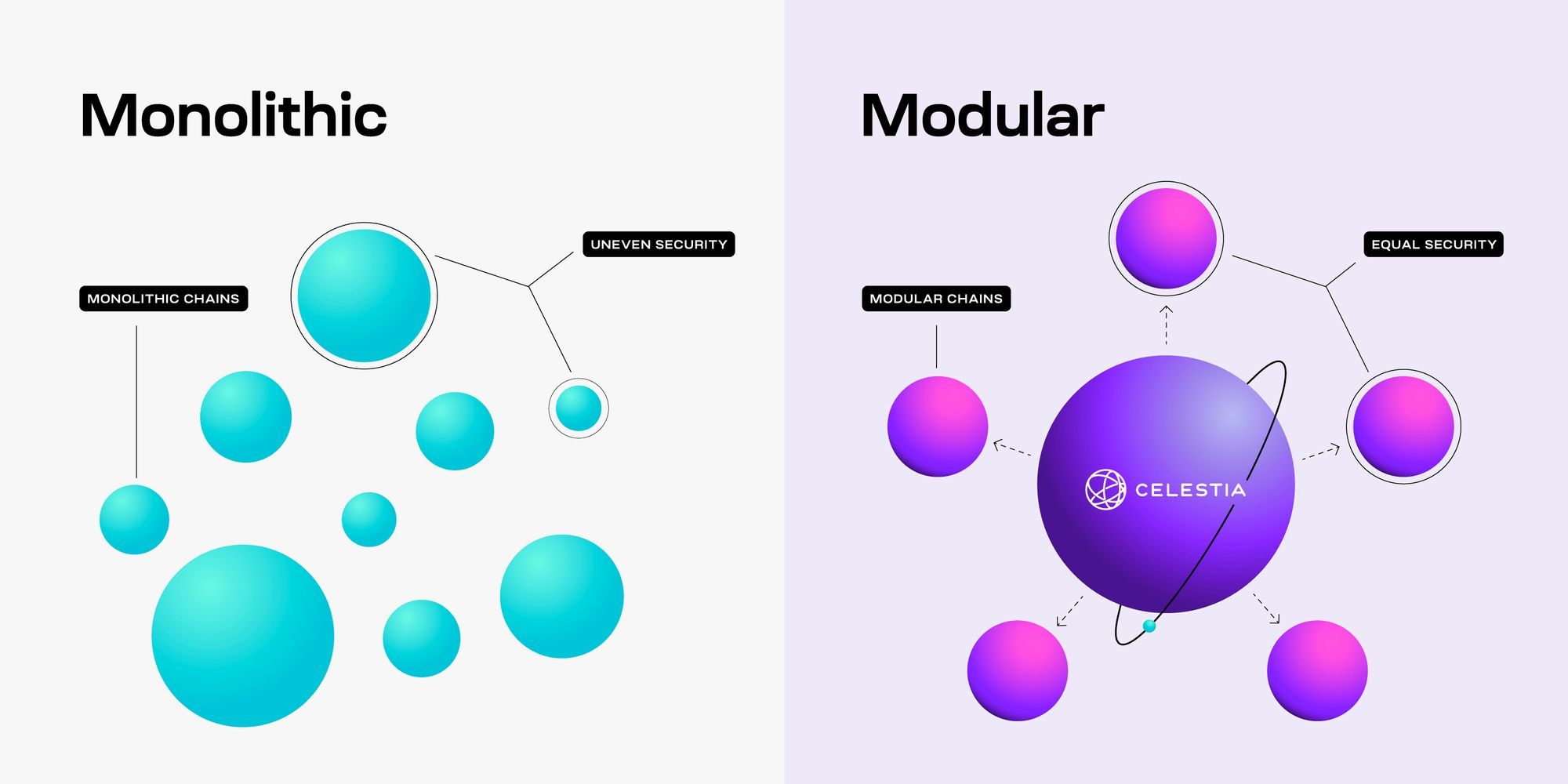

After years of building ever-larger monolithic chains that attempt to handle every function within a single system, the blockchain industry has reached a fundamental realization: specialization beats generalization.

As Mustafa Al-Bassam, co-founder of Celestia, argues, crypto has been bottlenecked by an endless cycle of new monolithic smart contract platforms, each sacrificing decentralization and security in pursuit of cheaper transaction fees. Web3 cannot scale within the constraints of a monolithic framework. This realization has catalyzed the rise of modular blockchain design, where core functions are separated into specialized layers that work together rather than competing within a single chain.

The trend accelerated dramatically between 2023 and 2025. Celestia launched its mainnet in October 2023, introducing the first production-ready data availability layer using data availability sampling. EigenDA followed in 2024, leveraging Ethereum's restaking infrastructure to provide hyperscale data services.

Avail emerged from Polygon's ecosystem in July 2024, positioning itself as a chain-agnostic data availability solution. These projects represent different approaches to the same problem: how to provide the foundational infrastructure for a modular blockchain ecosystem without forcing every chain to rebuild consensus, data storage, and execution from scratch.

The implications extend far beyond technical architecture. Modular blockchains challenge the fundamental economic models of blockchain networks, alter security assumptions, and create new opportunities for innovation while introducing novel risks. Understanding this transition requires examining not just how modular systems work, but why they emerged, what problems they solve, and what tradeoffs they introduce.

To grasp the magnitude of this shift, we must first understand what came before. The story of blockchain evolution follows a clear arc: from Bitcoin's singular focus on secure value transfer, through Ethereum's general-purpose computation, to the layer-two scaling solutions that revealed the limits of monolithic design, and finally to the modular architectures now being deployed at scale. Each stage built upon insights from the previous one, gradually exposing the constraints that modular design aims to overcome.

Monolithic Blockchains Explained

A monolithic blockchain performs all core functions within a single unified system. These functions include execution of transactions and smart contracts, consensus on the ordering and validity of those transactions, data availability to ensure all information is accessible for verification, and settlement to provide finality and resolve disputes. Traditional blockchain networks like Bitcoin, pre-rollup Ethereum, and Solana exemplify this approach.

The monolithic design offers significant advantages. Simplicity stands paramount among these benefits. When all functions operate within one system, developers face fewer integration challenges and users encounter a straightforward mental model. Security also benefits from this unified approach.

The same validator set secures all layers, eliminating the trust assumptions that arise when different components rely on separate security mechanisms. Composability reaches its peak in monolithic systems, as all smart contracts and applications share the same execution environment and can interact atomically without cross-chain bridges or message-passing protocols.

Bitcoin demonstrates monolithic design at its purest. The network focuses entirely on securing value transfer, with execution limited to a simple scripting language. Every full node downloads and validates every transaction, ensuring maximum security and decentralization at the cost of throughput.

Bitcoin processes roughly seven transactions per second, and attempts to increase this capacity have sparked contentious debates precisely because changing one aspect of the system affects everything else.

Ethereum, before its evolution toward modular architecture, exemplified a more complex monolithic chain. The network handles smart contract execution, consensus through proof of stake, data availability for all transaction data, and settlement for layer-two networks. This comprehensive approach enabled the explosion of decentralized applications and decentralized finance, but it also created significant scaling bottlenecks. During periods of high demand, gas fees have spiked to hundreds of dollars per transaction, pricing out many use cases and users.

Solana represents a different monolithic philosophy, prioritizing performance through a high-performance monolithic architecture. The network employs innovative consensus mechanisms and parallel transaction processing to achieve throughput exceeding 50,000 transactions per second in ideal conditions.

However, this performance comes with tradeoffs in hardware requirements for validators and has occasionally led to network outages when the system becomes overwhelmed.

The fundamental limitation of monolithic blockchains stems from the scalability trilemma, a concept that suggests blockchains can optimize for only two of three properties: decentralization, security, and scalability. When execution, consensus, and data availability all operate within the same system, they compete for the same resources.

Increasing throughput typically requires larger blocks, which makes running a full node more expensive and reduces decentralization. Maintaining tight decentralization constrains block size and throughput. Ensuring security requires redundant validation, which limits scalability.

These constraints became increasingly apparent as blockchain adoption grew. Ethereum's transition to proof of stake in September 2022 improved energy efficiency and security but did not fundamentally address scaling limitations. Transaction fees remained high during peak demand, and throughput stayed limited. Layer-two rollup solutions emerged as a response, processing transactions off-chain and posting compressed data back to Ethereum. But even these solutions faced constraints, particularly around data availability costs.

The monolithic approach also restricts innovation. Developers building on a monolithic chain must accept its design choices around programming languages, virtual machines, consensus mechanisms, and fee structures.

Creating an application-specific blockchain requires launching an entirely new monolithic chain with its own consensus, recruiting validators, and bootstrapping security from scratch. This high barrier to entry limited experimentation and fragmented liquidity across incompatible systems.

By 2023, the limitations of monolithic design had become undeniable. Data availability represented roughly 95 percent of the costs that rollups pay to Ethereum. This inefficiency pointed toward a solution: separate the functions that monolithic chains bundle together, allowing each to be optimized independently while still working together as a system.

Modular Blockchains: A New Design Philosophy

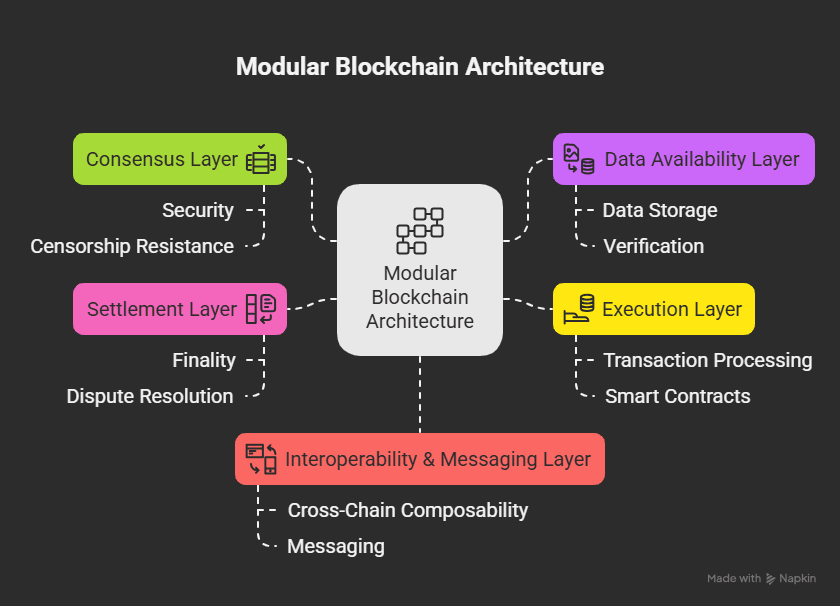

Modular blockchains decompose the functions of a traditional blockchain into specialized layers or components. Rather than handling execution, consensus, settlement, and data availability within a single system, modular architectures delegate these responsibilities to different specialized chains or services. Each component focuses on performing one task exceptionally well, then coordinates with other components to provide complete blockchain functionality.

The concept draws inspiration from modular design principles in software engineering and computer science. Just as modern applications separate concerns into distinct layers (presentation, business logic, data storage), modular blockchains separate blockchain functions into specialized tiers. This separation enables each layer to optimize for its specific purpose without compromising on others.

The four core functions in a modular blockchain architecture each serve distinct purposes. The execution layer processes transactions and runs smart contract logic, determining state transitions based on user actions. The consensus layer establishes agreement among network participants on the ordering and inclusion of transactions, ensuring everyone maintains the same view of blockchain history.

The data availability layer guarantees that all necessary transaction data is published and accessible for verification, even if full nodes don't need to process it. The settlement layer provides finality and dispute resolution, acting as a source of truth for rollups and other execution environments.

Modular design does not require all four layers to be separate. Some architectures combine consensus and data availability, while others merge settlement and consensus. The key principle involves specialization rather than complete separation. Each component should focus on what it does best, with clear interfaces for interaction with other components.

Celestia pioneered the modular data availability layer concept, launching its mainnet in October 2023. The project addresses a specific problem: rollups and other scaling solutions need somewhere to publish their transaction data cheaply and reliably, but posting this data to expensive execution layers like Ethereum creates bottlenecks.

Celestia scales by rethinking blockchain architecture from the ground up, decoupling execution from consensus by introducing data availability sampling. This approach allows Celestia to provide abundant data availability without imposing execution or settlement constraints on projects building on top of it.

The Celestia network operates as a minimal blockchain focused exclusively on consensus and data availability. It does not execute smart contracts or provide a virtual machine. Instead, developers can deploy their own execution layers, whether rollups, application-specific chains, or entirely custom environments, and use Celestia purely for ordering transactions and ensuring their data remains available. Celestia's roadmap targets relentlessly scaling beyond 1 gigabyte per second data throughput, aiming to remove crypto's ultimate scaling bottleneck.

The technical innovation enabling Celestia's scalability is data availability sampling. Traditional blockchains require every full node to download all transaction data to verify availability. This creates a direct tradeoff between block size and decentralization. Data availability sampling changes this dynamic by allowing light nodes to verify data availability by randomly sampling small portions of each block.

If the samples are available, nodes can be confident with high probability that all data is available, without downloading everything. This enables Celestia to scale data availability as more light nodes join the network, inverting the traditional scaling curve.

Celestia also introduced the concept of sovereign rollups, which are execution layers that use Celestia for data availability and consensus but make their own decisions about execution rules, governance, and upgrades.

Unlike Ethereum rollups, which typically inherit security and settlement from Ethereum, sovereign rollups on Celestia operate more independently. They post their data to Celestia to ensure availability, but they define their own validity conditions and do not rely on an external chain for final settlement.

EigenDA emerged as a different approach to modular data availability, built on top of the EigenLayer restaking protocol. EigenDA utilizes an elegant architecture that maintains optimality or near-optimality across the dimensions of performance, security, and cost through Reed Solomon encoding that is cryptographically verified by KZG polynomial opening proofs. Rather than building an independent blockchain like Celestia, EigenDA operates as an actively validated service within the EigenLayer ecosystem, allowing Ethereum stakers to reuse their staked ETH to help secure the data availability layer.

The EigenDA architecture separates roles among different participants. Dispersers encode data and distribute it to validator nodes. Validator nodes attest to data availability and store portions of each data blob. Retrieval nodes collect data shards from validators and reconstruct the original data when needed.

The network launched with an industry-leading 100 megabytes per second data availability throughput, with a roadmap to scale exponentially. This high throughput derives from EigenDA's design, which requires each operator to store only a fraction of the total data while maintaining the ability to reconstruct everything if needed.

EigenDA's integration with Ethereum through EigenLayer creates unique security properties. The protocol leverages billions of dollars in restaked ETH as economic security, inheriting Ethereum's robust validator set while providing specialized data availability services.

This shared security model reduces the capital cost of securing the data availability layer compared to bootstrapping an entirely independent blockchain. EigenDA also natively uses Ethereum as a settlement layer for operator set management, ensuring enhanced security for layer-two networks that settle to Ethereum.

Avail represents a third major approach to modular data availability, emphasizing chain-agnostic infrastructure and cross-chain interoperability. The project's horizontally scalable, chain-agnostic and trust-minimized infrastructure aims to unify the fragmented blockchain ecosystem by providing unlimited blockspace, native interoperability, and modular security. Built using the Polkadot SDK, Avail operates as a specialized data availability blockchain that connects with multiple layer-one ecosystems including Ethereum, Solana, and BNB Chain.

Avail's architecture consists of three components working together. The data availability layer stores transaction data using erasure coding and KZG polynomial commitments for efficient verification. The Nexus layer provides trust-minimized cross-chain interoperability, enabling seamless communication between rollups and sovereign chains built on different ecosystems. The Fusion layer offers multi-token economic security, allowing the network to be secured not just by Avail's native token but also by ETH, BTC, SOL, and other assets.

Avail's data availability layer employs KZG polynomial commitments to cryptographically prove data availability without requiring full downloads, allowing chains like Polygon zkEVM Validium to reduce Ethereum costs by approximately 90 percent while maintaining security. The protocol's emphasis on light client verification enables users to run lightweight nodes on devices like phones or browsers, verifying data availability in seconds without the resource requirements of full nodes.

Each of these projects represents a different philosophy about how modular blockchains should operate. Celestia prioritizes neutrality and sovereignty, allowing any execution environment to build on top without imposing specific settlement or security assumptions. EigenDA emphasizes deep integration with Ethereum's ecosystem, leveraging restaking to create cost-efficient data availability backed by Ethereum's security. Avail focuses on interoperability and unification, building bridges between different blockchain ecosystems through its Nexus layer.

The modular approach has catalyzed rapid innovation in execution layers as well. Projects like Arbitrum Orbit, Optimism's OP Stack, and Polygon's Chain Development Kit enable developers to deploy custom rollups with minimal effort. These rollup-as-a-service platforms leverage modular data availability layers for publishing transaction data, allowing development teams to focus on application-specific execution environments rather than rebuilding consensus and data availability infrastructure from scratch.

Data Availability Layers - The New Backbone

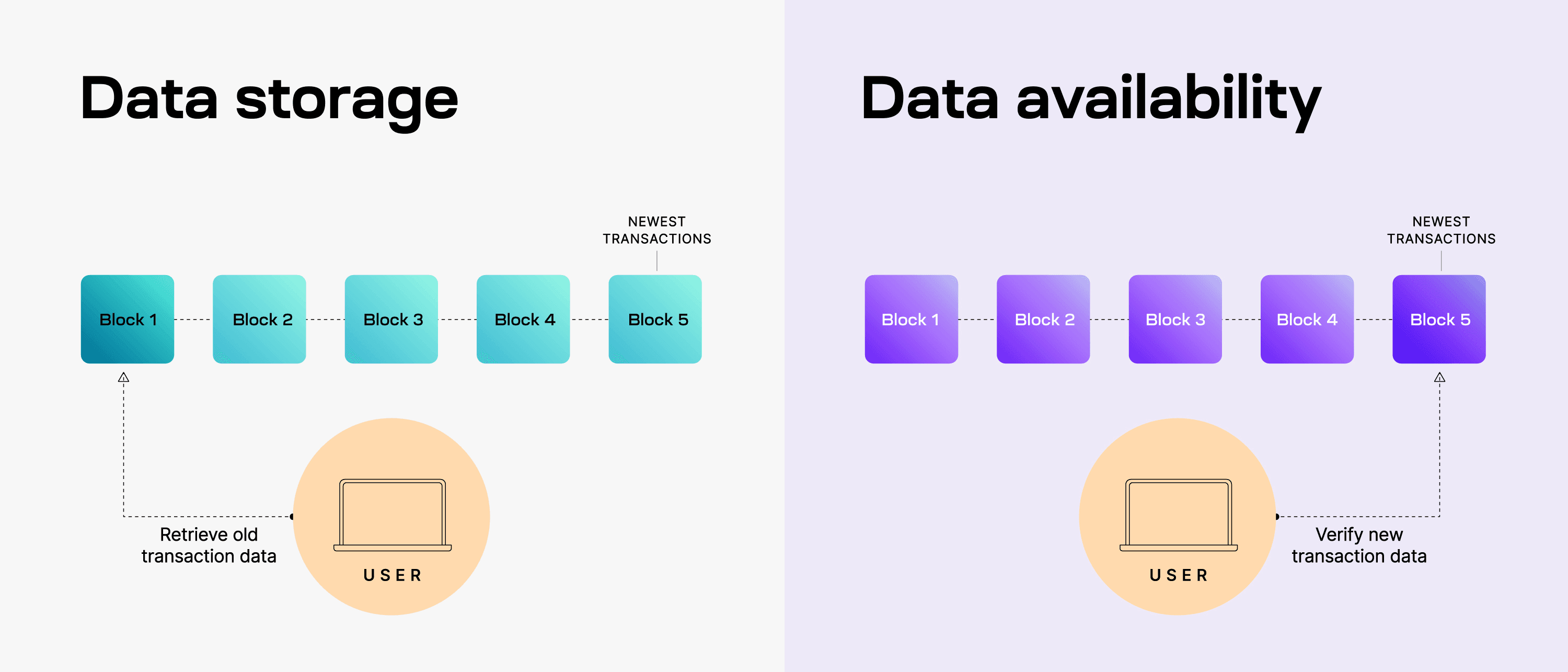

Data availability has emerged as the critical infrastructure bottleneck for blockchain scaling, and understanding why requires examining what data availability means and why it matters. When a blockchain produces new blocks containing transactions, the data availability problem asks: how can the network ensure that all the transaction data in those blocks is actually available to anyone who needs it for verification, without requiring every participant to download and store everything?

In traditional monolithic blockchains, solving data availability is straightforward but expensive. Every full node downloads every block and stores all the data. If a node can download it, the data must be available. This approach provides maximum security but creates significant scaling limitations. As blocks get larger to accommodate more transactions, running a full node becomes more expensive, reducing decentralization. The cost of storing all this data on a high-security blockchain like Ethereum makes data availability the dominant expense for layer-two rollups.

The problem becomes more complex in modular architectures where execution happens in one place and data is stored in another. A rollup processes thousands of transactions off-chain, but it must publish the transaction data somewhere so that anyone can reconstruct the rollup's state and verify its correctness. If the rollup operator withholds data, users cannot detect invalid state transitions, creating a vulnerability.

Data availability layers exist to solve this problem: providing a place to publish transaction data with cryptographic guarantees that the data is available, at a lower cost than posting everything to an execution layer.

Celestia's approach to data availability centers on data availability sampling, a technique that fundamentally changes the relationship between block size and verification cost. In traditional blockchains, doubling the block size doubles the amount of data each full node must download. But with data availability sampling, light nodes can verify that data is available by sampling small random portions of each block. Through erasure coding and clever cryptographic techniques, Celestia enables nodes to gain confidence in data availability without downloading everything.

The process works through several steps. First, block producers take the transaction data and encode it using a two-dimensional Reed-Solomon encoding scheme. This encoding adds redundancy to the data, expanding it beyond its original size but enabling reconstruction even if significant portions are missing. The encoded data is organized into a matrix and committed to using KZG polynomial commitments, which provide succinct cryptographic proofs about the data's structure.

Light nodes then randomly sample small portions of this extended data. Each sample includes a proof that the sampled data is part of the committed block. By collecting multiple random samples, light nodes can become confident with high probability that the entire data matrix is available.

The mathematics ensures that if the block producer withholds any significant portion of the data, light nodes will likely detect this through failed samples. Importantly, the confidence level increases with more light nodes, as each performs independent random sampling. This creates a unique scaling property: Celestia becomes more secure as more participants join the network.

Celestia's data availability layer costs approximately 64 percent less than Ethereum, with average costs of around $7.31 per megabyte compared to Ethereum's $20.56. The project's SuperBlobs feature further reduces fees to approximately $0.81 per megabyte, enabling cost-effective high-volume data processing for rollups. These economics make Celestia attractive for rollups and other scaling solutions that need to publish large amounts of data.

The technical implementation involves namespaced Merkle trees, which organize data into separate namespaces for different applications. This allows each rollup or chain using Celestia to publish its data to its own namespace, and light clients only need to download and verify data relevant to the chains they care about. A rollup monitoring its own namespace doesn't need to process data from other rollups sharing the same Celestia blocks, improving efficiency while maintaining shared security.

EigenDA approaches data availability with a different architecture, emphasizing extreme scalability through its operator-based model. The protocol is designed to achieve horizontal scaling such that the more operators there are on the network, the more throughput the network enables. In private testing with 100 nodes, EigenDA demonstrated throughput of up to 10 megabytes per second, with a roadmap to scale to 1 gigabyte per second.

The EigenDA system divides data into chunks through erasure coding, then distributes these chunks across a large number of operators. Each operator stores only a fraction of the total data, but the encoding ensures that the complete data can be reconstructed from any sufficient subset of chunks. This distribution reduces the storage and bandwidth burden on individual operators while maintaining data availability guarantees through cryptographic proofs.

KZG commitments play a central role in EigenDA's verification system, as they do in Celestia. These polynomial commitments allow proving properties about data without revealing all the data itself. When a disperser encodes and distributes data blobs, it generates KZG commitments that allow validators to verify the correctness of their data chunks without needing to see all the other chunks. This makes verification efficient while maintaining strong security guarantees.

The economic model behind EigenDA leverages restaking through EigenLayer. Ethereum validators who have staked ETH can opt into securing EigenDA by running additional software, earning rewards from rollups and other users of the data availability layer. This restaking approach provides several advantages.

It reduces the capital cost of securing the network because the same stake secures both Ethereum and EigenDA. It inherits Ethereum's decentralized validator set rather than requiring EigenDA to bootstrap its own from scratch. It creates a direct economic link between Ethereum's security and EigenDA's reliability.

Node operators must stake a minimum of 32 ETH or 1 EIGEN token to become members of the data availability network, though the protocol's slashing conditions remain under active development as individual actively validated services like EigenDA need to migrate to operator sets and define specific slashing conditions. This ongoing development of slashing mechanisms highlights both the innovation and the evolving nature of restaking-based security models.

Avail takes yet another approach to data availability, emphasizing interoperability between different blockchain ecosystems while maintaining strong security properties. The protocol's data availability layer employs KZG commitments and erasure coding similar to Celestia and EigenDA, but integrates these with a broader vision of cross-chain infrastructure.

The Avail network achieves data availability through a validator-based consensus mechanism built on the Polkadot SDK. Validators reach consensus on blocks containing transaction data from multiple rollups and chains, then make this data available for verification. Light clients can verify data availability through sampling, similar to Celestia's approach. Avail's light clients ensure fast transaction verification at the user level, with pre-confirmations enabling approximately 250-millisecond transaction verification, representing 15 times faster than traditional approaches.

What distinguishes Avail is its multi-token staking model and Nexus interoperability layer. Rather than relying solely on a native token for security, Avail enables staking with ETH, BTC, SOL, and other major assets. This multi-token approach aims to attract deeper liquidity and stronger economic security from multiple blockchain communities. The Nexus layer provides a trust-minimized coordination hub for cross-chain communication, enabling rollups and chains built on different ecosystems to interact without centralized bridges.

The technical foundation of these data availability layers rests on several shared innovations. Erasure coding expands data with redundancy so it can be recovered even if portions are lost. KZG polynomial commitments provide succinct proofs about data properties. Data availability sampling enables light clients to verify availability without downloading everything. These techniques combine to make data availability both scalable and verifiable.

But the implementations differ in important ways. Celestia prioritizes neutrality and sovereign rollups, allowing any execution environment to build on top without specific assumptions about settlement layers. EigenDA emphasizes integration with Ethereum and restaking-based security. Avail focuses on interoperability and multi-ecosystem support. These philosophical differences influence everything from economic models to governance structures to the types of applications each platform attracts.

The data availability layer has become the critical infrastructure enabling modular blockchain scaling. By providing abundant, verifiable, and affordable data availability, these protocols unlock new possibilities for execution layers to experiment with novel designs while maintaining security properties. The question shifts from whether to adopt modular data availability to which approach best fits specific application requirements.

Execution and Settlement Layers

While data availability layers provide the foundation for modular blockchains, execution and settlement layers determine how transactions are processed and finalized. Understanding the relationship between these components reveals the full architecture of modular systems and the design choices developers face when building scalable blockchain applications.

Execution layers handle transaction processing and smart contract computation. In modular architectures, execution can occur in specialized environments optimized for specific use cases rather than within a general-purpose monolithic chain. Rollups exemplify this approach, processing transactions off-chain in a dedicated execution environment and posting compressed data to a data availability layer for verification.

Two primary categories of rollups have emerged. Optimistic rollups, implemented by projects like Arbitrum and Optimism, assume transactions are valid by default and only check them if someone submits a fraud proof challenging their correctness. This assumption enables efficient processing but introduces a challenge period, typically seven days, during which users must wait before withdrawing funds. Zero-knowledge rollups, built by teams like StarkWare and zkSync, generate cryptographic proofs that transactions were executed correctly. These proofs enable immediate finality without challenge periods but require more complex cryptography and computation to generate.

Both types of rollups leverage modular data availability layers to reduce costs. Rather than posting full transaction data to Ethereum at $20 per megabyte or more, rollups can publish to Celestia or EigenDA at a fraction of the cost. The rollup still maintains its security properties because the data remains available for verification, but the economics become dramatically more favorable. Following Ethereum's Dencun upgrade in March 2024 which implemented EIP-4844, layer-two rollup Base saw a 224 percent transaction volume increase due to lower data posting fees enabled by blob transactions.

The execution layer's design flexibility constitutes one of modular blockchains' primary advantages. Developers can customize programming languages, virtual machine implementations, gas fee structures, and governance mechanisms without needing to deploy an entirely new monolithic chain.

A gaming application might prioritize high throughput and low latency. A decentralized finance protocol might emphasize security and formal verification. A supply chain solution might optimize for data privacy and regulatory compliance. Each can deploy its own execution environment while leveraging shared infrastructure for consensus and data availability.

Settlement layers provide finality and serve as a source of truth for rollups and other execution environments. Ethereum has emerged as the dominant settlement layer for modular blockchain ecosystems, particularly those using rollups. When a rollup processes a batch of transactions, it posts compressed data to a data availability layer and submits a state update to Ethereum. For optimistic rollups, this state update becomes final after the challenge period expires without valid fraud proofs. For zero-knowledge rollups, a validity proof accompanies the state update, enabling immediate finality once the proof is verified on Ethereum.

The separation between execution and settlement creates important tradeoffs. On one hand, rollups can process thousands of transactions quickly and cheaply in their own execution environment. On the other hand, final settlement on Ethereum provides strong security guarantees and enables composability with other applications on the settlement layer. Users bridging assets between rollups and Ethereum must wait for finality on the settlement layer, introducing friction compared to operations entirely within one chain.

Some modular architectures avoid external settlement layers entirely. Celestia's sovereign rollups, for example, define their own validity conditions and settlement mechanisms. They use Celestia purely for data availability and consensus, handling settlement internally. This approach maximizes sovereignty and flexibility but requires each rollup to establish its own security properties and bridge mechanisms for interacting with other chains.

The rise of rollups-as-a-service platforms has accelerated modular blockchain adoption by simplifying deployment. These platforms provide templates and tooling for launching custom execution environments without deep blockchain engineering expertise.

Arbitrum Orbit allows developers to deploy layer-three rollups that use Arbitrum for settlement and can choose between multiple data availability options including Celestia and EigenDA. The Optimism OP Stack provides a modular framework where developers can swap out components like the execution environment, data availability layer, and sequencing mechanism while maintaining compatibility with the broader Optimism ecosystem.

Conduit and AltLayer offer rollup-as-a-service solutions enabling deployment of fully-managed, production-grade rollups in just a few clicks, with integration options for EigenDA data availability. These platforms abstract much of the complexity involved in operating blockchain infrastructure, allowing developers to focus on application logic and user experience.

Polygon's Chain Development Kit represents another approach, enabling developers to build customizable layer-two chains that can connect to Ethereum or operate more independently. The modular architecture supports various execution environments, data availability providers, and bridge mechanisms. Projects like Immutable X use these tools to build application-specific chains optimized for NFT trading and blockchain gaming.

The proliferation of execution layers enabled by modular architecture creates both opportunities and challenges. On the positive side, developers gain unprecedented flexibility to optimize for specific use cases. Gaming applications can achieve sub-second block times. Privacy-focused applications can integrate zero-knowledge proofs deeply into their execution. Enterprise solutions can incorporate permissioned elements where needed. Each execution environment can experiment with novel approaches without requiring consensus from the broader blockchain community.

However, this flexibility also introduces fragmentation. Liquidity becomes divided across numerous execution layers. Users must bridge assets between chains, introducing friction and security risks. Applications that want to compose across multiple execution environments face increased complexity. The unified composability of monolithic blockchains gives way to a more fragmented landscape where interoperability becomes paramount.

Cross-chain communication protocols have emerged to address these challenges. The Inter-Blockchain Communication protocol, originally developed for Cosmos, enables different chains to exchange messages and transfer assets trustlessly. Hyperlane and LayerZero provide similar functionality with different security models and tradeoffs. These protocols aim to create a world where applications can span multiple execution environments, accessing liquidity and users across the modular blockchain ecosystem.

The relationship between execution and settlement layers also influences economic models. In monolithic chains, users pay fees directly to validators who secure the network. In modular systems, fees flow through multiple layers. A user executing a transaction on a rollup pays fees to the rollup's sequencer. The rollup pays fees to the data availability layer for posting data. The rollup also pays fees to the settlement layer for submitting state updates and storing commitments. This multi-layered fee structure creates complex economic dynamics and opportunities for optimization.

Sequencers play a critical role in modular execution layers. These entities collect transactions from users, order them into blocks, and submit batches to data availability and settlement layers. Most rollups currently operate with centralized sequencers, introducing concerns about censorship resistance and single points of failure. The industry is actively developing decentralized sequencing mechanisms, including shared sequencing protocols that allow multiple rollups to coordinate block production and provide stronger ordering guarantees.

The execution and settlement architecture continues evolving rapidly. Some projects experiment with asynchronous execution, where transactions process without immediately finalizing. Others explore parallel execution environments that can process non-conflicting transactions simultaneously. The separation of concerns in modular systems enables experimentation at the execution layer without requiring changes to underlying data availability or consensus mechanisms, accelerating the pace of innovation.

Economic and Security Tradeoffs

Modular blockchain architectures introduce new economic models and security assumptions that differ fundamentally from monolithic chains. Understanding these tradeoffs is essential for evaluating the viability and risks of modular systems as they scale to support mainstream blockchain adoption.

The security model for modular blockchains depends on how components interact and where trust assumptions lie. In a monolithic chain, a single validator set secures all functions. If the validators are honest, the entire system remains secure. In modular systems, different layers may have different security mechanisms, creating a stack of trust assumptions that must be carefully analyzed.

Consider a typical modular architecture: a rollup for execution, Celestia for data availability, and Ethereum for settlement. The security of this system depends on all three layers functioning correctly. If the rollup's sequencer acts maliciously, users must rely on fraud proofs or validity proofs submitted to the settlement layer. If Celestia withholds data, the rollup cannot prove what transactions occurred. If Ethereum's validator set gets corrupted, final settlement becomes unreliable.

Shared security models, like those implemented by EigenDA through restaking, aim to reduce these compounding trust assumptions. By allowing Ethereum validators to secure multiple services simultaneously, restaking creates stronger alignment between the settlement layer and other modular components. As of March 2025, EigenDA has 4.3 million ETH staked, representing billions of dollars of economic security backing the data availability layer. This substantial stake provides meaningful security guarantees, but it also introduces new risks around slashing conditions and the potential for cascading failures if vulnerabilities are discovered.

The economic incentives in modular systems create interesting dynamics. Data availability layers compete on throughput and cost, with Celestia, EigenDA, and Avail each offering different price-performance tradeoffs. EigenDA cut its data availability service prices by 10 times and introduced a free tier in August 2024, while aiming to boost data availability on Ethereum by 1,000 times to enable use cases including fully onchain order books, real-time gaming, and decentralized artificial intelligence. This price competition benefits rollups and application developers but raises questions about the sustainability of data availability layer business models.

Revenue flows in modular systems differ significantly from monolithic chains. In Ethereum, users pay gas fees that go to validators and are partially burned, creating deflationary pressure on ETH. In a modular ecosystem, users pay fees to rollup sequencers, who pay fees to data availability layers and settlement layers. The distribution of value across these layers remains uncertain, and it is unclear which components will capture the most value long-term.

The tokenomics of modular data availability layers reflect different approaches to value capture. Celestia's native TIA token is used to pay for data availability and to secure the network through staking. The token's value depends on demand for Celestia's data availability services and the security required to protect them.

EigenDA operates within the EigenLayer ecosystem, where restakers earn rewards in various tokens for securing actively validated services. Avail's token model incorporates multi-asset staking, allowing participation with ETH, BTC, and other major cryptocurrencies alongside its native AVAIL token.

The cost efficiency of posting data to specialized data availability layers versus general-purpose execution layers represents one of modular blockchains' most compelling economic advantages. Ethereum's block space is expensive because it serves multiple purposes: executing smart contracts, securing the network, and storing data. Specialized data availability layers can optimize purely for data throughput and verification, achieving much higher throughput at lower cost.

However, this cost advantage depends on maintaining sufficient demand for data availability services. If few rollups adopt modular data availability, the economies of scale that make these services cheap may not materialize. Network effects matter significantly in determining which data availability layers gain adoption and become economically viable.

The security of data availability layers themselves raises important considerations. Celestia relies on its own proof-of-stake validator set, which must be sufficiently decentralized and economically secured to resist attacks. An attacker who controls enough stake could potentially withhold data or censor specific transactions. The protocol mitigates this through data availability sampling and economic incentives, but the security ultimately depends on the cost of attacking the network exceeding the potential gain.

EigenDA inherits security from Ethereum's validator set through restaking but introduces new risks. If a vulnerability in EigenDA leads to slashing of restaked ETH, validators suffer losses that could cascade through the Ethereum ecosystem. The shared security model connects the fate of multiple systems, potentially amplifying failures.

While slashing is enabled at the EigenLayer protocol level, individual actively validated services like EigenDA must activate it by migrating to operator sets and defining slashing conditions. Currently, no slashing condition is in place for misbehaving EigenDA nodes. This ongoing development of slashing mechanisms reflects both the innovation and the unresolved challenges in restaking-based security.

Liveness guarantees represent another critical security consideration. A data availability layer must remain operational and responsive for rollups depending on it to function. If Celestia, EigenDA, or Avail experiences prolonged downtime or censorship, rollups using these services cannot post new data, effectively halting their operation. This creates single points of failure that differ from the distributed nature of monolithic chains, where consensus failure is less likely due to fewer dependencies.

The relationship between execution layers and settlement layers introduces additional security considerations. Rollups that settle to Ethereum inherit aspects of Ethereum's security, particularly for finality and dispute resolution. Sovereign rollups that avoid external settlement gain more autonomy but must establish their own security guarantees and bridge mechanisms. Neither approach is strictly superior; the choice depends on the application's specific requirements and risk tolerance.

Fragmentation poses both economic and security challenges in modular ecosystems. When liquidity and users are distributed across numerous rollups and execution environments, each individual system may lack the network effects and security that concentrated activity provides. Cross-chain bridges connecting these fragmented systems introduce additional attack vectors and have been responsible for some of the largest hacks in blockchain history, with billions of dollars stolen from poorly secured bridge contracts.

Interoperability solutions like Avail's Nexus layer and protocols like the Inter-Blockchain Communication standard aim to reduce fragmentation risks by providing trust-minimized communication between chains.

Avail's Nexus layer serves as a permissionless coordination hub enabling seamless cross-rollup and sovereign chain communication, addressing the growing need for unified infrastructure as blockchain ecosystems multiply. However, these solutions are relatively new and untested at scale, and their security properties require careful analysis.

The economic sustainability of modular blockchain ecosystems depends on achieving sufficient adoption to justify the infrastructure costs. Data availability layers require large validator sets or operator networks to provide decentralization and redundancy. Settlement layers must maintain high security to serve as trusted arbitration points. If revenue from rollups and applications proves insufficient to sustain these infrastructure layers, the modular approach may fail to achieve its scaling potential.

Market dynamics will ultimately determine value distribution across modular components. If data availability becomes commoditized with multiple providers offering similar services at razor-thin margins, these layers may capture little value despite being critical infrastructure. Alternatively, if network effects create winner-take-most dynamics, dominant data availability and settlement layers could accrue significant value while execution layers remain relatively undifferentiated.

The security and economic tradeoffs of modular blockchains require ongoing evaluation as the ecosystem matures. Early evidence suggests that specialization improves efficiency and reduces costs, but the long-term sustainability and security properties of highly modular systems remain open questions. The industry is essentially running a large-scale experiment in distributed system design, with billions of dollars at stake and the future architecture of Web3 infrastructure hanging in the balance.

Impact on Existing Chains

The rise of modular blockchain architecture poses significant strategic challenges for established monolithic chains. Networks that built their value propositions around being complete, self-contained systems now face competition from specialized components that may perform individual functions more efficiently. The responses from major blockchain platforms reveal different philosophies about how blockchain infrastructure should evolve.

Ethereum's evolution toward a modular architecture represents perhaps the most significant validation of the modular thesis. The network that pioneered smart contract platforms has systematically restructured itself to serve as the settlement and security layer for an ecosystem of rollups rather than trying to handle all execution on layer one. This transformation was not inevitable; it emerged from pragmatic recognition that scaling execution on a single layer while maintaining decentralization proved infeasible.

The roadmap toward modular Ethereum accelerated with several key upgrades. The Merge to proof of stake in September 2022 improved energy efficiency and security but did not directly address scaling. The critical scaling upgrade came with the Dencun hard fork in March 2024, which implemented EIP-4844, also known as proto-danksharding. EIP-4844 introduces blob-carrying transactions, enabling rollups to post large, temporary data chunks to Ethereum's consensus layer at dramatically reduced cost compared to permanent calldata storage. The upgrade slashed layer-two transaction fees by 10 to 100 times, boosting scalability while preserving decentralization.

Proto-danksharding represents an interim solution on the path toward full danksharding, which would expand data availability from six blobs per block to 64 blobs, enabling throughput approaching 100,000 transactions per second across the rollup ecosystem. The technical approach mirrors elements of Celestia's design, using KZG commitments and erasure coding to enable data availability sampling. Rather than compete with modular data availability layers, Ethereum is becoming one, providing native data availability services optimized for its rollup ecosystem.

This strategic pivot acknowledges that Ethereum's value lies not in executing every transaction on layer one, but in providing trusted settlement and coordination for a diverse ecosystem of execution environments. Rollups like Arbitrum, Optimism, StarkNet, and zkSync process the vast majority of transactions, while Ethereum layer one serves as the canonical source of truth and arbiter of disputes. The network's token economics are evolving to reflect this role, with fees from rollup settlements contributing to ETH burn and validator rewards.

Ethereum's modular transformation creates both opportunities and risks. On one hand, the network benefits from increased activity across its rollup ecosystem without the scaling constraints of processing everything on layer one. On the other hand, as execution moves to rollups and data availability potentially shifts to alternatives like Celestia or EigenDA, the question arises: what value does Ethereum layer one capture, and is it sufficient to sustain the network's security?

The emergence of rollup-centric Ethereum has sparked debate about whether the network is becoming primarily a settlement layer or maintaining its role as the computational backbone of Web3. Some argue that Ethereum's value proposition strengthens as it focuses on what it does best: providing robust security and finality for a diverse ecosystem. Others worry that offloading too much activity to external layers could diminish Ethereum's centrality and value capture.

Solana represents a contrasting approach, doubling down on the monolithic high-performance model. The network prioritizes achieving maximum throughput on a single layer through aggressive optimization of consensus mechanisms, parallel transaction processing, and hardware requirements. Solana's perspective holds that the complexity and fragmentation of modular systems introduce friction that undermines user experience and composability.

Solana's architecture achieves impressive throughput, regularly processing thousands of transactions per second with sub-second finality. The network's proponents argue that this performance, combined with the simplicity of a unified execution environment, provides a better foundation for applications than the fragmented landscape of modular blockchains. Gaming, high-frequency trading, and other latency-sensitive applications may indeed benefit from the tight integration and atomic composability that monolithic chains provide.

However, Solana's approach comes with acknowledged tradeoffs. The network's hardware requirements for validators are significantly higher than Ethereum's, potentially limiting decentralization. The network has experienced several outages when transaction volume overwhelmed the system, raising questions about the practical limits of monolithic scaling. These challenges suggest that even high-performance monolithic chains face constraints that modular architectures might circumvent.

The competitive dynamic between monolithic and modular approaches extends beyond technical considerations to ecosystem effects and developer mindshare. Ethereum's pivot toward modular infrastructure has catalyzed an explosion of rollup deployments and experimentation with novel execution environments. This proliferation of chains creates opportunities for innovation but also fragments liquidity and attention. Solana's unified environment provides simplicity but less flexibility for customization.

Avalanche occupies a middle ground with its subnet architecture, which allows developers to deploy custom blockchains that benefit from the security and interoperability of the broader Avalanche ecosystem. Subnets can define their own virtual machines, fee structures, and validator sets while maintaining compatibility with other Avalanche chains. This approach incorporates modular principles within a cohesive ecosystem, attempting to balance flexibility with integration.

The subnet model addresses some limitations of purely modular systems by maintaining strong coordination and shared security across chains while allowing customization where needed. However, subnets still require their own validator sets and security, distinguishing them from rollups that inherit security from a settlement layer. The approach represents a different point on the spectrum between full monolithic integration and complete modular decomposition.

Cosmos pioneered the application-specific blockchain concept through its Inter-Blockchain Communication protocol and Tendermint consensus mechanism. The Cosmos ecosystem has long embraced modularity in the form of specialized chains that communicate through standardized protocols. Many Cosmos chains now use Celestia for data availability, demonstrating how established ecosystems can integrate modular components to improve efficiency.

The Cosmos approach emphasizes sovereignty and interoperability rather than shared security. Each chain maintains its own validator set and security model, but standardized communication protocols enable value transfer and message passing across chains. This philosophy differs from rollup-centric Ethereum, where execution layers inherit security from the settlement layer, but it shares the modular principle of specialization and coordination.

Near Protocol has entered the modular data availability space through its spin-off project Nuffle Labs, launched with $13 million in funding. Rather than compete head-to-head with its layer-one chain, Near is positioning itself to provide infrastructure for the broader modular ecosystem. This strategic shift reflects the recognition that established platforms can participate in the modular wave by providing specialized services rather than defending purely monolithic architectures.

The impact of modular architectures on existing chains extends to token economics and value capture. As execution and data availability move to specialized layers, the question of where value accrues becomes critical. In monolithic chains, users pay fees directly to validators, creating a clear value flow. In modular systems, fees are distributed across multiple layers, and it remains uncertain which components will capture the most value long-term.

Settlement layers like Ethereum may benefit from strong network effects, as rollups prefer to settle where other rollups settle to enable composability. Data availability layers compete more directly on price and performance, potentially leading to commoditization. Execution layers may differentiate through application-specific optimizations but could also face intense competition as deployment becomes easier through rollup-as-a-service platforms.

The coexistence of monolithic and modular approaches seems likely for the foreseeable future. Different applications have different requirements, and no single architecture optimally serves all use cases. High-throughput gaming applications might prefer the low latency and simplicity of Solana. Complex decentralized finance protocols might value the security and decentralization of Ethereum-based rollups. Enterprise applications might prefer the customization possible with application-specific chains on modular infrastructure.

The competitive landscape will likely be determined not purely by technical superiority but by ecosystem effects, developer experience, liquidity concentration, and regulatory considerations. Blockchain infrastructure remains early enough that multiple architectural approaches can thrive, each finding product-market fit with specific applications and user communities.

The Future of Blockchain Design

The trajectory of blockchain architecture points toward increasingly sophisticated modular systems, but several open questions will shape how this evolution unfolds. The technical innovations enabling modular blockchains are well-established, but the economic models, governance structures, and social coordination required for a thriving modular ecosystem remain works in progress.

The vision of a composable, interconnected web of specialized blockchains has become clearer as projects implement the technical foundations. Developers can increasingly choose from a menu of components: execution environments ranging from EVM-compatible rollups to custom virtual machines, data availability layers offering different tradeoffs between cost and security, and settlement layers providing varying degrees of finality and composability. This flexibility enables experimentation and customization that was impossible in the monolithic era.

The concept of the modular stack extends beyond infrastructure to encompass entire application platforms. Projects are building frameworks where developers can launch application-specific chains in minutes, selecting data availability providers, consensus mechanisms, virtual machines, and bridge protocols from standardized options. This abstraction of complexity could accelerate blockchain adoption by lowering barriers to entry and enabling rapid iteration.

However, the modular future faces several significant challenges. Interoperability between execution layers remains imperfect despite progress on protocols like Inter-Blockchain Communication, Hyperlane, and LayerZero. These systems provide message passing and asset transfers across chains, but the user experience still involves friction that would be absent in a unified environment. Achieving seamless interoperability while maintaining security and decentralization represents an ongoing challenge.

Cross-chain communication introduces security risks that have already been exploited. Bridge contracts connecting different chains have been targets of some of the largest hacks in blockchain history. As the modular ecosystem proliferates with dozens or hundreds of execution layers, the attack surface for cross-chain exploits expands. Developing robust security standards and best practices for cross-chain infrastructure remains critical for realizing the modular vision.

The question of value capture across modular components will significantly influence how the ecosystem develops. If data availability becomes commoditized with minimal margins, the economic sustainability of these critical infrastructure layers could be threatened. If settlement layers capture disproportionate value through network effects, the benefits of modularization might accrue primarily to a few platforms rather than being distributed broadly. Finding the right economic balance to incentivize innovation while ensuring all necessary components remain well-supported is essential.

Governance presents another complex challenge in modular ecosystems. In monolithic chains, governance is relatively straightforward: a single community decides on protocol upgrades through established mechanisms. In modular systems, changes to one component may affect others, requiring coordination across multiple governance processes. A data availability layer upgrading its consensus mechanism might impact all rollups using it. A settlement layer modifying its fee structure affects all chains settling there. Developing governance frameworks that enable innovation while maintaining stability across interconnected components remains an open problem.

Regulatory considerations add another dimension of uncertainty to the modular blockchain future. Authorities around the world are developing frameworks for regulating digital assets and blockchain systems, but these frameworks generally assume monolithic chains where clear entities can be identified and regulated. The distributed nature of modular systems, where applications span multiple chains and infrastructure layers, complicates regulatory compliance. Questions about jurisdiction, responsibility for compliance, and liability in case of failures remain largely unresolved.

The scaling potential of modular blockchains appears substantial based on current trajectories. Celestia's roadmap targets scaling beyond 1 gigabyte per second data throughput. EigenDA projects similar scaling through horizontal growth as more operators join. Ethereum's full danksharding implementation aims to enable 100,000 transactions per second across its rollup ecosystem. These numbers suggest that data availability constraints, which have been the primary bottleneck, may be largely solved within a few years.

But achieving raw throughput represents only one dimension of scaling. True mainstream adoption requires not just technical capacity but also seamless user experience, regulatory clarity, and integration with existing financial and social systems. Modular blockchains must demonstrate that their added complexity translates to real benefits that users and developers value, not just theoretical improvements in system architecture.

The possibility exists that modularization represents a transitional phase rather than the final state of blockchain design. Just as monolithic chains evolved into modular systems to address scaling constraints, future innovations might enable new architectural approaches that transcend current modular designs. Zero-knowledge proofs, novel consensus mechanisms, and advances in distributed systems could reshape what is possible.

Some researchers are exploring radical ideas like fully homomorphic encryption, which would enable computation on encrypted data, potentially solving privacy and data availability problems simultaneously. Others are investigating consensus mechanisms that achieve finality faster than current approaches, reducing the need for layered architectures. Quantum-resistant cryptography may eventually require redesigning core protocols. The pace of innovation in blockchain technology remains rapid enough that architectural paradigms could shift again in coming years.

The relationship between decentralization and performance continues to evolve in ways that challenge assumptions underlying both monolithic and modular designs. Data availability sampling demonstrates that some traditional tradeoffs can be circumvented through clever cryptography and protocol design. Future innovations might reveal other ways to achieve seemingly incompatible properties, potentially enabling new architectural patterns.

The vision of a modular blockchain internet - where diverse execution environments interoperate seamlessly over shared data availability and settlement infrastructure - represents a compelling possible future for Web3. Such an ecosystem would support tremendous diversity in application design while maintaining interoperability and shared security. Developers could build exactly the chain they need for their use case, users could move value and identity across chains without friction, and the ecosystem as a whole would benefit from specialization and optimization.

Realizing this vision requires solving numerous technical, economic, and social challenges. But the progress in recent years suggests that the modular approach addresses real problems in ways that monolithic architectures cannot. The projects implementing modular infrastructure - Celestia, EigenDA, Avail, and others - have demonstrated technical viability and attracted significant adoption. The question shifts from whether modular blockchains can work to how they will be integrated into the broader blockchain landscape.

The future likely involves a heterogeneous ecosystem where multiple architectural approaches coexist. Monolithic chains will continue serving use cases where their properties provide advantages. Modular systems will enable experimentation and customization at scales impossible in unified chains. Hybrid approaches will combine elements of both paradigms. The diversity of approaches reflects the reality that blockchain technology is still early enough that no single architecture has proven optimal for all purposes.

Final thoughts

The emergence of modular blockchain architecture represents a fundamental reconceptualization of how decentralized systems should be built. After more than a decade of monolithic chains that bundle all functions into single systems, the industry has recognized that specialization and modularity unlock scaling potential impossible within unified architectures. The shift from monolithic to modular design is not merely a technical evolution but a philosophical transformation in how blockchain infrastructure is conceived.

Celestia, EigenDA, and Avail exemplify different approaches to modular data availability, each addressing the critical infrastructure bottleneck that has constrained blockchain scaling. By separating data availability from execution and settlement, these protocols enable rollups and application-specific chains to operate efficiently without bearing the full cost of running independent monolithic systems. The economics are compelling: data availability costs drop by orders of magnitude, throughput increases dramatically, and developers gain flexibility to customize execution environments for specific use cases.

The modular approach does not eliminate the scalability trilemma so much as it reframes the problem. Rather than forcing every blockchain to make identical tradeoffs between decentralization, security, and scalability, modular systems allow different layers to optimize for different properties. Data availability layers focus on throughput and verification efficiency. Settlement layers prioritize security and finality. Execution layers customize for specific application requirements. The combination achieves properties that no single layer could deliver alone.

But modularization introduces new challenges. The security model becomes more complex when multiple components must work correctly for the system to remain safe. Economic incentives must align across layers to ensure sustainable operation. Interoperability between execution environments remains imperfect despite progress on cross-chain communication protocols. Governance becomes more complicated when changes to one component affect many others. These challenges are not insurmountable, but they require careful attention as the ecosystem matures.

The question of whether modular blockchains represent the endgame for blockchain architecture or another transitional phase remains open. The technical innovations enabling modular systems - data availability sampling, zero-knowledge proofs, erasure coding, polynomial commitments - have proven powerful and robust. The economic models are still evolving, with uncertain value distribution across components and sustainability questions about commodity infrastructure layers.

What appears certain is that modular design has permanently expanded the design space for blockchain systems. The experiments enabled by modular infrastructure - sovereign rollups, application-specific chains, novel virtual machines, customized consensus mechanisms - would be impossible or impractical within monolithic constraints. This flourishing of innovation, even if some experiments fail, benefits the broader ecosystem by exploring possibilities that pure monolithic approaches cannot access.

Established chains are adapting to the modular wave in different ways. Ethereum is restructuring itself as the settlement and security layer for a rollup ecosystem, implementing proto-danksharding to provide native data availability. Solana continues doubling down on monolithic performance, arguing that simplicity and composability outweigh modular flexibility. Cosmos and Avalanche incorporate modular principles within cohesive ecosystems, attempting to balance customization with integration. This diversity of approaches reflects genuine uncertainty about optimal architectures and suggests that multiple paradigms will coexist.

The impact of modular blockchains extends beyond technical architecture to economic models, governance structures, and the fundamental question of how value accrues in Web3 infrastructure. If data availability commoditizes, will the economic incentives suffice to maintain robust infrastructure? If settlement layers capture disproportionate value through network effects, will execution layers remain viable? How will governance coordinate across interconnected but independent components? These questions will shape the modular ecosystem's evolution in coming years.

The infrastructure being built today - data availability layers, settlement protocols, execution frameworks, interoperability solutions - forms the foundation for the next generation of blockchain applications. These modular components enable possibilities that were economically or technically infeasible in the monolithic era. Fully onchain gaming with complex state transitions. Decentralized social networks with high-throughput data posting. Sophisticated DeFi protocols spanning multiple execution environments. Real-time applications requiring sub-second finality. The technical capacity to support these use cases at scale is increasingly available.

Whether modular blockchains fulfill their promise of enabling mainstream Web3 adoption depends on more than technical capacity. User experience must improve to the point where the underlying complexity becomes invisible. Regulatory frameworks must evolve to accommodate distributed modular systems. Economic incentives must align to sustain critical infrastructure. Security must be proven robust against sophisticated attacks. Social coordination must scale to manage governance across interconnected components.

The projects pioneering modular infrastructure are conducting a large-scale experiment in distributed system design. The outcome will determine not just which specific protocols succeed but what architectural patterns define blockchain infrastructure for decades. The early evidence suggests that modular designs address real constraints in ways monolithic architectures cannot, but the full implications will only become clear as the ecosystem matures and faces challenges that cannot be anticipated today.

Modular blockchains have moved from theoretical concept to production infrastructure supporting billions of dollars in value and millions of transactions daily. Celestia, EigenDA, Avail, and related projects provide the data availability backbone for an expanding ecosystem of execution layers. Ethereum's modular transformation validates the approach at the highest level of the industry. The question is no longer whether modular architectures are viable but how they will evolve and what role they will play in the broader blockchain landscape.

The transformation from monolithic to modular blockchains reflects maturation of the industry's understanding of distributed system design. Early blockchains necessarily bundled functions together, as the knowledge and tooling for modular architectures did not yet exist. As the technology advanced and scaling constraints became apparent, the possibility of separating concerns emerged. Now, with modular infrastructure deployed and operational, the industry can build the diverse, specialized, interconnected blockchain ecosystem that many have long envisioned.

The future of blockchain design remains uncertain, but the direction is clear: toward greater specialization, more flexible architectures, and systems optimized for specific purposes rather than attempting to serve all functions equally. Modular blockchains embody this evolution, and their success or failure will shape Web3 infrastructure for years to come. The foundation has been built. The experiment is underway. The implications will unfold as the ecosystem grows, faces challenges, and continues innovating toward the vision of a truly scalable, decentralized internet.