In a significant evolution of both traditional finance and digital assets, cryptocurrency-focused ETFs are rapidly entering the mainstream.

The most recent development is the U.S. Securities and Exchange Commission (SEC) approving ProShares' XRP Futures ETFs, launching April 30, 2025.

This move comes amid a broader trend of regulatory softening, with the approval of the first U.S. spot Bitcoin ETFs in January 2024 and the anticipated launch of spot Bitcoin ETFs in Hong Kong this April. These milestones signal a pivotal shift as crypto is no longer just a speculative asset class on the fringes but is becoming a staple of regulated investment portfolios.

ETFs (exchange-traded funds) have long been favored for their transparency, cost-efficiency, and ability to offer diversified exposure to markets. The surge in crypto ETFs represents a major crossover between the risk-averse architecture of institutional investing and the high-volatility realm of digital assets. From Bitcoin and Ethereum to newer products tied to Solana and now XRP, both futures- and spot-based ETFs are making it easier for investors to gain crypto exposure via conventional brokerage platforms.

As of 2025, crypto ETFs are not just financial instruments, they’re becoming indicators of investor sentiment, regulatory posture, and market maturity. With XRP’s strong institutional uptake post-ETF approval and Bitcoin’s record-breaking $5 billion in ETF inflows this past week, a new investment paradigm is clearly underway.

But with opportunity comes complexity. Understanding the fundamentals and distinctions of these evolving instruments is crucial before evaluating what the future holds.

Understanding ETFs: Traditional vs. Crypto

ETFs, or Exchange-Traded Funds, are investment vehicles that track the performance of an underlying asset or group of assets. Traded on stock exchanges like individual equities, ETFs offer exposure to everything from equity indices and bonds to commodities and emerging markets. Their popularity stems from offering diversification, intraday liquidity, and lower fees compared to mutual funds.

Traditional ETFs fall into several broad categories:

-

Equity ETFs track stock indices like the S&P 500 or Nasdaq-100.

-

Bond ETFs include government, municipal, and corporate bond exposure.

-

Commodity ETFs track prices of physical assets like gold or oil.

-

Thematic ETFs are based on investment themes—AI, ESG, clean energy, etc.

Crypto ETFs, by contrast, are structured to offer exposure to the price movements of cryptocurrencies without requiring direct ownership of the digital assets. These can be classified primarily into:

-

Futures-based ETFs: These track the price of crypto futures contracts traded on regulated exchanges like the CME. Examples include the ProShares Bitcoin ETF (BITO) and the new XRP Futures ETFs.

-

Spot ETFs: These hold actual crypto assets like Bitcoin or Ethereum. Approved in the U.S. only in January 2024, spot ETFs are considered more reflective of true market pricing but face stricter scrutiny due to concerns around custody, market manipulation, and liquidity.

Globally, approaches vary. The U.S. is cautiously approving spot ETFs, following years of resistance due to regulatory concerns. Brazil and Canada have taken a more open stance, launching spot crypto ETFs earlier. Hong Kong, aiming to reclaim its financial hub status, is expected to become Asia's first to approve spot Bitcoin ETFs.

However, regulatory challenges persist. Futures ETFs are often criticized for tracking errors and roll costs, while spot ETFs face questions on taxation and surveillance mechanisms. Despite these hurdles, the convergence of traditional finance structures with digital assets through ETFs marks a watershed moment in the institutionalization of crypto.

Financial Results of Leading Crypto ETFs

The financial performance of crypto ETFs has become a key indicator of both investor sentiment and broader market trends. With increasing inflows and institutional participation, the landscape is being shaped by prominent players such as BlackRock (IBIT), Grayscale (GBTC), Fidelity (FBTC & FETH), and 21Shares (ARKA). This section examines their NAVs, market prices, expense ratios, and strategic positioning in 2025.

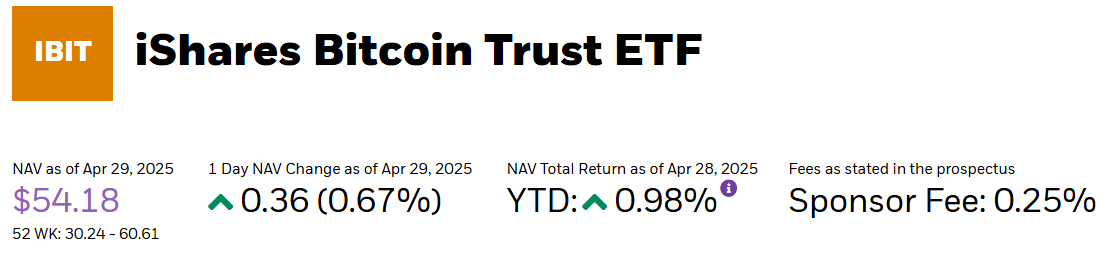

iShares Bitcoin Trust ETF (IBIT) – The Liquidity Leader

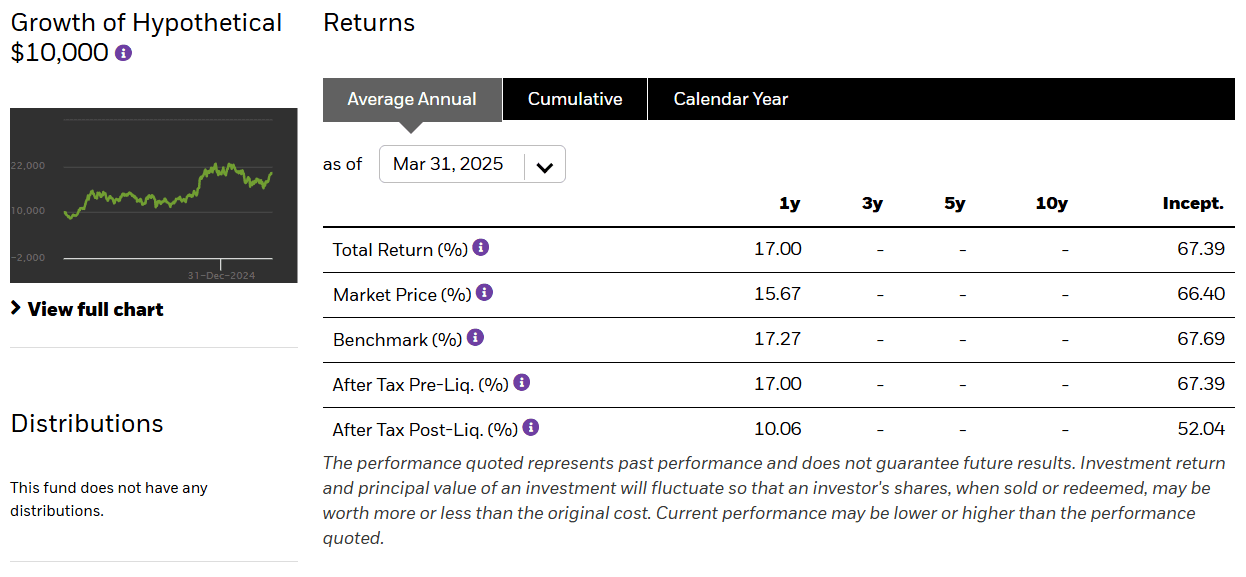

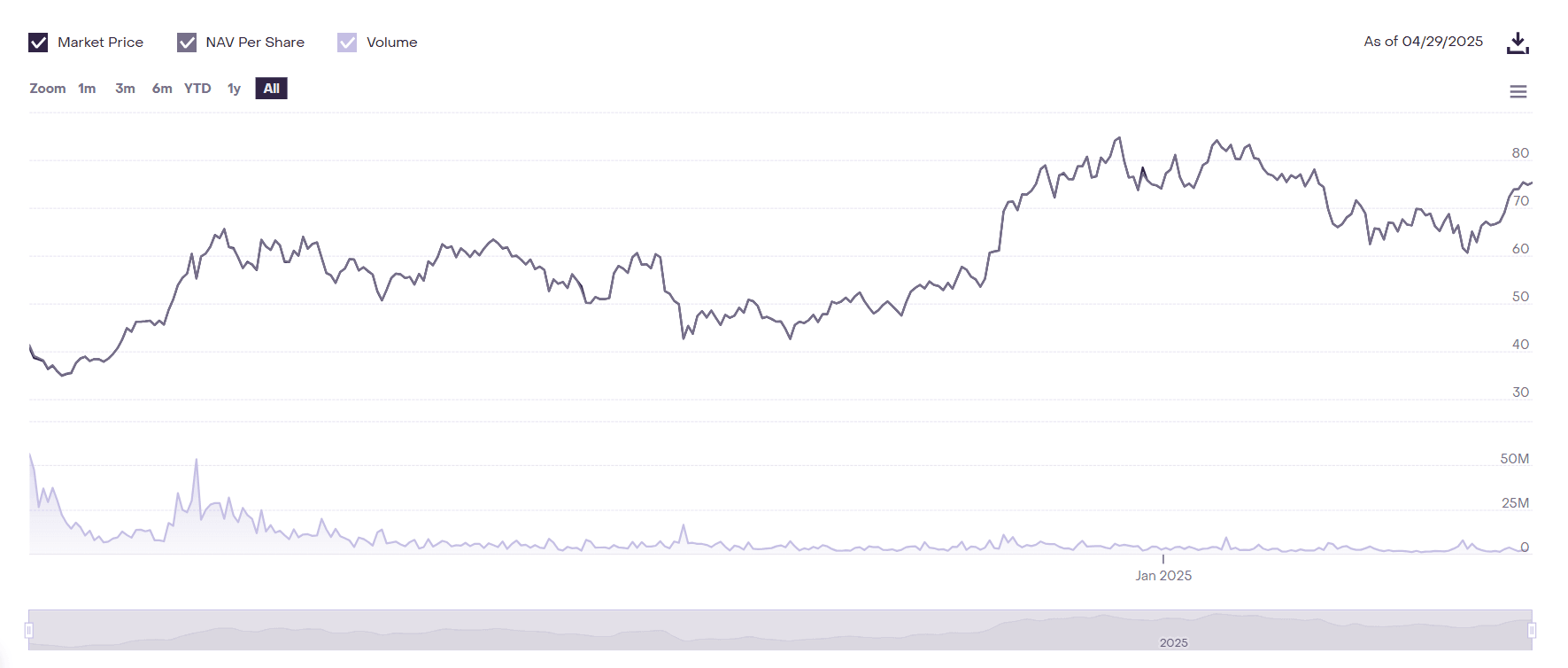

BlackRock’s iShares Bitcoin Trust ETF (IBIT) has quickly positioned itself as the dominant player in the spot Bitcoin ETF space. As of April 29, 2025, its NAV stands at $54.18, with a modest YTD return of 0.98% and a sponsor fee of 0.25% — among the lowest in its category. With a 1-day NAV gain of 0.67%, IBIT continues to attract volume due to its tight bid-ask spread and strong liquidity metrics.

The ETF's average annual return since inception is an impressive 67.39%, closely mirroring its benchmark. On a 1-year basis, IBIT has returned 17%, slightly outperforming Fidelity's comparable ETF and nearly matching Bitcoin’s raw price performance. The chart of its hypothetical $10,000 investment illustrates steady growth since January 2024, even amid short-term volatility.

One of IBIT’s key strengths lies in its institutional-grade infrastructure, backed by BlackRock’s $10.5T AUM and its technology integration with Coinbase Prime. Its performance consistency, transparent holdings, and massive trading volume have made it a preferred vehicle for institutional investors seeking regulated exposure to Bitcoin.

Grayscale Bitcoin Trust ETF (GBTC) – The Veteran Now Regulated

Grayscale’s GBTC was the first publicly tradable Bitcoin trust in the U.S., and it officially converted into a spot ETF on January 11, 2024. As of April 29, 2025, it trades at $75.25 with a daily volume of over 2.1 million shares. Despite its legacy structure, GBTC has adjusted to ETF competition, boasting a 0% premium/discount and smooth NAV tracking.

GBTC’s AUM is over $18.17 billion, making it the largest crypto ETF globally by assets. However, the 1.50% total expense ratio remains a concern for cost-sensitive investors. It has also undergone multiple fee reductions (from 2.00% pre-2024), reflecting its efforts to remain competitive in a rapidly expanding ETF ecosystem.

Its holding of 190,630+ BTC ensures it remains a key institutional barometer of market confidence. GBTC's early mover advantage, combined with Coinbase Custody's backing, still gives it relevance in long-term portfolios despite rising challengers.

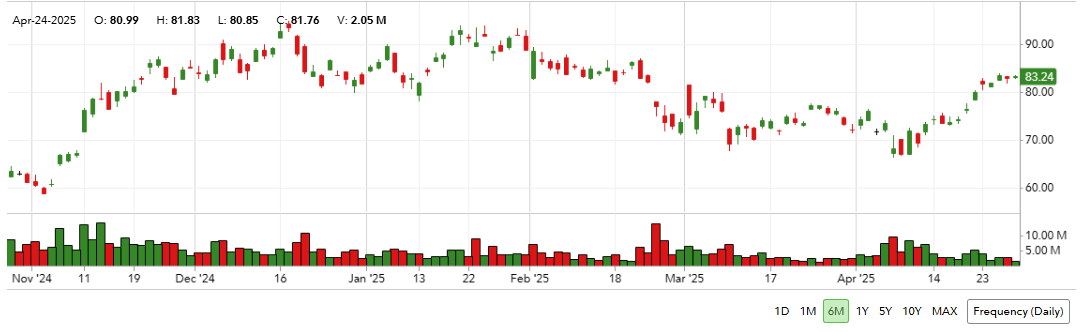

Fidelity Wise Origin Bitcoin Fund (FBTC) and Ethereum Fund (FETH) – Retail-Friendly Titans

Fidelity’s FBTC currently trades at $83.24 (as of April 29, 2025) and has a net asset base of $16.32 billion, with a consistent expense ratio of 0.25%. Over the past year, it posted a total return of +15.97%, marginally underperforming the Bitcoin Reference Rate’s +16.77%, indicating a relatively tight tracking error. FBTC is lauded for its tax-efficient grantor trust structure and transparent valuation, making it a go-to for retail investors using platforms like Robinhood or Fidelity itself.

Meanwhile, the Fidelity Ethereum Fund (FETH) is more volatile. Trading at $18.23, it has seen a life return of -47.67%, revealing the impact of Ethereum’s underperformance in recent quarters and regulatory headwinds related to staking features. Despite these, FETH offers affordable entry, 0.25% expense ratio, and managed to attract $727.5 million in AUM, signaling Ethereum’s persistent relevance.

ARK 21Shares Active Bitcoin Futures ETF (ARKA) – Active Exposure at a Cost

The ARKA ETF, launched in November 2023, is a futures-based Bitcoin ETF actively managed by Ark Invest and 21Shares. Its NAV is $59.77, but with a YTD return of -5.99% as of April 28, 2025, the fund has struggled to deliver alpha compared to passive counterparts like IBIT and FBTC.

ARKA’s pitch is active rolling of BTC futures contracts, potentially offering better returns in trending markets. However, the current performance reflects the costs and inefficiencies of such strategies, compounded by a 0.70% expense ratio — higher than most spot products.

Its net assets stand at just under $9 million, pointing to slow uptake despite the brand backing of Cathie Wood's Ark. Retail investors seem wary of high fees and tracking slippage.

VanEck Crypto & Blockchain Innovators ETF (DAPP) – The Thematic Underdog

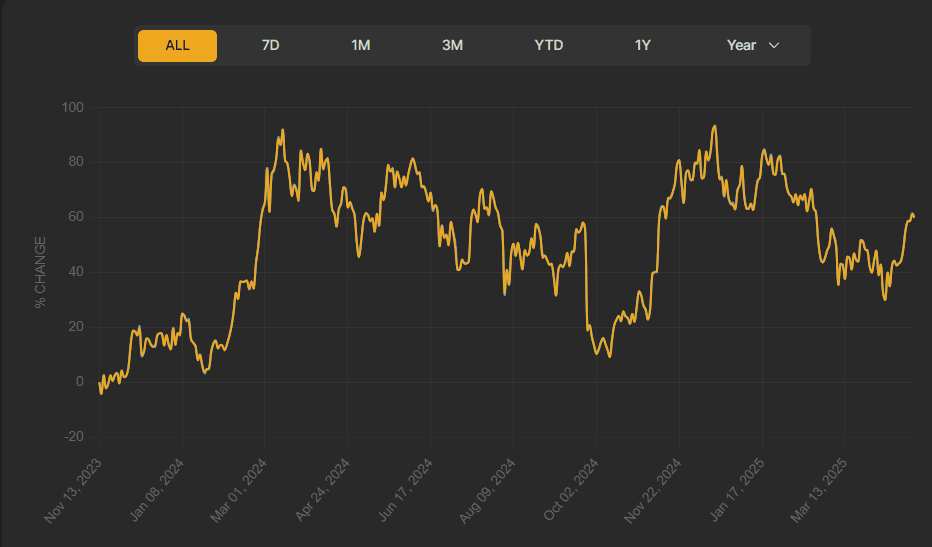

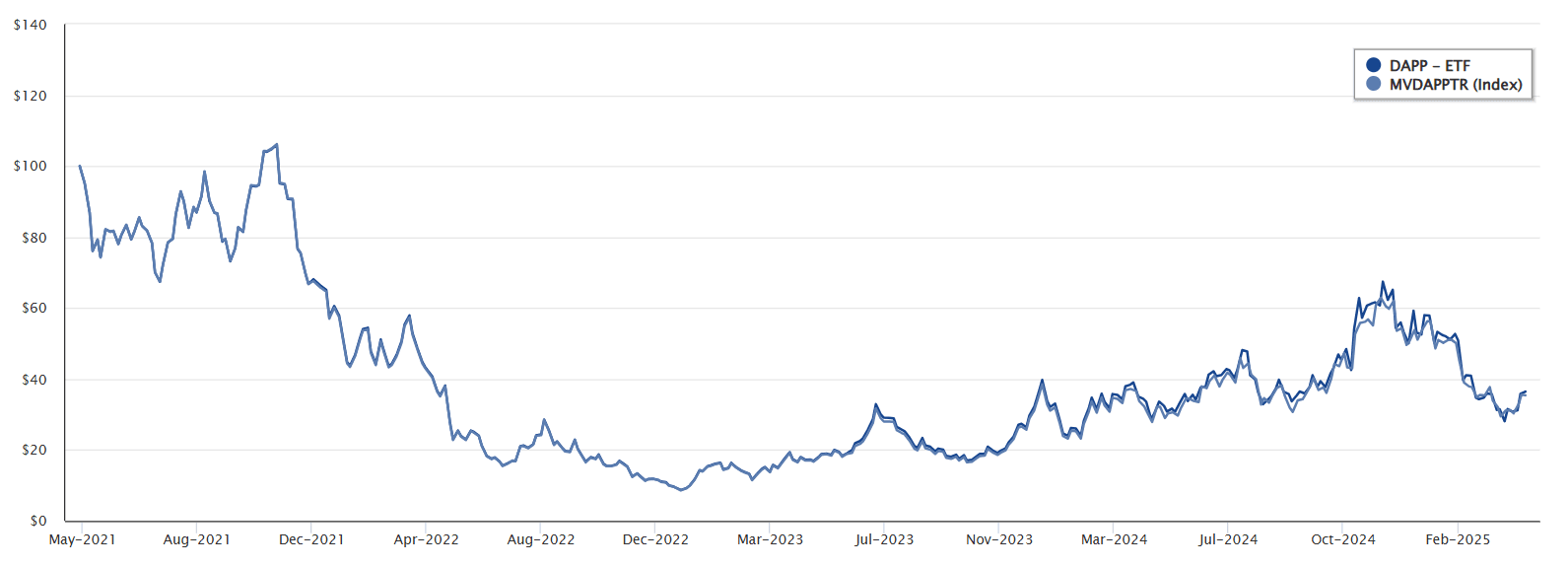

VanEck’s DAPP ETF doesn’t directly hold crypto, but invests in blockchain-related equities, including MicroStrategy, Coinbase, and Riot Platforms. As of April 29, 2025, its NAV sits at $7.45, with a YTD return of -27.12%, underlining its exposure to crypto-adjacent equities rather than crypto itself.

Since inception in 2021, a hypothetical $100 investment has fallen below $40, reflecting extreme sectoral volatility. Despite this, DAPP remains a UCITS-compliant product with global accessibility and is used by investors seeking diversified exposure to the crypto ecosystem without holding tokens or futures.

Inflows, Outflows, and Investor Sentiment

Bitcoin ETFs have entered a new phase of capital engagement marked by heavy institutional dominance, selective inflows, and volatility-induced repositioning. The past 6–12 months have seen ETF flows acting as a key barometer of sentiment, replacing traditional exchange activity as the preferred method of market exposure for large investors.

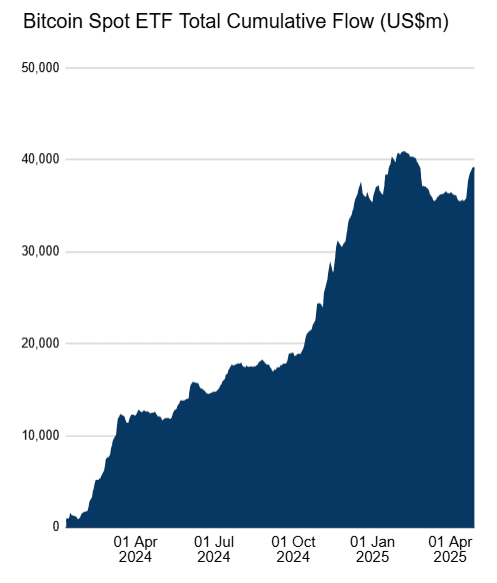

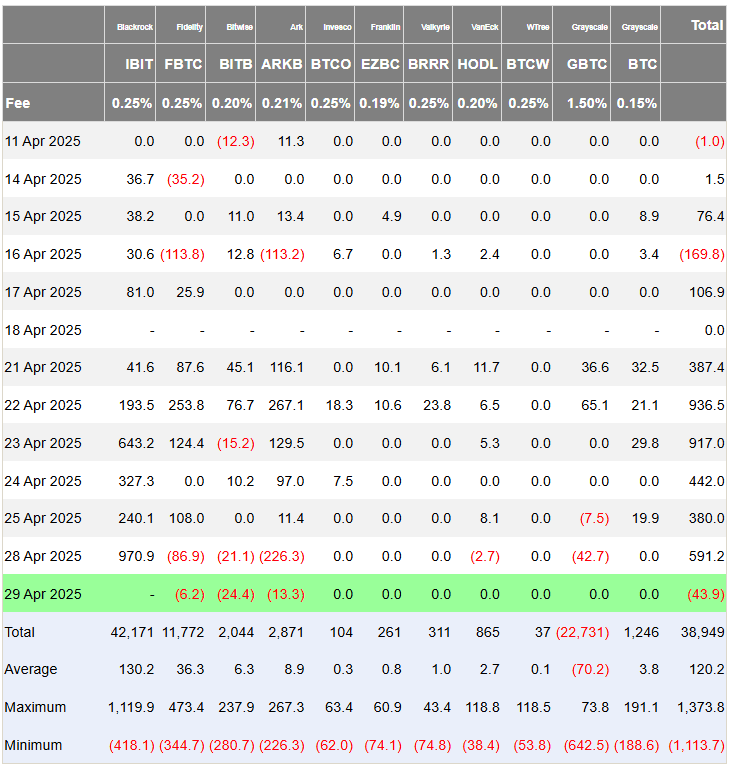

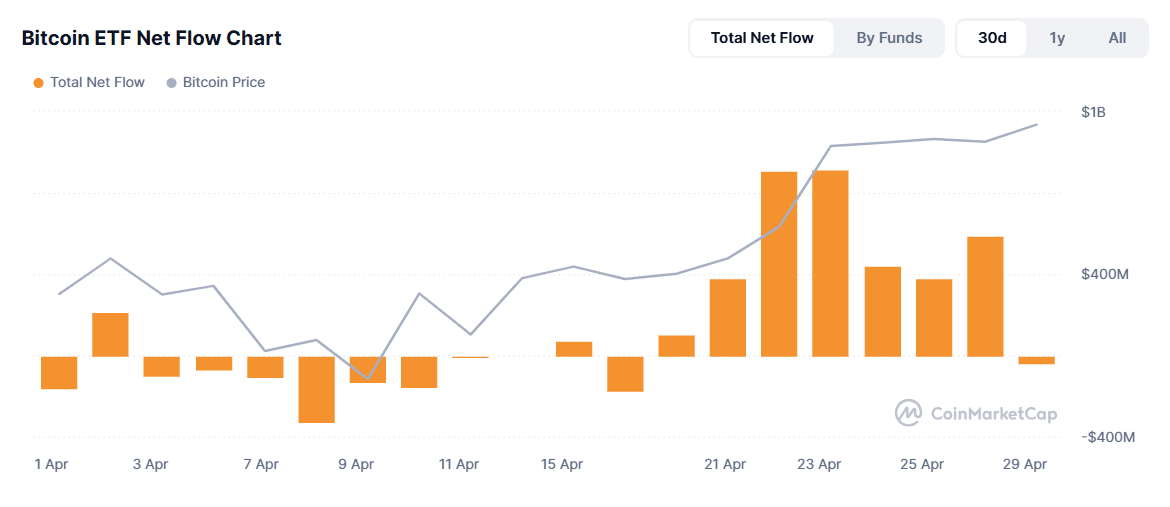

From January 2024 to April 2025, cumulative Bitcoin ETF inflows crossed $42 billion, peaking in momentum during Q1 2025. However, sentiment cooled in February amid macro uncertainty, with Bitcoin ETF flows turning negative. A strong rebound was seen in April 2025 as ETFs registered their second-highest weekly inflow on record—$3.06 billion in the week ending April 25, largely driven by BlackRock’s IBIT, which single-handedly pulled in $1.45 billion.

This resurgence in April is noteworthy. Between April 21–25, not a single day saw outflows, suggesting a short-term institutional consensus. However, the sentiment flipped quickly again by April 29, with net outflows of $36.76 million in Bitcoin ETFs and $43.86 million across all crypto ETFs, revealing how fragile and reactive the flow dynamics remain.

The dominant investors behind these moves are clearly institutional. Retail interest, as measured by Google Trends, has dropped to its lowest point since October 2024, despite Bitcoin nearing all-time highs (~$95,000). In contrast, institutional sentiment is rising, with sovereign entities, financial advisors, and hedge funds increasingly treating Bitcoin as a macro-hedge rather than a speculative asset.

This shift is evident in behavior. Institutions favor ETFs for regulated, passive exposure—resulting in capital concentration. Funds like IBIT, FBTC, and GBTC are now absorbing liquidity that might have previously fueled altcoin rallies. This is altering the risk appetite and market rhythm. Instead of typical altseason rotations, the market is witnessing ETF-driven repositioning around basis trades and macroeconomic signals.

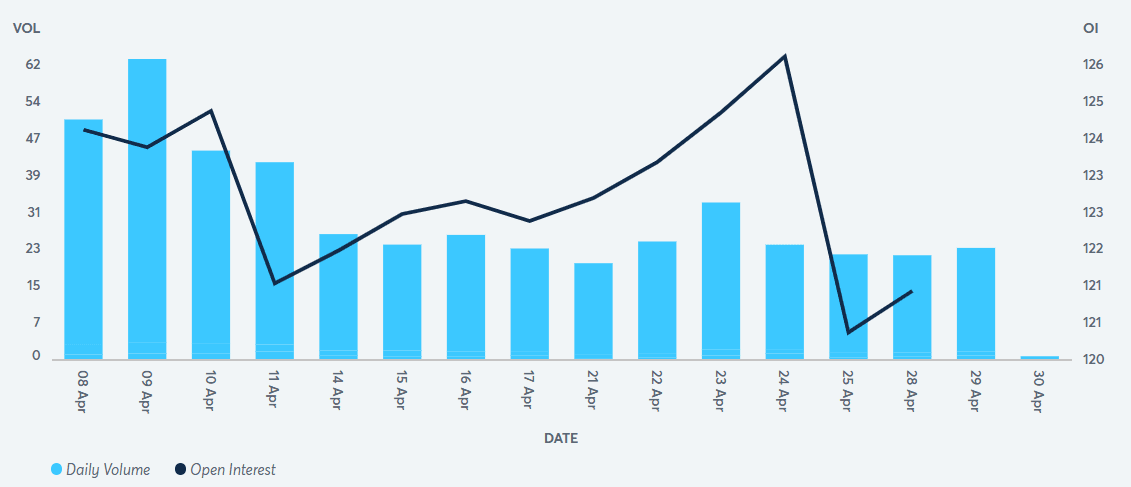

A critical example is CME Bitcoin Futures, where open interest (OI) dropped consistently over four days before stabilizing in late April due to rising basis yield (~9%), indicating traders’ renewed appetite for arbitrage opportunities.

Moreover, April’s ETF surge was not uniform. Outflows from ARKB and FBTC occurred even as IBIT gained, suggesting reallocations rather than net inflows. This was confirmed by Farside data on April 29, where IBIT saw $6.2 million outflows, FBTC lost $24.4 million, and ARKB shed $13.3 million, leading to a net negative day.

In summary, while capital continues to flow into Bitcoin ETFs at a historic pace, the pattern is marked by institutional caution and strategic rotations. ETFs have institutionalized sentiment, replacing retail-driven volatility with tactical accumulation and reallocation strategies.

Emerging ETFs and Global Trends

Altcoin ETFs Gain Momentum Beyond Bitcoin and Ethereum

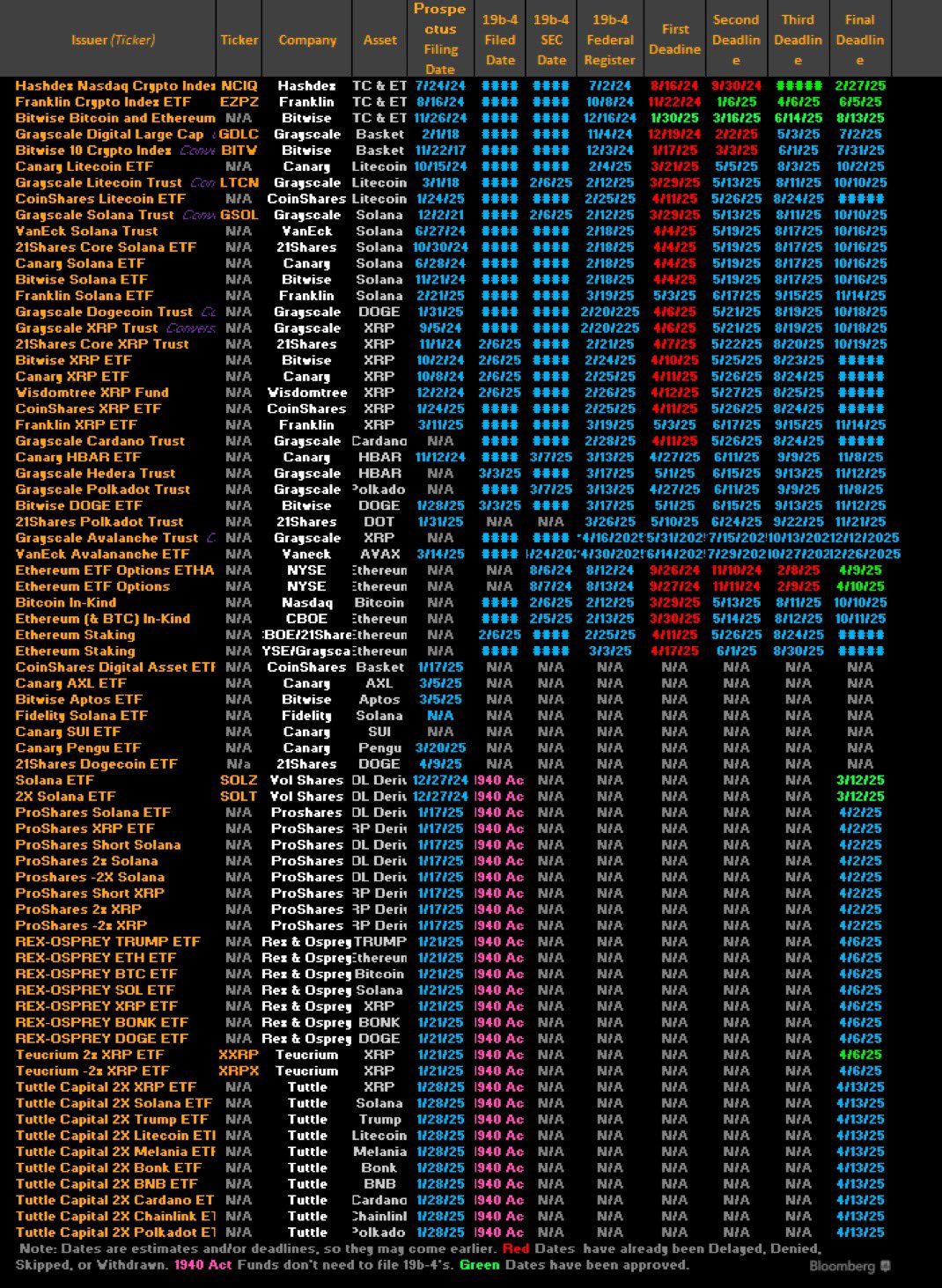

The success of spot Bitcoin and Ethereum ETFs has opened the door to the next wave of crypto ETF innovation, focused on altcoins like Solana, XRP, Cardano, and Avalanche. The U.S. Securities and Exchange Commission (SEC) is currently reviewing 72 crypto ETF applications, signaling an industry-wide race to bring diversified offerings to market. Major issuers including VanEck, Bitwise, Grayscale, 21Shares, and ProShares are expanding their ETF filings beyond BTC and ETH, targeting popular Layer 1 networks and payment-focused tokens.

ProShares recently filed for a suite of XRP-related ETFs, including long and inverse versions, while 21Shares submitted a Dogecoin ETF proposal. Meanwhile, Canada became the first North American market to list spot Solana ETFs in April 2025. 3iQ’s Solana Staking ETF (SOLQ) attracted C$90 million in assets within 48 hours, while CI Global’s SOLX offered dual-currency exposure and waived fees for initial investors. These developments point to surging institutional interest in altcoin access through regulated investment vehicles.

Regional Trends: U.S. Leads in Volume, Canada and Europe in Innovation

While the U.S. dominates in ETF trading volumes, Canada has taken the lead on innovation and speed of approvals. Canadian regulators approved both Bitcoin and Ethereum spot ETFs as early as 2021 and are now leading the altcoin ETF frontier. Europe, particularly Switzerland, has long supported ETPs tied to various crypto assets through progressive frameworks. Asia is also catching up. Hong Kong regulators have expressed openness to spot crypto ETFs, and South Korea continues to explore pathways for regulated crypto investment products with speculation of BTC ETF to be traded this year. However, regulatory conservatism and political caution still hinder widespread ETF rollout in the region.

Tech-Forward Innovation: Tokenized and Onchain ETFs

Beyond asset diversity, innovation in structure is reshaping the ETF landscape. Tokenized ETFs, which issue shares directly on blockchain networks, are under exploration for their potential to reduce settlement latency and improve transparency. Additionally, ETFs like VanEck’s upcoming Onchain Economy ETF aim to track companies building blockchain infrastructure—blending traditional finance with crypto-native exposure. This shift signals a future where ETFs are not only gateways to crypto assets but also built using the very technology they invest in. As the ETF ecosystem expands, the next frontier lies in fully integrating blockchain into how these products are constructed, traded, and settled.

Risks, Opportunities, and the Future of Crypto ETFs

Key Risks Shaping the Crypto ETF Landscape

Despite growing institutional interest, crypto ETFs face persistent risks that could hinder their long-term adoption. Regulatory uncertainty remains the most pressing challenge. While the approval of Bitcoin and Ethereum ETFs marked major milestones, the SEC continues to scrutinize altcoin ETFs, particularly those tied to assets like XRP and Solana. Filings can face delays of up to 240 days or be denied outright, depending on perceived risks around manipulation, liquidity, and investor protection.

Market volatility also poses a challenge. Cryptocurrencies are inherently more volatile than traditional assets, and ETF structures may magnify short-term price swings—especially in leveraged or inverse products. Custody remains another hurdle. Institutional-grade storage solutions must meet high security and compliance standards, and any breach could shake investor confidence. Lastly, the thin liquidity of some altcoins may hinder efficient ETF pricing, especially during market stress.

Unlocking Opportunities: Access, Diversification, and Institutional Growth

On the other side of the ledger, crypto ETFs unlock powerful opportunities. They offer a regulated, simplified entry point for both retail and institutional investors, allowing exposure without the complexities of wallets or private keys. ETFs enable portfolio diversification across digital assets, from Bitcoin to emerging altcoins, and provide passive exposure through traditional brokerages.

Experts like Eric Balchunas and Nate Geraci point out that ETFs are becoming the dominant structure for crypto adoption. With projections from Standard Chartered setting a $200,000 year-end price target for Bitcoin, ETFs are increasingly viewed not just as speculative vehicles, but as tools for long-term financial planning and hedging against macro risk. As tokenized ETFs and blockchain-native infrastructure develop further, crypto ETFs are poised to blur the line between legacy finance and decentralized technology reshaping capital markets in the process.

Closing Thoughts

Crypto ETFs are rapidly evolving from niche offerings into cornerstone instruments of mainstream digital asset investing. As regulatory clarity improves and altcoin applications grow, ETFs will play an even greater role in bridging the gap between traditional finance and crypto.

In today’s financial landscape, they represent a gateway—offering institutional-grade exposure to an asset class that is maturing under pressure. The future of crypto ETFs lies not just in tracking digital tokens, but in redefining how investors engage with innovation, risk, and opportunity.