The XRP Ledger stands at a critical inflection point where institutional finance meets blockchain infrastructure. In October 2025, when a prominent XRPL developer asked Ripple CEO Brad Garlinghouse what was needed to drive institutional adoption on the ledger, his one-word answer crystallized the entire conversation: "Privacy."

That single response encapsulates a fundamental paradox confronting blockchain's institutional adoption. Finance cannot function without confidentiality, yet blockchains are built on transparency.

For banks, asset managers, and enterprises that handle sensitive data under regulations like GDPR, Basel III, and the Bank Secrecy Act, conducting business on public ledgers means exposing competitive intelligence, trading strategies, and client relationships to anyone with an internet connection. Despite XRPL's impressive technical capabilities - three to five second settlement finality, sub-penny transaction costs, and 13 years of zero downtime - institutions have hesitated to deploy capital at scale precisely because of this transparency problem.

Yet the past year has witnessed remarkable momentum toward solving this challenge. Ripple has activated a compliance infrastructure stack including decentralized identifiers, verifiable credentials, and multi-purpose tokens with regulatory controls. Real-world asset tokenization on XRPL surged 2,260 percent in six months, reaching $118 million by July 2025. On-demand liquidity payments processed $1.3 trillion in the second quarter alone.

Now, with confidential multi-purpose tokens scheduled for first quarter 2026 and a native lending protocol under development, XRPL aims to become what Ripple's Senior Director of Engineering Ayo Akinyele calls "the first choice for institutions seeking innovation and trust."

In this article we examine the technical infrastructure, privacy solutions, market dynamics, and realistic challenges facing XRPL's institutional adoption trajectory. The opportunity is substantial - many trillions of dollars in assets are projected to move on-chain over the coming decade - but the path forward involves navigating complex regulatory landscapes, overcoming entrenched network effects, and proving unproven technologies at enterprise scale. Understanding both the genuine innovations and the real obstacles provides essential context for evaluating XRPL's institutional prospects over the next three to five years.

Why institutions demand privacy that XRPL currently cannot provide

Financial institutions operate under stringent confidentiality requirements that public blockchain transparency fundamentally violates. When JPMorgan Chase built its Quorum blockchain, the bank explicitly designed cryptography and segmentation features to prevent everyone except specific transaction parties from viewing sensitive data. As one JPMorgan managing director explained, the goal was satisfying regulators who need seamless access to financial information while protecting the privacy of parties who don't wish to reveal their identities or transaction details. This requirement isn't about hiding illicit activity - it's about protecting competitive intelligence and complying with data protection regulations.

The transparency problem manifests in multiple ways. If a transportation company charges one hundred dollars to transport a package for Company A but ninety dollars for Company B, broadcasting that pricing differential on a public ledger creates competitive disadvantages. Similarly, banks cannot afford having counterparties, transaction details, and trading strategies exposed where competitors can analyze them. When asset managers deploy institutional capital into DeFi protocols, revealing portfolio positions in real time allows front-running and strategic gaming. In traditional finance, nobody would consider logging into their bank without HTTPS encryption, yet many blockchain users still transact without equivalent baseline protections.

The data protection challenge extends beyond competitive concerns to regulatory compliance. The European Union's General Data Protection Regulation includes a "right to be forgotten" that conflicts with blockchain's immutability. Financial institutions face strict confidentiality mandates under Basel III capital adequacy rules. In the past five years alone, 69 percent of financial institutions experienced at least one data breach, heightening sensitivity around exposing customer information. Research from EY and Forrester Consulting found that enterprises are most concerned with privacy and security when evaluating blockchain adoption, with authentication, permissioning, and access management identified as critical security elements.

Brad Garlinghouse's October 2025 statement identifying privacy as the path to institutional adoption came after XRPL had already implemented an impressive compliance infrastructure. The ledger activated decentralized identifiers in October 2024, enabling W3C-compliant persistent identity anchors that users control with their private keys. Credentials went live that same month, allowing trusted issuers like banks to cryptographically attest to KYC completion without repeatedly sharing personal data. Multi-purpose tokens launched October 1, 2025, carrying on-chain metadata and compliance controls including transfer restrictions, authorized holder allowlists, and clawback capabilities for regulatory violations. Permissioned domains and a permissioned DEX entered validator voting to create credential-gated trading environments where only KYC-verified participants can access order books.

Yet even with this compliance foundation in place, institutions remained hesitant. As the XRPL developer who posed the question to Garlinghouse explained, institutions weren't comfortable sharing transaction hashes publicly despite XRPL's technical advantages. The missing piece was a privacy layer enabling confidential transactions while maintaining the regulatory accountability that compliance tools provide. Ayo Akinyele articulated the requirement starkly in his October 2025 blog post: "Without privacy, financial institutions cannot safely use public ledgers for core workflows. Without accountability, regulators cannot sign off. With programmable privacy, we can have both."

This "programmable privacy" philosophy represents XRPL's differentiated approach - not privacy coins that hide everything from everyone, but selective disclosure mechanisms where institutions control what information gets revealed, to whom, and under what circumstances. An institution could prove KYC checks were completed without revealing customer identities to the entire network. Auditors could verify proof-of-reserves without requiring exposure of all wallet data. Tokenized collateral could be deployed in lending workflows while keeping terms and positions confidential from competitors. The technical challenge involves implementing these privacy-preserving mechanisms without sacrificing the transparency that makes blockchains auditable and trustworthy.

The compliance foundation that XRPL has already built

Before addressing privacy, XRPL methodically constructed a compliance infrastructure that differentiates it from permissionless blockchains designed primarily for retail users. This multi-year effort culminated in 2024 and 2025 with the activation of several critical amendments that together create an institutional-grade regulatory framework.

Decentralized identifiers launched October 30, 2024, implementing the W3C DID version 1.0 specification. Each XRPL account can create one unique DID controlled by their private keys, with the DID document storing verification methods, service endpoints, and credential links. The implementation offers three storage options: a URI field pointing to external storage like IPFS, a DIDDocument field for minimal on-chain storage, or implicit documents auto-generated from the DID and public keys. This architecture enables a three-party model where users own DIDs, trusted issuers verify credentials offline, and verifiers confirm credentials on-chain without accessing personal data. The system is decentralized and self-sovereign, requiring no central authority, while remaining persistent across organizational changes and cryptographically verifiable.

The practical KYC application works elegantly. A financial institution issues a verifiable credential attesting to a user's KYC completion. The user presents their DID and credential to access DeFi protocols. The protocol verifies the credential cryptographically without viewing personal information, enabling compliant participation. This eliminates repeated KYC processes across platforms while protecting privacy through zero-knowledge verification - participants prove possession of valid credentials without revealing underlying identity data.

Multi-purpose tokens represent another critical innovation, addressing limitations in XRPL's original trust line token system. The XLS-33 proposal achieved final status and activated on mainnet October 1, 2025, introducing optimized fungible tokens with features specifically designed for institutional use cases. Unlike bidirectional trust lines that allow balance netting between parties, MPTs implement unidirectional flows where issuers cannot hold their own tokens - amounts automatically burn instead. Each MPT receives a 192-bit issuance identifier and stores up to 1,024 bytes of on-chain metadata including asset scale, recommended schemas, and immutable reference data.

The institutional value lies in granular control mechanisms. Transfer flags enable or disable peer-to-peer transfers entirely, useful for non-transferable certificates or licenses. The require-authorization flag creates allowlist-based holding where issuers must explicitly approve each holder, essential for securities compliance. Trading flags control DEX participation, while escrow flags govern time-locked functionality. Supply management includes configurable caps from zero to 2^63-1 units, with tokens burnable and reissuable within limits, and outstanding amounts tracked automatically.

Transfer fees represent a particularly sophisticated feature, allowing issuers to charge zero to 50 percent in increments of 0.0001 percent. Critically, fees are charged on top of the delivered amount rather than deducted from it. If a recipient needs to receive one hundred dollars and the fee is 0.5 percent, the sender pays $100.50 with the recipient getting exactly one hundred dollars and fifty cents burned. This prevents fee confusion while enabling business models around token usage.

Compliance controls include individual lock and freeze capabilities for specific holder balances, global freeze affecting all tokens of an issuance, and clawback allowing issuers to revoke tokens from holders. These features satisfy regulatory requirements around sanctions compliance, fraud prevention, and asset recovery. A fiat-backed stablecoin issuer can freeze tokens held by sanctioned addresses. Securities issuers can enforce transfer restrictions. Licensing authorities can revoke non-transferable credentials if qualifications expire.

The credentials system that activated in October 2024 as part of rippled 2.3.0 complements DIDs by enabling on-chain credential issuance, storage, and verification. The credential ledger object includes fields for subject (the receiving account), issuer (the trusted entity creating the credential), credential type (up to 64 bytes identifying the credential category), optional expiration timestamps, and URIs linking to off-chain verifiable credentials. Transactions include CredentialCreate for issuers, CredentialAccept transferring reserve responsibility to subjects, and CredentialDelete for either party or anyone after expiration.

The system integrates with deposit authorization, extending the DepositPreauth object to accept credential-based authorization rather than only specific addresses. Accounts can allowlist by credential type, enabling scenarios like "only accounts with verified institutional investor credentials can send me payments." The deposit-authorized RPC was extended to check credential validity, type matches, expiration status, and correct issuers before permitting transactions.

Two additional compliance tools complete the current stack. Deep freeze enhances the existing freeze capability with stronger enforcement, preventing flagged addresses from sending or receiving tokens across payments, DEX, and AMM. Unfreezing requires explicit issuer action. The simulate feature enables "dry run" transactions before submission, testing outcomes without committing to the ledger - critical for enterprise risk management that reduces costly production errors.

Ripple's official roadmap emphasizes that this compliance infrastructure already addresses regulatory requirements around identity, KYC, AML, and sanctions. But the question institutions kept asking was: can we conduct private transactions while maintaining this compliance posture? That question drives the privacy solutions currently under development.

Zero-knowledge proofs and four other privacy approaches XRPL could adopt

The term "zero-knowledge proof" refers to cryptographic methods enabling one party to prove they know information or that a statement is true without revealing the underlying information itself. For blockchain applications, ZKPs enable verification that a transaction is valid - with correct balances, authorized signatures, and proper amounts - without exposing what those balances or amounts actually are. This seemingly paradoxical capability derives from advanced mathematics allowing proof generation based on encrypted data that validators can verify matches the encrypted state without decrypting anything.

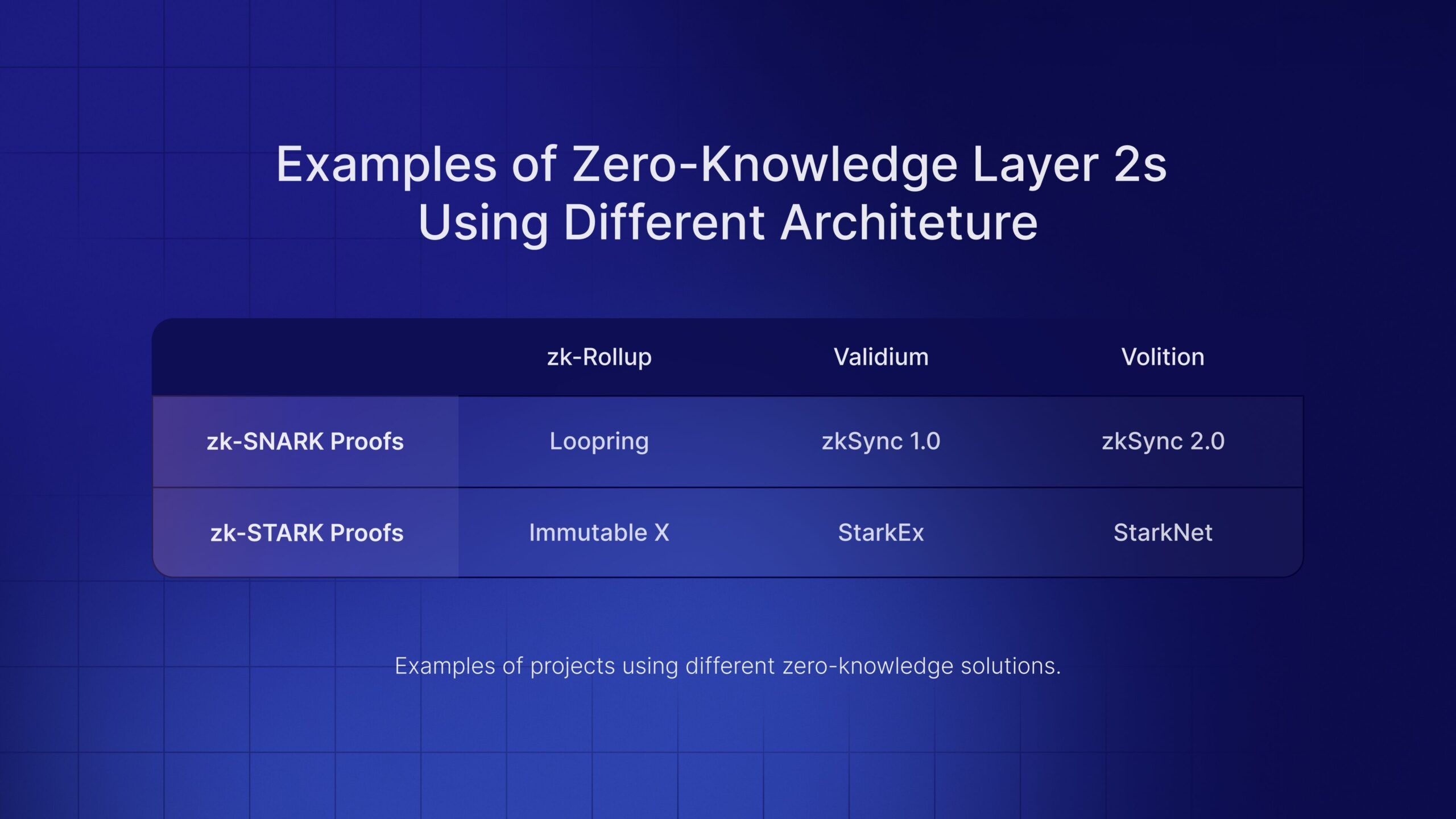

Zero-knowledge rollups combine this privacy capability with scaling benefits by moving computation off-chain while posting compressed data on-chain. An operator batches one thousand or more transactions, executes them off-chain, generates a validity proof of around 200 to 300 bytes, and submits it for verification. The proving circuit loops through each transaction, verifying senders exist through Merkle proofs, updating balances, generating intermediate state roots, and producing a final post-state root. Verifiers check the proof in approximately ten milliseconds using around 500,000 gas. Examples include zkSync processing over 2,000 transactions per second at one hundredth the cost of Ethereum, StarkNet handling millions of monthly transactions using STARKs, Polygon zkEVM offering full EVM compatibility, and Aztec combining privacy with scaling.

Implementing ZK-rollups on XRPL would require substantial protocol changes including a smart contract layer for proof verification, a data availability mechanism for compressed transaction data, and integration with RPCA consensus. Successfully deployed, this approach could increase throughput from 1,500 to potentially 100,000-plus transactions per second. The trade-offs involve fast finality without withdrawal delays, high throughput, and strong security, but expensive proof generation taking 1.6 to 2.3 seconds, high implementation complexity, and difficult auditing. Regulatory acceptance is generally favorable because data remains transparent even if processed off-chain.

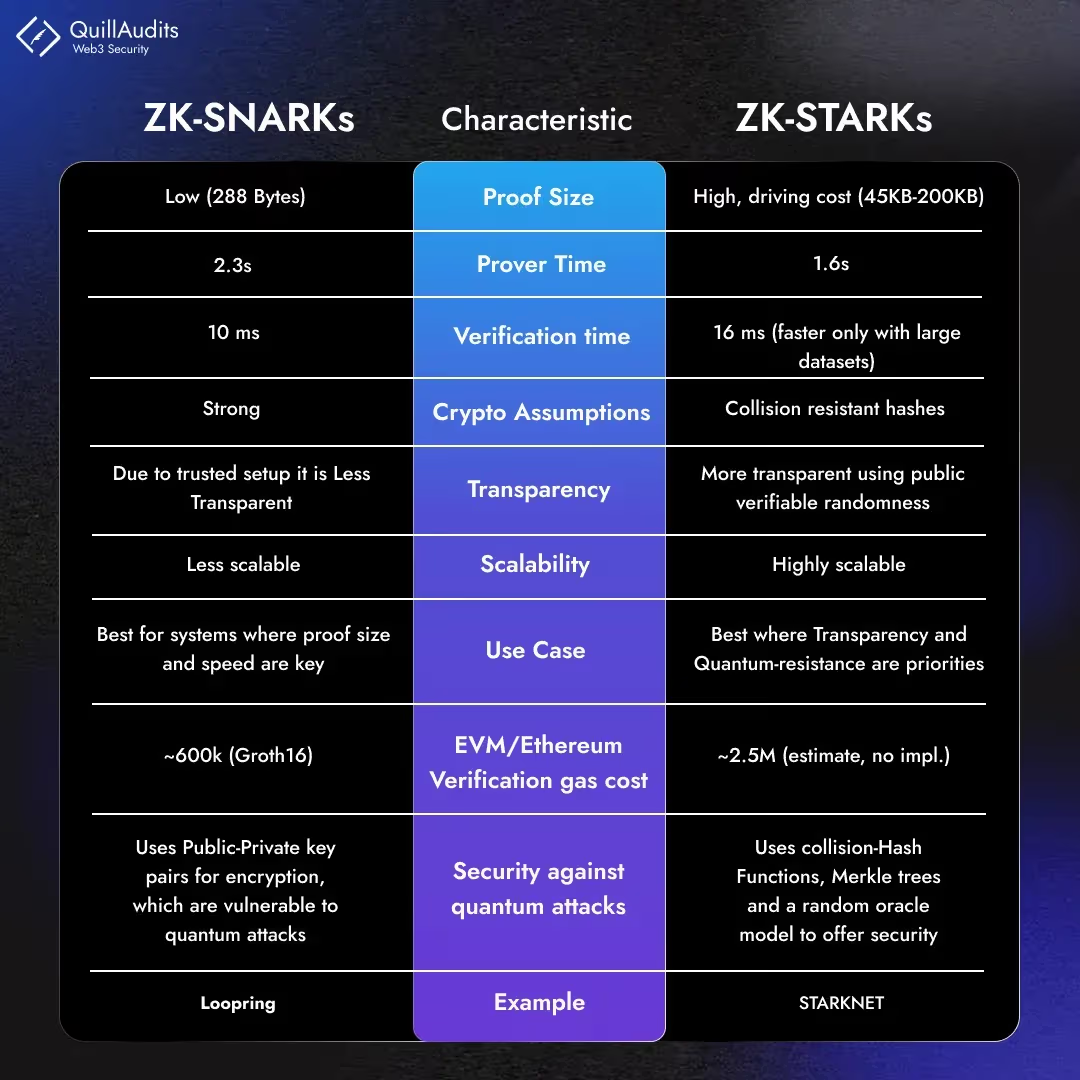

The distinction between zkSNARKs and zkSTARKs matters for implementation choices. Zero-knowledge succinct non-interactive arguments of knowledge - SNARKs - use elliptic curve cryptography producing approximately 288-byte proofs with ten-millisecond verification, but they require a trusted setup ceremony. If the "toxic waste" from this ceremony isn't destroyed, false proofs become possible. Zcash, zkSync, and Filecoin use SNARKs extensively. Zero-knowledge scalable transparent arguments - STARKs - use hash functions, require no trusted setup, offer quantum resistance, but produce larger proofs around 45,000 bytes with 16-millisecond verification. StarkNet and dYdX leverage STARKs.

For XRPL's specific needs, zkSNARKs using trustless variants like Halo 2 likely fit best, combining small proofs suitable for frequent transactions with elimination of trusted setup risks. This approach better matches XRPL's payment-focused architecture compared to STARKs, which excel for large computations but impose bandwidth costs from larger proofs.

Confidential transactions offer a second privacy approach focused specifically on hiding amounts rather than scaling throughput. The mechanism replaces visible amounts with Pedersen commitments: C equals aG plus bH where 'a' is the hidden amount and 'b' is a random blinding factor. These commitments add homomorphically so inputs equal outputs, remaining verifiable without knowing actual amounts. Range proofs using Bulletproofs of around 700 bytes prevent negative numbers that would enable creating money from nothing.

Monero implements this through ring confidential transactions mixing each transaction with ten-plus decoys via ring signatures, stealth addresses creating one-time addresses per payment, and Pedersen commitments hiding amounts. The result achieves exceptional privacy with sender, receiver, and amount all hidden, but creates trade-offs including a large blockchain exceeding 150 gigabytes, slower verification, and significant regulatory scrutiny. Mimblewimble variants used by Grin and Beam eliminate addresses entirely using Diffie-Hellman exchanges, omit scripts relying only on signatures, implement transaction cut-through pruning intermediate transactions, and merge transactions via CoinJoin. This produces strong privacy with a small blockchain around two gigabytes but requires interaction between senders and receivers.

XRPL's September 2024 confidential MPT proposal uses EC-ElGamal encryption with zero-knowledge proofs, implementing a conceptually similar approach to confidential transactions. The proposal maintains transaction graph visibility showing who sent to whom but hides amounts. This partial privacy preserves some transparency for compliance while protecting competitive intelligence about payment sizes. Regulatory acceptance remains uncertain given privacy coins like Monero face delisting and restrictions, though XRPL's accountability mechanisms may prove more acceptable.

Trusted execution environments represent a third privacy approach using isolated, encrypted memory regions in processors like Intel SGX, ARM TrustZone, and AMD SEV-SNP. Code and data inside TEEs remain protected from operating systems and other applications. Remote attestation proves correct code execution. The privacy workflow involves encrypting input data, sending it to the TEE, decrypting inside the secure enclave, processing on plaintext, re-encrypting before output, and attestation proving validity.

Secret Network uses Intel SGX for confidential CosmWasm contracts where validators share keys via threshold cryptography. Oasis Sapphire provides EVM-compatible confidential contracts where developers choose privacy levels from zero to one hundred percent. Flashbots employs TEE-based block building preventing miner extractable value. The advantages include fast performance with only two to five percent overhead, support for any computation, and easier implementation than zero-knowledge proofs. Disadvantages involve hardware dependency reducing decentralization, trust in manufacturers like Intel, AMD, and ARM, known security vulnerabilities including Spectre and Meltdown side-channel attacks, and lack of cryptographic proof.

XRPL could implement TEE-enabled validators processing encrypted transactions while maintaining fast performance. However, this approach works better as an optional layer combined with cryptographic methods rather than the sole privacy mechanism given the hardware trust assumptions and vulnerability history.

Privacy-preserving smart contracts extend beyond individual transactions to computation. Secret Network's approach makes contract code public while keeping inputs, outputs, and state encrypted, with validators decrypting only inside SGX enclaves using shared secrets. This enables use cases like private voting where ballots remain encrypted until deadlines, tallying occurs inside TEEs, and results become public after close. Oasis Sapphire's "programmable privacy" lets developers control what remains private versus public, with storage automatically encrypted.

XRPL's limited smart contract capabilities make this approach less immediately relevant. The Hooks amendment allows transaction-level logic but not Turing-complete contracts. The proposed XLS-101 smart contracts amendment would enable WASM-based execution, but implementation remains distant. For near-term institutional needs, the confidential MPT approach - private balances without full contracts - better fits XRPL's architecture.

Privacy sidechains offer a fifth approach, creating separate blockchains with two-way pegs to mainchains. These independent chains run specialized consensus optimized for privacy, with users opting in by moving assets via bridge contracts. Liquid Network implements this for Bitcoin using a federated sidechain managed by forty known functionaries, with confidential transactions hiding amounts and one-minute blocks versus Bitcoin's ten minutes. Litecoin's MimbleWimble extension blocks, activated May 2022, create an optional Mimblewimble sidechain where users peg-in to hide amounts and eliminate addresses, then peg-out returning to transparent Litecoin.

For XRPL, a privacy sidechain could use its own consensus - perhaps proof-of-stake with XRPL validators - with a bridge contract on mainnet managing the peg. Users would lock XRP on mainnet and receive private XRP on the sidechain, conduct confidential transactions with hidden amounts, then burn sidechain tokens to unlock mainnet XRP. Threshold signatures from N-of-M validators would secure the bridge.

The trade-offs favor experimentation without mainchain risk, opt-in participation, and regulatory flexibility, but bridge security becomes critical with validator collusion representing a failure mode, and managing two chains adds complexity. Failed sidechains don't affect mainchains, making this approach attractive for testing unproven privacy technologies.

Additional privacy approaches include homomorphic encryption, which allows computation on ciphertext without decryption such that the result when decrypted matches computation on plaintext. Fully homomorphic encryption supports unlimited operations enabling any computation, but suffers extreme slowness from 10,000 to one million times slower than plaintext, making it impractical for real-time payments though potentially useful for specific use cases like private auctions or voting where computation is infrequent.

Secure multi-party computation enables multiple parties to jointly compute functions over private inputs without revealing inputs to each other. Secret sharing splits private data into shares distributed to parties, distributed computation processes shares, and result reconstruction combines outputs to get final results with zero knowledge - no party learns others' inputs. Blockchain applications include threshold signatures for distributed key management, private cross-chain bridges, and decentralized key generation for ZK-rollups. For XRPL, SMPC could secure distributed validator key management, private multi-signature wallets, or cross-chain bridge security using threshold signatures, better fitting infrastructure roles than user-facing privacy.

Comparing these approaches reveals distinct trade-off profiles. Zero-knowledge rollups offer massive scaling with approximately 288-byte proofs, ten-millisecond verification, but high prover overhead and very high implementation complexity. Confidential transactions provide moderate privacy with approximately 700-byte proofs, under-five-millisecond verification, low overhead, and moderate complexity. Trusted execution environments deliver fast performance with one to two kilobyte attestations, under-one-millisecond verification, and very low overhead, but require hardware trust and suffer known vulnerabilities. Homomorphic encryption achieves ultimate privacy but imposes extreme overhead making it impractical for high-frequency operations. Each approach balances performance, security, regulatory acceptance, and implementation complexity differently.

For regulatory compliance, zero-knowledge rollups rate highly on auditability with transparent on-chain data. TEEs enable easy selective disclosure with decryption capabilities regulators prefer. Confidential transactions hiding amounts face privacy coin concerns similar to Monero. Homomorphic encryption makes verification extremely difficult. The regulatory landscape will significantly influence which technical approaches prove viable - no matter how elegant the cryptography, solutions regulators reject will fail to achieve institutional adoption.

How tokenized assets, lending protocols, and private settlement will actually work

The abstract promise of blockchain tokenization becomes concrete when examining real implementations and technical mechanisms. Archax, a UK Financial Conduct Authority-regulated exchange, tokenized abrdn's £3.8 billion US Dollar Liquidity Fund in November 2024, marking the first money market fund available on XRPL. Ripple allocated five million dollars supporting the initiative. Archax's pipeline includes "hundreds of millions" in additional tokenized assets scheduled for deployment. This represents actual institutional capital, not pilot programs - real money market funds with billions in assets under management now settling on XRPL infrastructure.

The technical mechanism leverages XRPL's native token issuance capabilities without requiring smart contracts. Multi-purpose tokens activated October 2025 carry on-chain metadata including maturity dates, coupon rates, tranches, voting rights, transfer restrictions, and identifiers like CUSIP or ISIN. Compliance features include authorized trust lines requiring explicit issuer approval before holding tokens, credentials verifying accredited investor status, deep freeze for sanctions compliance, and clawback for regulatory violations or fraud recovery. The native DEX provides protocol-wide liquidity rather than fragmented pools, three to five second settlement instead of T+2 batch processing, and sub-penny transaction fees versus traditional securities infrastructure costs.

Additional examples demonstrate expanding adoption. Ctrl Alt partnered with Dubai Land Department for property title deed tokenization. Mercado Bitcoin announced two hundred million dollars in Latin America asset tokenization. Societe Generale, DZ Bank, and DekaBank deployed tokenized bonds, stablecoins, and custody services on XRPL. The growth trajectory shows momentum: from five million dollars in tokenized assets in January 2025 to $118 million by July 2025 - a 2,260 percent increase in six months.

The infrastructure requirements extend beyond technical capabilities to regulatory frameworks under MiCA in the European Union and NYDFS in the United States, qualified custody with Ripple Custody serving Archax since 2022, on-ramps and off-ramps connecting traditional finance to blockchain rails, legal frameworks defining ownership and transfer rights, and audit mechanisms ensuring compliance and transparency.

Native lending represents XRPL's most ambitious institutional DeFi initiative, introducing protocol-level credit facilities without smart contract risk. The XLS-65 and XLS-66 proposals, targeted for XRPL version 3.0 in late 2025, implement a two-layer architecture. Single-asset vaults aggregate liquidity from multiple accounts into pooled vaults, issue vault shares that may be transferable or restricted, and can be public or gated via permissioned domains. The lending protocol builds atop vaults offering fixed-term uncollateralized loans with pre-set amortization schedules, off-chain underwriting with on-chain lifecycle management, and first-loss capital protecting depositors against defaults.

The operational workflow involves liquidity providers depositing into vaults and earning shares representing proportional ownership. Pool delegates evaluate borrowers off-chain using traditional credit scoring and risk assessment. Loans get issued with fixed terms drawing from pooled vault funds. Borrowers make periodic payments covering principal, interest, origination fees, service fees, and potentially late payment or early payoff fees. Payments flow back to vaults, increasing available assets for new loans. If defaults occur, first-loss capital deposited by loan brokers absorbs initial losses protecting depositors.

Interest rates include regular scheduled rates, elevated late payment rates, and potentially reduced early payoff rates, with payment resolution schedules as granular as sixty-second intervals. The on-chain debt tracking maintains total debt owed to vaults, maximum lending capacity caps, and automated accounting throughout loan lifecycles. Compliance features integrate clawback allowing asset issuers to reclaim funds from defaulting borrowers, freeze preventing borrower or broker accounts from operating if flagged, global freeze halting all loan operations during investigations, and permissions systems integrating with XLS-70 credentials verifying borrower eligibility.

The institutional value proposition involves pooling retail liquidity into institutional-sized loans, combining off-chain risk assessment with on-chain execution certainty, maintaining transparent loan terms while keeping underwriting criteria private, and enabling regulatory-compliant credit origination on public infrastructure. Early projects like XenDex, which launched the first non-custodial smart contract lending platform on XRPL in April 2025, and XpFinance, which announced peer-to-peer lending with NFT bonds for Q3 2025, demonstrate developer interest in building on this infrastructure.

The missing piece tying tokenization and lending together is privacy. Confidential multi-purpose tokens scheduled for Q1 2026 will encrypt balances and amounts using EC-ElGamal encryption while zero-knowledge proofs verify transaction validity without revealing values. This dual-balance system lets users maintain both public and confidential balances, converting between them as needed. Each confidential balance gets encrypted under three keys: the holder's key enabling decryption, the issuer's key allowing supply tracking, and an optional auditor key providing regulator access.

The privacy-preserving collateral management enabled by confidential MPTs allows institutions to deploy tokenized assets as loan collateral without revealing position sizes to competitors. Confidential institutional transfers hide payment amounts while maintaining counterparty visibility for compliance. Private tokenized securities keep trading activity confidential while enabling order books. Regulated stablecoin payments provide daily confidentiality with issuer oversight and auditor access as needed.

Permissioned domains and the permissioned DEX, currently under validator voting for activation, create credential-gated environments requiring specific verifiable credentials for participation. Government portals might require government-issued ID credentials. Accredited investor zones demand KYC and accreditation credentials. Institutional trading environments enforce licensing and compliance credentials. Regulated lending pools verify borrower eligibility. The technical implementation extends offer objects with domain identifier fields, creates domain-specific order books, and implements domain-aware routing where only credential-holders can match offers.

Cross-border payments represent XRPL's most mature institutional use case with over a decade of production deployment. On-demand liquidity uses XRP as a bridge currency, converting source currency to XRP at an exchange, transferring XRP across XRPL in three to five seconds, and converting XRP to destination currency at the receiving exchange. This eliminates pre-funded nostro accounts that tie up an estimated 27 trillion dollars globally in correspondent banking relationships. Payment service providers process transfers without maintaining capital in dozens of currencies, achieving 70 percent cost reductions versus traditional methods with sub-penny blockchain fees versus 20 to 50 dollar wire transfer costs.

SBI Holdings demonstrates institutional-scale adoption with approximately ten billion dollars in XRP and Ripple assets, processing billions in remittances from Japan to Southeast Asia since 2021. Ripple's ODL network operates forty corridors covering 90 percent of the foreign exchange market, processing $1.3 trillion in the second quarter of 2025 alone. When confidential MPTs activate in 2026, this payment infrastructure gains a privacy layer hiding transfer amounts through encrypted balances while maintaining compliance via zero-knowledge proofs, selective disclosure to regulators, and protection of competitive information around payment volumes and patterns.

Securities trading on permissioned DEX infrastructure combines XRPL's hybrid order book and automated market maker for optimal pricing, protocol-wide liquidity avoiding fragmentation across multiple venues, pathfinding with auto-bridging using XRP, and credential-based access controls. Pre-trade processes verify credentials, check accredited investor status, and enforce jurisdiction restrictions. Trade execution limits matches to compliant counterparties with real-time compliance checks. Post-trade creates immutable audit trails, enables regulatory reporting, and supports tax integration. Multi-purpose token metadata carries maturity dates, coupon rates, tranches, voting rights, transfer restrictions, and securities identifiers, while automated corporate actions handle interest payments, dividends, and redemptions.

The regulatory requirements remain substantial. Securities law must recognize tokenized assets as valid representations. Regulated exchanges like Archax provide compliant trading venues. Qualified custodians secure assets meeting regulatory standards. Legal frameworks must exist in each jurisdiction defining rights, obligations, and enforceability. Market infrastructure including clearing, settlement, and surveillance ensures orderly markets. Archax's FCA-regulated exchange represents one operational model, with money market funds live, MPT standard activated, and permissioned DEX awaiting final validator approval.

Where XRPL excels and struggles against Ethereum, StarkWare, and enterprise chains

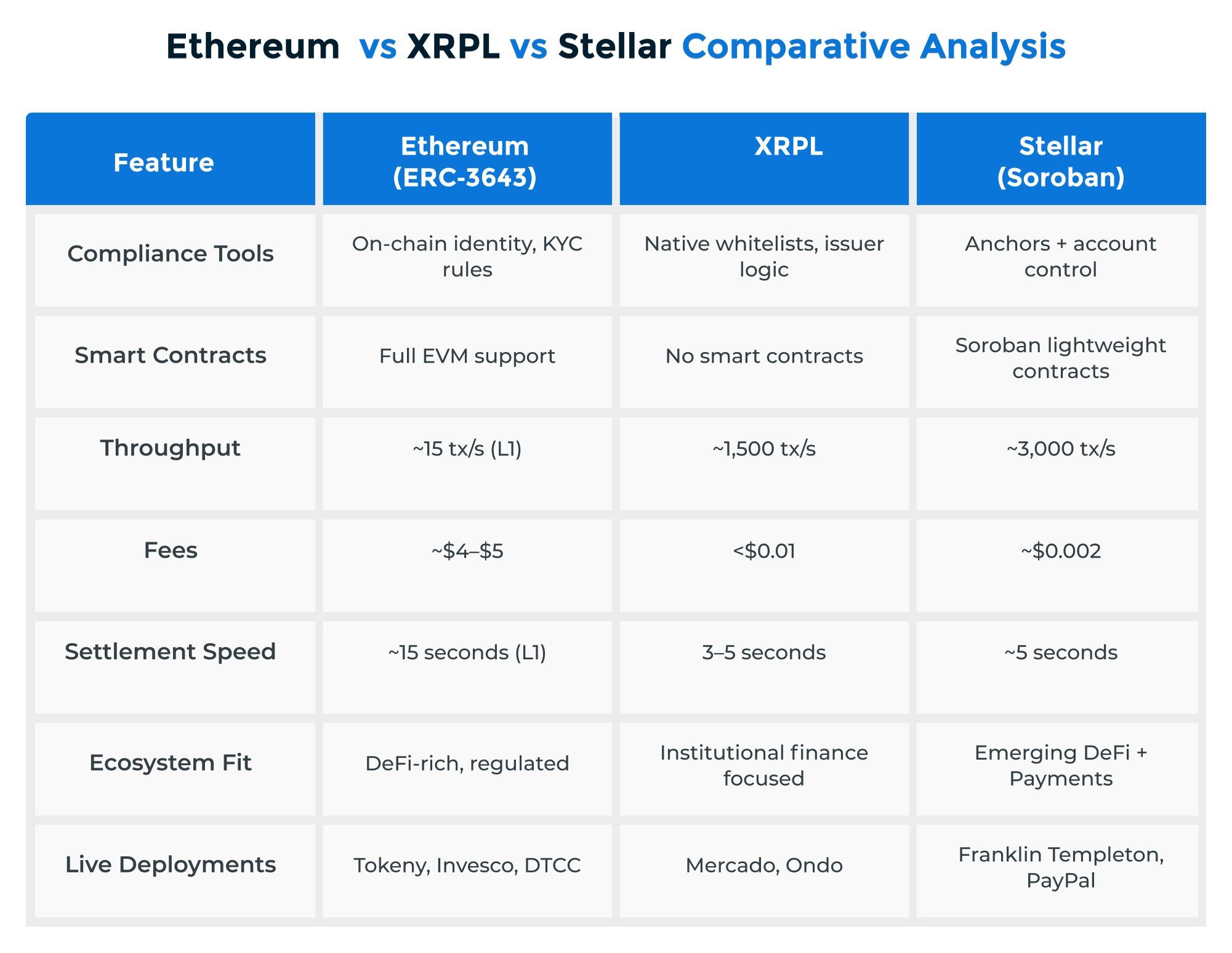

The competitive landscape for institutional blockchain infrastructure divides into three categories: public smart contract platforms led by Ethereum and its layer-two scaling solutions, zero-knowledge-focused chains like StarkNet, and permissioned enterprise blockchains including Hyperledger Fabric and R3 Corda. XRPL competes differently against each category, with distinct advantages and disadvantages shaping its institutional positioning.

Ethereum dominates public blockchain with massive network effects including 45,000-plus decentralized applications across multiple layer-two networks and approximately $97 billion in total value locked. For privacy specifically, Ethereum relies primarily on layer-two solutions rather than base layer features. Aztec Network implements a hybrid zero-knowledge rollup combining privacy with scalability using UltraPlonk proofs with recursive SNARKs, processing transactions at approximately one hundredth of Ethereum's cost through client-side execution where only proofs post on-chain. However, Aztec uses its own Noir language rather than EVM compatibility, creating a learning curve. Polygon zkEVM launched in March 2023 as a type-two zero-knowledge Ethereum Virtual Machine, offering EVM equivalence with two-second finality and a $4.12 billion ecosystem, but the platform is sunsetting in 2026 as Polygon pivots to its AggLayer architecture, and critically, Polygon uses zero-knowledge primarily for scaling rather than privacy.

XRPL's advantages versus Ethereum include purpose-built payment infrastructure with ten-plus years of production use, faster settlement finality at three to five seconds versus Ethereum's twelve-plus minutes, dramatically lower transaction costs at $0.0001 to $0.01 versus Ethereum's one to fifty-plus dollars, native decentralized exchange without smart contract risk, built-in payment channels and escrow, and carbon-negative sustainability. Ethereum's advantages include a vastly larger developer ecosystem, mature DeFi infrastructure with proven composability, sophisticated smart contract capabilities supporting any use case, and unmatched total value locked providing deep liquidity across thousands of protocols.

StarkWare represents the cutting edge of zero-knowledge cryptography using STARKs - zero-knowledge scalable transparent arguments. StarkNet operates a layer-two offering post-quantum security through hash-based proofs requiring no trusted setup, native account abstraction, and $252 million in total value locked. StarkEx powers applications in multiple modes including zero-knowledge rollup, validium, and volition, processing 15,000 to 50,000 transactions per second with dYdX having processed over one trillion dollars in cumulative volume using StarkEx infrastructure. The 2025 roadmap includes Bitcoin staking integration and one hundred million STRK tokens in incentives. StarkWare has the most advanced cryptography in production including post-quantum resistance, while XRPL offers simpler onboarding, payment specialization, faster time-to-finality, and a proven 13-year track record without requiring layer-two complexity.

Other zero-knowledge chains include zkSync Era with its Prividium platform providing privacy plus compliance for institutions and innovations like Airbender reducing costs to $0.0001 per transaction with native Python and TypeScript support. Scroll targets full Ethereum equivalence progressing from type three to type two zkEVM. Linea, built by ConsenSys, offers type three zkEVM with native MetaMask and Truffle integration. All provide Ethereum ecosystem access with lower costs than layer one. Against these competitors, XRPL differentiates through native payment primitives avoiding layer-two complexity, proven institutional adoption through RippleNet's three hundred bank partnerships, and compliance-first design with credentials and permissioned environments built into the protocol.

Enterprise blockchains represent fundamentally different architectures prioritizing privacy over public accessibility. Hyperledger Fabric implements a permissioned modular framework using channels for private transactions where only designated parties see data, pluggable consensus supporting crash fault tolerance or Byzantine fault tolerance, and a unique execute-order-validate architecture. The trade-off involves complex deployment requiring significant expertise but full privacy with no public visibility. R3 Corda operates as permissioned distributed ledger technology rather than a blockchain, implementing point-to-point communication where only counterparties see transaction data, notary-based consensus, and tight integration of legal prose with code. However, Corda's crash fault tolerance approach without production-ready Byzantine fault tolerance creates potential double-spend risks if notaries behave maliciously.

JPMorgan's Kinexys platform, formerly JPM Coin, operates on Quorum, an Ethereum fork with privacy extensions. JPM Coin processes approximately one billion dollars daily in settlements between JPMorgan clients using a one-to-one dollar-backed institutional stablecoin. Access remains permissioned and limited to JPMorgan clients. In 2025, JPMorgan piloted JPMD on Coinbase's Base, a public layer two, testing institutional stablecoins on public infrastructure.

The philosophical difference is fundamental: enterprise chains provide complete privacy with zero public visibility, while XRPL offers public infrastructure with institutional controls through credentials, permissioned domains, permissioned DEX, and upcoming confidential transactions. For banks requiring absolute privacy, Fabric and Corda deliver proven solutions. For institutions seeking public blockchain benefits including transparency, accessibility, and neutrality while maintaining compliance, XRPL's hybrid approach targets a different market segment.

Algorand and Hedera compete more directly with XRPL's public institutional positioning. Algorand uses pure proof-of-stake consensus achieving ten thousand-plus transactions per second with 4.5-second finality and carbon-negative energy profile. Adoption includes Colombia's COVID passport, Marshall Islands' SOV national currency, and Italy's SIAE issuing four million NFTs. The 2025 roadmap emphasizes post-quantum research, Rocca wallet eliminating seed phrases, debt asset tokenization, and newly launched staking rewards. Hedera employs hashgraph consensus rather than blockchain, achieving ten thousand-plus transactions per second with three to five second finality, governance by 30-plus global organizations including Google, IBM, and Boeing, and strong focus on asset tokenization through partnerships with Tokeny and ERC-3643 compliance. Institutional adoption includes State Street, Fidelity, LGIM, Wyoming's FRNT stablecoin, and SWIFT trials, with $69.4 million weekly institutional inflows in 2025.

Against Algorand, XRPL matches finality speed, offers a native decentralized exchange that Algorand lacks, and demonstrates stronger payment adoption with $1.3 trillion-plus in on-demand liquidity payments versus Algorand's smaller payment volumes. Algorand advantages include higher theoretical throughput, multiple CBDC implementations, and carbon-negative positioning. Against Hedera, XRPL offers comparable finality, similar institutional focus, and proven payment scale through RippleNet's three hundred institutions, while Hedera's unique hashgraph consensus and strong tokenization partnerships with major asset managers represent competitive advantages.

A quantitative comparison across key metrics reveals XRPL's positioning. Transaction throughput shows XRPL at 1,500 TPS, Ethereum at 15 to 30 TPS, Polygon zkEVM variable, Algorand and Hedera at ten thousand-plus TPS. Finality ranges from XRPL's three to five seconds and Hedera's three to five seconds being fastest, with Ethereum requiring twelve-plus minutes. Costs place XRPL at $0.0001 alongside Hedera at comparable levels, vastly cheaper than Ethereum's one to fifty-plus dollars. All major platforms except Ethereum achieve carbon-negative or low energy consumption. Uptime shows XRPL's ten-plus years standing out, though Ethereum maintains 99-percent-plus availability.

In institutional adoption scorecards, payments and settlement crown XRPL the winner with three hundred RippleNet institutions and $1.3 trillion-plus ODL volume versus JPM Coin's one billion dollars daily serving only internal clients and Hedera's SWIFT trials. Tokenization favors Ethereum with over 30 billion dollars tokenized and mature ERC-3643 standards, though Hedera shows strength through partnerships with State Street, Fidelity, and LGIM, while XRPL grows rapidly from a smaller base. CBDCs highlight Algorand with Colombia and Marshall Islands implementations, Hedera with Wyoming's FRNT, and XRPL with pilots in Bhutan and Palau. Enterprise privacy clearly favors Fabric and Corda dominating private consortiums.

XRPL's unique value proposition positions it as public, decentralized, payment-specialized blockchain infrastructure with institutional-grade compliance tools. This differs from competing with Ethereum on general smart contracts, Aztec on maximum privacy, or Fabric and Corda on fully private consortiums. Instead, XRPL competes on institutional cross-border payments, compliant tokenization, efficient settlement, and public infrastructure with privacy controls. The thesis holds that institutions need public blockchain infrastructure providing transparency and accessibility combined with privacy and compliance controls including KYC and AML checks, credentials, and confidential transactions.

How privacy-enabled adoption could drive XRP utility and reshape settlement infrastructure

Understanding XRP's role in XRPL's institutional vision requires examining the technical mechanisms creating utility rather than speculating on price. XRP serves three core protocol functions: transaction fees burned creating deflationary pressure, account reserves locking ten XRP as a base plus two XRP per object, and bridge currency for on-demand liquidity held for seconds during conversions between fiat currencies.

The liquidity requirements for institutional-scale usage demand deep order books at exchanges with tight spreads currently averaging 0.15 percent, capacity for institutional-size transactions without slippage, and 24/7 market making supporting global operations. As cross-border payment volumes increase, liquidity needs scale proportionally. On-demand liquidity processed $1.3 trillion in the second quarter of 2025 alone, requiring substantial XRP liquidity even though each unit moves through the system in seconds.

Multiple demand drivers stem from utility rather than speculation. Transaction volume growth increases fees burned - currently 4,500 XRP daily, scaling with activity. On-demand liquidity corridor expansion requires deeper liquidity pools at more exchanges. Account creation locks reserves permanently or until accounts close. Emerging DeFi and lending protocols will require collateral and potentially staking. Institutional treasury holdings provide payment capacity. RLUSD stablecoin adoption creates gas demand since every transaction needs XRP for fees. Tokenized asset activity generates transaction fees. Credit facilities may use XRP as collateral.

Network effects create positive feedback loops. More on-demand liquidity users deepen market liquidity, tighter spreads reduce costs for institutions, lower costs attract more users, and the cycle reinforces. XRPL's unique architecture aggregates liquidity protocol-wide into single pools per asset pair rather than fragmenting across thousands of separate decentralized exchange contracts. This concentration means developers building on XRPL access existing depth without bootstrapping liquidity, creating a structural advantage over fragmented models.

Corridor network effects follow Metcalfe's Law where value grows proportional to connections squared. With forty operational corridors, 780 possible routes exist calculated as N times N minus one divided by two. Each additional corridor connects to all existing corridors, creating exponentially increasing value. The demonstration that on-demand liquidity achieves 70 percent cost reductions versus traditional methods with three to five second settlement versus 36 to 96 hour correspondent banking creates compelling economics.

The RLUSD stablecoin introduces another utility flywheel. As RLUSD adoption increases, every transaction requires XRP for gas fees, increasing XRP demand. A stronger network with more activity makes RLUSD more credible and useful. Greater RLUSD confidence drives more adoption, and the cycle continues. RLUSD reached $455 million market capitalization in the second quarter of 2025 with NYDFS approval, BNY Mellon custody, and SBI Holdings distributing in Japan.

Comparing XRPL to SWIFT as a potential alternative reveals fundamental advantages beyond simple cost savings. SWIFT provides messaging only while XRPL combines messaging with settlement. Settlement time drops from 36 to 96 hours to three to five seconds. Costs decrease from 20 to 50-plus dollars to under one cent. Throughput increases from five to seven transactions per second to 1,500 TPS. XRPL operates 24/7/365 versus banking hours. Pre-funding requirements disappear since on-demand liquidity eliminates the need for billions tied up in nostro accounts. Finality becomes immediate rather than taking days. Transparency provides full blockchain audit trails versus limited SWIFT visibility. Intermediaries reduce from multiple correspondent banks to direct or minimal routing.

The capital liberation opportunity alone is substantial: an estimated 27 trillion dollars sits locked in pre-funded accounts globally under correspondent banking models. Even capturing a fraction of cross-border flows currently moving through SWIFT would require massive XRP liquidity scaling. However, the realistic assessment suggests XRPL complements rather than replaces SWIFT. A hybrid model appears most likely where SWIFT handles large institutional transactions with established trust relationships, while XRPL excels for remittances, small and medium enterprise payments, instant settlement requirements, emerging markets with limited correspondent relationships, and tokenized assets requiring programmable money.

SWIFT's response includes testing blockchain technology, selecting Linea, an Ethereum layer two, for some initiatives. SWIFT maintains advantages including universal trust from decades of operation, neutral governance without blockchain platform bias, and established relationships with every major bank globally. XRPL counters with superior technology proven production-ready and growing adoption, but changing institutional behavior requires years of trust building.

The 2025 data demonstrates meaningful traction toward critical mass. Active addresses reached 295,000, the highest ever recorded. On-chain volume shows 75 percent deriving from utility rather than speculation. Institutional accumulation totaled over 900 million XRP. The ecosystem matured with professional-grade infrastructure, custody, and compliance tools. However, competing platforms maintain massive leads. Ethereum's $97 billion total value locked versus XRPL's $88 million represents a 1,100-times gap. Even Solana at $11 billion maintains a 128-times advantage.

Growth scenarios depend on execution across multiple dimensions simultaneously. A high-probability remittance corridor expansion scenario could unfold over two to three years as the proven 70 percent cost reduction and regulatory clarity drive Asia expansion into Africa and Latin America. Success would moderately increase XRP demand with ten to twenty times corridor growth possible. Medium-to-high probability institutional real-world asset tokenization might achieve meaningful scale in three to five years following the progression from money market funds through bonds, equities, and real estate. The 2,260 percent growth in six months and "hundreds of millions" in Archax's pipeline support optimism, though Ethereum's 30-billion-dollar head start creates competitive challenges.

Medium probability CBDC interoperability faces a five-to-seven year timeline given slow political processes, but if XRP becomes a neutral bridge between sovereign digital currencies, the impact could prove transformative. Five active pilots provide early evidence. Medium probability private institutional DeFi depends on confidential MPT delivery in 2026 and native lending version 3.0 proving viable, with a three-to-five year timeline to meaningful adoption creating high-value frequent transactions and collateral use. High probability stablecoin settlement infrastructure builds on RLUSD's NYDFS approval and institutional custody, potentially reaching substantial scale in two to three years with significant volume since every RLUSD transaction requires XRP gas.

The most realistic path involves gradual use-case-specific adoption rather than wholesale infrastructure replacement. XRPL will likely excel in niches including remittances, tokenization, and instant settlement while coexisting with traditional systems. Meaningful participation over the coming decade appears achievable if execution quality and regulatory consistency support adoption. The growth trajectory depends more on regulatory environments and adoption timelines than technical capability since the infrastructure functions as designed.

Regulatory acceptance, technical risks, and the hard realities institutions face

The path toward institutional adoption confronts substantial obstacles that deserve equal attention to opportunities. The regulatory landscape creates perhaps the greatest uncertainty, with the European Union implementing a ban on privacy coins effective July 2027 under the Anti-Money Laundering Regulation. Similar restrictions exist in Japan, Dubai, South Korea, and Australia. Major exchanges including Kraken, Binance, and OKX have delisted privacy coins in multiple jurisdictions. This regulatory hostility toward anonymity-focused cryptocurrencies raises critical questions about whether "privacy with accountability" features will prove acceptable to regulators or face similar restrictions.

XRPL's confidential multi-purpose token proposal attempts differentiation through a multi-ciphertext architecture where amounts encrypt under holder keys, issuer keys, and optional auditor keys. Issuers can always decrypt balances, selective disclosure enables regulatory compliance, and view keys allow voluntary sharing with authorized parties. This design maintains supply visibility and address transparency, hiding only amounts. Whether this approach satisfies regulators remains uncertain - no precedent exists for "compliant privacy" features on public blockchains being accepted by financial regulators who previously banned outright privacy coins.

The Travel Rule compliance creates fundamental tension. The Financial Action Task Force requires virtual asset service providers to share originator and beneficiary information for transactions above thresholds ranging from one thousand to three thousand dollars depending on jurisdiction. Privacy features by definition hide exactly what the Travel Rule requires revealed. XRPL's proposed solution using view keys and selective disclosure remains unproven with regulators. Industry solutions from providers like Notabene, Sumsub, and Shyft Network focus on adding compliance layers atop blockchains rather than building privacy into protocols, suggesting the technical challenge of simultaneously achieving privacy and compliance remains unresolved.

Technical implementation challenges introduce additional risks. Research by Numen Cyber Labs found that 96 percent of bugs in SNARK-based systems stem from under-constrained circuits where proofs verify but produce incorrect results. Historical incidents include Zcash's Sapling flaw discovered in 2018 that could have enabled infinite counterfeiting had it been exploited, and BNB Chain's October 2022 hack stealing $586 million by exploiting proof verification vulnerabilities. Confidential transactions increase size dramatically, with Monero's transactions reaching approximately 5.9 kilobytes versus standard Bitcoin's 300 bytes - a twenty-times expansion. Audit challenges emerge from few firms possessing zero-knowledge proof expertise and limited automated analysis tools, creating bottlenecks in security verification.

XRPL's specific confidential MPT proposal using EC-ElGamal encryption with zero-knowledge proofs multiplies complexity through the multi-ciphertext architecture where each balance encrypts under three separate keys. The clawback mechanism creates privileged transaction vectors that attackers might exploit. Quantum computing presents a long-term threat since EC-ElGamal relies on elliptic curve cryptography vulnerable to future quantum computers, though post-quantum alternatives exist. Mitigation requires multiple independent security audits, substantial bug bounties, and gradual rollout beginning with low-value use cases before expanding to institutional scale.

Adoption hurdles extend beyond technology to network effects and ecosystem maturity. XRPL's total value locked of $88 million compared to Ethereum's $97 billion represents a 1,100-times gap. Solana maintains $11 billion in TVL, still 128 times greater than XRPL. These massive differences in capital deployed create self-reinforcing advantages for incumbents. Deep liquidity attracts more users and developers. Large developer communities produce more applications and tools. More applications increase network utility and user adoption. Institutional finance follows liquidity - asset managers deploy capital where depth prevents slippage on large trades.

XRPL launched its native lending protocol in late 2025, approximately five years after Ethereum DeFi summer established protocols like Aave and Compound that now manage tens of billions in TVL. First-mover advantages in DeFi compound over years as protocols build brand trust, accumulate liquidity, integrate with other protocols, and establish network effects that later entrants struggle to overcome. The developer community size disparity exacerbates challenges. Ethereum boasts the largest blockchain developer base globally, with hundreds of thousands of developers familiar with Solidity and EVM architecture. XRPL's developer community remains orders of magnitude smaller, limiting the pace of innovation and ecosystem development despite efforts including the EVM sidechain launched in June 2025 to attract Ethereum developers.

Trust issues around hybrid public-private blockchain models create adoption friction. Enterprises accustomed to private databases or permissioned blockchains like Hyperledger Fabric question whether public infrastructure can protect sensitive business data. The GDPR's "right to be forgotten" conflicts fundamentally with blockchain's immutability - personal data recorded on-chain cannot be deleted as the regulation requires. XRPL's hybrid approach using permissioned domains, credentials, and selective disclosure attempts bridging this gap, but no precedent exists for enterprises trusting public blockchains with core business operations at scale.

Governance and decentralization concerns persist despite Ripple's efforts toward greater decentralization. Ripple controls approximately 42 percent of XRP's total supply through escrow, regularly releasing and selling XRP to fund operations. Ripple operates validator nodes appearing on the default unique node list used by many validators, creating centralization concerns. Kaiko's blockchain security assessment scored XRPL 41 out of 100, the lowest among fifteen major blockchains analyzed, citing governance centralization and token distribution as primary factors. The 2025 governance reforms allowing token holders to propose validator removals created controversy, with some validators departing over concerns about Ripple's influence.

Ripple argues its phased decentralization strategy continues progressing as the network matures, noting over 150 validators operate globally with 35 on the default UNL, and Ripple controls only one of these validators. However, perception matters in institutional finance where decision committees scrutinize governance structures. Banks accustomed to neutral infrastructure like SWIFT may hesitate adopting a blockchain where a single company maintains significant influence and holds billions in the native asset.

Security risks specific to privacy implementations require serious consideration. Circuit design flaws represent the most critical vulnerability in zero-knowledge systems, accounting for 96 percent of bugs. Unlike traditional smart contracts where bugs create localized failures, ZKP flaws can enable systemic compromises like minting unbacked tokens or breaking privacy guarantees. The multi-ciphertext architecture proposed for confidential MPTs increases attack surface by requiring three separate encryption operations and multiple zero-knowledge proofs per transaction. Clawback functionality, while necessary for regulatory compliance, creates privileged transaction capabilities that might be exploited if issuer keys are compromised. The balance between security and usability manifests in key management complexity - users must protect ElGamal private keys since loss means permanent inability to decrypt balances, with no recovery mechanism.

Timeline realities and what needs to happen for meaningful institutional adoption

Understanding realistic timelines requires looking beyond announced targets to implementation complexities and dependency chains. Ripple officially targets Q1 2026 for confidential multi-purpose token activation, but the technical complexity involved - implementing EC-ElGamal encryption, integrating zero-knowledge proofs, achieving 80 percent validator approval for two weeks, and conducting security audits - suggests Q2 2026 as more realistic. The native lending protocol under XLS-65 and XLS-66 targets Q4 2025, currently under validator voting as of October 2025. The complete institutional DeFi stack including compliance features, privacy layer, lending infrastructure, and permissioned markets won't assemble until late 2026 to early 2027 realistically.

Already activated features provide current foundation. Credentials, deep freeze, simulate, automated market makers, and decentralized identifiers went live in October 2024. Multi-purpose tokens activated October 1, 2025. Under active voting as of late 2025 are permissioned domains, permissioned DEX, token escrow, and various MPT enhancements. The EVM sidechain reached mainnet in Q2 2025, processing $408 million in AMM volume during Q2 alone. This staged rollout demonstrates methodical progress, though official timelines historically slip three to six months as technical challenges emerge during implementation.

The lending protocol represents XRPL's most complex native financial primitive yet attempted. XLS-65 introduces single-asset vaults aggregating liquidity and issuing shares that may be transferable or restricted, with public or gated access via permissioned domains. XLS-66 builds atop this foundation, implementing fixed-term uncollateralized loans with predetermined amortization schedules, off-chain underwriting combined with on-chain contract enforcement, and first-loss capital protection where loan brokers deposit reserves to cover defaults. Integration points include RLUSD stablecoin support, automated market maker liquidity, permissioned domain access control, and credentials for borrower verification.

Ripple stated in September 2025 that "institutions are already lined up" to use the lending protocol upon launch, suggesting real demand exists. However, the protocol competes against Ethereum's mature DeFi ecosystem where Aave alone manages over twenty billion dollars in TVL. Compound, MakerDAO, and dozens of other protocols have operated for five-plus years, building brand recognition, accumulating liquidity, and integrating throughout DeFi composability stacks. XRPL's lending protocol advantages include native protocol implementation avoiding smart contract risk, built-in compliance through credentials and permissioned domains, and integration with XRPL's payment infrastructure. Yet overcoming incumbency advantages requires years of proving security, building trust, and demonstrating sustained operation.

The three-to-five year outlook envisions XRPL's institutional ecosystem evolving through distinct phases. The 2025 focus emphasizes launching the lending protocol, activating permissioned DEX, and expanding compliance features already built. The 2026 phase targets confidential MPT deployment, full zero-knowledge proof integration for privacy-preserving transactions, and CBDC interoperability pilots progressing toward production. By 2027 to 2028, the complete institutional DeFi stack becomes operational with integrated compliance, privacy, lending, and trading infrastructure. This timeline positions XRPL for meaningful institutional participation by the end of the decade.

Ripple's strategic positioning focuses explicitly on institutional finance rather than competing with Ethereum's retail DeFi or Solana's gaming and NFT ecosystems. The target markets include a projected 30 trillion dollars in tokenized real-world assets by 2030, stablecoin-based payments replacing correspondent banking inefficiencies, and cross-border settlement displacing costly wire transfers. Current metrics show promise: 300-plus bank partnerships through RippleNet, one billion dollars in on-demand liquidity payment volume, and top-ten positioning for real-world asset activity. Geographic expansion targets the United States following SEC lawsuit resolution, European Union under MiCA regulatory clarity, Asia-Pacific leveraging SBI Holdings partnership, and Middle East through Dubai and Abu Dhabi initiatives.

David Schwartz, XRPL's chief technical officer, stated in 2025 that there's "a clear direction for institutional DeFi on XRPL" emphasizing compliance, efficiency, and real-world asset integration. Ayo Akinyele's October 2025 blog post outlined the vision: "Privacy, compliance and trust at protocol level... confidential MPTs in 2026... making XRPL the first choice for institutions." The roadmap's most ambitious element involves competing against or complementing SWIFT's correspondent banking network that processes trillions daily. Even capturing 5 to 10 percent of cross-border flows would represent massive scale, but such adoption requires regulatory acceptance across dozens of jurisdictions, deep liquidity at hundreds of exchanges, and years of demonstrated reliability in production.

Requirements for mass institutional adoption extend well beyond technology into market structure, regulation, and ecosystem development. Technical prerequisites include proven scalability sustaining 1,500-plus transactions per second under load, three-plus years of secure privacy layer operation without incidents, and growth to 10,000-plus developers building infrastructure and applications. Regulatory prerequisites demand clarity from United States, European Union, and Asian regulators on tokenized asset treatment, Travel Rule compliance solutions accepted by FATF, legal enforceability of on-chain contracts in major jurisdictions, and privacy feature acceptance or at minimum tolerance.

Market prerequisites involve growing total value locked from current $88 million to ten billion dollars-plus - requiring one hundred times expansion - daily stablecoin volume reaching five billion dollars-plus from current levels, deep institutional infrastructure including multiple qualified custodians beyond Ripple Custody, prime brokerage services, and comprehensive insurance products. Governance prerequisites require expanding from 35 default UNL validators to 500-plus globally distributed validators, no single entity controlling over 10 percent of network influence, transparent governance processes with clear amendment procedures, and demonstrated independence from Ripple.

Ecosystem prerequisites include proven payment infrastructure processing one hundred billion dollars-plus in annual volume, validated enterprise integration with core banking systems and treasury management platforms, and confirmed use cases with ten billion dollars-plus in loans originated and sustained operation. The timeline for achieving these prerequisites realistically spans three to five years minimum from 2025, suggesting 2028 to 2030 for meaningful institutional adoption at scale rather than pilot programs.

The most critical bottlenecks involve regulatory acceptance presenting the highest risk, given privacy coin bans and uncertain Travel Rule compliance approaches. Competitive network effects create substantial headwinds as Ethereum's ecosystem advantages compound over time. Technical execution requires delivering complex cryptographic features without security incidents during critical early deployment periods. Governance evolution must convince institutional decision committees that XRPL provides neutral infrastructure rather than Ripple-controlled architecture.

Balanced assessment suggests three scenarios with differing probabilities. An optimistic case with approximately 20 percent probability sees privacy features broadly accepted by regulators, lending protocol succeeding at scale, major banks adopting for settlement, fifty billion dollars-plus TVL by 2030, and XRPL achieving top-five blockchain positioning. A pessimistic case with approximately 30 percent probability involves European Union privacy restrictions extending to XRPL features, competitive network effects proving insurmountable, TVL remaining under five billion dollars, and XRPL relegated to a niche payment rail without DeFi traction.

The most likely outcome with approximately 50 percent probability involves succeeding in specific niches including bank-to-bank settlement, tokenized bonds and money market funds, CBDC interoperability, while achieving ten to twenty-five billion dollars TVL, thirty to fifty banks actively using XRPL for payments and settlement, lending protocol reaching three to eight billion dollars TVL, and privacy features seeing limited adoption due to regulatory friction. Geographically, stronger traction emerges in Asia-Pacific and Middle East compared to cautious European Union implementation. XRPL coexists with Ethereum and Solana serving different use cases rather than displacing incumbent platforms.

This measured assessment balances XRPL's genuine technical innovations and real institutional traction against formidable competitive, regulatory, and adoption challenges. The infrastructure works as designed, demonstrated through 13 years of production operation processing billions of transactions. Real institutions including SBI Holdings, Archax, Santander, and three hundred RippleNet partners deploy real capital. However, building from $88 million TVL to institutional scale requires years of sustained execution, regulatory cooperation, and overcoming network effects that entrench competitors. The timeline for meaningful institutional adoption extends to 2028 through 2030, not 2025 through 2026, with success likely concentrated in specific high-value niches rather than wholesale blockchain infrastructure replacement.

Final thoughts

The XRP Ledger has methodically constructed technical infrastructure addressing institutional requirements that other public blockchains largely ignored. Decentralized identifiers enable persistent cryptographic identity. Verifiable credentials allow KYC attestation without repeatedly sharing personal data. Multi-purpose tokens carry compliance metadata and enforcement mechanisms including transfer restrictions, authorized holder lists, and regulatory clawback. Permissioned domains create credential-gated environments. A native lending protocol eliminates smart contract risk while enabling institutional credit facilities. Confidential multi-purpose tokens scheduled for 2026 promise privacy-preserving transactions with regulatory accountability.

This compliance-first approach differentiates XRPL from Ethereum's permissionless ethos and enterprise chains' fully private models. The bet involves institutions wanting public blockchain benefits - transparency, accessibility, neutral infrastructure - combined with privacy and compliance controls necessary for regulated finance. Brad Garlinghouse's identification of privacy as the critical missing piece makes strategic sense given that all other infrastructure exists or nears completion.

The competitive positioning targets institutional niches where XRPL's payment specialization creates advantages: cross-border remittances achieving 70 percent cost savings, tokenized money market funds and bonds requiring compliance controls, CBDC settlement bridging sovereign digital currencies, and stablecoin infrastructure benefiting from native payment rails. These represent multi-trillion-dollar opportunities where XRPL need not dominate globally but merely capture meaningful share to succeed.

Real traction exists. On-demand liquidity processing $1.3 trillion quarterly demonstrates proven payment scale. Archax tokenizing £3.8 billion in money market funds shows institutional confidence. RippleNet's three hundred bank partnerships provide distribution. The 2,260 percent growth in tokenized assets over six months indicates momentum. These data points validate that institutions will use public blockchain infrastructure when proper compliance tools exist.

However, the obstacles merit equal emphasis. Regulatory uncertainty around privacy features represents an existential risk, with the European Union banning privacy coins by 2027 and unclear whether "compliant privacy" proves acceptable. Network effects favoring Ethereum's 1,100-times-larger ecosystem create formidable moats. Technical complexity in zero-knowledge implementations has historically produced critical vulnerabilities. Developer community size disparities limit innovation pace. Governance concerns around Ripple's influence may deter institutional committees requiring neutral infrastructure.

Timeline realities suggest measuring progress in years not quarters. The complete privacy-enabled institutional DeFi stack won't fully deploy until late 2026 or 2027. Proving security requires years of operation without incidents. Regulatory acceptance demands multi-year engagement across jurisdictions. Building network effects from current $88 million TVL to institutional scale needs sustained growth over five-year horizons. The realistic assessment points toward 2028 through 2030 for meaningful institutional adoption rather than imminent transformation.

The most probable outcome involves partial success in specific niches. XRPL likely captures share in bank settlement where payment rails matter most, tokenized bonds and money market funds requiring compliance infrastructure, and potentially CBDC interoperability if pilots progress to production. Coexistence with Ethereum serving retail DeFi and Solana targeting gaming appears more plausible than winner-take-all dynamics. Geographic variation will likely favor Asia-Pacific and Middle East adoption ahead of cautious European implementation.

The fundamental question isn't whether XRPL's technology works - 13 years of operation proves functionality. The question involves whether the institutional finance market wants public blockchain infrastructure with compliance controls more than fully private enterprise chains or established Ethereum ecosystem. Early evidence suggests demand exists. Banks partnered with RippleNet because correspondent banking costs and delays create genuine pain points. Asset managers tokenize on XRPL because native compliance features reduce legal and technical overhead. These proof points validate market need.

Execution over the next three years determines outcomes. Delivering confidential MPTs without security incidents builds credibility. Growing lending protocol TVL from zero to billions demonstrates viability. Expanding tokenization from hundreds of millions to tens of billions proves scalability. Achieving regulatory acceptance in major jurisdictions removes existential risk. Converting pilots to production at scale with dozens of banks shows mainstream readiness.

The opportunity XRPL targets is real. Global cross-border payments exceed hundreds of trillions annually with substantial friction. Tokenized real-world assets could reach 30 trillion dollars by 2030. Institutional DeFi remains nascent with room for multiple winners. Privacy-preserving compliant infrastructure doesn't exist at scale today on public blockchains. If XRPL executes technically while navigating regulatory complexity, meaningful institutional participation appears achievable. The path involves focused success in specific high-value use cases rather than universal adoption, measured progress over years rather than explosive near-term growth, and realistic assessment of both genuine innovations and substantial challenges ahead.