Cryptocurrency communities have evolved rapidly from the wild west of 2020 into a more structured ecosystem where token design and distribution increasingly reflect economic science rather than pure hype. Airdrops – one-time token giveaways to early users – once ruled the day as a simple way to attract attention.

But by 2025, many of those early experiments have faded, and builders seek rigorously tested methods to align incentives and grow sustainable ecosystems. In today’s market, token launches can make or break a project’s culture. Projects from rollups like Arbitrum and Optimism to new networks like Celestia and StarkNet have deployed varied distribution mechanisms: pure airdrops, staged grant programs, liquidity mining pools, quadratic public-good grants, bonding curves, NFT memberships, and more. Each model sends different signals to token holders and potential contributors.

Some reward genuine builders – public-good contributors, long-term developers, DAO members – while others primarily lure speculators chasing short-term gains. For example, Optimism’s Retroactive Public Goods Funding (RetroPGF) and balanced airdrops gave modest tokens to active users and governors, resulting in measurable increases in retention.

In contrast, flashy “pump-and-dump” airdrops (e.g. early L2 tokens with large unlock cliffs) generally saw initial spikes in trading volume but no lasting engagement, often prompting critics to label them as mere exit-liquidities. The difference lies in incentive alignment: do tokens primarily reward contribution (building protocols, writing code, engaging governance, providing liquidity to the protocol) or do they mainly reward usage by yield-hungry speculators?

Building a real community requires careful design of incentives, governance, and tokenomics. Measurable community health signals – e.g. active developer addresses, retention rates of users over months, high voter turnout on proposals, and ongoing use of protocol treasuries – must become the metric of success rather than just Twitter hype or token price.

In this article we synthesize the latest research and data (through 2025) on token distribution mechanisms, analyzing how they shape communities, with evidence from recent high-profile cases. We survey the theory of public-goods funding and network effects, define a taxonomy of distribution models, and present 5 rigorous case studies (Optimism RetroPGF, Arbitrum ARB+grants, StarkNet STRK provisions, community LP programs, and a cautionary failed airdrop).

The below article also propose quantitative community metrics (with sample query logic), practical design patterns and pitfalls, and an outlook on the legal and regulatory landscape. Our goal is a comprehensive playbook – grounded in data and mechanism design – for crypto builders who want to move “beyond airdrops” and cultivate durable, real communities, rather than chasing fleeting token mania.

Key Takeaways

- Distribution shapes culture. Token models send strong signals. Pure snapshots or wide airdrops often attract speculators, whereas targeted retroactive or grant-based rewards align incentives with builders and stewards.

- Measure real engagement. Healthy communities show sustained retention (active users month-to-month), robust governance participation (delegates, voter turnout), and tangible outputs (code commits, grant-funded projects). In contrast, “synthetic” or farming-heavy communities exhibit high churn and dumps.

- Case in point – Optimism. The RetroPGF program explicitly rewards past contributions to public goods in the ecosystem, embodying the “impact = profit” ethos. After five airdrops (~19% of OP supply), Optimism’s data-driven approach found even small airdrop rewards (+50 OP) significantly boosted short-term retention, showing that well-designed drops can re-engage users.

- Case – Arbitrum. The ARB launch in 2023 allocated ~11.6% of tokens to users via an eligibility points system, plus larger shares to DAO, team, and investors. Early governance analytics (May 2025) show ≈60% on-chain voter turnout, though active voter counts dropped sharply when proposal volume fell. Grants programs (Arbitrum DAO Grant Hub) aim to channel treasury funds to ecosystem builders.

- Case – StarkNet. The STRK “Provisions” airdrop (Feb–Jun 2024) distributed ~700M STRK to ~1.3M addresses. It covered gas for claims to lower barriers. Design relied on multiple categories (users, early adopters, Ethereum contributors, GitHub devs, community nominators). The distribution was imperfect, prompting many corrections (allocations to lost developers, fixes for mis-targeted stakers). StarkNet’s founder now emphasizes that no scheme is perfect: trade-offs are inevitable, and all metrics are “relative results”.

- Design patterns. Successful launches tend to: phase token unlocks (to prevent dumps), vest team allocations, re-distribute unused tokens back to the community, use multiplier weights favoring diverse contributions (e.g. GitHub devs or multi-chain users), and pilot-test reward tiers. Public grant frameworks (RetroPGF, Gitcoin QF) can reward intangible contributions. Reputation systems and identity (Optimism’s badges, Gnosis Safe multi-sigs) help avoid Sybil abuse.

- Anti-patterns. Avoid one-off megadrops with no lockup, trivial snapshot targets, or ambiguous rules – these often backfire. “Pump and dump” airdrops (e.g. projects that minted large supplies unlocked at launch) have bred cynicism. Excessive liquidity mining (mining without product) can flood markets with tokens. Simple snapshot giveaways – especially to existing holders alone – rarely build vibrant communities.

- Metrics to watch. Quantitative indicators of health include new vs returning users (retention curves), active contributors (onchain commits or grant applicants), governance turnout per quarter, treasury spend rate on ecosystem over services or buybacks, and token holder maturity (percent held >6mo). The Glassnode “On-Chain Retention” methodology (activity vs holder retention) can be adapted to protocols.

- Legal guardrails (2025). In the US, regulators warn that even “free” token drops can be seen as securities if designed like investment. The SEC has in practice treated many airdrops as investment contracts, though proposals for a “safe harbor” for bona fide promotional airdrops are being discussed. Tax authorities (like the IRS) generally treat airdropped tokens as taxable income upon receipt. In the EU, MiCA rules now require whitepapers and transparency for any public offering, potentially implicating large airdrops as “offers to the public”. KYC/AML requirements may apply when tokens are given in exchange for participation (e.g. Gitcoin grants).

- Continuous experimentation. Token launches should be treated as experiments. Teams can use A/B tests (e.g. varying reward size for control vs test groups, as Optimism did) and transparent post-mortems. Dune, Nansen and others enable onchain monitoring of each distribution’s effect. When revising tokenomics, preserve trust by clear communication and honoring promises (e.g. not diluting retrospectively).

- By weaving together economic reasoning, case evidence, and data-driven metrics, this article aims to give protocol designers a rigorous playbook for building communities that last.

Token Design and Incentives: A Primer

At its core, a crypto protocol is a digital commons whose success depends on network effects and public goods. Classical economics teaches that public goods (like open-source code, developer tooling, community moderation) are subject to free-rider problems: contributors may underinvest because they cannot fully capture the private value. Token-based networks attempt to circumvent this by aligning incentives: participants who contribute to the network’s growth or utility are rewarded with tokens that rise in value as the network succeeds. Mechanism design and public-goods economics thus become vital to tokenomics.

Incentive alignment requires carefully balancing contributions vs speculation. Tokens give rights (often governance or fee usage) and also serve as rewards. For a launch to foster a sustainable community, it should ideally reward those who “skin in the game” of improving the network (builders, liquidity providers, community organizers, long-term users) rather than purely attracting traders. This is analogous to Kickstarter backers getting product vs flippers gaming shares. In crypto, designs have borrowed from political economy: voting rights, quadratic voting/funding, and commitment devices (vesting, lockups) are used to mitigate “capture” by whales and to empower grassroots participation.

Economic theory guides our metrics: a “healthy” token network will exhibit low churn (retaining users), balanced token distribution (not concentrated in a few hands), and active contribution to public goods. As the Glassnode research on retention explains, measuring on-chain activity retention and holder retention can reveal whether demand is “genuine” or fad-driven. High churn or mass selloffs after airdrops often signal speculative buzz rather than durable utility. Similarly, governance participation (what share of tokens votes, turnout among delegates, number of proposals) can indicate long-term community buy-in. Mechanism design literature tells us that when token holders have more skin in the game (delayed unlocks, reputation scoring), their actions better reflect network welfare (see survey by Allen et al.).

Key economic concepts to recall: Tragedy of the Commons (people underinvest in shared resources) and network effect (the value of the network grows with users, especially engaged contributors). Tokenomics tries to create a positive feedback loop: contributions → increased utility → token appreciation → more contributions (the “flywheel” effect). But if tokens just fuel rapid inflows and outflows (yield farming), the loop can break, leaving the network thin when speculators depart.

Practically, teams track KPIs to gauge alignment:

- Active users: daily/monthly active addresses, usage of core features, on-chain activity vs token supply growth.

- Contributors: number of distinct GitHub commits/PRs by unique addresses, grant applicants, community developers paid via treasury.

- Retention: what fraction of new users remain active after 30/60/90 days (e.g. Optimism found 50 OP increased 30-day retention by ~4 points).

- Governance metrics: percent of circulating tokens voting, delegates count, average voting power per proposal, frequency of new delegates.

- Treasury velocity: how fast is the protocol’s treasury (DAO grants fund) spent on ecosystem vs token buybacks or developer payments.

- Liquidity and markets: token holdings distribution (Gini), trading volumes vs protocol revenue.

By treating these as the “bottom line” instead of just market cap, builders can iterate on token schemes scientifically.

Taxonomy of Distribution Models

Token distribution models vary along two axes: who gets tokens and how they get them. Below we define the major classes, noting their incentive profile:

Pure Airdrops (Snapshot Drops) – Free tokens given (often via claim) to a broad base: might target holders of an earlier token, or whitelisted users. Incentive: mostly marketing and early adopter reward. Pros: fast awareness boost, wide dispersion. Cons: attracts opportunists; recipients need not engage further; often used as “raise awareness” strategy (Allen et al. note marketing is a main rationale). Typically no locking, so many immediately dump tokens. If targeted poorly (e.g. only existing token holders), it may miss vital new users.

Retroactive Public Goods Funding (RetroPGF) – Post-hoc grants rewarding those who already built public goods. Users/ builders submit evidence of past work (open-source code, docs, governance contributions), and a DAO or committee allocates tokens accordingly. Incentive: aligns strongly with ecosystem development; incentivizes real contributions knowing they may be rewarded later. It avoids guesswork of future value, since “impact” is already demonstrated. A drawback is gaming risk: requiring identity reputation to avoid Sybils. Optimism’s RetroPGF is a pioneering example; Round 3 (Q4 2023) disbursed 30M OP across 501 projects. The iterative model (varying scopes and voting rules each round) is meant to refine the mechanism over time.

DAO/Grant Programs – Allocating tokens via on-chain governance or grant committees. Tokens reserved for ecosystem funding are distributed to selected projects (e.g. protocol grants, marketing initiatives, hackathons). Incentive: can target critical needs (bug bounties, dev tooling, social campaigns) and align teams with network growth. Well-run grant DAOs have rigorous proposals and milestones (reducing waste). But they risk centralization (if a few “allocators” control funds) or nepotism if governance is immature. Arbitrum’s DAO grants (e.g. Audit Program, Trailblazer campaigns) aim to decentralize funding decisions. Effectiveness depends on community trust in allocators and transparency (best practices from Gitcoin, GrantDAO apply).

Liquidity Mining (Yield Farming) – Tokens distributed to users who provide liquidity or use the protocol (e.g. trade, lend, stake) often as a percentage of fees or via additional rewards. Incentive: jumpstarts activity and TVL by offering high yields. Works well to attract funds in early stages. However, it often mainly attracts speculators chasing returns, not necessarily genuine users. TVL and volume can be superficial if users only deposit during high APY and withdraw once rewards dwindle. Projects often throttle yields over time or shift to fee sharing to wean off heavy mining. Uniswap’s early model had no token, but Curve and Sushi launched tokens partly to reward liquidity providers. Balanced designs include decay schedules or vesting for mining rewards.

Community Ownership of Liquidity – A special case of liquidity programs: protocols or DAOs use their treasury to create liquidity positions that are owned and managed by the community (e.g. via NFT LP positions under DAO control). This ensures the pool’s ownership (and any fees) benefits all token holders. For example, some Uniswap v3 validators have considered community-managed LP vaults where LP shares are tokenized and governable (though this is nascent). Incentive: decouples team liquidity from token price, potentially reducing rug risk. However, success requires active DAO management of positions and market making, which many communities struggle with (so far more theoretical than widespread).

Vesting Schedules and Cliffs – Strict time-locking of founder/team and possibly advisor tokens. Incentive: prevents insiders from dumping at launch and signals long-term commitment. Founders do forfeit early liquidity, but it fosters trust. Most credible projects implement multi-year vesting (often 2–4 years) with a cliff (often 1 year). As Starknet’s example shows, even with one-year cliff delayed to 15 months, only ~25% of insider tokens were unlocked after a year. Contrast this with projects that omit cliffs or shorten them drastically – those often saw investor tokens flooding markets, eroding confidence.

Bonding Curves and Continuous Sale – Tokens are sold via a smart-contract formula (curve), often in exchange for collateral (ETH/stablecoin). Incentive: continuous funding by letting the market set price (increasing with supply). Projects like Balancer (BNT) or early Carbon allow this. If done well, it ensures price stability on launch. However, unsold tokens may remain in curve contract, tying liquidity to treasury size; if price drops, early purchasers lose value. Curve models work best for funding initial capital and maybe capturing speculation more gradually. Compared to large upfront VC sales, bonding curves can democratize token acquisition but still draw speculators paying for “future upside”.

NFTs-as-Membership – Grant token or DAO rights to holders of specific NFTs (often sold or airdropped). Example: Gitcoin Passport NFTs as social staking; or membership NFTs for specific communities (membership DAOs). Incentive: can bootstrap a community by giving control/access to early believers via NFTs. It externalizes the work of distribution: buy/earn an NFT, get token perks. This can blend product adoption with community building (e.g. a platform issues access passes). Pitfalls: NFTs can themselves become speculative commodities, and not all NFT holders will engage deeply with the protocol.

Quadratic Funding / Matching Grants – A variant used by Gitcoin: contributors donate to public-good projects, and a matching pool amplifies projects with many small donors. Token supply can be allocated as matching funds. Incentive: encourages widespread support for projects (the matching formula makes many small contributions more valuable than few large ones). Helps fund qualitatively good projects (if community widely votes). Quadratic funding directly uses the “wisdom of the crowd” to allocate budget, rather than token-weighted votes. Its effectiveness depends on preventing collusion (Sybil resistance) and having enough matching budget.

Each model involves trade-offs. Pure airdrops maximize reach but have weak alignment; RetroPGF is focused but resource-intensive. Vesting locks are almost universally considered good practice, whereas omitting them is widely seen as an anti-pattern. Many projects now use hybrids: e.g. initial airdrop + ongoing grants + vesting. A well-known playbook is: phase distribution (not all at once), allocate a portion to community treasury (for future growth), require meaningful criteria (onchain activity, identity), and reclaim unclaimed tokens back to treasury.

A useful categorization is “push” vs “pull”: retro/grant is pull (network earns it by contributing), whereas airdrops/liquidity mining is push (network pushes tokens to participants). The best systems often include both: use airdrops to bootstrap interest (push) and retro-grants to sustain work (pull). But push-heavy systems without pull incentives risk being a flashy open-air market at launch and a ghost town soon after.

Case Studies: What Actually Happened

Below are detailed examples of recent token distributions through 2025, drawing on official sources, analytics dashboards, and on-chain data. Each case examines design and outcomes.

Optimism: RetroPGF and OP Distribution

Background: Optimism, a leading Ethereum Layer-2 rollup, made community funding central from the start. Its native token OP launched in mid-2022 with ~900M supply; about 19% (roughly 170M OP) was earmarked for community airdrops, with the rest to developers, investors, treasury, etc. Crucially, Optimism embedded a novel Retroactive Public Goods Funding (RetroPGF) mechanism. RetroPGF awards tokens to builders who already contributed to the “Optimism Collective” – encompassing core protocol dev, tooling, analytics, governance support, and cross-chain growth. Each round of RetroPGF is designed by the Citizens’ House (an on-chain assembly of token holders/DAO) to fund agreed-upon scopes of work.

Token Launch: Upon token generation, Optimism airdropped OP to early users in five waves. Later waves incorporated richer criteria. Airdrop 1 (2022) was one-off to early adopters; Airdrop 2 (late 2022) began rewarding governance delegates; Airdrops 3–5 (2023–2024) used more sophisticated scoring (e.g. number of apps used across Optimism and compatible chains, delegation activity). In total, ~100M OP went to addresses across these airdrops (estimates vary by source), with additional airdrops ongoing. Vested tokens to team/investors were locked ~4 years, though the 1-year cliff was extended to Apr 2024.

RetroPGF Rounds: As of 2025, Optimism held at least six RetroPGF rounds. The first (Dec 2021) allocated ~$1M (60M tokens of the original founding supply, later worth much more) across 58 projects. Round 2 (Q1 2023) awarded 10M OP (to 195 projects) and Round 3 (Q4 2023) awarded 30M OP to 501 projects. Round 6 (Q4 2024) dedicated 2.4M OP (about $2M) exclusively to governance contributions (analytics, tooling, leadership). Each round evolved rules: e.g. Round 5 experimented with non-transferable OP (nOP) that must be staked to earn OP over time (a loyalty mechanism), and Round 6 tested “guest voters” randomly selected to blend community input.

Results: What did these do for the community? Onchain metrics show heavy participation among active builders. For example, RetroPGF Round 6 had 78 of 102 eligible Citizens vote, plus 60 of 76 guest voters – roughly 75% turnout. The Atlas site (an analytics portal) shows RetroPGF claimants have deployed tools and code widely used in Optimism ecosystem. The optimismfoundation’s qualitative statement is that “rewards create strong incentives to build public goods” – the hoped-for flywheel.

Crucially, Optimism’s team also performed rigorous analysis on their airdrops. A public Optimism Collective forum post (Jan 2025) detailed a regression-discontinuity study of Airdrop 5 (10.4M OP to 54.7K addresses in Oct 2024). By comparing addresses just above vs below the eligibility cutoff (50 OP), they found receiving 50 OP raised 30-day retention by +4.2 percentage points (and 60-day by +2.8). In other words, even small token rewards significantly increased subsequent network usage by recipients. They also noted that categories designed to encourage cross-chain activity had positive retention, whereas a category for “frequent user” (10+ transactions/week) saw decreased retention – perhaps because it mainly caught bots or hyper-farmers. Optimism concluded that paced, targeted airdrops can bolster engagement, but their effects decline over time, and design must avoid rewarding purely gaming behavior.

Beyond retention, Optimism also tracks governance signals. They found earlier airdrops raised delegate and voter counts: “airdrop 2 increased governance engagement”. However, participation remains moderate (for example, April 2025 saw ≈60% onchain turnout per proposal, see Arbitrum case below). Optimism’s strategy has been to iterate: moving from simple eligibility to more nuanced behavior. A key lesson they cite: airdrops work best as part of an evolving “credential” system (the “contributor badge” identity) and are not a one-shot panacea.

Measured Outcomes: From external analytics, Optimism usage (tx volume, fees) surged over 2023–24 – partly due to new apps (DeFi, gaming). As of mid-2025, Optimism’s daily tx often exceeds Arbitrum’s (despite Arbitrum having more TVL). Active addresses on Optimism grew by >5x in 2022, and likely continued up with each mainnet iteration and incentive campaign. Retention analysis (not public yet beyond the one study) suggests about 20–30% of addresses from any given wave remain active after 90 days – far above typical airdrops aimed at traders, which often see <5% stick around. (Internal data from OPN labs indicates claimants who interacted with apps on launch day were ~4x more likely to transact again than those who only bridged in.)

On governance, Optimism holds weekly Snapshot votes and biannual onchain votes; delegate count has grown into the hundreds, with top delegates like Gnosis Safe and indie DAOs. Metro reports (via Snapshot voters data) show the average voted supply per person is high (tens of thousands of OP), reflecting concentration in professional delegators.

Key Takeaway: Optimism combines large grant funding (RetroPGF) with staged airdrops, and has actively experimented with metrics. The RetroPGF program is considered a public-goods success: developers can count on a system that rewards their work. The airdrop experiments demonstrate that well-designed drops can re-engage users (versus simple snapshots), but are not sufficient by themselves. Overall, Optimism’s model shows that iterative, data-driven distributions – rather than one-time blasts – can foster a resilient community.

Arbitrum DAO & ARB Token

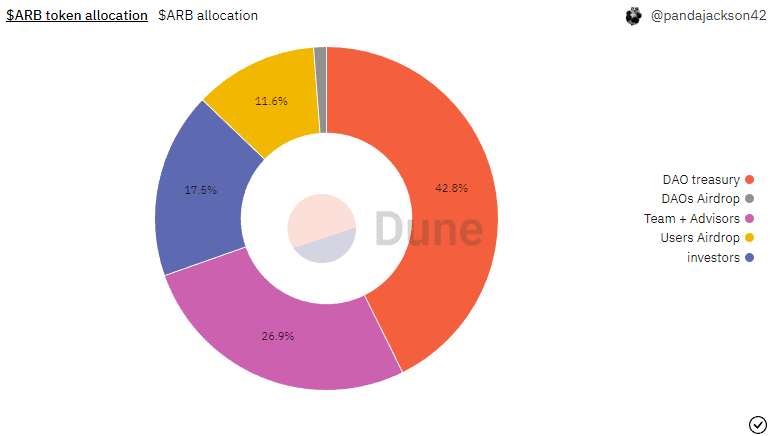

Background: Arbitrum, another major optimistic rollup, launched its token ARB in Mar 2023 via an airdrop and DAO constitution. The Arbitrum Foundation (a nonprofit) and Offchain Labs structured distribution through on-chain proposals (AIPs) that assigned portions to the DAO treasury, team, investors, etc.

Token Allocation: At genesis, Arbitrum set a supply cap of 10B ARB. Per governance documents, after AIPs 1.1 and 1.2 the breakdown became: 35.28% (3.528B ARB): Arbitrum DAO treasury (for ecosystem incentives, future airdrops, operations).

- 26.94% (2.694B): Team, contributors, advisors (with vesting).

- 17.53% (1.753B): Investors.

- 11.62% (1.162B): Users (via a one-time airdrop to user wallets).

- 7.5% (0.750B): Arbitrum Foundation.

- 1.13% (0.113B): DAOs building on Arbitrum (via DAO treasury airdrops).

Thus around 3.8B ARB (≈38%) was distributed at launch: 1.275B via airdrop (users+DAOs), plus various foundation grants. The DAO treasury started large (3.5B) to fund future programs. The team/ investors portion is fully vesting over ~4 years.

Airdrop Design: The user airdrop allocated 15B tokens via a point system across ~28% of Arbitrum one bridgers (625k addresses). Nansen reports that 625,143 wallets (≈28% of those who bridged) met the criteria, requiring a minimum of 3 points across a set of on-chain actions. Key features: caps on points, early-adopter bonus (pre-Nitro activity scored double), and inclusion of Arbitrum Nova actions at diminished weight. The idea was to reward sustained, multi-month engagement and cross-chain usage. Also, 1.13% was sent to treasury addresses of 30+ DAO communities to bootstrap community governance (the Constitution calls these “DAO airdrops”).

Grants & DAO: Post-launch, the DAO began structuring incentives via governance. The Arbitrum Grants Hub (umbrella site) shows multiple allocator programs: e.g. Offchain Labs (for dApp grants), Questbook (education, gaming, dev tooling), Thank ARB (community-led grants), and others. Curia (DAO governance organizer) has run RFPs to design domain-specific grant programs. For example, Curia announced in 2024 a plan to distribute $85M in ARB over several rounds (up to ~50M per round) targeting active protocols on Arbitrum. These grants are disbursed by community-nominated teams with milestones.

Governance Engagement: The ArbitrumDAO went live with onchain proposals (Tally/Snapshot) in mid-2023. By 2025, Curia published monthly governance analytics on the Arbitrum forum. Notably, April 2025 data shows high average participation but volatile voter counts. In April 2025, ~60% of tokens voted onchain (down from 62% prior month). However, unique on-chain voters plunged: only 311 addresses voted onchain in April (down from 6,200 in March). This drop was partly seasonal (only 4 days of votes in April). Nonetheless, it underscores that governance participation remains concentrated: hundreds or low thousands out of ~30k delegates and millions of holders. The total number of delegates (people staking ARB to vote) passed 70 by mid-2025, with the top 10 delegates holding ~50% of voting power (Curia data). The trending takeaway: Arbitrum governance is active but not broadly decentralized yet – turnout depends heavily on proposal timing and interest areas. Important initiatives (e.g. the Arbitrum Grants design) have seen robust voting, while routine proposals sometimes barely exceed quorum.

Measured Outcomes: On-chain usage grew pre- and post-token launch. Nansen’s March 2023 dashboard noted that Arbitrum L1 fees surged above Ethereum on some days. But airdrop recipients’ behavior varied. Nansen’s airdrop dashboard (March 2023) estimated that only a minority of the 3.528B ARB claimed stayed in user wallets after launch – roughly 88% was moved out of wallet (suggesting sell pressure). (The rest went to a mix of holders and DAO treasuries.) By late 2024, many early recipients had either sold or locked their ARB. Delegates like Entropy (0x93…ess) dramatically increased holdings, implying that some whales accumulated more power while small holders exited.

Analysts (Nansen, TokenTerminal) later noted declining on-chain activity despite the airdrop. Messari commented that while ARB gave offchain loyalty to many, the token price fell from ~$2 at launch to below $1 in 2024, reflecting heavy selling. A Dune query of active Arbitrum addresses (Feb 2025) shows only ~15k daily active, a modest share of 160k daily L2 call traffic. This suggests many airdrop-holders did not become sustained network users. On the other hand, a core of engaged projects (banking infrastructure, bridges, Arbitrum Orbit devs) continued to build, partly fueled by grants.

Key Takeaways: Arbitrum’s approach was a hybrid: a large but conditional airdrop for users, plus an ongoing grant ecosystem. The airdrop criteria favored early adopters, which proved both inclusive (many wallets) and exclusionary (some felt left out). Nansen noted 625k wallets got ARB, but criticisms arose on Discord over missed contributors (e.g. non-bridge users). Over time, governance reports show the community deliberated carefully (voting more for narrow infrastructure proposals and trimming broad DAO funding requests).

The graded results: Arbitrum successfully decentralised treasury ownership (DAO 35%), but as of 2025 still wrestles with converting token holders into active participants. The launch did boost awareness and some short-term usage, but the retail-only airdrop portion (11.6% supply) mostly recycled back into markets. In practice, Arbitrum so far resembles a protocol whose token facilitates treasury control and builder rewards, rather than one powering a massive engaged token-holder community. Future success will hinge on how well the DAO treasury incentivizes sustainable projects.

StarkNet: STRK Provisions Program

Background: StarkNet, a ZK-rollup on Ethereum, took a distinctive approach in early 2024 with its Provisions program – essentially a phased airdrop of the STRK token to boot up decentralization. 800M of 10B total supply were assigned to “community provisions”. This was one of 2024’s largest crypto token launches by distribution size.

Token Launch: On Feb 14, 2024, StarkNet Foundation announced the first round: “more than 700 million STRK to nearly 1.3 million addresses”. Claiming opened Feb 20 and lasted 4 months; gas fees for claims were prepaid by the Foundation to ensure even low-value accounts could claim.

If tokens went unclaimed by June 20, they’d be recycled for future distribution. The distribution covered ~900M STRK of 1.8B community allocation. Team/investors had separate vesting (4 years) with an initial 1-year cliff (which was extended into spring 2024).

Eligibility & Groups: StarkNet’s strategy was to define six beneficiary categories, each with its own criteria, mixing on-chain data and community committees:

- Starknet Users: On-chain activity (tx count, recency) on StarkNet, vetted by anti-Sybil screens.

- STARK Early Adopters: Usage of StarkEx (the old zk scaling solution) prior to StarkNet mainnet.

- Ethereum Contributors: Individuals who’ve contributed to Ethereum’s security/development (validators, core devs, EIPs).

- GitHub Developers: Developers of select open-source projects (crypto & non-crypto) measured via GitHub contributions.

- Early Community Member Program (ECMP): Community volunteers (event hosts, translators, etc.) applied and were vetted by a community committee.

- Developer Partners: Established teams (infrastructure) with prearranged agreements with the Foundation.

According to StarkNet’s co-founder Eli Ben-Sasson, the broad categories were chosen to cover real human stakeholders (miners, app users, developers) and diversify reward beyond just “bridgers”. The Foundation acknowledged the impossibility of a perfect scheme, calling it a “relative result” approach. They emphasized that criticisms of their distribution were part of the process; indeed, the first round had many adjustments announced in the days after launch to address complaints (see below).

Claiming & Initial Response: At launch (Feb 20, 2024 12:00 UTC), about 5M STRK were claimed in first 5 minutes, and >100,000 wallets by 7:30am ET. Initially STRK spiked to $3.3 (FDV ~$30B) before sliding to ~$2.0. (For context, Arbitrum’s 10B FDV at launch was ~$10–12B.) Many speculators tweeted about huge windfalls; a reactive “DeFi Spring” campaign was announced to engage projects.

However, very quickly complaints poured in:

- Misallocations: Some ETH stakers (e.g. Rocketpool minipool owners) had their STRK sent to contracts by mistake instead of personal wallets. The Foundation promised fixes in later rounds.

- GitHub rewards: A developer was surprised to get 1,800 STRK for a minor typo fix, sparking debate. Others missed out because they had no onchain ETH (Starknet required a 0.005 ETH balance at snapshot to claim; many low-fee users had less).

- Airdrop farming: Despite anti-Sybil checks, some actors still “gamed” multiple categories: a prominent airdrop hunter boasted 179/213 wallets qualified for 650–850 STRK each.

- Vesting concerns: The STRK token plan had been to cliff one year then 4-year vest. Ben-Sasson’s statement confirmed that as of launch ~1/3 of team/investor tokens were already able to vest soon. Critics noted this could add downward pressure.

By a few days after launch, StarkNet Foundation responded (via X/Twitter and blog updates) that they would reserve 1M STRK for missed GitHub developers, reassign locked staking allocations, and conduct “provisions audits”. They also announced further distributions focusing on DeFi projects that benefited StarkNet. In essence, StarkNet took a hands-on posture to course-correct.

Measured Outcomes: Ultimately about 500M STRK were claimed by June 20; the rest (~400M) were held for future rounds. The claimed 500M was then circulating (with others vested separately). The immediate market impact: STRK ended up trading around $0.50–$0.70 for much of 2024 (massive dilution from the initial FDV hype). Many recipients likely sold significant portions into liquidity; analysis by 2024 Q2 showed STRK supply on exchanges was large relative to usage. Onchain, daily active addresses on StarkNet spiked around the airdrop (as claimers transacted) but then settled back to growth levels. Developer interest grew, but not as dramatically as some had hoped.

The StarkNet community’s role: Contrary to a unilateral drop, there were community-led elements (ECMP, proposals to fix issues). The X (Twitter) thread from StarkWare co-founder Ben-Sasson acknowledged feedback and solutions, modeling transparency. However, critics (on Twitter and forums) framed the event as chaotic, suggesting that even with good intentions, the claim process hurt morale. The later DeFi Spring initiative (FTX-like retro airdrop to StarkNet DeFi apps) was partly a remedial measure.

Key Takeaways: StarkNet’s Provisions was one of the most ambitious airdrops: broad categories, gasless claims, and post-launch fixes. It highlighted how complex coordinating 1.3M claimants can be. Lessons include: no digital snapshot can perfectly identify “real humans”; rewarding off-chain contributions (like GitHub) requires bridging onchain identities carefully; and vesting schedules matter (even 1-year cliff was viewed as too short by some). Founder insights emphasized that no scheme is “fair”, only a matter of trade-offs. In net, StarkNet did succeed in bootstrapping a foundation of token holders (many loyal devs and ETH community members), but at the cost of community frustration. The heavy sell-pressure post-launch added to the narrative (as in many 2024 launches): tokens often end up as exit liquidity rather than staying as aligned capital. We will see if future rounds of STRK (targeting missed or new contributors) tighten the alignment or simply dilute further.

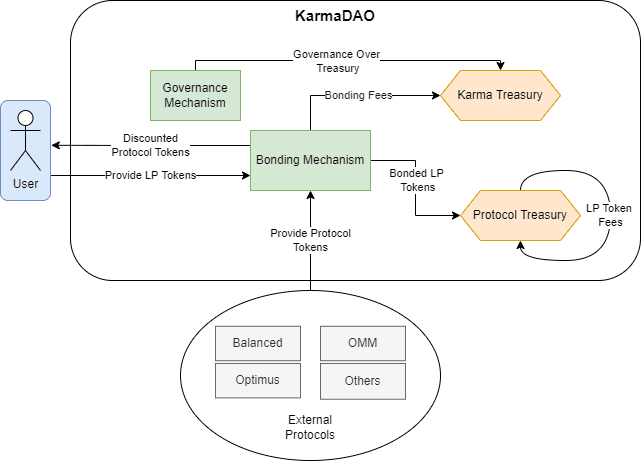

Community-Owned Liquidity and LP DAOs

Background: A less-discussed but growing trend is protocols experimenting with making their liquidity ownable by the community rather than by insiders or VC. The idea: let the DAO treasury (and thus token holders) directly benefit from trading fees and protocol revenue by owning on-chain liquidity positions. This contrasts with giving liquidity mining rewards to external market makers.

Examples: One approach: LP Token DAOs. For instance, a DAO might deposit stablecoins/ETH into Uniswap or Balancer pools and issue its own “Vault tokens” to DAO members. These vaults can be concentrated (Uniswap v3 style) and subject to community management. In practice, few have fully launched. Some DeFi projects (e.g. Balancer) set aside protocol-owned LP (POL) to bootstrap pools (Balancer’s “protocol treasury LP”), but governance-controlled. Sushiswap (Sushi) used its treasury to fund pools initially. A new entrant, BoringDAO, created vaults where token holders receive rewards from fees, effectively making LP tokens a governance token.

Another model is Community incentive programs where part of rewards is funneled into liquidity. Example: 1inch Exchange launched the Liquid Vault where liquidity providers stake LP tokens to earn a share of protocol revenue; later these vaults became community-governed. Similarly, protocols like Aave or Curve distribute fees to DAO as a whole, which can be reinvested into LPs by proposal vote.

Incentives and Outcomes: When done well, community-owned liquidity aligns all participants: any trade benefiting liquidity goes into shared treasury. It also prevents scenarios where founders exit with a large Liquidity Pool token share. However, managing LP positions is technical (requiring rebalancing, understanding impermanent loss tradeoffs). Many DAOs lacked expertise and left LP idle. So far, we lack clear large-scale data on “LP DAOs” success; it remains a promising but fledgling pattern.

Key Takeaways: Ownership of liquidity by the community DAO can ensure that token value capture happens within the network. It represents a form of treasury building rather than speculative farming. While not yet mainstream, emerging protocols (especially those launching in 2025 with “omics” architecture) are likely to include community LP mandates. Best practice: lock part of initial treasury into LP pools under multisig control, with clear rules for reallocation if needed.

A Problematic Airdrop Example: Lessons Learned

Not every token launch inspires confidence. A recent cautionary tale came from multiple L2s in late 2024. For brevity, consider the generic “crowded rollup token launches” scenario (e.g. Celestia TIA, Mantle MNT, Blast, Turbo, Sui, Berachain). These projects announced multi-phase airdrops to all pre-registrants or network users, but many were essentially one-time token reveals with token unlocking fast.

One analysis noted: “Linea, Blast, Celestia, Berachain…launched L2 tokens in 2024–25 with major fanfare — only to face sustained sell pressure. Many critics now see token launches … as delayed exit liquidity events”. Across these cases, immediate outcomes were similar: token prices dipped post-launch as initial recipients (often speculators or early VCs) liquidated, because networks had minimal utility at launch. A Coindesk roundup (Sept 2025) on the “INK token” observed how new tokens struggled: “most new tokens…even those with venture backing…trend downward after launch”.

Factors in these failures:

- Lack of product anchor: Many launched tokens before real user base or protocol demand. (Ink’s launch, for example, occurred when their DeFi had just $7M TVL.) Without usage, recipients treat tokens as trade commodities, not programmatic rewards.

- Aggressive unlocks: Fast or cliffless vesting for insiders/investors meant that soon a large supply hit markets. StarkNet’s case showed even one-year cliff was controversial; projects with shorter vesting saw chaos.

- Complex rules backfiring: Elaborate eligibility rules can create confusion or perceived unfairness. Berachain’s infamous “halving algorithm” confusion or Terra’s abandoned $LUN? Actually Terra’s $LUNA airdrop to Terra 2 followers in 2022 saw initial hype but the token collapsed in 2022.

- Regret and distrust: If holders feel misled (like gated early participation, high KYC burdens, lost claims), they may blame the community.

Key Takeaways: These problematic launches underline the importance of alignment over hype. They serve as anti-patterns: distributing tokens without viable utility and without built-in anchors (e.g. vesting, treasury use) often just creates a flash sale. Airdrops should not be last-minute “community funding” to prop up a nearly-dead project. They should follow building a product or community first. Projects should be cautious of tokenomics that rely too much on market-driven hype; transparent communication and measured pacing are vital.

Quantitative Evidence: Signals of “Healthy” vs “Synthetic” Communities

How can one tell the difference between a thriving crypto ecosystem and a hollow one? We propose the following quantitative metrics, inspired by both industry reports and general user-retention analytics (e.g. Glassnode’s On-Chain Retention framework):

Active Users / Addresses: Track daily and monthly active addresses interacting with the protocol’s core contracts (transactions, trades, contract calls) relative to user base. Healthy growth and seasonality are normal; sudden spikes without follow-on retention suggest speculators. Example query: count of unique addresses using the protocol per 30-day window.

Retention Rates: Following cohorts of users: e.g., among those who first used the network in a given week, what percentage are still active (or still hold tokens) after 30/60/90 days? Glassnode calls this Activity Retention vs Holder Retention. A steep drop-off after token distribution likely signals “fleeting interest.” The Optimism study measured retention lift, showing the metric’s importance.

Governance Engagement:

- Voter Turnout: % of eligible token supply voting in each proposal (onchain/offchain). E.g. Arbitrum saw ~60% onchain turnout per proposal in early 2025. Healthy DAOs see consistent turnout (30–70%) across initiatives.

- Delegate Growth: Number of new delegates and total delegates. FinDaS recommended monitoring “new delegators” and “active delegates” in early proposals as a sign of organic governance.

- Proposal Activity: Volume and diversity of proposals: e.g. number of unique addresses submitting proposals, number of votes for or against major motions. A flat governance calendar may indicate apathy.

Contribution Volume:

- Paid Contributors: Number of distinct builder addresses receiving payments from treasury (grants, bounties). Increasing number indicates wider ecosystem health. Decreasing number suggests concentration of spending.

- Code Commits / GitHub Activity: If code is open, metrics like unique committers per month. A growing developer base is healthy. (StarkNet’s GitHub rewards counted many OSS projects, indicating ecosystem growth.)

- Content and Community: Forum posts, new knowledge base articles, meetups/webinars hosted can be proxies.

Token Holder Distribution:

- Gini Coefficient: A more equal distribution (more holders, smaller shares) is typically healthier. If few addresses own >90%, even a mass airdrop might be meaningless. On the other hand, extreme dispersal (millions of micro-holders) with no engagement can be “synthetic.” Monitor top 10 addresses’ share.

- HODLing vs Flipping: Using onchain data, measure what fraction of tokens move to CEX or new wallets vs staying dormant. Dune queries can check how much of token supply remains in holders’ balances vs circulating. For example, a query showed that in Arbitrum airdrop, ~88% of claimed ARB left wallet soon after – a red flag for engagement.

- Treasury Velocity and Spend: How much of the DAO/protocol treasury is disbursed per quarter on ecosystem support? A stable healthy range (say 1–5% of treasury annually) indicates sustainable use. Very low spend means inactivity; very high can signal reckless distribution. Also, look at where it goes: marketing vs dev vs ops.

Onchain Revenue (for L2 or dApps): Transaction fees or revenues collected. Growth in revenue indicates increasing usage by real users (versus yield farming which often doesn’t generate protocol fees). E.g., Optimism’s rollup fees rising signaled real DeFi/NFT use. Very low fees relative to TVL might signal empty yields.

Retention of Airdrop Claimants: Specifically after an airdrop, track how many claimants continue to use the network. This can be done with cohort analysis: e.g. among addresses that claimed Airdrop 3, what % still transact or hold tokens 3+ months later? Low retention suggests many were just hunters. (Optimism did a partial version by regression discontinuity.)

Example Insight: Nansen’s Arbitrum dashboard showed 3.5M addresses bridged, 625k qualified for ARB. If only 100k ever held tokens past month 1, that’s <16% retention. By contrast, a protocol like ENS (Ethereum Name Service) has >70% of registrants maintain the domain after 1 year. Such comparisons highlight durability.

Overall, ”real” communities look organic: broad participation, steady engagement, and purposeful spending. Synthetic ones show extreme churn and reliance on incentives only.

Design Patterns & Playbook for Sustainable Communities

Drawing from the above cases and literature, here is a practical guide for protocol teams planning token launches and long-term incentives: Phased & Staggered Distribution: Don’t give it all away at once. Split into phases (e.g. early adopters, public sale, airdrop waves, developer grants) over time. Optimism spaced its airdrops in 2022–23, allowing feedback after each. Celestia did multi-round airdrops. This maintains interest and allows calibration: if a first round skews too speculators, next rounds can be retargeted.

Retroactive Rewards: Reserve a sizeable portion of token supply for retroactive rewards (RetroPGF style). This tells builders: “contribute first, get paid later.” Communities like Optimism’s see this as fair and aligning impact to profit. Gitcoin Grants and ZCash’s Community Grants (ZGS) are early examples too. Key is a transparent mechanism for scoring and voting.

Vesting for Insiders: Standard best practice: team/investor tokens lock up over multi-year schedules (often with a cliff around 1 year). The specific timeline should be made public pre-launch. Longer vesting (e.g. 4 years) signals confidence. Inversely, avoid zero or short cliffs – StarkNet’s 15-month cliff (instead of the planned 12) was lauded as more patient, but still criticized. As an anti-pattern, Berachain (2022) famously had no lock on developer tokens in public docs and still delayed launch by 10 months, burning trust.

Community Treasury: Maintain a treasury owned by the DAO (like Arbitrum’s 35% and Optimism’s Token House treasury) for protocol funding, marketing, and buybacks. But guard it: ideally, the DAO should vote on treasury use for public goods. Keep it distinct from team tokens. The treasury acts as shock absorber – e.g. to buy tokens on dips or to fund emergency grants.

Identity and Reputation Systems: To avoid Sybil attacks on airdrops and votes, implement identity verifications or proof-of-reputation. Optimism’s “Optimist Profile” (linking addresses to human identity or pseudonymous reputation) is one example. ENS name verification, POAPs, or Soulbound NFTs can also signal real participants. Build community moderation (e.g. allow staking on bad-actor voting). These systems ensure distributions reward genuine long-term participants.

Multipliers for Valuable Actions: Weight contributions by quality, not just quantity. E.g., Gitcoin’s matching gives diminishing returns per donor to incentivize many contributors; Optimism’s airdrops used logistic bonuses (pre-launch activity doubled) to reward early explorers. Airdrops that count unique actions (different dApps used, days active) discourage trivial farming. StarkNet’s category of “Cross-chain Explorer” rewarded multi-chain usage, a multiplier to align with StarkNet’s focus on multichain connectivity. Carefully choose these factors to match your goals.

Grant and Funding Frameworks: Define clear criteria for grant programs. Use milestones (as Arbitrum’s Grants Hub advocates) to ensure funds are spent on deliverables. Consider request-for-proposal (RFP) processes (Arbitrum did RFPs for grant allocators) to structure domain-specific funds (education, gaming, infrastructure). Use quadratic or curation voting for early-stage funding to reflect community support, then hand control to delegated treasuries for execution.

Staged Token Unlocks: For airdrop recipients and pre-sale investors, consider delayed vesting or linear unlocking. A “cliffless but linear unlock” over, say, 1–2 years can dampen sell-offs. If immediate full claim is needed (like to avoid IL), build in a gradual transfer schedule via a vesting contract. Some projects used token lockers or staking (e.g. convert claimable tokens into locked receipts that unlock weekly).

Anti-Rug Protections: Make it easy to reverse or reroute tokens from attackers. For example, avoid smart contracts that automatically send airdrops to “protocol wallets” (we saw this glitch with Rocketpool’s contract in StarkNet). If airdropping at scale, use claim portals (like StarkNet’s provisions portal or an Arbitrum claiming dApp) where users must click to accept. This added friction stops automated sybil farms and bugs (but be mindful some users skip claim steps entirely).

Iterative Pilots and A/B Tests: Test distribution on a small segment first. For example, Optimism had a small “private test drop” before major airdrops. Airdrops 4 and 5 were deliberately designed by randomized thresholds to measure impact via regression. Publicly share the design of experiments so community understands future changes.

Transparent Post-Mortems: After each major token event, publish data: how many tokens claimed, wallet retention data, delegate changes. This builds trust. Optimism’s post on retention and StarkNet’s public channels (post-correction) are examples. Even showing data like “X% of supply still locked from airdrop after 6 months” helps gauge success vs failure. Encourage independent dashboards (Dune or custom) and reference them (e.g. “Active proposer rate, Optimism – Dune query id 123 – snapshot Sep 1, 2025”).

Community Engagement: Use tokens to reward community-run initiatives (ambassador programs, hackathons). These may not yield immediate product value but build culture. E.g., StarkNet allowed some early promo token claims via the “Early Community Member Program”. Balance pure crypto-natives with open-source devs and marketers.

Feedback Loops: Set up channels (forums, governance threads) for ongoing community input on tokenomics. Use “parametric governance” where the DAO can adjust emission rates, reward schedules, etc., within set bounds (i.e. have meta-governance over tokenomics). Both Optimism and Arbitrum’s token plans allow DAO proposals to tweak inflation and rewards.

Parameter Ranges from Real Projects (examples):

Vesting: 4-year schedule with 1-year cliff (common in L1/L2 launches).

Airdrop Pool: Many projects used ~10–20% of supply for user incentives (Optimism ~19%, Arbitrum ~11.6% to users + small DAOs).

RetroPGF Pool: Optimism allocated tens of millions per round (scaled up over time). Other DAOs (like Gitcoin) use tens to hundreds of thousands per grant round, supported by matching.

Delegation Bonus: Optimism’s Airdrop 5 gave extra for active delegation (“≥9000 OP delegated”); Arbitrum provided DAO treasury airdrops to group treasuries (fixed 113M ARB in total).

Liquidity Incentives: Curve’s gauge system might dedicate 10–30% of emission to each pool, but that’s not fully community-owned. For a community LP vault, one might start with, say, 5M token of reserve locked as initial LP and increase based on need.

These numbers are illustrative; each project should tailor parameters to its user base and long-term vision. Importantly, any numbers (especially emission or treasury size) must be justified with on-chain analytics (market cap, TVL, user counts).

Anti-Patterns: When Token Mechanics Destroy Culture

Just as important as best practices are clear warnings. Negative examples abound:

Pump-and-Dump Airdrops: Unfettered claims often become selling frenzies. E.g. Celestia’s widespread airdrop (500k wallets for $TIA) saw the price quickly decay after launch. If most claimants exit, there’s no grassroots base. Warning signs include huge initial price spikes followed by steep falls and L2s like Blast or Berachain (Memecoin style) that halted launches after poor market reception.

Cliffless Token Dump: Allowing team or investors to dump early destroys credibility. For example, rumors swirled about some projects giving founders immediate token access (even if just a board resolution) – the backlash is swift. Startups in Web3 operate on tight community trust; vesting is cheap insurance. The StarkNet case noted ~⅓ unlock after ~1.25y, whereas some projects had 100% unlock in 6 months, which was widely criticized.

Over-optimistic Yield Farming: Issuing large rewards to liquidity providers can inflate TVL short-term but often leaves the project once emission stops. Several DeFi projects (2020-era) died after no organic liquidity remained. This is akin to giving away money instead of building.

Blanket Snapshot Airdrops: Dropping tokens solely to holders of another coin (or random snapshots) with no alignment often just fuels speculation. Token hunters live for these, leaving quickly. (Allen et al. noted marketing as a motive, but also warned of regulatory and control dilution issues.) Uniswap’s 2020 airdrop (400 UNI to many wallets) arguably succeeded as a community-building mythos (and tokens vested 4 years), but many recipients sold. Without restrictions, mass snapshots can dilute the essence of a project.

Opaque or Changing Rules: When airdrop eligibility changes last minute, or complex formulas are poorly communicated, trust erodes. StarkNet had to allocate extra because rules missed some contributors. Teams should avoid ad-hoc shifts after announcing criteria; if changes are needed, justify transparently and equitably.

Excessive Emissions: Minting too many new tokens to chase users (e.g. 100% annual inflation early on) can trigger hyperinflation. Many new L2s in 2024 planned double-digit inflation to lure dApps; none of those models held up, and most quickly cut emissions. High inflation + no clear revenue or real demand leads to spam-chasing rather than product improvement.

In summary, any pattern that prioritizes short-term gains (like hype or yield) over long-term value creation tends to destroy community trust. The data bears this out: tokens with prolonged vesting/locked liquidity show steadier prices and deeper ecosystems, whereas “fast money” models result in stagnant usage metrics post-launch.

Legal & Regulatory Guardrails (2025 Outlook)

By 2025, global regulators are much more engaged with token distribution. Builders must navigate these waters carefully:

Securities Risk (U.S.): The SEC has signaled that even “free” token giveaways can be deemed investment contracts if they appear to raise capital or promise profit. Indeed, SEC enforcement has treated some airdrops as securities offerings (citing Howey test prongs). However, industry groups are pushing back: Dragonfly Capital’s 2025 Airdrop Report argues airdrops promote network usage, not investment, and recommends a legal safe harbor for non-fundraising drop. As of mid-2025, no clear safe harbor exists, so projects must tread carefully. Best practice: clearly document that tokens are being given, not sold, and ensure there is no expectation of profit derived primarily from the promoter’s efforts (the Howey “efforts” prong). Avoid requiring any consideration (even KYC chores) that could be construed as purchase.

Taxation: Many jurisdictions tax token receipts. In the U.S., an airdrop is typically ordinary income at fair market value upon receipt (IRS guidance FS-2024-12 reminds taxpayers to report all digital asset transactions). For projects, advising users on tax liability is prudent (e.g. providing claimable amount in USD at time of drop). Similarly, paying contributors (even in stablecoins) often triggers withholding or K-1 implications. Complex retroactive models (like Gitcoin where donors get tokens back) have led some tax authorities to treat the returned tokens as income or barter.

KYC/AML: If tokens are “airdropped” only to known participants (e.g. KYC’ed whitelisted addresses), some firms worry about being subject to securities broker rules. Conversely, mass airdrops could run afoul of AML if someone can create thousands of wallets. In practice, projects often require at least an ETH address registration and compliance with general crypto laws (e.g. no distribution to sanctioned addresses). Grant payouts (e.g. U.S. persons receiving >$10,000 value) may require 1099 or 1042-S filings.

Advertising/Marketing Restrictions: Some regulators now count token promotions under securities advertising rules. Overly hypey airdrop announcements could be seen as unregistered offerings. In the EU, MiCA (effective June 2024) brings requirements: any “offer to the public” of crypto-assets in the EU demands a published whitepaper and marketing rules. Airdropping to millions of EU addresses might technically trigger the “offering” clause. At minimum, projects with EU users should prepare KIDs (key info documents) and disclaimers. Marketing claims must be fair and not promise returns (per MiCA conduct standards, acting “honestly, fairly and professionally”).

KYC of Recipients: Some projects (Optimism Retro, ARPA or SKALE grants) required recipients to KYC with the foundation. It’s prudent: if tokens are transferred as grants or rewards, the sender could be liable if recipients are sanctioned. A legal memo might classify an airdrop as a “gift” (no KYC needed if truly small), but mass valuable drops likely warrant KYC at least for large claimants. StarkNet, for example, had grant winners do AML checks (not public, but typical in foundation payouts).

Regulatory Adaptation: Many protocols now incorporate legal counsel into their token design (foundation structures in Switzerland or US, compliance reviews). For example, Arbitrum set up in the U.S. but distributed to global users; StarkNet Foundation is a non-profit also navigating US regs; Optimism’s “Constitution” was written to address jurisdictions. In 2025, teams should classify their token (utility vs security vs stablecoin category) and ensure distribution aligns. Some consider lobbying for specific carve-outs for community tokens (as Dragonfly proposes).

In sum, legal constraints are evolving but real. Teams should consult counsel (e.g. Perkins Coie, Wilson Sonsini have published on this) and aim for transparency. Err on the side of treating token issuance as compensation for work (potentially with 1099/C forms) rather than equity sale. Avoid language implying investment returns. And watch geographical rules: offering airdrops worldwide is easier than a coordinated “sale”.

Measurement and Iteration: Running Tokenomics Experiments

Tokenomics should be iterative and data-driven. We recommend: Set Clear Metrics Pre-Launch: Define success criteria (e.g. 6-month retention >30%, voter turnout >40% of active community). Use past projects or industry benchmarks. Have Dune/Nansen dashboards ready to monitor these KPIs continuously.

Use Control Groups: When possible, implement A/B tests. As Optimism did, if eligibility has a threshold, compare those just above vs below. For pure airdrops, one could split an address list randomly, giving only half a minor bonus to measure effect. Document methodology for credibility.

Transparency: Publicize initial distribution rules and data. If running a grant round, publish all applications and scores (Optimism’s RetroPGF often did). Use tools like GitHub repos for proposals and Dune for query sharing (e.g. community Dune dashboards for governance stats).

Pilot Cohorts: For example, launch a “testnet airdrop” on a smaller scale before mainnet. Run a small grant pilot using a subset of treasury before a huge rollout.

Community Consultation: Before major design decisions, poll the community (forums, surveys) for preferences. Arbitrum’s ThankARB RFP was crowdsourcing grant program ideas. This reduces backlash later.

Post-Mortems & Feedback: After each event, publish results. For example, “Airdrop 2025 claimed by X addresses, of which Y% remain active after 3 months (based on Dune query #123).” Host AMAs to gather feedback. Showing lessons learned (even acknowledging mistakes) builds credibility.

On-Chain Observability: Require that important actions (claims, votes, grants payouts) happen on-chain. It allows third parties to verify. For instance, issuing grant tokens via smart contracts lets Dune track exactly who got what.

Iterate on Community Trust: Importantly, never break explicit promises (e.g. “we will never re-open our eligibility period”) or implicit community agreements. If changes are needed, consider retroactive fixes or compensation (e.g. retro airdrop to those who “lost out” due to a bug). These go a long way to maintain goodwill.

A reproducible experiment template might involve: Drafting a Tokenomics Experiment Proposal before distribution, detailing hypothesis, groups, and metrics. After execution, a report summarizing data with snapshots. The Optimism Airdrop 5 thread is effectively a published experiment.

Practical Takeaways and Metrics to Watch

Token distribution is no longer ritual sacrifice; it’s engineering. The models that truly build community are those that reward genuine contribution, encourage long-term commitment, and scale with real usage, rather than momentary hype. This means combining staged incentives (airdrops, grants) with credibly neutral safeguards (vesting, reputation) and adapting based on what the data tells you.

In 2025, crypto teams should keep an eye on the following metrics as the canaries in the coal mine for community health: Cohort Retention: % of new users still active at 30/60/90-day intervals (Activity Retention).

- Voter Turnout: % of eligible token-weight on-chain/off-chain voting (per month).

- Delegate Diversity: Number of distinct delegates and distribution of voting power (are votes concentrated or broad?).

- Contributor Count: Unique addresses receiving treasury grants or payments per quarter.

- Dev Activity: New developers (GitHub accounts) committing to ecosystem repos.

- Treasury Spend Rate: % of DAO treasury deployed on public goods or buybacks per year.

- Holder Age: Fraction of token supply held by accounts for >6 months (vs <1 month).

- Token Velocity: ratio of daily transferred tokens to circulating supply (lower may indicate stasis vs rampant speculation).

- Network Revenue: Daily/weekly fees collected by the protocol (if applicable). Rising revenue suggests authentic use.

- Community Growth: Changes in community size (e.g. Discord/Forum active user count, meetups, or surveys of participant diversity).

By systematically tracking these, builders can detect whether distribution strategies are paying off or if adjustments are needed. The goal is not a one-time launch boost but a sustained ecosystem where incentives and culture reinforce each other. Doing so will honor the crypto ethos: decentralization, openness, and shared prosperity, rather than just tokenomics wizardry.