Cryptocurrency continues to redefine how we think about money, and in 2025, staking has solidified its place as one of the most accessible ways to earn passive income in this digital frontier.

Whether you’re a seasoned investor or just dipping your toes into the crypto waters, staking offers a way to grow your holdings without the complexity of trading or mining. As of February 25, 2025, the staking landscape is thriving, with platforms vying to offer the best rewards, security, and user experience.

After digging into the latest data and trends, five platforms stand out as the cream of the crop: Binance Staking, Coinbase Staking, Kraken Staking, Gemini, and Lido. Here’s why they’re leading the pack—and how they can help you make the most of your crypto in 2025.

The Rise of Crypto Staking: A Passive Income Powerhouse

Staking has become a cornerstone of the cryptocurrency ecosystem, particularly for networks that rely on Proof of Stake (PoS) to secure their blockchains.

Unlike mining, which demands hefty hardware and energy costs, staking lets you lock up your coins to validate transactions and earn rewards—think of it as earning interest on a savings account, but with a crypto twist. The appeal is clear: annual percentage yields (APYs) can range from modest single digits to eye-popping triple digits, depending on the platform and coin.

As of early 2025, the staking market is buzzing with opportunity, driven by growing adoption of PoS chains like Ethereum, Solana, and Cardano. Platforms have responded by offering a mix of flexibility, security, and innovation to attract users.

But with so many options, choosing the right one can feel daunting. That’s why we’ve zeroed in on five platforms that excel in delivering value, based on their reward potential, ease of use, and trustworthiness. From centralized exchanges to decentralized pioneers, these are the places to stake your claim this year.

The Leaders in Staking: Where to Park Your Crypto in 2025

These five platforms impress the most when talking about crypto staking.

Binance Staking: The Global Giant with Big Rewards

Binance has long been synonymous with crypto dominance, and Binance Staking cements that reputation in 2025 with a staking service that’s as versatile as it is lucrative.

The platform supports over 60 cryptocurrencies, ranging from giants like Ethereum, Solana, and Cardano to smaller altcoins like Cosmos and Algorand. APYs here are a standout feature—recent data shows yields reaching up to 100% or more for select coins under locked staking terms, though popular options like Ethereum hover around 5-7% with flexible staking.

For instance, staking Binance Coin can net you 8-12% APY with a 30-day lock, while high-risk coins like Axie Infinity have been known to spike past 50% during promotional periods.

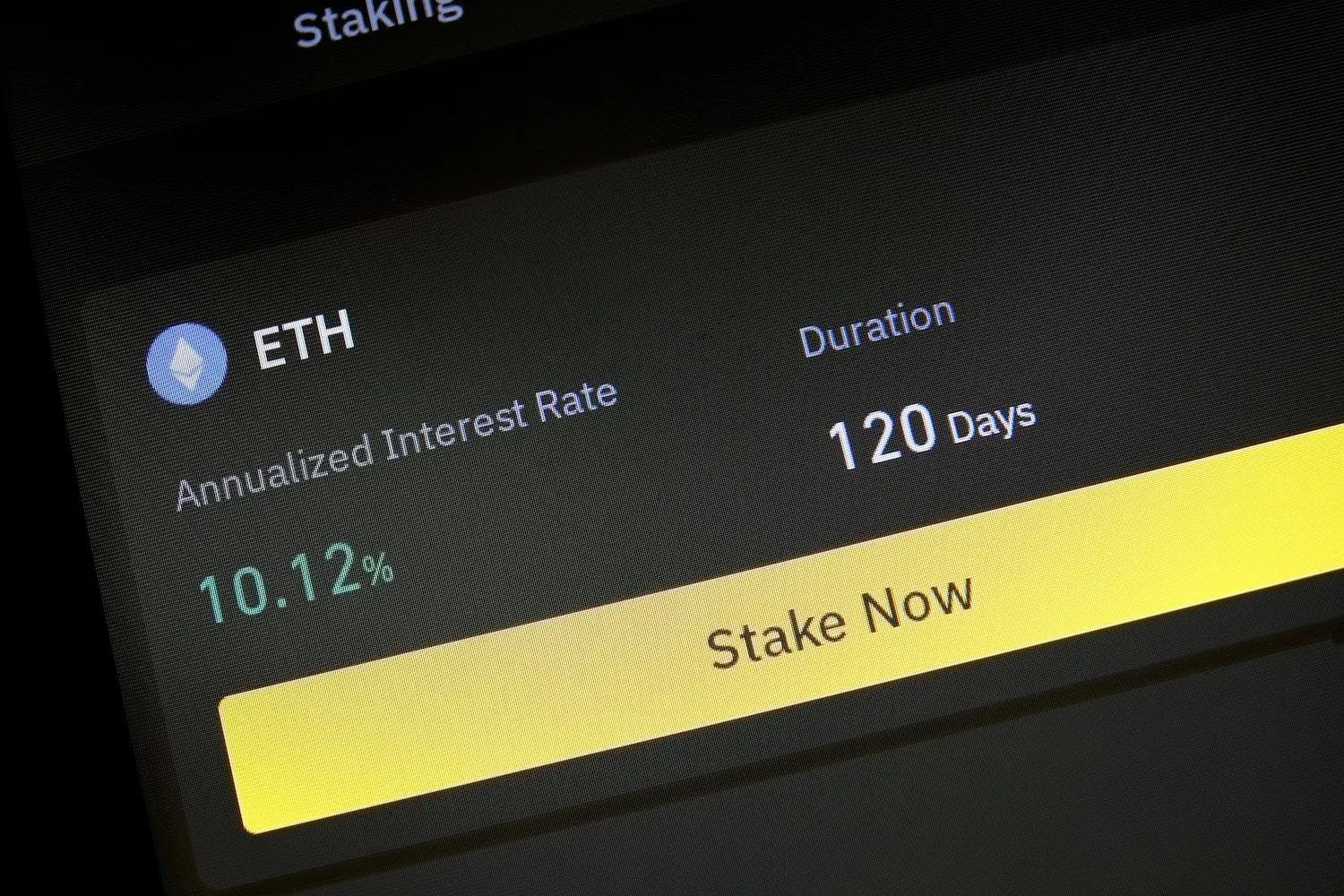

Binance Staking offers two main flavors: flexible staking, where you can withdraw anytime with lower yields (e.g., 4% on ETH), and locked staking, which boosts returns but ties up funds for 7 to 120 days.

Security is a fortress, with multi-signature wallets, cold storage for 98% of assets, and a SAFU (Secure Asset Fund for Users) insurance pool covering losses—a rare perk in the industry.

The platform’s liquidity, fueled by Binance’s 100 million+ users, means you can stake, unstake, or trade with minimal friction. Fees are negligible, often baked into the displayed APY, making it cost-effective. Whether you’re staking $10 or $10,000, Binancestaking’s scale and variety make it a powerhouse for maximizing returns in 2025.

Coinbase Staking: The Trusted Choice for Simplicity

Coinbase has mastered the art of bringing crypto to the masses, and Coinbase Staking reflects that ethos with a service that’s polished, compliant, and beginner-friendly.

As of February 2025, it supports around 15 cryptocurrencies, including Ethereum (5.1% APY), Solana (4.5% APY), and Cardano (3.5% APY), with a low entry bar—$1 gets you started on coins like SOL or ADA.

The platform doesn’t offer the dizzying coin selection of Binance, but it compensates with a seamless experience: sign up, stake from your dashboard, and watch rewards accrue weekly or monthly, depending on the blockchain.

What makes Coinbase Staking shine is its regulatory muscle—fully licensed in the US, it’s a haven for investors spooked by crypto’s Wild West reputation.

Security is tight, with 98% of assets in cold storage, two-factor authentication, and biometric login options.

However, there’s a catch: Coinbase takes a hefty cut of your rewards—25% for Ethereum, 35% for Cardano—meaning a 5.1% ETH APY nets you closer to 3.8% after fees. Staking terms are flexible, with no lockups for most coins (Ethereum requires a 24-hour wait to unstake), but rewards can take weeks to compound due to network delays.

For US-based stakers prioritizing trust over raw yield—especially with recent SEC scrutiny on competitors—Coinbase’s reliability makes it a 2025 staple.

Kraken Staking: Where Security Meets Substance

Kraken has built its name on rock-solid security, and Kraken Staking brings that pedigree to the table in 2025. The platform supports over 20 coins, including Ethereum (5-7% APY), Solana (6-8% APY), Tezos (5-6% APY), and even niche picks like Flow (FLOW) at 4-5%. Rewards vary by staking type: “on-chain” staking locks funds with network-specific unstaking periods (e.g., 21 days for ETH), yielding higher APYs, while “off-chain” flexible staking offers lower rates (e.g., 2-3% on SOL) but instant access.

For example, staking 100 SOL on-chain could earn you 6-8 SOL annually, paid bi-weekly, while flexible staking might drop that to 2-3 SOL.

Kraken’s security is its crown jewel—95% of funds sit in cold storage, protected by 24/7 monitoring, two-factor authentication, and regular third-party audits.

The platform’s transparency shines through in its proof-of-reserves reports, a rarity among exchanges. There are no minimums for most coins, though US users face hurdles: staking programs for coins like Mina or Kusama are off-limits due to regulatory quirks.

Fees are slim, with Kraken taking 7-15% of rewards (e.g., 15% on ETH, dropping your 7% APY to 5.95%). With a clean interface and a focus on asset safety, Kraken Staking is a top pick for cautious investors who still want competitive returns in 2025.

Gemini: Staking Made Accessible

Gemini’s staking platform is a masterclass in simplicity and inclusion, designed to welcome everyone from crypto newbies to seasoned traders. In 2025, it supports over 40 coins, including Ethereum (3-4% APY), Solana (4-5% APY via third-party validators), Polygon at 4-5%, and lesser-known gems like Audius (AUDIO) at 3-4%.

The kicker? Many coins have no minimum staking requirement—stake 0.01 ETH ($26 at current prices) or 0.1 MATIC ($0.05) and you’re in. APYs are modest compared to Binance’s highs, but consistency is Gemini’s game: Ethereum yields 3.2% with weekly payouts, while MATIC offers 4.5% with no lockup.

The platform’s staking process is dead simple—select your coin, confirm, and earn—backed by a sleek app and web interface. Security matches the industry’s best, with multi-signature wallets, cold storage, and FDIC insurance on USD balances (not crypto, mind you).

Gemini’s New York Trust Company status ensures regulatory compliance, though US users miss out on Solana staking due to jurisdictional limits. Fees are reasonable, with Gemini skimming 10-20% of rewards (e.g., 15% on ETH, netting you 2.72% from a 3.2% APY).

For small investors or those testing the waters, Gemini’s low barriers and steady returns make it a compelling choice in 2025.

Lido: The DeFi Darling Redefining Staking

Lido isn’t your typical staking platform—it’s a decentralized trailblazer reshaping how we think about staking in 2025.

Focused primarily on Ethereum, where it commands over 30% of staked ETH (per recent estimates), Lido offers a steady 4-5% APY—say, 4.5% on 10 ETH yields 0.45 ETH yearly, paid daily. Its secret sauce is liquid staking: stake your ETH and get stETH (staked ETH) in return, a token you can trade, lend, or use in DeFi protocols like Aave or Curve without losing staking rewards.

No minimums mean anyone can join, from 0.0001 ETH to whale-sized stacks.

Lido supports other chains too—Polygon (5-6% APY), Solana (5-7% via partners), and Kusama (10-12%)—but Ethereum is its bread and butter. Security comes from decentralization, with smart contracts audited by firms like Sigma Prime and Quantstamp, though its dominance in ETH staking sparks centralization debates.

Fees are a flat 10% of rewards (e.g., 0.045 ETH from that 0.45 ETH), and governance rests with a DAO, giving users a voice. For tech-savvy stakers who want flexibility and DeFi exposure—imagine earning 4.5% on ETH while lending stETH for an extra 3%—Lido’s innovative edge makes it a 2025 must-watch.

Conclusion: Staking Your Way to 2025 Success

The staking landscape in 2025 is rich with opportunity, and Binancestaking, Coinbasestaking, Kraken Staking, Gemini, and Lido are leading the charge.

Whether you’re chasing sky-high APYs with Binance, leaning on Coinbase’s trusted name, prioritizing Kraken’s security, easing into Gemini’s accessibility, or tapping Lido’s DeFi potential, there’s a platform here for you.