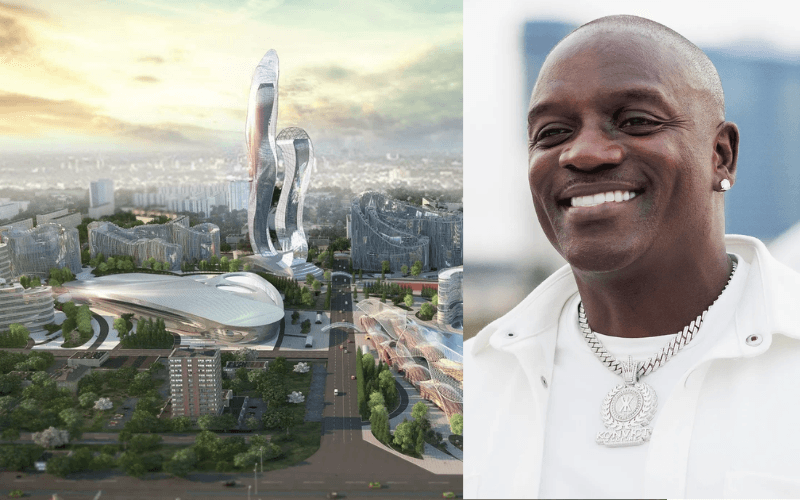

In 2018, R&B artist Akon stood before cameras and announced what seemed like the future incarnate: a $6 billion crypto-powered metropolis rising from the Senegalese coast. Akon City would run on his Akoin cryptocurrency, feature solar-powered skyscrapers, and become, in his words, a "real-life Wakanda." It would revolutionize how cities function, replacing traditional governance with blockchain transparency and fiat currency with digital tokens.

Seven years later, in July 2025, the Senegalese government officially terminated the project. Most of the 136 acres granted to Akon were reclaimed by the state. The grand vision of a futuristic crypto city dissolved into what critics called inevitable failure. Only a welcome center was partially constructed. Local residents who sacrificed their land remained uncompensated.

Akon City was not alone in its demise. Across the globe, dozens of "crypto cities" announced with fanfare between 2017 and 2022 have either collapsed entirely, stalled indefinitely, or shrunk to shadows of their promised scale. From the Pacific islands of Vanuatu to the rainforests of Honduras, from Puerto Rican tax havens to Wyoming ranchlands, the crypto urbanism movement has delivered a pattern: grand announcements, massive fundraising, minimal construction, and eventual abandonment.

Yet the question persists. As blockchain technology matures and 1,749 companies now populate Switzerland's Crypto Valley, with Dubai implementing blockchain across government services, and El Salvador's Bitcoin Beach demonstrating limited but functional crypto integration, the central question demands examination: Why have so many crypto cities failed, and can the dream still work?

The Intellectual Origins: From Seasteading to Network States

The crypto city concept did not emerge from a vacuum. Its roots trace to libertarian experiments in governance that predate Bitcoin itself.

The modern charter city movement gained momentum in the 2000s through economist Paul Romer's proposals for special economic zones managed by developed nations in developing countries. But the crypto-specific vision crystallized through multiple intellectual streams.

Patri Friedman's Seasteading Institute, founded in 2008, promoted permanent autonomous ocean communities beyond government jurisdiction. The institute attracted funding from Peter Thiel and sparked numerous failed attempts to establish floating crypto havens, including projects like Liberland, a self-proclaimed micronation on contested land between Croatia and Serbia.

The 2013-era emergence of Ethereum and smart contracts added technological credibility. If code could replace legal contracts and DAOs could govern digital organizations, why couldn't blockchain replace municipal governance? The conceptual leap seemed logical: deploy smart contracts for property rights, use tokens for local economies, record citizenship on-chain, and bypass traditional government inefficiencies.

Then came Balaji Srinivasan's "Network State" thesis, published in 2022. Srinivasan, former CTO of Coinbase and general partner at Andreessen Horowitz, proposed that digital communities could crowdfund physical territory globally and eventually achieve diplomatic recognition.

A network state, he defined, is "a social network with a moral innovation, a sense of national consciousness, a recognized founder, a capacity for collective action, an in-person level of civility, an integrated cryptocurrency, a consensual government limited by a social smart contract, an archipelago of crowdfunded physical territories, a virtual capital, and an on-chain census."

This vision resonated in crypto circles. By 2024, Srinivasan had launched Network School in Malaysia's troubled Forest City megaproject, where 150 students explored building "startup societies." The school represents the Network State concept in prototype form: a community united by shared technological values, experimenting with new governance models on physical land.

Honduras provided legal infrastructure through ZEDEs (Zones for Employment and Economic Development), special economic zones with autonomous governance. El Salvador's adoption of Bitcoin as legal tender in 2021 legitimized national-scale crypto integration. These developments created an environment where crypto cities seemed not just possible but inevitable.

The intellectual groundwork was laid. Billions in crypto wealth created from the 2017 and 2021 bull runs provided capital. Blockchain technology offered the tools. All that remained was execution.

The High-Profile Experiments: Case Studies in Failure and Friction

Akon City, Senegal: The Celebrity Mirage

Akon announced his Senegalese crypto city in 2018, promising to transform Mbodiène, a farming village 80 kilometers from Dakar, into a $6 billion metropolis powered by his Akoin cryptocurrency. The project would include a hospital, university, hotels, shopping malls, and a marina.

The government granted Akon 136 acres in 2020. Construction was promised to begin in 2023. By August 2024, Senegal's tourism development body SAPCO issued an ultimatum: make progress or return 90% of the land.

The ultimatum expired. In July 2025, Senegal officially scrapped the project, reclaiming most of the land. Akon retained only eight hectares for a scaled-back tourism development.

The financial realities tell the story. Akoin cryptocurrency, central to the city's economy, launched in 2020 at $0.15. By August 2024, it traded at $0.003, representing a 98% collapse. The currency had been delisted from every exchange where it once traded.

Local impact proved devastating. Residents who sacrificed land for the project received no compensation. The welcome center, the only partially constructed element, stood as a monument to failed promises. Meanwhile, Senegal faced a debt crisis after audits revealed $7 billion in hidden liabilities, constraining resources for any large-scale development.

Critics identified Akon City as speculative urbanization: a high-concept pitch designed primarily to promote Akoin cryptocurrency, with the city itself secondary. The pattern repeated elsewhere: token launches required hype, and nothing generated hype like announcing a futuristic city.

Akon himself stopped discussing the project publicly after 2022. When asked to record Cameo videos, he explicitly refused crypto-related requests. The dream of a "real-life Wakanda" dissolved into Senegal's coastal winds.

Praxis: The $525 Million Question Mark

In October 2024, a project called Praxis made headlines by securing $525 million in financing, making it one of the largest crypto city funding rounds ever. Led by Venezuelan entrepreneur Dryden Brown, Praxis aims to build a "heroic and beautiful" city combining AI, crypto, and biotech with minimal regulation.

The funding structure reveals the speculative nature. GEM Digital contributed $500 million, receiving compensation in crypto tokens tied to future real estate projects. Backers include Paradigm, Winklevoss Capital, and crypto personalities like Farcaster's Dan Romero.

But by early 2025, Praxis remained entirely conceptual. Brown anticipated a location decision by Q1 2025. The initial stage targets 1,000 acres for 10,000 people. No land has been purchased. No construction has begun. No governmental approvals have been secured.

The project describes itself as creating a city where "technology and minimal regulations coexist seamlessly," blending "futuristic and classical aesthetics with scalable urban planning." Yet concrete details remain scarce beyond marketing materials and investor pitches.

Praxis faces the same challenges that sank predecessors. Ari Redbord, global head of policy at TRM Labs, told Cointelegraph: "The realistic path isn't a new sovereign city; it's crypto native neighborhoods within state-backed zones where licensing, AML and immigration are already solved."

The project represents either evolution in thinking or repetition of past mistakes. Time will reveal which. For now, Praxis exists primarily as a $525 million promise and a vision document.

Satoshi Island, Vanuatu: NFT Paradise in Perpetual Development

Launched in 2021, Satoshi Island promised a 32-million-square-foot crypto paradise in Vanuatu where all transactions occur in Bitcoin and all property exists as NFTs. The project received government approval and attracted 50,000 citizenship NFT applications.

The island's 21,000 parcels would be sold as "Land NFTs" for cryptocurrency. Modular homes would be shipped and installed. Construction was promised for Q3 2022, with residents moving in by Q1 2023.

Three years later, progress remains minimal. An October 2024 update outlined plans for pre-fabricated structures but provided no arrival timeline. The project website shows artist renderings and blueprints, but physical development stays largely theoretical.

Financial indicators suggest trouble. The Satoshi Island Coin (STC) that would "power the economy" has collapsed 99.7% from all-time highs. Citizenship NFTs, once generating excitement, now trade on secondary markets with "no buyers to be found."

The project encountered predictable obstacles. Vanuatu citizenship costs $130,000 separately from the NFT, creating confusion. The citizenship NFT grants no actual Vanuatu citizenship, only project governance rights. Infrastructure challenges proved daunting: bringing power, water, internet, and waste management to a remote island requires massive investment beyond token sales.

Local complications emerged. The Vanuatu Financial Services Commission initially denied granting licenses, though later approvals were claimed. Questions about land rights and environmental impact persist.

Satoshi Island exemplifies projects where blockchain solutions created problems rather than solving them. Traditional land purchase and building permits, while bureaucratic, provide clarity. NFT-based land ownership with DAO governance and cryptocurrency citizenship added complexity without corresponding benefits.

CityDAO, Wyoming: Blockchain Meets Reality's Friction

In November 2021, CityDAO became the first DAO to legally purchase land in the United States, buying 40 acres near Yellowstone National Park for approximately $100,000. The project capitalized on Wyoming's pioneering DAO LLC law, which recognized DAOs as legal entities.

CityDAO sold citizenship NFTs for voting rights, raising over $8 million from 5,000+ members globally. The vision: demonstrate on-chain land ownership and governance, then scale to build "the city of the future on the Ethereum blockchain."

Reality proved more complex. A Harvard Belfer Center analysis in 2023 revealed governance paralysis. Every decision required a quorum of 500 voters. Simple choices about land use dragged on for months. The veto power embedded in DAO governance meant most proposals died.

Founder Scott Fitsimones acknowledged in later writings that immense coordination costs and regulatory friction "negate the benefits of using a DAO in the first place." The property remained largely undeveloped. Grant programs funded minor improvements, but the grand vision of a blockchain city stalled on a rocky Wyoming hilltop.

The experiment did prove one thing: blockchain can enable collective land ownership. But it also exposed that successful cities require more than distributed ledgers. They need water, electricity, sewage, road access, building permits, and mechanisms for quick decision-making that DAOs struggle to provide.

By 2024, CityDAO had become a cautionary tale rather than a blueprint. The 40-acre parcel exists. The DAO functions. But the gap between purchasing land via NFT and building a functioning city proved vast.

Prospera, Honduras: The Legal Battle for Crypto Sovereignty

Próspera represents perhaps the most advanced crypto city experiment, and simultaneously the most contentious. Founded in 2017 by Venezuelan entrepreneur Erick Brimen on Honduras's Roatán island, Próspera operated as a ZEDE with extraordinary autonomy: its own laws, courts, tax system, and regulations.

The city attracted significant crypto investment. Balaji Srinivasan visited in 2024, declaring it "crypto, bio, robo — and not San Francisco." Coinbase CEO Brian Armstrong invested in January 2025, calling it "the best place to do business on the planet."

Próspera launched over 200 businesses, raised over $100 million in investments, and established physical presence including a Bitcoin Center, luxury resort, golf course, and development zones. Bitcoin became legal tender within the ZEDE. Tax rates stayed minimal: 1% on business revenue, 5% on personal income.

But success bred conflict. Local communities, particularly neighboring Crawfish Rock's Garifuna population, opposed the development. Village leader Luisa Connor stated, "Próspera deceived us big time." Residents feared land expropriation and cultural displacement.

Political change escalated tensions. When Xiomara Castro became president in 2022, she vowed to eliminate ZEDEs, calling them creations of a "narco-regime." Congress unanimously repealed the ZEDE law in April 2022. In September 2024, the Supreme Court ruled all ZEDEs unconstitutional with retroactive effect.

Próspera's response: a $10.775 billion lawsuit against Honduras at the World Bank's ICSID tribunal, claiming lost future returns. The amount represents roughly two-thirds of Honduras's 2022 budget.

Honduras withdrew from ICSID in August 2024 to escape the tribunal's jurisdiction, but the ICSID ruled the claim could proceed. U.S. Representative María Elvira Salazar issued warnings about "expropriating the ZEDEs," and Brimen conducted Washington lobbying tours seeking support.

Meanwhile, Roatán's mayor ordered Próspera to pay municipal taxes, refusing to "recognize Próspera as another nation or country." The Ministry of Health launched investigations into unregulated genetic testing conducted by Minicircle, a biotech firm in Próspera's "longevity district."

As of 2025, Próspera remains operational but in legal limbo. It hosted a "crypto cities summit" in February 2025. Construction continues. But its future depends on arbitration outcomes that could bankrupt Honduras or shut down the ZEDE entirely.

Próspera demonstrates that crypto cities face existential challenges when they conflict with sovereign governments. No amount of blockchain sophistication or venture capital can override national jurisdiction. The question becomes whether collaboration or confrontation creates sustainable models.

Bitcoin Beach, El Salvador: The Functional Exception

While most crypto cities failed or stalled, Bitcoin Beach in El Zonte, El Salvador, achieved something different: a modest but functioning Bitcoin-powered local economy.

Starting in 2019, an anonymous donor gave $100,000 in Bitcoin to the coastal village with one condition: create a circular Bitcoin economy. Local leaders Roman Martínez and Mike Peterson built infrastructure. Shops accepted Bitcoin via Lightning Network. A Bitcoin Beach app facilitated transactions.

When President Nayib Bukele adopted Bitcoin as legal tender in 2021, he explicitly cited El Zonte as inspiration. Bitcoin Beach had proven the concept's viability on a small scale.

Results remain mixed. Land prices in El Zonte soared 134.8% since 2021, from $34.33 to $80.61 per square meter on average. Luxury projects price land at $1,058.57 per square meter. Beachfront properties now start at $1 million.

Some local businesses reported 30% increases from cryptocurrency tourists. New infrastructure emerged: Wave House luxury condos, upgraded roads, improved drainage systems. Foreign investment arrived, including from Tether executives Giancarlo Devasini and Paolo Ardoino.

But gentrification followed. Original residents faced displacement as prices rose beyond local affordability. Bitcoin adoption in El Salvador overall remained limited: polls showed usage declining from 25.7% in 2021 to 8.1% in 2024. The government's Chivo wallet struggled with low retention: 61% of users stopped using it after spending their $30 signup bonus.

In December 2024, as part of an IMF loan agreement, El Salvador reduced Bitcoin purchases, removed mandatory merchant acceptance, and stopped accepting tax payments in Bitcoin. The experiment scaled back significantly.

Bitcoin Beach's success was real but limited. It proved that Bitcoin payments can function at village scale with proper infrastructure. It demonstrated that crypto-tourism exists. But it also revealed that small-scale success doesn't guarantee larger viability, and that crypto integration creates winners (investors, expatriates) and losers (priced-out locals).

The model works as a pilot, not a blueprint for nation-building.

Puerto Rico: Tax Haven, Not Crypto City

After Hurricane Maria devastated Puerto Rico in 2017, crypto entrepreneurs led by Brock Pierce descended on the island, drawn by Act 22 tax incentives offering zero taxes on capital gains for new residents.

They announced "Puertopia" (later renamed "Sol"), a crypto city at Roosevelt Roads Naval Base in Ceiba where all transactions would use cryptocurrency. Pierce purchased a colonial building. Crypto banks and Bitcoin ATMs proliferated. Wealthy Bitcoin holders relocated for tax benefits.

The concept failed as a city but succeeded as a tax haven. No crypto city materialized. Roosevelt Roads remained largely vacant. But hundreds of crypto millionaires established residence, attending "Crypto Mondays San Juan" events at bars in Old San Juan's tourist district.

The economic impact proved controversial. Puerto Ricans faced rising housing costs and gentrification. In April 2025, Democratic lawmakers introduced legislation to end Puerto Rico's crypto tax benefits, with Representative Nydia Velázquez arguing the influx "drove up housing costs, pushed out local residents, and added pressure to an island where nearly 40% of people live in poverty."

Puerto Rico's experience revealed a fundamental distinction. Individual tax optimization does not constitute urban innovation. Wealthy crypto holders seeking tax benefits through Act 60 contributed little to Puerto Rican development beyond their own real estate investments and consumption.

The collapsed crypto banks Noble Bank and others left behind debts and broken promises. The "Puertopia" concept was later admitted by Pierce to be "loose ideas, nothing of which was concrete or well thought out".

Puerto Rico became a cautionary tale of disaster capitalism: wealthy outsiders exploiting post-catastrophe opportunities and tax loopholes while providing minimal benefit to local communities. Childhood poverty remained above 50%, power outages persisted, and wealth inequality increased despite crypto arrivals.

This wasn't a crypto city experiment. It was tax avoidance with blockchain branding.

The Pattern of Failure: Why Most Projects Collapsed

After examining dozens of crypto city projects across seven years and four continents, recurring failure patterns emerge with remarkable consistency.

Unrealistic Tokenomics and Fundraising Models

Nearly every failed crypto city launched with an associated token that would "power the economy." Akoin for Akon City. STC for Satoshi Island. Citizenship NFTs for CityDAO. The pattern repeated: create token hype, promise future utility, raise millions, deliver minimal infrastructure.

Akoin collapsed from $0.15 to $0.003, a 98% decline. Satoshi Island Coin dropped 99.7%. Token holders suffered massive losses while project founders retained control over funds.

The fundamental problem: tokens created to fund cities had no intrinsic value until the cities existed. But cities couldn't exist without token funding. This circular dependency made most tokenomics models speculation vehicles rather than functional currencies.

Traditional city funding uses bonds, taxes, and municipal revenues. These have centuries of refinement and legal frameworks. Crypto cities invented fundraising mechanisms without consideration for how cities actually finance infrastructure over decades.

Ari Redbord from TRM Labs explained to Cointelegraph: "Many crypto city experiments fail because they are fundamentally detached from the realities of urban development. You can't bootstrap a city with token sales alone."

Absence of Physical Infrastructure and Implementation Capability

Announcing a crypto city requires press releases and artist renderings. Building one requires engineers, construction workers, power systems, water treatment plants, roads, hospitals, schools, waste management, and telecommunications infrastructure.

Most crypto city projects excelled at the former and failed catastrophically at the latter.

Akon City built a welcome center. Satoshi Island shipped no modular homes despite years of promises. CityDAO purchased land but erected no buildings. The gap between vision and execution proved insurmountable.

Traditional urban development requires specialized expertise: civil engineers, urban planners, construction managers, utility specialists, environmental engineers, transportation experts. Few crypto entrepreneurs possessed these skills or adequately hired those who did.

The projects that achieved physical presence — Bitcoin Beach's infrastructure, Prospera's developments — succeeded by engaging conventional construction and engineering firms, not by innovating through blockchain.

Cities are fundamentally physical. Blockchain provides no shortcut around concrete, steel, plumbing, and electrical work.

Legal Gray Zones and Government Friction

Crypto cities operated in a fundamental paradox: they sought autonomy from government while requiring governmental legitimacy for property rights, legal enforcement, and international recognition.

Próspera obtained extraordinary autonomy through Honduras's ZEDE law, but when the government changed and repealed that law, the entire legal foundation collapsed. The $10.775 billion lawsuit represents an attempt to use international arbitration to override sovereign national decisions.

Akon City required Senegalese government land grants. When SAPCO demanded progress, the project ended. Satoshi Island needs Vanuatu's cooperation for infrastructure and regulations. CityDAO discovered that Wyoming state law and Park County zoning still applied despite blockchain governance.

Sean Ren, co-founder of Sahara AI, told Cointelegraph: "If a crypto city hopes to evade government control and regulation, it will be doomed. However, a purpose-built zone inside an already established city for testing new technologies, such as tokenized property rights or AI data governance, would have a greater chance of success."

No blockchain system can enforce property rights without state recognition. No DAO can provide police, courts, or military defense. No smart contract can negotiate water rights or electrical grid connections.

Successful special economic zones like Singapore, Hong Kong, or Dubai's free zones succeeded through government partnership, not opposition. Crypto cities attempting to bypass government inevitably failed.

Social Dimension: Colonial Optics and Community Resistance

Many crypto city projects exhibited troubling colonial patterns: wealthy foreigners arriving in economically disadvantaged regions, promising development while pursuing their own interests.

In Honduras, Crawfish Rock residents protested Próspera, claiming they were never properly consulted. In Puerto Rico, locals protested crypto millionaires driving gentrification. In Senegal, villagers sacrificed land for Akon City but received no compensation when it failed.

The pattern: outsiders with capital imposed visions on communities without meaningful local participation. When Stephen Morris, a Puertopia participant, told the New York Times, "It's only when everything's been swept away that you can make a case for rebuilding from the ground up," he articulated disaster capitalism openly.

Traditional urban development requires community buy-in, local government cooperation, and genuine benefit to existing residents. Crypto cities often treated local populations as obstacles or afterthoughts rather than stakeholders.

The successful models integrated with communities rather than displacing them. Bitcoin Beach worked through local leaders. Zug's Crypto Valley collaborated with cantonal government. The failed projects operated as colonial enclaves.

Misalignment Between Crypto Ideals and Urban Reality

Cities require centralized infrastructure coordination. Water systems need integrated planning. Electrical grids demand unified management. Emergency services require hierarchical command structures. Transportation networks need comprehensive coordination.

DAOs excel at certain functions: distributing rewards, coordinating online communities, managing digital assets. They struggle with rapid decision-making, emergency response, and complex system integration.

CityDAO discovered that requiring 500-voter quorums for every decision created governance paralysis. Simple decisions took months. The "vetocracy" problem — where the default outcome becomes "no" — plagued blockchain governance.

Cities face daily emergencies: fires, floods, accidents, crime, medical crises. These require instant decision-making authority, not on-chain voting. No DAO structure has solved this tension between decentralized ideals and operational reality.

The most successful blockchain urban integration models — Dubai, Zug, Singapore — maintained traditional governmental structures while using blockchain for specific functions like land registries, trade documentation, and identity management. They didn't replace government with code.

The Regulatory Reality: Cities Cannot Exist Outside Law

One fantasy united nearly all failed crypto cities: the belief that blockchain technology could somehow bypass or replace traditional legal and governmental structures.

Reality proved otherwise. Cities exist within national and international legal frameworks. Property rights require state enforcement. Contracts need judicial backing. Infrastructure requires regulatory approval. Cross-border recognition demands diplomatic relationships.

Prospera's $10.775 billion lawsuit exemplifies the problem. The project secured legal autonomy through Honduras's domestic law. When that law was repealed and declared unconstitutional, Próspera turned to international investment arbitration. But even with international tribunal support, enforcing a judgment against a sovereign nation requires cooperation from that nation's government.

Honduras responded by withdrawing from ICSID entirely, demonstrating that nations retain ultimate sovereignty regardless of blockchain systems or international tribunals.

Special economic zones succeed when they complement national development goals. China's SEZs like Shenzhen worked because they advanced Communist Party objectives. Dubai's free zones thrive because they support UAE economic diversification. Estonia's e-residency program functions because it strengthens Estonian digital leadership.

Successful models require governmental partnership. The Dubai Blockchain Strategy aims to make Dubai "the first city fully powered by blockchain by 2020" through government initiative, not private displacement. Wyoming's DAO LLC law creates legal frameworks for blockchain entities, allowing projects like CityDAO to function legally.

The lesson: blockchain can enhance governmental efficiency and transparency, but cannot replace governments. Cities attempting sovereignty through code alone failed uniformly.

What Actually Worked: Integration Over Isolation

While standalone crypto cities collapsed, blockchain integration into existing urban infrastructure achieved meaningful successes. The difference lay in approach: enhancement rather than replacement.

Zug, Switzerland: Crypto Valley's Cooperative Model

Zug transformed into Crypto Valley not by replacing government but by welcoming innovation. Starting in 2013 when Bitcoin Suisse and Monetas established operations, Zug grew to host 1,749 active blockchain companies by 2024, a 132% increase since 2020.

Success factors included:

Clear regulatory frameworks: Swiss Financial Market Supervisory Authority (FINMA) provided clear guidelines for crypto operations, reducing legal uncertainty.

Government cooperation: The City of Zug announced in 2016 it would accept Bitcoin for municipal payments up to CHF 200. The gesture signaled openness to blockchain business.

Educational infrastructure: The Canton of Zug invested 39.35 million Swiss francs over five years to establish blockchain research institutes at University of Lucerne and Lucerne University of Applied Sciences.

Quality of life: Switzerland's political stability, excellent education system, and high living standards attracted global talent naturally.

Strategic tax policy: Crypto capital gains remain tax-free for individuals unless classified as professional traders.

By 2025, Crypto Valley's top 50 companies reached a combined valuation of $593 billion, with major projects like Ethereum, Cardano, Solana, and Polkadot headquartered in Zug. The region accounted for 29.1% of European blockchain financing in 2024.

Zug succeeded by enhancing existing urban infrastructure with blockchain capabilities rather than attempting to build cities from scratch. The government remained traditional. Blockchain added efficiency and attracted specific industries. The model proved sustainable.

Dubai: Blockchain as Urban Enhancement

Dubai's blockchain strategy exemplifies governmental initiative leveraging technology. The emirate aims to process 50% of government transactions on blockchain by 2031 and become "the first blockchain-powered city."

Implementation focused on practical applications:

Land registry: Dubai Land Department partnered with Crypto.com in 2025, enabling property purchases with Bitcoin, Ethereum, and stablecoins. Major developers like Damac Properties and Emaar integrated cryptocurrency payment options.

Trade documentation: Dubai launched blockchain-based trade platforms in July 2024, automating customs clearance and reducing paperwork.

Identity management: UAE Pass integrates blockchain for secure identity verification, allowing residents to access government services, transfer money, and manage documents digitally.

Regulatory clarity: Virtual Assets Regulatory Authority (VARA) established in 2022 provides licensing and oversight for crypto businesses, ensuring investor protection while fostering innovation.

Results showed measurable impact. Dubai's blockchain integration could save the government at least $1.5 billion annually on document processing by achieving paperless transactions. Over 1,800 blockchain projects now operate under Dubai Blockchain Center oversight.

Marwan Al Zarouni, CEO of Dubai Blockchain Center, explained to TechInformed: "Part of the Digital Dubai strategy is that everything from the government has to be digitised and paperless, so it makes the integration of new digital projects much easier."

Dubai's success stemmed from government-led initiative using blockchain to improve existing services rather than private attempts to create parallel governance structures.

Estonia: Digital Governance Blueprint

Though not explicitly a crypto project, Estonia's e-residency program demonstrates how blockchain principles can enhance government services. Estonia uses distributed ledger technology for its digital identity system, healthcare records, and corporate registries.

The program allows global entrepreneurs to establish Estonian companies remotely, accessing EU markets through digital frameworks. Over 100,000 e-residents from 170+ countries have registered since 2014.

Estonia's approach: maintain traditional government while using blockchain for specific security and efficiency gains. The success proves that blockchain technology works best as governmental tool rather than governmental replacement.

The Evolving Blueprint: From Utopias to Urban Upgrades

As the first generation of crypto cities failed, a second generation emerged with more realistic models. The shift moved from building sovereign states to enhancing existing jurisdictions.

Network State Evolution

Balaji Srinivasan's Network School in Malaysia's Forest City represents the Network State concept in practice. Rather than building a city from nothing, the project operates within an existing (if troubled) development, focusing on community building and governance experimentation.

The three-month program brings together startup founders, engineers, and digital nomads to live, work, and learn together. The school emphasizes "continuous daily self-improvement: learning skills, burning calories, and earning currency" while fostering community around shared values.

This model scales down ambition from "sovereign state" to "intentional community with blockchain governance." It may prove more sustainable by avoiding conflict with national governments while still experimenting with new organizational forms.

Crypto-Native Neighborhoods

Rather than building entire cities, newer projects focus on crypto-enabled neighborhoods within existing urban frameworks. This approach provides blockchain benefits while leveraging established infrastructure and legal systems.

Ari Redbord articulated this path: "The realistic path isn't a new sovereign city; it's crypto native neighborhoods within state-backed zones where licensing, AML and immigration are already solved. The winning ingredients are: a government partner with delegated regulation and visas, multibillion-dollar staged capital, clear crypto rules, and anchor employers in AI, crypto and biotech."

Examples emerging include:

- Ethereum community popup events like Zuzalu in Montenegro

- Base Network creating "Basecamp" communities

- Solana's "Forma" and economic zones initiatives

- Telegram's Network State community programs

These experiments maintain legal compliance while creating blockchain-enabled communities. They avoid sovereign claims while delivering actual functionality.

DePIN: Decentralized Physical Infrastructure Networks

DePIN represents perhaps the most pragmatic application of crypto principles to physical infrastructure. Rather than building cities, DePIN projects create distributed physical networks rewarding participants with tokens.

The DePIN market reached $25 billion across 350 tokens in 2024, with over 13 million devices contributing daily. Applications include:

Wireless networks: Helium deployed over 1 million hotspots globally, creating decentralized IoT and mobile coverage. Users earn tokens by providing network connectivity.

Mapping services: Hivemapper incentivizes users to collect map data with dashcams, mapping over 330 million kilometers by October 2024.

Cloud computing: Projects like Akash Network, Render Network, and Flux provide decentralized computing resources, challenging centralized providers like AWS.

Energy grids: DePIN enables distributed renewable energy systems with blockchain-based trading and management.

Storage networks: Filecoin offers decentralized data storage with approximately 23 exbibytes of capacity.

DePIN proves more successful than crypto cities because it:

- Solves specific problems rather than reimagining entire systems

- Operates within existing legal frameworks

- Provides immediate utility to participants

- Scales incrementally rather than requiring massive upfront investment

- Avoids sovereignty claims that trigger government opposition

Sean Ren from Sahara AI noted: "The real opportunity isn't in creating walled gardens for tech elites but in creating regulatory sandboxes that feed lessons back into national policy."

Regulatory Sandboxes and Innovation Zones

Governments increasingly establish "regulatory sandboxes" allowing blockchain experimentation under controlled conditions. These zones provide legal clarity while limiting systemic risk.

Examples include:

- Abu Dhabi Global Markets (ADGM) offering pro-crypto regulation

- Singapore's $40 billion JTC development arm supporting innovation parks

- Dubai's crypto-friendly business zones with VARA oversight

- Wyoming's DAO LLC framework enabling legal blockchain entities

These approaches recognize blockchain's potential while maintaining governmental oversight. They enable innovation without threatening sovereignty.

The Global Map: What Remains Alive Today

By 2025, the crypto city landscape has winnowed dramatically. A status assessment:

Akon City (Senegal): Failed. Officially cancelled July 2025.

Satoshi Island (Vanuatu): Stalled. Minimal development after three years.

CityDAO (Wyoming): Limited success. Land purchased and legally owned, but development minimal.

Próspera (Honduras): Operational but contested. Facing constitutional challenges and $10.775 billion lawsuit.

Praxis: Concept stage. $525 million raised but no land purchased or construction begun as of Q1 2025.

Bitcoin Beach (El Salvador): Partial success. Functional Bitcoin economy at village scale, but facing gentrification pressures.

Puerto Rico crypto community: Transformed into tax haven rather than crypto city. No urban innovation achieved.

Network School (Malaysia): Active. Community experiment rather than sovereign city project.

The pattern reveals that projects achieving any success either integrated with existing governments (Bitcoin Beach, Network School) or operated under governmental frameworks initially (Próspera), while standalone sovereignty attempts universally failed.

Expert Perspectives: The Path Forward

Industry leaders and academics increasingly converge on similar conclusions about crypto urbanism's future.

Vladislav Ginzburg, founder of OneSource, advocates for strategic partnerships: "The realistic path isn't a new sovereign city; it's crypto native neighborhoods within state-backed zones where licensing, AML and immigration are already solved."

Maja Vujinovic from FG Nexus emphasizes infrastructure realities: "You can't bootstrap a city with token sales alone. Urban development requires civil engineering, not just software engineering."

Academic research from Harvard's Belfer Center concluded that "immense coordination and regulatory costs negate the benefits of using a DAO" for physical governance, suggesting blockchain works better for specific functions than comprehensive governance.

MIT Technology Review identified crypto cities as "speculative urbanization" — high-concept pitches designed primarily to promote token offerings rather than genuine urban development.

The consensus: blockchain technology offers valuable tools for enhancing urban governance, property rights, and infrastructure management, but cannot replace the complex institutional frameworks that make cities function.

What Next: The Future of Crypto Urbanism

If the first generation of crypto cities failed, what does the second generation look like?

Government-led integration: Cities like Dubai, Singapore, and Zug demonstrate that governmental initiative using blockchain technology works better than private replacement. Expect more cities to adopt blockchain for land registries, identity management, and supply chain documentation.

DePIN expansion: Messari predicts DePIN could capture 1% of the $5 trillion cloud infrastructure market, representing 10x growth from current $25 billion market cap. Local governments increasingly view DePIN as solution to infrastructure maintenance challenges.

Network state evolution: Rather than claiming sovereignty, network states may manifest as global communities with shared governance coordinating activities across multiple jurisdictions. Balaji's Network School represents this model, building culture and community before claiming territory.

Special economic zones with crypto focus: Future crypto-friendly jurisdictions will likely resemble Próspera's original vision but operate with explicit governmental partnerships rather than autonomous opposition. El Salvador's Bitcoin Office coordinating national crypto policy provides a model.

AI-governed systems: As artificial intelligence advances, AI-managed urban systems could coordinate infrastructure more efficiently than either traditional bureaucracies or DAOs. Smart cities may integrate AI decision-making with blockchain transparency.

Tokenized local economies: Rather than creating new currencies, successful models may tokenize specific urban services — parking, public transportation, energy credits — within existing monetary systems. Dubai's experiments with tokenized real estate suggest this direction.

Climate-focused crypto communities: Sustainable development may drive next-generation projects. DePIN enables distributed renewable energy systems. Blockchain can verify carbon credits and coordinate climate action. Crypto communities focused on environmental solutions rather than tax avoidance may achieve greater legitimacy.

The optimistic scenario: blockchain technology matures into valuable governmental tool, enhancing transparency, efficiency, and citizen participation without replacing democratic institutions.

The skeptical scenario: crypto urbanism proves fundamentally incompatible with physical reality's constraints, and blockchain remains primarily a financial technology rather than governance innovation.

The realistic scenario: both occur simultaneously. Blockchain integrates into existing urban systems for specific functions while standalone crypto cities remain technological fever dreams. Practical benefits emerge without revolutionary transformation.

Final thoughts

Seven years after Akon announced his Senegalese crypto city, the landscape looks dramatically different from early visions. No sovereign crypto states emerged. No cities run entirely on blockchain. No DAOs replaced traditional governments.

Yet blockchain technology did impact urban development meaningfully. Dubai processes government transactions on blockchain. Zug hosts 1,749 crypto companies in functional ecosystem. DePIN projects coordinate infrastructure across 13 million devices. Bitcoin functions at village scale in El Salvador.

The failures taught crucial lessons. Cities cannot exist outside governmental frameworks. Blockchain cannot replace the physical infrastructure expertise required for urban development. Token sales cannot substitute for municipal bonds and tax revenues. DAOs struggle with rapid decision-making needed for emergencies. Colonial approaches to development breed resistance.

But the successes revealed possibilities. Blockchain enhances property rights transparency. Smart contracts streamline bureaucratic processes. Tokenization enables new investment models. Distributed networks can coordinate infrastructure efficiently. Digital governance increases citizen participation.

The dream of crypto urbanism hasn't died — it evolved. The future won't feature blockchain cities isolated from nations. Instead, existing cities will integrate blockchain capabilities where they provide genuine benefits. Governments will use distributed ledgers for land registries, identity management, and supply chain transparency. Communities will experiment with DAO governance for specific neighborhood decisions. DePIN networks will coordinate infrastructure through token incentives.

The question was never whether blockchain could replace cities. The question was always how blockchain could improve them. That more modest but achievable vision represents crypto urbanism's viable future: not revolutionary overthrow of urban governance, but evolutionary enhancement of how cities function.

As Cointelegraph's sources concluded: "The winning ingredients are: a government partner with delegated regulation and visas, multibillion-dollar staged capital, clear crypto rules, and anchor employers in AI, crypto and biotech."

The failed utopias provide blueprints — not for building isolated crypto states, but for integrating blockchain principles into existing urban frameworks. The lesson is collaboration, not confrontation. Enhancement, not replacement. Evolution, not revolution.

That may seem disappointing to those who dreamed of blockchain-powered Wakandas rising from coastal plains. But it's the path forward that might actually work. Cities are complex adaptive systems refined over millennia. Blockchain technology is barely fifteen years old. Perhaps the real innovation lies not in replacing what works, but in augmenting it with new capabilities.

The crypto city dream didn't fail completely. It just grew up.