2025年11月10日,美國財政部及國稅局發布一項指引,將徹底改變權益證明區塊鏈的經濟學。Revenue Procedure 2025-31 創立了一個安全港,使加密貨幣ETF及信託可以質押數位資產並將獎勵分配給投資人,而不會引發稅務不利或失去信託優惠地位。

政策出台正值關鍵時機。2025年第三季,以太坊現貨ETF資產超過 $280億美元,同時首檔 Solana質押ETF正式上市,首日成交額達5540萬美元。這些產品過去因監管模糊無法質押。目前,機構資本終於能獲得零售用戶長期享有的質押收益。

然而,這項發展除了表面新聞外,相關分析卻相當有限。其影響遠超於簡單的收益提升。新規指引將改變機構資本在PoS網路間的分布,重塑DeFi流動性,並依據生態系統機構接納程度,產生顯著的赢家與輸家。

要判斷哪些網路可受惠,需綜合考量質押收益、託管基礎設施、驗證者經濟學、流動性質押協議及其對DeFi的二級效應。未來12至24個月,誰將成為機構資本流向的主導PoS代幣,誰會錯失世代機會,將見分曉。

發生了什麼事:IRS新指引解讀

Revenue Procedure 2025-31 所解決的問題雖晦澀但深遠。根據長期稅法,受託管理的投資信託只有在作為被動投資工具時,才能維持稅務通道待遇。IRS及法院一向對「被動」定義極為嚴格。

1941年案例 Commissioner v. North American Bond Trust 結論:若受託人利用市場波動優化投資,屬「管理權」,因此使信託變成課稅實體。這句話質押時產生明顯障礙。

驗證者為確保PoS網路安全而質押代幣時,積極參與共識機制,獲取獎勵,也須承擔不當行為遭懲罰的風險。這是否屬於不當「管理權」?2025年11月前,答案不明,導致大型資產管理人不敢將質押納入合規產品。

Revenue Procedure 2025-31 透過14項綜合測試條件提供明確依據。符合全部條件的信託,可以質押資產而不會喪失作為投資信託(Treasury Regulation 301.7701-4(c))或資助人信託(Internal Revenue Code Sections 671-679)的地位。

安全港規定 包含數項要件:信託僅可持有單一數位資產與現金作為營運之用,且須在SEC批准的全國證券交易所掛牌,由合格的獨立第三方託管所有私鑰,信託必須與獨立質押服務商簽署公允協議。管理活動限於收存款、支付費用、進行質押及分發獎勵,且不可透過交易套利市場波動。

更重要的是,安全港強制要求所有代幣皆須質押,僅限部分例外,包括維持流動性以應對贖回、保留營運現金、以及遵循底層鏈協議規定的非質押期。例如以太坊,在約24-48小時的出金佇列期間 ETF可保留部分未質押代幣 而不算違規。

新程序自2025年11月10日或之後結束的所有課稅年度追溯適用。發行前已成立的信託,須於該日起九個月內修訂信託協議以授權質押,前提是滿足其他全部要求。此寬限期確保現有以太坊和Solana ETF可迅速因應無須重組。

過去未有明確稅務處理,部分人認為質押獎勵屬於普通收入應當期課稅,另有說法視為新產生資產僅於出售時課稅。2025-31公告為符合標準的信託繞過這類爭議,維持通道待遇。合乎規定ETF的投資人,將透過分派或資產淨值提升取得獎勵,稅務處理適用標準信託課稅原則。信託本身避免實體階段課稅,有效保留投資報酬。

此時機點同時體現更廣泛的監管協作。財政部長Scott Bessent表示,新指引為ETP質押數位資產指明清晰道路,並允許與零售投資人共享收益,鞏固美國於區塊鏈科技領先地位。IRS同時明確援引SEC於2025年9月批准加密ETF掛牌通用標準規則修正案,反映前所未有的跨部門協同。

這點意義重大,因為SEC以往對PoS機制態度保守。前SEC主席Gensler於2023年曾表示PoS代幣可能構成證券,若成真將全面堵死機構質押產品。2025年11月新指引代表政策180度轉變,監管機關從阻擋變成積極鼓勵。

安全港的營運要求將迫使ETF質押架構產生變化。最核心的是合格第三方託管及獨立質押服務商的必要性,意味ETF發行商無法垂直整合這些服務。這將使 Coinbase Custody, Anchorage Digital 及 BitGo 等既有機構級託管商受惠,因它們已具備相應基礎設施與監管資格。

PoS質押經濟學

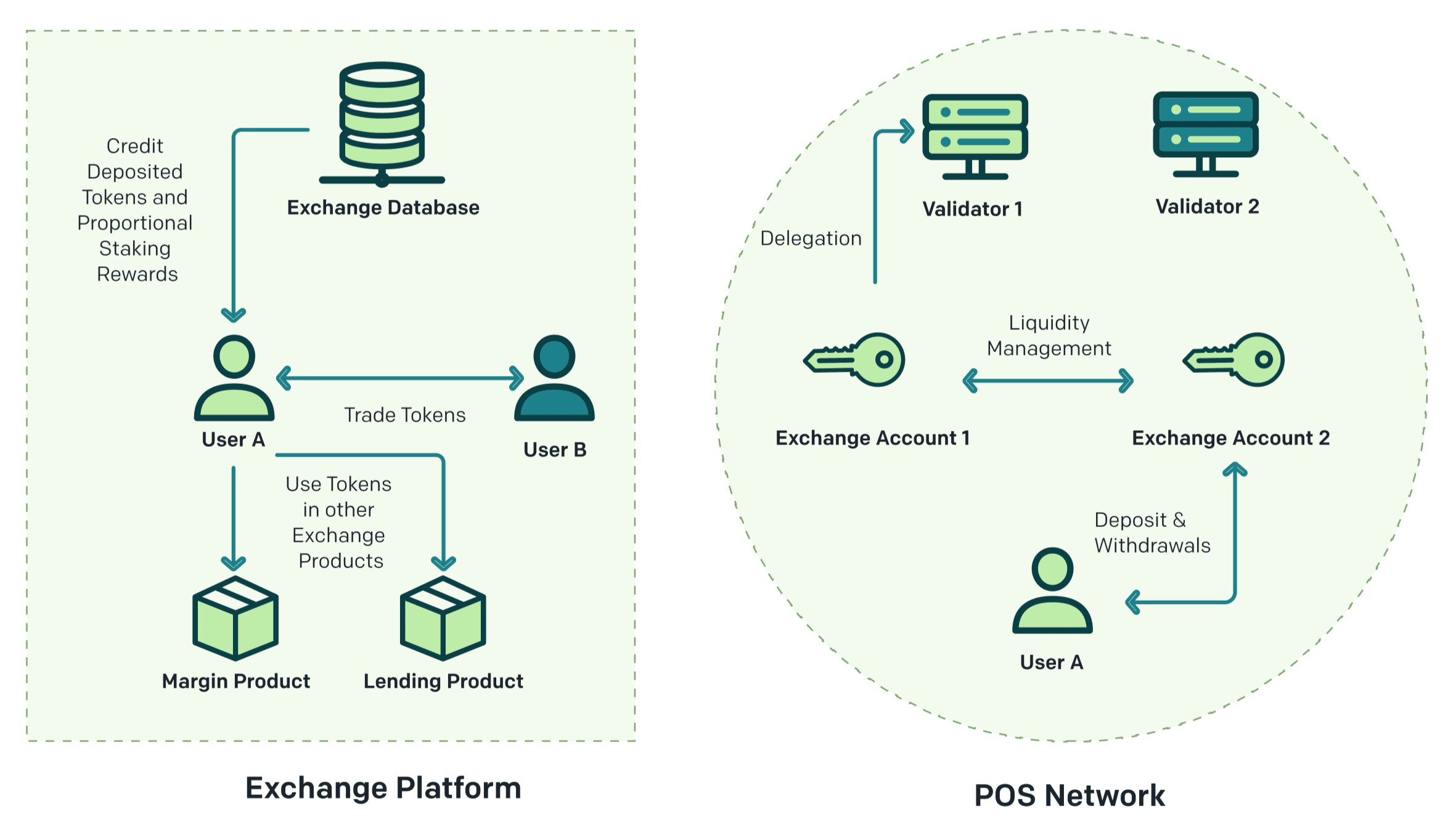

要了解機構採用影響,必須明白權益證明實際運作及產生獎勵的原理。不同網路間機制差異大,也形成對機構市場的吸引力區隔。

以太坊於2022年9月完成The Merge轉為權益證明。驗證者需質押32顆ETH作為保證金。此質押成為經濟安全基礎:誠信者可獲得獎勵,作惡或低上線率者將被處罰,甚至銷毀部分質押資產。

截至2025年11月,以太坊已超過3,570萬顆ETH質押,分布在106萬多個驗證者節點,約佔ETH總供應29.5%。驗證者收益來源有三:共識層產出(提議及見證新區塊)、交易優先費及交易排序所產生的最大可提取價值(MEV)。

目前以太坊質押年化收益率介於 2.89% 至 4.42%,取決於網路活動及驗證者表現。Lido的stETH年化約3.03%,獨立驗證者若能直接捕捉MEV則略高。這是以太坊成熟質押生態及低通膨率的體現。

以太坊設有質押/退出佇列以避免質押比例劇烈波動出現共識風險。2025年11月中,新驗證者需約等23天才能啟用,退出則需約38天。對ETF流動性管理來說,基金必須保留足夠未質押部位以應對贖回。

以太坊質押懲罰發生於驗證者簽署衝突見證、提議,或長時間離線。處罰從輕微非活躍損失到惡性行為所致質押全數銷毀皆有。2025年第二季,全網共21次斬首紀錄,顯示風險雖小但仍真實存在。機構級驗證如Figment達成零斬首、99.9%上線率,證明專業團隊風險控管具備優勢。

Solana運作邏輯則不同。其混合PoS與歷史證明共識,可極高速處理上千筆交易每秒。Solana驗證者接收委託無最低質押門檻,若要自架節點則對技術基礎和持續運維有極高需求。 operating costs.

Solana staking yields currently range from 6.3% to 6.7%, notably higher than Ethereum. This reflects Solana's different inflation schedule. The network launched with 8% annual inflation, decreasing by 15% year-over-year toward a terminal rate of 1.5%. As of 2025, inflation sits near 5-6%, giving a real yield of 0-3% after accounting for token dilution.

目前 Solana 的質押收益率介於 [6.3% 至 6.7%],明顯高於以太坊。這反映出 Solana 採用不同的通膨機制。該網路最初啟動時的年通膨率為 8%,每年遞減 15%,直到最終達到 1.5%。截至 2025 年,[通膨率約落在 5-6%],扣除代幣稀釋因素後,實際收益約為 0-3%。

Approximately 67% of SOL supply is staked, representing around 393.6 million SOL worth roughly $65 billion at recent prices. Solana's epoch system distributes rewards approximately every two days, faster than Ethereum's daily reward accrual. Validators earn from both inflation issuance and transaction fees, with Solana's high transaction volume generating material fee income.

大約有 [67% 的 SOL 供給被質押],總量約 3.936 億顆,按近期價格約等於 650 億美元。Solana 採用 epoch 機制,大約每兩天分配一次質押獎勵,速度快於以太坊每日一次。驗證者的收益來自於通膨新發的代幣以及交易手續費,而 Solana 極高的交易量也帶來可觀的手續費收入。

Cardano takes yet another approach. The network uses a UTXO-based architecture rather than an account model, with stake pools operated by community validators. ADA holders delegate to these pools without transferring custody, earning 4-5% annually depending on pool performance. Cardano's 71% staking participation rate represents one of the highest among major networks.

Cardano 採用截然不同的方式。該區塊鏈以 UTXO 架構取代帳戶制,質押池由社群驗證者管理。ADA 持有者可在不轉移資產託管的前提下委託這些池,根據池的績效可獲得 [年化 4-5%] 的收益。Cardano 的 [質押參與率高達 71%],在主流網路中屬於最高之一。

Cardano imposes no lockup periods and no slashing penalties, making it operationally simpler than Ethereum or Solana. However, this simplicity comes with lower institutional adoption of custody infrastructure. While major custodians support Cardano holdings, few offer delegated staking as a managed service comparable to their Ethereum and Solana offerings.

Cardano 沒有質押鎖倉期,也沒有懲罰質押(slashing)機制,在營運上比以太坊或 Solana 更單純。不過,這種簡化設計導致機構託管基礎建設的採用率較低。雖然主要託管服務商支援 Cardano 資產,但鮮少像支援以太坊或 Solana 那樣,提供委託質押的託管化服務。

Cosmos operates as an ecosystem of interoperable blockchains connected through the Inter-Blockchain Communication protocol. The Cosmos Hub, secured by ATOM staking, offers yields of 7-18.5%, among the highest of major networks. About 59% of ATOM supply is staked, worth approximately $1.2 billion.

Cosmos 是一個由多條區塊鏈組成的生態系,透過 IBC(區塊鏈間通訊協定)互通。Cosmos Hub 透過 ATOM 質押保護網絡安全,質押年化收益率介於 [7-18.5%],在主流網路中屬於最高一群。大約 59% 的 ATOM 供應被質押,市值約 12 億美元。

Cosmos's delegated proof-of-stake allows ATOM holders to delegate to validators without minimum thresholds. Unbonding periods last 21 days, during which tokens cannot be traded or restaked. Validators can be slashed for double-signing or prolonged downtime, with penalties passed through to delegators. The high yields reflect both inflation and the network's smaller scale compared to Ethereum.

Cosmos 採用委託權益證明(DPoS),ATOM 持有者可隨意委託給驗證者,無最低門檻。解綁需 21 天,期間代幣不能交易或重新質押。驗證者若雙重簽章或長時間離線會被處罰(slashing),懲罰也會轉嫁至委託人。高收益來自於通膨以及網路規模相對以太坊較小。

Avalanche uses a proof-of-stake system with three distinct chains: the X-Chain for asset creation, the C-Chain for smart contracts, and the P-Chain for validator coordination. Validators must stake a minimum of 2,000 AVAX for 14 days, while delegators need just 25 AVAX. Staking yields range from 7-11%, with about 53-58% of supply staked.

Avalanche 採用權益證明機制,擁有三條不同功能的鏈:X-Chain 用於資產創建,C-Chain 執行智慧合約,P-Chain 則負責驗證者協調。驗證者需至少質押 2,000 顆 AVAX,綁定 14 天;而委託人僅需 25 顆 AVAX。質押年化收益約 [7-11%],總供給有 53-58% 質押中。

Avalanche's transaction finality arrives within seconds, much faster than Ethereum's block times. This speed benefits DeFi applications but requires validators to maintain robust infrastructure to keep pace. The network's focus on custom subnets creates additional validator complexity, as validators may choose to validate multiple subnets for extra rewards.

Avalanche 可在數秒內完成交易最終確認,遠快於以太坊的出塊速度。這種效率有利於 DeFi 應用,但要求驗證者維持堅固的基礎設施,以跟得上網路節奏。此外,Avalanche 強調自訂子網,增加了驗證者營運複雜度,驗證者可以自行選擇參與多個子網以爭取額外獎勵。

The concept of liquid staking emerged to solve a fundamental problem: traditional staking locks capital, preventing its use elsewhere. Lido Finance pioneered liquid staking on Ethereum in December 2020 by issuing stETH tokens representing staked ETH plus accrued rewards. Users deposit any amount of ETH to Lido's smart contracts, receive stETH in return, and earn staking rewards as their stETH balance increases through rebasing.

流動性質押是為了解決傳統質押資金鎖定、無法靈活運用的根本問題而出現的。Lido Finance 於 2020 年 12 月率先在以太坊推出流動性質押,發行 stETH 代幣,代表已質押 ETH 及其產生的利息。[用戶可將任意數量的 ETH 存入 Lido 合約],換得 stETH,之後隨 stETH 自動增加(rebasing)而獲得質押獎勵。

Critically, stETH remains liquid and tradeable. Holders can use it as collateral in lending protocols like Aave, provide liquidity on decentralized exchanges, or sell it anytime without waiting for unstaking periods. This capital efficiency revolutionized DeFi by allowing the same ETH to earn both staking rewards and additional DeFi yields simultaneously.

關鍵在於,stETH 保持流通且可隨時交易。持有者可將其用於 [Aave 等借貸協議] 作為抵押品、參與去中心化交易所提供流動性,或隨時出售,無需等待解綁。這種資本效率徹底革新了 DeFi,讓同一份 ETH 同時賺取質押及其他 DeFi 收益。

Rocket Pool's rETH uses a non-rebasing design where the token's value increases against ETH rather than the supply expanding. As of 2025, Rocket Pool is Ethereum's second-largest liquid staking protocol behind Lido, with more than 1 million ETH staked. Rocket Pool emphasizes decentralization by allowing users to run validator nodes with just 8 ETH rather than the standard 32 ETH requirement.

[Rocket Pool 所推出的 rETH] 則採用不自動增發的設計,代幣與 ETH 的兌換價值會隨收益成長,而非發行量增加。截至 2025 年,Rocket Pool 已是以太坊僅次於 Lido 的第二大流動性質押協議,質押量超過 100 萬顆 ETH。Rocket Pool 鼓勵去中心化,允許用戶僅需 8 顆 ETH 就可運行驗證節點,遠低於一般標準的 32 顆要求。

Solana liquid staking protocols like Marinade Finance and Jito issue mSOL and JitoSOL respectively. These tokens work similarly to Ethereum's liquid staking derivatives, allowing SOL to remain productive in DeFi while earning staking rewards. Marinade optimizes yields by automatically routing stake to high-performing validators, while Jito incorporates MEV rewards into yields.

Solana 也有流動性質押協議,如 [Marinade Finance 和 Jito],分別發行 mSOL 及 JitoSOL。這些代幣與以太坊的流動性質押類似,允許 SOL 資產在 DeFi 中持續運用同時累積質押收益。Marinade 會自動將質押導向高績效驗證者以提升收益,Jito 則將 MEV 收益納入質押報酬。

MEV deserves special attention for institutional staking. Maximal extractable value refers to profit validators can extract by strategically ordering, including, or excluding transactions within blocks they produce. On Ethereum, sophisticated validators earn substantial MEV income by running specialized software that identifies profitable transaction ordering opportunities.

MEV(最大可提取價值)在機構質押中值得特別留意。MEV 指的是驗證者能透過調整區塊內交易排序、插入或排除特定交易,獲得的額外利潤。在以太坊,高階驗證者使用專業軟體發掘最佳排序,能夠賺取大筆 MEV 收益。

MEV and transaction fees provide smaller but variable contributions to total staking yields. During network congestion and high-fee periods, MEV can temporarily push total yields above 10%. However, MEV is highly variable and concentrated among technically sophisticated validators. Institutional staking providers must decide whether to pursue MEV optimization, which requires additional infrastructure and carries some risk, or focus purely on consensus rewards.

[MEV 與交易手續費] 對總質押收益的貢獻較小且波動大。在網路壅塞、手續費高漲時,MEV 甚至會讓總收益暫時超過 10%。但 MEV 貢獻高度不穩,且主要由技術能力強的驗證者獲得。機構級質押服務商必須抉擇是否追求 MEV 最佳化(這需要額外設施也有風險),或僅專注於共識獎勵。

Institutional Readiness: Which Chains Have Infrastructure for ETFs?

機構準備度:哪些鏈具備 ETF 所需基礎設施?

Revenue Procedure 2025-31 creates opportunity, but capturing it requires infrastructure most blockchain networks lack. The safe harbor's requirements for qualified custodians, independent staking providers, and arm's-length operations mean ETFs cannot simply self-stake. They need institutional-grade service providers with regulatory approvals, insurance, and operational track records.

Revenue Procedure 2025-31 創造了新機會,但能否把握,取決於大多數區塊鏈網絡尚未具備的基礎設施。根據安全港條款,必須有合格託管人、獨立質押服務提供商,以及授信至上的獨立運營,ETF 無法直接自行質押。他們需要具備監管批准、保險及營運紀錄的機構級服務商。

Ethereum holds overwhelming advantages here. The three largest institutional custodians - Coinbase Custody, Anchorage Digital, and BitGo - all offer comprehensive Ethereum staking services. These firms provide cold storage security, validator operations, slashing insurance, and regular third-party audits. They operate under state trust charters or money transmitter licenses, satisfying the safe harbor's qualified custodian requirement.

以太坊在這方面有壓倒性的優勢。三大機構級託管商——[Coinbase Custody、Anchorage Digital 及 BitGo]——均提供完整的以太坊質押服務。他們提供冷錢包安全、驗證者管理、懲罰保險以及定期第三方審計。在美國以州信託執照或金錢轉帳牌照運營,滿足安全港對合格託管人的要求。

Coinbase Custody, launched in 2018, custodies assets for more than 1,000 institutional clients including several current crypto ETFs. Its integrated staking service operates validators achieving 99.9% uptime with zero slashing events since launch. Coinbase offers staking for Ethereum, Solana, Cardano, Polkadot, Cosmos, and Avalanche, though Ethereum receives the most development resources and institutional demand.

Coinbase Custody 自 2018 年推出,已為超過 1,000 個機構客戶(包含多檔現有加密 ETF)保管資產。旗下質押服務所營運的驗證者自成立以來皆達到 99.9% 上線率,且未曾遭遇懲罰性削減(slashing)。Coinbase 提供 [以太坊、Solana、Cardano、Polkadot、Cosmos 與 Avalanche] 等多鏈質押,但以太坊獲得最多資源與機構需求。

Anchorage Digital, the first federally chartered crypto bank in the United States, provides custody and staking for qualified institutional clients. Its banking charter subjects it to OCC supervision and regular examinations, providing comfort to risk-averse asset managers. Anchorage's staking infrastructure emphasizes compliance and operational rigor over maximizing yields, aligning with institutional priorities.

Anchorage Digital 作為美國第一家聯邦認證的加密銀行,為合格機構客戶提供託管與質押服務。其銀行牌照需接受 OCC 監管和定期檢查,讓風險趨避的資產管理人更感安心。Anchorage 的質押基礎設施強調合規及營運嚴謹,而非僅專注於收益最大化,符合機構取向。

BitGo pioneered multi-signature custody and now serves as custodian for numerous crypto funds and ETFs. Its staking services focus on Ethereum and newer proof-of-stake chains, with particular strength in Solana infrastructure. BitGo's $100 million insurance policy covers custody risks but not slashing penalties, a distinction that matters for institutional risk management.

BitGo 率先推出多重簽名託管技術,現為多家加密基金和 ETF 提供託管。質押服務以以太坊及新型權益證明鏈為主,對 Solana 基礎設施尤具優勢。BitGo 的 1 億美元保險保障託管風險,但不涵蓋 slashing,這點對機構風險管理十分重要。

Beyond custody, staking requires validator operations. Some custodians run their own validators, while others partner with specialized staking providers. This separation satisfies Revenue Procedure 2025-31's requirement for independent staking providers under arm's-length agreements.

除託管外,質押還涉及驗證者運營。有些託管商自行營運驗證節點,有些則與專業質押業者合作。此分工模式符合 Revenue Procedure 2025-31 關於獨立質押服務商與授信協議的規範。

Figment, Blockdaemon, and Kiln dominate institutional staking-as-a-service. Figment operates validators on over 50 proof-of-stake networks, including Ethereum, Solana, Cosmos, Avalanche, and Polkadot. Its institutional clients include asset managers, hedge funds, and crypto exchanges. Figment achieved zero slashing events in Q2 2025 on Ethereum, demonstrating operational excellence.

[Figment、Blockdaemon 及 Kiln] 是機構質押服務的佼佼者。Figment 在 50 條以上的權益證明區塊鏈(如以太坊、Solana、Cosmos、Avalanche、Polkadot)運營驗證者,客戶涵蓋資產管理公司、對沖基金和加密貨幣交易所。Figment 於 2025 年第二季實現在以太坊零 slashing,展現營運卓越表現。

Blockdaemon provides validator infrastructure with a focus on white-label solutions for institutions that want branded staking products. Its platform supports staking for Ethereum, Solana, Avalanche, and numerous other chains, with SLA guarantees and insurance options. Blockdaemon's client list includes several Wall Street financial institutions exploring crypto products.

Blockdaemon 提供驗證節點基礎建設,並專注於為希望打造自有品牌質押產品的機構提供白牌解決方案。其平台支援以太坊、Solana、Avalanche 等多鏈質押,並配備 SLA 服務品質保證與保險選項。其客戶包含多家涉足加密產品的華爾街金融機構。

These service providers charge fees that compress net yields. Institutional custodians typically charge 0.5-2% annually for custody and staking services combined. Validator operators take additional commissions of 5-15% of staking rewards. After these costs, institutional clients earn meaningfully less than retail

這些服務提供者會收取費用,壓縮了最終收益。機構託管商通常針對託管與質押服務[綜合收取每年 0.5-2% 費用]。驗證者營運端還會抽取質押獎勵的 5-15% 作為佣金。扣除這些成本後,機構客戶的淨收益明顯低於散戶。users staking directly, but gain regulatory compliance, insurance, and operational simplicity.

用戶直接質押,但能獲得法規合規性、保險保障和操作簡易性。

Ethereum's institutional infrastructure extends beyond custody and validators to data providers, analytics platforms, and insurance products. Staking providers use services like Rated Network and Rated Labs to monitor validator performance and optimize operations. Insurance protocols provide coverage for slashing risks that traditional insurance markets avoid. This ecosystem depth makes Ethereum far easier for institutions to adopt compared to newer networks.

以太坊的機構基礎設施不僅僅涵蓋託管和驗證者,還延伸至數據供應商、分析平台和保險產品。質押服務商會使用如 Rated Network 和 Rated Labs 這樣的服務來監控驗證者表現並優化營運。保險協議提供針對罰沒(slashing)風險的保障,這類風險傳統保險市場通常會避開。這種生態系的深度使以太坊相比新興網路,對機構採用來說要容易得多。

Solana's institutional infrastructure has matured rapidly. All three major custodians now support SOL staking, though with less operational history than Ethereum. The first Solana staking ETF launched in July 2025 with institutional-grade custody from day one, demonstrating readiness for mainstream adoption. Solana's faster confirmation times and lower transaction costs appeal to institutions looking beyond Ethereum.

Solana 的機構基礎設施發展極為迅速。三大主流託管商如今都支持 SOL 質押,儘管其運作歷史尚不及以太坊。首檔 Solana 質押 ETF 於 2025 年 7 月推出,自第一天起即配備機構級託管,展現出大眾化採用的準備度。Solana 更快的確認時間和更低的交易成本,對於尋求以太坊以外選擇的機構尤具吸引力。

However, Solana faces network stability questions. The chain experienced several outages in 2022-2023 that damaged institutional confidence. While Solana's stability has improved significantly in 2024-2025, institutional risk committees remember these incidents. ETF sponsors must explain downtime risks in prospectuses, potentially deterring conservative investors.

然而,Solana 仍面臨網路穩定性的疑慮。該鏈於 2022-2023 年曾發生數次斷線,損及機構信心。儘管 2024-2025 年 Solana 的穩定性已有重大改善,但機構的風險委員會仍記得這些事件。ETF 發行商必須在說明書內解釋可能的停機風險,這有可能令保守投資人卻步。

Solana's validator economics differ meaningfully from Ethereum. The network's high transaction throughput means validators require more expensive infrastructure to keep pace. However, Solana's transaction fee income can supplement inflation rewards during busy periods, sometimes pushing yields higher than nominal APRs suggest. Institutional validators must invest in robust infrastructure to capture this opportunity.

Solana 的驗證者經濟模型與以太坊存在明顯差異。其高交易吞吐需求驗證者投入更昂貴的基礎設施以跟上市場。不過,Solana 的交易手續費收入能在網路繁忙期補充通膨獎勵,甚至使實際收益高於名目年化報酬率。機構級驗證者必須投資於強健設施,才能把握這項機會。

Cardano presents a puzzle. The network's 71% staking participation rate and no-slashing design should appeal to institutions. Cardano's UTXO architecture and formal verification approach satisfy compliance teams. Yet institutional custody and staking services remain limited. Only Coinbase among major custodians offers managed Cardano staking, and institutional demand remains modest.

Cardano 相當耐人尋味。該網路 71% 的質押參與率以及無罰沒(slashing)設計,理論上應該對機構很有吸引力。Cardano 的 UTXO 架構和形式化驗證方法,亦可滿足合規團隊的要求。但目前機構級託管與質押服務仍十分有限,主流託管商中僅 Coinbase 有提供 Cardano 的質押管理,機構端需求仍顯溫和。

The challenge is less technical than reputational. Cardano's deliberate development pace and academic focus create perception problems in an industry that values shipping fast. Institutional allocators struggle to articulate why they would choose Cardano over Ethereum or Solana, despite its technical merits. This perception gap may change if Cardano successfully activates high-profile decentralized applications, but for now it limits institutional staking potential.

困難所在更多是聲譽層面而非技術層面。Cardano 慢工出細活、強調學術特性的形象,在這個講究「速度至上」的產業中成為麻煩。機構分配人員很難解釋,儘管 Cardano 技術上有其優勢,為什麼要選擇 Cardano 而非以太坊或 Solana。這種認知落差可能在 Cardano 活躍啟用高人氣 DApp(去中心化應用)後會有所改善,但短期內仍限制了其機構質押潛力。

Cosmos occupies a unique position. The network's 18.5% staking yields attract attention, but its interchain architecture complicates institutional adoption. Custodians must choose which Cosmos zones to support, validator selection is more complex, and unbonding periods of 21 days challenge liquidity planning. Coinbase and others support basic ATOM staking, but comprehensive Cosmos ecosystem support remains limited.

Cosmos 佔據一個獨特的地位。該網路有 18.5% 的質押收益,格外吸睛,但其跨鏈架構使機構採用更加繁瑣。託管商需決定支援哪些 Cosmos 區域,驗證者挑選更複雜,且 21 天的解綁期為流動性規劃帶來挑戰。Coinbase 等機構雖已支援 ATOM 基本質押,但對 Cosmos 整體生態圈的全面服務仍相當有限。

Cosmos's strength is its growing ecosystem of independent zones using IBC to communicate. Networks like Osmosis, Celestia, and dYdX Chain all use Cosmos technology and offer staking. However, each requires separate custody and staking infrastructure. Institutional adoption likely focuses narrowly on ATOM initially, with broader ecosystem support developing slowly if ATOM proves successful.

Cosmos 強項在於其獨立區塊間利用 IBC(跨鏈通訊協議)交流、持續壯大的生態圈。像 Osmosis、Celestia、dYdX Chain 等網絡皆採用 Cosmos 技術並提供質押服務。然而這些網絡各自需要專屬的託管和質押架構。機構採用勢必一開始只聚焦 ATOM,若 ATOM 獲得成功,整體生態的機構支援才有機會漸進展開。

Avalanche benefits from Ethereum Virtual Machine compatibility, allowing institutions to repurpose Ethereum infrastructure. Staking yields of 7-11% attract attention, though the 2,000 AVAX minimum for validators creates friction. Avalanche's subnet architecture offers customization that could appeal to enterprise users, but also adds complexity that institutions must understand before committing capital.

Avalanche 因相容以太坊虛擬機(EVM),讓機構能重用以太坊的基礎架構。7-11% 的質押收益吸引目光,惟驗證者最低 2000 AVAX 門檻製造摩擦。Avalanche 子網路(subnet)架構高度可定製,也許會吸引企業用戶,但也增加機構投資前需要理解的複雜度。

Institutional custody support for Avalanche exists through Coinbase and others, but adoption lags Ethereum and Solana significantly. The network's positioning as an "Ethereum alternative" rather than a complement may limit its appeal to institutions hedging Ethereum exposure. Avalanche's strongest institutional case likely lies in its subnet model for permissioned enterprise applications rather than public staking.

Avalanche 已有 Coinbase 等機構級託管支援,但採用程度遠不及以太坊和 Solana。其自我定位較偏「以太坊替代品」而非互補,反而降低吸引機構用於分散以太坊風險的誘因。Avalanche 最有潛力的機構應用場景,大概率落在子網路(subnet)用於聯盟鏈企業應用,而非公開質押方面。

Polkadot's nominated proof-of-stake offers yields of 8-11.5% with about 56% of DOT staked. The network's focus on parachain auctions and interoperability creates unique institutional considerations. Custodians like Coinbase support DOT staking, but the complexity of parachain participation and the 28-day unbonding period create operational challenges.

Polkadot 的提名權益證明機制(NPoS)年化 8-11.5% 的收益,有約 56% DOT 進行質押。其側鏈拍賣和跨鏈互通等設計為機構帶來獨特考量。Coinbase 等託管商有支援 DOT 質押,但參與側鏈以及 28 天解綁期讓實務操作更具挑戰。

The broader pattern is clear: Ethereum and Solana have institutional infrastructure ready for immediate ETF staking adoption, while other networks lag meaningfully behind. Cardano, Cosmos, Avalanche, and Polkadot may build institutional readiness over time, but the next 12-24 months likely see capital concentration in ETH and SOL products due to their superior infrastructure depth.

整體趨勢明顯:以太坊和 Solana 的機構基礎設施已充分為 ETF 質押做好準備,其他網絡則明顯落後。Cardano、Cosmos、Avalanche 和 Polkadot 日後或逐步加強機構佈建,但未來 12-24 個月資本很可能會集中於 ETH 和 SOL 產品,因為它們基礎設施深度遠勝同儕。

Winners and Losers: Modeling Post-Ruling Capital Flows

Revenue Procedure 2025-31 will redistribute capital at unprecedented scale. To understand the winners and losers, we must model how institutional flows will behave and what second-order effects will emerge.

2025-31 號收益程序將以前所未有的規模重新分配資本。要理解誰是贏家誰是輸家,必須建模分析機構資金流向會如何變化,以及可能出現哪些次級效應。

Start with current ETF assets. Ethereum spot ETFs held $27.6 billion in Q3 2025, up 173% from $10.1 billion at quarter start. BlackRock's ETHA alone commands $15.7 billion, making it one of the largest crypto investment products globally. If these ETFs stake at the average 29.5% network rate, they could add over $8 billion in staked ETH.

先從目前 ETF 規模說起。以太坊現貨 ETF 在 2025 年第三季持有 276 億美元資產,比季初 101 億美元增長 173%。僅 BlackRock 的 ETHA 就有 157 億美元規模,成為全球最具規模的加密投資產品之一。如果這些 ETF 以 29.5% 平均網絡質押率參與,將能對質押 ETH 增加超過 80 億美元規模。

However, the reality will differ. ETFs cannot stake 100% of assets due to liquidity requirements. The SEC expects funds to maintain reserves ensuring at least 85% of assets can be redeemed quickly, even with some holdings staked. Given Ethereum's 23-day activation and 38-day exit queues, ETFs will likely stake 50-70% of assets initially, leaving substantial reserves for redemptions.

但實際情況有所不同。由於流動性規定,ETF 不可能質押 100% 旗下資產。SEC 預期基金要保留充裕備用金,至少 85% 資產可快速贖回,即便部分資產已質押。考慮以太坊 23 天啟動期和 38 天退出隊列,ETF 初期大約會質押 50-70% 資產,預留較大幅度的贖回準備金。

At 60% staking ratios, Ethereum ETFs would add roughly $16.5 billion in new staked capital. This represents approximately 4.7 million ETH at $3,500 prices, a 13% increase over current staking participation. Distributing this across validators, it could launch 147,000 new 32-ETH validators, a 14% increase in the validator set.

如果質押比例為 60%,以太坊 ETF 將新增約 165 億美元的質押資本。以每顆 3500 美元計算,約等於 470 萬顆 ETH,較目前質押參與率提升 13%。分配到驗證者,將新增 14.7 萬個 32 ETH 驗證者群,相當於驗證者總數增長約 14%。

This influx compresses yields through simple supply-demand mechanics. Ethereum's issuance rewards scale with total staked amount, while MEV and transaction fees are relatively fixed. As more ETH stakes, individual validator rewards decline. Current modeling suggests yields could fall from 3-4% to 2.5-3.5% if staking participation rises from 29.5% to 35%.

這種資本大舉湧入,會依供需機制壓縮質押收益。以太坊的發行獎勵會隨總質押量增長而稀釋,而 MEV 與手續費收益則相對固定。質押 ETH 越多,單一驗證者的報酬就越低。現有模型預估,若質押率由 29.5% 升至 35%,質押收益率將從 3-4% 下滑至 2.5-3.5%。

However, this yield compression might be offset by increased network security and value accrual. Higher staking participation makes attacks more expensive, potentially reducing risk premiums in ETH valuations. If ETH prices rise due to perceived increased security, total staking returns in dollar terms could remain attractive despite lower APR.

然而,這些收益壓縮有機會被更高網路安全性與價值增長抵消。質押參與度提高,使得攻擊成本更高,有機會降低 ETH 定價中的風險溢價。若市場認同安全提升進而推高 ETH 價格,即使年化收益率下降,折算成美元的總質押報酬仍有吸引力。

The validator distribution matters critically. Ethereum currently suffers from concentration risk, with Lido controlling 24.4% of staked ETH, down from over 32% at peak. Institutional ETF staking through qualified custodians will likely increase concentration among Coinbase, Anchorage, and BitGo validators. These three firms might collectively control 15-20% of Ethereum validators after ETF staking ramps up.

驗證者分布的狀況極其關鍵。以太坊目前有集中化風險,Lido 控制了 24.4% 的 ETH 質押,雖然已較高峰逾 32% 明顯下降。若機構 ETF 經合格託管人質押,很有可能讓 Coinbase、Anchorage、BitGo 旗下驗證者份額進一步集中。ETF 質押推升後,這三家公司合計可能掌控 15-20% 的以太坊驗證者。

This centralization creates governance risks. Ethereum uses social consensus for major decisions, but validator concentration gives large custodians disproportionate influence. If Coinbase, acting as custodian for multiple ETFs, controls 10% of validators, its technical decisions on client diversity and protocol upgrades carry significant weight. The community must watch custodian concentration carefully to preserve Ethereum's decentralization ethos.

這種集中化會帶來治理風險。以太坊大事仰賴社群共識,但驗證者過度集中會讓大型託管商擁有過度影響力。如果 Coinbase 作為多檔 ETF 託管商,控制 10% 驗證者,那它在客戶端多元化、協議升級等技術決策上就極具分量。社群必須密切關注託管端集中度,才能維護以太坊去中心化的核心精神。

Liquid staking protocols face existential questions. Lido's stETH holds over $18 billion TVL, representing about 30% of all staked ETH. When ETFs can offer staking directly with regulatory approval, will DeFi users still prefer Lido? The answer depends on use cases.

流動性質押協議正面臨生存難題。Lido 的 stETH TVL 已逾 180 億美元,約為所有質押 ETH 的 30%。當 ETF 能合規提供直接質押時,去中心化金融(DeFi)用戶還會選擇 Lido 嗎?答案取決於用例需求。

Retail and DeFi-native users will likely continue using liquid staking tokens because they offer composability ETFs cannot match. You can use stETH as collateral in Aave, provide liquidity on Curve, or farm additional yields on Convex. ETFs provide simpler exposure for traditional investors but lack DeFi integration. This suggests liquid staking and ETF staking will serve different market segments rather than directly competing.

散戶和 DeFi 原生用戶很可能會繼續使用流動質押代幣,因為其組合彈性遠超 ETF。你可以把 stETH 當作 Aave 抵押資產,或是到 Curve 提供流動性,甚至在 Convex 進行額外挖礦。ETF 為傳統投資人提供簡單入門途徑,但缺乏 DeFi 整合。這意味著流動質押和 ETF 質押會服務不同客群,而不是直接競爭。

However, marginal users face real choice. Someone holding ETH primarily for price exposure and secondary staking yield might choose an ETF over Lido for the simplicity and regulatory comfort. This could slow liquidstaking growth rather than shrinking it outright. Expect Lido's market share to decline from 30% toward 25% as ETF staking scales, but not collapse entirely.

隨著ETF賭注規模擴大,預期市場上的質押規模會持續成長而不是徹底萎縮。Lido 的市佔率預計會從 30% 下滑至約 25%,但不至於完全瓦解。

Rocket Pool's positioning as the more decentralized alternative to Lido might gain appeal in this environment. If institutional ETF staking increases centralization concerns, some portion of the crypto-native community may shift toward Rocket Pool's 2,700+ independent node operators. The network's 8 ETH minipool requirement democratizes validation more than ETFs ever could.

Rocket Pool 作為 Lido 更去中心化的替代方案,在此情勢下或將提升吸引力。如果機構型 ETF 質押加劇中心化疑慮,部分原生加密社群可能會轉往 Rocket Pool,因為該平台聚集了 2,700 多名獨立節點營運者。該網路僅需 8 ETH 的迷你質押池,讓參與驗證的門檻遠比 ETF 更具民主性。

Solana presents different dynamics. The Bitwise Solana Staking ETF launched in July 2025 with staking enabled from day one, demonstrating institutional readiness. If Solana ETFs accumulate assets at rates comparable to Ethereum products, the impact on network staking could be even more pronounced given Solana's smaller market capitalization.

Solana 方面狀況不同。Bitwise Solana Staking ETF 於 2025 年 7 月推出,上線首日即開放質押,展現出機構級的準備度。若 Solana 的 ETF 吸金速度可與以太坊產品媲美,在 Solana 市值較低的情況下,對網路質押的影響將更顯著。

Solana currently has approximately 393.6 million SOL staked worth about $65 billion. If Solana ETFs reach even 20% of Ethereum ETF assets - roughly $5.5 billion - and stake 60% of holdings, they would add about $3.3 billion in staked capital. At $165 per SOL, this represents 20 million additional staked SOL, a 5% increase in network staking.

Solana 目前約有 3.936 億枚 SOL 正在質押中,總市值約 650 億美元。若 Solana ETF 僅達到以太坊 ETF 資產的 20%(約 55 億美元),並將其中 60% 進行質押,就將為網絡新增約 33 億美元的質押資本。以每枚 165 美元計算,相當於 2,000 萬枚 SOL 將額外質押,帶動整體質押規模提升約 5%。

This smaller absolute increase reflects Solana's already high 67% staking participation rate, among the highest of major networks. With most SOL already earning rewards, incremental institutional staking has less room to grow participation percentages. Instead, it will concentrate stake with institutional validators, likely increasing Coinbase and BitGo's share of Solana validation.

這種規模較小的增幅,反映出 Solana 已擁有 67%的質押參與率,在主流網路中屬極高水準。由於絕大多數 SOL 已在領取質押獎勵,機構質押的後續增長空間有限,反而更可能讓質押資本集中於機構驗證者手上,進一步推高像 Coinbase、BitGo 在 Solana 網絡驗證的占比。

Solana liquid staking through Marinade and Jito may actually benefit from institutional ETF launches. These protocols emphasize MEV capture and validator optimization, offering higher yields than simple ETF staking. Sophisticated users might stake SOL through ETFs for regulatory-approved core holdings, while farming additional yields with liquid staking derivatives in DeFi. This complementary relationship could help both grow rather than cannibalize each other.

Solana 透過 Marinade 和 Jito 進行流動質押,反而可能因機構 ETF 的推廣而獲益。這些協議強調 MEV 擷取及驗證者優化,提供高於 ETF 質押的收益率。精明用戶可能透過 ETF 質押 SOL,取得合規的核心資產部位,同時運用流動質押衍生品在 DeFi 生態裡農耕追加收益。這種互補性關係,有助於助長雙方發展,而非單純相互競爭。

The second-order effects on DeFi liquidity deserve close attention. Currently, a significant portion of liquid staking tokens serve as collateral in lending protocols, liquidity in AMMs, and yield sources in farming strategies. As ETH and SOL migrate from liquid staking into ETFs, does DeFi liquidity dry up?

DeFi 流動性的次級效應值得關注。目前有大量的流動質押代幣用於借貸協議中的擔保品、AMM 流動性來源,以及作為農耕策略收益工具。當 ETH 與 SOL 從流動質押轉向 ETF,DeFi 流動性是否會枯竭?

The answer likely depends on which users move capital. If institutional buyers allocate new capital to ETFs rather than pulling existing DeFi positions, no displacement occurs. However, crypto-native funds that previously used liquid staking might shift some capital to staking ETFs for regulatory or operational reasons. This would reduce DeFi liquidity at the margin.

答案很大程度上取決於資本移動方向。如果機構投資人是用新資金投入 ETF,而非撤出台後再轉進 ETF,就不會產生排擠效果。但如果本來就有在使用流動質押的加密原生資金,因合規或操作理由,將部分資本轉去質押型 ETF,則 DeFi 流動性將會出現邊際減少。

Specific protocols face specific risks. Curve's stETH-ETH pool is among DeFi's deepest liquidity pools, enabling large stETH trades with minimal slippage. If stETH supply growth slows as institutional capital chooses ETFs instead, Curve liquidity could thin, increasing slippage and reducing capital efficiency. Similar risks exist for Rocket Pool's rETH pools and Solana liquid staking derivatives.

個別協議也會面臨特定風險。Curve 的 stETH-ETH 池是 DeFi 裡流動性最深的池之一,允許 stETH 大額交易而只產生極小滑價。如果 stETH 供應成長因機構資金選擇 ETF 而放緩,Curve 的流動性可能下降,滑價提升、資本效率下降。Rocket Pool 的 rETH 池與 Solana 的流動質押衍生品流動性皆將面臨相同風險。

The mitigation is that DeFi composability offers value ETFs cannot replicate. Users who want to earn staking yield while simultaneously providing liquidity, borrowing against their positions, or farming additional tokens will stick with liquid staking. Only users who want passive staking exposure without DeFi complexity will choose ETFs. This self-selection limits DeFi displacement.

緩解方案在於 DeFi 可組合性的價值是 ETF 難以複製的。想同時賺取質押收益並提供流動性、將部位作為擔保借款、或是參與農耕產生額外代幣的用戶,仍會選擇流動質押;只有想要被動質押、避免 DeFi 複雜度的用戶才會選擇 ETF。這種自我篩選效果有助於限縮 DeFi 被取代的規模。

Another critical consideration is validator rewards distribution. Currently, independent and small-scale validators earn the same per-validator rewards as large institutional operations. As institutional staking grows, the economics may shift. If Coinbase, Anchorage, and BitGo collectively operate 20% of Ethereum validators, they capture 20% of all staking rewards - hundreds of millions of dollars annually.

另一個關鍵考量是驗證者獎勵的分配。目前,獨立或小型驗證者與大型機構營運的獎勵本質上一樣。若機構質押持續擴大,經濟效益可能轉變。若 Coinbase、Anchorage、BitGo 這類機構集體掌握了以太坊 20% 的驗證者數量,就會攫取 20% 的質押獎勵,每年相當於數億美元。

This concentration of rewards with institutions rather than distributed among independent validators transfers wealth from crypto-native participants to traditional financial intermediaries. The trade is liquidity and regulatory comfort for decentralization and community alignment. Ethereum and Solana communities must decide if this trade serves their long-term interests or whether measures are needed to preserve independent validator economics.

這導致獎勵由分散的驗證者流向機構,將財富從原生加密參與者轉到傳統金融中介。這也是去中心化和社群共識換取流動性與合規便利的交換。以太坊和 Solana 社群必須思考這樣的交換是否符合長遠利益,或需採取措施保護獨立驗證者的經濟環境。

Network inflation dynamics also change. Ethereum's issuance is currently slightly deflationary due to EIP-1559 fee burning, with transaction fees often exceeding new issuance. If staking participation rises from 29.5% to 35%, total issuance increases while fee burning continues at recent rates. This could make Ethereum nominally inflationary again unless transaction activity increases proportionally.

網路通膨機制也會受到影響。目前以太坊執行 EIP-1559 交易費銷毀,發行量輕微減縮(通縮),因為手續費銷毀量經常超過新發行。然而,若質押參與率從 29.5% 增至 35%,總發行量就會提升,而手續費銷毀量若無相應增長,以太坊可能再次進入名義通膨狀態,除非交易量成長跟上。

For token holders, this matters tremendously. One of Ethereum's bull cases is its transition to a deflationary asset as usage grows. If institutional staking increases issuance faster than fee burning can offset, the deflationary narrative weakens. ETH prices might face headwinds from increased supply even as institutional adoption theoretically increases demand.

對於持幣者來說,這意義重大。以太坊的利多敘事之一就是使用量提升將推動其轉為通縮資產。如果機構質押帶動發行增速超過銷毀速率,通縮故事將失色。即使機構採用推升需求,ETH 價格也可能因供給增加而承壓。

Solana's inflation schedule provides more predictability. The network decreases inflation 15% year-over-year toward a 1.5% terminal rate, regardless of staking participation. Institutional staking simply redistributes who earns inflation rewards rather than changing total issuance. However, if staking participation increases above current 67% levels, yields per staker decline as more participants split the same reward pool.

Solana 的通膨排程則更為可預測。該網路 每年將通膨率削減 15%,最終至 1.5% 終點,參與質押比例不影響總發行。機構質押僅影響通膨獎勵的分配對象,不改變總體發行量。不過若質押參與超過現有的 67%,單一參與者的收益會下降(分蛋糕的人變多)。

The competitive implications extend beyond current major networks. Proof-of-stake chains not yet launched on ETFs face pressure to build institutional infrastructure quickly or miss the capital wave. Avalanche, Cosmos, Cardano, and others must convince custodians to prioritize their integration or risk permanent marginalization in institutional portfolios.

這些競爭態勢將延燒至現有主鏈之外。尚未推出 ETF 的權益證明鏈,面臨需迅速完善機構基礎設施或錯失資本浪潮的壓力。Avalanche、Cosmos、Cardano 等鏈必須說服託管商優先整合,否則將面臨在機構資產組合中被邊緣化的風險。

This creates winner-take-most dynamics where networks with early institutional readiness capture disproportionate capital, which then funds further infrastructure development, attracting more capital in a virtuous cycle. Networks without institutional traction spiral into irrelevance as capital and attention concentrate elsewhere. The next two years likely determine which proof-of-stake chains achieve institutional legitimacy and which become niche plays.

這最終形成贏者通吃的格局:越早具備機構基礎設施的網路,越能攫取大量資本,推動再投資完善基建,進一步吸引新資金之良性循環。缺乏機構吸力的網路則會因資本與關注外流而逐漸邊緣化。未來兩年將決定哪些權益證明鏈能取得機構認可,哪些只剩下小眾市場。

Secondary Effects: DeFi Disruption, Validator Economics, and Layer-2 Implications

次級影響:DeFi 動盪、驗證經濟學與 Layer-2 發展趨勢

The institutional staking revolution ripples far beyond simple yield capture. Second-order effects will reshape DeFi protocol economics, alter validator participation patterns, and influence Layer-2 development trajectories in ways that deserve dedicated analysis.

機構質押革命影響的不只是單純收益獲取。其次級效應將重新塑造 DeFi 協議經濟學、改變驗證者參與模式,並影響 Layer-2 的發展軌跡,值得深入剖析。

DeFi protocols built on proof-of-stake chains fundamentally depend on native token liquidity. When users lock tokens in staking, less remains available for DeFi activities. The liquid staking innovation solved this by tokenizing staked positions, but institutional ETF staking threatens to reverse this solution.

建構於權益證明鏈上的 DeFi 協議本質上依賴原生代幣流動性。當用戶將大量代幣鎖入質押,便減少投入 DeFi 的可用份額。流動質押的創新,透過將質押部位代幣化解決了這問題,但機構型 ETF 質押卻可能使這一進展走回頭路。

Consider Ethereum-based lending protocols. Aave allows stETH as collateral, enabling users to borrow against staked positions without unstaking. This capital efficiency drives significant DeFi activity. If ETF staking captures institutional capital that would otherwise enter DeFi through liquid staking, Aave's available collateral growth slows.

以以太坊借貸協議為例,Aave 已允許 stETH 作為擔保品,讓用戶無需解質押即可藉此借款。這種資本高效性促進了大量 DeFi 活動。若 ETF 質押把本應進入 DeFi 的機構資金攬走,Aave 的擔保品增長便會放緩。

The magnitude matters. If $5 billion of potential stETH deposits instead enter ETFs, Aave loses $5 billion in potential collateral, which might have supported $3-4 billion in additional lending at typical loan-to-value ratios. This contracts DeFi credit availability and potentially increases borrowing costs as supply tightens relative to demand.

規模十分關鍵。若有 50 億美元潛在 stETH 存款改為轉進 ETF,Aave 就損失 50 億美元潛在擔保品,這原可支撐 30~40 億美元新放款(以一般抵押率計)。這將收縮 DeFi 信貸供給,供給相對需求變緊下,也可能推升借貸成本。

Similar dynamics affect decentralized exchanges. Uniswap and Curve host massive stETH-ETH liquidity pools that enable efficient trading between staked and unstaked positions. These pools require providers to supply both assets, earning trading fees in return. If stETH supply growth slows due to ETF competition, providing liquidity becomes less attractive as volumes decline relative to capital requirements.

去中心化交易所亦受相同影響。Uniswap 與 Curve 擁有龐大的 stETH-ETH 流動性池,促進質押與非質押部位間的高效轉換。這些池需要供應商注入雙資產,以收取手續費作為回報。如果 stETH 供應量因 ETF 競爭而成長遲緩,流動性提供將隨交易量下滑而吸引力下降。

The self-correcting mechanism is yield differentials. If liquid staking token yields fall below ETF yields due to reduced demand, arbitrageurs will shift capital until yields equilibrate. However, during transition periods, significant dislocations can occur. DeFi protocols should prepare for potential liquidity shocks as capital migrates.

市場自我調節機制來自於收益率差。在需求減弱導致流動質押代幣收益低於 ETF 時,套利者會轉移資本直至兩者收益率再度趨同。然而,在過渡期,可能發生明顯資本錯位。DeFi 協議必須提早因應資本大規模轉移帶來的流動性衝擊。

Farming and yield aggregation protocols face particular disruption. Strategies that stake ETH via Lido to receive stETH, deposit stETH in Curve, stake the Curve LP tokens in Convex, and farm CVX rewards have been popular yield sources. Each step adds complexity but also additional yield. If institutional capital prefers simple ETF staking, these complex farming strategies lose depositors and their yields compress from reduced activity.

農耕與收益聚合協議將面臨格外衝擊。像透過 Lido 質押 ETH 獲得 stETH,將 stETH 存入 Curve、把 Curve LP 幣質押到 Convex 拿 CVX 獎勵這樣的複合收益策略深受用戶歡迎。雖然每層增加複雜性,但也提升收益。如果機構資金偏好單純的 ETF 質押,這些複雜策略將流失存戶,活動減少下收益也將壓縮。

The countervailing force is that sophisticated yield farming will always attract some participants regardless of institutional ETF availability. Professional DeFi farmers can achieve net returns materially higher than ETF staking by layering strategies, accepting smart contract risk, and actively managing positions. This subset of users won't migrate to ETFs because they're willing to

而對應的力量在於:不論 ETF 如何普及,複雜的收益農耕仍會吸引一部分進階用戶。專業 DeFi 農夫能透過疊加多層策略、承擔智能合約風險並主動管理部位,取得遠高於 ETF 的實際報酬。這類族群因為願意承擔風險與複雜度,不會輕易轉向 ETF。接受更高的複雜性與風險,以換取更高的報酬。

Validator economics 因機構參與而面臨深刻變革。目前,以太坊驗證節點仍保持相對去中心化,超過 106 萬名驗證者由數千個獨立實體運營。雖然 Lido 佔有最大比例(24.4%),但沒有任何單一實體控制超過三分之一的質押份額。

機構型 ETF 質押將驗證權限高度集中於少數符合資格的託管機構。如果 Coinbase、Anchorage 和 BitGo 在兩年內共同運營 20% 的驗證節點,這三家實體所控制的質押總額即與 Lido 持平。這種集中化威脅以太坊的抗審查性與可信中立性。

技術層面的擔憂在於驗證者串通。如果少數託管機構控制大量驗證節點,理論上他們可能協同審查交易、透過 MEV 搶先操作用戶,或影響協議治理。雖然這些參與者受到監管而較不會有惡意行為,但技術上的可行性仍帶來風險。

社群可能的回應包括:透過協議修正懲罰驗證者過度集中。像是限制單一實體可營運的驗證節點數量,或降低同一運營者的驗證節點獎勵,這些想法已在以太坊研究圈討論。然而,實施這類變革需要謹慎設計,以避免副作用並維持網絡的可信中立。

單機驗證者因機構競爭而面臨經濟壓力。個別驗證者必須自行投資硬體、維持上線狀態並持續監控運作。機構驗證者發揮規模經濟,將固定成本分攤到成千上萬個驗證節點。這種效率差距,讓機構營運商能提供比個人驗證者更高的 ETF 淨收益。

長期來看,這種經濟劣勢可能減少單機驗證者的參與。如果居家驗證者因為無法與機構競爭而退出,以太坊將失去關鍵的去中心化基礎。網絡必須設法維護單機驗證者的經濟誘因,否則將面臨被機構壟斷的風險。

流動質押協議事實上有助於維持去中心化。透過聚合小額質押並分散給多個獨立運營者,像 Rocket Pool 這樣的協議能在提供機構級收益的同時,維持驗證者多元性。如果以太坊研究社群重視去中心化,應鼓勵流動質押協議的發展,而不是將其視為機構採用的威脅。

Solana 的驗證者經濟與以太坊不同,原因是其基礎設施需求較高。運行一個 Solana 驗證節點所需的硬體和頻寬更昂貴,自然而然形成對大規模營運者有利的規模經濟。機構型 ETF 質押傾向加速這種集中,而非引入新的集中化。

正面觀點認為,機構資本提升了 Solana 的安全性。質押總額提升後,攻擊成本變高,機構驗證者引進專業運營標準,進一步降低斷線風險。如果 Solana 能在質押集中度上升的同時擴增驗證節點數量,即使大型營運商控制較多的質押,也能維持去中心化。

Layer-2 網絡因機構參與 Layer-1 質押而面臨複雜影響。以太坊主流擴容路徑仰賴像 Arbitrum、Optimism 和 Base 這類 rollups,以承擔大量交易並最終結算在以太坊主鏈。這些 rollup 依賴以太坊的安全性,理論上,參與質押的人愈多,主鏈安全性愈高。

但如果機構資本多數集中於 Layer-1 質押,流入 Layer-2 生態的資本會減少。和機構在各層分散資本的情境相比,這可能導致 Layer-2 DeFi 發展與流動性增長放緩。 Layer-2 團隊必須考量是否自設質押機制,或專注維繫於以太坊主鏈的安全性。

某些 Layer-2,如 Polygon,擁有獨立的驗證者集和質押代幣。Polygon PoS 採用 MATIC 質押,總質押超過 18 億美元以支援以太坊擴容。如果機構資本多數集中於 ETH 和 SOL 的質押,MATIC 這類替代 Layer-1 質押代幣,將較難爭取到機構配置。

例外可能是那些與以太坊共享安全性、且無獨立代幣的 rollup。例如由 Coinbase 建構的 Base,既承襲以太坊安全性,也給 Coinbase 用戶熟悉的品牌。機構投資人可能偏好這種方案,而非獨立 Layer-2 代幣,從而推動活動往共享安全的 rollup 聚集,並弱化獨立 Layer-1 競爭對手。

通過 EigenLayer 等協議重質押帶來了新的複雜度。這些服務允許已質押的 ETH 同時為多個協議提供安全,並產生額外收益。但重質押也提升風險,因懲罰措施(slashing)可能波及多個協議。

機構型 ETF 初期很可能會避開重質押,因相關風險過高。然而,若 EigenLayer 成熟並證明其風險控管有效,未來 ETF 產品可能會納入重質押,以提高收益。這將需要美國國稅局對重質押是否適用 Revenue Procedure 2025-31 的安全港給予進一步指引,增加了潛在監管的不確定性,可能拖慢普及步伐。

目前浮現的整體趨勢是:追求最高收益、運用複雜策略的 DeFi 原生用戶,與優先簡單合規的機構投資者,正出現分歧。這造就兩種平行的質押經濟:一類是高度專業的 DeFi 堆疊,包括流動質押衍生品、farming 與重質押;另一類是簡明直接的機構體系,透過 ETF 與託管質押進行。這兩個體系間會有互動、套利連結,但各自服務目標用戶群,且優先順序不同。

監管與全球影響:競爭格局

Revenue Procedure 2025-31 展現美國積極領導機構型加密採納的決心。然而,其影響範圍遠超美國本土,因各國正根據美國的競爭定位做出反應。

歐洲的加密資產市場法規(MiCA)於 2024 年生效,建立了歐盟首個全面的加密監管框架。MiCA 為加密服務提供者設立執照要求、對穩定幣施加準備金要求,並強制實施消費者保障。不過,MiCA 對質押的規範尚不如美國 Revenue Procedure 2025-31 明確。

歐洲資產管理業正在密切關注美國動態。如果美國 ETF 成功提供質押收益,且歐洲產品因監管不明確而無法效仿,資本將流向美國市場。這種競爭壓力可能推動歐洲證券與市場管理局(ESMA)加快對質押型金融商品的指引。預計如美國產品證明成功後,歐盟質押 ETF 規範將在 12 到 18 個月內明朗化。

英國金融行為監管局(FCA)對於加密產品創新持開放態度,並同時重視投資人保護。在脫歐後,英國可獨立於歐盟規範提前行動,或有可能讓英國資產管理業在 MiCA 合規產品出現前,率先發行質押產品。這讓倫敦能定位在美國創新與歐洲謹慎之間的中間地帶。

亞洲呈現分裂狀態。新加坡金融管理局(MAS)採取先進的加密監管策略,對交易所進行嚴格授權並規範風險管理。不過,新加坡本地市場規模有限,對全球影響力不大。即使新加坡監管機關批准質押 ETF,主要服務的還是區域性投資人,而非全球機構資本。

香港近期積極轉向支持加密政策,希望成為亞洲加密樞紐。香港證監會SFC 已批准比多數西方司法管轄區更開放的加密 ETF 規則,包括允許實物交收的創建和贖回。如果未來香港允許這些產品質押,將可吸引本可能流向美國市場的亞洲機構資本。

日本金融廳自從多起交易所駭客事件後,維持較保守的加密監理方針。預期日本監管機構對質押 ETF 採取觀望態度,會先觀察美歐發展經驗才會制定本地規則。這代表日本機構資本現階段主要透過海外產品參與質押,而非本國產品。

南韓的零售投資極為積極,但機構監管卻嚴謹保守。南韓的退休基金與保險公司不論質押 ETF 規則多開放,仍面臨嚴格的加密資產投資上限。若要促成南韓機構顯著參與,可能不僅需放寬質押商品,也得進行更廣泛的監管改革。

中東,尤其是阿聯酋,在發展加密友善監管方面表現積極。杜拜虛擬資產監管局(VARA)與阿布達比全球市場(ADGM)已有多家加密公司領牌,並展現對創新產品的開放態度。不過,這些司法管轄區內的機構資本有限,意味即便在當地批准質押 ETF,這些產品仍以監管試驗場(regulatory sandboxes)性質為主,而難成為全球資本重地。

拉丁美洲各國亦有意發展 吸引加密貨幣企業,但通常缺乏足夠成熟的監管能力,無法迅速建立質押ETF的框架。以巴西為區域內最大經濟體,若其證券監管機構Comissão de Valores Mobiliários把加密產品列為優先項目,則巴西或能領先同區。不過,政治動盪與經濟困難通常讓加密監管淪為政策優先次序的末端。

對區塊鏈網路而言,這種競爭格局有著深遠影響。美國機構投資人參與度強的網路—主要是Ethereum和Solana—因能率先捕獲ETF質押資金流而受益。其他在外國司法管轄區更受歡迎的網路,則須等待當地監管明朗才能取得類似的資本來源。

Cardano於日本和非洲市場的相對優勢,在這些地區尚未核准質押產品前,對機構資本貢獻甚微。Cosmos去中心化特性使其深受主權意識強烈的社群愛戴,但也更難符合機構需求。這些網路若無法說服美國監管機構及資產管理人將其與ETH、SOL同等看待,獲取機構資本的道路將更加艱困。

對資產管理人而言,「監管套利」至關重要。若美國維持最具吸引力的質押監管框架,而其他司法轄區進展緩慢,則美國ETF發行商將具備相較外國競爭者的顯著優勢。歐亞資產管理人可能設立美國子公司推質押產品,導致產業活動更加集中於美國市場。

加密產業活動集中於美國,產生了與加密去中心化理念背道而馳的集中風險。倘若美國規範有效決定哪些網路可取得機構資本,美方監管機構的影響力將過度主導哪些區塊鏈技術能夠成功。這種「監管俘虜」的憂慮促使國際協調,但國家競爭利益往往在實務上凌駕於合作之上。

國際證券監管機構組織(IOSCO)提供監管協調的平台。然而,IOSCO的建議並無約束力,各地常根據自身優先事項有所偏離。意義重大的質押產品全球標準,可能需數年協商,且未必能具體到為產品帶來確定性的程度。

新興的規律是監管分裂而非一致。美國首先推動明確的質押ETF規則;歐洲則謹慎跟進,更強調消費者保護;亞洲則分歧為創新友善(如香港、新加坡)與保守(如日本)轄區。這種分裂態勢對於全球佈局、擁有多元機構入口的網路有利,而地區性網路則處於劣勢。

稅務影響不只侷限於美國「安全港」本土。不同司法轄區對質押獎勵的課稅方式並不一:有些在收到時即視為所得,有些只在出售時課稅,也有些根本尚未釐清。機構投資人在多區佈局質押產品時,必須面對這層複雜性。

美國機構投資人透過合規ETF質押,因《2025-31號收入程序(Revenue Procedure 2025-31)》而享有明確稅務處理。相比之下,歐亞投資人大多沒有類似明朗性,使美國產品反而受惠。欲爭取全球機構資金的網路,必須與各地監管機構協作,取得稅務確定性——這一過程成本高昂,資源豐沛的協議比靠自力更生的新創更占優勢。

地緣政治因素重要性日益浮現。隨著加密逐漸成為戰略性基礎建設,各國爭相主導其發展。美國財政部強調該指引使美國持續領先全球區塊鏈技術,正反映這種競爭思維。中國的數位人民幣推進、歐洲的MiCA法規、以及新興市場的各類實驗,皆是塑造加密發展格局的嘗試。

質押ETF在這場棋局中成為博弈工具;准許此等產品的國家吸引資金與企業活動,禁止或延遲的國家則讓位於競爭對手。結果是各國爭相提供明確規則,勝者將瓜分這個可能達數兆美元產值的產業極大市佔。

結語

2025-31號收入程序(Revenue Procedure 2025-31)標誌著機構金融全面擁抱權益質押時代的來臨。多年來,加密業者強調,質押收益讓權益證明型(Proof-of-Stake, PoS)代幣本質上有別於傳統資產。如今,在IRS認可和操作明確之下,此論點首次以受監管產品的方式進入主流機構投資視野。

接下來的12到24個月,將決定哪些PoS網路能實質獲得機構資本,哪些則錯失世代機會。三大核心決勝因素為:既有機構基礎建設、質押以外領域的監管明朗性、以及能打動傳統資產配置者的投資敘事。

Ethereum在此階段具備近乎不可撼動的結構性優勢。超過280億美元ETF資產已待啟動質押,大規模託管及驗證基礎建設運作成熟,機構對Ethereum的熟悉度遠勝其他替代方案。僅黑石(BlackRock)旗下的157億美元ETHA ETF,就可能在全面推行後數月內額外增加300至500萬枚ETH進入質押。

但Ethereum年化3-4%的質押報酬率,低於Solana的6-7%,更遠遜於Cosmos等高收益替代方案(如18%)。尋求PoS最高收益的資產配置人可能會在市場領頭羊以外多元佈局。若競爭者能獲得等同機構信任,即有分庭抗禮機會。

Solana為最具競爭力的機構替代選擇。首檔質押ETF已順利推出,主要託管業者支持SOL質押,且其網路效能優勢可直接轉化為機構認可的數據。若Solana維持網路穩定,且Ethereum縮放爭議仍在膠著,則資金流入規模可能超乎預期。

2025-2026年需重點觀察的指標包括ETF資金流動、驗證者集中度、以及DeFi流動性影響。每月Ethereum和Solana質押ETF的資金流入將反映機構需求。若趨勢抄襲比特幣ETF初期採納幅度,2年內質押產品有機會吸納500至1000億美元,徹底重塑區塊鏈經濟學。

驗證者集中度需持續監控。倘若Coinbase、Anchorage、BitGo三家占Ethereum驗證者比例逾25%,則集中化疑慮將升高。社群可能會推動協議變更以限制集中度,抑或通過社會協調施壓機構更廣泛分散質押。這種拉鋸局最終結果將決定Ethereum長期的可信中立性。

DeFi協議適應力將體現更廣泛生態系的健康狀況。若Aave、Curve、Uniswap等協議即使面對機構質押競爭仍能維持甚至成長TVL,則代表複雜的DeFi策略在ETF產品橫空下依舊有其價值。反之,若DeFi TVL停滯或下跌,意味機構資本正取代而非補足原有活動。

代幣持有人應隨市場格局演變調整策略。對於追求低操作負擔的ETH持有人,質押ETF現已提供過去僅能經技術設置或DeFi協議獲得的收益之監管管道。強調去中心化與可組合性的用戶,則可持續透過Lido、Rocket Pool等流動性質押衍生品來參與。

網路驗證者必須因應機構競爭加劇所帶來新局。單獨驗證者或需加入質押池,方能抵禦機構規模經濟下的生存壓力。專業質押運營則可藉由優異表現、特殊地理多元化、或專精MEV策略,證明其可收取溢價費用的價值。

DeFi協議更應同時準備好機構資本身兼競爭者與潛在合作夥伴的雙重角色。設計能與ETF質押整合的產品—如ETF份額的二級市場或以質押收益為基礎的衍生品—有助吸引機構目光。全盤排斥機構採用的協議,將有遭資本繞過的風險。

2025年底最重要也最被低估的故事,是2025-31號收入程序帶來「權益質押屬於正當金融活動、非單純投機賭博」的監管認證。這種哲學層面的轉變,比任何單一技術細節都重要。當美國財政部和IRS明文允許受監管產品中的質押,其意義在於區塊鏈技術已從實驗晉升為基礎設施。

此認證將吸引目前因監管不明而擱置的機構資本。企業資金、退休基金、捐贈基金及保險公司等過去躲避加密的機構,現今可在合規部門允許下配資於質押產品。潛在進入質押的資本規模,遠勝當前參與水平。

未來兩年,預估質押ETF資產將從近乎零成長到一千億美元以上,且主要集中於Ethereum和Solana產品。這波機構採用潮,將使權益質押獲致合法化地位。consensus mechanisms and validates networks that prioritized institutional readiness over purely technical metrics. Networks that ignored institutional needs will struggle to catch up as first-movers compound their advantages.

對於共識機制以及驗證那些優先考慮機構就緒度而非純粹技術指標的網路來說,那些忽視機構需求的網路將很難追上,因為先行者的優勢會不斷累積。

For individual investors and institutions alike, the strategic imperative is clear: understand which networks have institutional infrastructure, monitor validator concentration carefully, and watch how traditional finance and DeFi coexist or compete. The great ETF staking revolution has begun. Those who understand its implications will capture returns. Those who ignore it will miss the most significant institutional capital inflow in cryptocurrency history.

對於個人投資人與機構來說,戰略重點十分明確:了解哪些網路擁有機構級基礎設施,密切監控驗證者集中度,並關注傳統金融與DeFi是如何共存或競爭的。ETF質押的大革命已經開始。能理解這股趨勢的人將把握住收益,而忽視它的人將錯過加密貨幣史上最重大的機構資金流入。

The transformation from niche crypto activity to mainstream institutional product represents a maturation moment for the entire blockchain industry. Revenue Procedure 2025-31 didn't just clarify tax treatment - it opened the floodgates for trillions in institutional capital to finally participate in the staking economy that has defined proof-of-stake networks since their inception. The winners in this new era will be networks that understood institutional requirements years ago and built accordingly. The losers will be those that prioritized decentralization rhetoric over practical infrastructure deployment.

從小眾加密活動轉變為主流機構產品,標誌著整個區塊鏈產業的成熟時刻。Revenue Procedure 2025-31不只是釐清了稅務處理,更為數兆規模的機構資金參與質押經濟打開了大門——這正是自權益證明網路誕生以來的核心。此新時代的贏家,將是那些早年就理解機構需求並相應建設的網路;而輸家,則是那些只強調去中心化口號,卻忽略實際基礎建設的網路。