。沒有監理安全網,使用者得面對詐騙、失竊、平台倒閉等高風險。這種曖昧狀態導致最壞情形:既無有效阻止使用,又缺乏充分法律保障。

Russia's position has evolved repeatedly. Initial hostility toward cryptocurrency has given way to gradual acceptance of crypto mining and limited trading. The government views digital financial assets as potentially useful for sanctions evasion and reducing dollar dependence but fears domestic financial instability and capital flight. This ambivalence creates stop-start regulation where rules change frequently, making long-term planning difficult.

俄羅斯的立場一再變化。最初對加密貨幣態度敵對,後來逐步接受挖礦與有限度交易。政府認為數位金融資產有助於規避制裁、減少對美元依賴,但又擔憂國內金融不穩及資本外流。這種猶豫和反覆讓法規時有時無、規則常常變動,難以做長期規劃。

Brazil oscillates between crypto-friendly policies and protective regulation. The country boasts high cryptocurrency adoption but lacks comprehensive federal legislation. Various agencies claim overlapping jurisdiction - the Central Bank for payments, securities regulator for investment products, tax authority for reporting. This fragmented approach creates compliance complexity without providing legal certainty about property rights or investor protection.

巴西則在加密友善政策與保護性監管之間搖擺。該國雖有高比率的加密貨幣採用,卻缺乏完善的聯邦層級立法。多個機關各自主張管轄權——中央銀行掌管支付、證券監管機關處理投資產品、稅務機構要求申報。這種碎片化監管造成合規困難,卻無法給予充分的財產權與投資人保障。

Token-Specific Classification Problems

各類代幣認定問題

Even in recognition jurisdictions, classification varies by token characteristics. Bitcoin's commodity-like nature makes property recognition straightforward. But tokens with governance rights, revenue sharing, or other securities-like features face uncertain status. This token-by-token analysis creates massive uncertainty for the thousands of cryptocurrencies in existence.

就算在承認加密貨幣的地區,依代幣特性不同,分類方式各異。比特幣因具備商品屬性,財產認定較為簡單。但若是具有治理權、收益分配或類似證券特徵的代幣,其定位就顯得模糊。這種逐一審視的方式,為市面上數以千計的加密貨幣帶來極大不確定性。

The Howey test asks whether an instrument involves investment of money in a common enterprise with expectation of profits from others' efforts. Applying this depression-era framework to blockchain tokens involves subjective judgment calls. Courts have reached different conclusions about similar tokens. This unpredictability makes it difficult for projects to design compliant token economics.

Howey 測試用來判斷金融商品是否屬於證券,即看該項工具是否涉及向共同事業投資,並期待他人努力帶來收益。將這種大蕭條時期的判準套用到區塊鏈代幣,會有很大的主觀判斷空間。法院對類似代幣的裁決各異,這種不可預測性使團隊難以設計完全合規的代幣經濟模型。

Utility tokens claiming to provide access to services rather than investment returns illustrate classification difficulties. If tokens are merely vouchers for future services, they may escape securities classification. But if tokens trade on secondary markets at fluctuating prices, investors may purchase primarily for speculative gain rather than utility, suggesting securities treatment. Whether classification depends on token design or purchaser intent remains unclear.

所謂「效用型代幣」聲稱僅作為服務兌換憑證,而非投資工具,正好展現分類之困難。若代幣僅為將來服務的兌換券,也許能不被視為證券。但若能在二級市場交易,且價格波動,投資人可能主要目的是賺取價差,而非使用服務,則又有證券的性質。分類判斷究竟依代幣設計還是購買目的,目前仍不明確。

NFTs create additional taxonomical challenges. Are they digital art collectibles, property titles, securities if fractionalized, gaming assets, or something entirely new? Their heterogeneity defies single classification. A cartoon ape NFT differs fundamentally from a tokenized real estate deed, yet both are "NFTs." Regulatory frameworks struggle to address this diversity, leaving NFT legal status largely undefined.

NFT 更加深分類難題。NFT 到底是數位藝術收藏品、財產權利證明、若分割持有時算證券,還是遊戲資產,抑或屬於全新類別?NFT 多樣性難以用單一標準來歸類。一隻卡通猿猴 NFT 和一份不動產權狀代幣,差異極大,卻同歸「NFT」。法規體系難以面對這種差異,致使 NFT 法律地位多半未明。

Cross-Border Enforcement and Custody Risks

跨境執法與託管風險

Cryptocurrency's borderless nature creates enforcement gaps even where legal recognition exists. When tokens are stolen and transferred through decentralized exchanges in non-cooperative jurisdictions, recovery becomes nearly impossible. Court judgments recognizing property rights mean little if assets can be transferred beyond reach.

加密貨幣無國界的特性,即使法律承認,執行力仍有極大漏洞。當代幣被竊並轉移到不配合司法管轄的去中心化交易所,基本無法追討。即使法院裁定擁有財產權,資產若能輕易移出該國界限,判決形同虛設。

The India WazirX case illustrates these limitations. While Justice Venkatesh's ruling protected Rhutikumari's holdings, WazirX's parent company operates from Singapore, hosts wallets across multiple jurisdictions, and could potentially move assets beyond Indian court jurisdiction. Without international cooperation and technical mechanisms to freeze tokens, legal recognition provides incomplete protection.

印度 WazirX 案正好說明這一點。雖然韋剛德法官裁定保障 Rhutikumari 的持有權,WazirX 的母公司卻設於新加坡,錢包分布多國,隨時可將資產移出印度法院的掌握。缺乏國際合作和技術性凍結機制,只靠法律認定很難提供完全保護。

Decentralized protocols particularly challenge enforcement. Traditional legal systems assume identifiable defendants - individuals or entities subject to court jurisdiction. But truly decentralized protocols lack central operators to sue or regulate. Smart contracts execute automatically without intermediaries who could comply with legal orders. This paradigm shift requires new legal approaches beyond traditional property or securities frameworks.

去中心化協議更挑戰監管可能。傳統司法假設有具體被告——即在法院管轄下的個人或法人。但真正的去中心化協議無中央實體可被提告或監管。智能合約自動履行程式碼,無人有能力配合法律命令。這種模式轉變,需要全新法律架構,僅靠傳統財產或證券法理難以應對。

Multi-signature custody and DAO governance structures complicate property concepts further. Who "owns" tokens held in multi-sig wallets requiring multiple parties' approval for transfers? How do property rights work when token holders collectively vote on protocol changes? These structures don't fit neatly into individual property ownership models, requiring legal innovation.

多重簽章託管與 DAO 治理架構更讓財產權概念複雜化。多簽錢包需要多人同意才能轉帳,究竟算誰「擁有」?若代幣由持有人集體表決治理協議,財產權又如何運作?這些結構已無法以個別所有權模式來處理,需要法律創新。

Recognition Without Investor Protection

僅有承認,無投資保護

Declaring cryptocurrency to be property doesn't automatically create meaningful investor protection. Without business regulation requiring exchanges to segregate assets, maintain reserves, and implement security standards, property rights provide limited practical benefit. Users may win court judgments against insolvent exchanges but be unable to collect if assets have been lost, stolen, or misappropriated.

將加密貨幣定義為財產,並不代表實際投資人保護。若未對交易所訂定分帳、備足準備金和資訊安全的營運規範,所謂財產權的效益有限。用戶即使在交易所破產時勝訴,若資產已被盜、挪用或遺失,仍難追回。

The Mt. Gox bankruptcy demonstrated this limitation. Creditors eventually established property claims to their Bitcoin, but recovering assets took over a decade due to the exchange's insolvency and commingled funds. Legal rights mattered little when the property couldn't be located or had been stolen. This illustrates why comprehensive regulatory frameworks combining property recognition with prudential oversight provide better protection than property status alone.

Mt. Gox 破產案即為明顯例證。債權人雖最終確認了對比特幣的財產權,但由於交易所破產和資金混用,實際追討資產耗時十年以上。當資產无法追蹤或已失竊,法律權益形同虛設。這反映出完備監管(結合財產權認定與審慎監管),遠比僅靠財產認定有用。

Proof of private key ownership creates additional complications. If cryptocurrency holdings are defined by possessing private keys, what happens when keys are lost, stolen, or held by deceased persons? Traditional property law has evolved mechanisms for transferring title without physical possession - court orders, documentation, successor interests. But cryptographic security makes these mechanisms inoperative for blockchain assets.

使用私鑰擁有權作為財產認定又產生新問題。如果加密貨幣的歸屬以私鑰持有人為準,那麼私鑰遺失、被盜,或所有人過世時怎麼處理?傳統財產法有法拍、公證、繼承等不需實體佔有的移轉機制,但密碼學安全設定讓這些傳統機制在區塊鏈資產難以適用。

Smart contract vulnerabilities present novel property questions. If a hacker exploits code vulnerabilities to transfer tokens, do they "own" the resulting holdings? The "code is law" philosophy suggests exploits merely execute smart contract terms as written. But property law generally doesn't recognize theft as conferring ownership. How courts resolve this tension remains uncertain, with different jurisdictions potentially reaching opposite conclusions.

智能合約漏洞又帶來嶄新的財產問題。如果駭客利用漏洞轉移代幣,這些資產算不算他的?「程式即法律」認為,漏洞僅是照程式條文執行。但傳統財產法一向否定竊盜取得合法所有權。法院最後如何裁決,至今未有定論,不同司法區的見解也可能完全相反。

Limited Regulatory Capacity and Resources

監管能量與資源侷限

Even jurisdictions committed to crypto regulation often lack technical expertise, enforcement resources, and international cooperation to effectively oversee the industry. Regulatory agencies accustomed to supervising banks and securities firms face challenges adapting to cryptocurrency's technical complexity, global reach, and rapid innovation.

即使堅持監管加密貨幣的法域,往往缺乏必要的技術人才、執法資源和國際合作網絡,難以有效監督產業。傳統監理機關主要面對銀行和證券公司,難以應對加密貨幣技術複雜、全球運作和迅速創新的特性。

Small countries attempting to become crypto hubs may particularly struggle. While favorable legal frameworks attract businesses, ensuring compliance requires sophisticated regulatory capacity. If oversight proves inadequate, these jurisdictions become havens for fraudulent schemes, ultimately damaging their reputations and undermining legitimate operators.

力圖成為加密聚落的小國家,更容易吃力不討好。雖然優惠法律吸引從業者,但若監管能量無法應付,當地就淪為詐騙溫床,最終損害國際聲譽,也傷害合法經營者。

The pace of innovation outstrips regulatory adaptation. By the time authorities develop frameworks for existing tokens and protocols, new variations emerge. DeFi protocols, NFTs, DAOs, and liquid staking derivatives appeared faster than regulators could analyze their characteristics and devise appropriate rules. This creates perpetual catch-up where grey zones dominate.

創新發展速度遠超乎監管因應。當主管機關針對現有代幣或協議定出框架,市場又冒出新變種。DeFi、NFT、DAO、流動質押衍生品等新產品層出不窮,遠遠超過監管預備進度。這樣便形成永遠落後、灰色地帶主導的狀態。

International coordination faces significant obstacles. Cryptocurrency regulation requires cooperation between countries with differing legal systems, economic priorities, and technical capacity. Organizations like the Financial Action Task Force attempt to establish global standards, but implementation varies widely. This fragmentation enables regulatory arbitrage and creates enforcement gaps that undermine national frameworks.

國際協調困難重重。加密貨幣監理需要不同法制、經濟利益和技術能力的國家通力合作。雖有金融行動工作組織(FATF)等嘗試推動全球標準,但各國執行差異極大。監理碎片化便讓業者進行監管套利,進一步削弱單一國家的框架效力。

Taxation Complexity Despite Property Classification

財產歸類下的稅務複雜性

Even when cryptocurrency is recognized as property for tax purposes, determining tax obligations creates complexity. Capital gains calculations require tracking cost basis for tokens acquired through multiple transactions, often across different exchanges. Fork events, airdrops, staking rewards, and DeFi yield farming generate taxable

即便在承認加密貨幣作為財產並採稅的體制下,計算納稅義務本身也非常複雜。資本利得計算須追蹤多次、跨平台取得代幣的成本基礎;分叉、空投、質押獎勵、DeFi 挖礦收益等也都產生應稅事件。跳過 markdown 連結的翻譯。

Content: 事件估值方法不明確。

大多數稅務機關缺乏先進的加密貨幣申報系統。投資人必須手動或使用第三方軟體來計算稅務義務,這造成合規困難並提高出錯風險。加密貨幣資產稽核需要區塊鏈分析的專業知識,而稅務機構可能缺乏這種能力。這導致謹慎納稅人可能申報過多,而對義務感到困惑的人則可能申報不足。

加密貨幣稅收的全球性產生了雙重課稅風險與規劃機會。不同國家可能對同一筆交易給予不同課稅方式——有的作為資本利得,有的則當作所得課稅。原本為防止傳統投資雙重課稅設計的協定,在加密貨幣領域是否適用並不明確,給跨國投資人帶來不確定性。

部分加密貨幣運作於強調隱私的區塊鏈上,交易細節被隱藏。對於這些設計為難以追蹤的資產,稅務機關該如何處理仍未有定論。雖然理論上這些代幣作為財產應該課稅,但實際執行上,若無用戶自願申報,幾乎不可能落實。

未來展望與關鍵指標

未來幾年內,加密貨幣法律承認的發展軌跡,將決定此產業的演變、市場結構,以及最終在全球金融體系中的角色。雖難以作出精確預測,但某些趨勢與指標仍能提供可能發展方向的洞見。

財產認定範圍擴大

近期最可能的發展趨勢是,財產權的認可將持續擴展到更多司法管轄區。隨著印度、香港等地法院建立判例,其他普通法系國家很可能跟進。法院認為加密貨幣具有可界定特性、可交易性與價值的司法推理,適用於多數法律體系,顯示財產分類將朝趨同演化。

新興市場可能成為這波擴展的領頭羊。希望吸引加密投資、但監理制度尚未全面的國家,可能優先採取財產認定作為第一步。這提供基本的法律保障,讓市場得以發展,並在主管機關累積經驗後,才進一步實施全方位監管。因此,財產分類成為邁向成熟監管體系的中繼站。

國際組織及標準制定機構很可能會將財產認定視為基線要求。FATF針對虛擬資產的指引(雖聚焦於防制洗錢),已默認加密貨幣構成受法律權利及義務規範的財產。隨著這些國際標準被廣泛採納,即使未有具約束力的條約,財產認定也可能實質成為全球常態。

重點管控資本流動與維護貨幣主權的地區將表現抵抗。維持匯率連結、資本控管或經歷貨幣不穩的國家,可能將財產認定視為正當化資本外逃工具,即便全球趨勢指向認可,這些國家還是可能維持模糊地位或直接禁令。

全面性監管架構:以 MiCA 為引領

歐盟的 MiCA(加密資產市場監管條例)可能成為其他地區制定類似全面性規範的催化劑。MiCA 結合財產認可、服務提供商義務、消費者保護、和防止市場濫用,為創新與監督之間提供平衡範本。其他司法轄區可能依自身法律架構調整採納 MiCA 架構。

英國因脫歐已不受歐盟規範約束,正以 MiCA 為學習藍本,根據本國情況制定自己的加密監管框架。香港成長中的虛擬資產服務提供商(VASP)制度,也參考國際最佳實踐,同時維持競爭優勢。這些平行發展顯示,即便無正式協調,全球將朝向全面受監管資產的架構趨同。

亞太合作有望產生區域標準。討論金融監管協調的東協國家,可望將其擴展到加密貨幣,建立類似 MiCA 跨歐洲作法的東南亞架構。這將減少套利空間,同時維持對歐、美的區域競爭力。

然而,全面監管也有風險。過於規條化的架構可能壓抑創新,讓業務轉往較少監管地區,或讓既有大機構佔優勢。如何在監督與創新間取得最佳平衡,仍難以定論。早期框架必須經受市場事件考驗——若危機在監管下依然發生,法規可能更趨嚴格;若創新蓬勃發展,則可能成為全球典範。

穩定幣監管加劇

穩定幣由於其支付系統牽連及宏觀經濟意義而受到越來越多監管關注。香港的《穩定幣條例》、日本的電子支付工具規定、以及 MiCA 對電子貨幣型代幣的規範,均顯示全球正朝向對法幣掛鉤幣實施銀行級監管。

美國仍是關鍵變數。儘管兩黨都認可規管的重要性,美國國會在穩定幣監管方面進展遲緩。究竟未來美國將依據聯邦銀行法、證券法還是新立法監管,關鍵在於美元主導地位和 USDT/USDC 在加密交易及 DeFi 市場的核心角色,將深刻影響全球穩定幣格局。

央行日益將穩定幣視為 CBDC 的競爭對手及貨幣政策傳導威脅。這種防衛姿態可能驅使監管採取超越支付穩定所需的嚴格標準。反之,倘若各國認同私人穩定幣帶來創新好處,則有望建立有利發展的框架。兩者如何取捨,將決定穩定幣是補充抑或妨礙公營數位貨幣。

商品掛鉤及算法型穩定幣的監管前景更不明朗。以法幣支援的穩定幣易納入既有支付法規管理;但掛鉤黃金、房地產或多元資產的代幣,難以簡單分類。經 UST/Luna 崩潰後,試圖以供給調節維穩的算法幣備受質疑。監管架構大概率會對不同穩定幣類型採取差異化限制。

更多司法區認定財產權

除了正式承認外,財產權將透過法院判決累積、法律更新及監管指引愈發鞏固。每多一則如印度 XRP 案等判例,都進一步加強將加密貨幣視為財產的法律基礎。隨著經濟利益、投資人預期以既有分類集結,這套法權體系也將愈加難以逆轉。

隨著司法認可,立法將可能跟進,明文規定加密貨幣為財產,並建立明確的所有權規則,這比僅靠判例帶來更高確定性。美國部分州份(如懷俄明州)已立法規範數位資產,內容最為完整。若主要經濟體亦聯邦層級立法,將是重大進展。

國際私法發展也會著手跨境財產爭議。加密貨幣交易涉及多國當事人,準據法選擇及判決強制執行成為關鍵。若有國際公約規範數位資產所有權,能減少不確定性並促進跨境一致應用,但談判、落實需多年。

財產權將超越單純持有,涵蓋更細緻情境:以加密貨幣做擔保、信託持有數位資產、無遺囑時的遺產繼承、或婚姻財產分割涉及加密資產。隨著法院逐項處理,相關法律將趨成熟,複雜度逐步比擬傳統財產領域。

代幣類型認定趨勢

不是所有加密貨幣都能獲得同等地位。比特幣與以太坊因其去中心化程度較高、非證券型資產地位,在取得廣泛財產認可方面佔優。治理較集中、分潤或明確投資性的代幣將面臨被歸類為證券。

此分歧未來可能正式制度化,形成不同代幣類別與法律對待方式。“支付型代幣”如比特幣,獲財產認定且受較寬鬆監理;“證券型代幣”設計作為投資契約者,將受證券法規範;“效用型代幣”則視其經濟設計及發行狀態逐案審查;“穩定幣”則進入支付法規範。雖然這套分類不盡完善,仍為不同對待提供基本架構。

迷因幣與高度投機性代幣可能面臨最嚴厲規管。懷疑加密貨幣監管機構,無法全面禁令,但或將重點打壓顯然投機、效用有限的資產。這種選擇性執法有助淘汰低質代幣、允許正規計畫發展,提高市場品質,但也增加審查風險。

DeFi 治理代幣代表認定分類的前沿。隨著這些代幣日益複雜,承載更多權利並能產生價值,法律地位勢將受測。若被監管機構強行歸為證券,現行 DeFi 可能全面潰散。反之,若以財產並具有治理效用予以承認,則可為繼續創新鋪路。

機構投資流入與市場成熟

隨法律承認繼續推進,加密貨幣機構投資將加速。資產管理公司、退休基金、保險公司與企業財務部門等,在顯著配置前,都需要法律確定性。隨著property status and regulatory frameworks spread, these institutional investors will increase exposure from current low single-digit percentages to potentially much higher levels.

隨著資產地位和監管框架的擴散,這些機構投資人將會把目前僅為個位數百分比的資產配置,提升至更高的水準。

This institutionalization will alter market dynamics. Retail-dominated markets exhibit high volatility, social-media-driven sentiment, and momentum trading. Institutional markets show more fundamental analysis, longer time horizons, and index-tracking behavior. As institutions gain share, crypto markets may become more efficient but less exciting, with lower volatility and return potential.

機構化將改變市場動態。以散戶為主導的市場,波動性高、情緒容易受社群媒體驅動,並偏好動能交易;而機構主導的市場著重基本面分析、投資期間較長,並展現指數化佈局。隨著機構持份比例提升,加密貨幣市場可能更有效率但較不刺激,波動度和潛在報酬也會降低。

Custody infrastructure will professionalize to serve institutional clients. Banks and specialist custodians will offer segregated storage, insurance, and governance services meeting fiduciary standards. This infrastructure investment requires regulatory clarity about liability, standards, and ownership - legal recognition enables it.

託管基礎設施也將朝向專業化,以服務機構客戶。銀行與專業託管機構將提供資產分離存放、保險及符合法定信託責任的治理服務。這些基礎建設的投資需要明確的監管規範,包括責任、標準與資產歸屬,法定認可是此成長的關鍵。

Derivatives and structured products will proliferate in recognition jurisdictions. Bitcoin and Ethereum futures, options, and ETFs already exist in major markets. As property status solidifies, these products will expand to more tokens and more complex structures. This financialization increases market depth and efficiency but may also introduce systemic risks if not properly supervised.

在認可加密資產身分的司法管轄區,衍生性金融商品與結構型產品會普及化。比特幣與以太幣的期貨、選擇權和ETF已在主要市場流通。隨著資產地位鞏固,這類產品將擴展到更多代幣與更複雜的結構。這種金融化能提升市場深度與效率,但若缺乏妥善監督,亦有引發系統性風險之虞。

Key Indicators to Monitor

重要觀察指標

Several specific developments will signal progress toward broader crypto recognition:

若干具體進展可作為加密貨幣廣泛獲得認可的信號:

Number of jurisdictions recognizing property status: Track countries where courts or legislatures have explicitly classified cryptocurrency as property. Acceleration beyond current common law countries toward civil law systems would be significant.

將加密貨幣明確認定為財產的司法管轄區數量:關注哪些國家之法院或立法機關已將加密貨幣明確歸類為財產。若該趨勢由現有的普通法國家拓展到大陸法系國家,將具有重大意義。

Major economy regulatory bills: Watch for comprehensive crypto legislation in the U.S., China (reversal), India, or other large economies. These frameworks will influence global standards given their market size.

主要經濟體的監管法案:密切留意美國、中國(或政策逆轉)、印度或其他大型經濟體出臺的全面性加密法規。由於其市場影響力,此類法案將左右全球標準。

Institutional investment metrics: Monitor disclosed crypto holdings by public pension funds, insurance companies, and asset managers. Significant increases would confirm that legal recognition is enabling institutional participation.

機構投資數據:追蹤公營退休基金、保險公司、資產管理業者公開的加密資產持有量。若明顯成長,代表法定認可確實促進機構參與。

Exchange listing patterns: Track which tokens are listed on regulated exchanges in strict jurisdictions like Japan, Hong Kong, and post-MiCA Europe. Expanding listings suggest growing comfort with property/asset classification.

交易所掛牌趨勢:觀察包括日本、香港及MiCA施行後的歐洲等嚴格司法管轄區,哪些代幣能在合規交易所掛牌。上市範圍擴大,代表對財產或資產性質的認可度提高。

Cross-border cooperation agreements: Watch for bilateral or multilateral agreements addressing crypto regulation coordination, information sharing, or enforcement cooperation. These would reduce arbitrage opportunities and enforcement gaps.

跨境合作協議:關注雙邊或多邊之加密監管協調、資訊共享、或執法合作協定。這些措施能縮小套利與執法落差。