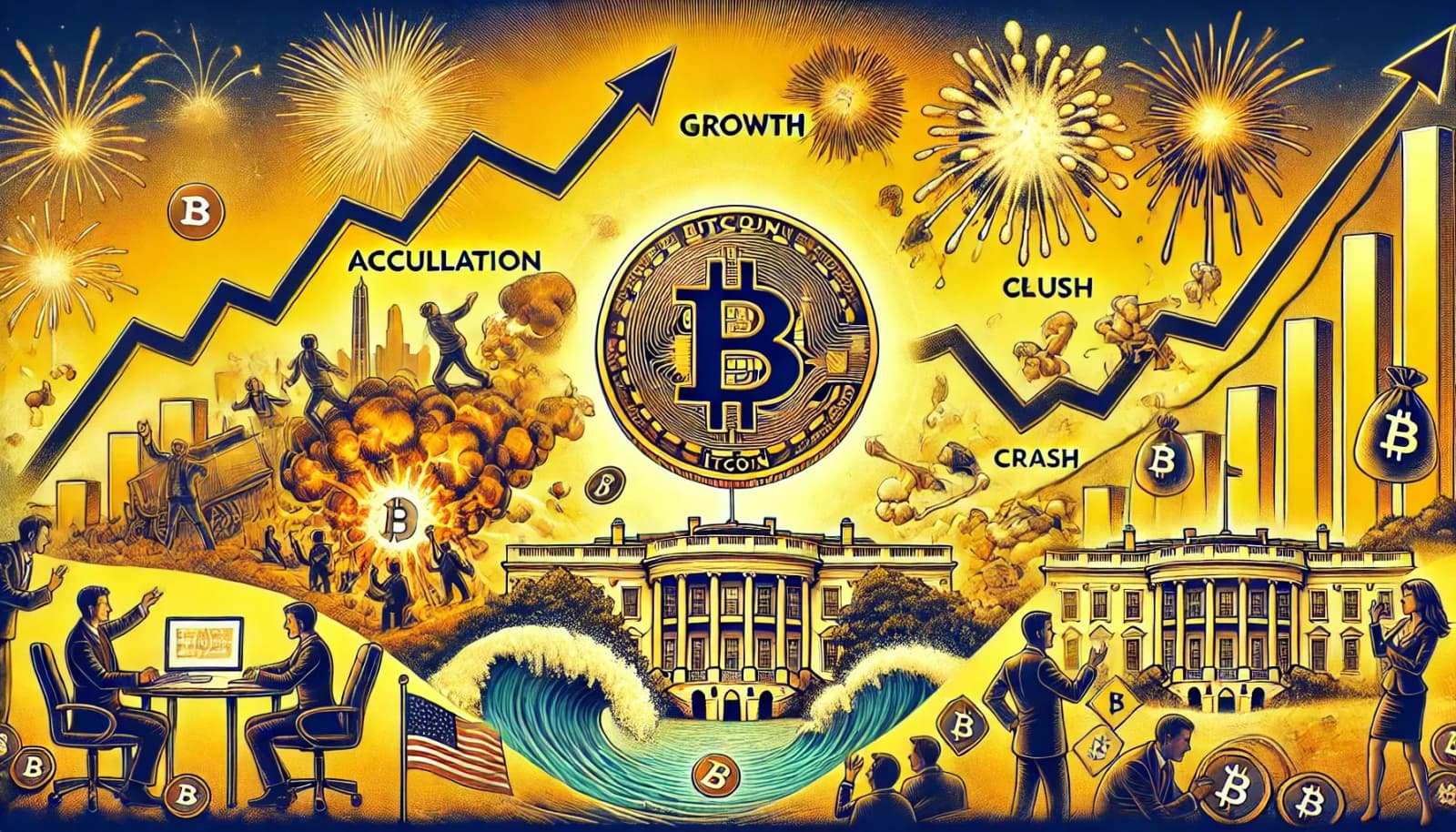

As Bitcoin hits a new all-time high riding the crypto market frenzy of the Trump administration taking over, we take a look at how this digital asset behaves. Bitcoin follows a distinctive price movement filled with its own rhythm, which can be decoded through its different phases. And this is what crypto market analysts call the Bitcoin market cycle.

What is a Bitcoin Market Cycle?

This cycle isn't just a noise of ups and downs but a complex articulation of technological milestones, market sentiments, and economic forces. At the core of this Bitcoin Market Cycle lies the halving event, which is programmed to reduce the mining rewards of every 4-year crypto cycle. The recent halving event that happened on April 19, 2024, reduced the block reward from 6.25 to 3.125 bitcoins. The next one will happen in April 2028.

The market's response to these cyclical events has been nothing short of dramatic. As of January 20th, 2025, Bitcoin reached an unprecedented all-time high of $110,000, coinciding with Donald Trump's inauguration as the 47th US President. This milestone exemplifies how political events and market cycles can create powerful synergies in the crypto space.

The Four Acts of the Bitcoin Market Cycle

The Bitcoin market cycle unfolds like a four-act play, each phase bringing its own distinct characteristics and opportunities.

- During the Accumulation phase, the first act of this financial drama, forward-thinking investors quietly build their positions while prices hover near cyclical lows. This phase is characterized by bearish sentiment and low trading volumes, creating an ideal entry point for those with long-term vision.

- As the curtain rises on the Growth phase, we witness the steady ascent toward previous highs. This period often coincides with halving events, creating a perfect storm of reduced supply and increasing demand. Exchange reserves typically shrink during this phase as buyers eagerly accumulate Bitcoin in anticipation of future price appreciation.

- The Bubble phase represents the climactic third act, where prices surge beyond previous records with exponential momentum. This period is marked by extreme volatility and a delicate balance between profit-taking sellers and optimistic buyers. The market psychology during this phase often reflects extreme greed, setting the stage for the final act.

- The Crash phase serves as the dramatic conclusion, bringing substantial corrections that have historically resulted in approximately 80% drawdowns from peak prices. The most recent example saw Bitcoin plummet from $69,000 in November 2021 to $15,476 in November 2022, demonstrating the magnitude of these corrections.

Dancing with Traditional Markets and Political Winds

Bitcoin's relationship with traditional markets, particularly the S&P 500, has evolved significantly. In 2024, the correlation coefficient averaged 0.51, suggesting that for every 10% movement in Bitcoin, the S&P 500 moved about 5.1%. This relationship, however, isn't static and has shown varying degrees of correlation throughout different market phases.

Looking ahead, the Trump administration's return to power has already demonstrated its impact on the crypto markets, with the launch of TRUMP and MELANIA meme coins creating additional market dynamics. Market analysts project that OFFICIAL TRUMP could reach $98.05 by the end of 2025, potentially commanding a market capitalization of approximately $19 billion. The meme coin frenzy already pushed Bitcoin to a new all time high at $110,000 on January 20, 2025 on Trump’s inauguration day.

The Mainstream Embrace

Bitcoin's journey toward mainstream adoption has accelerated dramatically, with trading volumes on major exchanges like Binance surging from $11 billion in January 2018 to over $1 trillion in March 2024. Institutional adoption has reached new heights, with public companies holding over 1.5% of the total supply. Notable holders include MicroStrategy with 439,000 bitcoins and Tesla maintaining a significant position.

The crypto asset class was further legitimised by the approval of Bitcoin and Ethereum spot ETFs earlier in 2024 which attracted a wide range of investors and traders to the coins. The uptick is so phenomenal that SEC has received approval for other ETF approvals like that of Solana, Litecoin and XRP. While regulatory frameworks continue to evolve globally, pioneering moves like El Salvador's adoption of Bitcoin as legal tender in 2021 demonstrate the potential for broader institutional and governmental acceptance. As these adoption trends continue and regulatory clarity improves, Bitcoin's market cycles may evolve, potentially offering new opportunities and challenges for investors navigating this dynamic digital asset landscape.