The cryptocurrency derivatives market is experiencing a fundamental shift in power. For years, centralized exchanges dominated perpetual futures trading - a derivative product that allows traders to speculate on crypto prices with leverage and no expiration dates. But in 2025, decentralized alternatives have captured more than one-fifth of the market, marking a transformation that few anticipated just three years ago.

At the center of this revolution stands Hyperliquid, a platform that has redefined what decentralized exchanges can achieve. Yet its dominance now faces an unprecedented challenge from Aster, a newcomer backed by Binance co-founder Changpeng "CZ" Zhao that has surged from zero to processing hundreds of billions in weekly volume within weeks of launch. The battle between these platforms represents more than a competition for market share - it embodies a broader struggle over the future architecture of crypto trading infrastructure.

Perpetual futures contracts, commonly called "perps," function as derivative instruments allowing traders to take leveraged positions on crypto assets without owning the underlying tokens. Unlike traditional futures that expire on specific dates, perpetuals remain open indefinitely. They maintain price alignment with spot markets through a funding rate mechanism, where traders on the more crowded side of a trade - usually longs - pay those on the opposite side every few hours. This elegant system has made perps the dominant form of crypto trading, accounting for approximately 68 to 75 percent of total crypto transaction volume in 2025.

The fundamental appeal of decentralized perpetual exchanges lies in their value proposition: traders retain custody of their assets, avoiding the counterparty risk that devastated users of collapsed centralized platforms like FTX. Decentralized perp exchanges settle trades on-chain, providing transparency while eliminating the black-box operations that plague some centralized venues. The trade-off has historically been performance - decentralized platforms struggled with the speed, liquidity depth, and user experience that professional traders demand.

That calculus changed dramatically with Hyperliquid's emergence. The platform proved that decentralized infrastructure could match or exceed centralized exchange performance, processing trades with sub-second finality while maintaining full on-chain transparency. This achievement opened floodgates for capital migration from centralized to decentralized venues, particularly as regulatory pressure intensified on traditional exchanges and traders sought self-custody solutions.

Market Evolution: From Niche to Mainstream

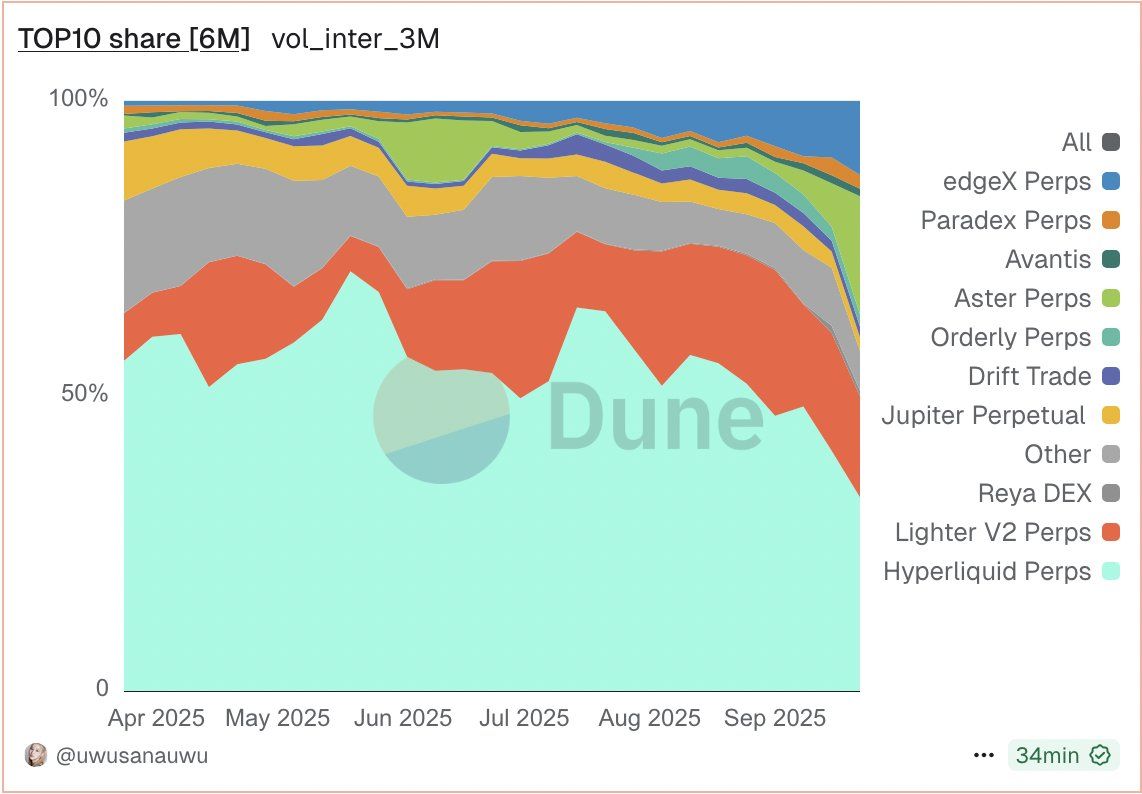

The growth trajectory of decentralized perpetual exchanges represents one of the most dramatic shifts in crypto market structure. In 2022, platforms offering decentralized perps commanded less than 2 percent of the perpetual trading volume processed by centralized exchanges. By mid-2024, that figure had climbed past 4.5 percent. As of September 2025, decentralized platforms account for more than 20 percent of all perpetual futures volume, with some metrics suggesting the ratio has reached 26 percent.

To contextualize this growth, consider the absolute numbers. In Q1 2025, the top ten centralized exchanges handled approximately $5.4 trillion in perpetual volume, with Binance alone commanding $2 trillion. During the same period, decentralized platforms processed hundreds of billions. By the second quarter of 2025, decentralized perp exchanges recorded $898 billion in trading volume. In September 2025 alone, these platforms surpassed $1 trillion in monthly volume for the first time in history.

Several catalysts have driven this unprecedented expansion. Regulatory enforcement actions against centralized exchanges in multiple jurisdictions have prompted traders to seek alternatives offering greater privacy and censorship resistance. The collapse of FTX in November 2022, along with other centralized entity failures, accelerated demand for non-custodial trading solutions. Meanwhile, technological advancements in blockchain infrastructure - particularly improvements in latency, throughput, and gas fee optimization - made high-frequency decentralized trading viable for the first time.

The maturation of DeFi liquidity infrastructure also played a crucial role. Early decentralized perp platforms struggled with fragmented liquidity, wide spreads, and significant slippage on larger trades. But newer platforms have achieved liquidity depth comparable to mid-tier centralized exchanges, with order book architectures that mirror traditional financial markets. This progress has attracted not just retail traders but also quantitative trading firms and institutional players seeking compliant, transparent venues.

The competitive dynamics between centralized and decentralized venues reveal distinct trade-offs. Centralized exchanges maintain advantages in absolute liquidity depth - Binance's order books can absorb multi-million-dollar trades with under 0.3 percent slippage. They offer integrated user experiences with advanced charting, mobile apps, and customer support. Many provide leverage options up to 125x on select pairs, along with sophisticated order types and portfolio margin systems.

Decentralized platforms counter with non-custodial trading, eliminating counterparty risk and allowing users to maintain control of private keys. Most require no KYC procedures, preserving privacy and enabling access for users in restricted jurisdictions. They provide full transparency, with all trades, liquidations, and funding rates visible on-chain. Many have implemented innovative token economics that direct protocol revenue to token holders rather than corporate shareholders.

For traders, the choice increasingly depends on priorities: those requiring maximum liquidity and lowest latency for large-volume trades still prefer centralized venues. But a growing cohort values self-custody, transparency, and censorship resistance enough to accept slightly wider spreads and nascent product ecosystems. The gap between these experiences narrows monthly as decentralized platforms refine their offerings.

Hyperliquid: The Incumbent Powerhouse

Hyperliquid's ascent to dominance in decentralized perpetual futures represents a case study in product-market fit executed at scale. Launched in private beta in 2023 and fully operational by 2024, the platform captured traders' attention through a combination of technological innovation and community-aligned incentives. By March 2025, Hyperliquid had processed over $1 trillion in cumulative perpetual volume, commanding approximately 60 percent of the decentralized perp market. In May 2025, it recorded $248 billion in monthly volume, more than doubling its total value locked to $1.46 billion while generating over $70 million in revenue.

The platform's dominance peaked in mid-2025, when it controlled between 75 and 80 percent of decentralized perpetual market share. During its strongest month in July 2025, Hyperliquid processed $320 billion in trading volume with a 47 percent month-over-month growth rate, capturing approximately 35 percent of total blockchain protocol revenue for that period. Its daily trading volume regularly exceeded $15 billion, more than twenty times that of competitors like dYdX, ApeX, and Drift combined.

What distinguishes Hyperliquid from previous attempts at decentralized derivatives trading lies in its architectural foundation. Rather than building atop an existing blockchain like Ethereum or deploying to a general-purpose layer-2 solution, Hyperliquid's team constructed a custom Layer-1 blockchain optimized specifically for high-frequency trading. This network, powered by the HyperBFT consensus mechanism, achieves sub-second finality and can process more than 200,000 orders per second - performance metrics that rival or exceed many centralized exchanges.

The architecture divides into two primary components. HyperCore serves as the on-chain matching engine, responsible for order placement, execution, margin management, and liquidation within a central limit order book system. Unlike automated market maker models that dominated earlier DeFi protocols, Hyperliquid's order book provides the familiar experience professional traders expect, displaying real-time bid and ask prices with precise execution at specified price points. The entire process occurs on-chain, ensuring transparency and eliminating the off-chain matching that some competing platforms employ.

HyperEVM complements HyperCore as a general-purpose smart contract layer compatible with Ethereum's virtual machine. This compatibility allows developers to deploy existing Ethereum applications to Hyperliquid with minimal modifications, fostering ecosystem growth. By September 2025, HyperEVM hosted over 100 protocols with approximately $2 billion in total value locked and was generating around $3 million in daily application revenue. Major DeFi projects including Pendle, Morpho, and Phantom have deployed to the network, alongside native applications like Kinetiq and Hyperlend.

Hyperliquid's user experience addresses pain points that historically deterred traders from decentralized platforms. The platform charges zero gas fees for perpetual trades, removing a friction point that made high-frequency trading uneconomical on earlier DEXs. It offers maker rebates up to 0.02 percent alongside taker fees of 0.05 percent, comparable to centralized exchange fee schedules. Traders can access leverage up to 50x on major assets like Bitcoin and Ethereum, with over 150 trading pairs available spanning mainstream cryptocurrencies and long-tail altcoins.

The platform requires no KYC procedures - users simply connect a Web3 wallet to begin trading. This permissionless access has attracted users from jurisdictions with restrictive financial regulations, though it has also drawn scrutiny from regulators concerned about compliance with anti-money laundering requirements. Hyperliquid's terms of service restrict access from the United States, Canada's Ontario province, and sanctioned regions, though enforcement relies on users' attestations rather than active geographic blocking.

The HYPE token lies at the heart of Hyperliquid's economic model. Launched through a community airdrop in November 2024, the token distributed 310 million units - 31 percent of the total 1 billion supply - to early users based on trading activity and platform participation. This airdrop, valued at several billion dollars at peak prices, created substantial wealth for active community members and established goodwill that competitors have struggled to replicate.

HYPE serves multiple functions within the ecosystem. Token holders can stake to participate in network security while earning rewards. The token grants governance rights, allowing holders to propose and vote on protocol upgrades and parameter adjustments. Most significantly, Hyperliquid implements an aggressive fee-burning mechanism that allocates approximately 97 percent of protocol fees to buy back and burn HYPE tokens, creating deflationary pressure that theoretically benefits long-term holders.

As of late September 2025, HYPE trades around $44 to $49, down from an all-time high of approximately $51 reached in August. The token commands a market capitalization exceeding $12.6 billion, making it the 19th-largest cryptocurrency by market cap. Trading volume regularly exceeds $600 million daily, providing liquidity for both long-term investors and active traders.

Yet Hyperliquid faces structural challenges that complicate its outlook. Beginning in November 2025, the platform will initiate a major token unlock, gradually releasing approximately 237.8 million HYPE tokens - representing 23.8 percent of total supply - to core contributors over 24 months. This translates to roughly 9.9 million tokens entering circulation monthly, worth approximately $446 million at current prices. Token unlocks of this magnitude create persistent selling pressure as recipients convert their holdings to liquid capital, potentially constraining price appreciation even as the protocol thrives operationally.

Analysts debate how this selling pressure will interact with Hyperliquid's fee-burning mechanism. Optimists note that the protocol's strong revenue generation - it regularly ranks among the top three crypto assets by fee revenue - should provide substantial buying power to offset unlock-related sales. The platform's upcoming HIP-3 proposal, which would require builders to stake significant HYPE holdings to launch new perpetual markets, could create additional demand that functions as a "supply sink" for the token. Critics counter that monthly unlock volumes exceeding $400 million will overwhelm even robust buyback programs, particularly if trading volumes decline or competition erodes market share.

Aster's Meteoric Rise: The Binance-Backed Challenger

If Hyperliquid's story is one of methodical market capture through technological excellence, Aster's trajectory represents disruption through explosive growth and high-profile backing. The platform emerged from the merger of Astherus, a multi-asset liquidity protocol, and APX Finance, a decentralized perpetuals platform, completed in late 2024. The combined entity officially launched under the Aster brand on March 31, 2025, with modest expectations for gradual adoption.

What followed defied industry norms. Aster's token generation event on September 17, 2025, catalyzed a price surge exceeding 1,500 percent in the first 24 hours, briefly pushing the token to a $3.2 billion market cap and the 50th position among all cryptocurrencies by valuation. More significantly, the platform's trading volumes exploded from negligible levels to over $270 billion weekly within weeks of launch. By late September 2025, Aster had captured majority market share among decentralized perp exchanges, processing $290 billion in perpetual trading volume over a 30-day period and surpassing Hyperliquid in some short-term metrics.

The catalyst for this remarkable adoption was unambiguous: Changpeng Zhao's public endorsement. CZ, as the Binance co-founder is universally known, posted his support for Aster on social media in September 2025, explicitly comparing it favorably to competitors. The endorsement carried extraordinary weight given CZ's status as crypto's most influential figure and Binance's position as the industry's largest exchange. Within days, Aster's total value locked briefly hit $2 billion before stabilizing around $655 million. Trading volume surged as both retail traders and whales - including BitMEX co-founder Arthur Hayes - rotated capital from Hyperliquid to explore the new platform.

Aster's competitive positioning emphasizes several differentiators. Unlike Hyperliquid's custom blockchain, Aster operates natively across multiple networks including BNB Chain, Solana, Ethereum, and Arbitrum. This multi-chain approach lowers friction for traders already active on these ecosystems, eliminating the need to bridge assets to a new network. The platform offers eye-watering leverage up to 1,001x on select pairs - far exceeding Hyperliquid's 50x maximum and even surpassing Binance's 125x limit for eligible traders. While such extreme leverage attracts attention and generates trading volume, it also magnifies risks and has drawn criticism from those concerned about retail trader protection.

The platform's "Trade & Earn" model allows users to employ yield-bearing assets as margin for perpetuals trading, theoretically enabling capital to serve dual purposes. This innovation addresses a common inefficiency where traders must choose between earning yield on stablecoins in lending protocols versus deploying those assets as trading margin. Aster also emphasizes privacy features, notably "Hidden Orders" that allow large traders to place orders without revealing size and price to the market - addressing a pain point CZ himself highlighted in June 2025 when advocating for dark pool functionality in decentralized exchanges.

Aster's institutional backing extends beyond CZ's endorsement. The project received support from YZi Labs, formerly known as Binance Labs, the investment and incubation arm of Binance. While the exact financial terms remain undisclosed, this backing provides not just capital but also access to Binance's extensive network of market makers, trading firms, and institutional partners. The platform's close ties to Binance raise questions about how "decentralized" it truly is - a tension evident in its reliance on Binance's oracles for price feeds and its integration with the broader BNB Chain ecosystem.

The platform's tokenomics and incentive structure have proven controversial. Aster implemented an aggressive points program that rewards trading activity with season-based accumulations expected to convert to token allocations. Critics argue that such programs inevitably attract mercenary capital - traders who farm points through wash trading or other artificial volume generation, only to dump tokens and depart once rewards vest. Data showing Aster's volume-to-open-interest ratio at unusually high levels compared to established platforms lends credence to these concerns.

Open interest, which measures the total value of outstanding futures contracts, provides a more stable indicator of genuine platform adoption than raw trading volume. While Aster's trading volume briefly exceeded Hyperliquid's in late September 2025, its open interest remained substantially lower. This discrepancy suggests that much of Aster's volume stems from short-term speculative positioning and incentive farming rather than sustained capital commitment from users building lasting positions.

Some analysts detect warning signs in Aster's explosive growth pattern. The platform's 30-day total value locked fluctuates dramatically, and concerns about wash trading persist despite the platform's anti-manipulation mechanisms. The upcoming token unlock scheduled for mid-October 2025 - releasing approximately 11 percent of supply - will test whether early users remain committed or capitalize on price appreciation to exit positions. Market observers note that projects experiencing parabolic initial growth often face steep corrections once incentive programs mature and early adopters seek liquidity.

Yet dismissing Aster as merely a flash-in-the-pan phenomenon would be premature. The platform has demonstrated genuine innovation in areas like hidden orders and multi-chain accessibility. Its revenue metrics, while disputed, show substantial fee generation that could translate to sustainable business fundamentals if retained. The backing from CZ and the Binance ecosystem provides resources and credibility that few competitors can match. Most significantly, Aster has exposed Hyperliquid's vulnerability to competition - proving that decentralized perp markets remain contestable rather than winner-take-all.

The platform's roadmap includes launching its own Layer-1 blockchain, currently in internal testing, designed specifically for private perpetuals trading using zero-knowledge proofs. This "Aster Chain" aims to provide institutional-grade privacy that masks trade sizes and profit-and-loss while maintaining auditability - a feature set that could attract large traders and funds requiring confidentiality. If successfully implemented, this infrastructure could differentiate Aster from transparent alternatives while addressing compliance concerns that prevent many traditional institutions from embracing fully public blockchains.

The Competitive Landscape: Beyond the Duopoly

While Hyperliquid and Aster dominate headlines, the decentralized perpetual futures ecosystem includes numerous platforms pursuing distinct strategies. Some position themselves as direct competitors to the market leaders, while others target underserved niches or experiment with novel mechanisms.

Lighter has emerged as perhaps the most credible third player in the space. Backed by prominent venture capital firms including Andreessen Horowitz (a16z), Dragonfly Capital, Haun Ventures, and Lightspeed Venture Partners, Lighter launched its private beta in January 2025 and transitioned to public mainnet in late summer. The platform processed approximately $9 billion in weekly trading volume as of late September 2025, capturing roughly 16.8 percent of decentralized perp market share.

Lighter's core innovation lies in its proprietary zero-knowledge rollup architecture, which enables the platform to prove every computation its central limit order book engine executes with sub-5-millisecond latency while settling finality to Ethereum. This approach theoretically provides the performance of a centralized exchange with the security guarantees of Ethereum settlement - a hybrid model that differs from both Hyperliquid's independent Layer-1 and Aster's multi-chain deployment. The platform targets institutional traders and high-frequency trading firms through a differentiated fee structure: retail traders accessing the front-end pay zero fees, while API and algorithmic trading flows incur charges that monetize professional usage.

Since launching public mainnet, Lighter has demonstrated impressive growth metrics. The platform achieved over $2 billion in daily trading volume with total value locked rising from $2.5 million in early March to over $340 million by July 2025. It attracted more than 56,000 users during its private beta phase, with approximately 188,000 unique accounts and 50,000 daily active users recorded. The platform's points program, which runs through late 2025 and is widely interpreted as preceding a token launch, has effectively incentivized participation.

Yet questions surround the sustainability of Lighter's growth. Its volume-to-open-interest ratio sits around 27 - substantially higher than Hyperliquid's 0.76, Jupiter's 2.44, or dYdX's 0.40. Analysts typically consider ratios below 5 as healthy, with figures above 10 suggesting significant wash trading or incentive-driven activity. Lighter's points system, while effective at attracting users, may be "contributing heavily to the platform's upbeat figures," as one analyst noted. The platform must demonstrate that users remain engaged once points programs conclude and token incentives vest.

EdgeX, a Layer-2 blockchain built atop Ethereum specifically for perpetual futures trading, represents another significant competitor. The platform processed approximately $6.1 billion in weekly trading volume in late September 2025, making it the fourth-largest on-chain derivatives trading project. EdgeX differentiates through its focus on fairness and transparency, employing mechanisms designed to prevent front-running and ensure that all market participants receive equitable treatment regardless of connection speed or geographic location.

Jupiter Perpetuals, the derivatives offering from Solana's largest decentralized exchange aggregator, has carved out meaningful market share by leveraging its existing user base and Solana's high-speed, low-cost infrastructure. The platform processed approximately $21.5 billion in perpetual trading volume during September 2025, ranking fifth among decentralized perp platforms. Jupiter offers leverage up to 100x on major cryptocurrencies and benefits from deep integration with Solana's DeFi ecosystem, allowing users to seamlessly transition between spot trading, yield farming, and perpetuals without bridging to other networks.

Additional platforms including DIME, ORDER, REYA, APEX, AVNT, RHO, Ostium, Hibachi, and MKL have attracted meaningful volume, collectively processing billions in weekly trades. Many experiment with novel approaches: some employ hybrid automated market maker and order book models, others focus on specific asset classes like tokenized real-world assets, and several target particular geographic markets or language communities.

The diversity of approaches suggests that the decentralized perpetual futures market remains in its experimental phase, with multiple competing visions for optimal architecture, user experience, and economic models. This proliferation of platforms benefits traders through competition that drives innovation and fee compression. However, it also fragments liquidity - a trader seeking to execute a large order may need to route across multiple platforms to achieve acceptable slippage, adding complexity that centralized exchanges avoid through concentrated liquidity pools.

Volume Versus Open Interest: Understanding the Metrics That Matter

The competition between Hyperliquid and Aster has elevated a longstanding debate about which metrics best measure a derivatives platform's true strength. Trading volume and open interest each tell part of the story, but they measure fundamentally different phenomena with distinct implications for platform health and sustainability.

Trading volume represents the total notional value of contracts traded over a specific period - typically measured daily, weekly, or monthly. High volume indicates active price discovery, tight spreads, and sufficient liquidity for traders to enter and exit positions. Platforms pursuing volume growth often implement maker rebates that reward liquidity providers, creating incentives for market makers to quote competitive prices. Volume also generates fee revenue directly - platforms typically charge a percentage of notional traded, meaning higher volume translates to greater protocol income.

Open interest measures the total value of outstanding futures contracts that remain open and unsettled at a given moment. It represents capital commitment - traders holding positions with unrealized profits or losses, rather than simply churning through short-term trades. Open interest grows when new contracts are created through a trade where both parties are opening positions, and it decreases when both parties are closing existing positions. Unlike volume, which can be generated repeatedly by the same capital trading back and forth, open interest reflects actual market participation depth.

DeFi analyst Patrick Scott has articulated the key distinction in explaining why he considers Hyperliquid more investable than Aster despite the latter's volume surge: "Unlike volume and revenue, which measure activity, open interest measures liquidity. It's much stickier." As of early October 2025, Hyperliquid commands approximately 62 percent of the decentralized perpetual exchange open interest market - substantially higher than its 8 to 38 percent share of trading volume depending on timeframe measured.

This divergence reveals important dynamics. Aster's explosive volume growth, which saw it process over $270 billion weekly by late September, has not translated to proportional open interest capture. The platform's volume-to-open-interest ratio remains elevated, suggesting that much trading activity represents short-term speculation, algorithmic trading churning through positions, or points farming rather than sustained capital allocation. Traders may be using Aster for specific trades or to farm incentives while maintaining their core positions and margin on Hyperliquid or other established platforms.

High volume combined with low open interest can indicate several scenarios, not all problematic. Active traders who rapidly enter and exit positions contribute genuine volume without maintaining significant open interest. Arbitrageurs exploiting price discrepancies between platforms generate substantial volume while keeping positions minimal. Market makers providing liquidity through algorithmic quoting add volume without directional exposure. These activities support price efficiency and tight spreads.

However, artificially inflated volume through wash trading - where the same party trades with itself or colluding entities to fake activity - remains a persistent concern in cryptocurrency markets. While decentralized platforms' transparency theoretically exposes wash trading more readily than centralized exchanges' black-box operations, sophisticated actors can obscure their activities through multiple wallets and complex trading patterns. Platforms running aggressive incentive programs that reward volume regardless of sustainability risk attracting mercenary capital that departs once rewards diminish.

Open interest stability provides a more reliable signal of platform stickiness and user commitment. Traders who maintain leveraged positions over days or weeks demonstrate confidence in the platform's reliability, security, and fair execution. High open interest relative to total value locked indicates capital efficiency - users putting their deposits to work in active positions rather than leaving funds idle. Platforms with deep open interest can better withstand market volatility, as the margin backing these positions provides stability during price swings.

Hyperliquid's ability to maintain dominant open interest market share even as competitors capture volume suggests several strengths. Its proven track record and months of reliable operation without major exploits or failures have earned user trust. Professional traders and market makers - who typically maintain larger positions and contribute disproportionately to open interest - may prefer Hyperliquid's mature infrastructure and deeper liquidity for their core operations while experimenting with new platforms for tactical trades. The platform's comprehensive trading pairs and efficient liquidation mechanisms reduce the risk of cascading failures during volatility.

Revenue generation, which combines aspects of both volume and open interest, provides another crucial metric. Platforms earn fees based on trading volume, meaning high-volume platforms can generate substantial income even with modest open interest. However, sustainable revenue typically requires a balance - pure volume without position commitment suggests reliance on incentive programs that drain treasury reserves, while high open interest with minimal trading indicates users are holding positions but not actively trading, limiting fee revenue.

Analysts evaluating platform investments or assessing competitive positioning increasingly emphasize metrics beyond headline volume. Revenue per user, cost of capital acquisition through incentives, platform fee revenue relative to token market cap, and sustainability of fee-burning or distribution mechanisms all factor into sophisticated analysis. The tension between short-term growth metrics and long-term sustainability will likely determine which platforms emerge as lasting leaders versus which fade after initial momentum wanes.

Hyperliquid's Expansion: Building an Ecosystem

Hyperliquid's leadership team has demonstrated awareness that relying solely on perpetual futures trading exposes the platform to competitive and market risks. The launch of HyperEVM in early 2025 represented the first major expansion beyond the platform's core perpetuals offering, transforming Hyperliquid from a single-product exchange into a Layer-1 blockchain supporting a broader DeFi ecosystem.

HyperEVM's growth has exceeded expectations. By September 2025, the network hosted over 100 protocols with approximately $2 billion in total value locked - a substantial figure for a blockchain less than a year old. Native applications like Kinetiq, a derivatives optimization protocol, and Hyperlend, a lending platform, have gained traction alongside deployments from established projects including Pendle, Morpho, and Phantom. The ecosystem generates around $3 million in daily application revenue, contributing meaningfully to overall blockchain activity beyond perpetuals trading.

This ecosystem expansion serves multiple strategic purposes. It creates network effects that make Hyperliquid stickier - users who deploy capital across multiple applications on the network face higher switching costs than those simply trading perpetuals. Revenue diversification reduces dependence on trading fees, which can fluctuate substantially with market conditions and competitive dynamics. Application developers building on HyperEVM become stakeholders invested in the network's success, forming a coalition that defends Hyperliquid's market position through continuous innovation.

The architectural decision to maintain Ethereum Virtual Machine compatibility was strategically critical. Developers familiar with Ethereum's dominant programming environment can deploy to Hyperliquid with minimal code modifications, dramatically lowering adoption barriers. Existing Ethereum tools, libraries, and infrastructure largely function on HyperEVM, allowing projects to leverage battle-tested components rather than building everything from scratch. This compatibility also enables cross-chain composability as DeFi matures, potentially positioning Hyperliquid as a liquidity hub that bridges multiple ecosystems.

The September 2025 launch of USDH represents Hyperliquid's most ambitious ecosystem expansion yet. This native stablecoin, pegged to the US dollar and backed by a combination of cash and short-term US Treasury securities, directly challenges the dominance of Circle's USDC and Tether's USDT - stablecoins that collectively command over 90 percent of the market. For Hyperliquid, which holds approximately $5.6 to $6 billion in USDC deposits representing roughly 7.5 percent of all USDC in circulation, launching a native stablecoin addresses both economic and strategic imperatives.

The economic rationale is straightforward: USDC's reserves generate substantial interest income from Treasury yields, all of which flows to Circle rather than Hyperliquid or its users. Analyst estimates suggest that fully migrating Hyperliquid's USDC holdings to USDH could capture approximately $220 million in annual Treasury yield revenue, assuming a 4 percent return on reserves. Under the proposed model, half of this revenue would fund HYPE token buybacks, creating ongoing demand for the governance token, while the other half would support ecosystem growth initiatives, developer grants, and user incentives.

The strategic benefits extend beyond revenue capture. A native stablecoin reduces systemic risk from dependence on external issuers. Circle has demonstrated willingness to freeze USDC in specific addresses when requested by law enforcement, raising concerns about censorship risk for decentralized platforms. Regulatory actions targeting Circle or changes to USDC's compliance policies could ripple through Hyperliquid if the platform remains overly dependent on the stablecoin. USDH provides optionality and resilience by diversifying stablecoin exposure.

Native Markets, the startup selected to issue USDH after a competitive bidding process that saw proposals from Paxos, Ethena, Frax Finance, Agora, and others, secured victory with 97 percent validator support. The team brings relevant experience - co-founder Max previously worked at Liquity and Barnbridge focusing on stablecoins and fixed-rate instruments, while advisor Mary-Catherine Lader served as President and COO of Uniswap Labs and led BlackRock's digital asset initiatives. This expertise should prove valuable as USDH navigates complex regulatory requirements and operational challenges.

USDH's reserve structure employs a dual approach: off-chain holdings managed by BlackRock combined with on-chain reserves handled by Superstate through Stripe's Bridge platform. This hybrid model balances security and transparency - institutional-grade custody for the majority of reserves with on-chain visibility that allows users to verify backing in real-time. The stablecoin complies with the GENIUS Act, comprehensive US stablecoin legislation signed into law in July 2025 that established regulatory standards for reserve composition, transparency, and redemption mechanisms.

Early adoption metrics show promise but also reveal challenges ahead. Within 24 hours of launch on September 24, 2025, Native Markets pre-minted over $15 million USDH with early trading generating more than $2 million in volume. The USDH/USDC pair maintained its dollar peg at 1.001 in initial sessions, demonstrating stability. By late September, total supply reached approximately 2.38 million tokens with a $2.37 million market cap - modest figures that underscore the difficulty of displacing entrenched stablecoins even with superior economics.

The platform's integration roadmap for USDH includes several critical milestones. Short-term plans involve making USDH available as a quote asset on spot markets, enabling direct minting on HyperCore, and potentially introducing USDH-margined perpetuals that would allow traders to post the stablecoin as collateral. Longer-term ambitions include expanding USDH adoption beyond Hyperliquid to other chains and DeFi protocols, transforming it from a platform-specific token into a widely-used stablecoin. Success would significantly enhance Hyperliquid's strategic position and revenue potential.

The upcoming HIP-3 proposal represents another major expansion initiative. This governance proposal would implement a permissionless market creation mechanism allowing builders to launch new perpetual markets by staking substantial amounts of HYPE tokens - initially proposed at 1 million HYPE, worth approximately $45 to $49 million at current prices. Market creators could earn up to 50 percent of fees generated by their markets, creating powerful incentives for identifying and launching trading pairs with genuine demand.

HIP-3 addresses several strategic objectives simultaneously. It creates substantial demand for HYPE tokens as prospective market creators must acquire and lock significant holdings, functioning as a "supply sink" that could offset selling pressure from token unlocks. It accelerates the addition of new trading pairs without requiring core team approval for each listing, enabling Hyperliquid to rapidly expand its asset coverage and capture emerging trends. It transforms Hyperliquid into infrastructure for other builders to create businesses, fostering ecosystem growth and innovation.

The proposal also carries risks. Permissionless market creation could flood the platform with low-quality trading pairs that fragment liquidity without attracting meaningful volume. Scam projects might launch deceptive markets hoping to profit from unsophisticated traders, creating reputational risks for Hyperliquid. The high HYPE staking requirement could limit market creation to well-funded entities, preventing grassroots community-driven listings. Execution details - including mechanisms to remove failed markets, adjust staking requirements, and govern fee sharing - will determine whether HIP-3 achieves its ambitious goals or introduces new challenges.

These expansion efforts collectively represent Hyperliquid's bet that sustainable competitive advantage requires more than excellence in a single product category. By building a comprehensive ecosystem encompassing perpetuals, spot trading, lending, stablecoins, and permissionless market creation, Hyperliquid aims to create a moat that pure-play competitors struggle to replicate. Whether this strategy succeeds depends on execution across multiple complex workstreams while maintaining the performance, security, and user experience that established the platform's reputation.

Compliance, Innovation, and Uncertainty

The explosive growth of decentralized perpetual exchanges operates against a backdrop of evolving regulatory frameworks that could fundamentally reshape the market. Regulators globally are grappling with how to apply traditional derivatives oversight to novel decentralized structures, while the industry debates optimal approaches to compliance that preserve decentralization's core benefits.

In the United States, perpetual futures have historically existed in a regulatory gray area. Traditional futures contracts trade on Commodity Futures Trading Commission-regulated Designated Contract Markets with strict rules governing margin, clearing, and reporting. Perpetuals, with their lack of expiration dates and continuous funding rate settlements, didn't fit neatly into existing frameworks. This ambiguity drove most perpetual trading to offshore exchanges like Binance, OKX, and Bybit, which captured enormous volume from US traders willing to use VPNs to circumvent geographic restrictions.

The regulatory landscape shifted dramatically in 2025. In April, the CFTC issued requests for comment on both 24/7 derivatives trading and perpetual-style contracts, signaling openness to onshoring these products. By July, Coinbase Derivatives self-certified two perpetual futures contracts - BTC-PERP and ETH-PERP - that became effective for trading on July 21, 2025, after the CFTC's ten-day review window passed without objection. This represented the first time a CFTC-regulated US exchange offered perpetual futures, marking a watershed moment for domestic market structure.

The products differ from offshore perpetuals in important ways. They carry five-year expirations rather than truly perpetual durations, though this distinction becomes semantic given the extended timeframe. They offer up to 10x leverage rather than the 100x or higher common internationally, reflecting conservative regulatory positioning. Most significantly, they trade on a regulated venue with CFTC oversight, providing legal clarity and consumer protections that unregulated offshore platforms lack.

In September 2025, the Securities and Exchange Commission and CFTC held a joint roundtable on regulatory harmonization, addressing jurisdictional overlaps and conflicts between the two agencies. Both regulators expressed interest in facilitating decentralized finance innovation, with statements indicating willingness to consider "innovation exemptions" that would allow peer-to-peer trading of perpetual contracts over DeFi protocols. This collaborative approach marks a stark departure from the adversarial regulatory environment that characterized much of 2023 and 2024.

The passage of the GENIUS Act in July 2025 provided crucial clarity for stablecoin operations. This comprehensive legislation established regulatory standards for dollar-backed stablecoins including reserve composition, transparency requirements, and redemption guarantees. For platforms like Hyperliquid launching native stablecoins, compliance with GENIUS Act standards provides legal certainty and builds trust with institutional users. The law's existence also signals broader regulatory acceptance of crypto infrastructure as permanent financial market components rather than temporary phenomena.

Europe has taken a more prescriptive approach through the Markets in Crypto-Assets Regulation, which established comprehensive rules for crypto service providers including derivatives offerings. Exchanges serving European users must obtain MiFID licenses to offer perpetual swaps and other leveraged products, subjecting them to traditional financial services oversight. This creates higher barriers to entry but provides clarity that enables institutional participation. Several platforms have pursued European licenses to access this market legally.

Asia presents a patchwork of regulatory environments. Hong Kong has embraced crypto innovation through clear licensing frameworks that enable regulated perpetual trading. Singapore maintains strict requirements but provides pathways for compliant operators. Mainland China continues its comprehensive ban on cryptocurrency trading. Japan requires registration and limits leverage offered to retail traders. The United Arab Emirates has positioned itself as crypto-friendly through low-friction licensing in free zones like Dubai's Virtual Assets Regulatory Authority jurisdiction.

Decentralized platforms face unique regulatory challenges. The absence of a central operator complicates questions of jurisdiction, compliance, and enforcement. Who bears responsibility for regulatory violations - token holders who govern the protocol, liquidity providers who facilitate trading, or individual users executing transactions? How can platforms implement know-your-customer procedures without centralized identity verification? Can protocols offering leveraged products to retail users in multiple jurisdictions simultaneously comply with divergent national requirements?

Some platforms have addressed these challenges through aggressive geographic restrictions. Hyperliquid blocks US and Canadian Ontario users, eliminating the largest potential enforcement jurisdiction but also excluding substantial market opportunity. Others like dYdX have implemented optional KYC that unlocks additional features or higher leverage tiers, attempting to balance permissionless access with regulatory compliance. Some new platforms are exploring zero-knowledge proof systems that verify user compliance with requirements like sanctions screening without revealing underlying personal information.

The tension between regulatory compliance and decentralization's core value propositions remains unresolved. Many traders embrace decentralized platforms specifically because they require no KYC, preserve privacy, and enable access regardless of jurisdiction. Introducing identity verification, geographic restrictions, or regulatory reporting fundamentally compromises these benefits. Yet operating without any compliance framework exposes platforms to enforcement actions, debanking of critical service providers, and exclusion from institutional adoption.

Institutional participation represents a particular regulatory pressure point. Traditional financial institutions - hedge funds, family offices, and eventually perhaps banks and pension funds - require regulatory clarity before allocating significant capital to any derivatives venue. They need assurance that trading on a platform won't violate internal compliance policies, trigger regulatory sanctions, or create legal liabilities. This requirement inherently pushes toward more regulated, compliant platforms and away from truly permissionless alternatives.

The question of whether perpetual contracts constitute securities versus commodities carries major implications. Bitcoin and Ethereum have achieved informal regulatory acceptance as commodities, allowing perpetual futures based on these assets to trade on CFTC-regulated venues. But hundreds of other crypto assets remain in regulatory limbo, with the SEC maintaining that many constitute unregistered securities. If a token underlying a perpetual contract is a security, the derivative itself may need to be a "security future" tradable only on SEC-regulated exchanges or jointly SEC-CFTC-regulated venues - a requirement that would dramatically complicate multi-asset decentralized platforms.

Looking forward, regulatory evolution will likely occur through iterative steps rather than comprehensive legislation. Pilot programs, no-action letters, and exemptive relief for specific use cases may provide pathways for compliant innovation. Regulatory sandboxes that allow experimentation under supervision could help authorities understand decentralized protocols' actual risks versus theoretical concerns. International coordination through bodies like the Financial Stability Board might harmonize approaches across jurisdictions, reducing the compliance burden for global platforms.

The regulatory uncertainty cuts both ways for decentralized versus centralized platforms. Centralized exchanges face clearer requirements but also direct enforcement mechanisms - regulators can sanction corporate entities, freeze assets, and compel operational changes. Decentralized platforms operate in greater legal ambiguity but lack clear enforcement targets, creating both opportunity and risk. As frameworks mature, platforms that successfully navigate compliance while preserving decentralization's benefits will likely capture the largest market share from traditional finance's eventual migration to crypto infrastructure.

Token Economics and Competitive Dynamics

The intensifying competition between Hyperliquid, Aster, and emerging platforms reverberates through token markets and protocol economics, creating winners and losers beyond just the trading volumes each platform captures. Understanding these secondary effects illuminates the broader transformation underway in crypto market structure.

Hyperliquid's HYPE token has experienced significant volatility as competitive dynamics shift. After reaching all-time highs near $51 in August 2025, the token declined over 20 percent through September as Aster's surge raised questions about Hyperliquid's sustainable dominance. The token stabilized in the $44 to $49 range by early October, down from peaks but substantially above its November 2024 airdrop levels around $3.81. This performance reflects investor uncertainty about whether Hyperliquid's fundamental strengths can overcome aggressive competition from well-funded challengers.

The token's valuation relative to protocol revenue provides context for investment analysis. Hyperliquid generates strong fee revenue, regularly ranking among the top three crypto assets by this metric. At current market capitalization of approximately $12.6 billion and monthly fee revenue reaching tens of millions during peak periods, the protocol trades at a premium to some DeFi comparables but at a discount to major centralized exchanges when normalized for volume. Bulls argue this valuation reflects Hyperliquid's growth potential and network effects, while bears point to competitive threats and upcoming token unlocks as headwinds.

The November 2025 token unlock represents the critical overhang on HYPE's near-term outlook. Releasing approximately $446 million worth of tokens monthly for 24 months creates persistent selling pressure as core contributors monetize their holdings. Historical precedent from other projects suggests that token unlocks of this magnitude typically depress prices unless offset by exceptional growth or aggressive buyback programs. Hyperliquid's substantial fee-burning mechanism may provide some counterbalance, but whether buybacks can absorb unlock-related sales remains uncertain.

Aster's ASTER token experienced even more dramatic volatility. The token surged over 1,500 percent in the 24 hours following its September 17, 2025 token generation event, briefly pushing market capitalization toward $3.2 billion. This meteoric rise reflected a combination of genuine enthusiasm from CZ's endorsement, speculative mania, and potential airdrop farming by users anticipating future token distributions. By late September, ASTER had retreated substantially from its peak but remained well above TGE levels, trading around $1.57 with a market cap near $655 million to $1 billion depending on methodology.

The token's sustainability faces significant questions. Its revenue generation, while impressive in absolute terms, remains disputed - critics argue that much derives from incentive-driven wash trading rather than organic activity. The October 2025 token unlock releasing 11 percent of supply will test whether early supporters remain committed or exit at the first opportunity. Without Aster's own equivalent to Hyperliquid's fee-burning mechanism, the token lacks clear value accrual beyond governance rights and speculative appreciation, potentially limiting long-term upside.

The competition between HYPE and ASTER tokens embodies broader debates about optimal token economics. Hyperliquid's aggressive fee-burning creates clear value accrual for holders - as the protocol generates revenue, it removes tokens from circulation, theoretically increasing the value of remaining supply. This mechanism aligns protocol success directly with token performance, though it requires sustained revenue generation to offset selling pressure from unlocks and general trader selling.

Aster has not yet implemented comparable token economics, though future governance proposals could introduce fee sharing, buybacks, or other mechanisms that direct protocol value to token holders. The platform's governance model remains under development, with community debates about optimal structures ongoing. Some argue that Aster should prioritize growth over immediate value accrual, using protocol revenue to fund liquidity mining, developer grants, and marketing that expand the user base. Others contend that without clear token utility, ASTER will struggle to maintain value as speculative fervor fades.

The broader implications extend beyond individual token performance to questions of sustainable business models for decentralized platforms. Traditional exchanges generate profits for shareholders through retained earnings, dividends, or buybacks funded by trading fees. Decentralized protocols must either distribute fees to token holders - creating investment returns that justify holding the token - or retain fees in treasuries for operational expenses and growth initiatives.

Heavy reliance on token incentives to attract users creates challenges. Mercenary capital - traders who chase subsidized fee rates and farm points only to exit once rewards diminish - generates impressive volume metrics but limited sustainable adoption. Platforms can burn through substantial treasury reserves funding these programs without building lasting competitive advantages. Yet some level of incentives appears necessary to bootstrap liquidity and overcome network effects that favor established platforms.

The competition has also influenced the broader DeFi derivatives ecosystem. Alternative platforms have seen renewed interest and capital inflows as traders diversify beyond Hyperliquid and Aster. Jupiter, Lighter, and edgeX have all experienced volume surges in recent months as users explore options. This fragmentation benefits traders through competition-driven innovation but challenges platforms trying to achieve the liquidity depth required for institutional-scale trading.

Liquidity mining programs - where platforms reward users with tokens for providing liquidity - remain controversial. Proponents note that these programs successfully attracted billions in liquidity to early DeFi protocols, catalyzing growth that eventually became self-sustaining. Critics argue that liquidity mining attracts unsustainable capital that departs when subsidies end, leaving platforms with depleted treasuries and reduced liquidity. The evidence suggests that liquidity mining works best when combined with strong product-market fit - users initially attracted by rewards stay because the underlying product delivers superior value.

Fee structures also reveal competitive positioning. Hyperliquid's zero gas fees and competitive maker rebates reduce trading costs to levels comparable with centralized exchanges. Aster's multi-chain approach leverages the low fees of networks like Solana and BNB Chain. Lighter offers zero fees for retail traders while charging institutional users, attempting to attract broad participation while monetizing professional activity. These different approaches reflect varying theories about optimal pricing: should platforms maximize fee revenue, subsidize usage to achieve scale, or implement tiered pricing that charges based on user sophistication?

The competition ultimately benefits traders and users through lower costs, improved execution, and accelerated innovation. Platforms racing to differentiate themselves introduce features that become industry standards, raising the baseline experience across all competitors. Fee compression transfers value from protocol operators to users, though it must be balanced against the need for sustainable protocol revenue that funds development, security, and infrastructure.

For investors, the competitive dynamics complicate valuation analysis. Market leaders command premium valuations due to network effects, proven execution, and sustainable competitive advantages - but face disruption risk from well-funded challengers. New entrants offer explosive growth potential with corresponding volatility and execution risk. Diversification across multiple platforms may provide optimal risk-adjusted exposure to the sector's growth, though concentrated bets on eventual winners would deliver superior returns if correctly timed.

Practical Implications and Opportunities

For active traders navigating this competitive landscape, the proliferation of decentralized perpetual platforms creates both opportunities and complexities. Understanding how to evaluate platforms, exploit inefficiencies, and manage risks has become increasingly sophisticated.

Liquidity distribution directly impacts execution quality. A trader placing a $100,000 order on a highly liquid market might experience 0.02 to 0.05 percent slippage - the difference between expected and actual execution price - whereas the same order on a fragmented or thin market could suffer 0.5 percent or greater slippage. This difference compounds across multiple trades, substantially affecting profitability for active traders. Platforms with deep order books and tight bid-ask spreads deliver better execution, making them preferable for larger trades despite potentially higher fees.

Sophisticated traders increasingly employ cross-platform strategies to optimize execution. Rather than conducting all activity on a single exchange, they monitor prices across multiple venues and route orders to wherever offers the best combination of liquidity, fees, and speed. This "smart order routing" mirrors practices common in traditional equity markets but requires technical sophistication and often algorithmic execution to capture fleeting arbitrage opportunities.

Arbitrage between decentralized platforms represents a significant trading strategy. Price discrepancies emerge regularly due to fragmented liquidity, varying funding rates, and temporary imbalances. A trader might simultaneously buy a perpetual contract on one platform while selling the equivalent position on another, capturing the price spread. As prices converge, they close both positions, profiting from the initial divergence. This activity provides valuable market function by enforcing price consistency across venues, though it requires capital, sophisticated execution infrastructure, and careful risk management.

Funding rate arbitrage offers another opportunity. Funding rates - periodic payments between longs and shorts that keep perpetual prices aligned with spot markets - vary across platforms. A trader might hold long positions on platforms with negative funding rates (where shorts pay longs) while simultaneously holding short positions on platforms with positive funding rates (where longs pay shorts), collecting payments from both sides while maintaining a market-neutral hedged position. This strategy requires precise risk management and monitoring, as price movements between platforms can generate losses that exceed funding rate income.

The proliferation of points programs and airdrops creates meta-trading opportunities where users optimize activity not just for trading profit but for expected token rewards. Sophisticated farmers analyze platform incentive structures to determine which activities generate maximum points per dollar of capital deployed. This might involve specific trading pairs, order sizes, or timing of transactions. While this activity inflates volume metrics, it also provides liquidity and early adoption that benefits platforms if converted to sustained usage.

Risk management becomes more complex in a multi-platform environment. Smart contract vulnerabilities represent the most severe risk - if a platform suffers an exploit, users could lose all deposited funds instantly with limited recourse. Decentralized platforms generally cannot reverse transactions or reimburse losses, unlike some centralized exchanges that maintain insurance funds for customer protection. Traders must evaluate each platform's security audit history, time in operation, and track record when deciding where to deploy capital.

Liquidation mechanics vary across platforms with meaningful implications. Some employ socialized loss systems where profitable traders share the cost of unrealized losses from bankrupt positions if insurance funds prove insufficient. Others use automatic deleveraging that closes positions from profitable traders to cover bankrupt accounts. Centralized exchanges sometimes step in with their own capital to prevent these scenarios. Understanding each platform's liquidation procedures helps traders assess tail risk - the probability of adverse outcomes during extreme volatility.

Regulatory risk affects traders differently based on jurisdiction. Users in countries with restrictive crypto policies face potential legal consequences for trading on certain platforms. While decentralized platforms' permissionless nature enables access regardless of location, traders must understand their local legal requirements. Some platforms implement soft restrictions asking users to attest they're not from prohibited jurisdictions, creating ambiguity about actual liability. VPN usage to circumvent geographic blocks violates most platforms' terms of service and risks account suspension if detected.

Withdrawal times and bridging costs represent practical concerns. Platforms built on their own Layer-1 blockchains like Hyperliquid require bridging assets in and out, incurring time delays and fees. Multi-chain platforms like Aster operating on Solana or BNB Chain enable faster, cheaper deposits and withdrawals. For traders needing rapid capital rotation or frequent rebalancing across venues, these differences materially impact operational efficiency.

User interface and tooling differences affect workflow efficiency. Professional traders typically rely on advanced charting, technical indicators, API access for algorithmic trading, and comprehensive order types like stop-losses, take-profits, trailing stops, and time-weighted average price orders. Platforms vary substantially in feature completeness - some match centralized exchange sophistication while others offer only basic functionality. Traders must balance feature sets against other considerations like fees and liquidity when selecting platforms.

Mobile accessibility has become increasingly important as trading becomes more global and continuous. Platforms with well-designed mobile applications enable position monitoring and rapid execution from anywhere, while those offering only web interfaces limit flexibility. The quality of mobile implementation - speed, reliability, feature parity with desktop - significantly impacts user experience for traders needing constant market access.

For retail traders, the considerations differ somewhat from institutional concerns. Lower capital levels make absolute fee costs less important than percentage impacts - saving ten basis points on fees matters more than marginal liquidity improvements. Ease of use and educational resources help newcomers navigate complexity. Security and platform stability become paramount since retail traders typically lack the resources to recover from losses due to exploits or failures.

Institutional traders prioritize different factors. They require substantial liquidity to execute large orders without material slippage. Custodial arrangements, counterparty risk management, and regulatory compliance drive venue selection more than fee minimization. API access, co-location opportunities, and algorithmic execution capabilities enable the high-frequency strategies many institutions employ. Regulatory clarity and licensing often prove determinative - institutions may pay premium fees for compliant venues rather than use unregulated alternatives offering better economics.

The practical reality for most serious traders involves maintaining accounts across multiple platforms. This diversification provides risk protection if any single platform suffers problems, enables cross-platform arbitrage and execution optimization, and ensures access to trading opportunities wherever they emerge. However, capital fragmentation reduces leverage efficiency, increases operational complexity, and exposes traders to multiple sets of smart contract risks. Finding the right balance between diversification and simplification represents an ongoing challenge.

Scenarios for Market Evolution

Projecting the future of decentralized perpetual futures trading requires considering multiple plausible scenarios shaped by competitive dynamics, regulatory developments, and technological evolution. The market's ultimate structure remains highly uncertain, with credible arguments supporting divergent outcomes.

The "Hyperliquid Sustained Dominance" scenario envisions the incumbent maintaining market leadership through execution excellence and ecosystem expansion. In this outcome, Hyperliquid's fundamental advantages - proven reliability, deepest liquidity, mature tooling, and strong community - overcome competitive threats. Aster's initial surge fades as incentive programs mature and wash trading diminishes, revealing sustainable volume well below headline figures. Emerging competitors like Lighter and edgeX capture niches but fail to threaten Hyperliquid's core position.

Supporting factors for this scenario include Hyperliquid's substantial head start and network effects. Traders familiar with the platform, market makers with optimized systems, and protocols integrated into HyperEVM all face switching costs. The platform's aggressive fee-burning mechanism and expanding ecosystem create self-reinforcing advantages - more users generate more revenue enabling more buybacks while supporting more ecosystem growth attracting more users. HIP-3's permissionless market creation could accelerate asset coverage expansion, preventing competitors from differentiating through more trading pairs.

USDH's successful adoption would significantly strengthen this scenario. If Hyperliquid converts a substantial portion of its USDC base to the native stablecoin, the resulting revenue and economic benefits could fund continued platform development and aggressive growth initiatives. The strategic independence gained from stablecoin self-sufficiency would reduce vulnerability to external pressures. Token buybacks funded by USDH yield could offset selling pressure from upcoming unlocks, stabilizing or appreciating HYPE price and attracting additional investment.

The "Aster Ascendant" scenario sees the challenger leverage Binance backing to ultimately surpass Hyperliquid. In this outcome, CZ's continued support and YZi Labs' resources provide sustained competitive advantage. Aster successfully transitions from incentive-driven growth to sustainable organic adoption as traders appreciate multi-chain accessibility, privacy features, and extreme leverage options. The planned Aster Chain launch delivers on its privacy promises, attracting institutional capital requiring confidential execution. Token economics evolve to match or exceed Hyperliquid's value accrual mechanisms.

This scenario gains credibility from Binance's vast resources and ecosystem. The exchange commands the largest trading volumes globally and maintains relationships with virtually every significant market maker, trading firm, and institutional participant in crypto. If Binance strategically prioritizes Aster's success - through preferential listings, cross-promotion to Binance users, or technical integration - these advantages could prove overwhelming. CZ's personal brand and influence in crypto may attract users who trust his judgment over competing platforms.

Aster's multi-chain architecture could become increasingly valuable as crypto fragments across multiple layer-1 and layer-2 networks. Rather than requiring traders to bridge assets to a single chain, Aster's presence across Solana, Ethereum, BNB Chain, and eventually its own chain meets users wherever they hold capital. This flexibility might overcome Hyperliquid's liquidity advantages as total market activity distributes across ecosystems.

The "Multi-Polar Market" scenario envisions no single dominant platform but rather several competitors capturing meaningful share across different use cases, user segments, and geographic markets. Hyperliquid maintains strong position among serious traders and DeFi natives prioritizing transparency and proven reliability. Aster succeeds with users seeking privacy, extreme leverage, and integration with Binance ecosystem. Lighter captures institutional clients through its Ethereum settlement and zero-knowledge architecture. Jupiter dominates among Solana users preferring an integrated experience with spot trading and DeFi.

In this outcome, market fragmentation persists as different platforms optimize for distinct value propositions. Some traders prioritize maximum leverage, others transparency, others institutional custody. Regulatory fragmentation reinforces this division - platforms compliant in some jurisdictions remain blocked in others, creating geographic market segmentation. Cross-platform infrastructure emerges to bridge these venues, potentially including aggregators that route orders across exchanges and protocols enabling shared liquidity.

This scenario benefits traders through competition-driven innovation and fee compression but challenges platforms achieving sufficient scale for sustainability. Liquidity fragmentation raises trading costs across all venues. Smaller platforms struggle funding development and security from limited revenue. Regulatory compliance becomes more challenging as platforms must navigate multiple jurisdictions' requirements. Market consolidation might eventually occur as weaker competitors fail or get acquired.

The "Regulatory Reset" scenario sees governmental intervention fundamentally reshape decentralized derivatives markets. Major jurisdictions could implement strict requirements making current decentralized platform operations untenable. These might include mandatory KYC, leverage limits, geographic restrictions, capital requirements for protocol operators, or securities registration for governance tokens. Platforms failing to comply face enforcement actions, while compliant venues operate under costly regulatory oversight that erodes decentralization's benefits.

This scenario would dramatically favor centralized exchanges or regulatory-compliant hybrid models over truly decentralized alternatives. Coinbase's CFTC-regulated perpetuals and other compliant offerings would capture share from platforms operating in regulatory gray areas. Some current platforms might seek licensing and accept centralized elements to continue operating legally. Others might shut down or relocate to permissive jurisdictions while blocking users from strict regulatory regimes.

Alternatively, positive regulatory developments could accelerate adoption. If the CFTC and SEC provide clear guidance enabling compliant decentralized perpetual trading, institutional capital might flood into the sector. Traditional finance firms could launch competing platforms or integrate decentralized protocols into their operations. This mainstreaming would dramatically expand the addressable market while potentially commoditizing current platforms as larger financial institutions leverage their advantages.

The "Technological Disruption" scenario imagines breakthrough innovations that obsolete current architectural approaches. New consensus mechanisms might achieve centralized-exchange performance with perfect decentralization. Zero-knowledge technology could enable private trading without trusted parties. Cross-chain protocols might unify liquidity across all platforms transparently. Artificial intelligence could optimize trade execution and risk management far beyond human capabilities.

Under this scenario, current market leaders face disruption risk from technologies not yet widely deployed. The specific form disruption takes remains speculative but precedent suggests crypto markets frequently experience rapid power shifts as innovations emerge. Platforms must continuously invest in research and development to avoid technological obsolescence, though first-mover advantages and network effects may prove difficult to overcome even with superior technology.

The most likely outcome probably incorporates elements of multiple scenarios. Hyperliquid likely maintains strong market position absent execution failures, given its substantial advantages and lead. Aster will probably capture meaningful sustained share though perhaps not majority dominance, particularly if it delivers on its privacy-focused blockchain. Several smaller competitors will carve out niches serving particular segments. Regulatory evolution will shape operations but likely through gradual clarification rather than sudden crackdowns, though jurisdiction-specific divergence will persist.

The competition ultimately benefits the ecosystem by driving innovation, compressing fees, and expanding options for traders. Whether centralization or decentralization better serves derivatives trading remains an open question that market forces will answer through revealed preference. The timeframe for market structure stabilization extends years rather than months - expect continued experimentation, new entrants, business model evolution, and unpredictable developments that rewrite conventional wisdom.

Final thoughts

The battle between Hyperliquid and Aster for decentralized perpetual futures dominance encapsulates broader tensions in crypto market evolution. These platforms represent competing visions for how derivatives trading should function: Hyperliquid's transparent, community-owned infrastructure built from first principles versus Aster's pragmatic multi-chain approach backed by crypto's most powerful incumbent.

Current metrics paint an ambiguous picture. Hyperliquid has seen its volume share decline from 45 to 80 percent down to 8 to 38 percent depending on timeframe, while Aster surged to process over $270 billion weekly. Yet Hyperliquid retains approximately 62 percent of open interest - the stickier, more meaningful indicator of true adoption. Revenue generation, ecosystem development, and token economics favor Hyperliquid's sustainability. Aster's explosive growth could represent either the early stages of a true challenger or unsustainable incentive-driven activity that fades as subsidies end.

The broader market transformation from less than 2 percent of centralized exchange volume in 2022 to over 20 percent in 2025 demonstrates that decentralized alternatives have achieved product-market fit. Traders increasingly accept - and in many cases prefer - on-chain derivatives that offer transparency, self-custody, and censorship resistance even if execution occasionally lags centralized counterparts. This shift will likely accelerate as technology matures, regulatory frameworks clarify, and institutional participation expands.

For market observers, several questions warrant monitoring. Can Hyperliquid's ecosystem expansion and stablecoin initiative reduce its dependence on perpetuals trading sufficiently to sustain growth if competitive pressure intensifies? Will Aster's connection to Binance prove sustainable competitive advantage or liability if regulatory scrutiny increases? Can Lighter, edgeX, and other competitors develop sufficient differentiation to capture lasting market share beyond initial farming enthusiasm? How will upcoming token unlocks affect market sentiment and platform stickiness?

Regulatory developments may prove most consequential. The CFTC and SEC's increasing engagement with perpetual futures suggests pathways for compliant operations that could unlock institutional capital. Conversely, aggressive enforcement against non-compliant platforms could dramatically reshape market structure. International regulatory coordination or fragmentation will determine whether global platforms can operate across jurisdictions or must fragment into regionally-specific offerings.

Ultimately, the competition benefits crypto ecosystem maturation. Competition drives innovation in execution technology, user experience, token economics, and risk management. Fee compression transfers value to traders and users. Multiple viable platforms provide redundancy and choice. The transformation from centralized exchange dominance to a more distributed landscape better aligns with crypto's foundational ethos of decentralization, even as practical trade-offs between performance and purity persist.

The market remains early in its evolution. Perpetual futures have existed in crypto for years but only recently achieved decentralized implementations that match centralized performance. Current platforms will face continued competition from new entrants employing novel approaches and architectures. Some current leaders will prove lasting while others fade as market forces separate sustainable business models from temporary success built on unsustainable incentives.

For traders, investors, and builders, the transformation creates opportunities across multiple vectors: protocol tokens offering exposure to platform success, market-making and liquidity provision, cross-platform arbitrage, and building complementary infrastructure. Risks abound from smart contract vulnerabilities, regulatory uncertainty, market volatility, and business model sustainability questions. Successful navigation requires sophisticated analysis, risk management, and continuous learning as the landscape evolves.

The battle for decentralized perpetual futures dominance will likely define crypto market structure for the remainder of this decade. Whether Hyperliquid maintains its lead, Aster overtakes through aggressive growth, or new competitors emerge to challenge both remains uncertain. What appears clear is that decentralized derivatives represent not a temporary phenomenon but a lasting transformation in how crypto trading operates - one that will continue shaping markets, attracting capital, and evolving technologically for years to come.