In August 2025, one of the cryptocurrency industry's longest and most consequential legal battles reached its conclusion. The Securities and Exchange Commission and Ripple Labs officially ended their multi-year legal battle, jointly dismissing appeals in the XRP case. After nearly five years of uncertainty, appeals, and market volatility, both parties withdrew from their appellate proceedings, bringing closure to a case that had become synonymous with regulatory ambiguity in digital assets.

The settlement's core outcome preserved a landmark judicial ruling: XRP sold on public exchanges does not qualify as a security, while institutional sales do. This distinction, first established in Judge Analisa Torres' July 2023 decision, created a bifurcated regulatory framework that would reshape how the cryptocurrency industry, regulators, and institutional investors approach digital asset classification.

The implications extended far beyond Ripple's balance sheet or XRP's token price. The case became a referendum on how decades-old securities laws would apply to novel blockchain-based assets, setting precedent for token classification methodology, the boundaries of the Howey Test in digital markets, and the path toward regulatory maturity for an industry that had operated largely in legal gray zones.

This article examines the XRP verdict's multidimensional impact: the legal architecture that led to this outcome, the immediate market consequences, the institutional adoption wave it triggered, and the broader regulatory realignment now underway across the global cryptocurrency landscape. The analysis draws from court documents, SEC filings, verified market data, and industry reporting to provide a comprehensive understanding of why this settlement represents a watershed moment in crypto's evolution from speculative frontier to regulated financial infrastructure.

How the SEC vs. Ripple Battle Began

The SEC's December 2020 lawsuit against Ripple Labs represented one of the agency's most aggressive enforcement actions in the cryptocurrency space. The court found that Ripple's institutional sales of XRP constituted an unregistered offer and sale of investment contracts in violation of Section 5 of the Securities Act of 1933, but that other secondary offers and sales did not.

The complaint alleged that Ripple had conducted an unregistered securities offering worth $1.3 billion by selling XRP tokens to institutional investors and retail markets. The SEC's theory rested on applying the Howey Test, a 1946 Supreme Court framework defining investment contracts, to Ripple's XRP distribution model. Under this test, a transaction qualifies as a security if it involves an investment of money in a common enterprise with an expectation of profits derived from the efforts of others.

The lawsuit's timing and scope sent shockwaves through the cryptocurrency market. Major U.S. exchanges immediately delisted or suspended XRP trading, institutional partnerships froze, and the token's price plummeted over 60 percent within weeks. The message was clear: regulatory uncertainty was no longer an abstract concern but an existential threat to any digital asset that might be deemed a security.

For nearly three years, the case proceeded through discovery, motions, and legal arguments that probed fundamental questions about cryptocurrency design and distribution. The core dispute centered on whether XRP's nature changed based on how it was sold. Ripple argued that XRP was a commodity, functioning as a bridge currency for cross-border payments on the decentralized XRP Ledger, regardless of distribution channel.

The breakthrough came in July 2023 when Judge Torres issued a summary judgment that split the difference. The court ordered that Ripple be permanently restrained and enjoined from future violations of Section 5 and ordered it to pay a civil penalty of over $125 million. Her ruling found that institutional sales to sophisticated investors did constitute unregistered securities offerings, but programmatic sales on digital asset exchanges and distributions to employees did not. This bifurcated approach created a novel legal framework: the same token could have different regulatory classifications depending on sale context rather than inherent characteristics.

Both parties appealed. The SEC challenged the finding that secondary market transactions weren't securities, while Ripple contested the institutional sales determination and penalty amount. Throughout 2024 and into 2025, the legal battle continued as the Second Circuit prepared to hear arguments, creating sustained uncertainty about XRP's ultimate regulatory status.

The case tested legal boundaries that extended beyond XRP. How should courts interpret 1946 securities law when applied to decentralized blockchain protocols? Can a digital asset's regulatory status vary by distribution method? What role does purchaser sophistication play in securities analysis? These questions made the Ripple case a proxy battle for the entire cryptocurrency industry's regulatory future.

The August 2025 Settlement - What It Really Means

The resolution came faster than many anticipated. The Securities and Exchange Commission filed a settlement agreement entered into with defendants Ripple Labs, Inc., Bradley Garlinghouse, and Christian A. Larsen that lays out a framework for resolving the Commission's civil enforcement action against them.

Under the settlement terms announced in May 2025 and finalized in August, the settlement agreement provides, among other things, that the Commission and Ripple would jointly request the district court to issue an indicative ruling as to whether it would dissolve the injunction against Ripple in the district court's August 7, 2024 final judgment and order the escrow account holding the $125,035,150 civil penalty imposed by the final judgment be released, with $50 million paid to the Commission in full satisfaction of that penalty and the remainder paid to Ripple.

Ripple has paid the $125 million penalty in cash as part of the XRP lawsuit settlement. Former SEC lawyer Marc Fagel confirmed that the payment was made in cash and not in XRP. This detail mattered: Ripple settled using traditional currency rather than its native token, maintaining clear separation between corporate obligations and token economics.

The legal precedent established through Judge Torres' preserved ruling created a taxonomy that would influence how other tokens might be analyzed. Secondary market transactions on digital asset exchanges, where purchasers have no direct relationship with the token issuer, fall outside securities regulation. Institutional sales, where sophisticated investors purchase directly from the issuer with expectations shaped by the issuer's promotional efforts, do constitute securities offerings requiring registration or exemption.

This framework implicitly recognized that distribution mechanics matter as much as token characteristics in regulatory classification. A token doesn't have an immutable regulatory identity; context determines classification. This principle represented a significant departure from earlier SEC enforcement actions that treated tokens as securities regardless of sales channel.

The reaction from SEC leadership revealed internal agency tensions about crypto policy. SEC Commissioner Caroline Crenshaw dissented from the settlement, stating "This settlement, alongside the programmatic disassembly of the SEC's crypto enforcement program, does a tremendous disservice to the investing public and undermines the court's role in interpreting our securities laws".

Her dissent highlighted concerns that the settlement undermines the court's order by razing the civil penalty ruling and court-imposed injunction, stating that if Ripple decides tomorrow to sell unregistered XRP tokens to institutional investors, this Commission will do absolutely nothing about it.

Industry leaders responded with cautious optimism. Ripple CEO Brad Garlinghouse previously hailed the final judgment as a victory for Ripple and the crypto sector. Ripple's legal team emphasized that the outcome vindicated their long-held position that XRP functions as a currency rather than an investment security in most contexts.

The settlement's broader significance lay in what it signaled about regulatory philosophy shifts. Under leadership that took office in January 2025, the SEC appeared to pivot from aggressive crypto enforcement toward clearer rulemaking and negotiated resolutions. The SEC had been pursuing a programmatic shift to dismiss registration cases in the crypto context, pointing to a new "regulatory path" based on the SEC's Crypto Task Force.

For Ripple, the settlement removed the existential threat that had hung over the company since December 2020. While the terms included a substantial penalty and preserved findings about institutional sales violations, Ripple could now operate with clarity about XRP's regulatory treatment in its primary use case: providing liquidity for cross-border payments on public exchanges. The company immediately announced plans to expand U.S. partnerships, pursue banking licenses, and deepen institutional relationships that had been on hold during the litigation.

Market Repercussions - XRP's Price, Volume, and Institutional Surge

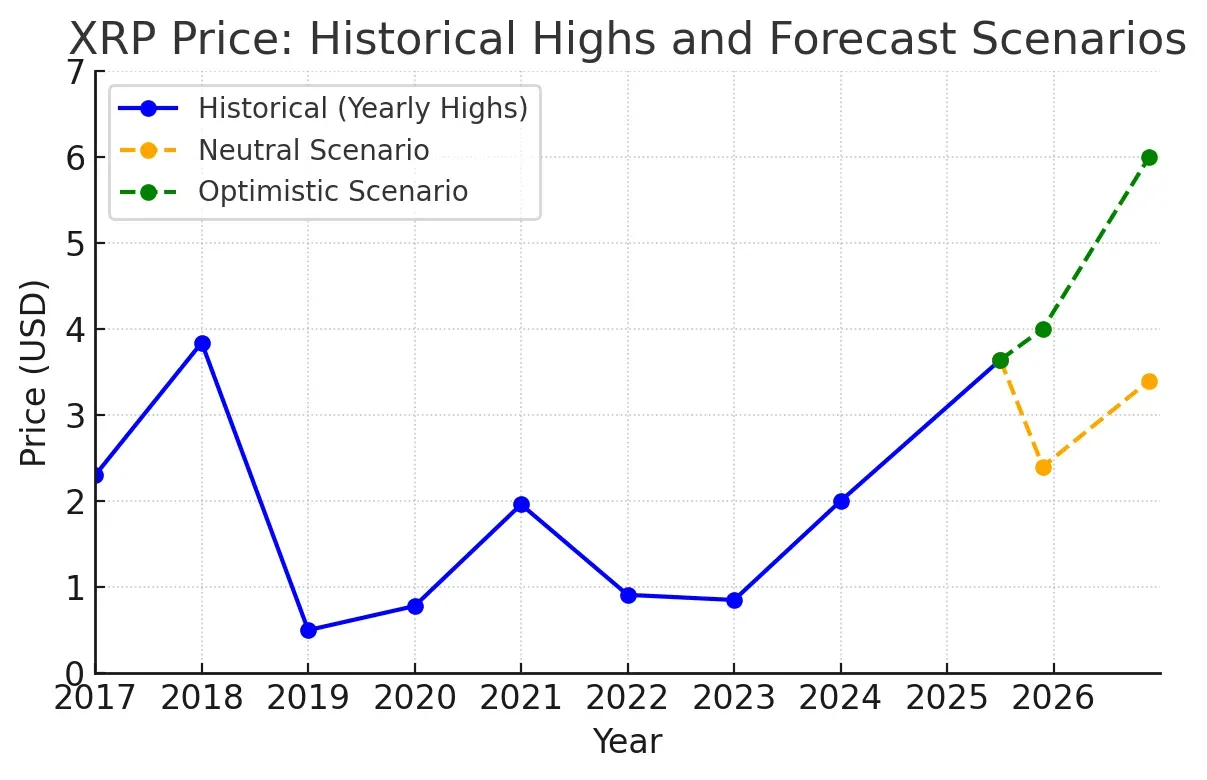

The market's response to regulatory clarity was immediate and dramatic. The settlement triggered a sharp price rally, with XRP surging from $2.99 to $3.30 within 24 hours. Trading volumes exploded as investors who had waited years for resolution rushed back into the market. Daily volumes increasing by 208% following the settlement announcement, with sustained elevated activity through August and September.

The price movement reflected more than speculative enthusiasm. XRP experienced a 5% drop in value before stabilizing, with significant trading volume highlighting institutional activity, demonstrating that sophisticated market participants were actively repositioning rather than simply retail traders chasing momentum.

Technical analysis revealed solid support establishing around specific price levels. $3.15-$3.16 emerges as strong accumulation zone following early-session selloff, while late-session breakout cleared $3.22 resistance on sustained large-order flow above 4 million units. These patterns indicated that institutional players were methodically accumulating positions at strategic price points rather than engaging in undisciplined buying.

The derivatives market provided perhaps the clearest evidence of institutional adoption's velocity. CME Group's XRP futures, launched in May 2025, became a phenomenon. XRP futures contracts on the Chicago Mercantile Exchange recorded over $19 million in notional trading volume on their first day. The growth trajectory proved even more impressive. XRP futures on CME Group has now crossed the $1 billion open interest milestone, becoming the fastest crypto contract to do so, just three months after launch.

The speed of this achievement was unprecedented. Solana futures reached a $1 billion open interest mark faster than ether and bitcoin. Futures tied to the payments-focused XRP crossed that threshold in August, just three months after they began trading. For context, Bitcoin took three years to reach the same milestone, Ethereum took eight months, and even the fast-growing Solana needed five months. XRP's three-month sprint to $1 billion open interest signaled extraordinary institutional appetite.

Record monthly XRP futures average daily volume of 6,600 contracts ($385 million in notional) and average daily open interest of 9,300 contracts ($942 million in notional) in August 2025. These figures represented genuine institutional positioning rather than retail speculation, as CME's regulatory framework and capital efficiency features primarily serve professional traders and fund managers.

The custodian market provided additional evidence of institutional adoption's depth. BitGo reported that XRP made up 3.9% of its holdings as of June 30, 2025, highlighting its growing share in regulated portfolios. For context, BitGo serves as one of the cryptocurrency industry's largest qualified custodians, managing assets for institutional clients including hedge funds, family offices, and traditional financial institutions. XRP's presence in nearly 4 percent of custodied assets represented substantial institutional allocation.

Market capitalization metrics told a compelling story about XRP's resurgence. XRP's market cap at $181.944 billion and $10 billion+ daily trading volume positioned it firmly as a major digital asset by any measure. Throughout 2025, XRP traded as the third or fourth largest cryptocurrency by market capitalization, occasionally surpassing Ethereum in specific trading metrics during peak institutional activity periods.

The liquidity profile transformation was equally significant. In the years following the SEC lawsuit, XRP suffered from fragmented liquidity across global exchanges, with U.S. markets effectively shut off. The settlement's resolution triggered relisting on major U.S. platforms and consolidated global liquidity. XRP rose 4% in the 24-hour period ending August 13, climbing from $3.15 to $3.25 within a $0.20 range with volume exceeding 140 million units. These volume figures represented healthy, sustained liquidity rather than episodic spikes.

Price stability patterns also emerged as institutional participation deepened. While XRP experienced the volatility typical of cryptocurrency markets, support confirmed at $2.84 with high-volume absorption of sell pressure, with resistance at $2.94-$2.95. These defined trading ranges with clear support and resistance levels indicated mature order flow and institutional market-making activity.

Institutional Reentry - From Risk Asset to Regulated Product

The settlement catalyzed a fundamental recategorization of XRP within institutional frameworks. Before August 2025, compliance departments at banks, asset managers, and broker-dealers treated XRP as radioactive due to the SEC lawsuit's unresolved status. After the settlement, institutional perspectives shifted dramatically.

The exchange-traded fund filing wave illustrated this transformation. Asset managers Grayscale, Bitwise, Canary, CoinShares, Franklin, 21Shares, and WisdomTree on Friday all filed updated statements for their proposed spot XRP exchange-traded funds. The synchronized filing activity demonstrated coordinated industry momentum toward creating regulated investment products.

XRP ETFs highly anticipated with approval odds 95%, while ProShares' UXRP (futures) already holds $1.2 billion. The ProShares Ultra XRP ETF, a two-times leveraged futures-based product, launched in July 2025 and quickly demonstrated robust institutional demand. Its $1.2 billion in assets under management within the first month provided a preview of potential capital inflows that spot ETF products might attract.

The first spot XRP ETF breakthrough came in September. The REX-Osprey XRPR, the first US-listed spot XRP ETF, launched on September 18, 2025, which garnered substantial first-day trading volume. The REX-Osprey XRP ETF launched with a record-breaking $37.7 million in trading volume - far exceeding the $1 million benchmark. This debut volume significantly surpassed typical ETF launch metrics and signaled strong pent-up demand for regulated XRP exposure.

Multiple additional spot ETF applications remained in SEC review with decision deadlines clustered in October 2025. Eight spot XRP ETF filings await SEC decision Oct 18-25, 2025. The compressed timeline suggested potential coordinated approval decisions similar to the Bitcoin spot ETF approvals in January 2024.

The structural amendments in ETF filings revealed regulatory engagement progress. Analysts take the cluster of filings as a sign that asset managers are responding to feedback from the regulatory agency. The updated filings appear to change the structure of some of the funds to allow for XRP or cash creations and cash or in-kind redemptions, rather than simply cash creations and redemptions. This evolution toward flexible creation and redemption mechanisms indicated that the SEC was working constructively with issuers to establish viable ETF structures rather than simply rejecting applications.

Beyond ETF products, direct institutional allocation strategies emerged. Galaxy Digital, a Wall Street crypto firm, disclosed a $34 million XRP holding in its Q2 2025 SEC filing. For a publicly traded financial services company to hold XRP on its balance sheet and disclose it in regulatory filings represented a significant validation of XRP's institutional acceptability.

Corporate treasury adoption marked another frontier. Corporate treasuries from non-crypto firms - Quantum Biopharma, Worksport Ltd., and Hyperscale Data Inc. - added XRP to their balance sheets. These companies, operating in pharmaceuticals, automotive manufacturing, and data infrastructure respectively, had no inherent connection to cryptocurrency or blockchain technology. Their XRP allocations signaled that treasury professionals viewed the token as a legitimate reserve asset with functional utility for corporate operations.

Nature's Miracle CEO James Li announced a $20 million XRP treasury allocation, signaling corporate validation of its cross-border payment utility. Li's public statements emphasized operational rather than speculative rationale: the company intended to use XRP for international payments and settlements, leveraging the token's fast settlement times and low transaction costs for business operations.

Institutional holdings reached substantial scale. Institutional holdings of XRP reached $7.1 billion in Q2 2025, with 92% client retention and 47 Fortune 500 companies now using RippleNet. The retention rate suggested that institutional adopters found sustained value in XRP-based payment solutions rather than engaging in experimental pilots that they later abandoned.

The custody and infrastructure buildout accelerated. South Korean custody provider BDACS launched institutional-grade XRP solutions for exchanges like Upbit and Coinone. South Korea represents one of the world's most active cryptocurrency markets, and BDACS's entry into XRP custody services indicated growing institutional demand in Asian markets.

Banking relationships also began normalizing. Ripple announced partnerships with multiple financial institutions that had paused collaborations during the SEC lawsuit. The company's expanded efforts to secure a national bank charter through Office of the Comptroller of the Currency review demonstrated ambitions to operate within traditional banking regulatory frameworks rather than circumventing them.

The institutional adoption wave distinguished itself from previous cryptocurrency hype cycles through its focus on utility over speculation. Ripple's On-Demand Liquidity service processed $1.3 trillion in Q2 2025 alone, with 300+ institutions, including J.P. Morgan and Santander, adopting the platform. These transaction volumes represented actual cross-border payments and liquidity management rather than speculative trading.

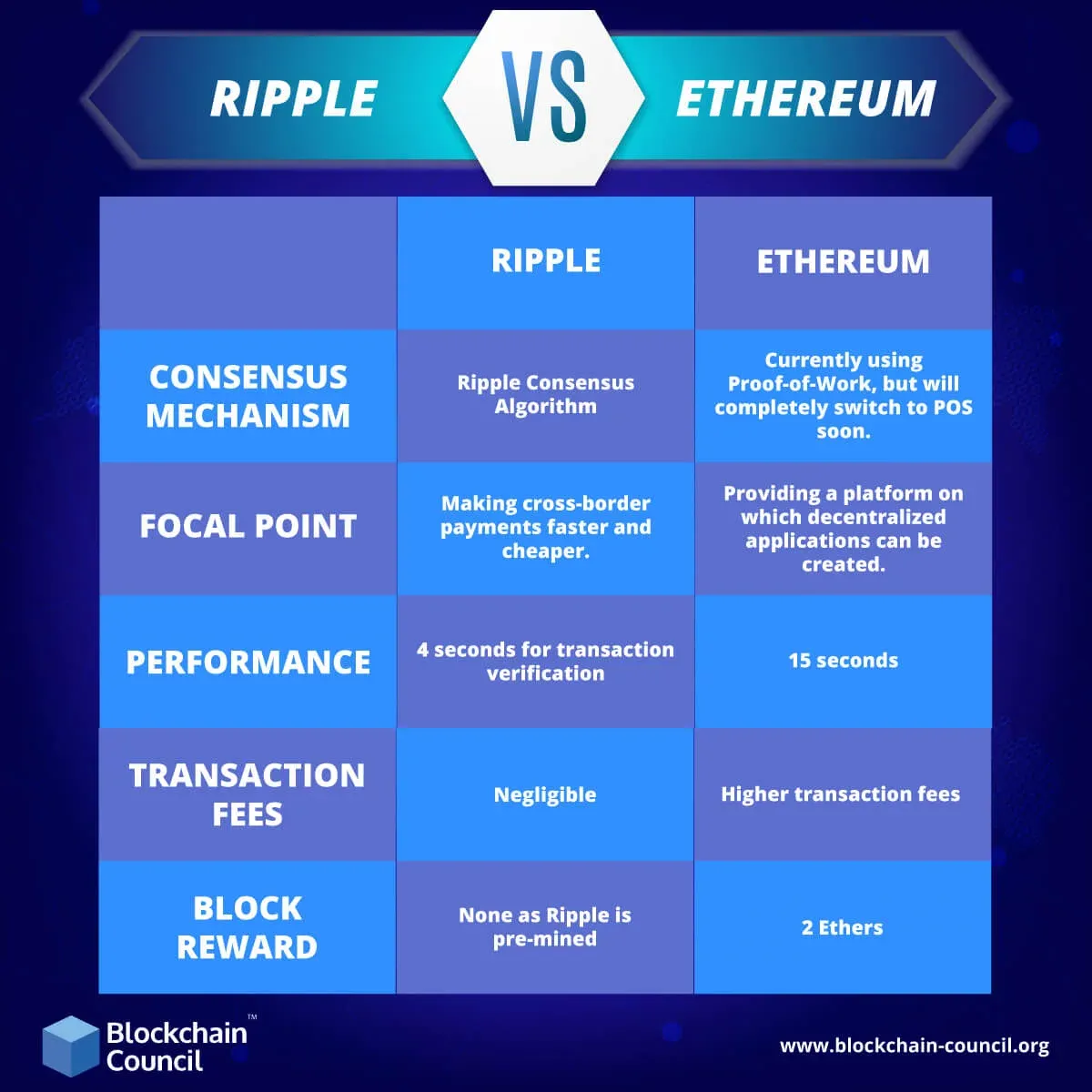

The cost efficiency advantage proved compelling for institutional adopters. XRP's cost efficiency - $0.0004 per transaction versus $1.88 for Bitcoin and $0.46 for Ethereum - has made it a preferred solution for correspondent banking. For institutions moving hundreds of millions or billions of dollars annually in cross-border payments, these cost differentials translated to meaningful operational savings.

Settlement speed provided another practical advantage. XRP Ledger transactions settle in three to five seconds with finality, compared to ten minutes or longer for Bitcoin and potentially longer for Ethereum depending on network congestion. For treasury operations and time-sensitive payments, settlement speed directly impacts working capital efficiency and operational flexibility.

XRP vs. ETH - The 2025 Rivalry in Context

Throughout 2025, XRP and Ethereum engaged in an unexpected rivalry for institutional attention and capital allocation. The comparison revealed fundamentally different value propositions competing for position in institutional portfolios.

Price performance metrics showed XRP's dramatic outperformance on an annual basis. XRP has significantly outperformed ETH over the past year. Since July 2024, XRP has surged by 552%, while ETH has recorded a modest gain of 6.34%, rising to $3,630 from $3,432. Year-to-date performance also highlights XRP's strength, with the token climbing to $3.10 from $2.08 (a 49% increase), compared to ETH's 9.5% rise over the same period.

These performance differentials reflected distinct catalyst timelines. XRP's surge came primarily from resolving regulatory uncertainty and the subsequent institutional reentry. Ethereum's more modest gains occurred despite its established position as the second-largest cryptocurrency, suggesting that market participants had already priced in much of Ethereum's institutional adoption story while XRP represented a reopening trade.

Market capitalization and liquidity metrics, however, showed Ethereum's continued dominance in absolute terms. Ethereum's market cap at $538.25 billion and a price of $4,465.74 as of 2025, with 24-hour trading volume of $14.42 billion. XRP holds a $169.82 billion market cap and a price of $2.99, with a trading volume of $2.13 billion. Ethereum commanded more than three times XRP's market capitalization and nearly seven times its daily trading volume.

The ecosystem comparison revealed divergent strategic focuses. Ethereum had established itself as the foundation for decentralized finance, with hundreds of billions of dollars locked in DeFi protocols, thriving NFT markets, and thousands of developers building smart contract applications. Its ecosystem breadth encompassed lending platforms, decentralized exchanges, synthetic assets, gaming applications, identity solutions, and layer-two scaling networks.

XRP Ledger, by contrast, optimized for a narrow but critical function: facilitating fast, low-cost value transfer. XRP's network utility is defined by its speed and low cost. The XRP Ledger handles 1,500 TPS with settlement times of 3–5 seconds. While Ethereum supported complex programmable money and decentralized applications, XRP focused on being exceptionally good at moving value efficiently.

This specialization versus generalization tradeoff shaped institutional allocation decisions. Asset managers seeking exposure to DeFi innovation, smart contract platforms, and Web3 application infrastructure naturally gravitated toward Ethereum. Those focused on payment optimization, treasury operations, and cross-border settlement efficiency found XRP's purpose-built design more appealing.

Regulatory clarity dynamics also differed significantly. Ethereum secured informal regulatory blessing as a non-security through SEC statements in 2018 and subsequent actions. XRP achieved similar clarity only after five years of litigation and a nuanced court ruling. However, XRP's hard-fought legal victory may have created more robust precedent than Ethereum's regulatory accommodation, as Judge Torres' decision provided detailed judicial analysis rather than agency discretion.

Institutional adoption pathways diverged based on use case. Ethereum's institutional momentum and regulatory clarity position it as a superior buy in 2025, particularly for investors seeking exposure to a maturing crypto ecosystem. XRP, while undervalued in its niche, remains a high-risk, high-reward asset dependent on regulatory outcomes.

The stablecoin relationship illustrated different strategic positions. Ethereum hosted the vast majority of stablecoin supply, with USDT, USDC, and other dollar-pegged tokens operating as ERC-20 tokens on Ethereum and its layer-two networks. Ethena Labs' inclusion of XRP in its $11.8 billion USDe stablecoin framework exemplifies this shift. By leveraging XRP's market cap and daily trading volume, USDe enhanced its peg stability and resilience during redemptions. XRP's role as stablecoin collateral represented a newer but growing use case.

Payment integration strategies also differed. PayPal's July 2025 integration of XRP into its "Pay with Crypto" service further expanded its retail and business reach, reducing fees to 0.99% and shielding users from volatility. Ethereum had earlier secured PayPal integration for stablecoin transfers, but XRP's addition to payment rails represented competitive positioning in the merchant services space.

Technical infrastructure evolution showed Ethereum prioritizing layer-two scaling solutions to address high gas fees, while XRP maintained its layer-one efficiency advantage but faced questions about programmability limitations. Ethereum's transition to proof-of-stake reduced energy consumption and established staking yield as an institutional value driver, while XRP's consensus protocol provided different security and decentralization tradeoffs.

The institutional portfolio positioning question crystallized around risk-adjusted return profiles and strategic alignment. A balanced portfolio could include both assets, leveraging Ethereum's ecosystem growth and XRP's utility in remittances. Additionally, exposure to Ethereum-based DeFi platforms enhances yield potential.

Legal and Regulatory Ripple Effects

The XRP settlement's influence extended far beyond Ripple's corporate interests, establishing precedent and principles that would shape cryptocurrency regulation globally.

The secondary market doctrine emerged as perhaps the most significant legal innovation. By distinguishing between institutional sales and programmatic secondary market transactions, Judge Torres' ruling created a pathway for tokens to achieve regulatory clarity even if their initial distribution involved securities law violations. This framework suggested that a token's current regulatory status depends on present distribution characteristics rather than being permanently determined by launch mechanics.

This principle carried profound implications for other tokens facing potential securities classification. Projects that conducted ICOs or token sales in 2017-2018 without proper registration might still argue their tokens currently function as commodities if secondary market trading has become sufficiently decentralized and disconnected from issuer promotional efforts.

The Howey Test application to digital assets gained nuance through the XRP ruling. Rather than analyzing whether a token itself is a security, the court focused on whether specific transaction types constitute investment contracts. This distinction matters because it shifts analysis from token characteristics to distribution context, potentially allowing the same token to have different regulatory treatments in different contexts.

Congressional action gained momentum from the regulatory uncertainty that the Ripple case highlighted. The passage of the GENIUS Act and Digital Asset Market CLARITY Act in July 2025 provided a legal framework for corporate adoption, reducing compliance burdens and encouraging firms to allocate XRP to their treasuries. These legislative initiatives reflected bipartisan recognition that regulatory clarity required statutory foundations rather than relying solely on enforcement actions and court interpretations of 1940s-era securities law.

The legislation established frameworks for treating certain digital assets as commodities rather than securities, created safe harbors for specific token distribution methods, and clarified the division of regulatory authority between the SEC and CFTC. While implementation details remained subject to rulemaking processes, the statutes provided legal architecture that the Ripple litigation had revealed was desperately needed.

International regulatory approaches showed divergent reactions to U.S. precedent. The European Union's Markets in Crypto-Assets Regulation (MiCA), which entered into force in stages throughout 2024-2025, took a different approach by creating bespoke regulatory categories for crypto-assets rather than forcing them into existing securities frameworks. XRP's classification under MiCA as a utility token eligible for certain regulatory accommodations demonstrated how different jurisdictions could reach similar practical outcomes through distinct legal pathways.

United Kingdom regulators observed the U.S. developments with interest. The Financial Conduct Authority's approach emphasized proportional regulation based on token functionality and use cases. XRP's payment-focused utility aligned well with the UK's regulatory philosophy of matching oversight intensity to consumer risk and market integrity concerns.

Asian financial centers, particularly Singapore, Hong Kong, and Japan, had already established clearer frameworks for payment tokens versus investment tokens before the Ripple settlement. In May 2025, CME Group introduced XRP futures, which saw $542 million in trading volume during their first month - about 45% of it from outside North America. The substantial non-U.S. participation in XRP derivatives trading reflected that international institutions had maintained engagement with XRP even during U.S. regulatory uncertainty.

Japan's relationship with XRP proved particularly noteworthy. Japanese regulators had classified XRP as a cryptocurrency rather than a security years before the U.S. settlement, and major Japanese financial institutions including SBI Holdings maintained active involvement in Ripple partnerships throughout the SEC litigation. The regulatory clarity in the U.S. removed friction for Japanese institutions' U.S. operations and cross-border integration of XRP-based payment systems.

The precedent's influence on other token cases began manifesting quickly. SEC enforcement actions against other projects now faced questions about whether the agency could distinguish between institutional sales and secondary market transactions as Judge Torres had done. Defendants in ongoing cases cited the XRP ruling to argue for similar analysis of their token distribution models.

The regulatory philosophy shift proved equally significant. The SEC was pursuing a programmatic shift to dismiss registration cases in the crypto context, pointing to a new regulatory path based on the SEC's Crypto Task Force. This pivot from aggressive enforcement toward rulemaking and negotiated frameworks suggested that the Ripple settlement represented an inflection point in the agency's approach to digital assets.

Commissioner Hester Peirce's leadership of the SEC's Crypto Task Force, established in 2025, reflected this evolution. The task force's mandate included developing clearer guidelines for token classification, creating safe harbor provisions for certain distribution methods, and establishing pathways for compliant token offerings. These initiatives acknowledged that pure enforcement had failed to provide the clarity that markets, issuers, and investors required.

The settlement also influenced state-level regulation. States with active virtual currency licensing regimes, including New York's BitLicense framework, began updating guidance to reflect federal precedent from the Ripple case. This coordination reduced regulatory fragmentation that had complicated interstate cryptocurrency operations.

Investor Behavior and Market Structure Evolution

The XRP settlement catalyzed measurable shifts in how both institutional and retail investors approached cryptocurrency portfolio construction and risk assessment.

The concept of "regulatory risk premium" became explicitly quantifiable. Before the settlement, XRP traded at valuations that embedded substantial discount for potential adverse legal outcomes. The litigation's resolution removed this uncertainty overhang, allowing investors to assess XRP based on fundamental utility and market dynamics rather than binary legal risk. The resulting price appreciation partially reflected compression of this regulatory risk premium.

Institutional allocation frameworks evolved to incorporate legal clarity as a portfolio construction factor. XRP's 3-5 second settlement speed and regulatory clarity position it as a bridge between traditional finance and blockchain ecosystems. Compliance departments at traditional financial institutions began distinguishing between legally-clear assets like Bitcoin (commodity classification confirmed), Ethereum (SEC statements indicating non-security status), and now XRP (court ruling establishing secondary market non-security status) versus tokens with ongoing regulatory uncertainty.

This taxonomy created a tiered market structure where legally-clear assets commanded premium valuations and institutional allocation preference. The market increasingly differentiated between speculative DeFi tokens with undefined regulatory status and utility-focused tokens with established legal frameworks.

Whale accumulation patterns demonstrated sophisticated investor positioning. According to data from Santiment, 2,743 wallets now hold over one million XRP each, amounting to 47.32 billion tokens - roughly 4.4% of the total circulating supply. This concentration level, while raising some concerns about market power, also indicated that large holders maintained conviction through the legal uncertainty and positioned for long-term appreciation.

The correlation dynamics between XRP and other major cryptocurrencies shifted through 2025. Historically, XRP traded with high correlation to Bitcoin and Ethereum, as most altcoins do during broad market moves. However, during specific periods surrounding settlement announcements and regulatory developments, XRP demonstrated reduced correlation, moving on idiosyncratic catalysts rather than following broader crypto market sentiment.

Retail investor behavior showed increased sophistication and longer holding periods. Exchange metrics revealed that XRP holders increasingly moved tokens off exchanges into self-custody or staking arrangements, suggesting investment rather than trading orientation. The average holding period for XRP positions extended significantly compared to 2023-2024, when litigation uncertainty encouraged shorter-term trading approaches.

The derivatives market structure matured alongside spot markets. Total crypto futures open interest has doubled year-over-year, now reaching $30 to $35 billion daily. XRP's contribution to this growth reflected both speculative interest and genuine hedging demand from institutional holders seeking to manage price risk while maintaining XRP exposure for operational purposes.

Options market development provided additional tools for sophisticated risk management. CME Group announced plans to launch options on Solana and XRP futures on October 13, 2025. Options strategies allow investors to establish asymmetric payoff profiles, hedge downside risk, or generate yield through covered call writing. The availability of these instruments attracted institutional capital that required risk management capabilities.

The yield-bearing asset development represented another evolution. The Flare Network's Total Value Locked grew to $236 million in August 2025, driven by institutional-grade yield strategies and partnerships with custodians like BitGo and Fireblocks. APY rates for XRP via Flare's FXRP model ranged between 4% and 7% in Q3 2025. These yield opportunities transformed XRP from a pure price-appreciation asset into a productive investment generating returns through DeFi protocols.

Portfolio allocation models began incorporating XRP into specific strategy buckets. Conservative institutional allocators treated XRP as a payment infrastructure investment, comparable to positions in payment processing companies or foreign exchange platforms. More aggressive allocators positioned XRP as a compliance-forward alternative to higher-risk DeFi tokens, accepting lower speculative upside in exchange for reduced regulatory uncertainty.

The retail investment thesis evolved from speculative moonshot to utility-based value proposition. Educational content and investor communications increasingly emphasized XRP's functional role in cross-border payments, institutional partnerships, and practical use cases rather than purely price speculation. This maturation reflected broader cryptocurrency market evolution toward fundamental analysis over meme-driven narratives.

Trading venue development also evolved. After major U.S. exchanges relisted XRP following settlement clarity, liquidity consolidated on regulated platforms. This centralization into compliant venues made markets more efficient but also highlighted the importance of regulatory status for liquidity access.

Challenges, Counterarguments, and Open Risks

Despite significant progress, XRP faces substantial challenges and legitimate skepticism about its long-term competitive position and growth sustainability.

Global regulatory inconsistency remains a persistent concern. While the U.S. settlement provided clarity within American jurisdiction, other countries maintain different classification frameworks. This fragmentation creates complexity for institutions operating across multiple jurisdictions, as an asset classified as a commodity in the U.S. might face different treatment in Europe, Asia, or Latin America. Multinational institutions must navigate these varying requirements, potentially limiting XRP's utility as a truly global bridge currency.

Competitive threats from central bank digital currencies represent perhaps the most formidable long-term challenge. Stablecoins may present a more practical bridge than XRP's native token, as banks and corporations generally prefer settling transactions in real-world denominations such as the U.S. dollar or other fiat currencies. As CBDCs emerge in major economies, they offer instant settlement, government backing, and native currency denomination without cryptocurrency volatility or conversion requirements.

The SWIFT network's modernization efforts also pose competitive risks. SWIFT has begun rolling out blockchain and tokenization pilots, partnering with several major financial institutions to test use of distributed ledger technology for cross-border payments. If SWIFT successfully integrates blockchain technology while maintaining its existing institutional relationships and network effects, it could capture efficiency gains without requiring adoption of a neutral cryptocurrency like XRP.

Stablecoin competition intensified through 2025. Circle's USDC, Tether's USDT, and PayPal's PYUSD all expanded into cross-border payment applications. These dollar-denominated stablecoins offer price stability that XRP cannot match, making them potentially more attractive for risk-averse institutions and treasury operations where currency volatility is unacceptable.

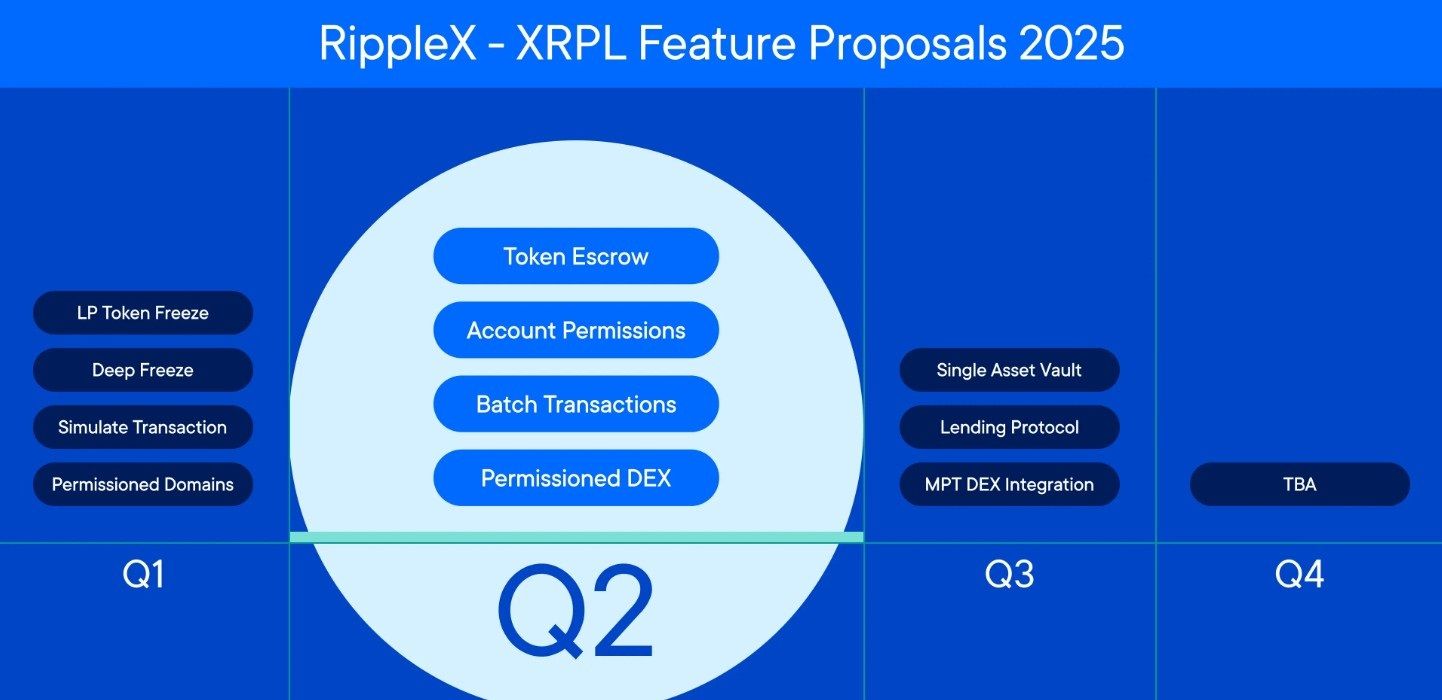

Developer ecosystem weaknesses relative to smart contract platforms remain evident. While XRP Ledger supports some programmability features, its developer community and application ecosystem pale in comparison to Ethereum, Solana, or other platforms optimized for decentralized applications. This limits XRP's flexibility to expand beyond payment use cases into broader DeFi functionality.

Market concentration concerns center on Ripple's substantial XRP holdings. The company maintains billions of XRP in escrow, releasing tokens periodically for operational expenses and to fund ecosystem development. Critics argue that reduced enforcement could embolden bad actors, creating a risk of regulatory arbitrage. This concentration gives Ripple significant influence over supply dynamics, raising questions about decentralization and whether XRP truly functions as a neutral, permissionless cryptocurrency or remains effectively controlled by its founding company.

Price volatility relative to stablecoins creates friction for enterprise adoption. While XRP settles transactions in seconds with minimal fees, corporations using it for cross-border payments face foreign exchange risk during the brief holding period. If XRP's price moves significantly between purchase and redemption, intended cost savings can evaporate. This volatility makes business case quantification more challenging than using stablecoins that maintain dollar parity.

Limited consumer application adoption distinguishes XRP from cryptocurrencies like Bitcoin that developed organic user bases through ideological appeal or from platforms like Ethereum that enabled novel applications. XRP remains primarily an institutional tool, with most tokens held by financial institutions, market makers, or investors rather than ordinary users conducting payments. This narrow user base creates dependency on institutional adoption continuing.

Skeptical analysts question whether XRP's institutional surge represents durable strategic positioning or temporary relief rally that will fade. Considering XRP's performance, investors are beginning to ask an important question: Could XRP be the smartest cryptocurrency to buy right now? There's no question that global financial infrastructure is overdue for digital modernization, and XRP has earned real credibility because it offers a compelling solution. Whether it's truly the smartest cryptocurrency to buy right now is debatable.

Network effect challenges persist as SWIFT continues dominating correspondent banking relationships. Despite RippleNet's growth, SWIFT connects over 11,000 financial institutions across 200 countries and territories. SWIFT's market share in institutional payments declining from 85% to 78% in 2025, but this still represents overwhelming dominance that will require years to substantially erode even with superior technology.

Alternative blockchain payment solutions also compete for the same institutional use cases. Stellar Lumens (XLM) offers similar fast, low-cost settlement and explicitly focuses on financial inclusion and cross-border payments. IBM and other major corporations have backed Stellar-based initiatives. While Stellar hasn't achieved XRP's scale, it demonstrates that multiple blockchains can target the same payment use case, potentially fragmenting adoption rather than consolidating around a single standard.

Scalability questions emerge about whether XRP Ledger can handle truly global payment volumes if mainstream adoption occurs. While current transaction throughput significantly exceeds Ethereum or Bitcoin, processing a substantial fraction of global cross-border payments would require orders of magnitude more capacity. Technical roadmap execution risks exist around whether the protocol can scale appropriately as demand grows.

Institutional adoption dependency creates concentration risk. If institutional interest cools or strategic partnerships fail to convert into sustained transaction volumes, XRP's fundamental value proposition weakens. Unlike cryptocurrencies with strong retail user bases or decentralized protocols that function independently of corporate adoption, XRP's success depends heavily on continued financial industry embrace.

Regulatory evolution remains unpredictable. While the current settlement provides clarity, future administrations could pursue different enforcement priorities. Additionally, comprehensive cryptocurrency legislation working through Congress could alter regulatory frameworks in ways that help or hurt XRP's competitive position relative to alternatives.

Ripple's Post-Victory Roadmap

With the SEC lawsuit resolved, Ripple Labs articulated an ambitious strategic vision for expanding XRP's role in global finance while deepening institutional penetration in the U.S. market.

The company's immediate priority focused on rebuilding and expanding U.S. partnerships that had frozen during the litigation. Ripple announced relationships with multiple regional banks and credit unions exploring RippleNet for correspondent banking and remittance corridors. The company emphasized that these partnerships would prioritize regulatory compliance and work within established banking frameworks rather than seeking to disrupt traditional finance from outside.

Central bank digital currency initiatives represented a major strategic thrust. Ripple positioned itself as infrastructure provider for CBDC implementations, offering the XRP Ledger as a technological foundation for sovereign digital currencies. The company announced CBDC pilots in multiple countries across Latin America, Asia, and the Middle East, though specific nation partnerships remained confidential in many cases to respect central bank communication preferences.

The CBDC strategy illustrated Ripple's pragmatic approach to blockchain's role in finance. Rather than positioning XRP as replacement for fiat currency, Ripple argued that the XRP Ledger could serve as neutral infrastructure supporting both XRP transfers and sovereign digital currencies. This multipurpose vision aimed to make Ripple essential to payment modernization regardless of whether XRP itself achieved universal adoption as a bridge asset.

Private ledger solutions for banks represented another enterprise-focused initiative. Ripple developed permissioned versions of its technology allowing banks to deploy blockchain-based payment rails without using XRP or operating on the public XRP Ledger. While this approach might seem to diminish XRP's role, Ripple argued that capturing bank payment modernization spending regardless of token adoption built enterprise relationships that could later expand into public XRP Ledger usage.

The national bank charter pursuit through the Office of the Comptroller of the Currency represented perhaps Ripple's boldest regulatory integration move. The OCC's decision on Ripple's national bank charter, expected in October 2025, could further solidify XRP's regulatory standing and market access within the United States. A national bank charter would allow Ripple to offer banking services directly rather than through partnerships, including deposit accounts, lending products, and payment services all potentially integrated with XRP.

Tokenization initiatives aimed to extend XRP Ledger functionality into real-world asset representation. Linklogis, a Chinese supply chain fintech giant, has integrated its $1.3 trillion digital supply chain finance platform onto the XRP Ledger, enabling cross-border settlements and tokenized real-world assets. These partnerships demonstrated how XRP Ledger could support asset classes beyond cryptocurrency, including invoices, trade finance instruments, and other commercial paper.

Stablecoin strategy evolved despite appearing potentially competitive with XRP's value proposition. Ripple launched RLUSD, a dollar-pegged stablecoin, in December 2024. The company argued that stablecoins complement rather than compete with XRP, as institutions might use RLUSD for dollar-denominated transactions while using XRP for foreign exchange conversion between other currency pairs. The stablecoin also provided Ripple with direct participation in the rapidly growing dollar-token market.

Decentralized finance integration through partners like Flare Network enabled XRP holders to generate yield without leaving the ecosystem. Flare's XRP Earn Account allows holders to earn yield via DeFi strategies like lending and liquid staking, bridging XRP into FXRP and generating returns of 4-7%. These partnerships addressed criticism that XRP lacked DeFi functionality by enabling XRP participation in lending, liquidity provision, and other yield-generating activities through wrapped or bridged representations.

Custody and institutional infrastructure buildout received substantial investment. Ripple formed partnerships with major custodians and prime brokers to ensure institutional-grade security and regulatory compliance for XRP holdings. Ripple's $1.25 billion purchase of the prime broker Hidden Road deepens XRP's claim to being a financial tool, as it gave 300 institutional clients a regulatory-compliant on-ramp that settles with XRP.

Regulatory engagement strategy shifted from defensive litigation posture to proactive policy advocacy. Ripple expanded its government relations and policy teams, participating actively in cryptocurrency legislation discussions and regulatory rulemaking processes. The company positioned itself as a responsible industry leader supporting clear rules and compliance rather than seeking regulatory arbitrage.

International expansion accelerated with particular focus on high-growth corridors. Ripple's UAE-India corridor processed $900 million in Q2 2025. The company identified specific remittance and trade finance corridors where traditional banking infrastructure remained expensive or inefficient, targeting these routes for concentrated RippleNet deployment.

Developer ecosystem cultivation remained a challenge requiring renewed attention. Ripple launched grant programs and developer incentives to expand the XRP Ledger's application ecosystem beyond Ripple's own products. While results remained modest compared to Ethereum or Solana developer activity, incremental progress in attracting independent builders could enhance XRP Ledger's versatility.

The strategic question facing Ripple involved balancing growth ambition against regulatory caution. Having narrowly survived an existential legal threat, the company operated with heightened awareness that regulatory missteps could trigger renewed enforcement. This created tension between aggressive expansion and conservative compliance, with Ripple generally erring toward the latter to protect its hard-won legal clarity.

The Broader Impact - Crypto's Legal Maturity Moment

The XRP settlement represented more than resolution of a single case; it symbolized cryptocurrency's transition from regulatory wilderness toward legal normalization and institutional integration.

The evolution from binary hostility to negotiated frameworks marked a philosophical shift. For years, cryptocurrency industry relationships with regulators oscillated between periods of benign neglect and aggressive enforcement with little middle ground. The XRP settlement demonstrated that complex regulatory questions could be resolved through litigation followed by pragmatic settlement rather than requiring complete capitulation by either party.

Comparison with other landmark cases illustrated this maturation process. The SEC's approval of Bitcoin ETFs in January 2024 represented regulatory acceptance of cryptocurrency as an investment asset class after years of rejections. The Grayscale litigation that compelled the SEC to approve Bitcoin ETF conversions established judicial oversight as a check on agency discretion. The XRP settlement added another dimension: tokens could secure non-security status through judicial determination even after allegations of initial distribution violations.

Binance's regulatory settlements in 2023-2024 with the Department of Justice, Treasury Department, and CFTC established precedent for resolving cryptocurrency exchange compliance failures through negotiated penalties and ongoing monitoring rather than criminal prosecution shutting down operations. This pattern of settlements rather than closures suggested regulators recognized that cryptocurrency businesses provided legitimate services worth preserving under reformed compliance frameworks.

Coinbase's legal challenge to the SEC's enforcement approach reflected industry confidence in seeking judicial review of regulatory interpretation. Rather than accepting the SEC's classification authority as final, major companies now regularly litigated regulatory questions, betting that courts would apply securities laws more narrowly than the agency's expansive interpretation.

The psychological impact on market participants transcended specific legal precedents. The resolution removes a long-standing regulatory overhang and opens the door for broader corporate and institutional adoption. After years of regulatory FUD (fear, uncertainty, and doubt) hanging over cryptocurrency markets, the XRP settlement contributed to a narrative shift where legal clarity seemed achievable rather than perpetually out of reach.

Institutional trust metrics showed measurable improvement. Survey data from institutional investors indicated that regulatory clarity ranked as the number one factor preventing larger cryptocurrency allocation. As major cases resolved and clearer frameworks emerged, these surveys showed declining regulatory concern and rising allocation intentions.

The ETF proliferation illustrated this trust evolution. After years of rejections, 2024-2025 saw waves of cryptocurrency ETF approvals: Bitcoin spot ETFs in January 2024, Ethereum spot ETFs in July 2024, and applications for Solana, XRP, Cardano, Litecoin, and other tokens through 2025. This progression from zero approved cryptocurrency ETFs to dozens within eighteen months represented regulatory normalization's rapid pace once the initial barrier broke.

Long-term credibility for cryptocurrency as an asset class strengthened through this regulatory evolution. Institutional investors who previously dismissed cryptocurrency as unregulated speculation increasingly treated it as an emerging asset class requiring specialized expertise but no longer off-limits for fiduciary duty reasons.

The professionalization of cryptocurrency companies paralleled regulatory normalization. Major cryptocurrency firms built substantial legal, compliance, and government relations departments rivaling those of traditional financial institutions. This infrastructure investment signaled industry recognition that operating within regulatory frameworks rather than fighting them represented the path to sustainable growth.

Academic and policy discourse evolved beyond whether cryptocurrency should exist to how it should be regulated. Law schools offered cryptocurrency law courses, regulatory agencies hosted cryptocurrency-focused working groups, and think tanks published detailed policy proposals for optimal regulatory frameworks. This intellectual infrastructure development suggested that cryptocurrency had achieved sufficient legitimacy to warrant serious policy attention rather than dismissal.

International regulatory coordination advanced, with multilateral organizations including the Financial Action Task Force, Bank for International Settlements, and International Organization of Securities Commissions developing harmonized approaches to cryptocurrency regulation. While perfect global uniformity remained elusive, the general direction toward clearer, more consistent rules reduced jurisdictional arbitrage opportunities and supported legitimate business development.

The symbolic importance of the XRP settlement extended beyond its legal specifics. The case demonstrated that even after years of regulatory adversity, cryptocurrency companies could achieve legal clarity, rebuild institutional relationships, and ultimately thrive. This resilience narrative encouraged other companies facing regulatory challenges to pursue judicial resolution rather than surrendering or relocating to more permissive jurisdictions.

What XRP's Victory Means for the Next Era of Crypto

The August 2025 resolution of the SEC versus Ripple litigation marked the conclusion of cryptocurrency's longest-running regulatory battle and the beginning of a new chapter in digital asset institutional adoption. The settlement's preservation of Judge Torres' bifurcated regulatory framework established that digital assets can achieve non-security status for secondary market transactions even amid institutional sales restrictions, creating a roadmap for regulatory clarity that other tokens and protocols may follow.

XRP's transformation from regulatory pariah to institutional favorite illustrated how rapidly market positioning can shift when legal uncertainty resolves. Within months, the token progressed from delisted on major U.S. exchanges to featuring in CME futures with record-breaking institutional adoption, proposed spot ETFs from every major asset manager, and $7 billion in institutional holdings. This velocity of institutional reentry demonstrated that regulatory clarity, not technological innovation or market sentiment, had been the binding constraint on institutional cryptocurrency adoption.

The settlement's core lesson centered on compliance and transparency as competitive advantages rather than mere legal obligations. Ripple's willingness to engage in years of expensive litigation rather than settling early or relocating operations to friendlier jurisdictions ultimately paid dividends through establishing precedent beneficial to the entire industry. Companies observing this outcome may conclude that proactive regulatory engagement and legal persistence deliver better long-term results than evasion strategies.

The regulatory landscape transformation extends beyond XRP to signal broader acceptance of cryptocurrency as a legitimate, if still emerging, component of the financial system. The progression from Bitcoin's commodity status to Ethereum's de facto non-security treatment to XRP's judicially-confirmed secondary market framework suggests an incremental but steady march toward comprehensive digital asset regulation. While the U.S. regulatory approach remains fragmented across multiple agencies with overlapping jurisdiction, the direction points toward eventual legislative clarity that supersedes case-by-case enforcement.

Looking forward, several questions will determine whether XRP maintains its momentum or faces new challenges. Can the token sustain institutional adoption as central bank digital currencies and stablecoin networks scale? Will spot ETF approvals trigger projected multi-billion-dollar inflows or disappoint relative to elevated expectations? Can Ripple convert payment corridor successes into sustained transaction volume growth that validates XRP's utility value proposition?

The competitive landscape for cross-border payment solutions remains dynamic, with established players like SWIFT innovating, new entrants like stablecoin networks gaining traction, and government-issued digital currencies potentially reshaping the playing field. XRP's edge lies in its established institutional relationships, proven technology operating at scale, and now-clarified regulatory status. Whether these advantages prove sufficient to capture meaningful market share in the massive global payments industry will determine XRP's long-term valuation trajectory.

The broader cryptocurrency implications extend beyond payment tokens to encompass governance around decentralized finance protocols, NFT platforms, layer-two scaling solutions, and novel tokenization applications. The XRP precedent of achieving legal clarity through litigation and settlement may inspire other projects to pursue similar paths rather than accepting regulatory ambiguity as permanent condition.

Regulatory certainty is emerging as cryptocurrency's most valuable commodity, potentially more important than technological superiority or network effects in driving institutional adoption. Projects that achieve clear legal status gain disproportionate institutional capital flows as compliance departments greenlight allocations, exchanges list tokens without reservation, and derivative products launch without regulatory intervention risk. This dynamic creates competitive incentive for proactive regulatory engagement rather than the earlier cryptocurrency ethos of regulatory avoidance.

The institutional integration of cryptocurrency continues accelerating, with XRP's post-settlement trajectory providing a case study in how assets transition from speculative trading instruments to operational financial infrastructure. This evolution from speculation to utility represents cryptocurrency's maturation from technological experiment to financial industry component, a transformation that will define the sector's next decade as significantly as price volatility and technological innovation defined its first.

Ripple's victory may not just reshape XRP's future - it may redefine the entire cryptocurrency industry's relationship with regulatory authority, shifting from adversarial resistance to cooperative coexistence within clear frameworks. This transition from regulatory frontier to normalized asset class will determine whether cryptocurrency achieves its advocates' vision of transforming global finance or remains a niche alternative to traditional systems. The XRP settlement suggests the former outcome grows more probable with each legal precedent established and each institutional allocation greenlit.

The path forward requires balancing innovation with compliance, decentralization ideals with institutional integration demands, and technological possibility with regulatory reality. XRP's journey from regulatory target to compliance exemplar offers a template other projects may follow as the cryptocurrency industry continues its evolution from outsider disruption to insider transformation of global financial infrastructure.