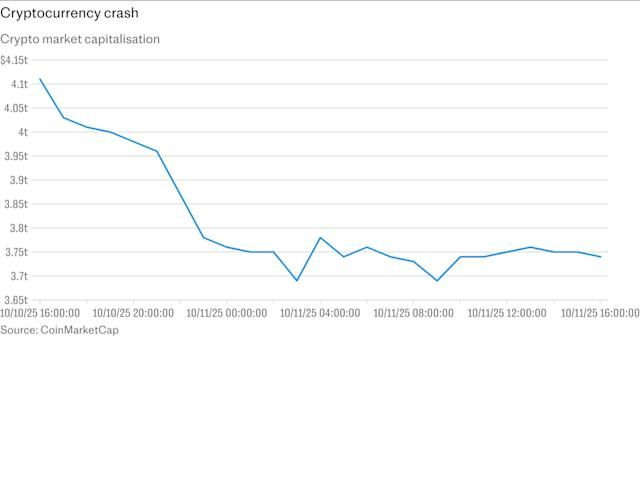

數十億損失。三項資產崩潰。八天漏洞視窗。這場加密貨幣有史以來最大規模崩盤,背後是一場精密針對全球最大交易所的定點打擊,而非單純的市場暴跌。

2025年10月10日晚上,幣安上的交易者驚恐地看著其投資組合瞬間蒸發。在短短40分鐘內,三項數位資產幾乎失去大部分價值:本應維持1美元錨定的Ethena USDe穩定幣跌至0.65美元,Wrapped Beacon ETH僅剩每美元0.2,Binance Staked SOL更只剩下0.13美元。將近170萬名交易者在這場加密貨幣史上最大單次強平事件中慘遭清算,市場總損失超過190億美元。

這場混亂的背景,是整體金融市場拋售。美國總統川普宣布自11月1日起對中國進口商品徵收100%關稅,引發金融市場震盪。比特幣僅幾天前創下125,000美元歷史新高,卻暴跌逾13%,以太幣也下跌18%。但幣安上發生的事,遠不止一次正常的市場修正。

包括 Enjin 和 Cosmos 在內的多種加密貨幣,價格一度崩到接近零元,許多用戶稱系統嚴重過載。交易者反映帳戶凍結、停損失效,甚至在市場最大跌幅期間好幾分鐘無法執行任何交易。

隨著塵埃落定,一個耐人尋味的理論浮現。知名加密貨幣記者吳說區塊鍊(Colin Wu)提出本次崩盤可能是協同攻擊針對幣安以及市場做市商,利用了眾所皆知的統一帳戶保證金系統漏洞。值得懷疑的是:崩盤時點,恰逢幣安宣布重大安全更新和真正實施更新之間的八天時間窗。

這三個受影響資產在幣安24小時成交額高達35至40億美元,實際虧損估算在5億至10億美元之間。倘若攻擊理論屬實,這將是加密貨幣史上最精密的利用事件之一——一場以資本效率為名、將底層結構武器化的精準打擊。

危機時序

要了解10月11日這場崩盤,必須回溯到事發前數天,也就是幣安風控團隊發布宣告、無意間向關注者暴露出漏洞的關鍵時刻。

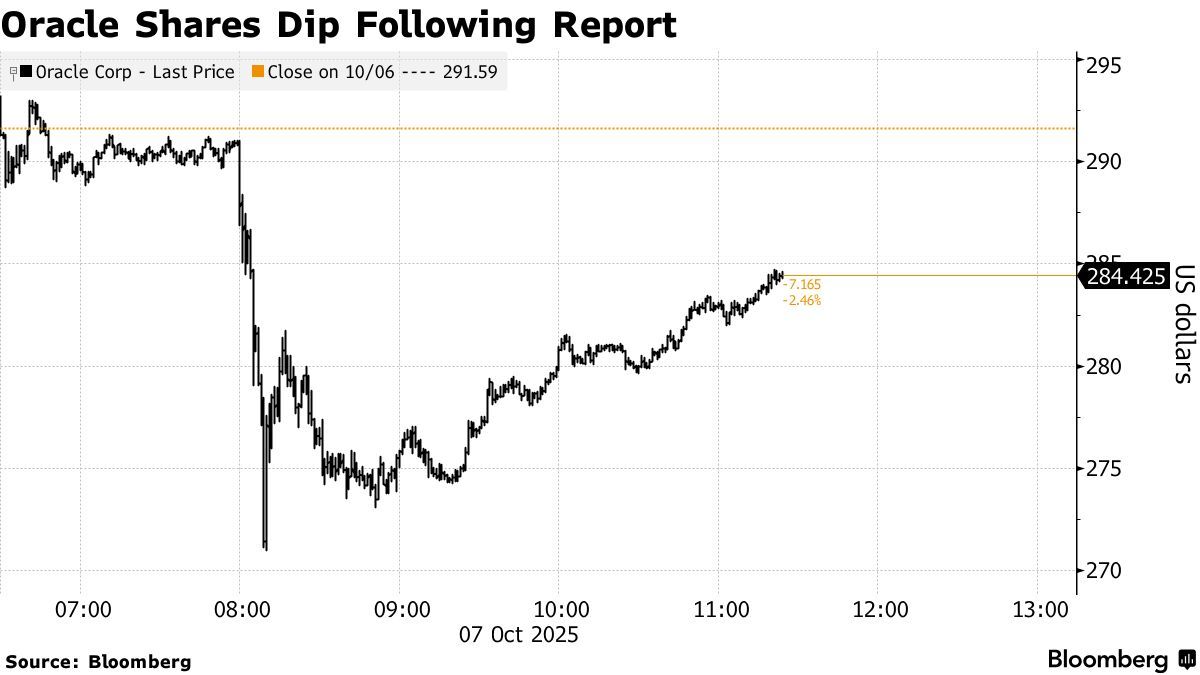

10 月 6 日:預言機更新公告

10月6日,幣安宣布將調整部分保證金交易抵押資產的定價機制,計劃從內部撮合價格轉為更可靠的外部數據來源,預計10月14日上線。

對幣安來說,這是再正常不過的技術升級——旨在提升質押衍生品與可產收益代幣之保證金抵押的價格精度。但同時也無意洩漏了關鍵訊息:風控團隊發現這些資產在強平流程中存在漏洞,需要修補。而且,幣安公開宣布這項漏洞在未來八天將維持開放。

10 月 10-11 日:攻擊視窗

崩盤於美國時間10月10日星期五深夜爆發,比特幣當日高點122,456美元跌至最低點105,262美元,近七成跌幅。以太幣跌幅超過12%,XRP則從2.83美元跌至1.89美元,跌幅13%。

但幣安保證金系統上的災情尤為突出。比特幣與主流山寨幣雖然全體下挫,相對有序,但幣安上的三種資產卻陷入死亡螺旋。市場波動加劇時,採用幣本位保證金的交易者,由於抵押品瞬間崩潰,損失急劇擴大。USDe跌至0.65美元,wBETH跌至0.2美元,BnSOL僅剩0.13美元,然而這些資產在其他平台或鏈上協議卻還是明顯更高價。

鏈上Aave的USDe預言機數據仍維持1:1,顯示這場災難其實僅限於幣安內部定價機制失效,未反映整個市場的真實狀態。這一斷層,成為「協同攻擊」理論的關鍵證據。

清算一波波湧現,幣安上的幣種紛紛閃崩,IOTX一度價值歸零。觀察者指出,消息來源稱主流中心化交易所自動清算與交叉保證金掛鉤的抵押品,連鎖觸發價格驟降。

10 月 11-12 日:系統失效與回應

清算海嘯加劇,幣安系統不堪負荷。交易所承認交易體驗中斷,因市場過於活躍導致系統延遲及顯示異常,同時承諾用戶資金安全無虞。

幣安聯合創辦人何一發表聲明,坦承本次異常並承諾對因系統失效造成直接損失的用戶進行補償。聲明指出市場劇烈波動與大量用戶湧入導致部分交易者遇到交易問題。

數據顯示,幣安合約(期貨)共用的BTC、ETH、BNB USDT本位保險基金從12.3億跌至10.4億美元,1.88億美金用來應對極端波動風險。

10 月 14 日:預言機修補

10月14日如期,幣安上線預言機更新,切換外部價格來源,並將贖回價格納入三個受影響代幣的指數計價。漏洞視窗終於關閉——但損失已經造成。

幣安統一帳戶保證金系統運作機制

要理解幣安為何曝露脆弱,就必須認識其統一帳戶保證金系統的運作方式,及其和傳統模式的根本差異。

統一保證金的願景

幣安的投資組合保證金模式(Portfolio Margin,又稱統一帳戶)將各類交易產品的保證金需求合併管理。此機制下,交易者能以各種不同資產作為抵押,提高資本利用率與操作彈性。

傳統保證金交易通常有兩種方式:以USDT計價倉位,借還都以最主流穩定幣USDT結算;幣本位倉位,則以比特幣或其他幣種做抵押,並按此計價。前者價格穩定,後者讓交易者可持續持倉自選資產。

幣安的統一帳戶則採用不同路徑。用戶不僅可用「穩定資產」做抵押,更允許用戶將多樣的受支持資產,跨現貨、合約、衍生品統一充當保證金。這讓資本效率空前提升——可用整個投資組合作為抵押,而無需分倉管理。

統一維持保證金率

投組保證金的核心是統一維持保證金率(Unified Maintenance Margin Ratio, uniMMR),評估交易者全帳戶的風險狀況,會計入整體資產的調整後權益與總維持保證金。

高uniMMR代表風險較低,低uniMMR則意味風險升高、隨時面臨強平。uniMMR計算方式為「統一帳戶調整後權益 / 統一維持保證金金額」。

當帳戶uniMMR低於1.05(即105%)就會被強平。若uniMMR降至1.5或以下觸發第一次通知,1.2再發第二次通知,當到這個門檻時,帳戶將自動限制為只能平倉模式,無法開新倉或借更多保證金。

抵押率與資產估價

統一帳戶內,不同資產的抵押價值不盡相同。根據交叉保證金錢包內資產量,部分資產會按一定抵押率(即可認列為抵押品的百分比)折算。

這裡,幣安有個關鍵設計選擇。比特幣、以太幣等主流資產享有極高抵押率——通常95%以上,但幣安也讓用戶將質押衍生品及有收益型穩定幣當作抵押品,包括wBETH、BnSOL、USDe。

理論上,接受這些資產沒問題。例如Wrapped Beacon ETH代表抵押質押以太幣及其累積的獎勵,一枚wBETH等同一枚質押ETH並持續獲得累積獎勵,自2023年4月27日起,wBETH價值會隨著質押收益逐漸超過ETH。

同理,Binance Staked SOL則將質押SOL和其獎勵合而為一,讓用戶在... 流動性。

而 Ethena 的 USDe,儘管並非傳統由法幣儲備支持的穩定幣,卻是透過一套精密的價差中性(delta-neutral)對沖策略來維持與美元掛鉤,其以質押的以太幣(Ethereum)作為抵押,並於衍生品市場建立空頭部位來對沖風險。

理論上,這些資產即使在市場波動期間也應維持相對穩定。然而,實際上卻隱藏著關鍵脆弱性。

價格定價問題

這正是「統一保證金系統」的致命弱點所在。與其他交易所不同,幣安採用自家內部訂單簿(即平台上的買賣盤)來作為保證金交易的價格依據。當交易量減少時,這就成了一個問題。

對於流動性深厚、買賣差價小的資產,內部定價通常運作良好;但像是新興的、流動性不足的資產(如權益證明衍生品),內部訂單簿價格很可能會與實際市場價值嚴重脫鉤。在壓力時期,這種價差可能迅速擴大。

Ethena Labs 創辦人、USDe 發行人 Guy Young 表示,脫鉤事件之所以發生,是因為幣安的價格體系依賴於自身有限的流動性,並未參考其他主要交易所的價格。

這個設計缺陷形成了一個封閉回路:幣安依據自己的訂單簿決定清算價格,當有集中的賣壓時,訂單簿就可能被操控或衝垮,從而引發更多清算,進而拋售更多資產到同一個流動性缺乏的訂單簿,讓連鎖清算進入惡性循環。

這就像一顆等著「對的人」或「對的條件」引爆的未爆彈。

脆弱性與利用理論

自 10 月 11 日起,困擾加密貨幣分析師的問題是:這場崩跌究竟是系統性失靈,還是更險惡的事——一場精心策畫、有組織的攻擊,利用了幣安的結構性弱點。

攻擊理論

根據吳說區塊鏈(Colin Wu)的分析,這次崩跌更像是一場有針對性的打擊,目標鎖定幣安及其主要的做市商之一。最脆弱之處,正是「統一賬戶」保證金系統允許用波動性大的資產作為抵押品。

這場攻擊需要多個協同要素。首先,攻擊者需發現漏洞——具體來說,就是幣安對流動性有限資產的清算計算採用自身現貨訂單簿價格;其次,他們得建立能從協同價格崩跌中獲利的部位;然後,他們要有足夠資本和協調力,去集中賣出相關資產,壓垮標的資產的訂單簿。

隨著川普關稅宣布後整體加密市場下殺,據傳攻擊者對 USDe、wBETH 和 BnSOL 在幣安上發動大量拋售,導致這些資產在幣安激烈脫鉤;但在其他交易所及鏈上,這些資產價格相對穩定。

攻擊時機特別關鍵,也印證了有蓄意操作的指控。攻擊發生於幣安 10 月 6 日預告調整價格預言機,10 月 14 日才實施的間隙,給了攻擊者一個明確的「作案視窗」。雖然幣安風控團隊察覺到部分風險敞口,但延宕處理,讓漏洞被成功利用。

再融資借貸與槓桿放大

攻擊效能還可能被「遞迴借貸」策略大幅放大。所謂遞迴借貸,就是用一個資產作為抵押,再借出資金——用來再買進該資產——再當作抵押進行新的借貸,如此重複。這能以較小本金建立極高槓桿曝險。

假若攻擊者用 wBETH、BnSOL 或 USDe 作抵押建倉,再引發價格閃崩,就會因保證金下降觸及清算線,系統被迫拋售這些抵押資產到原本就很脆弱的訂單簿,使價格進一步下跌並引爆更多清算,形成自我強化的連鎖效應。

與 DeFi 預言機攻擊的相似性

這種疑似漏洞利用法,與早前 DeFi 預言機操縱攻擊極為相似。2022 年 10 月,交易員透過操控 Mango Markets 平台 MNGO 代幣的預言機價格,壓高自身抵押品價值後貸出超過一億美元;2021 年 8 月,Cream Finance 也多次因此類預言機攻擊損失超過 1.3 億美元。

幣安這次則是一個變形版:攻擊者並非操縱「外部預言機」,而是鎖定幣安本身作為對這些資產訂價的「內部預言機」,利用集中的拋售行為讓這個封閉系統內部價格失真,進而觸發機制錯誤。

反駁觀點:系統性故障

並非所有人都認同這是協調攻擊的說法。另一種解釋認為,崩跌其實是「系統設計缺陷」與「超常市場壓力」交互作用下的結果,而非有意的人為操作。

從這觀點出發,幣安允許「可生息資產」作為抵押是根本誤判。比特幣與以太坊在市面上有豐沛流動性,但權益證明衍生品或合成穩定幣的市場盤子本就薄弱。在壓力時刻,買賣差價會劇烈擴大,流動性往往瞬間蒸發。

BitMine 董事長 Tom Lee 對 CNBC 表示,市場這波回調本來就是遲來的修正,自四月以來行情已漲 36%;他強調當天 VIX 波動指數飆升 29%,是歷史上前 1% 最大單日波動,而這次下殺其實算健康洗牌。

根據這解釋,川普關稅聲明是最初的「震撼彈」。當比特幣及其他代幣在各交易所齊跌,幣安上用 wBETH、BnSOL 或 USDe 杠桿建倉的用戶面臨追加保證金壓力。比特幣跌幅 13% 後,他們的杠桿部位本已淪為虧損,而抵押品本身也開始大幅貶值。

這些用戶為了補保證金或止損,紛紛賣出抵押資產,引發幣安冊本已稀薄的訂單簿雪崩,價格跳水,進而觸發更多清算,再造成更多出售壓力——這是「死亡螺旋」的經典案例,無需任何刻意協調。

雙方理據並存

事實很可能兼具兩種因素。研究人員指出,相關證據同時支持「協同操作」與「系統碰巧失靈」兩種說法。

支持攻擊論者的理據:攻擊時機精準落在系統漏洞的公告視窗內;資產價格僅在幣安閃崩,其它交易所穩定;爆量交易集中於三個資產;發現和利用內部訂價漏洞需極深專業知識。

支持系統故障論者的理據:川普關稅導致整體市場壓力爆發;波動資產做質押抵押其實本就風險極高;交易所極端成交量下,技術挑戰本來就很大;幣安公開承認問題是系統性故障並非惡意攻擊。

無論是哪一種,唯一不爭的事實是——這場壓力測試證明幣安的基礎建設根本無法應對如此極端場景,無論壓力來源是自然還是人為。

崩潰核心:三大重挫資產

10 月 11 日這場崩盤圍繞著三類資產展開,每一種都代表一種加密原生金融創新,也點出了複雜金融工程在極端壓力時的巨大風險。

Ethena USDe:合成穩定幣

Ethena USDe 是一種合成穩定幣,旨在透過加密原生穿插對沖機制維繫美元掛鉤,並透過質押與衍生品市場賺取收益。不同於以法幣儲備為基礎的 USDC 這類穩定幣,USDe 以加密資產(如質押的 ETH),以及 ETH 永續合約空單作為對沖。

該協議採雙機制設計:一方面以 ETH 和 stETH 等資產進行超額抵押,另一方面透過在 ETH 永續合約市場持有空單來平衡價格波動,保證抵押品的美元價值穩定。收益則來自質押獎勵和永續合約中杠桿交易員支付的資金費率。

截至 2025 年 10 月,USDe 的市值突破 120 億美元,成為全球最大型的穩定幣之一。該協議的迅猛成長引來市場讚賞其創新,也伴隨風險憂慮。

批評者早就質疑 USDe 是否真能穩定。只要空單需求突然大於多單,資金費率大幅轉負,Ethena 的空單可能難以覆蓋多頭部位;此時 USDe 價格就可能跌破 1 美元。

10 月 10 日至 11 日,這一擔憂成為現實。Ethena 合成穩定幣 USDe 快速跌至 0.65 美元,同時 wBETH、BnSOL 也陷入暴跌。但鏈上 Aave 預言機的 USDe 報價卻始終維持一比一,導致鏈外的問題不會在區塊鏈上大規模連鎖清算。

這個差異揭示了關鍵問題:USDe並未在任何根本意義上脫鉤。協議的對沖機制依然健全。實際上,是幣安的內部訂單簿買方流動性不足,無法承受高度集中的賣壓,導致該交易所的價格脫離了更廣泛的市場價格。

Ethena Labs創辦人Guy Young解釋,這次脫鉤發生,是因為幣安的定價系統僅依賴自身有限的流動性,而未與其他多個主流交易所的價格做比對。

Wrapped Beacon ETH (wBETH):質押獎勵的錯誤示範

Wrapped Beacon ETH是一種會累積價值的流動質押代幣,一枚wBETH代表一枚被質押的ETH及自2023年4月27日以來所累積的質押獎勵。用戶可以將ETH質押或將BETH代幣包裝轉換為wBETH,或於ETH質押頁面以零手續費將wBETH贖回ETH。

BETH與wBETH間的初始兌換比自2023年4月27日以一比一開始,但隨著質押獎勵累積,一枚wBETH的價值逐漸超過一枚ETH。此比率會每日更新,反映ETH質押所賺取的獎勵。

wBETH的設計旨在解決權益證明系統中的根本問題:被質押的資產通常鎖定且無流動性。透過將質押以太幣代幣化成可交易包裝代幣,幣安賦予用戶一邊賺取質押獎勵,一邊仍可交易、放貸或將資產作為抵押品的能力。

然而,這項創新也帶來了新風險,並在十月暴跌期間顯現。幣安的包裝beacon以太幣價格在UTC週五21:40左右暴跌至430美元,較當時超過3,800美元的以太幣/泰達現貨價格打了88%的折扣,跌幅驚人。

像wBETH這類代幣設計上應緊密追蹤其標的現貨資產價格。幣安將這些包裝資產估值依據其現貨市場價。在一般情況下,套利者會同時買入較便宜資產、賣出較貴資產,以協助維持其價格接近基本價值。

但10月10日並非一般情況。隨著以太坊在大盤拋售下自跌,wBETH遭遇雙重衝擊。首先,標的資產失去價值。其次,交易者為了補保證金或平倉,將wBETH大量拋入幣安訂單簿,速度遠超套利者反應能力。

包裝代幣暴跌,幣安基礎設施也出現瓶頸,使做市商更難維持價格穩定。系統過度仰賴幣安內部訂單簿,混亂中無法連結外部價格基準,導致wBETH脫離ETH真實價值的錨定。

Binance Staked SOL (BnSOL):Solana清算事件

Binance Staked SOL代表已質押SOL及其獎勵,並以可交易、可轉移的形式發行。該代幣透過BnSOL對SOL的轉換比率累積質押獎勵,即使用於其他幣安產品或外部DeFi應用亦同。

SOL質押年化報酬率(APR)為動態數值,跟隨鏈上質押獎勵,每兩至三天(每個Solana紀元)更新一次,並因網路整體質押參與度、驗證節點表現等因素波動。

BnSOL和wBETH有相同結構特徵:均屬於兼具收益與流動性的流動質押衍生品。在十月暴跌時,也出現同樣的弱點。

Binance Staked SOL也一度跌至34.90美元,與Solana現貨價大幅倒掛。暴跌期間,Solana在他所交易所價約在150至160美元波動,而BnSOL跌破35美元,貼現幅度超過75%。

與USDe、wBETH一樣,BnSOL的基本價值並未受損——質押的Solana持續賺取獎勵,協議機制也正常運作。危機完全是交易所層級的定價與流動性問題。

共同主線:內部定價與外部現實

三大資產暴跌的共同原因,在於幣安內部定價和外部市場現實之間的落差。USDe跌到0.65美元,wBETH插水到0.2美元,BnSOL跌到0.13美元,而這些資產在其他地方價格都高得多。

其他交易所與鏈上,這些資產相對穩定,顯示混亂僅侷限於幣安流動性。這種地域性集中危機——主要限於單一交易所內部定價系統——或許是最有力證據,顯示幣安基礎設施某處根本故障,讓暴跌一發不可收拾。

預言機缺口與時機問題

如果10月11日的崩盤確為蓄意攻擊,其時間點凸顯精心規劃,顯示攻擊者對幣安風控流程極為熟悉。

八日漏洞視窗

10月6日,幣安宣布將修正後來被利用的定價問題。交易所表示,將從只用自家訂單簿價格,轉為參考更具公信力的外部數據,預計10月14日啟用。

此舉本意是安撫用戶,表明幣安正主動解決潛在風險,卻意外等同於公開公告一個明確的已知漏洞,且附有解決的期限表。

攻擊正好發生於幣安宣布調整預言機價格與實際實裝之間,給予攻擊者明確的操作時窗。

對任何密切關注幣安公告的進階市場參與者來說,10月6日聲明就是明燈:這幾個特定資產有定價漏洞,交易所知情,距離修補還有八天。如果有心人士想利用內部定價弱點,10月6日至13日正是黃金時機。

預言機更新欲修復之問題

規劃中的預言機更新,核心在於將外部價格引入清算計算。幣安宣布調整包裝資產為比率定價,也就是不再參考充滿波動和壓力的現貨市場成交價,而是依據質押比率,也就是每枚包裝代幣所代表的實際ETH數量。

幣安同時宣布三項修正:將贖回價格納入三大代幣指數計算、為USDe設低價閾值,以及更頻繁審查風控。

這些措施可藉由將抵押資產估值與脆弱、易操弄的內部訂單簿脫鉤,避免連環清算。即使幣安wBETH現貨市場崩到0.2美元,預言機也會認定每枚wBETH仍代表具體且可查證的質押以太坊價值。

但10月10日,這道安全防線還未啟用。

內部警訊與風險控管失靈

幣安風控團隊在暴跌前已察覺部分風險,但修正延遲讓漏洞未及修補,最終讓攻擊有機可乘。

這暴露對幣安風險管理程序的嚴峻質疑。如果團隊發現漏洞嚴重到需公開說明並規劃變更,為何還要等八天才修正?為何不即刻調高風控參數或提高受影響資產抵押率做臨時處理?

答案很可能與在運作數十億日交易量的現貨交易所進行重大基礎設施調整的複雜度有關。適當測試、分段上線以及多系統協同都需時間。但這一現實,卻創造出已知的高風險時期——根據攻擊理論,有心人精準利用了這個窗口,重創平台。

時間差本身是否成為陷阱?

更悲觀的解讀是,公開提前八天公告安全更新時程,違反了資安最佳實踐。傳統金融系統的重大漏洞通常於修補後才公布,以防止惡意利用。

幣安選擇先公告、後實施,或許是考慮透明度與用戶資訊揭露的平衡。使用相關資產作為抵押品的交易者有權得知即將調整的價格機制。但這份透明,卻以操作安全為代價。

無論是被發現機會點並出動的複雜協作行動,還是單純市場力量壓倒已知弱點,從公告到實施間的八日窗口,已造成災難性後果。

系統設計瑕疵或蓄意協同攻擊?

關於10月11日究竟是攻擊還是結構缺陷,討論指向的是加密貨幣市場架構、交易所設計、及金融創新極限的更深層問題。

有計劃性利用的論據

多項因素支持協同行動者刻意利用幣安漏洞的推測。

時機精準:崩盤發生於已知漏洞視窗中,暗示行動者密切監控幣安公告並因勢利導。大盤自然調整恰巧落在這特定八天的機率極低。

資產選擇:在幣安統一保證金系統接受作為抵押品的眾多代幣中,唯有三枚出現災難性脫鉤,而這些恰恰是最容易受內部定價操控的資產,因為它們——

(內容未完)limited liquidity and reliance on Binance's order book for valuation.

流動性有限,以及依賴幣安的訂單簿進行估值。

Coordinated Selling: Attackers reportedly bombarded Binance with sell orders for USDe, wBETH, and BnSOL, causing their prices to depeg massively on just Binance's exchange while remaining stable elsewhere. This pattern suggests concentrated, coordinated selling rather than diffuse market panic.

協同拋售:有消息指出,攻擊者密集對幣安投下了大量USDe、wBETH和BnSOL的賣單,導致這些資產在幣安交易所價格嚴重脫鉤,而其他平台則保持穩定。這種模式顯示是集中的協同拋售,而非市場整體恐慌所致。

Profitability: If actors established short positions or removed collateral before initiating the crash, they could profit from both the price collapse and the liquidation cascade. Market rumors suggested that hours before Trump announced 100 percent China tariffs, a 2011 Bitcoin whale opened billion-dollar shorts on BTC and ETH, earning around 200 million dollars as markets plunged.

獲利方式:如果行動方在引發價格崩跌前建立空單或提前移除抵押品,便可同時從價格暴跌和清算連鎖反應中獲利。有市場傳聞稱,川普宣布對中國課徵100%關稅的數小時前,一名2011年比特幣巨鯨開設了數十億美元的BTC與ETH空單,隨著市場暴跌大約賺進2億美元。

Sophisticated Knowledge Required: Exploiting this vulnerability required understanding Binance's internal pricing mechanisms, margin calculation formulas, and the specific weaknesses of using yield-bearing assets as collateral during volatility - knowledge suggesting insider information or sophisticated market surveillance.

須具備高度知識:利用這種漏洞需要深刻理解幣安的內部定價機制、保證金計算公式,以及在高波動時以生息資產作為抵押品的特殊弱點——這樣的知識暗示可能涉及內線資訊或高階市場監控。

The Case for Systemic Failure

Equally compelling evidence suggests the crash resulted from structural flaws interacting with market stress rather than deliberate manipulation.

同樣有力的證據顯示,這次崩盤是結構性缺陷與市場壓力相互作用的結果,而非刻意操縱。

Macro Catalyst: Trump's tariff announcement provided a genuine, exogenous shock to markets. The announcement triggered a selloff of 18 billion dollars in cryptocurrency according to CNN, with effects rippling across all risk assets. This real market event could explain the initial downward pressure without requiring coordination.

宏觀導火線:川普宣布徵收新關稅給市場帶來了真正的外部衝擊。根據CNN,這項公告引發了180億美元加密貨幣拋售,並波及所有風險資產。這一實際的市場事件即可解釋初期下跌壓力,無需假設有事先協調。

Universal Exchange Stress: Binance wasn't the only exchange to experience outages and frozen transactions. Coinbase and Robinhood reported similar issues. This suggests the problem stemmed from unprecedented volume and volatility rather than targeted attack on one platform.

全體交易所壓力:幣安並非唯一出現系統當機與交易凍結的平台。Coinbase與Robinhood也報告了類似的問題。這顯示問題源於前所未有的交易量與波動,而非單獨針對某一平台的攻擊。

Predictable Failure Mode: Financial engineers have long understood that accepting volatile or illiquid assets as collateral creates pro-cyclical risk. During stress, collateral loses value precisely when it's needed most, forcing liquidations that create more stress. No coordination is required for this dynamic to spiral out of control.

可預期的失敗模式:金融工程師早已明白,以高波動或低流動性資產作為抵押品會創造順週期風險。在市場壓力下,抵押品往往於最需要時喪失價值,強迫進行清算、進而激化危機。這一動態無需協調,也能導致失控。

Arbitrage Failures: Market makers and arbitrageurs, who normally prevent large price discrepancies between venues, faced their own liquidity and risk management constraints during the chaos. Their inability to close the gaps between Binance prices and external markets could reflect overwhelming volatility rather than deliberate manipulation.

套利失靈:做市商與套利者通常能防止不同平台間出現巨大價差,但在此次混亂中卻受到自身資金流動與風險管控限制。平台價格與外部市場出現落差,可能反映的是極端波動而非刻意操縱。

Insufficient Infrastructure: Binance's system delays and transaction failures, while criticized by users, are consistent with inadequate infrastructure for handling extreme volume spikes. Binance stated that platform modules briefly experienced technical glitches, and certain assets had depegging issues due to sharp market fluctuations.

基礎設施不足:幣安系統延遲與交易失敗,雖遭用戶批評,但其實與其基礎設施不足以應對極端交易量激增相符。幣安聲明,平台部分模組曾短暫出現技術異常,部份資產因突發劇烈波動出現脫鉤。

Hybrid Explanations

The most plausible explanation may involve elements of both theories. Natural market stress provided the initial catalyst - Trump's tariff announcement was real, Bitcoin's decline was genuine, and trading volumes genuinely spiked across all exchanges.

最合理的解釋可能是兩種理論的結合:自然的市場壓力提供了最初的導火線——川普的關稅宣布是真實的、比特幣的下跌也確實發生,同時所有交易所的交易量也確有大幅激增。

But sophisticated actors may have recognized that this macro event created ideal conditions for exploiting Binance's known vulnerability. By adding concentrated selling pressure on the three vulnerable collateral assets at the precise moment when the exchange's systems were already stressed, they could amplify natural market forces into a catastrophic cascade.

但高階玩家可能意識到,這種宏觀事件為利用幣安已知漏洞創造了絕佳時機。於交易所系統已經吃緊的當下,對三項脆弱抵押資產進行集中賣壓,可將自然市場力量放大成災難性的連鎖效應。

This hybrid model doesn't require advance knowledge of Trump's announcement or the ability to create market-wide panics from scratch. It simply requires:

這種混合模式並不需要提前得知川普的宣布,也不必從零製造整個市場的恐慌,只需做到:

- Monitoring Binance's announcements to identify the vulnerability window

監測幣安公告以辨識漏洞出現時機 - Positioning to profit from a price collapse in the three vulnerable assets

佈局於這三項脆弱資產上,準備從價格暴跌中獲利 - Waiting for any significant market downturn to provide cover

等待一波明顯的市場下跌作為掩護 - Executing concentrated selling during the chaos to overwhelm internal order books

在混亂中集中賣出,壓垮內部訂單簿 - Allowing the recursive liquidation spiral to do the rest

剩下的就交給遞迴式清算漩渦繼續發酵

Whether purely coordinated attack or opportunistic exploitation of structural weakness during natural market stress, the result was the same: Binance's infrastructure failed catastrophically, and traders paid the price.

無論是完全集中協同攻擊,還是自然市場壓力下對結構性弱點的機會利用,結果都一樣:幣安的基礎設施災難性失效,交易者為此付出了代價。

Regulatory and Industry Implications

Crypto.com CEO Kris Marszalek called for regulators to investigate exchanges with high liquidation volumes, noting that 20 billion dollars in losses hurt many users.

Crypto.com執行長Kris Marszalek呼籲監管機構調查高清算量的交易所,強調200億美元損失衝擊大量用戶。

The October 11 crash has renewed calls for enhanced regulatory oversight of cryptocurrency exchanges, particularly regarding:

10月11日這場崩盤再度引發加強加密貨幣交易所監管的呼聲,特別是在以下方面:

- Collateral requirements: Should exchanges face restrictions on accepting volatile or illiquid assets as margin collateral?

抵押品要求:交易所是否應該被限制接受高波動或低流動性的資產作為保證金抵押品? - Pricing methodology: Should regulators mandate the use of external oracles or composite price feeds rather than internal order books?

價格機制:監管機構是否應要求交易所採用外部預言機或綜合價格來源,而非僅憑內部訂單簿報價? - Transparency requirements: Should exchanges disclose known vulnerabilities more carefully, or implement fixes before public announcement?

透明度要求:交易所是否應更謹慎披露已知漏洞,或在公告前就已實施修正? - Insurance funds: Are current exchange insurance funds adequate to cover losses from extreme events?

保險基金:目前交易所的保險基金是否足以應對極端事件的損失? - System resilience: Should exchanges face uptime and performance requirements during high-volume periods?

系統韌性:在高交易量時段,交易所是否必須達到一定的上線及效能標準?

These questions will likely shape the evolution of cryptocurrency regulation in the coming years, as policymakers seek to prevent future incidents while preserving the innovation that makes crypto markets distinctive.

這些問題預計將在未來數年內影響加密貨幣監管的發展方向,政策制定者將努力防止類似事件再發生,同時維護加密市場的創新特質。

Market-Wide Impact and Contagion

While the most severe damage concentrated on Binance, the October 11 crash sent shockwaves through the entire cryptocurrency ecosystem, raising questions about market structure and interconnectedness.

儘管最嚴重的衝擊集中在幣安,此次10月11日崩盤仍對整個加密貨幣生態系帶來震盪,並引發了市場結構與連動性的質疑。

The Scope of Losses

The crash resulted in 19 billion dollars liquidated on the crypto market in 24 hours, with more than 1.6 million traders liquidated. CoinGlass data showed that 7 billion dollars was flushed in a single hour during the peak of the crisis.

此次崩跌造成加密市場於24小時內清算共計190億美元資產,超過160萬名交易者遭清算。CoinGlass數據顯示,在危機巔峰時單小時內就蒸發70億美元。

Bitcoin, having reached an all-time high of 125,000 dollars earlier in the week, fell to around 105,000 dollars before partially recovering to trade in the 110,000 to 115,000 dollar range. Ethereum fell 12.15 percent, Binance Coin dropped 9.87 percent, and XRP plunged 13.17 percent.

比特幣本週稍早曾創下12.5萬美元新高,本次下跌至約10.5萬美元,隨後回升至11萬到11.5萬美元區間。以太幣重挫12.15%,幣安幣下跌9.87%,XRP暴跌13.17%。

Altcoins bore the brunt of the selloff. Altcoins tumbled between 30 percent and 80 percent as liquidations mounted. Some tokens experienced flash crashes to near-zero values before rebounding.

山寨幣成為此次賣壓的最大受災戶,紛紛暴跌30%至80%。部分代幣甚至閃崩至接近零價,隨後才略微反彈。

Contagion or Containment?

Despite the severity of losses, the crisis displayed both concerning contagion effects and surprising resilience in certain areas.

儘管損失慘重,此次危機展現了市場擴散風險及部分區域的韌性。

A recent market meltdown exposed vulnerabilities in centralized price oracles, such as Chainlink and Pyth, which feed dollar prices to exchanges, DEXs, and DeFi apps. While longs were liquidated and shorts hit liquidity boundaries, blockchains themselves remained stable, handling DeFi trades and swaps flawlessly.

近期的市場崩潰曝露出集中式價格預言機的弱點,例如Chainlink和Pyth等向交易所、DEX及DeFi應用提供美元價格的服務。多頭遭清算、空頭觸及流動性邊界,但底層區塊鏈依然運作正常,DeFi合約執行和調換毫無障礙。

This divergence reveals an important characteristic of the October 11 crash: it was primarily an exchange-level crisis rather than a protocol-level failure. Ethereum continued processing transactions normally. Solana's validators kept producing blocks. DeFi protocols on multiple chains functioned as designed.

此一分化現象揭示了10月11日崩盤的關鍵特徵:這是一次以交易所層面為主的危機,而非協議層級的失靈。以太坊照常處理交易;Solana驗證節點持續產塊;多鏈DeFi協議按原設計正常運行。

The crisis remained largely confined to centralized exchanges, with Binance bearing the most extreme impact due to its specific infrastructure vulnerabilities. This containment suggests that cryptocurrency markets have developed some resilience against systemic collapse, even as individual platforms remain vulnerable.

此次危機多半局限於中心化交易所,幣安因基礎設施弱點受到最大衝擊。這種「封閉」顯示加密市場對系統性崩潰具有一定抵抗力,即使單一平台仍存脆弱風險。

Impact on DeFi and Stablecoins

As liquidations mounted, many users of centralized crypto exchanges reported failed orders, with some traders unable to close positions before blowups. This experience drove renewed interest in decentralized alternatives.

清算潮湧現時,大量中心化交易所用戶反映訂單失敗,部分交易者甚至無法在爆倉前平倉。這種經驗重新激發了市場對去中心化替代品的興趣。

In the wake of the chaos, Binance acknowledged disruptions and said it would compensate losses directly caused by system failures. The promise of compensation may partially mollify affected users, but the crisis has intensified the long-standing debate over custody, counterparty risk, and the trade-offs between centralized and decentralized trading venues.

動盪之後,幣安承認交易異常,並表示會補償因系統性失誤直接導致的損失。賠償承諾或許能降低部分用戶怒氣,但本次危機已令有關資產託管、對手風險,以及中心化與去中心化平台取捨的爭論再度升溫。

For stablecoins, the crash provided a mixed stress test. Traditional fiat-backed stablecoins like USDT and USDC maintained their pegs throughout the crisis, demonstrating the value of simple, well-collateralized designs during extreme volatility. BUSD remained hard-pegged during the crisis, in contrast to the synthetic and yield-bearing alternatives that collapsed.

對於穩定幣來說,此崩盤構成壓力測試。以法幣儲備作為擔保的穩定幣(如USDT與USDC)全程維持錨定,顯示簡單、充份抵押架構於極端波動時的價值。BUSD同樣在危機裡維持強力錨定,對比之下合成型及生息型穩定幣則出現崩潰。

USDe's failure to maintain its peg on Binance, even as it held firm on other venues and in DeFi protocols, highlighted the risks of algorithmic and synthetic stablecoins during liquidity crises - but also suggested these risks may be more exchange-specific than protocol-level.

USDe即便在其他平台與DeFi協議內維持錨定,但卻獨於幣安失守,突顯演算法及合成型穩定幣於流動性危機下的特有風險——同時此案例亦暗示這些風險很可能偏向於交易所層面,而非協議本身。

Market Sentiment and Recovery

Tom Lee, chairman of BitMine, characterized the market pullback as overdue after a 36 percent gain since April, calling the sell-off a healthy shakeout and suggesting short-term returns could turn positive soon.

BitMine主席Tom Lee認為,市場自四月以來已上漲36%,本次回檔屬於「該來的修正」,並稱此次拋售是健康的洗牌,短線報酬很快就可能轉為正值。

Some analysts suggested that while retail fear dominated, institutions were quietly accumulating, mirroring the pattern seen after the March 2020 COVID crash, which later sparked one of the biggest altcoin seasons in history.

有分析指出,儘管市場小白恐慌主導整體氛圍,但機構投資人則在靜悄悄地佈局,狀況類似2020年3月COVID崩盤之後——而那次最終引爆了史上最大規模的山寨幣行情。

By October 12-13, markets had partially stabilized. Bitcoin recovered from its lows, trading back above 112,000 dollars. Many altcoins retraced a portion of their losses. Trading volumes remained elevated but orderly, suggesting the panic phase had passed.

到10月12-13日,市場局勢已部分穩定。比特幣從低點回升,重回11.2萬美元上方。不少山寨幣也開始回補部分跌幅。成交量依然高企,但市場已恢復秩序,意味著恐慌階段暫時告一段落。

However, the longer-term impacts on market structure and investor confidence remain uncertain. The crash served as a harsh reminder of the risks inherent in leveraged cryptocurrency trading and the potential for infrastructure failures during stress.

不過,中長期對市場結構及投資人信心的影響仍未明朗。這場崩盤無疑給所有人再次敲響了警鐘:加密市場槓桿交易的系統性風險,以及極端情況下基礎設施失效的現實威脅。

Expert Commentary and Regulatory Implications

The October 11 crash has prompted

10月11日崩盤已促使widespread analysis from industry observers, raising fundamental questions about exchange design, risk management, and the role of regulation in cryptocurrency markets.

來自產業觀察家的廣泛分析,引發了對於交易所設計、風險管理以及監管在加密貨幣市場中所扮演角色的根本性質疑。

Risk Management Failures

風險管理失誤

Analysts pointed to a clear failure in how margin collateral and liquidation pricing were structured, flaws that made the system easy to exploit.

分析師指出,保證金抵押品以及清算定價結構明顯失誤,這些缺陷讓系統容易被利用。

The choice of margin collateral and the design of liquidation pricing became key points tested by this market event, with experts noting that financial product innovation requires greater prudence, and exchanges still have much to improve in their risk management systems.

保證金抵押品的選擇以及清算定價的設計成為此次市場事件的關鍵考驗。專家們指出,金融商品創新需要更謹慎,交易所在風險管理體系上仍有相當大的改善空間。

The crisis exposed several specific risk management failures:

這場危機揭露了幾項特定的風險管理漏洞:

-

Collateral Acceptance Standards: Binance's decision to accept proof-of-stake derivatives and yield-bearing stablecoins as margin collateral without accounting for their liquidity characteristics during stress created unnecessary systemic risk.

抵押品接受標準:幣安允許質押衍生品和可產生收益的穩定幣於保證金抵押品,卻沒有在壓力情境下考慮到其流動性特性,由此創造了不必要的系統性風險。 -

Pricing Methodology: Relying on internal order book prices for assets with limited liquidity created a closed loop vulnerable to manipulation or simply inadequate for calculating true market value during volatility.

定價方法:對於流動性有限的資產,僅依賴內部訂單簿價格,造成一個容易受操縱的封閉回路,在波動時根本無法合理反映市場價值。 -

Vulnerability Disclosure: Publicly announcing a known security issue eight days before implementing the fix created a window of exploitation that sophisticated actors could monitor and potentially weaponize.

漏洞揭露:在修復安全問題前的八天就對外公開,提供了高明攻擊者監視並可能利用的攻擊窗口。 -

Insurance Fund Adequacy: While Binance deployed 188 million dollars from its insurance fund during the crisis, estimated losses ranged between 500 million and 1 billion dollars, raising questions about whether current insurance mechanisms provide adequate protection.

保險基金充足性:雖然幣安在危機中動用了一億八千八百萬美元的保險基金,但估計損失在五億到十億美元之間,令人質疑現有保險機制是否足以提供必要保障。

Calls for Enhanced Oversight

加強監管的呼聲

The magnitude of losses and the nature of the crash have intensified calls for regulatory intervention in cryptocurrency exchange operations.

損失規模與本次崩盤性質,進一步加強了外界要求監管機構介入加密貨幣交易所運作的聲浪。

Crypto.com CEO Kris Marszalek called for regulators to investigate exchanges with high liquidation volumes, noting that 20 billion dollars in losses hurt many users.

Crypto.com 執行長 Kris Marszalek 呼籲監管單位調查高清算量的交易所,並指出二百億美元損失已重創許多用戶。

Specific regulatory proposals emerging from industry discussions include:

業界討論中浮現的具體監管建議如下:

-

Standardized Risk Disclosures: Requirements for exchanges to clearly disclose how they calculate liquidation prices, what assets are accepted as collateral, and the specific risks of using illiquid assets in margin systems.

標準化風險揭露:規定交易所需明確說明清算價格計算方式、接受哪些資產為抵押品,以及在保證金機制中使用非流動性資產的特定風險。 -

External Oracle Requirements: Mandating that exchanges use external, manipulation-resistant price feeds for liquidation calculations rather than relying solely on internal order books.

外部預言機要求:強制交易所使用抗操縱的外部價格來源計算清算價,而不是僅依賴內部訂單簿。 -

Collateral Concentration Limits: Restricting the percentage of margin collateral that can consist of illiquid or volatile assets to prevent cascading liquidations.

抵押品集中度限制:限制保證金抵押品中非流動性或高波動性資產的比例,以避免連鎖清算。 -

Stress Testing and Scenario Analysis: Requiring exchanges to conduct and publish regular stress tests showing how their systems would perform during extreme market events.

壓力測試與情境分析:要求交易所定期進行並公開壓力測試結果,顯示其系統在極端市場情境下的表現。 -

Real-Time Monitoring and Alerts: Enhanced surveillance systems to detect unusual trading patterns that might indicate manipulation or coordinated attacks.

即時監控與警報:強化監控系統監測異常交易行為,以偵測可能的操縱或協同攻擊。

The Precedent of Traditional Finance

傳統金融的先例

Regulators examining the October 11 crash have relevant precedents from traditional financial crises to draw upon.

檢視 10 月 11 日崩盤事件的監管機構,可以參考過去傳統金融危機的先例。

The 2008 financial crisis revealed similar dynamics around collateral valuation during stress. Mortgage-backed securities that had traded at par suddenly became illiquid, forcing fire sales that created spiral effects throughout the banking system. Regulatory responses included enhanced collateral haircuts, stress testing requirements, and restrictions on accepting complex securities as margin.

2008 年金融危機顯示,壓力情境下的抵押品估值存在同樣機制。原本等值交易的房貸證券在壓力下突然喪失流動性,導致拋售進而在銀行體系內連鎖擴散。監管因應措施包括提高折價額度、強制壓力測試,以及限制複雜證券作為抵押品。

The 2010 Flash Crash demonstrated how automated trading systems can amplify volatility during periods of stress. Subsequent regulations introduced circuit breakers, revised market maker obligations, and enhanced monitoring to prevent similar incidents.

2010 年閃崩事件則說明自動化交易系統如何在壓力期間加劇波動。事後監管修訂包括設置斷路器、重新定義做市商義務及加強監管,以防止類似事件。

The lessons from traditional finance suggest that cryptocurrency exchanges may face increasing regulatory requirements around risk management, transparency, and system resilience - particularly for platforms offering leveraged trading and accepting complex assets as collateral.

傳統金融的經驗教訓顯示,加密貨幣交易所勢必將承受越來越多針對風險管理、資訊透明和系統韌性的監管要求,尤其是那些提供槓桿交易及接受複雜資產為擔保的平台。

Industry Self-Regulation vs. Government Oversight

產業自律 vs. 政府監督

The cryptocurrency industry faces a choice between proactive self-regulation and reactive government intervention.

加密貨幣產業正面臨「主動自律」與「政府被動介入」間的抉擇。

Some exchanges have already announced enhancements following the October 11 crash. Binance implemented its planned oracle updates and compensation program. Other platforms have reviewed their own collateral policies and risk management frameworks.

部分交易所已在 10 月 11 日崩盤後宣布補強措施。幣安落實計畫中的預言機功能更新並推出補償計畫,其他平台也檢討自身抵押政策及風險管理架構。

However, voluntary industry improvements may not satisfy regulators or protect users adequately. The concentration of risk in large centralized exchanges, combined with the potential for cascading failures across markets, suggests that comprehensive regulatory frameworks may be inevitable.

然而,產業自願改進可能無法令監管單位滿意,也難以充分保障用戶。龐大中心化交易所的風險集中,加上市場間可能發生的連鎖失靈,顯示全面監管體制勢在必行。

The key question is whether regulatory intervention can preserve innovation while preventing catastrophic failures. Overly restrictive rules could drive trading activity to unregulated offshore venues or entirely decentralized platforms, potentially increasing rather than decreasing systemic risk. Finding the right balance between safety and innovation will challenge policymakers in the years ahead.

關鍵問題在於監管介入能否兼顧創新、杜絕災難性失誤,過度嚴苛的規範恐將交易活動驅往未受監管的海外或完全去中心化的平台,反而可能增加而不是減少系統性風險。如何在安全與創新中取得平衡,將是未來數年政策制定者最大挑戰。

Comparative Lessons from Past Crises

歷次危機比較與啟示

The October 11, 2025 crash joins a growing list of catastrophic events in cryptocurrency history, each offering lessons about the interaction between innovation, risk, and system design.

2025 年 10 月 11 日這次崩盤成為加密貨幣史上又一起重大事件,每一樁災變都對於創新、風險與系統設計的相互作用提出了教訓。

The Luna-UST Collapse (May 2022)

Luna-UST 崩盤(2022 年 5 月)

The question of whether USDe is truly backed one-to-one remains hanging. The Luna-UST collapse proved how bad things can get when pegs fail. Back then, Binance lost money defending UST near 70 cents.

USDe 是否真有一對一儲備的疑問仍未解決。Luna-UST 的崩潰證明,錨定機制失敗時後果極其嚴重。當時幣安為了守住 0.7 美元附近的 UST 也損失慘重。

The Terra Luna ecosystem's implosion in May 2022 provides the most direct parallel to Binance's October 11 crisis. Terra's algorithmic stablecoin UST maintained its dollar peg through a mechanism involving minting and burning the LUNA token. When confidence wavered and selling pressure intensified, the system entered a death spiral: UST lost its peg, triggering LUNA issuance to restore it, flooding the market with new LUNA tokens, destroying LUNA's value, further undermining confidence in UST, and accelerating the collapse.

2022 年 5 月 Terra Luna 生態系的崩潰,與幣安此次事件最為相似。Terra 的演算法穩定幣 UST 是透過 LUNA 代幣鑄造與銷毀機制來維持對美元的固定匯率。但信心動搖、賣壓加劇時,系統進入死亡螺旋:UST 失去錨定→增發 LUNA 想要恢復錨定→LUNA 供給氾濫、市值崩毀→再度打擊 UST 信心→加速瓦解。

The parallel to October 11 lies in the feedback loops. In Terra, loss of peg triggered issuance, which accelerated the collapse. On Binance, collateral devaluation triggered liquidations, which caused more selling, which devalued collateral further, creating a similar spiral.

與 10 月 11 日事件相似的是「回饋螺旋」:Terra 失去錨定引發增發,進一步加速崩解;幣安則是抵押品貶值觸發清算,導致拋售,進一步壓低價格造成更大清算,形成相似的惡性循環。

Both crises revealed the danger of closed-loop systems where the mechanism designed to restore stability can amplify instability under stress. Terra's fix - burning LUNA to restore UST - created more problems than it solved. Binance's system - liquidating collateral to protect margin requirements - similarly intensified the very crisis it was designed to prevent.

兩者危機都揭示:「封閉循環」系統中的穩定機制,在壓力下反而能擴大不穩定性。Terra 以銷毀 LUNA 恢復 UST,結果問題更嚴重;幣安藉由清算抵押品來維護保證金門檻,也反而加劇本欲防範的危機。

The key difference: Terra's collapse stemmed from fundamental protocol design flaws. The system was mathematically destined to fail under sufficient stress. Binance's crisis reflected infrastructure and operational shortcomings rather than unavoidable protocol failures. Better pricing mechanisms, adequate liquidity, and proper risk management could have prevented or mitigated the cascade.

關鍵差異在於:Terra 崩潰肇因於協議設計根本缺陷,數學上在壓力下一定失敗;幣安這次更像基礎設施與營運管理出問題,若有更完善的定價機制、流動性與風險管理,或許能避免或緩解危機擴散。

Mango Markets Oracle Manipulation (October 2022)

Mango Markets 預言機操縱事件(2022 年 10 月)

In October 2022, a trader exploited Mango Markets, a Solana-based decentralized exchange, by manipulating the oracle price for its native MNGO token. The attacker built large positions, used those positions to manipulate the token's price upward through thin order books, borrowed against the artificially inflated collateral value, and withdrew more than 100 million dollars before the protocol could respond.

2022 年 10 月,一名交易者利用 Solana 上去中心化交易所 Mango Markets 的預言機漏洞,操控 MNGO 代幣價格。攻擊者建立巨額部位,利用清淡的訂單簿將 MNGO 價格拉高,然後以虛高的抵押品價值借款,等協議反應過來前即提走逾一億美元。

The Mango attack demonstrates how oracle manipulation can create leverage out of thin air. By controlling the price feed used for collateral valuation, the attacker made worthless positions appear valuable enough to support massive loans.

這起事件說明,透過預言機操縱可以無中生有地創造槓桿。控制抵押品評價的價格來源後,攻擊者能讓毫無價值的部位看似足夠借到巨額資金。

The October 11 Binance crash, whether coordinated or not, involved similar dynamics. Binance's reliance on internal order book prices for collateral valuation created a closed system where concentrated selling could drive artificial price movements disconnected from external market reality. The primary difference: Mango involved deliberately manipulating prices upward to borrow more, while the alleged Binance attack manipulated prices downward to trigger liquidations.

10 月 11 日幣安事件,不論是否為協同攻擊,其機制也近似。幣安用內部訂單簿價格評價抵押品,形成封閉系統;集中賣壓能推動價格脫離市場實際情況。最大差別是 Mango 事件是拉高價格好借更多錢,幣安事件則是壓低價格導致清算。

Both incidents highlight the critical importance of using robust, manipulation-resistant price oracles for any system involving collateralized lending or margin trading.

這兩起事件都強調,任何涉及抵押借貸或保證金交易的系統,使用健全且抗操縱的價格預言機是至關重要的。

FTX Collapse (November 2022)

FTX 破產(2022 年 11 月)

The FTX exchange's spectacular failure in November 2022 revealed how concentrated risk and inadequate separation of customer funds from exchange operations could lead to catastrophic losses.

FTX 於 2022 年 11 月驚天垮台,顯示風險集中與用戶資產/交易所營運混用能釀成巨大災難。

While FTX's collapse stemmed primarily from fraud and misappropriation of customer funds, it shares with the October 11 Binance crash a common thread: concentrated risk in large centralized platforms creates systemic vulnerabilities that can cascade through markets when confidence breaks.

儘管 FTX 崩潰主因是詐欺與挪用用戶資產,但與 10 月 11 日幣安事件的共同點在於:大型中心化平台的風險集中,當信心崩潰時會引發市場間連鎖性系統性脆弱。

FTX demonstrated that even well-regarded, heavily-used platforms can harbor critical weaknesses invisible to users until crisis strikes. The parallels to Binance are imperfect - there's no evidence of fraud or misappropriation in the October 11 event - but both cases reveal how dependent cryptocurrency markets remain on the operational integrity of centralized intermediaries.

FTX 的案例證明,即便獲高度評價、用戶眾多的平台,也可能潛藏致命漏洞,危機發生前用戶根本難以察覺。雖然兩案並非完全相似——幣安事件沒證據顯示詐欺或資產挪用——但都揭示加密市場對「中心化中介營運正直」依賴至深。

Cream Finance Repeated Exploits (2021)

Cream Finance 連環攻擊(2021 年)

Cream Finance, a DeFi lending protocol, suffered multiple exploits in 2021 that collectively drained more than 130 million dollars. Most involved flash loan attacks combined with oracle manipulation or reentrancy vulnerabilities.

DeFi 借貸協議 Cream Finance 在 2021 年歷經多起攻擊事件,累計損失超過一億三千萬美元。多數攻擊涉及閃電貸結合預言機操縱或重入漏洞。

The relevance to October 11 lies in the recurring theme: complex financial systems built on fragile foundations become vulnerable to sophisticated exploitation. Cream's fundamental protocol design wasn't necessarily flawed, but the implementation details - how prices were

和 10 月 11 日事發之關聯,在於主題重複:「建立在脆弱基礎上的複雜金融系統,容易遭到複雜手法利用」。Cream 協議基礎設計不見得有瑕疵,但實作細節——如價格來源——卻漏洞百出。calculated, which assets were accepted as collateral, and how quickly the system could respond to anomalies - created opportunities for attackers.

計算方式、哪些資產被接受為擔保品,以及系統對異常情況的反應速度——這些都為攻擊者創造了可乘之機。

Binance's October 11 crisis similarly reflects the gap between design intent and implementation reality. In theory, accepting yield-bearing assets as collateral makes sense if properly risk-adjusted. In practice, the details of pricing methodology, liquidity requirements, and stress scenario planning determined whether the system could withstand volatility.

Binance 在 10 月 11 日的危機同樣反映出設計目標與實際執行情況之間的落差。理論上,只要做好風險調整,接受有收益的資產作為擔保品是合理的。然而,在實際操作中,定價方法、流動性要求以及壓力場景規劃的細節,才真正決定這個系統是否能撐過波動。

The Recurring Pattern: Innovation Outpacing Risk Management

一再重現的模式:創新速度超越風險管理

These historical crises share a common pattern: financial innovation in cryptocurrency markets consistently outpaces the development of robust risk management frameworks.

這些歷史性危機都有一個共同點:加密貨幣市場的金融創新總是遠超健全風險管理體系的發展速度。

Terra pioneered algorithmic stablecoins without fully stress-testing the death spiral scenario. Mango built a sophisticated derivatives platform without adequately securing its price oracles. FTX scaled to become the second-largest exchange without implementing proper controls on fund movements. Cream pushed the boundaries of DeFi lending without anticipating complex attack vectors.

Terra 推出了創新的算法穩定幣,但未對死亡螺旋情境進行完整壓力測試。Mango 建置了複雜的衍生品平台,卻沒有充分完善其價格預言機的安全性。FTX 成長為全球第二大交易所,卻未落實資金流動的有效控管。Cream 在 DeFi 借貸領域不斷突破,卻沒預料到複雜的攻擊手法。

And Binance, seeking to offer maximum capital efficiency through unified margin across diverse assets, created a system where collateral valuation could become disconnected from market reality during stress.

而 Binance 為了提供最大資本效率,以統一保證金覆蓋多種資產,卻因此建立了一個在壓力時可能與實際市場價值脫鉤的擔保品估值機制。

The lesson isn't that innovation should cease. Liquid staking derivatives, synthetic stablecoins, and cross-margin systems all offer genuine benefits when properly implemented. The lesson is that each innovation creates new failure modes that must be anticipated, tested, and guarded against before they cause catastrophic losses.

結論不是創新不該發生。只要妥善推行,流動質押衍生品、合成穩定幣、交叉保證金系統都帶來真正益處。然而,每一次創新都會帶來新的潛在失敗模式,必須事先預見、測試與防範,否則可能釀成災難性損失。

Key Terms Explained

關鍵術語解釋

Understanding the October 11 crash requires familiarity with several technical concepts that define modern cryptocurrency trading. Here are concise explanations of the key terms central to this event.

了解 10 月 11 日崩盤事件,須認識數個定義現代加密貨幣交易的重要技術概念。以下為本次事件核心關鍵詞的簡明說明。

Proof-of-Stake Derivatives: These are tokenized representations of cryptocurrency staked in proof-of-stake blockchains. When users stake assets like Ethereum or Solana, they lock those tokens to help secure the network and earn rewards. Proof-of-stake derivatives like wBETH and BnSOL make this staked value liquid and tradable, allowing stakers to use their assets while still earning rewards. The derivatives' value typically equals the underlying staked asset plus accumulated rewards.

質押證明(Proof-of-Stake)衍生品:這類是將質押在 PoS 區塊鏈上的加密貨幣資產進行代幣化。當用戶質押例如以太坊或 Solana 時,他們鎖定這些代幣協助網路安全並獲得獎勵。像 wBETH、BnSOL 這種質押衍生品,能讓已質押價值流動化並可交易,持幣人可在繼續賺取獎勵的同時靈活運用資產。這類衍生品的價值一般等於原始質押資產加計累積獎勵。

Yield-Bearing Stablecoins: Unlike traditional stablecoins backed by dollars in bank accounts, yield-bearing stablecoins like Ethena's USDe generate returns for holders. USDe maintains its dollar peg through delta-neutral hedging - holding crypto collateral while simultaneously shorting that same crypto in derivatives markets, neutralizing price volatility. The yield comes from staking rewards on the collateral and funding rates from the derivatives positions. These stablecoins offer advantages over non-yielding alternatives but introduce additional complexity and risk.

有收益穩定幣:這類穩定幣如 Ethena 的 USDe,與傳統以銀行存款美元支持的穩定幣不同,能為持有人帶來回報。USDe 透過「Delta-Neutral」對沖維持與美元掛鉤——同時持有加密貨幣擔保品、並在衍生品市場做空等量加密貨幣,平抑價格波動。收益來源於擔保品的質押獎勵與衍生品部位的資金費率。這使得有收益穩定幣相對無收益替代品具有優勢,但也帶來更多複雜性與風險。

Margin Collateral: This refers to assets deposited to secure leveraged trading positions. When traders borrow funds to amplify their positions, they must post collateral that the exchange can liquidate if the trade moves against them. Margin collateral acts as a buffer protecting lenders from borrower defaults. The type of assets accepted as collateral and how those assets are valued critically affects system stability during volatility.

保證金擔保品:指的是用來確保槓桿交易部位的存入資產。當交易員借資增大操作部位時,須繳交可以被交易所強制平倉的擔保品。擔保品為放貸方設下風險緩衝,保障其免於借方違約。被接受的擔保品種類與估值方式,在市場波動時對系統穩定性極為關鍵。

Liquidation: When a leveraged position loses too much value, the exchange automatically closes it by selling the collateral to repay the borrowed funds. This process, called liquidation, prevents borrowers from owing more than their collateral is worth. Liquidations occur automatically when predetermined thresholds are breached. During the October 11 crash, cascading liquidations created a feedback loop where forced selling drove prices lower, triggering more liquidations.

強制平倉(Liquidation):當槓桿部位虧損過大時,交易所會自動平倉,賣出擔保品以償還借來的資金。此過程即為強制平倉,能避免借方負債超過其擔保品價值。當部位達到預先設定的閾值時,強平將自動啟動。於 10 月 11 日崩盤期間,連環強制平倉形成回饋循環——賣壓推低價格,誘發更多強平。

Oracles: In cryptocurrency systems, oracles provide external data to smart contracts and trading systems. Price oracles specifically supply information about asset values from various sources. Oracle design proves critical because systems rely on these feeds to calculate collateral values, trigger liquidations, and execute automated strategies. Poorly designed oracles can be manipulated or may fail to reflect true market conditions, as occurred with Binance's reliance on internal order books.

預言機(Oracles):在加密系統中,預言機負責為智能合約與交易系統提供外部數據。其中價格預言機會匯集不同來源的資產價值資訊。預言機設計極其重要,因為系統依賴這些數據計算擔保品價值、啟動強平、執行自動策略。若設計不良,預言機可遭操控,或未能反映真實市場行情——如本次 Binance 過度依賴內部訂單簿的情況。

Recursive Borrowing: This strategy involves depositing collateral, borrowing against it, using borrowed funds to acquire more collateral, depositing that additional collateral, and repeating the cycle. Recursive borrowing creates highly leveraged exposure with relatively little initial capital but amplifies both gains and losses. During crashes, recursive positions face compounding liquidations as each layer of borrowed collateral loses value.

遞迴借貸(Recursive Borrowing):此策略是存入擔保品以進行借款,再用借來的資金購買更多擔保品,循環重複操作,創造高槓桿曝險。僅需少量初始資本,即可放大盈虧。當市場下跌時,每一層借貸皆遭擠壓,導致遞增的強制平倉風險。

Hard Pegs vs. Soft Pegs: A hard peg means an asset maintains a fixed exchange rate through direct redemption mechanisms or regulatory guarantees. For example, BUSD maintained a hard peg because it could be redeemed one-to-one for dollars. A soft peg uses market mechanisms, arbitrage, or algorithmic adjustments to maintain approximate value. USDe uses a soft peg through delta-neutral hedging. During extreme stress, soft pegs can break while hard pegs generally hold - as occurred on October 11 when BUSD remained stable while USDe depegged on Binance.

硬掛鉤與軟掛鉤:硬掛鉤指資產透過直接兌換機制或法規保證維持固定匯率,例如 BUSD 可 1:1 兌換美元,因此穩定掛鉤。軟掛鉤則靠市場機制、套利或算法調整來維持大致價值。USDe 就透過 delta-neutral 對沖維持軟掛鉤。極端壓力下,軟掛鉤常會脫鉤,而硬掛鉤通常能維持——如 10 月 11 日 BUSD 穩定,USDe 卻在 Binance 上脫鉤。

Unified Margin: Also called portfolio margin or cross-margin, unified margin allows traders to use their entire portfolio as collateral for positions across multiple markets and products. Rather than siloing margin requirements for each position, unified margin calculates risk holistically, enabling greater capital efficiency. The October 11 crash exposed how this efficiency comes at the cost of interconnected risk - problems in one part of the portfolio can trigger liquidations across all positions.

統一保證金(Unified Margin):又稱組合保證金或交叉保證金,允許交易者用整個投資組合作為多市場、多產品部位的共同擔保品。不再將每個部位的保證金隔離管理,而是整體評估風險,可大幅提高資本效率。但 10 月 11 日的崩盤也揭露出,這類效率是以風險連動性為代價——投資組合一環出現問題就可能引爆全部部位強平。

Delta-Neutral Hedging: This strategy maintains exposure to non-price factors like yield or funding rates while eliminating exposure to price movements. For example, USDe achieves delta neutrality by holding long ETH exposure through staked collateral while simultaneously holding equal short ETH exposure through derivatives. If ETH rises or falls, gains in one position offset losses in the other. This approach works well during normal market conditions but can fail if hedge ratios slip or if one leg of the position becomes illiquid.

Delta-Neutral 對沖:這種策略消除對價格波動的曝險,同時保留對收益、資金費率等非價格因子的曝險。例如,USDe 以質押 ETH 做多,同時在衍生品市場做空等量 ETH,達到 Delta-Neutral。如果 ETH 上漲或下跌,單邊部位的損失可由另一邊獲利抵消。正常市況下此法有效,但若對沖比率失衡或一腳變得無流動性,則可能失效。

These technical concepts, while offering genuine innovation and efficiency gains, create complex systems where failures can cascade in unpredictable ways. The October 11 crash demonstrated how even well-intentioned financial engineering can produce catastrophic outcomes when implementation details prove inadequate for extreme stress scenarios.

這些技術雖帶來創新與效率提升,卻造就了可能以難以預測方式連鎖失效的複雜系統。10 月 11 日的崩盤證明,就算出發點良善,若執行細節無法承受極端壓力,金融工程也可能帶來毀滅性後果。

Aftermath and Open Questions

後續與未解之謎

As the cryptocurrency industry processes the October 11 crash, numerous critical questions remain unanswered, and the full scope of consequences continues to unfold.

隨著加密貨幣產業消化 10 月 11 日崩盤,許多重要問題仍未釐清,最終影響仍在持續發酵。

The Compensation Question

賠償問題

Binance announced it would review and compensate losses directly caused by its system failures, with co-founder Yi He stating that the exchange would review accounts individually, analyze situations, and provide compensation accordingly.

Binance 宣布將審查並賠償因系統故障直接導致的損失,聯合創辦人何一指出,交易所將針對個別帳戶逐一檢視、分析情況,再據以賠償。

Binance stated that payouts would equal the difference between the market price at midnight on October 11 and each user's liquidation price, with distribution planned within 72 hours.

Binance 表示,賠償金額將以 10 月 11 日午夜市價與用戶強平價的差額計算,並計畫 72 小時內發放。

However, significant ambiguities remain regarding compensation:

不過,有關賠償仍有諸多不確定之處:

-

Scope: Will Binance compensate all users who suffered losses during the crash, or only those who can demonstrate that specific system failures directly caused their losses? How will the exchange distinguish between losses caused by market volatility versus infrastructure failures?

-

範圍:Binance 會賠償所有因崩盤受損的用戶,還是只針對能證明由系統故障直接導致受損的人?如何界定市場波動造成的損失與基礎設施故障導致的損失?

-

Methodology: How will Binance calculate the "true" market price for assets like wBETH and USDe when their prices diverged dramatically between Binance and other venues? Using external prices could increase compensation costs substantially; using Binance's distorted internal prices would shortchange affected users.

-

方法:像 wBETH 與 USDe 價格在 Binance 與其他平台劇烈分歧時,Binance 如何計算「真正」的市場價格?採用外部價格會大幅提高賠償成本;但若用 Binance 受到扭曲的內部價格,又會讓受損用戶吃虧。

-

Coverage Amount: With estimated losses ranging from 500 million to 1 billion dollars, can Binance's insurance fund and balance sheet absorb the full cost? What happens if total claims exceed available funds?

-

賠償金額:據估損失在 5 億至 10 億美元,Binance 的保險基金與資產負債表能否全數承擔?若申請金額超過可用資金怎麼辦?

-

Timing: As of mid-October 2025, many users report delays in receiving compensation and uncertainty about claim status. The 72-hour timeline has elapsed, yet questions persist about when and how much users will ultimately receive.

-

時間點:截至 2025 年 10 月中,許多用戶反映賠償遲遲未到、申請進度不明。72 小時時限早已過,但最終什麼時候、能拿回多少,依然沒答案。

System Changes and Risk Management Reforms

系統調整與風險管理改革

Binance announced it has shifted to using conversion-ratio pricing for wrapped assets and added redemption prices to index calculations for all three affected tokens.

Binance 宣布已改用包裹資產(wrapped asset)的兌換比率作為定價,並將贖回價納入所有三種受影響代幣的指數計算。

The exchange implemented three specific fixes: adding redemption prices to index calculations, setting a minimum price threshold for USDe, and increasing the frequency of risk control reviews.

交易所具體採取三項修正:將贖回價納入指數計算、設立 USDe 價格最低門檻,以及提升風控審查頻率。

These changes address the immediate technical vulnerability but raise larger questions:

這些調整是針對眼前技術漏洞,但也引發更多重大問題:

-

Collateral Policy: Has Binance revised its standards for which assets qualify as margin collateral? Will proof-of-stake derivatives and yield-bearing stablecoins face higher haircuts or lower maximum loan-to-value ratios?

-

擔保品政策:Binance 是否修正了哪些資產得用作保證金的新標準?PoS 衍生品、有收益穩定幣等是否會被加重折價、降低最大貸款成數?

-

Liquidity Requirements: Will the exchange implement minimum liquidity thresholds for assets accepted as collateral, ensuring sufficient depth in order books to handle stress scenarios?

-

流動性門檻:交易所是否會為擔保品資產設定最低流動性標準,確保壓力時訂單簿有足夠深度?

-

Circuit Breakers: Does Binance plan to implement automatic trading halts or volatility controls that would pause liquidations during extreme price dislocations?

-

熔斷機制:Binance 是否計畫設立自動暫停交易或波動控管機制,在極端價格異動時暫停強平?

-

Third-Party Audits: Will independent risk management firms review Binance's updated systems to verify they can withstand future stress?

-

第三方審核:是否會引入獨立風控公司審查 Binance 升級後的系統,以確認未來壓力下可承受?

The Investigation Question

調查問題

Perhaps the most consequential unanswered question: will there be a formal investigation into whether the October 11 crash involved market manipulation or coordinated attack?

也許最關鍵、仍未解答的問題:10 月 11 日的崩盤,是否將展開正式調查,以釐清是否涉及市場操縱或協同攻擊?

Crypto.com CEO Kris Marszalek (以下原文未結束)called for regulators to investigate exchanges with high liquidation volumes.

呼籲監管機構調查清算量高的交易所。

Several potential investigative avenues exist:

有幾種潛在的調查路徑:

-

On-Chain Forensics: Blockchain analysis firms could trace transaction patterns to determine whether concentrated selling came from coordinated wallets or exhibited patterns suggesting deliberate manipulation.

-

區塊鏈鑑識:區塊鏈分析公司可以追蹤交易模式,以判斷集中拋售是否來自協調過的錢包,或表現出蓄意操縱的跡象。

-

Exchange Data Analysis: Regulators with subpoena power could examine Binance's internal transaction data to identify accounts that established positions before the crash and profited from it.

-

交易所數據分析:擁有傳票權力的監管機構可以調查幣安的內部交易數據,找出在崩盤前建立部位並從中獲利的帳戶。

-

Communication Surveillance: If coordination occurred, perpetrators may have communicated via encrypted messaging or social media, leaving digital footprints that investigators could uncover.

-

通訊監控:如果發生協調行為,涉案者可能通過加密訊息或社群媒體聯絡,留下一些可以被調查人員發現的數位足跡。

-

Timing Analysis: Detailed reconstruction of the timeline could reveal whether sell orders arrived in patterns consistent with algorithmic execution, human coordination, or simply panicked market response.

-

時序分析:詳細重建時間軸可以揭示拋售單是否呈現出與程式執行、人為協調或市場恐慌反應一致的模式。

As of mid-October 2025, no formal investigation has been announced by major regulators. Whether U.S. authorities, given Binance's complicated regulatory history, will pursue inquiries remains uncertain. The exchange's offshore status and lack of headquarters complicate jurisdiction questions.

截至2025年10月中,主要監管機構尚未宣布正式調查。美國主管機關是否會針對幣安複雜的監管歷史展開調查,目前仍不明朗。該交易所的海外註冊狀態與缺乏總部,讓管轄權問題更加複雜。

Broader Market Structure Questions

更廣泛的市場結構問題

The October 11 crash has catalyzed renewed debate about fundamental cryptocurrency market structure issues:

10月11日的崩盤引發了對加密貨幣市場根本結構的新一輪辯論:

Centralization vs. Decentralization: Does the crisis demonstrate that cryptocurrency markets remain dangerously dependent on centralized exchanges despite the theoretical availability of decentralized alternatives? Should policy encourage migration to decentralized trading venues, or do centralized platforms offer advantages that justify their continued dominance?

中心化與去中心化:這次危機是否顯示出儘管有去中心化選項,但加密貨幣市場仍然危險地依賴中心化交易所?政策應該鼓勵大家轉向去中心化交易場所,還是中心化平台有某些優勢讓它們依然值得主導地位?

Oracle Standardization: Should the industry develop standardized oracle networks that all exchanges must use for liquidation calculations, similar to how traditional finance relies on established reference rates for LIBOR or SOFR?

預言機標準化:產業是否應該建立標準化預言機網路,讓所有交易所都必須用於清算計算,就如同傳統金融仰賴LIBOR或SOFR等參考利率一樣?

Insurance Mechanisms: Are current exchange-level insurance funds adequate, or should the industry create cross-exchange insurance pools or mandatory insurance requirements similar to FDIC coverage in traditional banking?

保險機制:目前交易所層級的保險基金是否足夠?產業是否應建立跨交易所保險池,或強制保險要求,類似於傳統銀行的FDIC保障?

Leverage Limits: Should cryptocurrency exchanges face regulatory restrictions on maximum leverage ratios, particularly for retail traders, similar to leverage limits in foreign exchange and equity markets?

槓桿限制:加密貨幣交易所是否應該面臨最大槓桿比率的監管限制,特別是對散戶,如同外匯與股票市場中的槓桿限制?

Real-Time Risk Disclosure: Should exchanges provide real-time public dashboards showing their insurance fund balances, liquidation volumes, and system health metrics to enable users to assess counterparty risk?

即時風險揭露:交易所是否應提供公開的即時儀表板,顯示其保險基金餘額、清算量及系統健康指標,讓用戶能評估對手方風險?

Lessons for Market Participants

給市場參與者的啟示

For traders and investors processing the October 11 crash, several practical lessons emerge:

對於經歷10月11日崩盤的交易者與投資人,有幾個實用的教訓浮現:

Collateral Type Matters: Not all collateral is equal during stress. Yield-bearing assets and derivatives that seem stable during normal conditions can experience extreme volatility when liquidity evaporates.

抵押品種類很重要:市場壓力下,並非所有抵押品都等值。在正常情況下看似穩定且能產生收益的資產及衍生品,當流動性消失時可能會異常劇烈波動。

Exchange-Specific Risk: Prices for the same asset can diverge dramatically between exchanges during extreme conditions. Holding positions on multiple venues or understanding venue-specific risks becomes critical.

交易所特定風險:極端狀況下,相同資產的價格在不同交易所可能出現巨大差異。在多個平台分散持倉或了解交易所特定風險極為關鍵。

Leverage Amplifies Failure Modes: Highly leveraged positions face not just market risk but also execution risk, oracle risk, and counterparty risk. Each additional layer of leverage creates new failure points.

槓桿會放大失敗模式:高槓桿部位面臨的不僅是市場風險,還有操作風險、預言機風險與對手方風險。每多一層槓桿就多一個失敗點。

System Resilience Varies: The October 11 crash demonstrated that decentralized protocols and blockchains themselves performed reliably while centralized exchange infrastructure failed. This suggests value in diversifying not just across assets but across types of platforms and custody arrangements.

系統韌性各異:10月11日的崩盤顯示,去中心化協議與區塊鏈本身運作可靠,但中心化交易所的基礎設施卻失靈。這說明除了分散資產之外,分散平台類型與保管方式也很有價值。

Timing Matters for Security Updates: Public announcements of known vulnerabilities with scheduled fix dates create windows of exploitation. Traders should monitor platform announcements and understand when systems may be particularly vulnerable.

安全更新時機很重要:已知漏洞的公開修補時程會造成可被利用的窗口期。交易者應留意平台公告,評估系統何時特別脆弱。

Closing Thoughts: The Price of Innovation

結語:創新的代價

The October 11, 2025 cryptocurrency crash will likely be remembered as a watershed moment - not because of the dollar amounts lost, though those were substantial, but because of what the event revealed about the maturity and fragility of cryptocurrency market infrastructure.

2025年10月11日的加密貨幣崩盤,可能會被記為一個分水嶺──原因不僅僅是重大損失的金額,而在於這次事件揭示了加密貨幣市場基礎設施的成熟度與脆弱性。

The crash exposed a fundamental tension at the heart of cryptocurrency innovation. The same tools that make markets more efficient - unified margin, liquid staking derivatives, yield-bearing stablecoins - create complex systems where failures can cascade in unexpected ways. Capital efficiency and interconnectedness prove to be two sides of the same coin.

這次崩盤暴露了加密貨幣創新核心中的根本矛盾。那些提升市場效率的工具──統一保證金、流動質押衍生品、收益型穩定幣──同時也創造出失敗會意外連鎖擴散的複雜系統。資本效率與強連結性正是一體的兩面。

An investor compared the crash to Luna's implosion, noting that the danger comes from exchanges using non-fiat stablecoins as high-value collateral, letting risk spread everywhere. The warning highlighted that mixing market-based pricing with high collateral ratios is the most dangerous setup, especially when centralized exchanges have poor arbitrage mechanisms.

有投資人將這次崩盤比作Luna事件,指出危險之處在於交易所用非法幣穩定幣做高價值抵押品,讓風險擴散到整個市場。這則警示強調,市場價格加上高抵押比,是最危險的組合,尤其中心化交易所仲裁機制不良時。

Whether October 11 represents a coordinated attack exploiting known vulnerabilities or simply a catastrophic failure of risk management under natural market stress, the result demonstrates that cryptocurrency markets remain in crucial ways immature and vulnerable despite massive growth in adoption and trading volumes.

無論10月11日是有組織攻擊利用已知漏洞,還是單純風險管理徹底失敗的結果,這都證明儘管加密貨幣市場規模與交易量大幅成長,但在關鍵層面上依然不成熟且易受傷害。

The resolution of the attack-versus-failure-mode debate matters less than the systemic lessons the crisis teaches. Either scenario - deliberate exploitation or structural collapse - reveals that accepting illiquid, volatile assets as margin collateral without adequate pricing safeguards creates unacceptable risk. Either scenario shows that relying on internal order books for liquidation calculations in thin markets invites disaster. Either scenario proves that financial innovation must be matched by robust risk management infrastructure.

此事件究竟是攻擊還是管理失敗的結果,其判斷遠不如體制教訓重要。無論哪一種情形,都揭示:在沒有穩固價格保障下,接受不流動、波動劇烈資產作抵押風險過大;在流動性弱的市場,只靠內部訂單簿進行清算計價,等同自找災難;金融創新必須有強韌的風險管理作為支撐。

For the cryptocurrency industry, October 11 offers a choice. The crash can serve as a wake-up call driving substantive improvements in exchange design, risk management, and regulatory frameworks. Exchanges can implement stronger collateral standards, more robust oracle systems, and better stress-testing processes. Regulators can develop sensible oversight that enhances safety without stifling innovation. Traders can demand greater transparency and migrate to platforms that prioritize infrastructure resilience over maximum leverage.

對加密貨幣業界來說,10月11日是一個分水嶺。此次崩盤可成為推動交易所設計、風險管理、監管框架實質進步的警鐘。交易所可加強抵押標準、強化預言機和壓力測試流程。監管機構可設計兼顧安全與創新的監理方案。交易者可要求更高透明度,轉向重視基礎建設韌性勝於槓桿比例的平台。

Or the industry can treat October 11 as an isolated incident, implement narrow technical fixes to the specific vulnerabilities exploited, and continue on largely unchanged until the next crisis reveals the next set of systemic weaknesses.

或者,產業可以將10月11日視為偶發事件,只針對被利用的漏洞做表面修補,然後大致維持現狀,直到下一次危機爆發,再暴露新的體系性弱點。

Traditional financial markets have weathered centuries of crises, each teaching hard lessons about risk, leverage, and system design. Cryptocurrency markets, barely fifteen years old, are accelerating through this learning process at remarkable speed. The October 11 crash joins a growing list of expensive lessons in what can go wrong when innovation outpaces risk management.

傳統金融市場歷經數百年的危機,每次都留下有關風險、槓桿和系統設計的慘痛教訓。加密貨幣市場成立不過十五年,卻以驚人速度密集學習這些難題。10月11日的崩盤,只是當創新走在風險管理前頭時,可能出錯的昂貴教訓名單上的又一例。

The critical question is whether the industry will learn from this experience or merely move on to the next innovation, carrying forward the same structural vulnerabilities that made October 11 possible.

關鍵問題在於,產業是否能從這次經驗中學到教訓,還是只是繼續創新,卻遺留著導致10月11日風暴的結構性弱點。

As cryptocurrency markets mature and integrate more deeply with traditional finance, the stakes of getting risk management right grow higher. The hundreds of millions or billions lost on October 11 represent tragedy for affected traders but remain relatively contained compared to what could occur if similar vulnerabilities exist at even larger scale during the next major market stress.

隨著加密貨幣市場日益成熟並與傳統金融深度融合,做好風險管理的重要性不斷上升。10月11日損失的數億甚至數十億,對受害交易者是悲劇,但若類似弱點在更大規模下重現,下次重大市場壓力可能帶來的損失會遠不止如此。

The path forward requires balancing competing imperatives: preserving the innovation and efficiency that make cryptocurrency markets valuable while building the robust infrastructure and risk management frameworks necessary to prevent catastrophic failures. Finding that balance will determine whether cryptocurrency markets evolve into resilient, trustworthy components of the global financial system or remain speculative venues prone to periodic crises that erode public confidence and invite heavy-handed regulation.

未來方向需要並重取捨:一方面保有令加密市場有價值的創新與效率,另一方面又要建立足以防範災難性失誤的堅實基礎設施與風險管理。能否取得平衡,決定加密貨幣市場會否成為全球金融體系中有韌性且值得信賴的一環,或只是易遭危機侵襲、損及公信力並招致嚴苛監管的投機場所。

October 11, 2025, offered the cryptocurrency industry another chance to learn these lessons. Whether that opportunity will be seized or squandered remains to be seen.

2025年10月11日再給了加密貨幣產業一次學習的機會。這個機會是被把握還是被浪費,尚待觀察。