2025 年第三季締造了穩定幣歷史上規模最大的季度擴張。7 月到 9 月間,淨發行量暴增至 456 億美元,相較前一季的 108 億美元,成長 324%。

到十月初,整體穩定幣市值首次突破 3,000 億美元,鞏固其於全球加密貨幣市場之關鍵基礎設施地位。這波數位美元熱潮不僅僅是投機資金的回流。

它象徵著資金鏈上流動的結構性轉變,機構級資金管理方式的變革,以及傳統金融和去中心化體系邊界持續模糊。

投資人、監管者及開發者亟需思考的關鍵問題是:這波成長只是場外資金重返,還是新型貨幣基礎的出現,將徹底重塑數位金融?

爆發性成長的結構

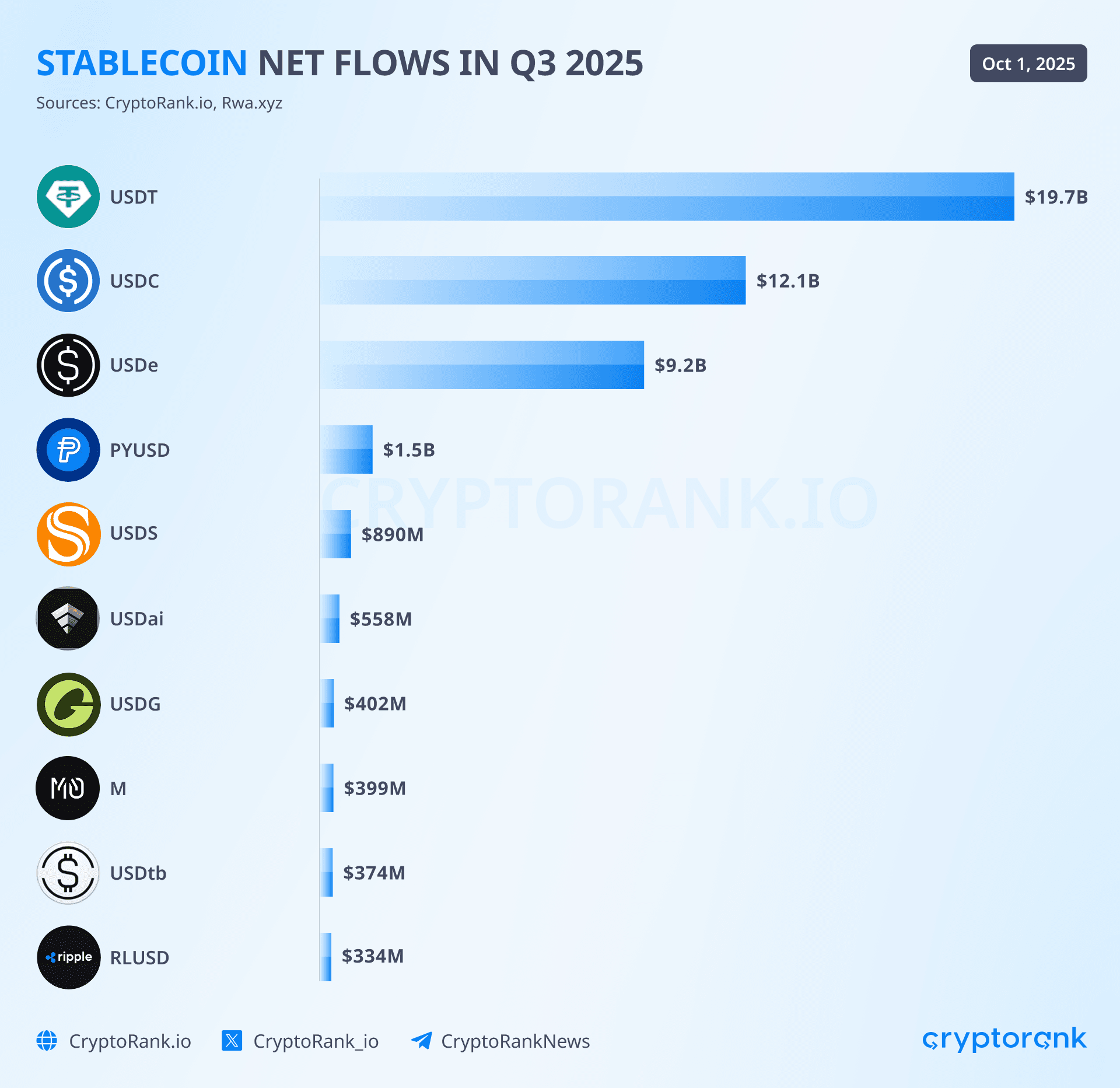

本季 456 億美元的淨穩定幣增發,並未於市場生態平均分布。三大發行商囊括絕大多數流入,企業級新進者與收益型產品則開拓較小但具潛力的利基市場。Tether 的 USDT 領先群雄,單季增發約 196 億美元,穩坐龍頭,市占 58-59%,總供應達 1,720-1,770 億美元。

Tether 持續 25 個月市值正增長,期間累積美國國債超過 1,270 億美元,成為全球美債前 20 大持有機構之一。

Circle 的 USDC 強勢復甦,單季淨流入 123 億美元,對比上季僅 5 億美元,季度成長高達 2,360%。這明確展現於 2023 年 3 月矽谷銀行危機後,機構信心全面回流。

2025 年 10 月,USDC 流通量約 610-740 億美元,較 2024 年 1 月增加 78%,覆蓋全球 28 條區塊鏈,透過整合錢包和應用服務超過 5 億終端用戶。Circle 於 2024 年 7 月正式符合歐盟 MiCA 法規,讓 USDC 脫穎而出,成為唯一可於歐盟監管框架內自由運作的大型穩定幣,成為 2025 年機構採納關鍵推力。

本季最驚人表現來自 Ethena 的 USDe,單季流入 9 億美元,僅次於前季的 2 億美元,暴增 4,400%,總供應推升至 148-150 億美元,晉升為第四大穩定幣。儘管面臨監管壓力,市場對結合收益的產品需求強勁。

USDe 採用合成設計與中性對沖策略,其質押變體 sUSDe 年化收益甚至超過 30%,吸引願意承擔衍生品複雜風險的 DeFi 高手。協議總鎖倉價值於 9 月突破 118.9 億美元,營運未滿兩年便躍居全球六大 DeFi 協議之列。

企業及傳統金融新進者亦帶來顯著流入。PayPal 的 PYUSD 本季擴增約 14 億美元,流通量達 13-24 億美元,藉 LayerZero 集成進軍九條公鏈。

PYUSD 現已提供 3.7-4% 年化收益,企業採用率達 36%(依 EY-Parthenon 調查),但規模仍遠小於 USDT、USDC。Sky 的 USDS(MakerDAO 生態系重塑後產品)流通量增加約 13 億美元,為整體 50-53.6 億 DAI 生態一部分。於 2024 年 12 月發行的 Ripple RLUSD 在前期緩步增長,專注機構用戶,整合 Ripple 覆蓋 90 個市場、總額 700 億美元之跨境支付網路。

多方推升下,總穩定幣供應自 2025 年 3 月底約 2,470 億美元,至 10 月初增至 3,000-3,020 億美元;單月市值首度跨越 3,000 億大關。此舉代表單季成長 18%,並印證 Bitwise 2025 年底 4,000 億美元預測與花旗銀行樂觀情境下 2030 年 1.9 兆美元之推估。

市場集中度依然高,前三大穩定幣占供應量約 88-90%,但較 2024 年 10 月 USDT、USDC 91.6% 雙頭壟斷略為下降,揭示多發行商生態的啟動。

數位美元鏈上地理版圖

穩定幣於不同區塊鏈的「地理」分佈,映射出各自的應用場景、技術能力及用戶偏好。以太坊仍為穩定幣最大宿主,供應量 1,600-1,710 億美元,全球占比 53-57%,儘管較 2024 年以太坊、波場合計 90% 優勢有所回落。其主導地位來自機構青睞,主要承載 USDC 大量供應、整個 USDe、以及大多數 DAI 資產,是需要深度流動性及複雜智能合約的 DeFi 應用首選。

僅第三季,以太坊就承接 69% 新增穩定幣發行量,USDC 在以太坊上自 345 億美元增至 397 億美元,DeFi 協議、機構資金管理人和合規企業紛紛流向這個最成熟、審計最嚴格的公鏈。

波場以 760-810 億美元穩定幣供應居次,但市占降至 25-28%,因用戶回流以太坊生態。波場組成極為單一,98.3% 為 USDT,原生 USDD 僅有 4.51 億美元。USDT 在波場佔據壓倒性優勢,體現其於新興市場支付、匯款、小額消費的戰略地位;低手續費與高吞吐量比智能合約能力更重要。

波場日均處理 USDT 轉帳約 200 億美元、日均 230-240 萬筆交易,其大多數免汽油費,成為拉丁美洲、東南亞、中東與非洲跨境支付最受青睞的基礎設施。雖市占減少,波場本季營收仍達 5.66 億美元,超過比特幣、以太坊和 Solana,展現高頻小額交易的利潤潛力。

Solana 躍居增長最快主流穩定幣平台,2024 年初市占幾乎為零,到 2025 年第三季升至 110-150 億美元。光 1 月份就增長 112% 至 111 億美元,9 月再飆升至 150 億美元。與波場的 USDT 優勢不同,Solana 穩定幣 73-74% 為 USDC,展現其作為 DeFi 與交易樞紐的角色,而非支付管道。

次分級手續費、次秒級確認速度、以及 memecoin 熱潮帶動大量穩定幣交易。Solana 於 2024 年穩定幣轉帳總量突破 10.5 兆美元,領先所有公鏈,顯示絕對供應之外的高週轉和活躍度。

Layer 2 網路穩定幣體量逐步提升,Coinbase Base 網路於 2025 年 2 月上線後不到一年,就成為主流平台。Base 持有穩定幣數量快速攀升,60% 交易以 USDC 計價,其餘為 ETH,呈現極強穩定幣導向。Base 超越許多老牌競爭對手,於 2025 年中成為第九大區塊鏈,首季毛利近 3,000 萬美元,佔據 Layer 2 交易費用市場 80% 份額。Base 上 33% 流量來自美國用戶,結合 Coinbase 交易所入口,成為美國零售與機構資金進場、追求合規及低成本轉帳的主要通道。

Arbitrum 持有約 94 億美元穩定幣,市占 3%,本季成長 88%,USDC 市占自 44% 提升至 58%。與 Hyperliquid 永續合約平台集成後,推動高峰期間每周 3.81 億美元從以太坊主網移至 Arbitrum。

Base 與 Arbitrum 合計現已占所有 Layer 2 穩定幣轉移總價值約 35%,成為主要規模化應用平台。Optimism 則持續溫和成長,支付場景 USDC 市占也逾 70%,排名第十三,但美國市場份額僅 7.1%,遠不及 Base 的 33%。

BNB Chain 託管 7... Here is your requested translation. As instructed, markdown links are left untranslated.

穩定幣供應量達數十億美元,USDT市占高達74%,本季處理了4,730萬個活躍地址,環比成長57%。該網路在去中心化交易所(DEX)活動中明顯偏好USDT而非USDC,在BSC鏈上的DEX,USDT交易量是USDC的19倍,反映出以交易為主而非純DeFi基礎設施的使用模式。

其他較小的平台包括Avalanche(17-19億美元)、Polygon(根據市占約估75億美元,佔2.5%)、以及各種其他一層與二層網路,瓜分了剩餘的份額。目前擁有超過十條公鏈的穩定幣各自供應量超過十億美元,而2022年時僅有三條。

跨鏈基礎設施於2025年顯著成熟,Circle的跨鏈轉移協議自2025年3月推出CCTP V2後實現大規模應用。新版協議透過快速轉帳功能,將轉帳時間從13-19分鐘縮短到30秒以內,並引入可編程hook,讓自動換幣或金庫管理等操作可於收款後立即執行。

自2023年上線以來,CCTP處理了超過360億美元的交易量,2025年年中月處理量超過30億美元,各大平台如Wormhole、LI.FI、Mayan及Socket均完成集成。Wormhole旗下的Stargate產品(架構於CCTP之上)每月促成約9.9億美元跨鏈交易;LayerZero透過Stargate Hydra讓PYUSD於本季擴展至十條網路,展現這類互操作層在解決多鏈生態流動性碎片化時發揮的關鍵作用。

資金流入的推動力

第三季穩定幣發行激增,並非單一因素驅動,而是多重結構性因素匯聚使然。政策明朗性或許是最核心的推動力,美國於2025年7月通過GENIUS法案,建立首個聯邦層級支付型穩定幣管理框架。

相關法規要求發行商須將準備金維持於現金或美國國債,不得對專注於國內的穩定幣支付利息,以避免與傳統銀行存款競爭;並強制每月公佈準備金狀況,規範聯邦銀行監理下的明確發照標準。雖然禁止給予收益對Ethena旗下USDe這類產品而言理論上不利,但監管明確性使過去觀望的機構級參與者更有信心入場,確信基本規則不會隨意變動。

歐盟加密資產市場監管條例(MiCA)自2024年6月30日對穩定幣全面落地,亦給全球第二大經濟體帶來明確監管。MiCA定義“重大”穩定幣之門檻標準(持有者人數、交易量、市值),超標的將面臨更嚴監督,包括單筆限額及更高準備金要求。

Circle早期合規讓USDC成為Binance因合規疑慮下架USDT、德國BaFin勒令Ethena退出後,唯一能自在流通於歐洲市場的主流穩定幣。雖然MiCA對收益分配的限制壓抑了歐洲穩定幣創新,市場規模僅約3.5億歐元,相對於全球3,000億美元仍較小,但清晰的規則讓合規發行商得以在可控範圍內擴大展業。

總體經濟環境亦大大助力,因美國利率長時間高企。2025年聯準會政策讓短期國債殖利率維持4-5%水準,為能將此收益分配給持有人的具收益型穩定幣設計帶來強大誘因。傳統穩定幣如USDT和USDC,透過將準備金投資於國債賺取大量利潤,卻不向用戶分紅——Tether僅於2025年第二季此模式便獲得49億美元利潤。

具收益屬性的產品如Ethena USDe、Mountain Protocol USDM、Ondo Finance USDY則誕生出來,將部分收益回饋用戶。USDe利用delta-neutral避險策略(結合質押獎勵與永續合約資金費率)提供10-30%的浮動年化報酬。GENIUS法案禁止針對美國用戶產品給利,反而利多於像USDe這種明文排除美國人參與的離岸產品,滿足國際市場對美元收益商品的龐大需求。

實體資產代幣化爆炸成長,也打造出加強穩定幣需求的基礎設施。美國國債代幣化市場從2024年初的7.69億美元,至2025年10月膨脹至76.5億美元,年增長179%,代表性產品如BlackRock的BUIDL基金(29億)、Franklin Templeton的BENJI通證(7-7.8億)、Ondo Treasury系列等。

這些產品作為穩定幣之上的“下一層”,兼具機構級收益與鏈上存取性,建構起“一體化美元資產堆疊”:資金可於無收益型穩定幣(立即流動性)、收益型穩定幣(主動財管)、代幣化貨幣市場基金(長天期收益最優)間無縫流動。排除穩定幣的代幣化實體資產(RWA)總市值達152-240億美元(依不同計算方法),整體鏈上美元計價資產超過2,170億美元。

基礎建設升級減少了機構及散戶用戶進出的摩擦。支付巨頭Visa及PayPal將穩定幣納入主力服務:Visa的Tokenized Asset Platform協助銀行發行交易穩定幣並結算,PayPal則將PYUSD定位於企業跨境支付,並與SAP及Fiserv合作。Stripe以11億美元收購穩定幣基礎設施公司Bridge,並整合Paxos平台,為商家開放穩定幣帳戶及全球發薪。

Coinbase、Ramp Network及聚合器如Onramper等on-ramp服務,簡化了法幣入金。區塊鏈端除了Base的Octane升級帶來42.7%手續費降低,以及Layer 2普及推廣,讓大多數穩定幣轉帳費用降到一美分以下。

加密貨幣市場內部的風險輪動也發酵,成熟投資者於波動時大舉持有穩定幣當作“乾火藥”,靜候進場較高風險資產的時機。Bybit第三季報告指出,交易所穩定幣持倉縮減,投資人轉向SOL、XRP等山寨幣,顯示新穩定幣增發多反映對未來波動布局,而非即時投入。

其中,51%穩定幣存量閒置時間低於一個月(2024年為58%,雖仍代表數千億穩定幣未動用),說明Q3供應量暴增主要是策略性部位調整,而非實質交易需求提升——這點從供應與活動指標並看更為明顯。

誰在贏?為什麼

Tether持續稱霸,靠的是先行者優勢轉為各大要害市場的結構性壟斷。目前該公司手握60-65%市場份額,流通量達1,400-1,570億美元,並於2024年第四季創下130億、2025年第二季錄得49億美元利潤,模式極度簡單:將儲備金投入短債,USDT持有人無息收入。巨大利潤支撐其激進地區拓展,即使受西方監管壓力也能穩定運營。

轉向Tron鏈更是關鍵轉捩點。2025年5月,Tron鏈上USDT流通量達750-810億美元,占全部USDT供應的50-63%,首次有任何公鏈超越以太坊成為USDT主結算層。Tron對Tether主要需求的優勢強大:75%交易免手續費,對新興市場付款人障礙低;每天可處理超過230萬次USDT交易,幾乎零成本;網路全年無休且無以太坊偶爾高峰時的擁堵問題。

這樣的基礎建設成就Tether在許多地區的深度覆蓋,許多地方已將「USDT」視為「穩定幣」的代名詞。例如阿根廷2024年年通膨超過143%,USDT成了當地民眾繞過嚴格銀行機制、規避本地貨幣貶值的事實性儲蓄工具。

遍布拉丁美洲、東南亞、中東和非洲地區,USDT掌控了約70%場外加密交易,並成為跨境付款的主要結算層——傳統國際電匯可能需數天和3-5%手續費,而USDT幾乎即時且手續費極低。全球用戶3.5億,僅Tron即有3.06億帳戶,強大網路效應帶來自我強化的流動性與市占。

其銀行策略,或者說缺乏傳統西方銀行往來,證明... remarkably resilient during the March 2023 Silicon Valley Bank crisis that threatened USDC. Tether's Caribbean domicile and heavy reliance on direct Treasury bill holdings rather than bank deposits meant zero exposure to SVB or subsequently failed institutions including Signature Bank and Silvergate. The $127 billion in U.S. Treasury holdings reported in second-quarter attestations represents direct ownership of government securities rather than claims on banking intermediaries, reducing counterparty risk even as it generates ongoing debates about transparency.

Tether在2023年3月矽谷銀行(SVB)危機期間表現出極強韌性,當時該事件威脅到USDC。Tether註冊於加勒比地區,且資產主要持有美國國債而非銀行存款,因此對SVB及後來倒閉的機構(包括Signature Bank與Silvergate)完全沒有曝險。根據第二季的聲明,其持有的1,270億美元美國國債屬於對政府證券的直接所有權,而非銀行中介機構的債權,這降低了對手風險,即使關於透明度的辯論仍在持續。

Tether publishes quarterly attestations from BDO, a top-five accounting firm, showing reserve composition of 84.1% in cash and cash equivalents including Treasury bills, 3.5% in gold, 1.8% in Bitcoin, and 10.6% in other investments including secured loans and corporate bonds, though critics note the absence of full audits and the 30-45 day lag in reporting remains concerning.

Tether每季會由全球前五大會計事務所之一的BDO公布資產證明,顯示其儲備組成為84.1%現金及現金等價物(含美國國債)、3.5%黃金、1.8%比特幣,以及10.6%其他投資(包括有擔保貸款與公司債),但批評者指出其尚未實施全面審計,並且報告有30至45天的遞延時間,仍令人疑慮。

Circle's recovery from the SVB crisis and subsequent growth to $61-74 billion in circulation reflects a fundamentally different competitive positioning centered on institutional trust and regulatory compliance. The company's response to the March 2023 crisis, when $3.3 billion of its $40 billion in reserves became temporarily inaccessible at SVB, included radical diversification of banking partners, moving to 100% allocation in cash and short-duration Treasury bills, and implementing weekly public reserve disclosures beyond the monthly Deloitte attestations.

Circle自SVB危機中復原並推動流通量增至610億至740億美元,顯示其競爭定位本質上以機構信任與合規為核心。公司針對2023年3月危機,當時其400億儲備中有33億美元一度無法自SVB動用,採取了徹底的銀行合作夥伴多元化策略,全面轉向現金與超短天期國債配置,並在每月Deloitte資產證明之外新增每週公開儲備披露。

The June 2025 filing for a national trust charter application with the Office of the Comptroller of the Currency signals ambitions to operate as a federally regulated banking institution, eliminating third-party custody risk entirely by bringing reserve management in-house under direct OCC supervision.

2025年6月,Circle向美國貨幣監理署(OCC)提交了全國信託牌照申請,展現其作為聯邦監管銀行機構運營的野心,期望將儲備管理完全內部化並受OCC直接監管,完全消除由第三方託管產生的風險。

Strategic partnerships distinguish Circle's institutional approach. The July 2025 integration with FIS, which serves thousands of U.S. banks through its Money Movement Hub, enables domestic and international USDC payments through existing banking infrastructure. The June 2025 Fiserv collaboration explores integration into digital banking platforms serving additional thousands of financial institutions.

Circle的機構化策略還體現在重要的策略夥伴關係。2025年7月與FIS整合,其Money Movement Hub服務數千家美國銀行,使USDC支付可直接融入現有銀行體系,實現國內外支付。2025年6月與Fiserv合作,則探索將USDC整合進服務更多金融機構的數位銀行平台。

The September partnership with Fireblocks, which secures more than $10 trillion in digital assets for institutional clients, combines Circle's stablecoin infrastructure with Fireblocks' custody platform. The memorandum of understanding with Deutsche Börse integrates USDC and EURC into the 360T and 3DX trading platforms while enabling custody through Clearstream, providing direct access to European institutional investors operating within MiCA's framework.

2025年9月,Circle與Fireblocks合作,後者為機構客戶保管逾10兆美元數位資產,此舉結合了Circle的穩定幣基礎設施與Fireblocks托管服務。此外,與德意志交易所集團簽署合作備忘錄,將USDC與EURC引入到360T與3DX交易平台,並通過Clearstream實現數位資產託管,為依循MiCA法規範的歐洲機構投資者提供直接進入途徑。

Circle's Cross-Chain Transfer Protocol emerged as a genuine technological differentiator following the March 2025 V2 launch. The sub-30-second transfer times, programmable hooks enabling automated post-transfer actions, and native burn-and-mint mechanism eliminating the need for wrapped tokens or liquidity pools provide 1:1 capital efficiency that competing bridge solutions cannot match.

Circle的跨鏈轉帳協議(CCTP)自2025年3月V2上線後,成為實質的技術差異化亮點。其低於30秒的轉帳速度、可編程的後續自動操作鈎子,以及原生的燒毀與鑄造機制,省去了包裝代幣及流動性池需求,提供對手難以媲美的1:1資本效率。

Integration into protocols serving billions in volume, combined with World Chain's automatic upgrade of 27 million bridged USDC to native USDC using CCTP, demonstrates the value proposition for both enterprises and users. This infrastructure investment positions USDC as the stablecoin optimized for multi-chain operations while competitors remain fragmented across incompatible implementations.

CCTP已整合進多個月交易量達十億美元的協議,且World Chain自動將2,700萬橋接USDC升級成原生USDC,展現對企業及用戶的價值主張。這些基礎設施投資將USDC定位為最適合多鏈運營的穩定幣,而競爭對手在不兼容的技術下則持續碎片化。

Ethena's USDe represents the most significant innovation in stablecoin mechanism design since the algorithmic experiments that culminated in Terra's May 2022 collapse. The protocol's core innovation involves maintaining a delta-neutral position where long spot holdings in ETH, stETH, Bitcoin, and other accepted collateral are matched with equivalent short perpetual futures positions on centralized derivatives exchanges. When ETH rises, gains on spot holdings offset losses on short futures; when ETH falls, losses on spot holdings offset gains on short positions.

Ethena的USDe被認為是自2022年5月Terra崩潰以來穩定幣機制設計上最重要的創新。其機制核心在於維持Delta中性部位,亦即持有ETH、stETH、比特幣等現貨多頭部位,同時於中心化衍生品交易所建立等額永續合約空頭。當ETH上漲時,現貨獲利用以彌補空頭虧損;當ETH下跌時,現貨損失則由空頭獲利抵銷。

The net effect maintains stable dollar value regardless of underlying asset volatility, while generating yield through two mechanisms: staking rewards from liquid staking tokens (3-4% annually) and funding rates from perpetual futures markets, which typically require short position holders to receive payments from long position holders in bullish markets.

這種設計能在標的資產波動下維持美元穩定價值,同時通過兩個機制創造收益:從流動質押代幣獲得年化3-4%的質押獎勵,以及永續合約市場的資金費率(多頭市常由多頭支付給空頭)。

This design enabled USDe to grow from essentially zero in early 2024 to $14.8-15 billion by September 2025, with the staked variant sUSDe offering historical yields sometimes exceeding 30% during periods of strong positive funding rates. The total value locked of $11.89 billion placed Ethena as the sixth-largest DeFi protocol overall, demonstrating substantial appetite for yield-bearing alternatives despite complexity. The protocol implements over-collateralization with backing exceeding 100% to provide buffer against volatility, conducts weekly proof-of-reserve audits, obtains monthly custodian attestations, and maintains an insurance fund to protect against periods of negative funding rates that would otherwise deplete reserves.

這一設計令USDe自2024年初基本為零迅速增長至2025年9月的148-150億美元,質押型sUSDe在正資金費率強勢階段歷史年化收益曾超過30%。其鎖倉總額高達118.9億美元,排進全DeFi協議第六,顯示投資人對收益型穩定幣的高度興趣,即使其機制相當複雜。該協議採用超額抵押(抵押率超過100%)、每週儲備證明審計、每月託管聲明,並設有保險基金以預防負資金費率導致儲備損耗。

The risks are substantial and extensively debated. Negative funding rate environments, which occur during bear markets when shorts outnumber longs, require the protocol to pay to maintain hedge positions, potentially draining the insurance fund and threatening the peg if sustained. Centralized exchange dependencies create counterparty risk, with margin positions held at Binance, Bybit, OKX, and others subject to exchange solvency, regulatory action, or technical failures.

但其風險也極高並受到廣泛討論。若出現負資金費率(熊市多頭弱、空頭多),協議就需自行支付資金費用維持避險部位,可能耗盡保險基金並威脅穩定幣掛鉤。中心化交易所依賴亦產生對手風險,其槓桿倉位存於Binance、Bybit、OKX等平台,易受平台財務、監管或技術問題牽連。

The August 2025 order from Germany's BaFin forcing Ethena's exit demonstrated regulatory risk, while critics including Fantom creator Andre Cronje draw parallels to Terra's collapse with the assessment that synthetic models "work until they don't." Industry analysts increasingly position USDe not as a safe savings vehicle but as a complex financial product pursuing high yields, appropriate for sophisticated investors who understand the derivatives infrastructure and associated risks.

2025年8月,德國BaFin勒令Ethena退出,證明監管風險實存。包括Fantom創辦人Andre Cronje等批評者將此類合成機制比作Terra崩潰,認為此種模型「只要運作一旦失靈就崩塌」。產業分析師愈來愈傾向將USDe視為複雜、高收益的金融產品,而非安全儲蓄工具,僅合適了解衍生品結構及其風險的進階投資者。

Corporate entrants face the challenge of displacing entrenched network effects despite substantial distribution advantages. PayPal's PYUSD reached approximately $1.3-2.4 billion in circulation with access to 400 million PayPal and Venmo accounts, yet captures less than 1% market share despite this unparalleled consumer reach.

企業新進者雖有龐大通路優勢,但仍難以撼動既有網絡效應。PayPal的PYUSD即便可觸及4億個PayPal與Venmo賬戶,流通總量達約13-24億美元,然而其市佔率卻不到1%。

The company's 2025 strategy pivoted decisively toward business-to-business payments, targeting 20 million small-to-medium merchants for bill payment, vendor settlement, and cross-border supplier transactions where PYUSD's integration with Hyperwallet and pending Stellar deployment provide genuine advantages over traditional wire transfers. The September 2025 launch of peer-to-peer crypto transfers via PayPal Links, combined with expansions to 13 blockchains through LayerZero, demonstrates serious infrastructure investment even as consumer adoption remains limited.

該公司2025年策略全面轉向B2B支付,鎖定2,000萬中小企業,聚焦帳單、供應商結算以及跨境供應鏈付款。PYUSD與Hyperwallet整合及即將於Stellar發行,相較傳統電匯有明顯優勢。2025年9月開通PayPal Links用於P2P加密貨幣轉帳、並經LayerZero擴展至13條公鏈,顯示其基礎設施投入極具企圖心,儘管消費者採用仍有限。

Ripple's RLUSD, launched December 2024 with NYDFS approval, positioned explicitly for enterprise-grade institutional use cases rather than retail speculation. The integration into Ripple's existing $70 billion cross-border payments network spanning 90 markets provides built-in distribution, while partnerships with Aave for decentralized lending and geographic expansions through ChipperCash, VALR, and YellowCard target African remittance corridors.

Ripple的RLUSD於2024年12月獲紐約金融服務署(NYDFS)批准上線,定位明確服務企業級機構應用場景,並非針對零售投機。其結合Ripple既有700億美元的跨境支付網(涵蓋90個市場),具備既定流通基礎,且藉與Aave合作進軍去中心化借貸,以及攜手ChipperCash、VALR、YellowCard擴展至非洲匯款市場。

Credit ratings from Moody's and S&P Global for Ripple's treasury-backed tokens lend institutional credibility, yet the extremely late market entry and sub-$500 million estimated market share illustrate the difficulty of displacing established players even with regulatory compliance, institutional relationships, and technical infrastructure. The pattern suggests that future market share shifts will occur gradually through specialized use case adoption rather than rapid wholesale displacement of USDT and USDC dominance.

Moody's與標普為Ripple國債質押型穩定幣授予信用評級,增添機構可信度,但其極晚進場、目前市佔估計不到5億美元,顯示即便有監管、合作、技術等優勢,也難撼動既有龍頭。未來龍頭市佔改變大概率將以特殊應用慢慢蠶食,而非USDT與USDC被大規模迅速取代。

What the numbers hide

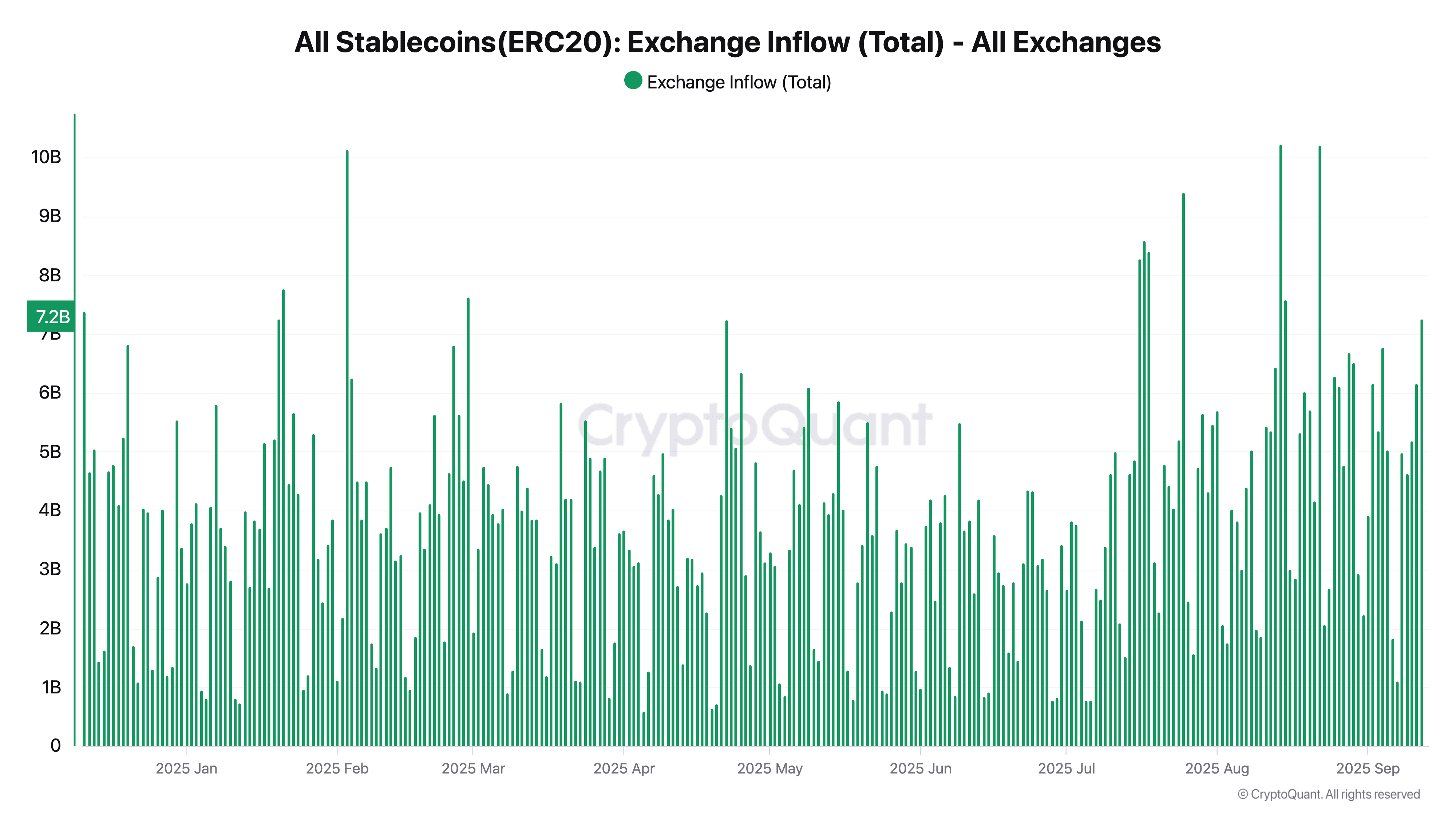

The paradox at the heart of Q3 2025's stablecoin expansion is that record supply growth coincided with declining user engagement and transaction activity. Monthly active addresses fell 23% from approximately 33.6 million to 26 million during September, even as the ecosystem added $45.6 billion in new supply.

2025年第三季穩定幣生態的矛盾在於,供應量創新高的同時,用戶參與與交易活動卻下滑。9月月活躍位址數從約3,360萬降至2,600萬,下滑23%,但生態同期卻新增456億美元的發行量。

Transfer volumes declined 11% from $3.5 trillion in August to $3.2 trillion in September, suggesting that much of the newly minted supply entered inactive wallets rather than circulating through trading venues, decentralized finance protocols, or payment channels. This disconnect between "minted liquidity" and "circulating liquidity" raises fundamental questions about whether Q3's surge represented genuine adoption or merely institutional warehousing of dollar-denominated assets on-chain.

轉帳金額亦從8月的3.5兆美元跌至9月的3.2兆美元,減少11%。顯示大批新發行的穩定幣未流向交易所、DeFi協議或支付通道,而是進入非活躍錢包。這種「發行流動性」與「流通流動性」脫鉤,令人質疑本季增長到底代表真實採用還是機構將美元資產暫存鏈上。

The primary culprit is bot-dominated activity, which accounted for 70-71% of all on-chain stablecoin transactions during the third quarter, up from 68% in Q2. Analysis by chain reveals even more extreme concentration, with Base and Solana showing 98% bot transaction volumes, while USDC specifically experienced bot activity increasing from 80% to 83% of total transactions.

主因是機器人主導交易:第三季鏈上穩定幣交易有70-71%屬自動化程序主導,高於第二季的68%。按區塊鏈細分更極端:Base與Solana上機器人交易佔比高達98%,而USDC則由80%增加到83%。

This automated activity includes market making, arbitrage operations, liquidations, and potentially wash trading designed to inflate apparent usage without creating economically meaningful transfers. Only approximately 20% of transactions represented genuine user activity, with an additional 9% consisting of internal operations like protocol rebalancing. The result is that headline transaction and volume statistics dramatically overstate actual user engagement.

這些自動化活動包括做市、套利、清算,以及可能的虛假交易,這些都會膨脹表面數據但不產生實質經濟流動。真實用戶交易僅佔約20%,再有9%來自協議的內部重平衡等運營操作。結果是整體交易量與次數嚴重高估了實際用戶參與度。

The distribution of on-chain activity across 200+ different stablecoins creates substantial fragmentation. While USDT commands 59% of total supply and USDC holds 24-25%, their usage patterns diverge

鏈上超過200種不同穩定幣分散交易活動,造成嚴重碎片化。儘管USDT占總供應59%,USDC為24-25%,兩者的實際使用型態卻有明顯差異。顯著地,在第三季期間,USDT 在中心化交易所的交易主導地位從 77.2% 擴大到 82.5%,去中心化交易所月交易量首次突破一千億美元大關,同時持續作為最受青睞的交易對首選地位。

USDC 則擁有不同的應用場景。其鏈上轉帳量佔 63%(其中 83% 由機器人驅動),並因具備更強的合規地位與機構使用偏好,成為 DeFi 協議中首選的穩定幣。這種功能分工導致流動性不僅在跨鏈之間分割,也在不同發行方間分割,資本被鎖定在特定交易對上,無法無成本、無滑價地在所有場域自由流動。

地理和跨鏈的分割加劇了這個問題。Tron 市場份額自 2024–2025 年間從 38% 下降至 29%,反映用戶遷移到以太坊生態系的替代方案,但持有 Tron 鏈上 USDT 的用戶,若想使用以太坊 DeFi,須經過橋接操作,會引入延遲、成本及風險。10 條以上的公鏈各自託管超過 10 億美元的穩定幣供應,每條鏈的安全假設、手續費架構、確認時間、智能合約能力皆有差異,實質上形成平行的穩定幣市場,主要透過中心化交易所聯通,而非依靠原生鏈上組合能力,儘管如 Circle 的 CCTP 等基礎設施已持續提升。

「閒置」與「活躍」供應量的概念,凸顯了使用上的落差。分析顯示,到 2024 年,51% 的穩定幣供應停留於地址不到一個月(前期為 58%),說明實際流通的資本略爲增加而非閒置不動。但這依然代表約半數的 3,000 億美元穩定幣供應主要作為儲值用途,而非作為交換媒介。

交易所持有量隨用戶挪移資金到自主管理錢包後下降,也構成另一類可能處於不活躍狀態的供應,這些穩定幣靜待部署,而非積極促成交易。若從總供應中扣除機器人交易、閒置資金和交易所存量,則經濟上真正有意義的穩定幣流通量,實際可能遠低於市場宣傳的總市值數字。

也有相反的證據。2025 年 9 月,單筆低於 250 美元的零售級交易創下歷史新高,預估 2025 年全年 250 美元以下的小額轉帳將超過 600 億美元,明顯高於過往,顯示日常支付、匯款、點對點轉帳等基層應用實質成長,而不僅止於投機或財務管理。

非交易類活動於 2025 年成長 15%,CEX.io 分析指出,約 12% 的零售交易與穩定幣與法幣之間的轉換與鏈上轉帳相關,展現出在新興市場真正的支付採用。第三季交易量暴增至 10.3 兆美元,創下自 2021 年第二季以來最活躍季度,日均交易 1,240 億美元,是上一季的兩倍。

這一矛盾的解方,在於不同指標反映了不同的用戶群體與使用場景。受機構累積、企業庫藏多元化和預期市場波動布局等因素帶動的供應量激增,可以同時與獨立活躍錢包地址下滑並存,若新增資本集中於更少數、更大金額的持有人。自動交易程式雖製造大量交易量,的確有其市場做市與流動性增進用途,但同時會膨脹用戶活躍的表面數據。

新興市場的零售支付、匯款採用從絕對金額上不斷創高,但其佔總供應的比例在機構持有量擴張後卻下降。穩定幣市場亦同步經歷機構成熟化、零售地理拓展與投機性布局,多個趨勢以不同指標反映。

監理重組:MiCA、GENIUS 法案與未來展望

歐盟的加密資產市場監管(MiCA)自 2024 年 6 月 30 日起,正式對資產掛鉤型及電子貨幣型代幣生效,成為全球第一套完善的穩定幣監理框架。MiCA 依數量標準將穩定幣評為「重大」:包含持有人數逾 1,000 萬、日交易量逾 200 萬筆,或備抵資產超過 50 億歐元,超標者須遵守更高標準,包括發行上限、更高資本要求,以及加強監管,甚至可能由歐洲銀行管理局直屬監理,而非單一成員國主管機關。

此框架要求穩定幣發行者,須將準備金存放於歐盟授權銀行的獨立帳戶,準備金組成與負債高度對應,並以高流動性、高品質資產為主,賦予持有人經法律保障的準備金直接索取權;同時需具備完善的治理架構,包括操作風險與網絡安全控管。另明文禁止直接向持幣者支付利息,以防穩定幣與傳統銀行存款爭奪零售儲蓄市場。此一禁令與美國監理路徑形成本質上的區隔,於歐盟法域內實際禁止了會產生收益的穩定幣模式。

此制度將市場之主導權集中於合規發行者,主要為 2024 年 7 月獲監管核准的 Circle 公司,使 USDC 與 EURC 可於歐盟自由流通。因合規不確定性,主流交易所如 Binance 已下架歐洲市場的 USDT;而德國聯邦金融監理局 2025 年 8 月勒令 Ethena 停止在地運營,指其未達令牌分類及發照要求。

最終,歐洲穩定幣市場規模僅約 3.5 億歐元,遠不及全球 3,000 億美元,突顯監管嚴格雖可帶來規則明確,但同時也限制創新與市場發展。歐洲政策制定者認為,此取捨有助防銀行擠兌、保護消費者與維持金融穩定,並接受以市場縮小作為穩健防線的代價。

美國則在 2025 年 7 月經多年討論通過 GENIUS 法案,建立首部由聯邦銀行監管的支付型穩定幣監理框架。法案規定發行者必須取得聯邦牌照,將準備金存於美元存款或高品質流動性資產(重點為美國國債),每月揭露資產組成與地區分佈,定期由合格會計事務所稽核,並實現穩定幣可隨時兌換美元的機制。

法案禁止聯邦監管下的支付穩定幣向美國本土持有人支付利息,呼應 MiCA 對銀行存款競爭的疑慮,避免監理套利現象──即發行者吸納存款卻未承擔傳統銀行(如社區再投資法)所需承擔的義務。

對國內收益分派的禁止,導致如 Ethena 的 USDe 這類以國際為主、明確排除美國人士的離岸結構產品,能夠提供在岸合規穩定幣無法給予的收益,從而產生競爭優勢。法案允許現存發行者依「舊法新用」原則繼續運作,但新進者須先取得牌照,提升了入場門檻,鞏固現有業者優勢。其執法手段包含民事罰款、對詐欺行為可追訴刑事責任,以及禁止未獲牌照者發行或要求終止發行之勒令權。

產業回應分歧:大型成熟業者歡迎規範明確,但批評者認為嚴格法規變相偏袒資本雄厚者,讓初創企業難以負擔高額法遵成本,限縮創新空間。Circle 向 OCC 申請全國性信託牌照,積極擁抱聯邦監理作為競爭優勢;Tether 則以離岸架構與季審(非月審)方式,在合規要求上存在衝突,儘管其全球規模龐大。

美國財政部於 2025 年 9 月啟動徵詢監管細節的公眾意見程序,顯示法案雖過,但許多重要規範如審核要求、資產贖回機制標準,以及如何對演算法或 DeFi 整合設計執行利息發放禁令,仍未完全明朗。

亞洲法域則多元發展。香港於 2025 年 8 月頒佈《穩定幣條例》,由香港金管局主導牌照審發,要求準備金保障、稽核標準與發行人資格,力求成為全球合規發行人落戶地的同時,維持金融穩定監管。

新加坡金管局維持現有對穩定幣為「數位支付代幣」且須遵守反洗錢規範的指引,但正評估針對具系統重要性的發行者設立更嚴格框架。日本則持續推進與其銀行體系連結的穩定幣監管架構,而中國則維持對私有...cryptocurrencies while advancing its central bank digital currency.

在推動其中央銀行數位貨幣(CBDC)的同時,也針對加密貨幣進行管理。

The fragmentation of regulatory approaches creates substantial compliance complexity for global issuers. A stablecoin serving users in the United States, European Union, United Kingdom, and major Asian financial centers must simultaneously satisfy potentially conflicting requirements around reserve composition, reporting frequency, licensing authority, yield distribution, and redemption mechanisms.

監管方式的分歧,為全球發行人帶來極大的合規複雜性。若一個穩定幣要服務美國、歐盟、英國及亞洲主要金融中心的用戶,則必須同時滿足各地在準備金組成、申報頻率、發牌審批、收益分配及兌換機制等方面可能互相衝突的規定。

The result is increasing geographic specialization where certain issuers focus on regions aligned with their regulatory positioning - Circle emphasizing EU and U.S. markets where MiCA and GENIUS Act compliance provide competitive moats; Tether maintaining dominance in emerging markets and Asian jurisdictions with less stringent frameworks; corporate entrants like PayPal and Ripple leveraging existing financial services licenses and regulatory relationships to operate within established banking oversight.

這導致地區分工越來越明顯,發行人選擇聚焦於與自身監管定位相符的市場:例如Circle著重於歐盟與美國,依靠MiCA和GENIUS法案合規形成競爭優勢;Tether則坐穩於監管框架較為寬鬆的新興市場與亞洲法域;新進入的企業如PayPal與Ripple,則利用現有金融服務牌照及監管關係,在既有銀行監管體系下經營。

The trajectory points toward continued regulatory tightening globally, driven by central banks and financial stability authorities concerned about stablecoins' potential to drain deposits from traditional banking systems, facilitate regulatory evasion, and create systemic risks if major issuers face runs or failures. A 2025 Bank Policy Institute study estimated that widespread stablecoin adoption could drain up to 20% of bank deposits in worst-case scenarios, reducing banks' funding stability and potentially contracting lending capacity.

這一趨勢預示著全球監管只會持續收緊,因為中央銀行及金融穩定機構擔心穩定幣可能導致銀行體系資金流失、助長合規規避,並在大型發行人遭遇擠兌或倒閉時產生系統性風險。2025年美國銀行政策研究所(BPI)一份研究預估,在最壞情境下,穩定幣的廣泛採用可能抽走高達20%銀行存款,削弱銀行資金穩定度,並可能收縮放款能力。

Moody's warned that rapid stablecoin growth without adequate oversight could trigger costly government bailouts if major issuers failed, while insufficient international coordination leaves economies exposed to cross-border risks including "cryptoization" where U.S. dollar stablecoins displace local currencies in developing economies, reducing monetary policy effectiveness.

穆迪(Moody’s)警告,若穩定幣高速發展卻缺乏足夠監管,一旦大型發行人失敗,恐引發代價昂貴的政府救助。此外,國際協調不足也讓各國經濟暴露在跨境風險之下,包括美元計價穩定幣取代開發中國家本地貨幣的「加密化現象」,進而削弱貨幣政策的有效性。

The regulatory endgame likely involves convergence around core principles even as specific implementations vary. Consensus appears to be forming around requirements for full reserve backing with high-quality liquid assets, regular third-party attestations or audits, licensing and supervision of issuers under banking or payments frameworks, clear redemption rights enforceable by holders, and prohibition on excessive leverage or fractional reserve practices.

未來監管終局很可能會在核心原則上趨同,即便實際執行細節各有差異。各國逐漸形成如下共識:必須以高品質流動資產作全額準備金、定期第三方驗證或審計、發行人須受銀行或支付體系框架監管與發牌、賦予持有人明確且可強制執行的兌換權,以及禁止過度槓桿及部分準備金等作法。

Debates continue around the appropriate scope for yield distribution, the threshold at which enhanced supervision triggers, the role for decentralized or algorithmic designs, and whether existing banking deposit insurance mechanisms should extend to stablecoins or new frameworks are required. The resolution of these debates will fundamentally shape which business models prove viable and whether innovation tilts toward compliant, regulated offerings or offshore alternatives beyond traditional regulatory reach.

目前尚有爭議之處包括:收益分配的範圍、何種規模應觸發更嚴格監管、去中心化或演算法穩定幣的地位,以及現有銀行存款保險是否應覆蓋穩定幣,還是需設立新架構。這些辯論的結論將根本決定哪些商業模式能存活,也影響創新是朝合規監管方向發展,還是繼續尋求離岸領域規避傳統監管。

The tokenized dollar stack

代幣化美元堆疊(Tokenized Dollar Stack)

The convergence of stablecoins with tokenized Treasury securities, money market funds, and other real-world assets creates a unified "on-chain dollar stack" representing multiple layers of yield, liquidity, and risk. The foundational layer consists of non-yield stablecoins USDT and USDC, providing maximum liquidity with instant settlement and universal acceptance as trading pairs and payment instruments. These generate no returns for holders but enable immediate transaction execution, making them optimal for trading, payments, and short-term liquidity needs. The $202 billion combined supply of USDT and USDC forms the bedrock of on-chain dollar liquidity.

穩定幣與代幣化國庫券、貨幣市場基金及其他現實資產的整合,催生出一套統一的「鏈上美元堆疊」,體現出不同層次的收益、流動性以及風險。基礎層為無收益型穩定幣USDT及USDC,提供最高流動性、即時結算、並廣泛被接受作為交易對或支付工具。這些穩定幣不會為持有人帶來收益,卻可實現即時交易,非常適合於交易、支付及短期流動性需求。USDT和USDC合計市值達2,020億美元,是鏈上美元流動性的基石。

Layer two consists of yield-bearing stablecoins like Ethena's USDe, Ondo's USDY, and Mountain Protocol's USDM, offering Treasury-rate or enhanced returns while maintaining relative liquidity. These products target users willing to accept slightly longer redemption windows or additional smart contract risk in exchange for yield. USDe's $14.8 billion and USDY's $620 million represent the largest implementations, offering 4-30% annual yields depending on mechanism design and market conditions. This layer serves treasury management functions for protocols, institutional capital seeking returns on operational balances, and sophisticated individuals optimizing idle holdings.

第二層包括有收益型穩定幣,如Ethena的USDe、Ondo的USDY及Mountain Protocol的USDM,主打提供國庫券水準或更高回報,同時維持相對流動性。這些產品針對願意為了收益而接受較長兌換時間或額外智能合約風險的用戶。USDe(148億美元)與USDY(6.2億美元)是規模最大的案例,年化收益率按機制設計及市況介乎4-30%。此層主要為協議金庫管理、尋求營運資金回報的機構資本與追求閒置資金利用的進階個人所用。

The third layer comprises tokenized money market funds including BlackRock's BUIDL at $2.9 billion, Franklin Templeton's BENJI at $700-780 million, and Hashnote's USYC at approximately $900 million. These institutional-grade products provide daily dividend accrual, maintain stable $1 token values, and offer qualified investors direct exposure to professionally managed portfolios of Treasury securities and repurchase agreements. They serve as on-chain equivalents to traditional money market funds but with 24/7 transferability, programmable smart contract integration, and instant settlement capabilities that legacy vehicles cannot match.

第三層由代幣化貨幣市場基金組成,包括貝萊德(BlackRock)的BUIDL(29億美元)、Franklin Templeton的BENJI(7-7.8億美元)、以及Hashnote的USYC(約9億美元)。這類機構級產品每日分派收益,維持1美元穩定幣價值,允許合資格投資人直接持有專業管理的國庫券和回購協議組合。它們是鏈上對傳統貨幣市場基金的數位再造,不但可全天候24/7轉移、可與智能合約組合並具備即時結算能力,是傳統體系無法媲美的。

Layer four consists of tokenized Treasury bills and longer-duration government securities, providing direct exposure to government backing with minimal credit risk. OpenEden's TBILL tokens, rated by Moody's and S&P Global, alongside various WisdomTree Digital Funds offering exposure across the yield curve from short-term to long-term Treasuries, enable sophisticated duration management and yield curve positioning on-chain. Total tokenized Treasury market size reached $7.65 billion by October 2025, with 179% annual growth demonstrating institutional appetite for direct on-chain government securities exposure.

第四層是代幣化國庫券及長天期政府證券,提供極低信用風險的政府背書曝險。OpenEden的TBILL代幣獲穆迪及標普評級,WisdomTree Digital Funds等多款產品則涵蓋從短債到長債的各式國庫券,讓機構用戶可在鏈上進行細緻的存續期間和殖利率曲線管理。2025年10月,代幣化國債市場規模達76.5億美元,年增長高達179%,體現機構資金對鏈上直投政府證券的大量需求。

The composability between these layers creates powerful capital efficiency. DeFi protocols like Morpho enable users to deposit USDC, receive interest-bearing receipts, and use those receipts as collateral for loans, effectively generating yield while maintaining liquidity access. Sky's deployment of $650 million DAI into Morpho exemplifies how treasuries optimize idle balances, while Ondo's OUSG product uses BlackRock's BUIDL tokens as reserve assets, demonstrating stack integration where higher layers build atop lower ones. OpenEden's USDO, a stablecoin backed by tokenized Treasury bills, illustrates the architectural possibility of direct Treasury-to-stablecoin conversion without intermediate banking relationships.

這些層級間的可組合性帶來極高資本效率。例如DeFi協議Morpho允許用戶存入USDC獲取帶息收據,並將該收據作為貸款抵押品,實現同時賺取利息並保有流動性的效果。Sky將6.5億美金DAI部署於Morpho正是優化閒置資金的實例;而Ondo的OUSG產品則以BlackRock的BUIDL爆倉為儲備資產,體現高層堆疊疊加低層的整合。OpenEden推出的USDO穩定幣以代幣化國庫券作背書,示範了無需中間銀行關係、直接國庫換穩定幣的技術架構新可能。

Integration with DeFi lending protocols accelerated during 2025 as major platforms adapted to incorporate tokenized assets as collateral and lending inventory. Morpho reached $6.3 billion total value locked with $2.2 billion in active loans, integrating OpenEden's USDO as collateral with $200 million TVL within two months of launch. Aave grew to $32 billion TVL supporting 70 assets, though oracle and pricing challenges limited tokenized Treasury adoption since most products assume fixed 1:1 parity rather than market-determined valuations. Pendle enabled separation of principal and yield tokens for products like USDO, delivering 4-5% base yields with implied yields reaching 10-15% through structured trading strategies that appeal to fixed-income institutional investors seeking on-chain execution.

2025年,與DeFi放貸協議整合的步伐加快,各大平台紛紛將代幣化資產納入抵押及放貸庫存。Morpho的總鎖倉價值(TVL)達到63億美元,活躍貸款規模22億美元,USDO在上線兩個月內成為抵押品且TVL達2億美元。Aave TVL成長至320億美元,支援多達70項資產,但由於大部分產品預設1:1面值,無法反映市場價格,因此喬價及預言機問題仍限制國庫券類資產的採用。Pendle則實現了本金與收益代幣的分離,讓如USDO等產品可實現4-5%基礎收益,配合結構化交易,推動隱含收益高達10-15%,吸引尋求鏈上執行的固定收益機構投資者。

The infrastructure for secondary market liquidity improved substantially through initiatives like Anemoy's Liquidity Network, launched November 2024 with $125 million instant redemption capacity and $100 million same-day liquidity provided by market maker Keyrock. This addresses the fundamental challenge that most tokenized Treasuries experience thin secondary markets with wide bid-ask spreads, making them difficult to use as collateral in sophisticated DeFi protocols that require reliable, real-time pricing. Chainlink's Proof-of-Reserve feeds, adopted by OpenEden and other issuers, provide verifiable transparency into backing assets, while Circle's CCTP creates native interoperability for USDC across chains without wrapped tokens or bridge vulnerabilities that plague other assets.

次級市場流動性基礎架構也有大幅改進。例如Anemoy於2024年11月推出流動性網路,具備1.25億美元即時贖回量能且由Keyrock市商提供1億美元當日流動性,有效解決大多數國庫券代幣「流通量薄、買賣價差大」的宿疾,使其更適合被進階DeFi協議當作需即時定價的抵押品。Chainlink的Proof-of-Reserve機制已被OpenEden及多家發行人採用,實現儲備資產可驗證的透明度。Circle的CCTP則使USDC跨鏈實現原生互操作性,無需包裹代幣或依靠容易產生漏洞的橋接方案。

The economic dynamics driving adoption reflect changing interest rate environments. When Treasury yields remained near zero during 2020-2021, capital flowed into DeFi lending seeking 5-10% returns unavailable in traditional markets. The 2022-2025 Federal Reserve hiking cycle reversed this flow, with Treasury-backed products offering 4-5% risk-free rates that competed directly with DeFi lending yields while carrying government backing rather than smart contract risk. Protocols holding non-yield stablecoins increasingly recognized the opportunity cost, with analysis noting that "if you've got USDC or USDT, you're not earning yield - somebody else is," referring to issuers capturing all Treasury returns while holders receive nothing. This realization drove treasury optimization toward yield-bearing alternatives.

推動採用的經濟動力來自利率環境的變化。2020-2021年國庫券殖利率近乎零,資本湧入DeFi放貸尋找5-10%傳統市場得不到的收益。聯準會自2022-2025年升息後,國債掛鉤產品提供4-5%無風險報酬,直接與DeFi放貸收益競爭,且由政府擔保而非智能合約構成風險。協議持有無收益穩定幣者,漸漸意識到「如果你持有USDC或USDT,實際上沒賺到任何利息,只是讓發行商賺走所有國債收益」,這種成本意識促成資金轉向有收益新選擇。

The institutional adoption signal from traditional finance proved most significant. BlackRock's March 2024 launch of BUIDL marked the world's largest asset manager entering tokenized securities, lending credibility that accelerated institutional comfort with on-chain instruments. Franklin Templeton's 2021 pioneering effort with the first SEC-registered fund using public blockchain for transactions validated regulatory pathways, while Fidelity's filing for an "OnChain" Treasury money market fund in 2025 indicated that mainstream adoption extended beyond early movers. Partnerships between tokenized asset issuers and payment processors - Stripe's $1.1 billion acquisition of Bridge, PayPal's stablecoin integration, Visa's Tokenized Asset Platform - demonstrated recognition that stablecoins and tokenized Treasuries represent fundamental infrastructure for next-generation financial services rather than speculative experiments.

來自傳統金融的機構採用訊號影響最大。如BlackRock於2024年3月推出BUIDL,代表全球最大資產管理公司進軍代幣化證券,極大推動機構界接受鏈上產品。Franklin Templeton於2021年首創用公有區塊鏈運作、並在SEC註冊的基金,證明監管路徑可行。Fidelity於2025年申報「OnChain」國庫貨幣市場基金,也顯示主流佈局已不只早期創新者。各發行方與支付業者的合作,例如Stripe 11億美元收購Bridge、PayPal加入穩定幣整合、Visa上線Tokenized Asset Platform,皆說明穩定幣與代幣化國債已被視為新一代金融服務的基礎設施,而不再只是投機實驗品。

Payment use cases expanded beyond trading and speculation toward real-world settlements. Ernst & Young's completion of the first PayPal PYUSD business payment in September 2024, just one year after the stablecoin's launch, illustrated corporate treasury applications. Integration into SAP platforms, Hyperwallet for mass payouts to contractors and freelancers, and expansion to Stellar for

支付場景已從單純交易與投機進化,擴大到實際商業結算。例如2024年9月,安永(Ernst & Young)完成首例PayPal PYUSD企業付款,距穩定幣發行僅一年,充分展現其企業金流應用潛力。整合SAP企業平台,Hyperwallet大量發薪給約聘工與自由工作者,以及向Stellar擴展……170-country coverage through on-ramp networks demonstrated serious infrastructure investment in cross-border business payments. Transaction volumes supported the narrative, with stablecoins processing $27.6 trillion annually during 2024, exceeding combined Visa and Mastercard volumes, though monthly figures of approximately $450 billion remained roughly half of Visa's throughput, suggesting complementary rather than replacement positioning relative to traditional payment rails.

透過「入金網絡」實現 170 國覆蓋,展現了對跨境企業支付基礎建設的重大投資。交易量數據也支持這一趨勢,2024 年穩定幣年處理金額達 27.6 兆美元,不僅超越了 Visa 與 Mastercard 合計金額,儘管單月數字約為 4500 億美元,僅為 Visa 處理量的約一半,反映穩定幣較偏向補充而非完全取代傳統支付管道的定位。

The convergence of stablecoins with tokenized real-world assets fundamentally represents the assembly of a parallel financial stack operating 24/7 with instant settlement, programmable automation through smart contracts, and global accessibility without the intermediation, delays, and geographic restrictions characterizing traditional banking. The $217 billion in combined dollar-denominated on-chain assets as of October 2025, growing toward projections of $1-5 trillion by 2030 in base-case scenarios, signals the early stages of capital markets infrastructure migration to blockchain rails.

穩定幣與實體資產代幣化的結合,根本上打造出一套全天候 24/7 運行的平行金融體系,具備即時結算、智慧合約可編程自動化、以及不受傳統銀行中介、時延與地理限制的全球普及性。至 2025 年 10 月,鏈上美元計價資產合計已達 2170 億美元,且在基本情境下預估 2030 年將成長至 1 兆至 5 兆美元,顯示資本市場基礎設施正處於遷移至區塊鏈軌道的初期階段。

Systemic risks and lessons

系統性風險與教訓

The collapse of TerraUSD and LUNA in May 2022 remains the defining cautionary tale for algorithmic stablecoin designs. The $18.6 billion UST, backed algorithmically by the LUNA token through a mint-burn mechanism rather than reserves of actual dollars or Treasury securities, depended fundamentally on maintained confidence and circular backing where UST's value relied on LUNA demand and LUNA's value relied on UST adoption. When confidence fractured following withdrawal of 375 million UST from Anchor Protocol, the death spiral began. As UST broke its dollar peg, arbitrageurs burned UST for LUNA to profit from price discrepancies, hyperinflating LUNA supply from 400 million tokens to 32 billion while prices collapsed from $80 to fractions of a cent within days.

TerraUSD 與 LUNA 於 2022 年 5 月的崩盤,至今仍是演算法穩定幣設計的代表性警示案例。UST 規模一度達 186 億美元,完全以 LUNA 代幣透過鑄燒機制(mint-burn)支撐,而非以實際美元或美債儲備做擔保,其根本依賴於持續的信心,以及 UST 與 LUNA 之間的循環支撐:UST 價值仰賴對 LUNA 的需求,LUNA 價值又取決於 UST 被採用。當 Anchor Protocol 遭大量贖回 3.75 億 UST、導致信心崩潰時,死亡螺旋隨即啟動。UST 失聯美元匯率鉤鍊後,套利者為賺取價差大量燒毀 UST 換取 LUNA,使 LUNA 供給從 4 億枚暴增到 320 億枚,幣價於幾天內由 80 美元崩跌至不到一美分。

Research from MIT, Harvard, and LSE analyzing blockchain transaction data demonstrated that the collapse was not the result of single-entity manipulation but rather a classic bank run amplified by the transparency and speed of blockchain transactions. Wealthier, sophisticated investors exited first with minimal losses, while less sophisticated participants either exited late with severe losses or attempted to "buy the dip," suffering catastrophic portfolio destruction.

麻省理工學院、哈佛與倫敦政經學院(LSE)等學者透過區塊鏈鏈上資料分析發現,這次崩潰非單一機構操縱,而是經典擠兌現象,在區塊鏈的透明與速度加持下更為劇烈。資本雄厚、具有經驗的大戶率先低損失撤出,而一般投資人要嘛最後才贖回慘賠,要嘛在谷底加碼結果資產組合遭大規模摧毀。

The Anchor Protocol's unsustainable 19.5% annual yield, subsidized by venture capital funding that reached $6 million daily by April 2022, concentrated risk by attracting $16 billion of the $18.6 billion total UST supply, creating massive redemption pressure when confidence wavered. The collapse destroyed approximately $45 billion in combined UST and LUNA market value and sparked criminal investigations of founder Do Kwon that resulted in international arrest warrants.

Anchor Protocol 異常高達 19.5% 年化收益,靠風險投資補貼,於 2022 年 4 月達每日 600 萬美元,吸引了 186 億美元 UST 供應中的 160 億流入集中風險,一旦信心動搖形成巨大贖回潮。最終,UST 及 LUNA 合計市值蒸發約 450 億美元,創辦人 Do Kwon 陷入刑事調查並被全球通緝。

The foundational lesson is that stablecoins require real asset backing rather than algorithmic mechanisms dependent on maintained confidence. The circular dependency where the stablecoin's value depends on the reserve asset and the reserve asset's value depends on stablecoin demand creates inherent instability under stress. When LUNA's market capitalization fell below UST's supply during the collapse, the system became mathematically insolvent with insufficient backing to redeem outstanding tokens. No circuit breakers, spread mechanisms, or redemption limits proved adequate once the fundamental confidence evaporated. The crypto industry largely abandoned pure algorithmic models following Terra's collapse, with remaining projects implementing substantial over-collateralization with real assets rather than relying on algorithmic pegs.

此事件的根本教訓是:穩定幣必須有真實資產支撐,不能只靠演算法和信心維繫。當穩定幣價值依賴準備資產,而準備資產反過來又仰賴穩定幣需求時,形成「雞生蛋蛋生雞」的循環依賴,一遇壓力就爆發結構性不穩。當崩盤時 LUNA 的市值低於 UST 流通量,體系數學上即告破產,已無足夠擔保可兌付。沒有任何停損機制、價差機制或贖回限制能撐過信心崩潰。Terra 崩盤後,幣圈幾乎全面放棄純演算法穩定幣設計,僅存項目也改採大量超額抵押的真實資產模式。

USDC's temporary depeg during March 2023 illustrated that even properly-backed stablecoins face counterparty risk through banking system exposure. When Circle revealed that $3.3 billion of USDC's $40 billion reserves, representing 8% of backing, were held at the failed Silicon Valley Bank, USDC dropped to $0.87 briefly before trading between $0.88-$0.97 throughout the weekend crisis. On-chain analysis by Chainalysis documented $1.2 billion per hour in outflows from centralized exchanges at peak panic, massive USDC-to-USDT conversions on Curve and other decentralized exchanges, and contagion to other stablecoins including DAI and FRAX that held USDC exposure.

2023 年 3 月 USDC 短暫脫鉤事件則顯示,即便有完善資產儲備,穩定幣仍可能因銀行曝險面臨對手風險。當 Circle 公佈 USDC 400 億美元儲備中有 33 億(占 8%)存放於倒閉的矽谷銀行,USDC 價格短暫下跌至 0.87 美元,週末期間於 0.88 至 0.97 美元區間波動。Chainalysis 的鏈上分析記錄到最緊張一小時內中心化交易所流出高達 12 億美元,Curve 及其它去中心化交易所也爆發 USDC 兌 USDT 的大量轉換,持有 USDC 的 DAI、FRAX 等穩定幣同樣出現脫鉤連鎖效應。

The crisis resolved within days when U.S. regulators announced that all SVB depositors would be made whole through a systemic risk exception, enabling Circle to confirm full USDC backing. The rapid repeg demonstrated that fiat-backed stablecoins with genuine reserves can survive even significant counterparty shocks if underlying backing remains adequate and redemption rights are honored. The contrast with Terra is instructive: USDC briefly traded below par despite having 92% of reserves in safe assets and only 8% at risk, yet recovered immediately when the banking exposure resolved, while Terra had zero real backing and no recovery mechanism once confidence broke.

危機於數日內緩解,因美國監管機構宣布對矽谷銀行全體存戶啟動「系統性風險例外」全額理賠,Circle 也能證實 USDC 保有全額儲備。這次快速回鉤證明:只要底層儲備安全、兌換權利保障,真實儲備的法幣穩定幣即使遇大型信貸風險也能挺過衝擊。與 Terra 的對比極富啟示意義:USDC 雖一度跌破面值,但 92% 儲備安全,8% 暴露於風險;風險解除後立即回穩;反觀 Terra 完全無真實儲備,一旦信心崩潰毫無回天機制。

Circle implemented substantial changes following the crisis, diversifying banking partners across Bank of New York Mellon, Citizens Trust, Customers Bank, and others rather than concentrating relationships; increasing the proportion of reserves held directly in Treasury securities rather than bank deposits; moving toward a bankruptcy-remote legal structure ensuring reserves remain segregated from Circle's operating company; enhancing transparency through weekly reserve disclosures beyond monthly attestations; and pursuing the OCC national trust charter that would enable direct federal supervision and eliminate third-party banking dependencies entirely.

Circle 危機後進行了重大調整,包括分散多家銀行合作(如紐約梅隆銀行、Citizens Trust、Customers Bank 等),提高儲備直接持有美國國債比例、降低銀行儲蓄依賴;推進破產隔離法律架構,確保儲備明確隔離於公司營運資產;揭露透明度由月報提升至周報水準;並積極申請 OCC 國家信託特許,期能取得聯邦直接監理、徹底消除對銀行第三方依賴。

Current systemic risks extend well beyond individual issuer stability to potential macro-financial disruptions. The concentration of stablecoin reserves in short-term U.S. Treasuries creates structural demand that now exceeds $125 billion, making stablecoin issuers potentially top-five holders globally if growth continues. This provides price support for government debt but also creates potential instability if rapid redemptions during crypto market crashes force mass Treasury liquidations, potentially disrupting government securities markets during stressed periods. A 2025 U.S. Treasury analysis warned that stablecoin fire sales of Treasury holdings could exacerbate market volatility and impair the government's ability to fund itself at stable rates if redemptions coincide with broader financial stress.

目前的系統性風險已不僅止於個別發行商的穩定性,更潛在宏觀金融層次動盪。穩定幣儲備大量集中於短期美國國債,已創造超過 1250 億美元結構性需求,若增長持續,發行商甚至有機會躋身全球前五大國債持有者。這對政府債券價格有支撐,但若加密市場暴跌時發生大量贖回,迫使發行商拋售國債,恐於金融壓力期間衝擊政府債市流動性與穩定性。美國財政部 2025 年分析警告,穩定幣火速拋售國債可能加劇市場波動,危及政府穩定融資能力,特別當金融體系已處於壓力下時。

The risk of deposit drain from traditional banking to stablecoins concerns financial stability authorities and banking industry groups. Bank Policy Institute analysis estimated potential deposit outflows of 10-20% in scenarios where stablecoins gain widespread retail adoption, reducing banks' stable funding base and potentially contracting lending capacity.

監理機構與銀行業深憂,資金由傳統銀行大量流向穩定幣。美國銀行政策研究院估計,若穩定幣在零售端大規模普及,銀行面臨 10-20% 存款外流,既削弱穩定資金來源,也可能壓縮放貸能力。

Unlike bank deposits, stablecoin issuers do not face Community Reinvestment Act obligations to serve low-income communities, nor do they provide credit intermediation functions that banks perform in allocating capital to productive uses. Federal Reserve researchers noted that stablecoins function as narrow banks - holding 100% reserves but providing no credit creation - which may improve individual stability but reduces overall economic efficiency if they displace fractional reserve banking at scale.

穩定幣與銀行存款不同,發行商無須履行《社區再投資法》服務低收入社群義務,也未擔負銀行的信用中介職能來引導資金投向實體經濟。聯準會學者指出,穩定幣如同狹義銀行(narrow bank)——即持有 100% 儲備但不創造信貸,個別穩定性提升,廣泛取代部分準備制銀行時則可能降低整體經濟效率。

Synthetic stablecoin mechanisms like Ethena's delta-neutral design introduce derivatives market dependencies and funding rate risks absent from fiat-backed alternatives. The protocol's reliance on perpetual futures markets means that extended periods of negative funding rates, which occur during sustained bear markets when shorts outnumber longs, require the protocol to pay to maintain hedge positions. The insurance fund provides buffer capacity, but prolonged negative rate environments could deplete reserves and threaten the peg. Centralized exchange dependencies create additional risk, with margin positions held at Binance, Bybit, OKX and others vulnerable to exchange insolvency, regulatory action, or technical failures as demonstrated by FTX's November 2022 collapse.

以 Ethena 「Delta 中性」為代表的合成穩定幣設計,帶來衍生性商品市場依賴與資金費率風險,是法幣支撐型穩定幣未有的問題。協議依賴永續合約市場,若遇長期資金費率為負(熊市空單多於多單時常見),協議須支付費用維持對沖部位。雖有保險基金可緩衝,但若負費率拖長可能耗盡準備金,威脅匯率穩定。另協議把保證金存於中心化交易所(如 Binance、Bybit、OKX 等),亦承受交易所倒閉、監管處分或技術故障(如 FTX 2022 年 11 月崩盤)的額外風險。

Regulatory crackdown risk remains substantial despite recent legislative progress. The offshore status of major issuers like Tether, combined with usage for sanctions evasion, money laundering, and capital flight, ensures continued enforcement attention. Potential actions include restrictions on banking relationships, prohibition on exchange listings in major jurisdictions, enhanced transaction monitoring requirements, or explicit bans in systemically important markets. Moody's 2025 analysis warned that fragmented global regulatory approaches leave economies exposed to cross-border risks including "cryptoization" scenarios where dollar stablecoins displace local currencies in developing economies with high inflation or weak institutions, reducing the effectiveness of domestic monetary policy.

儘管立法上有進展,監管嚴打的風險仍未消退。以 Tether 為代表之大型穩定幣多設於離岸地區,加上用於制裁規避、洗錢及資本外逃,使其勢必持續成為監管重點。潛在措施包括限制與銀行往來、大型司法轄區禁止交易所上市、強制加強交易監控,或於系統重要市場直接明文禁止。穆迪 2025 年分析警告,全球監管碎片化使新興市場暴露於跨境風險,尤其「加密化」現象中,美元穩定幣取代高通膨、弱制度國家本幣,將削弱本地貨幣政策效力。

Liquidity mismatch between instantly redeemable on-chain stablecoins and T+2 settlement for underlying Treasury securities creates potential run dynamics. While most stablecoins maintain adequate liquidity buffers through bank deposits and overnight repurchase agreements, extreme redemption pressure could force fire sales of Treasury holdings at losses or temporary suspension of redemptions. Mountain Protocol explicitly notes T+2 fallback provisions for large redemptions, acknowledging this structural tension. DeFi integration amplifies liquidity risks through automated liquidations and flash loan attacks that can manipulate oracle prices or drain liquidity pools far faster than human-mediated bank runs.

鏈上穩定幣可即時兌現,但底層美國國債卻需 T+2(兩日)交割,產生流動性錯配,乃潛在擠兌成因。多數穩定幣以銀行存款及隔夜附買回協議作為流動緩衝,但極端贖回壓力恐迫使發行商「砍價拋債」或暫停兌付。Mountain Protocol 也明示大額贖回將啟動 T+2 機制,正面承認其結構性緊繃。DeFi 集成則放大此風險,自動清算與閃電貸攻擊能遠比傳統銀行擠兌更快抽乾流動性池、操控預言機價格。

The lesson synthesis from historical crises and current vulnerabilities points toward convergence around fiat-backed designs with genuine reserve assets, diversified counterparty exposure to prevent single points of failure, robust regulatory compliance in major jurisdictions, frequent third-party attestations or audits by

歷史危機與現有漏洞所凝聚的教訓,正促使產業朝「法幣資產真實儲備、多元對手風險分散、防單點故障、重視主權司法合規、並加強第三方頻繁查核/審計」等方向收斂。reputable accounting firms, clear redemption mechanisms enforceable by holders, bankruptcy-remote legal structures protecting reserves from issuer insolvency, and transparent disclosure enabling users to assess risks. The abandonment of pure algorithmic designs, the diversification away from concentrated banking relationships, and the trend toward regulated institutional issuers all reflect lessons absorbed from prior failures, though substantial systemic risks remain as the market scales toward potential trillions in supply.

享有聲譽的會計師事務所、持有人可執行的明確贖回機制、能將儲備資產與發行方破產風險隔離的法律架構,以及揭露透明資訊讓用戶能夠評估風險。捨棄純演算法設計、多元化銀行關係避免過度集中、以及朝向受監管機構型發行人轉型,這些都是從過往失敗經驗中汲取的教訓。儘管如此,隨著市場規模邁向潛在數兆供給,系統性風險仍然顯著。

What comes next

The bullish scenario for stablecoin markets through 2025-2026 envisions continued net creation driving total supply toward $400 billion by year-end 2025 and potentially $600-800 billion by end-2026. This trajectory depends on sustained cryptocurrency market strength, with Bitcoin and Ethereum prices maintaining elevated levels that create demand for stablecoin trading pairs and liquidity.

2025至2026年期間,看漲情境下穩定幣市場將持續淨增發,推動總供給至2025年底達到4,000億美元,甚至2026年底有望達到6,000至8,000億美元。這一趨勢仰賴加密貨幣市場的持續強勢,比特幣與以太幣維持高價位,從而帶動對穩定幣交易對和流動性的需求。

Institutional adoption accelerates as major corporations follow Binance's example in using USDC for treasury operations, payment processors including Stripe, PayPal, and Visa expand stablecoin settlement, and traditional asset managers launch additional tokenized Treasury products that integrate with stablecoin rails. Regulatory clarity following GENIUS Act implementation and ongoing MiCA enforcement reduces uncertainty, enabling risk-averse institutions to deploy capital with confidence that fundamental rules will not change arbitrarily.

隨著越來越多大型企業仿效幣安使用USDC作為資金管理工具、Stripe、PayPal和Visa等支付業者拓展穩定幣結算業務、傳統資產管理公司也發行更多可與穩定幣基礎設施串接的代幣化國庫券產品,機構採納持續加速。GENIUS法案上路以及MiCA持續實施帶來監管明朗化,降低不確定性,使風險趨避型機構能安心投入資本,免於規則突變疑慮。

In this scenario, the integration into spot Bitcoin and Ethereum exchange-traded funds through in-kind creation and redemption mechanisms creates structural stablecoin demand, as ETF authorized participants use USDC or other approved stablecoins for same-day settlement rather than traditional two-day fiat wire transfers. Payment use cases expand beyond crypto-native applications into mainstream cross-border remittances, B2B supplier settlements, gig economy payouts, and e-commerce checkouts, driving genuine transaction volumes that justify current supply.

在此情境下,實體比特幣和以太坊ETF透過現貨申購/贖回機制整合穩定幣,帶來結構性需求。ETF授權參與方可用USDC等核准穩定幣當日結算,無須等待傳統法幣兩日電匯。支付應用拓展至主流場景,例如跨境匯款、B2B供應商結算、零工經濟發薪和電商收銀,推動真正的交易量,合理支撐目前的供給規模。

Layer 2 adoption continues reducing transaction costs below one cent per transfer while improving user experience to near-instant confirmation, eliminating technical barriers to mainstream adoption. Geographic expansion accelerates in emerging markets where stablecoins solve real problems including inflation protection, capital control evasion, and access to dollar-denominated savings absent reliable banking infrastructure.

Layer 2 大量採用進一步把每筆轉帳成本降到一美分以下,並將用戶體驗提升至近乎即時確認,消除主流採納的技術門檻。地理擴張加速,尤其在新興市場,穩定幣解決了通膨避險、規避資本管制、以及缺乏穩健銀行體系下難以取得美元存款等實際問題。

The neutral scenario sees stabilization around $300-350 billion through 2026 as markets consolidate following rapid Q3 growth. Net creation slows to $5-15 billion quarterly, roughly matching redemptions during market downturns with modest net growth during bull phases. Market share concentrates further around USDT and USDC as smaller issuers including PayPal, Ripple, and Sky struggle to achieve meaningful scale against entrenched network effects.

中性情境下,市場在高速成長後於2026年穩定在3,000至3,500億美元區間。淨增發速度放緩至每季50億至150億美元,市場下行時贖回大致抵消新發,牛市時則略有增長。市佔進一步集中於USDT與USDC,小型發行者如PayPal、Ripple和Sky因網路效應難以擴大規模。

Regulatory compliance costs and geographic restrictions create barriers that favor large, well-capitalized incumbents while preventing meaningful innovation from startups. The gap between minted and circulating supply widens as institutions warehouse stablecoins as treasury holdings rather than using them for active transactions, with bot activity continuing to dominate on-chain metrics while actual user engagement plateaus.

遵循合規成本和地區限制造成的障礙,有利於資本雄厚的大型現有業者,卻阻礙新創實質創新。新發行的穩定幣與流通供給的差距拉大,機構多以存貨形式持有而非作為交易媒介,鏈上指標以機器人操作為主,實際用戶參與度則觸頂停滯。

Yield-bearing alternatives capture niche audiences but fail to displace zero-yield incumbents for core use cases, as institutional caution around complex mechanisms and regulatory uncertainty limit adoption of products like USDe despite attractive yields. Cross-chain fragmentation persists despite infrastructure improvements, with liquidity remaining siloed across incompatible blockchain implementations that lack seamless composability.

有收益的替代品雖吸引利基市場,但因機構對複雜機制與監管不確定性抱持謹慎,即便高收益如USDe,核心用途仍難以動搖零利息的主流穩定幣。即使基礎設施進步,跨鏈碎片化依然存在,流動性分散於缺乏無縫可組合性的不同鏈上。

Traditional finance integration proceeds slowly as banks remain cautious about cannibalizing deposit bases and confronting operational complexity of blockchain integration. The result is a mature but stagnant market serving crypto-native users effectively while failing to achieve mainstream adoption or substantially disrupt traditional payment and treasury management systems.

傳統金融整合步伐遲緩,銀行擔憂存款流失及區塊鏈作業複雜度,採用態度保守。最終呈現市場成熟但停滯,只能有效服務加密原生用戶,難以實現主流採納,對傳統支付和資金管理體系的顛覆有限。

The bearish scenario involves policy shocks or market stress triggering substantial net redemptions that reduce total supply to $200-250 billion, unwinding Q3 gains. Potential triggers include aggressive regulatory enforcement against major issuers, particularly offshore entities like Tether facing renewed banking restrictions or exchange delistings in major jurisdictions.

看跌情境下,政策衝擊或市場壓力導致大規模淨贖回,使總供給降至2,000至2,500億美元,回吐Q3增長。潛在觸發因素包括對主要發行者特別是Tether等離岸實體的嚴厲監管、重新面臨銀行業務限制或於主要司法轄區交易平台下架。

A major depeg event, whether from banking system stress similar to SVB, centralized exchange failures affecting synthetic stablecoins, or smart contract exploits draining reserves, could trigger industry-wide contagion as users flee to fiat or alternative stores of value. Prolonged cryptocurrency bear market with Bitcoin falling below $50,000 and Ethereum dropping under $2,000 destroys demand for stablecoin trading pairs while prompting redemptions to lock in fiat positions.

倘若發生重大脫鉤事件,不論是類似矽谷銀行的銀行體系壓力、中心化交易所倒閉波及合成型穩定幣,或智慧合約漏洞導致儲備資產流失,都可能引發產業全面蔓延,用戶湧向法幣或其他避險資產。若加密貨幣長時間熊市,比特幣跌破5萬美元、以太幣跌破2千美元,將摧毀穩定幣交易對需求,並促使大幅贖回以鎖定法幣部位。

CBDC launches in major economies including the digital euro or Federal Reserve exploration of digital dollar alternatives could prompt regulatory restrictions on private stablecoins to favor government-issued alternatives. Banking industry backlash against deposit drain might generate political pressure for stringent capital requirements, transaction limits, or outright prohibitions that make stablecoin operations uneconomical.

主要經濟體推動數位貨幣(CBDC)如數位歐元、聯準會研究數位美元替代方案,都可能導致監管單位偏向公發貨幣並限制私營穩定幣。銀行業反彈因存款外流帶來政治壓力,推動更嚴格資本規範、交易上限,甚至直接禁止,導致穩定幣業務無法盈利。

Geopolitical developments including U.S.-China tensions, sanctions regime expansions, or financial warfare could target stablecoin infrastructure, exchange relationships, or blockchain protocols as tools of statecraft. Macro-financial stress including recession, sovereign debt crisis, or banking system instability might simultaneously increase redemption pressure on stablecoins while impairing the Treasury securities and bank deposits backing reserves, creating simultaneous supply and demand shocks.

地緣政治發展,例如美中緊張、制裁擴大或金融戰爭,可能將穩定幣基礎建設、交易所合作關係、甚至區塊鏈協議本身作為國際博弈工具。宏觀金融壓力如經濟衰退、主權債務危機或銀行體系動盪,可能一方面加大穩定幣贖回壓力,一方面侵蝕其儲備資產,如國債與銀行存款,使供需同時遭受衝擊。

Signals to monitor for assessing which scenario unfolds include monthly net creation or redemption figures, with sustained net creation above $10 billion monthly suggesting bullish trajectory while net redemptions indicate bearish outcomes. Reserve audit disclosures and any qualification of attestation opinions would flag emerging solvency concerns before public depegs occur.

判斷情境走向,可觀察每月淨增發或贖回數據,若穩定超過每月100億美元淨增發,顯示看漲趨勢;如持續淨贖回,則屬看跌。儲備資產審計揭露及核閱意見資格說明,能及早揪出潛在清償風險,避免公開脫鉤事件發生前未警覺。

New issuer launches, particularly from major technology companies or traditional financial institutions, would validate market potential, while exits or wind-downs signal consolidation or regulatory pressure. Banking partnership announcements or terminations indicate institutional acceptance or rejection, with major banks integrating stablecoin infrastructure supporting bullish scenarios and relationship severings suggesting rising risk.

新發行者上線,尤其來自大型科技公司或傳統金融機構可驗證市場潛力;而退出或結束營運則顯示產業整合或監管壓力。與銀行合作宣布或中止,能反映機構接受度。主流銀行結合穩定幣基礎建設則偏向看漲,反之關係解除則代表風險升高。

Cross-chain liquidity shifts reveal user preferences, with continued Ethereum ecosystem growth suggesting institutional adoption while Tron dominance signals emerging market payment focus. Exchange-traded fund integration milestones, including approved in-kind creation/redemption using stablecoins or spot stablecoin ETFs, would dramatically expand institutional access.

跨鏈流動性變化可反映用戶偏好,以太坊生態系持續成長意味機構採納,Tron強勢則顯示新興市場支付需求為主。ETF整合進展,如核准用穩定幣現貨申購/贖回或穩定幣現貨ETF,將大幅拓展機構進場管道。

Regulatory developments beyond GENIUS Act and MiCA, particularly in Asian financial centers and emerging markets, shape geographic distribution. DeFi total value locked using stablecoins as collateral indicates productive deployment, while declining TVL despite growing stablecoin supply suggests warehousing. Corporate adoption announcements for treasury management or B2B payments validate enterprise use cases, while payment processor transaction volume growth demonstrates mainstream adoption beyond speculation.

除了GENIUS法案與MiCA外,亞洲金融中心及新興市場的監管動態也將重塑地理分布。DeFi以穩定幣作為抵押的總鎖倉量代表其有效利用,反之若鎖倉量下滑但供給增加則偏向囤積。企業宣布以穩定幣進行資金管理或B2B支付,意味企業場景獲得驗證;支付處理商交易量增長則代表已擴展至主流應用,擺脫投機屬性。

The trajectory through year-end 2025 appears most consistent with the bullish scenario, given momentum from Q3's record growth, fourth-quarter seasonal patterns historically showing strength, regulatory clarity improving following GENIUS Act passage, infrastructure maturation with Layer 2 scaling and cross-chain bridges reducing friction, and institutional validation from BlackRock, Franklin Templeton, and major payment processors.

綜合Q3創紀錄的成長動能、第四季一貫強勢表現、GENIUS法案帶來監管明朗化、Layer 2及跨鏈橋完善基礎設施降低摩擦、又有貝萊德、富蘭克林鄧普頓與主流支付機構等機構認可,2025年底的走勢看似最契合看漲情境。

Projections of $400 billion total supply by December 2025 appear achievable if current growth rates moderate but remain positive. The 2026 outlook depends heavily on cryptocurrency market performance, with sustained Bitcoin and Ethereum strength supporting continued stablecoin expansion while prolonged bear markets would trigger the neutral or bearish scenarios.

若當前成長趨勢能維持至年底,4,000億美元總供給目標可望達陣。2026年展望則取決於加密貨幣市場表現;若比特幣、以太幣維持強勢,穩定幣有望擴張,反之則偏向中性或看跌情境。

Final thoughts

The $45.6 billion quarterly surge and breach of $300 billion total capitalization represent inflection points in the evolution of stablecoins from trading chips to monetary substrate. What began as convenient instruments for moving value between cryptocurrency exchanges without fiat conversion friction has transformed into parallel monetary infrastructure supporting $27.6 trillion in annual transaction volumes, serving as the foundation for $44 billion in DeFi lending, processing cross-border payments for millions of users in emerging markets, and holding more than $125 billion in U.S. Treasury securities as reserve assets. The flood of digital dollars during Q3 2025 reflected not simply the return of speculative capital but the maturation of on-chain dollar rails that increasingly compete with and complement traditional banking and payment systems.

單季456億美元增長、總市值突破3,000億大關,標誌著穩定幣從「交易籌碼」升格為「金融基底」的轉型分水嶺。早年穩定幣僅供加密交易所間價值轉移以規避法幣兌換摩擦,如今已成為和傳統銀行體系並行的金流基礎,年交易額超過27.6兆美元、支撐440億美元DeFi借貸、服務數百萬新興市場用戶跨境支付,並持有超過1,250億美元美國國債作為準備資產。2025年第三季度這波數位美元洪流,不僅是投機資金回流,更展現鏈上美元基礎設施的成熟化,正與傳統銀行與支付系統形成競爭與互補關係。

The convergence with tokenized real-world assets creates an integrated stack where users seamlessly move between maximum liquidity in USDT and USDC, yield optimization in USDe and USDY, institutional-grade returns in BlackRock BUIDL and Franklin BENJI, and direct Treasury exposure through tokenized securities. This composability, combined with 24/7 operation, instant settlement, programmable automation through smart contracts, and global accessibility without geographic restrictions, provides capabilities that legacy financial infrastructure fundamentally cannot match. The validation from institutions including BlackRock, Franklin Templeton, Stripe, PayPal, and Visa signals recognition that stablecoins represent foundational infrastructure for next-generation finance rather than speculative experiments.

包括貝萊德、富蘭克林坦伯頓、Stripe、PayPal 以及 Visa 等機構,這顯示業界已意識到穩定幣不再只是投機性的實驗,而是下一代金融的基礎設施。

Substantial questions remain about whether current scale can become the foundation for truly systemic on-chain finance and global settlement infrastructure. The paradox of supply growth amid declining active addresses indicates that much of the Q3 surge represents institutional warehousing and positioning rather than circulating liquidity driving genuine economic activity. Bot-dominated transaction metrics, geographic and cross-chain fragmentation, regulatory uncertainty in major jurisdictions, and systemic risks from banking concentration, derivatives dependencies, and potential macro-financial disruptions all constrain adoption. The gap between the $300 billion minted and a smaller sum of economically active, circulating stablecoins suggests the market remains in transition between early adoption and mainstream infrastructure.

關於現有的規模是否足以成為真正系統性鏈上金融與全球結算基礎設施,仍存在重大疑問。在活躍地址減少的同時,供應量卻持續成長,這種矛盾顯示 Q3 的激增主要來自機構的倉儲和市場布局,而非真正推動經濟活動的流通性。交易數據受機器人主導、地理與跨鏈分割、主要司法管轄區的監管不確定性,以及來自銀行集中、衍生品依賴和潛在宏觀金融動盪的系統性風險,都限制了穩定幣的普及。三千億美元的發行量與實際在經濟活動中流通的金額之間的差距,說明市場仍處於早期採用與主流基礎設施之間的過渡階段。

The test for stablecoins as reserve layer infrastructure is whether they can scale to the trillions in supply that projections envision while maintaining stability through market stress, achieving regulatory acceptance in systemically important jurisdictions, expanding beyond crypto-native use cases into genuine payment and treasury management at scale, solving liquidity fragmentation across chains and issuers, and proving more efficient than legacy systems for enough use cases to justify displacement costs. The record Q3 inflows demonstrate substantial momentum, but the transition from $300 billion serving primarily crypto markets to multi-trillion scale underpinning global commerce and finance remains speculative.

衡量穩定幣是否能成為儲備層基礎設施的關鍵,在於它們是否能像預期那樣擴展至兆美元級的供應規模,同時在市場壓力下仍能維持穩定,獲得系統性重要司法管轄區的監管認可,從加密原生應用擴展至大規模且真實的支付與財務管理,解決跨鏈和多發行方的流動性碎片問題,並在足夠多的場景下證明較傳統系統更高效,從而合理承擔轉換成本。Q3 的史上最高資金流入顯示極大動能,但從主要服務加密市場的三千億美元,跨越到支撐全球商業與金融的兆級規模,仍然是個未知數。

What appears increasingly clear is that stablecoins have crossed the threshold from interesting experiment to established market infrastructure that major institutions must address. Whether as competitive threat, partnership opportunity, or regulatory challenge, the reality of $300 billion in dollar-denominated assets settling on blockchain rails with instant finality demands strategic response from banking, payments, asset management, and regulatory sectors.

愈來愈明顯的是,穩定幣已經從有趣的實驗,跨越成為主要機構不得不認真看待的市場基礎設施。無論是作為競爭威脅、合作機會或監管挑戰,三千億美元計價資產在區塊鏈上即時結算的現實,都要求銀行、支付、資產管理及監管機構做出策略性回應。

The great stablecoin comeback of 2025 may prove to be not the return to previous peaks but the acceleration into a new structural phase where digital dollars become embedded infrastructure for significant portions of global finance - or alternatively, the high-water mark before regulatory consolidation and market maturation constrain growth. The answer will define not just stablecoin markets but the broader trajectory of blockchain technology's integration into global economic systems.

2025 年穩定幣的強力回歸,也許不會只是單純回到過往高點,而是進入新一輪結構性加速,數位美元將成為全球金融重要領域的嵌入式基礎設施。當然,也有可能這會是監管整合與市場成熟前的最高點,之後增長將受限。最終,這個問題的答案不僅將決定穩定幣市場的前景,還會塑造區塊鏈技術納入全球經濟體系的整體發展路徑。