Blockchain's promise has always been to make finance and coordination more accessible. Yet anyone who has attempted a simple cross-chain token swap knows the reality: multiple wallet interactions, chain-specific gas tokens, slippage calculations, and the constant threat of failed transactions draining your funds. The gap between blockchain's potential and its usability remains stubbornly wide.

Enter intent-centric design, an emerging paradigm that could fundamentally reshape how users interact with Web3. Rather than forcing users to specify every step of a transaction - which chain, which protocol, which exact sequence of smart contract calls - intent-centric architectures let users simply declare what they want to achieve. The infrastructure handles the rest.

This shift mirrors a broader pattern in computing history. Early computer users programmed in assembly language, specifying exact machine instructions. Modern users simply click, type, or speak their desired outcome. Intent-centric design promises a similar transformation for blockchain: from imperative programming ("do this, then this, then this") to declarative expression ("make this happen").

The transaction-based model that has dominated Web3 since Ethereum's launch requires users to understand technical details that should be abstracted away. If you want to swap tokens across chains, you must bridge assets, ensure you have the right gas token, navigate to the appropriate decentralized exchange, set slippage parameters, and hope no MEV bot front-runs your transaction. Each step presents friction and potential failure.

Projects like Anoma, Flashbots' SUAVE, and CoW Protocol are pioneering a different approach. These intent-centric architectures introduce solver networks that compete to fulfill user objectives optimally. Users express desired outcomes; solvers handle execution complexity. The result could be a Web3 that feels less like programming and more like simply getting things done.

This transformation carries profound implications for everyday users frustrated by complexity, developers drowning in cross-chain integration work, and the crypto ecosystem's ability to scale beyond current limitations. But intent-centric design also introduces new risks around centralization, privacy, and solver accountability. Understanding both the promise and the pitfalls matters now, as this architecture begins moving from theory to production.

What is Intent-Centric Design?

At its core, an intent represents a user's desired end state rather than a prescribed execution path. In technical terms, an intent is a signed message expressing what outcome a user wants to achieve, along with constraints that define acceptable ways to reach that outcome.

The distinction between transaction-based and intent-based interactions illustrates the paradigm shift. In transaction-based systems like Ethereum, users craft specific instructions: "Execute function X on contract Y with parameters Z." The blockchain deterministically processes these instructions. Users bear responsibility for understanding contract interfaces, managing nonces, holding gas tokens, and anticipating state changes.

Intent-based systems flip this model. Users declare: "I want to end up with asset B, starting from asset A, with constraints C." The declaration might specify maximum slippage tolerance, time windows, or privacy preferences, but it does not dictate the execution path. Third-party solvers receive these intents and compete to discover optimal fulfillment strategies, tapping into any combination of on-chain liquidity, cross-chain bridges, off-chain market makers, or peer-to-peer matches.

Consider a concrete example. In the transaction model, a user wanting to swap 100 USDC for ETH on Ethereum must:

- Ensure they have ETH for gas

- Navigate to a specific DEX

- Approve the USDC token contract

- Calculate acceptable slippage

- Submit the swap transaction

- Monitor for potential MEV attacks

- Wait for confirmation

In the intent model, the user simply signs: "I want at least X ETH for 100 USDC within the next 10 minutes." Solvers then compete to deliver the best execution, potentially:

- Matching with another user wanting the opposite trade (peer-to-peer settlement)

- Routing through multiple liquidity sources simultaneously

- Executing across multiple DEXes to minimize price impact

- Using off-chain market maker liquidity

- Handling all gas payments and approval logistics

The Anoma architecture describes this as "generalized intents" – intents that work across any application type, not just trading. A gaming intent might be "acquire this in-game item at the best price." A DeFi intent might be "maintain a leveraged position with specific collateral ratios across any chain where it's most capital-efficient." The system becomes outcome-focused rather than process-focused.

This abstraction provides several immediate benefits. Users no longer need deep technical knowledge to navigate blockchain complexity. They avoid holding multiple gas tokens. They gain protection against common pitfalls like front-running, as their intent is fulfilled optimally by competing solvers rather than executed naively in a public mempool. The cognitive overhead of Web3 interactions decreases dramatically.

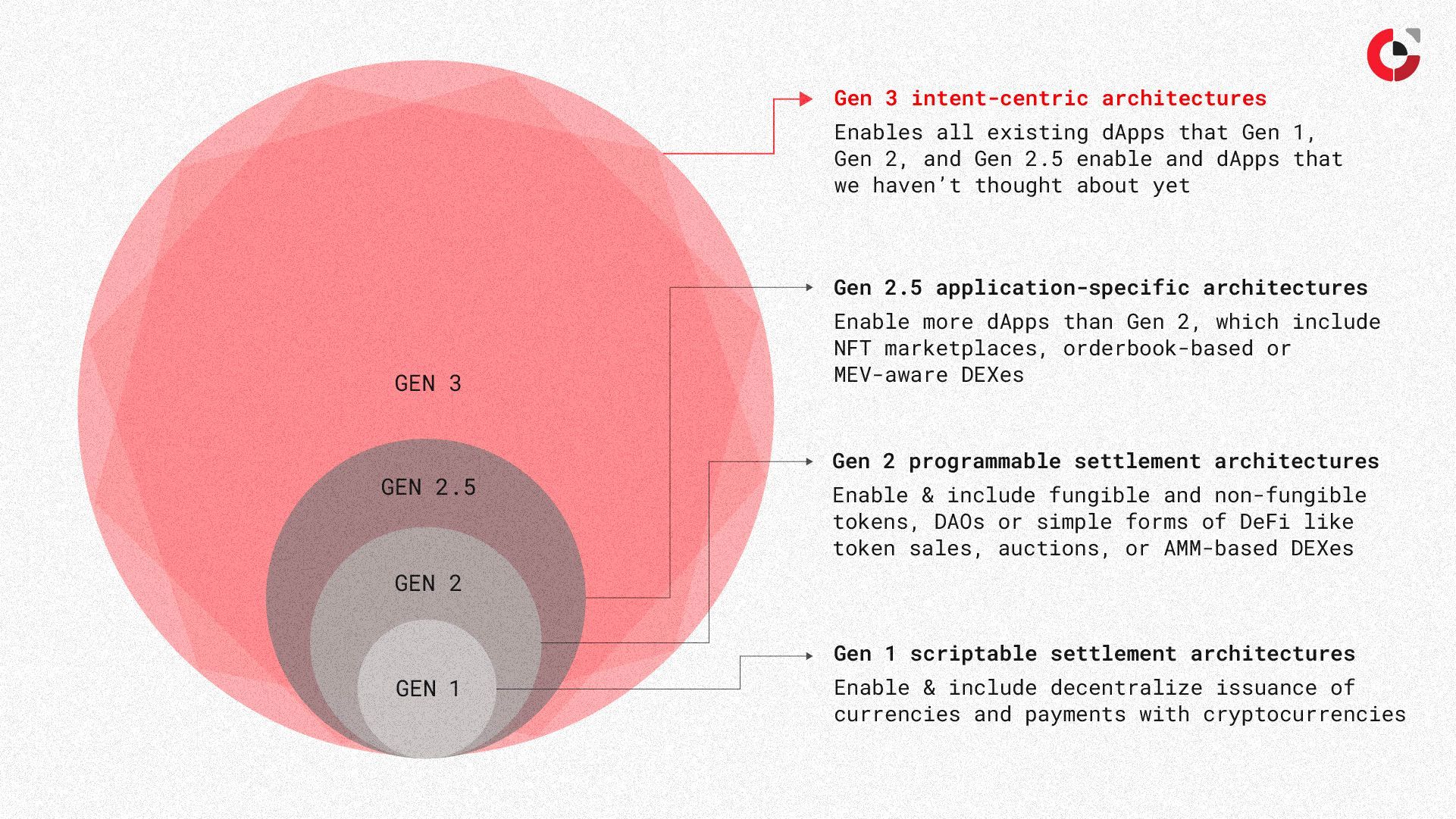

Intent-centric architectures treat applications as coordination systems where the fundamental primitive is not the transaction but the desired state transition. This reconceptualization has downstream implications for how protocols are built, how liquidity is structured, and how value flows through the ecosystem. It represents what some researchers call the "third generation" of blockchain architecture, following Bitcoin's scriptable settlements and Ethereum's programmable settlements.

How Projects Are Building Intent Layers

Several major projects are pioneering infrastructure for intent-centric architectures, each taking distinct approaches to the technical challenges involved.

Anoma: The Intent Operating System

Anoma positions itself as a distributed operating system for intent-centric applications. Rather than building atop existing blockchains as an application layer, Anoma reimagines the entire stack from an intent-first perspective. The project's architecture centers on several key components:

The Intent Machine processes user intents and coordinates their fulfillment. Similar to how Ethereum's Virtual Machine processes transactions into state changes, Anoma's Intent Machine processes intents into state changes. Users express desired outcomes through applications, which broadcast these intents to a decentralized gossip network. This differs fundamentally from traditional mempools, which broadcast executable transactions.

Solvers in Anoma's network are specialized nodes that listen to intent broadcasts and identify compatible matches. If Alice wants to buy an NFT and Bob wants to sell it, solvers match their intents and propose balanced transactions that atomically settle the trade across any connected chains. Crucially, Anoma supports generalized intents – the architecture can handle any type of request, from financial swaps to complex multi-party coordination.

The Anoma Resource Machine (ARM) enforces rules for valid state updates. This component is analogous to the EVM but designed specifically for intent-based computation. The ARM uses a resource-based state model where resources represent any asset along with the logic governing their creation and consumption. This abstraction enables more flexible composability than traditional account or UTXO models.

Anoma's architecture breaks free from blockchain-centric constraints, questioning whether blockchains are even necessary beyond settlement. The design unifies underlying blockchains into a single development environment, ending the fragmentation of state and users that limits today's applications. Developers can deploy once and access users, state, and settlement on any connected chain.

The project raised over $60 million from major investors including Polychain Capital, Coinbase Ventures, and Electric Capital, signaling institutional confidence in the intent-centric vision. Anoma is preparing for mainnet launch with plans to initially deploy on Ethereum before expanding to other ecosystems.

SUAVE: Flashbots' Intent Layer for MEV

Flashbots, the research organization focused on MEV mitigation, is building SUAVE (Single Unifying Auction for Value Expression) to serve as a common mempool and sequencing layer across multiple blockchains. SUAVE takes a different architectural approach from Anoma, focusing specifically on the MEV supply chain and order flow.

SUAVE operates as a specialized blockchain that unbundles the mempool and block builder role from existing chains. Rather than users submitting specific transactions to individual chain mempools, they submit preferences – intents – to SUAVE's universal auction. These preferences can range from simple ("swap A for B") to complex ("rebalance my portfolio across chains while maximizing yield").

The architecture introduces several novel components. SUAVE uses confidential computing through Intel SGX to allow computation on sensitive user order flow without revealing information to potential exploiters. This addresses a fundamental tension: solvers need information to provide optimal execution, but too much information enables MEV extraction.

Block builders who only operate on a single chain find themselves at a disadvantage due to cross-domain MEV. SUAVE allows builders to capture value across multiple chains simultaneously. Validators maximize revenue on their blockspace. Users transact privately with better execution and minimal fees. The design aims to prevent centralization induced by cross-chain MEV extraction.

SUAVE's roadmap includes progressive decentralization milestones. Early versions use trusted execution environments with assumptions about Flashbots, while later versions move toward fully decentralized operation. The project explicitly invites competitors to participate, recognizing that distributing MEV infrastructure serves the ecosystem's long-term health better than any single entity controlling it.

While SUAVE focuses more on searcher intents than general user intents currently, the infrastructure provides a foundation for broader intent-based applications. As the system matures, it may expand to handle more diverse intent types beyond order flow optimization.

CoW Protocol: Practical Intent-Based Trading

CoW Protocol pioneered intent-based trading in 2021, making it one of the earliest production implementations of these concepts. The protocol's name references "Coincidence of Wants" – the economic concept where two parties desire each other's goods and can trade directly without intermediaries.

CoW Protocol works by collecting trades over time into batches. Users sign off-chain orders expressing their trading intent: desired assets, acceptable price ranges, time limits. These intents flow to a network of solvers who compete in auctions to provide the best execution for the entire batch.

Solvers can fulfill intents through multiple methods:

- Direct matching: When two users want opposite trades, solvers match them peer-to-peer without using on-chain liquidity

- Ring trades: Multi-party circular trades that optimize across several simultaneous intents

- DEX aggregation: Routing through existing AMMs, combining liquidity sources

- Private market makers: Tapping off-chain liquidity when profitable

The batch auction mechanism provides natural MEV protection. All trades within a batch execute at uniform clearing prices, eliminating first-come-first-served dynamics that enable front-running. Solvers bear gas costs, meaning users pay nothing if trades fail to meet their specified minimums.

CoW Swap has processed over $30 billion in volume, saved users more than $82 million in surplus through optimal execution, and grown to capture 63% market share among intent-based DEX aggregators. The protocol demonstrates that intent-based architectures can work at scale today, not just in future systems.

Other Notable Projects

Several other projects contribute to the intent-centric ecosystem:

- Essential: Building intent-only protocols from the ground up, where no user-submitted transactions exist – only batched intent solutions

- UniswapX: Uniswap's intent-based routing using Dutch auctions and filler networks, with cross-chain capabilities launching in 2024-2025

- Across Protocol: Proposing standards for cross-chain intent interoperability alongside UniswapX

- 1inch Fusion: Intent-based swap routing from the established DEX aggregator

- DappOS: Infrastructure for intent-centric application interaction, including intent assets and intent execution

These projects share common technical patterns: off-chain intent broadcasting, competitive solver networks, on-chain settlement verification, and cross-chain coordination. The diversity of approaches suggests the space is still exploring which architectural choices prove most effective.

Why Intent-Centric Architectures Matter

Intent-centric design addresses several fundamental problems plaguing Web3 adoption and efficiency. The benefits span user experience, economic optimization, and systemic resilience.

Dramatic Improvement in User Experience

The most immediately visible benefit is radical simplification of the user journey. Current Web3 systems are complex and present barriers to entry, requiring users to navigate fragmented infrastructure. A user wanting to participate in DeFi across multiple chains faces daunting complexity: managing multiple wallets, holding various gas tokens, understanding protocol-specific interfaces, monitoring for optimal timing, and constantly worrying about MEV exploitation.

Intent-centric systems collapse this complexity. Users specify desired outcomes in natural terms. The system can even use AI interfaces to translate plain English into formal intents: "I want to rebalance my portfolio to 60% ETH, 30% stablecoins, 10% LINK" becomes a structured intent that solvers automatically fulfill.

This abstraction particularly benefits less sophisticated users. Today's average DeFi user struggles to access the types of execution and pricing only available to well-capitalized firms with in-house technical teams. Intent-based architectures democratize access to institutional-grade execution.

Failed transactions cost users nothing in gas with intent systems – solvers bear those costs. Users need not hold chain-specific gas tokens; solvers collect fees in the tokens being traded. The friction of managing technical minutiae decreases, while confidence in optimal execution increases.

MEV Reduction and Value Recapture

Miner/Maximal Extractable Value represents billions in value extracted annually from blockchain users. Traditional transaction models expose users to front-running, sandwich attacks, and other forms of predatory extraction. Public mempools broadcast users' intentions before execution, giving sophisticated actors time to exploit them.

Intent-centric architectures change these dynamics fundamentally. Since users sign intents rather than executable transactions, there's essentially no way to front-run an intent. Solvers compete to provide the best outcome for the signed state change, but the execution path remains flexible. This removes the predictability MEV bots exploit.

Batch auction mechanisms like those used by CoW Protocol aggregate orders over time windows, further reducing MEV opportunities. When multiple trades execute simultaneously at uniform prices, the traditional MEV extraction vectors disappear. What value does exist gets competed away by solver networks rather than captured by malicious actors.

Importantly, intent systems don't eliminate MEV entirely – they transform it from extractive to productive. Solvers in competitive networks bid value back to users rather than extracting it. The criterion for winning becomes maximizing user satisfaction rather than exploiting information asymmetries.

Cross-Chain Interoperability and Composability

Perhaps the most profound impact comes from how intent-centric design handles the multi-chain reality of Web3. Today's ecosystem is fragmented across Layer 1s, Layer 2s, and sidechains, each with isolated liquidity and user bases. Moving value between chains requires bridges, wrapped assets, and complex trust assumptions.

Intent-centric architectures enable composability at the intent level rather than the transaction level, unifying state across connected chains. Users express intents without specifying which chain executes them. Solvers determine optimal execution venues, potentially splitting large orders across multiple chains or routing through whichever venue offers best liquidity at that moment.

This abstraction benefits developers as much as users. Rather than deploying separate smart contracts per chain and managing cross-chain messaging complexity, developers can write intent-centric applications once. The underlying infrastructure handles chain-specific details. Applications become truly portable, following liquidity and users rather than being locked to specific chains.

The intent layer can aggregate liquidity across all connected domains, solving the chicken-and-egg problem where new chains struggle to bootstrap usage without liquidity. If users and solvers participate in a unified intent network, liquidity fragmentation becomes less critical. Orders flow to wherever they can be optimally filled.

Capital Efficiency and Innovation

Intent-based models enable new forms of capital efficiency. When solvers can use their own inventory to facilitate trades, capital no longer needs to sit idle in liquidity pools. Professional market makers can provide liquidity dynamically, only deploying capital when profitable opportunities arise.

The system unlocks use cases that couldn't exist in traditional transaction models. Complex multi-party coordination becomes feasible when expressing outcomes rather than choreographing exact execution sequences. Applications that were impractical due to high gas costs or coordination complexity become viable when intent networks handle the execution details efficiently.

What the Transition Looks Like: From Smart Contracts to Intent Layers

Understanding where intent-centric design fits in blockchain's evolution provides perspective on its significance and likely trajectory.

The Evolution of Web Architectures

Web1 was read-only: static pages served from centralized servers. Users consumed content but rarely participated in creating it. The architecture reflected this passivity – simple HTML pages with minimal interactivity.

Web2 introduced user-generated content and dynamic applications but maintained centralized control. Platforms like Facebook and Google enabled participation while capturing data and value centrally. Users traded control for convenience, creating the surveillance capitalism model that Web3 aims to disrupt.

Web3's first generation, exemplified by Bitcoin, introduced scriptable settlements. Users could program money with basic conditional logic, but the scripting language remained deliberately limited. Bitcoin proved blockchains could work but offered restricted expressiveness.

Ethereum pioneered second-generation architecture with fully programmable settlements. The EVM enabled arbitrary computation, spawning an explosion of applications: tokens, DAOs, DeFi protocols, NFT marketplaces. But this programmability came with complexity. Users became de facto programmers, composing transactions from smart contract calls.

The limitation of Gen 2 architectures became apparent as applications grew sophisticated. Complex applications like NFT marketplaces and orderbook DEXes require centralized components for counterparty discovery and optimization – functions the blockchain itself doesn't provide efficiently. These Gen 2.5 architectures work but compromise on decentralization.

Third-generation intent-centric architectures aim to provide end-to-end decentralization for arbitrary application types. By making intents the fundamental primitive, these systems offer generalized intent completion, counterparty discovery, solving, and settlement – everything applications need without forcing them into blockchain-centric designs.

What Changes for Developers

The shift to intent-centric architectures transforms the developer experience fundamentally. Today's blockchain developers must:

- Master multiple programming languages (Solidity, Rust, Move)

- Understand each chain's specific quirks and gas models

- Build custom bridges and cross-chain messaging

- Implement their own MEV protection

- Handle edge cases around chain reorganizations

- Optimize for expensive on-chain computation

Intent-centric development abstracts many of these concerns. Developers define intent languages – the vocabulary of desires their applications understand. The underlying infrastructure handles execution details. Rather than writing separate implementations per chain, applications become portable by default.

This mirrors earlier transitions in software development. Developers once managed memory allocation manually; now garbage collectors handle it. Developers once wrote platform-specific code; now frameworks provide cross-platform abstractions. Intent-centric design brings similar abstraction to blockchain development.

The transition won't happen overnight. Existing smart contracts represent significant investment and network effects. Migration paths must exist for current applications to incorporate intent-based interactions gradually. Hybrid architectures will likely dominate the transition period, with intent layers wrapping traditional transaction systems.

What Changes for Infrastructure

The infrastructure layer shifts from chains competing for applications to solver networks competing for order flow. Chains become settlement layers rather than execution environments. The valuable real estate moves up the stack to intent orchestration and solver networks.

This redistribution of value and power has significant implications. MEV searchers can transition to becoming solvers, using similar skills but in a value-positive rather than value-extractive context. Liquidity providers might operate differently, providing just-in-time liquidity rather than parking capital in pools. Validators' role becomes verifying intent fulfillment rather than ordering transactions.

New infrastructure needs emerge: intent gossip networks, solver reputation systems, constraint satisfaction engines, cross-chain settlement protocols. The ecosystem requires standards for expressing intents, allowing different systems to interoperate. Without standards, the space risks fragmenting into incompatible intent silos.

What Goes Wrong? Risks and Trade-Offs

Like any architectural shift, intent-centric design introduces new attack vectors, centralization risks, and unintended consequences alongside its benefits.

Solver Centralization

Perhaps the most significant risk involves solver network centralization. Running competitive solver infrastructure requires sophisticated technical capabilities and significant capital. Solvers must maintain inventory across multiple chains, run complex optimization algorithms, manage gas costs, and respond with minimal latency.

These requirements create barriers to entry. If only a handful of entities can effectively solve intents, the system reintroduces centralization under a new name. A few dominant solvers could collude to offer suboptimal execution, extracting value similarly to how MEV bots exploit traditional systems. Users gain simplified interfaces but lose the decentralization that made blockchain compelling.

Some protocols use permissioned solver networks initially, requiring whitelisting to participate. This ensures execution quality but contradicts Web3's permissionless ethos. The challenge lies in designing mechanisms that maintain quality while allowing open participation.

Reputation systems, stake requirements, and slashing mechanisms might mitigate these risks. Solvers could post significant bonds that get slashed if misconduct is detected. Users could monitor solver performance publicly and route intents to trustworthy operators. But these mechanisms add complexity and may not fully solve the centralization problem.

Privacy Concerns

Expressing intents publicly creates information leakage risks. Broadcasting that you want to trade large amounts reveals your strategy, potentially allowing solvers or observers to front-run at the intent level rather than transaction level. While intents provide some protection through competitive solving, they don't eliminate all information asymmetry.

SUAVE addresses this using trusted execution environments, but these introduce security assumptions around Intel SGX and similar hardware. Cryptographic approaches like zero-knowledge proofs offer stronger privacy guarantees but come with significant computational overhead.

The design space involves difficult tradeoffs. Solvers need information to provide optimal execution, but too much information enables exploitation. Finding the right balance remains an open research problem, with no clear winning solution yet.

Implementation Complexity and Latency

Building intent-centric systems involves substantial technical complexity. Efficient intent matching across potentially millions of users requires sophisticated algorithms. Cross-chain settlement introduces coordination challenges and latency. Ensuring atomic execution when multiple chains are involved demands careful protocol design.

These complexities can introduce failure modes. What happens when optimal solving takes longer than users tolerate? How do systems handle partial fulfillment? What recourse do users have when intents expire unfulfilled? Traditional transaction systems provide predictable outcomes; intent systems add uncertainty about if and how execution occurs.

Standardization challenges compound these technical hurdles. Without common intent expression formats, different systems can't interoperate. But premature standardization might lock in suboptimal designs. The ecosystem must balance moving fast with building robust foundations.

Smart Contract Legacy and Migration

The existing Web3 ecosystem contains billions in locked value across smart contracts built on transaction-based models. These contracts cannot simply be rewritten overnight. Migration paths must exist for gradual adoption of intent-centric designs.

Hybrid architectures where intent layers wrap existing contracts provide one solution, but add complexity. Developers must learn new paradigms while maintaining legacy systems. Users face confusion about which applications support which interaction models. The transition period creates fragmentation rather than unity.

Developer education poses another challenge. The mental model shift from imperative transaction programming to declarative intent expression is significant. Current blockchain developers have deep expertise in specific languages and patterns; retraining takes time. Universities and bootcamps have just begun teaching Solidity; intent-based development adds another learning curve.

Accountability and Recourse

Transaction-based systems provide clear accountability. If your transaction fails or behaves unexpectedly, you can examine the exact sequence of operations. Intent-based systems abstract execution away, making it harder to understand what went wrong when outcomes don't match expectations.

Who is responsible when a solver provides suboptimal execution? What recourse do users have? How can they prove a solver acted maliciously rather than making an honest error? These questions lack clear answers in many current designs. Building accountability frameworks for intent-centric systems remains crucial for user protection.

Pre-Token Launch Checklist for Intent-Based Projects

Teams preparing to launch tokens in intent-centric systems face unique considerations beyond typical token launch preparations. These projects must align tokenomics with the underlying solver network dynamics and intent matching mechanisms.

Define Clear Intent Language and Protocols

Successful intent-based projects require unambiguous intent expression standards. Teams should:

Document intent schemas comprehensively: Specify exactly what types of intents the system supports, how users express constraints, what parameters are required versus optional. Intent languages must be expressive enough to capture user desires while remaining parseable by solver networks.

Provide developer SDKs and tooling: Building applications on intent-centric systems requires different tools than transaction-based development. Clear documentation, code examples, and testing frameworks lower adoption barriers.

Consider future extensibility: Intent languages should support evolution. New intent types will emerge; the standard should accommodate them without breaking existing implementations. Versioning schemes and deprecation policies matter.

Build or Partner for Solver Infrastructure

Solver networks represent the execution backbone of intent systems. Token projects must ensure robust solving capacity:

Bootstrap initial solver participation: Launch requires sufficient solvers to provide competitive execution. Teams might need to run initial solvers themselves, provide subsidies for early participants, or partner with existing solver operators from other protocols.

Design solver incentive mechanisms carefully: Solvers need compensation that covers costs while incentivizing optimal user outcomes. Token economics should reward good solver behavior – providing surplus to users – while punishing or excluding bad actors.

Avoid solver monopolies through design: Multiple strategies can promote solver decentralization. Lower barriers to entry by minimizing capital requirements. Implement reputation systems that allow new solvers to build credibility gradually. Consider delegated solving models where solvers specialize rather than requiring each to handle everything.

Plan for cross-chain solver coordination: If the protocol involves cross-chain intents, solvers need mechanisms to cooperate across domains. Define how settlement occurs, who bears bridging costs, and how disputes are resolved.

Audit Intent-Solver Matching Logic

The core of any intent-based system is how intents match with solver capacity. Before token launch:

Conduct thorough security audits: Intent matching logic must be bulletproof. Bugs could enable solvers to extract value unfairly or leave intents unfulfilled. Engage multiple audit firms with experience in mechanism design, not just smart contract security.

Stress test matching algorithms: Simulate high-load scenarios. What happens when thousands of intents arrive simultaneously? How does the system degrade gracefully under load? Where are bottlenecks?

Verify incentive compatibility: Game theory matters enormously. Ensure solvers cannot profit from deviating from honest behavior. Check that Nash equilibria align with desired outcomes. Consider attack vectors where colluding solvers might exploit users.

Prioritize User Experience Testing

The purpose of intent-centric design is improving user experience. Validate this before launch:

Test with non-technical users: Put the interface in front of people unfamiliar with blockchain complexity. Can they understand what intents mean? Do they trust the system to execute as desired? Where do they get confused?

Measure against traditional alternatives: Compare the intent-based experience to transaction-based equivalents. Is it actually simpler? Are outcomes consistently better? Document specific improvements quantitatively.

Design clear feedback mechanisms: Users need to understand what's happening with their intents. Provide status updates: intent received, solvers competing, execution proposed, settlement confirmed. Unclear feedback breeds mistrust.

Prepare for edge cases: What do users see when intents can't be fulfilled? How do they modify or cancel intents? What happens during network congestion? Polish these experiences thoroughly.

Establish Governance and Decentralization Paths

Token-based governance should align with intent-centric principles:

Define upgrade mechanisms: Intent protocols will evolve. Establish clear processes for proposing, testing, and deploying changes. Balance move-fast iteration with stability that solver networks require.

Plan solver governance participation: Should solvers have special governance rights? How does the protocol prevent capture by a solver cartel? Consider whether solver participation requires token holdings and what that means for centralization risks.

Progressive decentralization roadmap: Most projects launch with some centralized components for pragmatic reasons. Document the path toward full decentralization explicitly. What milestones mark the transition? What triggers shifts in control?

Transparency in tokenomics: Users and solvers need confidence in token economics. Publish clear documentation about emissions, vesting, treasury usage, and value accrual mechanisms. Avoid surprises that erode trust.

Ensure Cross-Protocol Compatibility

Intent-centric ecosystems benefit from network effects. Isolating your protocol limits value:

Support emerging intent standards: Participate in cross-chain intent standard development. Implement proposed ERCs related to intent expression. Make integration with other protocols straightforward.

Build modular architecture: Avoid vendor lock-in by keeping components separable. Other projects should be able to integrate your solver network or intent matching without adopting your entire stack.

Partner with complementary protocols: Intent ecosystems involve specialized providers – some focus on cross-chain settlement, others on specific asset types, still others on privacy. Strategic partnerships create more value than isolated development.

Maintain chain neutrality: Avoid favoring specific Layer 1s or Layer 2s unless your use case demands it. Intent-centric design's power comes from abstracting chain differences; artificial limitations reduce appeal.

What the Future Could Look Like

Intent-centric architectures could reshape Web3 dramatically if they achieve widespread adoption. Extrapolating current trends suggests several possible futures.

Beyond Trading: Intent-Centric Everything

While early implementations focus on DeFi trading, the paradigm extends far beyond. Gaming applications could use intents for in-game asset management, allowing players to specify desired gear or progression paths without understanding blockchain mechanics. Supply chain coordination could express logistics intents: "deliver these materials to this location by this date with proof of authenticity."

Social coordination mechanisms might run on intents. DAOs could express collective desires – fund these public goods, achieve these outcomes – and solver networks could identify optimal resource allocations. Quadratic funding, retroactive public goods funding, and other mechanism designs become more practical when intent layers handle execution complexity.

Cross-chain yield optimization could become fully automated. Users express risk tolerance and return expectations; solvers dynamically rebalance across protocols and chains to maximize outcomes. The mental overhead of actively managing DeFi positions disappears.

Transformation of Exchange Design

Current DEX designs might be interim steps rather than end states. If intent matching becomes sufficiently efficient, separate exchange interfaces might become unnecessary. Wallets themselves could become intent interfaces, with solvers providing liquidity just-in-time rather than through always-on liquidity pools.

This transformation could dramatically improve capital efficiency. Rather than billions locked in AMM pools earning low returns, professional market makers deploy capital dynamically. Users get better prices; liquidity providers earn higher yields. The intermediaries providing value – sophisticated solvers – capture appropriate compensation rather than passive capital getting most rewards.

Aggregators might evolve into meta-solvers, coordinating between specialized solver networks. Rather than aggregating DEX liquidity sources directly, they aggregate solver capabilities, routing intents to whichever network can execute best for specific intent types.

Power Shifts: Chains to Solvers

The locus of value and control could shift from Layer 1 blockchains to intent orchestration layers. If users interact primarily through intent interfaces, the underlying settlement chain matters less. Solvers choose execution venues; users care only about outcomes.

This shift might reduce chain tribalism and competition. If Ethereum, Solana, and other chains primarily serve as settlement layers for intent networks, their differentiation becomes technical (speed, cost, security) rather than cultural. Applications become truly chain-agnostic.

However, this also concentrates power in solver networks. If a few solver operators dominate, they control which chains get used, which applications succeed, and how value flows. The decentralization that blockchains promised could be undermined by centralized solving infrastructure. Preventing this outcome requires vigilant attention to solver network design.

Evolution of Smart Contract Development

Smart contract developers might shift focus from writing execution logic to defining intent languages and validity conditions. Rather than programming "if X happens, do Y," they program "these outcomes are valid, anything else is invalid."

This transformation mirrors other shifts in programming paradigms. Declarative programming already dominates many fields – SQL for databases, CSS for styling, React for UIs. Intent-centric blockchain development extends declarative approaches to on-chain coordination.

The skills valued in developers might change. Deep knowledge of specific VM opcodes becomes less critical; understanding mechanism design, game theory, and constraint satisfaction becomes more important. The transition will favor developers who think about outcomes and incentives over those focused on implementation details.

Regulatory Implications

Intent-based systems could complicate regulatory oversight. When users express outcomes and solvers handle execution, who is responsible for compliance? If a solver facilitates an unintended regulatory violation while fulfilling a technically-valid intent, where does liability lie?

Conversely, intent architectures might enable better compliance. Intents could include regulatory constraints that solvers must satisfy. Geo-fencing, KYC requirements, transaction limits – all can be expressed as intent constraints. Solvers violating these lose reputation and bonds, creating market-driven compliance.

The outcome depends on how projects architect accountability. Systems that make compliance verification straightforward while preserving user privacy could satisfy both regulatory needs and Web3 values. Those that allow regulatory arbitrage through obscure solver networks will likely face crackdowns.

Final thoughts

Intent-centric design represents a fundamental reimagining of how humans interact with blockchain systems. Where smart contracts enabled programmable settlement, intent-centric architectures promise programmable intention – users declaring what they want rather than how to achieve it.

The benefits are compelling: dramatically simplified user experience, protection from MEV exploitation, seamless cross-chain coordination, and capital efficiency gains. Early implementations like CoW Protocol demonstrate these advantages can be realized today, not just in speculative futures. Projects like Anoma and SUAVE are building infrastructure that could make intent-centric interaction the default across all of Web3.

Yet the risks demand careful attention. Solver centralization could recreate the power concentration that blockchains aimed to eliminate. Privacy challenges remain unsolved. Implementation complexity might limit adoption. The transition from transaction-based systems will be gradual and messy.

For users, understanding this shift matters because it will shape how you interact with blockchain applications over the coming years. Intent-based interfaces will likely become the norm, abstracting complexity but also obscuring execution details. Know what you're trusting when you sign intents rather than transactions.

For developers, intent-centric design offers an opportunity to build applications that were previously impractical. But it requires learning new paradigms and accepting that your code won't directly execute – solver networks will. Consider whether this model fits your application's needs.

For token teams in this space, the checklist provided earlier highlights considerations beyond typical token launches. Intent-based protocols succeed or fail based on solver network health, mechanism design correctness, and user experience quality. Get these fundamentals right before focusing on token price.

The shift to intent-centric architectures won't happen overnight and likely won't be absolute. Hybrid systems will dominate for years. But the direction seems clear: Web3 needs to abstract away complexity if it hopes to reach mainstream adoption. Intent-centric design provides a path forward, trading some transparency for vast improvements in usability.

Whether this transformation ultimately delivers on its promise depends on how well the ecosystem navigates the tradeoffs. Can solver networks remain decentralized? Can privacy be preserved while enabling optimal execution? Can standards emerge that allow interoperability without stifling innovation?

The answers to these questions will determine whether intent-centric design becomes the dominant architecture for Web3 or remains a niche approach for specific use cases. What's certain is that the conversation has moved beyond "whether" to "how" – the paradigm is being built now, with billions in capital and significant developer mindshare behind it.

For anyone participating in Web3 – as a user, developer, investor, or researcher – understanding intent-centric architectures has moved from optional to essential. This is not a distant future possibility but an actively unfolding transformation of blockchain's fundamental architecture. The smart contracts that defined Web3's first chapter are giving way to intent layers that may define its next.

Pay attention, experiment cautiously, and recognize that what seems like incremental UX improvement might actually be the beginning of blockchain's most significant architectural evolution since Ethereum introduced programmable settlement. The future of Web3 is being written now in intent languages, solver networks, and the design choices that will determine whether blockchain finally becomes accessible to everyone or remains the domain of technical specialists.

The opportunity is enormous. So are the stakes.