The XRP Ledger activated a token standard that challenges a fundamental assumption in blockchain architecture: that compliance and regulatory controls must be implemented through smart contracts at the application layer.

The Multi-Purpose Token standard represents something different. It embeds authorization rules, transfer restrictions, metadata management, and recovery mechanisms directly into the protocol itself.

This matters because institutional tokenization has reached an inflection point. According to industry data, the real-world asset tokenization market has grown nearly fivefold over three years, with over 28 billion dollars in assets now represented on blockchains.

Yet despite this growth, financial institutions repeatedly encounter the same friction points when attempting to issue regulated securities on-chain: bespoke smart contract audits that cost hundreds of thousands of dollars, regulatory uncertainty about which code layer bears legal responsibility, and the technical complexity of ensuring compliance controls function correctly across different implementations.

The MPT standard attempts to solve these problems by standardizing compliance at the ledger level, making these capabilities native rather than optional. For institutions exploring tokenization, this shift from smart contract complexity to protocol guarantees could mean the difference between pilot projects that stall in legal review and production systems that scale.

For blockchain architecture more broadly, it reopens a decade-old debate: should compliance be enforced by application developers writing contracts, or by protocol designers building consensus rules?

Token Standards as Infrastructure: Lessons from Ethereum's Evolution

To understand what makes MPT architecturally significant, it helps to trace how token standards evolved on Ethereum, where nearly all tokenization innovation has occurred over the past eight years.

The ERC-20 standard emerged in 2015 as a simple interface specification. It defined six functions that any fungible token contract should implement: checking balances, transferring tokens, and managing approvals for third-party transfers. This simplicity became its strength. Because ERC-20 imposed minimal requirements, developers could easily create tokens, and wallets or exchanges could integrate them without custom code for each asset. The standard exploded in adoption, powering the initial coin offering wave of 2017 and establishing fungible tokens as a foundational blockchain primitive.

But ERC-20 was designed for permissionless assets. It had no mechanisms for restricting who could hold tokens, no way to attach regulatory disclosures, and no provisions for issuer controls like freezing transfers or clawing back funds. For simple utility tokens, this openness was fine. For representing securities, it was insufficient.

The security token wave that followed attempted to bolt compliance onto ERC-20's foundation. The ERC-1400 proposal, developed by companies including Polymath and Harbor, introduced the concept of token partitions. A single ERC-1400 token could be divided into tranches, each with different transfer rules. Tokens might have separate partitions for accredited investors, for locked-up founder shares, and for freely tradable portions. The standard also added document management, allowing issuers to attach legal agreements or prospectuses to tokens on-chain.

ERC-1400 represented significant progress, but it remained fundamentally a smart contract standard. Each issuer deployed their own contract, implemented their own partition logic, and managed their own compliance rules. The flexibility was powerful but created implementation variance. Different issuers' ERC-1400 tokens might behave differently in edge cases, making it harder for platforms to integrate them reliably.

ERC-3643, which received official approval from the Ethereum community and was merged into Ethereum's master GitHub, took a different approach. Rather than partitions, it introduced an identity layer called ONCHAIN ID. Before any transfer, a validator contract checks whether both sender and receiver have the required identity attestations from trusted issuers. These might prove that a holder completed KYC, meets accreditation requirements, or resides in an approved jurisdiction. The issuer defines transfer rules at the contract level, and the identity system ensures only eligible parties can transact.

The ERC-3643 standard has seen significant real-world adoption, with over 28 billion dollars in assets tokenized through its framework. Its strength lies in leveraging blockchain security for compliance validation. Rather than trusting off-chain keys or separate permission systems, every transfer verification happens on-chain. For regulated markets, this audit trail and cryptographic certainty provides assurance that compliance checks actually occurred.

Yet even with these advances, Ethereum's security token standards share a structural limitation. They are all implemented as smart contracts. This means every issuer must deploy contract code, either writing it themselves or using a template from a provider. That contract must be audited for security vulnerabilities. It must be maintained and potentially upgraded over time. And if a bug exists in the contract logic, tokens could be stolen or become stuck, with no protocol-level recourse.

The gas cost of running complex compliance logic on Ethereum creates another constraint. Every identity check, every partition transfer, every document hash lookup costs gas paid in ETH. For high-value, low-frequency securities this cost is manageable. But for use cases requiring many small transfers or frequent compliance checks, transaction costs can add up quickly.

These Ethereum standards established several key lessons. First, that tokenization requires standardization. Without common interfaces, integration costs become prohibitive. Second, that compliance cannot be an afterthought. Security tokens need authorization and control capabilities built in from the start. Third, that identity and disclosure are as important as the token itself. Regulators care about who can hold assets and what information issuers provide.

The question MPT asks is whether there is a better way to deliver these capabilities than asking thousands of issuers to each implement them in smart contracts.

Inside the MPT Standard: Protocol-Level Tokenization

The Multi-Purpose Token standard represents a fundamentally different architectural choice. Rather than defining a contract interface that developers implement, MPT adds token issuance capabilities directly to the XRP Ledger protocol.

When an issuer creates an MPT, they are not deploying a smart contract. They are creating a new ledger object type, similar to how creating an XRP Ledger account creates an account object. The MPT and its rules are stored in the ledger's state tree and managed by the consensus protocol's transaction processing logic.

This matters because it shifts where code execution happens. With Ethereum's ERC standards, token transfers invoke contract code written by the issuer or their platform provider. That code runs in the Ethereum Virtual Machine, consuming gas and potentially containing bugs. With MPT, transfers are processed by the core ledger code that every validator runs. The same code that validates XRP payments handles MPT transfers, applying the rules defined in each token's configuration.

The MPT specification defines a fixed set of capabilities that every token can opt into during creation. These form a standardized toolkit for compliance and control.

Transferability Controls determine who can send tokens and under what conditions. An MPT can be configured as non-transferable, meaning holders can only send tokens back to the issuer. This enables closed-loop systems where issuers mint tokens as they are earned or purchased, but prevent secondary market trading. For assets that should be tradeable, the "Require Auth" flag implements allowlisting. Holders must receive explicit approval from the issuer before they can hold the token. The issuer maintains an authorization list on-chain, and transfers to unauthorized addresses automatically fail at the protocol level.

Supply Management lets issuers cap the maximum number of tokens in circulation. Unlike Ethereum's ERC-20, where supply caps must be implemented in contract code and can potentially be bypassed if that code contains errors, MPT supply caps are enforced by the ledger itself. Once the cap is reached, attempts to mint more tokens are rejected by consensus. Tokens can still be burned by sending them to the issuer, freeing up supply for new issuance, but the total in circulation never exceeds the configured maximum.

Transfer Fees allow issuers to charge a percentage fee when holders transfer tokens to each other. The fee is paid by burning tokens, not by collecting them. This ensures fees cannot accumulate in issuer wallets in ways that might create tax complications or regulatory concerns. Instead, they simply reduce total supply. Fees range from zero to fifty percent in increments of 0.0001 percent, giving issuers fine-grained control. Importantly, fees do not apply to transfers back to the issuer, preserving the ability to redeem tokens without penalty.

Compliance Controls provide issuers with mechanisms to respond to regulatory requirements or security incidents. The "Can Lock" flag enables both individual and global freezes. An issuer can lock a specific holder's balance, preventing any transfers in or out except returns to the issuer. Or they can globally freeze all tokens of that issuance, halting all transfers across the network. These capabilities mirror traditional financial institution powers, like blocking accounts suspected of fraud or complying with asset seizure orders.

The "Can Clawback" flag goes further, allowing issuers to forcibly transfer tokens from a holder's account back to the issuer. This addresses scenarios where tokens are stolen, sent to the wrong address, or held by an account whose keys have been lost. In traditional securities systems, transfer agents can cancel and reissue certificates. Clawback gives token issuers equivalent powers on-chain.

Metadata Management provides 1024 bytes of arbitrary data storage per token issuance. By convention, this should contain JSON conforming to a schema that defines fields like asset name, description, issuer identity, legal documents, and custom properties. Because this metadata is stored in the ledger, it is replicated across all validators and becomes part of the permanent record. Platforms can rely on this data being present and consistently formatted, unlike systems where metadata lives off-chain and might become unavailable.

Decimal Precision settings allow tokens to represent fractional ownership. An MPT's "asset scale" determines where to place the decimal point when displaying balances. A token with scale 2 represents cents, with scale 6 represents millionths, and so on. This matters for assets like bonds, where par value might be $1,000 but secondary market trading happens in hundredths of par.

The key insight is that none of these capabilities require custom code. They are flags and parameters in a ledger object. The compliance logic, transfer rules, and restrictions are interpreted by the protocol's built-in transaction processors. Every validator runs the same code, ensuring consistent behavior across the network.

Issuers configure these settings when creating the token, and in the current MPT version, those settings are immutable. Once an MPT is created, its transferability rules, supply cap, and compliance controls cannot be changed. This immutability provides certainty to token holders about what rights they have and what controls exist, but also reduces flexibility if circumstances change.

A proposed extension called XLS-94 Dynamic MPT would allow certain fields to be marked as mutable during token creation. The issuer could then update these fields later through special transactions that require their digital signature. This would enable scenarios like gradually lifting transfer restrictions as regulatory requirements change, or updating metadata to reflect corporate actions. The proposal aims to balance flexibility with the security of immutability by making mutability an opt-in choice during token creation.

Ethereum Versus XRP Ledger: Architecture and Trade-Offs

The debate between smart contract flexibility and protocol standardization reflects competing visions of how blockchains should handle specialized use cases.

Ethereum's approach treats the base protocol as a general-purpose computation platform. The Ethereum Virtual Machine provides a Turing-complete execution environment where developers can implement any logic they can code. Token standards like ERC-20 or ERC-3643 are not enforced by the protocol. They are conventions that developers follow voluntarily because it makes their tokens compatible with wallets and exchanges.

This flexibility enables innovation. When developers encounter new requirements, they can write new contract code to address them. The ERC-3643 identity system, for instance, emerged from real-world experience issuing securities and discovering that simple token contracts were insufficient. Because Ethereum allowed arbitrary contract logic, developers could build and deploy this identity layer without needing protocol changes.

The downside is that every deployment is unique. Two tokens claiming to implement ERC-3643 might behave differently because their contracts interpret the standard differently or add custom extensions. Auditing each contract for security and regulatory compliance becomes necessary but expensive. And complex contracts increase gas costs, making some use cases economically impractical.

XRPL's approach treats specialized capabilities as protocol features. The ledger provides specific transaction types for specific purposes: payments, escrows, checks, AMM pools, and now Multi-Purpose Tokens. Rather than general computation, the protocol offers a curated set of primitives that cover common needs.

This standardization reduces integration costs. A wallet that supports MPTs can handle any MPT issuance because all MPTs follow the same protocol rules. There are no custom contract ABIs to parse, no unique logic paths to test. Compliance capabilities like freezing or clawback work identically across all issuers because the protocol implements them, not contract code.

The transaction cost benefit is significant. Because MPT operations are native protocol features, they cost only the base ledger transaction fee, currently around $0.0002 per transaction. There is no gas computation cost proportional to the complexity of compliance checks or transfer rules. This flat fee structure makes MPTs economically viable even for high-frequency or low-value transfers.

The main trade-off is reduced flexibility. Issuers can only use the compliance controls that MPT provides. If a use case requires authorization logic that does not fit MPT's allowlist model, there is no way to implement custom rules. The protocol's feature set constrains what is possible, for better and worse.

On Ethereum with ERC-3643, an issuer would deploy a token contract, an identity registry contract, and multiple validator contracts that check different eligibility criteria. Some validators might verify KYC attestations from approved identity providers. Others might check investor accreditation status or confirm residence in approved jurisdictions. The issuer configures which validators must approve transfers and can add or remove validators as requirements evolve. This modularity provides precise control over who can hold tokens and under what conditions.

The implementation requires coordinating multiple contracts, each of which must be audited. Changes to eligibility rules require deploying new validator contracts or updating existing ones if they were built to be upgradeable. The gas cost of each transfer includes calling the token contract, which calls the identity registry, which queries potentially multiple validator contracts. This multi-step verification adds up, especially if validators perform complex checks.

On XRPL with MPT, the issuer creates a token with the "Require Auth" flag enabled. They then authorize specific accounts to hold the token by sending MPTAuthorize transactions that add those accounts to the token's holder list. The authorization check happens at the protocol level during transfer processing. If the receiving account is not authorized, the transfer fails before any state changes.

The simplicity reduces deployment complexity and eliminates smart contract risk. But the authorization system is all-or-nothing. Either an account is authorized or it is not. The protocol provides no way to encode nuanced rules like "this holder can receive tokens only if their accreditation is current" or "transfers to this jurisdiction are limited to institutional investors." Those rules must be enforced off-chain, with the issuer deciding whether to authorize accounts based on their own eligibility checks.

Some use cases fit naturally into MPT's model. A corporate bond where the issuer maintains a registry of qualified purchasers and authorizes them individually works well. The authorization list serves as a ledger-native representation of the bond's holder record.

Other use cases clash with MPT's constraints. A real estate fund that wants to implement detailed waterfall distributions, where different share classes receive proceeds in specific orders depending on performance metrics, cannot express that logic in MPT's fixed feature set. Such complexity would require either building it off-chain or using a different platform.

The architectural choice reflects different philosophies about where complexity should live. Ethereum pushes complexity into smart contracts, giving developers freedom but requiring each implementation to be secured and audited individually. XRPL pulls common compliance patterns into the protocol, standardizing them but limiting what is possible to what the protocol designers anticipated.

Neither approach is objectively superior. The right choice depends on whether your use case fits within the protocol's feature set and whether you value reduced deployment complexity over implementation flexibility.

Institutional Finance Use Cases: Where MPT Aims

Ripple's positioning of MPT focuses specifically on use cases where regulated financial institutions are likely to issue tokens. The September 2025 institutional roadmap document outlined a clear vision: enable traditional finance to represent real-world assets on-chain without forcing banks and asset managers to become smart contract developers.

Fixed Income Securities represent perhaps the most straightforward MPT use case. A corporate bond traditionally consists of a promise to pay principal at maturity plus periodic coupon payments. Representing this on-chain has historically required either complex smart contracts that encode payment schedules or hybrid systems where on-chain tokens represent ownership but payments happen off-chain.

MPT's metadata capabilities allow bond characteristics to be recorded on-chain. The 1024-byte metadata field can contain maturity dates, coupon rates, payment frequencies, and references to legal documentation. While the protocol does not automatically execute coupon payments - that still requires the issuer to send payment transactions at appropriate times - having the bond's terms encoded in ledger data makes them transparent and verifiable.

The supply cap feature aligns naturally with bond issuance. If a company issues a 100 million dollar bond with 1,000 dollar par value, they configure a supply cap of 100,000 tokens. Once those tokens are minted and distributed to investors, no additional bonds of that issuance can be created, providing mathematical certainty about the debt's total size.

Transfer restrictions let issuers enforce regulatory limits. Bonds might be restricted to qualified institutional buyers in the United States, or to sophisticated investors under European prospectus exemptions. By requiring authorization before holders can receive tokens, issuers maintain control over their investor base and can demonstrate compliance with offering restrictions.

Equity Tokenization brings additional complexity around share classes and voting rights. Preferred shares might have different dividend rates, liquidation preferences, or redemption terms than common shares. Some shares might carry voting rights while others do not.

MPT handles this by treating each share class as a separate token issuance. A company might issue one MPT for Class A common shares, another for Class B preferred shares, and a third for non-voting restricted stock units. Each issuance has its own supply cap, transfer rules, and metadata describing the rights attached to that class.

The limitation is that relationships between share classes - like preferred shares' liquidation priority over common shares - cannot be encoded in the token protocol itself. Those contractual relationships exist in the company's charter documents, with the tokens serving as ledger-native certificates of ownership. When corporate actions occur, like dividends or redemptions, the company must process them using the token holder data from the ledger.

Stablecoins and Electronic Money fit particularly well into MPT's design. A stablecoin issuer creates an MPT with appropriate backing reserves off-chain, then mints tokens as users deposit fiat currency. The supply cap can be set high enough to accommodate growth, or omitted entirely for uncapped issuance.

The clawback feature addresses a key regulatory requirement: the ability to freeze and seize funds in response to law enforcement requests or sanctions compliance. Traditional financial institutions must be able to block accounts and reverse transactions under certain circumstances. MPT gives stablecoin issuers equivalent powers, making compliance with anti-money laundering regulations technically feasible.

The "Deep Freeze" feature, activated separately on XRPL, adds an additional layer. It allows issuers to prevent specific accounts from sending or receiving any tokens on trust lines, even through decentralized exchange orders or automated market makers. This comprehensive blocking capability addresses regulators' concerns about funds moving through unmonitored channels.

Recovery mechanisms matter for institutional stablecoin adoption. If a user loses their private keys, their stablecoin deposits become permanently inaccessible in a standard blockchain model. The clawback feature lets issuers recover these funds and reissue them to verified account holders who prove their identity through off-chain recovery processes. While this introduces centralization - the issuer has extraordinary power over user funds - it matches how electronic money works in traditional systems where banks can help customers recover lost account access.

Tokenized Money Market Funds represent one of the most promising near-term institutional use cases. Money market funds hold short-term, high-quality debt and provide returns slightly above bank savings accounts. They are a major store of value for corporations and institutions, with trillions of dollars in assets under management globally.

Tokenizing money market fund shares means investors can hold claims on the fund as on-chain assets, receive yield through token appreci or dividend distributions, and potentially use those shares as collateral in other protocols. Several traditional asset managers have launched tokenized money market funds on Ethereum, demonstrating demand exists.

MPT's protocol-level structure could reduce the operational complexity of issuing these products on-chain. Rather than deploying and maintaining smart contracts, a fund administrator configures an MPT with the fund's properties, authorizes qualified investors, and mints or burns tokens as subscriptions and redemptions occur. The ledger handles compliance verification and transfer restrictions automatically.

The upcoming XRPL lending protocol adds another dimension. If money market fund shares are represented as MPTs, they can potentially be used as collateral in the native lending system without requiring custom integration code. The protocol understands MPT properties like whether tokens are frozen or locked, making it possible to verify collateral status at the ledger level.

Fractionalized Real-World Assets enable smaller investors to own portions of expensive assets like real estate, art, or infrastructure projects. A property worth 10 million dollars might be divided into 10,000 tokens worth 1,000 dollars each, making it accessible to investors who cannot afford the full asset.

MPT's asset scale feature supports the precise fractional ownership needed for this use case. If a building is valued at 10 million dollars and represented by 10 million tokens, each token represents one dollar of value with additional precision available for market price fluctuations.

Transfer restrictions help manage the regulatory complexities of fractional real estate. In many jurisdictions, offering fractional interests in property requires either registering the offering as a security or qualifying for exemptions that limit who can invest. Authorization requirements let issuers enforce these restrictions at the protocol level.

The challenge with fractionalized assets is governance. Token holders need mechanisms to vote on property management decisions, receive rental income distributions, and eventually liquidate their interests. MPT provides the ownership record but not governance infrastructure. These capabilities must be built on top, either through off-chain processes that use the ledger as a registry or through additional protocol features that are not yet implemented.

Loyalty and Rewards Programs represent a less regulated use case that nonetheless benefits from tokenization. Airlines, hotels, retailers, and other businesses issue billions of dollars worth of loyalty points annually. These points are typically trapped in proprietary databases, non-transferable, and impossible to use across program boundaries.

Tokenizing loyalty points using MPT makes them portable across platforms while preserving the issuer's control. The non-transferable flag prevents a secondary market in points, which businesses generally want to avoid to prevent devaluation. The issuer can still allow redemption back to themselves, letting customers use points for rewards.

The supply cap and mint authority let businesses control the monetary properties of their points. If a retailer wants to limit total outstanding loyalty point liability, they can cap supply. If they want to issue points freely as customers spend, they can mint on demand.

Authorization requirements enable tiered programs where certain benefits are restricted to premium members. A hotel chain might issue one MPT for standard points and another for elite-member points with better redemption rates. Transfer restrictions ensure points stay within the intended program boundaries.

Regulatory Implications: Compliance by Design

Financial regulators globally have struggled with how to oversee tokenized securities. The technology promises benefits - faster settlement, transparent ownership records, reduced intermediary costs - but raises new questions about investor protection, market manipulation prevention, and regulatory jurisdiction.

The European Union's Markets in Crypto-Assets Regulation, which became fully applicable on December 30, 2024, establishes comprehensive rules for crypto-asset issuers and service providers. MiCA requires issuers of asset-referenced tokens and e-money tokens to maintain reserves backing those tokens one-for-one, publish detailed white papers disclosing risks, and grant token holders redemption rights at par. Service providers must obtain licenses, implement anti-money laundering controls, and ensure operational resilience.

For tokenized securities, MiCA largely defers to existing financial services regulation. Security tokens are treated as financial instruments subject to MiFID II and related frameworks. The regulatory question becomes whether a tokenized bond or stock meets the requirements applicable to traditional securities, not whether the blockchain technology creates new regulatory categories.

MPT's protocol-level compliance controls address several concerns that regulators have raised repeatedly in guidance documents and enforcement actions.

Investor Eligibility remains the primary concern in most securities offerings. Regulations typically restrict who can purchase certain investments based on wealth, income, investment experience, or professional status. In the United States, Regulation D offerings limit sales to accredited investors unless the issuer files extensive disclosures. European prospectus exemptions often require investors to be qualified or professional investors.

Enforcing these restrictions on public blockchains has proven challenging. If anyone can create a wallet and no permission is required to transact, how can issuers prevent unqualified investors from acquiring tokens on secondary markets? Smart contract solutions exist but require careful implementation. If the authorization logic contains bugs, tokens might transfer to unauthorized holders despite restrictions.

MPT builds authorization into consensus rules. The protocol itself rejects transfers to unauthorized addresses. This makes investor eligibility technically enforceable in a way that provides greater certainty to both issuers and regulators.

Transfer Restrictions and Lock-Ups address regulatory requirements around holding periods and offering constraints. Regulation S offerings, which exempt U.S. issuers from registration for offshore sales, impose lock-up periods during which securities cannot be resold to U.S. persons. Founder shares often have vesting schedules or transfer restrictions to prevent premature sales.

Implementing these restrictions through smart contracts requires encoding time-based logic and tracking transfer histories. MPT handles this through its transfer rules and authorization system. An issuer can simply decline to authorize transfers during lock-up periods, or use the non-transferable flag to prevent any secondary market sales.

The limitation is that MPT does not natively support scheduled unlocking. If founder shares vest over four years, the issuer must manually authorize transfers as vesting milestones are reached rather than encoding the schedule in the token itself. The proposed XLS-94 Dynamic MPT extension could address this by allowing time-based rule changes.

Issuer Controls and Emergency Powers matter for regulated securities in ways that defy permissionless blockchain principles. If a court orders asset seizure, if funds are stolen, or if an investor's account is compromised, traditional securities systems allow issuers and intermediaries to reverse transactions or freeze accounts.

MPT's freeze and clawback capabilities provide these powers. An issuer can lock an account in response to a court order, preventing further transfers. They can claw back tokens sent to the wrong address due to user error. These interventionist capabilities run counter to cryptocurrency culture but align with how regulated securities work in traditional markets.

The debate is whether these powers introduce unacceptable centralization or necessary regulatory compliance. Critics note that an issuer with clawback authority can arbitrarily seize tokens from holders, creating counterparty risk that does not exist with bearer assets like Bitcoin. Proponents counter that investors in regulated securities already trust issuers and transfer agents with similar powers, and that eliminating these capabilities makes blockchain unsuitable for institutional securities.

MPT makes this a choice rather than a mandate. The "Can Lock" and "Can Clawback" flags can be disabled during token creation. An issuer that wants to create a maximally decentralized asset can omit these features. One that needs regulatory compliance can include them. The key is that the choice is explicit and immutable, giving holders certainty about what controls exist.

Transparency and Disclosure requirements permeate securities regulation. Issuers must provide offering documents, financial statements, material disclosures, and ongoing reporting. Traditionally these documents are filed with regulators and distributed to investors through various channels.

MPT's metadata field provides on-chain disclosure storage. An issuer can include URLs pointing to offering documents, file hashes proving document authenticity, or even embed critical terms directly in the metadata JSON. Because this data is part of the ledger state, it is replicated across all validators and permanent.

The 1024-byte limit constrains what can be stored directly. Most legal documents exceed this size by orders of magnitude. But cryptographic hashes of documents fit easily, providing a tamper-evident way to link on-chain tokens to off-chain documentation. Regulators or investors can verify that the documents an issuer claims to have filed match the hashes embedded in the token metadata.

AML and KYC Requirements create perhaps the sharpest tension between blockchain pseudonymity and regulatory mandates. Financial institutions must verify customer identities, screen against sanctions lists, monitor for suspicious activity, and report large or unusual transactions.

MPT does not directly implement KYC. The protocol has no concept of real-world identity or know-your-customer checks. What it provides is the infrastructure for issuers to enforce identity requirements through their authorization process.

An issuer could establish an off-chain KYC process where investors submit identification documents and undergo verification. Once approved, the issuer authorizes that investor's XRPL address to hold tokens. The ledger then enforces the restriction that only authorized addresses can receive tokens, but the determination of whether someone should be authorized happens off-chain through the issuer's compliance procedures.

This hybrid approach keeps sensitive personal information off the public ledger while providing protocol-level enforcement of restrictions based on that information. The limitation is that the on-chain record provides no audit trail of why accounts were authorized or what identity verification occurred. Regulators must rely on issuers maintaining off-chain records.

The Credentials feature, which activated separately from MPT, adds an identity layer to XRPL. Issuers can attest to specific facts about addresses, like "this address completed KYC with provider X on date Y" or "this holder is accredited according to SEC rules." These attestations are on-chain but designed to reveal only necessary information, preserving privacy while enabling compliance verification.

Protocol Versus Smart Contract: A Deeper Trust Model Debate

The choice between embedding capabilities in protocols versus leaving them to application-layer smart contracts reflects competing beliefs about security, flexibility, and where trust should be placed in blockchain systems.

Protocol advocates argue that moving critical security and compliance logic into the base layer reduces the attack surface. Every XRPL validator runs the same core codebase. That code is developed by an open-source community, undergoes extensive review, and changes only through a formal amendment process requiring supermajority consensus. This shared codebase means MPT transfer restrictions, freeze capabilities, and authorization checks work identically everywhere. There is no way for an individual issuer's implementation to contain bugs that break these protections.

The argument continues that standardization protects users. With MPT, every token implements compliance the same way. A holder knows that if their account is frozen, no transfer attempts will succeed. If a token has a supply cap, mathematical certainty exists that no more than that cap can ever circulate. These guarantees come from protocol rules that cannot be subverted without the agreement of the validator network.

Smart contract advocates counter that flexibility matters more than standardization. Financial instruments are diverse. A municipal bond behaves differently than a real estate investment trust, which differs from preferred shares with conversion rights. Trying to design a protocol that accommodates every possible security structure is futile. Better to provide general computation capabilities and let developers build specialized logic as needed.

They note that bugs in protocol code affect everyone simultaneously. A vulnerability in MPT logic could potentially compromise all MPT tokens across the network. With smart contracts, a bug affects only that contract's users. The blast radius is contained. Yes, auditing thousands of contracts is more work than auditing one protocol, but distributed security review across many independent developers can be robust.

The upgrade path presents another trade-off. Protocol changes require coordination across validators, amendment proposals, voting periods, and community consensus. This process can take months or years. Smart contracts can be deployed instantly by their developers, enabling rapid iteration. If market needs change or regulations evolve, contract developers can adapt immediately. Protocol designers face much higher inertia.

Yet this inertia can be a feature rather than a bug. Immutable protocol rules provide stability that some applications require. A bond issuer might want certainty that the token's compliance rules will not change unexpectedly. If those rules are in a smart contract, the contract owner could upgrade them, potentially in ways that harm token holders. If they are in the protocol, changes require network-wide consensus that the issuer does not unilaterally control.

The integration cost consideration tilts toward protocols. A platform that wants to support tokenized securities must integrate with whatever token standards issuers use. With Ethereum, this means understanding multiple smart contract interfaces, handling differences between ERC-1400, ERC-3643, and various custom implementations, and potentially auditing each contract's code to ensure it behaves as expected.

With MPT, integration is uniform. A platform adds support for the MPT transaction types and ledger objects, then automatically supports all MPT issuances. The protocol documentation describes exact behavior, eliminating ambiguity about how features work.

Transaction costs present a stark difference. Complex Ethereum smart contracts can cost significant gas to execute. A security token transfer that must query identity registries, check multiple compliance rules, and update partition balances might cost tens of dollars in gas during periods of network congestion. MPT transfers cost around one-fiftieth of one cent regardless of how many compliance checks apply, because protocol features do not scale costs with complexity.

For high-value, low-frequency transactions, this cost difference barely registers. Transferring shares of a private company worth hundreds of thousands of dollars does not become impractical because the blockchain transaction costs twenty dollars. For retail securities, payment tokens, or high-frequency trading, transaction costs matter significantly.

The philosophical question underlying this debate is whether blockchains should be general-purpose computing platforms or specialized transaction processors. Ethereum champions the former view: provide a Virtual Machine capable of arbitrary computation, then let developers build whatever they need. XRPL represents the latter: identify common use cases, implement them as optimized protocol features, and avoid the complexity and costs of general computation.

Neither philosophy is objectively correct. The right answer depends on whether your application fits within a protocol's feature set and whether you prioritize standardization over flexibility, integration simplicity over implementation control, and predictable costs over rapid iteration capability.

Market Reaction: Enthusiasm Meets Skepticism

The announcement and activation of MPT produced reactions that split along predictable fault lines in the blockchain community.

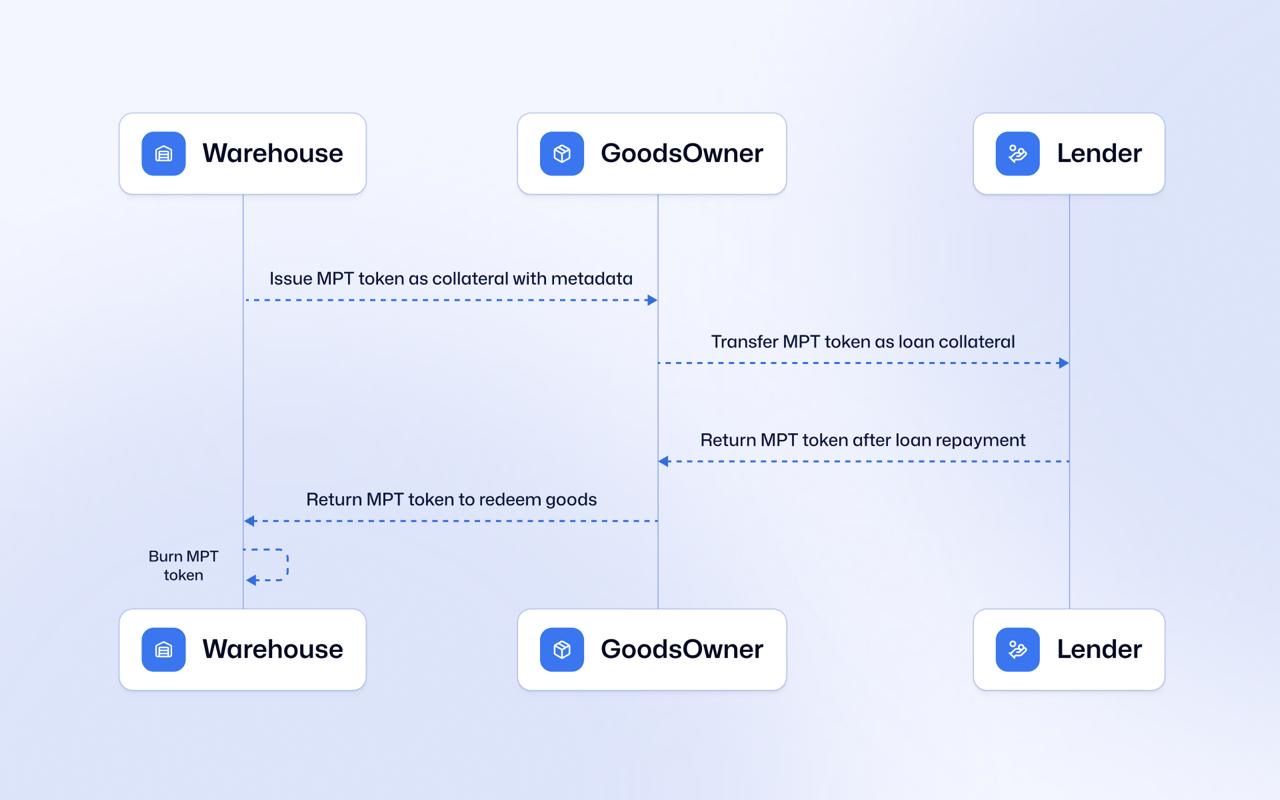

XRP advocates celebrated the launch as validation of XRPL's institutional focus. The multi-year development process, the formal amendment voting, and the immediate availability of compliance features demonstrated that XRPL was evolving specifically to meet enterprise needs. Community members highlighted use cases like FortStock's warehouse receipt tokenization pilot, which uses MPT to represent physical commodities as on-chain collateral, as proof that real institutions were already building on the standard.

The speed of development impressed observers familiar with blockchain governance challenges. From initial proposal to mainnet activation took approximately eighteen months, a relatively fast timeline for introducing major protocol changes. The amendment received strong validator support, passing the required eighty percent threshold and activating on October 1, 2025, without controversy.

Ethereum maximalists and DeFi advocates raised concerns about centralization. The clawback and freeze capabilities particularly drew criticism. Commentators noted that giving issuers unilateral power to seize tokens fundamentally contradicts cryptocurrency's goal of creating censorship-resistant money. If issuers can freeze accounts or reverse transactions, tokens become similar to traditional bank accounts rather than bearer instruments.

This criticism reflects a philosophical divide. To some, blockchain's value proposition is permissionlessness and resistance to arbitrary control. Features that enable issuers to override user control undermine this value. To others, compliance with legal requirements and institutional needs justifies capabilities that would be unacceptable for base-layer cryptocurrencies like Bitcoin or Ether.

Bitcoin purists, who often dismiss all other blockchain projects as insufficiently decentralized, used MPT as further evidence that XRP serves institutional interests over user freedom. Critics like Pierre Rochard, VP of Research at Riot Platforms, argue that Ripple's influence over XRPL validator selection and the amendment process means the network cannot provide credible neutrality. If Ripple effectively controls which validators are trusted, they contend, Ripple could push through amendments that serve their business interests rather than users' needs.

Ripple's CTO David Schwartz has repeatedly countered these centralization claims. He notes that XRPL has over 190 active validators, with only 35 in the default Unique Node List. Validators must reach consensus on transactions every three to five seconds, and no single party controls enough validators to unilaterally determine outcomes. The amendment process requires supermajority support for two weeks, preventing any entity from forcing protocol changes.

The empirical question is whether XRPL's consensus mechanism provides sufficient decentralization for institutional use cases, not whether it matches Bitcoin's decentralization model. Banks and asset managers comparing blockchain options care whether the network is reliable, whether their transactions will process as expected, and whether governance is transparent, not whether it is maximally resistant to nation-state attacks.

Security token professionals and compliance experts responded more positively. Multiple firms noted that MPT could significantly reduce legal and audit costs compared to deploying custom smart contracts on Ethereum. The protocol-level implementation means one security audit of the XRPL code covers all MPT tokens, rather than requiring per-issuer contract audits. For institutions issuing multiple securities, this could mean hundreds of thousands of dollars in cost savings.

The simplicity of MPT deployment also garnered praise. Creating an MPT requires submitting a single transaction with the desired configuration parameters. No Solidity code to write, no contracts to deploy, no gas optimization required. For financial institutions whose developers have limited blockchain experience, this ease of use lowers the barrier to experimentation.

Criticism emerged around MPT's limitations. Developers accustomed to Ethereum's flexibility noted that MPT lacks programmability. Complex securities with conditional logic, dynamic behaviors, or intricate governance cannot be represented purely through MPT's fixed feature set. Use cases requiring those capabilities would still need smart contract solutions, potentially on XRPL's EVM-compatible sidechain or on other platforms.

The immutability of MPT configurations also drew concern. If an issuer creates a token with specific settings and later discovers they need different capabilities, they must issue a new token and migrate holders. With smart contracts, upgradeable patterns allow changing logic without changing the token contract address. The proposed Dynamic MPT extension would address this, but it remains under development.

Competitors in the tokenization space acknowledged MPT as a serious offering while defending their own approaches. Ethereum-focused platforms emphasized their established ecosystems, the thousands of developers familiar with Solidity, and the availability of audited contract templates that reduce deployment risk. They argued that protocol ossification is a bug, not a feature - markets evolve quickly, and smart contract flexibility enables keeping pace.

Stellar, which competes directly with XRPL in the payment and settlement space, highlighted its own asset tokenization capabilities and questioned whether a separate MPT standard was necessary when trust line tokens already existed on XRPL. The response from Ripple engineers was that trust lines, while powerful, lack the compliance controls that regulated institutions require, making MPT a necessary evolution rather than redundant functionality.

Early adopters provided the most tangible reaction. FortStock's warehouse receipt pilot demonstrated real-world usage. The company is tokenizing inventory held in warehouses across emerging markets, allowing that inventory to serve as collateral for short-term credit. Using MPT, they can embed metadata about the commodity type, storage location, expiration dates, and audit trails directly in the token. The protocol-level transfer restrictions let them ensure only approved creditors receive tokens as collateral.

Financial institutions remained cautiously observant. While several banks and asset managers acknowledged exploring XRPL for institutional use cases, most were waiting to see whether liquidity and market infrastructure would develop before committing to production deployments. The chicken-and-egg problem persists: institutions want established ecosystems before committing, but ecosystems develop only when institutions commit.

The market's ultimate judgment will emerge over the next eighteen to twenty-four months as institutions decide whether to launch tokenized securities using MPT, Ethereum-based standards, or alternative platforms like Avalanche or Polygon. Early mover advantages in tokenization go to platforms that attract major issuers, creating network effects that make those platforms the default choice for subsequent issuers.

Ripple's Institutional DeFi Vision and XRPL 3.0

MPT exists not as a standalone feature but as a foundational component of Ripple's broader institutional DeFi strategy. The September 2025 roadmap announcement positioned MPT alongside several other protocol upgrades designed to make XRPL a comprehensive platform for regulated on-chain finance.

The centerpiece is a native lending protocol, currently under development and scheduled for inclusion in XRPL Version 3.0.0. This protocol would enable pooled lending and borrowing directly at the ledger level without requiring smart contracts.

The lending design uses "Single-Asset Vaults" that aggregate liquidity from multiple providers. If several institutions want to lend RLUSD, Ripple's upcoming stablecoin, they deposit their RLUSD into a vault. The protocol issues transferable vault shares representing each lender's proportional claim on the pool. Borrowers can request loans from the vault if they provide acceptable collateral, with the protocol enforcing loan-to-value ratios and managing repayment schedules automatically.

The connection to MPT is that vault shares themselves could be represented as MPT tokens. If a lending vault issues shares as MPTs with appropriate compliance controls, those shares become tradeable, usable as collateral in other protocols, or redeemable through the vault's automated mechanism. The protocol understands MPT properties like freeze status or transfer restrictions, letting it make safe lending decisions based on collateral quality.

This integration enables institutional credit markets at the protocol level. A money market fund represented as an MPT could serve as collateral for short-term loans. A tokenized bond could be borrowed against. Real-world assets held in MPT form could unlock liquidity without requiring centralized intermediaries to warehouse collateral and manage lending operations.

The "MPT DEX" concept extends XRPL's existing decentralized exchange to handle MPT trading. Currently, XRPL's native order book supports trading XRP and trust line tokens. Extending this to MPTs enables secondary market trading of tokenized securities, stablecoins, and real-world assets with the same low fees and high performance that XRPL provides for other assets.

The challenge is regulatory compliance. Securities trading must occur on registered exchanges or through broker-dealers in most jurisdictions. A fully permissionless order book where anyone can place orders for security tokens would violate these requirements. The solution involves "permissioned DEX" functionality where issuers can restrict who can place orders for their tokens.

If a tokenized bond issuer enables the "Can Trade" flag on their MPT, then only authorized addresses can participate in order book trading. The protocol enforces this restriction, ensuring that even if someone tries to place an order, it will fail unless they are on the issuer's approved list. This lets security tokens trade on decentralized infrastructure while maintaining compliance with trading restrictions.

The roadmap also includes confidential MPTs, scheduled for early 2026. These would use zero-knowledge proof technology to enable privacy-preserving transfers while maintaining the compliance and audit capabilities that regulators require.

The concept is to prove facts about transactions without revealing the facts themselves. A confidential MPT transfer could prove that the sender is authorized to hold the token, that the receiver is authorized, that the transfer amount does not exceed the sender's balance, and that all compliance rules are satisfied, all without revealing which accounts participated in the transfer or how many tokens moved.

For institutions, this addresses a critical need. Privacy is not just a preference but a requirement for many financial transactions. A corporation taking out a loan does not want competitors seeing the loan amount on a public ledger. An asset manager purchasing securities for a fund does not want their trading strategy exposed to front-runners. Traditional financial markets provide transaction privacy through opacity - information stays in private databases at centralized intermediaries.

Blockchain's transparency creates accountability but eliminates privacy. Confidential MPTs aim to restore privacy while retaining blockchain's advantages: cryptographic auditability, elimination of reconciliation, and reduced intermediary costs. Regulators and auditors could still verify that transactions followed rules and that balances are accurate, but market participants could not surveil each other's activities.

The technical implementation likely involves proving systems like zkSNARKs or zkSTARKs that generate cryptographic proofs of transaction validity. These proofs can be verified by validators without revealing transaction details. The sender and receiver know what they transacted, regulators with appropriate permissions could view transaction details for oversight, but the general public sees only that valid transactions occurred.

Zero-knowledge technology remains relatively early and carries performance costs. Proof generation is computationally intensive, potentially adding seconds of latency to transaction processing. Proof size affects blockchain throughput, as larger proofs consume more space in ledgers. These constraints are improving as the technology matures, but confidential transactions will likely remain more expensive and slower than transparent ones for some time.

Ripple's adoption strategy acknowledges this reality by making confidentiality optional. Standard MPTs remain fully transparent, suitable for use cases where privacy is unnecessary or where regulation requires transparency. Confidential MPTs opt into privacy features where that privacy is valuable enough to justify additional costs.

The Credentials system, which activated in September 2025, provides an identity layer that MPT and other XRPL features can leverage. Credentials are on-chain attestations about accounts, issued by trusted entities. A credential might attest that an account completed KYC with a specific provider, that the account holder is an accredited investor, or that the account belongs to a regulated financial institution.

Issuers can reference credentials in their authorization decisions. Rather than maintaining their own lists of approved addresses, an issuer could specify that their MPT requires holders to possess a specific credential. The protocol then checks credential presence during transfers. This decentralizes identity management - multiple credential issuers can provide attestations that many token issuers accept, rather than each token issuer building their own identity infrastructure.

The Deep Freeze feature, also recently activated, extends issuer control to decentralized exchange activity. A traditional freeze prevents an account from sending tokens through payment transactions. But on XRPL, accounts can also trade frozen tokens by placing offers on the decentralized exchange or providing liquidity to automated market makers. Deep Freeze closes these loopholes by preventing frozen tokens from being involved in any on-ledger activity, even DEX trading.

For compliance purposes, this ensures that freezes are comprehensive. If an account is flagged as suspicious and its token balances are frozen, the account cannot simply trade those tokens for XRP or other assets on the DEX. This level of control matches what regulators expect from traditional financial platforms.

The EVM-compatible sidechain, operational since early 2025, provides developers familiar with Ethereum a pathway to build on XRPL infrastructure while using Solidity and standard Ethereum tools. The sidechain connects to XRPL mainnet through a bridge, allowing assets to move between environments.

This hybrid approach acknowledges that some applications require smart contract flexibility that XRPL's native protocol does not provide. A complex DeFi protocol with novel logic could launch on the sidechain, while leveraging XRPL mainnet for settlement and custody. Tokenized assets on mainnet could be bridged to the sidechain for use in smart contract applications, then brought back to mainnet.

The architectural vision positions XRPL mainnet as a settlement layer optimized for security, compliance, and efficiency, while sidechains and layer-two solutions provide programmability for applications requiring it. This separation of concerns lets Ripple avoid compromising mainnet's design to accommodate every possible use case.

Competition and Ecosystem Effects in the Tokenization Landscape

MPT arrives in a crowded market where multiple blockchain platforms compete for institutional tokenization business. Understanding how MPT fits into this competitive landscape requires examining what each platform offers and where their strengths lie.

Ethereum remains the dominant platform for tokenized securities, with billions of dollars in assets represented through ERC-20, ERC-1400, and ERC-3643 standards. The ecosystem's depth - thousands of developers, extensive tooling, multiple auditing firms familiar with the technology, and institutional-grade infrastructure like Fireblocks and Anchorage - creates powerful network effects. Institutions considering tokenization often default to Ethereum simply because it is where the infrastructure and expertise already exist.

Layer-two solutions like Polygon and Optimism extend Ethereum's reach by providing lower transaction costs while inheriting Ethereum mainnet's security. A tokenized security could be issued on Polygon as an ERC-3643 token, benefiting from Ethereum's established standards and tooling while paying fraction-of-cent transaction fees. For high-frequency trading or retail-facing applications where Ethereum mainnet gas costs are prohibitive, these layer-twos present compelling alternatives.

Avalanche positions itself as an institutional blockchain platform with permissioned subnets that can enforce regulatory requirements while connecting to the public Avalanche network for settlement. An institution could launch a private subnet for tokenized securities trading, restricting access to approved participants, while still benefiting from Avalanche's architecture and tooling. Several institutions have explored this model for trade finance and private market securities.

Stellar, XRPL's closest competitor in the payment-focused blockchain space, has emphasized simplicity and regulatory friendliness for years. Its asset tokenization model uses native ledger capabilities similar to XRPL's approach, rather than relying on smart contracts. Stellar has particularly strong adoption in emerging market payment corridors and has positioned itself for both stablecoin issuance and remittances.

Traditional financial infrastructure providers present a different kind of competition. The Digital Asset Modeling Language platform, used by Australian Securities Exchange's upcoming settlement system replacement, keeps tokenization entirely within permissioned networks managed by traditional intermediaries. Canton, which powers post-trade settlement for multiple securities markets, provides blockchain benefits like synchronized state and cryptographic auditability without creating public tokens at all.

These permissioned approaches arguably address institutional needs more directly by avoiding public blockchain constraints entirely. Institutions can implement tokenization, programmable settlement, and cryptographic auditability without worrying about gas costs, public transparency, or integrating with cryptocurrency ecosystems. The trade-off is that they sacrifice blockchain's core innovation: shared infrastructure that eliminates reconciliation by giving all parties access to a common, verifiable state.

MPT's competitive advantage lies primarily in cost efficiency and integration simplicity. Transaction fees orders of magnitude lower than Ethereum enable use cases that are economically impractical elsewhere. Representing thousands of microtransactions, high-frequency trading scenarios, or retail payment tokens becomes viable when each transaction costs fractions of cents rather than dollars.

The protocol-level implementation reduces technical complexity for institutions. Banks and asset managers can use MPT without learning Solidity, hiring smart contract developers, or conducting extensive security audits of contract code. This lower barrier to entry could accelerate institutional experimentation, particularly among traditional financial institutions whose technical staff lack blockchain expertise.

Network effects favor incumbents, which poses MPT's biggest challenge. An institution issuing a tokenized bond on Ethereum can immediately access liquidity through established platforms like OpenEden, Ondo Finance, or Backed Finance. Secondary market makers, custodians, and trading venues understand Ethereum-based securities. Launching on a less established platform means building this infrastructure from scratch or convincing existing providers to add platform support.

Ripple's strategy appears to be building this infrastructure themselves where necessary. The upcoming native lending protocol, MPT DEX, and partnerships with stablecoin providers aim to create a vertically integrated stack where institutions can issue, trade, and use tokenized assets entirely within the XRPL ecosystem. If successful, this could bootstrap network effects without depending on third-party infrastructure that might never materialize.

The regulatory arbitrage potential presents another consideration. If MPT's protocol-level compliance proves more acceptable to regulators than smart contract-based approaches, institutions might prefer it specifically to reduce regulatory risk. A bank considering tokenized deposit receipts might choose MPT because the built-in freeze and clawback capabilities clearly demonstrate regulatory compliance, whereas proving the same properties about a complex smart contract requires extensive legal analysis.

Cross-chain bridges and interoperability protocols potentially reduce the importance of platform choice. If assets can move freely between blockchains through trustless bridges, institutions could issue on the platform best suited for their compliance needs then bridge to platforms with better liquidity or infrastructure. Projects like LayerZero and Axelar aim to enable this cross-chain future, though trustless bridge security remains an active research area.

The realistic outcome is likely ecosystem specialization rather than winner-takes-all dominance. Ethereum and its layer-twos will continue serving applications requiring maximum smart contract flexibility and where existing infrastructure integration is critical. XRPL and MPT will attract use cases prioritizing compliance, cost efficiency, and simplicity over programmability. Permissioned platforms will serve institutions that want blockchain benefits without public infrastructure.

Different institutions will make different choices based on their specific requirements, risk tolerances, and existing technology relationships. A cryptocurrency-native firm might naturally choose Ethereum because their developers already know Solidity and their infrastructure integrates with Ethereum tooling. A traditional bank exploring tokenization for the first time might prefer MPT's simplicity and lower technical complexity.

Market momentum will ultimately determine platform success. The first platform to host billions of dollars in actively traded tokenized securities from multiple issuers creates a gravitational pull that attracts additional issuers seeking liquidity and infrastructure that already exists. Whether MPT can achieve this momentum against Ethereum's substantial head start remains the key question for XRPL's institutional ambitions.

Technical Challenges and Implementation Roadblocks

Despite MPT's thoughtful design, several technical challenges could impede adoption or limit what the standard can achieve.

Validator Upgrade Coordination required for MPT activation highlighted governance challenges that will recur with future amendments. The MPT amendment needed eighty percent of trusted validators to vote for activation over a two-week period. While the amendment successfully activated on schedule, future protocol changes will face similar coordination requirements.

If an amendment proves controversial or validators disagree about technical implementation choices, achieving consensus could take significantly longer. Ethereum experienced this with its transition from proof-of-work to proof-of-stake, where years of discussion and multiple testnet iterations preceded mainnet deployment. XRPL's simpler amendment process might avoid such lengthy delays, but it also provides fewer opportunities for stakeholder input before changes become permanent.

The amendment mechanism's supermajority requirement prevents any single entity from forcing protocol changes, which protects against centralized control. But it also means necessary improvements might be delayed if validator consensus proves difficult to achieve. Balancing agility with decentralized governance remains an ongoing challenge for all blockchain platforms.

Privacy and Transparency Tradeoffs become more complex with confidential MPTs. Zero-knowledge proof systems that prove transaction validity without revealing details are powerful but introduce new trust assumptions and technical requirements.

The proof generation must happen somewhere. If users generate proofs on their own devices, they need sufficient computational power and must trust the proving key material. If a third-party service generates proofs, that service becomes a centralizing point of control and a potential target for coercion. If validators generate proofs collectively through secure multi-party computation, consensus latency increases significantly.

Regulatory acceptance of zero-knowledge privacy remains uncertain. Regulators want the ability to audit transactions for compliance, investigate suspicious activity, and enforce legal requirements. Confidential transactions make these tasks harder. While cryptographic protocols exist for selective disclosure - where regulators with proper authorization can view transaction details that remain hidden from the public - implementing these systems without compromising security is technically challenging.

The balance between privacy and accountability will likely require ongoing negotiation between technology designers, institutions seeking privacy for legitimate business reasons, and regulators ensuring they can fulfill oversight responsibilities.

Composability with Existing XRPL Features presents integration challenges. MPT must interact correctly with XRPL's decentralized exchange, automated market makers, escrow system, and other protocol features. Each interaction creates potential edge cases that require careful consideration.

For instance, what happens if someone places an offer to trade MPTs on the DEX but those MPTs get frozen before the offer executes? The protocol must either reject the offer creation, cancel the offer when the freeze occurs, or fail the trade attempt. Each choice has different implications for users and platform integrators.

Escrow functionality with MPTs introduces similar complexity. If tokens are escrowed with a time-based release condition but the issuer claws them back while escrowed, which operation takes precedence? If supply caps are configured, do escrowed tokens count toward circulating supply or not?

These edge cases might seem minor but become critical for institutional use. Financial systems depend on predictable, deterministic behavior in all circumstances. Ambiguity or unexpected behavior in corner cases creates operational risk and potential financial losses.

Thorough specification and testing can address these issues, but the combination of MPT with every other XRPL feature creates a large state space to explore. Bug bounties and testnet deployments help, but production systems inevitably discover edge cases that testing missed.

Interoperability with Other Blockchains matters as the industry moves toward multi-chain ecosystems. An institution might want to issue a tokenized security as an MPT on XRPL but enable trading on Ethereum's deeper liquidity pools, or vice versa. This requires bridge protocols that can safely move MPT tokens between chains while preserving their compliance properties.

Building such bridges is technically complex. The bridge must understand MPT semantics like authorization requirements, freeze status, and clawback capabilities. It must potentially replicate these features on the destination chain, or determine how to represent MPT properties using that chain's token standards.

Cross-chain bridges have historically been major security vulnerabilities, with billions of dollars lost to bridge exploits. Adding compliance requirements to bridge designs increases complexity and expands the attack surface. A bridge vulnerability that allows unauthorized addresses to receive MPTs would completely undermine the authorization system's security guarantees.

The alternative is keeping MPTs entirely within XRPL's ecosystem, which limits liquidity and market reach but eliminates cross-chain security concerns. This trade-off will influence whether institutions choose MPT or prefer platforms like Ethereum where most tokenization infrastructure already exists.

Scalability Limitations emerge as adoption grows. While XRPL can process over 1,500 transactions per second, much higher than Ethereum mainnet's current throughput, this still represents a finite limit. If MPT adoption accelerates significantly, transaction demand could exceed capacity.

The protocol's current architecture distributes validator workload across all validators for all transactions. As the ledger state grows with more accounts, MPTs, and other objects, validators must store and process increasing amounts of data. Storage scaling and state growth management become concerns if XRPL hosts thousands of MPT issuances with millions of holders.

Layer-two solutions or sidechains could address scaling limits by moving activity off mainnet while settling periodically on mainnet. But this introduces complexity and potentially undermines the simplicity advantage that makes MPT attractive. If institutions must understand layer-two architectures and cross-layer bridging, much of MPT's ease-of-use benefit disappears.

Network throughput and state growth constraints suggest that MPT will likely serve high-value, relatively low-frequency securities rather than retail payment tokens or extremely high-frequency trading scenarios. A corporate bond with a few thousand holders transacting occasionally fits comfortably within protocol limits. A consumer payment token with millions of users making daily transactions might require different infrastructure.

Case Study: Issuing a Corporate Bond with MPT Versus ERC-1400

To illustrate how MPT differs from Ethereum-based approaches in practice, consider a hypothetical scenario: a corporation issues a five-year, 100 million dollar bond to qualified institutional buyers.

ERC-1400 on Ethereum: The issuer or their platform provider deploys a custom ERC-1400 smart contract. This contract must implement partition logic to potentially separate tranches with different terms, document management to reference the bond prospectus and terms, and transfer restrictions to ensure only qualified buyers can hold the tokens.

The deployment process requires writing Solidity code, either from scratch or by customizing an existing template. The contract must then undergo security auditing by a reputable firm to verify the code correctly implements the desired logic and contains no vulnerabilities. This audit typically costs 50,000 to 200,000 dollars and takes several weeks.

Once deployed, the issuer funds the contract with gas costs for initializing state and minting initial tokens. Gas costs on Ethereum mainnet might total several thousand dollars depending on network congestion at deployment time. The contract address becomes the bond's permanent on-chain identifier.

Investors must be allowlisted by adding their Ethereum addresses to the contract's approved holder list. Each allowlist addition requires a transaction that costs gas. If a hundred qualified buyers exist initially, the issuer pays gas costs for one hundred separate allowlist transactions, potentially thousands of dollars total.

Transfers between qualified buyers also incur gas costs. If an investor sells a portion of their bond holdings to another qualified buyer, the transfer transaction might cost ten to fifty dollars depending on Ethereum network congestion. This variable cost model makes some transfer scenarios economically impractical - small denomination transfers where gas costs exceed the transfer value make no sense.

The issuer configures partition properties to handle coupon payments or redemptions. Semi-annual coupon payments might require the issuer to send payment tokens or stablecoins to all bondholders proportional to their holdings. This requires either iterating through holder addresses with individual transactions or using a batch processing contract that still incurs gas costs proportional to the number of holders.

At maturity, the bond must be redeemed. The issuer sends the principal amount in stablecoins or fiat-backed tokens to bondholders, then burns the bond tokens. This redemption process again incurs gas costs for each bondholder transaction.

The legal structure requires extensive documentation explaining how the smart contract implements bond terms, which party bears risk if contract vulnerabilities exist, and how investors can verify contract behavior. Legal review of smart contract implementations adds tens of thousands of dollars to issuance costs.

MPT on XRPL: The issuer creates an MPT by submitting an MPTCreate transaction containing the bond's properties. The transaction includes a supply cap of 100,000 (representing 100 million dollars at 1,000 dollar par value per token), enables the "Require Auth" flag to restrict holdings to qualified buyers, enables "Can Lock" for regulatory compliance, and embeds metadata with bond terms including maturity date, coupon rate, and document hashes.

The transaction costs approximately 0.0002 XRP, or about one-fiftieth of one cent at current exchange rates. No smart contract deployment, no Solidity coding, no separate security audit of contract logic needed. The protocol itself implements the compliance controls, and those have already been audited as part of XRPL's core codebase.

Investors are authorized by sending MPTAuthorize transactions that add their addresses to the token's holder allowlist. Each authorization costs 0.0002 XRP. For one hundred qualified buyers, total authorization costs are about two cents. These transactions complete in three to five seconds with finality.

Transfers between authorized investors cost 0.0002 XRP regardless of transfer size. An investor selling 100,000 dollars worth of bonds pays the same flat fee as one selling 100 dollars worth. This predictable, low-cost structure makes all transfer denominations economically rational.

Coupon payments require the issuer to send payment stablecoins to bondholders proportional to their holdings. This is similar to the Ethereum process but costs dramatically less. If the issuer sends payment to one hundred bondholders, the total transaction cost is about two cents in XRP fees, compared to thousands of dollars in Ethereum gas.

At maturity, redemption follows the same pattern. The issuer sends principal payments in stablecoins to bondholders, then burns the bond MPTs. Total cost remains trivial compared to Ethereum's gas requirements.

The legal structure is simpler because the bond's compliance controls are protocol features, not custom contract code. Legal documentation explains the MPT's configured properties and how XRPL's protocol enforces them. Because these are standardized protocol features, there exists less legal ambiguity about behavior in edge cases - the protocol specification serves as the source of truth.

Comparative Analysis: The ERC-1400 approach provides more flexibility. If the bond has unusual terms that require custom logic, smart contract programmability accommodates those requirements. The issuer can implement specialized partition structures, complex coupon calculation logic, or unusual redemption conditions.

The MPT approach provides lower cost and simpler deployment. For a straightforward bond where standard compliance controls suffice, MPT reduces issuance costs by potentially hundreds of thousands of dollars and eliminates weeks of contract development and auditing time. Ongoing operational costs are orders of magnitude lower due to flat, sub-cent transaction fees.

The key question is whether the bond's requirements fit within MPT's feature set. If they do, MPT provides substantial advantages. If they require custom logic that MPT cannot express, Ethereum's flexibility becomes necessary despite higher costs.

For most institutional securities, terms are relatively standardized. Bonds have coupons and maturity dates. Equity has share classes with defined rights. Money market funds have standardized share structures. These standardized instruments fit naturally into MPT's model, suggesting the protocol-level approach could serve a substantial portion of institutional tokenization needs.

Broader Industry Context: Global Regulatory Momentum

MPT's launch occurs against a backdrop of accelerating regulatory clarity for digital assets globally. Multiple jurisdictions have implemented or are finalizing frameworks that make institutional tokenization legally viable.

The European Union's Markets in Crypto-Assets Regulation, fully applicable since December 30, 2024, establishes comprehensive rules for crypto-asset issuers and service providers across all EU member states. For tokenized securities, MiCA defers to existing financial services regulation, treating security tokens as financial instruments. But for stablecoins and utility tokens, MiCA creates new categories with clear authorization requirements.

Asset-referenced tokens and e-money tokens must be issued by authorized entities that maintain reserves backing the tokens one-for-one. Issuers must publish white papers disclosing risks and token properties. Holders receive redemption rights ensuring they can convert tokens back to underlying assets at par. These requirements provide legal certainty for stablecoin issuers while protecting consumers.