XRP Ledger正處在機構金融與區塊鏈基礎建設融合的關鍵時刻。2025年10月,當一位知名XRPL開發者詢問Ripple執行長Brad Garlinghouse,推動機構在賬本上採用的關鍵時,他用一個字凝聚了這場對話:「隱私」。

這一簡單回應,正好體現了區塊鏈推動機構採用所面臨的核心矛盾。金融運作離不開保密性,但區塊鏈卻以透明為本。

對銀行、資產管理公司與需遵守GDPR、巴塞爾協議III及銀行保密法等法規的企業而言,在公開賬本上進行業務,意味著競爭情報、交易策略與客戶關係等敏感數據會被任何有網路的人看到。盡管XRPL展現出三到五秒結算、超低交易費用,以及十三年零停機等技術優勢,機構在大規模資本部署時,卻因區塊鏈的透明性問題而猶豫。

然而,過去一年已見證這場挑戰正快速獲得突破。Ripple已啟用包含去中心化識別、可驗證憑證及具合規控制的多用途代幣於一身的合規基礎架構。實體資產在XRPL的代幣化規模於六個月內激增2260%,到2025年7月達到1.18億美元。按需流動支付在單就第二季便處理了1.3兆美元。

現在,隨著具保密功能的多用途代幣預計於2026年首季上線,原生借貸協議亦在開發中,XRPL志在成為Ripple工程資深總監Ayo Akinyele所稱「尋求創新與信賴的機構首選」。

本文將剖析XRPL機構採用路徑上的技術基礎設施、隱私解決方案、市場動態與實際難題。這是一個龐大機遇——預期未來十年將有多兆美元資產搬上鏈——但這條路充滿著複雜監管、網絡效應與企業級新技術驗證等挑戰。唯有理解創新與障礙全貌,才能評估XRPL未來三到五年捕捉機構市場的潛力。

為何機構需要XRPL目前無法提供的隱私

金融機構的營運受高度機密要求約束,這正與公有鏈的透明本質衝突。當摩根大通打造Quorum區塊鏈時,便設計加密機制及分段功能,確保只有特定交易方可見敏感數據。一名摩根大通董事總經理指明,目標在於同時滿足監管者查帳需求,並保護希望隱匿資料的交易方隱私。這個需求不是為掩飾非法,而是為了保護競爭情報及配合資料保護規定。

透明問題有多重層次。例如運輸公司對A公司運費收100美元,卻對B公司只收90美元,將價格差異公開上鏈,勢必產生競爭劣勢。同理,銀行無法承受交易對手、交易資料、交易策略暴露於競爭對手分析。資產管理人進入DeFi協議時,如即時公布投資組合部位,會導致被前置操作、利基遊戲。在傳統金融,沒有人不經HTTPS登入網銀,但許多區塊鏈使用者卻無類似基本保障。

除競爭面外,資料保護對合規也極具挑戰。歐盟GDPR強調「被遺忘權」,與區塊鏈不可篡改性衝突。金融機構依巴塞爾協議III受嚴格保密約束。過去五年內,69%金融機構曾發生資料外洩,對客戶資料保護尤為敏感。根據安永與Forrester Consulting調查,企業評估區塊鏈最關注的也是隱私與資安,認證、權限、存取管控是關鍵。

Brad Garlinghouse於2025年10月點明「隱私」是機構採用關鍵時,XRPL其實早已建立起完善合規架構。XRPL於2024年10月啟用去中心化識別,讓用戶可用私鑰控制W3C合規的持久數位身分。憑證同月上線,允許如銀行等可信發行方以密碼學方式證明KYC已完成,無需重複洩露個資。多用途代幣2025年10月1日上線,具備鏈上描述及合規管制,包括轉移限制、持有人白名單與監管違規追回等。驗證器已開始為受限域及受限DEX投票,將建立憑證門檻交易空間,只有經KYC認證用戶可進入訂單簿。

儘管此等合規基礎已成型,機構仍猶豫觀望。正如提出隱私問題的XRPL開發者所說,儘管XRPL有技術優勢,機構還是不願公開交易雜湊。缺少的正是一層既能保密交易,又能維持合規審核的隱私機制。Ayo Akinyele於2025年10月在部落格中直言:「沒有隱私,機構就無法安全用公鏈進行核心作業。沒有問責,監管者就無法背書。可程式化隱私,兩者得兼。」

這種「可程式化隱私」理念,就是XRPL的差異策略——並非像隱私幣那樣徹底遮蔽,而是讓機構針對什麼資訊、在什麼情境下、對誰揭露,擁有自主選擇權。機構可以證明已完成KYC,卻不必對整個網絡公開用戶身分。稽核單位可驗證資產準備金,而無需暴露所有錢包資訊。經過代幣化的抵押品能參與借貸流程,條件與持倉不會對競爭對手曝光。技術挑戰在於設計這些隱私保護機制,又不損及區塊鏈作為可稽核、可信任基礎的透明性。

XRPL已建立的合規基礎

在解決隱私前,XRPL已系統性地構建合規基礎設施,與以散戶為主的無許可區塊鏈劃清差異。這項歷時多年的工程,於2024與2025年陸續啟動多項關鍵修正案,連結成機構級監管框架。

去中心化識別(DID)於2024年10月30日上線,實現W3C DID 1.0規範。每個XRPL帳號可創建唯一由其私鑰控制的DID,DID文件中儲存驗證方法、服務端點和憑證鏈結。此實作提供三種儲存模式:指向IPFS等外部儲存的URI欄位、鏈上極簡存儲的DIDDocument欄位,或從DID及公鑰自動生成的隱含文件。這套架構實現三方模式:用戶持有DID、可信發行方離線核發憑證、驗證者可在鏈上確認憑證而無須取得個資。此系統完全去中心化且自主擁有,無需中央機構,並具持久性與密碼學可驗證性,即便組織變更亦不受影響。

KYC應用設計貼合實務。金融機構發行一組可驗證憑證,證明某用戶已完成KYC;用戶以DID和憑證進入DeFi協議;協議採密碼學方式驗證憑證真偽,無需查看個人信息,讓合規參與變得可行。這消滅了跨平台重複KYC,同時用零知識驗證保護隱私——參與者僅需證明持有有效憑證,毋須揭露基礎身分資料。

多用途代幣則是另一項重要創新,補足XRPL原始信任線代幣機制的侷限。XLS-33提案經最終審查,於2025年10月1日主網上線,推出特為機構場景設計的最適化可替代代幣。相較於原來雙向信任線能在兩邊平帳,MPT採單向流動,發行人無法持有自己的代幣——金額將自動燃燒。每個MPT都配有192位元發行識別碼,並可存放最高1024位元組鏈上中繼數據,包括資產單位、建議schema及不可變鏈上參考資料。

機構級價值體現在細緻的控管設計。傳輸旗標可完全啟用/關閉點對點傳輸,此對 non-transferable certificates or licenses. The require-authorization flag creates allowlist-based holding where issuers must explicitly approve each holder, essential for securities compliance. Trading flags control DEX participation, while escrow flags govern time-locked functionality. Supply management includes configurable caps from zero to 2^63-1 units, with tokens burnable and reissuable within limits, and outstanding amounts tracked automatically.

non-transferable certificates or licenses. require-authorization 標誌創建基於允許清單的持有方式,發行方必須明確批准每一位持有人,這對於證券合規至關重要。trading 標誌控制去中心化交易所(DEX)參與,而 escrow 標誌則規範了鎖定功能。供應管理方面可自定義上限,範圍從零到 2^63-1 單位,代幣可以在限定範圍內銷毀與重新發行,未清代幣數量會自動追蹤。

Transfer fees represent a particularly sophisticated feature, allowing issuers to charge zero to 50 percent in increments of 0.0001 percent. Critically, fees are charged on top of the delivered amount rather than deducted from it. If a recipient needs to receive one hundred dollars and the fee is 0.5 percent, the sender pays $100.50 with the recipient getting exactly one hundred dollars and fifty cents burned. This prevents fee confusion while enabling business models around token usage.

轉帳手續費是一項特別精細的功能,允許發行方收取 0 到 50% 間,增量為 0.0001% 的費用。重點在於,手續費是加在收款金額之外,由發送方額外支付,而非從收款金額中扣除。舉例來說,收款人需要收到 100 美元,若手續費為 0.5%,那麼發送方需支付 100.50 美元,收款人仍獲得 100 美元,其中 0.50 美元會被銷毀。這種設計避免了手續費混亂,同時支持基於代幣使用的商業模式。

Compliance controls include individual lock and freeze capabilities for specific holder balances, global freeze affecting all tokens of an issuance, and clawback allowing issuers to revoke tokens from holders. These features satisfy regulatory requirements around sanctions compliance, fraud prevention, and asset recovery. A fiat-backed stablecoin issuer can freeze tokens held by sanctioned addresses. Securities issuers can enforce transfer restrictions. Licensing authorities can revoke non-transferable credentials if qualifications expire.

合規控管包括針對個別持有人餘額的鎖定與凍結功能、可影響整批發行代幣的全域凍結,以及發行者可收回代幣(clawback)的權限。這些功能能滿足制裁合規、防止詐騙及資產追回等法規要求。例如,法幣擔保的穩定幣發行者可凍結被制裁地址所持有的代幣;證券發行方可強制執行轉帳限制;發證單位在資格過期時,可撤銷非可轉讓的憑證。

The credentials system that activated in October 2024 as part of rippled 2.3.0 complements DIDs by enabling on-chain credential issuance, storage, and verification. The credential ledger object includes fields for subject (the receiving account), issuer (the trusted entity creating the credential), credential type (up to 64 bytes identifying the credential category), optional expiration timestamps, and URIs linking to off-chain verifiable credentials. Transactions include CredentialCreate for issuers, CredentialAccept transferring reserve responsibility to subjects, and CredentialDelete for either party or anyone after expiration.

2024 年 10 月隨 rippled 2.3.0 上線的憑證系統,補足了 DID 功能,支援鏈上憑證的發行、儲存與驗證。憑證總帳物件包含受證方(接收帳戶)、發行方(建立憑證的可信實體)、憑證類型(可用 64 字節識別類別)、可選到期時間戳,以及可鏈接到鏈下可驗證憑證的 URI。相關交易有:CredentialCreate(發行方建立)、CredentialAccept(將準備金責任移交給受證方)、CredentialDelete(到期後任一方或任意人可刪除)。

The system integrates with deposit authorization, extending the DepositPreauth object to accept credential-based authorization rather than only specific addresses. Accounts can allowlist by credential type, enabling scenarios like "only accounts with verified institutional investor credentials can send me payments." The deposit-authorized RPC was extended to check credential validity, type matches, expiration status, and correct issuers before permitting transactions.

系統支援存款授權,擴展了 DepositPreauth 物件,能接受基於憑證的授權,不再只限於明確地址。帳戶可依憑證類型設定允許清單,實現「僅允許擁有經驗證的機構投資人憑證帳戶給我付款」等場景。存款授權 RPC 亦增強,會先驗證憑證有效性、類型一致性、有效期限及發行者身份,才允許交易。

Two additional compliance tools complete the current stack. Deep freeze enhances the existing freeze capability with stronger enforcement, preventing flagged addresses from sending or receiving tokens across payments, DEX, and AMM. Unfreezing requires explicit issuer action. The simulate feature enables "dry run" transactions before submission, testing outcomes without committing to the ledger - critical for enterprise risk management that reduces costly production errors.

另外還有兩項合規工具補強現有功能。深度凍結進一步強化原有凍結功能,對標記地址實施強制限制,使其無法於支付、去中心化交易(DEX)、自動做市商(AMM)等場合發送或接收代幣。解凍必須由發行方明確執行。「模擬」功能則允許先行試跑交易而不直接記錄於總帳,這對企業管理風險、避免昂貴的生產環境錯誤至關重要。

Ripple's official roadmap emphasizes that this compliance infrastructure already addresses regulatory requirements around identity, KYC, AML, and sanctions. But the question institutions kept asking was: can we conduct private transactions while maintaining this compliance posture? That question drives the privacy solutions currently under development.

Ripple 官方路線圖強調,這套合規架構已涵蓋身份、KYC、AML 與制裁等法規要求。但機構們始終關心:在維持上述合規態勢下,是否還能實現隱私性交易?這個疑問推動著當前隱私解決方案的發展。

Zero-knowledge proofs and four other privacy approaches XRPL could adopt

零知識證明及 XRPL 潛在採用的其他四種隱私技術

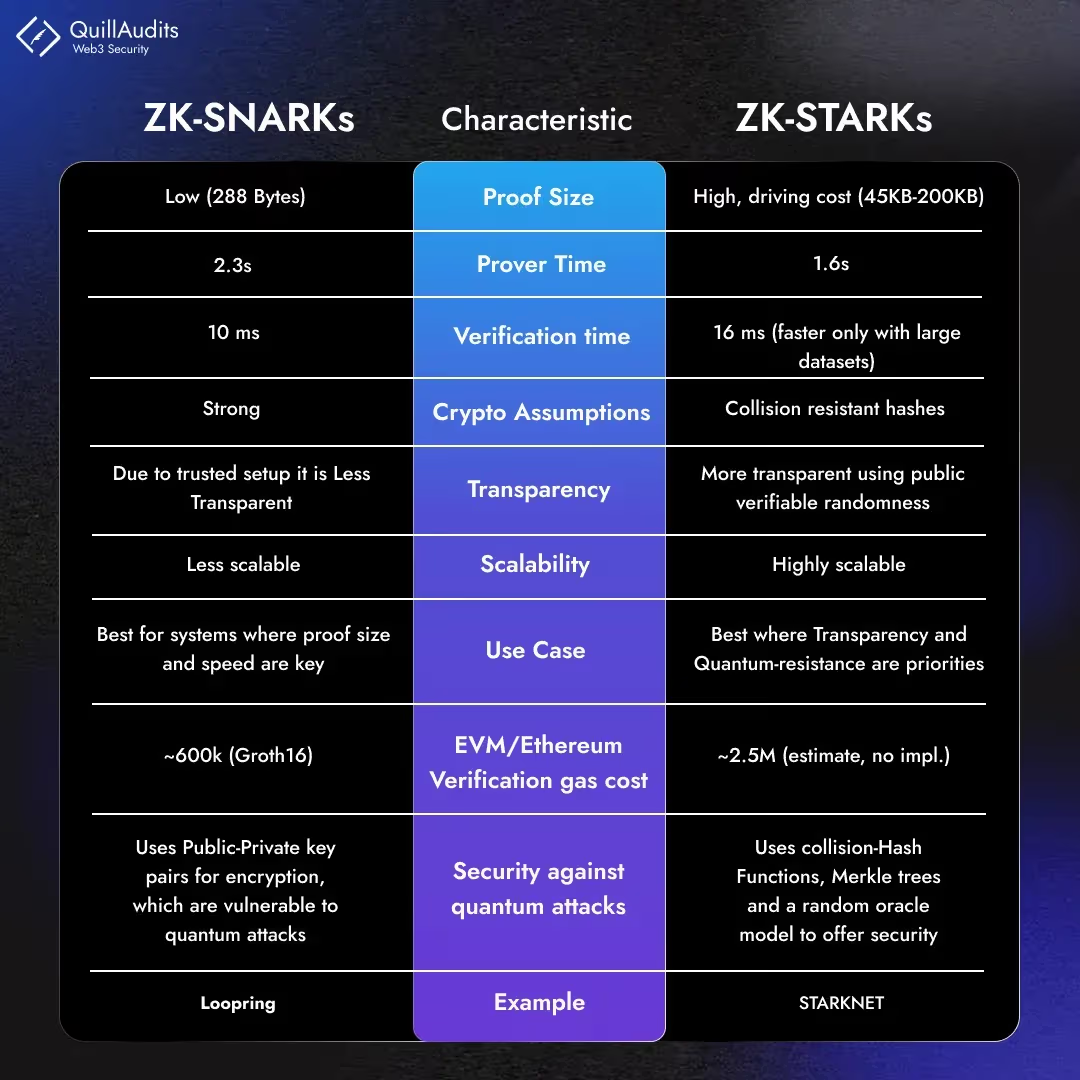

The term "zero-knowledge proof" refers to cryptographic methods enabling one party to prove they know information or that a statement is true without revealing the underlying information itself. For blockchain applications, ZKPs enable verification that a transaction is valid - with correct balances, authorized signatures, and proper amounts - without exposing what those balances or amounts actually are. This seemingly paradoxical capability derives from advanced mathematics allowing proof generation based on encrypted data that validators can verify matches the encrypted state without decrypting anything.

「零知識證明(Zero-knowledge proof)」指的是一種密碼學方法,可讓一方在不透露底層資訊的前提下,證明其知道某些資訊或某陳述為真。於區塊鏈應用中,零知識證明讓交易可被驗證(帳戶餘額正確、簽名授權、金額合法),卻不需公開實際餘額或金額。這種看似矛盾的能力,來自進階數學,可在加密狀態下產生證明,驗證者無需解密即可確認其正確性。

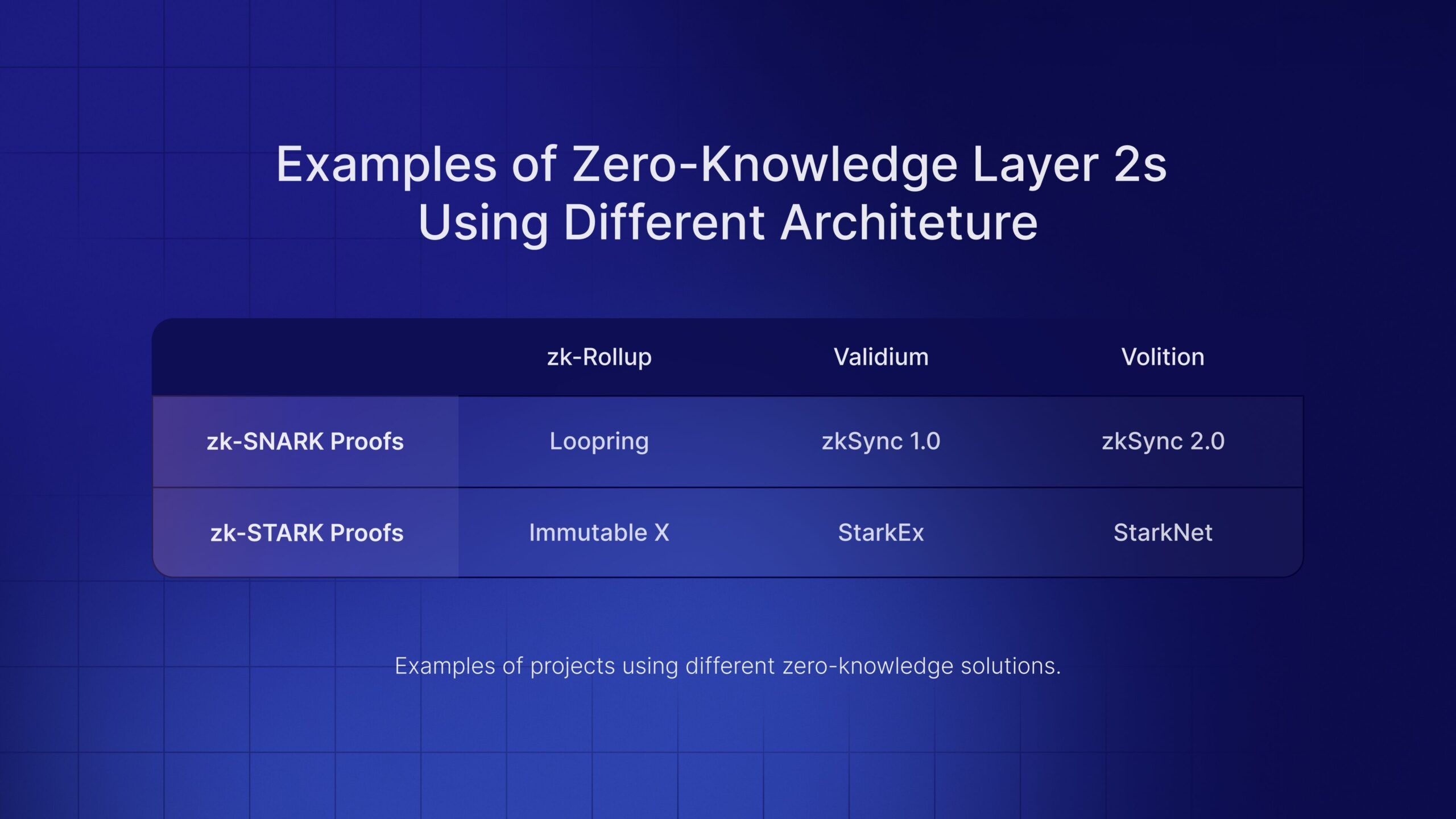

Zero-knowledge rollups combine this privacy capability with scaling benefits by moving computation off-chain while posting compressed data on-chain. An operator batches one thousand or more transactions, executes them off-chain, generates a validity proof of around 200 to 300 bytes, and submits it for verification. The proving circuit loops through each transaction, verifying senders exist through Merkle proofs, updating balances, generating intermediate state roots, and producing a final post-state root. Verifiers check the proof in approximately ten milliseconds using around 500,000 gas. Examples include zkSync processing over 2,000 transactions per second at one hundredth the cost of Ethereum, StarkNet handling millions of monthly transactions using STARKs, Polygon zkEVM offering full EVM compatibility, and Aztec combining privacy with scaling.

零知識 rollup 結合了隱私與區塊鏈擴容:計算於鏈下進行,僅壓縮資料上鏈。營運者將上千筆交易打包,在鏈下執行後產生 200~300 字節的有效性證明,上鏈供驗證電路審查。該電路逐筆驗證(利用 Merkle 證明驗證發送者存在、更新餘額、產生中間狀態 root 及最終狀態 root)。驗證者僅約需十毫秒、50 萬 gas 即能確認。現有例子包括 zkSync(每秒處理 2000 筆,費用僅以太坊1%)、StarkNet(用 STARK 技術月處理千萬筆)、Polygon zkEVM(完整 EVM 兼容)、Aztec(兼顧擴容與隱私)。

Implementing ZK-rollups on XRPL would require substantial protocol changes including a smart contract layer for proof verification, a data availability mechanism for compressed transaction data, and integration with RPCA consensus. Successfully deployed, this approach could increase throughput from 1,500 to potentially 100,000-plus transactions per second. The trade-offs involve fast finality without withdrawal delays, high throughput, and strong security, but expensive proof generation taking 1.6 to 2.3 seconds, high implementation complexity, and difficult auditing. Regulatory acceptance is generally favorable because data remains transparent even if processed off-chain.

若要將 ZK-rollup 實作於 XRPL,需大幅修改協議,包括新增智慧合約層負責證明驗證、壓縮交易數據的資料可用性方案,並與 RPCA 共識機制整合。若部署成功,吞吐量可由現有 1,500 提升至每秒 100,000 筆以上。利弊權衡在於:最終性快、無提領延遲、高吞吐量、安全性強,但證明產生成本高(1.6~2.3 秒)、實作極為複雜、審計困難。一般而言,由於資料仍具透明性(即使運算在鏈下),法規接受度相對較高。

The distinction between zkSNARKs and zkSTARKs matters for implementation choices. Zero-knowledge succinct non-interactive arguments of knowledge - SNARKs - use elliptic curve cryptography producing approximately 288-byte proofs with ten-millisecond verification, but they require a trusted setup ceremony. If the "toxic waste" from this ceremony isn't destroyed, false proofs become possible. Zcash, zkSync, and Filecoin use SNARKs extensively. Zero-knowledge scalable transparent arguments - STARKs - use hash functions, require no trusted setup, offer quantum resistance, but produce larger proofs around 45,000 bytes with 16-millisecond verification. StarkNet and dYdX leverage STARKs.

實作時,zkSNARK 和 zkSTARK 有重要區別。SNARK(零知識簡潔非互動式知識論證)採橢圓曲線密碼學,證明僅約 288 字節,驗證僅 10 毫秒,但需「可信設定」儀式,若產生的「有毒廢料」未及時銷毀,則可能偽造證明。Zcash、zkSync、Filecoin 均採用此方式。而 STARK(零知識可擴展透明論證)則用雜湊函數、無需可信設定、具量子抗性,證明更大(約 45,000 字節),驗證約 16 毫秒。StarkNet、dYdX 採用 STARK 技術。

For XRPL's specific needs, zkSNARKs using trustless variants like Halo 2 likely fit best, combining small proofs suitable for frequent transactions with elimination of trusted setup risks. This approach better matches XRPL's payment-focused architecture compared to STARKs, which excel for large computations but impose bandwidth costs from larger proofs.

對 XRPL 而言,採用像 Halo 2 這種「無需可信設定」的 zkSNARK 方案較為適合:證明體積小,適合高頻交易,且消除了可信設定風險。比起 STARK(適合大型計算但證明檔案大、消耗頻寬),更符合 XRPL 以支付為核心的架構。

Confidential transactions offer a second privacy approach focused specifically on hiding amounts rather than scaling throughput. The mechanism replaces visible amounts with Pedersen commitments: C equals aG plus bH where 'a' is the hidden amount and 'b' is a random blinding factor. These commitments add homomorphically so inputs equal outputs, remaining verifiable without knowing actual amounts. Range proofs using Bulletproofs of around 700 bytes prevent negative numbers that would enable creating money from nothing.

機密交易是另一種隱私方案,重點在隱藏金額,而非擴容。做法是將明文金額以 Pedersen 承諾替換:C = aG + bH,其中 a 為隱藏金額,b 為隨機遮罩。承諾具同態性,因此輸入總和等於輸出總和,在不知各自金額下仍可驗證平衡。範圍證明(Bulletproofs,約 700 字節)防止輸入負數,避免「憑空創幣」。

Monero implements this through ring confidential transactions mixing each transaction with ten-plus decoys via ring signatures, stealth addresses creating one-time addresses per payment, and Pedersen commitments hiding amounts. The result achieves exceptional privacy with sender, receiver, and amount all hidden, but creates trade-offs including a large blockchain exceeding 150 gigabytes, slower verification, and significant regulatory scrutiny. Mimblewimble variants used by Grin and Beam eliminate addresses entirely using Diffie-Hellman exchanges, omit scripts relying only on signatures, implement transaction cut-through pruning intermediate transactions, and merge transactions via CoinJoin. This produces strong privacy with a small blockchain around two gigabytes but requires interaction between senders and receivers.

Monero(門羅幣)的實作採用環簽名混入十多位誘餌、隱身地址每次付款產生一次性地址,以及 Pedersen 承諾隱藏金額。結果是發送方、接收方與金額全數隱蔽,隱私性極高,但也付出鏈體積大(超過 150GB)、驗證慢、受嚴格監管審查等代價。Grin、Beam 這類 Mimblewimble 變種透過 Diffie-Hellman 交換,徹底不記錄地址;不支援腳本,僅採用簽名;交易剪枝移除中間 UTXO,並用 CoinJoin 合併交易,其鍊容量僅約 2GB,隱私強但需收付款雙方即時互動。

XRPL's September 2024 confidential MPT proposal uses EC-ElGamal encryption with zero-knowledge proofs, implementing a conceptually similar approach to confidential transactions. The proposal maintains transaction graph visibility showing who sent to whom but hides amounts. This partial privacy preserves some transparency for compliance while protecting competitive intelligence about payment sizes. Regulatory acceptance remains uncertain given privacy coins like Monero face delisting and restrictions, though XRPL's accountability mechanisms may prove more acceptable.

XRPL 於 2024 年 9 月提出的 confidential MPT 提案,採用 EC-ElGamal 加密結合零知識證明,理論上類似機密交易。該方案保留交易圖透明度(可看出「誰傳給誰」),但隱藏金額。這種部分隱私既確保一定合規透明度,又可保護交易規模等敏感商業資訊不被窺探。法規能否接受仍待觀察,畢竟 Monero 這類隱私幣常遭下架與監管限制,不過 XRPL 責任機制或有助於被接受。

Trusted execution environments represent a third privacy approach using isolated, encrypted memory regions in processors like Intel SGX, ARM TrustZone, and AMD SEV-SNP. Code and data inside TEEs remain protected from operating systems and other applications. Remote attestation proves correct code execution. The privacy workflow involves encrypting input data, sending it to the TEE, decrypting inside the secure enclave, processing on plaintext, re-encrypting before output, and attestation proving validity.

可信執行環境(TEE)是第三類隱私技術,採用像 Intel SGX、ARM TrustZone、AMD SEV-SNP 這類 CPU 內建隔離且加密的記憶體區域。TEE 內部的程式與數據能防禦作業系統與應用程式存取。遠端證明(attestation)可驗證送入 TEE 的程式確實已安全執行。隱私操作流程為:輸入資料加密、送入 TEE 解密並在隔離區明文處理、處理完再加密輸出,以及 attestation 驗證處理過程正確性。

Secret Network uses Intel SGX for confidential CosmWasm contracts where validators share keys via threshold cryptography. Oasis Sapphire provides EVM-compatible confidential contracts where developers choose privacy levels from zero to one hundred percent. Flashbots employs TEE-based block building preventing miner extractable value. The advantages include fast performance with only two to five percent overhead, support for any computation, and easier implementation than zero-knowledge proofs. Disadvantages involve hardware dependency reducing decentralization, trust in manufacturers like Intel, AMD, and ARM, known security vulnerabilities including Spectre and Meltdown side-channel attacks, and lack of cryptographic proof.

Secret Network 用 Intel SGX 執行 CosmWasm 機密智慧合約,驗證者以門檻密碼學共管金鑰。Oasis Sapphire 提供 EVM 兼容機密合約,開發者可自選隱私等級。Flashbots 則用 TEE 組塊,防範礦工可提取價值(MEV)。TEE 優勢為效能高,僅有 2~5% 額外開銷,適合任意運算,且比零知識證明易於實現。缺點則為:依賴硬體降低去中心化,需信任硬體供應商(Intel、AMD、ARM),存在諸如 Spectre、Meltdown 等已知漏洞,且無法給出密碼學層面的嚴格證明。

XRPL

XRPLcould implement TEE-enabled validators processing encrypted transactions while maintaining fast performance. However, this approach works better as an optional layer combined with cryptographic methods rather than the sole privacy mechanism given the hardware trust assumptions and vulnerability history.

可以實作支援TEE(Trusted Execution Environment,信任執行環境)的驗證者來處理加密交易,同時維持高速效能。然而,鑒於硬體的信任假設及其歷史上的漏洞,這類方式作為隱私的唯一機制並不理想,更適合作為可選的附加層,配合密碼學方法一同運作。

Privacy-preserving smart contracts extend beyond individual transactions to computation. Secret Network's approach makes contract code public while keeping inputs, outputs, and state encrypted, with validators decrypting only inside SGX enclaves using shared secrets. This enables use cases like private voting where ballots remain encrypted until deadlines, tallying occurs inside TEEs, and results become public after close. Oasis Sapphire's "programmable privacy" lets developers control what remains private versus public, with storage automatically encrypted.

隱私保護型智慧合約的應用不僅限於單一交易,也擴展到計算層面。Secret Network 採用的做法,是讓合約程式碼公開,但把輸入、輸出及狀態加密,驗證者僅能在 SGX enclave 內透過共享密鑰進行解密。這使得如「隱私投票」等場景成為可能——選票在截止前都保持加密、計算統計在 TEE 內完成、結果於截止後公布。Oasis Sapphire 則透過「可編程隱私」讓開發者能細緻控制哪些數據應保密或公開,且儲存內容自動加密。

XRPL's limited smart contract capabilities make this approach less immediately relevant. The Hooks amendment allows transaction-level logic but not Turing-complete contracts. The proposed XLS-101 smart contracts amendment would enable WASM-based execution, but implementation remains distant. For near-term institutional needs, the confidential MPT approach - private balances without full contracts - better fits XRPL's architecture.

由於 XRPL 的智慧合約能力較有限,使上述方式短期內較難直接實現。目前 Hooks 協議僅支援交易層邏輯,而不支援圖靈完備的合約。所提的 XLS-101 智慧合約修正案將會支援基於 WASM 的執行,但短期內難以部署。對於近期機構需求來說,「Confidential MPT」這種不需完整合約、僅實現隱私餘額的方式,更適合 XRPL 現有架構。

Privacy sidechains offer a fifth approach, creating separate blockchains with two-way pegs to mainchains. These independent chains run specialized consensus optimized for privacy, with users opting in by moving assets via bridge contracts. Liquid Network implements this for Bitcoin using a federated sidechain managed by forty known functionaries, with confidential transactions hiding amounts and one-minute blocks versus Bitcoin's ten minutes. Litecoin's MimbleWimble extension blocks, activated May 2022, create an optional Mimblewimble sidechain where users peg-in to hide amounts and eliminate addresses, then peg-out returning to transparent Litecoin.

隱私側鏈則提供第五種解決方式:建立與主鏈雙向錨定的獨立鏈。這些側鏈運行針對隱私優化的專屬共識,用戶可透過橋接合約將資產移入以選擇參與。舉例來說,Liquid Network 為比特幣實現聯邦側鏈、由四十位已知成員管理,支援隱私交易(隱藏金額)、區塊時間一分鐘(對比比特幣十分鐘)。萊特幣於2022年5月啟用了 MimbleWimble 擴展區塊,使用戶可選擇將資產「錨定」進 Mimblewimble 側鏈達到隱藏金額與消除地址的效果,待結束後再回到公開透明的萊特幣鏈。

For XRPL, a privacy sidechain could use its own consensus - perhaps proof-of-stake with XRPL validators - with a bridge contract on mainnet managing the peg. Users would lock XRP on mainnet and receive private XRP on the sidechain, conduct confidential transactions with hidden amounts, then burn sidechain tokens to unlock mainnet XRP. Threshold signatures from N-of-M validators would secure the bridge.

對於 XRPL 而言,隱私側鏈可以採獨立共識(如 PoS,並由 XRPL 驗證者參與),由主鏈橋接合約管理資產錨定。用戶將 XRP 鎖定在主鏈後,獲得側鏈的隱私版 XRP,可進行隱藏金額的保密交易;等離開時,銷毀側鏈代幣再解鎖主鏈 XRP。橋的安全性則交由 N-of-M 驗證者門檻簽名負責。

The trade-offs favor experimentation without mainchain risk, opt-in participation, and regulatory flexibility, but bridge security becomes critical with validator collusion representing a failure mode, and managing two chains adds complexity. Failed sidechains don't affect mainchains, making this approach attractive for testing unproven privacy technologies.

這種方式的優點在於:不會影響主鏈安全、彈性參與、政策調整空間大,但卻非常重視橋接安全性,如驗證者串通將構成失敗風險。此外,管理兩條鏈的複雜度也相應增加。不過,失敗側鏈不會殃及主鏈,這使其非常適合作為新型隱私科技的實驗場。

Additional privacy approaches include homomorphic encryption, which allows computation on ciphertext without decryption such that the result when decrypted matches computation on plaintext. Fully homomorphic encryption supports unlimited operations enabling any computation, but suffers extreme slowness from 10,000 to one million times slower than plaintext, making it impractical for real-time payments though potentially useful for specific use cases like private auctions or voting where computation is infrequent.

更多隱私保護技術還包括同態加密,讓數據在未解密的情況下即可進行運算,且運算後解密結果等於以明文計算。完全同態加密(FHE)支援無限次運算,理論上能執行任意作業,但效能極慢,與明文相比慢了一萬到一百萬倍,難以應用於即時付款,但在比如私密拍賣、投票等計算頻率較低的場景或許有用武之地。

Secure multi-party computation enables multiple parties to jointly compute functions over private inputs without revealing inputs to each other. Secret sharing splits private data into shares distributed to parties, distributed computation processes shares, and result reconstruction combines outputs to get final results with zero knowledge - no party learns others' inputs. Blockchain applications include threshold signatures for distributed key management, private cross-chain bridges, and decentralized key generation for ZK-rollups. For XRPL, SMPC could secure distributed validator key management, private multi-signature wallets, or cross-chain bridge security using threshold signatures, better fitting infrastructure roles than user-facing privacy.

安全多方運算(SMPC)讓多方在不暴露彼此輸入的情況下,協同計算所需函式。透過秘密分享技術,將隱私資料拆分成多份分給參與者,由分布式計算處理各自份額,最終再組合計算輸出,過程中保證零知識——沒有人知道其他人的輸入。在區塊鏈上的應用包含:分布式密鑰管理所需的門檻簽名、私密跨鏈橋接、ZK-rollup 的去中心化密鑰產生等。在 XRPL 生態內,SMPC 更適用於基礎設施面,如分布式驗證者密鑰管理、私密多簽錢包,或使用門檻簽名保障跨鏈橋的安全,而不像是直接服務於終端用戶的隱私需求。

Comparing these approaches reveals distinct trade-off profiles. Zero-knowledge rollups offer massive scaling with approximately 288-byte proofs, ten-millisecond verification, but high prover overhead and very high implementation complexity. Confidential transactions provide moderate privacy with approximately 700-byte proofs, under-five-millisecond verification, low overhead, and moderate complexity. Trusted execution environments deliver fast performance with one to two kilobyte attestations, under-one-millisecond verification, and very low overhead, but require hardware trust and suffer known vulnerabilities. Homomorphic encryption achieves ultimate privacy but imposes extreme overhead making it impractical for high-frequency operations. Each approach balances performance, security, regulatory acceptance, and implementation complexity differently.

綜觀這些方案,各有不同的權衡點。零知識 rollup 提供極大擴展性、約288字節證明、驗證只需10毫秒,但證明端運算負擔及開發複雜度都極高。機密交易則有中等隱私性、約700字節證明、不到5毫秒驗證、運算耗能低、複雜度適中。TEE 擁有1-2 KB 認證資料、1 毫秒內完成驗證、低運算成本和高速表現,但必須信任硬體且存在已知漏洞。同態加密則給予最強隱私,但系統負擔極重,無法實用於高頻操作。各技術間在效能、安全、法規接受度、實作複雜度等面向都有不同取捨。

For regulatory compliance, zero-knowledge rollups rate highly on auditability with transparent on-chain data. TEEs enable easy selective disclosure with decryption capabilities regulators prefer. Confidential transactions hiding amounts face privacy coin concerns similar to Monero. Homomorphic encryption makes verification extremely difficult. The regulatory landscape will significantly influence which technical approaches prove viable - no matter how elegant the cryptography, solutions regulators reject will fail to achieve institutional adoption.

以法規合規的角度看,零知識 rollup 具有極高審計性,全鏈上資訊公開可查。TEE 則因能選擇性解密,方便向監管單位交代。機密交易隱藏金額,涉及隱私幣監管疑慮,類似於 Monero。完全同態加密驗證非常困難,使監理單位難已介入。因此,監理取向將直接影響技術路線的可行性──再精巧的密碼技術,若遭監理單位否決,也無法實現機構級應用。

How tokenized assets, lending protocols, and private settlement will actually work

The abstract promise of blockchain tokenization becomes concrete when examining real implementations and technical mechanisms. Archax, a UK Financial Conduct Authority-regulated exchange, tokenized abrdn's £3.8 billion US Dollar Liquidity Fund in November 2024, marking the first money market fund available on XRPL. Ripple allocated five million dollars supporting the initiative. Archax's pipeline includes "hundreds of millions" in additional tokenized assets scheduled for deployment. This represents actual institutional capital, not pilot programs - real money market funds with billions in assets under management now settling on XRPL infrastructure.

當我們檢視實際應用和技術機制時,區塊鏈資產代幣化的抽象承諾便會具體化。英國金融行為監管局(FCA)監管下的交易所 Archax,於 2024 年 11 月將 abrdn 的 38 億英鎊美元流動性基金代幣化,成為 XRPL 上首個貨幣市場基金。Ripple 為這項計畫投入五百萬美元資助。Archax 計畫中已排程「數億英鎊」規模的代幣化資產待上線。這些都是實際的機構資本,而非試點案──真正的貨幣市場基金、數十億資產現正於 XRPL 基礎設施結算。

The technical mechanism leverages XRPL's native token issuance capabilities without requiring smart contracts. Multi-purpose tokens activated October 2025 carry on-chain metadata including maturity dates, coupon rates, tranches, voting rights, transfer restrictions, and identifiers like CUSIP or ISIN. Compliance features include authorized trust lines requiring explicit issuer approval before holding tokens, credentials verifying accredited investor status, deep freeze for sanctions compliance, and clawback for regulatory violations or fraud recovery. The native DEX provides protocol-wide liquidity rather than fragmented pools, three to five second settlement instead of T+2 batch processing, and sub-penny transaction fees versus traditional securities infrastructure costs.

這一技術機制直接運用 XRPL 原生代幣發行功能,無需智慧合約。於 2025 年 10 月啟動的多功能代幣,具備鏈上元數據,如到期日、息票利率、資產分層、投票權益、轉讓限制及 CUSIP/ISIN 標識等。合規特性包括:只有經發行人批准的授權信任線才能持有資產、持有人資質驗證(合格投資人)、可深度凍結抵制制裁、發生違規或詐欺時可爪回資產。原生去中心化交易所(DEX)提供協議全域流動性,避免池分割,3~5 秒結算而非 T+2 批次處理,手續費低於一分錢,遠低於傳統證券基礎設施成本。

Additional examples demonstrate expanding adoption. Ctrl Alt partnered with Dubai Land Department for property title deed tokenization. Mercado Bitcoin announced two hundred million dollars in Latin America asset tokenization. Societe Generale, DZ Bank, and DekaBank deployed tokenized bonds, stablecoins, and custody services on XRPL. The growth trajectory shows momentum: from five million dollars in tokenized assets in January 2025 to $118 million by July 2025 - a 2,260 percent increase in six months.

更多案例展現生態持續擴展:Ctrl Alt 與杜拜土地局合作,推動房產權狀證書代幣化;Mercado Bitcoin 公布拉美 2 億美元資產代幣化方案;法國興業銀行、德意志中央合作銀行、DekaBank 等亦已在 XRPL 部署代幣債券、穩定幣及託管業務。成長曲線非常強勁:2025 年 1 月代幣化資產為 500 萬美元,至 2025 年 7 月已提升到 1.18 億美元,半年增幅達 2,260% 。

The infrastructure requirements extend beyond technical capabilities to regulatory frameworks under MiCA in the European Union and NYDFS in the United States, qualified custody with Ripple Custody serving Archax since 2022, on-ramps and off-ramps connecting traditional finance to blockchain rails, legal frameworks defining ownership and transfer rights, and audit mechanisms ensuring compliance and transparency.

現代基礎建設需求已超越技術本身,還需符合歐盟 MiCA、紐約州金融服務部(NYDFS)等監管架構;由 Ripple Custody 自 2022 年起為 Archax 提供合規託管;設有傳統金融對接區塊鏈的入金、出金通道;明確訂定法律上的資產歸屬與轉讓權利;另建立即時稽核和透明度機制以符合法規要求。

Native lending represents XRPL's most ambitious institutional DeFi initiative, introducing protocol-level credit facilities without smart contract risk. The XLS-65 and XLS-66 proposals, targeted for XRPL version 3.0 in late 2025, implement a two-layer architecture. Single-asset vaults aggregate liquidity from multiple accounts into pooled vaults, issue vault shares that may be transferable or restricted, and can be public or gated via permissioned domains. The lending protocol builds atop vaults offering fixed-term uncollateralized loans with pre-set amortization schedules, off-chain underwriting with on-chain lifecycle management, and first-loss capital protecting depositors against defaults.

XRPL 原生借貸協議是其目前最具野心的機構級 DeFi 創舉,能於協議層提供信貸,並消弭智慧合約風險。XLS-65 與 XLS-66 提案預計於 2025 年底 XRPL 3.0 版本納入,實現兩層結構。單一資產金庫可將多個帳戶流動性匯聚入合併金庫,發行可自由轉讓或受限轉讓的金庫份額,並可設為公開或僅限定於特定權限域。借貸協議則建構於金庫之上,提供固定期限、無抵押放款(有預設攤還計畫)、鏈下風控與鏈上全流程管理,另有「損失優先資本」設計保障存款人不致因違約受損。

The operational workflow involves liquidity providers depositing into vaults and earning shares representing proportional ownership. Pool delegates evaluate borrowers off-chain using traditional credit scoring and risk assessment. Loans get issued with fixed terms drawing from pooled vault funds. Borrowers make periodic payments covering principal, interest, origination fees, service fees, and potentially late payment or early payoff fees. Payments flow back to vaults, increasing available assets for new loans. If defaults occur, first-loss capital deposited by loan brokers absorbs initial losses protecting depositors.

運作流程為:流動性提供者將資金存入金庫,獲得相應份額為所有權憑證。池代表會以傳統信評方法鏈下審核借款人,合格者以固定條件由金庫出借。借款人須定期攤還本金、利息、發行及服務費,若有遲繳/提前清償則依調整費用計收;所有還款將重新注入金庫,用於新貸款循環。如發生違約,優先損失資本(由放貸中介預存)將吸收首波虧損,保護一般存款人利益。

Interest rates include regular scheduled rates, elevated late payment rates, and potentially reduced early payoff rates, with payment resolution schedules as granular as sixty-second intervals. The on-chain debt tracking maintains total debt owed to vaults, maximum lending capacity caps, and automated accounting throughout loan lifecycles. Compliance features integrate clawback allowing asset issuers to reclaim funds from defaulting borrowers, freeze preventing borrower or broker accounts from operating if flagged, global freeze halting all loan operations during investigations, and permissions systems integrating with XLS-70 credentials verifying borrower eligibility.

利率可依還款進度編排,包含正常利息、遲繳加收利率及提前清償時的優惠利率,可細至 60 秒為一循環結算。鏈上債務追蹤資料會記錄金庫總債權、最大可出借額度,整體貸款周期會自動化會計記錄。合規設計則整合爪回功能,讓資產發行人可向違約者索回資金,具有凍結機制防止借款/經紀帳戶異常操作,全球凍結功能於調查期間全鏈停貸,權限系統連結 XLS-70 憑證落實借款人資格審查。

The institutional value proposition involves pooling retail liquidity into institutional-sized

機構價值主張是將零散的零售資金匯聚為機構級規模流動性, ...loans, combining off-chain risk assessment with on-chain execution certainty, maintaining transparent loan terms while keeping underwriting criteria private, and enabling regulatory-compliant credit origination on public infrastructure. Early projects like XenDex, which launched the first non-custodial smart contract lending platform on XRPL in April 2025, and XpFinance, which announced peer-to-peer lending with NFT bonds for Q3 2025, demonstrate developer interest in building on this infrastructure.

貸款結合鏈下風險評估與鏈上執行確定性,在維持透明貸款條款的同時,也保障承保準則的隱私,並使合規信貸可在公共基礎設施上實現。2025年4月推出首個XRPL非託管智能合約借貸平台的XenDex,以及預計於2025年第三季以NFT債券提供P2P借貸的XpFinance,這些早期專案展現了開發者對該基礎設施的興趣。

The missing piece tying tokenization and lending together is privacy. Confidential multi-purpose tokens scheduled for Q1 2026 will encrypt balances and amounts using EC-ElGamal encryption while zero-knowledge proofs verify transaction validity without revealing values. This dual-balance system lets users maintain both public and confidential balances, converting between them as needed. Each confidential balance gets encrypted under three keys: the holder's key enabling decryption, the issuer's key allowing supply tracking, and an optional auditor key providing regulator access.

連結資產代幣化與借貸的關鍵環節就是隱私。預計 2026 年第一季推出的「機密多功能代幣」(Confidential MPT)將利用 EC-ElGamal 加密技術對餘額與數量進行加密,同時以零知識證明驗證交易有效性,而不暴露數值。這種雙重餘額系統,讓用戶同時維持公開及機密餘額,並可依需求相互兌換。每筆機密餘額均以三把密鑰加密:持有人密鑰用於解密、發行者密鑰可追蹤供應量、以及選擇性稽核者密鑰供監管機關查閱。

The privacy-preserving collateral management enabled by confidential MPTs allows institutions to deploy tokenized assets as loan collateral without revealing position sizes to competitors. Confidential institutional transfers hide payment amounts while maintaining counterparty visibility for compliance. Private tokenized securities keep trading activity confidential while enabling order books. Regulated stablecoin payments provide daily confidentiality with issuer oversight and auditor access as needed.

機密MPT實現的隱私保護型擔保品管理,讓機構能以代幣化資產作為貸款擔保,不必暴露持倉規模給競爭對手。機密機構間轉帳能隱藏支付金額,同時保留合規所需的交易對手識別。私密代幣化證券則能保密交易活動,同時支持委託簿。受監管穩定幣支付提供每日交易私密,但發行商可監控,稽核者可按需查閱。

Permissioned domains and the permissioned DEX, currently under validator voting for activation, create credential-gated environments requiring specific verifiable credentials for participation. Government portals might require government-issued ID credentials. Accredited investor zones demand KYC and accreditation credentials. Institutional trading environments enforce licensing and compliance credentials. Regulated lending pools verify borrower eligibility. The technical implementation extends offer objects with domain identifier fields, creates domain-specific order books, and implements domain-aware routing where only credential-holders can match offers.

受權域與受權DEX(去中心化交易所)目前正在驗證人投票啟用中,它們建立以「憑證」作為門檻的環境,參與者需持有特定可驗證證明。例如官方入口須檢附政府核發ID;合格投資人區需進行KYC及取得投資人認證;機構交易環境則強制執照與合規證明;受監管借貸池將驗證借款人資格。其技術實作包括為委託物件加上域識別碼欄位、建立專屬域委託簿,以及導入憑證持有人才能競價撮合的域識別路由。

Cross-border payments represent XRPL's most mature institutional use case with over a decade of production deployment. On-demand liquidity uses XRP as a bridge currency, converting source currency to XRP at an exchange, transferring XRP across XRPL in three to five seconds, and converting XRP to destination currency at the receiving exchange. This eliminates pre-funded nostro accounts that tie up an estimated 27 trillion dollars globally in correspondent banking relationships. Payment service providers process transfers without maintaining capital in dozens of currencies, achieving 70 percent cost reductions versus traditional methods with sub-penny blockchain fees versus 20 to 50 dollar wire transfer costs.

跨境支付是XRPL最成熟的機構級應用案例,已有逾十年實際運行經驗。按需流動性功能將XRP作為橋接貨幣:先於交易所把源幣轉換為XRP,在3到5秒內於XRPL鏈上傳輸,再於接收方交易所將XRP兌換成目標貨幣。這省去了需預存資金的Nostro帳戶,據估全球對應銀行體系有27兆美元被綁定。支付服務商不須持有多種法幣,即可處理資金匯出入,能實現70%成本降低,區塊鏈手續費僅為零頭,而傳統電匯每筆動輒20至50美元。

SBI Holdings demonstrates institutional-scale adoption with approximately ten billion dollars in XRP and Ripple assets, processing billions in remittances from Japan to Southeast Asia since 2021. Ripple's ODL network operates forty corridors covering 90 percent of the foreign exchange market, processing $1.3 trillion in the second quarter of 2025 alone. When confidential MPTs activate in 2026, this payment infrastructure gains a privacy layer hiding transfer amounts through encrypted balances while maintaining compliance via zero-knowledge proofs, selective disclosure to regulators, and protection of competitive information around payment volumes and patterns.

日本SBI控股展現了機構級的部署,持有約100億美元XRP和Ripple資產,自2021年起處理自日本往東南亞數十億美元匯款。Ripple的ODL(按需流動性)網路覆蓋40條通道、佔外匯市場九成份額,僅2025年第二季即處理1.3兆美元。在2026年機密MPT啟用後,這套支付基礎設施將具備隱私層,可用加密餘額隱藏轉帳數額,並透過零知識證明、管理機關選擇性揭露、及保護支付量與模式等競爭資訊,同時維持合規。

Securities trading on permissioned DEX infrastructure combines XRPL's hybrid order book and automated market maker for optimal pricing, protocol-wide liquidity avoiding fragmentation across multiple venues, pathfinding with auto-bridging using XRP, and credential-based access controls. Pre-trade processes verify credentials, check accredited investor status, and enforce jurisdiction restrictions. Trade execution limits matches to compliant counterparties with real-time compliance checks. Post-trade creates immutable audit trails, enables regulatory reporting, and supports tax integration. Multi-purpose token metadata carries maturity dates, coupon rates, tranches, voting rights, transfer restrictions, and securities identifiers, while automated corporate actions handle interest payments, dividends, and redemptions.

受權DEX證券交易架構,結合XRPL混合委託簿與自動做市商設計,以實現最佳價格發現、跨協議流動性避免場域分割、自動尋徑與以XRP進行橋接,以及憑證式存取控管。交易前流程包括驗證資格、確認合格投資人身份、強制轄區限制。交易中只允許合規對手進行撮合,並能即時合規檢查。交易後能產生不可竄改的稽核紀錄,有利於法規申報與稅制整合。多功能代幣之中繼資料可承載到期日、息票率、分層、表決權、流通限制及證券代碼,並由自動化企業行動管理利息、配息及贖回等作業。

The regulatory requirements remain substantial. Securities law must recognize tokenized assets as valid representations. Regulated exchanges like Archax provide compliant trading venues. Qualified custodians secure assets meeting regulatory standards. Legal frameworks must exist in each jurisdiction defining rights, obligations, and enforceability. Market infrastructure including clearing, settlement, and surveillance ensures orderly markets. Archax's FCA-regulated exchange represents one operational model, with money market funds live, MPT standard activated, and permissioned DEX awaiting final validator approval.

法規要求依然嚴峻。證券法需認可代幣資產為合法載體;如Archax等受監管交易所提供合規交易場域;合格託管商負責保存符合法規的資產;各轄區必須設立明確法律架構,定義權利、義務與強制力;而市場基礎建設如清算、結算、監察等則保障交易秩序。Archax作為英國FCA監管交易所就是一個營運示範,現有貨幣市場基金、MPT標準已啟用、受權DEX正在等候驗證人最終通過。

Where XRPL excels and struggles against Ethereum, StarkWare, and enterprise chains

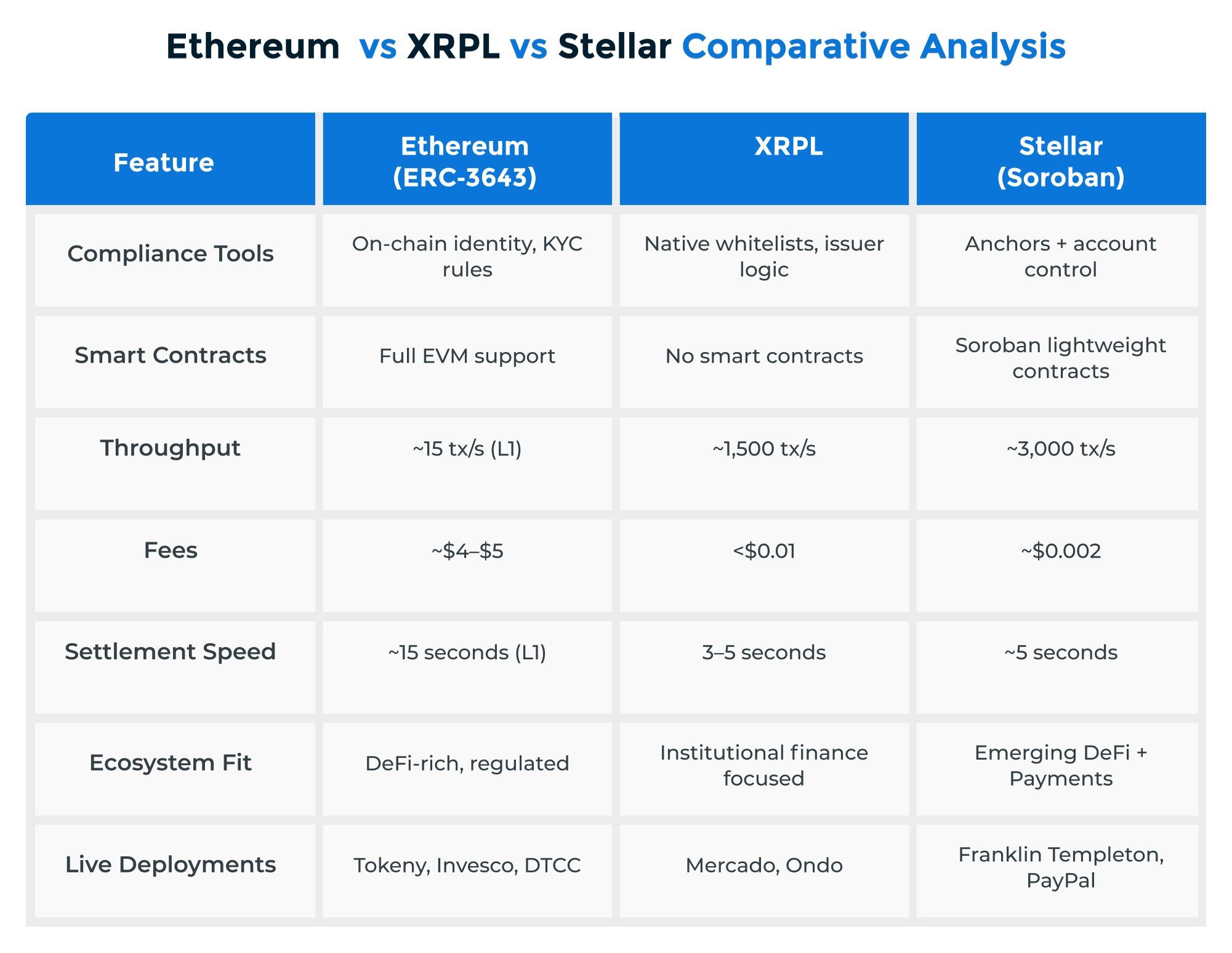

The competitive landscape for institutional blockchain infrastructure divides into three categories: public smart contract platforms led by Ethereum and its layer-two scaling solutions, zero-knowledge-focused chains like StarkNet, and permissioned enterprise blockchains including Hyperledger Fabric and R3 Corda. XRPL competes differently against each category, with distinct advantages and disadvantages shaping its institutional positioning.

機構級區塊鏈基礎設施的競爭格局,可分為三大類:由以太坊及其Layer 2擴展方案領銜的公有型智能合約平台、專注於零知識技術的鏈如StarkNet、以及Hyperledger Fabric、R3 Corda等受權企業區塊鏈。XRPL在這三類賽道的競爭方式各異,其優勢與劣勢直接影響機構定位。

Ethereum dominates public blockchain with massive network effects including 45,000-plus decentralized applications across multiple layer-two networks and approximately $97 billion in total value locked. For privacy specifically, Ethereum relies primarily on layer-two solutions rather than base layer features. Aztec Network implements a hybrid zero-knowledge rollup combining privacy with scalability using UltraPlonk proofs with recursive SNARKs, processing transactions at approximately one hundredth of Ethereum's cost through client-side execution where only proofs post on-chain. However, Aztec uses its own Noir language rather than EVM compatibility, creating a learning curve. Polygon zkEVM launched in March 2023 as a type-two zero-knowledge Ethereum Virtual Machine, offering EVM equivalence with two-second finality and a $4.12 billion ecosystem, but the platform is sunsetting in 2026 as Polygon pivots to its AggLayer architecture, and critically, Polygon uses zero-knowledge primarily for scaling rather than privacy.

以太坊憑藉巨大的網路效應統治公有鏈生態,擁有4.5萬個以上的去中心化應用並橫跨多條Layer 2網路、總鎖倉價值高達970億美元。在隱私面上,以太坊依賴Layer 2方案而非基礎層。Aztec Network 推出混合零知識Rollup,結合隱私與擴展性,透過UltraPlonk與遞迴SNARK,用戶端運算僅將證明錄上鏈,處理費用僅為以太坊的百分之一。不過Aztec採用自家Noir語言,非EVM兼容,學習曲線較高。Polygon zkEVM於2023年3月上線,屬於type-2 zkEVM,實現EVM等價、2秒最終性、41.2億美元資產規模,但預計2026年終止服務並切換至AggLayer架構,且Polygon主要以零知識作為擴展利器而非隱私。

XRPL's advantages versus Ethereum include purpose-built payment infrastructure with ten-plus years of production use, faster settlement finality at three to five seconds versus Ethereum's twelve-plus minutes, dramatically lower transaction costs at $0.0001 to $0.01 versus Ethereum's one to fifty-plus dollars, native decentralized exchange without smart contract risk, built-in payment channels and escrow, and carbon-negative sustainability. Ethereum's advantages include a vastly larger developer ecosystem, mature DeFi infrastructure with proven composability, sophisticated smart contract capabilities supporting any use case, and unmatched total value locked providing deep liquidity across thousands of protocols.

XRPL對比以太坊的優點:專為支付打造、累積十多年商用經驗;結算最快3至5秒,而以太坊需12分鐘以上;交易手續費極低僅0.0001至0.01美元,遠低於以太坊1至50美元以上;原生去中心化交易所無智能合約風險;內建支付通道和託管機制;此外更實現碳負永續。而以太坊則擁有遠大於XRPL的開發社群、成熟的DeFi生態、極高的合約靈活性與可組合性,以及無與倫比的鎖倉總價值帶來的深厚流動性。

StarkWare represents the cutting edge of zero-knowledge cryptography using STARKs - zero-knowledge scalable transparent arguments. StarkNet operates a layer-two offering post-quantum security through hash-based proofs requiring no trusted setup, native account abstraction, and $252 million in total value locked. StarkEx powers applications in multiple modes including zero-knowledge rollup, validium, and volition, processing 15,000 to 50,000 transactions per second with dYdX having processed over one trillion dollars in cumulative volume using StarkEx infrastructure. The 2025 roadmap includes Bitcoin staking integration and one hundred million STRK tokens in incentives. StarkWare has the most advanced cryptography in production including post-quantum resistance, while XRPL offers simpler onboarding, payment specialization, faster time-to-finality, and a proven 13-year track record without requiring layer-two complexity.

StarkWare代表了零知識密碼學前沿,採用STARK(零知識可擴展透明論證)技術。StarkNet運作於Layer 2之上,採哈希基證明無須信任設定,原生帳戶抽象化,總鎖倉2.52億美元。StarkEx以ZK Rollup、Validium、Volition等多模式支持應用,每秒可處理1.5萬至5萬筆交易,dYdX累積成交額超過一兆美元。2025年規劃納入比特幣質押與1億枚STRK激勵。StarkWare持有業界最先進的生產級密碼學(含抗量子特性),相對地XRPL則強調簡易上手、支付專精、更快結算、13年無需Layer 2即穩定運行。

Other zero-knowledge chains include zkSync Era with its Prividium platform providing privacy plus compliance for institutions and innovations like Airbender reducing costs to $0.0001 per transaction with native Python and TypeScript support. Scroll targets full Ethereum equivalence progressing from type three to type two zkEVM. Linea, built by ConsenSys, offers type three zkEVM with native MetaMask and Truffle integration. All provide Ethereum ecosystem access with lower costs than layer one. Against these competitors, XRPL differentiates through native payment primitives avoiding layer-two complexity, proven institutional adoption through RippleNet's three hundred bank partnerships, and compliance-first design with credentials and permissioned environments built into the protocol.

其他零知識鏈如zkSync Era推出Prividium平台,能兼顧隱私與機構合規,且透過Airbender技術交易成本降至0.0001美元,支援原生Python與TypeScript開發。Scroll 聚焦實現從type-3到type-2的完全EVM等價。ConsenSys團隊打造的Linea為type-3 zkEVM,深度整合MetaMask及Truffle。這些平台皆能以更低成本接軌以太坊生態。面對這些競爭對手,XRPL以原生支付功能迴避Layer 2複雜度、RippleNet三百家銀行連線證明機構採用、以及協議內建憑證及受權環境彰顯「合規優先」作差異化競爭。

Enterprise blockchains represent fundamentally different architectures prioritizing privacy over public accessibility. Hyperledger Fabric implements a permissioned modular framework using channels for private transactions where only designated parties see data, pluggable consensus supporting crash fault tolerance or Byzantine fault tolerance, and a unique execute-order-validate architecture. The trade-off involves complex deployment requiring significant expertise but full privacy with no public visibility. R3 Corda operates as permissioned distributed ledger technology rather than a blockchain, implementing point-to-point communication where only counterparties see transaction data, notary-based consensus, and

企業級區塊鏈本質上走的是重隱私、有限公開的架構。Hyperledger Fabric 採模組化受權設計,將交易分於通道,只有授權方可見資料,並支援可插拔共識(含容錯、拜占庭容錯),以獨有的「執行-排序-驗證」流程實現。其代價是部署複雜、專業門檻高,但能達到完全隱私且不對公眾開放。R3 Corda則以受權分散式帳本技術為主,非傳統區塊鏈,是點對點通訊,只有對手雙方可見交易資料,採公證人共識算法,並...tight integration of legal prose with code. However, Corda's crash fault tolerance approach without production-ready Byzantine fault tolerance creates potential double-spend risks if notaries behave maliciously.

完全跳過翻譯。

JPMorgan's Kinexys platform, formerly JPM Coin, operates on Quorum, an Ethereum fork with privacy extensions. JPM Coin processes approximately one billion dollars daily in settlements between JPMorgan clients using a one-to-one dollar-backed institutional stablecoin. Access remains permissioned and limited to JPMorgan clients. In 2025, JPMorgan piloted JPMD on Coinbase's Base, a public layer two, testing institutional stablecoins on public infrastructure.

摩根大通的 Kinexys 平台(前身為 JPM Coin)運行在 Quorum 上,這是一個帶有隱私擴展功能的以太坊分叉。JPM Coin 以一對一美元支持的機構型穩定幣,為摩根大通客戶每日處理約十億美元的結算。該平台仍採取授權制,僅限摩根大通客戶使用。2025 年,摩根大通在 Coinbase 的 Base(公共 Layer 2)進行了 JPMD 的試點,測試在公共基礎設施上運行的機構穩定幣。

The philosophical difference is fundamental: enterprise chains provide complete privacy with zero public visibility, while XRPL offers public infrastructure with institutional controls through credentials, permissioned domains, permissioned DEX, and upcoming confidential transactions. For banks requiring absolute privacy, Fabric and Corda deliver proven solutions. For institutions seeking public blockchain benefits including transparency, accessibility, and neutrality while maintaining compliance, XRPL's hybrid approach targets a different market segment.

根本上的理念差異顯著:企業鏈提供完全隱私,毫無對外公開資訊,而 XRPL 通過憑證、授權域名、授權 DEX 及即將推出的保密交易,提供具有機構管控功能的公共基礎設施。對於追求絕對隱私的銀行,Fabric 與 Corda 已證明能提供穩定的私有解決方案。至於希望兼顧合規前提、利用公共區塊鏈的透明度、可訪問性與中立性等優勢的機構,XRPL 的混合模式則切入不同的市場分段。

Algorand and Hedera compete more directly with XRPL's public institutional positioning. Algorand uses pure proof-of-stake consensus achieving ten thousand-plus transactions per second with 4.5-second finality and carbon-negative energy profile. Adoption includes Colombia's COVID passport, Marshall Islands' SOV national currency, and Italy's SIAE issuing four million NFTs. The 2025 roadmap emphasizes post-quantum research, Rocca wallet eliminating seed phrases, debt asset tokenization, and newly launched staking rewards. Hedera employs hashgraph consensus rather than blockchain, achieving ten thousand-plus transactions per second with three to five second finality, governance by 30-plus global organizations including Google, IBM, and Boeing, and strong focus on asset tokenization through partnerships with Tokeny and ERC-3643 compliance. Institutional adoption includes State Street, Fidelity, LGIM, Wyoming's FRNT stablecoin, and SWIFT trials, with $69.4 million weekly institutional inflows in 2025.

Algorand 與 Hedera 更直接地與 XRPL 的公有機構定位競爭。Algorand 採用純權益證明共識,實現每秒一萬筆以上交易、4.5 秒終局,以及碳負能耗特性。其應用範圍涵蓋哥倫比亞新冠護照、馬紹爾群島 SOV 國家貨幣,以及義大利 SIAE 發行的400 萬枚 NFT。2025 年路線圖重點為後量子加密研究、消除助記詞的 Rocca 錢包、債務型資產通證化,以及剛上線的質押獎勵。Hedera 採用 hashgraph 共識而非區塊鏈,實現每秒一萬筆以上交易、3-5 秒終局,以 Google、IBM、Boeing 等三十多家全球組織治理,並通過與 Tokeny 的合作及 ERC-3643 標準,專注於資產通證化。機構採用案例包含道富銀行、富達、LGIM、懷俄明州 FRNT 穩定幣以及 SWIFT 試點,2025 年每週機構資金流入達6940 萬美元。

Against Algorand, XRPL matches finality speed, offers a native decentralized exchange that Algorand lacks, and demonstrates stronger payment adoption with $1.3 trillion-plus in on-demand liquidity payments versus Algorand's smaller payment volumes. Algorand advantages include higher theoretical throughput, multiple CBDC implementations, and carbon-negative positioning. Against Hedera, XRPL offers comparable finality, similar institutional focus, and proven payment scale through RippleNet's three hundred institutions, while Hedera's unique hashgraph consensus and strong tokenization partnerships with major asset managers represent competitive advantages.

面對 Algorand,XRPL 的終局速度不相上下,並擁有原生去中心化交易所(Algorand 尚無此功能),且透過 1.3 兆美元以上隨需流動性支付,展現超越 Algorand 的支付應用規模。Algorand 優勢則在於較高的理論吞吐量、多項 CBDC 應用,以及碳負形象。面對 Hedera,XRPL 同樣提供相仿終局速度、相似機構導向,並憑藉 RippleNet 下三百家機構展現成熟支付規模;而 Hedera 則以獨特 hashgraph 共識及與大型資產管理機構的通證化合作構成競爭優勢。

A quantitative comparison across key metrics reveals XRPL's positioning. Transaction throughput shows XRPL at 1,500 TPS, Ethereum at 15 to 30 TPS, Polygon zkEVM variable, Algorand and Hedera at ten thousand-plus TPS. Finality ranges from XRPL's three to five seconds and Hedera's three to five seconds being fastest, with Ethereum requiring twelve-plus minutes. Costs place XRPL at $0.0001 alongside Hedera at comparable levels, vastly cheaper than Ethereum's one to fifty-plus dollars. All major platforms except Ethereum achieve carbon-negative or low energy consumption. Uptime shows XRPL's ten-plus years standing out, though Ethereum maintains 99-percent-plus availability.

根據多項重要指標進行定量比較,可見 XRPL 的定位:交易吞吐量部分,XRPL 約為每秒 1,500 筆,以太坊 15-30 筆,Polygon zkEVM 變動,Algorand 與 Hedera 則突破一萬筆。交易終局以 XRPL 和 Hedera 的 3-5 秒為最速,以太坊則須 12 分鐘以上。交易成本方面,XRPL 與 Hedera 均為 0.0001 美元等級,遠低於以太坊的 1 至 50 美元不等。除以太坊外,主流平台皆已達到碳負或低能耗。可用性方面,XRPL 維持超過十年運作記錄,雖然以太坊也維持 99% 以上可用性。

In institutional adoption scorecards, payments and settlement crown XRPL the winner with three hundred RippleNet institutions and $1.3 trillion-plus ODL volume versus JPM Coin's one billion dollars daily serving only internal clients and Hedera's SWIFT trials. Tokenization favors Ethereum with over 30 billion dollars tokenized and mature ERC-3643 standards, though Hedera shows strength through partnerships with State Street, Fidelity, and LGIM, while XRPL grows rapidly from a smaller base. CBDCs highlight Algorand with Colombia and Marshall Islands implementations, Hedera with Wyoming's FRNT, and XRPL with pilots in Bhutan and Palau. Enterprise privacy clearly favors Fabric and Corda dominating private consortiums.

在機構採用評比上,支付與結算領域,XRPL 以旗下三百家 RippleNet 機構和 1.3 兆美元 ODL 交易量勝出,高於 JPM Coin 僅限內部客戶的一天 10 億美元,以及 Hedera 的 SWIFT 試點。通證化則以以太坊 300 億美元的規模及成熟的 ERC-3643 標準為首,Hedera 則憑藉與 State Street、Fidelity、LGIM 的合作展現實力,而 XRPL 則從小基礎快速成長。CBDC 實績方面,Algorand 擁有哥倫比亞及馬紹爾應用,Hedera 有懷俄明 FRNT,XRPL 則有不丹及帛琉試點。企業隱私則由 Fabric、Corda 在私有聯盟市場上壟斷。

XRPL's unique value proposition positions it as public, decentralized, payment-specialized blockchain infrastructure with institutional-grade compliance tools. This differs from competing with Ethereum on general smart contracts, Aztec on maximum privacy, or Fabric and Corda on fully private consortiums. Instead, XRPL competes on institutional cross-border payments, compliant tokenization, efficient settlement, and public infrastructure with privacy controls. The thesis holds that institutions need public blockchain infrastructure providing transparency and accessibility combined with privacy and compliance controls including KYC and AML checks, credentials, and confidential transactions.

XRPL 獨特的價值主張,定位為具備機構級合規工具的公有、去中心化、專為支付設計的區塊鏈基礎設施。這與針對通用智慧合約的以太坊、極致隱私的 Aztec、或全私有聯盟導向的 Fabric/Corda 不同。XRPL 主要競爭領域為機構級跨境支付、合規化通證化、高效率結算,以及帶隱私管控的公有基礎設施。主論點認為,機構需要的是結合透明度、可及性、隱私與合規(包括 KYC、AML 驗證、憑證、保密交易等)的公有區塊鏈基礎設施。

How privacy-enabled adoption could drive XRP utility and reshape settlement infrastructure

隱私功能驅動採用,促進 XRP 實用性並重塑結算基礎建設的可能契機

Understanding XRP's role in XRPL's institutional vision requires examining the technical mechanisms creating utility rather than speculating on price. XRP serves three core protocol functions: transaction fees burned creating deflationary pressure, account reserves locking ten XRP as a base plus two XRP per object, and bridge currency for on-demand liquidity held for seconds during conversions between fiat currencies.

要理解 XRP 在 XRPL 機構願景中的定位,需要從創造實用性的技術機制下手,而非僅止於價格猜測。XRP 承擔三大核心協議功能:交易手續費銷毀以產生通縮壓力;帳戶儲備鎖定,每個帳戶須至少持有十枚 XRP,加上每新增一個物件鎖定兩枚 XRP;以及充當隨需流動性橋樑,在法幣間兌換過程中短暫持有秒級的 XRP。

The liquidity requirements for institutional-scale usage demand deep order books at exchanges with tight spreads currently averaging 0.15 percent, capacity for institutional-size transactions without slippage, and 24/7 market making supporting global operations. As cross-border payment volumes increase, liquidity needs scale proportionally. On-demand liquidity processed $1.3 trillion in the second quarter of 2025 alone, requiring substantial XRP liquidity even though each unit moves through the system in seconds.

機構級規模運用的流動性需求,仰賴交易所內深厚的訂單簿,點差需縮小至平均 0.15%,能支撐大額交易不產生滑價,並提供 24 小時全年無休的做市以配合全球運作。隨著跨境支付量成長,流動性需求亦呈等比增加。光是 2025 第二季,隨需流動性就處理了 1.3 兆美元交易,雖然每單位 XRP 在系統內僅停留幾秒,卻仍須有足夠規模的 XRP 支撐此流通。

Multiple demand drivers stem from utility rather than speculation. Transaction volume growth increases fees burned - currently 4,500 XRP daily, scaling with activity. On-demand liquidity corridor expansion requires deeper liquidity pools at more exchanges. Account creation locks reserves permanently or until accounts close. Emerging DeFi and lending protocols will require collateral and potentially staking. Institutional treasury holdings provide payment capacity. RLUSD stablecoin adoption creates gas demand since every transaction needs XRP for fees. Tokenized asset activity generates transaction fees. Credit facilities may use XRP as collateral.

多重需求動力皆來自實用性而非投機。例如交易量提升會增加當日燒毀手續費,目前每日約 4,500 枚 XRP,並隨活動規模增長。隨需流動性通道的擴展,需要在多家交易所提供更深層流動性池。創建帳戶則將儲備鎖定至帳戶關閉。新興 DeFi 與借貸協議會需抵押品與潛在的質押用途。機構資金池則支撐支付容量。RLUSD 穩定幣每筆交易都需 XRP 作為 gas 費,創造額外需求。資產通證化活動也會產生手續費收入。授信協議則有可能將 XRP 納入抵押品種類。

Network effects create positive feedback loops. More on-demand liquidity users deepen market liquidity, tighter spreads reduce costs for institutions, lower costs attract more users, and the cycle reinforces. XRPL's unique architecture aggregates liquidity protocol-wide into single pools per asset pair rather than fragmenting across thousands of separate decentralized exchange contracts. This concentration means developers building on XRPL access existing depth without bootstrapping liquidity, creating a structural advantage over fragmented models.

網絡效應帶來正向循環:更多的隨需流動性用戶,使市場流動性越來越深,點差變窄降低機構成本,低成本又吸引更多使用者,強化整體動能。XRPL 獨特架構將每個資產對的流動性聚合成單一池,而非像其他平台在數千份去中心化合約間分散,這種集中的流動性讓開發者可直接調用現有深度,無需自行引導流動性,大幅優於分散模式。

Corridor network effects follow Metcalfe's Law where value grows proportional to connections squared. With forty operational corridors, 780 possible routes exist calculated as N times N minus one divided by two. Each additional corridor connects to all existing corridors, creating exponentially increasing value. The demonstration that on-demand liquidity achieves 70 percent cost reductions versus traditional methods with three to five second settlement versus 36 to 96 hour correspondent banking creates compelling economics.

通道網絡效應符合梅特卡夫法則(價值隨節點連線數平方成長)。運作中的 40 條通道,就有 780 條可能路徑(計算式:N * (N-1) / 2)。每加入一條新通道,即與所有現有通道連結,總價值呈指數級上升。實證顯示,隨需流動性能比傳統作法節省 70% 成本、3-5 秒完成結算,遠勝對應銀行須 36-96 小時,呈現極佳經濟效益。

The RLUSD stablecoin introduces another utility flywheel. As RLUSD adoption increases, every transaction requires XRP for gas fees, increasing XRP demand. A stronger network with more activity makes RLUSD more credible and useful. Greater RLUSD confidence drives more adoption, and the cycle continues. RLUSD reached $455 million market capitalization in the second quarter of 2025 with NYDFS approval, BNY Mellon custody, and SBI Holdings distributing in Japan.

RLUSD 穩定幣構成另一個實用性飛輪。隨 RLUSD 採用增加,每一筆交易都需支付 XRP 手續費,推高 XRP 需求。網絡活動越旺,RLUSD 信用與實用性愈增,引發更多採用,形成自我強化循環。2025 年第二季,RLUSD 市值已達 4.55 億美元,並獲 NYDFS 核准、BNY Mellon 託管,SBI Holdings 在日本發行。

Comparing XRPL to SWIFT as a potential alternative reveals fundamental advantages beyond simple cost savings. SWIFT provides messaging only while XRPL combines messaging with settlement. Settlement time drops from 36 to 96 hours to three to five seconds. Costs decrease from 20 to 50-plus dollars to under one cent. Throughput increases from five to seven transactions per second to 1,500 TPS. XRPL operates 24/7/365 versus banking hours. Pre-funding requirements disappear since on-demand liquidity eliminates the need for billions tied up in nostro accounts. Finality becomes immediate rather than taking days. Transparency provides full blockchain audit trails versus limited SWIFT visibility. Intermediaries reduce from multiple correspondent banks to direct or minimal routing.

將 XRPL 作為 SWIFT 的潛在替代方案,不僅止於節省成本,更兼具根本性優勢。SWIFT 僅傳送訊息,而 XRPL 結合訊息與結算。結算時間從 36-96 小時降至 3-5 秒;費用從二十到五十美元以上降到一美分以下。吞吐量從每秒 5-7 筆大幅提升到 1,500 TPS。XRPL 全年無休 24 小時運行,不受銀行營業時間限制。隨需流動性消除前置資金要求,不再需要數十億美元鎖在 nostro 帳戶。交易終局即時到賬,不用等數天。透明度則整合區塊鏈全程稽核,相較 SWIFT 可見程度極有限。中介層級由多層對應銀行簡化至直接或極少路由。

The capital liberation opportunity alone is substantial: an estimated 27 trillion dollars sits locked in pre-funded accounts globally under correspondent banking models. Even capturing a fraction of cross-border flows currently moving through SWIFT would require massive XRP liquidity scaling. However, the realistic assessment suggests XRPL complements rather than replaces SWIFT. A hybrid model appears most likely where SWIFT handles large institutional transactions with established trust relationships, while XRPL excels for remittances, small and medium enterprise payments, instant settlement requirements, emerging markets with limited correspondent relationships, and tokenized assets requiring programmable money.

光是資本釋放機會便極為可觀:現今全球對應銀行模式下,預先資金帳戶中鎖定了約 27 兆美元。即使只將 SWIFT 跨境流的一小部分轉移,也需要 XRP 規模大幅擴充。然而,客觀判斷下,XRPL 可能更像是 SWIFT 的補充而非完全替代。最有可能的混合模式是,巨額機構交易仍由 SWIFT 處理(或倚賴既有信任關係),而 XRPL 則專攻匯款、中小企業支付、即時結算、新興市場(對應帳戶有限),及需程式化貨幣的通證資產。

SWIFT's response includes testing blockchain technology, selecting Linea, an Ethereum layer two, for some initiatives. SWIFT maintains advantages including universal trust from decades of operation, neutral governance without

完全跳過翻譯。區塊鏈平台的偏見,以及與全球每一家主要銀行建立的關係。XRPL 則以優越、經過生產驗證且不斷增長的採用率來抗衡,但改變機構行為需要數年的信任建立。

2025 年的數據顯示,向關鍵規模推進出現有意義的進展。活躍地址達到 295,000,創歷史新高。鏈上交易量有 75% 來自於實用性用途,而非投機。機構累積超過 9 億枚 XRP。生態系統隨著專業級基礎設施、託管和合規工具的成熟而提升。然而,競爭平台仍然領先巨大。以太坊的總鎖倉價值 (TVL) 達到 970 億美元,XRPL 僅 8,800 萬美元,兩者相差達 1,100 倍。即使是 Solana 的 110 億美元,也仍然有 128 倍的優勢。

成長場景取決於多個面向的同步執行。高機率的匯款通道擴展場景可能會在二至三年內發生,因為證實可達 70% 成本降低與監管清晰度,推動亞洲擴展至非洲和拉丁美洲。若成功,XRP 的需求將適度增加,匯款通道規模可能成長十到二十倍。中高機率的機構型實體資產代幣化,可能在三到五年內實現有意義的規模轉換,從貨幣市場基金擴展到債券、股票和房地產。Archax 六個月 2,260% 的成長與“數億”規模的待上線項目令人樂觀,雖然以太坊 300 億美元的先發優勢構成競爭挑戰。

中等機率的 CBDC 互通預計需五至七年,因為政治流程緩慢,但若 XRP 成為主權數位貨幣間的中立橋樑,可能帶來顛覆性影響。五個正在運行的試點項目提供了初步證據。中等機率的機構型私有 DeFi 須依賴 2026 年的保密多功能代幣(MPT)落地,以及原生借貸 3.0 版證明可行,預期三至五年可實現有意義的採用,創造高價值且頻繁的交易和抵押應用。高機率的穩定幣結算基礎建設,憑藉 RLUSD 獲得 NYDFS 核可與機構託管,可能在二至三年內實現龐大規模,因每一筆 RLUSD 交易都需使用 XRP 作為手續費。

最現實的路徑是逐步以特定應用場景滲透,而非一次性取代整體基礎設施。XRPL 很可能在匯款、資產代幣化與即時結算等利基市場表現突出,並與傳統系統共存。若執行品質及監管穩定性支持採用,未來十年實現有意義參與是有機會的。成長軌跡較大程度上受監管環境及採用時程影響,因為基礎架構的技術能力已能如預期運作。

監管接受度、技術風險與機構面臨的現實困難

邁向機構採用的道路會遇到重大障礙,這些障礙值得與機會同等重視。監管現況或許是最大的未定數,歐盟已決議自 2027 年 7 月起,根據《反洗錢條例》禁止隱私幣。日本、杜拜、南韓與澳洲也實施類似限制。包括 Kraken、Binance 與 OKX 等主要交易所在多個司法區下架隱私幣。這種對匿名加密貨幣的監管敵意,讓人質疑「可稽核隱私」功能是否能被監管單位接受,還是會遭遇類似限制。

XRPL 的保密多功能代幣(confidential MPT)提議嘗試以多重密文架構來區隔,金額分別以持有者金鑰、發行者金鑰及可選擇的審核者金鑰加密。發行者始終能解密餘額,有選擇性披露機制以符合監管規範,檢視金鑰允許自願與授權對象分享。此設計保有供應可見性與地址透明度,僅隱藏金額。不過此做法能否滿足監管機構仍屬未知——目前尚無公開區塊鏈具「合規隱私」功能獲得曾禁用隱私幣的金融監管機關接受。

「旅行規則」合規帶來根本張力。金融行動特別工作組(FATF)要求虛擬資產服務提供者,在一定金額(1,000 至 3,000 美元)以上的交易必須揭露發起與受益人信息。隱私功能定義上正好隱藏旅行規則要求揭露的資訊。XRPL 的檢視金鑰與選擇性披露解決方案尚未獲監管實證。業界供應商如 Notabene、Sumsub 及 Shyft Network 傾向於在區塊鏈頂層加裝合規機制,而非將隱私納入協議本身,反映同時實現隱私與合規的技術難題尚待解決。

技術實作困難帶來額外風險。Numen Cyber Labs 的研究指出,SNARK 系統中的 96% 漏洞來自設計約束不足,導致證明雖通過但結果錯誤。歷史事故如 Zcash 於 2018 年發現的 Sapling 漏洞,若遭利用可造成無限偽造——以及 2022 年 10 月 BNB Chain 經由證明驗證漏洞遭竊 5.86 億美元的駭客事件。保密交易會極大增加資料量,Monero 的單一交易大小約 5.9KB,遠高於比特幣標準的 300 bytes,膨脹了 20 倍。審計挑戰包含缺乏具備零知識證明專業的公司,以及有限的自動化分析工具,造成安全驗證的瓶頸。

XRPL 特定保密 MPT 提案以 EC-ElGamal 加密結合零知識證明,因多重密文架構,每筆餘額都需用三把金鑰進行加密,增添複雜性。回收機制(clawback)創造特權交易向量,潛在可能被攻擊者利用。長期來看,量子運算也是威脅,因 EC-ElGamal 依賴橢圓曲線密碼學,而此種加密未來對量子電腦無防護力,雖然已有後量子替代方案。應對措施包括多次獨立安全審計、實施高額漏洞懸賞及從小額試行逐步推展至機構規模。

導入障礙不只限於技術,更涉及網絡效應與生態系統成熟度。XRPL 的總鎖倉價值 8,800 萬美元,遠低於以太坊的 970 億美元,相差 1,100 倍。Solana 目前 TVL 則為 110 億美元,仍是 XRPL 的 128 倍。資本部署規模的巨大差距賦予既有勢力自我強化的優勢。深度流動性吸引更多用戶和開發者。大型開發者社群帶來更多應用與工具。更多應用提升網路效益,帶動用戶採用。機構金融更是隨流動性而動——資產管理業者資本僅會流向流動性充足、不致大額交易滑價的市場。

XRPL 直至 2025 年底推出原生借貸協議,與以太坊 DeFi 熱潮促成的 Aave、Compound 等協議成立已相隔將近五年,這些協議現今管理數百億 TVL。DeFi 領先者隨著品牌信任累積、流動性堆疊、協議整合及建立網絡效應,形成後進者難以逾越的壁壘。開發社群規模的差距進一步擴大挑戰。以太坊擁有全球最大區塊鏈開發群,數十萬開發者熟悉 Solidity 與 EVM 架構。XRPL 開發者規模則小數十甚至百倍,導致創新與生態發展步調受限,儘管 2025 年 6 月已推出 EVM 側鍊來吸引以太坊開發者。

混合公私區塊鏈模型的信任問題造成導入摩擦。企業過去使用私有資料庫或 Hyperledger Fabric 這類授權型區塊鏈,會質疑公有基礎架構是否能妥善保護敏感商務數據。GDPR「被遺忘權」與區塊鏈不可竄改性本質衝突——一旦個資上鏈便無法刪除,違反法規要求。XRPL 採用許可域、憑證與選擇性披露的混合路徑嘗試彌合這個鴻溝,但企業大規模信任公鏈作為核心營運基礎的先例尚未出現。

治理與去中心化疑慮依然存在,即便 Ripple 致力於加強去中心化。Ripple 仍透過托管合約持有約 42% 的 XRP 總供應量,且定期釋放及出售以支持營運。Ripple 運營的驗證節點位於許多驗證者預設的唯一節點列表(UNL)上,造成中心化憂慮。Kaiko 的區塊鏈安全評分中,XRPL 在十五大主鏈中以 41 分/100 分墊底,主因即為治理中心化與代幣分配。2025 年治理改革,賦予代幣持有者提出移除驗證者建議的權利,引發爭議,也有驗證者因擔心 Ripple 影響力而退出。

Ripple 主張隨網路成熟,漸進式去中心化策略持續推進,目前全球已有 150 多個驗證者,預設 UNL 上有 35 個,Ripple 僅控制其中一個。然而,金融機構決策委員會關注的是治理結構本身的觀感。銀行習慣於如 SWIFT 這樣的中立基礎設施,對於一間公司仍具有重大影響力與持有大量 Token 的區塊鏈,採納時勢必猶豫。billions in the native asset.

針對隱私實現的安全風險需要嚴肅對待。電路設計缺陷是零知識系統中最致命的漏洞,佔所有錯誤的 96%。與傳統智慧合約中的錯誤通常只會造成局部失效不同,ZKP(零知識證明)漏洞可能造成系統性攻擊,例如鑄造無抵押代幣或破壞隱私承諾。為機密化 MPT(多用途代幣)所提出的多密文架構擴大了攻擊面,因其每筆交易需完成三次獨立加密作業及多組零知識證明。回溯機制雖然有助於符合法規要求,卻會因發行人私鑰若遭盜取而暴露被濫用的特權交易能力。安全與易用性的平衡點反映於私鑰管理複雜度——使用者必須保護自己的 ElGamal 私鑰,否則一旦遺失將無法解密餘額且無法恢復。

實際時程現況與推動機構級採用需克服的條件

若要瞭解現實上的時程,需超越官方宣稱目標,看清實際執行難度與相依鏈條。Ripple 官方預計 2026 年第一季啟用機密化多用途代幣,但從技術複雜度——包括實作 EC-ElGamal 加密、整合零知識證明、於兩週內取得 80% 驗證者同意並完成安全審計——來看,2026 年第二季才較為實際。依 XLS-65 與 XLS-66進度,原生借貸協議目標上線為 2025 年第四季,截至 2025 年 10 月時正進行驗證者投票。至於完整的機構級 DeFi 堆疊(含合規機制、隱私層、借貸基礎設施及許可制市場),實際組建時點要到 2026 年底甚至 2027 年初。

已上線功能是現有基礎。憑證、凍結(deep freeze)、模擬、AMM 及去中心化身份識別(DID)已於 2024 年 10 月上線。多用途代幣於 2025 年 10 月 1 日啟用。至 2025 年底仍在投票階段的有:許可制網域、許可制去中心化交易所、代幣託管以及多項 MPT 增強功能。EVM 側鏈於 2025 年第二季進主網,單季處理了 4.08 億美元 AMM 交易量。這種階段推進展現出穩健步調,但官方時程總因技術瓶頸,歷來平均遞延 3~6 個月。

借貸協議將會是 XRPL 原生金融原語中最複雜者。XLS-65 推出單一資產保管庫,自動聚合流動性並發行可轉讓或限制流通權益憑證(shares),存取可由許可網域管控;XLS-66 建立在此基礎上,實作定期無抵押借貸、預定攤還進度,結合鏈下審核與鏈上契約自執行,以及首損資本保障(放款仲介需存備抵債預備金)。整合面向包括 RLUSD 穩定幣、AMM 流動性、許可網域存取權控管以及憑證驗證借款方。

Ripple 於 2025 年 9 月表示「機構用戶已經排隊等候借貸協議正式上線」,顯示確實有市場需求。但該協議需與以太坊成熟的 DeFi 生態競爭,單 Aave 即管理超 200 億美元 TVL。Compound、MakerDAO 等多個協議已運作 5 年以上,累積品牌、流動性,且深度融入 DeFi 可組合基礎設施。XRPL 的借貸協議優勢在於原生協議層實作,避開智慧合約風險,合規設計如憑證及許可網域,以及與 XRPL 支付基礎設施一體。但要撼動既有生態,仍須年復一年證明安全與可靠,建立信任與運作紀錄。

未來三年至五年,XRPL 機構生態將分階段發展。2025 年聚焦借貸協議上線、許可制 DEX 啟用及原有合規能力擴展。2026 年重點為推動機密 MPT 部署、全面啟用零知識隱私交易,以及 CBDC 互通試點進入量產前階段。2027~2028 年,建構完成合規、隱私、借貸及交易全方位基礎設施,成為機構級 DeFi 完整運作堆疊。此時程令 XRPL 有望於本年代末吸引重大機構參與。

Ripple 的戰略定位明確聚焦機構金融市場,而非與以太坊消費型 DeFi 或 Solana 遊戲/NFT 生態正面競爭。目標市場包括 2030 年預估 30 兆美元的實體資產代幣化、以穩定幣取代傳統銀行間支付摩擦,以及用跨境結算取代高昂電匯成本。現有數據具吸引力:RippleNet 已與 300+ 銀行合作、O D L(隨需流動性)年支付量達 10 億美元、在實體資產類別位居全球前十。區域布局鎖定美國(待 SEC 訴訟塵埃落定)、歐盟(MiCA 新規框架)、亞太(憑藉 SBI Holdings 合作)、中東(杜拜及阿布達比專案推進)。

XRPL 技術長 David Schwartz 在 2025 年表示 XRPL 機構級 DeFi「方向明確」——強調合規、效率與實體資產整合。Ayo Akinyele 於 2025 年 10 月發文闡述願景:「協議層隱私、合規與信任…2026 底要有機密化 MPT…讓 XRPL 成為機構第一選擇。」路線圖中最具野心者,乃攤牌與或補足 SWIFT 每日處理數兆美元銀行間結算網絡。即便僅拿 5~10% 市佔已極具規模,惟大規模機構採納須解決多國監管、數百交易所深度流動性及數年穩定生產運作。

大規模機構採用的前提遠超技術層面,還涵蓋市場結構、法規與生態成熟度。技術必備條件包括:實證能承受每秒 1,500 筆以上 TPS、隱私層穩定安全運作三年以上、全網開發者規模破萬人並持續建構基礎設施與應用。合規前提為:美國、歐盟及亞洲主要監理單位對資產代幣化處理方式形成明確規則、FATF 認可的 Travel Rule 方案、鏈上智能合約具司法強制力、(至少)監管容忍隱私功能。

市場前提包含:總鎖倉量須從現時的 8,800 萬美元增至 100 億美元以上(一百倍成長)、穩定幣日均量需達 50 億美元以上、機構級基礎設施成型(如多家合格託管、中介經紀服務、全方位保險產品)。治理結構需從 35 個 UNL 預設驗證者擴展為 500 個以上並全球分散,單一實體市佔不得逾 10%,治理程序公開透明且有明確修憲機制,並證明具Ripple 獨立性。

生態體系則必須驗證全年支付額超過一千億美元,且已被主流銀行核心系統及資金管理平台整合,並有連續放款總額超十億美元實例成果。達成這些條件至少還需三至五年,實際上代表從 2025 年起須等到 2028~2030 年,才有機會實現規模性機構用戶參與,非僅止於試點。

最關鍵的瓶頸仍是監管——隱私幣禁令及 Travel Rule 不確定性風險最大。網路效應競爭對手(如以太坊)優勢隨時間強化。技術推進面臨密碼學複雜度高,早期階段任何安全事件都極具殺傷力。治理變革須說服機構決策委員會,相信 XRPL 為中立基礎設施,而非 Ripple 控制體系。

綜合評估未來三種主場景。樂觀情境(約 20% 機率):監管廣泛接受隱私特性,借貸協議大規模成功,主要銀行加入結算,2030 年 TVL 衝破 500 億美元,XRPL 挺進區塊鏈前五名。悲觀情境(約 30% 機率):歐盟隱私限制波及 XRPL,網路效應無法撼動主流,TVL 長期停在 50 億以下,XRPL 只能維持利基支付服務但無法發展 DeFi。

最可能狀況(約 50% 機率):在某些細分領域勝出,例如銀行間結算、代幣化債券和貨幣市場基金、CBDC 互通,總 TVL 介於 100~250 億美元間,有三十至五十家銀行活躍使用 XRPL 處理支付與結算,借貸協議 TVL 達 30~80 億美元,隱私功能因監管摩擦僅限部分落地。區域上,亞太與中東市場較歐盟更具潛力。implementation. XRPL 與以太坊(Ethereum)和 Solana 並存,各自服務不同的應用場景,而非取代現有平台。

這種審慎的評估方式,平衡了 XRPL 真正的技術創新與實際機構採用實績,以及面對強大的競爭、市場監管和用戶採用等一系列挑戰。這項基礎設施經過 13 年的上線運作、處理數十億筆交易,證明其設計可用。實體機構,如 SBI Holdings、Archax、Santander 以及三百家 RippleNet 合作夥伴,都有實質資本部署。然而,要從 8,800 萬美元 TVL 規模提升至機構級規模,需多年持續執行、監管部門配合,以及克服鞏固競爭者的網絡效應。意義深遠的機構級採用時程很可能延後至 2028 至 2030 年,而非 2025 至 2026 年,屆時成功可能集中於特定高價值利基市場,而非全面取代區塊鏈基礎設施。

Final thoughts

XRP Ledger 穩步建立有助於機構級應用的技術基礎設施,針對其他公有鏈多半忽略的機構需求。去中心化識別(DID)實現持久加密身份;可驗證憑證讓 KYC 驗證無需反覆提供個資;多功能代幣附帶合規中繼資料與強制機制,包括轉帳限制、授權持有人名單、監管回收(clawback);有權限網域(permissioned domains)能創建受憑證保護的環境。原生借貸協議在免除智能合約風險下,提供機構信貸。預計 2026 年推出的加密多功能代幣則承諾隱私保護與監管可追溯兼容。

這種以合規為先的策略,使 XRPL 與以太坊鼓勵無許可創新的理念和企業專用全私有鏈區隔開來。其賭注在於:機構想要公有鏈的透明、開放、中立基礎設施,同時結合合規與隱私控管以滿足監管金融需求。Brad Garlinghouse 指出隱私是現有基礎設施最大缺口,此判斷具策略意義,特別是在其他部件已存在或即將完成之時。

競爭定位則聚焦於 XRPL 在付款領域的特長,可於以下機構利基市場創造優勢:跨境匯款降低 70% 成本;代幣化貨幣市場基金和債券需合規控管;CBDC 清算連結主權數位貨幣;穩定幣基礎設施可直接受惠於本地支付通道。這些市場商機額達數兆美元,XRPL 無需壟斷全球市佔,只需取得合理份額即可成功。

確實已有實質進展。隨需流動性 ODL 季度處理金額 1.3 兆美元,證明支付規模;Archax 代幣化 38 億英鎊貨幣市場基金,展現機構信心;RippleNet 擁有三百家銀行合作夥伴提供渠道;六個月內代幣化資產成長 2,260% 顯示強勁動能。這些數據驗證,只要合規工具齊備,機構願意使用公鏈基礎設施。

但同時,障礙不容忽視。隱私功能監管不明是一大結構性風險,歐盟已規定 2027 年前禁用隱私幣,目前無法明確「合規隱私」能否被接納。以太坊生態系 TVL 規模高出 1100 倍,網路效應難以撼動。零知識技術複雜度,歷來時有嚴重安全漏洞。開發者社群規模差距,限制創新速度。治理上,Ripple 影響力可能使需中立基礎設施的機構顧慮。

現實時程應以年為單位衡量,而非季。結合隱私功能的完整機構級 DeFi 堆疊,最快 2026 年底、2027 年方能全面部署。安全性需經多年無重大事故方可驗證。監管接受則需多國多年磨合。要從 8,800 萬美元 TVL 累積到機構規模,需五年以上持續成長。務實來看,2028 至 2030 年比近期快速轉型更符合現況。

最有可能的結果,是於部分利基市場取得階段性成功。XRPL 有望佔有銀行清算(支付通道極為關鍵)、代幣化債券/貨幣市場基金(需堅實合規底層),如果 CBDC 試點順利,也可能實現跨鏈互通。與以太坊服務零售 DeFi、生態系,Solana 著眼遊戲產業並行,比贏家通吃更合理。預期亞太及中東地區部署進度會領先較為保守的歐洲。

關鍵問題,其實不是 XRPL 技術可行否—13 年運作已證明其穩定可靠。焦點應在:機構金融市場是否比私有鏈或以太坊現有生態,更傾向公有鏈加合規控管?目前已見初步需求。銀行選擇 RippleNet,源自傳統代理銀行的高成本與緩慢痛點。資產管理機構採用 XRPL 代幣化,因原生合規功能能減少法律與技術負擔。這些案例驗證了市場需求。

未來三年執行將決定最終成敗。能否平安無事故地推出保密多功能代幣,關乎業界信任;借貸協議 TVL 能否從零成長至數十億,代表機構驗證;代幣化資產從數億擴大至數十億,才算通過規模考驗。主要法域監管鬆綁,則解除生死威脅;試點能大量轉為正式上線,多家銀行落地才算真正進入主流。

XRPL 所瞄準的市場是真實存在:全球跨境支付每年超過數百兆美元,摩擦巨大;至 2030 年實體資產代幣化規模可能達 30 兆美元;機構級 DeFi 剛起步,賽道容納多贏者;目前尚無在公鏈上大規模落地的合規加隱私基礎建設。若 XRPL 能技術到位,同時駕馭監管複雜度,實質機構採用可期。這條路強調在特定高價值利基贏得階段性突破,而非全面大規模採用;進展需以年衡量,而非短期爆發;並需務實看待創新亮點與必將面對的龐大挑戰。