Every major bank claims to be deploying artificial intelligence. They announce chatbots for customer service, fraud detection systems, and algorithmic trading desks. But most of these implementations represent incremental automation layered atop decades-old infrastructure, not fundamental transformation.

The real question confronting the financial industry in 2025 is not whether banks will use AI, but whether AI will fundamentally rewire banking itself - turning financial institutions into genuinely intelligent systems where every process, decision, and customer interaction flows through artificial intelligence.

JPMorgan Chase, the world's largest bank by market capitalization, is pursuing what it calls a "fully AI-connected enterprise," providing every employee with AI agents, automating every behind-the-scenes process, and curating every client experience with AI. This vision extends far beyond the superficial automation that characterizes most banking technology initiatives. It represents an attempt to fundamentally reimagine what a bank is and how it operates. Understanding this transformation requires distinguishing between marketing hype and systemic change, examining both the technological capabilities emerging today and the profound organizational, economic, and regulatory implications they carry.

The stakes are enormous. Consultancy McKinsey estimates that generative AI could create between $200 billion and $340 billion in additional annual value across the banking sector if institutions maximize its application across regulatory compliance, customer service, software development, and risk management. But realizing this potential requires more than deploying new tools. It demands rebuilding banking from its foundation, confronting entrenched legacy systems, navigating uncertain regulatory frameworks, and managing workforce disruption that could reshape employment across the industry.

This article explores what it truly means to build an AI-powered bank. It examines JPMorgan's pioneering deployment as a case study, analyzes how AI transforms core banking functions, explains the emergence of agentic AI systems capable of autonomous multistep decision-making, investigates workforce implications, assesses competitive dynamics, confronts implementation challenges, examines regulatory and ethical concerns, compares traditional banking AI to decentralized finance alternatives, and ultimately defines what a genuine AI bank might look like when this transformation reaches maturity. The picture that emerges is one of radical change - a fundamental redefinition of financial institutions that could blur the line between human organizations and intelligent systems.

Defining the AI Bank: Moving Beyond Surface Automation

The phrase "AI bank" risks becoming meaningless through overuse. Every financial institution deploys some form of machine learning for credit scoring, fraud detection, or customer segmentation. These applications represent important technological progress, but they do not constitute fundamental transformation. To understand what genuinely differentiates an AI-powered bank from a traditional institution with AI tools, we must examine several defining characteristics.

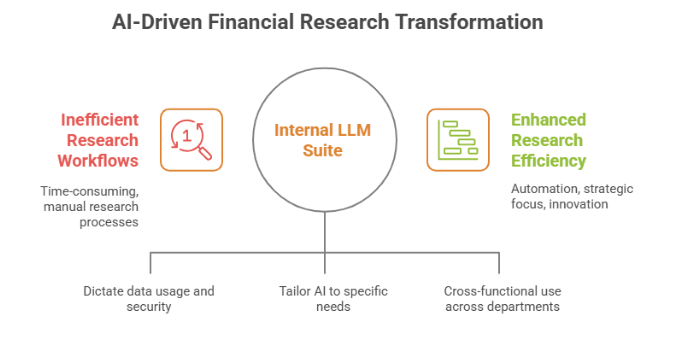

First, an AI bank integrates artificial intelligence throughout its entire operational stack, not just at specific touchpoints. Traditional banks deploy AI in isolated pockets: a fraud detection system here, a chatbot there, perhaps some algorithmic trading in specific markets. These implementations rarely communicate with each other or share learning across the institution. A true AI bank, by contrast, builds a unified intelligence layer that connects every system, database, and process. JPMorgan's LLM Suite exemplifies this approach, creating a portal that harnesses large language models from OpenAI and Anthropic, updated every eight weeks as the bank feeds it more data from its vast databases and software applications across major businesses.

Second, AI banks employ agentic systems capable of executing complex, multistep tasks with minimal human oversight. This represents a qualitative leap beyond previous automation. Earlier generations of banking technology automated specific, narrowly defined processes - posting transactions, generating standard reports, flagging suspicious activity based on predetermined rules. Agentic AI, however, can reason across ambiguous situations, make context-dependent decisions, and orchestrate workflows that previously required human judgment. JPMorgan has begun deploying agentic AI to handle complex multistep tasks for employees, with these agents becoming increasingly powerful and connected throughout the institution, allowing them to take on more responsibilities.

Third, true AI banks fundamentally reorganize work around AI capabilities rather than simply augmenting existing roles. This means reconceiving job functions, reporting structures, and operational processes to take full advantage of what AI enables rather than forcing new technology into old organizational molds. The distinction matters enormously. A bank that gives traders access to AI-powered analysis tools is augmenting traditional roles. A bank that deploys AI trading agents that operate with human oversight is transforming the nature of trading work itself.

Fourth, AI banks implement continuous learning systems that improve over time through interaction with real operational data. Unlike static software that performs the same way indefinitely, AI systems evolve. They learn from every customer interaction, every transaction pattern, every market movement, and every operational outcome. This creates compounding advantages as the system accumulates experience and refines its understanding of complex patterns.

Finally, AI banks embrace end-to-end automation of processes that traditionally required human intervention at multiple decision points. This does not necessarily eliminate humans from the loop, but it fundamentally changes their role from executing tasks to supervising and directing AI systems. The human becomes a conductor orchestrating machine intelligence rather than a worker performing tasks.

These characteristics distinguish genuine transformation from incremental improvement. Most banks today sit somewhere on the spectrum between traditional institutions with AI tools and true AI banks. JPMorgan's current initiative represents one of the most ambitious attempts to push toward the latter end of that spectrum.

JPMorgan Chase: Blueprint for an AI-First Institution

JPMorgan Chase's AI transformation provides the most comprehensive case study available of how a major financial institution attempts to rebuild itself around artificial intelligence. The initiative centers on LLM Suite, a proprietary platform that gives employees access to cutting-edge language models while maintaining the security and compliance requirements essential for banking operations.

The bank rolled out LLM Suite to 140,000 employees, making it one of the largest enterprise deployments of generative AI in any industry. The platform initially launched in summer 2024, and reached 200,000 onboarded users within eight months, driven partly by employee demand for AI capabilities. This organic adoption suggests the technology addresses genuine workflow needs rather than representing a top-down mandate employees resist.

The technical architecture reflects JPMorgan's approach to balancing innovation with institutional requirements. Rather than building its own foundation models from scratch - a resource-intensive endeavor even for a bank with JPMorgan's $18 billion annual technology budget - the firm created a portal architecture that provides access to multiple external language models. The platform launched with OpenAI's language model and is designed to tap multiple models depending on use cases, avoiding dependence on any single provider while enabling the bank to leverage rapid advances in AI capabilities as new models emerge.

Data security and intellectual property protection shaped this design. JPMorgan restricted employee use of ChatGPT because the bank didn't want to expose its data to external providers, implementing LLM Suite in a way that leverages models while keeping data protected and not used to train the models. This addresses a critical challenge for financial institutions: AI systems require vast amounts of data to function effectively, but banks hold intensely sensitive information about clients, transactions, and proprietary strategies. The portal approach allows JPMorgan to harness AI capabilities while maintaining control over its proprietary information.

The platform's capabilities span across the institution's major divisions. In investment banking, AI dramatically accelerates the production of materials that traditionally consumed enormous analyst hours. Derek Waldron, JPMorgan's chief analytics officer, demonstrated LLM Suite creating a five-page investment banking presentation for a technology company CEO meeting in about 30 seconds, work that would previously have required teams of analysts working long hours at night. The bank is also training AI to draft confidential memoranda for mergers and acquisitions clients, documents that traditionally run to hundreds of pages and synthesize complex financial, legal, and strategic analysis.

In consumer banking, the applications focus on operational efficiency and customer service enhancement. The bank launched EVEE Intelligent Q&A, a generative AI tool that allows customer service specialists to ask questions and receive concise answers about Chase's policies and documentation, improving efficiency, call resolution times, and employee and customer satisfaction. This addresses a persistent challenge in consumer banking: customer service representatives must navigate vast repositories of product information, regulatory requirements, and procedural guidelines. AI that can instantly surface relevant information transforms their effectiveness.

For technology teams, JPMorgan deployed a coding assistant that has been playing a significant role in improving software development efficiency, with the bank seeing 10 to 20 percent productivity increases. Given that Goldman Sachs equipped 12,000 of its developers with generative AI and cites significant productivity gains, this application represents a broad industry trend. Software development represents a particularly strong use case for AI because coding involves translating requirements into logical sequences of instructions - precisely the kind of pattern-matching and generation task where language models excel.

The most ambitious aspect of JPMorgan's initiative involves the transition from generative AI that creates content to agentic AI that executes processes. According to an internal roadmap, JPMorgan is now early in the next phase of its AI blueprint, having begun deploying agentic AI to handle complex multistep tasks for employees, with these agents becoming increasingly powerful in their capabilities and connectivity throughout the institution. This transition represents a fundamental escalation in AI's role, moving from assisting humans to autonomously executing tasks.

The vision extends to complete organizational integration. JPMorgan's broad vision is for a future where the bank is a fully AI-connected enterprise, with every employee provided with AI agents, every behind-the-scenes process automated, and every client experience curated with AI concierges. Realizing this vision, however, faces substantial obstacles. Even with an $18 billion annual technology budget, it will take years for JPMorgan to realize AI's potential by stitching the cognitive power of AI models together with the bank's proprietary data and software programs, with thousands of different applications requiring significant work to connect into an AI ecosystem.

The financial impact of JPMorgan's AI investments has begun materializing. The bank's first-quarter earnings in 2025 reflected the strategic importance of these innovations, reporting net income of $14.6 billion, up 9 percent year-over-year, with investments in AI and technology cited as major contributors to this performance. This validates the business case for AI transformation, demonstrating that the technology delivers measurable value rather than merely consuming resources in pursuit of speculative benefits.

JPMorgan's approach offers important lessons about AI transformation at scale. First, the bank prioritized internal, employee-facing applications before launching client-facing AI products. This strategy allows institutions to capture immediate efficiency gains while battle-testing technology in controlled, lower-risk environments. Second, the portal architecture that leverages multiple external models while protecting proprietary data provides a template for other regulated institutions navigating similar security and compliance requirements. Third, the emphasis on comprehensive integration rather than isolated pilot projects reflects recognition that AI's greatest value emerges from system-wide deployment rather than point solutions.

Transformation Across Banking Domains

Understanding how AI reshapes banking requires examining specific domains where the technology's impact manifests most dramatically. Each area of banking operations presents distinct challenges and opportunities for AI transformation.

Investment Banking: From Analyst Armies to AI Augmentation

Investment banking traditionally operated through a hierarchical model where junior analysts performed grunt work - building financial models, creating presentations, conducting research - while senior bankers focused on client relationships and deal structuring. AI fundamentally disrupts this model by automating much of the analytical drudgery while augmenting strategic decision-making.

JPMorgan's demonstration of creating investment banking presentations in 30 seconds illustrates this transformation. The implications extend beyond simple time savings. Investment banks have long faced criticism for brutal junior analyst working conditions, with 80 to 100 hour weeks common for entry-level employees. If AI can handle tasks that previously consumed thousands of analyst hours, banks face decisions about workforce sizing and the traditional apprenticeship model where junior analysts learn by doing extensive analytical work.

AI's capabilities in this domain continue expanding. The systems can now analyze earnings reports, synthesize market research, build comparable company analyses, and generate initial drafts of pitch materials. They can scan news feeds for relevant information about clients and prospects, monitor regulatory filings for material changes, and flag potential deal opportunities based on pattern recognition across vast datasets.

The strategic implications reach beyond efficiency. Investment banks compete largely on the depth of their industry knowledge, the sophistication of their analysis, and the speed with which they can respond to client needs. AI that rapidly synthesizes information across multiple sources and generates sophisticated analysis could compress the timeline for deal processes, raise analytical quality, and enable smaller teams to compete with larger institutions that traditionally wielded advantages through analyst armies.

However, investment banking also illustrates AI's current limitations. Deal-making fundamentally involves judgment calls about valuation, timing, competitive dynamics, and client relationships. While AI can inform these decisions by analyzing relevant data and generating options, the ultimate choices require human judgment shaped by experience, intuition, and interpersonal understanding that current AI systems lack. The most successful firms will likely be those that most effectively blend AI's analytical capabilities with human strategic insight.

Retail and Consumer Banking: Personalization at Scale

Retail banking faces different challenges than investment banking. Rather than supporting small numbers of high-value transactions, consumer banking handles millions of relatively standardized interactions. AI's ability to deliver personalized experiences at mass scale makes it particularly powerful in this domain.

Fraud detection represents one of the most mature AI applications in consumer banking. Traditional rules-based systems flagged transactions that matched predetermined suspicious patterns - large cash withdrawals, international purchases, rapid sequences of transactions. These systems generated many false positives while missing sophisticated fraud schemes. Modern AI systems analyze vast numbers of variables simultaneously, recognize subtle patterns that indicate fraud, and continuously learn from new fraud techniques. JPMorgan uses AI to curtail fraud, and such systems now operate across the industry.

Customer service represents another major application domain. Banks like HSBC use generative AI to create customized product recommendations based on individual spending habits. Rather than offering the same credit card or savings account to all customers, AI analyzes individual transaction histories, identifies patterns, and suggests products aligned with specific financial behaviors and needs. This personalization extends to timing - AI can determine optimal moments to present offers when customers are most likely to engage.

Account management processes that traditionally required extensive human involvement increasingly flow through AI systems. Opening accounts, verifying identities, assessing creditworthiness, and resolving routine issues can all be handled through AI-powered systems with human intervention reserved for edge cases and complex situations. This dramatically reduces operational costs while potentially improving customer experience through faster processing and 24/7 availability.

The vision extends to AI-powered financial advisors that provide personalized guidance across the customer base. Banks leverage AI-powered insights to understand customer behavior more deeply, with algorithms analyzing spending patterns and financial behaviors to provide personalized recommendations, and advanced machine learning models assessing risk tolerance through both traditional questionnaires and behavioral data. This democratizes financial planning capabilities that previously required human advisors accessible only to wealthy clients.

The consumer banking transformation, however, raises important questions about financial inclusion and algorithmic bias. AI systems trained on historical data can perpetuate or amplify existing disparities in credit access, insurance pricing, and financial services availability. Banks deploying AI in consumer-facing applications must grapple with ensuring their systems treat all customers fairly while remaining profitable businesses.

Risk Management and Compliance: Intelligent Monitoring

Banking fundamentally involves managing risk - credit risk, market risk, operational risk, liquidity risk, and compliance risk. AI transforms risk management by enabling continuous, comprehensive monitoring at scales impossible for human analysts.

Know Your Customer and Anti-Money Laundering processes exemplify AI's impact on compliance operations. HSBC's AI-powered approach enables the bank to navigate contemporary financial crime complexities by identifying unusual patterns and potentially illegal activities, proving far more effective at distinguishing between normal and suspicious behavior than traditional methods. Traditional compliance systems relied on rules-based screening that generated enormous numbers of alerts requiring manual review. Most proved to be false positives, consuming compliance staff time while creating risk that true suspicious activity might be buried in the noise. AI systems apply more sophisticated pattern recognition, learn from feedback about which alerts prove meaningful, and dramatically improve the signal-to-noise ratio.

Credit risk assessment illustrates how AI enables more nuanced evaluation. Credit risk assessment has evolved from analyzing 8 to 10 variables into a sophisticated system capable of processing over 100 different factors simultaneously. This allows banks to extend credit to customers who might be declined by traditional scoring models while more accurately identifying high-risk borrowers. The implications for financial inclusion are significant - many individuals and small businesses historically denied credit because they don't fit standard profiles may gain access through AI systems capable of recognizing creditworthiness through alternative data and more sophisticated analysis.

Market risk management benefits from AI's ability to process vast amounts of market data, news, and social media sentiment in real-time, identifying correlations and predicting volatility patterns that inform trading positions and hedging strategies. AI analytics tools process market data faster and more accurately than humans, spotting trends and predicting behavior with superior precision.

Regulatory compliance increasingly relies on AI to navigate the complexity of financial regulation. Investments like BBVA's stake in Parcha, which builds enterprise-grade AI agents that automate manual compliance and operations tasks including reviewing documents, extracting data, and making decisions on onboarding, compliance, and risk management, illustrate banks' recognition that AI is essential for managing regulatory burdens. The volume of regulatory requirements, the frequency of updates, and the need to apply rules consistently across thousands of transactions make compliance a natural fit for AI.

Treasury Operations and Trading: Speed and Precision

Trading represents one of the earliest and most extensive applications of AI in banking. Algorithmic trading has dominated equity markets for years, with AI-powered systems executing trades at microsecond speeds, managing complex portfolios, and identifying arbitrage opportunities faster than any human trader could comprehend.

The current wave of AI extends beyond traditional algorithmic trading into more sophisticated applications. AI systems now incorporate natural language processing to analyze earnings call transcripts, news articles, and social media for sentiment signals that might move markets. They apply machine learning to recognize patterns in order flow that indicate institutional positioning. They optimize trade execution strategies based on market microstructure analysis that considers liquidity, volatility, and transaction costs across multiple venues.

Treasury operations benefit from AI's ability to optimize liquidity management, predicting cash flows across the institution, determining optimal deployment of capital, and managing collateral requirements efficiently. These back-office functions lack the glamor of front-office trading but represent enormous operational complexity and significant optimization opportunities.

The competitive dynamics in AI-powered trading create a technological arms race. Institutions that deploy more sophisticated AI, access better data, or achieve faster execution speeds gain advantages that translate directly into profitability. This drives continuous investment in AI capabilities and infrastructure, with banks spending on AI initiatives projected to increase from $6 billion in 2024 to $9 billion in 2025, and potentially as much as $85 billion by 2030.

Operations: The Invisible Transformation

Banking operations - the behind-the-scenes functions that settle trades, reconcile accounts, process payments, and maintain systems - represent the largest single opportunity for AI-driven efficiency gains. These functions employ enormous numbers of people performing repetitive, rules-based work that AI can increasingly handle.

AI-powered automation has reduced the cost of routine banking operations by 25 to 30 percent for institutions like Wells Fargo, which uses AI to automate mortgage processing, saving millions in operational costs each year, while Citibank reports AI reduced document processing time by 60 percent, contributing to significant cost savings. These efficiency gains manifest not only in reduced costs but also in faster processing times, fewer errors, and improved customer experience.

The implications for employment in banking operations are profound. These roles represent exactly the kind of work AI systems excel at automating - high-volume, rules-based, repetitive tasks that require accuracy but not creative problem-solving or complex judgment. Banks face difficult questions about how to manage workforce transitions as automation eliminates jobs that currently employ hundreds of thousands of people.

Agentic AI: The Decisive Technological Shift

Understanding what makes current AI transformation fundamentally different from previous waves of banking automation requires examining agentic AI - systems capable of autonomous multistep reasoning and action with minimal human oversight. This represents a qualitative leap beyond earlier AI applications.

Traditional banking automation worked through predetermined rules. A system might automatically flag a transaction that exceeded certain thresholds, but a human decided how to respond. It might route customer inquiries to appropriate departments, but humans handled the actual interactions. It might generate standard reports, but humans interpreted them and made decisions. These systems followed scripts, and breaking from those scripts required human intervention.

Agentic AI operates differently. These systems can pursue goals through sequences of actions they determine autonomously. They reason about what steps are necessary to accomplish objectives, make decisions at each stage, and adapt their approach based on outcomes. They operate more like human employees who receive high-level direction and figure out how to execute than like traditional software that follows explicit instructions.

The technical capabilities enabling agentic AI emerged from advances in large language models. These models demonstrate something approaching general reasoning abilities - they can understand complex instructions, break problems into components, generate plans, and evaluate options. When combined with the ability to use tools and access data, they become capable of sophisticated autonomous behavior.

Consider a concrete example from investment banking. A traditional automation system might generate a standard financial analysis based on a template and predefined data sources. An agentic AI system, by contrast, could receive a high-level instruction like "prepare materials for a meeting with a potential acquisition target" and then autonomously determine what information to gather, which analyses are most relevant, what comparisons would be useful, and how to structure the presentation. At each step, the system reasons about options and makes choices without explicit human direction.

Capital One owns one of the only public agentic use cases in Chat Concierge and plans to use its same agentic framework to build other tools around the bank. The system demonstrates how agentic AI can handle complex customer interactions autonomously, understanding intent across multiple conversation turns, gathering necessary information, and taking action to resolve issues without human intervention.

The implications of widespread agentic AI deployment extend far beyond efficiency. These systems fundamentally change the nature of work by shifting humans from task execution to supervision and goal-setting. An investment banking analyst spends less time building models and more time formulating questions and evaluating AI-generated analyses. A compliance officer spends less time reviewing individual transactions and more time establishing parameters for AI monitoring systems and investigating flagged cases. A trader spends less time executing orders and more time developing strategies that AI trading agents implement.

This transformation creates both opportunities and challenges. On one hand, it potentially frees humans from tedious tasks and allows them to focus on higher-value activities requiring creativity, judgment, and interpersonal skills. On the other hand, it threatens to displace workers whose roles consisted primarily of tasks that agentic AI can now handle. The transition period - where some institutions have deployed agentic AI while others have not - creates significant competitive advantages for early adopters.

The technology also raises important questions about control and accountability. When an agentic AI system makes a sequence of decisions that leads to a poor outcome, who bears responsibility? The employee who set the system's goals? The institution that deployed the technology? The AI developers who created the underlying models? Traditional concepts of accountability assume human decision-makers whose judgment can be evaluated and who bear responsibility for outcomes. Agentic AI complicates these assumptions by distributing decision-making across human-AI systems in ways that obscure individual responsibility.

As agents become increasingly powerful in their AI capabilities and increasingly connected into JPMorgan, they can take on more and more responsibilities, but this shift also brings challenges with ensuring reliability, security, and transparency paramount as these agents make more consequential decisions, requiring robust governance frameworks, continuous monitoring, and ethical guardrails to manage risk and compliance. Banks deploying agentic AI must develop new governance frameworks that account for autonomous AI decision-making while maintaining accountability and regulatory compliance.

Workforce Disruption: Beyond Automation Anxiety

The employment implications of AI banking transformation extend far beyond simple automation displacing workers. The impact manifests through complex dynamics involving workforce composition changes, skill requirement shifts, geographic labor distribution, and fundamental questions about the future nature of banking employment.

The Displacement Reality

Citigroup published a research report predicting artificial intelligence will displace 54 percent of jobs in the banking industry, more than in any other sector, and a Bloomberg Intelligence report found that global banks are expected to cut as many as 200,000 jobs in the next three to five years as AI takes on more tasks. These projections reflect the reality that banking employs enormous numbers of people in roles involving information processing, analysis, and decision-making - precisely the kinds of tasks where AI systems demonstrate increasing competence.

JPMorgan's consumer banking chief told investors that operations staff would fall by at least 10 percent, providing specific indication of the scale of workforce reduction that even leading institutions expect. The impact falls unevenly across roles. Those at risk of having to find new roles include operations and support staff who mainly deal in rote processes like setting up accounts, fraud detection, or settling trades, while the shift favors those who work directly with clients like private bankers with rosters of rich investors, traders who cater to hedge fund and pension managers, or investment bankers with relationships with Fortune 500 CEOs.

This creates a bifurcation in banking employment. High-skill, client-facing roles that require relationship management, strategic judgment, and interpersonal skills remain valuable and may even become more valuable as AI handles supporting analytical work. Middle-skill roles involving standardized information processing and analysis face the greatest displacement risk. Entry-level positions that traditionally served as training grounds for careers in banking may largely disappear, raising questions about how institutions develop future senior talent.

Dario Amodei, chief executive of AI firm Anthropic, said nearly half of all entry-level white-collar jobs in tech, finance, law, and consulting could be replaced or eliminated by AI. This projection directly challenges the traditional career development model in professional services where junior employees learn by performing routine tasks under senior supervision. If AI eliminates these entry-level roles, institutions must develop alternative pathways for developing expertise and advancing careers.

Retraining: Promise and Limits

A Federal Reserve Bank of New York survey found that rather than laying off workers, many AI-adopting firms are retraining their workforces to use the new technology, with AI more likely to result in retraining than job loss for those already employed, though AI is influencing recruiting, with some firms scaling back hiring due to AI and some firms adding workers proficient in its use. This suggests institutions recognize the value of retaining experienced employees and helping them adapt to new roles rather than simply replacing them with AI.

However, research on retraining effectiveness paints a more sobering picture. Job-training programs under the Workforce Innovation and Opportunity Act generally lead to increased earnings for displaced workers, but those entering high AI-exposed occupations see smaller gains - about 25 to 29 percent less - than those targeting low AI-exposed roles, with only certain fields such as legal, computation, and arts showing high potential for retraining into well-paid, AI-exposed jobs. This indicates that while retraining helps, it may not fully compensate workers displaced from roles eliminated by AI.

The challenge extends beyond individual capability to systemic capacity. The World Economic Forum projects that 92 million jobs will be displaced by 2030 but 170 million new ones will be created requiring new skills. Even if this net-positive scenario materializes, the transition creates enormous friction as displaced workers acquire new skills, geographic labor markets adjust, and institutions adapt to new workforce models. The timeline matters critically - if displacement occurs faster than job creation and retraining, the period of disruption could be painful and prolonged.

McKinsey Global Institute estimates approximately 375 million workers globally - about 14 percent of the workforce - will need significant retraining by 2030 to remain economically viable, with the speed of current displacement surpassing even those predictions. The scale of this reskilling challenge dwarfs anything attempted in modern economic history, raising serious questions about whether existing training infrastructure can meet the need.

Geographic Redistribution

AI's impact on banking employment extends to geographic distribution of jobs. Banks have increasingly concentrated back-office operations in lower-cost locations - Bangalore, Hyderabad, Guangzhou, Manila, and other offshore centers. HSBC faces a shortfall of nearly 10,000 desks in locations like Bangalore, Hyderabad, and Guangzhou where technologists and back-office people work, and the bank is in talks with companies to automate back-office functions and reduce its cost base. If AI can perform work previously offshored, the geographic distribution of banking employment could shift significantly, with implications for both developed and developing economies.

This creates complex dynamics. Developing economies have built substantial sectors providing services to multinational banks. If AI displaces this work, it eliminates employment that has lifted millions into middle-class prosperity. Simultaneously, banks may consolidate operations closer to their headquarters if physical headcount becomes less relevant, potentially reversing offshoring trends but creating a smaller absolute workforce.

New Roles and Skills

Job displacement represents only part of the employment story. AI also creates new roles that didn't previously exist. As AI systems become more embedded in banking operations, a parallel workforce is emerging to manage, monitor, and refine these technologies, with AI auditors ensuring algorithms operate within regulatory and ethical boundaries, ethics officers evaluating AI models for biases and unintended consequences, and human-AI trainers continuously feeding data to machine learning models and fine-tuning outcomes based on customer behavior.

These roles require combinations of domain expertise and technical understanding. An AI auditor working in lending must understand both credit risk evaluation and machine learning model behavior. An ethics officer must comprehend both regulatory compliance and algorithmic bias. These hybrid roles command premium compensation but require skills that few current workers possess, creating talent shortages even as AI displaces workers from other banking roles.

The advent of generative AI is like the impact Microsoft Excel had when it came out in 1980, with everyone saying it would eliminate finance people, but instead it changed how they work. This historical analogy suggests AI might ultimately expand banking capabilities rather than simply replacing workers. Excel didn't eliminate financial analysts; it enabled them to perform more sophisticated analyses more quickly, raising expectations for analytical depth and creating demand for analysts who could leverage the tool effectively. AI might follow a similar pattern, with banks that deploy it effectively able to offer more sophisticated services, serve more clients, and ultimately employ substantial workforces in reconfigured roles.

The employment transition ultimately depends on how institutions manage change. Banks that invest in comprehensive retraining programs, create pathways for displaced workers to move into new roles, and approach AI deployment as augmenting rather than replacing humans can potentially minimize disruption. Those that pursue AI primarily as a cost-cutting measure through workforce reduction will create more painful transitions for employees while potentially sacrificing institutional knowledge and expertise that proved difficult to replicate with AI alone.

Competitive Dynamics and Strategic Advantages

If JPMorgan can beat other banks to the punch on incorporating AI, it will enjoy a period of higher margins before the rest of the industry catches up. This observation captures the competitive dynamics driving massive AI investments across banking. Early movers gain temporary advantages, but those advantages erode as competitors adopt similar capabilities, eventually pushing the entire industry to higher performance levels that become the new baseline.

The pattern mirrors previous technology transformations in banking. When ATMs emerged, early adopters gained cost advantages and customer convenience benefits. But ATMs quickly became ubiquitous, and the advantage shifted to banks that deployed them most extensively and integrated them most effectively with broader service offerings. Online banking followed similar dynamics - first-movers gained customer acquisition advantages, but within years, every bank needed online capabilities to compete. AI appears to be following this trajectory, but with potentially more dramatic effects.

Several factors determine which institutions gain the most from AI investments. First, scale matters enormously. JPMorgan's $18 billion annual technology budget enables investments that smaller institutions cannot match. Building sophisticated AI systems, assembling specialized talent, and integrating AI across vast operational infrastructure requires resources that favor the largest banks. This could accelerate industry consolidation as smaller banks struggle to keep pace with AI-powered competitors.

Second, data advantages create compounding returns. AI systems improve through exposure to more data, and larger banks process more transactions, serve more customers, and operate in more markets than smaller institutions. This data richness enables more sophisticated AI that delivers better customer experiences, attracts more customers, and generates more data - a reinforcing cycle that advantages incumbents with established customer bases over new entrants.

Third, legacy infrastructure both constrains and shapes AI deployments. Banks operate on technology stacks accumulated over decades, with critical systems running on mainframes alongside modern cloud applications. There is a value gap between what the technology is capable of and the ability to fully capture that within an enterprise, with companies working in thousands of different applications requiring significant work to connect those applications into an AI ecosystem and make them consumable. Institutions with more modern infrastructure can deploy AI more rapidly and comprehensively than those wrestling with complex legacy systems.

Fourth, regulatory compliance capabilities matter increasingly. Banks operate in heavily regulated environments where deploying new technology requires demonstrating that it meets regulatory requirements for transparency, fairness, security, and reliability. Institutions with sophisticated compliance frameworks and strong regulatory relationships can navigate AI deployment challenges more effectively than those with weaker compliance capabilities.

Industry structure influences how AI advantages manifest. In highly commoditized banking services - payments processing, basic deposit accounts, simple loans - AI-driven efficiency advantages translate primarily into cost reductions that either improve margins or enable price competition. In differentiated services - wealth management, investment banking, sophisticated corporate banking - AI can enable service enhancements that support premium pricing and market share gains.

Citigroup armed 30,000 developers with generative AI coding tools and rolled out a pair of generative AI-powered productivity enhancement platforms to its broader workforce, while Goldman Sachs has furnished roughly 10,000 employees with an AI assistant and expects to complete companywide rollout by year's end. These deployments by JPMorgan's major competitors indicate the AI transformation has become imperative across the industry. No major bank can afford to ignore AI, and competitive dynamics ensure that AI investments will continue accelerating.

The geographic dimension of competition adds complexity. Bank of America is spending $4 billion on AI and new technology initiatives in 2025, accounting for nearly one-third of its $13 billion technology cost line. American banks face competition not only from each other but also from European institutions, Asian banks, and potentially Big Tech firms that might expand into financial services. Chinese banks deploy AI extensively in mobile payments and lending, European banks face regulatory pressures that both constrain and shape AI deployment, and Asian institutions like DBS and HSBC pursue aggressive digitalization strategies.

Big Tech represents a particularly interesting competitive dynamic. Companies like Google, Amazon, and Microsoft possess world-leading AI capabilities, vast computational resources, and enormous user bases. While regulatory restrictions have historically limited their expansion into core banking, they increasingly offer financial services at the margins - payments, lending, financial planning. If regulators allow deeper Big Tech participation in banking, AI-powered platforms operated by technology giants could disrupt traditional banking business models fundamentally.

The ultimate competitive outcome remains uncertain. AI might amplify advantages held by the largest, most sophisticated institutions, leading to industry consolidation. Alternatively, AI could lower barriers to entry by enabling smaller institutions to deliver sophisticated services without massive human workforces, promoting competition. Most likely, the industry will bifurcate, with a small number of massive, AI-powered universal banks competing against specialized institutions that use AI to excel in specific niches.

Implementation Realities: The Value Gap Challenge

There is a value gap between what the technology is capable of and the ability to fully capture that within an enterprise, with companies working in thousands of different applications requiring significant work to connect those applications into an AI ecosystem and make them consumable. This observation by JPMorgan's chief analytics officer captures the central challenge in AI banking transformation: the technology's potential vastly exceeds what institutions can currently implement.

Several factors create this value gap. First, legacy infrastructure presents massive integration challenges. Banks operate critical systems dating to the 1960s and 1970s, written in COBOL and running on mainframes. These systems handle functions like account management, transaction processing, and payment clearing where any failure could be catastrophic. Connecting them to AI systems requires extensive interface development, rigorous testing, and careful risk management.

The complexity multiplies because banks don't operate on unified platforms but rather on collections of hundreds or thousands of distinct applications accumulated through decades of organic development, mergers and acquisitions, and technological evolution. Each application has its own data formats, business logic, and interfaces. Creating an AI layer that can interact with all these systems coherently represents an enormous engineering challenge.

Second, data quality and accessibility issues limit AI effectiveness. AI systems require clean, structured, consistent data to function well. Banks' data resides across innumerable systems in incompatible formats with inconsistent definitions, incomplete records, and quality problems accumulated over decades. Before AI can deliver its potential, institutions must undertake massive data remediation efforts - standardizing formats, resolving inconsistencies, establishing data governance, and building pipelines that make data accessible to AI systems.

Third, organizational resistance slows implementation. AI transformation requires changing how people work, which business processes flow, and who holds decision-making authority. These changes threaten existing power structures, require learning new skills, and create uncertainty about job security. Even when leadership commits to AI transformation, middle management resistance, employee anxiety, and simple inertia can dramatically slow implementation.

Fourth, talent scarcity constrains deployment speed. JPMorgan employs more AI researchers than the next seven largest banks combined, but even JPMorgan faces talent constraints. The number of people who understand both advanced AI and banking operations remains limited relative to industry needs. This talent shortage drives up compensation costs and limits the pace at which institutions can expand AI capabilities.

Fifth, regulatory uncertainty complicates planning. Banks must satisfy regulators that their AI systems operate safely, fairly, and transparently. However, regulatory frameworks for AI in banking remain under development, creating uncertainty about what requirements institutions must meet. This uncertainty makes banks cautious about deploying AI in ways that might later prove non-compliant, slowing adoption.

JPMorgan Chase builds its AI foundation on AWS, pushing the AWS SageMaker machine learning platform and AWS Bedrock generative AI platform beyond experimentation into production applications, with 5,000 company employees using SageMaker and more than 200,000 employees now using LLM Suite. This partnership approach - leveraging cloud infrastructure and AI platforms from technology providers rather than building everything internally - helps address some implementation challenges by providing scalable infrastructure and reducing the burden of maintaining AI development platforms.

The organizational dimension of implementation presents perhaps the greatest challenge. Chase is going with a "learn by doing" approach for generative AI, wanting tools in employees' hands with a belief that there is no better way to learn than by actually utilizing the tools, and the bank has been reported to have 450 proofs of concept in the works, a number expected to climb to 1,000. This grassroots approach recognizes that successful AI transformation requires cultural change, not just technology deployment. Employees must understand AI capabilities, identify opportunities for application, and integrate AI into daily workflows. This learning-by-doing approach takes time but builds sustainable capabilities.

The financial dimension complicates implementation. Banks' spending on AI initiatives is predicted to increase from $6 billion in 2024 to $9 billion in 2025, and potentially as much as $85 billion in 2030. These investments must be justified through clear return-on-investment cases, but AI's benefits often materialize over years through cumulative efficiency gains, improved decision-making, and enhanced customer experiences that prove difficult to quantify precisely. Institutions face pressure to demonstrate results while pursuing transformations that require sustained investment before full benefits emerge.

The testing and validation challenge for AI systems exceeds that of traditional software. Traditional software follows deterministic logic - given the same inputs, it produces the same outputs, making testing straightforward. AI systems, particularly those using advanced machine learning, behave probabilistically and can produce different outputs for the same inputs. Testing must evaluate not just whether the system works correctly for known cases but whether it generalizes appropriately to novel situations, handles edge cases safely, and degrades gracefully when encountering inputs outside its training distribution.

These implementation challenges explain why AI banking transformation proceeds gradually despite enormous potential. Institutions must balance moving quickly enough to capture competitive advantages against moving carefully enough to manage risks and ensure reliable operations. The tension between speed and caution shapes deployment strategies, with most banks pursuing parallel approaches that layer AI capabilities atop existing systems rather than attempting to rebuild core banking infrastructure from scratch.

Risks, Ethics, and Regulatory Gaps

AI banking transformation raises profound questions about safety, fairness, accountability, and social impact that regulators, banks, and society must address. These concerns span technical, ethical, legal, and political dimensions.

Algorithmic Bias and Fairness

AI systems in banking, particularly those used to help make credit decisions, may inadvertently discriminate against protected groups, with AI models that use alternative data like education or location potentially relying on proxies for protected characteristics, leading to disparate impact or treatment. This challenge emerges because AI systems learn patterns from historical data that may reflect past discrimination. If historical lending data shows that applicants from certain neighborhoods or with certain characteristics were denied credit, AI systems may learn to replicate these patterns even when the underlying factors don't represent legitimate credit risk indicators.

The problem extends beyond simple replication of historical bias. AI can amplify bias through feedback loops where algorithmic decisions influence future data in ways that reinforce initial patterns. For example, if an AI system denies credit to members of a particular group, those individuals cannot build credit histories that might later demonstrate creditworthiness, perpetuating the cycle.

Addressing algorithmic bias requires technical solutions, policy frameworks, and institutional commitments. Financial institutions must continuously monitor and audit AI models to ensure they do not produce biased outcomes, with transparency in decision-making processes crucial to avoiding disparate impacts. This monitoring must extend beyond simple outcome analysis to examine the factors AI systems use for decisions and ensure they don't rely on proxies for protected characteristics.

The challenge intensifies as AI systems become more sophisticated. Simple models using limited variables can be audited straightforwardly - analysts can examine each factor and assess whether it represents legitimate business considerations or problematic proxies for protected characteristics. Complex neural networks processing hundreds of variables through multiple hidden layers resist such straightforward analysis. They may achieve better predictive accuracy but at the cost of reduced transparency.

Data Privacy and Security

Banks hold vast amounts of sensitive personal information - financial transactions, account balances, investment positions, personal identifiers, behavioral patterns. AI systems require access to this data to function effectively, creating tension between AI's data appetite and privacy imperatives. The increasing volume of data and the use of non-traditional sources like social media profiles for credit decision-making raise significant concerns about how sensitive information is stored, accessed, and protected from breaches, with consumers not always aware of or consenting to the use of their data.

The privacy challenge extends beyond traditional data security to questions about data usage. Customers may consent to banks using their transaction data for fraud detection but not expect that same data to inform marketing algorithms or be shared with third parties. As AI systems become more sophisticated at extracting insights from data, the line between uses customers expect and approve versus those they find intrusive becomes increasingly important.

The technical challenge of privacy-preserving AI remains largely unsolved. Techniques like federated learning - where AI trains across distributed data without centralizing it - and differential privacy - where noise is added to data to protect individual privacy while preserving aggregate patterns - show promise but aren't yet mature enough for widespread banking deployment. Most AI systems still require access to detailed individual-level data to achieve optimal performance.

Model Opacity and Explainability

The German regulator BaFin stated that the extent to which a black box could be acceptable in supervisory terms is dependent on how the model concerned is treated in the bank's risk management, with expectation that financial service providers can explain model outputs as well as identify and manage changes in AI models' performance and behavior. This regulatory perspective captures a fundamental tension in AI banking: the most powerful AI systems are often the least explainable.

Traditional credit scoring models used linear regression with a handful of variables, making it straightforward to explain why any particular applicant received a specific score. Modern AI systems may use ensemble methods combining multiple models, neural networks with hidden layers, or other approaches that resist simple explanation. A bank might be able to demonstrate statistically that such a system performs better than simpler alternatives but struggle to explain why it made any specific decision.

This opacity creates problems for consumers who want to understand why they were denied credit or charged higher interest rates. It creates problems for regulators trying to assess whether models are fair and appropriate. It creates problems for banks trying to manage model risk and ensure their systems behave appropriately. The lack of explainability becomes particularly problematic when AI systems make consequential decisions that affect people's financial lives.

Regulatory approaches to explainability vary. The SEC implements the Market Access Rule mandating strict pre-trade risk controls to prevent market manipulation and erroneous trading, and joint guidance from OCC, Federal Reserve, CFPB, and FTC highlights explainability, bias mitigation, and consumer transparency requirements. These frameworks establish principles for AI transparency but often lack specific technical requirements, leaving banks to determine how to satisfy regulators that their systems are appropriate.

Systemic Risk and Stability

AI's impact on financial stability raises concerns that extend beyond individual institutions. If many banks deploy similar AI systems trained on similar data, their behavior may become correlated in ways that amplify market volatility or create systemic vulnerabilities. During market stress, AI trading systems might simultaneously try to sell the same assets or hedge the same risks, exacerbating price movements and potentially triggering cascading effects across financial markets.

The complexity of AI systems also creates operational risks. Banks become dependent on AI for critical functions, and failures or malfunctions could disrupt operations in ways that affect customers, counterparties, and markets. The interconnection of financial institutions means that AI failures at one bank could propagate through the financial system.

Citi projects 10 percent of global market turnover to be conducted through tokenized assets by 2030, with bank-issued stablecoins as the main enabler, and 86 percent of surveyed firms piloting generative AI for client onboarding and post-trade specifically. The convergence of AI and tokenization creates new systemic risk considerations as financial assets migrate to blockchain-based infrastructure where AI agents could execute transactions autonomously.

Accountability and Liability

When AI systems make decisions that result in harm - discriminatory lending, erroneous trading, privacy violations - questions of accountability become complex. Traditional liability frameworks assume human decision-makers who can be held responsible for choices. AI distributes decision-making across human-machine systems in ways that obscure responsibility.

If an AI-powered lending system systematically discriminates against a protected class, who bears liability? The data scientists who built the model? The business managers who deployed it? The executives who approved the AI strategy? The bank as an institution? These questions lack clear answers under current legal frameworks, creating uncertainty for both banks and consumers.

Regulatory Landscape

The EU AI Act, effective by mid-2025, classifies AI systems by risk, with high-risk applications in finance like credit assessments and insurance pricing requiring transparency, human oversight, and bias mitigation, with financial firms required to document and justify AI decisions, setting a global standard for responsible AI. The European approach establishes comprehensive regulatory frameworks specifically addressing AI risks.

American regulation, by contrast, remains fragmented. President Trump signed Executive Order 14179 on January 23, 2025, revoking President Biden's comprehensive AI Executive Order, with the Trump administration moving to deregulate AI use. This created regulatory uncertainty as federal frameworks were rolled back, leaving state regulators stepping in, passing legislation focused on bias, transparency, and compliance in AI-driven decision-making for lending and employment, with several states clarifying that discriminatory AI behavior would be assessed under their Unfair or Deceptive Acts or Practices laws, creating a patchwork of oversight.

The National Credit Union Administration lacks model risk management guidance with sufficient detail on how credit unions should manage model risks, including AI models, and the authority to examine technology service providers despite credit unions' increasing reliance on them for AI-driven services. This regulatory gap illustrates the challenge that AI outpaces regulatory capacity, with institutions deploying sophisticated systems faster than oversight frameworks can adapt.

Regulatory agencies should require banks to indicate whether they use AI to comply with Community Reinvestment Act regulations, require those systems to be explainable, require third-party AI audits for all institutions, and require banks to periodically review their Bank Secrecy Act systems to ensure accuracy and explainability. These proposals reflect growing recognition that AI in banking requires new forms of oversight, but translating principles into enforceable requirements remains a work in progress.

The global dimension complicates regulatory development. Banks operate across multiple jurisdictions with different regulatory approaches to AI. Institutions must navigate the EU AI Act, various national frameworks in Asia, state-level requirements in the United States, and emerging standards from international bodies like the Bank for International Settlements. This regulatory fragmentation creates compliance complexity and may slow AI deployment in cross-border banking operations.

AI Banking Versus Autonomous Finance: The DeFi Comparison

The emergence of AI-powered traditional banking coincides with the maturation of decentralized finance, creating an interesting contrast between two different visions for technology-driven financial transformation. While AI-powered banks enhance traditional institutions through intelligence and automation, DeFi pursues financial services without traditional intermediaries through blockchain-based protocols. The convergence and competition between these approaches shapes finance's future trajectory.

Stablecoins and Tokenization

Stablecoin circulation has doubled over the past 18 months but still facilitates only about $30 billion of transactions daily - less than 1 percent of global money flows, with advocates saying the technology can transcend banking hours and global borders, offering improvements on current payment infrastructure including speed, cost, transparency, availability, and increased inclusion of those underserved by the banking system. These digital assets represent cash equivalents on blockchain infrastructure, enabling 24/7 settlement without traditional banking intermediaries.

Tokenization is projected to bring up to $16 trillion in real-world assets on-chain by 2030, transforming how global finance operates, with Wall Street leaders like BlackRock, JPMorgan, and Goldman Sachs already piloting tokenized bonds, Treasuries, and deposits. This development indicates that traditional financial institutions increasingly view blockchain infrastructure as complementary to rather than competitive with their businesses.

The relationship between AI banking and tokenization becomes particularly interesting when institutions deploy AI to manage tokenized assets. Citi projects 10 percent of global market turnover to be tokenized by 2030, led by bank-issued stablecoins helping with collateral efficiency and fund tokenization, with 86 percent of surveyed firms testing AI for client onboarding as the key use case for asset managers, custodians, and broker-dealers. This convergence suggests a future where AI systems operate across both traditional banking infrastructure and blockchain-based tokenized assets.

Autonomous Protocols Versus AI Agents

DeFi protocols execute financial operations through smart contracts - code deployed on blockchains that automatically executes transactions based on predefined rules. These protocols handle lending, trading, derivatives, and other financial functions without human intermediaries. The vision involves financial services as software running on decentralized networks rather than as operations performed by institutions.

AI agents in banking serve analogous functions but operate within institutional frameworks. Rather than replacing banks, they make banks more efficient and capable. The fundamental difference lies in governance and control. DeFi protocols, once deployed, operate autonomously according to their code, with governance sometimes distributed across token holders. AI agents operate under institutional authority, with banks retaining control over their behavior and bearing responsibility for their actions.

This creates different risk-return profiles. DeFi offers censorship resistance, 24/7 availability, transparent code, and reduced dependency on traditional intermediaries. However, it also involves smart contract risk, limited recourse when things go wrong, regulatory uncertainty, and challenges with scaling to mainstream adoption. AI-powered traditional banks offer regulatory compliance, consumer protections, established dispute resolution, and integration with legacy financial infrastructure, but maintain gatekeeping roles, regulatory constraints, and potentially higher costs than decentralized alternatives.

Regulatory Treatment

Multiple pieces of legislation globally seek to ensure stable and secure operation of tokenized cash, covering reserves, disclosures, AML and KYC compliance, and proper licensing, with examples including the US Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025, which passed the Senate in June, stipulating conditions for reserves, stability, and oversight. These regulatory developments indicate that stablecoins and tokenization are moving from regulatory gray areas toward clearer frameworks.

The Federal Reserve Board hosted a conference focused on payments innovation exploring topics including stablecoins, decentralized finance, artificial intelligence, and tokenization, with Governor Christopher Waller saying these technologies could streamline payment operations and strengthen private sector collaboration. This official attention signals that central banks recognize these technologies' potential impact and are actively studying how they intersect with monetary policy and financial stability.

The regulatory dynamic creates interesting strategic questions for banks. Should they build AI capabilities exclusively within traditional banking infrastructure, or should they also develop capabilities to deploy AI within blockchain-based DeFi protocols? Should they issue their own stablecoins to compete with private issuers, or integrate existing stablecoins into their operations? How should they balance the efficiency advantages of blockchain settlement against the regulatory complexity and technical risks?

Hybrid Architectures

The most likely outcome involves hybrid approaches that blend traditional banking, AI capabilities, and blockchain infrastructure. Banks might issue tokenized deposits or stablecoins backed by traditional reserves, enabling blockchain-based settlement while maintaining institutional guarantees. AI systems could operate across both traditional payment rails and blockchain networks, optimizing routing based on cost, speed, and other factors.

Consensus 2025 discussions highlighted rapid growth in decentralized finance with panels centered on adoption of decentralized exchanges, surge in stablecoin usage, growing interest in tokenizing real-world assets, and momentum around yield-generating protocols, taking place against the backdrop of regulatory clarity emerging through legislation. This institutional engagement indicates that the boundary between traditional finance and DeFi is becoming more permeable.

The integration of AI and blockchain creates interesting technical possibilities. Smart contracts could incorporate AI decision-making, with autonomous protocols that adapt behavior based on market conditions. AI systems could monitor blockchain transactions for fraud, analyze DeFi protocol health, or optimize yield farming strategies across multiple protocols. Banks could deploy AI agents that operate across traditional banking infrastructure and DeFi protocols, providing clients with unified access to both.

This convergence raises philosophical questions about financial intermediation's future. If AI can automate most banking functions and blockchain can provide the infrastructure for executing transactions without traditional intermediaries, do we still need banks as institutions? Or does finance evolve toward a model where AI agents operate across decentralized protocols on behalf of users, with traditional banks either adapting to provide services in this new paradigm or gradually losing relevance?

The answer likely depends on regulatory evolution, consumer preferences, and technological maturation. If regulators successfully establish frameworks that allow blockchain-based financial services while protecting consumers, we might see substantial migration toward hybrid models. If blockchain scaling remains problematic or regulators impose restrictions that favor traditional institutions, AI-powered banks might maintain dominance. Most probable is a pluralistic outcome where traditional banking, AI-enhanced institutions, and decentralized protocols coexist, serving different needs and preferences.

The True AI Bank: A 2030 Vision

Extrapolating current trends toward their logical conclusion allows us to envision what a genuine AI bank might look like when the transformation reaches maturity, likely sometime in the early 2030s. This vision helps clarify what fundamental transformation means and raises profound questions about whether such an institution still represents a "bank" in any traditional sense.

Universal AI Assistance

In a true AI bank, every employee operates with a personal AI assistant deeply integrated into all workflows. Investment bankers instruct their AI to prepare client meeting materials, analyze potential acquisition targets, or draft term sheets. Traders direct AI agents to monitor markets, execute strategies, and optimize portfolios. Compliance officers task AI with monitoring transactions for suspicious patterns, generating regulatory reports, and researching regulatory changes. Technology teams use AI for software development, infrastructure management, and system optimization.

These AI assistants don't simply respond to individual queries like current chatbots. They maintain context across conversations, proactively identify tasks that need completion, schedule their own meetings with other AI assistants to coordinate work, and continuously learn from interactions to better anticipate needs. The human role shifts toward setting strategic direction, making high-level decisions, and handling situations requiring judgment, creativity, or interpersonal skills that AI lacks.

Autonomous Operational Processes

Core banking operations - account opening, payment processing, trade settlement, reconciliation, regulatory reporting - flow through AI systems with minimal human intervention. These systems don't follow rigid scripts but adapt behavior based on context. They detect anomalies and determine whether to flag them for human review or resolve them autonomously. They optimize resource allocation dynamically rather than following static rules. They identify process improvements and implement changes after appropriate approval.

The traditional operations workforce largely disappears, replaced by smaller teams of engineers, analysts, and oversight specialists who monitor AI systems, handle edge cases, and continuously refine automated processes. The efficiency gains prove dramatic - processes that required thousands of employees complete with dozens, and processing times measured in days compress to seconds.

AI-Curated Customer Experiences

Every customer interaction - whether through mobile apps, websites, phone calls, or in-person branches - flows through AI that personalizes the experience based on comprehensive understanding of the customer's financial situation, preferences, goals, and behavioral patterns. The AI doesn't offer generic products but instead designs solutions tailored to individual circumstances.

For retail customers, AI provides financial planning guidance that rivals human advisors, monitors spending patterns to identify savings opportunities, and proactively suggests actions to improve financial health. It detects life events - a new job, a home purchase, a child's birth - and adjusts recommendations accordingly. For corporate clients, AI analyzes business operations, identifies financial optimization opportunities, and structures tailored banking solutions.

The human advisor role doesn't disappear but evolves. For high-net-worth individuals and complex corporate clients, humans provide strategic counsel, relationship management, and judgment on sophisticated financial decisions. For routine needs and standard products, AI handles interactions entirely.

Intelligent Risk Management

Risk management becomes continuous, comprehensive, and adaptive rather than periodic and rules-based. AI systems monitor every transaction, every position, every counterparty exposure in real-time. They detect subtle patterns indicating emerging risks before they manifest as losses. They conduct scenario analysis across hundreds of potential futures, identifying vulnerabilities and suggesting mitigations. They optimize capital allocation to maximize risk-adjusted returns while maintaining regulatory compliance.

Credit decisions happen instantaneously through AI analysis that considers far more factors than traditional underwriting - transaction patterns, behavioral signals, external data sources, and subtle correlations that human analysts would never detect. The result is both more accurate risk assessment and greater financial inclusion as AI can extend credit to customers who lack traditional credit histories but demonstrate creditworthiness through alternative indicators.

Agentic Trading and Treasury Management

Trading evolves from humans making decisions with AI assistance to AI agents executing strategies under human supervision. These agents don't simply follow instructions but adapt tactics dynamically based on market conditions. They identify opportunities, assess risks, and execute trades across multiple markets and asset classes simultaneously.

Treasury operations become largely autonomous, with AI managing liquidity, optimizing funding costs, deploying capital efficiently, and managing regulatory capital requirements. The systems continuously learn from outcomes and refine their strategies, achieving performance that surpasses human traders while operating at scale impossible for human teams.

Seamless Cross-Border Operations

The AI bank operates globally as a unified institution rather than as a collection of regional operations. AI systems handle cross-border transactions, navigate different regulatory regimes, manage multiple currencies, and optimize global operations. Language barriers disappear as AI provides real-time translation. Time zone differences become irrelevant as AI operates 24/7. Regulatory complexity gets managed through AI that tracks requirements across jurisdictions and ensures compliance.

Predictive and Proactive Banking

Rather than reacting to customer requests, the AI bank anticipates needs. It identifies when a customer will likely need credit and offers it proactively. It detects when a business client might face cash flow challenges and suggests solutions before crises emerge. It recognizes market conditions where clients might benefit from portfolio adjustments and recommends actions.

This proactive approach extends to risk management, where AI predicts potential fraud before it occurs, identifies emerging cyber threats, and detects operational vulnerabilities. The institution shifts from managing problems to preventing them.

Organizational Structure

The organizational structure of a true AI bank differs dramatically from traditional banks. The massive hierarchical structures of traditional banking - layers of management overseeing armies of workers performing specialized functions - give way to flatter organizations where smaller teams of specialized experts oversee AI systems executing work.

Job categories shift from operators to orchestrators, from executors to strategists, from processors to problem-solvers. The institution becomes a hybrid human-AI organization where defining the boundary between human and machine contributions becomes difficult.

The Category Question

This raises a profound question: Is such an institution still a "bank," or does it represent something fundamentally new - an intelligent financial system that happens to be organized as a corporation? Traditional banks are human organizations that provide financial services. AI banks are artificial intelligence systems governed by humans that provide financial services. The distinction may seem semantic, but it carries implications for regulation, liability, corporate governance, and how we think about financial institutions' role in society.

If banking work largely flows through AI systems, with humans providing oversight and strategic direction but not executing most tasks, how should we regulate such institutions? Do traditional frameworks built around human decision-making and accountability still apply? What happens when AI systems make decisions that harm customers or create systemic risks?

These questions lack clear answers, and grappling with them will occupy regulators, legal scholars, ethicists, and industry participants throughout the coming decade. The transformation of banking through AI represents not just technological change but institutional evolution that challenges foundational assumptions about how financial services should be organized and governed.

Final thoughts

The transformation of banking through artificial intelligence has moved from speculative possibility to operational reality. JPMorgan Chase is being "fundamentally rewired" for the AI era, with plans to provide every employee with AI agents, automate every behind-the-scenes process, and curate every client experience with AI. This vision, while ambitious, increasingly appears achievable rather than fantastical.

The drivers of this transformation prove powerful and mutually reinforcing. Competitive dynamics compel banks to deploy AI or risk being outcompeted by institutions that do. Technological capabilities continue advancing at remarkable pace, with AI systems demonstrating competence across tasks previously thought to require uniquely human intelligence. Economic pressures favor automation that reduces costs while improving service quality. Customer expectations evolve toward digital experiences that demand sophistication only AI can deliver at scale.