The cryptocurrency market has been riding a wave of optimism in the past 24 hours, buoyed by a confluence of bullish factors. Bitcoin (BTC) smashed through a new all-time high of around $124,000 – a milestone that elevated its market capitalization to roughly $2.45 trillion, even surpassing Alphabet (Google’s parent company) in value.

This surge has been underpinned by four key tailwinds: growing expectations of Federal Reserve interest rate cuts, a friendlier regulatory climate, tentative easing of geopolitical tensions, and rising institutional interest in crypto assets. These macro tailwinds have created a risk-on environment that lifted the CoinDesk 20 index of major cryptos by over 1%, with Bitcoin’s dominance reaffirmed as it reached record highs.

Yet, even as euphoria builds, crypto’s notorious volatility remains on full display. Mere hours after notching its historic peak, Bitcoin suffered a sudden 5% flash crash from ~$124K down to about $118,500, triggering roughly $577 million in long-position liquidations within one hour. Ether (ETH) and several top altcoins likewise saw 3–5% pullbacks in that swift correction. Analysts attributed the jarring dip to extremely high leverage in altcoin markets – open interest across major alts had hit a record $47 billion – which magnified the downturn once profit-taking began. Notably, such whipsaw moves are typical in crypto: steep uptrends often invite sharp pullbacks that flush out speculation, only for the market to stabilize and resume its upward trajectory. In other words, the past day’s quick reset may well be the kind of “dip” that seasoned traders look to buy, provided the fundamental uptrend remains intact.

Amid this backdrop, altcoins have been shining. Many tokens beyond Bitcoin enjoyed outsized gains over the last day – in some cases double-digit percentage surges – before the brief market-wide pullback. From major smart contract platforms to exchange tokens and memes, capital has been rotating into coins that show strong recent performance and catalysts for further growth. Below, we highlight 10 of the top-performing cryptocurrencies in the past 24 hours that traders are eyeing. Each of these coins not only outpaced the market during the rally, but also exhibits indicators of future strength – whether technical patterns, fundamental news, or increasing adoption – that could signal continued upside ahead.

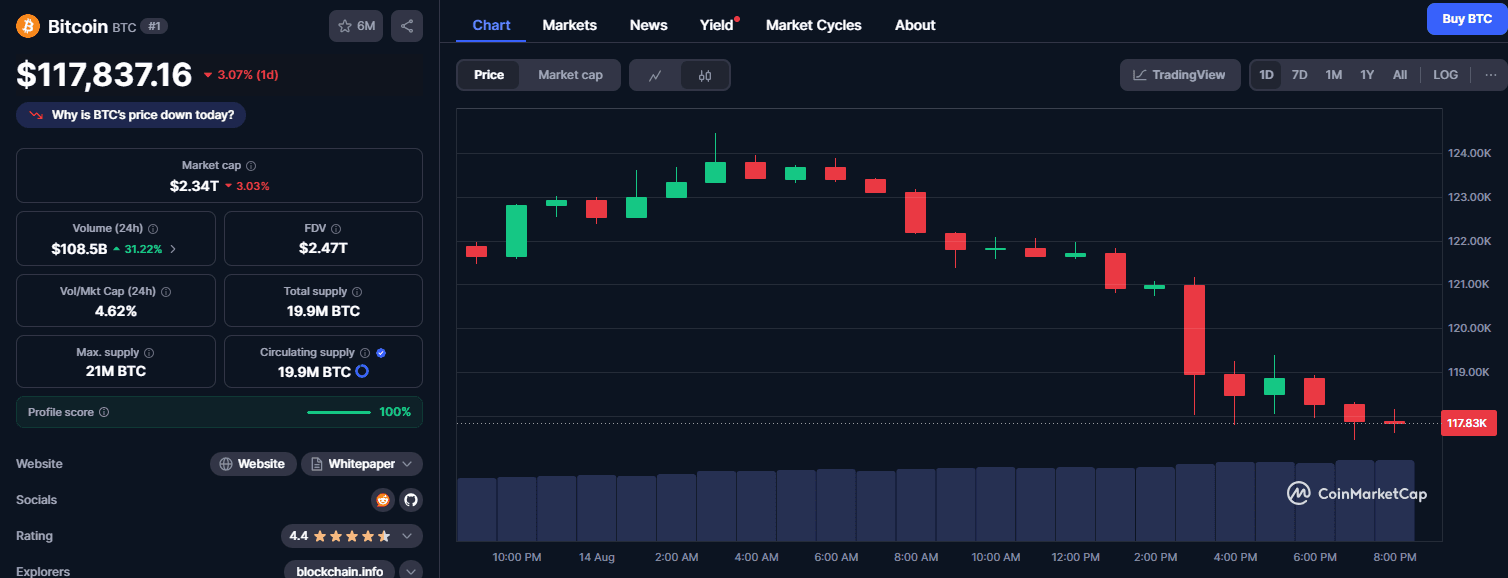

1. Bitcoin (BTC): New Highs, Then a Healthy Pullback

Bitcoin’s role as the market bellwether was on full display today. The leading cryptocurrency soared to an all-time high above $124,000 – a price spike of about 3.5% in 24 hours – cementing its status as a macro-scale asset. In fact, at that peak, Bitcoin’s market cap made it the world’s fifth-largest asset, leapfrogging mega-cap companies like Alphabet in valuation. This rally has been fueled by a potent mix of optimism: traders are anticipating that slowing inflation will spur the Fed to cut interest rates, regulatory pressures on crypto have eased somewhat, geopolitical risks (such as the war in Ukraine) show hints of de-escalation, and institutional investors are piling in via ETFs and corporate treasuries. All these factors converged to drive BTC to new heights, reinforcing its nickname as “digital gold.”

However, Bitcoin also reminded us that even in a bull run, it won’t move up in a straight line. After hitting ~$124K, BTC swiftly retreated to about $118K in a high-volume selloff, before finding its footing. This 5% pullback in a matter of hours triggered a wave of automated liquidations (over half a billion dollars in longs were wiped out) and momentarily rattled over-leveraged traders. Importantly, such a dip can be viewed as a “healthy correction” – a chance for the overheated market to cool off and shake out excess leverage. By press time, Bitcoin was already stabilizing in the $119K–$120K range, holding onto the bulk of its recent gains. Analysts note that strong support has formed around the $118K level, and market structure remains bullish overall. The quick recovery suggests that buy-the-dip demand kicked in, as many investors saw the sudden drop as an opportunity to enter Bitcoin’s uptrend at a relative discount.

Looking ahead, Bitcoin’s momentum appears intact. Key on-chain and macro indicators support the bulls: exchange-traded funds (ETFs) and institutional treasuries have accumulated over 3.6 million BTC (17% of supply) – up 3.3% in the past month alone – signaling robust long-term conviction. At the same time, the prospect of a Fed rate cut as early as next month has weakened the dollar outlook, which historically boosts Bitcoin and other hard assets. Risk factors remain – for instance, elevated derivatives open interest could still spark volatility – but overall sentiment is positive. As the rest of the crypto market rallies in Bitcoin’s wake, any further dips in BTC are likely to be closely watched. Many traders will be ready to “buy the dip” on Bitcoin, viewing it as the backbone of the crypto ecosystem and a must-have in any bullish rotation.

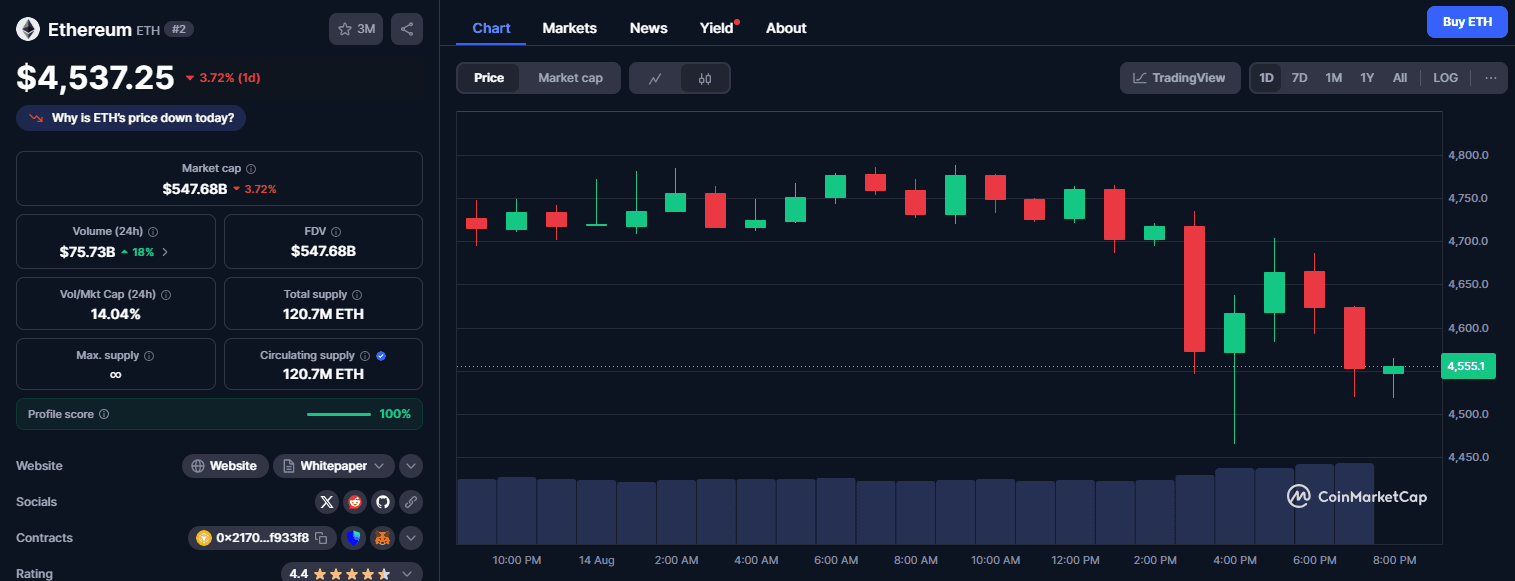

2. Ethereum (ETH): Steady Climb with Big Institutional Backing

Ethereum, the second-largest cryptocurrency, has been quietly but decisively advancing alongside Bitcoin’s surge. In the last day, ETH pushed up to about $4,750, gaining roughly 2–3% and coming within a whisker of its all-time high (just above $4,800). While not as headline-grabbing as Bitcoin’s record, Ethereum’s climb is significant – it’s now just shy of a new peak, reflecting renewed confidence in the platform’s prospects. Part of the optimism around Ethereum comes from the institutional side: this week saw record inflows into Ether-focused investment products, with more than $2.2 billion pouring into spot ETH ETFs and funds. At the same time, major crypto firms have been accumulating ETH for their treasuries, a trend that analysts say can have an outsized impact on price due to Ethereum’s smaller market cap (relative to BTC) and somewhat thinner liquidity. These institutional flows have provided a strong tailwind, and QCP Capital analysts noted they “expect the current momentum in ETH to persist as long as fresh flows continue”.

Beyond the charts, Ethereum’s fundamental outlook is bolstering its appeal. The network’s transition to proof-of-stake and recent upgrades (like EIP-1559’s fee burns and the Shanghai upgrade enabling staking withdrawals) have improved ETH’s token economics and usability. Moreover, regulatory sentiment toward Ethereum has warmed, with no signs of the kind of enforcement actions that haunted some altcoins. Investors are also watching the Ethereum ETF race: multiple Ether spot ETFs are pending approval in the U.S., and there’s rising speculation that the SEC could green-light them in the coming months, following in the footsteps of the Bitcoin ETF wave. If Ether ETFs get approved and stablecoin adoption on Ethereum continues to expand, some analysts see ETH potentially climbing toward $7,500 in the medium term. That target (50%+ above current levels) underscores the bullish case many have for the asset, given its role as the backbone of DeFi and countless blockchain applications.

All that said, Ethereum isn’t without sellers – the Ethereum Foundation itself has been trimming holdings during rallies (as a treasury management strategy). But these modest sales have done little to dent the upward trend. At ~$4,700, ETH is trading with a confident tone, and technical indicators show a strong uptrend (the token has held above its 50-day and 200-day moving averages for months). Short-term, traders are eyeing $4,800–$5,000 as a key resistance zone: a breakout above that would mark new record territory for Ethereum, likely inviting momentum buyers. On the downside, support around $4,400–$4,500 (previous consolidation areas) could serve as a cushion if another market-wide dip occurs. Given Ethereum’s integral role in crypto (powering everything from NFTs to smart contracts), many see any dip in ETH as a buying opportunity – especially with the network’s long-term indicators (like usage and fee burns) pointing to sustained growth. In summary, Ethereum’s recent steady gains, hefty institutional backing, and upcoming catalysts keep it firmly on the radar as one of the top coins to consider “buying the dip” on during market pullbacks.

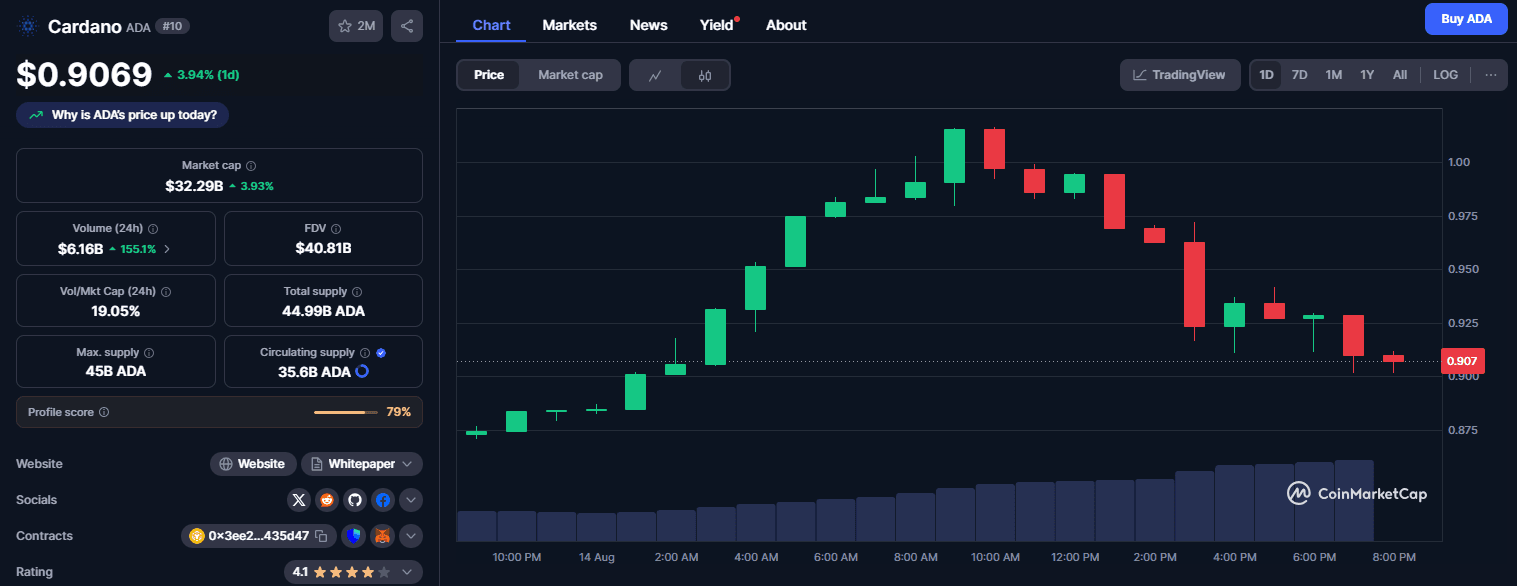

3. Cardano (ADA): Breakout Momentum After an 18% Surge

One of the standout altcoin performers in the past day has been Cardano (ADA), which is showing signs of a technical breakout after a prolonged period of consolidation. The price of ADA leapt by almost 9% in a single day and about 18% over the past week, recently trading around $0.90. This surge has pushed Cardano right up against a major resistance level – a descending trendline dating all the way back to its 2021 peak – and traders are taking notice. For most of the past four years, ADA’s rallies have been capped by a structural barrier roughly in the $0.90–$0.92 range. Now, Cardano is testing that ceiling once again, prompting speculation that a decisive breakout could open the floodgates for much larger gains ahead.

Multiple technical indicators are flashing bullish for ADA. One closely watched signal is the Moving Average Convergence Divergence (MACD) on the daily chart. According to a recent analysis by trading veteran Christopher Visser, Cardano’s daily MACD flipped to a bullish crossover earlier this week – the first such positive cross in months. Notably, the last time ADA’s daily MACD turned positive (in late June), the coin went on to rally roughly 62% in the ensuing weeks. Even more intriguing, Visser points out that we are seeing multiple timeframe MACD alignments: the 2-hour, 4-hour, and 6-hour MACDs for ADA are all either bullish or on the verge of crossing, a pattern that previously preceded explosive upside in Cardano. In addition, Bollinger Bands on the 6-hour chart have tightened significantly, indicating a period of low volatility that often comes before a major price move. This kind of volatility squeeze is relatively rare on higher timeframes and suggests ADA is coiling up for a potential jump – the bands narrowing implies the price has been range-bound, and when it breaks out of that range, the move can be sharp.

From a broader perspective, Cardano appears to be nearing the end of a multi-year downtrend. Since its September 2021 all-time high around $3.10, ADA spent four years in a wide consolidation range, with two failed breakout attempts (peaking at $1.63 in 2022 and $1.32 in 2024). Now, ADA is on its third attempt to escape this range, and the setup is “almost identical” to prior successful breakouts, according to Visser. The token has strong support in the mid-$0.70s (where trading volume has been highest historically), and above the current price, the volume profile thins out – meaning if bulls push past $1.00, there may be relatively little resistance until much higher levels. Visser even posits a long-term price target around $3.90 for Cardano if it can complete this breakout of the multi-year wedge pattern. That would imply ADA regaining and exceeding its former record high. While he doesn’t attach a specific timeline to that target, it underscores the growing optimism around Cardano’s trajectory.

It’s worth mentioning the fundamental context too: Cardano’s ecosystem development continues (e.g. recent upgrades like Hydra for scaling), and its community remains very active. ADA has sometimes lagged other majors during fast market moves, but its slow-and-steady approach – emphasizing peer-reviewed research and measured upgrades – means that when momentum does come, it can build unexpectedly fast as investor confidence returns. As always, nothing is guaranteed – false breakouts can happen, and Cardano’s low volatility phases have frustrated traders before. But with ADA’s chart flashing bullish signals and the coin outperforming many peers this week, it has earned a spot on the list of coins not to ignore when “buying the dip.” A successful push above the $1.00–$1.10 zone could mark a major trend change for Cardano, potentially kicking off a new chapter of upside for this long-consolidating cryptocurrency.

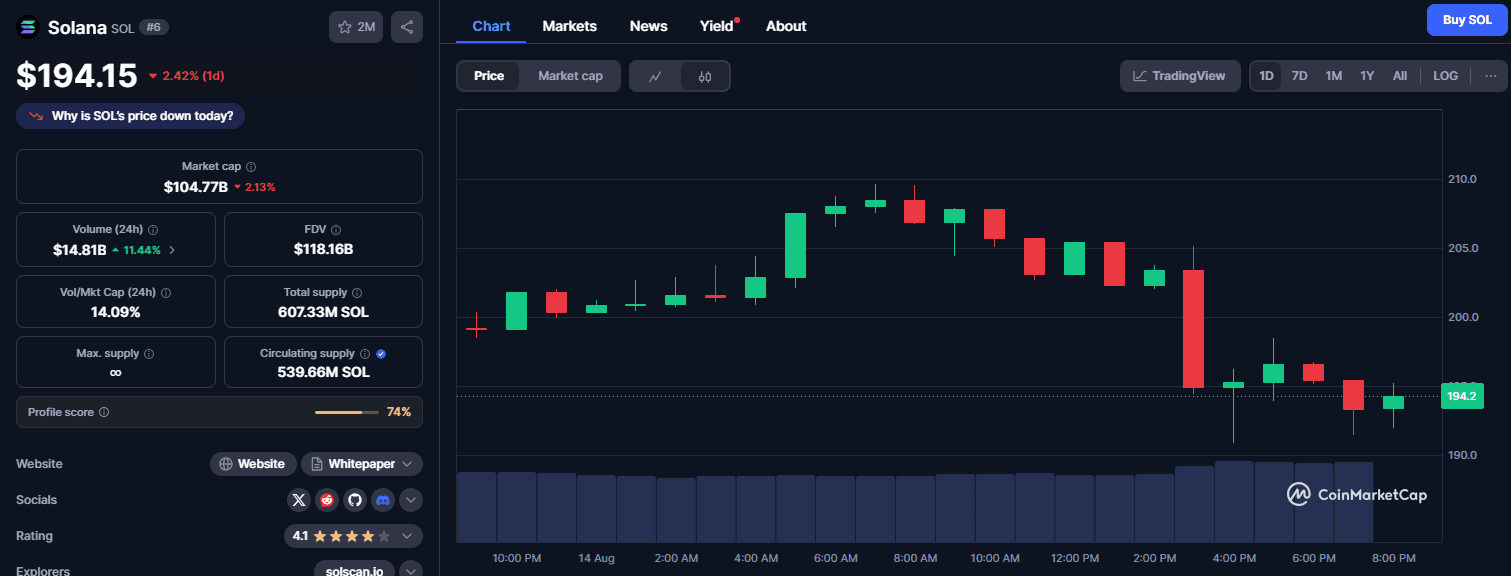

4. Solana (SOL): High-Performance Chain Regains the $200 Milestone

Solana (SOL) has made a dramatic comeback in recent days, reasserting itself as a top-performing layer-1 blockchain token. In the last 24 hours, Solana’s price surged back above the psychologically important $200 level, a price it had not seen in over a year. At one point SOL hit roughly $199.5 on major exchanges, up 13.5% on the day, before the broader market pullback trimmed its price to just under $200. Still, the very fact that Solana reclaimed the $200 mark is significant – it signals a full recovery from the deep slump of 2022 and showcases renewed investor enthusiasm for Solana’s ecosystem. This current rally to multi-month highs has reinvigorated interest in SOL and reinforced its position as a key player among smart contract platforms.

Solana’s rebound is underpinned by its strong technological fundamentals and expanding use-cases. Often dubbed a “high-performance blockchain,” Solana is known for processing thousands of transactions per second with negligible fees, thanks to its unique proof-of-history consensus design. These capabilities have fueled a vibrant developer community and led to a flourishing array of decentralized finance (DeFi) protocols, non-fungible token (NFT) projects, and blockchain games running on Solana. Over the last quarter, Solana’s on-chain activity has boomed: one report noted the network hit a record of 7.3 million monthly active addresses in Q3, indicating a surge in user engagement (though that particular stat was for Avalanche, Solana has likewise seen rising activity). Solana’s total value locked (TVL) in DeFi has also been climbing, reflecting renewed capital inflows into Solana-based lending, trading, and yield platforms. This uptick in on-chain metrics provides fundamental support to SOL’s price appreciation – investors see that the network is being used more heavily, which reinforces Solana’s value proposition as a fast, scalable blockchain for real-world applications.

Crucially, institutional and developer adoption of Solana is growing as well. Solana has attracted attention from enterprises and big players looking for scalable blockchain solutions. For example, there’s increasing talk of traditional finance experimenting with Solana for payment networks or tokenized assets, given its throughput advantages. The Solana Foundation has also been fostering development with hackathons and grants, leading to a proliferation of tools and platforms on Solana. The network’s resiliency has improved too – after some notorious outages in its early days, Solana has steadily enhanced its software to handle traffic bursts, which boosts confidence among users and validators. All these factors – high speed, low cost, a growing ecosystem – have solidified Solana’s status as a top “Ethereum-alternative” platform.

From a market perspective, flipping the $200 price level from resistance into support is a bullish development. $200 is a round-number milestone that carries psychological weight, and SOL’s ability to reclaim it indicates strong buying pressure. Technical analysts note that this move came on high volume and strong momentum, suggesting it wasn’t a fluke. Indeed, SOL was up nearly 50% over the past few weeks leading into this, making it one of the best-performing large-cap altcoins lately. Of course, after such a rapid ascent, some volatility is to be expected – and as the market pullback showed, SOL can retrace quickly if sentiment wavers. Traders will be watching how Solana behaves around the $180–$200 zone in the coming days; holding above previous resistance ($180) would be a sign of strength, while a deeper dip might find support around $150–$160 (areas of prior consolidation). For now, the broader trend is positive. The recent dip across crypto offers SOL believers a chance to “buy the dip” on Solana, betting that its combination of technical prowess and ecosystem growth will continue to drive adoption. With some analysts even floating long-term targets of $250–$300 for Solana in a sustained bull scenario, it’s clear that SOL has re-entered the conversation as one of the top coins to watch – and potentially accumulate on any interim weakness – as altseason momentum builds.

5. Dogecoin (DOGE): Meme King Flashes a Golden Cross Signal

A physical Dogecoin coin with the iconic Shiba Inu, set against an ascending candlestick chart. Dogecoin’s recent price uptick and “golden cross” pattern have traders speculating about another potential breakout.

No daily crypto roundup would be complete without the mention of Dogecoin (DOGE) – the original meme cryptocurrency that still commands a fervent fanbase. In the past 48 hours, Dogecoin quietly staged a robust rally, jumping about 15% over two days and briefly trading above $0.25 for the first time in several weeks. On Wednesday (Aug. 13), DOGE was up roughly 5.3% for the day to around $0.249, capping a steady climb from ~$0.22 earlier in the week. This push not only marked a one-month price high for Dogecoin, but it also coincided with a closely watched bullish technical pattern: a “golden cross” on its daily chart. A golden cross occurs when a coin’s 50-day moving average crosses above its 200-day moving average, signaling that recent upward momentum is overtaking the longer-term trend. For Dogecoin, this is the first golden cross since November 2024, a event that, in that instance, preceded a 130% price surge in the following month.

The emergence of this golden cross has stoked optimism among Doge enthusiasts that history might repeat – or at least rhyme. Dogecoin has a track record of explosive moves following technical signals: beyond the late-2024 rally, a similar golden cross in late 2023 foreshadowed a 25% climb in four weeks, and an earlier one in 2020 kick-started Dogecoin’s infamous 1,000%+ moonshot over a few months. While it’s important to note that technical patterns are not guarantees (and the golden cross can sometimes be a lagging indicator), the fact that DOGE’s averages have aligned bullishly reflects the genuine improvement in its market momentum recently. The rally has been accompanied by elevated trading volumes, indicating not just retail meme traders but also larger players are active in Dogecoin right now.

Indeed, behind the scenes, whale investors have been accumulating DOGE aggressively during this period of price strength. Blockchain data indicates that over 1 billion DOGE (worth roughly $200 million) were scooped up by large wallets in recent sessions. These whales now control nearly half of Dogecoin’s circulating supply – a remarkable concentration that signals sustained institutional or high-net-worth interest in Dogecoin, despite its lighthearted origins. Such accumulation often provides a floor of support under the price, as big holders are presumably confident in Dogecoin’s longer-term prospects (or at least are content to hold a large stake). This whale activity may help explain Doge’s resilience and its ability to break through resistance. In fact, as Dogecoin surged this week, it cleanly broke above the $0.25 level, which traders identify as a key psychological and technical resistance that had capped previous attempts. Conquering $0.25 is no small feat – it sets the stage for potential moves toward the next target around $0.28–$0.30, near the token’s local highs from July.

The broader backdrop is also in Dogecoin’s favor. In times of bullish market sentiment, meme coins like DOGE often see amplified gains as speculative appetite grows. Elon Musk’s rebranding of Twitter to “X” earlier in 2023 had sparked hopes of Dogecoin integration (given Musk’s fondness for Doge), and while nothing concrete has emerged on that front, the power of the Dogecoin community and brand shouldn’t be underestimated. It’s a coin that captures mainstream attention in a way few cryptocurrencies do – making it something of a sentiment gauge for crypto at large. Right now, that sentiment is turning positive. Analysts will be watching if Dogecoin can hold above the $0.22–$0.25 zone during any broader market dips; doing so would indicate a new support base. On the upside, clearing the $0.28 hurdle could open a run toward $0.35 or higher. As always, volatility is part of Dogecoin’s DNA – swift pullbacks can happen if euphoria fades. But given the fresh bullish signals (like the golden cross) and whale backing, many traders consider Dogecoin a top coin to accumulate on dips, hoping to ride the next wave of meme-fueled momentum if it comes. In sum, DOGE’s recent technical breakout and strong community support make it a coin you “shouldn’t dodge” when formulating a buy-the-dip strategy.

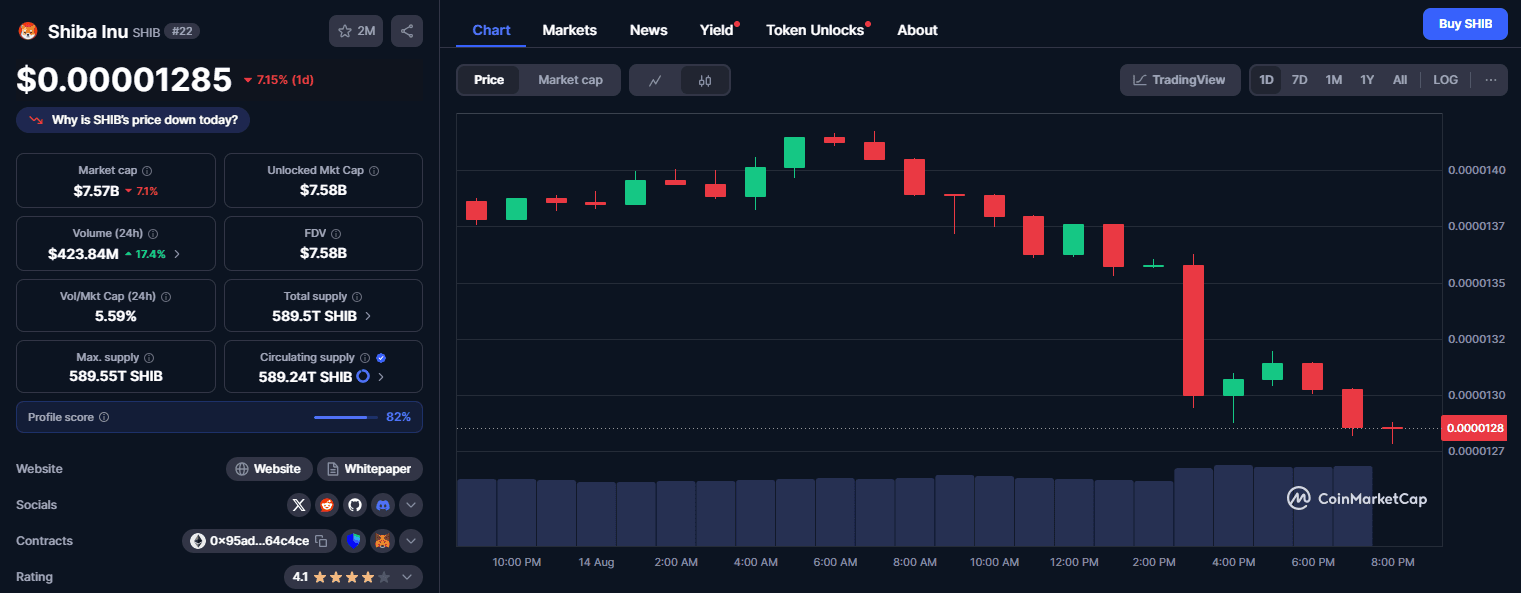

6. Shiba Inu (SHIB): Layer-2 Hype Gives the Meme Coin New Life

Another prominent meme-inspired cryptocurrency showing promising signs is Shiba Inu (SHIB) – often seen as Dogecoin’s younger cousin and one of the most popular Dogecoin alternatives. While Shiba Inu’s price is just a tiny fraction of a cent, its percentage movements and passionate community are anything but small. In the last day, SHIB jumped roughly 4–5% to around $0.0000138 per token. That pop outperformed many other large-cap coins and came on the back of a specific catalyst: fresh developments in Shiba Inu’s layer-2 network, Shibarium. The project’s developers teased upcoming upgrades to Shibarium, sparking a wave of optimism that propelled SHIB’s price higher and boosted its trading volumes.

The Shiba Inu team’s hint – delivered via a brief statement on social media – suggested that significant improvements or new features for Shibarium are on the horizon. This was enough to ignite speculation across major crypto forums and among retail traders who follow SHIB closely. Shibarium, which launched earlier in 2023, is a Layer-2 scaling solution for Ethereum aimed at making transactions faster and cheaper for the Shiba Inu ecosystem. If the hinted upgrades meaningfully enhance Shibarium’s performance or usability, it could drive greater adoption of SHIB in DeFi, gaming, or other applications, increasing the token’s utility. The mere anticipation of this has turned sentiment on SHIB bullish in the short term – a notable shift, because Shiba Inu had been relatively quiet price-wise in prior weeks. The renewed buzz translated into a 4.5% price pump on Aug. 13 and a flurry of chatter that pushed SHIB to the top of trending token lists on platforms like CoinMarketCap.

From a technical perspective, Shiba Inu’s move, while modest in percentage, did have it testing the upper bounds of recent trading ranges. SHIB has been fluctuating in a somewhat sideways pattern, and the push to $0.0000138 brought it near its local resistance levels (around the mid-$0.000013s). A clean break above $0.000014, if achieved, could signal a bullish breakout from its summer range. Some analysts highlight that Shiba Inu’s Bollinger Bands have tightened in the past week, similar to Dogecoin, indicating reduced volatility that often precedes a bigger move. The question is whether that move will be up or down, and the Shibarium upgrade news tilts the odds upward in the near term by injecting a dose of positive fundamentals.

It’s worth noting that Shiba Inu’s ecosystem has grown beyond just the SHIB token. It now includes other tokens (LEASH, BONE) and the Shibarium network itself, which collectively form a budding DeFi ecosystem. Hints of upgrades could involve anything from new decentralized apps (dApps) launching on Shibarium, to improved throughput or interoperability, or even new tokenomics like additional SHIB burning mechanisms. The SHIB community is known to rally around news of token burns (which reduce supply), and any upgrade that potentially increases the burn rate or utility of SHIB could be a bullish catalyst. In fact, Shibarium’s initial launch came with the promise of burning SHIB with each transaction, and further enhancements there would be welcomed by holders aiming for long-term scarcity.

However, caution is warranted. As TradersUnion analysts noted, SHIB still faces significant resistance at recent peaks and lacks clearly defined long-term support due to its large swings. The meme coin’s fortunes can be highly speculative and tied to hype cycles. If the actual Shibarium updates (when revealed) fall short of expectations or are delayed, the recent gains could fade quickly as “buy the rumor, sell the news” takes effect. For now though, market momentum appears skewed bullish for Shiba Inu, with momentum indicators and social sentiment on the upswing. For traders who believe in the Shiba Inu roadmap, any interim dip – for example, if SHIB pulls back to support around $0.000012 – might be seen as a chance to accumulate before the full Shibarium potential is realized. In summary, Shiba Inu’s recent pop and the prospect of its layer-2 upgrades have put it back on the radar as a coin to consider buying on dips, especially for those who missed its earlier 2023 rally. The combination of a fervent community, upcoming tech improvements, and the general uptick in meme-coin interest make SHIB a notable inclusion in today’s top 10 highlights.

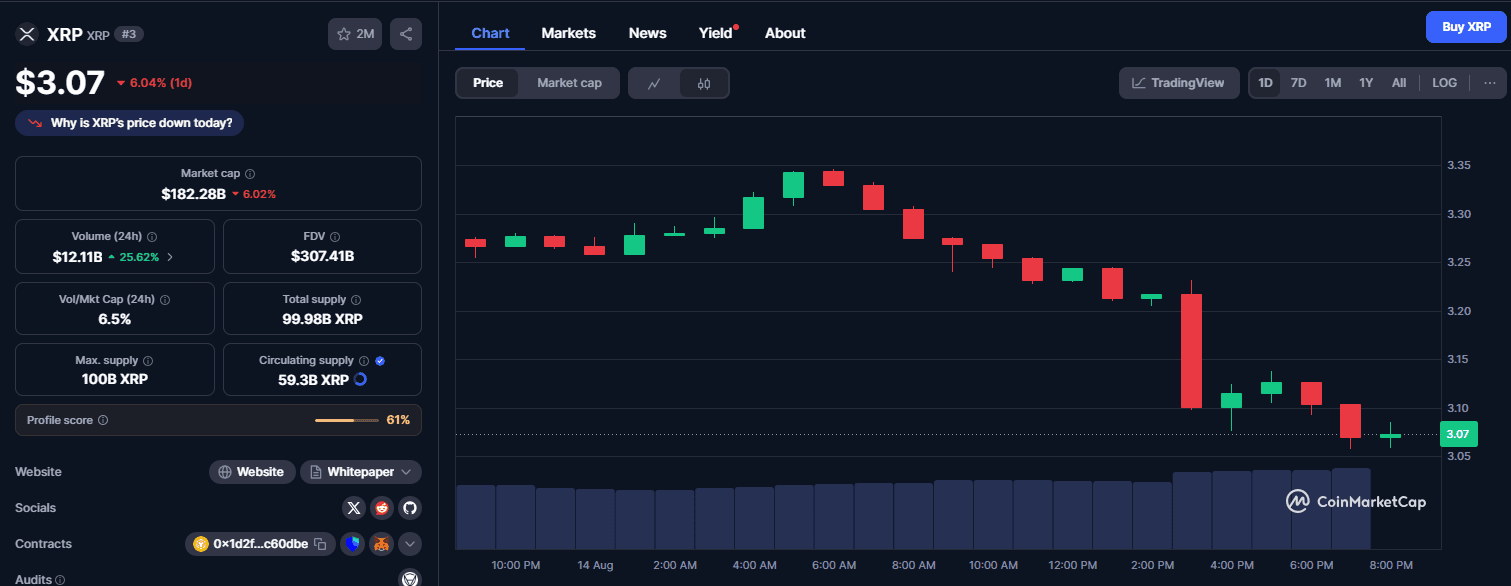

7. XRP (XRP): Holding Strong After a Legal Victory and Rally

XRP, the cryptocurrency associated with Ripple’s payments network, has had an eventful summer. Just a few weeks ago in mid-July, XRP soared to a multi-year high of around $3.65, fueled by a landmark legal victory in the long-running SEC vs. Ripple case (a U.S. judge ruled that XRP is not a security when sold to the public). That news catalyzed a surge of mainstream attention and a wave of FOMO buying, briefly making XRP one of the best-performing major assets of 2025. Since that spike, XRP did undergo a healthy correction, but impressively it has held onto much of its gains. Over the past 24–48 hours, as the market fluctuated, XRP found support and reclaimed the key $3.15 level, suggesting that bulls are stepping in to defend prices on dips. After the flash crash on Aug. 14, XRP quickly bounced from about $3.11 back above $3.15, indicating real buying interest at those levels.

Analysts note that $3.00–$3.20 is a pivotal zone for XRP – both psychologically and technically. Encouragingly, XRP’s ability to stay above $3 (even during market volatility) and claw back to $3.15 has reinforced bullish market structure. Crypto commentator Crypto Eagles highlighted that XRP “cleanly reclaimed” $3.15 support after filling a fair value gap during the pullback, calling it a “pivotal shift” that could signal the start of a new uptrend leg if the level holds. In practice, maintaining support above ~$3.15 keeps XRP in a pattern of higher lows, preserving its positive momentum from the July breakout. Should buying pressure persist, analysts are eyeing near-term targets around $3.30 and $3.40 – areas where XRP saw selling pressure on its way down from the recent highs. A break above ~$3.40 would be particularly bullish, potentially confirming a “third wave” uptrend for XRP, as some Elliott Wave theorists in the community have proposed.

Fundamentally, XRP’s backdrop remains strong post-SEC verdict. Ripple’s partial legal win (clarifying that programmatic sales of XRP aren’t securities) has led to XRP’s relisting on major U.S. exchanges like Coinbase, vastly improving access and liquidity for U.S. investors. Additionally, Ripple has been making strides in its business – expanding cross-border payment corridors and even testing a central bank digital currency platform – which bolsters the narrative of XRP as having real utility in global finance. On-chain metrics show that whale accumulation has been significant during this period: one market analysis noted that whales scooped up 900 million XRP within 48 hours during the post-ruling excitement. Such accumulation suggests large entities are positioning for potential long-term upside, viewing the recent legal clarity as a green light to get back into XRP. Moreover, institutional interest in XRP is rising; for instance, some crypto funds are dedicating a portion of their portfolio to XRP anticipating wider adoption in settlement networks.

That said, short-term sentiment on XRP is split between euphoria and caution. The run from $0.50 in early 2023 to over $3.50 now has been breathtaking – XRP is up several hundred percent year-to-date – so naturally some traders are wary of a “bull trap,” where the rebound could lure in late buyers before a deeper correction. The argument for caution cites that Bitcoin’s dominance is still high (~59%), and if Bitcoin were to retrace further, alts like XRP might also see outsized pullbacks. Additionally, XRP’s volatility is elevated, meaning 5-10% daily swings (in either direction) are still quite possible. However, the counter-argument – supported by people like Sasha (aka “why NOT”) from the XRP community – is that structural factors favor XRP’s bull case now. These include rising institutional adoption, the legal clarity (reducing existential risk), and whales actively buying. So far, those bullish factors have kept XRP on solid footing, even as it consolidates below its recent highs.

For traders considering XRP on a dip: the $2.70–$3.00 range has emerged as a support “buy zone” (it’s where XRP consolidated after the July spike), and many will be watching if any further dips toward that area get quickly bought up. Conversely, a push above ~$3.30 on strong volume could confirm that XRP’s next leg higher is underway, possibly targeting the mid-$3s or beyond. Some optimistic forecasts from analysts (for example, on Brave New Coin and Cryptobasic) even envision XRP reaching $5–$8 by year-end 2025 in a bull scenario, though those are speculative long-range calls. In the near term, XRP’s inclusion in the day’s top highlights is well-earned: it performed best among majors during the recent rally, has clear indicators of future growth (institutional interest, whale buys, technical support), and presents a compelling dip-buying case if one believes its uptrend will continue.

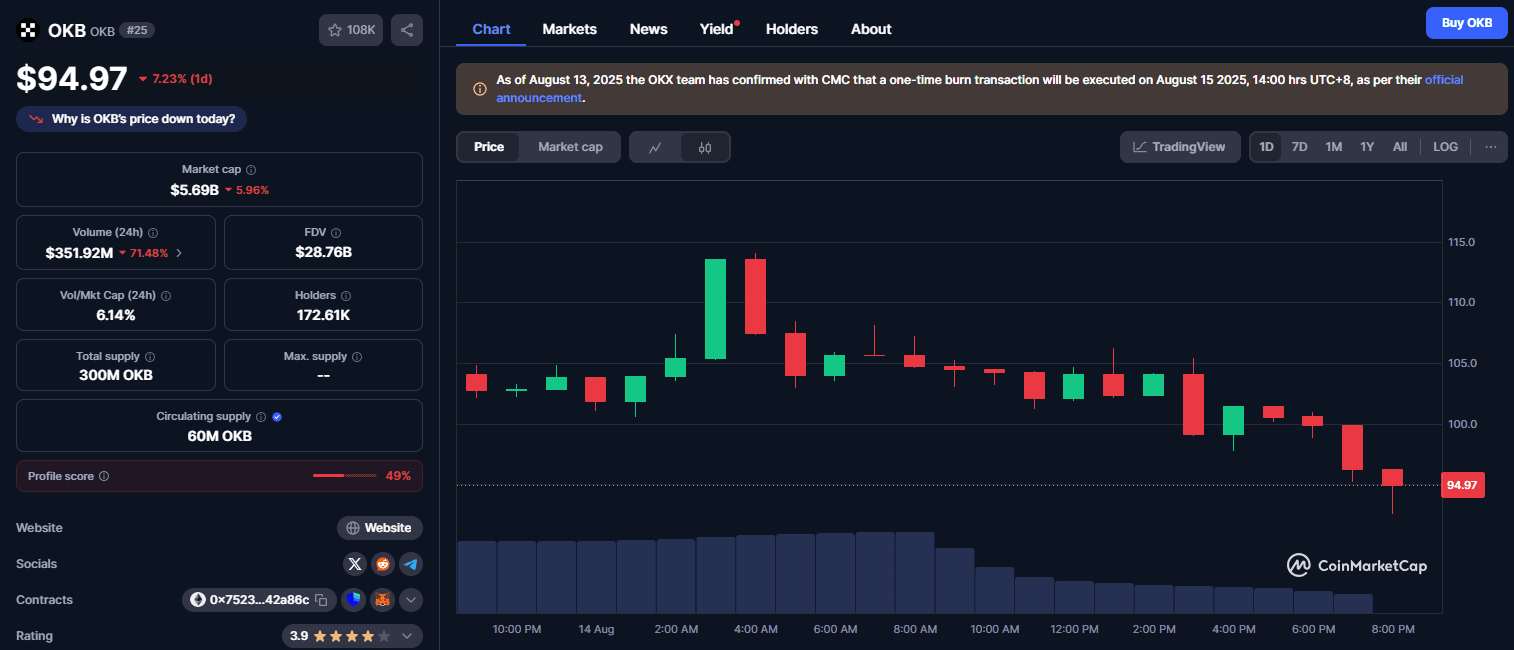

8. OKB (OKB): Exchange Token Soars on Massive Token Burn

If one coin exemplified the phrase “explosive breakout” in the last 24 hours, it’s OKB, the utility token of the OKX cryptocurrency exchange. OKB skyrocketed by over 130% in a single day, hitting a new all-time price high around $135 before settling back to the ~$110–$120 range – still more than doubling in value in 24 hours. Such a meteoric rise for a large-cap token (OKB was in the top 30 by market cap) is extraordinary, and it was driven by a game-changing announcement from OKX: a massive one-time token burn that permanently reduced OKB’s circulating supply by 65,000,000 tokens. In effect, OKX slashed OKB’s supply by 50% – an unprecedented burn worth about $7.6 billion, instantly making the remaining tokens far more scarce.

The market’s reaction was immediate and emphatic. Shortly after OKX confirmed the burn and associated ecosystem upgrades, OKB’s price leapt from roughly $45 to as high as $142 at the peak – a brief ~160% intraday jump. Even though some profit-taking ensued (natural after such a vertical move), OKB was still trading around $100+ (up ~132% in 24h) later that day. Trading volume exploded by over 130x during the frenzy, highlighting how significant this news was for OKB holders and the wider market. So, what exactly happened? OKX’s announcement had a few parts:

-

Token Burn: OKX burned 65,256,712 OKB tokens that had been previously repurchased or reserved, fixing the total supply at 21 million OKB – the same cap as Bitcoin’s supply. By halving the supply, OKX introduced a powerful deflationary dynamic. With demand being equal, a drop in supply typically boosts price, and here the supply shock was dramatic. Traders understandably rushed to reprice OKB given its new scarcity. The burn mechanism also signals OKX’s commitment to reward token holders; it’s arguably one of the largest burns (by dollar value) ever conducted by a crypto project.

-

“X Layer” Upgrade: Simultaneously, OKX unveiled a major upgrade to its own blockchain ecosystem, called OKB Chain or “X Layer.” It’s a zkEVM-based Layer-1 chain that OKX is developing (utilizing Polygon’s technology) to focus on DeFi, payments, and real-world asset applications. The upgrade – dubbed the “Project Phoenix” (PP) upgrade – boosted throughput to 5,000 TPS, cut fees, and improved compatibility with Ethereum. OKX plans to fully integrate X Layer into its products (exchange, wallet, payment), effectively creating a more robust use case for OKB as the native token of this ecosystem. Notably, OKX is migrating away from older chains (like OKTChain on Cosmos) and will use OKB exclusively on the new chain, while phasing out the Ethereum-version of OKB. All these moves aim to make OKB a central element of a next-gen blockchain platform, potentially increasing demand for OKB if the X Layer attracts users and developers.

-

Tokenomics Overhaul: After the burn, OKX also upgraded OKB’s smart contract to remove any future minting ability, effectively guaranteeing a hard cap of 21 million tokens. This means no new OKB can ever be created, turning OKB into a permanently scarce asset. For context, OKB was originally an exchange utility token without a fixed supply, so this change is a radical shift to a Bitcoin-like capped model. Additionally, OKX hinted at establishing an ecosystem fund and liquidity programs to foster growth on X Layer, which could further entrench OKB’s role.

In sum, OKX delivered a trifecta: drastically lower supply, improved utility, and strong future plans, all of which revalued OKB upwards in a flash. It’s little wonder that OKB became the day’s biggest winner by far. For traders, the question now is where OKB goes from here. After such a parabolic move, volatility will remain extreme in the near term. The Relative Strength Index (RSI) for OKB spiked above 94 (on a scale where >70 is overbought), reflecting the intensity of buying pressure. Typically, an RSI that high suggests the asset is overheated short-term; indeed OKB already pulled back about 15% from the top within an hour. But given the new fundamentals, bulls might view any sizable dip in OKB as a chance to accumulate a now much-scarcer token. Key levels to watch could be $90 (roughly where it settled after the initial spike) and $70 (the top of the pre-breakout range) – these might act as supports if the price retraces further.

It’s also worth comparing OKB’s valuation to peers. With a 21M max supply, at ~$100 each, OKB’s fully diluted market cap is ~$2.1 billion. That’s actually not that high for a major exchange token (Binance’s BNB, for example, is ~$40B). Of course, OKX is smaller than Binance, but OKX’s trading volumes are substantial, and if the new chain gains traction, some argue OKB could have more room to run in the long run. In any case, OKB’s deflationary shock and ecosystem expansion serve as a potent reminder of how quickly the narrative can change for an exchange token. It absolutely earns a spot among the top coins of the day, and those bullish on exchange tokens or OKX’s growth will be keen to buy on dips if the opportunity arises. Just remember: such rapid appreciation also carries risk – sharp corrections can occur once the initial euphoria fades. That said, with OKB now fundamentally more scarce and central to OKX’s future plans, it has transformed overnight into a coin that crypto investors are carefully watching (and many wish they had bought just 24 hours earlier).

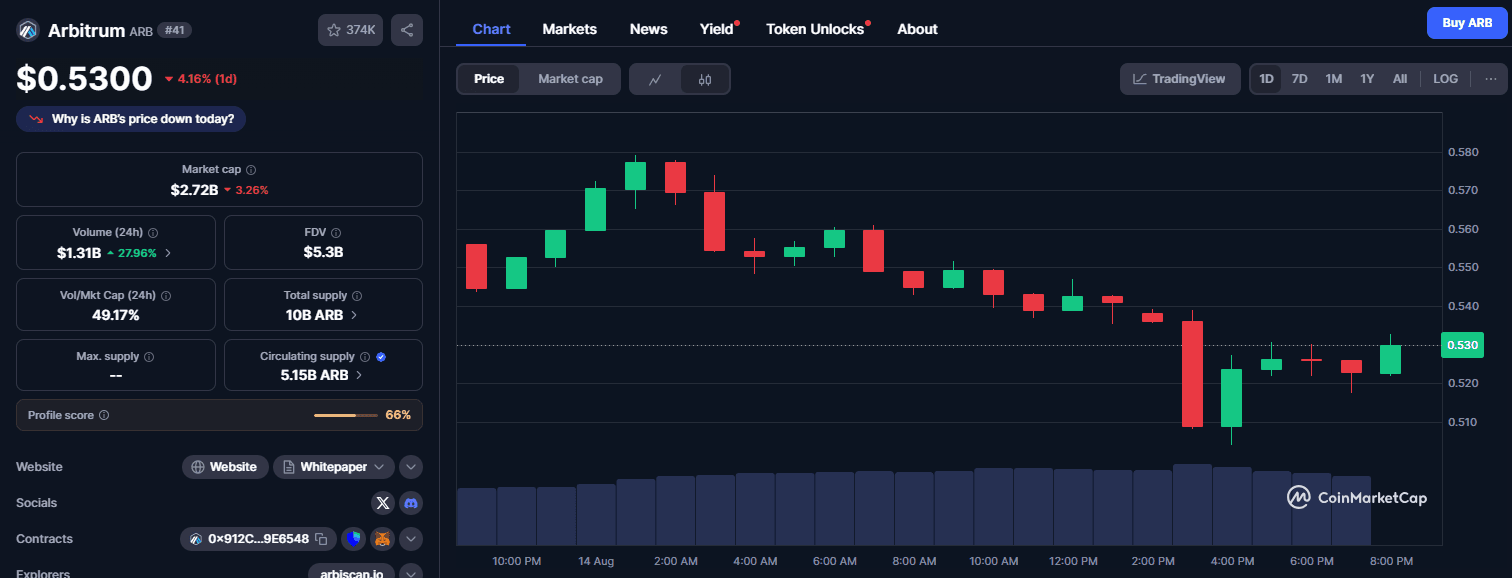

9. Arbitrum (ARB): Layer-2 Token Jumps on Adoption News, Despite Token Unlock Looming

Arbitrum (ARB), the token underpinning the popular Arbitrum Layer-2 scaling network for Ethereum, has been another strong performer, riding the wave of interest in scaling solutions. In the past day, ARB’s price climbed roughly 15–16% to about $0.56, putting it among the top gainers in the altcoin arena. This jump is a continuation of positive momentum Arbitrum has enjoyed over the last week, and it comes despite a looming token unlock event that some thought might weigh on the price. In fact, the rally in ARB appears to be driven by a bullish fundamental catalyst: PayPal’s adoption of the Arbitrum network. Recently, news emerged that PayPal’s new Ethereum-based stablecoin (PYUSD) is being issued on Ethereum but leverages Arbitrum for certain transactions, and more broadly PayPal has shown interest in Layer-2 networks. This kind of institutional validation – a payments giant tapping a Layer-2 solution – provided a significant bullish catalyst for ARB, helping it rebound from around $0.42 last week to the mid-$0.50s now.

What’s impressive is that ARB’s price surge is occurring in the face of a major token unlock scheduled for August 16, 2025. On that day, 92.65 million ARB tokens (about 1.8% of the total supply) will be released to early investors or team members, potentially introducing selling pressure as those holders get access to their tokens. Typically, the anticipation of a large unlock can dampen a token’s price (due to fears of increased supply hitting the market). However, the fact that ARB is running up now suggests traders may be either positioning ahead of the unlock (speculating that it’s already priced in or that new buyers will absorb the supply) or betting that Arbitrum’s recent positive developments will offset the dilution. It’s a vote of confidence in the project’s trajectory that ARB is buoyant regardless.

From a technical standpoint, Arbitrum’s charts are showing strong bullish signals. The Relative Strength Index (RSI) is around 69 – high but just below the typical overbought threshold of 70 – indicating robust momentum without screaming overextension. Meanwhile, the MACD on multiple timeframes has turned upward, and ARB’s price is trading above all its key moving averages (7-day, 20-day, 50-day, 200-day), which are now aligned in a bullish stack. This moving average alignment provides a supportive technical backdrop, as each dip tends to find support at one of these rising MAs. Additionally, Arbitrum’s price has broken above its upper Bollinger Band in this rally (a sign of strong trend), and although that often signals short-term overbought conditions, in powerful trends an asset can “ride the band” higher for some time. Traders have identified $0.58 as immediate resistance – that was ARB’s intraday high and also a level of interest on the chart. If ARB pushes above $0.58 and holds, the next target could be the previous major high around $1.17 (the 52-week high). That would be a substantial move, but not impossible if Layer-2 enthusiasm picks up steam. On the support side, $0.36 is noted as a strong support (the recent swing low), with additional backing around $0.29 if things were to drop further.

Looking beyond the immediate price action, Arbitrum is arguably the largest Layer-2 ecosystem by total value locked and user base at the moment. It has become a hub for DeFi activity outside the Ethereum main chain, thanks to its fast and cheap transactions. The PayPal news underscores Arbitrum’s growing real-world integration – it’s not every day a household name in finance uses crypto infrastructure, and Arbitrum’s role there is a big credibility boost. Moreover, the Arbitrum community and developers are active; there’s continuous progress on upgrades (like Arbitrum’s upcoming Stylus initiative to support more programming languages) and plenty of new dApps launching. These factors give investors confidence that ARB has fundamental staying power, not just speculative appeal.

In the context of “buying the dip,” ARB presents an interesting scenario. If one is bullish on the future of Ethereum Layer-2 networks, then any post-unlock dip in ARB (should it occur around mid-August) might be seen as a prime buying opportunity. The unlock is a known event; sometimes markets overshoot to the downside in fear of unlocks, only to rebound after the supply is absorbed. Conversely, if ARB doesn’t dip much at all during the unlock, that relative strength would be a very bullish sign in itself. In any case, ARB’s 24-hour performance and positive indicators (adoption by PayPal, strong tech outlook) firmly place it among the top coins of the day to monitor. The coin’s ability to defy unlock gravity so far shows the market’s focus on Arbitrum’s long-term value. Traders and investors who believe in the Layer-2 scaling narrative will likely be poised to accumulate ARB on any weakness, aiming to ride the next leg of growth as Ethereum’s scaling solutions gain further traction.

10. Avalanche (AVAX) & Polkadot (DOT): Surging on Strong Fundamentals and Institutional Interest

Rounding out our top 10 list, we spotlight two major layer-1 networks – Avalanche (AVAX) and Polkadot (DOT) – which have both seen noteworthy surges to multi-month highs, backed by improving fundamentals and growing interest from big players. While Avalanche and Polkadot are distinct projects, they share a common theme: each is a platform with a strong technological proposition that is now reaping rewards as the market shifts focus to coins with tangible use-cases and network activity. Their recent performance underscores a broader rotation into what one might call “quality alts” – cryptocurrencies that are more than just memes or hype, but have robust ecosystems or innovative tech. Let’s look at each:

-

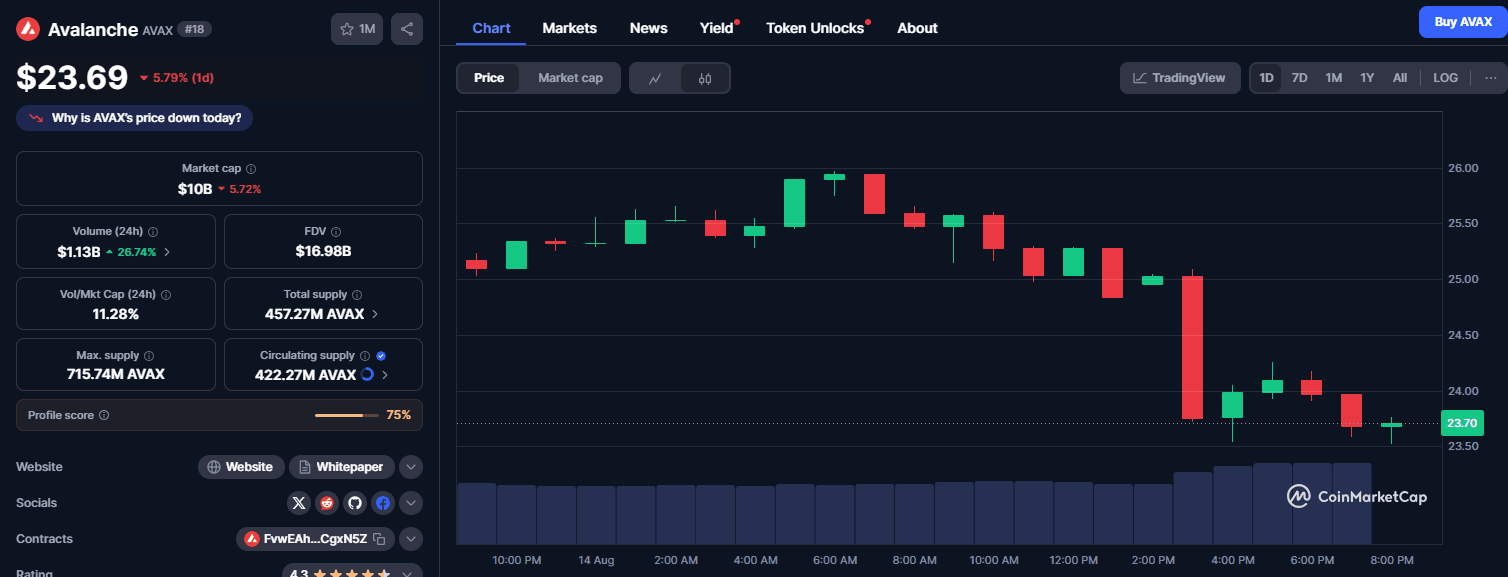

Avalanche (AVAX): Over the last day and week, Avalanche’s AVAX token has been on a tear, breaking through key resistance levels and climbing into the mid-$20s (it was around $24–$25, up ~4–5% on the day and significantly on the week). This puts AVAX at a multi-month peak, reflecting a clear change in its market trend from sideways to upward. What’s driving Avalanche’s rally? Fundamentally, Avalanche has posted impressive on-chain growth metrics: the network recently recorded over 7.3 million monthly active addresses in Q3, a new high that signals growing user engagement and adoption. Additionally, Avalanche’s tokenomics have turned increasingly deflationary due to its unique fee-burning mechanism. More than 4.7 million AVAX tokens have been permanently burned so far (through transaction fees and subnet creation fees), directly reducing supply. This deflationary pressure, combined with Avalanche’s high throughput and sub-second finality features, reinforces AVAX’s appeal as a top Layer-1 asset with a potentially diminishing supply over time. Traders have taken note that Avalanche’s price surge is underpinned by these strong fundamentals – record user activity and token burns – rather than just speculation. It suggests the rally has substance. Moreover, Avalanche has seen increasing institutional and developer interest. The network’s ability to host institutional-scale deployments (like financial asset tokenization projects) and its Avalanche Subnets (custom blockchains) have been attractive for certain enterprise and gaming use-cases. All this has led analysts to view AVAX as well-positioned for the next bull phase, which is now seemingly kicking off. Technically, Avalanche has broken above its 200-day moving average and previous resistance around $22, which now turns to support. The next significant resistance might be around the $30 mark (a round number and prior high range), and if momentum continues, some foresee AVAX heading toward that zone in the coming weeks. For dip-buyers, any retracement into the high teens or low $20s might be seen as an opportunity, given Avalanche’s strengthening fundamentals.

-

Polkadot (DOT): Not to be outdone, Polkadot’s DOT token also surged roughly 11% recently, pushing above the $4.20 level that it had struggled to crack in some time. This move came amid a “robust recovery rally” for DOT, where it bounced off support around ~$3.85 and rallied firmly, demonstrating resilience. Polkadot’s bullish case centers on its vision of cross-chain interoperability and a multi-chain future. Over the past weeks, there have been signs of renewed institutional accumulation of DOT – possibly as investors seek undervalued layer-1s that didn’t yet pump this cycle. Polkadot’s development activity remains among the highest in the industry (a metric where it often ranks at or near the top, reflecting the work on its ecosystem of parachains). The project’s unique architecture – connecting multiple specialized blockchains (parachains) into one unified network – continues to be a compelling alternative for developers who need scalability and interoperability. Recently, some Polkadot-based parachains have shown progress in areas like DeFi, and with Polkadot’s latest upgrades (such as asynchronous backing improving block time), the network is becoming more efficient. Analysts have pointed to Polkadot’s active developer community and ongoing innovation as reasons it’s a “dark horse” altcoin that could surprise the market. Now, with DOT’s price perking up, that thesis might be playing out. DOT pushing past $4.20 is significant because that level had been a stubborn ceiling; its clearance suggests the downtrend has been broken. The next challenge for DOT may be the $5 mark (and above that, $6, which some forecasts like a recent BeInCrypto analysis earmarked as a target if momentum continues). On the downside, DOT appears to have solid support in the high $3 range, courtesy of the strong base it built when it “defended pivotal support” during the crypto market dip earlier this year. For those bullish on Polkadot’s long-term prospects – like the rise of its parachains and use in Web3 – accumulating DOT on pullbacks (say, towards $4 or below) could be a favored strategy, given that DOT still trades far below its 2021 highs (around $55) and could have plenty of room to run if an altcoin season truly unfolds.

Stepping back, the success of Avalanche and Polkadot lately highlights a larger trend in the crypto market: a shift towards fundamentals-driven value. As noted in a CoinWorld market update, investors are increasingly rotating into altcoins with strong use cases, solid development, and clear value propositions, rather than chasing purely speculative plays. Both AVAX and DOT fit this bill – they’re backed by well-funded foundations, led by credible teams, and have vibrant ecosystems. The market’s optimism on them suggests that as the crypto rally broadens, the market is rewarding projects that have delivered technologically. It reflects a maturation: crypto participants are looking beyond just Bitcoin and Ethereum, and into the “infrastructure” altcoins that could form the backbone of Web3. Avalanche’s focus on speed and subnets and Polkadot’s focus on interoperability and shared security each address key scalability challenges, which is why institutional interest in these networks is picking up as well.

Of course, risks remain – broader market volatility could impact these tokens, and they face competition from other layer-1s and layer-2s. But their recent strength, both in price and fundamentals, makes AVAX and DOT hard to ignore. For someone looking to buy dips in high-quality projects, Avalanche and Polkadot present compelling cases. Both have significantly lagged their all-time highs (so some view them as value buys), and yet they are now showing tangible signs of a trend reversal upward. In summary, Avalanche and Polkadot’s multi-month highs and institutional tailwinds earn them a joint spot in today’s top highlights. They exemplify how altseason 2025 is not just about memes and micro-caps, but also about major platforms coming into their own. Any pullback in these two – which are bound to have bumps along the way – could be seen as a strategic entry point by those confident in their long-term trajectories.

Final thougths

The past 24 hours have showcased a broad resurgence of confidence – from Bitcoin’s record-setting rally to altcoins across the spectrum posting impressive gains. We’ve highlighted ten coins that stood out with exceptional performance and clear indicators of potential future growth. Each of these – whether it’s a blue-chip like Ethereum or a resurgent platform like Solana, a meme heavyweight like Dogecoin or an exchange token like OKB – has a story of strength in the current market and reasons to anticipate further upside. Crucially, many are backed by tangible fundamentals: technical breakouts, network upgrades, institutional inflows, or improving on-chain metrics. This suggests that the rally has depth beyond mere speculation.

However, as the saying goes, “markets take the stairs up and the elevator down.” Crypto’s notorious volatility means that “buying the dip” requires both courage and caution. The sharp midday correction we witnessed is a reminder that even in bullish times, rapid pullbacks can and do occur. For investors and traders, the key is discernment – separating temporary dips from fundamental trend reversals. The coins profiled above all experienced dips of their own amidst the market shake-out, yet each showed resilience or quickly regained support, indicating strong hands and interest on the buy-side. These are encouraging signs if you’re considering a dip-buying strategy.

Risk management, of course, remains paramount. Diversification across some of these leading assets can mitigate the risk of any single coin faltering. It’s also wise to scale into positions rather than going all-in at once – given the likelihood of continued swings. Keep an eye on major support levels we’ve discussed (for example, Bitcoin near $118K, Ethereum around $4.4K, ADA around $0.73, etc.) and how prices behave if they’re tested again. Technical levels and fundamental news will be catalysts: a successful retest of support or a positive development (like an ETF approval, a mainnet upgrade, or a partnership announcement) could quickly reignite an uptrend for these coins. On the flip side, external factors – macroeconomic news or regulatory changes – could introduce headwinds, so staying informed is critical.

The overarching tone of the market now is informative-analytical optimism: data and developments are tilting positive, but seasoned observers know to stay analytical, not get carried away by hype. Crypto readers following this space can take away that there are real reasons behind the pumps we’ve seen: Bitcoin’s surge was supported by macro tailwinds and institutional buys; altcoins like Cardano, Solana, and XRP have concrete technical and adoption signals backing their moves; tokens like OKB and ARB had specific fundamental catalysts (burns and network use) driving demand. This fact-based narrative provides confidence that these aren’t purely random jumps, but part of a broader crypto market upswing.

In conclusion, the last day’s highlights reaffirm a classic strategy: focus on the coins with strong momentum and strong stories, and consider accumulating them when the market hands you a dip. The ten coins we’ve covered fit that description, each in their own way. As always, do your own due diligence – but if the current trends persist, those who can strategically buy into temporary weakness on these leading performers may find themselves well-positioned to capitalize on the next leg up. The crypto market can be unforgiving, but it also tends to reward conviction paired with sound analysis. And right now, the analysis suggests that these top coins are among those you shouldn’t ignore when looking to buy the dip in today’s market. Stay safe, stay informed, and happy trading!